UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04138

Allmerica Investment Trust

(Name of Registrant)

440 Lincoln Street

Worcester, Massachusetts 01653

(Address of Principal Executive Offices)

George M. Boyd, Trust Secretary

Allmerica Financial

440 Lincoln Street

Worcester, MA 01653

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: (508) 855-1000

Date of Fiscal Year End: December 31

Date of Reporting Period: June 30, 2004

| Item 1. | Reports to Stockholders |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Allmerica Investment Trust

Semi-Annual Report

June 30, 2004

Allmerica Investment Trust – Money Market Fund

Semi-Annual Report

June 30, 2004

| | |

| Allmerica Financial | | Semi-Annual Report |

| June 30, 2004 | | |

| |

| | | Allmerica Investment Trust |

| |

| [GRAPHIC] | | 2004 |

[GRAPHIC]

Table of Contents

| | |

A Letter from the Chairman | | 1 |

Select Capital Appreciation Fund | | 2 |

Select Value Opportunity Fund | | 3 |

Select International Equity Fund | | 4 |

Select Growth Fund | | 5 |

Core Equity Fund | | 6 |

Equity Index Fund | | 7 |

Select Investment Grade Income Fund | | 8 |

Government Bond Fund | | 9 |

Money Market Fund | | 10 |

| |

Financials | | F-1 |

For information on ordering additional copies of this report, see Client Notices on page F-47.

One or more Funds may not be available under the variable annuity or variable life insurance policy which you have chosen. Inclusion in this report of a Fund which is not available under your policy is not to be considered a solicitation.

A Letter from the Chairman

Dear Client:

The first half of 2004 brought mixed news for the global economy. In the United Kingdom, consumer and mortgage credit continued to grow at a brisk pace with minimal signs of inflation, as the jobless rate dropped further. Unemployment remained high in France and Germany, as signs of recovery were muted in mainland Europe. Fueled by exploding growth in China and India, many Asian economies performed well, led by Thailand, Singapore and Malaysia. Domestic oriented companies helped stimulate stronger than expected growth in Japan. European stock markets held up relatively well as Germany’s DAX Index rose 2.21%, England’s FTSE Index gained 1.85% and France’s CAC 40 Index was up 7.25%. Asian stock markets were mixed, as Japan’s Nikkei Average finished the period up 11.58%, while Hong Kong’s Hang Seng Index was lower by 0.29%.

The United States economy turned in a solid performance during the first six months of 2004. First quarter GDP came in at 3.9% and growth for the full period is expected to be in the same range. The long-awaited growth in jobs finally began to occur during the first half of the year. After starting slowly, non-farm payroll gains averaged over 200,000 per month in the second quarter, persuading many that a traditional economic recovery was under way. Consumer spending remained strong, industrial production ramped up and business investment increased, while core producer prices came in slightly higher than expected. Core inflation also edged higher during the period, partially as a result of the voracious demand for raw materials from China and other recovering economies. These and other strong economic statistics caused many analysts to conclude that the Federal Reserve Board would need to raise interest rates sooner, rather than later, in order to head off a rapid rise in inflation. In late June, these concerns were realized, as the Federal Reserve Board raised its target for the federal funds rate by 0.25%, to 1.25%. Gas prices at the pump climbed to over $2.00 a gallon, as oil prices rose significantly in the first quarter, then fell back slightly during the second quarter. Several analysts expressed concern that higher oil prices might dampen the surging domestic economy. U.S. securities markets finished the first six months of 2004 with small gains. The S&P 500® Index rose 3.44% and the Nasdaq Composite Index was higher by 2.22%. Bonds struggled as interest rates ticked higher. For the period, the Lehman Brothers Aggregate Bond Index managed a gain of only 0.15%.

All of the Allmerica Investment Trust equity funds achieved positive results for the first half of 2004, led by the Select Capital Appreciation and Select Value Opportunity funds, which each gained more than 7%. On the fixed income side, higher interest rates adversely affected returns. The Select Investment Grade Income and Government Bond funds each reported slight declines.

On behalf of the Board of Trustees,

John P. Kavanaugh

Chairman of the Board

Allmerica Investment Trust

1

Select Capital Appreciation Fund

The Select Capital Appreciation Fund returned 7.86% for the first half of 2004, outperforming its benchmark, the Russell Midcap Index, which returned 6.67%.

U.S. stocks extended last year’s rally during the first half of the year, although gains were more modest. Most indexes closed below their highest levels of the year, as positive investor sentiment was tempered by concerns about inflation, high oil prices, and rising interest rates. Mid-cap stocks outperformed their larger peers, and value stocks surpassed growth. Information technology, industrials and business services, energy, and telecommunications contributed positively, while the consumer discretionary and materials sectors weighed on performance. Information technology was the best relative performer, although a more modest absolute gainer for the fund. Strength among communications equipment and software holdings aided relative performance. Continued economic strength benefited industrials and business services holdings and the fund’s education holdings also performed well. The energy sector was the second-best performer in the index, behind consumer staples. Strong commodity prices continued to benefit the sector and drilling activity is increasing. A continued overweight in this sector and effective stock selection bolstered relative performance. Media stocks hampered relative performance in the consumer discretionary sector, as a slower-than-expected recovery in radio advertising spending hurt holdings. Retail stocks, especially discounters, were weak over concerns about consumer spending in a rising interest rate environment. The materials sector was a relative detractor due to the fund’s metals and mining holdings.

Despite some risks, the economy and corporate profits appear strong, providing a moderately positive backdrop for stocks. The investment sub-adviser continues to see opportunities in the marketplace and believes that the portfolio is well-positioned for the current environment.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | Life of Fund |

Select Capital Appreciation Fund | | 26.77% | | 6.90% | | 13.08% |

| | | |

Russell Midcap Index | | 29.40% | | 6.51% | | 12.98% |

Lipper Mid-Cap Growth Funds Average | | 24.45% | | 1.08% | | 8.97% |

Growth of a $10,000 Investment Since 1995

The Select Capital Appreciation Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index. The Lipper Mid-Cap Growth Funds Average is a non-weighted average of funds within the mid-cap growth investment objective.

Performance prior to 4/1/98 is that of a prior Sub-Adviser.

Investment Sub-Adviser

T. Rowe Price Associates, Inc.

About the Fund

Seeks long-term growth of capital by investing primarily in mid-cap growth stocks selling at reasonable prices.

Portfolio Composition

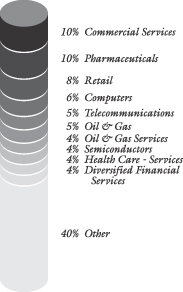

As of June 30, 2004, the sector allocation of net assets was:

2

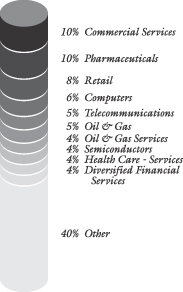

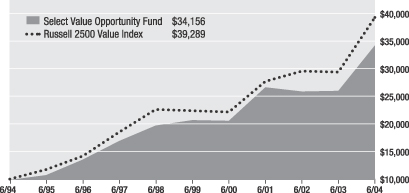

Select Value Opportunity Fund

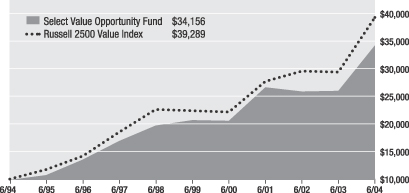

The Select Value Opportunity Fund returned 7.07% for the first half of 2004, outperforming its benchmark, the Russell 2500 Value Index, which returned 6.71%.

Major contributors to performance during the period included the dominant managed care company in the Las Vegas market, a manager of real estate, energy and alternative financial assets, a major cruise line with rising earnings estimates and a software company focused mainly on business performance management applications. Detractors included an operator of radio stations, a pasta maker whose sales volume was hurt by greater than expected acceptance of low carbohydrate diets in the United States, a major disk drive supplier impacted by weakness in the disk drive end market and a video game provider hit by slow expansion and continued lackluster results in the video rental business. Additions to the fund during the first half of the year included the leading producer of methanol, a leading provider of mechanic’s tools, a diversified insurance holding company that was recently divested by its European parent, a petrochemical producer with expanding margins, a manufacturer of fire, garbage, cement and military trucks and a high- end niche retailer. Sales during the last two quarters included several companies that had reached established price targets and a financial firm whose management had hired investment bankers to explore a sale of the company.

The investment sub-adviser believes that company-specific execution remains the overriding driver of individual stock performance. As is often the case when investing in companies undergoing strategic change, the investment sub-adviser believes that patience, combined with a process to differentiate between fundamental deterioration and temporary operating setbacks, remains critical to long-term investing success.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Select Value Opportunity Fund | | 31.43% | | 10.48% | | 13.07% |

| | | |

Russell 2500 Value Index | | 33.90% | | 11.92% | | 14.66% |

Lipper Mid-Cap Value Funds Average | | 31.33% | | 9.27% | | 13.19% |

Growth of a $10,000 Investment Since 1994

The Select Value Opportunity Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Russell 2500 Value Index is a capitalization weighted index measuring the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. The Lipper Mid-Cap Value Funds Average is a non-weighted average of mid-cap value funds.

Performance prior to 1/1/97 is that of a prior Sub-Adviser.

Investment Sub-Adviser

Cramer Rosenthal McGlynn, LLC

About the Fund

Seeks long-term growth of capital by investing primarily in small and mid-sized companies believed to be undervalued.

