UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4395

Smith Barney Muni Funds

|

| (Exact name of registrant as specified in charter) |

| | |

| 125 Broad Street, New York, NY | | 10004 |

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

C/o Citigroup Asset Management

300 First Stamford Place

Stamford, CT 06902

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: March 31

Date of reporting period: September 30, 2005

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

EXPERIENCE

SEMI-ANNUAL

REPORT

SEPTEMBER 30, 2005

Smith Barney Muni Funds

New York Money Market Portfolio

New York Portfolio

INVESTMENT PRODUCTS: NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

Smith Barney Muni Funds

New York Money Market Portfolio

New York Portfolio

Semi-Annual Report • September 30, 2005

What’s

Inside

Fund Objective

The Fund seeks as high a level of income exempt from federal income taxes and New York State and New York City personal income taxes as is consistent with prudent investing.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

There was no shortage of potential threats to the U.S. economy during the reporting period. These included record high oil prices, rising short-term interest rates, the devastation inflicted by Hurricanes Katrina and Rita, geopolitical issues and falling consumer confidence. However, the economy proved to be surprisingly resilient. First quarter 2005 gross domestic product (“GDP”)i growth was 3.8% and second quarter GDP growth was 3.3%, another solid advance. This marked nine consecutive quarters when GDP grew 3.0% or more.

The Federal Reserve Board (“Fed”)ii continued to raise interest rates in an attempt to ward off inflation. After raising rates seven times from June 2004 through March 2005, the Fed increased its target for the federal funds rateiii in 0.25% increments four additional times over the period. All told, the Fed’s eleven rate hikes have brought the target for the federal funds rate from 1.00% to 3.75%. This also represents the longest sustained Fed tightening cycle since 1977-1979. Following the end of the Fund’s reporting period, at its November meeting, the Fed once again raised the target rate by 0.25% to 4.00%.

During much of the reporting period, the fixed income market confounded investors as short-term interest rates rose in concert with the Fed rate tightening, while longer-term rates, surprisingly, declined. When the period began, the federal funds target rate was 2.75% and the yield on the 10-year Treasury was 4.13%. When the reporting period ended, the federal funds rate rose to 3.75%. Due to a spike in September, the 10-year yield was 4.29% at that time, slightly higher than when the period began, but still lower than its yield of 4.62% when the Fed began its tightening cycle on June 30, 2004. This trend also occurred in the municipal bond market.

Smith Barney Muni Funds 2005 Semi-Annual Report 1

New York Money Market Portfolio

Performance Review

As of September 30, 2005, the seven-day current yield for Class A shares of the Smith Barney Muni Funds — New York Money Market Portfolio was 2.07% and its seven-day effective yield, which reflects compounding, was 2.09%.1

Certain investors may be subject to the Federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

| | | | |

| Performance Snapshot |

| | |

| | | Seven Day

Current Yield1 | | Seven Day

Effective Yield1 |

| | | | | |

Class A Shares | | 2.07% | | 2.09% |

|

Class Y Shares | | 2.20% | | 2.22% |

|

|

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. |

| | | | | |

An investment in the Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

New York Portfolio

Performance Review

For the six months ended September 30, 2005, Class A shares of the Smith Barney Muni Funds — New York Portfolio, excluding sales charges, returned 1.15%. These shares underperformed the Lipper New York Municipal Debt Funds Category Average,2 which increased 2.62% over the same time frame. The Fund’s unmanaged benchmark,

| 1 | | The seven-day current yield reflects the amount of income generated by the investment during that seven-day period and assumes that the income is generated each week over a 365-day period. The yield is shown as a percentage of the investment. The seven-day effective yield is calculated similarly to the seven-day current yield but, when annualized, the income earned by an investment in the Fund is assumed to be reinvested. The effective yield typically will be slightly higher than the current yield because of the compounding effect of the assumed reinvestment. |

| 2 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended September 30, 2005, including the reinvestment of distributions, including returns of capital, if any, calculated among the 107 funds in the Fund’s Lipper category, and excluding sales charges. |

2 Smith Barney Muni Funds 2005 Semi-Annual Report

the Lehman Brothers Municipal Bond Index,iv returned 2.80% for the same period.

Certain investors may be subject to the Federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

| | |

| Performance Snapshot as of September 30, 2005 (excluding sales charges) (unaudited) |

| |

| | | 6 Months |

| | | |

New York Portfolio — Class A Shares | | 1.15% |

|

Lehman Brothers Municipal Bond Index | | 2.80% |

|

Lipper New York Municipal Debt Funds Category Average | | 2.62% |

|

|

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com. |

|

| All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. Excluding sales charges, Class B shares returned 0.80%, Class C shares returned 0.79% and Class Y shares returned 1.24% over the six months ended September 30, 2005. |

| |

Special Shareholder Notice

On June 24, 2005, Citigroup Inc. (“Citigroup”) announced that it has signed a definitive agreement under which Citigroup will sell substantially all of its worldwide asset management business to Legg Mason, Inc. (“Legg Mason”).

As part of this transaction, Smith Barney Fund Management LLC (the “Manager”), currently an indirect wholly owned subsidiary of Citigroup, would become an indirect wholly owned subsidiary of Legg Mason. The Manager is the investment manager to the Fund.

The transaction is subject to certain regulatory approvals, as well as other customary conditions to closing. Subject to such approvals and the satisfaction of the other conditions, Citigroup expects the transaction to be completed later this year.

Smith Barney Muni Funds 2005 Semi-Annual Report 3

Under the Investment Company Act of 1940, consummation of the transaction will result in the automatic termination of the investment management contract between the Fund and the Manager. Therefore the Trust’s Board of Trustees has approved a new investment management contract between the Fund and the Manager to become effective upon the closing of the sale to Legg Mason. The new investment management contract has been presented to shareholders for their approval.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Fund’s Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Adviser with regard to recent regulatory developments is contained in the Notes to the Financial Statements included in this report.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

November 1, 2005

4 Smith Barney Muni Funds 2005 Semi-Annual Report

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS:

New York Money Market Portfolio: Certain Investors may be subject to the Federal Alternative Minimum Tax, and state and local taxes will apply. Capital gains, if any, are fully taxable. An investment in a money market fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Please see the Fund’s prospectus for more information on these and other risks.

New York Portfolio: Keep in mind, the Fund’s investments are subject to interest rate and credit risks. As interest rates rise, bond prices fall, reducing the value of the Fund’s share price. As a non-diversified fund, it can invest a larger percentage of its assets in fewer issues than a diversified fund. This may magnify the Fund’s losses from events affecting a particular issuer. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The Lehman Brothers Municipal Bond Index is a broad measure of the municipal bond market with maturities of at least one year. |

Smith Barney Muni Funds 2005 Semi-Annual Report 5

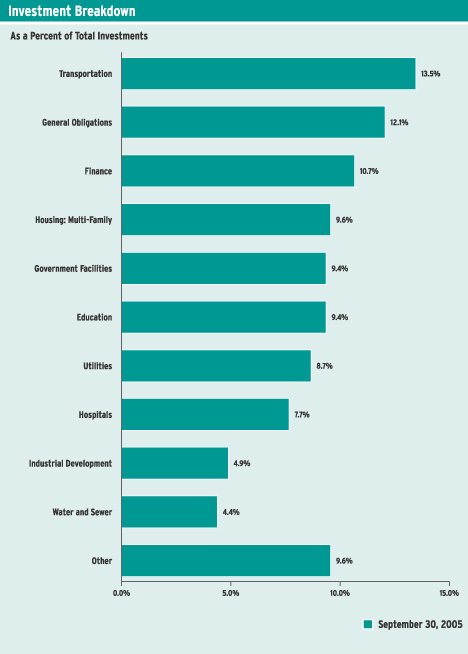

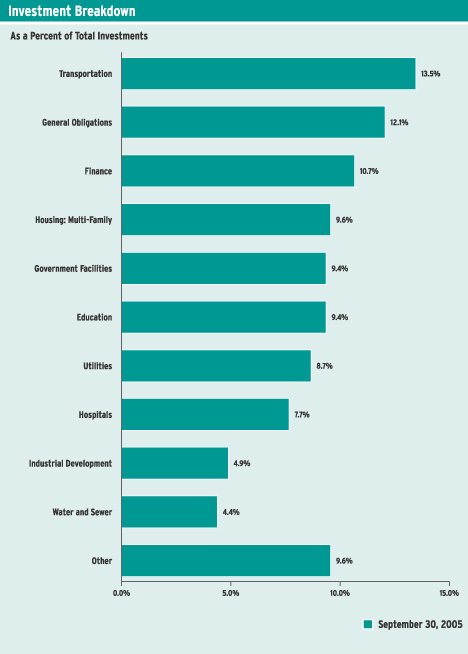

Fund at a Glance (unaudited)

New York Money Market Portfolio

6 Smith Barney Muni Funds 2005 Semi-Annual Report

Fund Expenses (unaudited)

New York Money Market Portfolio

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2005 and held for the six months ended September 30, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | | | | |

| | | | | |

| | | Actual

Total

Return(2) | | | Beginning

Account

Value | | Ending Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Class A | | 0.92 | % | | $ | 1,000.00 | | $ | 1,009.20 | | 0.62 | % | | $ | 3.12 |

|

Class Y | | 0.99 | | | | 1,000.00 | | | 1,009.90 | | 0.49 | | | | 2.47 |

|

| (1) | | For the six months ended September 30, 2005. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Smith Barney Muni Funds 2005 Semi-Annual Report 7

