UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04297

VANECK FUNDS

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: DECEMBER 31, 2019

| Item 1. | Report to Shareholders |

| | |

| ANNUAL REPORT

December 31, 2019 |

VanEck Funds

CM Commodity Index Fund

Certain information contained in this report represents the opinion of the investment adviser and may change at any time. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings, the Fund’s performance, and the views of the investment adviser are as of December 31, 2019.

PRIVACY NOTICE

(unaudited)

| FACTS | WHAT DOES VAN ECK DO WITH YOUR

PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number and account balances ■ assets and payment history ■ risk tolerance and transaction history |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Van Eck chooses to share; and whether you can limit this sharing. |

Reasons we can share your personal

information | Does Van Eck share? | Can you limit this

sharing? |

| For our everyday business purposes— such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes— to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | Yes | No |

| For our affiliates’ everyday business purposes— information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes— information about your creditworthiness | No | We don’t share |

| For our affiliates to market to you | Yes | Yes |

| For nonaffiliates to market to you | No | We don’t share |

| To limit our sharing | Call us at 1-800-826-2333. Please note: If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call us at 1-800-826-2333. |

PRIVACY NOTICE

(unaudited) (continued)

| Who we are | |

| Who is providing this notice? | Van Eck Global, its affiliates and funds sponsored or managed by Van Eck (collectively “Van Eck”). |

| What we do | |

| How does Van Eck protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does Van Eck collect my personal information? | We collect your personal information, for example, when you ■ open an account or give us your income information ■ provide employment information or give us your contact information ■ tell us about your investment or retirement portfolio We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes—information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| What happens when I limit sharing for an account I hold jointly with someone else? | Your choices will apply to everyone on your account – unless you tell us otherwise |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Our affiliates include companies with a Van Eck name such as Van Eck Securities Corporation and others such as Market Vectors Index Solutions GmbH. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ Van Eck does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ Our joint marketing partners include financial services companies |

| Other important information |

California Residents— In accordance with California law, we will not share information we collect about California residents with nonaffiliates except as permitted by law, such as with the consent of the customer or to service the customer’s accounts. We also will limit the sharing of information about you with our affiliates to the extent required by applicable California law. Vermont Residents— In accordance with Vermont law, we will not share information we collect about Vermont residents with nonaffiliates except as permitted by law, such as with the consent of the customer or to service the customer’s accounts. We will not share creditworthiness information about Vermont residents among Van Eck’s affiliates except with the authorization or consent of the Vermont resident. |

CM COMMODITY INDEX FUND

PRESIDENT’S LETTER

December 31, 2019 (unaudited)

Dear Shareholders:

The story for 2019 was simple and familiar — slower economic growth was combated by expansive monetary policy.

But first a comment on global growth: the two engines of the global economy, the U.S. and China, continue to move forward and we now have the prospect of at least some resolution of the trade dispute between them in the phase-one agreement. The latest economic statistics from China are steady and there are signs of “green shoots.” China’s services sector is expanding robustly and manufacturing is struggling, but not collapsing. My blog,China’s Economic Growth: Continuing Despite Headlines, shows this in two charts.

The biggest event in the markets last summer was the surge in bonds in Europe with negative interest rates. At the end of September, nearly $15 trillion worth of debt globally carried a negative yield.1Despite moves by the European Central Bank to stimulate, not only is the European economy slowing down, but there are also concerns about just how effective central bank actions are. Looking forward, therefore, I think investors should assess their hedge against central bank uncertainty by considering, for example, their gold allocations. While high interest rate environments tend to be tough for gold (it does not pay any yield), against negative interest rates, gold and other hedges against central bank impotence should be strongly considered.

We encourage you to stay in touch with us through the videos, email subscriptions and research blogs available on our website, www.vaneck.com. I have started my own email subscription where I share interesting research — you can sign up on www.vaneck.com. Should you have any questions regarding fund performance, please contact us at 800.826.2333 or visit ourwebsite.

CM COMMODITY INDEX FUND

PRESIDENT’S LETTER

(unaudited)(continued)

We sincerely thank you for investing in VanEck’s investment strategies. On the following pages, you will find a performance discussion and financial statements for the fund for the twelve month period ended December 31, 2019. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

CEO and President

VanEck Funds

January 24, 2020

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

| 1 | Financial Times: September was the busiest month ever for corporate debt issuance, September 30, 2019, https://www.ft.com/content/eef8234c-e3c0-11e9-b112-9624ec9edc59 |

MANAGEMENT DISCUSSION

December 31, 2019 (unaudited)

The CM (Constant Maturity) Commodity Index Fund (the “Fund”) gained 8.37% (Class A shares, excluding sales charge) for the 12 months ended December 31, 2019. The Fund’s benchmark, the UBS Bloomberg Constant Maturity Commodity Total Return Index (“CMCI”),1gained 9.82%.

CMCI, up 9.82%, outperformed the Bloomberg Commodity Index (“BCOM”),2at 7.69%, not least because of CMCI’s better roll yield,^which contributed. The S&P®GSCI Index (“SPGSCI”)3posted a gain of 17.63%, outperforming both the CMCI and BCOM because of its heavy energy weighting.

Market Review

Commodities recovered in 2019, reversing the sharp decline in the fourth quarter of 2018, and most commodity index products rose on the year after a strong fourth quarter rally triggered by the U.S./China trade talks which finally produced the outline of a phase-one agreement and a reduction of tariffs.

Global growth slowed most of the year on trade fears, but started to stabilize in the last quarter of 2019 as global central bank easing led by the Fed supported consumer and investor confidence. President Donald Trump’s political troubles, culminating in his impeachment by the U.S. House of Representatives, had almost no impact on markets, or the economy, but remain a risk as we enter the 2020 election cycle. There were several geopolitical events that generated some short-term volatility in commodity markets, for example, Iran’s attack on the Saudi Arabian oil facilities in September. The Iran/U.S. conflict now looks like it will become the headline geopolitical risk as we begin 2020.

Fund Review

All sectors represented in the CMCI, except for livestock, contributed positively to performance during the 12 month period, with the energy sector contributing the most.

The energy sector produced most of CMCI’s (and the Fund’s) returns for the year, rising almost 20% for the year. As mentioned earlier, most of the gains came in fourth quarter of 2019 on the U.S./China trade deal and have continued in early 2020 on Middle East tensions.

Industrial metals rose about 5% for the year. Again, like most markets, the improving trade outlook triggered a fourth quarter rally. Although the sector had mixed returns, the big gains in nickel and smaller gains in copper were partly offset by modest declines in aluminum, lead and zinc. Gold was strong all year as both falling global interest rates and global

CM COMMODITY INDEX FUND

MANAGEMENT DISCUSSION

(unaudited) (continued)

central banks’ aggressive easing triggered investor demand. The agriculture and livestock sectors were both almost unchanged for the year, with agriculture slightly up and livestock slightly down. However, both finished the year positively as the U.S./China trade deal improved the demand outlook for 2020.

