UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04253

MFS SERIES TRUST XV

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant's telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Annual Report

October 31, 2023

MFS® Commodity

Strategy Fund

MFS® Commodity

Strategy Fund

| 1 |

| 4 |

| 6 |

| 9 |

| 11 |

| 32 |

| 34 |

| 35 |

| 36 |

| 42 |

| 60 |

| 62 |

| 66 |

| 70 |

| 70 |

| 70 |

| 70 |

| 70 |

| 71 |

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Portfolio structure reflecting equivalent exposure of derivative positions (i)

Fixed income sectors (i)

| U.S. Treasury Securities | 40.7% |

| Investment Grade Corporates | 33.5% |

| Collateralized Debt Obligations | 7.9% |

| Commercial Mortgage-Backed Securities | 4.5% |

| Asset-Backed Securities | 4.0% |

| Emerging Markets Bonds | 1.0% |

| High Yield Corporates | 0.8% |

| Municipal Bonds | 0.6% |

| Mortgage-Backed Securities | 0.5% |

| Non-U.S. Government Bonds | 0.3% |

| Residential Mortgage-Backed Securities (o) | 0.0% |

Composition including fixed income credit quality (a)(i)

| AAA | 7.1% |

| AA | 7.6% |

| A | 14.4% |

| BBB | 22.7% |

| BB | 0.8% |

| U.S. Government | 26.2% |

| Federal Agencies | 0.5% |

| Not Rated | 14.5% |

| Non-Fixed Income | 100.8% |

| Cash & Cash Equivalents | 20.8% |

| Other | (115.4)% |

Portfolio Composition - continued

Commodity exposure (c)(i)

| Gold | 15.5% |

| Brent Crude | 9.4% |

| WTI Crude Oil | 8.9% |

| Natural Gas | 8.4% |

| Soybeans | 5.4% |

| Coffee | 4.6% |

| Silver | 4.6% |

| Corn | 4.3% |

| Soybean Meal | 4.3% |

| Aluminum | 4.2% |

| Live Cattle | 4.1% |

| Copper (COMEX) | 3.9% |

| Sugar | 3.9% |

| Unleaded Gasoline | 3.1% |

| Gas Oil | 2.9% |

| Soybean Oil | 2.7% |

| Zinc | 2.5% |

| Cocoa | 1.7% |

| Lean Hogs | 1.6% |

| Cotton | 1.5% |

| Heating Oil | 1.3% |

| Platinum | 1.3% |

| Wheat | 1.1% |

| Lead | 0.9% |

| Nickel | 0.6% |

| Kansas Wheat | (0.3)% |

| Feeder Cattle | (1.6)% |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. |

Non-Fixed Income includes equity securities (including convertible bonds and equity

Portfolio Composition - continued

derivatives), ETFs and Options on ETFs, and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies.

| (c) | MFS expects to gain exposure to the commodities markets by investing a portion of the fund’s assets in the MFS Commodity Strategy Portfolio, a wholly-owned and controlled subsidiary organized in the Cayman Islands (“Subsidiary”). The Subsidiary gains exposure to the commodities markets by investing in commodity-linked derivatives (such as commodity-linked futures, options, and/or swaps). The Subsidiary’s investments in commodity-linked derivatives are leveraged (i.e. involves investment exposure greater than the amount of the investment). For more information about commodity-linked derivatives and the risks of investing in such derivatives, please see the fund’s prospectus. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

The fund invests a portion of its assets in the MFS Commodity Strategy Portfolio, a wholly-owned subsidiary of the fund. Percentages reflect exposure to the underlying holdings of the MFS Commodity Strategy Portfolio and not to the exposure from investing directly in the MFS Commodity Strategy Portfolio itself.

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Consolidated Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of October 31, 2023.

The portfolio is actively managed and current holdings may be different.

Management Review

Summary of Results

For the twelve months ended October 31, 2023, Class A shares of the MFS Commodity Strategy Fund (fund) provided a total return of -3.10%, at net asset value. This compares with a return of -2.97% for the fund’s benchmark, the Bloomberg Commodity Index.

The fund’s investment adviser expects to gain exposure to the commodities markets by investing a portion of the fund’s assets in the MFS Commodity Strategy Portfolio, a wholly-owned and controlled subsidiary organized in the Cayman Islands (Subsidiary). The Subsidiary gains exposure to the commodities markets by investing in commodity-linked derivatives (such as commodity-linked futures, options and/or swaps).

Market Environment

During the reporting period, central banks around the world had to combat the strongest inflationary pressures in four decades, fueled by the global fiscal response to the pandemic, disrupted supply chains and the dislocations to energy markets stemming from the war in Ukraine. Interest rates rose substantially, but the effects of a tighter monetary policy may not have been fully experienced yet, given that monetary policy works with long and variable lags. Strains resulting from the abrupt tightening of monetary policy began to affect some parts of the economy, most acutely among small and regional US banks, which suffered from deposit flight as depositors sought higher yields on their savings. Additionally, activity in the US housing sector has slowed as a result of higher mortgage rates. China’s abandonment of its Zero-COVID policy ushered in a brief uptick in economic activity in the world’s second-largest economy in early 2023, although its momentum soon stalled as the focus turned to the country’s highly indebted property development sector. In developed markets, consumer demand for services remained stronger than the demand for goods.

Policymakers found themselves in the difficult position of trying to restrain inflation without tipping economies into recession. Despite the challenging macroeconomic and geopolitical environment, central banks remained focused on controlling price pressures while also confronting increasing financial stability concerns. Central banks had to juggle achieving their inflation mandates while using macroprudential tools to keep banking systems liquid, a potentially difficult balancing act, and one that suggested that we may be nearing a peak in policy rates.

Against an environment of relatively tight labor markets, tighter global financial conditions and volatile materials prices, investor anxiety appeared to have increased over the potential that corporate profit margins may be past peak for this cycle. That said, signs that supply chains have generally normalized, coupled with low levels of unemployment across developed markets and hopes that inflation levels have peaked, were supportive factors for the macroeconomic backdrop.

Commodities markets, as measured by the Bloomberg Commodity Index, declined nearly 3% during the period as global economic growth slowed and European energy markets reoriented after being disrupted early in the period by Russia’s halting of gas sales to Europe.

Management Review - continued

Factors Affecting Performance

Over the reporting period, the fund slightly lagged the Bloomberg Commodity Index, primarily due to the fixed income segment underperforming the funding cost of the commodity swaps. An underweight allocation to both livestock commodities and precious metals also detracted from relative performance.

Conversely, the fund’s out-of-benchmark exposure to the commodity swaps curve contributed to relative performance. The fund’s overweight exposure to soft commodities, particularly sugar, also supported relative results.

Respectfully,

Portfolio Manager(s)

Philipp Burgener, Alexander Mackey, Benjamin Nastou, and Natalie Shapiro

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

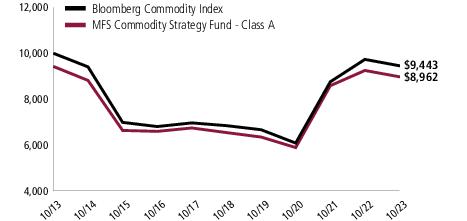

Performance Summary THROUGH 10/31/23

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

Performance Summary - continued

Total Returns through 10/31/23

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) |

| A | 6/02/2010 | (3.10)% | 6.50% | (0.50)% | N/A |

| B | 8/15/2018 | (4.08)% | 5.67% | N/A | 5.19% |

| C | 8/15/2018 | (3.72)% | 5.71% | N/A | 5.22% |

| I | 6/02/2010 | (2.79)% | 6.81% | (0.24)% | N/A |

| R1 | 8/15/2018 | (3.87)% | 5.72% | N/A | 5.23% |

| R2 | 8/15/2018 | (3.44)% | 6.21% | N/A | 5.74% |

| R3 | 8/15/2018 | (3.16)% | 6.48% | N/A | 6.00% |

| R4 | 8/15/2018 | (2.84)% | 6.77% | N/A | 6.27% |

| R6 | 9/04/2012 | (2.94)% | 6.83% | (0.23)% | N/A |

Comparative benchmark(s)

| | | | | |

| Bloomberg Commodity Index (f) | (2.97)% | 6.65% | (0.57)% | N/A |

Average annual with sales charge

| | | | | |

A

With Initial Sales Charge (5.75%) | (8.67)% | 5.25% | (1.09)% | N/A |

B

With CDSC (Declining over six years from 4% to 0%) (v) | (7.11)% | 5.47% | N/A | 5.09% |

C

With CDSC (1% for 12 months) (v) | (4.48)% | 5.71% | N/A | 5.22% |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition(s)

Bloomberg Commodity Index(a) – a highly liquid and diversified benchmark for the commodity futures market. The index tracks trades on futures contracts for physical commodities, such as energy (petroleum, gas), precious metals (gold, silver), industrial metals (zinc, copper), grains (corn, wheat), livestock (pork bellies), among others, and are traded in a variety of currencies.

Performance Summary - continued

It is not possible to invest directly in an index.

