UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04323

Natixis Funds Trust I

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

ANNUAL REPORT

December 31, 2013

CGM Advisor Targeted Equity Fund

Harris Associates Large Cap Value Fund

Natixis Oakmark International Fund

Vaughan Nelson Small Cap Value Fund

Vaughan Nelson Value Opportunity Fund

TABLE OF CONTENTS

Portfolio Review page 1

Portfolio of Investments page 24

Financial Statements page 41

Notes to Financial Statementspage 61

Barron’s/Lipper 2013 one-year fund family ranking based on 64 qualifying U.S. fund companies. Each fund family must have at least three funds in Lipper’s general U.S.-stock category, one world (global and international), one mixed-asset/balanced (stocks and bonds), two taxable bond and one tax-exempt bond fund. Past performance is no guarantee of future results.

For more details visit ngam.natixis.com/TopFundFamily

CGM ADVISOR TARGETED EQUITY FUND

| | |

| Manager | | Symbols |

| G. Kenneth Heebner, CFA | | Class A NEFGX |

| Capital Growth Management Limited Partnership | | Class B NEBGX |

| | Class C NEGCX |

| | Class Y NEGYX |

Objective

The Fund seeks long-term growth of capital through investments in equity securities of companies whose earnings are expected to grow at a faster rate than that of the overall United States economy.

Market Conditions

The U.S. stock market wrapped up its best year since 1997, defying skeptics as investor fears gave way to a belief in the recovery. Any number of things could have derailed the market’s rally: the U.S. government’s partial shutdown, the possibility of a default on federal government debt, the threat of military action in Syria, federal budget cuts and new worries about European government debt. Instead, the stock market just kept on climbing. Stock prices rose to an all-time high on the final trading day of 2013. This bull market approaches its fifth birthday in March 2014.

Performance Results

For the 12 months ended December 31, 2013, Class A shares of CGM Advisor Targeted Equity Fund returned 29.01% at net asset value. It trailed its benchmark, the S&P 500® Index, which returned 32.39%.

Explanation of Fund Performance

In a year of impressive gains, the fund’s modest shortfall against the benchmark was generally stock specific. Detractors included Herbalife, eBay and Microsoft. Nutritional supplement and weight management company Herbalife saw its share price fall because of negative publicity generated by a major hedge fund that shorted the stock. (Shorting is a technique that benefits an investor if a security loses value.) Claims by the hedge fund manager about the company’s allegedly abusive business practices pushed stock prices lower. We sold the issue.

During the year, shares of online auction giant eBay suffered as concern mounted about the impact of a new “digital wallet” fee on the company’s PayPal business. Many investors are worried that this move is part of a broader effort by credit card companies to target PayPal, which has recently become more of a direct competitor. We sold shares of eBay to fund other opportunities.

Software giant Microsoft has struggled as the world has moved away from the PC-centric version of computing to a more mobile platform. Unfortunately, the Windows Phone has yet to take off, and the Surface, Microsoft’s answer to the iPad, is a disappointment.

1 |

The fund was positioned throughout the year to benefit from healthy economic growth. In an environment of healthy economic growth, the portfolio maintained significant concentrations in investment banks and homebuilders, which lifted performance. Large investment banks profit from many financial transactions associated with a strengthening economy. Meanwhile, homebuilders are rewarded by increasing employment and consumer confidence. Leading contributors included Morgan Stanley and Citigroup. Morgan Stanley, one of the world’s largest diversified financial services companies, benefitted from the further consolidation of Salomon Smith Barney’s global wealth management business with its own operations. The acquisition, which closed with the purchase of the remaining one-third interest in Salomon Smith Barney, helped the firm take advantage of increased efficiencies. Morgan Stanley also experienced improving results in equity trading and investment banking and scaled back its underperforming fixed income operation.

Citigroup, a global financial services powerhouse, continued to make strong earnings progress as management disposed of unprofitable operations and reduced costs from non-performing assets. The company retains a leadership position in global banking, which is poised to profit from an expanding economy worldwide.

All sectors of the stock market ended the year with positive returns, but among the year’s biggest gainers were companies most exposed to the U.S. economy. In this environment, the fund benefited from its exposure to economically sensitive stocks, including automobile, airline and technology companies, which helped boost fund performance. Delta Airlines enjoyed solid earnings growth due to greater demand and significant industry reconstruction and consolidation. In recent years, the domestic airline industry has become progressively more efficient, reducing costs through bankruptcy and increased pricing power at major cities. For the first time since airline deregulation in the late 1970s, pricing has benefitted from concentration of industry capacity among several large carriers in key markets.

Outlook

We are optimistic about the U.S. economy in 2014. Several factors that have held back growth appear to be lessening. U.S. household finances have improved, and the outlook for home sales is brighter. While the stock market may not provide gains comparable to 2013, we see the potential for further gains as the economy continues to expand. With those expectations in mind, we have positioned CGM Advisor Targeted Equity Fund to continue to benefit from increasing strength in the U.S. economy. As always, we will maintain a portfolio focused on individual stocks with the potential to grow earnings at a rate faster than that of the overall economy.

| 2

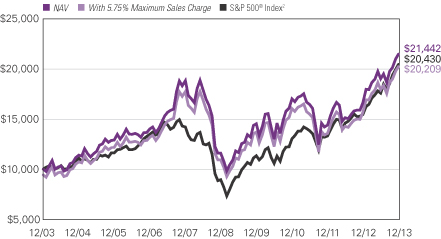

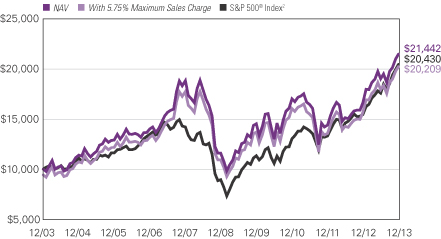

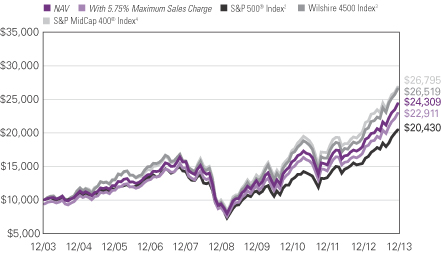

CGM ADVISOR TARGETED EQUITY FUND

Growth of $10,000 Investment in Class A Shares

December 31, 2003 through December 31, 2013

3 |

Average Annual Total Returns — December 31, 2013

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | |

Class A (Inception 11/27/68) | | | | | | | | | | | | |

NAV | | | 29.01 | % | | | 13.07 | % | | | 7.93 | % |

With 5.75% Maximum Sales Charge | | | 21.63 | | | | 11.74 | | | | 7.29 | |

| | | | |

Class B (Inception 2/28/97) | | | | | | | | | | | | |

NAV | | | 28.06 | | | | 12.26 | | | | 7.13 | |

With CDSC1 | | | 23.06 | | | | 12.00 | | | | 7.13 | |

| | | | |

Class C (Inception 9/1/98) | | | | | | | | | | | | |

NAV | | | 28.13 | | | | 12.25 | | | | 7.13 | |

With CDSC1 | | | 27.13 | | | | 12.25 | | | | 7.13 | |

| | | | |

Class Y (Inception 6/30/99) | | | | | | | | | | | | |

NAV | | | 29.34 | | | | 13.38 | | | | 8.22 | |

| | | | |

Comparative Performance | | | | | | | | | | | | |

S&P 500® Index2 | | | 32.39 | | | | 17.94 | | | | 7.41 | |

Past performance does not guarantee future results. The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | S&P 500® Index is a widely recognized measure of U.S. stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. |

| 4

HARRIS ASSOCIATES LARGE CAP VALUE FUND

| | |

| Managers | | Symbols |

| Edward S. Loeb, CFA | | Class A NEFOX |

| Michael J. Mangan, CFA | | Class B NEGBX |

| Diane L. Mustain, CFA | | Class C NECOX |

| Harris Associates L.P. | | Class Y NEOYX |

Objective

The Fund seeks opportunities for long-term capital growth and income

Market Conditions

In many ways, it was tough to say farewell to 2013. The S&P 500® Index’s 32% total return was the best in more than a decade-and-a-half, adding meaningfully to the market’s remarkable recovery from the financial crisis five years ago. Although the year started with legitimate concerns regarding new tax hikes and a budget sequester, it ended with reassuring answers to both concerns. As 2014 gets underway, we’re impressed by the broadening strength of both the economy and markets. Many varied economic indicators, such as industrial production, retail sales, auto production, exports and energy production recently approached or reached new highs. More important, we’ve seen impressive corporate performance from the companies we follow. The equity market is also – finally – gaining support from investors reconsidering their own asset allocations.

