UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

UNITED BANCORP, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| þ | No Fee Required | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| • | Title of each class of securities to which transaction applies: | |

| • | Aggregate number of securities to which transaction applies: | |

| • | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| • | Proposed maximum aggregate value of transaction: | |

| • | Total fee paid: | |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

March 26, 2012

Dear Shareholder:

You are invited to attend the 2012 Annual Meeting of Shareholders of United Bancorp, Inc., which will be held at 4:30 p.m. local time on Tuesday, May 8, 2012, at the Downing Center, United Bank & Trust, 209 E. Russell Road, Tecumseh, Michigan.

Please carefully read the accompanying Notice of Annual Meeting and Proxy Statement for information pertaining to the matters to be considered and acted upon at the Annual Meeting.

Your continued interest in the business of United Bancorp, Inc. and its subsidiary, United Bank & Trust, is appreciated, and we hope you will attend the Annual Meeting.

Whether or not you attend, it is important that your shares be represented at the Annual Meeting. Accordingly, please sign, date, and mail the Proxy promptly in the enclosed envelope, or vote your shares online according to the instructions included with your Proxy.

If you wish to vote in accordance with the recommendations of the Board of Directors, it is not necessary to specify your choices; merely sign, date, and return the enclosed Proxy.

Sincerely,

| /s/ James C. Lawson | /s/ Robert K. Chapman | |

| James C. Lawson | Robert K. Chapman | |

| Chairman of the Board | President and Chief Executive Officer |

United Bancorp, Inc. Ÿ Post Office Box 1127 Ÿ 2723 South State Street Ÿ Ann Arbor, Michigan 48104 Ÿ Phone 734.214.3700

Notice of

Annual Meeting of Shareholders

and

Proxy Statement

| 2012 |

P. O. Box 1127

Ann Arbor, MI 48104

Notice of Annual Meeting

of Shareholders

May 8, 2012

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of United Bancorp, Inc. will be held at the Downing Center, United Bank & Trust, 209 E. Russell Road, Tecumseh, Michigan, on Tuesday, May 8, 2012 at 4:30 p.m., local time. At the meeting, we will consider and vote on the following matters:

| 1. | To elect three directors constituting Class III of the Board of Directors, to serve until the 2015 Annual Meeting of Shareholders and upon the election of their successors. |

| 2. | To consider and approve an advisory proposal to approve the Company’s executive compensation practices as disclosed in the Proxy Statement. |

| 3. | To ratify the appointment of BKD, LLP as independent auditors. |

We will also conduct such other business as may properly come before the meeting or any adjournment of the meeting.

The Board of Directors has fixed the close of business on March 12, 2012 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

You are invited to attend the meeting in person. However, whether or not you expect to attend in person, please promptly sign and date your Proxy, and mail it in the return envelope that is enclosed for that purpose. It will assist us in preparing for the meeting, and it is important that your shares be represented at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 8, 2012. Our Proxy Statement, form of Proxy and 2011 Annual Report to Shareholders are available free of charge on our website, www.ubat.com.

| March 26, 2012 | By Order of the Board of Directors |

/s/ Randal J. Rabe | |

| Randal J. Rabe |

2012 Proxy Statement

| 1 | |

| 2 | |

| 3 | |

| 3 | |

| 4 | |

| 4 | |

| 4 | |

| 6 | |

| 7 | |

| 7 | |

| 7 | |

| 8 | |

| 10 | |

| 10 | |

| 10 | |

| 19 | |

| 20 | |

| 21 | |

| 23 | |

| 23 | |

25 | |

26 | |

| 27 | |

27 | |

28 | |

| 29 | |

| 29 | |

29 | |

30 | |

| AR-1 |

Annual Meeting of Shareholders

May 8, 2012

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of United Bancorp, Inc. (the "Company" or “UBI”) of the accompanying Proxy to be used at the 2012 Annual Meeting of Shareholders of the Company and any adjournment of the meeting. The meeting will be held on May 8, 2012 at the time and place and for the purposes stated in the accompanying Notice of Annual Meeting of Shareholders.

This Proxy Statement, Proxy and Notice of Annual Meeting are being mailed to shareholders on or after March 26, 2012. If you have elected to receive your Proxy Statement and Annual Report electronically, we will mail your Proxy by that same date, along with the address of the website where you may download and view your other materials. The mailing address of the principal executive offices of the Company is P.O. Box 1127, Ann Arbor, Michigan 48104.

Only shareholders of record at the close of business on March 12, 2012 will be entitled to notice of and to vote at the meeting. On March 12, 2012, there were 12,697,265 shares of the Company’s Common Stock outstanding and entitled to vote at the meeting. Each share of Common Stock is entitled to one vote. Common Stock constitutes the only voting security of the Company entitled to vote upon the proposals to be presented at the meeting.

Shares represented by properly executed Proxies received by the Company will be voted at the meeting in the manner specified in the Proxies. If no instructions are specified in any Proxy, the shares represented by the Proxy will be voted in favor of the proposals presented at the meeting by the Board of Directors. Any Proxy may be revoked by the person giving it at any time before being voted, either by giving another Proxy bearing a later date or by notifying the Secretary of the Company, Randal J. Rabe, at the Company’s principal executive offices, in writing of revocation or by attending the meeting and voting in person.

The cost of soliciting Proxies will be borne by the Company. The solicitation of Proxies will be made primarily by mail. Officers and regular employees of the Company and its subsidiaries may also solicit proxies, personally and by telephone or other means, for which they will receive no additional compensation and at a minimal cost to the Company. Arrangements may also be made directly by the Company with banks, brokerage houses, custodians, nominees, and fiduciaries to forward soliciting matter to the beneficial owners of stock held of record by them and to obtain authorization for the execution of Proxies. The Company may reimburse institutional holders for reasonable expenses incurred by them in connection with this process.

| Planning to attend the meeting? If your Company stock is held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares “held in street name,” and this Proxy Statement is being forwarded to you by your broker or nominee. Your name does not appear on the register of shareholders and, in order to be admitted to the meeting, you must bring a letter or account statement showing that you are the beneficial owner of the shares. You will not be able to vote at the meeting, and should instruct your broker or nominee how to vote on your behalf, unless you have a legal proxy from the shareholder of record appointing you as its proxy. If you have any questions about the meeting or require special assistance, please call Diane Skeels, Executive Assistant, at (517) 423-1760. |

Generally, broker non-votes occur when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker lacks discretionary voting power to vote those shares. If you do not provide your broker with voting instructions, then your broker has discretionary authority to vote your shares on certain "routine" matters. Election of directors and Proposal 2 are not considered routine matters and your broker will not have discretionary authority to vote your shares on election of directors and Proposal 2. It is important that you promptly provide your broker with voting instructions if you want your shares voted in the election of directors and on Proposal 2. We expect that Proposal 3 will be considered a routine matter and your broker will have discretionary authority to vote your shares on the proposal.

Vote Necessary to Approve Proposals

Election of Directors. A plurality of the shares voting is required to elect Directors. This means that if there are more nominees than positions to be filled, the nominees who receive the most votes will be elected to the open director positions. Abstentions, broker non-votes and other shares that are not voted in person or by proxy will not be included in the vote count.

Proposals 2 and 3. Proposals 2 and 3 will be approved if a majority of the shares that are voted on each proposal at the meeting are voted in favor of each proposal. Abstentions, broker non-votes and other shares that are not voted on Proposals 2 and 3 in person or by proxy will not be included in the vote count.

Required Vote for Other Matters. We do not know of any other matters to be presented at the meeting. Generally, any other proposal to be voted on at the meeting would be approved if a majority of the shares that are voted on the proposal at the meeting are voted in favor of the proposal. Abstentions, broker non-votes and other shares that are not voted on the proposal in person or by proxy would not be included in the vote count.

If any other matter should be presented upon which a vote properly may be taken, the shares represented by Proxies will be voted on the matter in accordance with the judgment of the person or persons named in the Proxies.

