Drew’s products include vinyl and aluminum windows and screens, doors, chassis, chassis parts, RV slide-out mechanisms and power units, leveling devices, bath and shower units, axles, steps, electric stabilizer jacks, as well as trailers for hauling equipment, boats, personal watercrafts and snowmobiles, and chassis and windows for modular homes and offices.

From 47 factories located throughout the United States and one factory in Canada, Drew supplies nearly all major national manufacturers of RVs and manufactured homes in an efficient and cost-effective manner. RV products account for about 67 percent of consolidated sales, and manufactured housing products account for about 33 percent.

Management of Drew is committed to acting ethically and responsibly, and to providing full and accurate disclosure to the Company’s stockholders, employees and other stakeholders.

Additional information about Drew and its products can be found at www.drewindustries.com.

Net sales in 2005 reached $669 million, an increase of 26 percent compared to 2004, while net income increased 34 percent to $33.6 million, or $1.56 per diluted share. During the year, Drew’s management team and employees successfully managed the Company through a period of high demand due to the Gulf Coast hurricanes, as well as unusual volatility in raw material costs.

At the same time, we successfully integrated a strategic acquisition for the Company’s manufactured housing segment and launched new products for the recreational vehicle segment that offer great promise for our future. Moving into 2006, we are on solid footing to continue our expansion through both internal initiatives and patiently planned acquisitions. In fact, Drew’s sales for January and February 2006 increased more than 35 percent from last year, and March 2006 sales remained very strong.

Further, during March 2006, we acquired Steelco Inc., a West Coast manufacturer of both RV and manufactured housing chassis, which will be integrated into our existing factories. Steelco’s sales were about $8 million in 2005. In addition, we recently announced an agreement in principle to acquire Happijac Company, a manufacturer of bed lifts and other innovative RV products with annual sales of more than $12 million.

SUCCESSFUL ACQUISITION

In May 2005, we acquired the business and certain assets of Venture Welding, a manufacturer of chassis and chassis parts for manufactured homes, modular homes and office units, for approximately $19 million. As with past acquisitions, the acquisition of Venture Welding, which had annualized sales of approximately $18 million prior to the acquisition, was immediately accretive to our earnings.

As part of the acquisition, we gained patents that will permit our Lippert Components subsidiary to efficiently manufacture cold cambered steel chassis for the manufactured housing market. We are in the process of building additional machines using this patented cold camber process that should increase manufacturing efficiencies, improve our product, and help in our efforts to increase our current 25 percent share in the $250 million manufactured housing chassis market.

RESPONSE TO HURRICANES

During the last two years, the Gulf Coast experienced significant damage from a series of hurricanes and related flooding. In response to these disasters, believed to be among the worst natural disasters ever experienced in the U.S., the Federal Emergency Management Agency (FEMA) purchased thousands of RV travel trailers and manufactured homes from both manufacturers and dealers for use as emergency housing.

Though we all wish the Gulf Coast residents could have been spared from this terrible disaster, we take pride in our efforts to assist our customers in providing emergency housing for those affected by the storms. Sales related to FEMA units added $32 million to $35 million to our revenue in 2005, or about 5 percent of our consolidated sales, resulting in an earnings increase of $0.11 to $0.15 per share.

Although the majority of units purchased by FEMA were delivered in 2005, some units will be delivered during 2006. It is important to note that the units purchased by FEMA were “bare-bone” units, which did not include as much of our product content as normal RVs or manufactured homes typically contain. However, as the cleanup of the affected areas is completed, we anticipate that some of the replacement housing will be the higher-end, larger manufactured homes which will contain more of Drew’s products.

