UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 28, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-14225

EXAR CORPORATION

(Exact Name of Registrant as specified in its charter)

| | |

| Delaware | | 94-1741481 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

48720 Kato Road, Fremont, CA 94538

(Address of principal executive offices, Zip Code)

Registrant’s telephone number, including area code: (510) 668-7000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

| Title of each class | | Name of exchange on which registered |

| Common Stock, $0.0001 Par Value | | The NASDAQ Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on it corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference inPart III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ Accelerated filer x |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 27, 2009 was approximately $128.4 million based upon the closing price reported on The NASDAQ Global Market as of the last business day of the Registrant’s most recently completed second fiscal quarter. Approximately 26.7 million shares of common stock held by officers, directors and persons known to the Registrant to hold 5% or more of the Registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the Registrant’s Common Stock was 43,905,208 as of May 25, 2010, net of 19,924,369 treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s 2010 Definitive Proxy Statement to be filed not later than 120 days after the close of the 2010 fiscal year are incorporated by reference intoPart III, Items 10, 11, 12, 13 and14 of this Report.

EXAR CORPORATION AND SUBSIDIARIES

INDEX TO

ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED MARCH 28, 2010

2

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are generally written in the future tense and/or may generally be identified by words such as “will,” “may,” “should,” “could,” “expect,” “suggest,” “believe,” “anticipate,” “intend,” “plan,” or other similar words. Forward-looking statements contained in this Annual Report include, among others, statements made in Part II, Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Summary” and elsewhere regarding (1) our revenue growth, (2) our future gross profits and margins, (3) our future research and development efforts and related expenses, (4) our future selling, general and administrative expenses, (5) our cash and cash equivalents, short-term marketable securities and cash flows from operations being sufficient to satisfy working capital requirements and capital equipment needs for at least the next 12 months, (6) our ability to continue to finance operations with cash flows from operations, existing cash and investment balances, and some combination of long-term debt and/or lease financing and sales of equity securities, (7) the possibility of future acquisitions and investments, (8) our ability to accurately estimate our assumptions used in valuing stock-based compensation, (9) our ability to estimate and reconcile distributors’ reported inventories to their activities, (10) our ability to estimate future cash flows associated with long-lived assets, (11) the volatile global economic and financial market conditions, and (12) anticipated results in connection with the acquisitions of hi/fn, inc. (“Hifn”), Galazar Networks, Inc. (“Galazar”) and Neterion, Inc. (“Neterion”). Actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Factors that could cause actual results to differ materially from those included herein include, but are not limited to, the factors contained under the captions Part I, Item 1—“Business,” Part I, Item 1A—“Risk Factors” and Part II, Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We disclaim any obligation to update information in any forward-looking statement.

OVERVIEW

Exar Corporation and its subsidiaries (“Exar” or “we”) is a fabless semiconductor company that designs, sub-contracts manufacturing and sells highly differentiated silicon, software and subsystem solutions for industrial, telecom, networking and storage applications. Our core expertise in silicon integration, system architecture and software has enabled the development of innovative solutions designed to meet the needs of the evolving connected world. Our product portfolio includes power management and interface components, datacom products, storage optimization solutions, network security and applied service processors. Applying both analog and digital technologies, our products are deployed in a wide array of applications such as portable electronic devices, set top boxes, digital video recorders, telecommunication systems, servers, enterprise storage systems and industrial automation equipment. We provide customers with a breadth of component products and subsystem solutions based on advanced silicon integration.

Exar was incorporated in California in 1971 and reincorporated in Delaware in 1991. Our common stock trades on The NASDAQ Global Market (“NASDAQ”) under the symbol “EXAR”. See the information inPart II, Item 8—“Financial Statements and Supplementary Data” for information on our financial position as of March 28, 2010 and March 29, 2009, and our results of operations and cash flows for fiscal years ended March 28, 2010, March 29, 2009 and March 30, 2008.

On March 16, 2010, we completed the acquisition of Neterion. Neterion, based in Sunnyvale, California, was a supplier of differentiated 10 Gigabit Ethernet controller silicon and card solutions optimized for virtualized environments. The acquisition of Neterion allows us to couple our high performance, power efficient solutions for data security and network bandwidth optimization with Neterion’s industry leading virtualization technology to address the emerging 10 Gigabit Ethernet data center infrastructure.

3

On June 17, 2009, we completed the acquisition of Galazar. Galazar, based in Ottawa, Ontario, Canada, was a fabless semiconductor company and software supplier focused on carrier grade transport over telecom networks. Galazar’s product portfolio addresses transport of a wide range of datacom and telecom services including Ethernet, SAN, TDM and video over SONET/SDH, PDH and OTN networks.

On April 3, 2009, we completed the acquisition of Hifn, a fabless semiconductor company that was founded in 1996, spun off from Stac, Inc. in 1999 and traded on the NASDAQ under the symbol “HIFN” since 1999. The acquisition of Hifn expands and complements our product offering in the enterprise storage, networking and telecom markets where we have had a significant base of business for more than 10 years. The Hifn technology adds world class compression and data deduplication products used in storage applications to optimize data and speed up data backup and retrieval. Hifn had also been a leading provider in security acceleration technology by providing encryption and compression products to leading networking and telecom system manufacturers.

On August 25, 2007, we acquired Sipex Corporation (“Sipex”), a fabless semiconductor company that designed, manufactured and marketed high performance, analog integrated circuits (“ICs”) used by original equipment manufacturers (“OEMs”) in the computing, consumer electronics, communications and networking infrastructure markets.

Our products are organized into four product lines, Datacom & Storage Products, Communication Products, Interface Products and Power Management Products, that define products based on market opportunities and trends. We believe such product line orientation allows for the concentration of market-specific technical expertise which enables us to connect product solutions to the largest users in a given market segment.

We believe our core competencies include:

Leading Analog and Mixed-Signal Design Expertise—We have over 35 years of proven technical competency in developing analog and mixed-signal ICs. As a result, we have developed a deep understanding of the subtleties of analog and mixed-signal design and a comprehensive library of analog core blocks, that we leverage across our broad range of products from programmable power management chips to virtualized network interface products that possess a high concentration of analog and mixed signal content to achieve high performance, power efficient solutions.

Comprehensive Solutions to Enhance System Integration—The combination of our design expertise, diverse technology and system-level expertise allows us to provide comprehensive solutions that encompass hardware, software and applications support. For example, we have developed many digital blocks and engines that are used in data aggregation, transmission, acceleration and compute offload. We believe that by using our solutions, OEMs can develop higher performance systems, better leverage their development resources and reduce their time-to-market.

Connectivity Solutions—Connectivity remains a key strategic direction that drives our product strategies and serves as a foundation for customer engagements. Expanding the range of connectivity solutions has driven acquisition activity in the last year. With the addition of Hifn, Galazar and Neterion, we extended our portfolio of products to offer new silicon products, card solutions and software to support the demand for system solutions in addition to component products. Our connectivity solutions span a range of applications that serve industrial, networking, storage and telecom applications. These solutions facilitate and optimize the virtual handshake between systems and across networks.

Compelling Performance Solutions—We use our systems expertise and our analog, digital and mixed-signal design techniques to architect high-performance products that are based on standard Complementary Metal Oxide Semiconductor (“CMOS”) process technologies. The goal of our product development efforts is to use our intellectual property to create and integrate differentiated solutions that provide speed advantages and power reductions.

