UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file Number: | | 811-04338 |

HERITAGE CAPITAL APPRECIATION TRUST

|

| (Exact name of Registrant as Specified in Charter) |

|

880 Carillon Parkway St. Petersburg, FL 33716 |

| (Address of Principal Executive Office) (Zip Code) |

STEPHEN G. HILL, PRESIDENT

880 Carillon Parkway

St. Petersburg, FL 33716

|

| (Name and Address of Agent for Service) |

Copy to:

Francine J. Rosenberger, ESQ.

Kirkpatrick & Lockhart Preston Gates Ellis LLP

1601 K Street, NW

Washington, D.C. 20006

Registrant’s Telephone Number, including Area Code: (727) 567-8143

Date of fiscal year end: October 31

Date of reporting period: October 31, 2007

| Item 1. | Reports to Shareholders |

Heritage Mutual Funds

Annual Report

and Investment Performance Review

for the fiscal year ended October 31, 2007

Capital Appreciation Trust

Core Equity Fund

Diversified Growth Fund

Growth and Income Trust

High Yield Bond Fund

International Equity Fund

Mid Cap Stock Fund

Small Cap Stock Fund

Table of Contents

Fellow Shareholders

I am pleased to present the annual report and investment performance review of the Heritage Mutual Funds (the “Funds”) for the fiscal year ended October 31, 2007 (the “reporting period”).

During the reporting period, most major equity market indices showed positive returns in spite of sharp market declines in February and August, each of which was followed by a strong rebound. Since the end of the reporting period, however, continuing market pressures relating to the credit and sub-prime mortgage issues have offset most of the market gains during the reporting period. Such volatility over short-term stresses the importance of adopting a long-term, diversified investment plan and maintaining discipline through all market environments. The table below provides the Class A shares return, without the imposition of a front-end sales charge, for each fund and its respective benchmark index during the reporting period.

| | |

| Fund/Benchmark index | | Class A

return

11/1/06 to

10/31/07 |

| Capital Appreciation Trust | | 22.02% |

| Russell 1000® Growth | | 19.23% |

| S&P 500 Index | | 14.56% |

| Core Equity Fund | | 9.85% |

| S&P 500 Index | | 14.56% |

| Diversified Growth Fund | | 34.28% |

| Russell Midcap® Growth Index | | 19.72% |

| Growth and Income Trust | | 28.17% |

| S&P 500 Index | | 14.56% |

| High Yield Bond Fund | | 4.93% |

| Citigroup High YieldSM Market Index | | 6.82% |

| International Equity Fund | | 32.58% |

| MSCI® ACWI ex-US | | 32.43% |

| MSCI EAFE® Index | | 25.43% |

| Mid Cap Stock Fund | | 20.08% |

| S&P MidCap 400 Index | | 17.02% |

| Small Cap Stock Fund | | 17.65% |

| Russell 2000® Index | | 9.27% |

Beginning on page 4, the portfolio managers for each fund will discuss their particular fund’s performance, including an assessment of the economic environment as it pertains to their particular fund. Please remember that the views expressed in this document are not meant as investment advice. Although some of the described portfolio holdings were viewed favorably as of the fiscal year end, there is no guarantee the Funds will continue to hold these securities in the future. Our website, HeritageFunds.com, provides monthly and quarterly performance updates, daily prices, portfolio holdings and other Fund information.

Earlier this month, Awad Asset Management, Inc., a subadviser to the Small Cap Stock Fund, was reorganized as a wholly-owned subsidiary of Eagle Asset Management, Inc. (“Eagle”) and renamed Eagle Boston Investment Management, Inc. The portfolio management team and other officers remain unchanged. Eagle and Heritage are both wholly-owned subsidiaries of Raymond James Financial, Inc. The Fund’s prospectus has been supplemented to reflect this change.

I would like to remind you that investing in any mutual fund carries certain risks. For your convenience, we have included a Principal Risks section beginning on page 66, which gives a description of the principal risk factors that relate to the Funds. In addition, I ask that you carefully consider the investment objectives, charges and expenses of any fund before you invest. Contact us at 800.421.4184 or at HeritageFunds.com or your financial advisor for a prospectus, which contains this and other important information about the Funds.

Our firm is committed to the financial well-being of our clients. We are grateful for your continued support and confidence in the Heritage Mutual Funds.