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) | | | | | | | | | |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Class A | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.96 | | 0.62 | % | | $ | 3.14 |

|

Class Y | | 5.00 | | | | 1,000.00 | | | 1,022.61 | | 0.49 | | | | 2.48 |

|

| (1) | | For the six months ended September 30, 2005. |

| (2) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

8 Smith Barney Muni Funds 2005 Semi-Annual Report

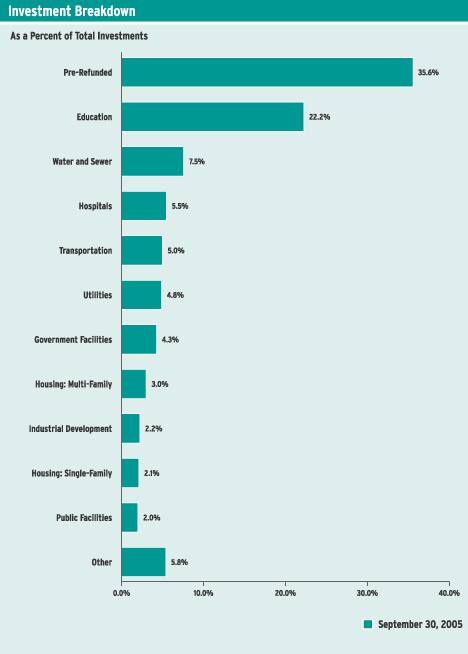

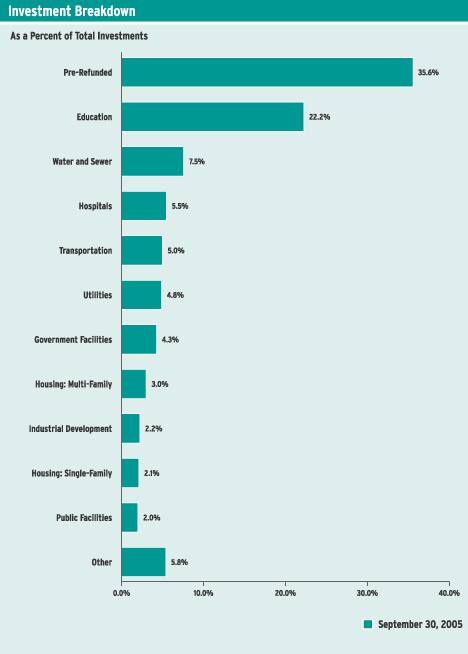

Fund at a Glance (unaudited)

New York Portfolio

Smith Barney Muni Funds 2005 Semi-Annual Report 9

Fund Expenses (unaudited)

New York Portfolio

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2005 and held for the six months ended September 30, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | | | | |

| | | | | |

| | | Actual Total

Return Without Sales Charges(2) | | | Beginning

Account

Value | | Ending Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

Class A | | 1.15 | % | | $ | 1,000.00 | | $ | 1,011.50 | | 0.71 | % | | $ | 3.58 |

|

Class B | | 0.80 | | | | 1,000.00 | | | 1,008.00 | | 1.25 | | | | 6.29 |

|

Class C | | 0.79 | | | | 1,000.00 | | | 1,007.90 | | 1.27 | | | | 6.39 |

|

Class Y | | 1.24 | | | | 1,000.00 | | | 1,012.40 | | 0.54 | | | | 2.72 |

|

| (1) | | For the six months ended September 30, 2005. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

10 Smith Barney Muni Funds 2005 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) | | | | | | | | | |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

Class A | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.51 | | 0.71 | % | | $ | 3.60 |

|

Class B | | 5.00 | | | | 1,000.00 | | | 1,018.80 | | 1.25 | | | | 6.33 |

|

Class C | | 5.00 | | | | 1,000.00 | | | 1,018.70 | | 1.27 | | | | 6.43 |

|

Class Y | | 5.00 | | | | 1,000.00 | | | 1,022.36 | | 0.54 | | | | 2.74 |

|

| (1) | | For the six months ended September 30, 2005. |

| (2) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Smith Barney Muni Funds 2005 Semi-Annual Report 11

Schedules of Investments (September 30, 2005) (unaudited)

New York Money Market Portfolio

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Education — 9.5% | | | | | | |

| | | | | | | Albany, NY, IDA, Civic Facilities University at Albany: | | | | |

| $ | 4,910,000 | | | A-1 | | Series A, AMBAC-Insured, SPA-Key Bank N.A.,

2.770%, 10/6/05 (a) | | $ | 4,910,000 | |

| | 13,770,000 | | | A-1 | | Series B, AMBAC-Insured, SPA-Key Bank N.A.,

2.770%, 10/6/05 (a) | | | 13,770,000 | |

| | 10,945,000 | | | A-1 | | Series C, AMBAC-Insured, SPA-Key Bank N.A.,

2.770%, 10/6/05 (a) | | | 10,945,000 | |

| | 15,615,000 | | | A-1 | | Series D, AMBAC-Insured, SPA-Key Bank N.A.,

2.770%, 10/6/05 (a) | | | 15,615,000 | |

| | 5,525,000 | | | A-1+ | | Dutchess County, NY, IDA, Marist College, Series A, LOC-Bank of New York, 2.720%, 10/6/05 (a) | | | 5,525,000 | |

| | 4,170,000 | | | A-1+ | | New York City, NY, IDA Revenue, Ethical Culture School Project Series A, XLCA-Insured, SPA-Dexia Credit Local,

2.750%, 10/6/05 (a) | | | 4,170,000 | |

| | | | | | | New York State Dormitory Authority Revenue: | | | | |

| | | | | | | Columbia University: | | | | |

| | 2,000,000 | | | AAA | | MSTC, SGA 132, PART, LIQ-Societe Generale, 2.760%, 10/5/05 (a) | | | 2,000,000 | |

| | 9,200,000 | | | A-1+ | | Series B, 2.740%, 10/6/05 (a) | | | 9,200,000 | |

| | 1,200,000 | | | A-1+ | | Cornell University, Series B, LOC-JPMorgan Chase,

2.740%, 10/6/05 (a) | | | 1,200,000 | |

| | | | | | | TECP: | | | | |

| | 10,000,000 | | | A-1+ | | 2.480% due 10/12/05 | | | 10,000,000 | |

| | 15,000,000 | | | A-1+ | | 2.620% due 12/2/05 | | | 15,000,000 | |

| | 15,000,000 | | | A-1+ | | 2.680% due 12/9/05 | | | 15,000,000 | |

| | 10,500,000 | | | VMIG1(b) | | Oxford University Press Inc. LOC-Landesbank

Hessen-Thuringen, 2.750%, 10/5/05 (a) | | | 10,500,000 | |

| | 3,700,000 | | | A-1+ | | Rockefeller University, Series A, 2.750%, 10/5/05 (a) | | | 3,700,000 | |

| | 7,842,500 | | | VMIG1(b) | | State Personal Income Tax Revenue, Series 821,PART,

FGIC-Insured, 2.760%, LIQ- Morgan Stanley, 10/6/05 (a) | | | 7,842,500 | |

| | 9,945,000 | | | A-1 | | State University, Series PA-622, PART, LIQ-Merrill Lynch Capital Services Inc., 4.000% 10/6/05 (a) | | | 9,945,000 | |

| | 2,600,000 | | | A-1+ | | Wagner College, LOC-JPMorgan Chase, 2.760%, 10/5/05 (a) | | | 2,600,000 | |

| | 4,330,000 | | | VMIG1(b) | | Oneida County, NY, IDA, Civic Facility Hamilton College, MBIA-Insured, SPA-Bank of New York, 2.750%, 10/5/05 (a) | | | 4,330,000 | |

| | 9,320,000 | | | VMIG1(b) | | Puerto Rico Industrial Tourist Educational, Medical & Environmental Cultural Facilities, Floater Certificates,

Series 464, PART, MBIA-Insured, LIQ-Morgan Stanley,

1.850% due 10/13/05 | | | 9,320,000 | |

| | 11,890,000 | | | VMIG1(b) | | Tompkins County, NY, IDA Revenue, Civic Facilities, Ithaca College, Series B, XCLA-Insured, SPA-HSBC Holdings PLC, 2.800%, 10/6/05 (a) | | | 11,890,000 | |

| | 1,500,000 | | | A-1+ | | Troy, NY, IDA, Civic Facilities Revenue, Rensselaer Polytechnic Institute, Series E, 2.750%, 10/6/05 (a) | | | 1,500,000 | |

|

|

|

| | | | | | | Total Education | | | 168,962,500 | |

|

|

|

See Notes to Financial Statements.

12 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Escrowed to Maturity — 0.5% | | | | |

| $ | 9,170,000 | | | A-1 | | New York State Environmental Facilities Clean Water MSTC, Class A, PART, 2.780%, 10/6/05 (a) (escrowed to maturity with U.S. government securities) | | $ | 9,170,000 | |

|

|

|

| | Finance — 10.9% | | | | |

| | | | | | | Nassau County, NY, Interim Finance Authority, Sales Tax Revenue, FSA-Insured: | | | | |

| | 14,165,000 | | | A-1+ | | Series A, LIQ-Dexia Credit Local, 2.700%, 10/5/05 (a) | | | 14,165,000 | |

| | 9,345,000 | | | A-1+ | | Series B, SPA-BNP Paribas, 2.720%, 10/5/05 (a) | | | 9,345,000 | |

| | | | | | | New York City, NY, TFA: | | | | |

| | 6,300,000 | | | A-1+ | | Future Tax Secured, Subordinated Series C2,

SPA-Landesbank Hessen, 2.790%, 10/3/05 (a) | | | 6,300,000 | |

| | 1,215,000 | | | A-1+ | | NYC Recovery, Series 3, Subordinated Series 3-G,

SPA-Bank of New York, 2.740%, 10/5/05 (a) | | | 1,215,000 | |

| | 1,000,000 | | | A-1+ | | Subordinated Series 2-D, LIQ-Lloyds TSB Bank,

2.740%, 10/5/05 (a) | | | 1,000,000 | |

| | | | | | | Future Tax Secured: | | | | |

| | 28,300,000 | | | A-1+ | | Series A2, LIQ-Bank of Nova Scotia,

2.740%, 10/5/05 (a) | | | 28,300,000 | |

| | 200,000 | | | A-1+ | | Series B, SPA-Landesbank Baden-Wurttemburg,

2.800%, 10/3/05 (a) | | | 200,000 | |

| | 700,000 | | | A-1+ | | Series C, LIQ-Landesbank Baden-Wurttemberg,

2.740%, 10/5/05 (a) | | | 700,000 | |

| | | | | | | New York City Recovery Project, Series 3, Subseries 3-H,

SPA-Royal Bank of Canada, | | | | |

| | 35,400,000 | | | A-1+ | | 2.790%, 10/3/05 (a) | | | 35,400,000 | |

| | 3,000,000 | | | A-1+ | | NYC Recovery, Series 1, Subordinated 1A, LOC-Landesbank Hessen-Thuringen, 2.740%, 10/5/05 (a) | | | 3,000,000 | |

| | 18,555,000 | | | A-1+ | | New York State, Series A, LOC-Bayerische Landesbank & Westdeustche Landesbank, 2.720%, 10/5/05 (a) | | | 18,555,000 | |

| | | | | | | New York State LGAC: | | | | |

| | 18,600,000 | | | A-1+ | | Refunding, Subordinated Lien, Series 4V, FSA-Insured,

