UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

FPA Paramount Fund, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

FPA PARAMOUNT FUND, INC.

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064-1550

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on Tuesday, July 31, 2012

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of FPA Paramount Fund, Inc. (the "Fund"), will be held at the offices of First Pacific Advisors, LLC, 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064, on Tuesday, July 31, 2012, at 10:00 a.m. Pacific Time, to consider and vote on the following matters:

1. Election of the Board of Directors (six directors); and

2. Such other matters as may properly come before the meeting or any adjournment or adjournments thereof.

Your Directors recommend that you vote FOR all items.

May 31, 2012, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting, and only holders of Common Stock of record at the close of business on that date will be entitled to vote.

By Order of the Board of Directors

SHERRY SASAKI

Secretary

June 15, 2012

It is requested that you promptly execute the enclosed proxy and return it in the enclosed envelope, thus enabling the Fund to avoid unnecessary expense and delay. No postage is required if mailed in the United States. You may also vote the enclosed proxy by telephone or over the Internet. The proxy is revocable and will not affect your right to vote in person if you attend the meeting.

FPA PARAMOUNT FUND, INC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board" or "Board of Directors", and each member of the Board, a "Director") of FPA Paramount Fund, Inc. (the "Fund"), of proxies to be voted at a special meeting of shareholders of the Fund to be held at 10:00 a.m. (Los Angeles time) on Tuesday, July 31, 2012, at the offices of First Pacific Advisors, LLC (the "Adviser" or "FPA"), 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064 (the "Meeting"), and at any and all adjournments thereof. The Meeting will be held for the purposes set forth in the accompanying Notice. This Proxy Statement and the accompanying materials are being mailed by the Board on or about June 15, 2012.

The Fund is organized as a Maryland corporation. In addition, the Fund is a registered investment company.

If you hold shares in your name as a record holder, you may vote your shares by proxy through the mail, telephone, or Internet as described on the proxy card. If you submit your proxy via the Internet, you may incur costs such as telephone and Internet access charges. Submitting your proxy will not limit your right to vote in person at the Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your shares according to the Board's recommendations thereon. Proxy solicitation will be principally by mail but may also be made by telephone or personal interview conducted by officers and regular employees of FPA or UMB Fund Services, Inc., the Fund's Transfer Agent, and the Fund reserves the right to retain outside agencies for the purpose of soliciting proxies. The cost of solicitation of proxies will be borne by the Fund, which will reimburse banks, brokerage firms, nominees, fiduciaries, and other custodians for reasonable expenses incurred by them in sending the proxy material to beneficial owners of shares of the Fund. The Fund's annual report to shareholders for the year ended September 30, 2011, may be viewed at www.proxyonline.us/docs/fpaparamount/ or may be obtained upon written request made to the Secretary of the Fund.

On May 31, 2012 (the record date for determining shareholders entitled to notice of and to vote at the Meeting), there were 13,115,728 shares of Common Stock outstanding, $0.25 par value. On May 31, 2012, the net assets of the Fund were $243,445,759. Shareholders of the Fund are entitled to one vote per share. No person is known by management to own beneficially or of record as much as 5% of the outstanding Common Stock, except the following entity.

| Title of Class | | Name & Address of

Beneficial Owner | | Number of

Shares Held | | Percent of Class | |

| Common Stock | | Southern Farm Bureau Life

Insurance Company

1401 Livingston Lane

Jackson, Mississippi 39213-8098 | | | 4,495,047 | | | | 34.27 | % | |

|

Annual reports are sent to shareholders of record of the Fund following the Fund's fiscal year end. The Fund's annual report is available at www.proxyonline.us/docs/fpaparamount/, and the Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request. Such written or oral requests should be directed to the Fund at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, or call (800) 982-4372 ext. 419. Please note that only one annual report or Proxy Statement may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or the Proxy Statement, or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Fund at the address and phone number set forth above.

1

1. ELECTION OF THE BOARD OF DIRECTORS

The Fund's Board of Directors is comprised of individuals with considerable and varied business experiences, backgrounds, skills, and qualifications who collectively have a strong knowledge of business and financial matters and are committed to helping the Fund achieve its investment objective while acting in the best interests of the Fund's shareholders. Several members of the Board and nominees have had a long and continued service with the Fund or other FPA Funds. As noted in the table below, the nominees bring a variety of experiences and qualifications through their business backgrounds in the fields of accounting, consulting and strategic planning, entertainment, and investment management. The Board believes that each particular nominee's financial and business experience give him the qualifications and skills to serve as a director.

