UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04236

JPMorgan Trust II

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2022 through December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

JPMorgan Small Cap Blend Fund |

JPMorgan Small Cap Equity Fund |

JPMorgan Small Cap Growth Fund |

JPMorgan Small Cap Sustainable Leaders Fund |

JPMorgan Small Cap Value Fund |

JPMorgan SMID Cap Equity Fund |

JPMorgan U.S. Small Company Fund |

1 | |

2 | |

3 | |

6 | |

9 | |

12 | |

15 | |

17 | |

20 | |

23 | |

57 | |

80 | |

106 | |

123 | |

127 |

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

February 13, 2023 (Unaudited)

| “Investors may face continued economic and geopolitical challenges in the year ahead. However, some of the acute risks encountered in 2022 appear to have receded and last year’s reset in asset prices may provide attractive investment opportunities.” — Brian S. Shlissel |

President - J.P. Morgan Funds

J.P. Morgan Asset Management

1-800-480-4111 or www.jpmorganfunds.com for more information

December 31, 2022 | J.P. Morgan Small Cap Funds | 1 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

2 | J.P. Morgan Small Cap Funds | December 31, 2022 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class A Shares, without a sales charge) * | 4.10% |

Russell 2000 Index | 3.91% |

Net Assets as of 12/31/2022 (In Thousands) | $1,169,706 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | Applied Industrial Technologies, Inc. | 1.6% |

2. | Matador Resources Co. | 1.1 |

3. | Selective Insurance Group, Inc. | 1.1 |

4. | Terreno Realty Corp. | 1.0 |

5. | Halozyme Therapeutics, Inc. | 0.9 |

6. | Patterson Cos., Inc. | 0.9 |

7. | Safety Insurance Group, Inc. | 0.8 |

8. | Agree Realty Corp. | 0.8 |

9. | McGrath RentCorp | 0.8 |

10. | Independent Bank Corp. | 0.8 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Industrials | 19.6% |

Financials | 16.2 |

Health Care | 14.5 |

Information Technology | 12.4 |

Consumer Discretionary | 10.6 |

Real Estate | 6.0 |

Consumer Staples | 4.2 |

Energy | 3.6 |

Materials | 3.0 |

Utilities | 2.4 |

Communication Services | 1.8 |

Short-Term Investments | 5.7 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 3 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

4 | J.P. Morgan Small Cap Funds | December 31, 2022 |

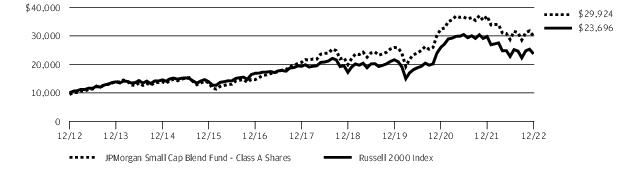

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | May 19, 1997 | ||||

With Sales Charge ** | (1.39)% | (23.30)% | 6.48% | 11.58% | |

Without Sales Charge | 4.10 | (19.04) | 7.64 | 12.19 | |

CLASS C SHARES | January 7, 1998 | ||||

With CDSC *** | 2.78 | (20.46) | 7.10 | 11.74 | |

Without CDSC | 3.78 | (19.46) | 7.10 | 11.74 | |

Class I SHARES | April 5, 1999 | 4.26 | (18.82) | 7.91 | 12.48 |

Class R6 SHARES | July 2, 2018 | 4.38 | (18.64) | 8.18 | 12.77 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

December 31, 2022 | J.P. Morgan Small Cap Funds | 5 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class A Shares, without a sales charge) * | 5.28% |

Russell 2000 Index | 3.91% |

Net Assets as of 12/31/2022 (In Thousands) | $5,669,659 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | WillScot Mobile Mini Holdings Corp. | 1.8% |

2. | MSA Safety, Inc. | 1.6 |

3. | AptarGroup, Inc. | 1.5 |

4. | Encompass Health Corp. | 1.4 |

5. | Performance Food Group Co. | 1.4 |

6. | Power Integrations, Inc. | 1.4 |

7. | WEX, Inc. | 1.3 |

8. | Lincoln Electric Holdings, Inc. | 1.3 |

9. | Brunswick Corp. | 1.3 |

10. | Primo Water Corp. | 1.3 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Industrials | 23.8% |

Financials | 16.7 |

Information Technology | 12.3 |

Health Care | 11.2 |

Consumer Discretionary | 9.9 |

Consumer Staples | 6.0 |

Real Estate | 5.8 |

Materials | 4.7 |

Utilities | 2.2 |

Short-Term Investments | 7.4 |

6 | J.P. Morgan Small Cap Funds | December 31, 2022 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 7 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

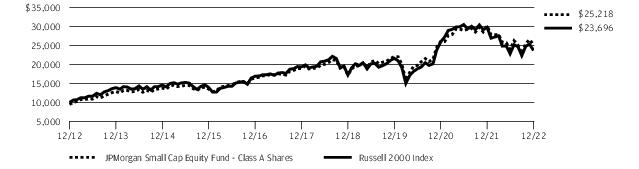

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | December 20, 1994 | ||||

With Sales Charge ** | (0.25)% | (20.71)% | 4.73% | 9.69% | |

Without Sales Charge | 5.28 | (16.32) | 5.87 | 10.29 | |

CLASS C SHARES | February 19, 2005 | ||||

With CDSC *** | 4.00 | (17.72) | 5.35 | 9.85 | |

Without CDSC | 5.00 | (16.72) | 5.35 | 9.85 | |

Class I SHARES | May 7, 1996 | 5.43 | (16.09) | 6.16 | 10.60 |

Class R2 SHARES | November 3, 2008 | 5.14 | (16.50) | 5.62 | 10.02 |

Class R3 SHARES | September 9, 2016 | 5.28 | (16.31) | 5.88 | 10.30 |

Class R4 SHARES | September 9, 2016 | 5.42 | (16.09) | 6.15 | 10.59 |

Class R5 SHARES | May 15, 2006 | 5.52 | (15.93) | 6.36 | 10.81 |

Class R6 SHARES | May 31, 2016 | 5.57 | (15.88) | 6.42 | 10.86 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

8 | J.P. Morgan Small Cap Funds | December 31, 2022 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class A Shares, without a sales charge) * | 0.53% |

Russell 2000 Growth Index | 3.91% |

Net Assets as of 12/31/2022 (In Thousands) | $3,658,174 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | Applied Industrial Technologies, Inc. | 2.0% |

2. | Halozyme Therapeutics, Inc. | 1.9 |

3. | Matador Resources Co. | 1.8 |

4. | National Vision Holdings, Inc. | 1.6 |

5. | Cactus, Inc., Class A | 1.6 |

6. | Shockwave Medical, Inc. | 1.5 |

7. | MSA Safety, Inc. | 1.5 |

8. | Valmont Industries, Inc. | 1.4 |

9. | Casella Waste Systems, Inc., Class A | 1.4 |

10. | Texas Roadhouse, Inc. | 1.4 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Health Care | 23.9% |

Industrials | 21.5 |

Information Technology | 19.7 |

Consumer Discretionary | 14.0 |

Energy | 5.1 |

Financials | 3.9 |

Consumer Staples | 3.2 |

Real Estate | 1.8 |

Communication Services | 0.4 |

Short-Term Investments | 6.5 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 9 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

10 | J.P. Morgan Small Cap Funds | December 31, 2022 |

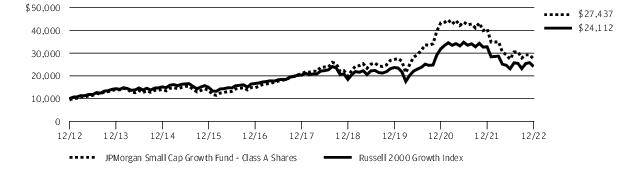

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | July 1, 1991 | ||||

With Sales Charge ** | (4.74)% | (35.98)% | 4.56% | 10.62% | |

Without Sales Charge | 0.53 | (32.43) | 5.69 | 11.22 | |

CLASS C SHARES | November 4, 1997 | ||||

With CDSC *** | (0.71) | (33.78) | 5.17 | 10.77 | |

Without CDSC | 0.29 | (32.78) | 5.17 | 10.77 | |

Class I SHARES | March 26, 1996 | 0.64 | (32.27) | 5.96 | 11.50 |

Class L SHARES | February 19, 2005 | 0.73 | (32.19) | 6.11 | 11.66 |

Class R2 SHARES | November 3, 2008 | 0.41 | (32.61) | 5.43 | 10.94 |

Class R3 SHARES | July 31, 2017 | 0.46 | (32.48) | 5.67 | 11.21 |

Class R4 SHARES | July 31, 2017 | 0.59 | (32.30) | 5.95 | 11.49 |

Class R5 SHARES | September 9, 2016 | 0.73 | (32.19) | 6.11 | 11.66 |

Class R6 SHARES | November 30, 2010 | 0.71 | (32.13) | 6.21 | 11.77 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

December 31, 2022 | J.P. Morgan Small Cap Funds | 11 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class R5 Shares) * | 6.04% |

Russell 2000 Index | 3.91% |

Net Assets as of 12/31/2022 (In Thousands) | $85,988 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | Halozyme Therapeutics, Inc. | 3.4% |

2. | Sarepta Therapeutics, Inc. | 3.0 |

3. | AAON, Inc. | 2.6 |

4. | Huron Consulting Group, Inc. | 2.6 |

5. | Amalgamated Financial Corp. | 2.6 |

6. | WESCO International, Inc. | 2.5 |

7. | Deckers Outdoor Corp. | 2.5 |

8. | American States Water Co. | 2.3 |

9. | Hilltop Holdings, Inc. | 2.3 |

10. | Visteon Corp. | 2.3 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Industrials | 21.1% |

Health Care | 18.9 |

Financials | 14.1 |

Consumer Discretionary | 13.0 |

Information Technology | 7.2 |

Real Estate | 6.9 |

Consumer Staples | 5.4 |

Materials | 4.7 |

Utilities | 4.6 |

Communication Services | 2.1 |

Energy | 0.6 |

Short-Term Investments | 1.4 |

12 | J.P. Morgan Small Cap Funds | December 31, 2022 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 13 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | May 31, 2016 | ||||

With Sales Charge ** | 0.26% | (25.24)% | 0.74% | 7.78% | |

Without Sales Charge | 5.80 | (21.10) | 1.83 | 8.36 | |

CLASS C SHARES | May 31, 2016 | ||||

With CDSC *** | 4.55 | (22.50) | 1.33 | 8.01 | |

Without CDSC | 5.55 | (21.50) | 1.33 | 8.01 | |

Class I SHARES | January 3, 2017 | 5.90 | (20.93) | 2.08 | 8.55 |

Class R2 SHARES | July 31, 2017 | 5.66 | (21.30) | 1.58 | 7.93 |

Class R3 SHARES | July 31, 2017 | 5.81 | (21.10) | 1.83 | 8.20 |

Class R4 SHARES | July 31, 2017 | 5.94 | (20.90) | 2.09 | 8.47 |

Class R5 SHARES | January 1, 1997 | 6.04 | (20.76) | 2.28 | 8.68 |

Class R6 SHARES | May 31, 2016 | 6.06 | (20.72) | 2.34 | 8.72 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