Under the Company's Articles of Incorporation and Bylaws, the Board of Directors is divided into three classes. Each year, on a rotating basis, the term of office of the Directors in one of the three classes will expire. Successors to the class of Directors whose terms have expired will be elected for a three-year term. The terms of Directors Robert K. Chapman, Norman G. Herbert and Len M. Middleton expire at the 2012 Annual Meeting of Shareholders. These individuals are Class III Directors.

The Compensation & Governance Committee and the Board of Directors have nominated Robert K. Chapman, Norman G. Herbert and Len M. Middleton for election as Class III Directors at the 2012 Annual Meeting of Shareholders. If elected as Class III Directors at the 2012 Annual Meeting of Shareholders, these individuals will hold office until their terms expire at the 2015 Annual Meeting of Shareholders and thereafter until their successor is elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office.

It is intended that the shares represented by Proxies will be voted for the election of the three nominees unless a contrary direction is indicated. If any of the nominees is unable to serve, the number of Directors to be elected at the meeting may be reduced by the number unable to serve or the individuals named in your Proxy may vote the shares to elect any substitute nominee recommended by the Board of Directors.

Your Board of Directors and Compensation & Governance Committee, which consists entirely of

independent directors, recommend that you vote “FOR” the election of all three nominees as Class III Directors

The Company believes that our executive compensation programs appropriately align executives’ incentives with shareholder interests and are designed to attract and retain high quality executive talent. We also believe that both the Company and shareholders benefit from responsive corporate governance policies and dialogue. In accordance with these beliefs and as required by the Emergency Economic Stabilization Act of 2009 because of the Company’s participation in the U.S. Treasury’s Capital Purchase Program, the Board of Directors has requested an advisory shareholder vote on the Company’s executive compensation.

This proposal (sometimes referred to as a “Say-on-Pay” proposal) gives you as a shareholder the opportunity to endorse or not endorse the compensation of our executives through the following resolution:

“Resolved, that the shareholders approve the Company’s compensation of executives as disclosed in the Proxy Statement, including the Compensation Discussion and Analysis, the tabular disclosure regarding named executive officer compensation and the accompanying narrative disclosure.”

The vote is not binding upon the Board, and may not be construed as overruling a decision by the board or creating an additional fiduciary duty of the Board. However, the Compensation &

Governance Committee will take into account the outcome of the vote when considering future executive compensation decisions.

Your Board of Directors and Compensation & Governance Committee, which consists entirely

of independent directors, recommend that you vote “FOR” Proposal 2.

The Audit Committee and the Board of Directors recommend the ratification of the appointment of BKD, LLP as independent auditors for the Company for the year ending December 31, 2012 to audit the consolidated financial statements of the Company and to perform such other appropriate accounting services as may be approved by the Audit Committee. BKD, LLP has been appointed as the Company’s independent public accountants to audit the Company's financial statements since the year ended December 31, 2002. One or more representatives of the firm of BKD, LLP are expected to be present at the meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Your Board of Directors and Audit Committee, which consists entirely of

independent directors, recommend that you vote “FOR” Proposal 3.

Information Concerning Nominees and Incumbent Directors

The following table discloses the name and age of each incumbent Director and Director Nominee, his or her five year business experience, the specific experience qualifications, attributes and skills that led to the conclusion of the Compensation & Governance Committee and the Board of Directors that the person should serve as a Director, and the year each became a Director of the Company. All information is as of the date of this proxy statement.

Name, Age, and Five Year Business Experience | Director Since |

| Director Nominees – Terms to Expire in 2015 (Class III) | |

Robert K. Chapman, age 68; President (since 2003) and Chief Executive Officer (since 2006) of the Company; Chief Executive Officer (2001– 2007) of the Company’s former subsidiary, United Bank & Trust – Washtenaw (“UBTW”). President and Chief Executive Officer of UBT (since 2010). Mr. Chapman is a CPA, and brings over thirty years of experience in the financial industry to the Board. More than twenty of those years were in a financial role, and five years were spent in mergers and acquisitions. Mr. Chapman has a strong background in risk management. | 2001 |

Norman G. Herbert, age 69; Independent financial consultant. Director of UBT since 2010; Director of UBTW (2006 – 2010). Mr. Herbert has an extensive financial background. For thirty-five years, he was a part of the financial management team for the University of Michigan, with responsibilities including management of endowment and working capital, real estate acquisitions and dispositions, external financing activities and risk management. He has long been active with a number of professional, civic and non-profit organizations. He brings an analytical background and a meticulous attention to detail to the Board. | 2009 |

Name, Age, and Five Year Business Experience | Director Since |

Director Nominees – Terms to Expire in 2015 (Class III) (continued) | |

Len M. Middleton, age 48: Professor of Strategy and Entrepreneurship, Ross School of Business at the University of Michigan. Director of UBT since 2010; Director of UBTW (2009 – 2010). Trustee at the Ann Arbor Hands-On Museum. In his role as a faculty member in the business school of the University of Michigan, Mr. Middleton works with entrepreneurial companies, non-profit organizations and major corporations. He holds an MBA, and is founder of a private equity firm that specializes in buyouts and other investment opportunities. He has worked in a family business and has a broad range of entrepreneurial experience. | 2010 |

| Incumbent Directors – Terms Expiring in 2013 (Class I) | |

James D. Buhr, age 64; Owner, J.D. Buhr & Company, LLC, corporate finance advisors, Ann Arbor, MI; Director of UBT since 2010; Director of UBTW (2001 – 2010). Mr. Buhr has an extensive financial background, including experience as a bank credit analyst, commercial lender and investment banker. He is a native of Washtenaw County, is a registered stock broker, and holds an MBA from the University of Michigan. Mr. Buhr currently owns his own corporate finance advisory practice, which provides corporate finance advisory services to Michigan and Midwestern based companies. | 2004 |

James C. Lawson, age 64; General Manager, Avery Oil & Propane, Tecumseh, MI; Chairman of the Board of United Bancorp, Inc. (2011); Vice-Chairman of the Board of United Bancorp, Inc. (2010 – 2011). Director of UBT. Mr. Lawson is an entrepreneur in Lenawee County, serving as owner or partner in a number of local businesses. These experiences have provided a diverse background into the formation and operation of a successful business. He is a lifelong resident of Lenawee County, and brings leadership, strategic planning, human resources and administrative skills and background to the Board. | 1986 |

| Incumbent Directors – Terms Expiring in 2014 (Class II) | |

Stephanie H. Boyse, age 43; President and Chief Executive Officer, Brazeway, Inc., manufacturer of extruded aluminum tubing and related products, Adrian, MI; Director of UBT. Ms. Boyse brings a diverse range of experience to the Board, including sales, marketing, operations, human resources, licensing and acquisitions as well as international experience. Her leadership is exhibited not only through her role as President of the world’s largest manufacturer of frost-free evaporators for household refrigeration, but also through board positions with many other local organizations. | 2008 |

Kenneth W. Crawford, age 54; Independent financial consultant. Retired Senior Vice President, Chief Financial Officer, Corporate Controller and Assistant Secretary of Kaydon Corporation, Ann Arbor, MI. Kaydon Corporation is a leading designer and manufacturer of custom engineered, performance-critical products, supplying a broad and diverse group of alternative energy, military, industrial, aerospace, medical and electronic equipment, and aftermarket customers. Mr. Crawford has held various accounting and finance positions with a number of public companies, and brings a strong accounting and financial background to the Board. | 2011 |

John H. Foss, age 69; Director, La-Z-Boy Incorporated; Retired Director, Vice President, Treasurer and Chief Financial Officer, Tecumseh Products Company, manufacturer of compressors and refrigeration components, engines, and power train components, Tecumseh, MI; Director of UBT. Mr. Foss is a CPA, and his work experience includes financial management and auditing. He has served as CFO of two publicly traded companies and as Chairman of the Audit Committee of La-Z-Boy. He provides practical experience and understanding in the areas of strategic planning, compensation management, internal controls, mergers and acquisitions and corporate governance. | 1992 |

None of the Director nominees or incumbents, with the exception of John H. Foss and Len M. Middleton, serves as a director, or at any time during the past five years served as a director, of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such act, or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Foss is a director of La-Z-Boy Incorporated. Mr. Middleton is a Director

of Arcadia Funds, Castle Oaks and One Tree. With the exception of Mr. Chapman, each Director and Director Nominee, and each person who served as a Director at any time during the last fiscal year, is or was independent as that term is defined under NASDAQ Listing Rules for service on the Board of Directors and each committee on which the Director serves. While the Company is not subject to these standards, it has chosen to comply with them voluntarily.