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

3

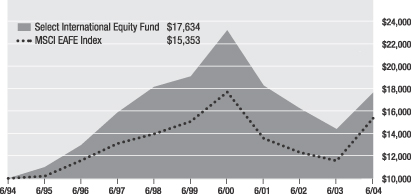

Select International Equity Fund

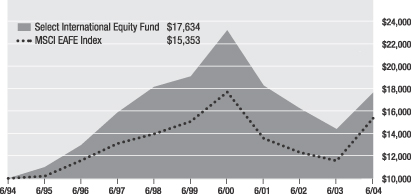

The Select International Equity Fund returned 1.99% for the first half of 2004, underperforming its benchmark, the MSCI EAFE Index, which returned 4.86%.

Equity markets posted moderate gains for the first six months of 2004 against a backdrop of improved economic conditions. The U.S.A., Japan and China produced much of the economic vigor that buoyed corporate earnings prospects and underpinned equity market advances. European markets were supported by low domestic interest rates and demand for their exports. Although the rate of growth has not been at a pace with that witnessed in much of the world, there is evidence of momentum building in parts of the Eurozone economy. German companies bolstered fund performance during the period, as a large luxury auto maker reported record American sales and Europe’s second-largest utility posted significant growth in its core energy business. Several consumer staples stocks aided fund performance, as did a large South Korean consumer-electronics manufacturer. The fund’s relative underweight exposure to the hot energy sector weighed somewhat on overall returns. The fund’s overweight position in the poorly performing information technology sector also detracted from performance, as did the negative results turned in by some stocks in the telecommunication services sector.

The investment sub-adviser feels that the assumed pace of expansion in the U.S. economy may be optimistic, but does not anticipate higher interest rates in Europe or Japan any time soon. The investment sub-adviser believes that equities continue to offer good value relative to other asset classes, but feels that terrorism, a disruption in oil supplies or a sharper-than-intended slowdown in China’s economy are factors that could upset this upbeat outlook.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Select International Equity Fund | | 22.59% | | (1.56)% | | 5.84% |

| | | |

MSCI EAFE Index | | 32.85% | | 0.40% | | 4.38% |

Lipper International Core Funds Average | | 28.48% | | 0.38% | | 5.13% |

Growth of a $10,000 Investment Since 1994

The Select International Equity Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

Special risk considerations are associated with investments in non-U.S. companies, including fluctuating foreign exchange rates, foreign governmental regulations and differing degrees of liquidity that may adversely affect the portfolio.

The MSCI EAFE Index is an unmanaged index of European, Australian and Far Eastern stocks. The Lipper International Core Funds Average is a non-weighted average of funds within the international core fund category.

Investment Sub-Adviser

Bank of Ireland Asset Management (U.S.) Ltd.

About the Fund

Seeks maximum long-term total return by investing in non-U.S. companies based on fundamental value.

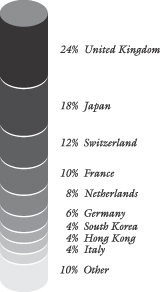

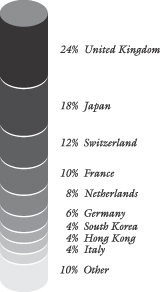

Portfolio Composition

As of June 30, 2004, the country allocation of net assets was:

4

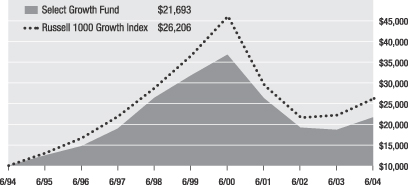

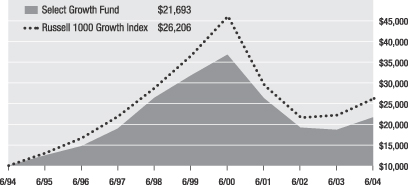

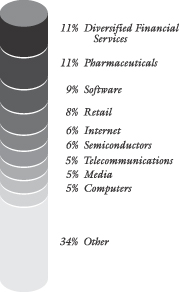

Select Growth Fund

The Select Growth Fund returned 1.60% for the first half of 2004, underperforming its benchmark, the Russell 1000 Growth Index, which returned 2.74%.

In the Jennison Associates LLC portion of the fund, consumer staples, information technology, energy and health care were the best performing sectors. A high-quality organic food retailer, a large internet portal, a major producer of electronic games, a prominent biotechnology firm and a large oil services company were among the fund’s top performers. The consumer discretionary and financials sectors were the main detractors from performance. Specialty retailers and media companies were hurt by concerns about consumer spending and weakness in advertising spending, respectively. The fund’s capital market holdings were negatively affected by the anticipation of rising interest rates. The investment sub-adviser feels that its holdings trade at an appropriate premium to the market relative to projected earnings growth for the next two years.

GE Asset Management Inc. replaced Putnam Investment Management, LLC as co-sub-adviser of the fund effective April 30, 2004. During the period that Putnam Investment Management, LLC managed its portion of the fund, performance was hampered by an overweight exposure to the technology sector. Stock selection in the consumer staples, financial and consumer cyclical sectors benefited performance. During the period that GE Asset Management Inc. managed its portion of the fund, the consumer staples sector contributed most to performance, while the underweighted industrials sector adversely affected performance. The fund’s primary holding in the telecommunications sector detracted from performance as did the fund’s information technology holdings. The investment sub-adviser feels that the portfolio remains well positioned for good relative performance and that its investment philosophy should continue to drive long-term outperformance.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Select Growth Fund | | 16.00% | | (7.36)% | | 8.05% |

| | | |

Russell 1000 Growth Index | | 17.89% | | (6.48)% | | 10.12% |

Lipper Large-Cap Growth Funds Average | | 16.68% | | (4.99)% | | 9.21% |

Growth of a $10,000 Investment Since 1994

The Select Growth Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Lipper Large-Cap Growth Funds Average is a non-weighted average of funds within the large-cap growth investment objective.

GE Asset Management Inc. became a Co-Sub-Adviser of the fund effective April 30, 2004.

Jennison Associates LLC became a Co-Sub-Adviser of the fund effective April 18, 2003.

Performance prior to these dates is that of prior Sub-Advisers.

Investment Sub-Advisers

GE Asset Management Inc.

Jennison Associates LLC

About the Fund

Seeks long-term growth of capital by investing in companies believed to have long-term growth potential.

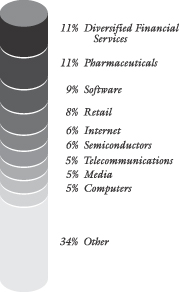

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

5

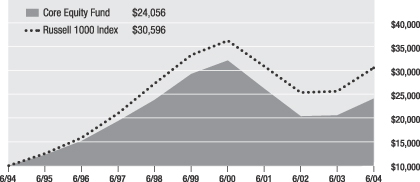

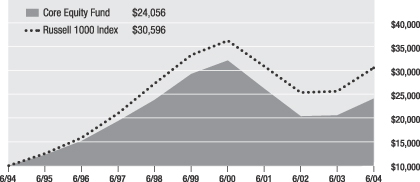

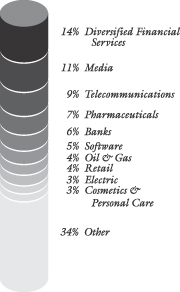

Core Equity Fund

The Core Equity Fund returned 2.44% for the first half of 2004, underperforming its benchmark, the Russell 1000 Index, which returned 3.32%.

In the Goldman Sachs Asset Management, L.P. portion of the fund, specific technology holdings benefited performance. A large cellular telephone manufacturer, a major internet portal and the premier on-line auction site were strong, as their growth prospects were supported by long-term secular trends. The investment sub-adviser recently boosted the fund’s allocation to the consumer staples sector, which also aided performance. Companies exposed to radio advertising detracted from performance, while some other media holdings performed well. Two large health care companies hurt performance as legal and product issues caused investor concern. The investment sub-adviser believes that its continued focus on businesses with strong franchises, favorable long-term prospects, and excellent management, should generate superior returns over the long term.

In the UBS Global Asset Management (Americas) Inc. portion of the fund, risk exposure was neutral to slightly lower than that of the benchmark. Benefiting performance were a significant overweight position in the top performing wireless communications sector and an underweight position in the poor performing media sector. The fund’s bias toward the health care and utilities sectors was a slight drag on relative performance. The potential impact of drug re-importation programs hampered pharmaceuticals, while rising interest rates made investors wary of utilities. Underweighting the energy sector also detracted from results, as skyrocketing oil prices drove shares higher. In order to produce attractive risk-adjusted returns, the investment sub-adviser intends to utilize its disciplined, bottom-up stock selection process to invest in stocks trading below their perceived intrinsic value.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Core Equity Fund | | 17.04% | | (3.87)% | | 9.18% |

| | | |

Russell 1000 Index | | 19.47% | | (1.65)% | | 11.83% |

Lipper Large-Cap Core Funds Average | | 16.87% | | (2.84)% | | 9.15% |

Growth of a $10,000 Investment Since 1994

The Core Equity Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index. The Lipper Large-Cap Core Funds Average is a non-weighted average of funds within the large-cap core investment objective.

Performance prior to May 1, 2002 is that of a prior Sub-Adviser.

Investment Sub-Advisers

Goldman Sachs Asset Management, L.P.

UBS Global Asset Management (Americas) Inc.

About the Fund

Seeks long-term growth of capital by investing in stocks that are believed to represent significant underlying value.

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

6

Equity Index Fund

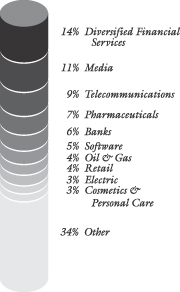

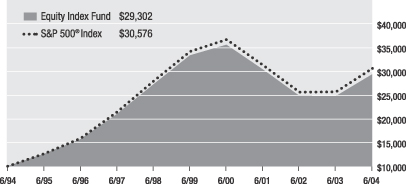

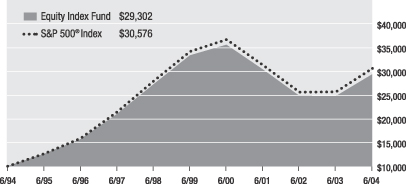

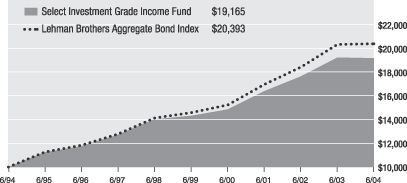

The Equity Index Fund returned 3.17% for the first half of 2004, underperforming its benchmark, the S&P 500® Index, which returned 3.44%.

