|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-4325 |

FIRST INVESTORS LIFE SERIES FUNDS

(Exact name of registrant as specified in charter)

| |

| 40 Wall Street | |

| New York, NY 10005 | |

| (Address of principal executive offices) (Zip code) | |

|

| Joseph I. Benedek |

| Foresters Investment Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| (Name and address of agent for service) |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: DECEMBER 31

DATE OF REPORTING PERIOD: JUNE 30, 2018

Item 1. Reports to Stockholders

| |

| The semi-annual report to stockholders follows |

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Foresters Investor Services, Inc., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: Foresters Financial Services, Inc., 40 Wall Street, New York, NY 10005, or by visiting our website at www.foresters.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Government Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results. There is no guarantee that a Fund’s investment objective will be achieved.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about their Trustees.

Foresters FinancialTM and ForestersTM are the trade names and trademarks of The Independent Order of Foresters (Foresters), a fraternal benefit society, 789 Don Mills Road, Toronto, Canada M3C 1T9 and its subsidiaries.

There are a variety of risks associated with investing in variable life and annuity subaccounts. For all subaccounts, there is the risk that securities selected by the portfolio manager may perform differently than the overall market or may not meet the portfolio managers’ expectations. For stock subaccounts, the risks include market risk (the risk that the entire stock market will decline because of an event such as a deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock subaccounts such as small-cap, global or international funds. For bond subaccounts, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, bonds with longer maturities fluctuate more than bonds with shorter maturities in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. There are also special risks associated with investing in certain types of bond subaccounts, including liquidity risk and prepayment and extension risk. To the extent a subaccount uses derivatives, it will have risks associated with such use. You should consult the Funds’ prospectus for a precise explanation of the risks associated with your subaccounts.

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS LIFE SERIES FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including advisory fees and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, January 1, 2018, and held for the entire six-month period ended June 30, 2018. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expense Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid during the period.

To estimate the expenses you paid on your account during this period simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expense Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical expense example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Fund Expenses (unaudited)

BALANCED INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 1 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/18) | (6/30/18) | (1/1/18–6/30/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $964.67 | $8.04 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,016.61 | $8.25 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.65%, multiplied by the average account |

| value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

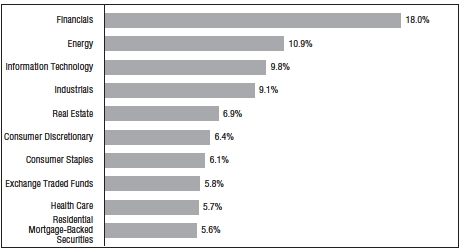

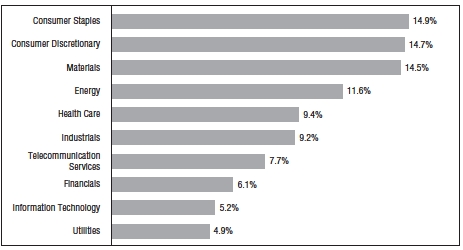

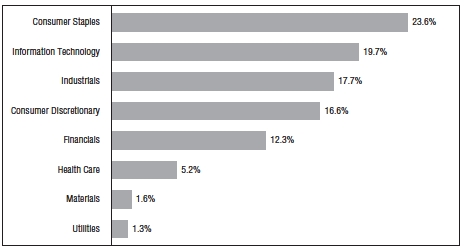

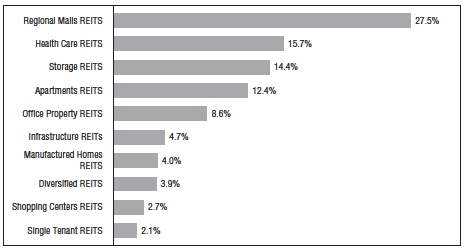

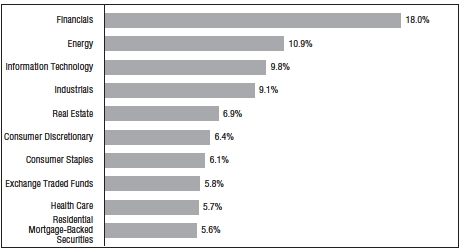

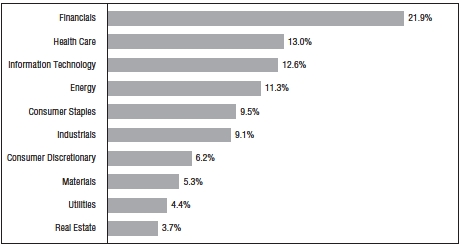

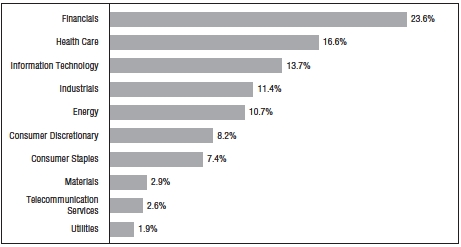

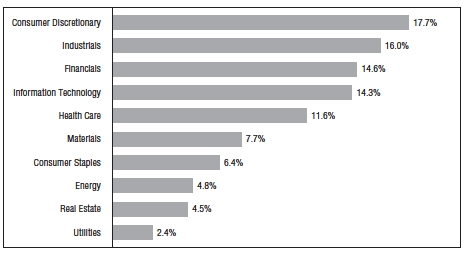

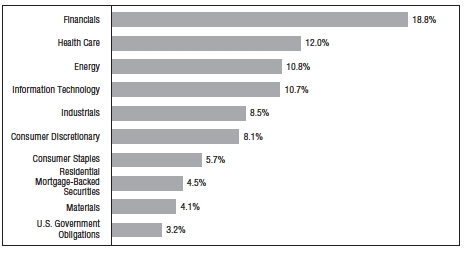

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2018, and are |

| based on the total value of investments. |

Portfolio of Investments

BALANCED INCOME FUND

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—41.1% | | |

| | | Automotive—1.4% | | |

| $ 100M | | O’Reilly Automotive, Inc., 3.55%, 3/15/2026 | | $ 95,287 |

| | | Chemicals—1.4% | | |

| 100M | | Dow Chemical Co., 3.5%, 10/1/2024 | | 97,527 |

| | | Energy—7.4% | | |

| 50M | | BP Capital Markets, PLC, 3.216%, 11/28/2023 | | 49,077 |

| 100M | | Enterprise Products Operating, 7.55%, 4/15/2038 | | 131,221 |

| 100M | | Kinder Morgan Energy Partners, LP, 3.45%, 2/15/2023 | | 96,602 |

| 100M | | Magellan Midstream Partners, LP, 5%, 3/1/2026 | | 105,479 |

| 100M | | Valero Energy Corp., 6.625%, 6/15/2037 | | 119,918 |

| | | | | 502,297 |

| | | Financial Services—5.9% | | |

| 100M | | American International Group, Inc., 3.75%, 7/10/2025 | | 96,740 |

| 100M | | Brookfield Finance, Inc., 4%, 4/1/2024 | | 99,057 |

| 100M | | General Motors Financial Co., Inc., 5.25%, 3/1/2026 | | 103,782 |

| 100M | | Travelers Cos., Inc., 4.05%, 3/7/2048 | | 97,153 |

| | | | | 396,732 |

| | | Financials—7.7% | | |

| 100M | | Citigroup, Inc., 4.3%, 11/20/2026 | | 97,749 |

| 50M | | Deutsche Bank AG of New York, 3.7%, 5/30/2024 | | 46,475 |

| 50M | | Goldman Sachs Group, Inc., 3.625%, 1/22/2023 | | 49,723 |

| 100M | | JPMorgan Chase & Co., 6.4%, 5/15/2038 | | 122,857 |

| 100M | | Morgan Stanley, 4%, 7/23/2025 | | 99,787 |

| 100M | | Wells Fargo & Co., 5.606%, 1/15/2044 | | 107,810 |

| | | | | 524,401 |

| | | Food/Beverage/Tobacco—1.4% | | |

| 100M | | Dr. Pepper Snapple Group, Inc., 3.43%, 6/15/2027 | | 92,568 |

| | | Forest Products/Containers—.7% | | |

| 50M | | Packaging Corp. of America, 3.4%, 12/15/2027 | | 47,252 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

June 30, 2018

| | | | |

| |

| | | | | |

| Principal | | | | |

| Amount | | | | |

| or Shares | | Security | | Value |

| | | Information Technology—3.2% | | |

| $ 100M | | Corning, Inc., 7.25%, 8/15/2036 | | $ 118,836 |

| 100M | | Microsoft Corp., 3.45%, 8/8/2036 | | 95,928 |

| | | | | 214,764 |

| | | Real Estate—4.3% | | |

| 100M | | Alexandria Real Estate Equities, Inc., 3.95%, 1/15/2028 | | 96,250 |

| 50M | | Essex Portfolio, LP, 3.875%, 5/1/2024 | | 49,701 |

| 50M | | Vornado Realty, LP, 3.5%, 1/15/2025 | | 47,931 |

| 100M | | Welltower, Inc., 4%, 6/1/2025 | | 98,220 |

| | | | | 292,102 |

| | | Retail-General Merchandise—.8% | | |

| 50M | | Amazon.com, Inc., 4.8%, 12/5/2034 | | 54,937 |

| | | Telecommunications—1.4% | | |

| 100M | | Verizon Communications, Inc., 4.272%, 1/15/2036 | | 92,527 |

| | | Transportation—3.0% | | |

| 100M | | Cummins, Inc., 4.875%, 10/1/2043 | | 108,510 |

| 100M | | Southwest Airlines Co., 3%, 11/15/2026 | | 92,902 |

| | | | | 201,412 |

| | | Utilities—2.5% | | |

| 100M | | Commonwealth Edison Co., 5.9%, 3/15/2036 | | 121,662 |

| 50M | | Oklahoma Gas & Electric Co., 4%, 12/15/2044 | | 50,483 |

| | | | | 172,145 |

| Total Value of Corporate Bonds (cost $2,924,757) | | 2,783,951 |

| | | COMMON STOCKS—37.4% | | |

| | | Consumer Discretionary—2.3% | | |

| 600 | | Acushnet Holdings Corp. | | 14,676 |

| 50 | | CBS Corp. – Class “B” | | 2,811 |

| 1,100 | | DSW, Inc. – Class “A” | | 28,402 |

| 550 | | Ford Motor Co. | | 6,088 |

| 300 | | Meredith Corp. | | 15,300 |

| 500 | | Nordstrom, Inc. | | 25,890 |

| 700 | | Tapestry, Inc. | | 32,697 |

| 300 | | Wyndham Destinations, Inc. | | 13,281 |

| 300 | | Wyndham Hotels & Resorts, Inc. | | 17,649 |

| | | | | 156,794 |

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Consumer Staples—4.5% | | |

| 1,050 | | Altria Group, Inc. | | $ 59,629 |

| 600 | | Coca-Cola Co. | | 26,316 |

| 1,226 | | Koninklijke Ahold Delhaize NV (ADR) | | 29,265 |

| 500 | | PepsiCo, Inc. | | 54,435 |

| 350 | | Philip Morris International, Inc. | | 28,259 |

| 350 | | Procter & Gamble Co. | | 27,321 |

| 500 | | Sysco Corp. | | 34,145 |

| 500 | | Wal-Mart Stores, Inc. | | 42,825 |

| | | | | 302,195 |

| | | Energy—3.0% | | |

| 100 | | Chevron Corp. | | 12,643 |

| 200 | | ExxonMobil Corp. | | 16,546 |

| 500 | | Marathon Petroleum Corp. | | 35,080 |

| 200 | | Occidental Petroleum Corp. | | 16,736 |

| 600 | | PBF Energy, Inc. – Class “A” | | 25,158 |

| 200 | | Phillips 66 | | 22,462 |

| 400 | | Royal Dutch Shell, PLC – Class “A” (ADR) | | 27,692 |

| 200 | | Schlumberger, Ltd. | | 13,406 |

| 800 | | Suncor Energy, Inc. | | 32,544 |

| | | | | 202,267 |

| | | Financials—5.0% | | |

| 300 | | Ameriprise Financial, Inc. | | 41,964 |

| 100 | | Bank of America Corp. | | 2,819 |

| 500 | | Berkshire Hills Bancorp, Inc. | | 20,300 |

| 200 | | Chubb, Ltd. | | 25,404 |

| 50 | | Citigroup, Inc. | | 3,346 |

| 600 | | Discover Financial Services | | 42,246 |

| 500 | | Hamilton Lane, Inc. – Class “A” | | 23,985 |

| 500 | | JPMorgan Chase & Co. | | 52,100 |

| 600 | | MetLife, Inc. | | 26,160 |

| 150 | | PNC Financial Services Group, Inc. | | 20,265 |

| 600 | | U.S. Bancorp | | 30,012 |

| 1,400 | | Waddell & Reed Financial, Inc. – Class “A” | | 25,158 |

| 450 | | Wells Fargo & Co. | | 24,948 |

| | | | | 338,707 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Health Care—5.5% | | |

