Management’s Discussion and Analysis

for the Year Ended December 31, 2010

TABLE OF CONTENTS

| Introduction | 1 |

| Core Business and Strategy | 2 |

| Highlights of 2010 | 4 |

| 2011 Project Development Objectives | 6 |

| 2011 Operating Outlook | 6 |

| 2010 Operating Performance | 11 |

| Overview of 2010 Financial Results | 22 |

| Liquidity Position | 26 |

| Investments and Investment Income | 27 |

| Capital Resources | 27 |

| Financial Instruments | 28 |

| Asset Retirement Obligations | 29 |

| Contractual Commitments and Contingencies | 29 |

| General and Administrative | 30 |

| Exploration and Project Development | 31 |

| Non-GAAP Measures | 32 |

| Governance and Corporate Social Responsibility | 32 |

| Risks and Uncertainties | 35 |

| Critical Accounting Policies and Estimates | 40 |

| Future Accounting Changes | 42 |

| Subsequent Events | 46 |

| Disclosure Controls and Procedures | 46 |

| Mineral Reserves and Resources | 49 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

March 22, 2011

INTRODUCTION

Management’s discussion and analysis (“MD&A”) is intended to help the reader understand the significant factors that have affected Pan American Silver Corp.’s and its subsidiaries’ (“Pan American” or the “Company”) performance and such factors that may affect its future performance. The MD&A should be read in conjunction with the Company’s Audited Consolidated Financial Statements for the year ended December 31, 2010 and the related notes contained therein. All amounts in this MD&A and in the consolidated financial statements are expressed in United States dollars (“USD”), unless identified otherwise. The Company reports its financial position, results of operations and cash flows in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Pan American’s significant accounting policies are set out in Note 2 of the Audited Consolidated Financial Statements. Differences between Canadian and United States generally accepted accounting principles (“US GAAP”) that would have affected the Company’s reported financial results are set out in Note 21 of the Audited Consolidated Financial Statements. This MD&A refers to various non-GAAP measures, such as “cash and total cost per ounce of silver”, which are used by the Company to manage and evaluate operating performance at each of the Company’s mines and are widely reported in the silver mining industry as benchmarks for performance, but do not have standardized meaning. To facilitate a better understanding of these measures as calculated by the Company, we have provided detailed descriptions and reconciliations where applicable.

Except for historical information contained in this MD&A, the following disclosures are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 or are future oriented financial information and as such are based on an assumed set of economic conditions and courses of action. Please refer to the cautionary note regarding the risks associated with forward looking statements at the back of this MD&A and the “Risks Related to Pan American’s Business” contained in the Company’s most recent Form 40-F and Annual Information Form on file with the US Securities and Exchange Commission and the Canadian provincial securities regulatory authorities. Additional information about Pan American and its business activities, including its Annual Information Form, is available on SEDAR at www.sedar.com

The scientific or technical information in this MD&A, which includes reserve estimates for the Huaron, Morococha, Quiruvilca, Alamo Dorado, La Colorada, Manantial Espejo, and San Vicente properties were based upon information prepared by or under the supervision of Michael Steinmann, P.Geo., Executive Vice President Geology & Exploration and Martin G. Wafforn, P.Eng., Vice President Technical Services, who are “Qualified Persons” for purposes of National Instrument 43-101. Navidad Resource estimates were prepared by Pamela De Mark, P. Geo. Mineral Resource estimates for Hog Heaven and Waterloo are based on historical third party estimates.

The Company’s 2011 forecast and the resultant forecast numbers contained in this MD&A include estimates of future production rates for silver and other metals and future cash and total costs of production at each of the Company’s properties, which are forward-looking estimates. These forecasts are based on the following key assumptions: (i) silver: $20.65 per ounce, gold: $1,320 per ounce, zinc: $2,050 per tonne ($0.93 per lb), lead: $2,050 per tonne ($0.93 per lb), and copper: $7,000 per tonne ($3.18 per lb); (ii) that we are able to ship and sell all of our 2011 production in the 2011 financial year; (iii) the Company’s forecast production for each individual mine is achieved; (iv) there is no disruption in production, increase in costs or disruption due to, among other things: natural phenomena and hazards; technological, mechanical or operational disruptions; changes in local governments, legislation, taxation or the political or economic environment; fluctuations in the price of silver, gold or base metals; fluctuations in the local currencies of those countries in which the Company carries on business; unexpected work stoppages or labour disputes; fluctuations in the price for electricity, natural gas, fuel oil, and other key supplies; or transportation disruptions.

No assurance can be given that the indicated quantities of silver and other metals will be produced, or that projected cash costs or forecast capital costs will be achieved. Expected future production, cash costs and capital costs are inherently uncertain and could materially change over time. If actual results differ from the assumptions set out above, the Company’s mineral production and cash costs may differ materially from the forecasts in this MD&A. Readers should review those matters discussed herein under the heading “Risks and Uncertainties” and are advised to read the “Cautionary Note Regarding Forward Looking statements” contained herein.

CORE BUSINESS AND STRATEGY

Pan American engages in silver mining and related activities, including exploration, mine development, extraction, processing, refining and reclamation. The Company owns and operates silver mines located in Peru, Mexico, Argentina, and Bolivia. In addition, the Company is exploring for new silver deposits throughout South America and Mexico. The Company is listed on the Toronto Stock Exchange (Symbol: PAA) and on the NASDAQ Exchange in New York (Symbol: PAAS).

Pan American was founded in 1994 with the specific intention of providing investors with the best investment opportunity to gain real exposure to silver prices. The Company's mission is to be the largest and lowest cost primary silver mining company globally. To realize this mission, Pan American’s strategy is to focus on growing its base of low cost silver production and silver reserves by constantly optimizing its production methods, and developing new silver deposits through acquisition and exploration.

To execute this strategy, Pan American has assembled a sector leading team of mining professionals with a depth of exploration, construction, operating, and financing knowledge that allows the Company to confidently advance early stage projects through construction and into operation.

Pan American is determined to conduct its business in a responsible and sustainable manner.

Being responsible for the environment in which we operate, contributing to the long-term development of our host communities and ensuring that our employees can work in a safe and secure manner are core values at Pan American. We are committed to maintaining positive relations with our employees, the local communities and the government agencies, all of whom we view as partners in our enterprise.

Pan American Silver’s priority at every operation is the safety of our employees. We believe that comprehensive and continuous training is fundamental to the safety of our employees. With our comprehensive safety training and strictly enforced safety procedures, our goal is to continually improve our safety performance and remain industry leaders in the health and safety of our workers.

In addition, the Company is committed to operating our mines and developing new projects in an environmentally responsible manner. We have developed a comprehensive environmental policy, which all operations adhere to and apply to their short and long-term plans. This policy addresses topics that include water use and recycling, waste disposition, the research and use of alternative energies, compliance with required laws, closure requirements and education initiatives. Each operation runs unique environmental programs according to its location, needs, resources and processes. We have a proactive approach to minimizing and mitigating environmental impacts during all phases of the mining cycle from exploration through project development and into full mining operations. This is accomplished by applying prudent design and operating practices, continuous monitoring and by providing training and education for the employees and contractors who work at our facilities.

The Company recognizes that the skills and dedication of our employees and contractors are important drivers of our success. We also recognize the vital contribution they make to the economic prosperity of the communities in which we operate. As such, we offer leading career development opportunities, competitive remuneration, an engaging working environment and a supportive culture where fairness, respect, safety and diversity are valued and practiced.

