Exhibit 15.6

DATE AND SIGNATURE PAGE

This technical report summary titled "Bilboes Gold Project Technical Report Summary" was prepared for Caledonia Mining Corporation Pie, in accordance with Subpart 1300 and Item 601(b)(96) of Regulation S-K, as adopted by the United States Securities and Exchange Commission. Its effective date is December 31 2023.

The Qualified Person ("QP") responsible for this Report is DRA Projects (Pty) Ltd.

Signature Date: May 15, 2024

ABBREVIATIONS, TERMS AND DEFINITIONS

Abbreviations/Terms | Definition |

°C | Degrees |

AACE | American Association of Cost Engineers |

AMIS | African Mineral Standards |

amsl | above mean sea level |

AMZIM | Anglo American Corporation of Zimbabwe Ltd |

Archean | Bubi Greenstone Belt |

Au | Native Gold |

Baker Steel | Baker Steel Resources Limited |

BBWi | Bond Ball Work Index |

BFS | Basic Ferric Sulphate |

Bilboes | Bilboes Gold Limited |

BIOX | Biological Oxidation |

BoQ | Bill of Quantities |

Caledonia | Caledonia Mining Corporation Plc |

CCD | Counter Current Decantation |

CCE | Capital Cost Estimate |

CIL | Carbon in Leach |

CIM | Canadian Institute of Mining |

CMCL | AIM of the London Stock Exchange plc |

COS | Crushed Ore Stockpile |

CRM’s | Certified Reference Materials |

CSR | Corporate Social Responsibility |

Datamine | Datamine Studio™ |

DD | Diamond Drilling |

DEM | Digital Elevation Model |

DRA | DRA Projects (Pty) Ltd |

EC&I | Electrical, Control and Instrumentation |

EHS | Environmental, Health and Safety |

EIA | Environmental Impact Assessment |

EMA | Environmental Management Agency |

EMC | Eurus Mineral Consultants |

EMP | Environmental Management Plans |

| EPCM | Engineering, Procurement, Construction Management |

EPO | Exclusive Prospecting Orders |

ESIA | Environmental and Social Impact Assessment |

ESMP | Environmental and Social Management Plan |

Abbreviations/Terms | Definition |

ESSMS | Environmental, Social and Safety Management System |

FEED | Front End Engineering Design |

FGR | Fidelity Gold Refinery |

GEV | Generalized Extreme Value |

IFC | International Finance Commission |

ILO | International Labor Organization |

IMTT | Intermediated Money Transfer Tax |

Infinite Treasure | Infinite Treasure Limited |

IRR | Internal Rate of Return |

ISBN | Isabella North |

ISBS | Isabella South |

LBMA | London Bullion Market Association |

LCR | Lab Coarse Duplicates |

LG | Lerchs-Grossman |

LoM | Life of Mine |

LPR | Lab Pulp Duplicates |

LRP | Livelihoods Restoration Plan |

ma | mega annum |

mamsl | Meter above mean sea level |

MAP | Mean Annual Precipitation |

MCC | Motor Control Centre |

MEL | Mechanical Equipment List |

MRE | Mineral Resource Estimate |

MSD-Z | Meteorological Services Department of Zimbabwe |

NPV | Net Present Value |

| OPEX | Operating Expenditure |

P&G | Preliminary and General |

PDC | Process Design Criteria |

PERC | percussion Reverse Circulation |

PFD | Process Flow Diagram |

PFS | Pre-Feasibility Study |

PGM | Platinum Group Metals |

PLZ | Performance Laboratories Zimbabwe Limited |

POX | Pressure Oxidation |

PSD | Particle Size Distribution |

PV | Prospecting Ventures |

QA/QC | Quality Assurance / Quality Control |

Abbreviations/Terms | Definition |

QP | Qualified Person as defined in S-K 1300 |

RC | Reverse Circulation |

RFQ | Rock Quality Designation |

RMR | Rock Mass Rating |

RoM | Run of Mine |

RoR | Rate of Rise |

RWD | Return Water Dam |

SANAS | South African National Accreditation System |

SEX | Sodium Ethyl Xanthate |

SIB | Stay in Business |

| S-K 1300 | Subpart 1300 and Item 601(b)(96) of Regulation S-K |

SLR | SLR Consulting (Africa) (Pty) Ltd |

TRS | Technical Report Summary within the meaning of S-K 1300 |

TSF | Tailings Storage Facility |

US$ | United States Dollar |

VAT | Value Added Tax |

WGC | World Gold Council |

WRD | Waste Rock Dumps |

ZETDC | Zimbabwe Electricity Transmission and Distribution Company |

ZINWA | Zimbabwe National Water Authority |

SYSTEM OF UNITS

The international metric system of units (SI) will be used throughout the design in all documentation, specifications, drawings, reports, and all other documents associated.

TABLE OF CONTENT

1 | EXECUTIVE SUMMARY | 20 |

| 1.1 | Introduction | 20 |

| | 1.2 | Report Purpose | 20 |

| | 1.3 | Project Location | 20 |

| | 1.4 | Permits | 20 |

| | 1.5 | History | 21 |

| | 1.6 | Geology and Resource Estimate | 21 |

| | 1.7 | Exploration | 21 |

| | 1.8 | Sample Preparation, Analysis and Security | 22 |

| | 1.9 | Mineral Resource Estimate | 24 |

| | 1.10 | Mineral Reserve | 26 |

| | 1.11 | Mining Strategy | 27 |

| | 1.12 | Mine Production Schedules | 28 |

| | 1.13 | Tailings Storage Facility | 29 |

| 1.14 | Infrastructure and Site Layout | 29 |

| 1.15 | Environmental | 31 |

| 1.16 | Project Permitting | 32 |

| 1.17 | Social and Community Related Requirements and Plans | 32 |

| 1.18 | Mine Closure | 33 |

| 1.19 | Process Plant | 33 |

| 1.20 | Capital Costs | 34 |

| 1.21 | Operating Costs | 35 |

| 1.22 | Market Studies | 36 |

| 1.23 | Economic Outcomes | 36 |

| 1.24 | Project Development | 37 |

| | 1.25 | Conclusions | 37 |

| | 1.26 | Recommendations | 39 |

| 2 | INTRODUCTION | 40 |

| | 2.1 | Report Purpose | 40 |

| | 2.2 | Sources of Information | 40 |

| | 2.3 | Personal Inspections / Site Visits | 40 |

| | 2.4 | QP Responsibilities and Relationships | 41 |

| 3 | PROPERTY DESCRIPTION | 42 |

| | 3.1 | Project Location | 42 |

| | 3.2 | Property Area | 42 |

| | 3.3 | Mineral Tenure and Title | 43 |

| | 3.4 | Royalties | 44 |

| | 3.5 | Permits | 44 |

| 3.6 | Political Risks | 45 |

| 3.7 | Indigenization and Economic Empowerment | 45 |

4 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY. | 47 |

| 4.1 | Access | 47 |

| | 4.2 | Physiography | 47 |

| | 4.3 | Climate | 47 |

| | 4.4 | Local Resources and Infrastructure | 47 |

| | 4.5 | Personnel | 48 |

| | 4.6 | Supplies | 48 |

5 | HISTORY | 49 |

| | 5.1 | Holdings | 49 |

| | 5.2 | Historical Sulfide Mineral Resource Estimates | 49 |

| | 5.3 | Production | 52 |

6 | GEOLOGICAL SETTING, MINERALIZATION AND DEPOSIT | 54 |

| | 6.1 | Regional Geology | 54 |

| 6.2 | Regional Geology as it Relates to the Bilboes Properties | 58 |

| | 6.3 | Stratigraphy | 59 |

| | 6.4 | Deposit Types | 60 |

7 | EXPLORATION | 62 |

| | 7.1 | Geological Mapping | 62 |

| | 7.2 | Trenching | 63 |

| | 7.3 | Ground Geophysical Surveying | 63 |

| | 7.4 | Prospecting and Sampling | 64 |

| | 7.5 | Drilling | 64 |

| | 7.6 | Hydrology and Hydrological Drilling | 68 |

| | 7.7 | Geotechnical Drilling | 69 |

8 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 70 |

| | 8.1 | Sampling | 70 |

| | 8.2 | Analysis | 70 |

| | 8.3 | Sample Security | 71 |

| | 8.4 | Quality Control | 71 |

| | 8.5 | QP Commentary | 73 |

9 | DATA VERIFICATION | 74 |

| | 9.1 | Historical Data | 74 |

| | 9.2 | 2017/2018 Drilling Campaign | 74 |

| | 9.3 | QP Commentary | 74 |

10 | MINERAL PROCESSING AND METALLURGICAL TESTING | 75 |

| | 10.1 | Test Work Programme Overview | 75 |

| | 10.2 | Discussion of the Results | 75 |

| | 10.3 | Process Route Identification | 77 |

| 10.4 | Variability Testing | 78 |

| | 10.5 | Pilot Plant Test Work | 78 |

| | 10.6 | Pilot Plant Results | 79 |

| | 10.7 | BIOX® | 81 |

| | 10.8 | QP Commentary | 83 |

11 | MINERAL RESOURCE ESTIMATES | 84 |

| | 11.1 | Topography | 84 |

| | 11.2 | Geological Database | 84 |

| | 11.3 | Bulk Density | 84 |

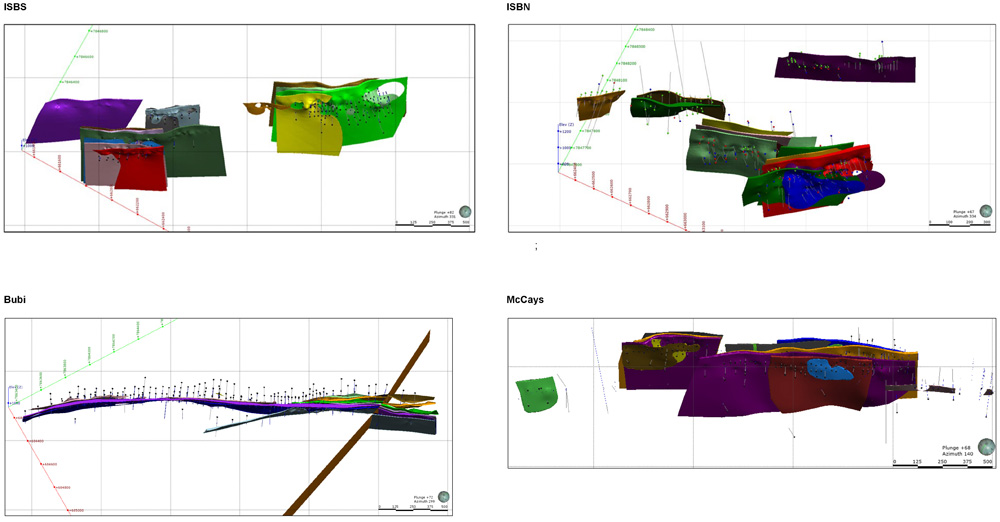

| | 11.4 | Geological Model | 85 |

| | 11.5 | Weathering and Oxidation | 87 |

| | 11.6 | Compositing | 88 |

| | 11.7 | Variography | 88 |

| | 11.8 | Top Capping | 89 |

| | 11.9 | Grade Estimation | 89 |

| | 11.10 | Model Validations | 91 |

| | 11.11 | Reconciliation | 92 |

| | 11.12 | Resource Classification | 92 |

| | 11.13 | Declaration | 94 |

| | 11.14 | QP Commentary | 96 |

12 | MINERAL RESERVE ESTIMATES | 97 |

| | 12.1 | Basis of Mineral Reserve Estimate | 97 |

| | 12.2 | Mineral Reserve Declaration | 98 |

| | 12.3 | Risk Assessment | 99 |

13 | MINING METHODS | 100 |

| | 13.1 | Hydrological and Geotechnical Investigation | 100 |

| | 13.2 | Rock Mass Classification | 101 |

| | 13.3 | Geotechnical Conclusions and Recommendations | 101 |

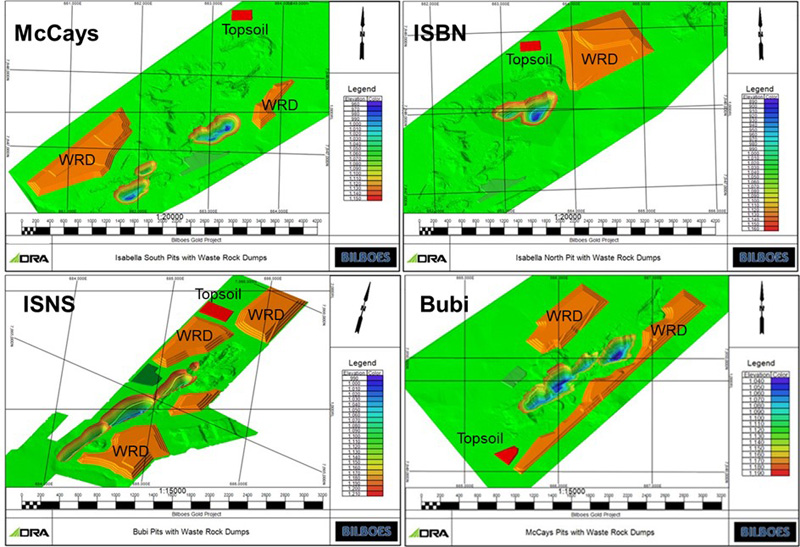

| | 13.4 | Mining Pit Locations | 103 |

| | 13.5 | Mining Strategy | 104 |

| | 13.6 | Mine Design | 108 |

| | 13.7 | Mine Production | 108 |

| | 13.8 | Operating Assumptions | 109 |

| | 13.9 | Fleet Requirements | 110 |

| | 13.10 | Mining Personnel | 111 |

14 | PROCESSING AND RECOVERY METHODS | 114 |

| | 14.1 | Process Test work Results | 114 |

| | 14.2 | Process Flow Description | 115 |

| | 14.3 | Plant Water Requirements | 121 |

| | 14.4 | Reagent Services | 121 |

15 | INFRASTRUCTURE | 123 |

| | 15.1 | Geotechnical Investigation and Design | 124 |

| | 15.2 | Tailings Storage Facility | 126 |

| | 15.3 | Civil Engineering and Earthworks | 130 |

| | 15.4 | Mechanical Engineering | 131 |

| | 15.5 | Electrical Power Supply and Reticulation (including Communications) | 132 |