| 850 | | Abbott Laboratories | | $ 51,841 |

| 800 | | AbbVie, Inc. | | 74,120 |

| 1,000 | | GlaxoSmithKline, PLC (ADR) | | 40,310 |

| 500 | | Johnson & Johnson | | 60,670 |

| 900 | | Koninklijke Philips NV (ADR) | | 38,043 |

| 650 | | Merck & Co., Inc. | | 39,455 |

| 1,800 | | Pfizer, Inc. | | 65,304 |

| | | | | 369,743 |

| | | Industrials—4.3% | | |

| 300 | | 3M Co. | | 59,016 |

| 300 | | Honeywell International, Inc. | | 43,215 |

| 800 | | Johnson Controls International, PLC | | 26,760 |

| 200 | | Lockheed Martin Corp. | | 59,086 |

| 600 | | Mobile Mini, Inc. | | 28,140 |

| 1,800 | | Triton International, Ltd. | | 55,188 |

| 150 | | United Technologies Corp. | | 18,755 |

| | | | | 290,160 |

| | | Information Technology—6.2% | | |

| 500 | | Apple, Inc. | | 92,555 |

| 1,300 | | Cisco Systems, Inc. | | 55,939 |

| 700 | | Intel Corp. | | 34,797 |

| 900 | | Maxim Integrated Products, Inc. | | 52,794 |

| 1,050 | | Microsoft Corp. | | 103,540 |

| 700 | | QUALCOMM, Inc. | | 39,284 |

| 1,250 | | Travelport Worldwide, Ltd. | | 23,175 |

| 200 | | Western Digital Corp. | | 15,482 |

| | | | | 417,566 |

| | | Materials—1.1% | | |

| 700 | | International Paper Co. | | 36,456 |

| 150 | | Praxair, Inc. | | 23,722 |

| 300 | | RPM International, Inc. | | 17,496 |

| | | | | 77,674 |

| | | Real Estate—2.3% | | |

| 600 | | Americold Realty Trust (REIT) | | 13,212 |

| 650 | | Chesapeake Lodging Trust (REIT) | | 20,566 |

| 200 | | Federal Realty Investment Trust (REIT) | | 25,310 |

| | | | |

| |

| | | | | |

| Principal | | | | |

| Amount | | | | |

| or Shares | | Security | | Value |

| | | Real Estate (continued) | | |

| 800 | | GGP, Inc. (REIT) | | $ 16,344 |

| 1,042 | | RLJ Lodging Trust (REIT) | | 22,976 |

| 800 | | Tanger Factory Outlet Centers, Inc. (REIT) | | 18,792 |

| 850 | | Urstadt Biddle Properties, Inc. (REIT) | | 19,236 |

| 1,400 | | Whitestone REIT (REIT) | | 17,472 |

| | | | | 153,908 |

| | | Telecommunication Services—1.2% | | |

| 1,150 | | AT&T, Inc. | | 36,926 |

| 900 | | Verizon Communications, Inc. | | 45,279 |

| | | | | 82,205 |

| | | Utilities—2.0% | | |

| 400 | | Black Hills Corp. | | 24,484 |

| 500 | | Duke Energy Corp. | | 39,540 |

| 500 | | Exelon Corp. | | 21,300 |

| 900 | | NiSource, Inc. | | 23,652 |

| 400 | | WEC Energy Group, Inc. | | 25,860 |

| | | | | 134,836 |

| Total Value of Common Stocks (cost $2,177,771) | | 2,526,055 |

| | | EXCHANGE TRADED FUNDS—5.5% | | |

| 3,665 | | iShares iBoxx USD High Yield Corporate Bond ETF (ETF) | | 311,818 |

| 1,675 | | SPDR Bloomberg Barclays High Yield Bond ETF (ETF) | | 59,429 |

| Total Value of Exchange Traded Funds (cost $313,222) | | 371,247 |

| | | RESIDENTIAL MORTGAGE-BACKED | | |

| | | SECURITIES—5.3% | | |

| | | Fannie Mae | | |

| $ 56M | | 3%, 5/1/2029 | | 56,230 |

| 183M | | 3.5%, 6/1/2046 | | 182,665 |

| 86M | | 4%, 3/1/2047 | | 88,211 |

| 30M | | 4.5%, 1/1/2047 | | 31,578 |

| Total Value of Residential Mortgage-Backed Securities (cost $372,861) | | 358,684 |

| | | PASS-THROUGH CERTIFICATES—1.4% | | |

| | | Transportation | | |

| 100M | | American Airlines 2017-2 AA PTT, 3.35%, 10/15/2029 (cost $100,780) | 96,655 |

Portfolio of Investments (continued)

BALANCED INCOME FUND

June 30, 2018

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | SHORT-TERM U.S. GOVERNMENT AGENCY | | | | |

| | | OBLIGATIONS—4.4% | | | | | |

| $300M | | U.S. Treasury Bills, 1.7775%, 7/26/2018 (cost $299,629) | | | | $ 299,656 |

| Total Value of Investments (cost $6,189,020) | 95.1 | % | | | 6,436,248 |

| Other Assets, Less Liabilities | 4.9 | | | | 330,282 |

| Net Assets | | | 100.0 | % | | | $6,766,530 |

| | |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| REIT | Real Estate Investment Trust |

| SPDR | Standard & Poor’s Depository Receipts |

| USD | United States Dollar |

| PTT | Pass-Through Trust |

Futures contracts outstanding at June 30, 2018:

| | | | | |

| Number of | | | Notional | Value at | Unrealized |

| Contracts | Type | Expiration | Amounts | June 30, 2018 | Appreciation |

| (1) | 5 Year U.S. | | | | |

| | Treasury Note | Sep. 2018 | $(114,336) | $(113,630) | $ 706 |

| (5) | 10 Year U.S. | | | | |

| | Treasury Note | Sep. 2018 | (604,531) | (601,001) | 3,530 |

| (1) | U.S. Treasury | | | | |

| | Long Bond | Sep. 2018 | (145,406) | (145,013) | 393 |

| (Premium received $89) | | | | $4,629 |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2018:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Assets | | | | | | | | | | | | |

| Corporate Bonds | | $ | — | | $ | 2,783,951 | | $ | — | | $ | 2,783,951 |

| Common Stocks | | | 2,526,055 | | | — | | | — | | | 2,526,055 |

| Exchange Traded Funds | | | 371,247 | | | — | | | — | | | 371,247 |

| Residential Mortgage-Backed | | | | | | | | | | | | |

| Securities | | | — | | | 358,684 | | | — | | | 358,684 |

| Pass-Through Certificates | | | — | | | 96,655 | | | — | | | 96,655 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Agency Obligations | | | — | | | 299,656 | | | — | | | 299,656 |

| Total Investments in Securities* | | $ | 2,897,302 | | $ | 3,538,946 | | $ | — | | $ | 6,436,248 |

| |

| Other Assets | | | | | | | | | | | | |

| Futures Contracts | | $ | 4,718 | | $ | — | | $ | — | | $ | 4,718 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for corporate |

| bonds, common stocks and pass-through certificates. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended |

| June 30, 2018. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| See notes to financial statements | 9 |

Fund Expenses (unaudited)

COVERED CALL STRATEGY FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 1 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/18) | (6/30/18) | (1/1/18–6/30/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $974.78 | $5.04 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.68 | $5.16 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.03%, multiplied by the average account |