PRODUCT EXPANSION

During the last two years, we introduced a series of new products to expand our product offerings and meet market demand. We estimate the total market potential for these new products to be $700 million. We are pleased with our success to date, as our sales of these products grew steadily throughout 2005, reaching more than $70 million on an annualized basis by December 31, 2005, or 10 percent of the market potential. For most of our established product offerings we have market shares ranging from 25 percent to more than 70 percent, and it is our goal to attain similar market shares for these new products, as well as for new products we hope to introduce in 2006.

| OVER THE LAST SEVERAL YEARS, THE INVESTMENT COMMUNITY HAS RECOGNIZED OUR PERFORMANCE, AS EVIDENCED BY OUR ADDITION TO THE S&P SMALL CAP 600 INDEX IN 2005, AND OUR INCLUSION IN BUSINESSWEEK’S 2005 LIST OF THE “100 BEST SMALL COMPANIES”. |

Many of these newer products, although profitable, generated lower than normal profit margins in 2005. As we gain market share and efficiencies with these products, we anticipate margins will improve. We also incurred $3.3 million of start-up losses at two new factories in 2005. While this was more than we expected, we anticipate significantly improved results at these facilities during 2006.

OPERATING RESULTS

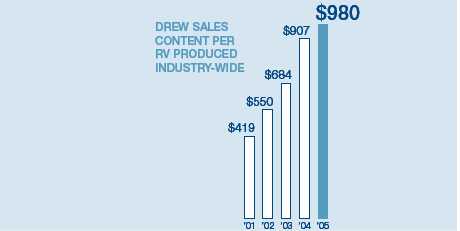

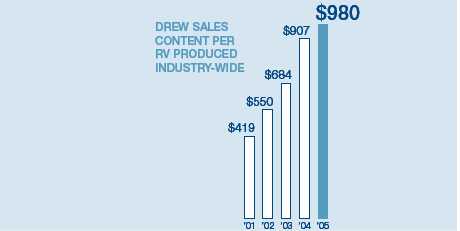

Our RV segment continued to outperform the RV industry in 2005 with sales increasing 29 percent to $448 million, or 67 percent of consolidated sales. Excluding sales price increases implemented to offset increases in the cost of raw materials, and the impact of sales from an acquisition in May 2004, Drew’s RV segment achieved sales growth of more than 19 percent in 2005, including FEMA-related sales. This compares to a 14 percent industry-wide increase, which also included units made specifically for FEMA.

Industry shipments have remained strong in 2006, with January and February shipments of towable RVs, the Company’s primary market, increasing almost 20 percent, which increase does not include more than 20,000 units made specifically for FEMA.

The operating profit margin of our RV segment improved slightly, to 9.3 percent in 2005 from 9.2 percent in 2004, despite continuing volatility in raw material costs, new factory start-up losses of nearly $2.4 million, and the lower margins of newly introduced product lines. In both 2005 and 2004, raw material cost increases were passed on to customers with little or no profit margin.

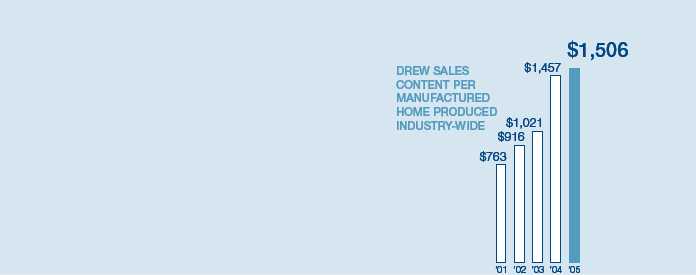

Sales for Drew’s manufactured housing segment increased 21 percent to $221 million in 2005, or approximately 33 percent of consolidated sales. Excluding sales price increases implemented to offset increases in the cost of raw materials, and the impact of sales resulting from acquisitions, Drew’s manufactured housing segment sales grew approximately six percent. This compares to a 12 percent industry-wide increase resulting from FEMA’s purchases of smaller homes, in which Drew has substantially less product content. Industry sales of manufactured homes remained strong in January 2006, with production up 15 percent.

The operating profit margin of our manufactured housing segment increased to 10.8 percent in 2005, from 10.1 percent in 2004. Excluding previously disclosed charges in 2004 and 2005 related to a workplace accident judgment, the operating profit margin of this segment increased slightly to 11.2 percent in 2005 from 11.0 percent in 2004, despite more than $900,000 in new factory start-up losses and continuing volatility in raw material costs. In both 2005 and 2004, raw material cost increases were passed on to customers with little or no profit margin.

OTHER HIGHLIGHTS

In our persistent effort to remain the most efficient and lowest cost producer in all of our product lines, we spent more than $26 million for capital improvements to increase capacity and improve operating efficiencies in 2005. We anticipate capital spending in 2006 will be in the range of $22 million to $25 million.

