SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| |

| ¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| x Definitive Proxy Statement | |

| ¨ Definitive Additional Materials | |

| ¨ Soliciting Material Pursuant to Rule 14a-12 | |

REMEC, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

May 10, 2004

To Our Shareholders:

You are cordially invited to attend the 2004 Annual Meeting of Shareholders of REMEC, Inc. (“REMEC”) to be held at REMEC’s offices located at 3790 Via de la Valle, Suite 311, Del Mar, California, on Friday, June 11, 2004 at 10:00 a.m., Pacific Daylight Savings Time. Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting of Shareholders and the attached proxy statement.

At the Annual Meeting, you will be asked (i) to elect the directors of REMEC to serve for the ensuing year and until their successors are elected, and (ii) to act on such other business as may properly come before the meeting or any adjournment thereof.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote by mailing a completed proxy card, by telephone or over the Internet. Please review the instructions on the proxy card regarding each of these voting options. Voting by any of these methods will ensure your representation at the Annual Meeting and will not limit your right to vote in person or attend the Annual Meeting.

We encourage you to conserve natural resources, as well as significantly reduce printing and mailing costs, bysigning up for electronic delivery of REMEC shareholder communications. For more information, see “Electronic Delivery of REMEC Shareholder Communications” on page 2 of the proxy statement.

We look forward to seeing you at the meeting.

Sincerely,

Robert W. Shaner

Interim Chief Executive Officer

|

|

|

YOUR VOTE IS IMPORTANT. PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE

ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU PLAN TO

ATTEND THE MEETING. PLEASE SEE “VOTING ELECTRONICALLY VIA THE INTERNET OR BY

TELEPHONE” ON PAGE 2 OF THE PROXY STATEMENT FOR ALTERNATIVE VOTING METHODS. |

|

3790 Via de la Valle, Suite 311—Del Mar, CA 92014—Tel 858-505-3713—Fax 858-847-0386

REMEC, INC.

3790 Via de la Valle, Suite 311

Del Mar, California 92014

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 11, 2004

TO THE SHAREHOLDERS OF REMEC, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of REMEC, Inc. (“REMEC”) will be held on Friday, June 11, 2004 at 10:00 a.m., Pacific Daylight Savings Time, at REMEC’s principal executive offices located at 3790 Via de la Valle, Suite 311, Del Mar, California, for the following purposes:

| | 1. | | To elect eight directors to serve on REMEC’s Board of Directors until the next Annual Meeting and until their successors have been elected and qualified. The nominees for election to REMEC’s Board of Directors are: Martin Cooper, Thomas A. Corcoran, Mark D. Dankberg, William H. Gibbs, Andre R. Horn, Harold E. Hughes, Jr., Jeffrey M. Nash, Ph.D., and Robert W. Shaner. |

| | 2. | | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only shareholders of record at the close of business on April 30, 2004 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. The stock transfer books will not be closed between the record date and the date of the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting will be available for inspection at the executive offices of REMEC.

All shareholders are cordially invited to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and submit your proxy as soon as possible. You may submit your proxy for the Annual Meeting by completing, signing, dating and returning your proxy card in the pre-addressed envelope provided, or, in most cases, by using the telephone or the Internet. Should you receive more than one proxy because your shares are held in multiple accounts or registered in different names or addresses, please returneachproxy to assure that all of your shares are voted. If you have Internet access,we encourage you to sign up for electronic delivery of REMEC shareholder communications.It is convenient, and it saves REMEC significant postage and processing costs.

FOR THE BOARD OF DIRECTORS

Andre R. Horn,

Chairman of the Board

Del Mar, California

May 10, 2004

|

|

|

YOUR VOTE IS IMPORTANT. PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE

ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU PLAN TO

ATTEND THE MEETING. PLEASE SEE “VOTING ELECTRONICALLY VIA THE INTERNET OR BY

TELEPHONE” ON PAGE 2 OF THE PROXY STATEMENT FOR ALTERNATIVE VOTING METHODS. |

|

REMEC, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

The enclosed proxy is solicited on behalf of the board of directors (the “Board”) of REMEC, Inc. (“REMEC”) for use at REMEC’s Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Friday, June 11, 2004 at 10:00 a.m., Pacific Daylight Savings Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Shareholders. The Annual Meeting will be held at REMEC’s principal executive offices located at 3790 Via de la Valle, Suite 311, Del Mar, California 92014. The telephone number at that address is (858) 505-3713. REMEC anticipates that these proxy solicitation materials will be distributed on or about May 10, 2004 to all shareholders entitled to vote at the Annual Meeting.

INFORMATION CONCERNING SOLICITATION AND VOTING

Record Date and Shares Outstanding

Shareholders of record at the close of business on April 30, 2004 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. At the Record Date,61,535,431 shares of REMEC common stock were issued, outstanding and entitled to vote at the Annual Meeting.

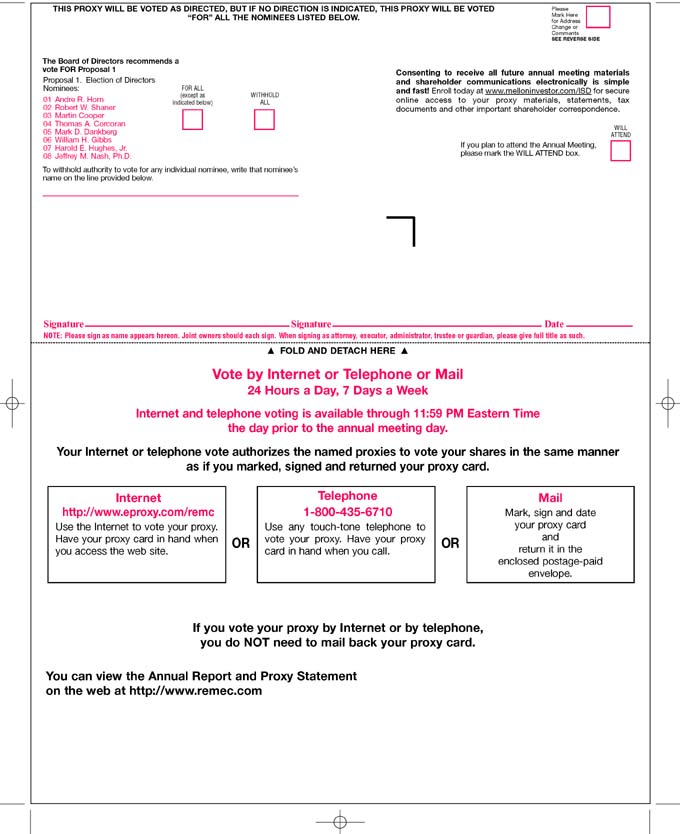

Voting; Proxies

To ensure that your vote is recorded promptly, please submit your proxy as soon as possible, even if you plan to attend the Annual Meeting in person. Most shareholders have three options for submitting their proxy: (1) via the Internet, (2) by phone or (3) by mail, using the paper proxy card.If you have Internet access, REMEC encourages you to record your proxy vote on the Internet. It is convenient, and it saves REMEC significant postage and processing costs. You may revoke or change your proxy at any time before the beginning of the Annual Meeting by submitting another proxy card with a later date, by voting via the Internet or by phone, or by sending a written notice of revocation to the Secretary of REMEC at REMEC’s principal executive offices. If you attend the Annual Meeting and vote by ballot, any proxy that you submitted previously to vote the same shares will be revoked automatically and only your vote at the Annual Meeting will be counted.Please note, however, that if your shares are held of record by a broker, bank or other nominee, you will not be able to vote in person at the Annual Meeting unless you have obtained and present a proxy issued in your name from the record holder.

