UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04264

Name of Fund: BlackRock California Municipal Opportunities Fund (formerly, BlackRock California Municipal Bond Fund) of BlackRock California Municipal Series Trust

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock California Municipal Opportunities Fund (formerly, BlackRock California Municipal Bond Fund) of BlackRock California Municipal Series Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2015

Date of reporting period: 11/30/2014

Item 1 – Report to Stockholders

NOVEMBER 30, 2014

SEMI-ANNUAL REPORT

|  |

BlackRock California Municipal Bond Fund | of BlackRock California Municipal Series Trust

BlackRock New Jersey Municipal Bond Fund | of BlackRock Multi-State Municipal Series Trust

BlackRock Pennsylvania Municipal Bond Fund | of BlackRock Multi-State Municipal Series Trust

BlackRock Strategic Municipal Opportunities Fund | of BlackRock Municipal Series Trust

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Table of Contents | ||||

| Page | ||||

| 3 | ||||

Semi-Annual Report: | ||||

| 4 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 17 | ||||

| 17 | ||||

| Financial Statements: | ||||

| 18 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 48 | ||||

| 59 | ||||

| 72 | ||||

| 73 | ||||

| 2 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

| What’s Happened in the Markets |

Dear Shareholder,

Financial markets generally had a strong first half of 2014 even as the U.S. Federal Reserve gradually reduced (or “tapered”) their asset purchase programs. The year got off to a rocky start, however, as a number of developing economies showed signs of stress and U.S. economic data weakened. Equities declined in January while bond markets found renewed strength from investors seeking relatively safer assets. Although these headwinds persisted, equities were back on the rise in February as investors were assuaged by increasing evidence that the soft patch in U.S. data had been temporary and weather-related, and forecasts pointed to growth picking up later in the year.

In the months that followed, interest rates trended lower and bond prices climbed higher in the modest growth environment. Financial markets exhibited a remarkably low level of volatility despite rising tensions in Russia and Ukraine and signs of decelerating growth in China. Investors focused on signs of improvement in the U.S. recovery, stronger corporate earnings, increased merger-and-acquisition activity and, perhaps most importantly, reassurance that the Fed had no imminent plans to increase short-term interest rates.

In the low-yield environment, more investors turned to equities, pushing major stock indices to record levels. However, investors eventually became wary of high valuations and began shedding stocks that had experienced significant price appreciation in 2013. A broad rotation into cheaper valuations resulted in the strongest performers of 2013 struggling most in 2014, and vice versa. Especially hard hit were U.S. small cap and European stocks, where earnings growth had not kept pace with their rising market prices. In contrast, emerging markets benefited from the trend after having suffered heavy selling pressure earlier in the year.

Volatility ticked up in the middle of the summer as geopolitical tensions escalated and investors feared that better U.S. economic indicators may compel the Fed to increase short-term interest rates sooner than previously anticipated. Global credit markets tightened as the U.S. dollar strengthened, ultimately putting a strain on investor flows. Most asset classes declined in the third quarter, particularly the riskier and higher valued segments such as U.S. small cap and international stocks. In fixed income markets, high yield bonds struggled. U.S. large cap stocks and municipal bonds held their ground as investors were drawn to these more stable segments.

In the final two months of the period, U.S. markets outperformed other parts of the world, driven largely by stronger economic growth versus other developed countries, most notably in Europe. The divergence of central bank policy came into focus as the European Central Bank and the Bank of Japan took aggressive measures to stimulate growth while the Fed moved toward tighter policy. U.S. equities benefited from the foreign central bank flows, while lower rates in Europe and Japan helped support demand for higher quality long-term U.S. bonds offering relatively attractive yields.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of November 30, 2014 | ||||||||

| 6-month | 12-month | |||||||

U.S. large cap equities | 8.58 | % | 16.86 | % | ||||

U.S. small cap equities | 4.09 | 3.99 | ||||||

International equities | (5.07 | ) | (0.02 | ) | ||||

Emerging market equities | (0.82 | ) | 1.06 | |||||

3-month Treasury bill | 0.02 | 0.05 | ||||||

U.S. Treasury securities | 3.61 | 8.09 | ||||||

U.S. investment grade | 1.92 | 5.27 | ||||||

Tax-exempt municipal | 2.35 | 8.34 | ||||||

U.S. high yield bonds | (0.59 | ) | 4.52 | |||||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| Fund Summary as of November 30, 2014 | BlackRock California Municipal Bond Fund | |||

| Investment Objective |

BlackRock California Municipal Bond Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal and California income taxes.

On November 14, 2014, the Board of Trustees of the Fund approved changes to the Fund’s name and investment strategies. The Fund will change its name to BlackRock California Municipal Opportunities Fund. Under its new investment strategies, the Fund will continue to seek to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in California municipal bonds. The Fund’s new investment strategies provide greater flexibility to navigate changing market conditions and a diverse interest rate environment. In addition, the Fund’s investment advisor has determined to change the Fund’s secondary benchmark from the Custom California Index to the S&P® California Municipal Bond Index. The investment advisor believes that the new benchmark is more relevant to the Fund’s new investment strategies. These changes become effective on January 26, 2015.

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | For the six-month period ended November 30, 2014, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index and underperformed its secondary benchmark, the Custom California Index. The following discussion of relative performance pertains to the Custom California Index. |

What factors influenced performance?

| Ÿ | The Fund’s overweight positions in the health care and utilities sectors made a positive contribution to performance during the period. The Fund benefited from income generated in the form of coupon payments from its portfolio of municipal bond holdings. In addition, the Fund’s limited use of leverage through its position in tender option bonds provided both incremental return and income in an environment of low short-term borrowing costs and declining interest rates. (Bond prices rise as yields fall). The Fund was also helped by its lack of exposure to Puerto Rico, which underperformed during the period. |

| Ÿ | The Fund’s shorter duration posture (lower sensitivity to interest rate movements) relative to the benchmark index detracted from performance as interest rates declined. The Fund’s high quality bias also had a negative impact on relative results. Although high quality issues provided positive returns, significant fund flows caused yield spreads to tighten more dramatically in lower-rated bonds (which indicates outperformance). |

Describe recent portfolio activity.

| Ÿ | The Fund’s duration was reduced during the six-month period. The Fund had an overweight duration coming into the period, and it closed the period with an underweight as the investment advisor sought to achieve a more defensive stance. New purchases were a mix of shorter maturity and higher coupon issues. The Fund also participated in some primary market issues in order to capture performance from the higher yields generally available on these bonds. The Fund reduced leverage during the period. |

Describe portfolio positioning at period end.

| Ÿ | Relative to the Custom California Index, the Fund ended the period with an underweight duration posture and overweight exposure to water and utility bonds. In addition, the Fund maintained a bias for higher quality California issues. The average coupon rate of the Fund’s municipal bond holdings stood at 5.38% at the close of the period. The Fund continued to hold exposure to tender option bonds in order to increase income while the municipal yield curve remained relatively steep and short-term interest rates remained low. In addition, the Fund continued to hold 10-year U.S. Treasury futures contracts to manage interest rate risk. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

