0000763852 jpmt2:C000173561Member oef:UtilitiesSectorMember 2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class A Shares/Ticker: OIEIX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class A Shares) | $49 | 0.95% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

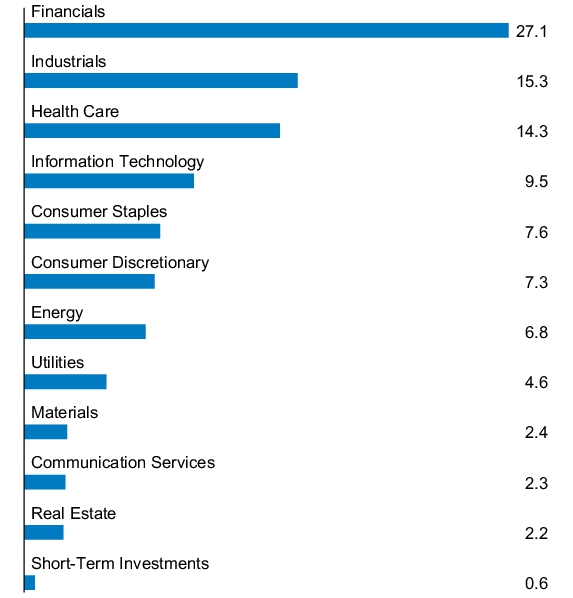

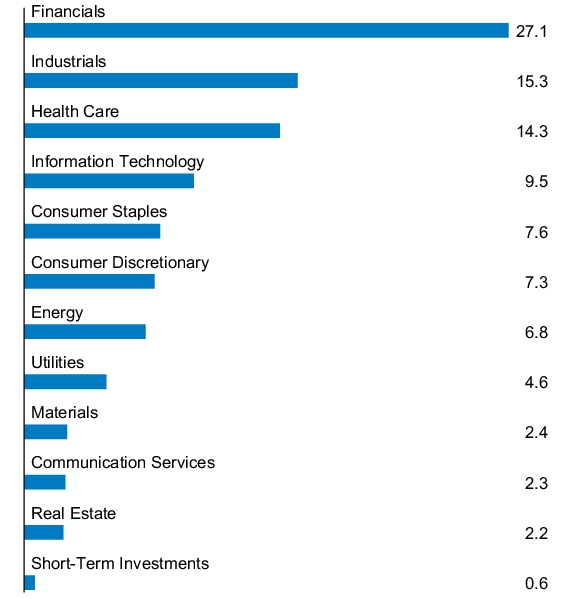

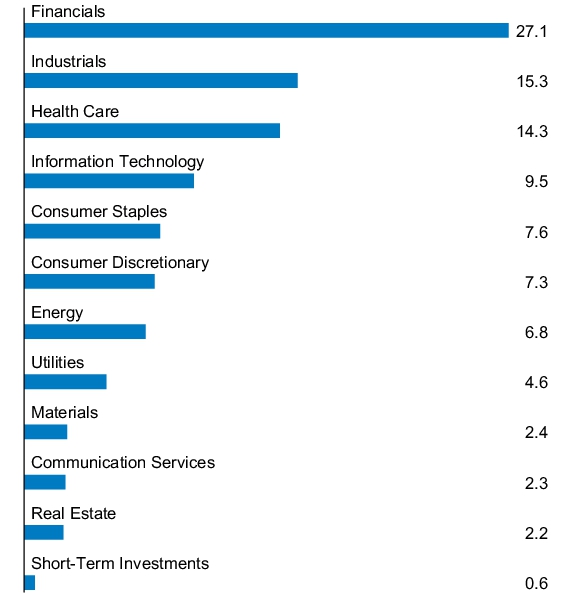

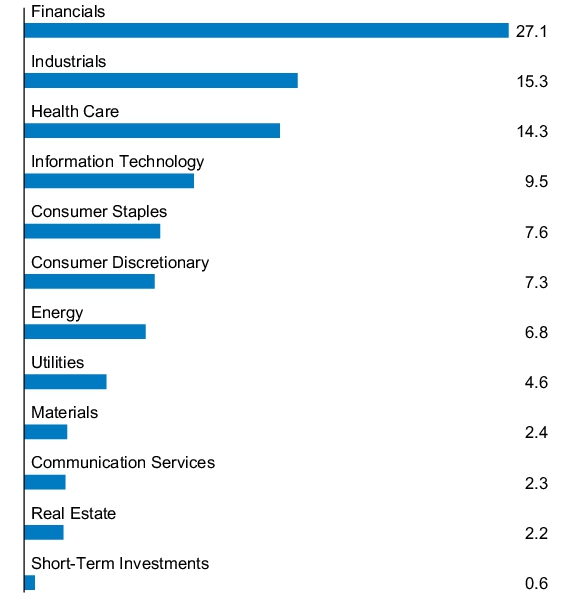

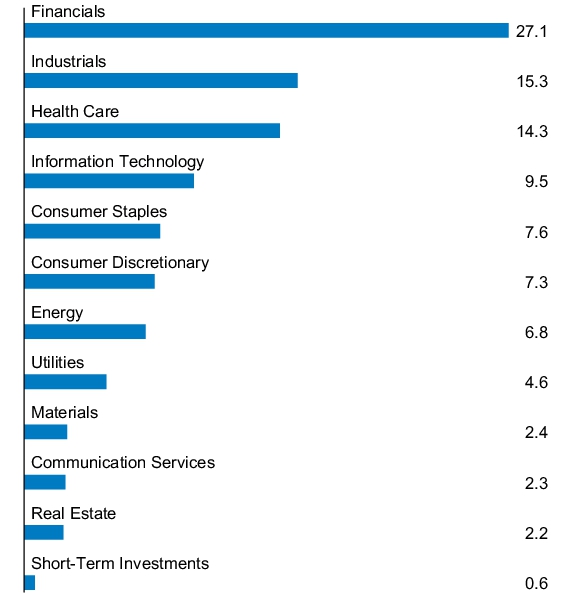

