UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-04363 | |||||||||||||||||||

| AMERICAN CENTURY GOVERNMENT INCOME TRUST | ||||||||||||||||||||

| (Exact name of registrant as specified in charter) | ||||||||||||||||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| JOHN PAK 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||||||||||||||||

| (Name and address of agent for service) | ||||||||||||||||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||||||||||||||||

| Date of fiscal year end: | 03-31 | |||||||||||||||||||

| Date of reporting period: | 03-31-2022 | |||||||||||||||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| Annual Report | |||||

| March 31, 2022 | |||||

| Capital Preservation Fund | |||||

| Investor Class (CPFXX) | |||||

| Table of Contents | ||

| President’s Letter | |||||

| Performance | |||||

| Fund Characteristics | |||||

| Shareholder Fee Example | |||||

| Schedule of Investments | |||||

| Statement of Assets and Liabilities | |||||

| Statement of Operations | |||||

| Statement of Changes in Net Assets | |||||

| Notes to Financial Statements | |||||

| Financial Highlights | |||||

| Report of Independent Registered Public Accounting Firm | |||||

| Management | |||||

| Liquidity Risk Management Program | |||||

| Additional Information | |||||

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter | ||

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Soaring Inflation, Escalating Volatility Led to Mixed Results for Stocks and Bonds

Upbeat economic and earnings data and continued Federal Reserve (Fed) support generally buoyed stock returns for most of the reporting period. Despite periodic outbreaks of COVID-19, the worst of the virus appeared over in the U.S., and pre-pandemic activities gradually resumed. Bonds delivered solid gains in the first half of the period before a Fed policy pivot triggered a drastic sentiment shift in fixed-income markets.

Early in the period, inflation began a steady upward march. Initially, the Fed was unfazed, viewing the price hikes as a temporary economic consequence of recovering from the pandemic. But by late 2021, inflation was surging toward multidecade highs, prompting the Fed to adopt a more hawkish strategy.

Policymakers announced an abrupt end to bond buying followed by a March rate hike, the first since 2018. At period-end, market indicators reflected expectations for more aggressive Fed rate hikes along with balance sheet cuts to tame inflation.

In addition to an 8.5% annual inflation rate and a hawkish Fed, Russia’s invasion of Ukraine further rattled investors in early 2022. Stocks declined sharply amid the unrest, but strong performance earlier in the fiscal year left most U.S. indices with solid 12-month gains. For bonds, declines in the second half of the reporting period overwhelmed earlier gains, and most U.S. fixed-income indices retreated for the 12 months overall.

Staying Focused in Uncertain Times

We expect market volatility to linger amid elevated inflation and tighter Fed policy. In addition, Russia’s invasion of Ukraine has led to a devastating humanitarian crisis and further complicated a tense geopolitical backdrop. We will continue to monitor the evolving situation and its implications for our clients and our investment exposure.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable and volatile markets, and we’re confident we will continue to meet prevailing challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance | ||

| Total Returns as of March 31, 2022 | |||||||||||||||||

| Average Annual Returns | |||||||||||||||||

| Ticker Symbol | 1 year | 5 years | 10 years | Inception Date | |||||||||||||

| Investor Class | CPFXX | 0.01% | 0.75% | 0.38% | 10/13/72 | ||||||||||||

Fund returns would have been lower if a portion of the fees had not been waived.

| Total Annual Fund Operating Expenses | ||||||||

| Investor Class | 0.48% | |||||||

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

The 7-day current yield more closely reflects the current earnings of the fund than the total return.

3

| Fund Characteristics | ||

| MARCH 31, 2022 | |||||

| 7-Day Current Yield | |||||

After waiver(1) | 0.01% | ||||

| Before waiver | -0.12% | ||||

| 7-Day Effective Yield | |||||

After waiver(1) | 0.01% | ||||

| (1) Yields would have been lower if a portion of the fees had not been waived. | |||||

| Portfolio at a Glance | |||||

| Weighted Average Maturity | 52 days | ||||

| Weighted Average Life | 106 days | ||||

| Portfolio Composition by Maturity | % of fund investments | ||||

| 1-30 days | 54% | ||||

| 31-90 days | 24% | ||||

| 91-180 days | 15% | ||||

| More than 180 days | 7% | ||||

4

| Shareholder Fee Example | ||

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2021 to March 31, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

| Beginning Account Value 10/1/21 | Ending Account Value 3/31/22 | Expenses Paid During Period(1) 10/1/21 - 3/31/22 | Annualized Expense Ratio(1) | |||||||||||

| Actual | ||||||||||||||

| Investor Class | $1,000 | $1,000.00 | $0.55 | 0.11% | ||||||||||

| Hypothetical | ||||||||||||||

| Investor Class | $1,000 | $1,024.38 | $0.56 | 0.11% | ||||||||||

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

6

| Schedule of Investments | ||

MARCH 31, 2022

| Principal Amount | Value | |||||||

U.S. TREASURY BILLS(1) — 45.8% | ||||||||

| U.S. Treasury Bills, 0.14%, 4/5/22 | $ | 65,000,000 | $ | 64,998,989 | ||||

| U.S. Treasury Bills, 0.25%, 4/12/22 | 67,500,000 | 67,495,273 | ||||||

| U.S. Treasury Bills, 0.25%, 4/19/22 | 21,500,000 | 21,497,313 | ||||||

| U.S. Treasury Bills, 0.26%, 5/3/22 | 27,000,000 | 26,993,940 | ||||||

| U.S. Treasury Bills, 0.24%, 5/5/22 | 65,000,000 | 64,985,267 | ||||||

| U.S. Treasury Bills, 0.08%, 5/12/22 | 23,800,000 | 23,795,725 | ||||||

| U.S. Treasury Bills, 0.35%, 5/17/22 | 100,000,000 | 99,955,917 | ||||||

| U.S. Treasury Bills, 0.07%, 5/19/22 | 72,000,000 | 71,982,760 | ||||||

| U.S. Treasury Bills, 0.09%, 5/26/22 | 17,000,000 | 16,997,753 | ||||||

| U.S. Treasury Bills, 0.09%, 6/2/22 | 50,000,000 | 49,992,250 | ||||||

| U.S. Treasury Bills, 0.11%, 6/9/22 | 50,000,000 | 49,988,795 | ||||||

| U.S. Treasury Bills, 0.43%, 6/16/22 | 55,000,000 | 54,950,557 | ||||||

| U.S. Treasury Bills, 0.52%, 7/28/22 | 60,000,000 | 59,899,947 | ||||||

| U.S. Treasury Bills, 0.07%, 9/8/22 | 25,900,000 | 25,892,095 | ||||||

| U.S. Treasury Bills, 0.89%, 9/22/22 | 100,000,000 | 99,579,500 | ||||||

| U.S. Treasury Bills, 0.16%, 11/3/22 | 25,000,000 | 24,976,000 | ||||||

| U.S. Treasury Bills, 0.24%, 12/1/22 | 20,000,000 | 19,967,467 | ||||||

| U.S. Treasury Bills, 1.30%, 1/26/23 | 5,525,000 | 5,466,688 | ||||||

| U.S. Treasury Cash Management Bills, 0.58%, 6/28/22 | 50,000,000 | 49,930,333 | ||||||

| U.S. Treasury Cash Management Bills, 0.54%, 7/5/22 | 40,000,000 | 39,943,528 | ||||||

| U.S. Treasury Cash Management Bills, 0.68%, 7/19/22 | 66,500,000 | 66,366,104 | ||||||