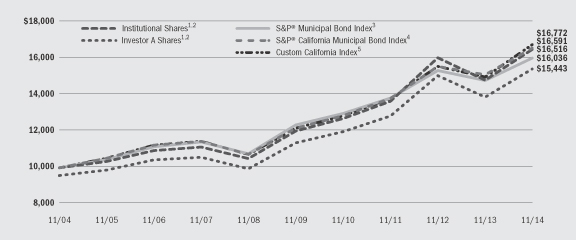

| BlackRock California Municipal Bond Fund |

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund invests primarily in a portfolio of long-term investment grade California municipal bonds. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The S&P® California Municipal Bond Index includes all California bonds in the S&P® Municipal Bond Index. Effective as of January 1, 2014, the Fund’s secondary benchmark, the S&P® California Municipal Bond Index, was replaced with the Custom California Index. |

| 5 | Custom California Index — a customized benchmark that reflects the returns of the S&P® California Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those California bonds in the S&P® California Municipal Bond Index that have maturities greater than 5 years for periods subsequent to January 1, 2013. |

| Performance Summary for the Period Ended November 30, 2014 |

| Average Annual Total Returns6 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 1.65 | % | 1.62 | % | 3.06 | % | 11.42 | % | N/A | 6.55 | % | N/A | 5.14 | % | N/A | |||||||||||||||||||||

Investor A | 1.39 | 1.34 | 2.96 | 11.22 | 6.49 | % | 6.31 | 5.39 | % | 4.90 | 4.44 | % | ||||||||||||||||||||||||

Investor A1 | 1.50 | 1.48 | 2.94 | 11.36 | 6.91 | 6.47 | 5.60 | 5.06 | 4.63 | |||||||||||||||||||||||||||

Investor B | 0.95 | 0.93 | 2.72 | 10.79 | 6.79 | 6.01 | 5.69 | 4.62 | 4.62 | |||||||||||||||||||||||||||

Investor C | 0.70 | 0.64 | 2.49 | 10.38 | 9.38 | 5.52 | 5.52 | 4.12 | 4.12 | |||||||||||||||||||||||||||

Investor C1 | 1.07 | 1.04 | 2.68 | 10.81 | 9.81 | 5.94 | 5.94 | 4.54 | 4.54 | |||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | 2.35 | 8.34 | N/A | 5.34 | N/A | 4.84 | N/A | |||||||||||||||||||||||||||

S&P® California Municipal | — | — | 2.76 | 9.74 | N/A | 6.38 | N/A | 5.19 | N/A | |||||||||||||||||||||||||||

Custom California Index | — | — | 3.27 | 11.75 | N/A | 6.61 | N/A | 5.31 | N/A | |||||||||||||||||||||||||||

| 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 5 |

| Fund Summary as of November 30, 2014 | BlackRock New Jersey Municipal Bond Fund | |||

| Investment Objective |

BlackRock New Jersey Municipal Bond Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal income tax and New Jersey personal income taxes.

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | For the six-month period ended November 30, 2014, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the Custom New Jersey Index. The following discussion of relative performance pertains to the Custom New Jersey Index. |

What factors influenced performance?

| Ÿ | The Fund benefited from income generated in the form of coupon payments from its portfolio of municipal bond holdings. In addition, the Fund’s limited use of leverage provided both incremental return and income in an environment of declining interest rates. (Bond prices rise as yields fall). The Fund’s positioning along the yield curve, which favored longer-dated bonds, aided performance as longer-term bonds generally outperformed those with shorter maturities. Exposure to lower-coupon bonds, or bonds priced at a discount, also benefited from declining interest rates. Such bonds tend to have longer durations and more capital appreciation potential than bonds with larger coupons, which helped their performance during the period. (Duration is a measure of interest-rate sensitivity.) The Fund’s positions in zero-coupon bonds also drove returns, as these securities generated strong price performance due to their relatively long durations for their respective maturities. Finally, overweight positions in the strong-performing hospital and housing sectors contributed to performance, as did underweights in lagging state and general obligation bonds (those supported by the taxing power of the issuing entity). |

| Ÿ | The Fund’s overall duration posture was shorter than the benchmark index, which detracted from performance as interest rates declined in the period. An overweight allocation to pre-refunded bonds was detrimental to relative performance given that the sector underperformed. Fund performance was also constrained by an underweight position in the middle range of the credit spectrum (specifically, A and BBB+ rated credits) at a time in which higher yielding credits, sectors and structures generally outperformed. |

Describe recent portfolio activity.

| Ÿ | The Fund’s trading activity for the period was focused on capturing relative value opportunities, while also taking care to maintain broad diversification and sufficient liquidity to manage cash flows from shareholders. The Fund was active in seeking to add exposure to new issues, as these bonds generally performed well at a time of both limited supply and strong demand. |

Describe portfolio positioning at period end.

| Ÿ | The Fund ended the period with a neutral to slightly short duration stance relative to the Custom New Jersey Index. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

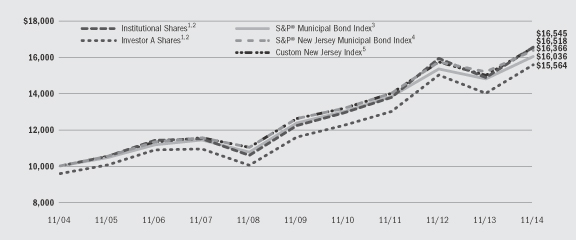

| BlackRock New Jersey Municipal Bond Fund |

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund invests primarily in a portfolio of long-term investment grade New Jersey municipal bonds. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The S&P® New Jersey Municipal Bond Index includes all New Jersey bonds in the S&P® Municipal Bond Index. Effective as of January 1, 2014, the Fund’s secondary benchmark, the S&P® New Jersey Municipal Bond Index, was replaced with the Custom New Jersey Index. |

| 5 | Custom New Jersey Index — a customized benchmark that reflects the returns of the S&P® New Jersey Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those New Jersey bonds in the S&P® New Jersey Municipal Bond Index that have maturities greater than 5 years for periods subsequent to January 1, 2013. |

| Performance Summary for the Period Ended November 30, 2014 |

| Average Annual Total Returns6 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 2.43 | % | 2.37 | % | 2.96 | % | 11.35 | % | N/A | 6.24 | % | N/A | 5.16 | % | N/A | |||||||||||||||||||||

Service | 2.33 | 2.16 | 2.81 | 11.12 | N/A | 6.07 | N/A | 4.97 | N/A | |||||||||||||||||||||||||||

Investor A | 2.23 | 2.12 | 2.90 | 11.21 | 6.49 | % | 6.08 | 5.17 | % | 4.98 | 4.52 | % | ||||||||||||||||||||||||

Investor A1 | 2.35 | 2.28 | 2.96 | 11.36 | 6.91 | 6.24 | 5.38 | 5.13 | 4.71 | |||||||||||||||||||||||||||

Investor C | 1.56 | 1.48 | 2.51 | 10.27 | 9.27 | 5.28 | 5.28 | 4.18 | 4.18 | |||||||||||||||||||||||||||

Investor C1 | 1.94 | 1.88 | 2.70 | 10.81 | 9.81 | 5.71 | 5.71 | 4.60 | 4.60 | |||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | 2.35 | 8.34 | N/A | 5.34 | N/A | 4.84 | N/A | |||||||||||||||||||||||||||

S&P® New Jersey Municipal | — | — | 1.55 | 7.76 | N/A | 5.34 | N/A | 5.05 | N/A | |||||||||||||||||||||||||||

Custom New Jersey Index | — | — | | 1.98 | | | 10.17 | | N/A | | 5.54 | | N/A | 5.15 | N/A | |||||||||||||||||||||

| 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 7 |

| Fund Summary as of November 30, 2014 | BlackRock Pennsylvania Municipal Bond Fund | |||

| Investment Objective |

BlackRock Pennsylvania Municipal Bond Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal income tax and Pennsylvania personal income taxes.