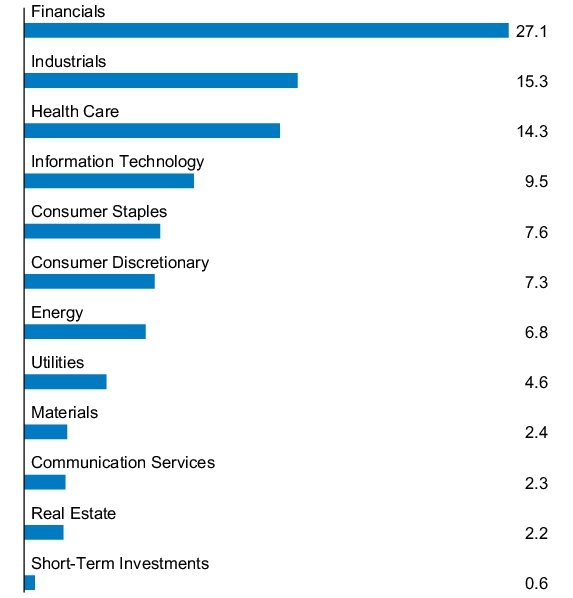

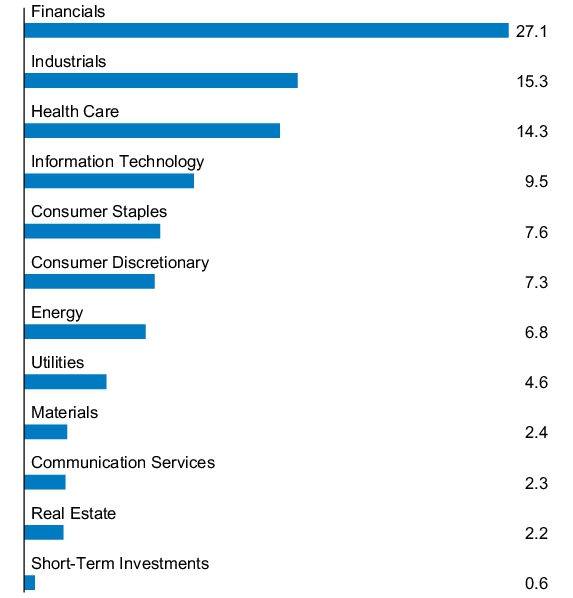

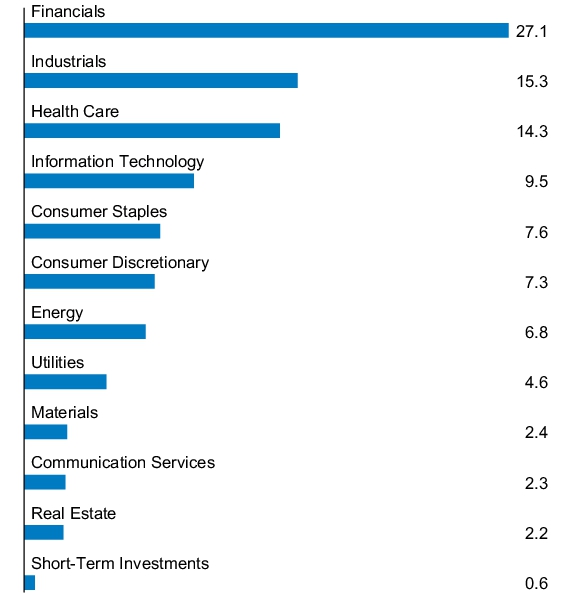

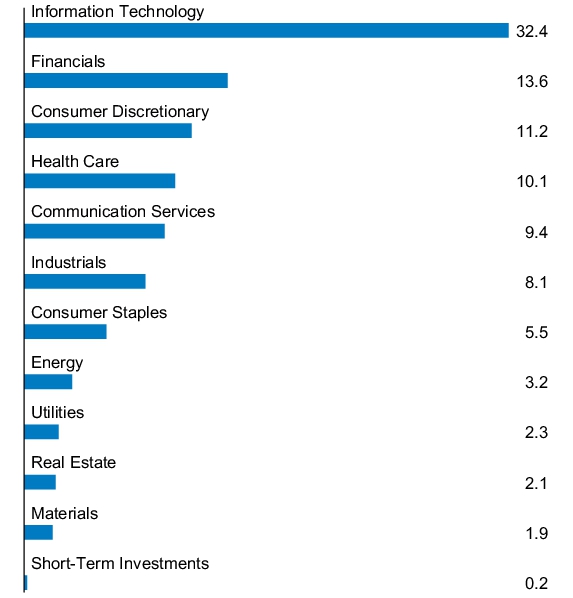

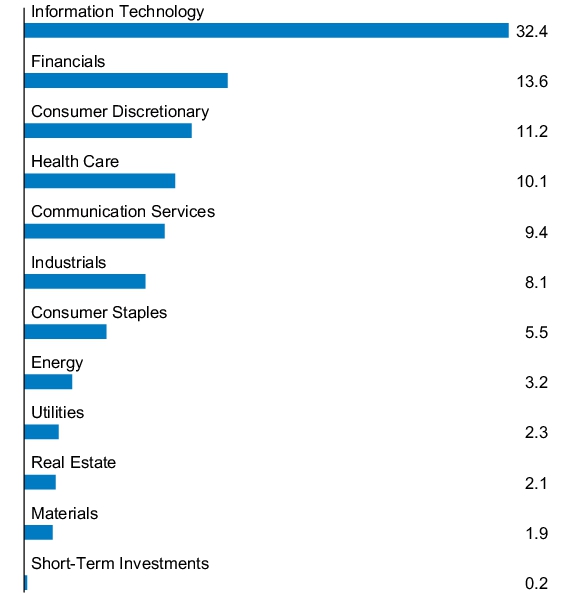

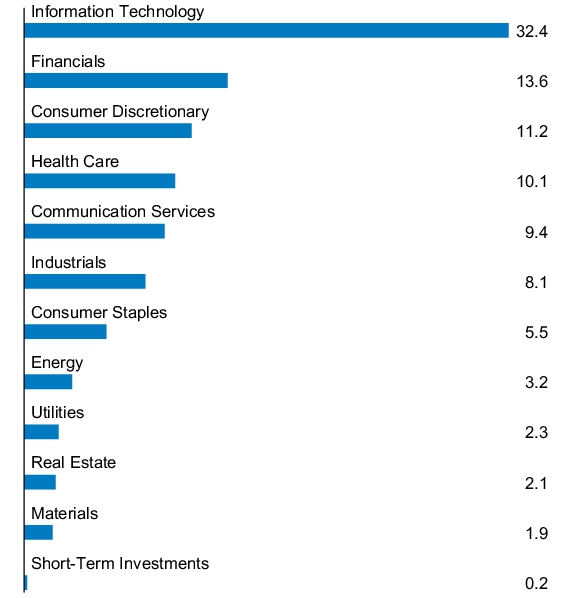

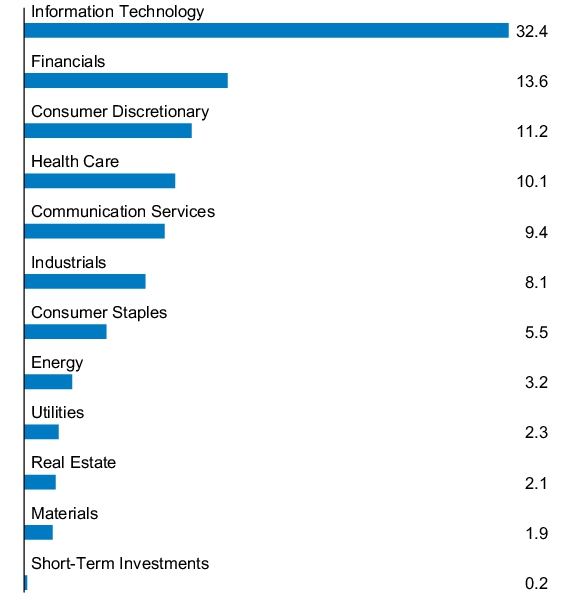

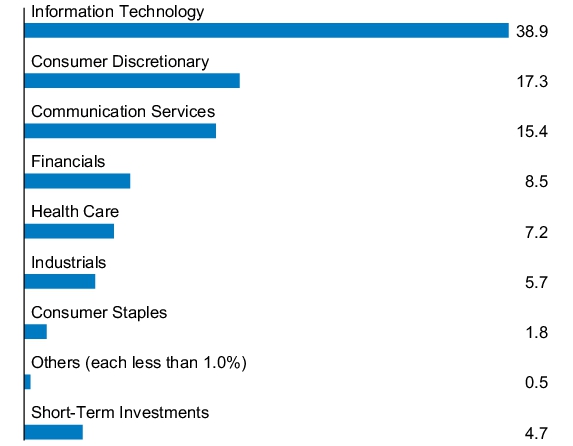

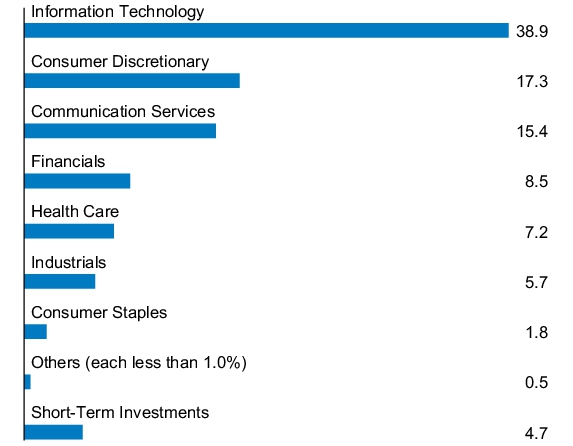

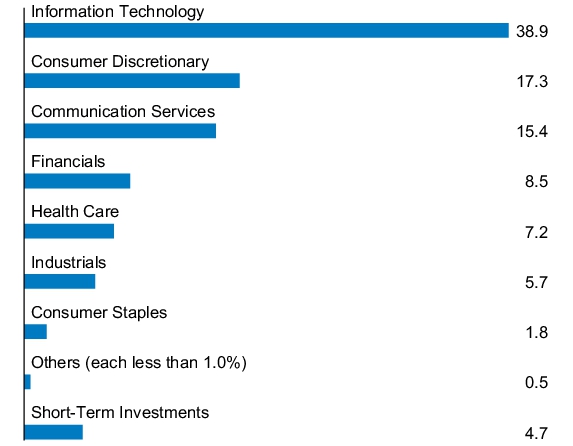

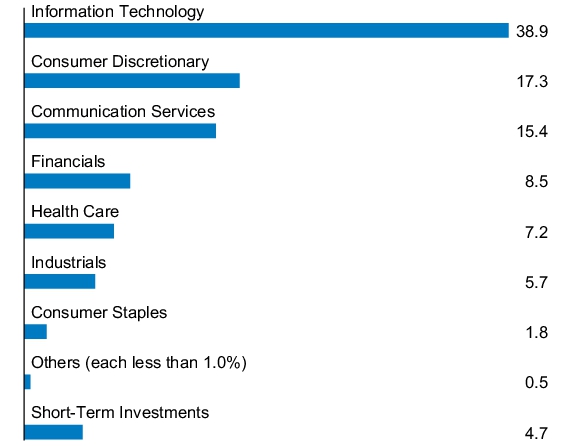

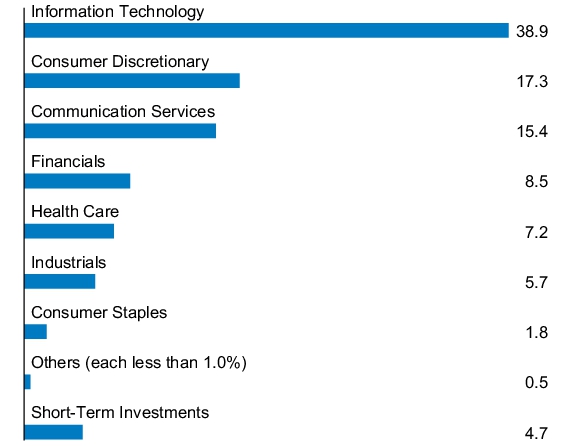