At the Meeting, six directors are to be elected to serve until the next meeting of shareholders or until their successors are duly elected and qualified. If a quorum is present at the Meeting, the six nominees receiving the highest number of votes will be elected, since a plurality of all the votes cast at the Meeting is sufficient to elect a director. Unless otherwise instructed, the proxy holders intend to vote proxies received by them for the six nominees named below. The following table sets forth certain information regarding each nominee for election as director. Willard H. Altman, Jr, Thomas P. Merrick, and Eric S. Ende are incumbent directors. A. Robert Pisano, Patrick B. Purcell, and Allan M. Rudnick have been nominated by the Board. As noted in the table below, Messrs. Purcell and Rudnick are current directors, and Mr. Pisano is formerly a director, of other funds in the FPA family of Funds and thus have experience in overseeing Funds managed by FPA and are familiar with FPA's operations, its personnel and investment style. In addition, the nominees are also nominated as directors of FPA Perennial Fund, Inc. at a meeting of shareholders scheduled for the same time as this Meeting. If elected to that Board and the Fund's Board, the same "non-interested" directors would oversee this Fund and FPA Perennial Fund, Inc., which the directors believe would likely result in more efficient oversight of these FPA Funds. Lawrence J. Sheehan, a current director, will retire, effective as of the election of a successor.

| Name, Address* & Age | | Position

With

Fund | | Elected as

Director

of the

Fund | | Year First

Principal Occupation(s)

During Past 5 Years (5) | | Number of

Which

Director

Currently

Serves | | FPA Fund

Boards on

Other

Directorships

Held by

Directors | |

| "Non-Interested" Directors | |

|

Willard H. Altman, Jr., 76

(1,2,3) | | Director & Chairman of the Board | | | 2002 | | | Former Partner of Ernst & Young LLP, a public accounting firm. Director/Trustee of FPA Capital Fund, Inc., of FPA New Income, Inc., of Source Capital, Inc., of FPA Perennial Fund, Inc., of FPA Funds Trust's FPA Crescent Fund, and of FPA Funds Trust's FPA International Value Fund (since November 2011) (4). Chairman of the Board of FPA Capital Fund, Inc., of FPA New Income, Inc., of FPA Perennial Fund, Inc., of FPA Funds Trust's FPA Crescent Fund, and of FPA Fund's Trust's FPA International Value Fund. Vice President of Evangelical Council for Financial Accountability, an accreditation organization for Christian non-profit entities, from 1995 to 2002. | | | 7 | | | | 0 | | |

|

Thomas P. Merrick, 75

(1,2,3) | | Director | | | 2008 | | | Private consultant. President of Strategic Planning Consultants for more than the past five years. Director of Source Capital, Inc. (since February 2006), of FPA Perennial Fund, Inc. (since August 2008), of FPA Capital Fund, Inc. (since July 2009), of FPA Funds Trust's FPA Crescent Fund (since July 2009), of FPA New Income, Inc. (since July 2009), and of FPA Funds Trust's FPA International Value Fund (since November 2011) (4). Former Executive Committee member and Vice President of Fluor Corporation, responsible for strategic planning, from 1993 to 1998. | | | 7 | | | | 0 | | |

|

2

| Name, Address* & Age | | Position

With

Fund | | Year First

Elected as

Director

of the

Fund | | Principal Occupation(s)

During Past 5 Years (5) | | Number of

FPA Fund

Boards on

Which

Director

Currently

Serves | | Other

Directorships

Held by

Directors | |

| A. Robert Pisano, 69 | | Nominee | | | — | | | Consultant, Former President and Chief Operating Officer of the Motion Picture Association of America, Inc. from October 2005 to 2011. Former National Executive Director and Chief Executive Officer of The Screen Actors Guild (2001 to April 2005). Director/Trustee of the Fund, of FPA Capital Fund, Inc., of FPA New Income, Inc., of FPA Funds Trust's FPA Crescent Fund, and of FPA Perennial Fund, Inc. (from 2002 to 2008). Nominee for Director of FPA Perennial Fund, Inc. (4). Chairman of the Board of The Motion Picture and Television Fund. Lead Independent Director of Resources Global Professionals. | | | — | | | Resources Global Professionals, The Motion Picture and Television Fund | |

|

| Patrick B. Purcell, 69 | | Nominee | | | — | | | Retired. Former Executive Vice President, Chief Financial and Administrative Officer of Paramount Pictures from 1983 to 1998. Director/Trustee (since May 2006) of FPA Capital Fund, Inc., of FPA New Income, Inc., and of FPA Funds Trust's FPA Crescent Fund, of Source Capital, Inc. (since May 2010), and of FPA Funds Trust's FPA International Value Fund (since November 2011). Nominee for Director of FPA Perennial Fund, Inc. (4). | | | 5 | | | The Motion Picture and Television Fund | |

