UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04149

Franklin Tax-Free Trust

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:(650) 312-2000

Date of fiscal year end:2/28

Date of reporting period: 02/28/14

Item 1. Reports to Stockholders.

| | | | | | | |

| | Contents | | | | | |

| Shareholder Letter | 1 | Annual Report | | Franklin Michigan Tax-Free | | Financial Highlights and | |

| | | Municipal Bond Market | | Income Fund | 37 | Statements of Investments | 87 |

| | | Overview | 4 | Franklin Minnesota Tax-Free | | Financial Statements | 156 |

| | | Investment Strategy and | | Income Fund | 47 | Notes to Financial Statements | 166 |

| | | Manager’s Discussion | 6 | Franklin Ohio Tax-Free | | Report of Independent | |

| | | Franklin Arizona Tax-Free | | Income Fund | 57 | Registered Public | |

| | | Income Fund | 7 | Franklin Oregon Tax-Free | | Accounting Firm | 182 |

| | | Franklin Colorado Tax-Free | | Income Fund | 67 | Tax Information | 183 |

| | | Income Fund | 17 | Franklin Pennsylvania | | Board Members and Officers | 184 |

| | | Franklin Connecticut Tax-Free | | Tax-Free Income Fund | 77 | | |

| | | Income Fund | 27 | | | Shareholder Information | 189 |

| | | | | | | | |

Annual Report

Municipal Bond Market Overview

For the 12-month period ended February 28, 2014, the municipal bond market declined in value. The Barclays Municipal Bond Index, which tracks investment-grade municipal securities, had a -0.21% total return for the 12-month period.1, 2 In comparison, the Barclays U.S. Treasury Index had a 12-month return of -0.88%.1, 2

Municipal bond and Treasury markets suffered steep declines beginning in late May 2013 following comments by Federal Reserve Board (Fed) Chairman Ben Bernanke that the Fed could begin tapering its bond buying in the coming months. Fears of declining bond prices increased when minutes from the Fed’s July meeting included more discussion of tapering. Municipal bond mutual funds experienced persistent, large outflows that accelerated during August. Selling in the Treasury and municipal bond markets caused yields on longer term bonds to rise faster than yields on shorter maturity bonds in both markets, but the yield difference was more pronounced for municipal bonds. Because bond prices move in the opposite direction from yields, the yield changes led to two significant developments during the sell-off — municipal bonds under-performed Treasury bonds, and longer term municipal bonds fared worse than shorter term municipal bonds. At its September meeting, the Fed decided to maintain its monthly level of bond purchases and wait for more evidence of sustained economic growth before tapering. Investors welcomed the news, and the municipal bond market posted positive returns for the month. At its December meeting, the Fed announced it would modestly reduce the pace of its bond buying program beginning in January 2014 while maintaining historically low interest rates. Municipal bond and Treasury markets showed little reaction to the news initially, but prices in both markets increased substantially during the first two months of 2014.

Other factors contributed to municipal bond price declines during the period under review. Several headline stories shook investor confidence in the municipal bond asset class. The City of Detroit, Michigan, filed for bankruptcy, the largest municipal bankruptcy filing in U.S. history. Independent credit rating agencies Standard & Poor’s, Moody’s Investors Service and Fitch Ratings downgraded Puerto Rico general obligation debt to below investment grade. The City of Chicago suffered a three-notch downgrade by Moody’s. In addition, reports from rating agencies and research organizations mentioned under-funded pensions that could affect the fiscal stability of several states and large municipalities. Bonds issued by municipalities involved in such stories have often experienced price erosion in secondary trading, but the extent of price erosion and the contagion to related issues have been unpredictable. Fallout

4 | Annual Report

from such headlines during the reporting period was no exception. As Puerto Rico debt traded at higher yields than similarly rated taxable securities, non-traditional buyers entered the market. Despite the entrance of these new buyers, Puerto Rico bonds experienced particularly poor performance and highly volatile trading. Puerto Rico bonds had a -16.99% total return for the reporting period, as measured by the Barclays Puerto Rico Municipal Bond Index.1, 2

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income while seeking value in the municipal bond market.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end of

the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings

may change depending on factors such as market and economic conditions. These opinions may not be relied upon

as investment advice or an offer for a particular security. The information is not a complete analysis of every

aspect of any market, state, industry, security or fund. Statements of fact are from sources considered reliable,

but the investment manager makes no representation or warranty as to their completeness or accuracy. Although

historical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

1. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. Past performance is no guarantee of future results.

2. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

Annual Report | 5

Investment Strategy and

Manager’s Discussion

Investment Strategy

We use a consistent, disciplined strategy in an effort to maximize tax-exempt income for our shareholders by seeking to maintain exposure to higher coupon securities while balancing risk and return within each Fund’s range of allowable investments. We generally employ a buy-and-hold approach and invest in securities we believe should provide the most relative value in the market. We do not use leverage or derivatives, nor do we use hedging techniques that could add volatility and contribute to underperformance in adverse markets.

Manager’s Discussion

Based on the combination of our value-oriented philosophy of investing primarily for income and a positive-sloping municipal yield curve, in which yields for longer term bonds are higher than those for shorter term bonds, we favored the use of longer term bonds. Consistent with our strategy, we sought to purchase bonds from 15 to 30 years in maturity with good call features. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

We invite you to read your Fund report for more detailed performance and portfolio information. Thank you for your participation in Franklin Tax-Free Trust. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Annual Report

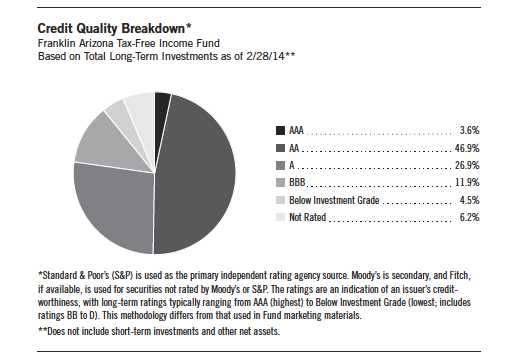

Franklin Arizona Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Arizona Tax-Free Income Fund

seeks to provide as high a level of income exempt from federal and Arizona personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its net assets in securities that pay interest free from such taxes.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This annual report Fund covers the fiscal year ended .

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.52 on February 28, 2013, to $10.80 on February 28, 2014. The Fund’s Class A shares paid dividends totaling 44.00 cents per share for the same period.2 The Performance Summary beginning on page 11 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 90.

Annual Report | 7

| | | |

| Dividend Distributions* | | | |

| Franklin Arizona Tax-Free Income Fund | | | |

| 3/1/13–2/28/14 | | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C | Advisor Class |

| March | 3.65 | 3.11 | 3.75 |

| April | 3.65 | 3.11 | 3.75 |

| May | 3.60 | 3.06 | 3.70 |

| June | 3.55 | 3.02 | 3.64 |

| July | 3.55 | 3.02 | 3.64 |

| August | 3.55 | 3.02 | 3.64 |

| September | 3.62 | 3.15 | 3.70 |

| October | 3.75 | 3.28 | 3.83 |

| November | 3.77 | 3.30 | 3.85 |

| December | 3.77 | 3.30 | 3.86 |

| January | 3.77 | 3.30 | 3.86 |

| February | 3.77 | 3.30 | 3.86 |

| Total | 44.00 | 37.97 | 45.08 |

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual dis-

tributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions

will vary depending upon current market conditions, and past distributions are not indicative of future trends.

4.01% based on an annualization of the 3.77 cent per share February dividend and the maximum offering price of $11.28 on February 28, 2014. An investor in the 2014 maximum combined effective federal and Arizona personal income tax bracket of 46.14% (including 3.8% Medicare tax) would need to earn a distribution rate of 7.45% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary.

State Update

Arizona’s economy continued to improve during the 12 months under review. The state’s troubled housing market, which collapsed during the last recession, strengthened as housing prices rose. These gains helped dramatically decrease the number of homes with mortgages greater than their property prices as homeowners regained equity lost during the real estate crash. Arizona also boasted one of the nation’s lowest percentages of foreclosed homes for sale. The state’s job market also improved. In 2013, Arizona’s employment growth outpaced the national rate. The state’s chronically high unemployment rate dropped to a six-year low of 7.3% at period-end based on strong growth in

8 | Annual Report

the private sector, a reduction in the size of the work force and some long-term unemployed not being tallied in surveys.3 In comparison, the national unemployment rate ended the period at 6.7%.3

The enacted fiscal year 2014 budget was balanced and modestly increased total spending, primarily on education, child welfare and protection services, and programs for the developmentally disabled. Lawmakers used federal assistance for the state Medicaid program to reduce long-term pressure on the general fund. The governor submitted a budget plan for fiscal year 2015 that called for increased spending on social service programs, education funding and infrastructure improvements. The proposal also included additional support for the state’s budget stabilization fund. The governor based spending hikes on a projection showing that tax collections could improve and help the budget achieve structural balance by the end of the governor’s term in January 2015. In contrast, lawmakers released a competing projection showing that Arizona would not achieve structural balance in the near future and also raised the possibility of the state’s finances heading toward a deficit.

