- BPOP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Popular (BPOP) PRE 14APreliminary proxy

Filed: 18 Mar 20, 4:49pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant o

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

Popular, Inc. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

| | DEAR SHAREHOLDERS: |  |

| | On behalf of the Board of Directors of Popular, Inc., you are cordially invited to our 2020 Annual Meeting of Shareholders, which will be held on May 12, 2020 at 9:00am (Atlantic Standard Time) at our headquarters located at Popular Center Building, PH floor, 209 Muñoz Rivera Avenue, San Juan, Puerto Rico. | |

| | During 2019, Popular achieved record earnings and loan growth in our Puerto Rico and United States operations, while maintaining positive credit quality trends and a robust capital position. We continued to execute our strategic plan based on four strategic pillars: sustainable and profitable growth, simplicity, customer focus and fit for the future. Our successes during 2019 allowed the Corporation to continue enhancing its capital return and driving long-term value to our shareholders. Such accomplishments have been built on Popular’s unwavering commitment to our customers, our people and our communities. We recognize our place as a responsible corporate citizen and are committed to formalize Popular’s corporate responsibility and sustainability priorities. We celebrate our recent successes and look forward to opportunities ahead as we remain committed to the long-term interests of Popular’s shareholders. | |

| | At this year’s Annual Meeting, shareholders will be considering the election of three candidates to our Board of Directors, an advisory vote to approve executive compensation, the ratification of PricewaterhouseCoopers LLP as our independent registered public accountants for 2020 and the adoption of the Popular, Inc. 2020 Omnibus Incentive Plan. This year, shareholders will also consider amendments to our Restated Certificate of Incorporation to declassify the Board of Directors, change the minimum and maximum size of the Board of Directors and elimate the supermajority vote requirements included in our Restated Certificate of Incorporation. We believe these amendments will improve our corporate governance and are in the best interest of our shareholders. | |

| | I encourage you to read our proxy statement, annual report and other proxy materials. Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote as soon as possible, either online, by phone or by mail. Please follow the voting instructions to ensure your shares are represented at the meeting. Your vote is important to us. | |

| | The Board of Directors is committed to Popular’s long-term success and to the delivery of value to our shareholders, customers and communities. On behalf of the Board of Directors, and everyone at Popular, thank you for your continued investment and support. | |

| | ||

| |  | |

| | RICHARD L. CARRIÓN Chairman of the Board Popular, Inc. | |

| | ||

| |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

| | DATE AND TIME | | | Tuesday, May 12, 2020 • 9:00 a.m. (Atlantic Standard Time) | |

| | PLACE | | | Popular Center Building, PH Floor, 209 Muñoz Rivera Avenue, San Juan, Puerto Rico* | |

| | RECORD DATE | | | March 13, 2020 | |

| | HOW TO VOTE | | | Only shareholders of record at the close of business on March 13, 2020 are entitled to notice of, and to vote at, the meeting. Each share of common stock is entitled to one vote. Your vote is important. Whether or not you plan to attend, please vote as soon as possible so that we may be assured of the presence of a quorum at the meeting. | |

| |  | | | In Person Attend the Annual Meeting | |

| |  | | | By Phone Call +1-800-690-6903 in the U.S. or P.R. to vote your shares | |

| |  | | | By Internet Visit www.proxyvote.com and vote online | |

| |  | | | By Mail Cast your ballot, sign your proxy card and return by free post | |

| | ITEMS OF BUSINESS | | | | |

| | • Elect three directors assigned to “Class 3” of the Board of Directors for a three-year term; | | |||

| | • Amendment to Article SEVENTH of Popular, Inc.’s Restated Certificate of Incorporation to Declassify the Board of Directors by the 2023 Annual Meeting of Shareholders; | | |||

| | • Amendment to the first sentence of Article SEVENTH of Popular, Inc.’s Restated Certificate of Incorporation to reduce the minimum and maximum amount of members comprising the Board of Directors; | | |||

| | • Amendment to Article NINTH of Popular, Inc.’s Restated Certificate of Incorporation to eliminate supermajority vote requirements; | | |||

| | • Adoption of the Popular, Inc. 2020 Omnibus Incentive Plan; | | |||

| | • Approve, on an advisory basis, our executive compensation; | | |||

| | • Ratify the appointment of PricewaterhouseCoopers LLP as Popular’s independent registered public accounting firm for 2020; | | |||

| | • Approve the adjournment or postponement of the meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes to approve Proposals 2, 3, 4 and 5; and | | |||

| | • Consider such other business as may be properly brought before the meeting or any adjournments thereof. | | |||

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 12, 2020: This 2020 Proxy Statement and our Annual Report for the year ended December 31, 2019 are available free of charge at www.popular.com and www.proxyvote.com. | | |||

| | | | | ||

| | * We intend to hold our annual meeting in person. However, we are actively monitoring the coronavirus (COVID-19) pandemic and are sensitive to the health and safety of our shareholders and employees and the protocols that federal, state, and local governments have imposed. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting, which may include holding the meeting solely by means of remote communication, as promptly as practicable through our annual meeting website https://www.popular.com/en/investor-relations/annual-meeting/ and the filing of additional proxy materials with the Securities and Exchange Commission. | | |||

| | In San Juan, Puerto Rico, on March , 2020. By Order of the Board of Directors, | | |||

| |  | | |||

| | Javier D. Ferrer Executive Vice President, Chief Legal Officer and Secretary | | |||

| | 209 Muñoz Rivera Avenue San Juan, Puerto Rico 00918 | | |  | |

TABLE OF CONTENTS |

PROXY STATEMENT SUMMARY |  |

| | | | | | | | | | | | | ||||||

| | PROPOSAL 1 | | | | |  BOARD’S RECOMMENDATION: “FOR” EACH NOMINEE | | ||||||||||

| | ELECTION OF DIRECTORS | | | | |||||||||||||

| | We are asking shareholders to elect three directors for a three-year term. The table below sets forth information with respect to our three nominees standing for election. All of the nominees are currently serving as directors. Additional information about the candidates and their respective qualifications can be found on the “Nominees for Election as Directors and Other Directors” section of this Proxy Statement. | | | | |||||||||||||

| | NAME | | | AGE | | | DIRECTOR SINCE | | | PRINCIPAL OCCUPATION | | | | ||||

| | IGNACIO ALVAREZ | | | 61 | | | 2017 | | | President & CEO of Popular, Inc. | |||||||

| | MARÍA LUISA FERRÉ | | | 56 | | | 2004 | | | President & CEO of FRG, Inc. | | | | ||||

| | C. KIM GOODWIN | | | 60 | | | 2011 | | | Private Investor | | | | ||||

| | | | | | | | | | | | | ||||||

| | PROPOSAL 2 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | AMENDMENT TO CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS | | | | |||||||||||||

| | We are asking shareholders to approve an amendment to Popular’s (“Popular” or the “Corporation”) Restated Certificate of Incorporation (the “Certificate of Incorporation”), to eliminate the Board of Directors’ classified structure by phasing it out over a three-year period, beginning at the 2021 annual meeting of shareholders. The declassification of the Board will permit shareholders to vote annually for all directors commencing with the 2023 annual meeting. The affirmative vote of the holders of not less than two-thirds (2/3) of the Corporation’s outstanding shares of common stock is necessary to adopt the proposed amendment. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | | | | | | | | | | | | ||||||

| | PROPOSAL 3 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | AMENDMENT TO CERTIFICATE OF INCORPORATION TO REDUCE THE MINIMUM AND MAXIMUM AMOUNT OF MEMBERS COMPRISING THE BOARD OF DIRECTORS | | |||||||||||||||

| | We are asking shareholders to approve an amendment to the Corporation’s Certificate of Incorporation to reduce the minimum and maximum amount of members comprising the Board of Directors to not less than seven (7) nor more than fifteen (15) members. The affirmative vote of the holders of not less than two-thirds (2/3) of the Corporation’s outstanding shares of common stock is necessary to adopt the proposed amendment. | | |||||||||||||||

| | 2020 POPULAR, INC. PROXY STATEMENT | 1 | |

| | | | | | | | | | | | | ||||||

| | PROPOSAL 4 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | AMENDMENT TO CERTIFICATE OF INCORPORATION TO ELIMINATE SUPERMAJORITY VOTE REQUIREMENTS | | | | |||||||||||||

| | We are asking shareholders to approve an amendment to the Corporation’s Certificate of Incorporation to eliminate the supermajority vote requirements included in Article NINTH of the Certificate of Incorporation. If approved, the vote of a majority of the holders of outstanding shares of the Corporation would be sufficient to amend the Certificate of Incorporation, approve business combinations, and approve the voluntary dissolution of the Corporation. The affirmative vote of the holders of not less than seventy-five percent (75%) of the Corporation’s outstanding shares of common stock is necessary to adopt the proposed amendment. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | | | | | | | | | | | | ||||||

| | PROPOSAL 5 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | ADOPTION OF THE POPULAR, INC. 2020 OMNIBUS INCENTIVE PLAN | | | | |||||||||||||

| | We are asking shareholders to approve the Popular, Inc. 2020 Omnibus Incentive Plan (the “2020 Plan”). The purpose of the 2020 Plan is to provide flexibility to the Corporation and its affiliates to attract, retain and motivate our officers, executives and other key employees through the grant of equity-based and/or cash-based compensation, and to adjust the Corporation’s compensation practices to the leading compensation practices and corporate governance trends as they develop from time to time. The 2020 Plan is further intended to help retain and align the interests of the non-employee directors of the Corporation and its affiliates with the Corporation’s shareholders. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | | | | | | | | | | | | ||||||

| | PROPOSAL 6 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | | | | |||||||||||||