4

Conscious Preservation Initiative—Environmental concerns are having a direct impact on electronic components and products. We are committed to reducing the impact that the end use and manufacturing of our products may have on the environment. To that end, we have taken the initiative to offer a portfolio of products that is truly “green” by transitioning our manufacturing processes to offer semiconductor devices that exceed the Restriction of Hazardous Substances Directive (“RoHS”) requirements and are halogen-free.

MARKETS AND PRODUCTS

Datacom and Storage

Today’s information technology infrastructure is going through significant changes, and a few of the key trends driving such changes in data center architectures and the underlying technologies that support them present an opportunity for us to influence our product decisions. We believe the most significant trend is the rapid growth of raw storage capacity requirements that is driven by the increase in digital media content and the expanded base of users. The tremendous growth in content requires efficient ways to store and retrieve data quickly. Another significant trend is “Cloud Computing” and the need to re-architect existing data centers to achieve higher levels of hardware utilization. Many existing data centers worldwide are struggling to keep up with demand, are inefficient in the way they virtualize applications and consume too much power. The upgrade process for such data centers will drive demand for servers, storage systems, software and a range of technologies to facilitate efficiencies. Further, the threat of a breakdown in secure transactions has become an enormous concern for IT departments around the world. Even a minor security breach in the IT infrastructure can cost tens of millions of dollars. The need to pass data securely through advanced encryption algorithms creates an opportunity to provide semiconductor solutions that protect sensitive data and exceed the government requirements for secure transactions.

To address such changes, our Datacom & Storage product portfolio provides a range of solutions for OEMs and IT organizations to efficiently optimize, secure, and transport data in next generation data centers. Our value proposition is driven by underlying hardware offload technology. The concept of offload is to use very efficient, dedicated hardware to provide functionality that would otherwise need to be done with power-hungry x86 application processors. General-purpose application processors are very flexible, but inefficient. The advantages of hardware offload are:

| | • | | High performance and scalability—they are dedicated to a specific task and architected for parallelism |

| | • | | Low power—dedicated hardware is highly power efficient |

| | • | | Data integrity—results of calculations can be checked in real time without performance degradation |

Our Datacom & Storage solutions provide hardware offload capabilities that are an ideal complement to the capabilities of costly application processors. Given the cost of server application processors, using them to perform tasks such as encrypting data or inspecting packets rather than executing application software is very inefficient. The result is higher operating costs and the need for additional, expensive hardware – as well as data center floor space to install it, the capability to cool it, and the headcount to manage it. A dedicated Exar device can perform encryption several times faster than two fully dedicated quad core, multi-threaded server microprocessors at approximately one percent of the power. This is just one example of the value hardware offload can provide in an enterprise environment.

We provide a variety of solutions to target optimization of the IT infrastructure. With the move to highly virtualized data centers, the strain on the network is growing, requiring migration to 10 Gigabit Ethernet solutions that provide high performance connectivity specifically architected for a virtualized environment. To help manage growing requirements placed on network bandwidth and storage infrastructure, the capability to minimize data footprint with compression, and eliminate redundancy with deduplication is becoming increasingly valued. Finally, a virtualized environment moves the burden of security from the edge of the data

5

center to throughout the data center. Data from individual virtual partitions needs to be secured not only in-transit, but also where it is eventually stored. Our product portfolio addresses these issues with a range of innovative solutions:

| | • | | 10 Gigabit Ethernet—Our Neterion X3100 line of 10 Gigabit Ethernet NIC solutions provides high performance 10 GbE server and storage connectivity coupled with advanced features to enable maximum performance in virtualized environments. Integrated offload capabilities ensure minimal hypervisor software intervention, allowing the host processor to dedicate cycles to application software. The Neterion products are supported by proven, enterprise-class software with support for the broadest range of operating systems and hypervisors in the industry. |

| | • | | Data Security and Compression—Our line of ASIC and Express PCI-Express add-in card solutions provide a range of functionality necessary for data encryption/authentication and data compression. These hardware solutions are supported by a comprehensive software suite to enable rapid time-to-market. The flexibility of these products allows high performance, low power solutions for both data-at-rest in storage environments as well as data-in-motion in networking applications. All of these solutions are engineered for end-to-end data integrity critical for protecting user data. |

| | • | | Data Deduplication—Our BitWackr™ is a comprehensive solution for in-line data deduplication for primary storage applications. These solutions offload the computationally intensive tasks necessary from the host processor to allow high performance, power efficient implementations of the data deduplication function as well as enabling data to be simultaneously compressed and encrypted for storage. |

Communications

Our communication products group designs, develops and markets high performance products for the transmission of digital data through global service provider networks. Conforming to international standards for the copper, fiber optic and wireless protocols, our broad portfolio of PDH, SONET, SDH and OTN products enable the delivery of highly reliable, value added communication services.

T/E Carrier

Service providers have a large investment in their existing copper infrastructure. This infrastructure remains a cost effective means of providing high value leased line and data services for enterprises, mobile backhaul and network interconnection. Exar offers a comprehensive portfolio of T1 and E1 devices for twisted pair copper and DS3 and E3 devices for coaxial copper connections. Our broad range of T1/E1 devices includes short-haul and long-haul Line Interface Units (“LIUs”) and LIU/framer combinations that incorporate reconfigurable, relayless redundancy (Exar R3 Technology™) with integrated termination resistors and jitter attenuation. Used individually or in chip sets, our T1/E1 technologies offer customers key advantages including design flexibility, enhanced system reliability and standards compliance, which are critical components of high-density, low-power system boards and line-cards. In addition, our T1/E1/J1 Framer/LIU combination products simplify the design process by saving board space and by reducing complexity as a result of lowering component count. In addition to T1/E1 solutions, we have developed a diverse portfolio of single- and multi-channel T3/E3 physical interface solutions with integrated LIU logic and jitter attenuation that achieve high performance levels while reducing board space and overall power in multi-port applications.

SONET/SDH

Synchronous Optical NETwork (“SONET”) and Synchronous Digital Hierarchy (“SDH”) protocols are the backbone of today’s high-capacity, long distance communications networks. Our portfolio of SONET/SDH products process data at speeds from 155Mb/s to 40Gb/s for the efficient transport of digital data over fiber optic networks. Products include mixed signal Clock and Data Recovery (“CDR”), transceivers, protocol framers and service mappers. Our high density, high-integration products enable significant flexibility in line card design coupled with cost, area and power savings.

6

Optical Transport Networks (“OTN”)

With the substantial growth of internet, wireless and broadband traffic, the demands on service providers for faster, high bandwidth, more reliable networks for ubiquitous services resulted in the development of the OTN protocol. Optimized for long distance transmission of data at speeds starting at 2.5 Gb/s and exceeding 100 Gb/s, OTN has been universally accepted as the global technology for the next generation of optical networks. We are developing a portfolio of products optimized for the efficient mapping of Ethernet, SONET/SDH, OTN, video, storage and data services over high capacity OTN networks. These multiservice products enable flexible, low power, “any service”, “any port line cards.”

