Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-04236

JPMorgan Trust II

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800)480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2019 through December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1).

Table of Contents

Semi-Annual Report

J.P. Morgan Small Cap Funds

December 31, 2019 (Unaudited)

JPMorgan Small Cap Blend Fund

JPMorgan Small Cap Core Fund

JPMorgan Small Cap Equity Fund

JPMorgan Small Cap Growth Fund

JPMorgan Small Cap Value Fund

JPMorgan U.S. Small Company Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ websitewww.jpmorganfunds.comand you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan) or, if you are a direct investor, by going towww.jpmorganfunds.com/edelivery.

You may elect to receive paper copies of all future reports free of charge. Contact your financial intermediary or, if you invest directly with the Funds, email us atfunds.website.support@jpmorganfunds.comor call 1-800-480-4111. Your election to receive paper reports will apply to all funds held within your account(s).

Table of Contents

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Table of Contents

February 10, 2020 (Unaudited)

Dear Shareholders,

We’ve entered 2020 with strong momentum at J.P. Morgan Asset Management, propelled by a strong 2019 for financial markets that included a 31.5% total return in the S&P 500 Index.

|

“Regardless of the market environment, our goal remains to be the most trusted asset manager in the world by using the unique breadth of capabilities to provide our clients and shareholders with the insights and solutions they need to achieve their long-term goals.” — Andrea L. Lisher |

At the end of July 2019, the U.S. Federal Reserve responded to signs of a weakening economy by cutting interest rates for the first time in more than a decade and proceeded to cut rates two more times in 2019. Financial markets responded favorably and the S&P 500 Index reached record highs in late October. Global equity prices were also supported by easing U.S.-China trade tensions, continued growth in corporate profits and accommodative policies of leading global central banks, including a reduction in interest rates and a resumption of monthly asset purchases by the European Central Bank. These tailwinds overshadowed investor concerns about Brexit and weak economic data, allowing for a strong second half of 2019 for financial markets.

While 2019 was largely a rewarding year for investors, 2020 may bring increased market volatility amid geo-political tensions, U.S. elections and a U.S. economy that appears to be in the late stages of a record long expansion. Additionally, the strong equity market returns of the past year may be hard to replicate. On the other hand, we believe leading central banks have clearly signaled they will remain supportive of continued economic expansion, which should benefit financial markets. We believe investors who maintain a well-diversified portfolio and a long-term outlook will be best positioned in the year ahead.

Regardless of the market environment, our goal remains to be the most trusted asset manager in the world by using the unique breadth of capabilities to provide our clients and shareholders with the insights and solutions they need to achieve their long-term goals.

On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your assets. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

Table of Contents

J.P. Morgan Small Cap Funds

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

Equity markets largely provided positive returns for the reporting period on the back of low interest rates, continued corporate profit growth and an easing of U.S.-China trade tensions. Overall, U.S. equity outperformed other equity markets as well as fixed income markets.

In response to slowing economic growth and continued low inflation, the U.S. Federal Reserve in late July 2019 cut interest rates for the first time in more than a decade. The central bank followed with another cut in mid-September and another at the end of October. Equity investors responded to lower interest rates by driving stock prices higher and by the end of October leading equity U.S. indexes had returned to record highs. Within U.S. large cap stocks, growth stocks mostly outperformed value stocks but within mid cap and small cap stocks, value generally outperformed growth.

Bond markets generally provided positive returns for the second half of 2019, led by U.S. high yield bonds (also known as “junk bonds”) and emerging markets debt. Investment grade U.S. corporate debt provided modest returns while yields on U.S. Treasury bonds fell during the period. For the six months ended December 31, 2019, the S&P 500 returned 10.9% and the Russell 2000 Index returned 7.3%.

| 2 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 8.11% | |||

| Russell 2000 Index | 7.30% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $ | 438,912 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Blend Fund (the “Fund”) seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, outperformed the Russell 2000 Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection in the industrials and its underweight position in the energy sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in the consumer discretionary and information technology sectors was a leading detractor from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Nevro Corp. and Generac Holdings Inc. and its out-of-Benchmark position in Horizon Therapeutics PLC. Shares of Nevro, a medical devices maker, rose after the company reported better-than-expected results for the third quarter of 2019 and raised its 2019 revenue forecast. Shares of Generac Holdings, a maker of electrical generators and related products, rose amid scheduled electricity blackouts in California and natural disasters elsewhere during the reporting period. Shares of Horizon Therapeutics, a pharmaceuticals company, rose after an advisory committee of the U.S. Food and Drug Administration recommended approval of the company’s drug for thyroid eye disease.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark positions in Farfetch Ltd. and Pluralsight Inc. and its underweight position in Medicines Co. Shares of Farfetch, a U.K. online luxury fashion retailer, fell after the company reported a wider-than-expected loss for the second quarter of 2019. Shares of Pluralsight, a provider of a cloud-based technology learning platform, fell after the company reported weak results for the second quarter of 2019. Shares of Medicines, a German pharmaceutical company not held in the Fund, rose ahead of its acquisition by Novartis AG.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies in an effort to construct a portfolio of companies that are attractively valued and stocks that have a history of growth. The Fund’s

portfolio managers preferred to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate consistent earnings. The Fund is positioned to invest in small cap companies across both growth and value styles.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | ITT, Inc. | 1.2 | % | |||||

| 2. | Simpson Manufacturing Co., Inc. | 1.1 | ||||||

| 3. | Performance Food Group Co. | 1.0 | ||||||

| 4. | Generac Holdings, Inc. | 0.9 | ||||||

| 5. | Teladoc Health, Inc. | 0.9 | ||||||

| 6. | MSA Safety, Inc. | 0.9 | ||||||

| 7. | Littelfuse, Inc. | 0.8 | ||||||

| 8. | Amedisys, Inc. | 0.8 | ||||||

| 9. | Applied Industrial Technologies, Inc. | 0.8 | ||||||

| 10. | John Bean Technologies Corp. | 0.8 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Industrials | 19.2 | % | ||

| Information Technology | 15.3 | |||

| Financials | 14.0 | |||

| Health Care | 13.0 | |||

| Consumer Discretionary | 10.5 | |||

| Real Estate | 6.3 | |||

| Communication Services | 4.1 | |||

| Utilities | 3.3 | |||

| Consumer Staples | 2.5 | |||

| Materials | 1.8 | |||

| Energy | 1.3 | |||

| Short-Term Investments | 8.7 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 3 | ||||||

Table of Contents

JPMorgan Small Cap Blend Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019 | ||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

CLASS A SHARES | May 19, 1997 | |||||||||||||||||

With Sales Charge** | 2.41 | % | 23.32 | % | 12.11 | % | 14.06 | % | ||||||||||

Without Sales Charge | 8.11 | 30.15 | 13.33 | 14.67 | ||||||||||||||

CLASS C SHARES | January 7, 1998 | |||||||||||||||||

With CDSC*** | 6.88 | 28.60 | 12.77 | 14.08 | ||||||||||||||

Without CDSC | 7.88 | 29.60 | 12.77 | 14.08 | ||||||||||||||

CLASS I SHARES | April 5, 1999 | 8.30 | 30.51 | 13.62 | 15.00 | |||||||||||||

CLASS R6 SHARES | July 2, 2018 | 8.45 | 30.87 | 13.91 | 15.35 | |||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

