UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

x | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

|

FPA PARAMOUNT FUND, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

[FPA Logo]

FPA Paramount Fund, Inc.

October [11], 2013

Dear Shareholder:

The attached Proxy Statement discusses proposals to be voted upon by the shareholders of FPA Paramount Fund, Inc. (the “Fund”). As a shareholder of the Fund, you are being asked to review the Proxy Statement and cast your votes on the proposals.

The Board of Directors (“Board”) unanimously recommends that shareholders vote FOR each of the proposals.

Proposal 1 seeks to approve a new Investment Advisory Agreement between the Fund and First Pacific Advisors, LLC (“FPA”) under which the Fund would pay FPA a higher advisory fee. Two years ago, in an effort to expand investment opportunities for the Fund and to differentiate the Fund from other FPA Funds, FPA began to implement a global investment program for the Fund. While the Fund had previously invested primarily in domestic equity securities, given the increasing importance of international markets, FPA sought to increase the Fund’s investment exposures to non-U.S. equity securities. Since FPA changed the Fund’s mandate to a global investment program, it has invested in expanding its research and investment management capabilities relating to non-U.S. investments, and FPA has created a new investment strategy — the FPA Global Value Strategy — that uses these resources to manage portfolios with a greater portion of assets in non-U.S. investments; FPA has been transitioning the Fund to the FPA Global Value Strategy since September 1, 2013. The FPA Global Value Strategy, and now the Fund, is led by Pierre Py and Gregory Herr, who have become the Fund’s Co-Presidents and Co-Chief Investment Officers. Messrs. Py and Herr previously served as co-portfolio managers of the Fund.

Under the new leadership of Messrs. Py and Herr, FPA intends to invest a greater portion of the Fund’s assets in non-U.S. equity securities. This transition will not result in changes to the Fund’s investment objective or its principal investment strategies, which were revised two years ago to implement the transition to a global program. However, in connection with the new leadership, current positions in the Fund will be sized down or sold over time, in order to redeploy capital investment opportunities that Messrs. Py and Herr find most compelling. Some of these changes could occur over a short period of time and may likely result in the Fund paying significantly higher taxable distributions of capital gains than in prior years.

In connection with transitioning to the FPA Global Value Strategy, FPA reviewed the fees charged the Fund and sought approval from the Fund’s Board of Directors (the “Board”) to revise the Fund’s Investment Advisory Agreement to increase the advisory fee. FPA believes that the Fund’s current fee is no longer appropriate given the broader investment reach of the Fund and the higher research and other expenses associated with managing a global investment portfolio. Under the FPA Global Value Strategy, the Fund has changed its performance benchmark to the MSCI All Country World Index, and funds benchmarked to that index generally charge higher fees than those following the Fund’s previous benchmark in recognition of the increased investment and administrative complexity of managing a global fund. The increased complexity, and thus cost, of managing a global fund arises out of the increased research effort necessary to analyze and research companies around the world, as well as the additional time and resources needed to address trading and settlement issues and compliance and tax reporting. For these reasons, FPA believes that the proposed fee would be competitive with other global funds, consistent with fees charged by FPA to other FPA Funds (and thus designed to create a proper alignment of internal incentives for the portfolio management team), and would allow FPA to attract and retain high quality investment and trading personnel to successfully manage the Fund into the future. FPA presented the proposed Investment Advisory Agreement to the Board, and the Board approved the proposed Investment Advisory Agreement and determined to submit it to shareholders of the Fund for their approval with the Board’s recommendation to vote in favor.

If shareholders approve the proposed Investment Advisory Agreement, the Fund’s advisory fee would increase from its current rate of 0.75% of the first $50 million of average daily net assets and 0.65% thereafter, to the proposed fee rate of 1.00% of average daily net assets. FPA would continue to be reimbursed, as under the current Investment Advisory Agreement, for monthly costs incurred in providing financial services to the Fund, which cannot exceed 0.10% of the average daily net assets of the Fund. For the first six months following the date of approval of the proposed Investment Advisory Agreement, however, FPA will waive any increase in advisory fees. In addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Fund’s operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. The Proxy Statement, under Proposal 1, contains comparative fee tables and examples showing the Fund’s fees and expenses under the current Investment Advisory Agreement compared with under the proposed Investment Advisory Agreement.

Proposal 2 seeks to change the Fund from a diversified fund to a non-diversified fund. Shareholder approval of this change would enable the Fund to take larger positions in a smaller number of issuers. FPA believes that changing the Fund from a diversified fund to a non-diversified fund will give FPA more flexibility in implementing the Fund’s investment strategies. The change would enable FPA to focus the Fund’s investments on those securities that FPA believes are the most promising. Because FPA would be able to invest larger percentages of the Fund’s assets in the securities of particular issuers, FPA would be able to take more meaningful positions in securities that are its top investment choices. FPA believes that this increased investment flexibility may provide opportunities to enhance the Fund’s performance; however, investing a larger percentage of the Fund’s assets in any one issuer could increase the Fund’s risk of loss and its share price volatility, because the value of its shares would be more susceptible to adverse events affecting that issuer.

Proposal 3 seeks to adopt updates to certain fundamental investment policies of the Fund and eliminate certain other fundamental investment policies that are not required by law or are more restrictive than the law requires. The updates to the fundamental policies are intended to standardize and conform the Fund’s policies to those of other funds managed by FPA. The changes are also recommended in an effort to modernize the Fund’s fundamental investment policies, to provide the Fund additional flexibility to pursue its investment strategies and objectives, to respond to an ever-changing investment environment, and to simplify compliance monitoring. The proxy statement explains the proposed changes to, or elimination of, each fundamental policy. Shareholders are being asked to approve the changes in certain investment policies that are “fundamental,” which can be changed only with the approval of shareholders. FPA has advised the Board that if the recommended changes are approved, FPA does not presently intend to materially change the manner in which it manages the Fund with respect to these policies, or to materially increase the Fund’s risk profile. Before a material change is made to the Fund’s investment strategies, FPA will seek Board consent.

Proposal 4 seeks approval to permit the Board to change the Fund’s investment objective without additional shareholder approval. Although the Fund has no current plans to change its investment objective, if circumstances change in the future, a shareholder vote would be required to change the objective. Since the Fund is seeking approvals on other matters at this time, the Board is seeking the flexibility to change the investment objective without a further shareholder vote in order to avoid the potential future cost of solicitation. If approved, and if the Board decides to change the Fund’s investment objective in the future, it would provide 90 days’ advance notice to shareholders before implementing the change.

