UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

JPMorgan Trust II

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2014 through April 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan International Equity Funds

April 30, 2015 (Unaudited)

JPMorgan Emerging Economies Fund

JPMorgan Emerging Markets Equity Fund

JPMorgan Emerging Markets Equity Income Fund

JPMorgan Global Research Enhanced Index Fund

JPMorgan Global Unconstrained Equity Fund

JPMorgan International Equity Fund

JPMorgan International Equity Income Fund

(formerly JPMorgan Global Equity Income Fund)

JPMorgan International Opportunities Fund

JPMorgan International Research Enhanced Equity Fund

JPMorgan International Unconstrained Equity Fund

JPMorgan International Value Fund

JPMorgan Intrepid International Fund

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

May 12, 2015 (Unaudited)

Dear Shareholder,

The sharp divergence between U.S. economic growth and the rest of the world that marked the end of 2014 receded somewhat in 2015 as aggressive actions by central banks and a stunning drop in global oil prices brought improved economic growth and strength in financial markets. Globally, equity markets and bond market aggregate indexes provided positive returns for the six months ended April 30, 2015.

| | |

| | “The collective, if not concerted, efforts of central bankers helped to drive financial markets higher during the six month period.” |

By the start of November, the U.S. Federal Reserve had ended its multi-billion dollar bond buying program amid substantial and continued improvement in employment. Meanwhile, Japan unleashed a massive economic stimulus to counter two consecutive quarters of economic contraction and the European Central Bank moved decisively to head off the threat of a deflationary spiral. China’s central bank also undertook a series of actions to counter a slowing economy. By the end of February 2015, the nations of India, Australia, Canada, Singapore and Denmark had also enacted monetary policies to counter economic weakness.

The collective, if not concerted, efforts of central bankers helped drive financial markets higher during the six month period. Global mergers and acquisitions activity and generally healthy corporate earnings contributed to strength in equity markets. By mid April, European stock prices, as measured by the FTSEurofirst 300 Index, closed at their highest level since 2000, while China’s Shanghai Composite Index rose to close at a seven year high and Japan’s Nikkei Stock Average 225 closed above the 20,000 point level for the first time in 15 years.

After notching record closing highs in February, March and April, the Standard & Poor’s 500 Index ended the six months through April 30, 2015, with a return of 4.40%. The MSCI Europe, Australasia and Far East Index returned 7.06% and the MSCI Emerging Markets Index returned 4.04% for the same period. Among bond indexes, the Barclays U.S. Aggregate Index returned 2.06% and the Barclays Emerging Markets Aggregate Index returned 1.15% for the same period.

While U.S. financial markets continued to benefit from low interest rates, expanding corporate profits and mergers, the overall U.S. economy — after leading all other developed markets in growth through 2014 — showed signs of weakening in early 2015.

For the first quarter of 2015, U.S. gross domestic product (GDP) actually contracted by 0.7% compared with 2.2% growth for the final quarter of 2014. In hindsight, economists noted two significant drags on the domestic economy in the first three months of 2015: Severe winter weather across the eastern half of the country impeded construction and transportation and a months-long labor dispute created significant backlogs at crucial West Coast ports. The relative strength of the U.S. dollar also made exports more expensive and curbed foreign demand for U.S.-made goods.

Declines in global oil prices, while helping consumer sectors of the economy, forced energy sector companies to curtail new projects and the U.S. dollar’s strength relative to other leading currencies put pressure on the earnings of companies with large overseas operations.

While U.S. unemployment fell to 5.4% in April 2015 from 5.8% in November 2014, the pace of job growth in March was the weakest in 15 months at 85,000 total jobs added. While wage growth in the U.S. showed improvement in April, it remained weak overall, as it has throughout the economic recovery.

Meanwhile, GDP growth in the European Union (EU) rose 0.4% in the final quarter of 2014 and by 0.4% in the first three months of 2015. The euro’s weakness relative to other currencies helped drive export growth and in April 2015, EU consumer prices ended a four-month string of declines and bank lending in March 2015 rose for the first time since 2012. Further, even as the ongoing Greek debt crisis curbed investor confidence in the EU, data from countries ranging from Germany to Spain showed the economic recovery gaining strength.

The changes in the relative strengths and trajectories in the economies of the developed and emerging market nations over the course of the past six months clearly demonstrate the fluid and interconnected nature of the global economy. We believe a well diversified portfolio and a patient, long-term perspective may allow investors to benefit from positive trends while limiting the impact of negative trends.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 1 | |

J.P. Morgan International Equity Funds

MARKET OVERVIEW

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

Developed Markets

Increased central bank stimulus in the European Union and the Japanese government’s bulk purchases of equities during the six month period provided support for equity markets outside the U.S. Meanwhile, the U.S. Federal Reserve (the “Fed”) ended its own asset purchasing program but held interest rates at historical lows. U.S. equity prices remained near record highs for much of the period, supported by low interest rates, earnings growth and mergers and acquisitions activity. For the six months ended April 30, 2015, the MSCI Europe, Australasia and Far East Index returned 7.06% and the S&P 500 Index returned 4.40%.

Large bond purchases by the European Central Bank drove up prices for European sovereign debt. Yields, which generally move in the opposite direction of prices, fell on German 10 year bonds to record lows and sent fixed income investors to seek relatively higher yields from U.S. Treasury bonds. Notably, April 2015 brought fresh signs of economic growth and inflation expectations in Europe and led to sharply higher German bond yields at the end of the month.

Commodities prices generally remained under pressure during the six month period amid tepid global demand. Oil and gas prices continued to fall until hitting a bottom in mid-March. While energy prices rose steadily through April, they remained well below levels seen at the start of the six month reporting period.

Emerging Markets

Slowing growth in China drove uncertainty across emerging markets. However, the Chinese central bank took several actions aimed at stabilizing a deceleration of growth to a moderate pace. During the six month period, Chinese equity prices provided positive returns and the Shanghai Composite Index closed at a seven year high in late April.

Falling energy prices for much of the six month period also provided a boost for other emerging market nations, including India, Brazil, South Africa and Turkey. Russia, which is an energy exporting nation, was hurt by low global oil prices as well as continued economic sanctions imposed by the West. For the six month period, the MSCI Emerging Markets Index returned 4.04%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

JPMorgan Emerging Economies Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 3.96% | |

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (net of foreign withholding taxes) | | | 3.92% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | $ | 843,847 | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Economies Fund (the “Fund”) seeks long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares outperformed the MSCI Emerging Markets Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015.