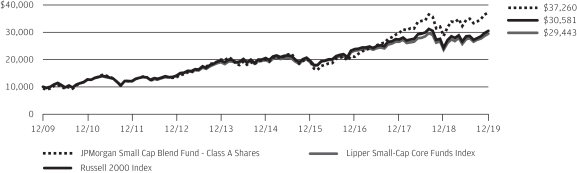

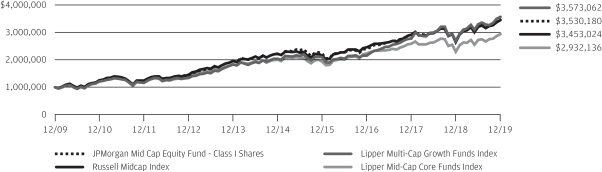

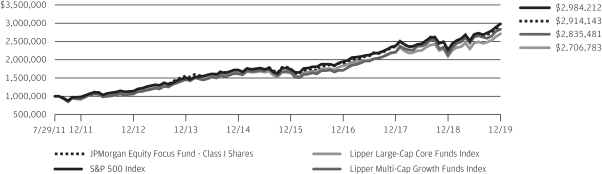

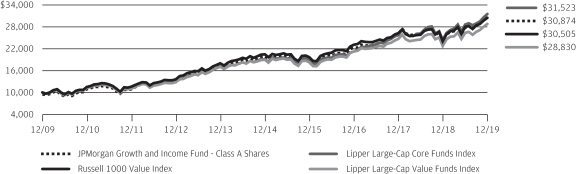

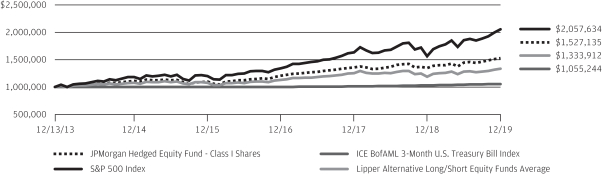

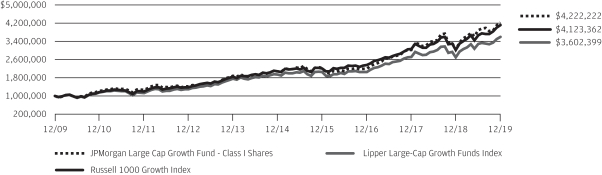

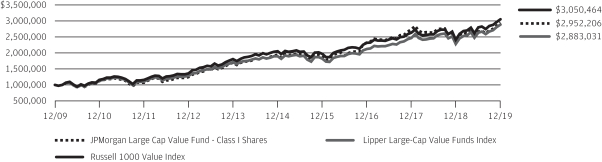

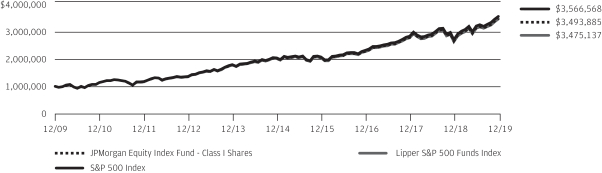

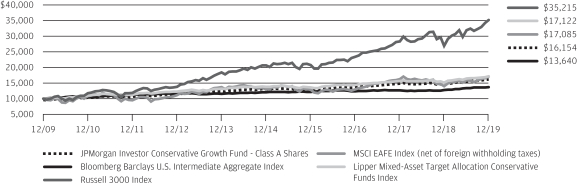

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class R6 Shares prior to their inception dates are based on the performance of Class I Shares. The actual returns for Class R6 Shares would have been different than those shown because Class R6 have different expenses than Class I Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Blend Fund, the Russell 2000 Index and the LipperSmall-Cap Core Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Index is an unmanaged index

which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The LipperSmall-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Effective June 1, 2018 (“the Effective Date”), the Fund’s investment strategies changed. Although past performance is not necessarily an indication of how the Fund will perform in the future, in view of these changes, the Fund’s performance record prior to this date might be less relevant for investors considering whether to purchase shares of the Fund.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 4 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class R5 Shares)* | 6.95% | |||

| Russell 2000 Index | 7.30% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $ | 492,786 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Core Fund (the “Fund”) seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class R5 Shares underperformed the Russell 2000 Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection in the pharmaceutical and consumer cyclical sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the software & services sector and the industrial cyclical sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Sinclair Broadcast Group Inc., Meritage Corp. and Core-Mark Holding Co. Shares of Sinclair Broadcast Group, a television broadcaster, fell after the company reported lower-than-expected earnings for the third quarter of 2019. Shares of Meritage, a developer of residential properties, fell amid weakness in the broader real estate sector during the second half of 2019. Shares of Core-Mark Holdings, a consumer goods distributor, fell amid investor concerns about the company’s tobacco products business.

Leading individual contributors to relative performance included the Fund’s overweight positions in Tenet Healthcare Corp., Atkore International Group Inc. and Medicines Co. Shares of Tenet Healthcare, a hospitals and health care facilities operator, rose after the company reported better-than-expected results for both the second and third quarters of 2019. Shares of Atkore International Group, a manufacturer of electrical infrastructure products, rose after the company reported better-than-expected earnings for the third quarter of 2019 and raised its forecast for the 2020 first quarter and full year. Shares of Medicines, a German pharmaceutical company, rose ahead of its acquisition by Novartis AG.

HOW WAS THE FUND POSITIONED?

In accordance with its investment process, the Fund’s portfolio managers take limited sector bets and construct the Fund so that stock selection is typically the primary driver of the Fund’s relative performance versus the Benchmark. The Fund’s portfolio managers employ a bottom-up approach to stock selection,

using quantitative screening and proprietary analysis to construct a portfolio of companies that they believe are attractively valued and possess strong momentum. During the reporting period, the Fund was managed and positioned in accordance with this investment process.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Deckers Outdoor Corp. | 1.1 | % | |||||

| 2. | EMCOR Group, Inc. | 1.0 | ||||||

| 3. | Tenet Healthcare Corp. | 1.0 | ||||||

| 4. | Rent-A-Center, Inc. | 1.0 | ||||||

| 5. | Essent Group Ltd. | 1.0 | ||||||

| 6. | Atkore International Group, Inc. | 0.9 | ||||||

| 7. | Investors Bancorp, Inc. | 0.9 | ||||||

| 8. | PennyMac Financial Services, Inc. | 0.9 | ||||||

| 9. | First Horizon National Corp. | 0.9 | ||||||

| 10. | Vectrus, Inc. | 0.9 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Health Care | 17.1 | % | ||

| Financials | 16.4 | |||

| Industrials | 16.1 | |||

| Information Technology | 12.5 | |||

| Consumer Discretionary | 8.6 | |||

| Real Estate | 6.4 | |||

| Materials | 3.6 | |||

| Utilities | 2.9 | |||

| Communication Services | 2.5 | |||

| Energy | 2.5 | |||

| Consumer Staples | 2.2 | |||

| Short-Term Investments | 9.2 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 5 | ||||||

Table of Contents

JPMorgan Small Cap Core Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNSAS OF DECEMBER 31, 2019 | ||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

CLASS A SHARES | May 31, 2016 | |||||||||||||||||

With Sales Charge** | 1.12 | % | 17.50 | % | 6.10 | % | 11.84 | % | ||||||||||

Without Sales Charge | 6.73 | 24.00 | 7.25 | 12.45 | ||||||||||||||

CLASS C SHARES | May 31, 2016 | |||||||||||||||||

With CDSC*** | 5.44 | 22.36 | 6.87 | 12.25 | ||||||||||||||

Without CDSC | 6.44 | 23.36 | 6.87 | 12.25 | ||||||||||||||

CLASS I SHARES | January 3, 2017 | 6.85 | 24.31 | 7.47 | 12.56 | |||||||||||||

CLASS R2 SHARES | July 31, 2017 | 6.57 | 23.66 | 6.85 | 11.84 | |||||||||||||

CLASS R3 SHARES | July 31, 2017 | 6.71 | 23.94 | 7.11 | 12.12 | |||||||||||||

CLASS R4 SHARES | July 31, 2017 | 6.85 | 24.30 | 7.38 | 12.40 | |||||||||||||

CLASS R5 SHARES | January 1, 1997 | 6.95 | 24.54 | 7.60 | 12.63 | |||||||||||||

CLASS R6 SHARES | May 31, 2016 | 6.98 | 24.60 | 7.64 | 12.65 | |||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

