UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

Reliv International, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

RELIV’ INTERNATIONAL, INC.

136 Chesterfield Industrial Boulevard

Chesterfield, Missouri 63005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO

BE HELD ON MAY 24, 2007

To: Stockholders of Reliv’ International, Inc.

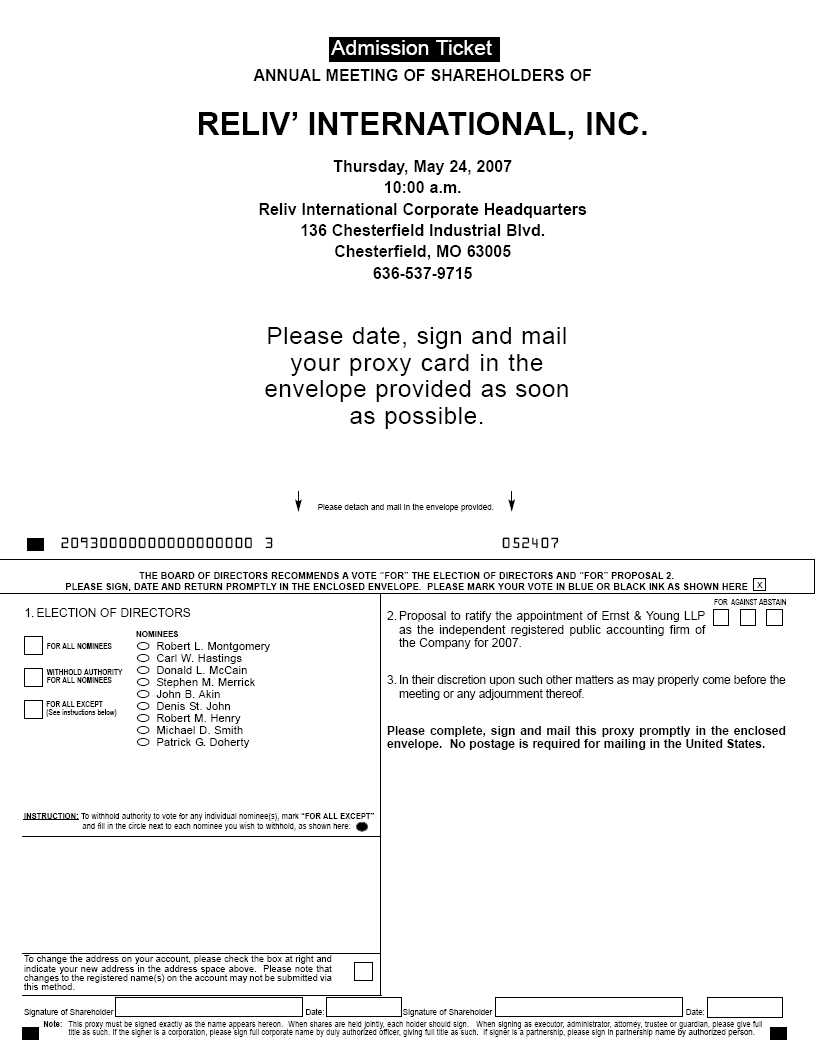

The Annual Meeting of the Stockholders of Reliv’ International, Inc. will be held at Reliv’ International, Inc., Corporate Headquarters, 136 Chesterfield Industrial Boulevard, Chesterfield, Missouri 63005, on Thursday, May 24, 2007, at 10:00 a.m., Central Daylight Savings Time, for the following purposes:

| | 1. | To elect 9 directors to hold office during the year following the Annual Meeting or until their successors are elected (Item No. 1 on proxy card); |

| | 2. | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for 2007 (Item No. 2 on proxy card); and |

| | 3. | To transact such other business as may properly come before the meeting. |

The close of business on March 22, 2007, has been fixed as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

| April 20, 2007 | /s/ Stephen M. Merrick |

| | Stephen M. Merrick, Secretary |

YOUR VOTE IS IMPORTANT

| | It is important that as many shares as possible be represented at the Annual Meeting. Please date, sign and promptly return the proxy in the enclosed envelope. Your proxy may be revoked by you at any time before it has been voted. | |

RELIV’ INTERNATIONAL, INC.

136 Chesterfield Industrial Boulevard

Chesterfield, Missouri 63005

PROXY STATEMENT

Information Concerning the Solicitation

The Board of Directors of Reliv International, Inc. (the “Company”) is providing this Proxy Statement for the solicitation of proxies from holders of the outstanding common stock of the Company to be used at the 2007 annual stockholders meeting (the “Annual Meeting”) of the Company which will be held on Thursday, May 24, 2007. The proxy materials are being mailed on or about April 20, 2007 to stockholders of record.

The cost of preparing, assembling and mailing the proxy material and of reimbursing brokers, nominees and fiduciaries for the out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of shares held of record by such persons will be borne by the Company. The Company does not intend to solicit proxies otherwise than by use of the mail, but certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies.

Your vote is very important. Whether or not you plan to attend our Annual Meeting, please take the time to vote either by the Internet or telephone using the instructions on the proxy card or by completing and mailing the enclosed proxy card as soon as possible. If you decide to vote using the proxy card, you must sign, date and mail it and indicate how you want to vote. If you do not so indicate, your proxy will be voted as recommended by the Board of Directors.

Quorum and Voting

Only stockholders of record at the close of business on March 22, 2007 are entitled to vote at the Annual Meeting. On that day, there were 16,292,155 shares of common stock outstanding. Each share has one vote. Shareholders do not have cumulative voting rights in the election of directors. A simple majority of the outstanding shares is required to be present in person or by proxy at the meeting for there to be a quorum for purposes of proceeding with the Annual Meeting. A simple majority of the shares present in person or by proxy at the Annual Meeting, at which a quorum is present, is required to elect directors and approve the appointment of the Company’s independent registered public accounting firm. Abstentions and withheld votes have the effect of votes against these matters. Broker non-votes (shares held of record by a broker for which a proxy is not given) will be counted for purposes of determining shares outstanding for purposes of a quorum, but will not be counted as present for purposes of determining the vote on any matter considered at the meeting.

If a stockholder specifies how the proxy is to be voted with respect to any of the proposals for which a choice is provided, the proxy will be voted in accordance with such specifications. If a stockholder fails to so specify with respect to such proposals, the proxy will be voted “FOR” the nominees for directors contained in these proxy materials and “FOR” the appointment of the Company’s independent registered public accounting firm. A stockholder signing and returning a proxy on the enclosed form has the power to revoke it at any time before the shares subject to it are voted by (i) sending a written statement to that effect to the Secretary of the Company, (ii) submitting a properly signed proxy having a later date, or (iii) voting in person at the Annual Meeting.

Discretionary Voting Power

The Board of Directors knows of no other matters to be presented for shareholder action at the Annual Meeting. On matters which may be raised at the Annual Meeting that are not covered by this Proxy Statement, the persons named in the proxy card will have full discretionary authority to vote. If any nominee for election as a director becomes unable to accept nomination or election, which we do not anticipate, the persons named in the proxy will vote for the election of another person recommended by the Board of Directors.