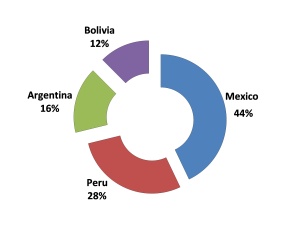

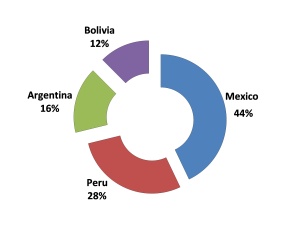

Pan American’s operational track record and strong financial standing has positioned the Company to take full advantage of strategic opportunities in the silver market, when and if they arise. Pan American’s silver production has grown for 15 consecutive years. At the end of 2010, Pan American had seven operating mines and also owned the world class Navidad silver development project in Argentina, and is the operator of the La Preciosa project in Mexico - a considerable portfolio of quality silver assets providing diversification of political and operational risk. Pan American also produces significant quantities of gold and base metals as by-products to its silver mining activities. The following charts reflect the geographic diversity of our silver production and the breakdown of our revenue, by metal type, for 2010:

| 2010 Silver Production by Country | 2010 Revenue by Metal |

|  |

OPERATIONAL & PROJECT DEVELOPMENT

| Record Silver Production |

Silver production was 24.3 million ounces in 2010, an increase of 5% over 2009. This new record is mainly attributable to exceptional silver production at Alamo Dorado, where 6.7 million ounces was produced compared to 5.3 million ounces in 2009.

| Navidad Project Update |

The Company released the results of Navidad’s preliminary assessment, which defined a highly economic project that would produce an estimated average of 19.8 million ounces of silver over the first 5 years of operation, have a mine life of 17 years and generate an after-tax return of $1.2 billion at a 5% discount rate (assuming a $25 per ounce silver price).

| La Preciosa Update |

The Company made good progress at the La Preciosa joint-venture project, where we invested in exploration and delineation drilling, metallurgical testing and engineering activities and are well on our way to producing a preliminary assessment by mid-year 2011.

| Robust Proven and Probable Silver Reserves |

A successful exploration and resource conversion program in 2010 very nearly fully replaced reserves that were mined during the year. As at December 31, 2010, proven and probable reserves totaled 230.7 million ounces. For the complete breakdown of reserves and resources by property and category, refer to section “Mineral Reserves and Resources” contained herein.

FINANCIAL

Annual sales in 2010 were a record $632.0 million, an increase of 39% over 2009 sales, driven primarily by increased quantities of silver sold, combined with higher realized prices for all metals.

| Record Mine Operating Earnings |

Mine operating earnings in 2010 increased to $239.8 million, an increase of 90% over the prior year, as growth in sales noted above significantly outweighed increases in cost of sales and depreciation.

| Record Operating Cash Flow |

Cash flow from operations was at a record $242.3 million, a 109% increase from 2009. Operating cash flow before changes in non-cash working capital was $218.3 million in 2010, a $66.7 million improvement on the comparable cash flow from 2009. The additional operating cash flow was mainly attributable to increased cash flow from Alamo Dorado and Manantial Espejo, which combined to generate $150.9 million.

| Record Liquidity and Working Capital Position |

The Company had a record cash and short term investment balance of $360.5 million and a working capital position at a record $433.8 million at December 31, 2010, an increase of $167.4 million and $161.5 million, respectively, from a year ago. This was driven mostly by the record operating cash flows as described above.

| Pan American Starts Paying Dividends |

Pan American declared its first dividend in February 2010 and a second dividend in August 2010, both in the amount of $0.025 per common share. In November 2010 the Company announced a dividend in the amount of $0.025 per common share and increased the frequency of the Company’s dividend distributions from a semi-annual to a quarterly basis.

BUSINESS DEVELOPMENT

During January 2010, the Company issued further common shares and share purchase warrants (1.7 million and 0.7 million, respectively) to bring its ownership interest in Aquiline Resources Inc. from 93% to 100% by January 22, 2010. The final step of the acquisition was achieved through a Compulsory Acquisition. Please refer to Note 3 of the Audited Consolidated Financial Statements for further details.

2011 PROJECT DEVELOPMENT OBJECTIVES

On November 30, 2010, the Company released the results of Navidad’s Preliminary Assessment, which defined a highly economic project that would involve developing and mining the deposit through conventional surface mining methods. The Preliminary Assessment technical report was subsequently filed with the applicable regulatory authorities on January 14, 2011 and is available on SEDAR at www.sedar.com. The Company expects to complete an Environmental Impact Assessment (“EIA”) during the second quarter of 2011 and a full feasibility study in the fourth quarter. In 2011, the Company plans to invest over $40.0 million in Navidad’s continued development, including $16 million for exploration diamond drilling. The remainder will be directed towards preparation of the EIA, tailings site and geotechnical evaluation, metallurgical studies, basic engineering, preparation of the feasibility study, and community, media and government relations activities. Pan American Silver remains confident that an open and informed dialogue with the provincial government and local communities regarding open pit mining in the Central Meseta of Chubut will ultimately be resolved favorably and lead to the responsible development of Navidad. The Company intends to transform Navidad into a world-class silver mine.

During 2010 Pan American was also very active at the La Preciosa joint-venture with Orko Silver Corp. The Company is currently completing additional work to evaluate alternative extraction and development scenarios in order to maximize the project’s economics, in view of the improved metals price environment. During the first half of 2011, Pan American expects to invest $1 million at La Preciosa to complete a preliminary assessment.

Pan American’s Morococha Relocation Project will advance in 2011 with completion of the construction of the new Morococha site infrastructure, including a maintenance facility, warehouse, administration building, and employee residence. A total of $43 million is budgeted for this work in 2011, which will be partially offset by progress payments received from Minera Peru Chinalco (“Chinalco”). The purpose of this project is to move existing facilities to outside the area of Chinalco’s future Toromocho open pit mine. The processing plant relocation is currently scheduled for 2013/2014, as the current concentrator is located a safe distance from the first Toromocho open pit activity.

2011 OPERATING OUTLOOK

This section of the MD&A provides management’s production and costs forecasts for 2011. We also discuss the major capital projects planned for each of the operations in 2011. These are forward-looking estimates and subject to the cautionary note regarding the risks associated with forward looking statements at the end of this MD&A.

Silver production is expected to decline slightly from 2010’s production to between 23.0 and 24.0 million ounces. The expected decrease is primarily due to lower production at Alamo Dorado and Quiruvilca partially offset by planned increases at Manantial Espejo, Huaron, La Colorada and San Vicente.

The expected reductions in gold grades at Manantial Espejo and Alamo Dorado will likely result in lower gold production in 2011. Zinc, lead and copper production are expected to increase in 2011 as compared to 2010’s production, due to higher throughput at Huaron and La Colorada.

Precious metals are expected to contribute approximately 79% of our sales in 2011, similar to the distribution sales in 2010. Gold is still expected to be our most significant by-product in 2011, despite lower production levels. Our sales base will continue to be geographically diversified in 2011 with the Peruvian operations contributing 35% of sales, the Mexican operations 32%, Manantial Espejo 23% and San Vicente 10%.

Silver Production Forecast

| | Silver Production ounces (000s) | Cash Costs per ounce (1) | Total Costs per ounce (1) |

| Huaron | 3,100 - 3,200 | $11.10 - $13.00 | $12.65 - $14.60 |

| Morococha | 2,600 - 2,700 | $4.80 - $6.60 | $7.57 - $9.48 |

| Quiruvilca | 1,000 - 1,100 | $8.80 - $9.90 | $16.07 - $17.90 |

| Alamo Dorado | 4,800 - 5,100 | $5.30 - $5.70 | $9.32 - $9.98 |

| La Colorada | 4,100 - 4,200 | $7.60 - $8.50 | $9.08 - $10.02 |

| San Vicente | 3,200 - 3,300 | $7.60 - $8.60 | $11.32 - $12.44 |

| Manantial Espejo | 4,200 - 4,500 | $4.80 - $5.60 | $13.23 - $14.63 |

| Consolidated Total | 23,000 - 24,100 | $7.00 - $7.50 | $11.08 -$11.78 |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. The cash cost forecasts assume by-product credit prices of $2,050/tonne ($0.93/lb) for Zinc and Lead, $7,000/tonne ($3.17/lb) for Copper, and $1,320/oz for gold. |

By-product Production Forecast

| | Gold ounces | Zinc tonnes | Lead tonnes | Copper tonnes |

| Huaron | 1,300 - 1,500 | 9,900 - 11,800 | 4,400 - 4,500 | 1,700 - 2,000 |

| Morococha | 1,300 - 1,400 | 16,000 - 16,800 | 4,600 - 5,700 | 1,450 - 1,550 |

| Quiruvilca | 1,450 - 1,550 | 9,200 - 9,500 | 2,500 - 2,600 | 1,300 - 1,400 |

| Alamo Dorado | 14,800 - 15,400 | - | - | 95 - 105 |

| La Colorada | 4,300 - 4,800 | 3,300 - 3,600 | 1,500 - 2,400 | - |

| San Vicente | - | 5,000 - 5,800 | - | 500 - 600 |

| Manantial Espejo | 52,000 - 53,200 | - | - | - |

| Consolidated Total | 75,150 - 77,850 | 43,400 - 47,500 | 13,000 - 15,200 | 5,045 - 5,655 |

| Cash and Total Costs Forecasts |

Cash costs are expected to increase to approximately $7.00 to $7.50 per ounce of payable silver in 2011 compared to the 2010 cash costs of $5.69 per ounce. This is primarily due to increases in direct operating costs (mostly labour related), royalties, treatment charges, and reduced gold by-product credits. The non-cash component of our total cost per ounce is expected to increase relative to the $3.82 per ounce recorded in 2010 to approximately $4.21 per ounce in 2011.

| Capital Expenditure Forecasts |

We are planning to invest $54.0 million in sustaining capital and $67.2 on project development in 2011, as set out in the table below:

| | | Capital budget (in millions) |

| Huaron | $ | 9.9 | |

| Morococha | $ | 12.2 | |

| Quiruvilca | $ | 2.9 | |

| Alamo Dorado | $ | 2.0 | |

| La Colorada | $ | 10.8 | |

| San Vicente | $ | 4.6 | |

| Manantial Espejo | $ | 11.6 | |

| Mine Capital | $ | 54.0 | |

| Navidad | $ | 28.7 | |

| Morococha Project | $ | 37.2 | |

| Other | $ | 1.3 | |

| Project Development Capital | $ | 67.2 | |

| Total Capital | $ | 121.2 | |

Management’s forecast for each mine’s operating performance and capital requirements in 2011 follows.

