QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the registrantý |

| Filed by a party other than the registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Under Rule 14a-12

|

REMEC, INC. |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of filing fee (Check the appropriate box): |

| ý | | No Fee Required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

May 3, 2002

To Our Shareholders:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders of REMEC, Inc. ("REMEC") to be held at REMEC's offices located at 3790 Via de la Valle, Suite 311, Del Mar, California, on Friday, June 14, 2002 at 4:00 p.m., Pacific Daylight Savings time. Enclosed are a notice to shareholders, a proxy statement describing the business to be transacted at the meeting, and a proxy card for use in voting at the meeting.

At the Annual Meeting, you will be asked to (i) elect the directors of REMEC to serve for the ensuing year and until their successors are elected, (ii) approve an amendment to REMEC's Employee Stock Purchase Plan to increase the number of shares of Common Stock reserved for issuance thereunder from 2,700,000 to 3,450,000 and (iii) act on such other business as may properly come before the meeting or any adjournment thereof.

It is important that you use this opportunity to take part in the affairs of your company by voting on the business to come before this meeting.WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE, OR VOTE BY TELEPHONE OR ON THE INTERNET, SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING. Returning the proxy card, or voting by telephone or the Internet, does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

| | | Sincerely, |

| | | |

| | |

Ronald E. Ragland

Chairman and Chief Executive Officer |

YOUR VOTE IS IMPORTANT. PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. PLEASE SEE "VOTING ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE" ON PAGE 1 OF THE PROXY STATEMENT FOR ALTERNATIVE VOTING METHODS. IF YOU ATTEND THE MEETING AND DESIRE TO WITHDRAW YOUR PROXY, YOU MAY VOTE IN PERSON AND YOUR PROXY WILL BE WITHDRAWN.

3790 Via de la Valle, Suite 311—Del Mar, CA 92014—Tel 858-505-3713—Fax 858-847-0386

REMEC, INC.

3790 Via de la Valle, Suite 311

Del Mar, California 92014

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 14, 2002

TO THE SHAREHOLDERS OF REMEC, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of REMEC, Inc. will be held on Friday, June 14, 2002 at 4:00 p.m., Pacific Daylight Savings time, at REMEC's principal executive offices located at 3790 Via de la Valle, Suite 311, Del Mar, California, for the following purposes:

- 1.

- To elect directors to serve for the ensuing year and until their successors are elected.

- 2.

- To approve an amendment to REMEC's Employee Stock Purchase Plan to increase the number of shares of Common Stock reserved for issuance thereunder from 2,700,000 to 3,450,000.

- 3.

- To transact such other business as may properly come before the meeting or any adjournments thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only shareholders of record at the close of business on April 19, 2002 are entitled to notice of and to vote at the meeting and any adjournments thereof.

All shareholders are cordially invited to attend the meeting in person. Any shareholder attending the meeting may vote in person even if such shareholder previously signed and returned a proxy, or voted by telephone or on the Internet.

| | | FOR THE BOARD OF DIRECTORS |

| | | |

| | |

Ronald E. Ragland,

Chairman and Chief Executive Officer |

|

|

|

Del Mar, California

May 3, 2002 | | |

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. PLEASE SEE "VOTING ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE" ON PAGE 1 OF THE PROXY STATEMENT FOR ALTERNATIVE VOTING METHODS.

REMEC, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

The enclosed proxy is solicited on behalf of the board of directors of REMEC, Inc. (the "Board") for use at REMEC's Annual Meeting of Shareholders (the "Annual Meeting") to be held Friday, June 14, 2002 at 4:00 p.m., Pacific Daylight Savings time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at REMEC's principal executive offices located at 3790 Via de la Valle, Suite 311, Del Mar, California 92014. The telephone number at that address is (858) 505-3713.

These proxy solicitation materials were mailed on or about May 10, 2002 to all shareholders entitled to vote at the Annual Meeting.

INFORMATION CONCERNING SOLICITATION AND VOTING

Record Date and Shares Outstanding

Shareholders of record at the close of business on April 19, 2002 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting. At the Record Date, 44,994,742 shares of REMEC's Common Stock were issued, outstanding and entitled to vote at the Annual Meeting.

Revocability of Proxies

Any proxy given in accordance with this solicitation may be revoked by the person giving it at any time before its use by delivering to the Secretary of REMEC a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

Voting

Every shareholder voting for the election of directors may exercise cumulative voting rights and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of votes to which the shareholder's shares are entitled, or distribute such shareholder's votes on the same principle among as many candidates as the shareholder may select. However, no shareholder shall be entitled to cumulate votes unless the candidate's name has been placed in nomination prior to the voting and the shareholder, or any other shareholder, has given notice at the meeting prior to the voting of the intention to cumulate votes. On all other matters each share is entitled to one vote on each proposal or item that comes before the Annual Meeting.

Voting Electronically via the Internet or by Telephone

Shareholders whose shares are registered in their own names may vote either via the Internet or by telephone. Specific instructions to be followed by any registered shareholder interested in voting via the Internet or by telephone are set forth on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate shareholders' identities, allow shareholders to give their voting instructions and confirm that shareholders' voting instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm offers Internet and telephone

voting, your proxy card will provide specific instructions. If your proxy card does not reference Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided.

Solicitation

Solicitation of proxies may be made by directors, officers and other employees of REMEC by personal interview, telephone, facsimile or other method. No additional compensation will be paid for any such services. Costs of solicitation, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any other information furnished to the shareholders, will be borne by REMEC. REMEC may reimburse the reasonable charges and expenses of brokerage houses or other nominees or fiduciaries for forwarding proxy materials to, and obtaining authority to execute proxies from, beneficial owners for whose account they hold shares of REMEC's Common Stock.

Quorum, Abstentions, and Broker Non-Votes

In the election of directors, the six nominees receiving the highest number of affirmative votes shall be elected. Proposal Two requires the approval of the affirmative vote of the holders of REMEC's Common Stock representing a majority of the voting power present or represented by proxy and voting at the Annual Meeting, which shares voting affirmatively must also constitute at least a majority of the voting power required to constitute a quorum. The presence at the Annual Meeting, either in person or by proxy, of holders of outstanding shares of REMEC's Common Stock entitled to vote and representing a majority of the voting power of such shares shall constitute a quorum for the transaction of business. Abstentions and shares held by brokers that are present in person or represented by proxy but that are not voted because the brokers were prohibited from exercising discretionary authority ("broker non-votes") will be counted for the purpose of determining whether a quorum is present for the transaction of business. Abstentions and broker non-votes can have the effect of preventing approval of a proposal where the number of affirmative votes does not constitute a majority of the required quorum. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Bylaws of REMEC provide for a Board consisting of at least six but no more than nine directors, with the size of the Board set at six as of the date of the Annual Meeting. Six directors are to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the six nominees named below. All of the nominees named below are presently directors of REMEC. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner in accordance with cumulative voting as will ensure the election of as many of the nominees listed below as possible. In such event, the specific nominees for whom such votes will be cumulated will be determined by the proxy holders. It is not expected that any nominee will be unable or will decline to serve as a director. The six nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of REMEC to serve until the next Annual Meeting of Shareholders and until their successors have been elected and qualified.

