0000770540natixis:NATIXISINDEXMSCIWorldIndexNet18048AdditionalIndexMember2023-07-310000770540natixis:NATIXISINDEXRussell1000Index18007AdditionalIndexMember2016-04-300000770540natixis:NATIXISINDEXRussell2000ValueIndex17969AdditionalIndexMember2018-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04323

Natixis Funds Trust I

(Exact name of Registrant as specified in charter)

888 Boylston Street, Suite 800, Boston, Massachusetts 02199-8197

(Address of principal executive offices) (Zip code)

Susan McWhan Tobin, Esq.

Natixis Distribution, LLC

888 Boylston Street, Suite 800

Boston, Massachusetts 02199-8197

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2139

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

| (a) | The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

Mirova Global Green Bond Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class A | $91 | 0.90% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

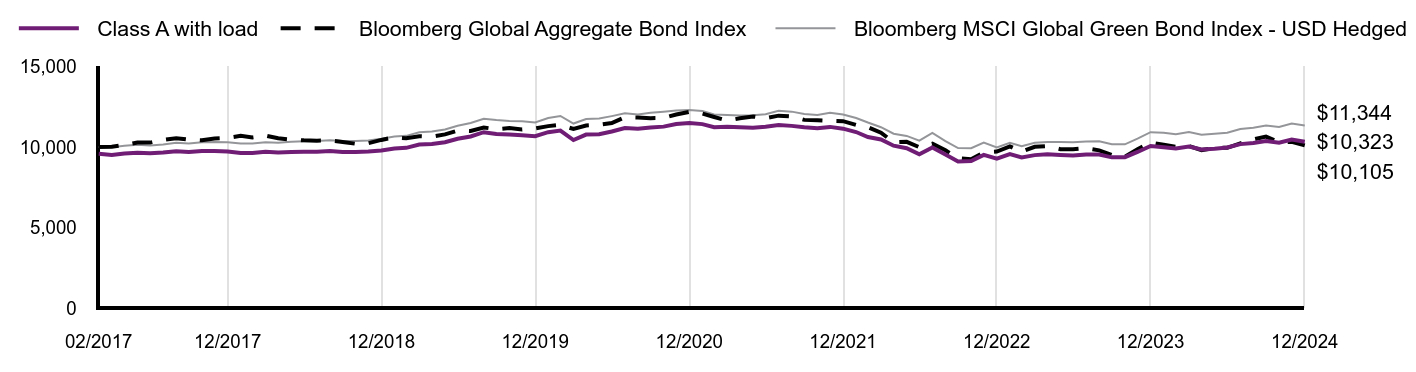

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve.

Top Contributors to Performance

•Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed.

•Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB.

Top Detractors from Performance

•The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance.

•Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year.

•Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

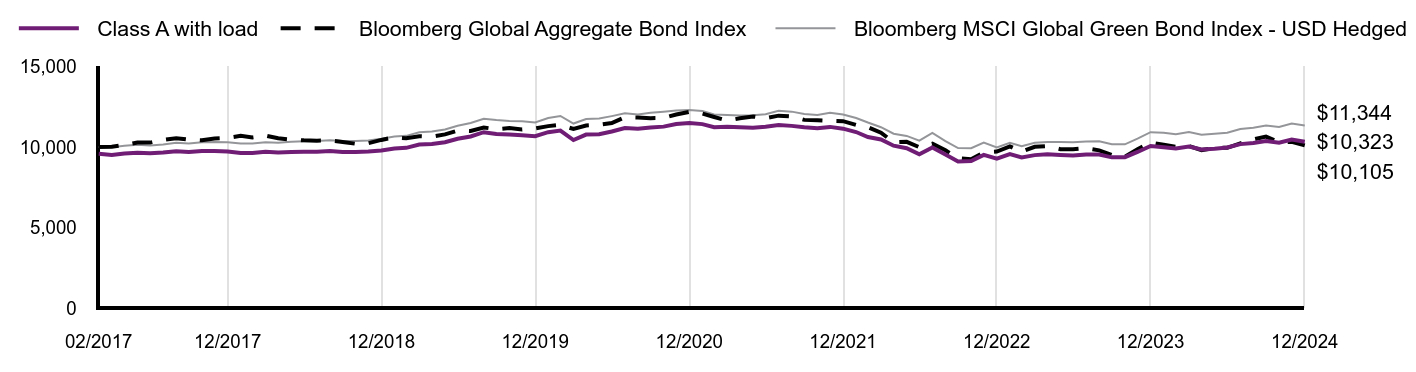

Total Return Based on a Hypothetical $10,000 Investment

| Class A with load | Bloomberg Global Aggregate Bond Index | Bloomberg MSCI Global Green Bond Index - USD Hedged |

|---|

| 02/2017 | $9,579 | $10,000 | $10,000 |

|---|

| 03/2017 | $9,502 | $10,015 | $9,984 |

|---|

| 04/2017 | $9,598 | $10,128 | $10,076 |

|---|

| 05/2017 | $9,646 | $10,285 | $10,149 |

|---|

| 06/2017 | $9,607 | $10,276 | $10,103 |

|---|

| 07/2017 | $9,655 | $10,449 | $10,153 |

|---|

| 08/2017 | $9,741 | $10,552 | $10,266 |

|---|

| 09/2017 | $9,689 | $10,457 | $10,216 |

|---|

| 10/2017 | $9,747 | $10,418 | $10,295 |

|---|

| 11/2017 | $9,756 | $10,533 | $10,316 |

|---|

| 12/2017 | $9,719 | $10,570 | $10,302 |

|---|

| 01/2018 | $9,631 | $10,696 | $10,217 |

|---|

| 02/2018 | $9,631 | $10,601 | $10,217 |

|---|

| 03/2018 | $9,701 | $10,714 | $10,293 |

|---|

| 04/2018 | $9,662 | $10,542 | $10,271 |

|---|

| 05/2018 | $9,691 | $10,462 | $10,322 |

|---|

| 06/2018 | $9,713 | $10,416 | $10,362 |

|---|

| 07/2018 | $9,713 | $10,398 | $10,368 |

|---|

| 08/2018 | $9,752 | $10,409 | $10,422 |

|---|

| 09/2018 | $9,697 | $10,319 | $10,372 |

|---|

| 10/2018 | $9,697 | $10,204 | $10,372 |

|---|

| 11/2018 | $9,717 | $10,236 | $10,404 |

|---|

| 12/2018 | $9,781 | $10,443 | $10,515 |

|---|

| 01/2019 | $9,912 | $10,602 | $10,648 |

|---|

| 02/2019 | $9,952 | $10,541 | $10,694 |

|---|

| 03/2019 | $10,156 | $10,673 | $10,923 |

|---|

| 04/2019 | $10,186 | $10,641 | $10,961 |

|---|

| 05/2019 | $10,298 | $10,785 | $11,095 |

|---|

| 06/2019 | $10,517 | $11,025 | $11,327 |

|---|

| 07/2019 | $10,659 | $10,994 | $11,494 |

|---|

| 08/2019 | $10,922 | $11,217 | $11,757 |

|---|

| 09/2019 | $10,814 | $11,103 | $11,675 |

|---|

| 10/2019 | $10,773 | $11,177 | $11,613 |

|---|

| 11/2019 | $10,732 | $11,093 | $11,596 |

|---|

| 12/2019 | $10,676 | $11,157 | $11,529 |

|---|

| 01/2020 | $10,924 | $11,300 | $11,801 |

|---|

| 02/2020 | $11,027 | $11,376 | $11,929 |

|---|

| 03/2020 | $10,434 | $11,121 | $11,460 |

|---|

| 04/2020 | $10,774 | $11,339 | $11,743 |

|---|

| 05/2020 | $10,795 | $11,389 | $11,771 |

|---|

| 06/2020 | $10,969 | $11,490 | $11,922 |

|---|

| 07/2020 | $11,186 | $11,857 | $12,093 |

|---|

| 08/2020 | $11,134 | $11,838 | $12,027 |

|---|

| 09/2020 | $11,216 | $11,796 | $12,125 |

|---|

| 10/2020 | $11,268 | $11,807 | $12,192 |

|---|

| 11/2020 | $11,434 | $12,022 | $12,265 |

|---|

| 12/2020 | $11,489 | $12,183 | $12,298 |

|---|

| 01/2021 | $11,425 | $12,076 | $12,244 |

|---|

| 02/2021 | $11,233 | $11,868 | $12,021 |

|---|

| 03/2021 | $11,267 | $11,640 | $11,990 |

|---|

| 04/2021 | $11,234 | $11,787 | $11,967 |

|---|

| 05/2021 | $11,202 | $11,898 | $11,972 |

|---|

| 06/2021 | $11,261 | $11,793 | $12,037 |

|---|

| 07/2021 | $11,369 | $11,950 | $12,248 |

|---|

| 08/2021 | $11,315 | $11,900 | $12,200 |

|---|

| 09/2021 | $11,230 | $11,688 | $12,055 |

|---|

| 10/2021 | $11,165 | $11,660 | $11,991 |

|---|

| 11/2021 | $11,252 | $11,626 | $12,132 |

|---|

| 12/2021 | $11,142 | $11,610 | $12,016 |

|---|

| 01/2022 | $10,933 | $11,372 | $11,806 |

|---|

| 02/2022 | $10,625 | $11,237 | $11,524 |

|---|

| 03/2022 | $10,473 | $10,895 | $11,233 |

|---|

| 04/2022 | $10,083 | $10,298 | $10,828 |

|---|

| 05/2022 | $9,927 | $10,326 | $10,691 |

|---|

| 06/2022 | $9,548 | $9,994 | $10,398 |

|---|

| 07/2022 | $9,971 | $10,207 | $10,872 |

|---|

| 08/2022 | $9,536 | $9,804 | $10,366 |

|---|

| 09/2022 | $9,101 | $9,300 | $9,935 |

|---|

| 10/2022 | $9,135 | $9,236 | $9,925 |

|---|

| 11/2022 | $9,514 | $9,671 | $10,278 |

|---|

| 12/2022 | $9,277 | $9,723 | $9,972 |

|---|

| 01/2023 | $9,568 | $10,043 | $10,263 |

|---|

| 02/2023 | $9,359 | $9,709 | $10,054 |

|---|

| 03/2023 | $9,498 | $10,016 | $10,267 |

|---|

| 04/2023 | $9,545 | $10,060 | $10,312 |

|---|

| 05/2023 | $9,510 | $9,863 | $10,308 |

|---|

| 06/2023 | $9,475 | $9,863 | $10,299 |

|---|

| 07/2023 | $9,533 | $9,931 | $10,341 |

|---|

| 08/2023 | $9,533 | $9,795 | $10,359 |

|---|

| 09/2023 | $9,359 | $9,509 | $10,170 |

|---|

| 10/2023 | $9,370 | $9,395 | $10,171 |

|---|

| 11/2023 | $9,695 | $9,869 | $10,520 |

|---|

| 12/2023 | $10,064 | $10,279 | $10,925 |

|---|

| 01/2024 | $9,993 | $10,137 | $10,887 |

|---|

| 02/2024 | $9,910 | $10,010 | $10,788 |

|---|

| 03/2024 | $10,028 | $10,065 | $10,928 |

|---|

| 04/2024 | $9,851 | $9,811 | $10,770 |

|---|

| 05/2024 | $9,898 | $9,940 | $10,826 |

|---|

| 06/2024 | $9,969 | $9,954 | $10,886 |

|---|

| 07/2024 | $10,182 | $10,229 | $11,123 |

|---|

| 08/2024 | $10,253 | $10,471 | $11,204 |

|---|

| 09/2024 | $10,372 | $10,649 | $11,344 |

|---|

| 10/2024 | $10,265 | $10,292 | $11,249 |

|---|

| 11/2024 | $10,466 | $10,327 | $11,458 |

|---|

| 12/2024 | $10,323 | $10,105 | $11,344 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 2/28/17 |

|---|

| Class A at NAV | 2.57% | (0.67%) | 0.96% |

|---|

Class A with 4.25% MSCFootnote Reference1 | (1.82%) | (1.53%) | 0.41% |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.13% |

|---|

| Bloomberg MSCI Global Green Bond Index - USD Hedged | 3.83% | (0.32%) | 1.62% |

|---|

| Footnote | Description |

Footnote1 | Maximum sales charge |

Effective May 1, 2024, in accordance with new regulations, the Fund’s primary broad-based index changed to the Bloomberg Global Aggregate Bond Index - USD Hedged. The Fund will retain the Bloomberg MSCI Global Green Bond Index - USD Hedged as an additional benchmark for performance comparison.

| Total Net Assets | $38,096,678 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements and derivatives) | 82 |

|---|

| Portfolio Turnover Rate | 10% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $17,744 |

|---|

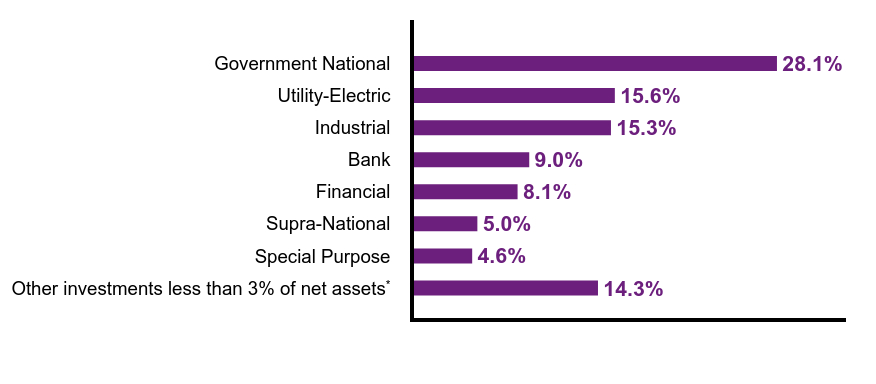

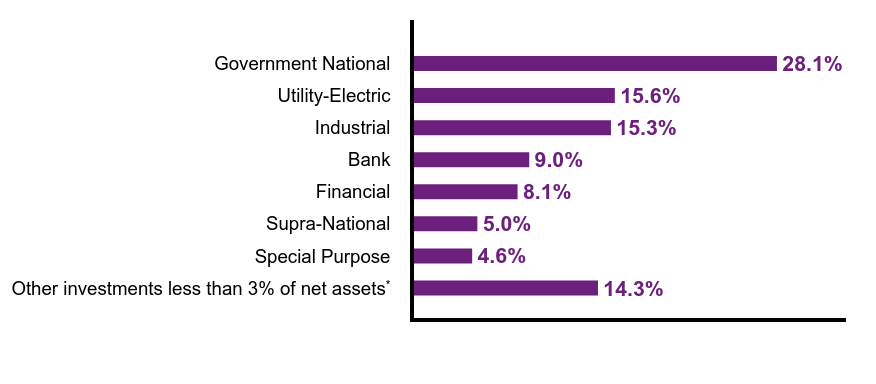

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 14.3% |

| Special Purpose | 4.6% |

| Supra-National | 5.0% |

| Financial | 8.1% |

| Bank | 9.0% |

| Industrial | 15.3% |

| Utility-Electric | 15.6% |

| Government National | 28.1% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities (including futures contracts) |

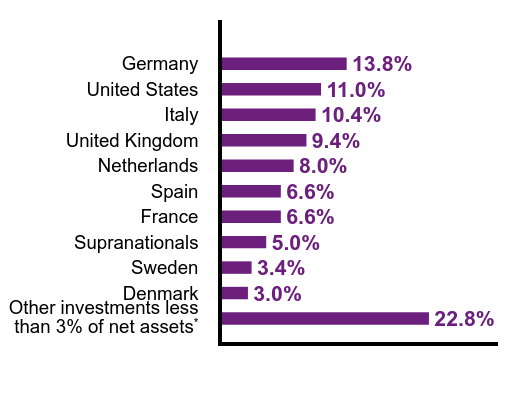

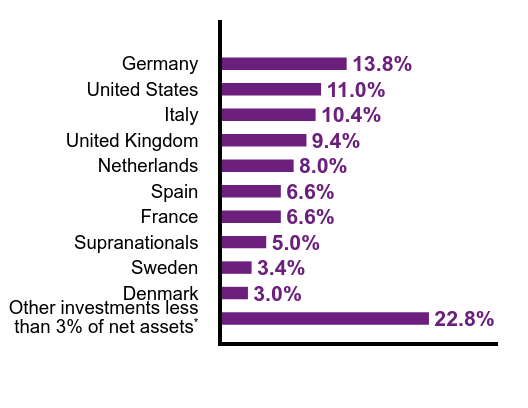

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 22.8% |

| Denmark | 3.0% |

| Sweden | 3.4% |

| Supranationals | 5.0% |

| France | 6.6% |

| Spain | 6.6% |

| Netherlands | 8.0% |

| United Kingdom | 9.4% |

| Italy | 10.4% |

| United States | 11.0% |

| Germany | 13.8% |

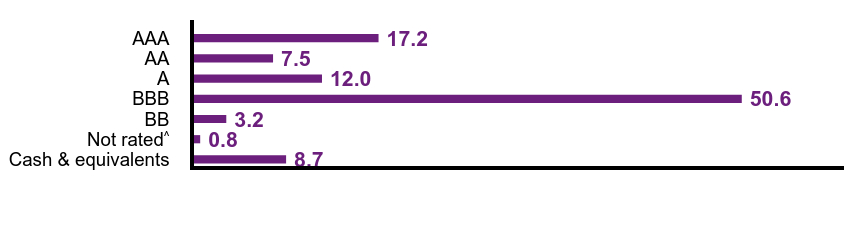

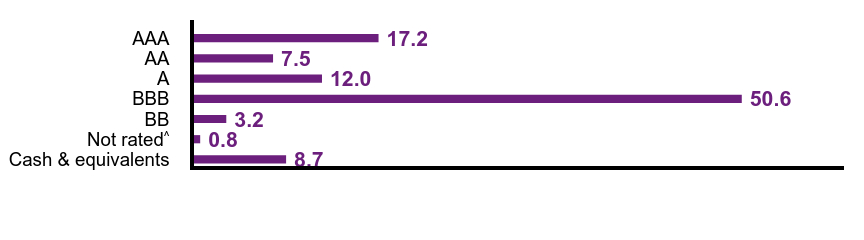

Credit QualityFootnote Reference†

| Value | Value |

|---|

| Cash & equivalents | 8.7 |

Not ratedFootnote Reference^ | 0.8 |

| BB | 3.2 |

| BBB | 50.6 |

| A | 12.0 |

| AA | 7.5 |

| AAA | 17.2 |

| Footnote | Description |

Footnote† | Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

Footnote^ | Not Rated category represents only those securities not rated by S&P Global Ratings. Such securities may be rated by other NRSROs not shown here. |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Green Bond Fund

Annual Shareholder Report

December 31, 2024

Mirova Global Green Bond Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $61 | 0.60% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

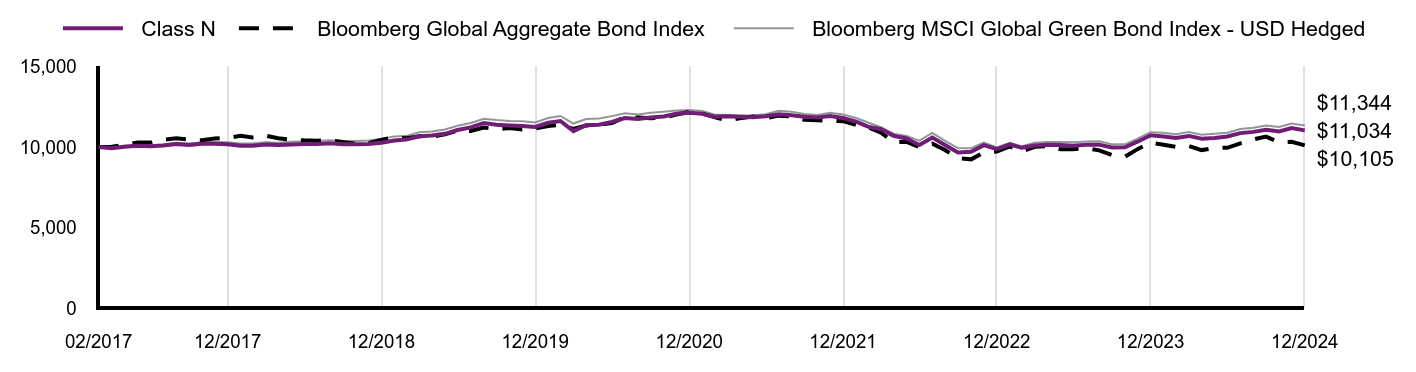

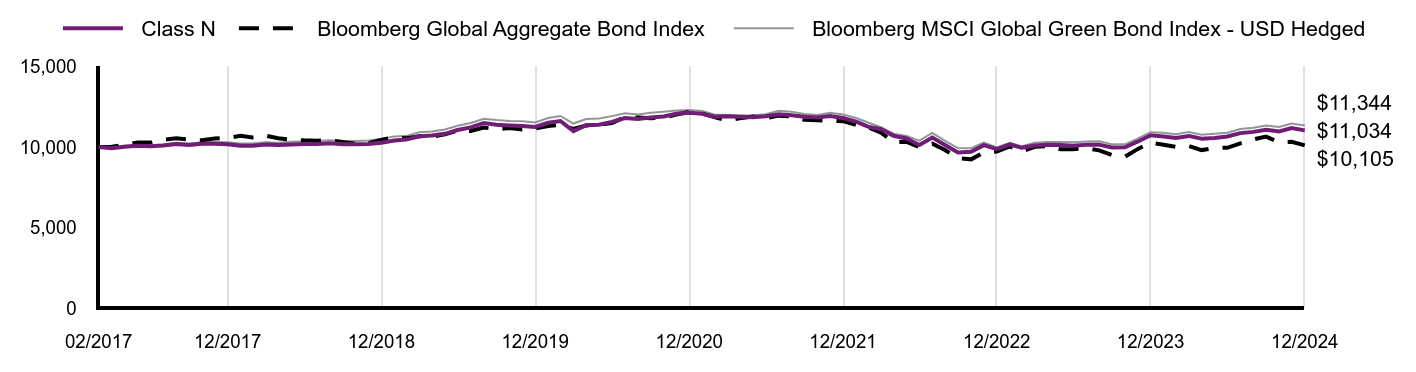

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve.