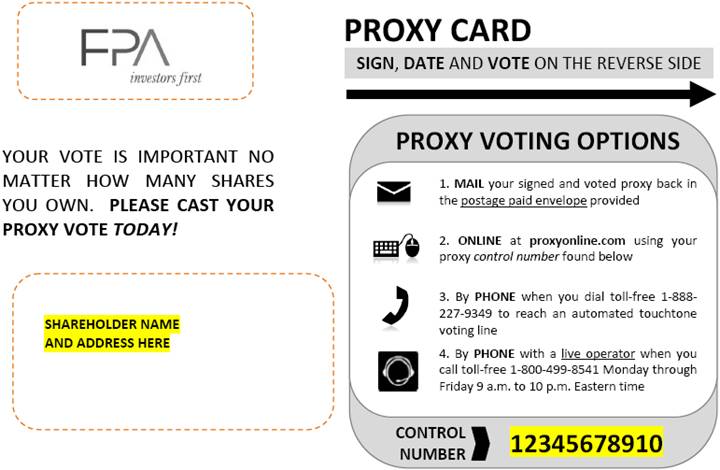

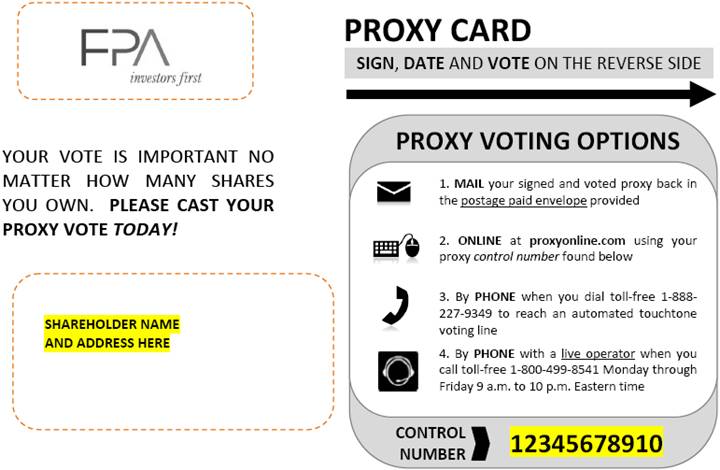

Your votes are important. To avoid the additional expense of further solicitation, we ask your cooperation in responding promptly, no matter how large or small your holdings may be. After reviewing the attached Proxy Statement, please indicate your voting instructions on the enclosed proxy card, sign and date it, and return it promptly in the enclosed postage paid envelope, or help us save time and postage costs by voting by telephone or through the internet — instructions can be found on your proxy card. If we do not hear from you by [ ], 2013, our proxy solicitor may contact you.

If you have any questions, please call [1-800-499-8541]. Our representatives will be glad to assist you Monday through Friday, 9:00 a.m. to 10:00 p.m. Eastern Time. Thank you for your response and your continued support of the FPA Paramount Fund, Inc.

| Very truly yours, | |

| | |

| [SHERRY SASAKI] | |

| [Secretary] | |

FPA PARAMOUNT FUND, INC.

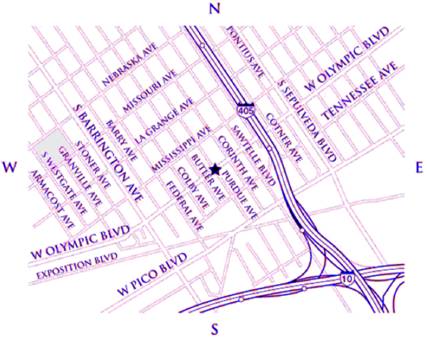

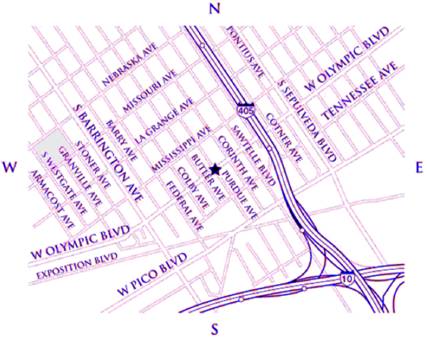

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064-1550

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on Friday, November 15, 2013

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of FPA Paramount Fund, Inc. (the “Fund”), will be held at the offices of First Pacific Advisors, LLC (“FPA”), 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, on Friday, November 15, 2013, at 10:00 a.m. Pacific Time, to consider and vote on the following matters:

1. Approval of a new Investment Advisory Agreement.

2. Approval to change the Fund from a diversified fund to a non-diversified fund.

3. Approval to adopt updates to certain fundamental investment policies of the Fund and eliminate certain other fundamental investment policies that are not required by law or are more restrictive than the law requires, as follows:

3a: Revise the fundamental policy relating to real estate

3b: Revise the fundamental policy relating to commodities

3c: Revise the fundamental policy relating to industry concentration

3d: Revise the fundamental policy relating to lending

3e: Revise the fundamental policy relating to the issuance of senior securities and borrowing

3f: Revise the fundamental policy relating to underwriting

3g: Remove the fundamental policy relating to participation in joint trading accounts for securities

3h: Remove the fundamental policy relating to affiliate transactions

3i: Remove the fundamental policy relating to purchasing and writing put and call options and engaging in short sales

3j: Remove the fundamental policy relating to investments in other investment companies

3k: Remove the fundamental policy relating to investments in companies for the purpose of exercising control or management.

4. Approval to change the Fund’s investment objective from a fundamental policy to a non-fundamental policy.

5. Such other matters as may properly come before the meeting or any adjournment or adjournments thereof.

Your Directors recommend that you vote FOR all items.

September 27, 2013, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting, and only holders of Common Stock of record at the close of business on that date will be entitled to vote.

FREQUENTLY ASKED QUESTIONS

Who is asking for your vote?

The Board of Directors (“Board”) of FPA Paramount Fund, Inc., on behalf of the Fund. The Board recommends that shareholders vote to approve each proposal.

Where and when will the meeting be held?

The meeting will be held at the offices of First Pacific Advisors, LLC (“FPA”), 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550 on Friday, November 15, 2013, at 10:00 a.m. Pacific Time.

What is happening?

Two years ago, in an effort to expand investment opportunities for the Fund and to differentiate the Fund from other FPA Funds, FPA began to implement a global investment program for the Fund. While the Fund had previously invested primarily in domestic equity securities, given the increasing importance of international markets, FPA sought to increase the Fund’s investment exposures to non-U.S. equity securities. Since FPA changed the Fund’s mandate to a global investment program, it has invested in expanding its research and investment management capabilities relating to non-U.S. investments, and FPA has created a new investment strategy — the FPA Global Value Strategy — that uses these resources to manage portfolios with a greater portion of assets in non-U.S. investments; FPA has been transitioning the Fund to the FPA Global Value Strategy since September 1, 2013. The FPA Global Value Strategy, and now the Fund, is led by Pierre Py and Gregory Herr, who have become the Fund’s Co-Presidents and Co-Chief Investment Officers. Messrs. Py and Herr previously served as co-portfolio managers of the Fund.

Under the new leadership of Messrs. Py and Herr, FPA intends to invest a greater portion of the Fund’s assets in non-U.S. equity securities. This transition will not result in changes to the Fund’s investment objective or its principal investment strategies, which were revised two years ago to implement the transition to a global program. However, in connection with the new leadership, current positions in the Fund will be sized down or sold over time, in order to redeploy capital investment opportunities that Messrs. Py and Herr find most compelling. Some of these changes could occur over a short period of time and may likely result in the Fund paying significantly higher taxable distributions of capital gains than in prior years.

In connection with transitioning to the FPA Global Value Strategy, FPA reviewed the fees charged the Fund and sought approval from the Fund’s Board of Directors (the “Board”) to revise the Fund’s Investment Advisory Agreement to increase the advisory fee. FPA believes that the Fund’s current fee is no longer appropriate given the broader investment reach of the Fund and the higher research and other expenses associated with managing a global investment portfolio. Under the FPA Global Value Strategy, the Fund has changed its performance benchmark to the MSCI All Country World Index, and funds benchmarked to that index generally charge higher fees than those following the Fund’s previous benchmark in recognition of the increased investment and administrative complexity of managing a global fund. The increased complexity, and thus cost, of managing a global fund arises out of the increased research effort necessary to analyze and research companies around the world, as well as the additional time and resources needed to address trading and settlement issues and compliance and tax reporting. For these reasons, FPA believes that the proposed fee would be competitive with other global funds, consistent with fees charged by FPA to other FPA Funds (and thus designed to create a proper alignment of internal incentives for the portfolio management team), and would allow FPA to attract and retain high quality investment and trading personnel to successfully manage the Fund into the future. FPA presented the proposed Investment Advisory Agreement to the Board, and the Board approved the proposed Investment Advisory Agreement and determined to submit it to shareholders of the Fund for their approval with the Board’s recommendation to vote in favor.

