Registration No. 333-[___]

As filed with the Securities and Exchange Commission on July 20, 2017

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

¨ PRE-EFFECTIVE AMENDMENT NO.

¨ POST-EFFECTIVE AMENDMENT NO.

JOHN HANCOCK Variable Insurance TRUST

(Exact Name of Registrant as Specified in Charter)

601 Congress Street

Boston, Massachusetts 02210

(Address of Principal Executive Offices)

617-663-3000

(Registrant’s Area Code and Telephone Number)

Christopher Sechler

Assistant Secretary

John Hancock Variable Insurance Trust

601 Congress Street

Boston, Massachusetts 02210

(Name and Address of Agent for Service)

Copy to:

Mark P. Goshko, Esq.

K&L Gates LLP

One Lincoln Street

Boston, Massachusetts 02111

Title of securities being registered: shares of beneficial interest ($0.01 par value) of the Registrant.

Approximate date of proposed public offering: as soon as practicable after this Registration Statement becomes effective.

No filing fee is required because an indefinite number of shares of the Registrant have previously been registered pursuant to Section 24(f) under the Investment Company Act of 1940.

It is proposed that this filing become effective on August 19, 2017 pursuant to Rule 488.

PART A

INFORMATION REQUIRED IN THE

PROXY STATEMENT/PROSPECTUS

JOHN HANCOCK VARIABLE INSURANCE TRUST

601 Congress Street

Boston, Massachusetts 02210-2805

617-663-3000

September 14, 2017

Dear Variable Annuity and Variable Life Contract Owners:

A Special Meeting of Shareholders of John Hancock Variable Insurance Trust (“JHVIT”) will be held at 601 Congress Street, Boston, Massachusetts 02210, on October 19, 2017 at 10:00 a.m., Eastern Time (the “Meeting”). At the Meeting, shareholders of three series or funds of JHVIT – Core Strategy Trust, Value Trust, and American New World Trust (each, an “Acquired Fund” and, together, the “Acquired Funds”) – will be asked to consider and approve a proposed Agreement and Plan of Reorganization (the “Plan”) providing for the combination of that Acquired Fund into the corresponding JHVIT fund listed below (each, an “Acquiring Fund” and, together, the “Acquiring Funds”) (each, a “Reorganization” and, together, the “Reorganizations”):

| Acquired Fund | Acquiring Fund |

| Core Strategy Trust | Lifestyle Growth PS Series |

| Value Trust | Mid Cap Index Trust |

| American New World Trust | Emerging Markets Value Trust |

The Reorganizations

Under the Plan and with respect to each Reorganization: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the shares of the Acquiring Fund will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will be liquidated and terminated. As a result, each shareholder of each Acquired Fund will become a shareholder of the corresponding Acquiring Fund. The total value of all shares of an Acquiring Fund issued in the Reorganization will equal the total value of the net assets of its corresponding Acquired Fund. The number of full and fractional shares of an Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (the “NYSE”) on the closing date of the Reorganization.

In the Reorganization, holders of Series I, Series II, and Series NAV shares of Core Strategy Trust and Value Trust will receive Series I, Series II, and Series NAV shares, respectively, of the corresponding Acquiring Fund. Holders of Series I, Series II, and Series III shares of American New World Trust will receive Series I, Series II, and Series NAV shares, respectively, of Emerging Markets Value Trust.

For certain variable annuity insurance contracts that currently invest in Series II shares of Core Strategy Trust, it is expected that, after the Reorganization, John Hancock Life Insurance Company (“John Hancock USA”) and John Hancock Life Insurance Company of New York (“John Hancock NY”) will replace such Series II shares with Series I shares issued by Lifestyle Growth PS Series having an equal value. As a result, affected contract holders will have contract values invested in a class with lower expenses than would have been the case otherwise.

If approved by shareholders of an Acquired Fund, the Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on October 27, 2017.

The Board has approved each Reorganization and believes that each Reorganization will benefit shareholders of the applicable Acquired Fund.

With respect to each Acquired Fund, the Reorganization is intended to result in a combined Acquiring Fund that has the same or lower net total annual fund operating expenses (both before and after any fee waivers or expense limitations) and stronger prospects for growth and potential opportunities for economies of scale than the Acquired Fund.

With respect to the Reorganization of each of Core Strategy Trust and Value Trust, the Reorganization is intended to result in a combined Acquiring Fund that has the same or lower effective management fees than the Acquired Fund. American New World Trust operates as a feeder fund that invests all of its assets in its master fund, New World Fund, a series of American Funds Insurance Series (the “Master Fund”). Although the Reorganization of American New World Trust will result in an Acquiring Fund with higher effective management fees than those of the Master Fund (which fees American New World Trust indirectly bears), each class of shares of Emerging Markets Value Trust to be received in the Reorganization has lower Rule 12b-1 distribution fees than the corresponding classes of shares of American New World Trust, which more than offsets the increase in effective management fees.

The value of your investment will not be affected by the applicable Reorganization. Furthermore, the Reorganizations are not expected to be taxable events for federal income tax purposes for variable annuity or variable life insurance contract owners whose contract values are determined by investment in shares of the Acquired Funds. With respect to the Reorganization of Value Trust and American New World Trust, the expenses of the Reorganization will be borne entirely by the applicable Acquired Fund. With respect to the Reorganization of Core Strategy Trust, the expenses of the Reorganization will be borne by John Hancock Investment Management Services, LLC, the Fund’s investment advisor.

* * *

Although you are not a shareholder of JHVIT, your purchase payments and the earnings on such purchase payments under your variable annuity or variable life insurance contracts issued by John Hancock USA and John Hancock NY are invested in subaccounts of separate accounts established by these companies, and each subaccount invests in shares of one of JHVIT’s funds. You have the right to instruct these insurance companies, as appropriate, how to vote the shares of the Acquired Funds that are attributable to your contracts as of August 21, 2017, the record date for the Meeting. John Hancock USA and John Hancock NY will vote all shares of each Acquired Fund owned by such companies and attributed to such contracts in proportion to the voting instructions with respect to that fund timely received from owners of contracts participating in separate accounts registered under the 1940 Act.

Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus for JHVIT, and a Voting Instructions Form. The Proxy Statement/Prospectus provides background information and describes in detail the matters to be voted on at the Meeting.

The Board has voted in favor of each proposed Reorganization and recommends that you give voting instructions FOR its approval, as applicable.

In order for shares to be voted at the Meeting based on your instructions, we urge you to read the Proxy Statement/Prospectus and then complete and mail your Voting Instructions Form in the enclosed postage-paid envelope, allowing sufficient time for its receipt by the close of business on October 18, 2017. To give voting instructions by touch-tone telephone or via the Internet, follow the instructions on the Voting Instructions Form.

If you have any questions regarding the Reorganization, please call one of the following numbers:

For John Hancock USA

variable annuity contracts: | (800) 344-1029 |

For John Hancock USA

variable life contracts: | (800) 827-4546 |

For John Hancock NY

variable annuity contracts: | (800) 551-2078 |

For John Hancock NY

variable life contracts: | (888) 267-7784 |

Sincerely,

| /s/ Christopher Sechler | |

| Christopher Sechler |

| Assistant Secretary |

| John Hancock Variable Insurance Trust |

JOHN HANCOCK VARIABLE INSURANCE TRUST

601 Congress Street

Boston, Massachusetts 02210-2805

617-663-3000

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of Core Strategy Trust, Value Trust, and American New World Trust:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of Core Strategy Trust, Value Trust, and American New World Trust (each, an “Acquired Fund” and, together, the “Acquired Funds”), each a separate series or fund of John Hancock Variable Insurance Trust (“JHVIT”), will be held at 601 Congress Street, Boston, Massachusetts 02210, on October 19, 2017 at 10:00 a.m., Eastern Time. A Proxy Statement/Prospectus providing information about the following proposals to be voted on at the Meeting is included with this notice.

| Proposal 1 | Approval of Agreement and Plan of Reorganization providing for the reorganization of Core Strategy Trust into Lifestyle Growth PS Series. (Only shareholders of Core Strategy Trust will vote on Proposal 1) |

| Proposal 2 | Approval of Agreement and Plan of Reorganization providing for the reorganization of Value Trust into Mid Cap Index Trust. (Only shareholders of Value Trust will vote on the Proposal 2) |

| Proposal 3 | Approval of Agreement and Plan of Reorganization providing for the reorganization of American New World Trust into Emerging Markets Value Trust. (Only shareholders of American New World Trust will vote on the Proposal 3) |

Any other business that may properly come before the Meeting.