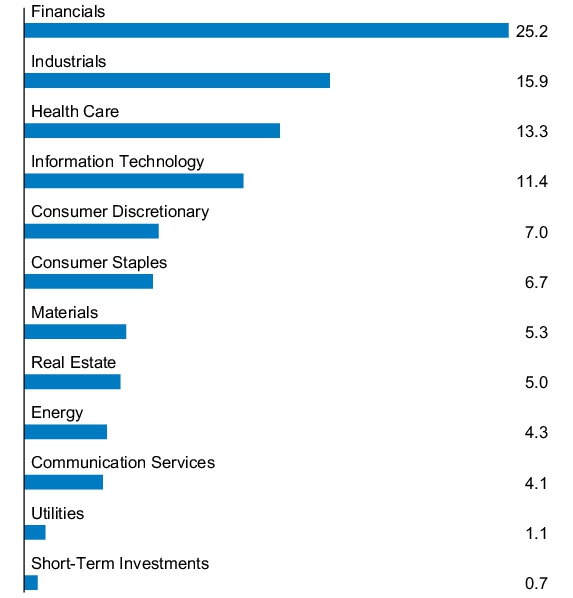

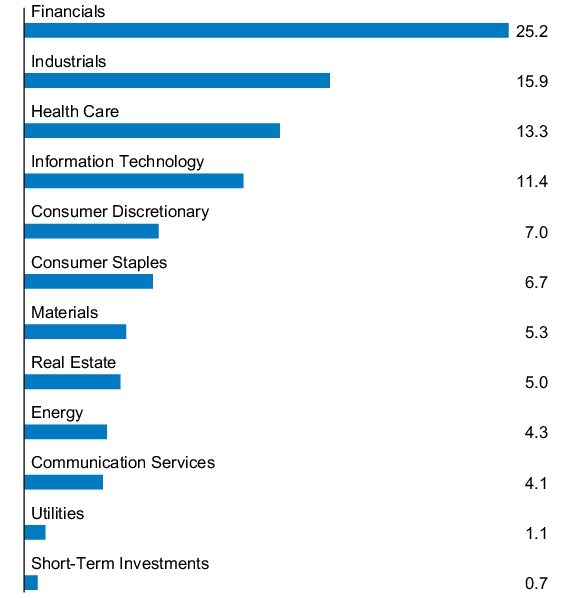

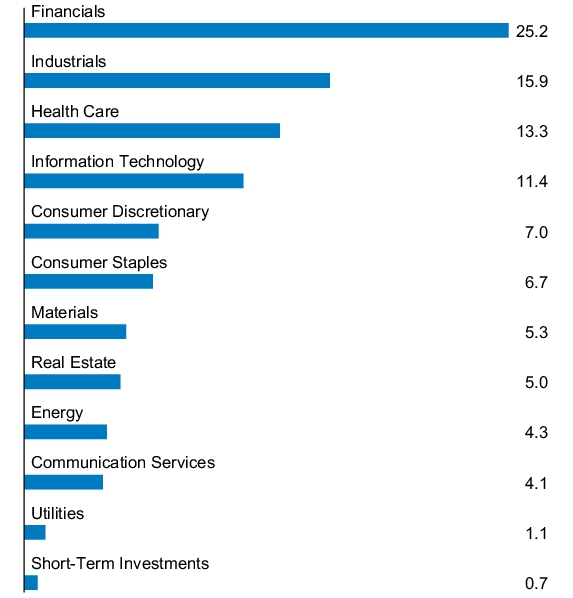

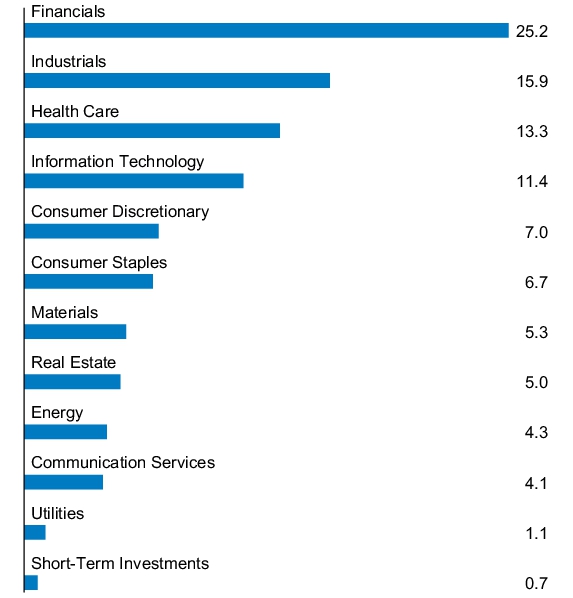

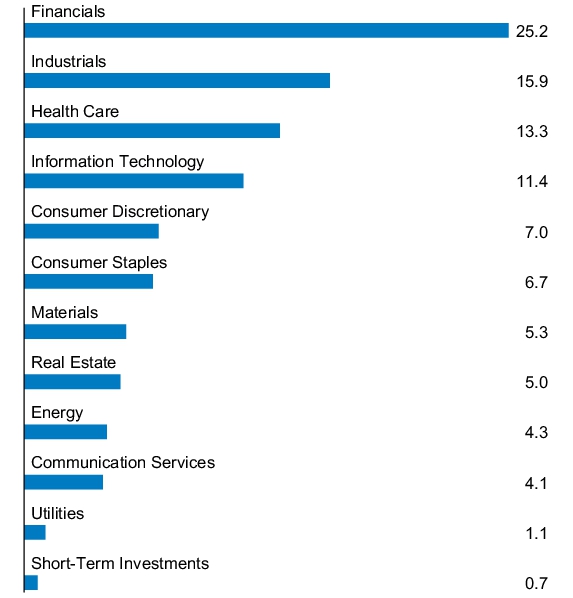

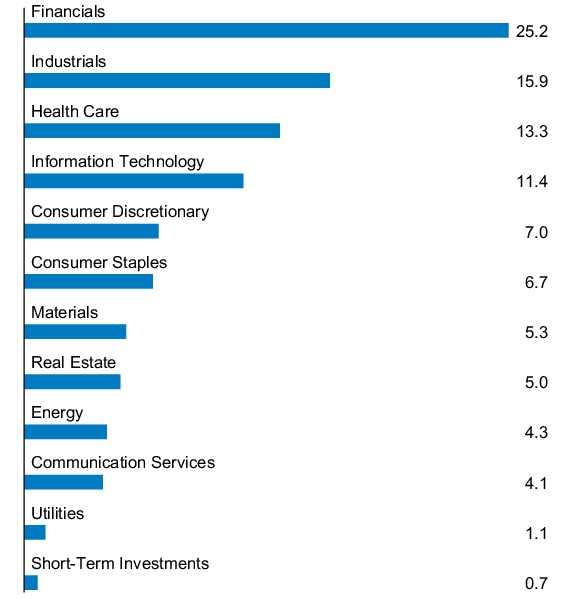

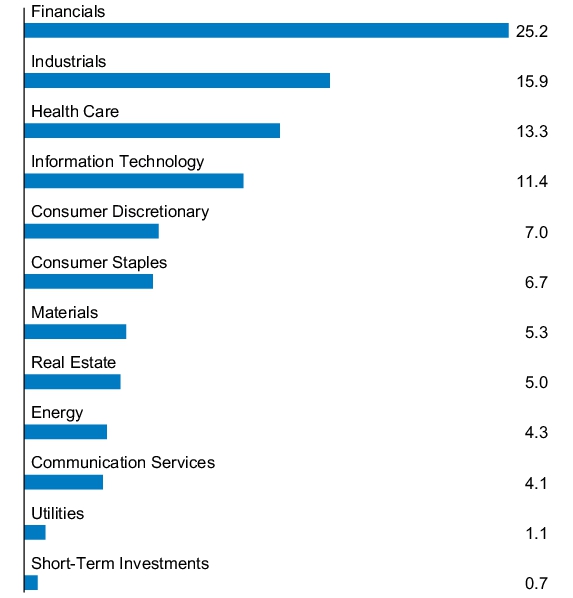

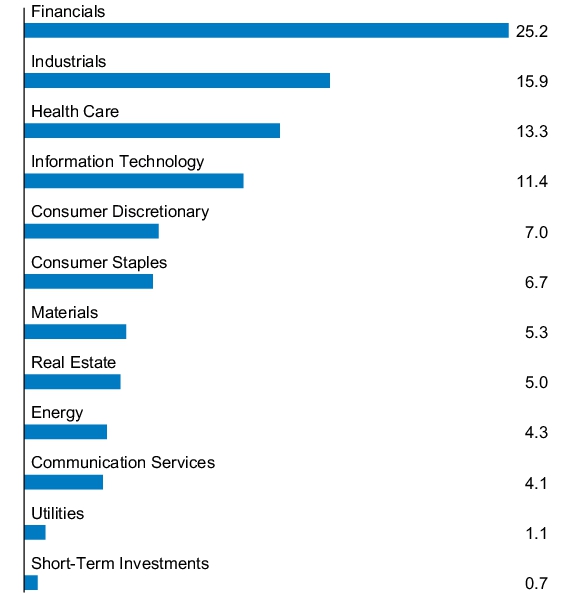

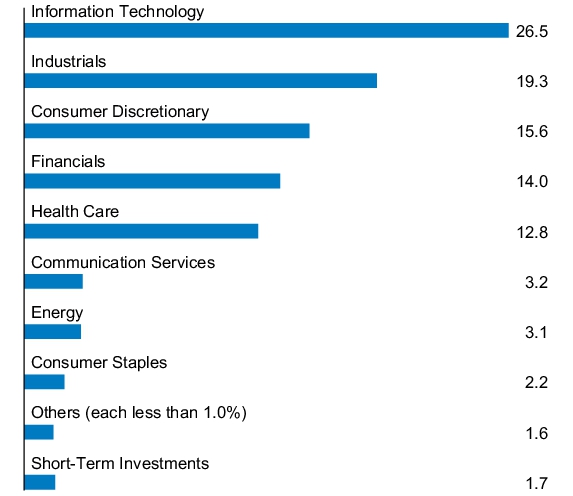

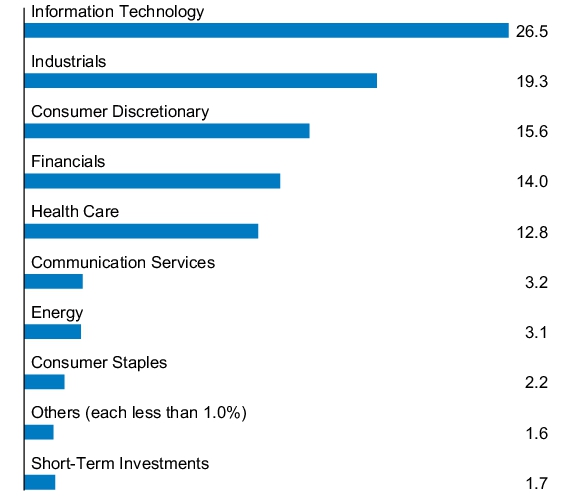

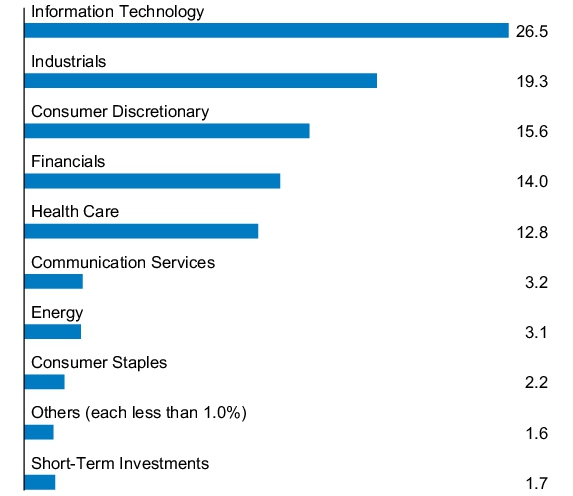

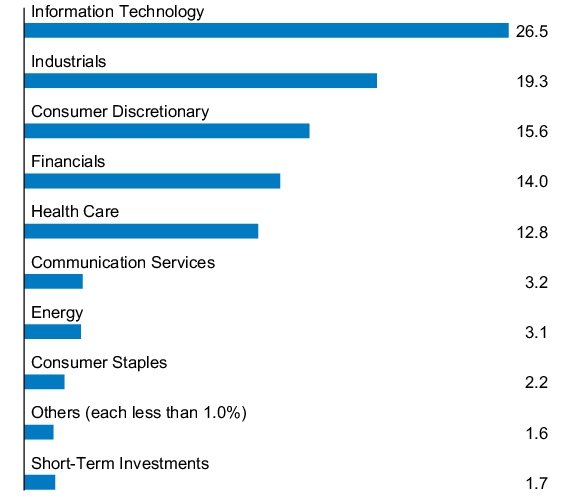

