UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04182

Name of Fund: BlackRock International Value Fund of BlackRock International Value Trust

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

International Value Fund of BlackRock International Value Trust, 55 East 52nd Street, New

York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2010

Date of reporting period: 06/30/2010

Item 1 – Report to Stockholders

Annual Report

JUNE 30, 2010

BlackRock EuroFund

BlackRock Focus Value Fund, Inc.

BlackRock Global SmallCap Fund, Inc.

BlackRock International Value Fund

OF BLACKROCK INTERNATIONAL VALUE TRUST

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

| Table of Contents | |

| Page | |

| Dear Shareholder | 3 |

| Annual Report: | |

| Fund Summaries | 4 |

| About Fund Performance | 12 |

| Disclosure of Expenses | 12 |

| Derivative Instruments | 13 |

| Financial Statements: | |

| Schedules of Investments | 14 |

| Statements of Assets and Liabilities | 24 |

| Statements of Operations | 26 |

| Statements of Changes in Net Assets | 27 |

| Financial Highlights | 29 |

| Notes to Financial Statements | 45 |

| Report of Independent Registered Public Accounting Firm | 54 |

| Important Tax Information | 54 |

| Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements | 55 |

| Officers and Directors | 59 |

| Additional Information | 62 |

| Mutual Fund Family | 63 |

2 ANNUAL REPORT

JUNE 30, 2010

Dear Shareholder

Although overall global economic and financial conditions have generally improved over the past year, the past several months have seen high levels of mar-

ket volatility and diminishing investor confidence sparked by the sovereign debt crisis in Europe and mixed economic data that have raised concerns over

the possibility that some economies could slide back into recession. Despite the uneven nature of recent market conditions, we continue to believe that the

“Great Recession” likely ended at some point last summer, thanks primarily to massive fiscal and monetary stimulus, and that the global economy remains

in recovery mode for most regions of the world. Regarding the US economy, we believe it is unlikely that the United States will experience a “double dip”

recession, although we acknowledge that subpar growth is likely to persist for some time.

Global equity markets bottomed in early 2009 and since that time have moved unevenly higher as investors were lured back into the markets by depressed

valuations, desire for higher yields and improvements in corporate earnings prospects. Volatility levels, however, have remained elevated — primarily as a

result of uneven economic data and lingering deflation issues (especially in Europe). As the period drew to a close, equity markets had endured a signifi-

cant correction that drove stock prices into negative territory on a year-to-date basis in almost every market. Over a 12-month basis, however, global equi-

ties posted positive returns thanks to improving corporate revenues and profits and a reasonably strong macro backdrop. From a geographic perspective,

US equities have significantly outpaced their international counterparts over the past six and twelve months, as the domestic economic recovery has been

more pronounced and as credit-related issues have held European markets down. Within the United States, smaller cap stocks have noticeably outper-

formed large caps.

In fixed income markets, yields have been moving unevenly over the past six and twelve months as improving economic conditions have been acting to

push Treasury yields higher (and prices correspondingly lower), while concerns over ongoing deflation threats have acted as a counterweight. As the period

drew to a close, however, Treasury yields fell sharply as investors flocked to the “safe haven” asset class in the face of escalating uncertainty. As a result, US

Treasuries became one of the world’s best-performing asset classes on a six-month basis. High yield bonds have also continued to perform well, thanks in

large part to ongoing high levels of investor demand. Meanwhile, municipal bonds performed in line with their taxable counterparts on a 12-month basis,

but slightly underperformed over the last six months as investors rotated to the relative safety of Treasuries.

Regarding cash investments, yields on money market securities remain near all-time lows (producing returns only marginally above zero percent), with

the Federal Open Market Committee reiterating that economic circumstances are likely to necessitate an accommodative interest rate stance for an

“extended period.”

| Against this backdrop, the major market averages posted the following returns: | ||

| Total Returns as of June 30, 2010 | 6-month | 12-month |

| US equities (S&P 500 Index) | (6.65)% | 14.43% |

| Small cap US equities (Russell 2000 Index) | (1.95) | 21.48 |

| International equities (MSCI Europe, Australasia, Far East Index) | (13.23) | 5.92 |

| 3-month Treasury bill (BofA Merrill Lynch 3-Month Treasury Bill Index) | 0.05 | 0.16 |

| US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | 9.36 | 8.20 |

| Taxable fixed income (Barclays Capital US Aggregate Bond Index) | 5.33 | 9.50 |

| Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | 3.31 | 9.61 |

| High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | 4.45 | 26.66 |

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Although conditions are certainly better than they were a couple of years ago, global financial markets continue to face high volatility and questions about

the strength and sustainability of the recovery abound. Through periods of uncertainty, as ever, BlackRock’s full resources are dedicated to the management

of our clients’ assets. For additional market perspective and investment insight, visit www.blackrock.com/shareholdermagazine, where you’ll find the most

recent issue of our award-winning Shareholder® magazine, as well as its quarterly companion newsletter, Shareholder Perspectives. As always, we thank

you for entrusting BlackRock with your investments, and we look forward to your continued partnership in the months and years ahead.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

THIS PAGE NOT PART OF YOUR FUND REPORT

3

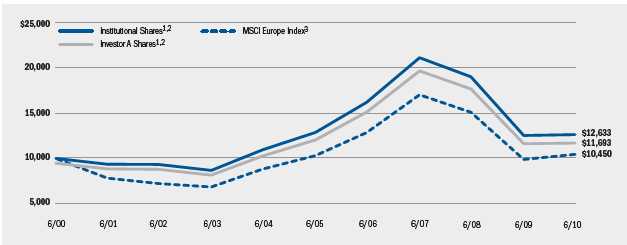

Fund Summary as of June 30, 2010 BlackRock EuroFund

Portfolio Management Commentary

How did the Fund perform?

•For the 12-month period ended June 30, 2010, the Fund underperformed

its benchmark, the MSCI Europe Index.

What factors influenced performance?

•During the period, both sector selection and stock allocation had a neg-

ative effect on performance. At the sector level, the Fund’s underweight

allocation in the consumer staples sector detracted from performance

as the sector performed strongly due to its defensive characteristics. An

underweight in the materials sector also hampered performance, along

with an overweight in the energy sector. Stock selection in consumer dis-

cretionary (Thomas Cook Group Plc, Fiat SpA) and industrials (Vinci SA)

also negatively affected Fund performance.

•At the sector level, the Fund benefited from an overweight exposure to

financials, as well as an overweight in industrials. Stock selection within

financials was also rewarding, particularly within banks (Banco Santander

SA, KBC Bancassurance Holding, Lloyds TSB Group Plc, Swedbank AB and

Unicredit SpA). In addition, stock selection in utilities was beneficial, as

integrated energy firm Centrica Plc benefited from increased demand for

gas in the residential market. Other top Fund holdings included pharma-

ceuticals company Novartis AG, brewer Carlsberg A/S and confectionery

conglomerate Nestle SA.

Describe recent portfolio activity.

•During the course of the period, the Fund’s exposure to financials was

reduced by trimming positions in banks HSBC Holdings Plc and BNP

Paribas SA, as well as selling insurance companies Allianz AG and Zurich.

We also marginally decreased the Fund’s weighting in energy by reducing

holdings of oil companies BP Plc and Total SA. The proceeds from these

sales were used to partially fund an increase in industrials, where we pur-

chased construction services company Bilfinger Berger AG, steel cable

maker Prysmian SpA and electronics manufacturer Koninklijke Philips

Electronics NV. Elsewhere, the Fund’s allocation in the consumer staples

sector was increased from underweight to neutral after the purchases of

Carlsberg A/S and food retailer Koninklijke Ahold NV.

Describe Fund positioning at period end.

•At period end, the Fund is overweight in the industrials, telecommunication

services and consumer discretionary sectors, and it is underweight in the

materials, financials and information technology sectors. In terms of coun-

try exposure, the Fund is overweight in Spain, the UK and Germany, and

underweight in Switzerland, Sweden and France.

•As always, a market dominated by fear presents attractive investment

opportunities. We continue to follow our disciplined investment process

that has guided us well through the volatility, and we are identifying good

companies trading at distressed prices, despite strong earnings streams

and generous dividends.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |||

| Percent of | Percent of | ||

| Long-Term | Long-Term | ||

| Ten Largest Holdings | Investments | Geographic Allocation | Investments |

| Novartis AG, Registered Shares | 5% | United Kingdom | 35% |

| Nestle SA, Registered Shares | 5 | Germany | 14 |

| Telefonica SA | 4 | France | 13 |

| Banco Santander SA | 4 | Spain | 11 |

| British American Tobacco Plc | 3 | Switzerland | 10 |

| Centrica Plc | 3 | Netherlands | 5 |

| Koninklijke Philips Electronics NV | 3 | Italy | 4 |

| BHP Billiton Plc | 3 | Sweden | 2 |

| Vinci SA | 3 | Finland | 2 |

| DaimlerChrysler AG | 2 | Denmark | 2 |

| Other1 | 2 | ||

| 1 Other includes a 1% holding in each of the following countries: Belgium and Russia. | |||

4 ANNUAL REPORT

JUNE 30, 2010

BlackRock EuroFund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do not

have a sales charge.