The Board of Trustees of JHVIT recommends that shareholders vote FOR each Proposal, as applicable.

Approval of each proposal will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as defined in the accompanying Proxy Statement/Prospectus) of the applicable Acquired Fund. Each shareholder of record at the close of business on August 21, 2017 is entitled to receive notice of and to vote at the Meeting.

Sincerely yours,

/s/ Christopher Sechler

Christopher Sechler

Assistant Secretary

September 14, 2017

Boston, Massachusetts

JOHN HANCOCK VARIABLE INSURANCE TRUST

601 Congress Street, Boston, Massachusetts 02210-2805, 617-663-3000

This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of Trustees (the “Board”) of John Hancock Variable Insurance Trust (“JHVIT”) of proxies to be used at a Special Meeting of Shareholders of JHVIT to be held at 601 Congress Street, Boston, Massachusetts 02210, on October 19, 2017, at 10:00 a.m., Eastern Time (the “Meeting”).

At the Meeting, shareholders of each of three series or funds of JHVIT listed below (each, an “Acquired Fund” and, together, the “Acquired Funds”), will separately be asked to consider and approve a proposed Agreement and Plan of Reorganization (the “Plan”) providing for the reorganization into corresponding JHVIT fund listed below (each, an “Acquiring Fund” and, together, the “Acquiring Funds”) (each, a “Reorganization” and, together, the “Reorganizations”).

| Acquired Fund | Acquiring Fund |

| Core Strategy Trust | Lifestyle Growth PS Series |

| Value Trust | Mid Cap Index Trust |

| American New World Trust | Emerging Markets Value Trust |

This Proxy Statement/Prospectus contains information shareholders should know before voting on the Reorganizations. Please read it carefully and retain it for future reference.

JHVIT’s Annual Report to Shareholders contains additional information about the investments of the Acquired and Acquiring Funds, as well as discussions of the market conditions and investment strategies that significantly affected the Funds during the fiscal year ended December 31, 2016.

For additional information regarding the Acquired and Acquiring Funds, see the JHVIT Prospectus dated May 1, 2017, as supplemented (File Nos. 2-94157 and 811-04146), and JHVIT’s Annual Reports for the period ended December 31, 2016 (File No. 811-04146). The JHVIT Prospectus and the audited financial statements in the Annual Report are incorporated by reference into this Proxy Statement/Prospectus insofar as they relate to the Acquired and Acquiring Funds. A Statement of Additional Information dated September 14, 2017 (File No. 333-[___]) relating to this Proxy Statement/Prospectus (the “SAI”) has been filed with the Securities and Exchange Commission (the “SEC”) and also is incorporated by reference into this Proxy Statement/Prospectus. The SAI incorporates by reference the Statement of Additional Information of JHVIT dated May 1, 2017, as supplemented (the “JHVIT SAI”) (File Nos. 2-94157 and 811-04146), insofar as it relates to the Acquired and Acquiring Funds. Copies of the Annual Report and the SAI, which will be accompanied by copies of the JHVIT SAI, may be obtained without charge by writing to JHVIT at the address stated above or by calling the appropriate toll free number listed below. For purposes of this Proxy Statement/Prospectus, references to information found or included in the SAI include information found or included in the JHVIT SAI. Contract holders having any questions regarding either Reorganization should call the appropriate toll free number listed below:

| For John Hancock USA variable annuity contracts: | (800) 344-1029 |

| For John Hancock USA variable life contracts: | (800) 827-4546 |

| For John Hancock NY variable annuity contracts: | (800) 551-2078 |

| For John Hancock NY variable life contracts: | (888) 267-7784 |

The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

The date of this Proxy Statement/Prospectus is September 14, 2017.

The Reorganization

Under the Plan and with respect to each Reorganization: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the shares of the Acquiring Fund will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate. As a result, each shareholder of an Acquired Fund will become a shareholder of the corresponding Acquiring Fund. The total value of all shares of the Acquiring Fund issued in a Reorganization will equal the total value of the net assets of the corresponding Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (the “NYSE”) on the closing date of the Reorganization, which is expected to be on or about October 27, 2017 (the “Exchange Date”).

In the Reorganization, holders of Series I, Series II, and Series NAV shares of Core Strategy Trust and Value Trust will receive Series I, Series II, and Series NAV shares, respectively, of the corresponding Acquiring Fund. Holders of Series I, Series II, and Series III shares of American New World Trust will receive Series I, Series II, and Series NAV shares, respectively, of Emerging Markets Value Trust.

For certain variable annuity insurance contracts that currently invest in Series II shares of Core Strategy Trust, it is expected that, after the Reorganization, John Hancock Life Insurance John Hancock USA and John Hancock NY will replace such Series II shares with Series I shares issued by Lifestyle Growth PS Series having an equal value. As a result, affected contract holders will have contract values invested in a class with lower expenses than would have been the case otherwise.

If approved by shareholders of an Acquired Fund, the Reorganization is expected to occur with respect to that fund as of the close of regularly scheduled trading on the NYSE on October 27, 2017. All share classes of each Acquired Fund will vote in the aggregate and not by class. The terms and conditions of each Reorganization are more fully described below in this Proxy Statement/Prospectus and in the form of the Plan attached hereto as Appendix A.

General

JHVIT is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. Such reports, proxy materials and other information may be inspected and copied (for a duplication fee) at the public reference facilities of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549 (information on the operation of this reference facility may be obtained by calling the SEC at 1-202-551-8090); at the Northeast Regional Office (3 World Financial Center, New York, New York 10281); and at the Midwest Regional Office (175 West Jackson Boulevard, Suite 900, Chicago, Illinois 60661). Such materials also are available on the SEC’s EDGAR Database on its website at sec.gov, and copies may be obtained, after paying a duplicating fee, by email request addressed to publicinfo@sec.gov or by writing to the SEC’s Public Reference Room.

TABLE OF CONTENTS

INTRODUCTION

This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of proxies to be used at the Meeting. The Board has designated August 21, 2017 as the record date for determining shareholders eligible to vote at the Meeting (the “Record Date”). All shareholders of record at the close of business on the Record Date are entitled to one vote for each share (and fractional votes for fractional shares) of beneficial interest of JHVIT held.

JHVIT. JHVIT is a Massachusetts business trust that is a no-load open-end investment company, commonly known as a mutual fund, registered under the 1940 Act. JHVIT currently offers 70 separate series or funds (each a “fund”), including the Acquired and Acquiring Funds. JHVIT does not sell its shares directly to the public but generally only to insurance companies and their separate accounts as the underlying investment media for variable annuity and variable life insurance contracts (“variable contracts”), certain entities affiliated with the insurance companies, as permitted by applicable law, and other funds of JHVIT that operate as funds of funds. Shares of JHVIT also may be sold to unaffiliated insurance companies and their separate accounts and certain qualified pension and retirement plans, but currently are not offered to such investors.

