FIRST COMMUNITY

FINANCIALCORPORATION

2009

Annual Report

| | |

| | | Page |

Management’s Letter to Shareholders | | 2-3 |

| |

Your Partners in Success | | 4-5 |

| |

Management’s Assessment of Internal Control Over Financial Reporting | | 6 |

| |

Report of Independent Registered Public Accounting Firm | | 7 |

| |

December 31, 2009 and 2008

Consolidated Balance Sheets: | | 8 |

| |

Years ended December 31, 2009 and 2008

Consolidated Statements of Income: | | 9 |

| |

Years ended December 31, 2009 and 2008

Consolidated Statements of Shareholders’ Equity: | | 10 |

| |

Years ended December 31, 2009 and 2008

Consolidated Statements of Cash Flows: | | 11 |

| |

Notes to Consolidated Financial Statements | | 12-39 |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 40-55 |

| |

Board of Directors:

First Community Financial Corporation | | 56 |

| |

Officers:

First Community Financial Corporation | | 57 |

| |

Officers:

The First National Bank of Mifflintown | | 58 |

| |

Directors Emeriti and Advisory Boards | | 59 |

| |

Bank Locations in Juniata County and Perry County | | 60-61 |

| |

Stock and Dividend Information | | 62-63 |

MANAGEMENT’S LETTER TO SHAREHOLDERS

Dear Shareholder:

As a community bank founded in 1864, our institution has experienced many economic cycles and trends over the years. Fundamental to community banking success through these cycles has been our devotion to customers and the communities in which we serve. With the people shown in this year’s report, our staff continues to carry on these values and traditions, while experiencing a very challenging economic period. This past year has seen many large, national financial institutions cease to exist, independently or otherwise, such as Bear Stearns, Lehman Brothers, Merrill Lynch and Wachovia. Meanwhile, our government has gotten involved in the financial system in unprecedented ways, while increasing spending to stimulate the economy.

While dealing with a significant economic recession, we report the following for 2009:

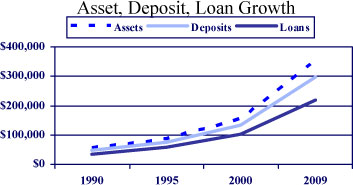

| | • | | Assets expanded over $29 million to $356 million. |

| | • | | Gross loans grew by $5 million. |

| | • | | Deposits added $34 million. |

| | • | | Net income was $2,226,000. |

| | • | | Dividends increased 11.5%. |

In addition, net income was impacted by an additional $544,000 more in FDIC and OCC fees than were paid in 2008, because of government assessments on all banks. As a result of loan volume growth and a challenging business environment, net income was also affected by an additional allocation to our loan reserves. Meanwhile, we remain well-capitalized.

Innovation, customer service and efficiency continue to be drivers of our organization. For example, we added a system to enable businesses to make deposits remotely from their locations and pay bills online. Our website was also updated during the year with a focus toward ease of use and enhanced information. Through it, we enable more customer feedback and communication, while we also still believe in maintaining the importance of personal relationships.

Also, during the year, Joseph E. Barnes and James R. McLaughlin left our Board; their years of service and contributions in making the bank what it is today have been greatly appreciated.

2

In 2010, we continue to move forward in our drive to continue to innovate as the bank grows. Thus, we plan to offer online mortgage loan applications through our updated website which should reach new customers, while streamlining lender paperwork. Additionally, a potential branch site is being pursued in Perry County near Newport.

Our bank maintains its commitment to our communities with the sponsorship of agricultural and business outlook meetings, food and toy drives, as well as supporting numerous community groups with our contributions of time and resources.

While continuing our efforts to be environmentally friendly, in addition to presenting committee and board materials in electronic form, we have begun to mail proxies and related financial reports on a consolidated household basis, unless shareholders prefer otherwise. Also, in 2010, we will offer online statements as an option to our bank customers which will save storage space for them, while cutting postage and handling costs.

Continuing to hire and develop high quality staff remains integral to our success, as we add new training options and resources during the year.

As always, we appreciate the contributions of our Board of Directors, Advisory Boards, Directors Emeriti, officers and employees, many of which I have been able to work alongside during my twenty two years at the bank. The efforts of this group, as well as those that were involved in past years, have enabled us to grow to eleven branches, while offering trust and investment services, today.

As economic conditions develop, we will continue to strive for future success with our commitment to community banking values and our local communities.

Your investment in our company is greatly appreciated. For additional information concerning our stock or other matters, please feel free to contact us by telephone at 717-436-2144, toll-free at 877-362-6433 or online atwww.fnbmiffintown.com.

| | |

John P. Henry III | | Jody D. Graybill |

Chairman | | President |

3

PICTURES

4

PICTURES

5

REPORTOF MANAGEMENT’S ASSESSMENTOF INTERNAL CONTROLOVER FINANCIAL REPORTING

First Community Financial Corporation is responsible for the preparation, integrity, and fair presentation of the consolidated financial statements included in this annual report. The consolidated financial statements and notes included in this annual report have been prepared in conformity with United States generally accepted accounting principles and necessarily include some amounts that are based on management’s best estimates and judgments.

We, as management of First Community Financial Corporation, are responsible for establishing and maintaining effective internal control over financial reporting that is designed to produce reliable financial statements in conformity with United States generally accepted accounting principles. Internal control over financial reporting includes those policies and procedures that pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Corporation; provide reasonable assurance that the transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles; provide a reasonable assurance that receipts and expenditures of the Corporation are only being made in accordance with authorizations of management and directors of the Corporation; and provide a reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Corporation’s assets that could have a material effect on the financial statements. The system of internal control over financial reporting as it relates to the financial statements is evaluated for effectiveness by management and tested for reliability through a program of internal audits. Actions are taken to correct potential deficiencies as they are noted.

Any system of internal control, no matter how well designed, has inherent limitations, including the possibility that a control can be circumvented or overridden and misstatements due to error or fraud may occur and not be detected. Also, because of changes in conditions, internal control effectiveness may vary over time. Accordingly, even an effective system of internal control will provide only a reasonable assurance with respect to financial statement preparation.

Management assessed the Corporation’s system of internal control over financial reporting as of December 31, 2009, in relation to the criteria for effective control over financial reporting as described in “Internal Control – Integrated Framework,” issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concludes that, as of December 31, 2009, its system of internal control over financial reporting is effective and meets the criteria of the “Internal Control – Integrated Framework.”

This Annual Report does not include an attestation report of the Corporation’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Corporation’s registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Corporation to provide only management’s report in this Annual Report.

|

|

/s/ Jody D. Graybill |

| Jody D. Graybill |

| President |

| (Principal Executive Officer) |

|

/s/ Richard R. Leitzel |

| Richard R. Leitzel |

| Vice President and Chief Financial Officer |

| (Principal Financial Officer) |

March 12, 2010

6

REPORTOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

First Community Financial Corporation

Mifflintown, Pennsylvania

We have audited the accompanying consolidated balance sheets of First Community Financial Corporation and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of income, shareholders’ equity, and cash flows for the years then ended. First Community Financial Corporation’s management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Corporation is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of First Community Financial Corporation and subsidiaries as of December 31, 2009 and 2008, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ ParenteBeard LLC

Harrisburg, Pennsylvania

March 12, 2010

FIRST COMMUNITY FINANCIAL CORPORATION

CONSOLIDATED BALANCE SHEETS

| | | | | | | | |

| | | December 31, | |

| | | 2009 | | | 2008 | |

| | | (In Thousands, Except Share Data) | |

| ASSETS | |

Cash and due from banks | | $ | 6,564 | | | $ | 6,278 | |

Interest-bearing demand deposits | | | 351 | | | | 586 | |

Federal funds sold | | | 1,718 | | | | — | |

| | | | | | | | |

Cash and Cash Equivalents | | | 8,633 | | | | 6,864 | |

Time certificates of deposit | | | 396 | | | | 396 | |

Securities available for sale | | | 81,437 | | | | 66,376 | |

Securities held to maturity, fair value 2009 $29,715; 2008 $23,248 | | | 30,204 | | | | 24,127 | |