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | For the six-month period ended November 30, 2014, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the Custom Pennsylvania Index, with the exception of Investor C shares. The following discussion of relative performance pertains to the Custom Pennsylvania Index. |

What factors influenced performance?

| Ÿ | The Fund’s positioning with respect to duration (sensitivity to interest rate movements) helped performance. Its positioning along the yield curve favored longer-dated bonds, which aided performance as these bonds generally outperformed those possessing shorter maturities. Investment grade bonds represent the bulk of the Fund’s holdings, which contributed significantly to overall results. Concentrations in the health care, education, and housing-related sectors were among the top contributors to performance. The Fund benefited from income generated in the form of coupon payments from its portfolio of municipal bond holdings. |

| Ÿ | There were no material detractors from performance for the period. |

Describe recent portfolio activity.

| Ÿ | During the six-month period, trading activity was focused on maintaining the Fund’s high level of income. Cash was committed to purchasing bonds that presented attractive income opportunities with compelling valuations relative to their level of credit risk. Capital was primarily deployed in bonds with maturities 20 years or longer that presented opportunities to diversify across sectors and issuers. |

Describe portfolio positioning at period end.

| Ÿ | Relative to the Custom Pennsylvania Index, the Fund ended the period with a longer duration posture and longer yield curve exposure, and it held an underweight position in the high yield sector. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 8 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

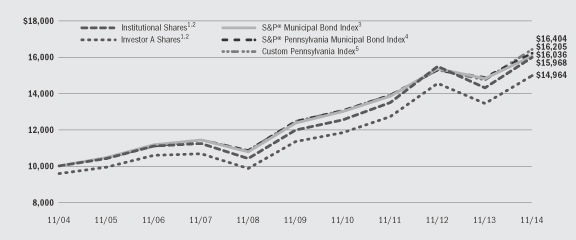

| BlackRock Pennsylvania Municipal Bond Fund |

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | The Fund invests primarily in a portfolio of long-term investment grade Pennsylvania municipal bonds. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The S&P® Pennsylvania Municipal Bond Index includes all Pennsylvania bonds in the S&P® Municipal Bond Index. Effective as of January 1, 2014, the Fund’s secondary benchmark, the S&P® Pennsylvania Municipal Bond Index, was replaced with the Custom Pennsylvania Index. |

| 5 | Custom Pennsylvania Index — a customized benchmark that reflects the returns of the S&P® Pennsylvania Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those Pennsylvania bonds in the S&P® Pennsylvania Municipal Bond Index that have maturities greater than 5 years for periods subsequent to January 1, 2013. |

| Performance Summary for the Period Ended November 30, 2014 |

| Average Annual Total Returns6 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 2.56 | % | 2.46 | % | 3.78 | % | 11.64 | % | N/A | 5.93 | % | N/A | 4.79 | % | N/A | |||||||||||||||||||||

Service | 2.38 | 2.30 | 3.59 | 11.43 | N/A | 5.74 | N/A | 4.57 | N/A | |||||||||||||||||||||||||||

Investor A | 2.27 | 2.23 | 3.59 | 11.43 | 6.69 | % | 5.72 | 4.81 | % | 4.57 | 4.11 | % | ||||||||||||||||||||||||

Investor A1 | 2.43 | 2.38 | 3.67 | 11.61 | 7.14 | 5.89 | 5.03 | 4.72 | 4.29 | |||||||||||||||||||||||||||

Investor C | 1.60 | 1.60 | 3.27 | 10.57 | 9.57 | 4.89 | 4.89 | 3.77 | 3.77 | |||||||||||||||||||||||||||

Investor C1 | 2.01 | 2.00 | 3.49 | 11.03 | 10.03 | 5.34 | 5.34 | 4.19 | 4.19 | |||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | 2.35 | 8.34 | N/A | 5.34 | N/A | 4.84 | N/A | |||||||||||||||||||||||||||

S&P® Pennsylvania Municipal | — | — | 2.67 | 9.01 | N/A | 5.43 | N/A | 4.95 | N/A | |||||||||||||||||||||||||||

Custom Pennsylvania Index | — | — | 3.33 | 11.31 | N/A | 5.69 | N/A | 5.07 | N/A | |||||||||||||||||||||||||||

| 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 9 |

| Fund Summary as of November 30, 2014 | BlackRock Strategic Municipal Opportunities Fund | |||

| Investment Objective |

BlackRock Strategic Municipal Opportunities Fund’s (the “Fund”) (formerly known as BlackRock Intermediate Municipal Fund) investment objective is to provide shareholders with a high level of income exempt from Federal income taxes.

| Portfolio Management Commentary |

How did the Fund perform?

| Ÿ | For the six-month period ended November 30, 2014, the Fund underperformed the primary benchmark, the S&P® Municipal Bond Index, as well as its custom blended secondary benchmark comprised of 65% S&P® Municipal Bond Investment Grade Index, 30% S&P® Municipal Bond High Yield Index and 5% Barclays Taxable Municipal: U.S. Aggregate Eligible Index. The following discussion of relative performance pertains to the custom blended benchmark. |

What factors influenced performance?

| Ÿ | The Fund used U.S. Treasury futures contracts to manage interest rate risk during the period. The futures contracts had a negative impact on Fund performance as interest rates declined over the period. (Bond prices rise as yields fall.) |

| Ÿ | The Fund’s sector allocations detracted from performance relative to the custom blended benchmark. In particular, exposure to state general obligation bonds (which are backed by the issuer’s taxing power) as well as to the corporate, education and transportation sectors underperformed versus the benchmark. Holdings within the utilities, tobacco and health care sectors added to relative performance. |

| Ÿ | Performance benefited from yield curve and credit positioning. In particular, holdings of bonds with maturities over 25 years and with maturities between eight and 10 years added to performance as interest rates declined. By contrast, holdings with maturities between 12 and 25 years and between four and seven years detracted. From a credit perspective, the Fund’s holdings of issues rated below AAA (specifically, those rated BB, AA, B and BBB) and lack of exposure to D-rated names contributed to results. Conversely, exposure to non-rated, CCC and AAA credits detracted from relative performance. |

| Ÿ | The Fund’s use of leverage through its position in tender option bonds provided both incremental return and income in an environment of low short-term borrowing costs and declining interest rates. |

Describe recent portfolio activity.

| Ÿ | Over the period, the Fund increased its overall duration (a measure of sensitivity to changes in interest rates), primarily by reducing the use of futures contracts. The Fund entered the period with concentrated positions in both the short and long ends of the yield curve. As yields declined and prices rose on longer-term bonds, the Fund’s overweighting of longer-term bonds was reduced, resulting in a more even distribution of maturities across holdings. With respect to credit, the Fund increased quality and liquidity by slightly reducing high yield in favor of A-rated bonds. At the sector level, exposure to pre-refunded/escrow bonds was reduced while exposure to local general obligations was increased. |

Describe portfolio positioning at period end.

| Ÿ | The Fund ended the period with a shorter duration posture as compared to the custom blended benchmark. The Fund was positioned with its largest exposures to state general obligation, dedicated tax and lease, utilities and health care bonds. The Fund maintained a high quality bias with its largest allocations to bonds rated AA, A or AAA. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