Investment Management. John Hancock Investment Management Services, LLC (“JHIMS” or the “Advisor”) serves as investment advisor to each of the Acquired and Acquiring Funds, except for American New World Trust. Pursuant to an Amended and Restated Advisory Agreement with JHVIT on behalf of the Acquired and Acquiring Funds, except for American New World Trust, dated September 26, 2008, JHIMS is responsible for, among other things, administering the business and affairs of each of the Acquired and Acquiring Funds, except for American New World Trust, and selecting, contracting with, compensating and monitoring the performance of any investment subadvisor that manages the investment of the assets of the applicable Funds pursuant to subadvisory agreements.

American New World Trust does not have an investment adviser and invests solely in a master fund, New World Fund, a series of American Funds Insurance Series (the “Master Fund”), which is managed by Capital Research and Management Company (“CRMC”). The address of CRMC is 333 South Hope Street, 55th Floor, Los Angeles, California, 90071.

Dimensional Fund Advisors LP (“DFA”) serves as investment subadvisor to Emerging Markets Value Trust. DFA’s address is 6300 Bee Cave Road, Building One, Austin, Texas 78746.

Invesco Advisers, Inc. (“Invesco”) serves as investment subadvisor to Value Trust. Invesco’s address is 1555 Peachtree Street, N.E., Atlanta, Georgia, 30309

John Hancock Asset Management a division of Manulife Asset Management (North America) Limited (“JHAM (NA)”) serves as investment subadvisor to Core Strategy Trust, Lifestyle Growth PS Series, and Mid Cap Index Trust. JHAM (NA)’s address is 200 Bloor Street East, Toronto, Ontario, Canada M4W 1E5.

John Hancock Asset Management a division of Manulife Asset Management (US) LLC (“JHAM (US)”) serves as investment subadvisor to Core Strategy Trust and Lifestyle Growth PS Series. JHAM (US)’s address is 197 Clarendon Street, Boston, Massachusetts 02116.

JHIMS, CRMC, DFA, Invesco, JHAM (NA), and JHAM (US) are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended.

JHIMS also provides to JHVIT certain financial, accounting and administrative services such as legal services, tax, accounting, valuation, financial reporting and performance, compliance and service provider oversight, as well as services related to the office of the Chief Compliance Officer.

The Distributor. John Hancock Distributors, LLC (“JH Distributors”) serves as JHVIT’s distributor.

The offices of JHIMS and JH Distributors are located at 601 Congress Street, Boston, Massachusetts 02210. Their ultimate parent entity is Manulife Financial Corporation (“MFC”), a publicly traded company based in Toronto, Canada. MFC and its subsidiaries operate as “Manulife Financial” in Canada and Asia and primarily as “John Hancock” in the United States.

OVERVIEW OF THE REORGANIZATIONS

The following is a summary discussion of the form and consequences of, and the reasons for, the Reorganizations.

At an in-person meeting held June 20-22, 2017, all of the Trustees in attendance, including all the Trustees in attendance comprising a majority of the Trustees who are not “interested persons” (as defined in the 1940 Act) of JHVIT, the Advisor, the subadvisors, or JH Distributors (the “Independent Trustees”), approved the Plan providing for the Reorganization of each Acquired Fund into its corresponding Acquiring Fund. Each Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the Acquired Fund to its corresponding Acquiring Fund in exchange for shares of the Acquiring Fund; (ii) the distribution to shareholders of the Acquired Fund of the shares of the Acquiring Fund; and (iii) the liquidation and termination of the Acquired Fund.

As a result of each Reorganization, shareholders of an Acquired Fund will become shareholders of the corresponding Acquiring Fund. In each Reorganization, the Acquiring Fund will issue a number of shares with a total value equal to the total value of the net assets of its corresponding Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a total value equal to the total value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the “Exchange Date”).

In the Reorganization, holders of Series I, Series II, and Series NAV shares of Core Strategy Trust and Value Trust will receive Series I, Series II, and Series NAV shares, respectively, of the corresponding Acquiring Funds. Holders of Series I, Series II, and Series III shares of American New World Trust will receive Series I, Series II, and Series NAV shares, respectively, of Emerging Markets Value Trust.

For certain variable annuity insurance contracts that currently invest in Series II shares of Core Strategy Trust, it is expected that, after the Reorganization, John Hancock USA and John Hancock NY will replace such Series II shares with Series I shares issued by Lifestyle Growth PS Series having an equal value. As a result, affected contract holders will have contract values invested in a class with lower expenses than would have been the case otherwise.

For certain variable life insurance contracts that currently invest in Series I shares of American New World Trust, it is expected that, after the Reorganization, John Hancock Life Insurance John Hancock USA and John Hancock NY will replace such Series I shares with Series NAV shares issued by Emerging Market Value Trust having an equal value. As a result, affected contract holders will have contract values invested in a class with lower expenses than would have been the case otherwise.

The Board has approved each Reorganization and believes that each Reorganization will benefit shareholders of the applicable Acquired Fund.

With respect to each Acquired Fund, the Reorganization is intended to result in a combined Acquiring Fund that has the same or lower net total annual fund operating expenses (both before and after any fee waivers or expense limitations), and stronger prospects for growth and economies of scale than the Acquired Fund. On a pro forma basis, each class of each resulting combined Acquiring Fund after the Reorganization is expected to have total operating expenses that are the same as or lower than those of the Acquired Fund share classes exchanged in the Reorganization.

With respect to the Reorganization of each of Core Strategy Trust and Value Trust, the Reorganization is intended to result in a combined Acquiring Fund that has the same or lower effective management fees than the Acquired Fund. American New World Trust operates as a feeder fund that invests all of its assets in the Master Fund. Although the Reorganization of American New World Trust will result in an Acquiring Fund with higher effective management fees than those of the Master Fund (which fees American New World Trust indirectly bears), each class of shares of Emerging Markets Value Trust to be received in the Reorganization has lower Rule 12b-1 distribution fees than the corresponding classes of shares of American New World Trust, which more than offsets the increase in effective management fees.

The factors that the Board considered in deciding to approve each Reorganization are discussed below under “Information About the Reorganizations — Board Consideration of the Reorganizations.”

None of the Reorganizations is expected to be a taxable event for federal income tax purposes for owners of variable contracts whose contract values are determined by investment in shares of each Acquired Fund. See “Information About the Reorganizations – Federal Income Tax Consequences.”

Immediately preceding each Reorganization, the Acquired Fund may, in certain situations, not comply with its investment policies due to the need to make changes to its portfolio to facilitate the Reorganization. The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the distribution of shares. See “Additional Information About the Funds — Purchase and Redemption of Shares” in the JHVIT Prospectus.

With respect to the Reorganization of Value Trust and American New World Trust, the expenses of the Reorganization will be borne entirely by the applicable Acquired Fund. With respect to the Reorganization of Core Strategy Trust, the expenses of the Reorganization will be borne by JHIMS. If any of the Reorganizations is not consummated, the expenses of that Reorganization will be paid by JHIMS.

Prior to the Reorganization: (a) American New World Trust anticipates that it will sell all of its investments; (b) Core Strategy Trust anticipates that it will not sell any of its investments and will transfer all of its securities to Lifestyle Growth PS Series; and (c) Value Trust anticipates that it will sell substantially all of its investments and invest the proceeds of such sales in securities in which Mid Cap Index Trust invests. Each of American New World Trust and Value Trust reserves the right not to proceed in this manner and may manage its portfolio in anticipation of the Reorganization in a different manner. The Board has authorized JHVIT to retain a transition manager for Value Trust to facilitate these sales. As noted above, such transactions may cause the Fund to not comply with their investment policies. Sales of portfolio securities by Value Trust are expected to result in brokerage commissions or other transaction costs of approximately $243,420.