SPA-Westdeustche Landesbank, 2.750%, 10/5/05 (a) | | | 18,600,000 | |

| | 38,600,000 | | | A-1+ | | Series 3V, Refunding, FGIC-Insured, SPA-Landesbank

Baden-Wurttemburg, 2.750%, 10/5/05 (a) | | | 38,600,000 | |

| | 350,000 | | | A-1+ | | Series SGA 59, PART, AMBAC-Insured, LIQ-Societe Generale,

2.830%, 10/3/05 (a) | | | 350,000 | |

| | 18,495,000 | | | A-1 | | Puerto Rico, IFA, MSTC, Class A, Series 2000-106, PART, LIQ-Bear Stearns ESC-U.S. Government Securities, 2.730%, 10/5/05 (a) | | | 18,495,000 | |

|

|

|

| | | | | | | Total Finance | | | 194,225,000 | |

|

|

|

| | General Obligations — 12.3% | | | | |

| | | | | | | Allegany County, NY, LOC-Depfa Bank Europe PLC State Aid Withholding: | | | | |

| | 6,250,000 | | | MIG1(b) | | State Aid Withholding BAN, 3.500% due 12/8/05 | | | 6,265,038 | |

| | 2,000,000 | | | MIG1(b) | | State Aid Withholding RAN, 3.500% due 12/8/05 | | | 2,004,812 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 13

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | General Obligations — 12.3% (continued) | | | | |

| $ | 1,750,000 | | | NR | | East Williston, NY, Union Free School District,

3.750% due 6/28/06 | | $ | 1,764,121 | |

| | 28,000,000 | | | MIG1(b) | | Half Hollow Hills, NY, Central School District, TAN,

4.000% due 6/30/06 | | | 28,248,633 | |

| | 300,000 | | | AAA | | Hempstead Town, NY, Series B, MBIA-Insured,

4.000% due 2/1/06 | | | 301,282 | |

| | | | | | | New York City, NY: | | | | |

| | 600,000 | | | A-1+ | | MSTC, Series SGB 35, PART, AMBAC-Insured, LOC-Societe Generale, 2.750%, 10/6/05 (a) | | | 600,000 | |

| | 29,500,000 | | | A-1+ | | Series A Subordinated Series A-3, LOC-BNP Paribas,

2.740%, 10/5/05 (a) | | | 29,500,000 | |

| | 800,000 | | | A-1+ | | Series A-4, LOC-Bayerische Landesbank, 2.800%, 10/3/05 (a) | | | 800,000 | |

| | 9,595,000 | | | A-1+ | | Series C, Subordinated Series C-2, LOC-Bayerische Landesbank, 2.740%, 10/5/05 (a) | | | 9,595,000 | |

| | 600,000 | | | A-1+ | | Series 95 F-6, LOC-JPMorgan Chase,

2.730%, 10/5/05 (a) | | | 600,000 | |

| | 18,000,000 | | | A-1+ | | Series J, Subordinated Series J-2, LOC-Westdeutsche Landesbank, 2.760%, 10/5/05 (a) | | | 18,000,000 | |

| | 1,000,000 | | | A-1+ | | Subordinated Series G-2, LOC-Bank of Nova Scotia,

2.730%, 10/5/05 (a) | | | 1,000,000 | |

| | 1,900,000 | | | A-1+ | | Subordinated Series H-1, LOC-Bank of New York,

2.800%, 10/3/05 (a) | | | 1,900,000 | |

| | 4,000,000 | | | A-1+ | | Subordinated Series H-5, 1994, MBIA-Insured, LIQ-Landesbank Hessen-Thuringen, 2.470%, due 11/8/05, TECP | | | 4,000,000 | |

| | | | | | | New York State TECP: | | | | |

| | | | | | | Series 98A, LOC-Bayerische Landesbank, JPMorgan Chase, Landesbank Hessen-Thuringen: | | | | |

| | 52,900,000 | | | A-1+ | | 2.620% due 12/1/05 | | | 52,900,000 | |

| | 24,605,000 | | | AAA | | Series A, LOC-Dexia Credit Local, 1.800% due 10/7/05 | | | 24,605,000 | |

| | 15,000,000 | | | MIG1(b) | | Syracuse City, NY, RAN, Series D, LOC-JPMorgan Chase,

4.000% due 6/30/06 | | | 15,118,800 | |

| | 21,000,000 | | | NR | | Three Village Central School District, TAN, 4.000% due 6/30/06 | | | 21,208,901 | |

| | 435,000 | | | Aaa(b) | | Warwick Valley, NY, Central School District, Series B, FGIC-Insured, 500% due 1/15/06 | | | 435,245 | |

|

|

|

| | | | | | | Total General Obligations | | | 218,846,832 | |

|

|

|

| | Government Facilities — 9.5% | | | | |

| | 61,025,000 | | | A-1+ | | New York State Dormitory Authority Revenue, Court Facilities Lease, Series B, LOC-Bayerische Landesbank,

2.730%, 10/5/05 (a) | | | 61,025,000 | |

| | | | | | | Jay Street Development Corp., Court Facilities Lease Revenue: | | | | |

| | 41,600,000 | | | A-1+ | | Series A-1, LOC-Bank of America, 2.750%, 10/5/05 (a) | | | 41,600,000 | |

| | | | | | | Series A-2, LOC-Depfa Bank PLC: | | | | |

| | 3,060,000 | | | A-1+ | | 2.550%, 10/12/05 (a) | | | 3,060,000 | |

| | 3,500,000 | | | A-1+ | | 2.610%, 10/12/05 (a) | | | 3,500,000 | |

| | 31,900,000 | | | A-1+ | | Series A-3, LOC-Depfa Bank PLC, 2.720%, 10/5/05 (a) | | | 31,900,000 | |

See Notes to Financial Statements.

14 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Government Facilities — 9.5% (continued) | | | | |

| $ | 21,200,000 | | | A-1 | | New York State Urban Development Corp., Putters Series 313, PART, SPA-JPMorgan Chase, 2.780%, 10/6/05 (a) | | $ | 21,200,000 | |

| | 8,000,000 | | | VMIG1(b) | | New York State Urban Development Corp. Revenue, MERLOT, Series N, PART, AMBAC-Insured, SPA-Wachovia Bank, 2.760%, 10/5/05 (a) | | | 8,000,000 | |

|

|

|

| | | | | | | Total Government Facilities | | | 170,285,000 | |

|

|

|

| | Hospitals — 7.8% | | | | | | |

| | | | | | | Nassau Health Care Corp.: | | | | |

| | 28,430,000 | | | A-1+ | | Series 2004-C1, Refunding, FSA-Insured, SPA-Dexia Credit Local, 2.720%, 10/6/05 (a) | | | 28,430,000 | |

| | 17,600,000 | | | A-1+ | | Series 2004-C3, FSA-Insured, SPA-Dexia Credit Local, 2.750%, 10/6/05 (a) | | | 17,600,000 | |

| | 2,345,000 | | | VMIG1(b) | | New York City, NY, IDA Revenue, Peninsula Hospital Center Project, LOC-JPMorgan Chase, 2.810%, 10/6/05 (a) | | | 2,345,000 | |

| | | | | | | New York State Dormitory Authority Revenue: | | | | |

| | 7,800,000 | | | A-1+ | | Mental Heath Facilities Improvement, Series 2B, FSA-Insured, SPA-Dexia Credit Local, 2.750%, 10/6/05 (a) | | | 7,800,000 | |

| | 3,004,000 | | | A-1+ | | Mental Health Facilities Improvement, Series F-2B, FSA-Insured, SPA-Dexia Credit Local, 2.740%, 10/6/05 (a) | | | 3,004,000 | |

| | | | | | | Mental Health Services: | | | | |

| | 7,300,000 | | | A-1+ | | Sub-Series D-2C, MBIA-Insured, LIQ-Landesbank Baden-Wuerttemberg, 2.730%, 10/6/05 (a) | | | 7,300,000 | |

| | 12,700,000 | | | A-1+ | | Sub-Series D-2E, SPA-BNP Paribas, 2.720%, 10/6/05 (a) | | | 12,700,000 | |

| | 15,000,000 | | | A-1+ | | Sub-Series D-2G, SPA-Bank of Nova Scotia,

2.720%, 10/6/05 (a) | | | 15,000,000 | |

| | 35,000,000 | | | A-1+ | | Sub-Series D-2H, LIQ-HSBC Holding PLC,

2.720%, 10/6/05 (a) | | | 35,000,000 | |

| | 8,000,000 | | | VMIG1(b) | | Ontario County, NY, IDA, Frederick Ferris Thompson Hospital,

Series B, LOC-Key Bank of New York, 2.770%, 10/5/05 (a) | | | 8,000,000 | |

| | 2,460,000 | | | A-1 | | Orange County, NY, IDR, Horton Medical Center Project, FSA-Insured, SPA-Bank of America, 2.730%, 10/6/05 (a) | | | 2,460,000 | |

|

|

|

| | | | | | | Total Hospitals | | | 139,639,000 | |

|

|

|

| | Housing: Multi-Family — 9.7% | | | | |

| | | | | | | New York City, NY, HDC: | | | | |

| | 44,910,000 | | | A-1+ | | 2 Gold Series A, LOC- Bank of America, 2.770%, 10/12/05 (a) | | | 44,910,000 | |

| | 18,500,000 | | | A-1+ | | 90 West Series A, LOC-HSBC Bank USA, 2.770%, 10/5/05 (a) | | | 18,500,000 | |

| | 5,000,000 | | | A-1+ | | Lyric Development Series A, FNMA-Collateralized, 2.760%, 10/5/05 (a)(c) | | | 5,000,000 | |

| | | | | | | Multi-Family Rental Housing Revenue: | | | | |

| | 8,000,000 | | | A-1+ | | Related Sierra Development, Series A, FNMA-Collateralized, 2.760%, 10/5/05 (a)(c) | | | 8,000,000 | |

| | 7,200,000 | | | A-1+ | | West 43rd Street Development, Series A, FNMA-Collateralized, 2.760%, 10/5/05 (a)(c) | | | 7,200,000 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 15