With the economic recovery gaining steam at the end of 2003, the outlook for the equity market in 2004 was positive. Fiscal and monetary stimuli caused the business sector to finally begin spending and low interest rates brought about a refinancing boom in the housing market. Gross domestic product and key manufacturing reports were strong, indicating to many that the recovery was here to stay. But, looming inflation and high oil prices worried investors, offsetting the positive economic data and causing the equity markets to remain relatively flat for the period. Within the fund, the best performers were the energy, casino and gaming, and wireless telecommunication sectors. Amid higher oil prices, the energy sector showed strong gains, and the casino and gaming sector benefited from an increase in demand. Bringing down performance were the auto manufacturing, railroad, and media sectors. U.S. auto manufacturers lost additional market share to foreign automakers and fears of lower SUV sales due to increasing oil prices forced automakers to increase rebates, hurting profits. The railroad sector suffered from increasing train delays, poor earnings reports, and escalating terrorism fears.

The investment sub-adviser feels that equities are positioned for a rally in the second half of 2004. Third and fourth quarter GDP is projected to show solid growth and many firms plan to increase employment over the next six months. The investment sub-adviser thinks that this bullish outlook should directly benefit consumer spending, as more jobs may be created to meet the higher expected demand.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Equity Index Fund | | 18.46% | | (2.49)% | | 11.35% |

| | | |

S&P 500® Index | | 19.10% | | (2.21)% | | 11.83% |

Lipper S&P 500 Index Objective Funds Average | | 18.54% | | (2.54)% | | 11.44% |

Growth of a $10,000 Investment Since 1994

The Equity Index Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The S&P 500® Index is an unmanaged index of 500 leading stocks. S&P 500® Index is a registered trademark of The McGraw-Hill Companies, Inc. The Lipper S&P 500 Index Objective Funds Average is a non-weighted average of funds within the S&P 500® Index investment objective.

Investment Sub-Adviser

Opus Investment Management, Inc.

About the Fund

Seeks to replicate the return of the S&P 500® Index.

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

7

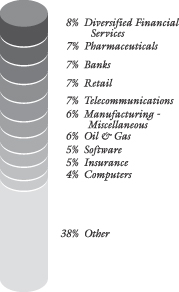

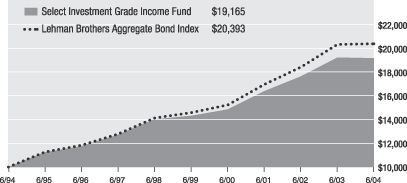

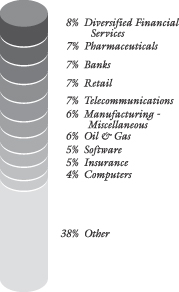

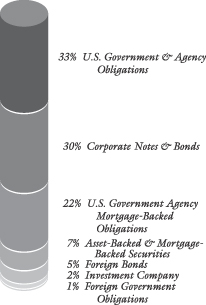

Select Investment Grade Income Fund

The Select Investment Grade Income Fund returned (0.08)% for the first half of 2004, underperforming its benchmark, the Lehman Brothers Aggregate Bond Index, which returned 0.15%.

Performance from the spread sectors was varied for the first six months of 2004. The asset-backed securities sector did best with an excess return of 53 basis points over U.S. Treasury Securities. The mortgaged-backed securities sector had excess return of 36 basis points, while the Agency sector had an excess return of 10 basis points. The corporate sector underperformed U.S. Treasury securities for the period, primarily as a result of a weak second quarter. Based on strong technical factors and fundamentals that continue to support the sector, the portfolio had a 50% overweight to the corporate bond sector. During the second quarter, the investment sub-adviser reduced the portfolio overweight to the corporate sector by half, in anticipation of spread volatility associated with the beginning of an interest rate tightening cycle. The reduction was primarily in those sectors that would be more negatively affected by rising interest rates: banks; finance and utilities.

The fund began the year with a neutral weighting to the mortgage-backed securities sector. As volatility hit low levels and fundamentals suggested that the sector was becoming fully valued, the investment sub-adviser reduced exposure to mortgage-backed securities to a slight underweight. This strategy was helpful until June when the sector posted large excess returns. Although recent economic data have generally been softer than expected, the investment sub-adviser feels that there have been no disruptions to threaten the scenario that the Federal Reserve Board has so carefully laid out – one of a “measured” reversal of policy accommodation.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Select Investment Grade Income Fund | | (0.25)% | | 6.01% | | 6.72% |

| | | |

Lehman Brothers Aggregate Bond Index | | 0.33% | | 6.95% | | 7.39% |

Lipper Intermediate Investment Grade

Debt Funds Average | | 0.29% | | 6.25% | | 6.89% |

Growth of a $10,000 Investment Since 1994

The Select Investment Grade Income Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Lehman Brothers Aggregate Bond Index is an unmanaged index of all fixed-rate debt issues with an investment grade rating, at least one year to maturity and an outstanding par value of at least $25 million. The Lipper Intermediate Investment Grade Debt Funds Average tracks the performance of funds investing in intermediate-term corporate and government debt securities.

Investment Sub-Adviser

Opus Investment Management, Inc.

About the Fund

Seeks to generate a high level of total return which includes income and capital appreciation.

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

8

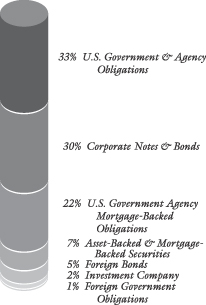

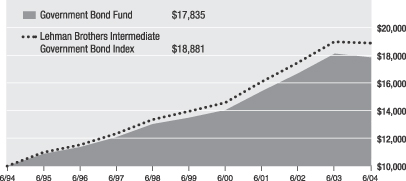

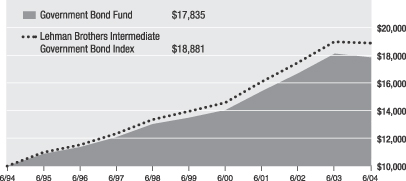

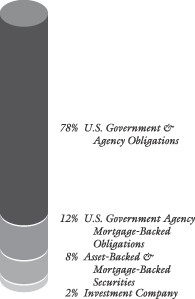

Government Bond Fund

The Government Bond Fund returned (0.47)% for the first half of 2004, underperforming its benchmark, the Lehman Brothers Intermediate Government Bond Index, which returned (0.15)%.

During the first quarter, the bond market was skeptical of the strength of the economic recovery, citing the lack of job creation. During the second quarter, after two impressive showings in monthly payroll growth and evidence of early inflationary pressure, market sentiment reversed itself, opining that the economy was too strong and that the Federal Reserve Board was potentially behind the inflation curve. This change in sentiment brought about a volatile first half for the bond market.

Performance from the spread sectors was strong in the first quarter but dismal during the second quarter. In Q1, investors’ craving for additional yield over U.S. Treasury securities helped Agencies post 28 basis points of excess return. In Q2, the transition to a Federal Reserve Board tightening cycle provided investors with many reasons to question valuations and reduce overall exposures. Evidence suggests that leveraged investors did just that, while retail-oriented mutual funds were forced to sell to meet redemptions. Intermediate maturity Agencies underperformed U.S. Treasury securities by 19 basis points, while asset-backed securities registered 15 basis points of negative excess return. The fund’s overweight to spread product, such as Agency securities, was the primary reason for outperformance in Q1 and underperformance in Q2 and the full period. Looking ahead, the investment sub-adviser plans to continue to overweight spread product as a source of outperformance for the fund, while intending to maintain a slightly shorter duration relative to the index during this Federal Reserve Board tightening cycle.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Government Bond Fund | | (1.58)% | | 5.73% | | 5.96% |

| | | |

Lehman Brothers Intermediate Government Bond Index | | (0.48)% | | 6.25% | | 6.56% |

Lipper General U.S. Government Funds Average | | (0.68)% | | 6.21% | | 6.63% |

Growth of a $10,000 Investment Since 1994

The Government Bond Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Fund is neither insured nor guaranteed by the U.S. Government.

The Lehman Brothers Intermediate Government Bond Index is an unmanaged index of U.S. Government and Agency bonds with remaining maturities of one to ten years. The Lipper General U.S. Government Funds Average is the non-weighted average performance of funds investing in general U.S. Government securities.

Investment Sub-Adviser

Opus Investment Management, Inc.

About the Fund

Seeks high income, capital preservation and maintenance of liquidity, primarily through investments in debt instruments issued or guaranteed by the U.S. Government or its Agencies.

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

9

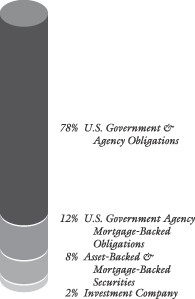

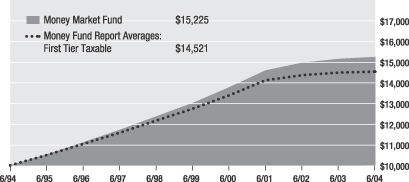

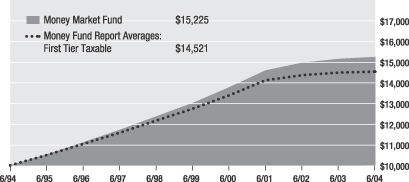

Money Market Fund

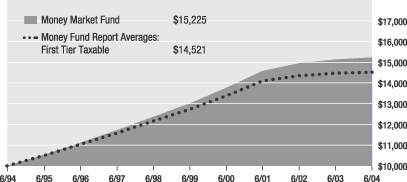

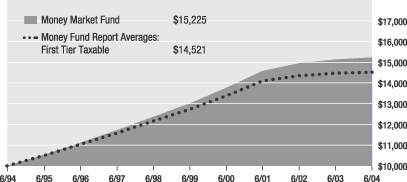

The Money Market Fund returned 0.32% for the first half of 2004, outperforming its benchmark, the Money Fund Report Averages: First Tier Taxable, which returned 0.19%.

