Annual

Information

Form

For the Year

Ended December 31, 2010

Dated: March 31, 2011

1500-625 Howe Street

Vancouver, British Columbia

V6C 2T6

Web Site: www.panamericansilver.com

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this Annual Information Form and in the documents incorporated by reference herein constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. All statements, other than statements of historical fact, are forward-looking statements or forward-looking information. When used in this Annual Information Form and the documents incorporated by reference herein, the words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “target”, “plan”, “forecast”, “strategies”, “objectives”, “budget”, “may”, “schedule” and other similar words and expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things:

| | · | the price of silver and other metals; |

| | · | the sufficiency of Pan American’s (as defined below) current working capital, anticipated operating cash flow or its ability to raise necessary funds; |

| | · | the accuracy of Mineral Reserve and Mineral Resource estimates, estimates of future production and future cash, and total costs of production, as applicable, at Huaron, Morococha, Quiruvilca, Alamo Dorado, La Colorada, Manantial Espejo, Navidad, San Vicente or other properties; |

| | · | estimated production rates for silver and other payable metals produced by Pan American, timing of production and the cash and total costs of production at each of Pan American’s properties; |

| | · | the estimated cost of and availability of funding for ongoing capital replacement, improvement or remediation programs; |

| | · | access to and availability of funding for the future construction and development of Pan American’s projects; |

| | · | estimated costs of construction, development and ramp-up of Pan American’s projects; |

| | · | future successful development of the Navidad property and other development projects of Pan American; |

| | · | the effects of laws, regulations and government policies affecting Pan American’s operations, including, without limitation, expectations relating to or the effect of certain highly restrictive laws and regulations applicable to mining in the Province of Chubut, Argentina; |

| | · | the estimates of expected or anticipated economic returns from a mining project, as reflected in feasibility studies or other reports prepared in relation to development of projects; |

| | · | estimated exploration expenditures to be incurred on Pan American’s various silver exploration properties; |

| | · | compliance with environmental, health, safety and other regulations; |

| | · | forecast capital and non-operating spending; |

| | · | future sales of the metals, concentrates or other products produced by Pan American; |

| | · | continued access to necessary infrastructure, including, without limitation, access to power, lands and roads to carry on activities as planned; and |

| | · | Pan American’s plans and expectations for its properties and operations, including, without limitation, those matters discussed under the heading “Outlook for 2011” herein. |

These statements reflect Pan American’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by Pan American, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained in this Annual Information Form and documents incorporated by reference, and Pan American has made assumptions based on or related to many of these factors. Such factors include, without limitation: fluctuations in spot and forward markets for silver, gold, base metals and certain other

commodities (such as natural gas, fuel oil and electricity); fluctuations in currency markets (such as the Peruvian sol, Mexican peso, Argentine peso and Bolivian boliviano versus the U.S. dollar and Canadian dollar); risks related to the technological and operational nature of Pan American’s business; changes in national and local government, legislation, taxation, controls or regulations and political or economic developments in Canada, the United States, Mexico, Peru, Argentina, Bolivia or other countries where Pan American may carry on business in the future; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); risks relating to the creditworthiness and financial condition of suppliers, refiners and other parties which Pan American deals with; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; employee relations; relations with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development, including the risks of obtaining necessary licenses and permits; diminishing quantities or grades of Mineral Reserves as properties are mined; global financial conditions; business opportunities that may be presented to, or pursued by, Pan American; Pan American’s ability to complete and successfully integrate acquisitions; challenges to, or difficulties in maintaining, Pan American’s title to properties and continued ownership thereof; the actual results of current exploration activities, conclusions of economic evaluations, and changes in project parameters to deal with unanticipated economic or other factors; increased competition in the mining industry for properties, equipment, qualified personnel, and their costs; and those factors identified under the captions “Outlook for 2011” and “Competitive Conditions” and “Risks Related to Pan American’s Business” in this Annual Information Form and the documents incorporated by reference herein. Investors are cautioned against attributing undue certainty to forward-looking statements. Although Pan American has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Pan American does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Please see “Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Resources” on page 3 of this Annual Information Form.

TABLE OF CONTENTS

| DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS | | i |

| TABLE OF CONTENTS | | iii |

| INTRODUCTION | | 1 |

| | Reporting Currency | | 1 |

| | Accounting Policies and Financial Information | | 1 |

| | Conversion Table | | 1 |

| | Glossary of Terms | | 2 |

| | Scientific and Technical Information | | 2 |

| | Classification of Mineral Reserves and Resources | | 3 |

| | Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Resources | | 3 |

| CORPORATE STRUCTURE | | 4 |

| | Incorporation | | 4 |

| | Capital Structure | | 4 |

| | Subsidiaries | | 4 |

| GENERAL DEVELOPMENT OF THE BUSINESS | | 7 |

| | Business of Pan American | | 7 |

| | Corporate Strategy and Financial Objectives | | 7 |

| | Developments Over the Last Three Financial Years | | 9 |

| | Significant Acquisitions | | 9 |

| | Outlook for 2011 | | 9 |

| NARRATIVE DESCRIPTION OF THE BUSINESS | | 10 |

| | Principal Products and Operations | | 10 |

| | Competitive Conditions | | 11 |

| | Employees | | 11 |

| | Research and Development | | 12 |

| | Working Capital | | 12 |

| | Environment | | 12 |

| | Health and Safety | | 13 |

| | Operating and Development Properties | | 14 |

| | I. | Operating Properties | | 17 |

| | A. | Peru | | 17 |

| | B. | Mexico | | 33 |

| | C. | Argentina | | 50 |

| | D. | Bolivia | | 57 |

| | II. | Development Properties | | 65 |

| | III. | Non-Material Properties and Interests | | 73 |

| | Mineral Property Expenditures | | 74 |

| | Metals Trading | | 74 |

| RISKS RELATED TO PAN AMERICAN’S BUSINESS | | 75 |

| SELECTED CONSOLIDATED FINANCIAL INFORMATION | | 86 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | | 88 |

| DIRECTORS AND OFFICERS | | 89 |

| EXCEPTIONS FROM NASDAQ CORPORATE GOVERNANCE REQUIREMENTS | | 93 |

| DIVIDENDS | | 93 |

| MARKET FOR SECURITIES | | 94 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 94 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 94 |

| TRANSFER AGENTS AND REGISTRAR | | 95 |

| MATERIAL CONTRACTS | | 95 |

| INTERESTS OF EXPERTS | | 95 |

| ADDITIONAL INFORMATION | | 95 |

| GLOSSARY OF TERMS | | 96 |

| APPENDIX “A” – AUDIT COMMITTEE CHARTER | | A-1 |

INTRODUCTION

In this Annual Information Form, the term “Company” refers to Pan American Silver Corp. and the term “Pan American” refers to the Company and its direct and indirect subsidiaries.

Reporting Currency

The Company’s reporting currency is the United States dollar. Unless otherwise indicated, all currency amounts in this Annual Information Form are stated in United States dollars. References to “C$” are to Canadian dollars.

Accounting Policies and Financial Information

Financial information contained in this Annual Information Form is presented in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”) unless otherwise indicated. Differences between Canadian GAAP and those generally accepted in the United States, as applicable to Pan American, are explained in Note 21 to the Consolidated Financial Statements of the Company for the year ended December 31, 2010. The Consolidated Financial Statements of the Company for the year ended December 31, 2010 are incorporated by reference herein and are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com.

The Accounting Standards Board (“AcSB”) adopted International Financial Reporting Standards (“IFRS”) as Canadian GAAP for publicly accountable enterprises for fiscal years beginning on or after January 1, 2011. The Company will report its first consolidated financial statements in accordance with IFRS for the three months ended March 31, 2011, with comparative figures for the corresponding period for 2010. In addition, the adoption date of January 1, 2011 will require the restatement, for comparative purposes, of amounts reported by the Company for its year ending December 31, 2010, and restatement of the opening balance sheet as at January 1, 2010.

This Annual Information Form refers to various non-GAAP measures, such as “cash and total cost per ounce of silver”, which are used by the Company to manage and evaluate operating performance at each of Pan American’s mines and are widely reported in the silver mining industry as benchmarks for performance, but do not have standardized meaning. To facilitate a better understanding of these measures as calculated by the Company, please refer to the Company’s Management’s Discussion and Analysis for the year ended December 31, 2010 where detailed descriptions and reconciliations, where applicable, have been provided.