BENEFICIAL OWNERSHIP OF SHARES BY MANAGEMENT AND

SIGNIFICANT SHAREHOLDERS

The following table provides information concerning the beneficial ownership of the Company’s common stock by each director and nominee for director, certain executive officers, and by all of the Company’s directors and officers as a group as of March 22, 2007. In addition, the table provides information concerning the beneficial owners known to the Company to hold more than five percent of the Company’s outstanding common stock as of March 22, 2007.

The amounts and percentage of common stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”) governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days after March 22, 2007. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed a beneficial owner of securities as to which he has no economic interest. Percentage of class is based on 16,292,155 shares of common stock outstanding as of March 22, 2007.

Name of beneficial owner(1) | | Amount and nature of beneficial ownership | | Percent of class |

| | | | | |

Robert L. Montgomery(2) | | 3,642,904 | | 22.14% |

| | | | | |

Carl W. Hastings(3) | | 618,028 | | 3.79% |

| | | | | |

Stephen M. Merrick(4) | | 558,969 | | 3.42% |

| | | | | |

R. Scott Montgomery(5) | | 117,858 | | * |

| | | | | |

Steven D. Albright(6) | | 41,283 | | * |

| | | | | |

Steven G. Hastings(7) | | 61,860 | | * |

| | | | | |

Ryan A. Montgomery(8) | | 31,436 | | * |

| | | | | |

Donald L. McCain(9) | | 360,545 | | 2.21% |

| | | | | |

John B. Akin(10) | | 11,326 | | * |

| | | | | |

Robert M. Henry(11) | | 12,000 | | * |

| | | | | |

Denis St. John(12) | | 13,000 | | * |

| | | | | |

| Michael D. Smith | | 0 | | * |

| | | | | |

| Patrick G. Doherty | | 0 | | * |

| | | | | |

All Directors, nominees and Executive Officers as a Group (13 persons)(13) | | 5,469,209 | | 32.72% |

(footnotes on following page) | | | | |

______________________

* less than one percent

| (1) | Unless otherwise indicated below, the person named in the table has sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise indicated, the address for each person is c/o Reliv International, Inc., 136 Chesterfield Industrial Boulevard, Chesterfield, Missouri 63005. |

| (2) | Includes 160,000 shares subject to options exercisable within 60 days after March 22, 2007, 1,154,970 shares held through the Montgomery Family Limited Partnership, 470,114 shares held through Montgomery Enterprises, Ltd., for which Mr. Montgomery has sole voting and investment power, and 125,920 shares held by Mr. Montgomery’s spouse. |

| (3) | Includes 20,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (4) | Includes 50,000 shares subject to options exercisable within 60 days after March 22, 2007. Includes 251,648 shares held in the name of Mr. Merrick’s spouse. |

| (5) | Includes 50,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (6) | Includes 20,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (7) | Includes 20,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (8) | Includes 25,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (9) | Includes 50,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (10) | Includes 10,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (11) | Includes 10,000 shares subject to options exercisable within 60 days after March 22, 2007. |

| (12) | Includes 10,000 shares subject to options exercisable within 60 days after March 22, 2007 and 500 shares held in the name of Mr. St. John’s spouse. |

| (13) | Includes 425,000 shares subject to options exercisable within 60 days after March 22, 2007. |

PROPOSAL ONE - ELECTION OF DIRECTORS

Nine directors will be elected at the Annual Meeting to serve for terms of one year expiring on the date of the Annual Meeting in 2008. Each director elected will continue in office until a successor has been elected. If a nominee is unable to serve, which the Board of Directors has no reason to expect, the persons named in the accompanying proxy intend to vote for the balance of those named and, if they deem it advisable, for a substitute nominee.

THE BOARD OF DIRECTORS RECOMMENDS THE ELECTION OF ALL OF THE NOMINEES.

Information Concerning Nominees

The following is information concerning nominees for election to the Board of Directors. Each of the following nominees, other than Patrick G. Doherty, is presently a member of the Board of Directors.

Robert L. Montgomery, age 65, is the Chairman of the Board, President and Chief Executive Officer. Mr. Montgomery became Chairman of the Board of Directors and Chief Executive Officer on February 15, 1985, and President on July 1, 1985. Mr. Montgomery has been a director of Reliv’ International since 1985. Mr. Montgomery is also the President and a director of Reliv’, Inc. and President and a director of Reliv’ World Corporation, both wholly owned subsidiaries of Reliv’ International. Mr. Montgomery received a B.A. degree in Economics from the University of Missouri in Kansas City, Missouri in 1965. Mr. Montgomery is the father of R. Scott Montgomery, the Company’s Executive Vice President and Chief Operating Officer, and Ryan A. Montgomery, the Company’s Executive Vice President, Worldwide Sales.

Stephen M. Merrick, age 65, has been the Senior Vice President, International and Corporate Development, Secretary, General Counsel and a member of the Board of Directors since July 20, 1989. Mr. Merrick is Of Counsel to Vanasco Genelly & Miller, which has served as counsel to the Company with respect to certain matters, and has been engaged in the practice of law for over 40 years. Previously, Mr. Merrick was a principal of the law firm of Merrick & Associates, P.C., which served as counsel to the Company with respect to certain matters. Mr. Merrick has represented the Company since the Company’s founding. Mr. Merrick received a Juris Doctor degree from Northwestern University School of Law in 1966. He is also an officer and director of CTI Industries Corporation (NASDAQ: CTIB).

Carl W. Hastings, age 65, was appointed Vice Chairman and Chief Scientific Officer in April 2007. Prior to his appointment in April 2007, he served as Vice President of the Company since July 1, 1992. Dr. Hastings has been employed by the Company since April 1991. Dr. Hastings was re-elected to the Board of Directors in May 2005 and formerly served as a member of the Board of Directors from February 1990 until May 2004. Dr. Hastings holds B.S. and M.S. degrees and a Ph.D. degree in Food Science from the University of Illinois. For more than the past 30 years, Dr. Hastings has been engaged in a variety of employment and consulting capacities as a food scientist. Dr. Hastings is the father of Steven G. Hastings, the Company’s Senior Vice President, North American Sales.

Donald L. McCain, age 63, has been a member of the Board of Directors since July 20, 1989. Mr. McCain is the Corporate Secretary and co-owner of The Baughan Group Inc., formerly Robertson International Inc., a supplier and manufacturer of mining equipment and supplies and has been associated with that company for more than five years. He is also co-owner of Coal Age Incorporated, a mining equipment manufacturer and rebuilding company. Mr. McCain is the father of Ronald McCain, the Director of Customer Service who is also the son-in-law of Robert L. Montgomery, the Chairman, President and Chief Executive Officer.

John B. Akin, age 78, has been a member of the Board of Directors since June 1986. Mr. Akin retired as Vice President, A.G. Edwards & Sons and resident manager of the Decatur, Illinois branch office in 1995. Mr. Akin had been associated with A.G. Edwards & Sons as a stock broker, manager and officer since April 1973. Mr. Akin holds a B.A. degree from the University of Northern Iowa, Cedar Falls, Iowa.