The year started with mixed to weak economic data, heightened questions about job growth, and overhanging concerns about Iraq and terrorism. Things changed in April when the March non-farm payrolls number showed that an impressive 308,000 jobs were created. At its May meeting, the Federal Reserve Board signaled that it would likely raise the 1.00% federal funds rate by 25 basis points in the near future. Subsequently, economic data remained strong and inflation started to become a concern. At its June meeting, as expected, the Federal Reserve Board raised the federal funds rate to 1.25%. While reaction to the move was muted, the rate hike was confirmation that the Federal Reserve Board believed that the U.S. economy was headed back on the right track.

Within the fund, the investment sub-adviser continued to emphasize investments in floating-rate notes during the period. In anticipation of the Federal Reserve Board’s rate hike, the investment sub-adviser shortened average maturities from 70 days, on average, to the mid 50 day range, in order to better take advantage of a rising rate environment. The investment sub-adviser believes that the U.S. economy is back on solid footing. Expectations are that the Federal Reserve Board will stick to its measured pace of interest rate hikes and that the federal funds rate may climb to about 2.00% by year end. The investment sub-adviser plans to maintain a mid-range average maturity in the coming months to take advantage of these upcoming interest rate hikes.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For information on the current month end performance of variable annuity and variable life insurance products, please call: (800) 533-7881. The performance data quoted is net of all fund operating expenses, but does not include variable insurance or variable annuity charges. If the performance data included the effect of these additional charges, it would have been lower.

Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | 10 Year |

Money Market Fund | | 0.64% | | 3.21% | | 4.29% |

| | | |

Money Fund Report Averages: First Tier Taxable | | 0.39% | | 2.69% | | 3.80% |

Lipper Money Market Funds Average | | 0.53% | | 2.88% | | 3.99% |

Average Yield as of June 30, 2004

| | |

Money Market Fund 7-Day Yield | | 0.70% |

Growth of a $10,000 Investment Since 1994

The Money Market Fund is a portfolio of Allmerica Investment Trust. Portfolio composition will vary over time.

The Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to maintain a net asset value of $1.00 per share, it is possible to lose money by investing in the Fund.

Money Fund Report Averages: First Tier Taxable is published by iMoneyNet, Inc., an independent firm that tracks 2a-7 regulated money market funds on a yield, shareholder, asset size and portfolio allocation basis. The Lipper Money Market Funds Average is the average investment performance of funds within the money market category.

Investment Sub-Adviser

Opus Investment Management, Inc.

About the Fund

Seeks to maximize current income for investors while preserving capital and liquidity.

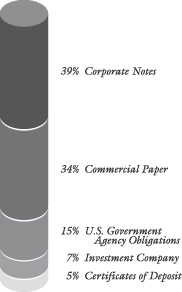

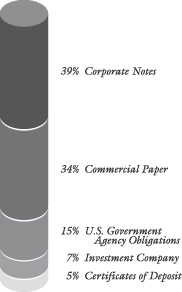

Portfolio Composition

As of June 30, 2004, the sector allocation of net assets was:

10

Financials

SELECT CAPITAL APPRECIATION FUND

PORTFOLIO OF INVESTMENTS • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

COMMON STOCKS - 97.2% | | | |

| | |

| | | Advertising - 0.8% | | | |

88,000 | | Catalina Marketing Corp. (a)* | | $ | 1,609,520 |

16,000 | | Lamar Advertising Co.* | | | 693,600 |

| | | | |

|

|

| | | | | | 2,303,120 |

| | | | |

|

|

| | | Aerospace & Defense - 2.3% | | | |

53,000 | | Alliant Techsystems, Inc. (a)* | | | 3,357,020 |

111,000 | | Rockwell Collins, Inc. | | | 3,698,520 |

| | | | |

|

|

| | | | | | 7,055,540 |

| | | | |

|

|

| | | Airlines - 0.6% | | | |

59,000 | | JetBlue Airways Corp. (a)* | | | 1,733,420 |

| | | | |

|

|

| | | Auto Manufacturers - 0.8% | | | |

43,000 | | Oshkosh Truck Corp. | | | 2,464,330 |

| | | | |

|

|

| | | Banks - 0.6% | | | |

29,000 | | Investors Financial Services Corp. | | | 1,263,820 |

16,000 | | Silicon Valley Bancshares* | | | 634,400 |

| | | | |

|

|

| | | | | | 1,898,220 |

| | | | |

|

|

| | | Beverages - 0.8% | | | |

80,000 | | Cott Corp.* | | | 2,592,000 |

| | | | |

|

|

| | | Biotechnology - 2.9% | | | |

15,000 | | Celgene Corp.* | | | 858,900 |

61,000 | | Human Genome Sciences, Inc.* | | | 709,430 |

23,000 | | Invitrogen Corp.* | | | 1,655,770 |

177,000 | | Medimmune, Inc.* | | | 4,141,800 |

40,000 | | Protein Design Labs, Inc.* | | | 765,200 |

58,000 | | Vertex Pharmaceuticals, Inc.* | | | 628,720 |

| | | | |

|

|

| | | | | | 8,759,820 |

| | | | |

|

|

| | | Building Materials - 0.9% | | | |

66,000 | | American Standard Companies, Inc.* | | | 2,660,460 |

| | | | |

|

|

| | | Chemicals - 1.0% | | | |

33,000 | | Potash Corp. of Saskatchewan, Inc. (a) | | | 3,197,700 |

| | | | |

|

|

| | | Commercial Services - 9.9% | | | |

16,000 | | Apollo Group, Inc.* | | | 1,412,640 |

131,000 | | BearingPoint, Inc.* | | | 1,161,970 |

94,000 | | Certegy, Inc. | | | 3,647,200 |

107,000 | | ChoicePoint, Inc.* | | | 4,885,620 |

61,000 | | Education Management* | | | 2,004,460 |

34,000 | | Fair Isaac Corp. | | | 1,134,920 |

7,000 | | Getty Images, Inc. (a)* | | | 420,000 |

27,000 | | Global Payments, Inc. | | | 1,215,540 |

78,000 | | Hewitt Associates, Inc.* | | | 2,145,000 |

57,000 | | Iron Mountain, Inc.* | | | 2,750,820 |

72,000 | | Manpower, Inc. | | | 3,655,440 |

89,000 | | Robert Half International, Inc. | | | 2,649,530 |

101,000 | | Viad Corp. | | | 2,728,010 |

| | | | |

|

|

| | | | | | 29,811,150 |

| | | | |

|

|

| | | Computers - 5.6% | | | |

23,000 | | CACI International, Inc., Class A* | | $ | 930,120 |

133,000 | | Cadence Design Systems, Inc. (a)* | | | 1,945,790 |

127,000 | | Ceridian Corp. (a)* | | | 2,857,500 |

46,000 | | Diebold Inc. | | | 2,432,020 |

78,000 | | DST Systems, Inc.* | | | 3,751,020 |

16,000 | | Lexmark International Group, Inc.* | | | 1,544,480 |

31,000 | | Research In Motion* | | | 2,121,640 |

48,000 | | SunGard Data Systems, Inc.* | | | 1,248,000 |

| | | | |

|

|

| | | | | | 16,830,570 |

| | | | |

|

|

| | | Diversified Financial Services - 3.7% | | | |

137,000 | | Ameritrade Holding Corp.* | | | 1,554,950 |

83,000 | | CapitalSource, Inc. (a)* | | | 2,029,350 |

54,000 | | Eaton Vance Corp. | | | 2,063,340 |

35,000 | | Federated Investors, Inc., Class B | | | 1,061,900 |

20,000 | | Legg Mason, Inc. | | | 1,820,200 |

116,000 | | Waddell & Reed Financial, Class A | | | 2,564,760 |

| | | | |

|

|

| | | | | | 11,094,500 |

| | | | |

|

|

| | | Electronics - 2.1% | | | |

35,000 | | Flir Systems, Inc. (a)* | | | 1,921,500 |

45,000 | | Garmin, Ltd. (a) | | | 1,666,800 |

49,000 | | Jabil Circuit, Inc.* | | | 1,233,820 |

35,000 | | Waters Corp.* | | | 1,672,300 |

| | | | |

|

|

| | | | | | 6,494,420 |

| | | | |

|

|

| | | Food - 1.1% | | | |

35,000 | | Whole Foods Market, Inc. (a) | | | 3,340,750 |

| | | | |

|

|

| | | Health Care - Products - 1.4% | | | |

46,000 | | Edwards Lifesciences Corp.* | | | 1,603,100 |

55,000 | | Kinetic Concepts, Inc.* | | | 2,744,500 |

| | | | |

|

|

| | | | | | 4,347,600 |

| | | | |

|

|

| | | Health Care - Services - 4.2% | | | |

3,000 | | Anthem, Inc. (a)* | | | 268,680 |

37,000 | | Community Health Systems, Inc.* | | | 990,490 |

26,000 | | Coventry Health Care, Inc.* | | | 1,271,400 |

39,000 | | Davita, Inc.* | | | 1,202,370 |

129,000 | | Health Management Associates, Inc., Class A (a) | | | 2,892,180 |

69,000 | | Laboratory Corp. of America Holdings* | | | 2,739,300 |

99,000 | | Manor Care, Inc. | | | 3,235,320 |

| | | | |

|

|

| | | | | | 12,599,740 |

| | | | |

|

|

| | | Insurance - 3.7% | | | |

50,000 | | Assurant, Inc. | | | 1,319,000 |

43,000 | | Axis Capital Holdings, Ltd. | | | 1,204,000 |

53,000 | | Genworth Financial, Inc., Class A (a)* | | | 1,216,350 |

53,000 | | Principal Financial Group, Inc. | | | 1,843,340 |

42,000 | | Protective Life Corp. | | | 1,624,140 |

35,000 | | Radian Group, Inc. | | | 1,676,500 |

60,000 | | Willis Group Holdings, Ltd. | | | 2,247,000 |

| | | | |

|

|

| | | | | | 11,130,330 |

| | | | |

|

|

See Notes to Financial Statements.