2 Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities, including common stock and convertible securities, of

companies located in Europe. The Fund currently expects that a majority of the Fund’s assets will be invested in equity securities of companies in Western

European countries, but may also invest in emerging markets in Eastern European countries.

3 This unmanaged broad-based capitalization-weighted index is comprised of a representative sampling of large-, medium- and small-capitalization compa-

nies in developed European countries.

Performance Summary for the Period Ended June 30, 2010

| Average Annual Total Returns4 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | (19.61)% | 0.78% | N/A | (0.37)% | N/A | 2.36% | N/A |

| Investor A | (19.72) | 0.53 | (4.75)% | (0.58) | (1.65)% | 2.13 | 1.58% |

| Investor B | (20.21) | (0.85) | (5.27) | (1.59) | (1.84) | 1.47 | 1.47 |

| Investor C | (20.04) | (0.36) | (1.33) | (1.40) | (1.40) | 1.31 | 1.31 |

| Class R | (20.04) | (0.05) | N/A | (1.09) | N/A | 1.87 | N/A |

| MSCI Europe Index | (16.72) | 5.70 | N/A | 0.27 | N/A | 0.44 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical6 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2010 | June 30, 2010 | During the Period5 | January 1, 2010 | June 30, 2010 | During the Period5 | Expense Ratio | |

| Institutional | $1,000 | $803.90 | $ 4.88 | $1,000 | $1,019.39 | $ 5.46 | 1.09% |

| Investor A | $1,000 | $802.80 | $ 5.72 | $1,000 | $1,018.45 | $ 6.41 | 1.28% |

| Investor B | $1,000 | $797.90 | $11.77 | $1,000 | $1,011.71 | $13.17 | 2.64% |

| Investor C | $1,000 | $799.60 | $ 9.50 | $1,000 | $1,014.24 | $10.64 | 2.13% |

| Class R | $1,000 | $799.60 | $ 8.34 | $1,000 | $1,015.53 | $ 9.35 | 1.87% |

5 Expenses are equal to the expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

ANNUAL REPORT JUNE 30, 2010 5

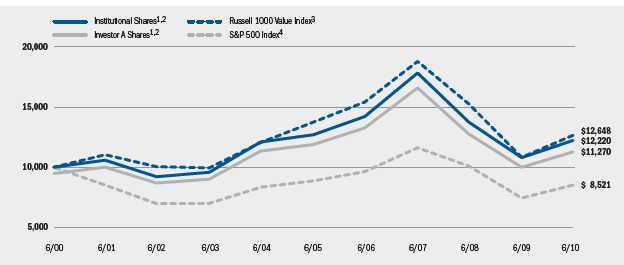

| Fund Summary as of June 30, 2010 | BlackRock Focus Value Fund, Inc. |

| Portfolio Management Commentary |

How did the Fund perform?

•For the 12-month period ended June 30, 2010, the Fund underperformed

its benchmark, the Russell 1000 Value Index, and the broad-market S&P

500 Index. The following discussion pertains to the Fund’s performance

relative to the Russell 1000 Value Index.

What factors influenced performance?

•Stock selection within the financials sector, particularly positions in Morgan

Stanley, Bank of New York Mellon Corp. and INVESCO Ltd., and a lack of

holdings in regional banks that posted gains detracted from performance

for the period. In the industrials sector, a lack of holdings of transportation

industry group stocks hindered returns, as did an underweight position in

General Electric Co. Stock. Selection in the materials sector detracted from

performance, as holdings in steel companies Nucor Corp. and U.S. Steel

Corp. performed poorly. These areas of weakness outweighed the relative

strength of the utilities sector, in which the Fund was underweight during

the period.

•Conversely, stock selection and an underweight in the energy sector bene-

fited the Fund. The sale of Anadarko Petroleum Corp. prior to the oil spill in

the Gulf of Mexico had a positive impact on returns. Holdings of Peabody

Energy Corp. and an underweight in Exxon Mobil Corp. also proved benefi-

cial. Stock selection in telecommunication services, particularly holdings of

Qwest Communications International, Inc. and the decision not to hold

AT&T, Inc., also benefited the Fund.

Describe recent portfolio activity.

•During the 12-month period, the Fund’s holdings were adjusted as stock

market volatility presented opportunities. Exposure to financials was

increased through new purchases of Bank of America Corp. Citigroup, Inc.

and an increase of holdings in Wells Fargo & Co. The Fund exited its

position in The Bank of New York Mellon Corp. and reduced its positions in

The Travelers Cos., Inc. and Invesco Ltd. The Fund increased its exposure in

consumer discretionary through new purchases of CBS Corp., Comcast

Corp. and Limited Brands, Inc., exited its position in Viacom, Inc. and

reduced its position in Time Warner, Inc. Holdings in information technology

(IT) were repositioned and reduced overall. The Fund swapped positions in

Applied Materials, Inc., Hewlett-Packard Co. and Analog Devices, Inc. for

Novellus Systems, Inc., International Business Machines Corp. and Intel

Corp. respectively, exited its positions in Microsoft Corp. and Nokia Corp.

and reduced its position in Micron Technology, Inc. Exposure to the health

care sector was reduced by the sale of Baxter International, Inc. and Pfizer,

Inc. following its purchase of Wyeth. The Fund’s shares of Schering-Plough

Co. were converted into shares of Merck & Co., Inc. following the merger of

the two companies.

Describe Fund positioning at period end.

•As of June 30, 2010, relative to its benchmark index, the Fund was over-

weight in IT, consumer discretionary, materials, energy, industrials and

telecommunication services and underweight in utilities, health care,

consumer staples and financials.

•While challenges remain, we believe the economy can sustain a modest

growth rate as inflation and interest rate pressures remain benign.

With good corporate profit growth and reasonable equity-market valuations,

we believe these conditions will help reinvigorate the stock market in the

months ahead and produce attractive returns through year-end. We believe

the Fund’s pro-cyclical bias will enhance results in this environment.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |||

| Percent of | Percent of | ||

| Long-Term | Long-Term | ||

| Ten Largest Holdings | Investments | Investment Criteria | Investments |

| ACE Ltd. | 3% | Above-Average Yield | 24% |

| Qwest Communications International, Inc. | 3 | Below-Average Price/Earnings Ratio | 22 |

| MetLife, Inc. | 3 | Low Price-to-Book Value | 18 |

| Citigroup, Inc. | 3 | Price-to-Cash Flow | 13 |

| Honeywell International, Inc. | 3 | Special Situations | 10 |

| Occidental Petroleum Corp. | 3 | Price-to-Earnings Per Share | 6 |

| Bank of America Corp. | 3 | Price-to-Book-Value | 3 |

| Lam Research Corp. | 3 | Discount to Assets | 2 |

| Tyco International Ltd. | 3 | Operational Restructuring | 1 |

| JPMorgan Chase & Co. | 3 | Earnings Turnaround | 1 |

6 ANNUAL REPORT

JUNE 30, 2010

BlackRock Focus Value Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do not

have a sales charge.

2 The Fund invests in a diversified portfolio of equity securities that Fund management believes are undervalued relative to its assessment of the current

or prospective condition of the issuer or relative to prevailing market ratios, including issuers that are experiencing poor operating conditions.

3 This unmanaged broad-based index is a subset of the Russell 1000 Index consisting of those Russell 1000 securities with lower price/book ratios and

lower forecasted growth values.

4 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”)

issues), representing about 75% of NYSE market capitalization and 30% of NYSE issues.

Performance Summary for the Period Ended June 30, 2010

| Average Annual Total Returns5 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | (8.11)% | 13.16% | N/A | (0.75)% | N/A | 2.03% | N/A |

| Investor A | (8.29) | 12.79 | 6.86% | (1.05) | (2.11)% | 1.75 | 1.20% |

| Investor B | (8.76) | 11.76 | 7.26 | (1.87) | (2.16) | 1.11 | 1.11 |

| Investor C | (8.66) | 11.91 | 10.91 | (1.84) | (1.84) | 0.95 | 0.95 |

| Class R | (8.55) | 12.04 | N/A | (1.60) | N/A | 1.40 | N/A |

| Russell 1000 Value Index | (5.12) | 16.92 | N/A | (1.64) | N/A | 2.38 | N/A |

| S&P 500 Index | (6.65) | 14.43 | N/A | (0.79) | N/A | (1.59) | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical7 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2010 | June 30, 2010 | During the Period6 | January 1, 2010 | June 30, 2010 | During the Period6 | Expense Ratio | |

| Institutional | $1,000 | $918.90 | $ 4.81 | $1,000 | $1,019.79 | $ 5.06 | 1.01% |

| Investor A | $1,000 | $917.10 | $ 6.18 | $1,000 | $1,018.35 | $ 6.51 | 1.30% |

| Investor B | $1,000 | $912.40 | $10.38 | $1,000 | $1,013.94 | $10.94 | 2.19% |

| Investor C | $1,000 | $913.40 | $10.06 | $1,000 | $1,014.29 | $10.59 | 2.12% |

| Class R | $1,000 | $914.50 | $ 9.45 | $1,000 | $1,014.93 | $ 9.94 | 1.99% |

6 Expenses are equal to the expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half-year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

ANNUAL REPORT JUNE 30, 2010 7

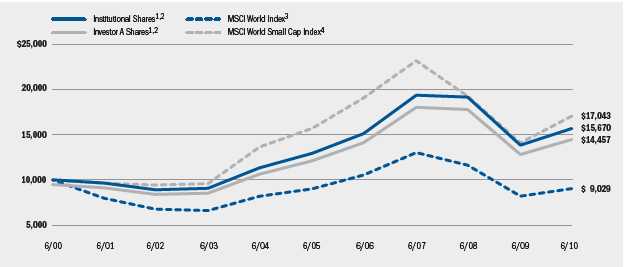

Fund Summary as of June 30, 2010 BlackRock Global SmallCap Fund, Inc.

