The following section also identifies significant factors that have affected our financial position and operating results during the periods included in the accompanying financial statements. We encourage you to read this discussion and analysis in conjunction with the financial statements and the related notes and the other information included in this Report.

Overview

SouthState Corporation is a financial holding company headquartered in Winter Haven, Florida, and was incorporated under the laws of South Carolina in 1985. We provide a wide range of banking services and products to our customers through our Bank. The Bank operates SouthState|Duncan-Williams, a registered broker-dealer headquartered in Memphis, Tennessee, which it acquired on February 1, 2021 that serves primarily institutional clients across the U.S. in the fixed income business. The Bank also operates SouthState Advisory, Inc., a wholly owned registered investment advisor, and CBI Holding Company, LLC (“CBI”), which in turn owns Corporate Billing, a transaction-based finance company headquartered in Decatur, Alabama that provides factoring, invoicing, collection and accounts receivable management services to transportation companies and automotive parts and service providers nationwide. The holding company also owns SSB Insurance Corp., a captive insurance subsidiary pursuant to Section 831(b) of the U.S. Tax Code.

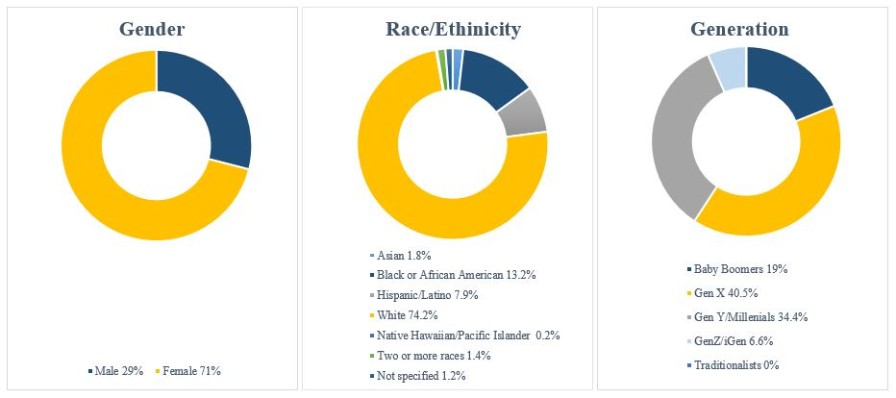

At December 31, 2022, we had $43.9 billion in assets and 5,029 full-time equivalent employees. Through our Bank branches, ATMs and online banking platforms, we provide our customers with a wide range of financial products and services, through a six (6) state footprint in Alabama, Florida, Georgia, North Carolina, South Carolina and Virginia. These financial products and services include deposit accounts such as checking accounts, savings and time deposits of various types, safe deposit boxes, bank money orders, wire transfer and ACH services, brokerage services and alternative investment products such as annuities and mutual funds, trust and asset management services, loans of all types, including business loans, agriculture loans, real estate-secured (mortgage) loans, personal use loans, home improvement loans, automobile loans, manufactured housing loans, boat loans, credit cards, letters of credit, home equity lines of credit, treasury management services, and merchant services.

We also operate a correspondent banking and capital markets division within our national bank subsidiary, of which the majority of its bond salesmen, traders and operational personnel are housed in facilities located in Atlanta, Georgia, Memphis, Tennessee, Walnut Creek, California, and Birmingham, Alabama. This division’s primary revenue generating activities are related to its capital markets division, which includes commissions earned on fixed income security sales, fees from hedging services, loan brokerage fees and consulting fees for services related to these activities; and its correspondent banking division, which includes spread income earned on correspondent bank deposits (i.e., federal funds purchased) and correspondent bank checking account deposits and fees from safe-keeping activities, bond accounting services for correspondents, asset/liability consulting related activities, international wires, and other clearing and corporate checking account services. The correspondent banking and capital markets division was expanded with the Bank’s acquisition of SouthState|Duncan-Williams.

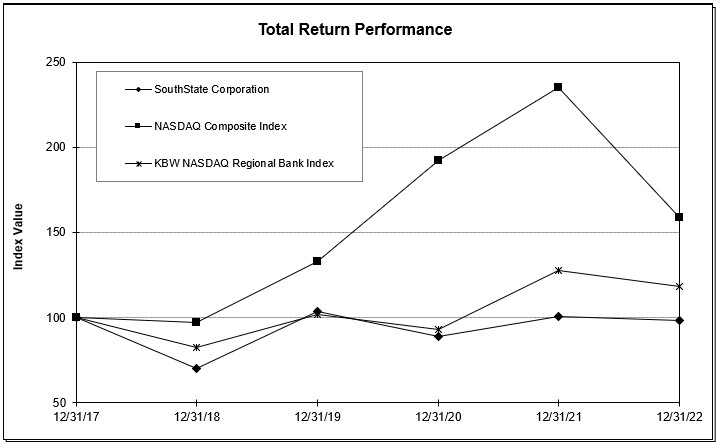

We earned net income of $496.0 million, or $6.60 diluted earnings per share (“EPS”), during 2022 compared to net income of $475.5 million, or $6.71 diluted EPS, in 2021. Net income available to the common shareholders was up $20.5 million, or 4.3%, in 2022 compared to 2021. For further discussion of the Company’s results of operations for the year ended December 31, 2022 as compared to the year ended December 31, 2021, and the year ended December 31, 2021 as compared to the year ended December 31, 2020, see Results of Operations section of this MD&A starting on page 55.

At December 31, 2022, we had total assets of approximately $43.9 billion compared to approximately $41.8 billion at December 31, 2021. See the Financial Condition section of this MD&A starting on page 66 for a more detailed description of the change in our balance sheet.

Our asset quality results remained strong in December 31, 2022, net charge offs as a percentage of average loans increased slightly to 0.02% compared to 0.01% for the year ended December 31, 2021. The total nonperforming assets (“NPAs”) increased $26.0 million to $109.7 million at December 31, 2022 from $83.7 million at December 31, 2021. Acquired NPAs increased $2.6 million to $62.5 million at December 31, 2022 from $59.8 million at December 31, 2021. Acquired nonperforming loans increased $4.6 million and acquired OREO and other nonperforming assets decreased $2.0 million. Non-acquired NPAs increased $23.4 million to $47.3 million at December 31, 2022 from $23.9 million at December 31, 2021, which was related to an increase in non-acquired