Robert M. Henry, age 60, has been a member of the Board of Directors since May 2004. On December 4, 2004, Mr. Henry became Chairman and Chief Executive Officer of Arbonne International, Inc., a skin care products company. From 2000 to 2003, he served as Chief Executive Officer and board member for Mannatech, Incorporated, a public multi-level marketing company that sells dietary supplements, wellness and weight-management products to independent distributors. From 1998 to 2000, Mr. Henry acted as an Operating Consultant for Gryphon Investors where he gave advice on the investment opportunities in the network marketing industry. From 1986 to 1998, Mr. Henry served in various executive positions in the advertising, communications, investment and women’s apparel industries. From 1982 to 1986, he served as Corporate Controller Worldwide for Amway Corporation, a multi-level marketer of various products. From 1971 to 1982, Mr. Henry served various management roles for Avon Products Inc., including Regional Controller, Manufacturing/Sales/Distribution, Chief Financial Officer for Avon Fashions, and Manager A/P & Intercompany Accounting. He received a B.S. degree in Accounting from Hunter College in New York and a J.D. from Brooklyn Law School. Mr. Henry has been a member of the New York State Bar since 1975 and also served on the Network Marketing Association Board of Directors during 2002.

Denis St. John, age 63, has been a member of the Board of Directors since May 2004. Mr. St. John is a CPA and principal with Larson Allen, a regional public accounting firm, focusing on physicians and institutions involved in clinics, nursing homes, medical office buildings, and other real estate intensive projects. For 15 years, Mr. St. John was associated with various accounting firms working primarily in the tax area, serving mid-size, closely held companies. Mr. St. John graduated from the University of Missouri with a Bachelor of Science in Business Administration with a major in Accounting and a minor in Economics. He is a former NASD registered representative, holding Series 6 and 63 securities licenses. Mr. St. John is a member of the Missouri Society of CPAs and the American Institute of CPAs.

Michael D. Smith, age 61, has been a member of the Board of Directors since August 2006. Mr. Smith has been Senior Vice President of Major Initiatives of Stampin' Up!, Inc. since July 2006. Prior to that time, Mr. Smith was employed by NuSkin Enterprises, Inc. for 17 years in various position including General Counsel and Director of Legal Affairs, Regional Vice President and Vice President of Global Industry and Government Relations. Mr. Smith is a retired Colonel in the U.S. Army (JAG Corps), with 26 years of active and reserve service, and he holds a Juris Doctorate Degree from the University of Utah (1973).

Patrick G. Doherty, age 41, recently organized and is President of Mariner Equity Management, LLC, a private equity and venture capital fund. Prior to that time, from 1993 through February 2007, he was employed by A.G. Edwards & Sons, most recently as Managing Director and Group Head of the firm’s Consumer and Industrial Investment Banking Group. He is a member of the Board of Directors of the Association for Corporate Growth - St. Louis. Mr. Doherty received a B.S.B.A. degree from Georgetown University and an MBA from the University of Chicago.

Executive Officers Other Than Nominees

R. Scott Montgomery, age 37, was appointed Executive Vice President and Chief Operating Officer in April 2007. Mr. Montgomery joined the Company in 1993 and previously served as Senior Vice President - Worldwide Operations from 2004 to 2007 and Vice President of International Operations from 2001 to 2004. Mr. Montgomery graduated from Southwest Missouri State University with a B.S. degree in Finance and Investments. Mr. Montgomery is the son of Robert L. Montgomery, the Chairman, President and Chief Executive Officer, and the brother of Ryan A. Montgomery, the Executive Vice President, Worldwide Sales.

Ryan A. Montgomery, age 33, was appointed Executive Vice President, Worldwide Sales in April 2007. Previously, he was Vice President, Sales from 2004 to 2007. Mr. Montgomery served as corporate counsel from September 1999 to October 2004. Mr. Montgomery received his B.A. degree in Economics from Vanderbilt University in 1995 and graduated from Saint Louis University Law School in 1999. Mr. Montgomery is the son of Robert L. Montgomery, the Chairman, President and Chief Executive Officer, and the brother of R. Scott Montgomery, the Executive Vice President and Chief Operating Officer.

Steven D. Albright, age 45, has been the Vice President, Finance and Chief Financial Officer since March 2005. Mr. Albright was the Vice President, Finance/Controller from 2002 to 2005 and was the Controller since 1992. Prior to his employment with the Company, Mr. Albright was employed from 1987 to 1992 as Assistant Controller for Kangaroos USA, Inc., an athletic shoe importer and distributor. For the period from 1983 to 1987, he was employed by the public accounting firm of Ernst & Young LLP. Mr. Albright received a B.S. degree in Accountancy from the University of Illinois at Urbana-Champaign in May 1983 and is a CPA.

Steven G. Hastings, age 41, was appointed Senior Vice President, North American Sales in April 2007. He served as Vice President, Sales from 2004 to 2007. Mr. Hastings was the Vice President of International Marketing from 2002 to 2004 and the Director of International Marketing from 1996 to 2002. Mr. Hastings started with the Company in January 1993 as Director of Marketing. Mr. Hastings graduated from the University of Illinois in 1987 with a Marketing degree and obtained his Masters in Business from Butler University in Indianapolis in 1995. Mr. Hastings is the son of Dr. Carl Hastings, the Vice Chairman and Chief Scientific Officer.

Committees of the Board of Directors

During 2006, the Board of Directors had eight members. The Board met four times during 2006. During 2006, no director attended less than 75% of the combined Board of Directors and Committee meetings. The Board has determined that Messrs. McCain, Akin, Henry, St. John and Smith are independent based on the application of the rules and standards of the NASDAQ Stock Market. Additionally, the Board has determined that first-time nominee, Mr. Doherty, is independent under the rules and standards of the NASDAQ Stock Market. The independent members of the Board held one meeting during 2006.

The Board of Directors has standing Executive, Compensation, Nominating, Audit and Sales and Marketing Committees.

The Executive Committee acts on various matters between meetings of the Board of Directors. The Executive Committee consists of Messrs. Montgomery, Merrick, Hastings and McCain. The Executive Committee met six times during 2006.

The Management Committee reviews the Company’s operations and policies on a regular basis. The Management Committee is composed of four members of the Board of Directors, including Messrs. Montgomery, Hastings, McCain and Merrick, as well as several other members of management. The Management Committee met 10 times during 2006.

The Company has a Sales and Marketing Committee that meets on a regular basis to discuss sales and marketing ideas and strategies as well as plan upcoming distributor events. The Sales and Marketing Committee met five times during 2006 and is made up of two members of the Board of Directors, including Messrs. Montgomery and Merrick, as well as several other members of management that are involved with sales and marketing.

All of the independent directors of the Board of Directors participated in the nominating process and voted in favor of the nomination of the directors nominated for election at the Annual Meeting of Stockholders to be held on May 24, 2007.

Audit Committee

Since 2000, the Company has had a standing Audit Committee, which is presently composed of Messrs. McCain, St. John and Henry. Mr. St. John has been designated and is the Company’s “Audit Committee Financial Expert” pursuant to Item 401 of Regulation S-K of the Securities Exchange Act of 1934. The Audit Committee held eight meetings during fiscal year 2006, including quarterly meetings with management and the independent registered public accounting firm to discuss the Company’s financial statements. Mr. St. John and each appointed member of the Committee satisfies the definition of “independent” as that term is defined in the rules governing companies whose stock is traded on the NASDAQ Stock Market. The Board of Directors has adopted a written charter for the Audit Committee. A copy of the Audit Committee Charter has been posted and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.” In addition, the Audit Committee has adopted a complaint monitoring procedure to enable confidential and anonymous reporting to the Audit Committee of concerns regarding, among other things, questionable accounting or auditing matters.