|

| Allan M. Rudnick, 72 | | Nominee | | | — | | | Private investor. Formerly Co-founder and Chief Investment Officer of Kayne Anderson Rudnick Investment Management ("KAR") in 1989. Prior to his retirement in December 2007, Mr. Rudnick served as President, Chief Executive Officer (from 2001) and Chairman of the Board (from 2001) of KAR. Director/Trustee (since January 2010) of FPA Capital Fund, Inc., of FPA New Income, Inc., and of FPA Funds Trust's FPA Crescent Fund, of FPA Funds Trust's FPA International Value Fund (since November 2011), and of Source Capital, Inc. (since May 2012). Nominee for Director of FPA Perennial Fund, Inc. (4). | | | 5 | | | | 0 | | |

|

| "Interested" Directors | |

|

| Eric S. Ende, 67** | | Director, President & Portfolio Manager | | | 2000 | | | Partner of FPA (since October 2006). Director, President and Chief Investment Officer of Source Capital, Inc., Director, President and Portfolio Manager of FPA Perennial Fund, Inc., and Vice President of FPA Capital Fund, Inc., of FPA New Income, Inc., of FPA Funds Trust's FPA Crescent Fund, and of FPA Funds Trust's FPA International Value Fund (4). Formerly, Senior Vice President of First Pacific Advisors, Inc. (1994 to September 2006). | | | 3 | | | | 0 | | |

|

* The address for each director is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550.

** "Interested person" within the meaning of the Investment Company Act of 1940 ("Act" or "1940 Act") by virtue of his affiliation with FPA.

(1) Member of the Audit and Compliance Committee of the Board of Directors.

(2) Member of the Corporate Responsibility Committee of the Board of Directors.

(3) Member of the Investment Policy Review Committee of the Board of Directors.

(4) FPA Capital Fund, Inc., FPA New Income, Inc., FPA Perennial Fund, Inc., FPA Funds Trust's FPA Crescent Fund, FPA Funds Trust's FPA International Value Fund, and Source Capital, Inc. are other investment companies advised by FPA. See "Information Concerning FPA" herein.

(5) "Principal Occupation" includes all positions held with affiliates of the Fund during the past five years.

3

All nominees have consented to being named in this Proxy Statement and have indicated their intention to serve if elected. Should any nominee for director withdraw or otherwise become unavailable for reasons not presently known, it is intended that the proxy holders will vote for the election of such other person or persons as the Board of Directors may designate.

The Board of Directors has designated the members identified by footnote (1) to the preceding table, in addition to Lawrence J. Sheehan, as the Audit and Compliance Committee of the Board. No member is considered an "interested person" of the Fund within the meaning of the 1940 Act. The Audit and Compliance Committee makes recommendations to the Board of Directors concerning the selection of the Fund's independent registered public accounting firm and reviews with such firm the results of the annual audit, including the scope of auditing procedures, the adequacy of internal controls and compliance by the Fund with the accounting, recording, and financial reporting requirements of the 1940 Act. In each instance, before an accountant has been engaged by the Fund, the engagement has been approved by the Audit and Compliance Committee. The Audit and Compliance Committee met four times during the last fiscal year. The responsibilities of the Audit and Compliance Committee are set forth in the Audit and Compliance Committee Charter, a copy of which is available, without charge, upon request, by calling (800) 982-4372.

The Board recommends that shareholders vote FOR the nominated directors.

The Board of Directors has designated the members identified by footnote (2) to the preceding table, in addition to Lawrence J. Sheehan, as the Corporate Responsibility Committee. No member is considered an "interested person" of the Fund within the meaning of the 1940 Act. The Corporate Responsibility Committee recommends to the full Board of Directors nominees for election as directors of the Fund to fill vacancies on the Board, when and as they occur. While the Corporate Responsibility Committee expects to be able to identify from its own resources an ample number of qualified candidates, it will review recommendations from shareholders of persons to be considered as nominees to fill future vacancies. The determination of nominees recommended by the Corporate Responsibility Committee is within the sole discretion of the Corporate Responsibility Committee, and the final selection of nominees is within the sole discretion of the Board. Therefore, no assurance can be given that persons recommended by shareholders will be nominated as directors. The Corporate Responsibility Committee currently has no charter. The Corporate Responsibility Committee met three times during the last fiscal year.