Arizona does not issue general obligation bonds but instead issues appropriation-backed lease debt and revenue bonds. The state had moderate debt levels, with net tax-supported debt of $902 per capita and 2.5% of personal income, compared with the national medians of $1,074 and 2.8%.4 Independent credit rating agency Standard & Poor’s (S&P) affirmed Arizona’s issuer rating of AA-and upgraded its outlook to positive from stable.5 The rating reflected S&P’s view of the state’s diverse economy, adequate per-capita personal income, strong financial position and moderate debt burden. S&P noted that challenges included cyclical finances, restricted operational flexibility resulting from voter initiatives and a potential for structural imbalance. The upgraded outlook reflected S&P’s view of Arizona’s improved budget stabilization fund balances and debt issuance plans.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Puerto Rico’s municipal bond market is widely traded because of its federal and state tax-exemption advantages. During the reporting period, some Puerto Rico issuers experienced a series of downgrades from S&P, Moody’s Investors Service and Fitch Ratings. In February 2014, these credit rating firms downgraded their respective ratings of Puerto Rico’s general obligation debt to below investment grade, along with the ratings of certain related Puerto Rico issuers. Additionally, each rating agency maintained a negative outlook on certain Puerto Rico issuers, and further downgrades are possible. The Fund is not required to sell securities that

| | |

| Portfolio Breakdown | | |

| Franklin Arizona Tax-Free Income Fund | |

| 2/28/14 | | |

| % of Total | |

| Long-Term Investments* | |

| Utilities | 21.4 | % |

| Hospital & Health Care | 20.0 | % |

| Tax-Supported | 14.5 | % |

| Subject to Government Appropriations | 13.7 | % |

| Higher Education | 9.4 | % |

| Other Revenue | 6.1 | % |

| Transportation | 4.5 | % |

| Refunded | 4.3 | % |

| General Obligation | 3.3 | % |

| Housing | 2.8 | % |

*Does not include short-term investments and other

net assets.

Annual Report | 9

have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience sharp declines in the latter half of 2013 and contrasting positive performance year-to-date in 2014.

Thank you for your continued participation in Franklin Arizona Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

1. For state personal income taxes, the 80% minimum is measured by total Fund assets. For investors subject to alter-

native minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally

taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S.

investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative

of future trends.

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, “2013 State Debt Medians Report,” 5/29/13.

5. This does not indicate S&P’s rating of the Fund.

10 | Annual Report

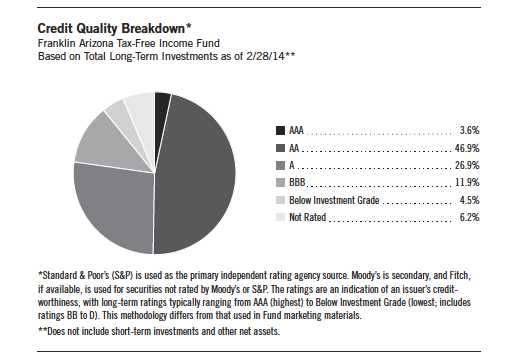

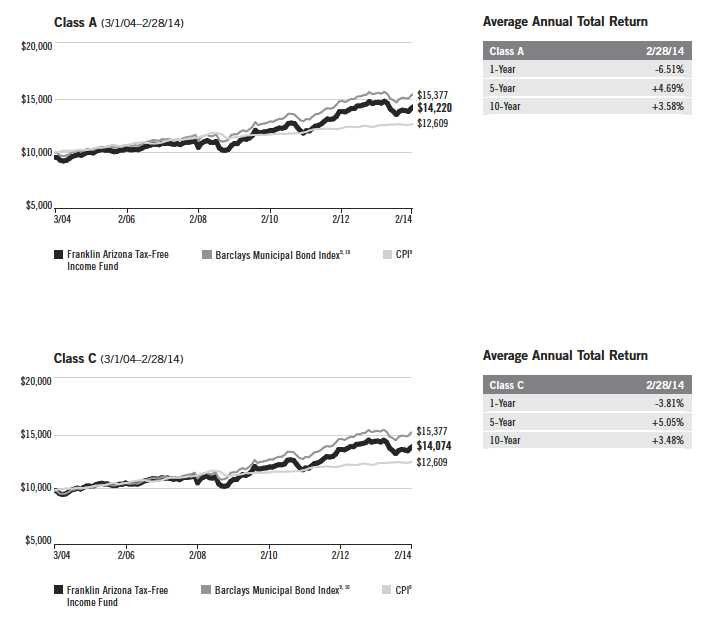

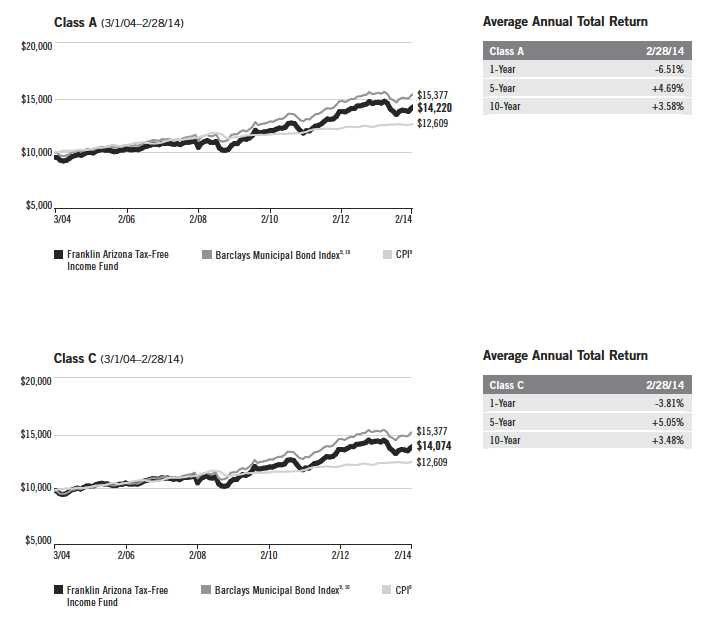

Performance Summary as of 2/28/14

Franklin Arizona Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FTAZX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | | -$0.72 | | $10.80 | | $11.52 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.4400 | | | | | | |

| Class C (Symbol: FAZIX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | | -$0.72 | | $10.96 | | $11.68 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.3797 | | | | | | |

| Advisor Class (Symbol: FAZZX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | | -$0.72 | | $10.83 | | $11.55 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.4508 | | | | | | |

