- BPOP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Popular (BPOP) PRE 14APreliminary proxy

Filed: 27 Feb 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☑ | Preliminary Proxy Statement | |||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☐ | Definitive Proxy Statement | |||

☐ | Definitive Additional Materials | |||

☐ | Soliciting Material Pursuant to §240.14a-12 | |||

Popular, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

☑ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: | |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

(4) | Proposed maximum aggregate value of transaction: | |||

| ||||

(5) | Total fee paid: | |||

| ||||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| ||||

(2) | Form, Schedule or Registration Statement No.: | |||

| ||||

(3) | Filing Party: | |||

| ||||

(4) | Date Filed: | |||

| ||||

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS AND

PROXY STATEMENT

DATE AND TIME

Tuesday, May 8, 2018

9:00 a.m. (local time)

PLACE

Popular Center Building

PH Floor

209 Muñoz Rivera Avenue

San Juan, Puerto Rico

RECORD DATE

March 9, 2018

ITEMS OF BUSINESS

| • | Elect four directors assigned to “Class 1” of the Board of Directors for a three-year term; |

| • | Authorize and approve an amendment to Article Seventh of our Restated Certificate of Incorporation to provide that directors shall be elected by a majority of the votes cast by shareholders at the annual meeting of shareholders, provided that in contested elections directors shall be elected by a plurality of votes cast; |

| • | Approve, on an advisory basis, our executive compensation; |

| • | Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for 2018; |

| • | Approve the adjournment or postponement of the meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes at the time of the meeting to approve the proposed amendment to Article Seventh of our Restated Certificate of Incorporation; and |

| • | Consider such other business as may be properly brought before the meeting or any adjournments thereof. |

In San Juan, Puerto Rico, on March [ ], 2018.

By Order of the Board of Directors,

Javier D. Ferrer

Executive Vice President, Chief Legal Officer and Secretary

HOW TO VOTE

|  |  |  | |||

| Online | Phone | In Person | ||||

Only shareholders of record at the close of business on March 9, 2018 are entitled to notice of, and to vote at, the meeting. Each share of common stock is entitled to one vote.

We encourage you to attend the meeting. Your vote is important. Whether or not you plan to attend, please vote as soon as possible so that we may be assured of the presence of a quorum at the meeting.

You may vote online, in person, by telephone or, if you received a paper proxy card in the mail, by mailing the completed proxy card. The instructions on the Notice of Internet Availability of Proxy Materials or your proxy card describe how to use these convenient services.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 8, 2018:

This 2018 Proxy Statement and our Annual Report for the year ended December 31, 2017 are available free of charge atwww.popular.comand www.proxyvote.com.

209 Muñoz Rivera Avenue

San Juan, Puerto Rico 00918

| PROXY STATEMENT SUMMARY | 1 | |||

| CORPORATE GOVERNANCE, DIRECTORS AND EXECUTIVE OFFICERS | 7 | |||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 23 | ||||

| 26 | ||||

| EXECUTIVE AND DIRECTOR COMPENSATION | 31 | |||

| 31 | ||||

| 31 | ||||

| 35 | ||||

| 38 | ||||

| 46 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

2017 Executive Compensation Tables and Compensation Information | 50 | |||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 62 | |||

| 62 | ||||

Shares Beneficially Owned by Directors and Executive Officers of Popular | 63 | |||

| 64 | ||||

| PROPOSALS | 65 | |||

| 65 | ||||

| 66 | ||||

| 67 | ||||

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm | 68 | |||

| 69 | ||||

| AUDIT COMMITTEE REPORT | 70 | |||

| GENERAL INFORMATION ABOUT THE MEETING | 71 | |||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| APPENDIX A—PROPOSED AMENDMENT TO ARTICLE SEVENTH OF THE RESTATED CERTIFICATE OF INCORPORATION | 77 | |||

| APPENDIX B—RECONCILIATION OF NON-GAAP MEASURES | 78 | |||

This summary highlights information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement before voting.

Meeting Agenda and Voting Recommendations

PROPOSAL 1

Election of Directors

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR EACH NOMINEE. |

We are asking shareholders to elect four directors. Popular’s directors are elected for a term of three years by the affirmative vote of a majority of the shares represented at the annual meeting in person or by proxy and entitled to vote. The table below sets forth information with respect to our four nominees standing for election. All of the nominees are currently serving as directors. Additional information about the director candidates and their respective qualifications can be found on the “Nominees for Election as Directors and Other Directors” section of this Proxy Statement.

| ||||||||||||||||||||||||

IGNACIO ALVAREZ |

ALEJANDRO M. BALLESTER |

RICHARD L. CARRIÓN |

CARLOS A. UNANUE | |||||||||||||||||||||

Age 59

| Age 51

| Age 65

| Age 54

| |||||||||||||||||||||

President and CEO of Popular, Inc.

| President of Ballester Hermanos, Inc.

| Executive Chairman of Popular, Inc.

| President of Goya de Puerto Rico

| |||||||||||||||||||||

Director since July 2017

| Director since 2010

| Director since 1991 | Director since 2010 | |||||||||||||||||||||

| ||||||||||||||||||||||||

PROPOSAL 2

Amendment to Restated Certificate of Incorporation

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION. |

We are asking shareholders to approve an amendment to Article Seventh of Popular’s Restated Certificate of Incorporation to provide that directors shall be elected by a majority of the votes cast by shareholders at the annual meeting of shareholders, provided that if the number of nominees exceeds the number of directors to be elected, the director nominees shall be elected by a plurality of the votes cast. Additional information with respect to the proposed amendment can be found in “Proposal 2: Amendment to Article Seventh of Popular’s Restated Certificate of Incorporation to Amend the Voting Standard for the Election of Directors to Provide that Directors Shall be Elected by a Majority of the Votes Cast by Shareholders at the Annual Meeting of Shareholders, Except that in Contested Elections Directors Shall be Elected by a Plurality of the Votes Cast.” In addition, the text of the proposed amendment is set forth in Appendix A to this Proxy Statement.

2018 PROXY STATEMENT | 1

PROPOSAL 3

Advisory Vote to Approve Executive Compensation

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THIS PROPOSAL. |

We are asking shareholders to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) as described in the sections titled “Compensation Discussion and Analysis” and “2017 Executive Compensation Tables and Compensation Information.” We hold this advisory vote on an annual basis.

PROPOSAL 4

Ratification of Auditors

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR RATIFICATION. |

We are asking shareholders to ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018. Information on fees paid to PricewaterhouseCoopers LLP during 2017 and 2016 appears on the “Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm” section of this Proxy Statement.

PROPOSAL 5

Adjournment or Postponement of the Meeting

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ADJOURNMENT OR POSTPONEMENT OF THE MEETING IN THE EVENT THERE ARE NOT SUFFICIENT VOTES TO ADOPT PROPOSAL 2. |

We are asking shareholders to approve the adjournment of the meeting, if necessary or appropriate, in order to allow for the solicitation of additional proxies in the event that there are not sufficient votes at the time of the meeting to adopt Proposal 2. This Proposal relates to the amendment to Article Seventh of the Corporation’s Restated Certificate of Incorporation to provide that directors shall be elected by a majority of the votes cast by shareholders at the annual meeting of shareholders, provided that if the number of nominees exceeds the number of directors to be elected, the director nominees shall be elected by a plurality of the votes cast.

For additional information about the meeting please refer to the “General Information About the Meeting” section of this Proxy Statement.