The Corporate Responsibility Committee is responsible for searching for director candidates that meet the evolving needs of the Board of Directors. Director candidates must have the highest personal and professional ethics and integrity. Additional criteria weighed by the Corporate Responsibility Committee in the director identification and selection process include the relevance of a candidate's experience in investment company and/or public company businesses, enterprise or business leadership and managerial experience, broad economic and policy knowledge, the candidate's independence from conflict or direct economic relationship with the Fund, financial literacy and knowledge, and the candidate's ability and willingness to devote the proper time to prepare for, attend and participate in discussions in meetings. The Committee also takes into account whether a candidate satisfies the criteria for independence under the rules and regulations of the 1940 Act, and if a nominee is sought for service on the Audit and Compliance Committee, the financial and accounting expertise of a candidate, including whether the candidate would qualify as an Audit and Compliance Committee financial expert. While the Corporate Responsibility Committee does not have a formal policy respecting diversity on the Board of Directors, consideration is given to nominating persons with different perspectives and experience to enhance the deliberation and decision-making processes of the Board of Directors.

The Board of Directors has designated the members identified by footnote (3) to the preceding table, in addition to Lawrence J. Sheehan, as the Investment Policy Review Committee. No member is considered an "interested person" of the Fund within the meaning of the 1940 Act. The Committee reviews the status, history and prospects for Fund investments with particular reference to investment policies and guidelines and recommends any appropriate changes to the full Board of Directors. The Investment Policy Review Committee met four times during the last fiscal year.

During the Fund's fiscal year ended September 30, 2011, the Board of Directors held four meetings. Each director attended more than 75% of the aggregate of (1) the total number of meetings of the Board of Directors and (2) the total number of meetings held by all Committees of the Board on which they served.

Corporate Governance

As noted above, the Fund has adopted a charter for its Audit and Compliance Committee. The Board has also adopted a Code of Ethics, which applies to, among others, all of the Fund's officers and directors, as well as a Code of Ethics for Senior Executive and Financial Officers that applies to and has been signed by all officers of the Fund, including the Principal Executive Officer and Principal Financial Officer of the Fund. These materials are available on the website of the Securities and Exchange Commission, www.sec.gov, or without charge, upon request, by calling (800) 982-4372.

The Board of Directors and Its Leadership Structure

The Board of Directors has general oversight responsibility with respect to the Fund's business and affairs. Although the Board has delegated day-to-day supervision to the Adviser, all Fund operations are overseen by the Fund's Board, which meets quarterly.

4

The Board is currently composed of four directors, including three directors who are not "interested persons" of the Fund, as that term is defined in the 1940 Act (each an "Independent Director"). The Board holds executive sessions (with and without partners and/or employees of the Adviser) in connection with its regularly scheduled Board meetings, and the Independent Directors frequently correspond with each other in between meetings to discuss specific matters that may require attention at or prior to the Board's next regularly scheduled meeting. The Audit and Compliance Committee of the Board of Directors meets quarterly at regularly scheduled meetings and the Corporate Responsibility Committee meets at least twice a year. The Independent Directors have retained "independent legal counsel" as defined in the 1940 Act.

The Board has appointed an Independent Director to serve in the role of Chairman. The Chairman's primary role is to preside at all meetings of the Board. The Chairman participates in the preparation for meetings of the Board in coordination with the Treasurer of the Fund. They have frequent discussions regarding matters related to the preparation of the agenda for Board meetings (with input from the Independent Directors, Fund Counsel, and other Fund officers), determining which matters need to be acted upon by the Board, and ensuring that the Board obtains all the information necessary to perform its functions and take actions. The Treasurer of the Fund also acts, with the assistance of staff, as a liaison with service providers, officers, attorneys, and the Independent Directors between meetings. Except for any duties specified herein or pursuant to the Fund's By-Laws, the assignment of duties to the Chairman will not reduce the responsibilities that must be discharged by any other Director.

The Board of Directors has delegated day-to-day Fund and risk management to the Adviser, which is responsible for managing all Fund operations and the Fund's risk management processes. The Board oversees the processes implemented by the Adviser or other service providers to manage relevant risks and considers risk management issues as part of its responsibilities throughout the year at regular meetings. The Audit and Compliance Committee also considers risk management issues affecting the Fund's financial reporting and controls at its regular meetings throughout the year. The Adviser and other service providers prepare regular reports for Board and Audit and Compliance Committee meetings that address a variety of risk-related matters, and the Board as a whole or the Audit and Compliance Committee may also receive special written reports or presentations on a variety of risk issues at their request. For example, the portfolio managers of the Fund meet regularly with the Board to discuss portfolio performance, including investment risk, counterparty risk and the impact on the Fund of investments in particular securities. The Adviser also prepares reports for the Board regarding various issues, including valuation and liquidity.