In 2011, we expect to produce approximately 3.1 to 3.2 million ounces of silver at Huaron at a cash cost in the range of $11.10 to $13.00 per ounce. Huaron plans to increase mining and milling rates by around 4% from its 2010 levels by accessing additional higher grade ore zones deeper in the mine. The increased throughput along with an approximate 5% increase in silver grade is expected to result in an increase in silver production of approximately 10%. The expected increase in throughput rates is also expected to yield higher production of zinc, lead and copper. Costs per dry metric tonne (“DMT”) milled are forecasted to remain fairly stable as compared to 2010 primarily as a result of the effect of increases in throughput offsetting cost increases. Cash costs per ounce are expected to reduce from the 2010 cash costs due to the increased by-product credit production and partially offset by the increased operating costs.

Capital spending of $9.9 million at Huaron in 2011 will allow for mine development, exploration to replace reserves mined, equipment overhauls and equipment replacements.

In 2011, we expect to produce approximately 2.6 to 2.7 million ounces of silver at a cash cost in the range of $4.80 to $6.60 per ounce for Pan American’s 92.2% interest in Morococha. Tonnes milled, silver grades and recoveries at Morococha in 2011 are all expected to remain similar to 2010 levels. Zinc and lead production is expected to increase marginally with higher grades in the areas planned to be mined. Operating costs per tonne are expected to increase by approximately 8% over 2010. We anticipate cash cost per ounce in 2011 to increase compared to 2010’s cash cost of $4.43 due to the higher operating costs partially offset by increased zinc and lead production.

In total, Morococha’s capital budget for 2011 is $12.2 million, primarily for the long term multiple year mine development advances towards the Yacamina zones, exploration to replace reserves mined, and equipment overhauls and replacements.

In 2011, we expect to produce 1.0 to 1.1 million ounces of silver at a cash cost in the range of $8.80 to $9.90 per ounce.

The production profile is anticipated to decline slightly from that achieved in 2010 due to lower expected grades. A decrease in by-product credits is the main reason for the expected increase in cash costs per ounce, compared to the $5.87 per ounce cash costs recorded in 2010. Our forecast reflects management’s intention to operate the mine throughout the year while concurrently advancing the mine closure.

Management’s forecast for 2011 assumes that mine development continues throughout 2011, anticipating the continuation of operations beyond 2011. Our plan includes concurrent reclamation spending of approximately $1.5 million which will be recorded against the existing mine closure obligation on our balance sheet. In 2011 we plan to capitalize expenditures of $2.9 million and amortize these amounts over the production life primarily for equipment overhauls and replacements.

Our assumption is that the La Oroya smelter will not restart in 2011 and we are therefore not anticipating any silver production from our pyrite stockpile operation. As such, the remaining silver ounces contained in the pyrite stockpiles have been re-categorized from Reserves to Resources and in 2010 we wrote down the remaining carrying value of the stockpiles.

In 2011, we expect Alamo Dorado to be our largest producer with anticipated production of 4.8 to 5.1 million ounces of silver at a cash cost in the range of $5.30 to $5.70 per ounce. Silver and gold grades will decrease at Alamo Dorado during 2011, with silver and gold recoveries stable around 88%. The mine is expected to produce 14,800 to 15,400 ounces of gold compared to the 16,476 ounces produced in 2010.

The expected increase in cash costs per ounce compared to the $3.16 per ounce incurred in 2010 is due to lower silver grades, higher direct operating costs and lower by-product credits from gold revenues.

Capital expenditures are expected to be $2.0 million, primarily for exploration and for equipment replacements and upgrades.

In 2011, we expect to produce 4.1 to 4.2 million ounces of silver at a cash cost in the range of $7.60 to $8.50 per ounce. La Colorada will continue shifting production from the oxide zone and expand production from the sulphide zone. A 12% increase in throughput is expected to result in an approximately 8% increase in silver production during 2011, as well as increases in the production of gold, zinc and lead.

Operating costs per tonne in 2011 are expected to remain similar to the 2010 level. Cash costs per ounce are expected to decrease by approximately 2% from 2010’s cash costs per ounce of $8.59 due to the effect of increased production, which outweighs the impact of higher direct operating costs.

Capital expenditures at La Colorada in 2011 are expected to be $10.8 million, and are comprised mostly of expenditures related to constructing a new tailings dam, equipment overhauls, equipment replacements and exploration drilling.

In 2011, we expect to produce 3.2 to 3.3 million ounces of silver at a cash cost in the range of $7.60 to $8.60 per ounce for Pan American’s 95.0% interest in San Vicente. Our 2011 forecast for San Vicente contemplates operating the plant at 11% above the design capacity of 750 tonnes per day. The mine plan for 2011 is expected to deliver ore with slightly lower silver and zinc grades than in 2010. The higher throughput rates are expected to outweigh the decrease in grades, resulting in increased production of silver and zinc compared to 2010 levels.

For 2011 the increase in throughput rates is expected to result in a decrease in the unit operating costs per tonne, offsetting the impact of lower grades and as a consequence cash costs per ounce are expected to remain similar to 2010 levels.

The main projects making up the $4.6 million capital budget at San Vicente include equipment overhauls and repairs, infrastructure upgrades, and exploration drilling.

In 2011, we expect to produce 4.2 to 4.5 million ounces of silver at a cash cost in the range of $4.80 to $5.60 per ounce. The key objectives in 2011 for Manantial Espejo are to maintain design capacity throughput of 2,000 tonnes per day of ore and to improve silver grades and recoveries, thereby increasing silver production from 2010 levels.

The 2011 mine plan calls for a total of approximately 10.1 million tonnes to be mined from open pits, including 0.6 million tonnes of ore from the open pit and an additional 0.2 million ore tonnes to be mined from underground. The open pit mining rates will be expanded

from the average 604,000 tonnes per month achieved in 2010 to 1.0 million tonnes per month beginning in July 2011 with an investment of $5.5 million for additional open pit equipment. The increased open pit mining rates provides enhanced flexibility, reduced unit operating costs, enhanced grades in 2011 to 2014, and an overall increase in life-of-mine cash flows. Gold head grades are expected to decrease which will result in an approximately 17% decline in gold production from the 2010 level. The drop in gold production and the resultant decline in by-product credit is the principal reason for the sharp increase from the 2010 cash costs of $1.61 per ounce.

Included in cash flow from operations at Manantial Espejo is an amount of $20.1 million related to recovery of value added tax ("VAT”) receivable balances. Operating cash flow from Manantial (excluding working capital) is expected to make up approximately 35% of the consolidated operating cash flow in 2011.

The capital budget for 2011 totals $11.6 million with the majority of the capital to be spent on equipment acquisitions, increased housing projects in Gobernador Gregores, work on the tailings dam, as well as exploration drilling.