Over the last several years, the investment community has recognized our performance, as evidenced by our addition to the S&P Small Cap 600 Index in 2005, and our inclusion in BusinessWeek’s 2005 list of the “100 Best Small Companies”. Partially due to this recognition, and because of our continued record of quarterly and annual operating results during 2005, our stock price appreciated significantly. To broaden the market for our stock, and increase liquidity, our Board of Directors declared a two-for-one stock split effective in September 2005.

We also saw changes to our Board of Directors in 2005. After serving as a Director of Drew since 1995, Gene H. Bishop retired during 2005. We are grateful for Gene’s dedicated service to Drew and for the wisdom and common sense that he shared with the Board.

We were very fortunate that John B. Lowe, Jr. agreed to fill the vacancy on our Board. Jack is Chairman of Dallas-based TDIndustries, Inc., a national construction and facility service company, and is a director of Zale Corporation, a publicly owned specialty retailer of fine jewelry. He also serves on the board of trustees of the Dallas Independent School District, and other non-for-profit organizations. We expect to benefit greatly from his management experience and business expertise.

As always, we want to thank our employees for their dedication, innovation and hard work on behalf of Drew. We are grateful to our customers, suppliers, and associates, all of whom were critical to our achieving record results in 2005. We look forward to continued success in 2006.

Edward W. Rose, III

Chairman of the Board

Leigh J. Abrams

President and Chief Executive Officer

David Webster, President and Chief Executive Officer Kinro, Inc. Drew’s success is in large part due to the highly talented and experienced operating management of our subsidiaries, Kinro, Inc. and Lippert Components, Inc. | Jason Lippert, President and Chief Executive Officer Lippert Components, Inc. | PERFORMANCE Drew Industries continued its string of record results in 2005 with a 34 percent increase in net income and a 26 percent increase in sales, while also posting a return on equity of 24 percent and a return on assets of 12 percent. Since 2001, we have increased net income at a 39 percent annual rate on a 27 percent annual increase in sales. We have achieved record results and sustained growth by maintaining focus on product innovation, strategic acquisitions and increased market share. Drew’s success is in large part due to the highly talented and experienced operating management of our subsidiaries, Kinro, Inc. and Lippert Components, Inc., whose knowledge and insight has enabled the Company to expand rapidly and successfully, while still responding quickly to the changing needs of our customers with outstanding service and quality products. Over the last seven years, we have invested over $125 million in new plants and equipment and more than $135 million in strategic acquisitions, while also significantly expanding our R&D capabilities. These investments have enabled us to be the low-cost producer, diversify our product offerings, increase our manufacturing capabilities, and improve production efficiencies. As a result, we are a key supplier to most of the leading producers of RVs and manufactured homes. We have market shares ranging from 25 percent to more than 70 percent in most of our established product lines. Our growth has far outpaced the industries we serve. Our content per unit produced by the RV industry has quadrupled since 1999, from $243 to $980 per recreational vehicle. Our content per home produced by the manufactured housing industry has nearly tripled, from $548 to $1,506 in 2005.

|

| | | |

Recreational Vehicles Drew’s potential is enhanced by the growth prospects of the RV industry. Demographic trends favor long-term growth in the RV industry, as demand for RVs has historically been strongest among the 50 and over age group, the fastest growing segment of the population. The RV market is also bolstered by a strong advertising campaign created by the Recreational Vehicle Industry Association, which has successfully promoted the RV lifestyle among the traditional RV buyers who are over 50, as well as younger families, which today is the fastest growing segment of RV buyers. RV buyers are likely to purchase three to five RVs in their lifetime. Several of Drew’s new products are aimed at motorhomes, a new area of focus for Drew in the RV market, and specialty trailers, a market which Drew recently entered through its acquisition of Zieman Manufacturing. Other new products expanded our product offerings for travel trailers and fifth-wheel RVs. Manufactured Housing Approximately 22 million people live in more than 10 million manufactured homes across the United States. Today’s manufactured homes are a far cry from the “mobile homes” of the past. These homes now come in a wide range of styles and sizes and offer all the amenities of traditional homes, but at a lower cost. For millions of Americans, manufactured homes will continue to provide quality, affordable housing, and the opportunity to realize the American dream of home ownership. It is reported that a manufactured home costs about $36 per square foot plus costs to site the home, compared to about $86 per square foot for a comparable stick-built home. The manufactured housing industry is showing signs of recovery after a six-year decline. Driving this recovery are lower inventory levels at retail dealers, lower repossessions and improved availability of financing. Demographic trends also favor the manufactured housing industry as many retirees move to warmer climates and purchase more affordable manufactured homes. Throughout the six-year decline in the manufactured housing industry, Drew’s manufactured housing segment has been consistently profitable. We expect continued growth as the industry begins to expand. | | RECREATIONAL VEHICLES MANUFACTURED HOUSING |