The Board has also appointed a chief compliance officer ("CCO") for the Fund. The CCO reports directly to the Board and participates in the meetings of the Board. The Independent Directors meet quarterly in executive session with the CCO, and the CCO prepares and presents periodic written compliance reports that update compliance activities to date and results thereon. Additionally, the CCO presents an annual report to the Board in accordance with the Fund's compliance policies and procedures. The CCO would report any material risk, should it arise to the Board. The CCO is also the CCO of the Adviser.

Shareholders wishing to communicate with the Board may do so by sending a written communication to the Secretary of the Fund, at the following address: 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550.

During the Fund's fiscal year ended September 30, 2011, the Fund did not pay any salaries directly to officers but paid an investment advisory fee to FPA. The following information relates to director compensation. During the last fiscal year, each director who was not an interested person of FPA was compensated by the Fund at the rate of $6,000 per year plus a fee of $1,500 per day for Board of Directors meetings attended. Since December 8, 2011, the Fund pays $750 for each Committee meeting held on a day other than a Board meeting. The three directors who were not interested persons of FPA received in the aggregate directors' fees of $36,000 for the last fiscal year. Each such director is also reimbursed for out-of-pocket expenses incurred as a director.

| Name | | Aggregate Compensation*

From the Fund | | Total Compensation*

From All FPA Funds,

Including the Fund | |

| "Non-Interested" Directors | |

| Willard H. Altman, Jr. | | $ | 12,000 | | | $ | 116,000 | ** | |

| Thomas P. Merrick | | | 12,000 | | | | 104,000 | ** | |

| Lawrence J. Sheehan (will retire in 2012) | | | 12,000 | | | | 24,000 | *** | |

| "Interested" Directors | |

| Eric S. Ende | | | 0 | | | | 0 | | |

* No pension or retirement benefits are provided to directors by the Fund or the FPA Funds.

** Includes compensation from the Fund, four other open-end investment companies, and one closed-end investment company.

*** Includes compensation from the Fund and one other open-end investment company.

5

Fund Shares Owned by Directors and Nominees as of May 31, 2012*

| Name | | Dollar Range of Fund

Shares Owned | | Aggregate Dollar Ranges of Shares

Owned in All FPA Funds

Overseen by Director | |

| "Non-Interested" Directors | |

| Willard H. Altman, Jr. | | $50,001 to $100,000 | | Over $100,000 | |

| Thomas P. Merrick | | $10,001 to $50,000 | | Over $100,000 | |

| A. Robert Pisano (Nominee) | | none | | none | |

| Patrick B. Purcell (Nominee) | | Over $100,000 | | Over $100,000 | |

| Allan M. Rudnick (Nominee) | | none | | Over $100,000 | |

| "Interested" Directors | |

| Eric S. Ende | | Over $100,000 | | Over $100,000 | |

* All officers and directors of the Fund, as a group owned, beneficially or of record 1.52% of the outstanding shares of the Fund.

The following information relates to the executive officers of the Fund who are not directors of the Fund. Each officer also serves as an officer of FPA. The business address of each of the following officers is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550.

Name and Position

With Fund | | Principal Occupation During Past Five Years (1) | | Age | | Officer

Since | |

Steven R. Geist

(Executive Vice President & Portfolio Manager) | | Partner of First Pacific Advisors, LLC (since October 2006). Executive Vice President and Portfolio Manager of Source Capital, Inc. and of FPA Perennial Fund, Inc. for more than the past five years. Vice President of First Pacific Advisors, Inc. from December 1994 to September 2006; and Senior Vice President and Fixed-Income Manager of Source Capital, Inc. from November 1999 to November 2006. | | | 58 | | | | 2000 | | |

|

Gregory A. Herr

(Vice President & Portfolio Manager) | | Vice President of First Pacific Advisors, LLC (since April 2007). Senior research analyst at Vontobel Asset Management, Inc. from September 2003 to March 2007. | | | 39 | | | | 2011 | | |

|

Pierre O. Py

(Vice President & Portfolio Manager) | | Vice President of First Pacific Advisors, LLC (since September 2011); portfolio manager of FPA International Value Fund since December 2011. International research analyst at Harris Associates from October 2005 to December 2010. | | | 35 | | | | 2011 | | |

|

J. Richard Atwood

(Treasurer) | | Managing Partner and Chief Operating Officer, Chief Financial Officer and Treasurer of First Pacific Advisors, LLC for more than the past five years. Director, President, Chief Executive Officer, Chief Compliance Officer, Chief Financial Officer and Treasurer for more than the past five years of FPA Fund Distributors, Inc.; and Treasurer of each FPA Fund for more than the past five years (since December 2011 for FPA International Value Fund), Director, Principal, Chief Operating Officer and Chief Financial Officer (from January 1997) of First Pacific Advisors, Inc. from May 2000 to September 2006. | | | 52 | | | | 1997 | | |