2010 OPERATING PERFORMANCE

The following table reflects silver production and cash costs at each of Pan American’s operations for 2010, as compared to 2009 and 2008.

| | | Silver Production (ounces ‘000s) | | | Cash Costs(1) ($ per ounce) | |

| | | 2010 | | | 2009 | | | 2008 | | | 2010 | | | 2009 | | | 2008 | |

| Huaron | | | 2,987 | | | | 3,563 | | | | 3,628 | | | $ | 12.35 | | | $ | 9.95 | | | $ | 8.06 | |

Morococha(2) | | | 2,633 | | | | 2,762 | | | | 2,476 | | | $ | 4.43 | | | $ | 5.86 | | | $ | 2.84 | |

| Quiruvilca | | | 1,245 | | | | 1,422 | | | | 1,383 | | | $ | 5.87 | | | $ | 8.64 | | | $ | 6.61 | |

| Pyrites Stockpiles | | | - | | | | 98 | | | | 284 | | | | - | | | $ | 3.78 | | | $ | 4.41 | |

| Alamo Dorado | | | 6,721 | | | | 5,321 | | | | 6,116 | | | $ | 3.16 | | | $ | 4.51 | | | $ | 4.38 | |

| La Colorada | | | 3,702 | | | | 3,468 | | | | 3,911 | | | $ | 8.59 | | | $ | 7.55 | | | $ | 8.06 | |

San Vicente(3) | | | 3,033 | | | | 2,627 | | | | 875 | | | $ | 8.21 | | | $ | 7.07 | | | $ | 7.57 | |

| Manantial Espejo | | | 3,965 | | | | 3,783 | | | | - | | | $ | 1.61 | | | $ | (0.84 | ) | | | - | |

| Consolidated Total | | | 24,286 | | | | 23,044 | | | | 18,673 | | | $ | 5.69 | | | $ | 5.53 | | | $ | 5.96 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

| (2) | Morococha data represents Pan American's 92.2% interest in the mine's production. |

| (3) | San Vicente data represents Pan American's 95.0% interest in the mine's production. |

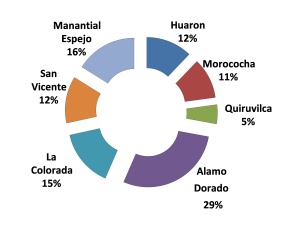

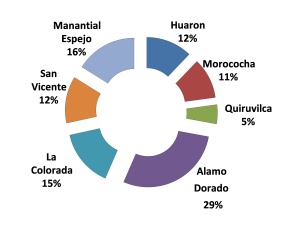

The graph below pictorially presents silver production by mine in 2010 and highlights the diverse nature of Pan American’s silver production.

| Silver Production by Mine |

|

In 2010, Pan American’s silver production increased by 1.2 million ounces to a record 24.3 million ounces. This increase was primarily driven by record production at Alamo Dorado, increased silver production at San Vicente, which was in its first full year of commercial operation and higher silver production relative to 2009 at Manantial Espejo and La Colorada. These increases were partially offset by decreases at our Peruvian operations. Silver production in 2010 was 800,000 ounces higher than management’s forecast of 23.4 million ounces.

Consolidated cash costs per ounce of silver were $5.69 in 2010, a 3% increase from 2009’s cash costs per ounce of $5.53. The small increase in cash costs were primarily due to a 10% increase in unit operating costs per tonne which were driven by increases in mining royalties in Argentina due to higher metal prices, stronger local currencies and higher labour costs, partially offset by the increased by-product credits as a result of the improved gold and base metal prices in 2010.

The following table sets out the Company’s by-product production over the past three years:

| | | By-Product Production | |

| | | 2010 | | | 2009 | | | 2008 | |

| Gold ounces | | | 89,555 | | | | 100,704 | | | | 25,146 | |

| Zinc tonnes | | | 43,103 | | | | 44,246 | | | | 39,811 | |

| Lead tonnes | | | 13,629 | | | | 14,328 | | | | 15,974 | |

| Copper tonnes | | | 5,221 | | | | 6,446 | | | | 6,069 | |

In 2010, production of all by-product metals decreased in comparison to 2009 production. Gold, zinc, lead and copper production relative to 2009 declined by 11%, 3%, 5% and 19%, respectively. Actual production in 2010 fell short of management’s expectation for zinc, lead and copper by 6%, 14% and 28%, respectively. While gold production in 2010 did

exceed management’s initial forecast of 85,600 ounces, it fell short of our revised guidance of 95,000 in the Q1 2010 MD&A. The shortfall in gold was due to lower than anticipated gold grades and recoveries over the last 3 quarters of 2010, while the shortfall in the base metals was primarily due to lower than expected grades.

A description of each mine and an analysis of their 2010 operating performance, measured against 2009 operating performance and management’s forecasts for 2010 follows.

| | Twelve months ended | |

| | December 31, | |

| | 2010 | | | 2009 | |

| Tonnes milled | | | 704,094 | | | | 699,420 | |

| Average silver grade – grams per tonne | | | 171 | | | | 200 | |

| Average zinc grade | | | 2.43 | % | | | 2.48 | % |

| Average silver recovery | | | 77.3 | % | | | 79.2 | % |

| Silver – ounces | | | 2,987,280 | | | | 3,562,893 | |

| Gold – ounces | | | 1,525 | | | | 1,235 | |

| Zinc – tonnes | | | 10,216 | | | | 11,198 | |

| Lead – tonnes | | | 4,346 | | | | 4,372 | |

| Copper – tonnes | | | 1,654 | | | | 2,166 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 12.35 | | | $ | 9.95 | |

Total costs per ounce (1) | | $ | 13.98 | | | $ | 11.33 | |

| | | | | | | | | |

| Payable ounces of silver | | | 2,753,906 | | | | 3,225,928 | |

| | | | | | | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

The Huaron silver-zinc underground polymetallic mine is located 320 highway km northeast of Lima in the heart of the Cerro de Pasco district. This is one of Peru's most important mining districts, accounting for more than half of the country's silver production. Since operations began in 1912, Huaron has produced more than 230 million ounces of silver.

Pan American acquired a majority interest in Huaron in March 2000 and re-opened the mine in April 2001 after completing a feasibility study, arranging financing and completing site rehabilitations.

In 2010, although mill tonnage at Huaron remained similar to 2009, silver production declined by 16% mainly due to lower silver grades and recoveries. Zinc and copper production was also hampered by lower grades and recoveries, while lead and gold production remained similar to 2009 levels. These declines were a result of less than expected ore tonnes and grades obtained from the 180 level mine deepening area.

Cash costs at Huaron increased by 24% in 2010 to $12.35 per ounce mainly due to the negative effect of fixed costs on lower production of silver ounces and increased costs associated with additional cost for dewatering and ventilation for the mine deepening to 180 level, additional underground mine development and ground support measures, general operating cost escalations and the strengthening local currency. Offsetting these factors were higher by-product credits resulting from stronger base metal prices in 2010.

Silver production in 2010 was 19% below management’s forecast of 3.7 million ounces and actual cash costs per ounce were 41% higher than our forecast of $8.75 per ounce. The reasons for the shortfall in production relative to management’s forecast were lower than planned throughput combined with lower grade silver ore. The latter was due to the shortfalls of high grade ore realized on the 180 level mine deepening. The actual cash costs in 2010 relative to forecasted cash costs were negatively impacted by (i) the negative effect of fixed costs on lower tonnage and lower production of silver; (ii) a six-day mine closure resulting from an illegal worker’s strike disputing the amount of the 2009 workers’ profit-sharing payment; (iii) additional underground mine development costs and increases in ground support measures; and (iv) the effect of strengthened local currency. Offsetting these factors were better realized by-product prices than expected.

Capital expenditures at Huaron during 2010 totalled $6.6 million and comprised mainly of mine development, exploration expenditures, process plant screening upgrades, mine equipment replacements, tailings dam improvements, and surface facility upgrades.

| | Twelve months ended | |

| | December 31, | |

| | 2010 | | 2009 | |

| | | | | |

| Tonnes milled | | 619,819 | | | 638,805 | |

| Average silver grade – grams per tonne | | 152 | | | 156 | |

| Average zinc grade | | 2.88 | % | | 3.24 | % |

| Average silver recovery | | 87.0 | % | | 86.1 | % |

| Silver – ounces | | 2,632,790 | | | 2,762,064 | |

| Gold – ounces | | 2,329 | | | 1,291 | |

| Zinc – tonnes | | 15,228 | | | 16,942 | |

| Lead – tonnes | | 4,927 | | | 5,520 | |

| Copper – tonnes | | 1,532 | | | 2,030 | |

| | | | | | | |

Cash costs per ounce (1) | $ | 4.43 | | $ | 5.86 | |

Total costs per ounce (1) | $ | 7.13 | | $ | 8.49 | |

| | | | | | | |

| Payable ounces of silver | | 2,338,121 | | | 2,469,949 | |

| | | | | | | |

| * | Production and cost figures are for Pan American’s 92.2% share only. |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

Pan American acquired the Morococha mine in Peru in August 2004. Morococha is a silver-zinc rich underground polymetallic vein mine located approximately 180 highway kilometres southwest of the Company's Huaron mine or 140 highway kilometers east of Lima.

The Morococha district has been mined continuously for more than 100 years and lies within one of the world's most prolific mineral belts for polymetallic vein systems. Morococha hosts a very large and productive network of veins, mantos, skarns, and other replacement ore bodies within a mineral rights package covering 110 square kilometres of concessions.

