Exhibit 4.15

NET SMELTER RETURNS

ROYALTY DEED

AMONG

CALEDONIA MINING CORPORATION PLC

AND

BILBOES HOLDINGS (PRIVATE) LIMITED

AND

BAKER STEEL RESOURCES TRUST LIMITED

TABLE OF CONTENTS

ARTICLE 1 INTERPRETATION | 2 |

| | |

1.1 | Definitions | 2 |

1.2 | Exhibits | 5 |

1.3 | Governing Law and Dispute Resolution | 5 |

1.4 | Severability | 6 |

1.5 | Calculation of Time | 6 |

1.6 | Headings | 6 |

1.7 | Other Matters of Interpretation | 6 |

| | | |

ARTICLE 2 ROYALTY GRANT | 7 |

| | |

2.1 | Grant of Royalty | 7 |

2.2 | Duration of Royalty | 7 |

| | | |

ARTICLE 3 ROYALTY PAYMENTS | 7 |

| | |

3.1 | Payment Commencement | 7 |

3.2 | Due Date | 7 |

3.3 | Royalty Statements | 7 |

3.4 | Provisional Settlements | 8 |

3.5 | Books and Records | 8 |

3.6 | Payment Form and Challenge | 8 |

3.7 | Zimbabwe Restrictions | 9 |

3.8 | No Payments In Kind | 9 |

3.9 | Capped Payments | 9 |

| | | |

ARTICLE 4 OPERATIONAL MATTERS | 9 |

| | |

4.1 | Control over Operations | 9 |

4.2 | Stockpilings and Tailings | 10 |

4.3 | Commingling | 10 |

| | | |

ARTICLE 5 PROPERTY MATTERS | 10 |

| | |

5.1 | Intention of Parties | 10 |

5.2 | Obligation to Maintain and Perfect | 11 |

5.3 | Abandonment Process | 11 |

5.4 | Reclamation Liabilities | 11 |

5.5 | Insurance | 12 |

5.6 | Registration on Title | 12 |

5.7 | Hedging of Product | 12 |

| | | |

ARTICLE 6 REPORTS AND INSPECTIONS | 12 |

| | |

6.1 | Annual Reports | 12 |

6.2 | Technical Reports | 12 |

6.3 | Inspections | 13 |

| | | |

ARTICLE 7 TRANSFERS AND ASSIGNMENT | 13 |

| | |

7.1 | By the Royalty Holder | 13 |

7.2 | By Payor | 14 |

| | | |

ARTICLE 8 WARRANTIES | | 14 |

| | | |

8.1 | Warranties of All Parties | 14 |

- 2 -

8.2 | Warranty Expiry | 15 |

| | | |

ARTICLE 9 MISCELLANEOUS | 15 |

| | |

9.1 | Competing Interests | 15 |

9.2 | Confidentiality | 15 |

9.3 | Amendment | 16 |

9.4 | No Partnership | 16 |

9.5 | Notice | 16 |

9.6 | Further Assurances | 17 |

9.7 | No Waivers | 17 |

9.8 | Time of the Essence | 17 |

9.9 | Counterparts | 17 |

9.10 | Parties in Interest | 17 |

9.11 | Termination | 17 |

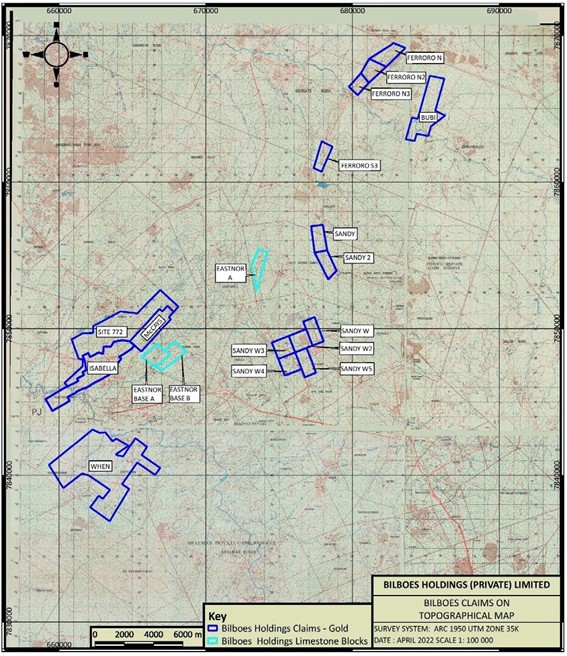

EXHIBIT I – THE PROPERTY

EXHIBIT II – THE ROYALTY AREA

NET SMELTER RETURNS ROYALTY DEED

THIS DEED is dated as of the 6 day of January , 2023

AMONG:

CALEDONIA MINING CORPORATION PLC, a company governed by the laws of Jersey with company number 120924 with its registered address at B006 Millais House, Castle Quay, St Helier, Jersey JE2 3EF Channel Islands

("Caledonia")

AND

BILBOES HOLDINGS (PRIVATE) LIMITED, a company governed by the laws of the Republic of Zimbabwe with registered number 113/82 with its registered address at 3 Cecil Rhodes Drive, Newlands, P O Box 3503, Harare, Zimbabwe

(the "Payor")

AND

BAKER STEEL RESOURCES TRUST LIMITED, a company validly subsisting under the laws of Guernsey with registered number 51576 with its registered address at Arnold House, St. Julian’s Avenue, St. Peter Port, Guernsey, GY1 3NF Channel Islands

(the "Royalty Holder")

WHEREAS the Royalty Holder and Caledonia, amongst others, entered into a Purchase Agreement (as defined below) pursuant to which Caledonia agreed to purchase the entire issued share capital of Bilboes Gold Limited, which owns all of the shares of the Payor, from, amongst others, the Royalty Holder;

AND WHEREAS under the terms of the Purchase Agreement the parties shall enter into this Deed and the Payor shall grant and convey to the Royalty Holder a 1.0% net smelter royalty on Completion (as defined in the Purchase Agreement);

NOW THEREFORE in consideration of the mutual covenants and agreements contained in this Deed and for other good and valuable consideration (the receipt and adequacy of which are acknowledged), the Parties agree as follows:

WITNESSETH by this Deed the Parties' covenants and agreements as follows:

ARTICLE 1

INTERPRETATION

In this Deed, unless otherwise provided:

| | (a) | "Acceptable Accounting Standards" means International Financial Reporting Standards as issued by the International Accounting Standards Board. |

| | (b) | "Affiliate" means with respect to a person, any other person that directly, or indirectly through one or more intermediaries, Controls, is Controlled by or is under common Control with, the subject person. |

| | (c) | "Alien Product" shall have the meaning given in Clause 4.3(a). |

| | (d) | "Allowable Deductions" means, for any Quarter, all costs, charges and expenses paid, incurred or suffered by the Payor during that Quarter for or with respect to Products in respect of: |

| | (i) | third party smelting or refining of Products, including any penalties; |

| | (ii) | weighing, sampling, assaying, umpire and representation services; |

| | (iii) | transportation of Products from the Property to the place of third party processing (including loading, freight, insurance, security, handling, port, demurrage, delay, and forwarding expenses incurred by reason of or in the course of transportation); |

| | (iv) | insurance in respect of the transportation of Products; and |

| | (v) | any early settlement discount paid to the smelter of the Products including but not limited to Fidelity Printers and Refiners (Private) Limited; |

and, for purposes of clarity, there shall be no deductions:

| | (vi) | pertaining to any crushing, milling or the processing of material through a CIL Plant; or |

| | (vii) | in respect of a Loss, unless Allowable Deductions were incurred by the Payor in respect of the Products that were the subject of the Loss. |

| | (e) | "Annual Report" means a written report including: |

| | (i) | an updated mine operating plan and forecast production pertaining to the year of the report; |

| | (ii) | a summary of any material permits needed to implement the mine operating plan (with a description of any permits that could suspend or impede production if not obtained); |

| | (iii) | if available, an updated resource and reserve statement in respect of the Property; and |

| | (iv) | a reconciliation between the information provided in the Quarterly financial statements and final annual information. |

| | (f) | "Blanket Mine" means the Blanket Gold Mine located in the south-west of Zimbabwe approximately 15 kilometres west of Gwanda and owned by Blanket Mine (1983) (Private) Limited, a 64% subsidiary of Caledonia. |

| | (g) | "Business Day" means a day that is not a Saturday, Sunday or any other day which is a statutory holiday or a bank holiday in either Harare, Zimbabwe, London, England, or Jersey and Guernsey, Channel Islands. |

| | (h) | "CIL Plant" means a carbon-in leach plant. |

| | (i) | "Commingle" shall have the meaning given in Clause 4.3(a); and “Commingling” and “Commingled” shall have corresponding meanings. |

| | (j) | "Concentrate" means any material resulting from the separation, washing, treatment, beneficiation or other form of processing of Ore, including any processing of Products via a CIL Plant. |

| | (k) | "Control" or "Controlled" means: |

| | (A) | with respect to an entity, the ability, directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of the entity through the legal or beneficial ownership of voting securities or the right to appoint managers, directors or corporate management, or by contract, voting trust or otherwise; and |

| | (B) | with respect to a natural person, the actual or legal ability to control the actions of another, through family relationship, agency, contract or otherwise, and |

| | (ii) | when used as a noun, an interest that gives the holder the ability to exercise any of the powers described in clause (i). |

| | (l) | "Deed" means this net smelter returns royalty deed together with its exhibits. |

| | (m) | "Further Right" has the meaning given in Clause 5.2. |

| | (n) | "Gross Revenue", in respect of a Quarter, means: |

| | (i) | the Product Revenue in such period; plus |

| | (ii) | any proceeds of insurance received by or payable to the Payor or its Affiliates in such period due to Loss in respect of Products. |

| | (o) | "Infertile Property" has the meaning given in Clause 5.3. |

| | (p) | "Loss" means an insured loss of or damage to Products, whether or not occurring on or off the Property and whether the Products are in the possession of the Payor (and/or its Affiliates) or otherwise. |

| | (q) | "Month" means a calendar month. |

| | (r) | "Net Smelter Returns", in respect of a Quarter, means Gross Revenue for such Quarter less Allowable Deductions for such Quarter. |

| | (s) | "Notice of Infertility" has the meaning given in Clause 5.3. |

| | (t) | "Ore" means any material mined, extracted or otherwise won from the Royalty Area. |

| | (u) | "Party" or "Parties" means the Payor, the Royalty Holder and Caledonia. |

| | (v) | "Payor" has the meaning first set out herein, but should the Property be Transferred to any third party pursuant to the terms hereof then Payor shall mean the party to whom the Property was Transferred, subject to the provisions of Clause 7.2. |

| | (w) | "Product" means any mineral, metal, aggregate or other substance, including Ore and Concentrates, produced from the Royalty Area. |

| | (x) | "Product Revenue" means the aggregate of the following: |

| | (i) | actual revenue received in respect of gold and silver contained in Product that is delivered to a third party smelter or refinery, or other person, for purchase or processing; plus |

| | (ii) | any other revenue generated from the sale of Product; whether received by the Payor or an Affiliate thereof. |

| | (y) | "Property" means the mining claims listed in Exhibit I to this Deed, together with all Further Rights, as defined herein. |

| | (z) | "Purchase Agreement" means the sale and purchase agreement dated 21 July 2022 (as subsequently amended on 22 September 2022), entered into by Caledonia (as buyer) and the Royalty Holder and the other shareholders of Bilboes Gold Limited, which owns all of the shares of the Payor (as sellers). |

| | (aa) | "Quarter" means a calendar quarter consisting of three Months and commencing on the first day of every January, April, July and October, and "Quarterly" shall have a corresponding meaning. |

| | (bb) | "Royalty" means ONE PER CENTUM (1.0%) of Net Smelter Returns. |

| | (cc) | "Royalty Area" means the area covered by the Property, as set out in Exhibit II. |

| | (dd) | "Royalty Cap" means $90,000,000. |

| | (ee) | “Settled Claim” means a Claim (as defined in the Purchase Agreement) which has been: |

| | (i) | agreed in writing between the relevant parties as to both liability and quantum (if any); or |

| | (ii) | finally determined by arbitration as to both liability and quantum (if any) in accordance with the terms of the Purchase Agreement and, in relation to which, all rights of appeal have been exhausted or are debarred by the passage of time; or |

| | (iii) | confirmed in writing by the relevant parties to been withdrawn or abandoned. |

| | (ff) | "Tax Deduction" has the meaning given in Clause 3.7(a). |

| | (gg) | "Transfer" has the meaning given in Clause 7.1 and “Transferee” and “Transferred” shall have a corresponding meaning. |

| | (hh) | "USD" and "$" means the lawful currency for the time being of the United States of America. |

| | (ii) | "Waste Materials" has the meaning given in Clause 4.2(a). |

| | (jj) | "When Claims" means the following mining claims: (i) When 32 (registration #120580BM) 150 hectares (ii) When 33 (registration #12059BM) 150 hectares and (iii) When 36 (registration #12062BM) 150 hectares. |

The Exhibits attached to this Deed are by reference incorporated into and form part of this Deed.

1.3 | Governing Law and Dispute Resolution |

| | (a) | Any dispute or claim arising out of or in connection with this Deed or its subject matter or formation (including non-contractual disputes or claims) shall be governed by and construed in accordance with the law of England and Wales. |

| | (b) | Any dispute arising out of or in connection with this Deed, including any question regarding its existence, validity or termination shall be referred to and finally resolved by arbitration under the Rules of the London Court of International Arbitration, which Rules are deed to be incorporated by reference into this Clause, and: |

| | (i) | the number of arbitrators shall be three; |

| | (ii) | the seat, or legal place, of arbitration shall be London, United Kingdom; and |

| | (iii) | the language to be used in the arbitral proceedings shall be English. |

| | (c) | The Royalty Holder hereby appoints K&L Gates LLP of One New Change, London EC4M 9AF as its agent for service of process, or such other agent(s) with offices in England as the Royalty Holder may notify to the Payor and Caledonia for the purpose. The Royalty Holder shall procure that, so long as it is under any liability contingent or otherwise to the Payor or Caledonia under or in connection with this Deed, there shall be in force such an appointment as aforesaid and, failing such appointment by the Royalty Holder within 30 days after demand by either of the Payor or Caledonia, the Payor or Caledonia (as the case |

may be) shall be entitled to appoint at the Royalty Holder’s expense any person of their choice to act as such agent.

| | (d) | Each of the Payor and Caledonia hereby appoint Memery Crystal (a trading name of RBG Legal Services Limited) of 165 Fleet Street, London EC4A 2DY as its agent for service of process, or such other agent(s) with offices in England as either of them may notify to the Royalty Holder for the purpose. Each of the Payor and Caledonia shall procure that, so long as it is under any liability contingent or otherwise to the Royalty Holder under or in connection with this Deed, there shall be in force such an appointment as aforesaid and, failing such appointment by any of them within 30 days after demand by the Royalty Holder, the Royalty Holder shall be entitled to appoint at the the Payor’s or Caledonia’s expense (as appropriate) any person of the Royalty Holder’s choice to act as such agent. |

If any provision contained in this Deed is held to be invalid, illegal or unenforceable in any respect under the laws of any foreign jurisdiction (such as the laws of Zimbabwe), the validity, legality and enforceability of such provision will not in any way be affected or impaired thereby under the laws of England and Wales.