Conversion Table

In this Annual Information Form, metric units are used with respect to mineral properties located in Peru, Mexico, Argentina, Bolivia and elsewhere, unless otherwise indicated. Conversion rates from imperial measures to metric units and from metric units to imperial measures are provided in the table set out below.

| Imperial Measure = Metric Unit | | Metric Unit = Imperial Measure |

| 2.47 acres | 1 hectare | | 0.4047 hectares | 1 acre |

| 3.28 feet | 1 metre | | 0.3048 metres | 1 foot |

| 0.62 miles | 1 kilometre | | 1.609 kilometres | 1 mile |

| 0.032 ounces (troy) | 1 gram | | 31.1 grams | 1 ounce (troy) |

| 1.102 tons (short) | 1 tonne | | 0.907 tonnes | 1 ton |

| 0.029 ounces (troy)/ton (short) | 1 gram/tonne | | 34.28 grams/tonne | 1 ounce (troy)/ton (short) |

Glossary of Terms

The glossary of terms set forth under the heading “Glossary of Terms” of this Annual Information Form contains definitions of certain terms used herein.

Scientific and Technical Information

Scientific or technical information in this Annual Information Form relating to Mineral Reserves or Mineral Resources, except for Mineral Resources relating to the Navidad property, is based on information prepared under the supervision of, or has been reviewed by, Michael Steinmann, P.Geo., Executive Vice President, Geology and Exploration of the Company and Martin Wafforn, P.Eng., Vice President, Technical Services of the Company. Scientific or technical information relating to the geology of particular properties, and the exploration programs described in this Annual Information Form, are prepared and/or designed and carried out under the supervision of Michael Steinmann. Scientific and technical information herein relating to the Navidad property is based on information contained in the Navidad Technical Report (as defined below) and the disclosure in this Annual Information Form relating thereto has been reviewed and consented to by Michal Steinmann, Martin Wafforn and Pamela De Mark, P.Geo., Director of Resources for the Company, the experts involved in the preparation of the applicable sections of the Navidad Technical Report. In particular, scientific or technical information in this Annual Information Form relating to the estimation of Mineral Resources for the Navidad property was prepared by Pamela De Mark. All other disclosures of scientific and technical information contained in the descriptions of Pan American’s mineral properties were prepared under the supervision of Michael Steinmann and Martin Wafforn.

Each of Michael Steinmann, Martin Wafforn, and Pamela De Mark is a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A “Qualified Person” means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

Scientific and technical disclosure in this Annual Information Form for the Company’s material properties is based on Technical Reports prepared for those properties in accordance with NI 43-101. The technical information in this Annual Information Form has been updated with current information where applicable. The Technical Reports are as follows:

| | · | a report entitled “43-101 Technical Report – Huaron Property, Cerro de Pasco, Peru” dated effective December 31, 2006 (the “Huaron Report”) relating to the Huaron mine; |

| | · | a report entitled “Morococha Property Technical Report, Yauli Province, Peru” dated effective December 30, 2007 (the “Morococha Report”) relating to the Morococha mine; |

| | · | a report entitled “Technical Report for the Quiruvilca Property, La Libertad, Peru” dated effective July 31, 2007 (the “Quiruvilca Report”) relating to the Quiruvilca mine; |

| | · | a report entitled “Feasibility Study Volume I – NI-43-101 Technical Report for Alamo Dorado Project, Alamos, Sonora, Mexico” dated March 31, 2005 (the “Alamo Report”) relating to the Alamo Dorado mine; |

| | · | a report entitled “Technical Report for the La Colorada Property, Zacatecas, México” dated effective September 30, 2007 (the “La Colorada Report”) relating to the La Colorada mine; |

| | · | a report entitled “Manantial-Espejo Project Canadian Standard NI 43-101, Santa Cruz Province, Argentina” dated March 2006 (the “Manantial Report”) relating to the Manantial Espejo mine; |

| | · | a report entitled “Technical Report for San Vicente Mine Expansion Project, Potosi, Bolivia” dated effective June 6, 2007 (the “San Vicente Report”) relating to the San Vicente mine; and |

| | · | a report entitled “Pan American Silver Corp.: Navidad Project, Chubut Province, Argentina: Preliminary Assessment” dated January 14, 2011 (the “Navidad Technical Report”) relating to the Navidad property, |

(collectively, the “Technical Reports”).

The Technical Reports have been filed on SEDAR at www.sedar.com.

Classification of Mineral Reserves and Resources

In this Annual Information Form, the definitions of Proven and Probable Mineral Reserves and Measured, Indicated and Inferred Mineral Resources are those used by Canadian provincial securities regulatory authorities and conform to the definitions utilized by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) in the “CIM Standards on Mineral Resources and Reserves – Definitions and Guidelines” adopted on August 20, 2000 and amended December 11, 2005.

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This Annual Information Form and the documents incorporated by reference have been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all Mineral Reserve and Mineral Resource estimates included in this Annual Information Form and the documents incorporated by reference herein have been prepared in accordance with NI 43-101 and the CIM classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”), and information with respect to mineralization and Mineral Reserves and Mineral Resources contained or incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, these documents use the terms ‘‘Measured Resources’’, ‘‘Indicated Resources’’ and ‘‘Inferred Resources’’. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC does not recognize them. Under U.S. standards, mineralization may not be classified as a ‘‘reserve’’ unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The requirements of NI 43-101 for identification of ‘‘reserves’’ are not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as ‘‘reserves’’ under SEC standards. U.S. investors should also understand that ‘‘Inferred Resources’’ have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. Under Canadian securities laws, disclosure must not be made of the results of an economic analysis that include ‘‘Inferred Resources’’, except in certain cases. Disclosure of ‘‘contained ounces’’ in a Mineral Resource is a permitted disclosure under Canadian securities laws, however, the SEC normally only permits issuers to report mineralization that does not constitute ‘‘reserves’’ by SEC standards as in place tonnage and grade, without reference to unit measures. U.S. investors are cautioned not to assume that any part of a ‘‘Measured Resource’’ or ‘‘Indicated Resource’’ will ever be converted into a ‘‘reserve’’. It cannot be assumed that all or any part of ‘‘Inferred Resources’’ exist, are economically or legally mineable or will ever be upgraded to a higher category.

CORPORATE STRUCTURE

Incorporation

The Company is the continuing corporation of Pan American Energy Corporation, which was incorporated under the Company Act (British Columbia) on March 7, 1979. The Company underwent two name changes by way of amendment to its memorandum, the last occurring on April 11, 1995, when the present name of the Company was adopted. Amendments to the memorandum of the Company to date have been limited to name changes and capital alterations. In May 2006, the Company obtained shareholder approval to amend its memorandum and articles, including the increase in its authorized share capital from 100,000,000 to 200,000,000 common shares, in connection with the Company’s required transition under the Business Corporations Act (British Columbia).

The Company’s head office is situated at 1500 - 625 Howe Street, Vancouver, British Columbia, Canada, V6C 2T6 and its registered and records offices are situated at 1200 Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia, Canada, V7X 1T2.

The Company’s web site can be found at www.panamericansilver.com.

Capital Structure

The Company’s authorized share capital consists of 200,000,000 common shares without par value. The holders of common shares are entitled to: (i) one vote per common share at all meetings of shareholders; (ii) receive dividends as and when declared by the directors of the Company; and (iii) receive a pro rata share of the assets of the Company available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of the Company. There are no pre-emptive, conversion or redemption rights attached to the common shares.