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Housing: Multi-Family — 9.7% (continued) | | | | |

| | | | | | | New York State HFA: | | | | |

| $ | 10,000,000 | | | VMIG1(b) | | 20 River Terrace Housing, Series A, FNMA-Collateralized, 2.760%, 10/5/05 (a) | | $ | 10,000,000 | |

| | 3,000,000 | | | VMIG1(b) | | 240 East 39th Street Housing, Series A, FNMA-Collateralized, 2.810%, 10/5/05 (a)(c) | | | 3,000,000 | |

| | 5,000,000 | | | VMIG1(b) | | 750 Sixth Avenue, Series A, FNMA-Collateralized,

2.810%, 10/5/05 (a)(c) | | | 5,000,000 | |

| | 3,000,000 | | | VMIG1(b) | | Chelsea Arms Housing, Series A, FNMA-Collateralized, 2.780%, 10/5/05 (a)(c) | | | 3,000,000 | |

| | 2,300,000 | | | VMIG1(b) | | Historic Front Street, Series A, LOC-Bank of New York, 2.730%, 10/5/05 (a) | | | 2,300,000 | |

| | 5,450,000 | | | A-1+ | | Normandie Court I Project, LOC-Landesbank Hessen-Thuringen, 2.680%, 10/5/05 (a) | | | 5,450,000 | |

| | 4,550,000 | | | A-1+ | | Revenue, 350 West 43rd Street, Series A, LOC-Landesbank Hessen-Thuringen, 2.760%, 10/5/05 (a)(c) | | | 4,550,000 | |

| | 22,500,000 | | | A-1+ | | Service Contract Revenue, Refunding, Series A, LOC-Westdeutsche Landesbank, 2.740%, 10/5/05 (a) | | | 22,500,000 | |

| | 5,000,000 | | | A-1+ | | Service Contract Revenue, Series B, LOC-BNP Paribas, 2.740%, 10/5/05 (a) | | | 5,000,000 | |

| | 16,400,000 | | | VMIG1(b) | | Union Square South Housing, FNMA-Collateralized, 2.800%, 10/5/05 (a)(c) | | | 16,400,000 | |

| | 2,000,000 | | | VMIG1(b) | | Victory Housing, Series 2002-A, FHLMC-Collateralized, 2.780%, 10/5/05 (a)(c) | | | 2,000,000 | |

| | 2,000,000 | | | VMIG1(b) | | Worth Street, Series A, FNMA-Collateralized, 2.780%, 10/5/05 (a)(c) | | | 2,000,000 | |

| | 9,000,000 | | | VMIG1(b) | | New York State, HFA, Series A, FNMA-Insured,

2.760%, 10/12/05 (a)(c) | | | 9,000,000 | |

|

|

|

| | | | | | | Total Housing: Multi-Family | | | 173,810,000 | |

|

|

|

| | Housing: Single Family — 3.0% | | | | |

| | 7,875,000 | | | VMIG1(b) | | New York State Mortgage Agency Revenue, Homeowner Mortgage, Series 115, SPA-Dexia Credit Local, 2.760%, 10/12/05 (a)(c) | | | 7,875,000 | |

| | | | | | | New York State Mortgage Agency Revenue: | | | | |

| | 20,000,000 | | | VMIG1(b) | | 37th Series, SPA-Dexia Credit Local, 2.810%, 10/5/05 (a)(c) | | | 20,000,000 | |

| | 26,300,000 | | | VMIG1(b) | | Series 122, SPA-Dexia Credit Local, 2.800%, 10/5/05 (a)(c) | | | 26,300,000 | |

|

|

|

| | | | | | | Total Housing: Single Family | | | 54,175,000 | |

|

|

|

| | Industrial Development — 5.0% | | | | |

| | 1,315,000 | | | VMIG1(b) | | Erie County, NY, IDA, Rosina Food Products, Inc., LOC-HSBC Bank USA, 2.900%, 10/12/05 (a)(c) | | | 1,315,000 | |

| | 2,475,000 | | | A-1+ | | Genesee County, NY, IDA, RJ Properties LLC Project, LOC-Fleet National Bank, 2.770%, 10/5/05 (a)(c) | | | 2,475,000 | |

| | 2,670,000 | | | A-1+ | | Lancaster, NY, IDA, Sealing Devices, Inc. Facility, LOC-HSBC Bank USA, 3.300%, 10/6/05 (a)(c) | | | 2,670,000 | |

| | 3,000,000 | | | A-1+ | | Lewis County, NY, IDA, Climax Manufacturing, SPA-Bank of America, 2.770%, 10/5/05 (a)(c) | | | 3,000,000 | |

See Notes to Financial Statements.

16 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Industrial Development — 5.0% (continued) | | | | |

| $ | 305,000 | | | A-1+ | | Monroe County, NY, IDA, JADA Precision, SPA-Bank of America, 2.770%, 10/5/05 (a)(c) | | $ | 305,000 | |

| | | | | | | Nassau County, NY, IDA: | | | | |

| | 17,500,000 | | | A-1+ | | Civic Facilities Revenue, Cold Spring Harbor, 2.790%, 10/3/05 (a) | | | 17,500,000 | |

| | 2,620,000 | | | A-1+ | | Rubies Costume Co. Project, SPA-Bank of America, 2.770%, 10/5/05 (a) | | | 2,620,000 | |

| | | | | | | New York City, NY, IDA: | | | | |

| | 3,875,000 | | | VMIG1(b) | | Ahava Food Corp. Project, LOC-Bank of America NA, 2.850%, 10/6/05 (a)(c) | | | 3,875,000 | |

| | 4,965,000 | | | VMIG1(b) | | Center For Jewish History Project, LOC-Bank of America NA, 2.720%, 10/6/05 (a) | | | 4,965,000 | |

| | 5,300,000 | | | A-1+ | | Children’s Oncology Society, LOC-Bank of New York, 2.760%, 10/5/05 (a) | | | 5,300,000 | |

| | 3,400,000 | | | A-1+ | | Gary Plastic Packaging Corp., LOC-JPMorgan Chase, 2.900%, 10/6/05 (a)(c) | | | 3,400,000 | |

| | 2,700,000 | | | A-1+ | | NY Stock Exchange Project, Series B, LOC-Bank of America NA, 2.720%, 10/6/05 (a) | | | 2,700,000 | |

| | 1,770,000 | | | A-1+ | | PS Bibbs Inc., LOC-JPMorgan Chase,

2.900%, 10/6/05 (a)(c) | | | 1,770,000 | |

| | 1,125,000 | | | A-1+ | | Oneida County, NY, IDA, Harden Furniture, LOC-Bank of America, 2.770%, 10/5/05 (a)(c) | | | 1,125,000 | |

| | | | | | | Onondaga County, NY, IDA: | | | | |

| | 3,355,000 | | | A-1+ | | Syracuse Executive Air Service, Series A, LOC-Bank of America,

2.770%, 10/5/05 (a)(c) | | | 3,355,000 | |

| | 5,410,000 | | | A-1+ | | Syracuse Research Corp., LOC-HSBC Bank USA,

2.850%, 10/6/05 (a) | | | 5,410,000 | |

| | 1,815,000 | | | A-1+ | | Ontario County, NY, IDA, Dixit Enterprises, Series B, LOC-HSBC Holdings PLC, 3.300%, 10/6/05 (a)(c) | | | 1,815,000 | |

| | 2,210,000 | | | A-1+ | | Oswego County, NY, IDR, Fulton Thermal Project Corp., LOC-Bank of America, 2.770%, 10/5/05 (a)(c) | | | 2,210,000 | |

| | 1,330,000 | | | P-1(b) | | Schenectady County, NY, IDA, IDR, Refunding, Scotia Industrial Park Project, Series 98-A, LOC-Bank of America,

2.720%, 10/5/05 (a) | | | 1,330,000 | |

| | 3,265,000 | | | A-1+ | | St. Lawrence County, NY, IDA, Civic Facilities Revenue, United Helpers Independent Living Corp., LOC-Bank of America,

2.720%, 10/5/05 (a) | | | 3,265,000 | |

| | 3,770,000 | | | A-1+ | | Suffolk County, NY, IDR, JBC Realty LLC, LOC-JPMorgan Chase, 2.770%, 10/5/05 (a)(c) | | | 3,770,000 | |

| | 4,895,000 | | | A-1+ | | Westchester County, NY, IDA, Boys & Girls Club Project, LOC-Bank of New York, 2.720%, 10/5/05 (a) | | | 4,895,000 | |

| | 2,020,000 | | | A-1+ | | Yates County, NY, IDA, Coach & Equipment Manufacturing Corp., Series A, LOC-Bank of America, 2.770%, 10/5/05 (a)(c) | | | 2,020,000 | |

| | | | | | | Yonkers, NY, IDA: | | | | |

| | 2,200,,000 | | | VMIG1(b) | | Civic Facilities RevenueLOC-Bank of New York, 2.750%, 10/5/05 (a) | | | 2,200,000 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 17