|

Sherry Sasaki

(Secretary) | | Assistant Vice President and Secretary of First Pacific Advisors, LLC for more than the past five years; and Secretary of each FPA Fund (since December 2011 for FPA International Value Fund), and of FPA Fund Distributors, Inc. for more than the past five years. Assistant Vice President (from December 1992) and Secretary (from June 1991) of First Pacific Advisors, Inc. to September 2006. | | | 57 | | | | 1982 | | |

|

Christopher H. Thomas

(Chief Compliance Officer) | | Vice President and Chief Compliance Officer of First Pacific Advisors, LLC (since October 2006); Director, Vice President and Controller for more than the past five years of FPA Fund Distributors, Inc.; and Chief Compliance Officer of each FPA Fund (since August 2004). Controller from March 1995 to December 2005, and Vice President (from March 1995) and Chief Compliance Officer (from August 2004) of First Pacific Advisors, Inc. to September 2006; and Assistant Treasurer of each FPA Fund from April 1995 (except FPA Funds Trust from August 2002) to February 2006. | | | 55 | | | | 1995 | | |

|

(1) "Principal Occupation" includes all positions held with affiliates of the Fund during the past five years.

6

Information Concerning Independent Registered Public Accounting Firm

The Board of Directors, including a majority of the directors who are not considered "interested persons" of the Fund as defined in the 1940 Act (the "Independent Board Members"), has selected Deloitte & Touche LLP to serve as the Fund's independent registered public accounting firm for the fiscal year ending September 30, 2012. The employment of such firm is conditioned upon the right of the Fund, by vote of a majority of its outstanding voting securities, to terminate such employment forthwith without any penalty. Deloitte & Touche LLP has served as the independent registered public accounting firm for the Fund since November 12, 2002. Representatives of Deloitte & Touche LLP are not expected to be present at the Meeting, but will be available to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders, if necessary.

Audit Fees

Aggregate fees paid to Deloitte & Touche LLP for professional services for the audits of the Fund's annual financial statements during the fiscal years ended September 30, 2010 and 2011, and the reviews of the financial statements included in the Fund's filings on Form N-SAR for those fiscal years, were $34,100 and $35,000, respectively.

Tax Fees

Aggregate fees for tax services provided by Deloitte & Touche LLP to the Fund during the 2010 and 2011 fiscal years were $7,100 for each year, respectively, in connection with the preparation and review of the federal and state tax returns for the Fund.

No other services were provided to the Fund by Deloitte & Touche LLP.

Information Concerning FPA

First Pacific Advisors, LLC, maintains its principal office at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550. FPA is a Delaware limited liability company that, together with its predecessor organizations, has been in the investment advisory business since 1954 and has served as the Fund's investment adviser since July 1, 1978.

FPA Fund Distributors, Inc. ("Distributor"), located at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, acts as principal underwriter of Fund shares. The Distributor is a wholly-owned subsidiary of FPA.

The Advisory Agreement permits the Adviser to render advisory services to others, and the Adviser also serves as investment adviser to FPA Capital Fund, Inc., FPA New Income, Inc., FPA Perennial Fund, Inc., FPA Funds Trust's FPA Crescent Fund, and FPA Funds Trust's FPA International Value Fund, open-end investment companies, and Source Capital, Inc., a closed-end investment company, which had net of assets of $1,309,144,784, $4,672,023,664, $257,832,662, $8,736,962,528, $4,644,157, and $578,182,990, respectively, at March 31, 2012. The annual advisory fees paid by the Fund, FPA Capital Fund, Inc. and FPA Perennial Fund, Inc. equal 0.75% of the first $50 million of each such fund's average daily net assets and 0.65% on the average daily net assets of each such fund in excess of $50 million. Those three funds also reimburse the Adviser for the cost of financial services in an amount of up to 0.10% of average daily net assets. FPA New Income, Inc. pays an advisory fee at the annual rate of 0.50% of its average daily net assets. FPA Crescent Fund and FPA International Value Fund each pays an advisory fee at the annual rate of 1.00% of its average daily net assets and pays the Adviser a fee of 0.10% of average daily net assets for the provision of financial services. Source Capital, Inc. pays an advisory fee at the annual rate of 0.725% on the first $100 million of its net assets, 0.700% on the next $100 million of its net assets, and 0.675% on any net assets in excess of $200 million. FPA also advises institutional accounts. The Adviser had total assets under management of approximately $19.6 billion at March 31, 2012.