Performance Results

For the 12 months ended December 31, 2013, Class A shares of Harris Associates Large Cap Value Fund returned 37.82% at net asset value. The fund outperformed its benchmark, the Russell 1000® Value Index, which returned 32.53%.

Explanation of Fund Performance

Because we are value investors with an emphasis on individual stock selection, the fund’s country and sector weights are a byproduct of our bottom-up investment process. Sector-wise, the fund’s relative overweight in consumer discretionary holdings, plus stock selection within the sector, contributed the most to relative performance in the year. The fund also benefited from stock selection in the financials sector. An underweight in health care holdings detracted from fund performance.

The leading contributors to fund performance in 2013 were MasterCard, Applied Materials and Wells Fargo. MasterCard reported what we consider to be strong earnings throughout the year. We recently met with MasterCard’s management, which stated that the company remains focused on “digital conversion” (paper to electronic forms of spending) and expanding market share through new co-branded products and commercial cards, along with other initiatives. Management continues to repurchase shares and increase its dividend to reward shareholders, which remains a priority at MasterCard. We continue to believe that MasterCard has a unique combination of competitive strength, secular growth and low capital intensity. Applied Materials experienced a number of positive events that boosted its

5 |

stock price during the year. The company experienced strengthening sales and gross margins along with market share increases and announced a new long-term growth and profitability strategy and financial model. Also, investors responded positively to news that Applied Materials is acquiring competitor Tokyo Electron in an all-stock transaction. Wells Fargo continues to build its credit quality, and its balance sheet remains strong in our view. Wells Fargo also announced earlier in the year that it is raising its dividend more than 80% (from $0.48 to $0.88 per share for the year). We think Wells Fargo continues to execute quite well in an environment of low interest rates, which has been challenging to many banks.

The holdings with the lowest returns in 2013 were Apache, Caterpillar and Unilever. Apache was the largest detractor from fund performance, and was sold from the portfolio during the first quarter of the year. When investors consider exploration and production company stocks, they are increasingly looking for companies that can find and produce oil and gas efficiently and at low cost. For many years, Apache was seen as a cost leader by its peers. However, the company’s statistics have been eroding meaningfully, which has limited its ability to grow intrinsic value per share, a characteristic that we demand in our investments. Caterpillar released weaker-than-expected earnings per share early in the year, which affected its share price. However, our investment thesis remains intact: Caterpillar’s strong brand is built on tangible product benefits, it offers unique customer-specific cost analysis, and its dealer network is a significant and often overlooked asset. We met with Caterpillar’s CEO Doug Oberhelman during the year. Going forward, he thinks miners will focus more intensely on improving productivity at existing mines. This works to Caterpillar’s advantage, as the company is the industry technology leader with a substantial dealer service/support network. Unilever’s fiscal first-half results included revenue growth of 5% (constant currency) including strong emerging markets growth of 10% (the ninth straight quarter of double-digit growth). However, overall organic growth was short of the company’s estimate (+5.5%) for the period. Nonetheless, margins improved by what we consider to be a notable amount from a combination of both product mix and cost savings across multiple aspects of the business. We think Unilever has the potential to maintain its steady value growth through a high quality formula of end market demand.

Outlook

Our basic fundamental outlook assumes continued company-specific progress on profitability, albeit at a more moderate pace than we’ve recently witnessed. The economy’s long-term potential may have suffered due to too much economic and legislative uncertainty and too much hunger for near-term return of capital. A meaningful increase in sensible long-term capital spending to promote real growth would likely deliver higher profitability than we currently project. It’s possible we’re closer to a change, with less uncertainty in Washington, more stability in Europe and Japan, a more secure and lower-cost energy outlook, rising consumer confidence and a more synchronized global economy as we enter 2014.

| 6

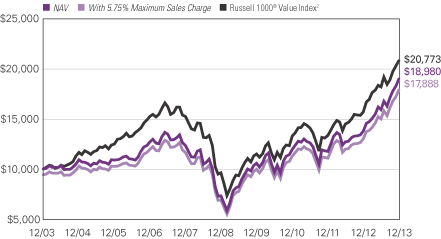

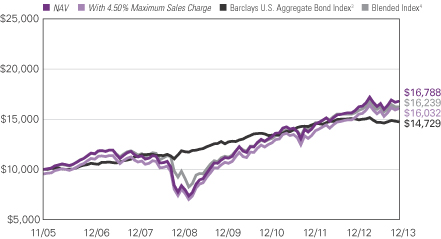

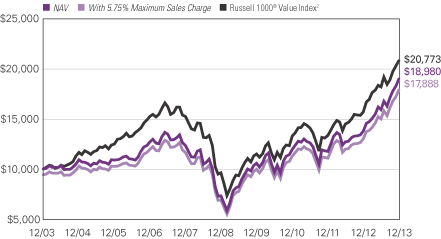

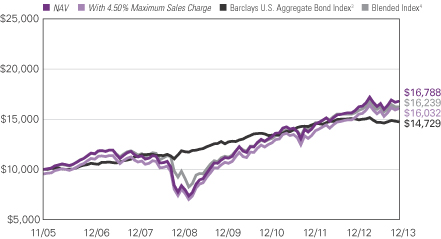

HARRIS ASSOCIATES LARGE CAP VALUE FUND

Growth of $10,000 Investment in Class A Shares3

December 31, 2003 through December 31, 2013

7 |

Average Annual Total Returns — December 31, 20133

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | |

Class A (Inception 5/6/31) | | | | | | | | | | | | |

NAV | | | 37.82 | % | | | 20.93 | % | | | 6.61 | % |

With 5.75% Maximum Sales Charge | | | 29.91 | | | | 19.49 | | | | 5.98 | |

| | | | |

Class B (Inception 9/13/93) | | | | | | | | | | | | |

NAV | | | 36.75 | | | | 20.02 | | | | 5.82 | |

With CDSC1 | | | 31.75 | | | | 19.83 | | | | 5.82 | |

| | | | |

Class C (Inception 5/1/95) | | | | | | | | | | | | |

NAV | | | 36.88 | | | | 20.04 | | | | 5.81 | |

With CDSC1 | | | 35.88 | | | | 20.04 | | | | 5.81 | |

| | | | |

Class Y (Inception 11/18/98) | | | | | | | | | | | | |

NAV | | | 38.21 | | | | 21.24 | | | | 6.94 | |

| | | | |

Comparative Performance | | | | | | | | | | | | |

Russell 1000® Value Index2 | | | 32.53 | | | | 16.67 | | | | 7.58 | |

Past performance does not guarantee future results. The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 8

NATIXIS OAKMARK INTERNATIONAL FUND

| | |

| Managers | | Symbols |

| David G. Herro, CFA | | Class A NOIAX |

| Robert A. Taylor, CFA | | Class C NOICX |

| Harris Associates L.P. | | |

Objective

The Fund seeks long-term capital appreciation

Market Conditions

2013 started with an abundance of negative news, including continued structural issues in Europe, slowed growth in the emerging markets and a questionable reform plan in Japan. However, foreign equity markets performed well in 2013. As the year progressed, it became evident that Europe would begin to recover slowly, partially because of self-help initiatives. Japan, too, was seriously tackling its deflation issue, which partially caused a strong yen, weak share prices and slow growth. As a result, both European and Japanese equity markets, which had been aggressively sold-off due to macro fears, began to recover.

Performance Results

For the 12 months ended December 31, 2013, Class A shares of Natixis Oakmark International Fund returned 28.13% at net asset value. The fund outperformed its benchmark, the MSCI World ex USA Index (Net), which returned 21.02%.

Explanation of Fund Performance

As of December 31, 2013, the fund’s European holdings totaled 79% of the portfolio, and 12% of the portfolio was invested in Japanese holdings. The remaining positions were in Australia, Canada, South Korea and the Middle East. Because we are value investors with an emphasis on individual stock selection, country and sector weights are a byproduct of our bottom-up investment process.