| | 15.6 | General Infrastructure | 133 |

| | 15.7 | Water Management Infrastructure | 134 |

| | 15.8 | Sewage Management | 135 |

| | 15.9 | Project Execution | 135 |

16 | MARKET STUDIES | 137 |

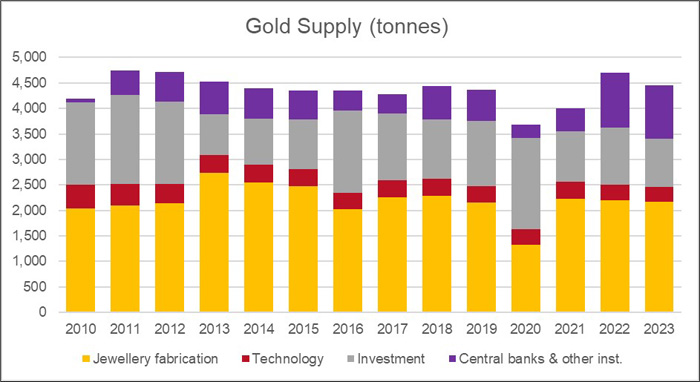

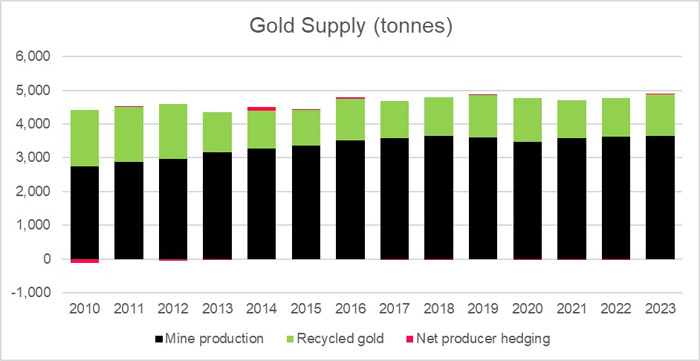

| | 16.1 | Historical Supply and Demand | 137 |

| | 16.2 | Gold Sales in Zimbabwe | 140 |

| | 16.3 | Gold Price Predictions | 141 |

17 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 142 |

| | 17.1 | Environmental Issues | 142 |

| | 17.2 | Waste, Tailings, Monitoring and Water Management | 143 |

| | 17.3 | Water Management | 146 |

| | 17.4 | Project Permitting | 146 |

| | 17.5 | Social and Community Related Requirements and Plans | 147 |

| | 17.6 | Social / Community Issues | 148 |

| | 17.7 | Mine Closure | 148 |

| | 17.8 | Estimated Environmental Costs for Closure | 150 |

| | 17.9 | QP Commentary | 150 |

| 18 | CAPITAL AND OPERATING COSTS | 151 |

| | 18.2 | Operating Cost Estimate | 155 |

19 | ECONOMIC ANALYSIS | 159 |

| | 19.1 | Introduction | 159 |

| | 19.2 | Method | 159 |

| | 19.3 | Sources of Information | 160 |

| | 19.4 | Base Date | 160 |

| | 19.5 | Production Profile | 160 |

| | 19.6 | Capital Expenditure and Phasing | 161 |

| | 19.7 | Stay in Business Capital | 161 |

| | 19.8 | Operating Expenditure | 161 |

| | 19.9 | Gold Recovery | 162 |

| | 19.10 | Gold Pricing | 162 |

| | 19.11 | Salvage Value | 162 |

| | 19.12 | Working Capital | 162 |

| | 19.13 | Sunk and On-going Capital | 162 |

| | 19.14 | Reclamation and Closure | 162 |

| | 19.15 | Royalty Tax | 163 |

| | 19.16 | Corporate Income Tax | 163 |

| | 19.17 | Discount Rate | 163 |

| | 19.18 | Economic Outcomes | 164 |

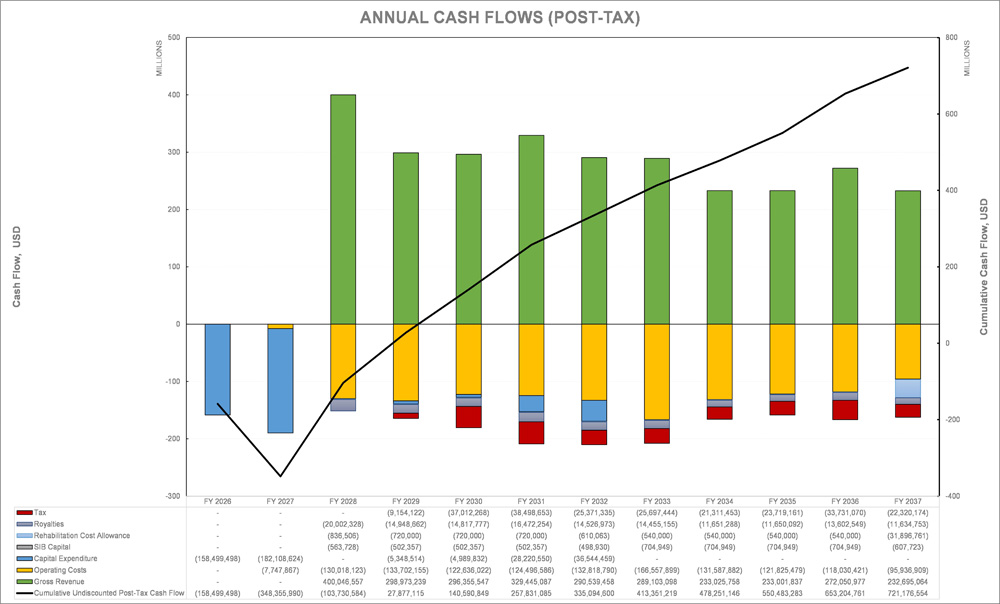

| | 19.19 | Cash Flow Model | 164 |

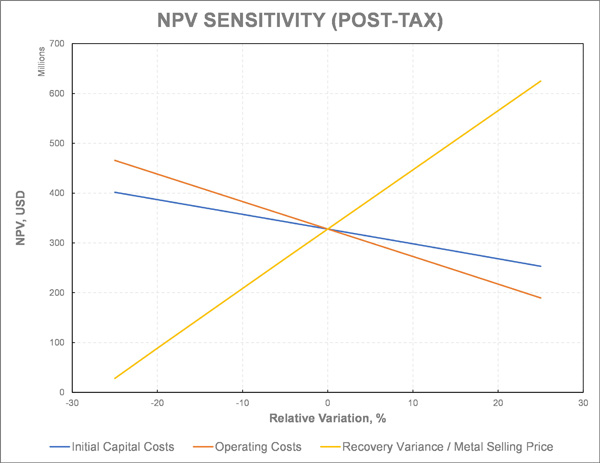

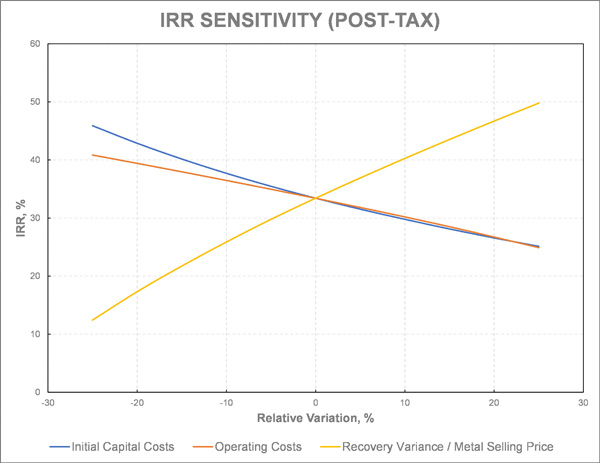

| | 19.20 | Sensitivity Analysis | 168 |

20 | ADJACENT PROPERTIES | 170 |

21 | OTHER RELEVANT DATA AND INFORMATION. | 172 |

| | 21.1 | Royalties, Taxes and Economic Climate in Zimbabwe | 172 |

| 21.2 | Mining Legislation | 177 |

22 | INTERPRETATION AND CONCLUSIONS | 178 |

| | 22.1 | Mineral Resource Estimate | 178 |

| | 22.2 | Mineral Reserves Estimate | 179 |

| | 22.3 | Economic Outcomes | 179 |

| | 22.4 | Risk Assessment | 180 |

23 | RECOMMENDATIONS | 183 |

| | 23.1 | Project Feasibility / Pre Project Execution / Implementation | 183 |

| | 23.2 | Mineral Resource Estimation | 183 |

| | 23.3 | Mineral Reserve Estimate | 183 |

24 | REFERENCES | 184 |

25 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 185 |

| Table 1-1: | Test work Program Outline | 26 |

| Table 1-2: | Mineral Resource based on a 0.9g/t Au Cut-Off Grade | 28 |

| Table 1-3: | Bilboes Gold Project Mineral Reserve Statement | 30 |

| Table 1-4: | Process Plant Main Design Criteria | 36 |

| Table 1-5: | Capital Summaries per Project Phase | 38 |

| Table 1-6: | Mining Contractor OPEX | 38 |

| Table 1-7: | Plant OPEX | 38 |

| Table 1-8: | LoM Operating Cost Summary | 39 |

| Table 1-9: | Project Economics Summary | 40 |

| Table 1-10: | Key Development Milestones | 40 |

| Table 3-1: | Bilboes Claims | 45 |

| Table 5-1: | Sulfide Inferred Mineral Resources as of 2009 | 52 |

| Table 5-2: | Sulfide Mineral Resources as of 31 March 2017, 0.0 g/t Au Block Cut-Off Applied | 54 |

| Table 5-3: | Sulfide Mineral Resources as of 31 March 2017, 0.9 g/t Au Block Cut-Off Applied | 54 |

| Table 5-4: | Production Data from Bilboes Mines to 31 December 2020 | 56 |

| Table 7-1: | History of Sulfide Project Core Drilling 1994 - 1999 (From Ngilazi & Martin, 2017) | 69 |

| Table 10-1: | Test work Program Outline | 78 |

| Table 10-2: | Optimum Flotation Conditions | 80 |

| Table 10-3: | Comparative Pilot Plant Simulated Recoveries | 83 |

| Table 10-4: | Flotation Residence Times | 83 |

| Table 10-5: | Summary of the Test Work Pre-Feasibility Results | 85 |

| Table 11-1: | Summary of Drill Holes | 87 |

| Table 11-2: | Summary of Density Measurement per Resource Area | 88 |

| Table 11-3: | Summary of the Geological Parameters for the Geological Models | 88 |

| Table 11-4: | Variogram Parameters used for Grade Estimation | 91 |

| Table 11-5: | Summary of Search Parameters | 93 |

| Table 11-6: | Block Model Configuration | 94 |

| Table 11-7: | Checklist Criteria for Resource Classification | 96 |

| Table 11-8: | Summary of Optimization Parameters used for the Lerchs-Grossmann Shells | 97 |

| Table 11-9: | Mineral Resource based on a 0.9g/t Au Cut-Off Grade | 98 |

| Table 12-1: | Bilboes Gold Project Mineral Reserve Statement (31 December 2023) | 101 |

| Table 12-2: | Risks associated with the Declaration of the Mineral Reserve | 102 |

| Table 13-1: | Isabella – McCays – Bubi – Predicted drawdown vs. time | 103 |

| Table 13-2: | Percentage Rock Types at Different Mining Pits | 104 |

| Table 13-3: | Slope Design | 105 |

| Table 13-4: | Optimization Financial Parameters | 108 |

| Table 13-5: | Geotechnical - Mining | 109 |

| Table 13-6: | Mining Continued – Throughput - Process | 109 |

| Table 13-7: | Summary of Selected Shells at US$1,800/oz | 110 |

| Table 13-8: | Bilboes Labor Compliments and Job Grades | 115 |

| Table 14-1: | Process Plant Design Criteria | 117 |

| Table 14-2: | Process Plant Major Reagents / Commodities | 124 |

| Table 15-1: | Proposed Soil and Rock Properties for Foundation Modelling on the TSF Site | 128 |

| Table 15-2: | Proposed Soil and Rock Properties for Foundation Modelling on Process Plant Site | 128 |

| Table 15-3: | Production Profile | 130 |

| Table 15-4: | Liner System | 132 |

| Table 15-5: | Substation Loading | 136 |

| Table 15-6: | Building Infrastructure | 136 |

| Table 16-1: | Predicted Gold Price | 144 |

| Table 17-1: | Potential Environmental Impacts | 145 |

| Table 18-1: | Exchange Rates | 154 |

| Table 18-2: | Capital Summary by Discipline | 156 |

| Table 18-3: | Capital Summaries per Project Phase | 157 |

| Table 18-4: | Mining Contractor Costs per Area (US$/total tonne) | 159 |

| Table 18-5: | Reagent Cost and Consumption for Isabella McCay’s and Bubi | 159 |

| Table 18-6: | Process Plant OPEX – Power | 161 |

| Table 18-7: | Process Plant OPEX | 161 |

| Table 19-1: | Sources of Information | 163 |

| Table 19-2: | Initial Capital Cost – Constant Terms (2023) | 164 |

| Table 19-3: | SIB Capital Cost (LoM) – Constant Terms (2023) | 164 |

| Table 19-4: | Operational Cost Estimate (LoM) – Constant Terms (2023) | 164 |

| Table 19-5: | Gold Recovery per Mineralization Property | 165 |

| Table 19-6: | Summary of Economic Outcomes | 167 |

| Table 19-7: | Cash Flow Model | 169 |

| Table 20-1: | Historic Gold Production from Mines around Isabella McCays and Bubi to 1980 | 174 |

| Table 21-1: | Capital Gains Tax | 177 |

| Table 21-2: | Vat Collection | 178 |

| Table 22-1: | Project Economics Summary | 182 |

| Table 22-2: | Summary of Identified Risks and The Mitigation Strategies | 184 |