| | We are asking shareholders to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) as described in the sections titled “Compensation Discussion and Analysis” and “2019 Executive Compensation Tables and Compensation Information.” We hold this advisory vote on an annual basis. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | | | | | | | | | | | | ||||||

| | PROPOSAL 7 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | RATIFICATION OF AUDITORS | | | | |||||||||||||

| | We are asking shareholders to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020. Information in fees paid to PricewaterhouseCoopers LLP during 2019 and 2018 appears on the “Proposal 7: Ratification of Appointment of Independent Registered Public Accounting Firm” section of this Proxy Statement. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | 2 | 2020 POPULAR, INC. PROXY STATEMENT | |

| | | | | | | | | | | | | ||||||

| | PROPOSAL 8 | | | | |  BOARD’S RECOMMENDATION: “FOR” THIS PROPOSAL | | ||||||||||

| | ADJOURNMENT OR POSTPONEMENT OF THE MEETING IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES, IN THE EVENT THAT THERE ARE NOT SUFFICIENT VOTES TO APPROVE PROPOSALS 2, 3, 4 AND 5 | | | | |||||||||||||

| | We are asking shareholders to approve the adjournment of the meeting, if necessary or appropriate, in order to allow for the solicitation of additional proxies in the event that there are not sufficient votes at the time of the meeting to adopt Proposals 2, 3, 4 and 5. If approved, the meeting could be adjourned and management could use the additional time to solicit proxies in favor of the adoption of the aforementioned proposals. | | |||||||||||||||

| | | | | | | | | ||||||||||

| | 2020 POPULAR, INC. PROXY STATEMENT | 3 | |

| | PUERTO RICO | | Popular remained the market leader in Puerto Rico in auto loans, personal loans, credit cards, mortgage origination, commercial loans and deposits. Our Puerto Rico operations experienced growth in deposits by $3 billion, an increase in our customer base by 45,000 clients and strong net interest margins of 4.30%. We continued providing innovative solutions to our customers through our ongoing digital transformation, capturing 52% of our deposit transactions through digital channels. | |

| | UNITED STATES | | In the United States, our total loan portfolio and our deposits increased by 9%. We continued expanding our specialized business segments of condominium association banking and health care lending and evolving our income streams led by private banking and residential mortgage originations. | |

| | POPULAR COMMON STOCK | | We increased the quarterly common stock dividend from $0.25 to $0.30 per share and completed a common stock repurchase program of $250 million. In January 2020, we announced an increase in the quarterly common stock dividend from $0.30 to $0.40 and a common stock repurchase program of up to $500 million. | |

| | | | SUSTAINABLE AND PROFITABLE GROWTH | | |

| | We increased our customer base reaching 1.8 million customers and grew loans and deposits by 1.5% and 10%, respectively, and auto loans by 9%. We acquired a $74 million credit card portfolio and the rights to issue credit cards under the JetBlue co-branded loyalty program in Puerto Rico. | | |||

| | | | SIMPLICITY | | |

| | We leveraged technology and process optimization to further streamline our operations to achieve efficiencies, improve both the customer and employee experience and position the Corporation for future growth. | | |||

| | | | CUSTOMER FOCUS | | |

| | We dedicated significant resources to reinforce our service culture and continued the transformation of our branch network by integrating technology to enhance our customers’ experience. | | |||

| | | | FIT FOR THE FUTURE | | |

| | We invested in our talent infrastructures by implementing initiatives related to the development, compensation, leadership and recognition of our people. We also continued to solidify our risk management program by strengthening our first line of defense and bolstering our cybersecurity program. | |

| | SOCIAL COMMITMENT | | | As part of Popular’s steadfast social commitment, valuable financial and in-kind assistance was provided through Fundación Banco Popular, Popular Bank Foundation and corporate donations and social programs impacting communities in Puerto Rico, the United States and the Virgin Islands. Our total social investment during 2019 amounted to $6 million. | |

| | 4 | 2020 POPULAR, INC. PROXY STATEMENT | |

| | PAY-FOR-PERFORMANCE | |

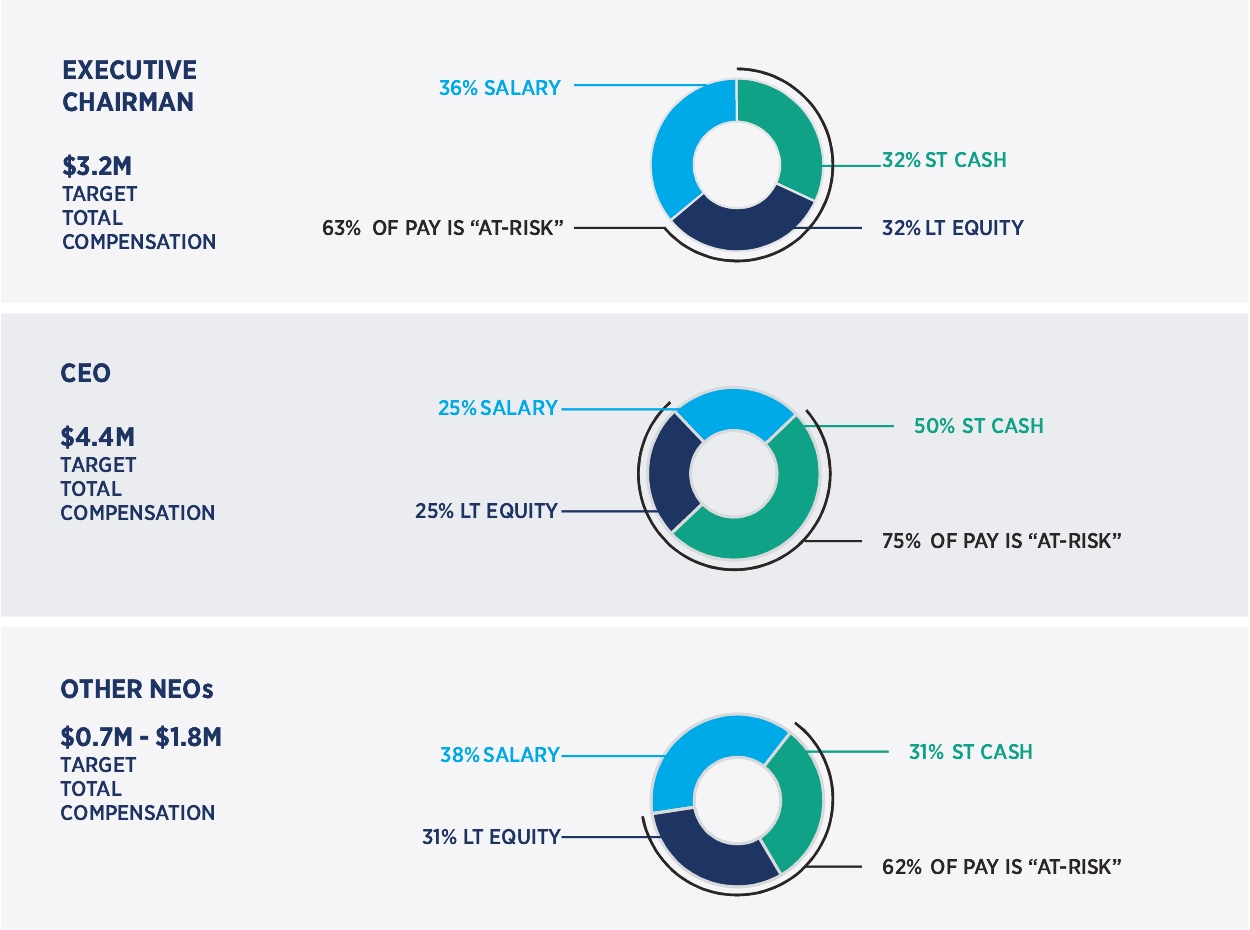

| | • Focus on variable, incentive-based pay (62%-75% of total target NEO pay is performance-based) | |

| | • Combination of short-term (cash) and long-term (equity) incentives | |

| | • Equity awards promote performance and retention of high-performing talent | |

| | • Total compensation opportunity targeted at median of our peer group | |

| | 2020 POPULAR, INC. PROXY STATEMENT | 5 | |

| | • No special retirement or severance programs | |

| | • Limited perquisites | |

| | STRONG GOVERNANCE | |

| | • Incentive risk mitigation through balanced compensation design and strong internal control framework | |

| | • No speculative transactions in Popular securities nor pledging or hedging of our common stock | |

| | • Clawback guideline | |

| | • Annual say-on-pay advisory vote | |

| | • Independent compensation consultant | |

| | • Compensation governance framework that includes internal guidelines covering compensation programs and incentive design | |

| | EXECUTIVE ALIGNMENT WITH LONG-TERM SHAREHOLDER VALUE | |

| | • Stock ownership requirements for our executive officers | |

| | • Extended equity vesting (including a portion vesting at retirement) | |

| | • Double-trigger equity vesting upon change in control | |

| | 6 | 2020 POPULAR, INC. PROXY STATEMENT | |

| | NAME AND PRINCIPAL POSITION | | | SALARY | | | BONUS | | | STOCK AWARDS | | | NON-EQUITY INCENTIVE PLAN COMPENSATION | | | CHANGE IN PENSION VALUE AND NONQUALIFIED DEFERRED COMPENSATION | | | ALL OTHER COMPENSATION | | | TOTAL | |

| | RICHARD L. CARRIÓN Former Executive Chairman* | | | $650,769 | | | $50,000 | | | $1,147,560 | | | $671,080 | | | $1,499,851 | | | $550,875 | | | $4,570,135 | |

| | IGNACIO ALVAREZ President and Chief Executive Officer (“CEO”) | | | 1,102,800 | | | 45,833 | | | 2,475,000 | | | 1,453,920 | | | __ | | | 57,846 | | | 5,135,399 | |