During the 12 month period, the Fund continued to utilize commodity index-linked swaps as an effective means of gaining exposure to the CMC Index. While there are costs associated with the use of swaps, we continue to believe it is the most effective way of replicating the CMC Index’s commodity exposures and weights.

As we look ahead to 2020, commodities could be poised for strong gains. Supply fundamentals continue to improve slowly and the outlook for global growth is much better than it was a year ago. As growth outside the U.S. improves, we should see the U.S. dollar decline, adding support to commodity demand. Global central banks have aggressively eased monetary policy and the U.S./China trade situation is much improved. As always there are risks to global growth, Middle East tensions, U.S. politics (2020 election) and Brexit, to name a few. But as we start the year, commodities look attractive and could outperform other asset classes.

For more information or to access investment and market insights from the investment team, visit our web site, vaneck.com or subscribe to our commentaries.

As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

| |  |

| | | |

| Roland Morris, Jr. | | Gregory Krenzer |

| Portfolio Manager | | Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes.

An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | UBS Bloomberg Constant Maturity Commodity Total Return Index (CMCI) is a rules-based, composite benchmark index diversified across commodities futures contracts from various sectors. CMCI is comprised of futures contracts with maturities ranging from around three months to over three years for each commodity, depending on liquidity. |

| | |

| 2 | The Bloomberg Commodity Index (BCOM) is composed of futures contracts on physical commodities. |

| | |

| 3 | The S&P®GSCI Index (SPGSCI) is composed of futures contracts on physical commodities, with high energy concentration and limited diversification. SPGSCI buys and sells short-term futures contracts. |

| | |

| ^ | Roll yield is the amount of return generated during periods of backwardation, while negative roll yield refers to the amount of return lost during periods of contango. Roll yield is calculated as equal to [(1+Excess Return)/(1+Spot Return)]-1. “Backwardation” is the opposite of contango, and refers to a downward sloping term structure. |

Backwardation tends to occur in contracts and during periods when traders are concerned about scarcity of supplies. Thus, traders would rather have commodities in-hand now (spot) than in the future, and will pay for the privilege. “Contango” refers to an upward sloping term structure, in which indices that hold front-month contracts will incur a cost each time contracts expire and must be rolled to more expensive, longer-dated contracts. As contracts move closer to expiration, their value converges with spot prices. So, “contango cost” usually is measured by the difference between spot prices and front-month futures.

Commodities are assets that have tangible properties, such as oil, metals, and agriculture. Commodities and commodity-linked derivatives may be affected by overall market movements and other factors that affect the value of a particular industry or commodity such as weather, disease, embargoes or political or regulatory developments. The value of a commodity-linked derivative is generally based on price movements of a commodity, a commodity futures contract, a commodity index or other economic variables based on the commodity markets. Derivatives use leverage, which may exaggerate a loss. The Fund is subject to the risks associated with its investments in commodity-linked derivatives, risks of investing in wholly owned subsidiary, risk of tracking error, risks of aggressive investment techniques, leverage risk, derivatives risks, counterparty risks, non-diversification risk, credit risk, concentration risk and market risk. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation risk, liquidity risk, interest-rate risk, market risk, credit risk, valuation risk and tax risk. Gains and losses from speculative positions in derivatives may be much greater than the derivative’s cost. At any time, the risk of loss of any individual security held by the Fund could be significantly higher than 50% of the security’s value. Investment in commodity

CM COMMODITY INDEX FUND

MANAGEMENT DISCUSSION

(unaudited) (continued)

markets may not be suitable for all investors. The Fund’s investment in commodity-linked derivative instruments may subject the fund to greater volatility than investment in traditional securities. Please see the prospectus and summary prospectus for information on these and other risk considerations.

All investments involve the risk of loss.

PERFORMANCE COMPARISON

December 31, 2019 (unaudited)

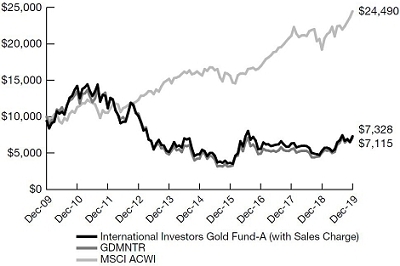

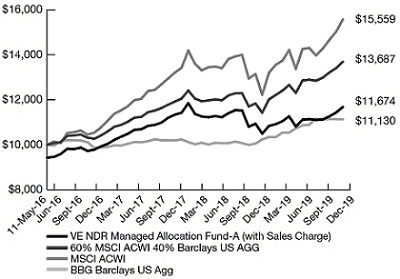

This chart shows the value of a hypothetical $10,000 investment in the Fund since inception. The result is compared with the Fund’s benchmark. Performance of Class I and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | | Hypothetical Growth of $10,000 (Since Inception: Class A)

|

| | Class A | Class A | |

| Average Annual | Before | After Max | |

| Total Return (%) | Sales Charge | Sales Charge | Class I* |

| One Year | 8.37% | 2.18% | 8.55% |

| Five Year | (2.54%) | (3.69%) | (2.23)% |

| Life^ | (5.44%) | (6.06%) | (5.15%) |

| | | | |

Average Annual

Total Return (%) | Class Y* | CMCITR | |

| One Year | 8.73% | 9.82% | |

| Five Year | (2.27%) | (1.18%) | |

| Life^ | (5.19%) | (4.11%) | |

| | |

| * | Classes are not subject to a sales charge |

| ^ | Since December 31, 2010 (inception date of all share classes) |

CM COMMODITY INDEX FUND

PERFORMANCE COMPARISON

(unaudited) (continued)

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

Investment return and value of shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance information reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the redemption of Fund shares. Performance information current to the most recent month end is available by calling 800.826.2333 or by visiting vaneck.com.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

UBS Bloomberg Constant Maturity Commodity Total Return Index (CMCITR) is a rules-based, composite benchmark index diversified across commodity components from various sectors, specifically energy, precious metals, industrial metals, agriculture and livestock (reflects no deduction for fees, expenses or taxes).