| TOTAL U.S. TREASURY BILLS | 1,005,656,201 | |||||||

U.S. TREASURY NOTES(1) — 31.9% | ||||||||

| U.S. Treasury Notes, 2.25%, 4/15/22 | 50,000,000 | 50,041,955 | ||||||

| U.S. Treasury Notes, 0.125%, 4/30/22 | 25,000,000 | 25,001,459 | ||||||

| U.S. Treasury Notes, 1.75%, 4/30/22 | 12,500,000 | 12,516,955 | ||||||

| U.S. Treasury Notes, 1.875%, 4/30/22 | 20,000,000 | 20,025,271 | ||||||

| U.S. Treasury Notes, 1.75%, 5/31/22 | 10,000,000 | 10,023,052 | ||||||

| U.S. Treasury Notes, 1.75%, 6/15/22 | 12,500,000 | 12,543,345 | ||||||

| U.S. Treasury Notes, 1.50%, 8/15/22 | 27,500,000 | 27,645,502 | ||||||

| U.S. Treasury Notes, 1.875%, 9/30/22 | 22,000,000 | 22,125,797 | ||||||

| U.S. Treasury Notes, 0.14%, 11/15/22 | 15,000,000 | 14,987,132 | ||||||

| U.S. Treasury Notes, 1.625%, 11/15/22 | 45,000,000 | 45,262,354 | ||||||

| U.S. Treasury Notes, 0.125%, 12/31/22 | 8,900,000 | 8,887,900 | ||||||

| U.S. Treasury Notes, VRN, 0.72%, (3-month USBMMY plus 0.11%), 4/30/22 | 105,940,000 | 105,943,983 | ||||||

| U.S. Treasury Notes, VRN, 0.66%, (3-month USBMMY plus 0.06%), 7/31/22 | 100,000,000 | 100,017,920 | ||||||

| U.S. Treasury Notes, VRN, 0.66%, (3-month USBMMY plus 0.06%), 10/31/22 | 34,250,000 | 34,257,071 | ||||||

| U.S. Treasury Notes, VRN, 0.65%, (3-month USBMMY plus 0.05%), 1/31/23 | 75,000,000 | 75,017,145 | ||||||

| U.S. Treasury Notes, VRN, 0.64%, (3-month USBMMY plus 0.03%), 4/30/23 | 25,000,000 | 25,002,460 | ||||||

| U.S. Treasury Notes, VRN, 0.63%, (3-month USBMMY plus 0.03%), 7/31/23 | 40,000,000 | 40,001,618 | ||||||

| U.S. Treasury Notes, VRN, 0.64%, (3-month USBMMY plus 0.04%), 10/31/23 | 25,000,000 | 24,998,797 | ||||||

7

| Principal Amount | Value | |||||||

| U.S. Treasury Notes, VRN, 0.59%, (3-month USBMMY minus 0.02%), 1/31/24 | $ | 45,000,000 | $ | 45,035,020 | ||||

| TOTAL U.S. TREASURY NOTES | 699,334,736 | |||||||

U.S. TREASURY BONDS(1) — 0.7% | ||||||||

| U.S. Treasury Bonds, 7.25%, 8/15/22 | 15,000,000 | 15,396,283 | ||||||

| TOTAL INVESTMENT SECURITIES — 78.4% | 1,720,387,220 | |||||||

| OTHER ASSETS AND LIABILITIES — 21.6% | 475,230,825 | |||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,195,618,045 | ||||||

| NOTES TO SCHEDULE OF INVESTMENTS | ||||||||

| USBMMY | - | U.S. Treasury Bill Money Market Yield | ||||||

| VRN | - | Variable Rate Note. The rate adjusts periodically based upon the terms set forth in the security’s offering documents. The rate shown is effective at the period end and the reference rate and spread, if any, is indicated. The security's effective maturity date may be shorter than the final maturity date shown. | ||||||

(1)The rates for U.S. Treasury Bills are the yield to maturity at purchase. The rates for U.S. Treasury Notes and U.S. Treasury Bonds are the stated coupon rates.

See Notes to Financial Statements.

8

| Statement of Assets and Liabilities | ||

| MARCH 31, 2022 | |||||

| Assets | |||||

| Investment securities, at value (amortized cost and cost for federal income tax purposes) | $ | 1,720,387,220 | |||

| Cash | 139,404 | ||||

| Receivable for investments sold | 475,001,916 | ||||

| Receivable for capital shares sold | 1,286,374 | ||||

| Interest receivable | 1,704,929 | ||||

| 2,198,519,843 | |||||

| Liabilities | |||||

| Payable for capital shares redeemed | 2,428,529 | ||||

| Accrued management fees | 473,181 | ||||

| Dividends payable | 88 | ||||

| 2,901,798 | |||||

| Net Assets | $ | 2,195,618,045 | |||

| Investor Class Capital Shares | |||||

| Shares outstanding (unlimited number of shares authorized) | 2,195,612,074 | ||||

| Net Asset Value Per Share | $ | 1.00 | |||

| Net Assets Consist of: | |||||

| Capital paid in | $ | 2,195,614,964 | |||

| Distributable earnings | 3,081 | ||||

| $ | 2,195,618,045 | ||||

See Notes to Financial Statements.

9

| Statement of Operations | ||

| YEAR ENDED MARCH 31, 2022 | |||||

| Investment Income (Loss) | |||||

| Income: | |||||

| Interest | $ | 1,939,586 | |||

| Expenses: | |||||

| Management fees | 10,338,034 | ||||

| Trustees' fees and expenses | 137,637 | ||||

| Other expenses | 49 | ||||

| 10,475,720 | |||||

| Fees waived | (8,755,922) | ||||

| 1,719,798 | |||||

| Net investment income (loss) | 219,788 | ||||

| Net realized gain (loss) on investment transactions | 6 | ||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 219,794 | |||

See Notes to Financial Statements.

10

| Statement of Changes in Net Assets | ||

| YEARS ENDED MARCH 31, 2022 AND MARCH 31, 2021 | ||||||||

| Increase (Decrease) in Net Assets | March 31, 2022 | March 31, 2021 | ||||||

| Operations | ||||||||

| Net investment income (loss) | $ | 219,788 | $ | 329,680 | ||||

| Net realized gain (loss) | 6 | 2,571 | ||||||

| Net increase (decrease) in net assets resulting from operations | 219,794 | 332,251 | ||||||

| Distributions to Shareholders | ||||||||

| From earnings | (219,788) | (329,680) | ||||||

| Capital Share Transactions | ||||||||

| Proceeds from shares sold | 729,596,968 | 1,053,529,982 | ||||||

| Proceeds from reinvestment of distributions | 215,245 | 323,676 | ||||||

| Payments for shares redeemed | (821,073,800) | (941,803,596) | ||||||

| Net increase (decrease) in net assets from capital share transactions | (91,261,587) | 112,050,062 | ||||||

| Net increase (decrease) in net assets | (91,261,581) | 112,052,633 | ||||||

| Net Assets | ||||||||

| Beginning of period | 2,286,879,626 | 2,174,826,993 | ||||||

| End of period | $ | 2,195,618,045 | $ | 2,286,879,626 | ||||

| Transactions in Shares of the Fund | ||||||||

| Sold | 729,596,968 | 1,053,529,982 | ||||||

| Issued in reinvestment of distributions | 215,245 | 323,676 | ||||||

| Redeemed | (821,073,800) | (941,803,596) | ||||||

| Net increase (decrease) in shares of the fund | (91,261,587) | 112,050,062 | ||||||

See Notes to Financial Statements.