If any time period set forth in this Deed ends on a day of the week which is not a Business Day, then notwithstanding any other provision of this Deed such period will be extended until the end of the next following day which is a Business Day.

The headings to the articles and Clauses of this Deed are inserted for convenience only and will not affect the construction hereof.

1.7 | Other Matters of Interpretation |

In this Deed:

| | (a) | the singular includes the plural and vice versa; |

| | (b) | the masculine includes the feminine and vice versa; |

| | (c) | references to "articles" and "Clauses" are to articles and Clauses of this Deed, respectively; |

| | (d) | all provisions requiring a Party to do or refrain from doing something will be interpreted as the covenant of that Party with respect to that matter notwithstanding the absence of the words "covenants" or "agrees" or "promises"; |

| | (e) | the words "hereto", "herein", "hereby", "hereunder", "hereof" and similar expressions when used in this Deed refer to the whole of this Deed and not to any particular article, part, Clause, exhibit or portion thereof; and |

| | (f) | any express reference to an enactment (which includes any legislation in any jurisdiction) includes reference to: |

| | (i) | that enactment as amended, extended or applied by or under any other enactment before or after the date of this Deed; |

| | (ii) | any enactment which that enactment re-enacts (with or without modification); and |

| | (iii) | any subordinate legislation (including regulations) made (before or after the date of this Deed) under that enactment, as re-enacted, amended, extended or applied as described in paragraph (i) above or under any enactment referred to in paragraph (ii) above; and |

| | (iv) | a "person" includes any individual, corporation, limited liability company, partnership, firm, joint venture, syndicate, association, trust, governmental agency or board or commission or authority and any other form of entity or organization. |

ARTICLE 2

ROYALTY GRANT

The Payor hereby grants, conveys and agrees to pay to the Royalty Holder the Royalty, on the terms and conditions specified in this Deed.

The Royalty created hereby shall be perpetual, it being the intent of the Parties that, to the extent allowed by applicable law, regulation or decree, the Royalty shall constitute a vested interest in and a covenant running with the land affecting the Property and all additions and successions thereof, whether created privately or through governmental action and shall inure to the benefit of and be binding upon the Parties and their respective successors and permitted assignees.

ARTICLE 3

ROYALTY PAYMENTS

The Royalty is granted, and the obligation to pay the Royalty when owing pursuant to the terms of this Deed shall commence, as of the date hereof.

Royalty payments shall be due and payable Quarterly on the last day of the first Month following the end of the Quarter in which such payment accrued (i.e., April 30, July 31, October 31 and January 31, as the case may be). Without limiting the rights of the Royalty Holder in relation to any breach of this Deed by the Payor, if the Payor fails to pay the Royalty when due, then the Payor shall be liable for interest payable at the rate of 2% per Month on any balance overdue, compounded monthly.

Royalty payments will be accompanied by a statement showing in reasonable detail on a Product- by-Product basis for the relevant Quarter:

| | (a) | the quantities and grades of Products produced; |

| | (b) | the quantities and grades of Products sold; |

| | (c) | the actual proceeds of sales received in the Quarter; |

| | (d) | the Allowable Deductions in the Quarter; and |

| | (e) | any other pertinent information in sufficient detail to explain the calculation of the Royalty payment. |

The Royalty Holder shall have the further right to request any information that is necessary or desirable to clarify the payment of Royalty and the Payor shall forthwith provide any such information.

3.4 | Provisional Settlements |

Where a sale of Products (including an insurance settlement in respect of a Loss) is made on a provisional basis, the amount of the Royalty payable shall be based upon the amount of metal or other Products included in (or the value of the Loss credited by) such provisional settlement, but will be adjusted to account for the amount of metal or other Products (or the value of the Loss) established by final settlement with the smelter, refinery or other purchaser (or insurer), as the case may be.

All books and records used by the Payor to calculate the Royalty due hereunder shall be kept according to Acceptable Accounting Standards. The Royalty Holder shall have the right, upon reasonable notice to the Payor, to inspect and copy all books, records and information pertaining to the calculation and value of the Royalty once in each calendar year; provided that such inspections shall not unreasonably interfere with the Payor's activities with respect to the Property.

3.6. | Payment Form and Challenge |

| | (a) | All Royalty payments made under this Deed shall be made Quarterly in USD by way of wire transfer to such account or accounts as the Royalty Holder may designate hereunder, from time to time. |

| | (b) | Subject to Clause 3.6(d), a Quarterly Royalty payment shall be considered final (and non- contestable), unless the Royalty Holder gives written notice to the Payor describing and setting forth a specific objection to the determination thereof within twelve (12) Months of its receipt of the applicable Quarterly Royalty statement. If the Royalty Holder duly objects to a particular Quarterly Royalty statement, then the Royalty Holder shall have the right, upon reasonable notice and at a reasonable time, to have the Payor's accounts and records relating to the calculation of the Royalty payment in question audited by a chartered accountant selected by the Royalty Holder and the Payor, or failing agreement between them within 30 days, by a chartered accountant selected by the President for the time being of the Institute of Chartered Accountants in England and Wales. If such chartered accountant, who shall act as an expert and not as arbitrator, determines that there has been a deficiency or an excess in such payment, then, save in the case of manifest error, his determination shall be final and binding and such deficiency or excess shall be resolved by immediate cash payment. |

| | (c) | The Royalty Holder shall pay all costs of any Royalty audit conducted pursuant to Clause 3.6(b), unless a deficiency of more than 3% has been established to be owing to the Royalty Holder, in which event the Payor shall pay the costs of such audit. |

| | (d) | Failure on the part of the Royalty Holder to make claim on the Payor for adjustment within twelve (12) Months of its receipt of the applicable Quarterly Royalty statement shall preclude the filing of any objection thereto or the making of any future claim for adjustment thereon (absent fraud). For purposes of clarity, in no event shall the Payor contest, deny or refute the accuracy of a Royalty payment, nor attempt to make any adjustment to any future Royalty payments, in respect of a Royalty payment that is considered final pursuant to Clause 3.6(b). |

| | (a) | All Royalty payments shall be made subject to withholding or deduction in respect of the Royalty for, or on account of, any present or future taxes, duties, assessments or governmental charges levied on such Royalty payments by or on behalf of any governmental authority having power and jurisdiction to tax and for which the Payor is obligated in law to withhold or deduct and remit to such governmental authority (“Tax Deduction”). The Payor shall set out in the statement referred to in Clause 3.3 any amount so withheld. |

| | (b) | It is recognised that Zimbabwe has certain laws or regulations in respect of the sale of Products containing gold. |

The Royalty Holder shall have no right to require the Payor to pay the Royalty in the form of physical product in kind.

Notwithstanding anything else in this Deed, no Royalty payment shall be due once the aggregate of all Royalty payments made pursuant to this Deed equals the Royalty Cap.