Annual Report | 11

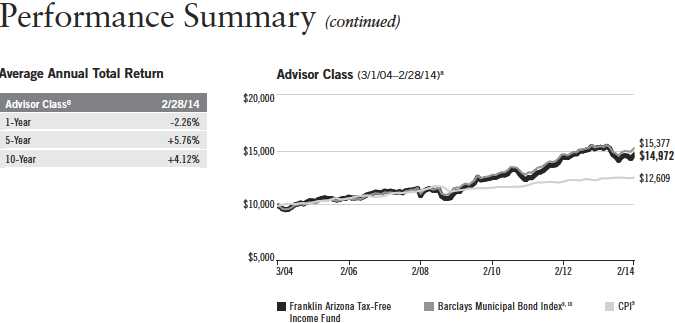

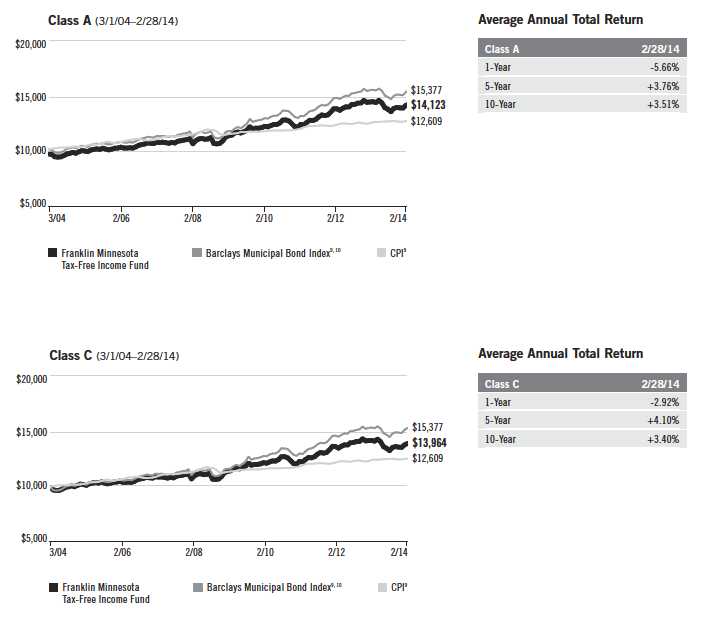

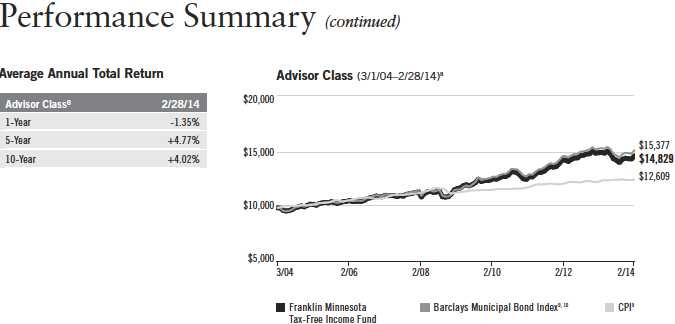

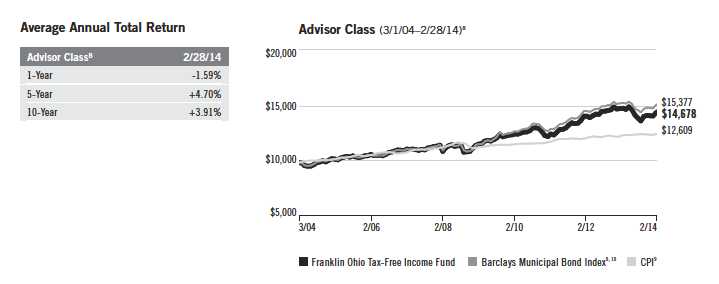

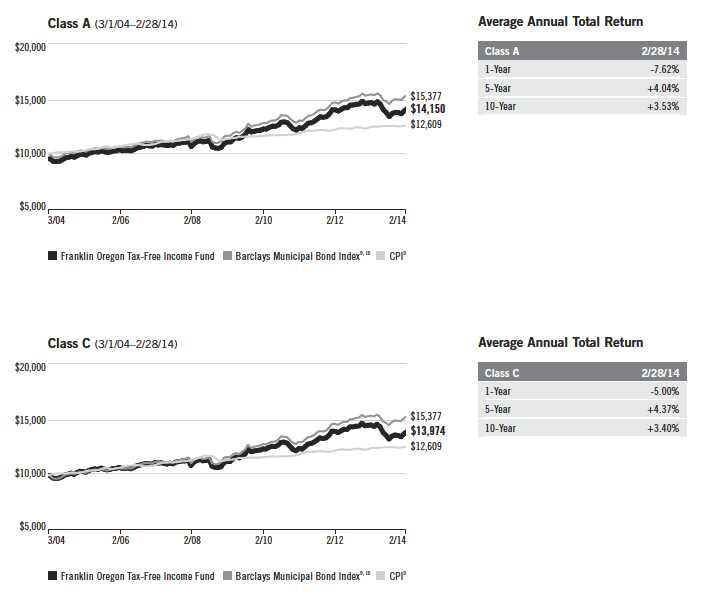

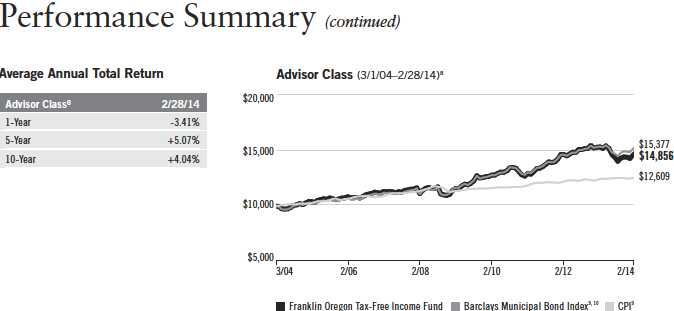

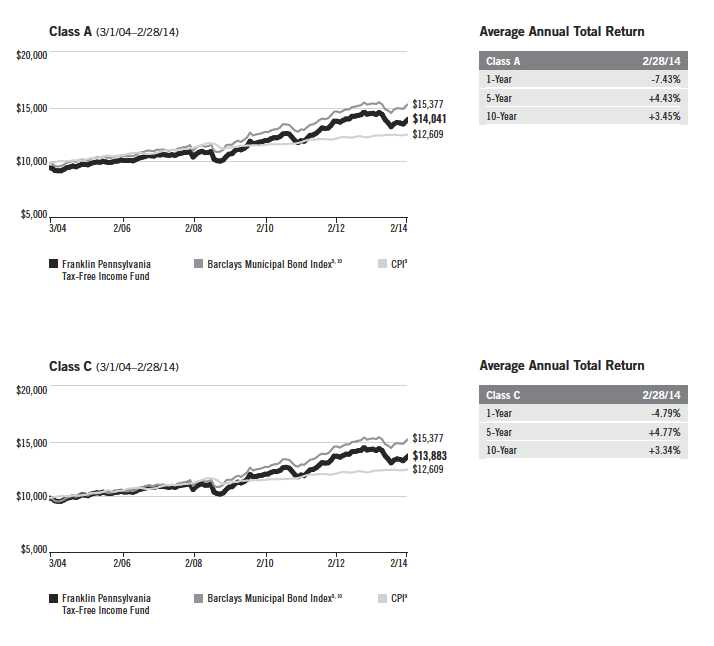

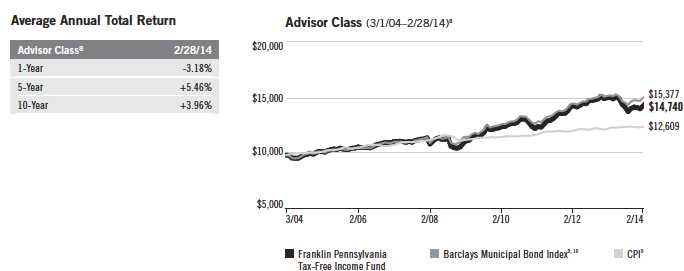

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges.

Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Advisor Class: no sales charges.

| | | | | | | | | | |

| Class A | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -2.37 | % | | +31.34 | % | | +48.54 | % |

| Average Annual Total Return2 | | | -6.51 | % | | +4.69 | % | | +3.58 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -5.44 | % | | +4.85 | % | | +3.67 | % |

| Distribution Rate4 | 4.01 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.45 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.44 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 6.39 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.63 | % | | | | | | | | |

| Class C | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -2.87 | % | | +27.94 | % | | +40.74 | % |

| Average Annual Total Return2 | | | -3.81 | % | | +5.05 | % | | +3.48 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -2.60 | % | | +5.19 | % | | +3.55 | % |

| Distribution Rate4 | 3.61 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.70 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.05 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 5.66 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 1.18 | % | | | | | | | | |

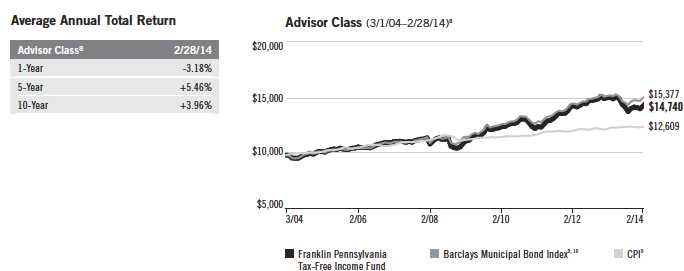

| Advisor Class8 | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -2.26 | % | | +32.30 | % | | +49.72 | % |

| Average Annual Total Return2 | | | -2.26 | % | | +5.76 | % | | +4.12 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -1.12 | % | | +5.90 | % | | +4.19 | % |

| Distribution Rate4 | 4.28 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.95 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.73 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 6.93 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.53 | % | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

12 | Annual Report

Performance Summary (continued)