EXPLANATION OF EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, July 1, 2019 to December 31, 2019.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

CM COMMODITY INDEX FUND

EXPLANATION OF EXPENSES

(unaudited) (continued)

| | | Beginning

Account Value

July 1, 2019 | Ending

Account Value

December 31,

2019 | Annualized

Expense Ratio

During Period | Expenses Paid

During the Period*

July 1, 2019 -

December 31,

2019 |

| Class A | Actual | $1,000.00 | $1,017.30 | 0.95% | $4.83 |

| | Hypothetical** | $1,000.00 | $1,020.42 | 0.95% | $4.84 |

| Class I | Actual | $1,000.00 | $1,020.40 | 0.65% | $3.31 |

| | Hypothetical** | $1,000.00 | $1,021.93 | 0.65% | $3.31 |

| Class Y | Actual | $1,000.00 | $1,019.60 | 0.70% | $3.56 |

| | Hypothetical** | $1,000.00 | $1,021.68 | 0.70% | $3.57 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended December 31, 2019), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of the days in the fiscal year (to reflect the one-half year period). |

| | |

| ** | Assumes annual return of 5% before expenses |

CM COMMODITY INDEX FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2019

Principal

Amount | | | | | Value | |

| |

| SHORT-TERM INVESTMENTS: 99.1% |

| |

| United States Treasury Obligations: 95.9% |

| | | | | United States Treasury Bills | | | | |

| | $5,000,000 | | | 1.50%, 02/18/20 (a) | | $ | 4,990,000 | |

| | 40,000,000 | | | 1.50%, 03/12/20 | | | 39,883,528 | |

| | 9,000,000 | | | 1.51%, 03/26/20 (a) | | | 8,968,442 | |

| | 65,000,000 | | | 1.53%, 02/06/20 (a) † | | | 64,900,875 | |

| | 55,000,000 | | | 1.53%, 05/21/20 (a) | | | 54,674,622 | |

| | 7,000,000 | | | 1.53%, 05/28/20 (a) | | | 6,956,260 | |

| | 45,000,000 | | | 1.53%, 06/11/20 | | | 44,691,836 | |

| | 40,000,000 | | | 1.57%, 06/25/20 | | | 39,702,305 | |

| | 45,000,000 | | | 1.59%, 02/27/20 (a) | | | 44,886,713 | |

| | 50,000,000 | | | 1.60%, 04/16/20 (a) † | | | 49,779,403 | |

| | 40,000,000 | | | 1.64%, 04/09/20 (a) † | | | 39,834,462 | |

| | 50,000,000 | | | 1.74%, 01/02/20 (a) † | | | 49,997,583 | |

| | | | | | | | 449,266,029 | |

Number

of Shares | | | | | Value | |

| | | | | | | | | |

| Money Market Fund: 3.2% | | | | |

| | 15,122,537 | | | Invesco Treasury Portfolio – Institutional Class | | $ | 15,122,537 | |

Total Short-Term Investments

(Cost: $464,342,365) | | | 464,388,566 | |

| SHORT-TERM INVESTMENT HELD AS COLLATERAL FOR SECURITIES ON LOAN: 5.2% | | | | |

| | | | | |

Money Market Fund: 5.2%

(Cost: $24,712,151) | | | | |

| | 24,712,151 | | | State Street Navigator Securities Lending Government Money Market Portfolio | | | 24,712,151 | |

Total Investments: 104.3%

(Cost: $489,054,516) | | | 489,100,717 | |

| Liabilities in excess of other assets: (4.3)% | | | (20,374,401 | ) |

| NET ASSETS: 100.0% | | $ | 468,726,316 | |

Total Return Swap Contracts

Long Exposure

| Counterparty | | Referenced

Obligation | | Notional

Amount | | Rate paid

by the

Fund (b) | | Payment

Frequency | | Termination

Date | | Unrealized

Appreciation | | % of

Net

Assets |

| UBS | | UBS Bloomberg Constant Maturity Commodity Index

Total Return | | $466,564,000 | | 1.98% | | Monthly | | 01/22/20 | | | $3,602,327 | | | 0.8% |

Footnotes:

| (a) | All or a portion of these securities are segregated for swap collateral. Total value of securities segregated is $70,795,890. |

| (b) | The rate shown reflects the rate in effect at the reporting period: 3-Month T-Bill rate + 0.42%. |

| † | Security fully or partially on loan. Total market value of securities on loan is $105,369,695. |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS

(continued)

Summary of Investments by

Sector Excluding Collateral

for Securities Loaned | | % of

Investments | | Value |

| Government | | | | 96.7 | % | | | $ | 449,266,029 | |

| Money Market Fund | | | | 3.3 | | | | | 15,122,537 | |

| | | | | 100.0 | % | | | $ | 464,388,566 | |

The summary of inputs used to value the Fund’s investments as of December 31, 2019 is as follows:

| | | | | | Level 2 | | | Level 3 | | | |

| | | Level 1 | | | Significant | | | Significant | | | |

| | | Quoted | | | Observable | | | Unobservable | | | |

| | | Prices | | | Inputs | | | Inputs | | Value | |

| United States Treasury Obligations | | $ | — | | | $ | 449,266,029 | | | | $ | — | | | $ | 449,266,029 | |

| Money Market Funds | | | 39,834,688 | | | | — | | | | | — | | | | 39,834,688 | |

| Total | | $ | 39,834,688 | | | $ | 449,266,029 | | | | $ | — | | | $ | 489,100,717 | |

| Other Financial Instruments: | | | | | | | | | | | | | | | | | |

| Swap Contracts | | $ | — | | | $ | 3,602,327 | | | | $ | — | | | $ | 3,602,327 | |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

December 31, 2019

| Assets: | | | | |

| Investments, at value (Cost: $464,342,365) (1) | | $ | 464,388,566 | |

| Short-term investment held as collateral for securities loaned (2) | | | 24,712,151 | |

| Total return swap contracts, at value | | | 3,602,327 | |

| Cash | | | 569 | |

| Receivables: | | | | |

| Shares of beneficial interest sold | | | 2,401,293 | |

| Dividends and interest | | | 40,565 | |

| Prepaid expenses | | | 17,270 | |

| Total assets | | | 495,162,741 | |

| Liabilities: | | | | |

| Payables: | | | | |

| Collateral for securities loaned | | | 24,712,151 | |

| Shares of beneficial interest redeemed | | | 1,247,697 | |

| Due to Adviser | | | 125,369 | |

| Due to Distributor | | | 5,599 | |

| Deferred Trustee fees | | | 293,621 | |

| Accrued expenses | | | 51,988 | |

| Total liabilities | | | 26,436,425 | |

| NET ASSETS | | $ | 468,726,316 | |

| Class A Shares: | | | | |

| Net Assets | | $ | 26,932,169 | |

| Shares of beneficial interest outstanding | | | 5,846,206 | |

| Net asset value and redemption price per share | | $ | 4.61 | |

| Maximum offering price per share (Net asset value per share ÷ 94.25%) | | $ | 4.89 | |

| Class I Shares: | | | | |

| Net Assets | | $ | 195,269,510 | |

| Shares of beneficial interest outstanding | | | 41,468,570 | |

| Net asset value, offering and redemption price per share | | $ | 4.71 | |

| Class Y Shares: | | | | |

| Net Assets | | $ | 246,524,637 | |

| Shares of beneficial interest outstanding | | | 52,488,860 | |

| Net asset value, offering and redemption price per share | | $ | 4.70 | |

| Net Assets consist of: | | | | |

| Aggregate paid in capital | | $ | 510,554,702 | |

| Total distributable earnings (loss) | | | (41,828,386 | ) |

| | | $ | 468,726,316 | |

| (1) Value of securities on loan | | $ | 105,369,695 | |

| (2) Cost of short-term investment held as collateral for securities loaned | | $ | 24,712,151 | |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED STATEMENT OF OPERATIONS