The following table sets forth certain information concerning the nominees for directors of REMEC as of March 28, 2002:

Name

| | Age

| | Position with REMEC

| | Director

Since

|

|---|

| Ronald E. Ragland(3) | | 60 | | Chairman of the Board and Chief Executive Officer | | 1983 |

| Thomas A. Corcoran(2) | | 57 | | Director | | 1996 |

| Mark D. Dankberg(1) | | 46 | | Director | | 1999 |

| William H. Gibbs(2) | | 58 | | Director | | 1996 |

| Andre R. Horn(1) | | 73 | | Director | | 1988 |

| Jeffrey M. Nash(1)(2)(3) | | 54 | | Director | | 1988 |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Compensation Committee.

- (3)

- Member of the Nominating Committee.

There is no family relationship between any of the directors or executive officers of REMEC.

Mr. Ragland founded REMEC and has served as our Chairman of the Board and Chief Executive Officer since January 1983. Prior to founding REMEC, he held general management and program management positions in the microwave component and aerospace industries. Mr. Ragland was a Captain in the United States Army and holds a B.S.E.E. degree from Missouri University at Rolla and an M.S.E.E. degree from St. Louis University.

Mr. Corcoran has been a director of REMEC since May 1996. From January 2001 to present he has served as President of Corcoran Enterprises, LLC. Until December 2000, Mr. Corcoran was the Chairman, President and Chief Executive Officer of Allegheny Teledyne Incorporated. Prior to that, Mr. Corcoran was a Vice President and the President and Chief Operating Officer of the Space and Strategic Missiles sector of Lockheed Martin Corporation from October 1998 to September 1999. From March 1995 to September 1998, he was the President and Chief Operating Officer of the Electronics sector of Lockheed Martin. From 1993 to 1995 Mr. Corcoran was President of the Electronics Group of Martin Marietta Corporation, and from 1983 to 1993 he held various management positions with the

3

Aerospace segment of General Electric Company. Mr. Corcoran is a director of L-3 Communications Holdings, Inc. Mr. Corcoran is a member of the Board of Trustees of Worcester Polytechnic Institute, the Board of Trustees of Stevens Institute of Technology and the Board of Governors of the Electronic Industries Association. Mr. Corcoran holds a B.S. degree in Chemical Engineering from the Stevens Institute of Technology.

Mr. Dankberg has been a director of REMEC since September 1999. Mr. Dankberg was a founder of, and has served as Chairman of the Board, President and Chief Executive Officer of ViaSat, Inc. since its inception in May 1986. Prior to founding ViaSat, he was Assistant Vice President of M/A-COM Linkabit, a manufacturer of satellite telecommunications equipment, from 1979 to 1986 and Communications Engineer for Rockwell International from 1977 to 1979. Mr. Dankberg holds B.S.E.E. and M.E.E. degrees from Rice University.

Mr. Gibbs has been a director of REMEC since May 1996. Mr. Gibbs was the President and Chief Executive Officer of DH Technology, Inc. from November 1985 to January 1998 and was Chairman of the Board of DH Technology, Inc. from March 1987 through October 1997. From August 1983 to November 1985, he held various positions, including those of President and Chief Operating Officer, with Computer and Communications Technology, a supplier of rigid disc magnetic recording heads to the peripheral equipment segment of the computer industry. Mr. Gibbs is a director of Fargo Electronic, Inc. Mr. Gibbs holds a B.S.E.E. degree from the University of Arkansas.

Mr. Horn has been a director of REMEC since 1988. Mr. Horn is the retired Chairman of the Board of Joy Manufacturing Company. From 1985 to 1991, Mr. Horn served as the Chairman of the Board of Needham & Company, Inc. He currently holds the honorary position of Chairman Emeritus of Needham & Company, Inc. Mr. Horn is a director of Varco International, Inc., a provider of equipment and services to the petroleum industry. Mr. Horn hold a B.S. degree in Mathematics from the University of Paris and is a graduate of the Ecole des Hautes Etudes Commerciales (Paris).

Dr. Nash has been a director of REMEC since September 1988. Since June 1994, Dr. Nash has been President of Digital Perceptions, Inc. From August 1995 to December 1997, he was the President of TransTech Information Management Systems, Inc. From 1989 to 1994, he was the President of Visqus Corporation as well as Conner Technology, Inc., both subsidiaries of Conner Peripherals, Inc. Dr. Nash is currently a director of ViaSat, Inc., a manufacturer of satellite communication equipment, and several private companies, including Prisa Networks, Orincon Corporation and Jaycor Tactical Systems Inc. Dr. Nash holds a B.S. and M.S. degree in Engineering from the University of California, Los Angeles ("UCLA"), and a Ph.D. in Large Scale Systems Engineering/Operations Research from UCLA.

Board Meetings and Committees

The Board held a total of eight meetings during the fiscal year ended January 31, 2002. During this period, each Director attended at least 75% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which he served. REMEC has a standing Audit Committee, Compensation Committee and Nominating Committee.

During the fiscal year ended January 31, 2002, the members of REMEC's Audit Committee were Mr. Dankberg, Mr. Horn and Dr. Nash. The principal functions of the Audit Committee are to recommend engagement of REMEC's independent auditors, to consult with REMEC's auditors concerning the scope of the audit and to review with them the results of their examination, to review and approve any material accounting policy changes affecting REMEC's operating results and to review REMEC's financial control procedures and personnel. The Audit Committee held two meetings during the fiscal year ended January 31, 2002. The Board has determined that each of the members of the

4

Audit Committee is an "independent director" as defined in Rule 4200 of the listing standards of the National Association of Securities Dealers, Inc.

During the fiscal year ended January 31, 2002, the members of the Compensation Committee were Mr. Corcoran, Mr. Gibbs and Dr. Nash. The Compensation Committee determines compensation and benefits for REMEC's executive officers and administers REMEC's equity incentive plans. The Compensation Committee held four meetings during the fiscal year ended January 31, 2002.

During the fiscal year ended January 31, 2002, the members of the Nominating Committee were Mr. Ragland and Dr. Nash. The Nominating Committee reviews potential candidates for service on the Board. The Nominating Committee did not hold any meetings during the fiscal year ended January 31, 2002. All the nominees proposed for election as directors presently are directors of REMEC and were nominated for re-election by the Board. Any shareholder who wishes to recommend a prospective board nominee for the committee to consider can write to Donald J. Wilkins, Secretary, Nominating Committee, REMEC, Inc., 3790 Via de la Valle, Suite 311, Del Mar, California 92014.

Compensation of Directors

Effective June 11, 2001, REMEC's outside directors receive an annual retainer fee of $7,200 for serving on the Board, a fee of $2,000 for each Board meeting attended and a fee of $600 for participation in a telephonic Board meeting. Outside directors also receive a fee of $600 ($900 for the committee chairman) for each committee meeting attended. Outside directors are reimbursed for their reasonable travel expenses in attending Board and committee meetings. Also, under REMEC's 1996 Nonemployee Director Stock Option Plan, each outside director receives (i) a one-time grant of an option to purchase 25,000 shares of REMEC's Common Stock upon the initial election of such person as a director and (ii) an annual grant of an option to purchase 9,000 shares of REMEC's Common Stock each year in which the director continues to serve on the Board.

Recommendation of the Board

The Board unanimously recommends the shareholders voteFOR the election of each of the nominees listed herein.