The Fund’s security selection and underweight position in the consumer staples sector and its security selection in the health care sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in the financials and consumer discretionary sectors were detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Great Wall Motor Co., Pegatron Corp. and China Merchants Bank Co. Shares of Great Wall Motor, a Chinese automaker, rose on increased sales of its budget-priced sport utility vehicles. Shares of Pegatron, a Taiwanese electronics manufacturer and the main assembler of Apple Inc. products, rose on strong sales and earnings in early 2015. Shares of China Merchants Bank, a Chinese commercial bank, strengthened on solid growth in earnings.

Leading individual detractors from relative performance included the Fund’s overweight position in Kroton Educacional SA and its underweight positions in Tencent Holdings Ltd. and Ping An Insurance Co. Shares of Kroton Educacional, a Brazilian

operator of private schools, fell after the Brazilian government tightened regulations on a college loan program that provides a large portion of Kroton’s revenue. Shares of Tencent Holdings, a provider of Internet and mobile services in China, gained from continued growth in its online advertising businesses. Shares of Ping An Insurance on strong earnings growth. However, the Fund had no position in the stock, which hurt relative performance.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers used a combination of top-down and bottom-up research, seeking what they believed to be attractively priced countries, sectors and securities with positive catalysts. As a result of this process, the Fund’s largest average positions during the six months ended April 30, 2015, were in China, South Korea and Taiwan and its smallest average positions in which the Fund invested were in Egypt, Malaysia and Greece. From a sector perspective, the Fund’s largest average positions were in the information technology, financials and consumer discretionary sectors, while its smallest average positions in which it was invested were in the health care, consumer staples and materials sectors.

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 3 | |

JPMorgan Emerging Economies Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO* | |

| | 1. | | | Bank of China Ltd., Class H (China) | | | 1.9 | % |

| | 2. | | | China Merchants Bank Co., Ltd., Class H (China) | | | 1.6 | |

| | 3. | | | China CITIC Bank Corp., Ltd., Class H (China) | | | 1.4 | |

| | 4. | | | Samsung Electronics Co., Ltd. (South Korea) | | | 1.2 | |

| | 5. | | | China Construction Bank Corp., Class H (China) | | | 1.2 | |

| | 6. | | | Catcher Technology Co., Ltd. (Taiwan) | | | 1.2 | |

| | 7. | | | Lenovo Group Ltd. (China) | | | 1.2 | |

| | 8. | | | CNOOC Ltd. (China) | | | 1.2 | |

| | 9. | | | Fubon Financial Holding Co., Ltd. (Taiwan) | | | 1.2 | |

| | 10. | | | Industrial & Commercial Bank of China Ltd., Class H (China) | | | 1.2 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY* | |

| China | | | 25.0 | % |

| South Korea | | | 19.6 | |

| Taiwan | | | 12.8 | |

| Russia | | | 6.4 | |

| Brazil | | | 6.4 | |

| India | | | 6.3 | |

| Thailand | | | 5.5 | |

| Turkey | | | 5.0 | |

| Hong Kong | | | 4.8 | |

| South Africa | | | 3.7 | |

| Indonesia | | | 1.0 | |

| Others (each less than 1.0%) | | | 2.2 | |

| Short-Term Investment | | | 1.3 | |

| * | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | February 28, 2008 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | 3.83 | % | | | 6.01 | % | | | 2.87 | % | | | 0.03 | % |

With Sales Charge** | | | | | (1.64 | ) | | | 0.46 | | | | 1.76 | | | | (0.72 | ) |

CLASS C SHARES | | February 28, 2008 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 3.61 | | | | 5.49 | | | | 2.35 | | | | (0.47 | ) |

With CDSC*** | | | | | 2.61 | | | | 4.49 | | | | 2.35 | | | | (0.47 | ) |

CLASS R5 SHARES | | February 28, 2008 | | | 4.10 | | | | 6.51 | | | | 3.34 | | | | 0.49 | |

SELECT CLASS SHARES | | February 28, 2008 | | | 3.96 | | | | 6.31 | | | | 3.13 | | | | 0.28 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

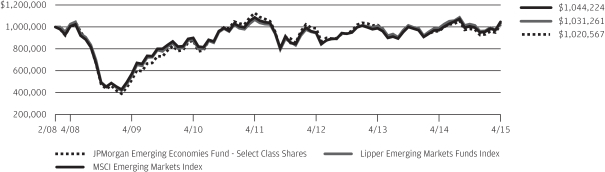

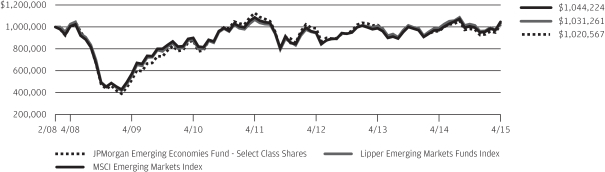

LIFE OF FUND PERFORMANCE (2/28/08 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 28, 2008.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Emerging Economies Fund, the MSCI Emerging Markets Index and the Lipper Emerging Markets Funds Index from February 28, 2008 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident individual investors who do not benefit from double taxation treaties. The performance of the Lipper Emerging Markets Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Lipper Emerging Markets Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 5 | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Institutional Class Shares)* | | | (2.98)% | |

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (net of foreign withholding taxes) | | | 3.92% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | $ | 2,088,476 | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Equity Fund (the “Fund”) seeks to provide high total return from a portfolio of equity securities from emerging markets issuers.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Institutional Class Shares underperformed the MSCI Emerging Markets Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015.

The Fund’s security selection in the consumer discretionary and financials sectors was the leading detractor from performance relative to the Benchmark. The Fund’s security selection and underweight position in the energy sector and its underweight position in the utilities sector were leading positive contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s positions in Sands China Ltd., Wynn Macau Ltd. and Baidu Inc., none of which were held in the Benchmark. Shares of Sands China and Wynn Macau, both Macau casino operators, declined as Chinese government efforts to curb corruption reduced casino traffic by wealthy customers. Shares of Baidu, a Chinese Internet portal operator, fell after the company posted revenues below analysts’ estimates.

