Exhibit 15.4

Caledonia Mining Corporation Plc S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on

the Blanket Gold Mine, Zimbabwe

QUALIFIED PERSONS: Mr. C Harvey NHD Econ. Geol MAIG, MGSSA Mr M. Van Staden B. Eng (Mining) Pr. Eng MAMMSA, MSAIMM Effective Date: 31 December 2023 Version: Final Issue Date: 15 May 2024 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

DATE AND SIGNATURE PAGE

This Report titled “S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe” has been prepared for Caledonia Mining Corporation Plc. The Report is compiled in accordance with the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. The effective date of this Report is 31 December 2023.

The Qualified Person (“QP”) responsible for the compilation of this Report is Mr. Craig Harvey who has relied on contributions from various sources.

__________________________________________________________

C HARVEY NHD Economic Geology MAIG (5458), MGSSA (966008) VP Technical Services Caledonia Mining |

__________________________________________________________

M VAN STADEN B. Eng (Mining) Pr. Eng (20150089). AMMSA (MB3709). SAIMM (20422) Technical Services Manager Caledonia Mining |

Signed at Little Falls, Gauteng, South Africa, on 15 May 2024.

ii

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

INFORMATION RISK

This Report was prepared by Craig Harvey, Vice President Technical Services for Caledonia Mining Corporation Plc (“Caledonia”), the QP. Mr Harvey is a full-time employee of the Caledonia group and in the preparation of the Report, has utilised information relating to operational methods and expectations provided by various sources. The QP has, where possible, verified this information from independent sources after making due enquiry of all material issues that are required in order to comply with the requirements of the United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300. No warranty or guarantee, be it express or implied, is made by the QP with respect to the completeness or accuracy of the legal aspects of this document.

OPERATIONAL RISKS

The business of mining and mineral exploration, development and production by their nature contain significant operational risks. The business depends upon, amongst other things, successful prospecting programmes and competent management. Profitability and asset values can be affected by unforeseen changes in operating circumstances and technical issues.

POLITICAL AND ECONOMIC RISK

Factors such as political and industrial disruption, currency fluctuation and interest rates could have an impact on future operations, and potential revenue streams can also be affected by these factors. The majority of these factors are, and will be, beyond the control of any operating entity.

FORWARD LOOKING STATEMENTS

Certain statements contained in this document other than statements of historical fact, contain forward-looking statements regarding the operations, economic performance or financial condition, including, without limitation, those concerning the economic outlook for the mining industry, expectations regarding commodity prices, exchange rates, production, cash costs and other operating results, growth prospects and the outlook of operations, including the completion and commencement of commercial operations of specific production projects, its liquidity and capital resources and expenditure, and the outcome and consequences of any pending litigation or enforcement proceedings.

Although the QP believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct. Accordingly, results may differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic and market conditions, changes in the regulatory environment and other State actions, success of business and operating initiatives, fluctuations in commodity prices and exchange rates, and business and potential risk management.

iii

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

TABLE OF CONTENTS

Item 1 | – Executive Summary | 13 |

I. | Geology and Mineral Deposit | 13 |

II. | Status of Exploration | 13 |

III. | Mineral Resource and Mineral Reserve Estimates | 14 |

IV. | Development and Operations | 16 |

V. | Economic Analysis | 17 |

VI. | Conclusions | 19 |

VII. | Recommendations | 20 |

Item 2 | – Introduction | 21 |

Item 2 (a) | Author | 21 |

Item 2 (b) | – Terms of Reference and Purpose of the Report | 21 |

Item 2 (c) | – Sources of Information and Data Contained in the Report | 21 |

Item 2 (d) | – Qualified Persons’ Personal Inspection of the Property | 22 |

Item 3 | – Property Description and Location | 22 |

Item 3 (a) | – Area of the Property | 22 |

Item 3 (b) | – Location of the Property | 22 |

Item 3 (c) | – Mineral Deposit Tenure | 23 |

Item 3 (d) | – Royalties and Payments | 25 |

I. | Government Royalties | 25 |

II. | Net Smelter Royalties | 26 |

Item 3 (e) | – Environmental Liabilities | 26 |

Item 3 (f) | – Permits to Conduct Work | 26 |

I. | Water Agreement | 27 |

II. | . Environmental Impact Assessment Certificates | 27 |

III. | Additional Environmental Permits | 27 |

Item 3 (g) | – Other Significant Factors and Risks | 28 |

Item 4 | – Accessibility, Climate, Local Resources, Infrastructure and Physiography | 28 |

Item 4 (a) | – Topography, Elevation and Vegetation | 28 |

Item 4 (b) | – Access to the Property | 28 |

Item 4 (c) | – Climate and Length of Operating Season | 29 |

Item 4 (d) | – Infrastructure | 30 |

I. | Regional Infrastructure | 30 |

I. | Mine Infrastructure | 30 |

Item 5 | – History | 30 |

Item 5 (a) | – Prior Ownership and Ownership Changes | 30 |

Item 5 (b) | – Historical Exploration and Development | 30 |

Item 6 | – Geological Setting, Mineralisation and Deposit | 31 |

Item 6 (a) | - Regional Geology | 31 |

Item 6 (b) | - Local and Property Geology | 32 |

Item 6 (c) | – Mineralisation and Deposit Type | 35 |

Item 6 (d) | – Geological Model | 37 |

Item 7 | – Exploration | 44 |

Item 7 (a) | – Non-drilling Work | 44 |

I. | Survey Procedures and Parameters | 44 |

II. | Sampling Methods and Sample Quality | 45 |

III. | Sample Data | 45 |

IV. | Results and Interpretation of Exploration Information | 45 |

Item 7 (b) | – Drilling | 45 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

I. | Type and Extent of Drilling | 45 |

II. | Factors Influencing the Accuracy of Results | 54 |

III. | Exploration Properties – Drill Hole Details | 54 |

Item 7 (c) | – Hydrogeology | 54 |

Item 7 (d) | – Geotechnical | 54 |

Item 8 | – Sample Preparation, Analyses and Security | 55 |

Item 8 (a) | Sample Handling Prior to Dispatch | 55 |

Item 8 (b) | – Sample Preparation and Analysis Procedures | 55 |

Item 8 (c) | – Quality Assurance and Quality Control | 55 |

I. | Assessment of Results | 56 |

Item 8 (d) | – Adequacy of Sample Preparation, Security and Analytical Procedures | 59 |

Item 9 | – Data Verification | 59 |

Item 9 (a) | – Data Verification Procedures | 59 |

Item 9 (b) | – Limitations on/Failure to Conduct Data Verification | 61 |

Item 9 (c) | – Adequacy of Data | 61 |

Item 10 | – Mineral Processing and Metallurgical Testing | 61 |

Item 10 (a) | – Nature and Extent of Testing and Analytical Procedures | 61 |

Item 10 (b) | Basis off Assumptions Regarding Recovery Estimates | 61 |

Item 10 (c) | – Representativeness of Samples and Adequacy of Data | 62 |

Item 10 (d) | – Deleterious Elements for Extraction | 62 |

Item 11 | – Mineral Resource Estimates | 62 |

Item 11 (a) | – Assumptions, Parameters and Methods Used for Resource Estimates | 62 |

I. | Mineral Resource Estimation Procedures | 62 |

II. | Initial Assessment | 83 |

III. | Mineral Resource Classification | 84 |

IV. | Mineral Resource Statement | 96 |

Item 11 (b) | – Individual Grade of Metals | 99 |

Item 11 (c) | – Factors Affecting Mineral Resource Estimates | 100 |

Item 12 | – Mineral Reserve Estimates | 100 |

Item 12 (a) | - Key Assumptions, Parameters and Methods | 100 |

I. | Stope Design Methodology | 100 |

II. | Cut- Off Grade | 101 |

III. | Modifying Factors | 101 |

IV. | Mineral Resource to Mineral Reserve Conversion | 102 |

Item 12 (b) | - Multiple Commodity Reserve | 103 |

Item 12 (c) | - Factors Affecting Mineral Reserve Estimation | 103 |

Item 13 | – Mining Methods | 103 |

Item 13 (a) | – Parameters Relevant to Mine Design | 108 |

I. | Geotechnical and Hydrological Parameters | 109 |

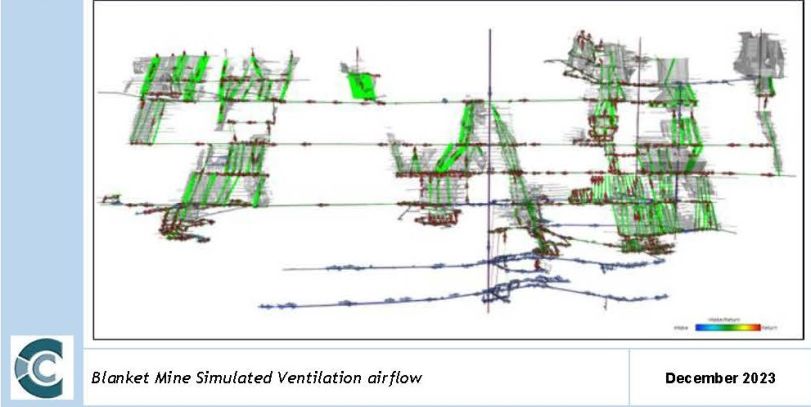

II. | Ventilation | 111 |

Item 13 (b) | – Production Rates, Expected Mine Life, Mining Unit Dimensions, and Mining Dilution | 112 |

I. | Shift Cycle | 112 |

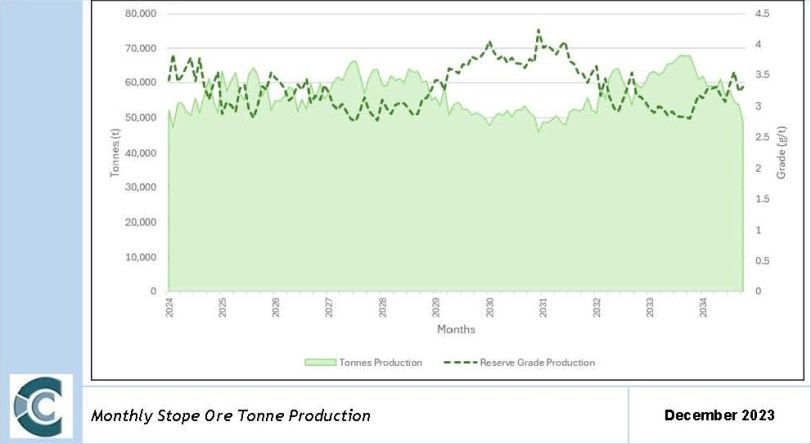

II. | Production Rates | 112 |

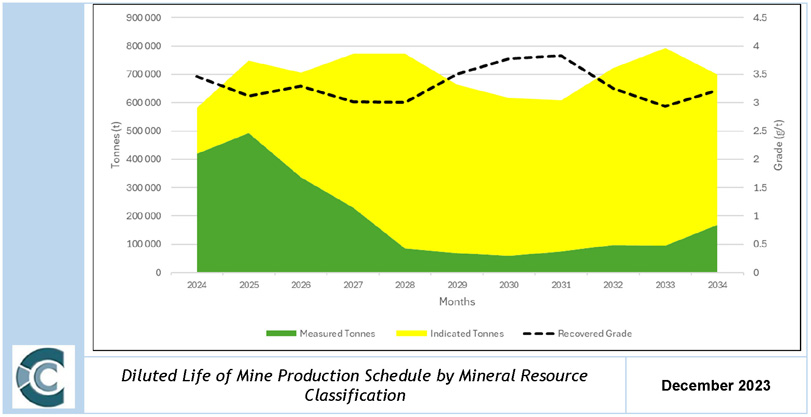

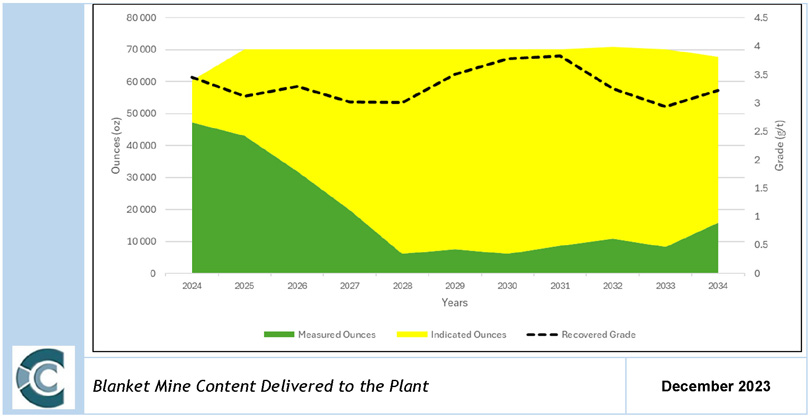

| Life of Mine Plan | 114 |

III. | Mineral Reserve Conversion Factors | 118 |

Item 13 (c) | – Requirements for Stripping, Underground Development and Backfilling | 120 |

I. | Underground Development | 120 |

II. | Backfilling | 122 |

Item 13 (d) | – Required Mining Fleet, Machinery and Personnel | 123 |

I. | Mining Fleet and Machinery | 123 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

II. | Personnel | 123 |

Item 14 | – Recovery Methods | 126 |

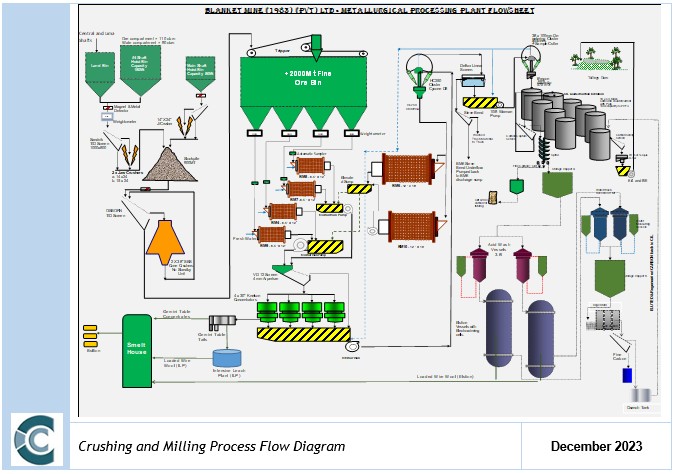

Item 14 (a) | - Flow Sheets and Process Recovery Methods | 126 |

Item 14 (b) | Process Flow and Equipment Specifications. | 128 |

Item 14 (c) | Slurry Deposition. | 133 |

Item 15 | – Project Infrastructure | 135 |

Item 15 (a) | - Mine Layout and Operations | 135 |

Item 15 (b) | – Infrastructure | 137 |

I. | Surface Infrastructure | 137 |

II. | Mining Section | 140 |

III. | Dewatering | 140 |

Item 15 (c) | – Services | 140 |

I. | Power Supply and Reticulation | 140 |

II. | Water Supply and Reticulation | 141 |

III. | Ventilation | 142 |

IV. | Compressed Air | 142 |

V. | Logistics | 143 |

Item 16 | – Market Studies | 143 |

Item 16 (a) | – Commodity Market Assessment | 143 |

Item 16 (b) | – Contracts | 154 |

Item 17 | – Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups | 154 |

Item 17 (a) | – Relevant Environmental Issues and Results of Studies Done | 154 |

Item 17 (b) | – Waste Disposal, Site Monitoring and Water Management | 155 |

Item 17 (c) | – Permit Requirements | 156 |

Item 17 (d) | – Social and Community-Related Requirements | 156 |

Item 17 (e) | – Mine Closure Costs and Requirements | 156 |

Item 17 (f) | - Adequacy of Current Plans | 157 |

Item 17 (g) | – Local Procurement and Hiring | 157 |

Item 18 | – Capital and Operating Costs | 157 |

Item 18 (a) | – Capital Costs | 157 |

Item 18 (b) | – Operating Cost | 159 |

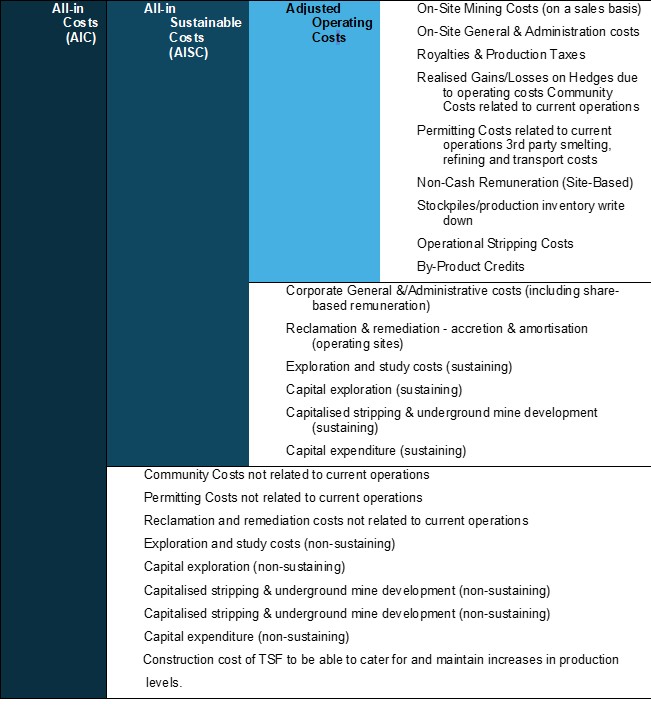

VI. | Financial Costs Indicators | 160 |

Item 18 (c) | – Accuracy of Estimates | 165 |

Item 19 | – Economic Analysis | 165 |

Item 19 (a) | - Principal Assumptions | 166 |

I. | Basis of Evaluation of the Mining Assets | 166 |

II. | Macro-Economic Forecasts | 166 |

III. | Working Capital | 167 |

IV. | Recoveries | 167 |

V. | Discount Rate | 167 |

VI. | Cash Flow Forecast | 168 |

Item 19 (b) | - Net Present Value | 171 |

Item 19 (c) | - Regulatory Items | 171 |

I. | Government Royalties | 171 |

VII. | Corporate Taxes | 171 |

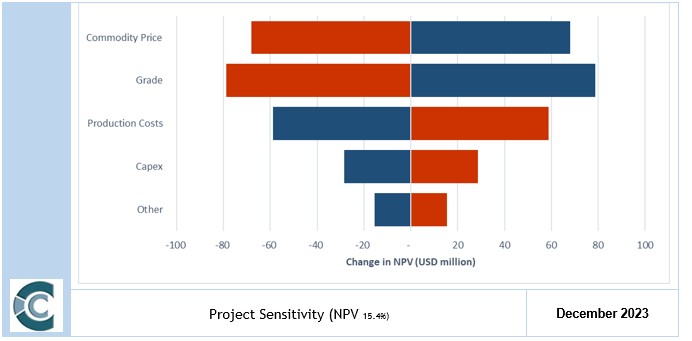

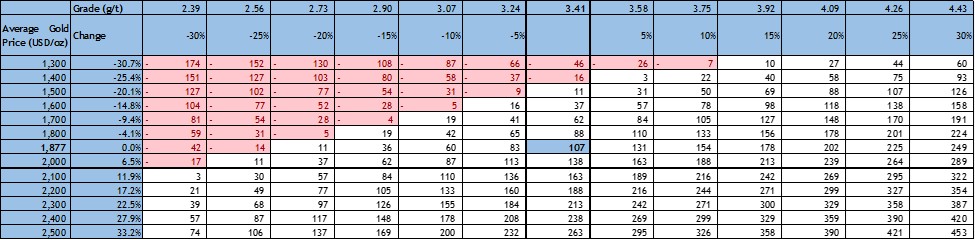

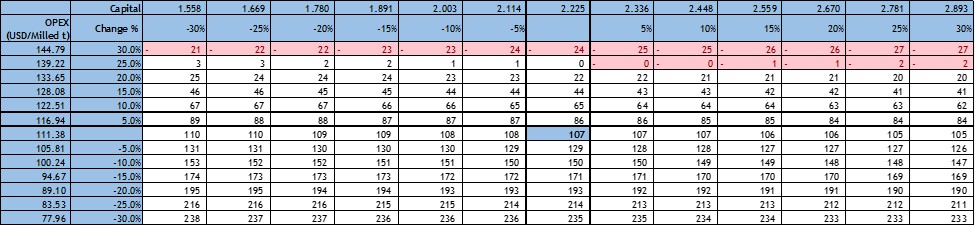

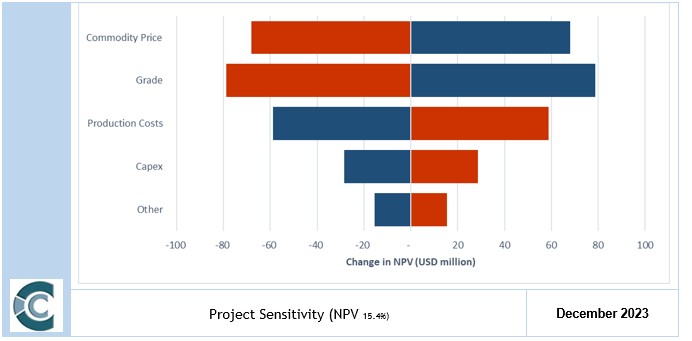

Item 19 (d) | - Sensitivity Analysis | 172 |

Item 19 (e) | – Economic Analysis Conclusions | 175 |

Item 20 | – Adjacent Properties | 175 |

Item 20 (a) | Sources of Information | 177 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Item 21 | – Other Relevant Data and Information | 177 |