Regardless of the method used to submit your proxy, your shares will be voted at the Annual Meeting as you direct. If you sign and return your proxy card (or vote via the Internet or by phone) without providing voting directions, your shares will be voted as recommended by the Board. The persons appointed proxies to vote at the Annual Meeting may vote or act in accordance with their judgment on any other matters properly presented for action at the Annual Meeting and at any adjournments of such meeting.

Every shareholder voting for the election of directors may exercise cumulative voting rights and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of votes to which the shareholder’s shares are entitled, or distribute such shareholder’s votes on the same principle among as many candidates as the shareholder may select. However, no shareholder shall be entitled to cumulate votes unless the candidate’s name has been placed in nomination prior to the voting and the shareholder, or any other shareholder, has given notice at the meeting prior to the voting of the intention to cumulate votes. On all other matters each share is entitled to one vote on each proposal or item that comes before the Annual Meeting.

1

Voting Electronically via the Internet or by Telephone

Shareholders whose shares are registered in their own names may vote either via the Internet or by telephone. Specific instructions to be followed by any registered shareholder interested in voting via the Internet or by telephone are set forth on the enclosed proxy card. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, allow shareholders to give their voting instructions and confirm that shareholders’ voting instructions have been properly recorded.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm offers Internet and telephone voting, your proxy card will provide specific instructions. If your proxy card does not reference Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided.

Electronic Delivery of REMEC Shareholder Communications

If you received your annual meeting materials by mail, we encourage you to conserve natural resources, as well as significantly reduce printing and mailing costs, by signing up to receive your REMEC shareholder communications via electronic delivery. With electronic delivery, you will be notified as soon as the annual report and the proxy statement are available on the Internet, and you can easily submit your proxy votes online. Electronic delivery can also help reduce the number of bulky documents in your personal files and eliminate duplicate mailings. Your electronic delivery enrollment will be effective until you cancel it.

| | • | | If you are a registered holder (you hold your REMEC shares in your own name through REMEC’s transfer agent, Mellon Investor Services, LLC, or you have stock certificates), visitwww.melloninvestor.com/isd orwww.eproxy.com/remc to enroll in electronic delivery. |

| | • | | If you are a beneficial holder (your shares are held by a brokerage firm or bank), follow the instructions on your proxy card or contact your brokerage firm or bank to enroll in electronic delivery. |

Solicitation

REMEC will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing, and mailing of this proxy statement, the proxy, and any additional solicitation material furnished to shareholders by REMEC. Certain of REMEC’s directors, officers and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail or otherwise. REMEC is required to request that brokers and nominees who hold stock in their name furnish REMEC’s proxy material to the beneficial owners of REMEC shares and must reimburse such brokers and nominees for the expenses of doing so in accordance with certain statutory fee schedules. See “Electronic Delivery of REMEC Shareholder Communications” for information on how you can help REMEC reduce printing and mailing costs.

Quorum, Abstentions, and Broker Non-Votes

In the election of directors, the eight nominees receiving the highest number of affirmative votes shall be elected. The presence at the Annual Meeting, either in person or by proxy, of holders of outstanding shares of REMEC common stock entitled to vote and representing a majority of the voting power of such shares shall constitute a quorum for the transaction of business. Abstentions and shares held by brokers that are present in person or represented by proxy but that are not voted because the brokers were prohibited from exercising discretionary authority (“broker non-votes”) will be counted for the purpose of determining whether a quorum is present for the transaction of business. Abstentions and broker non-votes can have the effect of preventing approval of a proposal where the number of affirmative votes does not constitute a majority of the required quorum. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Bylaws of REMEC provide for a Board consisting of at least six but no more than nine directors, with the size of the Board set at eight as of the date of the Annual Meeting. Eight directors are to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the eight nominees named below. All of the nominees named below are presently directors of REMEC. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner in accordance with cumulative voting as will ensure the election of as many of the nominees listed below as possible. In such event, the specific nominees for whom such votes will be cumulated will be determined by the proxy holders. It is not expected that any nominee will be unable or will decline to serve as a director. The eight nominees receiving the highest number of affirmative votes of the shares entitled to vote at the Annual Meeting will be elected directors of REMEC to serve until the next Annual Meeting of Shareholders and until their successors have been elected and qualified.

The following table sets forth certain information concerning the nominees for directors of REMEC as of April 30, 2004:

| | | | | | |

Name

| | Age

| | Position with REMEC

| | Director Since

|

Andre R. Horn | | 75 | | Chairman of the Board | | 1988 |

Robert W. Shaner | | 55 | | Interim Chief Executive Officer and Director | | 2002 |

Martin Cooper | | 75 | | Director | | 2002 |

Thomas A. Corcoran | | 59 | | Director | | 1996 |

Mark D. Dankberg | | 48 | | Director | | 1999 |

William H. Gibbs | | 60 | | Director | | 1996 |

Harold E. Hughes, Jr. | | 58 | | Director | | 2003 |

Jeffrey M. Nash, Ph.D. | | 56 | | Director | | 1988 |

There is no family relationship between any of the directors or executive officers of REMEC.

Business Experience of Nominees

Mr. Hornhas been a director of REMEC since 1988 and has served as REMEC’s Chairman of the Board since February 2004. Mr. Horn is the retired Chairman of the Board of Joy Manufacturing Company. From 1985 to 1991, Mr. Horn served as the Chairman of the Board of Needham & Company, Inc. He currently holds the honorary position of Chairman Emeritus of Needham & Company, Inc. Mr. Horn holds a B.S. degree in Mathematics from the University of Paris and is a graduate of the Ecole des Hautes Etudes Commerciales (Paris).

Mr. Shaner has been a director of REMEC since December 2002 and has served as REMEC’s Interim Chief Executive Officer since February 2004. From January 2001 to February 2003, Mr. Shaner served as the President of Wireless Operations for Cingular Wireless LLC, a joint venture between the wireless divisions of SBC Communications Inc. and BellSouth Corporation. From November 1999 to January 2001, Mr. Shaner served as the President and Chief Executive Officer of Southwestern Bell Mobile Systems and Pacific Bell Wireless, providers of wireless communication services to consumers and businesses. Mr. Shaner served as the President and Chief Executive Officer of Pacific Bell Wireless from August 1998 to November 1999. Prior to assuming that position, Mr. Shaner served as President and Chief Executive Officer of SBCI Europe and Middle East for SBC International, Inc. from March 1997 to July 1998. From 1995 to February 1997, Mr. Shaner held the

3

position of President and Chief Executive Officer for SBC International Wireless. From 1991 to 1995, Mr. Shaner served as Executive Vice President for Southwestern Bell Mobile Systems. Prior to 1991, Mr. Shaner held various other management positions at Southwestern Bell Telephone/Telecom and Cellular One. Mr. Shaner is currently a director of Interdigital Communications Corporation and serves on their Compensation and Corporate Governance Committees. Mr. Shaner also serves as Vice Chairman of the Board of Curators, Central Methodist College and serves on the National Board of Trustees of the Boys and Girls Clubs of America. He was a director of Spectrian Corporation (“Spectrian”) from April 1999 to December 2002 when REMEC acquired Spectrian. Mr. Shaner holds a B.A. degree in Chemistry from Central Methodist College.

Mr. Cooper has been a director of REMEC since December 2002. Mr. Cooper is a founder of ArrayComm, Inc., a wireless technology manufacturer, and has served as its Chairman since April 1992. He has served as President of Dyna, LLC, a consulting company, since 1986 and is presently its President. From 1985 to December 1992, he served as President of Cellular Pay Phone Incorporated, a cellular pay telephone company. From 1982 to 1986, he was a co-founder, Chairman and Chief Executive Officer of Cellular Business Systems, Inc., a management information company. From 1954 to 1983, Mr. Cooper served in a variety of positions including Corporate Vice President, Division Manager and Corporate Director of Research and Development of Motorola, Inc. He is a Fellow of the IEEE and of the Radio Club of America and a recipient of the IEEE Centennial medal. He serves on the Advisory Board of the International National Electronics Consortium and on the Board of Trustees of the Illinois Institute of Technology. He was a director of Spectrian from January 1994 to December 2002 when REMEC acquired Spectrian. Mr. Cooper holds B.S. and M.S. degrees in Electrical Engineering from the Illinois Institute of Technology.

