UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04297

VANECK FUNDS

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 Third Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: DECEMBER 31, 2021

| Item 1. | REPORTS TO SHAREHOLDERS. |

| ANNUAL REPORT

December 31, 2021 |

VanEck Funds

CM Commodity Index Fund

Emerging Markets Bond Fund

Emerging Markets Fund

Environmental Sustainability Fund

Global Resources Fund

International Investors Gold Fund

VanEck Morningstar Wide Moat Fund

VanEck NDR Managed Allocation Fund

Certain information contained in this report represents the opinion of the investment adviser which may change at any time. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings, the Funds’ performance, and the views of the investment adviser are as of December 31, 2021.

PRIVACY NOTICE

(unaudited)

| FACTS | WHAT DOES VANECK DO WITH YOUR PERSONAL

INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number and account balances ■ assets and payment history ■ risk tolerance and transaction history |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons VanEck chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does VanEck share? | Can you limit this sharing? |

| For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes— to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | Yes | No |

| For our affiliates’ everyday business purposes— information about your transactions and experiences | Yes | No |

| For our affiliates’ everyday business purposes— information about your creditworthiness | No | We don’t share |

| For our affiliates to market to you | Yes | Yes |

| For our nonaffiliates to market to you | No | We don’t share |

To limit our

sharing | Call us at 1-800-826-2333. Please note: If you are a new customer, we can begin sharing your information 30 days from the date we sent this notice. When you are no longer our customer, we continue to share your information as described in this notice. However, you can contact us at any time to limit our sharing. |

| Questions? | Call us at 1-800-826-2333. |

| | |

| Who we are |

| Who is providing this notice? | Van Eck Associates Corporation (“VEAC”), Van Eck Absolute Return Advisers Corporation (“VEARA”) and Van Eck Securities Corporation, and funds sponsored by VEAC or VEARA (collectively, “VanEck”). |

| What we do |

| How does VanEck protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does VanEck collect my information | We collect your personal information, for example, when you ■ open an account or give us your income information ■ provide employment information or give us your contact information ■ tell us about your investment or retirement portfolio We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes—information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. See below for more on your rights under state law. |

| What happens when I limit sharing for an account I hold jointly with someone else? | Your choices will apply to everyone on your account—unless you tell us. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Our affiliates include companies with a VanEck name such as VanEck |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ VanEck does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ Our joint marketing partners include financial services companies. |

PRIVACY NOTICE

(unaudited) (continued)

| Other important information |

| California Residents—In accordance with California law, we will not share information we collect about California residents with nonaffiliates except as permitted by law, such as with the consent of the customer or to service the customer’s accounts. We also will limit the sharing of information about you with our affiliates to the extent required by applicable California law. |

| Vermont Residents—In accordance with Vermont law, we will not share information we collect about Vermont residents with nonaffiliates except as permitted by law, such as with the consent of the customer or to service the customer’s accounts. We will not share creditworthiness information about Vermont residents among VanEck’s affiliates except with the authorization or consent of the Vermont resident. |

VANECK FUNDS

PRESIDENT’S LETTER

December 31, 2021 (unaudited)

Dear Fellow Shareholders:

This letter addresses two topics: a review of the markets today and, second, two multi-year themes.

The Economy

In 2021, the year began with the global economy hurtling forward like a car at top speed. But in the fall, the Fed started reducing its stimulative policies, especially as inflation statistics hit multi-decade highs.

As this point, the markets face several points of uncertainty. The most important concern is: will the Fed “hit the brakes” too hard as it reduces stimulus measures? But also, since China has been a large driver of global growth over the past 20 years, how long will China’s slow-down last and how deep will it be? Will Chinese policymakers stimulate the economy if growth slows too much?

“Net net”, I think our economy and markets can handle the withdrawal of Fed stimulus. While market returns may underwhelm in 2022, there is no reason to sell and try to time the market.

I expect that inflation will persist because I believe that deflation over the past 20 years was primarily driven by the supply shock as China joined the world economy. As a counter-example, there was inflation in the 1970s, and do we think there was no technology applied in that decade?

We are still debating whether we have an inflation problem. And I continue to believe that only later this year will we know whether we have permanent inflation—after all the COVID-19 distortions are behind us.

It is true that we are talking about supply chain issues and labor market issues longer than the transitory camp would like. But, while commodity price inflation matters, the real concern about inflation and financial markets is wage inflation, since this tends to be longer-lasting and may affect long-term interest rates. I believe that the tight labor conditions we have today will persist, even as the economy slows down.

If inflation doesn’t push rates higher, I don’t think the Fed will hit the brakes too hard by raising rates further than they have already indicated. Toward the end of last year, Bank of America released a research note1 that said over half of the S&P 500® Index’s returns in the past decade can be attributed to the Fed’s balance sheet expansion, rather than earnings. We live in an era in which the Fed has an eye on the financial markets. We still see little reason why that would change.

As to China, at the end of December 2021, the official purchasing managers’ indices (PMIs), our favorite indicators, showed signs of improvement for the second month in a row. This was a welcome development. But multiple growth headwinds remain: the small companies’ PMI sinking to 46.5 (the lowest since February 2020) was a firm reminder that the dovish policy tilt is justified, with more targeted support expected in the coming months. Despite this, though, we think policy makers have all the tools, including liquidity moves, to avoid a crash.

Multi-Year Investment Themes

So what to do in your portfolio? We continue to focus on two multi-year investment themes.

The first theme is the energy transition away from fossil fuels. We see this not only as being driven by government policy, but also by innovation in the private sector. In our resources portfolios, we’re looking for disruptive companies in the sectors that need to be more energy efficient. One is agriculture (which emits about as much CO2 as the energy sector). AgTech businesses are embracing technology to modernize agriculture, leading to higher crop yields, safer crop chemicals and other innovations in food production to provide healthy diets for the world’s growing population.

As the economy grows and demand for commodities grows, increasing supply has become harder. This is in part due to environmental, social and governance (ESG) policies in place, causing “greenflation” and

VANECK FUNDS

PRESIDENT’S LETTER

(unaudited) (continued)

a multi-year trend of price pressure. Finding supply sources like new copper, lithium or gold mines is harder because of, to a certain extent, the environmental impact of these activities. I think this supply issue will continue to underpin commodity prices, and this is why I believe that commodity equities remain an interesting investment that people should have in their portfolios.

The second theme is the use of blockchain in a large variety of industries, but especially finance and entertainment. And especially in the field of “smart contracts.” New open source database technology is enabling incredibly rapid adoption and at much lower cost than traditional companies using prior generation technology. The fintech revolution that goes hand in hand with crypto is something we find really exciting. Of course there are some over-valued companies, but we think it’s another interesting multi-year trend that investors should consider.

We thank you for investing in VanEck’s investment strategies. On the following pages, you will find a performance discussion and financial statements for each the funds for the 12 month period ended December 31, 2021. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

CEO and President

VanEck Funds

January 19, 2022

PS The investing outlook can change suddenly, as it certainly did in 2021. To get our quarterly investment outlooks, please subscribe to “VanEck News & Insights”. Should you have any questions regarding fund performance, please contact us at 800.826.2333 or visit our website.

1Source: Bloomberg, https://www.bloomberg.com/news/articles/2021-09-08/bofa-s-subramanian-dumps-dire-stock-call-to-catch-up-with-rally

CM COMMODITY INDEX FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The CM (Constant Maturity) Commodity Index Fund (the “Fund”) gained 32.96% (Class A shares, excluding sales charge) for the 12 months ended December 31, 2021. The Fund underperformed by 1.92% the UBS Bloomberg Constant Maturity Commodity Total Return Index (the “CMCITR” or “Index”),1 which posted a gain of 34.88%.

