|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-4325 |

| |

| FIRST INVESTORS LIFE SERIES FUNDS |

| (Exact name of registrant as specified in charter) |

| |

| 110 Wall Street |

| New York, NY 10005 |

| (Address of principal executive offices) (Zip code) |

| |

| Joseph I. Benedek |

| First Investors Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| 1-732-855-2712 |

| (Name and address of agent for service) |

| |

| REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: |

| 1-212-858-8000 |

| |

| DATE OF FISCAL YEAR END: DECEMBER 31, 2008 |

| |

| DATE OF REPORTING PERIOD: JUNE 30, 2008 |

| |

| Item 1. | Reports to Stockholders |

| | |

| | The Semi-Annual Report to Stockholders follows |

FOREWORD

This report is for the information of the shareholders of the Trust. It is the Trust’s practice to mail only one copy of its annual and semi-annual reports to all family members who reside in the same household. Additional copies of the reports will be mailed if requested by any shareholder in writing or by calling 800-423-4026. The Trust will ensure that separate reports are sent to any shareholder who subsequently changes his or her mailing address.

The views expressed in the Market Overview letter reflect those views of the Director of Equities and Director of Fixed Income of First Investors Management Company, Inc. through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is to guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Fund, including information about its Trustees.

Equity & Bond Markets Overview

FIRST INVESTORS LIFE SERIES FUNDS

Dear Investor:

The Economy

The financial markets continued to be extremely volatile during the past six months. The markets had to contend with ongoing concerns about the health of the financial system, a weak economy, and fear of inflation.

Subprime mortgage exposure at major financial institutions severely reduced liquidity in the markets, particularly in the first quarter. Markets had big swings, trading on supply and demand, instead of fundamentals. At times, certain markets stopped functioning, while others operated under extreme stress. Events reached crisis levels in March when the Federal Reserve (the “Fed”) bailed out Bear Stearns, a major investment bank. That action, combined with substantial interest rate reductions and additional extraordinary measures by the Fed, restored some stability to the markets. Nonetheless, continued write-downs by financial institutions during the second quarter dashed investors’ hopes for a quick return to normalcy and made clear that repair of the financial system would be a prolonged process.

Economic growth during the review period, although positive, was very weak. Facing falling home values, rising food and energy costs, and tighter financial conditions, consumers reduced spending. The rebate checks from the government’s stimulus program helped prop up second quarter growth, but a rise in the unemployment rate to a cycle high of 5.5% indicated continued weakness in the economy. The lone bright spot was the export sector, due to relatively strong overseas growth. But strength in foreign economies was accompanied by surging commodity costs, particularly oil, which caused the Consumer Price Index to accelerate to an annual rate of 5.0% .

The Fed was very active during the first quarter in response to financial system stress and a slowing economy, lowering the benchmark federal funds rate from 4.25% to 2.25% . In the second quarter the Fed lowered the federal funds rate an additional 0.25%, but then at its June meeting decided to keep rates unchanged — despite continued weak economic growth — because of increased worries about inflation. The Fed’s signal that it would be less likely to lower interest rates, as well as investors’ heightened inflation concerns, added additional uncertainty and stress to the financial markets.

The Equity Market

Amid the very challenging economic climate, the stock market struggled during the first half of 2008. After trending downward for much of the first quarter, stocks rebounded sharply — and briefly —early in the second quarter, before reversing course and moving lower through the end of the reporting period. Stocks were dragged down by worries over weakening economic growth, rising rates of inflation and unemployment and ongoing difficulties in the housing market and financial sector. The problems were broad-based, as most indexes for market-cap sectors and industry sectors were down for the period. Among market-cap sectors, mid-cap stocks posted the least negative returns declining 3.9%, followed by small caps and large caps, which were down 9.4% and 11.9%, respectively.

The Bond Market

Bond market returns in the aggregate were slightly positive, but returns varied substantially by sector with higher quality investments generally providing the best performance. The U.S. Treasury sector led the bond market with returns of 2.2% as it benefited from a decline in

Equity & Bond Markets Overview (continued)

FIRST INVESTORS LIFE SERIES FUNDS

benchmark interest rates. High quality mortgage-backed bonds had relatively good performance, returning 1.9%. Investment grade corporate bonds returned –0.8% as the slowing economy and concern about financial issuers hurt performance. Reflecting the weak economic conditions, high yield corporate bonds lost 1.3% during the review period, although default rates remained low. The usually staid municipal bond market also was very volatile. Multiple downgrades of most of the municipal bond insurance companies, the failure of the auction rate preferred market, and a decrease in market liquidity negatively affected the market, which returned –0.1%.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Sincerely,

Edwin D. Miska

Director of Equities

First Investors Management Company, Inc.

Clark D. Wagner

Director of Fixed Income

First Investors Management Company, Inc.

August 1, 2008

The Funds are only available through the purchase of variable life insurance policies and variable annuity contracts issued by First Investors Life Insurance Company. The reports do not reflect the additional expenses and charges that are applicable to variable life insurance policies and variable annuity contracts.

This Market Overview is not part of the Funds’ financial report and is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus. The Market Overview reflects conditions through the end of the period as stated on the cover. Market conditions are subject to change. This Market Overview may not be relied upon as investment advice or an indication of current or future trading intent on behalf of any Fund.

There are a variety of risks associated with investing in variable life and annuity subaccounts. For stock subaccounts, the risks include market risk (the risk that the entire stock market will decline because of an event such as a deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock subaccounts, such as small-cap, global and international funds. For bond subaccounts, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, longer-term bonds fluctuate more than shorter-term bonds in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. You should consult your prospectus for a pr ecise explanation of the risks associated with your subaccounts.

Understanding Your Fund’s Expenses

FIRST INVESTORS LIFE SERIES FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, January 1, 2008, and held for the entire six-month period ended June 30, 2008. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expense Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid during the period.

To estimate the expenses you paid on your account during this period simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expense Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical expense example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses

BLUE CHIP FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $878.12 | $3.88 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.73 | $4.17 |

| |

|

| * | Expenses are equal to the annualized expense ratio of .83%, multiplied by the average account |

| | value over the period, multiplied by 182/366 (to reflect the one-half year period). |

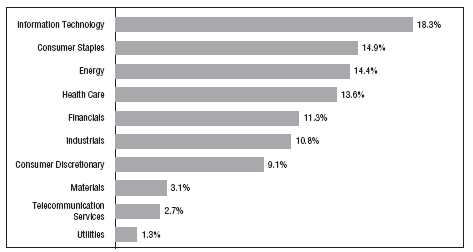

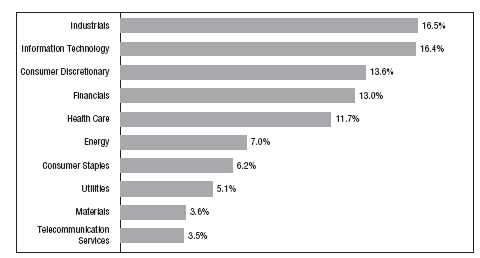

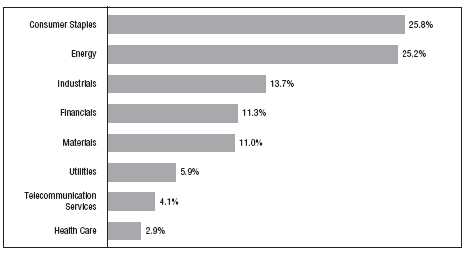

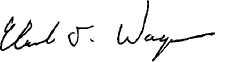

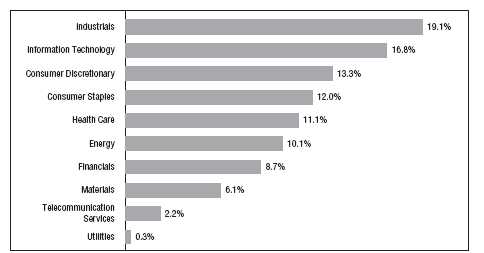

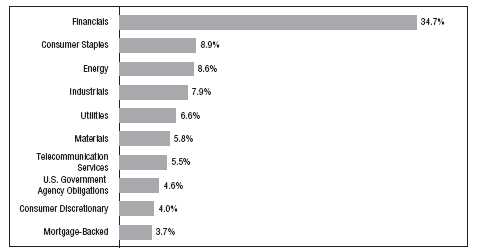

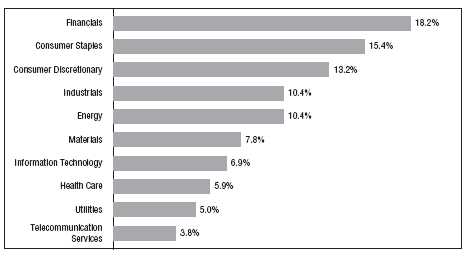

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

BLUE CHIP FUND

June 30, 2008

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | COMMON STOCKS—99.5% | | |

| | | | Consumer Discretionary—9.1% | | |

| 13,300 | | | Best Buy Company, Inc. | | $526,680 |

| 14,900 | | | Carnival Corporation | | 491,104 |

| 29,700 | | | CBS Corporation – Class “B” | | 578,853 |

| 20,200 | | | Clear Channel Communications, Inc. | | 711,040 |

| 16,971 | | | Comcast Corporation – Class “A” | | 321,940 |

| 27,150 | | | Comcast Corporation – Special Class “A” | | 509,334 |

| 20,800 | | | H&R Block, Inc. | | 445,120 |

| 49,900 | | | Home Depot, Inc. | | 1,168,658 |

| 11,400 | | * | Kohl’s Corporation | | 456,456 |

| 40,900 | | | Lowe’s Companies, Inc. | | 848,675 |

| 20,200 | | | McDonald’s Corporation | | 1,135,644 |

| 53,600 | | | News Corporation – Class “A” | | 806,144 |

| 9,500 | | | NIKE, Inc. – Class “B” | | 566,295 |

| 20,600 | | | Staples, Inc. | | 489,250 |

| 14,800 | | | Target Corporation | | 688,052 |

| 89,700 | | | Time Warner, Inc. | | 1,327,560 |

| 22,400 | | * | Viacom, Inc. – Class “B” | | 684,096 |

| 45,900 | | | Walt Disney Company | | 1,432,080 |

| |

| | | | | | 13,186,981 |

| |

| | | | Consumer Staples—14.9% | | |

| 26,100 | | | Altria Group, Inc. | | 536,616 |

| 25,200 | | | Anheuser-Busch Companies, Inc. | | 1,565,424 |

| 28,400 | | | Avon Products, Inc. | | 1,022,968 |

| 46,100 | | | Coca-Cola Company | | 2,396,278 |

| 11,200 | | | Colgate-Palmolive Company | | 773,920 |

| 7,900 | | | Costco Wholesale Corporation | | 554,106 |

| 29,400 | | | CVS Caremark Corporation | | 1,163,358 |

| 12,100 | | | General Mills, Inc. | | 735,317 |

| 10,900 | | | Hershey Company | | 357,302 |

| 19,900 | | | Kimberly-Clark Corporation | | 1,189,622 |

| 39,861 | | | Kraft Foods, Inc. – Class “A” | | 1,134,045 |

| 35,000 | | | PepsiCo, Inc. | | 2,225,650 |

| 30,300 | | | Philip Morris International, Inc. | | 1,496,518 |

| 43,335 | | | Procter & Gamble Company | | 2,635,201 |

| 34,800 | | | Walgreen Company | | 1,131,348 |

| 46,000 | | | Wal-Mart Stores, Inc. | | 2,585,200 |

| |

| | | | | | 21,502,873 |

Portfolio of Investments (continued)