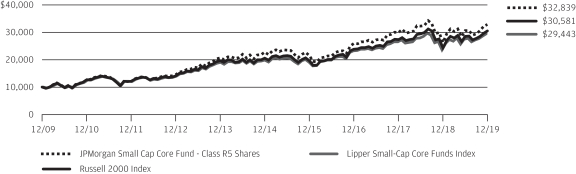

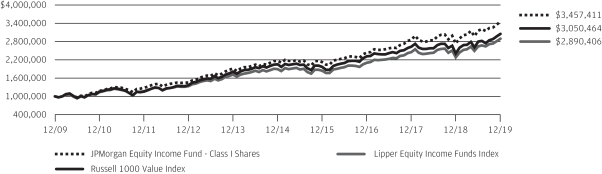

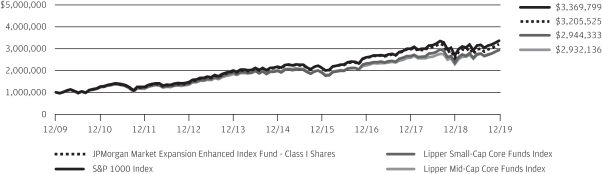

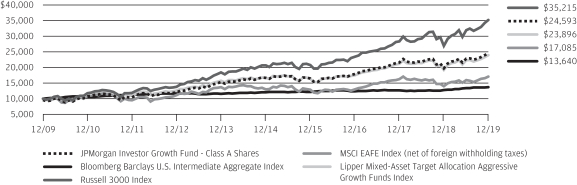

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class A, Class C, Class I, Class R2, Class R3, Class R4 and Class R6 Shares prior to their inception dates are based on the performance of Class R5 Shares. The actual returns of Class A, Class C, Class I, Class R2, Class R3 and Class R4 Shares would have been lower than those shown because these classes have higher expenses than Class R5 Shares. The actual returns of the Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $10,000 invested in Class R5 Shares of the JPMorgan Small Cap Core Fund, the Russell 2000 Index and the LipperSmall-Cap Core Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been

adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The LipperSmall-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class R5 Shares have no minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 6 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

JPMorgan Small Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 7.06% | |||

| Russell 2000 Index | 7.30% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $ | 7,273,029 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Equity Fund (the “Fund”) seeks capital growth over the long term.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, underperformed the Russell 2000 Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection and underweight position in the health care sector and its security selection in the materials & processing sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection in the producer durables sector and its underweight position and security selection in the energy sector were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark positions in ICU Medical Inc. and AptarGroup Inc. and its overweight position in Quaker Chemical Corp. Shares of ICU Medical, a medical devices manufacturer, fell after the company reported weaker-than-expected earnings for the second quarter of 2019. Shares of AptarGroup, a maker of consumer product dispensers, fell after the company reported lower-than-expected earnings for the third quarter of 2019. Shares of Quaker Chemical, a specialty chemicals manufacturer, fell after the company reported weak August and September 2019 sales and lowered its forecast for the full year 2019.

Leading individual contributors to relative performance included the Fund’s overweight position in Performance Food Group Co. and its out-of-Benchmark positions in Toro Co. and Brunswick Corp. Shares of Performance Food Group, a food products distributor, rose after the company reported better-than-expected earnings and revenue for its fiscal first quarter. Shares of Toro, a manufacturer of lawn care and irrigation equipment, rose after the company reported better-than-expected earnings and issued a positive forecast for the full year 2019. Shares of Brunswick, a maker of recreational products, rose after the company increased its quarterly dividend by 14% and reported better-than-expected earnings for the third quarter of 2019.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing portfolios based on company fundamentals and proprietary analysis. The Fund’s portfolio managers looked for companies that, in their view, had leading competitive advantages, predictable and durable business models, and sustainable free cash flow generation with management teams committed to increasing intrinsic value.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Toro Co. (The) | 2.5 | % | |||||

| 2. | Performance Food Group Co. | 2.5 | ||||||

| 3. | Pool Corp. | 2.5 | ||||||

| 4. | AptarGroup, Inc. | 2.2 | ||||||

| 5. | Catalent, Inc. | 1.7 | ||||||

| 6. | Brunswick Corp. | 1.5 | ||||||

| 7. | EastGroup Properties, Inc. | 1.5 | ||||||

| 8. | MSA Safety, Inc. | 1.5 | ||||||

| 9. | West Pharmaceutical Services, Inc. | 1.5 | ||||||

| 10. | Encompass Health Corp. | 1.5 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Industrials | 21.3 | % | ||

| Financials | 16.9 | |||

| Information Technology | 10.5 | |||

| Health Care | 10.4 | |||

| Consumer Discretionary | 9.5 | |||

| Materials | 6.5 | |||

| Real Estate | 6.4 | |||

| Consumer Staples | 4.0 | |||

| Utilities | 2.6 | |||

| Energy | 1.9 | |||

| Communication Services | 1.5 | |||

| Mutual Funds | 0.4 | |||

| Short-Term Investments | 8.1 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 7 | ||||||

Table of Contents

JPMorgan Small Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNSAS OF DECEMBER 31, 2019 | ||||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||||

CLASS A SHARES | December 20, 1994 | |||||||||||||||||||

With Sales Charge** | 1.44 | % | 21.37 | % | 8.71 | % | 12.87 | % | ||||||||||||

Without Sales Charge | 7.06 | 28.10 | 9.88 | 13.49 | ||||||||||||||||

CLASS C SHARES | February 19, 2005 | |||||||||||||||||||

With CDSC*** | 5.78 | 26.45 | 9.34 | 12.92 | ||||||||||||||||

Without CDSC | 6.78 | 27.45 | 9.34 | 12.92 | ||||||||||||||||

CLASS I SHARES | May 7, 1996 | 7.20 | 28.40 | 10.19 | 13.81 | |||||||||||||||

CLASS R2 SHARES | November 3, 2008 | 6.92 | 27.76 | 9.61 | 13.20 | |||||||||||||||

CLASS R3 SHARES | September 9, 2016 | 7.06 | 28.08 | 9.89 | 13.49 | |||||||||||||||

CLASS R4 SHARES | September 9, 2016 | 7.20 | 28.40 | 10.18 | 13.81 | |||||||||||||||

CLASS R5 SHARES | May 15, 2006 | 7.31 | 28.66 | 10.40 | 14.04 | |||||||||||||||

CLASS R6 SHARES | May 31, 2016 | 7.34 | 28.72 | 10.45 | 14.06 | |||||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

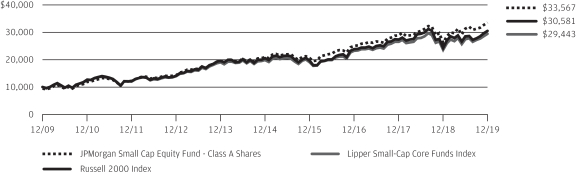

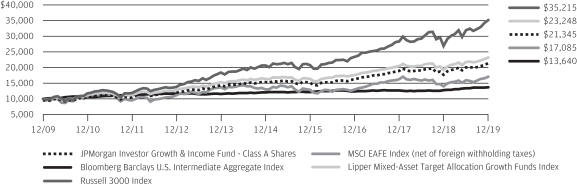

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R3 Shares would have been similar to those shown because Class R3 Shares have similar expenses to Class A Shares at time of launch.