Loans, net of allowance for loan losses 2009 $2,830; 2008 $1,633 | | | 216,600 | | | | 212,377 | |

Premises and equipment, net | | | 6,175 | | | | 6,397 | |

Restricted investment in bank stocks | | | 2,661 | | | | 2,661 | |

Investment in life insurance | | | 5,109 | | | | 4,933 | |

Other assets | | | 4,621 | | | | 2,583 | |

| | | | | | | | |

Total Assets | | $ | 355,836 | | | $ | 326,714 | |

| | | | | | | | |

| LIABILITIESAND SHAREHOLDERS’ EQUITY | |

| LIABILITIES | | | | | | | | |

Deposits: | | | | | | | | |

Non-interest bearing | | $ | 27,952 | | | $ | 29,192 | |

Interest-bearing | | | 268,507 | | | | 233,414 | |

| | | | | | | | |

Total Deposits | | | 296,459 | | | | 262,606 | |

Short-term borrowings | | | 4,512 | | | | 10,613 | |

Long-term debt | | | 22,000 | | | | 22,000 | |

Junior subordinated debt | | | 5,155 | | | | 5,155 | |

Other liabilities | | | 2,352 | | | | 2,927 | |

| | | | | | | | |

Total Liabilities | | | 330,478 | | | | 303,301 | |

| | | | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | | | |

Preferred stock, without par value; 10,000,000 shares authorized and unissued | | | — | | | | — | |

Common stock, $5 par value; 10,000,000 shares authorized; Shares issued, 2009 – 1,404,348; 2008 – 1,401,918 Shares outstanding, 2009 – 1,400,697; 2008 – 1,399,868 | | | 7,022 | | | | 7,010 | |

Capital in excess of par value | | | 350 | | | | 293 | |

Retained earnings | | | 16,820 | | | | 15,406 | |

Treasury stock, at cost 2009 – 3,651 shares; 2008 – 2,050 shares | | | (110 | ) | | | (62 | ) |

Accumulated other comprehensive income | | | 1,276 | | | | 766 | |

| | | | | | | | |

Total Shareholders’ Equity | | | 25,358 | | | | 23,413 | |

| | | | | | | | |

Total Liabilities and Shareholders’ Equity | | $ | 355,836 | | | $ | 326,714 | |

| | | | | | | | |

| | | | |

| See notes to consolidated financial statements | | 8 | | |

FIRST COMMUNITY FINANCIAL CORPORATION

CONSOLIDATED STATEMENTSOF INCOME

| | | | | | |

| | | Years Ended December, 31, |

| | | 2009 | | 2008 |

| | | (In Thousands, Except per Share Data) |

| INTEREST INCOME | | | | | | |

Loans, including fees | | $ | 14,143 | | $ | 13,942 |

Securities: | | | | | | |

Taxable | | | 3,149 | | | 3,414 |

Tax exempt | | | 1,158 | | | 866 |

Other | | | 54 | | | 186 |

| | | | | | |

Total Interest Income | | | 18,504 | | | 18,408 |

| | | | | | |

| INTEREST EXPENSE | | | | | | |

Deposits | | | 7,494 | | | 7,851 |

Short-term borrowings | | | 50 | | | 169 |

Long-term debt | | | 1,239 | | | 1,384 |

| | | | | | |

Total Interest Expense | | | 8,783 | | | 9,404 |

| | | | | | |

Net Interest Income | | | 9,721 | | | 9,004 |

PROVISIONFOR LOAN LOSSES | | | 1,237 | | | 365 |

| | | | | | |

Net Interest Income after Provision for Loan Losses | | | 8,484 | | | 8,639 |

| | | | | | |

| OTHER INCOME | | | | | | |

Service charges on deposits | | | 828 | | | 880 |

Fiduciary activities | | | 524 | | | 405 |

Earnings on investment in life insurance | | | 223 | | | 211 |

ATM and debit card fees | | | 572 | | | 545 |

Investment securities gains from sales | | | 459 | | | — |

Realized gains on sales of foreclosed real estate | | | 33 | | | — |

Other | | | 316 | | | 255 |

| | | | | | |

Total Other Income | | | 2,955 | | | 2,296 |

| | | | | | |

| OTHER EXPENSES | | | | | | |

Employee compensation and benefits | | | 4,218 | | | 3,971 |

Net occupancy and equipment | | | 1,152 | | | 1,192 |

Professional fees | | | 429 | | | 352 |

Director and advisory boards compensation | | | 337 | | | 371 |

ATM expenses | | | 406 | | | 364 |

Supplies and postage | | | 310 | | | 280 |

FDIC/OCC expense | | | 756 | | | 212 |

Pennsylvania bank shares tax | | | 230 | | | 242 |

Other operating | | | 959 | | | 994 |

| | | | | | |

Total Other Expenses | | | 8,797 | | | 7,978 |

| | | | | | |

Income before Income Taxes | | | 2,642 | | | 2,957 |

PROVISIONFOR INCOME TAXES | | | 416 | | | 621 |

| | | | | | |

Net Income | | $ | 2,226 | | $ | 2,336 |

| | | | | | |

BASIC EARNINGSPER SHARE | | $ | 1.59 | | $ | 1.67 |

| | | | | | |

DIVIDENDSPER SHARE | | $ | 0.58 | | $ | 0.52 |

| | | | | | |

| | | | |

| See notes to consolidated financial statements | | 9 | | |

FIRST COMMUNITY FINANCIAL CORPORATION

CONSOLIDATED STATEMENTSOF SHAREHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | |

| | | Common

Stock | | Capital In

Excess of

Par Value | | Retained

Earnings | | | Treasury

Stock | | | Accumulated

Other

Comprehensive

Income | | Total | |

| | | | | (In Thousands, Except per Share Data) | | | |

BALANCE—JANUARY 1, 2008 | | $ | 7,000 | | $ | 245 | | $ | 13,993 | | | $ | — | | | $ | 295 | | $ | 21,533 | |

Cumulative effect adjustment upon change in accounting principle | | | | | | | | | (195 | ) | | | | | | | | | | (195 | ) |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | 2,336 | | | | | | | | | | | 2,336 | |

Change in net unrealized gains on securities available for sale, net of deferred income taxes | | | | | | | | | | | | | | | | | 471 | | | 471 | |

| | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | 2,807 | |

| | | | | | | | | | | | | | | | | | | | | |

Issuance of stock in connection with dividend reinvestment plan 1,918 shares | | | 10 | | | 48 | | | | | | | | | | | | | | 58 | |

Treasury stock acquired – 2,050 shares | | | | | | | | | | | | | (62 | ) | | | | | | (62 | ) |

Cash dividends, $0.52 per share | | | | | | | | | (728 | ) | | | | | | | | | | (728 | ) |

| | | | | | | | | | | | | | | | | | | | | |

BALANCE, DECEMBER 31, 2008 | | $ | 7,010 | | $ | 293 | | $ | 15,406 | | | $ | (62 | ) | | $ | 766 | | $ | 23,413 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | 2,226 | | | | | | | | | | | 2,226 | |

Change in net unrealized gains on securities available for sale, net of deferred income taxes | | | | | | | | | | | | | | | | | 510 | | | 510 | |

| | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | 2,736 | |

| | | | | | | | | | | | | | | | | | | | | |

Issuance of stock in connection with dividend reinvestment plan 2,430 shares | | | 12 | | | 57 | | | | | | | | | | | | | | 69 | |