During the 12 month period, the Fund continued to utilize commodity index-linked swaps as an effective means of gaining exposure to its benchmark the UBS Bloomberg Constant Maturity Commodity Total Return Index. While there are costs associated with the use of swaps, we continue to believe it is the most effective way of replicating CMCITR’s commodity exposures and weights.

Market Review

2021 was a very strong year for commodity index products producing the best returns since 2009. Several macroeconomic forces constrained supply and supported continued strong demand. Some of these trends are contributing to the inflationary pressures which may to persist for the long term.

Energy was the best performing sector for CMCITR, rising almost 60% for the year. U.S. unleaded gasoline rallied 67%, WTI crude oil over 61%, Brent crude oil over 56% and U.S. natural gas 53%. OPEC+ remained disciplined all year, balancing supply with the rising demand. Despite the continued COVID-19 disruptions, demand globally rebounded throughout the year. Longer term, continued lack of investment in new traditional energy production could keep supply constrained for many years. While investment is shifting away from traditional energy as the world transitions to cleaner renewable energy sources, all energy prices are likely to continue rising. CMCITR’s positioning along the forward curve provided extra roll yield vs BCOM in both WTI and Brent crude oil. Additionally CMCITR’s monthly rebalancing added to returns in U.S. natural gas vs BCOM when prices spiked in the late-summer/early-fall.

The CMCITR Agriculture sector finished the year up nearly 29% on strong gains in most commodities. Corn rising over 39% provided most of the index gains, but coffee up nearly 63% and soybean oil up over 56% also contributed. Weather in South America, coupled with low global inventories and strong demand from China, pushed prices higher. Low inventories and strong demand should continue to keep prices strong, additionally, rising costs for seeds, fertilizer and fuel will add to the cost of production.

For CMCITR, the Industrial Metals sector was also very strong, rising over 28%. CMCITR’s higher exposure vs BCOM contributed to the relative outperformance. Aluminum rose over 36% and copper was up over 25% for the year. Supply challenges contributed to the rising prices, COVID-19 and labor problems limited output most of the year. Some of these problems will persist in 2022 and rising demand longer term from the energy transition story could make this sector a star performer for many years.

CMCITR’s Livestock sector rose over 18%, led by hog prices, which were up over 30% and cattle prices rose 10%. Rising input costs and government regulations could keep livestock prices rising again in 2022.

Precious Metals was the worst performing CMCITR sector, declining over 5%, led by silver—down over 12%. Gold prices also fell for the year, down over 4%. CMCITR’s lower exposure to precious metals vs BCOM also contributed to relative outperformance.

Commodities finished the year on the highs and the outlook for 2022 is good, but there could be some risk early in the year if the U.S. economy losses momentum from the U.S. Fed monetary tightening and less fiscal support.

Fund Review

Over the 12 month period under review, CMCITR gained 34.88%, outperforming BCOM, which gained 27.11% and underperforming the S&P® GSCI Index (“SPGSCI”) 3, which gained 40.35%. CMCITR’s performance relative to both BCOM and SPGSCI was driven largely by constituent commodity exposure in the energy sector—outperformance relative to the former and underperformance relative to the latter. On an index level, employment of its constant maturity methodology allowed CMCITR to benefit more than either other index from the positive impact of roll yield.

CM COMMODITY INDEX FUND

MANAGEMENT DISCUSSION (unaudited) (continued)

Four out of five sectors represented in CMCITR contributed positive returns over the 12 month period, with only the precious metals sector detracting from performance. Of the positively performing sectors, energy contributed the most and livestock the least.

Supply chain challenges from COVID-19 will most likely ease this year, but rising wages and housing costs are likely to last. Inflation has become persistent and could be difficult to contain. Rising geopolitical risk will also add to inflationary pressures. The U.S./China conflict will impact global trade, reversing decades of globalization. On-shoring of production will raise costs globally, adding to long-term inflation pressures. Finally energy transition is likely to keep all energy prices rising for the long term.

Another very important change in the outlook for commodity index products has been the shift in many forward curves from contango to backwardation. As commodities rallied in 2021, several forward curves provided positive roll yield due to tightness in the spot market supply. For many index products this provided positive roll yield for the year, adding to the positive annual returns.

There are some risks to the demand outlook in the near term. Global central banks have been shifting monetary policy. Emerging markets countries started raising rates last year to contain inflation and developed markets countries are starting to shift policy this year. Most importantly the U.S. Federal Reserve (“Fed”) is tightening monetary policy and U.S. fiscal support has peaked. Rising U.S. interest rates and waning fiscal support could lead to a weakening U.S. economy and a softer demand outlook. Longer term, the Fed is unlikely to be able to contain inflation because of its focus on financial stability and full employment will limit its ability to raise rates.

With supply constraints likely to last for several years, inflation and rising commodities prices could last for five years or longer.

For more information or to access investment and market insights from the investment team, visit our web site, vaneck.com or subscribe to our commentaries.

As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

| |  |

Roland Morris, Jr.

Portfolio Manager | | Gregory Krenzer

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes

An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made

| 1 | UBS Bloomberg Constant Maturity Commodity Total Return Index (CMCITR) is a rules-based, composite benchmark index. CMCITR is comprised of diversified commodities futures contracts with maturities ranging from around three months to over three years for each commodity, depending on liquidity. |

| 2 | The S&P® GSCI Index (SPGSCI) is composed of futures contracts on physical commodities, with high energy concentration and limited diversification. SPGSCI buys and sells short-term futures contracts. |

| 3 | The Bloomberg Commodity Index (BCOM) is composed of futures contracts on physical commodities covering specific sectors. Commodity weightings are based on production and liquidity, subject to weighting restrictions applied annually such that no related group of commodities constitutes more than 33% of the index and no single commodity constitutes more than 15%. |

EMERGING MARKETS BOND FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The VanEck Emerging Markets Bond Fund (the “Fund”) lost 4.57% (Class A shares, excluding sales charge) for the 12 month period ending December 31, 2021. The Fund outperformed its benchmark—a blended index consisting of 50% J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index1 and 50% J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) Global Diversified Index2—lost 5.30% (the EMBI [hard currency] lost 1.80% and the GBI-EM [local currency] lost 8.75% during the period).

On a country basis, outperformance was driven by investments in Ecuador, Zambia, Mexico and Ghana. These outperformances were based on bottom-up factors that were largely uncorrelated with the big global macroeconomic risks. Ecuador saw a very market-friendly presidential election that resulted in an IMF program. In Zambia, the Fund was exposed to very high-yielding local currency bonds and saw yields decline and the currency strengthen, also based on a market-friendly election for a government pursuing an IMF program. In Mexico, the Fund is mainly invested in the bonds of state owned Pemex, which pays much higher yields than Mexico itself, but which we believe is essentially backed by Mexico. In other words, the thesis was simply of continued government support for Pemex, not correlated with global macro phenomena. Finally, Ghana was due largely to a small position in a distressed corporate credit (an oil producer), clearly uncorrelated with broader global trends. Of our detractors, we would note that China was our biggest detractor, but we see the story as not over yet. The Fund started accumulating collapsing property sector bonds in the fourth quarter of 2021 and continued buying into early 2022. That sector continued to sell off as the Fund was buying, but that is not uncommon for repricings like this one. In Chile, the team simply missed surprise moves to a constitutional convention that could see significantly higher fiscal spending and early pension withdrawals that led to USD purchasing. In El Salvador, the team accumulated bonds in the fourth quarter of 2021 and thinks the thesis hasn’t yet had time to play out. Nonetheless, the government has made no real progress mending fences with the U.S. and an IMF program remains elusive.