The Board of Directors reviews transactions with companies owned or managed by Directors, for the purpose of determining whether those transactions impact the independence of Directors. The Company conducted transactions in the normal course of business with companies affiliated with a single director during 2011 and 2010. The Board determined that these transactions did not impact the independence of that Director.

Board of Directors Leadership Structure |

The Board of Directors of United is led by its Chairman of the Board, who is not the Chief Executive Officer of the Company. The Compensation & Governance Committee believes that separation of the positions of Chairman of the Board and Chief Executive Officer recognizes the difference between the two roles and reflects good corporate governance practice. The Chairman of the Board leads the Board of Directors in adopting an overall strategic plan for the Company, sets the agenda for the meetings of the Board of Directors, presides over all meetings of the Board of Directors, and provides guidance to the Chief Executive Officer. The Chief Executive Officer implements the strategic plan for the Company, as adopted by the Board of Directors, and leads the Company, its management and its employees on a day-to-day basis. Because of these differences, the Company currently believes keeping the Chairman of the Board and Chief Executive Officer as separate positions is the appropriate leadership structure for the Company.

James C. Lawson was elected as Chairman of the Board following the 2011 Annual Meeting of Shareholders. Mr. Lawson has a diverse background in the formation and operation of a successful business, and has served as a Director of the Company since 1986. Robert K. Chapman serves as the Company’s President and Chief Executive Officer, and brings more than thirty years of banking experience in various roles, as well as leadership in the Washtenaw County market, to his role.

| Board of Directors Role in Risk Oversight |

The Company continues to enhance and implement its enterprise risk management (“ERM”) process. The Board is responsible for overseeing the ERM process. The Enterprise Risk Management Committee implements the ERM process by overseeing policies, procedures and practices relating to enterprise-wide risk and compliance with bank and regulatory obligations. The committee consists of members of the executive management team and other appointed individuals from the various identified risk areas. The Chief Financial Officer serves as chair of the committee.

Among other things, the committee is responsible for designing and implementing effective ERM processes and practices, ensuring that management understands and accepts responsibility for identifying, assessing and managing risk, ensuring that risk assessments are completed for each identified risk area, and reviewing and updating risk assessments on at least a quarterly basis. The committee has identified and monitors 12 risk areas. In 2010 and 2011, the ERM

process involved a heightened focus on risks related to credit quality of the loan portfolio and earnings and capital, as both of these areas presented elevated levels of risk to the Company. The committee must meet at least four times per year. The Chief Financial Officer must report on the ERM process to the Board of Directors on at least a quarterly basis.

Communicating with the Board of Directors |

Shareholders may communicate with the Board of Directors, its committees or any member of the Board of Directors by sending a letter to Chairman of the Board, United Bancorp, Inc., P. O. Box 1127, Ann Arbor, Michigan, 48104. All shareholder communications will be forwarded to the Board, the committee or the Director as indicated in the letter. The Board of Directors reserves the right to revise this policy in the event that this process is abused, becomes unworkable or otherwise does not efficiently serve the purpose of the policy.

Meetings of the Board of Directors |

During the year ended December 31, 2011, the Board of Directors of the Company met a total of five times. Each of the Directors attended at least 75% of the aggregate of the total number of meetings of the Board and of the Board committees of which he or she is a member.

The Company encourages members of its Board of Directors to attend the Annual Meeting of Shareholders. All directors serving at April 26, 2011 attended the Company’s 2011 Annual Meeting of Shareholders held on that date.

| Committees of the Board of Directors |

The Board of Directors has established a standing Audit Committee and Compensation & Governance Committee. The Compensation & Governance Committee also performs the functions of a nominating committee.

Audit Committee Report, Charter, and Independence |

The Audit Committee consists of Kenneth W. Crawford, John H. Foss, Norman G. Herbert and Len M. Middleton. The Audit Committee met eight times during the year ended December 31, 2011. Each of the current members meets the requirements for independence as defined under NASDAQ listing rules. While the Company is not subject to these standards, it has chosen to comply with them voluntarily. In addition, the Board of Directors determined that Mr. Crawford and Mr. Foss have met the qualifications to be considered an “audit committee financial expert” as set forth under rules adopted by the Securities and Exchange Commission.

The Audit Committee has selected BKD LLP (“BKD”) as its independent registered public accounting firm for 2012. BKD has served in that capacity since 2002. The services provided by BKD are limited by the Audit Committee to audit services and certain permitted audit related and tax services.

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is available on the Company's website at www.ubat.com. The Board of Directors reviews and approves changes to the Audit Committee charter annually.

The Audit Committee assists the Board in its oversight responsibilities of the integrity of the Company’s financial statements, the system of internal control over financial reporting, the Company’s internal audit function and independence, the independent registered public accounting firm’s qualifications, independence and performance, and the Company’s process for monitoring compliance with ethics policies and legal and regulatory requirements. Management is responsible for the Company’s financial statements and the financial reporting process, and for establishing and maintaining the Company’s system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on the conformity of the Company’s financial statements with U.S. generally accepted accounting principles.

The Audit Committee reports that with respect to the audit of the Company's consolidated financial statements for the year ended December 31, 2011:

| • | The Audit Committee has reviewed and discussed the Company's 2011 audited consolidated financial statements with the Company's management. |

| • | The Audit Committee has discussed with its independent registered public accounting firm, BKD, LLP, the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU Section 380) as adopted by the Public Company Accounting Oversight Board in Rule 3200T. |

| • | The Audit Committee has received the written disclosures and the letter from its independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding BKD’s communications with the Audit Committee concerning independence, and has discussed with BKD its independence. |

Based on the review and the discussions referenced above, the Audit Committee recommended to the Board of Directors that the Company's 2011 audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011.

| Audit Committee | |

| Norman G. Herbert, Chairman | |

| Kenneth W. Crawford | |

| John H. Foss | |

| Len M. Middleton |

Compensation & Governance Committee |

The Board of Directors of the Company has established a Compensation & Governance Committee, which addresses matters relating to employment, compensation, and management performance. The Compensation & Governance Committee also performs the functions of a nominating committee for the Board of Directors. The Board of Directors has adopted a written charter for the Compensation & Governance Committee, a copy of which is available on the Company’s website at www.ubat.com.

Our Compensation & Governance Committee annually reviews and approves our compensation program, evaluates the performance of our Chief Executive Officer and, with input from the Chief Executive Officer, reviews the performance of the executive officers in achieving our business objectives, and recommends executive officers’ compensation to our Board of Directors for its approval. The Chief Executive Officer of the Company provides input into the recommended compensation of the other executive officers to the Compensation & Governance Committee, but does not participate or deliberate in compensation decisions regarding his own compensation. Although input from the Chief Executive Officer is considered by the Compensation & Governance Committee and the Board, it is not given any disproportionate weight. The committee also recommends targets for bonuses and profit sharing and has sole authority to grant stock options and other equity awards to eligible individuals. The Compensation & Governance Committee and the Board have the final authority on compensation matters. Except to the extent prohibited by exchange rules (if applicable) and state law, the committee may delegate its authority to subcommittees when it deems it appropriate and in the best interests of the Company.