Morococha’s 2010 silver production decreased by 5% as compared to 2009 mainly due to a 3% decrease in throughput rates combined with slightly lower silver grades, partially offset by higher silver recoveries. Lower zinc, lead and copper grades resulted in lower production of those metals.

Cash costs at Morococha decreased by 24% primarily due to higher by-product credits resulting from stronger base metal prices partially offset by an increase in unit operating costs per tonne for 2010 compared to 2009.

Actual performance at Morococha in 2010 with respect to throughput rates, silver grades and recoveries were all roughly in-line with management’s forecasts, resulting in silver production which was within 2% of management’s expectations. Gold production was ahead of management’s expectation due to higher gold grades. Zinc, lead and copper fell short of management’s forecast by 5%, 13% and 34%, respectively, due mainly to lower grades of those metals. The actual cash costs were 4% higher than forecasted cash costs of $4.25 per ounce due to higher operating costs from general cost escalations and the strengthened currency partially offset by higher than expected by-product credits.

Capital expenditures at Morococha during 2010 totalled $16.7 million. The capital spending was primarily on long term mine development advances, exploration drilling, mine and plant equipment replacements, and initial preparation work for the central facility relocations to make way for Chinalco’s Toromocho Project development.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes milled | | | 323,427 | | | | 330,030 | |

| Average silver grade – grams per tonne | | | 141 | | | | 155 | |

| Average zinc grade | | | 3.58 | % | | | 3.80 | % |

| Average silver recovery | | | 84.7 | % | | | 86.3 | % |

| Silver – ounces | | | 1,245,030 | | | | 1,421,897 | |

| Gold – ounces | | | 1,801 | | | | 1,522 | |

| Zinc – tonnes | | | 10,058 | | | | 10,993 | |

| Lead – tonnes | | | 2,989 | | | | 3,230 | |

| Copper – tonnes | | | 1,434 | | | | 1,643 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 5.87 | | | $ | 8.64 | |

Total costs per ounce (1) | | $ | 6.56 | | | $ | 9.25 | |

| | | | | | | | | |

| Payable ounces of silver | | | 1,128,557 | | | | 1,288,720 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

The Quiruvilca mine is located approximately 130 kilometres inland from the coastal city of Trujillo. Mineralization was first reported in the area in 1789, and the mine has been in continuous operation since 1926. The underground workings cover an area four kilometres long by three kilometres wide and extend more than 400 meters in depth. Pan American has operated Quiruvilca since acquiring the property from ASARCO in late 1995.

As reported previously, management has activated plans to place Quiruvilca on care and maintenance. Based on the improvement in the price environment for metals being sustained through 2010 and into 2011, our intention is to operate the Quiruvilca mine throughout 2011 while still continuing to prepare for mine closure should metal prices fall sharply.

In 2010, Quiruvilca’s silver production decreased by 12% in comparison to 2009. This decrease in silver production was due to a combination of lower tonnage and reduced silver grades and recoveries. Similarly, lower zinc, lead, and copper grades resulted in lower production of those metals in 2010.

Cash costs for 2010 were $5.87, a 32% decrease from $8.64 per ounce a year ago, primarily due to the increase in by-product credits resulting from stronger base metal prices in 2010 partially off-set by higher operating costs from general cost escalations and the strengthened currency. Cash costs in 2010 continue to reflect the fact that all expenditures in Quiruvilca were expensed (including items that would normally have been capitalized if the operation were not being prepared for care and maintenance).

Silver production during 2010 fell 11% short of management’s expectations, primarily due to the lower than expected silver grades and recoveries. Overall by-product production was reasonably within management’s forecast. Gold and zinc production were above management’s forecast by 15% and 3%, respectively, due to higher realized grades of those metals, while lead production was in-line with expectations, and copper production fell 10% short of forecast due to lower realized copper grades partially offset by higher than anticipated copper recoveries. Cash costs of $5.87 per ounce were 16% below management’s forecast of $7.00 per ounce primarily as a result of higher than expected base metal prices partially off-set by higher operating costs.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes sold | | - | | | | 13,984 | |

| Average silver grade – grams per tonne | | - | | | | 218 | |

| Silver – ounces | | - | | | | 98,235 | |

| | | | | | | | |

Cash costs per ounce (1) | | $ | - | | | $ | 3.78 | |

Total costs per ounce (1) | | $ | - | | | $ | 3.78 | |

| | | | | | | | | |

| Payable ounces of silver | | | - | | | | 50,218 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

The silver-rich stockpiles are located in the Cerro de Pasco mining district of Peru. Volcan Compañía Minera, a Peruvian mining company, is the largest ore producer in this district. For many decades, Volcan's Cerro de Pasco mine accumulated silver-rich stockpiles from which the silver could not be extracted by standard metallurgical processes. In November 2002, Pan American acquired the stockpiles and entered into an agreement to mine and sell 600,000 tonnes of the highest grade silver stockpiles to the La Oroya smelter, where the ore is used as a process flux and consequently the silver is recovered.

In 2010, there was no production from the Pyrite Stockpile operation as a direct consequence of the closure of the La Oroya smelter, which is the only buyer of this material.

Management’s expectation that the La Oroya smelter would restart operations in the second quarter of 2010 was not realized. As a consequence, there was no production in 2010 from

the pyrite stockpiles compared to the forecasted 0.2 million ounces of silver at a cash cost of $4.00 per ounce.

In Q4 2010, the Company made the decision to write-off the remaining $1.5 million book value associated with the pyrite stockpiles. This decision was based on the uncertainty related to the future of the La Oroya smelter. As a consequence of this decision the remaining silver reserves in the pyrite stockpile have been re-categorized to measured and indicated resources.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes milled | | | 1,675,952 | | | | 1,671,257 | |

| Average silver grade – grams per tonne | | | 147 | | | | 111 | |

| Average gold grade – grams per tonne | | | 0.38 | | | | 0.39 | |

| Average silver recovery | | | 88.4 | % | | | 87.7 | % |

| Silver – ounces | | | 6,721,258 | | | | 5,320,637 | |

| Gold – ounces | | | 16,746 | | | | 18,211 | |

| Copper – tonnes | | | 89 | | | | 206 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 3.16 | | | $ | 4.51 | |

Total costs per ounce (1) | | $ | 7.41 | | | $ | 9.12 | |

| | | | | | | | | |

| Payable ounces of silver | | | 6,693,134 | | | | 5,284,037 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

Alamo Dorado is an open-pit mine located in the Mexican state of Sonora, approximately 320 km from the state capital of Hermosillo. Corner Bay Silver Inc., a Toronto-listed exploration company, began grassroots reconnaissance of the area in 1997. Pan American acquired Corner Bay and the Alamo Dorado project in February 2003. The mine began commercial production on April 1, 2007 after the construction of the mine, plant and related infrastructure was completed substantially on schedule and on budget at the end of 2006.

Alamo Dorado was the Company’s largest silver producer in 2010, with record silver production of 6.7 million ounces. Silver production increased by 26% from the 2009 levels primarily due to significantly higher silver grades. The increased silver grades were a result of more mining than planned in the higher grade portions of the Phase I pit and encountering more tonnes and higher grades than anticipated in the Phase II pit. Gold production at approximately 17,000 ounces in 2010 was 8% lower than that in the comparable period of 2009 mainly as a result of lower gold grades.

Alamo Dorado’s cash costs per ounce were $3.16 in 2010, a 30% decrease from the 2009 cash costs of $4.51, due mainly to the positive effect of higher production of silver ounces on fixed costs and the higher gold price.

Alamo Dorado’s record silver production in 2010 was well above management’s forecast of 4.2 million ounces mainly due to higher than expected silver grades. Gold production was 23% ahead of the 13,700 ounce forecast as gold grades realized also exceeded expectations. Cash costs were 53% lower than our forecast of $6.75 per ounce as a result

of significantly higher silver production and higher realized gold by-product credits resulting from increased gold production and gold metal prices.

Capital expenditures at Alamo Dorado during 2010 totalled $2.1 million primarily for equipment replacements and infrastructure upgrades.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes milled | | | 345,697 | | | | 324,916 | |

| Average silver grade – grams per tonne | | | 378 | | | | 384 | |

| Average silver recovery | | | 88.0 | % | | | 86.2 | % |

| Silver – ounces | | | 3,701,568 | | | | 3,467,856 | |

| Gold – ounces | | | 4,312 | | | | 6,554 | |

| Zinc – tonnes | | | 2,940 | | | | 2,311 | |

| Lead – tonnes | | | 1,366 | | | | 1,205 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 8.59 | | | $ | 7.55 | |

Total costs per ounce (1) | | $ | 9.73 | | | $ | 11.21 | |

| | | | | | | | | |

| Payable ounces of silver | | | 3,537,905 | | | | 3,333,170 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

Pan American acquired the La Colorada mine in 1998 and invested through 2003 to refurbish the mine and construct a 650 tonne per day silver and gold oxide ore processing plant with associated infrastructure. Following the commissioning of the oxide plant in 2003, the Company made additional investments to expand the mine and the pre-existing sulphide processing plant to produce silver, gold, lead, and zinc from an additional 550 tonne per day sulphide plant which was commissioned in 2006. The mine consists of six continuous blocks of exploration permits and exploitation claims totalling 2,230 hectares.