2 | 2018 PROXY STATEMENT

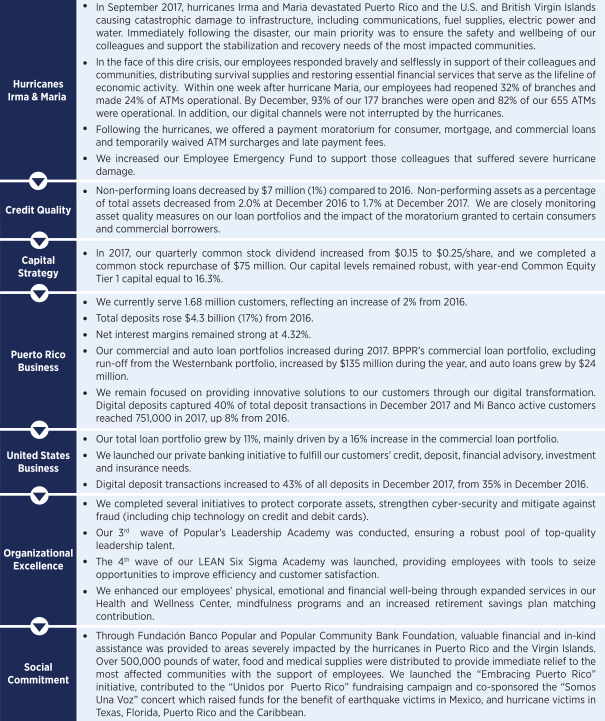

2017 Financial Performance and Executive Compensation Highlights

2017 CORPORATE HIGHLIGHTS

During 2017, we demonstrated the continued strength of our franchise while operating in a challenging economic environment impacted by the unprecedented destruction and disruption caused by hurricanes Irma and Maria. Notwithstanding the hurricanes’ impact, we persevered to achieve year-over-year growth in our net interest income, stable credit indicators and strong capital levels. Despite the challenges posed by the Puerto Rico economy and the hurricanes that made landfall in 2017, our Puerto Rico business experienced growth in deposits, an increase in our customer base and strong net interest margins. In the United States, our total loan portfolio grew mainly driven by an increase in our commercial loan portfolio. During 2017, Popular’s capital level remained strong. Our quarterly common stock dividend increased from $0.15 to $0.25 per share, and a common stock repurchase program of $75 million was completed by the Corporation.

Popular also enhanced its employees’ physical, emotional and financial well-being through expanded services in our Health and Wellness Center and an increased retirement savings plan matching contribution. During 2017, Popular also implemented several initiatives to develop a robust pool of leadership talent and give our employees tools to improve efficiency and customer satisfaction.

True to Popular’s core value of social commitment, our Puerto Rico and U.S. foundations sourced and provided valuable financial and in-kind assistance to areas severely impacted by the hurricanes, including the distribution of water, food and medical supplies. We launched the “Embracing Puerto Rico” initiative, contributed to the “Unidos por Puerto Rico” fundraising campaign and co-sponsored the “Somos Una Voz” concert which raised funds for the benefit of earthquake victims in Mexico, and hurricane victims in Texas, Florida, Puerto Rico and the Caribbean.

2017 FINANCIAL HIGHLIGHTS

Our 2017 net income was $107.7 million, reflecting the adverse effect of the hurricanes and the U.S. Tax Cut and Jobs Act’s impact on the value of Popular’s U.S. deferred tax asset (“DTA”). To provide meaningful information about the underlying performance of our ongoing operations, the $168.4 million DTA write-down is added back to net income to express our results on an adjusted net income basis, which is a non-GAAP measure; on this basis, our adjusted net income was $276.0 million. In addition, as outlined in the “Compensation Discussion and Analysis” section of this Proxy Statement, the Board of Directors’ Compensation Committee (the “Committee”) decided to make further net income adjustments, directly attributable to the hurricane’s impact that was beyond the Corporation’s control, for purposes of certain incentive awards; on this basis, our adjusted net income for incentives was $348.7 million. Refer to the GAPP to non-GAAP reconciliation in Appendix B.

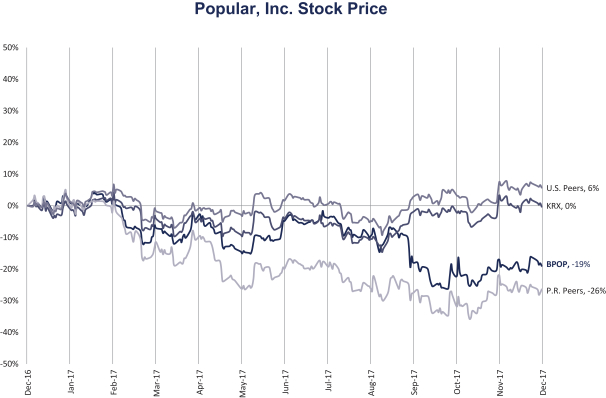

Popular (“BPOP”) shares closed 2017 at $35.49, 19% lower than 2016. This performance compared negatively against our U.S. peers, which increased by 6%, and the KBW Nasdaq Regional Banking Index (“KRX”), which remained relatively unchanged, but compared favorably to other Puerto Rico banks. Despite concerns about Puerto Rico’s economic and fiscal situation, including the Commonwealth’s May 3rd, 2017 bankruptcy filing under Title III of the Puerto Rico Oversight, Management and Economic Stability Act (“PROMESA”), for the first nine months of 2017 the price of Popular’s shares correlated to the movement of the mainland KRX. However, following the impact of Hurricane Maria in September, Popular’s share price was severely affected, closing the year at levels below our U.S. peers and the KRX. During the first eight weeks of 2018, Popular’s share price increased by 21%, while the aggregate share price of the KRX, our U.S. peers and other Puerto Rico peer banks rose by 4%, 8% and 20%, respectively.

CEO TRANSITION

As part of a planned leadership transition, Mr. Carrión, after 26 years as Chief Executive Officer (“CEO”), was appointed Executive Chairman of the Board of Directors. Ignacio Alvarez, who had been President and Chief Operating Officer since 2014, was named President and CEO. Both changes were effective July 1, 2017. To ensure a seamless transition of our CEO role, Mr. Carrión collaborates closely with our new CEO on corporate strategy, with emphasis on mergers and acquisitions, innovation and technology, social responsibility initiatives and government and client relations.

2018 PROXY STATEMENT | 3

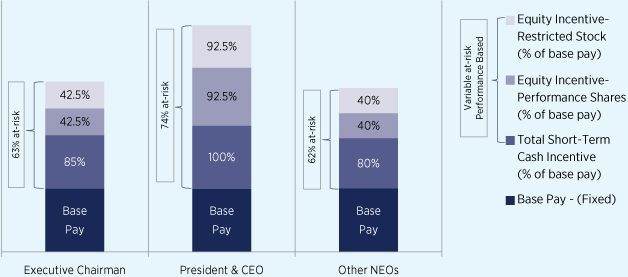

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

Our executive compensation program is designed to motivate and reward performance, align executives with shareholder interests, promote building long-term shareholder value, attract and retain highly qualified executives and mitigate conduct that may promote excessive or unnecessary risk taking. Our program is premised upon:

PAY-FOR-PERFORMANCE

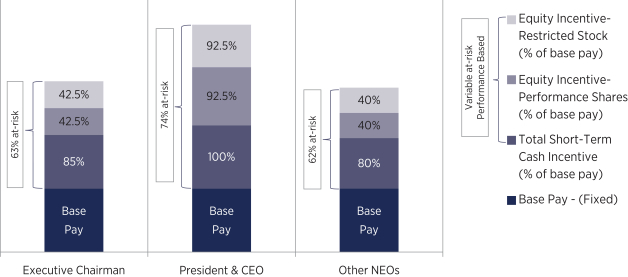

| w | Focus on variable, incentive-based pay (62%-74% of total target NEO pay is performance-based) |

| w | Combination of short-term (cash) and long-term (equity) incentives |

| w | Equity awards promote performance and retention of high-performing talent |

| w | Total compensation opportunity targeted at median of our peer group |

| w | No special retirement or severance programs |

| w | Limited perquisites |

STRONG GOVERNANCE

| w | Incentive risk mitigation through balanced compensation design and strong internal control framework |

| w | No speculative transactions in Popular securities nor pledging of common stock (except for certain grandfathered loans) |

| w | Clawback guideline |

| w | Annual say-on-pay advisory vote |

| w | Independent compensation consultant |

| w | Compensation Governance Framework which includes internal guidelines covering compensation programs and incentive design |

EXECUTIVE ALIGNMENT WITH LONG-TERM SHAREHOLDER VALUE

| w | Stock ownership requirements |

| w | Extended equity vesting (including a portion at retirement) |

| w | Double-trigger equity vesting upon change in control |

4 | 2018 PROXY STATEMENT

2017 COMPENSATION PROGRAM AND PAY DECISIONS

For 2017, the total compensation paid to or earned by our NEOs was as follows:

Name and Principal Position

| Salary

| Bonus

| Stock Awards

| Non-Equity

| Change in

| All Other

| Total

| |||||||||||||||||||||||||||||||||||||||||||||

Richard L. Carrión Executive Chairman since July 1, 2017 (formerly Chief Executive Officer through June 30, 2017) |

|

$1,300,000

|

|

|

$50,205

|

|

$

|

2,100,000

|

|

|

$1,016,133

|

|

|

$170,591

|

|

|

$209,168

|

|

|

$4,846,097

|

| |||||||||||||||||||||||||||||||

Ignacio Alvarez President and Chief Executive Officer since July 1, 2017 (formerly President and Chief Operating Officer through June 30, 2017) |

|

807,500

|

|

|

37,535

|

|

|

1,145,670

|

|

|

831,387

|

|

|

—

|

|

|

40,846

|

|

|

2,862,938

|

| |||||||||||||||||||||||||||||||

Carlos J. Vázquez Executive Vice President and Chief Financial Officer (“CFO”) |

|

675,000

|

|

|

28,225

|

|

|

506,250

|

|

|

537,030

|

|

|

47,055

|

|

|

21,089

|

|

|

1,814,649

|

| |||||||||||||||||||||||||||||||

Javier D. Ferrer Executive Vice President and Chief Legal Officer (“CLO”) |

|

550,000

|

|

|

22,932

|

|

|

412,500

|

|

|

437,953

|

|

|

—

|

|

|

13,639

|

|

|

1,437,078

|

| |||||||||||||||||||||||||||||||

Lidio V. Soriano Executive Vice President and Chief Risk Officer (“CRO”) |

|

500,000

|

|

|

20,863

|

|

|

375,000

|

|

|

365,764

|

|

|

—

|

|

|

12,855

|

|

|

1,274,482

|

| |||||||||||||||||||||||||||||||

Eli S. Sepúlveda Executive Vice President Commercial Credit Group |

|

450,000

|

|

|

18,905

|

|

|

337,500

|

|

|

363,050

|

|

|

58,418

|

|

|

22,342

|

|

|

1,250,215

|

| |||||||||||||||||||||||||||||||

BASE SALARY

Further to our CEO transition plan, changes in base pay were approved for Messrs. Carrión and Alvarez effective July 1, 2017. Upon assuming the Executive Chairman role, Mr. Carrión’s base pay was adjusted to $1,200,000 (14% reduction). Mr. Alvarez’s base salary was increased to $900,000 (26% increase) due to his promotion to the position of President and CEO.

SHORT-TERM ANNUAL CASH INCENTIVE

The short-term annual cash incentive is awarded based on the achievement of corporate results, individual goals and leadership competencies. In 2017, it had a target of 93.1% of base pay for Mr. Carrión, 95.6% for Mr. Alvarez (both prorated for the period before and after the organizational changes) and 80% of base pay for the other NEOs. Actual payouts can range from zero to 1.5 times the target award. After considering all incentive components, the Compensation Committee granted annual cash incentive awards at 78.2% of base pay for Mr. Carrión, 103.0% for Mr. Alvarez, 79.6% for Mr. Vázquez, 79.6% for Mr. Ferrer, 73.2% for Mr. Soriano and 80.7% for Mr. Sepúlveda.

LONG-TERM EQUITY INCENTIVE

The annual equity grant rewards performance and aligns the interests of our NEOs with those of our shareholders. One half of the target award consists of performance shares, with actual earned shares determined at the end of a 3-year performance period based on total shareholder return and earnings per share metrics. The other half of this award consists of restricted stock granted based on corporate and individual performance, with a vesting period. At the time of grant, in February 2017, the target incentive opportunity was 160% of base pay for Mr. Carrión, 100% of base pay for Mr. Alvarez and 80% of base pay for the other NEOs. The actual long-term incentive awards range from zero to 1.5 times the target award. The 2017 long-term incentive awards were granted considering our performance in 2016, during which we strengthened credit quality and capital levels even though our $358.1 million adjusted net income was below our budgeted $401.4 million. Upon consideration of the corporate and individual performance factors, the Compensation Committee granted equity awards in 2017 of 150% of base pay for Mr. Carrión, 93.8% for Mr. Alvarez and 75% for the other NEOs.

2018 PROXY STATEMENT | 5

Our executive compensation programs are discussed in more detail in the “Compensation Discussion and Analysis” and “2017 Executive Compensation Tables and Compensation Information” sections of this Proxy Statement.

PAY MIX IN THE COMPENSATION PROGRAM

Our executive compensation program focuses on the achievement of annual and long-term goals that generate sustained company performance and strong returns to our shareholders. As illustrated in the following chart, a significant portion of total target compensation is at-risk, subject to company and individual performance: 63% of total target compensation for the Executive Chairman, 74% for the President & CEO and 62% for the other NEOs.

PAY MIX IN THE EXECUTIVE COMPENSATION PROGRAM

Each element, at target, as a % of base pay

6 | 2018 PROXY STATEMENT

DIRECTORS AND EXECUTIVE OFFICERS

Our Board of Directors believes that high standards of corporate governance are an essential component of strengthening our corporate culture and embedding our institutional values in our day-to-day business operations. The Board’s Corporate Governance and Nominating Committee recommends to the Board the adoption of corporate governance guidelines to protect and enhance shareholder value and to set forth the principles as to how the Board, its various committees, individual directors and management should perform their functions. The Corporate Governance and Nominating Committee considers developments in corporate governance and periodically recommends to the Board changes to our corporate governance principles.

2018 PROXY STATEMENT | 7

BOARD OF DIRECTORS’ INDEPENDENCE

Popular’s Corporate Governance Guidelines provide that at least two-thirds of the Board shall consist of directors who the Board has determined have no material relationship with Popular and who are otherwise “independent” under the director independence standards of NASDAQ. The Board, with the assistance of the Corporate Governance and Nominating Committee, conducts an annual review of any relevant business relationships that each director may have with Popular and whether each director meets the independence standards of NASDAQ. The Board has determined that all of its directors

and nominees, except for Messrs. Carrión and Alvarez, have no material relationship with Popular and meet the independence standards of NASDAQ.

As part of the process to determine Ms. Ferré’s independence, the Board considered payments made by Popular in the ordinary course of business to various entities related to Ms. Ferré in connection with advertising activities of Popular and its affiliates and determined that these business relationships are not material and did not impair the ability of Ms. Ferré to act independently.

Each year, the Board evaluates whether Popular’s leadership structure is in the best interest of Popular. The Board does not have a policy on whether the Chairman and CEO positions should be separate or combined. Mr. Carrión served as Popular’s Chairman and CEO from 1994 to July 1, 2017, when the CEO and President positions were consolidated in Mr. Alvarez and Mr. Carrión assumed the position of Executive Chairman. In his role as Executive Chairman, Mr. Carrión continues to collaborate with Mr. Alvarez on corporate strategy, government and client relations and social responsibility initiatives. The Board could in the future decide to consolidate

the Chairman and CEO positions if it determines that doing so would serve the best interests of the Corporation.

Popular’s Corporate Governance Guidelines require the designation of a Lead Director when the Chairman of the Board is not an independent director. The Lead Director is an independent director elected annually by a majority of the independent members of the Board. On February 23, 2018 Mr. Teuber was reappointed as the Lead Director. The Corporate Governance Guidelines provide that the Lead Director will have the responsibilities listed below.

Lead Director Responsibilities

| ✓ | Preside over all meetings of the Board at which the Chairman is not present. |

| ✓ | Preside over executive sessions of the independent directors. |

| ✓ | Act as liaison between the independent directors and the Chairman. |

| ✓ | Have authority to call meetings of independent directors. |

| ✓ | Assist the other independent directors by ensuring that independent directors have adequate opportunities to meet in executive sessions and communicate to the Chairman, as appropriate, the results of such sessions and other private discussions among outside directors. |

| ✓ | Assist the Chairman and the remainder of the Board in assuming effective corporate governance in managing the affairs of the Board. |

| ✓ | Serve as the contact person to facilitate communications requested by major shareholders with independent members of the Board. |

| ✓ | Approve, in collaboration with the Chairman, meeting agendas and information sent to the Board. |

| ✓ | Approve, in collaboration with the Chairman, meeting schedules to assure that there is sufficient time for discussion of all agenda items. |

| ✓ | Serve temporarily as Chairman of the Board and the Board’s spokesperson if the Chairman is unable to act. |

| ✓ | Interview Board candidates. |

| ✓ | Recommend to the Corporate Governance and Nominating Committee nominees to Board committees and sub-committees as may come to the Lead Director’s attention. |

| ✓ | Ensure the Board works as a cohesive team. |

| ✓ | Be available for consultation and direct communication upon request of major shareholders. |

| ✓ | Make such recommendations to the Board as the Lead Director may deem appropriate for the retention of consultants who will report to the Board. |

| ✓ | Retain consultants, with the approval of the Board, as the Lead Director and the Board deem appropriate. |

8 | 2018 PROXY STATEMENT

Popular encourages directors to participate in continuing director education programs. To assist the Board in remaining current with its duties, committee responsibilities and the many important developments impacting our business, Popular participates in the Corporate Board

Member’s Board Leadership Program. This program offers our directors access to a wide range of in-person, peer-based and webinar educational programs on corporate governance, committee duties, board leadership and industry developments.