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Industrial Development — 5.0% (continued) | | | | |

| $ | 5,750,000 | | | A-1+ | | Consumers Union Facilities, AMBAC-Insured,

SPA-Bank of New York, 2.750%, 10/5/05 (a) | | $ | 5,750,000 | |

|

|

|

| | | | | | | Total Industrial Development | | | 89,040,000 | |

|

|

|

| | Miscellaneous — 2.0% | | | | | | |

| | 35,580,000 | | | A1+ | | Oneida Indian Nation, Series 2002, LOC-Bank of America NA, 2.720%, 10/5/05 (a) | | | 35,580,000 | |

|

|

|

| | Pollution Control — 1.2% | | | | |

| | | | | - | | New York State Environmental Facilities Corp., Solid Waste Disposal Revenue LOC-Bayerische Landesbank, Landesbank Hessen-Thuringen, TECP: | | | | |

| | 8,000,000 | | | A-1+ | | 2.630% due 10/14/05 | | | 8,000,000 | |

| | 5,000,000 | | | A-1+ | | 2.630% due 11/9/05 | | | 5,000,000 | |

| | 8,700,000 | | | A-1+ | | 2.650% due 12/6/05 | | | 8,700,000 | |

|

|

|

| | | | | | | Total Pollution Control | | | 21,700,000 | |

|

|

|

| | Public Facilities — 2.9% | | | | |

| | | | | | | New York City, NY, Trust for Cultural Resources Revenue: | | | | |

| | 3,035,000 | | | VMIG1(b) | | American Museum of Natural History, Series 162, PART, AMBAC-Insured, LIQ-Morgan Stanley, 2.760%, 10/6/05 (a) | | | 3,035,000 | |

| | 17,000,000 | | | A-1+ | | Pierpont Morgan Library, LOC-JPMorgan Chase,

2.750%, 10/6/05 (a) | | | 17,000,000 | |

| | 30,000 | | | VMIG1(b) | | Soloman R. Guggenheim Museum, Series B, LOC-Bank of America NA, 2.720%, 10/6/05 (a) | | | 30,000 | |

| | | | | | | New York State Dormitory Authority Revenue: | | | | |

| | | | | | | Metropolitan Museum of Art: | | | | |

| | 12,440,000 | | | A-1+ | | Series A, 2.720%, 10/5/05 (a) | | | 12,440,000 | |

| | 4,240,000 | | | A-1+ | | Series B, 2.720%, 10/5/05 (a) | | | 4,240,000 | |

| | | | | | | New York Public Library: | | | | |

| | 5,630,000 | | | A-1+ | | Series A, MBIA-Insured, SPA-Wachovia Bank NA,

2.750%, 10/5/05 (a) | | | 5,630,000 | |

| | 9,060,000 | | | A-1+ | | Series B, MBIA-Insured, SPA-Wachovia Bank NA,

2.750%, 10/5/05 (a) | | | 9,060,000 | |

|

|

|

| | | | | | | Total Public Facilities | | | 51,435,000 | |

|

|

|

| | Transportation — 13.7% | | | | |

| | | | | | | Metropolitan Transportation Authority of New York: | | | | |

| | | | | | | BAN, LOC-ABM-Amro Bank NV, TECP: | | | | |

| | | | | | | Series CP-1, Sub-Series A: | | | | |

| | 10,000,000 | | | A-1+ | | 2.520% due 10/3/05 | | | 10,000,000 | |

| | 7,500,000 | | | A-1+ | | 2.650% due 12/1/05 | | | 7,500,000 | |

| | | | | | | Sub-Series CP-1: | | | | |

| | 15,500,000 | | | A-1+ | | 2.530% due 10/11/05 | | | 15,500,000 | |

| | 5,000,000 | | | A-1+ | | 2.630% due 11/4/05 | | | 5,000,000 | |

| | 12,975,000 | | | A-1+ | | Series D-1, FSA-Insured, SPA-Westdeustche Landesbank, 2.720%, 10/6/05 (a) | | | 12,975,000 | |

See Notes to Financial Statements.

18 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Transportation — 13.7% (continued) | | | | |

| | | | | | | Series D-2: | | | | |

| $ | 5,000,000 | | | A-1+ | | AMBAC-Insured, SPA-Wachovia Bank, 2.750%, 10/6/05 (a) | | $ | 5,000,000 | |

| | 4,125,000 | | | A-1+ | | Refunding, FSA-Insured, SPA-Dexia Credit Local, 2.720%, 10/6/05 (a) | | | 4,125,000 | |

| | 18,950,000 | | | A-1+ | | Sub-Series A-3, XLCA-Insured, LOC-Depfa Bank,

2.720%, 10/6/05 (a) | | | 18,950,000 | |

| | | | | | | New York State Thruway Authority: | | | | |

| | 3,765,000 | | | SP-1+ | | BAN Series A, 2.250% due 10/6/05 | | | 3,765,270 | |

| | 8,845,000 | | | A-1 | | MSTC Series 2001-120, Class A, PART, FGIC-Insured, LIQ-Bear Stearns, 2.760%, 10/5/05 (a) | | | 8,845,000 | |

| | 5,000,000 | | | A-1+ | | Series 97 SGA 66, PART, SPA-Societe Generale, 2.760%, 10/5/05 (a) | | | 5,000,000 | |

| | | | | | | Port Authority of New York & New Jersey: | | | | |

| | | | | | | Equipment Notes: | | | | |

| | 3,500,000 | | | NR | | Series 1, 2.900%, 10/6/05 (a)(c) | | | 3,500,000 | |

| | 3,500,000 | | | NR | | Series 2, 2.800%, 10/6/05 (a) | | | 3,500,000 | |

| | 7,860,000 | | | A-1+ | | Putters Series 177Z, MBIA-Insured, LIQ-JPMorgan Chase, 2.800%, 10/6/05 (a) | | | 7,860,000 | |

| | 4,755,000 | | | A-1+ | | Series 646, PART, FSA-Insured, LIQ-Morgan Stanley

2.760%, 10/6/05 (a) | | | 4,755,000 | |

| | 4,585,000 | | | A-1+ | | Series A, LIQ-Bank of Nova Scotia, JPMorgan Chase, Lloyds Bank, 2.420% due 10/7/05 TECP (c) | | | 4,585,000 | |

| | | | | | | Series B, LIQ-Bank of Nova Scotia, JPMorgan Chase, Lloyds Bank TECP: | | | | |

| | 1,940,000 | | | A-1+ | | 2.630% due 11/1/05 | | | 1,940,000 | |

| | 7,000,000 | | | A-1+ | | 2.700% due 11/1/05 | | | 7,000,000 | |

| | 15,160,000 | | | A-1+ | | 2.630% due 12/7/05 | | | 15,160,000 | |

| | | | | | | Versatile Structure Obligation: | | | | |

| | 9,450,000 | | | A-1+ | | Series 3, SPA-JP Morgan Chase, 2.820%, 10/3/05 (a) | | | 9,450,000 | |

| | 8,975,000 | | | A-1+ | | Series 5, SPA-Bayerische Landesbank, 2.820%, 10/3/05 (a) | | | 8,975,000 | |

| | 3,470,000 | | | VMIG1(b) | | Puerto Rico Commonwealth Highway & Transportation Authority Revenue, MERLOT, Series FFF, PART, MBIA-Insured, SPA-Wachovia Bank NA, 2.740%, 10/5/05 (a) | | | 3,470,000 | |

| | | | | | | Triborough Bridge & Tunnel Authority: | | | | |

| | 17,520,000 | | | AAA | | MSTC, Series 1992-72, Class A, PART, MBIA-Insured, LIQ-Bear Stearns, 2.760%, 10/5/05 (a) | | | 17,520,000 | |

| | 7,135,000 | | | VMIG1(b) | | MSTC, Class A Series 2000-109, PART, LIQ-Bear Stearns,

2.830%, 10/3/05 (a) | | | 7,135,000 | |

| | 23,000,000 | | | A-1+ | | Subordinated Series B-4, SPA-Landesbank Baden-Wurttemberg, 2.750%, 10/6/05 (a) | | | 23,000,000 | |

| | | | | | | Refunding: | | | | |

| | 9,400,000 | | | A-1+ | | Series A, FSA-Insured, SPA-JPMorgan Chase,

2.760%, 10/5/05 (a) | | | 9,400,000 | |

| | 3,920,000 | | | A-1+ | | Series B, FSA-Insured, SPA-Landesbank Baden-Wuerttemberg, 2.740%, 10/5/05 (a) | | | 3,920,000 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 19

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Transportation — 13.7% (continued) | | | | |

| $ | 16,200,000 | | | A-1+ | | Series F, SPA-ABN Amro Bank NV, 2.750%, 10/6/05 (a) | | $ | 16,200,000 | |

|

|

|

| | | | | | | Total Transportation | | | 244,030,270 | |

|

|

|

| | Utilities — 8.8% | | | | | | |

| | | | | | | Long Island Power Authority: | | | | |

| | | | | | | Series 1: | | | | |

| | 22,100,000 | | | A-1 | | Series 7, Sub-Series 7-B, MBIA-Insured, SPA-Credit Suisse First Boston, 2.750%, 10/5/05 (a) | | | 22,100,000 | |

| | 14,450,000 | | | A-1+ | | Sub-Series 1A, LOC-Bayerische Landesbank, Landesbank Baden-Wurttemburg, 2.760%, 10/5/05 (a) | | | 14,450,000 | |

| | 9,590,000 | | | A-1+ | | Sub-Series 1B, LOC-State Street Bank & Trust Co., 2.790%, 10/3/05 (a) | | | 9,590,000 | |

| | 7,050,000 | | | A-1+ | | Series 2, Sub-Series 2A, LOC-Westdeutsche Landesbank, 2.750%, 10/5/05 (a) | | | 7,050,000 | |

| | 2,100,000 | | | A-1+ | | Series 3, Sub-Series 3B, LOC-Westdeutsche Landesbank, 2.800%, 10/3/05 (a) | | | 2,100,000 | |

| | 7,400,000 | | | A-1+ | | Series 3A, LOC-JPMorgan Chase, Landesbank Baden-Wuerttemberg, 2.740%, 10/5/05 (a) | | | 7,400,000 | |

| | 2,305,000 | | | A-1+ | | Electric Systems Revenue, General Series E, FSA-Insured, SPA-Dexia Credit Local 2.700%, 10/5/05 (a) | | | 2,305,000 | |

| | | | | | | New York State Energy Research & Development Authority: | | | | |

| | | | | | | Consolidated Edison Co.: | | | | |

| | 4,200,000 | | | A-1+ | | Sub-Series A-2, LOC-Wachovia Bank NA,

2.760%, 10/5/05 (a) | | | 4,200,000 | |

| | 23,000,000 | | | A-1+ | | Sub-Series A-3, LOC-Wachovia Bank NA,

2.740%, 10/5/05 (a) | | | 23,000,000 | |

| | 13,280,000 | | | VMIG1(b) | | Long Island Lighting Co., Series A, LOC-Royal Bank of Scotland, 2.810%, 10/5/05 (a)(c) | | | 13,280,000 | |

| | | | | | | New York State Power Authority, LIQ-Bank of New York, Bank of Nova Scotia. Bayerische Landesbank, JPMorgan Chase, Landesbank Hessen-Thuringen, State Street Bank & Trust Co., Wachovia Bank TECP: | | | | |

| | 10,000,000 | | | A-1 | | 2.620% due 11/7/05 | | | 10,000,000 | |

| | 16,000,000 | | | A-1 | | 2.660% due 11/7/05 | | | 16,000,000 | |

| | 17,500,000 | | | A-1 | | 2.700% due 11/8/05 | | | 17,500,000 | |

| | 7,400,000 | | | A-1 | | 2.700% due 11/9/05 | | | 7,400,000 | |

|

|

|

| | | | | | | Total Utilities | | | 156,375,000 | |

|

|

|

| | Water and Sewer — 4.5% | | | | |

| | | | | | | New York City, NY, Municipal Water Finance Authority: | | | | |

| | 6,100,000 | | | A-1+ | | Series A, FGIC-Insured, 2.800%, 10/3/05 (a) | | | 6,100,000 | |

| | | | | | | Series 5B, LIQ-Bayerische Landesbank, Westdeutsche Landesbank TECP: | | | | |

| | 7,200,000 | | | A-1+ | | 2.680% due 12/22/05 | | | 7,200,000 | |

| | 33,000,000 | | | A-1+ | | 2.700% due 12/22/05 | | | 33,000,000 | |

See Notes to Financial Statements.