Returns for Class R4 Shares prior to their inception date are based on the performance of the Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares have similar expenses to Class I Shares.

Returns for Class R6 Shares prior to their inception date are based on the performance of the Class R5 Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Equity Fund, the Russell 2000 Index and the LipperSmall-Cap Core Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital

gain distributions, if any, and includes a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The LipperSmall-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 8 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

JPMorgan Small Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class A Shares, without a sales charge)* | 8.29% | |||

| Russell 2000 Growth Index | 6.75% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $ | 3,271,877 | ||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Growth Fund (the “Fund”) seeks long-term capital growth primarily by investing in a portfolio of equity securities of small-capitalization and emerging growth companies.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, outperformed the Russell 2000 Growth Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection in the producer durable and consumer staples sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the consumer discretionary and energy sectors was a leading detractor from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Nevro Corp. and Generac Holdings Inc. and its out-of-Benchmark position in Horizon Therapeutics PLC. Shares of Nevro, a medical devices maker, rose after the company reported better-than-expected results for the third quarter of 2019 and raised its 2019 revenue forecast. Shares of Generac Holdings, a maker of electrical generators and related products, rose amid scheduled electricity blackouts in California and natural disasters elsewhere during the reporting period. Shares of Horizon Therapeutics, a pharmaceuticals company not held in the Benchmark, rose after an advisory committee of the U.S. Food and Drug Administration recommended approval of the company’s drug for thyroid eye disease.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark positions in Farfetch Ltd., Pluralsight Inc. and Zscaler Inc. Shares of Farfetch, a U.K. online luxury fashion retailer, fell after the company reported a wider-than-expected loss for the second quarter of 2019. Shares of Pluralsight, a provider of a cloud-based technology learning platform, fell after the company reported weak results for the second quarter of 2019. Shares of Zscaler, a provider of cloud-based internet security, fell amid investor concerns about slowing billings late in 2019.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers preferred to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Performance Food Group Co. | 1.9 | % | |||||

| 2. | Generac Holdings, Inc. | 1.9 | ||||||

| 3. | Teladoc Health, Inc. | 1.7 | ||||||

| 4. | MSA Safety, Inc. | 1.7 | ||||||

| 5. | Amedisys, Inc. | 1.6 | ||||||

| 6. | John Bean Technologies Corp. | 1.5 | ||||||

| 7. | National Vision Holdings, Inc. | 1.5 | ||||||

| 8. | ManTech International Corp., Class A | 1.5 | ||||||

| 9. | Trex Co., Inc. | 1.4 | ||||||

| 10. | Simpson Manufacturing Co., Inc. | 1.4 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Health Care | 23.2 | % | ||

| Information Technology | 21.0 | |||

| Industrials | 20.2 | |||

| Consumer Discretionary | 14.4 | |||

| Consumer Staples | 3.7 | |||

| Financials | 3.6 | |||

| Real Estate | 2.6 | |||

| Communication Services | 2.6 | |||

| Materials | 0.3 | |||

| Short-Term Investments | 8.4 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 9 | ||||||

Table of Contents

JPMorgan Small Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNSAS OF DECEMBER 31, 2019 | ||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

CLASS A SHARES | July 1, 1991 | |||||||||||||||||

With Sales Charge** | 2.61 | % | 29.93 | % | 12.98 | % | 14.68 | % | ||||||||||

Without Sales Charge | 8.29 | 37.10 | 14.20 | 15.30 | ||||||||||||||

CLASS C SHARES | November 4, 1997 | |||||||||||||||||

With CDSC*** | 7.06 | 35.46 | 13.63 | 14.71 | ||||||||||||||

Without CDSC | 8.06 | 36.46 | 13.63 | 14.71 | ||||||||||||||

CLASS I SHARES | March 26, 1996 | 8.43 | 37.48 | 14.48 | 15.59 | |||||||||||||

CLASS L SHARES | February 19, 2005 | 8.52 | 37.66 | 14.66 | 15.76 | |||||||||||||

CLASS R2 SHARES | November 3, 2008 | 8.15 | 36.76 | 13.92 | 15.02 | |||||||||||||

CLASS R3 SHARES | July 31, 2017 | 8.28 | 37.09 | 14.20 | 15.29 | |||||||||||||

CLASS R4 SHARES | July 31, 2017 | 8.47 | 37.54 | 14.48 | 15.59 | |||||||||||||

CLASS R5 SHARES | September 9, 2016 | 8.55 | 37.70 | 14.66 | 15.76 | |||||||||||||

CLASS R6 SHARES | November 30, 2010 | 8.60 | 37.86 | 14.77 | 15.86 | |||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

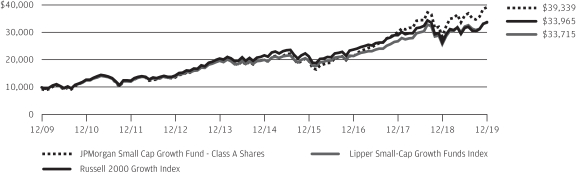

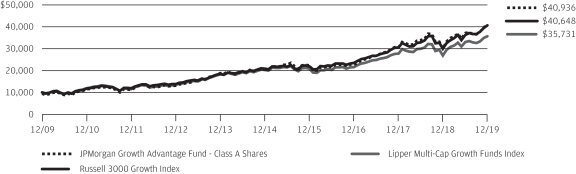

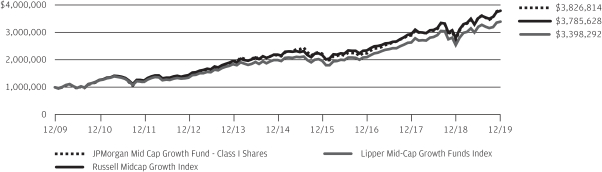

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. Prior performance for Class R3 Shares has been adjusted to reflect the differences in expenses between classes.

Returns for Class R4 Shares prior to their inception date are based on the performance of Class I Shares. Prior performance for Class R4 Shares has been adjusted to reflect the differences in expenses between classes.

Returns for Class R5 and Class R6 Shares prior to their inception dates are based on the performance of Class L Shares. The actual returns for Class R5 and Class R6 Shares would have been different than those shown because Class R5 and Class R6 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Growth Fund, the Russell 2000 Growth Index and the LipperSmall-Cap Growth Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The

performance of the Russell 2000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Growth Index is an unmanaged index which measures the performance of those Russell 2000 companies with higherprice-to-book ratios and higher forecasted growth values. The LipperSmall-Cap Growth Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 10 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class I Shares)* | 7.14% | |||

| Russell 2000 Value Index | 7.87% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $1,330,886 | |||

INVESTMENT OBJECTIVE**

The JPMorgan Small Cap Value Fund (the “Fund”) seeks long-term capital growth primarily by investing in equity securities of small-capitalization companies.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell 2000 Value Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection in the industrial and real estate investment trusts (REITs) sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the pharmaceutical and systems hardware sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight position in K12 Inc. and its out-of-Benchmark positions in Sinclair Broadcast Group Inc. and Geo Group Inc. Shares of K12, a provider of online educational products and services, fell after the company reported lower-than-expected earnings for its fiscal first quarter. Shares of Sinclair Broadcast Group, a television broadcaster, fell after the company reported lower-than-expected earnings for the third quarter of 2019. Shares of Geo Group, a prison and detention facilities REIT, fell amid U.S. Congressional scrutiny of private prison operators.