Subsidiaries

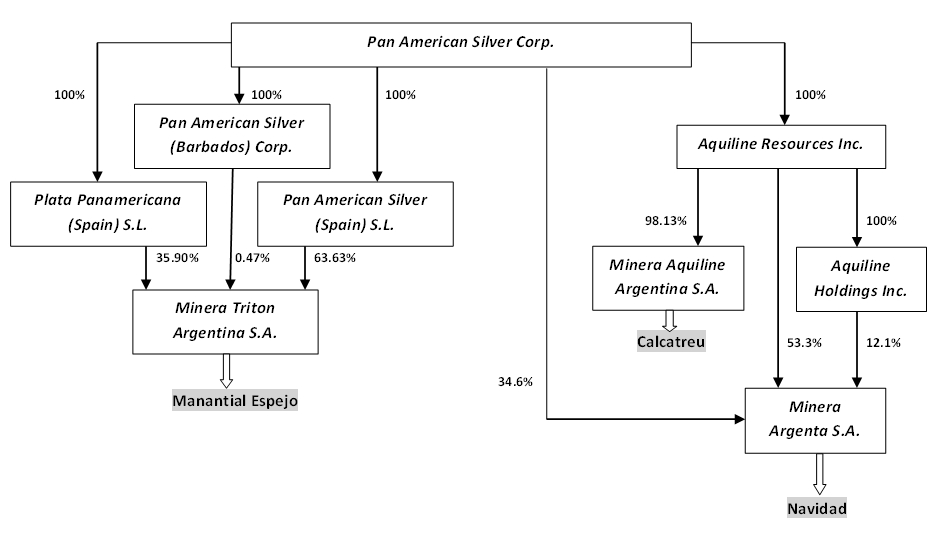

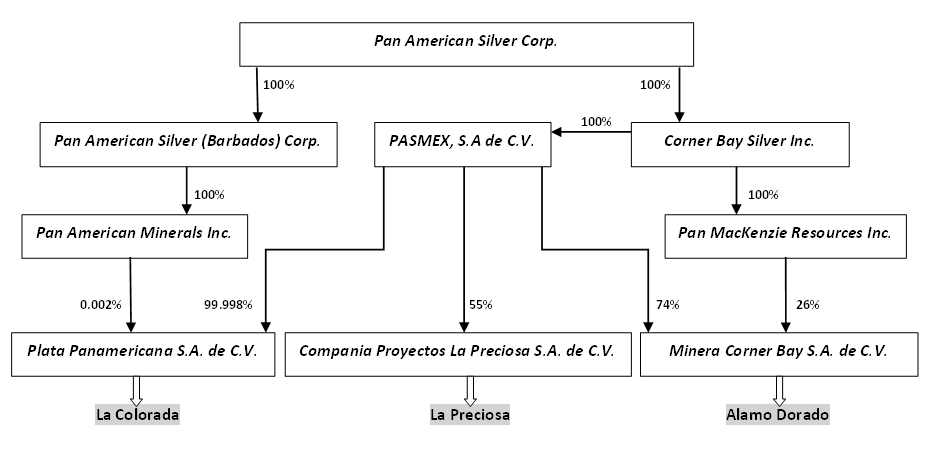

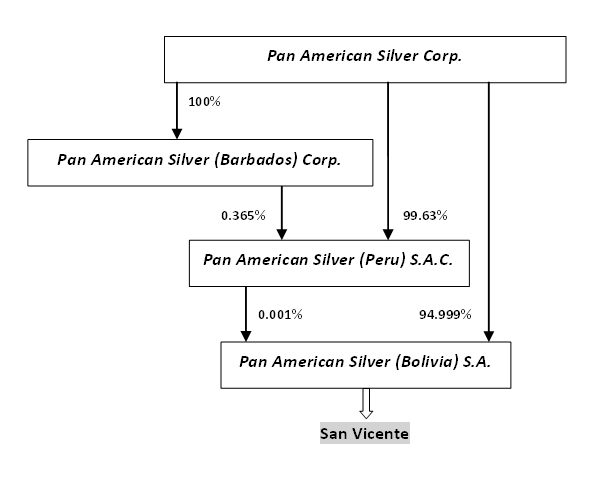

A significant portion of the Company’s business is carried on through its various subsidiaries. The following table and charts (set out by jurisdiction of the respective mineral properties) show, as at the date of this Annual Information Form, the significant subsidiaries, joint ventures and associated companies of the Company, including their respective jurisdictions of incorporation and the percentage of voting securities in each that are held by the Company directly or indirectly:

| Name | Jurisdiction |

| Corner Bay Silver Inc. (“Corner Bay”) | Canada |

| Aquiline Resources Inc. (“Aquiline”) | Ontario |

| Absolut Resources Inc. (“Absolut”) | Yukon |

| Pan American Minerals, Inc. (“Pan American U.S.”) | Nevada |

| Pan MacKenzie Resources Inc. | Delaware |

| Pan American Silver (Barbados) Corp. (“Pan American Barbados”) | Barbados |

| Aquiline Holdings Inc. (“Aquiline Barbados”) | Barbados |

| Pico Machay Cayman Limited (“PM Cayman”) | Cayman Islands |

| Plata Panamericana (Spain) S.L. | Spain |

| Pan American Silver (Spain) S.L. | Spain |

| Minera Triton Argentina S.A. (“MTA”) | Argentina |

| Minera Aquiline Argentina S.A. (“MAA”) | Argentina |

| Minera Argenta S.A. (“MASA”) | Argentina |

| Name | Jurisdiction |

| PASMEX, S.A. de C.V. (“PASMEX”) | Mexico |

| Minera Corner Bay S.A. de C.V. (“MCB”) | Mexico |

| Plata Panamericana S.A. de C.V. (“Pan American Mexico”) | Mexico |

| Proyectos Mineros La Preciosa, S.A. de C.V. | Mexico |

| Pan American Silver Peru S.A.C. (“Pan American Peru”) | Peru |

| Pan American Silver S.A. Mina Quiruvilca (“Mina Quiruvilca”) | Peru |

| Compañía Minera Argentum S.A. (“Argentum”) | Peru |

| Minera Calipuy S.A.C. (“Minera Calipuy”) | Peru |

| Minera Pico Machay S.A.C. (“MPM”) | Peru |

| Pan American Silver (Bolivia) S.A. (“PASB”) | Bolivia |

CORPORATE STRUCTURE

Argentina Properties

Mexico Properties

Peru Properties

Bolivia Properties

Note: In some jurisdictions in which Pan American operates, laws require that a company operating mineral properties must have more than one owner. As such, in some cases, a nominal interest may be held in trust for Pan American by an individual or other entity.

GENERAL DEVELOPMENT OF THE BUSINESS

Business of Pan American

Pan American is principally engaged in the operation and development of, and exploration for, silver producing properties and assets. Pan American’s principal product is silver, although gold, zinc, lead, and copper are also produced and sold. At present, Pan American carries on mining operations or is developing mining projects in Mexico, Peru, Argentina and Bolivia, and has control over non-producing silver assets in each of those jurisdictions and in the United States. With the exception of the United States, exploration work is carried out in all of the aforementioned countries, as well as elsewhere throughout the world.

Corporate Strategy and Financial Objectives

Pan American’s corporate strategy is to continuously strengthen its position as one of the world’s leading primary silver mining companies by acquiring or discovering silver resources that have the potential to be developed economically and to add meaningfully to Pan American’s production profile while lowering consolidated unit costs of production.

The key elements of Pan American’s strategy are to:

| | · | Increase silver production – Pan American has increased its annual silver production for 15 consecutive years since acquiring its first operating mine (Quiruvilca in Peru) in 1995, including an approximate 87% increase from approximately 13 million ounces in 2006 to approximately 24.3 million ounces in 2010. This |

| | | has been accomplished through a combination of acquisition, development and expansion efforts. Silver production during the year ended December 31, 2010 represented an approximate 5.7% increase over the approximately 23 million ounces produced in 2009. |

| | · | Increase Mineral Reserves and Mineral Resources – Historically, Pan American has consistently seen annual increases in its Mineral Reserves and Mineral Resources through exploration and acquisitions. In 2010, Pan American discovered and defined approximately 27.0 million ounces of new silver Mineral Reserves which was nearly sufficient to replace the approximately 28.3 million contained ounces consumed by mining operations in 2010. At December 31, 2010, Proven and Probable silver reserves for Pan American were approximately 230.7 million ounces, which represents a small decrease from the previous year’s total of 233.9 million ounces. Pan American’s Measured and Indicated Mineral Resources increased by approximately 4.3 million ounces to approximately 714.8 million ounces as at the end of 2010, while Inferred Mineral Resources increased by approximately 15.8 million ounces over the previous year to approximately 245.2 million ounces. |