Portfolio Management Commentary

How did the Fund perform?

•For the 12-month period ended June 30, 2010, the Fund underperformed

the benchmark MSCI World Small Cap Index but outperformed the broader

MSCI World Index. The following discussion pertains to the Fund’s perform-

ance relative to the MSCI World Small Cap Index.

What factors influenced performance?

•Detracting from relative performance during the 12-month period was

security selection across the Fund, particularly in the financials and health

care sectors and, to a lesser extent, in the industrials, information technol-

ogy (IT) and energy sectors. Within the financials sector, holdings in banks,

real estate investment trusts and insurance companies underperformed

relative to their benchmark counterparts; Alpha Bank AE and Fukuoka

Financial Group, Inc. were among the largest individual detractors. Within

the health care sector, the most challenged areas for the Fund were health

care providers & services and pharmaceuticals, where Laboratorios

Farmaceuticos Rovi SA was a notable detractor. Other areas in which

underperformance was concentrated included semiconductors, independ-

ent oil and gas producers and various cyclical industrials. Cash balances

modestly detracted from performance as most of the period was charac-

terized by rising equity markets.

•Positive contributions to performance during the period came from security

selection in the consumer staples sector, where household products com-

pany Ming Fai International Holdings Ltd. and beverage company Britvic Plc

were notable performers. In the IT sector, communications equipment com-

panies JDS Uniphase Corp., Polycom, Inc., and Tandberg ASA boosted per-

formance. An underweight exposure to the utilities sector added to relative

performance, as did stock selection within the sector, where ITC Holdings

Corp. and Northeast Utilities, Inc. outpaced their respective industry

performance averages.

Describe recent portfolio activity.

•During the period, we added to positions in IT, health care and utilities,

funding these purchases by reducing financials, consumer discretionary

and cash positions. Significant buys included Pharmaceutical Product

Development, Inc., Delhaize Group, Adtran, Inc., Northeast Utilities, Inc.

and Nuance Communications, Inc. Noteworthy sales included Citrix

Systems, Inc., Perusahaan Gas Negara Tbk PT, UBISOFT Entertainment,

TrygVesta A/S and Owens-Illinois, Inc.

Describe Fund positioning at period end.

•As of the period end, we believe the Fund’s position is neither aggressive

nor defensive, based on the belief that while economic conditions appear

to have bottomed out, the recovery is expected to be muted relative to

recoveries from previous recessions. Accordingly, the Fund is overweight in

higher-quality cyclical areas such as IT, and underweight in more leveraged

cyclical areas such as industrials and consumer discretionary. We believe

stock selection will play a critical role in generating outperformance versus

the benchmark in 2010. Our investment stance is geared toward high-qual-

ity companies with solid business models that can take advantage of the

current economic environment. While this positioning has hampered per-

formance in the very short term, we believe it will benefit the Fund as the

year progresses.

•At period end, the Fund’s notable overweights relative to the MSCI World

Small Cap Index were in the IT and health care sectors. The Fund was

underweight in the industrials, financials and consumer discretionary

sectors. Approximately 5% of the Fund was in cash and cash equivalents

at the end of the period. Geographically, the Fund was underweight in the

U.S. and Japan, and overweight in emerging markets.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

Portfolio Information

| Percent of | Percent of | ||

| Long-Term | Long-Term | ||

| Ten Largest Holdings | Investments | Geographic Allocation | Investments |

| Urban Outfitters, Inc. | 1% | United States | 50% |

| Rheinmetall AG | 1 | United Kingdom | 8 |

| Eldorado Gold Corp. | 1 | Japan | 6 |

| Ryanair Holdings Plc | 1 | Canada | 6 |

| Pharmaceutical Product Development, Inc. | 1 | Germany | 5 |

| Hikma Pharmaceuticals Plc | 1 | Switzerland | 3 |

| Adtran, Inc. | 1 | Hong Kong | 2 |

| Delhaize Group | 1 | Australia | 2 |

| Northeast Utilities, Inc. | 1 | Singapore | 2 |

| Tanger Factory Outlet Centers, Inc. | 1 | India | 2 |

| Other1 | 14 |

1 Other includes a 1% holding in each of the following countries: Ireland, France, Italy,

Cayman Islands, China, South Korea, Austria, Belgium, Israel, Taiwan, Finland,

Bermuda, Spain and Brazil.

8 ANNUAL REPORT

JUNE 30, 2010

BlackRock Global SmallCap Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in a diversified portfolio of equity securities of small cap issuers located in various foreign countries and the United States.

3 This unmanaged market-capitalization weighted index is comprised of a representative sampling of stocks of large-, medium- and small-

capitalization companies in 23 countries, including the United States.

4 This unmanaged broad-based index is comprised of small cap companies from 23 developed markets.

Performance Summary for the Period Ended June 30, 2010

| Average Annual Total Returns5 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | (7.71)% | 13.30% | N/A | 3.92% | N/A | 4.59% | N/A |

| Investor A | (7.85) | 12.96 | 7.03% | 3.62 | 2.51% | 4.32 | 3.75% |

| Investor B | (8.24) | 11.97 | 7.47 | 2.77 | 2.50 | 3.66 | 3.66 |

| Investor C | (8.20) | 12.06 | 11.06 | 2.79 | 2.79 | 3.49 | 3.49 |

| Class R | (8.02) | 12.58 | N/A | 3.24 | N/A | 4.06 | N/A |

| MSCI World Index | (9.84) | 10.20 | N/A | 0.06 | N/A | (1.02) | N/A |

| MSCI World Small Cap Index | (3.73) | 20.99 | N/A | 1.67 | N/A | 5.48 | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical7 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2010 | June 30, 2010 | During the Period6 | January 1, 2010 | June 30, 2010 | During the Period6 | Expense Ratio | |

| Institutional | $1,000 | $922.90 | $ 5.24 | $1,000 | $1,019.35 | $ 5.51 | 1.10% |

| Investor A | $1,000 | $921.50 | $ 6.72 | $1,000 | $1,017.81 | $ 7.05 | 1.41% |

| Investor B | $1,000 | $917.60 | $10.84 | $1,000 | $1,013.49 | $11.38 | 2.28% |

| Investor C | $1,000 | $918.00 | $10.65 | $1,000 | $1,013.69 | $11.18 | 2.24% |

| Class R | $1,000 | $919.80 | $ 8.62 | $1,000 | $1,015.82 | $ 9.05 | 1.81% |

6 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365 (to

reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

ANNUAL REPORT JUNE 30, 2010 9

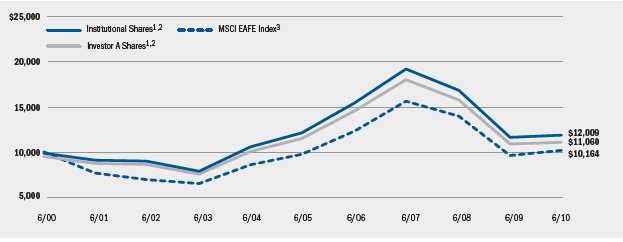

Fund Summary as of June 30, 2010 BlackRock International Value Fund

Portfolio Management Commentary

How did the Fund perform?

•For the 12-month period ended June 30, 2010, the Fund underperformed

its benchmark, the MSCI Europe, Australia, Far East (EAFE) Index.

What factors influenced performance?

•During the period, both stock selection and sector allocation had a

negative effect on performance.

•The Fund experienced negative stock selection effects in the industrials

(BAE Systems, Inc. and Mitsui OSK Lines, Ltd.), information technology

(HTC) and energy (ENI SpA and Petroplus Holdings AG) sectors during the

course of the period. Other individual holdings that detracted from perform-

ance included diversified financials firms Nomura Holdings, Inc. and ING

Group NV, integrated energy company EDF SA and cigarette producer

Japan Tobacco, Inc. Fund performance was also hindered by holding a

residual cash balance during periods of rising markets.