BLUE CHIP FUND

June 30, 2008

| | | | | | |

| |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Energy—14.4% | | |

| 12,700 | | | BP PLC (ADR) | | $ 883,539 |

| 39,200 | | | Chevron Corporation | | 3,885,896 |

| 25,771 | | | ConocoPhillips | | 2,432,525 |

| 66,900 | | | ExxonMobil Corporation | | 5,895,897 |

| 27,400 | | | Halliburton Company | | 1,454,118 |

| 5,500 | | | Hess Corporation | | 694,045 |

| 8,500 | | | Marathon Oil Corporation | | 440,895 |

| 24,100 | | | Schlumberger, Ltd. | | 2,589,063 |

| 29,550 | | | Spectra Energy Corporation | | 849,267 |

| 8,724 | | | Transocean, Inc. | | 1,329,450 |

| 10,800 | | | Valero Energy Corporation | | 444,744 |

| |

| | | | | | 20,899,439 |

| |

| | | | Financials—11.3% | | |

| 12,200 | | | ACE, Ltd. | | 672,098 |

| 15,600 | | | Allstate Corporation | | 711,204 |

| 32,500 | | | American Express Company | | 1,224,275 |

| 31,900 | | | American International Group, Inc. | | 844,074 |

| 43,214 | | | Bank of America Corporation | | 1,031,518 |

| 47,305 | | | Bank of New York Mellon Corporation | | 1,789,548 |

| 250 | | * | Berkshire Hathaway, Inc. – Class “B” | | 1,003,000 |

| 14,500 | | | Capital One Financial Corporation | | 551,145 |

| 15,500 | | | Chubb Corporation | | 759,655 |

| 51,400 | | | Citigroup, Inc. | | 861,464 |

| 56,032 | | | JPMorgan Chase & Company | | 1,922,458 |

| 17,700 | | | Marsh & McLennan Companies, Inc. | | 469,935 |

| 17,400 | | | Merrill Lynch & Company, Inc. | | 551,754 |

| 21,000 | | | Morgan Stanley | | 757,470 |

| 6,400 | | | PNC Financial Services Group, Inc. | | 365,440 |

| 7,500 | | | SunTrust Banks, Inc. | | 271,650 |

| 15,700 | | | Travelers Companies, Inc. | | 681,380 |

| 20,500 | | | U.S. Bancorp | | 571,745 |

| 23,600 | | | Wachovia Corporation | | 366,508 |

| 37,600 | | | Wells Fargo & Company | | 893,000 |

| |

| | | | | | 16,299,321 |

| |

| | | | Health Care—13.6% | | |

| 29,900 | | | Abbott Laboratories | | 1,583,803 |

| 17,800 | | | Aetna, Inc. | | 721,434 |

| 24,900 | | * | Amgen, Inc. | | 1,174,284 |

| 8,700 | | | Baxter International, Inc. | | 556,278 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Health Care (continued) | | |

| 46,200 | | | Bristol-Myers Squibb Company | | $948,486 |

| 15,025 | | | Covidien, Ltd. | | 719,547 |

| 8,300 | | * | Genentech, Inc. | | 629,970 |

| 59,200 | | | Johnson & Johnson | | 3,808,928 |

| 13,500 | | | McKesson Corporation | | 754,785 |

| 29,300 | | | Medtronic, Inc. | | 1,516,275 |

| 29,200 | | | Merck & Company, Inc. | | 1,100,548 |

| 23,700 | | | Novartis AG (ADR) | | 1,304,448 |

| 125,440 | | | Pfizer, Inc. | | 2,191,437 |

| 11,300 | | * | St. Jude Medical, Inc. | | 461,944 |

| 13,200 | | | Teva Pharmaceutical Industries, Ltd. (ADR) | | 604,560 |

| 19,400 | | | UnitedHealth Group, Inc. | | 509,250 |

| 21,900 | | | Wyeth | | 1,050,324 |

| |

| | | | | | 19,636,301 |

| |

| | | | Industrials—10.8% | | |

| 18,500 | | | 3M Company | | 1,287,415 |

| 6,800 | | | Boeing Company | | 446,896 |

| 4,900 | | | Caterpillar, Inc. | | 361,718 |

| 12,000 | | | Dover Corporation | | 580,440 |

| 5,700 | | | Eaton Corporation | | 484,329 |

| 22,700 | | | Emerson Electric Company | | 1,122,515 |

| 145,500 | | | General Electric Company | | 3,883,395 |

| 16,500 | | | Honeywell International, Inc. | | 829,620 |

| 14,800 | | | Illinois Tool Works, Inc. | | 703,148 |

| 12,200 | | | ITT Corporation | | 772,626 |

| 10,900 | | | Lockheed Martin Corporation | | 1,075,394 |

| 10,000 | | | Northrop Grumman Corporation | | 669,000 |

| 17,525 | | | Tyco International, Ltd. | | 701,701 |

| 11,200 | | | United Parcel Service, Inc. – Class “B” | | 688,464 |

| 33,700 | | | United Technologies Corporation | | 2,079,290 |

| |

| | | | | | 15,685,951 |

| |

| | | | Information Technology—18.3% | | |

| 11,600 | | | Accenture, Ltd. – Class “A” | | 472,352 |

| 11,500 | | | Analog Devices, Inc. | | 365,355 |

| 5,600 | | * | Apple, Inc. | | 937,664 |

| 23,400 | | | Applied Materials, Inc. | | 446,706 |

| 10,200 | | | Automatic Data Processing, Inc. | | 427,380 |

| 84,800 | | * | Cisco Systems, Inc. | | 1,972,448 |

| 29,000 | | | Corning, Inc. | | 668,450 |

Portfolio of Investments (continued)

BLUE CHIP FUND

June 30, 2008

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| Shares | | | Security | | Value |

| |

| | | | Information Technology (continued) | | |

| 60,800 | | * | Dell, Inc. | | $1,330,304 |

| 13,500 | | * | eBay, Inc. | | 368,955 |

| 74,300 | | * | EMC Corporation | | 1,091,467 |

| 43,000 | | | Hewlett-Packard Company | | 1,901,030 |

| 80,600 | | | Intel Corporation | | 1,731,288 |

| 22,900 | | | International Business Machines Corporation | | 2,714,337 |

| 180,600 | | | Microsoft Corporation | | 4,968,306 |

| 44,600 | | | Nokia Corporation – Class “A” (ADR) | | 1,092,700 |

| 59,700 | | * | Oracle Corporation | | 1,253,700 |

| 19,200 | | | QUALCOMM, Inc. | | 851,904 |

| 31,900 | | * | Symantec Corporation | | 617,265 |

| 35,300 | | | Texas Instruments, Inc. | | 994,048 |

| 16,025 | | | Tyco Electronics, Ltd. | | 574,016 |

| 33,800 | | | Western Union Company | | 835,536 |

| 28,900 | | | Xerox Corporation | | 391,884 |

| 21,900 | | * | Yahoo!, Inc. | | 452,454 |

| |

| | | | | | 26,459,549 |

| |

| | | | Materials—3.1% | | |

| 19,400 | | | Alcoa, Inc. | | 691,028 |

| 32,100 | | | Dow Chemical Company | | 1,120,611 |

| 24,800 | | | DuPont (E.I.) de Nemours & Company | | 1,063,672 |

| 17,800 | | | International Paper Company | | 414,740 |

| 6,700 | | | Newmont Mining Corporation | | 349,472 |

| 10,000 | | | PPG Industries, Inc. | | 573,700 |

| 6,400 | | | Weyerhaeuser Company | | 327,296 |

| |

| | | | | | 4,540,519 |

| |

| | | | Telecommunication Services—2.7% | | |

| 61,000 | | | AT&T, Inc. | | 2,055,090 |

| 51,000 | | | Verizon Communications, Inc. | | 1,805,400 |

| |

| | | | | | 3,860,490 |

| |

| | | | Utilities—1.3% | | |

| 9,100 | | | American Electric Power Company, Inc. | | 366,093 |

| 58,300 | | | Duke Energy Corporation | | 1,013,254 |

| 7,600 | | | FPL Group, Inc. | | 498,408 |

| |

| | | | | | 1,877,755 |

| |

| Total Value of Common Stocks (cost $107,415,267) | | 143,949,179 |

| | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| Principal | | | | | | | | |

| Amount | | | Security | | | | | Value |

| |

| | | | SHORT-TERM INVESTMENTS—.6% | | | | | |

| | | | Money Market Fund | | | | | |

| $825 | M | | First Investors Cash Reserve Fund, 2.24% | | | | | |

| | | | (cost $825,000)** | | | | | $ 825,000 |

| |

| Total Value of Investments (cost $108,240,267) | 100.1 | % | | | 144,774,179 |

| Excess of Liabilities Over Other Assets | (.1) | | | | (120,428) |

| |

| Net Assets | | | | 100.0 | % | | | $144,653,751 |

| |

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield |

| at June 30, 2008 (see Note 3). |

| |

|

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| |

| See notes to financial statements | 9 |

Fund Expenses

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,012.23 | $3.50 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.38 | $3.52 |

| |

| * | Expenses are equal to the annualized expense ratio of .70%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