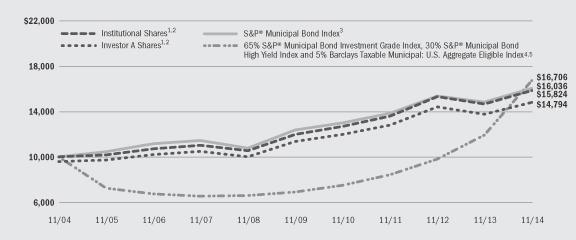

| BlackRock Strategic Municipal Opportunities Fund | ||||

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances the Fund invests at least 80% of its assets in municipal bonds. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | Effective January 27, 2014, the Fund replaced the S&P Intermediate Municipal Bond Index, a benchmark against which it measured performance, with a custom weighted index comprised of the returns of the S&P Municipal Bond Investment Grade Index (65%), the S&P Municipal Bond High Yield Index (30%), and the Barclays Taxable Municipal: U.S. Aggregate Eligible Index (5%). The investment advisor believes the customized weighted index more accurately reflects the investment strategies of the Fund. |

| 5 | See “About Fund Performance” on page 14 for descriptions of the indexes. |

| Performance Summary for the Period Ended November 30, 2014 |

| Average Annual Total Returns6 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 2.59 | % | 2.54 | % | 1.70 | % | 7.99 | % | N/A | 5.72 | % | N/A | 4.70 | % | N/A | |||||||||||||||||||||

Investor A | 2.24 | 2.19 | 1.49 | 7.75 | 3.17 | % | 5.45 | 4.54 | % | 4.45 | 3.99 | % | ||||||||||||||||||||||||

Investor A1 | 2.44 | 2.39 | 1.64 | 7.90 | 6.82 | 5.62 | 5.40 | 4.60 | 4.50 | |||||||||||||||||||||||||||

Investor C | 1.58 | 1.53 | 1.19 | 6.93 | 5.93 | 4.67 | 4.67 | 3.67 | 3.67 | |||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | 2.35 | 8.34 | N/A | 5.34 | N/A | 4.84 | N/A | |||||||||||||||||||||||||||

S&P Municipal Bond Investment Grade Index | — | — | 2.25 | 7.97 | N/A | 5.12 | N/A | 4.78 | N/A | |||||||||||||||||||||||||||

S&P Municipal Bond High Yield Index | — | — | 3.48 | 13.57 | N/A | 9.18 | N/A | 5.87 | N/A | |||||||||||||||||||||||||||

Barclays Taxable Municipal: U.S. Aggregate | — | — | 4.30 | 15.66 | N/A | 9.40 | N/A | 6.93 | N/A | |||||||||||||||||||||||||||

65% S&P® Municipal Bond Investment Grade Index, 30% S&P® Municipal Bond High Yield Index and 5% Barclays Taxable Municipal U.S. Aggregate Eligible Index | — | — | 2.73 | 10.01 | N/A | 6.55 | N/A | 5.27 | N/A | |||||||||||||||||||||||||||

| 6 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 14 for a description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

Past performance is not indicative of future results. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 11 |

| Portfolio Information as of November 30, 2014 | ||||

| BlackRock California Municipal Bond Fund |

| Sector Allocation | Percent of Long-Term Investments |

County/City/Special District/School District | 31 | % | ||

Utilities | 24 | |||

Health | 16 | |||

Transportation | 12 | |||

Education | 8 | |||

State | 8 | |||

Tobacco | 1 |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | Percent of Long-Term Investments |

AAA/Aaa | 15 | % | ||

AA/Aa | 63 | |||

A | 17 | |||

BBB/Baa | 2 | |||

N/R | 3 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| Call/Maturity Schedule2 | Percent of Long-Term Investments |

Calendar Year Ended December 31, | ||||

2014 | — | |||

2015 | 3 | % | ||

2016 | 8 | |||

2017 | 8 | |||

2018 | 8 |

| 2 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| BlackRock New Jersey Municipal Bond Fund |

| Sector Allocation | Percent of Long-Term Investments |

Transportation | 23 | % | ||

County/City/Special District/School District | 19 | |||

Health | 18 | |||

Education | 17 | |||

State | 13 | |||

Corporate | 4 | |||

Housing | 3 | |||

Utilities | 3 |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation3 | Percent of Long-Term Investments |

AAA/Aaa | 6 | % | ||

AA/Aa | 37 | |||

A | 43 | |||

BBB/Baa | 3 | |||

BB/Ba | 3 | |||

B | 2 | |||

N/R4 | 6 |

| 3 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 4 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of November 30, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $8,756,965, representing 3% of the Fund’s long-term investments. |

| Call/Maturity Schedule5 | Percent of Long-Term Investments |

Calendar Year Ended December 31, | ||||

2014 | — | |||

2015 | 6 | % | ||

2016 | 3 | |||

2017 | 9 | |||

2018 | 9 |

| 5 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| 12 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

| Portfolio Information as of November 30, 2014 (concluded) | ||||

| BlackRock Pennsylvania Municipal Bond Fund |

| Sector Allocation | Percent of Long-Term Investments |

Health | 23 | % | ||

Education | 22 | |||

State | 14 | |||

County/City/Special District/School District | 11 | |||

Transportation | 11 | |||

Corporate | 8 | |||

Housing | 7 | |||

Utilities | 4 |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation1 | Percent of Long-Term Investments |

AAA/Aaa | 2 | % | ||

AA/Aa | 59 | |||

A | 25 | |||

BBB/Baa | 9 | |||

N/R2 | 5 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of November 30, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $10,437,270, representing 2% of the Fund’s long-term investments. |

| Call/Maturity Schedule3 | Percent of Long-Term Investments |

Calendar Year Ended December 31, | ||||

2014 | — | |||

2015 | 7 | % | ||

2016 | 4 | |||

2017 | 6 | |||

2018 | 10 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| BlackRock Strategic Municipal Opportunities Fund |

| Sector Allocation | Percent of Long-Term Investments |

State | 29 | % | ||

County/City/Special District/School District | 17 | |||

Utilities | 14 | |||

Health | 12 | |||

Transportation | 11 | |||

Education | 10 | |||

Tobacco | 3 | |||

Corporate | 3 | |||

Investment Companies | 1 |

For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Credit Quality Allocation4 | Percent of Long-Term Investment |

AAA/Aaa | 21 | % | ||

AA/Aa | 42 | |||

A | 18 | |||

BBB/Baa | 4 | |||

BB/Ba | 4 | |||

B | 3 | |||

N/R5 | 8 |

| 4 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 5 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of November 30, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $4,490,720, representing less than 1% of the Fund’s long-term investments. |

| Call/Maturity Schedule6 | Percent of Long-Term Investments |

Calendar Year Ended December 31, | ||||

2014 | 1 | % | ||

2015 | 2 | |||

2016 | 4 | |||

2017 | 5 | |||

2018 | 3 |

| 6 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 13 |

| About Fund Performance | ||||

| Ÿ | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| Ÿ | Service Shares (available only in BlackRock New Jersey Municipal Bond Fund and BlackRock Pennsylvania Municipal Bond Fund) are not subject to any sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are available only to eligible investors. Prior to the Service Shares inception date of October 2, 2006, Service Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect Service Share fees. |

| Ÿ | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. Prior to the Investor A Shares inception date of October 2, 2006, Investor A Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect Investor A Share fees. |

| Ÿ | Investor A1 Shares (for all Funds except BlackRock Strategic Municipal Opportunities Fund) are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.10% per year (but no distribution fee). Investor A1 Shares for BlackRock Strategic Municipal Opportunities Fund incur a maximum initial sales charge (front-end load) of 1.00% and a service fee of 0.10% per year (but no distribution fee). Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at the time of purchase. |

| Ÿ | Investor B Shares (available only in BlackRock California Municipal Bond Fund) are subject to a maximum CDSC of 4.00% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.25% and a service fee of 0.25% per year. |