By sector, financials holdings contributed the most value relative to the benchmark, primarily due to stock selection. Both the fund’s overweight and stock selection in the consumer discretionary sector aided relative performance during the year. The fund’s lack of exposure to the telecommunications services sector detracted relative to the benchmark.

The top contributors to the yearly return were Daiwa Securities, Daimler and Intesa Sanpaolo. Daiwa released its fiscal first-half results during the quarter that showed pre-tax profit at the highest level since the company started reporting in 1995. Revenues rose across the board in retail, wholesale and asset management, and in total they are on track to meet full-year estimates. Of special note, the wholesale banking division became profitable for the first time since 2009. Another top contributor for the year was Daimler, the global auto manufacturer of the Mercedes brand. Shares reacted positively to the company’s 2012 results, which included higher profits than we expected for the company’s Mercedes-Benz Car and Truck divisions. More recently, Daimler announced significantly improved

9 |

earnings and net profits for the second quarter of 2013. Intesa Sanpaolo was another top contributor in 2013. Its fee generation was strong across the board, with fee growth in the commercial banking, portfolio management, insurance distribution and deal/placement fee areas. In addition, cost controls are intact and Intesa Sanpaolo’s capital ratios remain solid in our view and have improved since the end of last year.

The largest detractors from return were Orica, AMP and Canon. Orica’s shares were weakened by a reduction in guidance in July and by the market’s anticipation that the company would miss its 2013 fiscal-year targets. However, shares rebounded when Orica’s fiscal-year results showed 3% revenue growth and relatively flat margins, which put the company in line with expectations. This demonstrated that Orica’s explosives business is much more resilient than most other areas of mining services. We expect Orica to continue its capital-light strategy and that it will produce better cash flow in the future. AMP preannounced its earnings results late in June, which included AUD $32 million worth of losses in its Contemporary Wealth Protection (CWP) business during the first five months of the year. This news sent the share price tumbling. In May, the company noted that investor sentiment, market performance and the economic climate were particularly bad in Australia and had driven up claims and lapse rates. To address the problems in the CWP division, the company is raising its claims assumptions, believing some of its problems are structural. Canon also was a detractor from the yearly return, which was largely the result of the downgrade of the ILC business (digital SLRs and lenses). This business has lagged enough that management has lowered fiscal-year volume estimates from 9 million to 8 million. Despite falling prices due to uncertain consumer markets in developed economies and from trading down in emerging markets, management indicates pricing is normalizing. In addition, print volumes are growing again, and Canon is taking market share. We continue to believe that Canon is a compelling investment opportunity that will reward shareholders in the long term.

We no longer believe the yen to be overvalued and therefore closed the fund’s hedge of the underlying currency. The Australian dollar also weakened in 2013, but we still believe it to be overvalued. As of year end, we hedged 30% of the Australian dollar, 31% of the Swiss franc and 30% of the Swedish krona exposure.

Outlook

Despite strong past performance, we believe there is still value in global equity markets. Certainly, stocks are not selling at the incredible bargains they were in early 2009 or even early 2012, but with global economic growth appearing to be poised to accelerate, and with stock valuations that are still attractive, we believe there are reasons to be confident that global equities will continue to be an attractive asset class.

| 10

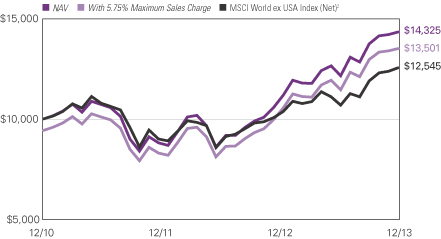

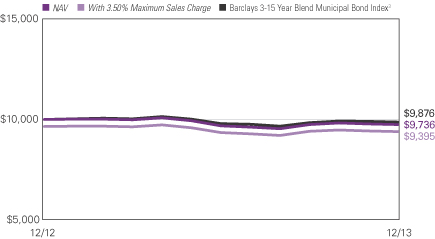

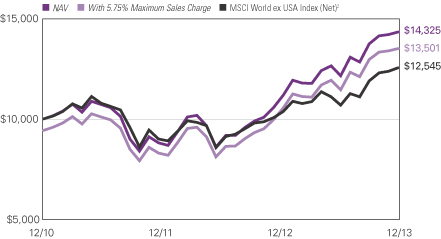

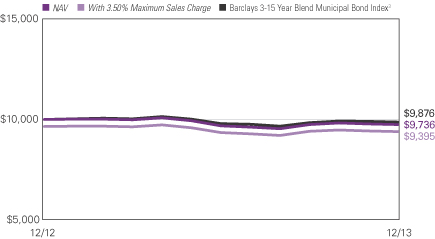

NATIXIS OAKMARK INTERNATIONAL FUND

Growth of $10,000 Investment in Class A Shares3

December 15, 2010 (inception) through December 31, 2013

Average Annual Total Returns — December 31, 20133

| | | | | | | | |

| | | |

| | | 1 Year | | | Life of Fund | |

| | | |

Class A (Inception 12/15/10) | | | | | | | | |

NAV | | | 28.13 | % | | | 12.54 | % |

With 5.75% Maximum Sales Charge | | | 20.72 | | | | 10.37 | |

| | | |

Class C (Inception 12/15/10) | | | | | | | | |

NAV | | | 27.13 | | | | 11.71 | |

With CDSC1 | | | 26.13 | | | | 11.71 | |

| | | |

Comparative Performance | | | | | | | | |

MSCI World ex USA Index (Net)2 | | | 21.02 | | | | 7.73 | |

Past performance does not guarantee future results. The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | MSCI World ex USA Index (Net) is an unmanaged index that is designed to measure the equity market performance of developed markets, excluding the United States. The index calculates reinvested dividends net of withholding taxes using Luxembourg tax rates. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

11 |

VAUGHAN NELSON SMALL CAP VALUE FUND

| | |

| Managers | | Symbols |

| Dennis G. Alff, CFA | | Class A NEFJX |

| Chad D. Fargason | | Class B NEJBX |

| Chris D. Wallis, CFA | | Class C NEJCX |

| Scott J. Weber, CFA | | Class Y NEJYX |

| Vaughan Nelson Investment Management, L.P. |

Effective July 31, 2009, the fund was closed to new investors.

Objective

The Fund seeks capital appreciation

Market Conditions

Against a backdrop of stable earnings growth, low inflation and easy money, the U.S. equity markets continued a broad advance, which began in the fourth quarter of 2012. However, the nature of its ascent changed dramatically after the Federal Reserve (the Fed) announced in May that it would begin tapering its monthly bond purchases, a program known as quantitative easing (QE). Prior to the tapering announcement, the equity market rally was led by stocks that were termed “bond proxies,” because of their dividend yields, and by cyclical sectors that responded to the ultra low interest rates, ample liquidity and credit availability. After the Fed’s announcement, these sectors came under pressure as 10-year Treasury rates rose from a low of approximately 1.4% to 3.0%. Despite the Fed’s claim otherwise, tapering QE does represent a tightening of monetary policy. The increase in interest rates across the entire Treasury curve represented an increase in overall real interest rates within the capital markets. (The Treasury curve is a graph that shows interest rates on U.S. Treasury securities across maturities, from short to long.) Given the significant expansion in the equity market’s valuation multiples, coupled with the declining impact of QE on corporate earnings and economic activity, we continue to expect the rate of return for the broader equity indices to moderate materially over the next three years.

Performance Results

For the 12 months ended December 31, 2013, Class A shares of Vaughan Nelson Small Cap Value Fund returned 39.01% at net asset value. The fund outperformed its benchmark, the Russell 2000® Value Index, which returned 34.52%.

Explanation of Fund Performance

Stock selection drove the overwhelming majority of the portfolio’s performance over the past year with broad based expansion of price-to-earnings multiples, a common measure of valuation, providing a healthy tailwind. Cyclical stocks disproportionately benefited the portfolio due to their leverage to an economic recovery. The cyclical exposure stemmed from our team’s focus on company-specific valuations and fundamentals as opposed to any targeted sector exposure. Consequently, the portfolio was materially underweight relative to its benchmark in real estate investment trusts (REITs) and utilities because both sectors

| 12

VAUGHAN NELSON SMALL CAP VALUE FUND

appeared overvalued. Industrials, financials, technology and consumer discretionary stocks were the biggest contributors to the fund’s performance, while no single sector detracted from results.