| | CARLOS J. VÁZQUEZ Executive Vice President and Chief Financial Officer (“CFO”) | | | 702,951 | | | 29,261 | | | 619,650 | | | 767,361 | | | 146,046 | | | 25,862 | | | 2,291,131 | |

| | JAVIER D. FERRER Executive Vice President and Chief Legal Officer (“CLO”) | | | 596,800 | | | 25,000 | | | 504,900 | | | 658,300 | | | __ | | | 26,704 | | | 1,811,704 | |

| | LIDIO V. SORIANO Executive Vice President and Chief Risk Officer (“CRO”) | | | 521,431 | | | 21,675 | | | 459,000 | | | 531,063 | | | __ | | | 24,540 | | | 1,557,709 | |

| | ELI S. SEPÚLVEDA Executive Vice President Commercial Credit Group, Banco Popular | | | 469,568 | | | 19,508 | | | 413,100 | | | 513,937 | | | 89,798 | | | 24,309 | | | 1,529,680 | |

| * | Mr. Carrión transitioned from Executive Chairman to non-executive Chairman of the Board of Directors on July 1, 2019. |

| | 2020 POPULAR, INC. PROXY STATEMENT | 7 | |

CORPORATE GOVERNANCE DIRECTORS AND EXECUTIVE OFFICERS |  |

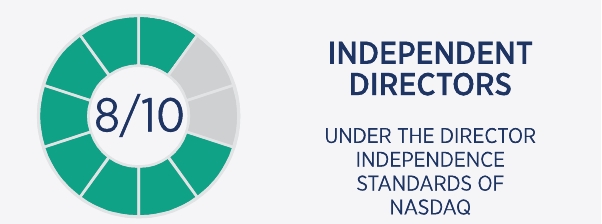

| | DIRECTOR INDEPENDENCE | | | Independent directors must compose at least two-thirds of the Board. At present, eight of our ten directors are independent in accordance with the standards of The Nasdaq Stock Market (“NASDAQ”). Messrs. Carrión and Alvarez are not considered independent. | |

| | INDEPENDENT LEAD DIRECTOR | | | Our Lead Director is elected annually by a majority of the independent members of the Board. | |

| | MAJORITY VOTING IN DIRECTOR ELECTIONS | | | Directors are elected by the affirmative vote of a majority of the shares represented at the annual meeting. An incumbent director not elected by the affirmative vote of a majority of the shares represented at the annual meeting must tender his or her resignation to the Board, which may accept or reject the director’s resignation. | |

| | BOARD OVERSIGHT OF RISK MANAGEMENT | | | The Board has a significant role in risk oversight. You can read about the role of the Board in risk oversight under “Board Oversight of Risk Management.” | |

| | SUCCESSION PLANNING | | | The Talent and Compensation Committee annually reviews a management succession plan, developed by the CEO, to ensure an orderly succession of the CEO and executive officers in both ordinary course and emergency situations. | |

| | DIRECTOR RETIREMENT | | | Directors may serve on the Board until the end of their term following their 72nd birthday, and may not be initially elected or re-elected after reaching age 72. | |

| | STOCK OWNERSHIP | | | Within three years of their election, directors must hold Popular stock with a value equal to five times the annual Board retainer. Within five years of designation, the President and CEO must hold Popular stock with a value equal to six times base pay and other executive officers must hold three times their base pay. | |

| | RESTRICTIONS ON PLEDGING, HEDGING AND SPECULATIVE TRANSACTIONS | | | Popular’s directors and executive officers are prohibited from pledging Popular’s common stock as collateral for loans. In addition, directors and executive officers are not allowed to engage in speculative transactions, such as hedging and monetization transactions, using Popular’s securities. | |

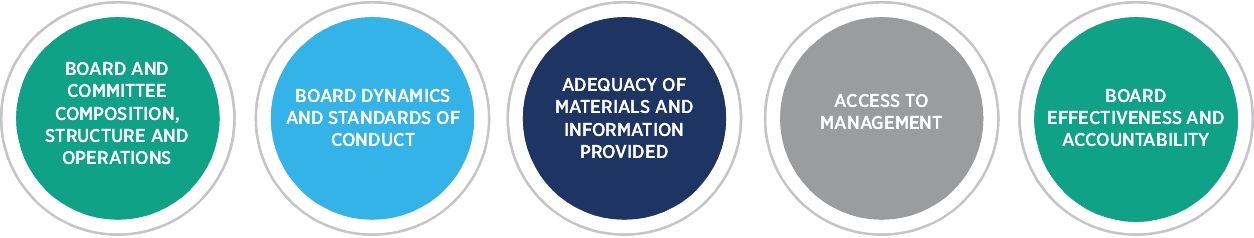

| | ANNUAL BOARD AND COMMITTEE SELF- ASSESSMENTS | | | The Board and each committee conduct annual self-evaluations to determine whether they are functioning effectively. | |

| | EXECUTIVE SESSIONS OF NON-MANAGEMENT DIRECTORS | | | Popular’s independent directors hold executive sessions without Popular’s non-independent directors and management. | |

| | LIMITS ON BOARD SERVICE | | | To ensure that Directors have sufficient time to devote to their responsibilities on Popular’s Board, Popular’s Corporate Governance Guidelines contain a policy about other directorships. Directors who also serve as CEOs of public companies should not serve on more than one public company board in addition to Popular’s Board, and other directors should not serve on more than four public company boards in addition to Popular’s Board. In addition, members of the Audit Committee may not serve on more than three public company audit committees, including Popular’s Audit Committee, without prior Board approval. | |

| | SHAREHOLDERS’ ABILITY TO CALL A SPECIAL MEETING OF SHAREHOLDERS | | | Popular’s Amended and Restated By-laws provide shareholders holding at least 20% of the outstanding shares of common stock with the right to request a special meeting of shareholders. | |

| | ✔ | | | Be available for consultation and direct communication upon request of major shareholders. | |

| | ✔ | | | Have authority to call meetings of independent directors and preside over executive sessions of the independent directors. | |

| | ✔ | | | Act as liaison between the independent directors and the Chairman. | |

| | ✔ | | | Assist the other independent directors by ensuring that independent directors have adequate opportunities to meet in executive sessions and communicate to the Chairman, as appropriate, the results of such sessions and other private discussions among outside directors. | |

| | ✔ | | | Assist the Chairman and the remainder of the Board in assuming effective corporate governance in managing the affairs of the Board. | |

| | ✔ | | | Serve as the contact person to facilitate communications requested by major shareholders with independent members of the Board. | |

| | ✔ | | | Approve, in collaboration with the Chairman, meeting agendas and information sent to the Board. | |

| | ✔ | | | Approve, in collaboration with the Chairman, meeting schedules to assure that there is sufficient time for discussion of all agenda items. | |

| | ✔ | | | Serve temporarily as Chairman of the Board and the Board’s spokesperson if the Chairman is unable to act. | |

| | ✔ | | | Interview Board candidates. | |

| | ✔ | | | Recommend to the Corporate Governance and Nominating Committee nominees to Board committees and sub-committees as may come to the Lead Director’s attention. | |

| | ✔ | | | Ensure the Board works as a cohesive team. | |

| | ✔ | | | Preside over all meetings of the Board at which the Chairman is not present. | |

| | ✔ | | | Make such recommendations to the Board as the Lead Director may deem appropriate for the retention of consultants who will report to the Board. | |

| | ✔ | | | Retain consultants, with the approval of the Board, as the Lead Director and the Board deem appropriate. | |

| | ✔ | | | responsibilities and organization of the committee, including adequacy of its charter; | |

| | ✔ | | | operations of the committee; | |

| | ✔ | | | adequacy of materials and information provided; and | |

| | ✔ | | | assessment of the committee’s performance. | |

Audit Committee | |||||||||

PRIMARY RESPONSIBILITIES: Assists the Board in its oversight of: • the outside auditors’ qualifications, independence and performance; • the performance of Popular’s internal audit function; • the integrity of Popular’s financial statements, including overseeing the accounting and financial processes, principles and policies, the effectiveness of internal controls over financial reporting and the audits of the financial statements; and • compliance with legal and regulatory requirements. In addition, the Audit Committee issues a report, as required by the U.S. Securities and Exchange Commission (the “SEC”) rules, for inclusion in Popular’s annual proxy statement. The Audit Committee was established in accordance with the requirements of the Securities Exchange Act of 1934. | | | | | | ||||

| | 12 MEETINGS IN 2019 8 were devoted to the discussion of earnings releases, Form 10-K and Form 10-Q filings | ||||||||

| | MEMBERS: John W. Diercksen (Chair) Alejandro M. Ballester C. Kim Goodwin Carlos A. Unanue | ||||||||

| | INDEPENDENCE: Each member of the committee is independent | ||||||||

| | AUDIT COMMITTEE FINANCIAL EXPERTS: Mr. Diercksen and Ms. Goodwin are Audit Committee Financial Experts as defined by SEC rules. | ||||||||

| | CHARTER LAST REVISED: December 13, 2019 | ||||||||

Talent and Compensation Committee | |||||||||

PRIMARY RESPONSIBILITIES: Discharges the Board’s responsibilities, subject to review by the full Board, relating to: • compensation of Popular’s CEO and all other executive officers; • adoption of policies that govern Popular’s compensation and benefit programs; • overseeing plans for executive officer development and succession; • overseeing, in consultation with management, compliance with federal, state and local laws as they affect compensation matters; • considering, in consultation with the Chief Risk Officer, whether the incentives and risks arising from the compensation plans for all employees are reasonably likely to have a material adverse effect on Popular and taking necessary actions to limit any risks identified as a result of the risk-related reviews; and • reviewing and discussing with management the “Compensation Discussion and Analysis” section in Popular’s annual proxy statement in compliance with applicable law, rules and regulations. | | | | | | ||||

| | 5 MEETINGS IN 2019 | ||||||||

| | MEMBERS: María Luisa Ferré (Chair) Robert Carrady John W. Diercksen Carlos A. Unanue | ||||||||

| | INDEPENDENCE: Each member of the committee is independent | ||||||||

| | CHARTER LAST REVISED: December 13, 2019 | ||||||||

TALENT AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION: None of the members of the Talent and Compensation Committee is or has been an officer or employee of Popular. In addition, none of our executive officers is, or was during 2019, a member of the board of directors or compensation committee (or other committee serving an equivalent function) of another company that has, or had during 2019, an executive officer serving as a member of our Talent and Compensation Committee. Other than as disclosed in the “Certain Relationships and Transactions” section of this Proxy Statement, none of the members of the Compensation Committee had any relationship with Popular requiring disclosure under Item 404 of Regulation S-K. | | ||||||||