Leading individual contributors to relative performance included the Fund’s overweight positions in Capitec Bank Holdings Ltd. and AIA Group Ltd., and its underweight position in

Petroleo Brasileiro SA (Petrobras). Shares of Capitec Bank, a South African financial services company, rose on solid earnings and revenue. Shares of AIA Group, a Hong Kong insurer and financial services company, rose on strong growth in new business. Shares of Petrobras, Brazil’s state-controlled energy company, fell amid weak global oil prices and an ongoing corruption scandal.

HOW WAS THE FUND POSITIONED?

The Fund employed an active strategy in which portfolio construction was focused on the highest-conviction ideas found at the security level. The Fund’s portfolio managers used bottom-up fundamental research to determine the Fund’s security weightings, researching companies in an attempt to determine their underlying value and potential for future earnings growth. As a result of this process, at the end of the reporting period the Fund’s largest average sector positions were the financials, information technology and consumer discretionary sectors, while the smallest average sector positions in which the Fund was invested were in the utilities, health care and telecommunication services sectors.

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO* | |

| | 1. | | | AIA Group Ltd. (Hong Kong) | | | 3.6 | % |

| | 2. | | | Taiwan Semiconductor Manufacturing Co., Ltd., ADR (Taiwan) | | | 3.1 | |

| | 3. | | | Housing Development Finance Corp., Ltd (India) | | | 2.8 | |

| | 4. | | | Tata Consultancy Services Ltd. (India) | | | 2.8 | |

| | 5. | | | Tencent Holdings Ltd. (China) | | | 2.7 | |

| | 6. | | | Bidvest Group Ltd. (The) (South Africa) | | | 2.2 | |

| | 7. | | | HDFC Bank Ltd., ADR (India) | | | 2.1 | |

| | 8. | | | Remgro Ltd. (South Africa) | | | 2.1 | |

| | 9. | | | MTN Group Ltd. (South Africa) | | | 2.0 | |

| | 10. | | | Baidu, Inc., ADR (China) | | | 1.9 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY* | |

| South Africa | | | 18.0 | % |

| India | | | 16.5 | |

| Brazil | | | 9.4 | |

| China | | | 8.9 | |

| Taiwan | | | 7.9 | |

| Russia | | | 6.9 | |

| Hong Kong | | | 6.3 | |

| Thailand | | | 5.5 | |

| South Korea | | | 4.0 | |

| Indonesia | | | 3.4 | |

| Turkey | | | 2.5 | |

| Mexico | | | 2.3 | |

| United Kingdom | | | 2.2 | |

| Peru | | | 1.5 | |

| Panama | | | 1.4 | |

| Australia | | | 1.2 | |

| Others (each less than 1.0%) | | | 1.0 | |

| Short-Term Investment | | | 1.1 | |

| * | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 7 | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | September 28, 2001 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (3.17 | )% | | | 0.82 | % | | | 1.72 | % | | | 8.47 | % |

With Sales Charge** | | | | | (8.24 | ) | | | (4.46 | ) | | | 0.63 | | | | 7.88 | |

CLASS B SHARES | | September 28, 2001 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (3.42 | ) | | | 0.30 | | | | 1.21 | | | | 8.05 | |

With CDSC*** | | | | | (8.42 | ) | | | (4.70 | ) | | | 0.82 | | | | 8.05 | |

CLASS C SHARES | | February 28, 2006 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (3.39 | ) | | | 0.31 | | | | 1.21 | | | | 7.93 | |

With CDSC**** | | | | | (4.39 | ) | | | (0.69 | ) | | | 1.21 | | | | 7.93 | |

CLASS R6 SHARES | | December 13, 2013 | | | (2.90 | ) | | | 1.33 | | | | 2.15 | | | | 8.94 | |

INSTITUTIONAL CLASS SHARES | | November 15, 1993 | | | (2.98 | ) | | | 1.25 | | | | 2.13 | | | | 8.92 | |

SELECT CLASS SHARES | | September 10, 2001 | | | (3.03 | ) | | | 1.10 | | | | 1.97 | | | | 8.75 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

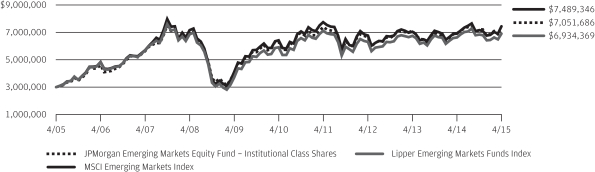

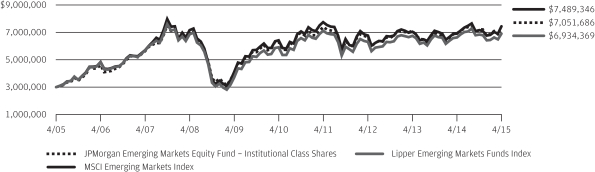

TEN YEAR PERFORMANCE (4/30/05 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to its inception date are based on the performance of Class B Shares. The actual returns of Class C Shares would have been similar to those shown because Class C Shares have expenses similar to those of Class B Shares.

Returns for Class R6 Shares prior to its inception date are based on the performance of Institutional Class Shares. The actual returns of R6 Shares would have been different than those shown because R6 Shares have different expenses than Institutional Class Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Emerging Markets Equity Fund, the MSCI Emerging Markets Index and the Lipper Emerging Markets Funds Index from April 30, 2005 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident individual investors who do not benefit from double taxation treaties. The performance of the Lipper Emerging Markets Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The MSCI

Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Lipper Emerging Markets Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category, as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B shares automatically convert to Class A shares after 8 years, the 10 Year average annual total return shown above for Class B reflects Class A performance for the period after conversion. The Board of Trustees of the Fund has approved the automatic conversion of the Fund’s Class B Shares into Class A Shares on June 19, 2015. On June 19, 2015, all Class B Shares of the Fund will automatically convert to Class A Shares of the Fund.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

JPMorgan Emerging Markets Equity Income Fund

FUND COMMENTARY

FOR THE PERIOD DECEMBER 12, 2014 (FUND INCEPTION DATE) THROUGH APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 4.96% | |

| Morgan Stanley Capital International (“MSCI”) Emerging Markets Index (net of foreign withholding taxes) | | | 12.42% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | | $3,175 | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Equity Income Fund (the “Fund”) seeks to provide both current income and long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares underperformed the MSCI Emerging Markets Index (net of foreign withholding taxes) (the “Benchmark”) from its inception on December 12, 2014 to April 30, 2015.

The Fund’s security selection and overweight position in the information technology sector and its security selection in the consumer discretionary sector were leading detractors from relative performance for the reporting period. The Fund’s security selection in the financials and materials sectors was a leading contributor to performance relative to the Benchmark for the reporting period.