Stock selection drove returns in the industrials sector. Notable standouts included Towers Watson and KAR Auction Services. Towers Watson began to earn market recognition for its health care exchange investments, as private exchanges are now a practical solution for employers to reduce healthcare costs. We sold the stock as expectations of broad private exchange proliferation were reflected in the stock price. KAR Auction Services stock appreciated as new vehicle sales in the United States continued to recover from the 2009 trough. This is an important indicator for whole car auction volumes, because there is a two to four year lag between new car sales and auction volumes.

Stock selection stood out as a driver in the financials sector, with FirstMerit and CNO Financial Group making the most significant contributions to performance. FirstMerit acquired peer bank Citizens Republic Bancorp in 2013 and realized 40% of its targeted cost savings by the end of the third quarter. Further, organic loan growth rebounded as the economy continued to recover. CNO Financial Group benefited from management’s plan to improve operating efficiency, run off low return blocks of business and return cash to shareholders through share repurchases—all of which contributed to improved returns. Also, management significantly improved CNO’s capital structure by issuing new debt to pay off the existing credit facility, retire expensive debt and repurchase the outstanding convertible bonds.

Strong stock selection also benefited the fund’s technology holdings, with SS&C Technologies and Broadridge Financial Services leading the way. SS&C provides software solutions to the financial services industry to automate client reporting, reconciliation and portfolio and investment accounting. The company has benefitted from the recovery in the stock market since a portion of its revenues is tied to client assets under management. This revenue growth, coupled with SS&C’s effort to pay down debt, has improved profit margins. Broadridge is the leading provider of investor communications and third-party trade processing services. The company has benefited from tighter regulation within the financial services industry and from the recovery in trading volumes.

The consumer discretionary sector was the only sector that detracted from relative performance during the year. Stock selection within specialty retail was the main detractor to relative performance with Aaron’s and Abercrombie & Fitch lagging the most. Both Aaron’s and Abercrombie were impacted by a weak macroeconomic environment that impacted store traffic and resulted in a highly promotional environment. On the other hand, Harman International was the greatest contributor to performance. Harman International enjoyed success as its leadership in automotive infotainment coincided with increased auto sales. Additionally, the company’s margin profile continues to improve as their backlog is becoming increasingly comprised of standardized products as opposed to custom designs.

Other notable performers during the year included: Packaging Corporation of America, LPL Financial Holdings, Oasis Petroleum and Health Management Associates. The

13 |

greatest increases in sector weights were in technology, consumer staples and energy. The rise in technology holdings was primarily the result of adding exposure to software and information technology services, through ACI Worldwide, Fair Isaac, Broadridge and Jack Henry. GNC Holdings and Rite Aid boosted the consumer staples weight, while Forum Energy accounted for most of the increase in the energy weight.

The largest reductions in sector weights were in financials, industrials and materials. The weight in financials was primarily driven by our decision to underweight REITs because valuations looked stretched. We also lowered the fund’s exposure to industrials and materials by reducing building products stocks and chemical stocks, respectively.

Outlook

Despite the rise in real interest rates, we continue to expect modest economic growth as the fiscal drags from government spending reductions will no longer be a headwind in 2014. The continued recovery in capital spending, residential construction, nonresidential construction and the elimination of the fiscal drags have the potential to drive real gross domestic product growth to between 2.5% and 3.5% in 2014. The primary risks to this outlook would be a flare up in the European credit markets, a significant slowdown in China’s economic growth or instability emanating from Japanese credit markets. As we enter 2014, we believe the U.S. equity markets will rely less on the Federal Reserve’s stimulus and more on individual company fundamentals. This will represent an incremental headwind to the broad averages but will have varying effects across individual securities. There are still individual stocks that will perform well despite the lowered return expectations for the general market. This positive outlook continues to be stock-specific and not reflective of opportunities in specific industries or regions of the world.

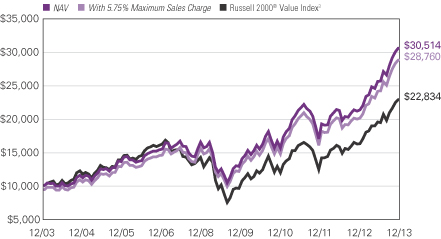

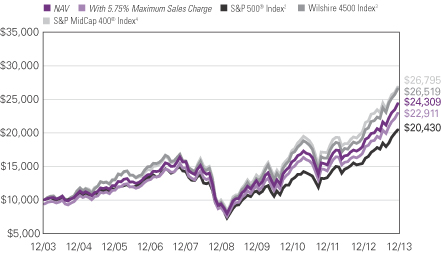

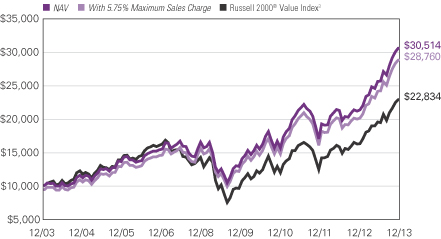

Growth of $10,000 Investment in Class A Shares4

December 31, 2003 through December 31, 2013

See notes to chart on page 15.

| 14

Average Annual Total Returns — December 31, 20134

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | |

Class A (Inception 12/31/96) | | | | | | | | | | | | |

NAV | | | 39.01 | % | | | 19.53 | % | | | 11.81 | % |

With 5.75% Maximum Sales Charge | | | 31.00 | | | | 18.12 | | | | 11.15 | |

| | | | |

Class B (Inception 12/31/96) | | | | | | | | | | | | |

NAV | | | 38.03 | | | | 18.64 | | | | 10.99 | |

With CDSC1 | | | 33.03 | | | | 18.44 | | | | 10.99 | |

| | | | |

Class C (Inception 12/31/96) | | | | | | | | | | | | |

NAV | | | 37.99 | | | | 18.64 | | | | 10.98 | |

With CDSC1 | | | 36.99 | | | | 18.64 | | | | 10.98 | |

| | | | |

Class Y (Inception 8/31/06)2 | | | | | | | | | | | | |

NAV | | | 39.43 | | | | 19.83 | | | | 12.03 | |

| | | | |

Comparative Performance | | | | | | | | | | | | |

Russell 2000® Value Index3 | | | 34.52 | | | | 17.64 | | | | 8.61 | |

Past performance does not guarantee future results. The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

| 2 | Prior to the inception of Class Y shares (8/31/06), performance is that of Class A shares and reflects the higher net expenses of that share class. |

| 3 | Russell 2000® Value Index is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

15 |

VAUGHAN NELSON VALUE OPPORTUNITY FUND

| | |

| Managers | | Symbols |

| Dennis G. Alff, CFA | | Class A VNVAX |

| Chad D. Fargason | | Class C VNVCX |

| Chris D. Wallis, CFA | | Class N VNVNX |

| Scott J. Weber, CFA | | Class Y VNVYX |

| Vaughan Nelson Investment Management, L.P. |

Objective

The Fund seeks long-term capital appreciation

Market Conditions

Against a backdrop of stable earnings growth, low inflation and easy money, the U.S. equity markets continued a broad advance, which began in the fourth quarter of 2012. However, the nature of its ascent changed dramatically after the Federal Reserve (the Fed) announced in May that it would begin tapering its monthly bond purchases, a program known as quantitative easing (QE). Prior to the tapering announcement, the equity market rally was led by stocks that were termed “bond proxies,” because of their dividend yields, and by cyclical sectors that responded to the ultra low interest rates, ample liquidity and credit availability. After the Fed’s announcement, these sectors came under pressure as 10-year Treasury rates rose from a low of approximately 1.4% to 3.0%. Despite the Fed’s claim otherwise, tapering QE does represent a tightening of monetary policy. The increase in interest rates across the entire Treasury curve represented an increase in overall real interest rates within the capital markets. (The U.S. Treasury curve is a graph that shows interest rates on U.S. Treasury securities across maturities, from short to long.) Given the significant expansion in the equity market’s valuation multiples, coupled with the declining impact of QE on corporate earnings and economic activity, we continue to expect the rate of return for the broader equity indices to moderate materially over the next three years.