F-1

SELECT CAPITAL APPRECIATION FUND

PORTFOLIO OF INVESTMENTS, Continued • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

| | | Internet - 3.5% | | | |

32,000 | | CheckFree Corp. (a)* | | $ | 960,000 |

39,000 | | CNET Networks, Inc. (a)* | | | 431,730 |

23,000 | | InterActiveCorp (a)* | | | 693,220 |

67,000 | | Monster Worldwide, Inc.* | | | 1,723,240 |

177,000 | | Network Associates, Inc.* | | | 3,209,010 |

160,000 | | VeriSign, Inc.* | | | 3,184,000 |

29,000 | | WebMD Corp.* | | | 270,280 |

| | | | |

|

|

| | | | | | 10,471,480 |

| | | | |

|

|

| | | Iron & Steel - 1.4% | | | |

40,000 | | International Steel Group, Inc. (a)* | | | 1,190,000 |

41,000 | | Nucor Corp. | | | 3,147,160 |

| | | | |

|

|

| | | | | | 4,337,160 |

| | | | |

|

|

| | | Leisure Time - 1.2% | | | |

86,000 | | Brunswick Corp. (a) | | | 3,508,800 |

| | | | |

|

|

| | | Lodging - 0.9% | | | |

98,000 | | Fairmont Hotels & Resorts, Inc. | | | 2,641,100 |

| | | | |

|

|

| | | Manufacturing - Miscellaneous - 2.9% | | | |

50,000 | | Danaher Corp. | | | 2,592,500 |

33,000 | | ITT Industries, Inc. | | | 2,739,000 |

59,000 | | Roper Industries, Inc. | | | 3,357,100 |

| | | | |

|

|

| | | | | | 8,688,600 |

| | | | |

|

|

| | | Media - 3.6% | | | |

66,000 | | Cablevision Systems Corp.* | | | 1,296,900 |

169,000 | | Citadel Broadcasting Corp. (a)* | | | 2,462,330 |

70,000 | | Cox Radio, Inc.* | | | 1,216,600 |

25,000 | | Entercom Communications Corp.* | | | 932,500 |

83,000 | | Rogers Communications, Inc., Class B (a) | | | 1,504,790 |

51,000 | | Scholastic Corp. (a)* | | | 1,527,450 |

67,000 | | XM Satellite Radio Holdings, Inc. (a)* | | | 1,828,430 |

| | | | |

|

|

| | | | | | 10,769,000 |

| | | | |

|

|

| | | Mining - 0.7% | | | |

53,000 | | Newmont Mining Corp. | | | 2,054,280 |

| | | | |

|

|

| | | Oil & Gas - 4.6% | | | |

96,000 | | Diamond Offshore Drilling, Inc. (a) | | | 2,287,680 |

54,000 | | EOG Resources, Inc. | | | 3,224,340 |

47,000 | | Murphy Oil Corp. | | | 3,463,900 |

68,000 | | Western Gas Resources, Inc. | | | 2,208,640 |

87,000 | | XTO Energy, Inc. | | | 2,591,730 |

| | | | |

|

|

| | | | | | 13,776,290 |

| | | | |

|

|

| | | Oil & Gas Services - 4.3% | | | |

99,000 | | BJ Services Co.* | | | 4,538,160 |

48,000 | | Cooper Cameron Corp.* | | | 2,337,600 |

72,000 | | FMC Technologies, Inc.* | | | 2,073,600 |

71,000 | | Smith International, Inc.* | | | 3,958,960 |

| | | | |

|

|

| | | | | | 12,908,320 |

| | | | |

|

|

| | | Pharmaceuticals - 9.8% | | | |

54,000 | | Abgenix, Inc. (a)* | | $ | 632,880 |

56,000 | | Alkermes, Inc. (a)* | | | 761,600 |

45,000 | | AmerisourceBergen Corp. | | | 2,690,100 |

38,000 | | Amylin Pharmaceuticals, Inc. (a)* | | | 866,400 |

57,000 | | Andrx Corp. (a)* | | | 1,592,010 |

35,000 | | Barr Pharmaceuticals* | | | 1,179,500 |

39,000 | | Cephalon, Inc. (a)* | | | 2,106,000 |

44,000 | | Gilead Sciences, Inc.* | | | 2,948,000 |

25,000 | | ICOS Corp. (a)* | | | 746,000 |

27,000 | | ImClone Systems, Inc. (a)* | | | 2,316,330 |

115,000 | | IVAX Corp. (a)* | | | 2,758,850 |

22,000 | | Neurocrine Biosciences, Inc.* | | | 1,140,700 |

135,000 | | Omnicare, Inc. (a) | | | 5,779,350 |

7,000 | | Sepracor, Inc. (a)* | | | 370,300 |

35,800 | | Taro Pharmaceuticals Industries (a)* | | | 1,557,300 |

42,200 | | Valeant Pharmaceuticals International | | | 844,000 |

48,000 | | Watson Pharmaceuticals, Inc. (a)* | | | 1,291,200 |

| | | | |

|

|

| | | | | | 29,580,520 |

| | | | |

|

|

| | | Retail - 7.5% | | | |

46,000 | | Best Buy Co., Inc. | | | 2,334,040 |

33,000 | | CDW Corp. | | | 2,104,080 |

66,000 | | Dollar Tree Stores, Inc.* | | | 1,810,380 |

96,000 | | Family Dollar Stores, Inc. | | | 2,920,320 |

11,000 | | MSC Industrial Direct Co., Class A (a) | | | 361,240 |

41,000 | | O’Reilly Automotive, Inc.* | | | 1,853,200 |

26,000 | | P.F. Chang’s China Bistro, Inc. (a)* | | | 1,069,900 |

104,000 | | Petsmart, Inc. (a) | | | 3,374,800 |

76,000 | | Ross Stores, Inc. | | | 2,033,760 |

43,000 | | Shoppers Drug Mart Corp. | | | 1,071,191 |

48,000 | | The Cheesecake Factory, Inc. (a)* | | | 1,909,920 |

59,000 | | Williams-Sonoma, Inc. (a)* | | | 1,944,640 |

| | | | |

|

|

| | | | | | 22,787,471 |

| | | | |

|

|

| | | Semiconductors - 4.3% | | | |

237,000 | | Agere Systems, Inc.* | | | 509,550 |

180,000 | | Agere Systems, Inc., Class A (a)* | | | 414,000 |

74,000 | | Amis Holdings, Inc.* | | | 1,252,080 |

61,000 | | Integrated Circuit Systems, Inc.* | | | 1,656,760 |

108,000 | | Intersil Corp., Class A | | | 2,339,280 |

78,000 | | Microchip Technology, Inc. | | | 2,460,120 |

49,000 | | Novellus Systems, Inc.* | | | 1,540,560 |

52,000 | | QLogic Corp.* | | | 1,382,680 |

61,000 | | Semtech Corp.* | | | 1,435,940 |

| | | | |

|

|

| | | | | | 12,990,970 |

| | | | |

|

|

| | | Software - 3.7% | | | |

49,000 | | Adobe Systems, Inc. | | | 2,278,500 |

29,000 | | Citrix Systems, Inc.* | | | 590,440 |

15,000 | | Cognos, Inc.* | | | 542,400 |

53,000 | | Fiserv, Inc.* | | | 2,061,170 |

43,000 | | Intuit, Inc.* | | | 1,658,940 |

51,000 | | Jack Henry & Associates, Inc. | | | 1,025,100 |

36,000 | | Mercury Interactive Corp. (a)* | | | 1,793,880 |

60,000 | | Red Hat, Inc. (a)* | | | 1,378,200 |

| | | | |

|

|

| | | | | | 11,328,630 |

| | | | |

|

|

See Notes to Financial Statements.