Risk Management Committee | |||||||||

PRIMARY RESPONSIBILITIES: Assists the Board in its oversight of: • Popular’s overall risk management framework; and • the monitoring, review and approval of the policies and procedures that measure, limit and manage Popular’s main risks, including operational, liquidity, interest rate, market, legal, compliance and credit risks. | | | | | | ||||

| | 10 MEETINGS IN 2019 | ||||||||

| | MEMBERS: C. Kim Goodwin (Chair) Joaquín E. Bacardí, III Robert Carrady John W. Diercksen Myrna M. Soto | ||||||||

| | INDEPENDENCE: Each member of the committee is independent | ||||||||

| | CHARTER LAST REVISED: February 28, 2020 | ||||||||

Corporate Governance and Nominating Committee | |||||||||

PRIMARY RESPONSIBILITIES: The Corporate Governance and Nominating Committee is responsible for: • exercising general oversight with respect to the governance of the Board; • identifying and recommending individuals qualified to become Board members and recommending director nominees and committee members to the Board; • reviewing and reporting to the Board on matters of corporate governance and developing and recommending to the Board a set of corporate governance principles applicable to Popular; • leading the Board and assisting its committees in the annual assessment of their performance; • recommending to the Board the form and amount of compensation for Popular’s directors; and • overseeing the Corporation’s approach to environmental, social and governance (ESG) matters. | | | | | | ||||

| | 5 MEETINGS IN 2019 | ||||||||

| | MEMBERS: Alejandro M. Ballester (Chair) Joaquín E. Bacardí, III John W. Diercksen Maria Luisa Ferré Myrna M. Soto | ||||||||

| | INDEPENDENCE: Each member of the committee is independent | ||||||||

| | CHARTER LAST REVISED: January 24, 2020 | ||||||||

| | | | AUDIT | | | CORPORATE GOVERNANCE & NOMINATING | | | RISK | | | TALENT & COMPENSATION | | |

| | CLASS 1 | | | | | | | | | | ||||

| | ALEJANDRO M. BALLESTER | | |  | | |  | | | | | | ||

| | RICHARD L. CARRIÓN | | | | | | | | | | ||||

| | CARLOS A. UNANUE | | |  | | | | | | |  | | ||

| | CLASS 2 | | | | | | | | | | ||||

| | JOAQUÍN E. BACARDÍ, III | | | | |  | | |  | | | | ||

| | ROBERT CARRADY | | | | | | |  | | |  | | ||

| | JOHN W. DIERCKSEN | | |  | | |  | | |  | | |  | |

| | MYRNA M. SOTO | | | | |  | | |  | | | | ||

| | CLASS 3 | | | | | | | | | | ||||

| | IGNACIO ALVAREZ | | | | | | | | | | ||||

| | MARÍA LUISA FERRÉ | | | | |  | | | | |  | | ||

| | C. KIM GOODWIN | | |  | | | | |  | | | |

| |  | | | Member | | |  | | | Committee Chair | | |  | | | Audit Committee Financial Expert | |

| | | ||||

| | Risk Management Committee | | |||

| | | ||||

| | RESPONSIBILITIES: | | |||

| | • | | | Review, approve and oversee management’s implementation of Popular’s risk management program and related policies, procedures and controls to measure, limit and manage Popular’s risks, including operational, liquidity, interest rate, market, legal, compliance and credit risks, while taking into consideration their alignment with Popular’s strategic and capital plans. | |

| | • | | | Review and recommend to the Board Popular’s capital plan. | |

| | • | | | Review and discuss with management Popular’s major financial risk exposures and the steps taken by management to monitor and control such exposures. | |

| | • | | | Review and receive reports on selected risk topics as management or the committee may deem appropriate. | |

| | • | | | After each meeting, report to the full Board regarding its activities. | |

| | | ||||

| | | ||||

| | Audit Committee | | |||

| | | ||||

| | RESPONSIBILITIES: | | |||

| | • | | | Oversee accounting and financial reporting principles and policies, internal controls and procedures and controls over financial reporting. | |

| | • | | | Review reports from management, independent auditors, internal auditors, compliance group, legal counsel, regulators and outside experts, as considered appropriate, that include risks Popular faces and Popular’s risk management function. | |

| | • | | | Evaluate and approve the annual risk assessment of the Internal Audit Division, which identifies the areas to be included in the annual audit plan. | |

| | • | | | After each meeting, report to the full Board regarding its activities. | |

| | | ||||

| | Talent and Compensation Committee | | |||

| | | ||||

| | RESPONSIBILITIES: | | |||

| | • | | | Establish Popular’s executive compensation and other incentive-based compensation programs, taking into account the risks to Popular that such programs may pose. | |

| | • | | | Evaluate, in consultation with the Chief Risk Officer, whether the incentives and risks arising from Popular’s compensation plans for all employees are likely to have a material adverse effect on Popular. | |

| | • | | | Take such action as the Committee deems necessary to limit any risks identified as a result of the risk-related reviews. | |

| | • | | | After each meeting, report to the full Board regarding its activities. | |

| | | ||||

| | Corporate Governance and Nominating Committee | | |||

| | | ||||

| | RESPONSIBILITIES: | | |||

| | • | | | Provide oversight to risks related to the composition and structure of the Board and its committees and the Corporation’s corporate governance practices. | |

| | • | | | Oversee the Corporation’s approach to environmental, social and governance (ESG) matters and how the Corporation advances sustainability in its business and operations. | |

| | CRITERIA FOR NOMINATION | | |||

| | ✔ | | | Personal qualities and characteristics, accomplishments and reputation in the business community. | |

| | ✔ | | | Current knowledge and contacts in the communities in which Popular does business and in Popular’s industry or other industries relevant to Popular’s business. | |

| | ✔ | | | Ability and willingness to commit adequate time to Board and committee matters. | |

| | ✔ | | | The fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of Popular. | |

| | ✔ | | | Diversity of viewpoints, background, experience and other demographic factors. | |

| | DIRECTORS’ EXPERIENCE AND SKILLS | | | CARRIÓN | | | ALVAREZ | | | BACARDÍ | | | BALLESTER | | | CARRADY | | | DIERCKSEN | | | FERRÉ | | | GOODWIN | | | SOTO | | | UNANUE | | |||

| | | | INTERNATIONAL BUSINESS EXPERIENCE | | | • | | | | | • | | | | | • | | | • | | | | | • | | | • | | | • | | ||||

| | | | TECHNOLOGY, INFORMATION SECURITY AND CYBERSECURITY | | | • | | | | | | | | | | | | | | | • | | | • | | | | ||||||||

| | | | BUSINESS OPERATION EXPERIENCE | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | |

| | | | SENIOR MANAGEMENT AND LEADERSHIP EXPERIENCE | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | |

| | | | PUBLIC COMPANY KNOWLEDGE | | | • | | | • | | | | | | | | | • | | | • | | | • | | | • | | | | |||||

| | | | AUDIT AND RISK OVERSIGHT EXPERIENCE | | | • | | | | | | | | | | | • | | | | | • | | | • | | | | |||||||

| | | | FINANCIAL SERVICES, INVESTMENT AND M&A | | | • | | | • | | | | | | | | | • | | | | | • | | | | | | |||||||

| | | | UNDERSTANDING POPULAR’S MAIN GEOGRAPHIC MARKETS | | | • | | | • | | | • | | | • | | | • | | | | | • | | | | | | | • | | ||||

| | ESG VISION | | ||||||

| | Since our founding, doing what is right has been an integral part of who we are. Today, Popular continues to be an active partner in the creation of a more sustainable and prosperous world for future generations – through our core service offerings and in the way we operate. | | ||||||

| | COMMUNITY | | ||||||

| | We strive to improve the social and economic well-being of our employees, customers and communities. • Practicing inclusive banking • Leveraging technology to increase access to financial services • Providing robust financial education • Accelerating entrepreneurship • Creating opportunities through youth education | | | 2019 HIGHLIGHTS • $3.3 million awarded in corporate donations in Puerto Rico, the United States, and the Virgin Islands. • $3 million granted in philanthropic donations through our foundations in Puerto Rico and the United States. • Opened a full-service branch in Virgin Gorda, British Virgin Islands, becoming the only financial institution with a presence on the island. • 177 financial education workshops offered to 6,105 participants in Puerto Rico. • $845 million provided in Small Business Loans and $457 million in Community Development Loans in Puerto Rico. • $36.5 million provided in Small Business Loans and $80 million in Community Development Loans in the United States. | | |||