Performance Results

For the 12 months ended December 31, 2013, Class A shares of Vaughan Nelson Value Opportunity Fund returned 41.22% at net asset value. The fund outperformed its benchmark, the Russell Midcap® Value Index, which returned 33.46%.

Explanation of Fund Performance

Stock selection drove the overwhelming majority of the portfolio’s performance over the past year with broad based expansion of price-to-earnings multiples, a common measure of valuation, providing a healthy tailwind. Cyclical stocks disproportionately benefited the portfolio due to their leverage to an economic recovery. The cyclical exposure stemmed from our team’s focus on company-specific valuations and fundamentals as opposed to any targeted sector exposure. Consequently, the portfolio was materially underweight in real estate investment trusts (REITs) and utilities because both sectors appeared overvalued. Industrials, financials, technology and consumer discretionary stocks were the biggest contributors to performance, while no single sector detracted from results.

| 16

VAUGHAN NELSON VALUE OPPORTUNITY FUND

Stock selection drove returns in the industrials sector. Notable standouts included Towers Watson and United Rentals. Towers Watson began to earn market recognition for its health care exchange investments, as private exchanges are now a practical solution for employers to reduce healthcare costs. We sold the stock as expectations of broad private exchange proliferation were reflected in the stock price. United Rentals, the largest equipment rental company in the world, performed well in light of the economic recovery and the synergies gained from its acquisition of RSC. We believe that United Rentals should continue to benefit from the recovery in non-residential construction and from the industry trend toward rental versus owned equipment.

Stock selection stood out as a driver in the financials sector, with The Hartford and Huntington Bancshares making the most significant contributions to performance. The Hartford executed on a turnaround plan that included selling non-core businesses, placing the U.S. annuity business into run-off, refinancing high cost debt and returning cash to shareholders. The implementation of this plan improved shareholder returns, and the market rewarded Hartford shares with a higher valuation. Huntington Bancshares completed a small acquisition during the year and benefited from organic loan growth and better credit.

The technology sector detracted from relative performance during the year. The biggest detractor to relative performance was stock selection within software. Specifically Nuance Communications, a speech recognition software provider, performed poorly during the year due to weak international sales, sluggish Windows-based software sales, and due to a slowdown in its health care business. Further, the company lowered 2014 earnings guidance due to the company’s ongoing transition to on-demand offerings, which will require more investment than originally anticipated. While relative performance lagged the benchmark the portfolio benefitted from owning Avago Technologies and Fiserv, which were strong performers during the year. Avago, an analog semiconductor manufacturer, has benefitted from strong demand for its products in the wireless communications market, which represents fifty percent of the company’s revenue. The company is positioned to benefit from several secular trends including: increased penetration of smart phone handsets, increased complexity in handsets as we move to 4G/LTE, and stronger demand for technology and equipment within the industrial and auto markets. Fiserv is a provider of financial services technology including core bank processing systems, electronic payments products, mobile and internet banking solutions, and loan processing systems. The company has benefited from increased regulation within the financial services industry and from the trend to online banking.

In the consumer discretionary sector, Harman International and Delphi Automotive were the greatest contributors to performance. Harman International enjoyed success as its leadership in automotive “infotainment” coincided with higher auto sales. Additionally, the company’s profit margin profile continues to improve as its backlog is shifting toward standardized products as opposed to custom designs. Delphi Automotive is a supplier of electrical systems, safety products, powertrain systems and thermal management products. The company benefited from the recovery in auto sales.

17 |

Other notable performers during the year were Warner Chilcott, Valeant Pharmaceuticals and HCA Holdings in the health care sector and GNC Holdings and Rite Aid in the consumer staples sector. The greatest additions to sector weights were in consumer staples, industrials, materials and consumer discretionary. The largest reductions in sector weights were in financials, technology and energy. The fund’s financials exposure was primarily driven by our decision to avoid REITs because valuations looked stretched.

Outlook

Despite the rise in real interest rates, we continue to expect modest economic growth as the fiscal drags from government spending reductions will no longer be a headwind in 2014. The continued recovery in capital spending, residential construction, nonresidential construction and the elimination of the fiscal drags have the potential to drive real GDP growth between 2.5% and 3.5% in 2014. We believe the primary risks to this outlook would be a flare up in the European credit markets, a significant slowdown in China’s economic growth or instability emanating from Japanese credit markets. As we enter 2014, we believe the U.S. equity markets will rely less on Federal Reserve stimulus and more on individual company fundamentals. This will represent an incremental headwind to the broad averages, but will have varying effects across individual securities. There are still individual stocks that will perform well despite the lowered return expectations for the general market. This positive outlook continues to be stock-specific and not reflective of opportunities in specific industries or regions of the world.

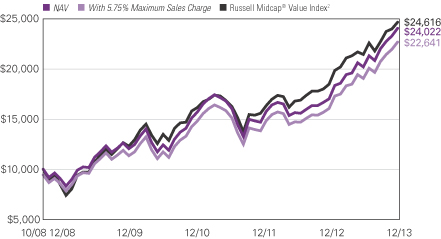

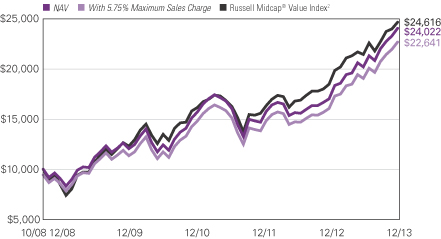

Growth of $10,000 Investment in Class A Shares3

October 31, 2008 (inception) through December 31, 2013

See notes to chart on page 19.

| 18

Average Annual Total Returns — December 31, 20133

| | | | | | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Year | | | Life of Class | |

| | | | | |

| | | | | | | | | | | | Class A/C/Y | | | | Class N | |

| | | | | |

Class A (Inception 10/31/08) | | | | | | | | | | | | | | | | |

NAV | | | 41.22 | % | | | 20.07 | % | | | 18.48 | % | | | — | |

With 5.75% Maximum Sales Charge | | | 33.06 | | | | 18.65 | | | | 17.13 | | | | — | |

| | | | | |

Class C (Inception 10/31/08) | | | | | | | | | | | | | | | | |

NAV | | | 40.13 | | | | 19.19 | | | | 17.61 | | | | — | |

With CDSC1 | | | 39.13 | | | | 19.19 | | | | 17.61 | | | | — | |

| | | | | |

Class N (Inception 5/1/13) | | | | | | | | | | | | | | | | |

NAV | | | — | | | | — | | | | — | | | | 24.70 | % |

| | | | | |

Class Y (Inception 10/31/08) | | | | | | | | | | | | | | | | |

NAV | | | 41.52 | | | | 20.38 | | | | 18.78 | | | | — | |

| | | | | |

Comparative Performance | | | | | | | | | | | | | | | | |

Russell Midcap® Value Index2 | | | 33.46 | | | | 21.16 | | | | 19.07 | | | | 17.05 | |

Past performance does not guarantee future results. The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class C shares assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 2 | Russell Midcap® Value Index is an unmanaged index that measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

19 |

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12-month period ended June 30, 2013 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public

Reference Room may be obtained by calling 800-SEC-0330.

| 20

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the funds’ prospectus. The following examples are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table of each class of fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from July 1, 2013 through December 31, 2013. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.60) and multiply the result by the number in the Expenses Paid During Period column as shown for your class.