What am I being asked to vote on?

You are being asked to approve a proposed Investment Advisory Agreement with FPA. Due to the Fund investing a greater portion of its assets in non-U.S. equity securities under the FPA Global Value Strategy, FPA has proposed,

and the Board of Directors has agreed, that the Fund enter into a new Investment Advisory Agreement under which FPA would be paid at an annual rate of 1.00% of the Fund’s average daily net assets. Under the Investment Company Act of 1940, shareholders are generally required to approve material changes to investment advisory agreements before they take effect. Because the proposed Investment Advisory Agreement provides for a higher fee, you are being asked for your approval. The proposed Investment Advisory Agreement would not take effect until it is approved by shareholders.

How will the proposed Investment Advisory Agreement impact me?

Messrs. Py and Herr have already been appointed as the Co-Presidents and Co-Chief Investment Officers of the Fund, and under their leadership the Fund is in the process of transitioning to the FPA Global Value Strategy. If shareholders approve the proposed Investment Advisory Agreement, the Fund’s advisory fee would increase from its current rate of 0.75% of the first $50 million of average daily net assets and 0.65% thereafter, to the proposed fee rate of 1.00% of average daily net assets. FPA would continue to be reimbursed, as under the current Investment Advisory Agreement, for monthly costs incurred in providing financial services to the Fund, which cannot exceed 0.10% of the average daily net assets of the Fund.

For the first six months following the date of approval of the proposed Investment Advisory Agreement, however, FPA will waive any increase in advisory fees. In addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Fund’s operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. There is no assurance, however, that the expense limitation will be maintained at the same level, if at all, after January 31, 2015.

Will the changes to the Fund have tax consequences?

As noted, positions in the Fund will be sized down or sold over time, in order to redeploy capital into investment opportunities that Messrs. Py and Herr find most compelling. Some of these changes could occur over a short period of time and may likely result in the Fund paying significantly higher taxable distributions of capital gains than in prior years. This is because when the Fund sells a portfolio security, it must realize capital gains at the time of sale, and the Fund must generally distribute these capital gains to shareholders at the end of the year in which the gain was realized. Most, but not all, of the gains are expected to be long-term capital gains. Some portfolio sales have already occurred, and more sales are expected to occur in the 2013 taxable year, with the remaining part of the transition taking place during the 2014 taxable year. While the amount of realized capital gains cannot be known at present and will depend on market values at the time of sale, the Fund’s investments have generally increased in value, and the realization of capital gains is expected to result in the Fund paying significantly higher taxable distributions of net long-term capital gain (that is, the excess of net long-term capital gain over net short-term capital loss) and possibly some short-term capital gain (that is, the excess of short-term capital gains over short-term capital losses) in 2013 and 2014. Absent the transition the Fund would eventually have to realize these gains as it sells portfolio securities over time, but the transition to the FPA Global Value Strategy accelerates the pace of recognizing potential capital gains. Higher taxable distributions would not impact tax-exempt investors. Taxable investors receiving the distributions should be prepared to pay taxes on them at ordinary income rates for the part attributable to net short-term capital gain and at maximum rates of 15% and 20% for the part attributable to net long-term capital gain.

How will the proposal impact the Fund’s expenses?

Under the proposed Investment Advisory Agreement, if approved by shareholders, FPA would receive for its services to the Fund a monthly fee at an annual rate of 1.00% of the Fund’s average daily net assets. The increase in the Fund’s advisory fee would similarly increase the Fund’s expense ratio. Based on the Fund’s fees and expenses for the fiscal year ended September 30, 2013 (unaudited), the Fund’s expense ratio would increase from [0.94]% to [1.28]%. The Proxy Statement contains fee tables showing the Fund’s fees and expenses under the current Investment Advisory Agreement compared to fees and expenses under the proposed Investment Advisory Agreement, along with examples in each case.

For the first six months following the date of approval of the proposed Investment Advisory Agreement, however, FPA will waive any increase in advisory fees. In addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Fund’s operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. Even though this limit is higher than the Fund’s anticipated expense ratio if the proposed Investment Advisory Agreement is approved, the limit is designed to protect the Fund from unexpected changes in expenses or asset levels due to market volatility or net redemptions from the Fund that could cause the expense ratio to rise.

What other proposals are you being asked to vote on?

The Board is also proposing that shareholders approve changing the Fund from a diversified fund to a non-diversified fund. Shareholder approval of this change would enable the Fund to take larger positions in a smaller number of issuers. FPA believes that changing the Fund from a diversified fund to a non-diversified fund would give FPA more flexibility in implementing the Fund’s investment strategies. The change would enable FPA to focus the Fund’s investments on those securities that FPA believes are the most promising. Because FPA would be able to invest larger percentages of the Fund’s assets in the securities of particular issuers, FPA would be able to take even more meaningful positions in securities that are its top investment choices. However, investing a larger percentage of the Fund’s assets in any one issuer could increase the Fund’s risk of loss and its share price volatility, because the value of its shares would be more susceptible to adverse events affecting that issuer.

Shareholders are also being asked to approve changes in, or the removal of, certain fundamental investment policies of the Funds, as described in the Proxy Statement. The updates to the fundamental policies are intended to standardize and conform the Fund’s policies to those of other funds managed by FPA. The changes are also recommended in an effort to modernize the Fund’s fundamental investment policies, to provide the Fund additional flexibility to pursue its investment strategies and objectives, to respond to an ever-changing investment environment, and to simplify compliance monitoring. The proxy statement explains the proposed changes to, or elimination of, each fundamental policy. Shareholders are being asked to approve the changes in certain investment policies that are “fundamental,” which can be changed only with the approval of shareholders. Each change to a fundamental policy requires a separate vote, so shareholders should vote for each sub-proposal appearing on the proxy card. FPA has advised the Board that if the recommended changes are approved, FPA does not presently intend to materially change the manner in which it manages the Fund with respect to these policies, or to materially increase the Fund’s risk profile. Before a material change is made to the Fund’s investment strategies, FPA will seek Board consent.

Finally, shareholders are being asked to approve a proposal to permit the Board to change the Fund’s investment objective without additional shareholder approval. Although the Fund has no current plans to change its investment objective, if circumstances change in the future, a shareholder vote would be required to change the objective. Since the Fund is seeking approvals on other matters at this time, the Board is seeking the flexibility to change the investment objective without a further shareholder vote in order to avoid the potential future cost of solicitation. If approved, and if the Board decides to change the Fund’s investment objective in the future, it would provide 90 days’ advance notice to shareholders before implementing the change.

What happens if shareholders do not approve a proposal?

If shareholders of the Fund do not approve the proposed Investment Advisory Agreement, the Board will consider whether or not to ask shareholders to approve the agreement at a later date. FPA has indicated, however, that if the proposed Investment Advisory Agreement is not approved, it would consider seeking Board approval to close the Fund to any future purchases. FPA is committed to the Global Value Strategy and would likely seek to launch a new fund using that strategy, proposing to the Board the same fee currently proposed for the Fund. If any other proposal or sub-proposal is not approved by shareholders, the non-approved proposal would not be implemented and FPA would manage the Fund in accordance with the applicable current policy.