| | | |  | | ||||

| | ENVIRONMENT | | ||||||

| | We endeavor to create a more sustainable future. • Reducing the environmental impact of our operations • Actively promoting sustainable finance • Bolstering the resilience of our communities and employees and aiding them when disaster strikes • Taking ESG impacts into consideration in lending processes | | | 2019 HIGHLIGHTS • Finished solar panel photovoltaic system installations at 28 branches and 5 corporate facilities. • 18 electric vehicle charging stations installed in our branches and facilities. • 1,559 tons of paper recycled. • Over 13,000 units (81,964 lbs.) of electronic equipment recycled. • $15.7 million capital investment towards the 2020 inauguration of two combined heat and power systems that will power buildings and crucial data systems with efficient, reliable energy. | | |||

| | | |  | | ||||

| | OUR PEOPLE | | ||||||

| | We aim to be a great place to work. • Building a performance-based culture that values diversity and inclusion • Fostering transparency and accountability • Investing in talent development and career advancement opportunities • Promoting employee wellness • Encouraging employee engagement and volunteerism | | | 2019 HIGHLIGHTS • 67% of Popular’s workforce is female. • 57% of Popular’s managerial positions and 27% of executive positions are held by women. • 78% of Popular’s workforce in Puerto Rico and 64% in the U.S. made voluntary monetary contributions to Popular’s foundations through recurring payroll deductions. • $843,569: total amount donated by Popular employees in Puerto Rico and the United States. • 3,236 employees performed over 13,000 hours of service through employee volunteer initiatives. | | |||

| | | |  | | ||||

| | Popular, Inc., Board of Directors (751), P.O. Box 362708, San Juan, PR 00936-2708 | | | Alternatively, a shareholder may contact the Audit Committee or any of its members telephonically by calling the toll-free number (866) 737-6813 or electronically through www.popular.com/ethicspoint-en. | |

| | ✔ | | | Code of Ethics | |

| | ✔ | | | Code of Ethics for Popular Suppliers | |

| | ✔ | | | Audit Committee Charter | |

| | ✔ | | | Corporate Governance and Nominating Committee Charter | |

| | ✔ | | | Talent and Compensation Committee Charter | |

| | ✔ | | | Risk Management Committee Charter | |

| | ✔ | | | Corporate Governance Guidelines | |

| | ✔ | | | Insider Trading Policy | |

| | NOMINEES FOR ELECTION - CLASS 3 DIRECTORS (TERMS EXPIRING 2020) | |

| |  President & CEO Expertise & Skills  | | | | | IGNACIO ALVAREZ President & Chief Executive Officer, Popular, Inc | | | DIRECTOR SINCE 2017 AGE 61 | | |

| | | | BACKGROUND Chief Executive Officer of Popular, BPPR and Popular Bank since July 2017. President of Popular, BPPR and Popular Bank since October 2014 and Chief Operating Officer of Popular and BPPR from October 2014 to July 2017. Executive Vice President and Chief Legal Officer of Popular from June 2010 to September 2014. President and CEO of Popular North America, Inc. and other direct and indirect wholly-owned subsidiaries of Popular. President of the Puerto Rico Bankers Association from October 2017 to September 2019. Director of Centro Financiero BHD León, S.A. and Banco BHD León, from March 2018 to March 2019. Member of the Board of Trustees of Fundación Banco Popular, Inc. and of Popular Bank Foundation, Inc. since November 2015. QUALIFICATIONS Prior to joining Popular in 2010 as Chief Legal Officer, Mr. Alvarez was one of the six founding partners of the law firm Pietrantoni Méndez & Alvarez LLC, one of Puerto Rico’s principal law firms. During his 27 years in private law practice, his main areas of expertise included banking, corporate and commercial law, corporate and public finance law, securities and capital markets. As President and Chief Operating Officer, Mr. Alvarez demonstrated his solid strategic and analytical skills, understanding of the markets in which we operate, business acumen and strength as a leader, delivering positive results in our Puerto Rico business despite challenging conditions and overseeing the repositioning of our operations in the United States. Mr. Alvarez’s understanding of the Corporation and excellent business skills, as well as his background as an attorney with vast experience on corporate matters, including regulatory and corporate governance, have proven to be a great asset. | | |||||||

| |  Committees Talent and Compensation (Chair) Corporate Governance & Nominating Other Current Public Company Boards W.R. Berkley Corporation (since May 2017) Expertise & Skills  | | | | | MARÍA LUISA FERRÉ President & Chief Executive Officer, FRG, LLC | | | Independent DIRECTOR SINCE 2004 AGE 56 | | |

| | | | BACKGROUND President and CEO of FRG, LLC, a diversified family holding company with operations in media, real estate, contact centers and distribution in Puerto Rico, the United States and Chile, since 2001. Member of the Board of Directors of GFR Media, LLC since 2003 and Chair from 2006 to February 2016. Publisher of El Nuevo Día, Puerto Rico’s most widely read and influential newspaper, and Primera Hora since 2006. President and Trustee of The Luis A. Ferré Foundation, Inc. since 2003. Trustee and Vice President of the Ferré Rangel Foundation, Inc. since 1999. President of the Board of Directors of Multisensory Reading Center of PR, Inc. since 2012. Member of the Latin American Caribbean Fund of The Museum of Modern Art since 2013 and of the Smithsonian National Board since 2017. Member of the Board of Directors of Endeavor Puerto Rico since January 2018 and of the Advisory Board of Boys & Girls Club of Puerto Rico since 2017. QUALIFICATIONS Ms. Ferré has 18 years of experience as the President and CEO of FRG, Inc., the largest communications and media group in Puerto Rico, with consolidated assets of approximately $373 million and annual net revenues of approximately $174 million as of December 31, 2019. She holds positions as director and officer of numerous entities related to FRG, LLC. She also serves as director and trustee of philanthropic and charitable organizations related to fine arts and education. As a result of these experiences, Ms. Ferré possesses a deep understanding of Popular’s main market and has developed management and oversight skills that allow her to make significant contributions to the Board. She also provides thoughtful insight regarding the communications needs of Popular. | | |||||||

| |  Committees Risk Management Expert) Audit (Financial Expert) Expertise & Skills  | | | | | C. KIM GOODWIN Private Investor | | | Independent DIRECTOR SINCE 2011 AGE 60 | | |

| | | | BACKGROUND Private investor since 2008. Non-executive director of PineBridge Investments, LLC, a global asset management boutique with over $101 billion in assets under management, since May 2011, and Chair of its Audit Committee. Trustee-Director of various equity funds within the Allianz Global Investors family of funds from June 2010 to October 2014. QUALIFICATIONS Ms. Goodwin’s experience as chief investment officer at several global financial services firms provides the Board with insight into the perspective of institutional investors. Her analytical skills and understanding of global financial markets have proved to be valuable assets. As Head of Equities at Credit Suisse Asset Management from 2006 to 2008, Ms. Goodwin oversaw enterprise risk functions for her global department. Through her experiences as a member of the Audit Committee of Akamai Technologies, Chair of the Audit Committee of PineBridge Investments and Chair of Popular’s Risk Management Committee, Ms. Goodwin has developed profound knowledge of the risks related to our business. She has also developed expertise in identifying, assessing and managing risk exposure, successfully leading the Board’s efforts on risk oversight. Finally, Ms. Goodwin also provides Popular with valuable insight regarding the use of technology by financial firms. | | |||||||

| | CLASS 1 DIRECTORS (TERMS EXPIRING 2021) | |

| |  Committees Corporate Governance & Nominating (Chair) Audit Expertise & Skills  | | | | | ALEJANDRO M. BALLESTER President, Ballester Hermanos, Inc. | | | Independent DIRECTOR SINCE 2010 AGE 53 | | |

| | | | BACKGROUND President of Ballester Hermanos, Inc., a major food and beverage distributor in Puerto Rico, since 2007. In 2009 served as Member of the Board of Directors of the Government Development Bank for Puerto Rico. QUALIFICATIONS Mr. Ballester has a comprehensive understanding of Puerto Rico’s consumer products and distribution industries acquired through over 29 years of experience at Ballester Hermanos, Inc., a privately-owned business dedicated to the importation and distribution of grocery products, as well as beer, liquors and wine for the retail and food service trade in Puerto Rico. As of December 31, 2019, Ballester Hermanos had approximately $125 million in assets and annual revenues of approximately $350 million. Mr. Ballester is familiar with the challenges faced by family-owned businesses, which constitute an important market segment for Popular’s commercial banking units. He has proven to be a successful entrepreneur establishing the food service division of Ballester Hermanos in 1999, which today accounts for 38% of the firm’s revenues. During 2009, he was a director of the Government Development Bank for Puerto Rico and member of its audit and investment committees where he obtained experience in overseeing a variety of fiscal issues related to various government agencies, instrumentalities and municipalities. The experience, skills and understanding of the Puerto Rico economy and government financial condition acquired by Mr. Ballester have been of great value to the Board. | | |||||||

| |  Chairman of the Board Expertise & Skills  | | | | | RICHARD L. CARRIÓN Chairman of the Board of Directors, Popular, Inc. | | | DIRECTOR SINCE 1991 AGE 67 | | |