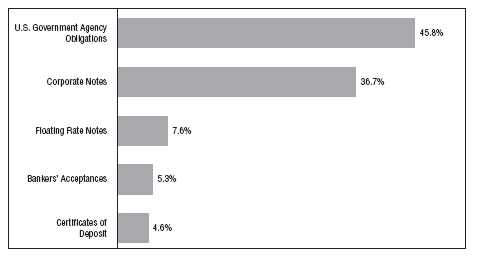

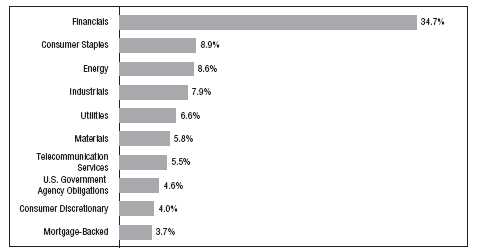

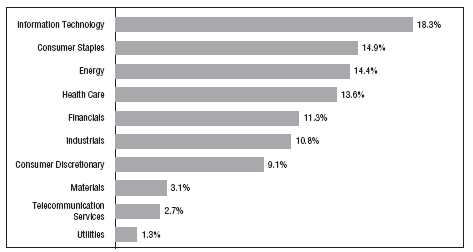

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

CASH MANAGEMENT FUND

June 30, 2008

| | | | | | |

| |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Principal | | | | Interest | | |

| Amount | | | Security | Rate | * | Value |

| |

| | | | U.S. GOVERNMENT AGENCY | | | |

| | | | OBLIGATIONS—45.7% | | | |

| $ 500 | M | | Fannie Mae, 8/22/08 | 2.25 | % | $498,374 |

| 250 | M | | Federal Farm Credit Bank, 8/25/08 | 2.75 | | 250,611 |

| | | | Federal Home Loan Bank: | | | |

| 1,300 | M | | 7/2/08 | 2.09 | | 1,299,924 |

| 500 | M | | 7/16/08 | 2.20 | | 499,541 |

| 250 | M | | 7/18/08 | 2.65 | | 250,215 |

| 400 | M | | 7/23/08 | 2.10 | | 399,485 |

| 400 | M | | 3/17/09 | 3.00 | | 399,374 |

| 400 | M | | 4/7/09 | 2.48 | | 400,000 |

| 230 | M | | 6/26/09 | 3.25 | | 230,000 |

| 300 | M | | 6/30/09 | 3.05 | | 300,000 |

| | | | Freddie Mac: | | | |

| 600 | M | | 8/11/08 | 2.19 | | 598,500 |

| 225 | M | | 10/17/08 | 2.68 | | 225,605 |

| 500 | M | | 1/14/09 | 3.54 | | 500,190 |

| 200 | M | | 7/3/09 | 3.20 | | 200,000 |

| |

| Total Value of U.S. Government Agency Obligations (cost $6,051,819) | | | 6,051,819 |

| |

| | | | CORPORATE NOTES—36.5% | | | |

| 250 | M | | Abbott Laboratories, 7/21/08 (a) | 1.98 | | 249,724 |

| 500 | M | | Brown-Forman Corp., 9/18/08 (a) | 2.39 | | 497,377 |

| 600 | M | | Coca Cola Co., 8/4/08 (a) | 2.09 | | 598,813 |

| 600 | M | | Dupont (E.I.) de Nemours & Co., 8/28/08 (a) | 2.17 | | 597,902 |

| 600 | M | | Hershey Co., 8/18/08 (a) | 2.20 | | 598,240 |

| 600 | M | | Kimberly Clark Worldwide, 7/7/08 (a) | 2.07 | | 599,793 |

| 500 | M | | Madison Gas & Electric Co., 7/15/08 | 2.20 | | 499,572 |

| 500 | M | | Pfizer, Inc., 7/25/08 (a) | 2.15 | | 499,283 |

| 250 | M | | Prudential Funding Corp., 7/22/08 | 2.20 | | 249,678 |

| 450 | M | | Toyota Motor Credit Corp., 8/6/08 | 2.60 | | 448,825 |

| |

| Total Value of Corporate Notes (cost $4,839,207) | | | 4,839,207 |

| |

| | | | FLOATING RATE NOTES—7.6% | | | |

| 100 | M | | Advanced Packaging Corp., 10/1/36 | | | |

| | | | (LOC; Fifth Third Bank) | 3.00 | | 100,000 |

| 250 | M | | Federal Home Loan Bank, 11/26/08 | 2.41 | | 249,962 |

| 300 | M | | General Electric Capital Corp., 4/30/09 | 3.00 | | 300,180 |

| 100 | M | | Genesys Medsports, LLC, 1/1/27 (LOC; Fifth Third Bank) | 3.00 | | 100,000 |

| 250 | M | | International Business Machines Corp., 9/8/08 (b) | 2.48 | | 249,964 |

| |

| Total Value of Floating Rate Notes (cost $1,000,106) | | | 1,000,106 |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

June 30, 2008

| | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Principal | | | | | | Interest | | |

| Amount | | | Security | | | Rate | * | Value |

| |

| | | | BANKERS’ ACCEPTANCES—5.3% | | | | | |

| | | | Bank of America, NA: | | | | | |

| $ 387 | M | | 7/10/08 | | | 2.48 | % | $ 386,759 |

| 321 | M | | 7/22/08 | | | 2.48 | | 320,533 |

| |

| Total Value of Bankers’ Acceptances (cost $707,292) | | | | | 707,292 |

| |

| | | | CERTIFICATES OF DEPOSIT—4.5% | | | | | |

| 600 | M | | Citibank NA, 9/3/08 (cost $601,895) | | | 2.71 | | 601,895 |

| |

| Total Value of Investments (cost $13,200,319)** | 99.6 | % | | | 13,200,319 |

| Other Assets, Less Liabilities | .4 | | | | 50,325 |

| |

| Net Assets | | | | 100.0 | % | | | $13,250,644 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on floating rate notes are adjusted periodically; the rates shown are the rates in effect |

| at June 30, 2008. |

| ** | Aggregate cost for federal income tax purposes is the same. |

| (a) | Security exempt from registration under Section 4(2) of the Securities Act of 1933 (see Note 5). |

| (b) | Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

| |

|

| Summary of Abbreviations: |

| LOC | Letters of Credit |

| |

| 12 | See notes to financial statements |

Fund Expenses

DISCOVERY FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $907.21 | $3.89 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.78 | $4.12 |

| |

|

| * | Expenses are equal to the annualized expense ratio of .82%, multiplied by the average account |

| | value over the period, multiplied by 182/366 (to reflect the one-half year period). |

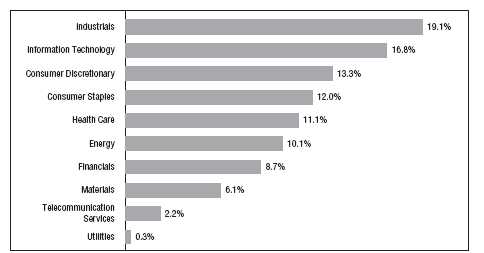

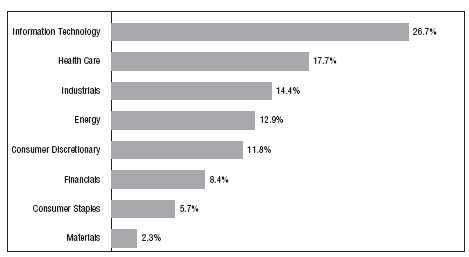

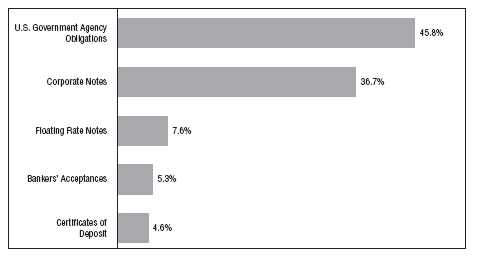

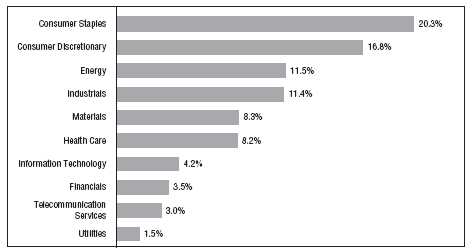

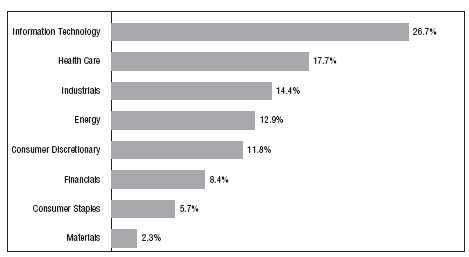

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

DISCOVERY FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | COMMON STOCKS—96.2% | | |

| | | | Consumer Discretionary—13.6% | | |

| 121,000 | | * | AnnTaylor Stores Corporation | | $2,899,160 |

| 161,000 | | | Callaway Golf Company | | 1,904,630 |

| 102,800 | | * | Goodyear Tire & Rubber Company | | 1,832,924 |

| 42,800 | | | Hillenbrand, Inc. | | 915,920 |

| 99,700 | | | Interactive Data Corporation | | 2,505,461 |

| 113,800 | | | Penske Automotive Group, Inc. | | 1,677,412 |

| 93,300 | | | PetSmart, Inc. | | 1,861,335 |

| 74,000 | | | Phillips Van-Heusen Corporation | | 2,709,880 |

| 157,600 | | | Regal Entertainment Group – Class “A” | | 2,408,128 |

| 63,400 | | | Tempur-Pedic International, Inc. | | 495,154 |

| |

| | | | | | 19,210,004 |

| |

| | | | Consumer Staples—6.2% | | |

| 37,875 | | | Church & Dwight Company, Inc. | | 2,134,256 |

| 79,300 | | | Flowers Foods, Inc. | | 2,247,362 |

| 69,200 | | | Hormel Foods Corporation | | 2,395,012 |

| 47,500 | | | J. M. Smucker Company | | 1,930,400 |

| |

| | | | | | 8,707,030 |

| |

| | | | Energy—7.0% | | |

| 66,300 | | * | Denbury Resources, Inc. | | 2,419,950 |

| 58,700 | | * | Plains Exploration & Production Company | | 4,283,339 |

| 29,600 | | * | Whiting Petroleum Corporation | | 3,139,968 |

| |

| | | | | | 9,843,257 |

| |

| | | | Financials—13.0% | | |

| 8,427 | | * | Alleghany Corporation | | 2,798,185 |

| 100,800 | | | American Financial Group, Inc. | | 2,696,400 |

| 406,200 | | | Anworth Mortgage Asset Corporation (REIT) | | 2,644,362 |

| 87,400 | | | Arthur J. Gallagher & Company | | 2,106,340 |

| 69,500 | | | FirstMerit Corporation | | 1,133,545 |

| 85,100 | | | Harleysville Group, Inc. | | 2,878,933 |

| 372,800 | | | MFA Mortgage Investments, Inc. (REIT) | | 2,430,656 |

| 61,500 | | | Wilmington Trust Corporation | | 1,626,060 |

| |

| | | | | | 18,314,481 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Health Care—11.6% | | |