Who is bearing the expenses related to the shareholder meeting?

All mailing, printing, legal, and proxy solicitation and tabulation expenses associated with the meeting will be paid by FPA. The Fund will not bear any of these expenses.

Who is eligible to vote?

You are entitled to notice of, and to vote at, the meeting (and any adjournment or adjournments of the meeting) if you owned shares of the Fund at the close of business on September 27, 2013.

What are the different ways to vote your shares?

· By Mail: You may vote by mail by indicating your voting instructions on the enclosed proxy card, signing and dating it, and returning it in the enclosed postage paid envelope. Please note that if you sign and date the proxy card but give no voting instructions, your shares will be voted “FOR” each of the proposals described above.

· By Phone: You may vote by telephone by calling the number on your proxy card.

· On the Internet: You may vote through the internet by visiting the website listed on your proxy card.

· In Person: If you plan to attend the meeting, you may vote in person.

Proxy cards submitted by corporations and partnerships will not be voted unless they are signed by the appropriate person(s) as indicated in the voting instructions on the proxy cards.

By Order of the Board of Directors

[SHERRY SASAKI]

[Secretary]

October [11], 2013

It is requested that you promptly execute the enclosed proxy and return it in the enclosed envelope thus enabling the Fund to avoid unnecessary expense and delay. No postage is required if mailed in the United States. You may also vote the enclosed proxy by telephone or over the Internet. The proxy is revocable and will not affect your right to vote in person if you attend the meeting.

FPA PARAMOUNT FUND, INC.

11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation, by the Board of Directors (the “Board” or “Board of Directors”, and each member of the Board, a “Director”) of FPA Paramount Fund, Inc. (the “Fund”), of proxies to be voted at a special meeting of shareholders of the Fund to be held at 10:00 a.m. Pacific Time on Friday, November 15, 2013, at the offices of First Pacific Advisors, LLC (“FPA”), 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550 (the “Meeting”), and at any and all adjournments thereof. The Meeting will be held for shareholders to consider and vote on the following matters:

1. Approval of a new Investment Advisory Agreement.

2. Approval to change the Fund from a diversified fund to a non-diversified fund.

3. Approval to adopt updates to certain fundamental investment policies of the Fund and eliminate certain other fundamental investment policies that are not required by law or are more restrictive than the law requires, as follows:

3a: Revise the fundamental policy relating to real estate

3b: Revise the fundamental policy relating to commodities

3c: Revise the fundamental policy relating to industry concentration

3d: Revise the fundamental policy relating to lending

3e: Revise the fundamental policy relating to the issuance of senior securities and borrowing

3f: Revise the fundamental policy relating to underwriting

3g: Remove the fundamental policy relating to participation in joint trading accounts for securities

3h: Remove the fundamental policy relating to affiliate transactions

3i: Remove the fundamental policy relating to purchasing and writing put and call options and engaging in short sales

3j: Remove the fundamental policy relating to investments in other investment companies

3k: Remove the fundamental policy relating to investments in companies for the purpose of exercising control or management.

4. Approval to change the Fund’s investment objective from a fundamental policy to a non-fundamental policy.

5. Such other matters as may properly come before the Meeting or any adjournment or adjournments thereof.

This Proxy Statement and the accompanying materials are being mailed by the Board on or about October [11], 2013.

The Fund is organized as a Maryland corporation. In addition, the Fund is a registered investment company.

If you hold shares in your name as a record holder, you may vote your shares by proxy through the mail, telephone, or internet as described on the proxy card. If you submit your proxy via the internet, you may incur costs such as telephone and internet access charges. Submitting your proxy will not limit your right to vote in person at the Meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your instructions by submitting a written notice of revocation or subsequently executed proxy to the Secretary of the Fund at the above address, or by faxing to the Secretary at (310) 996-5450. If you submit a signed proxy card without indicating your votes, the person voting the proxy will vote your shares according to the Board’s recommendations thereon. Proxy solicitation will be principally by mail but may also be made by telephone or personal interview conducted by officers and regular employees of FPA or AST Fund Solutions, the

Fund’s proxy solicitor. The cost of solicitation of proxies will be borne by FPA, which will reimburse banks, brokerage firms, nominees, fiduciaries, and other custodians for reasonable expenses incurred by them in sending the proxy material to beneficial owners of shares of the Fund. [In addition, the Fund has engaged AST Fund Solutions to assist in proxy solicitation and collection and has agreed to pay such firm approximately $[ ], plus out-of-pocket costs].

On September 27, 2013 (the record date for determining shareholders entitled to notice of, and to vote, at the Meeting), there were [ ] shares of Common Stock outstanding, no par value. Shareholders of the Fund are entitled to one vote per share. As of September 27, 2013, no person is known by management to own beneficially or of record as much as 5% of the outstanding Common Stock, except the following persons:

Title of Class | | Name & Address of

Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | Percent of

Class | |

Common Stock | | [Charles Schwab and Co. Inc.*

101 Montgomery Street

San Francisco, CA 94104] | | [ ] shares | | [ ] | % |

| | | | | | | |

| | [Southern Farm Bureau Life Insurance Company

1401 Livingston Lane

Jackson, Mississippi 39213-8098] | | [ ] shares | | [ ] | % |

* The foregoing broker-dealers advise that the shares are held for the benefit of their customers.

As of September 27, 2013, the Directors and officers of the Fund and their families, as a group, owned beneficially [ ]% of the outstanding shares of the Fund, [which included beneficial ownership of [ ]% by [ ], and beneficial ownership of [ ]% by [ ]] [OR] [of which no single Director or officer owned more than 1%].

Annual reports are sent to shareholders of record of the Fund following the Fund’s fiscal year end. The Fund’s most recent annual and semi-annual reports are available at www.fpafunds.com, and the Fund will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request made to the Secretary of the Fund. Such written or oral requests should be directed to the Fund at 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550, or call [(800) 982-4372 ext. 419]. Please note that only one annual report or Proxy Statement may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or this Proxy Statement, or for instructions as to how to request a separate copy of these documents or as to how to request a single copy if multiple copies of these documents are received, shareholders should contact the Fund at the address and phone number set forth above.

1. APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT

General Overview

Two years ago, in an effort to expand investment opportunities for the Fund and to differentiate the Fund from other FPA Funds, FPA began to implement a global investment program for the Fund. While the Fund had previously invested primarily in domestic equity securities, given the increasing importance of international markets, FPA sought to increase the Fund’s investment exposures to non-U.S. equity securities. Thus, the Fund invests primarily in the common stocks of international and U.S. companies in a variety of industries and market segments. FPA believes that the Fund’s international diversification can yield valuable benefits to Fund shareholders by providing exposure to more investment opportunities outside the U.S. that meet FPA’s investment criteria. The Fund will purchase foreign domiciled companies that meet FPA’s usual investment criteria and where differences in accounting, disclosure, culture, management accessibility and trading do not put the Fund at a competitive

disadvantage. Once the foreign portfolio is established, the Fund will typically maintain an allocation to foreign domiciled companies of more than 50% of total assets. Additional exposure to foreign business activity is expected to come from purchases of U.S.-based companies with strong worldwide franchises.

Since FPA changed the Fund’s mandate to a global investment program, it has invested in expanding its research and investment management capabilities relating to non-U.S. investments, and FPA has created a new investment strategy — the FPA Global Value Strategy — that uses these resources to manage portfolios with a greater portion of assets in non-U.S. investments; FPA has been transitioning the Fund to the FPA Global Value Strategy since September 1, 2013. The FPA Global Value Strategy, and now the Fund, is led by Pierre Py and Gregory Herr, who have become the Fund’s Co-Presidents and Co-Chief Investment Officers. Messrs. Py and Herr previously served as co-portfolio managers of the Fund. The transition and the new leadership do not require shareholder approval.

