Exhibit 99.1

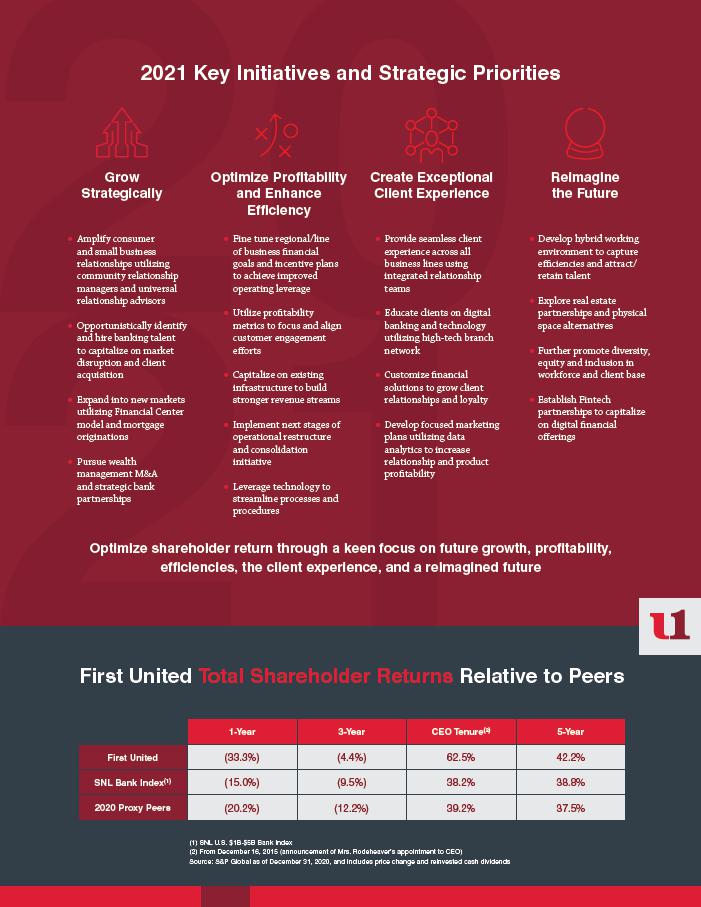

January 11, 2021 A Letter from our CEO and Lead Independent Director Dear Valued Shareholder, Happy New Year! With 2020 now in the rear-view mirror, it seems like an appropriate time to reflect on the past year and to look forward to 2021. During the past year, our nation faced unprecedented challenges including a pandemic, racial and political unrest, and economic turmoil. Through it all, your board of directors, the management team, and all First United Bank & Trust associates demonstrated resilience, adaptability, and above all compassion for each other, our clients, and our communities. SUPPORTING OUR STAKEHOLDERS THROUGH COVID-19 Our pandemic response has been led by our management team, with active and ongoing support from our Board. Protecting the health, safety, and financial well-being of our associates and customers was, and continues to be, our goal as we continue to deal with COVID-19 in 2021. Included in this letter is a detailed section describing how we have assisted our stakeholders, clients, and associates. We strongly believe that supporting the recovery of the communities we serve is paramount to the financial strength of our Company. For example, our participation in the Paycheck Protection Program (PPP) resulted in protecting over 17,600 local jobs, and during 2020 we modified the terms of approximately 650 loans totaling over $260 million for both businesses and individuals. We have heard from numerous business owners, accountants, and individuals that the expertise and knowledge our associates provided and the compassion and care that our associates offered during these challenging times was unparalleled. With the government recently announcing the Consolidated Appropriations Act, 2021, we will continue to support our stakeholders on these many fronts so that we can all emerge from this time stronger than before. DELIVERING SOLID FINANCIAL RESULTS Even amidst a healthcare crisis, we have continued to deliver strong financial results while conservatively providing for the uncertainties of the impact on our economy and clients. Our bank assets topped $1.7 billion, fueled by our PPP participation; trust assets exceeded $1.3 billion; and our pre-tax, pre-provision net income through the third quarter of 2020 topped $16.9 million. We conservatively added $5.7 million to our allowance for loan losses through September 30, 2020, and exercised strong liquidity and capital management. As a result of this strong financial performance, we have maintained our dividend, resulting in a dividend yield of 3.35% based on our December 31, 2020 closing price of $15.50 per share. While the share price has been volatile throughout 2020, consistent with the banking industry, our long-term total shareholder return has continued to outperform the market, and our peer group, as can be seen in the chart which is included in this letter.