5

PROPOSAL TWO

APPROVAL OF AMENDMENT TO REMEC'S EMPLOYEE STOCK PURCHASE PLAN

TO INCREASE THE NUMBER OF SHARES RESERVED FOR ISSUANCE

Approval of Amendment to Employee Stock Purchase Plan

REMEC's Employee Stock Purchase Plan (the "Purchase Plan"), originally covering 250,000 shares of REMEC's Common Stock, was adopted by the Board of Directors in November 1995 and approved by shareholders in January 1996. An amendment to the Purchase Plan to increase the number of shares available for issuance under the Purchase Plan to a total of 800,000 was approved by the Board of Directors in February 1997 and by shareholders in June 1997. The authorized number of shares under the Purchase Plan increased to a total of 1,200,000 shares on account of a three-for-two stock split effected on June 27, 1997. An amendment to the Purchase Plan to increase the number of shares available for issuance under the Purchase Plan to a total of 1,800,000 was approved by the Board in April 1999 and by the shareholders in June 1999. The authorized number of shares under the Purchase Plan increased to a total of 2,700,000 shares on account of a three-for-two stock split effected as a 50% stock dividend payable on June 30, 2000. Subject to shareholder approval, in April 2002, the Board approved an amendment to the Purchase Plan to increase the number of shares available for issuance by 750,000 to a total of 3,450,000 shares.

The purpose of this proposal is to obtain shareholder approval of the amendment to the Purchase Plan increasing the number of shares available for issuance by 750,000 to a total of 3,450,000. Providing employees with stock incentives under the Purchase Plan is a critical component of REMEC's employee compensation structure and growth strategy. This amendment is intended to afford REMEC greater flexibility in providing employees with stock incentives so that REMEC can continue to provide such incentives at levels determined appropriate by the Board.

The Purchase Plan permits employees to purchase REMEC's Common Stock at a discounted price. The Purchase Plan is designed to encourage and assist a broad spectrum of REMEC employees to acquire an equity interest in REMEC through the purchase of its Common Stock. The Purchase Plan is also intended to provide to participating employees the benefits available for tax qualified employee stock option plans.

As of March 28, 2002, 2,118,058 shares had been purchased under the Purchase Plan by participants and an additional 581,942 shares were available for issuance under the Purchase Plan (in each case before taking into account the proposed amendment to increase the authorized number of shares available for issuance by 750,000). On March 28, 2002, the closing sale price of REMEC's Common Stock was $9.25 per share. Management currently believes that the 3,450,000 shares available for issuance under the amended Purchase Plan (if approved) will be sufficient for all stock purchases under the plan for approximately two years.

Required Vote

Shareholders are requested in this Proposal 2 to approve an amendment to REMEC's Employee Stock Purchase Plan to increase the number of shares of REMEC's Common Stock available for issuance by 750,000, from 2,700,000 to 3,450,000. The affirmative vote of the holders of REMEC's Common Stock representing a majority of the voting power present in person or represented by proxy and voting at the Annual Meeting, which shares voting affirmatively must also constitute at least a majority of the voting power required to constitute a quorum, is required to approve this Proposal 2. Abstentions and broker non-votes can have the effect of preventing approval of this Proposal 2 where the number of affirmative votes does not constitute a majority of the required quorum.

Recommendation of the Board

The Board unanimously recommends the shareholders voteFOR Proposal 2.

6

Compensation and Growth Strategy

The purchase of REMEC's Common Stock under the Purchase Plan is a critical component of REMEC's employee compensation structure. Since the Purchase Plan was originally approved by the Board in November 1995, the number of REMEC employees has grown to a total of approximately 3,294 employees company-wide. Most of this growth in number of employees has been as a result of acquisitions of other companies by REMEC.

One critical element of REMEC's growth strategy is to continue to pursue acquisitions. Management believes that acquisition candidates are attracted to REMEC, in part, because REMEC generally desires to retain key executives and technology personnel by providing equity incentives for such executives and personnel in the form of participation in the Purchase Plan and other equity incentive plans. Also, management believes that the availability of shares under the Purchase Plan will help facilitate the acquisition of any target company that has an existing employee stock purchase plan.

Without approval of the amendment to the Purchase Plan increasing the number of shares available for issuance by 750,000 shares, REMEC will be unable to allow employee participation in the Purchase Plan beyond the level of shares currently authorized and the Board believes that REMEC would be:

- •

- disadvantaged in its recruitment and retention of employees; and

- •

- less attractive to acquisition targets and their key executives and technology personnel.

Description of Purchase Plan

Purpose. The purpose of the Purchase Plan is to provide eligible employees, including executive officers and directors who are employees, with the opportunity to acquire a stock ownership interest in REMEC through accumulated payroll deductions. These deductions will be applied from time to time to purchase shares of REMEC's Common Stock at a discount of at least 15% to the market price on the date of purchase.

Administration. The Board may administer the Purchase Plan or the Board may delegate its authority to a committee comprised of not less than two outside directors and may delegate routine matters to management. Subject to the express provisions of the Purchase Plan and the limitations of Section 423 of the Internal Revenue Code of 1986, as amended (the "Code"), the Board may administer and interpret the Purchase Plan in any manner it believes to be desirable, and any such interpretation is conclusive and binding on REMEC and all participants.

Shares Subject to the Purchase Plan. The total number of shares of REMEC's Common Stock reserved and available for issuance under the Purchase Plan is currently 2,700,000. If this Proposal 2 is approved by the shareholders, the total number of shares of REMEC's Common Stock reserved and available for issuance under the Purchase Plan will be increased by 750,000 to a total of 3,450,000.

Eligibility. All employees, including executive officers and directors, who are employees customarily employed more than 20 hours per week and more than five months per year by REMEC or a participating REMEC subsidiary, are eligible to participate in the Purchase Plan on the first enrollment date following employment. However, employees who hold, directly or through options, 5% or more of the stock of REMEC are not eligible to participate.

The Purchase Plan is implemented through a series of three-month consecutive offering periods, or such other periods as may be established by the Board from time to time. New offering periods begin on each enrollment date and end on the following purchase date. Enrollment dates occur on the first trading day of the fiscal quarter (i.e., quarterly enrollment dates are currently the first trading day of February, May, August and November), or such other dates as may be established by the Board from time to time. Purchase dates occur on the last trading day of the third month following an enrollment

7

date (i.e., quarterly purchase dates are currently the last trading day of April, July, October and January), or such other dates as may be established by the Board from time to time. Enrollment or re-enrollment by a participant in the Purchase Plan constitutes the grant by REMEC to the participant of an option to purchase fully vested shares of REMEC's Common Stock under the Purchase Plan.

Participants initially elect to participate in the Purchase Plan by completing an enrollment form on or before the 15th day of the month preceding an enrollment date. Thereafter, each participant whose prior option has expired and who has not withdrawn from the Purchase Plan will be automatically re-enrolled in the Purchase Plan and granted a new option on the next consecutive enrollment date. Each participant may contribute up to a maximum of 15% of his or her compensation during each offering period through payroll withholding, or such lesser percentage as the Board may establish from time to time; provided that no participant's right to acquire shares may accrue at a rate exceeding $25,000 of fair market value of REMEC's Common Stock (determined as of the enrollment dates) in any calendar year.

On each purchase date, REMEC applies the funds in each participant's payroll withholding account to purchase whole shares of REMEC's Common Stock. The cost of each share purchased is 85% of the lower of the fair market value of Common Stock on (i) the applicable enrollment date or (ii) the applicable purchase date. This allows participants a quarterly "look-back" period over which the price of their shares will be priced. For this purpose, the "fair market value" of a share of REMEC's Common Stock is the closing price quoted on the Nasdaq National Market System on the applicable date.

Participation in the Purchase Plan terminates immediately when a participant ceases to be employed by REMEC or a participating REMEC subsidiary for any reason whatsoever (excluding death or permanent disability) or otherwise becomes ineligible to participate in the Purchase Plan.