Market Review

2021 started as a story of rising rates and growth and ended as a story of rising rates and inflation. The U.S. Consumer Price Index (“CPI”) started 2021 with inflation below 1.40% and ended the year with 7.0% inflation. U.S. interest rates (10-year Treasury bonds) rose from nearly 1.0% to around 1.71% at the start of January 2022. However, it is more informative to note that the first part of 2021 also saw a big rates selloff to 1.74% that was driven by growth without serious inflation risks. Rates subsequently rallied back to around 1.31% (throughout July 2021). Starting in August, though, rates resumed their rise, but the context and economic driver was rising inflation.

This distinction—whether rising rates are due to growth or due to inflation—had important asset price implications. The beginning of the year saw hope and strength in emerging markets foreign currencies (“EMFX”), as a global synchronized recovery boosted commodity prices and supported some emerging markets (“EM”) currencies early in the year. However, when inflation became the driver, EM local currency suffered. This gave us the year’s returns in asset prices for 2021. EM local debt was down 8.75% for the year, while USD-denominated sovereign debt was up 4.76%. This is similar to the behavior of U.S. equities—a strong start to the year driven by growth, despite rising rates, that ended on a weak note driven by inflation and rising rates.

It is worth noting that EMFX weakness came despite commodity price strength that would normally have been considered supportive. One key reason is that a number of countries that happened to have big representation in the local currency indices faced country-specific risks. Colombia, Chile and Peru each faced surprising political developments that had direct market implications. Brazil is always on the verge of a “doom-loop” due to its precarious fiscal situation and proved it again in 2021. Turkey’s heterodox policies came home to roost. Additional reasons for the divergence between commodity prices and EMFX include the fact that EM countries generally tightened policy before the developed markets. This is a very good policy and sets us up for strength in the future. Keep in mind that higher rates combined with strong commodity prices meant these EM economies saw their external accounts boosted yet again. This is a big support for the credit quality of EM hard currency debt. But, until the rate rises stop, hikes will be a headwind to the upside in EM local currency bonds.

EMERGING MARKETS BOND FUND

MANAGEMENT DISCUSSION (unaudited) (continued)

During the 12-month period, the Fund took forward positions in a number of currencies that detracted from performance, and had a slight negative impact on the Fund’s performance for the period.

For more information or to access investment and market insights, visit our web site or subscribe to our commentaries. To review timely updates related to emerging markets bonds and to subscribe to our updates, please visit https://www.vaneck.com/us/en/blogs/emerging-markets-bonds/.

We thoroughly appreciate your participation in the Emerging Markets Bond Fund, and we look forward to helping you meet your investment goals in the future.

| |  |

Eric Fine

Portfolio Manager | | David Austerweil

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index tracks returns for actively traded external debt instruments in emerging markets, and is also J.P. Morgan’s most liquid U.S. dollar emerging markets debt benchmark. |

| 2 | J.P. Morgan Government Bond-Emerging Markets Index (GBI-EM) Global Diversified Index tracks local currency bonds issued by emerging markets governments. |

EMERGING MARKETS FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The Emerging Markets Fund (the “Fund”) lost 12.15% (Class A shares, excluding sales charge) for the 12 months ended December 31, 2021, underperforming the MSCI Emerging Markets Investment Market Index (MSCI EM IMI) 1, which lost 0.28%.

Fund Review

Swift, shifting market sentiment, shaped by the impact of inflation, the timing of normalization as new variants spread globally, and ongoing regulation concerns in China, ultimately had ramifications on stock selection leading to relative underperformance. As the year progressed, investors’ reaction to these forces swung decisively from aggressive growth to value, leaving our structural growth at a reasonable price names unappreciated and overlooked. On a sector level, information technology, consumer discretionary and healthcare detracted from the Fund on a relative basis. On a country level, Kazakhstan, Georgia and the Philippines contributed to relative performance, whereas China, India and the Taiwan region detracted.

The Fund’s top three contributing individual positions during 2021 were:

MediaTek Inc. (4.0% of Fund net assets*), principally involved in the design, manufacturing and distribution of multimedia integrated circuit chipsets, benefitted from industry tailwinds in its products designed for both the mobile and non-mobile sectors. During the year, the company gained market share from capacity-constrained competitors and successfully targeted customers benefitting from Huawei’s issues with the U.S. administration. Product momentum is expected to be strong.

International Container Terminal Services, Inc. (“ICTSI”) (2.6% of Fund net assets*) has become a leading operator, innovator and pioneer in its field of acquiring, developing and operating freight ports and terminals worldwide. The company has a long track record in acquiring terminals and adding substantial value by enhancing its efficiency. The management’s knowledge, skills and expertise also enable them to navigate and operate in different political and economic environments, giving them unique exposure to the long-term structural growth trends in non-G7 trade growth trends. The strong performance over the year further reiterates the non-cyclical nature of this business as global trade normalizes in the post-COVID-19 environment.

Transaction Capital Ltd. (1.3% of Fund net assets*) is a niche financial services company in South Africa with leading positions in its micro-lending and debt collection divisions. During the year, the company outperformed, as lending growth picked up and previous concerns around further asset quality deterioration and provisioning started easing coming out of 2020. Transaction Capital also acquired a 75% stake in WeBuyCars, a used car sales platform with a growing e-commerce presence in South Africa, which opens up new verticals for growth and further improves the outlook for the company.

The Fund’s three weakest performing companies during 2021 were:

A-Living Smart City Services Co., Ltd. (1.3% of Fund net assets*) is a top property manager in China, primarily (but not exclusively) focused on residential property management. The company’s structural growth themes include the following: M&A, benefitting from increased urbanization and limited management contracts, deeper penetration of existing customers with value-added services and expansion into non-residential areas and government contracts. During the year, the company was negatively impacted by the ongoing regulatory upheaval in China, the stock price valuation has contracted, but we have not seen any reason to materially reduce forecasted earning power or growth trajectory.

Alibaba Health Information Technology Ltd. (0.1% of Fund net assets*) is an integrated healthcare information and content service provider in China. The company’s share price languished in the second quarter of the company’s 2021 financial year, as revenue slowed down to 53% in the second half of the 2021 from 74% in the first half of the 2021 due to a high base effect. In addition, the market reacted negatively to management’s conservative gross profit margin guidance, which will likely be capped in the near term due to a product mix shift towards prescription drug sales. We are encouraged by management’s move as they are prioritizing long-term sustainable growth by sacrificing near-term profit growth to go after the online prescription drug market which is very large and underpenetrated with high barriers to entry.

EMERGING MARKETS FUND

MANAGEMENT DISCUSSION (unaudited) (continued)

LG Chem Ltd. (“LGC”) (2.7% of Fund net assets*) is an example of a global electric vehicle (“EV”) battery leader the Fund is invested in. The Korean EV battery sector has underperformed since mid-August. We attribute this underperformance to: i) weaker-than-expected sales resulting from semiconductor shortages; ii) competition from alternative battery chemistries, namely lithium iron phosphate (“LFP”) batteries; and iii) anticipation of LG Energy Solution’s IPO which is driving retail investors out of LG Chem.