11

| Notes to Financial Statements | ||

MARCH 31, 2022

1. Organization

American Century Government Income Trust (the trust) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Massachusetts business trust. Capital Preservation Fund (the fund) is one fund in a series issued by the trust. The fund is a money market fund and its investment objective is to seek maximum safety and liquidity. Its secondary objective is to seek to pay shareholders the highest rate of return consistent with safety and liquidity.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. Investments are generally valued at amortized cost, which approximates fair value. If the fund determines that the amortized cost does not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Trustees or its delegate, in accordance with policies and procedures adopted by the Board of Trustees.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Treasury Roll Transactions — The fund purchases a security and at the same time makes a commitment to sell the same security at a future settlement date at a specified price. These types of transactions are known as treasury roll transactions. The difference between the purchase price and the sale price represents interest income reflective of an agreed upon rate between the fund and the counterparty.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Distributions to Shareholders — Distributions from net investment income, if any, are declared daily and paid monthly. The fund may make capital gains distributions to comply with the distribution requirements of the Internal Revenue Code.

Indemnifications — Under the trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

12

3. Fees and Transactions with Related Parties

Certain officers and trustees of the trust are also officers and/or directors of American Century Companies, Inc. (ACC). The trust's investment advisor, American Century Investment Management, Inc. (ACIM), the trust's distributor, American Century Investment Services, Inc., and the trust's transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The trust has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee). The agreement provides that ACIM will pay all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent trustees (including legal counsel fees), and extraordinary expenses. The fee is computed and accrued daily based on the daily net assets of the fund and paid monthly in arrears. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all funds in the American Century Investments family of funds that have the same investment advisor and distributor as the fund. For purposes of determining the Investment Category Fee and Complex Fee, the assets of funds managed by the investment advisor that invest exclusively in the shares of

other funds (funds of funds) are not included. In order to maintain a positive yield, ACIM may voluntarily waive a portion of the management fee on a daily basis. The fee waiver may be revised or terminated at any time by the investment advisor without notice. The rates for the Investment Category Fee range from 0.1370% to 0.2500% and the rates for the Complex Fee range from 0.2500% to 0.3100%. The effective annual management fee for the period ended March 31, 2022 was 0.47% before waiver and 0.07% after waiver.

Trustees’ Fees and Expenses — The Board of Trustees is responsible for overseeing the investment advisor’s management and operations of the fund. The trustees receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Trustees. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. There were no interfund transactions during the period.

4. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

•Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

•Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

•Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

As of period end, the fund’s investment securities were classified as Level 2. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

13

5. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2022 and March 31, 2021 were as follows:

| 2022 | 2021 | |||||||

| Distributions Paid From | ||||||||

| Ordinary income | $ | 219,788 | $ | 329,680 | ||||

| Long-term capital gains | — | — | ||||||

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2022, the fund had undistributed ordinary income for federal income tax purposes of $5,400.

As of March 31, 2022, the fund had accumulated short-term capital losses of $(2,319), which represent net

capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes.

The capital loss carryovers may be carried forward for an unlimited period. Future capital loss carryover

utilization in any given year may be subject to Internal Revenue Code limitations.

14

| Financial Highlights | ||

| For a Share Outstanding Throughout the Years Ended March 31 | ||||||||||||||||||||||||||||||||||||||

| Per-Share Data | Ratios and Supplemental Data | |||||||||||||||||||||||||||||||||||||

| Income From Investment Operations: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period | Net Investment Income (Loss) | Net Realized and Unrealized Gain (Loss) | Total From Investment Operations | Distributions From Net Investment Income | Net Asset Value, End of Period | Total Return(1) | Operating Expenses | Operating Expenses (before expense waiver) | Net Investment Income (Loss) | Net Investment Income (Loss) (before expense waiver) | Net Assets, End of Period (in thousands) | |||||||||||||||||||||||||||

| Investor Class | ||||||||||||||||||||||||||||||||||||||

| 2022 | $1.00 | —(2) | —(2) | —(2) | —(2) | $1.00 | 0.01% | 0.08% | 0.48% | 0.01% | (0.39)% | $2,195,618 | ||||||||||||||||||||||||||

| 2021 | $1.00 | —(2) | —(2) | —(2) | —(2) | $1.00 | 0.01% | 0.21% | 0.48% | 0.01% | (0.26)% | $2,286,880 | ||||||||||||||||||||||||||

| 2020 | $1.00 | 0.01 | —(2) | 0.01 | (0.01) | $1.00 | 1.49% | 0.48% | 0.48% | 1.48% | 1.48% | $2,174,827 | ||||||||||||||||||||||||||

| 2019 | $1.00 | 0.02 | —(2) | 0.02 | (0.02) | $1.00 | 1.63% | 0.48% | 0.48% | 1.62% | 1.62% | $2,091,234 | ||||||||||||||||||||||||||

| 2018 | $1.00 | 0.01 | —(2) | 0.01 | (0.01) | $1.00 | 0.63% | 0.48% | 0.48% | 0.62% | 0.62% | $2,067,473 | ||||||||||||||||||||||||||

| Notes to Financial Highlights | ||

(1)Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized.

(2)Per-share amount was less than $0.005.

See Notes to Financial Statements.

| Report of Independent Registered Public Accounting Firm | ||

To the Shareholders and the Board of Trustees of American Century Government Income Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Capital Preservation Fund (the “Fund”), one of the funds constituting the American Century Government Income Trust, as of March 31, 2022, the related statement of operations, statement of changes in net assets, and financial highlights for the year then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of Capital Preservation Fund of the American Century Government Income Trust as of March 31, 2022, and the results of its operations, the changes in its net assets, and the financial highlights for the year then ended in conformity with accounting principles generally accepted in the United States of America. The statement of changes in net assets for the year ended March 31, 2021 and the financial highlights for each of the four years in the period ended March 31, 2021 were audited by other auditors, whose report, dated May 18, 2021, expressed an unqualified opinion on such statement of changes in net assets and financial highlights.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of March 31, 2022, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Kansas City, Missouri

May 16, 2022

We have served as the auditor of one or more American Century investment companies since 1997.

16

| Management | ||

Board of Trustees

The individuals listed below serve as trustees of the funds. Each trustee will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for trustees who are not “interested persons,” as that term is defined in the Investment Company Act (independent trustees). Independent trustees shall retire on December 31 of the year in which they reach their 76th birthday.

Jonathan S. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). The other trustees (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS), and they do not have any other affiliations, positions or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The trustees serve in this capacity for eight (in the case of Jonathan S. Thomas, 16; and Jeremy I. Bulow, 9) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the trustees. The mailing address for each trustee other than Jonathan S. Thomas is 3945 Freedom Circle, Suite #800, Santa Clara, California 95054. The mailing address for Jonathan S. Thomas is 4500 Main Street, Kansas City, Missouri 64111.

| Name (Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years | ||||||||||||

| Independent Trustees | |||||||||||||||||

| Tanya S. Beder (1955) | Trustee and Board Chair | Since 2011 (Board Chair since 2022) | Chairman and CEO, SBCC Group Inc. (independent advisory services) (2006 to present) | 38 | Kirby Corporation; Nabors Industries, Ltd.; CYS Investments, Inc.(2012-2017) | ||||||||||||

| Jeremy I. Bulow (1954) | Trustee | Since 2011 | Professor of Economics, Stanford University, Graduate School of Business (1979 to present) | 78 | None | ||||||||||||

| Jennifer Cabalquinto (1968) | Trustee | Since 2021 | Chief Financial Officer, 2K (interactive entertainment) (2021 to present); Special Advisor, GSW Sports, LLC (2020 to 2021); Chief Financial Officer, GSW Sports, LLC (2013 to 2020) | 38 | Sabio Holdings, Inc. | ||||||||||||

| Anne Casscells (1958) | Trustee | Since 2016 | Co-Chief Executive Officer and Chief Investment Officer, Aetos Alternatives Management (investment advisory firm) (2001 to present); Lecturer in Accounting, Stanford University, Graduate School of Business (2009 to 2017) | 38 | None | ||||||||||||

17

| Name (Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Trustee | Other Directorships Held During Past 5 Years | ||||||||||||

| Independent Trustees | |||||||||||||||||

| Jonathan D. Levin (1972) | Trustee | Since 2016 | Philip H. Knight Professor and Dean, Graduate School of Business, Stanford University (2016 to present); Professor, Stanford University, (2000 to present) | 38 | None | ||||||||||||

| Peter F. Pervere (1947) | Trustee | Since 2007 | Retired | 38 | None | ||||||||||||

| John B. Shoven (1947) | Trustee | Since 2002 | Charles R. Schwab Professor of Economics, Stanford University (1973 to present, emeritus since 2019) | 38 | Cadence Design Systems; Exponent; Financial Engines | ||||||||||||

| Interested Trustee | |||||||||||||||||

| Jonathan S. Thomas (1963) | Trustee | Since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Director, ACC and other ACC subsidiaries | 146 | None | ||||||||||||

The Statement of Additional Information has additional information about the fund's trustees and is available without charge, upon request, by calling 1-800-345-2021.