ARTICLE 4

OPERATIONAL MATTERS

4.1. | Control over Operations |

The Payor may, but will not be obligated to, treat, mill, heap leach, sort, concentrate, refine or smelt, or otherwise process, beneficiate or upgrade, the ores, concentrates and other products derived from the Property prior to sale. Save as specifically provided for in this Deed:

| | (a) | the Payor shall have sole discretion with regard to the nature, timing and extent of all exploration, development, mining and other operations conducted on or for the benefit of the Property and may suspend operations and production on the Property at any time it considers prudent or appropriate to do so; and |

| | (b) | the Payor owes the Royalty Holder no duty to explore, develop or mine the Property, or to do so at any rate or in any manner. |

4.2 | Stockpilings and Tailings |

| | (a) | All tailings, residues, waste rock, spoiled leach materials, and other materials (collectively "Waste Materials") resulting from the Payor's operations and activities on the Property shall remain subject to the Royalty. In the event Waste Materials from the Property are processed or reprocessed, as the case may be, and regardless of where such processing or reprocessing occurs, the Royalty shall be payable on any resulting sale of Products. |

| | (b) | Notwithstanding the foregoing, the Payor shall have the right to deal with Waste Materials other than by way of sale, in its sole discretion. |

| | (c) | The Payor shall be entitled to temporarily stockpile, store or place ores, concentrates or other products derived from the Property in any locations owned, leased or otherwise controlled by the Payor on or off the Property, provided the same are appropriately identified as to ownership and origin and secured from loss, theft, tampering and contamination. |

| | (a) | Subject to Clause 4.3(b)(i), the Payor shall be entitled to commingle (“Commingle”) Products produced from the Property with products produced from any other properties (“Alien Product”), including the Blanket Mine. |

| | (b) | Notwithstanding the foregoing: |

| | (i) | where not reasonably practical to segment Product from Alien Product, then before any such products are Commingled: |

| | (A) | the Payor shall outline its proposal for measuring, sampling and treating the Commingled products; |

| | (B) | the Payor shall share or commission metallurgical data and studies showing the impact of Commingling on the recovery of gold, silver and any other minerals from the Product (and report any losses expected to arise therefrom); and |

| | (C) | where the metallurgical data projects a loss in recoveries of any minerals as a result of Commingling of Product with Alien Product, the Payor shall outline its proposal for compensating the Royalty Holder. |

ARTICLE 5

PROPERTY MATTERS

| | (a) | Subject to clause Error! Reference source not found., it is the intention of the Parties that Royalty be payable over any Products produced, directly or indirectly, from the Royalty Area, where the Payor (or any of its Affiliates) now holds (through the Property) or acquires in the future (through a Further Right) any right, title or interest to mineral property that confers any right to explore, develop or mine Products, including where such holding or |

acquisition is is held as of, or made after, the date hereof and subsequently disposed to a third party.

| | (b) | The Royalty Holder acknowledges that there is a tribute over the When Claims in favour of Boss Para (Private) Limited ("Tribute") pursuant to a tribute agreement dated 1 June 2021 entered into by the Payor and Boss Para (Private) Limited ("Tribute Agreement"). The Royalty Holder agrees that the When Claims shall not form part of the Royalty Area and no Royalty shall be payable on the When Claims under this Deed until the earlier of: |

| | (i) | the expiry of the Tribute on 24 May 2024; or |

| | (ii) | the date on which the Tribute Agreement is terminated in accordance with its terms. |

5.2 | Obligation to Maintain and Perfect |

| | (a) | The Payor agrees to maintain the Property in good standing, subject to this Clause 5.2. If at any time the Payor or any Affiliate or successor or assignee of the Payor registers or otherwise acquires, directly or indirectly, any right to or interest in any exploration licence, prospecting licence, mining claim, lease, grant, concession, permit, patent or other mineral property or other rights or interests located wholly or partly within the boundaries of the Royalty Area ("Further Right"), such Further Right, but strictly only to the extent of that proportion of the Further Right that is within the boundaries of the Royalty Area and to that extent the expression Further Right shall be construed accordingly, shall thereafter become part of the Property. The Payor agrees to apply for, obtain or otherwise acquire (save for acquisitions from third parties involving material payments) all Further Rights available that perfect, extend or otherwise improve the existing rights of the Payor in respect of the Property. |

| | (b) | Caledonia agrees to ensure that any such Further Right is acquired by the Payor. Notwithstanding the provisions hereof, where a Further Right is acquired by Caledonia or any Affiliate of Caledonia other than the Payor, Caledonia agrees to, or agrees to cause the relevant Affiliate to, execute a similar deed to this Deed so as to ensure the payment of Royalty over the Royalty Area by such Affiliate. |

Subject to Clause 5.1, the Payor may abandon the Property or any portion thereof (the "Infertile Property"), provided it first gives notice to the Royalty Holder ("Notice of Infertility"). Provided it is lawful to do so, the Royalty Holder may give, within 30 days of its receipt of a Notice of Infertility, notice to the Payor electing to have the Infertile Property transferred to it (or an Affiliate of the Royalty Holder) for consideration of $1.00. Should the Royalty Holder give such notice and pay for all transfer costs, as and when required, then the Payor shall use all reasonable commercial efforts to assist in the transfer of the Infertile Property to the Royalty Holder (or any such Affiliate); otherwise, the Payor may abandon the Infertile Property without any liability whatsoever to the Royalty Holder.

5.4 | Reclamation Liabilities |

The Payor hereby assumes all liabilities of the Royalty Holder in, to and under the Royalty Area and the Property that may arise from and after the date of this Deed, including but not limited to any and all environmental liabilities, any liabilities arising from this Deed and any liabilities arising in the future as

a result of legislative changes. The Payor shall be solely responsible for all costs, fines, damages, judgments, penalties or responsibilities (environmental and otherwise) in connection with the Royalty Area and the Property and for any and all work required to be performed in the Royalty Area in respect of rehabilitation or remedial work, whether arising prior to or subsequent to the date hereof.

The Payor shall maintain insurances on and in relation to its business and assets against those risks and to the extent as is usual for companies carrying on the same or substantially similar business in Zimbabwe, including insurance protecting against the loss of Product (whether through theft, damage, accident or otherwise). All insurances shall be with reputable independent insurance companies or underwriters.

The Parties agree that the Royalty Holder may, insofar as permitted under applicable law, regulations and governmental decree or written policy, register or record against title to the Property this Deed or such other form of notice, caution or other document(s) as it considers appropriate, acting reasonably, from time to time, to protect the Royalty Holder's right to receive the Royalty or other sums due under this Deed. The Parties hereby consent to such registering or recording and agree to co-operate with the Royalty Holder to accomplish the same. The Royalty Holder may also request that this Deed be re-executed by all Parties in the event of the grant of one or more Further Rights (in order to perfect the Royalty as an interest in land in respect of such Further Rights) and, where made, any such request shall be accommodated by the Parties.

The Payor may engage in forward sales, futures trading or commodity options trading and other price hedging, price protection and speculative arrangements ("Trading Activities"), which may involve the physical delivery of Products. None of the revenues, costs, profits or losses from Trading Activities shall be taken into account in calculating the Royalty, except where Products are actually delivered and title transferred pursuant to such transactions. In no event shall the Payor hold Product as inventory that is capable of sale (and cash settlement) for a period in excess of 30 days, once such Product has been beneficiated in accordance with normal standards and processes applicable to Payor’s business.