Sincerely,

Stephen G. Hill

President

December 11, 2007

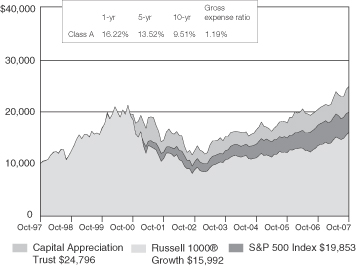

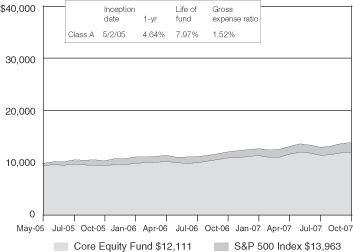

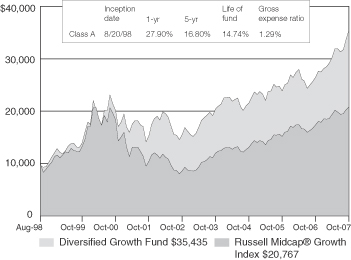

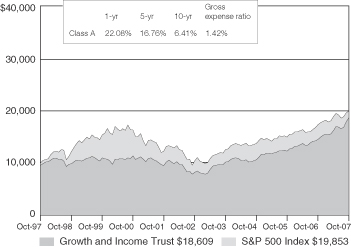

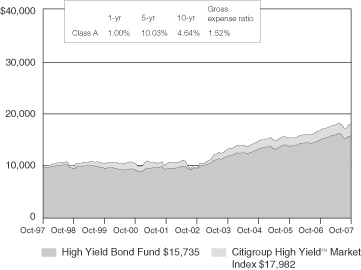

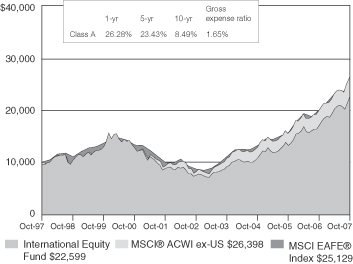

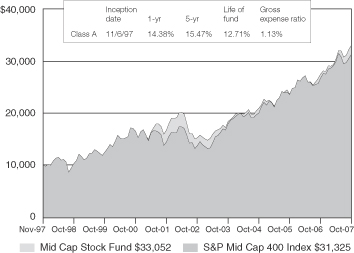

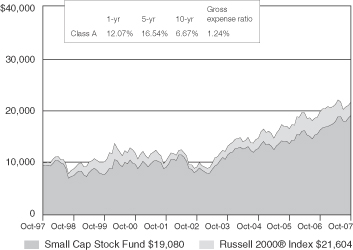

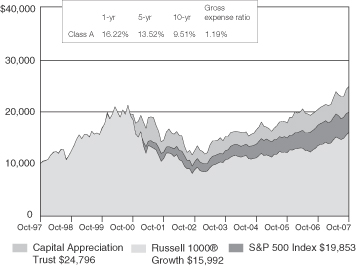

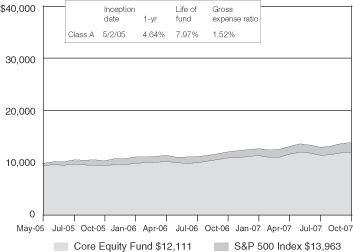

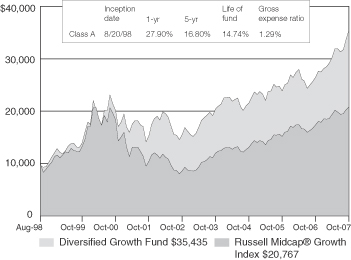

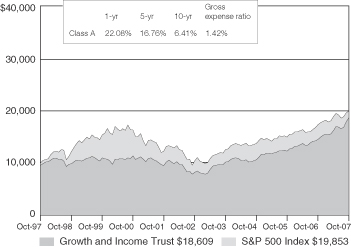

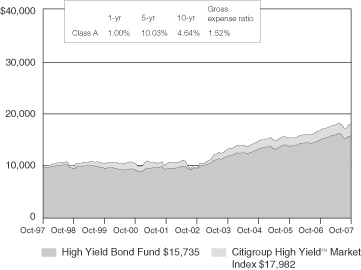

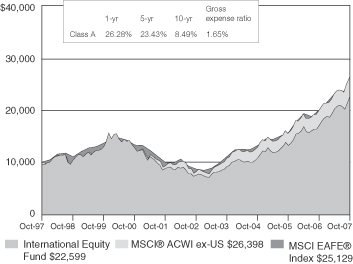

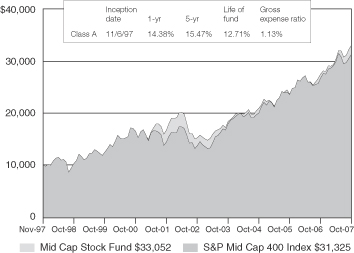

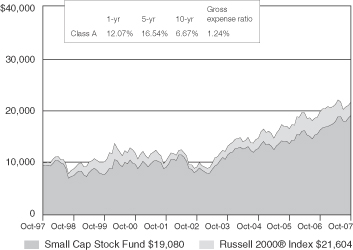

Growth of a $10,000 Investment

Performance Graph Information | The charts show the growth of a hypothetical $10,000 investment in each Fund’s class A shares for the periods shown, as well as each Fund’s respective benchmark index. Each Fund’s value reflects its respective maximum front-end sales charge, fund expenses and reinvestment of dividends, but does not reflect the deduction of taxes that you would pay on fund distributions or redemption of fund shares. The value of an investment in other share classes will differ due to each class’s respective sales charges and expenses.

The charts also show the investment returns and expense ratios of each Fund’s class A shares for the period ended October 31, 2007. The returns are calculated according to SEC regulations, which assume the maximum front-end sales charge for the class A shares of each Fund and the deduction of fund expenses. The expense ratios reflect the gross expense ratios shown in the Annual Fund Operating Expenses table of the January 2, 2007 prospectus. These gross expense ratios are based on these Funds’ previous fiscal year expenses and differ from the gross expense ratios for the current fiscal year as reflected in the Financial Highlights. Additional information pertaining to the Funds’ expense ratios as of October 31, 2007 can be found in the Financial Highlights.

Please consider the investment objectives, risks, charges and expenses of each fund carefully before investing. Contact Heritage at 800.421.4184 or your financial advisor for a prospectus, which contains this and other important information about each fund. Read the prospectus carefully before you invest or send money.

Investment in the Capital Appreciation Trust from 11/1/97 to 10/31/07

Investment in the Core Equity Fund from 5/2/05 to 10/31/07

Investment in the Diversified Growth Fund from 8/20/98 to 10/31/07

Investment in the Growth and Income Trust from 11/1/97 to 10/31/07

Growth of a $10,000 Investment

Investment in the High Yield Bond Fund from 11/1/97 to 10/31/07

Investment in the International Equity Fund(a) from 11/1/97 to 10/31/07

Investment in the Mid Cap Stock Fund from 11/6/97 to 10/31/07

Investment in the Small Cap Stock Fund from 11/1/97 to 10/31/07

(a) Effective July 1, 2007, the International Equity Fund replaced its performance benchmark index, the Morgan Stanley Europe Australasia and Far East Index (“MSCI EAFE®”), with the Morgan Stanley Capital International, Inc. All Country World ex-U.S. Index (“MSCI® ACWI-ex US”). The MSCI ACWI-ex US benchmark index contains emerging markets in the index, while the MSCI EAFE does not. Thus, the MSCI ACWI-ex US better reflects the holdings within this fund.

Performance data presented in the table and the graphs is historical and does not guarantee future results. The investment return and principal value of an investment will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be higher or lower than the performance data quoted. To obtain more current performance data as of the most recent month end, please visit our website at HeritageFunds.com.

|

| Discussion of Fund Performance |

| Capital Appreciation Trust |

Investment Objective | The Heritage Capital Appreciation Trust (the “Fund”) seeks long-term capital appreciation.

Investment Highlights | During normal market conditions, the Fund invests at least 65% of its total assets in common stocks. The portfolio management team invests in the stocks of companies of any size without regard to market capitalization.

The Fund’s portfolio management team uses a “bottom-up” method of analysis based on in-depth, fundamental research to determine which stocks to purchase for the Fund. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. The portfolio management team purchases stock of companies that have the potential for attractive long-term growth in earnings, cash flow and total worth of the company. In addition, the portfolio management team prefers to purchase such stocks that appear to be undervalued in relation to the company’s long-term growth fundamentals.

Benchmark Indices | The Russell 1000® Growth Index is constructed to provide a comprehensive and unbiased barometer of the large-cap growth market. The Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”) is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market.

Meet the Managers | Steven M. Barry, David G. Shell and Gregory H. Ekizian are Chief Investment Officers and Senior Portfolio Managers of Goldman Sachs Asset Management, and have been responsible for the day-to-day management of the Fund since 2002. Shell and Ekizian have been affiliated with the Fund since 1987 and 1990, respectively; Barry joined the team in 1999. Shell is a chartered Financial Analyst and has 20 years’ investment experience. He earned a BA from University of South Florida. Ekizian is a chartered Financial Analyst with 22 years’ investment experience. He earned an MBA from University of Chicago Graduate School of Business. Barry has 22 years’ investment experience and earned a BA from Boston College. Goldman Sachs Asset Management assumed management of the Fund in 1997.

During an interview conducted on November 28, 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the large-cap growth market environment (the Fund’s investment market) during the reporting period?

A: Despite periods of extreme volatility, the Russell 1000® Growth Index returned 19.23% for the fiscal year ended October 31, 2007. Rising oil prices and instability within the sub-prime mortgage market negatively affected the market. The Federal Reserve Board (the “Fed”) cut short-term interest rates twice during the period and noted that some inflation risk remains. The energy and technology sectors led the market while the media and consumer discretionary sectors lagged.

Q: How did the Fund perform during the reporting period?

A: For the fiscal year ended October 31, 2007, the Fund’s Class A shares returned 22.02% (excluding front-end sales charges). During that same period, the Fund’s benchmark, the Russell 1000® Growth Index, returned 19.23% and the S&P 500 Index, an additional benchmark, returned 14.56%. Strong performance of the Fund’s holdings within the healthcare, energy and technology sectors contributed to performance. On

the downside, select finance and producer goods and services holdings were weak in sympathy with the negative sentiment surrounding the sub-prime mortgage market.

Q: How did the Fund compare to its benchmark index during the reporting period?

A: During the reporting period, the Fund’s Class A shares outperformed its benchmark index. The portfolio’s sector weightings are a direct result of our bottom-up, research-intensive approach to investing. In several instances, on both a stock and sector level, the portfolio is meaningfully different from the benchmark, thus representing potential sources of positive or negative returns relative to the benchmark. For example, the Fund is underweight in cyclicals, as most of these businesses do not typically meet our investment criteria because their revenues predominately depend on the increasing price of an underlying commodity. This strategy has the potential to underperform in markets where the advance is narrow in breadth, or with an emphasis on lower quality, speculative names. However, we believe it should outperform over the long-term in most environments, especially where quality is favored.

We do not specifically avoid investments in a particular sector or industry; however, the aforementioned investment characteristics result in a low or zero weighting in several

|

| Discussion of Fund Performance |

| Capital Appreciation Trust (cont’d) |

sectors. These include capital goods, basic industry and other cyclical companies that we feel are incapable of exhibiting long-term growth. As mentioned, most businesses in the cyclical sector do not typically meet our investment criteria.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Schlumberger Ltd. was the top contributor to performance during the reporting period as the company reported a rise in third quarter net income driven by strong international growth. We understand that this oilfield service company continues to focus on international growth, including existing operations in Asia and the Middle East, as well as new opportunities in North Africa.