The project lies within one of Mexico’s geologic belts known as the "faja de plata" (silver belt) that extends for 800 km along the Sierra Madre Mountains and is defined by prolific silver deposits. The continued exploration success achieved at La Colorada reported over the last 5 years illustrates the excellent potential for extending reserves through discovery and additional development.

Silver production at the La Colorada mine in 2010 was 3.7 million ounces, a 7% increase compared to the previous year. This increase was due to higher throughput rates and improved silver recoveries as a result of benefits from previous investments in mine development, mine equipment purchases, ventilation and dewatering which are enabling higher productivities and efficiencies. Despite the higher throughput rates in 2010, lower gold grades led to a decrease in gold production while production of lead and zinc benefited from higher throughput.

Cash costs increased by 14% in 2010 compared to 2009 to $8.59 per ounce as a result of higher operating costs, partially offset by higher by-product credits.

Actual performance at La Colorada in 2010 with respect to silver production was 3% ahead of management’s expectation of 3.6 million ounces, resulting from higher realized silver

grades than expected. Gold grades were approximately 19% below expectations, whereas lead and zinc grades were in-line with expectations. Actual cash costs of $8.59 were in-line with management’s forecast for 2010 as higher operating costs were off-set by better than expected production and higher by-product metal prices.

Capital expenditures at La Colorada during 2010 totalled $9.1 million. The capital was spent mainly on a tailings dam expansion, additional underground mine equipment purchases, sulphide plant equipment upgrades, and exploration works.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes milled | | | 271,483 | | | | 167,006 | |

| Average silver grade – grams per tonne | | | 389 | | | | 537 | |

| Average zinc grade | | | 2.29 | % | | | 2.26 | % |

| Average silver recovery | | | 89.1 | % | | | 91.0 | % |

| Silver – ounces | | | 3,033,046 | | | | 2,626,774 | |

| Zinc – tonnes | | | 4,661 | | | | 2,803 | |

| Copper – tonnes | | | 512 | | | | 401 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 8.21 | | | $ | 7.07 | |

Total costs per ounce (1) | | $ | 12.07 | | | $ | 9.51 | |

| | | | | | | | | |

| Payable ounces of silver | | | 2,823,869 | | | | 2,458,600 | |

| * | Production and interest figures are for Pan American’s 95.0% share only. |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

The San Vicente silver-zinc mine is located in the Bolivian Andes. More than 20 bonanza type silver-zinc veins are known to occur over an area of 1.5 kilometres on surface and extend to at least 200 meters in depth. The project consists of 15 mining concessions totalling 8,159 hectares.

San Vicente was operated from 1972 to 1993 by COMIBOL, the Bolivian state mining company. In 1999 Pan American optioned the project from COMIBOL under a joint venture agreement. Following acquisition, Pan American investigated several development alternatives for San Vicente with local partnerships and by May 2007 secured 95.0% interest in the operating company of the Joint Venture Project with COMIBOL. Under the Joint Venture agreement, COMIBOL retains the rights to collect 9.4% of the operating cash flow while the Company recovers its capital investment increasing to 37.5% thereafter. Between 2000 and 2007 the Company invested in exploration drilling, underground development drifting, and performing various feasibility and development studies while conducting limited mining and toll milling production at a nearby neighbouring processing facility. During this period, Pan American discovered the rich Litoral II vein which served to significantly increase the Proven and Probable reserves at the mine. Pan American decided in mid-2007 to invest in expanding the mine by developing a modern trackless long-hole mining operation for the Litoral II vein and constructing its own 750 tonne-per-day processing facility. Commissioning activities proceeded smoothly since the April 2009 start-up leading the Company to declare commercial production in the first month of operation.

In 2010, San Vicente’s silver production increased by 15% compared to its 2009 production, mainly due to a full year of production offset by lower silver grades and recoveries. Zinc and copper production levels were significantly higher by 66% and 28%, respectively, compared to the same period last year primarily due to the increased throughput rates.

Cash costs at San Vicente increased by 16% to $8.21 in 2010 as compared to the previous year. The higher cash costs in 2010 resulted from anticipated lower silver grades as high grade ore that had been stockpiled during the exploration and development years was processed in 2009. This was partially offset by higher zinc and copper by-product credits due to increased production and prices of those metals.

Actual silver production attributable to Pan American in 2010 was in-line with management’s forecast, as the lower than expected silver grades were offset by the higher than anticipated throughput rates. Zinc and copper production fell short of forecast by 7% and 27% respectively due to the lower than expected grades of those metals. Actual cash costs of $8.21 were 17% above management’s forecast due to processing more tonnes and lower silver grades as well as higher than expected operating costs.

Capital expenditures at San Vicente during 2010 totalled $6.0 million. This consisted mainly of spending on exploration, additional underground mine equipment, concentrate handling and reagent storage facility upgrades, tailings pond water recycle system enhancements and a tailings dam rise.

| | | Twelve months ended | |

| | | December 31, | |

| | | 2010 | | | 2009 | |

| Tonnes milled | | | 717,463 | | | | 632,949 | |

| Average silver grade – grams per tonne | | | 191 | | | | 209 | |

| Average gold grade – grams per tonne | | | 2.81 | | | | 3.79 | |

| Average silver recovery | | | 90.5 | % | | | 87.6 | % |

| Average gold recovery | | | 94.7 | % | | | 94.6 | % |

| Silver – ounces | | | 3,964,822 | | | | 3,783,183 | |

| Gold – ounces | | | 62,843 | | | | 71,892 | |

| | | | | | | | | |

Cash costs per ounce (1) | | $ | 1.61 | | | $ | (0.84 | ) |

Total costs per ounce (1) | | $ | 10.16 | | | $ | 8.19 | |

| | | | | | | | | |

| Payable ounces of silver | | | 3,958,874 | | | | 3,777,508 | |

| (1) | Cash costs per ounce and total costs per ounce are non-GAAP measurements. Please refer to section Non-GAAP Measures for a detailed reconciliation of these measures to our cost of sales. |

Reconnaissance exploration on the Manantial Espejo property was first carried out in the 1970s by the Argentinean government. In 2002, the Company acquired a 50% interest in the project and in March 2006, the Company negotiated and entered into a purchase agreement for the remaining 50% interest, thus becoming a 100% owner of the Manantial Espejo project.

In March 2006, Pan American completed a feasibility study and the 43-101 Technical Report for the Manantial Espejo Project, based upon a combination open pit and underground mine plan, and a conventional milling and leaching circuit with a design capacity of 2,000 tonnes per day. In the same month, the Company’s board of directors

approved a project to construct the Manantial Espejo mine, which was completed in December 2008. In 2009, its first full year of commercial production, the mine achieved an outstanding start-up performance and produced 3.8 million ounces of silver and over 70,000 ounces of gold at cash costs of negative $0.84 per ounce of silver. The 2010 silver production levels surpassed the previous year’s outstanding production.

Silver production at the Manantial Espejo mine in 2010 was 4.0 million ounces, a 5% increase from the production level in 2009. This increase was a result of the higher throughput rates and silver recoveries, partially offset by lower silver grades. Gold production decreased by 13% in 2010 due to lower gold grades that were expected as the operation normalized towards the average reserve gold grades of the deposit, which is expected to be approximately 2.2 grams per tonne.

In 2010, cash costs at Manantial Espejo increased to $1.61, significantly higher than 2009’s cash costs of negative $0.84 per ounce. The main drivers of the increase in cash costs were higher operating costs mainly due to an increase in labour costs and the effects from the high sustained inflation rates in Argentina. These were partially offset by higher by-product gold prices.

In 2010, Manantial Espejo’s actual silver grades were below management’s forecast, resulting in 14% lower silver production than expected due to variations to the mine sequencing. Gold recoveries and grades were in-line with forecasts, resulting in gold production within 1% of management’s expectations. The actual cash costs in 2010 of $1.61 per ounce were significantly lower than the $3.25 per ounce forecast by management as actual cash costs benefited from higher than anticipated gold prices.