Assignment. The rights of a participant under the Purchase Plan are not assignable. A participant's right to purchase shares under the Purchase Plan are exercisable only during the participant's lifetime and only by him or her. No participant may create a lien on any funds, securities, rights, or other property held by REMEC for the account of the participant under the Purchase Plan, except to the extent that there has been a designation of beneficiaries in accordance with the Purchase Plan, and except to the extent permitted by the laws of descent and distribution if beneficiaries have not been designated.

The Board may amend, alter, or terminate the Purchase Plan at any time, including amendments to outstanding options. No amendment shall be effective unless within 12 months after it is adopted by the Board it is approved by the holders of a majority of the votes cast at a duly held shareholders' meeting at which a quorum of the voting power of the REMEC is represented in person or by proxy, if such amendment would (i) increase the number of shares reserved for purchase under the Purchase Plan or (ii) require shareholder approval in order to comply with Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended.

If the Purchase Plan is terminated, the Board may elect to terminate all outstanding options either immediately or upon completion of the purchase of shares on the next purchase date, or may elect to permit options to expire in accordance with their terms (and participation to continue through such expiration dates). If the options are terminated prior to expiration, all funds contributed to the Purchase Plan that have not been used to purchase shares shall be returned to the participants as soon as administratively feasible.

In the event of any reorganization, recapitalization, stock split, reverse stock split, stock dividend, combination of shares, merger, consolidation, offering of rights, or other similar change in the capital

8

structure of REMEC, the Board may make such adjustment, if any, as it deems appropriate in the number, kind, and purchase price of the shares available for purchase under the Purchase Plan and in the maximum number of shares subject to any option under the Purchase Plan.

In the event of the sale of all or substantially all of the assets of REMEC, or the merger of REMEC with or into another corporation, or the dissolution or liquidation of REMEC, a purchase date shall occur on the trading day immediately preceding the date of such event, unless otherwise provided by the Board in its sole discretion, including provision for the assumption or substitution of each option under the Purchase Plan by the successor or surviving corporation, or a parent or subsidiary thereof.

Plan Benefits

As of March 28, 2002, approximately 1,768 employees of REMEC were eligible to participate in the Purchase Plan and 684 employees were enrolled in the Purchase Plan. Since the number of shares purchased under the Purchase Plan by any employee and the purchase price thereof are determined by the level of voluntary contributions by such employee and the market price of the shares in effect from time to time, REMEC currently cannot determine the number of shares that may be purchased in the future by any eligible individual or group of individuals or the purchase price thereof.

From the date of the initial adoption of the Purchase Plan by the Board in November 1995 to March 28, 2002, shares of REMEC's Common Stock were purchased under the Purchase Plan as follows (as adjusted for stock splits, stock dividends and similar events): Ronald E. Ragland, Chairman and Chief Executive Officer, 7,747 shares; Errol Ekaireb, President and Chief Operating Officer, 11,043 shares; Jack A. Giles, Executive Vice President, 21,005 shares; Nicholas J.S. Randall, Executive Vice President, 3,133 shares; Jon E. Opalski, Executive Vice President, 16,079 shares (includes 2,643 shares purchased by Mr. Opalski's spouse); all current executive officers as group, 91,603 shares; and all employees (excluding executive officers) as a group, 2,026,455 shares. Only employees of REMEC and participating REMEC subsidiaries are eligible to participate in the Purchase Plan.

Federal Income Tax Consequences

In general, participants will not have taxable income or loss under the Purchase Plan until they sell or otherwise dispose of shares acquired under the Purchase Plan (or die holding such shares). If the shares are held, as of the date of sale or disposition, for longer than both: (i) two years after the beginning of the enrollment period during which the shares were purchased and (ii) one year following purchase, a participant will have taxable ordinary income equal to 15% of the fair market value of the shares on the first day of the enrollment period (but not in excess of the gain on the sale). Any additional gain from the sale will be long-term capital gain. REMEC is not entitled to an income tax deduction (even for the 15%) if the holding periods are satisfied. At present, there is no income or employment tax withholding on the purchase or sale of Purchase Plan shares (even where there is ordinary income). However, the Treasury Department has proposed imposing employment tax withholding on the spread at exercise of employment stock purchase plan options.

If the shares are disposed of before the expiration of both of the foregoing holding periods (a "disqualifying disposition"), a participant will have taxable ordinary income equal to the excess of the fair market value of the shares on the purchase date over the purchase price. In addition, the participant will have taxable capital gain (or loss) measured by the difference between the sale price and the participant's purchase price plus the amount of ordinary income recognized, which gain (or loss) will be long-term if the shares have been held as of the date of sale for more than one year. REMEC is entitled to an income tax deduction equal to the amount of ordinary income recognized by a participant in a disqualifying disposition. Special rules apply to participants who are directors or officers.

9

MANAGEMENT

Security Ownership of Certain Beneficial Owners and Management

The following sets forth certain information regarding beneficial ownership of REMEC's Common Stock as of March 28, 2002 (i) by each person who is known by REMEC to own beneficially more than 5% of REMEC's Common Stock, (ii) by each of REMEC's directors, (iii) by the Chief Executive Officer and the four other most highly paid executive officers of REMEC at fiscal year end (the "Named Executive Officers") and (iv) by all directors and executive officers as a group.

Beneficial Owner

| | Number of Shares

Beneficially Owned(1)

| | Percentage of

Shares Beneficially

Owned(1)(2)

| |

|---|

| Perkins, Wolf, McDonnell & Company(3) | | 5,512,330 | | 12.2 | % |

| State of Wisconsin Investment Board(4) | | 4,010,100 | | 8.9 | % |

| Ronald E. Ragland(5) | | 1,543,784 | | 3.4 | % |

| Errol Ekaireb(6) | | 288,279 | | * | |

| Jack A. Giles(7) | | 362,722 | | * | |

| Nicholas J.S. Randall(8) | | 742,508 | | 1.6 | % |

| Jon E. Opalski(9) | | 177,862 | | * | |

| Thomas A. Corcoran(10) | | 29,768 | | * | |

| Mark D. Dankberg(11) | | 29,521 | | * | |

| William H. Gibbs(12) | | 25,536 | | * | |

| Andre R. Horn(13) | | 40,077 | | * | |

| Jeffrey M. Nash(14) | | 66,393 | | * | |

| All directors and executive officers as a group (15 persons)(15) | | 3,918,960 | | 8.7 | % |

- *

- Less than 1% of the outstanding shares of REMEC's Common Stock.

- (1)

- This table is based upon information supplied by directors, officers and principal shareholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, each of the shareholders identified in this table has sole voting and investment power with respect to the shares shown. Percentage of ownership is based on 45,212,418 shares of REMEC's Common Stock outstanding as of March 28, 2002.

- (2)

- Shares issuable upon exercise of outstanding options are considered outstanding for purposes of calculating the percentage of ownership of REMEC's Common Stock of the person holding such options, but are not considered outstanding for computing the percentage of ownership of any other person.

- (3)

- The address of Perkins, Wolf, McDonnel & Company is 310 S. Michigan Avenue, Suite 2600, Chicago, Illinois 60604.

- (4)

- The address of State of Wisconsin Investment Board is P.O. Box 7842, Madison, Wisconsin 53707.

- (5)

- Includes 42,000 shares held by Mr. Ragland's minor children.

- (6)

- Includes 12,000 shares held by Mr. Ekaireb's spouse.

- (7)

- Includes 17,438 shares held by Mr. Giles' spouse.

- (8)

- Includes 15,000 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (9)

- Includes 5,625 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002 and 3,766 shares held by Mr. Opalski's spouse.