Item 21 (a) | – Upside Potential | 177 |

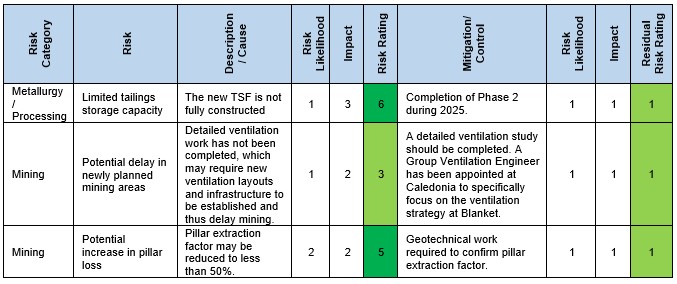

Item 21 (b) | – Risk Assessment | 177 |

Item 22 | – Interpretation and Conclusions | 178 |

| Mineral Resources | 178 |

| Mining | 179 |

| Engineering and Infrastructure | 179 |

| Processing | 179 |

| Economic Analysis | 179 |

Item 23 | – Recommendations | 180 |

Item 24 | – References | 180 |

Item 25 | – Reliance on Information Provided by the Registrant | 181 |

FIGURES

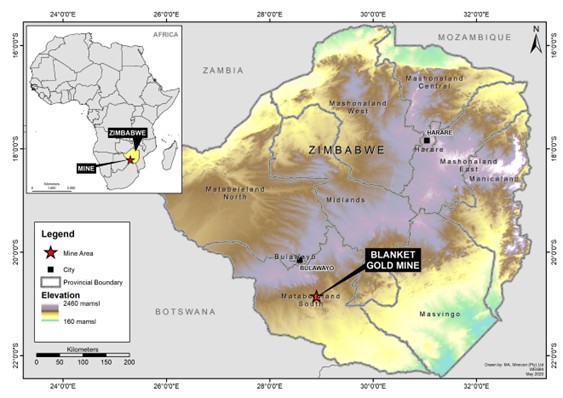

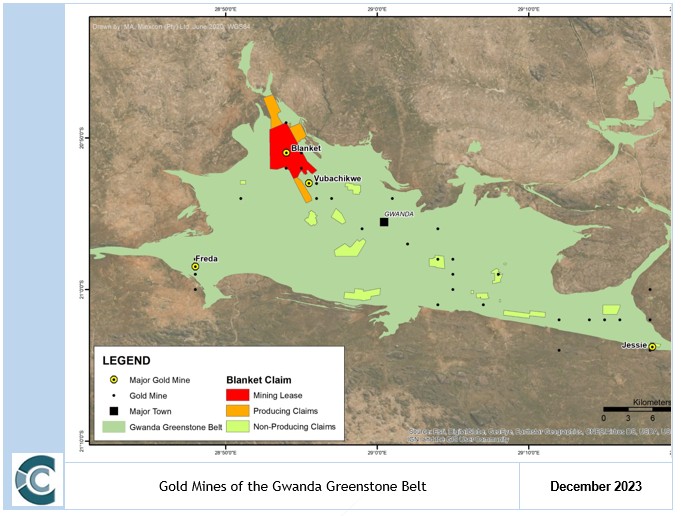

Figure 1: General Location of Blanket Mine | 22 |

Figure 2: Location of Blanket Mining Lease and Claims | 23 |

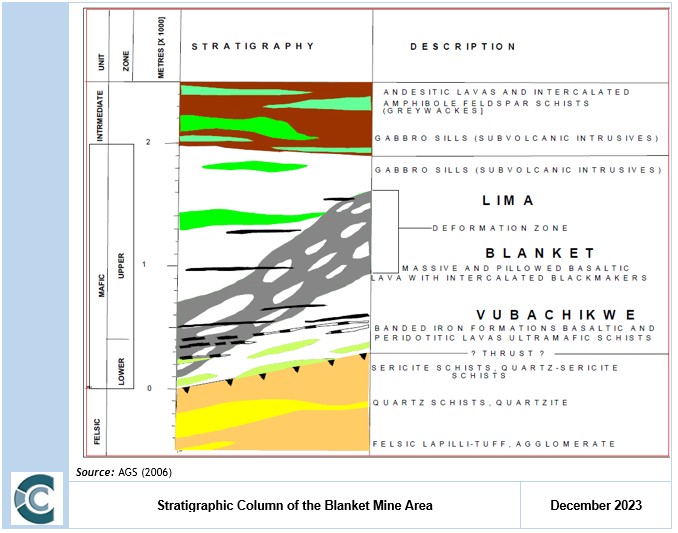

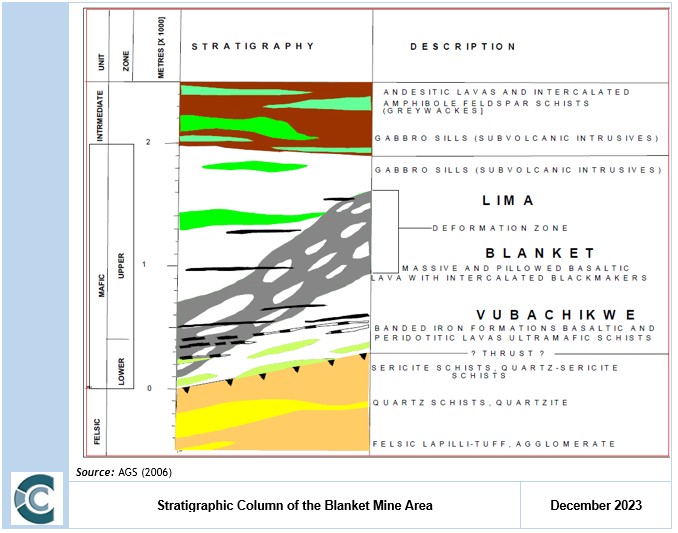

Figure 3: Stratigraphic Column of the Blanket Mine Area | 32 |

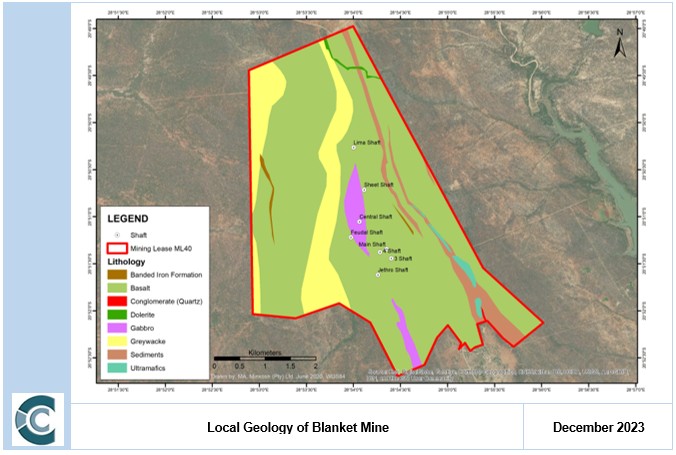

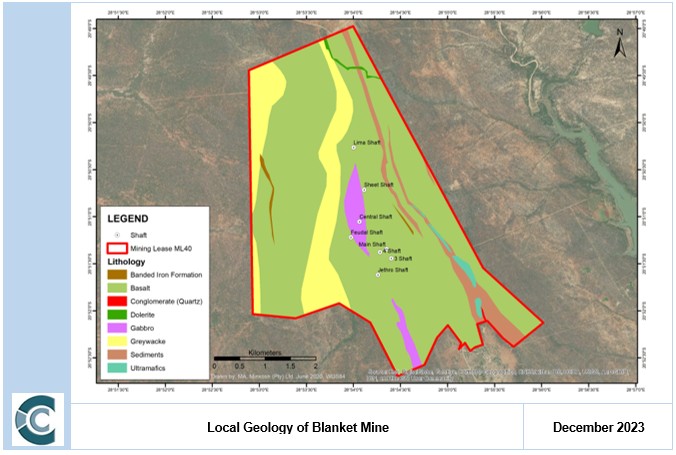

Figure 4: Local Geology of Blanket Mine | 33 |

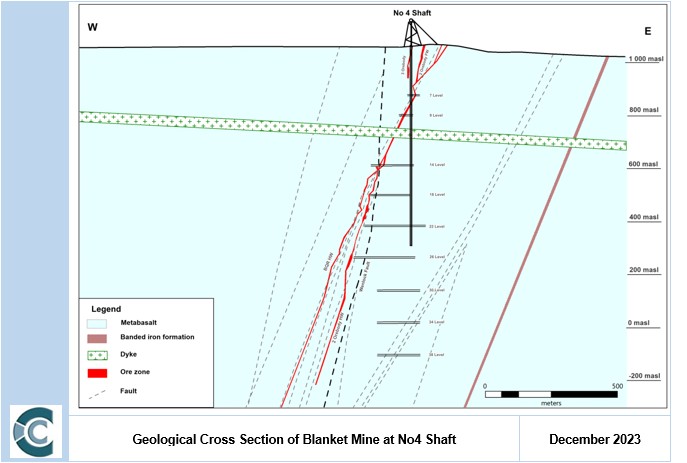

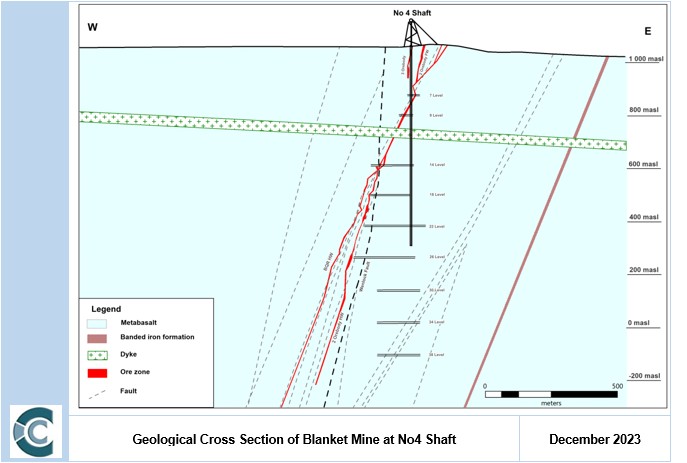

Figure 5: Geological Cross Section of Blanket Mine at No 4 Shaft | 33 |

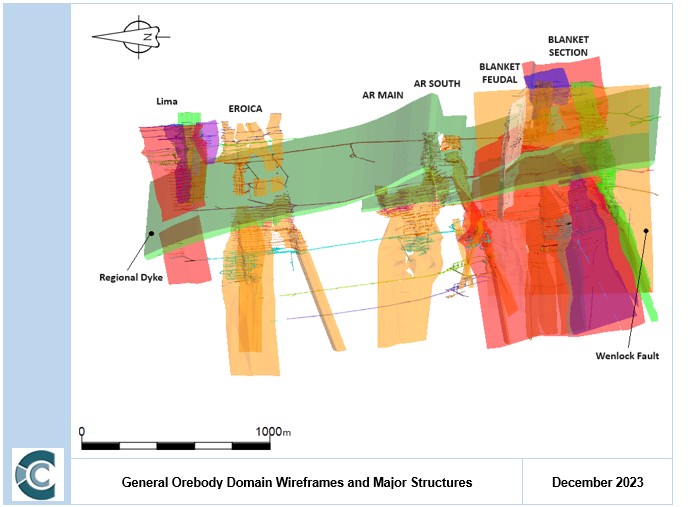

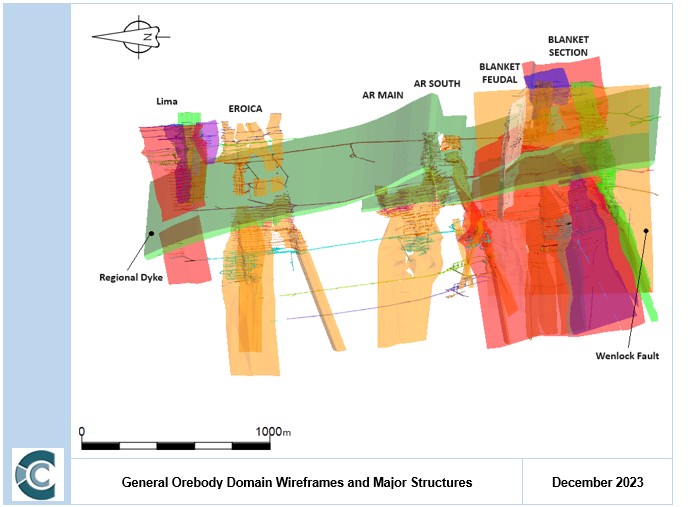

Figure 6: General Orebody Domain Wireframes and Major Structures | 37 |

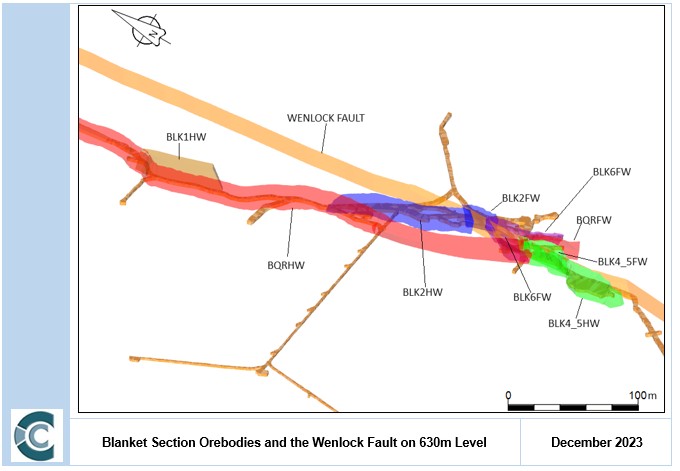

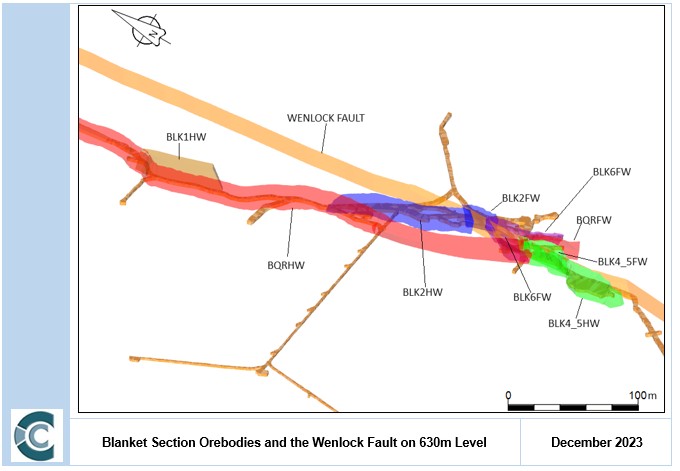

Figure 7: Blanket Section Orebodies and the Wenlock Fault on 630m Level | 38 |

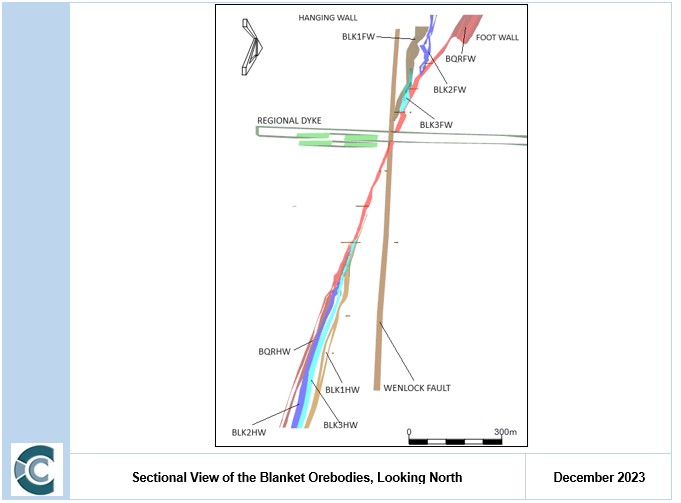

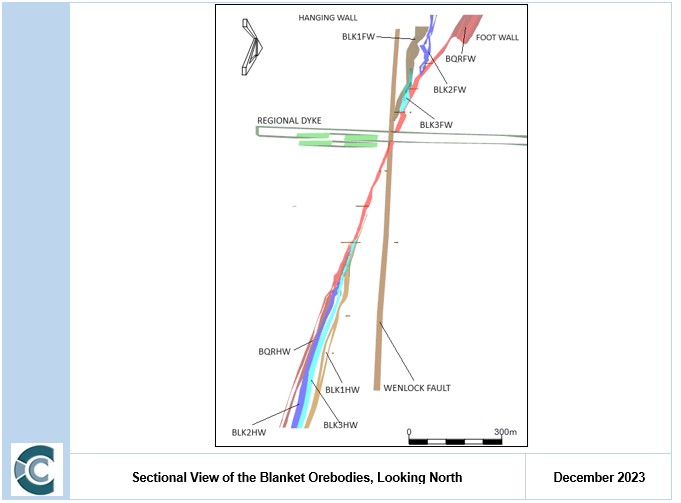

Figure 8: Sectional View of the Blanket Orebodies, Looking North | 39 |

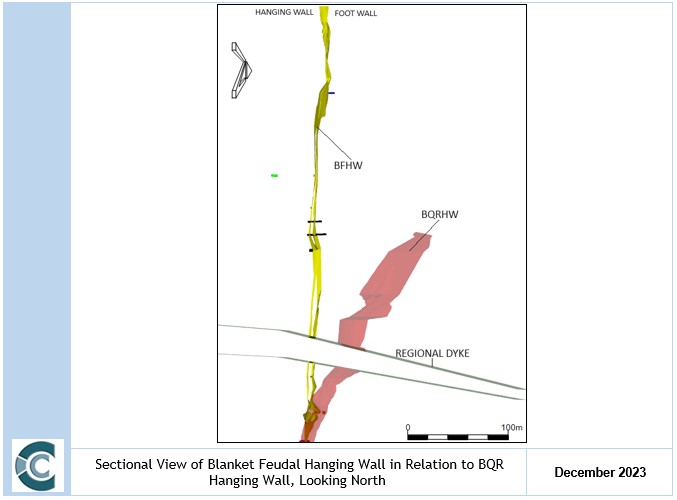

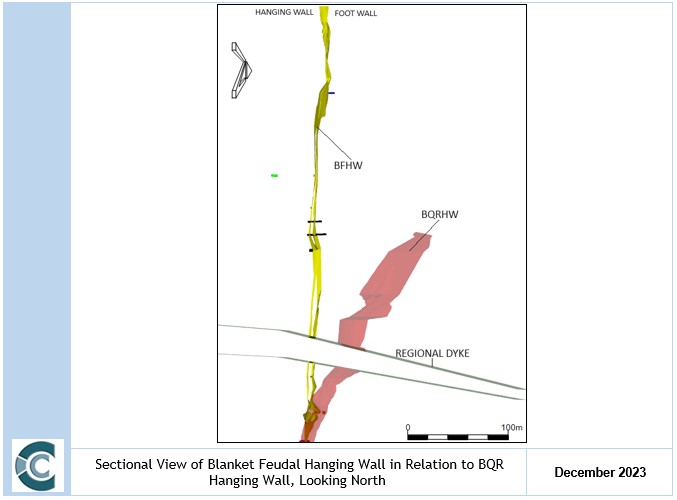

Figure 9: Sectional View of Blanket Feudal Hanging Wall in Relation to BQR Hanging Wall, Looking North | 40 |

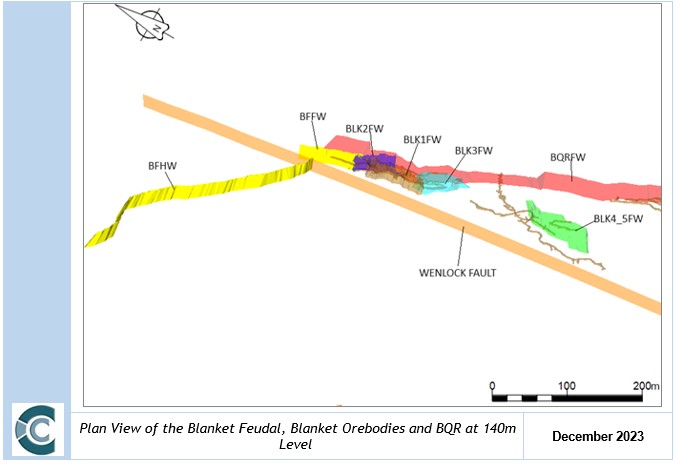

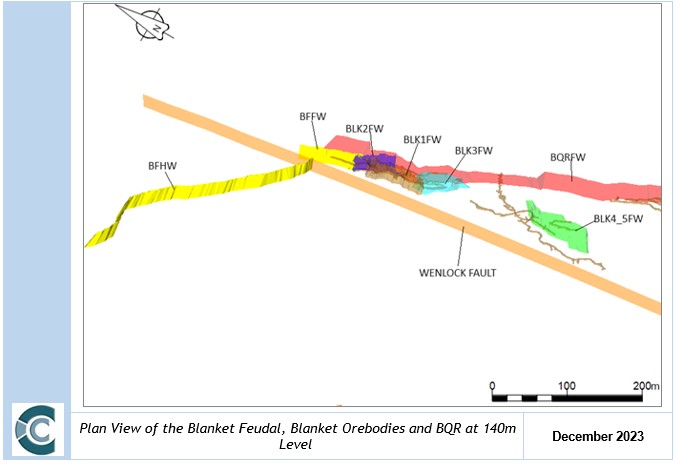

Figure 10: Plan View of the Blanket Feudal, Blanket Orebodies and BQR at 140m Level. | 40 |

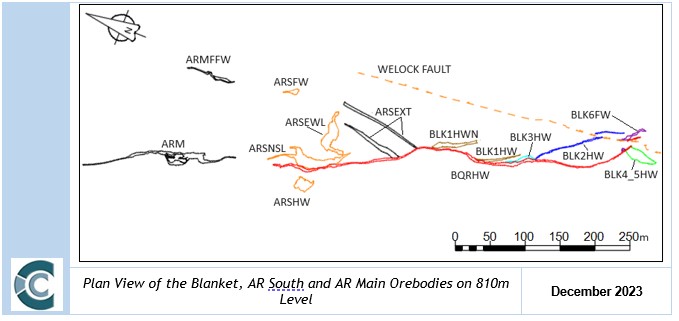

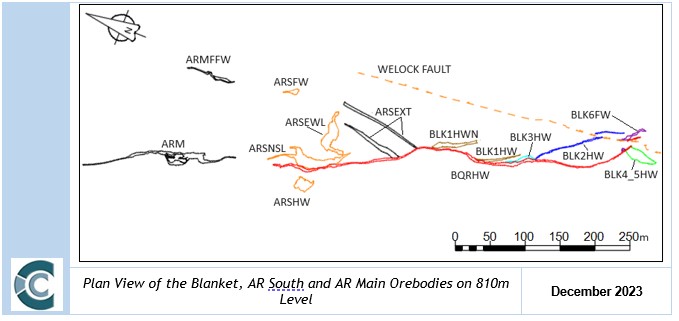

Figure 11: Plan View of the Blanket, AR South and AR Main Orebodies on 810m Level. | 42 |

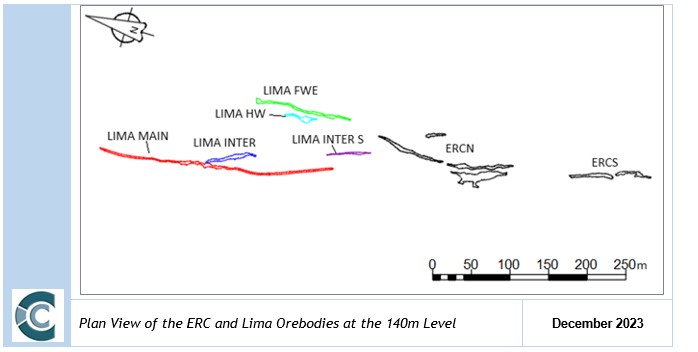

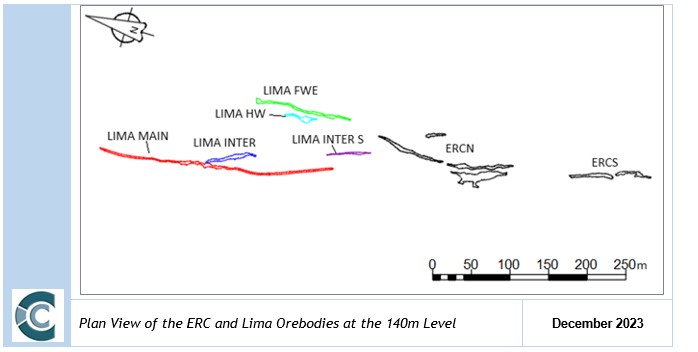

Figure 12: Plan View of the ERC and Lima Orebodies at the 140m Level. | 42 |

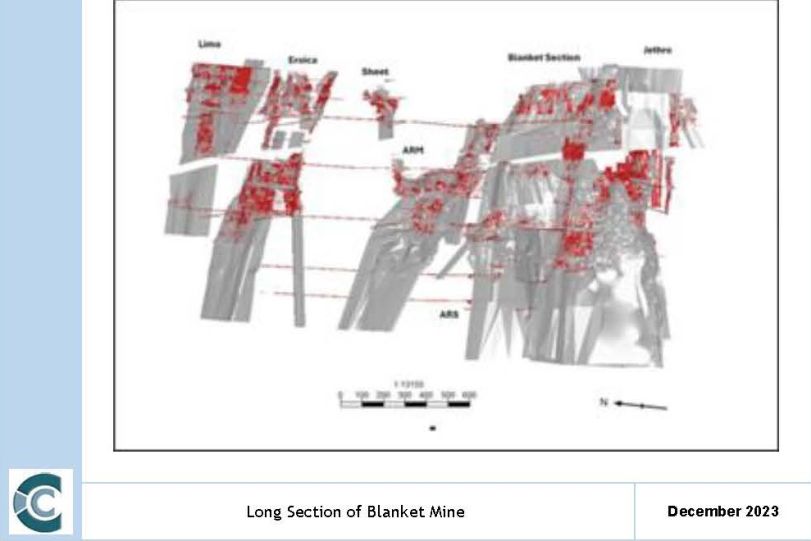

Figure 13: Long Section of Blanket Mine Showing the Total Database | 58 |

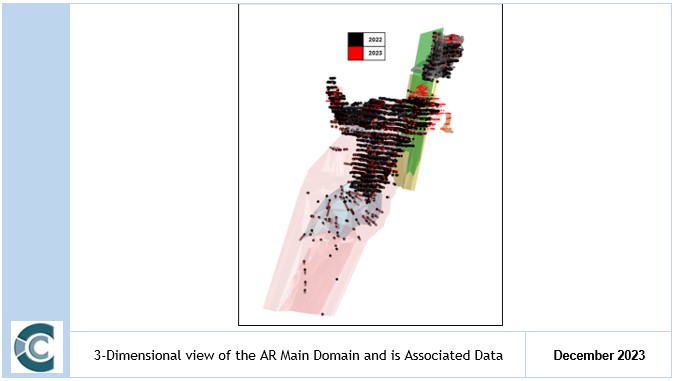

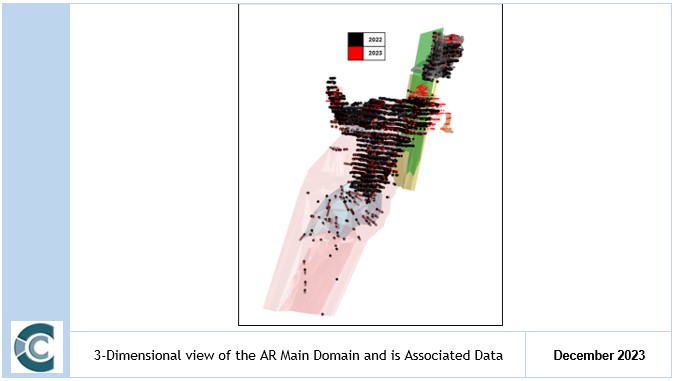

Figure 14: 3-Dimensional view of the AR Main Domain and is Associated Data | 60 |

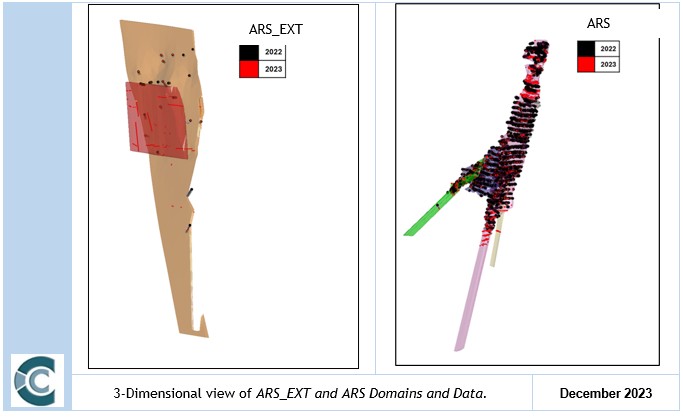

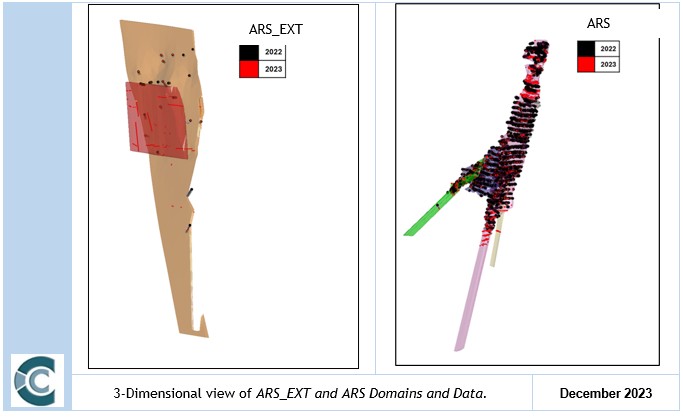

Figure 15: Section View of ARS_EXT and ARS Domains and Data. | 60 |

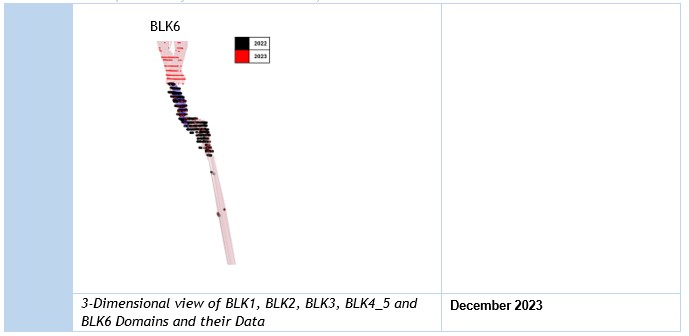

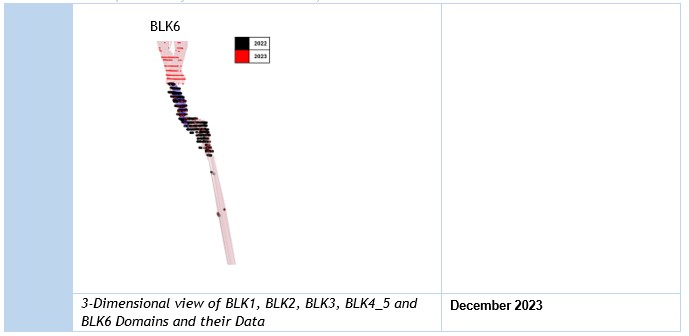

Figure 16: Section View of BLK1, BLK2, BLK3, BLK4_5 and BLK6 Domains and their Data. | 62 |