Leading individual detractors from relative performance included the Fund’s overweight positions in Wynn Macau Ltd. and Pt. Perusahaan Gas Negara and its underweight position in Tencent Holdings Ltd. Shares of Wynn Macau, an operator of casino resorts, declined as Chinese government efforts to curb corruption reduced casino traffic among wealthy customers. Perusahaan Gas, an Indonesian natural gas producer, declined in line with other energy sector companies amid weakness in oil and gas prices. Shares of Tencent Holdings, a provider of Internet and mobile services in China, gained from continued growth in its online advertising businesses.

Leading individual contributors to relative performance included the Fund’s overweight positions in Lukoil OAO, OTP Bank Nyrt and Mobile Telesystems OAO. Shares of Lukoil, a Russian oil and natural gas company, rose after the company reaffirmed its commitment to start production at the Filanovsky field in the Caspian Sea. Shares of OTP Bank Nyrt, Hungary’s largest bank, rose after the company forecast a profit for 2015. Shares of Mobile Telesystems, a Russian telecommunications services company, strengthened on solid earnings and revenue growth.

HOW THE FUND WAS MANAGED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to security selection, rigorously researching companies in an attempt to determine their underlying value and potential for future growth. The Fund’s portfolio managers looked for dividend yielding equity securities that they believed were undervalued and possessed the long-term earnings power and strong cash flow generation that would enable them to grow their dividends. In addition, the Fund employed futures and currency forwards to help manage cash flows and attempt to manage the Fund’s currency exposure.

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 9 | |

JPMorgan Emerging Markets Equity Income Fund

FUND COMMENTARY

FOR THE PERIOD DECEMBER 12, 2014 (FUND INCEPTION DATE) THROUGH APRIL 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO* | |

| | 1. | | | China Construction Bank Corp., Class H (China) | | | 2.5 | % |

| | 2. | | | Taiwan Semiconductor Manufacturing Co., Ltd., ADR (Taiwan) | | | 2.4 | |

| | 3. | | | MTN Group Ltd. (South Africa) | | | 2.4 | |

| | 4. | | | Industrial & Commercial Bank of China Ltd., Class H (China) | | | 2.4 | |

| | 5. | | | China Mobile Ltd. (Hong Kong) | | | 2.4 | |

| | 6. | | | Bank of China Ltd., Class H (China) | | | 2.3 | |

| | 7. | | | Siam Cement PCL (The), NVDR (Thailand) | | | 2.3 | |

| | 8. | | | Siliconware Precision Industries Co., Ltd. (Taiwan) | | | 2.2 | |

| | 9. | | | Bidvest Group Ltd. (The) (South Africa) | | | 2.1 | |

| | 10. | | | MediaTek, Inc. (Taiwan) | | | 2.1 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY* | |

| Taiwan | | | 22.0 | % |

| South Africa | | | 13.0 | |

| China | | | 10.6 | |

| Brazil | | | 10.2 | |

| Hong Kong | | | 8.1 | |

| Russia | | | 6.9 | |

| South Korea | | | 5.8 | |

| Turkey | | | 5.2 | |

| Thailand | | | 4.3 | |

| United States | | | 2.3 | |

| Mexico | | | 2.1 | |

| Chile | | | 1.9 | |

| Poland | | | 1.8 | |

| Indonesia | | | 1.6 | |

| Hungary | | | 1.5 | |

| Singapore | | | 1.4 | |

| United Arab Emirates | | | 1.3 | |

| * | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | |

TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | |

| | | INCEPTION DATE OF

CLASS | | SINCE

INCEPTION* | |

CLASS A SHARES | | December 12, 2014 | | | | |

Without Sales Charge | | | | | 4.83 | % |

With Sales Charge** | | | | | (0.67 | ) |

CLASS C SHARES | | December 12, 2014 | | | | |

Without CDSC | | | | | 4.62 | |

With CDSC*** | | | | | 3.62 | |

CLASS R5 SHARES | | December 12, 2014 | | | 5.03 | |

CLASS R6 SHARES | | December 12, 2014 | | | 5.03 | |

SELECT CLASS SHARES | | December 12, 2014 | | | 4.96 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

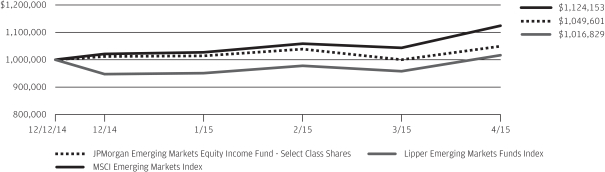

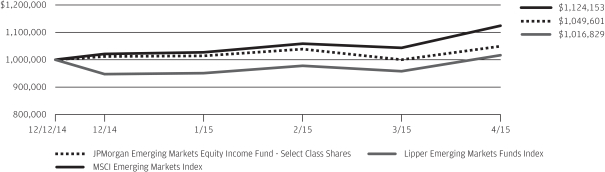

LIFE OF FUND PERFORMANCE (12/12/14 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on December 12, 2014.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Emerging Markets Equity Income Fund, the MSCI Emerging Markets Index and the Lipper Emerging Markets Funds Index from December 12, 2014 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident individual investors who do not benefit from double taxation treaties. The performance of the Lipper Emerging Markets Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the

Fund. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Lipper Emerging Markets Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category, as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 11 | |

JPMorgan Global Research Enhanced Index Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 4.41% | |

| Morgan Stanley Capital International (“MSCI”) World Index (net of foreign withholding taxes)1 | | | 5.09% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | | $6,528,573 | |

INVESTMENT OBJECTIVE**

The JPMorgan Global Research Enhanced Index Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares underperformed the MSCI World Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015. The Fund’s security selection in the basic industries and health care sectors detracted from performance relative to the Benchmark for the six month reporting period. The Fund’s security selection in the technology-hardware and autos sectors made a positive contribution to relative performance.

Due to the Fund’s holdings of a relatively large number of securities during the period, the impact of individual holdings on the Fund’s relative performance tended to be small.

HOW WAS THE FUND POSITIONED?