The aggregate estimated expenses of each Reorganization (consisting of brokerage commissions or other transaction costs, legal, accounting, printing, and solicitation and tabulation of proxies), and the expected reduction in net asset value per share (in parentheses) are as follows: approximately $146,519 (less than $0.01 per share) with respect to Core Strategy Trust; approximately $313,067 (less than $0.01 per share) with respect to Value Trust; and approximately $58,835 (less than $0.01 per share) with respect to American New World Trust.

PROPOSAL 1 —

APPROVAL OF AGREEMENT AND PLAN OF REORGANIZATION PROVIDING FOR

THE REORGANIZATION OF CORE STRATEGY TRUST INTO

LIFESTYLE GROWTH PS SERIES

Shareholders of Core Strategy Trust (the “Acquired Fund”) are being asked to approve the Plan providing for the Reorganization of that fund into Lifestyle Growth PS Series (the “Acquiring Fund”). The funds are compared below.

Comparison of Acquired and Acquiring Funds

As outlined in the chart below, the Acquired and Acquiring Funds have similar investment objectives and strategies. The following is a summary of the similarities and differences between the funds’ investment policies. Each fund operates as a “fund of funds,” i.e., it seeks to achieve its investment objective by investing in other investment companies. Both funds seek long-term growth of capital as an investment objective, with current income also a consideration. Both funds normally allocate 70% of their assets to equity underlying funds and 30% to fixed-income underlying funds, including exchange-traded funds (“ETFs”). Lifestyle Growth PS Series may invest directly in equity and fixed-income securities. Core Strategy Trust may vary its target allocation by 10% in either direction, whereas the subadvisor for Lifestyle Growth PS Series may determine in light of market or economic conditions that the normal percentage limitations should be exceeded to protect the fund or achieve its investment objective. Both funds may invest in derivatives, and both funds may invest in other types of investments, as described under “Other Permitted Investments by the Funds of Funds.”

Core Strategy Trust

(Acquired Fund) | Lifestyle Growth PS Series

(Acquiring Fund) |

| Approximate Net Assets of Each Fund as of December 31, 2016: |

$3,621,234,848 | $3,091,014,921 |

Investment Advisor: JHIMS |

| Investment Subadvisors: |

| JHAM (US) and JHAM (NA) |

| Investment Objectives: |

| Seeks long term growth of capital. Current income is also a consideration. | To seek long-term growth of capital. Current income is also a consideration. |

| Principal Investment Strategies: |

| Under normal market conditions, the fund invests in other funds of JHVIT and other investment companies (including exchange-traded funds (“ETFs”)) (“Underlying Funds”) as well as other types of investments, see “Other Permitted Investments by the Funds of Funds.” The fund invests approximately 70% of its total assets in equity securities and Underlying Funds that invest primarily in equity securities (“Equity Investments”) and approximately 30% of its total assets | The fund, except as otherwise described below, operates as a fund of funds and normally invests approximately 70% of its assets in underlying funds that invest primarily in equity securities or in futures contracts on equity markets (the “Equity Allocation”) and approximately 30% of its assets in underlying funds that invest primarily in fixed-income securities or in futures contracts on fixed-income markets (the “Fixed Income Allocation”). Underlying funds may |

Core Strategy Trust

(Acquired Fund) | Lifestyle Growth PS Series

(Acquiring Fund) |

in fixed-income securities and Underlying Funds that invest primarily in fixed-income securities (“Fixed-Income Investments”). The fund may also invest in various Underlying Funds that as a group hold a wide range of equity type securities in their portfolios. These include small-, mid- and large-capitalization stocks, domestic and foreign securities (including emerging market securities) and sector holdings such as utilities and science and technology stocks. Each of the Underlying Funds has its own investment strategy that, for example, may focus on growth stocks or value stocks or may employ a strategy combining growth and income stocks and/or may invest in derivatives such as options on securities and futures contracts. Certain of the Underlying Funds in which the fund invests focus their investment strategy on fixed-income securities, which may include investment grade and below investment grade debt securities with maturities that range from short to longer term. The fixed-income Underlying Funds collectively hold various types of debt instruments such as corporate bonds and mortgage-backed, government-issued, domestic and international securities. Variations in the target percentage allocations between Equity Investments and Fixed-Income Investments are permitted up to 10% in either direction. For example, based on its investment allocation of approximately 70% of assets in Equity Investments and 30% of assets in Fixed-Income Investments, the fund may have an equity/fixed-income allocation of 80%/20% or 60%/40%. Variations beyond the permissible deviation range of 10% are not permitted except that, in light of market or economic conditions, the subadvisor may determine that the normal percentage limitations should be exceeded to protect the fund or to achieve the fund’s investment objective. The fund is monitored daily. To maintain target allocations in the Underlying Funds, daily cash flow for the fund will be directed to the Underlying Fund that most deviates from target. Quarterly, the subadvisor may also rebalance the fund’s Underlying Funds to maintain target allocations. The subadvisor may from time to time adjust the percent of assets invested in any specific Underlying Fund held by the fund. Such adjustments may be made to increase or decrease the fund’s holdings of particular asset classes, such as common stocks of foreign issuers, or to adjust portfolio quality or the duration of fixed-income securities. Adjustments may also be made to increase or reduce the percent of the fund’s assets subject to the | include exchange traded funds (“ETFs”) and the fund may invest a significant portion of its assets in ETFs. At the discretion of the subadvisor, the Equity Allocation may also include direct investments in equity securities and the Fixed Income Allocation may also include direct investments in fixed-income securities. The subadvisor may also determine in light of market or economic conditions that the normal percentage limitations should be exceeded to protect the fund or achieve its investment objective. Within the prescribed percentage allocation, the subadvisor selects the percentage level to be maintained in specific underlying funds and in futures contracts on equity or fixed-income markets. These allocations may be changed at any time by the subadvisor. The fund may invest in various underlying funds that as a group hold a wide range of equity type securities. These include small-, mid- and large-capitalization stocks, domestic and foreign securities (including emerging market securities) and sector holdings such as utilities, science, and technology stocks. Each of these underlying funds has its own investment strategy which, for example, may focus on growth stocks or value stocks or may employ a strategy combining growth and income stocks and/or may invest in derivatives such as options on securities and futures contracts. The fund may also invest in underlying funds that purchase futures contracts on equity markets. Certain of these underlying funds focus their investment strategy on fixed-income securities, which may include investment grade and below investment grade debt securities with maturities that range from short to longer term. The fixed-income underlying funds collectively hold various types of debt instruments such as corporate bonds and mortgage backed, U.S. and foreign government issued, domestic and international securities. The fund may invest in derivatives, which are financial contracts with a value that depends on, or is derived from, the value of underlying assets, reference rates or indexes. Derivatives may relate to stocks, bonds, interest rates, currencies or currency exchange rates and related indexes. The fund may use derivatives for hedging and nonhedging purposes including, without limitation, the following purposes: ■ To establish a position in the derivatives markets as a method of gaining exposure to a particular security or |