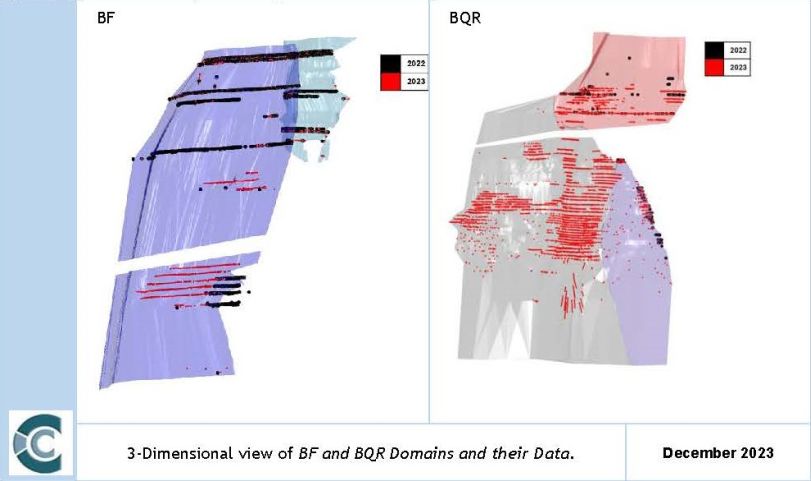

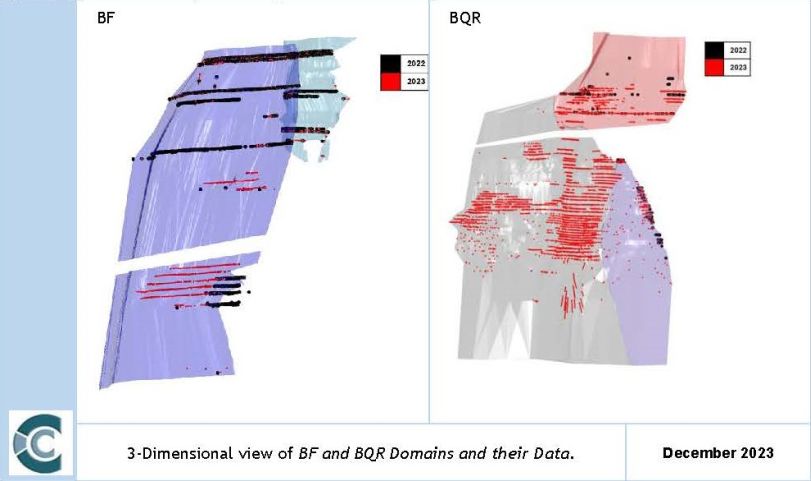

Figure 17: Section View of BF and BQR Domains and their Data. | 64 |

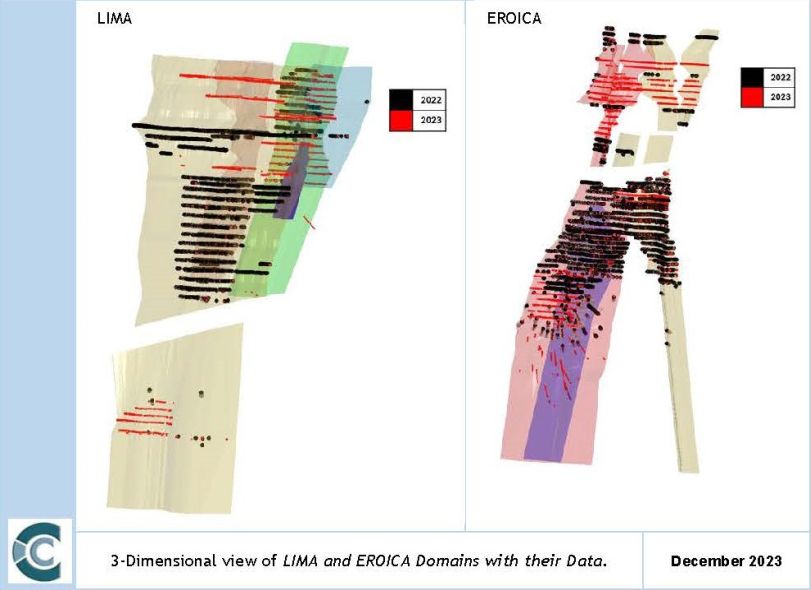

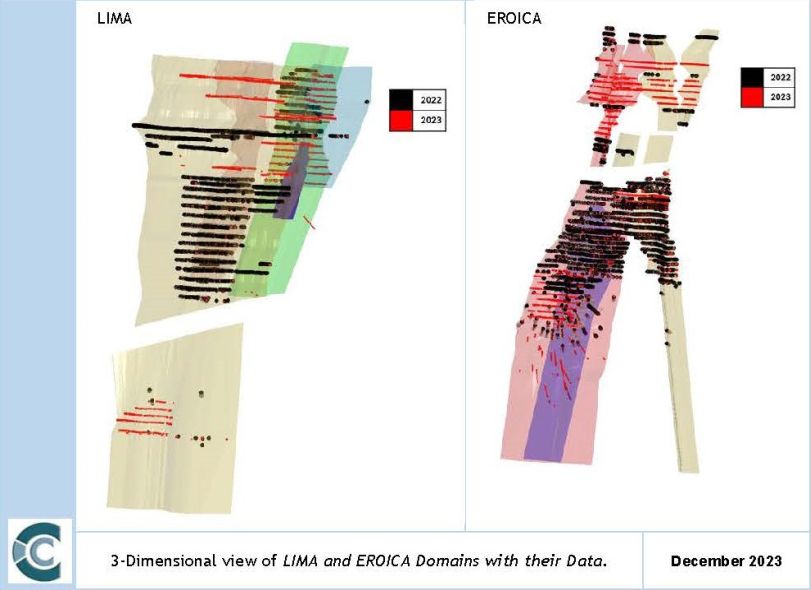

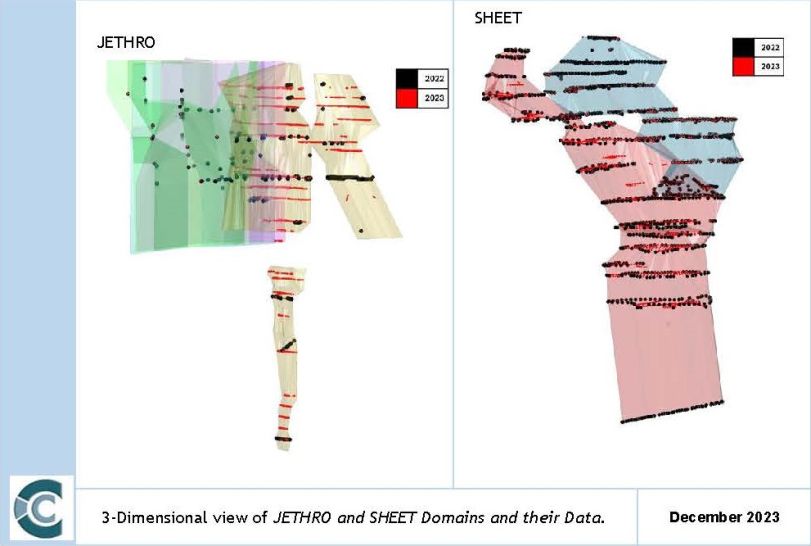

Figure 18: Section View of the LIMA and EROICA Domains with their Data. | 65 |

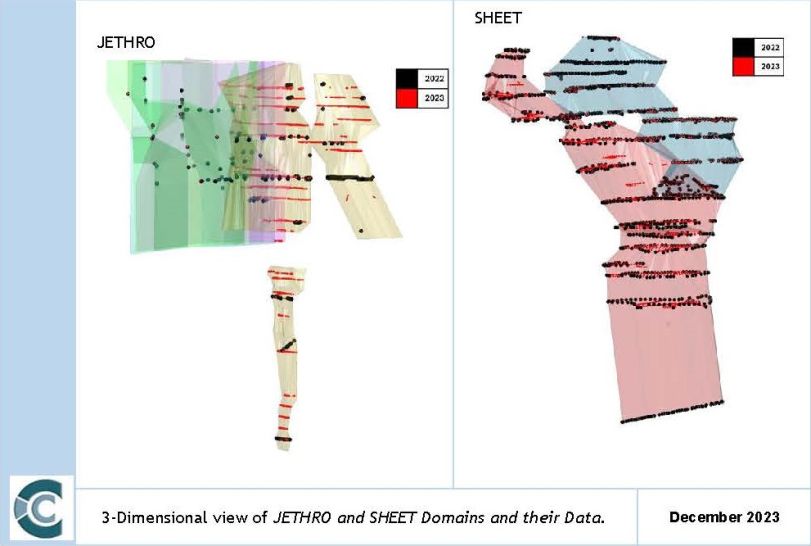

Figure 19: Section View of JETHRO and SHEET Domains and their Data. | 65 |

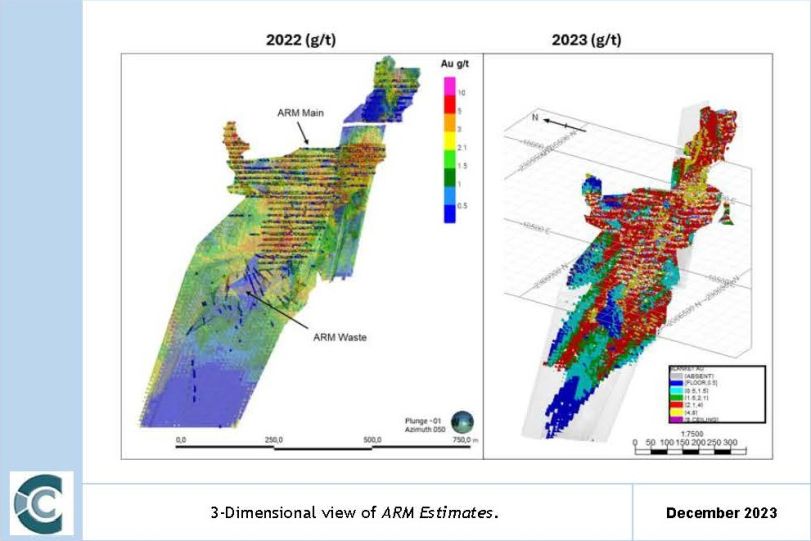

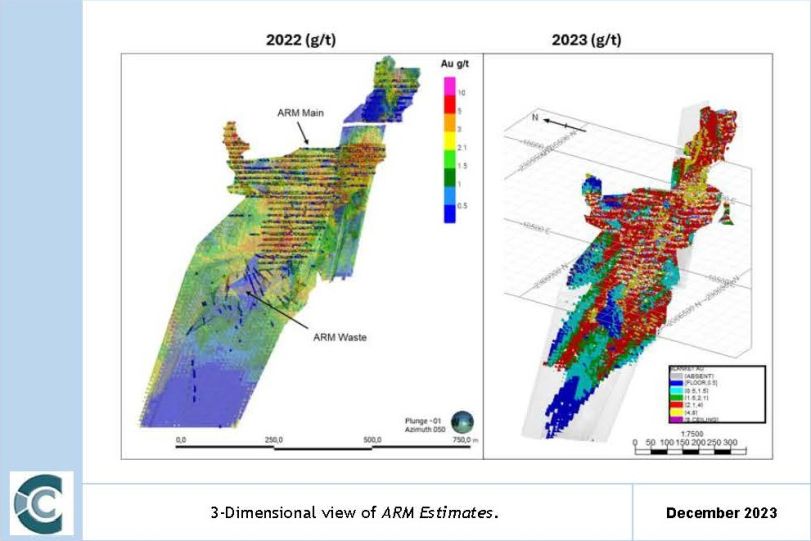

Figure 20: ARM Estimates | 68 |

Figure 21: ARS Estimates (including ARS_Ext) | 68 |

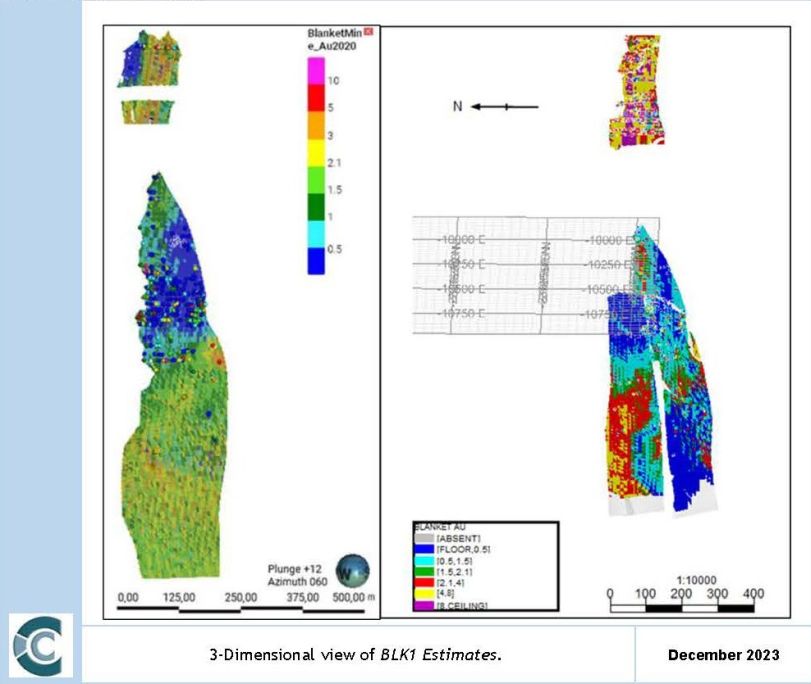

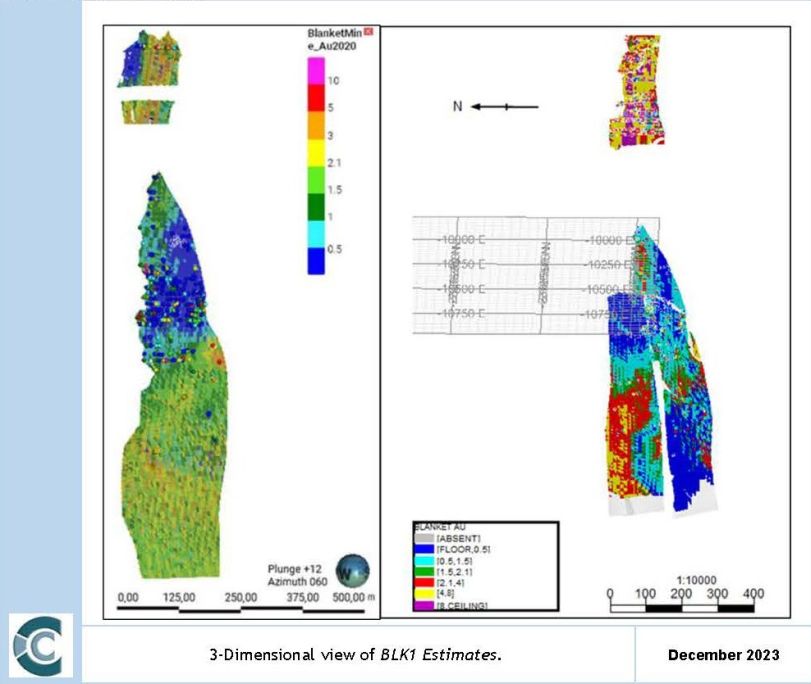

Figure 22: BLK1 Estimates | 69 |

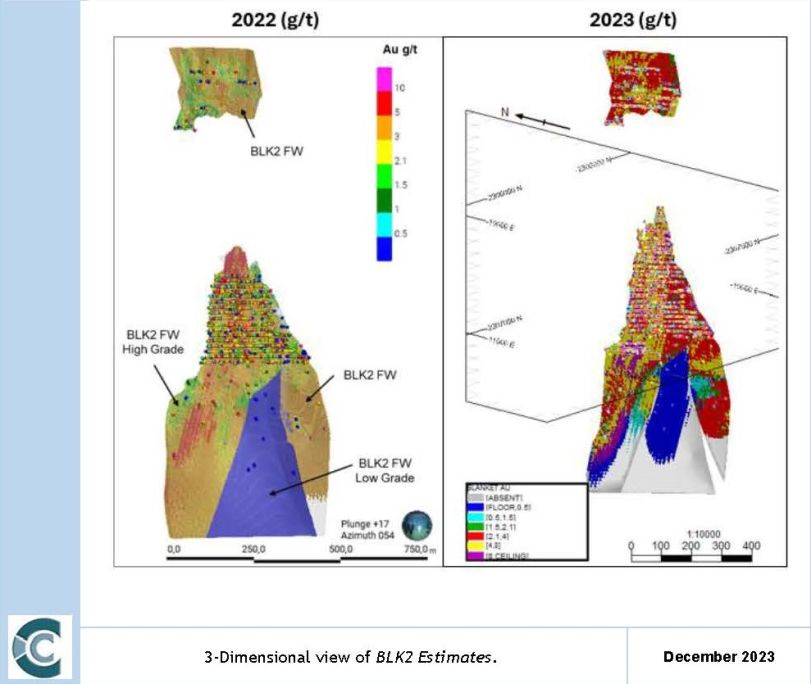

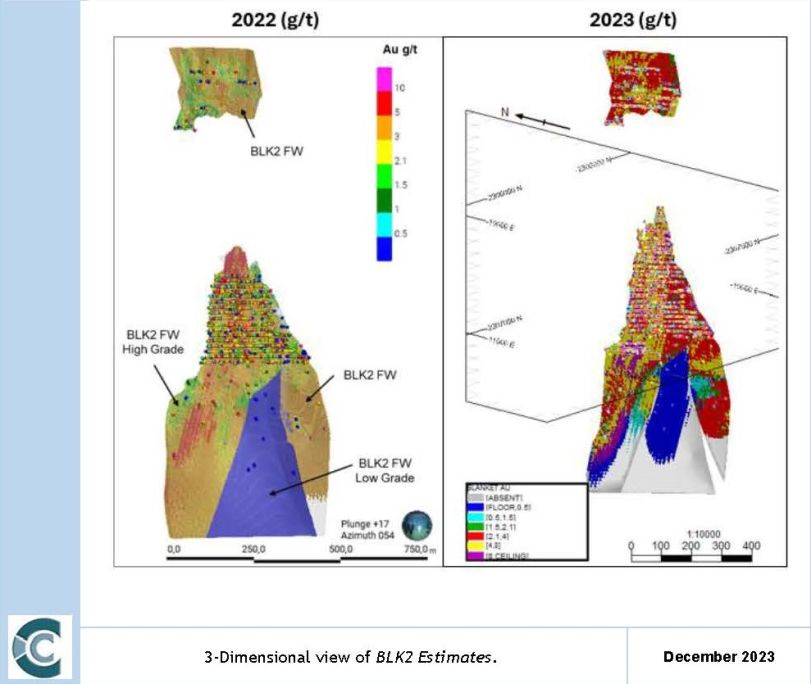

Figure 23: BLK2 Estimates | 70 |

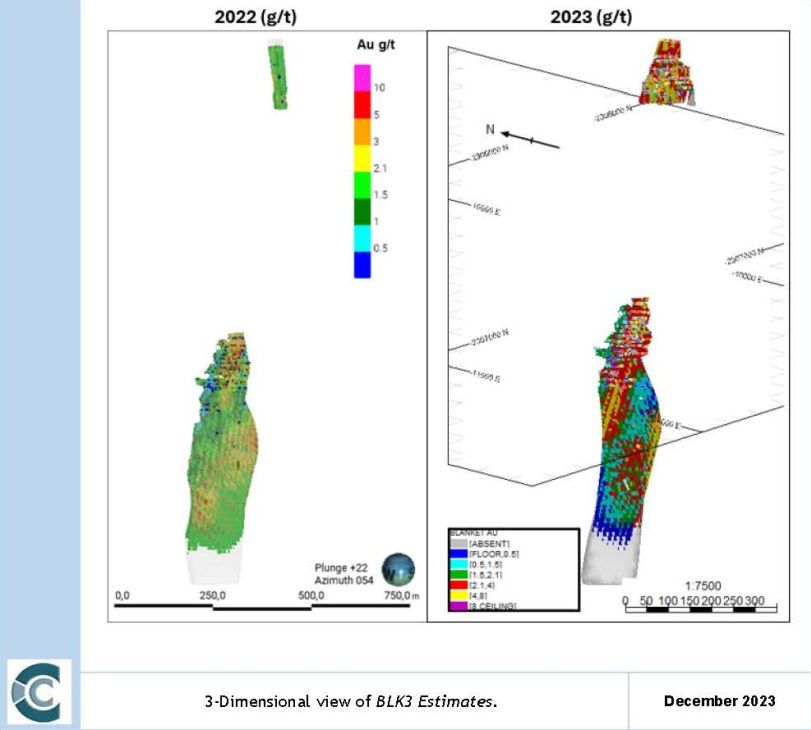

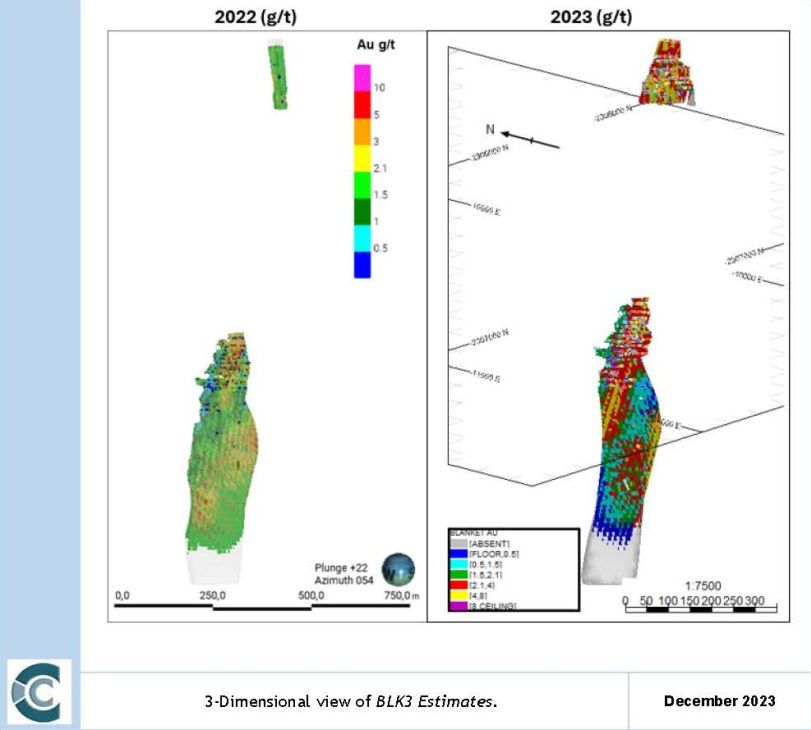

Figure 24: BLK3 Estimates | 71 |

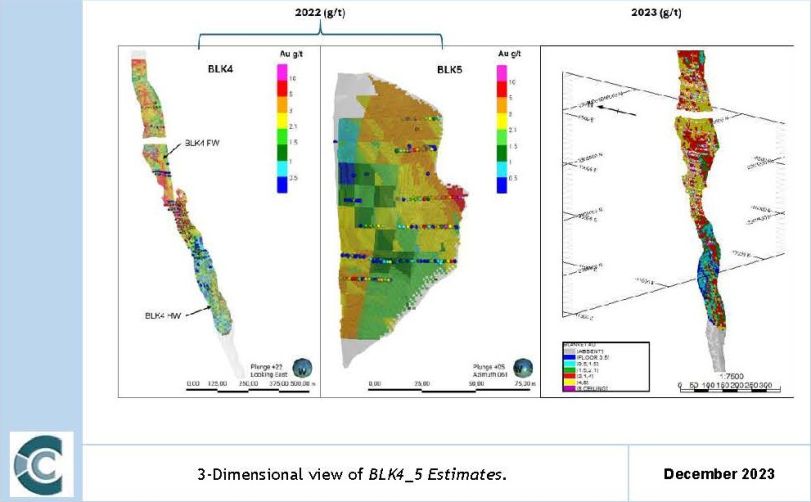

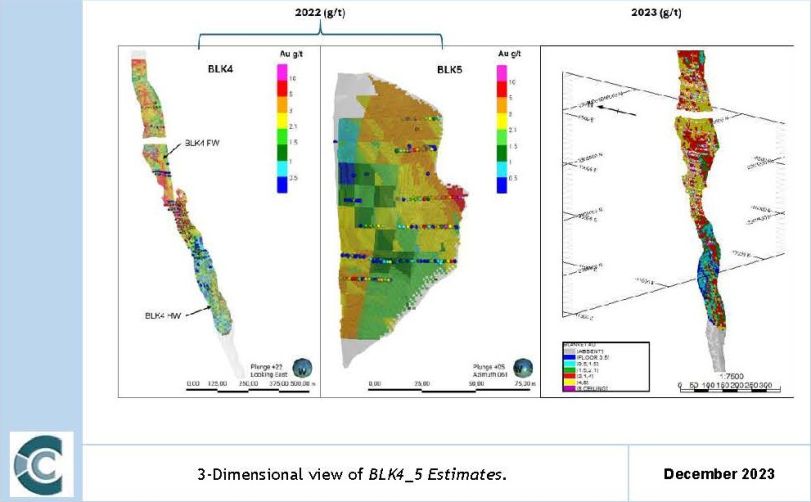

Figure 25: BLK4_5 Estimates | 72 |

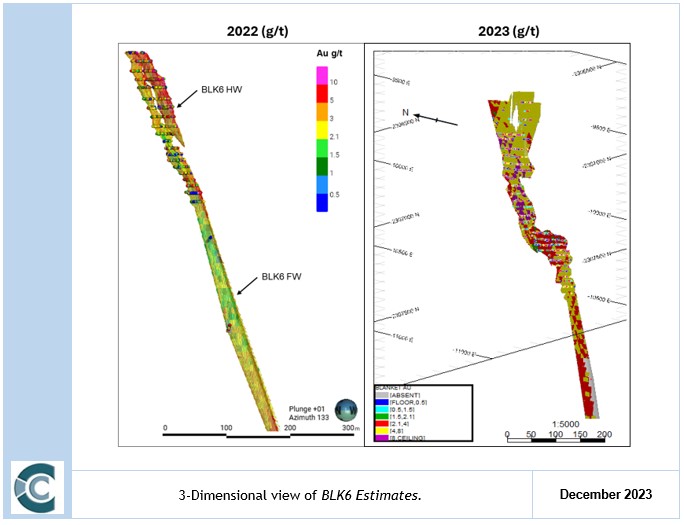

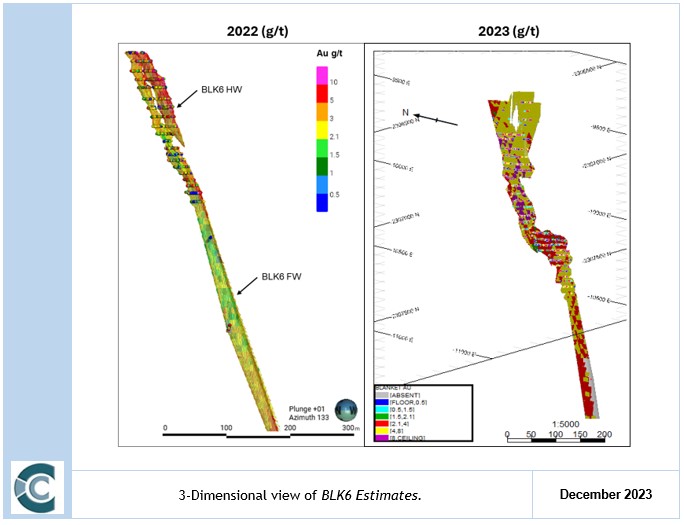

Figure 26: BLK6 Estimates | 72 |

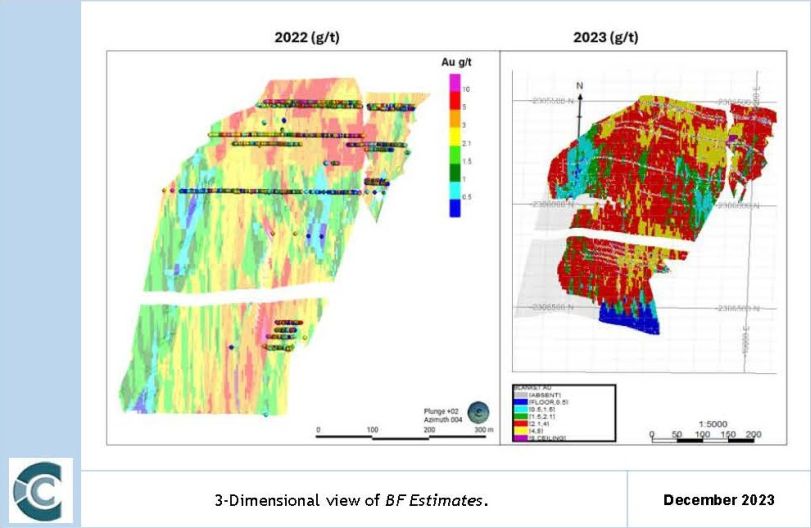

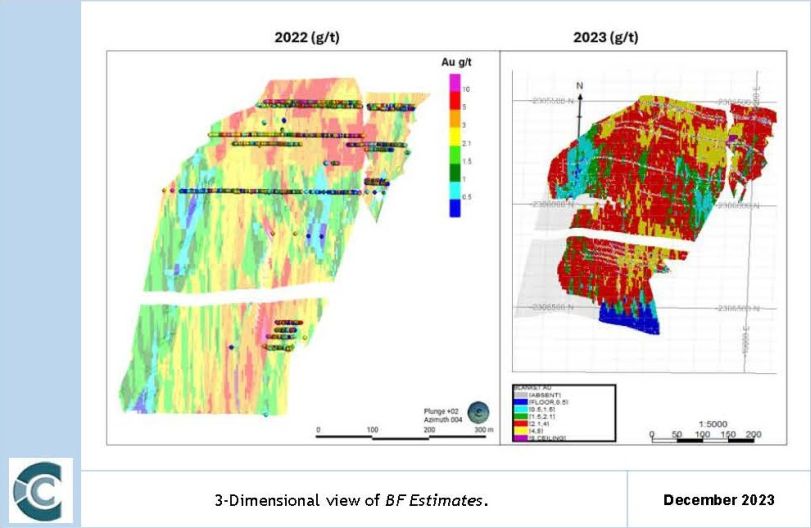

Figure 27: BF Estimates | 73 |

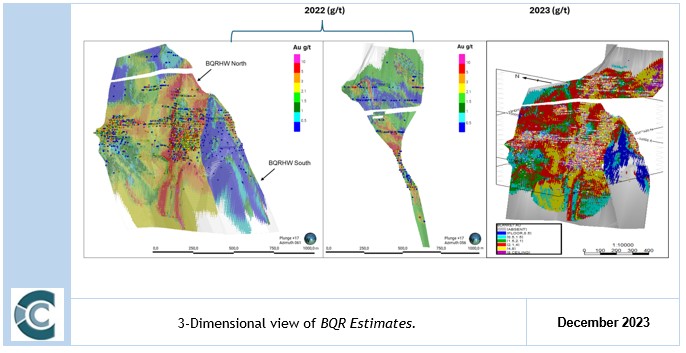

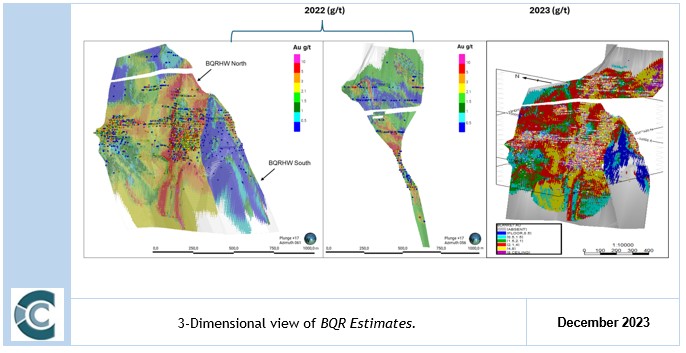

Figure 28: BQR Estimates | 74 |

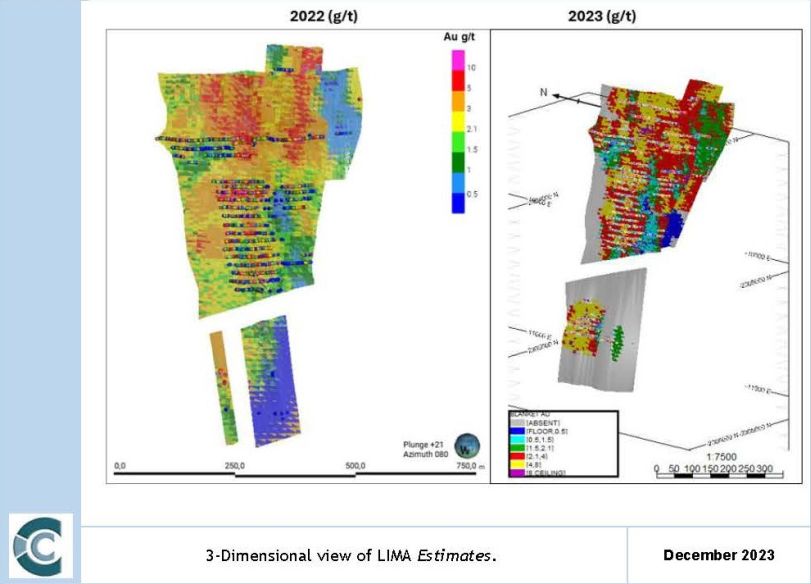

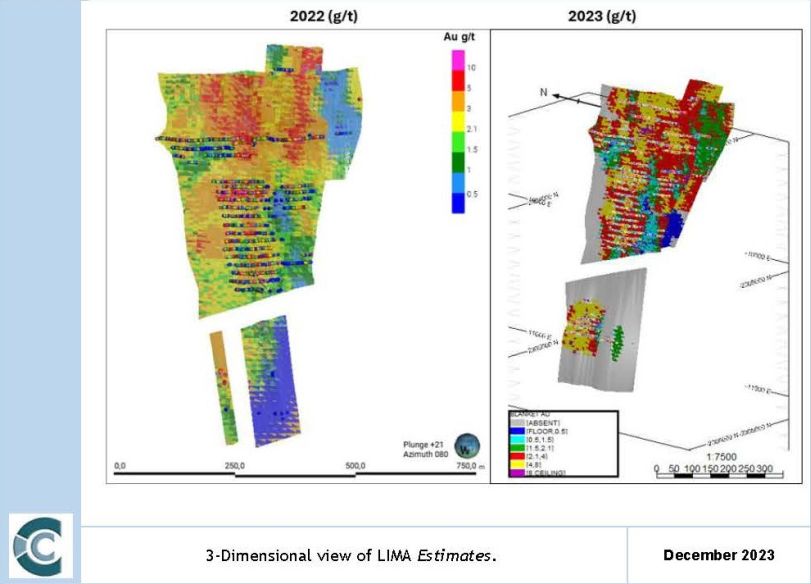

Figure 29: LIMA Estimates | 74 |

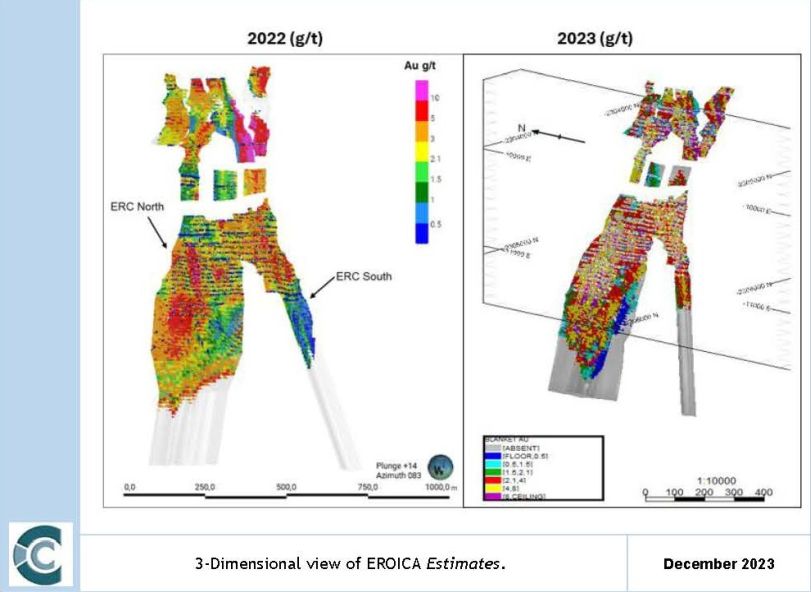

Figure 30: ERC Estimates | 75 |

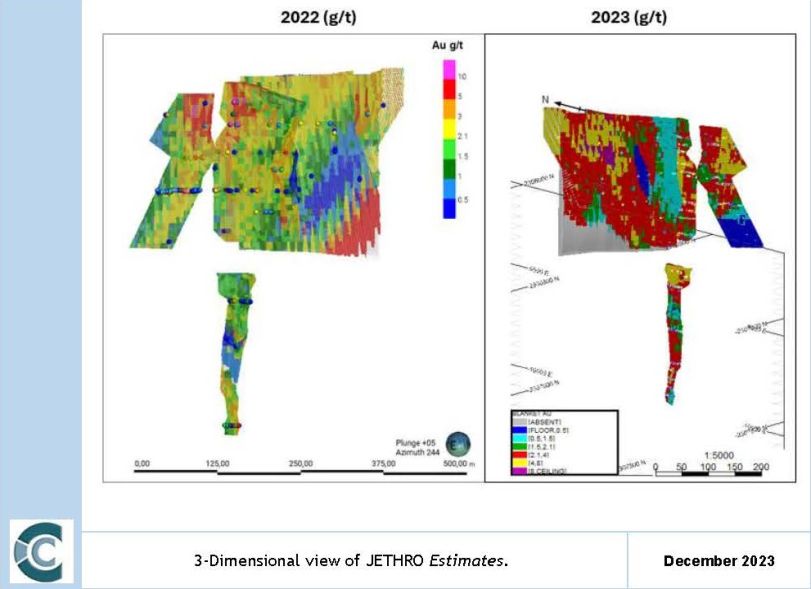

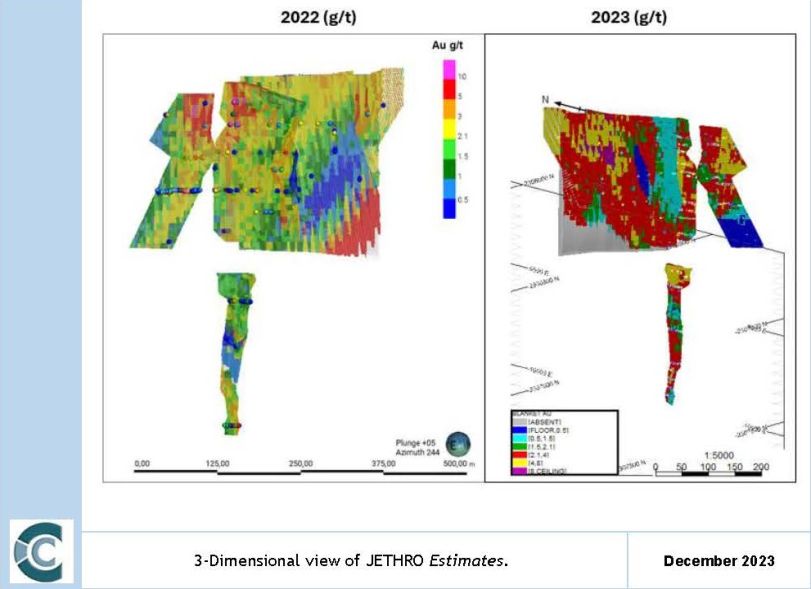

Figure 31: JTH Estimates | 76 |

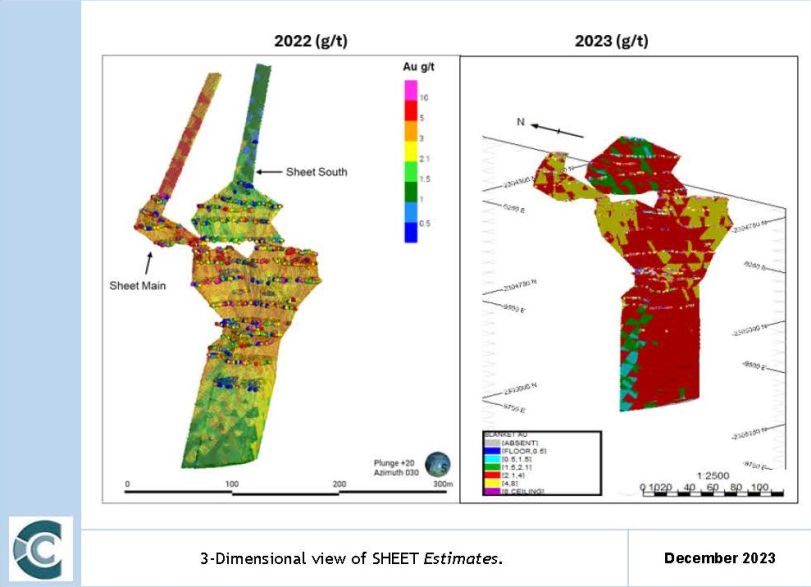

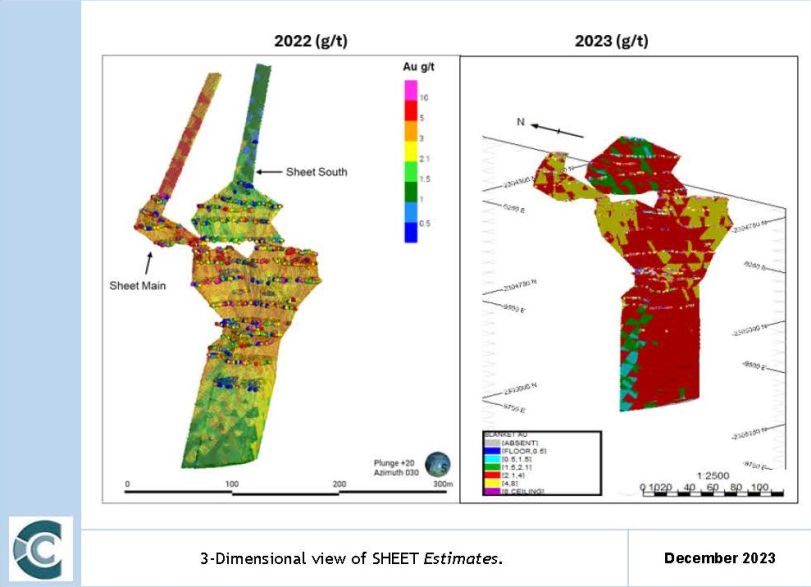

Figure 32: SHT Estimates | 77 |

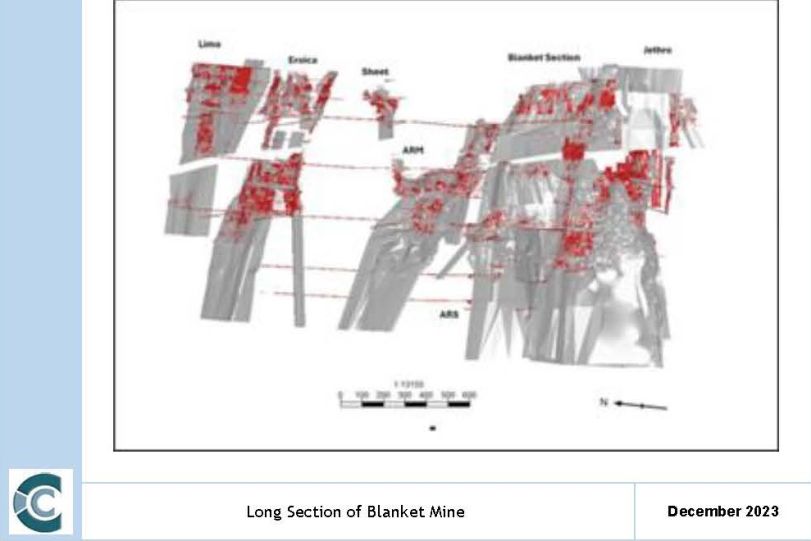

Figure 33: Long Section of Blanket Mine showing Stopes, Drives, Haulages and Shafts | 78 |

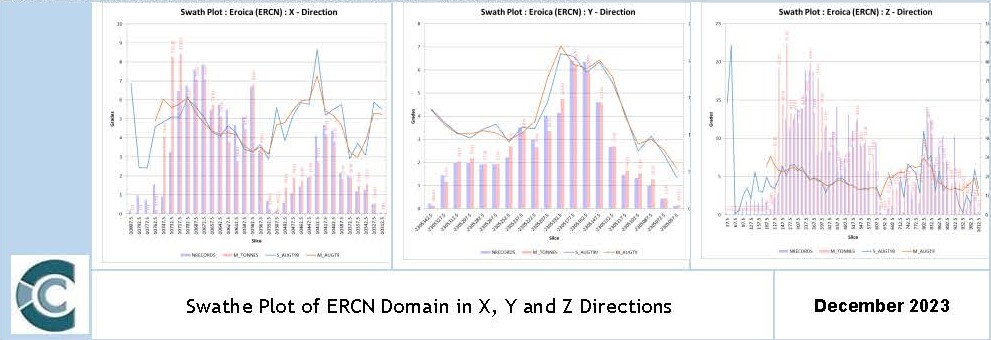

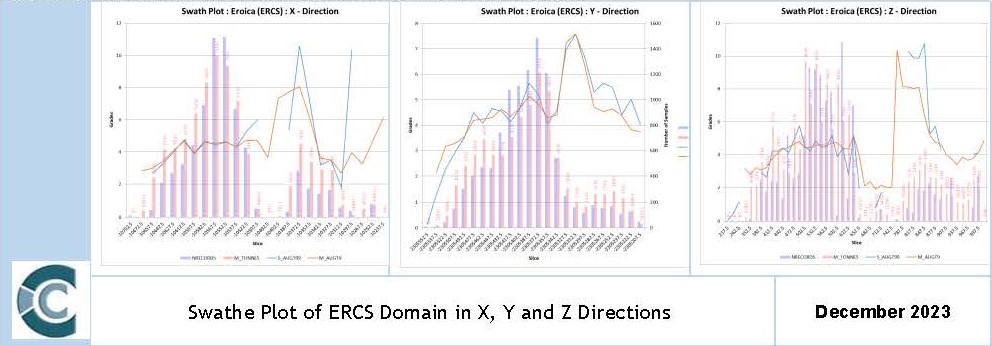

Figure 34: Swathe Plot of ERCN Domain in X, Y and Z Directions | 79 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