Treasury stock acquired – 1,601 shares | | | | | | | | | | | | | (48 | ) | | | | | | (48 | ) |

Cash dividends, $0.58 per share | | | | | | | | | (812 | ) | | | | | | | | | | (812 | ) |

| | | | | | | | | | | | | | | | | | | | | |

BALANCE, DECEMBER 31, 2009 | | $ | 7,022 | | $ | 350 | | $ | 16,820 | | | $ | (110 | ) | | $ | 1,276 | | $ | 25,358 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

| See notes to consolidated financial statements | | 10 | | |

FIRST COMMUNITY FINANCIAL CORPORATION

CONSOLIDATED STATEMENTSOF CASH FLOWS

| | | | | | | | |

| | | Years Ended

December 31, | |

| | | 2009 | | | 2008 | |

| | | (In Thousands) | |

| CASH FLOWSFROM OPERATING ACTIVITIES | | | | | | | | |

Net income | | $ | 2,226 | | | $ | 2,336 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Depreciation of premises and equipment | | | 527 | | | | 559 | |

Amortization of intangible assets | | | 17 | | | | 17 | |

Net accretion of investment securities | | | (113 | ) | | | (271 | ) |

Earnings on investment in life insurance | | | (223 | ) | | | (211 | ) |

Realized gains on securities | | | (459 | ) | | | — | |

Realized gains on sales of foreclosed real estate | | | (33 | ) | | | — | |

Provision for loan losses | | | 1,237 | | | | 365 | |

Deferred income taxes | | | (446 | ) | | | (227 | ) |

Increase in accrued interest receivable and other assets | | | (1,867 | ) | | | (241 | ) |

Increase (decrease) in accrued interest payable and other liabilities | | | (405 | ) | | | 491 | |

| | | | | | | | |

Net Cash Provided by Operating Activities | | | 461 | | | | 2,818 | |

| | | | | | | | |

| CASH FLOWSFROM INVESTING ACTIVITIES | | | | | | | | |

Securities available for sale: | | | | | | | | |

Proceeds from maturities, calls and principal repayments | | | 23,005 | | | | 18,292 | |

Proceeds from sales | | | 8,981 | | | | — | |

Purchases | | | (46,101 | ) | | | (20,643 | ) |

Securities held to maturity: | | | | | | | | |

Proceeds from maturities, calls and principal repayments | | | 3,886 | | | | 2,670 | |

Purchases | | | (9,570 | ) | | | (5,275 | ) |

Net increase in loans | | | (5,703 | ) | | | (21,517 | ) |

Decrease in time certificates of deposit | | | — | | | | 198 | |

Purchases of premises and equipment | | | (305 | ) | | | (186 | ) |

Proceeds from sale of foreclosed real estate | | | 154 | | | | — | |

Net purchases of restricted investment in bank stocks | | | — | | | | (696 | ) |

| | | | | | | | |

Net Cash Used in Investing Activities | | | (25,653 | ) | | | (27,157 | ) |

| | | | | | | | |

| CASH FLOWSFROM FINANCING ACTIVITIES | | | | | | | | |

Net increase in deposits | | | 33,853 | | | | 17,560 | |

Net increase (decrease) in short-term borrowings | | | (6,101 | ) | | | 293 | |

Proceeds from long-term debt | | | — | | | | 5,000 | |

Repayment of long-term debt | | | — | | | | (1,000 | ) |

Proceeds from issuance of common stock | | | 69 | | | | 58 | |

Acquisition of treasury stock | | | (48 | ) | | | (62 | ) |

Cash dividends paid | | | (812 | ) | | | (728 | ) |

| | | | | | | | |

Net Cash Provided by Financing Activities | | | 26,961 | | | | 21,121 | |

| | | | | | | | |

Net Increase (Decrease) in Cash and Cash Equivalents | | | 1,769 | | | | (3,218 | ) |

CASHAND CASH EQUIVALENTS—BEGINNING | | | 6,864 | | | | 10,082 | |

| | | | | | | | |

CASHAND CASH EQUIVALENTS—ENDING | | $ | 8,633 | | | $ | 6,864 | |

| | | | | | | | |

| SUPPLEMENTARY CASH FLOWS INFORMATION | | | | | | | | |

Interest paid | | $ | 8,910 | | | $ | 9,401 | |

| | | | | | | | |

Income taxes paid | | $ | 1,002 | | | $ | 732 | |

| | | | | | | | |

Non-cash investing activities | | | | | | | | |

Transfers from loans to foreclosed real estate | | $ | 243 | | | $ | — | |

| | | | | | | | |

| | | | |

| See notes to consolidated financial statements | | 11 | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES

First Community Financial Corporation (the Corporation) through its wholly-owned subsidiary, The First National Bank of Mifflintown (the Bank), provides loan, deposit, trust and other related financial services through eleven full service banking offices in Juniata and Perry Counties of Pennsylvania. The Corporation’s other subsidiary, First Community Financial Capital Trust I (the Trust), was established during December 2003 for the purpose of issuing $5,000,000 of trust preferred securities. The Corporation is subject to regulation and supervision by the Federal Reserve Board and the Bank is subject to regulation and supervision by the Office of the Comptroller of the Currency.

Basis of Presentation

The Corporation’s consolidated financial statements include the accounts of the Corporation and the Bank. All significant intercompany accounts and transactions have been eliminated.

Subsequent Events

The Corporation has evaluated events and transactions occurring subsequent to the balance sheet date of December 31, 2009, for items that should potentially be recognized or disclosed in these financial statements. The evaluation was conducted through the date these financial statements were issued.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the balance sheet dates, and the reported amounts of income and expenses for the years then ended. Actual results could differ from those estimates. The material estimates that are particularly susceptible to significant change are the determination of the allowance for loan losses and the evaluation of other-than-temporary impairment of securities.

Assets held by the Trust Department in an agency or fiduciary capacity for its customers are excluded from the financial statements since they do not constitute assets of the Corporation. The market value of assets held by the Trust Department amounted to $112,767,000 and $107,626,000 at December 31, 2009 and 2008, respectively. Income from fiduciary activities is recognized on the accrual method.

Significant Group Concentrations of Credit Risk

Most of the Corporation’s activities are with customers located within the Central Pennsylvania region. Note 3 discusses the types of securities that the Corporation invests in. Note 4 discusses the types of lending that the Corporation engages in. The Corporation does not have any significant concentrations in any one industry or customer.

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, interest bearing demand deposits, federal funds sold and investments with an original maturity of 90 days or less. Federal funds are typically purchased and sold for one day periods. At times, the Corporation may have due from bank balances with its correspondent banks that exceed the federally insured limits.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Securities

Management determines the appropriate classification of debt securities at the time of purchase and re-evaluates such designation as of each balance sheet date. Securities available for sale are those securities that the Corporation intends to hold for an indefinite period of time, but not necessarily to maturity. Any decision to sell an available for sale security would be based on various factors. These securities are stated at fair value. Unrealized gains (losses) are reported as changes in other comprehensive income, a component of shareholders’ equity, net of the related deferred tax effect. Premiums and discounts are recognized as interest income over the estimated lives of the securities, using the interest method. Securities held to maturity are those securities that the Corporation has the intent and ability to hold to maturity. These securities are stated at cost adjusted for amortization of premiums and accretion of discounts, which is recognized as interest income over their estimated lives, using the interest method. Gains and losses on the sale of securities are recorded on the trade date and are determined using the specific identification method.