The Fund sought to outperform the Benchmark over time, while seeking to achieve sector, geographic and risk characteristics similar to that of the Benchmark. Using the fundamental equity insights generated by JPMorgan’s team of analysts, the Fund’s portfolio managers implemented an overweight position in securities included within the universe of the Benchmark that they considered undervalued, while underweighting or not holding securities in the Benchmark that they considered overvalued. During the reporting period, the Fund’s portfolio managers used exchange-traded funds and futures to help manage cash flows.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Apple, Inc. (United States) | | | 2.2 | % |

| | 2. | | | Microsoft Corp. (United States) | | | 1.3 | |

| | 3. | | | Wells Fargo & Co. (United States) | | | 1.0 | |

| | 4. | | | Exxon Mobil Corp. (United States) | | | 0.9 | |

| | 5. | | | Johnson & Johnson (United States) | | | 0.9 | |

| | 6. | | | Nestle S.A. (Switzerland) | | | 0.8 | |

| | 7. | | | Roche Holding AG (Switzerland) | | | 0.8 | |

| | 8. | | | Pfizer, Inc. (United States) | | | 0.7 | |

| | 9. | | | Procter & Gamble Co. (The) (United States) | | | 0.7 | |

| | 10. | | | Verizon Communications, Inc. (United States) | | | 0.7 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| United States | | | 53.5 | % |

| Japan | | | 8.4 | |

| United Kingdom | | | 7.3 | |

| Switzerland | | | 4.1 | |

| France | | | 3.9 | |

| Germany | | | 3.7 | |

| Canada | | | 3.6 | |

| Australia | | | 2.5 | |

| Netherlands | | | 1.5 | |

| Spain | | | 1.3 | |

| Hong Kong | | | 1.1 | |

| Ireland | | | 1.0 | |

| Italy | | | 1.0 | |

| Others (each less than 1.0%) | | | 3.6 | |

| Short-Term Investment | | | 3.5 | |

| 1 | | MSCI World Index is a registered service mark of Morgan Stanley Capital International, which does not sponsor and is in no way affiliated with the Fund. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | February 28, 2013 | | | | | | | | | | | | |

Without Sales Charge | | | | | 4.34 | % | | | 7.37 | % | | | 13.83 | % |

With Sales Charge** | | | | | (1.14 | ) | | | 1.74 | | | | 11.03 | |

CLASS C SHARES | | February 28, 2013 | | | | | | | | | | | | |

Without CDSC | | | | | 4.01 | | | | 6.81 | | | | 13.24 | |

With CDSC*** | | | | | 3.01 | | | | 5.81 | | | | 13.24 | |

CLASS R2 SHARES | | February 28, 2013 | | | 4.15 | | | | 7.06 | | | | 13.52 | |

SELECT CLASS SHARES | | February 28, 2013 | | | 4.41 | | | | 7.61 | | | | 14.10 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

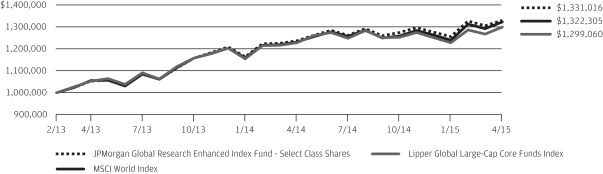

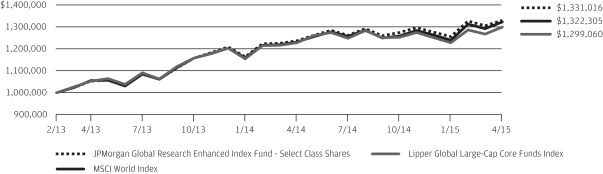

LIFE OF FUND PERFORMANCE (2/28/13 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 28, 2013.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Global Research Enhanced Index Fund, the MSCI World Index and the Lipper Global Large-Cap Core Funds Index from February 28, 2013 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI World Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Global Large-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Lipper Global Large-Cap Core Funds Index is an index based on the total returns of certain mutuals funds within the Fund’s designated category, as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also,

performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 13 | |

JPMorgan Global Unconstrained Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 7.39% | |

| Morgan Stanley Capital International (“MSCI”) All Country World Index (net of foreign withholding taxes) | | | 4.97% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | | $4,947 | |

INVESTMENT OBJECTIVE**

The JPMorgan Global Unconstrained Equity Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares outperformed the MSCI All Country World Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015.

The Fund’s security selection in the financials and industrials sectors was a leading contributor to performance relative to the Benchmark for the six month reporting period. The Fund’s security selection in the consumer discretionary sector and the information technology sector was a leading detractor from relative performance. By region, the Fund’s security selection in emerging markets and Continental Europe was a leading contributor to relative performance, while the Fund’s security selection in the Pacific region, excluding Japan, and its underweight position in Japan were leading detractors from relative performance.

Leading individual contributors to the Fund’s relative performance included overweight positions in Boston Scientific Corp., China Merchants Bank Co. and Industrial and Commercial Bank of China Ltd. Shares of Boston Scientific, a U.S. medical device manufacturer, rose after the company settled a long-running legal dispute with Johnson & Johnson and continued to deliver strong earnings. Shares of both China Merchants Bank and Industrial and Commercial Bank of China strengthened as China’s government took steps to counter slowing economic growth.

Leading individual detractors from the Fund’s relative performance included overweight positions in Sand China Ltd., MEG Energy Corp and Baidu Inc. Shares of Sands China, a Macau casino operator, fell as the Chinese government’s effort to curb corruption reduced casino traffic among wealthy customers. Shares of MEG Energy, a Canadian energy company focused on the Alberta oils sands region, declined on global weakness in oil prices. Shares of Baidu, a Chinese Internet portal operator not held in the Benchmark, fell after the company reported lower-than-expected earnings and a weak forecast for 2015.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers combined a contrarian approach with bottom-up fundamental research to construct a global portfolio of what they believed were undervalued companies,

characterized by sustainability of earnings, strong free cash flow and the ability to increase earnings faster than their sector peers.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Citigroup, Inc. (United States) | | | 3.2 | % |

| | 2. | | | Google, Inc., Class C (United States) | | | 3.1 | |

| | 3. | | | Twenty-First Century Fox, Inc., Class A (United States) | | | 2.9 | |

| | 4. | | | Baidu, Inc., ADR (China) | | | 2.8 | |

| | 5. | | | Johnson & Johnson (United States) | | | 2.8 | |

| | 6. | | | BG Group plc (United Kingdom) | | | 2.8 | |

| | 7. | | | Barclays plc (United Kingdom) | | | 2.7 | |

| | 8. | | | Sanofi (France) | | | 2.4 | |

| | 9. | | | MetLife, Inc. (United States) | | | 2.4 | |

| | 10. | | | Novartis AG (Switzerland) | | | 2.4 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| United States | | | 49.1 | % |

| United Kingdom | | | 8.1 | |

| France | | | 7.3 | |

| China | | | 7.2 | |

| Switzerland | | | 5.5 | |

| Canada | | | 2.5 | |

| South Korea | | | 2.4 | |

| Spain | | | 2.2 | |

| Israel | | | 2.0 | |

| Japan | | | 1.9 | |

| Germany | | | 1.6 | |

| Netherlands | | | 1.2 | |

| Hong Kong | | | 1.2 | |

| Ireland | | | 1.0 | |

| Others (each less than 1.0%) | | | 3.5 | |

| Short-Term Investment | | | 3.3 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 3 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | November 30, 2011 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | 7.15 | % | | | 9.27 | % | | | 13.39 | % | | | 14.91 | % |