Core Strategy Trust

(Acquired Fund) | Lifestyle Growth PS Series

(Acquiring Fund) |

management of a particular Underlying Fund subadvisor. In addition, changes may be made to reflect fundamental changes in the investment environment. The fund may also invest in the securities of other investment companies including exchange traded funds (ETFs) and may invest directly in other type of investments, such as equity and fixed-income securities including U.S. government securities, closed-end funds and partnerships. See “Other Permitted Investments by the Funds of Funds.” The fund may also engage in short selling. The investment performance of the fund will reflect both its subadvisor’s allocation decisions with respect to Underlying Funds and the investment decisions made by the Underlying Funds’ subadvisors. The fund bears its own expenses and, in addition, indirectly bears its proportionate share of the expenses of the Underlying Funds in which it invests. When purchasing shares of other JHVIT funds, the fund only purchases Class NAV shares (which are not subject to Rule 12b-1 fees). Use of Hedging and Other Strategic Transactions. The fund is authorized to use all of the various investment strategies referred to under “Additional Information About the Funds’ Principal Risks — Hedging, derivatives and other strategic transactions risk” including, without limitation, investing in credit default swaps, foreign currency forward contracts, futures contracts, interest rate swaps and options. | market; ■ To attempt to protect against possible changes in the market value of securities held or to be purchased by the fund or an underlying fund; ■ To manage the effective maturity or duration of the securities of the fund or an underlying fund; and ■ To facilitate the repatriation of foreign currency and the settlement of purchases of foreign securities. The fund may invest in other types of investments including exchange-traded notes (ETNs) as described under “Other Permitted Investments of the Fund of Funds.” The fund bears its own expenses and, in addition, indirectly bears its proportionate share of the expenses of the underlying funds in which it invests. |

| Temporary Defensive Investing. During unusual or unsettled market conditions, for purposes of meeting redemption requests, or pending investment of its assets, a fund generally may invest all or a portion of its assets in cash and securities that are highly liquid, including: (a) high quality money market instruments, such as short-term U.S. government obligations, commercial paper, repurchase agreements or other cash equivalents; and (b) money market funds. |

Comparison of, and Effect on, Fund Operating Expenses

The operating expenses of each fund for the twelve-month period ended December 31, 2016 (including pro forma expenses showing the effect of the Reorganization) are set forth below. On a pro forma basis, each class of shares of the resulting combined Acquiring Fund after the Reorganization is expected to have total operating expenses that are the same as those of the respective Acquired Fund share classes exchanged in the Reorganization.

The expense ratios and examples below do not reflect the fees and expenses of any variable contract that may use JHVIT as its underlying investment medium. If such fees and expenses had been reflected, the expense ratios would be higher.

In the Reorganization, holders of Series I, Series II, and Series NAV shares of Core Strategy Trust will receive Series I, Series II, and Series NAV shares, respectively, of Lifestyle Growth PS Series.

For certain variable annuity insurance contracts that currently invest in Series II shares of Core Strategy Trust, it is expected that, after the Reorganization, John Hancock USA and John Hancock NY will replace such Series II shares with Series I shares issued by Lifestyle Growth PS Series having an equal value. As a result, affected contract holders will have contract values invested in a class with lower expenses than would have been the case otherwise. See “Information About the Reorganizations – Other Matters Regarding Certain Contract Holders of Series II Shares.”

Annual Fund Operating Expenses (12-month period ended 12/31/16)

(expenses that you pay each year as a percentage of the value of your investment)

| Fund/Share | Management

fees | Distribution

and service

(Rule 12b-1)

fees | Other

expenses | Acquired

fund fees

and

expenses1 | Total annual

fund operating

expenses2 |

| (1) Core Strategy Trust (Acquired Fund) | | | | | |

| Series I | 0.04% | 0.05% | 0.02% | 0.55% | 0.66%2 |

| Series II | 0.04% | 0.25% | 0.02% | 0.55% | 0.86%2 |

| Series NAV | 0.04% | 0.00% | 0.02% | 0.55% | 0.61%2 |

(2) Lifestyle Growth PS Series

(Acquiring Fund) | | | | | |

| Series I | 0.04% | 0.05% | 0.02% | 0.55% | 0.66%2 |

| Series II | 0.04% | 0.25% | 0.02% | 0.55% | 0.86%2 |

| Series NAV | 0.04% | 0.00% | 0.02% | 0.55% | 0.61%2 |

(3) Lifestyle Growth PS Series

(Acquiring Fund)

(Pro forma combining (1) and (2)) | | | | | |

| Series I | 0.04% | 0.05% | 0.02% | 0.55% | 0.66% |

| Series II | 0.04% | 0.25% | 0.02% | 0.55% | 0.86% |

| Series NAV | 0.04% | 0.00% | 0.02% | 0.55% | 0.61% |

1. “Acquired fund fees and expenses” are based on indirect net expenses associated with each Fund’s investments in underlying investment companies.

2. The “Total annual fund operating expenses” shown may not correlate to a Fund’s ratios of expenses to average net assets shown in the “Financial highlights” section, which does not include “Acquired fund fees and expenses.”

Examples: The examples are intended to help you compare the costs of investing in the Acquired and Acquiring Funds. The examples assume that $10,000 is invested in the particular fund for the periods indicated and then all shares are redeemed at the end of those periods. The examples also assume that the investment has a 5% return each year and that each fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Fund/Share Class | | One Year | Three Years | Five Years | Ten Years |

(1) Core Strategy Trust

(Acquired Fund) | Series I | $67 | $211 | $368 | $822 |

| | Series II | $88 | $274 | $477 | $1,061 |

| | Series NAV | $62 | $195 | $340 | $762 |

(2) Lifestyle Growth PS Series (Acquiring Fund) | Series I | $67 | $211 | $368 | $822 |

| | Series II | $88 | $274 | $477 | $1,061 |

| | Series NAV | $62 | $195 | $340 | $762 |

| Fund/Share Class | | One Year | Three Years | Five Years | Ten Years |

(3) Lifestyle Growth PS Series (Acquiring Fund)

(Pro forma combining (1) and (2)) | Series I | $67 | $211 | $368 | $822 |

| | Series II | $88 | $274 | $477 | $1,061 |

| | Series NAV | $62 | $195 | $340 | $762 |

Portfolio Turnover. Each of the Acquired and Acquiring Funds, which operates as a fund of funds and invests in underlying funds, does not pay transaction costs, such as commissions, when it buys and sells shares of underlying funds (or “turns over” its portfolio). An underlying fund does pay transaction costs when it turns over its portfolio, and a higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the performance of the underlying funds and of the fund. During the fiscal year ended December 31, 2016, the portfolio turnover rate for Core Strategy Trust was 4% of the average value of its portfolio, and the portfolio turnover rate for Lifestyle Growth PS Series was 12% of the average value of its portfolio.

Distribution, Purchase and Redemption Procedures and Exchange Rights. The distribution, purchase and redemption procedures of each fund, and the exchange rights of the corresponding classes of each fund, are the same.

Principal Risks of Investing in the Funds

The net asset value (“NAV”) of each fund’s shares will go up and down, meaning that you could lose money on your investment in either fund. Because the funds have similar investment objectives and principal investment strategies, as described above, they have similar risks. The principal risks of investing in the funds are:

Risks Common to Both Funds as Funds of Funds

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of fund securities may not make timely payments or otherwise honor its obligations. A downgrade or default affecting any of the fund’s securities could affect the fund’s performance.

Cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund’s securities may negatively impact performance.

Economic and market events risk. Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed-income markets could adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Equity securities risk. The price of equity securities may decline due to changes in a company’s financial condition or overall market conditions.

Exchange-traded funds risk. An ETF generally reflects the risks of the underlying securities it is designed to track. A fund bears ETF fees and expenses indirectly.

Fixed-income securities risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by a fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security’s credit quality may adversely affect fund performance.