Effective April 1, 2009, the Corporation adopted new accounting guidance related to recognition and presentation of other-than-temporary impairment (FASB ASC 320-10). This recent accounting guidance amends the recognition guidance for other-than-temporary impairments of debt securities and expands the financial statement disclosures for other-than-temporary impairment losses on debt and equity securities. The recent guidance replaced the “intent and ability” indication in current guidance by specifying that (a) if a company does not have the intent to sell a security prior to recovery and (b) it is more likely than not that it will not have to sell the security prior to recovery, the security would not be considered other-than-temporarily impaired unless there is a credit loss. When an entity does not intend to sell the security, and it is more likely than not, the entity will not have to sell the security before the recovery of its cost basis, it will recognize the credit component of an other-than-temporary impairment of a debt security in earnings and the remaining portion in other comprehensive income. For held-to-maturity debt securities, the amount of an other-than-temporary impairment recorded in other comprehensive income for the noncredit portion of a previous other-than-temporary impairment should be amortized prospectively over the remaining life of the security on the basis of the timing of future estimated cash flows of the security. The adoption of this standard did not have a material impact on the Corporation’s consolidated financial statements.

Prior to the adoption of the recent accounting guidance on April 1, 2009, management considered, in determining whether other-than-temporary impairment exists, (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

Management evaluates equity securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) for equity securities, the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

Time Certificates of Deposit

Time certificates of deposit are carried at cost, which approximates fair value.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Loans

Loans that management has the intent and ability to hold for the foreseeable future or until maturity or payoff are stated at their outstanding unpaid principal balances, net of an allowance for loan losses and any deferred fees or costs. Interest income is accrued on the unpaid principal balance. Loan origination fees, net of related costs, are deferred and recognized as an adjustment of the yield (interest income) of the related loans. The Corporation is generally amortizing these amounts over the contractual life of the loan.

The accrual of interest is generally discontinued when the contractual payment of principal or interest has become 90 to 120 days past due or management has serious doubts about further collectibility of principal or interest, even though the loan is currently performing. A loan may remain on accrual status if it is in the process of collection and is either guaranteed or well secured. When a loan is placed on non-accrual status, unpaid interest credited to income in the current year is reversed and unpaid interest accrued in prior years is charged against the allowance for loan losses. Interest received on non-accrual loans generally is either applied against principal or reported as interest income, according to management’s judgment as to the collectibility of principal. Generally, loans are restored to accrual status when the obligation is brought current, has performed in accordance with the contractual terms for a reasonable period of time and the ultimate collectibility of the total contractual principal and interest is no longer in doubt.

Allowance for Loan Losses

The allowance for loan losses is established through provisions for loan losses charged against income. Loans deemed to be uncollectible are charged against the allowance for loan losses, and subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is maintained at a level considered adequate to provide for losses that can be reasonably anticipated. Management’s periodic evaluation of the adequacy of the allowance is based on the Corporation’s past loan loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, the estimated value of any underlying collateral, composition of the loan portfolio, current economic conditions and other relevant factors. This evaluation is inherently subjective as it requires material estimates that may be susceptible to significant change, including the amounts and timing of future cash flows expected to be received on impaired loans.

The allowance consists of specific, general and unallocated components. The specific component relates to loans that are classified as impaired. For such loans, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value for that loan. The general component covers non-classified loans and is based on historical loss experience adjusted for qualitative factors. An unallocated component is maintained to cover uncertainties that could affect management’s estimate of probable losses. The unallocated component of the allowance reflects the margin of imprecision inherent in the underlying assumptions used in the methodologies for estimating specific and general losses in the portfolio.

A loan is considered impaired when, based on current information and events, it is probable that the Corporation will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Allowance for Loan Losses (Continued)

significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis for commercial, financial and agricultural loans by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price or the fair value of the collateral if the loan is collateral dependent.

Large groups of smaller balance homogeneous loans are collectively evaluated for impairment. Accordingly, the Corporation does not separately identify individual installment and residential loans for impairment disclosures unless such loans are the subject of a restructuring agreement.

Restricted Investment in Bank Stocks

Restricted investment in bank stocks represents required investments in the common stock of correspondent banks, consisting of the Federal Reserve Bank of Philadelphia in the amount of $258,500, Atlantic Central Bankers Bank in the amount of $20,000, and the Federal Home Loan Bank (FHLB) of Pittsburgh in the amount of $2,382,100. These restricted investments are carried at cost. In December 2008, the FHLB of Pittsburgh notified member banks that it was suspending dividend payments and the repurchase of capital stock.

Management evaluates the restricted stock for impairment in accordance with FASB ASC Topic 942,Financial Services – Depository and Lending. Management’s determination of whether these investments are impaired is based on their assessment of the ultimate recoverability of their cost rather than by recognizing temporary declines in value. The determination of whether a decline affects the ultimate recoverability of their cost is influenced by criteria such as (1) the significance of the decline in net assets of the FHLB as compared to the capital stock amount for the FHLB and the length of time this situation has persisted, (2) commitments by the FHLB to make payments required by law or regulation and the level of such payments in relation to the operating performance of the FHLB, and (3) the impact of legislative and regulatory changes on institutions and, accordingly, on the customer base of the FHLB.

Management believes no impairment charge is necessary related to its restricted stock as of December 31, 2009.

Premises and Equipment

Premises and equipment are stated at cost less accumulated depreciation computed on the straight-line method over the estimated useful lives of the assets. Leasehold improvements are depreciated over the shorter of the estimated useful lives or the lease terms. Maintenance and repairs are expensed when incurred and expenditures for significant improvements are capitalized.

Foreclosed Real Estate

Foreclosed real estate includes assets acquired through foreclosure and loans identified as in-substance foreclosures. A loan is classified as in-substance foreclosure when the Corporation has taken possession of the collateral regardless of whether formal foreclosure proceedings have taken place. Foreclosed real estate is initially valued at its estimated fair market value, net of selling costs, at the time of foreclosure. Subsequent to foreclosure, valuations are periodically performed by

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreclosed Real Estate (Continued)

management and the foreclosed assets are carried at the lower of carrying amount or fair value less cost to sell. Gains and losses resulting from the sale or write-down of foreclosed real estate are recorded in other income, and revenues and expenses from operations and any changes in the valuation allowance are included in noninterest expense. Foreclosed real estate, which is included in other assets, amounted to $122,000 at December 31, 2009 and $0 in 2008.

Transfers of Financial Assets

Transfers of financial assets are accounted for as sales, when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when (1) the assets have been isolated from the Corporation, (2) the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and (3) the Corporation does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity.

Advertising Costs

The Corporation charges the costs of advertising to expense as incurred. Advertising expense was $99,000 and $109,000 for the years ended December 31, 2009 and 2008, respectively.

Income Taxes

Deferred income taxes are provided on the liability method whereby deferred tax assets are recognized for deductible temporary differences and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation allowance, when in the opinion of management, it is more likely than not that some portion or all the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted through the provision for income taxes for the effects of changes in tax laws and rates on the date of enactment.

Earnings per Share

The Corporation has a simple capital structure. Basic earnings per share represents net income divided by the weighted average number of common shares outstanding during the period. The weighted average number of common shares outstanding was 1,399,459 and 1,399,998 for the years ended 2009 and 2008.

Segment Reporting

Management does not separately allocate expenses, including the cost of funding loan demand, between the commercial, retail, trust and other operations of the Corporation. As such, discrete financial information is not available and segment reporting would not be meaningful.