Mr. Corcoranhas been a director of REMEC since May 1996. From January 2001 to present he has served as President of Corcoran Enterprises, LLC. Until December 2000, Mr. Corcoran was the Chairman, President and Chief Executive Officer of Allegheny Teledyne Incorporated. Prior to that, Mr. Corcoran was President and Chief Operating Officer of the Space and Strategic Missiles sector of Lockheed Martin Corporation from October 1998 to September 1999. From March 1995 to September 1998, he was the President and Chief Operating Officer of the Electronics sector of Lockheed Martin. From 1993 to 1995 Mr. Corcoran was President of the Electronics Group of Martin Marietta Corporation, and from 1967 to 1993 he held various management positions, including Vice President and General Manager, with the Aerospace segment of General Electric Company. Mr. Corcoran is a director of L-3 Communications Holdings, Inc. and UIC Corporation. In recognition of Corcoran Enterprises’ strong relationship with The Carlyle Group, a Washington D.C. based private equity group, Mr. Corcoran is a director of the following Carlyle Group companies: Sippican, Inc., Gemini Air Cargo, Inc. and Vought Aircraft Industries, Inc. Mr. Corcoran is a member of the Board of Trustees of Stevens Institute of Technology. Mr. Corcoran holds a B.S. degree in Chemical Engineering and a Ph.D. (Hon.) from the Stevens Institute of Technology.

Mr. Dankberghas been a director of REMEC since September 1999. Mr. Dankberg was a founder of ViaSat, Inc. and has served as Chairman of the Board and Chief Executive Officer of ViaSat since its inception in May 1986. Mr. Dankberg also serves as a director of TrellisWare Technologies, Inc., a privately-held subsidiary of ViaSat that develops advanced signal processing technologies for communication applications, and U.S. Monolithics, a privately-held subsidiary of ViaSat that develops millimeter-wave components and integrated millimeter-wave equipment. Prior to founding ViaSat, he was Assistant Vice President of M/A-COM Linkabit, a manufacturer of satellite telecommunications equipment from 1979 to 1986 and Communications Engineer for Rockwell International from 1977 to 1979. Mr. Dankberg holds B.S.E.E. and M.E.E. degrees from Rice University.

Mr. Gibbs has been a director of REMEC since May 1996. From January 1998 to present he has served as President of Parafix Management, a company specializing in corporate turnaround and restructuring. Mr. Gibbs was the President and Chief Executive Officer of DH Technology, Inc. from November 1985 to January 1998 and was Chairman of the Board of DH Technology, Inc. from March 1987 through October 1997. From August 1983 to November 1985, he held various positions, including those of President and Chief Operating Officer,

4

with Computer and Communications Technology, a supplier of rigid disc magnetic recording heads to the peripheral equipment segment of the computer industry. Mr. Gibbs is currently a director of Fargo Electronic, Inc. Mr. Gibbs holds a B.S.E.E. degree from the University of Arkansas.

Mr. Hughes has been a director of REMEC since September 2003. Mr. Hughes is the former Chairman and Chief Executive Officer of Pandesic LLC, an e-commerce software supplier owned jointly by Intel Corporation and SAP. Prior to that, he spent 23 years with Intel where he held key positions in finance and operations management, including Treasurer, Chief Financial Officer and Vice President of Planning and Logistics. Mr. Hughes also founded and served as the Vice President of Intel Capital, Intel’s venture investment operation. From 1969 to 1974, Mr. Hughes served as an officer in the United States Army. He holds an M.B.A. degree from the University of Michigan and a B.A. degree from the University of Wisconsin.

Dr. Nashhas been a director of REMEC since September 1988. Since September 2003, Dr. Nash has served as Chairman and President of Inclined Plane, Inc. From June 1994 until September 2003, he was President of Digital Perceptions, Inc. From August 1995 to December 1997, he was the President of TransTech Information Management Systems, Inc. From 1989 to 1994, he was the President of Visqus Corporation as well as Conner Technology, Inc., both subsidiaries of Conner Peripherals, Inc. Dr. Nash is currently a director of ViaSat, Inc., a manufacturer of satellite communication equipment, and several private companies, including Pepperball Technologies, Inc. (formerly Jaycor Tactical Systems) and BinaryLabs, Inc. Dr. Nash holds B.S. and M.S. degrees in Engineering from UCLA, and a Ph.D. in Large Scale Systems Engineering/Operations Research, also from UCLA.

Board Meetings and Committees

The Board held a total of nine meetings during the fiscal year ended January 31, 2004. During this period, each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board (held during the period for which he was a director) and (ii) the total number of meetings held by all committees of the Board on which he served (held during the periods that he served), except the total attendance of Mr. Hughes was less than 75% because he was unable to attend two Board meetings due to scheduling conflicts in connection with his recent appointment to the Board on September 5, 2003 in addition to family matters. Mr. Hughes was briefed on all matters covered at both of these meetings. Mr. Hughes was not a member of any Board committee in fiscal 2004. He was appointed to the Audit Committee on February 10, 2004. In addition, all members of the Board, except Mr. Hughes, attended the 2003 Annual Meeting of Shareholders. Although REMEC has no formal policies regarding director attendance at annual meetings, REMEC does expect that all members of the Board will attend the 2004 Annual Meeting of Shareholders.

REMEC has four standing committees: the Audit Committee, the Compensation and Human Resources Committee, the Nominating and Corporate Governance Committee and the Strategy Committee. Each of these committees has a written charter approved by the Board. A copy of each charter can be found under the “Investors” section of our website at www.remec.com. In addition, a copy of the charter for the Audit Committee is attached hereto as Appendix A. The current members of the committees are identified on the following table.

| | | | | | | | |

| | | Audit Committee

| | Compensation &

Human Resources

Committee

| | Nominating &

Corporate Governance

Committee

| | Strategy Committee

|

Martin Cooper | | | | Member | | | | Member |

Thomas A. Corcoran | | | | Member | | | | Member |

Mark D. Dankberg | | Member | | | | Member | | Chairman |

William H. Gibbs | | Member | | | | Chairman | | |

Harold E. Hughes, Jr. | | Chairman | | | | | | |

Jeffrey M. Nash, Ph.D. | | | | Chairman | | Member | | Member |

The principal functions of the Audit Committee are to select REMEC’s independent auditors and approve their compensation, oversee and evaluate the performance of the independent auditors, oversee REMEC’s

5

accounting and financial reporting policies and internal control systems and review REMEC’s interim and annual financial statements. The Audit Committee held eight meetings during the fiscal year ended January 31, 2004. The Board has determined that all members of the Audit Committee are independent directors under the current rules promulgated by the National Association of Securities Dealers, Inc. (“NASD”) and each of them is able to read and understand fundamental financial statements. The Board has also determined that Harold E. Hughes, Jr. qualifies as an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K.

The Compensation and Human Resources Committee determines compensation levels for REMEC’s executive officers, oversees the administration of REMEC’s equity incentive plans, and performs other duties regarding compensation for employees and consultants as the Board may delegate from time to time. The Compensation and Human Resources Committee held six meetings during the fiscal year ended January 31, 2004. The Board has determined that all members of the Compensation and Human Resources Committee are independent directors under the current rules promulgated by the NASD.

The Nominating and Corporate Governance Committee oversees REMEC’s Code of Business Ethics and Conduct, develops and implements policies and processes regarding corporate governance matters, reviews potential director nominees and recommends a slate of director nominees to the Board. The Nominating and Corporate Governance Committee held three meetings during the fiscal year ended January 31, 2004.All the nominees proposed for election as directors presently are directors of REMEC and were nominated for election by the Board. The Board has determined that all members of the Nominating and Corporate Governance Committee are independent directors under the current rules promulgated by the NASD.