Fund of funds risk. The fund is subject to risks related to: (i) the underlying funds’ performance, expenses, and ability to meet their investment objectives; (ii) properly rebalancing assets among underlying funds and different asset classes; (iii) layering of fees of the underlying funds; and (iv) conflicts of interest associated with the subadvisor’s ability to allocate fund assets without limit to underlying funds advised by the subadvisor and/or other affiliated subadvisors.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase a fund’s volatility and could produce disproportionate losses, potentially more than the fund’s principal investment. Risks of these transactions are different from and possibly greater than risks of investing directly in securities and other traditional instruments. Under certain market conditions, derivatives could become harder to value or sell and may become subject to liquidity risk (i.e., the inability to enter into closing transactions). Derivatives and other strategic transactions that the fund may utilize include: futures contracts and options. Futures contracts and options generally are subject to counterparty risk.

Investment company securities risk. A fund bears underlying fund fees and expenses indirectly.

Liquidity risk. The extent to which a security may be sold or a derivative position closed without negatively impacting its market value, if at all, may be impaired by reduced market activity or participation, legal restrictions, or other economic and market impediments. Liquidity risk may be magnified in rising interest rate environments due to higher than normal redemption rates. Widespread selling of fixed-income securities to satisfy redemptions during periods of reduced demand may adversely impact the price or salability of such securities. Periods of heavy redemption could cause the fund to sell assets at a loss or depressed value, which could negatively affect performance. Redemption risk is heightened during periods of declining or illiquid markets.

Particular Risks of Core Strategy Trust as a Fund of Funds

Hedging, derivatives, and other strategic transactions risk; other specific transactions. Derivatives and other strategic transactions that the fund intends to utilize include: foreign currency forward contracts, credit default swaps, and interest-rate swaps. Foreign currency forward contracts and swaps generally are subject to counterparty risk. In addition, swaps may be subject to interest-rate and settlement risk, and the risk of default of the underlying reference obligation. Derivatives associated with foreign currency transactions are subject to currency risk.

Large company risk. Larger companies may grow more slowly than smaller companies or be slower to respond to business developments. Large-capitalization securities may underperform the market as a whole.

Short sales risk. In a short sale, a fund pays interest on the borrowed security. The fund will lose money if the security price increases between the short sale and the replacement date.

Particular Risks of Lifestyle Growth PS Series as a Fund of Funds

Commodity risk. Commodity investments involve the risk of volatile market price fluctuations of commodities resulting from fluctuating demand, supply disruption, speculation and other factors.

Exchange-traded notes risk. An ETN generally reflects the risks associated with the assets composing the underlying market benchmark or strategy it is designed to track. ETNs also are subject to issuer and fixed-income risks.

PS Series Asset Transfer Risk. Lifestyle Growth PS Series, Lifestyle Moderate PS Series, Lifestyle Balanced PS Series and Lifestyle Conservative PS Series (collectively, the “JHVIT Lifestyle PS Series”) are offered in connection with specific guaranteed benefits under variable annuity contracts (the “Contracts”) issued by John Hancock USA and John Hancock NY (collectively, the “John Hancock Issuers”).

The Contracts provide that the John Hancock Issuers can automatically transfer contract value between the JHVIT Lifestyle PS Series and Bond Trust, another series of JHVIT, through a non-discretionary, systematic

mathematical process. The purpose of these transfers is to attempt to protect contract value from declines due to market volatility, and thereby limit the John Hancock Issuers’ exposure to risk under the guaranteed benefits under the Contracts. The timing and amount of any transfer of contract value under the John Hancock Issuers’ process will depend on several factors including market movements. In general, the higher the equity component of a JHVIT Lifestyle PS Series, the more likely that contract value will be reallocated from the JHVIT Lifestyle PS Series to the Bond Trust when equity markets fall. These asset flows may negatively affect the performance of an underlying fund in which the JHVIT Lifestyle PS Series invests by increasing the underlying fund’s transaction costs and causing it to purchase or sell securities when it would not normally do so. It could be particularly disadvantageous for the underlying fund if it experiences outflows and needs to sell securities at a time of volatility in the markets, when values could be falling. Because the JHVIT Lifestyle PS Series bear their proportionate share of the transaction costs of the underlying funds, increased underlying fund expenses may indirectly negatively affect the performance of the JHVIT Lifestyle PS Series.

Target allocation risk. Relatively large redemptions from or investments in an underlying fund due to reallocation or rebalancing of portfolio assets could affect the performance of the underlying fund and the fund.

Principal Risks of investing in the Underlying Funds

The principal risks of investing in the underlying funds include:

Underlying Fund Risks Common to Both Funds

Convertible securities risk. The market values of convertible securities tend to fall as interest rates rise and rise as interest rates fall. As the market price of underlying common stock declines below the conversion price, the market value of the convertible security tends to be increasingly influenced by its yield.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of fund securities may not make timely payments or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. A downgrade or default affecting any of the fund’s securities could affect the fund’s performance.

Cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund’s securities may negatively impact performance.

Economic and market events risk. Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed-income markets could adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Equity securities risk. The price of equity securities may decline due to changes in a company’s financial condition or overall market conditions. Growth company securities may fluctuate more in price than other securities because of the greater emphasis on earnings expectations. Securities the manager believes are undervalued may never realize their full potential value, and in certain markets value stocks may underperform the market as a whole.

Fixed-income securities risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by a fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security’s credit quality may adversely affect fund performance.

Foreign securities risk. Less information may be publicly available regarding foreign issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and

political and economic developments may adversely impact the value of foreign securities. The risks of investing in foreign securities are magnified in emerging markets.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase a fund’s volatility and could produce disproportionate losses, potentially more than the fund’s principal investment. Risks of these transactions are different from and possibly greater than risks of investing directly in securities and other traditional instruments. Under certain market conditions, derivatives could become harder to value or sell and may become subject to liquidity risk (i.e., the inability to enter into closing transactions). Derivatives and other strategic transactions that a fund may utilize include: futures contracts and options. Futures contracts and options generally are subject to counterparty risk.

Index management risk. Certain factors may cause a fund that is an index fund to track its target index less closely. For example, a subadvisor may select securities that are not fully representative of the index, and the fund’s transaction expenses, and the size and timing of its cash flows, may result in the fund’s performance being different than that of its index. Moreover, the fund will generally reflect the performance of its target index even when the index does not perform well.

Industry or sector risk. When a fund focuses on one or more industries or sectors of the economy, its performance may be largely driven by industry or sector performance and could fluctuate more widely than if the fund were invested more evenly across industries or sectors.

Initial public offerings risk. IPO share prices are frequently volatile and may significantly impact fund performance.

Large company risk. Larger companies may grow more slowly than smaller companies or be slower to respond to business developments. Large-capitalization securities may underperform the market as a whole.

Liquidity risk. The extent to which a security may be sold or a derivative position closed without negatively impacting its market value, if at all, may be impaired by reduced market activity or participation, legal restrictions, or other economic and market impediments. Liquidity risk may be magnified in rising interest rate environments due to higher than normal redemption rates. Widespread selling of fixed-income securities to satisfy redemptions during periods of reduced demand may adversely impact the price or salability of such securities. Periods of heavy redemption could cause the fund to sell assets at a loss or depressed value, which could negatively affect performance. Redemption risk is heightened during periods of declining or illiquid markets.

Lower-rated and high-yield fixed-income securities risk. Lower-rated and high-yield fixed-income securities (junk bonds) are subject to greater credit quality risk, risk of default, and price volatility than higher-rated fixed-income securities, may be considered speculative, and can be difficult to resell.

Mortgage-backed and asset-backed securities risk. Mortgage-backed and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and other market risks.

Non-diversified risk. Adverse events affecting a particular issuer or group of issuers may magnify losses for non-diversified funds, which may invest a large portion of assets in any one issuer or a small number of issuers.

Short sales risk. In a short sale, a fund pays interest on the borrowed security. The fund will lose money if the security price increases between the short sale and the replacement date.

Small and mid-sized company risk. Small and mid-sized companies are generally less established and may be more volatile than larger companies. Small capitalization securities may underperform the market as a whole.