| | | |

| | |

RECREATIONAL VEHICLE PRODUCTS SEGMENT | | POTENTIAL MARKET FOR NEW PRODUCTS IS ESTIMATED TO BE

$700 MILLION |

| | | Drew manufactures a growing line of products for RVs, including windows, doors, chassis, slide-out mechanisms and power units, axles, bath products and electric stabilizer jacks, primarily for travel trailers and fifth-wheel RVs. Drew’s RV segment, which also includes specialty trailers, represented 67 percent of consolidated net sales in 2005, of which approximately 95 percent were for travel trailers and fifth-wheel RVs. Over the last two years, Drew has introduced a variety of new products for the RV and specialty trailer markets, including products for the motorhome market, a new category for the Company. New products introduced in 2004 and 2005 included slide-out mechanisms and leveling devices for motorhomes, axles for towable RVs and specialty trailers, entry steps for towable RVs, and thermo-formed bath products and exterior parts for both towable RVs and motorhomes. We estimate that the market potential for these products is approximately $700 million. As of the fourth quarter of 2005, the Company’s sales of these new products were running at an annualized rate of more than $70 million, or about 10 percent of the market potential. Drew’s RV segment outperformed the industry in 2005 with a 29 percent increase in sales to a record $448 million. Excluding sales price increases and sales resulting from acquisitions, Drew’s RV segment achieved organic sales growth of approximately $66 million, or nearly 19 percent in 2005. This compares to a 14 percent industry-wide increase, which included units made specifically for FEMA in response to the demand for emergency housing for victims of the Gulf Coast hurricanes. Drew’s RV segment has maintained a consistent record of growth and profitability. In the last five years, both sales and operating profit of Drew’s RV segment have increased each year, for an aggregate increase of more than 300 percent. |

| | | |

| 67% | | RV Segment Products Account for 67%, or $448 million, of Drew’s Revenue RV Chassis and Chassis Parts: $194 million RV Windows and Doors: $112 million RV Slide-out Mechanisms: $90 million Other RV Segment Products: $52 million |

| | | |

| | | |

| | |

MANUFACTURED HOUSING PRODUCTS SEGMENT | Drew supplies a wide variety of components for manufactured homes, including vinyl and aluminum windows and screens, chassis, chassis parts, and bath and shower units. Drew’s manufactured housing (MH) segment represented 33 percent of net sales in 2005. As in the RV industry, production levels in the manufactured housing industry increased dramatically because of FEMA’s need for emergency housing for hurricane victims. As a result of this demand, beginning in September 2005, there was a significant shift in production toward smaller, single-section manufactured homes, in which Drew has substantially less product content per home. However, we still increased our average content per home produced by the industry to $1,506 in 2005 compared with $1,457 in 2004. Drew’s MH segment has outperformed the industry and remained profitable each quarter throughout the industry’s six-year decline. In 2005, MH segment operating profit increased 29 percent on a 21 percent increase in sales. Excluding sales price increases and sales resulting from acquisitions, the MH segment achieved organic sales growth of approximately $10 million, or nearly 6 percent, in 2005. This compares to a 12 percent industry-wide increase, including purchases of smaller homes by FEMA in which Drew had substantially less product content. | |

| | | |

| 33% | Segment Products Account for 33%, or $221 million, of Drew’s Revenue MH Windows and Screens: $94 million MH Chassis and Chassis Parts: $83 million MH Bath Products: $19 million Other MH Segment Products: $25 million | |

| | | |

TOP LEFT PHOTO (FROM LEFT TO RIGHT):