| | · | Continue to be a “Low Cost Producer” – Full year 2010 consolidated cash costs to produce an ounce of silver were approximately $5.69, net of by-product credits. Consolidated cash costs increased in 2010 for a number of reasons, including a reduction in by-product production from less gold and zinc production, an increase in certain government royalties and the industry-wide escalation of energy, labour, consumable and material costs. Pan American’s growth strategy continues to emphasize reducing overall unit production costs. To keep production costs down, Pan American has added newer more mechanized mines (such as Alamo Dorado and Manantial Espejo) to its portfolio of assets, and will continue to review mining plans at its operating mines in order to find greater productivities and efficiencies as well as develop financial strategies to reduce exposure to foreign currency exchange fluctuations and base metal price fluctuations. Cash costs for 2011 are forecast at between $7.00 and $7.50 per ounce, net of by-product credits, for the full year. The projected increase is partially as a result of expected upward-inflationary operating cost pressures, stronger local currencies relative to the United States dollar, and increased treatment charges. |

| | · | Acquire additional silver exploration properties – Pan American actively investigates and evaluates strategic opportunities to acquire promising silver production, development and exploration properties in those jurisdictions where Pan American is presently active as well as elsewhere throughout the world. For example, Pan American completed its acquisition of the Navidad, Calcatreu and Pico Machay properties pursuant to its acquisition of all of the issued and outstanding shares of Aquiline in January 2010. Pan American’s exploration and acquisition focus is on silver properties with bulk mineable targets that have the possibility of possessing over 50 million ounces of silver mineralization. |

| | · | Generate sustainable profits from mining operations – Financial performance is monitored annually against targets for operating earnings and cash flow from operations, as well as against operating measures such as production and cash costs. Pan American continuously develops and implements tax planning strategies and seeks to organize its corporate structure and activities to optimize its overall tax position. |

| | · | Continue to be a responsible company, committed to sustainable development – Pan American is committed to the highest standards of governance and ethics, and to operate its business in a sustainable fashion. Pan American has operations in a number of countries and across diverse cultures, and because of this, its business has the potential to impact its host communities and nearby populations both positively and negatively. Pan American’s goal is to minimize the negative impacts and maximize the benefits garnered to local populations, while at the same time achieving success from a business perspective. Pan American conscientiously strives to operate within a framework of moral principles and values and to engage and interact regularly, and in an open and honest way, with governments, shareholders, employees, local communities, business partners and other stakeholders affected by Pan American’s operations. Pan American is aware that its business is in many ways dependent on these various stakeholders and views establishing relationships of mutual trust and respect as important. By building such relationships and conducting itself in a transparent manner, Pan American can further the exchange of information, address specific concerns of stakeholders and work cooperatively and effectively towards |

| | | achieving Pan American’s goals while at the same time being accountable and responsible to those affected by Pan American. |

Developments Over the Last Three Financial Years

During the last three financial years Pan American has undertaken the following:

| | · | 2008 – (i) increased annual consolidated silver production to approximately 18.7 million ounces, the largest contributor being Alamo Dorado, which produced approximately 6.1 million ounces of silver in 2008; (ii) substantially completed construction and began production at the Manantial Espejo mine, making its first pour of silver and gold doré on December 29, 2008; (iii) substantially completed the expansion of the San Vicente mine and increased San Vicente’s production by approximately 33% compared to 2007; (iv) completed over 99,600 metres of exploration drilling at its existing sites and development properties; and (v) entered into a $70 million revolving credit facility. |

| | · | 2009 – (i) increased annual consolidated silver production to approximately 23.0 million ounces; (ii) acquired control of Aquiline pursuant to a friendly take-over offer in the fourth quarter of 2009 and thereby became the owner of the Navidad property, one of the largest undeveloped silver deposits in the world; (iii) completed an equity financing, the gross proceeds of which totalled approximately $103.5 million; (iv) entered into a joint venture arrangement with Orko Silver Corp. to obtain a 55% interest in the early-stage La Preciosa project in Mexico; (v) completed its first full year of production at the Manantial Espejo mine, which produced approximately 3.8 million ounces of silver and nearly 72,000 ounces of gold for the year; (vi) completed the expansion and commenced commercial production at the San Vicente mine; and (vii) conducted over 98,930 metres of exploration drilling on Pan American’s existing mine sites and exploration properties, contributing to a 5% increase in Pan American’s Proven and Probable Mineral Reserves. |

| | · | 2010 – (i) increased annual consolidated silver production to approximately 24.3 million ounces, the largest contributor remaining Alamo Dorado, which produced approximately 6.7 million ounces of silver in 2010; (ii) completed the acquisition of Aquiline by way of compulsory acquisition; (iii) invested approximately $37.5 million in, and substantially completed a preliminary assessment on, the Navidad project; (iv) invested approximately $10 million in exploration and delineation drilling, metallurgical testing, and engineering activities on the La Preciosa joint-venture; (v) completed the first full year of production from the expanded San Vicente mine, which produced approximately 3.2 million ounces of silver for the year, 3.0 million of which was attributed to Pan American; (vi) performed a tax consolidation of certain of the Company’s Mexican subsidiaries and completed the merger of Minera Triton Argentina S.A. with Minera Alto Valle S.A., both subsidiaries of the Company that held and operated the Manantial Espejo mine; (vii) increased the availability under Pan American’s corporate credit facility from $70 million to $150 million; and (viii) conducted over 110,000 metres of diamond drilling on Pan American’s existing mine sites. |

Significant Acquisitions

In January 2010, the Company completed its acquisition of all of the issued and outstanding shares of Aquiline by way of a compulsory acquisition under the Business Corporations Act (Ontario). The Company had originally acquired shares of Aquiline by its takeover bid made by way of a takeover bid circular dated October 31, 2009. The Company filed a business acquisition report for this significant acquisition on SEDAR on February 22, 2010.

Outlook for 2011

In 2011, Pan American expects to produce between 23 and 24 million ounces of silver and to execute approximately 108,000 metres of diamond drilling in brownfield projects. In addition, Pan American plans to invest approximately $12 million in greenfield exploration activities at selected properties in Mexico, Peru and Argentina. Pan American is planning to invest approximately $54 million in sustaining capital and $67 million on project development in 2011.

Pan American has added several development projects to its portfolio since the end of 2009. The Company concluded its acquisition of Aquiline in January 2010 and as a result, acquired the rights to the Navidad, Calcatreu and Pico Machay properties. In addition, in October 2009, the Company and Orko Silver Corp. entered into a formal joint venture agreement in respect of the La Preciosa silver project in the state of Durango, Mexico.

Pan American completed and filed a preliminary assessment on the Navidad project in January 2011 and intends to invest approximately $45 million towards Navidad’s continued development in 2011, including approximately $16 million for definition drilling. The remainder of the spending will be directed towards preparation of an environmental impact assessment, tailings site and geotechnical evaluation, metallurgical studies, basic engineering designs and the completion of a full feasibility study by the end of 2011. Similarly, work at the La Preciosa project in 2011 will initially focus on completing additional work to evaluate alternative extraction and development scenarios to maximize the project’s economics and the Company intends to complete a preliminary assessment on the project by mid-year 2011.

Pan American will continue to investigate, evaluate and, where appropriate, acquire additional silver production, exploration and development properties.

NARRATIVE DESCRIPTION OF THE BUSINESS

Principal Products and Operations

Pan American’s principal products and sources of sales are silver and gold doré and silver bearing zinc, lead, and copper concentrates. In 2010, the Huaron, Morococha, Quiruvilca, Alamo Dorado, La Colorada, Manantial Espejo and San Vicente mines accounted for virtually all of Pan American’s production of concentrates and doré. Information related to Pan American’s segmented information is set forth in Note 17 to the Consolidated Financial Statements and is referred to in the Management’s Discussion and Analysis of the Company for the year ended December 31, 2010 (the “MD&A”) under the heading “Operating Performance”.