Comprehensive Income

Accounting principles generally accepted in the United States of America generally require that recognized revenue, expenses, gains and losses be included in net income. Changes in certain assets and liabilities, such as unrealized gains (losses) on securities available for sale, are reported as a separate component of the equity section of the balance sheet. Such items, along with net income, are components of comprehensive income.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Comprehensive Income (Continued)

The components of other comprehensive income and the related tax effects are as follows:

| | | | | | | | |

| | | Years Ended

December 31, | |

| | | 2008 | | | 2009 | |

| | | (In Thousands) | |

Unrealized holding gains on available for sale securities | | $ | 1,226 | | | $ | 708 | |

Reclassification adjustment for gains realized in net income | | | (459 | ) | | | — | |

| | | | | | | | |

Net Unrealized Gains | | | 767 | | | | 708 | |

Tax effect | | | (257 | ) | | | (237 | ) |

| | | | | | | | |

Net of Tax Amount | | $ | 510 | | | $ | 471 | |

| | | | | | | | |

Off Balance Sheet Financial Instruments

In the ordinary course of business, the Corporation has entered into off balance sheet financial instruments consisting of commitments to extend credit and standby letters of credit. Such financial instruments are recorded in the financial statements when they become payable.

New and Recently Adopted Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 168, “The FASB Accounting Standards Codification” and the Hierarchy of Generally Accepted Accounting Principles – a replacement of FASB Statement No. 162,” (“SFAS 168”). SFAS 168 establishes the FASB Accounting Standards Codification (“Codification”) as the source of authoritative generally accepted accounting principles (“GAAP”) for nongovernmental entities. The Codification does not change GAAP. Instead, it takes the thousands of individual pronouncements that currently comprise GAAP and reorganizes them into approximately 90 accounting Topics, and displays all Topics using a consistent structure. Contents in each Topic are further organized first by Subtopic, then Section and finally Paragraph. The Paragraph level is the only level that contains substantive content. Citing particular content in the Codification involves specifying the unique numeric path to the content through the Topic, Subtopic, Section and Paragraph structure. FASB suggests that all citations begin with “FASB ASC,” where ASC stands forAccounting Standards Codification. Changes to the ASC subsequent to June 30, 2009 are referred to as Accounting Standards Updates (“ASU”).

In conjunction with the issuance of SFAS 168, the FASB also issued its first Accounting Standards Update No. 2009-1, “Topic 105 – Generally Accepted Accounting Principles” (“ASU 2009-1”) which includes SFAS 168 in its entirety as a transition to the ASC. ASU 2009-1 was effective for interim and annual periods ending after September 15, 2009 and did not have an impact on the Corporation’s financial position or results of operations but did change the referencing system for accounting standards.

In May 2009, FAS issued Statement No. 165,Subsequent Events,(codified within ASC 855). It requires the disclosure of the date through which an entity has evaluated subsequent events and the basis for that date, that is, whether that date represents the date the financial statements were issued.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

New and Recently Adopted Accounting Pronouncements (Continued)

This disclosure should alert all users of financial statements that an entity has not evaluated subsequent events after that date in the set of financial statements being presented. This statement should not result in significant changes in the subsequent events that an entity reports – either through recognition or disclosure – in its financial statements.

In accordance with this statement, an entity should apply the requirements to the interim or annual financial periods ending after June 15, 2009.

In August 2009, the FASB issued ASU 2009-05,Fair Value Measurements and Disclosures (Topic 820): Measuring Liabilities at Fair Value.The amendments within ASU 2009-05 clarify that in circumstances in which a quoted price in an active market for the identical liability is not available, a reporting entity is required to measure fair value using one or more of the following techniques:

A valuation technique that uses:

a. The quoted price of the identical liability when traded as an asset.

b. Quoted prices for similar liabilities or similar liabilities when traded as assets.

Another valuation technique that is consistent with the principles of Topic 820.

Two examples would be an income approach, such as a present value technique, or a market approach, such as a technique that is based on the amount at the measurement date that the reporting entity would pay to transfer the identical liability or would receive to enter into the identical liability.

When estimating the fair value of a liability, a reporting entity is not required to include a separate input or adjustment to other inputs relating to the existence of a restriction that prevents the transfer of the liability.

Both a quoted price in an active market for the identical liability at the measurement date and the quoted price for the identical liability when traded as an asset in an active market when no adjustments to the quoted price of the asset are required are Level 1 fair value measurements.

This guidance was effective for the first reporting period (including interim periods) beginning after issuance. The adoption of this guidance did not have a material impact on the Corporation’s financial statements.

In November 2008, the SEC released a proposed roadmap regarding the potential use by U.S. issuers of financial statements prepared in accordance with International Financial Reporting Standards (IFRS). IFRS is a comprehensive series of accounting standards published by the International Accounting Standards Board (“IASB”). Under the proposed roadmap, the Corporation may be required to prepare financial statements in accordance with IFRS as early as 2014. The SEC is currently required to make a determination in 2011 regarding the mandatory adoption of IFRS. The Corporation is currently assessing the impact that this potential change would have on its consolidated financial statements, and it will continue to monitor the development of the potential implementation of IFRS.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2—RESTRICTIONSON CASHAND DUEFROM BANKS

In return for services obtained through correspondent banks, the Corporation is required to maintain non-interest bearing cash balances in those correspondent banks. At December 31, 2009 and 2008, compensating balances approximated $1,779,000 and $1,676,000, respectively. During 2009 average required balances totaled $1,833,000 and during 2008 totaled $1,508,000.

NOTE 3—SECURITIES

Amortized cost and fair value at December 31 were as follows:

| | | | | | | | | | | | | |

| | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | | Fair

Value |

| | | (In Thousands) |

SECURITIES AVAILABLEFOR SALE: | | | | | | | | | | | | | |

December 31, 2009: | | | | | | | | | | | | | |

U.S. Government agencies | | $ | 12,195 | | $ | 74 | | $ | (38 | ) | | $ | 12,231 |

Mortgage-backed securities | | | 66,619 | | | 1,687 | | | (72 | ) | | | 68,234 |

Equity securities | | | 661 | | | 311 | | | — | | | | 972 |

| | | | | | | | | | | | | |

| | $ | 79,475 | | $ | 2,072 | | $ | (110 | ) | | $ | 81,437 |

| | | | | | | | | | | | | |

December 31, 2008: | | | | | | | | | | | | | |

U.S. Government agencies | | $ | 6,590 | | $ | 134 | | $ | — | | | $ | 6,724 |

Mortgage-backed securities | | | 58,084 | | | 883 | | | (205 | ) | | | 58,762 |

Equity securities | | | 507 | | | 387 | | | (4 | ) | | | 890 |

| | | | | | | | | | | | | |

| | $ | 65,181 | | $ | 1,404 | | $ | (209 | ) | | $ | 66,376 |

| | | | | | | | | | | | | |

| | | | |

| | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | | Fair

Value |

| | | (In Thousands) |

SECURITIES HELDTO MATURITY: | | | | | | | | | | | | | |

December 31, 2009: | | | | | | | | | | | | | |

U.S. Government agencies | | $ | 250 | | $ | 11 | | $ | — | | | $ | 261 |

State and municipal securities | | | 29,954 | | | 374 | | | (874 | ) | | | 29,454 |

| | | | | | | | | | | | | |

| | $ | 30,204 | | $ | 385 | | $ | (874 | ) | | $ | 29,715 |

| | | | | | | | | | | | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3—SECURITIES (CONTINUED)

| | | | | | | | | | | | | |

| | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | | Fair

Value |

| | | (In Thousands) |

December 31, 2008: | | | | | | | | | | | | | |

U.S. Government agencies | | $ | 250 | | $ | 17 | | $ | — | | | $ | 267 |

State and municipal securities | | | 23,877 | | | 186 | | | (1,082 | ) | | | 22,981 |

| | | | | | | | | | | | | |

| | $ | 24,127 | | $ | 203 | | $ | (1,082 | ) | | $ | 23,248 |

| | | | | | | | | | | | | |

The following table shows the Corporation’s investments’ gross unrealized losses and fair value, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, at December 31, 2009 and 2008:

| | | | | | | | | | | | | | | | | | |

| | | Less than 12 Months | | 12 Months or More | | Total |

| | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses |

| DECEMBER 31, 2009 | | (In Thousands) |

SECURITIES AVAILABLEFOR SALE: | | | | | | | | | | | | | | | | | | |

Mortgage-backed securities | | $ | 7,797 | | $ | 71 | | $ | 215 | | $ | 1 | | $ | 8,012 | | $ | 72 |