These shares automatically convert to Investor A1 Shares after approximately 10 years. (There is no initial sales charge for automatic share conversions.) On June 10, 2013, all issued and outstanding Investor B Shares of BlackRock New Jersey Municipal Bond Fund and BlackRock Pennsylvania Municipal Bond Fund were converted into Investor A Shares with the same relative aggregate net asset value and all issued and outstanding Investor B Shares of BlackRock Strategic Municipal Opportunities Fund were converted into Investor A1 Shares with the same relative aggregate net asset value.

| Ÿ | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. Prior to the Investor C Shares inception date of October 2, 2006, Investor C Share performance results are those of Institutional Shares (which have no distribution or service fees) restated to reflect Investor C Share fees. |

| Ÿ | Investor C1 Shares (available in all Funds except BlackRock Strategic Municipal Opportunities Fund) are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.35% per year and a service fee of 0.25% per year. |

Investor A1, Investor B and Investor C1 Shares are only available through exchanges and dividend reinvestments by current holders and for purchase by certain employer-sponsored retirement plans.

On June 10, 2013, all issued and outstanding Investor B1 Shares of BlackRock New Jersey Municipal Bond Fund and BlackRock Pennsylvania Municipal Bond Fund were converted into Investor A1 Shares with the same relative aggregate net asset value.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original costs. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders. The Funds’ investment advisor waived and/or reimbursed a portion of each Fund’s expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

Barclays Taxable Municipal: U.S. Aggregate Eligible Index — represents securities that are taxable, dollar denominated, and issued by a U.S. state or territory, and have at least one year to final maturity regardless of call features, have at least $250 million par amount outstanding, and are rated investment-grade (at least BBB- by S&P or Fitch Ratings (“Fitch”) and/or Baa3 by Moody’s) by at least two of the following ratings agencies: S&P, Moody’s and Fitch.

S&P® Municipal Bond High Yield Index — a market-value-weighted index that consists of bonds in the S&P Municipal Bond Index that are non-rated or that are rated BB+ by S&P and/or Ba1 by Moody’s or lower; bonds that are prerefunded or escrowed to maturity are not included in this index.

S&P® Municipal Bond Investment Grade Index — a market-value-weighted index that consists of bonds in the S&P Municipal Bond Index that are rated at least BBB- by S&P and/or Baa3 by Moody’s.

| 14 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

| Disclosure of Expenses |

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples shown below (which are based on a hypothetical investment of $1,000 invested on June 1, 2014 and held through November 30, 2014) are intended to assist shareholders both in calculating expenses based on an investment in the Funds and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| Expense Examples |

| Actual | Hypothetical2 | |||||||||||||||||||||||||||

| BlackRock California Municipal Bond Fund (Including Interest Expense and Fees) | Beginning Account Value June 1, 2014 | Ending Account Value November 30, 2014 | Expenses Paid During the Period1 | Beginning Account Value June 1, 2014 | Ending Account Value November 30, 2014 | Expenses Paid During the Period1 | Annualized Expense Ratio | |||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,030.60 | $ | 3.46 | $ | 1,000.00 | $ | 1,021.66 | $ | 3.45 | 0.68 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,029.60 | $ | 4.43 | $ | 1,000.00 | $ | 1,020.71 | $ | 4.41 | 0.87 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,029.40 | $ | 3.82 | $ | 1,000.00 | $ | 1,021.31 | $ | 3.80 | 0.75 | % | ||||||||||||||

Investor B | $ | 1,001.00 | $ | 1,027.20 | $ | 6.76 | $ | 1,001.00 | $ | 1,018.40 | $ | 6.73 | 1.33 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,024.90 | $ | 8.27 | $ | 1,000.00 | $ | 1,016.90 | $ | 8.24 | 1.63 | % | ||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 1,026.80 | $ | 6.40 | $ | 1,000.00 | $ | 1,018.75 | $ | 6.38 | 1.26 | % | ||||||||||||||

| BlackRock California Municipal Bond Fund (Excluding Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,030.60 | $ | 3.31 | $ | 1,000.00 | $ | 1,021.81 | $ | 3.29 | 0.65 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,029.60 | $ | 4.27 | $ | 1,000.00 | $ | 1,020.86 | $ | 4.26 | 0.84 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,029.40 | $ | 3.71 | $ | 1,000.00 | $ | 1,021.41 | $ | 3.70 | 0.73 | % | ||||||||||||||

Investor B | $ | 1,001.00 | $ | 1,027.20 | $ | 6.61 | $ | 1,001.00 | $ | 1,018.55 | $ | 6.58 | 1.30 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,024.90 | $ | 8.12 | $ | 1,000.00 | $ | 1,017.05 | $ | 8.09 | 1.60 | % | ||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 1,026.80 | $ | 6.25 | $ | 1,000.00 | $ | 1,018.90 | $ | 6.23 | 1.23 | % | ||||||||||||||

| BlackRock New Jersey Municipal Bond Fund (Including Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,029.60 | $ | 3.87 | $ | 1,000.00 | $ | 1,021.26 | $ | 3.85 | 0.76 | % | ||||||||||||||

Service | $ | 1,000.00 | $ | 1,028.10 | $ | 4.37 | $ | 1,000.00 | $ | 1,020.76 | $ | 4.36 | 0.86 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,029.00 | $ | 4.37 | $ | 1,000.00 | $ | 1,010.76 | $ | 4.36 | 0.86 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,029.60 | $ | 3.77 | $ | 1,000.00 | $ | 1,021.36 | $ | 3.75 | 0.74 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,025.10 | $ | 8.27 | $ | 1,000.00 | $ | 1,016.90 | $ | 8.24 | 1.63 | % | ||||||||||||||

Investor C1 | �� | $ | 1,000.00 | $ | 1,027.00 | $ | 6.35 | $ | 1,000.00 | $ | 1,018.80 | $ | 6.33 | 1.25 | % | |||||||||||||

| BlackRock New Jersey Municipal Bond Fund (Excluding Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,029.60 | $ | 3.77 | $ | 1,000.00 | $ | 1,021.36 | $ | 3.75 | 0.74 | % | ||||||||||||||

Service | $ | 1,000.00 | $ | 1,028.10 | $ | 4.27 | $ | 1,000.00 | $ | 1,020.86 | $ | 4.26 | 0.84 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,029.00 | $ | 4.27 | $ | 1,000.00 | $ | 1,020.86 | $ | 4.26 | 0.84 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,029.60 | $ | 3.66 | $ | 1,000.00 | $ | 1,021.46 | $ | 3.65 | 0.72 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,025.10 | $ | 8.17 | $ | 1,000.00 | $ | 1,017.00 | $ | 8.14 | 1.61 | % | ||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 1,027.00 | $ | 6.25 | $ | 1,000.00 | $ | 1,018.90 | $ | 6.23 | 1.23 | % | ||||||||||||||

| 1 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). |

| 2 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 15 |

| Disclosure of Expenses (concluded) | ||||

| Expense Examples (concluded) |

| Actual | Hypothetical2 | |||||||||||||||||||||||||||

| BlackRock Pennsylvania Municipal Bond Fund (Including Interest Expense and Fees) | Beginning Account Value June 1, 2014 | Ending Account Value November 30, 2014 | Expenses Paid During the Period1 | Beginning Account Value June 1, 2014 | Ending Account Value November 30, 2014 | Expenses Paid During the Period1 | Annualized Expense Ratio | |||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,037.80 | $ | 3.98 | $ | 1,000.00 | $ | 1,021.16 | $ | 3.95 | 0.78 | % | ||||||||||||||