With Sales Charge** | | | | | 1.54 | | | | 3.55 | | | | 11.36 | | | | 13.11 | |

CLASS C SHARES | | November 30, 2011 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 6.91 | | | | 8.76 | | | | 12.82 | | | | 14.34 | |

With CDSC*** | | | | | 5.91 | | | | 7.76 | | | | 12.82 | | | | 14.34 | |

CLASS R2 SHARES | | November 30, 2011 | | | 7.03 | | | | 8.99 | | | | 13.09 | | | | 14.62 | |

CLASS R5 SHARES | | November 30, 2011 | | | 7.40 | | | | 9.80 | | | | 13.91 | | | | 15.43 | |

CLASS R6 SHARES | | November 30, 2011 | | | 7.45 | | | | 9.85 | | | | 13.96 | | | | 15.49 | |

SELECT CLASS SHARES | | November 30, 2011 | | | 7.39 | | | | 9.63 | | | | 13.71 | | | | 15.22 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

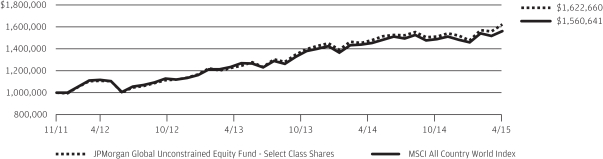

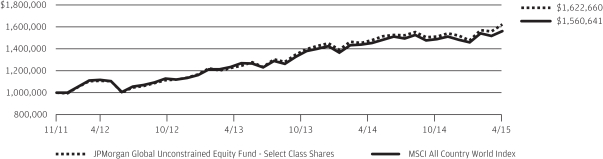

LIFE OF FUND PERFORMANCE (11/30/11 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on November 30, 2011.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Global Unconstrained Equity Fund and the MSCI All Country World Index from November 30, 2011 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI All Country World Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through January 5, 2015, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 15 | |

JPMorgan International Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Select Class Shares)* | | | 7.36% | |

| Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index (net of foreign withholding taxes) | | | 6.81% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | | $2,809,702 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Fund (the “Fund”) seeks total return from long-term capital growth and income. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares outperformed the MSCI EAFE Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015.

The Fund’s security selection in the financials and energy sectors was a leading contributor to performance relative to the Benchmark during the six month reporting period. The Fund’s security selection in the consumer discretionary and industrials sectors was a leading detractor from relative performance.

Leading individual contributors to the Fund’s relative performance included the Fund’s overweight positions in Ping An Insurance Group Co., Cheung Kong Holdings Ltd. and China Overseas Land & Investment Ltd. Shares of Ping An Insurance Group Co., a Chinese insurer, and China Overseas Land, a Chinese real estate and investment company, rose amid China’s efforts to counter slowing economic growth. Shares of Cheung Kong, a Hong Kong property developer and conglomerate, rose on news that the company, along with its Hutchison Whampoa affiliate, was revamping its organizational structure to separate Chinese real estate activities from the rest of the business.

Leading individual detractors from the Fund’s relative performance included its overweight positions in Sands China Ltd., Wynn Macau Ltd. and Komatsu Ltd. Shares of Sands China and Wynn Macau, both resort casino operators in Macau, came under pressure as the Chinese government’s effort to curb corruption reduced casino traffic among wealth customers. Shares of Komatsu, a Japanese construction equipment maker, declined as a pullback in mining company equipment purchases resulted in earnings weakness.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on security selection to build a portfolio of international equities. They used bottom-up fundamental research to identify what they

believed were attractively priced securities of well-managed companies with the potential to grow their earnings faster than their industry peers.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | BG Group plc (United Kingdom) | | | 2.6 | % |

| | 2. | | | Novartis AG (Switzerland) | | | 2.5 | |

| | 3. | | | HSBC Holdings plc (United Kingdom) | | | 2.3 | |

| | 4. | | | Vodafone Group plc (United Kingdom) | | | 2.2 | |

| | 5. | | | Toyota Motor Corp. (Japan) | | | 2.2 | |

| | 6. | | | Roche Holding AG (Switzerland) | | | 2.1 | |

| | 7. | | | Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 2.0 | |

| | 8. | | | CK Hutchison Holdings Ltd. (Hong Kong) | | | 2.0 | |

| | 9. | | | Nestle S.A. (Switzerland) | | | 1.9 | |

| | 10. | | | Japan Tobacco, Inc. (Japan) | | | 1.9 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| United Kingdom | | | 21.8 | % |

| Japan | | | 19.4 | |

| Switzerland | | | 14.8 | |

| France | | | 11.6 | |

| Germany | | | 8.7 | |

| Netherlands | | | 4.9 | |

| Hong Kong | | | 4.4 | |

| China | | | 3.0 | |

| South Korea | | | 1.9 | |

| Australia | | | 1.6 | |

| Belgium | | | 1.5 | |

| Israel | | | 1.0 | |

| Others (each less than 1.0%) | | | 3.7 | |

| Short-Term Investment | | | 1.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 28, 2002 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | 7.23 | % | | | 2.58 | % | | | 6.97 | % | | | 5.20 | % |

With Sales Charge** | | | | | 1.63 | | | | (2.81 | ) | | | 5.82 | | | | 4.64 | |

CLASS B SHARES | | February 28, 2002 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 6.98 | | | | 2.02 | | | | 6.43 | | | | 4.73 | |

With CDSC*** | | | | | 1.98 | | | | (2.98 | ) | | | 6.12 | | | | 4.73 | |

CLASS C SHARES | | January 31, 2003 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 6.98 | | | | 2.06 | | | | 6.43 | | | | 4.63 | |