For the Year Ended December 31, 2019

| Income: | | | | |

| Dividends | | $ | 592,661 | |

| Interest | | | 10,097,630 | |

| Securities lending income | | | 8,348 | |

| Foreign taxes withheld | | | (24,623 | ) |

| Total income | | | 10,674,016 | |

| Expenses: | | | | |

| Management fees | | | 3,649,521 | |

| Distribution fees – Class A | | | 71,925 | |

| Transfer agent fees – Class A | | | 74,429 | |

| Transfer agent fees – Class I | | | 277,965 | |

| Transfer agent fees – Class Y | | | 419,002 | |

| Custodian fees | | | 27,684 | |

| Professional fees | | | 107,436 | |

| Registration fees – Class A | | | 24,051 | |

| Registration fees – Class I | | | 20,940 | |

| Registration fees – Class Y | | | 27,951 | |

| Reports to shareholders | | | 90,518 | |

| Insurance | | | 25,077 | |

| Trustees’ fees and expenses | | | 182,253 | |

| Other | | | 10,801 | |

| Total expenses | | | 5,009,553 | |

| Waiver of management fees | | | (1,645,687 | ) |

| Net expenses | | | 3,363,866 | |

| Net investment income | | | 7,310,150 | |

| Net realized gain on: | | | | |

| Investments | | | 923 | |

| Swap contracts | | | 13,742,736 | |

| Net realized gain | | | 13,743,659 | |

| Net change in net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 38,946 | |

| Swap contracts | | | 16,545,803 | |

| Net change in unrealized appreciation (depreciation) | | | 16,584,749 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 37,638,558 | |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended

December 31,

2019 | | | Year Ended

December 31,

2018 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 7,310,150 | | | $ | 5,088,993 | |

| Net realized gain (loss) | | | 13,743,659 | | | | (38,959,661 | ) |

| Net change in unrealized appreciation (depreciation) | | | 16,584,749 | | | | (23,181,525 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 37,638,558 | | | | (57,052,193 | ) |

| Distributions to shareholders: | | | | | | | | |

| Class A Shares | | | (223,974 | ) | | | (155,947 | ) |

| Class I Shares | | | (2,276,974 | ) | | | (1,874,989 | ) |

| Class Y Shares | | | (2,601,306 | ) | | | (1,671,466 | ) |

| Total distributions | | | (5,102,254 | ) | | | (3,702,402 | ) |

| Share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| Class A Shares | | | 9,945,004 | | | | 20,394,798 | |

| Class I Shares | | | 106,661,636 | | | | 134,714,965 | |

| Class Y Shares | | | 74,346,188 | | | | 130,900,874 | |

| | | | 190,952,828 | | | | 286,010,637 | |

| Reinvestment of distributions | | | | | | | | |

| Class A Shares | | | 151,697 | | | | 119,745 | |

| Class I Shares | | | 970,897 | | | | 1,057,340 | |

| Class Y Shares | | | 2,573,715 | | | | 1,641,482 | |

| | | | 3,696,309 | | | | 2,818,567 | |

| Cost of shares redeemed | | | | | | | | |

| Class A Shares | | | (14,978,313 | ) | | | (9,623,579 | ) |

| Class I Shares | | | (140,738,163 | ) | | | (69,932,816 | ) |

| Class Y Shares | | | (66,236,967 | ) | | | (67,557,151 | ) |

| | | | (221,953,443 | ) | | | (147,113,546 | ) |

| Net increase (decrease) in net assets resulting from share transactions | | | (27,304,306 | ) | | | 141,715,658 | |

| Total increase in net assets | | | 5,231,998 | | | | 80,961,063 | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 463,494,318 | | | | 382,533,255 | |

| End of year | | $ | 468,726,316 | | | $ | 463,494,318 | |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year:

| | | Class A |

| | | Year Ended December 31, |

| | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| Net asset value, beginning of year | | | | $4.29 | | | | | $4.87 | | | | | $4.76 | | | | | $4.55 | | | | | $6.09 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b) | | | | 0.06 | | | | | 0.04 | | | | | (0.01 | ) | | | | (0.03 | ) | | | | (0.05 | ) |

| Net realized and unrealized gain (loss) on investments | | | | 0.30 | | | | | (0.60 | ) | | | | 0.32 | | | | | 0.71 | | | | | (1.49 | ) |

| Total from investment operations | | | | 0.36 | | | | | (0.56 | ) | | | | 0.31 | | | | | 0.68 | | | | | (1.54 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | (0.04 | ) | | | | (0.02 | ) | | | | (0.20 | ) | | | | (0.47 | ) | | | | — | |

| Net asset value, end of year | | | | $4.61 | | | | | $4.29 | | | | | $4.87 | | | | | $4.76 | | | | | $4.55 | |

| Total return (a) | | | | 8.37 | % | | | | (11.42 | )% | | | | 6.58 | % | | | | 15.01 | % | | | | (25.29 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $26,932 | | | $29,682 | | | $22,189 | | | $26,835 | | | $28,678 | |

| Ratio of gross expenses to average net assets | | | | 1.43 | % | | | | 1.39 | % | | | | 1.41 | % | | | | 1.31 | % | | | | 1.25 | % |

| Ratio of net expenses to average net assets | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % |

| Ratio of net expenses to average net assets, excluding interest expense | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 0.95 | % |

| Ratio of net investment income (loss) to average net assets | | | | 1.24 | % | | | | 0.88 | % | | | | (0.12 | )% | | | | (0.70 | )% | | | | (0.92 | )% |

| Portfolio turnover rate | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of year, reinvestment of any dividends and distributions at net asset value on the dividend/distributions payment date and a redemption at the net asset value on the last day of the year. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

| (b) | Calculated based upon average shares outstanding. |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year:

| | | Class I |

| | | Year Ended December 31, |

| | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| Net asset value, beginning of year | | | | $4.39 | | | | | $4.98 | | | | | $4.86 | | | | | $4.63 | | | | | $6.16 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b) | | | | 0.07 | | | | | 0.06 | | | | | 0.01 | | | | | (0.02 | ) | | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments | | | | 0.30 | | | | | (0.61 | ) | | | | 0.32 | | | | | 0.72 | | | | | (1.50 | ) |

| Total from investment operations | | | | 0.37 | | | | | (0.55 | ) | | | | 0.33 | | | | | 0.70 | | | | | (1.53 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | (0.05 | ) | | | | (0.04 | ) | | | | (0.21 | ) | | | | (0.47 | ) | | | | — | |

| Net asset value, end of year | | | | $4.71 | | | | | $4.39 | | | | | $4.98 | | | | | $4.86 | | | | | $4.63 | |

| Total return (a) | | | | 8.55 | % | | | | (11.13 | )% | | | | 6.95 | % | | | | 15.18 | % | | | | (24.84 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $195,270 | | | $214,324 | | | $177,578 | | | $136,710 | | | $107,459 | |