Top Contributors to Performance

•Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed.

•Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB.

Top Detractors from Performance

•The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance.

•Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year.

•Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

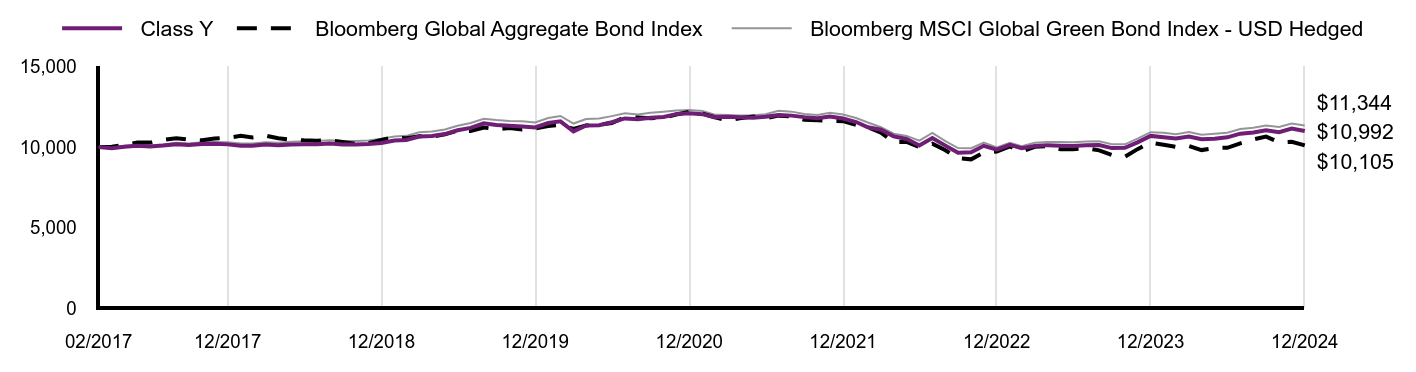

Total Return Based on a Hypothetical $10,000 Investment

| Class N | Bloomberg Global Aggregate Bond Index | Bloomberg MSCI Global Green Bond Index - USD Hedged |

|---|

| 02/2017 | $10,000 | $10,000 | $10,000 |

|---|

| 03/2017 | $9,930 | $10,015 | $9,984 |

|---|

| 04/2017 | $10,020 | $10,128 | $10,076 |

|---|

| 05/2017 | $10,080 | $10,285 | $10,149 |

|---|

| 06/2017 | $10,050 | $10,276 | $10,103 |

|---|

| 07/2017 | $10,100 | $10,449 | $10,153 |

|---|

| 08/2017 | $10,190 | $10,552 | $10,266 |

|---|

| 09/2017 | $10,131 | $10,457 | $10,216 |

|---|

| 10/2017 | $10,201 | $10,418 | $10,295 |

|---|

| 11/2017 | $10,211 | $10,533 | $10,316 |

|---|

| 12/2017 | $10,177 | $10,570 | $10,302 |

|---|

| 01/2018 | $10,086 | $10,696 | $10,217 |

|---|

| 02/2018 | $10,086 | $10,601 | $10,217 |

|---|

| 03/2018 | $10,165 | $10,714 | $10,293 |

|---|

| 04/2018 | $10,123 | $10,542 | $10,271 |

|---|

| 05/2018 | $10,165 | $10,462 | $10,322 |

|---|

| 06/2018 | $10,184 | $10,416 | $10,362 |

|---|

| 07/2018 | $10,194 | $10,398 | $10,368 |

|---|

| 08/2018 | $10,236 | $10,409 | $10,422 |

|---|

| 09/2018 | $10,176 | $10,319 | $10,372 |

|---|

| 10/2018 | $10,176 | $10,204 | $10,372 |

|---|

| 11/2018 | $10,196 | $10,236 | $10,404 |

|---|

| 12/2018 | $10,272 | $10,443 | $10,515 |

|---|

| 01/2019 | $10,409 | $10,602 | $10,648 |

|---|

| 02/2019 | $10,462 | $10,541 | $10,694 |

|---|

| 03/2019 | $10,672 | $10,673 | $10,923 |

|---|

| 04/2019 | $10,714 | $10,641 | $10,961 |

|---|

| 05/2019 | $10,820 | $10,785 | $11,095 |

|---|

| 06/2019 | $11,059 | $11,025 | $11,327 |

|---|

| 07/2019 | $11,219 | $10,994 | $11,494 |

|---|

| 08/2019 | $11,495 | $11,217 | $11,757 |

|---|

| 09/2019 | $11,385 | $11,103 | $11,675 |

|---|

| 10/2019 | $11,343 | $11,177 | $11,613 |

|---|

| 11/2019 | $11,311 | $11,093 | $11,596 |

|---|

| 12/2019 | $11,249 | $11,157 | $11,529 |

|---|

| 01/2020 | $11,509 | $11,300 | $11,801 |

|---|

| 02/2020 | $11,617 | $11,376 | $11,929 |

|---|

| 03/2020 | $10,991 | $11,121 | $11,460 |

|---|

| 04/2020 | $11,361 | $11,339 | $11,743 |

|---|

| 05/2020 | $11,382 | $11,389 | $11,771 |

|---|

| 06/2020 | $11,562 | $11,490 | $11,922 |

|---|

| 07/2020 | $11,801 | $11,857 | $12,093 |

|---|

| 08/2020 | $11,747 | $11,838 | $12,027 |

|---|

| 09/2020 | $11,840 | $11,796 | $12,125 |

|---|

| 10/2020 | $11,895 | $11,807 | $12,192 |

|---|

| 11/2020 | $12,070 | $12,022 | $12,265 |

|---|

| 12/2020 | $12,137 | $12,183 | $12,298 |

|---|

| 01/2021 | $12,069 | $12,076 | $12,244 |

|---|

| 02/2021 | $11,878 | $11,868 | $12,021 |

|---|

| 03/2021 | $11,910 | $11,640 | $11,990 |

|---|

| 04/2021 | $11,876 | $11,787 | $11,967 |

|---|

| 05/2021 | $11,853 | $11,898 | $11,972 |

|---|

| 06/2021 | $11,913 | $11,793 | $12,037 |

|---|

| 07/2021 | $12,038 | $11,950 | $12,248 |

|---|

| 08/2021 | $11,981 | $11,900 | $12,200 |

|---|

| 09/2021 | $11,889 | $11,688 | $12,055 |

|---|

| 10/2021 | $11,832 | $11,660 | $11,991 |

|---|

| 11/2021 | $11,923 | $11,626 | $12,132 |

|---|

| 12/2021 | $11,805 | $11,610 | $12,016 |

|---|

| 01/2022 | $11,584 | $11,372 | $11,806 |

|---|

| 02/2022 | $11,271 | $11,237 | $11,524 |

|---|

| 03/2022 | $11,107 | $10,895 | $11,233 |

|---|

| 04/2022 | $10,694 | $10,298 | $10,828 |

|---|

| 05/2022 | $10,529 | $10,326 | $10,691 |

|---|

| 06/2022 | $10,128 | $9,994 | $10,398 |

|---|

| 07/2022 | $10,588 | $10,207 | $10,872 |

|---|

| 08/2022 | $10,116 | $9,804 | $10,366 |

|---|

| 09/2022 | $9,668 | $9,300 | $9,935 |

|---|

| 10/2022 | $9,704 | $9,236 | $9,925 |

|---|

| 11/2022 | $10,116 | $9,671 | $10,278 |

|---|

| 12/2022 | $9,867 | $9,723 | $9,972 |

|---|

| 01/2023 | $10,161 | $10,043 | $10,263 |

|---|

| 02/2023 | $9,953 | $9,709 | $10,054 |

|---|

| 03/2023 | $10,100 | $10,016 | $10,267 |

|---|

| 04/2023 | $10,149 | $10,060 | $10,312 |

|---|

| 05/2023 | $10,124 | $9,863 | $10,308 |

|---|

| 06/2023 | $10,087 | $9,863 | $10,299 |

|---|

| 07/2023 | $10,149 | $9,931 | $10,341 |

|---|

| 08/2023 | $10,149 | $9,795 | $10,359 |

|---|

| 09/2023 | $9,977 | $9,509 | $10,170 |

|---|

| 10/2023 | $9,989 | $9,395 | $10,171 |

|---|

| 11/2023 | $10,333 | $9,869 | $10,520 |

|---|

| 12/2023 | $10,728 | $10,279 | $10,925 |

|---|

| 01/2024 | $10,653 | $10,137 | $10,887 |

|---|

| 02/2024 | $10,565 | $10,010 | $10,788 |

|---|

| 03/2024 | $10,691 | $10,065 | $10,928 |

|---|

| 04/2024 | $10,515 | $9,811 | $10,770 |

|---|

| 05/2024 | $10,565 | $9,940 | $10,826 |

|---|

| 06/2024 | $10,653 | $9,954 | $10,886 |

|---|

| 07/2024 | $10,866 | $10,229 | $11,123 |

|---|

| 08/2024 | $10,942 | $10,471 | $11,204 |

|---|

| 09/2024 | $11,080 | $10,649 | $11,344 |

|---|

| 10/2024 | $10,967 | $10,292 | $11,249 |

|---|

| 11/2024 | $11,180 | $10,327 | $11,458 |

|---|

| 12/2024 | $11,034 | $10,105 | $11,344 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 2/28/17 |

|---|

| Class N | 2.85% | (0.39%) | 1.26% |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.13% |

|---|

| Bloomberg MSCI Global Green Bond Index - USD Hedged | 3.83% | (0.32%) | 1.62% |

|---|

Effective May 1, 2024, in accordance with new regulations, the Fund’s primary broad-based index changed to the Bloomberg Global Aggregate Bond Index - USD Hedged. The Fund will retain the Bloomberg MSCI Global Green Bond Index - USD Hedged as an additional benchmark for performance comparison.

| Total Net Assets | $38,096,678 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements and derivatives) | 82 |

|---|

| Portfolio Turnover Rate | 10% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $17,744 |

|---|

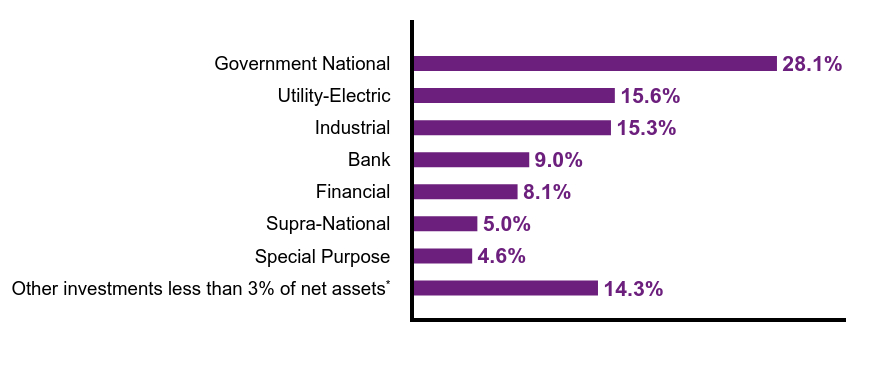

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 14.3% |

| Special Purpose | 4.6% |

| Supra-National | 5.0% |

| Financial | 8.1% |

| Bank | 9.0% |

| Industrial | 15.3% |

| Utility-Electric | 15.6% |

| Government National | 28.1% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities (including futures contracts) |

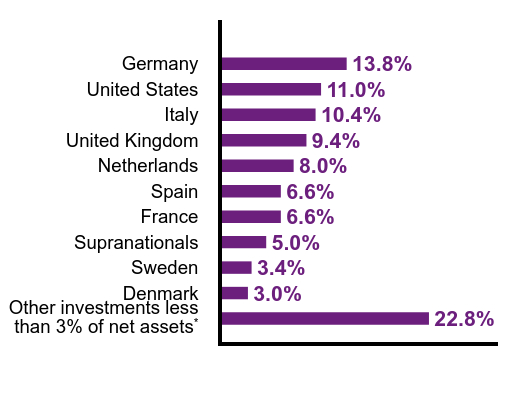

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 22.8% |

| Denmark | 3.0% |

| Sweden | 3.4% |

| Supranationals | 5.0% |

| France | 6.6% |

| Spain | 6.6% |

| Netherlands | 8.0% |

| United Kingdom | 9.4% |

| Italy | 10.4% |

| United States | 11.0% |

| Germany | 13.8% |

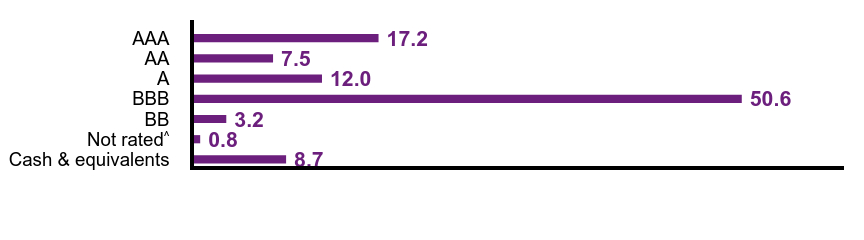

Credit QualityFootnote Reference†

| Value | Value |

|---|

| Cash & equivalents | 8.7 |

Not ratedFootnote Reference^ | 0.8 |

| BB | 3.2 |

| BBB | 50.6 |

| A | 12.0 |

| AA | 7.5 |

| AAA | 17.2 |

| Footnote | Description |

Footnote† | Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

Footnote^ | Not Rated category represents only those securities not rated by S&P Global Ratings. Such securities may be rated by other NRSROs not shown here. |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Green Bond Fund

Annual Shareholder Report

December 31, 2024

Mirova Global Green Bond Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class Y | $66 | 0.65% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

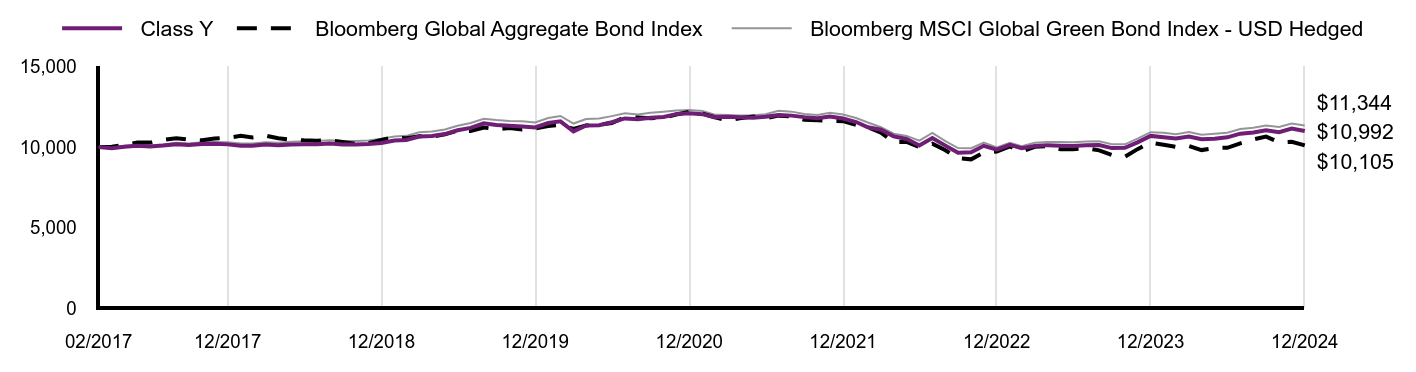

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve.

Top Contributors to Performance

•Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed.

•Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB.

Top Detractors from Performance

•The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance.

•Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year.

•Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

Total Return Based on a Hypothetical $10,000 Investment

| Class Y | Bloomberg Global Aggregate Bond Index | Bloomberg MSCI Global Green Bond Index - USD Hedged |

|---|

| 02/2017 | $10,000 | $10,000 | $10,000 |

|---|

| 03/2017 | $9,920 | $10,015 | $9,984 |

|---|

| 04/2017 | $10,020 | $10,128 | $10,076 |

|---|

| 05/2017 | $10,080 | $10,285 | $10,149 |

|---|

| 06/2017 | $10,040 | $10,276 | $10,103 |

|---|

| 07/2017 | $10,090 | $10,449 | $10,153 |

|---|

| 08/2017 | $10,180 | $10,552 | $10,266 |

|---|

| 09/2017 | $10,130 | $10,457 | $10,216 |

|---|

| 10/2017 | $10,191 | $10,418 | $10,295 |

|---|

| 11/2017 | $10,201 | $10,533 | $10,316 |

|---|

| 12/2017 | $10,166 | $10,570 | $10,302 |

|---|

| 01/2018 | $10,075 | $10,696 | $10,217 |

|---|

| 02/2018 | $10,075 | $10,601 | $10,217 |

|---|

| 03/2018 | $10,153 | $10,714 | $10,293 |

|---|

| 04/2018 | $10,112 | $10,542 | $10,271 |

|---|

| 05/2018 | $10,153 | $10,462 | $10,322 |

|---|

| 06/2018 | $10,171 | $10,416 | $10,362 |

|---|

| 07/2018 | $10,171 | $10,398 | $10,368 |

|---|

| 08/2018 | $10,213 | $10,409 | $10,422 |

|---|

| 09/2018 | $10,162 | $10,319 | $10,372 |

|---|

| 10/2018 | $10,162 | $10,204 | $10,372 |

|---|

| 11/2018 | $10,183 | $10,236 | $10,404 |

|---|

| 12/2018 | $10,257 | $10,443 | $10,515 |

|---|

| 01/2019 | $10,405 | $10,602 | $10,648 |

|---|

| 02/2019 | $10,436 | $10,541 | $10,694 |

|---|

| 03/2019 | $10,656 | $10,673 | $10,923 |

|---|

| 04/2019 | $10,688 | $10,641 | $10,961 |

|---|

| 05/2019 | $10,804 | $10,785 | $11,095 |

|---|

| 06/2019 | $11,042 | $11,025 | $11,327 |

|---|

| 07/2019 | $11,190 | $10,994 | $11,494 |

|---|

| 08/2019 | $11,477 | $11,217 | $11,757 |

|---|

| 09/2019 | $11,367 | $11,103 | $11,675 |

|---|

| 10/2019 | $11,324 | $11,177 | $11,613 |

|---|

| 11/2019 | $11,282 | $11,093 | $11,596 |

|---|

| 12/2019 | $11,218 | $11,157 | $11,529 |

|---|

| 01/2020 | $11,489 | $11,300 | $11,801 |

|---|

| 02/2020 | $11,597 | $11,376 | $11,929 |

|---|

| 03/2020 | $10,970 | $11,121 | $11,460 |

|---|

| 04/2020 | $11,339 | $11,339 | $11,743 |

|---|

| 05/2020 | $11,361 | $11,389 | $11,771 |

|---|

| 06/2020 | $11,539 | $11,490 | $11,922 |

|---|

| 07/2020 | $11,778 | $11,857 | $12,093 |

|---|

| 08/2020 | $11,724 | $11,838 | $12,027 |

|---|

| 09/2020 | $11,816 | $11,796 | $12,125 |

|---|

| 10/2020 | $11,871 | $11,807 | $12,192 |

|---|

| 11/2020 | $12,045 | $12,022 | $12,265 |

|---|

| 12/2020 | $12,099 | $12,183 | $12,298 |

|---|

| 01/2021 | $12,043 | $12,076 | $12,244 |

|---|

| 02/2021 | $11,852 | $11,868 | $12,021 |

|---|

| 03/2021 | $11,883 | $11,640 | $11,990 |

|---|

| 04/2021 | $11,849 | $11,787 | $11,967 |

|---|

| 05/2021 | $11,826 | $11,898 | $11,972 |

|---|

| 06/2021 | $11,884 | $11,793 | $12,037 |

|---|

| 07/2021 | $11,997 | $11,950 | $12,248 |

|---|

| 08/2021 | $11,952 | $11,900 | $12,200 |

|---|

| 09/2021 | $11,859 | $11,688 | $12,055 |

|---|

| 10/2021 | $11,791 | $11,660 | $11,991 |

|---|

| 11/2021 | $11,893 | $11,626 | $12,132 |

|---|

| 12/2021 | $11,774 | $11,610 | $12,016 |

|---|

| 01/2022 | $11,554 | $11,372 | $11,806 |

|---|

| 02/2022 | $11,229 | $11,237 | $11,524 |

|---|

| 03/2022 | $11,076 | $10,895 | $11,233 |

|---|

| 04/2022 | $10,664 | $10,298 | $10,828 |

|---|

| 05/2022 | $10,499 | $10,326 | $10,691 |

|---|

| 06/2022 | $10,099 | $9,994 | $10,398 |

|---|

| 07/2022 | $10,558 | $10,207 | $10,872 |

|---|

| 08/2022 | $10,087 | $9,804 | $10,366 |

|---|

| 09/2022 | $9,640 | $9,300 | $9,935 |

|---|

| 10/2022 | $9,675 | $9,236 | $9,925 |

|---|

| 11/2022 | $10,075 | $9,671 | $10,278 |

|---|

| 12/2022 | $9,838 | $9,723 | $9,972 |

|---|

| 01/2023 | $10,132 | $10,043 | $10,263 |

|---|

| 02/2023 | $9,923 | $9,709 | $10,054 |

|---|

| 03/2023 | $10,070 | $10,016 | $10,267 |

|---|

| 04/2023 | $10,119 | $10,060 | $10,312 |

|---|

| 05/2023 | $10,083 | $9,863 | $10,308 |

|---|

| 06/2023 | $10,058 | $9,863 | $10,299 |

|---|

| 07/2023 | $10,107 | $9,931 | $10,341 |

|---|

| 08/2023 | $10,119 | $9,795 | $10,359 |

|---|

| 09/2023 | $9,936 | $9,509 | $10,170 |

|---|

| 10/2023 | $9,948 | $9,395 | $10,171 |

|---|

| 11/2023 | $10,291 | $9,869 | $10,520 |

|---|

| 12/2023 | $10,693 | $10,279 | $10,925 |

|---|

| 01/2024 | $10,605 | $10,137 | $10,887 |

|---|

| 02/2024 | $10,530 | $10,010 | $10,788 |

|---|

| 03/2024 | $10,655 | $10,065 | $10,928 |

|---|

| 04/2024 | $10,480 | $9,811 | $10,770 |

|---|

| 05/2024 | $10,518 | $9,940 | $10,826 |

|---|

| 06/2024 | $10,605 | $9,954 | $10,886 |

|---|

| 07/2024 | $10,831 | $10,229 | $11,123 |

|---|

| 08/2024 | $10,906 | $10,471 | $11,204 |

|---|

| 09/2024 | $11,044 | $10,649 | $11,344 |

|---|

| 10/2024 | $10,918 | $10,292 | $11,249 |

|---|

| 11/2024 | $11,144 | $10,327 | $11,458 |

|---|

| 12/2024 | $10,992 | $10,105 | $11,344 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 2/28/17 |

|---|

| Class Y | 2.80% | (0.41%) | 1.21% |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.13% |

|---|

| Bloomberg MSCI Global Green Bond Index - USD Hedged | 3.83% | (0.32%) | 1.62% |

|---|

Effective May 1, 2024, in accordance with new regulations, the Fund’s primary broad-based index changed to the Bloomberg Global Aggregate Bond Index - USD Hedged. The Fund will retain the Bloomberg MSCI Global Green Bond Index - USD Hedged as an additional benchmark for performance comparison.

| Total Net Assets | $38,096,678 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements and derivatives) | 82 |

|---|

| Portfolio Turnover Rate | 10% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $17,744 |

|---|

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 14.3% |

| Special Purpose | 4.6% |

| Supra-National | 5.0% |

| Financial | 8.1% |

| Bank | 9.0% |

| Industrial | 15.3% |

| Utility-Electric | 15.6% |

| Government National | 28.1% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities (including futures contracts) |

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 22.8% |

| Denmark | 3.0% |

| Sweden | 3.4% |

| Supranationals | 5.0% |

| France | 6.6% |

| Spain | 6.6% |

| Netherlands | 8.0% |

| United Kingdom | 9.4% |

| Italy | 10.4% |

| United States | 11.0% |

| Germany | 13.8% |

Credit QualityFootnote Reference†

| Value | Value |

|---|

| Cash & equivalents | 8.7 |

Not ratedFootnote Reference^ | 0.8 |

| BB | 3.2 |

| BBB | 50.6 |

| A | 12.0 |

| AA | 7.5 |

| AAA | 17.2 |

| Footnote | Description |

Footnote† | Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

Footnote^ | Not Rated category represents only those securities not rated by S&P Global Ratings. Such securities may be rated by other NRSROs not shown here. |

There were no material fund changes during the period.

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Green Bond Fund

Annual Shareholder Report

December 31, 2024

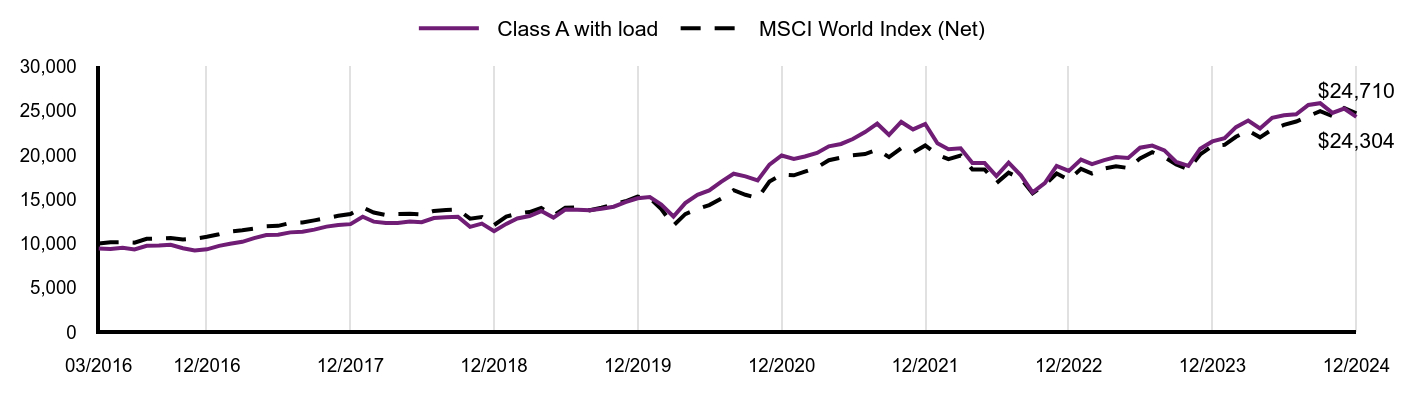

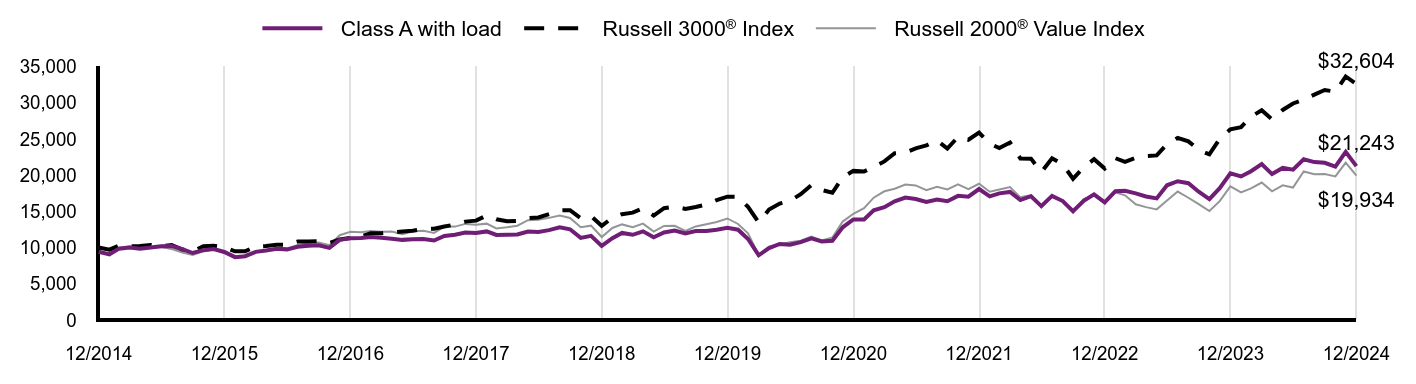

Mirova Global Sustainable Equity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class A | $128 | 1.20% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

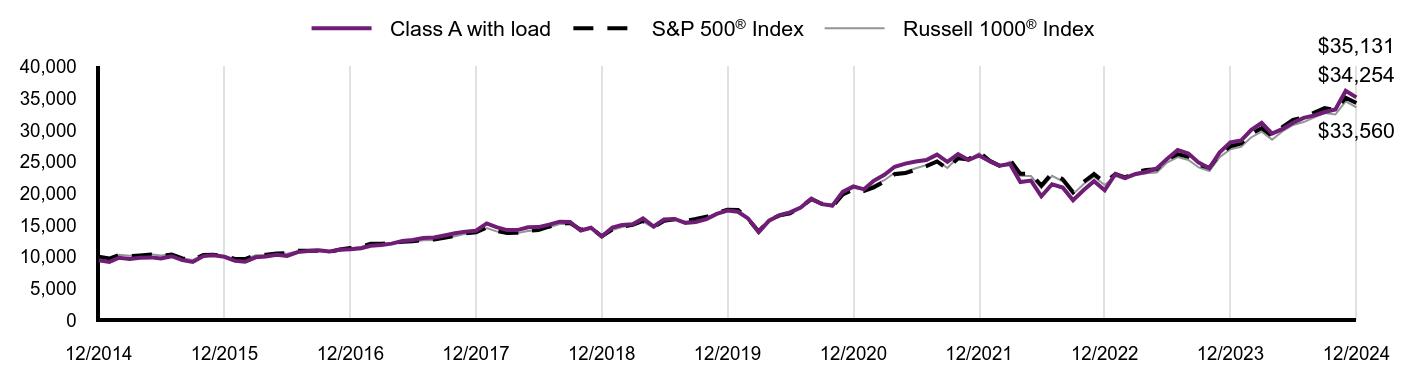

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges.

Top Contributors to Performance

• Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance.

• Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed.

•Nvidia, Taiwan Semi and eBay were the largest contributors to performance.

Top Detractors from Performance

•An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted.

•As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted.

•Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance.

•Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall.

The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade.