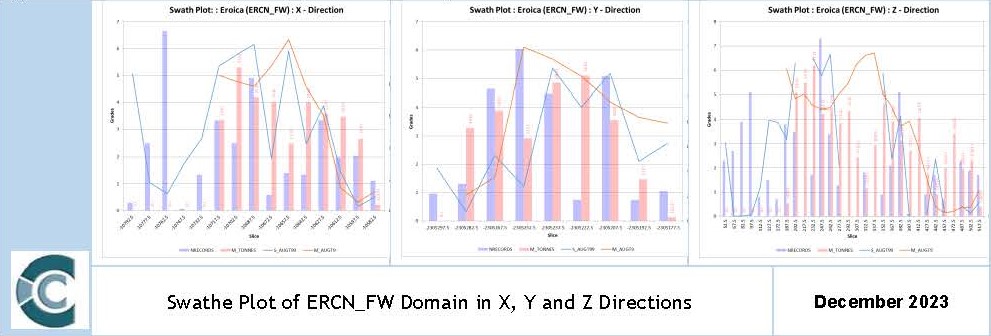

Figure 35: Swathe Plot of ERCN_FW Domain in X, Y and Z Directions | 79 |

Figure 36: Swathe Plot of ERCS Domain in X, Y and Z Directions | 79 |

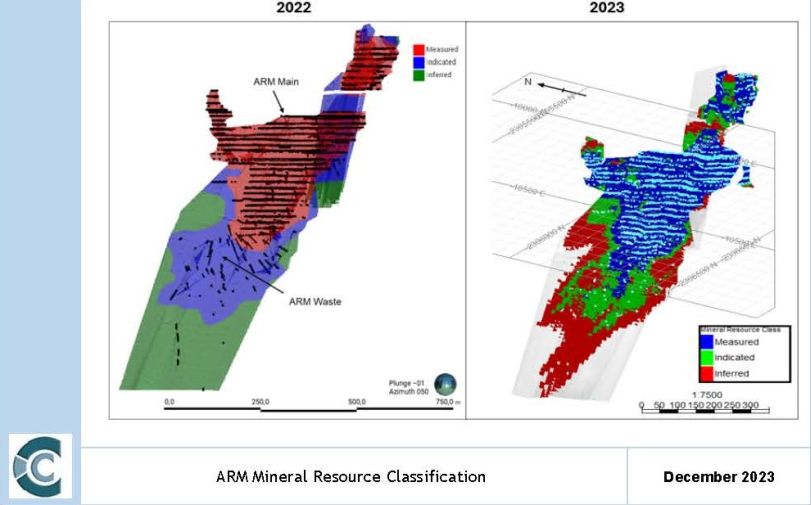

Figure 37: ARM Mineral Resource Classification | 83 |

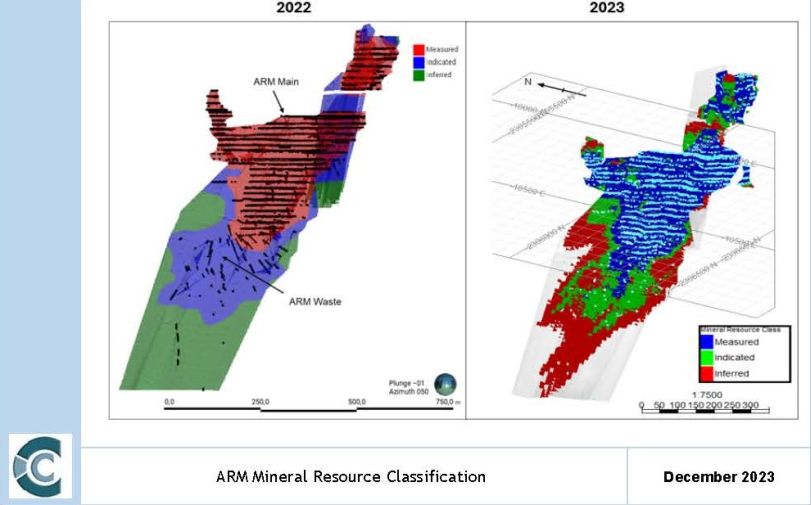

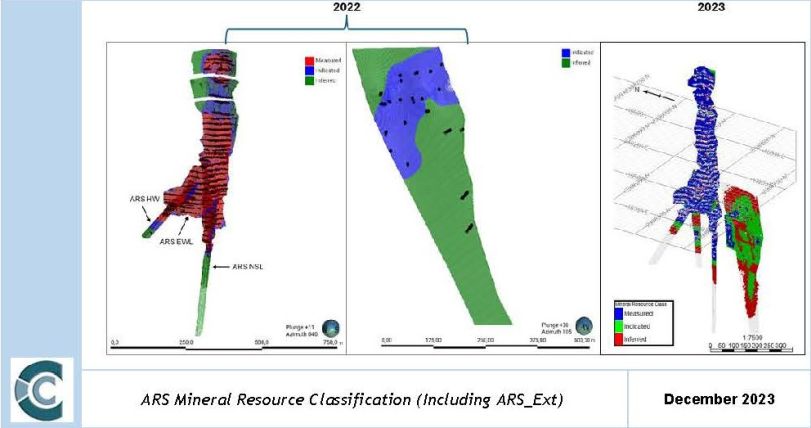

Figure 38: ARS Mineral Resource Classification (Including ARS_Ext) | 84 |

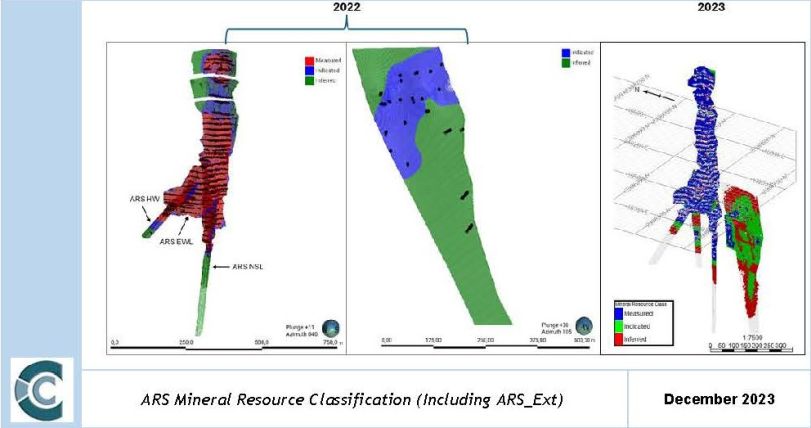

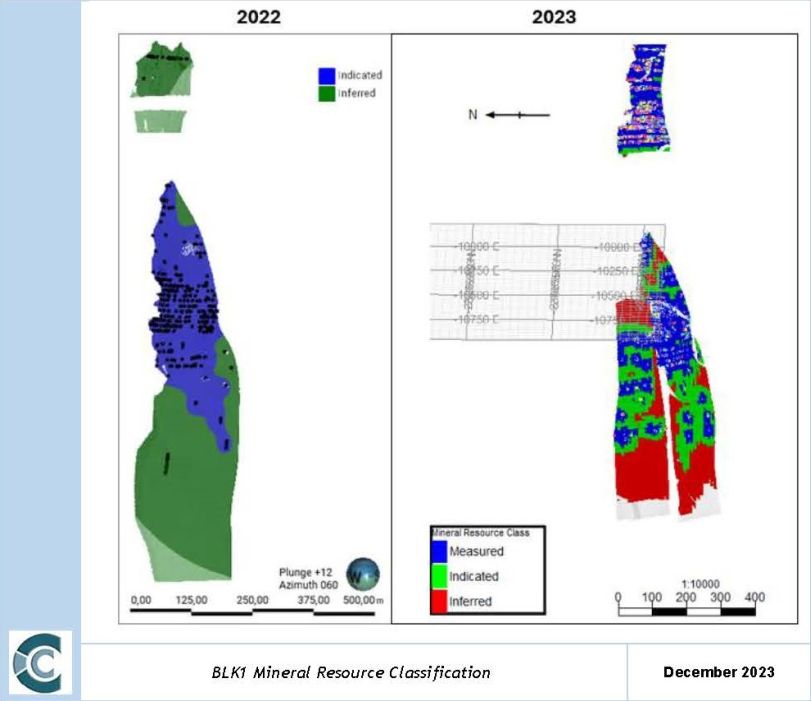

Figure 39: BLK1 Mineral Resource Classification | 85 |

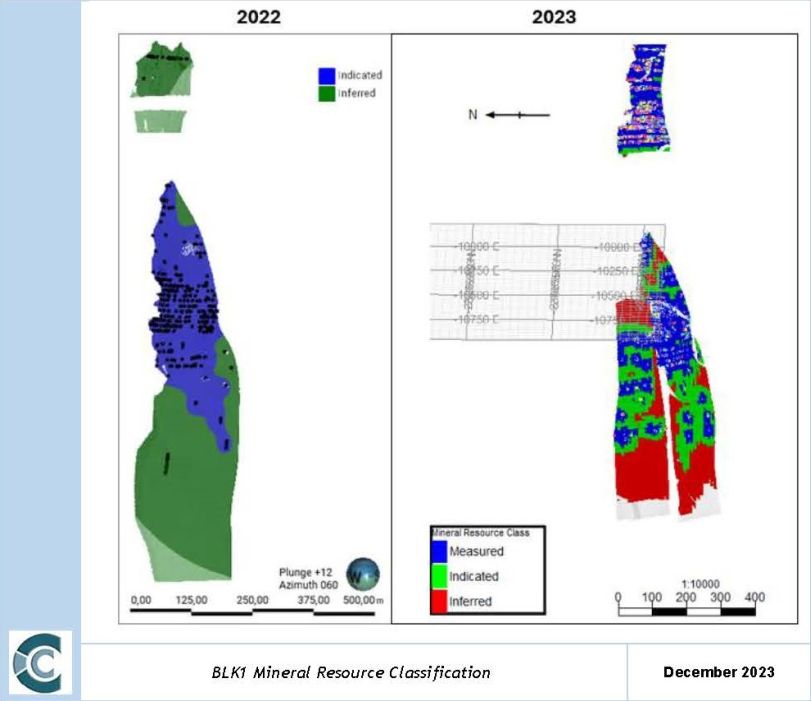

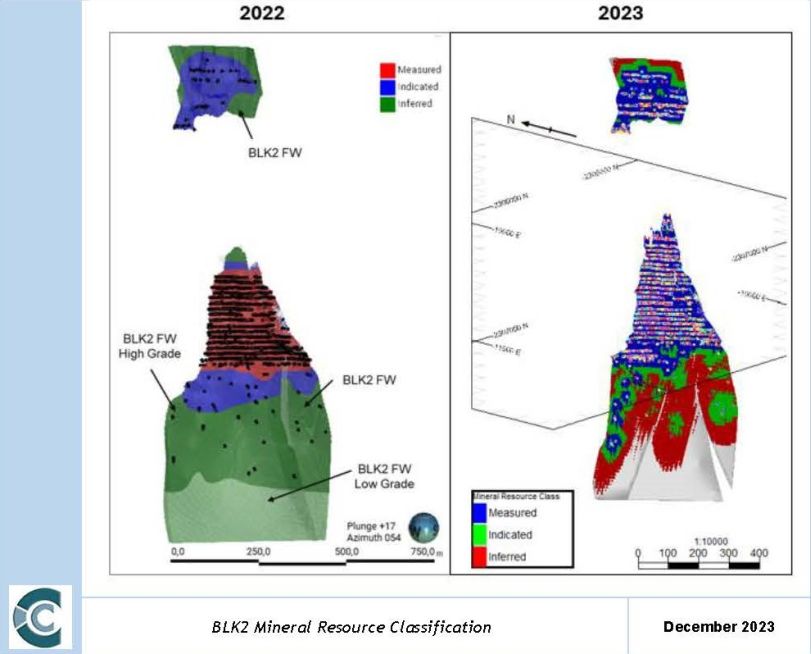

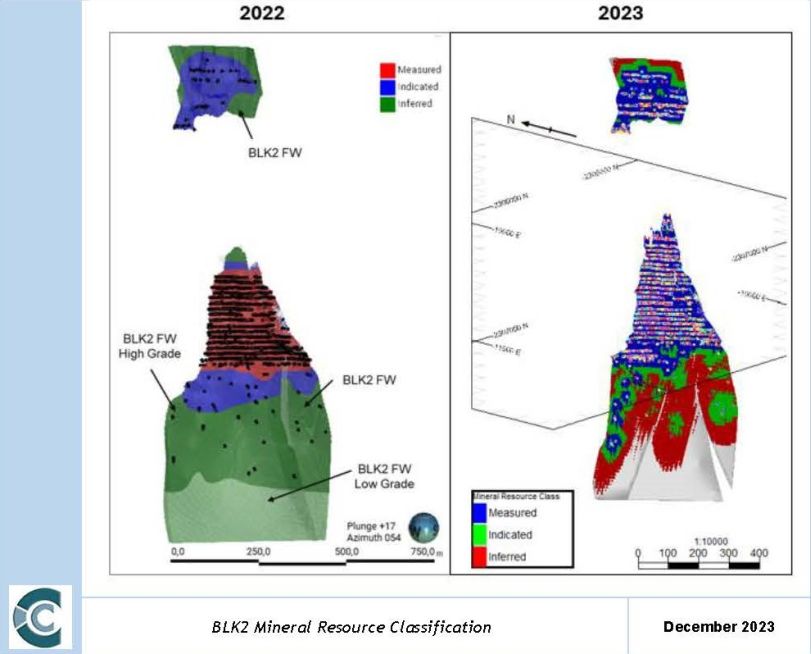

Figure 40: BLK2 Mineral Resource Classification | 86 |

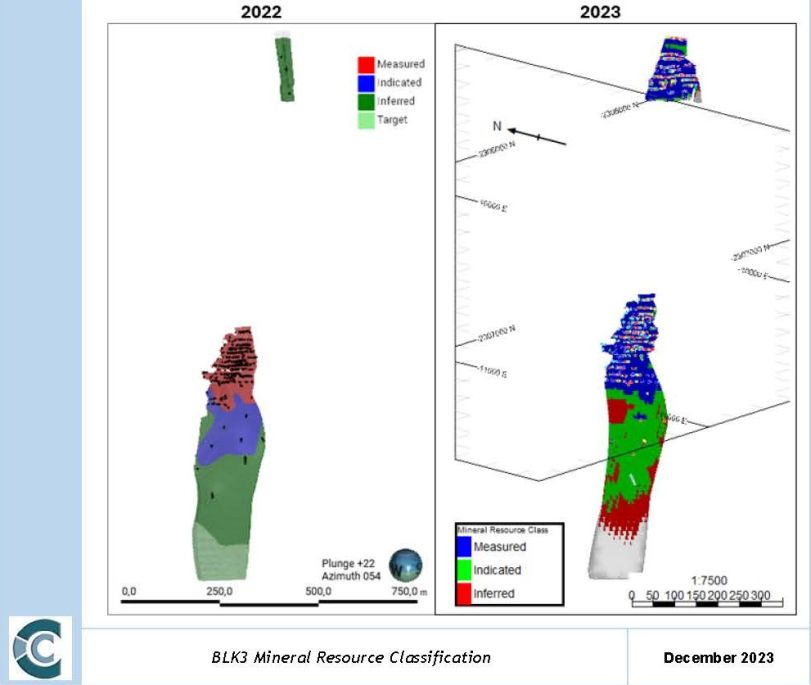

Figure 41: BLK3 Mineral Resource Classification | 87 |

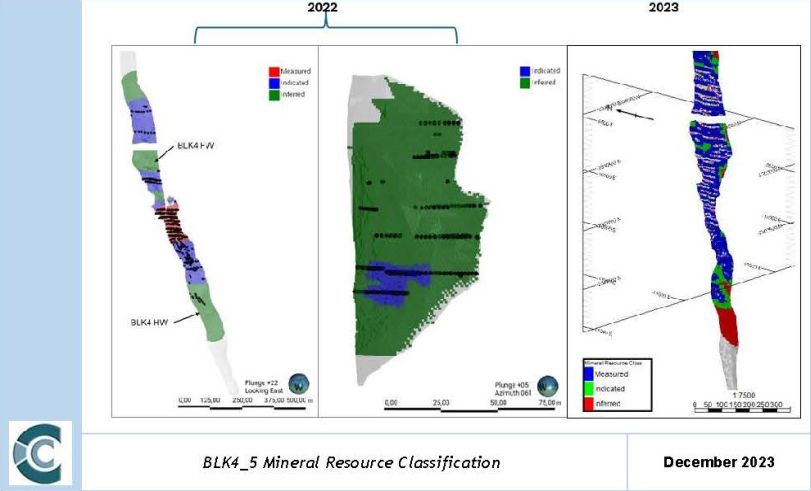

Figure 42: BLK4_5 Mineral Resource Classification | 88 |

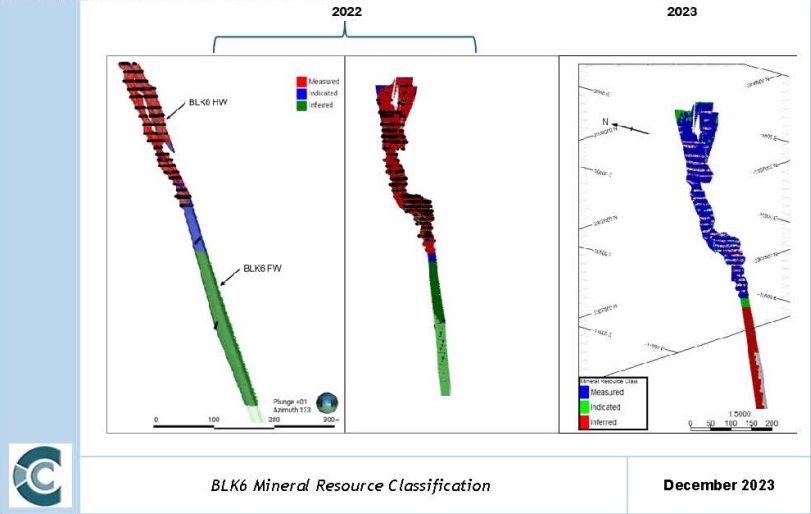

Figure 43: BLK6 Mineral Resource Classification | 88 |

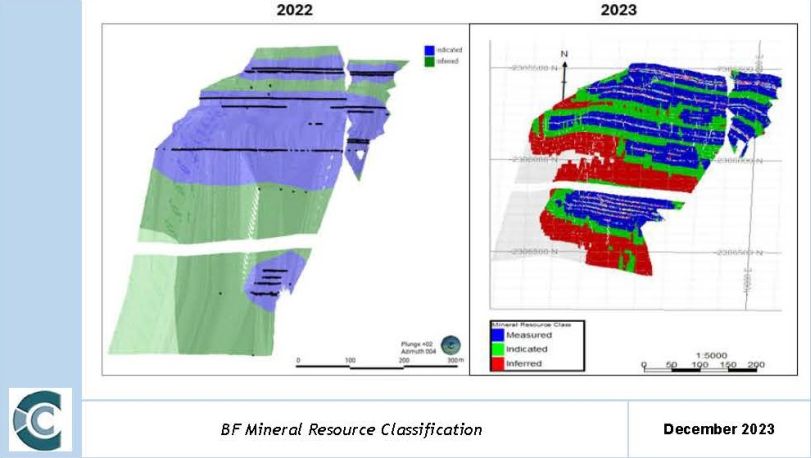

Figure 44: BF Mineral Resource Classification | 89 |

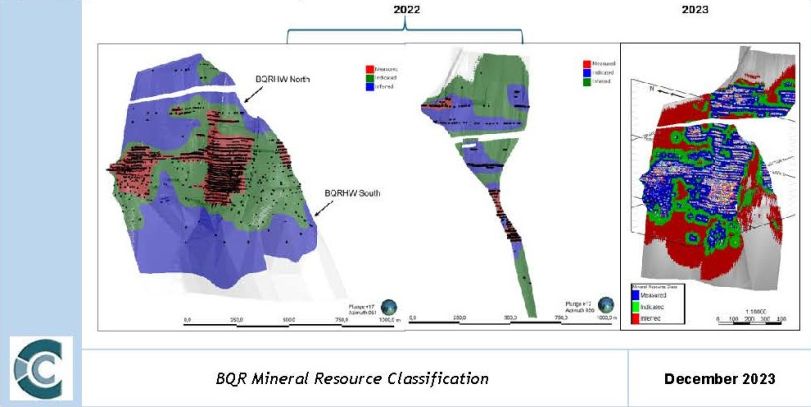

Figure 45: BQR Mineral Resource Classification | 89 |

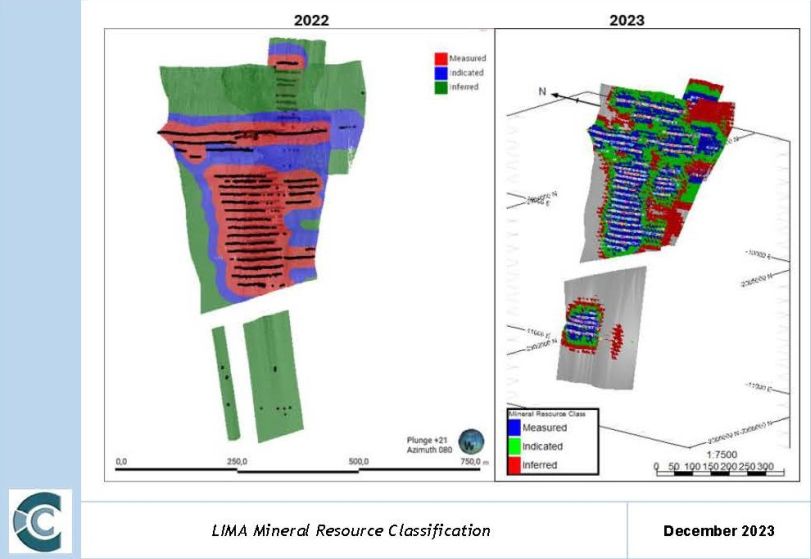

Figure 46: LIMA Mineral Resource Classification | 90 |

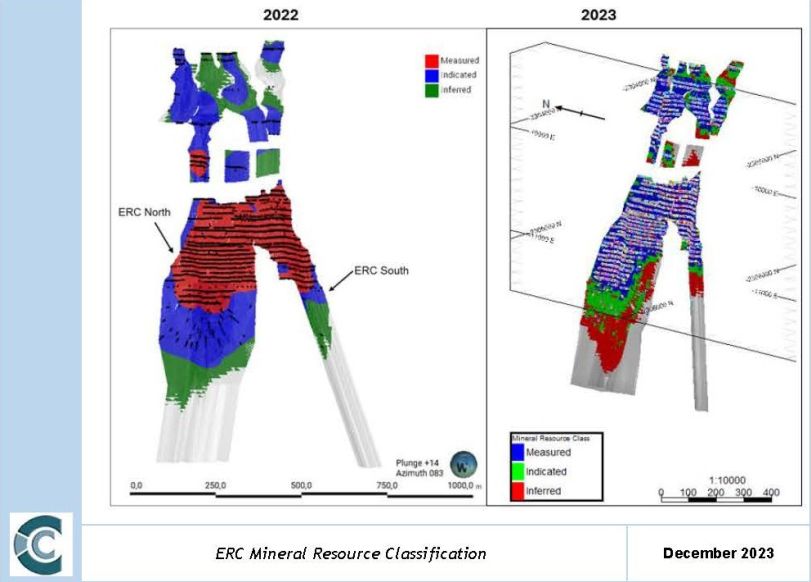

Figure 47: ERC Mineral Resource Classification | 91 |

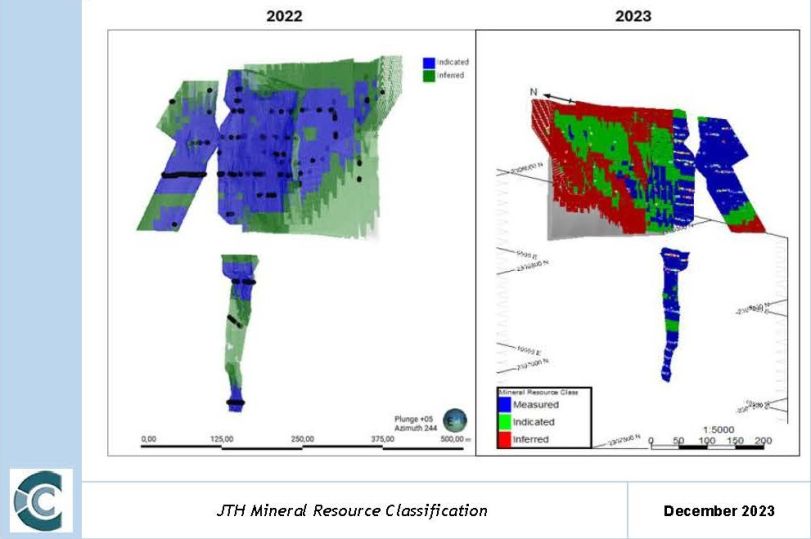

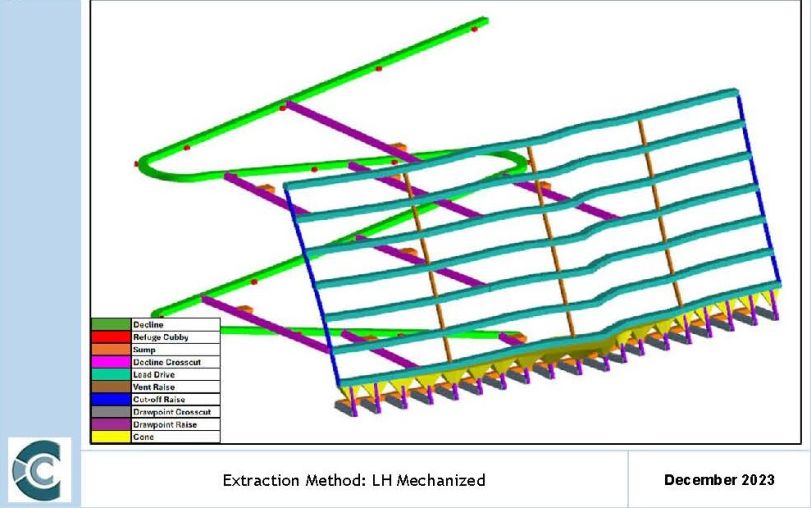

Figure 48: JTH Mineral Resource Classification | 92 |

Figure 49: SHT Mineral Resource Classification | 93 |

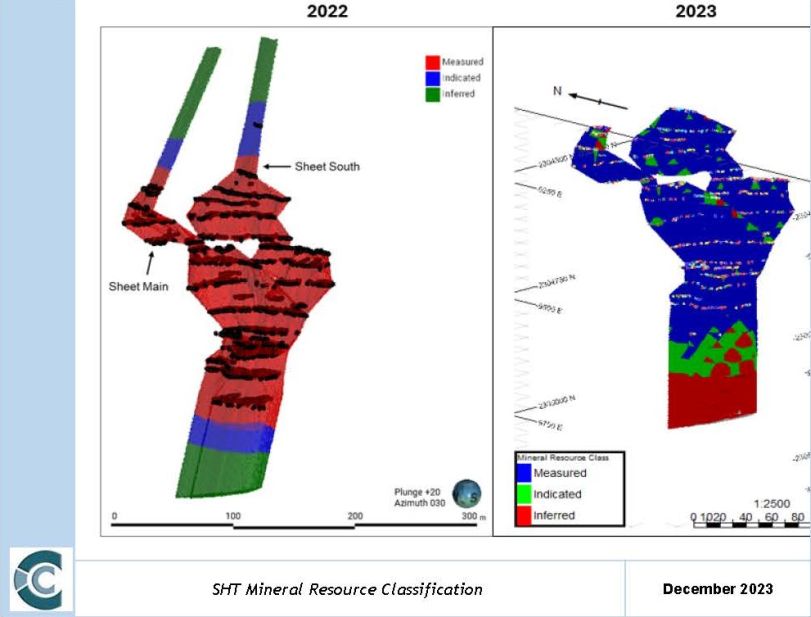

Figure 50: Diluted Life of Mine Production Schedule by Mineral Resource Classification (2023) | 99 |