Leading individual contributors to relative performance included the Fund’s overweight positions in Medicines Co., Builders FirstSource Inc. and Synaptics Inc. Shares of Medicines, a German pharmaceutical company, rose ahead of its acquisition by Novartis AG. Shares of Builders FirstSource, a construction materials and components manufacturer, rose after the company reported better-than-expected earnings for the second and third quarters of 2019. Shares of Synaptics, a maker of human interface semiconductors for mobile and other electronic devices, rose on news reports that the company may have won a significant supplier contract from Apple Inc.

HOW WAS THE FUND POSITIONED?

In accordance its investment process, the Fund’s portfolio managers take limited sector bets and construct the Fund so that stock selection is typically the primary driver of the Fund’s

relative performance versus the Benchmark. The Fund’s portfolio managers use a quantitative ranking methodology to identify stocks in each sector that, in their view, trade at attractive levels. Through bottom-up fundamental research, they seek companies that they believe have attractive valuations, exhibit high earnings quality and have management teams that make effective capital deployment decisions. During the reporting period, the Fund was managed and positioned in accordance with this investment process.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | Washington Federal, Inc. | 1.2 | % | |||||

| 2. | United Bankshares, Inc. | 1.1 | ||||||

| 3. | Trustmark Corp. | 1.1 | ||||||

| 4. | TRI Pointe Group, Inc. | 1.1 | ||||||

| 5. | Rambus, Inc. | 1.0 | ||||||

| 6. | Westamerica Bancorp | 1.0 | ||||||

| 7. | Sanderson Farms, Inc. | 1.0 | ||||||

| 8. | Portland General Electric Co. | 1.0 | ||||||

| 9. | Delek US Holdings, Inc. | 1.0 | ||||||

| 10. | Sunstone Hotel Investors, Inc. | 1.0 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Financials | 26.8 | % | ||

| Industrials | 14.4 | |||

| Real Estate | 9.2 | |||

| Consumer Discretionary | 9.2 | |||

| Information Technology | 8.8 | |||

| Health Care | 6.1 | |||

| Utilities | 5.3 | |||

| Energy | 4.9 | |||

| Materials | 3.7 | |||

| Communication Services | 2.2 | |||

| Consumer Staples | 1.5 | |||

| Short-Term Investments | 7.9 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 11 | ||||||

Table of Contents

JPMorgan Small Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNSAS OF DECEMBER 31, 2019 | ||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

CLASS A SHARES | January 27, 1995 | |||||||||||||||||

With Sales Charge** | 1.39 | % | 12.61 | % | 3.53 | % | 9.30 | % | ||||||||||

Without Sales Charge | 7.01 | 18.82 | 4.65 | 9.89 | ||||||||||||||

CLASS C SHARES | March 22, 1999 | |||||||||||||||||

With CDSC*** | 5.77 | 17.20 | 4.07 | 9.25 | ||||||||||||||

Without CDSC | 6.77 | 18.20 | 4.07 | 9.25 | ||||||||||||||

CLASS I SHARES | January 27, 1995 | 7.14 | 19.08 | 4.90 | 10.17 | |||||||||||||

CLASS R2 SHARES | November 3, 2008 | 6.89 | 18.53 | 4.37 | 9.61 | |||||||||||||

CLASS R3 SHARES | September 9, 2016 | 7.03 | 18.84 | 4.64 | 9.88 | |||||||||||||

CLASS R4 SHARES | September 9, 2016 | 7.14 | 19.09 | 4.88 | 10.15 | |||||||||||||

CLASS R5 SHARES | May 15, 2006 | 7.21 | 19.28 | 5.04 | 10.28 | |||||||||||||

CLASS R6 SHARES | February 22, 2005 | 7.29 | 19.42 | 5.16 | 10.37 | |||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

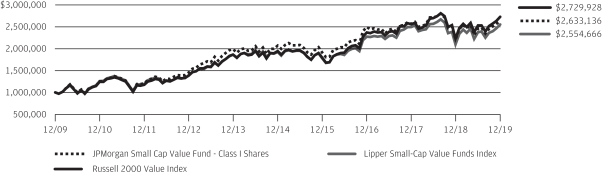

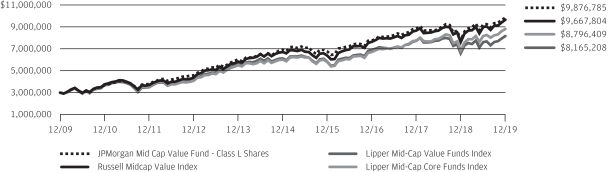

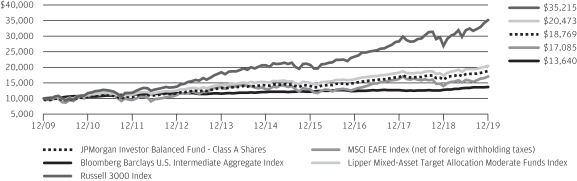

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. Prior performance for Class R3 Shares has been adjusted to reflect the differences in expenses between classes.

Returns for Class R4 Shares prior to their inception date are based on the performance of Class I Shares. Prior performance for Class R4 Shares has been adjusted to reflect the differences in expenses between classes.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Small Cap Value Fund, the Russell 2000 Value Index and the LipperSmall-Cap Value Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 2000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has

been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Value Index is an unmanaged index which measures the performance of those Russell 2000 companies with lowerprice-to-book ratios and lower forecasted growth values. The LipperSmall-Cap Value Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 12 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

JPMorgan U.S. Small Company Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Fund (Class L Shares)* | 9.25% | |||

| Russell 2000 Index | 7.30% | |||

| Net Assets as of 12/31/2019 (In Thousands) | $1,334,155 | |||

INVESTMENT OBJECTIVE**

The JPMorgan U.S. Small Company Fund (the “Fund”) seeks to provide high total return from a portfolio of small company stocks.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares outperformed the Russell 2000 Index (the “Benchmark”) for the six months ended December 31, 2019. The Fund’s security selection in the systems hardware and semiconductors sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the real estate investment trusts and finance sectors was a leading detractor from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Forty Seven Inc., Cirrus Logic Co. and Generac Holdings Inc. Shares of Forty Seven, a drug development company, rose following positive data from clinical trials of its lead anti-cancer treatment. Shares of Cirrus Logic, a maker of analog and other integrated circuits, rose after the company reported better-than-expected earnings and revenue for its fiscal second quarter. Shares of Generac Holdings, a maker of electrical generators and related products, rose amid scheduled electricity blackouts in California and natural disasters elsewhere during the reporting period.

Leading individual detractors from relative performance included the Fund’s overweight positions in K12 Inc. and Allscripts Healthcare Solutions Inc. and its out-of-Benchmark position in Sinclair Broadcast Group Inc. Shares of K12, a provider of online educational products and services, fell after the company reported lower-than-expected earnings for its fiscal first quarter. Shares of Allscripts Healthcare Solutions, a provider of information technology to the health care sector, fell after the company reported lower-than-expected revenue for the second quarter of 2019. Shares of Sinclair Broadcast Group, a television broadcaster, fell after the company reported lower-than-expected earnings for the third quarter of 2019.

HOW WAS THE FUND POSITIONED?

In accordance with its investment process, the Fund’s portfolio managers take limited sector bets and construct the Fund so that stock selection is typically the primary driver of the Fund’s relative performance versus the Benchmark. The Fund’s portfolio managers use a quantitative ranking methodology to

identify stocks in each sector that, in their view, trade at attractive levels. Through bottom-up fundamental research, they seek companies that they believe have attractive valuations, exhibit high earnings quality and have management teams that make effective capital deployment decisions. During the reporting period, the Fund was managed and positioned in accordance with this investment process.