BOARD MEETINGS AND EXECUTIVE SESSIONS

The Board met 14 times during 2017. Each director attended 75% or more meetings of the Board and the meetings of committees of the Board on which each such director served. While Popular has not adopted a formal policy with respect to directors’ attendance at the meetings of shareholders, Popular encourages directors to attend all meetings. All of Popular’s directors attended the 2017 annual meeting of shareholders

and all directors are expected to attend the 2018 annual meeting. The Corporate Governance Guidelines require the independent directors to meet in executive session once every in-person regularly scheduled Board meeting. During 2017, the independent directors held executive sessions without Popular’s management after each regularly scheduled in-person Board meeting.

Our Board conducts an annual self-assessment aimed at improving its performance. As part of such assessment, each director completes a written questionnaire that is designed to gather suggestions for improving Board effectiveness and solicit feedback on a wide range of issues, including:

| • | Board and committee composition, structure and operations; |

| • | Board dynamics and standards of conduct; |

| • | adequacy of materials and information provided; |

| • | access to management; and |

| • | Board effectiveness and accountability. |

Each of the four standing Board committees also conducts its own written annual self-assessment, which generally includes issues such as:

| • | responsibilities and organization of the committee, including adequacy of its charter; |

| • | operations of the committee; |

| • | adequacy of materials and information provided; and |

| • | assessment of the committee’s performance. |

Responses to the Board and committee self-assessments, including written comments, are tabulated to show trends since prior years. Responses are not attributed to individual directors in order to promote openness and transparency. The Board self-assessment report is discussed by the Corporate Governance and Nominating Committee and then the Chair of the Corporate Governance and Nominating Committee leads the discussion with the full Board. The committee self-assessment reports are discussed at each committee, followed by a discussion with the full Board led by the Committee Chair. The Corporate Governance and Nominating Committee annually discusses the format and process to be used to carry out the Board and committee self-assessment.

2018 PROXY STATEMENT | 9

The Board has four standing Committees: an Audit Committee, a Corporate Governance and Nominating Committee, a Risk Management Committee and a Compensation Committee. All committees operate under written charters which are posted in our website under the heading Corporate Governance at www.popular.com/en/investor-relations/. The following highlights some of the key responsibilities of each standing committee as well as information about committee members and their independence, number of meetings in 2017 and last charter revision date, among others. For additional information on the role of certain of the standing committees in connection with risk oversight, please see the “Board Oversight of Risk Management” section of this Proxy Statement.

AUDIT COMMITTEE

Members: Alejandro M. Ballester John W. Diercksen C. Kim Goodwin William J. Teuber, Jr. (Chair) Carlos A. Unanue

Independence: Each member of the committee is independent

Audit Committee Financial Expert: Messrs. Teuber and Diercksen and Ms. Goodwin are Audit Committee Financial Experts as defined by SEC rules

Meetings in 2017: 11 meetings of which 8 were devoted to the discussion of earnings releases, Form 10-K and Form 10-Q filings

Charter last revised: December 14, 2017 |

Primary Responsibilities:

Assists the Board in its oversight of:

• the outside auditors’ qualifications, independence and performance;

• the performance of Popular’s internal audit function;

• the integrity of Popular’s financial statements, including overseeing the accounting and financial processes, principles and policies, the effectiveness of internal controls over financial reporting and the audits of the financial statements; and

• compliance with legal and regulatory requirements.

In addition, the Audit Committee issues a report, as required by the U.S. Securities and Exchange Commission (the “SEC”) rules, for inclusion in Popular’s annual proxy statement. The Audit Committee was established in accordance with the requirements of the Securities Exchange Act of 1934. | |||||||

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

Members: Joaquín E. Bacardí, III Alejandro M. Ballester (Chair) Maria Luisa Ferré William J. Teuber, Jr.

Independence: Each member of the committee is independent

Meetings in 2017: 5

Charter last revised: January 26, 2018 |

Primary Responsibilities:

The Corporate Governance and Nominating Committee is responsible for:

• exercising general oversight with respect to the governance of the Board;

• identifying and recommending individuals qualified to become Board members and recommending director nominees and committee members to the Board;

• reviewing and reporting to the Board on matters of corporate governance and developing and recommending to the Board a set of corporate governance principles applicable to Popular;

• leading the Board and assisting its committees in the annual assessment of their performance; and

• recommending to the Board the form and amount of compensation for Popular’s directors.

| |||||||

10 | 2018 PROXY STATEMENT

RISK MANAGEMENT COMMITTEE

Members: Joaquín E. Bacardí, III John W. Diercksen David E. Goel C. Kim Goodwin (Chair) William J. Teuber, Jr.

Independence: Each member of the committee is independent

Meetings in 2017: 11

Charter last revised: January 26, 2018 |

Primary Responsibilities:

Assists the Board in the oversight of:

• Popular’s overall risk management framework; and

• the monitoring, review and approval of the policies and procedures that measure, limit and manage Popular’s main risks, including operational, liquidity, interest rate, market, legal, compliance and credit risks. | |||||||

COMPENSATION COMMITTEE

Members: David E. Goel Maria Luisa Ferré (Chair) William J. Teuber, Jr. Carlos A. Unanue

Independence: Each member of the committee is independent

Meetings in 2017: 5

Charter last revised: December 14, 2017 |

Primary Responsibilities:

Discharges the Board’s responsibilities, subject to review by the full Board, relating to:

• compensation of Popular’s Executive Chairman, CEO and all other executive officers;

• adoption of policies that govern Popular’s compensation and benefit programs;

• overseeing plans for executive officer development and succession;

• overseeing, in consultation with management, compliance with federal, state and local laws as they affect compensation matters;

• considering, in consultation with the CRO, whether the incentives and risks arising from the compensation plans for all employees are reasonably likely to have a material adverse effect on Popular and taking necessary actions to limit any risks identified as a result of the risk-related reviews; and

• reviewing and discussing with management the Compensation Discussion and Analysis Section for Popular’s annual proxy statement in compliance with and to the extent required by applicable law, rules and regulations.

Compensation Committee Interlocks and Insider Participation:

None of the members of the Compensation Committee is or has been an officer or employee of Popular. In addition, none of our executive officers is, or was during 2017, a member of the board of directors or compensation committee (or other committee serving an equivalent function) of another company that has, or had during 2017, an executive officer serving as a member of our Compensation Committee. Other than as disclosed in the “Certain Relationships and Transactions” section of this Proxy Statement, none of the members of the Compensation Committee had any relationship with Popular requiring disclosure under Item 404 of Regulation S-K.

| |||||||

2018 PROXY STATEMENT | 11

MEMBERSHIP IN BOARD COMMITTEES

Name

| Audit

| Compensation

| Corp. Gov. & Nominating

| Risk

| ||||||

Class 1 |

Ignacio Alvarez

| |||||||||

Alejandro M. Ballester

|

|

| ||||||||

Richard L. Carrión

| ||||||||||

Carlos A. Unanue

|

|

| ||||||||

Class 2 |

Joaquín E. Bacardí, III

|

|

| |||||||

John W. Diercksen

|

|

| ||||||||

David E. Goel

|

|

| ||||||||

Class 3 |

Maria Luisa Ferré

|

|

| |||||||

C. Kim Goodwin

|

|

| ||||||||

William J. Teuber, Jr. (Lead Director)

|

|

|

|

|

Member Member |  Chair Chair |  Financial Expert Financial Expert | ||||||||||

BOARD OVERSIGHT OF RISK MANAGEMENT

While management has primary responsibility for managing risk, the Board has a significant role in the risk oversight of Popular. The Board performs its risk oversight functions directly and through several Board committees, each of which oversees the management of risks that fall within its areas of responsibility, as described below. In discharging their responsibilities, Board committees have full access to management and independent advisors as they deem necessary or appropriate. Whenever it is deemed appropriate, management gives presentations to the full Board in connection with specific risks, such as those related to compliance and information security, among others. The principal roles and responsibilities of the Board committees in the oversight of risk management are described below:

Risk Management |

Responsibilities:

• Review, approve and oversee management’s implementation of Popular’s risk management program and related policies, procedures and controls to measure, limit and manage Popular’s risks, including operational, liquidity, interest rate, market, legal, compliance and credit risks, while taking into consideration their alignment with Popular’s strategic and capital plans.