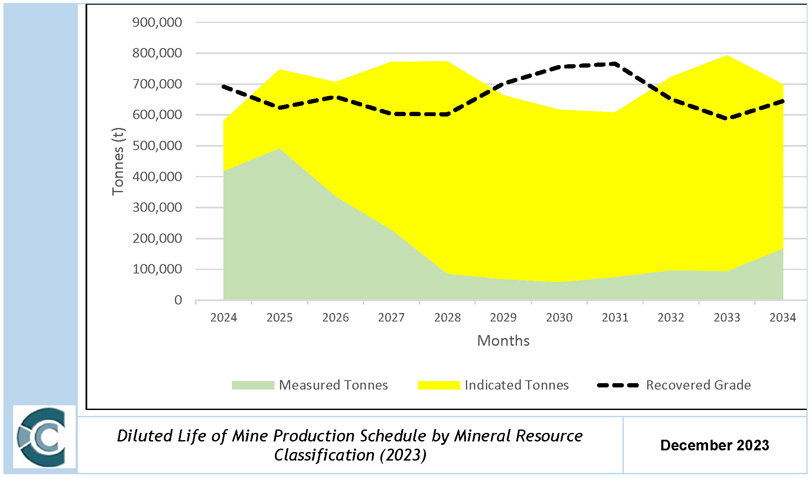

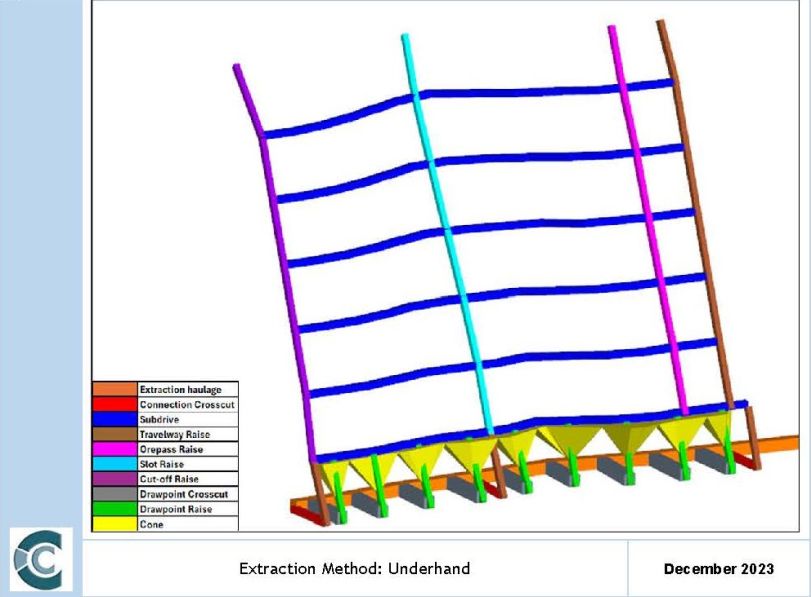

Figure 51: Extraction Method: LH Mechanized | 101 |

Figure 52: Extraction Method: Underhand | 102 |

Figure 53: Schematic Representation of Long-hole Stoping Mining Method | 104 |

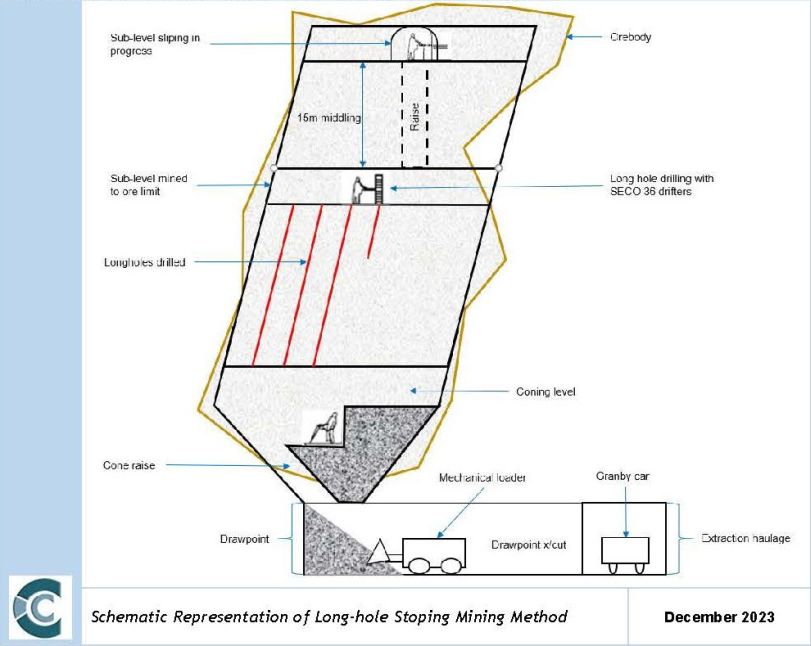

Figure 54: Schematic Representation of Underhand Stoping Mining Method | 105 |

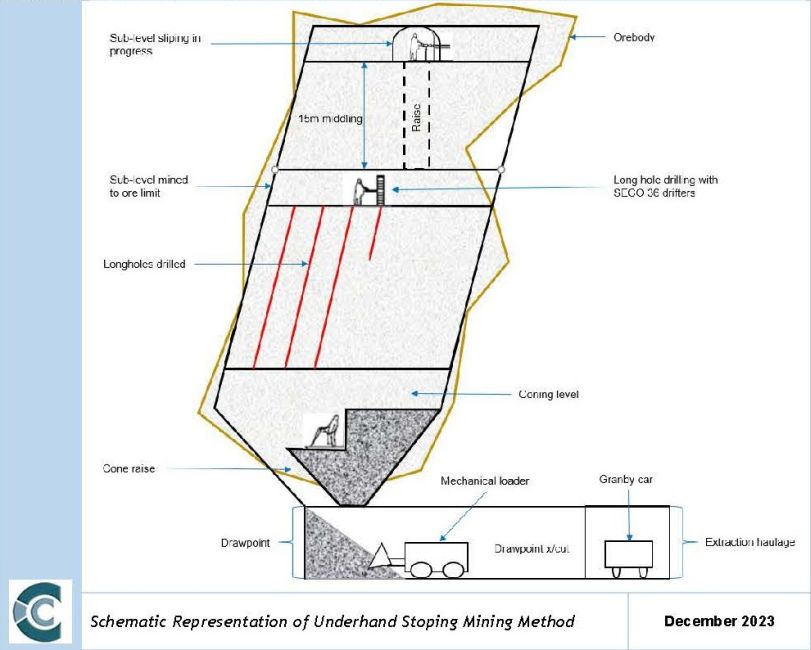

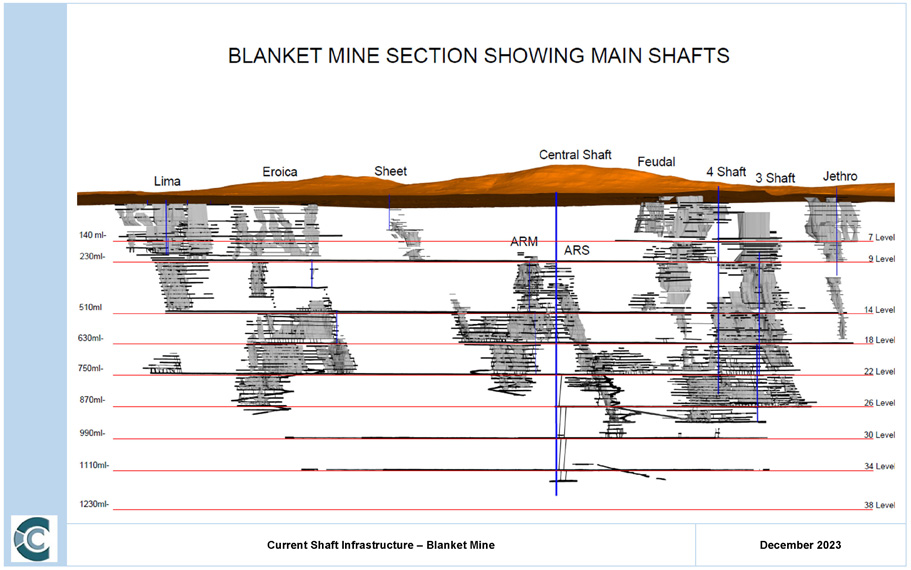

Figure 55: Blanket Mine Shaft Infrastructure | 107 |

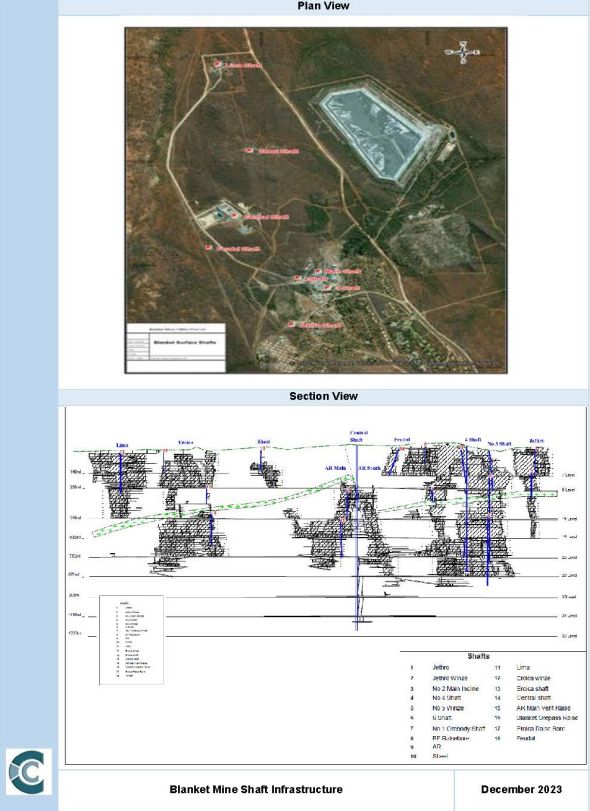

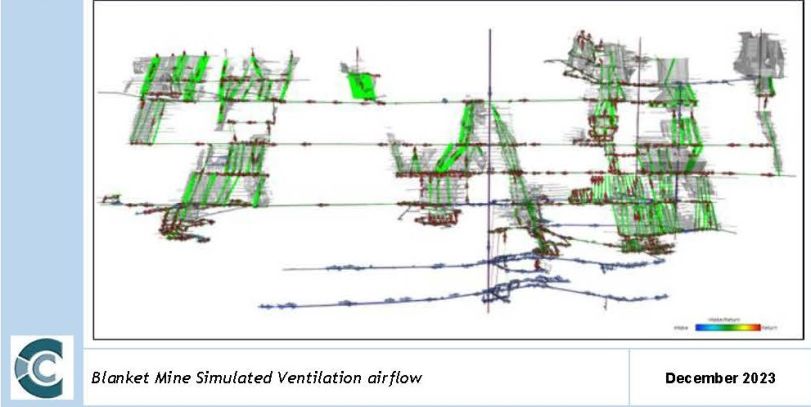

Figure 56: Blanket Mine Simulated Ventilation airflow | 108 |

Figure 57: Diluted Life of Mine Production Schedule by Mineral Resource Classification | 111 |

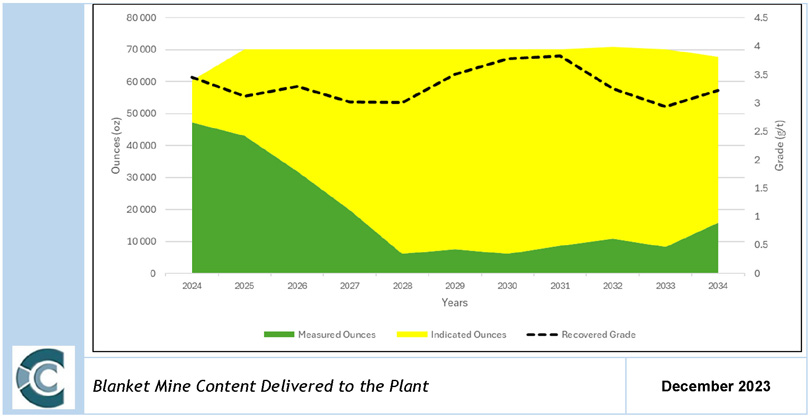

Figure 58: Blanket Mine Content Delivered to the Plant | 112 |

Figure 59: Monthly Stope Ore Tonne Production | 112 |

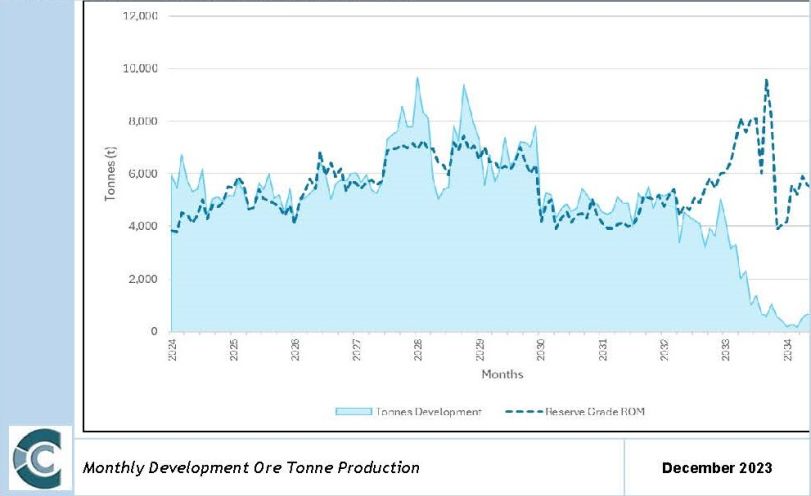

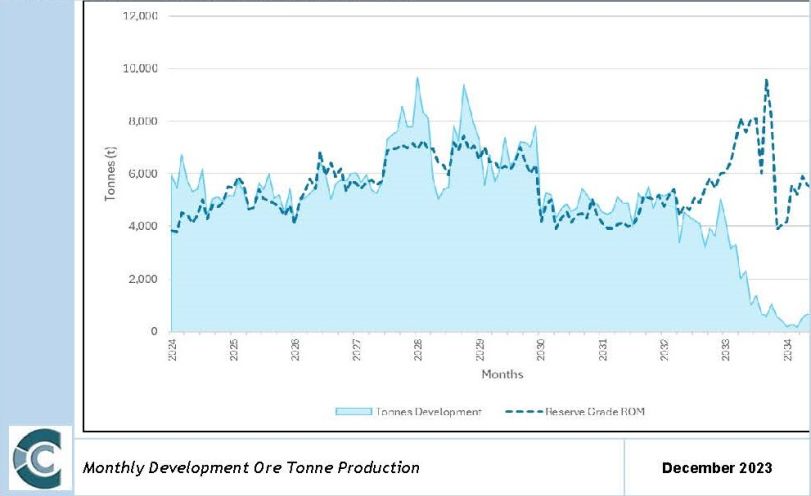

Figure 60: Monthly Development Ore Tonne Production | 113 |

Figure 61: Blanket Mine Design | 115 |

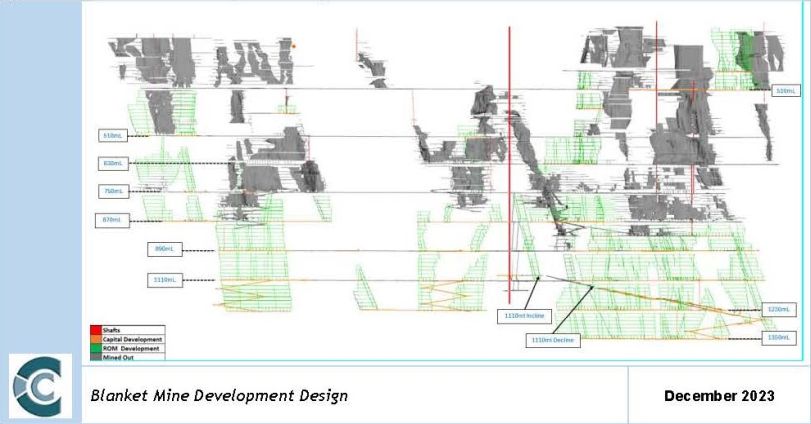

Figure 62: Blanket Mine Development Design | 119 |

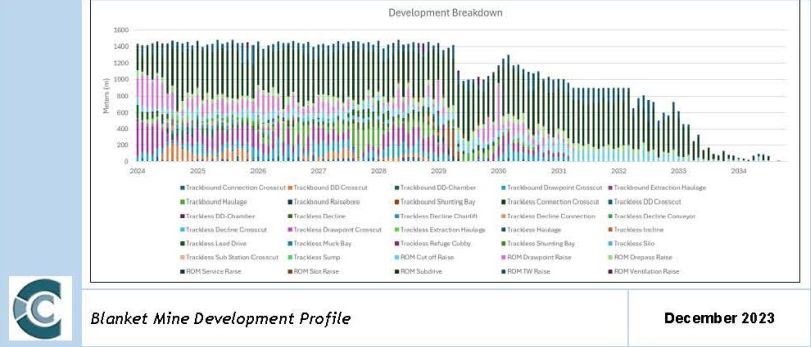

Figure 63: Blanket Mine Development Profile | 119 |

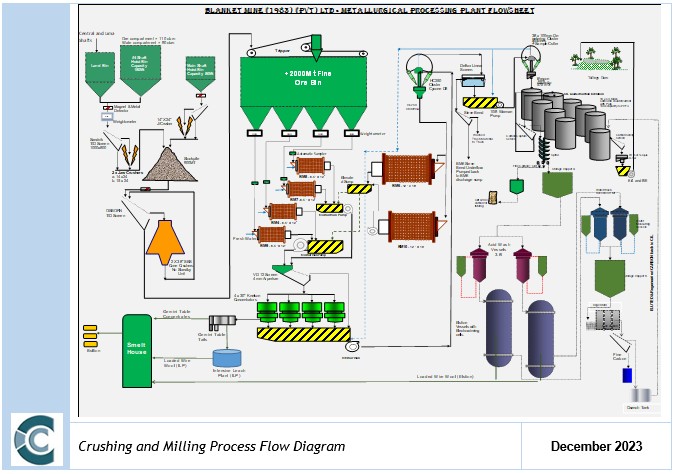

Figure 64: Crushing and Milling Process Flow Diagram | 123 |

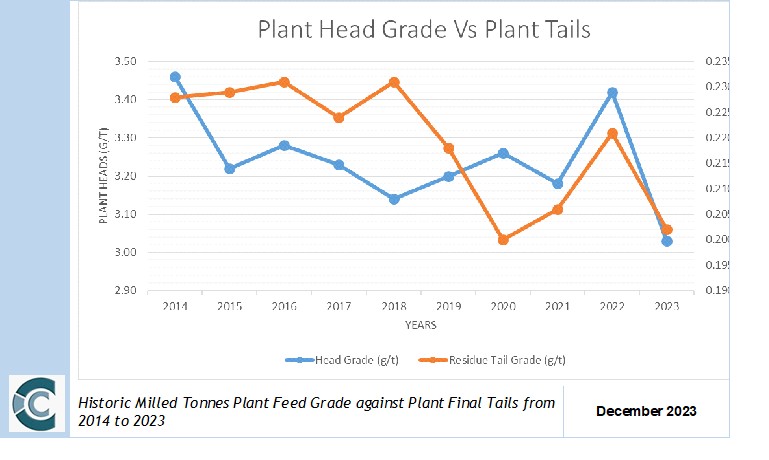

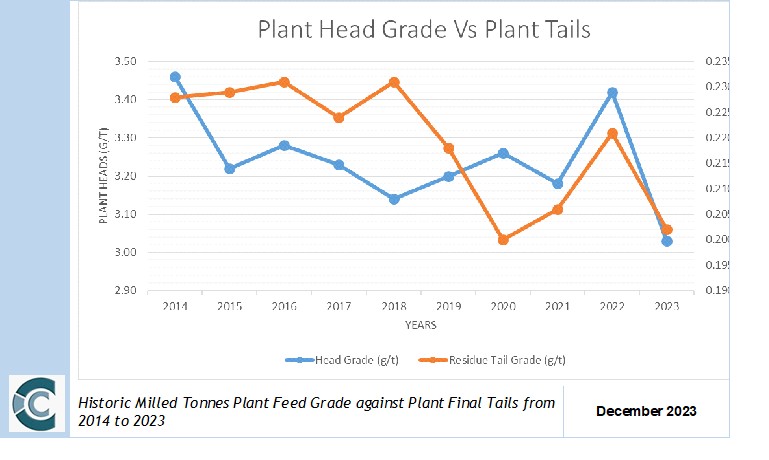

Figure 65: Historic Milled Tonnes Plant Feed Grade against Plant Final Tails from 2014 to 2023 | 124 |

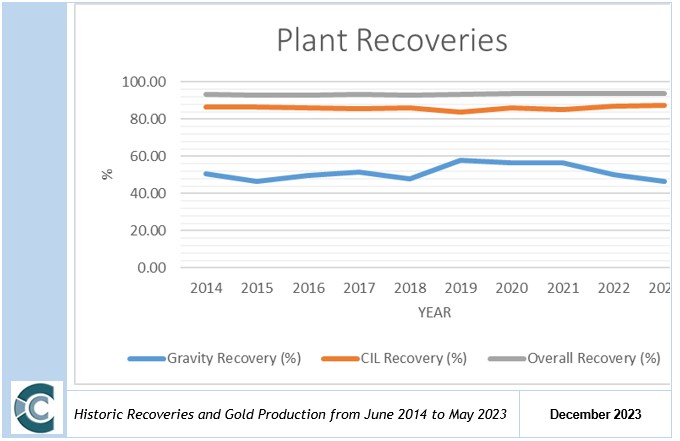

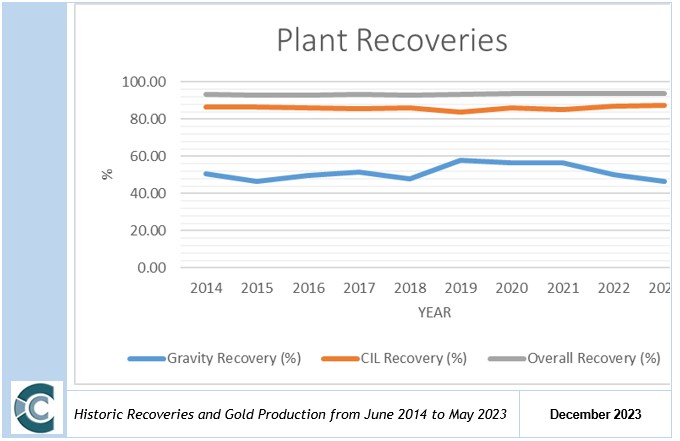

Figure 66: Historic Recoveries and Gold Production from June 2014 to May 2023 | 125 |