Report of the Audit Committee

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management and the Company’s independent registered public accounting firm, Ernst & Young LLP, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and internal controls.

The Audit Committee reviewed with the independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s application of accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards, including but not limited to those matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU §380, as amended). In addition, the Audit Committee has discussed with the independent registered public accounting firm their independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit of the Company’s financial statements, management’s report on internal control over financial reporting and the effectiveness of internal controls over financial reporting. The Audit Committee meets with the internal auditor and independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2006 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors have also recommended, subject to stockholder approval, the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm.

Donald L. McCain, Audit Committee Chair

Robert M. Henry, Member

Denis St. John, Member

Nominating Committee

In May 2004, the Company established a Nominating Committee. The Nominating Committee consists of three directors, Messrs. McCain, Akin and St. John. The Nominating Committee does not have a charter. The Board of Directors has determined that each of the members of the Nominating Committee is independent as defined in the listing standards for the NASDAQ Stock Market.

The Nominating Committee has not adopted a formal policy with regard to consideration of director candidates recommended by security holders. The Company believes that continuing service of qualified incumbent members of the Board of Directors promotes stability and continuity at the Board level, contributes to the Board’s ability to work as a collective body and provides the benefit of familiarity and insight into the Company’s affairs. Accordingly, the process of the Nominating Committee for identifying nominees reflects the Company’s practice of re-nominating incumbent directors who continue to satisfy the criteria for membership on the Board. For vacancies which are anticipated on the Board of Directors, the Nominating Committee intends to seek out and evaluate potential candidates from a variety of sources that may include recommendations by security holders, members of management and the Board of Directors, consultants and others. The minimum qualifications for potential candidates for the Board of Directors include demonstrated business experience, decision-making abilities, personal integrity and a good reputation. In light of the foregoing, and the fact that two new independent directors were elected to the Board in 2004, one in 2005 and a fourth is now nominated, it is believed that a formal policy and procedure with regard to consideration of director candidates recommended by security holders is not necessary in order for the Nominating Committee to perform its duties.

The Nominating Committee met one time. All of the independent directors of the Board of Directors participated in the nominating process and voted in favor of the nomination of the persons nominated for election as directors at the Annual Meeting of Stockholders to be held on May 24, 2007. The nomination of Patrick G. Doherty was recommended to the Nominating Committee by the Company’s Chief Executive Officer.

Compensation Committee

The Compensation Committee consists of three directors: Messrs. St. John (Chairman), McCain and Akin. The Board has determined that each of the members of the Compensation Committee is independent as defined in the listing standards for the NASDAQ Stock Market. The Compensation Committee reviews and acts on the Company’s executive compensation and employee benefit plans, including their establishment, modification and administration. It also determines the compensation of the Chief Executive Officer and certain other executive officers. The Compensation Committee has a charter which has been posted and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.” The Compensation Committee met seven times in 2006.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview of our Compensation Philosophy

Our general compensation philosophy is to provide compensation and reward programs that will attract, retain and motivate quality executive talent.

We believe that applying and implementing this basic philosophy is fundamental to our goal of achieving excellent business performance and increased shareholder value.

Principles and Objectives

The basic principles and objectives of our executive compensation program are:

| · | To provide a total compensation package that is competitive with prevailing practices for the industries in which we operate, allowing for above average total compensation when justified by business results and individual performance. |

| · | To provide a reasonable and competitive level of base compensation to our executives. |

| · | To provide incentive compensation based, principally, on the profitability of the Company to motivate our executives in a manner consistent with the interests of the shareholders. |

| · | To create a mutuality of interests among executive officers and shareholders by providing long-term equity compensation programs including stock options and an Employee Stock Ownership Plan, and otherwise encouraging equity ownership by executives, so that executive officers will share the risks and rewards of strategic decision making and its effect on shareholder value. |

Components of Compensation

The components of our executive compensation program are:

| · | Annual Cash Incentive Compensation. We have adopted and maintain an incentive compensation program in which executives and a number of managerial employees participate. Incentive payments are made on a quarterly basis and are a based on our operating profits if they exceed a threshold amount. |

| · | Long-Term Equity Incentive Compensation |

| o | Incentive Stock Option Plan. We provide performance-based incentive stock option awards, under our current 2003 Stock Option Plan. Recipients realize a profit based on stock price appreciation. |

| o | Employee Stock Ownership Plan. On September 1, 2006, we adopted an Employee Stock Ownership Plan (ESOP) under which executives and all other employees are eligible to participate in stock ownership benefits based on contributions to the plan. For the year ended December 31, 2006, we contributed $250,000 to the plan, all of which was invested in our common stock and allocated to participants in the plan. |

| · | Retirement Benefits. We provide retirement benefits to executives and other employees which include: |

| o | 401(k) Retirement Plan. We maintain a 401(k) retirement plan providing for employee contributions and matching employer contributions. Employees may contribute up to 15% of their eligible gross income to the Plan and we match a percentage of the employee’s contribution at the rate of 50%. |

| o | ESOP. Our Employee Stock Ownership Plan is a qualified retirement plan providing for salary-based employer contributions in the form of, or invested in, our stock. |

| · | Welfare Plans and Other Benefits. We provide medical and life plan benefits to all employees. We provide additional life insurance, car allowance and fringe benefits to certain executives, as well as limited perquisites. |

Compensation Committee Processes

The role of our Compensation Committee is (i) to establish and maintain our executive compensation policies, (ii) to review, evaluate and recommend to the Board of Directors salary, incentive compensation and other compensation items for the Chief Executive Officer, the Chief Financial Officer, other senior members of management, members of the Board of Directors and senior management of our subsidiaries, (iii) review, evaluation and recommendations concerning our compensation and benefit plans, and (iv) approve grants of stock options and other equity based incentives.

The Chief Executive Officer’s overall compensation is set by the Board of Directors in consultation with, and on the recommendation of, the Compensation Committee. The Compensation Committee recommendation is based on its assessment of the Chief Executive Officers individual performance and the financial and operating performance of the Company. Compensation of the other Named Executive Officers and of other senior executive officers is established on the basis of recommendation of the Compensation Committee in consultation with the Chief Executive Officer and the Executive Vice President. The Compensation Committee considers the recommendations of the Chief Executive Officer and the Executive Vice President and considers each executive’s responsibility, experience and overall performance. Generally, the Compensation Committee reviews and adjusts recommended compensation levels annually at its first meeting of the year. The Compensation Committee will have met periodically during the preceding year to consider compensation programs and to gain relevant information and context for determining compensation for executives.

To assist the Compensation Committee in discharging its responsibilities, the Compensation Committee has reviewed and considered (i) compensation information and detail of executives of the Company provided by the Human Resources department of the Company, and (ii) compensation survey data including the 2007 Executive Compensation Report of Aon Consulting’s eComp Data Service, for companies of comparable size in related industries.