Underlying Fund Risks Particular to Core Strategy Trust

Hedging, derivatives, and other strategic transactions risk; other specific transactions. Derivatives and other strategic transactions that the fund intends to utilize, along with specific additional associated risks, if any, include: foreign currency forward contracts, credit default swaps, and interest-rate swaps. Foreign currency forward contracts and swaps generally are subject to counterparty risk. In addition, swaps may be subject to interest-rate and settlement risk, and the risk of default of the underlying reference obligation. Derivatives associated with foreign currency transactions are subject to currency risk.

Technology companies risk. Technology companies can be significantly affected by rapid obsolescence, short product cycles, competition, and government regulation, among other factors.

Utilities sector risk. Utilities companies’ performance may be volatile due to variable fuel, service, and financing costs, conservation efforts, government regulation, and other factors.

Underlying Fund Risks Particular to Lifestyle Growth PS Series

Advance trade estimate risk. The JHVIT Lifestyle PS Series may seek to mitigate asset transfer risk by adjusting its portfolio based on advance estimates of automatic transfers of Contract value under the Contracts. The John Hancock Issuers have provided the JHVIT Lifestyle PS Series’ subadvisor with an analytical tool that calculates estimates of automatic transfers based on several factors, including the mathematical process for automatic transfers and market movements before the daily close of trading. The subadvisor may, but is not required to, use the tool to adjust the JHVIT Lifestyle PS Series’ portfolio with the goal of trading in securities or purchasing shares of underlying funds as close to the market close as possible in order to limit the JHVIT Lifestyle PS Series’ exposure to cash drag (i.e., holding cash while markets are rising) and adverse overnight market fluctuations. For example, in a rising market, if the analytical tool suggests that the JHVIT Lifestyle PS Series will receive inflows that day (the “Trade Date”), the subadvisor could buy securities or shares of an underlying fund close to or at the closing prices on the Trade Date, as opposed to the following business day, when the actual transfer amount would be known. In a falling market, if the analytical tool suggests that the JHVIT Lifestyle PS Series will experience outflows on Trade Date, the subadvisor could sell securities or shares of an underlying fund close to or at the closing prices on Trade Date, as opposed to the following business day, when the actual transfer amount would be known.

If the subadvisor relies on the analytical tool or its own judgment and places trades in anticipation of purchases and redemptions of JHVIT Lifestyle PS shares, there can be no assurance that the prices paid by the JHVIT Lifestyle PS Series will be better than if the JHVIT Lifestyle PS Series had traded the following business day. The estimated transfer amount may be different from the actual transfer amount for various reasons, including changes in market direction, contract owner behavior and faulty inputs. If the estimated transfer amount is different from the actual transfer amount, the JHVIT Lifestyle PS Series will buy or sell securities or shares of an underlying fund the following business day to adjust for this difference. For example, if cash flows into the JHVIT Lifestyle PS Series are less than estimated, the JHVIT Lifestyle PS Series could be forced to liquidate positions it had purchased. Conversely, if cash flows out of the JHVIT Lifestyle PS Series are less than estimated, the JHVIT Lifestyle PS Series may be required to repurchase positions it had sold. In addition, purchasing securities or shares of an underlying fund early could cause the JHVIT Lifestyle PS Series to spend more money than it has available and, in the event of a market decline, such leverage will magnify losses because the decline also affects the securities purchased with amounts in excess of the JHVIT Lifestyle PS Series’ assets. Due to these various factors, trading on the basis of advance estimates of automatic transfers may cause higher portfolio turnover than that based solely on automatic transfers of Contract value under the Contracts, increase JHVIT Lifestyle PS Series expenses and adversely affect the performance of the JHVIT Lifestyle PS Series.

Exchange-traded funds risk. An ETF generally reflects the risks of the underlying securities it is designed to track. A fund bears ETF fees and expenses indirectly.

* * *

These risks are more fully described below and in the JHVIT Prospectus under “Additional Information About the Funds’ Principal Risks.” Additional information on these risks is included in the JHVIT SAI under “Risk Factors.”

Investment Management Fees/Subadvisory Arrangements

Each fund pays JHIMS a management fee that is accrued and paid daily. The advisory fee for the fund is calculated by applying to the net assets of the fund an annual fee rate, which is determined based on the application of the annual percentage rates for the fund to the “Aggregate Net Assets” of the fund.

| Core Strategy Trust (Acquired Fund) | Lifestyle Growth PS Series (Acquiring Fund) |

| The management fee has two components: (a) a fee on assets invested in funds of JHVIT, John Hancock Funds II (“JHF II”), or John Hancock Funds III (“JHF III”) (“Affiliated Funds Assets”)* and (b) a fee on assets not invested in Affiliated Funds (“Other Assets”). |

| *The following JHVIT funds are not included in Affiliated Funds Assets: 500 Index Trust B, International Equity Index Trust B, and Total Bond Market Trust B. |

(a) The fee on Affiliated Funds Assets is stated as an annual percentage of the current value of the net assets of the fund determined in accordance with the following schedule and that rate is applied to the Affiliated Funds Assets of the fund. 0.050% — first $500 million; and 0.040% — excess over $500 million. (b) The fee on Other Assets is stated as an annual percentage of the current value of the net assets of the fund determined in accordance with the following schedule and that rate is applied to the Other Assets of the fund. 0.500% — first $500 million; and 0.490% — excess over $500 million. | (a) The fee on Affiliated Funds Assets is stated as an annual percentage of the current value of the aggregate net assets of the JHVIT Lifestyle MVPs, the JHVIT Lifestyle PS Series, and the Multimanager Lifestyle Portfolios, and Multi-Index Lifestyle Portfolios that are series of JHF II, determined in accordance with the following schedule and that rate is applied to the Affiliated Funds Assets of the fund. 0.050% — first $7.5 billion; and 0.040% — excess over $7.5 billion. (b) The fee on Other Assets is stated as an annual percentage of the current value of the aggregate net assets of the JHVIT Lifestyle MVPs, the JHVIT Lifestyle PS Series and the Multimanager Lifestyle Portfolios and Multi-Index Lifestyle Portfolios that are series of JHF II determined in accordance with the following schedule and that rate is applied to the Other Assets of the fund. 0.500% — first $7.5 billion; and 0.490% — excess over $7.5 billion. |

During the twelve-month period ended December 31, 2016, Core Strategy Trust paid an effective advisory fee of 0.04% and Lifestyle Growth PS Series paid an effective advisory fee of 0.04%.

JHAM (NA) and JHAM (US) serve as the subadvisors to Core Strategy Trust and Lifestyle Growth PS Series. For its services, each of JHAM (NA) and JHAM (US) receives a subadvisory fee. The subadvisory fees are paid by JHIMS and are not additional charges to the funds.

* * *

For additional information about the subadvisor and portfolio manager for the Acquired and Acquiring Funds, see “Additional Information About the Funds – The Subadvisors and Portfolio Managers.”

A discussion of the basis of the Board’s approval of the continuation of the advisory and subadvisory agreements for the Acquired and Acquiring Funds at the June 21-23, 2016 Board meeting is available in JHVIT’s Semiannual Report to Shareholders for the six-month period ended June 30, 2016.

Performance

The following information provides some indication of the risks of investing in each fund by showing changes in performance from year to year and by showing how average annual returns for specified periods compare with those of a broad measure of market performance. Lifestyle Growth PS Series slightly outperformed Core Strategy Trust for the one-year period ended December 31, 2016, but slightly underperformed Core Strategy Trust for the five-year period ended December 31, 2016.

The calendar year total returns for each fund represent the returns for that fund’s oldest share class.