Google, Inc. contributed to performance as the company reported a surge in third quarter profits, driven by market share gains and continued strength in its search advertising business. In our view, Google is competitively well positioned, as it has over 50% market share in the U.S. and over 70% share of web searches worldwide.

Crown Castle International Corporation contributed to performance as the company raised its outlook for 2007 during the reporting period. Management cited an increase in tower site rental revenue and continued advances in the company’s integration of Global Signal as the main drivers of results. We continue to have conviction in the company as we believe the underlying prospects of the wireless tower industry remains robust. Growth is being driven by demand for tower space, new technology service offerings and an emphasis on enhancing network quality.

Research In Motion contributed to performance as the company continued to benefit from subscriber growth and expanding business opportunities in key markets. We believe the company’s growth prospects are favorable as businesses advance the adoption of mobile e-mail and introduce it more deeply within their organizations. In addition, the consumer-focused BlackBerry products appear to be broadening the brand’s appeal into a larger potential market.

Shares of Charles Schwab Corporation were strong as the company saw a surge in third quarter earnings on increased trading activity and asset inflows. Furthermore, the company announced a $2.3 billion share repurchase program that boosted its share price in July.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Freddie Mac’s stock detracted from performance in sympathy with negative sentiment surrounding the sub-prime

mortgage market. In our view, Freddie Mac’s loan portfolio is strong with fewer delinquencies than the broad credit market and no default risk. We continue to have conviction in Freddie Mac and believe the government sponsored enterprise charter provides an enduring competitive advantage.

McGraw-Hill Companies, Inc. and Moody’s Corporation (which owns Standard & Poor’s) experienced weakness over the last twelve months as they have been impacted by the issues in the sub-prime mortgage market. McGraw-Hill rates some sub-prime loans in its ratings business. The company has no balance sheet risk from sub-prime loans and less than 5% of the company’s revenue comes from sub-prime ratings. While McGraw-Hill’s growth may be affected if issuance slows, we believe this is already reflected in the stock price and have managed position sizes accordingly.

Despite posting solid financial results, shares of Genentech, Inc. were weak during the period. We believe the company’s growth prospects are favorable as its key products Avastin, Herceptin and Rixtan are standard of care monopolies that have proven survival benefits in cancer patients. In our view, Genentech should deliver strong growth as the company has a successful track record of new product development.

Shares of Home Depot, Inc. pulled back as a result of a struggling U.S. housing market that has resulted in fewer home sales and rising inventory. The company has also been impacted by weakness in the sub-prime mortgage market, which has led to increasing home foreclosures and less residential construction. We believe long-term growth prospects are still favorable for Home Depot. In addition, Home Depot is starting to implement a large stock buyback program and we understand that management is focusing on making investments in the business and growing cash flow.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: The risks of the Fund are managed in three key ways: thorough knowledge of high-quality companies, a consistent investment style, and disciplined portfolio construction. Our ability to identify excellent companies, which we believe are strategically poised for long-term growth, is a key component of our risk management process. We perform rigorous fundamental research on each of our investments to ensure that we understand the risks and rewards. We define risk as related to the probability of a permanent loss of capital rather than the volatility of returns and we assess the real business worth of each company that meets our rigorous standards. Our research includes extensive visits with company managements

|

| Discussion of Fund Performance |

| Capital Appreciation Trust (cont’d) |

as well as customers, competitors, and suppliers, in-depth balance sheet and income statement analysis, analysis of company- and industry-specific risks and continual reassessment of the threats to portfolio holdings. Since we invest in high-quality growth companies whose stocks are attractively valued, we believe that we are inherently limiting our level of risk over the long-term. The second component of risk management is a consistent investment style, which has remained the same since its inception. Our team approach to investment management helps ensure that we maintain our defined style. Our portfolio characteristics, which have remained consistent over time, reflect our disciplined style

adherence. The third component of risk management is disciplined portfolio construction. An experienced senior portfolio management team, rather than an individual, manages the portfolio. We actively monitor the individual stock, sector, and thematic exposure of the portfolio in order to adhere to the risk profile of the portfolio. Our guidelines are as follows: we strive to have no more than 10% of the portfolio concentrated in any one stock holding and no more than 50% of the portfolio concentrated in any single sector. We are not market timers and we strive to remain fully invested, aiming for less than 5% cash at all times.

Core Equity Fund

Investment Objective | The Core Equity Fund (the “Fund”) seeks long-term growth through capital appreciation.

Investment Highlights | Under normal market conditions, the Fund invests at least 80% of its net assets in equity securities consisting primarily of common stocks of large U.S. companies (i.e., typically having a market capitalization over $5 billion at the time of investment).

The Fund seeks to achieve its objective by investing in equity securities which the portfolio managers believe to have the potential for growth over the intermediate- and long-term. The Fund will invest in established companies that the portfolio managers determine are undervalued relative to their earnings growth prospects. The portfolio managers’ strategy combines a “bottom-up” research process with a relative-valuation discipline in purchasing stocks. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. In general, the Fund’s portfolio managers seek to select securities that, at the time of purchase, typically have at least one of the following characteristics:

| | (1) | projected earnings growth rate at or above the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”), |

| | (2) | above-average earnings quality and stability, or |

| | (3) | a price-to-earnings ratio comparable to the S&P 500 Index. |

Benchmark Index | The S&P 500 Index is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market.

Meet the Managers | Craig Dauer, John “Jay” Jordan, Robert Marshall and Richard Skeppstrom, of Eagle Asset Management, Inc. (“Eagle”) are Portfolio Co-Managers. Skeppstrom is a managing director of Eagle and has 16 years’ investment experience. He earned a BA and an MBA from University of Virginia. Jordan is a chartered Financial Analyst and has 16 years’ investing experience. He received a BS from University of Virginia. Dauer has 13 years’ investing experience and holds a BA from Colgate University and an MBA from University of Virginia. Marshall has 20 years’ investing experience. He received a BA from University of Virginia and an MBA from Santa Clara (California) University. The team has managed the Fund since inception.

During an interview conducted on November 20, 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the large-cap growth market environment (the Fund’s investment market) during the reporting period?

A: The Fund’s benchmark, the S&P 500 Index returned 14.56% for the period. An expanding economy with relatively low “core” inflation (excluding food and energy), interest rates that remained in an historically low range, and attractive, but

|

| Discussion of Fund Performance |

| Core Equity Fund (cont’d) |

slowing corporate profit growth, provided a favorable backdrop for the equity market as represented by the benchmark S&P 500 Index during the period. Stock prices generally trended higher from the beginning of the period through late February when a global sell-off interrupted the rally that had begun during July 2006. Prior to the sell-off, deteriorating housing market-related news began to weigh on stock prices. Rising delinquency rates on sub-prime mortgages that resulted in large provisions for losses triggered a sell-off of sub-prime specialist lenders. Then, on February 27th, Shanghai’s stock exchange plunged 9%, triggered in part by increasing government efforts to quell speculative investments, and the sell-off spread to markets around the globe, raising risk premiums in both equity and fixed income markets. Contributing to the markets’ heightened focus on risk included: former Federal Reserve (the “Fed”) Chairman Greenspan’s mention of a possible recession in a satellite presentation to a Hong Kong audience; a sharp drop in January’s durable goods orders, and Freddie Mac’s plan to tighten its purchase standards on sub-prime loans, adding to the widening fallout from rising default rates in the sub-prime mortgage sector.