| value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses paid |

| during the period are net of expenses waived. |

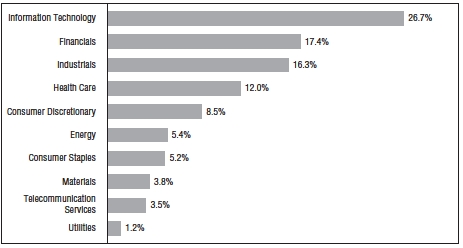

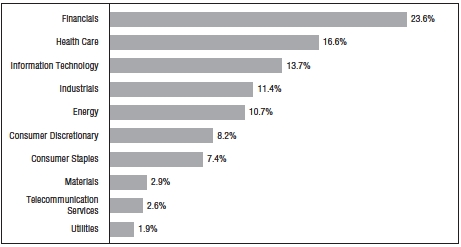

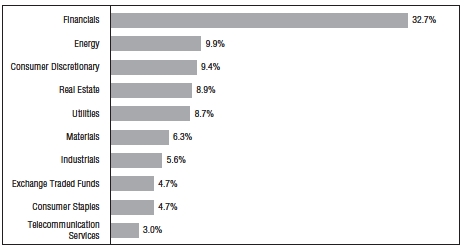

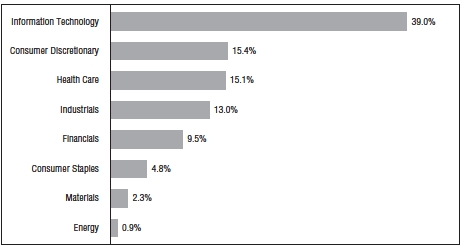

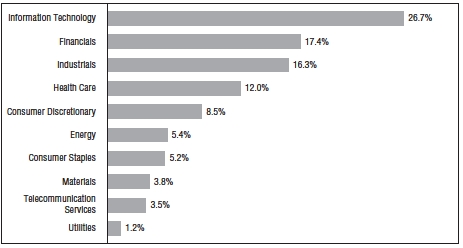

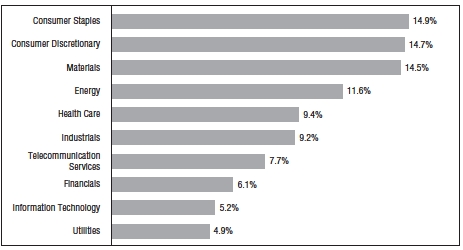

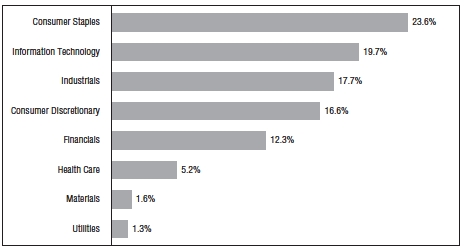

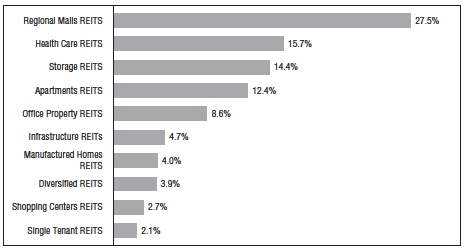

Portfolio Composition

BY SECTOR

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2018, and are |

| based on the total value of investments. |

Portfolio of Investments

COVERED CALL STRATEGY FUND

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—99.3% | | |

| | | Consumer Discretionary—8.4% | | |

| 4,400 | | Carnival Corp. | | $ 252,164 |

| 6,500 | | Ford Motor Co. | | 71,955 |

| 2,300 | | Home Depot, Inc. | | 448,730 |

| 3,000 | | Whirlpool Corp. | | 438,690 |

| | | | | 1,211,539 |

| | | Consumer Staples—5.2% | | |

| 1,900 | | Costco Wholesale Corp. | | 397,062 |

| 2,300 | | PepsiCo, Inc. | | 250,401 |

| 1,200 | | Wal-Mart Stores, Inc. | | 102,780 |

| | | | | 750,243 |

| | | Energy—5.4% | | |

| 3,700 | | Chevron Corp. | | 467,791 |

| 6,900 | | Halliburton Co. | | 310,914 |

| | | | | 778,705 |

| | | Financials—17.3% | | |

| 3,400 | | American Express Co. | | 333,200 |

| 12,300 | | Bank of America Corp. | | 346,737 |

| 5,700 | | BB&T Corp. | | 287,508 |

| 900 | | BlackRock, Inc. | | 449,136 |

| 2,300 | | Chubb, Ltd. | | 292,146 |

| 5,700 | | JPMorgan Chase & Co. | | 593,940 |

| 4,100 | | Morgan Stanley | | 194,340 |

| | | | | 2,497,007 |

| | | Health Care—11.9% | | |

| 1,800 | | Allergan, PLC | | 300,096 |

| 3,300 | * | Celgene Corp. | | 262,086 |

| 3,900 | | CVS Health Corp. | | 250,965 |

| 7,500 | | Medtronic, PLC | | 642,075 |

| 4,200 | | Merck & Co., Inc. | | 254,940 |

| | | | | 1,710,162 |

Portfolio of Investments (continued)

COVERED CALL STRATEGY FUND

June 30, 2018

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | Industrials—16.2% | | | | | |

| 2,500 | | Delta Air Lines, Inc. | | | | | $ 123,850 |

| 3,800 | | Honeywell International, Inc. | | | | | 547,390 |

| 1,100 | | Lockheed Martin Corp. | | | | | 324,973 |

| 3,300 | | Parker Hannifin Corp. | | | | | 514,305 |

| 1,600 | | Raytheon Co. | | | | | 309,088 |

| 3,600 | | Union Pacific Corp. | | | | | 510,048 |

| | | | | | | | 2,329,654 |

| | | Information Technology—26.5% | | | | | |

| 3,900 | | Apple, Inc. | | | | | 721,929 |

| 1,600 | | Broadcom, Ltd. | | | | | 388,224 |

| 11,900 | | Cisco Systems, Inc. | | | | | 512,057 |

| 9,500 | | Intel Corp. | | | | | 472,245 |

| 2,000 | | International Business Machines Corp. | | | | | 279,400 |

| 3,300 | | Mastercard, Inc. – Class “A” | | | | | 648,516 |

| 6,300 | | Microsoft Corp. | | | | | 621,243 |

| 1,600 | | Texas Instruments, Inc. | | | | | 176,400 |

| | | | | | | | 3,820,014 |

| | | Materials—3.8% | | | | | |

| 8,200 | | DowDuPont, Inc. | | | | | 540,544 |

| | | Telecommunication Services—3.5% | | | | | |

| 15,604 | | AT&T, Inc. | | | | | 501,028 |

| | | Utilities—1.1% | | | | | |

| 1,000 | | NextEra Energy, Inc. | | | | | 167,030 |

| Total Value of Common Stocks (cost $13,300,262) | 99.3 | % | | | 14,305,926 |

| Other Assets, Less Liabilities | .7 | | | | 96,909 |

| Net Assets | | | 100.0 | % | | $14,402,835 |

| | | | |

| |

| | Expiration | Exercise | | |

| CALL OPTIONS WRITTEN—(1.1)% | Date | Price | Contracts | Value |

| Allergan, PLC | 7/20/18 | $180.00 | (18) | $ (1,116) |

| American Express Co | 7/20/18 | 105.00 | (25) | (750) |

| American Express Co | 7/20/18 | 100.00 | (9) | (1,341) |

| Apple, Inc. | 7/20/18 | 195.00 | (39) | (1,872) |

| AT&T, Inc | 9/21/18 | 34.00 | (156) | (7,800) |

| Bank of America Corp. | 7/20/18 | 31.00 | (123) | (861) |

| BB&T Corp | 9/21/18 | 57.50 | (57) | (1,425) |

| BlackRock, Inc. | 10/19/18 | 590.00 | (1) | (237) |

| BlackRock, Inc. | 10/19/18 | 570.00 | (8) | (4,400) |

| Broadcom, Ltd. | 8/17/18 | 280.00 | (14) | (840) |

| Broadcom, Ltd. | 8/17/18 | 280.00 | (2) | (120) |

| Carnival Corp. | 7/20/18 | 67.50 | (38) | (114) |

| Carnival Corp. | 8/17/18 | 62.50 | (6) | (240) |

| Celgene Corp. | 8/17/18 | 85.00 | (33) | (5,214) |

| Chevron Corp. | 7/20/18 | 135.00 | (31) | (527) |

| Chevron Corp. | 8/17/18 | 135.00 | (6) | (576) |

| Chubb, Ltd. | 7/20/18 | 130.00 | (1) | (150) |

| Chubb, Ltd. | 8/17/18 | 140.00 | (22) | (770) |

| Cisco Systems, Inc. | 7/20/18 | 45.00 | (119) | (1,666) |

| Costco Wholesale Corp | 9/21/18 | 210.00 | (16) | (11,600) |

| Costco Wholesale Corp | 9/21/18 | 210.00 | (3) | (2,175) |

| CVS Health Corp. | 8/17/18 | 75.00 | (37) | (1,036) |

| CVS Health Corp. | 8/17/18 | 77.50 | (2) | (32) |

| Delta Air Lines, Inc | 7/20/18 | 53.50 | (25) | (775) |

| DowDuPont, Inc. | 9/21/18 | 75.00 | (64) | (3,008) |

| DowDuPont, Inc. | 9/21/18 | 72.50 | (13) | (1,118) |

| DowDuPont, Inc. | 9/21/18 | 70.00 | (5) | (690) |

| Ford Motor Co. | 9/21/18 | 11.87 | (65) | (1,170) |

| Halliburton Co | 7/20/18 | 57.50 | (25) | (25) |

| Halliburton Co | 7/27/18 | 50.00 | (44) | (1,056) |

| Home Depot, Inc | 8/17/18 | 210.00 | (17) | (2,057) |

| Home Depot, Inc | 9/21/18 | 195.00 | (6) | (4,650) |

| Honeywell International, Inc | 9/21/18 | 160.00 | (38) | (1,710) |

| Intel Corp. | 7/20/18 | 60.00 | (81) | (81) |

| Intel Corp. | 7/20/18 | 52.50 | (14) | (434) |

| International Business Machines Corp | 9/21/18 | 150.00 | (20) | (3,020) |

| JPMorgan Chase & Co. | 9/21/18 | 120.00 | (57) | (2,622) |

| Lockheed Martin Corp. | 7/20/18 | 340.00 | (9) | (90) |

| Lockheed Martin Corp. | 8/17/18 | 320.00 | (2) | (560) |

| Mastercard, Inc. - Class “A” | 7/20/18 | 195.00 | (15) | (7,050) |

| Medtronic, PLC | 7/20/18 | 87.50 | (75) | (3,825) |

| Merck & Co., Inc. | 9/21/18 | 60.00 | (42) | (13,020) |

| Microsoft Corp. | 9/21/18 | 105.00 | (23) | (4,255) |

| Microsoft Corp. | 9/21/18 | 100.00 | (40) | (15,080) |

| Morgan Stanley | 7/27/18 | 54.00 | (30) | (240) |

Portfolio of Investments (continued)

COVERED CALL STRATEGY FUND

June 30, 2018

| | | | |

| |

| | Expiration | Exercise | | |

| CALL OPTIONS WRITTEN (continued) | Date | Price | Contracts | Value |

| Morgan Stanley | 8/17/18 | 52.50 | (11) | $ (363) |

| NextEra Energy, Inc. | 7/20/18 | 165.00 | (8) | (3,232) |

| NextEra Energy, Inc. | 8/17/18 | 170.00 | (2) | (556) |

| Parker Hannifin Corp. | 7/20/18 | 175.00 | (12) | (120) |

| Parker Hannifin Corp. | 8/17/18 | 200.00 | (8) | (40) |

| Parker Hannifin Corp. | 8/17/18 | 175.00 | (13) | (1,339) |

| PepsiCo, Inc. | 7/20/18 | 105.00 | (11) | (5,500) |

| PepsiCo, Inc. | 9/21/18 | 110.00 | (12) | (3,948) |

| Raytheon Co. | 7/20/18 | 200.00 | (16) | (1,920) |

| Texas Instruments, Inc. | 7/20/18 | 110.00 | (13) | (3,562) |

| Texas Instruments, Inc. | 8/17/18 | 115.00 | (3) | (666) |

| Union Pacific Corp. | 8/17/18 | 140.00 | (36) | (21,420) |

| Wal-Mart Stores, Inc | 9/21/18 | 95.00 | (12) | (564) |

| Whirlpool Corp | 7/20/18 | 160.00 | (25) | (425) |

| Whirlpool Corp | 8/17/18 | 160.00 | (5) | (818) |

| Total Call Options Written (premium received $240,645) | | | $ (155,871) |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2018:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Assets | | | | | | | | | | | | |

| Common Stocks* | | $ | 14,305,926 | | $ | — | | $ | — | | $ | 14,305,926 |

| Liabilities | | | | | | | | | | | | |

| Call Options Written | | $ | (155,871) | | $ | — | | $ | — | | $ | (155,871) |

| |

| * | The Portfolio of Investments provides information on the industry categorization for common stocks. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended |

| June 30, 2018. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| See notes to financial statements | 15 |

Fund Expenses (unaudited)

EQUITY INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 1 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/18) | (6/30/18) | (1/1/18–6/30/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $986.48 | $3.99 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.77 | $4.06 |

| |

| * | Expenses are equal to the annualized expense ratio of .81%, multiplied by the average account |

| value over the period, multiplied by 181/365 (to reflect the one-half year period). |