The Compensation Committee takes into account the estimated accounting and tax impact of all material changes to the executive compensation program and discusses such matters periodically during the year. Generally, an accounting expense is accrued over the relevant service period for the particular pay element and the Company realizes a tax deduction upon the payment to the executive. In general, the policy of the Company and the Compensation Committee is to optimize the tax deductibility of executive compensation so long as deductibility is consistent with more important objectives of retaining executives and maintaining competitive, motivational performance-based compensation that is aligned with shareholder interests.

Base Salary. Base salaries are an important element of compensation and provide executives with a base level of income. In determining base pay, the Compensation Committee considers the executive’s responsibilities, individual performance, base salary competitiveness as compared to the external market and the Company’s operating performance. While base salaries are reviewed annually, changes in base salary compensation generally are made in relation to changes in position and responsibility.

Annual Cash Incentive Compensation. The Board of Directors has authorized profit-based incentive compensation in 2006 and prior years. Under the incentive compensation program, designated Named Executive Officers and a number of other executive officers and managers participate in incentive compensation payments, determined on a quarterly and annual basis, which are based upon the profits of the Company for the period if the profits exceed a designated threshold profit amount. Pool I of the Plan covers senior executive officers and Pool II covers other executives and managers who are selected to participate. The Compensation Committee believes such incentive compensation motivates participants to achieve strong profitability which is viewed as the most significant element of corporate performance, provides rewards for strong corporate performance and aligns the incentive with the interests of the shareholders. Incentive compensation participation levels are generally determined during the first quarter of each fiscal year.

With respect to Pool I participants (other than the Chief Executive Officer whose participation is determined solely by the Compensation Committee and the Board of Directors), the Compensation Committee in consultation with the Chief Executive Officer and Executive Vice President, determine the participants and their relative level of participation during the first quarter of the year. In determining participation and the level of participation each year, the Compensation Committee considers the executive’s responsibilities and individual performance during the prior year.

In connection with base salary and incentive compensation, the Committee considers individual wealth and the gap between compensation of the Chief Executive Officer and other executives. In 2006, the Compensation Committee determined, and the Chief Executive Officer requested, that there be no increase in his base salary and that the level of his participation in the annual incentive compensation be reduced. The base salaries, and level of incentive compensation of certain Named Executives, and others, were increased in 2006.

Long-Term Equity Incentives. Long-term incentive awards are granted to executives under the 2003 Stock Option Plan approved by the shareholders in May 2003. Long-term incentive expected values are based on a review of current market practices provided to the Compensation Committee. Stock option grants are determined from time to time by the Compensation Committee. The actual grant for each executive is determined taking into consideration (i) individual performance, (ii) corporate performance and (iii) prior grants to, or stock ownership of the Company by, the executive. Generally, stock options are granted with an exercise price equal to or greater than the closing price of the Company’s common stock on the NASDAQ Global Select Market on the date of the grant. Stock options generally are exercisable within 10 years from the date of grant. The Company does not have, and has not had, any program, plan or practice to time stock option grants in relation to, or in coordination with, the release of material nonpublic information.

During 2006, no stock options were granted.

On September 1, 2006, the Company adopted an Employee Stock Ownership Plan as a qualified retirement plan. Under the Plan, all employees of the Company are eligible to participate in the Plan and interests in the Plan are allocated to participants based on relative eligible compensation. Contributions to the Plan are made by the Company and may be in the form of cash or stock of the Company. The maximum amount of contributions which may be made is 25% of the annual eligible compensation of employees after taking into account contributions to the 401(k) Plan. With respect to cash contributions to the Plan, the Plan Trust purchases shares of Company common stock utilizing such funds. The assets of the Plan consist of shares of common stock of the Company. During 2006, the Company contributed an aggregate of $250,000 to the Plan all of which was invested in shares of common stock of the Company and allocated to participants.

Retirement Benefits. The Company maintains a 401(k) employee savings plan in which all salaried employees are eligible to participate. The Company also maintains the ESOP Plan. Both plans are tax qualified retirement plans. Under the 401(k) Plan, employees may contribute up to 15% of their eligible compensation to the Plan and the Company will contribute a matching amount to the Plan each year. The federal statutory limit for eligible compensation in 2006 was $220,000. During 2006, the Company made matching contributions of 50% of the amount contributed by employees to the Plan, subject to statutory limits and top-heavy plan rules. The Company’s contributions to the 401(k) plan totaled $283,000 in 2006.

All contributions to the ESOP Plan are made by the Company and are discretionary. The maximum amount of contribution which the Company can make is 25% of the annual eligible compensation of employees after taking into account contributions to the 401(k) Plan. During 2006, the Company contributed $250,000 to the ESOP plan.

These contributions and matching percentages are intended to reflect competitive market conditions for plans of this type. With respect to the 401(k) Plan, participating employees may direct the investment of individual and company contributions into one or more of the investment options offered by the Plan, provided that, for new contributions, employees may not invest more than 15% in common stock of the Company.

The policy and plan of the Compensation Committee is to provide a reasonable level of retirement benefits for employees through these plans, rather than minimum benefit amounts, in order to reward long-term employees and keep employee turnover low.

Other Benefits. The Company believes that its employee benefit plans, health insurance plans and perquisites are of the type commonly offered by other employers. These benefits form part of our compensation philosophy because the Company believes they are necessary in order to attract, motivate and retain talented executives.

Employment and Change of Control Agreements

The Company has employment or services agreements with Robert L. Montgomery, the Chief Executive Officer and two other Named Executives, including Carl W. Hastings and R. Scott Montgomery. For a description of these agreements, see the narrative disclosure following the Summary Compensation Table. We do not maintain any change of control agreements with any executives.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis section appearing above with the Company’s management. Based on this review and these discussions, the Compensation Committee recommended to the Company’s Board of Directors that the Compensation Committee Analysis be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 and in this Proxy Statement.

Denis St. John, Chairman

Donald L. McCain

John Akin

SUMMARY COMPENSATION TABLE

The following table sets forth the annual and long-term compensation for the fiscal year ended December 31, 2006, of the Company’s Chief Executive Officer and Chief Financial Officer and each of the three other most highly compensated executive officers. These individuals, including the Chief Executive Officer and Chief Financial Officer are collectively referred to in this proxy statement as the Named Executive Officers.