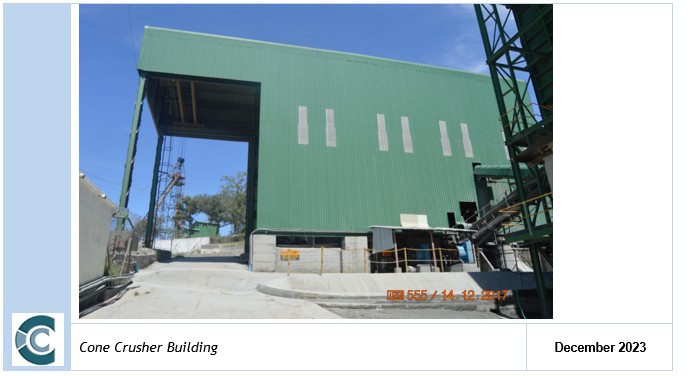

Figure 67: Cone Crusher Building | 126 |

Figure 68: Cone Crushers | 126 |

Figure 69: Rod Mills | 127 |

Figure 70: CIL Circuit | 128 |

Figure 71: Elution and Electrowinning Vessels | 129 |

Figure 72: Current Shaft Infrastructure – Blanket Mine | 133 |

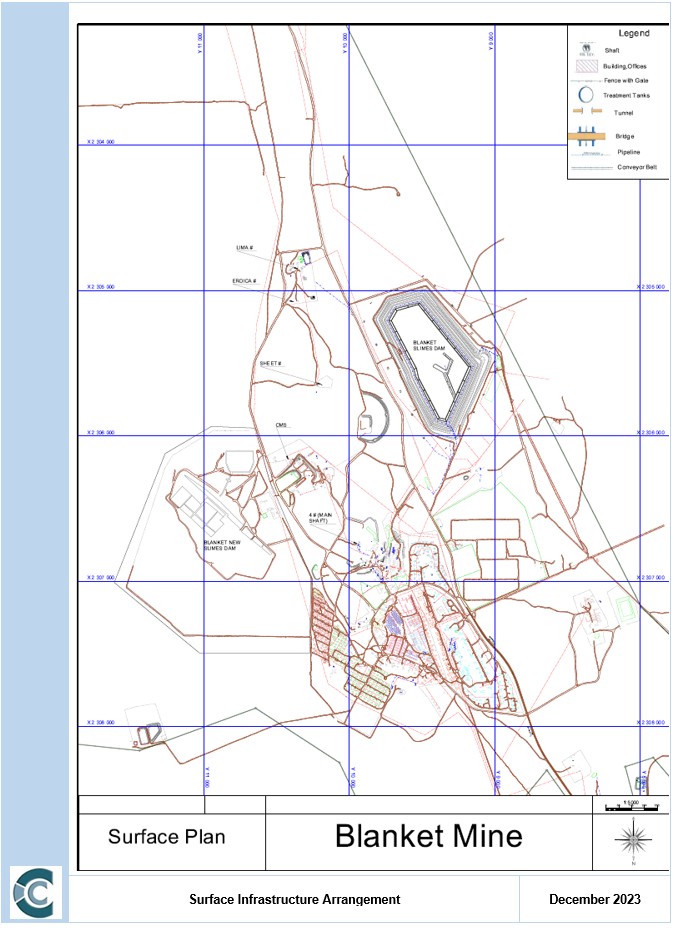

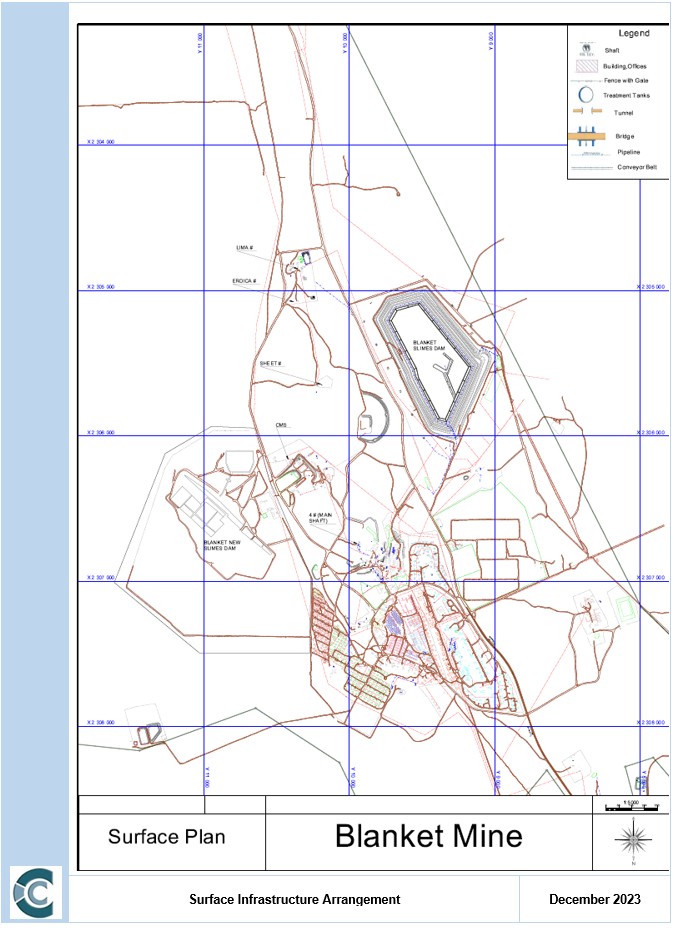

Figure 73: Surface Infrastructure Arrangement | 135 |

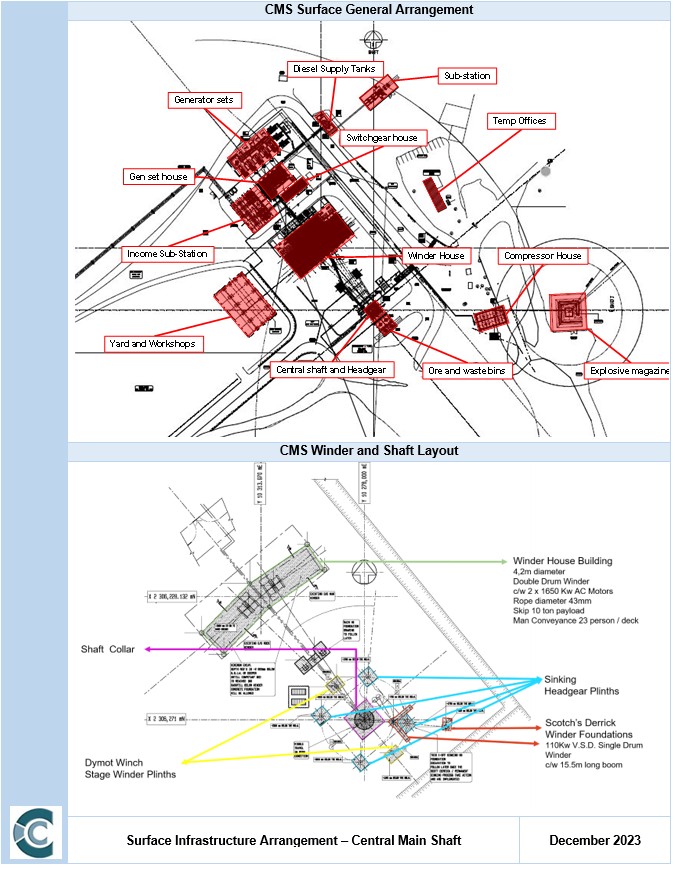

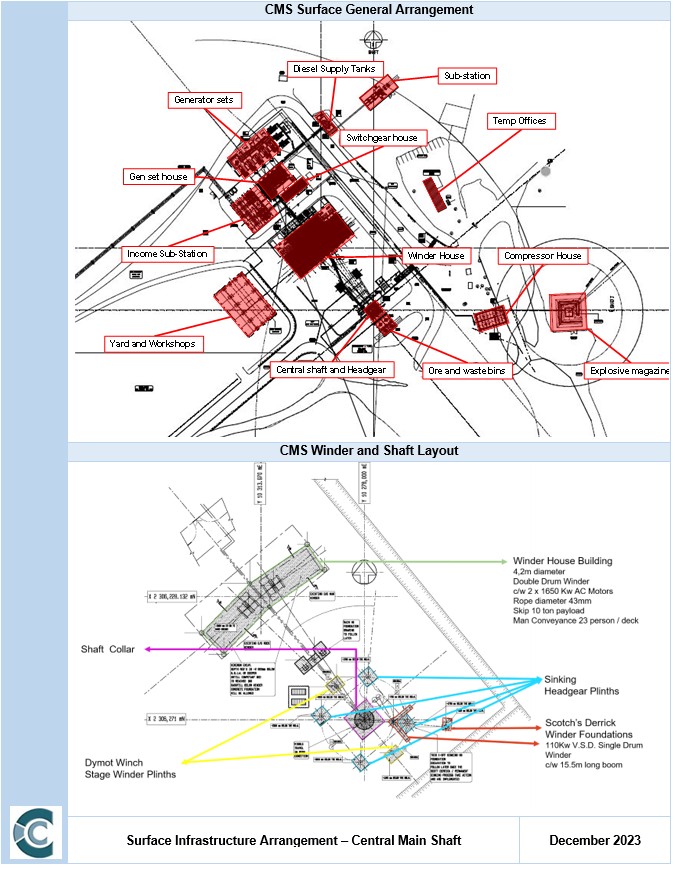

Figure 74: Surface Infrastructure Arrangement – Central Main Shaft | 136 |

Figure 75: Compressors at Blanket | 139 |

Figure 76: Compressors at Central Main Shaft | 140 |

Figure 77: Global Distribution of Gold Deposits | 141 |

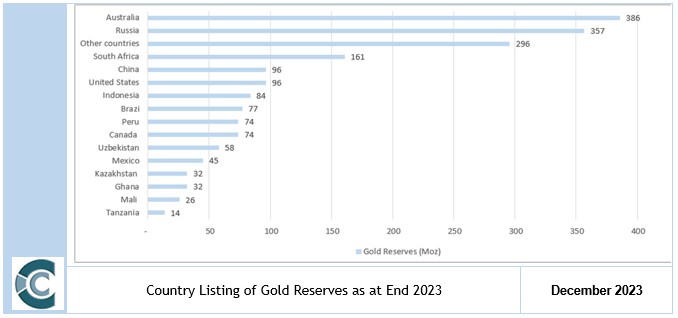

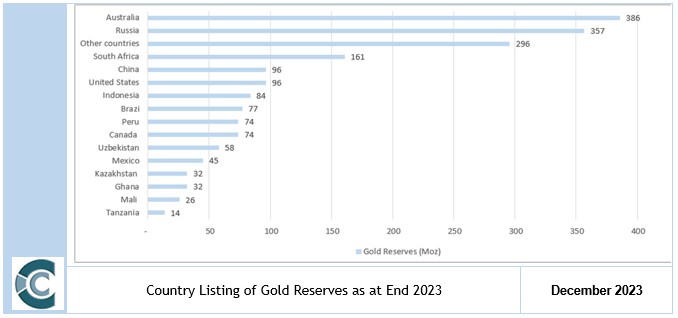

Figure 78: Country Listing of Gold Reserves as at End 2023 | 142 |

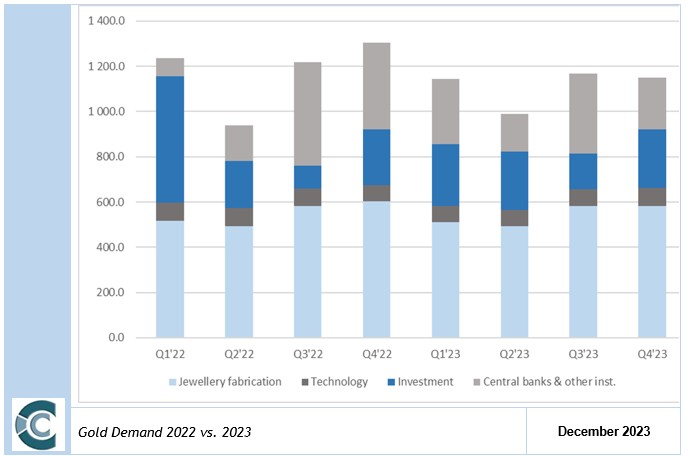

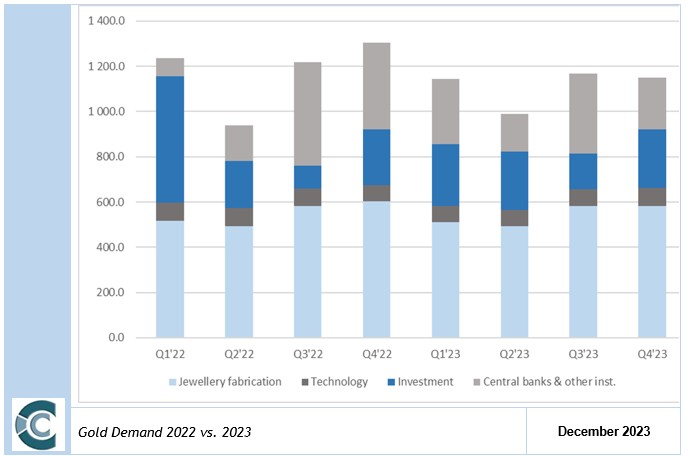

Figure 79: Gold Demand 2022 vs. 2023 | 144 |

Figure 80: Gold Price vs Trade Weighted U.S. Dollar Index | 147 |

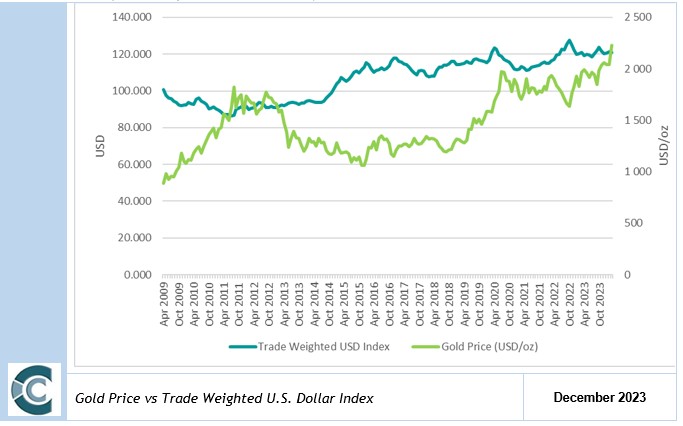

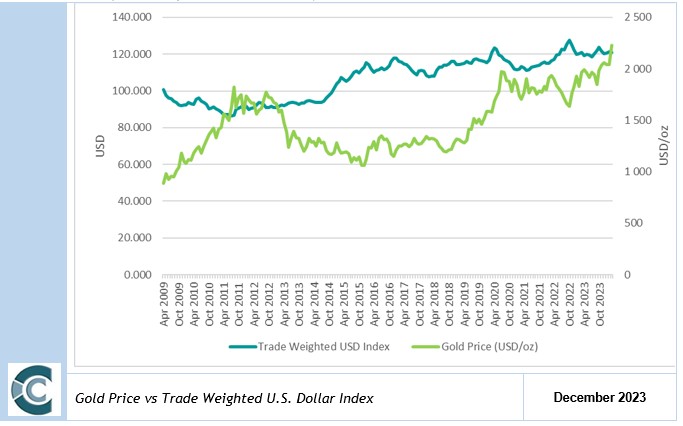

Figure 81: Gold Price vs. Real USD Rate | 148 |

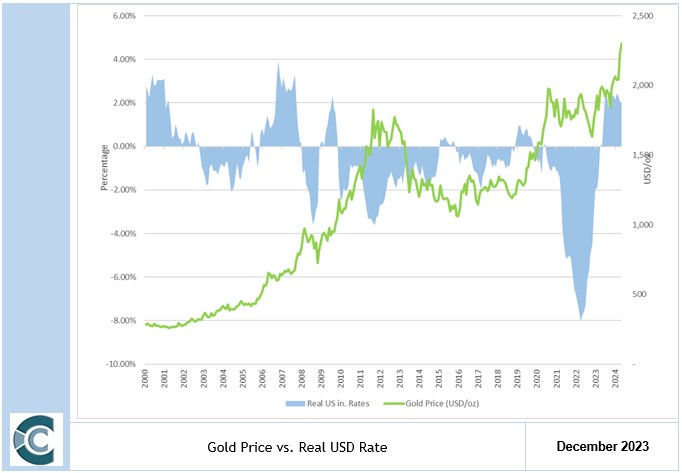

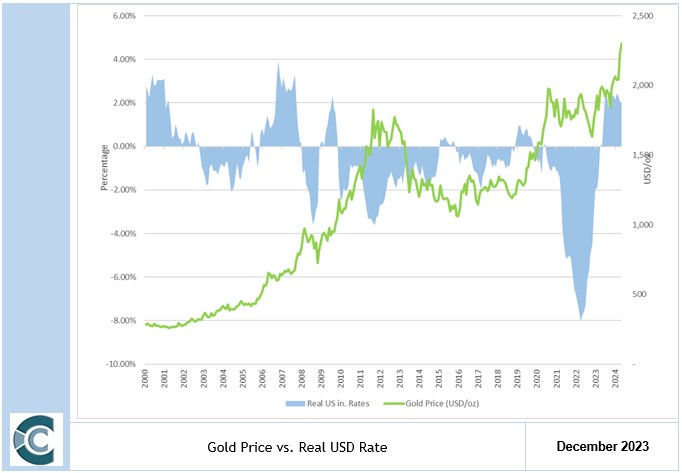

Figure 82: Gold Yearly Prices | 149 |

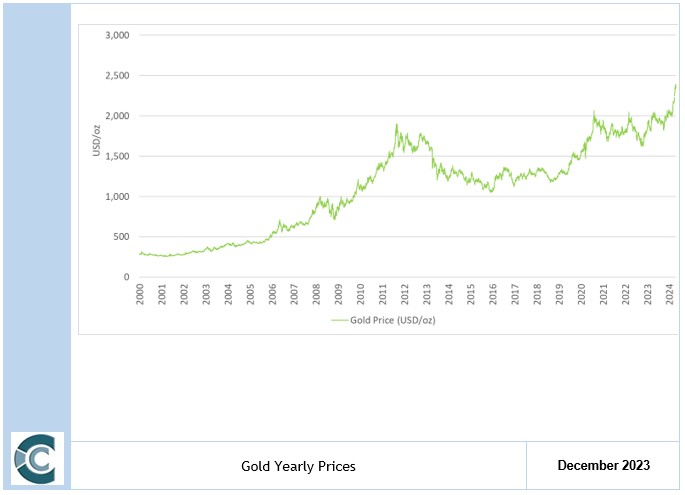

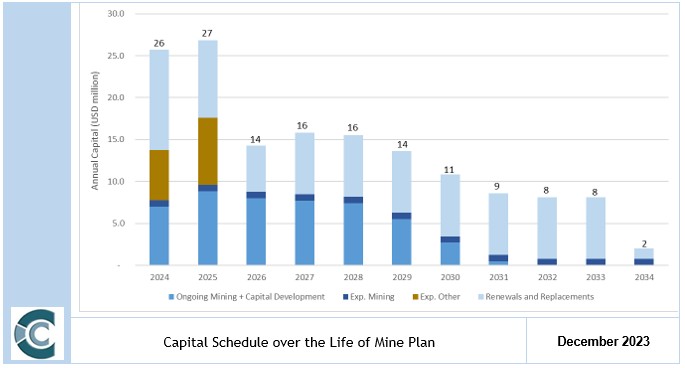

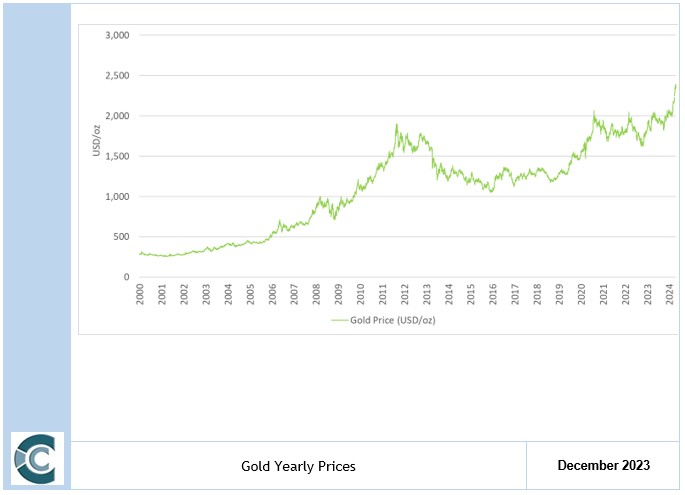

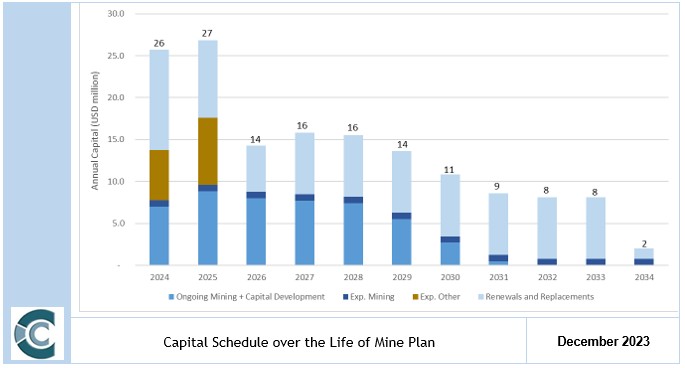

Figure 83: Capital Schedule | 155 |

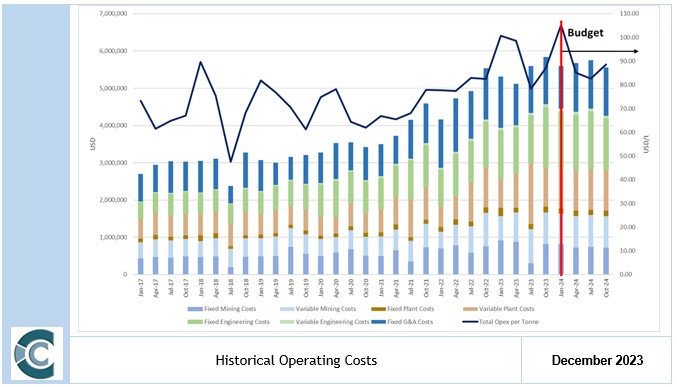

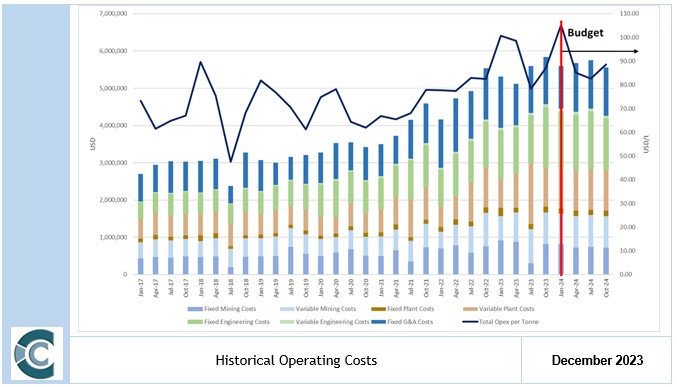

Figure 84: Historical Operating Costs | 156 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

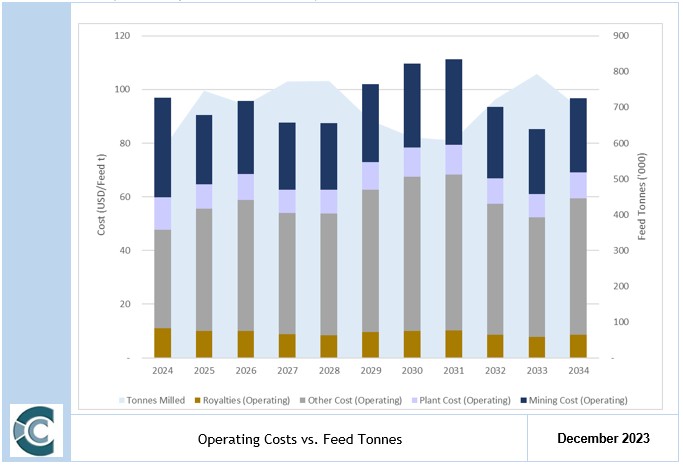

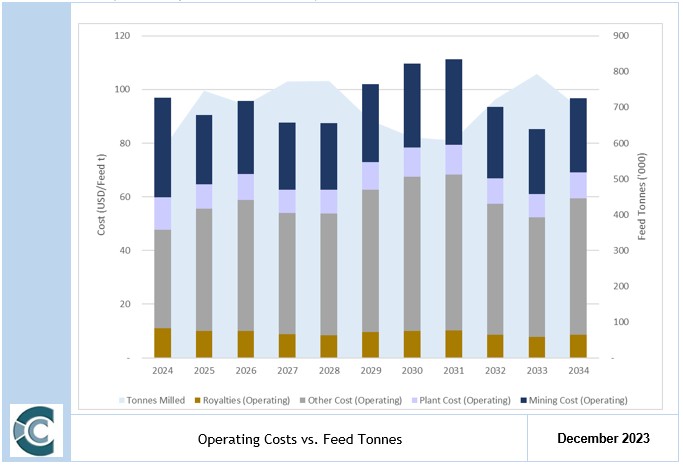

Figure 85: Operating Costs vs. Feed Tonnes | 160 |

Figure 86: AIC vs. Realised Gold Price | 161 |

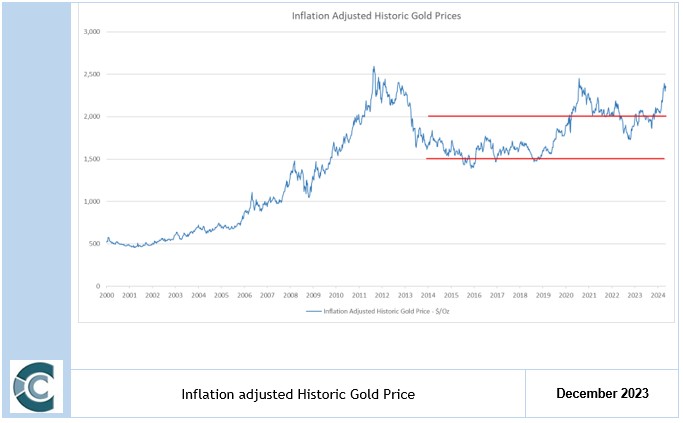

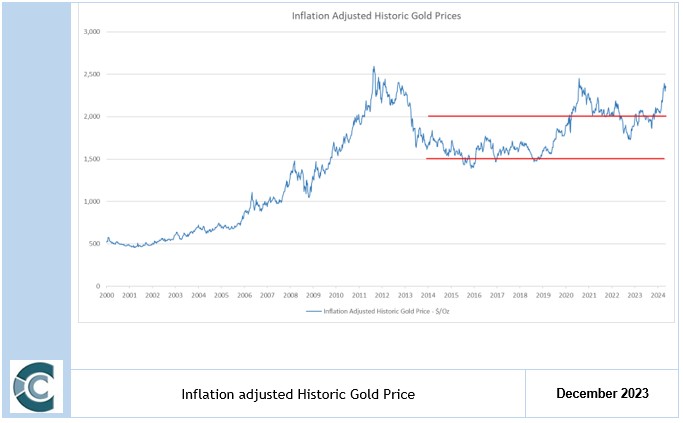

Figure 87: Inflation Adjusted Historic Gold Price | 163 |

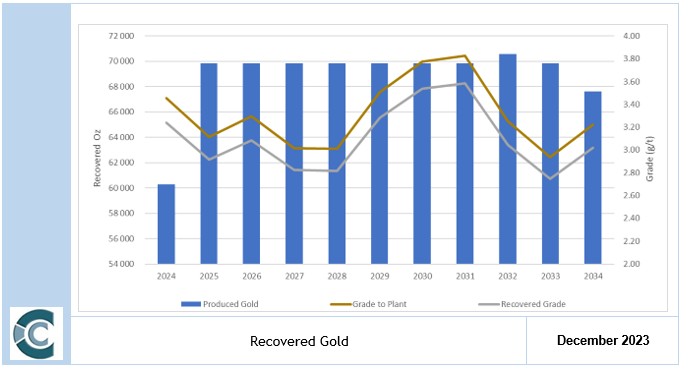

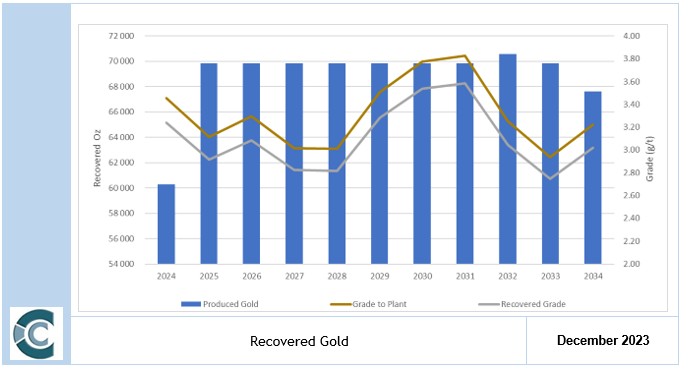

Figure 88: Recovered Gold | 164 |

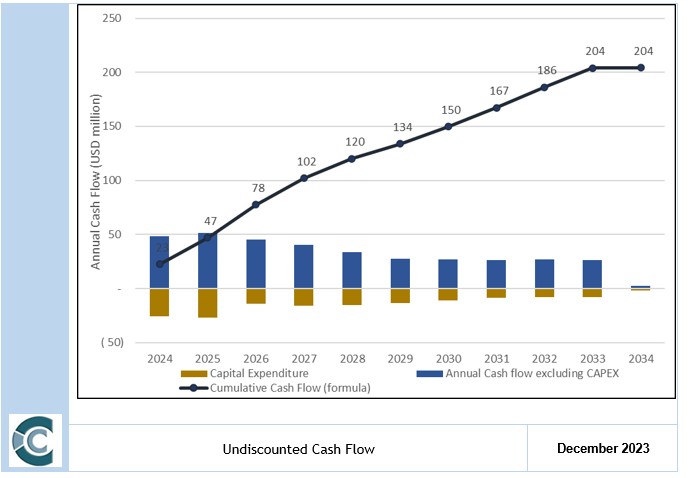

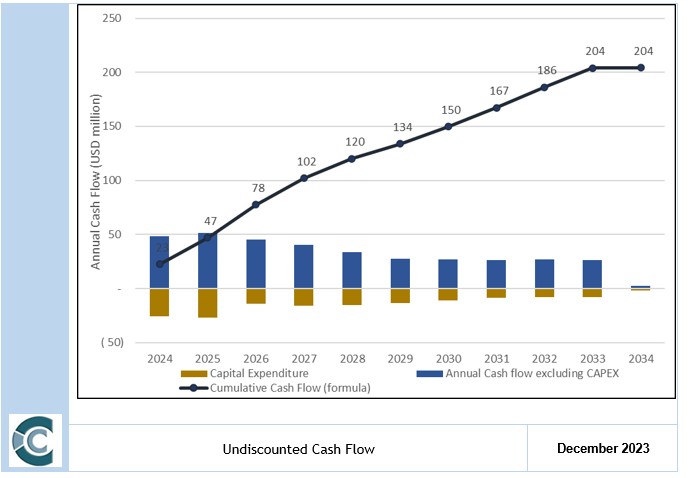

Figure 89: Undiscounted Cash Flow | 165 |

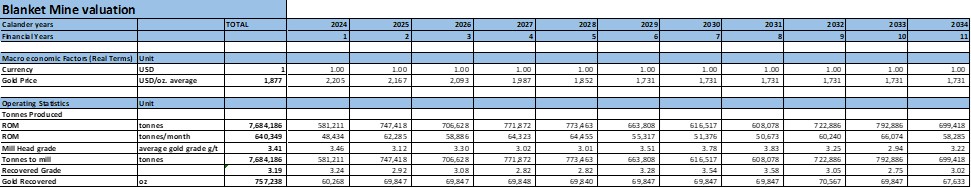

Figure 90: Project Sensitivity (NPV 15.4%) | 168 |

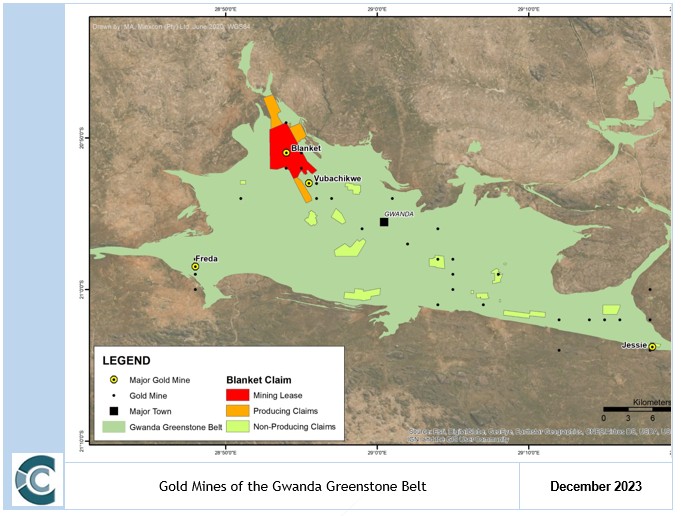

Figure 91: Gold Mines of the Gwanda Greenstone Belt | 172 |

TABLES

Table 1: Mining Lease Details | 21 |

Table 2: Blanket Mineral Title Areas and Status | 22 |

Table 3: Blanket Mineral Title Areas and Ownership | 24 |

Table 4: EIA Certificates | 25 |

Table 5: Environmental Permits | 26 |

Table 6: Description of Deposits at Blanket Mine (after MSA, 2011) | 33 |

Table 7: Exploration Holes and Meters by Year | 44 |

Table 8: Long Hole Deep Drilling Results at Blanket (2022 - 2023) | 44 |

Table 9: Long Hole Deep Drilling Location and Information at Blanket (2022-2023) | 46 |