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | ||||||||

| 1. | EMCOR Group, Inc. | 1.2 | % | |||||

| 2. | TRI Pointe Group, Inc. | 1.1 | ||||||

| 3. | Integer Holdings Corp. | 1.1 | ||||||

| 4. | Darling Ingredients, Inc. | 1.1 | ||||||

| 5. | ACI Worldwide, Inc. | 1.0 | ||||||

| 6. | KB Home | 1.0 | ||||||

| 7. | Allscripts Healthcare Solutions, Inc. | 1.0 | ||||||

| 8. | CommVault Systems, Inc. | 1.0 | ||||||

| 9. | Generac Holdings, Inc. | 1.0 | ||||||

| 10. | Trustmark Corp. | 1.0 | ||||||

PORTFOLIO COMPOSITION BY SECTOR*** | ||||

| Health Care | 18.3 | % | ||

| Industrials | 15.1 | |||

| Financials | 14.5 | |||

| Information Technology | 13.2 | |||

| Consumer Discretionary | 11.3 | |||

| Real Estate | 6.2 | |||

| Utilities | 3.0 | |||

| Materials | 3.0 | |||

| Energy | 2.7 | |||

| Communication Services | 2.3 | |||

| Consumer Staples | 1.9 | |||

| Short-Term Investments | 8.5 | |||

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2019. The Fund’s portfolio composition is subject to change. |

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 13 | ||||||

Table of Contents

JPMorgan U.S. Small Company Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2019 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNSAS OFDECEMBER 31, 2019 | ||||||||||||||||||

| INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

CLASS A SHARES | November 1, 2007 | |||||||||||||||||

With Sales Charge** | 3.32 | % | 15.22 | % | 4.89 | % | 10.94 | % | ||||||||||

Without Sales Charge | 9.01 | 21.58 | 6.03 | 11.54 | ||||||||||||||

CLASS C SHARES | November 1, 2007 | |||||||||||||||||

With CDSC*** | 7.69 | 19.98 | 5.49 | 10.98 | ||||||||||||||

Without CDSC | 8.69 | 20.98 | 5.49 | 10.98 | ||||||||||||||

CLASS I SHARES | September 10, 2001 | 9.12 | 21.90 | 6.29 | 11.83 | |||||||||||||

CLASS L SHARES | November 4, 1993 | 9.25 | 22.15 | 6.47 | 12.02 | |||||||||||||

CLASS R2 SHARES | November 1, 2011 | 8.79 | 21.24 | 5.75 | 11.31 | |||||||||||||

CLASS R3 SHARES | September 9, 2016 | 8.97 | 21.61 | 6.03 | 11.54 | |||||||||||||

CLASS R4 SHARES | September 9, 2016 | 9.10 | 21.96 | 6.29 | 11.83 | |||||||||||||

CLASS R5 SHARES | September 9, 2016 | 9.23 | 22.08 | 6.46 | 12.01 | |||||||||||||

CLASS R6 SHARES | November 1, 2011 | 9.22 | 22.18 | 6.57 | 12.09 | |||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 5.25%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

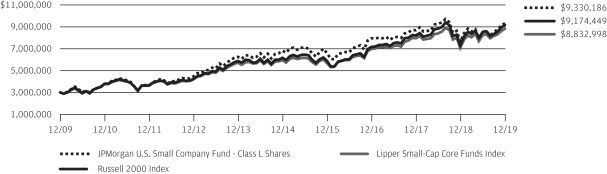

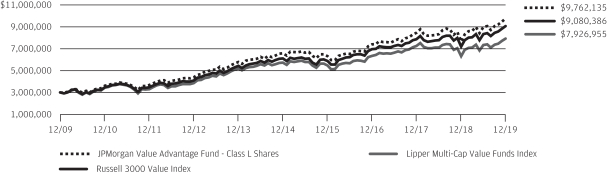

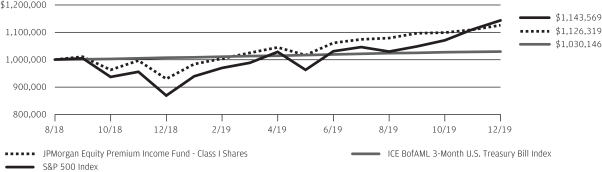

TEN YEAR PERFORMANCE(12/31/09 TO 12/31/19)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-datemonth-end performance information please call1-800-480-4111.

Returns for Class R4 Shares prior to their inception date are based on the performance of the Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares have similar expenses to Class I Shares.

Returns for Class R2 and Class R3 shares prior to their inception dates are based on the performance of the Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares. The actual returns for Class R3 Shares would have been similar to those shown because Class R3 Shares have similar expenses to Class A Shares.

Returns for Class R5 and Class R6 Shares prior to their inception dates are based on the performance of the Class L Shares. The actual returns of Class R5 Shares would have been similar to those shown because Class R5 Shares have similar expenses to Class L Shares. The actual returns of Class R6 Shares would have been different than these shown because Class R6 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan U.S. Small Company Fund, the Russell 2000 Index and the

LipperSmall-Cap Core Funds Index from December 31, 2009 to December 31, 2019. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 2000 Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the LipperSmall-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 2000 Index is an unmanaged index which measures the performance of the 2000 smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The LipperSmall-Cap Core Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 14 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

JPMorgan Small Cap Blend Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (Unaudited)

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Common Stocks — 98.0% | ||||||||

Aerospace & Defense — 1.0% | ||||||||

Curtiss-Wright Corp. | 12 | 1,698 | ||||||

Hexcel Corp. | 25 | 1,851 | ||||||

National Presto Industries, Inc. (a) | 11 | 934 | ||||||

|

| |||||||

| 4,483 | ||||||||

|

| |||||||

Auto Components — 0.6% | ||||||||

Cooper-Standard Holdings, Inc. * | 11 | 381 | ||||||

Fox Factory Holding Corp. * (a) | 22 | 1,509 | ||||||

LCI Industries | 8 | 813 | ||||||

|

| |||||||

| 2,703 | ||||||||

|

| |||||||

Automobiles — 0.6% | ||||||||

Winnebago Industries, Inc. (a) | 50 | 2,666 | ||||||

|

| |||||||

Banks — 10.1% | ||||||||

1st Source Corp. | 22 | 1,137 | ||||||

BancFirst Corp. | 33 | 2,052 | ||||||

Camden National Corp. | 57 | 2,633 | ||||||

City Holding Co. | 25 | 2,065 | ||||||

Community Trust Bancorp, Inc. | 53 | 2,476 | ||||||

First Busey Corp. | 86 | 2,358 | ||||||

First Commonwealth Financial Corp. (a) | 139 | 2,019 | ||||||

First Financial Bancorp | 91 | 2,314 | ||||||

First Financial Bankshares, Inc. | 58 | 2,042 | ||||||

First Merchants Corp. | 53 | 2,214 | ||||||

Great Western Bancorp, Inc. (a) | 44 | 1,523 | ||||||

Heritage Commerce Corp. | 143 | 1,841 | ||||||

Heritage Financial Corp. | 50 | 1,428 | ||||||

Independent Bank Corp. | 70 | 1,580 | ||||||

Independent Bank Corp. (a) | 27 | 2,280 | ||||||

Lakeland Bancorp, Inc. | 127 | 2,201 | ||||||

NBT Bancorp, Inc. | 27 | 1,088 | ||||||

Park National Corp. | 11 | 1,099 | ||||||

S&T Bancorp, Inc. | 46 | 1,870 | ||||||

Sandy Spring Bancorp, Inc. (a) | 22 | 830 | ||||||

Signature Bank | 10 | 1,363 | ||||||

Simmons First National Corp., Class A | 45 | 1,206 | ||||||

Tompkins Financial Corp. (a) | 18 | 1,666 | ||||||

Trustmark Corp. (a) | 53 | 1,824 | ||||||

Webster Financial Corp. | 22 | 1,149 | ||||||

|

| |||||||

| 44,258 | ||||||||

|

| |||||||

Biotechnology — 6.0% | ||||||||

ACADIA Pharmaceuticals, Inc. * | 36 | 1,520 | ||||||

Adverum Biotechnologies, Inc. * | 24 | 272 | ||||||

Amicus Therapeutics, Inc. * | 113 | 1,098 | ||||||

Atara Biotherapeutics, Inc. * (a) | 62 | 1,026 | ||||||

Avrobio, Inc. * | 57 | 1,142 | ||||||

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Biotechnology — continued | ||||||||