14 | J.P. Morgan Small Cap Funds | December 31, 2022 |

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class I Shares) * | 5.12% |

Russell 2000 Value Index | 3.42% |

Net Assets as of 12/31/2022 (In Thousands) | $1,276,346 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | Agree Realty Corp. | 1.2% |

2. | Old National Bancorp | 1.1 |

3. | OceanFirst Financial Corp. | 1.0 |

4. | Academy Sports & Outdoors, Inc. | 0.9 |

5. | New Jersey Resources Corp. | 0.9 |

6. | Hub Group, Inc., Class A | 0.8 |

7. | Hancock Whitney Corp. | 0.8 |

8. | OFG Bancorp (Puerto Rico) | 0.8 |

9. | Veritex Holdings, Inc. | 0.8 |

10. | Taylor Morrison Home Corp. | 0.8 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Financials | 27.2% |

Industrials | 14.6 |

Health Care | 11.2 |

Real Estate | 9.3 |

Consumer Discretionary | 7.5 |

Information Technology | 6.8 |

Energy | 4.8 |

Utilities | 4.7 |

Materials | 2.9 |

Consumer Staples | 2.6 |

Communication Services | 2.1 |

Short-Term Investments | 6.3 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 15 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

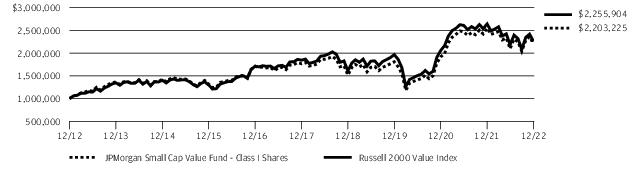

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | January 27, 1995 | ||||

With Sales Charge ** | (0.53)% | (18.19)% | 3.13% | 7.36% | |

Without Sales Charge | 4.98 | (13.65) | 4.25 | 7.95 | |

CLASS C SHARES | March 22, 1999 | ||||

With CDSC *** | 3.74 | (15.06) | 3.75 | 7.46 | |

Without CDSC | 4.74 | (14.06) | 3.75 | 7.46 | |

Class I SHARES | January 27, 1995 | 5.12 | (13.40) | 4.53 | 8.22 |

Class R2 SHARES | November 3, 2008 | 4.85 | (13.85) | 4.00 | 7.67 |

Class R3 SHARES | September 9, 2016 | 5.00 | (13.63) | 4.27 | 7.95 |

Class R4 SHARES | September 9, 2016 | 5.12 | (13.41) | 4.53 | 8.21 |

Class R5 SHARES | May 15, 2006 | 5.18 | (13.30) | 4.67 | 8.35 |

Class R6 SHARES | February 22, 2005 | 5.23 | (13.23) | 4.77 | 8.46 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

16 | J.P. Morgan Small Cap Funds | December 31, 2022 |

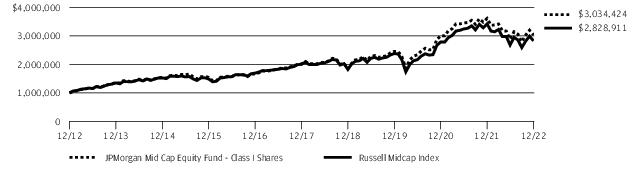

SIX MONTHS ENDED December 31, 2022 (Unaudited)

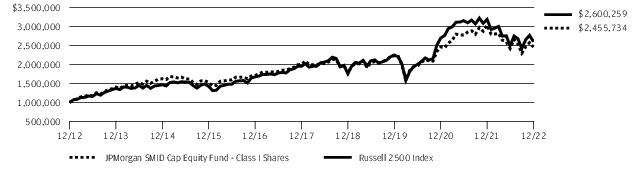

REPORTING PERIOD RETURN: | |

Fund (Class I Shares) * | 1.45% |

Russell 2500 Index | 4.40% |

Net Assets as of 12/31/2022 (In Thousands) | $301,177 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | WillScot Mobile Mini Holdings Corp. | 1.5% |

2. | MSA Safety, Inc. | 1.4 |

3. | WEX, Inc. | 1.4 |

4. | Encompass Health Corp. | 1.4 |

5. | Lincoln Electric Holdings, Inc. | 1.4 |

6. | Pool Corp. | 1.4 |

7. | Performance Food Group Co. | 1.4 |

8. | Toro Co. (The) | 1.3 |

9. | LPL Financial Holdings, Inc. | 1.3 |

10. | Vail Resorts, Inc. | 1.3 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Industrials | 24.8% |

Financials | 17.2 |

Information Technology | 15.8 |

Consumer Discretionary | 10.8 |

Health Care | 10.7 |

Real Estate | 7.0 |

Consumer Staples | 5.3 |

Materials | 3.9 |

Utilities | 1.0 |

Short-Term Investments | 3.5 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 17 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

18 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | May 1, 1992 | ||||

With Sales Charge ** | (4.00)% | (23.49)% | 2.80% | 8.54% | |

Without Sales Charge | 1.35 | (19.24) | 3.91 | 9.13 | |

CLASS C SHARES | March 22, 1999 | ||||

With CDSC *** | 0.15 | (20.61) | 3.40 | 8.64 | |

Without CDSC | 1.15 | (19.61) | 3.40 | 8.64 | |

Class I SHARES | June 1, 1991 | 1.45 | (19.04) | 4.17 | 9.40 |

Class R3 SHARES | September 9, 2016 | 1.36 | (19.22) | 3.92 | 9.13 |

Class R4 SHARES | September 9, 2016 | 1.51 | (19.06) | 4.17 | 9.40 |

Class R6 SHARES | November 2, 2015 | 1.65 | (18.82) | 4.44 | 9.60 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

December 31, 2022 | J.P. Morgan Small Cap Funds | 19 |

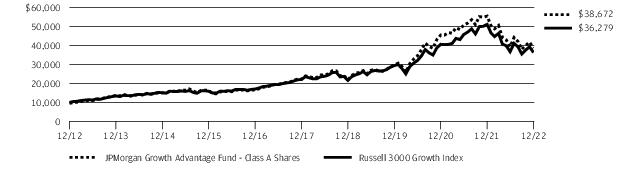

SIX MONTHS ENDED December 31, 2022 (Unaudited)

REPORTING PERIOD RETURN: | |

Fund (Class L Shares) * | 6.40% |

Russell 2000 Index | 3.91% |

Net Assets as of 12/31/2022 (In Thousands) | $864,748 |

TOP TEN HOLDINGS OF THE PORTFOLIO AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS | |

1. | Inspire Medical Systems, Inc. | 1.2% |

2. | Catalyst Pharmaceuticals, Inc. | 1.1 |

3. | Silicon Laboratories, Inc. | 1.0 |

4. | Atkore, Inc. | 0.9 |

5. | Sonos, Inc. | 0.9 |

6. | Comfort Systems USA, Inc. | 0.9 |

7. | Taylor Morrison Home Corp. | 0.9 |

8. | Axonics, Inc. | 0.8 |

9. | Calix, Inc. | 0.8 |

10. | Chegg, Inc. | 0.8 |

PORTFOLIO COMPOSITION BY SECTOR AS OF December 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

Health Care | 16.4% |

Financials | 16.2 |

Industrials | 15.5 |

Information Technology | 12.7 |

Consumer Discretionary | 11.1 |

Energy | 5.6 |

Real Estate | 5.0 |

Consumer Staples | 3.6 |

Materials | 3.4 |

Utilities | 2.8 |

Communication Services | 1.7 |

Short-Term Investments | 6.0 |

20 | J.P. Morgan Small Cap Funds | December 31, 2022 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 21 |

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

INCEPTION DATE OF CLASS | 6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | November 1, 2007 | ||||

With Sales Charge ** | 0.67% | (21.31)% | 3.76% | 8.64% | |

Without Sales Charge | 6.25 | (16.93) | 4.88 | 9.23 | |

CLASS C SHARES | November 1, 2007 | ||||

With CDSC *** | 4.94 | (18.36) | 4.35 | 8.79 | |

Without CDSC | 5.94 | (17.36) | 4.35 | 8.79 | |

Class I SHARES | September 10, 2001 | 6.32 | (16.69) | 5.16 | 9.51 |

Class L SHARES | November 4, 1993 | 6.40 | (16.59) | 5.32 | 9.69 |

Class R2 SHARES | November 1, 2011 | 6.12 | (17.13) | 4.61 | 8.96 |

Class R3 SHARES | September 9, 2016 | 6.19 | (16.93) | 4.89 | 9.23 |

Class R4 SHARES | September 9, 2016 | 6.33 | (16.70) | 5.14 | 9.50 |

Class R5 SHARES | September 9, 2016 | 6.43 | (16.58) | 5.32 | 9.69 |

Class R6 SHARES | November 1, 2011 | 6.53 | (16.48) | 5.42 | 9.79 |

* | Not annualized. |

** | Sales Charge for Class A Shares is 5.25%. |

*** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

22 | J.P. Morgan Small Cap Funds | December 31, 2022 |

AS OF December 31, 2022 (Unaudited)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — 97.2% | ||

Aerospace & Defense — 0.8% | ||

AerSale Corp. * (a) | 170 | 2,757 |

Hexcel Corp. | 114 | 6,732 |

9,489 | ||

Airlines — 0.2% | ||

Frontier Group Holdings, Inc. * | 219 | 2,246 |

Auto Components — 0.5% | ||

Fox Factory Holding Corp. * | 32 | 2,963 |

Patrick Industries, Inc. | 40 | 2,424 |

5,387 | ||

Automobiles — 0.2% | ||

Winnebago Industries, Inc. (a) | 52 | 2,714 |

Banks — 10.4% | ||

Camden National Corp. | 100 | 4,169 |

City Holding Co. | 60 | 5,585 |

Columbia Banking System, Inc. | 270 | 8,135 |

First Busey Corp. | 320 | 7,910 |

First Commonwealth Financial Corp. | 450 | 6,287 |

First Financial Bankshares, Inc. | 187 | 6,426 |

First Merchants Corp. | 180 | 7,400 |

Heritage Commerce Corp. | 550 | 7,150 |

Independent Bank Corp. | 90 | 7,599 |

Independent Bank Corp. | 390 | 9,329 |

Lakeland Bancorp, Inc. | 300 | 5,283 |

Old National Bancorp | 465 | 8,361 |

Pinnacle Financial Partners, Inc. | 46 | 3,407 |

Premier Financial Corp. | 235 | 6,338 |

Simmons First National Corp., Class A | 250 | 5,395 |

SouthState Corp. | 120 | 9,163 |

TriCo Bancshares | 140 | 7,139 |

Trustmark Corp. | 180 | 6,266 |

121,342 | ||

Beverages — 0.6% | ||

Primo Water Corp. | 485 | 7,537 |

Biotechnology — 5.9% | ||

ACADIA Pharmaceuticals, Inc. * | 152 | 2,413 |

ADC Therapeutics SA (Switzerland) * (a) | 190 | 731 |

Alector, Inc. * | 160 | 1,480 |

Allogene Therapeutics, Inc. * (a) | 171 | 1,076 |

Amicus Therapeutics, Inc. * | 571 | 6,974 |

Apellis Pharmaceuticals, Inc. * | 75 | 3,875 |

Arrowhead Pharmaceuticals, Inc. * | 141 | 5,704 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Biotechnology — continued | ||