18

Officers

The following table presents certain information about the executive officers of the funds. Each officer serves as an officer for 16 (in the case of Robert J. Leach, 15) investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the funds. The listed officers are interested persons of the funds and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

| Name (Year of Birth) | Offices with the Funds | Principal Occupation(s) During the Past Five Years | ||||||

| Patrick Bannigan (1965) | President since 2019 | Executive Vice President and Director, ACC (2012 to present); Chief Financial Officer, Chief Accounting Officer and Treasurer, ACC (2015 to present). Also serves as President, ACS; Vice President, ACIM; Chief Financial Officer, Chief Accounting Officer and/or Director, ACIM, ACS and other ACC subsidiaries | ||||||

| R. Wes Campbell (1974) | Chief Financial Officer and Treasurer since 2018 | Vice President, ACS (2020 to present); Investment Operations and Investment Accounting, ACS (2000 to present) | ||||||

| Amy D. Shelton (1964) | Chief Compliance Officer and Vice President since 2014 | Chief Compliance Officer, American Century funds, (2014 to present); Chief Compliance Officer, ACIM (2014 to present); Chief Compliance Officer, ACIS (2009 to present). Also serves as Vice President, ACIS | ||||||

| John Pak (1968) | General Counsel and Senior Vice President since 2021 | General Counsel and Senior Vice President, ACC (2021 to present); Also serves as General Counsel and Senior Vice President, ACIM, ACS and ACIS. Chief Legal Officer of Investment and Wealth Management, The Bank of New York Mellon (2014 to 2021) | ||||||

| C. Jean Wade (1964) | Vice President since 2012 | Senior Vice President, ACS (2017 to present); Vice President ACS (2000 to 2017) | ||||||

| Robert J. Leach (1966) | Vice President since 2006 | Vice President, ACS (2000 to present) | ||||||

| David H. Reinmiller (1963) | Vice President since 2000 | Attorney, ACC (1994 to present). Also serves as Vice President, ACIM and ACS | ||||||

| Ward D. Stauffer (1960) | Secretary since 2005 | Attorney, ACC (2003 to present) | ||||||

19

| Liquidity Risk Management Program | ||

The Fund has adopted a liquidity risk management program (the “program”). The Fund’s Board of Trustees (the "Board") has designated American Century Investment Management, Inc. (“ACIM”) as the administrator of the program. Personnel of ACIM or its affiliates conduct the day-to-day operation of the program pursuant to policies and procedures administered by the Program Administrator, including members of ACIM’s Investment Oversight Committee who are members of the ACIM’s Investment Management and Global Analytics departments.

Under the program, ACIM manages the Fund’s liquidity risk, which is the risk that the Fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the Fund. This risk is managed by monitoring the degree of liquidity of the Fund’s investments, limiting the amount of the Fund’s illiquid investments, and utilizing various risk management tools and facilities available to the Fund for meeting shareholder redemptions, among other means. ACIM’s process of determining the degree of liquidity of certain Fund’s investments is supported by a third-party liquidity assessment vendor.

The Board reviewed a report prepared by ACIM regarding the operation and effectiveness of the program for the period January 1, 2021 through December 31, 2021. No significant liquidity events impacting the Fund were noted in the report. In addition, ACIM provided its assessment that the program had been effective in managing the Fund’s liquidity risk.

20

| Additional Information | ||

Retirement Account Information

As required by law, distributions you receive from certain retirement accounts are subject to federal income tax withholding, unless you elect not to have withholding apply*. Tax will be withheld on the total amount withdrawn even though you may be receiving amounts that are not subject to withholding, such as nondeductible contributions. In such case, excess amounts of withholding could occur. You may adjust your withholding election so that a greater or lesser amount will be withheld.

If you don’t want us to withhold on this amount, you must notify us to not withhold the federal income tax. You may notify us in writing or in certain situations by telephone or through other electronic means. For systematic withdrawals, your withholding election will remain in effect until revoked or changed by filing a new election. You have the right to revoke your election at any time and change your withholding percentage for future distributions.

Remember, even if you elect not to have income tax withheld, you are liable for paying income tax on the taxable portion of your withdrawal. If you elect not to have income tax withheld or you don’t have enough income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the estimated tax rules if your withholding and estimated tax payments are not sufficient. You can reduce or defer the income tax on a distribution by directly or indirectly rolling such distribution over to another IRA or eligible plan. You should consult your tax advisor for additional information.

State tax will be withheld if, at the time of your distribution, your address is within one of the mandatory withholding states and you have federal income tax withheld (or as otherwise required by state law). State taxes will be withheld from your distribution in accordance with the respective state rules.

*Some 403(b), 457 and qualified retirement plan distributions may be subject to 20% mandatory withholding, as they are subject to special tax and withholding rules. Your plan administrator or plan sponsor is required to provide you with a special tax notice explaining those rules at the time you request a distribution. If applicable, federal and/or state taxes may be withheld from your distribution amount.

Proxy Voting Policies

Descriptions of the principles and policies that the fund's investment advisor uses in exercising the voting rights associated with the securities purchased and/or held by the fund are available without charge, upon request, by calling 1-800-345-2021 or visiting American Century Investments’ website at americancentury.com/proxy. A description of the policies is also available on the Securities and Exchange Commission’s website at sec.gov. Information regarding how the investment advisor voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available on americancentury.com/proxy. It is also available at sec.gov.

Portfolio Holdings Disclosure

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) each month on Form N-MFP. The fund’s Form N-MFP reports are available on its website at americancentury.com and on the SEC’s website at sec.gov. The fund also makes its complete schedule of portfolio holdings for the most recent first and third quarters of its fiscal year available on its website at americancentury.com and, upon request, by calling 1-800-345-2021.