•Conversely, performance was aided by an overweight exposure to the con-

sumer discretionary sector. Stock selection in that area was also rewarding,

with automobile manufacturer DaimlerChrysler AG performing particularly

well. An overweight in the information technology (IT) sector made a posi-

tive contribution, as did underweight positions in financials and utilities. At

the stock level, the Fund’s positions within financials were helpful, with

banks Erste Group Bank AG, Banco Santander SA, Swedbank AB and

Unicredit Bank AG among the Fund’s top holdings during the period.

•The Fund uses currency forward contracts to hedge exposure in situations

where the view on a currency and the underlying securities denominated in

that currency differs. The Fund may identify significant investment opportu-

nities in a particular country but have a negative view on the currency and

therefore not be comfortable being overweight that currency. During the

period, the impact of the Fund's currency hedging strategy had a neutral

effect on performance.

Describe recent portfolio activity.

•There were no dramatic sector changes during the period. However, we

increased the Fund’s exposure to energy by purchasing oil major Royal

Dutch Shell Plc, drilling services company Transocean Ltd. and gas supplier

OAO Gazprom. We also increased the Fund’s allocation in IT by purchasing

computer manufacturer Quanta Computer, Inc., consumer electronics

maker Samsung Electronics Co., Ltd. and Taiwan Semiconductor Manu-

facturing Co., Ltd. These additions were partially funded by a reduction in

the materials sector, including the sales of industrial chemicals maker

BASF SE and miner Xstrata Plc, as well as the reduction of BHP Billiton Plc.

There was also a decrease in exposure to the telecommunication services

sector, as we reduced positions in Vodafone Group Plc and Telefonica SA

and sold KDDI Corp.

•During the period, the Fund’s weightings in Japan and Asia/Pacific ex-

Japan were reduced and the proceeds were used to increase our alloca-

tions to the UK and select emerging markets.

Describe Fund positioning at period end.

•As always, a market dominated by fear presents attractive investment

opportunities. We continue to follow our disciplined investment process

that has guided us well through the volatility, and we are indentifying good

companies trading at distressed prices with attractive upside potential. At

period end, the Fund was overweight in the energy, IT and telecommunica-

tion services sectors, and it was underweight in the materials, financials

and utilities sectors. Regionally, the Fund was overweight in the select

emerging markets and underweight in Japan and Asia/Pacific ex-Japan.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |||

| Percent of | Percent of | ||

| Long-Term | Long-Term | ||

| Ten Largest Holdings | Investments | Geographic Allocation | Investments |

| Novartis AG, Registered Shares | 4% | United Kingdom | 19% |

| Nestle SA, Registered Shares | 3 | Japan | 18 |

| Telefonica SA | 3 | Germany | 11 |

| Centrica Plc | 3 | Switzerland | 10 |

| Royal Dutch Shell Plc, Class B | 3 | France | 9 |

| British American Tobacco Plc | 3 | Spain | 8 |

| Total SA | 3 | Australia | 5 |

| Banco Santander SA | 3 | South Korea | 3 |

| Zurich Financial Services AG | 3 | Brazil | 3 |

| BHP Billiton Plc | 2 | Taiwan | 3 |

| Israel | 2 | ||

| Netherlands | 2 | ||

| Mexico | 2 | ||

| India | 2 | ||

| Other1 | 3 |

1 Other includes a 1% holding in each of the following countries: Denmark, Finland

and Russia.

10 ANNUAL REPORT

JUNE 30, 2010

BlackRock International Value Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in stocks of companies in developed countries located outside of the United States.

3 This index is an arithmetical average weighted by market value of the performance of over 1,000 non-U.S. companies representing 21 stock markets in

Europe, Australia, New Zealand and the Far East.

Performance Summary for the Period Ended June 30, 2010

| Average Annual Total Returns4 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | (15.52)% | 2.08% | N/A | (0.42)% | N/A | 1.85% | N/A |

| Investor A | (15.71) | 1.62 | (3.71)% | (0.74) | (1.81)% | 1.56 | 1.01% |

| Investor B | (16.12) | 0.59 | (3.89) | (1.71) | (1.99) | 0.92 | 0.92 |

| Investor C | (16.09) | 0.63 | (0.37) | (1.69) | (1.69) | 0.73 | 0.73 |

| Class R | (15.80) | 1.35 | N/A | (1.05) | N/A | 1.33 | N/A |

| MSCI EAFE Index | (13.23) | 5.92 | N/A | 0.88 | N/A | 0.16 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical6 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2010 | June 30, 2010 | During the Period5 | January 1, 2010 | June 30, 2010 | During the Period5 | Expense Ratio | |

| Institutional | $1,000 | $844.80 | $ 4.53 | $1,000 | $1,019.89 | $ 4.96 | 0.99% |

| Investor A | $1,000 | $842.90 | $ 6.40 | $1,000 | $1,017.86 | $ 7.00 | 1.40% |

| Investor B | $1,000 | $838.80 | $11.03 | $1,000 | $1,012.80 | $12.08 | 2.42% |

| Investor C | $1,000 | $839.10 | $ 5.88 | $1,000 | $1,018.40 | $ 6.46 | 1.29% |

| Class R | $1,000 | $842.00 | $ 7.72 | $1,000 | $1,016.42 | $ 8.45 | 1.69% |

5 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 181/365

(to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

ANNUAL REPORT JUNE 30, 2010 11

About Fund Performance

•Institutional Shares are not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only to

eligible investors.

•Investor A Shares incur a maximum initial sales charge (front-end load) of

5.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor B Shares are subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service fee

of 0.25% per year. These shares automatically convert to Investor A Shares

after approximately eight years. (There is no initial sales charge for auto-

matic share conversions.) All returns for periods greater than eight years

reflect this conversion. Investor B Shares of the Funds are only available

through exchanges, dividend reinvestment by existing shareholders or for

purchase by certain qualified employee benefit plans.

•Investor C Shares are subject to a 1% contingent deferred sales charge if

redeemed within one year of purchase. In addition, Investor C Shares are

subject to a distribution fee of 0.75% per year and a service fee of 0.25%

per year.

•Class R Shares do not incur a maxium initial sales charge (front-end load)

or deferred sales charge. These shares are subject to a distribution fee of

0.25% per year and a service fee of 0.25% per year. Class R Shares are

available only to certain retirement plans. Prior to January 3, 2003 for

BlackRock EuroFund, BlackRock Focus Value Fund, Inc. and BlackRock

International Value Fund, and February 4, 2003 for BlackRock Global

SmallCap Fund, Inc., Class R Share performance results are those of the

Institutional Shares (which have no distribution or service fees) restated to

reflect Class R Share fees.

The returns for BlackRock International Value Fund’s Investor B and Investor

C Shares prior to October 6, 2000, are based upon performance of the

Fund’s Institutional Shares. The returns for Investor B and Investor C Shares,

however, are adjusted to reflect the distribution and service (12b-1) fees

applicable to each class of shares.

Performance information reflects past performance and does not guarantee

future results. Current performance may be lower or higher than the perform-

ance data quoted. Refer to www.blackrock.com/funds to obtain performance

data current to the most recent month-end. Performance results do not

reflect the deduction of taxes that a shareholder would pay on fund distri-

butions or the redemption of fund shares. The Funds may charge a 2%

redemption fee for sales or exchanges of shares within 30 days of purchase

or exchange. Performance data does not reflect this potential fee. Figures

shown in the performance tables on the previous pages assume reinvest-

ment of all dividends and capital gain distributions, if any, at net asset value

on the ex-dividend date. Investment return and principal value of shares will

fluctuate so that shares, when redeemed, may be worth more or less than

their original cost. Dividends paid to each class of shares will vary because

of the different levels of service, distribution and transfer agency fees appli-

cable to each class, which are deducted from the income available to be

paid to shareholders.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees, distri-

bution fees including 12b-1 fees, and other Fund expenses. The expense

examples on the previous pages (which are based on hypothetical invest-

ments of $1,000 invested on January 1, 2010 and held through June 30,

2010) are intended to assist shareholders both in calculating expenses

based on investments in the Funds and in comparing these expenses with

similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during

the period covered by this report, shareholders can divide their account

value by $1,000 and then multiply the result by the number correspond-

ing to their share class under the heading entitled “Expenses Paid During

the Period.”

The tables also provide information about hypothetical account values and

hypothetical expenses based on each Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in these

Funds and other funds, compare the 5% hypothetical example with the 5%

hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such as

sales charges, redemption fees or exchange fees. Therefore, the hypotheti-

cal examples are useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning different

funds. If these transactional expenses were included, shareholder expenses

would have been higher.

12 ANNUAL REPORT JUNE 30, 2010

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including foreign

currency exchange contracts, as specified in Note 2 of the Notes to Fin-

ancials Statements, which may constitute forms of economic leverage.