Table 10: Standards Utilised at Blanket Mine with Expected Value and the Number Used | 53 |

Table 11: Sample Database Summarised by Year | 55 |

Table 12: Sample Database Summarised by Drillhole Type | 56 |

Table 13: Hole and Sample Count | 56 |

Table 14: Capping Valuers Applied per Domain | 65 |

Table 15: SG Samples per Orebody | 67 |

Table 16: Cut-off Derivation Factors | 80 |

Table 17: Mineral Resource Classification Criteria for Blanket Mine | 81 |

Table 18: In Situ Measured and Indicated Mineral Resources for Blanket Mine as at 31 December 2023 (Inclusive of Mineral Reserves) | 93 |

Table 19: In Situ Inferred Mineral Resources for Blanket Mine as of 31 December 2023 (Inclusive of Mineral Reserves) | 94 |

Table 20: In Situ Measured and Indicated Mineral Resources for Blanket Mine as at 31 December 2023 (Exclusive of Mineral Reserves) | 95 |

Table 21: Cut-Off Grade Calculation | 97 |

Table 22: Mineral Reserve Conversion Factors Summary | 97 |

Table 23: Blanket Mine Mineral Reserve Estimate as at 31 December 2023 | 99 |

Table 24: Shaft Utilisation and Hoisting Capacity | 107 |

Table 25: Blanket Mine Shift System | 108 |

Table 26: Blanket Mine Development Rates | 108 |

Table 27: Blanket Mine Production Rates | 109 |

Table 28: Development Dimensions | 113 |

Table 29: Mine Design Criteria for Blanket Mine | 114 |

Table 30: Blanket Mine Average Dilution Calculation | 115 |

Table 31: Blanket Mine - Mine Call Factor Calculation 2015 to 2022 | 116 |

Table 32: Development Designs Naming Convention | 116 |

Table 33: Blanket Mine Current Mining Fleet | 119 |

Table 34: Blanket Mine Mining Personnel | 119 |

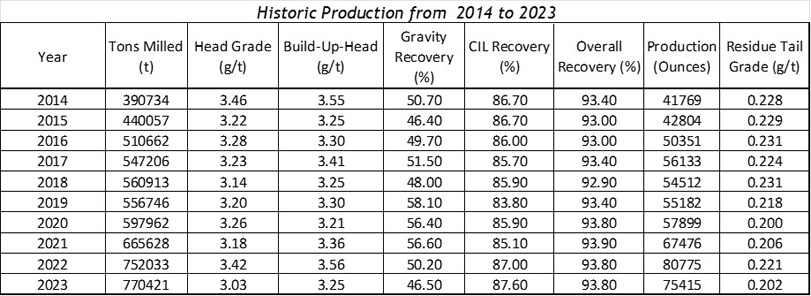

Table 35: Historic Plant Production 2014 – 2023 | 123 |

Table 36: Reagent and Consumable Consumptions | 128 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Table 37: Plant Labour Complement | 129 |

Table 38: Blanket Mine Shaft Access | 131 |

Table 39: Planned Shaft Infrastructure Development | 133 |

Table 40: Top 20 Gold Mining Countries | 142 |

Table 41: Official Gold Holdings per Country, 31 December 2023 | 144 |

Table 42: Gold Price Forecast (Nominal Terms) | 148 |

Table 43: Capital and Infrastructure Development Costs | 152 |

Table 44: Capital Summary | 153 |

Table 45: Management and shared service costs | 155 |

Table 46: Financial Cost Indicators | 155 |

Table 47: Project Cost Indicators | 158 |

Table 48: Macro-economic Forecasts (Real Terms) | 161 |

Table 49: Capital Asset Pricing Model Discount Rate Calculation | 162 |

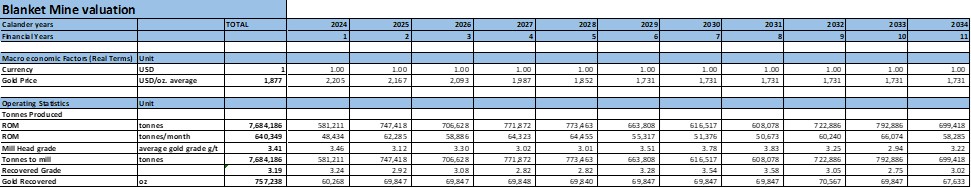

Table 50: Production Breakdown in Life of Mine | 163 |

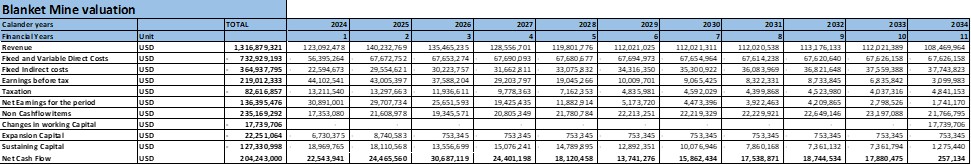

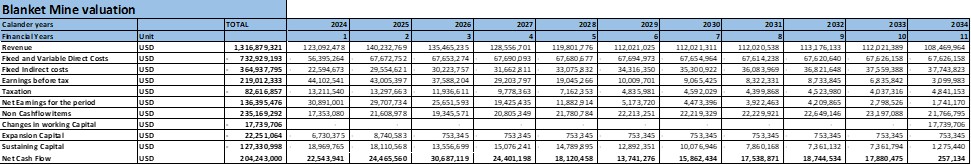

Table 51: Annual Cash Flow – Techno-economic Inputs | 165 |

Table 52: Annual Real Cash Flow | 165 |

Table 53: Blanket Mine NPV Summary – Real Terms | 166 |

Table 54: Profitability Ratios | 166 |

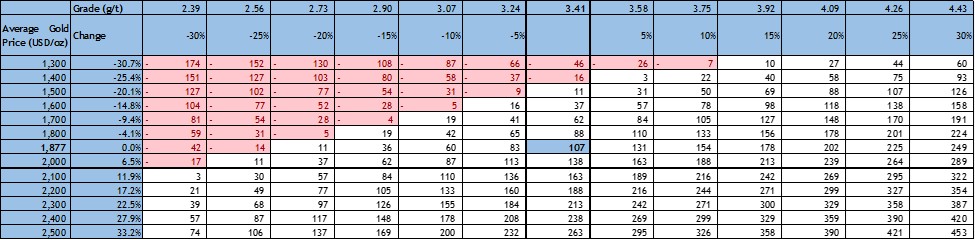

Table 55: Sensitivity Analysis of Commodity Prices and Mill Head Grade to NPV15.4% (USDm) | 168 |

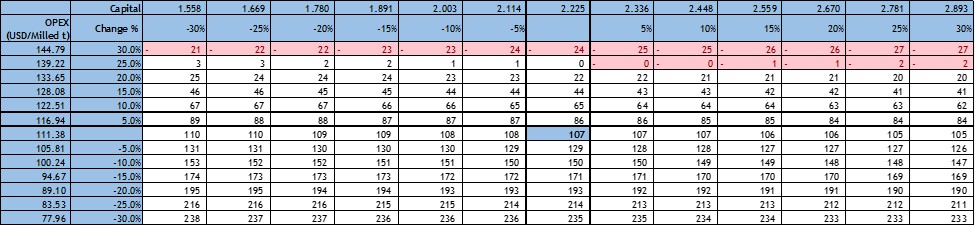

Table 56: Sensitivity Analysis of Cash Operating Costs and Capital spend to NPV15.4% (USDm) | 169 |

Table 57: Blanket Mine Economic Analysis Summary – Real Terms | 170 |

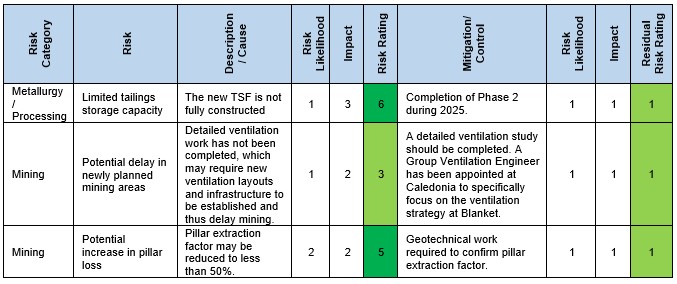

Table 58: Risk Assessment | 173 |

7

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

LIST OF UNITS AND ABBREVIATIONS

Units: The following units were used in this Report, and are in metric terms:-

Unit | Definition | | | |

% | Per cent | | ktpm | Kilo tonnes per month |

/ | Per | | kV | Kilovolt (1,000 volts) |

± or ~ | Approximately | | kVA | Kilovolt ampere |

° | Degrees | | kW | Kilowatt (1,000 W) |

°C | Degrees Celsius | | l | Litre |

a | Year | | m | Metre |

cm | Centimetre | | m2 | Square metres |

d | Day | | m3 | Cubic metres |

g | Grammes | | mm | Millimetre |

g/cm3 | Grammes per cubic centimetre | | Moz | Million ounces (1,000,000 oz) |

g/t | Grammes per tonne | | Mt | Million tonnes (1,000,000 t) |

Ga | Billion years (1,000,000,000 years) | | Mtpa | Million tonnes per annum |

ha | Hectares | | MVA | Megavolt ampere |

hr | Hour | | oz | Troy Ounces |

kg | Kilogram (1,000 g) | | t | Tonne |

kL | Kilolitres (1,000 l) | | t/m³ | Tonnes per cubic meter |

km | Kilometre (1,000 m) | | tpd | Tonnes per day |

km2 | Square kilometres | | V | Volts |

koz | Kilo ounces (1,000 oz) | | x | By / Multiplied by |

kt | Kilotonnes (1,000 t) | | | |

Computation: It is noted that throughout the Report, tables may not compute due to rounding.

Abbreviations: The following abbreviations were used in this Report:-

Abbreviation | Description |

AC | Asbestos Cement |

amsl | Above Mean Sea Level |

Au | Gold |

BETS | Employee Trust for the benefit of the present and future employees of Blanket Mine |

BIF | Banded Iron Formation |

Blanket Mine Company | Blanket Mine (1983) (Pvt) Ltd |

Blanket or the Mine | Blanket Gold Mine |

BQR | Blanket Quartz Reef |

Caledonia or the Company | Caledonia Mining Corporation Plc |

CAPM | Capital Asset Pricing Model |

CBDZ | Colleen Bawn Deformation Zone |

CIL | Carbon-in-Leach |

CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

CMS | Central Main Shaft |

CPI | Consumer Price Indices |

CRM | Certified Reference Material |

DCF | Discounted Cash Flow |

DSR | Disseminated Sulphide Reefs |

EIA | Environmental Impact Assessment |

EM Act | Environmental Management Act (Chapter 20:27) No. 13/2002 |

EMA | Environmental Management Agency |

Epoch | Epoch Resources (Pty) Ltd |

FCFE | Free Cash Flow to Equity |

FCFF | Free Cash Flow to Firm |

Fidelity | Fidelity Printers and Refiners Limited |

FW | Footwall |

G&A | General and Administrative |

GGB | Gwanda Greenstone Belt |

GMS | Greenstone Management Services (Pty) Limited |

HG | High Grade |

HW | Hanging Wall |

ID2 | Inverse Distance Squared |

IL | Intensive Leach |

Kinross | Kinross Gold Corporation |

KNA | Kriging Neighbourhood Analysis |

LG | Low Grade |

LHDP | Long Hole Drilling Program |

LIMS | Laboratory Information Management System |

LoM | Life of Mine |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Abbreviation | Description |

Minxcon | Minxcon (Pty) Ltd |

ML40 | Mining Lease with registered number 40 |

MMA | Mines and Minerals Act (Chapter 21:05) of 1961 |

MMCZ | Minerals Marketing Corporation of Zimbabwe |

MSO | Geovia Stope Shape Optimiser |

NIEEF | National Indigenisation and Economic Empowerment Fund |

NIR | Not-In-Reserve |

NMD | Nominal Maximum Demand |

NPV | Net Present Value |

NSR | Net Smelter Royalty |

NWGDZ | North West Gwanda Deformation Zone |

OHL | Overhead Powerlines |

PEM | Prospectivity Enhancement Multiplier |

PPE | Personal Protective Equipment |

PSA | Pressure Swing Absorption |

QAQC | Quality Assurance and Quality Control |

QP | Qualified Person |

RoM | Run of Mine |

RoR | Rate of Rise |

SG | Specific Gravity |

SGDZ | South Gwanda Deformation Zone |

S-K 1300 | United States Securities and Exchange Commission Part 229 Standard Instructions for Filing Forms Regulation S-K subpart 1300 |

SoR | Slope of Regression |

The Act | Indigenisation and Economic Empowerment Act |

TRS | Technical Report Summary |

TSF | Tailings Storage Facility |

WACC | Weighted Average Cost of Capital |

ZESA | Zimbabwe Electricity Supply Authority |

ZINWA | Zimbabwe National Water Authority |

ZMDC | Zimbabwe Mining Development Corporation |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

ITEM 1 - EXECUTIVE SUMMARY

The Blanket Mine is an operating underground gold mine situated on the Gwanda Greenstone Belt targeting shear zone hosted gold mineralisation. It is located in the southwest of Zimbabwe, approximately 15 km northwest of Gwanda, the provincial capital of Matabeleland South. Gwanda is located 147 km southeast of Bulawayo, 197 km northwest of the Beitbridge Border post with South Africa, and 560 km from Harare.

The Mine complex comprises a cluster of mines extending from Lima in the north, through Eroica, Sheet, AR Main, AR South, the currently defunct Feudal, Blanket Section (Blanket 1 to Blanket 6) and Jethro over a total strike length of some 3 km. Gold has been commercially mined at the Project Area from several closely spaced orebodies, defining a mineralised trend via several shafts since the early 1900s. The Mine covers the operating claims of Jethro, Blanket, Feudal, Harvard, Mbudzane Rock, Oqueil, Sabiwa, Sheet, Eroica and Lima, largely encompassed in a 2,120 ha Mining Lease. Ore is processed at an on-site plant.

The Blanket Mine operates under a mining lease ML40 issued to Blanket Mine (1983) (Pvt) Ltd, which is incorporated in Zimbabwe and a 64% owned, indirect subsidiary of Caledonia. The mine’s claims under the lease cover an area of 2,120 ha.

I. Geology and Mineral Deposit

The Blanket Mine is situated on the north-western limb of the Archaean Gwanda Greenstone Belt along strike from several other gold deposits. In the Blanket Mine area, lithologies comprise non-mineralised basal felsic schists of igneous or sedimentary origin in the east. The felsics are overlain by a metabasaltic ultramafic to mafic unit with pillow basalts remnants.

Mining at Blanket occurs over a 3 km strike that includes from north to south, the deposits of Lima, Eroica, Sheet, AR Main, AR South, Feudal, Blanket Section (Blanket 1 to Blanket 6) and Jethro. The main Blanket underground workings are connected to Lima by a 2 km long haulage which follows the strike of the main fabric. Mineralisation occurs in near vertical shoots aligned along an approximately N-S axis. The ore shoots vary in shape from the tabular-lensoidal quartz reefs to the massive to pipe-like disseminated sulphide reefs (or DSR). Gold is deposited at crustal levels within and near the brittle-ductile transition zone. The deposits may have a vertical extent of up to 2 km, demonstrate extensive down-plunge continuity, and lack pronounced zoning. The ore mineralogy is dominated by gold, pyrite and arsenopyrite.

Two quartz-filled shear zones are mined, namely the Blanket Quartz Reef (or BQR) and the Eroica Reef, which have long strike lengths but are not uniformly mineralised although continuous pay shoots of over 100 m on strike are seen. Gold grade fluctuations are more extreme in the quartz reefs than in the DSR type reefs but on average these quartz shears have higher grades.

II. Status of Exploration

Blanket Mine is continuing with the Long Hole Drilling Program (“LHDP”) which is the down-dip exploration drilling (below 750 m Level) as drilling platforms are established. This drilling will continue to improve the interpretation and confidence in the down-dip continuity of the fourteen current mineralised domains at Blanket. An electromagnetic survey may be considered which could potentially delineate additional structural features and targets. These targets, in conjunction with the structural model and underground observations may be used may be tested with underground drilling and further refine the geological model at Blanket and potentially target areas in the upper levels of the mine between existing orebodies.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

The combination of the exploration drilling, geophysical surveys, conceptual geological model (based on the sampling database) and structural geological modelling may increase the exploration targets and ultimately assist in increasing the Mineral Resource.

III. Mineral Resource and Mineral Reserve Estimates

Measured, Indicated and Inferred Mineral Resources, based on ordinary kriging and inverse distance estimation methods, can be declared for Blanket Mine due to the continuity of the geology and grade as well as a history of proven historical mining. The Inferred resources show geological continuity, while grade continuity requires improvement through additional drilling. The 2023 estimates are complete 3D digital estimates in the form of block models. Previous estimates were a combination of digital estimates and manual block listings above a specific elevation. The in situ Measured, Indicated and Inferred Mineral Resources, inclusive and exclusive of Mineral Reserves are shown in the tables below.

In Situ Measured and Indicated Mineral Resource Tabulation for Blanket Mine as of 31 December 2023 (inclusive of Mineral Reserves)

Mineral Resource Classification | Orebody | Tonnes | Au Grade | Gold Content |

| | | Kt | g/t | Koz |

Measured (2.5% Geological Loss) | ARM | 660 | 3.12 | 66 |

ARS | 514 | 3.62 | 60 |

ARS_Ext | 32 | 2.56 | 3 |

BF | 176 | 3.43 | 19 |

BLK1 | 261 | 3.43 | 29 |

BLK2 | 150 | 3.66 | 18 |

BLK3 | 180 | 3.41 | 20 |

BLK4_5 | 490 | 3.26 | 51 |

BLK6 | 49 | 3.78 | 6 |

BQR | 785 | 4.36 | 110 |

ERC | 303 | 5.21 | 51 |

Jethro | 53 | 3.11 | 5 |

Lima | 203 | 3.94 | 26 |

Sheet | 88 | 2.99 | 9 |

Measured Total | 3 943 | 3.72 | 471 |

Indicated (5.0% Geological Loss) | ARM | 630 | 2.78 | 56 |

ARS | 437 | 3.48 | 49 |

ARS_Ext | 189 | 2.93 | 18 |

BF | 205 | 2.99 | 20 |

BLK1 | 663 | 3.21 | 68 |

BLK2 | 442 | 4.98 | 71 |

BLK3 | 189 | 2.91 | 18 |

BLK4_5 | 126 | 3.05 | 12 |

BLK6 | 27 | 3.99 | 4 |

BQR | 1 888 | 3.61 | 219 |

ERC | 593 | 4.76 | 91 |

Jethro | 288 | 3.34 | 31 |

Lima | 115 | 3.73 | 14 |

Sheet | 41 | 2.60 | 3 |

Indicated Total | 5 832 | 3.59 | 673 |

Measured + Indicated Total | 9 775 | 3.64 | 1 145 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Notes:

| | 1. | Cut-off applied 1.5 g/t. |

| | 2. | Geological Losses: 2.5% Measured, 5.0% Indicated, 10.0% Inferred |

| | 3. | Commodity price utilised: USD2,150/oz. |

| | 4. | Mineral Resources are stated inclusive of Mineral Reserves. |

| | 5. | Mineral Resources are reported as 64% attributable to Caledonia. |

| | 6. | All orebodies are depleted for mining. |

In Situ Inferred Mineral Resource Tabulation for Blanket Mine as of 31 December 2023 (inclusive of Mineral Reserves)

Mineral Resource Classification | Orebody | Tonnes | Au | Ounces |

| | | Kt | g/t | Koz |

Inferred | ARM | 299 | 2.87 | 28 |

ARS | 170 | 3.88 | 21 |

ARS_Ext | 68 | 3.48 | 8 |

BF | 150 | 3.05 | 15 |

BLK1 | 871 | 3.20 | 90 |

BLK2 | 584 | 4.91 | 92 |

BLK3 | 73 | 3.33 | 8 |

BLK4_5 | 269 | 3.32 | 29 |

BLK6 | 83 | 3.57 | 10 |

BQR | 1 900 | 3.71 | 227 |

ERC | 928 | 4.30 | 128 |

Jethro | 108 | 3.28 | 11 |

Lima | 95 | 3.41 | 10 |

Sheet | 47 | 2.52 | 4 |

Inferred Total | 5 646 | 3.74 | 679 |

Notes:

| | 1. | Cut-off applied 1.5 g/t. |

| | 2. | Geological Losses: 2.5% Measured, 5.0% Indicated, 10.0% Inferred |

| | 3. | Commodity price utilised: USD2,150/oz. |

| | 4. | Mineral Resources are stated inclusive of Mineral Reserves. |

| | 5. | Mineral Resources are reported as 64% attributable to Caledonia. |

| | 6. | All orebodies are depleted for mining. |

In Situ Measured and Indicated Mineral Resource Tabulation for Blanket Mine as of 31 December 2023 (exclusive of Mineral Reserves)

Mineral Resource Classification | Orebody | Tonnes | Au Grade | Gold Content |

| | | Kt | g/t | Koz |

Measured (2.5% Geological Loss) | ARM | 653 | 3.12 | 66 |

ARS | 329 | 3.70 | 39 |

ARS_Ext | 11 | 1.83 | 1 |

BF | 89 | 3.58 | 10 |

BLK1 | 136 | 3.74 | 16 |

BLK2 | 148 | 3.66 | 17 |

BLK3 | 109 | 3.44 | 12 |

BLK4_5 | 194 | 3.85 | 24 |

BLK6 | 48 | 3.79 | 6 |

BQR | 482 | 4.31 | 67 |

ERC | 208 | 4.93 | 33 |

Jethro | 53 | 3.11 | 5 |

Lima | 151 | 3.64 | 18 |

Sheet | 88 | 2.99 | 9 |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Measured Total | 2 700 | 3.72 | 323 |

Indicated (5.0% Geological Loss) | ARM | 475 | 2.68 | 41 |

ARS | 337 | 3.13 | 34 |

ARS_Ext | 50 | 2.31 | 4 |

BF | 103 | 3.04 | 10 |

BLK1 | 232 | 3.19 | 24 |

BLK2 | 228 | 3.86 | 28 |

BLK3 | 66 | 2.45 | 5 |

BLK4_5 | 70 | 2.99 | 7 |

BLK6 | 17 | 4.17 | 2 |

BQR | 711 | 3.45 | 79 |

ERC | 144 | 4.69 | 22 |

Jethro | 177 | 2.82 | 16 |

Lima | 74 | 3.44 | 8 |

Sheet | 41 | 2.60 | 3 |

Indicated Total | 2 726 | 3.23 | 283 |

Measured + Indicated Total | 5 426 | 3.47 | 606 |

Notes:

| | 1. | Cut-off applied 1.5 g/t. |

| | 2. | Geological Losses: 2.5% Measured, 5.0% Indicated, 10.0% Inferred |

| | 3. | Commodity price utilised: USD2,150/oz. |

| | 4. | Mineral Resources are stated exclusive of Mineral Reserves. |

| | 5. | Mineral Resources are reported as 64% attributable to Caledonia. |

| | 6. | All orebodies are depleted for mining. |

Inferred Mineral Resources inclusive and exclusive of Mineral Reserves are the same as there are no inferred Mineral Resources in the Mineral Reserve.

Mineral Resources in the Measured and Indicated Mineral Resource classifications have been converted into Proven and Probable Mineral Reserves respectively, by applying the applicable modifying factors.

The updated Mineral Reserve estimation as of 31 December 2023, is detailed in the table below. Mineral Reserves are stated as delivered to plant, fully diluted with the application of modifying factors.

Diluted Proven and Probable Mineral Reserve Tabulation for Blanket Mine as of 31 December 2023

Mineral Reserve Classification | Tonnes | Grade | Au Content |

| | Kt | g/t | Kg | Koz |

Proven | 1 363 | 3.21 | 4 377 | 141 |

Probable | 3 555 | 3.31 | 11 782 | 379 |

Total | 4 918 | 3.29 | 16 158 | 519 |

Notes:

| | 1. | Mineral Reserve cut-off of 2.1 g/t applied. |

| | 2. | The gold price that has been utilised in the economic analysis to convert diluted Measured and Indicated Mineral Resources in the LoM plan to Mineral Reserves is an average real term price of USD1,877/oz over the LoM, using the forecast prices as per Economic Analysis. |

| | 3. | The Mineral Reserve estimation utilises the depleted 2023 Mineral Resource estimation, the 31 December 2023 mine design and LoM plan. |

| | 4. | Mineral Reserves are reported as 64% attributable to Caledonia. |

An uneconomical tail containing 212.5 koz of gold over a period of 6 years has been excluded from the Mineral Reserve since it is not economical on its own.

IV. Development and Operations

Blanket Mine employs two mining methods that are well suited to the nature of the mineral deposits. The variation within the Blanket Mine mineral deposits necessitates modification of the exact mining methods that suit the specific characteristics of each deposit. The general practice on the Mine is to implement one of two tailored mining methods, determined mainly by the width of the mineral deposit. Long-hole stoping is utilised in wider mineral deposits (orebody widths generally more than 3 m), and underhand stoping is utilised in narrow mineral deposits (orebody widths generally less than 3m).

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

The planned thrust in development is aimed at opening up ground below 750 m Level which will be the primary production areas, as well as create the necessary exploration drilling platforms. In the Lima, ARS, Blanket and Blanket Feudal areas some mining activities will take place above 750 m Level. Blanket Mine plans to produce in a range of 75 - 80 koz (recovered) of gold per year.

Blanket Mine is an operational mine with well-established infrastructure and no major modifications or upgrades are necessary to sustain mining and processing operations. Sufficient capital has been allowed for the development, equipment and infrastructure. An upgrade of the ore handling infrastructure between Central Shaft and the Blanket Gold Plant is planned. Power and water supply allocation to the total Blanket operation is deemed to be sufficient to meet current needs although further expansion to the solar plant and efficiency improvements to equipment are under consideration.

The process plant has been operating at a consistent recovery of 93.8%, and this can be expected to continue as long as the ore mineralogy does not change. The average processing rate for the past 12 months was 64.2ktpm, and there are indications that higher processing rates can be achieved with operational improvements, as demonstrated in December 2023 where 85.2 kt was milled.

A new TSF was constructed during 2023 and commissioned in February 2024. Deposition commenced on the phase 1A during December 2023 and is currently in use. Construction on a phase 1B has commenced and is earmarked to be completed during 2024. Phase 2, the final stage of the TSF design is planned for construction during 2025.

V. Economic Analysis

The company performed a mineral asset economic analysis on the Blanket Mine and the diluted Indicated and Measured Resources in the LoM plan, for conversion to Mineral Reserves. The Discounted Cash Flow, or DCF, is based on the production schedule and all costs and capital associated to develop, mine and process the orebody. Relevant taxation and other operating factors, such as recoveries and stay-in-business costs were incorporated into the economic analysis to produce a cash flow over the life cycle of the Mine.

USD commodity prices for the period 2024-2029 have been converted from nominal to real terms. The table below illustrates the forecasts for these six years as well as the long-term forecast used in the financial model. The price forecasts are based on the median of various banks, brokers and analyst forecasts and are in real-terms throughout the life of mine. The average price over the LoM equates to USD1,877/oz. The inflation rate was sourced from the World Economic Outlook.

Gold price forecast (Real Terms)

Item | Unit | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | Long-Term |

| | | 1 | 2 | 3 | 4 | 5 | 6 | |

Gold | USD/oz | 2,205 | 2,167 | 2,093 | 1,987 | 1,852 | 1,731 | 1,731 |

Source: Consensus Economic Inc. & World Economic Outlook January 2024.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

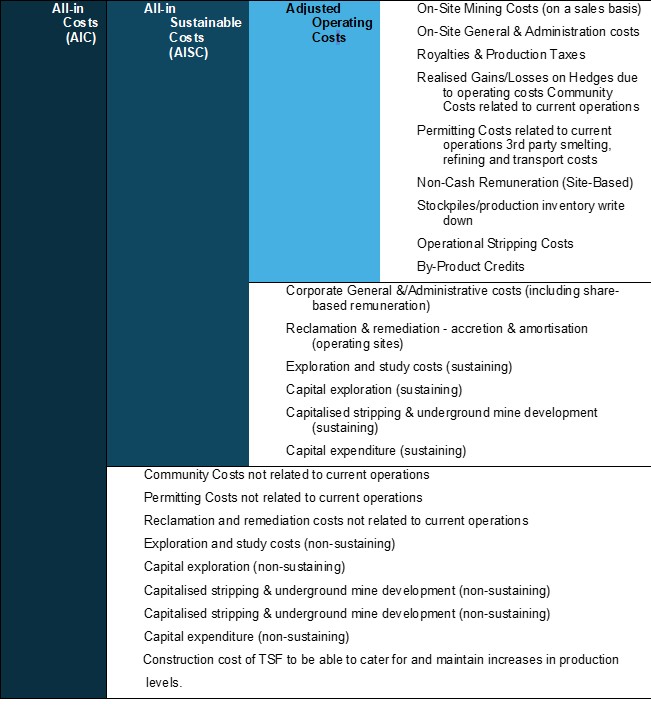

Costs reported for the Blanket Mine, which consists of mining, plant and other operating costs, as well as government royalty payments are displayed in the table to follow. Other costs in the Adjusted Operating Costs category include the central and technical services, general and administration, human resources, and other services costs. Other costs for the AISC category include corporate management costs. The costs are displayed per milled tonne as well as per recovered gold ounce.