• Review and approve Popular’s capital plans.

• Review and discuss with management Popular’s major financial risk exposures and the steps taken by management to monitor and control such exposures.

• Review and receive reports on selected risk topics as management or the committee may deem appropriate.

• After each meeting, report to the full Board regarding its activities.

| |||||||

12 | 2018 PROXY STATEMENT

Audit Committee |

Responsibilities:

• Oversight of accounting and financial reporting principles and policies, internal controls and procedures, and controls over financial reporting.

• Review reports from management, independent auditors, internal auditors, compliance group, legal counsel, regulators and outside experts, as considered appropriate, that include risks Popular faces and Popular’s risk management function.

• Evaluate and approve the annual risk assessment of the Internal Audit Division, which identifies the areas to be included in the annual audit plan.

• After each meeting, report to the full Board regarding its activities.

| |||||||

Compensation Committee |

Responsibilities:

• Establish Popular’s executive compensation and other incentive-based compensation programs, taking into account the risks to Popular that such programs may pose.

• Periodically evaluate, in consultation with the CRO, whether the incentives and risks arising from Popular’s compensation plans for all employees are likely to have a material adverse effect on Popular.

• Take such action as the Committee deems necessary to limit any risks identified as a result of the risk-related reviews.

• After each meeting, report to the full Board regarding its activities.

| |||||||

The Corporate Governance and Nominating Committee Charter provides that, in nominating candidates, the Committee will take into consideration such factors as it deems appropriate, which may include judgment, skill, diversity, experience with business and other organizations, the interplay of the candidate’s experience with the experience of the existing Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. In practice, the Board has determined that for a community-based financial institution such as Popular it is more important to look for candidates with broad management experience than for persons with a specific skill set. Collectively, the members of our Board embody a range of viewpoints, backgrounds and expertise.

The Corporate Governance and Nominating Committee will consider candidates for director who are recommended by its members, by other Board members, by management, and by

shareholders. There are no differences in the manner in which the Corporate Governance and Nominating Committee will evaluate nominees for director in the event the nominee is recommended by a shareholder. There were no nominees for director recommended by shareholders for consideration by the Corporate Governance and Nominating Committee for election at the 2018 meeting. Shareholders who wish to submit nominees for director for consideration by the Corporate Governance and Nominating Committee for election at Popular’s 2019 annual meeting of shareholders may do so as set forth under “General Information About the Meeting—Shareholder Proposals.”

Under Popular’s Corporate Governance Guidelines, the Board should, based on the recommendations of the Corporate Governance and Nominating Committee, select new nominees for the position of independent director by considering the criteria outlined below:

Criteria for Nomination

| ✓ | Personal qualities and characteristics, accomplishments and reputation in the business community. |

| ✓ | Current knowledge and contacts in the communities in which Popular does business and in Popular’s industry or other industries relevant to Popular’s business. |

| ✓ | Ability and willingness to commit adequate time to Board and committee matters. |

| ✓ | The fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of Popular. |

| ✓ | Diversity of viewpoints, background, experience and other demographic factors. |

2018 PROXY STATEMENT | 13

BOARD DIVERSITY

The Corporate Governance and Nominating Committee does not have a specific diversity policy with respect to the director nomination process. Rather, the Committee considers diversity in the broader sense of how a candidate’s viewpoints, experience, skills, background and other demographics could assist the Board in light of the Board’s composition at the time. The Board believes that each director

contributes to the overall diversity by providing a variety of personal and professional experiences and backgrounds. The Board believes that, as shown below, the current directors and nominees reflect an appropriate diversity of gender, age, race, geographical background and experience and are committed to considering diversity issues in evaluating the composition of the Board.

|

DIRECTORS’ EXPERIENCE AND SKILLS

The main skills and experience of our director nominees are presented below:

Global Business Experience |

Senior Management and Leadership Experience

|

Business Operation Experience |

Financial, Investment and M&A | |||||||||

Audit and Risk Oversight Experience

|

Financial Expertise/ Literacy

|

Marketing and Media Communications

|

Telecommunications

| |||||||||

Technology Systems Experience

|

Public Company Governance Experience

| Distribution and Sales

|

Knowledge and Understanding of Popular’s Main Markets

|

80% are female or ethnically diverse 1 is African-American 6 are Hispanic 1 is Asian 2 are women Tenure Years of Service 0-5 6-10 11-15 >15 Average tenure: 9.5 yrs. Independence 80% Independent (all directors are independent except the Executive Chairman and the CEO and President) Age Retirement Age: 72 Average Age: 57 0 2 4 6 46-50 51-55 56-60 61-65 66-70

14 | 2018 PROXY STATEMENT

Popular’s Board recognizes that one of its most important duties is to ensure senior leadership continuity by overseeing the development of executive talent and planning for the efficient succession of the CEO and other executive officers. The Board has delegated primary responsibility for succession planning to the Compensation Committee. The Compensation Committee reviews annually a management succession plan, developed by the CEO, and reports annually to the Board on the management succession plan. The principal components of this plan are: (1) a proposed plan for emergency CEO

succession, (2) a proposed plan for CEO succession in the ordinary course of business, and (3) the CEO’s plan for management succession for the other policy-making officers of Popular. The succession plan includes an assessment of the experience, performance, skills and planned career paths for possible candidates within the senior management team. Development initiatives supporting the succession plan include job enhancements and rotations, the Popular Leadership Academy, specialized external trainings and competency assessments.

The Board has adopted a Code of Ethics to be followed by Popular’s employees, officers (including the Executive Chairman, President and CEO, CFO and Corporate Comptroller) and directors to achieve conduct that reflects our ethical principles. Directors, NEOs, executive officers and employees are required to read and comply with the Code. Popular requires that all new employees take Code training shortly after their start date and also provides periodic Code training to all employees. All employees must certify annually that they have read the Code and complete a declaration on possible conflicts of interest. In addition, other persons performing services for Popular by contract or other agreement may be subject to the Code of Ethics for Service Providers.

The Code provides that any waivers for NEOs, executive officers or directors may be made only by the independent members of the Board and must be promptly disclosed to the shareholders.

During 2017, Popular did not receive nor grant any request from directors, NEOs or executive officers for waivers under the provisions of the Code. The Code was last revised on September 27, 2017 and is available on the Corporate Governance section of Popular’s website at www.popular.com/en/investor-relations/. Popular will post on its website any amendments to the Code and any waivers to the Executive Chairman, President and CEO, the CFO, the Corporate Comptroller or directors.

Popular expects employees to report behavior that concerns them or that may represent a violation of the Code. Popular offers several channels by which employees may raise an issue or concern, including any actual or potential violations of the Code. One such method is EthicsPoint, a website and telephone hotline that is available 24/7. EthicsPoint reports can be submitted anonymously.

Any shareholder who desires to contact the Board or any of its members may do so by writing to:

Popular, Inc., Board of Directors (751), P.O. Box 362708, San Juan, PR 00936-2708

Alternatively, a shareholder may contact the Audit Committee or any of its members telephonically by calling the toll-free number (866) 737-6813 or electronically through www.popular.com/ethicspoint-en. |

Popular’s CLO and Secretary reviews all correspondence addressed to the Board or any of its members and provides the Board with copies of all communications that deal with the functions of the Board or its committees, or that otherwise require Board attention. Communications received by the Audit Committee that are not related to accounting or auditing matters may, in its discretion, be forwarded by the Audit Committee or any of its members to other committees of the Board or Popular’s management for review.