The Strategy Committee reviews acquisition strategies and opportunities with management, approves certain acquisition and investment transactions and makes recommendations to the Board. The Strategy Committee did not hold any meetings during the fiscal year ended January 31, 2004.

Compensation of Directors

During the 2004 fiscal year, non-employee directors received the following cash compensation for serving on the Board: (i) non-employee directors who were members of the Audit Committee received an annual retainer fee of $10,800, the chairman of the Audit Committee received an additional annual retainer fee of $3,600, and Mr. Shaner who served as Lead Independent Director on the Audit Committee from June 20, 2003 to February 9, 2004 received $9,360 and (ii) all other non-employee directors received an annual retainer fee of $7,200 for serving on the Board, except that Mr. Hughes whose period of Board service did not commence until September 5, 2003 was paid $6,115. Non-employee directors also received a fee of $2,000 for each Board meeting attended, a fee of $1,000 for each Board meeting attended via telephone and a fee of $600 for participation in a telephonic Board meeting. In addition, non-employee directors received a fee of $600 for each committee meeting attended, except the chairman of the Audit Committee received a fee of $1,800, and the chairmen of all other committees received a fee of $900, for each committee meeting attended. However, non-employee directors who participated in a committee meeting by telephone or other electronic means, rather than in person, received only one-half of the applicable meeting fee.

During the 2005 fiscal year, non-employee directors will receive the following cash compensation for serving on the Board: (i) the non-employee Chairman of the Board will receive an annual retainer fee of $40,000; (ii) each non-employee director who is a member of the Audit Committee will receive an annual retainer fee of $10,800 and the chairman of the Audit Committee will receive an additional annual retainer of $3,600; and (iii) all other non-employee directors will receive an annual retainer fee of $7,200. Non-employee directors also will receive a fee of $2,000 for each Board meeting attended, a fee of $1,000 for each Board meeting attended via telephone and a fee of $600 for participation in a telephonic Board meeting. In addition, non-employee directors will receive a fee of $600 for each committee meeting attended, except the chairman of the Audit Committee will receive a fee of $1,800 and

6

the chairmen of all other committees will receive a fee of $900 for each committee meeting attended. However, non-employee directors who participate in a committee meeting by telephone or other electronic means, rather than in person, will receive only one-half of the applicable meeting fee.

Under REMEC’s 1996 Nonemployee Director Stock Option Plan, each non-employee director currently receives (i) a one-time grant of an option to purchase 25,000 shares of REMEC common stock upon the initial election of such person as a director and (ii) an annual grant of an option to purchase 9,000 shares of REMEC common stock each year in which the director continues to serve on the Board. Non-employee directors are also reimbursed for their reasonable travel expenses in attending Board and committee meetings.

Directors who are also employees of REMEC do not receive any additional compensation for serving on the Board other than reimbursement for reasonable travel expenses.

Recommendation of the Board

The Board unanimously recommends the shareholders voteFOR the election of each of the nominees listed herein.

7

CORPORATE GOVERNANCE

REMEC’s Website

REMEC maintains a corporate governance page on its website which includes important information about its corporate governance initiatives, including REMEC’s Code of Business Ethics and Conduct and charters for the committees of the Board. The corporate governance page can be found at www.remec.com, by clicking “Investors” and then selecting “Corporate Governance.”

Corporate Governance Policies

REMEC’s polices and practices reflect corporate governance initiatives that are compliant with the listing requirements of Nasdaq and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including the following:

| | • | | A majority of the Board is comprised of “independent directors” as defined in Rule 4200(a)(15) of the listing standards of the NASD. The Board has determined that Messrs. Cooper, Corcoran, Dankberg, Gibbs, Horn, Hughes and Nash are “independent directors” under Rule 4200(a)(15). |

| | • | | All members of the Board committees are independent directors under the current rules promulgated by the NASD. |

| | • | | The independent members of the Board have regularly scheduled meetings at which only independent directors are present. |

| | • | | The charters of the Board committees clearly establish their respective roles and responsibilities. |

| | • | | The Compensation and Human Resources Committee provides independent director oversight of executive compensation. |

| | • | | The Nominating and Governance Committee provides independent director oversight of director nominations. |

| | • | | The Audit Committee has procedures in place for the confidential and anonymous receipt, retention and treatment of complaints about accounting, internal controls and auditing matters. |

Code of Ethics

REMEC has adopted a Code of Business Ethics and Conduct that applies to all officers and employees, including its principal executive officer, principal financial officer and controller. This Code of Business Ethics and Conduct is posted on the corporate governance page of REMEC’s website at www.remec.com.

Director Nomination

Criteria for Nomination to the Board. The Nominating and Corporate Governance Committee (the “Nominating Committee”) considers the appropriate balance of experience, skills and characteristics required of the Board, and seeks to insure that (i) at least a majority of the directors are independent under the rules of the NASD; (ii) members of the Audit Committee meet the financial literacy and sophistication requirements under the rules of the NASD; and (iii) at least one of the members of the Audit Committee qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. Nominees for director are selected on the basis of their depth and breadth of experience, wisdom, integrity, ability to make independent analytical inquiries, understanding of REMEC’s business environment and willingness to devote adequate time to Board duties.

Shareholders Proposals for Nominees. The Nominating Committee will consider written proposals from shareholders for nominees for director. Written proposals should include the following information: (i) all

8

information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (ii) the names and addresses of the shareholders making the nomination and the number of shares of REMEC’s common stock which are owned beneficially and of record by such shareholders; and (iii) appropriate biographical information and a statement as to the qualification of the nominee should be submitted in the time frame described in the Bylaws of REMEC and under the caption “Shareholder Proposals” below. Written proposals meeting the above requirements should be sent to Donald J. Wilkins, Secretary, Nominating and Corporate Governance Committee, REMEC, Inc., 3790 Via de la Valle, Suite 311, Del Mar, California 92014.

Process for Identifying and Evaluating Nominees. The process for identifying and evaluating nominees to the Board is initiated by identifying a slate of candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board and, if the Nominating Committee deems appropriate, a third-party search firm. These candidates are evaluated by the Nominating Committee by reviewing the candidates’ biographical information and qualification and checking the candidates’ references, and qualified nominees are interviewed by at least one member of the Nominating Committee. Serious candidates meet with members of the Board, and using the input from such interviews and other information obtained by the Nominating Committee, the Nominating Committee evaluates which of the prospective candidates is qualified to serve as a director and whether the Nominating Committee should recommend to the Board that the Board nominate, or elect to fill a vacancy, these final prospective candidates. Candidates recommended by the Nominating Committee are presented to the Board for selection as nominees to be presented for the approval of the shareholders or for election by the Board to fill a vacancy.

The Nominating Committee expects that a similar process would be used to evaluate nominees recommended by shareholders. However, to date, REMEC has not received any shareholder’s proposal to nominate a director.

Board Nominees for the 2004 Annual Meeting. Each of the nominees listed in this Proxy Statement are current directors standing for re-election, except for Mr. Hughes. Mr. Hughes was appointed by the Board in September 2003. Prior to his appointment to the Board, Mr. Hughes was recommended to the Nominating Committee by a third party.

Shareholder Communications

Generally, shareholders who have questions or concerns regarding REMEC should contact our Investor Relations department at (858) 505-3713. However, any shareholders who wish to address questions regarding the business or affairs of REMEC directly with the Board, or any individual director, should direct his or her questions in writing to the Chairman of the Board at 3790 Via de la Valle, Suite 311, Del Mar, California 92014.