Market Review

During the period under review, overall optimism about the prospects for the asset class gave way to underlying debate and concern on certain key topics such as normalization, inflation and regulation.

Normalization

Domestic restrictions have followed different paths across emerging markets (“EM”), with China/LatAm now at quite low levels. Rapidly rising immunity should reduce the health consequences of future COVID-19 waves. In part, this is driven by a significant increase in the rate of vaccination in emerging markets. Availability of vaccines and actual vaccination rates have generally surpassed expectations. Looking forward, we have cautious optimism that the worst fears for the new variant will not materialize. Periodic restrictions to economic activity will likely feature along a bumpy road to normalization

Inflation

While global growth has been impressive, driven by a cocktail of year-over-year comparisons, near-normal mobility in the U.S. and continued super-relaxed monetary and fiscal policies, it has not been without challenges. Supply chains were somewhat stretched and vulnerable and previous underinvestment in commodities was coming home to roost in an environment of rapidly accelerating demand. Looking forward, a normalizing supply chain meeting more moderate demand for consumer goods and persistent digitization are amongst the reasons why we are less concerned about strongly persistent inflation in the medium term. Emerging markets are generally in better shape with regards to inflation (with notable exceptions), in part because of a higher food weighting in the Consumer Price Index (“CPI”) basket.

Regulation

The shifting landscape of regulatory action and property angst in China were widely discussed, but not always understood. Indeed, many regulations will ultimately create a better endpoint for fairer, more sustainable industries, but the journey can be arduous and uncertain. Investors do not like uncertainty. Looking forward, we see very significant signs of a policy change in favor of a pro-growth phase in China and that the effect of heightened regulatory tightening that scared and confused the markets is diminishing.

For more information or to access investment and market insights from the investment team, visit our web site or subscribe to our commentaries. To review timely updates related to the VanEck Emerging Markets Fund, please visit www.vaneck.com/blogs/emerging-markets-equity. To subscribe to VanEck’s emerging markets equity updates, please contact us at 800.826.2333 or visit www.vaneck.com/subscribe to register.

We appreciate your participation in the Emerging Markets Fund, and we look forward to helping you meet your investment goals in the future.

| |  |

David Semple

Portfolio Manager | | Angus Shillington

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

| * | All Fund assets referenced are Total Net Assets as of December 31, 2021. |

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | The MSCI Emerging Markets Investable Markets Index captures large-, mid- and small-cap representation across emerging markets countries and covers approximately 99% of the free float adjusted market capitalization in each country |

GLOBAL RESOURCES FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The Global Resources Fund (the Fund) gained 18.61% (Class A shares, excluding sales charge) for the 12 months ended December 31, 2021, underperforming the S&P ® North American Natural Resources Sector Index (SPGINRTR), 1 which gained 39.95%. Where the Fund’s overweight positioning within renewable and alternative energy—and subsequent underweight positioning within oil and gas—was the largest relative driver of outperformance versus the benchmark in 2020, this year, the opposite held true.

2021 wound up being a year marked with stronger-than-anticipated gains across a variety of the more traditional resources sectors and, in particular, within the traditional energy space where crude oil and natural gas prices notched multi-year highs on strong rebounds in demand. Base and industrial metals as well as many agriculture sub-sectors also contributed to resource portfolios, broadly, as underlying commodity prices strengthened steadily throughout the year.

Renewable and alternative energy companies, on the other hand, faced myriad headwinds including supply chain logistics issues, rising materials costs and stalled policy initiatives. All these factors, when combined and for most companies in the space, created a significant drag on underlying share prices and adversely affected the Fund.

Market Review

Over 2021, U.S. unemployment rates continued to fall, its economy strengthened and, by the fourth quarter, it had strengthened enough that even the Fed’s monetary policy is set to change in 2022. The year was, in particular, marked by the change in sentiment around inflation. While the first half of the year was dominated by considerations around the possible appearance and risk of inflation, the second half was marked by inflation being acknowledged as an actual state of affairs, with “transitory” no longer the operative word.

In China, earlier in the year, the unpredictability of the political climate will continue to slow the economy, but we actually started to see both fiscal and monetary easing in the second half of the year which we think will continue and accelerate into 2022.

Crude Oil

In the first half of the year, crude oil, with prices rising inexorably and U.S. weekly gasoline demand rising, was the dominating factor of the reopening trade. In the second half of the year, we saw the steady march upward continue, with crude oil prices peaking at the end of October and into early November. At the start of the year, estimates for global demand were some 94 million barrels per day. By the end of June, this figure looked to be in the region of 96 million barrels and, by the end of the year, some estimates had it at 99 million barrels per day: a significant change over the 12-month period.

On a global basis, inventories of energy in general, e.g. crude products, coal and natural gas, continued to fall throughout the year, tightening up the physical market. Evidence of this can be found not only in the current situation around natural gas shortages in Europe, but also the pressure on coal and natural gas prices in China.

During the first half of the year, OPEC+ appeared to be on a “glide path”, gradually bringing production back. As with the group’s discipline (and its response, neither one way nor the other, to demands from governments to raise (or reduce) production), this continued into the year’s second half. In contrast with 2021, the year was marked by quite a notable “solidity” within OPEC+.

Gold

The price of gold remained pretty much range-bound during 2021, pivoting around $1,800 per ounce over the second half of the year. Throughout the year, it appeared to be caught (and bounced back and forth) between anticipation of the U.S. Fed raising rates and higher inflation numbers and more negative real rates—with neither dominant.

Energy Transition Metals

Demand, and prices, for industrial metals remained high over the year, not least because of inflationary pressures, as they did for energy transition metals, including cobalt, copper, nickel and rare earth metals. The physical markets continued to tighten in energy transition metals, with most displaying a seemingly inexorable rise over the long-term. Although retreating from the highs they saw in the late second quarter, prices still remained at elevated levels relative to those over the last several years. Nickel, for example, finished the year close to its 52-week high.

Grains and Fertilizers

Grain, fertilizer and, indeed, food, prices and their associated equities, were very strong throughout the year, albeit volatile. Having been affected quite strongly by high energy prices during the year, including sporadic shut downs by producers in both China and Europe, the prices of most fertilizers and fertilizer company stocks finished the year close to their all-time highs.

Alternative Energy

Following an exceptional 2020 and, subject as they were going into 2021 to both high expectations and valuations, alternative energy equities suffered from a malaise during the most of the year. We still believe that the energy transition (and alternative energy) should be seen as being more like a marathon than a baseball game—in which progress is measured by miles instead of innings. If 2020 was “Mile 1” with participants “fresh out of the gate” (to mix metaphors), then we are now in “Mile 2”, with the associated realization that there is a long way to go yet. For us, we still see those companies with businesses that are robust, resilient and disciplined as being those that will last the course.

We continued to see further national and international moves towards “Net Zero” targets at both company and government levels. And while, for some, the expectations for the 26th UN Climate Change Conference (COP 26) in Glasgow, Scotland, at the beginning of November may have been high, ours were more tempered. Perhaps sadly, we appear to have been right.

Fund Review

In terms of absolute performance, the strongest positive contributions came from positions in the oil and gas exploration and production, copper and fertilizers and agricultural chemicals sub-industries. The greatest negative contributions were ascribable to positions in gold and renewable energy. Versus the S&P North American Natural Resources Sector Index, while our overweight positioning in both copper and fertilizers and agricultural chemicals led to outperformance, our underweight positioning in the integrated oil and gas and oil and gas storage and transportation sub-industries led to the Fund’s most significant relative underperformance for the year.