Service | $ | 1,000.00 | $ | 1,035.90 | $ | 4.90 | $ | 1,000.00 | $ | 1,020.26 | $ | 4.86 | 0.96 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,035.90 | $ | 4.90 | $ | 1,000.00 | $ | 1,020.26 | $ | 4.86 | 0.96 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,036.70 | $ | 4.08 | $ | 1,000.00 | $ | 1,021.06 | $ | 4.05 | 0.80 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,032.70 | $ | 8.87 | $ | 1,000.00 | $ | 1,016.34 | $ | 8.80 | 1.74 | % | ||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 1,034.90 | $ | 6.78 | $ | 1,000.00 | $ | 1,018.40 | $ | 6.73 | 1.33 | % | ||||||||||||||

| BlackRock Pennsylvania Municipal Bond Fund (Excluding Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,037.80 | $ | 3.63 | $ | 1,000.00 | $ | 1,021.51 | $ | 3.60 | 0.71 | % | ||||||||||||||

Service | $ | 1,000.00 | $ | 1,035.90 | $ | 4.54 | $ | 1,000.00 | $ | 1,020.61 | $ | 4.51 | 0.89 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,035.90 | $ | 4.54 | $ | 1,000.00 | $ | 1,020.61 | $ | 4.51 | 0.89 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,036.70 | $ | 3.73 | $ | 1,000.00 | $ | 1,021.41 | $ | 3.70 | 0.73 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,032.70 | $ | 8.56 | $ | 1,000.00 | $ | 1,016.65 | $ | 8.49 | 1.68 | % | ||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 1,034.90 | $ | 6.43 | $ | 1,000.00 | $ | 1,018.75 | $ | 6.38 | 1.26 | % | ||||||||||||||

| BlackRock Strategic Municipal Opportunities Fund (Including Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,017.00 | $ | 3.24 | $ | 1,000.00 | $ | 1,021.86 | $ | 3.24 | 0.64 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,014.90 | $ | 4.39 | $ | 1,000.00 | $ | 1,020.71 | $ | 4.41 | 0.87 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,016.40 | $ | 3.79 | $ | 1,000.00 | $ | 1,021.31 | $ | 3.80 | 0.75 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,011.90 | $ | 8.27 | $ | 1,000.00 | $ | 1,016.85 | $ | 8.29 | 1.64 | % | ||||||||||||||

| BlackRock Strategic Municipal Opportunities Fund (Excluding Interest Expense and Fees) | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 1,017.00 | $ | 2.98 | $ | 1,000.00 | $ | 1,022.11 | $ | 2.99 | 0.59 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 1,014.90 | $ | 4.14 | $ | 1,000.00 | $ | 1,020.96 | $ | 4.15 | 0.82 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 1,016.40 | $ | 3.49 | $ | 1,000.00 | $ | 1,021.61 | $ | 3.50 | 0.69 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 1,011.90 | $ | 8.02 | $ | 1,000.00 | $ | 1,017.10 | $ | 8.04 | 1.59 | % | ||||||||||||||

| 1 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). |

| 2 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| 16 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

| The Benefits and Risks of Leveraging |

The Funds may utilize leverage to seek to enhance yield and NAV. However, these objectives cannot be achieved in all interest rate environments.

Each Fund may leverage its assets through the use of proceeds received in tender option bond (“TOB”) transactions, as described in Note 3 of the Notes to Financial Statements. In a TOB transaction, a third party sponsor establishes a special purpose entity (a “TOB Trust”) into which the Fund transfers municipal bonds or other municipal securities. TOB investments generally will provide the Fund with economic benefits in periods of declining short-term interest rates, but expose the Fund to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into a TOB Trust may adversely affect the Fund’s NAV per share.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which will be based on short-term interest rates, will normally be lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Fund’s shareholders will benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to Fund shareholders, and the value of these portfolio holdings is reflected in the Fund’s per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders will be lower than if the Fund had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on Fund performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage will also generally cause greater changes in each Fund’s NAV and distribution rates than a comparable fund that does not use leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund will incur expenses in connection with the use of leverage, all of which are borne by Fund shareholders and may reduce income.

| Derivative Financial Instruments |

The Funds may invest in various derivative financial instruments. Derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage. Derivative financial instruments also involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 17 |

BlackRock California Municipal Bond Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||

California — 92.8% |

| |||||||

County/City/Special District/School District — 29.7% |

| |||||||

Centinela Valley Union High School District, GO, Election of 2010, Series A, 5.75%, 8/01/36 | $ | 1,690 | $ | 2,046,489 | ||||

Centinela Valley Union High School District, GO, Refunding, Election of 2008, Series B, 6.00%, 8/01/36 | 2,000 | 2,456,920 | ||||||

Chaffey Joint Union High School District, GO, Election of 2012, Series A, 5.00%, 8/01/33 | 3,105 | 3,578,668 | ||||||

City & County of San Francisco California, COP, Series C, AMT, 5.25%, 3/01/33 | 140 | 160,021 | ||||||

City of Los Angeles California, COP, Senior, Sonnenblick Del Rio West Los Angeles (AMBAC), 6.20%, 11/01/31 | 4,000 | 4,017,000 | ||||||

City of Martinez California, GO, Election of 2008, Series A, 5.88%, 2/01/39 | 6,035 | 7,079,477 | ||||||

City of Sacramento California Unified School District, GO, Election of 2002 (NPFGC), 5.00%, 7/01/30 | 7,000 | 7,174,650 | ||||||

City of San Jose California Hotel Tax, RB, Convention Center Expansion & Renovation Project, 6.50%, 5/01/42 | 2,395 | 2,920,583 | ||||||

County of Orange California Sanitation District, COP, Series A, 5.00%, 2/01/39 | 2,800 | 3,149,104 | ||||||

County of Orange California Water District, COP, Refunding, Series A, 5.00%, 8/15/32 | 3,030 | 3,486,288 | ||||||

County of San Joaquin California Transportation Authority, Refunding RB, Limited Tax, Measure K, Series A: | ||||||||

6.00%, 3/01/36 | 2,955 | 3,613,847 | ||||||

5.50%, 3/01/41 | 10,450 | 12,264,852 | ||||||

County of San Mateo California Community College District, GO, Election of 2005, Series B, 5.00%, 9/01/16 (a) | 19,000 | 20,540,140 | ||||||

County of Santa Clara California Financing Authority, Refunding LRB, Series L, 5.25%, 5/15/36 | 9,845 | 10,870,849 | ||||||

County of Ventura California, COP, Refunding, Public Financing Authority III, 5.75%, 8/15/29 | 1,000 | 1,172,440 | ||||||

Grossmont Healthcare District, GO, Election of 2006, Series B: | ||||||||

6.00%, 7/15/34 | 2,755 | 3,380,357 | ||||||

6.13%, 7/15/40 | 3,045 | 3,759,479 | ||||||

Los Angeles Community College District California, GO, Election of 2008, Series C, 5.25%, 8/01/39 | 5,495 | 6,368,210 | ||||||