LIST OF FIGURES

| Figure 1‑1: | Total Mine Material Movements for LoM | 34 |

| Figure 1‑2: | Overall Site Plan | 35 |

| Figure 1‑3: | Bilboes Simplified Process Flow Diagram | 39 |

| Figure 3‑1: | Regional Location of the Bilboes | 47 |

| Figure 3‑2: | Isabella-McCays Mine Claims Map | 48 |

| Figure 3‑3: | Bubi Mine Claims Map | 49 |

| Figure 6‑1: | Geological Map Zimbabwe (taken from Mugumbate, unknown year) | 59 |

| Figure 6‑2: | Greenstone Belts and known Gold Deposits in Zimbabwe (Mugandani 2017) | 60 |

| Figure 6‑3: | NNE Trending Great Dyke Cutting Across the Zimbabwe Craton (Mukaka et al 1998) | 61 |

| Figure 6‑4: | Geological Map showing the Zimbabwe Craton and Mobile Belts (Gore et al 2009) | 62 |

| Figure 6‑5: | Sedimentary Basins of Zimbabwe (taken from Mugumbate, unknown year) | 63 |

| Figure 6‑6: | Regional Geological Map showing Bilboes Properties (from Ngilazi and Martin ’17) | 64 |

| Figure 6‑7: | Bilboes Site Stratigraphy | 65 |

| Figure 7‑1: | Map of the Surface Geology at Bubi | 67 |

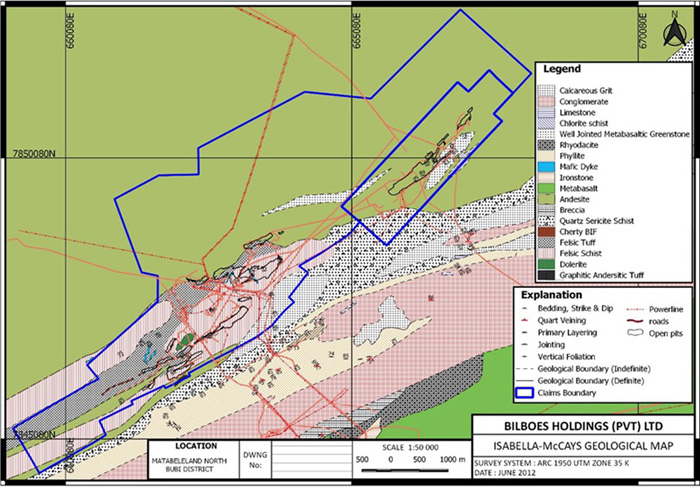

| Figure 7‑2: | Map of the Surface Geology at Isabella McCays | 68 |

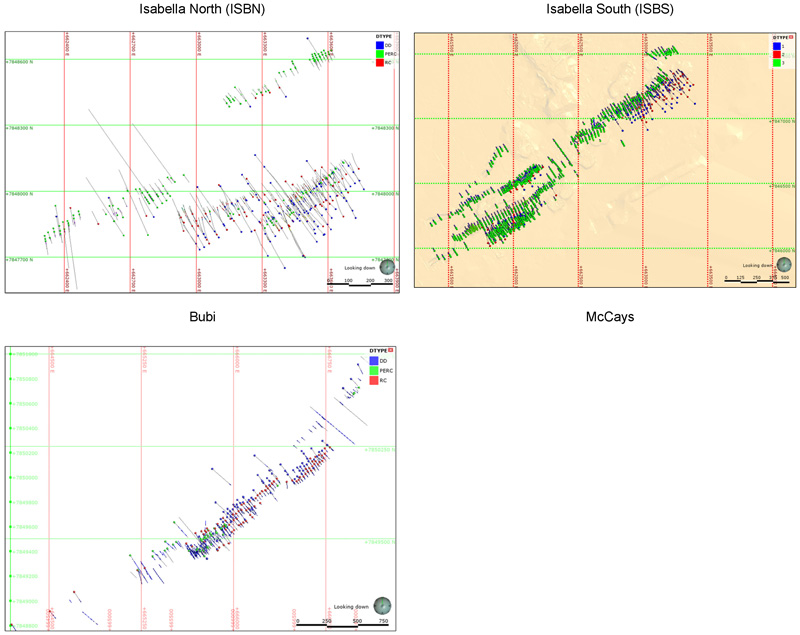

| Figure 7‑3: | Plans Showing the Drilling for the Various Areas | 72 |

| Figure 10‑1: | Pilot Plant Campaign Flowsheets | 84 |

| Figure 11‑1: | Views of the Mineralization Zones | 91 |

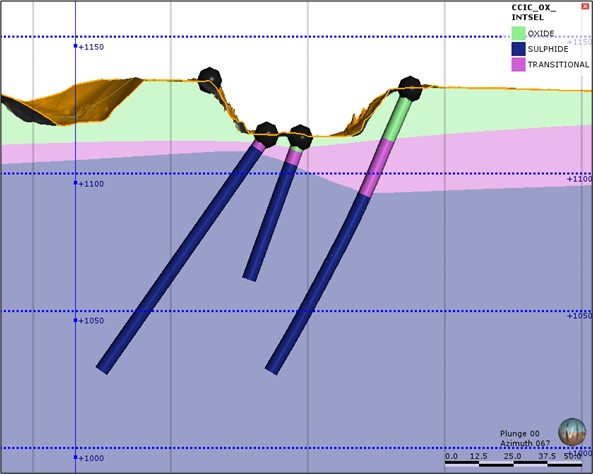

| Figure 11‑2: | Section View showing Oxidation Profile at ISBS | 92 |

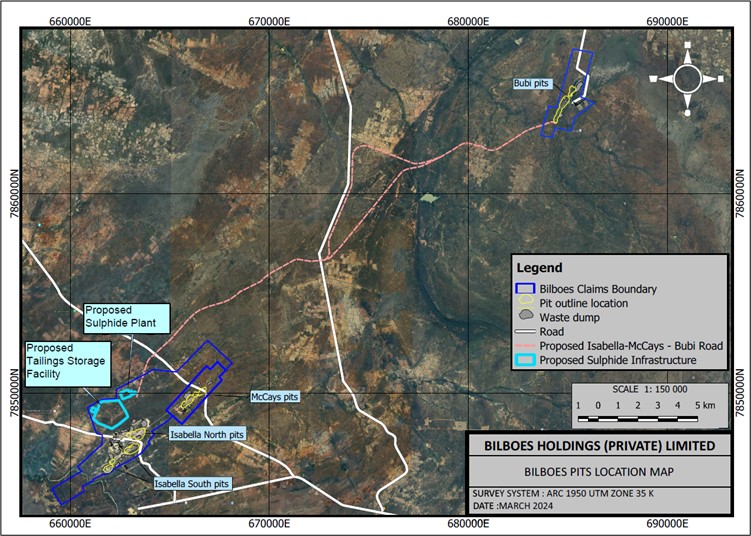

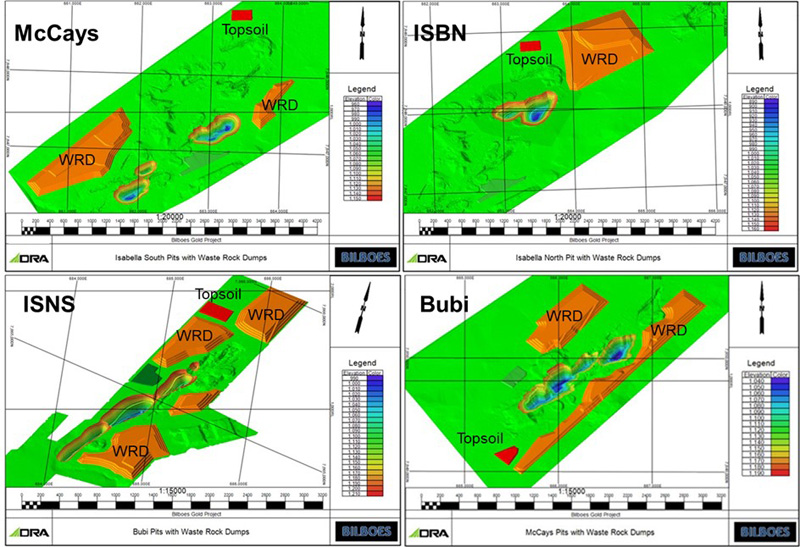

| Figure 13‑1: | Block Plan Showing Bilboes Pits and Process Plant Location | 108 |

| Figure 13‑2: | Block Plan Showing Bilboes Pits Location | 109 |

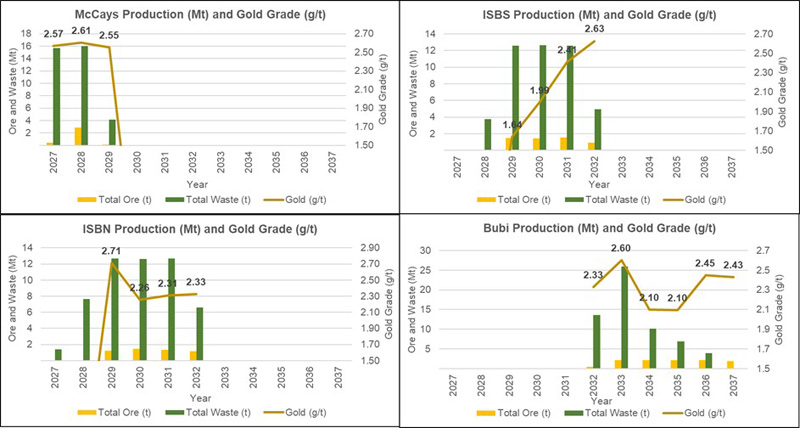

| Figure 13‑3: | Production Schedules per Area | 115 |

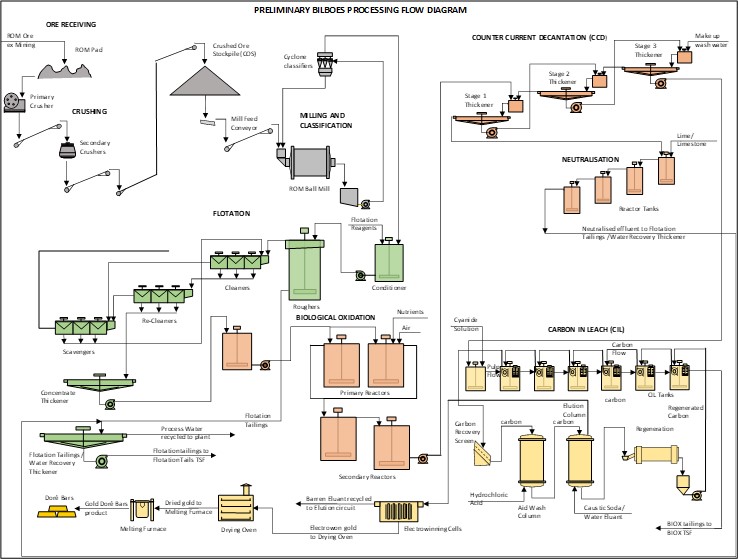

| Figure 14‑1: | Bilboes Simplified Process Flow Diagram | 121 |

| Figure 15‑1: | Mine Layout | 128 |

| Figure 15‑2: | Overall Site Plan | 129 |

| Figure 16‑1: | Historical Gold Supply (2010 -2023) | 142 |

| Figure 16‑2: | Historical Gold Demand (2010 - 2023) | 143 |

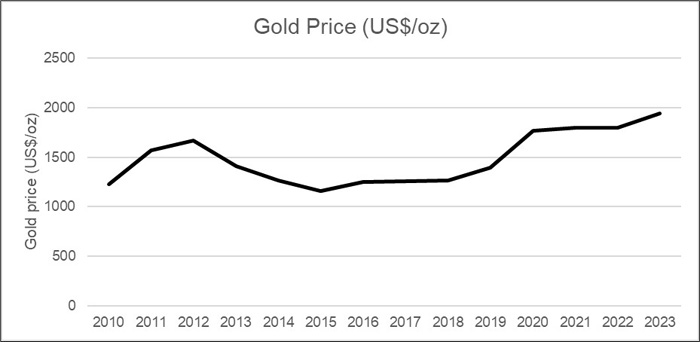

| Figure 16‑3: | Gold Price (2010 - 2023) | 144 |

| Figure 19‑1: | LoM Cash Flow Model | 170 |

| Figure 19‑2: | Sensitivity Analysis | 174 |

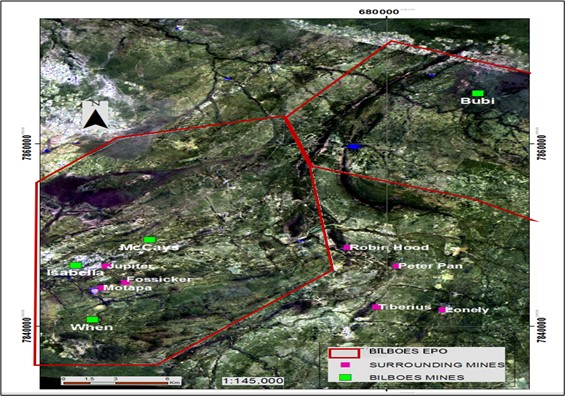

| Figure 20‑1: | Adjacent Properties around Isabella McCays and Bubi | 175 |

This Technical Report Summary (TRS) has been prepared for Caledonia Mining Corporation Plc (Caledonia) on the Bilboes Gold Mine, Zimbabwe which Caledonia acquired with the acquisition of Bilboes Gold Limited (Bilboes) on 6 January 2023. Caledonia is a Zimbabwean focused exploration, development, and mining corporation. Caledonia shares are listed on the NYSE American LLC and depositary interests in the shares are traded on the AIM of the London Stock Exchange plc (symbol: CMCL). Caledonia listed depositary receipts on the Victoria Falls Stock Exchange, a subsidiary of the Zimbabwe Stock Exchange, on December 2, 2021.

Caledonia mandated DRA Projects (Pty) Ltd (DRA) to complete this TRS to report the Mineral Resources and Mineral Reserves on the Bilboes Gold Mine effective as of 31 December 2023. This is the initial filing of a TRS in respect of the Bilboes Mine.