The management committee of the Adviser is comprised of three Managing Partners, Mr. Atwood, Steven T. Romick, and Robert L. Rodriguez. Thomas H. Atteberry, Dennis M. Bryan, Rikard B. Ekstrand, Mr. Ende, and Mr. Geist, are the other partners of the Adviser.

No Independent Board members or nominees own, beneficially or of record, interests of FPA or any entity under common control with FPA.

2. OTHER MATTERS

The proxy holders have no present intention of bringing before the Meeting for action any matters other than those specifically referred to in the foregoing, and in connection with or for the purpose of effecting the same, nor has the management of the Fund any such intention. Neither the proxy holders nor the management of the Fund are aware of any matters that may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

7

Voting Requirements

A quorum of shareholders is required to take action at the Meeting. For purposes of this Meeting, a quorum is present to transact business on a proposal if the holders of a majority of the outstanding shares of the Fund entitled to vote on the proposal are present in person or by proxy. The shares represented by a proxy that is properly executed and returned will be considered to be present at the Meeting.

Based on the Fund's interpretation of Maryland law, abstentions on a proposal set forth herein will have the same effect as a vote against the proposal. Brokers who hold shares in street name for customers have the authority to vote on all of the proposals set forth herein if they have not received instructions from beneficial owners.

Simultaneous Meetings

The Meeting of shareholders of the Fund is called to be held at the same time as the special meeting of shareholders of FPA Perennial Fund, Inc. It is anticipated that such meetings will be held simultaneously. In the event that any Fund shareholder at the Meeting objects to the holding of a simultaneous meeting and moves for an adjournment of the Meeting so that the Meeting of the Fund may be held separately, the person named as proxies will vote in favor of such an adjournment.

Shareholder Proposals

No annual or other special meeting is currently scheduled for the Fund and, in order to minimize costs, the Fund does not intend to hold meetings unless required by applicable law or regulation, or if otherwise deemed advisable by the Board. To be considered for presentation at a shareholder meeting, a shareholder's proposal must be received at the offices of the Fund a reasonable time before a solicitation is made. Mere submission of a shareholder proposal does not guarantee the inclusion of the proposal in the proxy statement or presentation of the proposal at the Meeting since inclusion and presentation are subject to compliance with certain federal regulations.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on July 31, 2012

The Fund's proxy statement and annual report for the fiscal year ended September 30, 2011, are available free of charge at www.proxyonline.us/docs/fpaparamount/.

Adjournment

In the event that sufficient votes in favor of the proposals set forth herein are not received by the time scheduled for the Meeting, the persons named as proxies may move one or more adjournments of the Meeting for a period or periods of not more than 120 days in the aggregate to permit further solicitation of proxies with respect to any such proposal. Any such adjournment will require the affirmative vote of a majority of the shares present at the Meeting. The persons named as proxies will vote in favor of such adjournment those shares which they are entitled to vote which have voted in favor of such proposals. They will vote against any such adjournment those proxies which have voted against any of such proposals.

By Order of the Board of Directors

Sherry Sasaki

Secretary

June 15, 2012

Please complete, date and sign the enclosed proxy, and return it promptly in the enclosed reply envelope. No postage is required if mailed in the United States. You may also vote your proxy by telephone or over the Internet.

8

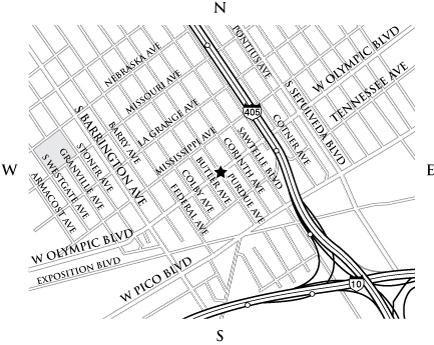

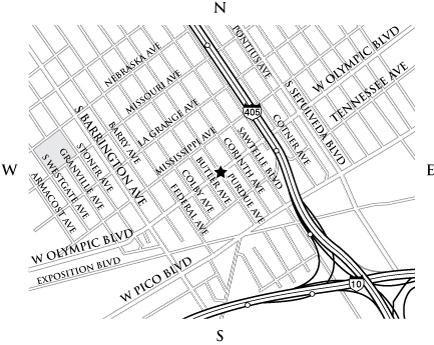

Directions: First Pacific Advisors, LLC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California, Telephone (310) 473-0225

Entrance to parking lot on Purdue Avenue

405 Southbound:

Take Pico Blvd. exit. (Tennessee)

Go West on Tennessee.