The Compensation & Governance Committee considers various potential candidates for Director that may come to its attention through current board members, shareholders or other persons. The Compensation & Governance Committee will review and evaluate candidates for Director nominated by shareholders in the same manner as it evaluates all other candidates. When considering and evaluating candidates for nomination to the Board, the committee considers a number of factors. The Compensation & Governance Committee considers board diversity as a factor in identifying nominees for Director, but diversity is not a dispositive factor and the committee has no formal diversity policy. In addition, the Compensation & Governance Committee believes that a Board candidate should:

| • | Be a shareholder of United Bancorp, Inc. |

| • | Be willing and able to devote full interest and attendance to the Board and its committees |

| • | Bring their financial business to the Company, including personal and business accounts |

| • | Lend credibility to the Company and enhance its image |

| • | Help develop business and promote the Company and its subsidiaries |

| • | Provide advice and counsel to the CEO |

| • | Maintain integrity and confidentiality at all times. |

The Compensation & Governance Committee will consider shareholder nominations for candidates for membership on the Board when properly submitted in accordance with the Company’s bylaws. The bylaws provide that no less than 120 days prior to the date of the meeting, in the case of an annual meeting, and not more than seven days following the date of notice of the meeting, in the case of a special meeting, any shareholder who intends to make a nomination at the meeting shall deliver a notice to the secretary of the Company setting forth (i) the name, age, business address and residence of each nominee proposed in such notice, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares of each class and series of capital stock of the Company which are beneficially owned by each such nominee and (iv) such other information concerning each such nominee as would be required,

under the rules of the Securities and Exchange Commission, in a proxy statement soliciting proxies for the election of such nominee.

The Compensation & Governance Committee met eight times during 2011, and is composed of the following Directors of the Company: Stephanie H. Boyse, James D. Buhr, John H. Foss and James C. Lawson. All members of the Company’s Compensation & Governance Committee meet the requirements for independence under NASDAQ Listing Rules. While the Company is not subject to these standards, it has chosen to comply with them voluntarily.

Information Concerning Executive Officers |

Following is a current listing of executive officers of the Company, setting forth the name, age, five year business experience, and year each became an executive officer of the Company. All information is as of the date of this proxy statement. Officer appointments for the Company are made or reaffirmed annually at the Organizational Meeting of the Board of Directors. The Board may also designate executive officers at regular or special meetings of the Board.

Name, Age, and Five Year Business Experience | Executive Officer Since |

Robert K. Chapman, age 68; Director of UBI; President (since 2003) and Chief Executive Officer (since 2006) of the Company; President and Chief Executive Officer of UBT (since 2010); President (2001–2005) and Chief Executive Officer (2001 – 2007) of UBTW; Director of UBTW (2001–2010) | 2001 |

Randal J. Rabe, age 53; Executive Vice President (since 2003) and Chief Financial Officer (since December, 2007) of the Company; President (2003 – 2007) & Chief Executive Officer (2005–2007) and Director (2003–2007) of UBT | 2003 |

Todd C. Clark, age 42; Executive Vice President of the Company; Chief Operating Officer and Washtenaw Community President (since 2010); President (2006–2010) and Chief Executive Officer (2007–2010) of UBTW; Director (2006–2010) of UBTW | 2005 |

Gary D. Haapala, age 48; Executive Vice President of the Company; Executive Vice President – Wealth Management Group of UBT | 2006 |

Joseph R. Williams, age 48; Executive Vice President of the Company (since December, 2007); Lenawee Community President (since 2010); President and Chief Executive Officer and Director of UBT (2007–2010); Executive Vice President – Community Banking of UBT (2003–2007) | 2007 |

| Compensation Discussion and Analysis |

This discussion describes all material elements of our compensation program for our executive officers named in the Summary Compensation Table below ("named executive officers").

Compensation Philosophy and Objectives

Our executive compensation program is overseen by our Compensation & Governance Committee. The Compensation & Governance Committee believes that our compensation program should be designed to tie annual and long-term cash and stock incentives to achievement of measurable business and individual performance objectives. The Compensation

& Governance Committee believes that this approach aligns executives’ incentives with shareholder value creation and allows the Company to attract and retain high quality executive talent. Accordingly, a portion of our executives’ overall compensation is tied to our financial performance (including our return on assets and net income). Our compensation philosophy is intended to compensate our executives with base salary targeted at the midrange of market competitive levels, while rewarding for outstanding corporate performance with our performance based plans. If performance goals are achieved, they will result in above-average total compensation based on a market comparison.

The Company provides its shareholders with the opportunity to cast an annual advisory vote on executive compensation (a “say-on-pay proposal”). At the Company’s annual meeting of shareholders held in April 2011, 89.9% of the votes cast on the say-on-pay proposal at that meeting were voted in favor of the Company’s executive compensation for 2010. The Compensation & Governance Committee believes this affirms shareholders’ support of the Company’s approach to executive compensation. In light of the voting results, the Committee did not materially change its approach in 2011. The Compensation & Governance Committee will continue to consider the outcome of advisory votes on the Company’s say-on-pay proposals when making future compensation decisions for the named executive officers.

Compensation Process

In its process for deciding how to compensate our named executive officers, the Compensation & Governance Committee considers, among other things, competitive market data. The Compensation & Governance Committee periodically engages the services of compensation consultants to help evaluate our executive compensation and to help select appropriate market data for comparison. Some of the resources considered were the ABA Executive Compensation Standard Report, American Bankers Association Compensation Benefits Survey, BAI Bank Cash Compensation Survey, Crowe Chizek Financial Institutions Compensation Survey, Mercer Benchmark Database Human Resource Management, Michigan Bankers Association Compensation Survey and Watson Wyatt Benchmark Compensation Report for Financial Institutions. None of the resources was specifically prepared or customized for the Company and each resource contained only aggregate data with regard to the institutions surveyed. While the Compensation & Governance Committee considered these resources, it determined compensation levels in its judgment based on what it considered to be reasonable and appropriate for the Company.

For 2011, the Committee engaged the services of Findley Davies as compensation consultants. Findley Davies assisted the Compensation & Governance Committee in evaluating the mix of cash and equity compensation for our executives. Based on their recommendations and comparison to the market data they have provided, we believe that our mix of cash and equity compensation is appropriate and is consistent with that of similar financial institutions. Findley Davies also was engaged to assist with the development of certain non-equity based compensation plans, which have not yet been finalized or adopted. Findley Davies did not provide any other services to the Company.

The Compensation & Governance Committee also uses tally sheets prepared by our payroll department with respect to each of our named executive officers. Tally sheets include the dollar value of each component of the named executive officers’ compensation, including current cash compensation, accumulated deferred compensation balances, outstanding equity awards,

retirement benefits, perquisites and any other compensation. The primary purpose of the tally sheets is to bring together in one place all of the elements of compensation of our named executive officers so that the Compensation & Governance Committee may analyze both the individual elements of compensation (including the compensation mix) as well as the aggregate total amount of compensation. The Compensation & Governance Committee generally compares the information on the tally sheets, on an individual and aggregate basis, to the extent comparisons are available, to market data. In addition, such tallies are also used to determine internal equity conformance.

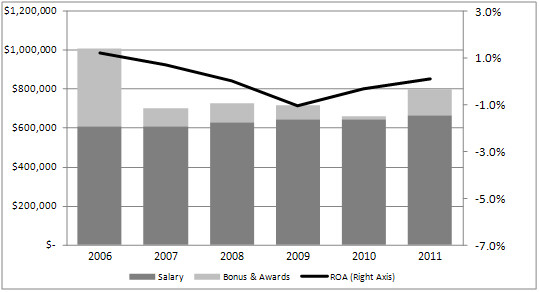

We believe that it is important that our executive compensation reflect the relative financial performance of the Company. The table below shows the base pay, bonus and awards of the named executive officers, compared to the return on average assets (“ROA”) of the Company for the past six years. We have included 2006 for comparison, as it was the most recent year in which cash bonuses were paid.