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund's share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund's performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

Expense Table

Fund expenses borne by the shareholders during the period,

May 1, 2023 through October 31, 2023

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2023 through October 31, 2023.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Table - continued

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

5/01/23 | Ending

Account Value

10/31/23 | Expenses

Paid During

Period (p)

5/01/23-10/31/23 |

| A | Actual | 1.13% | $1,000.00 | $1,019.61 | $5.75 |

| Hypothetical (h) | 1.13% | $1,000.00 | $1,019.51 | $5.75 |

| B | Actual | 1.88% | $1,000.00 | $1,014.05 | $9.54 |

| Hypothetical (h) | 1.88% | $1,000.00 | $1,015.73 | $9.55 |

| C | Actual | 1.88% | $1,000.00 | $1,017.00 | $9.56 |

| Hypothetical (h) | 1.88% | $1,000.00 | $1,015.73 | $9.55 |

| I | Actual | 0.88% | $1,000.00 | $1,022.28 | $4.49 |

| Hypothetical (h) | 0.88% | $1,000.00 | $1,020.77 | $4.48 |

| R1 | Actual | 1.88% | $1,000.00 | $1,016.81 | $9.56 |

| Hypothetical (h) | 1.88% | $1,000.00 | $1,015.73 | $9.55 |

| R2 | Actual | 1.38% | $1,000.00 | $1,019.66 | $7.03 |

| Hypothetical (h) | 1.38% | $1,000.00 | $1,018.25 | $7.02 |

| R3 | Actual | 1.13% | $1,000.00 | $1,019.55 | $5.75 |

| Hypothetical (h) | 1.13% | $1,000.00 | $1,019.51 | $5.75 |

| R4 | Actual | 0.88% | $1,000.00 | $1,022.35 | $4.49 |

| Hypothetical (h) | 0.88% | $1,000.00 | $1,020.77 | $4.48 |

| R6 | Actual | 0.81% | $1,000.00 | $1,022.35 | $4.13 |

| Hypothetical (h) | 0.81% | $1,000.00 | $1,021.12 | $4.13 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Consolidated Portfolio of Investments

10/31/23

The Consolidated Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Bonds – 78.7% |

| Aerospace & Defense – 0.9% |

| Boeing Co., 1.433%, 2/04/2024 | | $ | 3,511,000 | $3,466,478 |

| Boeing Co., 2.196%, 2/04/2026 | | | 2,850,000 | 2,618,669 |

| Huntington Ingalls Industries, Inc., 3.844%, 5/01/2025 | | | 1,273,000 | 1,232,050 |

| | | | | $7,317,197 |

| Asset-Backed & Securitized – 16.3% |

| 3650R Commercial Mortgage Trust, 2021-PF1, “XA”, 1.02%, 11/15/2054 (i) | | $ | 19,795,166 | $968,063 |

| ACREC 2021-FL1 Ltd., “AS”, FLR, 6.949% ((SOFR - 1mo. + 0.11448%) + 1.5%), 10/16/2036 (n) | | | 1,812,000 | 1,759,563 |

| ACREC 2021-FL1 Ltd., “B”, FLR, 7.249% ((SOFR - 1mo. + 0.11448%) + 1.8%), 10/16/2036 (n) | | | 1,406,000 | 1,356,533 |

| ACREC 2021-FL1 Ltd., “C”, FLR, 7.599% ((SOFR - 1mo. + 0.11448%) + 2.15%), 10/16/2036 (n) | | | 1,129,000 | 1,079,558 |

| ACRES 2021-FL2 Issuer Ltd., “B”, FLR, 7.699% ((SOFR - 1mo. + 0.11448%) + 2.25%), 1/15/2037 (n) | | | 1,527,500 | 1,483,518 |

| Allegro CLO Ltd., 2014-1RA, “A2”, FLR, 7.273% ((SOFR - 3mo. + 0.26161%) + 1.6%), 10/21/2028 (n) | | | 252,269 | 251,134 |

| AmeriCredit Automobile Receivables Trust, 2020-1, “C”, 1.59%, 10/20/2025 | | | 369,829 | 365,674 |

| AmeriCredit Automobile Receivables Trust, 2022-2, “A2A”, 4.2%, 12/18/2025 | | | 570,382 | 567,635 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “B”, FLR, 6.948% ((SOFR - 1mo. + 0.11448%) + 1.5%), 12/15/2035 (n) | | | 375,500 | 364,561 |

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “C”, FLR, 7.449% ((SOFR - 1mo. + 0.11448%) + 2%), 12/15/2035 (n) | | | 153,500 | 148,767 |

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “B”, FLR, 7.049% ((SOFR - 1mo. + 0.11448%) + 1.6%), 8/15/2034 (n) | | | 571,500 | 548,209 |

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “C”, FLR, 7.299% ((SOFR - 1mo. + 0.11448%) + 1.85%), 8/15/2034 (n) | | | 332,000 | 314,820 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “AS”, FLR, 7.149% ((SOFR - 1mo. + 0.11448%) + 1.7%), 11/15/2036 (n) | | | 1,684,000 | 1,652,300 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “B”, FLR, 7.448% ((SOFR - 1mo. + 0.11448%) + 2%), 11/15/2036 (n) | | | 1,684,000 | 1,640,230 |

| Arbor Realty Trust, Inc., CLO, 2021-FL4, “C”, FLR, 7.749% ((SOFR - 1mo. + 0.11448%) + 2.3%), 11/15/2036 (n) | | | 1,014,000 | 973,555 |

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “C”, FLR, 7.62% (SOFR - 30 day + 2.3%), 1/15/2037 (n) | | | 2,695,500 | 2,574,556 |

| AREIT 2019-CRE3 Trust, “AS”, FLR, 6.748% ((SOFR - 1mo. + 0.11448%) + 1.3%), 9/14/2036 (n) | | | 486,917 | 481,775 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| AREIT 2019-CRE3 Trust, “B”, FLR, 6.999% ((SOFR - 1mo. + 0.11448%) + 1.55%), 9/14/2036 (n) | | $ | 303,000 | $292,017 |

| AREIT 2019-CRE3 Trust, “C”, FLR, 7.348% (SOFR - 1mo. + 2.014%), 9/14/2036 (n) | | | 250,500 | 237,604 |

| AREIT 2022-CRE6 Trust, “C”, FLR, 7.471% (SOFR - 30 day + 2.15%), 1/20/2037 (n) | | | 894,000 | 860,208 |

| AREIT 2022-CRE6 Trust, “D”, FLR, 8.171% (SOFR - 30 day + 2.85%), 1/20/2037 (n) | | | 795,500 | 747,939 |

| AREIT 2022-CRE7 LLC, “B”, FLR, 8.579% (SOFR - 1mo. + 3.244%), 6/17/2039 (n) | | | 2,563,500 | 2,539,188 |

| ARI Fleet Lease Trust, 2023-B, “A2”, 6.05%, 7/15/2032 (n) | | | 520,918 | 520,982 |

| Balboa Bay Loan Funding Ltd., 2020-1A, “BR”, FLR, 7.323% ((SOFR - 3mo. + 0.26161%) + 1.65%), 1/20/2032 (n) | | | 1,606,204 | 1,569,629 |

| Balboa Bay Loan Funding Ltd., 2020-1A, “CR”, FLR, 7.774% ((SOFR - 3mo. + 0.26161%) + 2.1%), 1/20/2032 (n) | | | 870,027 | 848,320 |

| Ballyrock CLO 2018-1A Ltd., “A2”, FLR, 7.277% ((SOFR - 3mo. + 0.26161%) + 1.6%), 4/20/2031 (n) | | | 1,368,365 | 1,344,419 |

| Ballyrock CLO 2018-1A Ltd., “B”, FLR, 7.577% ((SOFR - 3mo. + 0.26161%) + 1.9%), 4/20/2031 (n) | | | 579,877 | 565,308 |

| BBCMS Mortgage Trust, 2018-C2, “XA”, 0.753%, 12/15/2051 (i)(n) | | | 19,207,239 | 561,606 |

| BBCMS Mortgage Trust, 2021-C10, “XA”, 1.287%, 7/15/2054 (i) | | | 7,318,587 | 450,530 |

| BBCMS Mortgage Trust, 2021-C11, “XA”, 1.376%, 9/15/2054 (i) | | | 7,441,693 | 517,178 |

| BBCMS Mortgage Trust, 2021-C9, “XA”, 1.612%, 2/15/2054 (i) | | | 11,289,196 | 911,706 |

| BDS 2021-FL10 Ltd., “B”, FLR, 7.399% ((SOFR - 1mo. + 0.11448%) + 1.95%), 12/16/2036 (n) | | | 793,500 | 767,076 |

| BDS 2021-FL10 Ltd., “C”, FLR, 7.749% ((SOFR - 1mo. + 0.11448%) + 2.3%), 12/16/2036 (n) | | | 577,000 | 553,002 |

| Benchmark 2021-B23 Mortgage Trust, “XA”, 1.267%, 2/15/2054 (i) | | | 12,522,933 | 754,495 |

| Benchmark 2021-B27 Mortgage Trust, “XA”, 1.262%, 7/15/2054 (i) | | | 14,479,190 | 932,839 |

| Benchmark 2021-B28 Mortgage Trust, “XA”, 1.275%, 8/15/2054 (i) | | | 10,198,947 | 664,489 |

| Benchmark 2021-B29 Mortgage Trust, “XA”, 1.034%, 9/15/2054 (i) | | | 14,810,002 | 739,757 |

| BSPRT 2021-FL6 Issuer Ltd., “C”, FLR, 7.499% ((SOFR - 1mo. + 0.11448%) + 2.05%), 3/15/2036 (n) | | | 485,000 | 462,405 |

| BSPRT 2021-FL7 Issuer Ltd., “B”, FLR, 7.499% ((SOFR - 1mo. + 0.11448%) + 2.05%), 12/15/2038 (n) | | | 339,000 | 331,478 |

| BSPRT 2021-FL7 Issuer Ltd., “C”, FLR, 7.748% ((SOFR - 1mo. + 0.11448%) + 2.3%), 12/15/2038 (n) | | | 408,500 | 397,750 |

| BSPRT 2022-FL8 Issuer Ltd., “A”, FLR, 6.82% (SOFR - 30 day + 1.5%), 2/15/2037 (n) | | | 3,217,000 | 3,177,898 |

| BSPRT 2022-FL8 Issuer Ltd., “B”, FLR, 7.37% (SOFR - 30 day + 2.05%), 2/15/2037 (n) | | | 445,500 | 430,367 |

| BSPRT 2022-FL8 Issuer Ltd., “C”, FLR, 7.62% (SOFR - 30 day + 2.3%), 2/15/2037 (n) | | | 719,500 | 688,057 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Business Jet Securities LLC, 2020-1A, “A”, 2.981%, 11/15/2035 (n) | | $ | 124,046 | $116,966 |

| Business Jet Securities LLC, 2021-1A, “A”, 2.162%, 4/15/2036 (n) | | | 248,427 | 226,450 |

| Business Jet Securities LLC, 2021-1A, “B”, 2.918%, 4/15/2036 (n) | | | 57,597 | 51,320 |

| BXMT 2020-FL2 Ltd., “B”, FLR, 6.85% ((SOFR - 1mo. + 0.11448%) + 1.4%), 2/15/2038 (n) | | | 1,492,000 | 1,305,134 |

| BXMT 2020-FL2 Ltd., “A”, FLR, 6.349% ((SOFR - 1mo. + 0.11448%) + 0.9%), 2/15/2038 (n) | | | 1,579,709 | 1,514,962 |

| BXMT 2021-FL4 Ltd., “AS”, FLR, 6.749% ((SOFR - 1mo. + 0.11448%) + 1.3%), 5/15/2038 (n) | | | 2,601,000 | 2,420,108 |

| Capital Automotive, 2020-1A, “A4”, REIT, 3.19%, 2/15/2050 (n) | | | 562,035 | 532,399 |