The second line in the table for each class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

| CGM ADVISOR TARGETED EQUITY FUND | | BEGINNING

ACCOUNT VALUE

7/1/2013 | | | ENDING

ACCOUNT VALUE

12/31/2013 | | | EXPENSES PAID

DURING PERIOD*

7/1/2013 – 12/31/2013 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,128.00 | | | | $6.33 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.26 | | | | $6.01 | |

Class B | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,123.40 | | | | $10.28 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.53 | | | | $9.75 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,124.20 | | | | $10.33 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.48 | | | | $9.80 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,129.70 | | | | $4.99 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.52 | | | | $4.74 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 1.18%, 1.92%, 1.93% and 0.93% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

21 |

| | | | | | | | | | | | |

| HARRIS ASSOCIATES LARGE CAP VALUE FUND | | BEGINNING

ACCOUNT VALUE

7/1/2013 | | | ENDING

ACCOUNT VALUE

12/31/2013 | | | EXPENSES PAID

DURING PERIOD*

7/1/2013 – 12/31/2013 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,192.20 | | | | $7.18 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.65 | | | | $6.61 | |

Class B | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,187.30 | | | | $11.30 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.87 | | | | $10.41 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,187.60 | | | | $11.30 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.87 | | | | $10.41 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,193.40 | | | | $5.80 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.91 | | | | $5.35 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 1.30%, 2.05%, 2.05% and 1.05% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| NATIXIS OAKMARK INTERNATIONAL FUND | | BEGINNING

ACCOUNT VALUE

7/1/2013 | | | ENDING

ACCOUNT VALUE

12/31/2013 | | | EXPENSES PAID

DURING PERIOD*

7/1/2013 – 12/31/2013 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,179.00 | | | | $7.91 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.95 | | | | $7.32 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,174.90 | | | | $12.01 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.17 | | | | $11.12 | |

| * | Expenses are equal to the Fund’s annualized expense ratio: 1.44% and 2.19% for Class A and C, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| 22

| | | | | | | | | | | | |

| VAUGHAN NELSON SMALL CAP VALUE FUND | | BEGINNING

ACCOUNT VALUE

7/1/2013 | | | ENDING

ACCOUNT VALUE

12/31/2013 | | | EXPENSES PAID

DURING PERIOD*

7/1/2013 – 12/31/2013 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,191.90 | | | | $7.62 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.25 | | | | $7.02 | |

Class B | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,188.00 | | | | $11.75 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.47 | | | | $10.82 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,187.50 | | | | $11.74 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.47 | | | | $10.82 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,193.60 | | | | $6.25 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.51 | | | | $5.75 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 1.38%, 2.13%, 2.13% and 1.13% for Class A, B, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

| | | | | | | | | | | | |

| VAUGHAN NELSON VALUE OPPORTUNITY FUND | | BEGINNING

ACCOUNT VALUE

7/1/2013 | | | ENDING

ACCOUNT VALUE

12/31/2013 | | | EXPENSES PAID

DURING PERIOD*

7/1/2013 – 12/31/2013 | |

Class A | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,190.40 | | | | $7.01 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.80 | | | | $6.46 | |

Class C | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,185.60 | | | | $11.13 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.02 | | | | $10.26 | |

Class N | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,191.30 | | | | $5.63 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.06 | | | | $5.19 | |

Class Y | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,191.90 | | | | $5.64 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.06 | | | | $5.19 | |

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 1.27%, 2.02%, 1.02% and 1.02% for Class A, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), divided by 365 (to reflect the half-year period). |

23 |

Portfolio of Investments – as of December 31, 2013

CGM Advisor Targeted Equity Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 99.3% of Net Assets | | | | |

| | | | Aerospace & Defense — 1.3% | | | | |

| | 55,000 | | | Boeing Co. (The) | | $ | 7,506,950 | |

| | | | | | | | |

| | | | Airlines — 4.7% | | | | |

| | 990,000 | | | Delta Air Lines, Inc. | | | 27,195,300 | |

| | | | | | | | |

| | | | Automobiles — 8.7% | | | | |

| | 800,000 | | | General Motors Co.(b) | | | 32,696,000 | |

| | 145,000 | | | Toyota Motor Corp., Sponsored ADR | | | 17,678,400 | |

| | | | | | | | |

| | | | | | | 50,374,400 | |

| | | | | | | | |

| | | | Capital Markets — 17.4% | | | | |

| | 89,000 | | | BlackRock, Inc. | | | 28,165,830 | |

| | 2,330,000 | | | Morgan Stanley | | | 73,068,800 | |

| | | | | | | | |

| | | | | | | 101,234,630 | |

| | | | | | | | |

| | | | Computers & Peripherals — 5.5% | | | | |

| | 380,000 | | | Western Digital Corp. | | | 31,882,000 | |

| | | | | | | | |

| | | | Diversified Financial Services — 6.9% | | | | |

| | 765,000 | | | Citigroup, Inc. | | | 39,864,150 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 5.3% | | | | |

| | 160,000 | | | Wynn Resorts Ltd. | | | 31,073,600 | |

| | | | | | | | |

| | | | Household Durables — 17.0% | | | | |

| | 1,470,000 | | | DR Horton, Inc. | | | 32,810,400 | |

| | 810,000 | | | Lennar Corp., Class A | | | 32,043,600 | |

| | 920,000 | | | Toll Brothers, Inc.(b) | | | 34,040,000 | |

| | | | | | | | |

| | | | | | | 98,894,000 | |

| | | | | | | | |

| | | | Insurance — 4.8% | | | | |

| | 305,000 | | | Prudential Financial, Inc. | | | 28,127,100 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 5.3% | | | | |

| | 26,600 | | | priceline.com, Inc.(b) | | | 30,919,840 | |

| | | | | | | | |

| | | | Internet Software & Services — 5.8% | | | | |

| | 30,300 | | | Google, Inc., Class A(b) | | | 33,957,513 | |

| | | | | | | | |

| | | | IT Services — 7.2% | | | | |

| | 29,000 | | | MasterCard, Inc., Class A | | | 24,228,340 | |

| | 80,000 | | | Visa, Inc., Class A | | | 17,814,400 | |

| | | | | | | | |

| | | | | | | 42,042,740 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 4.5% | | | | |

| | 1,200,000 | | | Micron Technology, Inc.(b) | | | 26,112,000 | |

| | | | | | | | |

| | | | Tobacco — 4.9% | | | | |

| | 565,000 | | | Lorillard, Inc. | | | 28,634,200 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $486,204,657) | | | 577,818,423 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of December 31, 2013

CGM Advisor Targeted Equity Fund – (continued)

| | | | | | | | |

Principal

Amount | | | Description | | Value (†) | |

| | Short-Term Investments — 1.8% | | | | |

| $ | 10,675,000 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2013 at 0.000% to be repurchased at $10,675,000 on 1/02/2014 collateralized by $10,075,000 U.S. Treasury Note, 3.250% due 7/31/2016 valued at $10,893,594 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $10,675,000) | | $ | 10,675,000 | |

| | | | | | | | |

| | | | Total Investments — 101.1%

(Identified Cost $496,879,657)(a) | | | 588,493,423 | |

| | | | Other assets less liabilities — (1.1)% | | | (6,672,741 | ) |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 581,820,682 | |

| | | | | | | | |

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | | | | |

| | (a) | | | Federal Tax Information: | | | | |

| | | | At December 31, 2013, the net unrealized appreciation on investments based on a cost of $497,291,038 for federal income tax purposes was as follows: | | | | |

| | | | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 91,657,972 | |

| | | | Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (455,587 | ) |

| | | | | | | | |

| | | | Net unrealized appreciation | | $ | 91,202,385 | |

| | | | | | | | |

| | (b) | | | Non-income producing security. | | | | |

| | | | | | | | |

| | ADR | | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | |

Industry Summary at December 31, 2013 (Unaudited)

| | | | |

Capital Markets | | | 17.4 | % |

Household Durables | | | 17.0 | |

Automobiles | | | 8.7 | |

IT Services | | | 7.2 | |

Diversified Financial Services | | | 6.9 | |

Internet Software & Services | | | 5.8 | |

Computers & Peripherals | | | 5.5 | |

Hotels, Restaurants & Leisure | | | 5.3 | |

Internet & Catalog Retail | | | 5.3 | |

Tobacco | | | 4.9 | |

Insurance | | | 4.8 | |

Airlines | | | 4.7 | |

Semiconductors & Semiconductor Equipment | | | 4.5 | |

Other Investments, less than 2% each | | | 1.3 | |

Short-Term Investments | | | 1.8 | |

| | | | |

Total Investments | | | 101.1 | |

Other assets less liabilities | | | (1.1 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of December 31, 2013