Atara Biotherapeutics, Inc. * | 357 | 1,170 |

Blueprint Medicines Corp. * | 82 | 3,575 |

Coherus Biosciences, Inc. * | 361 | 2,855 |

G1 Therapeutics, Inc. * (a) | 180 | 978 |

Halozyme Therapeutics, Inc. * | 196 | 11,144 |

Heron Therapeutics, Inc. * (a) | 589 | 1,473 |

Kronos Bio, Inc. * | 208 | 337 |

Natera, Inc. * | 117 | 4,714 |

PMV Pharmaceuticals, Inc. * | 157 | 1,368 |

REGENXBIO, Inc. * | 172 | 3,900 |

Relay Therapeutics, Inc. * | 193 | 2,887 |

REVOLUTION Medicines, Inc. * | 128 | 3,053 |

Sage Therapeutics, Inc. * | 72 | 2,735 |

Sana Biotechnology, Inc. * (a) | 100 | 396 |

Twist Bioscience Corp. * | 165 | 3,920 |

Verve Therapeutics, Inc. * (a) | 95 | 1,841 |

68,599 | ||

Building Products — 2.1% | ||

Advanced Drainage Systems, Inc. | 42 | 3,469 |

CSW Industrials, Inc. | 43 | 4,927 |

Hayward Holdings, Inc. * (a) | 550 | 5,170 |

Simpson Manufacturing Co., Inc. | 55 | 4,904 |

UFP Industries, Inc. | 75 | 5,944 |

24,414 | ||

Capital Markets — 1.8% | ||

Evercore, Inc., Class A | 36 | 3,862 |

Focus Financial Partners, Inc., Class A * | 175 | 6,533 |

LPL Financial Holdings, Inc. | 25 | 5,404 |

Virtus Investment Partners, Inc. | 27 | 5,169 |

20,968 | ||

Chemicals — 3.1% | ||

Chase Corp. | 75 | 6,469 |

Diversey Holdings Ltd. * | 750 | 3,195 |

Hawkins, Inc. | 140 | 5,404 |

HB Fuller Co. | 100 | 7,162 |

Innospec, Inc. | 65 | 6,686 |

Stepan Co. | 65 | 6,920 |

35,836 | ||

Commercial Services & Supplies — 2.3% | ||

ACV Auctions, Inc., Class A * | 353 | 2,896 |

Brady Corp., Class A | 145 | 6,830 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 23 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Commercial Services & Supplies — continued | ||

Casella Waste Systems, Inc., Class A * | 102 | 8,112 |

MSA Safety, Inc. | 59 | 8,452 |

26,290 | ||

Communications Equipment — 0.9% | ||

Ciena Corp. * | 111 | 5,643 |

Viavi Solutions, Inc. * | 490 | 5,150 |

10,793 | ||

Construction & Engineering — 1.8% | ||

Comfort Systems USA, Inc. | 65 | 7,480 |

EMCOR Group, Inc. | 15 | 2,277 |

MasTec, Inc. * | 39 | 3,290 |

Valmont Industries, Inc. | 25 | 8,207 |

21,254 | ||

Diversified Consumer Services — 0.4% | ||

Bright Horizons Family Solutions, Inc. * | 36 | 2,277 |

Carriage Services, Inc. | 80 | 2,203 |

4,480 | ||

Diversified Telecommunication Services — 1.3% | ||

Cogent Communications Holdings, Inc. | 55 | 3,139 |

Iridium Communications, Inc. * | 80 | 4,112 |

Radius Global Infrastructure, Inc. * | 700 | 8,274 |

15,525 | ||

Electric Utilities — 0.4% | ||

Portland General Electric Co. | 95 | 4,655 |

Electrical Equipment — 1.2% | ||

AZZ, Inc. | 90 | 3,618 |

Bloom Energy Corp., Class A * | 257 | 4,915 |

Shoals Technologies Group, Inc., Class A * | 236 | 5,827 |

14,360 | ||

Electronic Equipment, Instruments & Components — 2.6% | ||

Coherent Corp. * | 61 | 2,145 |

Fabrinet (Thailand) * | 58 | 7,361 |

Insight Enterprises, Inc. * | 75 | 7,520 |

Knowles Corp. * | 275 | 4,515 |

Littelfuse, Inc. | 13 | 2,916 |

TTM Technologies, Inc. * | 400 | 6,032 |

30,489 | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Energy Equipment & Services — 1.3% | ||

Cactus, Inc., Class A | 180 | 9,059 |

ChampionX Corp. | 200 | 5,798 |

14,857 | ||

Equity Real Estate Investment Trusts (REITs) — 6.2% | ||

Agree Realty Corp. | 140 | 9,930 |

American Homes 4 Rent, Class A | 120 | 3,617 |

Centerspace | 65 | 3,813 |

CubeSmart | 95 | 3,834 |

Highwoods Properties, Inc. (a) | 155 | 4,337 |

JBG SMITH Properties | 150 | 2,847 |

Kite Realty Group Trust | 300 | 6,315 |

Plymouth Industrial REIT, Inc. | 200 | 3,836 |

Rayonier, Inc. | 160 | 5,274 |

Rexford Industrial Realty, Inc. | 90 | 4,918 |

RLJ Lodging Trust | 445 | 4,712 |

Sunstone Hotel Investors, Inc. | 630 | 6,086 |

Terreno Realty Corp. | 221 | 12,563 |

72,082 | ||

Food & Staples Retailing — 1.2% | ||

Grocery Outlet Holding Corp. * | 210 | 6,132 |

Performance Food Group Co. * | 128 | 7,443 |

13,575 | ||

Food Products — 1.2% | ||

Flowers Foods, Inc. | 180 | 5,173 |

Freshpet, Inc. * (a) | 78 | 4,098 |

Hostess Brands, Inc. * | 125 | 2,805 |

J & J Snack Foods Corp. | 15 | 2,246 |

14,322 | ||

Gas Utilities — 1.2% | ||

Chesapeake Utilities Corp. | 40 | 4,727 |

ONE Gas, Inc. | 90 | 6,815 |

Southwest Gas Holdings, Inc. | 40 | 2,475 |

14,017 | ||

Health Care Equipment & Supplies — 3.4% | ||

CONMED Corp. | 70 | 6,196 |

iRhythm Technologies, Inc. * | 61 | 5,702 |

Nevro Corp. * (a) | 75 | 2,989 |

NuVasive, Inc. * | 125 | 5,154 |

Outset Medical, Inc. * | 226 | 5,824 |

24 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Health Care Equipment & Supplies — continued | ||

Shockwave Medical, Inc. * | 42 | 8,676 |

Utah Medical Products, Inc. | 55 | 5,529 |

40,070 | ||

Health Care Providers & Services — 3.8% | ||

Acadia Healthcare Co., Inc. * | 89 | 7,297 |

Accolade, Inc. * | 262 | 2,043 |

Amedisys, Inc. * | 41 | 3,460 |

Cano Health, Inc. * (a) | 849 | 1,163 |

Encompass Health Corp. | 155 | 9,271 |

Ensign Group, Inc. (The) | 60 | 5,677 |

ModivCare, Inc. * | 60 | 5,384 |

Patterson Cos., Inc. | 375 | 10,511 |

44,806 | ||

Health Care Technology — 0.6% | ||

Evolent Health, Inc., Class A * | 263 | 7,391 |

Hotels, Restaurants & Leisure — 4.1% | ||

Bloomin' Brands, Inc. (a) | 135 | 2,716 |

Boyd Gaming Corp. | 72 | 3,938 |

El Pollo Loco Holdings, Inc. (a) | 50 | 498 |

Everi Holdings, Inc. * | 350 | 5,023 |

Jack in the Box, Inc. | 40 | 2,729 |

Life Time Group Holdings, Inc. * (a) | 359 | 4,300 |

Marriott Vacations Worldwide Corp. | 41 | 5,466 |

Papa John's International, Inc. | 46 | 3,752 |

Planet Fitness, Inc., Class A * | 98 | 7,742 |

Six Flags Entertainment Corp. * | 144 | 3,346 |

Texas Roadhouse, Inc. | 88 | 8,021 |

47,531 | ||

Household Durables — 1.3% | ||

Helen of Troy Ltd. * | 36 | 4,046 |

La-Z-Boy, Inc. (a) | 110 | 2,510 |

M/I Homes, Inc. * | 60 | 2,771 |

MDC Holdings, Inc. | 70 | 2,212 |

Sonos, Inc. * | 189 | 3,187 |

14,726 | ||

Insurance — 2.2% | ||

Kinsale Capital Group, Inc. | 9 | 2,348 |

Safety Insurance Group, Inc. | 120 | 10,111 |

Selective Insurance Group, Inc. | 150 | 13,292 |

25,751 | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Interactive Media & Services — 0.6% | ||

Bumble, Inc., Class A * | 110 | 2,315 |

IAC, Inc. * | 95 | 4,218 |

6,533 | ||

Internet & Direct Marketing Retail — 0.4% | ||

Global-e Online Ltd. (Israel) * (a) | 103 | 2,112 |

Xometry, Inc., Class A * (a) | 94 | 3,038 |

5,150 | ||

IT Services — 1.9% | ||

CSG Systems International, Inc. | 60 | 3,432 |

DigitalOcean Holdings, Inc. * (a) | 89 | 2,275 |

ExlService Holdings, Inc. * | 38 | 6,435 |

Flywire Corp. * | 76 | 1,851 |

Globant SA * | 30 | 5,112 |

Remitly Global, Inc. * | 254 | 2,909 |

22,014 | ||

Life Sciences Tools & Services — 0.1% | ||

Personalis, Inc. * | 242 | 479 |

Seer, Inc. * | 68 | 397 |

876 | ||

Machinery — 5.2% | ||

Alamo Group, Inc. | 50 | 7,080 |

Altra Industrial Motion Corp. | 105 | 6,274 |

Chart Industries, Inc. * | 39 | 4,522 |

Evoqua Water Technologies Corp. * | 156 | 6,172 |

Hillenbrand, Inc. | 150 | 6,400 |

ITT, Inc. | 75 | 6,045 |

John Bean Technologies Corp. | 49 | 4,506 |

Kadant, Inc. | 25 | 4,441 |

Lincoln Electric Holdings, Inc. | 30 | 4,335 |

Mueller Industries, Inc. | 70 | 4,130 |

Watts Water Technologies, Inc., Class A | 50 | 7,311 |

61,216 | ||

Mortgage Real Estate Investment Trusts (REITs) — 0.7% | ||

Ares Commercial Real Estate Corp. (a) | 375 | 3,859 |

Ladder Capital Corp. | 400 | 4,016 |

7,875 | ||

Multi-Utilities — 0.4% | ||

Unitil Corp. | 90 | 4,622 |

Oil, Gas & Consumable Fuels — 2.4% | ||

Chord Energy Corp. | 26 | 3,591 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 25 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Oil, Gas & Consumable Fuels — continued | ||