Targets and Peer Data

The Compensation & Governance Committee has the authority to set targets at other than those contained in the current year Board-approved financial plan. For 2011, the targets for payouts under the 2009 Management Committee Incentive Compensation Plan were set at a level that was considerably higher than the 2011 board-approved financial plan, and targets for performance based vesting of Restricted Stock Units granted in 2011 were based on the 2011 board-approved financial plan.

The Compensation & Governance Committee has utilized comparison to a number of peer groups for the purpose of ranking our financial performance with peers in order to validate our performance targets. However, these peer groups were not used specifically to compare our compensation practices and levels to peer companies.

Compensation Components

The key components of our executive compensation program consist of a base salary and participation in various performance-based compensation plans, including our Management Committee Incentive Compensation Plan, Senior Management Bonus Deferral Stock Plan, 401(k) Plan, and our Stock Incentive Plan of 2010.

Base Salary

We use base salary to attract and retain executive officers near the midpoint of market rates, and rely on our performance-based plans to reward for performance. The Company generally hires executive officers at market rates necessary to attract talent. Raises and salary adjustments for named executive officers are provided primarily to allow us to retain our existing talent.

Generally, we believe that base salary should be set at mid-level market competitive levels. Base salaries are reviewed annually and are compared to several databases and public information, and adjusted from time to time.

2009 Management Committee Incentive Compensation Plan

The named executive officers participate in the Management Committee Incentive Compensation Plan. Under the plan, a participant is paid a percentage of his or her base salary based on the achievement of business and individual performance objectives. Bonuses under the plan are based all or in part on our achieving a target return on assets as established annually by the Board of Directors. For 2011, our target ROA was 1.0%.

The plan is divided into groups, each with differing payout levels based on a percentage of base salary. Participants in the plan may earn more or less than the prescribed bonus percentages at target levels, with threshold and maximum bonus levels established. The table below details the range of minimum, target and maximum thresholds and payouts for each group of the plan, relating to the named executive officers.

No Bonus is Earned if Performance is Below: | Bonus Earned at Minimum Threshold | Bonus Earned at 100% of Target | Maximum Bonus That Can Be Earned | Maximum Bonus is Earned At or Above: | |||

| Group 1 | 0.50% | ROA | 11.25% | 45% | 90% | 1.625% | ROA |

| Group 2 | 0.50% | ROA | 8.75% | 35% | 70% | 1.625% | ROA |

Targets for 2011 for all participants were based 100% on ROA, as participants each have responsibilities with regard to the overall performance of the Company. Targets were not achieved in 2011, and as a result, no incentive compensation was paid to any of the named executive officers under the plan.

The table below details the respective named executive officers in each group, the group within the plan that each participates in, the basis upon which the bonus is determined, and the payout percentages for calendar year 2011.

| Executive Officer | Group | Based on: | 2011 Payout |

| Chapman | 1 | Target ROA (100%) | 0% |

| Rabe | 2 | Target ROA (100%) | 0% |

| Clark | 2 | Target ROA (100%) | 0% |

Under the 1996 Senior Management Bonus Deferral Stock Plan, participating officers are eligible to elect cash bonus deferrals and, after employment termination, to receive payment in

the form of shares of Company stock. During 2010 and 2011, none of the named executive officers received bonuses eligible to be deferred under the plan and, as of December 31, 2011, none of the named executive officers had any balance in the plan.

Stock Incentive Plan of 2010

At the 2010 Annual Meeting of Shareholders, shareholders approved the United Bancorp, Inc. Stock Incentive Plan of 2010 (the “Incentive Plan”). The Incentive Plan is intended to supplement and continue the compensation policies and practices of our other equity compensation plans, which we have used for many years. The Board of Directors believes that the Incentive Plan is important to attract, retain and motivate corporate and subsidiary directors, officers and key employees of exceptional abilities, and to recognize the significant contributions these individuals have made to the long-term performance and growth of the Company and its subsidiaries. The Compensation & Governance Committee awarded grants in 2011 under the Incentive Plan based on the Company’s 2010 performance. No awards were made in 2010 under the Incentive Plan.

The Incentive Plan includes a number of components, as follows:

| Stock Options |

The Incentive Plan permits the Company to grant to participants options to purchase shares of common stock at stated prices for specific periods of time. Stock options that may be granted under the Incentive Plan could be either nonqualified stock options or incentive stock options as defined in Section 422 of the Internal Revenue Code. The Compensation & Governance Committee may award options for any amount of consideration or no consideration, as the committee determines. No stock options were granted in 2011.

| Stock Appreciation Rights |

The Incentive Plan permits the Compensation & Governance Committee to grant stock appreciation rights. A stock appreciation right permits the holder to receive the difference between the market value of a share of common stock subject to the stock appreciation right on the exercise date of the stock appreciation right and a “base” price set by the Compensation & Governance Committee. Stock appreciation rights are exercisable on dates determined by the Compensation & Governance Committee at the time of grant. The committee may award stock appreciation rights for any amount of consideration or no consideration, as the committee determines.

Stock appreciation rights are subject to terms and conditions determined by the Compensation & Governance Committee. A stock appreciation right may relate to a particular stock option and may be granted simultaneously with or subsequent to the stock option to which it relates. The Company granted Stock-Only Stock Appreciation Rights (“SOSARs”) in 2011.

| Restricted Stock and Restricted Stock Units |

The Incentive Plan permits the Compensation & Governance Committee to award restricted stock and restricted stock units, subject to the terms and conditions set by the committee that are consistent with the Incentive Plan. Shares of restricted stock are shares of common stock, the retention, vesting and transferability of which are subject, for specified periods of time, to such terms and conditions as the Compensation & Governance Committee deems appropriate (including continued service or employment and/or achievement of performance goals

established by the committee). The Compensation & Governance Committee may award restricted stock or restricted stock units for any amount of consideration or no consideration, as the committee determines.

As with stock option grants, the Compensation & Governance Committee establishes the terms of individual awards of restricted stock and restricted stock units in award agreements or certificates of award. Restricted stock and restricted stock units granted to a participant “vest” (i.e., the restrictions on them would lapse) in the manner and at the times that the Compensation & Governance Committee determines. The Company granted restricted stock and restricted stock units (“RSUs”) during 2011.

The period during which restricted stock and RSU grants are unvested under the Plan are known as the “Restricted Period.” The restrictions imposed on 100% of the restricted stock awarded are time-based, and lapse two years from the date of award.

RSUs vest upon satisfaction of time based and performance based vesting requirements. Vesting for RSUs granted in 2011 is as follows:

| · | Time Based Vesting. The percentage of RSUs awarded that satisfy the performance based vesting requirements will generally vest and be settled three years from the date of the grant. |

| · | Performance Based Vesting. The performance period for the RSUs granted in 2011 is the period beginning January 1, 2011 and ending December 31, 2011. The percentage specified below of RSUs awarded will satisfy the performance based vesting requirements of the award if the Company’s core earnings, as measured by pre-tax, pre-provision return on assets (“PTPP ROA”), earnings, as measured by return on assets (“ROA”) and asset quality, as measured by the ratio of non-performing assets1 to total assets (“NPA/Assets”), as determined by the Company in a manner consistent with the information reported in its filings with the Securities and Exchange Commission, meet the standards set forth in the following schedule: |

| Performance Measure (Metric) | Weight | Performance Standard | % of RSU Award Performance Vested |

| Core Earnings (PTPP ROA) | 1/3 | 1.35% | 25% |

| 1.45% | 50% | ||

| 1.55% | 75% | ||

| 1.65% | 100% | ||

| Earnings (ROA) | 1/3 | 0.08% | 25% |

| 0.17% | 50% | ||

| 0.25% | 75% | ||

| 0.33% | 100% | ||

| Asset Quality (NPA/Assets) | 1/3 | 4.00% | 25% |

| 3.80% | 50% | ||

| 3.60% | 75% | ||

| 3.40% | 100% |

1 | Nonperforming assets includes non-accrual loans, 90 day delinquent loans and OREO, but does not include accruing restructured loans. |