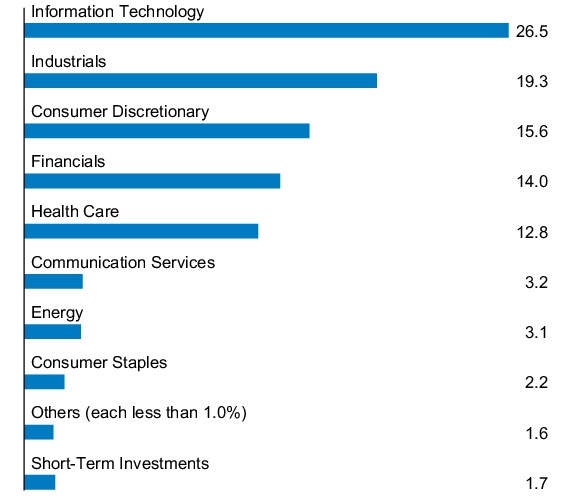

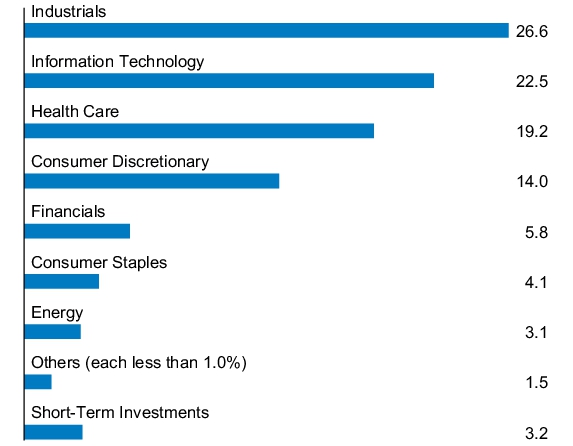

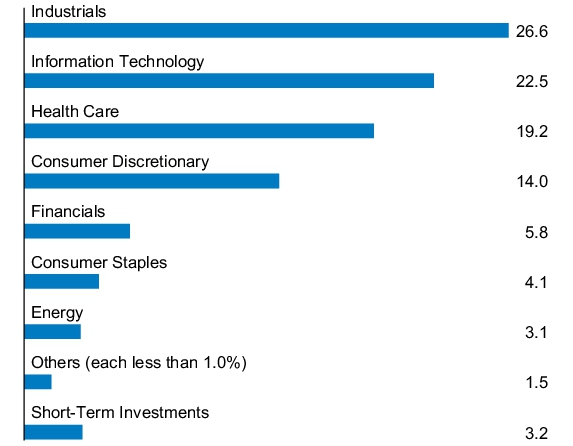

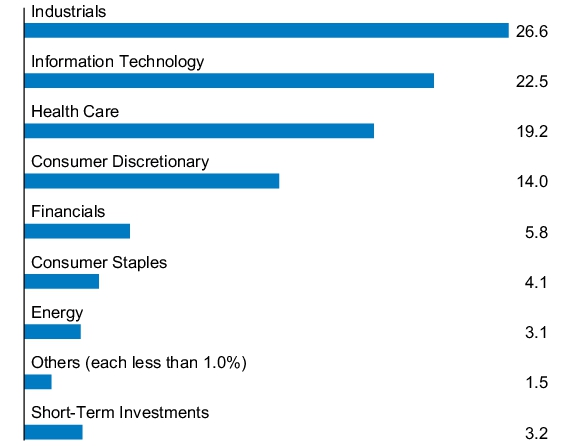

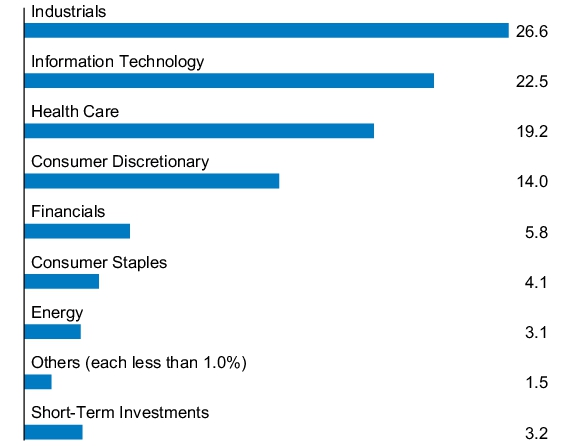

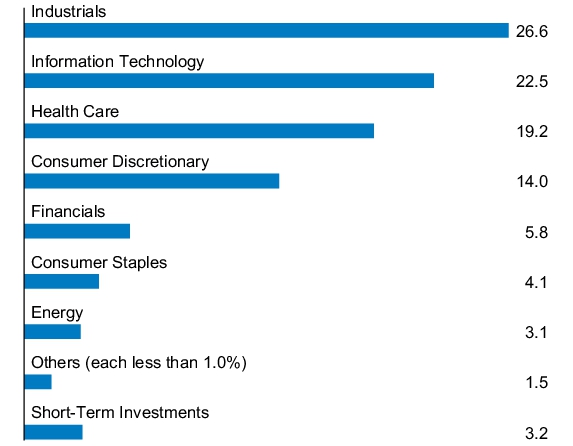

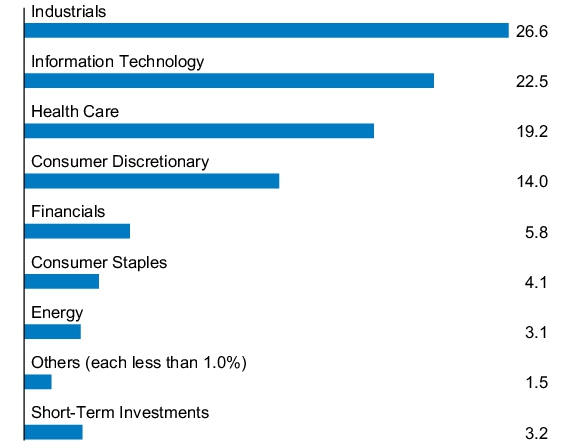

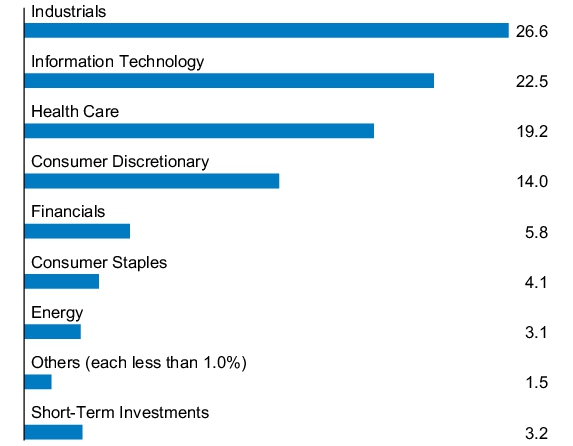

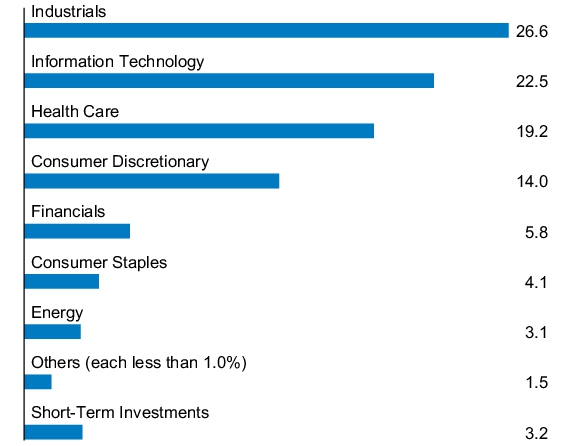

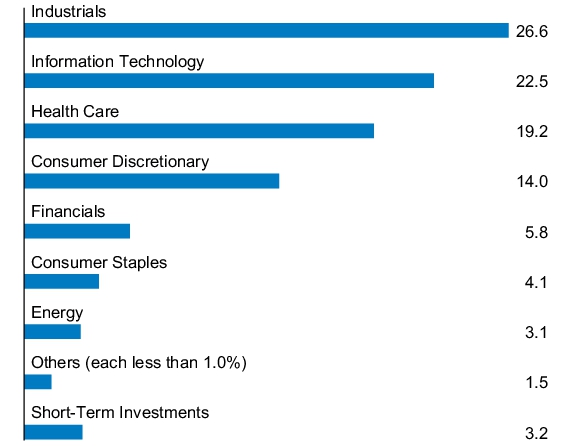

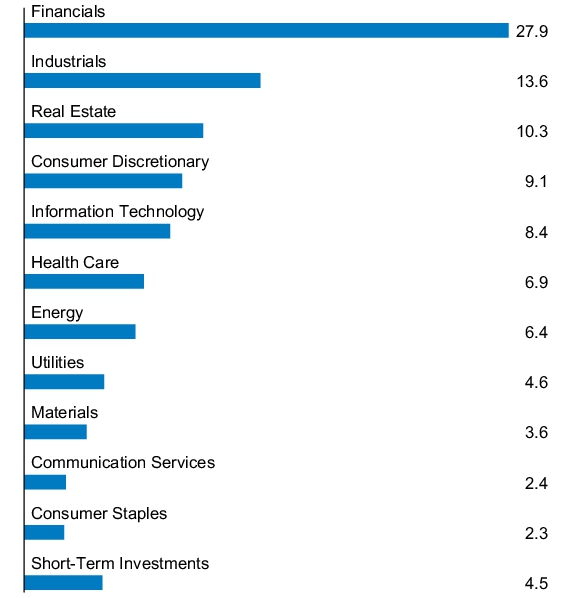