| | | | BACKGROUND Chairman of Popular since 1993 and Executive Chairman from July 2017 to July 2019. CEO of Popular from 1994 to June 2017 and President from 1991 to January 2009 and from May 2010 to September 2014. Executive Chairman of BPPR from July 2017 to July 2019, Chairman since 1993 and CEO from 1989 to June 2017. President of BPPR from 1985 to 2004 and from May 2010 to September 2014. Executive Chairman of Popular Bank from July 2017 to July 2019 and Chairman since 1998. Chairman of Popular North America, Inc. and other direct and indirect wholly-owned subsidiaries of Popular and CEO until 2017. Director of the Federal Reserve Bank of New York from January 2008 to December 2015. Chairman of the Board of Trustees of Fundación Banco Popular, Inc. since 1991. Chairman and Director of Popular Bank Foundation, Inc. since 2005. Member of the Board of Directors of Verizon Communications, Inc. from 1995 to May 2019. Member of the International Olympic Committee since 1990 and Chairman of the International Olympic Committee Finance Commission from 2002 to 2013. Managing Member of RCA3 Investments, LLC, an entity engaged in financial consulting since October 2017. Chairman of the Board of Vall Banc, an Andorra-based bank, since October 2017. Member of the Supervisory Board of NIBC Holding N.V. and NIBC Bank N.V., both entities engaged in banking in the Netherlands, since 2017. Member of the Board of Directors of First Bank, an entity engaged in banking in Romania, since November 2018. QUALIFICATIONS Mr. Carrión’s 43 years of banking experience, over 33 years heading Popular, give him a unique level of knowledge of the Puerto Rico financial system. Mr. Carrión is a well-recognized leader with a vast knowledge of the Puerto Rico economy, and is actively involved in major efforts impacting the local economy. His knowledge of the financial industry led him to become a director of the Federal Reserve Bank of New York for eight years. | | |||||||

| |  Committees Talent and Compensation Audit Expertise & Skills  | | | | | CARLOS A. UNANUE President, Goya de Puerto Rico, Inc. | | | Independent DIRECTOR SINCE 2010 AGE 56 | | |

| | | | BACKGROUND President of Goya de Puerto Rico, Inc. since 2003 and of Goya Santo Domingo, S.A. since 1994, food processors and distributors. QUALIFICATIONS Mr. Unanue has 33 years of experience at Goya Foods, Inc., a privately-held family business with operations in the United States, Puerto Rico, Spain and the Dominican Republic that is dedicated to the sale, marketing and distribution of Hispanic food, as well as to the food processing and canned food manufacturing business. Through his work with Goya Foods, Mr. Unanue has developed a profound understanding of Popular’s two main markets, Puerto Rico and the United States. His experience in distribution, sales and marketing has provided him with the knowledge and experience to contribute to the development of Popular’s business strategy, while his vast experience in management at various Goya entities has allowed him to make valuable contributions to the Board in its oversight functions. | | |||||||

| | CLASS 2 DIRECTORS (TERMS EXPIRING 2022) | |

| |  Committees Corporate Governance & Nominating Risk Management Expertise & Skills  | | | | | JOAQUÍN E. BACARDÍ, III Chairman, Edmundo B. Fernández, Inc. | | | Independent DIRECTOR SINCE 2013 AGE 54 | | |

| | | | BACKGROUND Chairman and majority shareholder of Edmundo B. Fernández, Inc., a privately held producer and distributor of rum since November 2017. Private investor since 2016. President and Chief Executive Officer of Bacardi Corporation, a privately held business and major producer and distributor of rum and other spirits, from April 2008 to April 2016. QUALIFICATIONS On November 2017, Mr. Bacardí completed the acquisition of Edmundo B. Fernández, Inc., a 137 year old privately owned rum company. Mr. Bacardí has extensive experience in the development and implementation of international marketing, sales and distribution strategies acquired throughout more than 24 years at various Bacardi companies and 3 years as Product Manager of Nestlé of Puerto Rico. As President and Chief Executive Officer of Bacardi Corporation, Mr. Bacardí directed and managed all business operations with full profit and loss responsibilities and government relations for Bacardi in the Caribbean, Mexico, Central and South America. Prior to becoming President and Chief Executive Officer of Bacardi Corporation, Mr. Bacardí held positions in various Bacardi enterprises where, among other things, he was responsible for the development of all global communication strategies for Bacardi Limited’s whisky portfolio, with total sales of approximately $400 million, and supervision of marketing for all Bacardi brands globally. Mr. Bacardí’s vast experience in business operations in Puerto Rico and across various international markets, as well as his expertise in global communication strategies, have been of great benefit to the Board. | | |||||||

| |  Committees Risk Management Talent and Compensation Expertise & Skills  | | | | | ROBERT CARRADY President, Caribbean Cinemas | | | Independent DIRECTOR SINCE 2019 AGE 64 | | |

| | | | BACKGROUND President of Caribbean Cinemas, a family-owned business and the largest movie theater chain in the Caribbean, since 2006. QUALIFICATIONS Mr. Carrady, as President of Caribbean Cinemas, has acquired extensive leadership and business operations experience by overseeing and managing a theater operation of approximately 570 cinema screens in 68 locations across Puerto Rico, the Dominican Republic and several other Caribbean islands, as well as in Guyana, Panama and Bolivia. His entrepreneurial skills have helped develop Caribbean Cinemas into the largest movie theater chain in the Caribbean and has transformed the company which today manages in-house the construction of new sites, theatre operations, film buying, food concessions, screen advertising, game room concessions and real estate leasing and management. Mr. Carrady’s experience as a business leader and entrepreneur, as well as his thorough understanding of the Caribbean region, one of the markets where Popular operates, brings great value to our board. | | |||||||

| |  Lead Director Committees Audit (Chair & Financial Expert) Talent and Compensation Corporate Governance & Nominating Risk Management Other Current Public Company Boards Intelsat, S.A. (since September 2013) Cyxtera Technologies (since May 2017) Expertise & Skills  | | | | | JOHN W. DIERCKSEN Principal, Greycrest, LLC | | | Independent DIRECTOR SINCE 2013 AGE 70 | | |

| | | | BACKGROUND Principal of Greycrest, LLC, a privately-held financial and operational advisory services company, since October 2013. Chief Executive Officer of Beachfront Wireless LLC, a privately-held investment entity organized to participate in a Federal Communications Commission airwaves auction, from December 2015 to November 2016, when it was sold. Senior Advisor at Liontree Investment Advisors, an investment banking firm, since April 2014. Director of Harman International Industries, Incorporated, an audio and infotainment equipment company, from June 2013 to June 2017, when it was sold. QUALIFICATIONS Mr. Diercksen has 30 years of experience in the communications industry. From 2003 to 2013, he was an Executive Vice President of Verizon Communications, Inc., a global leader in delivering consumer, enterprise wireless and wire line services, as well as other communication services. At Verizon he was responsible for key strategic initiatives related to the review and assessment of potential mergers, acquisitions and divestitures and was instrumental in forging Verizon’s strategy of technology investment and repositioning its assets. He possesses a vast experience in matters related to corporate strategy, mergers, acquisitions and divestitures, business development, venture investments, strategic alliances, joint ventures and strategic planning. Mr. Diercksen’s extensive senior leadership experience, together with his financial and accounting expertise, position him well to advise the Board and senior management on a wide range of strategic and financial matters. | | |||||||

| |  Committees Risk Management (Risk Management Expert) Corporate Governance & Nominating Other Current Public Company Board CMS Energy Corporation (since January 2015) Spirit Airlines, Inc. (since March 2016) Expertise & Skills  | | | | | MYRNA M. SOTO Chief Operating Officer, Digital Hands, LLC | | | Independent DIRECTOR SINCE 2018 AGE 50 | | |

| | | | BACKGROUND Chief Operating Officer of Digital Hands, LLC, a managed security service provider, since March 2019. Partner at ForgePoint Capital, a venture capital firm concentrating exclusively on cybersecurity related companies, from April 2018 to March 2019, when she assumed the role of Venture Advisor. Senior Vice President and Global Chief Information Security Officer of Comcast Corporation, a worldwide media and technology company, from September 2009 to April 2018. Vice President of Information Technology Governance and Chief Information Security Officer of MGM Resorts International, a global hospitality company, from 2005 until September 2009. QUALIFICATIONS Ms. Soto has over 29 years of information technology and security experience in a variety of industries, including financial services, hospitality, insurance, risk management, as well as gaming and entertainment. During her years in the information and cybersecurity field, she successfully managed global cybersecurity and technology risk programs at leading Fortune 500 companies. Ms. Soto’s extensive experience in cybersecurity, as well as her experience as a business leader and as a member of several public company boards, brings an invaluable and unique perspective to our Board and helps ensure that the Corporation is well-positioned to meet the technology and cybersecurity needs of today’s marketplace, a matter that becomes more critical each day. | | |||||||

| | | ||||||||||

| |  | | | IGNACIO ALVAREZ President and Chief Executive Officer Mr. Alvarez, age 61, has been Chief Executive Officer of Popular since July 2017 and President and Chief Operating Officer since October 2014. Prior to that he was Executive Vice President and Chief Legal Officer of Popular from June 2010 to September 2014. For additional information, please refer to the “Nominees for Election as Directors and Other Directors” section of this Proxy Statement. | |

| |  | | | CAMILLE BURCKHART Executive Vice President, Chief Information & Digital Strategy Officer Innovation, Technology & Operations Group Ms. Burckhart, age 40, has been Executive Vice President and Chief Information and Digital Officer of Popular since July 2015. Prior to becoming Executive Vice President, Ms. Burckhart was the Senior Vice President in charge of the Technology Management Division from December 2010 to June 2015. She has been a member of the Board of Directors of Nuestra Escuela since August 2016 and of the Board of Trustees of Fundación Banco Popular since October 2018. | |

| |  | | | BEATRIZ CASTELLVÍ Executive Vice President and Chief Security Officer Corporate Security Group Ms. Castellví, age 52, has been Executive Vice President and Chief Security Officer of Popular in charge of cybersecurity and fraud since May 2018. Prior to becoming Executive Vice President, she was Senior Vice President and General Auditor of the Corporation from November 2012 to April 2018. Ms. Castellví has served as a member of the Executive Council of the Puerto Rico Ellevate Chapter since 2013 and as Treasurer from 2013 to January 2019, when she became a member of its Advisory Board. | |