| Ratio of gross expenses to average net assets | | | | 0.97 | % | | | | 0.90 | % | | | | 0.92 | % | | | | 0.91 | % | | | | 0.90 | % |

| Ratio of net expenses to average net assets | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % |

| Ratio of net expenses to average net assets, excluding interest expense | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % | | | | 0.65 | % |

| Ratio of net investment income (loss) to average net assets | | | | 1.50 | % | | | | 1.19 | % | | | | 0.20 | % | | | | (0.39 | )% | | | | (0.62 | )% |

| Portfolio turnover rate | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of year, reinvestment of any dividends and distributions at net asset value on the dividend/distributions payment date and a redemption at the net asset value on the last day of the year. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends distributions or the redemption of Fund shares. |

| (b) | Calculated based upon average shares outstanding. |

See Notes to Consolidated Financial Statements

CM COMMODITY INDEX FUND

CONSOLIDATED FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year:

| | | Class Y |

| | | Year Ended December 31, |

| | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| Net asset value, beginning of year | | | | $4.37 | | | | | $4.96 | | | | | $4.85 | | | | | $4.62 | | | | | $6.15 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (b) | | | | 0.07 | | | | | 0.06 | | | | | 0.01 | | | | | (0.02 | ) | | | | (0.04 | ) |

| Net realized and unrealized gain (loss) on investments | | | | 0.31 | | | | | (0.62 | ) | | | | 0.31 | | | | | 0.72 | | | | | (1.49 | ) |

| Total from investment operations | | | | 0.38 | | | | | (0.56 | ) | | | | 0.32 | | | | | 0.70 | | | | | (1.53 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | (0.05 | ) | | | | (0.03 | ) | | | | (0.21 | ) | | | | (0.47 | ) | | | | — | |

| Net asset value, end of year | | | | $4.70 | | | | | $4.37 | | | | | $4.96 | | | | | $4.85 | | | | | $4.62 | |

| Total return (a) | | | | 8.73 | % | | | | (11.23 | )% | | | | 6.71 | % | | | | 15.24 | % | | | | (24.88 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $246,525 | | | $219,489 | | | $182,766 | | | $135,589 | | | $83,425 | |

| Ratio of gross expenses to average net assets | | | | 1.04 | % | | | | 1.12 | % | | | | 0.97 | % | | | | 0.99 | % | | | | 1.00 | % |

| Ratio of net expenses to average net assets | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % |

| Ratio of net expenses to average net assets, excluding interest expense | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % | | | | 0.70 | % |

| Ratio of net investment income (loss) to average net assets | | | | 1.53 | % | | | | 1.14 | % | | | | 0.15 | % | | | | (0.43 | )% | | | | (0.67 | )% |

| Portfolio turnover rate | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % | | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of year, reinvestment of any dividends and distributions at net asset value on the dividend/distributions payment date and a redemption at the net asset value on the last day of the year. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

| (b) | Calculated based upon average shares outstanding. |

See Notes to Consolidated Financial Statements

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2019

Note 1—Fund Organization—VanEck Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on April 3, 1985. The CM Commodity Index Fund (the “Fund”) is a diversified series of the Trust and seeks to track, before fees and expenses, the performance of the UBS Bloomberg Constant Maturity Commodity Total Return Index. The Fund may effect certain investments through the Commodities Series Fund I Subsidiary (the “Subsidiary”), a wholly-owned subsidiary. The Fund offers three classes of shares: Class A, I and Y Shares. Each share class represents an interest in the same portfolio of investments of the Fund and is substantially the same in all respects, except that the classes are subject to different distribution fees and sales charges. Class I and Y Shares are sold without a sales charge; Class A Shares are sold subject to a front-end sales charge. The Van Eck Absolute Return Advisers Corporation (the “Adviser”) is the investment adviser to the Fund and its Subsidiary.

Note 2—Significant Accounting Policies—The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The Fund is an investment company and follows accounting and reporting requirements of Accounting Standards Codification (“ASC”) 946Financial Services – Investment Companies.

The following is a summary of significant accounting policies followed by the Fund.

| A. | Security Valuation—The Fund values its investments in securities and other assets and liabilities at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Debt securities are valued on the basis of evaluated prices furnished by an independent pricing service approved by the Fund’s Board of Trustees or provided by securities dealers. The pricing services may use valuation models or matrix pricing, which consider: (i) yield or price with respect to bonds that are considered comparable in characteristics such as rating, interest rate and maturity date and/or (ii) quotations from bond dealers to determine current value and are categorized as Level 2 in the fair value hierarchy (as described below). Short-term obligations with sixty days or less to maturity are valued at amortized cost, which with accrued interest |

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

approximates fair value. Open-end mutual fund investments (including money market funds) are valued at their closing net asset value each business day and are categorized as Level 1 in the fair value hierarchy. Swap contracts are marked to market daily using either pricing vendor quotations, counterparty prices or model prices and the net change in value, if any, is regarded as an unrealized gain or loss and is categorized as Level 2 in the fair value hierarchy. The Pricing Committee of the Adviser provides oversight of the Fund’s valuation policies and procedures, which are approved by the Fund’s Board of Trustees. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities dealers, and other market sources to determine fair value. The Pricing Committee convenes regularly to review the fair value of financial instruments or other assets. If market quotations for a security or other asset are not readily available, or if the Adviser believes they do not otherwise reflect the fair value of a security or asset, the security or asset will be fair valued by the Pricing Committee in accordance with the Fund’s valuation policies and procedures. The Pricing Committee employs various methods for calibrating the valuation approaches utilized to determine fair value, including a regular review of key inputs and assumptions, periodic comparisons to valuations provided by other independent pricing services, transactional back-testing and disposition analysis.

Certain factors such as economic conditions, political events, market trends, the nature of and duration of any restrictions on disposition, trading in similar securities of the issuer or comparable issuers and security specific information are used to determine the fair value of these securities. Depending on the relative significance of valuation inputs, these securities may be classified either as Level 2 or Level 3 in the fair value hierarchy. The price which the Fund may realize upon sale of an investment may differ materially from the value presented in the Consolidated Schedule of Investments.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis which includes a hierarchy that prioritizes inputs to valuation methods used to measure fair value. The fair value hierarchy gives highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three levels of the fair value hierarchy are described below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

A summary of the inputs and the levels used to value the Fund’s investments are located in the Consolidated Schedule of Investments. Additionally, tables that reconcile the valuation of the Fund’s Level 3 investments and that present additional information about the valuation methodologies and unobservable inputs, if applicable, are located in the Consolidated Schedule of Investments.

| B. | Basis for Consolidation—The Commodities Series Fund I Subsidiary, a Cayman Islands exempted company, was incorporated on June 26, 2009. Consolidated financial statements of the Fund present the financial position and results of operations for the Fund and its wholly-owned Subsidiary. All interfund account balances and transactions between the parent and subsidiary have been eliminated in consolidation. As of December 31, 2019, the Fund held $94,101,495 in its Subsidiary, representing 20% of the Fund’s net assets. |

| C. | Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute all of its net investment income and net realized capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. |