Under the new leadership of Messrs. Py and Herr, FPA intends to invest a greater portion of the Fund’s assets in non-U.S. equity securities. This transition will not result in changes to the Fund’s investment objective or its principal investment strategies, which were revised two years ago to implement the transition to a global program. However, in connection with the new leadership, current positions in the Fund will be sized down or sold over time, in order to redeploy capital investment opportunities that Messrs. Py and Herr find most compelling. Some of these changes could occur over a short period of time and may likely result in the Fund paying significantly higher taxable distributions of capital gains than in prior years.

In connection with transitioning to the FPA Global Value Strategy, FPA reviewed the fees charged the Fund and sought approval from the Fund’s Board of Directors (the “Board”) to revise the Fund’s Investment Advisory Agreement to increase the advisory fee. FPA believes that the Fund’s current fee is no longer appropriate given the broader investment reach of the Fund and the higher research and other expenses associated with managing a global investment portfolio. Under the FPA Global Value Strategy, the Fund has changed its performance benchmark to the MSCI All Country World Index, and funds benchmarked to that index generally charge higher fees than those following the Fund’s previous benchmark in recognition of the increased investment and administrative complexity of managing a global fund. The increased complexity, and thus cost, of managing a global fund arises out of the increased research effort necessary to analyze and research companies around the world, as well as the additional time and resources needed to address trading and settlement issues and compliance and tax reporting. For these reasons, FPA believes that the proposed fee would be competitive with other global funds, consistent with fees charged by FPA to other FPA Funds (and thus designed to create a proper alignment of internal incentives for the portfolio management team), and would allow FPA to attract and retain high quality investment and trading personnel to successfully manage the Fund into the future. FPA presented the proposed Investment Advisory Agreement to the Board, and the Board approved the proposed Investment Advisory Agreement and determined to submit it to shareholders of the Fund for their approval with the Board’s recommendation to vote in favor.

As discussed below, if shareholders approve the proposed Investment Advisory Agreement, the Fund’s advisory fee would increase from its current rate of 0.75% of the first $50 million of average daily net assets and 0.65% thereafter, to the proposed fee rate of 1.00% of average daily net assets. FPA would continue to be reimbursed, as under the current Investment Advisory Agreement, for monthly costs incurred in providing financial services to the Fund, which cannot exceed 0.10% of the average daily net assets of the Fund. For the first six months following the date of approval of the proposed Investment Advisory Agreement, however, FPA will waive any increase in advisory fees. In addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Fund’s operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. Comparative fee tables and examples showing the Fund’s fees and expenses under the current Investment Advisory Agreement compared with under the proposed Investment Advisory Agreement appear below. In addition, more information appears below about FPA and the proposed Investment Advisory Agreement, including the proposed fee and the factors considered by the Board in recommending approval of the proposed Investment Advisory Agreement.

About FPA

First Pacific Advisors, LLC was formed in July 2004, by the principals and key investment professionals of the Fund’s previous adviser, First Pacific Advisors, Inc. Together with its predecessor organizations, First Pacific Advisors, LLC has been in the investment advisory business since 1954 and has served as the Fund’s investment adviser since July 1, 1978. FPA exercised its option to purchase, among other items, the operating assets and name “First Pacific Advisors” from the previous parent company, Old Mutual (US) Holdings Inc. This purchase took effect on September 30, 2006, and the current investment advisory agreement became effective on October 1, 2006. FPA had approximately $[ ] billion in assets under management as of September 30, 2013. FPA’s address is 11400 West Olympic Boulevard, Suite 1200, Los Angeles, California 90064-1550. FPA is a Delaware limited liability company. More information about FPA’s management appears in Appendix B, along with a list of the officers or Directors of the Fund who hold positions with FPA.

FPA does not currently serve as investment adviser to any other mutual funds with an investment objective and strategies similar to the FPA Global Value Strategy to be used by the Fund.

Description of the Proposed Investment Advisory Agreement

A general description of the proposed Investment Advisory Agreement appears below, but it is qualified in its entirety by reference to the form of the proposed Investment Advisory Agreement attached as Appendix A to this Proxy Statement, which is marked to show changes from the current Investment Advisory Agreement. Except for the fee, the removal of the expense limitation and the effective date, the terms of the proposed Investment Advisory Agreement are the same as the current Investment Advisory Agreement; the expense limitation would be replaced by a separate contractual obligation of FPA. Information comparing the fees payable under the current Investment Advisory Agreement and the proposed Investment Advisory Agreement appears below.

General Information. The current Investment Advisory Agreement was approved by shareholders of the Fund on May 2, 2006 and took effect on October 1, 2006. The continuation of the current Investment Advisory Agreement was last renewed by the Board at an in-person meeting held on August 5, 2013, for a one-year term ending on September 30, 2014.

Investment Advisory Services. The services FPA would provide under the proposed Investment Advisory Agreement are the same as those currently provided by FPA under the current Investment Advisory Agreement, except that different portfolio managers at FPA would lead the Fund in its transition to a global fund using the FPA Global Value Strategy. Messrs. Py and Herr were previously co-portfolio managers of the Fund and began serving as Co-Presidents and Co-Chief Investment Officers on September 1, 2013. Since 2013, Mr. Herr has served as Managing Director of FPA. Mr. Herr also serves as Vice President and Portfolio Manager of FPA Perennial Fund, Inc. (since 2013) and of Source Capital, Inc. (since 2013). Mr. Herr served as Vice President and Portfolio Manager of the Fund from 2011 to 2013 and Vice President of the Adviser from 2007 to 2013. Since 2013, Mr. Py has served as Managing Director of FPA. Mr. Py also serves as Portfolio Manager of FPA International Value Fund (since 2011). Mr. Py served as Vice President and Portfolio Manager of the Fund from 2011 to 2013, Vice President of the Adviser from 2011 to 2013, and as a senior international investment analyst at Harris Associates from 2005 to 2010.

FPA provides continuing supervision of the Fund’s investment portfolio. FPA is authorized, subject to the oversight of the Fund’s Board, to determine which securities are to be bought or sold and in what amounts.

Payment of Fund Expenses. In addition to providing investment advisory and management services, the proposed Investment Advisory Agreement, as with the current Investment Advisory Agreement, obligates FPA to furnish office space, furniture, equipment and supplies, and maintain the Fund’s books and records. FPA is also obligated to compensate all officers and other personnel of the Fund, all of whom are employed by FPA, subject to reimbursement from the Fund for personnel involved in providing financial services as indicated below. Other than the expenses FPA specifically assumes under the Investment Advisory Agreement, the Fund bears all costs of its operation. These costs include brokerage commissions and other costs of portfolio transactions; fees and expenses of directors not affiliated with FPA; taxes; transfer agent; interest on indebtedness, if any, incurred by the Fund; dividend disbursement, reinvestment and custodian fees; legal and audit fees; printing and mailing of reports to shareholders and proxy materials; shareholders’ and directors’ meetings; registration of Fund shares under federal

and state laws; printing, engraving and issuing stock certificates; trade association membership fees; premiums for the fidelity bond and errors and omissions insurance maintained by the Fund; litigation; interest on indebtedness; and reimbursement of FPA’s expenses in providing financial services to the Fund as described below.