| 63,800 | | * | Invitrogen Corporation | | $2,504,788 |

| 124,200 | | * | K-V Pharmaceutical Company – Class “A” | | 2,400,786 |

| 89,100 | | * | Lincare Holdings, Inc. | | 2,530,440 |

| 68,600 | | * | Magellan Health Services, Inc. | | 2,540,258 |

| 78,000 | | | PerkinElmer, Inc. | | 2,172,300 |

| 75,600 | | | STERIS Corporation | | 2,174,256 |

| 48,800 | | | West Pharmaceutical Services, Inc. | | 2,112,064 |

| |

| | | | | | 16,434,892 |

| |

| | | | Industrials—16.4% | | |

| 49,100 | | | Alexander & Baldwin, Inc. | | 2,236,505 |

| 22,500 | | * | Alliant Techsystems, Inc. | | 2,287,800 |

| 26,400 | | | Carlisle Companies, Inc. | | 765,600 |

| 55,000 | | | CLARCOR, Inc. | | 1,930,500 |

| 68,300 | | | Curtiss-Wright Corporation | | 3,055,742 |

| 64,500 | | | Deluxe Corporation | | 1,149,390 |

| 87,900 | | | Interface, Inc. – Class “A” | | 1,101,387 |

| 72,054 | | * | Kansas City Southern, Inc. | | 3,169,655 |

| 66,200 | | | Pentair, Inc. | | 2,318,324 |

| 59,000 | | | Robbins & Myers, Inc. | | 2,942,330 |

| 65,200 | | | Woodward Governor Company | | 2,325,032 |

| |

| | | | | | 23,282,265 |

| |

| | | | Information Technology—16.3% | | |

| 83,300 | | * | Avnet, Inc. | | 2,272,424 |

| 162,000 | | | AVX Corporation | | 1,832,220 |

| 50,200 | | * | Cabot Microelectronics Corporation | | 1,664,130 |

| 114,200 | | * | Checkpoint Systems, Inc. | | 2,384,496 |

| 219,700 | | * | Compuware Corporation | | 2,095,938 |

| 149,800 | | * | Convergys Corporation | | 2,226,028 |

| 122,100 | | * | Epicor Software Corporation | | 843,711 |

| 98,100 | | | Fair Isaac Corporation | | 2,037,537 |

| 105,400 | | * | Sybase, Inc. | | 3,100,868 |

| 69,975 | | * | Varian Semiconductor Equipment Associates, Inc. | | 2,436,530 |

| 95,100 | | * | Verigy, Ltd. | | 2,159,721 |

| |

| | | | | | 23,053,603 |

Portfolio of Investments (continued)

DISCOVERY FUND

June 30, 2008

| | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Shares or | | | | | | | | |

| Principal | | | | | | | | |

| Amount | | | Security | | | | | Value |

| |

| | | | Materials—3.6% | | | | | |

| 56,800 | | | AptarGroup, Inc. | | | | | $ 2,382,760 |

| 31,200 | | | H.B. Fuller Company | | | | | 700,128 |

| 34,100 | | | Innospec, Inc. | | | | | 641,762 |

| 38,900 | | * | RTI International Metals, Inc. | | | | | 1,385,618 |

| |

| | | | | | | | | 5,110,268 |

| |

| | | | Telecommunication Services—3.4% | | | | | |

| 174,400 | | * | Premiere Global Services, Inc. | | | | | 2,542,752 |

| 52,775 | | | Telephone & Data Systems, Inc. – Special Shares | | | | 2,327,378 |

| |

| | | | | | | | | 4,870,130 |

| |

| | | | Utilities—5.1% | | | | | |

| 134,100 | | | CMS Energy Corporation | | | | | 1,998,090 |

| 221,500 | | * | Dynegy, Inc. – Class “A” | | | | | 1,893,825 |

| 45,100 | | | Energy East Corporation | | | | | 1,114,872 |

| 98,000 | | | Portland General Electric Company | | | | | 2,206,960 |

| |

| | | | | | | | | 7,213,747 |

| |

| Total Value of Common Stocks (cost $127,291,258) | | | | | 136,039,677 |

| |

| | | | SHORT-TERM INVESTMENTS—3.3% | | | | |

| | | | Money Market Fund | | | | | |

| $4,695 | M | | First Investors Cash Reserve Fund, 2.24% (cost $4,695,000)** | | | | 4,695,000 |

| |

| Total Value of Investments (cost $131,986,258) | 99.5 | % | | | 140,734,677 |

| Other Assets, Less Liabilities | .5 | | | | 670,810 |

| |

| Net Assets | | | | 100.0 | % | | | $141,405,487 |

| |

|

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| | accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield |

| | at June 30, 2008 (see Note 3). |

| |

|

| Summary of Abbreviations: |

| REIT | Real Estate Investment Trust |

| |

| 16 | See notes to financial statements |

Fund Expenses

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $1,016.37 | $4.06 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.83 | $4.07 |

| |

|

| * | Expenses are equal to the annualized expense ratio of .81%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

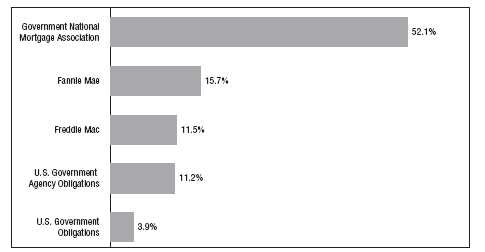

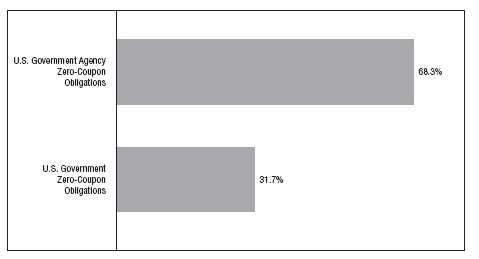

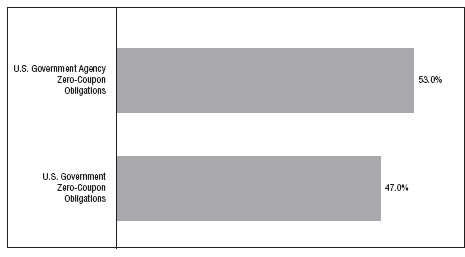

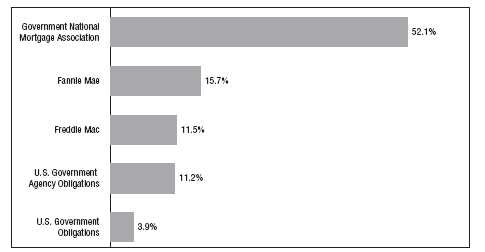

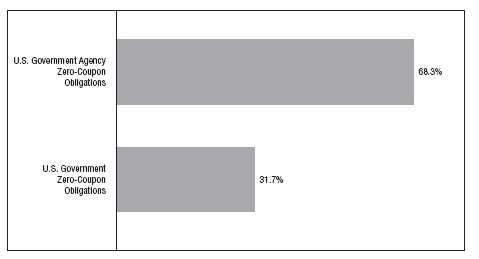

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

GOVERNMENT FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | MORTGAGE-BACKED CERTIFICATES—78.3% | | |

| | | | Fannie Mae—15.5% | | |

| $ 898 | M | | 5%, 1/1/2035 – 7/1/2035 | | $ 865,136 |

| 956 | M | | 5.5%, 10/1/2032 – 7/1/2034 | | 947,231 |

| 851 | M | | 6%, 2/1/2036 – 7/1/2037 | | 859,354 |

| 456 | M | | 9%, 6/1/2015 – 11/1/2026 | | 504,229 |

| 288 | M | | 11%, 10/1/2015 | | 329,587 |

| |

| | | | | | 3,505,537 |

| |

| | | | Freddie Mac—11.4% | | |

| 2,236 | M | | 6%, 6/1/2035 – 11/1/2037 | | 2,266,240 |

| 297 | M | | 6.5%, 7/1/2032 – 12/1/2032 | | 308,772 |

| |

| | | | | | 2,575,012 |

| |

| | | | Government National Mortgage Association I | | |

| | | | Program—51.4% | | |

| 1,958 | M | | 5%, 3/15/2033 – 5/15/2034 | | 1,906,087 |

| 4,117 | M | | 5.5%, 2/15/2033 – 6/15/2037 | | 4,109,936 |

| 3,116 | M | | 6%, 11/15/2032 – 3/15/2038 | | 3,175,276 |

| 1,165 | M | | 6.5%, 7/15/2032 – 3/15/2038 | | 1,211,773 |

| 1,005 | M | | 7%, 1/15/2030 – 10/15/2032 | | 1,080,943 |

| 123 | M | | 10%, 5/15/2019 – 8/15/2019 | | 141,890 |

| |

| | | | | | 11,625,905 |

| |

| Total Value of Mortgage-Backed Certificates (cost $17,777,323) | | 17,706,454 |

| |

| | | | U.S. GOVERNMENT AGENCY | | |

| | | | OBLIGATIONS—11.1% | | |

| 1,000 | M | | Federal Farm Credit Bank, 4.74%, 2015 | | 998,768 |

| 1,000 | M | | Federal Home Loan Bank, 5%, 2014 | | 1,006,550 |

| 500 | M | | Tennessee Valley Authority, 4.5%, 2018 | | 489,428 |

| |

| Total Value of U.S. Government Agency Obligations (cost $2,509,499) | | 2,494,746 |

| |

| | | | U.S. GOVERNMENT OBLIGATIONS—3.8% | | |

| 780 | M | | FDA Queens LP, 6.99%, 2017 (cost $887,021) (a) | | 866,918 |

| | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Principal | | | | | | | | |

| Amount | | | Security | | | | | Value |

| |

| | | | SHORT-TERM U.S. GOVERNMENT | | | | | |

| | | | OBLIGATIONS—5.5% | | | | | |

| | | | U.S. Treasury Bills: | | | | | |

| $ 700 | M | | 1.82%, 7/10/08 | | | | | $ 699,681 |

| 550 | M | | 1.52%, 7/24/08 | | | | | 549,466 |

| |

| Total Value of Short-Term U.S. Government Obligations (cost $1,249,147) | | | | 1,249,147 |

| |

| Total Value of Investments (cost $22,422,990) | 98.7 | % | | | 22,317,265 |

| Other Assets, Less Liabilities | 1.3 | | | | 303,982 |

| |

| Net Assets | | | | 100.0 | % | | | $22,621,247 |

| |

|

| (a) | Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

| |

| See notes to financial statements | 19 |

Fund Expenses

GROWTH & INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $881.62 | $3.84 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.78 | $4.12 |

| |

|

| * | Expenses are equal to the annualized expense ratio of .82%, multiplied by the average account |

| | value over the period, multiplied by 182/366 (to reflect the one-half year period). |