Biohaven Pharmaceutical Holding Co. Ltd. * | 37 | 2,024 | ||||||

Bridgebio Pharma, Inc. * | 16 | 560 | ||||||

Coherus Biosciences, Inc. * | 84 | 1,518 | ||||||

FibroGen, Inc. * | 51 | 2,175 | ||||||

G1 Therapeutics, Inc. * (a) | 44 | 1,172 | ||||||

Global Blood Therapeutics, Inc. * | 12 | 922 | ||||||

Halozyme Therapeutics, Inc. * | 125 | 2,222 | ||||||

Heron Therapeutics, Inc. * (a) | 67 | 1,572 | ||||||

Homology Medicines, Inc. * (a) | 59 | 1,215 | ||||||

Intercept Pharmaceuticals, Inc. * (a) | 18 | 2,200 | ||||||

Natera, Inc. * (a) | 46 | 1,557 | ||||||

REGENXBIO, Inc. * (a) | 31 | 1,271 | ||||||

Rubius Therapeutics, Inc. * (a) | 30 | 288 | ||||||

Sage Therapeutics, Inc. * | 10 | 702 | ||||||

Twist Bioscience Corp. * (a) | 61 | 1,274 | ||||||

Viela Bio, Inc. * (a) | 26 | 704 | ||||||

|

| |||||||

| 26,434 | ||||||||

|

| |||||||

Building Products — 3.5% | ||||||||

Advanced Drainage Systems, Inc. | 83 | 3,243 | ||||||

CSW Industrials, Inc. | 26 | 2,018 | ||||||

Simpson Manufacturing Co., Inc. | 67 | 5,378 | ||||||

Trex Co., Inc. * | 37 | 3,333 | ||||||

Universal Forest Products, Inc. | 30 | 1,436 | ||||||

|

| |||||||

| 15,408 | ||||||||

|

| |||||||

Capital Markets — 1.0% | ||||||||

Evercore, Inc., Class A | 26 | 1,964 | ||||||

LPL Financial Holdings, Inc. | 26 | 2,426 | ||||||

|

| |||||||

| 4,390 | ||||||||

|

| |||||||

Chemicals — 1.8% | ||||||||

Ferro Corp. * | 48 | 710 | ||||||

Innophos Holdings, Inc. (a) | 60 | 1,922 | ||||||

Innospec, Inc. | 24 | 2,527 | ||||||

Sensient Technologies Corp. | 16 | 1,068 | ||||||

Stepan Co. | 16 | 1,608 | ||||||

|

| |||||||

| 7,835 | ||||||||

|

| |||||||

Commercial Services & Supplies — 3.0% | ||||||||

Brady Corp., Class A | 37 | 2,140 | ||||||

Brink’s Co. (The) | 28 | 2,527 | ||||||

Deluxe Corp. | 36 | 1,814 | ||||||

Kimball International, Inc., Class B | 63 | 1,299 | ||||||

MSA Safety, Inc. (a) | 32 | 4,063 | ||||||

UniFirst Corp. | 6 | 1,178 | ||||||

|

| |||||||

| 13,021 | ||||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| DECEMBER 31, 2019 | J.P. MORGAN SMALL CAP FUNDS | 15 | ||||||

Table of Contents

JPMorgan Small Cap Blend Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2019 (Unaudited) (continued)

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Common Stocks — continued | ||||||||

Communications Equipment — 0.8% | ||||||||

Ciena Corp. * | 39 | 1,663 | ||||||

EchoStar Corp., Class A * | 47 | 2,041 | ||||||

|

| |||||||

| 3,704 | ||||||||

|

| |||||||

Construction & Engineering — 0.5% | ||||||||

Comfort Systems USA, Inc. | 42 | 2,117 | ||||||

|

| |||||||

Containers & Packaging — 0.2% | ||||||||

Silgan Holdings, Inc. | 22 | 681 | ||||||

|

| |||||||

Distributors — 0.6% | ||||||||

Pool Corp. | 12 | 2,646 | ||||||

|

| |||||||

Diversified Consumer Services — 0.5% | ||||||||

Bright Horizons Family Solutions, Inc. * | 14 | 2,176 | ||||||

|

| |||||||

Diversified Telecommunication Services — 0.4% | ||||||||

Cincinnati Bell, Inc. * (a) | 174 | 1,824 | ||||||

|

| |||||||

Electric Utilities — 0.3% | ||||||||

Portland General Electric Co. | 26 | 1,467 | ||||||

|

| |||||||

Electrical Equipment — 1.6% | ||||||||

EnerSys | 16 | 1,230 | ||||||

Generac Holdings, Inc. * | 44 | 4,405 | ||||||

nVent Electric plc | 60 | 1,541 | ||||||

|

| |||||||

| 7,176 | ||||||||

|

| |||||||

Electronic Equipment, Instruments & Components — 2.2% |

| |||||||

ePlus, Inc. * | 19 | 1,570 | ||||||

Fabrinet (Thailand) * | 25 | 1,634 | ||||||

Littelfuse, Inc. (a) | 20 | 3,900 | ||||||

SYNNEX Corp. | 19 | 2,399 | ||||||

|

| |||||||

| 9,503 | ||||||||

|

| |||||||

Entertainment — 1.1% | ||||||||

Cinemark Holdings, Inc. | 39 | 1,336 | ||||||

Glu Mobile, Inc. * (a) | 137 | 829 | ||||||

Sciplay Corp., Class A * | 55 | 677 | ||||||

World Wrestling Entertainment, Inc., Class A (a) | 30 | 1,937 | ||||||

|

| |||||||

| 4,779 | ||||||||

|

| |||||||

Equity Real Estate Investment Trusts (REITs) — 6.8% |

| |||||||

American Campus Communities, Inc. | 43 | 2,011 | ||||||

American Homes 4 Rent, Class A | 86 | 2,242 | ||||||

Brixmor Property Group, Inc. | 110 | 2,371 | ||||||

CubeSmart | 41 | 1,299 | ||||||

EastGroup Properties, Inc. | 14 | 1,861 | ||||||

Equity Commonwealth | 56 | 1,825 | ||||||

Highwoods Properties, Inc. | 39 | 1,884 | ||||||

JBG SMITH Properties | 48 | 1,928 | ||||||

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Equity Real Estate Investment Trusts (REITs) — continued |