9

MANAGEMENT

Security Ownership of Certain Beneficial Owners and Management

The following sets forth certain information regarding beneficial ownership of REMEC common stock as of March 26, 2004 (i) by each person who is known by REMEC to own beneficially more than 5% of REMEC common stock, (ii) by each of REMEC’s directors, (iii) by the Chief Executive Officer and the four other most highly paid executive officers of REMEC at fiscal year end (the “Named Executive Officers”) and (iv) by all directors and executive officers as a group.

| | | | | |

Beneficial Owner

| | Number of Shares Beneficially Owned(1)

| | Percentage of Shares

Beneficially Owned(1)(2)

| |

Kopp Investment Advisors, LLC and Affiliates(3) | | 4,955,369 | | 8.0 | % |

Royce & Associates, LLC(4) | | 4,143,600 | | 6.7 | % |

Ronald E. Ragland(5) | | 2,263,522 | | 3.7 | % |

Thomas H. Waechter(6) | | 370,397 | | * | |

Jack A. Giles(7) | | 445,217 | | * | |

Jon E. Opalski(8) | | 305,627 | | * | |

H. Clark Hickock | | 156,522 | | * | |

Martin Cooper(9) | | 52,945 | | * | |

Thomas A. Corcoran(10) | | 47,408 | | * | |

Mark D. Dankberg(11) | | 49,467 | | * | |

William H. Gibbs(12) | | 43,176 | | * | |

Andre R. Horn(13) | | 57,717 | | * | |

Harold E. Hughes, Jr. | | — | | * | |

Jeffrey M. Nash, Ph.D.(14) | | 75,033 | | * | |

Robert W. Shaner(15) | | 26,695 | | * | |

All directors and executive officers as a group (16 persons)(16) | | 4,474,405 | | 7.2 | % |

| * | | Less than 1% of the outstanding shares of REMEC common stock. |

| (1) | | This table is based upon information supplied by directors, officers and principal shareholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, each of the shareholders identified in this table has sole voting and investment power with respect to the shares shown. Percentage of ownership is based on 61,772,664 shares of REMEC common stock outstanding as of March 26, 2004. |

| (2) | | Shares issuable upon exercise of outstanding options are considered outstanding for purposes of calculating the percentage of ownership of REMEC common stock of the person holding such options, but are not considered outstanding for computing the percentage of ownership of any other person. |

| (3) | | Reflects beneficial ownership as reported on Schedule 13G/A filed on January 30, 2004 with the SEC by Kopp Investment Advisors, LLC (“KIA”). Represents shares beneficially owned by (i) KIA, a registered investment advisor, (ii) Kopp Holding Company (“Holding”), (iii) Kopp Holding Company, LLC (“LLC”) and (iv) LeRoy C. Kopp individually and through his ownership of a controlling interest in KIA and his control over Holding. KIA is the beneficial owner of 4,560,369 shares of REMEC common stock, has sole voting power over 3,731,030 shares of REMEC common stock, sole dispositive power over 1,000,000 shares of REMEC common stock and shared dispositive power over 3,505,369 shares of REMEC common stock. Holding is the beneficial owner of 4,560,369 shares of REMEC common stock. LLC is the beneficial owner of 4,560,369 shares of REMEC common stock. Mr. Kopp has beneficial ownership of 4,955,369 shares of REMEC common stock and sole voting and dispositive power over 450,000 shares of REMEC common stock. The address of KIA, Holding, LLC and Mr. Kopp is 7701 France Avenue South, Edina, Minnesota 55435. |

10

| (4) | | Reflects beneficial ownership as reported on Schedule 13G/A filed with the SEC by Royce & Associates, LLC (“Royce”) on February 5, 2004. Royce is a registered investment advisor pursuant to the Investment Advisors Act of 1940. Royce has sole voting and dispositive power of 4,143,600 shares of REMEC common stock. The address of Royce is 1414 Avenue of the Americas, New York, New York 10019. |

| (5) | | Includes 51,000 shares held by Mr. Ragland’s minor children, 105,000 shares held by Mr. Ragland in an IRA and 9,000 shares held by Mrs. Linda Ragland in an IRA. |

| (6) | | Includes 9,797 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (7) | | Includes 17,438 shares held by Mr. Giles’ spouse. |

| (8) | | Includes 3,766 shares held by Mr. Opalski’s spouse. |

| (9) | | Includes 329 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (10) | | Includes 1,035 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (11) | | Includes 1,035 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (12) | | Includes 1,035 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (13) | | Includes 1,035 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (14) | | Includes 1,035 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (15) | | Includes 329 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

| (16) | | Includes 19,327 shares issuable upon exercise of outstanding options that are exercisable within 60 days of March 26, 2004. |

11

Executive Compensation

Summary Compensation Table. The following table sets forth the total compensation received by the Named Executive Officers. None of the Named Executive Officers earned any bonuses or compensation for the fiscal years other than as set forth in the table or received any restricted stock awards, stock appreciation rights or long-term incentive plan payouts.

Summary Compensation Table

| | | | | | | | | | |

| | | Fiscal

Year

| | Annual Compensation

| | Long Term

Compensation

| | All Other

Compensation ($)

|

Name and Principal Position

| | | Salary

($)(1)

| | Bonus ($)

| | Securities

Underlying

Options (#)

| |

Ronald E. Ragland Former Chairman and Chief Executive Officer (retired February 2004) | | 2004

2003

2002 | | 454,658

439,995

432,429 | | —

—

— | | —

200,000

400,000 | | 18,750(2)

17,847(3)

17,020(4) |

| | | | | |

Thomas H. Waechter President and Chief Operating Officer | | 2004

2003

2002 | | 375,960

28,846

— | | —

1,000,000

— | | —

100,000

— | | 47,557(5)

1,500(6)

— |

| | | | | |

Jack A. Giles Executive Vice President, Defense and Space | | 2004

2003

2002 | | 330,139

316,008

311,107 | | —

—

— | | —

100,000

120,000 | | 266,130(7)

13,075(8)

13,045(9) |

| | | | | |

Jon E. Opalski Executive Vice President, Commercial Operations | | 2004

2003

2002 | | 249,516

240,467

234,222 | | —

—

— | | —

150,000

32,000 | | 11,190(10)

10,650(11)

9,690(12) |

| | | | | |

H. Clark Hickock Executive Vice President, Global Manufacturing | | 2004

2003

2002 | | 238,063

183,906

170,543 | | —

—

25,000 | | —

205,000

20,000 | | 135,893(13)

17,790(14)

17,760(15) |

| (1) | | Includes amounts deferred at the option of the officer pursuant to REMEC’s deferred compensation plan for employee directors. |

| (2) | | Consists of a $9,000 automobile allowance, $9,030 in life insurance premiums and a $720 contribution to the REMEC 401(k) plan. |

| (3) | | Consists of a $9,000 automobile allowance, $8,127 in life insurance premiums and a $720 contribution to the REMEC 401(k) plan. |

| (4) | | Consists of a $9,000 automobile allowance, $7,330 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. In addition, Mr. Ragland sold to REMEC 175,000 restricted shares of the Common Stock of Nanowave, Inc. (“Nanowave”), a majority owned subsidiary of REMEC. REMEC paid a purchase price of $1.00 per share (equal to the purchase price paid by Mr. Ragland). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sale, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share. |

| (5) | | Consists of a $9,000 automobile allowance, $1,865 in life insurance premiums, a $720 contribution to the REMEC 401(k) plan and $35,972 in relocation expenses. |

| (6) | | Consists of a $1,500 automobile allowance. |

| (7) | | Consists of a $9,000 automobile allowance, $3,355 in life insurance premiums, a $720 contribution to the REMEC 401(k) plan and $253,055 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price multiplied by the number of option shares exercised). |