Harris Associates Large Cap Value Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 95.2% of Net Assets | | | | |

| | | | Air Freight & Logistics — 3.6% | | | | |

| | 41,900 | | | FedEx Corp. | | $ | 6,023,963 | |

| | | | | | | | |

| | | | Auto Components — 6.0% | | | | |

| | 33,800 | | | Autoliv, Inc. | | | 3,102,840 | |

| | 70,500 | | | Delphi Automotive PLC | | | 4,239,165 | |

| | 37,200 | | | TRW Automotive Holdings Corp.(b) | | | 2,767,308 | |

| | | | | | | | |

| | | | | | | 10,109,313 | |

| | | | | | | | |

| | | | Automobiles — 4.1% | | | | |

| | 167,900 | | | General Motors Co.(b) | | | 6,862,073 | |

| | | | | | | | |

| | | | Capital Markets — 8.8% | | | | |

| | 14,000 | | | BlackRock, Inc. | | | 4,430,580 | |

| | 89,600 | | | Franklin Resources, Inc. | | | 5,172,608 | |

| | 29,500 | | | Goldman Sachs Group, Inc. (The) | | | 5,229,170 | |

| | | | | | | | |

| | | | | | | 14,832,358 | |

| | | | | | | | |

| | | | Commercial Banks — 6.7% | | | | |

| | 76,600 | | | US Bancorp | | | 3,094,640 | |

| | 180,100 | | | Wells Fargo & Co. | | | 8,176,540 | |

| | | | | | | | |

| | | | | | | 11,271,180 | |

| | | | | | | | |

| | | | Consumer Finance — 2.4% | | | | |

| | 53,400 | | | Capital One Financial Corp. | | | 4,090,974 | |

| | | | | | | | |

| | | | Diversified Financial Services — 3.9% | | | | |

| | 113,800 | | | JPMorgan Chase & Co. | | | 6,655,024 | |

| | | | | | | | |

| | | | Electrical Equipment — 0.8% | | | | |

| | 10,800 | | | Rockwell Automation, Inc. | | | 1,276,128 | |

| | | | | | | | |

| | | | Energy Equipment & Services — 2.8% | | | | |

| | 60,500 | | | National Oilwell Varco, Inc. | | | 4,811,565 | |

| | | | | | | | |

| | | | Food Products — 1.8% | | | | |

| | 74,300 | | | Unilever PLC, Sponsored ADR | | | 3,061,160 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 1.0% | | | | |

| | 29,200 | | | Medtronic, Inc. | | | 1,675,788 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 6.2% | | | | |

| | 111,600 | | | Marriott International, Inc., Class A | | | 5,508,576 | |

| | 27,000 | | | McDonald’s Corp. | | | 2,619,810 | |

| | 29,900 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 2,375,555 | |

| | | | | | | | |

| | | | | | | 10,503,941 | |

| | | | | | | | |

| | | | Insurance — 6.8% | | | | |

| | 127,400 | | | American International Group, Inc. | | | 6,503,770 | |

| | 60,400 | | | Aon PLC | | | 5,066,956 | |

| | | | | | | | |

| | | | | | | 11,570,726 | |

| | | | | | | | |

| | | | Internet Software & Services — 1.1% | | | | |

| | 1,700 | | | Google, Inc., Class A(b) | | | 1,905,207 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 26

Portfolio of Investments – as of December 31, 2013

Harris Associates Large Cap Value Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | IT Services — 5.2% | | | | |

| | 5,400 | | | MasterCard, Inc., Class A | | $ | 4,511,484 | |

| | 19,200 | | | Visa, Inc., Class A | | | 4,275,456 | |

| | | | | | | | |

| | | | | | | 8,786,940 | |

| | | | | | | | |

| | | | Machinery — 6.2% | | | | |

| | 28,600 | | | Caterpillar, Inc. | | | 2,597,166 | |

| | 18,100 | | | Cummins, Inc. | | | 2,551,557 | |

| | 64,700 | | | Illinois Tool Works, Inc. | | | 5,439,976 | |

| | | | | | | | |

| | | | | | | 10,588,699 | |

| | | | | | | | |

| | | | Media — 4.1% | | | | |

| | 83,800 | | | Comcast Corp., Special Class A | | | 4,179,944 | |

| | 37,200 | | | Omnicom Group, Inc. | | | 2,766,564 | |

| | | | | | | | |

| | | | | | | 6,946,508 | |

| | | | | | | | |

| | | | Multiline Retail — 1.1% | | | | |

| | 29,600 | | | Family Dollar Stores, Inc. | | | 1,923,112 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 2.1% | | | | |

| | 35,300 | | | ExxonMobil Corp. | | | 3,572,360 | |

| | | | | | | | |

| | | | Road & Rail — 2.4% | | | | |

| | 23,900 | | | Union Pacific Corp. | | | 4,015,200 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 9.2% | | | | |

| | 301,400 | | | Applied Materials, Inc. | | | 5,331,766 | |

| | 242,100 | | | Intel Corp. | | | 6,284,916 | |

| | 57,000 | | | Lam Research Corp.(b) | | | 3,103,650 | |

| | 19,200 | | | Texas Instruments, Inc. | | | 843,072 | |

| | | | | | | | |

| | | | | | | 15,563,404 | |

| | | | | | | | |

| | | | Software — 3.6% | | | | |

| | 160,200 | | | Oracle Corp. | | | 6,129,252 | |

| | | | | | | | |

| | | | Specialty Retail — 4.2% | | | | |

| | 28,600 | | | Advance Auto Parts, Inc. | | | 3,165,448 | |

| | 29,900 | | | CarMax, Inc.(b) | | | 1,405,898 | |

| | 28,200 | | | Tiffany & Co. | | | 2,616,396 | |

| | | | | | | | |

| | | | | | | 7,187,742 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 1.1% | | | | |

| | 23,500 | | | NIKE, Inc., Class B | | | 1,848,040 | |

| | | | | | | | |

| | | | Total Common Stocks (Identified Cost $107,796,432) | | | 161,210,657 | |

| | | | | | | | |

Principal

Amount | | | | | | |

| | Short-Term Investments — 4.8% | | | | |

| $ | 8,230,632 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2013 at 0.000% to be repurchased at $8,230,632 on 1/02/2014 collateralized by $8,505,000 U.S. Treasury Note, 0.625% due 5/31/2017 valued at $8,399,079 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $8,230,632) | | | 8,230,632 | |

| | | | | | | | |

See accompanying notes to financial statements.

27 |

Portfolio of Investments – as of December 31, 2013

Harris Associates Large Cap Value Fund – (continued)

| | | | | | |

| | | Description | | Value (†) | |

| | Total Investments — 100.0% (Identified Cost $116,027,064)(a) | | $ | 169,441,289 | |

| | Other assets less liabilities — (0.0)% | | | (38,909 | ) |

| | | | | | |

| | Net Assets — 100.0% | | $ | 169,402,380 | |

| | | | | | |

| (†) | | See Note 2 of Notes to Financial Statements. | | | | |

| (a) | | Federal Tax Information: | | | | |

| | At December 31, 2013, the net unrealized appreciation on investments based on a cost of $116,679,438 for federal income tax purposes was as follows: | | | | |

| | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 52,761,851 | |

| | Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | — | |

| | | | | | |

| | Net unrealized appreciation | | $ | 52,761,851 | |

| | | | | | |

| (b) | | Non-income producing security. | | | | |

| | | | | | |

| ADR | | An American Depositary Receipt is a certificate issued by a custodian bank representing the right to receive securities of the foreign issuer described. The values of ADRs may be significantly influenced by trading on exchanges not located in the United States. | | | | |

Industry Summary at December 31, 2013 (Unaudited)

| | | | |

Semiconductors & Semiconductor Equipment | | | 9.2 | % |

Capital Markets | | | 8.8 | |

Insurance | | | 6.8 | |

Commercial Banks | | | 6.7 | |

Machinery | | | 6.2 | |

Hotels, Restaurants & Leisure | | | 6.2 | |

Auto Components | | | 6.0 | |

IT Services | | | 5.2 | |

Specialty Retail | | | 4.2 | |

Media | | | 4.1 | |

Automobiles | | | 4.1 | |

Diversified Financial Services | | | 3.9 | |

Software | | | 3.6 | |

Air Freight & Logistics | | | 3.6 | |

Energy Equipment & Services | | | 2.8 | |

Consumer Finance | | | 2.4 | |

Road & Rail | | | 2.4 | |

Oil, Gas & Consumable Fuels | | | 2.1 | |

Other Investments, less than 2% each | | | 6.9 | |

Short-Term Investments | | | 4.8 | |

| | | | |

Total Investments | | | 100.0 | |

Other assets less liabilities | | | (0.0 | ) |

| | | | |

Net Assets | | | 100.0 | % |

| | | | |

See accompanying notes to financial statements.