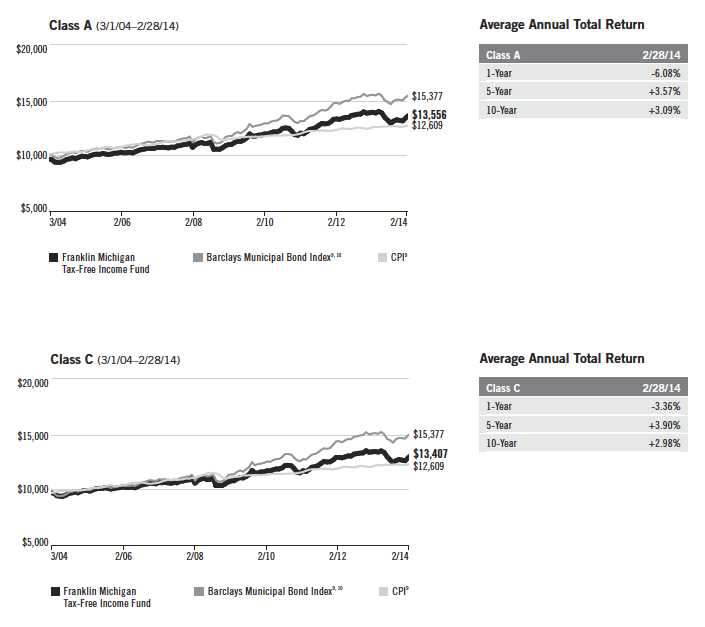

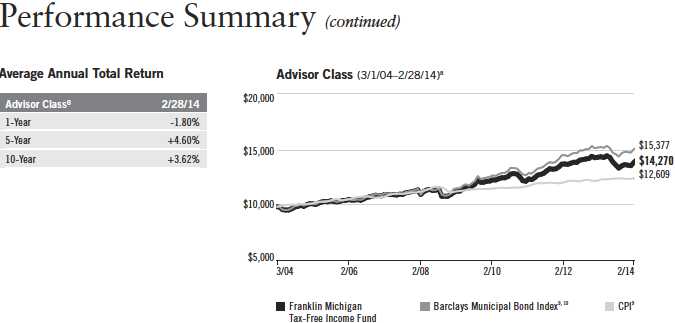

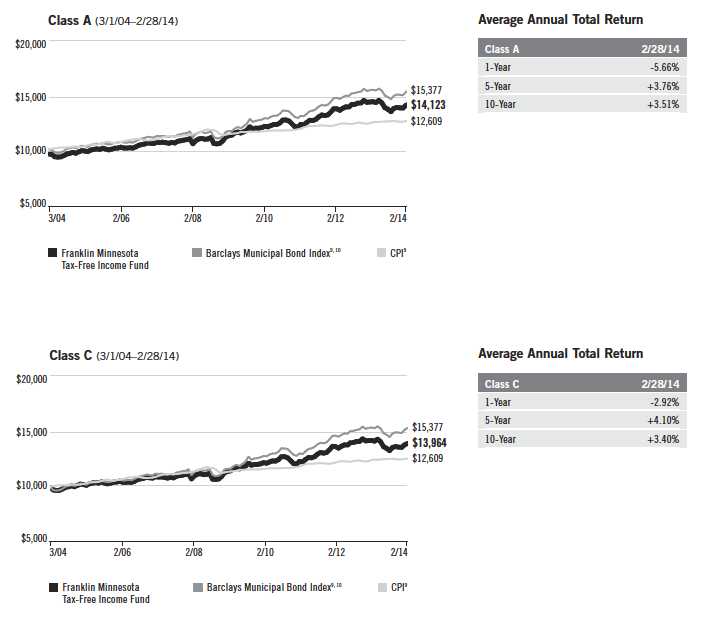

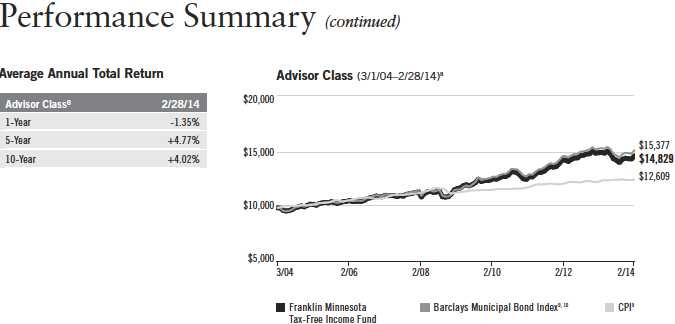

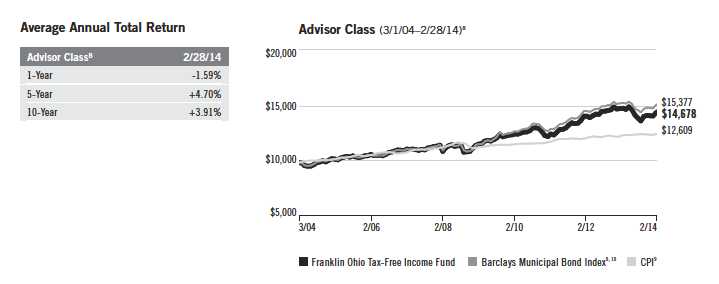

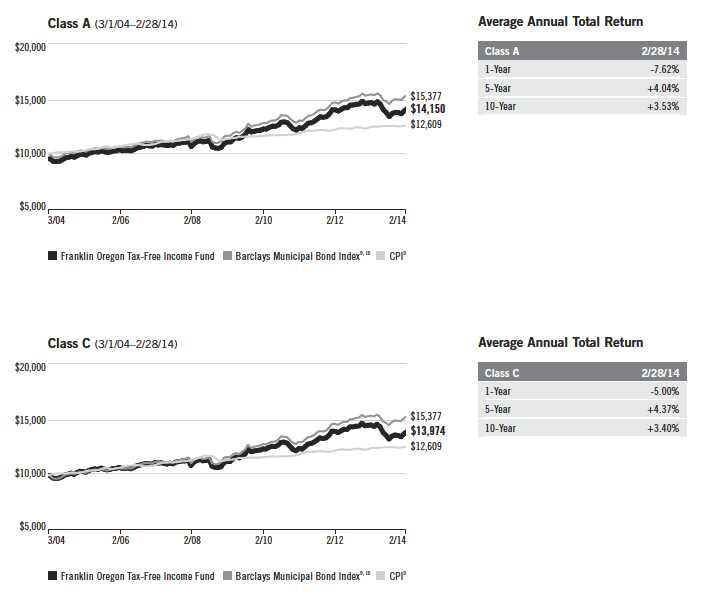

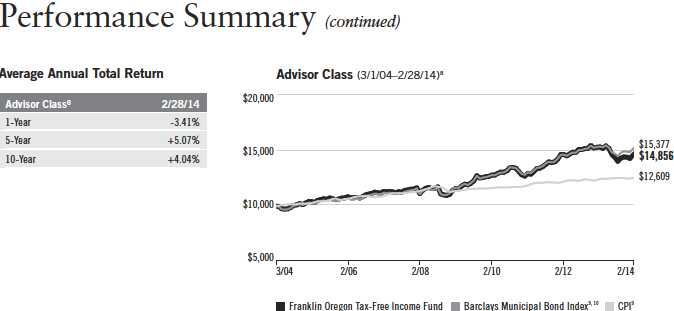

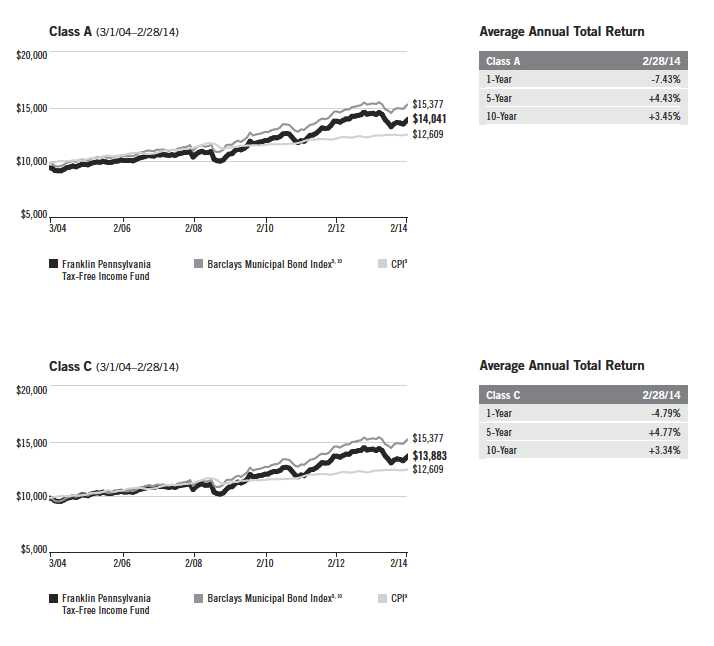

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 13

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s

yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as

prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a

single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund.