Stock prices stabilized during March and trended higher during April and May as: economic releases showed signs of improvement following a weak first quarter; underlying inflation pressures remained stable; profit growth was better-than-expected; merger and acquisition activity continued at a high level; and global markets remained strong. Investor sentiment turned sour during June; however, on interest rate and inflation worries. Housing data also continued to deteriorate as RealtyTrac reported that May foreclosure filings surged 90% year-to-year and rose 19% from April. Stocks trended higher during the first half of July, supported by encouraging economic data and merger and acquisition activity. During the third week, however, the stock market began a one-month descent, triggered in part by Standard and Poors and Moody’s announced plans to downgrade hundreds of bonds backed by sub-prime mortgages, belatedly acknowledging their misjudgment of risk associated with these securities. Negative sentiment was reinforced on August 9th when a global sell-off was sparked by BNP Paribas, a major French bank, when it halted withdrawals from three investment funds holding sub-prime-backed securities, reigniting credit market concerns that sent short rates higher and prompted the European Central Bank and, later on, the Fed to inject liquidity into the banking system to bring short rates down. Spreading credit market turmoil into the asset-backed commercial paper market weighed on the equity market through August 16th. The next morning, the Fed stepped in with a 50 basis point cut in the discount rate to 5.75% that sparked a rally supported by

expectations of a Fed rate cut by or on its next meeting date (9/18), strong durable goods orders, and by the Fed’s acceptance of asset-backed commercial paper as collateral which helped sooth credit markets.

Stocks moved irregularly higher through the end of October as investors focused on the Fed’s greater-than-expected 50 basis point cut in its target fed funds rate (to 4.75%) and an unexpectedly strong September employment report. During the third week, however, stocks sold off in reaction to a combination of disappointing earnings reports, rising crude oil prices, heightened credit market concerns, and weak housing market news including Fed Chairman Bernanke’s comments at the New York Economic Club where he said that the housing downturn is likely to remain “a significant drag” on economic growth through early 2008. Stocks rebounded during the last full week, however, on Microsoft’s surprisingly strong earnings announcement, Countrywide Financial’s expectation of a profitable fourth quarter, and consensus expectations of another Fed rate cut which were fulfilled on October 31st when the Fed lowered its target interest rate by a quarter point to 4.5%, but with the added caveat that risks of weaker economic growth and higher inflation were roughly balanced, thereby discouraging expectations of further reductions. October ended with a stronger-than-expected gross domestic product report, crude oil futures reaching a new record of $94.53 a barrel, gold futures rising to a 27-year high of $792 an ounce, the U.S. dollar declining to a new low against the Euro, and credit market concerns temporarily placed on the back burner.

Within the environment described above, the strongest-performing Standard and Poor’s sectors included: energy, materials, information technology, utilities, telecommunications services, and industrials. The weakest sectors included: financials, consumer discretionary, healthcare, and consumer staples.

Q: How did the Fund perform during the reporting period?

A: The Fund’s Class A shares returned 9.85% during the period (excluding front-end sales charges). The strongest performing sectors in the Fund included: information technology, consumer staples, consumer discretionary, and industrials. Lagging sectors included: telecommunications services, financials, materials, healthcare, utilities, and energy.

Q: How did the Fund compare to its benchmark index during the reporting period?

A: The Fund’s Class A shares underperformed its benchmark during the period, held back by a lack of meaningful participation in the strong-performing energy sector,

|

| Discussion of Fund Performance |

| Core Equity Fund (cont’d) |

underperformance in the weak and somewhat over-weighted finance sector, and underperformance in market-weighted telecommunications services. On the other hand, the Fund benefited from outperformance in the slightly over-weighted and strong-performing information technology sector, outperformance in the slightly underweighted consumer discretionary sector, and outperformance in market-weighted consumer staples. The Fund’s overall sector positioning continues to be more reflective of a dynamic process that seeks attractive businesses selling at reasonable valuations.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Countrywide Financial’s stock declined during the Fund’s holding period. Mortgage banks and mortgage originators came under tremendous pressure during the period. The Fund’s very small position in this stock was a mistimed attempt to profit from what appeared to be an overly pessimistic view of the situation as Countrywide did not initially appear to be overly exposed as some sub-prime lenders were. Events in sub-prime and in mortgage related lending in general have materially deteriorated and we decided to sell the Fund’s position in anticipation of prolonged impairment of Countrywide’s business model.

The performance of large capitalization domestic banks was generally lackluster throughout most of the period as a flat yield curve and the expectation of normalizing credit bit into earnings and enthusiasm for the group. However, we were positive on these institutions given their huge capital cushions, diversified revenue streams, attractive valuations, and apparent lack of significant sub-prime exposure. Citigroup Inc. stock declined during the period. Citigroup was more diversified than the average given its strong international presence and large investment bank and brokerage operations. In late October sustained selling of many large financial institutions’ stocks began as unexpectedly large sub-prime exposures were disclosed and/or suspected. In Citigroup’s third quarter earnings call they revealed $13 billion of collateralized debt obligation (“CDO”) exposure, a modest write-down of same as well as a significant increase in the loss provision for other mortgage assets. The problem securities are CDOs and other securities with sub-prime collateral. While Citigroup’s original disclosure did not significantly damage its capital position it raised red flags. Merrill Lynch’s subsequent revelation of much larger CDO exposure and write-down caused us to reconsider Citigroup’s stated exposure given their sizable participation in the CDO business. It appears that many large financial institutions got into the sub-prime CDO manufacturing and distribution business and when the market for these securities

evaporated in the late summer, they were left with significant balance sheet exposure. The Fund’s position was significantly reduced at the end of the period and subsequently the Fund sold out of the position. Citigroup has revealed significantly higher CDO exposure and fired its chief executive officer.

Wachovia Corporation’s stock price declined during the period. In late October sustained selling of many large financial institutions’ stocks began as unexpectedly large sub-prime exposures were disclosed and/or suspected. In addition, residential mortgage lenders came under pressure as credit began to normalize, especially in markets such as California, Nevada and Florida that had enjoyed excessive price appreciation. While Wachovia did not disclose a significant CDO portfolio, the company did substantially increase its loan loss reserves which set off fears that its purchase of Golden West, primarily a high quality option arm mortgage lender in California, will turn out to be a significant drag or worse. Our view of Wachovia remains that it is diversified lender with a generally high quality portfolio of assets, a large portion of which are mortgages. We have no evidence to suggest that Golden West’s high lending standards were compromised and we added to the Fund’s position several times during the period. Wachovia remains one of the Fund’s larger positions because it is attractively valued and we believe that large banks will survive this crisis in better position.

The stock price of Capital One Financial Corporation declined during the period. Capital One’s business until very recently was credit card lending. Despite all of Capital One’s innovations in this business, competition and a maturing of growth in the industry drove Capital One to diversify its business. It added auto lending and international card and then unfortunately it purchased two large regional banks. The Fund purchased the stock subsequent to what we believed would be the final earnings adjustment related to the bank acquisitions. This turned out to be premature as the company experienced a series of earnings reductions most significantly related to an alternative-documentation mortgage (“Alt-A”) mortgage originator acquired along with the North Fork bank acquisition. We decided to sell the Fund’s position in anticipation of the spread of credit problems into Capital One’s sub-prime credit card and auto portfolios as a result of obvious strains on the economy.

Freddie Mac’s stock declined during the period. The stock market has developed a very negative view of mortgage insurers and the government sponsored enterprise’s (“GSE”) high credit standards do not appear to count for much in the

|

| Discussion of Fund Performance |

| Core Equity Fund (cont’d) |

current environment. Importantly, we believe that this environment is reinforcing the need for the GSE’s in terms of providing liquidity to the mortgage markets. In addition, we believe the companies will face less competition and may be able to pass on higher guarantee fees. While the superior position of the GSEs will likely not be obvious in earnings growth in the next quarter or two, we believe it will over the long-term. The Fund maintained its position throughout the period.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Nokia Corporation contributed meaningfully to portfolio performance for the period as solid underlying handset industry growth coupled with increased market share drove strong revenue and earnings growth. We decided to trim the Fund’s position in early August and then eliminated the position in September based on our concern that Nokia’s handset market share had reached unsustainable levels, making earnings expectations difficult to achieve going forward.