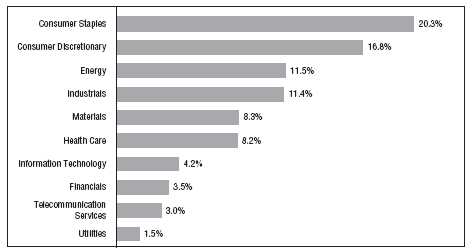

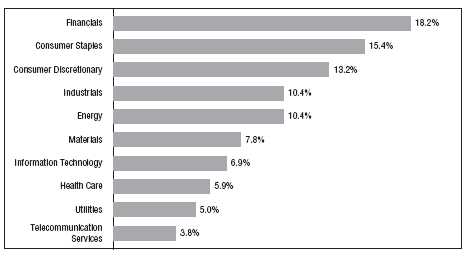

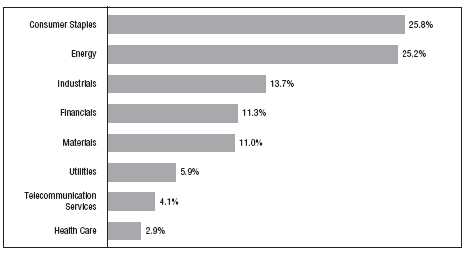

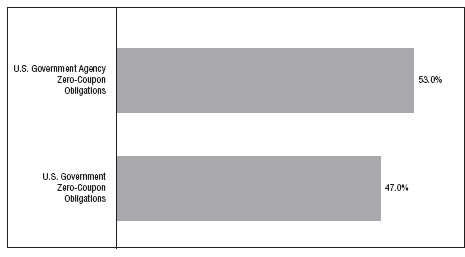

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

GROWTH & INCOME FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | COMMON STOCKS—99.4% | | |

| | | | Consumer Discretionary—13.3% | | |

| 30,500 | | | bebe stores, inc. | | $ 293,105 |

| 33,900 | | | BorgWarner, Inc. | | 1,504,482 |

| 79,200 | | | Brown Shoe Company, Inc. | | 1,073,160 |

| 45,800 | | * | Carter’s, Inc. | | 632,956 |

| 61,000 | | | CBS Corporation – Class “B” | | 1,188,890 |

| 58,200 | | * | CEC Entertainment, Inc. | | 1,630,182 |

| 48,600 | | | Cinemark Holdings, Inc. | | 634,716 |

| 39,100 | | | Clear Channel Communications, Inc. | | 1,376,320 |

| 37,000 | | * | Coach, Inc. | | 1,068,560 |

| 33,700 | | * | Eddie Bauer Holdings, Inc. | | 139,855 |

| 22,100 | | | Genuine Parts Company | | 876,928 |

| 31,700 | | | H&R Block, Inc. | | 678,380 |

| 78,500 | | | Home Depot, Inc. | | 1,838,470 |

| 18,100 | | | J.C. Penney Company, Inc. | | 656,849 |

| 64,800 | | * | Jack in the Box, Inc. | | 1,452,168 |

| 65,800 | | * | Lincoln Educational Services Corporation | | 765,254 |

| 27,700 | | | Luxottica Group SpA (ADR) | | 646,241 |

| 44,400 | | | McDonald’s Corporation | | 2,496,168 |

| 140,800 | | * | Morgans Hotel Group Company | | 1,450,240 |

| 24,800 | | | Movado Group, Inc. | | 491,040 |

| 59,100 | | | Newell Rubbermaid, Inc. | | 992,289 |

| 15,600 | | | Polo Ralph Lauren Corporation – Class “A” | | 979,368 |

| 79,700 | | | Ruby Tuesday, Inc. | | 430,380 |

| 16,400 | | | Sherwin-Williams Company | | 753,252 |

| 65,500 | | | Staples, Inc. | | 1,555,625 |

| 32,800 | | * | Steiner Leisure, Ltd. | | 929,880 |

| 33,950 | | * | Viacom, Inc. – Class “B” | | 1,036,833 |

| 70,000 | | * | Westwood One, Inc. | | 86,800 |

| 78,900 | | | Wyndham Worldwide Corporation | | 1,413,099 |

| |

| | | | | | 29,071,490 |

| |

| | | | Consumer Staples—12.0% | | |

| 108,700 | | | Altria Group, Inc. | | 2,234,872 |

| 40,000 | | | Avon Products, Inc. | | 1,440,800 |

| 20,700 | | * | Chattem, Inc. | | 1,346,535 |

| 22,500 | | | Coca-Cola Company | | 1,169,550 |

| 73,800 | | | CVS Caremark Corporation | | 2,920,266 |

| 36,746 | | | Kraft Foods, Inc. – Class “A” | | 1,045,424 |

| 161,900 | | | Nu Skin Enterprises, Inc. – Class “A” | | 2,415,548 |

| 16,500 | | | PepsiCo, Inc. | | 1,049,235 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Consumer Staples (continued) | | |

| 73,300 | | | Philip Morris International, Inc. | | $ 3,620,287 |

| 25,400 | | | Procter & Gamble Company | | 1,544,574 |

| 71,200 | | | Safeway, Inc. | | 2,032,760 |

| 3,579 | | | Tootsie Roll Industries, Inc. | | 89,940 |

| 80,500 | | | Walgreen Company | | 2,617,055 |

| 47,200 | | | Wal-Mart Stores, Inc. | | 2,652,640 |

| |

| | | | | | 26,179,486 |

| |

| | | | Energy—10.1% | | |

| 100 | | * | Bristow Group, Inc. | | 4,949 |

| 82,200 | | * | Cal Dive International, Inc. | | 1,174,638 |

| 17,400 | | | Chesapeake Energy Corporation | | 1,147,704 |

| 27,500 | | | ConocoPhillips | | 2,595,725 |

| 37,200 | | | ExxonMobil Corporation | | 3,278,436 |

| 51,000 | | | Noble Corporation | | 3,312,960 |

| 27,400 | | | Sasol, Ltd. (ADR) | | 1,614,956 |

| 17,500 | | | Schlumberger, Ltd. | | 1,880,025 |

| 57,900 | | | Suncor Energy, Inc. | | 3,365,148 |

| 24,700 | | | World Fuel Services Corporation | | 541,918 |

| 45,625 | | | XTO Energy, Inc. | | 3,125,769 |

| |

| | | | | | 22,042,228 |

| |

| | | | Financials—8.6% | | |

| 17,500 | | | American Express Company | | 659,225 |

| 35,774 | | | American International Group, Inc. | | 946,580 |

| 36,500 | | | Astoria Financial Corporation | | 732,920 |

| 45,500 | | | Bank of America Corporation | | 1,086,085 |

| 59,900 | | | Brookline Bancorp, Inc. | | 572,045 |

| 21,900 | | | Capital One Financial Corporation | | 832,419 |

| 35,300 | | | Citigroup, Inc. | | 591,628 |

| 67,400 | | | Colonial BancGroup, Inc. | | 297,908 |

| 32,400 | | | Discover Financial Services | | 426,708 |

| 54,400 | | * | First Mercury Financial Corporation | | 959,616 |

| 16,400 | | | Hartford Financial Services Group, Inc. | | 1,058,948 |

| 60,000 | | | JPMorgan Chase & Company | | 2,058,600 |

| 29,757 | | | KeyCorp | | 326,732 |

| 12,700 | | | Merrill Lynch & Company, Inc. | | 402,717 |

| 18,400 | | | Morgan Stanley | | 663,688 |

| 89,800 | | | NewAlliance Bancshares, Inc. | | 1,120,704 |

| 43,300 | | | South Financial Group, Inc. | | 169,736 |

| 56,800 | | | Sovereign Bancorp, Inc. | | 418,048 |

| | | | | |

| |

| | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Financials (continued) | | |

| 102,700 | | | Sunstone Hotel Investors, Inc. (REIT) | | $ 1,704,820 |

| 15,100 | | | SunTrust Banks, Inc. | | 546,922 |

| 65,000 | | | U.S. Bancorp | | 1,812,850 |

| 12,400 | | | Wachovia Corporation | | 192,572 |

| 19,900 | | | Webster Financial Corporation | | 370,140 |

| 40,000 | | | Wells Fargo & Company | | 950,000 |

| |

| | | | | | 18,901,611 |

| |

| | | | Health Care—11.1% | | |

| 45,000 | | | Abbott Laboratories | | 2,383,650 |

| 30,500 | | | Aetna, Inc. | | 1,236,165 |

| 15,300 | | * | Amgen, Inc. | | 721,548 |

| 37,100 | | * | Barr Pharmaceuticals, Inc. | | 1,672,468 |

| 7,600 | | | Baxter International, Inc. | | 485,944 |

| 6,400 | | * | Genentech, Inc. | | 485,760 |

| 57,700 | | | Johnson & Johnson | | 3,712,418 |

| 16,800 | | * | Laboratory Corporation of America Holdings | | 1,169,784 |

| 24,300 | | | Medtronic, Inc. | | 1,257,525 |

| 33,500 | | | Merck & Company, Inc. | | 1,262,615 |

| 141,500 | | | Pfizer, Inc. | | 2,472,005 |

| 44,000 | | | Sanofi-Aventis (ADR) | | 1,462,120 |

| 42,400 | | * | St. Jude Medical, Inc. | | 1,733,312 |

| 19,700 | | * | Thermo Fisher Scientific, Inc. | | 1,097,881 |

| 21,000 | | * | TriZetto Group, Inc. | | 448,980 |

| 55,000 | | | Wyeth | | 2,637,800 |

| |

| | | | | | 24,239,975 |

| |

| | | | Industrials—19.0% | | |

| 50,700 | | | 3M Company | | 3,528,213 |

| 87,900 | | * | AAR Corporation | | 1,189,287 |

| 28,500 | | | Alexander & Baldwin, Inc. | | 1,298,175 |

| 80,400 | | * | Altra Holdings, Inc. | | 1,351,524 |

| 58,000 | | | Armstrong World Industries, Inc. | | 1,694,760 |

| 49,300 | | | Avery Dennison Corporation | | 2,165,749 |

| 54,300 | | | Barnes Group, Inc. | | 1,253,787 |

| 32,100 | | * | BE Aerospace, Inc. | | 747,609 |

| 23,100 | | | Burlington Northern Santa Fe Corporation | | 2,307,459 |

| 39,100 | | | Chicago Bridge & Iron Company NV – NY Shares | | 1,556,962 |

| 24,200 | | | Dover Corporation | | 1,170,554 |

| 101,000 | | | General Electric Company | | 2,695,690 |

| 40,300 | | | Harsco Corporation | | 2,192,723 |

Portfolio of Investments (continued)