The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market

changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength

of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities

that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would

likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s

investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Classes C and

Advisor) per share on 2/28/14.

5. Taxable equivalent distribution rate and yield assume the published rates as of 12/18/13 for the maximum combined effective federal and Arizona

personal income tax rate of 46.14%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

6. The 30-day standardized yield for the month ended 2/28/14 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

8. Effective 7/1/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for

this class reflect the following methods of calculation: (a) For periods prior to 7/1/08, a restated figure is used based upon the Fund’s Class A per-

formance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods

after 7/1/08, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 7/1/08 (commencement of

sales), the cumulative and average annual total returns of Advisor Class shares were +30.61% and +4.83%.

9. Source: © 2014 Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond

market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or

higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the Bureau of

Labor Statistics, is a commonly used measure of the inflation rate.

10. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

14 | Annual Report

Your Fund’s Expenses

Franklin Arizona Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period, by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 15

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/13 | | Value 2/28/14 | | Period* 9/1/13–2/28/14 |

| Actual | $ | 1,000 | $ | 1,059.50 | $ | 3.27 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.62 | $ | 3.21 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,056.90 | $ | 6.07 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.89 | $ | 5.96 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,060.90 | $ | 2.76 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.12 | $ | 2.71 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.64%; C: 1.19%; and Advisor: 0.54%),

multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

16 | Annual Report

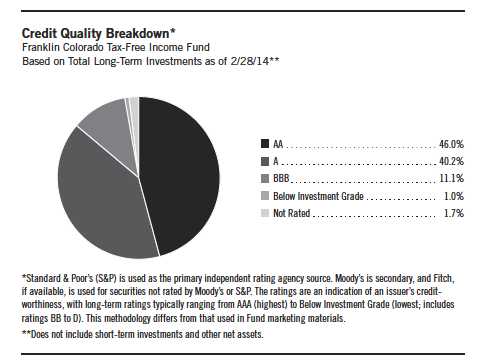

Franklin Colorado Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Colorado Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and Colorado personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its net assets in securities that pay interest free from such taxes.1

This annual report for Franklin Colorado Tax-Free Income Fund covers the fiscal year ended February 28, 2014.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $12.44 on February 28, 2013, to $11.66 on February 28, 2014. The Fund’s Class A shares paid dividends totaling 45.50 cents per share for the same period.2 The Performance Summary beginning on page 21 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 98.

Annual Report | 17

| | | |

| Dividend Distributions* | | | |

| Franklin Colorado Tax-Free Income Fund | | | |

| 3/1/13–2/28/14 | | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C | Advisor Class |

| March | 3.67 | 3.09 | 3.77 |

| April | 3.67 | 3.09 | 3.77 |

| May | 3.67 | 3.09 | 3.77 |

| June | 3.67 | 3.11 | 3.77 |

| July | 3.67 | 3.11 | 3.77 |

| August | 3.67 | 3.11 | 3.77 |

| September | 3.82 | 3.30 | 3.91 |

| October | 3.87 | 3.35 | 3.96 |

| November | 3.92 | 3.40 | 4.01 |

| December | 3.92 | 3.41 | 4.01 |

| January | 3.95 | 3.44 | 4.04 |

| February | 4.00 | 3.49 | 4.09 |

| Total | 45.50 | 38.99 | 46.64 |

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual dis-

tributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions

will vary depending upon current market conditions, and past distributions are not indicative of future trends.

3.94% based on an annualization of the 4.00 cent per share February dividend and the maximum offering price of $12.18 on February 28, 2014. An investor in the 2014 maximum combined effective federal and Colorado personal income tax bracket of 46.20% (including 3.8% Medicare tax) would need to earn a distribution rate of 7.32% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary.

State Update

Colorado’s economy continued to expand during the 12 months under review. The state enjoyed strong employment growth, particularly in the Denver metropolitan area, which attracted businesses from the technology, telecommunications and energy industries. Many of these businesses were drawn to the area’s highly educated workforce, low cost of doing business and rapid rate of in-migration. A real estate boom also contributed to Colorado’s economic expansion. Home sales and prices increased for much of the reporting period. Higher prices, cold weather and the holiday season, however, slowed sales in the fourth quarter of 2013. The overall gains helped Colorado’s unemployment rate stay below the nation’s during the fiscal year. The state’s unemployment rate fell to 6.1% from 7.1% over the period, while the national rate ended the period at 6.7%.3

18 | Annual Report

The enacted fiscal year 2014 budget recognized that revenue outperformance during the period was likely one-time in nature and ensured that some of the new spending was on one-time items. Lawmakers allocated additional funding for K-12 and higher education, infrastructure construction and maintenance, health services and child welfare, and economic development initiatives such as tourism promotion and incentives for companies to relocate to or expand their workforce in the state. Additionally, the fiscal year 2014 budget increased Colorado’s allocation to the general fund reserve. The governor submitted a budget proposal for fiscal year 2015 that restored funding for agencies that had endured budget cuts resulting from the need for emergency funding to address a series of wildfires and floods. Highlights of the proposal included increased spending on education, corrections and emergency recovery efforts, and increasing the general fund reserve. The governor based the spending recommendations on forecasts that the state’s economy could continue to strengthen. Near period-end, the governor released an updated budget proposal reflecting that sales tax collections from Colorado’s recently legalized marijuana market exceeded lawmakers’ expectations. The updated proposal allocated additional funding for substance abuse prevention and treatment programs. Analysts noted, however, that continued strong revenue collections could trigger a constitutional requirement that surplus revenue be returned to taxpayers as a refund.

Colorado’s constitution prohibits the state from issuing long-term general obligation debt, but the state has issued general fund appropriation-backed lease revenue debt for general purposes. Colorado’s debt levels were lower than most states, with net tax-supported debt at $525 per capita and 1.2% of personal income, compared with the $1,074 and 2.8% national medians.4 Independent credit rating agency Standard & Poor’s (S&P) affirmed its Colorado issuer rating of AA with a stable outlook.5 The rating and outlook reflected S&P’s view of the state’s strong economic fundamentals that included above-average income, employment and population trends, history of making midyear budget adjustments as required by quarterly revenue forecasts, good financial performance and low debt levels. According to S&P, challenges included a high level of unfunded pension liabilities and a track record of funding less than the required pension contribution, as well as constitutional restrictions and voter initiatives that limit tax revenue growth and spending flexibility.

| | |

| Portfolio Breakdown | | |

| Franklin Colorado Tax-Free Income Fund | |

| 2/28/14 | | |

| % of Total | |

| Long-Term Investments* | |

| Hospital & Health Care | 19.0 | % |

| Tax-Supported | 16.3 | % |

| Subject to Government Appropriations | 15.0 | % |

| Utilities | 14.9 | % |

| Higher Education | 12.2 | % |

| Refunded | 10.1 | % |

| Other Revenue | 4.9 | % |

| General Obligation | 4.1 | % |

| Transportation | 3.5 | % |

*Does not include short-term investments and other net assets.

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Puerto Rico’s municipal bond market is widely traded because of its federal and state tax-exemption advantages. During the reporting period, some Puerto Rico issuers experienced a series of downgrades from S&P, Moody’s Investors Service

Annual Report | 19

and Fitch Ratings. In February 2014, these credit rating firms downgraded their respective ratings of Puerto Rico’s general obligation debt to below investment grade, along with the ratings of certain related Puerto Rico issuers. Additionally, each rating agency maintained a negative outlook on certain Puerto Rico issuers, and further downgrades are possible. The Fund is not required to sell securities that have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience sharp declines in the latter half of 2013 and contrasting positive performance year-to-date in 2014.

Thank you for your continued participation in Franklin Colorado Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end

of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings

may change depending on factors such as market and economic conditions. These opinions may not be relied upon

as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect

of any market, state, industry, security or the Fund. Statements of fact are from sources considered reliable, but

the investment manager makes no representation or warranty as to their completeness or accuracy. Although

historical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

1. For state personal income taxes, the 80% minimum is measured by total Fund assets. For investors subject to alter-

native minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally

taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S.

investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative

of future trends.

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, “2013 State Debt Medians Report,” 5/29/13.