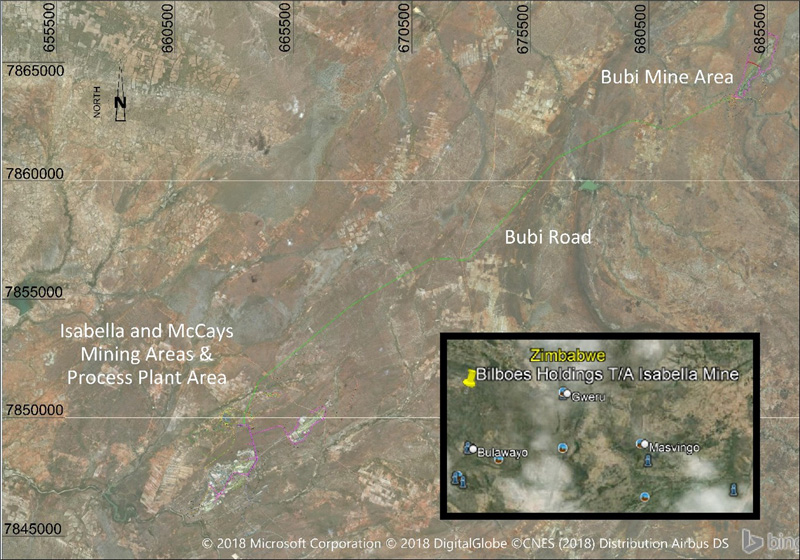

The Bilboes properties are located in the Matabeleland North Province of Zimbabwe. The Isabella-McCays properties are situated approximately 80 km north of Bulawayo while Bubi is situated approximately 100 km north of Bulawayo. Bubi is 32 km due north-east of Isabella.

Bilboes have rights to three groups of claims covering an area of 2,664.4 ha that consist of four open-pit mining properties in Matabeleland North Province of Zimbabwe. These open pits are referred to as Isabela North; Isabela South; McCays and Bubi.

Average daily temperatures range from 24°C in June, to 32° in October and apart from the occasional heavy downpour in the rainy season, there are no climatic conditions that prevent all year-round exploration and mining.

Bilboes has been operating in Matabeleland since 1989. It holds the necessary mining permits and complies with the terms of the Mines and Minerals Act and allied regulations with respect to all of their claims and in particular that all of the registration certificates are valid, and the protection certificates are up to date. Bilboes thus requires no further permits to explore or produce from the current operational areas, but further permits will be required for the proposed haul road between Bubi and Isabella plant.

Further exploration outside the current claims will require approvals by the Environmental Management Agency (EMA) who may request an Environmental Impact Assessment (EIA) study.

Initial exploration allowed the estimation of a small oxide Resource and an open-pit, heap-leach mine was commissioned in 1989. Some 90,048 oz of gold was produced since 2003. Subsequent exploration extended Isabella and new discoveries were made at Bubi and McCays, which has yielded production of 8,954 kg of gold (287,883 oz) to December 2020. All mining has been from open pit oxide ore utilizing the heap leach extraction processing method.

Exploration for sulfide Mineral Resources began in 1994/95, with 17,650m of exploratory drilling being completed by 1999, covering a strike length of 3,440 m. A maiden Mineral Resource estimate for the sulfide Mineral Resources was completed by SRK in 2009, containing 4.75 Mt of Inferred Mineral Resources grading 3.49 g/t. This estimate used a 2.0 g/t cut-off for delineation of the mineral Resource estimation domains.

1.6 | Geology and Resource Estimate |

| | 1.6.1 | Geological Setting and Mineralization |

The Bubi Greenstone Belt (Archean) which consists of volcanic rocks of the Upper Bulawayan Group and capped by sedimentary sequences of the Shamvaian Group, all of which have been metamorphosed into felsic and mafic schists, underlies the Bilboes Properties. Gold deposits are concentrated at the interface between these two groups, where major structural breaks and splays provide pathways for hydrothermal vein mineralization.

Gold is associated with sulfides that is commonly found in hydrothermal systems. These include pyrite and arsenopyrite as major components, but copper, lead, zinc, antimony, are also present in some deposits. Common alteration associated with gold mineralization is silicification, with lesser sericite and chlorite alteration.

Mineralization is hydrothermal and consists of silicified stockworks that host pyrite and arsenopyrite. The stockworks are characterized by a series of subparallel echelon zones. The gold is very finely dispersed within the sulfides and is refractory. All the deposits are oxidized with the sulfide interface occurring between 6 m and 50 m below surface.

Soil sampling, trenching and geological mapping have been progressively conducted since exploration and oxide mining commenced in 1982. Soil sampling was used to identify areas for trenching and mapping. Trenches were sampled at 1 m to 2 m intervals. The assays were used to guide the interpretation and projection of oxide mineralization along strike and at depth. The assays from trench sampling were not used in grade estimation.

Ground Magnetics and Induced Polarization geophysical surveys have been conducted at Isabella, as part of the oxide ore exploration since 1996.

Drilling of the sulfides to provide data for the mineral resource estimate was done in three phases totaling 93,400 m. The first phase by Anglo American Corporation was between 1994 and 1999 and the second phase by Bilboes from 2011 to 2013. The latest drilling was from December 2017 to November 2018. The third campaign focused on upgrading of the mineral resources from the Inferred and Indicated to Indicated and Measured categories.

1.8 | Sample Preparation, Analysis and Security |

During the drilling campaigns, all geological logging and sampling was conducted in accordance with Bilboes standard operating procedures which were adopted by AMZIM and enhanced over time to keep up with industry best practices.

Independent South African National Accreditation System (SANAS) accredited laboratories were used in the analyses of samples. Performance Laboratories Zimbabwe Limited (PLZ) in Harare was selected as the primary laboratory. ZIMLABS and Antech Laboratories (Antech) in Zimbabwe were used for check analyses.

Certified Reference Materials (CRMs), blanks, field duplicates, coarse and pulp repeats were used for Quality Assurance Quality Control (QA/QC) purposes.

The QP has assessed the standard operating procedures together with the results of the QA/QC program and are of the view that these are adequate for the purposes of reporting the Mineral Resources contained herein.

Before commencement of the 2017/2018 drilling campaign in addition to the Datamine™ software already in place Bilboes acquired Fusion database software for the capture: storage and management of drill hole information. This software has built in data verification tools to minimize transcription errors. Bilboes standard operating procedure involves a thorough audit by a senior geologist of each drillholes’ geology and sampling logs, from data logging through to capturing into the database and QA/QC checks.

Each hardcopy log is audited and signed-off by a senior geologist prior to being used in modelling and estimation.

DRA visited the site during drilling and performed various checks to verify the integrity of the collar co-ordinates, logging and sampling procedures, and assay results and concluded that the data collection was consistent with industry standards.

| | 1.8.2 | Metallurgical Test Work |

The metallurgical test work campaign was concluded in different phases over a period extending from September 2013 to March 2019 and involved various laboratories and consultants as outlined in Table 1‑1. The outcomes from the test work have been used to define the processing route, process design basis and gold recoveries.

Table 1‑1: Test work Program Outline

Phase | Test work Description | Done By | Supervision and Oversight | Date |

1A | Sample characterization detailing mineralogical and chemical analysis | Mintek, South Africa | Bilboes, MMC and MDM Engineering | September 13 to December 13 |

1B | Comminution test work done on the two composites namely Composite 1 (Bubi ore) and Composite 2 (combination of Diana, Calcite, Castile, Maria and McCays ores) | Mintek, South Africa | Bilboes, MMC and MDM Engineering | January 14 to April 14 |

2 | Selection of a process route covering gravity amenability tests, flotation optimization and treatment of the sulfide flotation concentrates via POX, Bio-Oxidation and Ultra-fine grinding followed by cyanidation | Mintek and Suntech, South Africa | Bilboes and MMC | May 14 to September 14 |

3 | Variability flotation tests and bulk flotation concentrate production for additional BIOX® and gold leach tests | Suntech and SGS, South Africa | Bilboes, Minxcon and MMC | October 15 to August 16 |

4A | Laboratory and Pilot plant test work campaigns on the different ore types to generate additional flotation kinetics and grind data, bulk concentrates for BIOX® pilot plants, flotation design parameters and validate flowsheet | MMC at the client's project site in Zimbabwe | Bilboes and DRA | April 18 to September 18 |

4B | Review, modelling and simulation of laboratory and pilot plant test results | EMC, South Africa | Bilboes, MMC and DRA | October 18 to March 19 |

| | 1.8.3 | Process Route Identification |

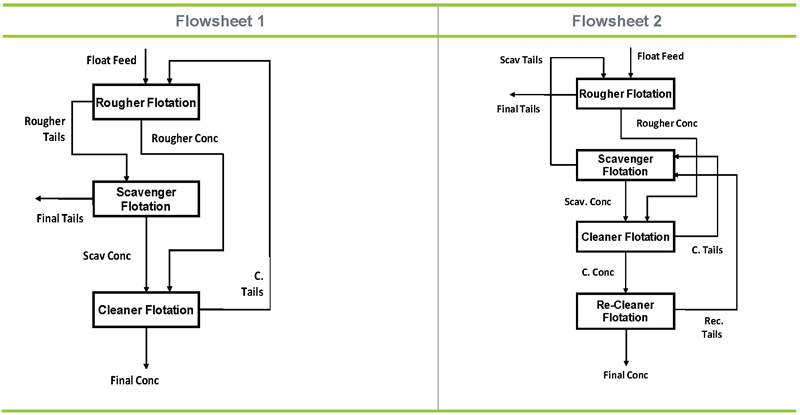

Gravity amenability tests indicated poor gold recoveries and varied from 14% to 22% at 0.5% mass pull. Initial milling and flotation results indicated high gold recoveries of 89 - 97% with high mass pulls ranging 10 -15%, low concentrate grades of 12-20 g/t Au and unacceptable high levels of carbonates in the range of 7-13% which were bound to negatively affect the down-stream gold recovery process. Gold Dissolution from Flotation Concentrates using Biological Oxidation (BIOX®) provided 99% sulfide decomposition with 97% gold dissolution by cyanidation of the bio-residue.

Based on the test work and consideration of environmental impacts and risk minimization by adopting commercially established and proven processes, the process route identified for additional evaluation was flotation, pre-treatment of the concentrate by Bio-oxidation followed by cyanidation.

| | 1.8.4 | Pilot Plant Test Work |

The pilot plant test work was conducted over a period of three months from July 2018 to September 2018, utilizing 20 t of the Isabella McCays ore and 15 t of Bubi ore. The Isabella McCays ores gold recoveries ranged from 85.9% to 91.0% and the mass pulls ranged from 3.8% to 6.0% with a weighted average of 88.4% recovery and 5.0% mass pull. The Bubi ore recoveries ranged from 85.9% to 88.8% and mass pulls ranged from 7.8% to 15.2% with averages of 87.5% recovery and 10.0% mass pull.

Test work was conducted during 2019 on Ore samples from Isabella McCays and Bubi deposits to develop test work data to design a gold processing plant.

The BIOX® test work indicated the following:

| | ● | An average BIOX® sulfide oxidation of 90% was achieved at a 6.5-day retention time and a feed slurry solids concentration of 20%, |

| | ● | This resulted in an average CIL gold dissolution of 95.7% on the BIOX® product solids, |

| | ● | The BAT tests completed on the Bubi concentrate sample achieved sulfide oxidation levels in the range 97 – 98% and yielded gold dissolutions in the range 92.3 to 96.8%. |

1.9 | Mineral Resource Estimate |

The Mineral Resource Estimate (MRE) has been declared in terms of S-K 1300 Table 1‑2.

The Mineral Resource Estimate is summarized in Table 1‑2 using a cut-off grade of 0.9 g/t Au and constrained inside a Lerchs-Grossman (LG) optimized pit shell using US$ 2,400 per ounce gold price. Mineral Resources exclude Mineral Reserves.

Table 1‑2: Mineral Resource based on a 0.9g/t Au Cut-Off Grade

Mineral Ressources (0.9 g/t Au) Reference Point: In Situ |

Property | Classification | Tonnes (Mt) | Au (g/t) | Metal (kg) | Ounces (koz) |

Isabella South (ISBS) | Measured | 0.034 | 1.80 | 61.66 | 1.98 |

| | Indicated | 1.043 | 2.07 | 2,154.20 | 69.26 |

| | Total Measured and Indicated | 1.077 | 2.06 | 2 215.85 | 71.24 |

| | Inferred | 1.335 | 1.80 | 2,403.91 | 77.29 |

Isabella North (ISBN) | Measured | 0.082 | 2.40 | 196.56 | 6.32 |

| | Indicated | 1.734 | 2.29 | 3,971.85 | 127.70 |

| | Total Measured and Indicated | 1.816 | 2.29 | 4,168.41 | 134.02 |

| | Inferred | 1.613 | 2.18 | , 519.53 | 113.16 |

Bubi | Measured | 0.059 | 1.22 | 72.17 | 2.32 |

| | Indicated | 4.437 | 1.51 | 6,702.28 | 215.49 |

| | Total Measured and Indicated | 4.496 | 1.51 | 6,774.44 | 217.81 |

| | Inferred | 5.116 | 1.80 | 9,208.47 | 296.06 |

McCays | Measured | 0.066 | 1.77 | 117.27 | 3.77 |

| | Indicated | 1.261 | 1.85 | 2,338.52 | 75.19 |

| | Total Measured and Indicated | 1.327 | 1.85 | 2,455.79 | 78.96 |

| | Inferred | 1.054 | 2.16 | 2,273.84 | 73.11 |

Totals (ISBS +ISBN+ Bubi + McCays) | Total Measured | 0.241 | 1.85 | 447.66 | 14.39 |

| | Total Indicated | 8.475 | 1.79 | 15,166.84 | 487.63 |

| | Total Measured and Indicated | 8.716 | 1.79 | 15,614.50 | 502.03 |

| | Total Inferred | 9.118 | 1.91 | 17,405.76 | 559.62 |

| | ● | S-K 1300 definitions observed for classification of Mineral Resources. |

| | ● | Mineral Resources are reported exclusive of Mineral Reserves Block bulk density interpolated from specific gravity measurements taken from core samples. |

| | ● | Resources are constrained by a Lerchs-Grossman (LG) optimized pit shell using Whittle software. |

| | ● | Mineral Resources are not Mineral Reserves and have no demonstrated economic viability. The estimate of Mineral Resources may be materially affected by mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, and governmental factors (Modifying Factors). |

| | ● | Numbers may not add due to rounding. |

| | ● | The Mineral Resource Estimate has been depleted to reflect mining up to 31 December 2023 |

| | ● | Effective Date of Resource Estimate is 31 December 2023. |

The process to develop the Mineral Reserve estimate in accordance with S-K 1300 was as follows:

| | ● | Ore recovery of 95% and fixed dilution parameters of 20 cm of hanging wall and 20 cm of footwall (4% in Whittle) were applied in the optimizations, |

| | ● | A Whittle Pit optimization was performed, |

| | ● | A base gold price of United States Dollar (US$) 1,800/oz. A government royalty of 5.0% of revenue and a Refining/Selling Cost of 1.0% of revenue was then applied. This resulted in a Net Gold Price of ~US$ 1,692/oz, |

| | ● | Pit slopes inter-ramp angles ranging from 30° to 55°. Resulting overall pit slopes account for access ramps where applicable, |

| | ● | Gold recovery ranging from 83.62% to 88.88% dependent on mining area and ore type being processed, |

| | ● | Processing throughput of 2.88 Mtpa for Phase 1 and 2.16 Mtpa for Phase 2, |

| | ● | Mining contractor costs based on budget submissions from Southern African based mining contractors, |

| | ● | Average annual processing cost per tonne of ore, inclusive of general / administration costs range from US$ 21.56/t to US$ 44.24/t for all transitional and fresh ores depending on processing parameters, |

| | ● | The reference point for all grade and plant feed ore is the RoM plant feed tip and the plant feed stockpiles, |

A sensitivity assessment was done on gold prices of US$ 1,650/oz and US$ 1,950/oz. A gold price of US$2,400/oz scenario assessment was also completed to determine surface infrastructure boundaries only to ensure that no potential future resource is sterilized. This indicated that the optimal shell inventory (i.e., the size and shape of the optimal shell and therefore the ore and waste generated) was relatively robust for all mining areas.