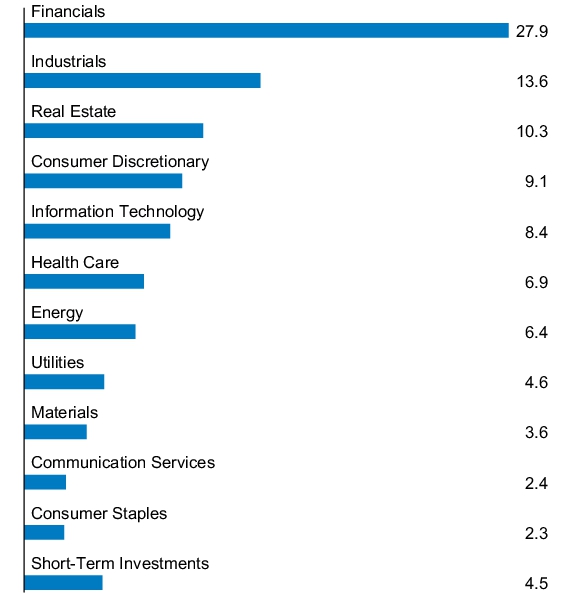

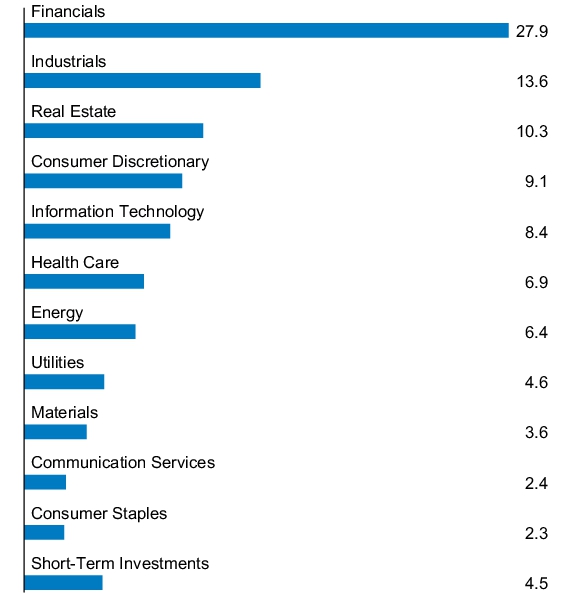

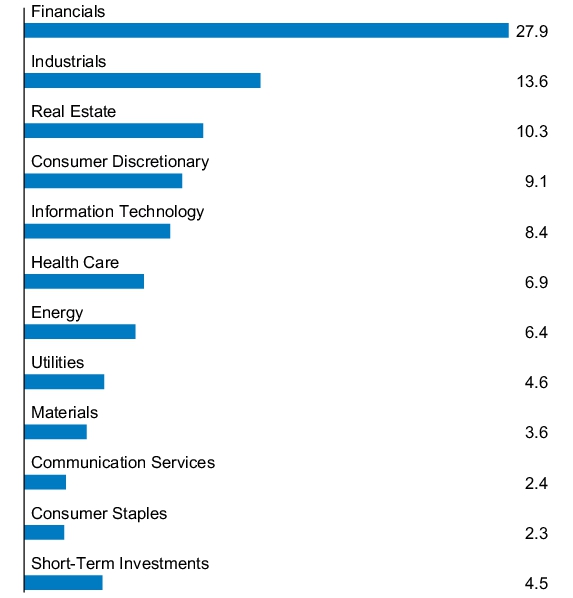

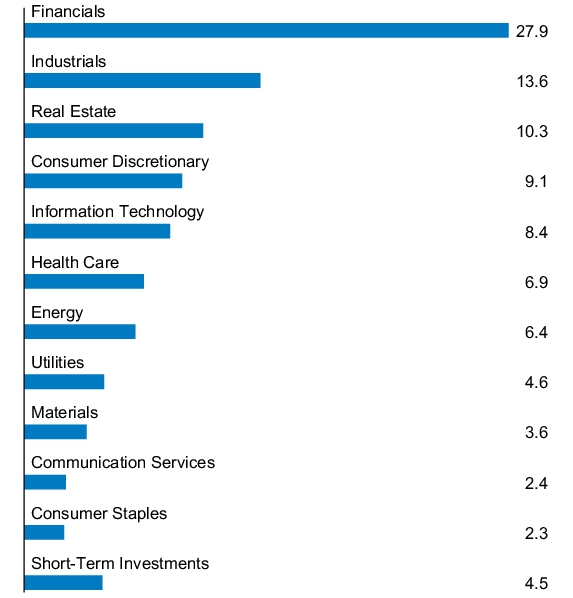

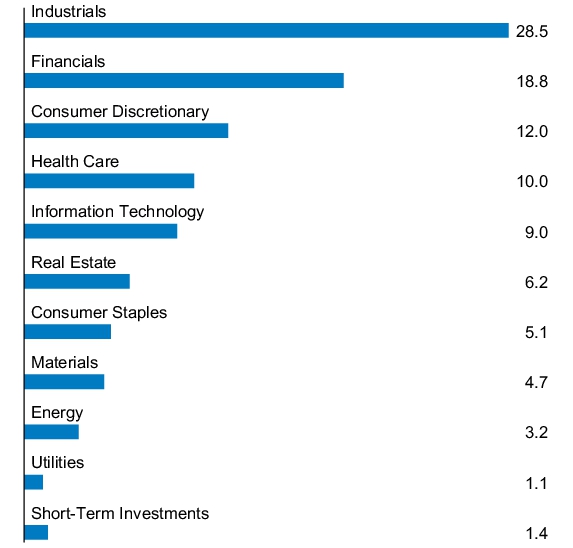

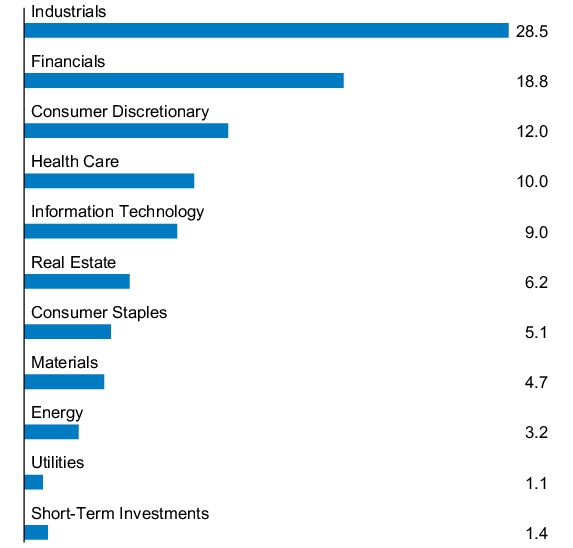

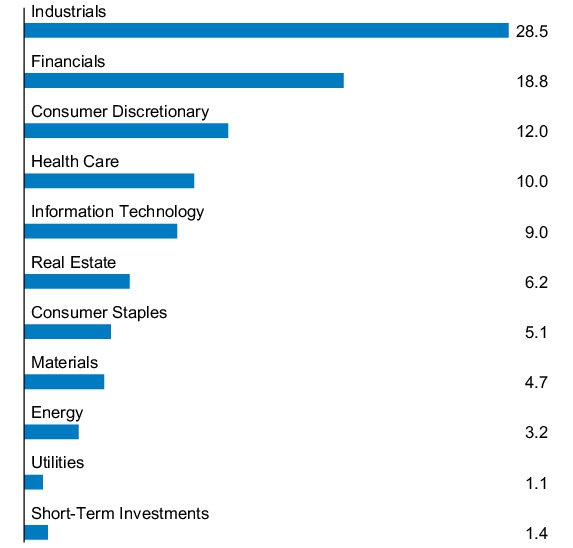

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class C Shares/Ticker: OINCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class C Shares) | $75 | 1.44% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