20 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | | |

| | | |

Face

Amount | | | Rating‡ | | Security | | Value | |

| | | | | | | | | | | |

| | Water and Sewer — 4.5% (continued) | | | | |

| | | | | | | Water & Sewer System Revenue: | | | | |

| $ | 13,600,000 | | | A-1+ | | Fiscal 2003, Sub-Series C-1, SPA-Depfa Bank PLC, 2.800%, 10/3/05 (a) | | $ | 13,600,000 | |

| | 3,900,000 | | | A-1+ | | Fiscal 2003, Sub-Series C-3, SPA-Bank of New York, 2.790% due 10/3/05 | | | 3,900,000 | |

| | 5,690,000 | | | A-1+ | | Series F, Subordinated Series F-1, SPA-Dexia Credit Local, | | | | |

| | | | | | | 2.680%, 10/6/05 (a) | | | 5,690,000 | |

| | 9,990,000 | | | A-1 | | New York State Environmental Facilities Clean Water MSTC, Series 9040, Class A, PART, LIQ-Bear Stearns, 2.760%, 10/5/05 (a) | | | 9,990,000 | |

|

|

|

| | | | | | | Total Water and Sewer | | | 79,480,000 | |

|

|

|

| | | | | | | TOTAL INVESTMENTS —101.3% (Cost — $1,806,753,602#) | | | 1,806,753,602 | |

| | | | | | | Liabilities in Excess of Other Assets — (1.3)% | | | (23,813,232 | ) |

|

|

|

| | | | | | | TOTAL NET ASSETS — 100.0% | | $ | 1,782,940,370 | |

|

|

|

| ‡ | | All ratings are by Standard & Poor’s Ratings Service, unless otherwise footnoted. All ratings are unaudited. |

| (a) | | Variable rate demand obligations have a demand feature under which the fund could tender them back to the issuer on no more than 7 days notice. Date shown is the date of the next interest rate change. |

| (b) | | Rating by Moody’s Investors Service. All ratings are unaudited. |

| (c) | | Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax (AMT). |

| (d) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. |

| # | | Aggregate cost for federal income tax purposes is substantially the same. |

| | | See pages 30 and 31 for definitions of ratings. |

| | |

Abbreviations used in this schedule:

|

| AMBAC | | — Ambac Assurance Corporation |

| BAN | | — Bond Anticipation Notes |

| COP | | — Certificate of Participation |

| FGIC | | — Financial Guaranty Insurance Company |

| FHA | | — Federal Housing Administration |

| FHLMC | | — Federal Home Loan Mortgage Corporation |

| FNMA | | — Federal National Mortgage Association |

| FSA | | — Financial Security Assurance |

| GDB | | — Government Development Bank |

| GIC | | — Guaranteed Investment Contract |

| GO | | — General Obligation |

| HDC | | — Housing Development Corporation |

| HFA | | — Housing Finance Authority |

| IBC | | — Insured Bond Certificates |

| IDA | | — Industrial Development Authority |

| IDR | | — Industrial Development Revenue |

| IFA | | — Industrial Finance Agency |

| LGAC | | — Local Government Assistance Corporation |

| LIQ | | — Liquidity Facility |

| LOC | | — Letter of Credit |

| MBIA | | — Municipal Bond Investors Assurance Corporation |

| MERLOT | | — Municipal Exempt Receipts Liquidity Option Tender |

| MFA | | — Municipal Finance Authority |

| MFH | | — Multi-Family Housing |

| MSTC | | — Municipal Securities Trust Certificates |

| RAN | | — Revenue Anticipation Notes |

| RDA | | — Redevelopment Agency |

| RIBS | | — Residual Interest Bonds |

| SONYMA | | — State of New York Mortgage Association |

| SPA | | — Standby Bond Purchase Agreement |

| TAN | | — Tax Anticipation Notes |

| TCRS | | — Transferable Custodial Receipts |

| TECP | | — Tax Exempt Commercial Paper |

| TFA | | — Transitional Finance Authority |

| XLCA | | — XL Capital Assurance |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 21

Schedules of Investments (September 30, 2005) (unaudited) (continued)

NEW YORK PORTFOLIO

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | MUNICIPAL BONDS — 98.1% | | | | |

| | Education — 21.9% | | | | | | |

| $ | 2,755,000 | | Aaa(a) | | Albany, NY, IDA, Civic Facility Revenue, St. Rose Project, Series A, AMBAC-Insured, 5.375% due 7/1/31 | | $ | 2,951,735 | |

| | | | | | Amherst, NY, IDA, Civic Facilities Revenue, University of Buffalo Foundation, Faculty-Student Housing, Series B, AMBAC-Insured: | | | | |

| | 1,000,000 | | AAA | | 5.125% due 8/1/20 | | | 1,079,170 | |

| | 3,615,000 | | AAA | | 5.250% due 8/1/31 | | | 3,860,639 | |

| | | | | | Madison County, NY, IDA, Civic Facilities Revenue, Colgate University Project, Series B: | | | | |

| | 2,250,000 | | AA- | | 5.000% due 7/1/23 | | | 2,376,878 | |

| | 2,000,000 | | AA- | | 5.000% due 7/1/33 | | | 2,077,860 | |

| | | | | | New York State Dormitory Authority Revenue: | | | | |

| | 1,000,000 | | AA- | | 4201 School Program, 5.000% due 7/1/18 | | | 1,042,260 | |

| | | | | | City University Systems: | | | | |

| | 14,000,000 | | AAA | | 2nd Generation, Series A, FGIC-Insured, 5.000% due 7/1/16 (b) | | | 14,877,520 | |

| | 16,925,000 | | AAA | | 3rd Generation, Series 1, FGIC-Insured, 5.250% due 7/1/25 (b) | | | 18,012,770 | |

| | 5,825,000 | | AAA | | Series A, FGIC-TCRS-Insured, 5.625% due 7/1/16 (c) | | | 6,704,866 | |

| | 7,000,000 | | AAA | | Series B, FSA-Insured, 6.000% due 7/1/14 | | | 7,830,200 | |

| | 2,155,000 | | A3(a) | | Series C, 7.500% due 7/1/10 | | | 2,377,913 | |

| | 2,000,000 | | AAA | | Columbia University, 5.000% due 7/1/18 | | | 2,108,140 | |

| | 2,000,000 | | AA- | | Department of Education, 5.000% due 7/1/24 | | | 2,103,940 | |

| | 5,000,000 | | AAA | | New School University, MBIA-Insured, 5.000% due 7/1/29 | | | 5,162,000 | |

| | 10,260,000 | | AAA | | Rockefeller University, 5.000% due 7/1/28 | | | 10,606,993 | |

| | 546,000 | | AA- | | Series B, 7.500% due 5/15/11 | | | 613,862 | |

| | 1,150,000 | | AAA | | St. John’s University, MBIA-Insured, 5.250% due 7/1/25 | | | 1,213,446 | |

| | | | | | State University Educational Facility: | | | | |

| | | | | | Series A: | | | | |

| | 12,110,000 | | AAA | | FSA-Insured, 5.875% due 5/15/17 (c) | | | 14,263,642 | |

| | 7,030,000 | | AAA | | MBIA-Insured, 5.000% due 5/15/16 | | | 7,394,576 | |

| | 5,000,000 | | AAA | | Series B, FGIC-Insured, 5.250% due 5/15/19 | | | 5,622,850 | |

| | 3,000,000 | | Aaa(a) | | Teachers College, MBIA-Insured, 5.000% due 7/1/22 | | | 3,150,180 | |

| | | | | | University of Rochester, Series A, MBIA-Insured: | | | | |

| | 3,915,000 | | AAA | | 5.000% due 7/1/16 | | | 4,124,570 | |

| | 2,300,000 | | AAA | | 5.000% due 7/1/27 | | | 2,364,515 | |

| | | | | | Rensselaer County, NY, IDA, Civic Facilities Revenue, Polytechnic Institute Dormitory Project: | | | | |

| | 5,430,000 | | A+ | | Series A, 5.125% due 8/1/29 | | | 5,649,698 | |

| | 5,820,000 | | A+ | | Series B, 5.125% due 8/1/27 | | | 6,068,048 | |

| | | | | | Schenectady, NY, IDA, Civic Facilities Revenue, Union College Project, Series A, AMBAC-Insured: | | | | |

| | 2,000,000 | | Aaa(a) | | 5.375% due 12/1/19 | | | 2,180,020 | |

| | 1,725,000 | | Aaa(a) | | 5.000% due 7/1/22 | | | 1,822,273 | |

| | 3,000,000 | | Aaa(a) | | 5.450% due 12/1/29 | | | 3,250,650 | |

| | 2,390,000 | | Aaa(a) | | 5.625% due 7/1/31 | | | 2,635,692 | |

See Notes to Financial Statements.