| CD 2017-CD4 Mortgage Trust, “XA”, 1.378%, 5/10/2050 (i) | | | 9,444,898 | 301,441 |

| CF Hippolyta Issuer LLC, 2020-1, “A1”, 1.69%, 7/15/2060 (n) | | | 358,250 | 324,921 |

| CF Hippolyta Issuer LLC, 2020-1, “B1”, 2.28%, 7/15/2060 (n) | | | 113,394 | 100,097 |

| Chesapeake Funding II LLC (CF II) 2023-2A, “A1”, 6.16%, 10/15/2035 (n) | | | 1,175,967 | 1,173,510 |

| Chesapeake Funding II LLC, 2023-1A, “A1”, 5.65%, 5/15/2035 (n) | | | 1,147,652 | 1,139,016 |

| CNH Equipment Trust 2023-A, “A2”, 5.34%, 9/15/2026 | | | 824,473 | 820,036 |

| Commercial Equipment Finance 2021-A, LLC, “A”, 2.05%, 2/16/2027 (n) | | | 349,219 | 339,832 |

| Commercial Mortgage Pass-Through Certificates, 2019-BN24, “XA”, 0.636%, 11/15/2062 (i) | | | 8,995,251 | 278,374 |

| Commercial Mortgage Pass-Through Certificates, 2021-BN31, “XA”, 1.317%, 2/15/2054 (i) | | | 10,967,408 | 735,475 |

| Commercial Mortgage Pass-Through Certificates, 2021-BN32, “XA”, 0.774%, 4/15/2054 (i) | | | 10,530,610 | 402,939 |

| Commercial Mortgage Pass-Through Certificates, 2021-BN34, “XA”, 0.974%, 6/15/2063 (i) | | | 11,381,059 | 564,688 |

| Commercial Mortgage Pass-Through Certificates, 2021-BN35, “XA”, 1.041%, 6/15/2064 (i) | | | 6,101,359 | 326,657 |

| Credit Acceptance Auto Loan Trust, 2021-2A, “A”, 0.96%, 2/15/2030 (n) | | | 121,959 | 120,726 |

| Credit Acceptance Auto Loan Trust, 2021-2A, “B”, 1.26%, 4/15/2030 (n) | | | 250,000 | 243,350 |

| Credit Acceptance Auto Loan Trust, 2021-3A, “B”, 1.38%, 7/15/2030 (n) | | | 312,000 | 297,991 |

| Credit Acceptance Auto Loan Trust, 2021-3A, “C”, 1.63%, 9/16/2030 (n) | | | 250,000 | 234,910 |

| Credit Acceptance Auto Loan Trust, 2021-4, “A”, 1.26%, 10/15/2030 (n) | | | 318,000 | 309,523 |

| Credit Acceptance Auto Loan Trust, 2021-4, “B”, 1.74%, 12/16/2030 (n) | | | 584,000 | 549,330 |

| Credit Acceptance Auto Loan Trust, 2023-3A, “B”, 7.09%, 10/17/2033 (n) | | | 1,292,000 | 1,275,408 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Cutwater 2015-1A Ltd., “AR”, FLR, 6.875% ((SOFR - 3mo. + 0.26161%) + 1.22%), 1/15/2029 (n) | | $ | 322,438 | $322,167 |

| Dell Equipment Finance Trust, 2023-1, “A2”, 5.65%, 9/22/2028 (n) | | | 2,617,000 | 2,607,562 |

| Dryden Senior Loan Fund, 2017-49A, “BR”, CLO, FLR, 7.256% ((SOFR - 3mo. + 0.26161%) + 1.6%), 7/18/2030 (n) | | | 1,945,990 | 1,907,549 |

| DT Auto Owner Trust, 2023-2A, “A”, 5.88%, 4/15/2027 (n) | | | 1,434,116 | 1,430,321 |

| Enterprise Fleet Financing 2023-1 LLC, “A2”, 5.51%, 1/22/2029 (n) | | | 1,340,173 | 1,327,776 |

| Enterprise Fleet Financing 2023-2 LLC, “A2”, 5.56%, 4/22/2030 (n) | | | 1,135,000 | 1,125,092 |

| Enterprise Fleet Financing 2023-2 LLC, “A3”, 5.5%, 4/22/2030 (n) | | | 689,000 | 676,050 |

| Fortress CBO Investments Ltd., 2022-FL3, “A”, FLR, 7.17% (SOFR - 30 day + 1.85%), 2/23/2039 (n) | | | 1,917,000 | 1,865,028 |

| Fortress CBO Investments Ltd., 2022-FL3, “AS”, FLR, 7.57% (SOFR - 30 day + 2.25%), 2/23/2039 (n) | | | 1,785,500 | 1,730,567 |

| GLS Auto Receivables Trust, 2021-3A, “B”, 0.78%, 11/17/2025 (n) | | | 200,177 | 199,321 |

| GreatAmerica Leasing Receivables Funding LLC, 2023-1, “A2”, 5.35%, 2/16/2026 (n) | | | 782,000 | 775,868 |

| GS Mortgage Securities Trust, 2017-GS6, “XA”, 1.156%, 5/10/2050 (i) | | | 10,481,538 | 298,761 |

| GS Mortgage Securities Trust, 2017-GS7, “XA”, 1.226%, 8/10/2050 (i) | | | 10,792,455 | 327,895 |

| GS Mortgage Securities Trust, 2020-GC47, “A5”, 1.127%, 5/12/2053 (i) | | | 8,632,804 | 475,996 |

| Jamestown CLO Ltd., 2020-15A, “C”, FLR, 8.105% ((SOFR - 3mo. + 0.26161%) + 2.45%), 4/15/2033 (n) | | | 3,069,116 | 2,977,687 |

| JPMorgan Chase Commercial Mortgage Securities Corp., 0.985%, 9/15/2050 (i) | | | 11,518,222 | 292,807 |

| LAD Auto Receivables Trust, 2022-1A, “A”, 5.21%, 6/15/2027 (n) | | | 565,588 | 559,959 |

| LoanCore 2021-CRE5 Ltd., “AS”, FLR, 7.199% ((SOFR - 1mo. + 0.11448%) + 1.75%), 7/15/2036 (n) | | | 1,752,500 | 1,718,105 |

| LoanCore 2021-CRE5 Ltd., “B”, FLR, 7.449% (LIBOR - 1mo. + 2%), 7/15/2036 (n) | | | 741,000 | 713,335 |

| Madison Park Funding Ltd., 2014-13A, “BR2”, FLR, 7.158% ((SOFR - 3mo. + 0.26161%) + 1.5%), 4/19/2030 (n) | | | 2,174,539 | 2,152,922 |

| MF1 2020-FL4 Ltd., “B”, FLR, 8.199% ((SOFR - 1mo. + 0.11448%) + 2.75%), 11/15/2035 (n) | | | 2,437,000 | 2,412,091 |

| MF1 2021-FL6 Ltd., “B”, FLR, 7.099% ((SOFR - 1mo. + 0.11448%) + 1.65%), 7/16/2036 (n) | | | 3,089,144 | 2,966,025 |

| MF1 2022-FL8 Ltd., “C”, FLR, 7.534% (SOFR - 30 day + 2.2%), 2/19/2037 (n) | | | 941,914 | 902,509 |

| MF1 2022-FL9 Ltd., “B”, FLR, 8.483% (SOFR - 1mo. + 3.15%), 6/19/2037 (n) | | | 2,988,000 | 2,954,373 |

| Morgan Stanley Bank of America Merrill Lynch Trust, 2017-C33, “XA”, 1.248%, 5/15/2050 (i) | | | 8,988,239 | 276,760 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Morgan Stanley Capital I Trust, 2017-H1, “XA”, 1.321%, 6/15/2050 (i) | | $ | 4,033,562 | $117,259 |

| Morgan Stanley Capital I Trust, 2018-H4, “XA”, 0.822%, 12/15/2051 (i) | | | 14,851,046 | 487,590 |

| Morgan Stanley Capital I Trust, 2021-L5, “XA”, 1.291%, 5/15/2054 (i) | | | 9,469,688 | 576,166 |

| Morgan Stanley Capital I Trust, 2021-L6, “XA”, 1.211%, 6/15/2054 (i) | | | 8,668,818 | 478,288 |

| Navistar Financial Dealer Note Master Owner Trust, 2022-1, “A”, FLR, 6.571% (SOFR - 30 day + 1.25%), 5/25/2027 (n) | | | 2,109,000 | 2,111,398 |

| NextGear Floorplan Master Owner Trust, 2022-1A, “A1”, FLR, 6.37% (SOFR - 30 day + 1.05%), 3/15/2027 (n) | | | 1,387,000 | 1,388,471 |

| NextGear Floorplan Master Owner Trust, 2023-1A, “A1”, FLR, 6.42% (SOFR - 1mo. + 1.1%), 3/15/2028 (n) | | | 956,000 | 958,764 |

| Oaktree CLO 2019-1A Ltd., “BR”, FLR, 7.423% ((SOFR - 3mo. + 0.26161%) + 1.75%), 4/22/2030 (n) | | | 1,427,638 | 1,399,702 |

| Oaktree CLO 2019-1A Ltd., “CR”, FLR, 8.024% ((SOFR - 3mo. + 0.26161%) + 2.35%), 4/22/2030 (n) | | | 1,427,638 | 1,380,610 |

| OCP CLO 2015-10A Ltd., “BR2”, FLR, 7.291% ((SOFR - 3mo. + 0.26161%) + 1.65%), 1/26/2034 (n) | | | 2,250,000 | 2,211,010 |

| OneMain Financial Issuance Trust (OMFIT) 2023-2A, “B”, 6.17%, 9/15/2036 (n) | | | 969,000 | 944,607 |

| OneMain Financial Issuance Trust (OMFIT) 2023-2A, “C”, 6.74%, 9/15/2036 (n) | | | 2,280,000 | 2,221,505 |

| OneMain Financial Issuance Trust, 2020-1A, “A”, 3.84%, 5/14/2032 (n) | | | 49,375 | 49,321 |

| OneMain Financial Issuance Trust, 2020-2A, “A”, 1.75%, 9/14/2035 (n) | | | 1,819,000 | 1,628,387 |

| OneMain Financial Issuance Trust, 2022-S1, “A”, 4.13%, 5/14/2035 (n) | | | 1,170,000 | 1,114,326 |

| OSD CLO, 2023-27, Ltd., “B”, FLR, 7.794% (SOFR - 3mo. + 2.4%), 4/16/2035 (n) | | | 1,609,161 | 1,602,423 |