Project Cost Indicators

Item | Unit | Blanket Mine |

Net Turnover | USD/Feed tonne | 171 |

Mine Cost | USD/Feed tonne | 31 |

Plant Costs | USD/Feed tonne | 17 |

Other Costs | USD/Feed tonne | 48 |

| | | |

Operating Costs | USD/Feed tonne | 96 |

SIB | USD/Feed tonne | 18 |

Royalties | USD/Feed tonne | 9 |

Reclamation | USD/Feed tonne | 0 |

Other Costs | USD/Feed tonne | 7 |

All-in Sustainable Costs (AISC) | USD/Feed tonne | 130 |

Capital | USD/Feed tonne | 2 |

Other Cash Costs | USD/Feed tonne | 0 |

All-in Costs (AIC) | USD/Feed tonne | 132 |

All-in Cost Margin | % | 23% |

EBITDA1 | USD/Feed tonne | 76 |

EBITDA Margin | % | 44% |

Gold Recovered | oz | 757 238 |

| | | |

Average Gold Price | USD/Gold oz | 1,877 |

| | | |

Net Turnover2 | USD/Gold oz | 1,739 |

Mine Cost | USD/Gold oz | 311 |

Plant Costs | USD/Gold oz | 171 |

Other Costs | USD/Gold oz | 485 |

Operating Costs | USD/Gold oz | 967 |

SIB Capex | USD/Gold oz | 179 |

Royalties | USD/Gold oz | 93 |

Reclamation | USD/Gold oz | 1 |

Other Costs | USD/Gold oz | 72 |

All-in Sustainable Costs (AISC) | USD/Gold oz | 1,312 |

Capital | USD/Gold oz | 18 |

Other Cash Costs | USD/Gold oz | 0 |

All-in Costs (AIC) | USD/Gold oz | 1,330 |

EBITDA* | USD/Gold oz | 771 |

Notes:

| | 1. | *Earnings before interest, tax, depreciation and amortisation (excludes CAPEX). |

The total capital including the sustaining capital amounts to USD149.6 million over the mine life. The Mine has no funding requirement as it has long been in operation.

For the DCF, the gold price and grade have the most significant impact on the sensitivity of the Mine followed by the central services and operating costs. The Mine is least sensitive to capital and plant operating costs.

The value derived for the income approach only reflects the diluted Indicated and Measured Resources in the LoM plan, for conversion to Mineral Reserves. The Mineral Reserve is economically viable with a best estimated NPV of USD107 million (USD83 million attributable to Caledonia) at a real discount rate of 15.4%. No IRR could be calculated as Blanket is already in operation and no initial investment is required. The following table shows a summary of the economic analysis.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Blanket Mine Economic Analysis Summary – Real Terms

Item | Unit | Blanket Gold Mine | Caledonia Attributable* |

NPV @ 0% | USDm | 204 | 158 |

NPV @ 2.5% | USDm | 181 | 140 |

NPV @ 5% | USDm | 161 | 125 |

NPV @ 7.5% | USDm | 145 | 112 |

NPV @ 10% | USDm | 131 | 101 |

NPV @ 12.5% | USDm | 119 | 92 |

NPV @ 15.0% | USDm | 109 | 84 |

NPV @ 15.4% | USDm | 107 | 83 |

NPV @ 17% | USDm | 102 | 79 |

IRR | % | N/A | N/A |

All-in Cost Margin | % | 23% | 23% |

Break-even Gold Price (AIC) | USD/oz. | 1 331 | 1 331 |

*Caledonia has a 64% direct equity holding in Blanket and receives dividends, facilitation loan repayments, procurement fees, and management fees.

VI. Conclusions

Over the past few years Blanket Mine have been in the process of upgrading their Mineral Resource estimation system from historical manual block listing methodology to digital estimation processes. Much of the historical sampling database has been captured and can be used for more sophisticated estimation methodologies in the 3D environment. In addition to this, the historical mining voids and development have been captured and can be utilised for the Mineral Resource depletions and mine planning for Mineral Reserve purposes.

The 3D digital environment allows for the scrutiny and review of the geological data in a holistic fashion that was previously not possible. By doing so, geological trends and patterns can be identified for the development of geological concepts that can be utilised in the exploration targeting and the planning of drilling programmes.

This change in Mineral Resource estimation and management systems has resulted in some fluctuations in the Mineral Resource in the short term but these should stabilise and has resulted in an increase in the Blanket Mine Mineral Resources due to improved geological understanding, geological modelling, estimation processes, management and planning systems.

The life of mine plan is logical and the planned production rates are achievable. The mining strategy is focused on a thrust in development to open up ground for planned mining areas below 750 m Level in line with the planned production targets. Blanket mine plans to produce 74 - 80 koz (recovered) of gold per annum.

Existing and planned infrastructure at Blanket are sufficient to sustain the current production profile and the planned increased production.

The process plant has been operating at a consistent recovery of 93.8%, and this can be expected to continue as long as the ore mineralogy does not change. The average processing rate for the past 12 months was 64.2ktpm, and there are indications that higher processing rates can be achieved with operational improvements, as demonstrated in December 2023 where 85.2kt was milled.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

The Blanket Mine plan including only the diluted Indicated and Measured Resources in the LoM plan, for conversion to Mineral Reserves is financially feasible. The updated Mineral Reserve can therefore be declared. The DCF value of USD107 million for the Blanket Mine (USD83 million attributable to Caledonia) was calculated at a real discount rate of 15.4%. No IRR could be calculated since the mine is in operation and no initial investment is required.

Blanket Mine financials are most sensitive to commodity prices, and grade. The Mine financials are least sensitive to capital expenditure and plant operating costs.

The all-in sustaining costs for the Blanket Mine amount to USD130/milled t, which equates to USD1,312/oz. The all-in costs for the Blanket Mine were calculated as USD132/milled t, which equates to USD1,330/oz.

VII. Recommendations

It is recommended that Blanket Mine continue with enhancements to the Mineral Resource estimation process to investigate potential increases in the Mineral Resources in areas above current infrastructure and enhance the planning down-dip. These digital modelling systems should be incorporated into the monthly planning system to ensure the Mineral Resource remains active and updated. The exploration activities, being so successful, should focus along the trends of the main orebodies to determine geological continuity at depths approaching an equivalent 50 level. This will allow the company to obtain a view of longer-term strategies and planning for the mine.

The QAQC data shows an improvement in the QAQC processes for the sampling database but still requires additional focus to ensure accuracy and precision, and to implement remedial action if required, especially for the down dip exploration drilling as this can impact the Mineral Resources significantly and thus requires the highest integrity.

The geotechnical study should be maintained, enhanced and broadened to determine the geotechnical parameters for pillar extraction and the possible changes in support strategy required at depth.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

ITEM 2 - INTRODUCTION

Item 2 (a) – Author

The author of this Technical Report Summary (“TRS”) is Craig Harvey who is a Qualified Person (“QP”). Mr. Harvey was responsible for the compilation of the TRS document with input provided by specialists in relevant sections. Mr Harvey is responsible for the Mineral Resources disclosed in this TRS.

Mr Martiens van Staden is a Qualified Person (“QP”) and is responsible for the Mineral Reserves disclosed in this TRS.

Item 2 (b) – Terms of Reference and Purpose of the Report

This TRS follows the guidelines as prescribed by S-K 1300, and only such terms as defined in §229.1300-1305 have been utilised. The TRS is structured in accordance with the format prescribed in §229.601(b)(96).

Blanket is an operating underground mine with ore processed at an on-site plant. The purpose of this TRS is to present the Mineral Resources and Mineral Reserves of the Mine as at the Company financial year end 31 December 2023. The Mineral Resources and Mineral Reserves are stated at the effective date of 31 December 2023.

The basis for the Mineral Reserves stated in this TRS is a life of mine plan, which constitutes a study with detail and accuracy levels better than the requirements for a pre-feasibility study. The QP has reviewed the life of mine plan and is satisfied that it has demonstrated that, at the time of reporting, the extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. The life of mine plan is technically achievable and is the basis of determining the Mineral Reserve.

This TRS updates the previously filed TRS titled S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe and dated 31 December 2022, prepared by Minxcon and filed by Caledonia, in terms of S-K 1300.

All monetary figures in this TRS are expressed in United States Dollars (“USD”).

Item 2 (c) – Sources of Information and Data Contained in the Report

The following sources of information, all from Caledonia, were used to compile this TRS:-

| | ● | Legal aspects and tenure: Mr Curtis van Heerden and Mr Patrick Hill; |

| | ● | The Mineral Resource estimate: Mr Craig Harvey, Ms Sego Mashego and Ms Elizabeth van Tubbergh. |

| | ● | The Mineral Reserve estimate: Mr Craig Harvey, Mr Moses Matimba, Mr Ettienne de Villiers and Mr Martiens van Staden. |

| | ● | The life of mine (“LoM”) plan and supporting information that forms the basis of the revised plan: Mr Craig Harvey, Mrs Sego Mashego, Mrs Elizabeth van Tubbergh, Mr Ettienne de Villiers, Mr Martiens van Staden, Mr Elton Gwatidzo and Mr Caxton Mangezi; |

| | ● | Metallurgical information: Mr Gibson Kadzikano; |

| | ● | Engineering information: Mr Deon Niemand and Mr Martiens van Staden, Mr Dirk Bleeker, Mr Nico Spies and Mr Pieter Greyling |

| | ● | Environmental information: Ms Colleen Parkins; and |

| | ● | Financial information: Mr Chester Goodburn, Ms Anja Grobler, Yolandi van den Berg, Mr Darlington Mabvoro and Mr Duncan Mpofu. |

Additional information was sourced from those references listed in Item 24 and is duly referenced in the text where appropriate.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Item 2 (d) – Qualified Persons’ Personal Inspection of the Property

The Qualified Person (“QP”), term as defined within S-K 1300, responsible for the compilation of this TRS is Mr Craig Harvey. Mr Harvey additionally is QP for the Mineral Resource estimate while Mr Martiens van Staden is QP for the Mineral Reserve estimate.

Mr Harvey is a full-time employee of Caledonia Mining South Africa since 1 March 2023 and has visited the operation on numerous occasions in 2023 to review and assist with the upgrading of the Mineral Resource systems on the operation.

Mr van Staden is a full-time employee of Caledonia Mining South Africa since 2021 and has visited the operation on numerous occasions in 2023 to review and assist with the mining and engineering relating to the underground operations of Blanket.

On visits to the property, time has been spent underground viewing the ore mining operations, including the development operations, the shaft hoisting systems, underground reticulation systems and all aspects relating to the gathering of geological information, underground surveying, and exploration drilling activities. Surface visits have included the new and old TSF’s, the mineral processing plant, on-site analytical laboratory, exploration core logging yard, and the technical service departments.

ITEM 3 – PROPERTY DESCRIPTION AND LOCATION

Item 3 (a) – Area of the Property

The Blanket Mine is an operating underground gold mine situated on the Gwanda Greenstone Belt (“GGB”) targeting shear zone hosted gold mineralisation. The Mine complex comprises a cluster of mines extending from Lima in the north, through Eroica, Sheet, AR Main, AR South, Feudal, Blanket Section (Blanket 1 to Blanket 6) and Jethro over a total strike length of some 3km. Gold has been commercially mined at the Project Area from several closely spaced orebodies defining a mineralised trend via several shafts since the early 1900s. The Mine covers the operating claims of Jethro, Blanket, Feudal, Harvard, Mbudzane Rock, Oqueil, Sabiwa, Sheet, Eroica and Lima, largely encompassed in a 2,120ha mining lease. Ore is processed at an on-site processing plant.

Item 3 (b) – Location of the Property

As illustrated in Figure 1, the Mine is located in the southwest of Zimbabwe, approximately 15 km northwest of Gwanda, the provincial capital of Matabeleland South. Gwanda is located 150 km southeast of Bulawayo, 196 km northwest of the Beitbridge Border post with South Africa, and 560 km from Harare, Zimbabwe's capital city. The Mine is centred on the coordinates (WGS84 system) 20°52' S, 28°54' E.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Figure 1: General Location of Blanket Mine

| |

| General Location of Blanket Mine | December 2023 |

Item 3 (c) – Mineral Deposit Tenure

The Blanket Mine's interests in Zimbabwe include a Mining Lease, operating claims (i.e., on-mine), non- operating claims and a portfolio of brownfields exploration projects (satellite projects), as illustrated in Figure 2 as blocks of claims.

The Blanket Mine operates under a mining lease with registered number 40 (“ML40”) which was issued under the Mines and Minerals Act (Chapter 21:05) of 1961 (“MMA”) as detailed in Table 1. The mine’s claims under the lease cover an area of 2,120 ha, and include Lima, Sheet, Oqueil, Feudal, Sabiwa, Jethro, Harvard, and Blanket claims. The ML40, in which boundaries all current mining activities occur, is issued to Blanket Mine Company.

Table 1: Mining Lease Details

Mining Lease Number | Holder | Mining District | Area | Principal Mineral | Other Minerals | Date of Issue | Validity Period |

| | | | ha | | | | |

ML40 | Blanket Mine (1983) (Pvt) Ltd | Matabeleland South | 2,120.00 | Gold | Silver, Copper, Arsenic | 25 May 2023 | 1 year, renewable. Current tenure period expires on 24 May 2024 |

Blanket Mine also has several registered claims not incorporated under the lease. The 90 claims contiguous to the mining lease comprise a total area of approximately 998 ha. The registration numbers, area, number of claims and number of blocks for the individual claims are listed in Appendix 1.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

In addition, Blanket Mine holds several non-operating claims located away from ML40 and the adjoining claims described above, that form a portion of the Gwanda portfolio. The names of each claim, as well as registration numbers and type of minerals are listed in Appendix 2. These non-producing claims (satellite projects) consist of 184 blocks of registered base metal (Ni, Cu and As) and precious metal claims covering a total area of 2,443ha.

Figure 2: Location of Blanket Mining Lease and Claims

A summary of the Blanket mineral titles is provided in Table 2 and corresponds to the Figure 2.

Table 2: Blanket Mineral Title Areas and Status

Claim Block | Status |

ML40 | Operating |

Valentine | Operating |

Sabiwa | Operating |

Mbudzane Rock | Operating |

GG | Non-operating (was under development for gold mining, currently on hold) |

Annette | Non-operating |

Cinderella | Non-operating |

Dan’s Luck | Non-operating |

Gum | Non-operating |

Banshee J | Non-operating |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Mazeppa | Non-operating |

Will South | Non-operating |

Spruit | Non-operating |

Shakeshake | Non-operating |

Rubicon | Non-operating |

Surprise | Non-operating |

Bunny’s Luck | Non-operating |

Abercorn | Non-operating |

A number of claims are subject to active tribute agreements between the Mine and local small-scale miners as part of the Company’s Corporate Social Responsibility. This is further discussed in Item 17 (d).

Annual payments (non-material) are due to government authorities for each of the claims and lease areas in order to continue the validity of the licences.

In accordance with paragraph 178(2)(a)(b)(c) of the MMA, the owners of the claims of this project possess the following respective surface rights:-

| | ● | use of any surface within the boundaries for all necessary mining purposes; |

| | ● | the right to use, free of charge, soil, waste rock or indigenous grass situated within the claims boundaries for all necessary mining purposes; |

| | ● | the right to sell or dispose of recovered waste rock. |

It is the belief of Caledonia that this clause provides sufficient rights to use the surfaces of the claim blocks that have been consolidated into the ML40. The MMA Amendment Bill makes instruction for landowner compensation in case of land loss due to mining activities in the form of land reallocation or outright purchase. Blanket Mine activities have not triggered this compensation and are not foreseen to do so.

Blanket Mine (1983) (Pvt) Ltd is held 64% by Caledonia Holdings Zimbabwe (Pvt) Ltd, which is a wholly owned subsidiary of Greenstone Management Services Holdings Limited (“GMS”), which in turn is wholly owned by Caledonia. Blanket Mine Company is incorporated in Zimbabwe and is the owner and operator of the Blanket Mine. 16% Share in Blanket Mine Company is held by the National Indigenisation and Economic Empowerment Fund, 10% by Gwanda Community Share Ownership Trust, and 10% by an Employee Trust for the benefit of the present and future employees of Blanket Mine.

Pursuant to an arrangement agreed in February 2020, the Gwanda Community Share Ownership Trust (“GSCOT”) received 20% of its dividends declared by Blanket and the remaining 80% was set off against the advance dividends. As of September 2023, GSCOT repaid the advance dividends and now receives its full dividend entitlement.

Item 3 (d) – Royalties and Payments

I. Government Royalties

Mining royalties are charged in terms of the MMA. The royalties are collectable from all the minerals or mineral-bearing products obtained from any mining location and disposed of by a miner or on his behalf. The royalties are chargeable whether the disposal is made within or outside Zimbabwe.

In terms of Zimbabwean tax laws, where gold produced exceeds 0.5kg, a 5% royalty is applicable. For primary gold producers a two-tier system that is based on gold prices is applicable. For gold prices below US$1,200/oz, the rate is 3%, and for gold prices above US$1,200/oz, the rate is 5% of the gross revenue from gold mining.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

II. Net Smelter Royalties

Blanket Mine does not have any net smelter royalties applicable to its current operations.

A number of claims were held under option agreements between Blanket Mine Company and the claim holders. Blanket Mine Company has exercised all its options and purchased the claims under conditions outlined in the option agreements. Each of these has a net smelter royalty (“NSR”) associated with it. The remainder of claims are 100% held by Blanket Mine Company. A summary of the ownership of each claims area is provided in Table 3.

Table 3: Blanket Mineral Title Areas and Ownership

Claim Block | Ownership | Royalty Condition |

ML40 | Blanket Mine (1983) (Pvt) Ltd | |

Valentine | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 3.0% NSR |

Sabiwa | Blanket Mine (1983) (Pvt) Ltd | |

Mbudzane Rock | Blanket Mine (1983) (Pvt) Ltd | |

GG | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 2.5% NSR |

Annette | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 3.0% NSR |

Cinderella | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 3.0% NSR |

Dan’s Luck | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 2.5% NSR |

Gum | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 3.0% NSR |

Banshee J | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 3.0% NSR |

Mazeppa | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 2.5% NSR |

Will South | Blanket Mine (1983) (Pvt) Ltd – Option exercised | 2.5% NSR |

Spruit | Blanket Mine (1983) (Pvt) Ltd | |

Shakeshake | Blanket Mine (1983) (Pvt) Ltd | |

Rubicon | Blanket Mine (1983) (Pvt) Ltd | |

Surprise | Blanket Mine (1983) (Pvt) Ltd | |

Bunny’s Luck | Blanket Mine (1983) (Pvt) Ltd | |

Abercorn | Blanket Mine (1983) (Pvt) Ltd | |

Item 3 (e) – Environmental Liabilities

Operating mines in Zimbabwe are required to set aside money as part of the closure plan and fulfilment of the provisions of the MMA and Environmental Management Act (Chapter 20:27) (“EM Act”). The Ministry of Mines is working on amendments to the MMA in which there will be conditions for protection of the environment through the Safety, Health and Rehabilitation Fund.

At the time of writing, no statutory instrument has been gazetted implementing an environmental fund as yet, thus no fees are currently due. As such, no environmental rehabilitation trusts and guarantees have been established for Blanket Mine in terms of Zimbabwean law. The closure report for Blanket Mine (which has been undertaken independently by Knight Piesold) was updated at the end of 2023, and closure costs are accounted for as a contingent liability internally in terms of the accounting standard IAS 37 (Provisions, Contingent Liabilities and Contingent Assets).

Item 3 (f) – Permits to Conduct Work

The permits relating to the mining operations at Blanket are described in the sections to follow. The Mine is compliant in terms of authorisations and adheres to all government protocols and regulations as required.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

I. Water Agreement

Water for the operations is sourced from the Blanket Dam that is situated on the Mtshabezi River and owned by the Zimbabwe National Water Authority (“ZINWA”). The use of this water is authorised through a contract agreement between Blanket Mine and ZINWA in terms of the Zimbabwe National Water Authority Act (Chapter 20:251).

In terms of this agreement, Blanket Mine is allowed to extract 1,200,000 m3 of water for the period 1 April 2023 to 31 March 2024. The agreement is valid for one-year periods and is renewed annually. ZINWA sends the renewable agreement for signing to Blanket on an annual basis.

Blanket continues to extract water in the interim at a rate of USD $0.17/m3.

II. Environmental Impact Assessment Certificates

In Zimbabwean mining legislation, an Environmental Impact Assessment (“EIA”) is not required in order to issue a mining licence, and in terms of the EM Act and its First Schedule is only required prior to commencement of mining and forms part of the planning process. Blanket Mine was established in the early 1900s, long prior to the implementation of governing mining and environmental laws. As such, it appears that an EIA is not required for the Blanket Mine. However, the Company is in constant communication with the Environmental Management Agency (“EMA”) regarding environmental permitting requirements and an EIA was completed for the Mine in 1995. Should the EMA communicate that an EIA certificate for the Mine be obtained, the Company will submit all relevant and associated applications to obtain such and remain fully compliant.

Blanket Mine holds EIA certificates as issued by the EMA for the solar plant, both the old and new TSF’s and development of the additional GG and Abercorn gold mines, which do not form subject of this Report but are detailed in Table 4 for completeness.

Table 4: EIA Certificates

Licence Number | Activity | Valid Period |

8000120641 | EIA Certificate - Abercorn Mine | 15 June 2023 – 14 June 2024 |

44GC0094/2020 | Solar Plant Licence (generation licence) | 25 years (from 2020) |

8000120642 | GG Mine – Gold Mining Development | 15 June 2023 – 14 June 2024 |

8000124691 | EIA Certificate – new TSF | 10 October 2023 – 9 October 2024 |

The new TSF is currently operating under the authorisation granted through the approval of the Environmental Impact Assessment, and a licence will be issued by the Zimbabwean Environmental Management Agency (EMA).

III. Additional Environmental Permits

In order for operations to continue, the EMA has issued a number of additional environmental licences to Blanket Mining Company, including:

| | ● | air emissions (clinic incinerator, blacksmith shop, laboratory, smelter house and power plant generators); |

| | ● | solid waste (landfill and tailings); |

| | ● | effluent disposal (sewerage and car wash bay); |

| | ● | hazardous substances (importation, transportation and storage); and |

| | ● | hazardous waste generation (oils and clinical waste). |

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

These licences are listed in Table 5.

Table 5: Environmental Permits

Licence Number | Activity | Valid Period |

L0000010451 | Diesel generator | 18 Mar 2024 – 31 Dec 2024 |

L0000010449 | Clinic incinerator | 18 Mar 2024 – 31 Dec 2024 |

L0000010452 | Blacksmith Licence | 18 Mar 2024 – 31 Dec 2024 |

L0000010453 | Assay laboratory | 18 Mar 2024 – 31 Dec 2024 |

L0000010450 | Smelter Licence | 18 Mar 2024 – 31 Dec 2024 |

L0000010455 | Washbay effluent disposal | 18 Mar 2024 – 31 Dec 2024 |

L0000010454 | Sewage effluent disposal | 18 Mar 2024 – 31 Dec 2024 |

L0000010463 | Hazardous substance generation | 18 Mar 2024 – 31 Dec 2024 |

L0000010457 | Solid waste Disposal (Landfill) | 18 Mar 2024 – 31 Dec 2024 |

L0000010458 | TSF Licence (old TSF) | 18 Mar 2024 – 31 Dec 2024 |

L0000010462 | TSF Licence (new TSF) | 18 Mar 2024 – 31 Dec 2024 |

L0000010456 | Workshops and oil separators | 18 Mar 2024 – 31 Dec 2024 |

L0000010451 | Diesel generator | 18 Mar 2024 – 31 Dec 2024 |

L0000010449 | Clinic incinerator | 18 Mar 2024 – 31 Dec 2024 |

L0000010452 | Blacksmith Licence | 18 Mar 2024 – 31 Dec 2024 |

The QP is not aware of any past material violations or fines.

Item 3 (g) – Other Significant Factors and Risks

The QP is not aware of any factors or risks that may affect access, title or right or the ability to perform work on the property.

ITEM 4 – ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

Item 4 (a) – Topography, Elevation and Vegetation

The area around the Blanket Mine is hilly and lies at an altitude of about 1,000 m to 1,300 m above mean sea level (“amsl”). Drainage is to the northeast, into the Mtshabezi River on which the Sheet Dam and the Blanket Dam are located (some 5 km to the east of the Mine). The main natural water sources include the Tuli River, with its main tributaries (in the east bank running in a north-south direction) being the Mnyabetsi River in the Dibilashaba Communal Area, the Sengezane River in the Garanyemba Communal Area, and the Ntswangu and Pelele Rivers in the Gwanda Bolamba Communal Area.

The indigenous vegetation is dominated by savannah with Marula (Sclerocarya birrea), a variety of Combretum species, Terminalia sericea, Mopane groves and patches of grassland. Around the mine and local settlements, vegetation has been cut down and invaded by secondary thorny scrub dominated by Dichrostachys cinerea. Agriculture is limited to subsistence farming of maize and vegetables.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

Item 4 (b) – Access to the Property

Access to the Blanket Mine is by an all-weather single lane tarred road from Gwanda. Gwanda is linked by national highways to Bulawayo, Harare, and the Beitbridge Border post. Earlier, Zimbabwe had good road infrastructure. However, lack of investment over the past ten to fifteen years resulted in its deterioration; substantial investment is required country wide. The railway line connecting the Zimbabwean national network to South Africa passes through Gwanda. An airstrip for light aircraft is located 5 km to the northwest of the town.

Gwanda Town is the provincial capital of Matabeleland South Province and district capital of Gwanda District. The village of Vubachikwe lies immediately adjacent to the southeast of ML 40. Blanket Mine labourers and their families are accommodated in a mine village about 1 km from the Mine. Gwanda offers a number of lodges and alternative accommodation options. Gwanda offers limited hospitals and medical services, business and financial services, educational facilities, shops, recreational facilities, and amenities. Larger hospitals and establishments are offered in Bulawayo, in addition to more skilled service industries. Neighbouring towns and villages to the Mine provide skilled and unskilled labour.

Major economic activities in the district include gold mining, cement production, livestock production, game ranching and tourism. A number of dams and irrigation schemes are established. The population in the district is mostly rural, with the majority of employed people servicing the agriculture and related industries.

The district is serviced by telecommunication services, and Blanket Mine provides its own Wi-Fi and communication systems.

The A6 highway, forming part of the Trans-African Highway network, is orientated roughly northwest-southeast and links Bulawayo with the Beitbridge border post and Musina in South Africa. The highway runs through the town of Gwanda. A major sealed road, the Old Gwanda Road, branches off from the A6 in Gwanda and runs directly through the ML 40 to Bulawayo. The Blanket claims are all located along these major roads and are thus easily accessible. The roads are sealed and although potholing is frequent, the surfaces are navigable by all vehicles. The Beitbridge Bulawayo Railway runs roughly parallel to the A6 through Gwanda Town.

An airstrip and informal airport building are located in Gwanda along the A6. The Joshua Mqabuko Nkomo International Airport is located in Bulawayo. The Mine can be accessed either via the Beitbridge-Bulawayo Road, or by flying into Bulawayo and driving two hours via the Old Gwanda Road or the A6 to the site.

Item 4 (c) – Climate and Length of Operating Season

The climate in Gwanda is hot and semi-arid, classified as BSh type (extremely hot summers and warm to cool winters, with minimal precipitation) by the Köppen climate classification system. Temperatures are as high as 40ºC during summer months of November to February and average 13ºC during winter (May to August). The climatic conditions make the area vulnerable to meteorological hazards such as droughts, floods, gusty winds, as well as lightening during the wet and hot season.

The region experiences short, variable rainfall seasons (averaging generally below 400 mm per year), and long, dry winter periods. Rainfall is usually associated with thunderstorms, producing rainfall of short duration and high intensity. The rainfall, in general, is less than half of the potential evaporation which has necessitated irrigation development and infield rainwater harvesting to improve crop production which complements animal husbandry as well as reclaims open access areas such as grazing lands. It also induces underground water recharge as part of improving the environment.

Caledonia Mining Corporation Plc

S-K 1300 Technical Report Summary on the Blanket Gold Mine, Zimbabwe

No appreciable mine production downtime is expected owing to unfavourable climatic or weather conditions. The mine is able to operate year-round.

Item 4 (d) – Infrastructure

I. Regional Infrastructure

The Blanket mine area is supplied with power through the national grid operated by the Zimbabwe Electricity Transmission and Distribution Company. Power is supplied from the grid to the operations via three overhead powerlines (“OHLs”) energized at 11 kV and 33 kV supplying 18MVA and Mtshabezi line adding another 7MVA. This totals to a maximum demand supply of 25MVA. The Zimbabwe Electricity Supply Authority (“ZESA”) currently allocates a capacity of 18MVA to the operations.

Water supply to the Blanket Mine area is sourced from the Blanket Dam located 5 km east of the Mine, as well as groundwater. The Blanket Dam has a capacity of 15 Mm³ and all water rights are held by ZINWA. Water users including Blanket Mine purchase all service and domestic / potable water from ZINWA.

Logistics infrastructure in the Blanket Mine area consists mainly of the local road network, national rail network and an airstrip located northwest of the town of Gwanda. All of the above-mentioned infrastructure is easily accessible from Blanket Mine.

I. Mine Infrastructure

Mine infrastructure comprises of underground workings, various shaft with head gear and hoisting facilities, a process plant, workshops and a new tailings storage facility (“TSF”) commenced deposition during December 2023 and was fully commissioned during February 2024. Stores, workshops and offices, as well as an assay laboratory, are located adjacent to the mine shafts. There is adequate surface area for any potential future expansion. With regards to the accessibility to personnel, services and supporting industries refer to Item 4 (b).

ITEM 5 – HISTORY

Item 5 (a) – Prior Ownership and Ownership Changes

The Blanket Mine is part of the Sabiwa group of mines within the GGB from which gold was first extracted in the 19th century. The Blanket Mine is a cluster of mines extending some 3 km from Jethro in the south through Blanket itself, Feudal, AR South, AR Main, Sheet, and Eroica, to Lima in the north. Blanket Mine has produced over a million ounces of gold during its lifetime.