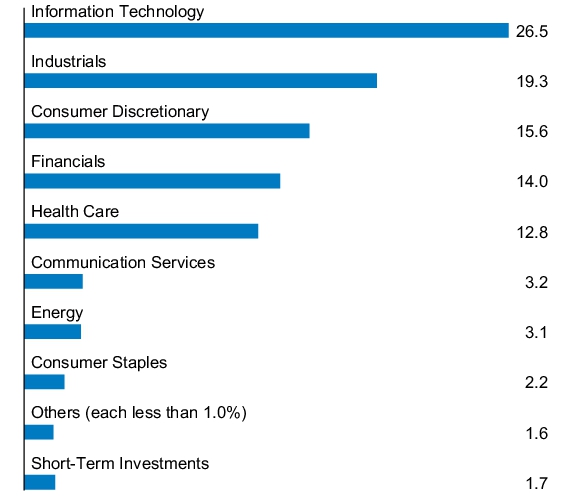

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class I Shares/Ticker: HLIEX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class I Shares) | $36 | 0.69% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

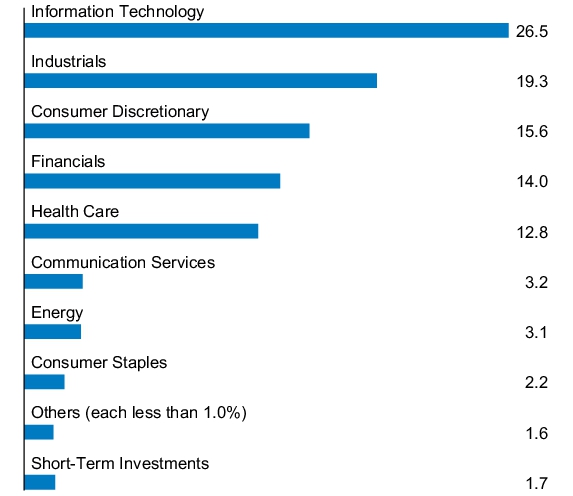

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class R2 Shares/Ticker: OIEFX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class R2 Shares) | $63 | 1.20% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

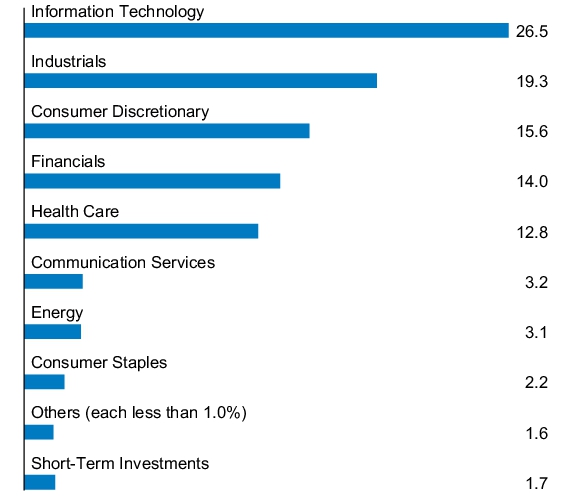

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class R3 Shares/Ticker: OIEPX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class R3 Shares) | $49 | 0.95% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

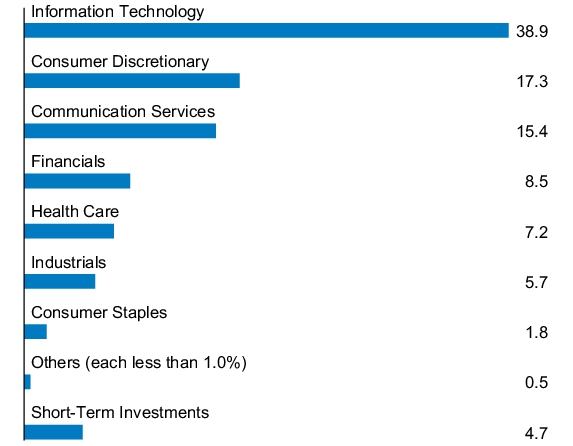

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class R4 Shares/Ticker: OIEQX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class R4 Shares) | $36 | 0.69% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class R5 Shares/Ticker: OIERX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class R5 Shares) | $28 | 0.54% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Income Fund

Class R6 Shares/Ticker: OIEJX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Income Fund

(Class R6 Shares) | $23 | 0.44% |

| * | This charge is annualized. |

| Fund net assets (000's) | $44,076,697 | |

| Total number of portfolio holdings | 88 | |

| Portfolio turnover rate | 9 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Index Fund

Class A Shares/Ticker: OGEAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Index Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Index Fund

(Class A Shares) | $24 | 0.45% |

| * | This charge is annualized. |

| Fund net assets (000's) | $10,750,457 | |

| Total number of portfolio holdings | 507 | |

| Portfolio turnover rate | 5 | % |

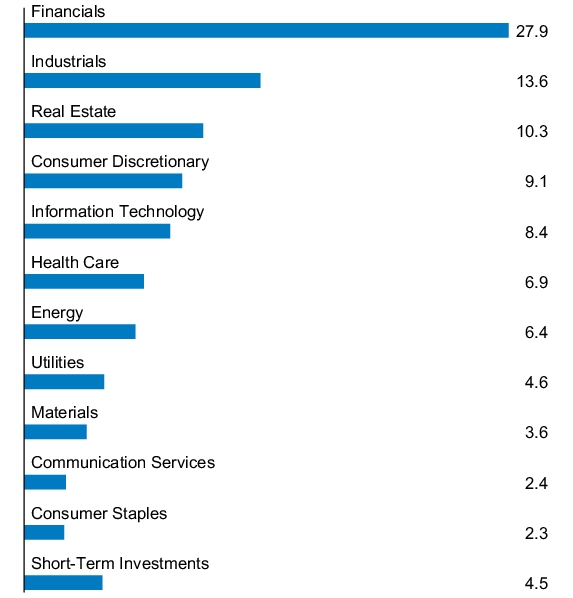

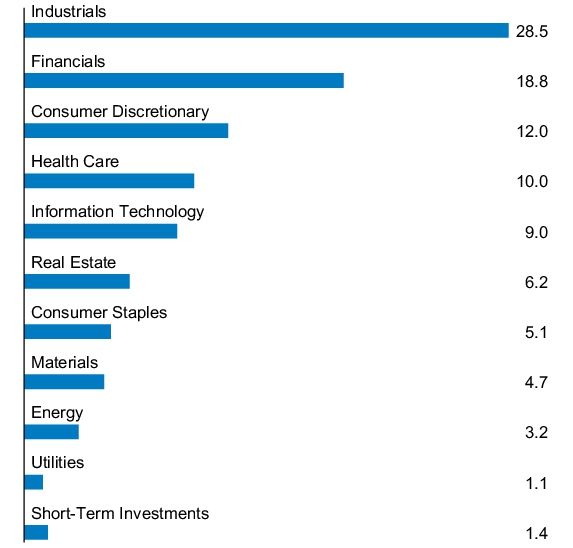

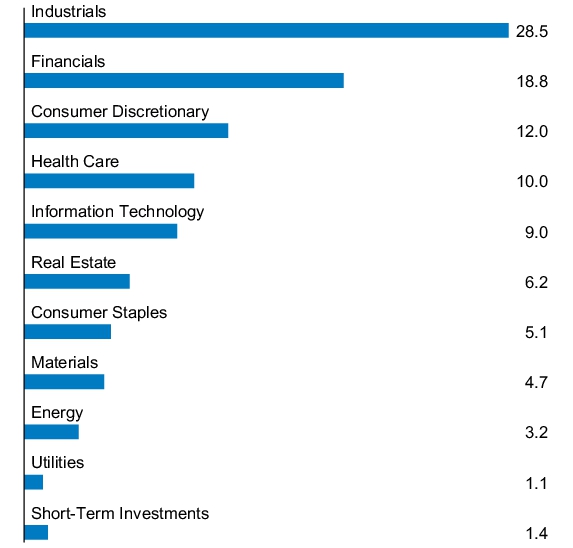

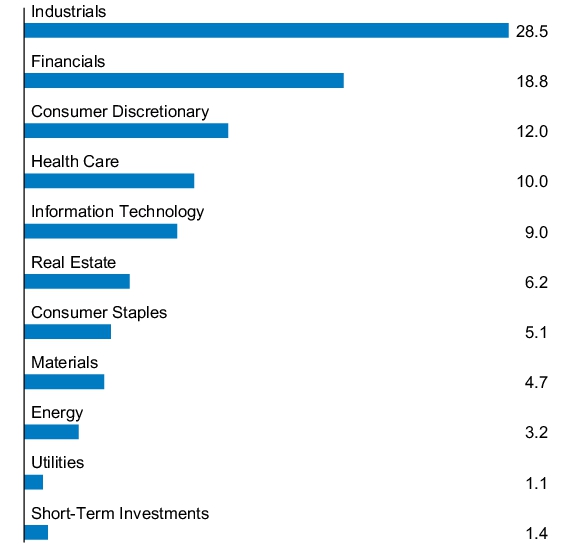

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Index Fund

Class C Shares/Ticker: OEICX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Index Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Index Fund