ARTICLE 6

REPORTS AND INSPECTIONS

An Annual Report shall be delivered to the Royalty Holder by the Payor on or before the 1st day of March in each calendar year.

If so requested by the Royalty Holder, the Payor shall cooperate with the Royalty Holder in respect to the preparation of a technical report, including a report in compliance with (Canadian) National Instrument 43-101 or (American) Regulation S-K, by:

| | (a) | providing the Royalty Holder and its technical consultants with the right to access the Property for purposes of completing a site visit; |

| | (b) | providing the Royalty Holder and its technical consultants with accurate and complete technical data, records or information necessary to complete any such report; |

| | (c) | reviewing any draft technical report and providing comments thereon without unreasonable delay (and within 30 days); and |

| | (d) | providing any consent reasonably obtainable and necessary to enable the Royalty Holder and its technical consultants to rely upon any third party report; |

provided, however, that any reasonable cost in respect of same is borne solely by the Royalty Holder. The Royalty Holder agrees that neither the Payor nor any of its Affiliates shall assume any liability in connection with any disclosure by the Royalty Holder or any of its Affiliates with respect to the Property, including any disclosure made in such a technical report.

The Royalty Holder and/or its Affiliates (and their respective agents, representatives and up to five nominee guests) shall be entitled to enter the mine workings and structures on the Property at reasonable times upon reasonable advance notice for inspection thereof in furtherance of the objects of this Deed, but the Royalty Holder and/or its Affiliates (and their respective agents and representatives) shall so enter at their own risk and may not hinder or interfere with operations on or pertaining to the Property.

ARTICLE 7

TRANSFERS AND ASSIGNMENT

The Royalty Holder shall have the right, at any time after after all Claims (as defined in the Purchase Agreement) which have been made before 3 January 2024 or, if later, the first anniversary of Completion (as defined in the Purchase Agreement) have become Settled Claims, and from time to time, to sell, assign or otherwise transfer (“Transfer”), in whole or in part, its right, title and interest in and to the Royalty and its interest in and to this Deed, provided that:

| | (a) | the necessary approvals, including but not limited to Reserve Bank of Zimbabwe exchange control approval if required, are in force for the Transferee to receive Royalty from the Payor; |

| | (b) | where the Royalty Holder Transfers only a portion of its right, title and interest in and to the Royalty or its interest in this Deed, the Royalty Holder shall act as agent of such Transferee in all respects, including the receipt of any payment of Royalty; and |

| | (c) | where the Royalty Holder Transfers all of its right, title and interest in and to the Royalty and its interest in this Deed, the Royalty Holder may request that the Payor execute a novation agreement (whereby the Transferee is entitled to the benefits and assumes the obligations of the Royalty Holder, and the Royalty Holder and Payor grant each other mutual releases from all obligations hereunder) and the Payor shall execute any reasonable documentation prepared by the Royalty Holder to give effect to same. |

Notwithstanding the foregoing, nothing herein shall derogate from the obligation to pay Royalty in USD, and the Payor shall act as agent for the Royalty Holder and any Transferee, where applicable, in applying

for any necessary approvals from the Reserve Bank of Zimbabwe to effect any Royalty payments hereunder.

The Payor shall be entitled to Transfer, mortgage, charge or otherwise encumber all or any part of the Property or the Products or the proceeds thereof and its rights and obligations under this Deed, provided the following conditions are satisfied:

| | (a) | any Transferee shall agree, in advance and in writing in favour of the Royalty Holder, to be bound by the terms of this Deed including, without limitation, this Clause 7.2 (in such form as is prepared by the Royalty Holder, acting reasonably); and |

| | (b) | any mortgagee, chargee or encumbrancer of the Property or this Deed shall agree, in advance and in writing in favour of the Royalty Holder, to be bound by and subject to the terms of this Deed in the event it takes possession of or forecloses on all or part of the Property, and undertakes to obtain an agreement in writing in favour of the Royalty Holder from any subsequent Transferee of such mortgagee, chargeholder or encumbrancer that such subsequent Transferee will be bound by the terms of this Deed, including this Clause 7.2; |

but nothing shall release the Payor from its obligations hereunder in any such circumstance, save where the Royalty Holder, in its sole discretion, agrees to release the Payor by separate instrument in writing.

ARTICLE 8

WARRANTIES

8.1 | Warranties of All Parties |

Each Party warrants to and in favor of each of the other Parties, as of the date hereof, the following (and acknowledges and agrees that each of the other parties is entering into this Deed on the basis of such warranties), namely:

| | (a) | it is a company duly incorporated and organized and validly existing under the laws of its jurisdiction of incorporation; |

| | (b) | it has the corporate power, capacity, and authority to execute, deliver, and perform this Deed; |

| | (c) | this Deed creates valid and binding obligations on it duly enforceable against it in accordance with its terms; and |

| | (d) | the entry into and the exercise of its rights and the performance of its obligations under this Deed or any other documents to be executed in connection with it and the transactions contemplated by them will not constitute a breach or give rise to a default under: |

| | (i) | any applicable laws or regulations; |

| | (ii) | any order, decree, judgment, or other obligation binding on it of any court, governmental agency, or regulatory authority or other public body applicable to it or any of its assets; |

| | (iii) | any provision of its constitutional documents; or |

| | (iv) | any contract or other instrument to which it is a party or by which it is bound, |

which in each case has or could have a material adverse effect on Payor’s ability to execute or perform its obligations under this Deed or any other documents to be executed in connection with it.

The foregoing warranties shall survive any transaction contemplated herein and shall remain valid for so long as this Deed is valid.

ARTICLE 9

MISCELLANEOUS

This Deed and the rights and obligations of the Parties hereunder are strictly limited to the Royalty Area. Each Party will have the free and unrestricted right to enter into, conduct and benefit from any and all business ventures of any kind whatsoever, whether or not competitive with the activities undertaken pursuant hereto, without disclosing such activities to the other Party or inviting or allowing the other to participate therein, subject to Clause 5.1.

The Royalty Holder shall not, without the prior written consent of Caledonia, which shall not be unreasonably delayed or withheld, disclose to any third party data or information obtained pursuant to this Deed which is not generally available to the public; provided, however, the Royalty Holder may disclose data or information so obtained without the consent of Caledonia:

| | (a) | if required for compliance with laws, rules, regulations or orders of a governmental agency or stock exchange (or a sponsor or nominated advisor); |

| | (b) | to any of its Affiliates, employees, directors, officers or any of its consultants or advisors; |

| | (c) | to any third party to whom it, in good faith, wishes to secure finance or to share information in furtherance of a possible sale, assignment or transfer of the Infertile Property or the Royalty, as the case may be; or |

| | (d) | to a third party in respect of which the Royalty Holder or any Affiliate thereof contemplates a possible merger, amalgamation or other corporate reorganization; |

provided, however, that in the case of (c) or (d) any such third party to whom disclosure is intended to be made has first agreed in writing with the Royalty Holder to protect the confidential nature of such information.

This Deed may be amended, modified or supplemented only by a written agreement signed by all Parties.

This Deed is not intended to, and will not be deemed to, create any partnership relation between the Parties including, without limitation, a joint venture, mining partnership or commercial partnership. The obligations and liabilities of the Parties shall be several and not joint and no Party shall have or purport to have any authority to act for or to assume any obligations or responsibility on behalf of the other Party. Nothing herein contained shall be deemed to constitute a Party the partner, agent, joint venturer or legal representative of the other Party.