5. This does not indicate S&P’s rating of the Fund.

20 | Annual Report

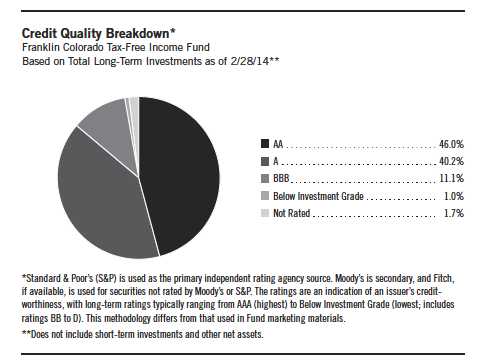

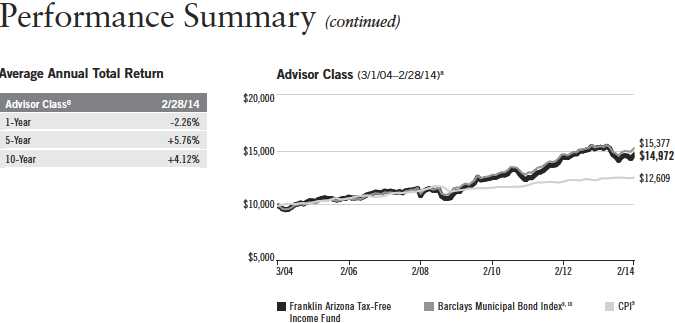

Performance Summary as of 2/28/14

Franklin Colorado Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FRCOX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.78 | $ | 11.66 | $ | 12.44 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.4550 | | | | | | |

| Class C (Symbol: FCOIX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.78 | $ | 11.78 | $ | 12.56 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.3899 | | | | | | |

| Advisor Class (Symbol: FCOZX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.77 | $ | 11.66 | $ | 12.43 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.4664 | | | | | | |

Annual Report | 21

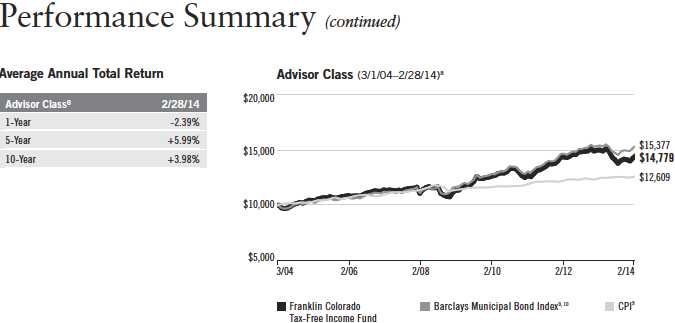

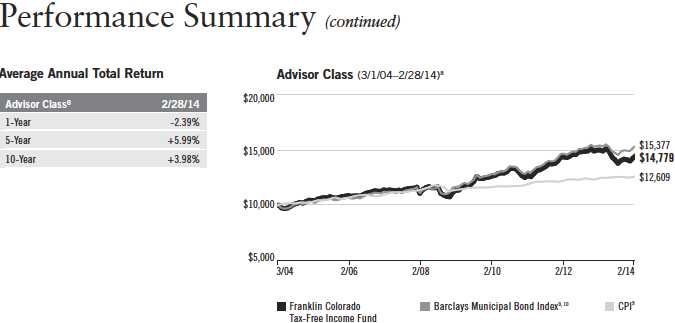

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges.

Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Advisor Class: no sales charges.

| | | | | | | | | | |

| Class A | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -2.56 | % | | +33.17 | % | | +47.11 | % |

| Average Annual Total Return2 | | | -6.68 | % | | +4.98 | % | | +3.49 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -5.70 | % | | +4.94 | % | | +3.54 | % |

| Distribution Rate4 | 3.94 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.32 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.32 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 6.17 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.65 | % | | | | | | | | |

| Class C | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -3.07 | % | | +29.56 | % | | +39.27 | % |

| Average Annual Total Return2 | | | -4.01 | % | | +5.32 | % | | +3.37 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -2.87 | % | | +5.29 | % | | +3.44 | % |

| Distribution Rate4 | 3.56 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.62 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 2.92 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 5.43 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 1.20 | % | | | | | | | | |

| Advisor Class8 | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -2.39 | % | | +33.78 | % | | +47.79 | % |

| Average Annual Total Return2 | | | -2.39 | % | | +5.99 | % | | +3.98 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -1.39 | % | | +5.95 | % | | +4.05 | % |

| Distribution Rate4 | 4.21 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.82 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.57 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 6.64 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.55 | % | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

22 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes

any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions.

The unmanaged index includes reinvestment of any income or distributions. It differs from the

Fund in composition and does not pay management fees or expenses. One cannot invest directly

in an index.

Annual Report | 23

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s

yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as

prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a

single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund.

The Fund holds a small portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market

changes, which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength

of a bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities

that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would

likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s

investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Classes C and

Advisor) per share on 2/28/14.

5. Taxable equivalent distribution rate and yield assume the published rates as of 12/18/13 for the maximum combined effective federal and

Colorado personal income tax rate of 46.20%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

6. The 30-day standardized yield for the month ended 2/28/14 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

8. Effective 7/15/09, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 7/15/09, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 7/15/09, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 7/15/09 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +26.39% and +5.19%.

9. Source: © 2014 Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond

market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or

higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the Bureau of

Labor Statistics, is a commonly used measure of the inflation rate.

10. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

24 | Annual Report

Your Fund’s Expenses

Franklin Colorado Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 25

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/13 | | Value 2/28/14 | | Period* 9/1/13–2/28/14 |

| Actual | $ | 1,000 | $ | 1,059.70 | $ | 3.42 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.47 | $ | 3.36 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,056.20 | $ | 6.22 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.74 | $ | 6.11 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,060.20 | $ | 2.91 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.97 | $ | 2.86 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.67%; C: 1.22%; and Advisor: 0.57%),

multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

26 | Annual Report

Franklin Connecticut Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Connecticut Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and Connecticut personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its net assets in securities that pay interest free from such taxes.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This annual report for Franklin Connecticut Tax-Free Income Fund covers the fiscal year ended February 28, 2014.

Performance Overview

The Fund’s Class A share price, as measured by net asset value, decreased from $11.43 on February 28, 2013, to $10.65 on February 28, 2014. The Fund’s Class A shares paid dividends totaling 38.29 cents per share for the same period.2 The Performance Summary beginning on page 31 shows that at the end of this reporting period the Fund’s Class A shares’ distribution rate was

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 106.

Annual Report | 27

| | | |

| Dividend Distributions* | | | |

| Franklin Connecticut Tax-Free Income Fund | | | |

| 3/1/13-2/28/14 | | | |

| | Dividend per Share (cents) |

| Month | Class A | Class C | Advisor Class |

| March | 2.99 | 2.46 | 3.09 |

| April | 2.99 | 2.46 | 3.09 |

| May | 2.99 | 2.46 | 3.09 |

| June | 2.99 | 2.48 | 3.08 |

| July | 2.99 | 2.48 | 3.08 |

| August | 3.19 | 2.68 | 3.28 |

| September | 3.24 | 2.77 | 3.32 |

| October | 3.29 | 2.82 | 3.37 |

| November | 3.34 | 2.87 | 3.42 |

| December | 3.39 | 2.93 | 3.48 |

| January | 3.42 | 2.96 | 3.51 |

| February | 3.47 | 3.01 | 3.56 |

| Total | 38.29 | 32.38 | 39.37 |

*Assumes shares were purchased and held for the entire accrual period. Since dividends accrue daily, your actual dis-

tributions will vary depending on the date you purchased your shares and any account activity. All Fund distributions

will vary depending upon current market conditions, and past distributions are not indicative of future trends.

3.74% based on an annualization of the 3.47 cent per share February dividend and the maximum offering price of $11.12 on February 28, 2014. An investor in the 2014 maximum combined effective federal and Connecticut personal income tax bracket of 47.45% (including 3.8% Medicare tax) would need to earn a distribution rate of 7.12% from a taxable investment to match the Fund’s Class A tax-free distribution rate. For the Fund’s Class C and Advisor shares’ performance, please see the Performance Summary.

State Update

Connecticut’s economy continued to show signs of improvement during the 12 months under review. The state’s above-average reliance on economically sensitive industries such as finance, insurance and real estate slowed the pace of its recovery. The troubled housing market had mixed results during the period. Foreclosure and housing permit issuance levels worsened, but home sales and prices improved. Connecticut’s persistently elevated unemployment rate fell to a five-year low of 7.0% at period-end.3 Most of the gains made in the fourth quarter of 2013 were attributed to employment, rather than job

28 | Annual Report

seekers leaving the labor force. In comparison, the national rate was 6.7% at period-end.3 Near period-end, the governor proposed a series of legislative actions to address unemployment that included borrowing funds for wage subsidy and job placement programs and creating a law that would make it illegal for employers to screen job seekers by their length of unemployment.