The Fund’s entire position in EMC Corporation was sold in July as the stock moved higher in anticipation of the partial initial public offering of the company’s wholly owned subsidiary VM Ware. EMC was a strong contributor to the performance of the portfolio; however, valuation became a bit frothy as more speculative investors sought to game the offering. Compounding our worries were the troubles being experienced in the finance vertical as sub-prime mortgage woes continued to crop up.

Microsoft Corporation’s new Vista operating system started to get some traction in the calendar third quarter of 2007, driving above consensus earnings growth. We believe that the current product cycle should last through 2008 into 2009 as enterprise adoption of Vista/Office 2007 finally hits stride. The success of the new operating system is being further enhanced by higher price points in the form of a new premium offering and lower rates of piracy, primarily in Asia. As we move into 2008, earnings should find further support in new releases of Windows Server, SQL Server, and Visual Studio. Valuation remains quite compelling, especially in light of the new release pipeline.

CVS Caremark Corporation had a positive impact on the Fund’s performance during the period. Early in the period, there was concern in the market that both drugstores and pharmacy

benefit managers (“PBM”s) were threatened by (1) Wal-Mart’s $4 generic prescription drug program, and (2) a potential change to the benchmark used to set wholesale prices for drugs. CVS’ offer to buy Caremark, and Caremark’s willingness to sell, were taken by some as corroboration of these concerns. After a battle with Express Scripts, CVS ultimately acquired Caremark in March. Meanwhile, CVS’ retail business remained strong, with no discernible impact from Wal-Mart and none likely from the wholesale benchmark change. Cost synergies from the Caremark integration, primarily from combining the purchasing power of the two companies, have been ahead of plan, supporting an upward bias to 2008 earnings expectations. The Fund continues to hold CVS shares, as the outlook remains solid and expectations reasonable, for both the retail and PBM segments. There may also be room for valuation upside if CVS can begin to show how it might leverage its retail business into an improved PBM offering.

McDonald’s Corporation’s stock increased during the period. Domestic and international same store sales continue to run at above consensus expectations. This U.S. strength is primarily related to operational improvements, longer hours, enhanced menu options, and competitor stumbles. All are the result of a focus on improving store level sales rather than growing store numbers. International improvements are generally the result of improved economies. This sales leverage has translated into increasing earnings estimates and strong price growth. The Fund held the security throughout the period.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: Portfolio risk control measures include the following:

| | • | | Diversification – Initial position sizes are normally 2% to 3%, and successful positions are not allowed to exceed 5% to 6% of the total portfolio. The typical number of holdings ranges between 25 and 40 with diversification across most industry sectors; |

| | • | | Knowledge – Internal development of thorough understanding of company fundamentals; |

| | • | | Quality – Internal focus is on above-average quality and predictability characteristics within a universe of large-cap, seasoned companies; |

| | • | | Valuation – Diligent attention to valuations via a continually-updated relative valuation discipline. |

|

| Discussion of Fund Performance |

| Diversified Growth Fund |

Investment Objective | The Diversified Growth Fund (the “Fund”) seeks long-term capital appreciation.

Investment Highlights | Under normal market conditions, the Fund invests at least 65% of its total assets in equity securities consisting primarily of common stocks of U.S. companies (i.e., typically having a market capitalization between $1 billion and $16 billion at the time of investment).

The Fund seeks to achieve its objective by investing in the equity securities of companies that the portfolio manager believes to have high growth rates and strong prospects for their business or services. The Fund’s portfolio manager uses a “bottom-up” method of analysis based on fundamental research to determine which common stocks to purchase for the Fund. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. The portfolio manager attempts to purchase stocks that have the potential for above-average earnings or sales growth, reasonable valuations and acceptable debt levels.

Benchmark Index | The Russell Midcap® Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

Meet the Managers | Bert L. Boksen, CFA, is the Managing Director of the small-cap equity program at subadviser Eagle Asset Management, Inc. (“Eagle”) and has 30 years of investment experience. Before joining Eagle in 1995, Boksen served as Chief Investment Officer of Raymond James & Associates, Inc. Prior to working for Raymond James & Associates, Inc., he was an Analyst for Standard & Poor’s. He has managed the Fund since inception. Christopher Sassouni, DMD, was named Assistant Portfolio Manager of the Fund in 2006. He has 18 years of investment experience as an Analyst and President of an independent investment research firm focused on healthcare as well as 5 years working with various healthcare companies. Sassouni joined Eagle in 2003. Eagle is an affiliate of Heritage Asset Management, Inc., the Fund’s Investment Adviser.

During an interview conducted on November 20, 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the mid-cap growth market environment (the Fund’s investment market) during the reporting period?

A: The mid-cap growth portion of the market as measured by the Russell Midcap® Growth Index was up 19.72% for the fiscal year ended October 31, 2007. The broad rally in the fourth quarter of 2006 capped off a solid calendar year for equity markets. The first quarter of 2007 witnessed increased volatility in the market, due in part to rising energy costs and mounting fears that troubles in the sub-prime mortgage market could spill over into other segments of the economy. During the second quarter the strong tailwinds of continued favorable rate environment and spate of merger and acquisition activity drove positive performance. During the third quarter, the sub-prime mortgage issues that had been escalating for more than a year came to the forefront causing a market sell-off and high amount of volatility which tapered off towards the end of the quarter.

Q: How did the Fund perform during the reporting period?

A: For the fiscal year ended October 31, 2007, the Fund’s Class A shares returned 34.28% (excluding front-end sales charges). The Fund’s absolute performance was positive in every major sector, with very strong absolute returns in materials, healthcare, information technology, financials, energy, and industrials.

Q: How did the Fund compare to its benchmark index during the reporting period?

A: During the fiscal year ended October 31, 2007, the Fund’s Class A performance exceeded that of the Russell Midcap® Growth Index. The Fund’s outperformance relative to the benchmark was primarily due to the holdings in the materials, healthcare, information technology, financials, and energy sectors. In materials, healthcare and information technology, strong stock selection and an overweight position magnified the strong benchmark performance. The financial and energy sectors both benefited from strong stock selection. In the consumer discretionary sector, the Fund has a positive absolute return but underperformed the benchmark.

|

| Discussion of Fund Performance |

| Diversified Growth Fund (cont’d) |

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Intuitive Surgical is a medical device company that specializes in robotic-assisted, minimally invasive surgery. The company has continue to beat earnings expectations and during the third quarter increased full-year guidance. The Fund continues to hold the stock due to the increasing success of its daVinci surgical system and accessories.

Oceaneering International is a provider of engineering products to the oil and gas industries. For the fiscal year, the stock positively contributed to the portfolio returns due in part to its strong earnings as well as its dominant position in the deepwater exploration space.

CF Industries Inc. manufactures and distributes nitrogen and phosphate fertilizer. Corn is the primary raw material in the production of ethanol, and corn acreage is expected to increase dramatically over the next few years in order to meet demand for ethanol. Recent strength in corn prices makes it attractive for farmers to fertilize more heavily in order to lessen the need to rotate between crops. As higher corn prices encourage increased plantings, we believe that demand for fertilizers will likely show considerable growth in the coming years.

Freeport-McMoRan Copper & Gold engages in the exploration of copper as well as gold and silver byproducts. We initially became interested in the stock after noticing significant insider buying of company shares by several board members. With the global economy experiencing significant growth, we believe demand and pricing for copper should be strong.

IntercontinentalExchange is a leading exchange in the growing energy-derivatives sector, with a significant presence in the futures and over-the-counter (“OTC”) energy markets. The firm had been benefiting from volatility in energy markets, strong earnings and speculation that the company could be acquired in a consolidating industry. The Fund sold the position after the company reported lighter-than-expected OTC volumes in the fourth quarter of 2006.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Coldwater Creek is a retailer of women’s apparel. The stock traded down partially due to concerns about the economy and consumer spending. Additionally, store traffic decreased, de-leveraging operating margin. The Fund sold its position during the third quarter of 2007.

Carter’s markets apparel for babies and young children in the United States under the Carter’s and OshKosh brand names. We decided to sell the position in August after a disappointing quarter. Although overall earnings increased due to Carter’s strong results, disappointing sales volume from OshKosh caused a negative market reaction.