RSUs will not vest upon performance below the minimum performance standards provided above. Vesting upon performance between the performance standards provided above will be interpolated based on the actual performance. For 2011, RSUs performance vested at 60.2% of target.

| Stock Awards |

The Incentive Plan permits the Compensation & Governance Committee to make stock awards. The committee may make stock awards for any amount of consideration, or no consideration, as the committee determines. A stock award of common stock is subject to terms and conditions set by the Compensation & Governance Committee at the time of the award. Stock award recipients generally have all voting, dividend, liquidation and other rights with respect to awarded shares of common stock. However, the committee may impose restrictions on the assignment or transfer of common stock awarded under the Incentive Plan. No stock awards were granted in 2011.

| Other Stock-Based Awards |

Finally, the Incentive Plan permits the Compensation & Governance Committee to grant a participant one or more types of awards based on or related to shares of common stock, other than the types described above. Any such awards are subject to such terms and conditions as the Compensation & Governance Committee deems appropriate, as set forth in the respective award agreements and as permitted under the Incentive Plan. No other stock-based awards were granted in 2011.

Stock Option Plans

Before December 31, 2009, we granted stock options under one of two stock option plans: the 1999 and 2005 stock option plans. The 1999 and 2005 stock option plans have expired and been replaced by the Stock Incentive Plan of 2010. Options granted under the plans and not exercised are still outstanding, and no new options may be granted under either plan.

Under the plans, options were granted at the then-current market price at the time the option was granted. The options have a three-year vesting period and, with certain exceptions, expire at the end of ten years from the date of grant, or three years after retirement. Options granted under our plans are non-qualified stock options as defined under the Internal Revenue Code.

Our Compensation & Governance Committee administers our stock option plans. Option grants for any certain year were generally determined by evaluating the number of option grants available under the plan, divided by the number of years remaining in the plan. The Committee allocated some or all of the options available for a particular year to eligible participants based on a number of factors, including the relative rank of the executive officer within our Company and his or her specific contributions to the success of the Company for the prior year. The committee did not time the grant of stock options to take advantage of material non-public information, or time the release of material non-public information to increase the value of option grants.

We believe the options served to enhance shareholder value by aligning the interests of our executive officers with those of the shareholders and also by acting to retain our executive officers through the vesting of the options. The exercise price of all options granted under the plans was higher than the Company’s stock price as of December 31, 2011, and accordingly,

unless the stock price significantly improves, the ability of those options to assist in retention of our executive officers may not be realized.

401(k) Plan

Under our 401(k) plan, named executive officers and other participants may defer a portion of their compensation, and the Company’s 401(k) plan provides for a match of up to 4% of salary, subject to IRS regulations. In addition to the match contributions, the plan includes a profit-sharing feature based on achievement of a net income target as established annually by the Board of Directors. Effective July 1, 2009, the Company discontinued its match and profit sharing contributions to the 401(k) plan as a cost-cutting measure, and no match or profit sharing payments were paid in 2010. The Company reinstated match contributions beginning January 1, 2011, but did not make profit sharing contributions in 2011.

Severance Arrangements

Each named executive officer has an employment agreement with the Company. As part of our goal to attract and retain our executive officers, such employment agreements provide that if the Company terminates the employee’s employment before a Change in Control (as defined in the agreement) other than for Cause (as defined in the agreement), the employee will receive severance pay consisting of six months’ salary continuation and six months of COBRA payments, provided that the severance pay will end if the employee secures other employment. If the Company terminates the employee’s employment other than for Cause within 12 months after a Change in Control, or if the employee resigns for Good Reason (as defined in the agreement) within 12 months after a Change in Control, the employee will receive severance pay consisting of a lump sum payment equal to one year’s salary, and will also receive 12 months of COBRA payments. However, no severance payments will be made either before or after a Change in Control during the period in which any obligation arising from financial assistance under the Troubled Assets Relief Program remains outstanding, if such payments would be prohibited as to any employee of the Company under Section 111 of the Emergency Economic Stabilization Act of 2008 as amended by Section 7001 of the American Recovery and Reinvestment Act of 2009.

The contracts provide for a general release from the employee as a condition to eligibility for severance pay. The contracts also provide that to be eligible for severance pay the employee must comply with confidentiality requirements and 12-month non-solicitation and non-competition commitments included in the contracts. The purpose of the severance arrangements is to minimize the uncertainty and distraction caused by the current climate of bank acquisitions, and to allow our executive officers to focus on performance by providing transition assistance if we are acquired or if there is a change in control.

Inter-Relationship of Elements of Compensation Packages

The various elements of the compensation package are not inter-related. There is no significant interplay of the various elements of total compensation between each other. While the Compensation & Governance Committee may recommend, and the Board has discretion to make exceptions to any compensation or bonus payouts under existing plans, the Compensation &

Governance Committee has not recommended, and the Board has not approved, any exceptions to the plans with regard to any named executive officer.

Limitations on Executive Compensation

The Company participated in the United States Department of the Treasury’s (“Treasury”) Capital Purchase Program (“CPP”) effective January, 2009. The Company made immaterial, technical amendments to certain employment agreements and plans with the Corporation’s executive officers to comply with the limits on executive compensation as required by the CPP and the Emergency Economic Stabilization Act of 2008 as that Act existed at the time of the Company’s participation in the CPP.

The Company’s compensation plans are in compliance with the requirements of the American Recovery and Reinvestment Act of 2009 (the “Recovery Act”), which significantly amended the executive compensation requirements for all CPP participants. The Recovery Act prohibits the following practices:

| • | making any payments (other than accrued wages and benefits) to senior executive officers and the five most highly-compensated employees upon departure from United for any reason; |

| • | paying or accruing any bonus, retention award or incentive compensation to our highest-compensated employee (subject to certain exceptions); and |

| • | using any compensation plan that would encourage earnings manipulation to enhance the compensation of any employee. |

On September 15, 2009, the Company approved certain amendments to its compensation plans to comply with applicable requirements under the Economic Stabilization Act of 2008 as amended by the Recovery Act and related regulations.

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies participating in the CPP for taxable compensation in excess of $500,000 paid to their chief executive officer or certain other highly compensated officers. Qualifying performance-based compensation is not subject to the deduction limitation if certain requirements are met. We consider the impact of Section 162(m) when structuring the performance based portion of our executive compensation, but Section 162(m) is not a dispositive consideration. No compensation was non-deductible because of Section 162(m) in 2011, and we do not expect any compensation to be non-deductible because of Section 162(m) in 2012.

As a condition to participation in the CPP, we are required to recover from any named executive officer and any of the next twenty highest-compensated employees any bonus or incentive compensation paid to such named executive officer if the financial statement or payment method on which the payment was based later proves to be materially inaccurate. Each named executive officer has consented to provisions which require him to repay any such amount. This obligation will continue for as long as the U.S. Treasury holds a debt or equity position in the Company. It is anticipated that actions to be taken under such circumstances would be determined by the Compensation & Governance Committee. We offer minor perquisites to some executive officers,

none of which have an annual aggregate incremental cost to us of more than $10,000 per executive.

Stock Ownership Guidelines

We believe that stock ownership by our executive officers is the clearest, most direct way to align their interests with those of our stockholders and that, by holding an equity position in the Company, executive officers demonstrate their commitment to and belief in the long-term profitability of the Company. Accordingly, guidelines for stock ownership by executive officers were adopted in 2008. As of December 31, 2011, all of the named executive officers had stock ownership in compliance with the stock ownership guidelines. We currently have no policies regarding hedging the economic risk of any ownership of our common stock.