| |||||||

National Health Investors, Inc. | 16 | 1,335 | ||||||

Rayonier, Inc. | 62 | 2,039 | ||||||

Rexford Industrial Realty, Inc. | 52 | 2,370 | ||||||

RLJ Lodging Trust | 110 | 1,941 | ||||||

Sunstone Hotel Investors, Inc. | 123 | 1,715 | ||||||

Terreno Realty Corp. | 60 | 3,257 | ||||||

Washington (a) | 56 | 1,626 | ||||||

|

| |||||||

| 29,704 | ||||||||

|

| |||||||

Food & Staples Retailing — 1.3% | ||||||||

Grocery Outlet Holding Corp. * | 37 | 1,187 | ||||||

Performance Food Group Co. * | 89 | 4,602 | ||||||

|

| |||||||

| 5,789 | ||||||||

|

| |||||||

Food Products — 1.1% | ||||||||

Flowers Foods, Inc. | 71 | 1,549 | ||||||

Freshpet, Inc. * | 53 | 3,123 | ||||||

|

| |||||||

| 4,672 | ||||||||

|

| |||||||

Gas Utilities — 1.6% | ||||||||

Chesapeake Utilities Corp. | 22 | 2,080 | ||||||

ONE Gas, Inc. | 30 | 2,809 | ||||||

Southwest Gas Holdings, Inc. | 28 | 2,103 | ||||||

|

| |||||||

| 6,992 | ||||||||

|

| |||||||

Health Care Equipment & Supplies — 2.1% | ||||||||

Insulet Corp. * | 14 | 2,321 | ||||||

iRhythm Technologies, Inc. * (a) | 33 | 2,258 | ||||||

Nevro Corp. * | 28 | 3,277 | ||||||

Shockwave Medical, Inc. * | 27 | 1,199 | ||||||

|

| |||||||

| 9,055 | ||||||||

|

| |||||||

Health Care Providers & Services — 2.6% | ||||||||

Acadia Healthcare Co., Inc. * | 48 | 1,587 | ||||||

Amedisys, Inc. * | 22 | 3,739 | ||||||

Encompass Health Corp. | 29 | 2,014 | ||||||

Ensign Group, Inc. (The) | 31 | 1,413 | ||||||

Pennant Group, Inc. (The) * | 13 | 426 | ||||||

Providence Service Corp. (The) * (a) | 34 | 2,027 | ||||||

|

| |||||||

| 11,206 | ||||||||

|

| |||||||

Health Care Technology — 1.1% | ||||||||

Evolent Health, Inc., Class A * (a) | 100 | 905 | ||||||

Teladoc Health, Inc. * | 49 | 4,096 | ||||||

|

| |||||||

| 5,001 | ||||||||

|

| |||||||

Hotels, Restaurants & Leisure — 3.3% | ||||||||

Boyd Gaming Corp. | 108 | 3,244 | ||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 16 | J.P. MORGAN SMALL CAP FUNDS | DECEMBER 31, 2019 | ||||

Table of Contents

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Common Stocks — continued | ||||||||

Hotels, Restaurants & Leisure — continued | ||||||||

Cheesecake Factory, Inc. (The) (a) | 35 | 1,376 | ||||||

Cracker Barrel Old Country Store, Inc. (a) | 8 | 1,283 | ||||||

Jack in the Box, Inc. | 9 | 684 | ||||||

Planet Fitness, Inc., Class A * | 29 | 2,185 | ||||||

Red Rock Resorts, Inc., Class A | 89 | 2,123 | ||||||

Ruth’s Hospitality Group, Inc. (a) | 50 | 1,097 | ||||||

Texas Roadhouse, Inc. | 47 | 2,658 | ||||||

|

| |||||||

| 14,650 | ||||||||

|

| |||||||

Household Durables — 0.7% | ||||||||

Helen of Troy Ltd. * | 9 | 1,652 | ||||||

TRI Pointe Group, Inc. * | 91 | 1,421 | ||||||

|

| |||||||

| 3,073 | ||||||||

|

| |||||||

Insurance — 2.2% | ||||||||

Argo Group International Holdings Ltd. | 7 | 487 | ||||||

eHealth, Inc. * (a) | 20 | 1,950 | ||||||

James River Group Holdings Ltd. | 17 | 706 | ||||||

Old Republic International Corp. | 78 | 1,742 | ||||||

Safety Insurance Group, Inc. | 16 | 1,446 | ||||||

Selective Insurance Group, Inc. | 27 | 1,786 | ||||||

Third Point Reinsurance Ltd. (Bermuda) * | 127 | 1,341 | ||||||

|

| |||||||

| 9,458 | ||||||||

|

| |||||||

Interactive Media & Services — 0.3% | ||||||||

Cars.com, Inc. * | 99 | 1,205 | ||||||

|

| |||||||

Internet & Direct Marketing Retail — 0.3% | ||||||||

Farfetch Ltd., Class A (United Kingdom) * | 87 | 897 | ||||||

RealReal, Inc. (The) * (a) | 29 | 548 | ||||||

|

| |||||||

| 1,445 | ||||||||

|

| |||||||

IT Services — 2.8% |

| |||||||

CSG Systems International, Inc. | 35 | 1,812 | ||||||

ManTech International Corp., Class A (a) | 43 | 3,452 | ||||||

MAXIMUS, Inc. | 20 | 1,467 | ||||||

MongoDB, Inc. * (a) | 11 | 1,449 | ||||||

Science Applications International Corp. | 23 | 2,009 | ||||||

Wix.com Ltd. (Israel) * | 19 | 2,300 | ||||||

|

| |||||||

| 12,489 | ||||||||

|

| |||||||

Leisure Products — 0.3% | ||||||||

Callaway Golf Co. | 58 | 1,220 | ||||||

|

| |||||||

Life Sciences Tools & Services — 0.3% | ||||||||

10X Genomics, Inc., Class A * (a) | 9 | 693 | ||||||

Adaptive Biotechnologies Corp. * (a) | 13 | 375 | ||||||

Personalis, Inc. * (a) | 36 | 387 | ||||||

|

| |||||||

| 1,455 | ||||||||

|

| |||||||

| INVESTMENTS | SHARES (000) | VALUE ($000) | ||||||

Machinery — 6.6% | ||||||||

Alamo Group, Inc. | 19 | 2,443 | ||||||

Blue Bird Corp. * | 93 | 2,136 | ||||||

Chart Industries, Inc. * | 28 | 1,856 | ||||||

Crane Co. | 12 | 1,074 | ||||||

Graco, Inc. | 35 | 1,841 | ||||||

Hillenbrand, Inc. | 61 | 2,044 | ||||||

ITT, Inc. | 75 | 5,514 | ||||||

John Bean Technologies Corp. (a) | 33 | 3,679 | ||||||

Kadant, Inc. | 19 | 2,019 | ||||||

Lincoln Electric Holdings, Inc. (a) | 21 | 2,014 | ||||||

Mueller Industries, Inc. | 54 | 1,702 | ||||||

Oshkosh Corp. | 9 | 870 | ||||||

Watts Water Technologies, Inc., Class A | 18 | 1,844 | ||||||

|

| |||||||

| 29,036 | ||||||||

|

| |||||||

Marine — 0.3% | ||||||||

Kirby Corp. * | 15 | 1,382 | ||||||

|

| |||||||

Media — 2.6% | ||||||||

Cable One, Inc. | 1 | 927 | ||||||

Emerald Expositions Events, Inc. | 119 | 1,260 | ||||||

Hemisphere Media Group, Inc. * | 104 | 1,546 | ||||||

John Wiley & Sons, Inc., Class A | 16 | 797 | ||||||

Liberty Latin America Ltd., Class C (Chile) * (a) | 126 | 2,452 | ||||||

New York Times Co. (The), Class A (a) | 82 | 2,645 | ||||||

Nexstar Media Group, Inc., Class A | 15 | 1,704 | ||||||

|

| |||||||

| 11,331 | ||||||||

|

| |||||||

Multiline Retail — 0.2% | ||||||||

Ollie’s Bargain Outlet Holdings, Inc. * (a) | 17 | 1,088 | ||||||

|

| |||||||

Multi-Utilities — 0.5% | ||||||||