10

- (10)

- Includes 2,130 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (11)

- Includes 3,091 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (12)

- Includes 2,130 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (13)

- Includes 2,130 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (14)

- Includes 2,130 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

- (15)

- Includes 85,611 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 28, 2002.

Executive Compensation

Summary Compensation Table. The following table sets forth the total compensation received by the Named Executive Officers. None of the Named Executive Officers earned any bonuses or compensation for the fiscal years other than as set forth in the table or received any restricted stock awards, stock appreciation rights or long-term incentive plan payouts.

Summary Compensation Table

| |

| | Annual Compensation

| | Long Term

Compensation

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)(1)

| | Bonus ($)

| | Securities

Underlying

Options (#)

| | All Other

Compensation ($)

| |

|---|

Ronald E. Ragland

Chairman and Chief Executive Officer | | 2002

2001

2000 | | 432,829

393,553

372,752 | | —

230,000

— | | 400,000

120,000

120,000 | | 17,020

6,056,054

14,870 | (2)

(3)

(4) |

Errol Ekaireb

President and Chief Operating Officer |

|

2002

2001

2000 |

|

364,003

331,085

313,757 |

|

—

155,000

— |

|

180,000

75,000

75,000 |

|

14,445

2,072,093

388,755 |

(5)

(6)

(7) |

Jack A. Giles

Executive Vice President |

|

2002

2001

2000 |

|

311,107

284,095

268,865 |

|

—

112,000

— |

|

120,000

52,500

52,500 |

|

13,045

1,098,431

537,055 |

(8)

(9)

(10) |

Nicholas J.S. Randall

Executive Vice President |

|

2002

2001

2000 |

|

260,000

200,000

201,172 |

|

—

40,000

— |

|

80,000

—

60,000 |

|

57,257

51,167

48,206 |

(11)

(12)

(13) |

Jon E. Opalski

Executive Vice President |

|

2002

2001

2000 |

|

234,222

210,739

188,666 |

|

—

40,000

— |

|

32,000

43,500

60,000 |

|

9,690

4,498

490,169 |

(14)

(15)

(16) |

- (1)

- Includes amounts deferred at the option of the officer pursuant to REMEC's deferred compensation plan for employee directors.

- (2)

- Consists of a $9,000 automobile allowance, $7,330 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. In addition, Mr. Ragland sold to REMEC 175,000

11

restricted shares of the Common Stock of Nanowave, Inc. ("Nanowave"), a majority owned subsidiary of REMEC. REMEC paid a purchase price of $1.00 per share (equal to the purchase price paid by Mr. Ragland). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sale, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share.

- (3)

- Consists of a $9,000 automobile allowance, $6,600 in life insurance premiums, a $600 contribution to the REMEC 401(k) plan and $6,039,854 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised). In addition, Mr. Ragland purchased 175,000 restricted shares of the Common Stock of Nanowave. Mr. Ragland paid a purchase price of $1.00 per share (equal to the exercise price of stock options granted to Nanowave's employees at the time of purchase). Certain of these shares are subject to a right of repurchase by Nanowave that expires over four years.

- (4)

- Consists of a $9,000 automobile allowance and $5,870 in life insurance premiums.

- (5)

- Consists of a $9,000 automobile allowance, $4,755 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. In addition, Mr. Ekaireb sold to REMEC 175,000 restricted shares of the Common Stock of Nanowave. REMEC paid a purchase price of $1.00 per share (equal to the purchase price paid by Mr. Ekaireb). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sale, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share.

- (6)

- Consists of a $9,000 automobile allowance, $4,755 in life insurance premiums, a $600 contribution to the REMEC 401(k) plan and $2,057,738 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised). In addition, Mr. Ekaireb purchased 175,000 restricted shares of the Common Stock of Nanowave. Mr. Ekaireb paid a purchase price of $1.00 per share (equal to the exercise price of stock options granted to Nanowave's employees at the time of purchase). Certain of these shares are subject to a right of repurchase by Nanowave that expires over four years.

- (7)

- Consists of a $9,000 automobile allowance, $4,755 in life insurance premiums and $375,000 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised).

- (8)

- Consists of a $9,000 automobile allowance, $3,355 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. In addition, Mr. Giles sold to REMEC 50,000 restricted shares of the Common Stock of Nanowave. REMEC paid a purchase price of $1.00 per share (equal to the purchase price paid by Mr. Giles). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sale, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share.

- (9)

- Consists of a $9,000 automobile allowance, $3,355 in life insurance premiums, a $600 contribution to the REMEC 401(k) plan and $1,085,476 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised). In addition, Mr. Giles purchased 50,000 restricted shares of the Common Stock of Nanowave. Mr. Giles paid a purchase price of $1.00 per share (equal to the exercise price of stock options granted to Nanowave's employees at the time of purchase). Certain of these shares are subject to a right of repurchase by Nanowave that expires over four years.

12

- (10)

- Consists of a $9,000 automobile allowance, $3,908 in life insurance premiums and $524,147 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised).

- (11)

- Consists of a $23,000 automobile allowance, a $33,000 contribution to a UK pension plan and $1,257 in medical insurance premiums.

- (12)

- Consists of a $20,002 automobile allowance, a $30,000 contribution to a UK pension plan and $1,165 in medical insurance premiums.

- (13)

- Consists of a $19,767 automobile allowance, a $27,143 contribution to a UK pension plan and $1,296 in medical insurance premiums.

- (14)

- Consists of a $9,000 automobile allowance and a $690 contribution to the REMEC 401(k) plan.

- (15)

- Consists of a $3,898 automobile allowance and a $600 contribution to the REMEC 401(k) plan.

- (16)

- Consists of a $100 contribution to the REMEC 401(k) plan and $490,069 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price, multiplied by the number of option shares exercised).

Option Grant Table. The following table sets forth certain information relating to options to purchase shares of REMEC's Common Stock granted to the Named Executive Officers granted during the fiscal year ended January 31, 2002.

Option Grants in Fiscal 2002

| |

| |

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(2) ($)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| | Percent of Total

Options

Granted

to Employees

in Fiscal Year

| |

| |

|

|---|

Name

| | Exercise or

Base Price Per

Share(1)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Ronald E. Ragland | | 400,000 | | 14.84 | % | $ | 9.00 | | 3/5/2010 | | 1,984,782 | | 4,888,612 |

| Errol Ekaireb | | 180,000 | | 6.68 | % | $ | 9.00 | | 3/5/2010 | | 893,152 | | 2,199,875 |

| Jack A. Giles | | 120,000 | | 4.45 | % | $ | 9.00 | | 3/5/2010 | | 595,434 | | 1,466,584 |

| Nicholas J.S. Randall | | 80,000 | | 2.97 | % | $ | 9.00 | | 3/5/2010 | | 396,956 | | 977,722 |

| Jon E. Opalski | | 32,000 | | 1.19 | % | $ | 9.00 | | 3/5/2010 | | 158,783 | | 391,089 |

- (1)

- Options were granted at 100% of fair market value on the date of grant.

- (2)

- The dollar amounts set forth under these columns are the result of calculations of assumed annual rates of stock appreciation of 5% and 10%, the two assumed rates of stock price appreciation required under the rules of the Securities and Exchange Commission ("SEC"). The calculations are for the period beginning on the date of grant of the fiscal 2002 option awards (March 5, 2001) and ending on the date of expiration of such options (March 5, 2010). Based on the assumed annual rates of stock price appreciation of 5% and 10%, REMEC's projected stock price at the dates of expiration of these options are as follows: $13.96 and $21.22, respectively. These assumed annual rates of stock price appreciation are not intended to forecast future appreciation of REMEC's stock price. Indeed REMEC's stock price may increase or decrease in value over the time period set forth above. The potential realizable value computation also does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock.