The Fund’s top three contributing individual positions were: diversified mining company, Freeport-McMoRan, Inc. (4.3% of Fund net assets*) and oil and gas exploration and production (“E&P”) companies Devon Energy Corp. (3.3% of Fund net assets*) and Diamondback Energy, Inc. (3.4% of Fund net assets*).

Freeport-McMoRan, Inc. together with Devon Energy, Corp. and Diamondback Energy, Inc. benefited from the strengths of copper and crude oil prices respectively. However, as leaders in their respective industries, they also benefited from the tight capital discipline they continued to exercise, each generating strong free cash flow. For Freeport-McMoRan, Inc., as it reaped the rewards of its multi-year restructuring of operations, this enabled it to increase further its financial strength. For the two E&P companies it enabled them to focus on the return of capital to shareholders.

The Fund’s three weakest contributing companies were: solar energy company, Sunrun Inc. (2.1% of Fund net assets*), financial company and climate solutions provider, Hannon Armstrong Sustainable Infrastructure Capital, Inc. (3.5% of Fund net assets*) and solar inverter manufacturer, SolarEdge Technologies, Inc. (3.1% of Fund net assets*). During the year, all three companies continued to suffer from the malaise that hit

GLOBAL RESOURCES FUND

MANAGEMENT DISCUSSION (unaudited) (continued)

renewable energy companies off the back of an exceptional 2020. In addition, structural growth stories also remained challenged during the second half of the year.

As a team staffed with former geologists and engineers, we have and will continue to emphasize a bottom up investment approach—seeking to identify natural resource companies that we believe have the highest quality management teams and assets, trade at a significant discount to their intrinsic value and their peers, and that are well-positioned to deliver shareholder value over the long run.

As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

For more information or to access investment and timely market insights from the investment team, visit our website and subscribe to our commentaries.

| |  |

Shawn Reynolds

Portfolio Manager | | Charles T. Cameron

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

| * | All Fund assets referenced are Total Net Assets as of December 31, 2021. |

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | S&P® North American Natural Resources Sector (SPGINRTR) Index includes mining, energy, paper and forest products, and plantation-owning companies, but excludes the chemicals industry and steel sub-industry |

INTERNATIONAL INVESTORS GOLD FUND

MANAGEMENT DISCUSSION

Decemberr 31, 2021 (unaudited)

Dear Shareholder:

The VanEck International Investors Gold Fund (the “Fund”) declined 14.30% (Class A shares, excluding sales charge) during the twelve months ended December 31, 2021, underperforming the NYSE Arca Gold Miners Index1 (GDMNTR) which posted a loss of 9.37% during the same period.

The Fund’s overweight (relative to the benchmark) position in small-cap, junior companies was a detractor in 2021. In the third quarter of 2021, we took a modest defensive positioning by trimming junior exposure, adding gold bullion and increasing our cash. In the longer term, we expect that our ability to pick winners in the junior gold mining sector should be a significant source of Fund outperformance. The high quality, small-cap companies become acquisition targets for the larger companies. Such transactions generally come with handsome takeover price premiums, generating substantial returns for the shareholders of the target company. In 2021, two of the Fund’s junior holdings Great Bear Resources and Corvus Gold became such targets.

The mid-tiers and small-cap gold mining stocks, as represented by the MVIS Global Junior Gold Miners Index2 (MVGDXJTR) recorded a loss of 20.99%.

Gold Sector Overview

Gold started the year strong, rising to a 2021 year high of $1,959 on January 5, which coincided with fresh lows for the U.S. Dollar Index (DXY).3 However, expectations for trillions of U.S. dollars in fiscal spending for pandemic relief, infrastructure and green initiatives, combined with encouraging vaccination progress and fiscal relief boosted consumer sentiment. An optimistic economic outlook in the first quarter drove interest rates higher, allowing the U.S. dollar to strengthen, pushing gold prices down. Gold fell to a year low of $1,677 on March 8. May was the first month that excessive inflation was reported in the economic statistics and gold responded nicely. The Consumer Price Index (CPI) for April surprised the market with a 4.2% annual increase, followed by a higher than expected 5.0% increase in the May CPI. This propelled gold up to $1,900 once again.

Gold’s second quarter rally came to an abrupt end on June 16, following the Federal Open Market Committee (FOMC) announcement for its June 15-16 meeting. The possibility floated of an accelerated rate hike schedule, combined with talks about reducing quantitative easing caught markets by surprise, causing strong moves across most asset classes. In spite of these potential reactions, the Fed continued to view inflationary pressures as transitory. This outlook propelled the U.S. dollar and caused gold to trade below multiple technical support levels. Gold had been trading range-bound around the $1,800 per ounce level, but a so-called “flash crash” during Asian trading hours on August 8 drove it down $60 in a matter of minutes, with it trading as low as $1,690.61 per ounce. Gold managed to climb back above $1,800 per ounce, supported by mounting concern around the impact on growth of the COVID-19 Delta variant.

The gold market spent the rest of the year trying to assess and price-in two different forces: the risk that a tighter Fed policy presents to the economy; and inflation, is it transitory or more persistent and can the Fed combat it? Gold clearly responded to inflationary pressures. However, this was offset by a belief in the market that tighter Fed policies will corral inflation and that the economy is robust enough to withstand higher rates. For example, the headline consumer price index (CPI) climbed from 5.4% to 6.2% from September to October—the fastest pace since 1990. The news, released on November 10, renewed concerns around inflation and gold traded as high as $1,877.15 on November 16. However, following the November 22 nomination of Jerome Powell as Fed chair, and current governor Lael Brainard for vice chair, gold fell over $40 to below $1,800, as these appointments were viewed as positive to the broader markets and the economy. Then, in December, the metal dropped to $1,753 following the FOMC meeting in which the Fed set the stage to begin increasing rates as early as next spring 2022 in order fight rising inflation. However, the selling pressure quickly dissipated and gold rallied to the $1,800 level the following day. Gold’s resilience suggests the Fed might have a tough time in its battle with inflation. Gold closed at $1,829.20 on December 31, 2021, posting a $69.16 (3.64%) loss for the year.

INTERNATIONAL INVESTORS GOLD FUND

MANAGEMENT DISCUSSION (unaudited) (continued)

High gold prices but weak gold stock prices proved to be a boom for the gold companies and a bust for investors. The industry is financially healthy and able to return capital to shareholders in the form of dividends and stock buybacks. However, gold is the primary driver of gold stocks and when sentiment towards gold is low, there is little interest in them. As a result, the NYSE Arca Gold Miners Index declined 9.37% and the MVIS Global Junior Gold Miners Index fell 20.99%. Junior stocks have a tougher time in a weak market and tax-loss selling brought additional pressure late in the year. The underperformance has driven valuations to historic lows, so any pickup in the gold price should bode well for gold stocks.

Fund Review

In the second half of the year, in response to continued gold price consolidation and its amplified impact on the gold equities, the Fund increased its cash allocation and established exposure to gold bullion. At the end of December 2021, cash holdings represented 4.92% of net assets; holdings in gold bullion exchange traded products accounted for 5.11% of net assets; and the balance was invested in precious metals equities.