The wholly owned Subsidiary of the Fund is classified as a controlled foreign corporation (“CFC”) under the Code. For U.S. tax purposes, a CFC is not subject to U.S. income tax. However, as a wholly owned CFC, its net income and capital gains, to the extent of its earnings and profits, will be included each year in the Fund investment company taxable income. Net losses of the CFC cannot be deducted by the Fund in the current year, nor carried forward to offset taxable income in future years.

| D. | Dividends and Distributions to Shareholders—Dividends to shareholders from net investment income and distributions from net realized capital gains, if any, are declared and paid annually. Income dividends and capital gain distributions are determined in accordance with U.S. income tax regulations, which may differ from such amounts determined in accordance with GAAP. |

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

| E. | Use of Derivative Instruments—The Fund may investment in derivative instruments, including, but not limited to, options, futures, swaps and forward foreign currency contracts. A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. Derivative instruments may be privately negotiated contracts (often referred to as over-the-counter (“OTC”) derivatives) or they may be listed and traded on an exchange. Derivative contracts may involve future commitments to purchase or sell financial instruments or commodities at specified terms on a specified date, or to exchange interest payment streams or currencies based on a notional or contractual amount. Derivative instruments may involve a high degree of financial risk. The use of derivative instruments also involves the risk of loss if the investment adviser is incorrect in its expectation of the timing or level of fluctuations in securities prices, interest rates or currency prices. Investments in derivative instruments also include the risk of default by the counterparty, the risk that the investment may not be liquid and the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument. GAAP requires enhanced disclosures about the Fund’s derivative instruments and hedging activities. Details of these disclosures are found below as well as in the Consolidated Schedule of Investments. |

Total Return Swaps—The Fund enters into total return swaps in order take a “long” position with respect to an underlying referenced asset. The Fund is subject to market price volatility of the underlying referenced asset. A total return swap involves commitments to pay interest in exchange for a market linked return based on a notional amount. To the extent that the total return of the security, group of securities or index underlying the transaction exceeds or falls short of the offsetting interest obligation, the Fund will receive a payment from or make a payment to the counterparty. Documentation governing the Fund’s swap transactions may contain provisions for early termination of a swap in the event the net assets of the Fund decline below specific levels set forth in the documentation (“net asset contingent features”). If these levels are triggered, the Fund’s counterparty has the right to terminate the swap and require the Fund to pay or receive a settlement amount in connection with the terminated swap transaction. The total return swap position held by the Fund at December 31, 2019 is reflected in the Fund’s Consolidated Schedule of Investments. The average monthly

notional amount was $486,781,846 during the year ended December 31, 2019.

At December 31, 2019, the Fund held the following derivatives (not designated as hedging instruments under GAAP):

| | Asset |

| | Derivatives |

| | Commodities |

| | Futures Risk |

| Swap contracts1 | $3,602,327 |

| 1 | Consolidated Statement of Assets and Liabilities location: Total return swap contracts, at value |

The impact of transactions in derivative instruments during the year ended December 31, 2019, was as follows:

| | Commodities |

| | Futures Risk |

| Realized gain: | |

| Swap contracts1 | $13,742,736 |

| | |

| Net change in unrealized appreciation (depreciation): | |

| Swap contracts2 | 16,545,803 |

| 1 | Consolidated Statement of Operations location: Net realized gain on swap contracts |

| 2 | Consolidated Statement of Operations location: Net change in unrealized appreciation (depreciation) on swap contracts |

| F. | Offsetting Assets and Liabilities—In the ordinary course of business, the Fund enters into transactions subject to enforceable master netting agreements or other similar agreements. Generally, the right of offset in those agreements allows the Fund to offset any exposure to a specific counterparty with any collateral received from or delivered to that counterparty based on the terms of the agreements. The Fund may pledge or receive cash and/or securities as collateral for derivative instruments and securities lending. Collateral held for derivative instruments at December 31, 2019 is presented in the Consolidated Schedule of Investments. |

For financial reporting purposes, the Fund presents securities lending assets and liabilities on a gross basis in the Consolidated Statement of Assets and Liabilities. Cash collateral held in the form of money market investments, if any, for securities loaned at December 31, 2019 is presented in the Consolidated Schedule of Investments and in the Consolidated Statement of Assets and Liabilities. Non-cash collateral is disclosed in Note 9 (Securities Lending).

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

Additionally, the Fund presents derivatives instruments on a gross basis in the Consolidated Statement of Assets and Liabilities. The table below includes both gross and net information about the derivative instruments eligible for offset in the Consolidated Statement of Assets and Liabilities subject to master netting agreement or similar agreements, as well as financial collateral received or pledged (including cash collateral) as of December 31, 2019. The total amount of collateral reported, if any, is limited to the net amounts of financial assets and liabilities presented in the Consolidated Statement of Assets and Liabilities for the respective financial instruments. In general, collateral received or pledged exceeds the net amount of the unrealized gain/loss or market value of financial instruments.

| | | | | | | Net Amount | | | | |

| | | | | Gross | | of Assets | | | | |

| | | | | Amount | | Presented | | | | |

| | | | | Offset in the | | in the | | Financial | | |

| | | Gross | | Consolidated | | Consolidated | | Instruments | | |

| | | Amount of | | Statement of | | Statements | | and Cash | | |

| | | Recognized | | Assets and | | of Assets | | Collateral | | Net |

| | | Assets | | Liabilities | | and Liabilities | | Received | | Amount |

| Total return swap contracts | | $3,602,327 | | $— | | $3,602,327 | | $— | | $3,602,327 |

| G. | Other—Security transactions are accounted for on trade date. Realized gains and losses are determined based on the specific identification method. Dividend income is recorded on the ex-dividend date. Income, non-class specific expenses, gains and losses on investments are allocated to each class of shares based on its relative net assets. Expenses directly attributable to a specific class are charged to that class. |

The Fund earns interest income on uninvested cash balances held at the custodian bank, such amounts, if any, are presented as interest income in the Consolidated Statement of Operations.

In the normal course of business, the Fund enter into contracts that contain a variety of general indemnifications. The Fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the investment adviser believes the risk of loss under these arrangements to be remote.

Note 3—Investment Management and Other Agreements—The Adviser receives a management fee, calculated daily and payable monthly based on an annual rate of 0.75% of the Fund’s average daily net assets.

The Adviser has agreed, until at least May 1, 2020, to waive management fees and assume expenses to prevent the Fund’s total annual operating expenses

(excluding acquired fund fees and expenses, interest expense, trading expenses, dividends and interest payments on securities sold short, taxes, and extraordinary expenses) from exceeding the expense limitations listed in the table below.