13

Option Exercise Table. The following table sets forth certain information relating to options to purchase REMEC's Common Stock exercised by the Named Executive Officers during the fiscal year ended January 31, 2002 and the unexercised options held by them as of the end of such year. With respect to the Named Executive Officers, no stock appreciation rights were exercised during the fiscal year and no stock appreciation rights were outstanding at the end of the fiscal year.

Option Values at January 31, 2002

| |

| |

| | Number Of Securities

Underlying Unexercised

Options At

Fiscal Year-End (#)

| |

| |

|

|---|

| |

| |

| | Value Of Unexercised

In-The-Money Options

At Fiscal Year-End(1)($)

|

|---|

Name

| | Shares Acquired on

Exercise (#)

| | Value Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ronald E. Ragland | | 0 | | 0 | | 180,000 | | 580,000 | | 357,504 | | 609,504 |

| Errol Ekaireb | | 0 | | 0 | | 103,500 | | 292,500 | | 198,240 | | 307,440 |

| Jack A. Giles | | 0 | | 0 | | 67,500 | | 195,000 | | 124,908 | | 198,408 |

| Nicholas J.S. Randall | | 0 | | 0 | | 30,000 | | 110,000 | | 56,343 | | 140,343 |

| Jon E. Opalski | | 0 | | 0 | | 77,437 | | 102,313 | | 136,809 | | 147,249 |

- (1)

- Calculated on the basis of the closing price of REMEC's Common Stock on the Nasdaq National Market on January 31, 2002 ($10.05 per share).

Equity Compensation Plan Information

The following table provides information as of January 31, 2002 about the number of shares of REMEC's Common Stock that may be issued upon the exercise of outstanding options, warrants and rights under REMEC's currently existing equity compensation plans, including the 2001 Equity Incentive Plan, Equity Incentive Plan (approved by the REMEC shareholders in January 1996), Employee Stock Purchase Plan (approved by the REMEC shareholders in January 1996) and the 1996 Nonemployee Director Stock Option Plan.

Plan Category

| | (A)

Number of securities

to be issued

upon outstanding

options, warrants

and rights (#)

| | (B)

Weighted-average

exercise price

of outstanding

options, warrants

and rights ($)

| | (C)

Number of securities

remaining available for future

issuances under equity compensation

plans (excluding securities

reflected in Column (A))(#)

|

|---|

| Equity Compensation Plans approved by security holders: | | | | | | |

2001 Equity Incentive Plan |

|

411,250 |

|

8.74 |

|

2,838,750 |

Equity Incentive Plan |

|

5,223,719 |

|

12.55 |

|

313,662 |

Employee Stock Purchase Plan |

|

- -0- |

|

N/A |

|

581,942 |

1996 Nonemployee Directors Stock Option Plan |

|

169,875 |

|

14.03 |

|

139,125 |

Equity Compensation Plans not approved by security holders: |

|

- -0- |

|

N/A |

|

- -0- |

| | |

| |

| |

|

Total: |

|

5,804,844 |

|

12.32 |

|

3,873,479 |

| | |

| |

| |

|

14

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Employment Contracts. As of the end of REMEC's 2002 fiscal year, none of REMEC's Named Executive Officers had employment agreements with REMEC and their employment could be terminated at any time at the direction of the Board.

Each Named Executive Officer has entered into a Change in Control Agreement with REMEC dated September 1, 2001 (each an "Agreement"). Under each Agreement, certain benefits will be paid to each Named Executive Officer if REMEC incurs a change of control. In the absence of a change in control of REMEC, the Agreements do not provide any additional severance benefits to any Named Executive Officer (other than payment for unpaid base salary, unused vacation time and certain business expenses accrued before termination).

A "change of control" is defined in the Agreements as the occurrence of any one of the following events: (i) the completion of a merger or consolidation of REMEC with any other corporation or entity, other than a merger or consolidation that would result in the voting securities of REMEC outstanding immediately prior thereto continuing to represent more than 50% of the total voting power represented by the voting securities of REMEC or such surviving entity outstanding immediately after such merger or consolidation; (ii) any approval by the shareholders of REMEC of a plan of complete liquidation of REMEC or an agreement for the sale or disposition by REMEC of all or substantially all of the assets of REMEC; (ii) any person becoming the beneficial owner of securities of REMEC representing 50% or more of the total voting power represented by REMEC's then outstanding voting securities; or (iv) change in the composition of the Board, as a result of which less than a majority of the directors are incumbent directors.

If REMEC incurs a change of control, all unvested options granted to the Named Executive Officers prior to the change of control that are scheduled to vest within one (1) year from the date of the change of control will immediately vest and become fully exercisable. In addition, if REMEC incurs a change of control and a Named Executive Officer's employment is terminated without cause or constructively terminated within two years after the change of control, or if a Named Executive Officer's employment terminates within two years after the change of control as a result of the failure of any REMEC successor to assume REMEC's obligations under his Agreement, then such Named Executive Officer will be entitled to receive the following severance benefits: (i) eighteen months of his annualized base salary as in effect immediately before the change of control, payable in equal monthly installments in accordance with REMEC's normal payroll practices; (ii) one and one half (1.5) times the average of any annual bonuses received from REMEC during the two years immediately prior to the change of control, payable in equal monthly installments in accordance with REMEC's normal payroll practices; (iii) during the payment period of the severance benefits described in (i) and (ii) above, REMEC will continue to make available REMEC's medical, dental, disability, life insurance and other similar plans in which the Named Executive Officer or his spouse or dependents participated on the date of termination; and (iv) for an additional 18 months after termination of the payment period described in (iii) above, REMEC will continue to make available benefits that would be available under the Consolidated Omnibus Budget Reconciliation Act. These severance benefits described above may be subject to the 20% excise tax imposed by the Code on "golden parachute" payments. In the event that these payments would otherwise be subject to the excise tax, the severance benefits will be reduced to the level at which no tax would be imposed.

The Agreements also impose certain non-solicitation obligations upon each of the Named Executive Officers for a period of 18 months following the termination of such Named Executive Officer's employment for any reason, whether or not such termination is in connection with a change of

15

control. Each Agreement will terminate upon the date that all obligations of REMEC and the applicable Named Executive Officer have been satisfied.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires REMEC's directors and executive officers, and persons who own more than 10% of a registered class of REMEC's equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or 5 with the SEC and the National Association of Securities Dealers, Inc. Such officers, directors and 10% shareholders are also required by SEC rules to furnish REMEC with copies of all Section 16(a) forms that they file. To REMEC's knowledge, based solely upon review of the copies of such reports and certain representations furnished to it, REMEC's executive officers and directors complied with all applicable Section 16(a) filing requirements during the fiscal year ended January 31, 2002.