Edward W. Rose, III; James F. Gero; Frederick B. Hegi, Jr.;

David A. Reed; John B. Lowe, Jr.; Leigh J. Abrams;

L. Douglas Lippert; David L. Webster

BOARD OF DIRECTORS

Enhancing Stockholder Value

To enhance stockholder value by increasing sales and profitability, we seek growth through the development of new products, increased market share and acquisitions. We remain focused on properly evaluating the long-term profit potential of each expansion opportunity.

To attain our goals, we consistently follow these basic strategies:

Satisfy customer needs.

Our success stems largely from the ability of operating management to respond quickly to the changing needs of customers with quality products, outstanding service and competitive prices.

Align management incentives with stockholder interests.

Drew has a long-standing policy of motivating operating management and employees with profit incentive programs and stock compensation plans designed to align the interests of our employees with those of our stockholders.

Drew also encourages management to maintain significant equity ownership in the Company.

Remain the low-cost producer.

We continue to invest in facilities, equipment, and training programs for our highly capable employees, to ensure that we maximize production efficiencies and enhance profitability.

CORPORATE INFORMATION

BOARD OF DIRECTORS Edward W. Rose, III(1) Chairman of the Board of Drew Industries Incorporated President of Cardinal Investment Company James F. Gero(1)(2)(3) Private Investor, Chairman Orthofix International, N.V. Frederick B. Hegi, Jr.(1)(2)(3) Founding Partner Wingate Partners, Chairman United Stationers, Inc. David A. Reed(1)(2)(3) Managing Partner of Causeway Capital Partners, L.P. John B. Lowe, Jr.(1)(2)(3) Chairman of TDIndustries, Inc. Leigh J. Abrams President and Chief Executive Officer of Drew Industries Incorporated L. Douglas Lippert Chairman of Lippert Components, Inc. David L. Webster Chairman, President and Chief Executive Officer of Kinro, Inc. Members of the Committees of the Board of Directors, as follows:

(1) Compensation Committee (2) Audit Committee (3) Corporate Governance and Nominating Committee CORPORATE OFFICERS Leigh J. Abrams President and Chief Executive Officer Fredric M. Zinn Executive Vice President and Chief Financial Officer Harvey F. Milman, Esq. Vice President-Chief Legal Officer Joseph S. Giordano III Corporate Controller and Treasurer John F. Cupak Director of Internal Audit and Secretary | | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM KPMG LLP Stamford Square 3001 Summer Street Stamford, CT 06905 TRANSFER AGENT AND REGISTRAR American Stock Transfer & Trust Company 59 Maiden Lane New York, NY 10038 (212) 936-5100 (800) 937-5449 website: www.amstock.com EXECUTIVE OFFICES 200 Mamaroneck Avenue White Plains, NY 10601 (914) 428-9098 website: www.drewindustries.com E-mail: drew@drewindustries.com KINRO, INC. David L. Webster Chairman, President and Chief Executive Officer Corporate Headquarters 4381 Green Oaks Boulevard West Arlington, TX 76016 (817) 483-7791 LIPPERT COMPONENTS, INC. L. Douglas Lippert Chairman Jason D. Lippert President and Chief Executive Officer Corporate Headquarters 2766 College Avenue Goshen, IN 46526 (574) 535-2085

| | CORPORATE GOVERNANCE Copies of the Company’s Governance Principles, Guidelines for Business Conduct, Code of Ethics for Senior Financial Officers, and the Charters and Key Practices of the Audit, Compensation, and Corporate Governance and Nominating Committees are on the Company’s website, and are available upon request, without charge, by writing to: Secretary Drew Industries Incorporated 200 Mamaroneck Avenue White Plains, NY 10601 CEO/CFO CERTIFICATIONS The most recent certifications by our Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are filed as exhibits to our Form 10-K. We have also filed with the New York Stock Exchange the most recent Annual CEO Certification as required by Section 303A.12 (a) of the New York Stock Exchange Listed Company Manual.

designed by curran & connors, inc. / www.curran-connors.com |