With CDSC**** | | | | | 5.98 | | | | 1.06 | | | | 6.43 | | | | 4.63 | |

CLASS R2 SHARES | | November 3, 2008 | | | 7.08 | | | | 2.31 | | | | 6.68 | | | | 5.02 | |

CLASS R5 SHARES | | May 15, 2006 | | | 7.49 | | | | 3.00 | | | | 7.45 | | | | 5.64 | |

CLASS R6 SHARES | | November 3, 2010 | | | 7.51 | | | | 3.11 | | | | 7.49 | | | | 5.67 | |

SELECT CLASS SHARES | | January 1, 1997 | | | 7.36 | | | | 2.78 | | | | 7.22 | | | | 5.46 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

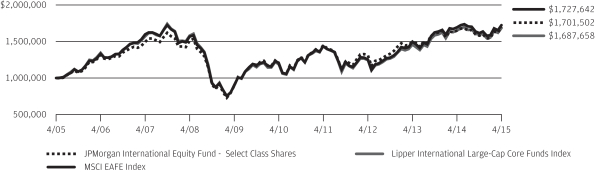

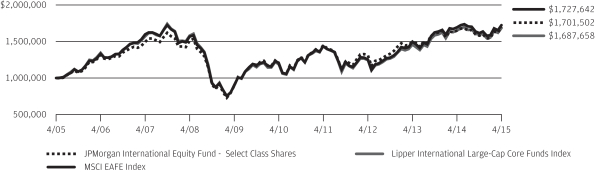

TEN YEAR PERFORMANCE (4/30/05 TO 4/30/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 Shares prior to its inception date are based on the performance of Class A Shares. The actual returns of R2 Shares would have been lower than those shown because R2 Shares have higher expenses than Class A Shares.

Returns for Class R5 Shares prior to its inception date are based on the performance of Select Class Shares. The actual returns of Class R5 Shares would have been different than those shown because Class R5 Shares have different expenses than Select Class Shares.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class R5 Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan International Equity Fund, the MSCI EAFE Index and the Lipper International Large-Cap Core Funds Index from April 30, 2005 to April 30, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the Lipper International Large-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The Lipper International Large-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category, as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 17 | |

JPMorgan International Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited) (continued)

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion. The Board of Trustees of the Fund has approved the automatic conversion of the Fund’s Class B Shares into

Class A Shares on June 19, 2015. On June 19, 2015, all Class B Shares of the Fund will automatically convert to Class A Shares of the Fund.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

JPMorgan International Equity Income Fund1

(formerly JPMorgan Global Equity Income Fund)

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 6.18% | |

| Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index (net of foreign withholding taxes)2 | | | 6.81% | |

| Morgan Stanley Capital International (“MSCI”) All County World Index (net of foreign withholding taxes) | | | 4.97% | |

| |

| Net Assets as of 4/30/2015 (In Thousands) | | | $98,925 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Income Fund (the “Fund”) seeks to provide current income and long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Select Class Shares underperformed the MSCI EAFE Index (net of foreign withholding taxes) (the “Benchmark”) for the six months ended April 30, 2015.

The Fund’s security selection in the health care and insurance sectors was a leading detractor from performance relative to the Benchmark for the six month reporting period. The Fund’s security selection and underweight positions in the consumer non-durables and banks sectors was a leading positive contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Suncorp Group Ltd., Johnson & Johnson and Microsoft Corp. Shares of Suncorp Group, an Australian banking and insurance company, declined on investor worries about the company’s exposure to damage from cyclone Marcia. Shares of Johnson & Johnson, a U.S. diversified health care products company, weakened on investor concerns about increased competition for a number of its best selling products and the negative impact of a strong U.S. dollar relative to other companies. Shares of Microsoft, a U.S. provider of computer software and services, fell after the company reported disappointing sales for its Windows operating system and issued a cautious earnings forecast.

Leading individual contributors to relative performance included the Fund’s overweight positions in Man Group PLC, Japan Tobacco Inc. and Mitsubishi UFJ Financial Group. Shares of Man Group, a U.K. asset management company, rose on

investor expectations that the strong performance of its flagship investment fund would lead to an increase in assets under management. Shares of Japan Tobacco strengthened on investor expectations of an increased dividend payment. Shares of Mitsubishi UFJ Financial, a Japanese banking company, rose amid signs of improvement in the Japanese economy and the company’s plan to repurchase shares and increase its dividend payment.

HOW THE FUND WAS MANAGED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to security selection, rigorously researching companies in an attempt to determine their underlying value and potential for future growth. The Fund’s portfolio managers looked for dividend yielding equity securities that they believed were undervalued and possessed the long-term earnings power and strong cash flow generation that would enable them to grow their dividends. In addition, the Fund employed futures and currency forwards to help manage cash flows and attempt to manage the Fund’s currency exposure.

| 1 | | Effective January 30, 2015, the Fund’s name was changed from “JPMorgan Global Equity Income Fund” and the Fund’s investment strategy was changed. |

| 2 | | Effective January 30, 2015, the Fund’s primary benchmark changed from the MSCI All Country World Index (net of foreign withholding taxes) to the MSCI EAFE Index (net of foreign withholding taxes) to more closely align the Fund’s primary benchmark with its investment strategies. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | |

| | | |

| APRIL 30, 2015 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 19 | |

JPMorgan International Equity Income Fund

(formerly JPMorgan Global Equity Income Fund)