Duration and Termination. Unless earlier terminated as described below, the proposed Investment Advisory Agreement will remain in effect through September 30, 2015 and from year to year thereafter if specifically approved each year (a) by the Fund’s Board or by the vote of a majority (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Fund’s outstanding voting securities and (b) by the vote of a majority of the Fund’s Directors who are not parties to the Investment Advisory Agreement or interested persons (as defined in the 1940 Act) of any such party (the “Independent Directors”), by votes cast in person at a meeting called for the purpose of voting on such approval. The Investment Advisory Agreement may be terminated without penalty by the Fund’s Board or the vote of a majority (as defined in the 1940 Act) of the Fund’s outstanding voting securities on 60 days’ written notice to the other party. The Investment Advisory Agreement automatically terminates in the event of its assignment (as defined in the 1940 Act).

Limitation of Liability. The proposed Investment Advisory Agreement, as with the current Investment Advisory Agreement, provides that FPA does not have any liability to the Fund or any of its shareholders for any error of judgment, any mistake of law or any loss the Fund suffers in connection with matters related to the Investment Advisory Agreement, except for liability resulting from willful misfeasance, bad faith or negligence on the part of FPA or the reckless disregard of its duties under the Investment Advisory Agreement.

Expense and Management Fees. Under the current Investment Advisory Agreement, for services rendered, FPA is paid a monthly fee computed at the annual rate of 0.75% of the first $50 million, and 0.65% of the excess over $50 million, of the Fund’s average net assets. The average net assets are determined by taking the average of all the daily determinations of net assets made, in the manner provided in the Fund’s Articles of Incorporation, during a calendar month.

In addition to the advisory fee, the Fund reimburses FPA monthly for costs incurred in providing financial services to the Fund. Such financial services include (a) maintaining the accounts, books and other documents forming the basis for the Fund’s financial statements, (b) preparing such financial statements and other Fund documents and reports of a financial nature required by federal and state laws, (c) calculating daily net assets and (d) participating in the production of the Fund’s registration statements, prospectuses, proxy materials and reports to shareholders (including compensation of the Treasurer or other principal financial officer of the Fund, compensation of personnel working under such person’s direction and expenses of office space, facilities and equipment such persons use to perform their financial services duties). However, for any fiscal year, the cost of such financial services paid by the Fund cannot exceed 0.10% of the average daily net assets of the Fund.

Currently, the advisory fee and cost of financial services are reduced in the amount by which certain defined operating expenses of the Fund (including the advisory fee and cost of financial services) for any fiscal year exceed 1.50% of the first $30 million of average net assets, plus 1% of the remaining average net assets. Such values are calculated at the close of business on the last business day of each calendar month. Any required reduction or refund is computed and paid monthly. Operating expenses (as defined in the Investment Advisory Agreement) exclude (a) interest, (b) taxes, (c) brokerage commissions and (d) any extraordinary expenses, such as litigation, merger, reorganization or recapitalization, to the extent such extraordinary expenses can be excluded under the rules or policies of the states in which Fund shares are registered for sale. All expenditures, including costs connected with the purchase, retention or sale of portfolio securities, which are capitalized in accordance with generally accepted accounting principles applicable to investment companies, are accounted for as capital items and not as expenses. This expense limitation provision does not require any payment by FPA beyond the return of the advisory fee and cost of financial services paid to it by the Fund for a fiscal year.

Under the proposed Investment Advisory Agreement, if approved by shareholders, FPA would receive for its services to the Fund a monthly fee at an annual rate of 1.00% of the Fund’s average daily net assets. In addition, as is currently the case, the Fund would reimburse FPA monthly for costs incurred in providing financial services to the Fund, up to 0.10% of the average daily net assets of the Fund. For the first six months following the date of approval of the proposed Investment Advisory Agreement, however, FPA will waive any increase in advisory fees. In addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a

portion of the advisory fees and/or reimburse a portion of the Fund’s operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. This new expense limitation will be a separate contractual obligation of FPA and cannot be terminated without the approval of the Board. There is no assurance, however, that the expense limitation will be maintained at the same level, if at all, after January 31, 2015.

For the fiscal years ended September 30, 2011, 2012 and 2013, FPA received gross advisory fees of $1,779,614, $1,705,521, and $[ ], respectively, plus $266,094, $254,696, and $[ ] respectively, for costs incurred in providing financial services to the Fund. During these periods, no amounts were waived or reduced under the expense reduction provision described above.

The table below shows the aggregate management fees (before fee waivers and reimbursements) that FPA earned from the Fund for the fiscal year ended September 30, 2013, the amount that would have been received for the fiscal year if the proposed investment advisory fees had been in effect, and the difference between these amounts.

Investment Advisory Fees

(based on current fee rate) | | Investment Advisory Fees

(based on proposed fee rate) | | Percentage Change | |

$ | [ ] | | $ | [ ] | | [ ] | % |

| | | | | | | |

Current and Pro Forma Fee Tables. The tables below show the Annual Fund Operating Expenses as of the end of the Fund’s fiscal year ended September 30, 2013, under the current Investment Advisory Agreement, and pro forma Annual Fund Operating Expenses if the proposed Investment Advisory Agreement is approved. Annual Fund Operating Expenses are expenses that cover the cost of operating the Fund and are paid out of the Fund’s assets. These expenses are borne indirectly by all shareholders. Information for the fiscal year ended September 30, 2013 has not yet been audited, however, the difference in advisory fee rates under the current and proposed Investment Advisory Agreements would be the same as shown below (even if the audited total expense ratios based on the 2013 fiscal year may vary from that shown below).

The table is followed by an example showing the cost of investing in the Fund based on the current Investment Advisory Agreement and under the pro forma proposed Investment Advisory Agreement.

CURRENT INVESTMENT ADVISORY AGREEMENT — current fees

Shareholder Fees

(fees paid directly from your investment) | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of original sales price or redemption proceeds, as applicable) | | None | |

Redemption Fee (as a percentage of amount redeemed) | | 2.00 | %(1) |

Exchange Fee | | None | |

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets) | | | |

Management Fees | | 0.65 | % |

Distribution (12b-1) Fees | | None | |

Other Expenses | | [0.29 | ]% |

Other Expenses | | [0.19 | ]% |

Financial Services | | [0.10 | ]% |

Total Annual Fund Operating Expenses | | [0.94 | ]% |

(1) Redemptions by wire are subject to a $3.50 charge per wire. Your broker-dealer may charge you a fee for redemptions.

PROPOSED INVESTMENT ADVISORY AGREEMENT — pro forma fees

Shareholder Fees

(fees paid directly from your investment) | | | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of original sales price or redemption proceeds, as applicable) | | None | |

Redemption Fee (as a percentage of amount redeemed) | | 2.00 | %(1) |

Exchange Fee | | None | |

Annual Fund Operating Expenses

(expenses that are deducted from Fund assets) | | | |

Management Fees* | | 1.00 | % |

Distribution (12b-1) Fees | | None | |

Other Expenses | | [0.29 | ]% |

Other Expenses | | [0.19 | ]% |

Financial Services | | [0.10 | ]% |

Total Annual Fund Operating Expenses | | [1.29 | ]% |

(1) Redemptions by wire are subject to a $3.50 charge per wire. Your broker-dealer may charge you a fee for redemptions.