2018 PROXY STATEMENT | 15

WHERE TO FIND MORE INFORMATION ON GOVERNANCE

Popular maintains a corporate governance section on its website at www.popular.com/en/investor-relations/ where investors may find copies of its principal governance documents. The corporate governance section of Popular’s website contains, among others, the following documents:

| ||||||

| ✓ | Code of Ethics

| ✓ |

Risk Committee Charter | |||

| ✓ | Audit Committee Charter

| ✓ | Corporate Governance Guidelines

| |||

| ✓ | Corporate Governance and Nominating Committee Charter | ✓ | Insider Trading Policy | |||

| ✓ |

Compensation Committee Charter

| |||||

16 | 2018 PROXY STATEMENT

Directors and Executive Officers

NOMINEES FOR ELECTION AS DIRECTORS AND OTHER DIRECTORS

Information relating to director’s participation in Popular’s committees, age, principal occupation, business experience during the past five years (including positions held with Popular or its subsidiaries and the period during which each director has served in such capacity), directorships and qualifications is set forth below. All of Popular’s directors are also directors of the following subsidiaries of Popular: Banco Popular de Puerto Rico (“BPPR”), Popular North America, Inc. and Banco Popular North America, which operates under the name Popular Community Bank.

NOMINEES FOR ELECTION – CLASS 1 DIRECTORS (TERMS EXPIRING 2018)

Director since July 2017

Age 59 | IGNACIO ALVAREZ

BACKGROUND

Chief Executive Officer of Popular, BPPR and Popular Community Bank since July 2017. President of Popular, BPPR and Popular Community Bank since October 2014 and Chief Operating Officer of Popular and BPPR from October 2014 to July 2017. Executive Vice President and Chief Legal Officer of Popular from June 2010 to September 2014. President and CEO of Popular North America, Inc. and other direct and indirect wholly-owned subsidiaries of Popular. Director of Popular since July 2017 and of BPPR and Popular Community Bank since October 2014. Member of the Board of Trustees of Fundación Banco Popular, Inc. and of Popular Community Bank Foundation, Inc. since November 2015.

QUALIFICATIONS

Prior to joining Popular in 2010 as Chief Legal Officer, Mr. Alvarez was one of the six founding partners of the law firm Pietrantoni Méndez & Alvarez LLC, one of Puerto Rico’s principal law firms. During his 27 years in private law practice, his main areas of expertise included banking, corporate and commercial law, corporate and public finance law, securities and capital markets. As President and Chief Operating Officer, Mr. Alvarez demonstrated his solid strategic and analytical skills, understanding of the markets in which we operate, business acumen and strength as a leader, delivering positive results in our Puerto Rico business despite challenging conditions and overseeing the repositioning of our operations in the United States. Mr. Alvarez’s understanding of the Corporation and excellent business skills, as well as his background as an attorney with vast experience on corporate matters, including regulatory and corporate governance, have proven to be a great asset. |

2018 PROXY STATEMENT | 17

Director since 2010

Age 51

Committees

• Audit • Corporate | ALEJANDRO M. BALLESTER

BACKGROUND

President of Ballester Hermanos, Inc., a major food and beverage distributor in Puerto Rico, since 2007.

QUALIFICATIONS

Mr. Ballester has a comprehensive understanding of Puerto Rico’s consumer products and distribution industries acquired through over 27 years of experience at Ballester Hermanos, Inc., a privately-owned business dedicated to the importation and distribution of grocery products, as well as beer, liquors and wine for the retail and food service trade in Puerto Rico. As of December 31, 2017, Ballester Hermanos had approximately $118 million in assets and annual revenues of approximately $320 million. Mr. Ballester is familiar with the challenges faced by family-owned businesses, which constitute an important market segment for Popular’s commercial banking units. He has proven to be a successful entrepreneur establishing the food service division of Ballester Hermanos in 1999, which today accounts for 35% of the firm’s revenues. During 2009, he was a director of the Government Development Bank for Puerto Rico and member of its audit and investment committees where he obtained experience in overseeing a variety of fiscal issues related to various government agencies, instrumentalities and municipalities. The experience, skills and understanding of the Puerto Rico economy and government financial condition acquired by Mr. Ballester have been of great value to the Board. |

Director since 1991

Age 65

Chairman since 1993

Executive Chairman since July | RICHARD L. CARRIÓN

BACKGROUND

Executive Chairman of Popular since July 2017. CEO of Popular from 1994 to June 2017 and President from 1991 to January 2009 and from May 2010 to September 2014. Executive Chairman of BPPR since July 2017, Chairman since 1993 and CEO from 1989 to June 2017. President of BPPR from 1985 to 2004 and from May 2010 to September 2014. Chairman and CEO, until June 2017, of Popular North America, Inc. and other direct and indirect wholly-owned subsidiaries of Popular. Executive Chairman of BPNA since July 2017 and Chairman since 1998. Director of the Federal Reserve Bank of New York from January 2008 to December 2015. Chairman of the Board of Trustees of Fundación Banco Popular, Inc. since 1991. Chairman and Director of Popular Community Bank Foundation, Inc. since 2005. Member of the Board of Directors of Verizon Communications, Inc. since 1995. Member of the International Olympic Committee since 1990 and Chairman of the International Olympic Committee Finance Commission from 2002 to 2013. Managing Member of RCA3 Investments, LLC, an entity engaged in financial consulting since October 2017. Chairman of the Board of Vall Banc, an Andorra-based bank, since October 2017. Member of the of the Supervisory Board of NIBC Holding N.V. and NIBC Bank N.V., both entities engaged in banking in the Netherlands, since September 2017.

QUALIFICATIONS

Mr. Carrión’s 42 years of banking experience, 33 heading Popular, Puerto Rico’s largest financial institution, give him a unique level of knowledge of the Puerto Rico financial system. Mr. Carrión is a well-recognized leader with a vast knowledge of the Puerto Rico economy, and is actively involved in major efforts impacting the local economy. His knowledge of the financial industry led him to become a director of the Federal Reserve Bank of New York for eight years. |

18 | 2018 PROXY STATEMENT

Director since 2010

Age 54

Committees

• Compensation • Audit | CARLOS A. UNANUE

BACKGROUND

President of Goya de Puerto Rico, Inc. since 2003 and of Goya Santo Domingo, S.A. since 1994, food processors and distributors.

QUALIFICATIONS

Mr. Unanue has 31 years of experience at Goya Foods, Inc., a privately-held family business with operations in the United States, Puerto Rico, Spain and the Dominican Republic that is dedicated to the sale, marketing and distribution of Hispanic food, as well as to the food processing and canned food manufacturing business. Through his work with Goya Foods, Mr. Unanue has developed a profound understanding of Popular’s two main markets, Puerto Rico and the United States. His experience in distribution, sales and marketing has provided him with the knowledge and experience to contribute to the development of Popular’s business strategy, while his vast experience in management at various Goya entities has allowed him to make valuable contributions to the Board in its oversight functions. |

CLASS 2 DIRECTORS (TERMS EXPIRING 2019)

Director since 2013

Age 52

Committees

• Corporate • Risk | JOAQUÍN E. BACARDÍ, III

BACKGROUND

Chairman and majority shareholder of Edmundo B. Fernández, Inc., a privately held producer and distributor of rum since November 2017. Private investor since 2016. President and Chief Executive Officer of Bacardi Corporation, a privately held business and major producer and distributor of rum and other spirits, from April 2008 to April 2016.