Such instruments are used to obtain exposure to a market without owning

or taking physical custody of securities or to hedge market and/or foreign

currency exchange rate risk. Such derivative instruments involve risks,

including the imperfect correlation between the value of a derivative instru-

ment and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the derivative instrument. The Funds’ ability to

successfully use a derivative instrument depends on the investment

advisor’s ability to accurately predict pertinent market movements, which

cannot be assured. The use of derivative instruments may result in losses

greater than if they had not been used, may require the Funds to sell or

purchase portfolio securities at inopportune times or for distressed values,

may limit the amount of appreciation the Funds can realize on an invest-

ment, may result in lower dividends paid to shareholders or may cause the

Funds to hold a security that it might otherwise sell. The Funds’ invest-

ments in these instruments are discussed in detail in the Notes to

Financial Statements.

ANNUAL REPORT

JUNE 30, 2010

13

Schedule of Investments June 30, 2010 BlackRock EuroFund

(Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Belgium — 1.2% | ||

| KBC Bancassurance Holding | 100,591 | $ 3,855,686 |

| Denmark — 1.8% | ||

| Carlsberg A/S | 74,743 | 5,696,091 |

| Finland — 2.0% | ||

| KCI Konecranes Oyj | 239,381 | 6,242,682 |

| France — 13.0% | ||

| AXA SA | 398,093 | 6,081,718 |

| BNP Paribas SA | 113,858 | 6,125,664 |

| European Aeronautic Defense and Space Co. | 235,731 | 4,810,765 |

| Sanofi-Aventis | 112,940 | 6,802,087 |

| Societe Generale SA | 160,539 | 6,606,022 |

| Total SA | 71,829 | 3,206,368 |

| Vinci SA | 187,054 | 7,766,809 |

| 41,399,433 | ||

| Germany — 13.6% | ||

| Bayer AG | 130,146 | 7,272,759 |

| Bilfinger Berger AG | 121,168 | 6,714,936 |

| Continental AG | 124,242 | 6,449,337 |

| DaimlerChrysler AG | 147,892 | 7,481,208 |

| Deutsche Post AG | 379,496 | 5,533,115 |

| E.ON AG | 151,281 | 4,067,684 |

| HeidelbergCement AG | 122,172 | 5,773,943 |

| 43,292,982 | ||

| Italy — 3.6% | ||

| Prysmian SpA | 390,748 | 5,608,066 |

| Unicredit SpA | 2,671,768 | 5,910,062 |

| 11,518,128 | ||

| Netherlands — 4.6% | ||

| Koninklijke Ahold NV | 445,018 | 5,504,834 |

| Koninklijke Philips Electronics NV | 305,567 | 9,124,882 |

| 14,629,716 | ||

| Russia — 1.2% | ||

| OAO Gazprom — ADR | 203,155 | 3,821,346 |

| Spain — 10.3% | ||

| Amadeus IT Holding SA, Class A (a) | 134,802 | 2,142,959 |

| Banco Santander SA | 1,103,364 | 11,570,107 |

| Repsol YPF SA | 316,467 | 6,386,342 |

| Telefonica SA | 681,810 | 12,630,347 |

| 32,729,755 | ||

| Sweden — 2.1% | ||

| TeliaSonera AB | 1,016,232 | 6,529,953 |

| Switzerland — 9.7% | ||

| Nestle SA, Registered Shares | 292,768 | 14,116,931 |

| Novartis AG, Registered Shares | 343,968 | 16,669,765 |

| 30,786,696 |

| Common Stocks | Shares | Value | |

| United Kingdom — 33.9% | |||

| Aviva Plc | 1,365,057 | $ 6,343,673 | |

| Barclays Plc | 1,678,869 | 6,701,206 | |

| BHP Billiton Plc | 308,763 | 8,005,766 | |

| BP Plc (a) | 728,654 | 3,488,184 | |

| British American Tobacco Plc | 293,069 | 9,300,772 | |

| Centrica Plc | 2,107,387 | 9,299,932 | |

| HSBC Holdings Plc | 507,530 | 4,636,638 | |

| Ladbrokes Plc | 2,024,864 | 3,826,392 | |

| Lloyds TSB Group Plc (a) | 7,337,322 | 5,792,570 | |

| Redrow Plc (a) | 1,349,801 | 2,263,684 | |

| Reed Elsevier Plc | 802,987 | 5,953,978 | |

| Royal Dutch Shell Plc | 254,260 | 6,416,514 | |

| Royal Dutch Shell Plc, Class B | 264,248 | 6,387,054 | |

| Taylor Wimpey Plc (a) | 8,004,653 | 3,127,194 | |

| Tesco Plc | 1,237,552 | 6,981,535 | |

| Thomas Cook Group Plc | 1,654,956 | 4,380,458 | |

| Vodafone Group Plc | 2,649,865 | 5,460,019 | |

| Wolseley Plc (a) | 164,591 | 3,267,109 | |

| Xstrata Plc | 441,365 | 5,779,517 | |

| 107,412,195 | |||

| Total Long-Term Investments | |||

| (Cost — $333,470,415) — 97.0% | 307,914,663 | ||

| Short-Term Securities | |||

| Money Market Funds — 0.3% | |||

| BlackRock Liquidity Funds, TempFund, | |||

| Institutional Class, 0.16% (b)(c) | 893,336 | 893,336 | |

| Par | |||

| Time Deposits | (000) | ||

| Euro — 0.0% | |||

| Brown Brothers Harriman & Co., 0.01%, 7/01/10 | EUR | 1 | 1,765 |

| Netherlands — 0.0% | |||

| Brown Brothers Harriman & Co., 0.01%, 7/01/10 | DKK | 43 | 7,095 |

| Norway — 0.0% | |||

| Brown Brothers Harriman & Co., 0.01%, 7/01/10 | NOK | —(d) | 49 |

| Total Time Deposits | 8,909 | ||

| Total Short-Term Securities | |||

| (Cost — $902,245) — 0.3% | 902,245 | ||

| Total Investments (Cost — $334,372,660*) — 97.3% | 308,816,908 | ||

| Other Assets Less Liabilities — 2.7% | 8,536,955 | ||

| Net Assets — 100.0% | $ 317,353,863 | ||

| Portfolio Abbreviations | ||||

| To simplify the listings of portfolio holdings in | ADR | American Depositary Receipts | GBP | British Pound |

| the Schedules of Investments, the names and | AUD | Australian Dollar | HKD | Hong Kong Dollar |

| descriptions of many of the securities have been | CAD | Canadian Dollar | JPY | Japanese Yen |

| abbreviated according to the following list: | CHF | Swiss Franc | NOK | Norwegian Krone |

| DKK | Danish Krone | USD | US Dollar | |

| EUR | Euro |

See Notes to Financial Statements.

14 ANNUAL REPORT JUNE 30, 2010

Schedule of Investments (concluded) BlackRock EuroFund

* The cost and unrealized appreciation (depreciation) of investments as of June 30,

2010, as computed for federal income tax purposes, were as follows:

| Aggregate cost | $ 337,836,864 |

| Gross unrealized appreciation | $ 14,670,239 |

| Gross unrealized depreciation | (43,690,195) |

| Net unrealized depreciation | $ (29,019,956) |

(a) Non-income producing security.

(b) Investments in companies considered to be an affiliate of the Fund, for purposes

of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were

as follows:

| Shares Held | Shares Held | |||

| at June 30, | Net | at June 30, | ||

| Affiliate | 2009 | Activity | 2010 | Income |

| BlackRock Liquidity | ||||

| Funds, TempFund, | ||||

| Institutional Class | 8,551,926 | (7,658,590) | 893,336 | $ 14,966 |

(c) Represents the current yield as of report date.

(d) Amount is less than $1,000.

•Foreign currency exchange contracts as of June 30, 2010 were as follows:

| Unrealized | ||||||

| Currency | Currency | Settlement Appreciation | ||||

| Purchased | Sold | Counterparty | Date | (Depreciation) | ||

| USD | 1,600,485 | EUR | 1,303,328 | The Goldman | 7/01/10 | $ 6,702 |

| Sachs Group, Inc. | ||||||

| USD | 2,078,472 | NOK 13,381,414 | Brown Brothers | 7/01/10 | 22,351 | |

| Harriman & Co. | ||||||

| USD | 7,101 | DKK | 43,146 | JPMorgan | 7/02/10 | 18 |

| Chase Bank NA | ||||||

| USD | 1,570,646 | EUR | 1,288,048 | Citibank N.A. | 7/02/10 | (4,458) |

| USD | 1,311,599 | NOK | 8,525,394 | Citibank N.A. | 7/02/10 | 1,697 |

| USD | 1,171,463 | EUR | 955,117 | Citibank N.A. | 7/06/10 | 3,471 |

| Total | $ 29,781 | |||||

•Fair Value Measurements — Various inputs are used in determining the fair value of

investments and derivatives, which are as follows:

•Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

•Level 2 — other observable inputs (including, but not limited to: quoted prices for

similar assets or liabilities in markets that are active, quoted prices for identical

or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the assets or liabilities (such as interest

rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs)

•Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including

the Fund’s own assumptions used in determining the fair value of investments

and derivatives)

The inputs or methodologies used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to financial statements.