Carrier Ethernet Services

The exponential increase of Internet Protocol (“IP”) traffic within service provider networks has created a need for products to efficiently map internet data onto the existing PDH and SONET/SDH digital networks and evolving OTN network. As the ubiquitous interface for internet and data traffic in general, Ethernet mappers are key components for the transformation of the network from circuit based to packet based transport. Exar’s extensive portfolio of Ethernet over PDH (“EoPDH”), Ethernet over SONET/SDH (“EoS”) and Ethernet over OTN enable the efficient mapping of Ethernet packets into flexible bandwidth transport networks.

Interface

We provide the broadest line of industry-proven Universal Asynchronous Receiver/Transmitter (“UART”) solutions as well as synergistic serial transceiver devices into pervasive applications in industrial, telecommunications and consumer markets. Typical applications served by our serial communications products include Point-of-Sale (“POS”), process control, factory automation as well as servers, embedded systems, routers, network management equipment, remote access servers, wireless base-stations and repeaters. Additionally, our single and multi-channel UARTs are used in portable consumer applications such as multi-media, Global Positioning System (“GPS”), Personal Digital Assistant (“PDA”) and smart phone devices.

Our UART product portfolio ranges from cost-effective industry-standard devices to high-performance multi-channel UARTs with a broad range of First In, First Out (“FIFO”) depths and industry leading performance and features that support popular interfaces such as 8-bit Industry Standard Architecture (“ISA”), 8-bit VLIO, 2-wire Inter-Integrate Circuit (“I2C”), 4-wire Serial Peripheral Interface (“SPI”), Peripheral Component Interconnect (“PCI”), Peripheral Component Interconnect Express (“PCIe”) and Universal Serial Bus (“USB”). In addition, we were first to market with a wireless UART solution that includes a high-performance UART, controller and Radio Frequency (“RF”) functionality along with our proprietary firmware that enables the application to send and receive data wirelessly over a secure proprietary protocol.

Our serial transceiver solutions consist of Recommended Standard (“RS”)-232, RS-485, RS-422 and multiprotocol devices that ensure reliable connectivity between computing devices. Our RS-232, RS-485 and RS-422 transceivers comply with international standards in delivering multi-channel digital signals between two systems. Our proprietary multiprotocol transceivers enable network equipment to communicate with a large population of peripherals that use a diverse set of serial protocol standards without the added burden of multiple add-on boards and cables.

7

Our interface product strategy is to continue to enhance our product portfolio with higher speed, lower power and higher functionality devices that meet or exceed the growing demands of the serial communications market. We expect to grow our interface product business by increasing integration and value with additional UART and serial transceiver devices as well as bridging products for popular and growing bus interfaces such as Universal Serial Bus (“USB”), Peripheral Component Interconnect Express (“PCIe”) and Ethernet, among others.

Power Management

The power management market has changed considerably over time. The practice of deferring power considerations to the final stages of the system design has given rise to increased difficulties in space, available energy and heat dissipation. Power management has now moved from the final design stage to one of the primary considerations when defining a system. As a result, power solutions today are challenged to solve a variety of these problems.

While the latest generation of consumer, communication and industrial products are delivering lower-power, feature-rich devices, system architects for these new products are being inundated with several new and complex challenges. As embedded intelligence and features increase, the requirements for multiple voltages and currents, temperature stability and the associated power sequencing and monitoring become daunting tasks for the system designer. Additionally, time-to-market considerations are placing significant schedule demands on product manufacturers forcing the use of concurrent engineering methodologies. For the developers of end products, this means that their system architecture, software and hardware design efforts are happening at the same time as the required next generation integrated circuits are completing their development cycle. This “perfect storm” of simultaneous engineering has become the norm for product manufacturers and has created a demand for more flexibility in the system design process. PowerXR, our new line of programmable power management products provides system designers with the ability to reconfigure the power management sub-system throughout the development cycle and even in the field if required. Simply by using PowerXR technology, product development cycles are being reduced from many months to several weeks. This change in product development methodology is happening right now and we are at the forefront of the industry in providing the enabling high performance and cost effective programmable power solutions that make it possible.

8

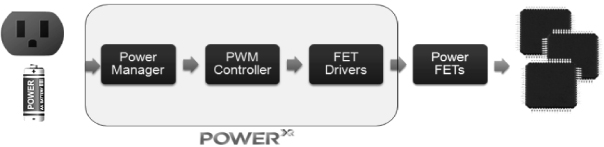

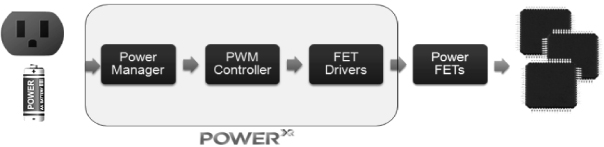

The Power Delivery System

PowerXR products utilize proprietary technology that has evolved from our previous acquisitions of Sipex and FyreStorm, a collaborative development partnership with the University of Toronto and an internal engineering team. PowerXR technology combines digital control and monitoring with our high performance analog circuitry allowing the system architect to design products that reduce wasted energy by orders of magnitude and are reconfigurable on the fly. Our proprietary technology enables efficient partitioning of the digital and analog circuitry within the IC creating the ability to tailor products to match the application requirements in a fraction of the silicon area required by other non-configurable technologies.

All power management products, whether digitally controlled or analog, require world class analog process capability and design tools and methodologies to win in today’s markets. As a fabless semiconductor manufacturer, we have access to the broad range of wafer fabs that are driving innovation in analog process technology, and have developed strong relationships with the world’s leading suppliers of analog and mixed signal silicon. This access to leading edge process technology coupled with our ongoing investment in analog and mixed signal design automation tools has made Exar competitive with the world’s best manufacturers of analog power management products. Our goal is to be the clear technology leader in the fast growing market for programmable power management products.

While we believe our programmable power products represent a fundamental advance in the capability of power management devices, many of today’s products are better served by traditional analog power components. For these applications, we have a full line of non-programmable power products which utilize the same state-of-the-art analog circuitry and design tools as those found in PowerXR products. Our portfolio of power products is focused on a range of solutions that offer power management, voltage conversion and Light-Emitting Diode (“LED”) control. In each area, we have delivered products that offer differentiating capabilities based on innovative circuit design and integration. We have built upon our strong heritage of analog and mixed signal capability with the addition of proprietary technology enabling the creation of world class products that will continue to evolve as our customers’ requirements become ever more complex. This differentiated, proprietary portfolio of power products has been developed with one goal in mind: make power system design easy. In doing so, we seek to lower the costs and labor burden on our customers so that they do not need to become “power experts”. We enable them to focus on resolving their higher level system related challenges.

Strategy

We strive to be a leading provider of highly differentiated silicon, software and subsystem solutions for industrial, telecom, networking and storage applications. To achieve our long-term business objectives, we employ the following strategies:

Leverage Analog and Mixed-Signal Design Expertise to Provide Integrated System-Level Solutions—Utilizing our analog and mixed-signal design expertise, we integrate mixed-signal physical interfaces in a broad range of silicon solutions. This capability continues to be the backbone of our integration strategy and enables us to offer optimized solutions to the markets we serve. Our customers depend on analog and mixed signal integration for power reduction, size optimization and signal integrity.

9

Expand Product Portfolio—We have developed a strong presence in the broad industrial, telecom, networking and storage markets where we have industry leading customers and proven technological capabilities. Our design expertise has enabled us to offer a diverse portfolio of both industry standard and proprietary products serving a range of connectivity and power management needs. Our extensive product portfolio provides the framework for customers to work with many of our products on a single board design. Our ability to serve the various needs of a customer’s system enables us to meet procurement and support needs by providing a single point of contact for applications support and supply chain management while reducing their number of vendors.