Any notice, demand, consent or other communication ("Notice") given or made under this Deed:

| | (a) | shall be in writing and signed by a person duly authorised by the sender; |

| | (b) | shall be delivered to the intended recipient by hand or email to the address or email address last notified by the intended recipient to the sender: |

To Payor and / or Caledonia:

| | B006 Millais House |

| | Castle Quay |

| | St Helier |

| | Jersey JE2 3EF |

| | Attention: | Adam Chester, General Counsel, Conmpany Secretary and Head of Risk and Compliance |

| | Email: | achester@caledoniamining.com with a copy to info@caledoniamining.com |

To Royalty Holder:

| | Baker Steel Resources Trust Limited |

| | c/o Baker Steel Resources Capital Managers LLP |

| | 34 Dover Street |

| | London, W15 4NG |

| | United Kingdom |

| | | |

| | Attention: | T. Isnardi |

| | Email: | confirmations@bakersteelcap.com |

With a copy (which shall not constitute notice) to

| | Fasken Martineau LLP |

| | 6th Floor |

| | 100 Liverpool St |

| | | |

| | London |

| | EC2M 2AT |

| | | |

| | Attention: | Al Gourley |

| | Email: | agourley@fasken.com |

| | (c) | shall be deemed to be duly given or made: |

| | (i) | in the case of delivery in person, when delivered; and |

| | (ii) | in the case of email, on the day it is received by the recipient; |

but if the result is that a Notice would be deemed to be given or made on a day which is not a Business Day or is sent or delivered later than 4:00 pm (Harare time) it shall be deemed to have been duly given or made at the commencement of business on the next Business Day.

Each Party shall, at the request of another Party and at the requesting Party's expense, execute all such documents and take all such actions as may be reasonably required to effect the purposes and intent of this Deed.

No waiver of or with respect to any term or condition of this Deed shall be effective unless it is in writing and signed by the waiving Party, and then such waiver shall be effective only in the specific instance and for the purpose of which given. No course of dealing among the Parties, nor any failure to exercise, nor any delay in exercising, any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any specific waiver of any right, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, power or privilege.

Time is of the essence in the performance of any and all of the obligations of the Parties, including, without limitation, the payment of monies.

This Deed may be executed in multiple counterparts, each of which shall constitute an original, but all of which together shall constitute one and the same instrument.

This Deed shall enure to the benefit of and be binding on the Parties and their respective successors and permitted assigns.

This Deed shall terminate on the earlier of: (a) 99 years from the date hereof; (b) the termination of this Deed by written notice given by the Royalty Holder; (c) the date upon which the aggregate of all

Royalty payments made pursuant to this Deed equals the Royalty Cap and (d) by written agreement signed by all the Parties.

This document has been executed as a deed and is delivered and takes effect on the date stated at the beginning of it.

Caledonia

Executed as a deed by CALEDONIA MINING CORPORATION PLC acting by John Mark Learmonth and Adam Chester who, in accordance with the laws of Jersey, are acting under the authority of the company | | | |

| | Authorised signatory | |

| | | |

| | | |

| | Authorised signatory | |

Payor

| Executed as a deed by BILBOES HOLDINGS (PRIVATE) LIMITED acting by and who, in accordance with the laws of the Republic of Zimbabwe, are acting under the authority of the company | | | |

| | Authorised signatory | |

| | | |

| | | |

| | Authorised signatory | |

Royalty Holder

Executed as a deed by BAKER STEEL RESOURCES TRUST LIMITED acting by its Investment Manager, BAKER STEEL CAPITAL MANAGERS LLP | | | |

| | Authorised signatory | |

| | | |

| | | |

| | Authorised signatory | |

EXHIBIT I

THE PROPERTY

Mineral Rights comprising the Property

ISABELLA

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

ISABELLA | CALCITE | 32454 | 10 | GOLD REEF |

| | CALCITE 6 | 33291 | 10 | GOLD REEF |

| | CALCITE 8 | 33292 | 10 | GOLD REEF |

| | CALCITE 9 | 33144 | 10 | GOLD REEF |

| | CALCITE 10 | 33468 | 10 | GOLD REEF |

| | CALCITE 11 | 33489 | 10 | GOLD REEF |

| | CALCITE 12 | 33490 | 10 | GOLD REEF |

| | CALCITE 13 | 33491 | 10 | GOLD REEF |

| | CALCITE 14 | 33492 | 10 | GOLD REEF |

| | CALCITE 15 | 33493 | 10 | GOLD REEF |

| | CALCITE 16 | 33494 | 10 | GOLD REEF |

| | CALCITE 17 | 33540 | 10 | GOLD REEF |

| | CALCITE 18 | 33541 | 10 | GOLD REEF |

| | CALCITE 19 | 33542 | 10 | GOLD REEF |

| | CALCITE 20 | 33543 | 10 | GOLD REEF |

| | CALCITE 21 | 33560 | 10 | GOLD REEF |

| | CALCITE 22 | 33561 | 10 | GOLD REEF |

| | CALCITE 23 | 33562 | 10 | GOLD REEF |

| | CALCITE 24 | 33563 | 10 | GOLD REEF |

| | CALCITE 25 | 33564 | 10 | GOLD REEF |

| | CALCITE 26 | 33565 | 10 | GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | CALCITE 27 | 33566 | 10 | GOLD REEF |

| | CALCITE 28 | 33567 | 10 | GOLD REEF |

| | CALCITE 29 | 33568 | 10 | GOLD REEF |

| | CALCITE 30 | 33569 | 10 | GOLD REEF |

| | CALCITE 31 | 33570 | 10 | GOLD REEF |

| | CALCITE 32 | 33571 | 10 | GOLD REEF |

| | CALCITE 33 | 33572 | 10 | GOLD REEF |

| | CALCITE 34 | 33573 | 10 | GOLD REEF |

| | CALCITE 35 | 33574 | 10 | GOLD REEF |

| | CALCITE 36 | 33575 | 10 | GOLD REEF |

| | CALCITE 38 | 34445 | 10 | GOLD REEF |

| | CALCITE 39 | 34446 | 10 | GOLD REEF |

| | CALCITE 40 | 34447 | 10 | GOLD REEF |

| | CALCITE 41 | 34448 | 10 | GOLD REEF |

| | CALCITE 42 | 34449 | 10 | GOLD REEF |

| | CALCITE 44 | 40146 | 10 | GOLD REEF |

| | CALCITE 45 | 40148 | 10 | GOLD REEF |

| | CALCITE 46 | 40149 | 10 | GOLD REEF |

| | CALCITE SOUTH | 32637 | 10 | GOLD REEF |

| | CALCITE SOUTH 2 | 33290 | 10 | GOLD REEF |

| | KERRY WEST | 11014 BM | 150 | TUNGSTEN |

| | KERRY NORTH | 11015 BM | 150 | TUNGSTEN |

| | SITE 772 | SITE 772 | 1,128 | New Sulphide |

| | EASTNOR 19A | 49111 | 1.8 | PROJECTS GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | EASTNOR 19B | 49110 | 6.3 | GOLD REEF |