Right on Purdue.

405 Northbound:

Exit on National Blvd.

Left on National. (West)

Right on Sawtelle. (North)

Left on Olympic.

Left on Purdue. | | 10 Westbound:

Exit Bundy North.

Right on Olympic.

Right on Purdue.

10 Eastbound:

Exit Centinela. (Pico)

Go East on Pico.

Left on Purdue. | |

|

map not to scale

| | |

| | |

| | |

| |

PROXY CARD FOR |

|

FPA PARAMOUNT FUND, INC. |

|

Proxy for A Special Meeting of Shareholders – July 31, 2012 |

| |

The undersigned Shareholder(s) of FPA Paramount Fund, Inc. (“Fund”), hereby appoint(s) Willard H. Altman, Jr. and Patrick B. Purcell (each with full power of substitution), the proxy or proxies of the undersigned, to attend the Special Meeting of Shareholders of the FPA Paramount Fund, Inc., to be held on July 31, at 10:00 a.m., Pacific Time, at the offices of First Pacific Advisors, LLC, 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064, and at any postponements or adjournments thereof (“Special Meeting”), to vote all of the shares of FPA Paramount Fund, Inc. that the undersigned would be entitled to vote if personally present at the Special Meeting and on any other matters properly brought before the Special Meeting, all as set forth in the Proxy Statement for the Special Meeting of Shareholders.

Shareholder Registration Printed Here (shows through window on outbound envelope) | | QUESTIONS ABOUT THIS PROXY? Should you have any questions about the proxy materials or regarding how to vote your shares, please contact our proxy information line toll-free at 1-800-499-8541. Representatives are available Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time. |

| |

| Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on July 31, 2012 |

|

| |

The proxy materials for this meeting are available at: www.proxyonline.us/docs/fpaparamount/

PLEASE FOLD HERE AND RETURN THE ENTIRE BALLOT – DO NOT DETACH

Please see the instructions below if you wish to vote by PHONE (live proxy representative), by MAIL or via the INTERNET. Please use whichever method is most convenient for you. If you choose to vote via the Internet or by phone, you should not mail your proxy card. Please vote today!

PHONE: | To cast your vote by phone with a proxy voting representative, call toll-free 1-800-499-8541 and provide the representative with the control number found on the reverse side of this proxy card. Representatives are available to take your voting instructions Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time. | | NOTE: This proxy must be signed exactly as your name(s) appears hereon. If as an attorney, executor, guardian or in some representative capacity or as an officer of a corporation, please add titles as such. Joint owners must each sign. By signing this proxy card, you acknowledge that you have received the proxy statement that accompanies this proxy card. |

| | | |

MAIL: | To vote your proxy by mail, check the appropriate voting box on the reverse side of this proxy card, sign and date the card and return it in the enclosed postage-paid envelope. | | |

| | | Shareholder sign here | Date |

| | | |

Option below is available 24 hours a day / 7 days a week | | |

| | | |

INTERNET: | To vote via the Internet, go to www.proxyonline.us and enter the control number found on the reverse side of this proxy card. | | |

| | | Joint owner sign here | Date |

IT IS IMPORTANT THAT PROXIES BE VOTED PROMPTLY. EVERY SHAREHOLDER’S VOTE IS IMPORTANT.

FPA PARAMOUNT FUND, INC.

| | CONTROL NUMBER |

| | |

| | 123456789123 |

| |

| |

If you received more than one ballot because you have multiple investments in FPA Paramount Fund, please remember to vote all of your ballots!

Remember to sign and date the reverse side before mailing in your vote. This proxy card is valid only when signed and dated.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. This proxy card will be voted as instructed. If no specification is made, the proxy card will be voted “FOR” the Proposal. The proxies are authorized, in their discretion, to vote upon such matters as may come before the Special Meeting or any adjournments.

PLEASE FOLD HERE AND RETURN THE ENTIRE BALLOT – DO NOT DETACH

TO VOTE, MARK BOXES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example:

1. ELECTION OF THE BOARD OF DIRECTORS

| | FOR | | WITHHOLD | | |

| | | | | | |

1.1 Willard H. Altman, Jr. | | o | | o | | |

| | | | | | |

1.2 Eric S. Ende | | o | | o | | |

| | | | | | |

1.3 Thomas P. Merrick | | o | | o | | |

| | | | | | |

1.4 A. Robert Pisano | | o | | o | | |

| | | | | | |

1.5 Patrick B. Purcell | | o | | o | | |

| | | | | | |

1.6 Allan M. Rudnick | | o | | o | | |

THANK YOU FOR VOTING