CNX Resources Corp. * | 125 | 2,105 |

Matador Resources Co. (a) | 235 | 13,472 |

PDC Energy, Inc. | 50 | 3,174 |

SM Energy Co. | 178 | 6,184 |

28,526 | ||

Personal Products — 1.3% | ||

BellRing Brands, Inc. * | 90 | 2,308 |

Edgewell Personal Care Co. | 165 | 6,359 |

elf Beauty, Inc. * | 23 | 1,283 |

Inter Parfums, Inc. | 60 | 5,791 |

15,741 | ||

Pharmaceuticals — 1.1% | ||

Arvinas, Inc. * | 104 | 3,544 |

Intra-Cellular Therapies, Inc. * | 83 | 4,372 |

Revance Therapeutics, Inc. * | 262 | 4,845 |

12,761 | ||

Professional Services — 1.0% | ||

ASGN, Inc. * | 55 | 4,481 |

KBR, Inc. | 138 | 7,260 |

11,741 | ||

Road & Rail — 1.1% | ||

Marten Transport Ltd. | 345 | 6,824 |

Saia, Inc. * | 28 | 5,969 |

12,793 | ||

Semiconductors & Semiconductor Equipment — 1.4% | ||

Cohu, Inc. * | 65 | 2,083 |

MKS Instruments, Inc. | 54 | 4,590 |

Power Integrations, Inc. | 43 | 3,100 |

Rambus, Inc. * | 100 | 3,582 |

Wolfspeed, Inc. * (a) | 49 | 3,343 |

16,698 | ||

Software — 5.9% | ||

Blackline, Inc. * | 88 | 5,891 |

Clear Secure, Inc., Class A (a) | 130 | 3,560 |

Confluent, Inc., Class A * | 157 | 3,482 |

Coupa Software, Inc. * | 29 | 2,332 |

CyberArk Software Ltd. * | 52 | 6,701 |

Elastic NV * | 59 | 3,045 |

Envestnet, Inc. * | 108 | 6,662 |

Everbridge, Inc. * | 80 | 2,370 |

Five9, Inc. * | 59 | 3,999 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Software — continued | ||

HashiCorp, Inc., Class A * (a) | 201 | 5,499 |

JFrog Ltd. (Israel) * | 122 | 2,605 |

New Relic, Inc. * | 90 | 5,110 |

Paycor HCM, Inc. * | 159 | 3,889 |

SentinelOne, Inc., Class A * | 207 | 3,016 |

Smartsheet, Inc., Class A * | 140 | 5,527 |

Sprout Social, Inc., Class A * | 38 | 2,124 |

Vertex, Inc., Class A * | 228 | 3,313 |

69,125 | ||

Specialty Retail — 2.7% | ||

Burlington Stores, Inc. * | 24 | 4,945 |

Floor & Decor Holdings, Inc., Class A * (a) | 44 | 3,039 |

Group 1 Automotive, Inc. | 31 | 5,591 |

Lithia Motors, Inc., Class A | 17 | 3,491 |

National Vision Holdings, Inc. * | 151 | 5,842 |

Petco Health & Wellness Co., Inc. * (a) | 395 | 3,749 |

Urban Outfitters, Inc. * | 220 | 5,247 |

31,904 | ||

Technology Hardware, Storage & Peripherals — 0.1% | ||

Super Micro Computer, Inc. * | 19 | 1,572 |

Textiles, Apparel & Luxury Goods — 1.6% | ||

Kontoor Brands, Inc. | 160 | 6,398 |

Movado Group, Inc. | 95 | 3,064 |

Oxford Industries, Inc. (a) | 35 | 3,261 |

Steven Madden Ltd. | 182 | 5,817 |

18,540 | ||

Thrifts & Mortgage Finance — 1.6% | ||

PennyMac Financial Services, Inc. | 75 | 4,250 |

Radian Group, Inc. | 330 | 6,293 |

WSFS Financial Corp. | 180 | 8,161 |

18,704 | ||

Trading Companies & Distributors — 4.3% | ||

Air Lease Corp. | 111 | 4,271 |

Applied Industrial Technologies, Inc. | 152 | 19,190 |

Beacon Roofing Supply, Inc. * | 110 | 5,807 |

McGrath RentCorp | 95 | 9,380 |

Rush Enterprises, Inc., Class A | 94 | 4,915 |

SiteOne Landscape Supply, Inc. * (a) | 23 | 2,743 |

WESCO International, Inc. * | 36 | 4,459 |

50,765 | ||

26 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Water Utilities — 0.4% | ||

American States Water Co. | 50 | 4,628 |

Total Common Stocks (Cost $1,103,323) | 1,137,290 | |

Short-Term Investments — 5.9% | ||

Investment Companies — 2.8% | ||

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c) (Cost $32,332) | 32,327 | 32,343 |

Investment of Cash Collateral from Securities Loaned — 3.1% | ||

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | 29,255 | 29,263 |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | 7,614 | 7,614 |

Total Investment of Cash Collateral from Securities Loaned (Cost $36,870) | 36,877 | |

Total Short-Term Investments (Cost $69,202) | 69,220 | |

Total Investments — 103.1% (Cost $1,172,525) | 1,206,510 | |

Liabilities in Excess of Other Assets — (3.1)% | (36,804) | |

NET ASSETS — 100.0% | 1,169,706 | |

Percentages indicated are based on net assets. |

* | Non-income producing security. |

(a) | The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $35,764. |

(b) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

(c) | The rate shown is the current yield as of December 31, 2022. |

December 31, 2022 | J.P. Morgan Small Cap Funds | 27 |

AS OF December 31, 2022 (Unaudited)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — 97.6% | ||

Aerospace & Defense — 0.8% | ||

Woodward, Inc. | 473 | 45,683 |

Airlines — 0.7% | ||

Alaska Air Group, Inc. * | 907 | 38,965 |

Auto Components — 0.9% | ||

LCI Industries | 550 | 50,851 |

Automobiles — 0.6% | ||

Thor Industries, Inc. (a) | 428 | 32,317 |

Banks — 9.4% | ||

BankUnited, Inc. | 1,635 | 55,545 |

Commerce Bancshares, Inc. (a) | 632 | 43,001 |

Cullen/Frost Bankers, Inc. | 404 | 54,008 |

First Financial Bancorp | 2,314 | 56,075 |

First Hawaiian, Inc. | 1,990 | 51,828 |

First Interstate BancSystem, Inc., Class A | 1,090 | 42,106 |

ServisFirst Bancshares, Inc. | 746 | 51,417 |

Signature Bank | 389 | 44,818 |

Western Alliance Bancorp | 1,056 | 62,895 |

Wintrust Financial Corp. | 837 | 70,737 |

532,430 | ||

Beverages — 1.3% | ||

Primo Water Corp. | 4,816 | 74,841 |

Building Products — 2.0% | ||

AZEK Co., Inc. (The) * (a) | 1,314 | 26,703 |

Hayward Holdings, Inc. * (a) | 3,614 | 33,971 |

Simpson Manufacturing Co., Inc. | 627 | 55,595 |

116,269 | ||

Capital Markets — 6.1% | ||

AssetMark Financial Holdings, Inc. * | 1,643 | 37,790 |

Evercore, Inc., Class A (a) | 598 | 65,263 |

Focus Financial Partners, Inc., Class A * | 1,751 | 65,267 |

Moelis & Co., Class A | 1,432 | 54,939 |

Morningstar, Inc. | 287 | 62,164 |

StepStone Group, Inc., Class A | 2,375 | 59,791 |

345,214 | ||

Chemicals — 3.4% | ||

Axalta Coating Systems Ltd. * | 1,014 | 25,837 |

Diversey Holdings Ltd. * | 3,359 | 14,308 |

Perimeter Solutions SA * (a) | 3,428 | 31,335 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Chemicals — continued | ||

Quaker Chemical Corp. | 395 | 65,889 |

Valvoline, Inc. | 1,703 | 55,584 |

192,953 | ||

Commercial Services & Supplies — 9.3% | ||

Brady Corp., Class A | 1,232 | 58,001 |

Casella Waste Systems, Inc., Class A * | 814 | 64,532 |

Driven Brands Holdings, Inc. * (a) | 2,332 | 63,689 |

IAA, Inc. * (a) | 1,815 | 72,613 |

MSA Safety, Inc. (a) | 673 | 97,050 |

Ritchie Bros Auctioneers, Inc. (Canada) (a) | 877 | 50,722 |

Stericycle, Inc. * | 1,299 | 64,825 |

UniFirst Corp. | 282 | 54,408 |

525,840 | ||

Construction & Engineering — 1.9% | ||

WillScot Mobile Mini Holdings Corp. * | 2,378 | 107,404 |

Containers & Packaging — 1.6% | ||

AptarGroup, Inc. (a) | 815 | 89,674 |

Diversified Consumer Services — 1.1% | ||

Bright Horizons Family Solutions, Inc. * | 990 | 62,470 |

Electric Utilities — 1.2% | ||

Portland General Electric Co. | 1,417 | 69,436 |

Electrical Equipment — 0.3% | ||

Generac Holdings, Inc. * (a) | 165 | 16,572 |

Electronic Equipment, Instruments & Components — 2.5% | ||

Badger Meter, Inc. | 496 | 54,102 |

nLight, Inc. * | 2,090 | 21,197 |

Novanta, Inc. * | 485 | 65,875 |

141,174 | ||

Equity Real Estate Investment Trusts (REITs) — 5.2% | ||

CubeSmart (a) | 1,439 | 57,901 |

EastGroup Properties, Inc. | 468 | 69,314 |

National Retail Properties, Inc. | 1,299 | 59,455 |

Outfront Media, Inc. | 3,076 | 51,005 |

Ryman Hospitality Properties, Inc. | 707 | 57,783 |

295,458 | ||

Food & Staples Retailing — 3.6% | ||

BJ's Wholesale Club Holdings, Inc. * | 1,021 | 67,529 |

Casey's General Stores, Inc. | 234 | 52,532 |

Performance Food Group Co. * | 1,450 | 84,689 |

204,750 | ||

28 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Food Products — 1.4% | ||