12

| (8) | | Consists of a $9,000 automobile allowance, $3,355 in life insurance premiums and a $720 contribution to the REMEC 401(k) plan. |

| (9) | | Consists of a $9,000 automobile allowance, $3,355 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. In addition, Mr. Giles sold to REMEC 50,000 restricted shares of the Common Stock of Nanowave. REMEC paid a purchase price of $1.00 per share (equal to the purchase price paid by Mr. Giles). Nanowave is a privately held corporation without an easily determinable fair market value. At the time of the sale, the Board determined that the fair market value of the Nanowave shares was not less than $1.00 per share. |

| (10) | | Consists of a $9,000 automobile allowance, $1,470 in life insurance premiums and a $720 contribution to the REMEC 401(k) plan. |

| (11) | | Consists of a $9,000 automobile allowance, $930 in life insurance premiums and a $720 contribution to the REMEC 401(k) plan. |

| (12) | | Consists of a $9,000 automobile allowance and a $690 contribution to the REMEC 401(k) plan. |

| (13) | | Consists of a $9,000 automobile allowance, $8,070 in life insurance premiums, a $720 contribution to the REMEC 401(k) plan and $118,103 from the exercise of stock options (the difference between the fair market value on the date of exercise and the exercise price multiplied by the number of option shares exercised). |

| (14) | | Consists of a $9,000 automobile allowance, $8,070 in life insurance premiums and a $720 contribution to the REMEC 401(k) Plan. |

| (15) | | Consists of a $9,000 automobile allowance, $8,070 in life insurance premiums and a $690 contribution to the REMEC 401(k) plan. |

13

Option Grant Table. The following table sets forth certain information relating to options to purchase shares of REMEC common stock granted to the Named Executive Officers granted during the fiscal year ended January 31, 2004.

Option Grants in Fiscal 2004

| | | | | | | | | | | | | |

| | | Number of Securities Underlying Options Granted(#)(1)

| | Percent of Total Options Granted to

Employees in Fiscal Year

| | | Exercise or Base Price Per Share(1) ($)

| | Expiration Date

| | Potential Realizable

Value at Assured

Annual Rates of Stock

Price Appreciation for

Option Term(2) ($)

|

Name

| | | | | | 5%

| | 10%

|

Ronald E. Ragland | | — | | 0.00 | % | | — | | | | — | | — |

Thomas H. Waechter | | — | | 0.00 | % | | — | | | | — | | — |

Jack A. Giles | | — | | 0.00 | % | | — | | | | — | | — |

Jon E. Opalski | | — | | 0.00 | % | | — | | | | — | | — |

H. Clark Hickock | | — | | 0.00 | % | | — | | | | — | | — |

| (1) | | There were no stock options granted to the Named Executive Officers during the year ended January 31, 2004. |

| (2) | | The 5% and 10% assumed rates of stock price appreciation used to calculate potential gains to optionees are provided pursuant to the rules of the SEC. |

Option Exercise Table. The following table sets forth certain information relating to options to purchase REMEC common stock exercised by the Named Executive Officers during the fiscal year ended January 31, 2004 and the unexercised options held by them as of the end of such year. With respect to the Named Executive Officers, no stock appreciation rights were exercised during the fiscal year and no stock appreciation rights were outstanding at the end of the fiscal year.

Option Values at January 31, 2004

| | | | | | | | | | | | |

| | | Shares Acquired

on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)

| | Value of Unexercised In-The-Money Options at Fiscal Year-End ($) (1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Ronald E. Ragland | | — | | — | | 580,000 | | 380,000 | | 1,027,204 | | 1,066,000 |

Thomas H. Waechter | | — | | — | | 344,576 | | 115,424 | | 144,000 | | 432,000 |

Jack A. Giles | | 62,499 | | 329,368 | | 151,876 | | 148,125 | | 150,733 | | 492,600 |

Jon E. Opalski | | — | | — | | 190,375 | | 139,375 | | 423,489 | | 548,689 |

H. Clark Hickock | | 40,501 | | 168,638 | | 80,000 | | 169,250 | | 197,300 | | 704,450 |

| (1) | | Calculated on the basis of the closing price of REMEC common stock on the Nasdaq National Market on January 30, 2004 ($10.01 per share). |

14

Equity Compensation Plan Information

The following table provides information as of January 31, 2004 with respect to the shares of REMEC common stock that may be issued under REMEC’s existing equity compensation plans. In addition, the table does not include information with respect to shares of REMEC common stock subject to outstanding options granted under equity compensation plans assumed by REMEC in connection with its acquisitions of the companies which originally granted those options. However, Footnote (1) to the table sets forth the total number of shares of REMEC common stock issuable upon the exercise of those assumed options as of January 31, 2004, and the weighted average exercise price of those options. Except for the adjustments described in Footnote (1) with respect to the outstanding assumed options, no additional options may be granted under the assumed plans.

| | | | | | | |

| | | (A) | | (B) | | (C) |

Plan Category

| | Number of securities to be

issued upon exercise of outstanding options, warrants and rights (#)

| | Weighted-average exercise price of outstanding options, warrants and rights

($)

| | Number of securities remaining available for

future issuances

under equity compensation plans (excluding securities reflected in Column (A))

(#)

|

Equity Compensation Plans approved by security holders: | | | | | | | |

1995 Equity Incentive Plan | | 4,530,633 | | $ | 11.84 | | 2,862,433 |

2001 Equity Incentive Plan | | 2,818,715 | | $ | 6.15 | | 298,354 |

1996 Nonemployee Directors Stock Option Plan | | 334,875 | | $ | 10.12 | | 46,500 |

Employee Stock Purchase Plan | | — | | | N/A | | 2,141,480 |

Equity Compensation Plans not approved by security holders | | — | | | N/A | | — |

Total(1) | | 7,684,223 | | $ | 9.68 | | 5,348,767 |

| (1) | | The table does not include information with respect to equity compensation plans assumed by REMEC in connection with its acquisitions of the companies which originally established those plans. As of January 31, 2004, a total of 1,431,385 shares of REMEC common stock were issuable upon exercise of outstanding options under the assumed plans. The weighted average exercise price of the outstanding options to acquire shares of REMEC common stock under the assumed plans is $17.03 per share. No additional options may be granted under the assumed plans. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Employment Contracts. As of the end of REMEC’s 2004 fiscal year, Mr. Waechter was the only Named Executive Officer that had an employment agreement with REMEC.

In connection with the acquisition of Spectrian in December 2002 pursuant to the merger of Spectrian with a wholly owned subsidiary of REMEC, Mr. Waechter, Spectrian’s President and Chief Executive Officer, entered into an employment agreement with REMEC (the “Employment Agreement”), to be effective upon the closing of the merger. Pursuant to the Employment Agreement, Mr. Waechter became the President and Chief Operating Officer of REMEC upon the closing of the merger. Mr. Waechter also agreed to waive his rights under his agreements with Spectrian upon the closing of the merger, and REMEC paid Mr. Waechter $1,000,000 in cash (subject to applicable tax withholding) upon the closing of the merger as consideration for the waiver of the approximately $1,600,000 in payments he would have been entitled to receive under his Spectrian change of control agreement.

Under the Employment Agreement, Mr. Waechter is entitled to receive: an annual base salary of $375,000; an annual target bonus of 30% of his annual base salary provided Mr. Waechter achieves certain company-related objectives; reimbursement for expenses incurred in relocating to REMEC’s principal executive offices located in

15

Del Mar, California (including a tax gross-up payment); reimbursement for the reasonable cost of a country club membership; a $9,000 annual car allowance; six weeks of vacation per year; and an option to purchase 100,000 shares of REMEC common stock with a four year vesting period; a $1 million life insurance policy; and other employee benefits available to senior executives of REMEC.