GROWTH & INCOME FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Industrials (continued) | | |

| 34,200 | | | Honeywell International, Inc. | | $ 1,719,576 |

| 34,400 | | | IDEX Corporation | | 1,267,296 |

| 42,600 | | | Illinois Tool Works, Inc. | | 2,023,926 |

| 17,200 | | | Lockheed Martin Corporation | | 1,696,952 |

| 100,500 | | * | Mobile Mini, Inc. | | 2,010,000 |

| 27,800 | | | Northrop Grumman Corporation | | 1,859,820 |

| 28,300 | | * | PGT, Inc. | | 97,352 |

| 13,600 | | | Precision Castparts Corporation | | 1,310,632 |

| 93,300 | | | TAL International Group, Inc. | | 2,121,642 |

| 18,300 | | | Textainer Group Holdings, Ltd. | | 357,399 |

| 32,025 | | | Tyco International, Ltd. | | 1,282,281 |

| 44,500 | | | United Technologies Corporation | | 2,745,650 |

| |

| | | | | | 41,645,018 |

| |

| | | | Information Technology—16.7% | | |

| 10,000 | | * | CACI International, Inc. – Class “A” | | 457,700 |

| 128,800 | | * | Cisco Systems, Inc. | | 2,995,888 |

| 64,700 | | * | Electronics for Imaging, Inc. | | 944,620 |

| 113,600 | | * | EMC Corporation | | 1,668,784 |

| 85,000 | | * | Entrust, Inc. | | 249,900 |

| 59,400 | | | Harris Corporation | | 2,999,106 |

| 42,600 | | | Hewlett-Packard Company | | 1,883,346 |

| 60,100 | | | Intel Corporation | | 1,290,948 |

| 37,000 | | | International Business Machines Corporation | | 4,385,610 |

| 62,000 | | * | Macrovision Solutions Corporation | | 927,520 |

| 125,100 | | | Microsoft Corporation | | 3,441,501 |

| 49,800 | | * | NCI, Inc. – Class “A” | | 1,139,424 |

| 84,400 | | | Nokia Corporation – Class “A” (ADR) | | 2,067,800 |

| 67,686 | | * | Parametric Technology Corporation | | 1,128,326 |

| 53,900 | | | QUALCOMM, Inc. | | 2,391,543 |

| 38,800 | | * | SI International, Inc. | | 812,472 |

| 112,400 | | * | Symantec Corporation | | 2,174,940 |

| 153,100 | | * | TIBCO Software, Inc. | | 1,171,215 |

| 16,425 | | | Tyco Electronics, Ltd. | | 588,343 |

| 27,000 | | * | ValueClick, Inc. | | 409,050 |

| 46,300 | | | Western Union Company | | 1,144,536 |

| 32,200 | | * | Wright Express Corporation | | 798,560 |

| 61,600 | | | Xilinx, Inc. | | 1,555,400 |

| |

| | | | | | 36,626,532 |

| | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Shares or | | | | | | | | |

| Principal | | | | | | | | |

| Amount | | | Security | | | | | Value |

| |

| | | | Materials—6.1% | | | | | |

| 60,700 | | | Celanese Corporation – Series “A” | | | | | $ 2,771,562 |

| 21,200 | | | Dow Chemical Company | | | | | 740,092 |

| 21,400 | | | Freeport-McMoRan Copper & Gold, Inc. | | | | | 2,507,866 |

| 40,600 | | | Lubrizol Corporation | | | | | 1,880,998 |

| 22,800 | | | PPG Industries, Inc. | | | | | 1,308,036 |

| 21,600 | | | Praxair, Inc. | | | | | 2,035,584 |

| 73,100 | | | RPM International, Inc. | | | | | 1,505,860 |

| 49,600 | | | Temple-Inland, Inc. | | | | | 558,992 |

| |

| | | | | | | | | 13,308,990 |

| |

| | | | Telecommunication Services—2.2% | | | | | |

| 65,100 | | | AT&T, Inc. | | | | | 2,193,219 |

| 76,700 | | | Verizon Communications, Inc. | | | | | 2,715,180 |

| |

| | | | | | | | | 4,908,399 |

| |

| | | | Utilities—.3% | | | | | |

| 25,000 | | | Atmos Energy Corporation | | | | | 689,250 |

| |

| Total Value of Common Stocks (cost $216,721,861) | | | | | 217,612,979 |

| |

| | | | SHORT-TERM INVESTMENTS—.4% | | | | | |

| | | | Money Market Fund | | | | | |

| $790 | M | | First Investors Cash Reserve Fund, 2.24% (cost $790,000)** | | | 790,000 |

| |

| Total Value of Investments (cost $217,511,861) | 99.8 | % | | | 218,402,979 |

| Other Assets, Less Liabilities | .2 | | | | 413,934 |

| |

| Net Assets | | | | 100.0 | % | | | $218,816,913 |

| |

|

| * | Non-income producing |

| ** | Affiliated unregistered money market fund available only to First Investors funds and certain |

| | accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield |

| | at June 30, 2008 (see Note 3). |

| |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| REIT | Real Estate Investment Trust |

| |

| See notes to financial statements | 25 |

Fund Expenses

HIGH YIELD FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $985.73 | $4.20 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.63 | $4.27 |

| |

|

| * | Expenses are equal to the annualized expense ratio of .85%, multiplied by the average account |

| | value over the period, multiplied by 182/366 (to reflect the one-half year period). |

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

HIGH YIELD FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | CORPORATE BONDS—90.9% | | |

| | | | Aerospace/Defense—3.7% | | |

| $725 | M | | Alliant Techsystems, Inc., 6.75%, 2016 | | $706,875 |

| 750 | M | | DRS Technologies, Inc., 6.875%, 2013 | | 753,750 |

| 460 | M | | DynCorp International, LLC, 9.5%, 2013 | | 460,000 |

| 190 | M | | GenCorp, Inc., 9.5%, 2013 | | 188,100 |

| 625 | M | | L-3 Communications Corp., 7.625%, 2012 | | 632,813 |

| |

| | | | | | 2,741,538 |

| |

| | | | Automotive—4.9% | | |

| 300 | M | | Accuride Corp., 8.5%, 2015 (a) | | 222,000 |

| | | | Asbury Automotive Group, Inc.: | | |

| 600 | M | | 8%, 2014 | | 522,000 |

| 250 | M | | 7.625%, 2017 | | 202,500 |

| 1,025 | M | | Avis Budget Car Rental, LLC, 7.75%, 2016 | | 791,812 |

| 594 | M | | Cambridge Industries Liquidating Trust, 2008 (b)(c) | | 371 |

| 750 | M | | Tenneco Automotive, Inc., 8.625%, 2014 (a) | | 665,625 |

| 925 | M | | United Auto Group, Inc., 7.75%, 2016 | | 814,000 |

| 400 | M | | United Components, Inc., 9.375%, 2013 | | 376,000 |

| |

| | | | | | 3,594,308 |

| |

| | | | Chemicals—4.5% | | |

| | | | Huntsman, LLC: | | |

| 250 | M | | 11.625%, 2010 | | 258,750 |

| 569 | M | | 11.5%, 2012 | | 593,182 |

| 750 | M | | Nell AF S.a.r.l., 8.375%, 2015 (d) | | 480,000 |

| 700 | M | | Newmarket Corp., 7.125%, 2016 | | 698,250 |

| 500 | M | | Terra Capital, Inc., 7%, 2017 | | 492,500 |

| 575 | M | | Tronox Worldwide, LLC, 9.5%, 2012 | | 471,500 |

| 425 | M | | Westlake Chemical Corp., 6.625%, 2016 | | 359,125 |

| |

| | | | | | 3,353,307 |

| |

| | | | Consumer Non-Durables—2.0% | | |

| 500 | M | | GFSI, Inc., 10.5%, 2011 (d)(e) | | 477,500 |

| | | | Levi Strauss & Co.: | | |

| 500 | M | | 9.75%, 2015 | | 505,000 |

| 500 | M | | 8.875%, 2016 | | 488,750 |

| |

| | | | | | 1,471,250 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | Energy—12.1% | | |

| $725 | M | | Basic Energy Services, Inc., 7.125%, 2016 | | $708,687 |

| 400 | M | | Calfrac Holdings, 7.75%, 2015 (d) | | 388,000 |

| | | | Chesapeake Energy Corp.: | | |

| 200 | M | | 7.5%, 2014 (a) | | 199,500 |

| 500 | M | | 6.375%, 2015 | | 475,000 |

| 1,150 | M | | 6.625%, 2016 | | 1,109,750 |

| 500 | M | | Cimarex Energy Co., 7.125%, 2017 | | 493,750 |

| 650 | M | | Compagnie Generale de Geophysique, 7.5%, 2015 | | 651,625 |

| 625 | M | | Complete Production Services, Inc., 8%, 2016 | | 627,344 |

| 200 | M | | Connacher Oil & Gas, Ltd., 10.25%, 2015 (d) | | 212,000 |

| 1,300 | M | | Delta Petroleum Corp., 7%, 2015 | | 1,118,000 |

| 150 | M | | Hilcorp Energy I, LP, 9%, 2016 (d) | | 153,375 |

| 24 | M | | National Oilwell Varco, Inc., 6.125%, 2015 | | 24,145 |

| 500 | M | | Pacific Energy Partners LP, 7.125%, 2014 | | 504,639 |

| | | | Petroplus Finance, Ltd.: | | |

| 100 | M | | 6.75%, 2014 (d) | | 91,000 |

| 550 | M | | 7%, 2017 (d) | | 488,125 |

| 375 | M | | Plains Exploration & Production Co., 7.625%, 2018 | | 376,875 |

| 400 | M | | Stallion Oilfield Services, Ltd., 9.75%, 2015 (d) | | 342,000 |

| 400 | M | | Stewart & Stevenson, LLC, 10%, 2014 | | 397,000 |

| 100 | M | | Swift Energy Co., 7.125%, 2017 | | 92,750 |

| 510 | M | | Tesoro Corp., 6.25%, 2012 | | 487,050 |

| |

| | | | | | 8,940,615 |

| |

| | | | Financial Services—2.1% | | |

| 1,615 | M | | Targeted Return Index Securities Trust, 7.117%, 2016 (d) | | 1,574,361 |