Newmont (6.8% of Fund net assets*), which is a top holding for the Fund, and Franco Nevada (0.4% of Fund net assets*), both had strong relative performance during the year. Newmont outperformed, gaining 7.42% during the year. The outperformance comes despite the company facing COVID-19-related interruptions and other operational challenges in 2021, which we think speaks to the company’s position as an industry leader and its ability to create value. The company is well run, with high quality assets and a sound business strategy that has delivered strong shareholder returns in the form of dividends and share buy backs. We expect Newmont’s leadership, combined with solid operational and financial results, should continue to attract investor interest in its shares.

Royalty and streaming company Wheaton Precious Metals (5.1% of Fund net assets*) also outperformed (+4.22%). The company’s robust business model and good track record continues to attract investors. In an environment of range-bound gold prices, as 2021 proved to be, the streaming and royalty companies tend to be viewed as a safer gold investment vehicle, with lower share price downside risk relative to the producers, but retaining some of the equity leverage to potentially outperform the metal.

Our top junior position, West African Resources (3.2% of Fund net assets*) was a strong outperformer in 2021 (+19.47%). West African continued a very successful ramp up of its Sanbrado mine in Burkina Faso, with gold production consistently increasing every quarter and total production for 2021 exceeding guidance. In addition, the company released good drill results at Sanbrado and at its feasibility stage Toega project, and in November completed the acquisition of neighboring Kiaka gold project, further enhancing the company’s growth profile.

The Fund also held significant positions in several smaller-cap companies that are not members of the benchmark. As a group, the smaller companies underperformed and this negatively impacted the Fund’s performance during the period. Junior developer Sabina Gold & Silver Corp. (1.2% of Fund net assets*) and junior producer Pure Gold (0.6% of Fund net assets*) were two significant detractors from the Fund’s performance. The Fund held an overweight position in mid-tier producer B2Gold (5.3% of Fund net assets†), which also pushed down returns relative to the benchmark during the year.

B2Gold (5.3% of Fund net assets*) underperformed (-27.01%), despite better than expected operating results that led to a full-year production guidance increase. Most of the underperformance came in the first half of the year, after B2Gold shares were impacted by political instability in Mali and the company commenced arbitration proceedings against the Mali government after being denied an exploration permit in the Fekola region. The company operated without interruptions and the permit denial did not have any negative impacts on the Fekola mine plan, but the market priced in higher risk for the stock. Our long-term outlook for B2Gold is unchanged, as the fundamentals of the company remain robust. Its shares should begin to reflect this outlook. The company announced in December that it has reached an agreement with the government of Mali, which will grant B2Gold a permit to explore the same area covered by the previously denied permit.

Among the junior companies, Pure Gold (0.6% of Fund net assets*) underperformed (-73.00%). The company encountered some operational mining challenges that negatively impacted production during the year.

Recent management changes should help rectify these issues, and early signs show positive results. We look forward to upcoming reports to assess the progress the new leadership has made in overcoming these challenges and improving the mine’s performance.

Access investment and market insights from VanEck’s investment professionals by subscribing to our commentaries. To subscribe to the gold and precious metals update, please https://www.vaneck.com/subscribe

We appreciate your continued investment in the International Investors Gold Fund, and we look forward to helping you meet your investment goals in the future.

| |  |

Joseph M. Foster

Portfolio Manager | | Imaru Casanova

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

| * | All Fund assets referenced are Total Net Assets as of December 31, 2021. |

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | NYSE Arca Gold Miners (GDMNTR) Index is a market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold. |

| 2 | MVIS Global Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver. |

| 3 | U.S. Dollar Index (DXY) indicates the general international value of the U.S. dollar. The DXY does this by averaging the exchange rates between the U.S. dollar and six major world currencies: Euro, Japanese yen, Pound sterling, Canadian dollar, Swedish kroner, and Swiss franc. |

MORNINGSTAR WIDE MOAT FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The VanEck Morningstar Wide Moat Fund (the “Fund”) returned 24.15% (Class Z shares) for the 12 month period ended December 31, 2021. The Fund underperformed the broad U.S. stock market as represented by the S&P 500® Index 1 which posted a 28.71% return.

For the period, the Morningstar® Wide Moat Focus IndexSM (the “Index”) 2 returned 24.10%.

Fund Review

Information technology, followed by Financials and Industrials, were the top contributing sectors to the Fund’s return. While no sectors detracted from returns, the Materials and Utilities sectors contributed the least.

The top five individual stock performance contributors were: Cheniere Energy Inc. (2.6% of Fund net assets*), Wells Fargo & Co. (2.5% of Fund net assets*), Alphabet Inc. (2.5% of Fund net assets*), Pfizer Inc. (no longer held by the fund) and Microsoft Corp. (2.6% of Fund net assets*). Cheniere Energy Inc. (“Cheniere”), the Fund’s top contributor, benefited from a broad energy market recovery in 2021. Operating in the midstream liquefied natural gas (LNG) market, Cheniere has developed a competitive advantage from its long-term take-or-pay contracts with customers. These position the company as a pure toll-taker with limited commodity price risk. The extremely tight LNG markets benefited Cheniere throughout the year as customers in Europe and China competed for supply leaving Cheniere trading at close to Morningstar’s fair value estimate.

The bottom five performance contributors were: Zimmer Biomet Holdings Inc. (2.3% of Fund net assets*), Compass Minerals International Inc. (2.2% of Fund net assets*), The Western Union Co. (2.3% of Fund net assets*), Medtronic PLC (2.1% of Fund net assets*) and Boeing Co. (2.3% of Fund net assets*). The Fund’s top detractor from performance, Zimmer Biomet Holdings Inc., is a market leader in joint replacement implants. The company has struggled through the global pandemic as elective surgeries have been delayed or cancelled altogether. However, the Morningstar Equity Research Team remains confident in its optimistic long-term growth projections for Zimmer Biomet Holding Inc.

Please access investment and market insights from VanEck’s investment professionals by subscribing to our blogs. To learn more about Moat Investing and to read our Moat Investing insights, visit our website and subscribe to our Moat Investing updates.

We appreciate your participation in the VanEck Morningstar Wide Moat Fund, and we look forward to helping you meet your investment goals in the future.

| |  |

Peter H. Liao

Portfolio Manager | | Gregory F. Krenzer

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| * | All Fund assets referenced are Total Net Assets as of December 31, 2021. |

| | |

| 1 | S&P 500® Index: consists of 500 widely held common stocks covering the leading industries of the U.S. economy (reflects no deduction for fees, expenses or taxes). |

| 2 | Morningstar® Wide Moat Focus IndexSM (MWMFTR) is a rules-based, equal-weighted index intended to offer exposure to companies that Morningstar, Inc. determines have sustainable competitive advantages based on a proprietary methodology that considers quantitative and qualitative factors (“wide moat companies”) (reflects no deduction for fees, expenses or taxes). |

NDR MANAGED ALLOCATION FUND

MANAGEMENT DISCUSSION

December 31, 2021 (unaudited)

The VanEck NDR Managed Allocation Fund (the “Fund”) gained 11.30% (Class A shares, excluding sales charge) for the 12 months ending December 31, 2021. It outperformed its benchmark, 1 comprised of 60% MSCI AC World Daily TR Gross USD Index (MSCI All Country World Index) and 40% Bloomberg Barclays US Aggregate Total Return Value Unhedged USD Index (Bloomberg Barclays US Aggregate Bond Index), which returned 10.52%.