Grow Market Share with System Solutions—We create systems solutions by coupling system expertise, software and advanced silicon integration to provide optimized solutions that are designed to be technically compelling and cost effective, resulting in distinctive products like Tethys™, 10G Sonet Multiplexer (“Mux”)/DeMux, Flowthough® Security Processors, Bitwackr™ data deduplication solutions and PowerXR. These solutions and others provide platform engagements that involve software and hardware integration at the system level resulting in a deeper bond with customers.

Strengthen and Expand Strategic OEM Relationships—To promote the early adoption of our solutions, we actively seek collaborative relationships with strategic OEMs during product development. We believe that OEMs recognize the value of our early involvement, because designing their system products in parallel with our development can accelerate time-to-market for their end products. Collaborative relationships also help us to obtain early design wins and to increase the likelihood of market acceptance of our new products.

Use Standard CMOS and Bipolar CMOS-DMOS (“BCD”) Process Technologies to Provide Compelling Price/Performance Solutions—We design our products to be manufactured using standard CMOS and BCD processes. We believe that these processes are proven, stable and predictable and benefit from the extensive semiconductor-manufacturing infrastructure devoted to CMOS and BCD processes. In certain specialized cases, we may use other process technologies to take advantage of their performance characteristics.

Employ Fabless Semiconductor Model—We have long-standing relationships with third-party wafer foundries, assembly and test subcontractors to manufacture our ICs. Our fabless approach allows us to avoid substantial capital spending, obtain competitive pricing, minimize the negative effects of industry cycles, reduce time-to-market, reduce technology and product risks, and facilitate the migration of our products to new CMOS and BCD process technologies. By employing the fabless model, we can focus on our core competencies in product design, development and support as well as in sales and marketing.

Broaden Sales Coverage with Channel Partners—We have strong relationships with our distributors and sales representatives throughout the world representing a significant portion of our total revenue. Through our partners, we have access to large market segments that we cannot support directly. Through these relationships, we extend our expertise and product exposure by enabling our partners to discover new demands for our solutions as well as aid us in defining our next generation solutions.

Expand our Business Through Strategic Commercial Transactions—The markets in which we compete require a wide variety of technologies, products and capabilities. The combination of technological complexity and rapid change within our markets makes it difficult for a single company to develop all the solutions that it desires to offer within its family of products. Through acquisitions, we aim to deliver a broader range of products to customers in target markets. We employ the following strategies to address the need for new or enhanced products: we develop new technologies and products internally; we acquire field proven third-party intellectual property cores to accelerate time to market; and we acquire all or parts of other companies.

Sales and Customers

We market our products globally through both direct and indirect channels. In the Americas, we are represented by 17 independent sales representative groups and two independent, non-exclusive primary distributors, as well as our own direct sales organization. In addition, we have two independent, non-exclusive

10

system distributors for card products. We currently have domestic sales offices in or near Allentown, Pennsylvania; Atlanta, Georgia; Boston, Massachusetts; Chicago, Illinois; Dallas, Texas; Denver, Colorado; Raleigh, North Carolina and Fremont, California.

Internationally, we are represented by our wholly-owned foreign subsidiaries and international support offices in Canada, China, France, Germany, Italy, Japan, Singapore, South Korea, Taiwan and the United Kingdom. In addition to these offices, 37 independent sales representative groups and other independent, non-exclusive distributors represent us in Europe, Japan and the Asia-Pacific region. Our international sales represented 75%, 75% and 69% of net sales for fiscal years ended March 28, 2010, March 29, 2009 and March 30, 2008, respectively. Sales to China accounted for 35%, 24% and 20% of net sales in fiscal years 2010, 2009 and 2008, respectively, while sales to Singapore accounted for 11%, 13% and 9% of net sales in fiscal years 2010, 2009 and 2008, respectively. No other country accounted for sales in excess of 10% of net sales during fiscal years 2010, 2009 or 2008. We expect international sales to continue to be a significant portion of our net sales in the future. All of our sales to foreign entities are denominated in U.S. dollars. For a detailed description of our sales by geographic regions, seePart II, Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations, Net Sales by Geography” andPart II, Item 8—“Notes to Consolidated Financial Statement, Note 19 – Segment and Geographic Information.” For a discussion of the risk factors associated with our foreign operations, seePart I, Item 1A—“Risk Factors—‘Our engagement with foreign customers could cause fluctuations in our operating results, which could materially and adversely impact our business, financial condition and results of operations.’”

We sell our products to distributors and OEMs throughout the world. Alcatel-Lucent accounted for 11% of our net sales in fiscal year 2008. No other OEM customer accounted for 10% or more of our net sales in fiscal years 2010, 2009 or 2008. Future Electronics Inc. (“Future”), a related party, was our largest distributor and accounted for 28%, 35% and 24% of net sales in fiscal years 2010, 2009 and 2008, respectively. Our second largest distributor, Nu Horizons Electronics Corp. (“Nu Horizons”), accounted for 11% of net sales in the fiscal year 2008. No other distributor accounted for 10% or more of net sales for any of those three fiscal years.

We work directly with many key customers including, among others, Alcatel-Lucent, Cisco Systems Inc., Delta, Echostar, EMC, Ericsson Inc., Fujitsu Limited, Hewlett-Packard, Huawei Technologies Co., Ltd., IBM Corporation, LG Electronics Inc., NEC Corporation, Nokia Siemens Networks, Pace, Panasonic Corporation, Parrot, Samsung Electronics, Tellabs, Inc., United Telecom, and ZTE Corporation.

Manufacturing

We outsource all of our fabrication and assembly as well as the majority of our testing operations. This fabless manufacturing model allows us to focus on product design, development and support as well as on sales and marketing.

Our products are manufactured using standard CMOS, bipolar, BiCMOS (bipolar CMOS) and BCD process technologies. We use wafer foundries located in the United States and Asia to manufacture our semiconductor wafers.

Most of our semiconductor wafers are shipped directly from our foundries to our subcontractors in Asia for wafer test and assembly, where the wafers are cut into individual die and packaged. Independent contractors in Malaysia, China, Indonesia and Taiwan perform most of our assembly work. Final test and quality assurance are performed at our subcontractors’ facilities in Asia or at our Fremont, California facility. All of our primary manufacturing partners are certified to ISO 9001:2000 and are or soon will be automotive specification TL16949 compliant.

For all acquired Hifn, Galazar and Neterion products currently in production, we will continue to use the turnkey manufacturing model, with our suppliers delivering fully assembled and tested products based on our proprietary designs.