21

| Notes | ||

22

| Notes | ||

23

| Notes | ||

24

| ||||||||

| Contact Us | americancentury.com | |||||||

| Automated Information Line | 1-800-345-8765 | |||||||

| Investor Services Representative | 1-800-345-2021 or 816-531-5575 | |||||||

| Investors Using Advisors | 1-800-378-9878 | |||||||

| Business, Not-For-Profit, Employer-Sponsored Retirement Plans | 1-800-345-3533 | |||||||

| Banks and Trust Companies, Broker-Dealers, Financial Professionals, Insurance Companies | 1-800-345-6488 | |||||||

| Telecommunications Relay Service for the Deaf | 711 | |||||||

| American Century Government Income Trust | ||||||||

Investment Advisor: American Century Investment Management, Inc. Kansas City, Missouri | ||||||||

| This report and the statements it contains are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. | ||||||||

| ©2022 American Century Proprietary Holdings, Inc. All rights reserved. CL-ANN-92274 2205 | ||||||||

| Annual Report | |||||

| March 31, 2022 | |||||

| Ginnie Mae Fund | |||||

| Investor Class (BGNMX) | |||||

| I Class (AGMHX) | |||||

| A Class (BGNAX) | |||||

| C Class (BGNCX) | |||||

| R Class (AGMWX) | |||||

| R5 Class (AGMNX) | |||||

| Table of Contents | ||

| President’s Letter | |||||

| Performance | |||||

| Portfolio Commentary | |||||

| Fund Characteristics | |||||

| Shareholder Fee Example | |||||

| Schedule of Investments | |||||

| Statement of Assets and Liabilities | |||||

| Statement of Operations | |||||

| Statement of Changes in Net Assets | |||||

| Notes to Financial Statements | |||||

| Financial Highlights | |||||

| Report of Independent Registered Public Accounting Firm | |||||

| Management | |||||

| Liquidity Risk Management Program | |||||

| Additional Information | |||||

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter | ||

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Soaring Inflation, Escalating Volatility Led to Mixed Results for Stocks and Bonds

Upbeat economic and earnings data and continued Federal Reserve (Fed) support generally buoyed stock returns for most of the reporting period. Despite periodic outbreaks of COVID-19, the worst of the virus appeared over in the U.S., and pre-pandemic activities gradually resumed. Bonds delivered solid gains in the first half of the period before a Fed policy pivot triggered a drastic sentiment shift in fixed-income markets.

Early in the period, inflation began a steady upward march. Initially, the Fed was unfazed, viewing the price hikes as a temporary economic consequence of recovering from the pandemic. But by late 2021, inflation was surging toward multidecade highs, prompting the Fed to adopt a more hawkish strategy.

Policymakers announced an abrupt end to bond buying followed by a March rate hike, the first since 2018. At period-end, market indicators reflected expectations for more aggressive Fed rate hikes along with balance sheet cuts to tame inflation.

In addition to an 8.5% annual inflation rate and a hawkish Fed, Russia’s invasion of Ukraine further rattled investors in early 2022. Stocks declined sharply amid the unrest, but strong performance earlier in the fiscal year left most U.S. indices with solid 12-month gains. For bonds, declines in the second half of the reporting period overwhelmed earlier gains, and most U.S. fixed-income indices retreated for the 12 months overall.

Staying Focused in Uncertain Times

We expect market volatility to linger amid elevated inflation and tighter Fed policy. In addition, Russia’s invasion of Ukraine has led to a devastating humanitarian crisis and further complicated a tense geopolitical backdrop. We will continue to monitor the evolving situation and its implications for our clients and our investment exposure.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable and volatile markets, and we’re confident we will continue to meet prevailing challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance | ||

| Total Returns as of March 31, 2022 | ||||||||||||||||||||

| Average Annual Returns | ||||||||||||||||||||

| Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date | |||||||||||||||

| Investor Class | BGNMX | -5.41% | 0.98% | 1.14% | — | 9/23/85 | ||||||||||||||

| Bloomberg U.S. GNMA Index | — | -4.60% | 1.24% | 1.52% | — | — | ||||||||||||||

| I Class | AGMHX | -5.22% | — | — | 1.08% | 4/10/17 | ||||||||||||||

| A Class | BGNAX | 10/9/97 | ||||||||||||||||||

| No sales charge | -5.65% | 0.73% | 0.89% | — | ||||||||||||||||

| With sales charge | -9.90% | -0.20% | 0.43% | — | ||||||||||||||||

| C Class | BGNCX | -6.35% | -0.02% | 0.14% | — | 3/1/10 | ||||||||||||||

| R Class | AGMWX | -5.79% | 0.48% | 0.64% | — | 9/28/07 | ||||||||||||||

| R5 Class | AGMNX | -5.22% | 1.19% | 1.34% | — | 9/28/07 | ||||||||||||||

Average annual returns since inception are presented when ten years of performance history is not available.