| Palmer Square Loan Funding 2023-1A Ltd., “A2”, FLR, 7.755% (SOFR - 3mo. + 2.5%), 7/20/2031 (n) | | | 2,888,785 | 2,881,205 |

| PFP III 2021-7 Ltd., “B”, FLR, 6.848% ((SOFR - 1mo. + 0.11448%) + 1.4%), 4/14/2038 (n) | | | 604,470 | 587,499 |

| PFP III 2021-7 Ltd., “C”, FLR, 7.098% ((SOFR - 1mo. + 0.11448%) + 1.65%), 4/14/2038 (n) | | | 191,490 | 185,156 |

| PFP III 2021-8 Ltd., “B”, FLR, 6.949% ((SOFR - 1mo. + 0.11448%) + 1.5%), 8/09/2037 (n) | | | 617,500 | 593,461 |

| Progress Residential 2021-SFR1 Trust, “B”, 1.303%, 4/17/2038 (n) | | | 248,000 | 218,885 |

| Progress Residential 2021-SFR1 Trust, “C”, 1.555%, 4/17/2038 (n) | | | 186,000 | 164,427 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Asset-Backed & Securitized – continued |

| Shackleton 2013-4RA CLO Ltd., “B”, FLR, 7.555% (LIBOR - 3mo. + 1.9%), 4/13/2031 (n) | | $ | 722,762 | $692,548 |

| Shelter Growth CRE 2021-FL3 Ltd., “C”, FLR, 7.598% ((SOFR - 1mo. + 0.11448%) + 2.15%), 9/15/2036 (n) | | | 2,649,500 | 2,507,882 |

| Southwick Park CLO, Ltd., 2019-4A, “B1R”, FLR, 7.177% ((SOFR - 3mo. + 0.26161%) + 1.5%), 7/20/2032 (n) | | | 645,000 | 633,231 |

| Southwick Park CLO, Ltd., 2019-4A, “B2R”, 2.46%, 7/20/2032 (n) | | | 1,123,000 | 934,765 |

| Southwick Park CLO, Ltd., 2019-4A, “CR”, FLR, 7.627% ((SOFR - 3mo. + 0.26161%) + 1.95%), 7/20/2032 (n) | | | 1,528,000 | 1,496,867 |

| Starwood Commercial Mortgage, 2021-FL2, “B”, FLR, 7.249% ((SOFR - 1mo. + 0.11448%) + 1.8%), 4/18/2038 (n) | | | 2,295,000 | 2,129,824 |

| TPG Real Estate Finance, 2021-FL4, “AS”, FLR, 6.85% ((SOFR - 1mo. + 0.11448%) + 1.4%), 3/15/2038 (n) | | | 1,305,000 | 1,268,807 |

| TPG Real Estate Finance, 2021-FL4, “B”, FLR, 7.3% ((SOFR - 1mo. + 0.11448%) + 1.85%), 3/15/2038 (n) | | | 2,749,000 | 2,653,038 |

| UBS Commercial Mortgage Trust, 2017-C1, “XA”, 1.012%, 11/15/2050 (i) | | | 6,057,088 | 178,347 |

| UBS Commercial Mortgage Trust, 2018-C14, “XA”, 0.881%, 12/15/2051 (i) | | | 6,512,600 | 223,277 |

| Wells Fargo Commercial Mortgage Trust, 2021-C61, “XA”, 1.361%, 11/15/2054 (i) | | | 6,093,341 | 405,249 |

| Westlake Automobile Receivables Trust, 2023-1A, “A2B”, FLR, 6.17% (SOFR - 1mo. + 0.85%), 6/15/2026 (n) | | | 480,374 | 480,510 |

| World Omni Auto Receivables Trust, 3.67%, 6/15/2027 | | | 678,000 | 661,964 |

| World Omni Select Auto Trust 2023-A, “A2B”, FLR, 6.17% (SOFR - 1mo. + 0.85%), 3/15/2027 | | | 1,598,530 | 1,599,010 |

| | | | | $126,264,566 |

| Automotive – 1.6% |

| Daimler Trucks Finance North America LLC, 1.625%, 12/13/2024 (n) | | $ | 2,671,000 | $2,545,964 |

| Daimler Trucks Finance North America LLC, 5.2%, 1/17/2025 (n) | | | 457,000 | 452,958 |

| Hyundai Capital America, 0.8%, 1/08/2024 (n) | | | 249,000 | 246,521 |

| Hyundai Capital America, 5.875%, 4/07/2025 (n) | | | 2,077,000 | 2,069,352 |

| LKQ Corp., 5.75%, 6/15/2028 | | | 1,711,000 | 1,658,127 |

| Stellantis Finance US, Inc., 1.711%, 1/29/2027 (n) | | | 1,276,000 | 1,108,174 |

| Volkswagen Group of America Finance LLC, 2.85%, 9/26/2024 (n) | | | 878,000 | 852,300 |

| Volkswagen Group of America Finance LLC, 3.35%, 5/13/2025 (n) | | | 2,014,000 | 1,931,020 |

| Volkswagen Group of America Finance LLC, 1.25%, 11/24/2025 (n) | | | 1,359,000 | 1,238,243 |

| | | | | $12,102,659 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Broadcasting – 0.7% |

| WarnerMedia Holdings, Inc., 3.788%, 3/15/2025 | | $ | 4,233,000 | $4,093,276 |

| WarnerMedia Holdings, Inc., 6.412%, 3/15/2026 | | | 564,000 | 562,848 |

| WarnerMedia Holdings, Inc., 3.755%, 3/15/2027 | | | 1,062,000 | 977,677 |

| | | | | $5,633,801 |

| Brokerage & Asset Managers – 1.2% |

| Brookfield Finance, Inc., 3.9%, 1/25/2028 | | $ | 4,053,000 | $3,694,535 |

| Charles Schwab Corp., 5.875%, 8/24/2026 | | | 2,177,000 | 2,161,939 |

| Charles Schwab Corp., 5.643% to 5/19/2028, FLR (SOFR - 1 day + 2.210%) to 5/19/2029 | | | 1,707,000 | 1,643,240 |

| LPL Holdings, Inc., 4.625%, 11/15/2027 (n) | | | 898,000 | 821,174 |

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | | | 1,416,000 | 1,217,571 |

| | | | | $9,538,459 |

| Business Services – 0.6% |

| Equinix, Inc., 1.25%, 7/15/2025 | | $ | 972,000 | $896,589 |

| Global Payments, Inc., 1.2%, 3/01/2026 | | | 2,281,000 | 2,033,747 |

| Tencent Holdings Ltd., 1.81%, 1/26/2026 (n) | | | 1,551,000 | 1,424,033 |

| | | | | $4,354,369 |

| Chemicals – 0.1% |

| Nutrien Ltd., 4.9%, 3/27/2028 | | $ | 927,000 | $888,021 |

| Computer Software – 0.1% |

| Dell International LLC/EMC Corp., 4%, 7/15/2024 | | $ | 1,151,000 | $1,134,918 |

| Computer Software - Systems – 0.3% |

| VMware, Inc., 1%, 8/15/2024 | | $ | 1,476,000 | $1,417,614 |

| VMware, Inc., 1.4%, 8/15/2026 | | | 1,143,000 | 1,006,835 |

| | | | | $2,424,449 |

| Conglomerates – 0.7% |

| Regal Rexnord Corp., 6.05%, 2/15/2026 (n) | | $ | 2,249,000 | $2,212,127 |

| Regal Rexnord Corp., 6.05%, 4/15/2028 (n) | | | 1,366,000 | 1,306,706 |

| Westinghouse Air Brake Technologies Corp., 4.15%, 3/15/2024 | | | 2,070,000 | 2,055,703 |

| | | | | $5,574,536 |

| Consumer Products – 0.5% |

| Haleon UK Capital LLC, 3.125%, 3/24/2025 | | $ | 2,654,000 | $2,551,083 |

| Haleon US Capital LLC, 3.375%, 3/24/2027 | | | 1,154,000 | 1,064,185 |

| | | | | $3,615,268 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Containers – 0.6% |

| Berry Global, Inc., 1.57%, 1/15/2026 | | $ | 2,361,000 | $2,133,092 |

| Berry Global, Inc., 1.65%, 1/15/2027 | | | 2,847,000 | 2,453,291 |

| | | | | $4,586,383 |

| Electrical Equipment – 0.0% |

| Arrow Electronics, Inc., 6.125%, 3/01/2026 | | $ | 338,000 | $335,499 |

| Electronics – 0.9% |

| Microchip Technology, Inc., 0.983%, 9/01/2024 | | $ | 3,485,000 | $3,339,269 |

| Qorvo, Inc., 1.75%, 12/15/2024 (n) | | | 909,000 | 859,101 |

| SK Hynix, Inc., 6.25%, 1/17/2026 (n) | | | 2,977,000 | 2,966,094 |

| | | | | $7,164,464 |

| Emerging Market Quasi-Sovereign – 0.3% |

| DAE Funding LLC (United Arab Emirates), 1.55%, 8/01/2024 (n) | | $ | 796,000 | $765,453 |

| DAE Funding LLC (United Arab Emirates), 2.625%, 3/20/2025 (n) | | | 1,375,000 | 1,291,961 |

| | | | | $2,057,414 |

| Energy - Independent – 0.1% |

| EQT Corp., 5.7%, 4/01/2028 | | $ | 778,000 | $756,837 |

| Financial Institutions – 1.3% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 3.15%, 2/15/2024 | | $ | 1,243,000 | $1,230,809 |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 1.75%, 10/29/2024 | | | 1,571,000 | 1,500,042 |

| Air Lease Corp., 2.2%, 1/15/2027 | | | 1,590,000 | 1,393,698 |

| Avolon Holdings Funding Ltd., 5.5%, 1/15/2026 (n) | | | 892,000 | 858,862 |

| Avolon Holdings Funding Ltd., 2.125%, 2/21/2026 (n) | | | 2,500,000 | 2,229,747 |

| Avolon Holdings Funding Ltd., 4.25%, 4/15/2026 (n) | | | 769,000 | 717,768 |

| Avolon Holdings Funding Ltd., 2.528%, 11/18/2027 (n) | | | 1,715,000 | 1,432,338 |

| Avolon Holdings Funding Ltd., 2.75%, 2/21/2028 (n) | | | 1,313,000 | 1,098,726 |