Lawmakers used nonrecurring measures including fund transfers, maturity extension of economic recovery notes and appropriation of a sizable portion of the fiscal year 2013 surplus to help bridge a large gap in the enacted fiscal 2014–2015 biennial budget. Other measures the state employed to balance the budget consisted of revenue enhancements without creating new taxes but encompassed reduced transfers for municipal aid, the special transportation fund, as well as spending cuts resulting largely from changes in the Medicaid cost program. Connecticut experienced positive revenue performance in fiscal year 2013 after taxpayers cashed in dividends and capital gains ahead of tax law changes. The governor proposed using an expected budget surplus for tax-free rebates and replenishing the underfunded pension fund. Lawmakers from the state house offered a competing plan that called for tax cuts. Both parties, however, agreed that surplus funds should be used to boost the rainy day fund used for fiscal emergencies and paying down long-term debt.

Connecticut’s above-average reliance on economically sensitive industries has resulted in a historically volatile revenue base and has caused the state to increase the issuance of debt to cover operating deficits during difficult economic periods. In addition, the higher level of debt can largely be attributed to funding education programs and pension liability as mandated by Connecticut, while other states may utilize local government contribution for public programs. As a result, Connecticut’s debt levels remained among the nation’s highest, with net tax-supported debt at 9.1% of personal income and $5,185 per capita, compared with the 2.8% and $1,074 national medians.4 Independent credit rating agency Standard & Poor’s (S&P) rated the state’s general obligation debt AA with a stable outlook.5 The rating reflected S&P’s view of the state’s diverse economy, high wealth and income levels, flexibility to adjust revenues and manage budget volatility, active monitoring of revenues and expenditures, and adequate operating liquidity. In S&P’s view, despite such strong fundamentals, Connecticut’s cyclical budget performance has caused it to issue debt to help finance operations during recessionary periods. Additionally, S&P expected the state’s significant cost pressure from high debt levels and large unfunded postretirement liabilities to accelerate because of new bond authorizations. The outlook reflected S&P’s expectation that the state will continue to work on restoring fiscal balance over the next two years.

Portfolio Breakdown

Franklin Connecticut Tax-Free Income Fund 2/28/14

| | |

| % of Total | |

| Long-Term Investments* | |

| Higher Education | 29.5 | % |

| Hospital & Health Care | 20.3 | % |

| Utilities | 12.4 | % |

| General Obligation | 9.5 | % |

| Other Revenue | 8.3 | % |

| Refunded | 6.4 | % |

| Tax-Supported | 5.1 | % |

| Transportation | 3.9 | % |

| Housing | 3.4 | % |

| Subject to Government Appropriations | 1.2 | % |

*Does not include short-term investments and other net assets.

Annual Report | 29

Manager’s Discussion

We used various investment strategies during the 12 months under review as we sought to maximize tax-free income for shareholders. Puerto Rico’s municipal bond market is widely traded because of its federal and state tax-exemption advantages. During the reporting period, some Puerto Rico issuers experienced a series of downgrades from S&P, Moody’s Investors Service and Fitch Ratings. In February 2014, these credit rating firms downgraded their respective ratings of Puerto Rico’s general obligation debt to below investment grade, along with the ratings of certain related Puerto Rico issuers. Additionally, each rating agency maintained a negative outlook on certain Puerto Rico issuers, and further downgrades are possible. The Fund is not required to sell securities that have been downgraded to below investment grade, but it is prohibited from making further purchases of such securities as long as the securities are not rated investment grade by at least one U.S. nationally recognized rating service. Rating actions combined with news related to the commonwealth’s financial position and future financing endeavors caused the Puerto Rico bond market to experience sharp declines in the latter half of 2013 and contrasting positive performance year-to-date in 2014.

Thank you for your continued participation in Franklin Connecticut Tax-Free Income Fund. We believe our conservative, buy-and-hold investment strategy can help us achieve high, current, tax-free income for shareholders.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2014, the end

of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings

may change depending on factors such as market and economic conditions. These opinions may not be relied

upon as investment advice or an offer for a particular security. The information is not a complete analysis of

every aspect of any market, state, industry, security or the Fund. Statements of fact are from sources considered

reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy.

Although historical performance is no guarantee of future results, these insights may help you understand our

investment management philosophy.

1. For state personal income taxes, the 80% minimum is measured by total Fund assets. For investors subject to alter-

native minimum tax, a small portion of Fund dividends may be taxable. Distributions of capital gains are generally

taxable. To avoid imposition of 28% backup withholding on all Fund distributions and redemption proceeds, U.S.

investors must be properly certified on Form W-9 and non-U.S. investors on Form W-8BEN.

2. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative

of future trends.

3. Source: Bureau of Labor Statistics.

4. Source: Moody’s Investors Service, “2013 State Debt Medians Report,” 5/29/13.

5. This does not indicate S&P’s rating of the Fund.

30 | Annual Report

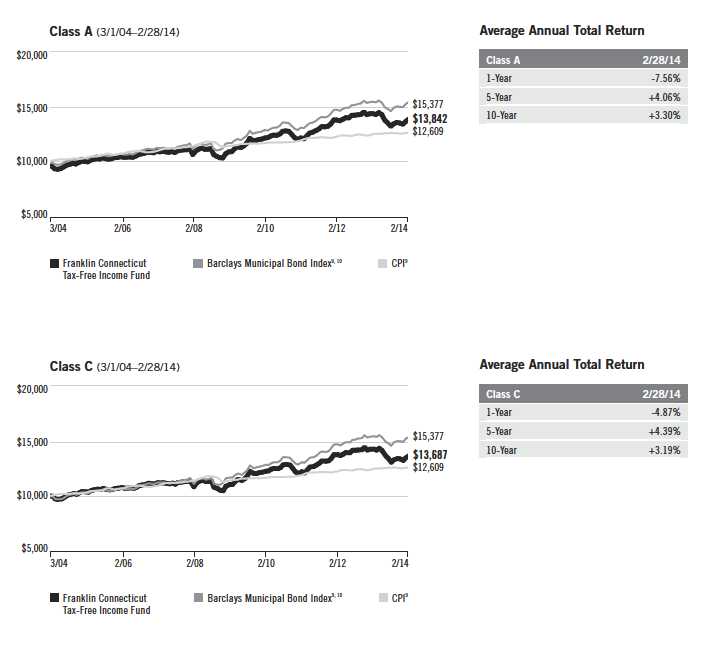

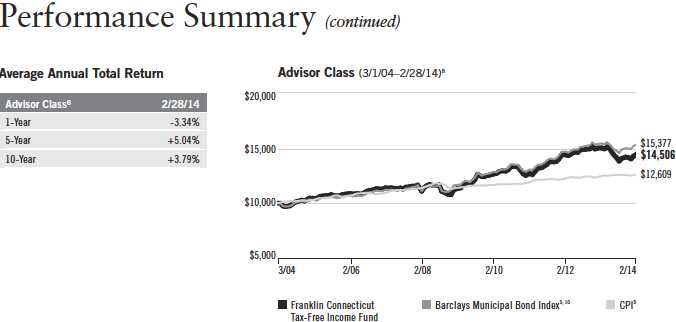

Performance Summary as of 2/28/14

Franklin Connecticut Tax-Free Income Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Price and Distribution Information | | | | | | |

| Class A (Symbol: FXCTX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.78 | $ | 10.65 | $ | 11.43 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.3829 | | | | | | |

| Class C (Symbol: FCTIX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.78 | $ | 10.73 | $ | 11.51 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.3238 | | | | | | |