FUND COMMENTARY

SIX MONTHS ENDED APRIL 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO* | |

| | 1. | | | Japan Tobacco, Inc. (Japan) | | | 3.2 | % |

| | 2. | | | DNB ASA (Norway) | | | 2.9 | |

| | 3. | | | Toyota Motor Corp. (Japan) | | | 2.8 | |

| | 4. | | | Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 2.6 | |

| | 5. | | | Nippon Telegraph & Telephone Corp. (Japan) | | | 2.2 | |

| | 6. | | | Accor S.A. (France) | | | 2.0 | |

| | 7. | | | ING Groep N.V., CVA (Netherlands) | | | 2.0 | |

| | 8. | | | Hitachi Ltd. (Japan) | | | 1.9 | |

| | 9. | | | Seven & I Holdings Co., Ltd. (Japan) | | | 1.8 | |

| | 10. | | | Telefonica S.A. (Spain) | | | 1.8 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY* | |

| United Kingdom | | | 22.3 | % |

| Japan | | | 20.4 | |

| Germany | | | 7.3 | |

| Switzerland | | | 6.6 | |

| Australia | | | 5.7 | |

| France | | | 5.6 | |

| Netherlands | | | 5.6 | |

| Israel | | | 3.3 | |

| Norway | | | 2.9 | |

| Spain | | | 2.7 | |

| Finland | | | 2.3 | |

| Taiwan | | | 2.0 | |

| China | | | 1.8 | |

| Sweden | | | 1.8 | |

| Hong Kong | | | 1.7 | |

| South Africa | | | 1.2 | |

| South Korea | | | 1.1 | |

| Italy | | | 1.1 | |

| Others (each less than 1.0%) | | | 1.7 | |

| Short-Term Investment | | | 2.9 | |

| * | | Percentages indicated are based on total investments as of April 30, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 20 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | APRIL 30, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF APRIL 30, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 3 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | February 28, 2011 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | 6.00 | % | | | 5.25 | % | | | 11.27 | % | | | 6.92 | % |

With Sales Charge** | | | | | 0.43 | | | | (0.26 | ) | | | 9.28 | | | | 5.54 | |

CLASS C SHARES | | February 28, 2011 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 5.69 | | | | 4.75 | | | | 10.72 | | | | 6.38 | |

With CDSC*** | | | | | 4.69 | | | | 3.75 | | | | 10.72 | | | | 6.38 | |

CLASS R2 SHARES | | February 28, 2011 | | | 5.86 | | | | 4.97 | | | | 10.97 | | | | 6.63 | |

CLASS R5 SHARES | | February 28, 2011 | | | 6.24 | | | | 5.73 | | | | 11.76 | | | | 7.39 | |

CLASS R6 SHARES | | January 30, 2015 | | | 6.13 | | | | 5.61 | | | | 11.72 | | | | 7.36 | |

SELECT CLASS SHARES | | February 28, 2011 | | | 6.18 | | | | 5.55 | | | | 11.56 | | | | 7.19 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

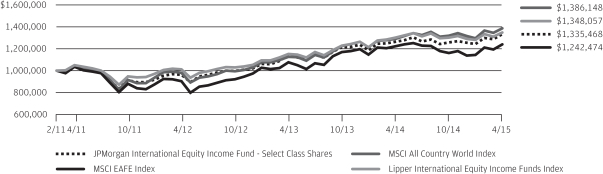

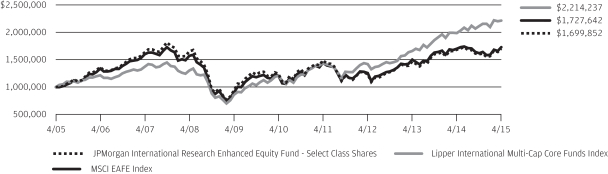

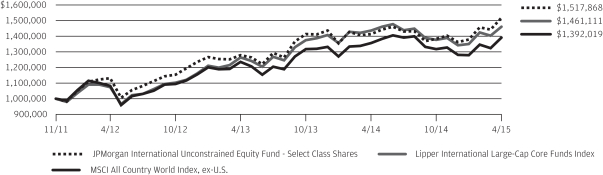

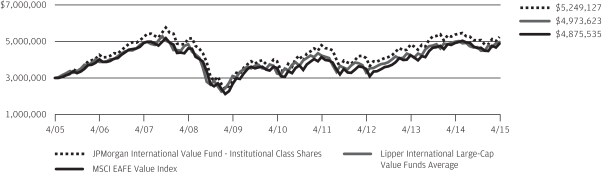

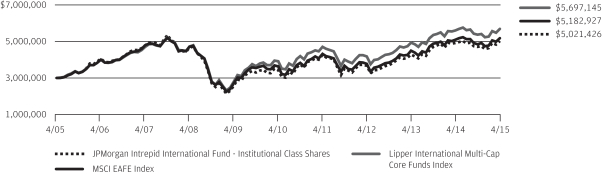

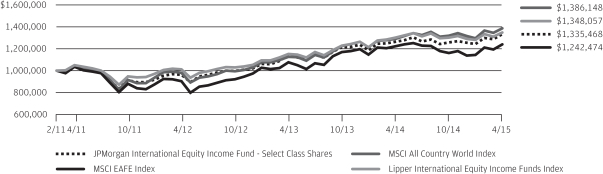

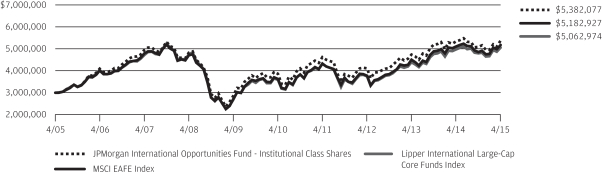

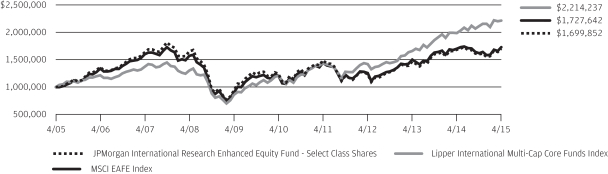

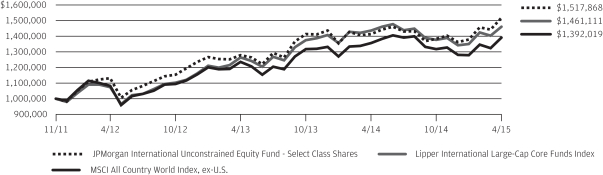

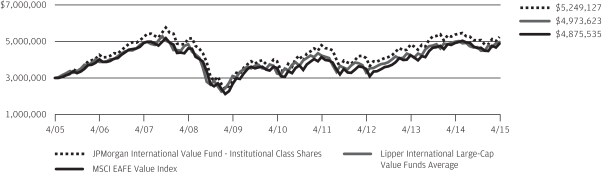

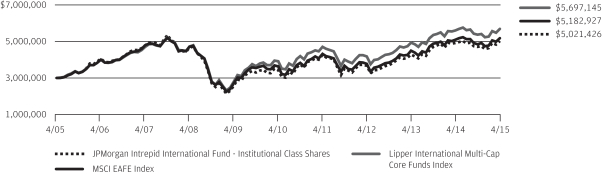

LIFE OF FUND PERFORMANCE (2/28/11 TO 4/30/15)