The following tables summarize the inputs used as of June 30, 2010 in determining

the fair valuation of the Fund’s investments and derivatives:

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Investments in Securities: | ||||

| Long-Term | ||||

| Investments1 | — | $ 307,914,663 | — | $ 307,914,663 |

| Short-Term | ||||

| Securities | ||||

| Money Market | ||||

| Fund | $ 893,336 | — | — | 893,336 |

| Time Deposits | — | 8,909 | — | 8,909 |

| Total | $ 893,336 | $ 307,923,572 | — | $ 308,816,908 |

1 See above Schedule of Investments for values in each country.

| Derivative Financial Instruments2 | ||||

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Foreign currency | ||||

| exchange | ||||

| contracts | — | $34,239 | — | $ 34,239 |

| Liabilities: | ||||

| Foreign currency | ||||

| exchange | ||||

| contracts | — | (4,458) | — | (4,458) |

| Total | — | $29,781 | — | $ 29,781 |

2 Derivative financial instruments are foreign currency exchange contracts, which

are shown at the unrealized appreciation/depreciation on the instrument.

ANNUAL REPORT JUNE 30, 2010 15

Schedule of Investments June 30, 2010 BlackRock Focus Value Fund, Inc.

(Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Above-Average Yield* — 23.7% | ||

| Aerospace & Defense — 2.9% | ||

| Honeywell International, Inc. | 103,400 | $ 4,035,702 |

| Chemicals — 2.1% | ||

| E.I. du Pont de Nemours & Co. | 81,800 | 2,829,462 |

| Diversified Financial Services — 2.8% | ||

| JPMorgan Chase & Co. | 106,500 | 3,898,965 |

| Diversified Telecommunication Services — 2.1% | ||

| Verizon Communications, Inc. | 104,700 | 2,933,694 |

| Industrial Conglomerates — 4.8% | ||

| General Electric Co. | 177,900 | 2,565,318 |

| Tyco International Ltd. | 112,150 | 3,951,044 |

| 6,516,362 | ||

| Metals & Mining — 1.7% | ||

| Alcoa, Inc. | 229,400 | 2,307,764 |

| Pharmaceuticals — 4.8% | ||

| Bristol-Myers Squibb Co. | 120,300 | 3,000,282 |

| Merck & Co, Inc. | 100,600 | 3,517,982 |

| 6,518,264 | ||

| Specialty Retail — 2.5% | ||

| Limited Brands, Inc. | 152,800 | 3,372,296 |

| Total Above-Average Yield | 32,412,509 | |

| Below-Average Price/Earnings Ratio* — 21.5% | ||

| Capital Markets — 2.4% | ||

| Morgan Stanley | 140,000 | 3,249,400 |

| Diversified Financial Services — 6.0% | ||

| Bank of America Corp. | 276,500 | 3,973,305 |

| Citigroup, Inc. (a) | 1,114,600 | 4,190,896 |

| 8,164,201 | ||

| Food Products — 2.2% | ||

| Unilever NV — ADR | 110,500 | 3,018,860 |

| Insurance — 9.2% | ||

| ACE Ltd. | 88,700 | 4,566,276 |

| MetLife, Inc. | 113,000 | 4,266,880 |

| The Travelers Cos., Inc. | 77,600 | 3,821,800 |

| 12,654,956 | ||

| Oil, Gas & Consumable Fuels — 1.7% | ||

| Devon Energy Corp. | 38,100 | 2,321,052 |

| Total Below-Average Price/Earnings Ratio | 29,408,469 | |

| Discount to Assets* — 1.9% | ||

| Hotels, Restaurants & Leisure — 1.9% | ||

| Carnival Corp. | 86,400 | 2,612,736 |

| Total Discount to Assets | 86,400 | 2,612,736 |

| Earnings Turnaround* — 1.0% | ||

| Semiconductors & Semiconductor | ||

| Equipment — 1.0% | ||

| Micron Technology, Inc. (a) | 160,100 | 1,359,249 |

| Total Earnings Turnaround | 160,100 | 1,359,249 |

| Financial Restructuring* — 0.0% | ||

| Semiconductors & Semiconductor | ||

| Equipment — 0.0% | ||

| Legacy Holdings, Inc. (a) | 1,500 | 5 |

| Total Financial Restructuring | 1,500 | 5 |

| Common Stocks | Shares | Value |

| Low Price-to-Book Value* — 18.1% | ||

| Aerospace & Defense — 2.3% | ||

| Raytheon Co. | 65,900 | $ 3,188,901 |

| Commercial Banks — 2.7% | ||

| Wells Fargo & Co. | 142,300 | 3,642,880 |

| Energy Equipment & Services — 2.4% | ||

| Halliburton Co. | 131,700 | 3,233,235 |

| Household Products — 2.2% | ||

| Kimberly-Clark Corp. | 50,800 | 3,080,004 |

| Insurance — 0.9% | ||

| Hartford Financial Services Group, Inc. | 57,200 | 1,265,836 |

| Metals & Mining — 2.2% | ||

| United States Steel Corp. (b) | 76,400 | 2,945,220 |

| Semiconductors & Semiconductor | ||

| Equipment — 5.4% | ||

| LSI Corp. (a) | 754,300 | 3,469,780 |

| Lam Research Corp. (a) | 104,300 | 3,969,658 |

| 7,439,438 | ||

| Total Low Price-to-Book Value | 24,795,514 | |

| Operational Restructuring* — 1.3% | ||

| Food & Staples Retailing — 1.3% | ||

| Walgreen Co. | 63,900 | 1,706,130 |

| Total Operational Restructuring | 1,706,130 | |

| Price-to-Book Value* — 2.6% | ||

| Semiconductors & Semiconductor Equipment — 2.6% | ||

| Novellus Systems, Inc. (a) | 138,100 | 3,502,216 |

| Total Price-to-Book Value | 3,502,216 | |

| Price-to-Cash Flow* — 13.1% | ||

| Diversified Telecommunication Services — 3.1% | ||

| Qwest Communications International, Inc. | 820,600 | 4,308,150 |

| Media — 4.7% | ||

| Time Warner, Inc. | 97,100 | 2,807,161 |

| Comcast Corp., Special Class A | 216,400 | 3,555,452 |

| 6,362,613 | ||

| Oil, Gas & Consumable Fuels — 5.3% | ||

| Occidental Petroleum Corp. | 53,200 | 4,104,380 |

| Peabody Energy Corp. | 80,000 | 3,130,400 |

| 7,234,780 | ||

| Total Price-to-Cash Flow | 17,905,543 | |

| Price-to-Earnings Per Share* — 6.4% | ||

| Energy Equipment & Services — 3.8% | ||

| Ensco International Plc - ADR | 82,000 | 3,220,960 |

| Weatherford International Ltd. (a) | 152,500 | 2,003,850 |

| 5,224,810 | ||

| Media — 2.6% | ||

| CBS Corp., Class B | 278,000 | 3,594,540 |

| Total Price-to-Earnings Per Share | 8,819,350 | |

| Special Situations* — 9.7% | ||

| Capital Markets — 2.6% | ||

| Invesco Ltd. | 215,900 | 3,633,597 |

| Health Care Equipment & Supplies — 1.8% | ||

| Covidien Plc | 61,700 | 2,479,106 |

| IT Services — 2.8% | ||

| International Business Machines Corp. | 30,800 | 3,803,184 |

See Notes to Financial Statements.

16 ANNUAL REPORT JUNE 30, 2010

Schedule of Investments (concluded) BlackRock Focus Value Fund, Inc.

(Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Special Situations (concluded) | ||

| Semiconductors & Semiconductor | ||

| Equipment — 2.5% | ||

| Intel Corp. | 173,500 | $ 3,374,575 |

| Total Special Situations | 13,290,462 | |

| Total Long-Term Investments | ||

| (Cost — $124,957,361) — 99.3% | 135,812,183 | |

| Short-Term Securities | ||

| BlackRock Liquidity Funds, TempCash, | ||

| Institutional Class, 0.16% (c)(d) | 1,199,007 | 1,199,007 |

| Beneficial | ||

| Interest | ||

| (000) | ||

| BlackRock Liquidity Series, LLC | ||

| Money Market Series, 0.27% (c)(d)(e) | $ 1,960 | 1,960,000 |

| Total Short-Term Securities | ||

| (Cost — $3,159,007) — 2.3% | 3,159,007 | |

| Total Investments (Cost — $128,116,368**) — 101.6% | 138,971,190 | |

| Liabilities in Excess of Other Assets — (1.6)% | (2,164,982) | |

| Net Assets — 100.0% | $ 136,806,208 | |

* Classification is unaudited.

** The cost and unrealized appreciation (depreciation) of investments as of June 30,

2010, as computed for federal income tax purposes, were as follows:

| Aggregate cost | $ 130,115,761 |

| Gross unrealized appreciation | $ 16,297,607 |

| Gross unrealized depreciation | (7,442,178) |

| Net unrealized appreciation | $ 8,855,429 |

(a) Non-income producing security.

(b) Security, or a portion of security, is on loan.