| | | | | | | | | Non-Equity | | All Other | | | |

| | | | | | | | | Incentive Plan | | Compensation | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Compensation (1) | | (2, 3, 4, 5, 6) | | Total | |

| | | | | | | | | | | | | | |

| Robert L. Montgomery | | | 2006 | | $ | 642,625 | | $ | - | | $ | 551,327 | | $ | 80,947 | | $ | 1,274,899 | |

| Chairman, Chief Executive | | | | | | | | | | | | | | | | | | | |

| Officer and President | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Carl W. Hastings | | | 2006 | | $ | 360,000 | | $ | 70,000 | | $ | 133,782 | | $ | 30,479 | | $ | 594,261 | |

| Vice President | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Stephen M. Merrick | | | 2006 | | $ | 225,000 | | $ | - | | $ | 135,225 | | $ | - | | $ | 360,225 | |

| Senior Vice President, Secretary | | | | | | | | | | | | | | | | | | | |

| and General Counsel | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| R. Scott Montgomery | | | 2006 | | $ | 168,750 | | $ | - | | $ | 199,230 | | $ | 13,020 | | $ | 381,000 | |

| Senior Vice President of | | | | | | | | | | | | | | | | | | | |

| Worldwide Operations | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Steven D. Albright | | | 2006 | | $ | 157,500 | | $ | - | | $ | 162,579 | | $ | 14,693 | | $ | 334,772 | |

| Vice President, Finance and | | | | | | | | | | | | | | | | | | | |

| Chief Financial Officer | | | | | | | | | | | | | | | | | | | |

| (1) | Amounts determined under Company’s incentive compensation program discussed under “Compensation Discussion and Analysis.” |

| (2) | Includes matching 401(k) contribution of as follows: Robert L. Montgomery, $10,000, Carl W. Hastings, $10,000, R. Scott Montgomery, $6,000 and Steven D. Albright, $7,500 |

| (3) | Includes Company contributions to ESOP plan for 2006 of $6,683 for each NEO, except Stephen M. Merrick. |

| (4) | Includes life insurance allowance paid for Robert L. Montgomery of $30,000 and value of life insurance provided of $4,196 for Carl W. Hastings, $337 for R. Scott Montgomery, and $510 for Steven D. Albright. |

| (5) | Includes value of automobile provided for Robert L. Montgomery of $1,410 and automobile allowance provided to Carl W. Hastings of $9,600. |

| (6) | Includes country club dues of $8,445 and financial planning services of $24,409 paid for Robert L. Montgomery. |

GRANTS OF PLAN-BASED AWARDS DURING FISCAL YEAR 2006

There were no grants in 2006 under equity or non-equity incentive plans of the Company which would have effect in 2007 or thereafter and no stock or stock option awards.

Narrative Disclosure For Summary Compensation Table and Grants of Plan-Based Awards Table

Employment Agreements with Our Named Executive Officers

In June 1997, the Company entered into an Employment Agreement with Robert L. Montgomery replacing a prior agreement. The agreement was originally for a term of six years commencing on January 1, 1997 with a provision for automatic one year renewal terms, and provides for Mr. Montgomery to receive base annual compensation during the term of not less than $485,000. Mr. Montgomery is also to participate in the Company’s annual incentive compensation and the Company’s long-term incentive compensation plans, the Company’s stock option plan and such other compensation plans as the Company may from time to time have for executives. In the event of Mr. Montgomery’s death during the term of the agreement, payments equal to his total compensation under the agreement will be made to his heirs for a period of six months. The agreement also allows Mr. Montgomery the option, upon reaching age 60, to reduce his level of service to the Company by approximately one-half with a corresponding decrease in position and compensation. Mr. Montgomery also has the option upon reaching age 60 to terminate his active service and continue in a consulting capacity. The term of the consulting period will be 10 years and Mr. Montgomery will receive approximately 20% of his prior annual compensation as a consulting fee. The agreement includes the obligation of Mr. Montgomery to maintain the confidentiality of the Company’s confidential information and contains a covenant of Mr. Montgomery not to compete with the Company.

In June 2002, the Company entered into a Services Agreement with Dr. Hastings replacing a prior employment agreement. The services agreement is for a period of twenty years with a provision for automatic one year renewal terms. The agreement provides for the employment of Dr. Hastings for a term commencing on July 1, 2001 and expiring on June 30, 2006. During the term of employment, the Company is obligated to pay Dr. Hastings a basic salary at the rate of $22,500 per month. Effective December 15, 2005, the Compensation Committee increased Dr. Hastings’ basic salary to $30,000 per month and extended the employment term for one year. Upon expiration of the term of employment, Dr. Hastings will be retained to provide consulting services to the Company for the remainder of the term of the services agreement. During the consulting term, the Company will pay Dr. Hastings the sum of $10,000 per month. In the event of Dr. Hastings’ death during the term of the agreement, payments equal to his total compensation under the agreement will be made to his heirs for a period of six months. During the term of the services agreement, the Company will be entitled to use the name and likeness of Dr. Hastings in connection with the Company’s promotional materials and activities. The services agreement also includes the obligation of Dr. Hastings to maintain the confidentiality of the Company’s confidential information and to hold any and all inventions made or conceived by him during the term of the agreement as the Company’s fiduciary and a covenant of Dr. Hastings not to compete with the Company.

In April 2002, the Company entered into an Employment Agreement with R. Scott Montgomery under which he was employed as Vice President of International Operations. The agreement was originally for a term of one year commencing on April 3, 2002 with a provision for automatic one year renewal terms, and provides for Mr. Montgomery to receive base annual compensation of not less than $105,000. Mr. Montgomery is also to participate in the Company’s annual incentive compensation plan and such other compensation plans as the Company may from time to time have for executives. In the event of Mr. Montgomery’s termination for reasons other than an event of default or permanent mental or physical disability, Mr. Montgomery will receive a severance payment equal to six months salary. The agreement includes the obligations of Mr. Montgomery to maintain the confidentiality of the Company’s confidential information and hold certain inventions for the Company in his fiduciary capacity, and contains a covenant not to solicit the Company’s distributors for a period of 24 months after the date of termination of this agreement.

In May 2006, the Company entered into Split-Dollar Agreements with each of Messrs. R. Scott Montgomery and Steven D. Albright. Under these agreements, the Company pays the premiums on life insurance policies covering each above-named officer’s life with a death benefit of $500,000. Upon the death of either of Messrs. R. Scott Montgomery or Steven D. Albright, the Company is entitled to receive the greater of (1) one-third of the insurance proceeds, (2) the cash surrender value of the policy or (3) the total premiums paid under the policy, with the insured’s beneficiary receiving the balance of the insurance proceeds. On termination of the agreement prior to the death of the insured, he shall have the right to purchase the policy for the fair market value of the policy, as determined in accordance with IRS guidelines and procedures.

Information Relating to Cash Incentives and Stock and Option Awards

Each of the Named Executives participated in the incentive compensation program of the Company during 2006. The incentive compensation program is described in the Compensation Discussion and Analysis. The amount shown as Non-Equity Incentive Compensation represents amounts earned by each of the Named Executives under that program during 2006 and paid during 2006 and 2007.

There were no stock or stock option awards made to any of the Named Executives during 2006.

Salary and Bonus Proportion of Compensation

During 2006, salary and bonus paid to the Named Executive Officers represented 55% of the total compensation paid to them and incentive compensation payments represented 40% of their total compensation. Long-term compensation consisting of matching 401(k) contributions and ESOP contributions represented 2% of total compensation.

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2006

The following chart sets forth all outstanding equity awards to named executive officers as of December 31, 2006. All awards are in the common stock of the Company.

| | | Option Awards | |

| | | Number of Securities Underlying | | Option | | Option | |

| | | Unexercised Options (#) | | Exercise | | Expiration | |

| Name | | Exercisable | | Unexercisable | | Price ($) | | Date | |

| | | | | | | | | | |

| Robert L. Montgomery | | | 160,000 | | | - | | $ | 7.92 | | | 1/5/2015 | |

| Carl W. Hastings | | | 20,000 | | | - | | | 7.92 | | | 1/5/2015 | |

| Stephen M. Merrick | | | 50,000 | | | - | | | 7.92 | | | 1/5/2015 | |

| R. Scott Montgomery | | | 50,000 | | | - | | | 7.92 | | | 1/5/2015 | |

| Steven D. Albright | | | 20,000 | | | - | | | 7.92 | | | 1/5/2015 | |

The Company does not issue stock awards.