The Cheesecake Factory is a casual-dining restaurant chain with more than 130 locations. The stock traded down partly because of lowered second quarter of 2007 earnings expectations and partly by weak results in the restaurant group. The Fund sold the position.

Barr Pharmaceuticals develops, manufactures, and sells generic and branded drugs. Although the company beat fourth quarter 2006 expectations on revenues and earnings per share, forward guidance was not as strong as anticipated. The Fund sold its position in Barr Pharmaceuticals during the first half of the year.

ENSCO International is an international offshore contract drilling company whose operations are integral to the exploration, development and production of oil and natural gas. We decided to sell the position due to oversupply in the industry.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: Investments in mid-cap companies generally involve greater risks than large-cap companies due to their more limited managerial and financial resources. In our efforts to manage these risks, prior to purchasing a security we perform fundamental research on the company and a comparative analysis of its peer group. We will then only purchase the security if we can do so at what we consider a reasonable price. In addition, we diversify among market sectors and trim holdings that grow above 5% of the total portfolio.

|

| Discussion of Fund Performance |

| Growth and Income Trust |

Investment Objective | The Heritage Growth and Income Trust (the “Fund”) primarily seeks long-term capital appreciation and, secondarily, seeks current income.

Investment Highlights | The Fund expects to invest primarily in domestic equity securities (primarily common stocks) selected on a value basis. However, the Fund may own a variety of securities, including foreign equity and debt securities and domestic debt securities which, in the opinion of the Fund’s investment subadviser, offer prospects for meeting the Fund’s investment goals. The Fund may invest up to 30% of its net assets in foreign securities.

The Fund’s portfolio managers use a “bottom-up” method of analysis based on fundamental research to select securities for the Fund’s portfolio. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. Investments in the Fund’s portfolio typically have at least one of the following characteristics:

| | (1) | a forecasted long-term growth rate greater than inflation; |

| | (2) | securities priced below estimated intrinsic value, illustrated by the Fund’s portfolio overall value |

| | indicators relative to the Standard & Poor’s 500 Composite Stock Index (“S&P 500 Index”); |

| | (3) | investing in companies that the Fund believes to have a greater profitability and shareholder orientated management than the overall market based on the portfolio managers’ analysis; |

| | (4) | broadly diversified across industries and sectors, as well as diversified with holdings outside the United States of America; and |

| | (5) | weighted average market capitalization approximating that of the S&P 500. |

Benchmark Index | The S&P 500 Index is an unmanaged index of 500 widely held stocks that are considered representative of the U.S. stock market.

Meet the Managers | William V. Fries, CFA, is a Managing Director of Thornburg Investment Management (“Thornburg”) and Portfolio Co-Manager. He has more than 31 years of investment experience. Fries joined Thornburg in 1995. He began his investment career as a Security Analyst and Bank Investment Officer. He assumed management of the Fund in July 2001. Brad Kinkelaar is a Managing Director of Thornburg and has been a Portfolio Co-Manager of the Fund since 2006. He has 11 years of investment experience. Kinkelaar received an MBA from the J.L. Kellogg School of Management at Northwestern University.

During an interview conducted on November 19, 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the large-cap equity market environment (the Fund’s investment market) during the reporting period?

A: The S&P 500 Index returned 14.56% during the period. Most sectors in the benchmark showed positive performance, with strongest performance coming from information technology, energy and industrials. Financials, consumer discretionary and telecommunication services were the weakest sectors for the benchmark during the period.

The silver lining in the weakness of the U.S. dollar is that large companies with global businesses are doing very well. We are identifying companies that are not as susceptible to a possible downturn in the U.S. economy. Presently, large global businesses are benefiting both from global diversification of

their revenue streams and from the increased demand for U.S. exports due to weakness in the U.S. dollar.

We believe that weak consumer spending and housing starts will likely have a negative impact on corporate earnings, but not so much of an impact as to create year over year earnings declines. Rather we expect to see a deceleration in earnings growth rates.

Q: How did the Fund perform during the reporting period?

A: The Fund’s Class A shares returned 28.17% (excluding front-end sales charges) during the period. Consistent with our bottom-up approach, stock selection was a significant driver of relative performance for the Fund, which returned positively during the period. Most sectors showed positive performance, with strongest performance coming from materials, telecommunication services, and financials. Healthcare, industrials, and consumer staples were the weakest sectors during the period.

|

| Discussion of Fund Performance |

| Growth and Income Trust (cont’d) |

Q: What factors led the Fund to outperform its benchmark index during the reporting period?

A: The primary driver of the Fund’s outperformance during the period in comparison to its benchmark index was stock selection in the materials, financials, consumer discretionary, and telecommunication services sectors. The holdings of the Fund in each of these sectors outperformed these sectors’ respective holdings in the S&P 500 Index.

The Fund was underweight in the consumer discretionary, consumer staples and healthcare sectors—each underperforming sectors for the S&P 500 Index. This created a positive allocation effect for these sectors. The Fund was also underweight in information technology, industrials, and energy, but the securities we selected in these sectors performed greater than those selected in the benchmark which led to a positive selection effect.

The Fund was overweight in the materials, telecommunication services, and utilities sectors which were all outperforming sectors leading to both a positive allocation and selection effect. The Fund was also overweight in the financials sector which was an underperforming sector for the benchmark, however, the securities we selected outperformed leading to a positive selection effect.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Telefonica SA continues to effectively defend its legacy Spanish fixed line business while growing its wireless businesses across Europe and South America. Management has kept to its guidance of prudent capital discipline and returning capital to shareholders, which has alleviated investor fears of a dilutive acquisition.

Hong Kong Exchanges & Clearing Ltd. was boosted by the announcement that Chinese financial institutions can now offer overseas investments under the Qualified Domestic Institutional Investor arrangement. At the present time, the Hong Kong Exchange is the only venue approved for such investments. More recently, the Hong Kong government announced that it has purchased a 5.88% stake in the Hong Kong Exchange (which may boost daily turnover if a potential swap with the mainland stock exchanges occurs).

Southern Copper Corporation continued to perform well as China demonstrated strong import demand growth from year ago levels for copper. Southern Copper reached its target price and was sold out of the portfolio during the period.

Nokia Corporation contributed meaningfully to portfolio performance for the reporting period as solid underlying handset industry growth coupled with increased market share drove strong revenue and earnings growth. The company was also assisted by the combination of subscriber growth and substantial free cash flow.

Freeport-McMoRan Copper & Gold Inc. benefited from increased production in a capacity constrained industry. A fair degree of skepticism on the sustainability of copper prices contributed to the opportunity that developed in this stock.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: JetBlue Airways Corporation suffered as crude oil prices rose and fears over a U.S. recession have grown louder. Our investment thesis is still tracking well which we believe show stronger yields and higher load factors in the future. With respect to Freddie Mac, we believe there was uncertainty regarding credit losses and capital adequacy. The Fund sold its position during the reporting period. Wachovia Corporation’s stock price weakness reflects concerns about a sub-prime contagion in the mortgage business, which from what we can discern, should not be material for the company. Wyeth’s stock price suffered from negative news regarding their late state drug pipeline. The Fund’s position has been sold. Precision Drilling Trust was sold due to ongoing weak drilling activity in Western Canada.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: We attempt to manage risk through diversification and stock selection. We are broadly diversified across market sectors, and over 25% of the Fund’s assets are invested in non-U.S. securities. In addition, we believe that the process of identifying companies at a discount through bottom-up fundamental research helps us to identify these potential risks and incorporate them into our evaluation of each stock’s risk/reward trade-off.

Occasionally, the Fund invests in forward currency contracts as a risk control measure. We evaluate currency risk on a stock-by-stock basis. We will hedge currencies utilizing forward contracts if deemed appropriate. We use currency hedging to protect the investment thesis for a given stock from being significantly undermined by dollar/foreign currency fluctuations.