Compensation of Executive Officers |

The following table sets forth information concerning the compensation earned by each person who served as Chief Executive Officer during 2011 and the two most highly compensated executive officers other than the Chief Executive Officer during 2011.

Summary Compensation Table

| Name and Principal Position | Year | Salary (1) | Option Awards (2) | Stock Awards (3) | Non-Equity Incentive Comp (4) | All Other Compen-sation (5) | Total Compen-sation | |||||||||||||||||||

Robert K. Chapman, President and Chief Executive Officer | 2011 | $ | 267,692 | $ | 0 | $ | 44,976 | $ | 0 | $ | 20,300 | $ | 332,968 | |||||||||||||

| 2010 | 260,000 | 0 | 0 | 0 | 10,500 | 270,500 | ||||||||||||||||||||

| 2009 | 260,000 | 20,813 | 0 | 0 | 15,507 | 296,320 | ||||||||||||||||||||

Randal J. Rabe, Executive Vice President & Chief Financial Officer | 2011 | $ | 199,231 | $ | 0 | $ | 22,488 | $ | 0 | $ | 11,694 | $ | 233,413 | |||||||||||||

| 2010 | 190,000 | 0 | 0 | 0 | 3,725 | 193,725 | ||||||||||||||||||||

| 2009 | 190,000 | 11,655 | 0 | 0 | 7,384 | 209,039 | ||||||||||||||||||||

Todd C. Clark, Executive Vice President | 2011 | $ | 200,385 | $ | 0 | $ | 22,488 | $ | 0 | $ | 10,201 | $ | 233,074 | |||||||||||||

| 2010 | 195,000 | 0 | 0 | 0 | 2,400 | 197,400 | ||||||||||||||||||||

| 2009 | 195,000 | 11,655 | 0 | 0 | 6,156 | 212,811 | ||||||||||||||||||||

| (1) | Salary amounts include amounts deferred under the Company’s 401(k) plan. |

| (2) | Amounts reflect the grant date fair value computed in accordance with FASB ASC Topic 718 (formerly FAS 121R). Amounts include awards of stock options. Further information regarding grant valuation is contained in Note 16 of the Notes to Consolidated Financial Statements. |

| (3) | Amounts reflect the grant date fair value computed in accordance with FASB ASC Topic 718 (formerly FAS 121R). Amounts include awards of restricted stock, RSUs and SOSARs. Further information regarding grant valuation is contained in Note 16 of the Notes to Consolidated Financial Statements. |

| (4) | “Non-Equity Incentive Compensation” includes amounts paid under the Management Committee Incentive Compensation Plan and as a profit-sharing contribution under the Company’s 401(k) plan as further described in the “Compensation Discussion and Analysis” section of this Proxy Statement. Detail is shown in the table below. |

| (5) | "All other Compensation" includes matching contributions made by us under our 401(k) plan and life insurance premiums paid by the Company for the benefit of the named executive officers. Detail is shown in the table below. |

| Name | Year | Management Committee Incentive Pay | 401(k) Profit Sharing | Total Non-Equity Incentive Pay | 401(k) Match Contribu-tions (a) | Life Insurance Premiums | Total Other Compen-sation | |||||||||||||||||||||

| Chapman | 2011 | $ | 0 | $ | 0 | $ | 0 | $ | 9,800 | $ | 10,500 | $ | 20,300 | |||||||||||||||

| 2010 | 0 | 0 | 0 | 0 | 10,500 | 10,500 | ||||||||||||||||||||||

| 2009 | 0 | 0 | 0 | 5,007 | 10,500 | 15,507 | ||||||||||||||||||||||

| Rabe | 2011 | $ | 0 | $ | 0 | $ | 0 | $ | 7,969 | $ | 3,725 | $ | 11,694 | |||||||||||||||

| 2010 | 0 | 0 | 0 | 0 | 3,725 | 3,725 | ||||||||||||||||||||||

| 2009 | 0 | 0 | 0 | 3,659 | 3,725 | 7,384 | ||||||||||||||||||||||

| Clark | 2011 | $ | 0 | $ | 0 | $ | 0 | $ | 7,801 | $ | 2,400 | $ | 10,201 | |||||||||||||||

| 2010 | 0 | 0 | 0 | 0 | 2,400 | 2,400 | ||||||||||||||||||||||

| 2009 | 0 | 0 | 0 | 3,756 | 2,400 | 6,156 | ||||||||||||||||||||||

| (a) | The match, which was discontinued July 1, 2009, was reinstated January 1, 2011 at a maximum of 4%. | |||||||||||||||||||||||||||

Narrative disclosure of the material terms of the compensation components shown in the Summary Compensation Table may be found above under the heading "Compensation Components" and is here incorporated by reference.

Outstanding Equity Awards at Fiscal Year End 2011 |

The following table provides information as of December 31, 2011 regarding the Company’s outstanding equity awards under the Company’s equity compensation plans. As of December 31, 2011, the exercise price of all of the stock options shown below was higher than the Company’s stock price, and accordingly, the options cannot be exercised profitably at this time. All shares issuable under the Senior Management Bonus Deferral Stock Plan are fully vested, and are not included in the table below.

| Option and SOSAR Awards | Stock Awards | ||||||||||||||||||||||

| Name | Grant Date (1) | # of Shares Underlying Unexercised Grants at Year-End (2) | Option Exercise Price (2) | Option Expiration Date (3) | Number of Shares or Units of Stock Not Vested 4,5That Have | Market Value of Shares or Units of Stock That Have Not Vested 4,5 | |||||||||||||||||

| Exercisable | Unexercisable | ||||||||||||||||||||||

| Robert K. Chapman | |||||||||||||||||||||||

Stock Option Grants | 01/09/02 | 4,135 | - - | $ | 19.98 | 01/09/12 | |||||||||||||||||

| 01/10/03 | 5,348 | - - | 22.21 | 01/10/13 | |||||||||||||||||||

| 01/09/04 | 5,788 | - - | 27.21 | 01/09/14 | |||||||||||||||||||

| 01/03/05 | 5,512 | - - | 30.39 | 01/03/15 | |||||||||||||||||||

| 01/03/06 | 5,880 | - - | 29.52 | 01/03/16 | |||||||||||||||||||

| 01/02/07 | 6,000 | - - | 22.50 | 01/02/17 | |||||||||||||||||||

| 02/15/08 | 4,752 | - - | 19.75 | 02/15/18 | |||||||||||||||||||

| 03/04/09 | 8,250 | 4,250 | 7.24 | 03/04/19 | |||||||||||||||||||

| SOSAR Grants | 03/02/11 | - - | 16,000 | 3.35 | 03/02/21 | ||||||||||||||||||

| RSU Grants | 03/02/11 | 3,612 | $ | 9,030 | |||||||||||||||||||

| Restricted Stock | 03/02/11 | 2,000 | 5,000 | ||||||||||||||||||||

| Option and SOSAR Awards | Stock Awards | ||||||||||||||||||||||

| Grant | # of Shares Underlying Unexercised Grants at Year-End (2) | �� | Option Exercise | Option Expiration | Number of Shares or Units of Stock That Have | Market Value of Shares or Units of Stock That Have | |||||||||||||||||

| Name | Date (1) | Exercisable | Unexercisable | Price (2) | Date (3) | Not Vested 4,5 | Not Vested 4,5 | ||||||||||||||||

| Randal J. Rabe | |||||||||||||||||||||||

Stock Option Grants | 02/17/03 | 2 | - - | $ | 23.04 | 02/17/13 | |||||||||||||||||