F-2

SELECT CAPITAL APPRECIATION FUND

PORTFOLIO OF INVESTMENTS, Continued • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

| | | Telecommunications - 5.2% | | | |

51,000 | | Comverse Technology, Inc.* | | $ | 1,016,940 |

155,000 | | Crown Castle International Corp.* | | | 2,286,250 |

73,000 | | Harris Corp., Inc. | | | 3,704,750 |

58,000 | | Juniper Networks, Inc.* | | | 1,425,060 |

47,000 | | Nextel Communications, Inc., Class A* | | | 1,253,020 |

124,000 | | Nextel Partners, Inc., Class A* | | | 1,974,080 |

41,000 | | Triton PCS Holdings, Inc.* | | | 178,760 |

131,000 | | Western Wireless Corp., Class A (a)* | | | 3,787,210 |

| | | | |

|

|

| | | | | | 15,626,070 |

| �� | | | |

|

|

| | | Transportation - 1.2% | | | |

41,000 | | C.H. Robinson Worldwide, Inc. | | | 1,879,440 |

35,000 | | Expeditors International of Washington, Inc. | | | 1,729,350 |

| | | | |

|

|

| | | | | | 3,608,790 |

| | | | |

|

|

| | | Total Common Stocks (Cost $222,568,017) | | | 293,391,151 |

| | | | |

|

|

Par Value | | | | | |

U.S. GOVERNMENT AGENCY OBLIGATIONS (b) - 2.8% |

| | |

| | | Fannie Mae - 1.7% | | | |

$5,000,000 | | 1.27%, 08/11/04 | | | 4,992,768 |

| | | | |

|

|

| | | Federal Home Loan Bank - 1.1% | | | |

3,185,000 | | 1.20%, 07/01/04 | | | 3,185,000 |

| | | | |

|

|

| | | Freddie Mac - 0.0% | | | |

124,000 | | 1.22%, 07/07/04 | | | 123,975 |

| | | | |

|

|

| | | Total U.S. Government Agency Obligations (Cost $8,301,743) | | | 8,301,743 |

| | | | |

|

|

| |

Total Investments - 100.0% (Cost $230,869,760) | | | 301,692,894 |

| | | | |

|

|

Net Other Assets and Liabilities - 0.0% | | | 92,184 |

| | | | |

|

|

Total Net Assets - 100.0% | | $ | 301,785,078 |

| | | | |

|

|

| * | Non-income producing security. |

| (a) | All or a portion of this security is out on loan at June 30, 2004; the value of the securities loaned amounted to $60,259,083. The value of collateral amounted to $62,987,027 which consisted of cash equivalents. |

| (b) | Effective yield at time of purchase. |

FEDERAL INCOME TAX INFORMATION (SEE NOTE 2)

At June 30, 2004, the aggregate cost of investment securities for tax purposes was $236,311,845. Net unrealized appreciation (depreciation) aggregated $65,381,049, of which $71,986,374 related to appreciated investment securities and $(6,605,325) related to depreciated investment securities.

OTHER INFORMATION

For the six months ended June 30, 2004, the aggregate cost of purchases and the proceeds of sales, other than from short-term investments, included $69,352,301 and $87,557,989 of non-governmental issuers, respectively.

See Notes to Financial Statements.

F-3

SELECT VALUE OPPORTUNITY FUND

PORTFOLIO OF INVESTMENTS • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

COMMON STOCKS - 96.8% | | | |

| | |

| | | Aerospace & Defense - 6.8% | | | |

223,400 | | Goodrich (B.F.) Co. | | $ | 7,222,522 |

208,050 | | Moog, Inc., Class A* | | | 7,720,735 |

238,400 | | United Defense Industries, Inc.* | | | 8,344,000 |

| | | | |

|

|

| | | | | | 23,287,257 |

| | | | |

|

|

| | | Auto Manufacturers - 1.8% | | | |

108,100 | | Oshkosh Truck Corp. | | | 6,195,211 |

| | | | |

|

|

| | | Auto Parts & Equipment - 0.0% | | | |

267,700 | | Mascotech, Inc. (a) | | | 0 |

| | | | |

|

|

| | | Banks - 3.6% | | | |

183,300 | | Hibernia Corp., Class A | | | 4,454,190 |

210,350 | | North Fork Bancorp., Inc. | | | 8,003,818 |

| | | | |

|

|

| | | | | | 12,458,008 |

| | | | |

|

|

| | | Beverages - 1.3% | | | |

118,200 | | Constellation Brands, Inc.* | | | 4,388,766 |

| | | | |

|

|

| | | Building Materials - 1.7% | | | |

142,900 | | York International Corp. | | | 5,868,903 |

| | | | |

|

|

| | | Chemicals - 10.8% | | | |

400,000 | | Airgas, Inc. | | | 9,564,000 |

129,120 | | Georgia Gulf Corp. | | | 4,630,243 |

159,800 | | International Flavors & Fragrances, Inc. | | | 5,976,520 |

473,500 | | Lyondell Chemical Co. (b) | | | 8,234,165 |

662,700 | | Methanex Corp. | | | 8,761,557 |

| | | | |

|

|

| | | | | | 37,166,485 |

| | | | |

|

|

| | | Commercial Services - 6.1% | | | |

144,060 | | Aramark Services, Inc., Class B | | | 4,143,166 |

420,500 | | BISYS Group, Inc. (b)* | | | 5,912,230 |

106,610 | | Manpower, Inc. (b) | | | 5,412,590 |

168,212 | | R. R. Donnelley & Sons Co. | | | 5,554,360 |

| | | | |

|

|

| | | | | | 21,022,346 |

| | | | |

|

|

| | | Diversified Financial Services - 0.8% | | | |

233,300 | | E*TRADE Financial Corp.* | | | 2,601,295 |

| | | | |

|

|

| | | Electric - 1.8% | | | |

225,300 | | PG&E Corp.* | | | 6,294,882 |

| | | | |

|

|

| | | Entertainment - 2.8% | | | |

201,700 | | Alliance Gaming Corp.* | | | 3,461,172 |

377,200 | | Intrawest Corp. (b) | | | 6,016,340 |

| | | | |

|

|

| | | | | | 9,477,512 |

| | | | |

|

|

| | | Environmental Control - 2.9% | | | |

364,500 | | Watts Industries, Inc., Class A | | | 9,823,275 |

| | | | |

|

|

| | | Forest Products & Paper - 1.1% | | | |

96,800 | | Boise Cascade Corp. | | $ | 3,643,552 |

| | | | |

|

|

| | | Hand & Machine Tools - 3.2% | | | |

107,800 | | Snap-On, Inc. | | | 3,616,690 |

160,200 | | Stanley Works (b) | | | 7,301,916 |

| | | | |

|

|

| | | | | | 10,918,606 |

| | | | |

|

|

| | | Health Care - Products - 1.6% | | | |

94,280 | | C.R. Bard, Inc. | | | 5,340,962 |

| | | | |

|

|

| | | Health Care - Services - 1.3% | | | |

176,600 | | Kindred Healthcare, Inc.* | | | 4,653,410 |

| | | | |

|

|

| | | Holding Companies - Diversified - 2.7% | | | |

324,300 | | Brascan Corp., Class A (b) | | | 9,158,232 |

| | | | |

|

|

| | | Home Builders - 1.8% | | | |

180,700 | | Thor Industries, Inc. (b) | | | 6,046,222 |

| | | | |

|

|

| | | Insurance - 10.5% | | | |

90,400 | | AMBAC Financial Group, Inc. | | | 6,638,976 |

241,000 | | Assurant, Inc. | | | 6,357,580 |

144,090 | | Everest Re Group, Ltd. | | | 11,579,072 |

149,000 | | Fidelity National Financial, Inc. | | | 5,563,660 |

161,300 | | Willis Group Holdings, Ltd. | | | 6,040,685 |

| | | | |

|

|

| | | | | | 36,179,973 |

| | | | |

|

|

| | | Leisure Time - 1.7% | | | |

134,700 | | Royal Caribbean Cruises, Ltd. (b) | | | 5,847,327 |

| | | | |

|

|

| | | Machinery - Diversified - 1.5% | | | |

247,700 | | UNOVA, Inc. (b)* | | | 5,015,925 |

| | | | |

|

|

| | | Manufacturing - Miscellaneous - 1.2% | | | |

133,600 | | A.O. Smith Corp. | | | 4,247,144 |

| | | | |

|

|

| | | Media - 6.8% | | | |

215,500 | | Belo Corp. | | | 5,786,175 |

249,686 | | Cablevision Systems Corp.* | | | 4,906,330 |

207,700 | | Entercom Communications Corp.* | | | 7,747,210 |

68,800 | | Knight-Ridder, Inc. (b) | | | 4,953,600 |

| | | | |

|

|

| | | | | | 23,393,315 |

| | | | |

|

|

| | | Metal Fabricate & Hardware - 1.6% | | | |

183,000 | | Kaydon Corp. | | | 5,660,190 |

| | | | |

|

|

| | | Oil & Gas - 2.0% | | | |

399,600 | | Pride International, Inc. (b)* | | | 6,837,156 |

| | | | |

|

|

| | | Oil & Gas Services - 1.5% | | | |

114,100 | | Weatherford International, Ltd.* | | | 5,132,218 |

| | | | |

|

|

See Notes to Financial Statements.

F-4

SELECT VALUE OPPORTUNITY FUND

PORTFOLIO OF INVESTMENTS, Continued • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

| | | Pharmaceuticals - 1.4% | | | |

114,200 | | Omnicare, Inc. (b) | | $ | 4,888,902 |

| | | | |

|

|

| | | Real Estate - 0.5% | | | |

43,200 | | The St. Joe Co. (b) | | | 1,715,040 |

| | | | |

|

|

| | | Retail - 6.4% | | | |

290,400 | | CSK Auto Corp.* | | | 4,977,456 |

265,700 | | Dollar Tree Stores, Inc.* | | | 7,288,151 |

211,600 | | Insight Enterprises, Inc.* | | | 3,758,016 |

201,100 | | Tuesday Morning Corp.* | | | 5,831,900 |

| | | | |

|

|

| | | | | | 21,855,523 |

| | | | |

|

|

| | | Semiconductors - 1.6% | | | |

1,269,900 | | Conexant Systems, Inc.* | | | 5,498,667 |

| | | | |

|

|

| | | Software - 3.5% | | | |

172,500 | | Hyperion Solutions Corp.* | | | 7,541,700 |

192,300 | | NDCHealth Corp. (b) | | | 4,461,360 |

| | | | |

|

|

| | | | | | 12,003,060 |

| | | | |

|

|

| | | Telecommunications - 2.7% | | | |

154,200 | | Amdocs, Ltd.* | | | 3,612,906 |

958,300 | | Arris Group, Inc. (b)* | | | 5,692,302 |

| | | | |

|

|

| | | | | | 9,305,208 |

| | | | |

|

|

| | | Transportation - 1.8% | | | |

194,200 | | CSX Corp. | | | 6,363,934 |

| | | | |

|

|

| | | Total Common Stocks (Cost $284,653,927) | | | 332,288,506 |

| | | | |

|

|

| |

Total Investments - 96.8% (Cost $284,653,927) | | | 332,288,506 |

| | | | |

|

|

Net Other Assets and Liabilities - 3.2% | | | 10,991,741 |

| | | | |

|

|

Total Net Assets - 100.0% | | $ | 343,280,247 |

| | | | |

|

|

| * | Non-income producing security. |

| (a) | Contingent Value Obligation. |

| (b) | All or a portion of this security is out on loan at June 30, 2004; the value of the securities loaned amounted to $45,788,751. The value of collateral amounted to $47,855,415 which consisted of cash equivalents. |

FEDERAL INCOME TAX INFORMATION (SEE NOTE 2)

At June 30, 2004, the aggregate cost of investment securities for tax purposes was $285,444,209. Net unrealized appreciation (depreciation) aggregated $46,844,297, of which $50,974,567 related to appreciated investment securities and $(4,130,270) related to depreciated investment securities.