| | EASTNOR 19C | 49108 | 8 | GOLD REEF |

| | EASTNOR 19D | 49109 | 10.3 | GOLD REEF |

McCAYS

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

McCAYS | RUSWAYI 1 | 37302 | 10 | GOLD REEF |

| | RUSWAYI 2 | 37303 | 10 | GOLD REEF |

| | RUSWAYI 3 | 37304 | 10 | GOLD REEF |

| | RUSWAYI 4 | 37305 | 10 | GOLD REEF |

| | RUSWAYI 5 | 37306 | 10 | GOLD REEF |

| | RUSWAYI 7 | 37307 | 10 | GOLD REEF |

| | RUSWAYI 8 | 37308 | 10 | GOLD REEF |

| | RUSWAYI 9 | 37309 | 10 | GOLD REEF |

| | RUSWAYI 10 | 37310 | 10 | GOLD REEF |

| | RUSWAYI 11 | 37311 | 10 | GOLD REEF |

| | RUSWAYI 12 | 37312 | 10 | GOLD REEF |

| | RUSWAYI 13 | 37313 | 10 | GOLD REEF |

| | RUSWAYI 14 | 37314 | 10 | GOLD REEF |

| | RUSWAYI 15 | 37315 | 10 | GOLD REEF |

| | RUSWAYI 16 | 37316 | 10 | GOLD REEF |

| | RUSWAYI 17 | 37317 | 10 | GOLD REEF |

| | RUSWAYI 18 | 37318 | 10 | GOLD REEF |

| | RUSWAYI 19 | 37319 | 10 | GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | RUSWAYI 20 | 37320 | 10 | GOLD REEF |

| | RUSWAYI 21 | 37321 | 10 | GOLD REEF |

| | RUSWAYI 22 | 37322 | 10 | GOLD REEF |

| | RUSWAYI 23 | 37323 | 10 | GOLD REEF |

| | RUSWAYI 24 | 37324 | 10 | GOLD REEF |

| | RUSWAYI 25 | 37325 | 10 | GOLD REEF |

| | RUSWAYI 26 | 37326 | 10 | GOLD REEF |

| | RUSWAYI 27 | 37327 | 10 | GOLD REEF |

| | RUSWAYI 28 | 37328 | 10 | GOLD REEF |

| | RUSWAYI 29 | 37329 | 10 | GOLD REEF |

| | RUSWAYI 30 | 37330 | 10 | GOLD REEF |

| | RUSWAYI 31 | 37331 | 10 | GOLD REEF |

| | RUSWAYI 33 | 40143 | 10 | GOLD REEF |

| | RUSWAYI 34 | 40144 | 10 | GOLD REEF |

| | RUSWAYI 35 | 40145 | 10 | GOLD REEF |

WHEN

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

WHEN | WHEN 1 | 35065 | 10 | GOLD REEF |

| | WHEN 2 | 35066 | 10 | GOLD REEF |

| | WHEN 3 | 35067 | 10 | GOLD REEF |

| | WHEN 4 | 35068 | 10 | GOLD REEF |

| | WHEN 5 | 35069 | 10 | GOLD REEF |

| | WHEN 6 | 35070 | 10 | GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | WHEN 7 | 35071 | 10 | GOLD REEF |

| | WHEN 8 | 35072 | 10 | GOLD REEF: |

| | WHEN 9 | 35073 | 10 | GOLD REEF |

| | WHEN 10 | 35074 | 10 | GOLD REEF |

| | WHEN 11 | 35075 | 10 | GOLD REEF |

| | WHEN 12 | 35076 | 10 | GOLD REEF |

| | WHEN 13 | 35077 | 10 | GOLD REEF |

| | WHEN 14 | 35078 | 10 | GOLD REEF |

| | WHEN 15 | 35079 | 10 | GOLD REEF |

| | WHEN 16 | 35080 | 10 | GOLD REEF |

| | WHEN 17 | 35081 | 10 | GOLD REEF |

| | WHEN 18 | 35082 | 10 | GOLD REEF |

| | WHEN 23 | 12049 BM | 38 | BASE METAL |

| | WHEN 24 | 12050 BM | 80 | BASE METAL |

| | WHEN 25 | 12051 BM | 150 | BASE METAL |

| | WHEN 26 | 12052 BM | 119 | BASE METAL |

| | WHEN 27 | 12053 BM | 150 | BASE METAL |

| | WHEN 28 | 12054 BM | 47 | BASE METAL |

| | WHEN 29 | 12055 BM | 150 | BASE METAL |

| | WHEN 30 | 12056 BM | 150 | BASE METAL |

| | WHEN 31 | 12057 BM | 69 | BASE METAL |

| | WHEN 32 | 12058 BM | 150 | BASE METAL |

| | WHEN 33 | 12059 BM | 150 | BASE METAL |

| | WHEN 34 | 12060 BM | 87 | BASE METAL |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | WHEN 35 | 12061 BM | 137 | BASE METAL |

| | WHEN 36 | 12062 BM | 150 | BASE METAL |

| | WHEN 37 | 12063 BM | 150 | BASE METAL |

BUBI

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

BUBI | CHIKOSI 1 | 37441 | 10 | GOLD REEF |

| | CHIKOSI 2 | 37442 | 10 | GOLD REEF |

| | CHIKOSI 3 | 37443 | 10 | GOLD REEF |

| | CHIKOSI 4 | 37444 | 10 | GOLD REEF |

| | CHIKOSI 5 | 37404 | 10 | GOLD REEF |

| | CHIKOSI 6 | 37405 | 10 | GOLD REEF |

| | CHIKOSI 7 | 37406 | 10 | GOLD REEF |

| | CHIKOSI 8 | 37407 | 10 | GOLD REEF |

| | CHIKOSI 9 | 37408 | 10 | GOLD REEF |

| | CHIKOSI 10 | 37409 | 10 | GOLD REEF |

| | CHIKOSI 11 | 37410 | 10 | GOLD REEF |

| | CHIKOSI 12 | 37411 | 10 | GOLD REEF |

| | CHIKOSI 13 | 37412 | 10 | GOLD REEF |

| | CHIKOSI 14 | 37413 | 10 | GOLD REEF |

| | CHIKOSI 15 | 37414 | 10 | GOLD REEF |

| | CHIKOSI 16 | 37415 | 10 | GOLD REEF |

| | CHIKOSI 17 | 37416 | 10 | GOLD REEF |

| | CHIKOSI 18 | 37417 | 10 | GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | CHIKOSI 19 | 37418 | 10 | GOLD REEF |

| | CHIKOSI 20 | 37419 | 10 | GOLD REEF |

| | CHIKOSI 21 | 37420 | 10 | GOLD REEF |

| | CHIKOSI 22 | 37421 | 10 | GOLD REEF |

| | CHIKOSI 23 | 37422 | 10 | GOLD REEF |

| | CHIKOSI 24 | 37423 | 10 | GOLD REEF |

| | CHIKOSI 25 | 37424 | 10 | GOLD REEF |

| | CHIKOSI 26 | 37425 | 10 | GOLD REEF |

| | CHIKOSI 27 | 37426 | 10 | GOLD REEF |

| | CHIKOSI 28 | 37427 | 10 | GOLD REEF |

| | CHIKOSI 29 | 37428 | 10 | GOLD REEF |

| | CHIKOSI 30 | 37429 | 10 | GOLD REEF |

| | CHIKOSI 31 | 37430 | 10 | GOLD REEF |

| | CHIKOSI 32 | 37431 | 10 | GOLD REEF |

| | CHIKOSI 33 | 37432 | 10 | GOLD REEF |

| | CHIKOSI 34 | 37433 | 10 | GOLD REEF |

| | CHIKOSI 35 | 37434 | 10 | GOLD REEF |

| | CHIKOSI 36 | 37435 | 10 | GOLD REEF |

| | CHIKOSI 37 | 37436 | 10 | GOLD REEF |

| | CHIKOSI 38 | 37437 | 10 | GOLD REEF |

| | CHIKOSI 39 | 37438 | 10 | GOLD REEF |

| | CHIKOSI 40 | 37439 | 10 | GOLD REEF |

| | CHIKOSI 41 | 37440 | 10 | GOLD REEF |

| | CHIKOSI SW | 39842 | 10 | GOLD REEF |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | CHIKOSI SW2 | 39843 | 10 | GOLD REEF |