Consolidated production for the year ended December 31, 2010 was as follows:

| | Huaron | Morococha1 | Quiruvilca | Alamo Dorado | La Colorada2 | San Vicente3 | Manantial Espejo | Total |

| Tonnes milled | 704,094 | 619,819 | 323,427 | 1,675,952 | 345,697 | 271,483 | 717,463 | 4,657,936 |

| Grade | | | | | | | | |

| Silver - g/t | 170.61 | 151.92 | 141.35 | 146.56 | 378.49 | 388.54 | 191.17 | N/A |

| Gold - g/t | 0.31 | 0.33 | 1.29 | 0.38 | 0.52 | - | 2.81 | N/A |

| % Zinc | 2.43 | 2.88 | 2.88 | - | 2.09 | 2.29 | - | N/A |

| % Lead | 0.91 | 1.05 | 1.05 | - | 0.91 | - | - | N/A |

| % Copper | 0.39 | 0.38 | 0.38 | - | - | 0.25 | - | N/A |

| Production | | | | | | | | |

| Ounces silver | 2,987,280 | 2,632,790 | 1,245,030 | 6,721,258 | 3,701,568 | 3,033,046 | 3,964,822 | 24,285,794 |

| Ounces gold | 1,525 | 2,329 | 1,801 | 16,746 | 4,312 | - | 62,843 | 89,555 |

| Tonnes zinc | 10,216 | 15,228 | 10,058 | - | 2,940 | 4,661 | - | 43,103 |

| Tonnes lead | 4,346 | 4,927 | 2,989 | - | 1,366 | - | - | 13,629 |

| Tonnes copper | 1,654 | 1,532 | 1,434 | 89 | - | 512 | - | 5,221 |

_______________

| 1 | Morococha data represents Pan American’s 92.2% interest in mine production. |

| 2 | La Colorada zinc and lead grades are for sulphide ore only. |

| 3 | San Vicente data represents Pan American’s 95% interest in mine production. |

Doré

Pan American’s principal buyers of silver and gold doré from its Alamo Dorado, La Colorada, and Manantial Espejo mines, once refined, are international bullion banks and traders. Silver and gold doré is delivered to refineries in Mexico, Germany, and the United States, and subsequently transferred to the accounts of its buyers.

Concentrate

Pan American’s principal markets for copper concentrates are Peru, Japan and Canada. The majority of the Peruvian copper concentrates and all stockpile ore were traditionally sold to Doe Run Peru’s metallurgical complex in La Oroya, Peru. However, in 2009, the Doe Run Peru complex experienced financial difficulties and Pan American was unable to continue sales to the smelter. As a result, Pan American entered into a number of contracts with other smelters and traders for these concentrates.

Pan American’s principal markets for zinc concentrates are Peru, Korea, Brazil, Mexico and Spain. Zinc concentrate is delivered to Peruvian and Mexican customers by truck. Zinc concentrates are delivered to customers in Japan, Brazil, and Spain first via truck to ports in Peru, Chile, and Mexico, and from there by ship.

Pan American’s principal markets for lead concentrates are Peru, China, and Belgium. Lead concentrates are delivered by truck to the port of Callao, Peru, and Altamica, Mexico and from there by ship.

Please see the discussion under “Risks Relating to Pan American’s Business – Smelter Supply Arrangements” and “Risks Relating to Pan American’s Business – Trading Activities and Credit Risk”.

Competitive Conditions

The mining industry is intensely competitive, particularly in the acquisition of additional Mineral Reserves and Mineral Resources in all of its phases of operation, and Pan American competes with many companies possessing similar or greater financial and technical resources.

Pan American’s competitive position is largely determined by its costs compared to other producers throughout the world and its ability to maintain its financial integrity through the lows of the metal price cycles. Costs are governed to a large extent by the location, grade and nature of Pan American’s Mineral Reserves as well as by operating and management skills. In contrast with diversified mining companies, Pan American focuses on silver production, development, and exploration, and is therefore subject to unique competitive advantages and disadvantages related to the price of silver and to a lesser extent, the price of base metal by-products. If silver prices substantially increase, Pan American will be in a relatively stronger competitive position than diversified mining companies that produce, develop and explore for other minerals in addition to silver. Conversely, if silver prices substantially decrease, Pan American may be at a competitive disadvantage to diversified mining companies.

Employees

At the end of 2010, Pan American had over 4,600 employees and nearly 2,500 contractors. The majority of those employees and contractors were working at Pan American’s operations in South America and in Mexico, although the Company had 38 employees at its head office in Vancouver as at December 31, 2010. Pan American’s Peruvian operations had approximately 4,600 total employees and contractors, while its Bolivian operations had approximately 600 employees and contractors, its Argentinean operations had approximately 850 employees and contractors and its Mexican operations had approximately 1,000 employees and contractors.

Some employees of Pan American and its contractors are unionized. In particular, unions have been established at its operations in Peru, Argentina, and Bolivia. Although Pan American has reached agreements with its various unions and places significant emphasis on maintaining positive relationships with the unions and

employees, it has experienced labour strikes and work stoppages in the past. Should they occur, some labour strikes and work stoppages have the potential to materially affect Pan American’s operations and thereby adversely impact Pan American’s future cash flows, earnings, production, and financial conditions.

Research and Development

Pan American conducts research and development activities through its feasibility work in order to develop improved production processes and exploration techniques. Costs associated with this work are expensed as incurred. Pan American did not incur any significant research and development costs during 2008, 2009 or 2010.

Working Capital

Management of Pan American believes that its working capital of approximately $433.8 million as at December 31, 2010, plus its expected operating cash flows in the future, is sufficient to sustain funding for projects currently underway, capital expenditures in connection therewith, and to discharge current estimated liabilities as they come due in the foreseeable future. In addition, the Company made certain amendments to its existing $70 million credit facility and in early 2011, which increased the amount available under the facility to $150 million. As at December 31, 2010, there were no drawings under this facility.

All phases of Pan American’s operations are subject to environmental regulation in the various jurisdictions in which it operates. To the best of management’s knowledge, Pan American’s activities in 2010 were, and continue to be, in compliance in all material respects with such environmental regulations applicable to its mining operations, development, and exploration activities. The Company has implemented an environmental policy and a health and safety policy in which the Company accepts its corporate responsibility to practice environmental protection and provide a safe and healthy workplace for its employees, and commits to comply with all relevant industry standards, environmental legislation and regulations in the countries where it carries on business.

During 2010, reviews of the environmental performance of all the operations and projects were conducted by the Company’s Director, Environmental Affairs. The reviews included inspections of the mine and project sites with key operations personnel, a review of environmental monitoring program procedures and results and a review of principal environmental issues related to each of these operations. The key observations and recommendations from the reviews are reported monthly to senior management and quarterly to the Board of Directors. In addition to the periodic reviews, detailed Corporate Social Responsibility (“CSR”) Audits are conducted periodically. These audits review environmental compliance and environmental and social performance. During 2010, CSR Audits were conducted of the operations at Morococha, Huaron, Quiruvilca, and San Vicente.

Pan American's Huaron, Morococha, Quiruvilca, La Colorada, Alamo Dorado, Manantial Espejo and San Vicente operations were all inspected by government agencies in 2010 and no material issues were observed during these inspections.

Peru has proposed changes to its liquid effluent discharge limits. Pan American has implemented a baseline assessment at each of its three operating mines in Peru in order to assess the potential impact of these changes to water treatment practices at each operation. Pan American has proactively implemented changes in order to be in a better position to meet new discharge limits.

Pan American submitted an environmental impact assessment (“EIA”) for the Morococha mine to the Peruvian Ministry of Mining for evaluation. The EIA was for the construction of a new process plant. The EIA has gone through the public disclosure process and it is currently in the final approval stage.

Key accomplishments during 2010 related to the environmental management of the mines and development projects include:

| | · | Pan American’s Peruvian operations received the prestigious Premio Desarrollo Sostenible 2010 award (“2010 Sustainable Development Award”) in the category of Esfuerzos de Promoción en el Desarrollo Local - Minería (“Promotion Initiatives for Local Development – Mining”) for its exemplary work in social and environmental management and the positive effect it has brought to the Peruvian communities where Pan American operates; |

| | · | San Vicente won third place for the Best CSR Community Driven Project in Bolivia from the National Chamber of Industry. 236 companies competed in the category which included all types of industries including banks and petroleum; |

| | · | Alamo Dorado concluded the draft protocol on agricultural research to be submitted to the National Institute of Research on Forestry, Agricultural and Livestock (“INIFAP”). The projects include evaluating cultivation in greenhouses, shade and natural environment; |

| | · | La Colorada received authorization from the Mexican Secretary for Environmental and Natural Resources (“SEMARNAT”) on the EIA for an extension of five years; |

| | · | the EIA for the new tailings dam at La Colorada, which will be used for sulfides tailings, has been prepared and presented to the authorities; |

| | · | baseline data collection conducted at the La Preciosa project; |

| | · | the La Colorada operation was re-certified as a “Clean Industry” by the environmental agency of Mexico; and |

| | · | two of the Company’s subsidiaries, Plata Panamericana S.A. de C.V. and Minera Corner Bay S.A. de C.V., were each certified by the Mexican Center for Philanthropy as a “Socially Responsible Company”. |

In the financial year-end dated December 31, 2010, Pan American’s environmental expenditures for concurrent reclamation were approximately $1.05 million. The Company has estimated the aggregate present value of expenditures required for closure and reclamation costs in respect of the Huaron, Morococha, Quiruvilca, Alamo Dorado, La Colorada, Manantial Espejo, and San Vicente mines to be approximately $69.5 million, which is an increase over the estimate of $67.1 million at December 31, 2009. The increase in estimated closure and reclamation costs is primarily due to allowance for inflation and the result of $0.9 million in revisions made to the reclamation obligations as a result of increased site disturbance and development at Quiruvilca, La Colorada, and Alamo Dorado.