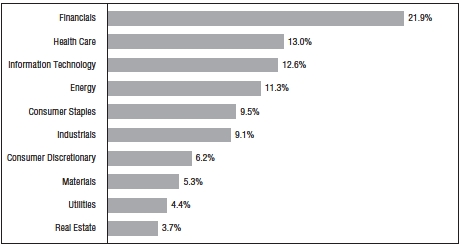

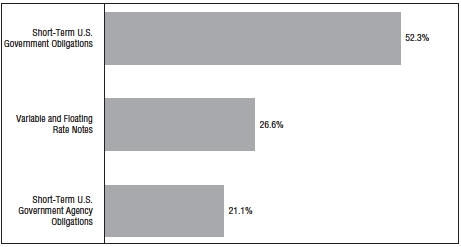

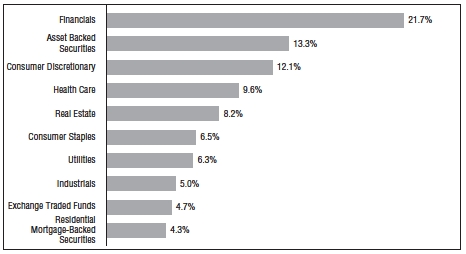

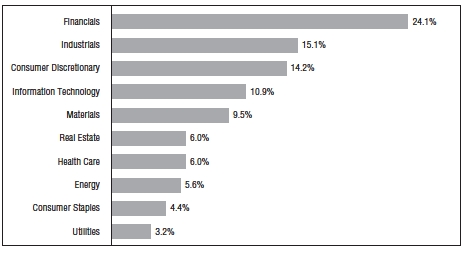

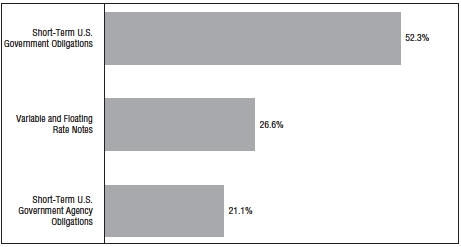

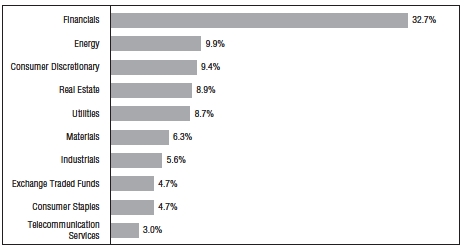

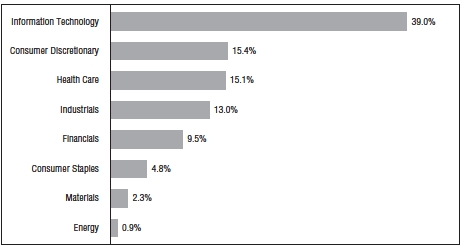

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2018, and are |

| based on the total value of investments. |

Portfolio of Investments

EQUITY INCOME FUND

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | COMMON STOCKS—96.5% | | |

| | | Consumer Discretionary—6.1% | | |

| 14,400 | | Acushnet Holdings Corp. | | $ 352,224 |

| 11,400 | | American Eagle Outfitters, Inc. | | 265,050 |

| 39,000 | | Comcast Corp. – Special Shares “A” | | 1,279,590 |

| 22,145 | | Dana Holding Corp. | | 447,108 |

| 28,050 | | Ford Motor Co. | | 310,513 |

| 12,800 | | Lowe’s Cos., Inc. | | 1,223,296 |

| 5,200 | | McDonald’s Corp. | | 814,788 |

| 3,000 | | Oxford Industries, Inc. | | 248,940 |

| 26,000 | | Penske Automotive Group, Inc. | | 1,218,100 |

| 17,000 | | Tapestry, Inc. | | 794,070 |

| 11,600 | | Wyndham Hotels & Resorts, Inc. | | 682,428 |

| | | | | 7,636,107 |

| | | Consumer Staples—9.2% | | |

| 17,100 | | Altria Group, Inc. | | 971,109 |

| 18,600 | | Coca-Cola Co. | | 815,796 |

| 12,700 | | CVS Health Corp. | | 817,245 |

| 4,700 | | J.M. Smucker Co. | | 505,156 |

| 7,950 | | Keurig Dr Pepper, Inc. | | 969,900 |

| 7,400 | | Kimberly-Clark Corp. | | 779,516 |

| 10,582 | | Koninklijke Ahold Delhaize NV (ADR) | | 252,592 |

| 6,966 | | Kraft Heinz Co. | | 437,604 |

| 12,800 | | PepsiCo, Inc. | | 1,393,536 |

| 15,200 | | Philip Morris International, Inc. | | 1,227,248 |

| 14,200 | | Pinnacle Foods, Inc. | | 923,852 |

| 14,600 | | Procter & Gamble Co. | | 1,139,676 |

| 16,100 | | Wal-Mart Stores, Inc. | | 1,378,965 |

| | | | | 11,612,195 |

| | | Energy—11.1% | | |

| 11,700 | | Anadarko Petroleum Corp. | | 857,025 |

| 6,600 | | Andeavor Logistics, LP | | 865,788 |

| 21,400 | | Chevron Corp. | | 2,705,602 |

| 14,950 | | ConocoPhillips | | 1,040,819 |

| 71,000 | | EnCana Corp. | | 926,550 |

| 7,100 | | EOG Resources, Inc. | | 883,453 |

| 12,300 | | ExxonMobil Corp. | | 1,017,579 |

| 18,600 | | Occidental Petroleum Corp. | | 1,556,448 |

| 9,800 | | PBF Energy, Inc. – Class “A” | | 410,914 |

Portfolio of Investments (continued)

EQUITY INCOME FUND

June 30, 2018

| | | | |

| |

| | | | |

| | | | |

| | | | |

| Shares | | Security | | Value |

| | | Energy (continued) | | |

| 22,650 | | Royal Dutch Shell, PLC – Class “A” (ADR) | | $ 1,568,060 |

| 18,800 | | Schlumberger, Ltd. | | 1,260,164 |

| 20,300 | | Suncor Energy, Inc. | | 825,804 |

| | | | | 13,918,206 |

| | | Financials—20.8% | | |

| 30,700 | * | AllianceBernstein Holding, LP (MLP) | | 876,485 |

| 15,950 | | American Express Co. | | 1,563,100 |

| 21,900 | | Bank of New York Mellon Corp. | | 1,181,067 |

| 17,650 | | Berkshire Hills Bancorp, Inc. | | 716,590 |

| 14,067 | | Chubb, Ltd. | | 1,786,790 |

| 12,200 | | Comerica, Inc. | | 1,109,224 |

| 13,250 | | Discover Financial Services | | 932,932 |

| 19,700 | | FNF Group, Inc. | | 741,114 |

| 21,500 | | Hamilton Lane, Inc. – Class “A” | | 1,031,355 |

| 17,300 | | Invesco, Ltd. | | 459,488 |

| 22,400 | | iShares S&P U.S. Preferred Stock Index Fund (ETF) | | 844,704 |

| 25,600 | | JPMorgan Chase & Co. | | 2,667,520 |

| 15,800 | | MetLife, Inc. | | 688,880 |

| 31,900 | | Old National Bancorp of Indiana | | 593,340 |

| 9,700 | | PNC Financial Services Group, Inc. | | 1,310,470 |

| 13,600 | | Popular, Inc. | | 614,856 |

| 13,000 | | Prosperity Bancshares, Inc. | | 888,680 |

| 69,700 | | Regions Financial Corp. | | 1,239,266 |

| 41,000 | | Sterling Bancorp | | 963,500 |

| 7,900 | | Travelers Cos., Inc. | | 966,486 |

| 21,900 | | U.S. Bancorp | | 1,095,438 |

| 30,400 | | Waddell & Reed Financial, Inc. – Class “A” | | 546,288 |

| 58,650 | | Wells Fargo & Co. | | 3,251,556 |

| | | | | 26,069,129 |

| | | Health Care—12.6% | | |

| 20,300 | | Abbott Laboratories | | 1,238,097 |

| 12,000 | | AbbVie, Inc. | | 1,111,800 |

| 4,400 | | Aetna, Inc. | | 807,400 |

| 17,050 | | GlaxoSmithKline, PLC (ADR) | | 687,285 |

| 19,550 | | Johnson & Johnson | | 2,372,197 |

| 16,600 | | Koninklijke Philips NV (ADR) | | 701,682 |

| 13,112 | | Medtronic, PLC | | 1,122,518 |

| 40,820 | | Merck & Co., Inc. | | 2,477,774 |

| 77,485 | | Pfizer, Inc. | | 2,811,156 |

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Health Care (continued) | | |

| 12,301 | | Phibro Animal Health Corp. – Class “A” | | $ 566,461 |

| 20,600 | | Smith & Nephew, PLC (ADR) | | 773,118 |

| 5,000 | | UnitedHealth Group, Inc. | | 1,226,700 |

| | | | | 15,896,188 |

| | | Industrials—8.9% | | |

| 4,400 | | 3M Co. | | 865,568 |

| 5,600 | | A.O. Smith Corp. | | 331,240 |

| 14,300 | | Eaton Corp., PLC | | 1,068,782 |

| 3,400 | | General Dynamics Corp. | | 633,794 |

| 11,100 | | Honeywell International, Inc. | | 1,598,955 |

| 10,300 | | Ingersoll-Rand, PLC | | 924,219 |

| 6,250 | | ITT, Inc. | | 326,688 |

| 16,600 | | Knight-Swift Transportation Holdings, Inc. | | 634,286 |

| 3,680 | | Lockheed Martin Corp. | | 1,087,182 |

| 27,300 | | Schneider National, Inc. – Class “B” | | 751,023 |

| 22,900 | | Triton International, Ltd. | | 702,114 |

| 7,500 | | United Parcel Service, Inc. – Class “B” | | 796,725 |

| 11,500 | | United Technologies Corp. | | 1,437,845 |

| | | | | 11,158,421 |

| | | Information Technology—12.4% | | |

| 6,890 | | Apple, Inc. | | 1,275,408 |

| 3,500 | | Broadcom, Ltd. | | 849,240 |

| 51,500 | | Cisco Systems, Inc. | | 2,216,045 |

| 37,300 | | Cypress Semiconductor Corp. | | 581,134 |

| 42,000 | | HP Enterprise Co. | | 613,620 |

| 28,000 | | HP, Inc. | | 635,320 |

| 34,200 | | Intel Corp. | | 1,700,082 |

| 3,650 | | Lam Research Corp. | | 630,903 |

| 6,100 | | LogMeIn, Inc. | | 629,825 |

| 8,800 | | Microchip Technology, Inc. | | 800,360 |

| 28,250 | | Microsoft Corp. | | 2,785,733 |

| 9,600 | | MKS Instruments, Inc. | | 918,720 |

| 19,200 | | QUALCOMM, Inc. | | 1,077,504 |

| 14,900 | | Silicon Motion Technology Corp. (ADR) | | 788,061 |

| | | | | 15,501,955 |

Portfolio of Investments (continued)