(c) Represents the current yield as of report date.

(d) Investments in companies considered to be an affiliate of the Fund, for purposes

of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were

as follows:

| Shares Held/ | Shares Held/ | |||||

| Beneficial Interest | Beneficial Interest | |||||

| at June 30, | Net | at June 30, | ||||

| Affiliate | 2009 | Activity | 2010 | Income | ||

| BlackRock Liquidity | ||||||

| Funds, TempCash, | ||||||

| Institutional Class | 2,361,791 | (1,162,784) | 1,199,007 | $ 5,674 | ||

| BlackRock Liquidity | ||||||

| Series, LLC | ||||||

| Money Market | ||||||

| Series | $5,175,000 | $(3,215,000) | $1,960,000 | $ 6,677 | ||

(e) Security was purchased with the cash collateral from loaned securities.

•For Fund compliance purposes, the Fund’s industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized

market indexes or rating group indexes, and/or as defined by Fund management.

This definition may not apply for purposes of this report, which may combine such

industry sub-classifications for reporting ease.

•Fair Value Measurements — Various inputs are used in determining the fair value of

investments, which are as follows:

•Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

•Level 2 — other observable inputs (including, but not limited to: quoted prices for

similar assets or liabilities in markets that are active, quoted prices for identical

or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the assets or liabilities (such as interest

rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs)

•Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including

the Fund’s own assumptions used in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of June 30, 2010 in determining

the fair valuation of the Fund’s investments:

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Investments in Securities: | ||||

| Long-Term | ||||

| Investments1 | $ 135,812,183 | — | — | $ 135,812,183 |

| Short-Term | ||||

| Securities | 1,199,007 | $ 1,960,000 | — | 3,159,007 |

| Total | $ 137,011,190 | $ 1,960,000 | — | $ 138,971,190 |

1 See above Schedule of Investments for values in each industry.

See Notes to Financial Statements.

ANNUAL REPORT JUNE 30, 2010 17

Schedule of Investments June 30, 2010 BlackRock Global SmallCap Fund, Inc.

(Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Australia — 1.8% | ||

| CFS Retail Property Trust | 3,825,538 | $ 6,046,806 |

| Iba Technologies Limited | 2,298,700 | 324,484 |

| Linc Energy Ltd. (a) | 222,993 | 188,009 |

| Metcash Ltd. | 567,400 | 1,994,256 |

| Mount Gibson Iron Ltd. (a) | 1,577,400 | 1,998,564 |

| Myer Holdings Ltd. | 1,537,800 | 4,057,839 |

| Sigma Pharmaceuticals Ltd. | 5,885,400 | 2,063,055 |

| 16,673,013 | ||

| Austria — 0.9% | ||

| CAT Oil AG | 269,800 | 2,275,127 |

| Schoeller-Bleckmann Oilfield Equipment AG | 143,700 | 6,515,421 |

| 8,790,548 | ||

| Belgium — 0.8% | ||

| Delhaize Group | 106,100 | 7,699,221 |

| Bermuda — 0.5% | ||

| Lazard Ltd., Class A | 195,900 | 5,232,489 |

| Brazil — 0.5% | ||

| Santos Brasil Participacoes SA | 527,400 | 4,382,826 |

| Canada — 5.2% | ||

| Biovail Corp. (b) | 292,600 | 5,629,624 |

| Denison Mines Corp. (a) | 1,924,000 | 2,295,317 |

| DiagnoCure, Inc. (a)(c) | 4,278,880 | 4,300,786 |

| Dollarama, Inc. (a) | 70,600 | 1,641,398 |

| Dollarama, Inc. (a)(d) | 203,600 | 4,733,549 |

| Eastern Platinum Ltd. (a) | 2,759,900 | 2,514,774 |

| Eldorado Gold Corp. | 530,900 | 9,515,356 |

| Jaguar Mining, Inc. (a)(b) | 660,400 | 5,831,332 |

| Lundin Mining Corp. (a) | 1,193,900 | 3,375,735 |

| Quadra FNX Mining Ltd. (a) | 465,300 | 4,279,073 |

| Thompson Creek Metals Co., Inc. (a) | 413,400 | 3,588,198 |

| Ultra Petroleum Corp. (a) | 50,500 | 2,234,625 |

| 49,939,767 | ||

| Cayman Islands — 1.0% | ||

| Ming Fai International Holdings Ltd. | 8,355,400 | 3,279,936 |

| Parkson Retail Group Ltd. | 2,415,800 | 4,072,037 |

| Polarcus Ltd. (a) | 2,586,500 | 1,780,573 |

| 9,132,546 | ||

| China — 0.9% | ||

| Shenzhen Expressway Co., Ltd. | 8,423,100 | 3,711,970 |

| WuXi PharmaTech Cayman, Inc. — ADR (a) | 332,100 | 5,300,316 |

| 9,012,286 | ||

| Denmark — 0.3% | ||

| D/S Norden | 72,400 | 2,495,513 |

| Finland — 0.6% | ||

| Ramirent Oyj | 664,550 | 5,579,112 |

| France — 1.2% | ||

| Bonduelle SA | 52,800 | 4,778,638 |

| Eurofins Scientific SA | 76,275 | 2,713,732 |

| Scor SE | 181,920 | 3,474,563 |

| 10,966,933 | ||

| Germany — 5.0% | ||

| Asian Bamboo AG | 24,900 | 978,467 |

| Celesio AG | 157,600 | 3,436,567 |

| Deutsche Euroshop AG | 162,833 | 4,426,455 |

| GEA Group AG | 335,050 | 6,668,492 |

| Gerresheimer AG | 195,500 | 6,258,115 |

| Paion AG (a) | 475,886 | 1,065,236 |

| Rheinmetall AG | 170,200 | 9,721,354 |

| Rhoen-Klinikum AG | 242,600 | 5,398,757 |

| Salzgitter AG | 61,600 | 3,670,974 |

| Common Stocks | Shares | Value |

| Germany (concluded) | ||

| Symrise AG | 277,400 | $ 5,727,661 |

| TUI AG (a) | 58,400 | 513,190 |

| 47,865,268 | ||

| Greece — 0.2% | ||

| Alpha Bank AE | 327,300 | 1,599,660 |

| Hong Kong — 1.8% | ||

| City Telecom (HK) Ltd. — ADR | 96,900 | 1,098,846 |

| Clear Media Ltd. (a) | 4,052,000 | 2,219,869 |

| Lu Ning Co. Ltd. | 1,854,400 | 6,076,338 |

| NVC Lighting Holdings Ltd. (a) | 7,805,500 | 2,305,494 |

| Ports Design Ltd. | 2,010,700 | 5,114,174 |

| 16,814,721 | ||

| India — 1.7% | ||

| Container Corp. of India | 156,300 | 4,521,727 |

| Federal Bank Ltd. | 275,600 | 1,868,068 |

| PTC India Ltd. | 872,800 | 1,873,342 |

| United Phosphorus Ltd. | 1,311,200 | 5,162,792 |

| Vijaya Bank | 1,940,700 | 2,667,545 |

| 16,093,474 | ||

| Ireland — 1.2% | ||

| Allied Irish Banks Plc (a) | 419,800 | 445,489 |

| Bank of Ireland (a) | 2,591,750 | 2,106,834 |

| Ryanair Holdings Plc — ADR (a) | 314,396 | 8,516,988 |

| 11,069,311 | ||

| Israel — 0.7% | ||

| NICE Systems Ltd. — ADR (a) | 255,600 | 6,515,244 |

| Italy — 1.0% | ||

| DiaSorin SpA | 168,800 | 6,183,170 |

| Iren SPA | 2,177,900 | 3,252,990 |

| 9,436,160 | ||

| Japan — 5.7% | ||

| Asics Corp. | 432,950 | 3,964,041 |

| CMIC Co. Ltd. | 6,300 | 1,676,637 |

| Citizens Holding Co., Ltd. | 653,100 | 3,989,728 |

| Don Quijote Co., Ltd. | 189,000 | 5,067,348 |

| Fukuoka Financial Group, Inc. | 1,467,800 | 6,109,915 |

| Hisaka Works Ltd. | 298,500 | 3,017,728 |

| Koito Manufacturing Co., Ltd. | 246,100 | 3,624,028 |

| Kose Corp. | 222,800 | 5,238,173 |

| Kureha Chemical Industry Co., Ltd. | 1,423,200 | 6,857,732 |

| Makita Corp. | 89,150 | 2,385,656 |

| NGK Insulators Ltd. | 208,400 | 3,245,838 |

| Osaka Securities Exchange Co., Ltd. | 647 | 2,747,653 |

| Sekisui Chemical Co., Ltd. | 1,034,000 | 6,449,915 |

| 54,374,392 | ||

| Malaysia — 0.4% | ||

| AirAsia Bhd (a) | 8,864,400 | 3,404,549 |

| Netherlands — 0.2% | ||

| TomTom NV (a) | 371,000 | 2,010,356 |

| Norway — 0.4% | ||

| Marine Harvest | 5,550,400 | 3,665,197 |

| Singapore — 1.7% | ||

| Avago Technologies Ltd. (a) | 322,500 | 6,791,850 |

| Cityspring Infrastructure Trust | 15,536,600 | 6,541,360 |

| Wing Tai Holdings Ltd. | 2,797,600 | 3,128,832 |

| 16,462,042 | ||

| South Africa — 0.3% | ||

| African Bank Investments Ltd. | 762,200 | 2,991,387 |

See Notes to Financial Statements.