Other than specific environmental concerns discussed in this Annual Information Form, the Company is not aware of any material environmental matter requiring significant capital outlays in the immediate future. It is difficult to estimate closure and reclamation costs and actual costs may vary, perhaps materially, from estimates and investors are cautioned against attributing undue certainty to these estimates. The reclamation and closure costs estimate for each of the operating mines and development projects was updated to reflect the conditions as of December 31, 2010.

Health and Safety

The Company has implemented a health, safety and environment policy in which Pan American accepts its corporate responsibility to provide a safe and healthy workplace for its personnel, and commits to comply with all relevant industry standards, legislation, and regulations in the countries where it carries on business. The policy is reviewed annually to ensure that it remains current, if not ahead, of industry standards and best practices.

In 2005, the Company introduced regular, informal safety audits at all of its operations, increased the frequency of, and requirements for, training programs, and purchased more advanced mine rescue equipment. Periodically, formal corporate health and safety audits are also conducted at Pan American’s operating mines and active development properties. As with previous years, in 2010, each of Pan American’s operating mines were subject to an informal safety audit where particular focus was placed on a review of emergency preparedness,

health and safety systems, safety training, and the general condition of each mine. The Company’s Director of Health and Safety participates in the formal audits, as well as safety managers and operations supervisors from other Pan American operations. Management reports health and safety findings and mitigation progress to the Company’s Board of Directors on a regular basis.

During 2010, Pan American focused on introducing new safety programs and training at its operating mines in Peru as well as maintaining excellent safety records at the other mines and development projects. Total hours worked at operating mines and active development projects increased by approximately 6% versus 2009 while the number of lost time injuries (“LTI”) increased by approximately 38%. Pan American recorded a lost time injury frequency (“LTIF”) of 2.33 during 2010 versus 1.79 during 2009 and 2.55 in 2008. LTIF is calculated as follows:

In 2005, the Company introduced the “Chairman’s Safety Award” that is presented to the Pan American mine with the best overall safety performance. In 2009, this award went to the La Colorada mine and in 2010, the winner of the award was the Manantial Espejo mine which, amongst other accomplishments, operated the entire year without a single LTI.

During 2010, the Alamo Dorado and La Colorada mines were each awarded the “Casco de Plata” trophy by CAMIMEX for being the mines with the best safety record in Mexico in the categories of open pit mine with less than 5,000 employees and underground mine with more than 500 employees, respectively.

Pan American will continue to make substantial investments in its safety programs throughout 2011, particularly through the implementation of more training programs, and will continue safety audits as required in order to measure and adjust the success of these programs.

Operating and Development Properties

Pursuant to National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), the following properties and projects have been identified by Pan American as being material: the Huaron mine, the Morococha mine, the Alamo Dorado mine, the La Colorada mine, the Manantial Espejo mine, the San Vicente mine and the Navidad property. The Company does not consider the Quiruvilca mine to be a material property for the purposes of NI 51-102. In addition, the Company does not consider the stockpiles or any of Pan American’s other development or investment properties, including the La Preciosa project, to be material properties for the purposes of NI 51-102.

Mineral Reserve and Mineral Resource Estimate Information

The process for economic assessment of the Mineral Reserves and Mineral Resources at Pan American’s operating mines and those development projects that have previously been the subject of a positive feasibility study and/or a NI 43-101 technical report is as follows:

Each resource block at each mine or project is assigned a resource confidence rating based on CIM Standards, as well as tonnes and metal grades, typically using MineSight, Datamine, AutoCAD, database and/or Excel software.

Mining parameters such as dilution and losses due to pillars or mining are applied to the resource blocks based on experience with the expected mining method for the block at the particular mine or, in the case of projects, on the basis of engineering studies. These factors are reviewed and adjusted on at least an annual basis using information from a number of geologic and engineering observations including reconciliation data to the tonnes and grades measured in the process plant.

For the Huaron, Morococha, La Colorada, and San Vicente mines, metal price factors are calculated for each mine using a Microsoft Excel spreadsheet to manipulate the data. A separate factor is calculated for each of the metals of economic significance at the particular mine. These metals (not necessarily in order of overall economic significance) are: silver, zinc, lead, copper, and gold. The key inputs used in order to determine the factors are: metal prices established for Mineral Reserve and Mineral Resource estimation each year, metallurgical recovery for each metal in each concentrate, expected grade of concentrate, any elements that are present that detract from the value, the costs of smelting and or refining, escalator and de-escalator for each metal, the percentage of each metal payable by the smelter or the refinery, the cost of transporting concentrate or doré to the smelter or refinery including insurance and other costs that may be incurred in the process of selling the product like port fees and cost of concentrate storage and handling. In the case of the Huaron mine, individual factors are determined separately for the main ore veins or structures in order to account for variances in metallurgical recovery. The La Colorada mine has separate factors for oxide and sulphide ores as these two types of ore are processed in separate plants.

The factors are applied to the metal grades in each of the resource blocks and summated in order to estimate a net smelter return value per tonne for each of the blocks in the resource model.

In order to determine if a block can be reasonably believed to be economic, estimated mine operating costs are used to determine the value per tonne that is required from each block in each area of the mine. Blocks that are in the Measured and Indicated category that form part of a previously created mine plan are then converted to Proven and Probable Reserves. Measured resource blocks are converted into either Proven or Probable Reserves, and Indicated resource blocks are converted into Probable Reserves all at the discretion of, and based on the experience of, Michael Steinmann, Executive Vice President, Geology and Exploration and Martin Wafforn, Vice President, Technical Services. Measured and Indicated resource blocks that do not fit into a mine plan are either in an area of the mine where a development decision has not been made, or are in an area where more information is required to determine mineability, but remain as Measured and Indicated resource blocks as long as they are potentially economic. Inferred resource blocks remain as Inferred Resources as long as the estimated grade is such that they will be potentially economic. A cut-off value per tonne is established each year for the major areas of each mine or project.

The metal prices used for the December 31, 2010 Mineral Reserve and Mineral Resource estimations are as follows 1:

| | Silver | US$/ounce | $18.00 | |

| | Zinc | US$/tonne | $1,950 | |

| | Lead | US$/tonne | $1,950 | |

| | Copper | US$/tonne | $6,500 | |

| | Gold | US$/ounce | $1,100 | |

| | _______________ | |

| | 1. | Metal prices valid for all Pan American mines except: | |

| | (a) Navidad which used $12.52 per ounce of silver and $1,102 per tonne of lead to estimate Mineral Resources. | |

| | (b) Calcatreu which used $12.50 per ounce of silver and $650 per ounce of gold to estimate Mineral Resources. | |