* Management Fees are restated reflecting the fee under the proposed Investment Advisory Agreement.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Current Investment Advisory Agreement

One year | | $ | [96 | ] |

Three years | | $ | [300 | ] |

Five years | | $ | [520 | ] |

Ten years | | $ | [1,155 | ] |

Proposed Investment Advisory Agreement

One year | | $ | [ | ] |

Three years | | $ | [ | ] |

Five years | | $ | [ | ] |

Ten years | | $ | [ | ] |

Board Considerations Regarding Approval of the proposed Investment Advisory Agreement

Information Received. At each regular quarterly meeting, the Board reviews a wide variety of materials relating to the nature, extent and quality of FPA’s services. The Board met on August 5, 2013 to consider renewal of the current Investment Advisory Agreement, reviewing information about FPA’s services and the Fund. At that meeting, FPA noted that it was developing the FPA Global Value Strategy and planning on transitioning the Fund to that mandate under the new leadership of Messrs. Py and Herr. FPA discussed the transition with the Board, and noted that it could begin the transition in early September, but that, given the increased research and expense of

managing a global fund, it would seek approval of a new Investment Advisory Agreement in the near term. The Board requested that FPA present its proposal to change the advisory fee at a subsequent in-person meeting of the Board, and directed counsel to the Independent Directors to request information from FPA on a variety of topics on behalf of the Independent Directors. FPA responded to the additional requests, and the Board met again on August 14, 2013, to consider whether to approve the proposed Investment Advisory Agreement and to discuss changes to the portfolio with FPA representatives. In connection with the August 5 and August 14 meetings, the Directors received and reviewed extensive materials prepared by FPA relating to its services and its business, including information about the proposed Investment Advisory Agreement at the August 14 meeting.

Factors Considered. In reviewing the proposed Investment Advisory Agreement, the Board and the Independent Directors considered a number of factors including, but not limited to: (1) the nature, extent and quality of the services provided by FPA, both in the past and as anticipated under the proposed Investment Advisory Agreement, (2) the investment performance of the Fund, (3) comparisons of the services to be rendered and the amounts to be paid under the proposed Investment Advisory Agreement with those of other funds and those of FPA under other investment advisory agreements with other registered investment companies and other types of clients, (4) the costs of the services to be provided and estimated profits to be realized by FPA and its affiliates from their relationship with the Fund, (5) the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund investors, and (6) any other benefits derived by FPA from its relationship with the Fund.

The Board and the Independent Directors considered the impact of implementing the FPA Global Value Strategy for the Fund. They discussed with FPA representatives the manner in which the portfolio would be invested, observing that the Fund would increase its exposure to non-U.S. securities, but that the Fund’s investment objective and principal investment strategies would not change. The Board and the Independent Directors noted that none of the Fund’s service providers would change, but that the Fund would, beginning September 1, 2013, be managed by Messrs. Py and Herr. The Board and the Independent Directors recognized that the transition of the portfolio would result in the Fund paying significantly higher taxable distributions of capital gains than in prior years. While FPA discussed estimates of the potential capital gains that might be realized in the transition, the Board and the Independent Directors noted that the timing and amount of any realized capital gains would depend on market values at the time of sale. The Board and the Independent Directors also noted that, absent the transition, the Fund would eventually have to realize these gains as it sells portfolio securities over time, but the transition to the FPA Global Value Strategy accelerates the pace of recognizing potential capital gains. FPA noted that in light of the Fund’s low portfolio turnover, the portfolio did not have a significant amount of recent purchases such that it did not expect to realize a significant amount of short-term capital gains. The Board and the Independent Directors observed that higher distributions would not impact tax-exempt investors, but that taxable investors (including themselves) receiving the distributions would be required to pay taxes on them at ordinary income rates for the part attributable to net short-term capital gain and at maximum rates of 15% and 20% for the part attributable to net capital gain.

Nature, Extent and Quality of Services. The Board and the Independent Directors considered, among other matters, FPA’s personnel, experience, track record, and compliance program. The Board and the Independent Directors considered the qualifications, backgrounds and responsibilities of FPA’s principal personnel who provide services to the Fund, and who would continue to provide services to the Fund under the proposed Investment Advisory Agreement, as well as the level of attention those individuals provide to the Fund. They noted that Messrs. Py and Herr serve as portfolio managers for other FPA Funds, and noted their positive experiences with them. The Board and the Independent Directors noted FPA’s commitment to devoting resources to staffing and technology in support of its investment management services. They also reviewed FPA’s investment philosophy and processes and its compliance program and considered the scope of FPA’s services, and they discussed the FPA Global Value Strategy with Messrs. Py and Herr. The Board and the Independent Directors noted increased allocations to non-U.S. securities would increase the complexity of the services to be provided by FPA, which would incur additional costs and responsibilities for researching and trading securities, overseeing service providers and other matters, and they noted the nature, extent and quality of these services provided by FPA to other FPA Funds that invest in non-U.S. securities. The Board and the Independent Directors concluded that the nature, extent and quality of the services provided by FPA have benefited and were expected to continue to benefit the Fund and its shareholders.

Investment Performance. The Board and the Independent Directors reviewed the Fund’s investment results for various periods ended June 30, 2013, compared to the results of the Russell 2500 and the Fund’s new benchmark, the MSCI All Country World Index, as well as the mutual funds included in a peer group of world stock funds selected by Morningstar (“Peer Group”). They noted the Fund’s competitive longer-term investment performance when compared to the prior benchmark and discussed with FPA how the Fund was expected to perform in relation to its new benchmark and Peer Group, recognizing that the Fund and portfolio managers did not have a track record to evaluate but that Mr. Py had produced strong returns for another FPA Fund investing in non-U.S. securities. The Board and the Independent Directors concluded that FPA’s record in managing the Fund and other FPA Funds indicates that its continued management will benefit the Fund and its shareholders, and that they were confident in FPA’s ability to manage the Fund in the future.

Advisory Fees and Fund Expenses; Comparison with Peer Group and Institutional Fees. The Board and the Independent Directors compared the Fund’s proposed advisory fee and expenses with those of other similar mutual funds in the Peer Group. They noted that fees and expenses were above the average for the Peer Group. The Board and the Independent Directors also noted that the overall expense ratio of the Fund, if the proposed fee is approved, would be slightly above the Peer Group average. They noted that FPA believed that the fee was competitive within the industry for similar global funds and that it recognized the increased complexity of managing a global fund. They also noted that many funds in the universe charge fees for outside administration and similar services in addition to the advisory fee, and they considered amounts paid or reimbursed to FPA for financial services. In addition, the Board and the Independent Directors noted that FPA does not currently manage other funds or accounts using the FPA Global Value Strategy, but that FPA expected that the rate would compare favorably with such fees if the strategy is employed by other accounts. The Board and the Independent Directors noted that the proposed fee would be consistent with fees charged by FPA to another FPA Fund investing in non-U.S. securities, and they noted that FPA had proposed this consistency to create a proper alignment of internal incentives for the portfolio management team. They also noted that FPA would continue to contractually limit the Fund’s direct expenses and that, even though the limit was higher than the expense ratio expected for the Fund, the limit protected investors from unexpected changes in expenses or asset levels due to market volatility or net redemptions from the Fund that could cause the expense ratio to rise. They also noted that there was no assurance that the expense limitation will be maintained at the same level, if at all, after January 31, 2015. They noted that although the Fund’s proposed advisory fee is higher than the current fee, the increased complexity, and thus cost, of managing a global fund, deriving from the increased research effort to analyze and research companies around the world, as well as the additional time and resources needed to address trading and settlement issues and compliance and tax reporting, justified the increase. The Board and the Independent Directors concluded that the Fund’s proposed advisory fee and expected expense ratios are reasonable and appropriate under the circumstances.