OPTION EXERCISES AND STOCK VESTED

The following table sets forth information with respect to common shares acquired upon the exercise of stock options of the Named Executive Officers during the fiscal year ended December 31, 2006.

| | | Option Awards | | Stock Awards | |

| | | Number of Shares | | | | Number of Shares | | | |

| | | Acquired on | | Value Realized | | Acquired on | | Value Realized | |

| | | Exercise | | on Exercise | | Vesting | | on Vesting | |

| Name | | (#) | | ($) | | (#) | | ($) | |

| | | | | | | | | | |

| Robert L. Montgomery | | | 128,720 | | $ | 1,107,486 | | | - | | $ | - | |

| Carl W. Hastings | | | - | | | - | | | - | | | - | |

| Stephen M. Merrick | | | - | | | - | | | - | | | - | |

| R. Scott Montgomery | | | - | | | - | | | - | | | - | |

| Steven D. Albright | | | 34,970 | | | 308,240 | | | - | | | - | |

NON-QUALIFIED DEFERRED COMPENSATION

The following table set forth all non-qualified deferred compensation of the Named Executive Officers for the fiscal year ended December 31, 2006.

| | | Executive | | Company | | Aggregate | | Aggregate | | Aggregate | |

| | | Contributions | | Contributions | | Earnings(Loss) | | Withdrawals/ | | Balance at | |

| Name | | in Last FY ($) | | in Last FY ($) | | in Last FY ($) | | Distributions ($) | | Last FYE ($) | |

| | | | | | | | | | | | |

| Robert L. Montgomery | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Carl W. Hastings | | | - | | | - | | | (341,174 | ) | | - | | | 285,842 | |

| Stephen M. Merrick | | | - | | | - | | | - | | | - | | | - | |

| R. Scott Montgomery | | | - | | | - | | | - | | | - | | | - | |

| Steven D. Albright | | | - | | | - | | | - | | | - | | | - | |

Narrative Description of Non-Qualified Deferred Compensation

Supplemental Executive Retirement Plan

The Company sponsors a Supplemental Executive Retirement Plan (SERP) that previously allowed certain executives to defer a portion of their annual salary and bonus into a grantor trust. A grantor trust was established to hold the assets of the SERP. The Company funded the grantor trust by paying the amount deferred by the participant into the trust at the time of deferral. Investment earnings and losses accrue to the benefit or detriment of the participants. The SERP also provided for a discretionary matching contribution by the Company not to exceed 100% of the participant’s annual contribution. The participants fully vested in the deferred compensation three years from the date they entered the SERP. The participants are not eligible to receive distributions under the SERP until retirement, death, or disability of the participant.

In 2006, the SERP was amended to provide, among other things, that no new participants may be designated and no new or additional salary deferrals may be made. Accordingly, none of the named executive officers made a contribution to the SERP in 2006 and no Company additions or matches were provided. Carl W. Hastings is the only current executive officer of the Company that is a participant in the SERP.

Payments upon Termination or Change of Control

The Company has no agreements with Named Executives or other executives of the Company under which payments are to be made in the event of change of control of the Company.

Under the Employment Agreement between the Company and Robert L. Montgomery, Mr. Montgomery has the right, upon reaching age 60, to reduce his level of service to the Company by approximately one-half with a corresponding decrease in position and compensation. Mr. Montgomery also has the option upon reaching age 60 to terminate his active service and continue in a consulting capacity. The term of the consulting period will be 10 years and Mr. Montgomery will receive approximately 20% of his prior annual compensation as a consulting fee.

Under the Services Agreement between the Company and Carl W. Hastings, upon expiration of the term of employment, Dr. Hastings will be retained to provide consulting services to the Company for the remainder of the term of the services agreement. During the consulting term, the Company will pay Dr. Hastings the sum of $10,000 per month. In the event of Dr. Hastings’ death during the term of the agreement, payments equal to his total compensation under the agreement will be made to his heirs for a period of six months.

Under the Employment Agreement of R. Scott Montgomery, in the event of Mr. Montgomery’s termination for reasons other than an event of default or permanent mental or physical disability, Mr. Montgomery will receive a severance payment equal to six months salary. The agreement includes the obligations of Mr. Montgomery to maintain the confidentiality of the Company’s confidential information and hold certain inventions for the Company in his fiduciary capacity, and contains a covenant not to solicit the Company’s distributors for a period of 24 months after the date of termination of the agreement.

DIRECTOR COMPENSATION

| Name | | Fees Earned or Paid in Cash ($) | | All Other Compensation ($) | | Total ($) | |

| | | | | | | | |

| Donald L. McCain | | $ | 102,000 | | $ | - | | $ | 102,000 | |

| Denis St. John | | | 75,000 | | | - | | | 75,000 | |

| Robert M. Henry | | | 42,000 | | | - | | | 42,000 | |

| John B. Akin | | | 52,500 | | | - | | | 52,500 | |

| Michael Smith | | | 17,500 | | | 12,000 (1 | ) | | 29,500 | |

__________________

(1) Mr. Smith is engaged by the Company as a consultant and is paid $3,000 per month as consideration for his services.

Narrative Description of Director Compensation

Members of the Board of Directors who are not employees receive a monthly fee of $2,500 and $1,500 per attendance at meetings of the Board of Directors or any committees of the Board of Directors.

The Company and Michael D. Smith have an arrangement under which the Company pays to Mr. Smith an annual consulting fee of $36,000 in addition to the director compensation he receives.

Compensation Committee Interlocks and Insider Participation

Messrs. St. John, McCain and Akin currently serve on the Compensation Committee. None of these committee members is employed by the Company.

Certain Relationships and Related Transactions

Stephen M. Merrick is Senior Vice President and a director. Mr. Merrick previously was a principal of the law firm of Merrick & Associates, P.C., is Of Counsel to Vanasco Genelly & Miller P.C. and has served as General Counsel since the Company’s inception. During the year ended December 31, 2006, the aggregate amounts paid or incurred by the Company to Vanasco Genelly & Miller P.C. for legal services was $114,000.

The Chief Executive Officer, President and Chairman of the Board, Robert L. Montgomery, is the father of R. Scott Montgomery and Ryan A. Montgomery. Ryan A. Montgomery is Executive Vice President, Worldwide Sales and received cash compensation from the Company of $326,933 for 2006. Ronald McCain is the son of Donald L. McCain, a director, and Ronald McCain is the son-in-law of the Chief Executive Officer, President and Chairman of the Board, Robert L. Montgomery. Ronald McCain is Director of Customer Service and as a result of serving in such capacity, the Company paid him cash compensation of $225,972 for 2006.

Vice Chairman, Chief Scientific Officer and director, Dr. Carl W. Hastings, is the father of Steven G. Hastings and Brett M. Hastings. Steven G. Hastings is Senior Vice President, North American Sales and received cash compensation from the Company of $326,933 for 2006. Brett M. Hastings is Associate General Counsel and as a result of serving in such capacity, the Company paid him cash compensation of $201,164 for 2006.