The cut-off (in $/tonne) for Mineral Reserve and Mineral Resource factors at the Huaron, Morococha, La Colorada, Manantial Espejo, San Vicente, and Quiruvilca underground mines are shown in the following table:

| | Mineral Reserve Cut-Off ($/tonne) | Mineral Resource Cut-Off ($/tonne) |

| Huaron – Above 500 level | 63.00 | 56.00 |

| Huaron – 250 to 500 levels | 64.00 | 57.00 |

| Huaron – Below 250 level | 68.00 | 61.00 |

| Morococha – Average | 58.51 | 51.51 |

| La Colorada – Candelaria oxide | 83.33 | 83.33 |

| La Colorada – Candelaria sulphide | 73.42 | 73.42 |

| La Colorada – Estrella oxide | 74.45 | 74.45 |

| La Colorada – Recompensa sulphide | 66.23 | 66.23 |

| Manantial Espejo – Open Pit | 40.47 | 40.47 |

| Manantial Espejo – Longhole Open | 113.53 | 40.47 |

| Manantial Espejo – Melissa and Sol Sur (narrow) | 124.63 | 40.47 |

| Manantial Espejo – Maria (narrow) | 113.53 | 40.47 |

| Manantial Espejo – Cut and Fill | 120.63 | 40.46 |

| San Vicente – Shrinkage | 83.40 | 44.00 |

| San Vicente – Avoca longhole | 72.90 | 44.00 |

| Quiruvilca – Upper mine | 79.00 | 42.00 |

The cut-off values per tonne for the Huaron mine are separated by level in the mine; the cut-off costs below the 250 level are higher in order to account for the cost of pumping water up to the drainage level as well as additional haulage and ventilation. The cut-off value per tonne for the Morococha mine is the average applied for the mine; there are seven mining areas at the Morococha mine that have individual cut-off value per tonne estimates. La Colorada has specific cut-offs for oxide and sulphide ore and are also separated by operating mine. With the exception of Manantial Espejo, Quiruvilca, and San Vicente, these are all values that pay at a minimum the variable costs of production (incremental ore). As the average value per tonne of the Mineral Reserve is higher than these minimum values, the mine plans at each operation are designed to ensure that the fixed costs of the operation are paid by the higher-grade ore. At each of the operations shown in the table, the current throughput capacity of the process plant(s) is either greater than the capacity of the mine, or the mine would not be able to produce enough ore to keep the mill operating at full capacity without the addition of incremental ore. The cut-off values per tonne for San Vicente are based on the full expected operating costs from the shrinkage and the Avoca mining methods. The cut-off values per tonne for Manantial Espejo are based on the full expected operating costs.

The Alamo Dorado open pit mine uses a cut-off grade that varies by each block, primarily as a function of the copper grade and expected cyanide consumption during the treatment process. The lowest value for cut-off grade used at Alamo Dorado is 56 grams per tonne (“g/t”) silver equivalent grade. The metallurgical recoveries for gold and silver are estimated for each block using the following formulae:

Silver recovery = 0.95 - 5 / silver grade (g/t) – 0.0005 * copper grade (ppm)

Gold recovery = 0.95 - 0.001 / gold grade (g/t) – 0.0005 * copper grade (ppm)

The Alamo Dorado cut-off has a cost basis that includes the full milling and tails storage cost (including a variable cyanide cost based on the copper grade), the differential mining cost between ore and waste, the administration cost at the time of milling low grade ore and the low grade re-handle cost. Processing cost is correlated to rock hardness which in turn is correlated to depth; for 2010 this amount is determined using the following formula:

Processing cost = $21.79 per tonne - $0.0057 * elevation

For all ores at Manantial Espejo, the metallurgical recovery of the plant was assumed to be 95% for gold. Metallurgical recovery of silver for the Melissa deposit was assumed to be 85% and for all other ores to be 93.57%. Payable amounts in the doré product of the mine are assumed to be 99.75% for silver and 98.87% for gold. The

nominal value per tonne cut-off used to define underground longhole stoping ore and Maria narrow ore was $113.53 per tonne. The nominal cut-off used to define underground Melissa and Sol Sur narrow ore was $124.63 per tonne and Concepcion cut and fill stoping ore was $120.63 per tonne. In all Mineral Reserves, the cited cut-offs were converted to a silver equivalent grade using a silver to gold equivalency ratio of 62.48 to 1 with the exception of Melissa and Sol Sur where a silver to gold equivalency ratio of 68.77 to 1 was used. The silver equivalent cut-off grades used were 232 g/t AgEq for longhole stoping and Maria narrow ore, 280 g/t AgEq for Melissa and Sol Sur narrow ore, and 246 g/t AgEq for shrinkage Concepcion cut and fill stoping. The Mineral Reserve panels were then visually defined using the cited cut-offs with a long section display of silver equivalent grade. However, once the Mineral Reserve panels were defined, all recovered material inside of the Reserve panels was defined as ore regardless of grade (i.e. 100% of the Reserve panels will be mined with the exception of pillars that are excluded when the stoping blocks are designed). The Mineral Reserves for open pit ores were calculated using industry standard optimization software, pits were then designed and the resultant information summarized. In general, the total of the mine re-handling, processing, and administration costs used for estimation of the Mineral Reserves in the open pit mines was $40.47 per tonne.

Mineral Resources for all deposits at Navidad are reported above a cut-off grade of 50 g/t AgEq. The most likely cut-off grade for these deposits is not known at this time and must be confirmed by the appropriate economic studies. Silver equivalent grades are determined without consideration of variable metal recoveries for silver and lead. A silver price of $12.52 per ounce and lead price of $0.50 per pound were used to derive the following equivalence formula:

AgEq = Ag + (Pb * 10,000 / 365).

Mineral Resources for Pico Machay are reported above a nominal 0.2 g/t Au cut-off grade.

Mineral Resources for Calcatreu are a summation of three sets of assumptions for being potentially economic, namely (i) open pit and processing plant with Mineral Resources reported above a cut-off of 1.04 g/t gold; (ii) heap leach ore with a cut-off of 0.34 g/t gold, and (iii) underground and processing plant with a cut-off of 2.1 g/t AuEq with gold equivalence determined as follows:

AuEq = Au + (Ag/63.2).

Although Pan American believes that its Mineral Reserve and Mineral Resource estimates will not be materially impacted by external factors such as metallurgical, safety, environmental, permitting, legal, taxation, and other factors disclosed in this Annual Information Form, there can be no assurance that they will not be impacted. There are numerous uncertainties inherent in estimating Mineral Reserves and Resources. The accuracy of any Mineral Reserve and Mineral Resource estimation is the function of the quality of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices or a change in the planned mining method, subsequent to the date of the estimate, may justify revision of such estimates and may differ, perhaps materially, and investors are cautioned against attributing undue certainty to Mineral Reserves and Mineral Resources.

I. Operating Properties

A. Peru

(i) Huaron Mine

| | Ownership and Property Description |

The Huaron mine is owned and operated by Mina Quiruvilca, an entity in which the Company, indirectly through its subsidiaries, owns 100% of the outstanding voting shares and 99.93% of the total outstanding equity. Mina Quiruvilca was formed effective January 2006 through a merger between Pan American Silver S.A.C. Mina Quiruvilca and Compañía Minera Huaron.

The Huaron mine is an underground silver mine located in the Department of Pasco, Province of Pasco, District of Huayllay in central Peru, 320 kilometres northeast of Lima. The property consists of 252 concessions spanning over 63,822.2 hectares. Pan American has the exclusive right on all of these concessions to explore, develop and exploit as well as the right to market the products. To the Company’s knowledge, all permits and licences required for the conduct of mining operations at Huaron are currently in good standing.

Certain statements in the following summary of the Huaron property are based on and, in some cases, extracted directly from the Huaron Technical Report.

| | Location, Access, Climate and Infrastructure |

The Huaron mine lies on the eastern flank of the West Cordillera branch of the Andean mountain range from an elevation of 4,250 metres to 4,800 metres above sea level. Access to the Huaron mine is by a continuously maintained 285 kilometre paved highway between Lima and Unish and a 35 kilometre road between Unish and the Huaron mine. A program by the Peruvian government to upgrade the road to a paved highway between Unish and the Huaron mine is mostly complete.

The topographical relief at the mine site is hilly and uneven with local slopes of more than sixty degrees. Natural vegetation consists mainly of grasses forming meadows. These meadows have permitted development of varied livestock operations. The climate at the mine site is classified as “cold climate” or “boreal” with average annual temperatures ranging from three to ten degrees Celsius. The Huaron mine operates throughout the entire year.

The primary source of power for the Huaron mine is the Peruvian national power grid. The supply of water has been abundant and is provided by local lakes and rivers.

Peru’s economy is dependent on mining and currently there is a sufficient local source of mining personnel and related infrastructure.

| | Royalties and Encumbrances |

To the best of Pan American’s knowledge, the Huaron mine is not subject to any royalties or encumbrances other than the mining royalty tax described under “Taxation” in the following Huaron mine section of this Annual Information Form.

The principal taxes of Peru affecting the Huaron mine include income tax, employee profit sharing taxes, annual fees for holding mineral properties, various payroll and social security taxes, refundable value added tax and Peruvian mining royalty tax.

The Huaron operation generated income tax provisions of approximately $5.4 million, $2.9 million and $4.0 million in 2010, 2009, and 2008, respectively. In addition, employee profit sharing taxes of approximately $1.4 million, $0.2 million and $0.8 million were generated in 2010, 2009, and 2008, respectively.