11

Research and Development

We believe that ongoing innovation and introduction of new products in our targeted and adjacent markets is essential to sustaining growth. Our ability to compete depends on our ability to offer technologically innovative products on a timely basis. As performance demands and the complexity of ICs have increased, the design and development process has become a multi-disciplinary effort requiring diverse competencies. Our research and development is focused on developing high-performance analog, digital and mixed-signal solutions addressing the high-bandwidth requirements of communications and storage systems OEMs and the high-current, high-voltage requirements of interface and power management OEMs. We make investments in advanced design tools, design automation and high-performance intellectual property libraries while taking advantage of readily available specialty intellectual property through licensing or purchases. We also augment our skill sets and intellectual property through university collaboration, incorporating talent through acquisition and by accessing needed skills with off-campus design centers. We continue to pursue the development of design methodologies that are optimized for reducing design-cycle time and increasing the likelihood of first-time success. While we continually upgrade our internal technology to develop innovative products, as a fabless company, we also work with foundries that provide our wafers. As a result of the Hifn acquisition we now have a substantive research and development presence in the People’s Republic of China (“PRC”) and with Galazar and Neterion invested $48.5 million, $31.8 million and $30.7 million on research and development in fiscal years 2010, 2009 and 2008, respectively. For the explanation of our increased expenses in research and development, please seePart II, Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Competition

The semiconductor industry is intensely competitive and is characterized by rapid technological change and a history of price reductions as design improvements and production efficiencies are achieved in successive generations of products. Although the market for analog and mixed-signal ICs is generally characterized by longer product life cycles and less dramatic price reductions than the market for digital ICs, we face substantial competition in each market in which we participate.

We believe that the principal competitive factors in the market segments in which we operate are:

| | • | | product performance, quality, reliability and features; |

| | • | | customer support and services; |

| | • | | rapid technological change; |

| | • | | number of design wins released to production; |

| | • | | lowering total system cost; |

| | • | | product innovation; and |

| | • | | compliance with and support of industry standards. |

We compete with many other companies and many of our current and potential competitors may have certain advantages over us such as:

| | • | | longer presence in key markets; |

| | • | | greater name recognition; |

| | • | | stronger financial position and liquidity; |

| | • | | more secure supply chain; |

12

| | • | | access to larger customer bases; |

| | • | | broader product offerings; |

| | • | | significantly greater sales and marketing, and other resources. |

Because IC markets are highly fragmented, we generally encounter different competitors in our various target markets. Competitors with respect to our communications products include Applied Micro Circuits Corporation, Integrated Device Technology, Inc., Maxim Integrated Products, Inc., Mindspeed Technologies, Inc., PMC-Sierra, Inc., TranSwitch Corporation and Vitesse Semiconductor Corporation. Competitors in the datacom and storage market include Broadcom, Cavium Networks and Netlogic Microsystems. Competitors in the serial interface market include NXP B.V., Texas Instruments Incorporated, Analog Devices, Inc., Intersil Corporation, Linear Technology Corporation and Maxim Integrated Products, Inc. Our primary competitors with respect to our power products include Advanced Analogic Technologies Incorporated, Analog Devices, Inc., Intersil Corporation, Linear Technology Corporation, Maxim Integrated Products, Inc., Micrel Incorporated, National Semiconductor Corporation, On Semiconductor Corporation, Pioneer Corporation, Semtech Corporation, Sharp Electronics Corporation, Sony Corporation and Texas Instruments Incorporated. See Part I, Item 1A—“Risk Factors—‘If we are unable to compete effectively with existing or new competitors, we will experience fewer customer orders, reduced revenues, reduced gross margins and lost market share.’”

Backlog

Our sales are made pursuant to either purchase orders for current delivery of standard items or agreements covering purchases over a period of time, which are frequently subject to revisions and, to a lesser extent, cancellations with little or no penalties. Lead times for the release of purchase orders depend on the scheduling practices of the individual customer, and our rate of bookings varies from month-to-month. Certain distributors’ agreements allow for stock rotations, scrap allowances and volume discounts. Further, we defer recognition of revenue on shipments to certain distributors until the product is resold. For all of these reasons, we believe backlog as of any particular date should not be used as a predictor of future sales.

Intellectual Property Rights

To protect our intellectual property, we rely on a combination of patents, mask work registrations, trademarks, copyrights, trade secrets, and employee and third-party nondisclosure agreements. We have 200 patents issued and 59 patent applications pending in the United States. We have 37 patents issued and 167 patent applications pending in various foreign countries. Our existing patents will expire between 2010 and 2028, or sooner if we choose not to pay renewal fees. We may also enter into license agreements or other agreements to gain access to externally developed products or technologies. While our intellectual property is critically important, we do not believe that our current or future success is materially dependent upon any one patent.

Despite our protection efforts, we may fail to adequately protect our intellectual property. Others may gain access to our trade secrets or disclose such trade secrets to third parties without our knowledge. Some or all of our pending and future patent applications may not result in issued patents that provide us with a competitive advantage. Even if issued, such patents, as well as our existing patents, may be challenged and later determined to be invalid or unenforceable. Others may develop similar or superior products without access to or without infringing upon our intellectual property, including intellectual property that is protected by trade secret and patent rights. In addition, the laws of certain territories in which our products are or may be developed, manufactured or sold, including Asia, Europe, the Middle East and Latin America, may not protect our products and intellectual property rights to the same extent as the laws of the United States of America.

We cannot be sure that our products or technologies do not infringe patents that may be granted in the future pursuant to pending patent applications or that our products do not infringe any patents or proprietary rights of

13

third parties. Occasionally, we are informed by third parties of alleged patent infringement. In the event that any relevant claims of third-party patents are found to be valid and enforceable, we may be required to:

| | • | | stop selling, incorporating or using our products that use the infringed intellectual property; |

| | • | | obtain a license to make, sell or use the relevant technology from the owner of the infringed intellectual property, although such license may not be available on commercially reasonable terms, if at all; or |

| | • | | redesign our products so as not to use the infringed intellectual property, which may not be technically or commercially feasible or meet customer requirements. |

If we are required to take any of the actions described above or defend against any claims from third parties, our business, financial condition and results of operations could be harmed. See Part I, Item 1A—“Risk Factors—‘We may be unable to protect our intellectual property rights, which could harm our competitive position’ and ‘We could be required to pay substantial damages or could be subject to various equitable remedies if it were proven that we infringed the intellectual property rights of others.’”

Employees

As of March 28, 2010, we employed 572 full-time employees, with 316 in research and development, 95 in operations, 88 in marketing and sales and 73 in administration. Of the 572 employees, 196 are located in our international offices. SeePart I, Item 1A—“Risk Factors—‘We depend in part on the continued service of our key engineering and management personnel and our ability to identify, hire, incentivize and retain qualified personnel. If we lose key employees or fail to identify, hire, incentivize and retain these individuals, our business, financial condition and results of operations could be materially and adversely impacted.’” None of our employees are represented by a collective bargaining agreement, and we have never experienced a work stoppage due to labor issues.