22 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Education — 21.9% (continued) | |

| | | | | | Taconic Hills, NY, School District at Craryville, FGIC-Insured, State Aid Withholding: | | | | |

| $ | 1,420,000 | | Aaa(a) | | 5.000% due 6/15/25 | | $ | 1,500,883 | |

| | 700,000 | | Aaa(a) | | 5.000% due 6/15/26 | | | 738,192 | |

|

|

|

| | | | | | Total Education | | | 145,765,981 | |

|

|

|

| | Escrowed to Maturity (d) — 1.2% | | | | |

| | 820,000 | | AAA | | Commonwealth of Puerto Rico, Aqueduct & Sewer Authority Revenue, 10.250% due 7/1/09 | | | 937,399 | |

| | 1,655,000 | | AAA | | New York City, NY, Trust Cultural Resource Revenue, AMBAC-Insured, American Museum of Natural History, Series A,

5.250% due 7/1/17 | | | 1,763,518 | |

| | 4,980,000 | | AAA | | New York State Environmental Facilities Corp.,

Clean Water & Drinking Revolving Funds, Correctional Facilities Service Contract Series C, AMBAC-Insured, Call 6/15/09 @ 100, 5.000% due 6/15/16 | | | 5,149,171 | |

|

|

|

| | | | | | Total Escrowed to Maturity | | | 7,850,088 | |

|

|

|

| | Finance — 1.0% | | | | |

| | 5,000,000 | | AAA | | New York State LGAC, Series B, MBIA-Insured, 4.875% due 4/1/20 | | | 5,188,950 | |

| | 1,260,000 | | BBB- | | Puerto Rico Public Financial Corp., Series E, 5.500% due 8/1/29 | | | 1,358,015 | |

|

|

|

| | | | | | Total Finance | | | 6,546,965 | |

|

|

|

| | General Obligation — 0.4% | |

| | 2,750,000 | | AA | | New York State, 9.875% due 11/15/05 | | | 2,771,395 | |

|

|

|

| | Government Facilities — 4.3% | |

| | | | | | New York State Urban Development Corp. Revenue: | | | | |

| | 3,050,000 | | AAA | | Correctional Capital Facilities, MBIA-Insured, 5.000% due 1/1/20 | | | 3,183,743 | |

| | 20,000,000 | | AA- | | Correctional & Youth Facilities, Series A, 5.500% due 1/1/17 (b) | | | 21,718,800 | |

| | 3,000,000 | | AA- | | State Facilities, 5.700% due 4/1/20 | | | 3,516,870 | |

|

|

|

| | | | | | Total Government Facilities | | | 28,419,413 | |

|

|

|

| | Hospitals — 5.4% | |

| | 1,620,000 | | AAA | | East Rochester, NY, Housing Authority Revenue, North Park Nursing Home, GNMA, 5.200% due 10/20/24 | | | 1,726,256 | |

| | | | | | New York City Health & Hospital Corp. Revenue, Health System, Series A: | | | | |

| | 3,000,000 | | AAA | | AMBAC-Insured, 5.000% due 2/15/20 | | | 3,148,590 | |

| | | | | | FSA-Insured: | | | | |

| | 1,110,000 | | AAA | | 5.000% due 2/15/22 | | | 1,159,695 | |

| | 3,750,000 | | AAA | | 5.125% due 2/15/23 | | | 3,952,387 | |

| | | | | | New York State Dormitory Authority Revenue: | | | | |

| | 5,000,000 | | AAA | | Maimonides Medical Center, MBIA-Insured, 5.000% due 8/1/24 | | | 5,254,400 | |

| | | | | | Mental Health Services Facilities, Series B: | | | | |

| | 40,000 | | AA- | | 5.000% due 2/15/18 | | | 41,552 | |

| | | | | | Unrefunded Balance: | | | | |

| | 4,180,000 | | AA- | | 5.625% due 2/15/21 | | | 4,362,331 | |

| | 190,000 | | AAA | | 5.250% due 8/15/30 | | | 199,960 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 23

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Hospitals — 5.4% (continued) | |

| $ | 2,450,000 | | AAA | | St. Vincent’s Hospital & Medical Center, FHA-Insured,

7.400% due 8/1/30 | | $ | 2,468,522 | |

| | 1,500,000 | | AAA | | United Cerebral Palsy, AMBAC-Insured, 5.125% due 7/1/21 | | | 1,609,290 | |

| | 2,000,000 | | AAA | | Victory Memorial Hospital, MBIA-Insured, 5.375% due 8/1/25 | | | 2,115,100 | |

| | 2,500,000 | | AAA | | 5.400% due 2/1/34 | | | 2,670,475 | |

| | | | | | New York State Medical Care Facilities: | | | | |

| | | | | | Finance Agency Revenue: | | | | |

| | 2,500,000 | | B | | Central Suffolk Hospital Mortgage Project, Series A,

6.125% due 11/1/16 | | | 2,381,600 | |

| | 955,000 | | Aa1(a) | | Health Center Projects, Secured Mortgage Program, SONYMA-Insured, 6.375% due 11/15/19 | | | 977,452 | |

| | | | | | Series B: | | | | |

| | 900,000 | | AA | | Hospital & Nursing Home Insured Mortgage, FHA-Insured, 7.000% due 8/15/32 | | | 904,770 | |

| | 2,955,000 | | AA | | Mortgage Project, FHA-Insured, 6.100% due 2/15/15 | | | 3,023,438 | |

|

|

|

| | | | | | Total Hospitals | | | 35,995,818 | |

|

|

|

| | Housing: Multi-Family — 2.9% | |

| | | | | | New York City, NY, HDC: | | | | |

| | 1,234,994 | | NR | | Cadman Project, FHA, 6.500% due 11/15/18 | | | 1,299,684 | |

| | 996,744 | | NR | | Kelly Project, 6.500% due 2/15/18 | | | 1,052,203 | |

| | 5,000,000 | | AA | | Series A, 5.100% due 11/1/24 | | | 5,200,450 | |

| | | | | | New York State Dormitory Authority Revenue, Park Ridge Housing Inc., FNMA: | | | | |

| | 1,000,000 | | AAA | | 6.375% due 8/1/20 (c) | | | 1,131,150 | |

| | 1,470,000 | | AAA | | 6.500% due 8/1/25 | | | 1,664,569 | |

| | | | | | New York State Housing Finance Agency Revenue, Secured Mortgage Program: | | | | |

| | | | | | Series A, SONYMA-Insured: | | | | |

| | 500,000 | | Aa1(a) | | 7.000% due 8/15/12 (e) | | | 503,180 | |

| | 500,000 | | Aa1(a) | | 7.050% due 8/15/24 (e) | | | 511,225 | |

| | 6,870,000 | | Aa1(a) | | Series B, SONYMA-Insured, 6.250% due 8/15/29 (e) | | | 7,082,077 | |

| | 515,000 | | AAA | | Series C, FHA-Insured, 6.500% due 8/15/24 | | | 516,488 | |

| | 605,000 | | A1(a) | | Rensselaer Housing Authority, MFH Mortgage Revenue, Rensselaer Elderly Apartments, 7.750% due 1/1/11 | | | 605,538 | |

|

|

|

| | | | | | Total Housing: Multi-Family | | | 19,566,564 | |

|

|

|

| | Housing: Single-Family — 2.1% | |

| | | | | | New York State Mortgage Agency Revenue, Homeowner Mortgage: | | | | |

| | 2,835,000 | | Aa1(a) | | Series 65, 5.850% due 10/1/28 (e) | | | 2,900,489 | |

| | 4,730,000 | | Aa1(a) | | Series 67, 5.800% due 10/1/28 (e) | | | 4,859,129 | |

| | 6,000,000 | | Aa1(a) | | Series 71, 5.350% due 10/1/18 (e) | | | 6,122,640 | |

|

|

|

| | | | | | Total Housing: Single-Family | | | 13,882,258 | |

|

|

|

| | Industrial Development — 2.1% | |

| | 2,250,000 | | BBB | | Essex County, NY, IDA Revenue, Solid Waste, International Paper Co. Project, Series A, 6.150% due 4/1/21 (e) | | | 2,335,388 | |

See Notes to Financial Statements.

24 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Industrial Development — 2.1% (continued) | |

| $ | 400,000 | | NR | | Monroe County, NY, IDA Revenue, Public Improvement, Canal Ponds Park, Series A, 7.000% due 6/15/13 | | $ | 400,612 | |

| | | | | | Onondaga County, NY, IDA: | | | | |

| | 750,000 | | A | | Civic Facilities Revenue, Syracuse Home Association Project, 5.200% due 12/1/18 | | | 797,235 | |

| | 8,000,000 | | A+ | | Sewer Facilities Revenue, Bristol-Myers Squibb Co. Project, 5.750% due 3/1/24 (e) | | | 9,144,400 | |

| | 1,410,000 | | AA | | Rensselaer County, NY, IDA, Albany International Corp.,

7.550% due 7/15/07 | | | 1,490,934 | |

|

|

|

| | | | | | Total Industrial Development | | | 14,168,569 | |

|

|

|

| | Life Care Systems — 1.7% | |

| | | | | | New York State Dormitory Authority Revenue Bonds, FHA-Insured: | | | | |

| | 3,780,000 | | AA | | Hebrew Nursing Home, 6.125% due 2/1/37 | | | 3,943,939 | |

| | 1,500,000 | | AAA | | Menorah Campus Nursing Home, 6.100% due 2/1/37 | | | 1,584,765 | |

| | 1,310,000 | | AA | | Niagara Frontier Methodist Home Inc., 6.200% due 2/1/15 | | | 1,332,309 | |

| | 3,275,000 | | AA | | Wesley Garden Nursing Home, 6.125% due 8/1/35 | | | 3,417,692 | |

| | 1,250,000 | | AAA | | Syracuse, NY, IDA Revenue, James Square Association, FHA-Insured, 7.000% due 8/1/25 | | | 1,257,125 | |

|

|

|

| | | | | | Total Life Care Systems | | | 11,535,830 | |

|

|

|

| | Pollution Control — 0.7% | |

| | | | | | New York State Environmental Facilities Corp., State Water Revolving Fund, Series A: | | | | |

| | 155,000 | | AAA | | 7.500% due 6/15/12 | | | 168,095 | |

| | 805,000 | | AAA | | GIC-Societe Generale, 7.250% due 6/15/10 | | | 810,796 | |

| | 1,060,000 | | AAA | | New York State Environmental Facilities Corp., Clean Water & Drinking Revolving Funds, Series C, 5.000% due 6/15/16 | | | 1,116,307 | |

| | 1,000,000 | | AAA | | North Country, NY, Development Authority, Solid Waste Management System Revenue, FSA-Insured, 6.000% due 5/15/15 | | | 1,135,600 | |

| | 1,710,000 | | CCC | | Puerto Rico Industrial Medical & Environmental Facilities, Finance Authority Revenue, American Airlines Inc., Series A,