| | | | | $10,461,990 |

| Food & Beverages – 1.3% |

| Bacardi-Martini B.V., 5.25%, 1/15/2029 (n) | | $ | 2,239,000 | $2,132,551 |

| General Mills, Inc., 5.241%, 11/18/2025 | | | 1,962,000 | 1,941,151 |

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 3%, 2/02/2029 | | | 2,313,000 | 1,904,328 |

| JDE Peet's N.V., 0.8%, 9/24/2024 (n) | | | 2,980,000 | 2,839,943 |

| JDE Peet's N.V., 1.375%, 1/15/2027 (n) | | | 1,050,000 | 901,805 |

| | | | | $9,719,778 |

| Food & Drug Stores – 0.3% |

| 7-Eleven, Inc., 0.8%, 2/10/2024 (n) | | $ | 2,125,000 | $2,093,421 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Gaming & Lodging – 1.2% |

| GLP Capital LP/GLP Financing II, Inc., 5.25%, 6/01/2025 | | $ | 2,186,000 | $2,132,212 |

| GLP Capital LP/GLP Financing II, Inc., 5.375%, 4/15/2026 | | | 405,000 | 388,153 |

| Hyatt Hotels Corp., 1.8%, 10/01/2024 | | | 1,976,000 | 1,900,893 |

| Hyatt Hotels Corp., 5.75%, 1/30/2027 | | | 1,067,000 | 1,054,505 |

| Las Vegas Sands Corp., 3.2%, 8/08/2024 | | | 1,270,000 | 1,235,777 |

| Marriott International, Inc., 3.75%, 10/01/2025 | | | 459,000 | 440,508 |

| Marriott International, Inc., 4.9%, 4/15/2029 | | | 1,307,000 | 1,225,856 |

| Sands China Ltd., 4.3%, 1/08/2026 | | | 1,030,000 | 955,438 |

| | | | | $9,333,342 |

| Industrial – 0.0% |

| Howard University, Washington D.C., AGM, 2.516%, 10/01/2025 | | $ | 152,000 | $142,127 |

| Insurance – 1.0% |

| Corebridge Financial, Inc., 3.5%, 4/04/2025 | | $ | 1,146,000 | $1,101,827 |

| Corebridge Financial, Inc., 3.65%, 4/05/2027 | | | 1,613,000 | 1,477,206 |

| Equitable Financial Life Insurance Co., 1.4%, 7/07/2025 (n) | | | 1,485,000 | 1,368,865 |

| Equitable Financial Life Insurance Co., 5.5%, 12/02/2025 (n) | | | 1,377,000 | 1,355,494 |

| Metropolitan Life Global Funding I, 0.4%, 1/07/2024 (n) | | | 2,146,000 | 2,124,362 |

| | | | | $7,427,754 |

| International Market Quasi-Sovereign – 0.3% |

| NBN Co. Ltd. (Commonwealth of Australia), 5.75%, 10/06/2028 (n) | | $ | 2,064,000 | $2,064,949 |

| Machinery & Tools – 0.3% |

| CNH Industrial Capital LLC, 4.2%, 1/15/2024 | | $ | 1,726,000 | $1,718,533 |

| CNH Industrial Capital LLC, 1.875%, 1/15/2026 | | | 448,000 | 411,140 |

| | | | | $2,129,673 |

| Major Banks – 8.9% |

| Barclays PLC, 1.007% to 12/10/2023, FLR (CMT - 1yr. + 0.8%) to 12/10/2024 | | $ | 781,000 | $775,977 |

| Barclays PLC, 2.852% to 5/07/2025, FLR (SOFR - 3mo. + 2.71361%) to 5/07/2026 | | | 759,000 | 715,980 |

| Barclays PLC, 2.279% to 11/24/2026, FLR (CMT - 1yr. + 1.05%) to 11/24/2027 | | | 2,856,000 | 2,500,018 |

| BNP Paribas S.A., 2.591% to 1/20/2027, FLR (SOFR - 1 day + 1.228%) to 1/20/2028 (n) | | | 3,494,000 | 3,091,986 |

| Capital One Financial Corp., 4.166% to 5/09/2024, FLR (SOFR - 1 day + 1.37%) to 5/09/2025 | | | 2,319,000 | 2,272,049 |

| Capital One Financial Corp., 2.636% to 3/03/2025, FLR (SOFR - 1 day + 1.29%) to 3/03/2026 | | | 1,712,000 | 1,605,666 |

| Capital One Financial Corp., 7.149% to 10/29/2026, FLR (SOFR - 1 day + 2.44%) to 10/29/2027 (w) | | | 1,305,000 | 1,305,194 |

| Deutsche Bank AG, 0.898%, 5/28/2024 | | | 694,000 | 674,217 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| Deutsche Bank AG, 1.447% to 4/01/2024, FLR (SOFR - 1 day + 1.131%) to 4/01/2025 | | $ | 3,247,000 | $3,169,130 |

| Deutsche Bank AG, 7.146% to 7/13/2026, FLR (SOFR - 1 day + 2.52%) to 7/13/2027 | | | 958,000 | 957,339 |

| Deutsche Bank AG, 2.311% to 11/16/2026, FLR (SOFR - 1 day + 1.219%) to 11/16/2027 | | | 849,000 | 734,325 |

| Deutsche Bank AG, 6.72% to 1/18/2028, FLR (SOFR - 1 day + 3.18%) to 1/18/2029 | | | 169,000 | 165,881 |

| Goldman Sachs Group, Inc., 1.093% to 12/09/2025, FLR (SOFR - 1 day + 0.789%) to 12/09/2026 | | | 1,268,000 | 1,132,016 |

| HSBC Holdings PLC, 2.099% to 6/04/2025, FLR (SOFR - 1 day + 1.929%) to 6/04/2026 | | | 728,000 | 678,358 |

| HSBC Holdings PLC, 7.336% to 11/03/2025, FLR (SOFR - 1 day + 3.03%) to 11/03/2026 | | | 646,000 | 657,149 |

| HSBC Holdings PLC, 1.589% to 5/24/2026, FLR (SOFR - 1 day + 1.29%) to 5/24/2027 | | | 860,000 | 757,501 |

| HSBC Holdings PLC, 2.251% to 11/22/2026, FLR (SOFR - 1 day + 1.1%) to 11/22/2027 | | | 2,840,000 | 2,489,995 |

| Huntington Bancshares, Inc., 4.008% to 5/16/2024, FLR (SOFR - 1 day + 1.205%) to 5/16/2025 | | | 2,090,000 | 2,029,823 |

| Huntington Bancshares, Inc., 5.699% to 11/18/2024, FLR (SOFR - 1 day + 1.215%) to 11/18/2025 | | | 1,500,000 | 1,456,375 |

| Huntington Bancshares, Inc., 4.443% to 8/04/2027, FLR (SOFR - 1 day + 1.970%) to 8/04/2028 | | | 254,000 | 231,994 |

| Huntington Bancshares, Inc., 6.208% to 8/21/2028, FLR (SOFR - 1 day + 2.02%) to 8/21/2029 | | | 449,000 | 431,620 |

| JPMorgan Chase & Co., 1.04% to 2/04/2026, FLR (SOFR - 1 day + 0.695%) to 2/04/2027 | | | 1,700,000 | 1,511,681 |

| Lloyds Banking Group PLC, 3.511% to 3/18/2025, FLR (CMT - 1yr. + 1.6%) to 3/18/2026 | | | 2,402,000 | 2,302,674 |

| Mitsubishi UFJ Financial Group, Inc., 0.953% to 7/19/2024, FLR (CMT - 1yr. + 0.55%) to 7/19/2025 | | | 1,997,000 | 1,920,787 |

| Mitsubishi UFJ Financial Group, Inc., 0.962% to 10/11/2024, FLR (CMT - 1yr. + 0.45%) to 10/11/2025 | | | 1,264,000 | 1,200,048 |

| Nationwide Building Society, 2.972% to 2/16/2027, FLR (SOFR - 1 day + 1.29%) to 2/16/2028 (n) | | | 2,445,000 | 2,172,519 |

| NatWest Group PLC, 4.269% to 3/22/2024, FLR (LIBOR - 3mo. + 1.762%) to 3/22/2025 | | | 2,276,000 | 2,253,103 |

| NatWest Markets PLC, 3.479%, 3/22/2025 (n) | | | 2,257,000 | 2,177,838 |

| PNC Bank N.A., 2.5%, 8/27/2024 | | | 1,122,000 | 1,089,543 |

| PNC Financial Services Group, Inc., 5.354% to 12/02/2027, FLR (SOFR - 1 day + 1.62%) to 12/02/2028 | | | 3,959,000 | 3,782,378 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Major Banks – continued |

| Standard Chartered PLC, 1.214% to 3/23/2024, FLR (CMT - 1yr. + 0.88%) to 3/23/2025 (n) | | $ | 812,000 | $793,116 |

| Standard Chartered PLC, 1.822% to 11/23/2024, FLR (CMT - 1yr. + 0.95%) to 11/23/2025 (n) | | | 806,000 | 764,071 |

| Standard Chartered PLC, 3.971% to 3/30/2025, FLR (CMT - 1yr. + 1.65%) to 3/30/2026 (n) | | | 1,077,000 | 1,035,224 |

| Sumitomo Mitsui Financial Group, Inc., 0.508%, 1/12/2024 | | | 801,000 | 792,431 |

| Sumitomo Mitsui Financial Group, Inc., 1.474%, 7/08/2025 | | | 1,675,000 | 1,551,450 |

| Sumitomo Mitsui Financial Group, Inc., 2.174%, 1/14/2027 | | | 2,295,000 | 2,031,483 |

| Sumitomo Mitsui Trust Bank Ltd., 0.85%, 3/25/2024 (n) | | | 1,334,000 | 1,307,084 |

| Toronto-Dominion Bank, 5.532%, 7/17/2026 | | | 3,664,000 | 3,626,082 |

| UBS Group AG, 5.711%, 1/12/2027 (n) | | | 1,513,000 | 1,488,366 |

| UBS Group AG, 4.703% to 8/05/2026, FLR (CMT - 1yr. + 2.05%) to 8/05/2027 (n) | | | 1,000,000 | 952,669 |

| UniCredit S.p.A., 2.569% to 9/22/2025, FLR (CMT - 1yr. + 2.3%) to 9/22/2026 (n) | | | 2,522,000 | 2,311,490 |

| Wells Fargo & Co., 2.164% to 2/11/2025, FLR ((SOFR - 3mo. + 0.26161%) + 0.75%) to 2/11/2026 | | | 2,599,000 | 2,458,395 |