Executive Officers of the Registrant

Our executive officers and their ages as of May 28, 2010, are as follows:

| | | | |

Name | | Age | | Position |

Pedro (Pete) P. Rodriguez | | 48 | | Chief Executive Officer, President and Director |

Kevin Bauer | | 50 | | Vice President and Chief Financial Officer |

George Apostol | | 45 | | Executive Vice President, Engineering and Operations and Chief Technology Officer |

Paul Pickering | | 50 | | Executive Vice President of Sales and Marketing |

Hung P. Le | | 49 | | Vice President of Engineering |

Bentley Long | | 48 | | Vice President of Worldwide Sales |

Thomas R. Melendrez | | 56 | | General Counsel, Secretary and Executive Vice President of Business Development |

Frank Marazita | | 54 | | Senior Vice President of Worldwide Operations and Reliability & Quality Assurance |

Jiebing Wang | | 42 | | Vice President of Acceleration Technology and General Manager, China Development Center |

Trong Vu | | 57 | | Chief Information Officer and Vice President of Information Technology |

Diane Hill | | 53 | | Vice President, Human Resources |

Pedro (Pete) P. Rodriguez was appointed our Chief Executive Officer and President in April 2008. He has served as our director since October 2005. Mr. Rodriguez has 26 years of engineering, sales, marketing and executive management experience in the semiconductor industry. Mr. Rodriguez served, most recently, from June 2007 to April 2008, as Chief Marketing Officer of Virage Logic Corporation, a semiconductor intellectual property supplier for Systems on a Chip (“SoC”). Prior to his appointment at Virage Logic, Mr. Rodriguez served

14

as President, Chief Executive Officer and Director of Xpedion Design Systems, Inc., a private, venture-funded developer of design solutions for Radio Frequency Integrated Circuits (“RFIC”) from May 2000 to August 2006. Mr. Rodriguez held this role for six years until shortly after Xpedion was acquired by Agilent Technologies, Inc. in 2006. Prior to Xpedion, he held various senior management positions in sales and marketing at Escalade Corporation, a provider of software for chip design, and LSI Corporation (formerly LSI Logic Corporation) as well as design engineering, product management and process engineering positions at Aerojet Electronics, Teledyne Microwave and Siliconix Incorporated. Mr. Rodriguez holds an MBA from Pepperdine University, an MSEE from California Polytechnic University and a BS in Chemical Engineering from California Institute of Technology.

Kevin Bauerwas appointed Vice President and Chief Financial Officer in June 2009. Prior to his appointment he was our Corporate Controller from August 2005 to June 2009 and was promoted to Vice President in December 2008. Before that Mr. Bauer was our Operations Controller from February 2001 to August 2005. Previously, Mr. Bauer was Operations Controller at WaferTech LLC (a joint venture semiconductor fabrication plant of Taiwan Semiconductor Manufacturing Company Limited, Altera Corporation, Analog Devices, Inc. and Integrated Silicon Solution, Inc.) from July 1997 to February 2001. Prior to that he was at VLSI Technology for ten years where he held a variety of increasingly more senior roles culminating in his position as Director, Group Controller-Communications Group. Prior to that he held finance positions at Memorex and Bank of America. Mr. Bauer has over 22 years of finance experience in the semiconductor industry and received an MBA from Santa Clara University and a BS in Business Administration from California Lutheran University.

George Apostol was appointed Executive Vice President, Engineering and Operations and Chief Technology Officer in March 2010. Prior to his appointment he was Chief Technology Officer from May 2008 to February 2010. Mr. Apostol has over 20 years of experience in the systems electronics and semiconductor industries. From May 2005 to May 2008, Mr. Apostol served as Chief Technology Officer and Vice President of Engineering at PLX Technology, Inc., an integrated circuits company. Mr. Apostol was Vice President of Engineering at Audience, Inc., a supplier of audio software and semiconductor systems, from May 2004 to May 2005 and Vice President of Engineering at Brecis Communications Corporation, the inventor of the popular Multi-service Processor (MSP), from February 2000 to April 2004. Prior to that, he held various senior engineering and management positions at TiVo, Inc., LSI Corporation (formerly LSI Logic Corporation), Silicon Graphics, Inc. and Xerox Corporation. With a strong background designing systems on silicon, he holds several patents in the areas of system bus interface, clocking and buffer management design, and has written and deployed multiple Application-Specification Integrated Circuit (“ASIC”) design productivity tools. Mr. Apostol performed his academic research at the Dana Farber Cancer Institute and Massachusetts Institute of Technology Sloan School of Management and holds a BSEE from Massachusetts Institute of Technology.

Paul Pickeringwas appointed Executive Vice President of Sales and Marketing in March 2010. Prior to his appointment he was Senior Vice President of Marketing from June 2008 to February 2010. Mr. Pickering has over 28 years of semiconductor marketing and sales experience. Prior to joining us, Mr. Pickering was the Vice President of Field Operations for Innovative Silicon from March 2007 to June 2008, a venture-capital funded company that developed a pioneering memory—Z-RAM®—technology for stand-alone DRAM and embedded memory applications. Prior to Innovative Silicon, Mr. Pickering was executive vice-president of sales and marketing of Xpedion Design Systems, Inc., a private, venture-funded developer of design solutions for RFIC from May 2003 to March 2007. Prior to Agilent Technologies, Mr. Pickering worked in senior management sales and marketing roles at Fairchild, Toshiba, LSI Corporation, and PMC-Sierra. Mr. Pickering received a BS in Social Science from the West Chester University of Pennsylvania.

Hung P. Le was appointed Vice President of Engineering in July 2007. Prior to his current position, Mr. Le was Division Vice President of Technology from October 2004 to July 2007. He joined Exar in March 1995 and served as Director of Technology when we acquired Startech Semiconductor, Inc. Prior to joining Startech in 1994, he was Manager of Technology at Sierra Semiconductor, Inc. Mr. Le has over 25 years of experience in

15

semiconductor physics and design and holds eleven patents. He received his MS and BS in Electrical Engineering and Computer Science from Massachusetts Institute of Technology.

Bentley Long was appointed Vice President of Worldwide Sales in January 2008. Mr. Long joined us as Vice President of North America Sales and Global Distribution in January 1997 and has over 20 years of semiconductor sales and marketing experience. Mr. Long has previously worked at VLSI Technology, Inc. as an Area Sales Manager and Worldwide Strategic Account Manager, and also held various technical positions at Texas Instruments Incorporated. He holds a Bachelor of Engineering Degree in Electrical Engineering and Mathematics from Vanderbilt University and an MBA from the University of Tennessee.

Thomas R. Melendrez joined us in April 1986 as our Corporate Attorney. He was promoted to Director, Legal Affairs in July 1991, and again to Corporate Vice President, Legal Affairs in March 1993. In March 1996, he was promoted to Corporate Vice President, General Counsel and in June 2001, he was appointed Secretary. In April 2003, he was promoted to General Counsel, Secretary and Vice President of Business Development and in July 2005, he was promoted to Senior Vice President of Business Development. In April 2007, he was promoted to his current position as General Counsel, Secretary and Executive Vice President of Business Development. Mr. Melendrez has over 25 years of legal experience in the semiconductor and related industries and he received a BA from the University of Notre Dame, a JD from University of San Francisco and an MBA from Pepperdine University.

Frank Marazita joined us in March 2010 as our Senior Vice President of Worldwide Operations and Reliability & Quality Assurance. Mr. Marazita has over 30 years of experience in semiconductor manufacturing and his company experience ranges from new startups to well established entities giving him a broad range of skills. Prior to joining us, Mr. Marazita was owner and General Manager for Special-Ops Consulting from November 2005 to March 2009. Prior to Special-Ops Consulting, Mr. Marazita was Vice President of Worldwide Operations and Finance at Analogix Semiconductor, from November 2005 to March 2009. Prior to Analogix, Mr. Marazita held the role of Vice President of Manufacturing and Operations at Brecis Communications from 2000 to 2005. Prior appointments include Vice President Operations for ATI Technology, HOTRAIL, and Exponential Technology. Additionally Mr. Marazita has held senior Engineering Management Roles at Sun Microsystems, and National Semiconductor. Mr. Marazita has been issued seven semiconductor patents and holds a BSEE degree from Michigan State University.