EQUITY INCOME FUND

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| Shares | | Security | | Value |

| | | Materials—5.2% | | |

| 26,431 | | DowDuPont, Inc. | | $ 1,742,332 |

| 7,400 | | Eastman Chemical Co. | | 739,704 |

| 14,300 | | FMC Corp. | | 1,275,703 |

| 6,800 | | LyondellBasell Industries NV – Class “A” | | 746,980 |

| 4,400 | | Praxair, Inc. | | 695,860 |

| 8,000 | | Sealed Air Corp. | | 339,600 |

| 16,690 | | WestRock Co. | | 951,664 |

| | | | | 6,491,843 |

| | | Real Estate—3.0% | | |

| 37,000 | | Americold Realty Trust (REIT) | | 814,740 |

| 14,200 | | Douglas Emmett, Inc. (REIT) | | 570,556 |

| 5,200 | | Federal Realty Investment Trust (REIT) | | 658,060 |

| 34,400 | | GGP, Inc. (REIT) | | 702,792 |

| 20,800 | | Sunstone Hotel Investors, Inc. (REIT) | | 345,696 |

| 30,200 | | Urstadt Biddle Properties, Inc. (REIT) | | 683,426 |

| | | | | 3,775,270 |

| | | Telecommunication Services—2.9% | | |

| 47,884 | | AT&T, Inc. | | 1,537,555 |

| 42,300 | | Verizon Communications, Inc. | | 2,128,113 |

| | | | | 3,665,668 |

| | | Utilities—4.3% | | |

| 7,450 | | American Electric Power Co., Inc. | | 515,912 |

| 20,500 | | CenterPoint Energy, Inc. | | 568,055 |

| 10,350 | | Dominion Energy, Inc. | | 705,663 |

| 7,100 | | Duke Energy Corp. | | 561,468 |

| 25,700 | | Exelon Corp. | | 1,094,820 |

| 4,100 | | NextEra Energy, Inc. | | 684,823 |

| 13,000 | | PPL Corp. | | 371,150 |

| 13,000 | | Vectren Corp. | | 928,850 |

| | | | | 5,430,741 |

| Total Value of Common Stocks (cost $88,580,650) | | 121,155,723 |

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shares | | Security | | | | | Value |

| | | PREFERRED STOCKS—1.2% | | | | | |

| | | Financials—.6% | | | | | |

| 200 | | Citizens Financial Group, Inc., Series A, 5.5%, 2049 | | | | $ 204,000 |

| 21,200 | | JPMorgan Chase & Co., Series Y, 6.125%, 2020 | | | | 555,016 |

| | | | | | | | 759,016 |

| | | Real Estate—.6% | | | | | |

| 11,400 | | Digital Realty Trust, Inc. (REIT), Series G, 5.875%, 2049 | | | | 289,674 |

| | | Urstadt Biddle Properties, Inc. (REIT): | | | | | |

| 11,000 | | Series G, 6.75%, 2049 | | | | | 277,090 |

| 8,300 | | Series H, 6.25%, 2022 | | | | | 207,878 |

| | | | | | | | 774,642 |

| Total Value of Preferred Stocks (cost $1,495,099) | | | | | 1,533,658 |

| Total Value of Investments (cost $90,075,749) | 97.7 | % | | | 122,689,381 |

| Other Assets, Less Liabilities | 2.3 | | | | 2,826,514 |

| Net Assets | | | 100.0 | % | | $125,515,895 |

| | |

| * | Non-income producing |

| |

| Summary of Abbreviations: |

| ADR | American Depositary Receipts |

| ETF | Exchange Traded Fund |

| MLP | Master Limited Partnership |

| REIT | Real Estate Investment Trust |

| | | | |

| |

| CALL OPTIONS WRITTEN—.0% | Date | Price | Contracts | Value |

| Bank of New York Mellon Corp | 7/20/18 | $ 56.00 | (10) | $ (610) |

| JP Morgan Chase & Co | 7/13/18 | 108.00 | (10) | (600) |

| McDonald’s Corp | 7/20/18 | 162.50 | (20) | (1,400) |

| Microsoft Corp. | 7/6/18 | 103.00 | (10) | (60) |

| Total Call Options Written (premium received $8,340) | | | $(2,670) |

Portfolio of Investments (continued)

EQUITY INCOME FUND

June 30, 2018

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. Government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of June 30, 2018:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 121,155,723 | | $ | — | | $ | — | | $ | 121,155,723 |

| Preferred Stocks | | | 1,533,658 | | | — | | | — | | | 1,533,658 |

| Total Investments in Securities* | | $ | 122,689,381 | | $ | — | | $ | — | | $ | 122,689,381 |

| |

| Liabilities | | | | | | | | | | | | |

| Call Options Written | | $ | (2,670) | | $ | — | | $ | — | | $ | (2,670) |

| |

| * | The Portfolio of Investments provides information on the industry categorization for common stocks |

| and preferred stocks. |

| |

| There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended |

| June 30, 2018. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| 22 | See notes to financial statements | |

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 1 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (1/1/18) | (6/30/18) | (1/1/18–6/30/18)* |

| Expense Examples | | | |

| Actual | $1,000.00 | $993.79 | $4.40 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,020.38 | $4.46 |

| |

| * | Expenses are equal to the annualized expense ratio of .89%, multiplied by the average account |

| value over the period, multiplied by 181/365 (to reflect the one-half year period). |

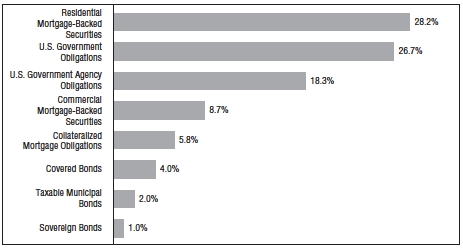

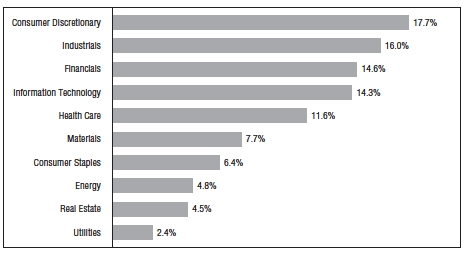

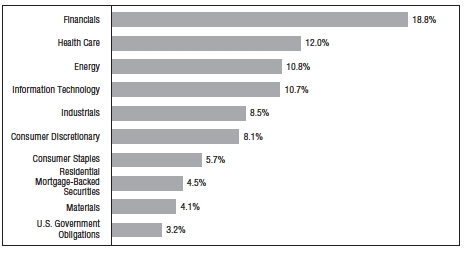

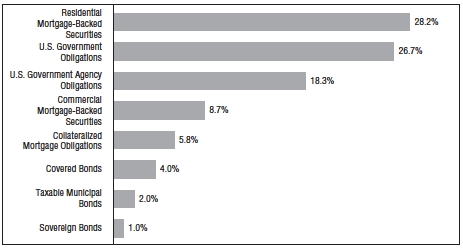

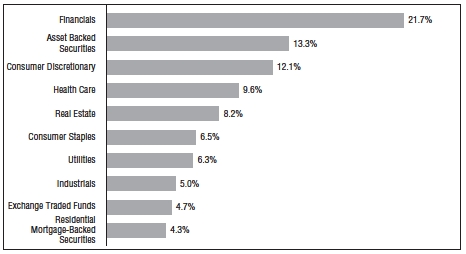

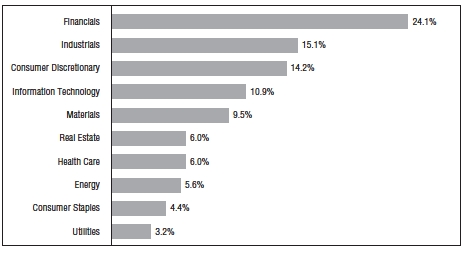

Portfolio Composition

TOP TEN SECTORS

|

| Portfolio holdings and allocations are subject to change. Percentages are as of June 30, 2018, and are |

| based on the total value of investments. |

Portfolio of Investments

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—88.2% | | |

| | | Aerospace/Defense—2.5% | | |

| | | Bombardier, Inc.: | | |

| $ 375M | | 8.75%, 12/1/2021 (a) | | $ 414,375 |

| 275M | | 7.5%, 12/1/2024 (a) | | 290,125 |

| 150M | | 7.5%, 3/15/2025 (a) | | 156,938 |

| 500M | | KLX, Inc., 5.875%, 12/1/2022 (a) | | 521,250 |

| | | Meccanica Holdings USA, Inc.: | | |

| 275M | | 7.375%, 7/15/2039 (a) | | 325,875 |

| 100M | | 6.25%, 1/15/2040 (a) | | 108,500 |

| | | TransDigm, Inc.: | | |

| 250M | | 5.5%, 10/15/2020 | | 250,313 |

| 525M | | 6.375%, 6/15/2026 | | 522,375 |

| | | | | 2,589,751 |

| | | Automotive—2.8% | | |

| 425M | | Adient Global Holdings, Ltd., 4.875%, 8/15/2026 (a) | | 383,562 |

| 425M | | American Axle & Manufacturing, Inc., 6.25%, 4/1/2025 | | 423,406 |

| 225M | | Asbury Automotive Group, Inc., 6%, 12/15/2024 | | 224,086 |

| 225M | | Avis Budget Group, Inc., 6.375%, 4/1/2024 (a) | | 221,625 |

| 175M | | Cooper Standard Automotive, Inc., 5.625%, 11/15/2026 (a) | | 173,250 |

| 150M | | Dana Financing Luxembourg Sarl, 6.5%, 6/1/2026 (a) | | 152,625 |

| | | Dana Holding Corp.: | | |

| 200M | | 6%, 9/15/2023 | | 207,250 |

| 250M | | 5.5%, 12/15/2024 | | 248,125 |

| 100M | | Group 1 Automotive, Inc., 5.25%, 12/15/2023 (a) | | 96,500 |

| | | Hertz Corp.: | | |

| 250M | | 5.875%, 10/15/2020 | | 245,625 |

| 250M | | 7.625%, 6/1/2022 (a) | | 240,625 |

| 225M | | J.B. Poindexter & Co., 7.125%, 4/15/2026 (a) | | 231,750 |

| | | | | 2,848,429 |

| | | Building Materials—1.2% | | |

| 500M | | Building Materials Corp., 5.375%, 11/15/2024 (a) | | 496,250 |

| 500M | | Griffon Corp., 5.25%, 3/1/2022 | | 488,325 |

| 250M | | New Enterprise Stone & Lime Co., 6.25%, 3/15/2026 (a) | | 253,125 |

| | | | | 1,237,700 |

| | | Chemicals—3.3% | | |

| 175M | | A. Schulman, Inc., 6.875%, 6/1/2023 | | 184,931 |

| 275M | | Blue Cube Spinco, Inc., 10%, 10/15/2025 | | 321,062 |

| 275M | | CF Industries, Inc., 4.95%, 6/1/2043 | | 233,406 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Chemicals (continued) | | |

| $ 225M | | Chemours Co., 6.625%, 5/15/2023 | | $ 236,250 |

| 275M | | CVR Partners, LP, 9.25%, 6/15/2023 (a) | | 284,281 |

| 225M | | PQ Corp., 6.75%, 11/15/2022 (a) | | 237,094 |

| 650M | | Rain CII Carbon, LLC, 7.25%, 4/1/2025 (a) | | 663,000 |

| 350M | | Rayonier AM Products, Inc., 5.5%, 6/1/2024 (a) | | 330,750 |

| 500M | | Tronox, Inc., 6.5%, 4/15/2026 (a) | | 498,125 |

| 375M | | Univar USA, Inc., 6.75%, 7/15/2023 (a) | | 387,188 |

| | | | | 3,376,087 |

| | | Consumer Non-Durables—1.8% | | |

| 225M | | Eagle Intermediate Global Holding, 7.5%, 5/1/2025 (a) | | 225,281 |

| 125M | | Energizer Gamma Acquisition, 6.375%, 7/15/2026 (a)(b) | | 127,344 |

| 250M | | Energizer Holdings, Inc., 5.5%, 6/15/2025 (a) | | 246,250 |

| 350M | | First Quality Finance Co., 4.625%, 5/15/2021 (a) | | 343,000 |

| 550M | | Kronos Acquisition, Inc., 9%, 8/15/2023 (a) | | 496,375 |

| | | Reynolds Group Holdings, Inc.: | | |

| 267M | | 5.75%, 10/15/2020 | | 267,837 |

| 125M | | 5.125%, 7/15/2023 (a) | | 123,594 |

| | | | | 1,829,681 |

| | | Energy—11.5% | | |

| 250M | | Andeavor Logistics, LP, 6.875%, 12/29/2049 | | 247,969 |

| | | Antero Resources Corp.: | | |

| 125M | | 5.375%, 11/1/2021 | | 127,031 |

| 50M | | 5.125%, 12/1/2022 | | 50,375 |

| 250M | | Apergy Corp., 6.375%, 5/1/2026 (a) | | 254,375 |

| 250M | | Baytex Energy Corp., 5.125%, 6/1/2021 (a) | | 243,125 |

| 225M | | Berry Petroleum Co., 7%, 2/15/2026 (a) | | 230,625 |

| 200M | | Blue Racer Midstream, LLC, 6.125%, 11/15/2022 (a) | | 203,000 |

| | | Carrizo Oil & Gas, Inc.: | | |

| 50M | | 6.25%, 4/15/2023 | | 50,875 |

| 75M | | 8.25%, 7/15/2025 | | 79,875 |

| 150M | | CONSOL Energy, Inc., 5.875%, 4/15/2022 | | 151,154 |

| | | Consolidated Energy Finance SA: | | |

| 375M | | 6.09063%, 6/15/2022 (a)† | | 375,140 |

| 225M | | 6.875%, 6/15/2025 (a) | | 231,750 |

| 150M | | 6.5%, 5/15/2026 (a) | | 148,688 |

| 250M | | Covey Park Energy, LLC, 7.5%, 5/15/2025 (a) | | 256,250 |

| | | Crestwood Midstream Partners, LP: | | |

| 250M | | 6.25%, 4/1/2023 | | 255,625 |

| 450M | | 5.75%, 4/1/2025 | | 451,125 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy (continued) | | |