Los Angeles Community College District California, GO, Refunding, Election of 2008, Series A, 6.00%, 8/01/33 | 6,250 | 7,515,125 | ||||||

California (continued) |

| |||||||

County/City/Special District/School District (concluded) |

| |||||||

Millbrae School District, GO, Series B-2, 6.00%, 7/01/41 | $ | 2,585 | $ | 3,147,418 | ||||

Pittsburg Unified School District, GO, Election of 2006, Series B (AGM), 5.63%, 8/01/39 | 5,000 | 5,639,000 | ||||||

Riverside County Transportation Commission, Refunding RB, Limited Tax, Series A, 5.25%, 6/01/39 | 3,000 | 3,479,130 | ||||||

San Diego Regional Building Authority, RB, County Operations Center & Annex, Series A, 5.38%, 2/01/36 | 5,455 | 6,235,774 | ||||||

San Francisco California Bay Area Rapid Transit District, GO, Election of 2004, Series B, 5.00%, 8/01/32 | 18,050 | 19,927,742 | ||||||

San Francisco California Bay Area Rapid Transit District, Refunding RB, Series A (NPFGC), 5.00%, 7/01/30 | 4,770 | 4,897,502 | ||||||

San Jose California Financing Authority, LRB, Convention Center Expansion & Renovation Project, Series A, 5.75%, 5/01/42 | 2,010 | 2,407,357 | ||||||

San Leandro California Unified School District, GO, Election of 2010, Series A, 5.75%, 8/01/41 | 5,000 | 5,886,650 | ||||||

South San Francisco Unified School District, GO, Series G, 3.50%, 7/01/18 | 15,000 | 16,408,650 | ||||||

West Contra Costa California Unified School District, GO, Election of 2010, Series A (AGM), 5.25%, 8/01/41 | 4,395 | 4,901,700 | ||||||

|

| |||||||

| 178,485,422 | ||||||||

Education — 6.7% | ||||||||

California Educational Facilities Authority, RB, California Institute of Technology, 5.00%, 11/01/39 | 7,000 | 8,043,910 | ||||||

California Educational Facilities Authority, Refunding RB: | ||||||||

Pitzer College, 6.00%, 4/01/40 | 2,500 | 2,964,125 | ||||||

San Francisco University, 6.13%, 10/01/30 | 1,250 | 1,532,400 | ||||||

California Municipal Finance Authority, RB: | ||||||||

6.00%, 7/01/44 | 500 | 492,480 | ||||||

Emerson College, 6.00%, 1/01/42 | 7,000 | 8,147,650 | ||||||

Series A, 5.00%, 10/01/44 | 2,000 | 2,010,680 | ||||||

California Statewide Communities Development Authority, Refunding RB, 5.00%, 11/15/44 | 2,250 | 2,485,958 | ||||||

University of California, RB: | ||||||||

Series AM, 5.25%, 5/15/44 | 10,230 | 11,921,530 | ||||||

Series O, 5.75%, 5/15/34 | 2,500 | 2,928,275 | ||||||

|

| |||||||

| 40,527,008 | ||||||||

| Portfolio Abbreviations |

| AGC | Assured Guarantee Corp. | GARB | General Airport Revenue Bonds | |||||||

| AGM | Assured Guaranty Municipal Corp. | GO | General Obligation Bonds | |||||||

| AMBAC | American Municipal Bond Assurance Corp. | HFA | Housing Finance Agency | |||||||

| AMT | Alternative Minimum Tax (subject to) | HUD | Department of Housing and Urban Development | |||||||

| ARB | Airport Revenue Bonds | IDA | Industrial Development Authority | |||||||

| BHAC | Berkshire Hathaway Assurance Corp. | LRB | Lease Revenue Bonds | |||||||

| CAB | Capital Appreciation Bonds | M/F | Multi-Family | |||||||

| CIFG | CIFG Assurance North America, Inc. | MRB | Mortgage Revenue Bonds | |||||||

| COP | Certificates of Participation | NPFGC | National Public Finance Guarantee Corp. | |||||||

| EDA | Economic Development Authority | RB | Revenue Bonds | |||||||

| EDC | Economic Development Corp. | S/F | Single-Family | |||||||

| ETF | Exchange-Traded Fund | SPDR | Standard & Poor’s Depository Receipts | |||||||

| GAN | Grant Anticipation Notes |

See Notes to Financial Statements.

| 18 | SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 |

Schedule of Investments (continued) | BlackRock California Municipal Bond Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) | Value | ||||||

California (continued) |

| |||||||

Health — 14.3% | ||||||||

ABAG Finance Authority for Nonprofit Corps., Refunding RB, Sharp Healthcare: | ||||||||

Series A, 6.00%, 8/01/30 | $ | 2,020 | $ | 2,468,763 | ||||

Series B, 6.25%, 8/01/39 | 3,775 | 4,432,190 | ||||||

California Health Facilities Financing Authority, RB: | ||||||||

Adventist Health System West, Series A, 5.75%, 9/01/39 | 5,310 | 6,137,882 | ||||||

Children’s Hospital, Series A, 5.25%, 11/01/41 | 7,060 | 7,786,403 | ||||||

Scripps Health, Series A, 5.00%, 11/15/40 | 7,530 | 8,271,404 | ||||||

Sutter Health, Series A (BHAC), 5.00%, 11/15/42 | 14,415 | 15,412,374 | ||||||

Sutter Health, Series B, 6.00%, 8/15/42 | 9,680 | 11,656,075 | ||||||

California Health Facilities Financing Authority, Refunding RB: | ||||||||

Catholic Healthcare West, Series A, 6.00%, 7/01/29 | 2,000 | 2,364,680 | ||||||

Catholic Healthcare West, Series A, 6.00%, 7/01/39 | 6,000 | 6,990,420 | ||||||

Stanford Hospital, Series A-3, 5.50%, 11/15/40 | 10,500 | 12,464,865 | ||||||

California Statewide Communities Development Authority, Refunding RB: | ||||||||

Kaiser Permanente, Series C, 5.25%, 8/01/31 | 2,500 | 2,653,600 | ||||||

Trinity Health Credit Group Composite Issue, 5.00%, 12/01/41 | 5,000 | 5,508,250 | ||||||

|

| |||||||

| 86,146,906 | ||||||||

State — 7.8% | ||||||||

State of California, GO, Various Purposes: | ||||||||

6.00%, 3/01/33 | 4,195 | 5,129,310 | ||||||

6.00%, 4/01/38 | 15,570 | 18,649,123 | ||||||

State of California Public Works Board, LRB: | ||||||||

Correctional Facilities Improvements, Series A, 5.00%, 9/01/39 | 1,500 | 1,695,150 | ||||||

Department of Education, Riverside Campus Project, Series B, 6.50%, 4/01/34 | 10,000 | 12,112,700 | ||||||

Department of General Services, Buildings 8 & 9, Series A, 6.25%, 4/01/34 | 2,425 | 2,911,916 | ||||||

Various Capital Projects, Series I, 5.25%, 11/01/32 | 1,115 | 1,308,386 | ||||||

Various Capital Projects, Series I, 5.50%, 11/01/33 | 2,295 | 2,763,409 | ||||||

Various Capital Projects, Sub-Series I-1, 6.38%, 11/01/34 | 1,725 | 2,119,991 | ||||||

|

| |||||||

| 46,689,985 | ||||||||

Tobacco — 1.0% | ||||||||

Golden State Tobacco Securitization Corp., Refunding RB, Asset Backed, Senior, Series A-1, 5.75%, 6/01/47 | 7,025 | 5,888,917 | ||||||