| |  | | | LUIS E. CESTERO Executive Vice President Retail Banking Group Mr. Cestero, age 46, has been Executive Vice President of BPPR in charge of the Retail Banking Group since July 2017. Prior to becoming Executive Vice President, Mr. Cestero was the Senior Vice President in charge of Retail Banking Administration from May 2009 to June 2017. | |

| |  | | | MANUEL CHINEA Executive Vice President Chief Operating Officer of Popular Bank Mr. Chinea, age 54, has been Executive Vice President of Popular since January 2016 and Chief Operating Officer of Popular Bank since February 2013. He has served as a Member of the Board of Trustees of Popular Bank Foundation since October 2013, member of the Board of Directors of the Hispanic Federation since June 2016 and member of the Board of Junior Achievement New York since October 2017. | |

| |  | | | JAVIER D. FERRER Executive Vice President, Chief Legal Officer and Secretary of the Board Mr. Ferrer, age 58, has been the Executive Vice President, Chief Legal Officer and Secretary of the Board of Directors of Popular since October 2014 and a Director of BPPR since March 2015. In January 2019, he assumed oversight of the Corporation’s strategic planning function. Since September 2019, Mr. Ferrer has been a member of the Trust Committee of the Board of Directors of BPPR. Prior to joining Popular, Mr. Ferrer was a Partner at Pietrantoni Méndez & Alvarez LLC, a San Juan, Puerto Rico based law firm, were he worked from September 1992 to December 2012 and from August 2013 to September 2014. From January 2013 to July 2013, Mr. Ferrer served as President of the Government Development Bank for Puerto Rico and Vice Chairman of its Board of Directors as well as Chairman of the Economic Development Bank for Puerto Rico. | |

| |  | | | JUAN O. GUERRERO Executive Vice President Financial and Insurance Services Group Mr. Guerrero, age 60, has been an Executive Vice President of BPPR in charge of the Financial and Insurance Services Group since April 2004. He has been a Director of Popular Securities LLC since 1995, Popular Insurance LLC since 2004 and of other subsidiaries of Popular. Mr. Guerrero has served as a Director of SER de Puerto Rico since December 2010 and the Puerto Rico Open since October 2016. | |

| |  | | | GILBERTO MONZÓN Executive Vice President Individual Credit Group Mr. Monzón, age 60, has been an Executive Vice President of BPPR in charge of the Individual Credit Group since October 2010. He has also served as Member of the Board of Directors of the San Jorge Children’s Hospital Professional Board since 2011 and director of the Center for a New Economy and the Coalition for the Prevention of Colorectal Cancer of Puerto Rico since 2014. | |

| |  | | | EDUARDO J. NEGRÓN Executive Vice President Administration Group Mr. Negrón, age 55, has been Executive Vice President of Popular since April 2008 and has been in charge of the Administration Group since December 2010. He became Chairman of Popular’s Benefits Committee on April 2008. He has served as Member of the Board of Trustees and Treasurer of Fundación Banco Popular and of the Popular Bank Foundation since March 2008. Since 2015, Mr. Negrón has served as Trustee of Fundación Angel Ramos and Chairman of its Finance and Investment Committee. Mr. Negrón has also been a Director of the Fundación Puertorriqueña de las Humanidades since June 2017. | |

| |  | | | ELI S. SEPÚLVEDA Executive Vice President Commercial Credit Group Mr. Sepúlveda, age 57, has been Executive Vice President of Popular since February 2010 and of BPPR since December 2009. He has been the supervisor in charge of the Commercial Credit Group in Puerto Rico since January 2010. Mr. Sepúlveda has been a member of the Board of Managers of the Puerto Rico Idea Seed Fund, LLC since December 2016. | |

| |  | | | LIDIO V. SORIANO Executive Vice President and Chief Risk Officer Mr. Soriano, age 51, has been the Executive Vice President and Chief Risk Officer of Popular since August 2011 and a Director of Popular Bank since October 2014. He served as a Director of BPPR from October 2014 to September 2019. He has been a member of the Board of Directors of the Puerto Rican League Against Cancer since August 2018. | |

| |  | | | CARLOS J. VÁZQUEZ Executive Vice President and Chief Financial Officer Mr. Vázquez, age 61, has been the Chief Financial Officer of Popular since March 2013. He was President of Popular Bank from September 2010 to September 2014 and has been Executive Vice President of Popular since February 2010 and Senior Executive Vice President of BPPR since 2004. He has served as Director of BPPR and of Popular Bank since October 2010. He has been Vice Chairman of the Board of Directors of Popular Bank Foundation since November 2010, Director of the Federal Home Loan Bank of New York since November 2013 and Member of the National Board of Directors of Operation Hope since 2012. | |

| • | 30-year mortgage loan in the original principal amount of $537,000 made in 2003 by Popular Mortgage, then a subsidiary of BPPR, which was secured by a first mortgage over the residential property. Said mortgage was subsequently restructured in August 2005, February 2006 and July 2011. The latest restructuring resulted in a 30-year mortgage loan with an aggregate principal amount of $662,945 and a fixed annual interest rate of 6.50%. In 2006 a private investor acquired this loan and delegated to BPPR the authority to make decisions as servicer pursuant to established investor guidelines regarding the loss mitigation options available to borrowers. The borrowers became delinquent on their payments under this mortgage in September 2017 and, in July 2018, the Bank received a loss mitigation application from the borrowers as a result of which a three-month forbearance was granted. As of December 31, 2019, the loan was 822 days past due. No payment was received during 2019. As of December 31, 2019, the outstanding balance of the loan was $652,970 which also represented the largest outstanding balance of the loan during 2019. |

| • | 30-year mortgage loan in the original principal amount of approximately $104,000 and a fixed annual interest rate of 7.375%, made by BPPR in 2006 and secured by a second mortgage on the same residential property. The loan was restructured in 2011 and from September 2017 to January 2018 the loan participated in the moratorium of principal and interest offered to BPPR’s mortgage clients in the aftermath of Hurricane Maria and also benefitted from the same three-month forbearance as the first mortgage loan. In May 2018, the borrower defaulted on his payment obligations under the restructured loan and as of December 31, 2019 the loan was 610 days past due. No payment was received during 2019. As of December 31, 2019, the outstanding balance of the loan was $98,081 which also represented the largest outstanding balance of the loan during 2019. |

| • | 5-year term loan in the original principal amount of $100,000 and a fixed annual interest rate of 5%, made by BPPR in 2010 and secured by a third mortgage on the same residential property. Since 2015, when the loan matured, the borrowers have only made partial payments of principal. During 2019 borrower only paid $1,000 in principal. As of December 31, 2019, the |

EXECUTIVE AND DIRECTOR COMPENSATION |  |

| | | ||||

| | Richard L. Carrión | | | Former Executive Chairman of the Board of Directors* | |

| | Ignacio Alvarez | | | President & Chief Executive Officer (“CEO”) | |

| | Carlos J. Vázquez | | | Executive Vice President and Chief Financial Officer (“CFO”) | |

| | Javier D. Ferrer | | | Executive Vice President and Chief Legal Officer (“CLO”) | |

| | Lidio V. Soriano | | | Executive Vice President and Chief Risk Officer (“CRO”) | |

| | Eli S. Sepúlveda | | | Executive Vice President, Commercial Credit Group, Banco Popular de Puerto Rico | |

| | | ||||

| | PUERTO RICO BUSINESS | | |||

| | • | | | Increased total deposits by $3 billion (10%) from 2018. | |

| | • | | | Maintained strong net interest margins at 4.30%. | |

| | • | | | Acquired a credit card portfolio ($74 million) and the rights to issue the JetBlue co-branded loyalty credit card in Puerto Rico. | |

| | • | | | Served 1.8 million customers, as of 2019 year-end, increasing by 45,000 from 2018. | |

| | • | | | Market leader in auto loans, personal loans, credit cards, mortgage origination, commercial loans and deposits. | |

| | • | | | Increased the offerings of innovative solutions to our customers through our digital transformation. Digital deposits captured 52% of total deposit transactions, up 10% from December 2018, and Mi Banco (online platform) active customers reached 915,000 in 2019, up 9% from 2018. | |

| | UNITED STATES BUSINESS | | |||

| | • | | | Increased our total loan portfolio by $603 million (9%) and total deposits by $652 million (9%). | |

| | • | | | Continued expanding our specialized business segments of condominium association banking and healthcare lending, and continued to evolve income streams led by private banking and residential mortgage originations. | |

| | • | | | Increased digital deposit transactions to 49% of all deposits in December 2019, up from 47% in December 2018. | |

| | CREDIT QUALITY AND PROFITABILITY | | |||

| | • | | | Improved the credit quality of our portfolio including reduction of non-performing loans held-in-portfolio as a percentage of loans held-in-portfolio (1.9%) and net charge-offs as a percentage of average loans held-in-portfolio (0.96%). The Corporation continues to closely monitor its portfolios and related credit metrics given Puerto Rico’s ongoing economic and fiscal challenges. | |

| | • | | | Increased net interest margin to 4.03%, a 2-bps improvement from 2018. | |

| | CAPITAL STRATEGY | | |||

| | • | | | Increased earnings per share and tangible book value by 14% and 17%, respectively. | |

| | • | | | Capital levels remained robust, with year-end Common Equity Tier 1 capital equal to 17.8%. | |

| | • | | | Completed a common stock repurchase of $250 million. | |

| | • | | | Increased our quarterly dividend to $0.30 per share from $0.25 per share. | |

| | ORGANIZATIONAL EXCELLENCE | | |||

| | • | | | Transformed 28 branches in Puerto Rico to run on clean renewable energy sources. | |

| | • | | | Streamlined our operations through robotic automation technology and the enhancements of procurement and vendor management processes. | |

| | • | | | Continued the evolution of our corporate-wide customer service framework to enhance customer experience; comprehensive training for all employees was completed in 2019. | |

| | • | | | Increased compensation (minimum base salaries and other adjustments) in Popular Bank and the Virgin Islands, enabling us to secure top talent. | |

| | • | | | Developing talent is at the forefront of our business strategy. We have bolstered our learning initiatives to ensure our people have the skills required now and in the future. | |

| | SOCIAL COMMITMENT | | |||

| | • | | | Maintained a strong branch presence in low and moderate-income communities: 28% of Banco Popular and 54% of Popular Bank branches are in these communities. | |

| | • | | | Provided valuable financial and in-kind assistance through Fundación Banco Popular, Popular Bank Foundation and Popular’s corporate donations and social programs. Our total social investment during 2019 was $6 million, impacting communities in Puerto Rico, United States and Virgin Islands in the areas of education, economic development, and the promotion of socially innovative ideas. Please refer to the Corporate Responsibility and Sustainability section of this Proxy Statement for additional details. | |

| | • | | | 78% of our employees in Puerto Rico and 65% of our employees in the United States made voluntary financial contributions to our foundations, which were matched by the Corporation. | |