| $ 300M | | CSI Compressco, LP, 7.5%, 4/1/2025 (a) | | $ 302,625 |

| | | DCP Midstream Operating, LP: | | |

| 325M | | 5.35%, 3/15/2020 (a) | | 331,906 |

| 225M | | 7.375%, 12/29/2049 † | | 215,859 |

| 275M | | Delek Logistics Partners, LP, 6.75%, 5/15/2025 | | 276,375 |

| | | Diamondback Energy, Inc.: | | |

| 75M | | 4.75%, 11/1/2024 | | 73,406 |

| 100M | | 5.375%, 5/31/2025 (a) | | 100,125 |

| 400M | | Exterran Partners, LP, 6%, 10/1/2022 | | 398,000 |

| 100M | | Forum Energy Technologies, Inc., 6.25%, 10/1/2021 | | 100,250 |

| | | Genesis Energy, LP: | | |

| 200M | | 6.75%, 8/1/2022 | | 203,000 |

| 100M | | 5.625%, 6/15/2024 | | 94,000 |

| 300M | | Global Partners, LP, 6.25%, 7/15/2022 | | 292,500 |

| 175M | | Gulfport Energy Corp., 6.375%, 5/15/2025 | | 170,844 |

| 125M | | Hilcorp Energy I, LP, 5%, 12/1/2024 (a) | | 121,875 |

| 275M | | Matador Resources Co., 6.875%, 4/15/2023 | | 288,750 |

| 125M | | McDermott Escrow 1, Inc., 10.625%, 5/1/2024 (a) | | 130,625 |

| 250M | | MEG Energy Corp., 6.375%, 1/30/2023 (a) | | 233,750 |

| | | Murphy Oil Corp.: | | |

| 200M | | 4.45%, 12/1/2022 | | 197,482 |

| 175M | | 5.75%, 8/15/2025 | | 174,947 |

| 100M | | 5.875%, 12/1/2042 | | 91,000 |

| 275M | | Nabors Industries, Inc., 5.75%, 2/1/2025 (a) | | 260,562 |

| 250M | | Newfield Exploration Co., 5.375%, 1/1/2026 | | 256,875 |

| 250M | | NGPL Pipeco, LLC, 4.875%, 8/15/2027 (a) | | 247,813 |

| | | Oasis Petroleum, Inc.: | | |

| 250M | | 6.875%, 1/15/2023 | | 254,688 |

| 175M | | 6.25%, 5/1/2026 (a) | | 176,969 |

| 250M | | Parkland Fuel Corp., 6%, 4/1/2026 (a) | | 246,875 |

| | | Parsley Energy, LLC: | | |

| 50M | | 6.25%, 6/1/2024 (a) | | 52,000 |

| 275M | | 5.25%, 8/15/2025 (a) | | 271,563 |

| 50M | | 5.625%, 10/15/2027 (a) | | 49,750 |

| | | PDC Energy, Inc.: | | |

| 175M | | 6.125%, 9/15/2024 | | 179,375 |

| 100M | | 5.75%, 5/15/2026 (a) | | 99,125 |

| | | Precision Drilling Corp.: | | |

| 121M | | 6.5%, 12/15/2021 | | 124,619 |

| 150M | | 7.125%, 1/15/2026 (a) | | 154,425 |

| 200M | | QEP Resources, Inc., 6.875%, 3/1/2021 | | 213,500 |

| 100M | | RSP Permian, Inc., 5.25%, 1/15/2025 | | 107,470 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy (continued) | | |

| | | SM Energy Co.: | | |

| $ 350M | | 5%, 1/15/2024 | | $ 332,937 |

| 150M | | 5.625%, 6/1/2025 | | 143,625 |

| | | Southwestern Energy Co.: | | |

| 150M | | 7.5%, 4/1/2026 | | 156,000 |

| 175M | | 7.75%, 10/1/2027 | | 182,437 |

| 100M | | Suburban Propane Partners, LP, 5.875%, 3/1/2027 | | 94,000 |

| 175M | | Sunoco, LP, 5.875%, 3/15/2028 (a) | | 165,433 |

| 225M | | Transocean Guardian, Ltd., 5.875%, 1/15/2024 (a)(b) | | 224,438 |

| 75M | | Unit Corp., 6.625%, 5/15/2021 | | 75,187 |

| 350M | | Whiting Petroleum Corp., 6.25%, 4/1/2023 | | 359,625 |

| | | WPX Energy, Inc.: | | |

| 94M | | 6%, 1/15/2022 | | 98,230 |

| 150M | | 5.75%, 6/1/2026 | | 150,141 |

| | | | | 11,831,963 |

| | | Financials—5.2% | | |

| 350M | | Ally Financial, Inc., 8%, 11/1/2031 | | 418,250 |

| 250M | | Arch Merger Sub, Inc., 8.5%, 9/15/2025 (a) | | 233,750 |

| 225M | | Credit Suisse Group AG, 7.5%, 12/11/2023 (a) | | 232,855 |

| 275M | | CSTN Merger Sub, Inc., 6.75%, 8/15/2024 (a) | | 269,844 |

| 550M | | DAE Funding, LLC, 5%, 8/1/2024 (a) | | 529,650 |

| | | Icahn Enterprises, LP: | | |

| 200M | | 6.25%, 2/1/2022 | | 204,500 |

| 275M | | 6.75%, 2/1/2024 | | 278,094 |

| | | Intesa Sanpaolo SpA: | | |

| 300M | | 5.017%, 6/26/2024 (a) | | 272,642 |

| 250M | | 5.71%, 1/15/2026 (a) | | 228,930 |

| | | Ladder Capital Finance Holdings, LLLP: | | |

| 200M | | 5.25%, 3/15/2022 (a) | | 200,500 |

| 400M | | 5.25%, 10/1/2025 (a) | | 376,420 |

| 375M | | LPL Holdings, Inc., 5.75%, 9/15/2025 (a) | | 365,625 |

| 400M | | Navient Corp., 5.875%, 3/25/2021 | | 407,500 |

| | | Springleaf Finance Corp.: | | |

| 175M | | 7.75%, 10/1/2021 | | 188,781 |

| 250M | | 5.625%, 3/15/2023 | | 249,300 |

| 250M | | 6.875%, 3/15/2025 | | 248,750 |

| 525M | | UniCredit SpA, 5.861%, 6/19/2032 (a) | | 468,750 |

| 175M | | Wand Merger Corp., 8.125%, 7/15/2023 (a)(b) | | 178,063 |

| | | | | 5,352,204 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Food/Beverage/Tobacco—1.9% | | |

| $ 325M | | Barry Callebault Services SA, 5.5%, 6/15/2023 (a) | | $ 339,137 |

| 300M | | JBS USA LUX SA, 6.75%, 2/15/2028 (a) | | 283,785 |

| | | Pilgrim’s Pride Corp.: | | |

| 25M | | 5.75%, 3/15/2025 (a) | | 24,063 |

| 275M | | 5.875%, 9/30/2027 (a) | | 255,750 |

| | | Post Holdings, Inc.: | | |

| 250M | | 5.5%, 3/1/2025 (a) | | 244,688 |

| 400M | | 5.75%, 3/1/2027 (a) | | 389,000 |

| 350M | | Sigma Holdco BV, 7.875%, 5/15/2026 (a) | | 329,875 |

| 125M | | Simmons Foods, Inc., 5.75%, 11/1/2024 (a) | | 109,062 |

| | | | | 1,975,360 |

| | | Forest Products/Containers—1.6% | | |

| 675M | | Ardagh Holdings USA, Inc., 7.25%, 5/15/2024 (a) | | 704,531 |

| | | BWAY Holding Co.: | | |

| 75M | | 5.5%, 4/15/2024 (a) | | 73,312 |

| 200M | | 7.25%, 4/15/2025 (a) | | 195,500 |

| | | Mercer International, Inc.: | | |

| 50M | | 7.75%, 12/1/2022 | | 52,562 |

| 175M | | 6.5%, 2/1/2024 | | 177,625 |

| 75M | | 5.5%, 1/15/2026 (a) | | 72,937 |

| 325M | | Sealed Air Corp., 6.875%, 7/15/2033 (a) | | 358,313 |

| | | | | 1,634,780 |

| | | Gaming/Leisure—3.2% | | |

| | | Boyd Gaming Corp.: | | |

| 375M | | 6.875%, 5/15/2023 | | 394,219 |

| 200M | | 6%, 8/15/2026 (a) | | 199,000 |

| 275M | | CRC Escrow Issuer, LLC, 5.25%, 10/15/2025 (a) | | 260,906 |

| 225M | | Golden Nugget, Inc., 8.75%, 10/1/2025 (a) | | 231,685 |

| 550M | | IRB Holding Corp., 6.75%, 2/15/2026 (a) | | 526,625 |

| 50M | | Lions Gate Entertainment Corp., 5.875%, 11/1/2024 (a) | | 50,859 |

| 250M | | National CineMedia, LLC, 6%, 4/15/2022 | | 254,688 |

| 275M | | Pinnacle Entertainment, Inc., 5.625%, 5/1/2024 | | 286,866 |

| 175M | | Silversea Cruise Finance, Ltd., 7.25%, 2/1/2025 (a) | | 189,893 |

| 175M | | Stars Group Holdings BV, 7%, 7/15/2026 (a)(b) | | 177,188 |

| | | Viking Cruises, Ltd.: | | |

| 600M | | 6.25%, 5/15/2025 (a) | | 591,000 |

| 175M | | 5.875%, 9/15/2027 (a) | | 165,812 |

| | | | | 3,328,741 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care—8.3% | | |