18 ANNUAL REPORT JUNE 30, 2010

Schedule of Investments (continued) BlackRock Global SmallCap Fund, Inc.

(Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| South Korea — 0.9% | ||

| Celltrion, Inc. | 410,200 | $ 6,887,095 |

| Dongbu Insurance Co., Ltd. | 70,200 | 2,014,538 |

| 8,901,633 | ||

| Spain — 0.5% | ||

| Laboratorios Farmaceuticos Rovi SA | 923,794 | 5,203,481 |

| Switzerland — 2.7% | ||

| Actelion Ltd. (a) | 54,200 | 2,029,349 |

| Addex Pharmaceuticals Ltd. (a) | 79,700 | 746,829 |

| Aryzta AG | 166,300 | 6,398,334 |

| Barry Callebaut AG | 2,400 | 1,491,379 |

| Clariant AG | 106,600 | 1,349,813 |

| Foster Wheeler AG (a) | 200,800 | 4,228,848 |

| Lindt & Spruengli AG ‘R’ | 233 | 5,709,828 |

| Rieter Holding AG | 15,931 | 4,046,418 |

| 26,000,798 | ||

| Taiwan — 0.7% | ||

| Lite-On Technology Corp. | 5,773,000 | 6,326,305 |

| Thailand — 0.3% | ||

| Mermaid Maritime PCL (a) | 7,639,205 | 2,582,743 |

| United Kingdom — 7.6% | ||

| Amlin Plc | 966,815 | 5,564,456 |

| Antofagasta Plc | 154,600 | 1,798,714 |

| Britvic Plc | 882,600 | 6,254,764 |

| Cairn Energy Plc (a) | 661,300 | 4,062,634 |

| Charter International Plc | 653,200 | 6,110,538 |

| EasyJet PLC (a) | 771,000 | 4,550,899 |

| GKN Plc (a) | 1,033,100 | 1,777,506 |

| Group 4 Securicor Plc | 1,640,097 | 6,502,565 |

| Halfords Group Plc | 847,700 | 6,170,298 |

| Hikma Pharmaceuticals Plc | 766,400 | 8,137,622 |

| Inchcape Plc (a) | 480,700 | 1,756,479 |

| Intertek Group Plc | 242,900 | 5,207,144 |

| Premier Oil Plc (a) | 255,800 | 4,722,802 |

| Rexam Plc | 1,420,672 | 6,390,970 |

| Schroders Plc | 185,000 | 3,329,608 |

| 72,336,999 | ||

| United States — 47.3% | ||

| AMB Property Corp. | 88,600 | 2,100,706 |

| Abercrombie & Fitch Co., Class A | 25,800 | 791,802 |

| Acadia Realty Trust | 159,600 | 2,684,472 |

| Adtran, Inc. | 284,900 | 7,769,223 |

| Advanced Energy Industries, Inc. (a) | 380,002 | 4,670,225 |

| Alpha Natural Resources, Inc. (a) | 115,500 | 3,911,985 |

| Arch Capital Group Ltd. (a) | 53,500 | 3,985,750 |

| Ariba, Inc. (a) | 252,400 | 4,020,732 |

| Autoliv, Inc. (a)(b) | 82,500 | 3,947,625 |

| BJ’s Restaurants, Inc. (a)(b) | 170,500 | 4,023,800 |

| BMC Software, Inc. (a) | 181,600 | 6,288,808 |

| Bank of Hawaii Corp. | 116,400 | 5,627,940 |

| Bill Barrett Corp. (a) | 69,700 | 2,144,669 |

| Blackboard, Inc. (a)(b) | 187,800 | 7,010,574 |

| BorgWarner, Inc. (a) | 80,150 | 2,992,801 |

| Brocade Communications Systems, Inc. (a) | 1,259,100 | 6,496,956 |

| Brooks Automation, Inc. (a) | 555,550 | 4,294,402 |

| Brown & Brown, Inc. | 126,000 | 2,411,640 |

| Cadence Design Systems, Inc. (a) | 826,150 | 4,783,408 |

| CardioNet, Inc. (a)(b) | 212,400 | 1,163,952 |

| Celanese Corp., Series A | 247,400 | 6,162,734 |

| Cliffs Natural Resources, Inc. | 72,098 | 3,400,142 |

| Commercial Vehicle Group, Inc. (a) | 395,132 | 4,034,298 |

| ComScore, Inc. (a) | 200,700 | 3,305,529 |

| Core Laboratories NV | 37,100 | 5,476,331 |

| Corporate Office Properties Trust | 100,200 | 3,783,552 |

| Covanta Holding Corp. (a) | 292,550 | 4,853,404 |

| Common Stocks | Shares | Value |

| United States (continued) | ||

| Cullen/Frost Bankers, Inc. | 145,000 | $ 7,453,000 |

| DSP Group, Inc. (a) | 793,800 | 5,072,382 |

| Delta Air Lines, Inc. (a) | 354,000 | 4,159,500 |

| Digital Realty Trust, Inc. (b) | 110,400 | 6,367,872 |

| Drew Industries, Inc. (a) | 211,800 | 4,278,360 |

| Duoyuan Printing, Inc. (a) | 124,400 | 960,368 |

| Electronic Arts, Inc. (a) | 450,200 | 6,482,880 |

| Electronics for Imaging, Inc. (a) | 404,800 | 3,946,800 |

| Essex Property Trust, Inc. | 30,500 | 2,974,970 |

| FTI Consulting, Inc. (a) | 88,300 | 3,848,997 |

| Fidelity National Title Group, Inc., Class A | 200,600 | 2,605,794 |

| Foot Locker, Inc. | 397,600 | 5,017,715 |

| Guess?, Inc. | 213,650 | 6,674,426 |

| Home Properties, Inc. | 92,900 | 4,187,003 |

| IDEX Corp. | 249,350 | 7,123,929 |

| IPC The Hospitalist Co., Inc. (a) | 189,100 | 4,746,410 |

| ITC Holdings Corp. | 133,100 | 7,042,321 |

| InterMune, Inc. (a) | 196,600 | 1,838,210 |

| Intersil Corp., Class A | 590,800 | 7,154,588 |

| j2 Global Communications, Inc. (a) | 303,500 | 6,628,440 |

| JDS Uniphase Corp. (a) | 462,300 | 4,549,032 |

| Kindred Healthcare, Inc. (a) | 199,000 | 2,555,160 |

| Kinetic Concepts, Inc. (a) | 128,350 | 4,686,059 |

| King Pharmaceuticals, Inc. (a) | 326,700 | 2,479,653 |

| Landstar System, Inc. | 164,250 | 6,404,107 |

| Linear Technology Corp. | 72,950 | 2,028,740 |

| LKQ Corp. (a) | 337,663 | 6,510,143 |

| The Macerich Co. (b) | 146,875 | 5,481,375 |

| Manpower, Inc. | 81,300 | 3,510,534 |

| Maxim Integrated Products, Inc. | 335,300 | 5,609,569 |

| Meadowbrook Insurance Group, Inc. | 287,100 | 2,477,673 |

| Mentor Graphics Corp. (a) | 632,050 | 5,593,642 |

| Merit Medical Systems, Inc. (a) | 430,561 | 6,919,115 |

| Molex, Inc. (b) | 309,100 | 5,637,984 |

| Myriad Genetics, Inc. (a) | 53,800 | 804,310 |

| Nektar Therapeutics (a) | 249,700 | 3,021,370 |

| Nordson Corp. (b) | 81,450 | 4,567,716 |

| Northeast Utilities, Inc. | 299,900 | 7,641,452 |

| Nuance Communications, Inc. (a)(b) | 475,200 | 7,104,240 |

| OM Group, Inc. (a) | 81,800 | 1,951,748 |

| ON Semiconductor Corp. (a) | 443,000 | 2,826,340 |

| Oasis Petroleum, Inc. (a) | 244,300 | 3,542,350 |

| PMC-Sierra, Inc. (a) | 776,100 | 5,836,272 |

| Packaging Corp. of America | 289,900 | 6,383,598 |

| PartnerRe Ltd. | 55,300 | 3,878,742 |

| People’s United Financial, Inc. | 177,474 | 2,395,899 |

| PetroHawk Energy Corp. (a) | 196,500 | 3,334,605 |

| Pharmaceutical Product Development, Inc. | 333,100 | 8,464,071 |

| Phillips-Van Heusen Corp. | 156,300 | 7,232,001 |

| Polycom, Inc. (a) | 223,400 | 6,655,086 |

| Popular, Inc. (a) | 822,300 | 2,203,764 |