Optimal shells (maximum profit) were selected for each deposit area based on a US$ 1,800/oz gold price that were then used as the basis for pit designs.

These shell selection criteria are relatively conservative, based on a 24-month (2022-2023) trailing average gold price of US$ 1,875/oz.

A conservative cut-off grade of 0.9 g/t based on project specific projected revenue and cost was applied to all Project resources to ensure tonnes milled generate enough revenue to cover processing costs as shown in Table 1‑3.

Table 1‑3: Bilboes Gold Project Mineral Reserve Statement

| | Classification | Tonnage (Mt) | Au Grade (g/t) | Cut-off grade (g/t) | In-situ Gold Content (koz) |

McCays | Proven | 0.8 | 2.99 | 0.9 | 80 |

| | Probable | 2.7 | 2.47 | 0.9 | 212 |

Isabella South | Proven | 1.3 | 2.24 | 0.9 | 93 |

| | Probable | 4.1 | 2.08 | 0.9 | 272 |

Isabella North | Proven | 2.5 | 2.57 | 0.9 | 207 |

| | Probable | 2.7 | 2.23 | 0.9 | 192 |

Bubi | Proven | 1.2 | 1.90 | 0.9 | 75 |

| | Probable | 9.7 | 2.39 | 0.9 | 743 |

Total | Proven | 5.9 | 2.42 | 0.9 | 455 |

| | Probable | 19.1 | 2.31 | 0.9 | 1,418 |

Grand Total | Probable + Proven | 24.9 | 2.34 | 0.9 | 1,873 |

| | ● | S-K 1300 definitions observed for classification of Mineral Reserves. |

| | ● | Mineral reserves are quoted as head grade or as plant feed. |

| | ● | All tonnes quoted are dry tonnes. |

| | ● | Numbers may not add due to rounding. |

| | ● | No metal equivalents are reported. |

| | ● | Effective Date of Mineral Reserve Estimate is 31 December 2023. |

The estimate of Mineral Reserves of the Bilboes Gold Mine could be affected by any unknown environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant issue. Furthermore, the estimate of Mineral Reserves could be affected by any unknown mining, metallurgical, infrastructure, or other relevant factor.

A Life of Mine (LoM) schedule has been developed to supply two processing phases. These consist of Phase 1 at a processing capacity of 2.88 Mtpa (Isabella and McCays) and Phase 2 at a processing capacity of 2.16 Mtpa (Bubi). The LoM schedule considers the blending requirement that a maximum of 50% of feed to plant be sourced from Isabella North and the remainder from Isabella South (preferred blend) or McCays for Phase 1.

The mining utilizes conventional truck and shovel method with a mining contractor will be used for all open pit mining related earthmoving activities. Free dig and blasted waste will be loaded, hauled with 60t haul trucks, and dumped to designated waste dump locations which will be systematically dozed and levelled to allow dump to be raised to design heights.

The Bubi ore will be dumped on the pit rim stockpiles before being loaded and hauled with a fleet of road trucks to the central processing facility at Isabella. There it will either be directly tipped into the crushing facility or placed on the RoM pad stockpile areas.

McCays will commence production first. This will assist in delivering higher mill feed grades early in the project life.

Approximately eleven months of waste stripping will be required to expose sufficient ore to maintain a constant ore feed rate during Phase 1 once the processing plant has been commissioned.

The mining of all four deposits will run for a period of approximately 10 years at full process capacity - based on the current production schedule. The peak production requirements are 32.3 Mtpa (total material movement) in year 2029.

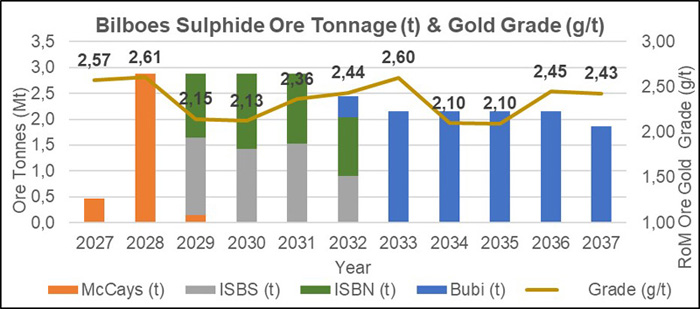

1.12 | Mine Production Schedules |

For scheduling purposes, it was assumed that 100 t excavators with 6 m³ bucket will be deployed on waste and 75 t excavators (4 m³ bucket) on ore. These excavators will be loading trucks with a payload capacity of 60 t and 40 t, respectively.

The production profile is reported as ore fed to the plant from four mineralization properties which are McCays, Isabella North, Isabella South and Bubi. A total of 24.9 million tonnes of mineralized material is delivered to the processing facility, with 198 million tonnes of waste removed over the same period. The average gold grade over life of mine is estimated at 2.34 g/t.

The scheduling results are summarized in Figure 1‑1. The results show that the schedule is a practical solution that targets value and meets all mining and processing goals monthly.

Figure 1‑1: Total Mine Material Movements for LoM

1.13 | Tailings Storage Facility |

Two streams of tailings were envisaged: the flotation circuit (which produces flotation tailings), and the BIOX® circuit (which produces BIOX® CIL tailings and the neutralized BIOX® product that is mixed back with flotation tailings). The flotation and BIOX® tailings will be stored separately in two compartments due to variations in chemistry and rheology. A hybrid lined TSF development system that incorporated full containment of tailings during the initial high Rate of Rise (RoR) deposition phases, followed by upstream development in the latter phases of development when the RoR reduces to the permissible 2 m/year, was designed.

Full wall containment during the initial stages of deposition allows for storage of water on top of the TSF for as long as freeboard is maintained and seepage through surrounding embankments is prevented. Storage of water on the dam further allows for the deferment of the construction of the flotation Return Water Dam RWD (together with associated return water infrastructure) to that time when upstream construction commences. A floating barge, or an on-shore skid-mounted appropriately sized pump can then be used during that time. The return water flows have been provided accordingly.

The BIOX® RWD was designed assuming return to the plant or elsewhere for treatment. The BIOX® return water flows have also been provided accordingly.

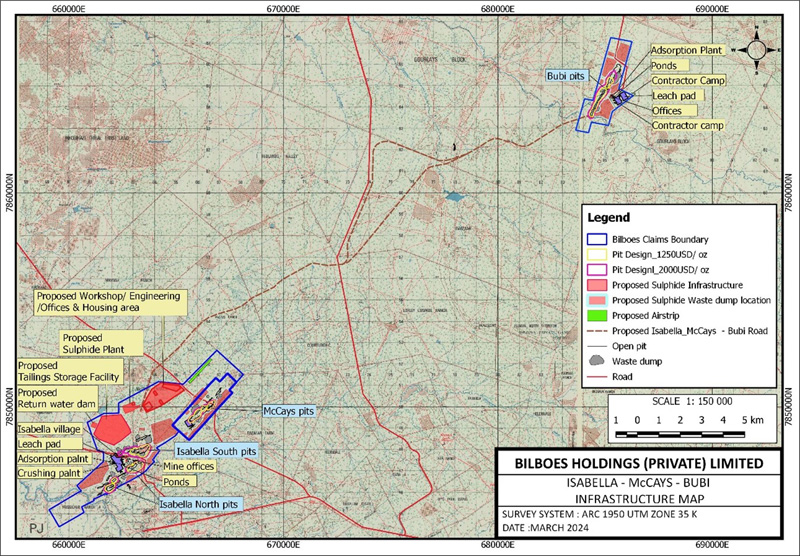

1.14 | Infrastructure and Site Layout |

The overall site plan is shown in Figure 1‑2 and includes major facilities of the Project including the Isabella North and South, McCays and Bubi open pit mines, gold processing plan, TSF, Waste Stockpiles, demarcated areas for mine buildings and accommodation facilities, main power line internal mine roads and access public roads.

Grid power will be supplied from the Zimbabwe National Grid by constructing a 70 km 132 kV Lynx line from Shangani Substation. To feed the line, a line bay will be constructed at Shangani. A mine substation will be constructed at Isabella. The estimate received is for a 132kV substation, equipped with a 50 MVA 132/33 kV step-down transformer.

Raw water will be provided from open pit dewatering and the wellfield boreholes located across the mine license area.

Figure 1‑2: Overall Site Plan

The ESIA and accompanying specialist studies were conducted in conformance with the relevant International Finance Corporation (IFC) Performance Standards and associated guidelines and in compliance with the legal framework of Zimbabwe. The EIA (SLR, 2019) identified the following potential environmental impacts:

The EIA (SLR, 2019) concluded that the proposed project presents several potential positive and negative impacts associated with the unmitigated scenario. With mitigation (in the residual impact scenario) some of the identified potential impacts can be prevented and the remainder can be managed and mitigated to remain within acceptable environmental limits so long as the mitigation set out in the Environmental and Social Management Plan (ESMP) is implemented and Bilboes develops, implements, and annually reviews the Environmental, Social and Safety Management System (ESSMS). Positive impacts can be enhanced by developing and implementing a Community Development Plan as set out in the ESMP.

Bilboes is committed to implementing the mitigation measures within the ESMP together with the ESSMS which will be implemented as part of Bilboes’ on-going efforts of continuous environmental improvement. The management system will contain plans and procedures to help manage environmental aspects and impacts and help ensure legal compliance.

Requirements for post-closure monitoring to determine whether the mitigation and rehabilitation measures are effective would be incorporated into a final Closure Plan to be compiled for the operations prior to the commencement of decommissioning.

An approved EIA is required in terms of the Environmental Management Act (Chapter 20:27) No. 13 of 2002 and the Mines and Minerals Act (Chapter 21:05) of 1996. The ESIA was undertaken for the project to satisfy the requirement and an ESIA Report completed for submission to Environmental Management Agency (EMA) within the first quarter of 2020. Thereafter, public feedback meetings were held to disclose the findings of the ESIA Report to the identified stakeholders. A record of this disclosure process was compiled and submitted to the EMA. An Environmental Impact Assessment (EIA) certificate was issued to Bilboes for the project in February 2021 and was valid for 2 years. The EIA certificate was renewed for 1 year to March 2024 and now to March 2025. The EIA certificate renewal process will continue annually for the duration of the operations, subject to conditions which include project update reports, compliance to Environmental Management Plans (EMP) outlined in the ESIA Report and notification to EMA for any changes in the project likely to alter the project as stipulated in the ESIA Report. Other project related licenses include air emissions (generators, smelter, incinerator), explosives (purchase and storage), firearms, medicines control, public health (medical examination), water abstract and hazardous substances (importation, transportation, storage and use), solid waste disposal which are renewed quarterly or annually.

1.17 | Social and Community Related Requirements and Plans |

An Environmental and Social Management Plan (ESMP) has been developed which contains the environmental, social and safety management and monitoring commitments that Bilboes will implement to manage the negative impacts and enhance the positive impacts identified in the EIA. This will include

| | ● | A Livelihoods Restoration Plan (LRP). |

| | ● | Several Corporate Social Responsibility (CSR) programmes. |

| | ● | Develop fair and transparent labor, working conditions and recruitment policy. |

| | ● | A local procurement policy will be developed and implemented. |

| | ● | Develop a Stakeholder Engagement Plan. |

| | ● | Addressing the social or community impacts. |

Generally accepted “good international practice” mine closure methods were used as the basis for the conceptual closure plan, as well as, for determining the unit rates for the various closure components used in the LoM liability calculation. The mine closure methods also conform to the statutory requirements of Zimbabwe EMA who are the regulatory body.