The Fund was correctly positioned to benefit from the continuation of the bull market with an average equity overweight of 17%. This worked well as the Fund’s equity allocation returned +17.87% versus the -1.82% return for its bond allocation. Within equities, the Fund was most overweight the U.S. This also helped relative performance, as the U.S. equity allocation returned +23.36% and outpaced the MSCI All Country World Index, which returned +18.54%. The equity allocation within the U.S. detracted from relative performance and lagged the Russell 3000 Total Return Index, which returned +25.66%. The relative underperformance was due to the Fund’s market cap and style positioning.

The NDR Managed Allocation Fund will be closed in 2022. We thank you for your investment in the Fund and wish you a happy and healthy New Year.

| |  |

David Schassler

Portfolio Manager | | John Lau

Deputy Portfolio Manager |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. Certain indices may take into account withholding taxes. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made.

| 1 | The Fund’s benchmark is a blended index consisting of 60% MSCI AC World Daily TR Gross USD Index (MSCI All Country World Index) and 40% Bloomberg Barclays US Aggregate Total Return Value Unhedged USD Index (Bloomberg Barclays US Aggregate Bond Index). The ACWI represents large- and mid-cap companies across developed and emerging market countries. The Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. |

CM COMMODITY INDEX FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class I* | | Class Y* | | CMCITR |

| One Year | | 32.96% | | 25.31% | | 33.07% | | 33.14% | | 34.88% |

| Five Year | | 6.58% | | 5.33% | | 6.86% | | 6.79% | | 8.02% |

| Ten Year | | (1.22)% | | (1.81)% | | (0.94)% | | (0.98)% | | 0.16% |

| | | | | | | | | | �� | | | | | | |

| * | Class is not subject to a sales charge |

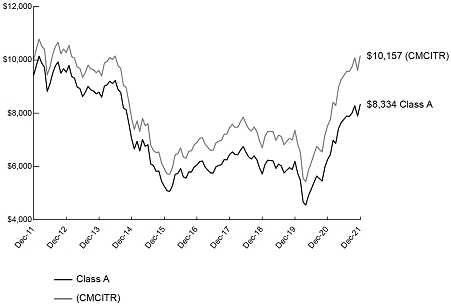

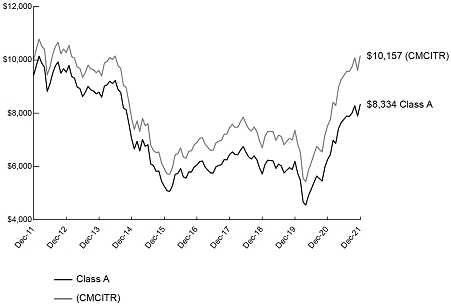

| Hypothetical Growth of $10,000 (Ten Year: Class A - with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past ten years. The result is compared with the Fund’s benchmark. Performance of Class I and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

UBS Bloomberg Constant Maturity Commodity Total Return Index (CMCITR) is a rules-based, composite benchmark index diversified across commodity components from various sectors, specifically energy, precious metals, industrial metals, agriculture and livestock (reflects no deduction for fees, expenses or taxes).

EMERGING MARKETS BOND FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average

Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class I* |

| One Year | | (4.57)% | | (10.06)% | | (4.30)% |

| Five Year | | 4.59% | | 3.36% | | 4.87% |

| Life^ | | 2.26% | | 1.62% | | 2.55% |

| | | | | | | | | | |

Average

Annual

Total Return | | Class Y* | | 50% EMBI

50% GBI-EM | | GBI-EM | | EMBI |

| One Year^ | | (4.33)% | | (5.30)% | | (8.75)% | | (1.80)% |

| Five Year^ | | 4.83% | | 3.79% | | 2.82% | | 4.65% |

| Life^ | | 2.49% | | 2.44% | | 0.11% | | 4.69% |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

| | |

| ^ | Since July 9, 2012 (inception date for all share classes). |

| Hypothetical Growth of $10,000 (Since Inception: Class A – with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund since inception. The result is compared with the Fund’s benchmark, and a broad-based market index. Performance of Class I, and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

The 50/50 benchmark Index (50% EMBI/50% GBI-EM) is a blended index consisting of 50% J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index and 50% J.P. Morgan Government Bond Index Emerging Markets Global Diversified Index (reflects no deduction for fees, expenses or taxes).

The J.P. Morgan Government Bond Index-Emerging Markets Global Diversified Index tracks local currency bonds issued by Emerging Markets governments (reflects no deduction for fees, expenses or taxes).

J.P. Morgan Emerging Markets Bond Index Global Diversified Index tracks returns for actively traded external debt instruments in emerging markets, and is also J.P. Morgan’s most liquid U.S-dollar emerging markets debt benchmark (reflects no deduction for fees, expenses or taxes).

EMERGING MARKETS FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average

Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class C

Before

Sales Charge | | Class C

After Maximum

Sales Charge |

| One Year | | (12.15)% | | (17.20)% | | (12.87)% | | (13.67)% |

| Five Year | | 8.75% | | 7.47% | | 7.90% | | 7.90% |

| Ten Year | | 6.64% | | 6.01% | | 5.77% | | 5.77% |

| | | | | | | | | | | | | |

Average

Annual

Total Return | | Class I* | | Class Y* | | Class Z* | | MSCI EM IMI |

| One Year | | (11.76)% | | (11.84)% | | (11.66)% | | (0.28)% |

| Five Year | | 9.27% | | 9.17% | | n/a | | 10.06% |

| Ten Year | | 7.15% | | 7.00% | | n/a | | 5.71% |

| Life^ | | n/a | | n/a | | 4.65% | | n/a |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

| ^ | Class Z since September 16, 2019 |

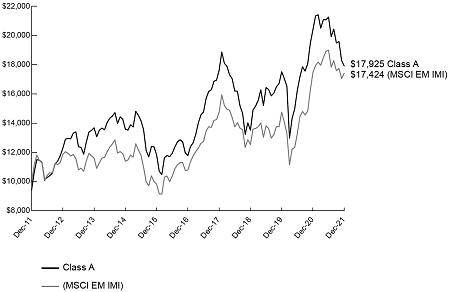

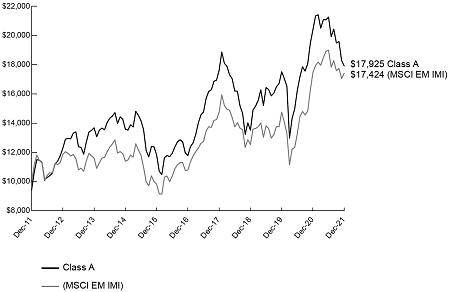

| Hypothetical Growth of $10,000 (Ten Year: Class A – with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years. The result is compared with the Fund’s benchmark. Performance of Class C, Class I, and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

The MSCI Emerging Markets Investable Market Index (MSCI EM IMI) captures large, mid and small cap representation across emerging markets countries. The index covers approximately 99% of the free float-adjusted market capitalization in each country.