In March 2005, the Company entered into a stock redemption agreement with David G. Kreher, a former officer/director and his spouse. Mr. Kreher is the brother-in-law of Robert L. Montgomery, the Company’s Chief Executive Officer, President and Chairman of the Board. Under the stock redemption agreement, the Company issued promissory notes totaling $4,050,000 to Mr. Kreher and his spouse in exchange for 450,000 shares of the Company’s common stock ($9.00 per share) owned by Mr. Kreher and his spouse. In 2006, the Company paid in full the remaining outstanding balance of principal and accrued interest due under the promissory notes in the aggregate amount of $3,172,022.

Mr. Kreher is employed by the Company as Director of Special Projects, and he is the brother-in-law of Robert L. Montgomery, Chief Executive Officer, President and Chairman of the Board. As a result of serving as Director of Special Projects, the Company paid Mr. Kreher cash compensation of $135,000 for 2006.

Approval of Related Party Transactions

The Company has an unwritten policy that any related party transaction, other than employment compensation of executive officers, is submitted to the Audit Committee. The Audit Committee is responsible for reviewing and approving all transactions between the Company and certain related persons, such as its executive officers, directors and owners of more than 5% of the Company’s voting securities. In reviewing a transaction, the Committee considers the relevant facts and circumstances, including the benefits to the Company, and whether the transaction is fair to the Company and consistent with a transaction available on an arms-length basis. Only those related person transactions that are determined to be in (or not inconsistent with) the best interests of the Company and shareholders are approved.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and with the NASDAQ Stock Market. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company, or written representations that no Form 5’s were required, the Company believes that during calendar year 2006, all of the officers, directors and ten percent beneficial owners of the Company complied with all applicable Section 16(a) filing requirements, except Michael D. Smith’s Form 3 was inadvertently filed late.

Code of Ethics

The Company has adopted a code of ethics that applies to senior executive and financial officers. The Company’s Code of Ethics seeks to promote (1) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (2) full, fair, accurate, timely and understandable disclosure of information to the Commission, (3) compliance with applicable governmental laws, rules and regulations, (4) prompt internal reporting of violations of the Code of Ethics to predesignated persons, and (5) accountability for adherence to the Code of Ethics. A copy of the Company’s Code of Ethics has been attached to and can be viewed on the Company’s Internet website at http://www.reliv.com under the section entitled “Investor Relations.”

PROPOSAL TWO - SELECTION OF AUDITORS

Ratification of Appointment of Independent Registered Public Accounting Firm

The Board of Directors has selected and approved Ernst & Young LLP as the independent registered public accounting firm to audit the Company’s financial statements for 2007, subject to ratification by the stockholders. It is expected that a representative of the firm of Ernst & Young LLP will be present at the Annual Meeting and will have an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fees Billed By Independent Registered Public Accounting Firm

The following table sets forth the amount of fees billed by Ernst & Young LLP for services rendered for the years ended December 31, 2006 and 2005:

| | | 2006 | | 2005 | |

Audit Fees (1)(1) | | $ | 635,000 | | $ | 548,800 | |

Audit-Related Fees (2) | | | 20,000 | | | 17,400 | |

Tax Fees (3) | | | 188,900 | | | 307,700 | |

| Total Fees | | $ | 843,900 | | $ | 873,900 | |

______________________

(1) | Includes the annual consolidated financial statement audit, limited quarterly reviews, reviews of registration statements and comfort letters, statutory audits required internationally and the audit of internal controls. |

| (2) | Represents fees paid for the annual audit of the Company’s 401(k) Plan. |

| (3) | Primarily represents the preparation of tax returns and other tax compliance and consulting services. |

All audit, tax, and other services to be performed by Ernst & Young LLP for the Company must be pre-approved by the Audit Committee. The Audit Committee reviews the description of the services and an estimate of the anticipated costs of performing those services. Services not previously approved cannot commence until such approval has been granted. Pre-approval is granted usually at regularly scheduled meetings. If unanticipated items arise between meetings of the Audit Committee, the Audit Committee has delegated approval authority to the chairman of the Audit Committee, in which case the chairman communicates such pre-approvals to the full committee at its next meeting. During 2006, all services performed by Ernst & Young LLP were pre-approved by the Audit Committee in accordance with this policy.

The Audit Committee reviews all relationships with Ernst & Young LLP, including the provision of non-audit services, which may relate to the independent registered public accounting firm’s independence. The Audit Committee considered the effect of Ernst & Young LLP’s non-audit services in assessing the independence of the independent registered public accounting firm and concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

THE BOARD OF DIRECTORS RECOMMENDS STOCKHOLDERS VOTE “FOR” SUCH RATIFICATION.

Stockholder Proposals for 2008 Proxy Statement

Proposals by stockholders for inclusion in the Company’s Proxy Statement and form of Proxy relating to the 2008 Annual Meeting of Stockholders, which is scheduled to be held on May 22, 2008, should be addressed to the Secretary, Reliv’ International, Inc., P.O. Box 405, Chesterfield, Missouri 63006, and must be received at such address no later than December 31, 2007. Upon receipt of any such proposal, the Company will determine whether or not to include such proposal in the Proxy Statement and Proxy in accordance with applicable law. It is suggested that such proposal be forwarded by certified mail, return receipt requested.

Proxy Statement and Annual Report Delivery

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for annual reports and proxy statements with respect to two or more shareholders sharing the same address by delivering a single annual report and/or proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for shareholders and cost savings for companies. The Company and some brokers household annual reports and proxy materials, delivering a single annual report and/or proxy statement to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders.

Once you have received notice from your broker or the Company that your broker or the Company will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate annual report and/or proxy statement in the future, please notify your broker if your shares are held in a brokerage account or the Company if you hold registered shares. If, at any time, you and another shareholder sharing the same address wish to participate in householding and prefer to receive a single copy of the Company’s annual report and/or proxy statement, please notify your broker if your shares are held in a brokerage account or the Company if you hold registered shares.

You may request to receive at any time a separate copy of our annual report or proxy statement, or notify the Company that you do or do not wish to participate in householding by sending a written request to the Corporate Secretary at P.O. Box 405, Chesterfield, Missouri 63006 or by telephoning (636) 537-9715.

Stockholder Communications with the Board of Directors

Stockholders of the Company may communicate with the Board of Directors in writing addressed to:

Board of Directors

c/o Corporate Secretary

Reliv International, Inc.

P.O. Box 405

Chesterfield, Missouri 63006

The Secretary will review each communication from a stockholder. The Secretary will forward to the members of the Board of Directors each communication that (1) concerns the Company’s business or governance, (2) is not offensive and is legible in form and reasonably understandable in content, and (3) does not relate to a personal grievance against the Company or a team member or further a personal interest not shared by the other stockholders generally.

The Company strongly encourages each of its directors to attend each Annual Meeting of the Company’s stockholders where attendance does not unreasonably conflict with the director’s other business and personal commitments. All of the members of the Board of Directors attended the 2006 Annual Meeting of Stockholders.

BY ORDER OF THE

BOARD OF DIRECTORS

Dated: April 20, 2007

/s/ Stephen M. Merrick

Stephen M. Merrick, Secretary