C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

3

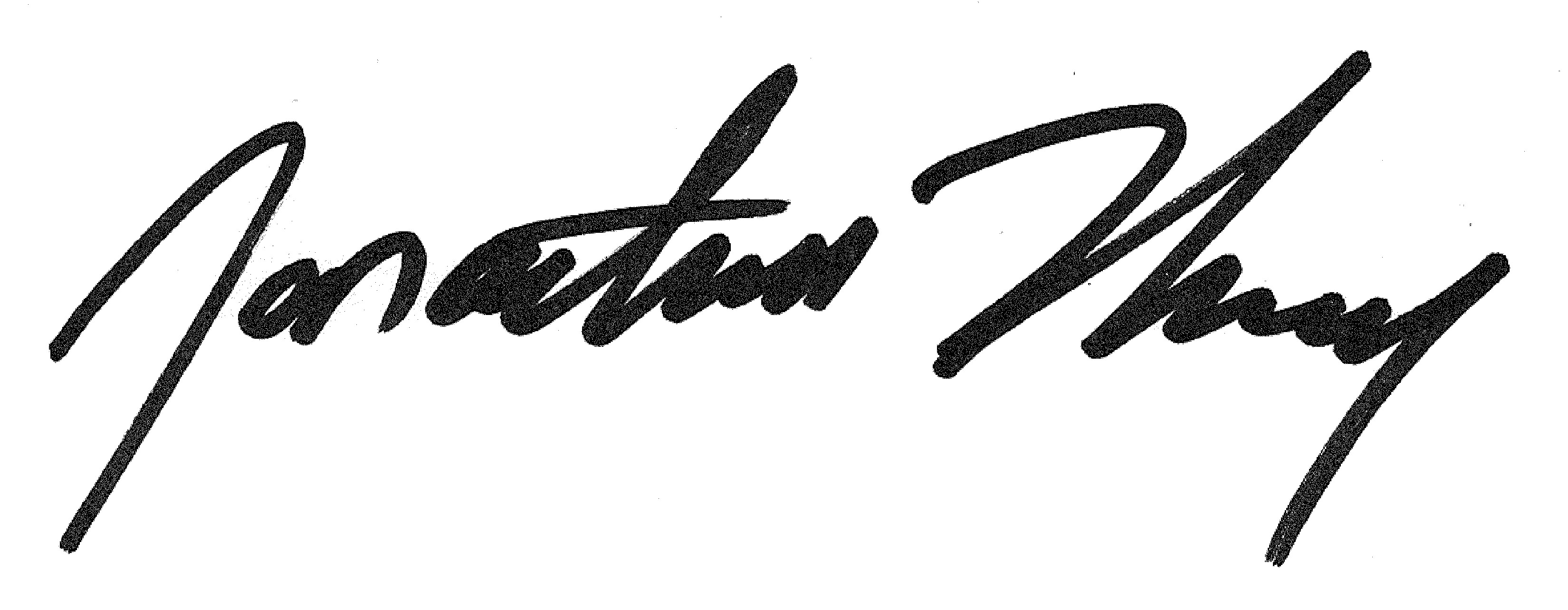

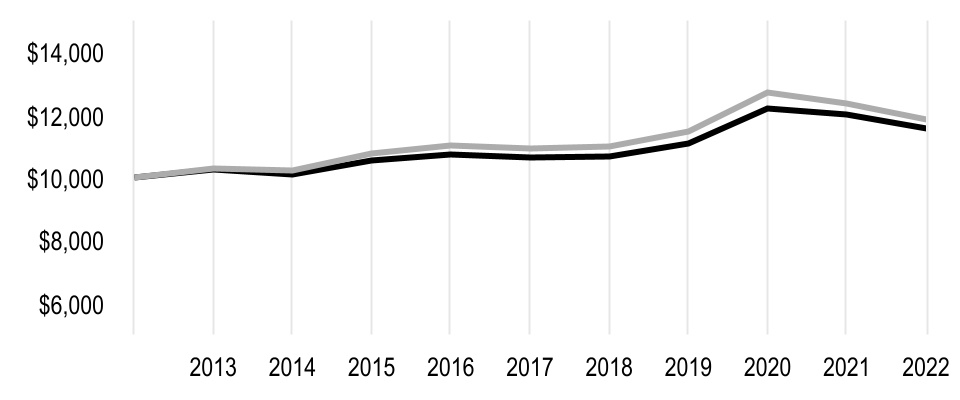

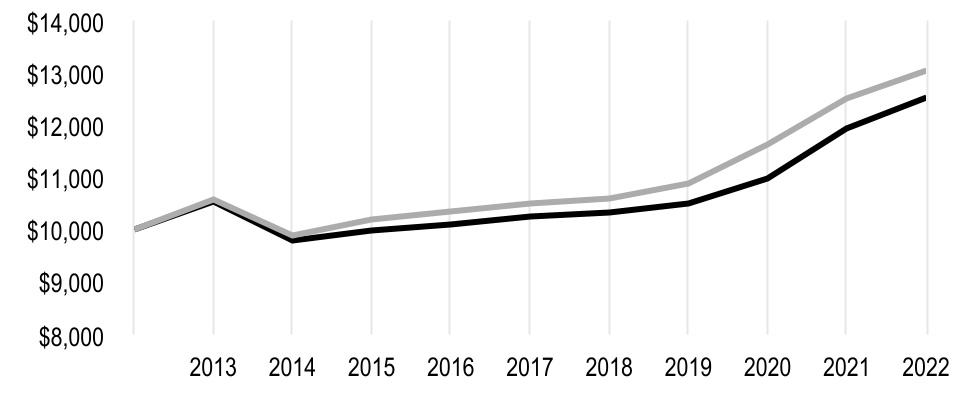

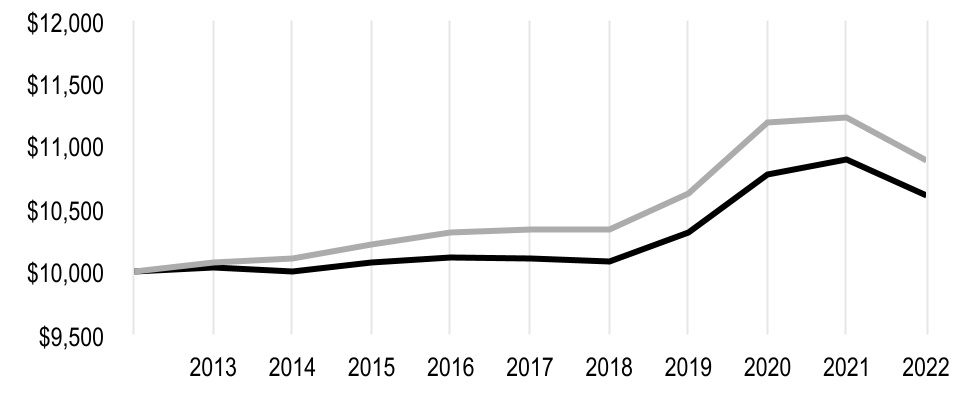

| Growth of $10,000 Over 10 Years | ||

| $10,000 investment made March 31, 2012 | ||

| Performance for other share classes will vary due to differences in fee structure. | ||

| Value on March 31, 2022 | |||||

| Investor Class — $11,203 | |||||

| Bloomberg U.S. GNMA Index — $11,624 | |||||

| Total Annual Fund Operating Expenses | |||||||||||||||||

| Investor Class | I Class | A Class | C Class | R Class | R5 Class | ||||||||||||

| 0.55% | 0.45% | 0.80% | 1.55% | 1.05% | 0.35% | ||||||||||||

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

4

| Portfolio Commentary | ||

Portfolio Managers: Peter Van Gelderen, Dan Shiffman, Bob Gahagan and Jesse Singh

In August 2021, Peter Van Gelderen joined the fund’s portfolio management team, and Hando Aguilar left the team.

Performance Summary

Ginnie Mae returned -5.41%* for the 12 months ended March 31, 2022. By comparison, the Bloomberg U.S. GNMA Index declined -4.60%. Fund returns reflect operating expenses, while index returns do not.

Inflation and changing Federal Reserve (Fed) policy dominated the market backdrop during the reporting period. Inflation started the period higher than the Fed’s longtime 2% target and remained on an upward trajectory. Persistent supply chain challenges, surging demand, soaring oil and commodity prices, labor shortages and fiscal policy contributed to spiking prices.

Fed policy generally remained dovish until late 2021, as inflation showed no signs of easing. Until then, policymakers had insisted rising prices would be transitory. The Fed accelerated the tapering of its bond-buying program and in March 2022 finally hiked interest rates just as inflation was revisiting 40-year highs.

The U.S. economy expanded at a healthy clip through much of the period, bolstered by robust manufacturing activity, a strong housing market and job gains. By period-end, however, business and consumer confidence wavered, and retail sales weakened in the face of soaring prices and sharply higher interest rates.

Resurgent waves of COVID-19 cases and, in the period’s final weeks, Russia’s invasion of Ukraine contributed to significant rate volatility during the period. After starting the reporting period at 1.75%, the 10-year Treasury yield ended March 2022 at 2.34%, fueled by an 83-basis-point jump in the first quarter of 2022. More closely tied to the Fed’s key rate, the two-year Treasury yield jumped from 0.16% at the start of the period to 2.34%, including a 161-basis-point surge during the first quarter of 2022. The Treasury yield curve flattened significantly during the period, reflecting a larger rise in short-maturity yields than in long-maturity yields.

For most of the period, a robust housing market and attractive mortgage rates helped support the broad mortgage-backed securities (MBS) market. However, when the Fed ended its quantitative easing (QE) program, which initially included monthly MBS purchases of $40 billion, the mortgage market lost a significant buyer. At the same time, rising Treasury yields and expectations for aggressive Fed tightening drove mortgage rates higher, further pressuring the housing market.

For the full 12-month period, most bond market sectors, including MBS, declined. Against this backdrop, security selection accounted for much of Ginnie Mae’s underperformance.

Security Selection Detracted

Within the portfolio, security selection was the main detractor from relative performance. In particular, our selections among lower-coupon Ginnie Mae securities weighed on results in late

2021, as the Fed began tapering. Previously, these securities benefited from the Fed’s QE program, which favored lower-coupon mortgages, and from their lower prepayment risk versus higher-coupon mortgages.

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the index, other share classes may not. See page 3 for returns for all share classes.

5

But, as tapering took hold and prepayment risk increased, these securities suffered. In early 2022, we shifted portfolio exposure to favor higher-coupon securities in anticipation of rising interest and mortgage rates. This strategy aided relative results late in the period.

Allocations, Out-of-Index Holdings Added Value

We continued to favor 30-year Ginnie Mae securities over 15-year securities. This strategy lifted results through the first several months of the period, largely due to the Fed’s purchase of longer-maturity MBS as part of QE. Within the 30-year segment, we emphasized deep discount Ginnie Maes in demographically and geographically diverse pools.

We continued to invest in out-of-index securities, including agency collateralized mortgage obligations and agency adjustable-rate mortgages. These positions contributed modestly to results.

Portfolio Positioning

We believe the U.S. economy will continue to grow in the coming quarters, but likely at a slower pace than in 2021. We believe elevated market volatility will persist as investors contend with potential headwinds, including ongoing pressures from elevated inflation, Fed tightening and geopolitical unrest. The annual headline inflation may peak in the coming months. However, several factors, including supply chain issues, record federal spending and deficits, rising wages and deglobalization, likely will keep inflation well above pre-pandemic levels.