Adviser Profitability and Costs. The Board and the Independent Directors considered information provided by FPA regarding FPA’s estimated costs in providing services to the Fund under the proposed Investment Advisory Agreement, the anticipated profitability of FPA and the benefits to FPA from its relationship to the Fund, including amounts to be paid or reimbursed to FPA for financial services. They reviewed and considered FPA’s representations regarding its assumptions and methods of allocating certain costs, such as personnel costs, which constitute FPA’s largest operating cost. The Board and the Independent Directors recognized that FPA should be entitled to earn a reasonable level of profits for the services that it provides to the Fund. The Board and the Independent Directors concluded that FPA’s anticipated level of profitability from its relationship with the Fund under the proposed Investment Advisory Agreement was not unreasonable or excessive.

Economies of Scale and Sharing of Economies of Scale. The Board and the Independent Directors considered whether there would be economies of scale under the proposed Investment Advisory Agreement with respect to the management of the Fund, whether the Fund will appropriately benefit from any economies of scale, and whether the proposed fee rate is reasonable in relation to the Fund’s asset levels and any economies of scale that may exist. The Board and the Independent Directors observed that, although the Fund’s proposed advisory fee does not contain breakpoints, it is difficult to determine the existence or extent of any economies of scale. They noted that FPA is sharing economies of scale through reasonable advisory fee levels and that it is devoting additional resources to staff and technology to focus on continued performance and service to the Fund’s shareholders. They also noted that, for the first six months following the date of approval of the proposed Investment Advisory Agreement, FPA will waive any increase in advisory fees and that, in addition, if the proposed Investment Advisory Agreement is approved, FPA has contractually agreed to waive a portion of the advisory fees and/or reimburse a portion of the Fund’s

operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) through January 31, 2015 to ensure that the Fund’s total expenses will not exceed 1.32% of the Fund’s average daily net assets. They noted the additional complexity and resources required to manage the Fund using the FPA Global Value Strategy, and discussed with FPA its plans to expand the Fund’s investment team. The Board and the Independent Directors concluded that under the circumstances FPA is sharing any economies of scale with the Fund appropriately.

Ancillary Benefits. The Board and the Independent Directors considered other actual and potential benefits to FPA from managing the Fund, including the acquisition and use of research services with commissions generated by the Fund, in concluding that the contractual advisory and other fees are fair and reasonable for the Fund. In particular, they noted that FPA does not have any affiliates that benefit from its relationship to the Fund. The Board and the Independent Directors observed that FPA does not earn common ancillary benefits such as affiliated custody fees, affiliated transfer agency fees, affiliated brokerage commissions, profits from rule 12b-1 fees, “contingent deferred sales commissions,” or “float” benefits on short-term cash.

Conclusions. At the August 14, 2013 meeting, the Board and the Independent Directors approved the proposed Investment Advisory Agreement, which is the same as the current Investment Advisory Agreement except for the advisory fee, the expense reduction and the effective date, and determined that the Fund would benefit from the services of an experienced portfolio management team, which was expected to produce competitive long-term returns. In addition, the Board and the Independent Directors agreed that the Fund would continue to receive high quality accounting, administrative, shareholder and other ancillary services from FPA. The Board and the Independent Directors concluded that the advisory fee rate under the proposed Investment Advisory Agreement is reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services provided and expected to be provided by FPA and FPA’s profitability and costs. The Board and the Independent Directors also stated their intention to continue monitoring the factors relevant to FPA’s compensation, such as changes in the Fund’s asset levels, changes in portfolio management personnel and the cost and quality of the services provided by FPA to the Fund. On the basis of the foregoing, and without assigning particular weight to any single factor, none of which was dispositive, the Board and the Independent Directors concluded that it would be in the best interests of the Fund to continue to be advised and managed by FPA and determined to approve the proposed Investment Advisory Agreement for a two-year period through September 30, 2015, subject to the subsequent approval of shareholders of the Fund.

If approved by shareholders, the proposed Investment Advisory Agreement would take effect as soon as practicable following such approval.

If shareholders do not approve the proposed Investment Advisory Agreement, the Fund will continue to operate under its current Investment Advisory Agreement and the Board will consider other actions that may be taken, including whether to resubmit the proposal to shareholders in the future. FPA has indicated, however, that if the proposed Investment Advisory Agreement is not approved, it would consider seeking Board approval to close the Fund to any future purchases. FPA is committed to the Global Value Strategy and would likely seek to launch a new fund using that strategy, proposing to the Board the same fee currently proposed for the Fund.

The Board of Directors, including the Independent Directors,

believes that the proposal is in the best interests of shareholders and

recommends that you vote “FOR” this proposal.

The approval of this proposal requires the approval of the holders of a majority of outstanding Fund shares. The 1940 Act defines this majority as the lesser of (a) 67% or more of the voting securities present in person or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (b) more than 50% of the outstanding voting securities.

2. APPROVAL TO CHANGE THE FUND FROM A DIVERSIFIED FUND

TO A NON-DIVERSIFIED FUND

Current Fundamental Policy | | Proposed Fundamental Policy |

The Fund shall not invest more than 5% of its total assets, based on market value, in the securities of any one issuer (except the U.S. Government); or acquire more than 10% of any class of securities of any one issuer. | | None |

FPA has recommended, and the Board has approved, changing the Fund from a diversified fund to a non-diversified fund. Shareholder approval would enable the Fund to invest larger percentages of its assets in the securities of particular issuers. FPA believes that the proposed change would provide the Fund with increased flexibility to respond to future investment opportunities. There will be no material changes to FPA’s investment strategies or the Fund’s investment objectives as a result of this proposed change being approved by the shareholders. If shareholders approve the proposal, the Fund would become classified as a “non-diversified” fund under the 1940 Act and its fundamental investment policy concerning diversification, set forth above, would be eliminated. Investing a larger percentage of the Fund’s assets in any one issuer carries certain risks, as described below.

Since its inception in 1958, the Fund has operated as a “diversified” fund, as defined in the 1940 Act. As a 1940 Act diversified fund, the Fund must invest at least 75% of its total assets so that no more than 5% of its total assets is invested in the securities of any issuer, and so that it holds no more than 10% of the outstanding voting securities of any issuer. With respect to the remaining 25% of its total assets, there is no limit on the amount of assets the Fund may invest in the securities of a single issuer. These 1940 Act limits do not apply to securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities, or to securities issued by other investment companies. These limits apply at the time the Fund purchases a security; the Fund may exceed these limits if positions it already holds increase in value relative to the rest of the Fund’s holdings.

FPA believes that changing the Fund from a diversified fund to a non-diversified fund would give FPA more flexibility in implementing the Fund’s investment strategies. The change would enable FPA to focus the Fund’s investments on those securities that FPA believes are the most promising. The Fund has generally invested in a limited number of holdings since inception, which FPA believes is a key aspect of the portfolio management strategy. Because FPA would be able to invest larger percentages of the Fund’s assets in the securities of particular issuers, FPA would be able to take even more meaningful positions in securities that are its top investment choices. Of course, FPA’s top investment choices represent its subjective determinations; FPA may not accurately assess the investment prospects of a particular security.

Risks. Shareholder approval of the proposal would enable the Fund to operate as a non-diversified fund. As a non-diversified fund, the percentage of the Fund’s assets invested in any single issuer would not be limited by the 1940 Act. The Fund would be able to invest larger percentages of its assets in the securities of a single issuer — potentially as much as 25% in one issuer, and potentially as much as 25% in a second issuer. (See discussion below regarding the diversification rules in the Internal Revenue Code.)