6.450% due 12/1/25 | | | 1,298,420 | |

|

|

|

| | | | | | Total Pollution Control | | | 4,529,218 | |

|

|

|

| | Pre-Refunded (f) — 35.0% | |

| | 1,000,000 | | AAA | | Buffalo, NY, Municipal Water Finance Authority, Water Systems Revenue, FGIC-Insured, Call 7/1/06 @ 102, 6.100% due 7/1/26 | | | 1,043,200 | |

| | | | | | Metropolitan Transportation Authority: | | | | |

| | | | | | Dedicated Tax Fund, Series A: | | | | |

| | | | | | FSA-Insured, Call 10/1/14 @ 100: | | | | |

| | 2,290,000 | | AAA | | 5.125% due 4/1/19 | | | 2,541,305 | |

| | 4,500,000 | | AAA | | 5.250% due 4/1/23 | | | 5,036,535 | |

| | 11,000,000 | | AAA | | MBIA-Insured, Call 11/15/11 @ 100, 5.250% due 11/15/23 (b) | | | 12,120,350 | |

| | | | | | Transit Facilities Revenue: | | | | |

| | 5,000,000 | | AAA | | Series A, Call 7/1/09 @ 100, 6.000% due 7/1/19 (b) | | | 5,507,900 | |

| | 10,000,000 | | AAA | | Series A, MBIA-Insured, Call 7/1/07 @ 101.50,

5.625% due 7/1/25 (b) | | | 10,597,500 | |

See Notes to Financial Statements.

Smith Barney Muni Funds 2005 Semi-Annual Report 25

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Pre-Refunded (f) — 35.0% (continued) | |

| $ | 5,000,000 | | AAA | | Nassau Health Care Corp., New York Health Systems Revenue, FSA-Insured, Call 8/1/09 @ 102, 5.500% due 8/1/19 | | $ | 5,508,500 | |

| | 2,595,000 | | AAA | | New York City, NY, COP, Transit Authority, Metropolitan Transportation Authority, Triborough Bridge & Tunnel Authority, AMBAC-Insured, Call 1/1/10 @ 101, 5.875% due 1/1/30 | | | 2,891,764 | |

| | | | | | New York City, NY, Municipal Water Finance Authority, Water & Sewer System Revenue: | | | | |

| | 1,000,000 | | AAA | | FSA-Insured, Call 6/15/07 @ 101, 5.250% due 6/15/29 | | | 1,038,760 | |

| | | | | | Series B: | | | | |

| | 1,565,000 | | AA+ | | Call 6/15/10 @ 101, 6.000% due 6/15/33 | | | 1,765,805 | |

| | 990,000 | | AA+ | | Unrefunded Balance, Call 6/15/10 @ 101,

6.000% due 6/15/33 | | | 1,107,840 | |

| | 10,000,000 | | AAA | | New York City, NY, TFA Revenue, Series C, Call 5/1/10 @ 101, 5.500% due 11/1/29 | | | 11,061,800 | |

| | 20,000,000 | | AAA | | New York City, NY, Transit Authority, Metropolitan Transportation Authority, Series A, AMBAC-Insured, Call 1/1/10 @ 101, 5.250% due 1/1/29 (b) | | | 21,795,400 | |

| | | | | | New York State Dormitory Authority Revenue: | | | | |

| | 5,375,000 | | AA- | | 4th Generation, Series A, Call 7/1/11 @ 100, 5.250% due 7/1/31 | | | 5,895,085 | |

| | | | | | City University Systems: | | | | |

| | 625,000 | | AA- | | 4th Generation, Series A, Call 7/1/11 @ 100,

5.250% due 7/1/31 | | | 685,475 | |

| | 4,500,000 | | AAA | | MBIA/IBC-Insured, Call 7/1/08 @ 101, 5.000% due 7/1/28 | | | 4,776,210 | |

| | | | | | Court Facilities: | | | | |

| | 3,000,000 | | AAA | | City of New York Issue, AMBAC-Insured, Call 5/15/10 @ 101, 5.750% due 5/15/30 | | | 3,352,710 | |

| | 5,000,000 | | A+ | | City of New York Issue, Call 5/15/10 @101,

6.000% due 5/15/39 | | | 5,629,600 | |

| | | | | | Mental Health Services Facilities: | | | | |

| | | | | | Series B: | | | | |

| | 2,820,000 | | A2(a) | | Call 2/15/07 @ 102, 5.625% due 2/15/21 | | | 2,974,790 | |

| | 2,460,000 | | AA- | | Call 2/15/08 @ 102, 5.000% due 2/15/18 | | | 2,615,939 | |

| | 324,000 | | AA- | | Call 5/15/09 @ 100, 7.500% due 5/15/11 | | | 375,117 | |

| | 2,410,000 | | AAA | | Series D, FSA-Insured, Call 8/15/10 @ 100,

5.250% due 8/15/30 | | | 2,627,285 | |

| | | | | | State University Dormitory Facility, FGIC-Insured,

Call 7/1/11 @ 100: | | | | |

| | 1,000,000 | | AAA | | 5.500% due 7/1/26 | | | 1,112,450 | |

| | 1,000,000 | | AAA | | 5.500% due 7/1/27 | | | 1,112,450 | |

| | 12,000,000 | | AAA | | 5.100% due 7/1/31 (b) | | | 13,100,640 | |

| | | | | | State University Educational Facility: | | | | |

| | 12,750,000 | | AAA | | Series A FGIC-Insured, Call 5/15/12 @ 101,

5.000% due 5/15/27 (b) | | | 14,026,530 | |

| | 5,000,000 | | AAA | | Series B, FSA-Insured, Call 5/15/10 @ 101,

5.500% due 5/15/30 | | | 5,534,650 | |

See Notes to Financial Statements.

26 Smith Barney Muni Funds 2005 Semi-Annual Report

Schedules of Investments (September 30, 2005) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | Rating‡ | | Security | | Value | |

| | | | | | | | | | |

| | Pre-Refunded (f) — 35.0% (continued) | |

| | | | | | New York State Environmental Facilities Corp., Clean Water & Drinking Revolving Funds, Series B, Call 10/15/09 @ 100: | | | | |

| $ | 295,000 | | AAA | | 5.250% due 4/15/17 | | $ | 318,839 | |

| | 400,000 | | AAA | | 5.250% due 4/15/18 | | | 432,324 | |

| | | | | | New York State Thruway Authority, Highway & Bridge Toll Revenue Fund, FGIC-Insured: | | | | |

| | | | | | Series A, Call 4/1/11 @ 101: | | | | |

| | 3,410,000 | | AAA | | 5.000% due 4/1/19 | | | 3,729,142 | |

| | 2,000,000 | | AAA | | 5.000% due 4/1/20 | | | 2,187,180 | |

| | 2,500,000 | | AAA | | 5.000% due 4/1/21 | | | 2,733,975 | |

| | 15,000,000 | | AAA | | Series B, Call 4/1/09 @ 101, 5.000% due 4/1/19 (b) | | | 16,085,700 | |

| | 4,000,000 | | AAA | | Series B-1, Call 4/1/10 @ 101, 5.500% due 4/1/18 | | | 4,418,280 | |

| | | | | | New York State Urban Development Corp. Revenue, Correctional Facilities Service Contract: | | | | |

| | 6,600,000 | | AAA | | Series C, AMBAC-Insured, Call 1/1/09 @ 101,

6.000% due 1/1/29 | | | 7,251,288 | |

| | 18,400,000 | | AAA | | Series D, FSA-Insured, Call 1/1/11@ 100, 5.250% due 1/1/30 (b) | | | 20,121,504 | |

| | 4,505,000 | | Aaa(a) | | North Hempstead, NY, GO, Series A, FGIC-Insured, Call 9/1/09 @ 101, 5.000% due 9/1/22 | | | 4,857,381 | |

| | 3,740,000 | | BBB- | | Puerto Rico Public Financial Corp., Series E, Call 2/1/12 @ 100, 5.500% due 8/1/29 | | | 4,142,873 | |

| | | | | | Triborough Bridge & Tunnel Authority: | | | | |

| | 3,500,000 | | AA- | | Series A, Call 1/1/22 @ 100, 5.250% due 1/1/28 | | | 3,978,065 | |

| | 4,200,000 | | AAA | | Series B, Call 1/1/16 @ 100, 5.375% due 1/1/19 | | | 4,756,500 | |

| | 10,125,000 | | AAA | | Triborough Bridge & Tunnel Authority, GO, Series B, Call 1/1/22 @ 100, 5.500% due 1/1/30 | | | 11,710,778 | |

| | 1,000,000 | | AAA | | Yonkers, NY, GO, Series C, State Aid Withholding, FGIC-Insured, Call 6/1/09 @ 101, 5.000% due 6/1/19 | | | 1,075,160 | |

|

|

|

| | | | | | Total Pre-Refunded | | | 233,634,579 | |

|

|

|

| | Public Facilities — 2.0% | |

| | | | | | New York City, NY, Trust Cultural Resource Revenue, AMBAC-Insured, Museum of Modern Art: | | | | |

| | 3,100,000 | | AAA | | Series A, 5.000% due 4/1/23 | | | 3,255,744 | |

| | 9,000,000 | | AAA | | Series D, 5.125% due 7/1/31 | | | 9,445,950 | |

| | 500,000 | | AA- | | New York State, COP, Hanson Redevelopment Project,

8.375% due 5/1/08 | | | 531,825 | |

|

|

|

| | | | | | Total Public Facilities | | | 13,233,519 | |

|

|

|

| | Tobacco — 0.3% | |