Capital expenditures at Manantial Espejo during 2010 totalled $7.0 million. The capital expenditures consisted mainly of exploration drilling, acquisition of additional open pit mining equipment, and a tailings dam expansion.

OVERVIEW OF 2010 FINANCIAL RESULTS

The table below sets out highlights of Pan American’s quarterly results, expressed in thousands of US dollars (except for per share detail), for the past 12 quarters, together with select balance sheet information for the prior three years.

| | QUARTERS ENDED (UNAUDITED) | YEARS ENDED |

| | | |

| 2010 | MARCH 31 | JUNE 30 | SEPT. 30 | DEC. 31 | DEC. 31 |

| Net income for the period | $ | 19,113 | $ | 18,256 | $ | 28,815 | $ | 46,389 | $ | 112,573 |

| Net income per share - Basic | $ | 0.18 | $ | 0.17 | $ | 0.27 | $ | 0.43 | $ | 1.05 |

- Diluted | $ | 0.18 | $ | 0.17 | $ | 0.27 | $ | 0.43 | $ | 1.05 |

| Dividends declared per share | $ | 0.025 | $ | - | $ | 0.025 | $ | 0.025 | $ | 0.075 |

| Sales | $ | 132,375 | $ | 147,250 | $ | 161,262 | $ | 191,099 | $ | 631,986 |

| Mine operating earnings* | $ | 36,874 | $ | 51,144 | $ | 60,581 | $ | 91,208 | $ | 239,807 |

| Income tax provision | $ | (11,416) | $ | (18,757) | $ | (17,588) | $ | (43,226) | $ | (90,987) |

| Cash Flow from operations | $ | 48,916 | $ | 45,091 | $ | 64,620 | $ | 83,629 | $ | 242,256 |

Other financial information: | | | | | | |

| Total Assets | | | | | $ | 2,072,608 |

| Total long-term financial liabilities | | | | | $ | 429,305 |

| Total Shareholders’ Equity | | | | | $ | 1,520,288 |

| 2009 | MARCH 31 | JUNE 30 | SEPT. 30 | DEC. 31 | DEC. 31 |

| Net income for the period | $ | 6,610 | $ | 10,208 | $ | 17,375 | $ | 27,805 | $ | 61,998 |

| Net income per share - Basic | $ | 0.08 | $ | 0.12 | $ | 0.20 | $ | 0.31 | $ | 0.71 |

- Diluted | $ | 0.08 | $ | 0.12 | $ | 0.20 | $ | 0.31 | $ | 0.71 |

| Sales | $ | 70,406 | $ | 111,392 | $ | 118,608 | $ | 154,406 | $ | 454,812 |

| Mine operating earnings* | $ | 10,474 | $ | 23,490 | $ | 34,708 | $ | 57,334 | $ | 126,006 |

| Income tax provision | $ | (2,350) | $ | (2,694) | $ | (7,483) | $ | (15,229) | $ | (27,756) |

| Cash Flow from (used in) operations | $ | (5,375) | $ | 32,034 | $ | 37,099 | $ | 52,118 | $ | 115,876 |

Other financial information: | | | | | | |

| Total Assets | | | | | $ | 1,848,609 |

| Total long-term financial liabilities | | | | $ | 389,383 |

| Total Shareholders’ Equity | | | | | $ | 1,343,790 |

| |

| 2008 | MARCH 31 | JUNE 30 | SEPT. 30 | DEC. 31 | DEC. 31 |

| Net income (loss) for the period | $ | 30,157 | $ | 21,357 | $ | 6,404 | $ | (33,316) | $ | 24,602 |

| Net income (loss) per share - Basic | $ | 0.38 | $ | 0.26 | $ | 0.08 | $ | (0.41) | $ | 0.31 |

- Diluted | $ | 0.38 | $ | 0.26 | $ | 0.08 | $ | (0.41) | $ | 0.30 |

| Sales | $ | 108,750 | $ | 104,079 | $ | 79,493 | $ | 46,278 | $ | 338,600 |

| Mine operating earnings (losses)* | $ | 48,375 | $ | 39,259 | $ | 15,469 | $ | (9,884) | $ | 93,219 |

| Income tax (provision) recovery | $ | (14,497) | $ | (12,451) | $ | (5,988) | $ | 8,506 | $ | (24,430) |

| Cash Flow from (used in) operations | $ | 20,964 | $ | 52,654 | $ | 24,262 | $ | (4,352) | $ | 93,528 |

Other financial information: | | | | | | |

| Total Assets | | | | | $ | 873,383 |

| Total long-term financial liabilities | | | | $ | 102,715 |

| Total Shareholders’ Equity | | | | | $ | 685,641 |

| * | Mine operating earnings/(losses) are equal to sales less cost of sales less depreciation and amortization, which is considered to be substantially the same as gross margin. |

| | Note: The Company announced its first dividend on February 15, 2010. |

Net income for 2010 was $112.6 million, compared to net income of $62.0 million for 2009. Basic earnings per share for 2010 were $1.05 compared to $0.71 in 2009. The significant increase in net income was primarily attributable to improved metal prices and a 6% increase in the quantity of silver sold.

Earnings before taxes for 2010 were reduced by $24.5 million in exploration expenses and a non-cash doubtful provision of $4.8 million and the associated write-down of inventory related to Doe Run Peru ("DRP"). The exploration expenses were primarily incurred on drilling and prefeasibility work at the Navidad and La Preciosa projects and the non-cash doubtful provision of $4.8 million was due to the uncertainty in collecting a long-term receivable from Doe Run Peru and the associated write-down of pyrite stockpile inventories that were being sold to Doe Run Peru. Net income in 2010 benefited from $11.1 million in foreign exchange gain resulting primarily from the revaluation of the long-term future income tax liability denominated in Argentine pesos and gains on Canadian dollar bank balances.

Earnings before taxes for 2009 were reduced by the following items: (i) a non-cash, doubtful debt provision of $4.4 million due to the uncertainty in collecting a long-term receivable from Doe Run Peru; (ii) a non-cash fair value charge of $2.2 million for a delay in recovery of the long-term VAT receivable in Argentina; and (iii) a donation of $2.3 million to the University of British Columbia for the construction of an earth science building.

Sales in 2010 were a record $632.0 million, an increase of 39% over the 2009 sales. This increase was driven primarily by increased metal prices and silver quantities sold, with a partial offset from lower base metal quantities sold.

Mine operating earnings, defined as sales less cost of sales and depreciation and amortization, increased to $239.8 million in 2010, an increase of 90% over the prior year. This change was from the combined effect of an increase in sales, as described above, which outweighed increased cost of sales and depreciation charges.

Cost of sales for the year was $305.7 million, a 24% increase from the $245.6 million realized in the same period last year. This increase was primarily a result of greater quantities of silver sold and higher operating costs.

Depreciation and amortization charges of $86.5 million in 2010 were 4% higher than the $83.2 million recorded in 2009.

Income tax provisions for 2010 amounted to $91.0 million compared to $27.8 million in 2009. This increase was primarily a consequence of (i) higher taxable income generated at our operations; (ii) an additional Bolivian mining tax of 12.5% introduced in October 2009; and (iii) withholding taxes on both technical services and interest paid from our foreign subsidiaries to Pan American Silver Corp.

Operating activities generated $242.3 million in 2010, a new record for the Company, compared to $115.9 million generated by operations in 2009, which was the previous record for operating cash flow. The increase in cash flow from operations resulted from improved operating earnings due to higher quantities of silver sold and higher realized prices. Before changes in non-cash working capital items, which generated $23.9 million in 2010 (2009: used $35.8 million), cash flow from operations in 2010 was $218.3 million (2009: $151.7 million). The largest contributors to the operating cash flows, before changes in non-cash working capital items, were Alamo Dorado and Manantial Espejo at $77.4 million and $73.5 million, respectively.

Changes in non-cash working capital contributed $23.9 million in 2010 compared with non-cash working capital requirements of $35.8 million in 2009. The net non-cash working capital contributions in 2010 consisted primarily of an increase in income taxes payable of $37.1 million and an increase in accounts payable and other current liabilities of $5.7 million, which were offset by a $12.1 million increase in inventories. The higher accrued current income taxes resulted from the substantial increase in taxable income generated. The increase in accounts payable and other current liabilities was mainly due to the cash payments received for the Morococha relocation project and due to the timing of royalty and other payables. The increase in inventory levels is mainly attributable to an increase in both silver doré inventory due to timing of shipments and material and supplies inventory at Manantial Espejo. In 2009, the main movements in working capital accounts that required funding were a $26.8 million increase in accounts receivables and other current assets and an increase in inventories of $15.2 million offset by an increase in taxes payable of $4.0 million.