Certain Relationships and Related Transactions

In December 2000, eight REMEC officers purchased a total of 490,000 restricted shares of the Common Stock of Nanowave, Inc. ("Nanowave"), a majority owned subsidiary of REMEC. Among the eight were the following Named Executive Officers: Mr. Ekaireb, who serves as Chairman of the Board of Nanowave; Mr. Ragland, who serves as a Director of Nanowave; and Mr. Giles. Messrs. Ekaireb and Ragland each purchased 175,000 restricted shares, and Mr. Giles purchased 50,000 restricted shares. Each REMEC officer paid a purchase price of $1.00 per share (equal to the exercise price of stock options granted to Nanowave's employees at the time of purchase). For corporate governance reasons, it was later determined by the REMEC Board to be in the best interest of REMEC to purchase these Nanowave shares from the REMEC officers. Therefore, during December 2001 and January 2002, the eight officers, including Mr. Ragland, Mr. Ekaireb and Mr. Giles, each sold to REMEC all of their restricted shares of the Common Stock of Nanowave at a purchase price of $1.00 per share (equal to the purchase price paid by the REMEC officers). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sales, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share.

16

COMPENSATION COMMITTEE REPORT AND RELATED INFORMATION

Compensation Committee Report

The Compensation Committee of the Board has furnished the following report:

The Compensation Committee is comprised of three independent nonemployee directors. As members of the Compensation Committee, it is our responsibility to determine the most effective total executive compensation strategy, based upon the business needs of REMEC and consistent with shareholders' interests, to administer REMEC's executive compensation plans, programs and policies, to monitor corporate performance and its relationship to compensation of executive officers, and to make appropriate recommendations concerning matters of compensation.

Compensation Philosophy. The major goals of the compensation program are to align compensation with the attainment of key business objectives and to enable REMEC to attract, retain and reward capable executives who can contribute to the continued success of REMEC. Three key goals form the basis of compensation decisions for all employees of REMEC:

- 1.

- To attract and retain the most highly qualified management and employee team;

- 2.

- To pay competitively compared to similar technology and defense electronics companies and to provide appropriate reward opportunities for achieving high levels of performance compared to similar organizations in the marketplace; and

- 3.

- To motivate executives and employees to achieve REMEC's annual and long-term business goals and encourage behavior toward the fulfillment of those objectives.

As a result of this philosophy, REMEC's executive compensation program consists of base salary, bonuses, participation in equity-based incentive plans (stock option and stock purchase plans) and standard benefits.

Base Salary. The Compensation Committee recognizes the importance of maintaining compensation practices and levels of compensation competitive with technology and defense electronics companies in comparable stages of development and other comparable technology companies in the San Diego area. For external marketplace comparison purposes, a group of companies operating in our industry are utilized for determining competitive compensation levels. Also, the Compensation Committee reviewed compensation information presented in the 2000 Executive Compensation Survey for Electronics, Software and Information Technology Companies prepared by the AeA (formerly the American Electronics Association).

Base salary represents the fixed component of the executive compensation program. Determination of base salary levels is established on an annual review of marketplace competitiveness with similar technology and defense electronics companies, and on individual performance. Periodic increases in base salary relate to individual contributions evaluated against established objectives, relative marketplace competitiveness levels, length of service and the industry's annual competitive pay practice movement.

Bonuses and Stock Plans. REMEC's bonus program is an integral part of its compensation program and is designed to reward executives for long-term strategic management and for attaining specific annual performance goals. Each year a portion of REMEC's pre-tax profits comprise the bonus "pool." The Compensation Committee determines the bonus amount for the Chief Executive Officer, the President and the Executive Vice Presidents of REMEC, based on both the attainment by those officers of specific goals, and on overall corporate performance. The Chief Executive Officer, President and Executive Vice Presidents determine the bonus amount for the other executive officers and for all other salaried employees, based on the same criteria. Executive officers of REMEC are eligible to

17

receive awards under REMEC's equity incentive plans and to participate in the Employee Stock Purchase Plan.

Compensation for the Chief Executive Officer. For the fiscal year ended January 31, 2002, Ronald E. Ragland was paid a base salary of $432,829 and did not receive a bonus. During the fiscal year ended January 31, 2002, Mr. Ragland was also granted a stock option to purchase 400,000 shares of REMEC's Common Stock. This option grant was intended to include options for a two-year period as an incentive to increase shareholder value on a longer term and, therefore, Mr. Ragland will not receive an option grant during the current fiscal year. The Compensation Committee reviewed and analyzed the total compensation packages, including base salary, offered to chief executive officers by high technology companies of similar size. The comparative information was obtained from a number of sources, including surveys prepared by national consulting companies, publicly available information and extrapolations therefrom where appropriate. In addition, the Compensation Committee considered data and surveys from the AeA and other industry groups. In making its decision, the Compensation Committee weighed a number of factors, including competitive forces in the industry, individual motivation, REMEC's financial and overall performance and Mr. Ragland's leadership role in achieving the long-term strategic goals set by the Board. The Compensation Committee exercised its discretion and judgment to determine appropriate officer compensation based upon these factors.

Summary. The Compensation Committee believes that the compensation of executives by REMEC is appropriate and competitive with the compensation provided by other technology and defense electronics companies with which REMEC competes for executives and employees. The Committee believes its compensation strategy, principles and practices result in a compensation program tied to shareholder returns and linked to the achievement of annual and longer-term financial and operational results of REMEC on behalf of REMEC's shareholders.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee for REMEC's 2002 fiscal year were Mr. Corcoran, Mr. Gibbs and Dr. Nash. No member of the Compensation Committee was at any time during REMEC's 2002 fiscal year or at any other time an officer or employee of REMEC.

During the fiscal year ended January 31, 2002, no executive officer of REMEC served on the board of directors or compensation committee of another company that had an executive officer serving on REMEC's Board or Compensation Committee.

18

AUDIT COMMITTEE REPORT AND RELATED INFORMATION

Audit Committee Report

The Audit Committee of the Board has furnished the following report:

The Board has adopted a written charter for the Audit Committee (the "Audit Committee Charter").

The Board has determined that each member of the Audit Committee is "independent," as defined in the listing standards of the National Association of Securities Dealers.

As noted in the Audit Committee Charter, REMEC's management is responsible for preparing REMEC's financial statements. REMEC's independent auditors are responsible for auditing the financial statements. The activities of the Audit Committee are in no way designed to supersede or alter those traditional responsibilities. The Audit Committee's role does not provide any special assurances with regard to REMEC's financial statements, nor does it involve a professional evaluation of the quality of the audits performed by the independent auditors.

The Audit Committee has reviewed and discussed the audited financial statements with REMEC's management.

The Audit Committee has discussed with the independent auditors, Ernst & Young LLP, the matters required to be discussed by Statement of Auditing Standards No. 61,Communication With Audit Committees.

The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions With Audit Committees, has considered the compatibility of receiving nonaudit services from the independent auditors with maintaining the independent auditors' independence, and has discussed with the independent auditors the independent auditors' independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in REMEC's Annual Report on Form 10-K for the fiscal year ended January 31, 2002.

Management is responsible for the financial reporting process, the preparation of consolidated financial statements in accordance with generally accepted accounting principles, the system of internal controls and procedures designed to insure compliance with accounting standards and applicable laws and regulations. REMEC's independent accountants are responsible for auditing the financial statements. The Audit Committee's responsibility is to monitor and review processes and procedures. The members of the Audit Committee are not professionally engaged in the practice of accounting or auditing. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management and the independent accountants that the financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles.

19

Independent Public Accountants

The Board has selected Ernst & Young LLP as independent public accountants to audit the financial statements of REMEC for the fiscal year ended January 31, 2002. Ernst & Young LLP has been engaged as REMEC's auditors since 1985. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they desire to do so. The representatives of Ernst & Young LLP also will be available to respond to questions raised during the meeting.

Audit Fees. Ernst & Young LLP's fees for our annual audit and review of interim financial statements for the 2002 fiscal year were $315,000.