Huaron’s revenue for 2010 was approximately $75.8 million. In June 2004, Peru’s Congress approved a new bill that allows royalties to be charged on mining projects. These royalties are payable on Peruvian mine production at the following progressive rates: (i) 1.0% for companies with sales up to $60 million; (ii) 2.0% for companies with sales between $60 million and $120 million; and (iii) 3.0% for companies with sales greater than $120 million. This royalty is a net smelter returns royalty, which cost is deductible for income tax purposes. The total royalty tax on Huaron’s production amounted to approximately $1.2 million in 2010, $0.8 million in 2009, and $0.9 million in 2008.

The Huaron mine is an underground mine with narrow and wide veins of silver-rich base metal sulphides, as well as replacement mineralization in conglomerates and dissemination in sediments. The mine, mill and supporting villages were originally built and operated by a subsidiary of the French Penarroya company from 1912 to 1987. In 1987 the mine was sold to Mauricio Hochschild and Cia Ltda. Prior to its acquisition by Pan American, approximately 22 million tonnes of silver-rich base metals sulphide ore were mined from the Huaron property. Silver was the main constituent, contributing about 49% of the historic sales value, with zinc, lead and copper, 33%, 15% and 3% respectively, making up the remainder. Ore from the mine was processed on-site by crushing, grinding, and differential flotation to produce copper, lead and zinc concentrates.

In April 1998, a portion of the lakebed of nearby Lake Naticocha collapsed and water from the lake flowed into the adjacent Animon mine (operated by an unrelated company) and, through interconnected tunnels, the water entered and flooded the Huaron mine, causing its closure.

After the April 1998 flooding, the Huaron mine operations were shut down, the labour force was terminated, the village closed, and work was undertaken to clean up the flood damage, drain the workings and prepare for an eventual mine re-opening. The water level in the lake, which provided the source of floodwater, is currently maintained well below the level where it flooded into the old workings and the Company does not expect a threat of further flooding. The Animon mine, in accordance with a settlement agreement reached with Cía. Minera Huaron S.A., in September 2000, constructed a channel to route water around the lake to provide water for the Huaron mine operation and to reduce the water in upstream lakes to prevent agricultural flooding which had created local social pressures.

| | Geology and Mineralization |

The main lithology in the area of the Huaron mine is a sequence of continental “redbeds” consisting of interbedded sandstones, limestones, marls, conglomerates, breccias and cherts of the Abigarrada and Casapalca Formations of Upper Cretaceous to Lower Tertiary age. These rocks unconformably overlay massive marine limestones of the Upper Cretaceous Jumasha Formation. To the west of the mine, a series of andesites and dacites are outcropping, which are part of the mid to lower Tertiary Calipuy Formation. A series of sub-vertical porphyritic quartz monzonite dykes, generally strike north-south and cut across the mine stratigraphy.

The rocks in the central part of the mine and at lower elevations are principally thinly bedded marls and sandstones known as the lower redbeds. In the eastern side of the mine the upper redbeds occur consisting of a calcareous Sevilla chert that overlies sandstones and marls. The bottom of this sequence consists of the Barnabe quartzite conglomerate. On the western side of the mine, the stratigraphy consists of a series of interbedded conglomerates and sandstones. The conglomerate contains poorly sorted limestone and quartz clasts in a sandy matrix.

The Huaron mine is located within an anticline formed by east-west compressional forces. The axis of the anticline is approximately north-south striking and gently plunging to the north. There are two main fault systems: (i) north-south striking thrust faults, parallel to the axis of the anticline; and (ii) east-west striking tensional faults. The intrusives strike in two principal directions: N70°E and S10°E. Most of the area is covered with recent soils except where the more resistant cherts and conglomerates form ridges parallel to the flanks of the anticline. These outcrops are discontinuous and frequently offset by the crosscutting east-west faults.

The Huaron mine is a polymetallic deposit (hosting silver, lead, zinc, and copper) consisting of mineralized structures probably related to Miocene monzonite dykes principally within, but not confined to the Huaron anticline. Mineralization is encountered in veins parallel to the main fault systems, in replacement bodies associated with the calcareous sections of the conglomerates and other favourable stratigraphic horizons, and as dissemination in the monzonitic intrusions at vein intersections.

The first pulse of mineralization was associated with the emplacement of intrusive bodies and the subsequent opening of structures, during which zinc, iron, tin, and tungsten minerals were deposited. This was followed by a copper, lead, and silver rich stage, and finally by an antimony/silver phase associated with quartz.

More than 95 minerals have been identified at Huaron with the most important economic minerals being tennantite-tetrahydrite (containing most of the silver), sphalerite and galena. The principal gangue minerals are pyrite, quartz, calcite and rhodochrosite. Enargite and pyrrhotite are common in the central copper core of the mine and zinc oxides and silicates are encountered in structures with deep weathering. Silver is also found in pyrargyrite, proustite, polybasite and pearceite.

There is a definite mineral zoning at Huaron and the mine has been divided into seven separate zones. There is a central copper core (Zone 5) where the principal economic mineral is enargite. The structures contain copper with pyrite and quartz. This area was extensively mined by previous operators but, because of the high arsenic and antimony content and poor metal recoveries, further mining in this area could be problematic. To the east and west of the central core are Zones 2, 3, and 4 where silver, lead, and zinc are found in carbonates; principally calcite and rhodochrosite. Zone 1 to the north of the central core contains silver, lead, and zinc associated with pyrite. Zone 6 is along the west side of the axis of the anticline and south of Zone 2 is principally lead and zinc with lower silver values within carbonates. Zone 7 is a narrow band running north-south along the general axis of the anticline and to the south of Zone 3 and contains principally sphalerite and sulfosalts with rhodochrosite.

The central core of the district has adularia-sericite alteration overprinted by strong silicification and epidote-pyrite. This core is surrounded by a zone containing epidote-pyrite-quartz that grades outwardly to a zone containing chlorite and magnetite. The mineralized structures are concentrated in the central core of the district but important structures continue into the outer zones.

| | Exploration, Drilling, Sampling and Analysis |

Exploration at Huaron is conducted using a combination of underground drilling and drifting. Generally, underground drillholes that intersect promising ore grade mineralization are followed up by drifting for Mineral Resource and Mineral Reserve definition. During 2010, 16,248 metres were drilled using three drill rigs. In addition, 3,381 metres of underground drifting were completed for Mineral Resource and Mineral Reserve definition.

Drill core is split with half remaining on-site for further reference. Assaying, for both drill samples and underground channel samples, is done at the mine laboratory. The quality assurance/quality control (“QA/QC”) program includes sample checks performed at an outside lab and the submission of standards to the mine lab.

Additionally, there is a QA/QC program supervised by the geology department. It includes the submission of at least one certified standard and blank per day as well as tertiary lab check assays on 2 to 5% of the samples and 1 to 2% of the check samples.

All of the geologic activities, including sampling, are conducted under the direct supervision of the Chief Geologist at the Huaron mine.

In the fall of 2003, Pan American initiated a technical and economic evaluation to determine the benefits of re-engineering the main haulage system at the Huaron mine. As a result of that evaluation, an electric locomotive haulage system was installed in expanded tunnels on the 500 level for haulage to the upper parts of the mine. In addition, an evaluation was undertaken in 2006 to determine whether to use the existing mine shafts (not operative) to replace diesel trucks and reduce mine haulage costs from the lower levels of the mine. During 2009, work to refurbish the D shaft continued and a decline to access the 180 level below the primary 250

drainage level was successfully completed with the construction of a permanent pumping station and back-up power supply.

During 2010, the D shaft refurbishment was completed and the shaft was put into operation. In 2011, it is planned to install an electric locomotive haulage system on the 250 level to connect the D shaft with the North zone and to continue to develop the 180 level.

The Company’s management estimates Proven and Probable Mineral Reserves at the Huaron mine, as at December 31, 2010, are as follows:

Huaron Mineral Reserves 1, 2 | |

| | | | | Grams of Silver | | | | | | | | | | |

Proven | | | 6,284 | | | | 174 | | | | 2.98 | | | | 1.46 | | | | 0.29 | |

Probable | | | 4,336 | | | | 173 | | | | 3.05 | | | | 1.46 | | | | 0.26 | |

TOTAL | | | 10,619 | | | | 174 | | | | 3.01 | | | | 1.46 | | | | 0.28 | |

_______________