| Wells Fargo & Co., 3.526% to 3/24/2027, FLR (SOFR - 1 day + 1.51%) to 3/24/2028 | | | 3,868,000 | 3,526,745 |

| | | | | $68,881,770 |

| Medical & Health Technology & Services – 0.6% |

| IQVIA, Inc., 5.7%, 5/15/2028 (n) | | $ | 788,000 | $756,480 |

| Thermo Fisher Scientific, Inc., 1.215%, 10/18/2024 | | | 4,014,000 | 3,836,771 |

| | | | | $4,593,251 |

| Metals & Mining – 0.9% |

| Anglo American Capital PLC, 4.75%, 4/10/2027 (n) | | $ | 2,009,000 | $1,921,374 |

| Glencore Funding LLC, 4.125%, 3/12/2024 (n) | | | 1,146,000 | 1,137,494 |

| Glencore Funding LLC, 1.625%, 9/01/2025 (n) | | | 2,677,000 | 2,472,233 |

| Glencore Funding LLC, 1.625%, 4/27/2026 (n) | | | 1,675,000 | 1,508,710 |

| | | | | $7,039,811 |

| Midstream – 1.1% |

| DCP Midstream Operating, LP, 5.625%, 7/15/2027 | | $ | 2,537,000 | $2,490,568 |

| Enbridge, Inc., 2.5%, 2/14/2025 | | | 1,542,000 | 1,474,791 |

| Enbridge, Inc., 5.969%, 3/08/2026 | | | 737,000 | 731,865 |

| Energy Transfer LP, 2.9%, 5/15/2025 | | | 846,000 | 805,897 |

| Energy Transfer LP, 5.55%, 2/15/2028 | | | 755,000 | 732,953 |

| TC Energy Corp., 6.203%, 3/09/2026 | | | 1,410,000 | 1,409,128 |

| Western Midstream Operating LP, 3.1%, 2/01/2025 | | | 1,082,000 | 1,039,529 |

| | | | | $8,684,731 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Mortgage-Backed – 0.5% | |

| Fannie Mae, 4.5%, 4/01/2024 - 5/01/2025 | | $ | 7,705 | $7,682 |

| Fannie Mae, 3%, 12/01/2031 | | | 228,302 | 212,986 |

| Fannie Mae, 2%, 5/25/2044 | | | 93,532 | 90,137 |

| Freddie Mac, 0.906%, 4/25/2024 (i) | | | 81,317 | 168 |

| Freddie Mac, 4%, 7/01/2025 | | | 19,528 | 19,097 |

| Freddie Mac, 1.579%, 4/25/2030 (i) | | | 6,362,155 | 491,675 |

| Freddie Mac, 3%, 4/15/2033 - 6/15/2045 | | | 2,684,344 | 2,420,625 |

| Freddie Mac, 2%, 7/15/2042 | | | 381,177 | 337,596 |

| | | | | $3,579,966 |

| Municipals – 0.6% |

| California Municipal Finance Authority Rev., Taxable (Century Housing Corp.), 1.605%, 11/01/2023 | | $ | 305,000 | $305,000 |

| Illinois Sales Tax Securitization Corp., Second Lien, Taxable, “B”, BAM, 2.225%, 1/01/2024 | | | 1,030,000 | 1,023,917 |

| Kentucky Higher Education Student Loan Corp. Rev., Taxable, “A-2”, 5.949%, 6/01/2037 | | | 2,265,000 | 2,040,287 |

| Massachusetts Educational Financing Authority, Education Loan Rev., Taxable, “A”, 2.156%, 7/01/2024 | | | 320,000 | 312,663 |

| Massachusetts Educational Financing Authority, Education Loan Rev., Taxable, “A”, 2.306%, 7/01/2025 | | | 250,000 | 236,678 |

| Massachusetts Educational Financing Authority, Education Loan Rev., Taxable, “A”, 2.562%, 7/01/2026 | | | 315,000 | 290,658 |

| Michigan Finance Authority Tobacco Settlement Asset-Backed Rev., Taxable (2006 Sold Tobacco Receipts), “A-1”, 2.326%, 6/01/2030 | | | 331,603 | 309,027 |

| New Jersey Transportation Trust Fund Authority, Transportation System, Taxable, “B”, 2.631%, 6/15/2024 | | | 450,000 | 441,576 |

| | | | | $4,959,806 |

| Natural Gas - Pipeline – 0.5% |

| APA Infrastructure Ltd., 4.2%, 3/23/2025 (n) | | $ | 3,842,000 | $3,739,976 |

| Other Banks & Diversified Financials – 2.1% |

| AIB Group PLC, 7.583% to 10/14/2025, FLR (SOFR - 1 day + 3.456%) to 10/14/2026 (n) | | $ | 2,182,000 | $2,208,812 |

| AIB Group PLC, 6.608% to 9/13/2028, FLR (SOFR - 1 day + 2.33%) to 9/13/2029 (n) | | | 409,000 | 400,021 |

| American Express Co., 2.25%, 3/04/2025 | | | 859,000 | 816,970 |

| Banque Federative du Credit Mutuel S.A., 0.65%, 2/27/2024 (n) | | | 2,782,000 | 2,734,883 |

| Banque Federative du Credit Mutuel S.A., 5.896%, 7/13/2026 (n) | | | 1,573,000 | 1,557,349 |

| Macquarie Group Ltd., 1.201% to 10/14/2024, FLR (SOFR - 1 day + 0.694%) to 10/14/2025 (n) | | | 2,251,000 | 2,141,354 |

| Macquarie Group Ltd., 1.34% to 1/12/2026, FLR (SOFR - 1 day + 1.069%) to 1/12/2027 (n) | | | 1,904,000 | 1,699,844 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Other Banks & Diversified Financials – continued |

| National Bank of Canada, 0.55% to 11/15/2023, FLR (CMT - 1yr. + 0.4%) to 11/15/2024 | | $ | 1,312,000 | $1,308,990 |

| U.S. Bancorp, 6.787% to 10/26/2026, FLR (SOFR - 1 day + 1.88%) to 10/26/2027 | | | 2,991,000 | 3,013,373 |

| | | | | $15,881,596 |

| Pharmaceuticals – 0.2% |

| Amgen, Inc., 5.507%, 3/02/2026 | | $ | 1,758,000 | $1,748,734 |

| Real Estate - Office – 0.3% |

| Corporate Office Property LP, REIT, 2.25%, 3/15/2026 | | $ | 2,617,000 | $2,366,491 |

| Retailers – 0.1% |

| Nordstrom, Inc., 2.3%, 4/08/2024 | | $ | 832,000 | $812,240 |

| Specialty Stores – 0.3% |

| Genuine Parts Co., 1.75%, 2/01/2025 | | $ | 1,302,000 | $1,230,693 |

| Ross Stores, Inc., 0.875%, 4/15/2026 | | | 926,000 | 819,865 |

| | | | | $2,050,558 |

| Telecommunications - Wireless – 0.8% |

| Crown Castle, Inc., REIT, 1.35%, 7/15/2025 | | $ | 492,000 | $453,930 |

| Crown Castle, Inc., REIT, 2.9%, 3/15/2027 | | | 448,000 | 402,089 |

| Rogers Communications, Inc., 3.2%, 3/15/2027 | | | 3,568,000 | 3,243,545 |

| T-Mobile USA, Inc., 3.5%, 4/15/2025 | | | 2,527,000 | 2,441,392 |

| | | | | $6,540,956 |

| Tobacco – 0.6% |

| B.A.T. International Finance PLC, 5.931%, 2/02/2029 | | $ | 880,000 | $855,720 |

| Philip Morris International, Inc., 5.125%, 11/15/2024 | | | 1,300,000 | 1,291,102 |

| Philip Morris International, Inc., 5%, 11/17/2025 | | | 591,000 | 583,609 |

| Philip Morris International, Inc., 5.125%, 11/17/2027 | | | 526,000 | 512,725 |

| Philip Morris International, Inc., 4.875%, 2/15/2028 | | | 1,262,000 | 1,212,747 |

| | | | | $4,455,903 |

| Transportation - Services – 1.5% |

| Element Fleet Management Corp., 1.6%, 4/06/2024 (n) | | $ | 6,310,000 | $6,174,311 |

| Element Fleet Management Corp., 6.271%, 6/26/2026 (n) | | | 2,816,000 | 2,800,335 |

| ERAC USA Finance LLC, 2.7%, 11/01/2023 (n) | | | 974,000 | 974,000 |

| ERAC USA Finance LLC, 3.85%, 11/15/2024 (n) | | | 684,000 | 669,152 |

| ERAC USA Finance LLC, 3.8%, 11/01/2025 (n) | | | 684,000 | 656,740 |

| | | | | $11,274,538 |

Consolidated Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| U.S. Treasury Obligations – 26.0% |

| U.S. Treasury Notes, 0.5%, 11/30/2023 (f)(s) | | $ | 12,515,000 | $12,466,126 |

| U.S. Treasury Notes, 0.875%, 1/31/2024 (f)(s) | | | 25,867,000 | 25,578,017 |

| U.S. Treasury Notes, 2.5%, 4/30/2024 (f)(s) | | | 25,217,000 | 24,845,640 |

| U.S. Treasury Notes, 1.875%, 8/31/2024 (f)(s) | | | 17,444,000 | 16,932,945 |

| U.S. Treasury Notes, 2.75%, 5/15/2025 (f) | | | 21,100,000 | 20,333,477 |

| U.S. Treasury Notes, 5%, 9/30/2025 | �� | | 33,859,000 | 33,796,837 |

| U.S. Treasury Notes, 3.75%, 4/15/2026 (f) | | | 16,708,000 | 16,239,393 |

| U.S. Treasury Notes, 4.125%, 6/15/2026 | | | 40,206,000 | 39,405,021 |

| U.S. Treasury Notes, 4.5%, 7/15/2026 | | | 11,726,000 | 11,597,747 |

| | | | | $201,195,203 |

| Utilities - Electric Power – 3.1% |

| American Electric Power Co., Inc., 5.699%, 8/15/2025 | | $ | 1,067,000 | $1,058,234 |

| Edison International, 4.7%, 8/15/2025 | | | 1,686,000 | 1,638,099 |

| Emera US Finance LP, 0.833%, 6/15/2024 | | | 1,057,000 | 1,017,840 |

| Enel Finance International N.V., 6.8%, 10/14/2025 (n) | | | 889,000 | 899,038 |