U. S. agency securities | | | 4,872 | | | 38 | | | — | | | — | | | 4,872 | | | 38 |

| | | | | | | | | | | | | | | | | | |

| | | 12,669 | | | 109 | | | 215 | | | 1 | | | 12,884 | | | 110 |

| | | | | | | | | | | | | | | | | | |

SECURITIES HELDTO MATURITY: | | | | | | | | | | | | | | | | | | |

State and municipal securities | | | 7,479 | | | 119 | | | 4,648 | | | 755 | | | 12,127 | | | 874 |

| | | | | | | | | | | | | | | | | | |

Total | | $ | 20,148 | | $ | 228 | | $ | 4,863 | | $ | 756 | | $ | 25,011 | | $ | 984 |

| | | | | | | | | | | | | | | | | | |

| | | |

| | | Less than 12 Months | | 12 Months or More | | Total |

| | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses |

| DECEMBER 31, 2008 | | (In Thousands) |

SECURITIES AVAILABLEFOR SALE: | | | | | | | | | | | | | | | | | | |

Mortgage-backed securities | | $ | 10,812 | | $ | 84 | | $ | 5,207 | | $ | 121 | | $ | 16,019 | | $ | 205 |

Equity securities | | | 16 | | | 4 | | | — | | | — | | | 16 | | | 4 |

| | | | | | | | | | | | | | | | | | |

| | | 10,828 | | | 88 | | | 5,207 | | | 121 | | | 16,035 | | | 209 |

| | | | | | | | | | | | | | | | | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3—SECURITIES (CONTINUED)

| | | | | | | | | | | | | | | | | | |

| | | Less than 12 Months | | 12 Months or More | | Total |

| | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses | | Fair

Value | | Unrealized

Losses |

| DECEMBER 31, 2008 | | (In Thousands) |

SECURITIES HELDTO MATURITY: | | | | | | | | | | | | | | | | | | |

State and municipal securities | | | 11,408 | | | 818 | | | 1,025 | | | 264 | | | 12,433 | | | 1,082 |

| | | | | | | | | | | | | | | | | | |

Total | | $ | 22,236 | | $ | 906 | | $ | 6,232 | | $ | 385 | | $ | 28,468 | | $ | 1,291 |

| | | | | | | | | | | | | | | | | | |

Management evaluates equity securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) for equity securities, the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 320, Investments – Debt and Equity Securities, clarifies the interaction of the factors that should be considered when determining whether a debt security is other-than-temporarily impaired. For debt securities, management assesses whether (a) it has the intent to sell the security and (b) it is more likely than not that it will be required to sell the security prior to its anticipated recovery. These steps are done before assessing whether the entity will recover the cost basis of the investment. Previously, this assessment required management to assert it has both the intent and the ability to hold a security for a period of time sufficient to allow for an anticipated recovery in fair value to avoid recognizing an other-than-temporary impairment. This change does not affect the need to forecast recovery of the value of the security through either cash flows or market price.

In instances when a determination is made that an other-than-temporary impairment exists but the investor does not intend to sell the debt security and it is not more likely than not that it will be required to sell the debt security prior to its anticipated recovery, FASB Topic 320 changes the presentation and amount of the other-than-temporary impairment recognized in the income statement. The other-than-temporary impairment is separated into (a) the amount of the total other-than-temporary impairment related to a decrease in cash flows expected to be collected from the debt security (the credit loss) and (b) the amount of the total other-than-temporary impairment related to all other factors. The amount of the total other-than-temporary impairment related to the credit loss is recognized in earnings. The amount of the total other-than-temporary impairment related to all other factors is recognized in other comprehensive income. FASB ASC Topic 320 was effective for the Corporation for interim and annual reporting periods June 30, 2009 and after. The adoption of this FASB ASC Topic did not impact the Corporation’s financial condition or results of operations.

At December 31, 2009, 3 U. S. agency securities have unrealized losses. The aggregate depreciation from the Corporation’s amortized cost basis on these securities is 0.8%. In management’s opinion, these unrealized losses relate to changes in interest rates.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3—SECURITIES (CONTINUED)

At December 31, 2009, 19 mortgage-backed securities have unrealized losses. The aggregate depreciation from the Corporation’s amortized cost basis on these securities is 0.9%. In management’s opinion, these unrealized losses relate to changes in interest rates. The Corporation’s mortgage backed security portfolio consists of only government sponsored agencies, and contains no private label securities.

At December 31, 2009, 47 state and municipal securities have unrealized losses with aggregate depreciation of 6.7% from the Corporation’s amortized cost basis. In management’s opinion, these unrealized losses relate primarily to changes in interest rates. In analyzing the issuer’s financial condition, management considers the issuer’s bond rating as well as the financial performance of the respective municipality.

Management of the Corporation has determined none of the debt securities have declines that are deemed to be other-than-temporary.

During 2009, one equity security, a regional bank holding company, was deemed to be other-than-temporarily impaired and a $15,000 charge was recorded in the second quarter of 2009. This equity security had depreciated in fair value 70% during the last year, its dividend has been significantly reduced, and a near term recovery of value is not expected.

Amortized cost and fair value at December 31, 2009 by contractual maturity are shown below. Municipal securities with prerefunded issues are included in the category in which payment is expected to occur. Expected maturities will differ from contractual maturities because issuers may have the right to call or prepay with or without penalties.

| | | | | | | | | | | | |

| | | Available for Sale | | Held to Maturity |

| | | Amortized

Cost | | Fair

Value | | Amortized

Cost | | Fair

Value |

| | | (In Thousands) |

1 year or less | | $ | 3,365 | | $ | 3,385 | | $ | 1,102 | | $ | 1,121 |

Over 1 year through 5 years | | | 7,963 | | | 7,966 | | | 3,584 | | | 3,590 |

Over 5 years through 10 years | | | 867 | | | 880 | | | 13,731 | | | 13,789 |

Over 10 years | | | — | | | — | | | 11,787 | | | 11,215 |

Mortgage-backed securities | | | 66,619 | | | 68,234 | | | — | | | — |

Equity securities | | | 661 | | | 972 | | | — | | | — |

| | | | | | | | | | | | |

| | $ | 79,475 | | $ | 81,437 | | $ | 30,204 | | $ | 29,715 |

| | | | | | | | | | | | |

At December 31, 2009 and 2008, securities with a book value of $34,700,000 and $26,123,000, respectively, were pledged as collateral as required by law on public deposits and for other purposes.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4—LOANS

Loans at December 31 were as follows:

| | | | | | | | |

| | | 2009 | | | 2008 | |

| | | (In Thousands) | |

Commercial, financial and agricultural | | $ | 32,369 | | | $ | 22,944 | |

Real estate: | | | | | | | | |

Commercial | | | 37,842 | | | | 41,227 | |

Construction | | | 5,057 | | | | 5,730 | |

Residential | | | 139,055 | | | | 138,209 | |

Installment | | | 5,339 | | | | 6,159 | |

| | | | | | | | |

Total | | | 219,662 | | | | 214,269 | |

Allowance for loan losses | | | (2,830 | ) | | | (1,633 | ) |

Deferred loan fees and costs, net | | | (232 | ) | | | (259 | ) |

| | | | | | | | |

Loans | | $ | 216,600 | | | $ | 212,377 | |

| | | | | | | | |

The Bank grants commercial, residential and consumer loans to customers primarily within Juniata and Perry Counties of Pennsylvania and the surrounding area. A large portion of the loan portfolio is secured by real estate. Although the Bank has a diversified loan portfolio, its debtors’ ability to honor their contracts is influenced by the region’s economy.