During the reporting period, the Fund had very limited exposure to high yield securities. We attempt to manage the risks associated with these types of securities through

|

| Discussion of Fund Performance |

| Growth and Income Trust (cont’d) |

comprehensive credit analysis techniques, including, but not limited to, cash flow analysis, balance sheet ratios, and

competitive positioning. We used the results of our analysis to evaluate the risk/reward trade-off.

High Yield Bond Fund

Investment Objective | The High Yield Bond Fund (the “Fund”) seeks high current income.

Investment Highlights | The Fund seeks to achieve its objective by investing at least 80% of its net assets (plus any borrowings for investment purposes) in lower-rated corporate bonds and other fixed income securities that focus on delivering high income, or if not rated, securities deemed to be of comparable quality by the portfolio managers. These lower-rated securities are commonly known as “junk bonds” or “high-yield securities.” High-yield securities offer the potential for greater income than securities with higher ratings. Most of the securities in which the Fund invests are rated B or lower by Moody’s Investors Service, Inc. (“Moody’s”) or B or lower by Standard & Poor’s Ratings Services (“S&P”). Certain of the securities purchased by the Fund may be rated as low as C by Moody’s or D by S&P.

The Fund may invest up to 20% of its assets in foreign debt securities (including emerging market securities). Normally, the portfolio managers seek to maintain a weighted average portfolio maturity of between 5 to 10 years.

Although credit ratings are considered, the Fund’s portfolio managers select high-yield securities based primarily on its own investment analysis, which involves relative value analysis, qualitative analysis and quantitative analysis.

Benchmark Index | The Citigroup High YieldSM Market Index is a broad-based unmanaged index that measures the performance of below-investment grade debt issued by corporations domiciled in the U.S. or Canada.

Meet the Managers | A team of investment professionals from Western Asset Management Company led by Chief Investment Officer S. Kenneth Leech, Deputy Chief Investment Officer Stephen A. Walsh and Portfolio Manager Michael C. Buchanan are responsible for the day-to-day management of the Fund. The team assumed management of the Fund effective April 1, 2006. Leech has 29 years of investment experience and earned an MBA, BS and BA from The Wharton School, University of Pennsylvania. Walsh has 25 years of investing experience and earned a BS degree from University of Colorado at Boulder. Buchanan is a chartered financial analyst with 17 years of investment experience. He earned a BA from Brown University.

During an interview conducted on November 23 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the high-yield bond market environment (the Fund’s investment market) during the reporting period?

A: The Citigroup High YieldSM Market Index returned 6.82% for the period. Yields fell and the yield curve gradually steepened over the course of the fiscal year as the market began to suspect that the Federal Reserve (the “Fed”) had reached the end of its tightening cycle and would begin easing; these expectations were subsequently validated by the Fed’s decision to cut its target funds rate by a total of 75 basis points at the September and October Federal Open Market Committee meetings. Short-term interest rates fell significantly, while

long-term rates declined modestly. Core inflation measures showed signs of moderation as the increase in the Fed’s preferred personal consumption expenditures deflator was just under 2%. Headline inflation picked up, however, driven by rising energy prices. Home prices began to decline and housing market indicators deteriorated markedly as the year progressed. Despite the ongoing weakness in residential construction and the collapse of the sub-prime lending market, economic growth picked up in the second and third quarters, thanks largely to double-digit growth in nonresidential construction and net exports. Credit spreads widened significantly with a great deal of the losses coming in the final months of the period. The price of a barrel of oil approached $100, the dollar lost substantial value against a trade-weighted basket of currencies, and gold and commodity prices approached new all-time highs. Equity markets moved generally higher throughout the period.

|

| Discussion of Fund Performance |

| High Yield Bond Fund (cont’d) |

Q: How did the Fund perform during the reporting period?

A: The Fund’s Class A shares returned 4.93% (excluding front-end sales charges) for the period. Industry positioning was generally positive in large part due to overweights outperforming industries including capital goods, basic industry and wireless.

Q: How did the Fund compare to its benchmark index during the reporting period?

A: The Fund’s Class A shares outperformed its benchmark index through the first three quarters of the period but an overweight to CCC rated securities in the period from July 31, 2007 to October 31, 2007 significantly impacted returns negatively, making the Fund underperform against its benchmark index for the reporting period. This overweight dominated performance as rising sub-prime mortgage concerns resulted in a flight to quality trade that severely penalized the higher beta lower quality section of the market.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Leiner Health is a leading manufacturer and distributor of store brand vitamins, minerals, nutritional supplements and over-the-counter (“OTC”) pharmaceuticals. The company announced further delays and increased costs in re-launching its U.S. OTC production after it voluntarily halted production and distribution of its U.S. OTC products on March 22, 2007 as a result of quality control deficiencies at one of its facilities. The company hired a financial advisor to assist in considering its strategic alternatives.

Saint Acquisitions is the largest truckload carrier in the U.S. based on the number of trucks in its fleet. During the past two quarters, the company has reported slightly softer than expected results. Recently the Saint Acquisitions bonds have declined disproportionately versus the market due to its heightened sensitivity to a decline in economic activity. However, Saint Acquisitions has ample financial liquidity, as well as flexibility to shrink its fleet and reduce its capital expenditures in 2008 in response to softer demand.

Continental Airlines and all the airlines are suffering from high fuel costs that have risen more than 15% during the past two months, as well as concerns regarding softer demand in 2008. Recently, Continental provided updated guidance for the fourth quarter of 2007 that was fairly optimistic. Demand remains strong in all of their regions and the pricing environment is favorable for both the leisure and business segments. Continental also has ample liquidity with almost $3 billion of cash on its balance sheet.

Hovnanian is suffering from a weaker-than-expected housing market with no quick turn around in sight. Hovnanian did not reduce inventory and generate free cash flows as quickly as investors have liked. Their borrowing availability under revolver was about $132 million as of the third quarter ended in July. Some investors fear the company would run into liquidity problems, but in reality the availability is on a borrowing base and Hovnanian has begun to generate free cash flows to reduce debt and future capital needs in the fourth quarter.

Ashton Woods is suffering due to a bleak broad housing market. Lehman Brothers homebuilding sector returned -20% year-to-date, making it the worst performing sector. Although Ashton Woods has conservative management that adopts prudent and conservative land policy, high investor fear still sent the company’s bond prices down.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: El Paso traded higher during the period due to the company’s completion of the initial public offering for El Paso Pipeline Partners, which now owns and operates certain natural gas transportation, pipelines, and storage assets serving the Rocky Mountain region. The public offering raised approximately $500 million for El Paso, which was subsequently used to reduce debt.

HCA traded higher during the period due to solid fundamentals and favorable industry trends. They maintain good operating momentum as far as volume, pricing, margins, and liquidity. The company is also benefiting from a positive market buzz on Democrats winning the upcoming election and subsequently implementing a plan for the uninsured.

Freeport McMoran is the second largest copper producer in the world. This is a well-managed, geographically diversified mining company with a low-cost asset base. Sustained strength in copper prices has allowed the company to rapidly reduce leverage to a level that is appropriate to copper prices throughout the commodity cycle.

Energy Future Holdings Corporation is a recently leveraged bought out Texas-based, integrated, deregulated electric utility company. The company has a low-cost portfolio of electric utility assets in a region with a favorable growth outlook.

Hawaiian Telecom recently completed the sale of its prized directories business with proceeds slated to pay down debt and increase liquidity. This allows the company more time to try to reverse recent poor operating performance.

|

| Discussion of Fund Performance |

| High Yield Bond Fund (cont’d) |

Q: Are there other factors that affected Fund performance during the reporting period?