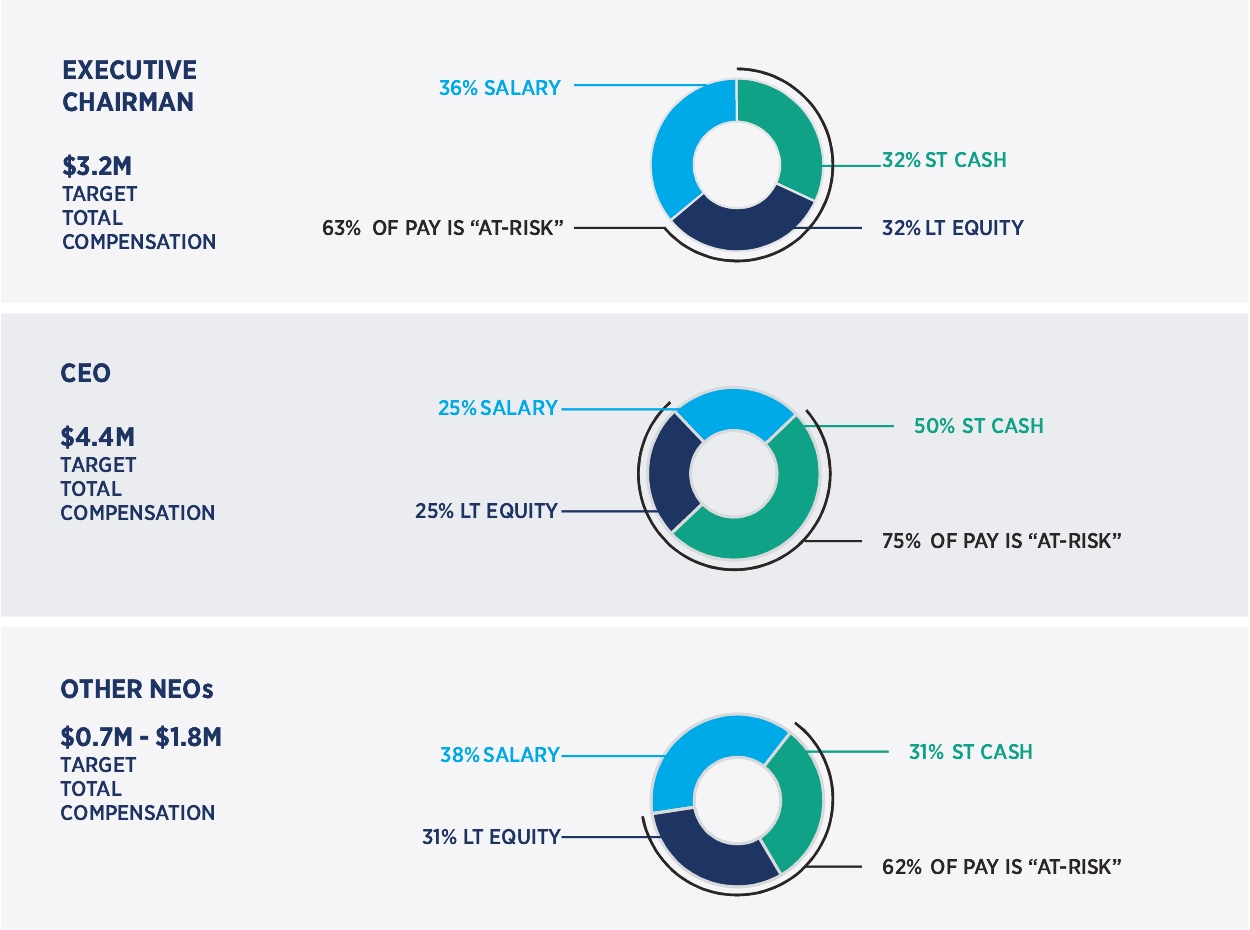

| • | Continued Focus on Performance-based Compensation. As seen in the graphs below, performance-based short- and long-term incentives represent the majority of our executive officers’ target total compensation opportunity (63% of total compensation for the Executive Chairman, 75% for the President and CEO and 62% for the other NEOs). The target long-term equity incentive is based on two components: (i) one-half (50%) is granted as restricted stock, a portion of which vests upon retirement (whose grant value considers prior-year company and individual performance); and (ii) one-half (50%) is granted as performance shares, with actual value based on future performance over a 3-year period (one-half based on Total Shareholder |

| • | 2019 Short-term Incentives. Our NEOs’ 2019 short-term incentives ranged from 127% to 137% of target, reflecting Popular's strong net income results and favorable performance against pre-established financial and non-financial goals, as the Corporation strengthened its franchise, grew its customer base, managed credit exposure and delivered record core earnings. |

| • | 2019 Long-term Awards. Equity grants in 2019 were made above target (at midpoint between target and maximum), recognizing each NEOs’ contribution to Popular’s solid performance and strong leadership in the face of Puerto Rico’s continued challenging social and macroeconomic conditions during 2018. |

Note: Target total compensation is based on the base salary as of December 31, 2019.

Note: Target total compensation is based on the base salary as of December 31, 2019.| • | 2019 Salary Adjustments. Each NEO, except for the former Executive Chairman and the CEO, received a merit increase adjustment ranging from 2% to 7% of base salary upon consideration of market benchmarking and individual performance. |

| • | 2017-2019 Performance Share Vesting. Upon the conclusion of the 2017-2019 performance cycle, the Committee approved vesting at 150% of target, based on the following results - equally weighted at 50%: (i) TSR - 92nd percentile relative to an industry index of U.S. banks with assets greater than $10 billion, resulted in maximum award (1.5 times target) and (ii) EPS – cumulative 3 year EPS result of $14.04 exceeded the target of $10.64 and maximum of $11.16, thereby yielding the maximum award (1.5 times target). |

| |  WHAT WE DO | ✔ | Use a combination of performance metrics to deter excessive risk-taking by eliminating focus on any single performance goal. The Committee may adjust incentive payouts if results are not aligned with Popular’s risk appetite and related tolerances. | |

✔ | Balance short-term (cash) and long-term (equity) compensation to discourage short-term risk-taking at the expense of long-term results. | | ||

✔ | Use equity incentives to promote total return to shareholders, company performance and executive retention. | | ||

✔ | Require significant stock ownership from our executive officers. Our CEO has a requirement of six times his base salary, and the other NEOs must own three times their base salary. As of February 2020, all NEOs had either met the requirement or were on track to comply within the designated timeframe. | | ||

✔ | Hold a portion of equity vesting until retirement, thereby reinforcing long-term risk management and alignment with shareholder interests. | | ||

✔ | Apply clawback features to all executive officer variable pay in the event of a financial results restatement, a materially inaccurate performance metric, or an executive’s misconduct. | | ||

✔ | Employ “double-trigger” vesting of equity awards in the event of a change in control (i.e., vesting is only triggered upon a qualifying termination of employment following a change in control). | | ||

✔ | Conduct annual incentives and sales practices risk reviews in conjunction with Popular’s Chief Risk Officer. | | ||

✔ | Assess the competitiveness of our executive compensation program through benchmarking of industry and peer group practices. | | ||

✔ | Engage an independent compensation consultant who advises and reports directly to the Committee. | |

| |  WHAT WE DON’T DO | ✘ | No tax gross-ups provided for any compensation or benefits. | |

✘ | No special executive retirement programs or severance programs specific to executive officers. | | ||

✘ | No speculative transactions in Popular’s securities by executive officers is permitted, including: hedging and monetization transactions, such as zero-cost collars, forward sale contracts and short sales, equity swaps, options, and other derivative transactions. | | ||

✘ | No pledging of common stock or other Popular securities as collateral for margin accounts or loans. | | ||

✘ | No employment or change in control agreements with our NEOs. | | ||

✘ | No excessive perquisites for executives. | |

| | MOTIVATE AND REWARD HIGH PERFORMANCE | |

| | Ensuring and sustaining a proper pay-for-performance relationship is one of our key objectives. For Popular, performance means a combination of financial results (e.g., net income, earnings per share, total shareholder return), strategic accomplishments and a demonstration of leadership competencies, all designed to support our company’s business strategy and drive long-term shareholder value. | |

| | Base salary, as well as short- and long-term incentive compensation opportunities, are targeted at market median, with actual pay varying according to each executive’s experience and performance. Our short-term incentive and equity awards provide the opportunity to earn increased pay (up to 1.5 times target) for superior performance and similar downside (no payout) should we not achieve our performance goals. | |

| | ALIGN EXECUTIVES WITH SHAREHOLDER INTERESTS AND BUILD LONG-TERM SHAREHOLDER VALUE | |