The Employment Agreement also provides that if in the first three years of Mr. Waechter’s employment with REMEC he is terminated without cause or resigns for good reason, then Mr. Waechter will be entitled to receive: payment of his base salary for three years after termination and three times his target bonus, as in effect at the time of such termination and calculated at the 100% achievement level; employee benefits for three years following termination; accelerated vesting of all of his outstanding options that were assumed by REMEC in connection with the merger to the extent that such options would vest in the three year period following Mr. Waechter’s termination date had he remained an employee of REMEC; and accelerated vesting of all of his outstanding options that were granted by REMEC after the closing of the merger to the extent that such options would vest in the year following Mr. Waechter’s termination date had he remained an employee of REMEC. The Employment Agreement defines “good reason” as the occurrence of any of the following unless expressly consented to by Mr. Waechter: a significant reduction of Mr. Waechter’s duties, position or responsibilities or his removal from such duties, position or responsibilities, unless he is provided with comparable duties, position and responsibilities; a substantial reduction, without good business reasons, in the facilities and perquisites available to Mr. Waechter; a reduction in Mr. Waechter’s base salary or target bonus; a material reduction in kind or level of Mr. Waechter’s benefits, with the result that Mr. Waechter’s overall benefits package is significantly reduced; the relocation of Mr. Waechter to a facility more than 35 miles away from REMEC’s Del Mar, California offices; any termination without cause or for which the grounds are not valid; or REMEC’s failure to cause the assumption of the Employment Agreement by a successor entity.

In the event Mr. Waechter is employed at REMEC on the date of a change of control of REMEC, Mr. Waechter will be entitled to receive: accelerated vesting of all of his outstanding options that were assumed by REMEC in connection with the merger to the extent that such options would vest in the three years following the date of the change of control of REMEC; and accelerated vesting of all of his options that were granted after the closing of the merger to the extent that such options would vest in the year following the date of the change of control of REMEC. In the event Mr. Waechter is terminated without cause or resigns for good reason within two years following a change of control of REMEC, then Mr. Waechter will also be entitled to receive: payment of his base salary for three years and three times his target bonus, as in effect at the time of such termination and calculated at the 100% achievement level; employee benefits for three years after his termination; and accelerated vesting of all his outstanding options. The Employment Agreement defines a “change of control” in the same manner as the Change of Control Agreements described below.

The Employment Agreement also provides for the imposition of a “best-of” provision with respect to Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), or any similar tax, if Mr. Waechter’s employment with REMEC is terminated without cause or for good reason within three years of the closing date of the merger or within two years after a change of control of REMEC. Upon the occurrence of either of these events, the benefits received by Mr. Waechter under the Employment Agreement will be paid at his election either in full or in such lesser amount such that the excise tax associated with Section 280G of the Internal Revenue Code will not apply with respect to the receipt of such benefits.

In order to receive severance payments and benefits during the three year severance period following his termination as described above, Mr. Waechter has agreed not to engage in any activity which is deemed to be in competition with REMEC’s business. Mr. Waechter has also agreed, for a 12-month period after the termination of his employment with REMEC for any reason, not to solicit, directly or indirectly, any employee to leave his or her employment with REMEC. Mr. Waechter also released REMEC from any and all claims or any liability for severance benefits or stock acceleration except as set forth in the Employment Agreement.

16

Change of Control Agreements.

Each of Messrs. Ragland, Opalski and Giles (collectively, the “Executive Officers”) have entered into a Change in Control Agreement with REMEC dated October 21, 2002 (each an “Agreement”). Under each Agreement, certain benefits will be paid to each Executive Officer if REMEC incurs a change of control. In the absence of a change in control of REMEC, the Agreements do not provide any additional severance benefits to any Executive Officer (other than payment for unpaid base salary, unused vacation time and certain business expenses accrued before termination).

A “change of control” is defined in the Agreements as the occurrence of any one of the following events: (i) the completion of a merger or consolidation of REMEC with any other corporation or entity, other than a merger or consolidation that would result in the voting securities of REMEC outstanding immediately prior thereto continuing to represent more than 50% of the total voting power represented by the voting securities of REMEC or such surviving entity outstanding immediately after such merger or consolidation; (ii) any approval by the shareholders of REMEC of a plan of complete liquidation of REMEC or an agreement for the sale or disposition by REMEC of all or substantially all of the assets of REMEC; (iii) any person becoming the beneficial owner of securities of REMEC representing 50% or more of the total voting power represented by REMEC’s then outstanding voting securities; or (iv) change in the composition of the Board, as a result of which less than a majority of the directors are incumbent directors.

If REMEC incurs a change of control, all unvested options granted to the Executive Officers prior to the change of control that are scheduled to vest within one (1) year from the date of the change of control will immediately vest and become fully exercisable. In addition, if REMEC incurs a change of control and an Executive Officer’s employment is terminated without cause or constructively terminated within two years after the change of control, or if an Executive Officer’s employment terminates within two years after the change of control as a result of the failure of any REMEC successor to assume REMEC’s obligations under his Agreement, then such Executive Officer will be entitled to receive the following severance benefits: (i) eighteen months of his annualized base salary as in effect immediately before the change of control, payable in equal monthly installments in accordance with REMEC’s normal payroll practices; (ii) one and one half (1.5) times the average of any annual bonuses received from REMEC during the two years immediately prior to the change of control, payable in equal monthly installments in accordance with REMEC’s normal payroll practices; (iii) during the payment period of the severance benefits described in (i) and (ii) above, REMEC will continue to make available REMEC’s medical, dental, disability, life insurance and other similar plans in which the Executive Officer or his spouse or dependents participated on the date of termination; (iv) for an additional 18 months after termination of the payment period described in (iii) above, REMEC will continue to make available benefits that would be available under the Consolidated Omnibus Budget Reconciliation Act; and (v) all outstanding options granted to the Executive Officer before the change of control will immediately vest and become fully exercisable, except the Agreements entered into by Messrs. Opalski and Giles require approval of the Board before this option acceleration will occur. These severance benefits described above may be subject to the 20% excise tax imposed by the Code on “golden parachute” payments. In the event that these payments would otherwise be subject to the excise tax, the severance benefits will be reduced to the level at which no tax would be imposed.

The Agreements also impose certain non-solicitation obligations upon each of the Executive Officers for a period of 18 months following the termination of such Executive Officer’s employment for any reason, whether or not such termination is in connection with a change of control. Each Agreement will terminate upon the date that all obligations of REMEC and the applicable Executive Officer have been satisfied.

Mr. Ragland’s Agreement terminated upon Mr. Ragland’s resignation with REMEC effective February 9, 2004.

Mr. Ragland entered into an Executive Transition Agreement with REMEC dated February 9, 2004 (the “Transition Agreement”). Pursuant to the Transition Agreement, Mr. Ragland resigned as a director and officer of REMEC. In consideration for the covenants in the Transition Agreement, REMEC agreed to pay Mr. Ragland

17

$915,200, which is equivalent to two years of Mr. Ragland’s salary, in 24 equal monthly installments. REMEC also agreed to accelerate the vesting of options to purchase 380,000 shares of REMEC common stock and to continue health insurance coverage for Mr. Ragland and Mrs. Linda Ragland. Pursuant to the Transition Agreement, Mr. Ragland agreed not to solicit any REMEC employees for a period of 12 months following Mr. Ragland’s termination date.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires REMEC’s directors and executive officers, and persons who own more than 10% of a registered class of REMEC’s equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or 5 with the SEC and the National Association of Securities Dealers, Inc. Such officers, directors and 10% shareholders are also required by SEC rules to furnish REMEC with copies of all Section 16(a) forms that they file. To REMEC’s knowledge, based solely upon review of the copies of such reports and certain representations furnished to it, REMEC’s executive officers and directors complied with all applicable Section 16(a) filing requirements during the fiscal year ended January 31, 2004. Dr. Nash filed an amended report on Form 4 to correct an administrative error on a Form 4 filed in 2000.