The current expense limitations and the amounts waived by the Adviser for the year ended December 31, 2019, are as follows:

| | | | | Waiver of |

| | | Expense | | Management |

| | | Limitation | | Fees |

| Class A | | | 0.95 | % | | $ | 138,527 | |

| Class I | | | 0.65 | | | | 731,370 | |

| Class Y | | | 0.70 | | | | 775,790 | |

For the year ended December 31, 2019, Van Eck Securities Corporation (the “Distributor”), and affiliate of the Adviser, received a total of $14,031 in sales loads relating to the sale of shares of the Fund, of which $12,434 was reallowed to broker/dealers and the remaining $1,597 was retained by the Distributor.

Certain officers of the Trust are officers, directors or stockholders of the Adviser and the Distributor.

State Street Bank and Trust Company is the Fund’s custodian and securities lending agent.

Note 4—12b-1 Plan of Distribution—Pursuant to a Rule 12b-1 Plan of Distribution (the “Plan”), the Fund is authorized to incur distribution expenses which will principally be payments to securities dealers who have sold shares and serviced shareholder accounts, and payments to the Distributor for reimbursement of other actual promotion and distribution expenses incurred by the Distributor on behalf of the Fund. The amount paid under the Plan in any one year is limited to 0.25% of average daily net assets for Class A Shares and is recorded as Distribution fees in the Consolidated Statement of Operations.

Note 5—Investments—During the year ended December 31, 2019, the Fund had no purchases and sales of investments, other than U.S. government securities and short-term obligations.

Note 6—Income Taxes—As of December 31, 2019, for Federal income tax purposes, the identified cost of investments owned, net unrealized appreciation (depreciation), gross unrealized appreciation, and gross unrealized depreciation of investments were as follows:

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

| | | Gross | | Gross | | Net Unrealized |

| Cost of | | Unrealized | | Unrealized | | Appreciation |

| Investments | | Appreciation | | Depreciation | | (Depreciation) |

| $511,677,380 | | $26,448,747 | | $(45,421,692) | | $(18,972,945) |

At December 31, 2019, the components of accumulated earnings (deficit) on a tax basis, for the Fund, were as follows:

| | | | | | | | | Total |

| Undistributed | | Accumulated | | Other | | Unrealized | | Distributable |

| Ordinary | | Capital | | Temporary | | Appreciation | | Earnings |

| Income | | Losses | | Differences | | (Depreciation) | | (Loss) |

| $230,266 | | $(834) | | $(293,621) | | $(41,764,197) | | $(41,828,386) |

The tax character of dividends paid to shareholders were as follows:

| | | Year Ended | | Year Ended |

| | | December 31, 2019 | | December 31, 2018 |

| Ordinary income | | $5,102,254 | | $3,702,402 |

At December 31, 2019, the Fund had capital loss carryforwards available to offset future capital gains, as follows:

| | Short-Term |

| | Capital Losses |

| | with No Expiration |

| | $(834) |

Additionally, the Fund utilized $395 of its capital loss carryover available from prior years.

During the year ended December 31, 2019, as a result of permanent book to tax differences primarily due to differences in the treatment of income and realized gains from the Fund’s controlled foreign corporation subsidiary, the Fund incurred differences that affected net distributable earnings and aggregate paid in capital by the amounts in the table below. Net assets were not affected by these reclassifications.

| Increase | | |

| (Decrease) | | Increase |

| in Distributable | | (Decrease) |

| Earnings | | in Paid-in-Capital |

| $(15,921,955) | | $15,921,955 |

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more-likely-than-not” to be sustained assuming examination by applicable tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on return filings for all open tax years. The Fund does not have exposure for additional years that might

still be open in certain foreign jurisdictions. Therefore, no provision for income tax is required in the Fund’s financial statements. However, the Fund is subject to foreign taxes on the appreciation in value of certain investments. The Fund provides for such taxes, if any, on both realized and unrealized appreciation.

The Fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Consolidated Statement of Operations. During the year ended December 31, 2019, the Fund did not incur any interest or penalties.

Note 7—Principal Risks—The Fund may invest in commodity-linked derivative instruments, including commodity index-linked notes, swap agreements, commodity futures contracts and options on futures contracts that provide economic exposure to the investment returns of the commodities markets. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Derivative strategies often involve leverage, which may exaggerate a loss, potentially causing the Fund to lose more money than it would have lost had it invested in the underlying security. The value of commodity-linked derivative instruments may be affected by overall market movements and other factors affecting the value of a particular industry or commodity, such as weather, disease, embargoes, or political and economic events and regulatory developments. Exposure to the commodities markets, such as precious metals, industrial metals, natural resources, and gas and other energy products, may subject the Fund to greater volatility than investments in traditional securities.

Changes in laws or government regulations by the United States and/or the Cayman Islands could adversely affect the operations of the Fund.

A more complete description of risks is included in the Fund’s Prospectus and Statement of Additional Information.

Note 8—Shareholder Transactions—Shares of beneficial interest issued, reinvested and redeemed (unlimited number of $0.001 par value shares authorized):

| | | Year Ended | | Year Ended |

| | | December 31, 2019 | | December 31, 2018 |

| Class A | | | | | | | | |

| Shares sold | | | 2,191,177 | | | | 4,381,056 | |

| Shares reinvested | | | 33,121 | | | | 27,719 | |

| Shares redeemed | | | (3,295,795 | ) | | | (2,045,237 | ) |

| Net increase (decrease) | | | (1,071,497 | ) | | | 2,363,538 | |

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

| | | Year Ended | | Year Ended |

| | | December 31, 2019 | | December 31, 2018 |

| Class I | | | | | | | | |

| Shares sold | | | 22,942,274 | | | | 27,967,057 | |

| Shares reinvested | | | 207,456 | | | | 239,217 | |

| Shares redeemed | | | (30,555,856 | ) | | | (15,007,475 | ) |

| Net increase (decrease) | | | (7,406,126 | ) | | | 13,198,799 | |

| Class Y | | | | | | | | |

| Shares sold | | | 16,080,750 | | | | 27,277,400 | |

| Shares reinvested | | | 551,117 | | | | 373,064 | |

| Shares redeemed | | | (14,334,406 | ) | | | (14,282,920 | ) |

| Net increase | | | 2,297,461 | | | | 13,367,544 | |

Note 9—Securities Lending—To generate additional income, the Fund may lend its securities pursuant to a securities lending agreement with the securities lending agent. The Fund may lend up to 33% of its investments requiring that the loan be continuously collateralized by cash, cash equivalents, U.S. government securities, or any combination of cash and such securities at all times equal to at least 102% (105% for foreign securities) of the market value plus accrued interest on the securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. During the term of the loan, the Fund will continue to receive any dividends, interest or amounts equivalent thereto, on the securities loaned while receiving a fee from the borrower and/or earning interest on the investment of the cash collateral. Such fees and interest are shared with the securities lending agent under the terms of the securities lending agreement. Securities lending income is disclosed as such in the Consolidated Statement of Operations. The cash collateral is maintained on the Fund’s behalf by the lending agent and is invested in the State Street Navigator Securities Lending Government Money Market Portfolio. Non-cash collateral consists of U.S. Treasuries and U.S. Government Agency securities, and is not disclosed in the Fund’s Consolidated Schedule of Investments or Consolidated Statement of Assets and Liabilities as it is held by the agent on behalf of the Fund, and the Fund does not have the ability to re-hypothecate those securities. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the Fund securities identical to the securities loaned. The Fund bears the risk of delay in recovery of, or even loss of rights in, the securities loaned should the borrower of the securities fail financially. The value of loaned securities and related cash collateral, if any, at December 31, 2019 is presented on a gross basis in the Consolidated Schedule of Investments and Consolidated Statement of Assets and Liabilities.