Financial Information Systems Design And Implementation Fees. Ernst & Young LLP did not render any professional services to us during the 2002 fiscal year with respect to financial information systems design and implementation.

All Other Fees. Ernst & Young LLP's fees for all other professional services rendered to us during the 2001 fiscal year were $507,000, including audit related services of $133,000 and non-audit services of $374,000. Audit related services included fees for statutory audits at foreign locations, due diligence on acquisitions, SEC registration statement review and accounting consultations. Non-audit services included fees for tax consultation, expatriate administration and tax preparation, and other consultations.

20

PERFORMANCE GRAPH

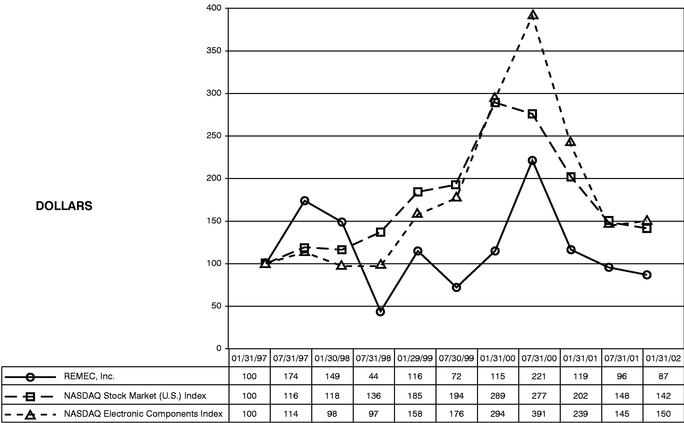

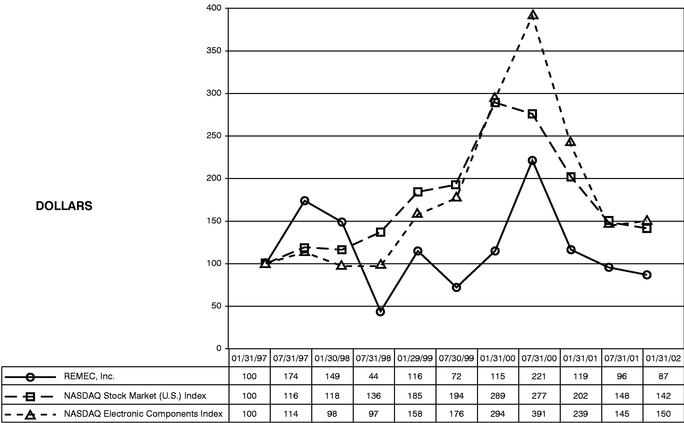

The graph set forth below compares the split adjusted cumulative total shareholder return on REMEC's Common Stock with the cumulative total return on the Nasdaq Stock Market (U.S.) Index and the Nasdaq Electronic Components Index over a five-year period, beginning January 31, 1997 and ending January 31, 2002. The total shareholder return assumes (i) the investment of $100 at the beginning of the period in REMEC's Common Stock, the Nasdaq Stock Market (U.S.) Index and the Nasdaq Electronic Components Index and (ii) the reinvestment of all dividends.

21

SHAREHOLDER PROPOSALS

Proposals of shareholders of REMEC which are intended to be presented at REMEC's 2003 annual meeting of shareholders and included in REMEC's proxy soliciting material must be received by the Secretary of REMEC, in accordance with rules of the SEC, no later than January 10, 2003.

Proposals of shareholders of REMEC which are intended to be presented at REMEC's 2003 annual meeting of shareholders, but are not intended to be included in REMEC's proxy soliciting material, must be received by the Secretary of the REMEC no later than March 26, 2003.

2002 ANNUAL REPORTS

REMEC's 2002 Annual Report, including audited financial statements for the fiscal years ending January 31, 2000, 2001 and 2002, are being forwarded to each person who is a shareholder of record as of April 19, 2002, together with this proxy statement.

A copy of REMEC's 2002 Annual Report on Form 10-K is available without charge to those shareholders who would like more detailed information concerning REMEC. If you desire a copy of that document, please send a written request to Investor Relations, REMEC, Inc., 3790 Via de la Valle, Suite 311, Del Mar, California 92014 (telephone: 858-505-3713).

OTHER MATTERS

REMEC knows of no other matters to be submitted at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed proxy to vote the shares they represent as the Board may recommend.

THE BOARD OF DIRECTORS

Del Mar, California

May 3, 2002

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE REQUESTED TO SIGN AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE PAID ENVELOPE, OR VOTE BY TELEPHONE OR ON THE INTERNET.

22

REMEC, INC.

EMPLOYEE STOCK PURCHASE PLAN

AMENDED AND RESTATED

AS OF JUNE 30, 2000

1. Purpose

This REMEC, Inc. Employee Stock Purchase Plan (the "Plan") is designed to encourage and assist employees of REMEC, Inc. (the "Company") to acquire an equity interest in the Company through the purchase of shares of Company common stock (the "Common Stock").

2. Administration

The Plan shall be administered by the Board of Directors of the Company (or by a committee of the Board that will satisfy Rule 16b-3 of the Securities and Exchange Commission ("Rule 16b-3") as in effect with respect to the Company from time to time, which in either case is referred to as the "Board") in accordance with Rule 16b-3. The Board may from time to time select a committee or persons (the "Administrator"), to be responsible for any matters so long as such selection comports with the requirements of Rule 16b-3. Subject to the express provisions of the Plan, to the overall supervision of the Board and to the limitations of Section 423 of the Internal Revenue Code of 1986, as amended (the "Code"), the Administrator may administer and interpret the Plan in any manner it believes to be desirable, and any such interpretation shall be conclusive and binding on the Company and all participants.

3. Number of Shares

- (a)

- The total number of shares of Common Stock reserved and available for issuance pursuant to this Plan shall be 2,700,000 shares. This number reflects (i) the one-for-two reverse split of the common stock effected after the adoption of the Plan by the Board but prior to the date of closing of the Company's sale and issuance of common stock to the public in a firm underwritten public offering registered under the Securities Act of 1933, as amended, (ii) the increase in the authorized number of shares under the Plan approved by shareholders on June 6, 1997, (iii) the adjustment by the Board to the authorized number of shares pursuant to Section 3(b) of the Plan to account for the three-for-two split of Common Stock effected as a 50% stock dividend payable on June 27, 1997 to shareholders of record as of June 20, 1997, (iv) the increase in the authorized number of shares under the Plan approved by shareholders on June 4, 1999, and (v) the adjustment by the Board to the authorized number of shares pursuant to Section 3(b) of the Plan to account for the three-for-two split of Common Stock effected as a 50% stock dividend payable on June 30, 2000 to shareholders of record as of June 19, 2000. Such shares may consist, in whole or in part, of authorized and unissued shares or treasury shares reacquired in private transactions or open market purchases, but all shares issued under this Plan shall be counted against the 2,700,000-share limitation.

- (b)

- In the event of any reorganization, recapitalization, stock split, reverse stock split, stock dividend, combination of shares, merger, consolidation, offering of rights, or other similar change in the capital structure of the Company, the Board may make such adjustment, if any, as it deems appropriate in the number, kind, and purchase price of the shares available for purchase under the Plan and in the maximum number of shares subject to any option under the Plan.

4. Eligibility Requirements

- (a)

- Each employee, except those described in the next paragraph, shall become eligible to participate in the Plan in accordance with Section 5 on the first Enrollment Date on or following commencement of his or her employment by the Company or following such period

5. Enrollment