OTHER INFORMATION

For the six months ended June 30, 2004, the aggregate cost of purchases and the proceeds of sales, other than from short-term investments, included $174,094,426 and $229,590,061 of non-governmental issuers, respectively.

See Notes to Financial Statements.

F-5

SELECT INTERNATIONAL EQUITY FUND

PORTFOLIO OF INVESTMENTS • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

COMMON STOCKS - 97.8% | | | |

| | |

| | | Australia - 2.1% | | | |

171,597 | | James Hardie Industries NV | | $ | 715,714 |

105,363 | | National Australia Bank, Ltd. | | | 2,185,574 |

273,727 | | News Corp., Ltd. | | | 2,412,767 |

159,561 | | Westpac Banking Corp., Ltd. | | | 1,952,171 |

| | | | |

|

|

| | | | | | 7,266,226 |

| | | | |

|

|

| | | Canada - 0.4% | | | |

32,793 | | Royal Bank of Canada (a) | | | 1,446,243 |

| | | | |

|

|

| | | Finland - 1.0% | | | |

240,806 | | Nokia Oyj | | | 3,478,701 |

| | | | |

|

|

| | | France - 9.8% | | | |

96,747 | | Aventis (a) | | | 7,312,138 |

168,609 | | Axa | | | 3,717,273 |

73,288 | | BNP Paribas (a) | | | 4,512,520 |

113,058 | | France Telecom SA | | | 2,949,755 |

38,799 | | Lafarge SA | | | 3,464,094 |

60,697 | | Total SA, Class B | | | 11,585,141 |

| | | | |

|

|

| | | | | | 33,540,921 |

| | | | |

|

|

| | | Germany - 6.0% | | | |

96,753 | | Bayer AG | | | 2,793,045 |

130,740 | | Bayerische Motoren Werke (BMW) AG | | | 5,791,844 |

45,229 | | Deutsche Bank AG (a) | | | 3,557,789 |

115,537 | | Veba AG | | | 8,345,280 |

| | | | |

|

|

| | | | | | 20,487,958 |

| | | | |

|

|

| | | Hong Kong - 3.6% | | | |

272,000 | | Cheung Kong Holdings, Ltd. | | | 2,005,218 |

271,000 | | Esprit Holdings, Ltd. | | | 1,212,606 |

186,400 | | Hang Seng Bank, Ltd. | | | 2,389,851 |

950,000 | | Johnson Electric Holdings, Ltd. | | | 968,313 |

814,000 | | Li & Fung, Ltd. | | | 1,189,746 |

305,000 | | Sun Hung Kai Properties, Ltd. | | | 2,502,676 |

291,000 | | Swire Pacific, Ltd. | | | 1,884,123 |

| | | | |

|

|

| | | | | | 12,152,533 |

| | | | |

|

|

| | | Ireland - 0.9% | | | |

148,082 | | CRH, Plc | | | 3,138,460 |

| | | | |

|

|

| | | Italy - 3.6% | | | |

362,165 | | ENI SpA (a) | | | 7,199,324 |

1,622,383 | | Telecom Italia SpA | | | 5,049,047 |

| | | | |

|

|

| | | | | | 12,248,371 |

| | | | |

|

|

| | | Japan - 17.5% | | | |

6,630 | | Acom Co., Ltd. | | | 430,011 |

196,900 | | Canon, Inc. | | | 10,356,996 |

39,800 | | Fanuc, Ltd. | | | 2,370,196 |

135,400 | | Honda Motor Co., Ltd. | | | 6,515,153 |

41,400 | | Hoya Corp. | | | 4,325,006 |

353 | | Japan Tobacco, Inc. | | | 2,738,362 |

164 | | Millea Holdings, Inc. | | | 2,430,408 |

337 | | Mitsubishi Tokyo Financial Group, Inc. | | | 3,113,662 |

227,000 | | Mitsui Sumitomo Insurance Co., Ltd. | | | 2,128,482 |

1,423 | | Nippon Telegraph & Telephone Corp. | | | 7,589,160 |

1,260 | | NTT Mobile Communcations Network, Inc. | | | 2,247,633 |

94,000 | | Ricoh Co., Ltd. | | | 1,994,969 |

19,400 | | Rohm Co., Ltd. | | | 2,317,742 |

88,300 | | Shin-Etsu Chemical Co., Ltd. | | | 3,150,254 |

130,000 | | Shionogi & Co., Ltd. | | | 2,230,984 |

443 | | Sumitomo Mitsui Financial Group, Inc. (a) | | | 3,031,277 |

59,000 | | Takeda Chemical Industries, Ltd. | | | 2,585,281 |

| | | | |

|

|

| | | | | | 59,555,576 |

| | | | |

|

|

| | | Netherlands - 8.4% | | | |

306,845 | | ABN-Amro Holdings | | | 6,720,071 |

209,354 | | Elsevier NV | | | 2,942,742 |

37,667 | | Heineken NV | | | 1,239,227 |

354,589 | | ING Groep NV | | | 8,378,998 |

65,760 | | Koninklijke Ahold NV* | | | 516,638 |

212,243 | | Koninklijke (Royal) Phillips Electronics NV | | | 5,721,105 |

82,277 | | TNT Post Group NV | | | 1,882,085 |

47,253 | | VNU NV | | | 1,373,874 |

| | | | |

|

|

| | | | | | 28,774,740 |

| | | | |

|

|

| | | Singapore - 0.6% | | | |

262,000 | | United Overseas Bank, Ltd. | | | 2,039,621 |

| | | | |

|

|

| | | South Korea - 4.2% | | | |

35,670 | | Hyundai Motor Co., Ltd. | | | 1,372,160 |

99,060 | | Korea Electric Power Corp. | | | 1,594,562 |

43,330 | | Korea Telecom Corp. | | | 1,449,333 |

19,950 | | POSCO | | | 2,572,523 |

17,826 | | Samsung Electronics Co. | | | 7,358,721 |

| | | | |

|

|

| | | | | | 14,347,299 |

| | | | |

|

|

| | | Spain - 3.0% | | | |

517,053 | | Banco de Santander | | | 5,372,163 |

331,122 | | Telefonica SA | | | 4,900,376 |

| | | | |

|

|

| | | | | | 10,272,539 |

| | | | |

|

|

| | | Switzerland - 12.2% | | | |

46,858 | | Nestle SA | | | 12,500,956 |

167,488 | | Novartis AG | | | 7,391,439 |

65,127 | | Roche Holdings AG | | | 6,450,536 |

82,596 | | Swiss Reinsurance Co. | | | 5,366,975 |

139,765 | | UBS AG | | | 9,852,040 |

| | | | |

|

|

| | | | | | 41,561,946 |

| | | | |

|

|

| | | Taiwan - 0.6% | | | |

229,814 | | Taiwan Semiconductor Manufacturing Co., ADR (a) | | | 1,909,752 |

| | | | |

|

|

| | | United Kingdom - 23.9% | | | |

708,946 | | Barclays, Plc | | | 6,036,288 |

224,344 | | British American Tobacco Industries, Plc | | | 3,474,694 |

See Notes to Financial Statements.

F-6

SELECT INTERNATIONAL EQUITY FUND

PORTFOLIO OF INVESTMENTS, Continued • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