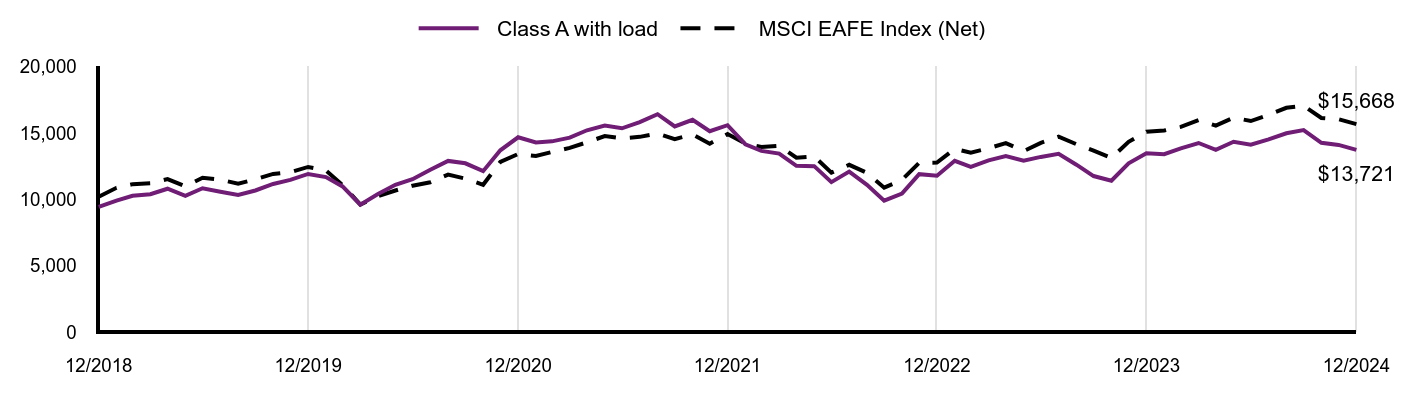

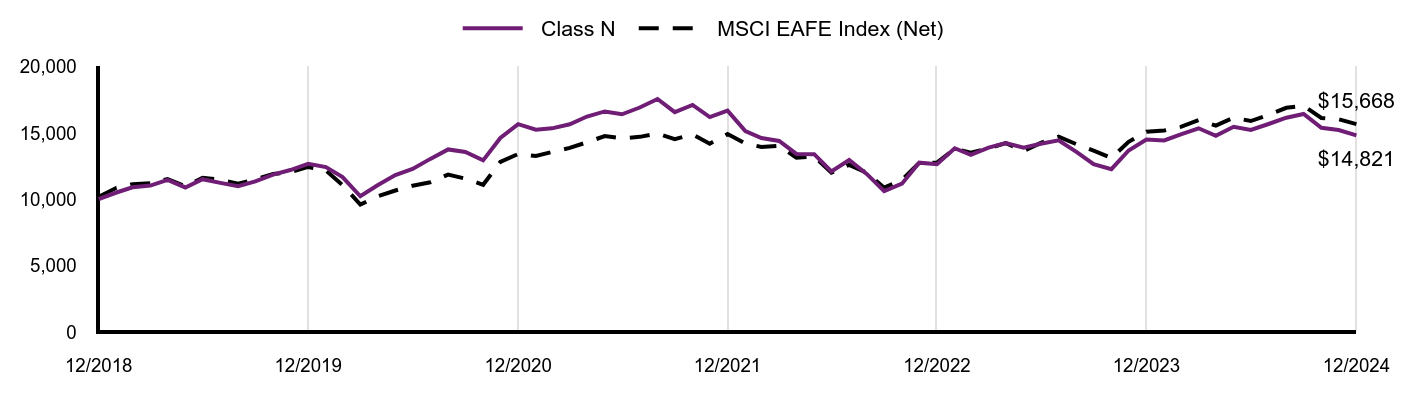

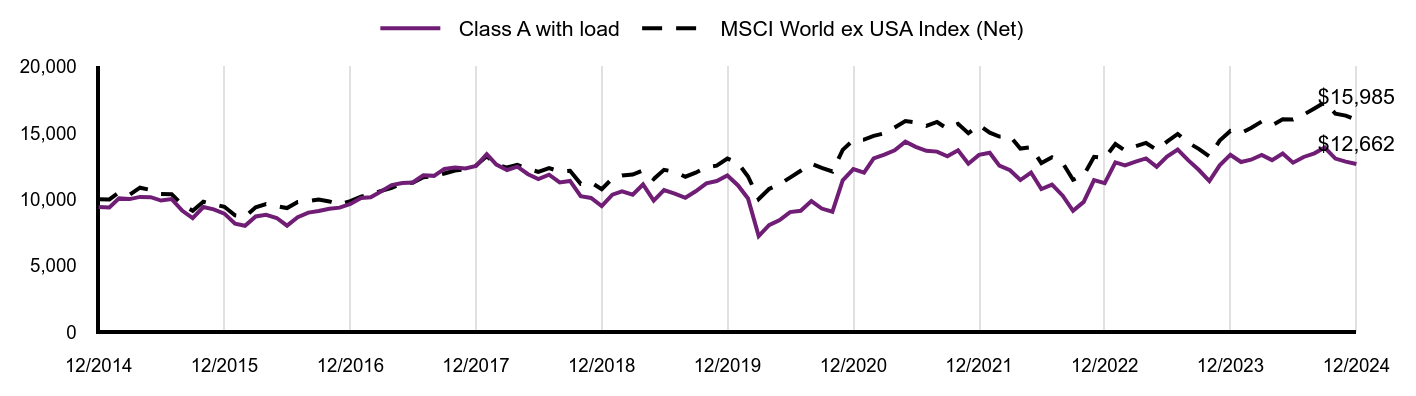

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

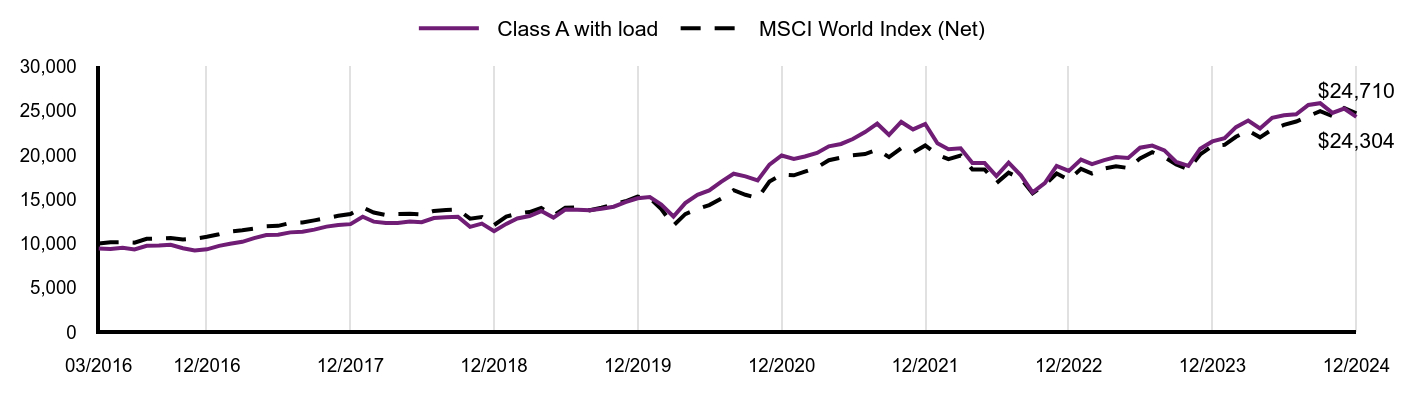

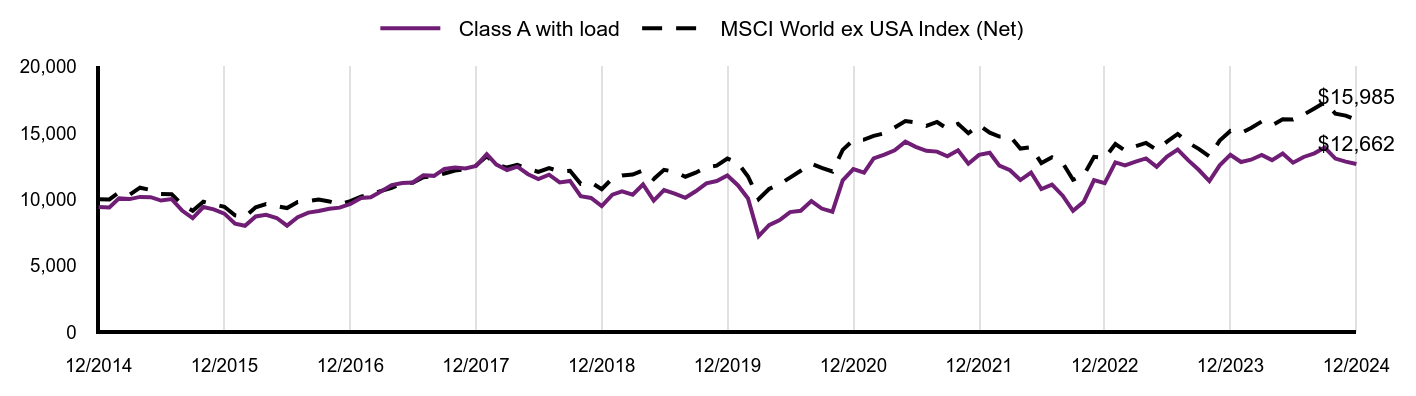

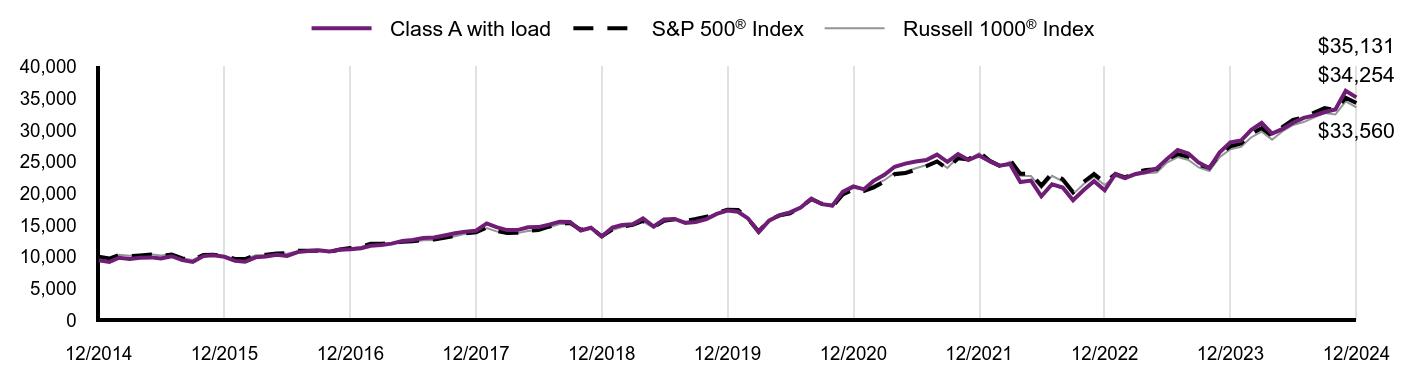

Total Return Based on a Hypothetical $10,000 Investment

| Class A with load | MSCI World Index (Net) |

|---|

| 03/2016 | $9,425 | $10,000 |

|---|

| 04/2016 | $9,369 | $10,148 |

|---|

| 05/2016 | $9,529 | $10,160 |

|---|

| 06/2016 | $9,331 | $10,099 |

|---|

| 07/2016 | $9,746 | $10,534 |

|---|

| 08/2016 | $9,764 | $10,570 |

|---|

| 09/2016 | $9,859 | $10,634 |

|---|

| 10/2016 | $9,463 | $10,454 |

|---|

| 11/2016 | $9,208 | $10,533 |

|---|

| 12/2016 | $9,345 | $10,761 |

|---|

| 01/2017 | $9,732 | $11,055 |

|---|

| 02/2017 | $9,967 | $11,365 |

|---|

| 03/2017 | $10,194 | $11,504 |

|---|

| 04/2017 | $10,609 | $11,683 |

|---|

| 05/2017 | $10,968 | $11,941 |

|---|

| 06/2017 | $10,987 | $11,996 |

|---|

| 07/2017 | $11,261 | $12,331 |

|---|

| 08/2017 | $11,336 | $12,378 |

|---|

| 09/2017 | $11,572 | $12,617 |

|---|

| 10/2017 | $11,912 | $12,879 |

|---|

| 11/2017 | $12,101 | $13,129 |

|---|

| 12/2017 | $12,189 | $13,340 |

|---|

| 01/2018 | $13,029 | $14,093 |

|---|

| 02/2018 | $12,476 | $13,501 |

|---|

| 03/2018 | $12,333 | $13,212 |

|---|

| 04/2018 | $12,322 | $13,338 |

|---|

| 05/2018 | $12,475 | $13,355 |

|---|

| 06/2018 | $12,418 | $13,283 |

|---|

| 07/2018 | $12,879 | $13,683 |

|---|

| 08/2018 | $12,975 | $13,791 |

|---|

| 09/2018 | $13,023 | $13,851 |

|---|

| 10/2018 | $11,880 | $12,813 |

|---|

| 11/2018 | $12,245 | $13,000 |

|---|

| 12/2018 | $11,392 | $12,084 |

|---|

| 01/2019 | $12,218 | $13,039 |

|---|

| 02/2019 | $12,834 | $13,387 |

|---|

| 03/2019 | $13,103 | $13,556 |

|---|

| 04/2019 | $13,667 | $14,013 |

|---|

| 05/2019 | $12,935 | $13,182 |

|---|

| 06/2019 | $13,838 | $14,045 |

|---|

| 07/2019 | $13,808 | $14,087 |

|---|

| 08/2019 | $13,757 | $13,752 |

|---|

| 09/2019 | $13,938 | $14,042 |

|---|

| 10/2019 | $14,159 | $14,426 |

|---|

| 11/2019 | $14,681 | $14,778 |

|---|

| 12/2019 | $15,109 | $15,299 |

|---|

| 01/2020 | $15,261 | $15,130 |

|---|

| 02/2020 | $14,400 | $13,908 |

|---|

| 03/2020 | $13,053 | $12,030 |

|---|

| 04/2020 | $14,573 | $13,319 |

|---|

| 05/2020 | $15,510 | $13,898 |

|---|

| 06/2020 | $16,008 | $14,342 |

|---|

| 07/2020 | $16,995 | $15,101 |

|---|

| 08/2020 | $17,891 | $16,025 |

|---|

| 09/2020 | $17,596 | $15,508 |

|---|

| 10/2020 | $17,128 | $15,131 |

|---|

| 11/2020 | $18,919 | $16,996 |

|---|

| 12/2020 | $19,954 | $17,785 |

|---|

| 01/2021 | $19,566 | $17,705 |

|---|

| 02/2021 | $19,842 | $18,115 |

|---|

| 03/2021 | $20,239 | $18,598 |

|---|

| 04/2021 | $20,983 | $19,412 |

|---|

| 05/2021 | $21,252 | $19,714 |

|---|

| 06/2021 | $21,810 | $19,973 |

|---|

| 07/2021 | $22,595 | $20,111 |

|---|

| 08/2021 | $23,545 | $20,614 |

|---|

| 09/2021 | $22,274 | $19,763 |

|---|

| 10/2021 | $23,741 | $20,772 |

|---|

| 11/2021 | $22,894 | $20,271 |

|---|

| 12/2021 | $23,509 | $21,082 |

|---|

| 01/2022 | $21,333 | $20,047 |

|---|

| 02/2022 | $20,657 | $19,529 |

|---|

| 03/2022 | $20,772 | $19,952 |

|---|

| 04/2022 | $19,088 | $18,355 |

|---|

| 05/2022 | $19,088 | $18,377 |

|---|

| 06/2022 | $17,624 | $16,828 |

|---|

| 07/2022 | $19,148 | $18,003 |

|---|

| 08/2022 | $17,707 | $17,340 |

|---|

| 09/2022 | $15,790 | $15,680 |

|---|

| 10/2022 | $16,838 | $16,626 |

|---|

| 11/2022 | $18,767 | $17,916 |

|---|

| 12/2022 | $18,206 | $17,211 |

|---|

| 01/2023 | $19,486 | $18,444 |

|---|

| 02/2023 | $18,983 | $17,916 |

|---|

| 03/2023 | $19,426 | $18,468 |

|---|

| 04/2023 | $19,785 | $18,734 |

|---|

| 05/2023 | $19,666 | $18,533 |

|---|

| 06/2023 | $20,827 | $19,609 |

|---|

| 07/2023 | $21,066 | $20,327 |

|---|

| 08/2023 | $20,527 | $19,759 |

|---|

| 09/2023 | $19,223 | $18,942 |

|---|

| 10/2023 | $18,780 | $18,372 |

|---|

| 11/2023 | $20,719 | $20,068 |

|---|

| 12/2023 | $21,541 | $21,032 |

|---|

| 01/2024 | $21,913 | $21,155 |

|---|

| 02/2024 | $23,150 | $22,063 |

|---|

| 03/2024 | $23,906 | $22,756 |

|---|

| 04/2024 | $23,000 | $22,005 |

|---|

| 05/2024 | $24,213 | $22,899 |

|---|

| 06/2024 | $24,489 | $23,409 |

|---|

| 07/2024 | $24,598 | $23,786 |

|---|

| 08/2024 | $25,667 | $24,390 |

|---|

| 09/2024 | $25,859 | $24,957 |

|---|

| 10/2024 | $24,766 | $24,397 |

|---|

| 11/2024 | $25,258 | $25,309 |

|---|

| 12/2024 | $24,304 | $24,710 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 3/31/16 |

|---|

| Class A at NAV | 12.83% | 9.97% | 11.43% |

|---|

Class A with 5.75% MSCFootnote Reference1 | 6.37% | 8.68% | 10.68% |

|---|

| MSCI World Index (Net) | 17.49% | 10.06% | 10.85% |

|---|

| Footnote | Description |

Footnote1 | Maximum sales charge |

| Total Net Assets | $974,101,733 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements) | 51 |

|---|

| Portfolio Turnover Rate | 18% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $8,602,808 |

|---|

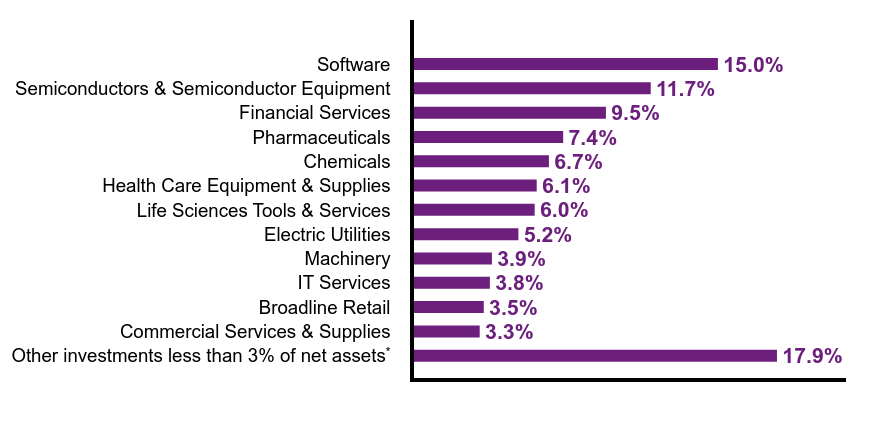

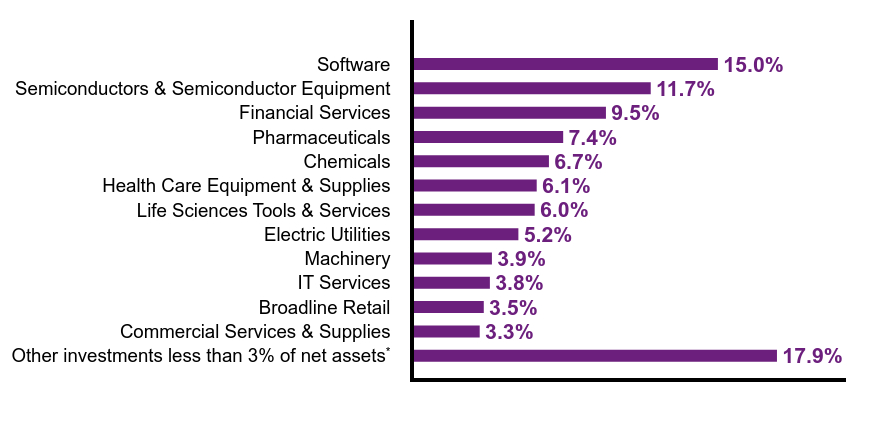

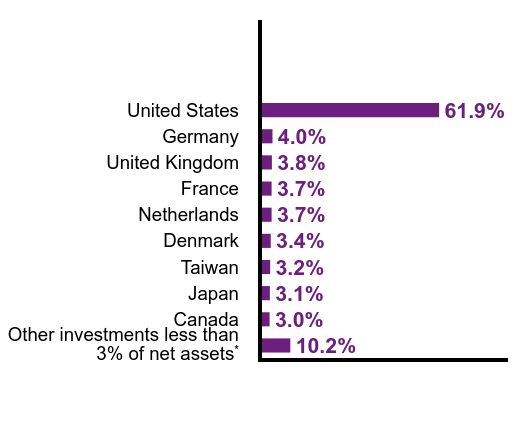

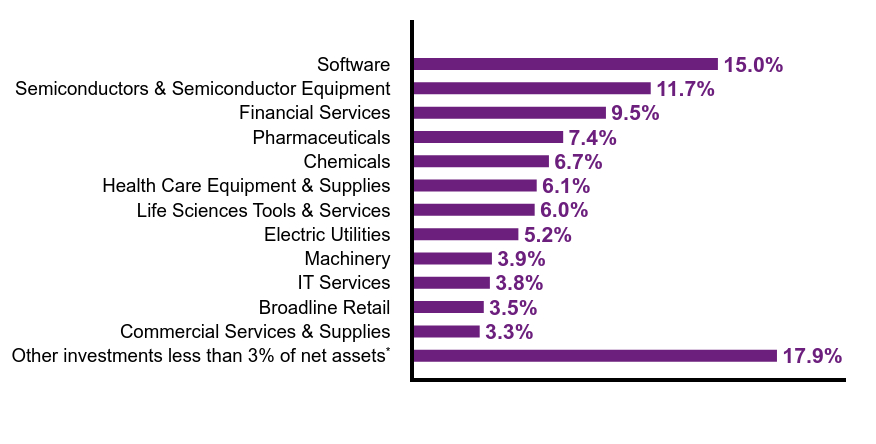

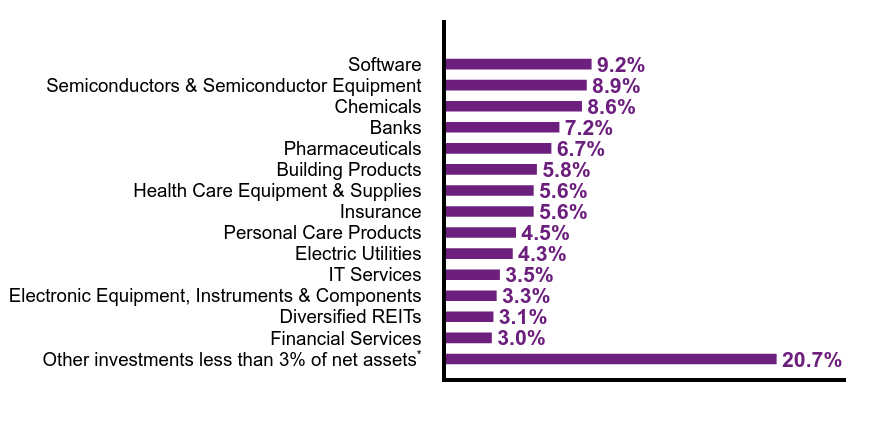

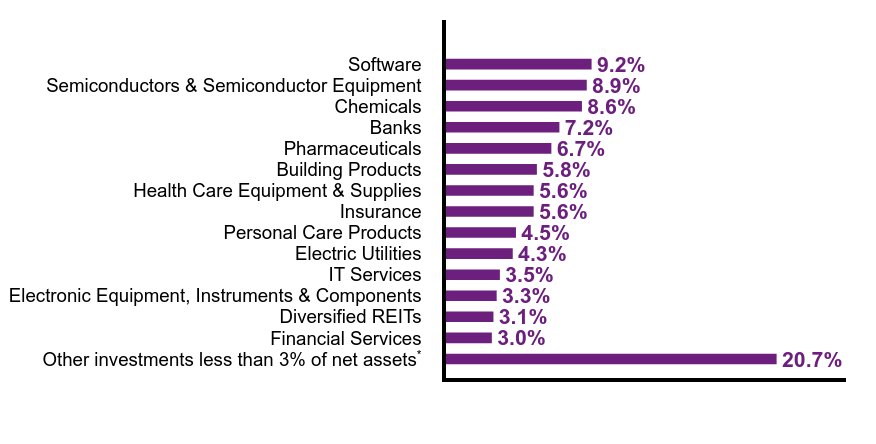

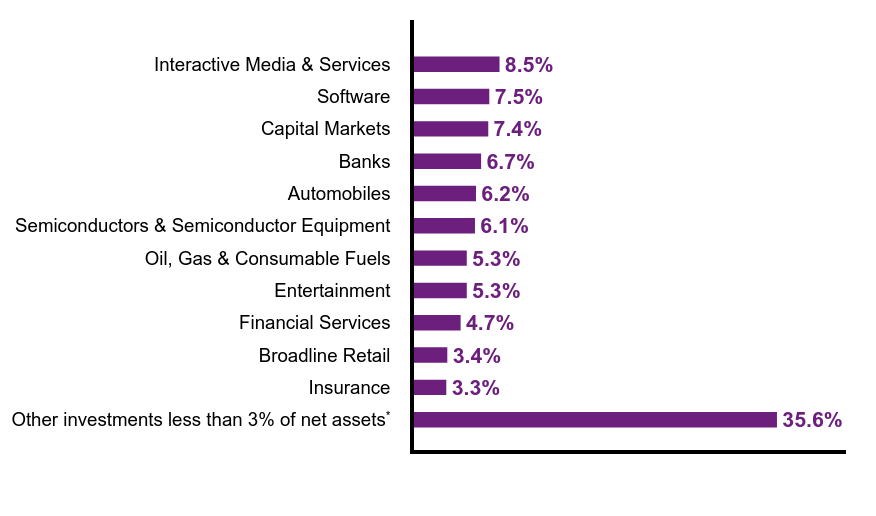

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 17.9% |

| Commercial Services & Supplies | 3.3% |

| Broadline Retail | 3.5% |

| IT Services | 3.8% |

| Machinery | 3.9% |

| Electric Utilities | 5.2% |

| Life Sciences Tools & Services | 6.0% |

| Health Care Equipment & Supplies | 6.1% |

| Chemicals | 6.7% |

| Pharmaceuticals | 7.4% |

| Financial Services | 9.5% |

| Semiconductors & Semiconductor Equipment | 11.7% |

| Software | 15.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| NVIDIA Corp. | 5.9% |

| Microsoft Corp. | 5.5% |

| Mastercard, Inc., Class A | 5.2% |

| Eli Lilly & Co. | 3.8% |

| Ecolab, Inc. | 3.7% |

| eBay, Inc. | 3.5% |

| Thermo Fisher Scientific, Inc. | 3.4% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 3.2% |

| Roper Technologies, Inc. | 3.0% |

| Iberdrola SA | 2.9% |

There were no material fund changes during the period.