QUALIFICATIONS

On November 2017, Mr. Bacardí completed the acquisition of Edmundo B. Fernández, Inc., a 137 year old privately owned rum company. Mr. Bacardí has extensive experience in the development and implementation of international marketing, sales and distribution strategies acquired throughout more than 24 years at various Bacardi companies and 3 years as Product Manager of Nestlé of Puerto Rico. As President and Chief Executive Officer of Bacardi Corporation, Mr. Bacardí directed and managed all business operations with full profit and loss responsibilities and government relations for Bacardi in the Caribbean, Mexico, Central and South America. Prior to becoming President and Chief Executive Officer of Bacardi Corporation, Mr. Bacardí held positions in various Bacardi enterprises where, among other things, he was responsible for the development of all global communication strategies for Bacardi Limited’s whisky portfolio, with total sales of approximately $400 million, and supervision of marketing for all Bacardi brands globally. Mr. Bacardí’s vast experience in business operations in Puerto Rico and across various international markets, as well as his expertise in global communication strategies, have been of great benefit to the Board. |

2018 PROXY STATEMENT | 19

Director since 2013

Age 68

Committees

• Audit (Financial Expert) • Risk | JOHN W. DIERCKSEN

BACKGROUND

Principal of Greycrest, LLC, a privately-held financial and operational advisory services company, since October 2013. Chief Executive Officer of Beachfront Wireless LLC, a privately-held investment entity organized to participate in a Federal Communications Commission airwaves auction, from December 2015 to November 2016, when it was sold. Senior Advisor at Liontree Investment Advisors, an investment banking firm, since April 2014. Executive Vice President of Verizon Communications, Inc. from January 2013 to September 2013. Director of Harman International Industries, Incorporated, an audio and infotainment equipment company, from June 2013 to June 2017, when it was sold, Intelsat, S.A., a communications satellite services provider, since September 2013 and Cyxtera Technologies, an entity that provides data center services, since May 2017.

QUALIFICATIONS

Mr. Diercksen has 29 years of experience in the communications industry. During his tenure at Verizon, a global leader in delivering consumer, enterprise wireless and wire line services, as well as other communication services, Mr. Diercksen was responsible for key strategic initiatives related to the review and assessment of potential mergers, acquisitions and divestitures and was instrumental in forging Verizon’s strategy of technology investment and repositioning its assets. He possesses a vast experience in matters related to corporate strategy, mergers, acquisitions and divestitures, business development, venture investments, strategic alliances, joint ventures and strategic planning. Mr. Diercksen’s extensive senior leadership experience, together with his financial and accounting expertise, position him well to advise the Board and senior management on a wide range of strategic and financial matters. |

Director since 2012

Age 48

Committees

• Compensation • Risk | DAVID E. GOEL

BACKGROUND

Co-Founder and Managing General Partner of Matrix Capital Management Company, LP since 1999. Member of the Board of Directors of Univision Communications, Inc., a privately held media company, since January 2014 and of Adaptive Biotechnologies, Inc., a privately held company specializing in T-cell sequencing and immunotherapy since August 2016. Trustee of Philips Exeter Academy since 2013, of the Museum of Fine Arts, Boston, since 2010 and of The Winsor School, in Boston, Massachusetts, since April 2016.

QUALIFICATIONS

During his 25-year career as a fundamentals-focused value investor, Mr. Goel has developed a comprehensive understanding of corporate finance, venture capital and public investing. Having founded Matrix Capital Management in 1999, Mr. Goel has built an 19-year investment track record. Through sound and responsible investing for the Matrix Fund, he gained valuable insight into global financial markets and corporate best practices. His experience in the investment management industry allows him insight into the needs of the financial services business, providing extensive knowledge of risk management and corporate governance to the Board. Mr. Goel’s service as a fund manager, trustee, and board member of other organizations provides him with a unique expertise and global perspective to assist the Board with its oversight of Popular. |

20 | 2018 PROXY STATEMENT

CLASS 3 DIRECTORS (TERMS EXPIRING 2020)

Director since 2004

Age 54

Committees

• Compensation(Chair) • Corporate | MARIA LUISA FERRÉ

BACKGROUND

President and CEO of FRG, Inc., a diversified family holding company with leading operations in media, real estate, contact centers and distribution in Puerto Rico, the United States and Chile, since 2001. Member of the Board of Directors of GFR Media, LLC since 2003 and Chair from 2006 to February 2016. Publisher of El Nuevo Día, Puerto Rico’s most widely read and influential newspaper, and Primera Hora since 2006. Member of the Board of Directors of W.R. Berkley Corporation, an insurance holding company, since May 2017. President and Trustee of The Luis A. Ferré Foundation, Inc. since 2003. Trustee and Vice President of the Ferré Rangel Foundation, Inc. since 1999. President of the Board of Directors of Multisensory Reading Center of PR, Inc. since 2012. Member of the Latin American Caribbean Fund of The Museum of Modern Art since 2013 and of the Smithsonian National Board since 2017. Member of the Board of Directors of Endeavor Puerto Rico since January 2018 and of the Advisory Board of Boys & Girls Club of Puerto Rico since 2017.

QUALIFICATIONS

Ms. Ferré has 16 years of experience as the President and CEO of FRG, Inc., the largest communications and media group in Puerto Rico, with consolidated assets of approximately $310 million and annual net revenues of approximately $189 million as of December 31, 2017. She holds positions as director and officer of numerous entities related to FRG, Inc. She also serves as director and trustee of philanthropic and charitable organizations related to fine arts and education. As a result of these experiences, Ms. Ferré possesses a deep understanding of Popular’s main market and has developed management and oversight skills that allow her to make significant contributions to the Board. She also provides thoughtful insight regarding the communications needs of Popular. |

Director since 2011

Age 58

Committees

• Risk (Chair) • Audit (Financial | C. KIM GOODWIN

BACKGROUND

Private investor since 2008. Non-executive director of PineBridge Investments, LLC, a global asset management boutique with over $88 billion in assets under management, since May 2011, and Chair of its Audit Committee. Director of Akamai Technologies, Inc., a technology and Internet corporation, from October 2008 to May 2013, and prior to that from January 2004 to November 2006, and member of the Audit Committee from 2004 to 2006 and from 2008 to 2011. Trustee-Director of various equity funds within the Allianz Global Investors family of funds from June 2010 to October 2014.

QUALIFICATIONS

Ms. Goodwin’s experience as chief investment officer at several global financial services firms provides the Board with insight into the perspective of institutional investors. Her analytical skills and understanding of global financial markets have proved to be valuable assets. As Head of Equities at Credit Suisse Asset Management from 2006 to 2008, Ms. Goodwin oversaw enterprise risk functions for her global department. Through her experiences as a member of the Audit Committee of Akamai Technologies, Chair of the Audit Committee of PineBridge Investments and Chair of Popular’s Risk Management Committee, Ms. Goodwin has developed profound knowledge of the risks related to our business. She has also developed expertise in identifying, assessing and managing risk exposure, successfully leading the Board’s efforts on risk oversight. Finally, Ms. Goodwin also provides Popular with valuable insight regarding the use of technology by financial firms. |

2018 PROXY STATEMENT | 21

Director since 2004

Age 66

Lead Director

Committees

• Audit (Chair and

• Risk

• Compensation

• Corporate | WILLIAM J. TEUBER, JR.

BACKGROUND

Private investor since October 2016. Senior Operating Principal of Bridge Growth Partners, LLC, a private equity firm, since November 2016. Vice Chairman of EMC Corporation, a provider of information technology infrastructure solutions, from May 2006 to September 2016, when Dell Technologies acquired the company. Director of CRH Plc, a global diversified building materials group based in Ireland, since March 2016. Director of Inovalon Holdings, Inc., a provider of data driven healthcare solutions, since April 2013.