The Corporation, in the ordinary course of business, has loan, deposit and other routine transactions with its officers, directors and principal shareholders and entities in which they have principal ownership. Loans are made to such customers at the same credit terms as other borrowers and do not represent more than the usual risk of collection. Changes during 2009 in these related party loans were as follows (in thousands):

| | | | |

Balance, beginning | | $ | 962 | |

Advances | | | 1,323 | |

Repayments | | | (1,457 | ) |

| | | | |

Balance, ending | | $ | 828 | |

| | | | |

Changes in the allowance for loan losses were as follows:

| | | | | | | | |

| | | 2009 | | | 2008 | |

| | | (In Thousands) | |

Balance, beginning | | $ | 1,633 | | | $ | 1,249 | |

Provision charged to operations | | | 1,237 | | | | 365 | |

Recoveries on charged off loans | | | 1 | | | | 28 | |

Loans charged off | | | (41 | ) | | | (9 | ) |

| | | | | | | | |

Balance, ending | | $ | 2,830 | | | $ | 1,633 | |

| | | | | | | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4—LOANS (CONTINUED)

The following is a summary of information pertaining to impaired and nonaccrual loans as of the years ended December 31:

| | | | | | |

| | | 2009 | | 2008 |

| | | (In Thousands) |

Impaired loans without a valuation allowance | | $ | 243 | | $ | 562 |

Impaired loans with a valuation allowance | | | 2,410 | | | 73 |

| | | | | | |

Total Impaired Loans | | $ | 2,653 | | $ | 635 |

| | | | | | |

Valuation allowance related to impaired loans | | $ | 1,016 | | $ | 36 |

| | | | | | |

Total nonaccrual loans | | $ | 4,254 | | $ | 2,623 |

| | | | | | |

Troubled debt restructurings | | $ | 2,305 | | $ | — |

| | | | | | |

Average investment in impaired loans | | $ | 1,924 | | $ | 718 |

| | | | | | |

Interest income recognized on impaired loans | | $ | 115 | | $ | 23 |

| | | | | | |

Interest earned but not accrued on nonaccrual loans | | $ | 143 | | $ | 91 |

| | | | | | |

No additional funds are committed to be advanced in connection with impaired loans, which includes troubled debt restructurings. Impaired loans include nonperforming loans and also include loans modified in troubled debt restructurings where concessions have been granted to borrowers experiencing financial difficulties. These concessions could include a reduction in the interest rate on the loan, payment extensions, forgiveness of principal, forbearance or other actions intended to maximize collection.

At December 31, 2009, the Corporation had a $2,305,000 commercial real estate loan that was modified in troubled debt restructurings. Subsequent to December 31, 2009, the Bank received additional information on the financial condition of this borrower and increased its provision for loan losses by $500,000 bringing the total reserve allocation for this credit to $1,000,000 as of December 31,2009. This is a loan to a manufacturer of supplies to the construction industry.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5—PREMISESAND EQUIPMENT

Premises and equipment at December 31 were as follows:

| | | | | | | | | | |

| | | Range of

Useful Lives | | 2009 | | | 2008 | |

| | | (in years) | | (In Thousands) | |

Land | | — | | $ | 741 | | | $ | 741 | |

Buildings and improvements | | 7 - 39 | | | 7,631 | | | | 7,627 | |

Furniture, equipment and software | | 3 - 20 | | | 4,630 | | | | 4,329 | |

| | | | | | | | | | |

| | | | | 13,002 | | | | 12,697 | |

Accumulated depreciation | | | | | (6,827 | ) | | | (6,300 | ) |

| | | | | | | | | | |

| | | | $ | 6,175 | | | $ | 6,397 | |

| | | | | | | | | | |

NOTE 6—DEPOSITS

Deposits were comprised of the following as of December 31:

| | | | | | |

| | | 2009 | | 2008 |

| | | (In Thousands) |

Non-interest bearing demand | | $ | 27,952 | | $ | 29,192 |

Interest bearing demand | | | 24,452 | | | 23,523 |

Savings | | | 67,886 | | | 24,129 |

Time deposits less than $100,000 | | | 123,193 | | | 132,260 |

Time deposits greater than $100,000 | | | 52,976 | | | 53,502 |

| | | | | | |

| | $ | 296,459 | | $ | 262,606 |

| | | | | | |

Scheduled maturities of time deposits at December 31, 2009 were as follows (in thousands):

| | | |

Years ending December 31: | | | |

2010 | | $ | 96,047 |

2011 | | | 41,207 |

2012 | | | 10,110 |

2013 | | | 25,073 |

2014 | | | 3,732 |

| | | |

| | $ | 176,169 |

| | | |

The following table sets forth maturity information on time deposits of $100,000 or more as of December 31, 2009 (in thousands):

| | | |

Three months or less | | $ | 8,808 |

Over three and through six months | | | 14,347 |

Over six and through twelve months | | | 5,598 |

Over twelve months | | | 24,223 |

| | | |

Total | | $ | 52,976 |

| | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7—BORROWINGS

Short-term borrowings at December 31 were as follows:

| | | | | | |

| | | 2009 | | 2008 |

| | | (In Thousands) |

Amount outstanding at end of year: | | | | | | |

Securities sold under agreements to repurchase | | $ | 4,415 | | $ | 4,189 |

Federal funds purchased | | | — | | | 324 |

Federal Home Loan Bank | | | — | | | 6,000 |

Treasury tax and loan note | | | 97 | | | 100 |

| | | | | | |

| | $ | 4,512 | | $ | 10,613 |

| | | | | | |

Securities sold under agreements to repurchase generally mature within one day from the transaction date. Securities with a carrying amount of $6,633,000 and $10,698,000 at December 31, 2009 and 2008, were pledged as collateral for these agreements. As of December 31, 2009, the interest rate on securities sold under agreements to repurchase was 1.14%. The securities underlying the agreements were under the Corporation’s control.

Long-term borrowings at December 31 were as follows:

| | | | | | |

| | | 2009 | | 2008 |

| | | (In Thousands) |

Convertible advances: | | | | | | |

Maturing in 2010 with an initial fixed rates ranging from 5.91% to 6.54%, with a weighted average rate of 6.23% at December 31, 2009 and 2008 | | $ | 6,000 | | $ | 6,000 |

Maturing in 2011 with an initial fixed rate of 4.98% | | | 1,000 | | | 1,000 |

Maturing in 2013 with an initial fixed rate of 3.11% | | | 5,000 | | | 5,000 |

Maturing in 2017 with initial fixed rates ranging from 4.30% to 4.60%, with a weighted average rate of 4.45% at December 31, 2009 and 2008. | | | 10,000 | | | 10,000 |

| | | | | | |

| | $ | 22,000 | | $ | 22,000 |

| | | | | | |

Convertible advances allow the FHLB the periodic option to convert to a LIBOR adjustable-rate advance after the specified fixed rate period has elapsed. At December 31, 2009, the FHLB has the option to convert advances to rates that range from three month LIBOR plus 0.07% to 0.13%, of which $17 million is eligible for the conversion option, but not exercised by the FHLB, at December 31, 2009. The remaining $5 million is not eligible for conversion until 2011. Upon the FHLB’s conversion option being exercised, the Bank has the option to repay the respective advance in full, without penalty.

The Corporation has a maximum borrowing capacity through the Federal Home Loan Bank of approximately $137,368,000, of which $115,368,000 was available at December 31, 2009. The borrowing capacity is collateralized by security agreements in certain residential real estate backed assets of the Corporation, including loans and investments.