(Class C Shares) | $55 | 1.05% |

| * | This charge is annualized. |

| Fund net assets (000's) | $10,750,457 | |

| Total number of portfolio holdings | 507 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Index Fund

Class I Shares/Ticker: HLEIX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Index Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Index Fund

(Class I Shares) | $10 | 0.20% |

| * | This charge is annualized. |

| Fund net assets (000's) | $10,750,457 | |

| Total number of portfolio holdings | 507 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Equity Index Fund

Class R6 Shares/Ticker: OGFAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Equity Index Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Equity Index Fund

(Class R6 Shares) | $2 | 0.04% |

| * | This charge is annualized. |

| Fund net assets (000's) | $10,750,457 | |

| Total number of portfolio holdings | 507 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Balanced Fund

Class A Shares/Ticker: OGIAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Balanced Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Balanced Fund

(Class A Shares) | $29 | 0.56% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,477,675 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 5 | % |

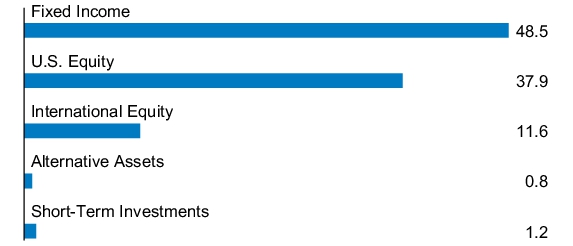

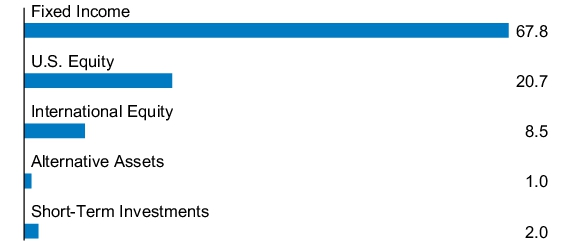

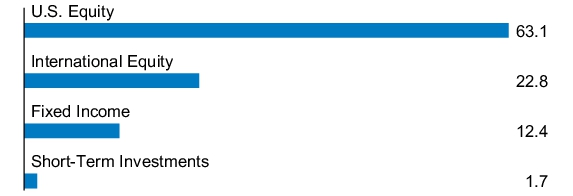

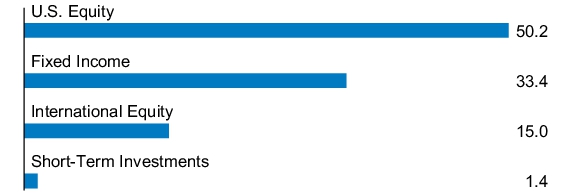

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Balanced Fund

Class C Shares/Ticker: OGBCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Balanced Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Balanced Fund

(Class C Shares) | $54 | 1.06% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,477,675 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Balanced Fund

Class I Shares/Ticker: OIBFX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Balanced Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Balanced Fund

(Class I Shares) | $16 | 0.31% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,477,675 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Balanced Fund

Class R6 Shares/Ticker: JFQUX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Balanced Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Balanced Fund

(Class R6 Shares) | $3 | 0.06% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,477,675 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 5 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Conservative Growth Fund

Class A Shares/Ticker: OICAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Conservative Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Conservative Growth Fund

(Class A Shares) | $29 | 0.56% |

| * | This charge is annualized. |

| Fund net assets (000's) | $3,956,365 | |

| Total number of portfolio holdings | 27 | |

| Portfolio turnover rate | 3 | % |

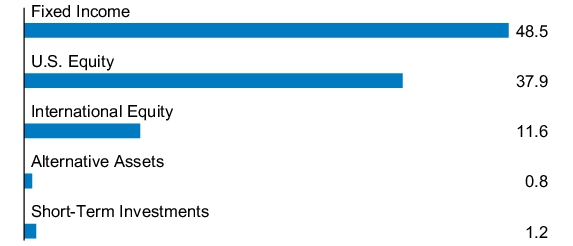

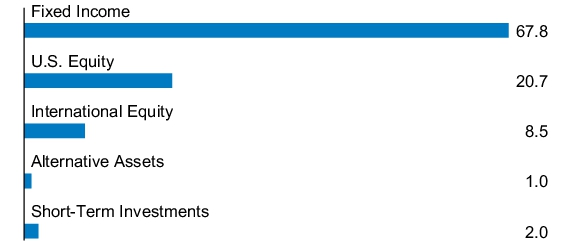

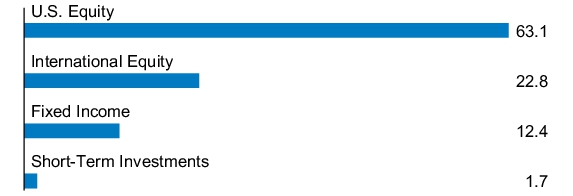

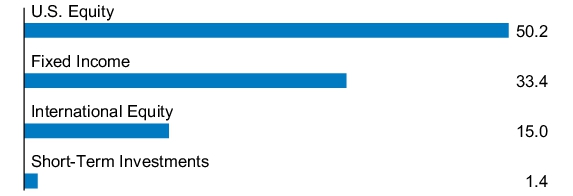

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Conservative Growth Fund

Class C Shares/Ticker: OCGCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Conservative Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Conservative Growth Fund

(Class C Shares) | $54 | 1.06% |

| * | This charge is annualized. |

| Fund net assets (000's) | $3,956,365 | |

| Total number of portfolio holdings | 27 | |

| Portfolio turnover rate | 3 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Conservative Growth Fund

Class I Shares/Ticker: ONCFX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Conservative Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Conservative Growth Fund

(Class I Shares) | $16 | 0.31% |

| * | This charge is annualized. |

| Fund net assets (000's) | $3,956,365 | |

| Total number of portfolio holdings | 27 | |

| Portfolio turnover rate | 3 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Conservative Growth Fund

Class R6 Shares/Ticker: JFLJX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Conservative Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Conservative Growth Fund

(Class R6 Shares) | $3 | 0.06% |

| * | This charge is annualized. |

| Fund net assets (000's) | $3,956,365 | |

| Total number of portfolio holdings | 27 | |

| Portfolio turnover rate | 3 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth Fund

Class A Shares/Ticker: ONGAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth Fund

(Class A Shares) | $28 | 0.55% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,603,548 | |

| Total number of portfolio holdings | 24 | |

| Portfolio turnover rate | 1 | % |

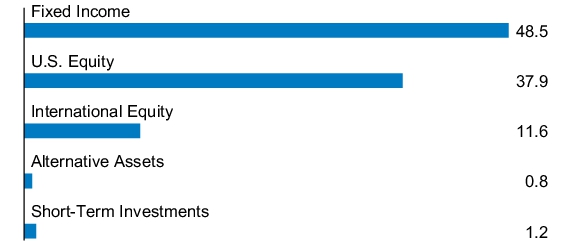

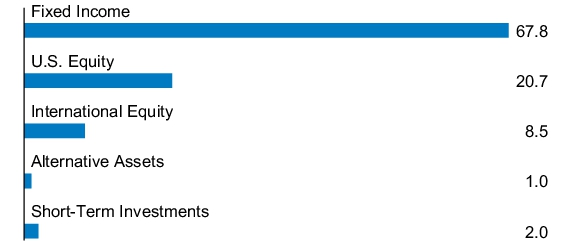

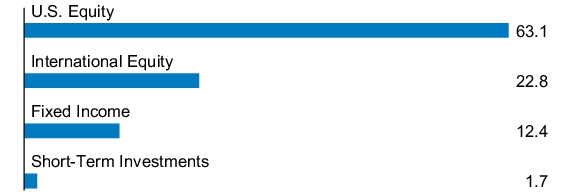

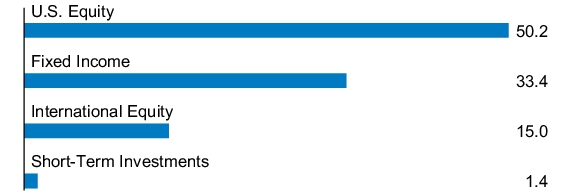

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth Fund

Class C Shares/Ticker: OGGCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth Fund

(Class C Shares) | $55 | 1.07% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,603,548 | |

| Total number of portfolio holdings | 24 | |

| Portfolio turnover rate | 1 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth Fund

Class I Shares/Ticker: ONIFX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth Fund

(Class I Shares) | $16 | 0.31% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,603,548 | |

| Total number of portfolio holdings | 24 | |

| Portfolio turnover rate | 1 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth Fund

Class R6 Shares/Ticker: JFTUX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth Fund