| $ 375M | | Centene Corp., 6.125%, 2/15/2024 | | $ 396,094 |

| | | CHS/Community Health Systems, Inc.: | | |

| 100M | | 5.125%, 8/1/2021 | | 93,000 |

| 375M | | 6.25%, 3/31/2023 | | 345,469 |

| 175M | | 8.125%, 6/30/2024 | | 145,141 |

| 250M | | Cimpress NV, 7%, 6/15/2026 (a) | | 256,563 |

| 825M | | DaVita, Inc., 5.125%, 7/15/2024 | | 801,797 |

| | | Endo Finance, LLC: | | |

| 175M | | 7.25%, 1/15/2022 (a)(c) | | 161,875 |

| 225M | | 6%, 7/15/2023 (a) | | 186,187 |

| | | HCA, Inc.: | | |

| 250M | | 6.25%, 2/15/2021 | | 260,000 |

| 475M | | 5.875%, 5/1/2023 | | 494,000 |

| 350M | | 5.875%, 2/15/2026 | | 353,937 |

| | | HealthSouth Corp.: | | |

| 175M | | 5.125%, 3/15/2023 | | 175,875 |

| 200M | | 5.75%, 11/1/2024 | | 200,866 |

| 450M | | inVentiv Group Holdings, Inc., 7.5%, 10/1/2024 (a) | | 475,875 |

| | | LifePoint Health, Inc.: | | |

| 400M | | 5.875%, 12/1/2023 | | 399,500 |

| 275M | | 5.375%, 5/1/2024 | | 265,719 |

| | | Mallinckrodt Finance SB: | | |

| 275M | | 5.75%, 8/1/2022 (a) | | 248,875 |

| 225M | | 5.5%, 4/15/2025 (a) | | 181,125 |

| | | Molina Healthcare, Inc.: | | |

| 400M | | 5.375%, 11/15/2022 | | 404,500 |

| 250M | | 4.875%, 6/15/2025 (a) | | 243,750 |

| 125M | | MPH Operating Partnership, LP, 7.125%, 6/1/2024 (a) | | 128,437 |

| 250M | | Polaris Intermediate Corp., 8.5%, 12/1/2022 (a) | | 258,750 |

| 141M | | RegionalCare Hospital Partners Holdings, Inc., 8.25%, 5/1/2023 (a) | | 149,019 |

| 264M | | Universal Hospital Services, Inc., 7.625%, 8/15/2020 | | 264,330 |

| | | Valeant Pharmaceuticals International, Inc.: | | |

| 200M | | 7.5%, 7/15/2021 (a) | | 203,500 |

| 50M | | 6.5%, 3/15/2022 (a) | | 51,938 |

| 300M | | 7.25%, 7/15/2022 (a) | | 307,248 |

| 450M | | 7%, 3/15/2024 (a) | | 473,490 |

| 325M | | 6.125%, 4/15/2025 (a) | | 300,625 |

| 325M | | 9%, 12/15/2025 (a) | | 337,984 |

| | | | | 8,565,469 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Home Building—.2% | | |

| $ 250M | | William Lyon Homes, Inc., 6%, 9/1/2023 (a) | | $ 248,053 |

| | | Information Technology—3.9% | | |

| 550M | | Alliance Data Systems Corp., 5.375%, 8/1/2022 (a) | | 555,431 |

| 250M | | CDW, LLC, 5%, 9/1/2025 | | 246,875 |

| 250M | | CommScope Technologies, LLC, 6%, 6/15/2025 (a) | | 256,563 |

| 375M | | Diamond 1 Finance Corp., 5.875%, 6/15/2021 (a) | | 381,046 |

| | | NCR Corp.: | | |

| 300M | | 4.625%, 2/15/2021 | | 298,500 |

| 300M | | 5.875%, 12/15/2021 | | 305,625 |

| 275M | | Nuance Communications, Inc., 6%, 7/1/2024 | | 278,781 |

| 275M | | NXP BV, 3.875%, 9/1/2022 (a) | | 270,875 |

| 550M | | Rackspace Hosting, Inc., 8.625%, 11/15/2024 (a) | | 554,125 |

| 575M | | Solera, LLC, 10.5%, 3/1/2024 (a) | | 641,487 |

| 250M | | Symantec Corp., 5%, 4/15/2025 (a) | | 242,819 |

| | | | | 4,032,127 |

| | | Manufacturing—2.1% | | |

| 125M | | American Woodmark Corp., 4.875%, 3/15/2026 (a) | | 118,750 |

| 375M | | ATS Automation Tooling Systems, Inc., 6.5%, 6/15/2023 (a) | | 383,437 |

| 100M | | Boise Cascade Co., 5.625%, 9/1/2024 (a) | | 100,750 |

| 175M | | Cloud Crane, LLC, 10.125%, 8/1/2024 (a) | | 188,562 |

| 425M | | Grinding Media, Inc., 7.375%, 12/15/2023 (a) | | 444,125 |

| 300M | | H&E Equipment Services, Inc., 5.625%, 9/1/2025 | | 295,500 |

| 200M | | Park-Ohio Industries, Inc., 6.625%, 4/15/2027 | | 203,500 |

| 475M | | Wabash National Corp., 5.5%, 10/1/2025 (a) | | 457,188 |

| | | | | 2,191,812 |

| | | Media-Broadcasting—1.7% | | |

| | | Belo Corp.: | | |

| 100M | | 7.75%, 6/1/2027 | | 106,000 |

| 25M | | 7.25%, 9/15/2027 | | 25,875 |

| 225M | | LIN Television Corp., 5.875%, 11/15/2022 | | 230,625 |

| | | Nexstar Broadcasting, Inc.: | | |

| 225M | | 6.125%, 2/15/2022 (a) | | 231,187 |

| 300M | | 5.625%, 8/1/2024 (a) | | 291,000 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Media-Broadcasting (continued) | | |

| | | Sinclair Television Group, Inc.: | | |

| $ 50M | | 5.625%, 8/1/2024 (a) | | $ 49,750 |

| 100M | | 5.875%, 3/15/2026 (a) | | 97,625 |

| 75M | | 5.125%, 2/15/2027 (a) | | 69,375 |

| 650M | | Sirius XM Radio, Inc., 6%, 7/15/2024 (a) | | 663,813 |

| | | | | 1,765,250 |

| | | Media-Cable TV—9.4% | | |

| | | Altice Financing SA: | | |

| 525M | | 6.625%, 2/15/2023 (a) | | 518,700 |

| 200M | | 7.5%, 5/15/2026 (a) | | 193,940 |

| 200M | | Altice Finco SA, 7.625%, 2/15/2025 (a) | | 179,750 |

| 550M | | Altice U.S. Finance I Corp., 5.375%, 7/15/2023 (a) | | 548,625 |

| 100M | | AMC Networks, Inc., 4.75%, 8/1/2025 | | 96,376 |

| | | CCO Holdings, LLC: | | |

| 200M | | 5.25%, 9/30/2022 | | 201,000 |

| 275M | | 5.125%, 2/15/2023 | | 272,852 |

| 150M | | 5.75%, 9/1/2023 | | 151,500 |

| 500M | | 5.875%, 4/1/2024 (a) | | 502,500 |

| 200M | | 5.125%, 5/1/2027 (a) | | 187,625 |

| 275M | | 5.875%, 5/1/2027 (a) | | 269,156 |

| 150M | | 5%, 2/1/2028 (a) | | 138,000 |

| 225M | | Cequel Communications Holdings I, LLC, 7.75%, 7/15/2025 (a) | | 236,250 |

| | | Clear Channel Worldwide Holdings, Inc.: | | |

| 650M | | Series “A”, 6.5%, 11/15/2022 | | 663,000 |

| 550M | | Series “B”, 6.5%, 11/15/2022 | | 563,750 |

| | | CSC Holdings, LLC: | | |

| 1,250M | | 10.125%, 1/15/2023 (a) | | 1,381,250 |

| 200M | | 6.625%, 10/15/2025 (a) | | 205,250 |

| 200M | | 10.875%, 10/15/2025 (a) | | 231,060 |

| | | DISH DBS Corp.: | | |

| 400M | | 7.875%, 9/1/2019 | | 416,000 |

| 225M | | 5%, 3/15/2023 | | 196,031 |

| 250M | | 5.875%, 11/15/2024 | | 212,500 |

| | | Gray Television, Inc.: | | |

| 50M | | 5.125%, 10/15/2024 (a) | | 47,985 |

| 300M | | 5.875%, 7/15/2026 (a) | | 286,125 |

| 225M | | Mediacom Broadband, LLC, 5.5%, 4/15/2021 | | 228,094 |

| 575M | | Midcontinent Communications & Finance Corp., 6.875%, 8/15/2023 (a) | 604,469 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Media-Cable TV (continued) | | |

| | | Netflix, Inc.: | | |

| $ 100M | | 4.375%, 11/15/2026 | | $ 93,980 |

| 100M | | 4.875%, 4/15/2028 (a) | | 95,442 |

| 600M | | Numericable Group SA, 6.25%, 5/15/2024 (a) | | 585,000 |

| 425M | | Virgin Media Finance, PLC, 6.375%, 4/15/2023 (a) | | 427,125 |

| | | | | 9,733,335 |

| | | Media-Diversified—1.0% | | |

| 100M | | E.W. Scripps Co., 5.125%, 5/15/2025 (a) | | 94,000 |

| 75M | | LSC Communications, Inc., 8.75%, 10/15/2023 (a) | | 73,781 |

| 225M | | Outdoor Americas Capital, LLC, 5.875%, 3/15/2025 | | 227,678 |

| 675M | | Tribune Media Co., 5.875%, 7/15/2022 | | 684,619 |

| | | | | 1,080,078 |

| | | Metals/Mining—7.2% | | |

| 250M | | AK Steel Corp., 7%, 3/15/2027 | | 238,750 |

| 150M | | Allegheny Technologies, Inc., 7.875%, 8/15/2023 | | 162,000 |

| 175M | | Alliance Resourse Operating Partners, LP, 7.5%, 5/1/2025 (a) | | 187,031 |

| 175M | | Big River Steel, LLC, 7.25%, 9/1/2025 (a) | | 180,267 |

| 250M | | Cleveland-Cliffs, Inc., 4.875%, 1/15/2024 (a) | | 241,875 |

| 175M | | Commercial Metals Co., 5.375%, 7/15/2027 | | 166,688 |

| 300M | | CONSOL Mining Corp., 11%, 11/15/2025 (a) | | 330,750 |

| 250M | | Constellium NV, 5.75%, 5/15/2024 (a) | | 243,125 |

| | | First Quantum Minerals, Ltd.: | | |

| 400M | | 7.25%, 5/15/2022 (a) | | 406,000 |

| 350M | | 6.5%, 3/1/2024 (a) | | 338,625 |

| | | HudBay Minerals, Inc.: | | |

| 175M | | 7.25%, 1/15/2023 (a) | | 181,125 |

| 75M | | 7.625%, 1/15/2025 (a) | | 78,937 |

| 450M | | Joseph T. Ryerson & Son, Inc., 11%, 5/15/2022 (a) | | 496,125 |

| 250M | | Mountain Province Diamonds, Inc., 8%, 12/15/2022 (a) | | 250,000 |

| 250M | | Natural Resource Partners, LP, 10.5%, 3/15/2022 | | 271,250 |

| | | Novelis, Inc.: | | |

| 575M | | 6.25%, 8/15/2024 (a) | | 576,438 |

| 425M | | 5.875%, 9/30/2026 (a) | | 408,000 |

| 325M | | Peabody Energy Corp., 6%, 3/31/2022 (a) | | 330,964 |

| 950M | | SunCoke Energy Partners, LP, 7.5%, 6/15/2025 (a)(b) | | 971,375 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Metals/Mining (continued) | | |