The Corporation has issued $5,155,000 of floating rate junior subordinated deferrable interest debentures to a non-consolidated subsidiary trust, First Community Financial Capital Trust I (the Trust). The

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7—BORROWINGS (CONTINUED)

Corporation owns all of the common equity of the Trust. The debentures held by the trust are the sole assets of the trust.

The Trust issued $5,000,000 of mandatorily redeemable preferred securities to third-party investors. The Corporation’s obligations under the debentures and related documents, taken together, constitute a full and unconditional guarantee by the Corporation of the Trust’s obligations under the preferred securities. The junior subordinated debt securities pay interest quarterly at 3-month LIBOR plus 3.00%, (3.28% at December 31, 2009). Pursuant to the debenture agreement, the Corporation can elect to defer payments of interest for up to 20 consecutive quarterly periods, provided there is no event of default as defined in the indenture. The Corporation has not deferred any quarterly interest payments through December 31, 2009. The preferred securities are redeemable quarterly by the Corporation at 100% of principal plus accrued interest on or after January 7, 2009. The preferred securities must be redeemed upon maturity of the debentures on January 7, 2034. The terms of the junior subordinated deferrable interest debentures match those of the preferred securities.

NOTE 8—OPERATING LEASES

The Corporation leases its Delaware (Juniata County) and Shermans Dale offices and the land on which its East Waterford office was constructed. The Corporation has an option through 2010 to purchase the land, for predetermined prices ranging from $105,000 up to $125,000. The Corporation also receives rental income for leasing of available space at its West Perry, Mifflintown and Loysville offices. Net lease expense was $7,000 in 2009 and $8,000 in 2008 after deducting rental expense of $62,000 and $63,000 respectively.

NOTE 9—INCOME TAXES

The components of income tax expense for the years ended December 31, 2009 and 2008 are as follows:

| | | | | | | | |

| | | 2009 | | | 2008 | |

| | | (In Thousands) | |

Federal: | | | | | | | | |

Current | | $ | 862 | | | $ | 848 | |

Deferred | | | (446 | ) | | | (227 | ) |

| | | | | | | | |

| | $ | 416 | | | $ | 621 | |

| | | | | | | | |

Reconciliations of the statutory federal income tax at a rate of 34% to the income tax expense reported in the consolidated statements of income for the years ended December 31, 2009 and 2008 are as follows:

| | | | | | |

| | | Percentage of Income

before Income Taxes | |

| | | 2009 | | | 2008 | |

Federal income tax at statutory rate | | 34.0 | % | | 34.0 | % |

Tax-exempt income | | (16.2 | ) | | (11.2 | ) |

Earnings on investment in life insurance | | (2.1 | ) | | (1.8 | ) |

| | | | | | |

| | 15.7 | % | | 21.0 | % |

| | | | | | |

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9—INCOME TAXES (CONTINUED)

Components of deferred tax assets and liabilities at December 31 were as follows:

| | | | | | | | |

| | | 2009 | | | 2008 | |

| | | (In Thousands) | |

Deferred tax assets: | | | | | | | | |

Allowance for loan losses | | $ | 947 | | | $ | 548 | |

Nonaccrual loans interest | | | 49 | | | | 31 | |

Intangible assets | | | 9 | | | | 6 | |

Retirement liabilities | | | 506 | | | | 477 | |

State net operating loss carryforward | | | 119 | | | | 104 | |

| | | | | | | | |

Gross deferred tax asset | | | 1,630 | | | | 1,166 | |

Valuation allowance | | | (119 | ) | | | (104 | ) |

| | | | | | | | |

| | | 1,511 | | | | 1,062 | |

| | | | | | | | |

Deferred tax liabilities: | | | | | | | | |

Accumulated depreciation | | | 279 | | | | 271 | |

Available for sale securities | | | 686 | | | | 429 | |

Other | | | 20 | | | | 25 | |

| | | | | | | | |

| | | 985 | | | | 725 | |

| | | | | | | | |

Net Deferred Tax Assets | | $ | 526 | | | $ | 337 | |

| | | | | | | | |

The Corporation accounts for Income Taxes in accordance with income tax accounting guidance (FASB ASC 740,Income Taxes). On January 1, 2008, the Corporation adopted the recent accounting guidance related to accounting for uncertainty in income taxes, which sets out a consistent framework to determine the appropriate level of tax reserves to maintain for uncertain tax positions.

The income tax accounting guidance results in two components of income tax expense: current and deferred. Current income tax expense reflects taxes to be paid or refunded for the current period by applying the provisions of the enacted tax law to the taxable income or excess of deductions over revenue. The Corporation determines deferred income taxes using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is based on the tax effects of the differences between the book and tax bases of assets and liabilities, and enacted changes in tax rates and laws are recognized in the period in which they occur.

Deferred income tax expense results from changes in deferred tax assets and liabilities between periods. Deferred tax assets are reduced by a valuation allowance if, based on the weight of evidence available, it is more likely than not that some portion or all of a deferred tax asset will not be realized.

As of December 31, 2009, the Corporation has State net operating loss carryforwards of $1,808,000 that expire through the year 2029. Management does not believe that these net operating loss carryforwards will be utilized prior to their expiration, as they were incurred by the holding company with little revenue opportunities to offset the losses, and as such, a valuation allowance has been provided for them.

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9—INCOME TAXES (CONTINUED)

Uncertain tax positions are recognized if it is more likely than not, based on the technical merits, that the tax position will be sustained upon examination. The term “more likely than not” means a likelihood of more than 50 percent; the terms examined and upon examination also include resolution of the related appeals of litigation processes, if any. A tax position that meets the more-likely-than-not recognition threshold is initially and subsequently measured as the largest amount of tax benefit that has a greater than 50 percent likelihood of being sustained upon settlement with a taxing authority that has full knowledge of all relevant information. The determination of whether or not a tax position has met the more-likely-than-not recognition threshold considers the facts, circumstances, and information available at the reporting date and is subject to management’s judgment.

The Corporation recognizes interest and penalties on income taxes as a component of income tax expense. Tax years subject to examination by tax authorities are the years ended December 31, 2008, 2007 and 2006.

NOTE 10—RETIREMENT PLANS

The Corporation maintains a 401(k) plan for the benefit of eligible employees. Employer contributions include matching a portion of employee contributions and a discretionary contribution determined by the Corporation. Corporation contributions to the Plan were $160,000 and $148,000 for 2009 and 2008.

The Corporation maintains non-qualified compensation plans for selected employees (supplemental retirement) and directors (deferred fees). The estimated present value of future benefits is accrued over the period from the effective date of the agreements until the expected retirement dates of the individuals. Expenses include the following amounts for these non-qualified plans:

| | | | | | |

| | | 2009 | | 2008 |

| | | (In Thousands) |

Employee compensation | | $ | 41 | | $ | 43 |

Director compensation | | | 70 | | | 119 |

The balance accrued for these plans included in other liabilities as of December 31, 2009 and 2008 totaled $1,489,000 and $1,403,000.

To fund the benefits under these plans, the Corporation is the owner of single premium life insurance policies on participants in the non-qualified retirement plans. At December 31, 2009 and 2008, the cash value of these policies was $5,109,000 and $4,933,000.

NOTE 11—REGULATORY MATTERSAND SHAREHOLDERS’ EQUITY

The Corporation and the Bank are subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet the minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Corporation’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Corporation and the Bank must meet specific capital guidelines that involve quantitative measures of their assets, liabilities and certain off-balance sheet items as calculated under regulatory accounting practices. The capital amounts and classification

FIRST COMMUNITY FINANCIAL CORPORATION

NOTESTO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 11—REGULATORY MATTERSAND SHAREHOLDERS’ EQUITY (CONTINUED)

are also subject to qualitative judgments by the regulators about components, risk weightings and other factors.