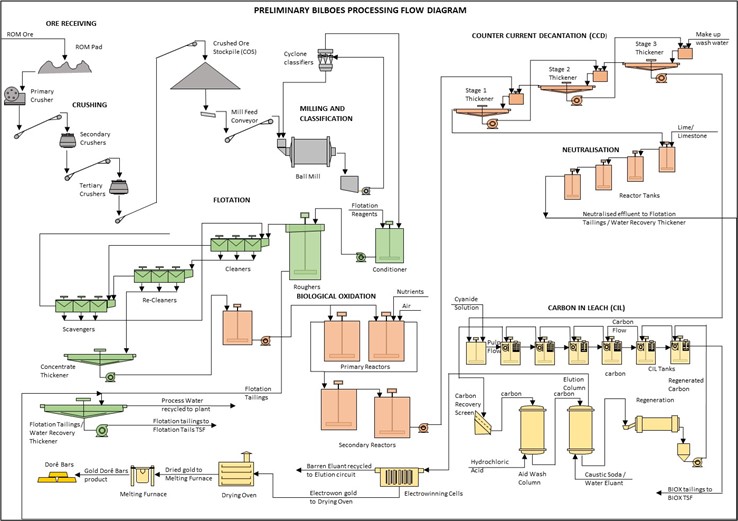

Extensive test work has been undertaken. The ore (fresh sulfide) is refractory to normal free milling processing due to the ultrafine gold particles being largely encapsulated (and generally appearing in solid solution) within the sulfide minerals. As a result, the selected process encompasses a biological sulfide destruction step (the Outotec proprietary BIOX® process) to liberate the gold particles and allow dissolution by a cyanide solution in the CIL circuit. The test work results were used to derive the Process Design Criteria (PDC) for the processing plant as depicted in Table 1‑4.

Table 1‑4: Process Plant Main Design Criteria

Description | Unit | Design | Remarks |

Plant Annual RoM Throughput | | | |

Phase 1 Isabella McCays | tpa | 2,880,000 | |

Phase 2 Bubi | tpa | 2,160,000 | |

Plant Monthly RoM Throughput | | | |

Phase 1 Isabella McCays | tpm | 240,000 | |

Phase 2 Bubi | tpm | 180,000 | |

Au Head Grade Analysis (LoM) | | | |

Isabella McCays | g/t | 2.51 | |

Bubi | g/t | 2.33 | |

Ore Characteristics | | | |

SG (specific gravity) | | | |

Isabella McCays | t/m³ | 2.77 | |

Bubi | t/m³ | 2.85 | |

BBWi (Bond ball work index) | | | |

Isabella McCays | kWh/t | 17.00 | |

Bubi | kWh/t | 21.45 | |

Ore Product Sizes | | | |

Crushed Ore (P80) (80% passing size) | mm | 13 | |

Milled Ore (P80) (80% passing size) | microns | 75 | |

Flotation Mass Pull | | | |

Isabella McCays | % | 5 | |

Bubi | % | 10 | |

Ore will be derived from the two main mining areas (Isabella McCays and Bubi) with production throughput to be phased over the LoM based on tonnage, proximity to the process plant and metallurgical characteristics. Bubi ore, destined to be processed over the latter part of the LoM will be trucked approximately 23 km to the processing plant which will be situated at the Isabella McCays complex. The envisaged phasing is as depicted in Figure 1‑3.

Figure 1‑3: Bilboes Simplified Process Flow Diagram

DRA developed and costed the two phases:

| | ● | Phase 1: 240 ktpm milled ore originating from the Isabella McCays mining area (years 1-6), |

| | ● | Phase 2: 180 ktpm milled ore originating from the Bubi mining area (years 6-10). |

The Capital Cost Estimate (CCE) (December 2023) meets the required accuracy criteria of -15% +25% and is equivalent to a Class 4 Estimate as defined by the American Association of Cost Engineers, (AACE).

The estimate further assumes that the project would be executed on an EPCM basis.

The Capital Estimate is summarized in Table 1‑5.

Table 1‑5: Capital Summaries per Project Phase

Description | Grand Total | Sub Total Phase 1 | Sub Total Phase 2 |

| (Million US$) | (Million US$) | (Million US$) |

Mining | 32.03 | 32.03 | - |

Process | 170.02 | 146.90 | 23.12 |

Infrastructure, Utilities and Ancillaries | 132.55 | 110.76 | 21.79 |

Indirect Cost | 45.18 | 42.98 | 2.20 |

Contingency | 34.23 | 29.83 | 4.40 |

Total Project Costs | 414.03 | 362.50 | 51.51 |

The operating cost estimate has been completed from a zero base and presented in US$. Costs associated with labor, materials and consumables have been included in this estimate.

| | 1.21.1 | Mining Contractor Costing |

The average mining cost based on pricing received is US$ 3.01 /t including the ore transport cost from all mining areas process plant. The cost breakdown is shown in Table 1‑6.

Table 1‑6: Mining Contractor OPEX

Area | Cost per Total Tonne Mined (Ore and Waste) (US$) |

G & A | 0.34 |

Drill and Blast | 0.44 |

Load and Haul Incl. Rehandle & Services | 2.23 |

Total | 3.01 |

Diesel Cost | $1.52 (October 2023) |

| | 1.21.2 | Process Plant Operating Cost |

Operating costs have been estimated and based on the production profile for LoM. For illustrative purposes, static costs are presented for Phase 1 and Phase 2 in Table 1‑7. Main drivers in costs include reagents and power which collectively account for more than 70% of total plant operating costs.

Table 1‑7: Plant OPEX

Description | Unit | Phase 1: 240 ktpm IM | Phase 2: 180 ktpm Bubi |

RoM | t/a | 2,880,000 | 2,160,000 |

Total variable | US$ m/a | 38 | 53 |

Total fixed | US$ m/a | 12 | 17 |

Total | US$ m/a | 50 | 71 |

Unit cost | US$/t ore | 17.47 | 32.69 |

| | 1.21.3 | General and Administration Cost |

The G&A cost includes administrative personnel, general office supplies, safety and training, travel (both on site and off site), independent contractors, insurance, permits, fuel levies, security, camp power, camp costs, ICT, relocation, and recruitment.

Total G&A costs amount to US$ 4,912,650 per annum in Phases 1 and 2.

| | 1.21.4 | Total Operating Costs Summary |

The Bilboes Gold Mines total operating costs have been estimated and based on the production profile over LoM. A summary of LoM operating costs is shown in Table 1‑8.

Table 1‑8: LoM Operating Cost Summary

Description | Cost (US$ m) | Unit cost (US$ / t RoM) |

Mining | 639 | 26 |

Process Plant | 600 | 24 |

G&A | 46 | 2 |

Total | 1,285 | 52 |

The Gold Trade Act empowers the Minister responsible for Finance to issue a Gold Dealers License which entitles entities to export and sell gold from Zimbabwe to customers of its choice. Prior to 1 June 2021, only Fidelity Gold Refinery (Private) Limited (FGR) had the Gold Dealership License and therefore all gold bullion was sold to FGR. With effect from 1 August 2021, all gold producers can directly sell any incremental production to customers of their choice using FGR’s license to export. Caledonia’s Blanket Mine is currently selling its gold to a customer of its choice but exporting the gold using FGR’s license. Sales proceeds come directly into Caledonia’s bank account. As all Bilboes’ production is considered incremental, Bilboes will be able to choose to sell its gold directly to customers of its choice or to continue selling to FGR.

Bilboes is confident that it will be able to export and sell its gold production on similar terms as those obtaining from FGR.

The financial model has been prepared on a 100% equity project basis and does not consider alternative financing scenarios. A discount rate of 10% has been applied in the analysis. The outcomes are presented on a pre-tax and post-tax basis. A static metal price of US$ 1,800/oz has been applied. All-in sustaining costs have been reported as per the World Gold Council (WGC) guideline dated November 2018 and is exclusive of project capital, depreciation, and amortization costs. Capital payback is exclusive of the construction period and referenced to the start of first production. Key financial outcomes are shown in Table 1‑9.

Table 1‑9: Project Economics Summary

Description | Units | Value |

Financial Outcomes (Post-tax, Constant Model Terms) |

NPV @ 10% | US$ m | 328 |

IRR | % | 33.4 |

Peak Cash Funding | US$ m | 348 |

AISC | US$/oz | 922 |

Payback (UNDISCOUNTED) - From Production Start | years | 1.8 |

The key development milestones are as follows:

Table 1‑10: Key Development Milestones

Project Milestones | Completion |

Client reviews and project roadmap decision making | June 2024 |

FS revision phase | February 2025 |

Funding for execution | October 2025 |

Project execution of Phase 1 to achieve 240 ktpm | December 2027 |

Phase 2 project execution for Bubi | December 2032 |

| | 1.25.1 | Mineral Resource Estimates |

The data was reviewed and validated by the QP who concluded that the data is suitable for the construction of the geological model and for the estimation of the Mineral Resource.

The QP is confident that enough geological work has been undertaken, and sufficient geological understanding gained, to enable the construction of a geological model suitable for the determination of a Mineral Resource estimate.

The geological modelling, Mineral Resource estimate and classification were undertaken utilizing recognized deposit and industry strategies/methodologies for the type of deposit of the Bilboes Gold Mine.

The MR is constrained in an optimized pit shell. This together with the assumptions relating to mining, processing, infrastructure, and market factors supports the “reasonable prospects for eventual economic extraction”.

The QP is not aware of any metallurgical, infrastructural, environmental, legal, title, taxation, socio-economic, or marketing issues that would impact on the Mineral Resource, or Reserve statements as presented.

Based on an assessment including: - data quality and integrity, data spacing, confidence in the grade interpolation, confidence in the geological interpretation and confidence in the estimate the QP believes the Mineral Resource estimated is robust.

| | 1.25.2 | Mining and Mineral Reserves |

The QP responsible for the declaration of the Mineral Reserve, is confident that significant geological work has been undertaken, and sufficient geological understanding gained, to enable the construction of an ore body model suitable for the derivation of Mineral Resource and Mineral Reserve estimates.

Based on the information presented in this TRS, the QP considers the MRE to be supported by the appropriate technical data and assumptions.

The open pit modelling is based on suitably supported assumptions and parameters and completed utilizing appropriate industry standards suitable for the Bilboes Gold Mine.

The economic modelling is supported by technical studies in mining, processing, infrastructure, environmental, social, and marketing. Based on the inputs from these disciplines, the financial model demonstrates a feasible mine. The economic analysis is based on a US$ 1,800/oz.

The sensitivity analyses demonstrates that the profitability of the project is most sensitive to revenue related factors such as gold price and recovery.

The QP is not aware of any metallurgical, infrastructural, environmental, legal, title, taxation, socio-economic, or marketing issues that would impact on the Mineral Reserve statements as presented or that would impact on the reliability and/or confidence of the declaration.

Various risks have been identified with consideration of the appropriate mitigating factors.

| | 1.26.1 | Geology and Mineral Resource |

During the operational phase, drilling is required to develop an advanced grade control model prior to mining. A drill spacing study will be required to determine the optimum spacing for “grade control” drilling. The closed space drilling will also enable a more accurate estimation of tonnage and grade as well as a greater definition of oxide, transitional and sulfide ore boundaries.

Investigate waste stripping optimization in the early LoM to reduce early operating costs and improve the overall business case.

Investigate pit slope optimization due to very short pits life, to reduce stripping ratio and total waste movements.

On-going geotechnical analysis is recommended during future mining operations to assess pit slope angles to investigate if improvements can be made for less waste stripping, reduced operating costs, and improve overall business economics.

Optimization efforts could be considered during the project execution front-end engineering and design phase, by conducting further test work focused on flotation optimization (including variability tests) to establish a grade-recovery relationship and validate recovery upsides.

Development of the skills base to effectively run the BIOX® operations is crucial for the business and should be prioritized prior and during the operational phase.

A sufficiently sized water storage dam should be constructed to collect and store water during the wet season and times when the operation is water positive to cater for the dry season.

This TRS has been prepared for Caledonia on the Bilboes Gold Mine, Zimbabwe, by DRA Projects (Pty) Ltd, which is a Qualified Person, in accordance with S-K 1300. For purposes of S-K 1300, this TRS is considered a Pre-Feasibility Study, or PFS. Caledonia acquired Bilboes on 6 January 2023. Caledonia is a Zimbabwean focused exploration, development, and mining corporation. Caledonia shares are listed on the NYSE American LLC and depositary interests in the shares are traded on the AIM of the London Stock Exchange plc (symbol: CMCL). Caledonia listed depositary receipts on the Victoria Falls Stock Exchange, a subsidiary of the Zimbabwe Stock Exchange, on December 2, 2021.

Caledonia mandated the completion of this TRS to report the Mineral Resources and Mineral Reserves on the Bilboes Gold Mine effective as of 31 December 2023 in compliance with S-K 1300. This is the first TRS to be prepared on the Bilboes Gold Mine. This is the initial filing of a TRS in respect of the Bilboes Mine.

2.2 | Sources of Information |

All input drilling data used for the generation of the geological and resource models were supplied by Bilboes who also supplied all historical information including geological data, reports, and maps. The Whittle shells used to define the Mineral Resource and Mineral Reserve were created by DRA, using the latest block models supplied by DRA.

| | ● | All exploration and mining permit information was supplied by Bilboes, |

| | ● | Information on the process was obtained from the pilot plant test work, |

| | ● | The rest of the technical information was obtained by the various consultants engaged by Bilboes. |

2.3 | Personal Inspections / Site Visits |

The following personal inspections/site visits were completed by the QP on the properties by DRA on 3 - 6 July 2017, 6 and 7 December 2017, 21 and 22 February 2018, 20 and 22 March 2018, 26 September 2018.

After discussion with the mine and based on the lack of any significant mine production or construction, it was deemed that site visits in 2023 would not add any value to the work completed.

2.4 | QP Responsibilities and Relationships |

The QP is not affiliated with Caledonia or any other entity that has an ownership, royalty or other interest in the Bilboes properties.

The Bilboes properties are located in the Matabeleland North Province of Zimbabwe. The Isabella-McCays properties are situated approximately 80 km north of Bulawayo while Bubi is situated approximately 100 km north of Bulawayo. Bubi is 32 km due north-east of Isabella See Table 3‑1 for coordinates).

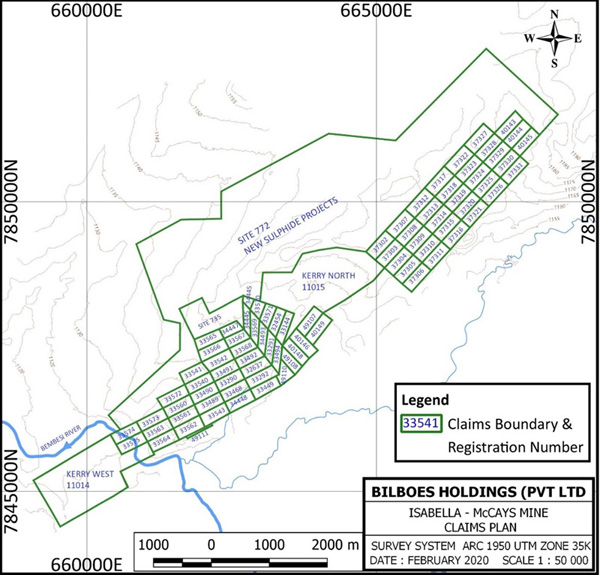

Figure 3‑1: Regional Location of the Bilboes1

The Isabella-McCays-Bubi properties comprise 130 claim blocks covering an area of 2,731.6 ha as shown in Table 3‑1.