Freshpet, Inc. * (a) | 508 | 26,793 |

Utz Brands, Inc. (a) | 3,268 | 51,839 |

78,632 | ||

Health Care Equipment & Supplies — 3.5% | ||

Envista Holdings Corp. * (a) | 1,457 | 49,070 |

ICU Medical, Inc. * (a) | 438 | 68,964 |

Neogen Corp. * | 2,029 | 30,907 |

QuidelOrtho Corp. * (a) | 601 | 51,463 |

200,404 | ||

Health Care Providers & Services — 5.5% | ||

Agiliti, Inc. * (a) | 3,355 | 54,718 |

Chemed Corp. | 134 | 68,404 |

Encompass Health Corp. | 1,448 | 86,624 |

HealthEquity, Inc. * | 1,008 | 62,136 |

Progyny, Inc. * | 1,272 | 39,612 |

311,494 | ||

Health Care Technology — 1.2% | ||

Certara, Inc. * | 2,332 | 37,464 |

Definitive Healthcare Corp. * (a) | 2,607 | 28,654 |

66,118 | ||

Hotels, Restaurants & Leisure — 3.3% | ||

Monarch Casino & Resort, Inc. * | 505 | 38,832 |

Planet Fitness, Inc., Class A * | 935 | 73,646 |

Wendy's Co. (The) (a) | 3,238 | 73,285 |

185,763 | ||

Insurance — 2.1% | ||

Kinsale Capital Group, Inc. | 193 | 50,412 |

RLI Corp. | 510 | 66,931 |

117,343 | ||

Internet & Direct Marketing Retail — 0.5% | ||

Xometry, Inc., Class A * (a) | 845 | 27,249 |

IT Services — 1.4% | ||

WEX, Inc. * (a) | 486 | 79,579 |

Leisure Products — 2.2% | ||

Acushnet Holdings Corp. (a) | 1,108 | 47,035 |

Brunswick Corp. | 1,051 | 75,775 |

122,810 | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Life Sciences Tools & Services — 1.6% | ||

Azenta, Inc. * | 792 | 46,119 |

Syneos Health, Inc. * | 1,189 | 43,607 |

89,726 | ||

Machinery — 6.0% | ||

Altra Industrial Motion Corp. | 217 | 12,978 |

Douglas Dynamics, Inc. | 996 | 36,010 |

Gates Industrial Corp. plc * | 3,076 | 35,100 |

Hillman Solutions Corp. * (a) | 5,622 | 40,537 |

Lincoln Electric Holdings, Inc. | 536 | 77,447 |

RBC Bearings, Inc. * | 325 | 67,908 |

Toro Co. (The) | 642 | 72,643 |

342,623 | ||

Multi-Utilities — 1.1% | ||

NorthWestern Corp. | 1,044 | 61,949 |

Professional Services — 0.8% | ||

First Advantage Corp. * (a) | 3,379 | 43,933 |

Real Estate Management & Development — 1.0% | ||

Cushman & Wakefield plc * | 4,417 | 55,039 |

Road & Rail — 2.2% | ||

Knight-Swift Transportation Holdings, Inc. (a) | 953 | 49,950 |

Landstar System, Inc. | 369 | 60,162 |

Lyft, Inc., Class A * | 1,608 | 17,721 |

127,833 | ||

Semiconductors & Semiconductor Equipment — 3.4% | ||

Allegro MicroSystems, Inc. (Japan) * (a) | 1,754 | 52,651 |

MACOM Technology Solutions Holdings, Inc. * | 937 | 59,000 |

Power Integrations, Inc. | 1,165 | 83,555 |

195,206 | ||

Software — 5.5% | ||

Clearwater Analytics Holdings, Inc., Class A * (a) | 2,614 | 49,022 |

Envestnet, Inc. * | 896 | 55,260 |

Guidewire Software, Inc. * (a) | 805 | 50,339 |

nCino, Inc. * (a) | 1,498 | 39,617 |

Paycor HCM, Inc. * (a) | 1,676 | 41,014 |

Q2 Holdings, Inc. * | 1,498 | 40,249 |

Workiva, Inc. * | 470 | 39,444 |

314,945 | ||

December 31, 2022 | J.P. Morgan Small Cap Funds | 29 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Specialty Retail — 1.2% | ||

Leslie's, Inc. * (a) | 2,412 | 29,449 |

National Vision Holdings, Inc. * (a) | 1,014 | 39,291 |

68,740 | ||

Textiles, Apparel & Luxury Goods — 0.7% | ||

Carter's, Inc. (a) | 562 | 41,916 |

Trading Companies & Distributors — 1.1% | ||

Applied Industrial Technologies, Inc. | 487 | 61,326 |

Total Common Stocks (Cost $4,419,687) | 5,534,929 | |

Short-Term Investments — 7.9% | ||

Investment Companies — 2.8% | ||

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c) (Cost $156,340) | 156,312 | 156,390 |

Investment of Cash Collateral from Securities Loaned — 5.1% | ||

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | 189,029 | 189,086 |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | 98,408 | 98,408 |

Total Investment of Cash Collateral from Securities Loaned (Cost $287,469) | 287,494 | |

Total Short-Term Investments (Cost $443,809) | 443,884 | |

Total Investments — 105.5% (Cost $4,863,496) | 5,978,813 | |

Liabilities in Excess of Other Assets — (5.5)% | (309,154) | |

NET ASSETS — 100.0% | 5,669,659 | |

Percentages indicated are based on net assets. |

* | Non-income producing security. |

(a) | The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $279,974. |

(b) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

(c) | The rate shown is the current yield as of December 31, 2022. |

30 | J.P. Morgan Small Cap Funds | December 31, 2022 |

AS OF December 31, 2022 (Unaudited)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — 99.2% | ||

Aerospace & Defense — 1.2% | ||

Hexcel Corp. | 767 | 45,139 |

Airlines — 0.4% | ||

Frontier Group Holdings, Inc. * (a) | 1,449 | 14,884 |

Auto Components — 0.5% | ||

Fox Factory Holding Corp. * | 216 | 19,720 |

Automobiles — 0.5% | ||

Winnebago Industries, Inc. (a) | 342 | 18,039 |

Banks — 1.8% | ||

First Financial Bankshares, Inc. | 1,252 | 43,076 |

Pinnacle Financial Partners, Inc. | 310 | 22,713 |

65,789 | ||

Biotechnology — 12.6% | ||

ACADIA Pharmaceuticals, Inc. * | 1,005 | 15,997 |

ADC Therapeutics SA (Switzerland) * (a) | 1,208 | 4,637 |

Alector, Inc. * | 1,051 | 9,701 |

Allogene Therapeutics, Inc. * (a) | 1,108 | 6,971 |

Amicus Therapeutics, Inc. * | 3,830 | 46,767 |

Apellis Pharmaceuticals, Inc. * | 500 | 25,865 |

Arrowhead Pharmaceuticals, Inc. * | 942 | 38,191 |

Atara Biotherapeutics, Inc. * | 2,408 | 7,899 |

Blueprint Medicines Corp. * | 544 | 23,847 |

Coherus Biosciences, Inc. * | 2,390 | 18,925 |

G1 Therapeutics, Inc. * (a) | 1,205 | 6,543 |

Halozyme Therapeutics, Inc. * | 1,317 | 74,914 |

Heron Therapeutics, Inc. * (a) | 3,869 | 9,672 |

Kronos Bio, Inc. * | 1,439 | 2,332 |

Natera, Inc. * | 785 | 31,537 |

PMV Pharmaceuticals, Inc. * (a) | 1,261 | 10,974 |

REGENXBIO, Inc. * | 1,148 | 26,032 |

Relay Therapeutics, Inc. * | 1,285 | 19,199 |

REVOLUTION Medicines, Inc. * | 852 | 20,305 |

Sage Therapeutics, Inc. * | 477 | 18,181 |

Sana Biotechnology, Inc. * (a) | 672 | 2,655 |

Twist Bioscience Corp. * | 1,099 | 26,170 |

Verve Therapeutics, Inc. * (a) | 627 | 12,131 |

459,445 | ||

Building Products — 1.5% | ||

Advanced Drainage Systems, Inc. | 282 | 23,135 |

Simpson Manufacturing Co., Inc. | 370 | 32,811 |

55,946 | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Capital Markets — 1.9% | ||

Evercore, Inc., Class A | 237 | 25,781 |

Focus Financial Partners, Inc., Class A * | 1,175 | 43,798 |

69,579 | ||

Commercial Services & Supplies — 3.6% | ||

ACV Auctions, Inc., Class A * (a) | 2,345 | 19,255 |

Casella Waste Systems, Inc., Class A * | 687 | 54,458 |

MSA Safety, Inc. | 393 | 56,739 |

130,452 | ||

Communications Equipment — 1.0% | ||

Ciena Corp. * | 741 | 37,786 |

Construction & Engineering — 2.5% | ||

EMCOR Group, Inc. | 102 | 15,091 |

MasTec, Inc. * | 257 | 21,925 |

Valmont Industries, Inc. | 167 | 55,096 |

92,112 | ||

Diversified Consumer Services — 0.4% | ||

Bright Horizons Family Solutions, Inc. * (a) | 239 | 15,071 |

Electrical Equipment — 2.0% | ||

Bloom Energy Corp., Class A * (a) | 1,719 | 32,876 |

Shoals Technologies Group, Inc., Class A * | 1,583 | 39,044 |

71,920 | ||

Electronic Equipment, Instruments & Components — 1.5% | ||

Coherent Corp. * | 404 | 14,182 |

Fabrinet (Thailand) * | 169 | 21,709 |

Littelfuse, Inc. | 88 | 19,396 |

55,287 | ||

Energy Equipment & Services — 1.7% | ||

Cactus, Inc., Class A | 1,211 | 60,844 |

Equity Real Estate Investment Trusts (REITs) — 2.0% | ||

CubeSmart (a) | 636 | 25,596 |

Terreno Realty Corp. | 811 | 46,118 |

71,714 | ||

Food & Staples Retailing — 2.5% | ||

Grocery Outlet Holding Corp. * (a) | 1,408 | 41,104 |

Performance Food Group Co. * | 856 | 49,948 |

91,052 | ||

Food Products — 0.8% | ||

Freshpet, Inc. * (a) | 519 | 27,366 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 31 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Health Care Equipment & Supplies — 6.5% | ||