A: The change in portfolio focus to a more concentrated portfolio had a negative impact on performance as the Fund became more concentrated in higher beta (higher risk) lower rated issues that came under tremendous pressure during the July-October period. A more concentrated portfolio would likely, but not always, result in a higher beta strategy due to our belief that the best relative value anomalies are in lower rated bonds. Throughout a cycle we believe a concentrated portfolio would outperform due to our strong research advantage. Unfortunately, this portfolio has only experienced one small part of a cycle (severe sell-off) where high beta would be expected to underperform.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: We have a dedicated team that oversees risk management and incorporates it into the investment process. The risk management team combines the best of technology and experience to develop useful risk management tools and

procedures. These tools and procedures provide daily analysis for the investment team, ensuring the integration of professional risk management practices into the investment process. Furthermore, we have a risk management committee that is responsible for ensuring the risk management process is complete and monitored on a regular basis. Despite using a large number of independent models to evaluate the risk of different portfolios, we understand that quantitative models are only as good as the assumptions on which they are based. Therefore, the high-quality analysis and observation that comes with experience is applied to all model output, increasing the usefulness of the data.

Analysis of data is carried on throughout the trading day and involves a thorough review of portfolio holdings and sector concentrations. Techniques such as factor analysis, key rate duration measurement and other analytic systems are also employed to evaluate portfolio risk. In addition, the investment team regularly performs scenario analysis and stress testing to analyze portfolio exposure to market factors. Tracking error is also monitored on a historical and a forward-looking basis.

|

| Discussion of Fund Performance |

| International Equity Fund |

Investment Objective | The International Equity Fund (the “Fund”) seeks capital appreciation principally through investment in a portfolio of international equity securities.

Investment Highlights | The Fund may invest in securities traded on any securities market in the world but normally invests at least 50% of its investment portfolio in securities traded in developed foreign securities markets. Generally, the Fund will invest in companies with a market capitalization greater than $2.5 billion. The Fund may also invest up to 35% of its total assets in emerging markets.

The Fund seeks to achieve its objective by investing, under normal market conditions, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of foreign companies that the portfolio managers believe to have the potential to capitalize on worldwide growth trends and global changes. The Fund primarily invests in equity securities of foreign issuers and depository receipts representing the securities of foreign issuers. In allocating the Fund’s assets among various securities markets of the world, the portfolio managers consider such factors as the condition and growth potential of the economies and securities markets, currency and taxation considerations, and financial, social, national and political factors. Market regulations and market liquidity are also considered. The Fund’s portfolio managers use a “bottom-up” sector and stock-specific approach within the developed markets. A bottom-up method of analysis de-emphasizes the significance of economic and market cycles. The primary focus is the analysis of individual companies rather than the industry in which that company operates or the economy as a whole. Within the emerging

markets, a “top-down”, macro-economic driven process is adopted. A top-down method of analysis emphasizes the significance of economic and market cycles. The primary focus is the analysis of the economy as a whole to discover which industries will generate the best returns. Finally, when considering investments in Japanese companies, a hybrid approach (both bottom-up and top-down) is most effective.

Benchmark Indices | The Morgan Stanley Capital International® All Country World Index ex-US (“MSCI® ACWI ex-US”) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets. The Morgan Stanley Capital International Europe, Australasia, and Far East® Index (“MSCI EAFE® Index”) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada.

Meet the Managers | Richard Pell is Chief Investment Officer and Chief Executive Officer at Julius Baer Investment Management LLC (“Julius Baer”) and has 23 years of investment experience. He joined Julius Baer in 1995. Pell has a BA from the University of California, Berkeley, and an MBA in finance from New York University. Rudolph-Riad Younes, CFA, is Managing Director, Head of International Equities at Julius Baer and has 17 years of investment experience. He joined Julius Baer in 1993. Younes received an MS from Columbia University and an MBA in management from Yale University. Richard Pell and Rudolph-Riad Younes assumed management of the Fund in July 2002.

During an interview conducted on November 21 2007, the portfolio managers of the Fund discussed the Fund’s performance for the fiscal year ended October 31, 2007. For specific Fund performance, please see Stephen G. Hill’s letter on page one of this report.

Q: How would you describe the international equity market environment (the Fund’s investment market) during the reporting period?

A: During the reporting period, the MSCI® ACWI ex-US returned 32.43% and the MSCI EAFE® Index returned 25.43%. International equities exhibited strong results, particularly within emerging markets, with Asia topping the charts amid continued strong economic growth. Commodity-oriented markets were also solid performers as demand for raw materials continued at a robust pace. The notable exception to the strong equity

environment was once again Japan, which achieved only low single-digit returns for investors.

Q: How did the Fund perform during the reporting period? How did the Fund compare to its benchmark index during the reporting period?

A: During the period, the Fund’s Class A shares returned 32.58% (excluding front-end sales charges), modestly outperforming the new benchmark, the MSCI® ACWI ex-US which was adopted July 1, 2007. This benchmark change coincided with the Fund’s ability to invest between 0-35% of the portfolio in emerging markets.

Our decision to underweight Japan once again proved beneficial to results. Lack of reforms, poor corporate governance and extended valuations leave little incentive for us to increase exposure there. The Fund also maintained its

|

| Discussion of Fund Performance |

| International Equity Fund (cont’d) |

underweight to the U.K. which benefited results. Our continued enthusiasm toward emerging markets was also rewarded during the period. Although concerns about global economic growth mounted amid the sub-prime debacle, the emerging world continued to advance. Our underweight to China and South Korea negatively impacted results, however the Fund’s position in the Indian banking sector as well various Central and Eastern European countries including Russia more than made up for this shortfall.

The Fund’s underweight to materials dragged down results given rising commodities. While its overweight to industrials was positive, stock selection negated this effect. On a positive note, our decision to underweight U.K. financials along with strong performance from several emerging market banks led us to outperform within the sector overall. This positioning more than made up for poor performance from several European financials. In Continental Europe, stock selection within the utility and consumer-oriented sectors was a strong contributor. Within the energy sector, stock selection, particularly within emerging markets, detracted from results.

Q: Which securities had the most positive impact on the Fund’s performance during the reporting period?

A: Not surprisingly, the top five contributors to relative performance came from the emerging markets. Within India, warrants held in the State Bank of India and Bharti Tele-ventures had very strong results amid continued strong economic growth. The same can be said for positions held in China Merchants Holdings (International) Co. Ltd, and Beijing Capital International Airport Co. Ltd in China. Finally, in Poland, the Fund’s position in PKO Bank Polski continued to outperform during the period. As of the end of the reporting period, all of these positions mentioned were still held by the Fund.

Q: Which securities had the most negative impact on the Fund’s performance during the reporting period?

A: Detracting from results was the position held in KKR Private Equity Investors L.P which seeks opportunities in private equity and opportunistic investments identified by Kohlberg Kravis Roberts & Co. The shares underperformed as liquidity for private equity and other investments dried up amid the sub-prime crisis. At the end of the period, we were reviewing the position. In Hong Kong, Melco International Development, an investor in Macau casinos and gaming technology, underperformed on concerns that revenue would not meet forecasts. The position was maintained. Swedbank AB, the largest bank in the Baltics, declined slightly given higher than

expected losses from bad loans and expansion costs. We remain optimistic toward several banks in the region including Swedbank given exposure to the higher growth rates of Eastern Europe and attractive valuations. In Greece, shares of Marfin Investment Group Holdings S.A. declined. This holding company invests in private equity, infrastructure projects and other investments in Greece, Cyprus and South East Europe, a continued area of interest for us. Finally, shares of OJSC OC Rosneft GDR, Russia’s largest oil company, underperformed as revenues did not meet forecasts. We remain attracted to the valuations within the Russian oil sector, preferring investments there to alternatives in many of the developed markets.

Q: Are there other factors that affected Fund performance during the reporting period?

A: During the period, the absolute return for the Fund was positively impacted by the decline in the U.S. dollar. As an example, versus the Euro, the dollar declined by approximately 13% which was of benefit to investors in the Fund given underlying equities denominated in Euros.

Q: What is your methodology for managing the Fund’s portfolio investment risks?

A: Portfolio risk control measures include the following:

| | • | | Valuation risk management – The most critical component of our overall risk management is our stock selection process. We constantly evaluate the risk/reward profile of every security. When a security is considered for inclusion we evaluate all potential risk factors (quantitative and qualitative); |