| |

| | | | Financials—.6% | | |

| 650 | M | | General Motors Acceptance Corp., 6.75%, 2014 | | 429,788 |

| |

| | | | Food/Beverage/Tobacco—2.5% | | |

| 1,250 | M | | Constellation Brands, Inc., 7.25%, 2016 | | 1,181,250 |

| | | | Land O’Lakes, Inc.: | | |

| 200 | M | | 9%, 2010 | | 207,000 |

| 42 | M | | 8.75%, 2011 | | 42,578 |

| 375 | M | | Southern States Cooperative, Inc., 10.5%, 2010 (d) | | 384,375 |

| |

| | | | | | 1,815,203 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | Food/Drug—1.1% | | |

| $750 | M | | Ingles Markets, Inc., 8.875%, 2011 | | $763,125 |

| 24 | M | | Rite Aid Corp., 8.125%, 2010 | | 24,106 |

| |

| | | | | | 787,231 |

| |

| | | | Forest Products/Containers—2.8% | | |

| 350 | M | | Jefferson Smurfit Corp., 8.25%, 2012 | | 307,125 |

| 500 | M | | Packaging Dynamics Finance Corp., 10%, 2016 (d) | | 335,000 |

| 600 | M | | Sappi Papier Holding, AG, 6.75%, 2012 (d) | | 576,918 |

| 500 | M | | Tekni-Plex, Inc., 8.75%, 2013 (a) | | 420,000 |

| 475 | M | | Verso Paper Holdings, LLC, 6.623%, 2014 (e) | | 439,375 |

| |

| | | | | | 2,078,418 |

| |

| | | | Gaming/Leisure—5.8% | | |

| 750 | M | | Circus & Eldorado/Silver Legacy, 10.125%, 2012 | | 725,625 |

| 500 | M | | Isle of Capri Casinos, Inc., 7%, 2014 (a) | | 355,000 |

| 780 | M | | Mandalay Resort Group, 6.375%, 2011 | | 713,700 |

| 1,040 | M | | MGM Mirage, Inc., 6.625%, 2015 | | 839,800 |

| 200 | M | | Pinnacle Entertainment, Inc., 7.5%, 2015 (a) | | 154,000 |

| 1,255 | M | | Speedway Motorsports, Inc., 6.75%, 2013 | | 1,229,900 |

| 500 | M | | Station Casinos, Inc., 6.875%, 2016 (a) | | 275,625 |

| |

| | | | | | 4,293,650 |

| |

| | | | Health Care—8.5% | | |

| | | | Alliance Imaging, Inc.: | | |

| 200 | M | | 7.25%, 2012 | | 189,000 |

| 350 | M | | 7.25%, 2012 | | 330,750 |

| 625 | M | | Community Health Systems, 8.875%, 2015 | | 632,030 |

| 500 | M | | Cooper Companies, Inc., 7.125%, 2015 | | 482,500 |

| 900 | M | | DaVita, Inc., 7.25%, 2015 | | 879,750 |

| 520 | M | | Fisher Scientific International, Inc., 6.125%, 2015 | | 516,230 |

| 600 | M | | Genesis Health Ventures, Inc., 9.75%, 2011 (b)(c) | | 375 |

| 800 | M | | HCA, Inc., 6.75%, 2013 | | 706,000 |

| 1,000 | M | | Omnicare, Inc., 6.875%, 2015 | | 930,000 |

| 343 | M | | Res-Care, Inc., 7.75%, 2013 | | 328,423 |

| | | | Tenet Healthcare Corp.: | | |

| 550 | M | | 7.375%, 2013 | | 519,750 |

| 250 | M | | 9.25%, 2015 | | 246,250 |

| 600 | M | | Universal Hospital Services, Inc., 6.303%, 2015 (e) | | 564,000 |

| |

| | | | | | 6,325,058 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | Housing—2.5% | | |

| $320 | M | | Beazer Homes USA, Inc., 6.875%, 2015 (a) | | $230,400 |

| 900 | M | | Builders FirstSource, Inc., 6.926%, 2012 (e) | | 616,500 |

| 100 | M | | NTK Holdings, Inc., 0%–10.75%, 2014 (a)(f) | | 46,000 |

| 440 | M | | Ply Gem Industries, Inc., 9%, 2012 (a) | | 260,700 |

| 500 | M | | Realogy Corp., 12.375%, 2015 (a) | | 247,500 |

| | | | William Lyon Homes, Inc.: | | |

| 500 | M | | 7.625%, 2012 | | 262,500 |

| 300 | M | | 10.75%, 2013 | | 163,500 |

| |

| | | | | | 1,827,100 |

| |

| | | | Information Technology—4.5% | | |

| 850 | M | | Belden CDT, Inc., 7%, 2017 | | 820,250 |

| 500 | M | | Exodus Communications, Inc., 10.75%, 2009 (b)(c) | | 313 |

| | | | Freescale Semiconductor, Inc.: | | |

| 750 | M | | 9.125%, 2014 | | 586,875 |

| 125 | M | | 10.125%, 2016 (a) | | 95,937 |

| | | | Iron Mountain, Inc.: | | |

| 1,000 | M | | 8.25%, 2011 | | 1,000,000 |

| 500 | M | | 8%, 2020 | | 495,000 |

| | | | Sanmina – SCI Corp.: | | |

| 125 | M | | 5.526%, 2014 (d)(e) | | 116,250 |

| 200 | M | | 8.125%, 2016 | | 181,000 |

| |

| | | | | | 3,295,625 |

| |

| | | | Investment/Finance Companies—1.0% | | |

| 700 | M | | LaBranche & Co., Inc., 11%, 2012 | | 722,750 |

| |

| | | | Manufacturing—1.4% | | |

| 260 | M | | Case New Holland, Inc., 7.125%, 2014 | | 256,100 |

| 250 | M | | ESCO Corp., 8.625%, 2013 (d) | | 253,750 |

| 500 | M | | Terex Corp., 8%, 2017 | | 498,750 |

| |

| | | | | | 1,008,600 |

| |

| | | | Media-Broadcasting—3.8% | | |

| 1,250 | M | | Block Communications, Inc., 8.25%, 2015 (d) | | 1,193,750 |

| 600 | M | | LBI Media, Inc., 8.5%, 2017 (d) | | 465,000 |

| 320 | M | | Nexstar Finance Holding, LLC, 11.375%, 2013 | | 308,405 |

| 22 | M | | Sinclair Broadcasting Group, Inc., 8%, 2012 | | 226,240 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | Security | | Value |

| |

| | | | Media-Broadcasting (continued) | | |

| | | | Young Broadcasting, Inc.: | | |

| $476 | M | | 10%, 2011 | | $268,940 |

| 600 | M | | 8.75%, 2014 | | 327,000 |

| |

| | | | | | 2,789,335 |

| |

| | | | Media-Cable TV—8.2% | | |

| 1,255 | M | | Adelphia Communications Escrow Bond, 10.25%, 2011 (b) | | 112,950 |

| 850 | M | | Atlantic Broadband Finance, LLC, 9.375%, 2014 | | 769,250 |

| 600 | M | | Cablevision Systems Corp., 8%, 2012 | | 570,000 |

| | | | Charter Communications Holdings, LLC: | | |

| 2,000 | M | | 10%, 2009 | | 1,950,000 |

| 250 | M | | 11.75%, 2011 | | 182,500 |

| 375 | M | | CSC Holdings, Inc., 8.125%, 2009 | | 378,750 |

| 1,060 | M | | Echostar DBS Corp., 6.375%, 2011 | | 1,025,550 |

| 1,000 | M | | Mediacom LLC/Mediacom Capital Corp., 7.875%, 2011 | | 927,500 |

| 200 | M | | Quebecor Media, Inc., 7.75%, 2016 | | 187,000 |

| |

| | | | | | 6,103,500 |

| |

| | | | Media-Diversified—3.8% | | |

| 800 | M | | Cenveo, Inc., 7.875%, 2013 | | 672,000 |

| 100 | M | | Deluxe Corp., 7.375%, 2015 | | 88,000 |

| 1,125 | M | | Idearc, Inc., 8%, 2016 | | 712,969 |

| | | | MediaNews Group, Inc.: | | |

| 375 | M | | 6.875%, 2013 | | 155,625 |

| 400 | M | | 6.375%, 2014 | | 166,000 |

| 650 | M | | R.H. Donnelley Corp., 8.875%, 2017 (d) | | 390,000 |

| 600 | M | | Universal City Development Partners, Ltd., 11.75%, 2010 | | 618,000 |

| |

| | | | | | 2,802,594 |

| |

| | | | Metals/Mining—1.4% | | |

| 250 | M | | Metals USA, Inc., 11.125%, 2015 | | 261,250 |

| 830 | M | | Russell Metals, Inc., 6.375%, 2014 | | 784,350 |

| |

| | | | | | 1,045,600 |

| |

| | | | Retail-General Merchandise—2.5% | | |

| 600 | M | | Claire’s Stores, Inc., 9.625%, 2015 PIK (a) | | 258,000 |

| 325 | M | | GSC Holdings Corp., 8%, 2012 | | 333,125 |

| 900 | M | | Neiman Marcus Group, Inc., 10.375%, 2015 (a) | | 904,500 |

| 500 | M | | Yankee Acquisition Corp., 9.75%, 2017 (a) | | 362,500 |

| |

| | | | | | 1,858,125 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Principal | | | | | |