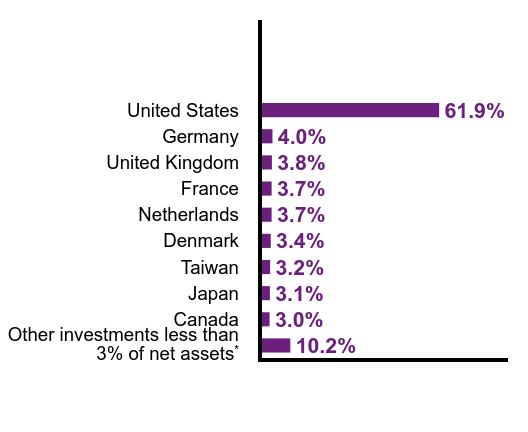

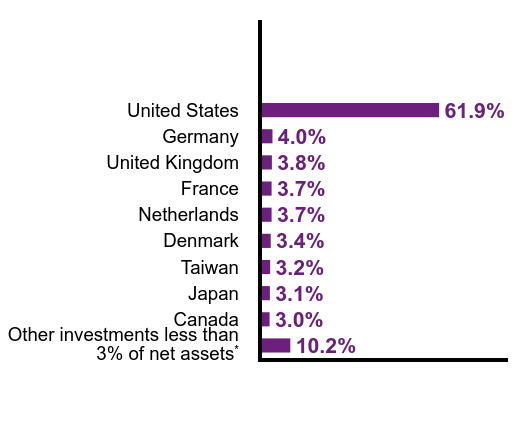

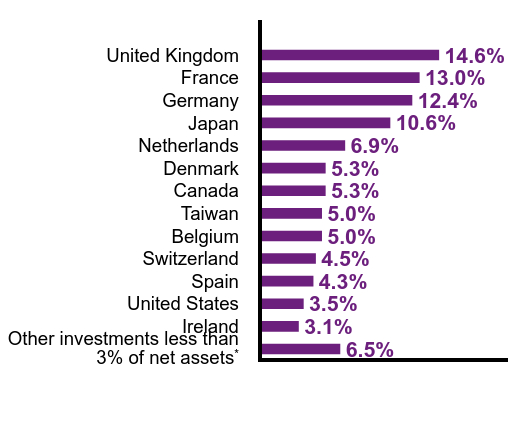

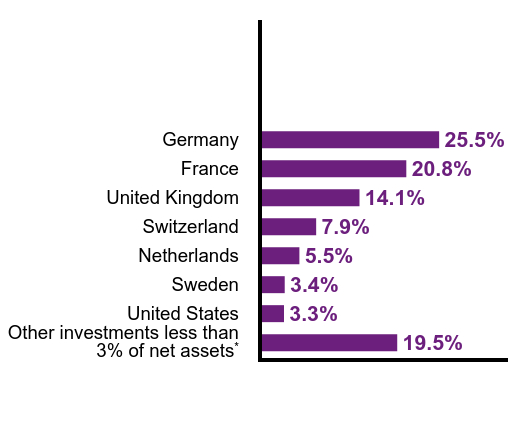

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 10.2% |

| Canada | 3.0% |

| Japan | 3.1% |

| Taiwan | 3.2% |

| Denmark | 3.4% |

| Netherlands | 3.7% |

| France | 3.7% |

| United Kingdom | 3.8% |

| Germany | 4.0% |

| United States | 61.9% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Sustainable Equity Fund

Annual Shareholder Report

December 31, 2024

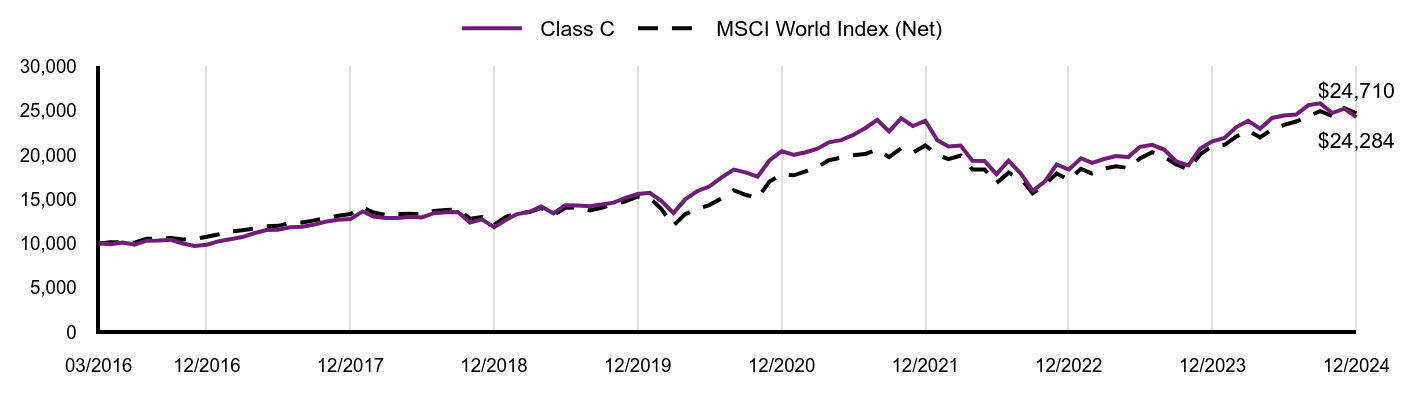

Mirova Global Sustainable Equity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

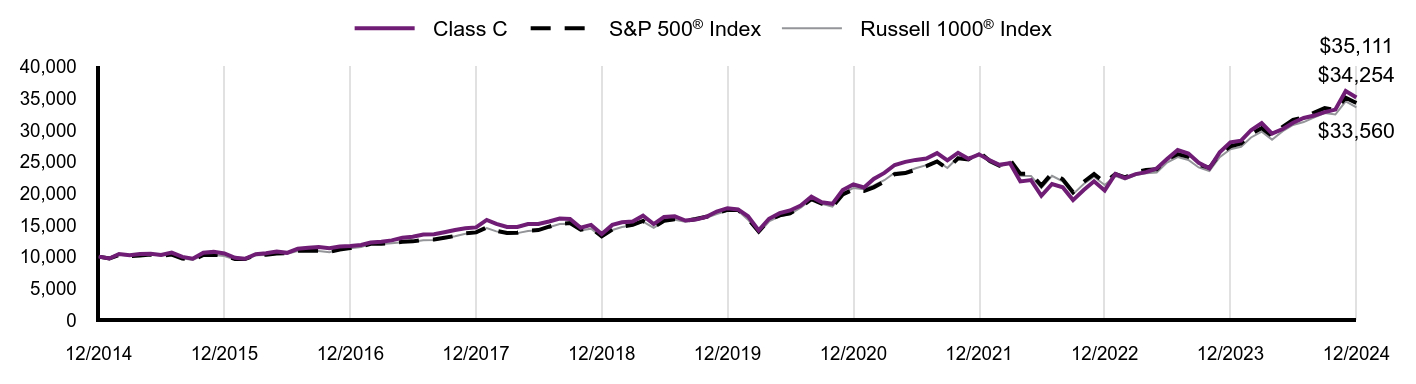

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class C | $207 | 1.95% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

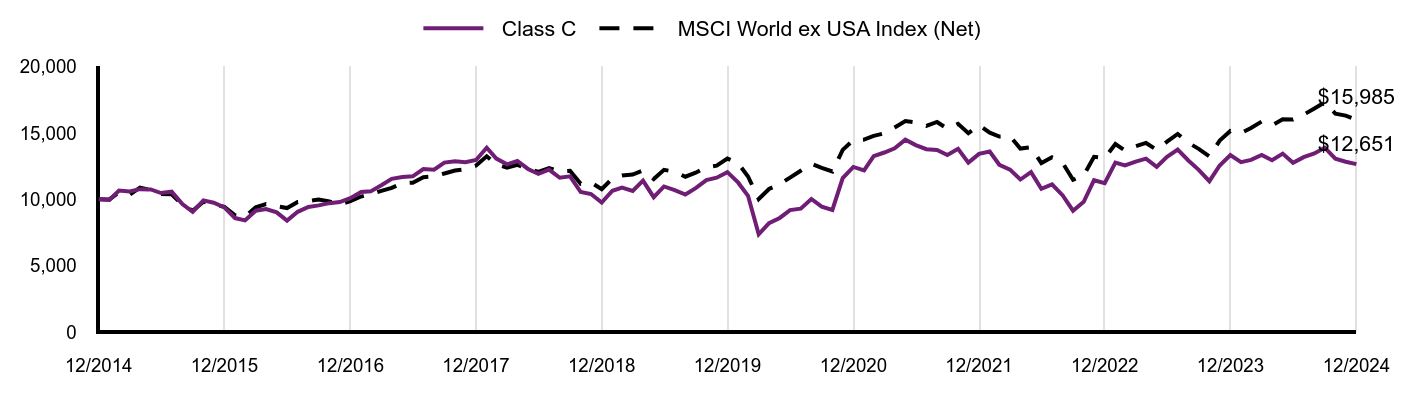

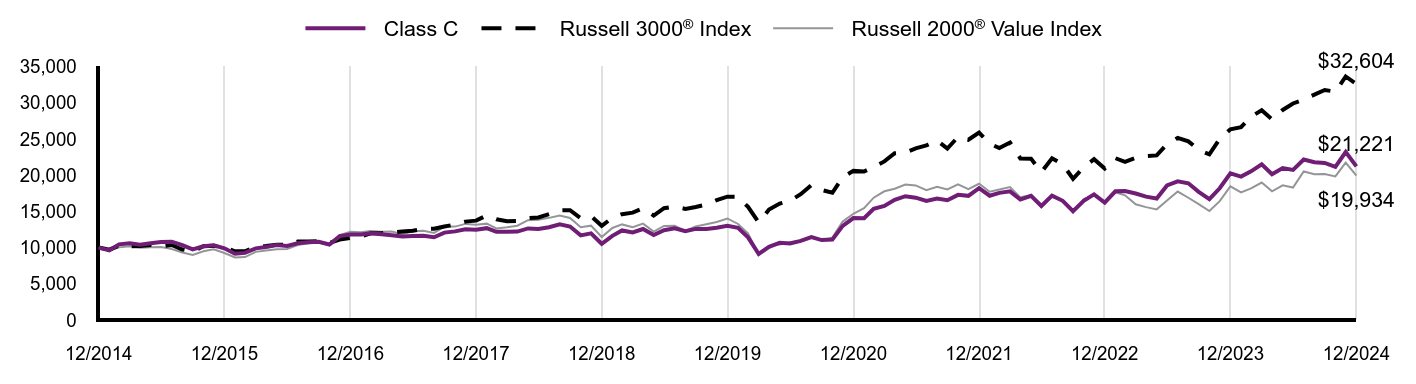

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges.

Top Contributors to Performance

• Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance.

• Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed.

•Nvidia, Taiwan Semi and eBay were the largest contributors to performance.

Top Detractors from Performance

•An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted.

•As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted.

•Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance.

•Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall.

The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

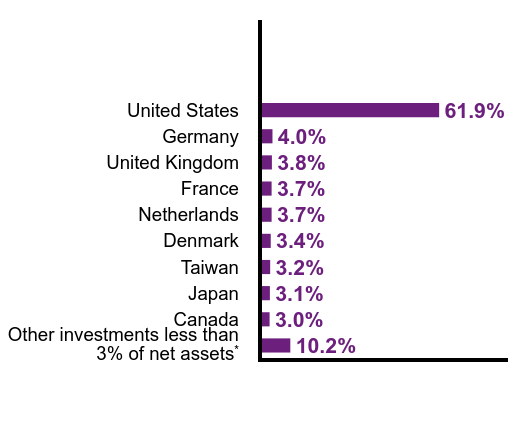

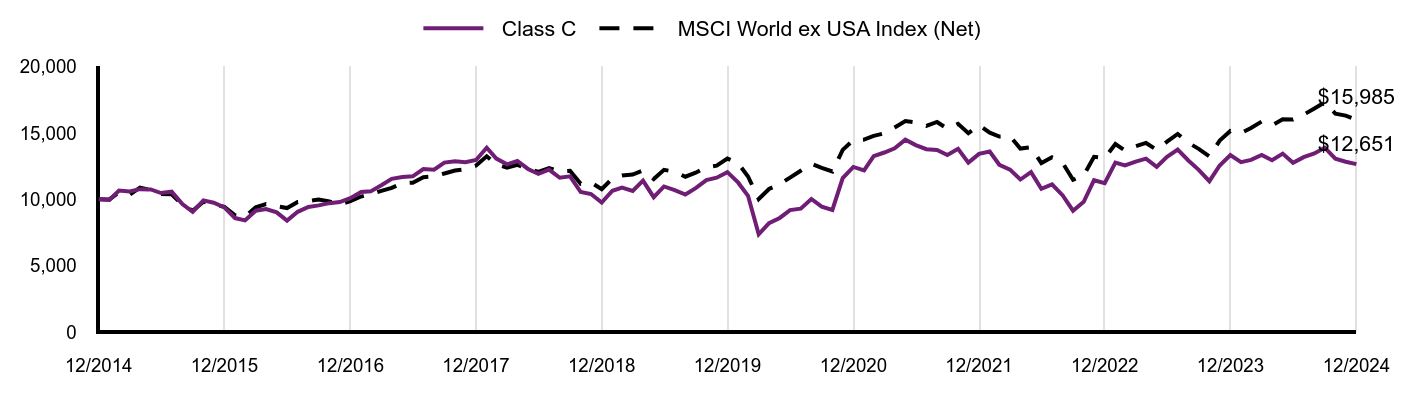

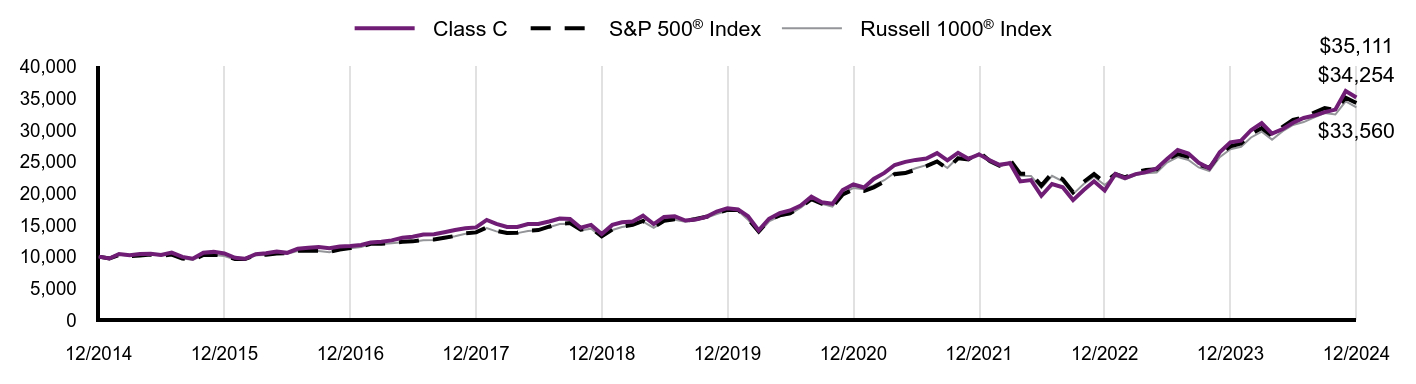

Total Return Based on a Hypothetical $10,000 Investment

| Class C | MSCI World Index (Net) |

|---|

| 03/2016 | $10,000 | $10,000 |

|---|

| 04/2016 | $9,930 | $10,148 |

|---|

| 05/2016 | $10,100 | $10,160 |

|---|

| 06/2016 | $9,880 | $10,099 |

|---|

| 07/2016 | $10,320 | $10,534 |

|---|

| 08/2016 | $10,330 | $10,570 |

|---|

| 09/2016 | $10,420 | $10,634 |

|---|

| 10/2016 | $10,000 | $10,454 |

|---|

| 11/2016 | $9,720 | $10,533 |

|---|

| 12/2016 | $9,861 | $10,761 |

|---|

| 01/2017 | $10,262 | $11,055 |

|---|

| 02/2017 | $10,492 | $11,365 |

|---|

| 03/2017 | $10,732 | $11,504 |

|---|

| 04/2017 | $11,163 | $11,683 |

|---|

| 05/2017 | $11,533 | $11,941 |

|---|

| 06/2017 | $11,553 | $11,996 |

|---|

| 07/2017 | $11,833 | $12,331 |

|---|

| 08/2017 | $11,894 | $12,378 |

|---|

| 09/2017 | $12,134 | $12,617 |

|---|

| 10/2017 | $12,484 | $12,879 |

|---|

| 11/2017 | $12,684 | $13,129 |

|---|

| 12/2017 | $12,761 | $13,340 |

|---|

| 01/2018 | $13,630 | $14,093 |

|---|

| 02/2018 | $13,054 | $13,501 |

|---|

| 03/2018 | $12,892 | $13,212 |

|---|

| 04/2018 | $12,871 | $13,338 |

|---|

| 05/2018 | $13,023 | $13,355 |

|---|

| 06/2018 | $12,952 | $13,283 |

|---|

| 07/2018 | $13,430 | $13,683 |

|---|

| 08/2018 | $13,521 | $13,791 |

|---|

| 09/2018 | $13,562 | $13,851 |

|---|

| 10/2018 | $12,362 | $12,813 |

|---|

| 11/2018 | $12,728 | $13,000 |

|---|

| 12/2018 | $11,841 | $12,084 |

|---|

| 01/2019 | $12,695 | $13,039 |

|---|

| 02/2019 | $13,327 | $13,387 |

|---|

| 03/2019 | $13,590 | $13,556 |

|---|

| 04/2019 | $14,177 | $14,013 |

|---|

| 05/2019 | $13,401 | $13,182 |

|---|

| 06/2019 | $14,326 | $14,045 |

|---|

| 07/2019 | $14,294 | $14,087 |

|---|

| 08/2019 | $14,219 | $13,752 |

|---|

| 09/2019 | $14,400 | $14,042 |

|---|

| 10/2019 | $14,623 | $14,426 |

|---|

| 11/2019 | $15,155 | $14,778 |

|---|

| 12/2019 | $15,590 | $15,299 |

|---|

| 01/2020 | $15,729 | $15,130 |

|---|

| 02/2020 | $14,830 | $13,908 |

|---|

| 03/2020 | $13,438 | $12,030 |

|---|

| 04/2020 | $14,991 | $13,319 |

|---|

| 05/2020 | $15,938 | $13,898 |

|---|

| 06/2020 | $16,444 | $14,342 |

|---|

| 07/2020 | $17,456 | $15,101 |

|---|

| 08/2020 | $18,360 | $16,025 |

|---|

| 09/2020 | $18,048 | $15,508 |

|---|

| 10/2020 | $17,553 | $15,131 |

|---|

| 11/2020 | $19,382 | $16,996 |

|---|

| 12/2020 | $20,434 | $17,785 |

|---|

| 01/2021 | $20,024 | $17,705 |

|---|

| 02/2021 | $20,283 | $18,115 |

|---|

| 03/2021 | $20,682 | $18,598 |

|---|

| 04/2021 | $21,436 | $19,412 |

|---|

| 05/2021 | $21,687 | $19,714 |

|---|

| 06/2021 | $22,245 | $19,973 |

|---|

| 07/2021 | $23,032 | $20,111 |

|---|

| 08/2021 | $23,983 | $20,614 |

|---|

| 09/2021 | $22,671 | $19,763 |

|---|

| 10/2021 | $24,147 | $20,772 |

|---|

| 11/2021 | $23,272 | $20,271 |

|---|

| 12/2021 | $23,878 | $21,082 |

|---|

| 01/2022 | $21,663 | $20,047 |

|---|

| 02/2022 | $20,969 | $19,529 |

|---|

| 03/2022 | $21,066 | $19,952 |

|---|

| 04/2022 | $19,350 | $18,355 |

|---|

| 05/2022 | $19,337 | $18,377 |

|---|

| 06/2022 | $17,841 | $16,828 |

|---|

| 07/2022 | $19,362 | $18,003 |

|---|

| 08/2022 | $17,904 | $17,340 |

|---|

| 09/2022 | $15,964 | $15,680 |

|---|

| 10/2022 | $17,004 | $16,626 |

|---|

| 11/2022 | $18,944 | $17,916 |

|---|

| 12/2022 | $18,361 | $17,211 |

|---|

| 01/2023 | $19,641 | $18,444 |

|---|

| 02/2023 | $19,121 | $17,916 |

|---|

| 03/2023 | $19,553 | $18,468 |

|---|

| 04/2023 | $19,895 | $18,734 |

|---|

| 05/2023 | $19,768 | $18,533 |

|---|

| 06/2023 | $20,923 | $19,609 |

|---|

| 07/2023 | $21,152 | $20,327 |

|---|

| 08/2023 | $20,593 | $19,759 |

|---|

| 09/2023 | $19,274 | $18,942 |

|---|

| 10/2023 | $18,830 | $18,372 |

|---|

| 11/2023 | $20,745 | $20,068 |

|---|

| 12/2023 | $21,558 | $21,032 |

|---|

| 01/2024 | $21,926 | $21,155 |

|---|

| 02/2024 | $23,131 | $22,063 |

|---|

| 03/2024 | $23,880 | $22,756 |

|---|

| 04/2024 | $22,981 | $22,005 |

|---|

| 05/2024 | $24,193 | $22,899 |

|---|

| 06/2024 | $24,469 | $23,409 |

|---|

| 07/2024 | $24,577 | $23,786 |

|---|

| 08/2024 | $25,646 | $24,390 |

|---|

| 09/2024 | $25,838 | $24,957 |

|---|

| 10/2024 | $24,745 | $24,397 |

|---|

| 11/2024 | $25,237 | $25,309 |

|---|

| 12/2024 | $24,284 | $24,710 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 3/31/16 |