CONMED Corp. | 469 | 41,519 |

iRhythm Technologies, Inc. * | 408 | 38,202 |

Nevro Corp. * (a) | 503 | 19,899 |

NuVasive, Inc. * | 836 | 34,491 |

Outset Medical, Inc. * | 1,787 | 46,150 |

Shockwave Medical, Inc. * | 283 | 58,263 |

238,524 | ||

Health Care Providers & Services — 2.6% | ||

Acadia Healthcare Co., Inc. * | 595 | 48,960 |

Accolade, Inc. * | 1,737 | 13,531 |

Amedisys, Inc. * | 276 | 23,067 |

Cano Health, Inc. * (a) | 5,675 | 7,775 |

93,333 | ||

Health Care Technology — 1.4% | ||

Evolent Health, Inc., Class A * | 1,766 | 49,586 |

Hotels, Restaurants & Leisure — 6.7% | ||

Boyd Gaming Corp. | 482 | 26,296 |

Life Time Group Holdings, Inc. * (a) | 2,403 | 28,742 |

Marriott Vacations Worldwide Corp. | 272 | 36,605 |

Papa John's International, Inc. | 304 | 25,045 |

Planet Fitness, Inc., Class A * | 660 | 51,959 |

Six Flags Entertainment Corp. * (a) | 959 | 22,300 |

Texas Roadhouse, Inc. | 592 | 53,853 |

244,800 | ||

Household Durables — 1.3% | ||

Helen of Troy Ltd. * (a) | 244 | 27,003 |

Sonos, Inc. * | 1,256 | 21,231 |

48,234 | ||

Insurance — 0.4% | ||

Kinsale Capital Group, Inc. | 60 | 15,583 |

Interactive Media & Services — 0.4% | ||

Bumble, Inc., Class A * (a) | 729 | 15,346 |

Internet & Direct Marketing Retail — 0.9% | ||

Global-e Online Ltd. (Israel) * (a) | 676 | 13,951 |

Xometry, Inc., Class A * (a) | 627 | 20,218 |

34,169 | ||

IT Services — 3.4% | ||

DigitalOcean Holdings, Inc. * (a) | 592 | 15,065 |

ExlService Holdings, Inc. * | 255 | 43,146 |

Flywire Corp. * | 498 | 12,185 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

IT Services — continued | ||

Globant SA * | 203 | 34,206 |

Remitly Global, Inc. * | 1,686 | 19,306 |

123,908 | ||

Life Sciences Tools & Services — 0.2% | ||

Personalis, Inc. * | 1,538 | 3,046 |

Seer, Inc. * | 433 | 2,509 |

5,555 | ||

Machinery — 3.9% | ||

Chart Industries, Inc. * | 262 | 30,230 |

Evoqua Water Technologies Corp. * | 1,045 | 41,370 |

ITT, Inc. | 499 | 40,503 |

John Bean Technologies Corp. | 330 | 30,121 |

142,224 | ||

Oil, Gas & Consumable Fuels — 3.7% | ||

Chord Energy Corp. | 175 | 23,962 |

Matador Resources Co. (a) | 1,246 | 71,304 |

SM Energy Co. | 1,190 | 41,451 |

136,717 | ||

Personal Products — 0.2% | ||

elf Beauty, Inc. * | 152 | 8,380 |

Pharmaceuticals — 2.3% | ||

Arvinas, Inc. * | 690 | 23,621 |

Intra-Cellular Therapies, Inc. * | 552 | 29,212 |

Revance Therapeutics, Inc. * | 1,757 | 32,429 |

85,262 | ||

Professional Services — 1.3% | ||

KBR, Inc. | 922 | 48,702 |

Road & Rail — 1.1% | ||

Saia, Inc. * | 191 | 40,003 |

Semiconductors & Semiconductor Equipment — 2.0% | ||

MKS Instruments, Inc. (a) | 362 | 30,688 |

Power Integrations, Inc. | 288 | 20,646 |

Wolfspeed, Inc. * (a) | 323 | 22,293 |

73,627 | ||

Software — 12.6% | ||

Blackline, Inc. * | 587 | 39,466 |

Clear Secure, Inc., Class A (a) | 865 | 23,738 |

Confluent, Inc., Class A * | 1,044 | 23,215 |

Coupa Software, Inc. * | 195 | 15,459 |

CyberArk Software Ltd. * | 346 | 44,926 |

32 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Software — continued | ||

Elastic NV * | 394 | 20,269 |

Envestnet, Inc. * | 724 | 44,660 |

Everbridge, Inc. * | 531 | 15,706 |

Five9, Inc. * | 393 | 26,702 |

HashiCorp, Inc., Class A * (a) | 1,347 | 36,821 |

JFrog Ltd. (Israel) * | 811 | 17,299 |

New Relic, Inc. * | 606 | 34,198 |

Paycor HCM, Inc. * (a) | 1,061 | 25,966 |

SentinelOne, Inc., Class A * (a) | 1,374 | 20,045 |

Smartsheet, Inc., Class A * | 940 | 37,007 |

Sprout Social, Inc., Class A * | 249 | 14,056 |

Vertex, Inc., Class A * | 1,522 | 22,082 |

461,615 | ||

Specialty Retail — 4.5% | ||

Burlington Stores, Inc. * | 163 | 33,084 |

Floor & Decor Holdings, Inc., Class A * (a) | 290 | 20,239 |

Lithia Motors, Inc., Class A | 114 | 23,274 |

National Vision Holdings, Inc. * (a) | 1,637 | 63,446 |

Petco Health & Wellness Co., Inc. * (a) | 2,639 | 25,018 |

165,061 | ||

Technology Hardware, Storage & Peripherals — 0.3% | ||

Super Micro Computer, Inc. * | 126 | 10,337 |

Trading Companies & Distributors — 5.1% | ||

Air Lease Corp. | 743 | 28,529 |

Applied Industrial Technologies, Inc. | 620 | 78,177 |

Rush Enterprises, Inc., Class A | 629 | 32,885 |

SiteOne Landscape Supply, Inc. * (a) | 155 | 18,234 |

WESCO International, Inc. * | 238 | 29,806 |

187,631 | ||

Total Common Stocks (Cost $3,676,276) | 3,630,742 | |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short-Term Investments — 6.9% | ||

Investment Companies — 1.1% | ||

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c) (Cost $38,890) | 38,878 | 38,897 |

Investment of Cash Collateral from Securities Loaned — 5.8% | ||

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | 166,216 | 166,266 |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | 47,033 | 47,033 |

Total Investment of Cash Collateral from Securities Loaned (Cost $213,266) | 213,299 | |

Total Short-Term Investments (Cost $252,156) | 252,196 | |

Total Investments — 106.1% (Cost $3,928,432) | 3,882,938 | |

Liabilities in Excess of Other Assets — (6.1)% | (224,764) | |

NET ASSETS — 100.0% | 3,658,174 | |

Percentages indicated are based on net assets. |

* | Non-income producing security. |

(a) | The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $208,340. |

(b) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

(c) | The rate shown is the current yield as of December 31, 2022. |

December 31, 2022 | J.P. Morgan Small Cap Funds | 33 |

AS OF December 31, 2022 (Unaudited)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — 99.2% | ||

Auto Components — 2.3% | ||

Visteon Corp. * | 15 | 1,953 |

Banks — 9.5% | ||

Amalgamated Financial Corp. | 98 | 2,262 |

Customers Bancorp, Inc. * | 14 | 390 |

Hilltop Holdings, Inc. | 65 | 1,960 |

Signature Bank | 3 | 289 |

Synovus Financial Corp. | 39 | 1,463 |

Zions Bancorp NA | 37 | 1,812 |

8,176 | ||

Biotechnology — 8.5% | ||

Apellis Pharmaceuticals, Inc. * | 18 | 931 |

Fate Therapeutics, Inc. * | 33 | 331 |

Halozyme Therapeutics, Inc. * | 51 | 2,908 |

Natera, Inc. * | 15 | 595 |

Sarepta Therapeutics, Inc. * | 20 | 2,560 |

7,325 | ||

Building Products — 4.2% | ||

AAON, Inc. | 30 | 2,273 |

Advanced Drainage Systems, Inc. | 6 | 504 |

AZEK Co., Inc. (The) * | 42 | 851 |

3,628 | ||

Capital Markets — 1.4% | ||

Federated Hermes, Inc. | 33 | 1,208 |

Chemicals — 1.1% | ||

Avient Corp. | 26 | 895 |

Ginkgo Bioworks Holdings, Inc. * | 21 | 35 |

930 | ||

Commercial Services & Supplies — 4.4% | ||

ABM Industries, Inc. | 15 | 655 |

Interface, Inc. | 57 | 568 |

MillerKnoll, Inc. | 54 | 1,134 |

Tetra Tech, Inc. | 10 | 1,456 |

3,813 | ||

Diversified Consumer Services — 0.8% | ||

Coursera, Inc. * | 56 | 663 |

Electric Utilities — 2.1% | ||

Portland General Electric Co. | 37 | 1,838 |

Electrical Equipment — 2.8% | ||

Acuity Brands, Inc. | 3 | 571 |

Bloom Energy Corp., Class A * | 14 | 262 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Electrical Equipment — continued | ||

Fluence Energy, Inc. * | 11 | 187 |

FuelCell Energy, Inc. * | 46 | 128 |

SunPower Corp. * | 69 | 1,247 |

2,395 | ||

Electronic Equipment, Instruments & Components — 2.9% | ||

Badger Meter, Inc. | 12 | 1,360 |

Itron, Inc. * | 23 | 1,165 |

2,525 | ||

Equity Real Estate Investment Trusts (REITs) — 5.9% | ||

Alexander & Baldwin, Inc. | 63 | 1,181 |

Hudson Pacific Properties, Inc. | 21 | 202 |

Kilroy Realty Corp. | 21 | 799 |

Paramount Group, Inc. | 126 | 751 |

Rayonier, Inc. | 36 | 1,203 |

Rexford Industrial Realty, Inc. | 17 | 907 |

5,043 | ||

Food & Staples Retailing — 2.7% | ||

Sprouts Farmers Market, Inc. * | 40 | 1,276 |

United Natural Foods, Inc. * | 28 | 1,094 |

2,370 | ||

Food Products — 2.5% | ||

AppHarvest, Inc. * | 48 | 27 |

Darling Ingredients, Inc. * | 28 | 1,771 |

Vital Farms, Inc. * | 26 | 393 |

2,191 | ||

Health Care Equipment & Supplies — 1.4% | ||

Shockwave Medical, Inc. * | 6 | 1,223 |

Health Care Providers & Services — 6.5% | ||

AMN Healthcare Services, Inc. * | 18 | 1,792 |

Encompass Health Corp. | 22 | 1,322 |

Enhabit, Inc. * | 11 | 150 |

HealthEquity, Inc. * | 28 | 1,698 |

Progyny, Inc. * | 20 | 624 |

5,586 | ||

Health Care Technology — 1.9% | ||

Schrodinger, Inc. * | 34 | 640 |

Veradigm, Inc. * | 56 | 978 |

1,618 | ||

Hotels, Restaurants & Leisure — 0.1% | ||

Sweetgreen, Inc., Class A * | 12 | 100 |

34 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Household Durables — 2.7% | ||