Certain Relationships and Related Transactions

As of April 22, 2004, REMEC has outstanding orders of approximately $995,000 from ViaSat, Inc. (“ViaSat”), of which Mr. Dankberg is Chairman of the Board, Chief Executive Officer and a shareholder. Pursuant to the current rules promulgated by the NASD, Mr. Dankberg’s relationship with ViaSat does not preempt the Board’s determination that Mr. Dankberg is an independent director.

18

COMPENSATION AND HUMAN RESOURCES COMMITTEE

REPORT AND RELATED INFORMATION

Compensation and Human Resources Committee Report

The Compensation and Human Resources Committee of the Board (the “Compensation Committee”) has furnished the following report:

The Compensation Committee is comprised of three independent directors and is responsible to assist the Board in discharging its responsibilities with respect to compensation of REMEC’s executive officers. The Compensation Committee, after reviewing all relevant and appropriate information related to business objectives and organizational performance, exercises independent responsibility to determine the most effective total compensation strategy for REMEC’s senior executive officers. The compensation strategy necessarily serves the business needs of REMEC and is consistent with the Board’s goal to build shareholder value, serve shareholders’ interests, and to attract, retain, and motivate the diverse talent required to do so. The Compensation Committee seeks to accomplish this goal by developing and administering REMEC’s executive compensation plans, programs and policies, by monitoring corporate performance and its bearing on the compensation of executive officers, and by making appropriate recommendations concerning matters of executive and director compensation.

Compensation Philosophy. REMEC operates in extremely competitive and rapidly changing industries, and its success depends upon its ability to attract and retain qualified executives through competitive compensation packages. The Compensation Committee’s general compensation philosophy is to provide executive officers with compensation based upon their personal performance, the financial performance of REMEC and their contribution to REMEC’s financial performance. The major goals of REMEC’s compensation program are to align compensation with the attainment of key business objectives and to enable REMEC to attract, retain and reward capable executives who can contribute to the continued success of REMEC. Within this overall philosophy, three key goals form the basis of compensation decisions for all employees of REMEC:

| | 1. | | To attract and retain the most highly qualified management and employee team; |

| | 2. | | To pay competitively compared to similar technology and defense electronics companies and to provide appropriate reward opportunities for achieving high levels of performance compared to similar organizations in the marketplace; and |

| | 3. | | To motivate executives and employees to achieve REMEC’s annual and long-term business goals and encourage behavior toward the fulfillment of those objectives. |

As a result of this philosophy, REMEC’s executive compensation program consists of base salary, bonuses, participation in equity-based incentive plans (stock option and stock purchase plans) and standard benefits.

Base Salary. The Compensation Committee recognizes the importance of maintaining compensation practices and levels of compensation competitive with telecommunications, defense and electronics manufacturing companies in comparable stages of development and with other comparable technology companies in the geographical regions where REMEC is located. For external marketplace comparison purposes, a group of companies operating in our industry is used for determining competitive compensation levels.

The Compensation Committee reviews and determines the base salary amount for the Chief Executive Officer, the President, and the Executive Vice Presidents of REMEC. Base salary represents the fixed component of the executive compensation program. Determination of base salary levels is established on an annual review of marketplace competitiveness with similar technology and defense electronics companies, and on individual performance. Periodic increases in base salary relate to individual contributions evaluated against established objectives, relative marketplace competitiveness levels, length of service and movements in the industry’s annual competitive pay practices.

Bonuses and Stock Plans. REMEC’s bonus program is an integral part of its compensation program and is designed to reward executives for long-term strategic management and for attaining specific annual performance

19

goals. Each year a portion of REMEC’s pre-tax profits comprise the bonus “pool.” The Compensation Committee reviews and determines the bonus amounts for the Chief Executive Officer, the President, and the Executive Vice Presidents of REMEC, based on both the attainment by those officers of specific business plan targets, and on overall corporate performance. Executive officers of REMEC are eligible to receive awards under REMEC’s equity incentive plans and to participate in the Employee Stock Purchase Plan.

Compensation for the Chief Executive Officer. For the fiscal year ended January 31, 2004, Ronald E. Ragland was paid a base salary of $455,000 and did not receive a bonus. During the fiscal year ended January 31, 2004, Mr. Ragland was not granted any options to purchase shares of REMEC common stock. The Compensation Committee reviewed and analyzed the total compensation packages offered to chief executive officers by high technology and defense electronics companies of similar size. The comparative information was obtained from a number of sources, including surveys prepared by national consulting companies, publicly available information and extrapolations therefrom where appropriate. In addition, the Compensation Committee considered data and surveys from various industry groups. The Compensation Committee exercised its discretion and judgment to determine the appropriate compensation after weighing a number of factors, including competitive forces in the industry, individual motivation, REMEC’s financial and overall performance and Mr. Ragland’s leadership role in achieving REMEC’s long-term strategic goals established by the Board.

Policy Regarding Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for compensation paid to the chief executive officer or any of the other four most highly compensated officers to the extent that the compensation exceeds $1 million in any one year. “Performance-based” compensation is excluded from this $1 million limitation. REMEC’s Equity Incentive Plan (approved by REMEC shareholders in 1996) and 2001 Equity Incentive Plan have been designed so that grants under those plans may qualify for the exclusion for performance-based compensation. REMEC’s policy is to attempt to qualify its compensation for tax deductions whenever possible and consistent with the long-term goals of REMEC. None of REMEC’s executive officers subject to Section 162(m) received non-performance based compensation from REMEC for the 2003 fiscal year that exceeded the $1 million limit. The Compensation Committee may pay officers amounts exceeding the 162(m) limit in the future where warranted to promote REMEC’s corporate goals.

Summary. The Compensation Committee believes that the compensation of REMEC executives is appropriate and competitive with the compensation provided by other technology and defense electronics companies with which REMEC competes for executives and employees. The Compensation Committee believes its compensation strategy, principles and practices result in a compensation program tied to shareholder returns and linked to the achievement of annual and longer-term financial and operational objectives of REMEC.

Compensation Committee Members:

Jeffrey M. Nash, Ph.D., Chairman

Martin Cooper

Thomas A. Corcoran

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during REMEC’s 2004 fiscal year were Mr. Corcoran, Mr. Shaner and Dr. Nash. No member of the Compensation Committee was at any time during REMEC’s 2004 fiscal year or at any other prior time an officer or employee of REMEC. Mr. Shaner was hired as REMEC’s Interim Chief Executive officer after his resignation from the Compensation Committee. No member of the Compensation Committee had any relationship during the 2004 fiscal year requiring disclosure by REMEC under Item 404 of Regulation S-K.

During the fiscal year ended January 31, 2004, no executive officer of REMEC served on the board of directors or compensation committee of another company that had an executive officer serving on REMEC’s Board or Compensation Committee.

20

AUDIT COMMITTEE REPORT AND RELATED INFORMATION

Audit Committee Report

The Audit Committee of the Board is comprised of the three directors named below and has previously adopted a written charter, which is included as Appendix A to this proxy statement. The Audit Committee reviews and reassesses the adequacy of its written charter on an annual basis. The Board has determined that all members of the Audit Committee are independent directors under the current Nasdaq listing standards and SEC rules regarding audit committee membership.

The Audit Committee monitors and reviews REMEC’s financial reporting processes and procedures on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting processes, including the system of internal controls. REMEC’s independent auditor is responsible for auditing the financial statements.

The Audit Committee has met and held discussions with management and the independent auditor, Ernst & Young LLP, regarding the fair and complete presentation of REMEC’s results. The Audit Committee has discussed significant accounting policies applied by REMEC in its financial statements, as well as alternative treatments. Management represented to the Audit Committee that REMEC’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditor. The Audit Committee discussed with the independent auditor matters required to be discussed by the Statement on Auditing Standards No. 61 (Communication With Audit Committees).