Transportation — 12.9% |

| |||||||

City & County of San Francisco California Airports Commission, ARB: | ||||||||

Series E, 6.00%, 5/01/39 | 5,150 | 6,099,814 | ||||||

Special Facility Lease, SFO Fuel, Series A, AMT (AGM), 6.10%, 1/01/20 | 1,250 | 1,255,863 | ||||||

City & County of San Francisco California Airports Commission, Refunding ARB, 2nd Series A, AMT, 5.25%, 5/01/33 | 1,645 | 1,879,215 | ||||||

California (concluded) |

| |||||||

Transportation (concluded) |

| |||||||

City of Los Angeles California Department of Airports, Refunding ARB, Los Angeles International Airport, Series A, Senior: | ||||||||

5.00%, 5/15/34 | $ | 8,600 | $ | 9,805,376 | ||||

5.00%, 5/15/40 | 25,765 | 29,175,513 | ||||||

City of Los Angeles California Department of Airports, Refunding RB, Los Angeles International Airport, Senior Series A, AMT, 5.38%, 5/15/33 | 1,010 | 1,121,221 | ||||||

City of San Jose California, Refunding ARB, Series A-1, AMT: | ||||||||

5.75%, 3/01/34 | 4,570 | 5,189,875 | ||||||

6.25%, 3/01/34 | 2,450 | 2,867,578 | ||||||

County of Orange California, ARB, Series B, 5.75%, 7/01/34 | 3,000 | 3,340,350 | ||||||

County of Sacramento California, ARB: | ||||||||

Senior Series B, 5.75%, 7/01/39 | 1,600 | 1,815,264 | ||||||

Subordinated & Passenger Facility Charges/Grant, Series C (AGC), 5.75%, 7/01/39 | 3,150 | 3,583,220 | ||||||

San Francisco Municipal Transportation Agency, RB, 5.00%, 3/01/44 (b) | 10,000 | 11,337,700 | ||||||

|

| |||||||

| 77,470,989 | ||||||||

Utilities — 20.4% | ||||||||

City of Los Angeles California Department of Water & Power, Refunding RB, Series A, 5.25%, 7/01/39 | 8,000 | 9,004,640 | ||||||

City of Los Angeles California Wastewater System, Refunding RB, Series A, 5.38%, 6/01/39 | 5,000 | 5,768,400 | ||||||

City of Petaluma California Wastewater, Refunding RB, 6.00%, 5/01/36 | 5,625 | 6,820,200 | ||||||

City of San Juan California Water District, COP, Series A, 6.00%, 2/01/39 | 5,700 | 6,628,530 | ||||||

County of Orange California Sanitation District, COP, Series B (AGM), 5.00%, 2/01/37 | 8,015 | 8,643,216 | ||||||

County of Sacramento California Sanitation Districts Financing Authority, RB: | ||||||||

5.00%, 6/01/16 (a) | 8,000 | 8,557,200 | ||||||

5.00%, 12/01/36 | 2,890 | 3,057,649 | ||||||

County of San Diego California Water Authority, COP, Refunding, Series A (AGM), 5.00%, 5/01/33 | 4,760 | 5,252,041 | ||||||

Dublin-San Ramon Services District Water, Refunding RB, 5.50%, 8/01/36 | 4,235 | 4,979,682 | ||||||

Los Angeles Department of Water & Power, RB, Power System, Sub-Series A-1, 5.25%, 7/01/38 | 5,330 | 5,958,887 | ||||||

Metropolitan Water District of Southern California, RB, Authorization, Series A, 5.00%, 1/01/39 | 17,005 | 19,042,029 | ||||||

Metropolitan Water District of Southern California, Refunding RB, Series A, 5.00%, 10/01/35 | 5,000 | 5,725,250 | ||||||

San Diego Public Facilities Financing Authority Sewer, Refunding RB: | ||||||||

Senior Series A, 5.25%, 5/15/29 | 4,000 | 4,649,440 | ||||||

Senior Series A, 5.25%, 5/15/34 | 13,000 | 14,888,770 | ||||||

Series B, 5.75%, 8/01/35 | 5,000 | 5,923,550 | ||||||

Tuolumne Wind Project Authority, RB, Tuolumne Co. Project, Series A, 5.88%, 1/01/29 | 6,395 | 7,543,030 | ||||||

|

| |||||||

| 122,442,514 | ||||||||

| Total Municipal Bonds — 92.8% | 557,651,741 | |||||||

See Notes to Financial Statements.

| SEMI-ANNUAL REPORT | NOVEMBER 30, 2014 | 19 |

Schedule of Investments (continued) | BlackRock California Municipal Bond Fund (Percentages shown are based on Net Assets) |

| Municipal Bonds Transferred to Tender Option Bond Trusts (c) | Par (000) | Value | ||||||

California — 11.7% | ||||||||

County/City/Special District/School District — 2.3% |

| |||||||

County of Orange California Water District, COP, Refunding, Series A, 5.25%, 8/15/34 | $ | 12,200 | $ | 14,108,934 | ||||

Education — 1.8% |

| |||||||

California State University, Refunding RB, Systemwide, Series A (AGM), 5.00%, 11/01/32 | 10,000 | 10,864,600 | ||||||

Health — 2.8% |

| |||||||

California Statewide Communities Development Authority, RB, Kaiser Permanente, Series A, 5.00%, 4/01/42 | 15,000 | 16,518,900 | ||||||

Utilities — 4.8% |

| |||||||

City & County of San Francisco California Public Utilities Commission, RB, Water Revenue, Series B, 5.00%, 11/01/39 | 13,000 | 14,813,630 | ||||||

San Diego Public Facilities Financing Authority Sewer, Refunding RB, Senior Series A, 5.25%, 5/15/39 | 12,108 | 13,828,179 | ||||||

|

| |||||||

| 28,641,809 | ||||||||

| Total Municipal Bonds Transferred to Tender Option Bond Trusts — 11.7% | 70,134,243 | |||||||

| Total Long-Term Investments (Cost — $ 578,525,179) — 104.5% | 627,785,984 | |||||||

| Short-Term Securities | Shares | Value | ||||||

Money Market Funds — 1.4% | ||||||||

BIF California Municipal Money Fund, | 8,600,510 | $ | 8,600,510 | |||||

| Municipal Bonds — 0.3% | Par (000) | |||||||

County/City/Special District/School District — 0.3% |

| |||||||

California School Cash Reserve Program Authority, RB, Series G, 2.00%, 2/27/15 | $ | 1,670 | 1,676,881 | |||||

| Total Short-Term Securities (Cost — $10,276,684) — 1.7% | 10,277,391 | |||||||

| Total Investments (Cost — $588,801,863) — 106.2% | 638,063,375 | |||||||

| Liabilities in Excess of Other Assets — (1.0)% | (6,325,393 | ) | ||||||

Liability for TOB Trust Certificates, Including Interest |

| (31,156,646 | ) | |||||

|

| |||||||

| Net Assets — 100.0% | $ | 600,581,336 | ||||||

|

| |||||||

| Notes to Schedule of Investments |

| (a) | U.S. government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the date indicated, typically at a premium to par. |

| (b) | When-issued security. Unsettled when-issued transactions were as follows: |