|---|

| Class C at NAV | 11.99% | 9.14% | 10.67% |

|---|

Class C with 1.00% CDSCFootnote Reference1 | 10.99% | 9.14% | 10.67% |

|---|

| MSCI World Index (Net) | 17.49% | 10.06% | 10.85% |

|---|

| Footnote | Description |

Footnote1 | Contingent deferred sales charge |

| Total Net Assets | $974,101,733 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements) | 51 |

|---|

| Portfolio Turnover Rate | 18% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $8,602,808 |

|---|

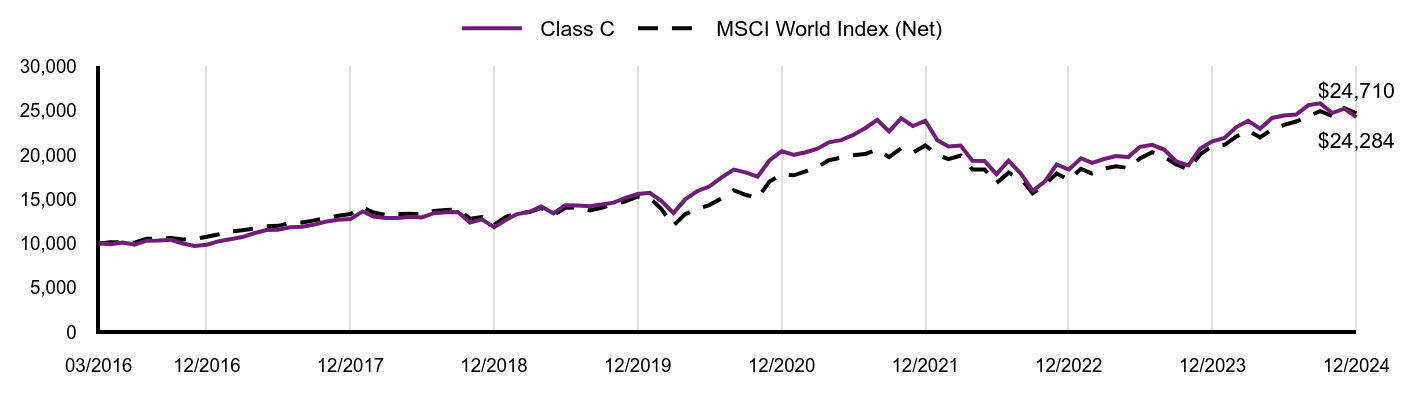

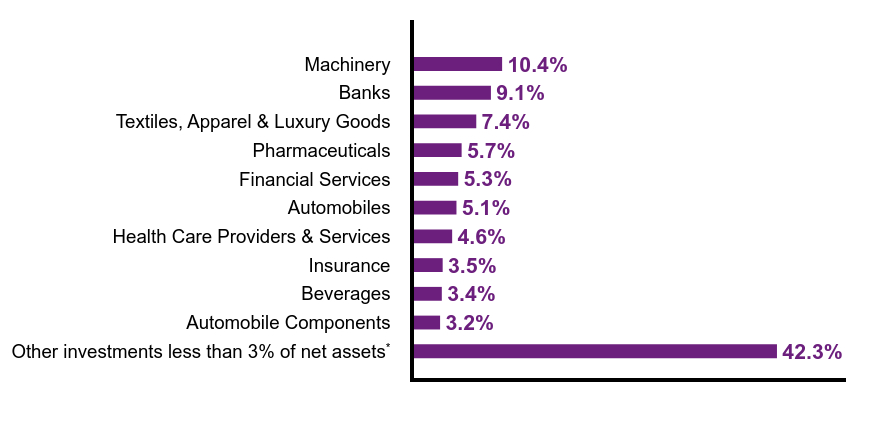

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 17.9% |

| Commercial Services & Supplies | 3.3% |

| Broadline Retail | 3.5% |

| IT Services | 3.8% |

| Machinery | 3.9% |

| Electric Utilities | 5.2% |

| Life Sciences Tools & Services | 6.0% |

| Health Care Equipment & Supplies | 6.1% |

| Chemicals | 6.7% |

| Pharmaceuticals | 7.4% |

| Financial Services | 9.5% |

| Semiconductors & Semiconductor Equipment | 11.7% |

| Software | 15.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| NVIDIA Corp. | 5.9% |

| Microsoft Corp. | 5.5% |

| Mastercard, Inc., Class A | 5.2% |

| Eli Lilly & Co. | 3.8% |

| Ecolab, Inc. | 3.7% |

| eBay, Inc. | 3.5% |

| Thermo Fisher Scientific, Inc. | 3.4% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 3.2% |

| Roper Technologies, Inc. | 3.0% |

| Iberdrola SA | 2.9% |

There were no material fund changes during the period.

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 10.2% |

| Canada | 3.0% |

| Japan | 3.1% |

| Taiwan | 3.2% |

| Denmark | 3.4% |

| Netherlands | 3.7% |

| France | 3.7% |

| United Kingdom | 3.8% |

| Germany | 4.0% |

| United States | 61.9% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Sustainable Equity Fund

Annual Shareholder Report

December 31, 2024

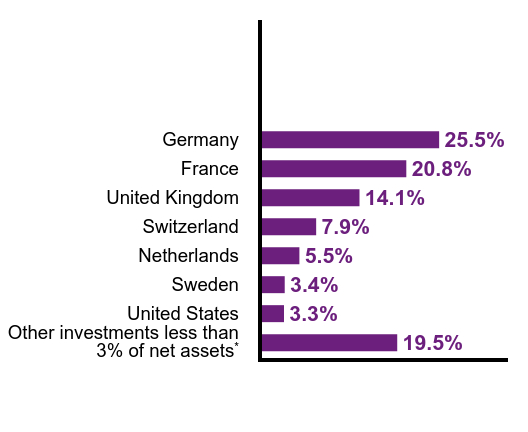

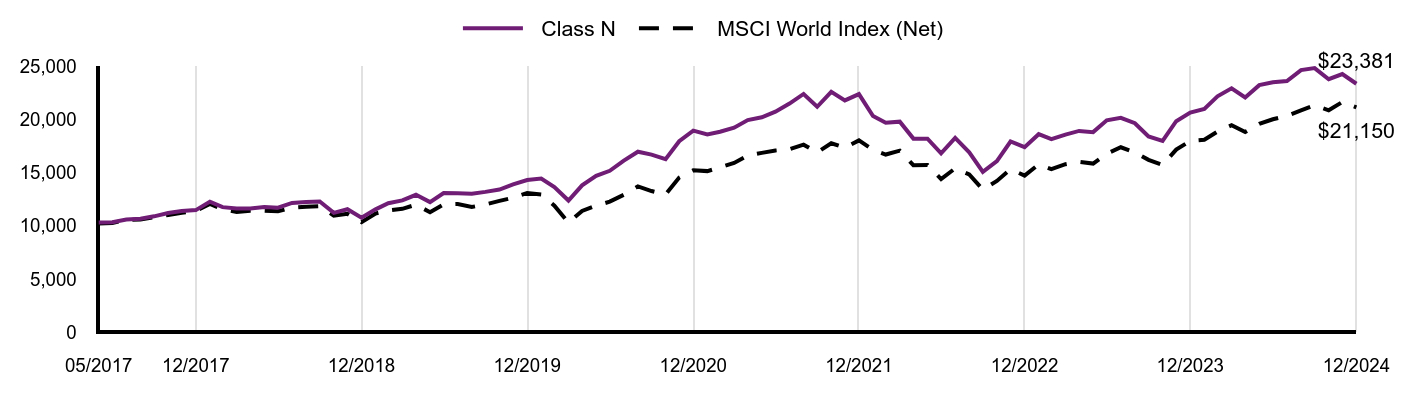

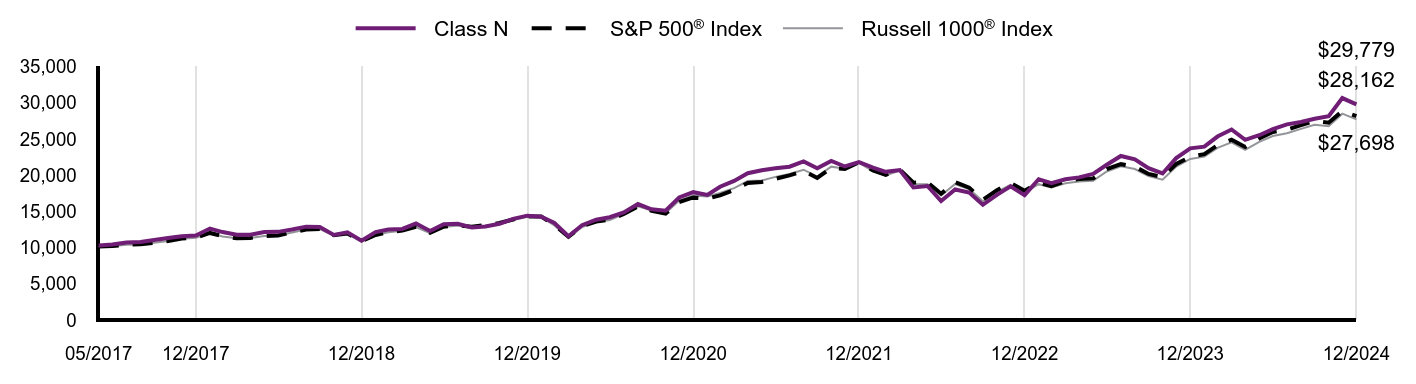

Mirova Global Sustainable Equity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class N | $95 | 0.89% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

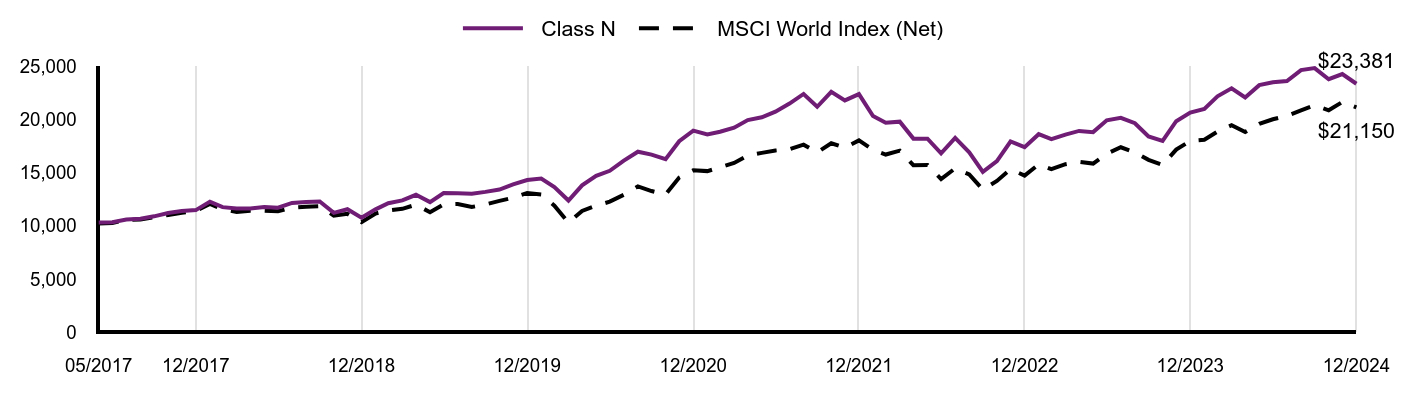

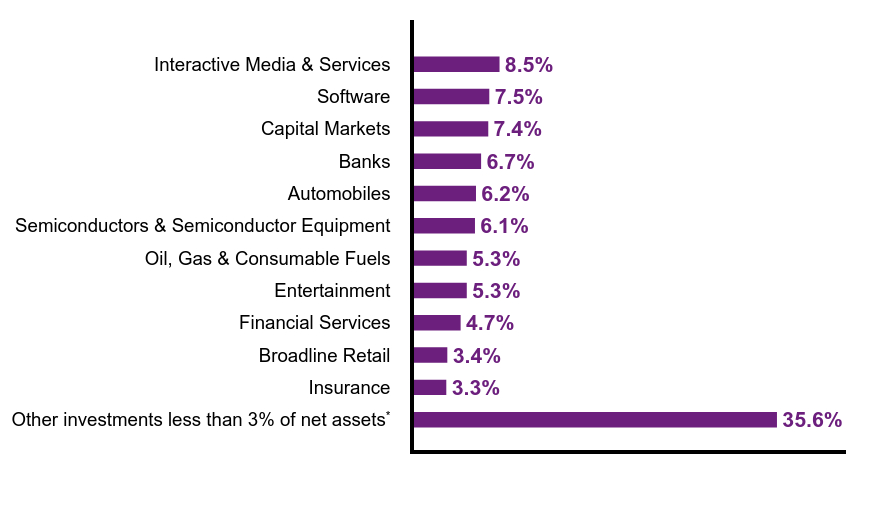

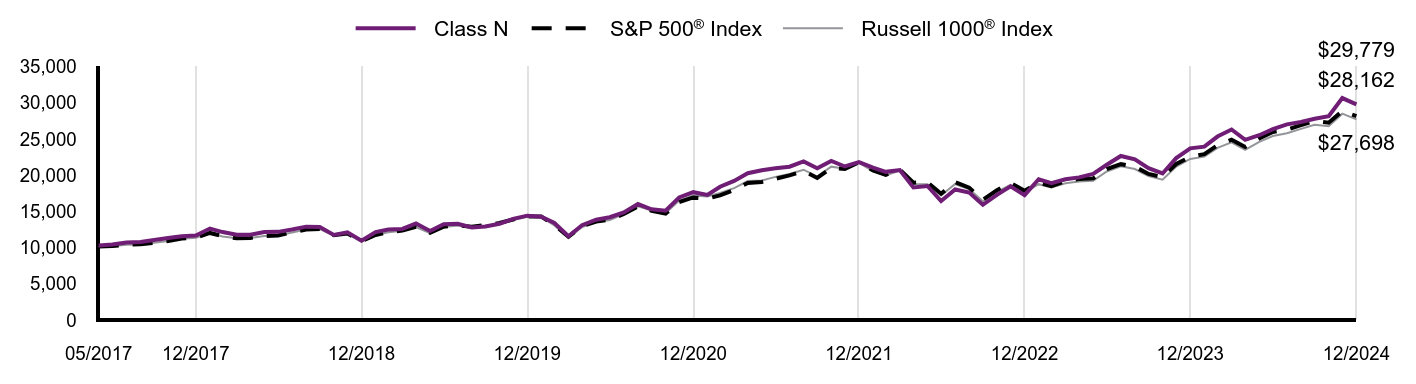

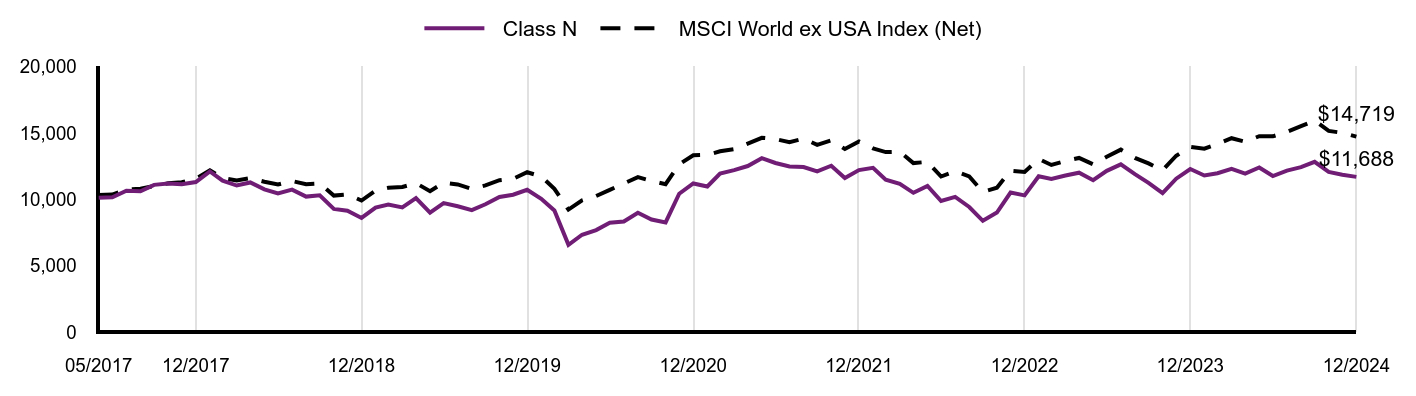

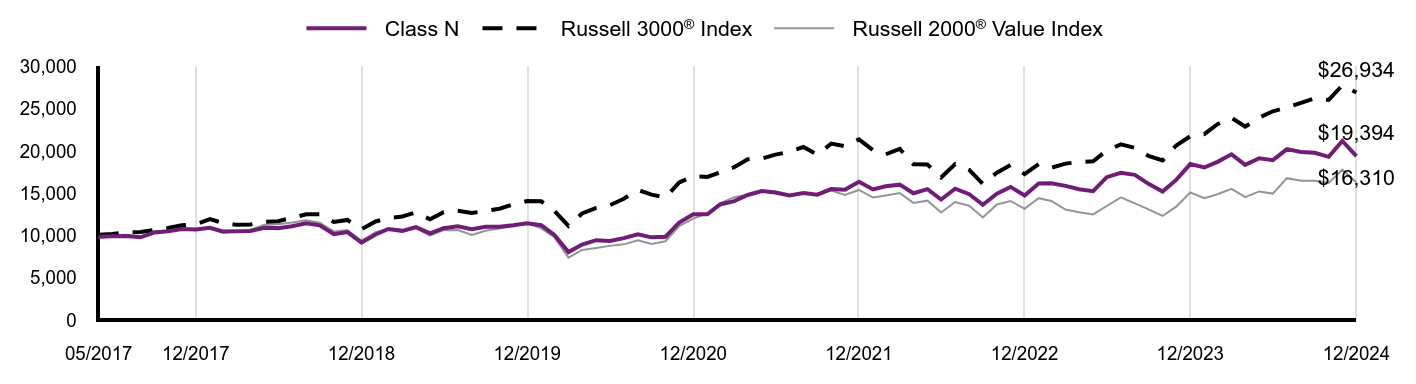

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges.