GLOBAL RESOURCES FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average

Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class C

Before

Sales Charge | | Class C

After Maximum

Sales Charge |

| One Year | | 18.61% | | 11.79% | | 17.67% | | 16.67% |

| Five Year | | 1.81% | | 0.61% | | 0.99% | | 0.99% |

| Ten Year | | (0.47)% | | (1.06)% | | (1.27)% | | (1.27)% |

| | | | | | | | | | | | | |

Average

Annual

Total Return | | Class I* | | Class Y* | | SPGINRTR | | MSCI ACWI |

| One Year | | 19.12% | | 18.92% | | 39.95% | | 19.04% |

| Five Year | | 2.25% | | 2.06% | | 1.27% | | 14.97% |

| Ten Year | | (0.07)% | | (0.23)% | | 1.27% | | 12.44% |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

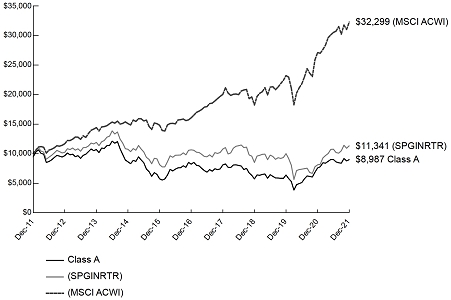

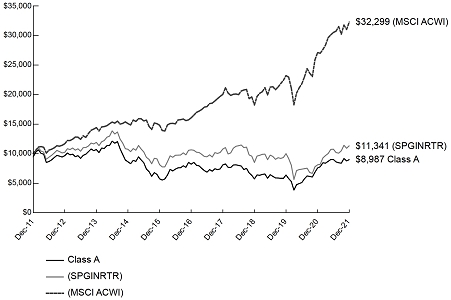

| Hypothetical Growth of $10,000 (Ten Year: Class A – with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 years. The result is compared with the Fund’s benchmark, and a broad-based market index. Performance of Class C, Class I, and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

S&P® North American Natural Resources Sector Index (SPGINRTR) represents U.S. traded securities that are classified under the GICS® energy and materials sector excluding the chemicals industry and steel sub-industry (reflects no deduction for fees, expenses or taxes).

MSCI All Country World Index (MSCI ACWI) captures large- and mid-cap representation across both developed and emerging markets countries (reflects no deduction for fees, expenses or taxes except withholding taxes).

INTERNATIONAL INVESTORS GOLD FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average

Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class C

Before

Sales Charge | | Class C

After Maximum

Sales Charge |

| One Year | | (14.30)% | | (19.23)% | | (14.89)% | | (15.68)% |

| Five Year | | 9.69% | | 8.40% | | 8.88% | | 8.88% |

| Ten Year | | (2.27)% | | (2.85)% | | (3.00)% | | (3.00)% |

| | | | | | | | | | | | | |

Average

Annual

Total Return | | Class I* | | Class Y* | | GDMNTR | | MSCI ACWI |

| One Year | | (13.94)% | | (14.02)% | | (9.37)% | | 19.04% |

| Five Year | | 10.14% | | 10.01% | | 10.10% | | 14.97% |

| Ten Year | | (1.86)% | | (1.98)% | | (3.50)% | | 12.44% |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

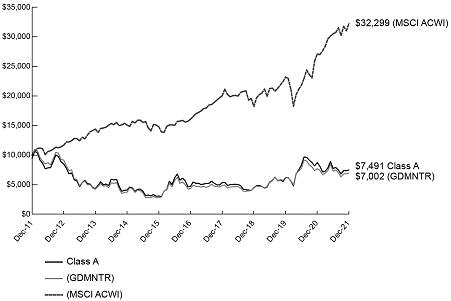

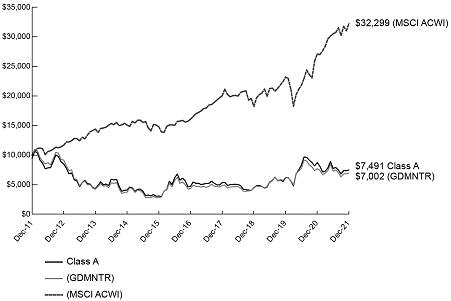

| Hypothetical Growth of $10,000 (Ten Year: Class A - with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund over the past 10 years. The result is compared with the Fund’s benchmark, and a broad-based market index. Performance of Class C, Class I, and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

NYSE Arca Gold Miners (GDMNTR) Index is a market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold (reflects no deduction for fees, expenses or taxes except withholding taxes).

MSCI All Country World Index (MSCI ACWI) captures large- and mid-cap representation across both developed and emerging markets countries (reflects no deduction for fees, expenses or taxes except withholding taxes).

MORNINGSTAR WIDE MOAT FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average Annual

Total Return | | Class I* | | Class Z* | | MWMFTR | | SPTR |

| One Year | | 24.04% | | 24.15% | | 24.81% | | 28.71% |

| Life^ (annualized) | | 18.18% | | 18.31% | | 18.96% | | 17.94% |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

| | |

| ^ | Since November 6, 2017 (inception date for all share classes). |

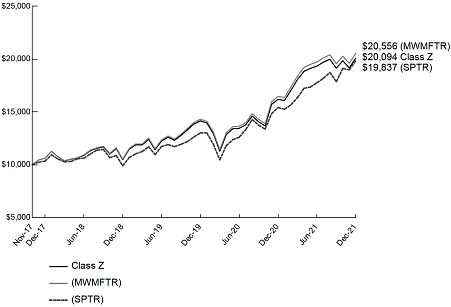

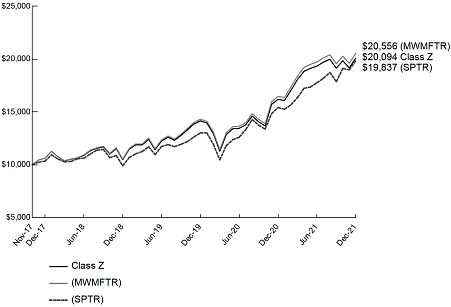

| Hypothetical Growth of $10,000 (Since Inception: Class Z) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund since inception. The result is compared with the Fund’s benchmark, and a broad-based market index. Performance of Class I shares will vary from that of the Class Z shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.

Morningstar® Wide Moat Focus Index (MWMFTR) is a rules-based index intended to offer exposure to companies that the Index Provider determines have sustainable competitive advantages based on a proprietary methodology that considers quantitative and qualitative factors (“wide moat companies”) (reflects no deduction for fees, expenses or taxes).

S&P 500® Index (SPTR) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial and transportation).

NDR MANAGED ALLOCATION FUND

PERFORMANCE COMPARISON

December 31, 2021 (unaudited)

Average

Annual

Total Return | | Class A

Before

Sales Charge | | Class A

After Maximum

Sales Charge | | Class I* |

| One Year | | 11.30% | | 4.90% | | 11.66% |

| Five Year | | 7.24% | | 5.98% | | 7.57% |

| Life^ | | 7.37% | | 6.25% | | 7.69% |

| | | | | | | | | | |

Average

Annual

Total Return | | Class Y* | | 60% MSCI

40% BB US | | LBUSTRUU | | MSCI ACWI |

| One Year^ | | 11.59% | | 10.52% | | (1.54)% | | 19.04% |

| Five Year^ | | 7.51% | | 10.57% | | 3.57% | | 14.97% |

| Life^ | | 7.64% | | 10.10% | | 2.95% | | 14.66% |

| | | | | | | | | | | | | |

| * | Class is not subject to a sales charge |

| | |

| ^ | Since May 11, 2016 (inception date for all share classes). |

| Hypothetical Growth of $10,000 (Since Inception: Class A – with sales charge) |

| | | |

This chart shows the value of a hypothetical $10,000 investment in the Fund since inception. The result is compared with the Fund’s benchmark, and a broad-based market index.

Performance of Class I and Class Y shares will vary from that of the Class A shares due to differences in class specific fees and any applicable sales charges. | |  |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

See “About Fund Performance” on page 27 for more information.