| 01/09/04 | 4,630 | - - | 27.21 | 01/09/14 | |||||||||||||||||||

| 4,410 | - - | 30.39 | 01/03/15 | ||||||||||||||||||||

| 3,990 | - - | 29.52 | 01/03/16 | ||||||||||||||||||||

| 01/02/07 | 3,800 | - - | 22.50 | 01/02/17 | |||||||||||||||||||

| 02/15/08 | 4,000 | - - | 19.75 | 02/15/18 | |||||||||||||||||||

| 03/04/09 | 4,620 | 2,380 | 7.24 | 03/04/19 | |||||||||||||||||||

| SOSAR Grants | 03/02/11 | - - | 8,000 | 3.35 | 03/02/21 | ||||||||||||||||||

| RSU Grants | 03/02/11 | 1,806 | $ | 4,515 | |||||||||||||||||||

| Restricted Stock | 03/02/11 | 1,000 | 2,500 | ||||||||||||||||||||

| Todd C. Clark | |||||||||||||||||||||||

Stock Option Grants | 01/10/03 | 992 | - - | $ | 22.21 | 01/10/13 | |||||||||||||||||

| 01/09/04 | 2,018 | - - | 27.21 | 01/09/14 | |||||||||||||||||||

| 01/03/05 | 3,528 | - - | 30.39 | 01/03/15 | |||||||||||||||||||

| 01/03/06 | 4,200 | - - | 29.52 | 01/03/16 | |||||||||||||||||||

| 01/02/07 | 4,600 | - - | 22.50 | 01/02/17 | |||||||||||||||||||

| 02/15/08 | 5,000 | - - | 19.75 | 02/15/18 | |||||||||||||||||||

| 03/04/09 | 4,620 | 2,380 | 7.24 | 03/04/19 | |||||||||||||||||||

| SOSAR Grants | 03/02/11 | - - | 8,000 | 3.35 | 03/02/21 | ||||||||||||||||||

| RSU Grants | 03/02/11 | 1,806 | $ | 4,515 | |||||||||||||||||||

| Restricted Stock | 03/02/11 | 1,000 | 2,500 | ||||||||||||||||||||

| (1) | Option grants are fully vested at the end of the first three years following the grant date; 33% per year at the end of each of the first two years and 34% at the end of the third year. The right to exercise SOSARs vests 1/3 on each of the first three anniversaries of the date of the award. | |

| (2) | The number of shares granted and the exercise price for each stock option grant is adjusted in accordance with the Company’s stock option plans to reflect stock dividends paid. | |

| (3) | Dates shown for Stock Option and SOSAR awards are the award expiration dates. | |

| (4) | Shares of restricted stock and RSUs are subject to risks of forfeiture as follows: | |

| - | Restricted stock awards. The restrictions imposed on 100% of the restricted stock awarded lapse two years from the date of award. | |

- | RSUs: Performance based vesting requirements for 2011 are described previously under “Compensation Components – Stock Incentive Plan of 2010.” For 2011, RSUs performance vested at 60.2% of target. The performance vested RSUs are subject to time-based vesting requirements and will generally vest and be settled three years from the date of grant. | |

| (5) | The market value of the shares of restricted stock and RSUs that have not vested is based on the closing price of the Company's common stock on December 31, 2011. | |

The Company has not adjusted or amended the exercise price of options previously awarded to any executive officer.

Retirement, Termination or Change of Control Payments. |

As discussed in the Compensation Discussion & Analysis section of this Proxy Statement, the Recovery Act directs the Secretary of the Treasury to establish standards that would prohibit the Company from making payments (other than accrued wages and benefits) to any named executive officer who departs the Company for any reason for as long as Treasury owns an

equity position in United. The Company modified its employment agreements in 2009 to comply with Treasury requirements.

The Company has entered into employment agreements with each of the named executive officers. Additional information about retirement, termination or change in control payments under the employment agreements may be found above under the heading "Severance Arrangements" and is here incorporated by reference.

Under the terms of the Company’s 2005 stock option plan, upon the earlier of the occurrence of an Applicable Event (as defined in the plan), and the death or total disability of a Participant, all Options granted to the Participant shall be fully exercisable in accordance with terms of the plan. At December 31, 2011, the exercise price of all of the options granted to our named executive officers was higher than the Company’s stock price, and therefore, the options could not have been exercised profitably.

Under the terms of the Incentive Plan, if an Incentive Plan participant retires, dies, or becomes disabled while an employee of the Company or one of its subsidiaries, SOSAR grants under the Incentive Plan shall become fully vested and exercisable for one year following employee’s death or disability and for three years following employee’s retirement; however, in no event will the employee’s retirement, death, or disability extend the last date to exercise the SOSARs. Notwithstanding any provisions of the Incentive Plan, all of the SOSAR grants under the Incentive Plan shall be immediately exercisable in the event of any change in control (as defined in the Incentive Plan) and may be exercised for the remaining term of the award.

If the Employee’s employment or officer status with United or any of its subsidiaries is terminated during any restricted period as defined by the Incentive Plan, all Restricted Stock still subject to restrictions at the date of such termination shall either vest or automatically be forfeited and returned to United as provided in the plan. Notwithstanding any provisions of the Incentive Plan, 100% of the Restricted Stock shall fully vest upon the following events resulting in termination of employment or officer status: (a) death; (b) disability; (c) change in control; or (d) retirement.

Notwithstanding any provisions of the Incentive Plan, a portion of Restricted Stock Units shall satisfy the time based vesting requirement upon the following events resulting in termination of employment or officer status: (a) death; (b) disability; or (c) retirement (collectively any of (a), (b) or (c) are an “Acceleration Event”). Upon the occurrence of an Acceleration Event, the percentage of Restricted Stock Unit awards that shall satisfy the time based vesting requirement shall be determined by dividing the number of full calendar months between the date of this Agreement and the date of the Acceleration Event by thirty six (36) and in no event may the percentage accelerated exceed 100%. Notwithstanding the preceding two sentences, the Restricted Stock Units that satisfy the time based vesting requirements due to an Acceleration Event remain subject to the performance based vesting requirements.

Notwithstanding any provisions of the Incentive Plan or this Agreement, 100% of the Restricted Stock Units outstanding shall fully vest, including both time based vesting and performance based vesting, upon a change in control.

At December 31, 2011, there were no fully vested grants under the Incentive Plan.

Named executive officers may participate in the Company’s 401(k) plan, which will provide payment following retirement dependent on contributions by the officer and the Company during their term as an employee. Terms of the plan are disclosed above in the “Compensation Components” section. Named executive officers are not eligible for other Company benefits following retirement.

Equity Compensation Plan Information |

The following table provides information regarding equity compensation plans approved by shareholders as of December 31, 2011.

| Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (A)) | |||||||||

| Equity compensation plans approved by shareholders | (A) | (B) | (C) | |||||||||

Stock Option Plans (1) | 381,743 | $ | 21.19 | - | ||||||||

| Stock Incentive Plan of 2010 | 102,606 | 3.35 | 359,250 | |||||||||

Director Retainer Stock Plan (2) | 104,489 | NA | 243,008 | |||||||||

Senior Management Bonus Deferral Stock Plan (2) | 4,568 | NA | 21,373 | |||||||||

| Total | 593,406 | $ | 17.92 | 623,631 | ||||||||

| (1) | The Company's 2005 Stock Option Plan expired on January 1, 2010, and no additional options can be issued under the plan. |

| (2) | The number of shares credited to participants under the Director Retainer Stock and Senior Management Bonus Deferral Stock Plans is determined by dividing the amount of each deferral by the market price of stock at the date of that deferral. |

The Company has no equity compensation plans not approved by shareholders.

Compensation of Directors |

All of the Company’s Directors are Directors of United Bank & Trust. As of January 1, 2010, payment of the annual retainer for Directors was suspended. Effective January 1, 2011, the Company reinstated its annual retainer for Directors, and board fees were increased modestly.

The table below details the fees paid to Directors for 2011:

| Director Fees for 2011 | UBI | UBT | ||||||

| Annual retainer | ||||||||

| Non-officer directors | $ | 1,000 | $ | 4,000 | ||||

| Committee Chairs | 2,500 | 2,500 | ||||||

| Meeting attendance fee | ||||||||

| Board meeting | 500 | 500 | ||||||

| Board Committee | 250 | 250 | ||||||