| | CHIKOSI SW3 | 39844 | 10 | GOLD REEF |

| | CHIKOSI SW4 | 39845 | 10 | GOLD REEF |

| | CHIKOSI SW5 | 39846 | 10 | GOLD REEF |

| | CHIKOSI SW6 | 39847 | 10 | GOLD REEF |

SANDY and FERRORO

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

SANDY and FERRORO | FERRORO N | 10540 BM | 129 | COPPER |

| | FERRORO N2 | 10541 BM | 123 | COPPER |

| | FERRORO N3 | 10542 BM | 100 | COPPER |

| | FERRORO S3 | 10545 BM | 132 | COPPER |

| | SANDY | 10546 BM | 150 | COPPER |

| | SANDY 2 | 10547 BM | 144 | COPPER |

| | SANDY W | 10552 BM | 150 | COPPER |

| | SANDY W2 | 10553 BM | 150 | COPPER |

| | SANDY W3 | 10554 BM | 150 | COPPER |

| | SANDY W4 | 10555 BM | 150 | COPPER |

| | SANDY W5 | 10556 BM | 150 | COPPER |

LIMESTONE

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

LIMESTONE | EASTNOR A | 17538 BM | 150 | LIMESTONE |

| | EASTNOR BASE A | 17575 BM | 150 | LIMESTONE |

Mine | Name of Claim | Reg. No. | Area (Ha) | Type of Claim |

| | EASTNOR BASE B | 17577 BM | 150 | LIMESTONE |

EXHIBIT II

THE ROYALTY AREA

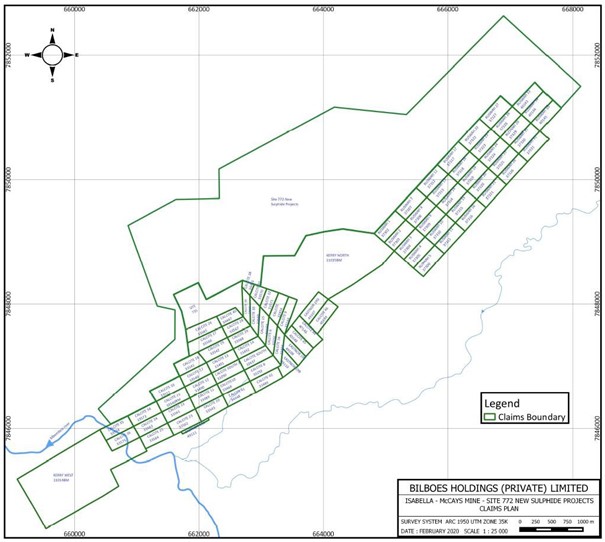

ISABELLA and McCAYS

WHEN

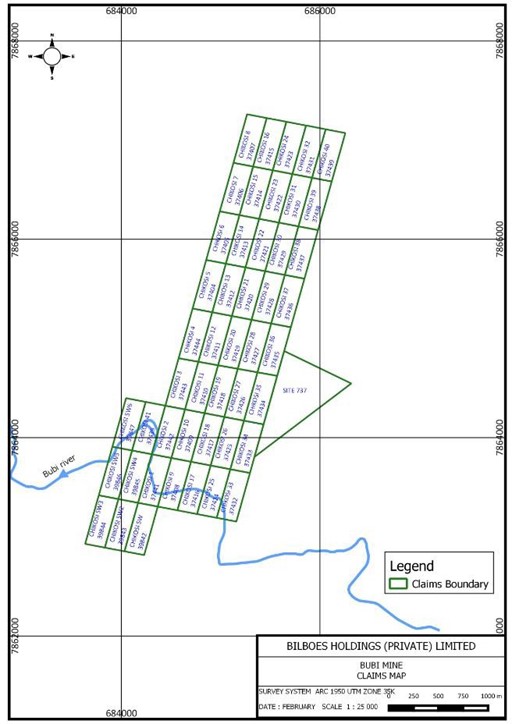

BUBI

Site 737 as shown on the attached map is in the process of being converted into a mine site (infrastructure site). This will increase the Bubi mine total claims area by c. 40 hectares.

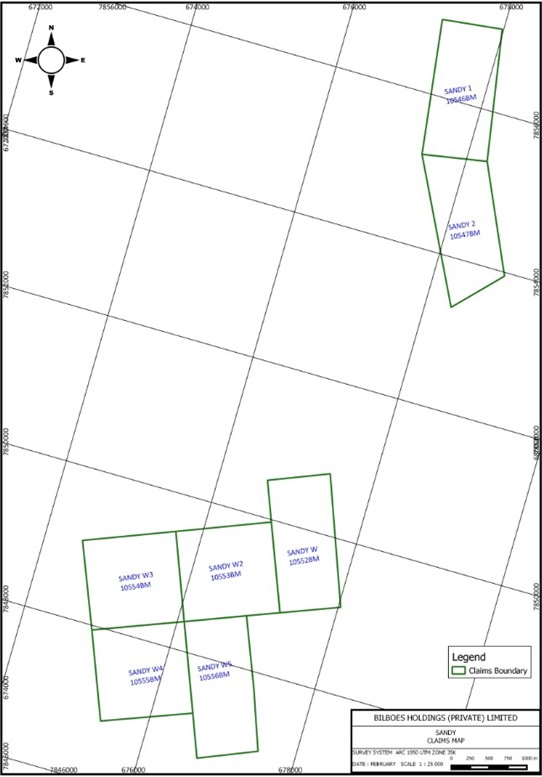

SANDY

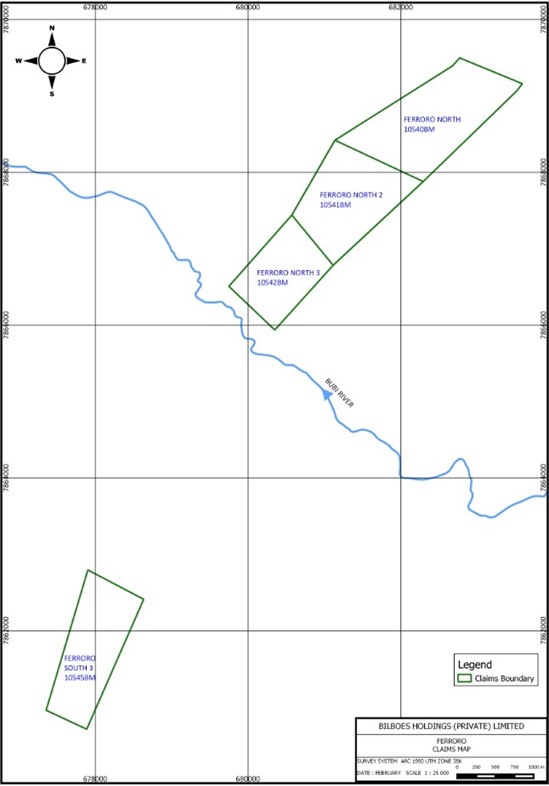

FERRORO