Jiebing Wang joined us in April 2009 after the completion of our acquisition of Hifn. Dr. Wang joined Hifn in March 2004 as President of Hifn’s China Operations based in Hangzhou and was promoted to Vice President of Worldwide Engineering and General Manager of Hifn’s China Product Operations in March 2007. Before joining Hifn, Dr. Wang was a founder and CTO of Hangzhou C-Sky Microsystems from 2002 to 2004, where he led the development of a high performance 32-bit embedded CPU. Dr. Wang has held technical positions with Nishan Systems, Philips Semiconductors and Toshiba America from 1998 to 2002. Dr. Wang has extensive technical experiences in the area of networking, security and embedded systems. Dr. Wang earned his Ph.D. in physics from the University of Nevada, and a master’s degree in electrical engineering from Stanford University.

Trong Vujoined us in October 2007 as our Chief Information Officer and Vice President of Information Technology. Mr. Vu has over 25 years of experience with leading semiconductor companies. Prior to joining us, Mr. Vu was founder, CIO and Information Systems consultant of EGIS Systems Inc., since April 2002. Prior to EGIS Systems Inc., Mr. Vu held the role of Vice President of Information Technology at Mattson Technology Inc. from 2000 to 2002. Additionally Mr. Vu was Director of IT at LSI Logic and National Semiconductor from 1981 to 2000. Mr. Vu has a broad background in system integration as well as developing enterprise software. Mr. Vu has also been involved in building computer centers and infrastructure needed for companies to effectively run their worldwide information systems. Mr. Vu received his Bachelor of Information System Management degree from University of San Francisco.

Diane Hill was appointed Vice President, Human Resources in April 2010. Since joining us in September 2000, Ms. Hill has held various senior Human Resources positions prior to her current role, including Division

16

Vice President, Director and Senior Manager. Before joining us, Ms. Hill was Manager, Employment and Affirmative Action at Daisy Systems, and worked as Benefits Supervisor at Teledyne MEC. Ms. Hill has over 17 years of Human Resources experience in the semiconductor industry and over 25 years in combined industries. Ms. Hill holds a B.A. degree in Psychology from the University of California at Santa Barbara.

Available Information

We file electronically with the Securities and Exchange Commission (“SEC”) our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, current Reports on Form 8-K, and amendments to those Reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Those reports and statements: (1) may be read and copied at the SEC’s public reference room at 100 F Street, N.E., Washington, DC 20549, (2) are available at the SEC’s Internet site (http://www.sec.gov), which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC; and (3) are available free of charge through our website (www.exar.com) as soon as reasonably practicable after electronic filing with, or furnishing to, the SEC. Information regarding the operation of the SEC’s public reference room may be obtained by calling the SEC at 1-800-SEC-0330. Copies of such documents may be requested by contacting our Investor Relations Department at (510) 668-7201 or by sending an e-mail through the Investor Relations page on our website. Information on our website is not incorporated by reference into this Report.

Global capital, credit market, employment, and general economic conditions, and resulting declines in consumer confidence and spending, could have a material adverse effect on our business, operating results, and financial condition.

Periodic declines or fluctuations in the U.S. dollar, corporate results of operations, interest rates, inflation or deflation, the global impact of sovereign debt, economic trends, actual or feared economic recessions, lower spending, the impact of conflicts throughout the world, terrorist acts, natural disasters, volatile energy costs, the outbreak of communicable diseases and other geopolitical factors, have had, and may continue to have, a negative impact on the U.S. and global economies. Volatility and disruption in the global capital and credit markets have led to a tightening of business credit and liquidity, a contraction of consumer credit, business failures, higher unemployment, and declines in consumer confidence and spending in the U.S. and internationally. If global economic and financial market conditions, currently showing signs of recovery, deteriorate or remain weak for an extended period of time, many related factors could have a material adverse effect on our business, operating results, and financial condition, including the following:

| | • | | slower spending and market fluctuations may result in reduced demand for our products, reduced orders for our products, order cancellations, lower revenues, increased inventories, and lower gross margins; |

| | • | | we may be unable to predict the strength or duration of market conditions or the effects of consolidation of our customers in their industries, which may result in project delays or cancellations; |

| | • | | we may be unable to find suitable investments that are safe, liquid, and provide a reasonable return resulting in lower interest income or longer investment horizons, and disruptions to capital markets or the banking system may also impair the value of investments or bank deposits we currently consider safe or liquid; |

| | • | | the failure of financial institution counterparties to honor their obligations to us under credit instruments could jeopardize our ability to rely on and benefit from those instruments, and our ability to replace those instruments on the same or similar terms may be limited under poor market conditions; |

| | • | | continued volatility in the markets and prices for commodities and raw materials we use in our products and in our supply chain could have a material adverse effect on our costs, gross margins, and profitability; |

| | • | | if distributors of our products experience declining revenues, or experience difficulty obtaining financing in the capital and credit markets to purchase our products, or experience severe financial difficulty, it |

17

| | could result in insolvency, reduced orders for our products, order cancellations, inability to timely meet payment obligations to us, extended payment terms, higher accounts receivable, reduced cash flows, greater expenses associated with collection efforts, and increased bad debt expenses; |

| | • | | if contract manufacturers or foundries of our products or other participants in our supply chain experience difficulty obtaining financing in the capital and credit markets to purchase raw materials or to finance general working capital needs, it may result in delays or non-delivery of shipments of our products; |

| | • | | potential shutdowns or over capacity constraints by our third-party foundry, assembly and test subcontractors could result in longer lead-times, higher buffer inventory levels and degraded on-time delivery performance; and |

| | • | | the current macroeconomic environment also limits our visibility into future purchases by our customers and renewals of existing agreements, which may necessitate changes to our business model. |

Our financial results may fluctuate significantly because of a number of factors, many of which are beyond our control.

Our financial results may fluctuate significantly as a result of a number of factors, many of which are difficult or impossible to control or predict, which include:

| | • | | the depth and duration of the current economic downturn; |

| | • | | the cyclical nature of the semiconductor industry; |

| | • | | difficulty in predicting revenues and ordering the correct mix of products from suppliers due to limited visibility provided by customers and channel partners; |

| | • | | fluctuations of our revenue and gross profits due to the mix of product sales as our margins vary by product; |

| | • | | the impact of our revenue recognition policies on reported results; and |

| | • | | the reduction, rescheduling, cancellation or timing of orders by our customers, distributors and channel partners due to, among others, the following factors: |

| | • | | management of customer, subcontractor and/or channel inventory; |

| | • | | delays in shipments from our subcontractors causing supply shortages; |

| | • | | inability of our subcontractors to provide quality products, in adequate quantities and in a timely manner; |

| | • | | dependency on a single product with a single customer and/or distributor; |

| | • | | volatility of demand for equipment sold by our large customers, which in turn, introduces demand volatility for our products; |

| | • | | disruption in customer demand as customers change or modify their complex subcontract manufacturing supply chain; |

| | • | | disruption in customer demand due to technical or quality issues with our devices or components in their system; |

| | • | | the inability of our customers to obtain components from their other suppliers; |

| | • | | disruption in sales or distribution channels; |

| | • | | our ability to maintain and expand distributor relationships; |

| | • | | changes in sales and implementation cycles for our products; |

18

| | • | | the ability of our suppliers and customers to remain solvent, obtain financing or fund capital expenditures as a result of the current global economic slowdown; |