| Advisor Class (Symbol: FCNZX) | | | | Change | | 2/28/14 | | 2/28/13 |

| Net Asset Value (NAV) | | | -$ | 0.78 | $ | 10.64 | $ | 11.42 |

| Distributions (3/1/13–2/28/14) | | | | | | | | |

| Dividend Income | $ | 0.3937 | | | | | | |

Annual Report | 31

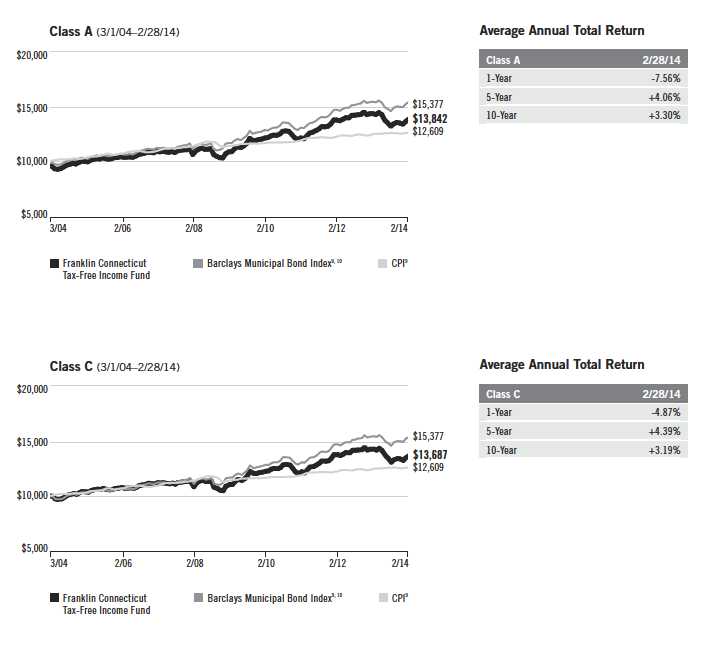

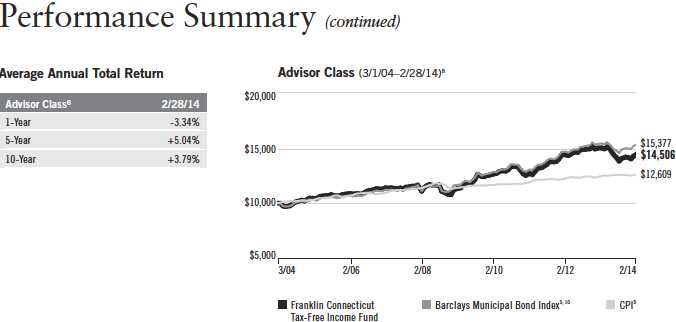

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns include maximum sales charges.

Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Advisor Class: no sales charges.

| | | | | | | | | | |

| Class A | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -3.44 | % | | +27.39 | % | | +44.52 | % |

| Average Annual Total Return2 | | | -7.56 | % | | +4.06 | % | | +3.30 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -6.65 | % | | +4.09 | % | | +3.33 | % |

| Distribution Rate4 | 3.74 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.12 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.11 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 5.92 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.66 | % | | | | | | | | |

| Class C | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -3.94 | % | | +23.99 | % | | +36.87 | % |

| Average Annual Total Return2 | | | -4.87 | % | | +4.39 | % | | +3.19 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -4.06 | % | | +4.44 | % | | +3.22 | % |

| Distribution Rate4 | 3.37 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 6.41 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 2.71 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 5.16 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 1.21 | % | | | | | | | | |

| Advisor Class8 | | | 1-Year | | | 5-Year | | | 10-Year | |

| Cumulative Total Return1 | | | -3.34 | % | | +27.87 | % | | +45.06 | % |

| Average Annual Total Return2 | | | -3.34 | % | | +5.04 | % | | +3.79 | % |

| Avg. Ann. Total Return (3/31/14)3 | | | -2.43 | % | | +5.08 | % | | +3.82 | % |

| Distribution Rate4 | 4.02 | % | | | | | | | | |

| Taxable Equivalent Distribution Rate5 | 7.65 | % | | | | | | | | |

| 30-Day Standardized Yield6 | 3.35 | % | | | | | | | | |

| Taxable Equivalent Yield5 | 6.37 | % | | | | | | | | |

| Total Annual Operating Expenses7 | 0.56 | % | | | | | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

32 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 33

All investments involve risks, including possible loss of principal. Because municipal bonds are sensitive to interest rate movements, the Fund’s

yield and share price will fluctuate with market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as

prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund invests principally in a

single state, it is subject to greater risk of adverse economic and regulatory changes in that state than a geographically diversified fund. The

Fund holds a portion of its assets in Puerto Rico municipal bonds that have been impacted by recent adverse economic and market changes,

which may cause the Fund’s share price to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a

bond’s issuer, insurer or guarantor, may affect the bond’s value. The Fund may invest a significant part of its assets in municipal securities

that finance similar types of projects, such as utilities, hospitals, higher education and transportation. A change that affects one project would

likely affect all similar projects, thereby increasing market risk. The Fund is actively managed but there is no guarantee that the manager’s

investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

4. Distribution rate is based on an annualization of the respective class’s February dividend and the maximum offering price (NAV for Classes C and

Advisor) per share on 2/28/14.

5. Taxable equivalent distribution rate and yield assume the published rates as of 12/18/13 for the maximum combined effective federal and

Connecticut personal income tax rate of 47.45%, based on the federal income tax rate of 39.60% plus 3.8% Medicare tax.

6. The 30-day standardized yield for the month ended 2/28/14 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

8. Effective 7/15/09, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 7/15/09, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 7/15/09, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 7/15/09 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +22.49% and +4.49%.

9. Source: © 2014 Morningstar. The Barclays Municipal Bond Index is a market value-weighted index engineered for the long-term tax-exempt bond

market. To be included in the index, bonds must be fixed rate, have at least one year to final maturity and be rated investment grade (Baa3/BBB- or

higher) by at least two of the following agencies: Moody’s, Standard & Poor’s and Fitch. The Consumer Price Index (CPI), calculated by the Bureau of

Labor Statistics, is a commonly used measure of the inflation rate.

10. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

34 | Annual Report

Your Fund’s Expenses

Franklin Connecticut Tax-Free Income Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 35

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 9/1/13 | | Value 2/28/14 | | Period* 9/1/13–2/28/14 |

| Actual | $ | 1,000 | $ | 1,050.90 | $ | 3.51 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.37 | $ | 3.46 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 1,048.80 | $ | 6.30 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.65 | $ | 6.21 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 1,051.50 | $ | 3.00 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.87 | $ | 2.96 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 0.69%; C: 1.24%; and Advisor: 0.59%),

multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

36 | Annual Report

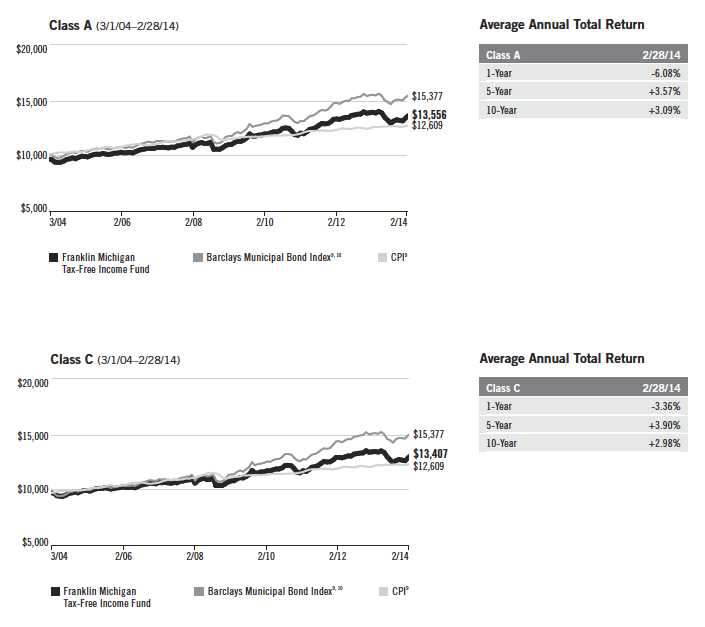

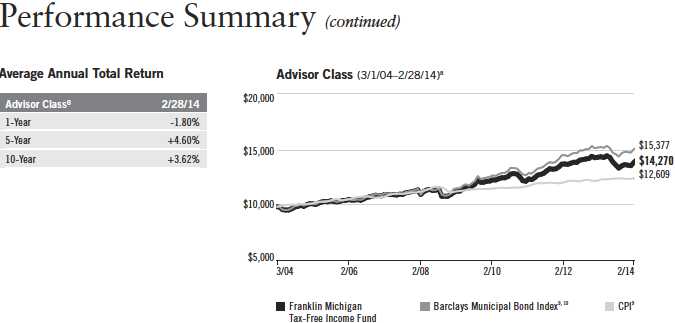

Franklin Michigan Tax-Free Income Fund

Your Fund’s Goal and Main Investments: Franklin Michigan Tax-Free Income Fund seeks to provide as high a level of income exempt from federal and Michigan personal income taxes as is consistent with prudent investment management and preservation of capital by investing at least 80% of its total assets in securities that pay interest free from such taxes.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

| | |

| Credit Quality Breakdown* | | |

| Franklin Michigan Tax-Free Income Fund | | |

| 2/28/14 | | |

| | % of Total | |

| Ratings | Long-Term Investments** | |