The following is a summary of the Fund’s securities on loan and related collateral as of December 31, 2019:

Market Value

of Securities

on Loan | | Cash

Collateral | | Non-Cash

Collateral | | Total Collateral |

| $105,369,695 | | $24,712,151 | | $82,810,538 | | $107,522,689 |

The following table presents money market fund investments held as collateral by type of security on loan as of December 31, 2019:

| | | Gross Amount of

Recognized Liabilities

for Securities Loaned

in the Statements of

Assets and Liabilities* |

| Equity Securities | | $24,712,151 |

* Remaining contractual maturity of the agreements: overnight and continuous

Note 10—Bank Line of Credit—The Trust participates with VanEck VIP Trust (collectively the “VE/VIP Funds”) in a $30 million committed credit facility (the “Facility”) to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the participating Fund and other temporary or emergency purposes. The participating VE/VIP Funds have agreed to pay commitment fees, pro rata, based on the unused but available balance. Interest is charged to the participating VE/VIP Funds at rates based on prevailing market rates in effect at the time of borrowings. During the year end December 31, 2019, the Fund had no outstanding borrowings under the Facility.

Note 11—Trustee Deferred Compensation Plan—The Trust has a Deferred Compensation Plan (the “Deferred Plan”) for Trustees under which the Trustees can elect to defer receipt of their trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in eligible shares of the VE/VIP Funds as directed by the Trustees.

The expense for the Deferred Plan is included in “Trustees’ fees and expenses” in the Consolidated Statement of Operations. The liability for the Deferred Plan is shown as “Deferred Trustee fees” in the Consolidated Statement of Assets and Liabilities.

Note 12—Recent Accounting Pronouncements—The Fund early adopted certain provisions of Accounting Standards Update No. 2018-13Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement(“ASU 2018-13”) that eliminate and modify certain disclosure

CM COMMODITY INDEX FUND

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)

requirements for fair value measurements. The adoption of certain provisions of ASU 2018-13 had no material effect on the financial statements and related disclosures. Management evaluated the additional requirements, not yet adopted, and they are not expected to have a material impact to the financial statements. Public companies will be required to disclose the range and weighted average of significant unobservable inputs for Level 3 fair value measurements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years.

Note 13—Subsequent Event Review—The Fund has evaluated subsequent events and transactions for potential recognition or disclosure through the date the financial statements were issued.

VANECK CM COMMODITY INDEX FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of CM Commodity Index Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities of CM Commodity Index Fund (the “Fund”) (one of the series constituting VanEck Funds (the “Trust”)), including the consolidated schedule of investments, as of December 31, 2019, and the related consolidated statement of operations for the year then ended, the consolidated statements of changes in net assets for each of the two years in the period then ended, the consolidated financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the consolidated financial position of CM Commodity Index Fund (one of the series constituting VanEck Funds) at December 31, 2019, the consolidated results of its operations for the year then ended, the consolidated changes in its net assets for each of the two years in the period then ended and its consolidated financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more of the VanEck investment companies since 1999.

New York, New York

February 27, 2020

VANECK CM COMMODITY INDEX FUND

TAX INFORMATION

(unaudited)

The following information is provided with respect to the distributions paid during the taxable year ended December 31, 2019. Please consult your tax advisor for proper treatment of this information.

| Record Date: | 12/20/2019 | |

| Ex and Payable Date: | 12/23/2019 | |

| Ordinary Income Paid Per Share - Class A | $0.03870 | |

| Ordinary Income Paid Per Share - Class I | $0.05450 | |

| Ordinary Income Paid Per Share - Class Y | $0.05050 | |

| Qualified Dividend Income for Individuals | 0.00 | % |

| Dividends Qualifying for the Dividends Received Deduction for Corporations | 0.00 | % |

| Interest from Federal Obligations | 99.90 | % |

The interest from Federal obligations represents income derived from assets backed by the full faith and credit of the U.S. Government. State law varies as to what percentage of this dividend income is exempt from state income tax.

VANECK FUNDS

SPECIAL MEETING OF SHAREHOLDERS

October 11, 2019 (unaudited)

VANECK FUNDS

CM Commodity Index Fund

Emerging Markets Fund

Global Hard Assets Fund

International Investors Gold Fund

Unconstrained Emerging Markets Bond Fund

VanEck Morningstar Wide Moat Fund

VanEck NDR Managed Allocation Fund

A Special Meeting of Shareholders of VanEck Funds (the “Trust”) was held at the offices of the Trust, 666 Third Avenue, 9th Floor, New York, New York 10017 on October 11, 2019. The purpose of the meeting was to elect Trustees of the Trust. At the meeting, the following persons were elected by the shareholders to serve as Trustees of the Trust: Jon Lukomnik, Jane DiRenzo Pigott, R. Alastair Short, Richard D. Stamberger, Robert L. Stelzl, and Jan F. van Eck. No other business was transacted at the meeting.

The results of the voting at the meeting are as follows:

Proposal: To elect a Board of Trustees*:

| Name | For | Withheld |

| Jon Lukomnik | 239,074,404.179 | 1,973,903.626 |

| Jane DiRenzo Pigott | 239,734,349.197 | 1,313,958.608 |

| R. Alastair Short | 239,059,688.386 | 1,988,619.419 |

| Richard D. Stamberger | 239,110,733.308 | 1,937,574.497 |

| Robert L. Stelzl | 239,042,995.154 | 2,005,312.651 |

| Jan F. van Eck | 239,874,952.434 | 1,173,355.371 |

| Total Trust Shares Outstanding**: 327,471,673.186 |

| * | Results are for all series portfolios within the Trust. |

| ** | As of the record date. |

VANECK FUNDS

BOARD OF TRUSTEES AND OFFICERS

December 31, 2019 (unaudited)

Trustee Information

The Trustees of the Trust, their address, position with the Trust, age and principal occupations during the past five years, as of January 1, 2020, are set forth below:

Trustee’s Name,

Address(1)and

Year of Birth | | Position(s) Held With Trust,

Term of Office(2)and

Length of Time Served | | Principal Occupation(s)

During Past Five Years | | Number of

Portfolios

In Fund

Complex(3)

Overseen

By Trustee | | Other Directorships Held Outside The

Fund Complex(3)During The Past Five Years |

| | | | | | | | | |