| Amount | | | | | |

| or Shares | | | Security | | Value |

| |

| | | | Services—6.1% | | |

| | | | Allied Waste NA, Inc.: | | |

| $200 | M | | 7.875%, 2013 | | $204,500 |

| 1,000 | M | | 7.375%, 2014 | | 1,020,000 |

| 750 | M | | 6.875%, 2017 | | 736,875 |

| 550 | M | | Ashtead Capital, Inc., 9%, 2016 (a)(d) | | 486,750 |

| 300 | M | | First Data Corp., 9.875%, 2015 (d) | | 261,375 |

| | | | United Rentals, Inc.: | | |

| 323M | M | | 6.5%, 2012 | | 292,541 |

| 650 | M | | 7%, 2014 | | 507,000 |

| 1,000 | M | | Waste Services, Inc., 9.5%, 2014 | | 1,015,000 |

| |

| | | | | | 4,524,041 |

| |

| | | | Telecommunications—.6% | | |

| 500 | M | | Citizens Communications Co., 7.125%, 2019 | | 450,000 |

| |

| | | | Transportation—.8% | | |

| 600 | M | | Roadway Corp., 8.25%, 2008 | | 603,000 |

| |

| | | | Utilities—1.5% | | |

| 600 | M | | Dynegy Holdings, Inc., 7.75%, 2019 | | 549,000 |

| 625 | M | | NRG Energy, Inc., 7.375%, 2017 | | 592,188 |

| |

| | | | | | 1,141,188 |

| |

| | | | Wireless Communications—2.2% | | |

| 1,000 | M | | Nextel Communications, Inc., 5.95%, 2014 | | 803,417 |

| 800 | M | | Rogers Wireless, Inc., 6.375%, 2014 | | 801,867 |

| |

| | | | | | 1,605,284 |

| |

| Total Value of Corporate Bonds (cost $75,790,317) | | 67,181,469 |

| |

| | | | COMMON STOCKS—2.3% | | |

| | | | Food/Drug—.1% | | |

| 4,575 | | | Ingles Markets, Inc. | | 106,735 |

| |

| | | | Media-Broadcasting—.3% | | |

| 32,500 | | | Sinclair Broadcasting Group, Inc. | | 247,000 |

| |

| | | | Media-Cable TV—1.0% | | |

| 1,253,066 | | * | Adelphia Recovery Trust | | 67,039 |

| 25,557 | | * | Time Warner Cable, Inc. – Class “A” | | 676,749 |

| |

| | | | | | 743,788 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares, | | | | | |

| Principal | | | | | |

| Amount | | | | | |

| or Warrants | | | Security | | Value |

| |

| | | | Media-Diversified—.5% | | |

| 2,500 | | | MediaNews Group, Inc. – Class “A” (c) | | $328,125 |

| |

| | | | Telecommunications—.4% | | |

| 25,000 | | * | Citizens Communications Company | | 283,500 |

| 3 | | * | Viatel Holding (Bermuda), Ltd. (c) | | 11 |

| 5,970 | | * | World Access, Inc. | | 5 |

| |

| | | | | | 283,516 |

| |

| Total Value of Common Stocks (cost $1,993,638) | | 1,709,164 |

| |

| | | | AUCTION RATE SECURITIES(g)—1.4% | | |

| $ 175 | M | | New Jersey St Trans. Trust Fund Auth. Rev. Bonds, 3.7%, 2019 | | 175,000 |

| 500 | M | | New York State Thruway Auth. Svc. Contract Rev., 3.725%, 2021 | | 500,000 |

| 375 | M | | Winter Park, FL Elec. Rev. Bonds, 4.345%, 2034 | | 375,000 |

| |

| Total Value of Auction Rate Securities (cost $1,050,000) | | 1,050,000 |

| |

| | | | WARRANTS—.0% | | |

| | | | Telecommunication Services | | |

| 250 | | * | GT Group Telecom, Inc. (expiring 2/1/10) (cost $22,587) (c)(d) | | — |

| |

| | | | SHORT-TERM INVESTMENTS—4.2% | | |

| | | | Money Market Fund | | |

| $3,085 | M | | First Investors Cash Reserve Fund, 2.24% (cost $3,085,000) (h) | | 3,085,000 |

| |

| | | | CERTIFICATES OF DEPOSIT(i)—3.2% | | |

| 200 | M | | American Express Centurion Bank, 2.72%, 8/8/08 | | 199,959 |

| 200 | M | | Bank of Scotland PLC, 2.73%, 7/11/08 | | 200,004 |

| 200 | M | | Barclays Bank PLC, 2.68%, 7/2/08 | | 200,000 |

| 200 | M | | BNP Paribas, 2.66%, 7/15/08 | | 200,000 |

| 200 | M | | Commonwealth Bank of Australia, 2.63%, 7/11/08 | | 199,998 |

| 200 | M | | Deutsche Bank AG, 2.72%, 7/30/08 | | 200,010 |

| 200 | M | | Dexia Credit Local SA, 2.685%, 8/7/08 | | 199,952 |

| 200 | M | | Nordea Bank Finland PLC, 2.7%, 8/4/08 | | 199,959 |

| 200 | M | | Skandinaviska Enskilda Banken AB, 2.7%, 7/17/08 | | 200,003 |

| 200 | M | | Societe Generale, 2.93%, 7/2/08 | | 200,003 |

| 200 | M | | Svenska Handelsbanken AB, 2.55%, 7/11/08 | | 199,993 |

| 200 | M | | Toronto Dominion Bank, 2.77%, 9/5/08 | | 199,873 |

| |

| Total Value of Certificates of Deposit (cost $2,399,754 ) | | 2,399,754 |

Portfolio of Investments (continued)

HIGH YIELD FUND

June 30, 2008

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | | Security | | | | Value |

| |

| | | | REPURCHASE AGREEMENTS(i)—2.9% | | | |

| $162 | M | | Barclays Bank PLC, 2.5%, dated 6/30/08, to be repurchased | | | |

| at $162,011 on 7/1/08 (collateralized by Fannie Mae, 4.12%, | | | | |

| | | | 5/6/13, valued at $162,275) | | | | $162,000 |

| 2,00 | M | | Deutsche Bank, 2.5%, dated 6/30/08, to be repurchased | | | |

| at $2,000,139 on 7/1/08 (collateralized by Fannie Mae, 5.28%, | | | | |

| | | | 9/17/12 valued at $2,041,778) | | | | 2,000,000 |

| |

| Total Value of Repurchase Agreements (cost $2,162,000) | | | | 2,162,000 |

| |

| Total Value of Investments (cost $86,503,296) | 104.9 | % | | 77,587,387 |

| Excess of Liabilities Over Other Assets | (4.9) | | | (3,643,364) |

| |

| Net Assets | | | | 100.0 | % | | $73,944,023 |

| |

| * | Non-income producing |

| (a) | Loaned security; a portion or all of the security is on loan as of June 30, 2008 (see Note 1G). |

| (b) | In default as to principal and/or interest payment |

| (c) | Securities valued at fair value (see Note 1A) |

| (d) | Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 5). |

| (e) | Interest rates on adjustable rate bonds are determined and reset quarterly by the indentures. The |

| interest rates shown are the rates in effect on June 30, 2008. |

| (f) | Denotes a stepbond (a zero coupon bond that converts to a fixed interest rate at a designated date) |

| (g) | Interest rates on action rate securities are determined and reset periodically by the issuer and the |

| | rates in effect on June 30, 2008. |

| (h) | Affiliated unregistered money market fund available only to First Investors funds and certain |

| accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield |

| at June 30, 2008 (see Note 3). |

| (i) | Issued as collateral for securities on loan |

| |

| 34 | See notes to financial statements |

Fund Expenses

INTERNATIONAL FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/08) | (6/30/08) | (1/1/08–6/30/08)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $874.67 | $4.29 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.29 | $4.62 |

| |

| * | Expenses are equal to the annualized expense ratio of .92%, multiplied by the average account |

| value over the period, multiplied by 182/366 (to reflect the one-half year period). |

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2008, and are |

| based on the total value of investments. |

Portfolio of Investments

INTERNATIONAL FUND

June 30, 2008

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | COMMON STOCKS—94.8% | | |

| | | | United Kingdom—18.0% | | |

| 32,000 | | | AMEC PLC | | $566,800 |

| 133,525 | | | BG Group PLC | | 3,473,186 |

| 214,520 | | | British American Tobacco PLC | | 7,424,329 |

| 74,729 | | | Diageo PLC | | 1,374,203 |

| 112,457 | | | Imperial Tobacco Group PLC | | 4,187,455 |

| 46,659 | | | Reckitt Benckiser Group PLC | | 2,363,269 |

| 607,353 | | | Tesco PLC | | 4,463,858 |

| |

| | | | | | 23,853,100 |

| |

| | | | Brazil—8.6% | | |

| 86,825 | | | Banco Itau Holding Financeira SA (ADR) | | 1,763,416 |

| 95,200 | | | Companhia Vale do Rio Doce (ADR) | | 3,410,064 |

| 78,080 | | | Petroleo Brasileiro SA – Petrobras (ADR) | | 5,530,406 |

| 22,280 | | | Souza Cruz SA | | 639,193 |

| |

| | | | | | 11,343,079 |

| |

| | | | Japan—8.4% | | |

| 25,400 | | | Daito Trust Construction Company, Ltd. | | 1,233,998 |

| 93,200 | | | Millea Holdings, Inc. | | 3,639,904 |

| 63,600 | | | Mitsubishi Corporation | | 2,099,901 |

| 70,900 | | | Mitsui & Company, Ltd. | | 1,568,421 |

| 54,100 | | | Secom Company, Ltd. | | 2,633,423 |

| |

| | | | | | 11,175,647 |

| |

| | | | Australia—8.1% | | |

| 78,200 | | | BHP Billiton, Ltd. | | 3,279,440 |

| 121,000 | | | Coca-Cola Amatil, Ltd. | | 813,982 |

| 10,182 | | | Incitec Pivot, Ltd. | | 1,807,658 |

| 14,300 | | | Macquarie Group, Ltd. | | 667,484 |

| 15,200 | | | Rio Tinto, Ltd. | | 1,976,489 |

| 61,468 | | | WorleyParsons, Ltd. | | 2,233,269 |

| |

| | | | | | 10,778,322 |

| | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Shares | | | Security | | Value |

| |

| | | | Switzerland—6.8% | | |

| 66,700 | | | ABB, Ltd. – Registered | | $1,902,908 |

| 297 | | | Lindt & Spruengli AG | | 822,538 |

| 1,500 | | * | Meyer Burger Technology AG | | 452,091 |

| 69,850 | | | Nestle SA – Registered | | 3,165,400 |

| 14,708 | | | Roche Holding AG – Genusscheine | | 2,656,855 |

| |

| | | | | | 8,999,792 |

| |

| | | | Canada—6.1% | | |

| 43,900 | | | Canadian Natural Resources, Ltd. | | 4,420,938 |

| 64,145 | | | Suncor Energy, Inc. | | 3,735,323 |

| |

| | | | | | 8,156,261 |

| |

| | | | United States—5.6% | | |