| Entergy Louisiana LLC, 0.95%, 10/01/2024 | | | 5,399,000 | 5,159,849 |

| FirstEnergy Corp., 2.05%, 3/01/2025 | | | 1,202,000 | 1,128,475 |

| FirstEnergy Corp., 1.6%, 1/15/2026 | | | 734,000 | 660,657 |

| NextEra Energy Capital Holdings, Inc., 6.051%, 3/01/2025 | | | 1,486,000 | 1,485,149 |

| NextEra Energy Capital Holdings, Inc., 5.749%, 9/01/2025 | | | 1,681,000 | 1,673,098 |

| Pacific Gas & Electric Co., 1.7%, 11/15/2023 | | | 854,000 | 852,635 |

| Pacific Gas & Electric Co., 3.25%, 2/16/2024 | | | 1,838,000 | 1,821,919 |

| Pacific Gas & Electric Co., 6.1%, 1/15/2029 | | | 1,552,000 | 1,493,243 |

| Vistra Operations Co. LLC, 4.875%, 5/13/2024 (n) | | | 3,851,000 | 3,807,434 |

| WEC Energy Group, Inc., 0.8%, 3/15/2024 | | | 1,019,000 | 1,000,192 |

| | | | | $23,695,862 |

| Total Bonds (Identified Cost, $627,671,391) | | $608,623,266 |

| Investment Companies (h) – 10.8% |

| Money Market Funds – 10.8% | |

| MFS Institutional Money Market Portfolio, 5.43% (v) (Identified Cost, $83,580,062) | | | 83,585,647 | $83,594,006 |

| Short-Term Obligations (s)(y) – 6.4% | | | | |

| Federal Home Loan Bank, 0%, due 11/01/2023 (Identified Cost, $49,875,000) | | $ | 49,875,000 | $49,875,000 |

|

|

| Other Assets, Less Liabilities – 4.1% | | 31,479,893 |

| Net Assets – 100.0% | $773,572,165 |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts, cleared swap agreements, and uncleared swap agreements. | | | |

Consolidated Portfolio of Investments – continued

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $83,594,006 and $658,498,266, respectively. | | | |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. | | | |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $208,444,707, representing 26.9% of net assets. | | | |

| (s) | All or a portion of security is held by a wholly-owned subsidiary. See Note 2 of the Notes to Consolidated Financial Statements for details of the wholly-owned subsidiary. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

| (w) | When-issued security. | | | |

| (y) | The rate shown represents an annualized yield at time of purchase. | | | |

| The following abbreviations are used in this report and are defined: |

| AGM | Assured Guaranty Municipal |

| BAM | Build America Mutual |

| BCOMCOT | Bloomberg Brent Crude Subindex Total Return, this index is composed of futures contracts on brent crude. It is quoted in USD. |

| BCOMF3T | Bloomberg Commodity Index 3 Month Forward Total Return, this index is composed of longer-dated futures contracts on 19 physical commodities. It is quoted in USD. |

| BCOMFCT | Bloomberg Feeder Cattle Subindex Total Return, this index is comprised of futures contracts on feeder cattle. It is quoted in USD. |

| BCOMGCTR | Bloomberg Gold Subindex Total Return, this index is composed of futures contracts on gold. It is quoted in USD. |

| BCOMHGTR | Bloomberg Copper Subindex Total Return, this index is composed of futures contracts on copper. It is quoted in USD. |

| BCOMHOTR | Bloomberg Heating Oil Subindex Total Return, this index is composed of futures contracts on heating oil. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| BCOMKCTR | Bloomberg Coffee Subindex Total Return, this index is composed of futures contracts on coffee. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| BCOMKWT | Bloomberg Kansas Wheat Subindex Total Return, this index is composed of futures contracts on wheat and Kansas wheat. It is quoted in USD. |

| BCOMNGTR | Bloomberg Natural Gas Subindex Total Return, this index is composed of futures contracts on natural gas. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| BCOMNITR | Bloomberg Nickel Subindex Total Return, this index is a single commodity subindex of the Bloomberg CI composed of futures contracts on Nickel. It reflects the return of underlying commodity futures price movements only. It is quoted in USD. |

| BCOMPLTR | Bloomberg Platinum Subindex Total Return, this index is composed of futures contracts on platinum. It is quoted in USD. |

| BCOMRBTR | Bloomberg Unleaded Gasoline Subindex Total Return, this index is composed of futures contracts on unleaded gasoline. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

Consolidated Portfolio of Investments – continued

| BCOMSMT | Bloomberg Soybean Meal Subindex Total Return, this index is composed of futures contracts on soybean meal. It is quoted in USD. |

| BCOMTR | Bloomberg Commodity Index Total Return |

| BCOMWHTR | Bloomberg Wheat Subindex Total Return, this index is composed of futures contracts on wheat. It reflects the return on fully collateralized futures positions. It is quoted in USD. |

| CLO | Collateralized Loan Obligation |

| CMT | Constant Maturity Treasury |

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| LIBOR | London Interbank Offered Rate |

| MLCILPRT | Merrill Lynch International Bloomberg Commodity Index Total Return |

| REIT | Real Estate Investment Trust |

| SOFR | Secured Overnight Financing Rate |

| SPGCCCTR | S&P GSCI Cocoa Index Total Return |

Derivative Contracts at 10/31/23

| Futures Contracts |

| Description | Long/

Short | Currency | Contracts | Notional

Amount | Expiration

Date | Value/Unrealized

Appreciation

(Depreciation) |

| Liability Derivatives |

| Interest Rate Futures | | |

| U.S. Treasury Note 2 yr | Long | USD | 266 | $53,844,219 | December – 2023 | $(214,998) |

Consolidated Portfolio of Investments – continued

| Cleared Swap Agreements |

Maturity

Date | Notional

Amount | Counterparty | Cash Flows

to Receive/

Frequency | Cash Flows

to Pay/

Frequency | Unrealized

Appreciation

(Depreciation) | | Net Unamortized

Upfront Payments

(Receipts) | | Value |

| Asset Derivatives | | | | | |

| Interest Rate Swaps | | | | | |

| 10/02/25 | USD | 13,800,000 | centrally cleared | 5.014%/Annually | SOFR - 1 day/Annually | $3,270 | | $(1,293) | | $1,977 |

| Liability Derivatives | | | | | |

| Interest Rate Swaps | | | | | |

| 10/02/26 | USD | 44,600,000 | centrally cleared | 4.697%/Annually | SOFR - 1 day/Annually | $(13,906) | | $(4,024) | | $(17,930) |

| Uncleared Swap Agreements |

Maturity

Date | Notional

Amount | Counterparty | Cash Flows

to Receive

(Monthly) | Cash Flows

to Pay

(Monthly) | Unrealized

Appreciation

(Depreciation) | Net Unamortized

Upfront Payments

(Receipts) | Value |

| Asset Derivatives | | | |

| Total Return Swaps | | | |

| 12/29/23 | USD | 9,061,891 (Short) | Morgan Stanley | 3 month T-Bill - 0.02% | BCOMGCTR (floating rate) | $39,863 | $— | $39,863 |

| 2/26/24 | USD | 3,751,367 (Short) | Morgan Stanley | 3 month T-Bill - 0.02% | BCOMNGTR (floating rate) | 15,610 | — | 15,610 |

| 5/06/24 | USD | 12,029,110 (Short) | Merrill Lynch International | 3 month T-Bill - 0.05% | BCOMFCT (floating rate) | 61,174 | — | 61,174 |

| 5/07/24 | USD | 3,247,764 (Short) | Goldman Sachs International | 3 month T-Bill - 0.04% | BCOMNGTR (floating rate) | 13,464 | — | 13,464 |

| 5/28/24 | USD | 9,605,902 (Short) | Morgan Stanley | 3 month T-Bill - 0.03% | BCOMHGTR (floating rate) | 46,168 | — | 46,168 |

| 6/14/24 | USD | 9,799,702 (Short) | Morgan Stanley | 3 month T-Bill - 0.02% | BCOMNITR (floating rate) | 47,773 | — | 47,773 |

| 9/06/24 | USD | 8,644,412 (Short) | Merrill Lynch International | 3 month T-Bill - 0.02% | BCOMWHTR (floating rate) | 39,561 | — | 39,561 |

| 9/30/24 | USD | 6,990,590 (Short) | Merrill Lynch International | 3 month T-Bill - 0.05% | BCOMHOTR (floating rate) | 35,898 | — | 35,898 |

Consolidated Portfolio of Investments – continued

| Uncleared Swap Agreements - continued |

Maturity

Date | Notional

Amount | Counterparty | Cash Flows

to Receive

(Monthly) | Cash Flows

to Pay

(Monthly) | Unrealized

Appreciation

(Depreciation) | | Net Unamortized

Upfront Payments

(Receipts) | | Value |

| Asset Derivatives - continued |

| Total Return Swaps - continued |

| 10/18/24 | USD | 12,993,332 (Short) | Goldman Sachs International | 3 month T-Bill - 0.05% | BCOMKWT (floating rate) | $64,069 | | $— | | $64,069 |

| | | | | | | $363,580 | | $— | | $363,580 |

| Liability Derivatives | | | | | |

| Total Return Swaps | | | | | |

| 11/17/23 | USD | 123,336,298 (Long) | Merrill Lynch International | MLCILPRT (a) (floating rate) | 3 month T-Bill + 0.13% | $(597,268) | | $— | | $(597,268) |

| 12/29/23 | USD | 103,885,049 (Long) | JPMorgan Chase Bank N.A. | BCOMTR (floating rate) | 3 month T-Bill + 0.07% | (497,450) | | — | | (497,450) |

| 12/29/23 | USD | 50,053,705 (Long) | Goldman Sachs International | BCOMTR (floating rate) | 3 month T-Bill + 0.09% | (240,568) | | — | | (240,568) |

| 2/26/24 | USD | 8,261,743 (Long) | Morgan Stanley | BCOMSMT (floating rate) | 3 month T-Bill + 0.09% | (35,978) | | — | | (35,978) |

| 3/15/24 | USD | 30,323,844 (Long) | Goldman Sachs International | BCOMTR (floating rate) | 3 month T-Bill + 0.065% | (145,071) | | — | | (145,071) |

| 5/06/24 | USD | 29,892,234 (Long) | JPMorgan Chase Bank N.A. | BCOMF3T (floating rate) | 3 month T-Bill + 0.10% | (143,552) | | — | | (143,552) |

| 5/07/24 | USD | 29,892,234 (Long) | Goldman Sachs International | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | (143,288) | | — | | (143,288) |

| 5/28/24 | USD | 13,139,591 (Long) | Goldman Sachs International | SPGCCCTR (floating rate) | 3 month T-Bill + 0.10% | (56,564) | | — | | (56,564) |

| 6/25/24 | USD | 37,752,020 (Long) | Goldman Sachs International | BCOMTR (floating rate) | 3 month T-Bill + 0.065% | (180,606) | | — | | (180,606) |

| 7/15/24 | USD | 91,974,700 (Long) | Merrill Lynch International | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | (440,890) | | — | | (440,890) |

| 8/16/24 | USD | 35,316,178 (Long) | JPMorgan Chase Bank N.A. | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | (169,291) | | — | | (169,291) |