KB Home | 45 | 1,419 |

Sonos, Inc. * | 51 | 867 |

2,286 | ||

Independent Power and Renewable Electricity Producers — 0.2% | ||

Sunnova Energy International, Inc. * | 8 | 144 |

Insurance — 2.0% | ||

CNO Financial Group, Inc. | 74 | 1,683 |

Lemonade, Inc. * | 2 | 36 |

1,719 | ||

Interactive Media & Services — 2.1% | ||

Bumble, Inc., Class A * | 42 | 875 |

Yelp, Inc. * | 33 | 909 |

1,784 | ||

Internet & Direct Marketing Retail — 0.5% | ||

Rent the Runway, Inc., Class A * | 133 | 407 |

ThredUp, Inc., Class A * | 38 | 49 |

456 | ||

Life Sciences Tools & Services — 0.6% | ||

Azenta, Inc. * | 7 | 435 |

Singular Genomics Systems, Inc. * | 59 | 118 |

553 | ||

Machinery — 2.8% | ||

AGCO Corp. | 9 | 1,214 |

Lindsay Corp. | 7 | 1,156 |

2,370 | ||

Metals & Mining — 3.6% | ||

Alcoa Corp. | 20 | 919 |

Constellium SE * | 87 | 1,023 |

Schnitzer Steel Industries, Inc., Class A | 38 | 1,178 |

3,120 | ||

Mortgage Real Estate Investment Trusts (REITs) — 1.3% | ||

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 38 | 1,111 |

Oil, Gas & Consumable Fuels — 0.6% | ||

Clean Energy Fuels Corp. * | 102 | 530 |

Personal Products — 0.2% | ||

Honest Co., Inc. (The) * | 45 | 136 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Professional Services — 4.6% | ||

Huron Consulting Group, Inc. * | 31 | 2,265 |

ICF International, Inc. | 17 | 1,662 |

3,927 | ||

Real Estate Management & Development — 1.1% | ||

Cushman & Wakefield plc * | 74 | 920 |

Semiconductors & Semiconductor Equipment — 1.7% | ||

Power Integrations, Inc. | 13 | 966 |

Wolfspeed, Inc. * | 7 | 462 |

1,428 | ||

Software — 2.7% | ||

Everbridge, Inc. * | 9 | 265 |

NCR Corp. * | 38 | 897 |

Q2 Holdings, Inc. * | 24 | 649 |

Workiva, Inc. * | 6 | 479 |

2,290 | ||

Specialty Retail — 0.4% | ||

Warby Parker, Inc., Class A * | 24 | 322 |

Textiles, Apparel & Luxury Goods — 6.3% | ||

Allbirds, Inc., Class A * | 62 | 149 |

Columbia Sportswear Co. | 12 | 1,093 |

Deckers Outdoor Corp. * | 5 | 2,170 |

Kontoor Brands, Inc. | 33 | 1,302 |

Unifi, Inc. * | 81 | 697 |

5,411 | ||

Trading Companies & Distributors — 2.5% | ||

WESCO International, Inc. * | 18 | 2,196 |

Water Utilities — 2.3% | ||

American States Water Co. | 22 | 2,018 |

Total Common Stocks (Cost $103,259) | 85,306 | |

NO. OF RIGHTS (000) | ||

Rights — 0.0% ^ | ||

Pharmaceuticals — 0.0% ^ | ||

Contra Aduro Biotech I ‡ *(Cost $108) | 42 | — |

December 31, 2022 | J.P. Morgan Small Cap Funds | 35 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short-Term Investments — 1.4% | ||

Investment Companies — 1.4% | ||

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (a) (b) (Cost $1,236) | 1,236 | 1,236 |

Total Investments — 100.6% (Cost $104,603) | 86,542 | |

Liabilities in Excess of Other Assets — (0.6)% | (554) | |

NET ASSETS — 100.0% | 85,988 | |

Percentages indicated are based on net assets. | ||

Amounts presented as a dash ("-") represent amounts that round to less than a thousand. |

^ | Amount rounds to less than 0.1% of net assets. | |

‡ | Value determined using significant unobservable inputs. | |

* | Non-income producing security. | |

(a) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. | |

(b) | The rate shown is the current yield as of December 31, 2022. | |

36 | J.P. Morgan Small Cap Funds | December 31, 2022 |

AS OF December 31, 2022 (Unaudited)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — 96.2% | ||

Air Freight & Logistics — 1.1% | ||

Atlas Air Worldwide Holdings, Inc. * (a) | 31 | 3,085 |

Hub Group, Inc., Class A * | 139 | 11,041 |

Radiant Logistics, Inc. * | 88 | 450 |

14,576 | ||

Airlines — 0.3% | ||

Hawaiian Holdings, Inc. * | 42 | 435 |

SkyWest, Inc. * | 200 | 3,302 |

3,737 | ||

Auto Components — 0.4% | ||

Adient plc * | 104 | 3,625 |

American Axle & Manufacturing Holdings, Inc. * | 41 | 319 |

Dana, Inc. | 105 | 1,586 |

5,530 | ||

Banks — 17.5% | ||

American National Bankshares, Inc. | 11 | 414 |

Ameris Bancorp | 73 | 3,422 |

Associated Banc-Corp. | 132 | 3,048 |

Atlantic Union Bankshares Corp. | 77 | 2,713 |

Banc of California, Inc. | 93 | 1,486 |

Bancorp, Inc. (The) * | 27 | 763 |

Bank of NT Butterfield & Son Ltd. (The) (Bermuda) | 89 | 2,665 |

BankUnited, Inc. | 18 | 608 |

Banner Corp. | 20 | 1,232 |

Brookline Bancorp, Inc. | 230 | 3,249 |

Business First Bancshares, Inc. | 75 | 1,667 |

Byline Bancorp, Inc. | 152 | 3,482 |

Cadence Bank | 14 | 342 |

Capital City Bank Group, Inc. | 25 | 812 |

Capstar Financial Holdings, Inc. | 133 | 2,343 |

Cathay General Bancorp | 29 | 1,199 |

Central Pacific Financial Corp. | 72 | 1,466 |

Civista Bancshares, Inc. | 17 | 381 |

Columbia Banking System, Inc. (a) | 87 | 2,624 |

Community Trust Bancorp, Inc. | 56 | 2,561 |

ConnectOne Bancorp, Inc. | 250 | 6,052 |

Customers Bancorp, Inc. * (a) | 117 | 3,316 |

CVB Financial Corp. | 268 | 6,893 |

Eastern Bankshares, Inc. | 289 | 4,984 |

Enterprise Financial Services Corp. | 98 | 4,808 |

Equity Bancshares, Inc., Class A | 33 | 1,088 |

FB Financial Corp. | 24 | 857 |

Financial Institutions, Inc. | 32 | 787 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Banks — continued | ||

First Bancorp | 12 | 505 |

First BanCorp (Puerto Rico) | 329 | 4,184 |

First Bancshares, Inc. (The) | 20 | 640 |

First Citizens BancShares, Inc., Class A | 4 | 2,821 |

First Commonwealth Financial Corp. | 330 | 4,617 |

First Financial Corp. | 67 | 3,110 |

First Internet Bancorp | 44 | 1,068 |

First Interstate BancSystem, Inc., Class A | 107 | 4,124 |

First Merchants Corp. | 102 | 4,210 |

First Western Financial, Inc. * | 9 | 253 |

FNB Corp. | 54 | 709 |

Glacier Bancorp, Inc. | 43 | 2,135 |

Hancock Whitney Corp. | 224 | 10,816 |

Heritage Commerce Corp. | 185 | 2,408 |

Home BancShares, Inc. | 130 | 2,954 |

HomeTrust Bancshares, Inc. | 57 | 1,378 |

Independent Bank Corp. | 28 | 2,373 |

Independent Bank Corp. | 26 | 615 |

Mercantile Bank Corp. | 9 | 295 |

Metropolitan Bank Holding Corp. * | 10 | 581 |

Mid Penn Bancorp, Inc. | 16 | 477 |

Midland States Bancorp, Inc. | 44 | 1,182 |

MVB Financial Corp. | 12 | 258 |

National Bank Holdings Corp., Class A | 58 | 2,427 |

Nicolet Bankshares, Inc. * | 9 | 702 |

OceanFirst Financial Corp. | 620 | 13,181 |

OFG Bancorp (Puerto Rico) | 383 | 10,561 |

Old National Bancorp | 794 | 14,277 |

Old Second Bancorp, Inc. | 311 | 4,988 |

Origin Bancorp, Inc. | 16 | 587 |

Orrstown Financial Services, Inc. | 20 | 456 |

Peapack-Gladstone Financial Corp. | 98 | 3,662 |

Peoples Bancorp, Inc. | 8 | 232 |

Pinnacle Financial Partners, Inc. | 33 | 2,393 |

Preferred Bank | 6 | 478 |

Premier Financial Corp. | 39 | 1,049 |

QCR Holdings, Inc. | 68 | 3,366 |

Republic Bancorp, Inc., Class A | 14 | 561 |

Sandy Spring Bancorp, Inc. | 32 | 1,127 |

Sierra Bancorp | 23 | 499 |

Simmons First National Corp., Class A | 53 | 1,135 |

SmartFinancial, Inc. | 38 | 1,039 |

South Plains Financial, Inc. | 10 | 264 |

SouthState Corp. | 131 | 10,008 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 37 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Banks — continued | ||

TriCo Bancshares | 45 | 2,320 |

Trustmark Corp. | 30 | 1,047 |

UMB Financial Corp. | 48 | 4,017 |

United Community Banks, Inc. | 23 | 771 |

Veritex Holdings, Inc. | 367 | 10,314 |

Washington Federal, Inc. | 134 | 4,496 |

Webster Financial Corp. | 13 | 592 |

WesBanco, Inc. | 13 | 466 |

Western Alliance Bancorp | 62 | 3,717 |

Wintrust Financial Corp. | 69 | 5,840 |

223,547 | ||

Beverages — 0.3% | ||

Primo Water Corp. | 208 | 3,232 |

Biotechnology — 6.6% | ||

2seventy bio, Inc. * | 62 | 585 |

Agios Pharmaceuticals, Inc. * | 95 | 2,665 |

Allovir, Inc. * (a) | 341 | 1,747 |

Arcellx, Inc. * | 168 | 5,217 |

Arcus Biosciences, Inc. * | 219 | 4,522 |

BioCryst Pharmaceuticals, Inc. * (a) | 167 | 1,918 |

Biohaven Ltd. * | 5 | 75 |

Bluebird Bio, Inc. * (a) | 187 | 1,295 |

CTI BioPharma Corp. * (a) | 314 | 1,885 |

Cytokinetics, Inc. * | 69 | 3,143 |

Enanta Pharmaceuticals, Inc. * | 13 | 614 |

EQRx, Inc. * (a) | 613 | 1,507 |

Fate Therapeutics, Inc. * (a) | 66 | 665 |

Iovance Biotherapeutics, Inc. * | 91 | 580 |

iTeos Therapeutics, Inc. * | 169 | 3,310 |

IVERIC bio, Inc. * | 245 | 5,246 |

Kezar Life Sciences, Inc. * (a) | 452 | 3,179 |

Kymera Therapeutics, Inc. * (a) | 206 | 5,152 |

Lexicon Pharmaceuticals, Inc. * | 1,360 | 2,598 |

Lyell Immunopharma, Inc. * (a) | 232 | 805 |

MoonLake Immunotherapeutics * | 19 | 205 |

Nuvalent, Inc., Class A * (a) | 236 | 7,016 |

Prothena Corp. plc (Ireland) * | 101 | 6,073 |

REGENXBIO, Inc. * | 152 | 3,436 |

Relay Therapeutics, Inc. * | 258 | 3,858 |

SpringWorks Therapeutics, Inc. * (a) | 138 | 3,597 |

Travere Therapeutics, Inc. * | 217 | 4,557 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Biotechnology — continued | ||