QUALIFICATIONS

Mr. Teuber has significant financial and financial reporting expertise, which he acquired as a Partner in Coopers & Lybrand LLP from 1988 to 1995 and then as Chief Financial Officer of EMC Corporation from 1996 to 2006. At EMC he demonstrated vast management and leadership skills as he led EMC’s worldwide finance operation and was responsible for all of its financial planning and reporting, balance sheet management, foreign exchange, audit, tax, treasury, investment banking, governance and investor relations function. As Vice Chairman of EMC, he focused on strategy and business development in emerging markets, assisted with government relations and worked closely with the Board of Directors. In addition, he worked closely with EMC’s Chairman, President and CEO in the day to day management of EMC as well as with the company’s executive team to develop future leaders of the company. Mr. Teuber’s significant financial and accounting expertise, vast management experience and skills developed throughout the years that he provided strategic direction at a multinational public company provide the Board with invaluable insight and a unique global perspective. |

22 | 2018 PROXY STATEMENT

The following information sets forth the names of our executive officers, their age, business experience and directorships during the past five years, as well as the period during which each such person has served as executive officer of Popular.

| RICHARD L. CARRIÓN AGE: 65

Mr. Carrión has been Chairman of the Board since 1993. He has served as Executive Chairman of Popular since July 2017, as CEO from 1994 to June 2017 and as President from 1991 to January 2009 and from May 2010 to September 2014. For additional information, please refer to the “Nominees for Election as Directors and Other Directors” section of this Proxy Statement. |

| IGNACIO ALVAREZ AGE: 59

Mr. Alvarez has been Chief Executive Officer of the Corporation since July 2017 and President and Chief Operating Officer since October 2014. Prior to that he was Executive Vice President and Chief Legal Officer of Popular from June 2010 to September 2014. For additional information, please refer to the “Nominees for Election as Directors and Other Directors” section of this Proxy Statement. |

| CAMILLE BURCKHART AGE: 38

Ms. Burckhart has been Executive Vice President and Chief Information and Digital Officer of Popular since July 2015. Prior to becoming Executive Vice President, Ms. Burckhart was the Senior Vice President in charge of the Technology Management Division from December 2010 to June 2015. She has been a member of the Board of Directors of Nuestra Escuela since August 2016. |

| LUIS E. CESTERO AGE: 44

Mr. Cestero has been Executive Vice President of BPPR in charge of the Retail Banking Group since July 2017. Prior to becoming Executive Vice President, Mr. Cestero was the Senior Vice President in charge of Retail Banking Administration from May 2009 to June 2017. |

2018 PROXY STATEMENT | 23

| MANUEL CHINEA AGE: 52

Mr. Chinea has been Executive Vice President of Popular since January 2016 and Chief Operating Officer of Popular Community Bank since February 2013. Prior to becoming Chief Operating Officer of Popular Community Bank, from April 2012 to January 2013, he was Executive Vice President and Chief Marketing and Product Executive at CertusBank. He has served as a Member of the Board of Trustees of Popular Community Bank Foundation, Inc. since October 2013, member of the Board of Directors of the Hispanic Federation, since June 2016 and member of the Board of Junior Achievement New York since October 2017 |

| JAVIER D. FERRER AGE: 56

Mr. Ferrer has been the Executive Vice President, Chief Legal Officer and Secretary of the Board of Directors of Popular since October 2014 and a Director of BPPR since March 2015. Prior to joining Popular, Mr. Ferrer was a Partner at Pietrantoni Méndez & Alvarez LLC, a San Juan, Puerto Rico based law firm, were he worked from September 1992 to December 2012 and from August 2013 to September 2014. From January 2013 to July 2013, Mr. Ferrer served as President of the Government Development Bank for Puerto Rico and Vice Chairman of its Board of Directors as well as Chairman of the Economic Development Bank for Puerto Rico. From March 2001 to December 2012 and from September 2013 to September 2014, Mr. Ferrer was Secretary of the Board of Directors of the First Puerto Rico Family of Funds, which, as of September 2014, was comprised of 17 funds. |

| JUAN O. GUERRERO AGE: 58

Mr. Guerrero has been an Executive Vice President of BPPR in charge of the Financial and Insurance Services Group since April 2004. He has been a Director of Popular Securities LLC since 1995, Popular Insurance LLC since 2004 and of other subsidiaries of Popular. Mr. Guerrero has served as a Director of SER de Puerto Rico since December 2010 and the Puerto Rico Open since October 2016. |

| GILBERTO MONZÓN AGE: 58

Mr. Monzón has been an Executive Vice President of BPPR in charge of the Individual Credit Group since October 2010. He has also served as Member of the Board of Directors of the San Jorge Children’s Hospital Professional Board since 2011, Member of the Government Relations Council of the American Bankers Association since 2013 and director of the Center for a New Economy and of the Coalition for the Prevention of Colorectal Cancer of Puerto Rico since 2014. |

24 | 2018 PROXY STATEMENT

| EDUARDO J. NEGRÓN AGE: 53

Mr. Negrón has been Executive Vice President of Popular since April 2008 and has been in charge of the Administration Group since December 2010. He became Chairman of Popular’s Benefits Committee on April 2008. He has served as Member of the Board of Trustees and Treasurer of Fundación Banco Popular, Inc. and of the Popular Community Bank Foundation, Inc. since March 2008. Mr. Negrón has been a Director of Fundación Angel Ramos since April 2012 and Chairman of its Investment and Finance Committee since March 2014. He has also been Director and Treasurer of the Fundación Puertoriqueña de las Humanidades since June 2017. |

| ELI S. SEPÚLVEDA AGE: 55

Mr. Sepúlveda has been Executive Vice President of Popular since February 2010 and of BPPR since December 2009. He has been the supervisor in charge of the Commercial Credit Group in Puerto Rico since January 2010. Mr. Sepúlveda has been a member of the Board of Managers of the Puerto Rico Idea Seed Fund, LLC since December 2016. |

| LIDIO V. SORIANO AGE: 49

Mr. Soriano has been the Executive Vice President and Chief Risk Officer of Popular since August 2011 and a Director of BPPR and Popular Community Bank since October 2014. |

| CARLOS J. VÁZQUEZ AGE: 59

Mr. Vázquez has been the Chief Financial Officer of Popular since March 2013. He was President of Popular Community Bank from September 2010 to September 2014 and has been Executive Vice President of Popular since February 2010 and Senior Executive Vice President of BPPR since 2004. He has served as Director of BPPR and of Popular Community Bank since October 2010. He has been Vice Chairman of the Board of Directors of Popular Community Bank Foundation since November 2010, Director of the Federal Home Loan Bank of New York since November 2013 and Member of the National Board of Directors of Operation Hope since 2012. |

2018 PROXY STATEMENT | 25

CERTAIN RELATIONSHIPS AND TRANSACTIONS

We may be party to transactions, arrangements or relationships with our directors, director nominees, executive officers or greater than 5% shareholders, or their immediate family members (each, a “Related Party”). We have adopted a written Policy on Related Party Transactions (the “Related Party Policy”) to identify and evaluate potential conflicts of interest, independence factors and disclosure obligations arising out of transactions, arrangements or relationships between Related Parties and us.

Transactions covered by the Related Party Policy may also be subject to restrictions pursuant to Federal Reserve Board Regulation O,Loans to Executive Officers, Directors and Principal Shareholders, which is the subject of a separate policy.

OUR POLICY ON RELATED PARTY TRANSACTIONS

The Related Party Policy governs the review, approval or ratification of transactions, arrangements or relationships: (i) in which Popular or any subsidiary is a participant; (ii) the aggregate amount involved will or may be expected to exceed $120,000 in any given year; and (iii) a Related Party has or will have a direct or indirect material interest. These transactions must be submitted to the Audit Committee for their review, evaluation and approval, unless pre-approved under the Related Party Policy.

Directors and executive officers must notify the CLO of any related party transaction in which they, or their immediate family members, have a material interest. Any unit or division proposing a related party transaction must also notify the CLO by completing a Related Party Transaction Request Form. After review by the CLO, the form is submitted for consideration and approval of the Audit Committee. The form must contain, among other things, a description of the proposed transaction, its benefits to Popular and an assessment of whether the proposed related party transaction is on terms that are comparable to the terms available to an unrelated third party or to employees generally. Only disinterested members of the Audit Committee will participate in the review and determination of whether a related party transaction is approved. The Audit Committee will approve or ratify transactions with Related Parties when the transaction is deemed to be in, or is not inconsistent with, the best interest of Popular.

PRE-APPROVED CATEGORIES OF RELATED PARTY TRANSACTIONS

In accordance with the terms of the Related Party Policy, certain types of transactions are pre-approved and certain recurring transactions are approved annually, without the need to submit the corresponding form to the Audit Committee. Pre-approved transactions include certain banking-related services and transactions in the ordinary course of business involving financial products and services provided by, or to, Popular, including loans, provided such transactions comply with the Sarbanes-Oxley Act of 2002, Federal Reserve Board Regulation O and other applicable laws and regulations. In the event Popular becomes aware of a transaction with a Related Party that has not been approved under the terms of the Related Party Policy, the Audit Committee considers all relevant facts and circumstances regarding the transaction with the Related Party and evaluates all options available to Popular, including ratification, revision or termination. The Audit Committee also examines the facts and circumstances pertaining to the failure of reporting such related party transaction to the Committee, as required by the Related Party Policy, and may take such actions as it deems appropriate.

RELATED PARTY TRANSACTIONS