Consolidated Portfolio of Investments – continued

| Uncleared Swap Agreements - continued |

Maturity

Date | Notional

Amount | Counterparty | Cash Flows

to Receive

(Monthly) | Cash Flows

to Pay

(Monthly) | Unrealized

Appreciation

(Depreciation) | | Net Unamortized

Upfront Payments

(Receipts) | | Value |

| Liability Derivatives - continued |

| Total Return Swaps - continued |

| 8/16/24 | USD | 35,316,178 (Long) | Merrill Lynch International | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | $(169,291) | | $— | | $(169,291) |

| 8/16/24 | USD | 9,690,078 (Long) | Merrill Lynch International | BCOMPLTR (floating rate) | 3 month T-Bill + 0.10% | (45,154) | | — | | (45,154) |

| 8/16/24 | USD | 30,951,436 (Long) | Goldman Sachs International | BCOMTR (floating rate) | 3 month T-Bill + 0.065% | (148,072) | | — | | (148,072) |

| 8/16/24 | USD | 15,356,707 (Long) | Goldman Sachs International | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | (73,615) | | — | | (73,615) |

| 8/16/24 | USD | 36,325,211 (Long) | Goldman Sachs International | BCOMF3T (floating rate) | 3 month T-Bill + 0.09% | (174,126) | | — | | (174,126) |

| 9/06/24 | USD | 6,579,485 (Long) | Merrill Lynch International | BCOMRBTR (floating rate) | 3 month T-Bill + 0.075% | (33,646) | | — | | (33,646) |

| 9/06/24 | USD | 9,304,545 (Long) | Merrill Lynch International | BCOMCOT (floating rate) | 3 month T-Bill + 0.07% | (47,274) | | — | | (47,274) |

| 9/30/24 | USD | 12,019,823 (Long) | JPMorgan Chase Bank N.A. | BCOMKCTR (floating rate) | 3 month T-Bill + 0.12% | (50,665) | | — | | (50,665) |

| 10/18/24 | USD | 146,761,555 (Long) | Merrill Lynch International | MLCILPRT (a) (floating rate) | 3 month T-Bill + 0.14% | (712,009) | | — | | (712,009) |

| | | | | | | $(4,104,378) | | $— | | $(4,104,378) |

At October 31, 2023, the fund had cash collateral of $2,191,838 and other liquid securities with an aggregate value of $81,279,179 to cover any collateral or margin obligations for certain derivative contracts. Restricted cash and/or deposits with brokers in the Consolidated Statement of Assets and Liabilities are comprised of cash collateral.

Consolidated Portfolio of Investments – continued

| (a) | The Merrill Lynch MLCILPRT Commodity Index, the components of which are not publicly available, seeks to provide exposure to a diversified group of commodities. Through its investment in the swap, the fund has indirect exposure to the following positions that compose the MLCILPRT: |

| Referenced Commodity Futures Contracts | % of Notional | Notional

Amount:

$146,761,555* | Notional

Amount:

$123,336,299* | |

| Long Futures Contracts | | | | |

| Corn - December 2023 | 1.1% | 1,603,871 | 1,347,870 | |

| Cotton - December 2023 | 0.4% | 587,260 | 493,525 | |

| Gold - December 2023 | 4.3% | 6,296,020 | 5,291,085 | |

| Copper Comex - December 2023 | 1.3% | 1,938,760 | 1,629,306 | |

| Coffee - December 2023 | 0.8% | 1,200,310 | 1,008,724 | |

| Kansas Wheat - December 2023 | 0.4% | 527,270 | 443,110 | |

| Live Cattle - December 2023 | 1.0% | 1,544,090 | 1,297,631 | |

| Lean Hogs - December 2023 | 0.4% | 618,969 | 520,173 | |

| Silver - December 2023 | 1.2% | 1,745,795 | 1,467,141 | |

| Wheat - December 2023 | 0.6% | 830,667 | 698,080 | |

| Soybean Oil - January 2024 | 2.7% | 3,914,947 | 3,290,064 | |

| WTI - January 2024 | 8.6% | 12,592,187 | 10,582,293 | |

| Brent - January 2024 | 2.1% | 3,108,352 | 2,612,215 | |

| Heating Oil - January 2024 | 2.1% | 3,057,610 | 2,569,571 | |

| Aluminum - January 2024 | 4.1% | 5,989,895 | 5,033,821 | |

| Lead - January 2024 | 0.9% | 1,318,703 | 1,108,219 | |

| Nickel - January 2024 | 1.8% | 2,673,580 | 2,246,838 | |

| Zinc - January 2024 | 2.4% | 3,469,897 | 2,916,052 | |

| Natural Gas - January 2024 | 9.1% | 13,299,286 | 11,176,529 | |

| Gasoil - January 2024 | 2.8% | 4,048,842 | 3,402,588 | |

| Soybeans - January 2024 | 5.2% | 7,568,463 | 6,360,428 | |

| Soybean Meal - January 2024 | 3.1% | 4,602,126 | 3,867,560 | |

| Gasoline RBOB - January 2024 | 2.2% | 3,215,021 | 2,701,857 | |

| Gold - February 2024 | 11.9% | 17,490,295 | 14,698,592 | |

| Live Cattle - February 2024 | 2.9% | 4,271,117 | 3,589,385 | |

| Lean Hogs - February 2024 | 1.2% | 1,776,920 | 1,493,298 | |

Consolidated Portfolio of Investments – continued

| Referenced Commodity Futures Contracts | % of Notional | Notional

Amount:

$146,761,555* | Notional

Amount:

$123,336,299* | |

| Corn - March 2024 | 3.1% | 4,541,927 | 3,816,970 | |

| Brent - March 2024 | 5.7% | 8,434,358 | 7,088,113 | |

| Cotton - March 2024 | 1.1% | 1,660,498 | 1,395,459 | |

| Copper Comex - March 2024 | 3.7% | 5,385,650 | 4,526,023 | |

| Coffee - March 2024 | 2.2% | 3,253,501 | 2,734,196 | |

| Kansas Wheat - March 2024 | 1.0% | 1,477,645 | 1,241,791 | |

| Sugar - March 2024 | 3.7% | 5,442,240 | 4,573,580 | |

| Silver - March 2024 | 3.3% | 4,872,056 | 4,094,406 | |

| Wheat - March 2024 | 1.6% | 2,403,427 | 2,019,806 | |

| | 100.0% | 146,761,555 | 123,336,299 | |

| * The notional amount is indicative of the quantity and proportionate value of each commodity futures contract. |

See Notes to Consolidated Financial Statements

Consolidated Financial Statements

Consolidated Statement of Assets and Liabilities

At 10/31/23

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $677,546,391) | $658,498,266 |

| Investments in affiliated issuers, at value (identified cost, $83,580,062) | 83,594,006 |

| Cash | 7,474,867 |

| Restricted cash for | |

| Uncleared swaps | 2,191,838 |

| Receivables for | |

| Due from uncleared swap brokers | 10,109,682 |

| Investments sold | 18,913,696 |

| Fund shares sold | 67,237 |

| Interest | 4,621,405 |

| Uncleared swaps, at value | 363,580 |

| Total assets | $785,834,577 |

| Liabilities | |

| Payables for | |

| Distributions | $1,080 |

| Due to uncleared swap brokers | 2,679,529 |

| Net daily variation margin on open cleared swap agreements | 16,074 |

| Net daily variation margin on open futures contracts | 35,337 |

| Investments purchased | 3,121,535 |

| When-issued investments purchased | 1,305,000 |

| Fund shares reacquired | 812,458 |

| Uncleared swaps, at value | 4,104,378 |

| Payable to affiliates | |

| Investment adviser | 31,370 |

| Administrative services fee | 666 |

| Shareholder servicing costs | 11,929 |

| Distribution and service fees | 186 |

| Payable for independent Trustees' compensation | 10 |

| Accrued expenses and other liabilities | 142,860 |

| Total liabilities | $12,262,412 |

| Net assets | $773,572,165 |

Consolidated Statement of Assets and Liabilities – continued

| Net assets consist of | |

| Paid-in capital | $1,375,455,171 |

| Total distributable earnings (loss) | (601,883,006) |

| Net assets | $773,572,165 |

| Shares of beneficial interest outstanding | 211,314,918 |

| | Net assets | Shares

outstanding | Net asset value

per share (a) |

| Class A | $10,165,745 | 2,793,226 | $3.64 |

| Class B | 91,652 | 25,357 | 3.61 |

| Class C | 514,040 | 143,317 | 3.59 |

| Class I | 12,576,067 | 3,430,586 | 3.67 |

| Class R1 | 65,136 | 17,964 | 3.63 |

| Class R2 | 310,787 | 85,618 | 3.63 |

| Class R3 | 67,734 | 18,557 | 3.65 |

| Class R4 | 68,622 | 18,760 | 3.66 |

| Class R6 | 749,712,382 | 204,781,533 | 3.66 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $3.86 [100 / 94.25 x $3.64]. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Consolidated Financial Statements

Consolidated Financial Statements

Consolidated Statement of Operations

Year ended 10/31/23

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | |

| Income | |

| Interest | $26,658,781 |

| Dividends from affiliated issuers | 4,549,673 |

| Other | 118,014 |

| Total investment income | $31,326,468 |

| Expenses | |

| Management fee | $5,846,136 |

| Distribution and service fees | 44,713 |

| Shareholder servicing costs | 36,798 |

| Administrative services fee | 123,447 |

| Independent Trustees' compensation | 14,763 |

| Custodian fee | 50,345 |

| Shareholder communications | 15,271 |

| Audit and tax fees | 96,788 |

| Legal fees | 29,251 |

| Miscellaneous | 243,854 |

| Total expenses | $6,501,366 |

| Reduction of expenses by investment adviser | (99,976) |

| Net expenses | $6,401,390 |