STRENGTHENING OUR BOARD AND GOVERNANCE Led by our Board of Directors, we made several enhancements to strengthen our governance last year. During 2020, long-term directors, Robert W. Kurtz and Elaine L. McDonald retired from the Board with our gratitude and best wishes. We then continued to bring additional talent and perspectives to the Board through our ongoing “board refreshment” program. In July of 2020, we welcomed Patricia Milon to our Board. Patricia brings regulatory and risk management expertise, and currently serves on our Nominating and Corporate Governance Committee, Compensation Committee, as well as the Risk and Compliance Committee. Additionally, last week, we announced the appointments of Sanu Chadha and Christy DiPietro to the Board. Sanu will contribute expertise in strategic process and technology solutions, project management, process improvement, data analytics, and cloud solutions. As the Managing Partner of a consulting company she co-founded, which serves private and government clients both domestically and internationally, she also possesses in-depth small business knowledge, an area of specific focus for First United. Christy, a Chartered Financial Analyst, brings past investment experience managing a $2.3 billion institutional fund and participating in fixed income research and analysis. Her experience and expertise in wealth management will complement the financial expertise of our Board. Over the next few years, we expect our Board refreshment program will result in the strategic evolution of our Board, and we are actively and regularly reviewing potential future candidates. Our Board formalized two important policies last year. Our Nominating and Governance Committee introduced a Board Diversity policy under which the Board will seek to review candidates from a diverse set of backgrounds. This policy ensures director candidates are diverse across a number of dimensions, including race, ethnicity, and gender. Our Board also formalized the Lead Independent Director role, in which John McCullough currently serves. Finally, as previously announced, the Board intends to ask shareholders at the 2021 annual meeting to approve a proposal to declassify the Board of Directors over a period of three years. Currently, the Company’s directors are divided into three classes. Directors of each class serve three-year terms, and the terms of one class expire at the conclusion of each annual meeting of shareholders. This decision to advance this proposal was based on the Board’s evaluation of the Company’s corporate governance practices, feedback from our investors, market views on best-in-class governance practices, and the preferences of leading proxy advisors. The Board believes that declassifying our Board (so that each director stands for election annually, rather than every three years) will underscore the Board’s deep commitment to be accountable to our shareholders, and the Board will strongly encourage shareholders to support this change at the 2021 annual meeting. LOOKING FORWARD The world around us has changed significantly over the past year. However, through the dedication and perseverance of our associates as well as the leadership of our management team and Board of Directors, we have not only adapted but we have learned, grown, and in some cases, embraced new and more e.cient ways to provide financial solutions to our clients. Above all, we believe that 2020 has proven the essential role that our bank plays in our community and for our customers. As we strategically plan for and reimagine the future of community banking, we remain confident in our leadership, our strategy, and the direction of our Company. As we enter 2021, we thank you for your strong support in 2020 and want you to know that we will continue to invest in serving our customers and our communities, which we believe will provide compelling returns for you, our shareholders. Very truly yours, Carissa L. Rodeheaver Chairman, CEO and President, First United Corporation Lead Independent Director, First United Corporation

2021 Key Initiatives and Strategic Priorities Grow Strategically Amplify consumer and small business relationships utilizing community relationship managers and universal relationship advisors Opportunistically identify and hire banking talent to capitalize on market disruption and client acquisition Expand into new markets utilizing Financial Center model and mortgage originations Pursue wealth management M&A and strategic bank partnerships Optimize Profi tability and Enhance Effi ciency Fine tune regional/line of busin Utilize pro Capitalize on existing infrastructure to build stronger revenue streams Implement next stages of operational restructure and consolidation initiative Leverage technology to streamline processes and procedures Create Exceptional Client Experience Provide seamless client experience across all business lines using integrated relationship teams Educate clients on digital banking and technology utilizing high-tech branch network Customiz Develop focused marketing plans utilizing data analytics to increase relationship and product pro Reimagine the Future Develop hybrid working environment to capture effi ciencies and attract/ retain talent Explore real estate partnerships and physical space alternatives Further promote diversity, equity and inclusion in workforce and client base Establish Fintech partnerships to capitalize on digi Optimize shareholder return through a keen focus on future growth, profi tability, effi ciencies, the client experience, and a reimagined future First United Total Shareholder Returns Relative to Peers 1-Year 3-Year CEO Tenure(2) 5-Year First United (33.3%) (4.4%) 62.5% 42.2% SNL Bank Index(1) (15.0%) (9.5%) 38.2% 38.8% 2020 Proxy Peers (20.2%) (12.2%) 39.2% 37.5% (1) SNL U.S. $1B-$5B Bank Index (2) From December 16, 2015 (announcement of Mrs. Rodeheaver’s appointment to CEO) Source: S&P Global as of December 31, 2020, and includes price change and reinvested cash dividends

COVID-19 Response for Stakeholders Quickly responded to COVID-19 through our well-designed and tested Business Continuity Plan, focusing on the health, safety, an Proactive communication and outreach with shareholders, clients and associates regarding enhanced measures and procedures Assisted our associates through work-at-home accommodations, pandemic pay policies, Financial First Responder bonuses, an Excellent delivery for new and existing clients on the Paycheck Protection Program origination and forgiveness, protecting over 17,620 local jobs and funding over $149 million in loans to local businesses (1) Provided COVID-19 loan mo Utilized recent branch enhancements to deliver updated technology to our clients and to properly social distance clients and associates Relieve Supported our communities through continued support of non-pro As of September 30, 2020(2) As of October 30, 2020 IMPORTANT ADDITIONAL INFORMATION First United, its directors and certain of its executive offi cers will be deemed to be participants in the solicitation of proxies from First United’s shareholders in connection with First United’s 2021 annual meeting of shareholders. First United intends t 1-888-692-2654 Member FDIC MyBank.com Our business ties to our clients and communities will withstand the crisis, support our market presence and enhance our competitive positioning long term. Our clients and communities are not just “stakeholders,” but also a key value driver for our shareholders. Enduring associate engagement will strengthen our culture and organization well beyond the crisis. First United understands the long-term impact of our stewardship of human capital.