Top Contributors to Performance

• Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance.

• Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed.

•Nvidia, Taiwan Semi and eBay were the largest contributors to performance.

Top Detractors from Performance

•An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted.

•As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted.

•Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance.

•Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall.

The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

Total Return Based on a Hypothetical $10,000 Investment

| Class N | MSCI World Index (Net) |

|---|

| 05/2017 | $10,319 | $10,221 |

|---|

| 06/2017 | $10,337 | $10,267 |

|---|

| 07/2017 | $10,593 | $10,554 |

|---|

| 08/2017 | $10,673 | $10,595 |

|---|

| 09/2017 | $10,895 | $10,799 |

|---|

| 10/2017 | $11,213 | $11,024 |

|---|

| 11/2017 | $11,399 | $11,237 |

|---|

| 12/2017 | $11,481 | $11,418 |

|---|

| 01/2018 | $12,278 | $12,062 |

|---|

| 02/2018 | $11,759 | $11,556 |

|---|

| 03/2018 | $11,624 | $11,308 |

|---|

| 04/2018 | $11,623 | $11,416 |

|---|

| 05/2018 | $11,767 | $11,431 |

|---|

| 06/2018 | $11,713 | $11,369 |

|---|

| 07/2018 | $12,155 | $11,712 |

|---|

| 08/2018 | $12,245 | $11,804 |

|---|

| 09/2018 | $12,299 | $11,855 |

|---|

| 10/2018 | $11,217 | $10,967 |

|---|

| 11/2018 | $11,560 | $11,127 |

|---|

| 12/2018 | $10,762 | $10,343 |

|---|

| 01/2019 | $11,549 | $11,160 |

|---|

| 02/2019 | $12,129 | $11,458 |

|---|

| 03/2019 | $12,392 | $11,603 |

|---|

| 04/2019 | $12,923 | $11,994 |

|---|

| 05/2019 | $12,233 | $11,283 |

|---|

| 06/2019 | $13,093 | $12,022 |

|---|

| 07/2019 | $13,064 | $12,057 |

|---|

| 08/2019 | $13,017 | $11,771 |

|---|

| 09/2019 | $13,197 | $12,018 |

|---|

| 10/2019 | $13,414 | $12,347 |

|---|

| 11/2019 | $13,905 | $12,649 |

|---|

| 12/2019 | $14,319 | $13,094 |

|---|

| 01/2020 | $14,452 | $12,950 |

|---|

| 02/2020 | $13,650 | $11,904 |

|---|

| 03/2020 | $12,380 | $10,297 |

|---|

| 04/2020 | $13,813 | $11,400 |

|---|

| 05/2020 | $14,706 | $11,895 |

|---|

| 06/2020 | $15,186 | $12,276 |

|---|

| 07/2020 | $16,137 | $12,925 |

|---|

| 08/2020 | $16,981 | $13,716 |

|---|

| 09/2020 | $16,703 | $13,274 |

|---|

| 10/2020 | $16,271 | $12,951 |

|---|

| 11/2020 | $17,970 | $14,547 |

|---|

| 12/2020 | $18,964 | $15,223 |

|---|

| 01/2021 | $18,598 | $15,153 |

|---|

| 02/2021 | $18,858 | $15,504 |

|---|

| 03/2021 | $19,243 | $15,919 |

|---|

| 04/2021 | $19,964 | $16,615 |

|---|

| 05/2021 | $20,218 | $16,873 |

|---|

| 06/2021 | $20,754 | $17,096 |

|---|

| 07/2021 | $21,514 | $17,213 |

|---|

| 08/2021 | $22,421 | $17,644 |

|---|

| 09/2021 | $21,212 | $16,915 |

|---|

| 10/2021 | $22,616 | $17,779 |

|---|

| 11/2021 | $21,816 | $17,351 |

|---|

| 12/2021 | $22,409 | $18,045 |

|---|

| 01/2022 | $20,343 | $17,158 |

|---|

| 02/2022 | $19,705 | $16,715 |

|---|

| 03/2022 | $19,813 | $17,077 |

|---|

| 04/2022 | $18,213 | $15,710 |

|---|

| 05/2022 | $18,213 | $15,729 |

|---|

| 06/2022 | $16,830 | $14,403 |

|---|

| 07/2022 | $18,280 | $15,409 |

|---|

| 08/2022 | $16,920 | $14,841 |

|---|

| 09/2022 | $15,087 | $13,421 |

|---|

| 10/2022 | $16,099 | $14,231 |

|---|

| 11/2022 | $17,943 | $15,334 |

|---|

| 12/2022 | $17,408 | $14,731 |

|---|

| 01/2023 | $18,632 | $15,787 |

|---|

| 02/2023 | $18,156 | $15,334 |

|---|

| 03/2023 | $18,587 | $15,807 |

|---|

| 04/2023 | $18,939 | $16,034 |

|---|

| 05/2023 | $18,825 | $15,863 |

|---|

| 06/2023 | $19,937 | $16,784 |

|---|

| 07/2023 | $20,175 | $17,398 |

|---|

| 08/2023 | $19,664 | $16,912 |

|---|

| 09/2023 | $18,417 | $16,212 |

|---|

| 10/2023 | $18,009 | $15,725 |

|---|

| 11/2023 | $19,857 | $17,176 |

|---|

| 12/2023 | $20,664 | $18,001 |

|---|

| 01/2024 | $21,018 | $18,107 |

|---|

| 02/2024 | $22,204 | $18,884 |

|---|

| 03/2024 | $22,946 | $19,477 |

|---|

| 04/2024 | $22,085 | $18,834 |

|---|

| 05/2024 | $23,249 | $19,599 |

|---|

| 06/2024 | $23,523 | $20,036 |

|---|

| 07/2024 | $23,637 | $20,359 |

|---|

| 08/2024 | $24,664 | $20,876 |

|---|

| 09/2024 | $24,858 | $21,361 |

|---|

| 10/2024 | $23,808 | $20,881 |

|---|

| 11/2024 | $24,299 | $21,662 |

|---|

| 12/2024 | $23,381 | $21,150 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 5/1/17 |

|---|

| Class N | 13.15% | 10.30% | 11.71% |

|---|

| MSCI World Index (Net) | 17.49% | 10.06% | 10.19% |

|---|

| Total Net Assets | $974,101,733 |

|---|

| # of Portfolio Holdings (including overnight repurchase agreements) | 51 |

|---|

| Portfolio Turnover Rate | 18% |

|---|

| Total Advisory Fees Paid (after waiver/reimbursement, if applicable) | $8,602,808 |

|---|

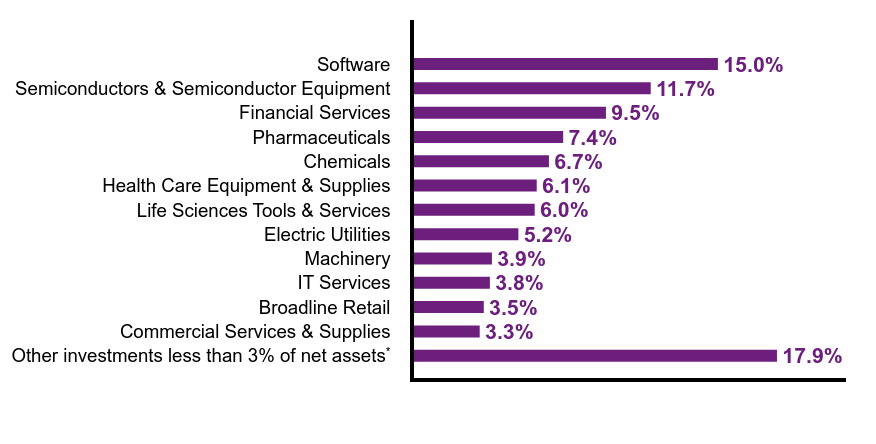

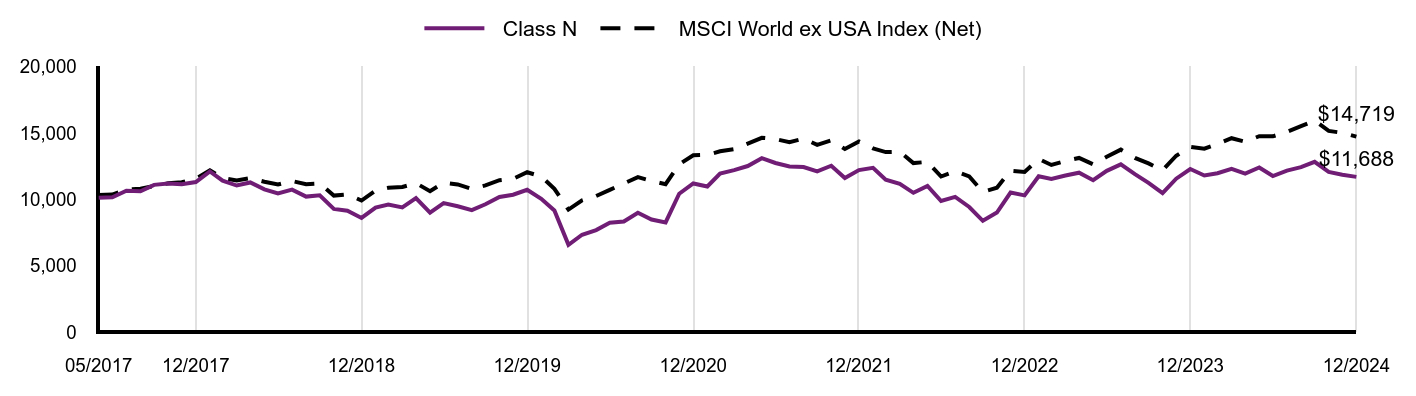

What did the Fund invest in? (% of Net Assets)

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 17.9% |

| Commercial Services & Supplies | 3.3% |

| Broadline Retail | 3.5% |

| IT Services | 3.8% |

| Machinery | 3.9% |

| Electric Utilities | 5.2% |

| Life Sciences Tools & Services | 6.0% |

| Health Care Equipment & Supplies | 6.1% |

| Chemicals | 6.7% |

| Pharmaceuticals | 7.4% |

| Financial Services | 9.5% |

| Semiconductors & Semiconductor Equipment | 11.7% |

| Software | 15.0% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

| NVIDIA Corp. | 5.9% |

| Microsoft Corp. | 5.5% |

| Mastercard, Inc., Class A | 5.2% |

| Eli Lilly & Co. | 3.8% |

| Ecolab, Inc. | 3.7% |

| eBay, Inc. | 3.5% |

| Thermo Fisher Scientific, Inc. | 3.4% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 3.2% |

| Roper Technologies, Inc. | 3.0% |

| Iberdrola SA | 2.9% |

There were no material fund changes during the period.

| Value | Value |

|---|

Other investments less than 3% of net assetsFootnote Reference* | 10.2% |

| Canada | 3.0% |

| Japan | 3.1% |

| Taiwan | 3.2% |

| Denmark | 3.4% |

| Netherlands | 3.7% |

| France | 3.7% |

| United Kingdom | 3.8% |

| Germany | 4.0% |

| United States | 61.9% |

| Footnote | Description |

Footnote* | Net of other assets less liabilities |

There were no changes in or disagreements with Accountants during the period.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit im.natixis.com/funddocuments.

Mirova Global Sustainable Equity Fund

Annual Shareholder Report

December 31, 2024

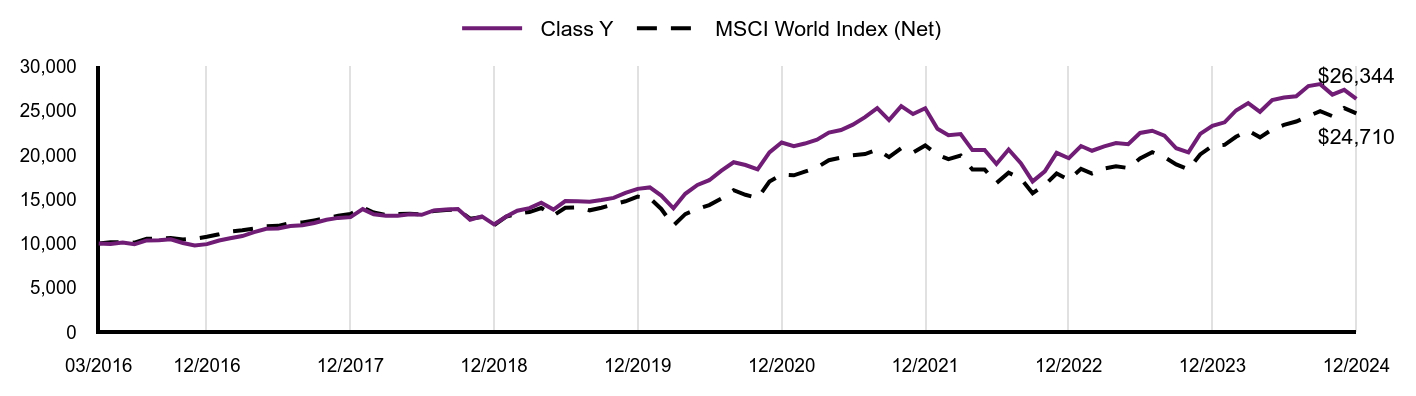

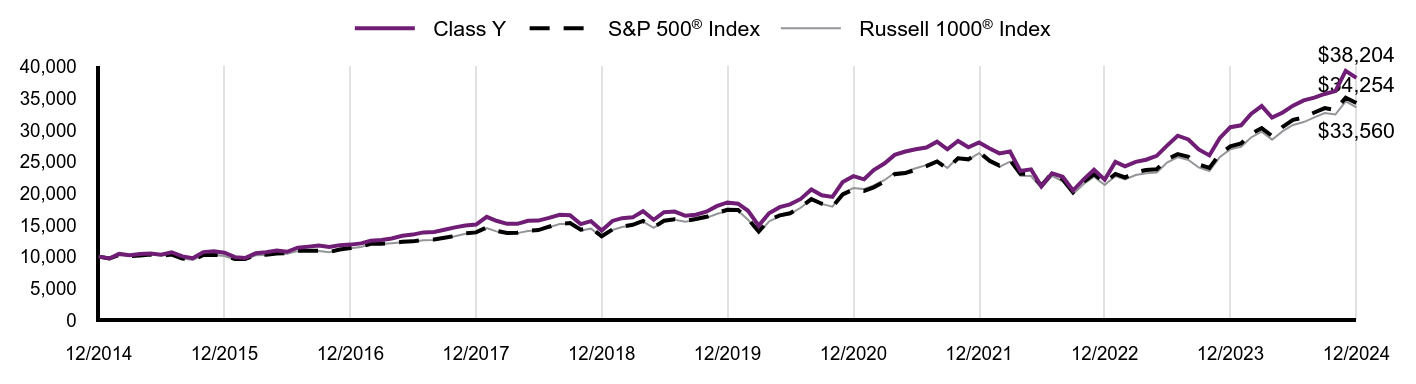

Mirova Global Sustainable Equity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

|---|

| Class Y | $101 | 0.95% |

|---|

| Footnote | Description |

Footnote† | Annualized for periods less than one year (if applicable). |

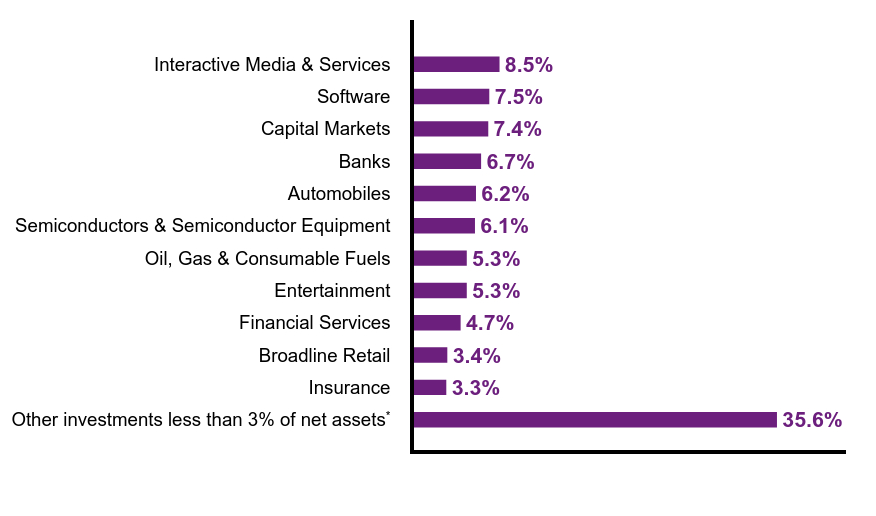

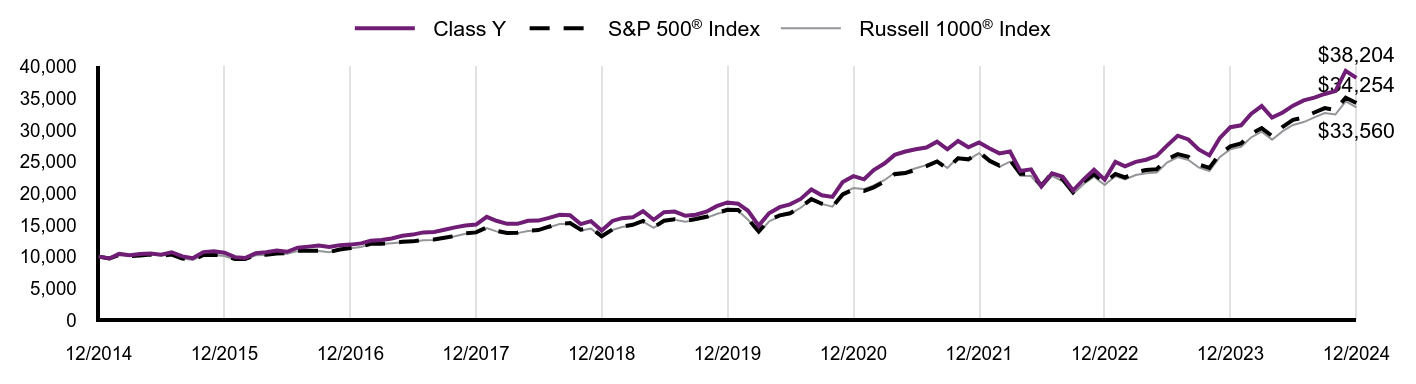

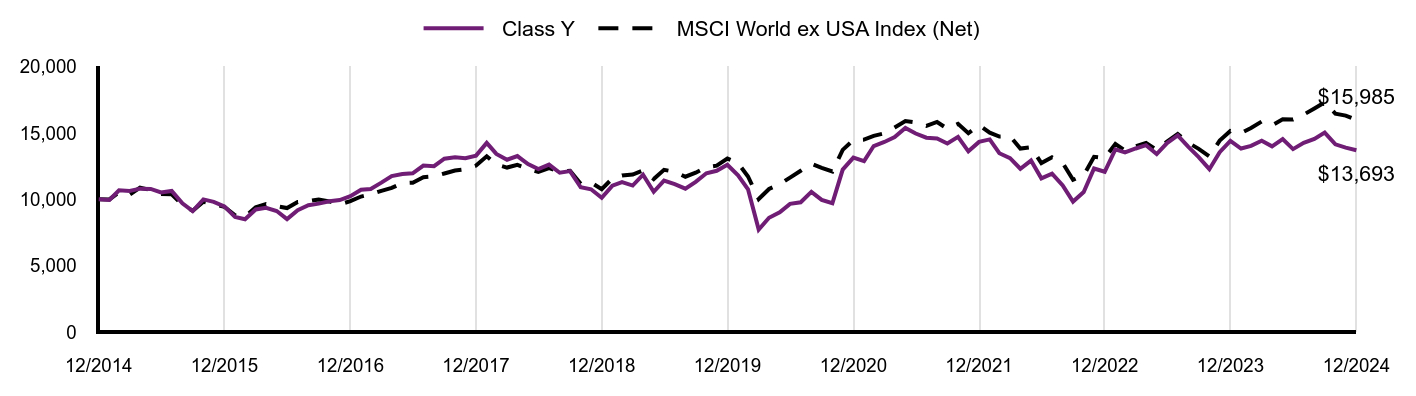

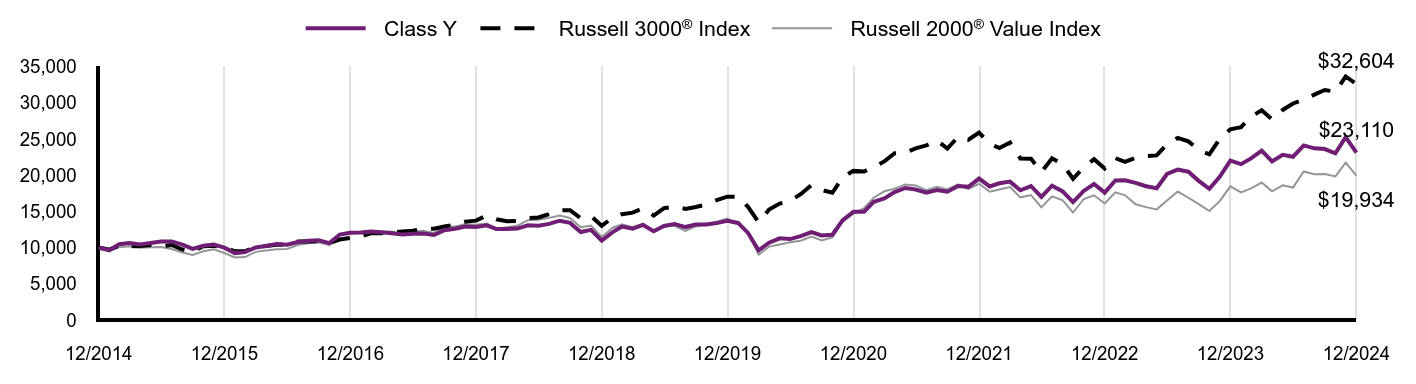

How did the fund perform last year and what affected its performance?