The Fed faces a formidable task in tempering inflation without triggering a recession. Anticipating further Fed tightening and elevated inflation, we believe bond market yields may yet climb modestly higher, so we ended the period with a relatively short duration. An inverted yield curve remains a possibility, but we don’t think a recession is imminent, largely due to relatively strong economic fundamentals.

So far, rising mortgage rates haven’t dampened housing demand. However, because we expect rates to move higher, we believe housing demand eventually will slow. In our view, this scenario warrants continued focus on security selection.

6

| Fund Characteristics | ||

| MARCH 31, 2022 | |||||

| Types of Investments in Portfolio | % of net assets | ||||

| U.S. Government Agency Mortgage-Backed Securities (all GNMAs) | 100.6% | ||||

| U.S. Government Agency Collateralized Mortgage Obligations (all GNMAs) | 7.6% | ||||

| Short-Term Investments | 9.7% | ||||

| Other Assets and Liabilities | (17.9)% | ||||

7

| Shareholder Fee Example | ||

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2021 to March 31, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

| Beginning Account Value 10/1/21 | Ending Account Value 3/31/22 | Expenses Paid During Period(1) 10/1/21 - 3/31/22 | Annualized Expense Ratio(1) | |||||||||||

| Actual | ||||||||||||||

| Investor Class | $1,000 | $949.70 | $2.62 | 0.54% | ||||||||||

| I Class | $1,000 | $951.10 | $2.14 | 0.44% | ||||||||||

| A Class | $1,000 | $948.50 | $3.84 | 0.79% | ||||||||||

| C Class | $1,000 | $944.90 | $7.47 | 1.54% | ||||||||||

| R Class | $1,000 | $948.20 | $5.05 | 1.04% | ||||||||||

| R5 Class | $1,000 | $950.60 | $1.65 | 0.34% | ||||||||||

| Hypothetical | ||||||||||||||

| Investor Class | $1,000 | $1,022.24 | $2.72 | 0.54% | ||||||||||

| I Class | $1,000 | $1,022.74 | $2.22 | 0.44% | ||||||||||

| A Class | $1,000 | $1,020.99 | $3.98 | 0.79% | ||||||||||

| C Class | $1,000 | $1,017.25 | $7.75 | 1.54% | ||||||||||

| R Class | $1,000 | $1,019.75 | $5.24 | 1.04% | ||||||||||

| R5 Class | $1,000 | $1,023.24 | $1.72 | 0.34% | ||||||||||

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

9

| Schedule of Investments | ||

MARCH 31, 2022

| Principal Amount | Value | |||||||

| U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES — 100.6% | ||||||||

| Adjustable-Rate U.S. Government Agency Mortgage-Backed Securities — 2.6% | ||||||||

| GNMA, VRN, 1.625%, (1-year H15T1Y plus 1.50%), 8/20/36 to 3/20/48 | $ | 6,733,921 | $ | 6,875,294 | ||||

| GNMA, VRN, 1.75%, (1-year H15T1Y plus 1.50%), 10/20/27 to 10/20/35 | 1,892,035 | 1,940,257 | ||||||

| GNMA, VRN, 1.875%, (1-year H15T1Y plus 1.50%), 4/20/38 | 2,400,607 | 2,486,644 | ||||||

| GNMA, VRN, 2.00%, (1-year H15T1Y plus 1.50%), 2/20/34 | 2,358,763 | 2,412,329 | ||||||

| GNMA, VRN, 3.50%, (1-year H15T1Y plus 1.50%), 8/20/49 | 2,125,969 | 2,125,362 | ||||||

| 15,839,886 | ||||||||

| Fixed-Rate U.S. Government Agency Mortgage-Backed Securities — 98.0% | ||||||||

| GNMA, 2.00%, 4/20/51 to 1/20/52 | 88,833,133 | 84,126,829 | ||||||

| GNMA, 2.50%, 7/20/46 to 9/20/51 | 96,742,163 | 93,876,975 | ||||||

| GNMA, 2.50%, 4/21/52, TBA | 29,144,273 | 28,268,806 | ||||||

| GNMA, 3.00%, 2/20/43 to 2/20/52 | 133,997,303 | 132,877,671 | ||||||

| GNMA, 3.50%, 12/20/41 to 1/20/48 | 55,215,943 | 56,534,652 | ||||||

GNMA, 3.50%, 4/20/42(1) | 11,520,317 | 11,832,056 | ||||||

| GNMA, 3.50%, 4/21/52, TBA | 56,220,000 | 56,545,022 | ||||||

| GNMA, 4.00%, 12/20/39 to 2/20/47 | 37,393,462 | 39,411,625 | ||||||

| GNMA, 4.00%, 4/21/52, TBA | 21,625,000 | 22,057,500 | ||||||

| GNMA, 4.50%, 7/15/33 to 3/20/42 | 18,788,317 | 20,124,570 | ||||||

| GNMA, 5.00%, 6/15/33 to 5/20/41 | 18,425,867 | 20,260,182 | ||||||

| GNMA, 5.50%, 4/15/33 to 8/15/39 | 11,425,130 | 12,648,729 | ||||||

| GNMA, 6.00%, 2/20/26 to 2/20/39 | 9,321,173 | 10,310,815 | ||||||

| GNMA, 6.50%, 9/20/23 to 11/15/38 | 1,213,498 | 1,340,933 | ||||||

| GNMA, 7.00%, 12/20/25 to 12/20/29 | 232,328 | 253,942 | ||||||

| GNMA, 7.25%, 6/15/23 | 5,109 | 5,126 | ||||||

| GNMA, 7.50%, 12/20/23 to 2/20/31 | 59,000 | 65,650 | ||||||

| GNMA, 8.00%, 7/15/22 to 7/20/30 | 131,916 | 135,132 | ||||||

| GNMA, 8.50%, 5/20/22 to 12/15/30 | 50,639 | 55,587 | ||||||

| GNMA, 8.75%, 7/15/27 | 21,313 | 21,398 | ||||||

| GNMA, 9.00%, 5/15/22 to 12/15/24 | 1,630 | 1,635 | ||||||

| GNMA, 9.25%, 3/15/25 | 15,914 | 15,980 | ||||||

| GNMA, 9.50%, 12/20/24 to 7/20/25 | 15,490 | 15,632 | ||||||

| 590,786,447 | ||||||||

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Cost $625,753,765) | 606,626,333 | |||||||

| U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS — 7.6% | ||||||||

| GNMA, Series 2002-13, Class FA, VRN, 0.93%, (1-month LIBOR plus 0.50%), 2/16/32 | 174,896 | 174,916 | ||||||

| GNMA, Series 2003-110, Class F, VRN, 0.85%, (1-month LIBOR plus 0.40%), 10/20/33 | 656,856 | 658,259 | ||||||

| GNMA, Series 2003-66, Class HF, VRN, 0.90%, (1-month LIBOR plus 0.45%), 8/20/33 | 352,713 | 354,157 | ||||||

| GNMA, Series 2004-76, Class F, VRN, 0.85%, (1-month LIBOR plus 0.40%), 9/20/34 | 619,001 | 620,760 | ||||||

| GNMA, Series 2005-13, Class FA, VRN, 0.65%, (1-month LIBOR plus 0.20%), 2/20/35 | 1,308,273 | 1,304,879 | ||||||

| GNMA, Series 2007-5, Class FA, VRN, 0.59%, (1-month LIBOR plus 0.14%), 2/20/37 | 1,328,031 | 1,326,663 | ||||||

| GNMA, Series 2007-58, Class FC, VRN, 0.95%, (1-month LIBOR plus 0.50%), 10/20/37 | 794,256 | 797,714 | ||||||