Table 3‑1: Bilboes Claims

Group of Claims | Mining District | Province | No. of Blocks | Area (ha) | Coordinate X1 | Coordinate Y1 |

Calcite and Kerry

(Isabella Mine) | Bulawayo | Matabeleland North | 49 | 1,894.4 | 662,106 | 7,846,712 |

Ruswayi

(McCays Mine | Bulawayo | Matabeleland North | 33 | 330 | 666,339 | 7,849,975 |

Chikosi

(Bubi Mine) | Bulawayo | Matabeleland North | 48 | 507.2 | 684,838 | 7,865,515 |

Total | | | 130 | 2,731.6 | | |

Coordinates are in UTM Arc 1950 Zone 35K, Clarke 1880 spheroid format.

________________________________

1 Source: Burger et al, 2017

3.3 | Mineral Tenure and Title |

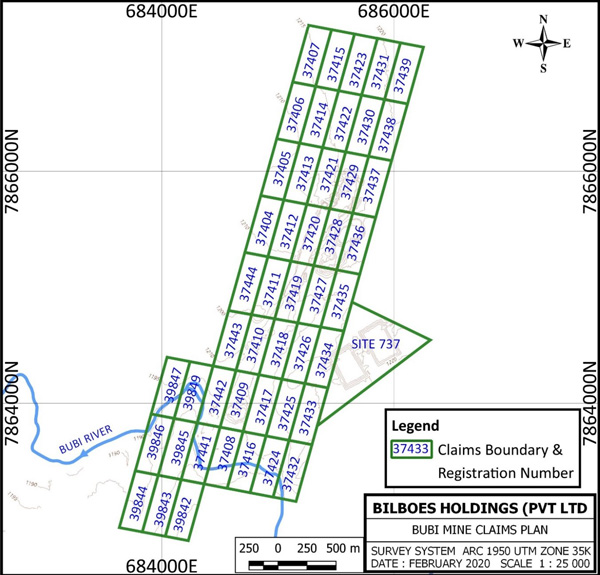

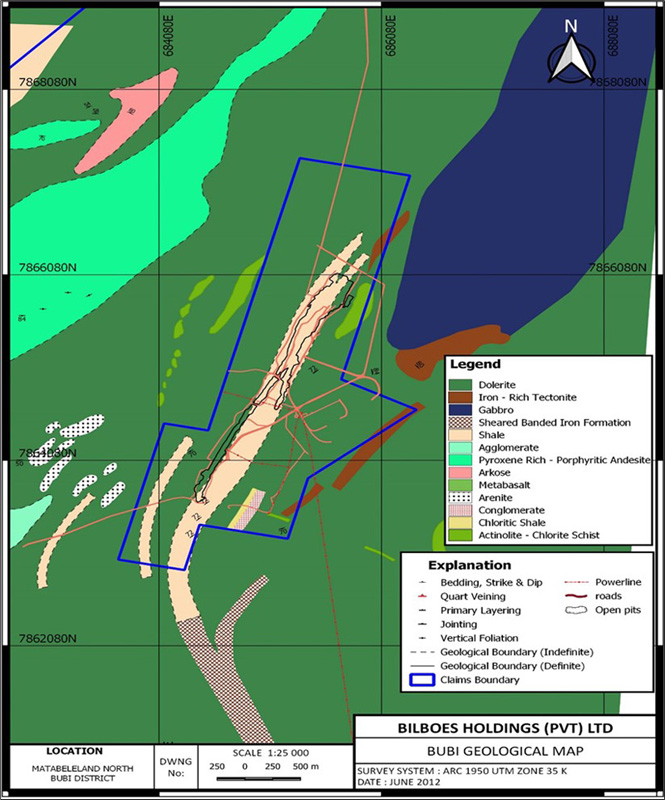

Bilboes consist of 130 claim blocks wholly owned by Bilboes. Of the 130 blocks, 49 gold and base metal blocks and a Special Mine site belong to the Isabella mining area while McCays comprise of 33 gold blocks (Figure 3‑2) and Bubi consisting of 48 gold blocks (Figure 3‑3). The rights were obtained through certificates of Registration After Transfer from Prospecting Ventures, an exploration entity owned Anglo American which had pegged these claims after carrying out exploration work. Bilboes also thereafter registered additional claims in the surrounding area. The claims are protected annually against forfeiture through gold production and exploration work. The Company has exclusive rights to subsurface areas to produce gold from these properties and the rights are transferable and do not expire if the annual protection fees are paid when they become due.

Figure 3‑2: Isabella-McCays Mine Claims Map

Figure 3‑3: Bubi Mine Claims Map

Royalty in Zimbabwe is levied as 5% on gross gold sales revenue.

Bilboes has been operating in Matabeleland since 1989. It holds the necessary mining permits and complies with the terms of the Mines and Minerals Act and allied regulations with respect to all of their claims and in particular that all of the registration certificates are valid, and the protection certificates are up to date. Bilboes thus requires no further permits to explore or produce from the current operational areas, but further permits will be required for the proposed haul road between Bubi and Isabella plant.

Further exploration outside the current claims will require approvals by the EMA who may request an EIA study.

SLR Consulting based in South Africa in partnership with the local GryinOva Environmental Consultants conducted an ESIA study for the project and an EIA certificate of approval was issued by EMA in February 2021 and the certificate was valid for 2 years and subject to renewal on an annual basis for the duration of the operations. The current EIA certificate expires in March 2025. The conditions of renewal are notification to the agency of any changes in the project, compliance to the approved environmental plan and submission of progress report on the project. There is no reason that the renewal will not be granted.

Other project related licenses which are currently in use include air emissions (generators, smelter, incinerator), explosives (purchase and storage), firearms, medicines control, public health (medical examination), water abstract and hazardous substances (importation, transportation, storage and use), solid waste disposal which are renewed when they become due either quarterly or annually. The conditions of renewal involve payment of applicable fees to the regulatory bodies for an amount of $70,000 per annum.

Bilboes also hold 3,935 ha of additional claims and 51,900 ha of exploration licenses referred to as Exclusive Prospecting Orders (EPOs) around Isabella-McCays-Bubi and the Gweru area. These claims and EPOs have highly prospective targets which offer Bilboes excellent prospects for organic growth. The company has applied for an extension of the EPOs tenure for a further 3 years after the initial 3-year tenure expired in July 2021. The decision on the EPO applications is pending.

Political uncertainties are risks, which may lead to unfavorable legislative and taxation framework changes, exchange control restrictions, international monetary fluctuations, civil unrest, or any other political instability. However, the current political environment is looking favorable due to the recent reforms by the Government under the new dispensation. It is expected that this or any other politically related risks will not affect Bilboes now or in the foreseeable future.

All the properties belonging to Bilboes are protected in respect of the Mines and Minerals Act. All the blocks of claims are registered with the Mining Commissioner’s office and are regularly inspected in compliance with the mining regulations and preserved against forfeiture.

3.7 | Indigenization and Economic Empowerment |

The Indigenization and Economic Empowerment Act has since been amended and it now allows foreign entities to own 100% mining rights. Foreign shareholding will now be negotiated with investors.

All new foreign investment into Zimbabwe requires an investment license issued by the Zimbabwe Investment Authority in terms of the Zimbabwe Investment Authority Act.

Moreover, in the mid-term budgetary review statement of 2019 the Indigenization and Economic Empowerment Act was repealed and replaced by the Economic Empowerment Act, which is consistent with the current thrust “Zimbabwe is Open for Business".

4 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY. |

Isabella McCays and Bubi are approximately 80 km and 100 km directly north and northeast of Bulawayo, the second largest city of Zimbabwe with an approximate population of 655,675 (2013). All the mines are accessed via public roads and although these are of variable quality, they are accessible by all types of vehicles. Isabella is 110 km (1.5 hours) whilst Bubi is 140 km (2 hours) by road from Bulawayo. Bubi can also be accessed by road from Isabella (70 km in 1 hour).

The properties lie between 1,150 m and 1,200 m above mean sea level (amsl). The area is covered by red and grey soils characteristic of greenstone rocks in Zimbabwe. Vegetation is dominated by scrubby Colophospermum Mopane, Acacia, and Combretum woodlands and minor occurrences of miombo with no extensive grasslands. Agricultural activities are restricted to ranching.

Despite lying in the tropics, the climate is subtropical due to its relatively high altitude. The mean annual temperature is 19°C. Three broad seasons are prevalent: a dry, cool winter season from May to August; a dry, hot early summer from late August to Early November and a wet, warm summer from early November to April. Rainfall during the wet season averages 594 mm. The climatic conditions allow for a year-round exploration and mining activities.

4.4 | Local Resources and Infrastructure |

The terms of the claims tenure system in Zimbabwe confer rights to use of the land surface for mining and construction of all related infrastructure such as housing, offices, plant, and tailings/waste disposal facilities subject to adherence to the environmental legislation. In 2019, Bilboes obtained rights for an additional 1,128 ha for a mine site at Isabella which will be adequate to cater for the additional sulfide mine infrastructure such as the sulfide plant, tailing’s storage facility, waste dumps, housing, and additional office infrastructure.

There is sufficient underground water around the mines to run the current heap-leach operations, but additional drill holes and pumping capacity will be required for the proposed sulfide-mining project. This issue was identified in the Pre-Feasibility stage of the project, along with water-use permits.

There are 33 kV power lines within 5 km and 25 km of the Isabella McCays and Bubi deposits respectively, that form part of the national grid, but new lines will have to be constructed to meet the increased capacity of the proposed exploitation of the sulfides.

A 70 km kV Lynx line will be constructed from Shangani Substation to a substation which will be constructed at Isabella. An alternative 88 kV power line, which is sufficient for the sulfide project, is located at Turk Mine about 40 km from Isabella McCays and 60 km from Bubi, but this line has recently had an increased consumer load.

Workshops, offices, and housing amenities are available for heap leach extraction, and these will require to be upgraded for the proposed sulfide mining project.

The mines have cell phone and internet connectivity and utilize a two-way radio system.

Generators at all mines allow continued production during load shedding. The capacity will need to be upgraded to cater for the sulfide operation.

Zimbabwe continues to boast the highest literacy rate in sub-Saharan Africa National examinations are written during the third term in November, with "O" level and "A" level subjects (UK based qualification for students aged 16 and above). Currently, there are seven public universities as well as four church-related universities in Zimbabwe that are fully internationally accredited. Zimbabwean culture places a high premium on education. Various mining related qualification such as geology, mining engineering and mineral processing are offered at tertiary level.

Mining supplies, including mining and processing equipment, are readily available in Zimbabwe.

Bilboes was previously owned by Anglo American Corporation of Zimbabwe Ltd (AMZIM) and was later taken over by GAT investments (Pvt) Ltd in 2003. Bilboes held the Isabella, McCays and Bubi claims. AMZIM acquired the Isabella claims in 1982.

The Bilboes Properties are wholly owned by Bilboes Holdings (Pvt) Ltd, which is 100% owned by Bilboes Gold Limited (Bilboes Gold), which was acquired by Caledonia on 6 January 2023. Prior to its acquisition by Caledonia, Bilboes was a private company owned by three shareholders, Gat Investments (Private) Limited (Gat Investments), Baker Steel Resources (Baker Steel), and Infinite Treasure Limited (Infinite Treasure).

5.2 | Historical Sulfide Mineral Resource Estimates |

In 2009, SRK undertook a Mineral Resource Estimate for the sulfide Properties based on the drill holes and geological interpretations supplied by Bilboes.

Geological models were created for all these deposits, excluding the oxide portions, to a depth of up to 150 m. Solid models were created from the wireframes generated and assays for gold within these were used for geostatistical modelling and resource estimation. The Mineral Resource of 5.2 Mt containing 533,000 oz was declared to 100 mbs with mineralization from 3.5 Mt containing 240,000 oz being declared from 100 – 150 mbs.

The grade estimation for the Sulfide Projects was based on a 2.0 g/t cut-off mineralized envelope. In general, the drill coverage was poor, with drill spacing ranging from 25 m (Bubi) to up to 100 m for McCays. In most cases there was only one hole per drill line.

Classification of the anomalies was based on the quality of the estimate, which in turn was based on grade continuity and data spacing and was done according to the guidelines contained within the JORC code (2012).

Estimates were validated by visually comparing the drill hole grades to the block model grades for each section line in Datamine Studio™ (Datamine).

The results of the estimation for the classification as an Inferred Mineral Resource (Table 5‑1).

Table 5‑1: Sulfide Inferred Mineral Resources as of 2009

Deposit | Cut-Off (g/t) | Tonnes (Mt) | Au (g/t) | Content (koz) |

Bubi | 2.00 | 1.435 | 2.68 | 124 |

Calcite | 2.00 | 0.500 | 4.96 | 80 |

Castile | 2.00 | 0.902 | 4.32 | 125 |

Diana | 2.00 | 0.915 | 3.49 | 103 |

Maria | 2.00 | 0.177 | 3.10 | 18 |

McCays | 2.00 | 0.821 | 3.20 | 84 |

Total / Average | 4.750 | 3.49 | 534 |

Subsequent to the 17,650 m core drilling by Anglo of 1994 - 1999, additional exploration work under Bilboes resumed in 2011 through to 2016 where an additional 20,527 m of core and 20,235 m of RC drilling was completed bringing the total metreage to 58,412 m. The drilling culminated in an interim Mineral Resource update by Mr. Arimon Ngilazi and Dr Anthony Martin in 2017.

These results are presented in Table 5‑2 and Table 5‑3, respectively.