Explanation of Fund Performance

While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges.

Top Contributors to Performance

• Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance.

• Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed.

•Nvidia, Taiwan Semi and eBay were the largest contributors to performance.

Top Detractors from Performance

•An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted.

•As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted.

•Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance.

•Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall.

The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade.

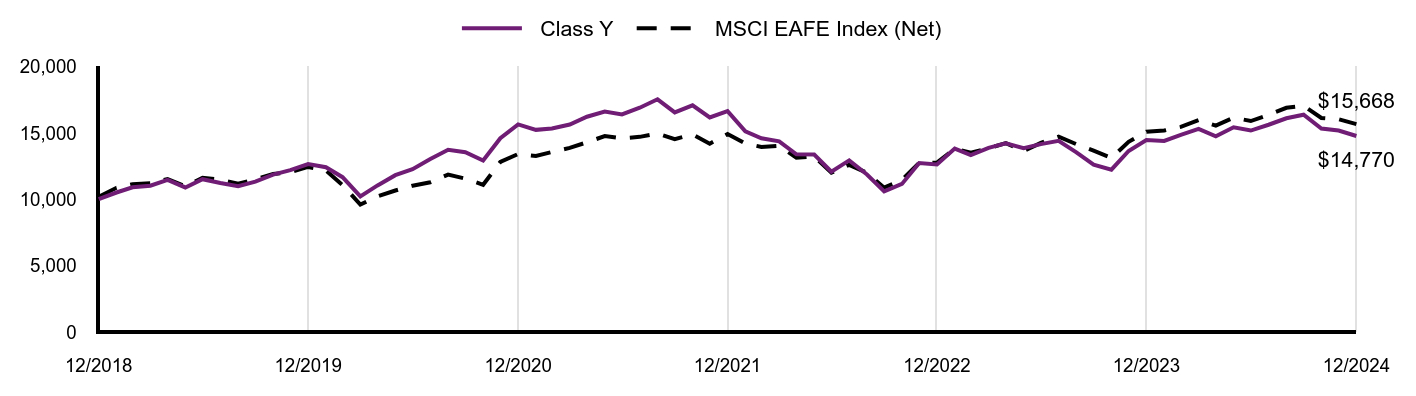

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested. The tables do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares. You cannot invest directly in an index.

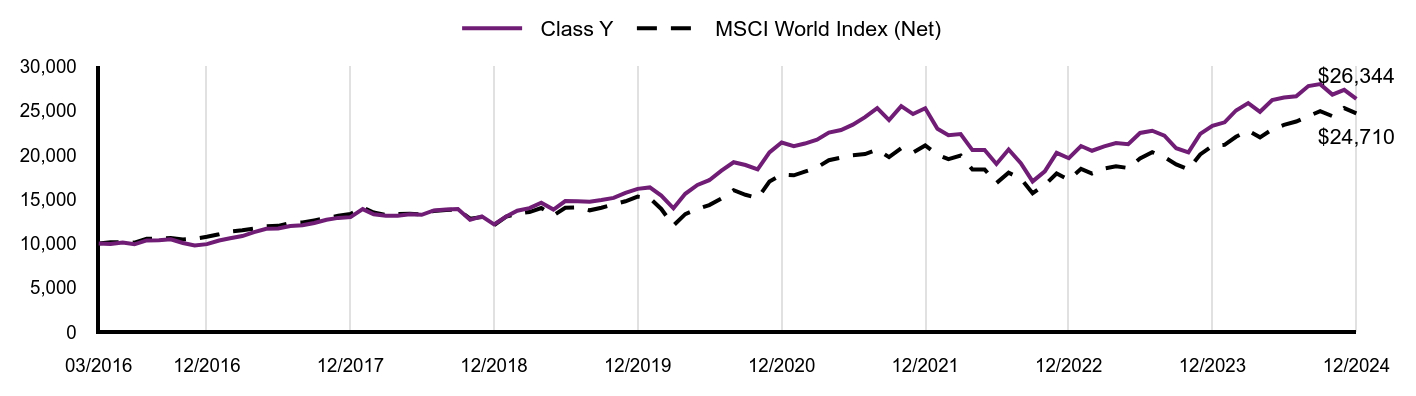

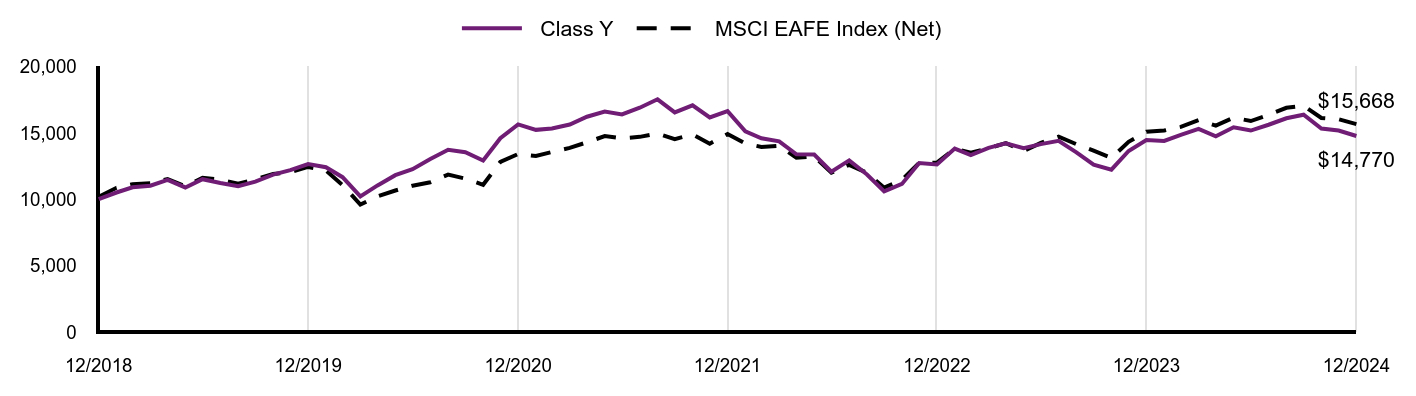

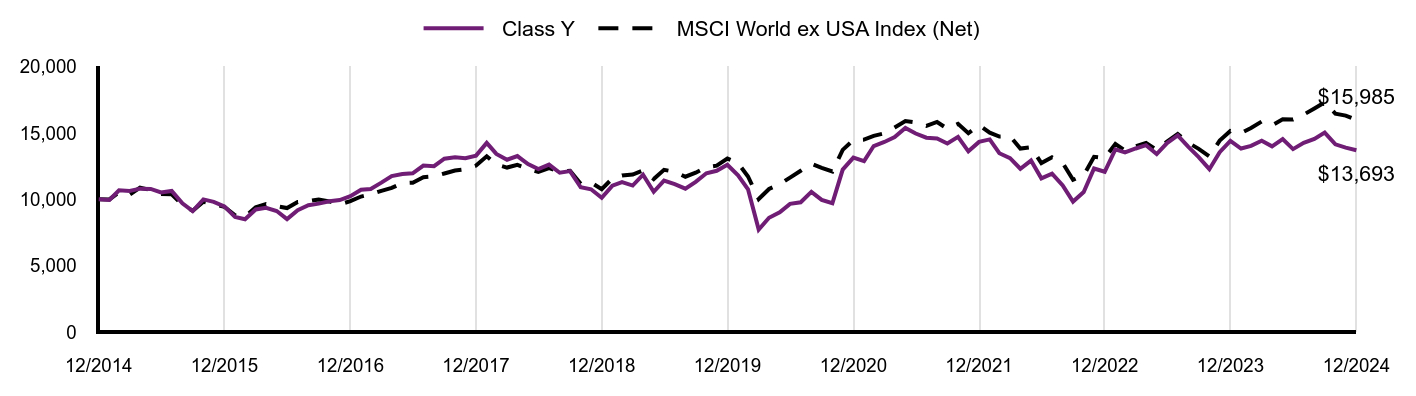

Total Return Based on a Hypothetical $10,000 Investment

| Class Y | MSCI World Index (Net) |

|---|

| 03/2016 | $10,000 | $10,000 |

|---|

| 04/2016 | $9,940 | $10,148 |

|---|

| 05/2016 | $10,120 | $10,160 |

|---|

| 06/2016 | $9,910 | $10,099 |

|---|

| 07/2016 | $10,350 | $10,534 |

|---|

| 08/2016 | $10,370 | $10,570 |

|---|

| 09/2016 | $10,470 | $10,634 |

|---|

| 10/2016 | $10,060 | $10,454 |

|---|

| 11/2016 | $9,790 | $10,533 |

|---|

| 12/2016 | $9,930 | $10,761 |

|---|

| 01/2017 | $10,341 | $11,055 |

|---|

| 02/2017 | $10,591 | $11,365 |

|---|

| 03/2017 | $10,842 | $11,504 |

|---|

| 04/2017 | $11,283 | $11,683 |

|---|

| 05/2017 | $11,673 | $11,941 |

|---|

| 06/2017 | $11,693 | $11,996 |

|---|

| 07/2017 | $11,984 | $12,331 |

|---|

| 08/2017 | $12,064 | $12,378 |

|---|

| 09/2017 | $12,325 | $12,617 |

|---|

| 10/2017 | $12,685 | $12,879 |

|---|

| 11/2017 | $12,896 | $13,129 |

|---|

| 12/2017 | $12,983 | $13,340 |

|---|

| 01/2018 | $13,885 | $14,093 |

|---|

| 02/2018 | $13,297 | $13,501 |

|---|

| 03/2018 | $13,145 | $13,212 |

|---|

| 04/2018 | $13,144 | $13,338 |

|---|

| 05/2018 | $13,307 | $13,355 |

|---|

| 06/2018 | $13,246 | $13,283 |

|---|

| 07/2018 | $13,745 | $13,683 |

|---|

| 08/2018 | $13,847 | $13,791 |

|---|

| 09/2018 | $13,909 | $13,851 |

|---|

| 10/2018 | $12,675 | $12,813 |

|---|

| 11/2018 | $13,072 | $13,000 |

|---|

| 12/2018 | $12,163 | $12,084 |

|---|

| 01/2019 | $13,052 | $13,039 |

|---|

| 02/2019 | $13,708 | $13,387 |

|---|

| 03/2019 | $14,005 | $13,556 |

|---|

| 04/2019 | $14,616 | $14,013 |

|---|

| 05/2019 | $13,836 | $13,182 |

|---|

| 06/2019 | $14,797 | $14,045 |

|---|

| 07/2019 | $14,776 | $14,087 |

|---|

| 08/2019 | $14,712 | $13,752 |

|---|

| 09/2019 | $14,915 | $14,042 |

|---|

| 10/2019 | $15,160 | $14,426 |

|---|

| 11/2019 | $15,715 | $14,778 |

|---|

| 12/2019 | $16,176 | $15,299 |

|---|

| 01/2020 | $16,338 | $15,130 |

|---|

| 02/2020 | $15,421 | $13,908 |

|---|

| 03/2020 | $13,985 | $12,030 |

|---|

| 04/2020 | $15,616 | $13,319 |

|---|

| 05/2020 | $16,614 | $13,898 |

|---|

| 06/2020 | $17,156 | $14,342 |

|---|

| 07/2020 | $18,230 | $15,101 |

|---|

| 08/2020 | $19,184 | $16,025 |

|---|

| 09/2020 | $18,870 | $15,508 |

|---|

| 10/2020 | $18,371 | $15,131 |

|---|

| 11/2020 | $20,301 | $16,996 |

|---|

| 12/2020 | $21,420 | $17,785 |

|---|

| 01/2021 | $21,007 | $17,705 |

|---|

| 02/2021 | $21,300 | $18,115 |

|---|

| 03/2021 | $21,735 | $18,598 |

|---|

| 04/2021 | $22,539 | $19,412 |

|---|

| 05/2021 | $22,825 | $19,714 |

|---|

| 06/2021 | $23,430 | $19,973 |

|---|

| 07/2021 | $24,289 | $20,111 |

|---|

| 08/2021 | $25,313 | $20,614 |

|---|

| 09/2021 | $23,948 | $19,763 |

|---|

| 10/2021 | $25,534 | $20,772 |

|---|

| 11/2021 | $24,631 | $20,271 |

|---|

| 12/2021 | $25,288 | $21,082 |

|---|

| 01/2022 | $22,968 | $20,047 |

|---|

| 02/2022 | $22,235 | $19,529 |

|---|

| 03/2022 | $22,369 | $19,952 |

|---|

| 04/2022 | $20,562 | $18,355 |

|---|

| 05/2022 | $20,562 | $18,377 |

|---|

| 06/2022 | $18,989 | $16,828 |

|---|

| 07/2022 | $20,626 | $18,003 |

|---|

| 08/2022 | $19,090 | $17,340 |

|---|

| 09/2022 | $17,021 | $15,680 |

|---|

| 10/2022 | $18,163 | $16,626 |

|---|

| 11/2022 | $20,245 | $17,916 |

|---|

| 12/2022 | $19,641 | $17,211 |

|---|

| 01/2023 | $21,022 | $18,444 |

|---|

| 02/2023 | $20,485 | $17,916 |

|---|

| 03/2023 | $20,971 | $18,468 |

|---|

| 04/2023 | $21,355 | $18,734 |

|---|

| 05/2023 | $21,227 | $18,533 |

|---|

| 06/2023 | $22,494 | $19,609 |

|---|

| 07/2023 | $22,750 | $20,327 |

|---|

| 08/2023 | $22,187 | $19,759 |

|---|

| 09/2023 | $20,766 | $18,942 |

|---|

| 10/2023 | $20,306 | $18,372 |

|---|

| 11/2023 | $22,391 | $20,068 |

|---|

| 12/2023 | $23,300 | $21,032 |

|---|

| 01/2024 | $23,699 | $21,155 |

|---|

| 02/2024 | $25,037 | $22,063 |

|---|

| 03/2024 | $25,873 | $22,756 |

|---|

| 04/2024 | $24,890 | $22,005 |

|---|

| 05/2024 | $26,215 | $22,899 |

|---|

| 06/2024 | $26,511 | $23,409 |

|---|

| 07/2024 | $26,640 | $23,786 |

|---|

| 08/2024 | $27,798 | $24,390 |

|---|

| 09/2024 | $28,017 | $24,957 |

|---|

| 10/2024 | $26,833 | $24,397 |

|---|

| 11/2024 | $27,373 | $25,309 |

|---|

| 12/2024 | $26,344 | $24,710 |

|---|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance, visit im.natixis.com/en-us/products/mutual-funds/price-and-performance.

Average Annual Total Returns (%)

| AATR | 1 Year | 5 Years | Since Inception 3/31/16 |

|---|

| Class Y | 13.06% | 10.25% | 11.70% |

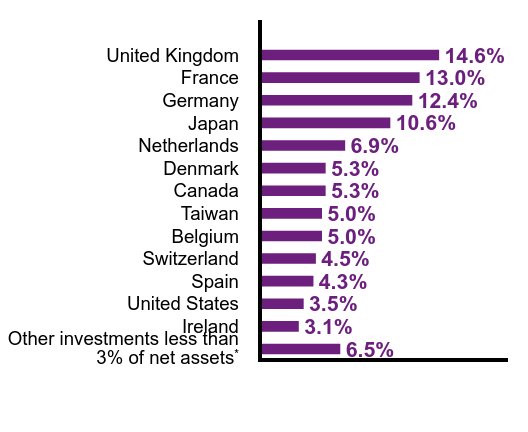

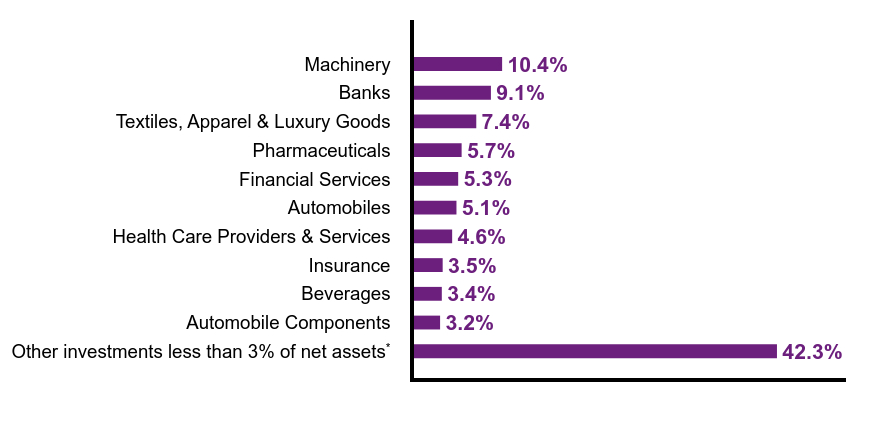

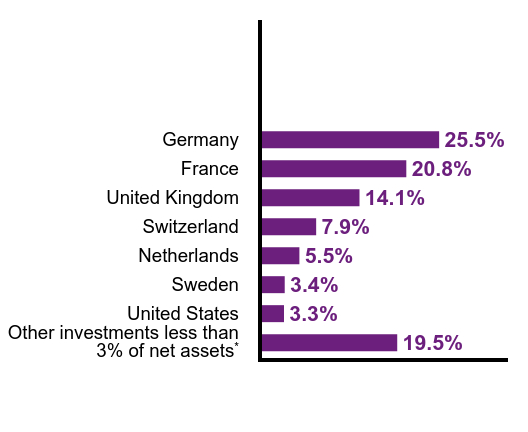

|---|