10

| Principal Amount/Shares | Value | |||||||

| GNMA, Series 2007-74, Class FL, VRN, 0.89%, (1-month LIBOR plus 0.46%), 11/16/37 | $ | 2,297,154 | $ | 2,305,503 | ||||

| GNMA, Series 2008-18, Class FH, VRN, 1.05%, (1-month LIBOR plus 0.60%), 2/20/38 | 1,196,138 | 1,196,384 | ||||||

| GNMA, Series 2008-2, Class LF, VRN, 0.91%, (1-month LIBOR plus 0.46%), 1/20/38 | 951,240 | 954,957 | ||||||

| GNMA, Series 2008-27, Class FB, VRN, 1.00%, (1-month LIBOR plus 0.55%), 3/20/38 | 1,853,792 | 1,864,194 | ||||||

| GNMA, Series 2008-61, Class KF, VRN, 1.12%, (1-month LIBOR plus 0.67%), 7/20/38 | 919,978 | 926,711 | ||||||

| GNMA, Series 2008-73, Class FK, VRN, 1.21%, (1-month LIBOR plus 0.76%), 8/20/38 | 1,319,703 | 1,331,870 | ||||||

| GNMA, Series 2008-75, Class F, VRN, 0.98%, (1-month LIBOR plus 0.53%), 8/20/38 | 1,620,777 | 1,626,439 | ||||||

| GNMA, Series 2008-88, Class UF, VRN, 1.45%, (1-month LIBOR plus 1.00%), 10/20/38 | 830,412 | 837,153 | ||||||

| GNMA, Series 2009-127, Class FA, VRN, 1.00%, (1-month LIBOR plus 0.55%), 9/20/38 | 1,238,788 | 1,246,130 | ||||||

| GNMA, Series 2009-76, Class FB, VRN, 1.03%, (1-month LIBOR plus 0.60%), 6/16/39 | 161,057 | 161,272 | ||||||

| GNMA, Series 2009-92, Class FJ, VRN, 1.11%, (1-month LIBOR plus 0.68%), 10/16/39 | 509,113 | 515,501 | ||||||

| GNMA, Series 2010-101, Class FH, VRN, 0.78%, (1-month LIBOR plus 0.35%), 8/16/40 | 2,982,369 | 2,983,916 | ||||||

| GNMA, Series 2010-25, Class FB, VRN, 0.98%, (1-month LIBOR plus 0.55%), 2/16/40 | 2,941,708 | 2,966,608 | ||||||

| GNMA, Series 2012-38, Class FA, VRN, 0.85%, (1-month LIBOR plus 0.40%), 3/20/42 | 2,035,723 | 2,038,750 | ||||||

| GNMA, Series 2012-97, Class CF, VRN, 0.88%, (1-month LIBOR plus 0.45%), 8/16/42 | 1,897,430 | 1,908,305 | ||||||

| GNMA, Series 2015-111, Class FK, VRN, 0.43%, (1-month LIBOR plus 0.20%), 8/20/45 | 2,678,662 | 2,668,227 | ||||||

| GNMA, Series 2016-68, Class MF, VRN, 0.53%, (1-month LIBOR plus 0.30%), 5/20/46 | 1,285,608 | 1,284,547 | ||||||

| GNMA, Series 2019-110, Class F, VRN, 0.90%, (1-month LIBOR plus 0.45%), 9/20/49 | 8,416,631 | 8,448,898 | ||||||

| GNMA, Series 2021-151, Class AB SEQ, 1.75%, 2/16/62 | 3,108,021 | 2,910,020 | ||||||

| GNMA, Series 2021-164, Class AH SEQ, 1.50%, 10/16/63 | 2,850,800 | 2,632,982 | ||||||

TOTAL U.S. GOVERNMENT AGENCY COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $46,444,590) | 46,045,715 | |||||||

| SHORT-TERM INVESTMENTS — 9.7% | ||||||||

| Money Market Funds — 2.4% | ||||||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 14,596,592 | 14,596,592 | ||||||

| Repurchase Agreements — 7.3% | ||||||||

| BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 3.125% - 3.625%, 2/15/43 - 8/15/43, valued at $4,068,449), in a joint trading account at 0.26%, dated 3/31/22, due 4/1/22 (Delivery value $3,987,951) | 3,987,922 | |||||||

| Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.875% - 3.75%, 5/15/43 - 11/15/43, valued at $40,677,661), at 0.25%, dated 3/31/22, due 4/1/22 (Delivery value $39,880,277) | 39,880,000 | |||||||

| 43,867,922 | ||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $58,464,514) | 58,464,514 | |||||||

TOTAL INVESTMENT SECURITIES — 117.9% (Cost $730,662,869) | 711,136,562 | |||||||

| OTHER ASSETS AND LIABILITIES — (17.9)% | (107,919,155) | |||||||

| TOTAL NET ASSETS — 100.0% | $ | 603,217,407 | ||||||

11

| FUTURES CONTRACTS PURCHASED | ||||||||||||||

| Reference Entity | Contracts | Expiration Date | Notional Amount | Unrealized Appreciation (Depreciation)^ | ||||||||||

| U.S. Treasury 10-Year Notes | 12 | June 2022 | $ | 1,474,500 | $ | (25,898) | ||||||||

| U.S. Treasury 10-Year Ultra Notes | 15 | June 2022 | 2,032,031 | (37,764) | ||||||||||

| U.S. Treasury 2-Year Notes | 43 | June 2022 | 9,112,641 | (74,662) | ||||||||||

| U.S. Treasury 5-Year Notes | 36 | June 2022 | 4,128,750 | (68,976) | ||||||||||

| U.S. Treasury Long Bonds | 23 | June 2022 | 3,451,437 | (27,732) | ||||||||||

| U.S. Treasury Ultra Bonds | 6 | June 2022 | 1,062,750 | (1,137) | ||||||||||

| $ | 21,262,109 | $ | (236,169) | |||||||||||

^Amount represents value and unrealized appreciation (depreciation).

| NOTES TO SCHEDULE OF INVESTMENTS | ||||||||

| GNMA | - | Government National Mortgage Association | ||||||

| H15T1Y | - | Constant Maturity U.S. Treasury Note Yield Curve Rate Index | ||||||

| LIBOR | - | London Interbank Offered Rate | ||||||

| SEQ | - | Sequential Payer | ||||||

| TBA | - | To-Be-Announced. Security was purchased on a forward commitment basis with an approximate principal amount and maturity date. Actual principal amount and maturity date will be determined upon settlement. | ||||||

| VRN | - | Variable Rate Note. The rate adjusts periodically based upon the terms set forth in the security’s offering documents. The rate shown is effective at the period end and the reference rate and spread, if any, is indicated. The security's effective maturity date may be shorter than the final maturity date shown. | ||||||

(1)Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on forward commitments and/or futures contracts. At the period end, the aggregate value of securities pledged was $1,352,970.

See Notes to Financial Statements.

12

| Statement of Assets and Liabilities | ||

| MARCH 31, 2022 | |||||

| Assets | |||||

| Investment securities, at value (cost of $730,662,869) | $ | 711,136,562 | |||

| Receivable for investments sold | 44,420,067 | ||||

| Receivable for capital shares sold | 56,585 | ||||

| Receivable for variation margin on futures contracts | 32,998 | ||||

| Interest receivable | 1,503,552 | ||||

| 757,149,764 | |||||

| Liabilities | |||||

| Payable for investments purchased | 153,232,286 | ||||

| Payable for capital shares redeemed | 362,368 | ||||

| Accrued management fees | 268,468 | ||||

| Distribution and service fees payable | 9,323 | ||||

| Dividends payable | 59,912 | ||||

| 153,932,357 | |||||

| Net Assets | $ | 603,217,407 | |||

| Net Assets Consist of: | |||||