| | • | | risks associated with entering new markets; |

| | • | | the announcement or introduction of products by our existing competitors or new competitors; |

| | • | | loss of market share by our customers; |

| | • | | competitive pressures on selling prices or product availability; |

| | • | | pressures on selling prices overseas due to foreign currency exchange fluctuations; |

| | • | | erosion of average selling prices coupled with the inability to sell newer products with higher average selling prices, resulting in lower overall revenue and margins; |

| | • | | delays in product design releases; |

| | • | | market and/or customer acceptance of our products; |

| | • | | consolidation among our competitors, our customers and/or our customers’ customers; |

| | • | | changes in our customers’ end user concentration or requirements; |

| | • | | loss of one or more major customers; |

| | • | | significant changes in ordering pattern by major customers; |

| | • | | our or our channel partners’ ability to maintain and manage appropriate inventory levels; |

| | • | | the availability and cost of materials and services, including foundry, assembly and test capacity, needed by us from our foundries and other manufacturing suppliers; |

| | • | | disruptions in our or our customers’ supply chain due to natural disasters, fire, outbreak of communicable diseases, labor disputes, civil unrest or other reasons; |

| | • | | delays in successful transfer of manufacturing processes to our subcontractors; |

| | • | | fluctuations in the manufacturing output, yields, and capacity of our suppliers; |

| | • | | fluctuation in suppliers’ capacity due to reorganization, relocation or shift in business focus, financial constraints, or other reasons; |

| | • | | problems, costs, or delays that we may face in shifting our products to smaller geometry process technologies and in achieving higher levels of design and device integration; |

| | • | | our ability to successfully introduce and transfer into production new products and/or integrate new technologies; |

| | • | | increased manufacturing costs; |

| | • | | higher mask tooling costs associated with advanced technologies; and |

| | • | | the amount and timing of our investment in research and development; |

| | • | | costs and business disruptions associated with stockholder or regulatory issues; |

| | • | | the timing and amount of employer payroll tax to be paid on our employees’ gains on stock options exercised; |

| | • | | inability to generate profits to utilize net operating losses; |

| | • | | increased costs and time associated with compliance with new accounting rules or new regulatory requirements; |

| | • | | changes in accounting or other regulatory rules, such as the requirement to record assets and liabilities at fair value; |

19

| | • | | write-off of some or all of our goodwill and other intangible assets; |

| | • | | fluctuations in interest rates and/or market values of our marketable securities; |

| | • | | litigation costs associated with the defense of suits brought or complaints made against us; and |

| | • | | change in or continuation of certain tax provisions. |

Our expense levels are based, in part, on expectations of future revenues and are, to a large extent, fixed in the short-term. Our revenues are difficult to predict and at times we have failed to achieve revenue expectations. We may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. If revenue levels are below expectations for any reason, our business, financial condition and results of operations could be materially and adversely impacted.

If we fail to develop, introduce or enhance products that meet evolving market needs or which are necessitated by technological advances, or we are unable to grow revenues, then our business, financial condition and results of operations could be materially and adversely impacted.

The markets for our products are characterized by a number of factors, some of which are listed below:

| | • | | changing or disruptive technologies; |

| | • | | evolving and competing industry standards; |

| | • | | changing customer requirements; |

| | • | | increasing price pressure; |

| | • | | increasing product development costs; |

| | • | | long design-to-production cycles; |

| | • | | fluctuations in capital equipment spending levels and/or deployment; |

| | • | | rapid adjustments in customer demand and inventory; |

| | • | | increasing functional integration; |

| | • | | moderate to slow growth; |

| | • | | frequent product introductions and enhancements; |

| | • | | changing competitive landscape (consolidation, financial viability); and |

| | • | | finite market windows for product introductions. |

Our growth depends in part on our successful continued development and acceptance of new products for our core markets. We must: (i) anticipate customer and market requirements and changes in technology and industry standards; (ii) properly define and develop new products on a timely basis; (iii) gain access to and use technologies in a cost-effective manner; (iv) have suppliers produce quality products; (v) continue to expand our technical and design expertise; (vi) introduce and cost-effectively manufacture new products on a timely basis; (vii) differentiate our products from our competitors’ offerings; and (viii) gain customer acceptance of our products. In addition, we must continue to have our products designed into our customers’ future products and maintain close working relationships with key customers to define and develop new products that meet their evolving needs. Moreover, we must respond in a rapid and cost-effective manner to shifts in market demands, the trend towards increasing functional integration and other changes. Migration from older products to newer products may result in volatility of earnings as revenues from older products decline and revenues from newer products begin to grow.

20

Products for our customers’ applications are subject to continually evolving industry standards and new technologies. Our ability to compete will depend in part on our ability to identify and ensure compliance with these industry standards. The emergence of new standards could render our products incompatible. We could be required to invest significant time, effort and expenses to develop and qualify new products to ensure compliance with industry standards.

The process of developing and supporting new products is complex, expensive and uncertain, and if we fail to accurately predict and understand our customers’ changing needs and emerging technological trends, our business may be harmed. In addition, we may make significant investments to modify new products according to input from our customers who may choose a competitor’s or an internal solution, or cancel their projects. We may not be able to identify new product opportunities successfully, develop and bring to market new products, achieve design wins, ensure when and which design wins actually get released to production, or respond effectively to technological changes or product announcements by our competitors. In addition, we may not be successful in developing or using new technologies or may incorrectly anticipate market demand and develop products that achieve little or no market acceptance. Our pursuit of technological advances may require substantial time and expense and may ultimately prove unsuccessful. Failure in any of these areas may materially and adversely harm our business, financial condition and results of operations.

We have made and in the future may make acquisitions and significant strategic equity investments, which may involve a number of risks. If we are unable to address these risks successfully, such acquisitions and investments could have a materially adverse effect on our business, financial condition and results of operations.

We have recently undertaken a number of strategic acquisitions, have made strategic investments in the past, and may make further strategic acquisitions and investments from time to time in the future. The risks involved with these acquisitions and investments include:

| | • | | the possibility that we may not receive a favorable return on our investment or incur losses from our investment or the original investment may become impaired; |

| | • | | revenues or synergies could fall below projections or fail to materialize as assumed; |

| | • | | failure to satisfy or set effective strategic objectives; |

| | • | | our assumption of known or unknown liabilities or other unanticipated events or circumstances; and |

| | • | | the diversion of management’s attention from day-to-day operations of the business and the resulting potential disruptions to the ongoing business. |

Additional risks involved with acquisitions include:

| | • | | difficulties in integrating and managing various functional areas such as sales, engineering, marketing, and operations; |

| | • | | difficulties in incorporating or leveraging acquired technologies and intellectual property rights in new products; |

| | • | | difficulties or delays in the transfer of manufacturing flows and supply chains of products of acquired businesses; |

| | • | | failure to retain and integrate key personnel; |

| | • | | failure to retain and maintain relationships with existing customers, distributors, channel partners and other parties; |

| | • | | failure to manage and operate multiple geographic locations both effectively and efficiently; |

| | • | | failure to coordinate research and development activities to enhance and develop new products and services in a timely manner that optimize the assets and resources of the combined company; |

21

| | • | | difficulties in creating uniform standards, controls (including internal control over financial reporting), procedures, policies and information systems; |

| | • | | unexpected capital equipment outlays and continuing expenses related to technical and operational integration; |