| | | United Kingdom (continued) | | | |

470,649 | | BT Group, Plc | | $ | 1,693,354 |

361,131 | | Cadbury Schweppes, Plc | | | 3,114,107 |

501,865 | | Centrica, Plc | | | 2,042,176 |

449,238 | | Compass Group, Plc, Sponsored ADR | | | 2,740,006 |

300,015 | | Diageo, Plc | | | 4,043,095 |

90,695 | | Enterprise Inns Plc | | | 945,238 |

236,625 | | GlaxoSmithKline, Plc | | | 4,786,464 |

60,820 | | GUS, Plc | | | 932,073 |

517,760 | | HSBC Holdings, Plc | | | 7,695,420 |

461,821 | | Kingfisher, Plc | | | 2,396,123 |

139,394 | | Marks & Spencer Group, Plc | | | 916,519 |

300,485 | | Prudential Corp., Plc | | | 2,584,336 |

165,137 | | Reed Elsevier, Plc | | | 1,604,350 |

164,187 | | Royal Bank of Scotland | | | 4,725,843 |

319,821 | | Smith & Nephew, Plc | | | 3,440,469 |

95,292 | | Smiths Group, Plc | | | 1,289,366 |

1,188,725 | | Tesco, Plc | | | 5,736,685 |

246,487 | | Tomkins, Plc | | | 1,226,384 |

38,099 | | Travis Perkins, Plc | | | 948,144 |

531,355 | | Unilever, Plc | | | 5,210,412 |

3,219,151 | | Vodafone Airtouch, Plc | | | 7,045,608 |

60,509 | | Whitbread, Plc | | | 902,082 |

253,186 | | Wolseley, Plc | | | 3,923,700 |

195,734 | | WPP Group, Plc | | | 1,986,755 |

| | | | |

|

|

| | | | | | 81,439,691 |

| | | | |

|

|

| | | Total Common Stocks (Cost $302,872,459) | | | 333,660,577 |

| | | | |

|

|

| |

PREFERRED STOCKS - 0.1% | | | |

| | |

| | | France - 0.1% | | | |

13,241 | | AXA Preferred, Convertible | | | 296,114 |

| | | | |

|

|

| | | Total Preferred Stocks (Cost $197,489) | | | 296,114 |

| | | | |

|

|

| |

RIGHTS - 0.0% | | | |

| | |

| | | Thailand - 0.0% | | | |

100,421 | | TelecomAsia Corp., Public Co., Ltd. (b)* | | | 0 |

| | | | |

|

|

| | | United Kingdom - 0.0% | | | |

332,400 | | Ti Automotive, Ltd. (b)* | | | 0 |

| | | | |

|

|

| | | Total Rights (Cost $68,642) | | | 0 |

| | | | |

|

|

| |

Total Investments - 97.9% (Cost $303,138,590) | | | 333,956,691 |

| | | | |

|

|

| | | | |

Net Other Assets and Liabilities - 2.1% | | | 7,039,334 |

| | | | |

|

|

Total Net Assets - 100.0% | | $ | 340,996,025 |

| | | | |

|

|

| * | Non-income producing security. |

| (a) | All or a portion of this security is out on loan at June 30, 2004; the value of the securities loaned amounted to $21,471,927. The value of collateral amounted to $22,723,493 which consisted of cash equivalents. |

| (b) | Contingent Value Obligation. |

| ADR | American Depositary Receipt. Shares of a foreign based corporation held in U.S. banks entitling the shareholder to all dividends and capital gains. |

FEDERAL INCOME TAX INFORMATION (SEE NOTE 2)

At June 30, 2004, the aggregate cost of investment securities for tax purposes was $312,421,255. Net unrealized appreciation (depreciation) aggregated $21,535,436, of which $40,944,750 related to appreciated investment securities and $(19,409,314) related to depreciated investment securities.

OTHER INFORMATION

For the six months ended June 30, 2004, the aggregate cost of purchases and the proceeds of sales, other than from short-term investments, included $42,588,530 and $84,148,458 of non-governmental issuers, respectively.

FORWARD FOREIGN CURRENCY CONTRACTS SOLD:

| | | | | | | | | | | | | | |

Contracts To Deliver

| | Currency

| | Settlement

Date

| | Contracts At

Value

| | In Exchange

For U.S. $

| | Unrealized

Depreciation

| |

32,132,988 | | JPY | | 07/01/04 | | $ | 97,983 | | $ | 97,901 | | $ | (82 | ) |

| | | | | | |

|

| |

|

| |

|

|

|

Industry Concentration of Investments

as a Percentage of Net Assets:

| | | |

Advertising | | 0.6 | % |

Agriculture | | 1.8 | |

Auto Manufacturers | | 4.0 | |

Banks | | 17.6 | |

Beverages | | 1.6 | |

Building Materials | | 2.4 | |

Chemicals | | 1.7 | |

Distribution & Wholesale | | 1.9 | |

Diversified Financial Services | | 0.1 | |

Electric | | 2.9 | |

Electrical Components & Equipment | | 2.4 | |

Electronics | | 2.9 | |

Food | | 7.9 | |

Food Service | | 0.8 | |

Gas | | 0.6 | |

Health Care-Products | | 2.3 | |

Holding Companies - Diversified | | 0.9 | |

Home Furnishings | | 1.4 | |

Insurance | | 7.3 | |

Iron & Steel | | 0.8 | |

Manufacturing - Miscellaneous | | 0.4 | |

Media | | 2.4 | |

Office & Business Equipment | | 3.6 | |

Oil & Gas | | 5.5 | |

Pharmaceuticals | | 9.0 | |

Real Estate | | 1.3 | |

Retail | | 1.8 | |

Semiconductors | | 0.7 | |

Telecommunications | | 10.7 | |

Transportation | | 0.6 | |

Net Other Assets and Liabilities | | 2.1 | |

| | |

|

|

Total | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

F-7

SELECT GROWTH FUND

PORTFOLIO OF INVESTMENTS • June 30, 2004 (Unaudited)

| | | | | |

Shares

| | | | Value (Note 2)

|

COMMON STOCKS - 98.1% | | | |

| | |

| | | Banks - 2.4% | | | |

276,215 | | State Street Corp. (a) | | $ | 13,545,584 |

| | | | |

|

|

| | | Biotechnology - 2.1% | | | |

80,600 | | Amgen, Inc.* | | | 4,398,342 |

95,100 | | Genentech, Inc.* | | | 5,344,620 |

81,800 | | Medimmune, Inc.* | | | 1,914,120 |

| | | | |

|

|

| | | | | | 11,657,082 |

| | | | |

|

|

| | | Commercial Services - 2.8% | | | |

51,900 | | Apollo Group, Inc.* | | | 4,582,251 |

150,225 | | Certegy, Inc. | | | 5,828,730 |

155,442 | | Paychex, Inc. | | | 5,266,375 |

| | | | |

|

|

| | | | | | 15,677,356 |

| | | | |

|

|

| | | Computers - 4.7% | | | |

116,900 | | Apple Computer, Inc.* | | | 3,803,926 |

435,782 | | Dell, Inc.* | | | 15,609,711 |

60,400 | | International Business Machines Corp. | | | 5,324,260 |

14,500 | | Lexmark International Group, Inc.* | | | 1,399,685 |

| | | | |

|

|

| | | | | | 26,137,582 |

| | | | |

|

|

| | | Cosmetics & Personal Care - 2.0% | | | |

92,400 | | Avon Products, Inc. | | | 4,263,336 |

23,900 | | Estee Lauder Cos., Inc., Class A | | | 1,165,842 |

67,205 | | Gillette Co. | | | 2,849,492 |

52,800 | | Procter & Gamble Co. | | | 2,874,432 |

| | | | |

|

|

| | | | | | 11,153,102 |

| | | | |

|

|

| | | Diversified Financial Services - 10.7% | | | |

254,045 | | American Express Co. | | | 13,052,832 |

328,703 | | Citigroup, Inc. | | | 15,284,689 |

150,224 | | Fannie Mae | | | 10,719,985 |

35,700 | | Goldman Sachs and Co. | | | 3,361,512 |

57,200 | | Merrill Lynch & Co., Inc. | | | 3,087,656 |

183,100 | | Morgan (J.P.) & Co., Inc. (a) | | | 7,098,787 |

185,804 | | SLM Corp. | | | 7,515,772 |

| | | | |

|

|

| | | | | | 60,121,233 |

| | | | |

|

|

| | | Electrical Components & Equipment - 1.6% | | | |

332,074 | | Molex Inc., Class A | | | 9,058,979 |

| | | | |

|

|

| | | Electronics - 1.0% | | | |

199,700 | | Agilent Technologies, Inc.* | | | 5,847,216 |

| | | | |

|

|

| | | Food - 1.4% | | | |

115,500 | | Kroger Co. (a)* | | | 2,102,100 |

58,400 | | Whole Foods Market, Inc. (a) | | | 5,574,280 |

| | | | |

|

|

| | | | | | 7,676,380 |

| | | | |

|

|

| | | Health Care - Products - 4.5% | | | |

23,400 | | Alcon, Inc. | | | 1,840,410 |

98,830 | | Dentsply International, Inc. | | | 5,149,043 |

53,200 | | Guidant Corp. | | $ | 2,972,816 |

142,317 | | Johnson & Johnson | | | 7,927,057 |

93,945 | | Medtronic, Inc. | | | 4,577,000 |

31,626 | | Zimmer Holdings, Inc.* | | | 2,789,413 |

| | | | |

|

|

| | | | | | 25,255,739 |

| | | | |

|

|

| | | Health Care - Services - 2.3% | | | |

162,084 | | Lincare Holding, Inc. (a)* | | | 5,326,080 |

122,550 | | UnitedHealth Group, Inc. | | | 7,628,737 |

| | | | |

|

|

| | | | | | 12,954,817 |

| | | | |

|

|

| | | Home Furnishings - 0.4% | | | |

26,900 | | Harman International Industries, Inc. | | | 2,447,900 |

| | | | |

|

|

| | | Insurance - 3.8% | | | |

199,007 | | AFLAC, Inc. | | | 8,121,476 |

187,083 | | American International Group, Inc. | | | 13,335,276 |

| | | | |

|

|

| | | | | | 21,456,752 |

| | | | |

|

|

| | | Internet - 6.1% | | | |

90,100 | | eBay, Inc.* | | | 8,284,695 |

319,082 | | InterActiveCorp (a)* | | | 9,617,131 |

63,500 | | Symantec Corp.* | | | 2,780,030 |

366,710 | | Yahoo!, Inc.* | | | 13,322,574 |

| | | | |

|

|

| | | | | | 34,004,430 |

| | | | |

|

|

| | | Leisure Time - 1.9% | | | |

225,336 | | Carnival Corp. | | | 10,590,792 |

| | | | |

|

|

| | | Manufacturing - Miscellaneous - 3.2% | | | |

221,382 | | Dover Corp. | | | 9,320,182 |

272,400 | | General Electric Co. | | | 8,825,760 |

| | | | |

|

|

| | | | | | 18,145,942 |

| | | | |

|

|

| | | Media - 5.0% | | | |