(Class R6 Shares) | $4 | 0.07% |

| * | This charge is annualized. |

| Fund net assets (000's) | $5,603,548 | |

| Total number of portfolio holdings | 24 | |

| Portfolio turnover rate | 1 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth & Income Fund

Class A Shares/Ticker: ONGIX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth & Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth & Income Fund

(Class A Shares) | $28 | 0.55% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,741,140 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 4 | % |

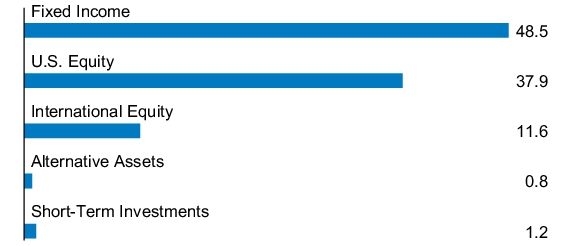

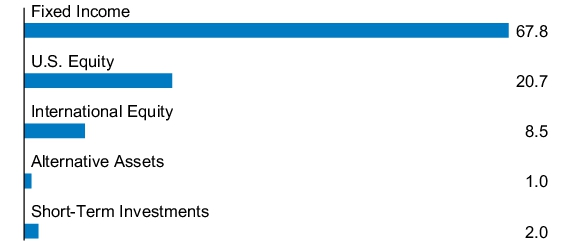

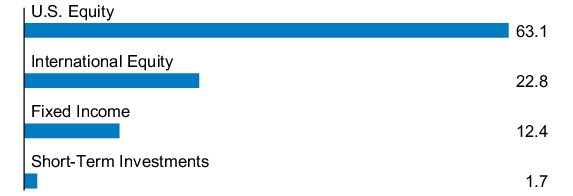

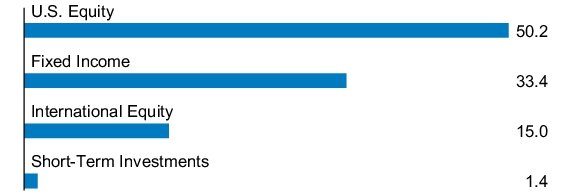

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth & Income Fund

Class C Shares/Ticker: ONECX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth & Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth & Income Fund

(Class C Shares) | $55 | 1.07% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,741,140 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 4 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth & Income Fund

Class I Shares/Ticker: ONGFX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth & Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth & Income Fund

(Class I Shares) | $16 | 0.31% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,741,140 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 4 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Investor Growth & Income Fund

Class R6 Shares/Ticker: JFBUX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Investor Growth & Income Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Investor Growth & Income Fund

(Class R6 Shares) | $3 | 0.06% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,741,140 | |

| Total number of portfolio holdings | 26 | |

| Portfolio turnover rate | 4 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class A Shares/Ticker: OLGAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class A Shares) | $49 | 0.93% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

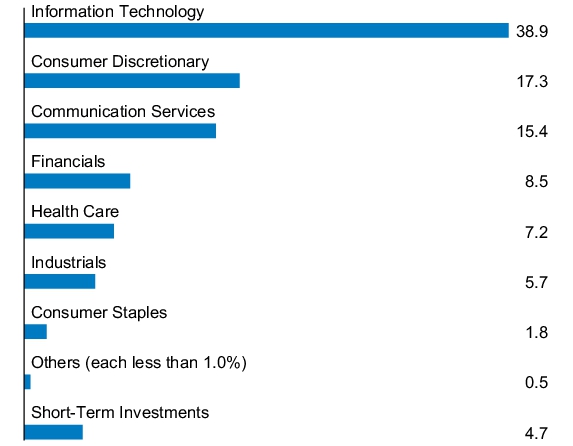

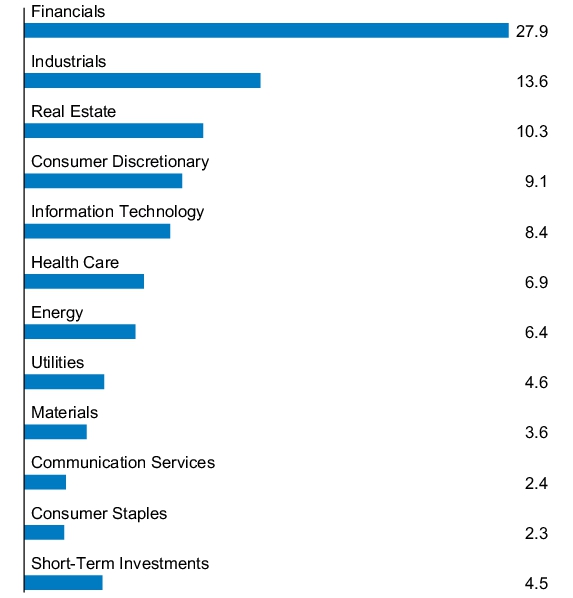

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class C Shares/Ticker: OLGCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class C Shares) | $75 | 1.43% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class I Shares/Ticker: SEEGX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class I Shares) | $36 | 0.68% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class R2 Shares/Ticker: JLGZX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class R2 Shares) | $62 | 1.18% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class R3 Shares/Ticker: JLGPX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class R3 Shares) | $49 | 0.93% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

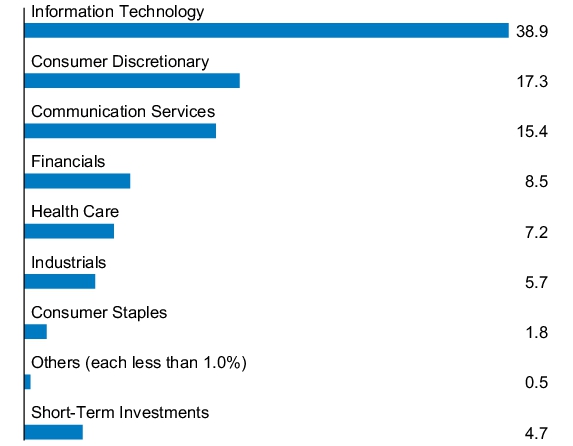

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class R4 Shares/Ticker: JLGQX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class R4 Shares) | $36 | 0.68% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class R5 Shares/Ticker: JLGRX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class R5 Shares) | $28 | 0.53% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Growth Fund

Class R6 Shares/Ticker: JLGMX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Growth Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Growth Fund

(Class R6 Shares) | $23 | 0.43% |

| * | This charge is annualized. |

| Fund net assets (000's) | $103,997,128 | |

| Total number of portfolio holdings | 73 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class A Shares/Ticker: OLVAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class A Shares) | $49 | 0.93% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

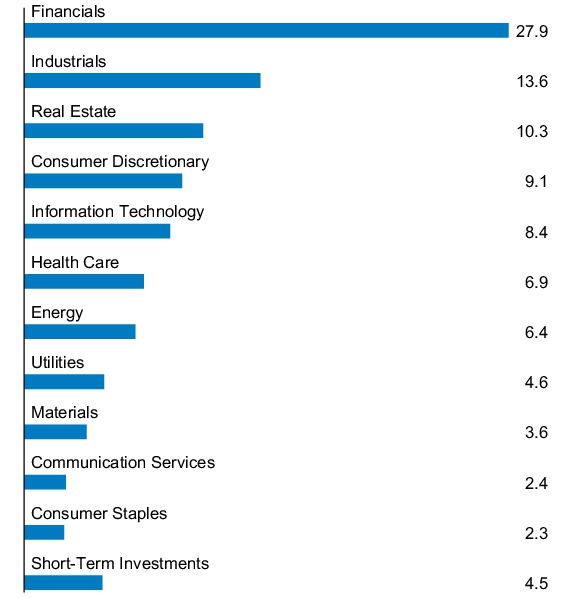

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class C Shares/Ticker: OLVCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class C Shares) | $75 | 1.43% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class I Shares/Ticker: HLQVX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class I Shares) | $36 | 0.69% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class R2 Shares/Ticker: JLVZX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class R2 Shares) | $62 | 1.18% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class R3 Shares/Ticker: OLVTX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class R3 Shares) | $49 | 0.94% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class R4 Shares/Ticker: OLVRX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class R4 Shares) | $36 | 0.69% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class R5 Shares/Ticker: JLVRX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class R5 Shares) | $28 | 0.54% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Large Cap Value Fund

Class R6 Shares/Ticker: JLVMX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Large Cap Value Fund (the "Fund") for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Large Cap Value Fund

(Class R6 Shares) | $23 | 0.44% |

| * | This charge is annualized. |

| Fund net assets (000's) | $4,868,924 | |

| Total number of portfolio holdings | 118 | |

| Portfolio turnover rate | 69 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class A Shares/Ticker: OSGIX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class A Shares) | $58 | 1.12% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class C Shares/Ticker: OMGCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class C Shares) | $84 | 1.62% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class I Shares/Ticker: HLGEX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class I Shares) | $45 | 0.87% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class R2 Shares/Ticker: JMGZX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class R2 Shares) | $75 | 1.43% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class R3 Shares/Ticker: JMGPX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class R3 Shares) | $62 | 1.18% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class R4 Shares/Ticker: JMGQX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Growth Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Growth Fund

(Class R4 Shares) | $49 | 0.93% |

| * | This charge is annualized. |

| Fund net assets (000's) | $11,615,217 | |

| Total number of portfolio holdings | 116 | |

| Portfolio turnover rate | 25 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Growth Fund

Class R5 Shares/Ticker: JMGFX

SEMI-ANNUAL SHAREHOLDER REPORT