Investing activities used $166.1 million in 2010, inclusive of $80.2 million invested in short-term investments. The balance of investing activities consisted primarily of spending $28.0 million on the Navidad project and sustaining investments in property, plant and equipment primarily at Morococha, La Colorada, Manantial Espejo, Huaron, San Vicente and Alamo Dorado of $11.3 million, $9.1 million, $7.0 million, $6.6 million, $6.0 million and $2.1 million, respectively. In addition, $5.4 million was spent on the Morococha relocation project and $5.0 million was paid as refundable VAT tax in Argentina and Bolivia.

Investing activities used $146.3 million in 2009, inclusive of $80.1 million invested in short- term investments. The balance of investing activities was dominated by final construction related expenditures at Manantial Espejo of $13.5 million and $19.0 million spent to complete the expansion at San Vicente. Sustaining investments in property, plant, and equipment were made at Morococha, Huaron, and La Colorada where $8.1 million, $7.0 million and $3.1 million were spent, respectively. In addition, $12.4 million was paid as refundable VAT tax in Argentina and Bolivia.

Financing activities in 2010 generated $2.6 million, whereas financing activities in 2009 generated $104.1 million. Cash generated from financing activities in 2010 was a result of $11.9 million in proceeds from the exercising of warrants and options which was offset by $8.0 million in dividend payments to our shareholders.

In 2009, the $104.1 million in cash generated from financing activities consisted primarily of proceeds from the public offering of 6.37 million common shares in February 2009 at a

price of $16.25 per share, for proceeds of $98.3 million, net of underwriting fees and issue expenses, along with contributions from minority shareholders in the San Vicente project of $1.6 million. In addition, proceeds from short term concentrate advances provided $4.1 million.

| Statement of Operations: Q4 2010 |

Net income in the fourth quarter of 2010 (Q4 2010) was $46.4 million or $0.43 per share compared to $27.8 million or $0.31 per share for the comparable period in 2009. The 67% increase in net income was a result of significantly better operating results mainly attributable to higher metal prices and partially offset by lower quantities sold of all metals, with the exception of lead. Silver, gold, zinc and copper quantities sold in 2010 declined by 6%, 26%, 19% and 24% respectively, while lead quantities sold increased by 8% in comparison to 2009.

Earnings before taxes for the period were negatively impacted by higher general and administration costs due to the timing of the Company’s annual incentive plan and severance payments and a non-cash $1.5 million write-down of pyrite stockpile inventories that were being sold to the La Oroya smelter, which remains closed. Net income in Q4 2010 benefited from $1.9 million in foreign exchange gain resulting primarily from the revaluation of the long-term future income tax liability denominated in Argentine pesos and an insurance claim related to theft of doré at La Colorada for $1.7 million.

Earnings for the fourth quarter of 2009 (Q4 2009) were negatively impacted by: (i) a non-cash fair value charge of $2.2 million for a delay in recovery of the long-term VAT receivable in Argentina; (ii) a donation of $2.3 million to the University of British Columbia for the construction of an earth science building; and (iii) $4.6 million in exploration activities, mainly at La Preciosa.

Sales during Q4 2010 were a record $191.1 million, a significant increase from the $154.4 million of sales in the same period last year. This 24% increase in sales was driven primarily by higher realized prices for all metals partially offset by lower quantities sold of all metals, except lead as described above.

Mine operating earnings rose to $91.2 million in Q4 2010 from $57.3 million in the same quarter last year. This increase was attributable to increased sales in Q4 2010, as described above, and due to a reduction in depreciation charges, which outweighed the increase in cost of sales.

Cost of sales for Q4 2010 of $78.8 million was an increase of 8% from $72.7 million in the comparable period last year.

Depreciation and amortization charges for Q4 2010 decreased to $21.1 million from $24.4 million in Q4 2009. The reduction in depreciation was mainly a result of lower quantities of metals sold compared to the same period in 2009.

Income tax provision during Q4 2010 amounted to $43.2 million compared to $15.2 million in Q4 2009. The income tax expense resulted primarily from: (i) increased taxable income generated in all the jurisdictions the Company operates in; (ii) reduction of tax

assets in Bolivia; and (iii) withholding taxes on both technical services and interest paid from our foreign subsidiaries to Pan American Silver Corp.

Operating activities in Q4 2010 generated a record cash flow of $83.6 million, a 60% increase from the $52.1 million generated in Q4 2009. This operating cash flow record in Q4 2010 was mainly attributable to the significantly higher metal prices.

Cash flow generated from operating activities in Q4 of 2009 was $52.1 million compared to cash used in operating activities of $4.9 million in the comparable quarter of 2008. Operating cash flow in Q4 of 2009 was positively impacted by significantly higher metal prices and by operating cash flow from Manantial Espejo and San Vicente, both of which were in their first year of operation.

Cash flow from investing activities used $69.0 million in Q4 2010. This consisted primarily of $41.6 million in short term investments, $5.7 million spending on the Navidad project and an aggregate $29.6 million in sustaining capital investments at Morococha, La Colorada, San Vicente and Manantial Espejo.

Investing activities in Q4 of 2009 used $17.9 million, including the investment of $6.3 million in short-term investments. Aggregate sustaining capital expenditures of $7.6 million were spent during the quarter at all operations and an additional $1.9 million was paid as refundable VAT in Argentina and Bolivia. The Company also spent approximately $3.3 million on costs associated with closing the Aquiline transaction in the quarter.

Financing activities in Q4 2010 generated $10.2 million and consisted primarily of $8.7 million from the exercising of warrants and options offset by $2.7 million in dividend payment to our shareholders. In Q4 of 2009, cash generated by financing activities totalled $1.0 million and was comprised of advances against concentrate shipments.

LIQUIDITY POSITION

The Company’s cash balance at December 31, 2010 was $179.9 million, which was an increase of $79.4 million from the balance at December 31, 2009. The balance of the Company’s short-term investments at December 31, 2010 was $180.6 million, an increase of $88.0 million from a year ago. This increase in liquidity in 2010 resulted primarily from cash generated by operating activities of $242.3 million in addition to $11.9 million in proceeds from the exercising of warrants and options, partially offset by capital expenditures on property, plant and equipment of $87.3 million which includes $3.9 million in refundable VAT payments. The Company does not own any asset-backed commercial paper in its investment portfolio.

Working capital at December 31, 2010 was $433.8 million, an increase of $161.5 million from the prior year-end’s working capital of $272.3 million. The increase in working capital was mainly due to a $167.4 million increase in cash and short-term investments, plus an increase in inventory of $13.4 million, in addition to a decrease in accounts payable and other current liabilities of $14.9 million. These were partially offset by an increase in the current income tax liability of $30.0 million and a decrease in income taxes receivable of $12.0 million. The increase in income tax liability is primarily a result of the higher current

taxable income generated in 2010. The increase in inventory is mainly attributable to an increase in both silver doré inventory due to timing of shipments and material and supplies inventory at Manantial Espejo.

On October 10, 2008, Pan American entered into a $70 million revolving credit facility (“the Facility”) with Scotia Capital and Standard Bank Plc (“the Lenders”). The purpose of the Facility is for general corporate purposes, including acquisitions. The Facility, which is principally secured by a pledge of Pan American’s equity interests in its material subsidiaries, had a term of four years. On December 20, 2010 the Company renewed the Facility and extended the term to December 2014 and increased the amount of the Facility to $150 million by expanding the number of Lenders to include West LB, CIBC and BMO. The interest margin on the renewed Facility ranges from 3.00% to 4.00% over LIBOR, based on the Company’s net debt to EBITDA ratio. Pan American has agreed to pay a commitment fee of between 0.90% and 1.20% on undrawn amounts under the Facility, depending on the Company’s net debt to EBITDA ratio. To the date of this MD&A, the Company has not made any drawings under the Facility.

Alternatives for financing the Company’s future capital needs include our significant liquidity position, future operating cash flow, unutilized credit facility and the proceeds of exercised share options. In the opinion of management, based on the Company’s current liquidity position and the operating cash flows that are expected in 2011, the Company’s liquid assets will be sufficient to discharge liabilities as they come due and to fund planned project development and sustaining capital expenditures in 2011. Please refer to the “2011 Operating Outlook” section of this MD&A for a more detailed description of the sustaining capital expenditures planned for each mine in 2011.

The impact of inflation on the Company’s financial position, operational performance, or cash flows over the next twelve months cannot be determined with any degree of certainty.

INVESTMENTS AND INVESTMENT INCOME