| 28

Portfolio of Investments – as of December 31, 2013

Natixis Oakmark International Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 91.7% of Net Assets | | | | |

| | | | Australia — 4.9% | | | | |

| | 3,102,168 | | | AMP Ltd. | | $ | 12,192,845 | |

| | 682,390 | | | Orica Ltd. | | | 14,592,039 | |

| | | | | | | | |

| | | | | | | 26,784,884 | |

| | | | | | | | |

| | | | Canada — 1.0% | | | | |

| | 153,000 | | | Thomson Reuters Corp. | | | 5,785,841 | |

| | | | | | | | |

| | | | France — 14.3% | | | | |

| | 228,842 | | | BNP Paribas S.A. | | | 17,851,335 | |

| | 23,500 | | | Christian Dior S.A. | | | 4,448,101 | |

| | 153,600 | | | Danone S.A. | | | 11,080,988 | |

| | 69,350 | | | Kering | | | 14,659,233 | |

| | 57,200 | | | LVMH Moet Hennessy Louis Vuitton S.A. | | | 10,450,092 | |

| | 99,800 | | | Pernod-Ricard S.A. | | | 11,370,326 | |

| | 51,729 | | | Publicis Groupe S.A. | | | 4,739,681 | |

| | 38,400 | | | Sanofi | | | 4,100,920 | |

| | | | | | | | |

| | | | | | | 78,700,676 | |

| | | | | | | | |

| | | | Germany — 11.0% | | | | |

| | 107,930 | | | Allianz SE, (Registered) | | | 19,419,376 | |

| | 110,000 | | | Bayerische Motoren Werke AG | | | 12,917,591 | |

| | 9,400 | | | Continental AG | | | 2,065,079 | |

| | 193,100 | | | Daimler AG, (Registered) | | | 16,758,072 | |

| | 107,000 | | | SAP AG | | | 9,279,206 | |

| | | | | | | | |

| | | | | | | 60,439,324 | |

| | | | | | | | |

| | | | Ireland — 2.0% | | | | |

| | 607,200 | | | Experian PLC | | | 11,216,412 | |

| | | | | | | | |

| | | | Israel — 0.8% | | | | |

| | 71,900 | | | Check Point Software Technologies Ltd.(b) | | | 4,638,988 | |

| | | | | | | | |

| | | | Italy — 3.4% | | | | |

| | 7,711,500 | | | Intesa Sanpaolo SpA | | | 18,967,973 | |

| | | | | | | | |

| | | | Japan — 11.1% | | | | |

| | 477,500 | | | Canon, Inc. | | | 15,236,259 | |

| | 1,163,000 | | | Daiwa Securities Group, Inc. | | | 11,648,073 | |

| | 3,500 | | | FANUC Corp. | | | 641,342 | |

| | 243,200 | | | Honda Motor Co. Ltd. | | | 10,038,591 | |

| | 30,000 | | | Meitec Corp. | | | 813,296 | |

| | 265,000 | | | Olympus Corp.(b) | | | 8,404,936 | |

| | 4,800 | | | Omron Corp. | | | 212,128 | |

| | 11,700 | | | Secom Co. Ltd. | | | 705,919 | |

| | 223,800 | | | Toyota Motor Corp. | | | 13,646,219 | |

| | | | | | | | |

| | | | | | | 61,346,763 | |

| | | | | | | | |

| | | | Korea — 1.0% | | | | |

| | 4,400 | | | Samsung Electronics Co. Ltd. | | | 5,733,407 | |

| | | | | | | | |

| | | | Netherlands — 7.3% | | | | |

| | 72,994 | | | Akzo Nobel NV | | | 5,660,385 | |

| | 1,299,400 | | | CNH Industrial NV(b) | | | 14,810,131 | |

| | 111,200 | | | Heineken Holding NV | | | 7,038,932 | |

See accompanying notes to financial statements.

29 |

Portfolio of Investments – as of December 31, 2013

Natixis Oakmark International Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | Netherlands — continued | | | | |

| | 306,200 | | | Koninklijke Ahold NV | | $ | 5,502,761 | |

| | 195,089 | | | Koninklijke Philips Electronics | | | 7,183,402 | |

| | | | | | | | |

| | | | | | | 40,195,611 | |

| | | | | | | | |

| | | | Sweden — 4.1% | | | | |

| | 295,600 | | | Atlas Copco AB, Series B | | | 7,514,537 | |

| | 141,300 | | | Hennes & Mauritz AB, Series B | | | 6,507,775 | |

| | 322,800 | | | SKF AB, Series B | | | 8,465,554 | |

| | | | | | | | |

| | | | | | | 22,487,866 | |

| | | | | | | | |

| | | | Switzerland — 16.3% | | | | |

| | 89,900 | | | Adecco S.A., (Registered) | | | 7,136,862 | |

| | 115,200 | | | Cie Financiere Richemont S.A., (Registered) | | | 11,508,179 | |

| | 837,958 | | | Credit Suisse Group AG, (Registered) | | | 25,862,194 | |

| | 625 | | | Geberit AG, (Registered) | | | 189,613 | |

| | 3,580 | | | Givaudan S.A., (Registered) | | | 5,121,422 | |

| | 178,600 | | | Holcim Ltd., (Registered) | | | 13,352,964 | |

| | 83,300 | | | Kuehne & Nagel International AG, (Registered) | | | 10,948,898 | |

| | 145,500 | | | Nestle S.A., (Registered) | | | 10,663,698 | |

| | 61,200 | | | Novartis AG, (Registered) | | | 4,905,137 | |

| | 1,800 | | | Schindler Holding AG | | | 264,985 | |

| | | | | | | | |

| | | | | | | 89,953,952 | |

| | | | | | | | |

| | | | United Kingdom — 14.3% | | | | |

| | 383,400 | | | Diageo PLC | | | 12,705,329 | |

| | 393,800 | | | GlaxoSmithKline PLC | | | 10,521,339 | |

| | 9,820,300 | | | Lloyds Banking Group PLC(b) | | | 12,886,063 | |

| | 193,500 | | | Schroders PLC | | | 8,345,512 | |

| | 100 | | | Schroders PLC, (Non Voting) | | | 3,346 | |

| | 300,000 | | | Smiths Group PLC | | | 7,366,681 | |

| | 2,405,300 | | | Tesco PLC | | | 13,357,430 | |

| | 270,300 | | | Willis Group Holdings PLC | | | 12,112,143 | |

| | 10,796 | | | Wolseley PLC | | | 613,787 | |

| | 44,200 | | | WPP PLC | | | 1,012,354 | |

| | | | | | | | |

| | | | | | | 78,923,984 | |

| | | | | | | | |

| | | | United States — 0.2% | | | | |

| | 14,900 | | | Signet Jewelers Ltd. | | | 1,172,630 | |

| | | | | | | | |

| | | | Total Common Stocks (Identified Cost $462,251,426) | | | 506,348,311 | |

| | | | | | | | |

Principal

Amount | | | | | | |

| | Short-Term Investments — 9.3% | | | | |

| $ | 51,123,893 | | | Tri-Party Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/2013 at 0.000% to be repurchased at $51,123,893 on 01/02/2014 collateralized by $48,230,000 U.S. Treasury Note, 3.250% due 7/31/2016 valued at $52,148,688 including accrued interest (Note 2 of Notes to Financial Statements) (Identified Cost $51,123,893) | | | 51,123,893 | |

| | | | | | | | |

| | | | Total Investments — 101.0% (Identified Cost $513,375,319)(a) | | | 557,472,204 | |

| | | | Other assets less liabilities — (1.0)% | | | (5,643,904 | ) |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 551,828,300 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 30

Portfolio of Investments – as of December 31, 2013

Natixis Oakmark International Fund – (continued)

| | | | | | | | |

| | (†) | | | See Note 2 of Notes to Financial Statements. | | | | |

| | (a) | | | Federal Tax Information: | | | | |

| | | | At December 31, 2013, the net unrealized appreciation on investments based on a cost of $514,843,814 for federal income tax purposes was as follows: | | | | |

| | | | Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 45,828,169 | |