Unless all share classes shown in the average annual total returns table have the same inception date, performance shown for periods prior to the inception date of a class is the performance of the fund’s oldest share class. This pre-inception performance, with respect to any other share class of the fund, has not been adjusted to reflect the Rule 12b-1 fees of that class. As a result, the pre-inception performance shown for a share class other than the oldest share class may be higher or lower than it would be if adjusted to reflect the Rule 12b-1 fees of the class. The performance information below does not reflect fees and expenses of any variable insurance contract that may use JHVIT as its underlying investment medium. If such fees and expenses had been reflected, performance would be lower.

For each fund’s average annual total returns table, the Combined Index represents 49% of the Russell 3000 Index, 21% of the MSCI EAFE Index, and 30% of the Bloomberg Barclays U.S. Aggregate Bond Index.

The past performance of a fund is not necessarily an indication of how it will perform in the future.

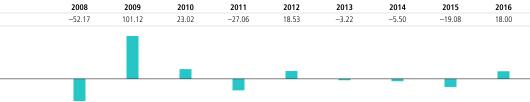

Core Strategy Trust

(Acquired Fund)

Calendar year total returns for Series II (%)

| Best Quarter: | 13.17% (Quarter ended June 30, 2009) |

| Worst Quarter: | -14.86% (Quarter ended December 31, 2008) |

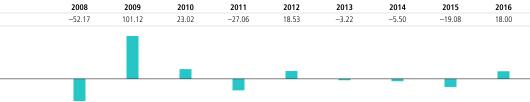

Lifestyle Growth PS Series

(Acquiring Fund)

Calendar year total returns for Series II (%)

| Best Quarter: | 9.44% (Quarter ended March 31, 2012) |

| Worst Quarter: | -5.45% (Quarter ended September 30, 2015) |

Average Annual Total Returns for Periods Ended December 31, 2016

Core Strategy Trust

(Acquired Fund)

| | One

Year | Five

Year | Inception | Date of

Inception |

| Series I | 7.11% | 8.77% | 5.05% | 04/28/2008 |

| Series II | 6.96% | 8.57% | 4.89% | 02/10/2006 |

| Series NAV | 7.16% | 8.83% | 5.10% | 04/28/2008 |

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 11.96% | 14.66% | 6.95% | |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 2.65% | 2.23% | 4.34% | |

| Combined Index (reflects no deduction for fees, expenses, or taxes) | 7.45% | 9.40% | 5.37% | |

Lifestyle Growth PS Series

(Acquiring Fund)

| | One

Year | Five

Year | Inception | Date of

Inception |

| Series I | 7.23% | 8.74% | 6.16% | 11/01/2013 |

| Series II | 7.02% | 8.60% | 6.04% | 04/29/2011 |

| Series NAV | 7.21% | 8.77% | 6.19% | 11/01/2013 |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 2.65% | 2.23% | 3.04% | 04/29/2011 |

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 11.96% | 14.66% | 11.55% | 04/29/2011 |

| Combined Index (reflects no deduction for fees, expenses, or taxes) | 7.45% | 9.40% | 7.06% | 04/29/2011 |

PROPOSAL 2 —

APPROVAL OF AGREEMENT AND PLAN OF REORGANIZATION PROVIDING FOR

THE REORGANIZATION OF VALUE TRUST INTO

MID CAP INDEX TRUST

Shareholders of Value Trust (the “Acquired Fund”) are being asked to approve the Plan providing for the Reorganization of that fund into Mid Cap Index Trust (the “Acquiring Fund”). The funds are compared below.

Comparison of Acquired and Acquiring Funds

Both Value Trust and Mid Cap Index Trust have similar investment objectives and policies, as outlined in the chart below. The following is a summary of the similarities and differences between the funds’ investment policies. Value Trust and Mid Cap Index Trust are similar in that both funds invest in mid cap equity securities (at least 65% of total assets in the case of Value Trust and 80% of net assets in the case of Mid Cap Index Trust). The funds differ in that Mid Cap Index Trust seeks to approximate the return of the S&P Mid Cap 400 whereas Value Trust is not an index fund and invests in equity securities of companies with capitalizations, at the time of investment, similar to the market capitalization of companies in the Russell Midcap Value Index. Value Trust may invest without limit in American Depositary Receipts (“ADRs”), up to 20% of total assets in foreign equities, and up to 15% of net assets in real estate investment trusts, or REITs, whereas Mid Cap Index Trust has no such investment policies.

Value Trust (Acquired Fund) | Mid Cap Index Trust

(Acquiring Fund) |

| Approximate Net Assets of Each Fund as of December 31, 2016: |

$528,451,503 | $1,006,286,909 |

Investment Advisor:

JHIMS |

| Investment Subadvisors: |

| Invesco | JHAM (NA) |

| Investment Objectives: |

| To realize an above-average total return over a market cycle of three to five years, consistent with reasonable risk. | Seeks to approximate the aggregate total return of a mid cap U.S. domestic equity market index. |

| Principal Investment Strategies: |

Under normal market conditions, the fund invests in equity securities of companies with capitalizations, at the time of investment, similar to the market capitalization of companies in the Russell Midcap Value Index ($703.3 million to $39.3 billion as of February 28, 2017). The fund invests at least 65% of its total assets in equity securities. These primarily include common stocks but may also include preferred stocks, convertible securities, rights, warrants and ADRs. The fund may invest without limit in ADRs and may invest | Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) at the time of investment in: (a) the common stocks that are included in the S&P MidCap 400 Index; and (b) securities (which may or may not be included in the S&P MidCap 400 Index) that the subadvisor believes as a group will behave in a manner similar to the index. As of February 28, 2017, the market capitalizations of companies included in the S&P MidCap 400 Index ranged from $910 million to $13.4 billion. |

Value Trust (Acquired Fund) | Mid Cap Index Trust

(Acquiring Fund) |

up to 20% of its total assets in foreign equities (investments in ADRs are not foreign securities for the purposes of this limit and the fund may invest without limitation in ADRs). The fund may invest up to 15% of its net assets in real estate investment trusts, or REITs. The fund may hedge non-U.S. currency exposure through the use of forward foreign currency contracts. The subadvisor’s approach is to select equity securities which are believed to be undervalued relative to the stock market in general as measured by the Russell Midcap Value Index. Generally, medium market capitalization companies will consist primarily of those that the subadvisor believes are selling below their intrinsic value and offer the opportunity for growth of capital. The fund emphasizes a “value” style of investing focusing on those companies with strong fundamentals, consistent track records, growth prospects, and attractive valuations. The subadvisor may favor securities of companies that are in undervalued industries. The subadvisor may purchase stocks that do not pay dividends. The subadvisor may also invest the fund’s assets in companies with smaller or larger market capitalizations. | An index is an unmanaged group of securities whose overall performance is used as an investment benchmark. Indexes may track broad investment markets, such as the global equity market, or more narrow investment markets, such as the U.S. small cap equity market. In contrast to actively managed funds, which seek to outperform their respective benchmark indexes through research and analysis, index funds are passively managed funds that seek to mirror the performance of their target indexes, minimizing performance differences over time. The fund attempts to match the performance of the S&P MidCap 400 Index by: (a) holding all, or a representative sample, of the securities that comprise that index; and/or (b) by holding securities (which may or may not be included in the index) that the subadvisor believes as a group will behave in a manner similar to the index. However, the fund has operating expenses and transaction costs, while a market index does not. Therefore, the fund, while it attempts to track its target index closely, typically will be unable to match the performance of the target index exactly. The composition of an index changes from time to time, and the subadvisor will reflect those changes in the composition of the fund’s portfolio as soon as practicable. The fund may invest in index futures for the purposes of replicating an index and Depositary Receipts. |