Twist Bioscience Corp. * | 204 | 4,869 |

Veracyte, Inc. * | 146 | 3,462 |

83,781 | ||

Building Products — 0.6% | ||

Resideo Technologies, Inc. * | 95 | 1,553 |

UFP Industries, Inc. | 80 | 6,364 |

7,917 | ||

Capital Markets — 1.5% | ||

AssetMark Financial Holdings, Inc. * | 44 | 1,019 |

BGC Partners, Inc., Class A | 166 | 624 |

Blucora, Inc. * | 208 | 5,318 |

Cowen, Inc., Class A | 30 | 1,147 |

Donnelley Financial Solutions, Inc. * | 45 | 1,739 |

Piper Sandler Cos. | 9 | 1,211 |

Stifel Financial Corp. | 31 | 1,809 |

StoneX Group, Inc. * | 30 | 2,849 |

Victory Capital Holdings, Inc., Class A | 36 | 974 |

Virtus Investment Partners, Inc. | 14 | 2,642 |

19,332 | ||

Chemicals — 0.9% | ||

AdvanSix, Inc. | 54 | 2,042 |

Avient Corp. | 51 | 1,728 |

Ecovyst, Inc. * | 54 | 477 |

HB Fuller Co. | 28 | 2,027 |

Minerals Technologies, Inc. | 33 | 1,992 |

Tronox Holdings plc, Class A | 245 | 3,357 |

11,623 | ||

Commercial Services & Supplies — 1.8% | ||

ABM Industries, Inc. | 184 | 8,164 |

ACCO Brands Corp. | 426 | 2,381 |

Cimpress plc (Ireland) * | 5 | 138 |

Ennis, Inc. | 33 | 725 |

Heritage-Crystal Clean, Inc. * | 51 | 1,665 |

MillerKnoll, Inc. | 373 | 7,839 |

Steelcase, Inc., Class A | 268 | 1,898 |

22,810 | ||

Communications Equipment — 1.4% | ||

Aviat Networks, Inc. * | 26 | 817 |

Calix, Inc. * | 149 | 10,183 |

38 | J.P. Morgan Small Cap Funds | December 31, 2022 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Communications Equipment — continued | ||

Comtech Telecommunications Corp. | 378 | 4,591 |

NETGEAR, Inc. * | 134 | 2,423 |

18,014 | ||

Construction & Engineering — 1.4% | ||

Argan, Inc. | 147 | 5,410 |

Comfort Systems USA, Inc. | 26 | 2,946 |

MasTec, Inc. * | 47 | 4,062 |

MYR Group, Inc. * | 45 | 4,134 |

Primoris Services Corp. | 81 | 1,784 |

18,336 | ||

Construction Materials — 0.3% | ||

Summit Materials, Inc., Class A * | 114 | 3,228 |

Consumer Finance — 1.7% | ||

Bread Financial Holdings, Inc. | 120 | 4,519 |

Encore Capital Group, Inc. * (a) | 123 | 5,921 |

Enova International, Inc. * | 98 | 3,764 |

Green Dot Corp., Class A * | 46 | 723 |

LendingClub Corp. * | 102 | 897 |

PROG Holdings, Inc. * | 329 | 5,555 |

21,379 | ||

Containers & Packaging — 0.3% | ||

Greif, Inc., Class A | 36 | 2,428 |

Myers Industries, Inc. | 17 | 369 |

O-I Glass, Inc. * | 69 | 1,148 |

3,945 | ||

Diversified Consumer Services — 0.4% | ||

2U, Inc. * | 586 | 3,672 |

Stride, Inc. * (a) | 58 | 1,821 |

5,493 | ||

Diversified Financial Services — 0.2% | ||

Jackson Financial, Inc., Class A (a) | 66 | 2,279 |

Diversified Telecommunication Services — 0.7% | ||

EchoStar Corp., Class A * | 228 | 3,803 |

Liberty Latin America Ltd., Class A (Puerto Rico) * | 89 | 674 |

Liberty Latin America Ltd., Class C (Puerto Rico) * | 538 | 4,087 |

8,564 | ||

Electric Utilities — 1.1% | ||

IDACORP, Inc. | 45 | 4,842 |

Otter Tail Corp. | 17 | 1,004 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Electric Utilities — continued | ||

Portland General Electric Co. | 164 | 8,026 |

Via Renewables, Inc. (a) | 71 | 366 |

14,238 | ||

Electrical Equipment — 0.6% | ||

Encore Wire Corp. | 37 | 5,035 |

Powell Industries, Inc. | 80 | 2,835 |

7,870 | ||

Electronic Equipment, Instruments & Components — 1.8% | ||

Belden, Inc. | 45 | 3,257 |

Benchmark Electronics, Inc. (a) | 135 | 3,613 |

Knowles Corp. * | 323 | 5,302 |

OSI Systems, Inc. * | 82 | 6,513 |

ScanSource, Inc. * | 153 | 4,468 |

23,153 | ||

Energy Equipment & Services — 0.9% | ||

Bristow Group, Inc. * | 13 | 349 |

ChampionX Corp. | 91 | 2,658 |

Helmerich & Payne, Inc. | 63 | 3,128 |

Nabors Industries Ltd. * | 3 | 434 |

NexTier Oilfield Solutions, Inc. * | 188 | 1,736 |

Patterson-UTI Energy, Inc. | 82 | 1,384 |

Solaris Oilfield Infrastructure, Inc., Class A | 70 | 693 |

US Silica Holdings, Inc. * | 69 | 859 |

11,241 | ||

Entertainment — 0.1% | ||

Lions Gate Entertainment Corp., Class A * | 106 | 607 |

Equity Real Estate Investment Trusts (REITs) — 9.1% | ||

Acadia Realty Trust | 145 | 2,085 |

Agree Realty Corp. | 220 | 15,606 |

Alexander & Baldwin, Inc. | 47 | 880 |

American Assets Trust, Inc. | 36 | 943 |

Apple Hospitality REIT, Inc. | 309 | 4,878 |

Armada Hoffler Properties, Inc. | 76 | 868 |

Broadstone Net Lease, Inc. (a) | 70 | 1,128 |

Centerspace | 27 | 1,572 |

City Office REIT, Inc. | 48 | 399 |

Corporate Office Properties Trust | 135 | 3,499 |

CTO Realty Growth, Inc. | 53 | 972 |

DiamondRock Hospitality Co. | 302 | 2,476 |

Equity Commonwealth | 163 | 4,070 |

Essential Properties Realty Trust, Inc. | 113 | 2,657 |

December 31, 2022 | J.P. Morgan Small Cap Funds | 39 |

AS OF December 31, 2022 (Unaudited) (continued)

INVESTMENTS | SHARES (000) | VALUE ($000) |

Common Stocks — continued | ||

Equity Real Estate Investment Trusts (REITs) — continued | ||

First Industrial Realty Trust, Inc. | 28 | 1,342 |

Getty Realty Corp. | 68 | 2,313 |

Global Medical REIT, Inc. | 57 | 537 |

Healthcare Realty Trust, Inc. | 223 | 4,291 |

Independence Realty Trust, Inc. (a) | 350 | 5,908 |

Kite Realty Group Trust | 208 | 4,376 |

Macerich Co. (The) | 223 | 2,511 |

NETSTREIT Corp. | 102 | 1,877 |

NexPoint Residential Trust, Inc. | 5 | 227 |

Paramount Group, Inc. | 116 | 687 |

Pebblebrook Hotel Trust (a) | 55 | 732 |

Phillips Edison & Co., Inc. | 51 | 1,637 |

Physicians Realty Trust | 243 | 3,519 |

Piedmont Office Realty Trust, Inc., Class A | 215 | 1,975 |

Plymouth Industrial REIT, Inc. | 29 | 552 |

PotlatchDeltic Corp. | 135 | 5,952 |

Retail Opportunity Investments Corp. | 47 | 703 |

RLJ Lodging Trust | 401 | 4,251 |

Ryman Hospitality Properties, Inc. | 73 | 5,954 |

Sabra Health Care REIT, Inc. | 304 | 3,775 |

SITE Centers Corp. | 365 | 4,993 |

STAG Industrial, Inc. | 233 | 7,535 |

Terreno Realty Corp. | 45 | 2,582 |

UMH Properties, Inc. | 160 | 2,573 |

Uniti Group, Inc. | 339 | 1,874 |

Xenia Hotels & Resorts, Inc. | 119 | 1,564 |

116,273 | ||

Food & Staples Retailing — 0.7% | ||

Andersons, Inc. (The) | 83 | 2,883 |

SpartanNash Co. | 24 | 735 |

Sprouts Farmers Market, Inc. * | 118 | 3,829 |

United Natural Foods, Inc. * | 33 | 1,258 |

8,705 | ||

Food Products — 0.5% | ||

Darling Ingredients, Inc. * | 100 | 6,265 |

Gas Utilities — 2.0% | ||

Brookfield Infrastructure Corp., Class A (Canada) | 30 | 1,173 |

Chesapeake Utilities Corp. | 11 | 1,359 |

New Jersey Resources Corp. | 239 | 11,864 |

Northwest Natural Holding Co. | 77 | 3,669 |

ONE Gas, Inc. | 33 | 2,484 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Gas Utilities — continued | ||

Southwest Gas Holdings, Inc. | 5 | 285 |

Spire, Inc. | 65 | 4,448 |

25,282 | ||

Health Care Equipment & Supplies — 1.5% | ||

Alphatec Holdings, Inc. * | 406 | 5,010 |

AngioDynamics, Inc. * | 82 | 1,131 |

Bioventus, Inc., Class A * | 135 | 352 |

Cue Health, Inc. * (a) | 117 | 243 |

Embecta Corp. | 90 | 2,271 |

Inari Medical, Inc. * (a) | 48 | 3,051 |

SeaSpine Holdings Corp. * | 218 | 1,816 |

Sight Sciences, Inc. * (a) | 240 | 2,935 |

Utah Medical Products, Inc. | 10 | 1,035 |

Varex Imaging Corp. * | 52 | 1,060 |

18,904 | ||

Health Care Providers & Services — 0.6% | ||

AdaptHealth Corp. * | 284 | 5,464 |

Fulgent Genetics, Inc. * | 78 | 2,314 |

7,778 | ||

Health Care Technology — 2.0% | ||

Computer Programs and Systems, Inc. * | 128 | 3,492 |

Evolent Health, Inc., Class A * | 168 | 4,720 |

Health Catalyst, Inc. * | 547 | 5,817 |

Phreesia, Inc. * | 81 | 2,621 |

Veradigm, Inc. * | 521 | 9,180 |

25,830 | ||

Hotels, Restaurants & Leisure — 1.3% | ||