Table 5‑2: Sulfide Mineral Resources as of 31 March 2017, 0.0 g/t Au Block Cut-Off Applied

Property | Indicated | Inferred |

| Mass (Mt) | Au Grade (g/t) | Au (kg) | Au (Moz) | Mass (Mt) | Au Grade (g/t) | Au (kg) | Au (Moz) |

BUBI | 29.96 | 2.20 | 65,912 | 2.12 | 9.05 | 1.90 | 17,195 | 0.55 |

ISBN | 12.07 | 2.19 | 26,433 | 0.85 | 1.55 | 2.01 | 3,116 | 0.10 |

ISBS | 7.90 | 2.43 | 19,197 | 0.62 | 0.51 | 2.62 | 1,336 | 0.04 |

MCCAYS | 3.48 | 2.44 | 8,491 | 0.27 | 7.07 | 1.97 | 13,928 | 0.45 |

Total | 53.41 | 2.25 | 120,034 | 3.86 | 18.17 | 1.96 | 35,575 | 1.14 |

Table 5‑3: Sulfide Mineral Resources as of 31 March 2017, 0.9 g/t Au Block Cut-Off Applied

Property | Indicated | Inferred |

| Mass (Mt) | Au Grade (g/t) | Au (kg) | Au (Moz) | Mass (Mt) | Au Grade (g/t) | Au (kg) | Au (Moz) |

BUBI | 28.05 | 2.27 | 63,674 | 2.05 | 8.66 | 1.93 | 16,714 | 0.54 |

ISBN | 9.94 | 2.53 | 25,148 | 0.81 | 1.29 | 2.27 | 2,928 | 0.09 |

ISBS | 7.05 | 2.60 | 18,330 | 0.59 | 0.44 | 2.86 | 1,258 | 0.04 |

MCCAYS | 2.55 | 3.19 | 8,135 | 0.26 | 5.58 | 2.38 | 13,280 | 0.43 |

Total | 47.60 | 2.42 | 115,286 | 3.71 | 15.97 | 2.14 | 34,181 | 1.10 |

| | 5.3.1 | Oxide Mineralization |

There are early records of insignificant gold production for the Isabella Mine prior to 1982. In its first year of operation the Isabella open pit operation produced 170 kg of gold from a monthly rate of 15,000 t of ore. At start of production there were three pits with a Mineral Reserve life of 18 months and as of 31 December 2020, the Mine had treated 6.4 Mt of oxides at 1.16 g/t (239 koz) and recovered 147 koz of gold inclusive of re-leached gold from the old heap leach pads. The bulk of the production from Isabella was from uncrushed ore with only 33 koz of gold being recovered from 2.3 Mt of crushed oxide ore after the installation of a crushing plant in 2007.

Bubi was commissioned in 1997 at 25,000 t per month of oxide ore and produced 9.5 koz of gold in its first year. Mining activities were suspended at Bubi Mine in 2007 after running out of oxide ore. Gold production from that period to 2013 has been from re-leaching of the old heaps. Progressively inclusive of re-leached gold from the old heap leach pads, the mine has produced 84 koz of gold as at end of December 2020 from 4.3 Mt of oxide ore at 1.00 g/t (138 koz). All the ore at Bubi Mine was treated without crushing. There has not been any mining at Bubi from 2005 after the exhaustion of oxides until the commencement of re-leaching activities at the beginning of 2019.

As a result of regional exploration by Prospecting Ventures (PV), an Anglo American Corporation exploration company based in Zimbabwe at the time, a new gold deposit was discovered at McCays in 1997. In 1998 production from an open pit, heap-leach mine started. Further exploration work within the claims area during the operational phase of the mine was added to the Reserves until depletion and temporary closure in 2002. No mining activities took place between 2002 and 2012 at McCays. Gold production was through re-leaching from the year 2004 until 2009. No gold production occurred from 2010 to 2012. Activities commenced after the recapitalization of Bilboes in 2013. Cumulative gold production from inception at McCays was 55 koz) as of 31 December 2020. This included the re-leached gold from the old heap leach pads from treating 2.1 Mt of oxide ore at 1.16 g/t (78 koz). Inclusive of this, an estimated 22 koz) of gold was recovered from 950,000 t of crushed oxide ore after the installation of a crushing plant in 2013. The oxides at McCays are finished and only re-leaching activity is taking place.

Prior to the open-pit exploitation of the Isabella Mineral Resource by Bilboes, the Calcite Mine (underground and now part of the Isabella strike) produced 559 kg of gold at an average recovered grade of 8.2 g/t.

The production from Bilboes mines including When Mine from inception to 31 December 2020 is presented in Table 5‑4.

Bilboes has produced some 90,048 oz of gold from the four mines since the takeover of the company in 2003 to 31 December 2020

Table 5‑4: Production Data from Bilboes Mines to 31 December 2020

| | Start-up Date | Ore Treated (kt) | Grade (g/t) | Au Recovered (koz) |

Isabella | 1989 | 6,384 | 1.16 | 146.8 |

Bubi | 1997 | 4,342 | 1.00 | 84.0 |

McCays | 1998 | 2,094 | 1.16 | 55.2 |

When | 2005 | 184 | 0.78 | 1.9 |

Total | 13,004 | 1.10 | 287.9 |

6 | GEOLOGICAL SETTING, MINERALIZATION AND DEPOSIT |

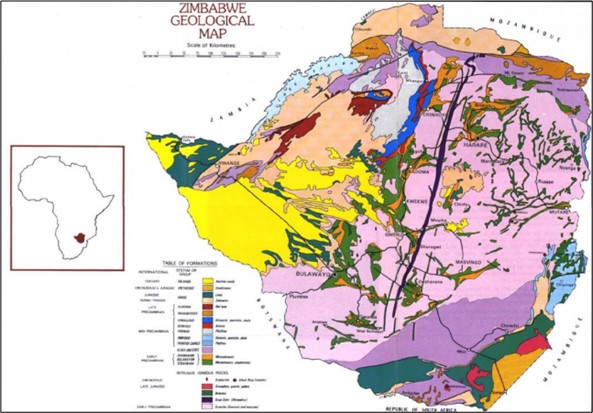

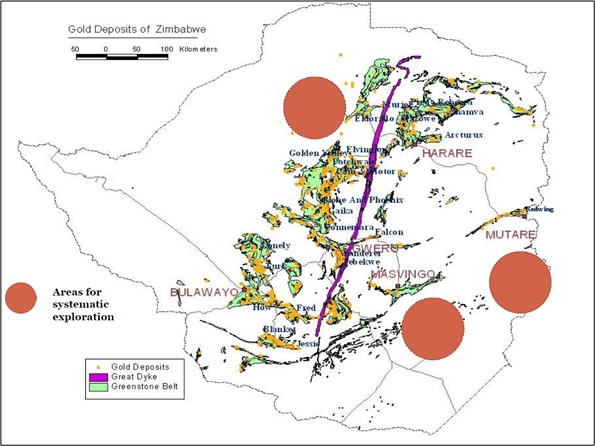

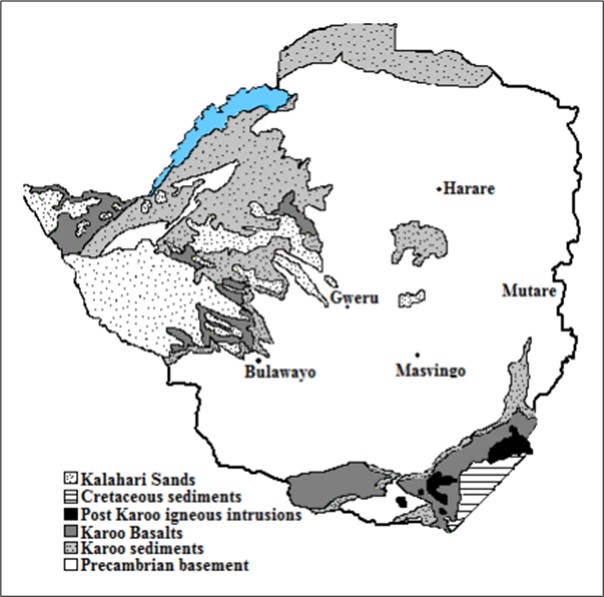

Geology in Zimbabwe can be divided into three main areas, the Archean, the Proterozoic, and the Phanerozoic (Figure 6‑1).

Figure 6‑1: Geological Map Zimbabwe (taken from Mugumbate, unknown year)

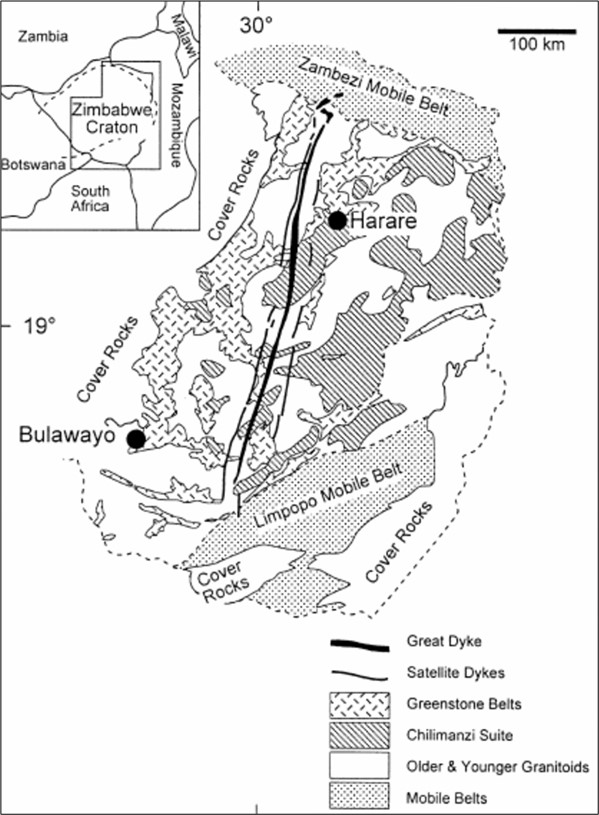

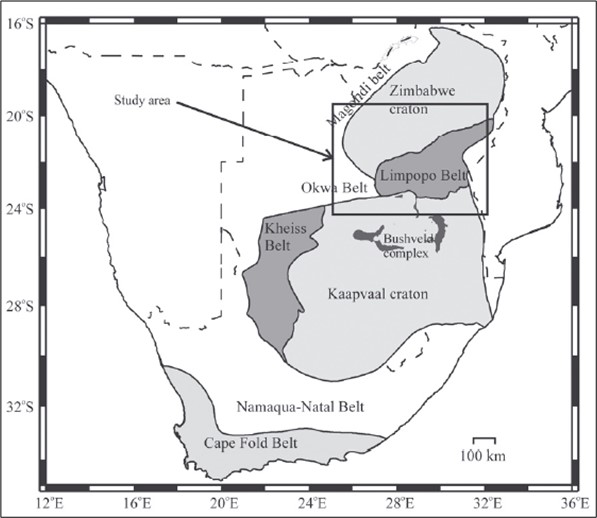

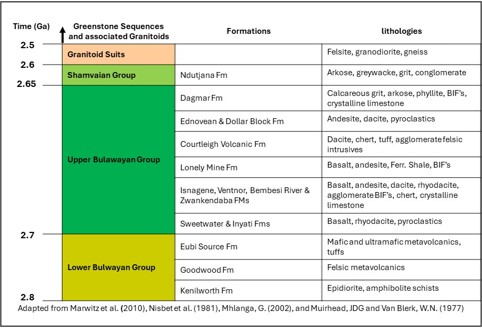

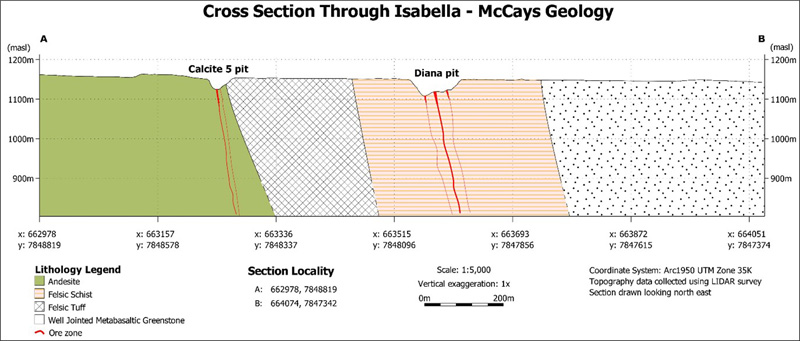

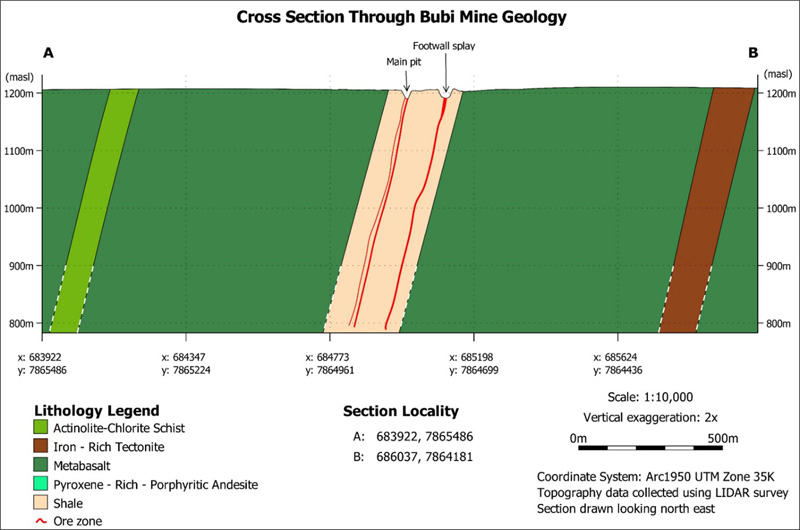

Rocks from the Archean era in Zimbabwe occupy most of the Zimbabwe Craton, an ancient stable continental block. This is the basement and primarily comprises granites and gneisses with remnants of volcano-sedimentary piles known as Greenstone Belts. Greenstone Belts cover approximately 60% of the land surface of Zimbabwe. The Greenstone Belts are renowned for their rich variety of Mineral Resources as shown in Figure 6‑2.

Figure 6‑2: Greenstone Belts and known Gold Deposits in Zimbabwe (Mugandani 2017)