| | | Teck Resources, Ltd.: | | |

| $ 125M | | 8.5%, 6/1/2024 (a) | | $ 137,344 |

| 300M | | 6%, 8/15/2040 | | 293,250 |

| 425M | | TMS International Corp., 7.25%, 8/15/2025 (a) | | 435,625 |

| 500M | | United States Steel Corp., 6.25%, 3/15/2026 | | 494,380 |

| | | | | 7,419,924 |

| | | Real Estate—1.8% | | |

| | | Geo Group, Inc.: | | |

| 100M | | 5.125%, 4/1/2023 | | 98,500 |

| 225M | | 6%, 4/15/2026 | | 219,375 |

| 150M | | Greystar Real Estate Partners, 5.75%, 12/1/2025 (a) | | 145,875 |

| | | Iron Mountain, Inc.: | | |

| 225M | | 5.75%, 8/15/2024 | | 221,063 |

| 250M | | 5.25%, 3/15/2028 (a) | | 232,600 |

| 175M | | Lennar Corp., 4.875%, 12/15/2023 | | 175,219 |

| 80M | | MPT Operating Partnership, LP, 6.375%, 3/1/2024 | | 84,200 |

| 225M | | Sabra Health Care, LP, 5.125%, 8/15/2026 | | 215,343 |

| 379M | | VICI Properties 1, LLC, 8%, 10/15/2023 | | 422,362 |

| | | | | 1,814,537 |

| | | Retail-General Merchandise—1.9% | | |

| | | 1011778 B.C., ULC: | | |

| 500M | | 4.625%, 1/15/2022 (a) | | 501,250 |

| 250M | | 5%, 10/15/2025 (a) | | 237,800 |

| | | AmeriGas Partners, LP: | | |

| 125M | | 5.625%, 5/20/2024 | | 123,594 |

| 250M | | 5.5%, 5/20/2025 | | 243,437 |

| 225M | | J.C. Penney Co., Inc., 8.625%, 3/15/2025 | | 191,250 |

| 150M | | KFC Holding Co., LLC, 5%, 6/1/2024 (a) | | 148,455 |

| 425M | | L Brands, Inc., 6.75%, 7/1/2036 | | 376,125 |

| 125M | | SRS Distribution, Inc., 8.25%, 7/1/2026 (a) | | 124,688 |

| | | | | 1,946,599 |

| | | Services—1.8% | | |

| 425M | | ADT Corp., 3.5%, 7/15/2022 | | 399,925 |

| 25M | | AECOM, 5.125%, 3/15/2027 | | 23,625 |

| 225M | | BlueLine Rental Finance Corp., 9.25%, 3/15/2024 (a) | | 239,940 |

| 500M | | First Data Corp., 5.375%, 8/15/2023 (a) | | 505,875 |

| 325M | | GW Honos Security Corp., 8.75%, 5/15/2025 (a) | | 333,125 |

| 50M | | KAR Auction Services, Inc., 5.125%, 6/1/2025 (a) | | 47,875 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Services (continued) | | |

| | | United Rentals, Inc.: | | |

| $ 150M | | 4.625%, 10/15/2025 | | $ 143,250 |

| 175M | | 5.5%, 5/15/2027 | | 170,187 |

| | | | | 1,863,802 |

| | | Telecommunications—3.5% | | |

| 375M | | CenturyLink, Inc., 5.8%, 3/15/2022 | | 373,125 |

| | | Frontier Communications Corp.: | | |

| 425M | | 10.5%, 9/15/2022 | | 387,813 |

| 350M | | 11%, 9/15/2025 | | 281,645 |

| 125M | | 8.5%, 4/1/2026 (a) | | 121,094 |

| | | GCI, Inc.: | | |

| 300M | | 6.75%, 6/1/2021 | | 303,375 |

| 500M | | 6.875%, 4/15/2025 | | 520,000 |

| 225M | | Qwest Corp., 7.25%, 9/15/2025 | | 240,755 |

| 125M | | Telecom Italia Capital SA, 7.2%, 7/18/2036 | | 130,112 |

| 400M | | Telecom Italia SpA, 5.303%, 5/30/2024 | | 396,000 |

| 200M | | Telesat Canada, 8.875%, 11/15/2024 (a) | | 214,500 |

| 400M | | Wind Tre SpA, 5%, 1/20/2026 (a) | | 319,084 |

| | | Zayo Group, LLC: | | |

| 50M | | 6.375%, 5/15/2025 | | 51,125 |

| 275M | | 5.75%, 1/15/2027 (a) | | 270,875 |

| | | | | 3,609,503 |

| | | Transportation—1.6% | | |

| 375M | | BCD Acquisition, Inc., 9.625%, 9/15/2023 (a) | | 401,250 |

| 275M | | Fly Leasing, Ltd., 6.375%, 10/15/2021 | | 284,281 |

| 225M | | Mobile Mini, Inc., 5.875%, 7/1/2024 | | 228,375 |

| 750M | | XPO Logistics, Inc., 6.125%, 9/1/2023 (a) | | 772,500 |

| | | | | 1,686,406 |

| | | Utilities—4.3% | | |

| | | AES Corp.: | | |

| 150M | | 6%, 5/15/2026 | | 156,000 |

| 100M | | 5.125%, 9/1/2027 | | 100,000 |

| 350M | | Avantor, Inc., 9%, 10/1/2025 (a) | | 353,570 |

| | | Calpine Corp.: | | |

| 425M | | 5.75%, 1/15/2025 | | 389,672 |

| 275M | | 5.25%, 6/1/2026 (a) | | 260,047 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Utilities (continued) | | |

| | | Cheniere Corpus Christi Holdings: | | |

| $ 225M | | 5.875%, 3/31/2025 | | $ 234,844 |

| 250M | | 5.125%, 6/30/2027 | | 248,750 |

| 425M | | Cheniere Energy Partners, LP, 5.25%, 10/1/2025 (a) | | 415,629 |

| 300M | | Drax Finco, PLC, 6.625%, 11/1/2025 (a) | | 299,250 |

| | | Dynegy, Inc.: | | |

| 275M | | 7.375%, 11/1/2022 | | 288,062 |

| 125M | | 8%, 1/15/2025 (a) | | 134,844 |

| 250M | | Energy Transfer Partners, LP, 6.25%, 12/29/2049 | | 232,031 |

| 38M | | Indiantown Cogeneration Utilities, LP, 9.77%, 12/15/2020 | | 41,303 |

| 150M | | NRG Energy, Inc., 6.25%, 7/15/2022 | | 154,733 |

| 150M | | NRG Yield Operating, LLC, 5%, 9/15/2026 | | 143,625 |

| 316M | | NSG Holdings, LLC, 7.75%, 12/15/2025 (a) | | 346,469 |

| 350M | | Targa Resources Partners, LP, 5.875%, 4/15/2026 (a) | | 353,063 |

| 250M | | Terraform Power Operating, LLC, 5%, 1/31/2028 (a) | | 237,812 |

| | | | | 4,389,704 |

| | | Waste Management—.5% | | |

| 325M | | Covanta Holding Corp., 5.875%, 7/1/2025 | | 314,438 |

| 175M | | GFL Environmental, Inc., 5.625%, 5/1/2022 (a) | | 169,312 |

| | | | | 483,750 |

| | | Wireless Communications—4.0% | | |

| 125M | | Hughes Satellite Systems Corp., 5.25%, 8/1/2026 | | 117,656 |

| 150M | | Inmarsat Finance, PLC, 4.875%, 5/15/2022 (a) | | 148,125 |

| 800M | | Intelsat Jackson Holdings SA, 8%, 2/15/2024 (a) | | 842,000 |

| | | Level 3 Financing, Inc.: | | |

| 250M | | 5.125%, 5/1/2023 | | 245,937 |

| 300M | | 5.375%, 1/15/2024 | | 294,600 |

| 850M | | Sprint Communications, Inc., 6%, 11/15/2022 | | 844,688 |

| | | Sprint Corp.: | | |

| 625M | | 7.875%, 9/15/2023 | | 649,609 |

| 125M | | 7.125%, 6/15/2024 | | 126,511 |

| 150M | | 7.625%, 2/15/2025 | | 153,376 |

| 200M | | 7.625%, 3/1/2026 | | 204,500 |

Portfolio of Investments (continued)

FUND FOR INCOME

June 30, 2018

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Wireless Communications (continued) | | |

| | | T-Mobile USA, Inc.: | | |

| $ 50M | | 6.5%, 1/15/2024 | | $ 52,375 |

| 250M | | 6%, 4/15/2024 | | 259,375 |

| 200M | | 5.125%, 4/15/2025 | | 201,500 |

| | | | | 4,140,252 |

| Total Value of Corporate Bonds (cost $91,971,948) | | 90,975,297 |

| | | LOAN PARTICIPATIONS†—9.3% | | |

| | | Automotive—.4% | | |

| 446M | | Truck Hero, Inc., 5.8379%, 4/22/2024 | | 446,057 |

| | | Chemicals—.9% | | |

| 498M | | Avantor Performance Materials, 6.0935%, 11/21/2024 | | 501,201 |

| 497M | | ColourOz Investment, 5.3592%, 9/7/2021 | | 467,571 |

| | | | | 968,772 |

| | | Energy—.6% | | |

| 125M | | California Resources Corp., 6.8379%, 12/31/2022 | | 127,396 |

| 500M | | Foresight Energy, LLC, 5.75%, 3/28/2022 (b) | | 497,915 |

| | | | | 625,311 |

| | | Financial Services—.5% | | |

| 499M | | NFP Corp., 5.0935%, 1/8/2024 | | 496,395 |

| | | Food/Beverage/Tobacco—.5% | | |

| 497M | | Chobani, LLC, 5.5935%, 10/10/2023 | | 498,624 |

| | | Gaming/Leisure—2.2% | | |

| 500M | | Cyan Blue Holdco 2, Ltd., 2.75%, 8/23/2024 (b) | | 499,688 |

| 500M | | Dorna Sports SL, 5.5844%, 4/12/2024 | | 493,645 |

| 499M | | Scientific Games International, 4.8435%, 8/14/2024 | | 496,568 |

| 214M | | Seminole Hard Rock Entertainment, Inc., 5.058%, 5/14/2020 | | 215,250 |

| 325M | | Sigma Bidco BV, 3%, 3/6/2025 (b) | | 323,091 |

| 200M | | Stars Group Holdings BV, 3.5%, 7/28/2025 (b)(d) | | 199,000 |

| | | | | 2,227,242 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care—1.0% | | |

| $250M | | Amneal Pharmaceuticals, LLC, 5.625%, 5/4/2025 | | $ 250,150 |

| | | Heartland Dental, LLC: | | |

| 51M | | 3.75%, 4/30/2025 (b) | | 50,979 |

| 342M | | 5.8435%, 4/30/2025 | | 341,856 |

| 350M | | Inovalon Holdings, Inc., 5.5625%, 4/2/2025 | | 343,437 |

| | | | | 986,422 |

| | | Information Technology—.7% | | |

| 250M | | Microchip Technology, 4.1%, 5/29/2025 | | 250,860 |

| 249M | | Solarwinds, Inc., 5.0935%, 2/5/2024 | | 249,147 |

| 250M | | SS&C Technologies Holdings, Inc., 2.5%, 4/16/2025 (b) | | 250,521 |

| | | | | 750,528 |

| | | Manufacturing—1.0% | | |

| 499M | | Filtration Group Corp., 5.0935%, 3/29/2025 | | 500,034 |

| 500M | | GrafTech International, Ltd., 5.5047%, 2/12/2025 | | 500,235 |

| | | | | 1,000,269 |

| | | Metals/Mining—.4% | | |

| 372M | | Big River Steel, LLC, 7.3344%, 8/23/2023 | | 376,840 |

| | | Retail-General Merchandise—.2% | | |

| 248M | | Staples, Inc., 6.3581%, 9/12/2024 | | 244,282 |

| | | Telecommunications—.4% | | |

| 425M | | GTT Communications, Inc., 4.875%, 5/31/2025 | | 419,877 |

| | | Utilities—.3% | | |