| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4417

| Shelton Funds |

| (Exact name of registrant as specified in charter) |

| |

| 1050 17th Street, Suite 1710, Denver, CO 80265 |

| (Address of principal executive offices) (Zip code) |

| |

| |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: (415) 398-2727

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ANNUAL REPORT

August 31, 2018

California Tax-Free Income Fund

U.S. Government Securities Fund

Short-Term U.S. Government Bond Fund

The United States Treasury Trust

S&P 500 Index Fund

S&P MidCap Index Fund

S&P SmallCap Index Fund

Shelton Core Value Fund

Nasdaq-100 Index Fund

Shelton Green Alpha Fund

This report is intended only for the information of shareholders or those who have received the offering prospectus covering shares of beneficial interest of the Shelton Funds (referred to collectively as the “Funds” or individually the “Fund”) which contains information about the management fee and other costs. Investments in shares of the funds of the Shelton Funds are neither insured nor guaranteed by the U.S. Government, and there is no assurance that any Fund, which is designated a Money Market Fund, will be able to maintain a stable net asset value of $1.00 per share.

Table of Contents | August 31, 2018 |

Historical Performance and Manager’s Discussion | 1 |

About Your Fund’s Expenses | 7 |

Top Holdings and Sector Breakdowns | 9 |

Portfolio of Investments | 13 |

Statements of Assets & Liabilities | 30 |

Statements of Operations | 33 |

Statements of Changes in Net Assets | 36 |

Financial Highlights | 40 |

Notes to Financial Statements | 50 |

Fund Holdings | 57 |

Proxy Voting Policies, Procedures and Voting Records | 57 |

Report of Independent Registered Public Accounting Firm | 58 |

Board of Trustees and Executive Officers | 59 |

Historical Performance and Manager’s Discussion (Unaudited) | August 31, 2018 |

Bond Funds

The bond markets experienced rising interest rates over the course of the last fiscal year, with the more rapidly rising short rates flattening the yield curve. The rising interest rates are a result of a continued economic growth and optimism for future growth bolstered by the Tax Cuts and Jobs Act and a Congress and President that are generally perceived to be pro-business, e.g., lower taxes and less regulation. The US GDP rose by 4.2% in the second quarter of 2018, a rate which last seen in the third quarter of 2014. Unemployment continued the downward trend that began in 2009, with the Bureau of Labor Statistics and reporting a low of 3.8% unemployment in May 2018 and 3.9% at fiscal year end. The US Consumer Price Index was above 2% for the first sustained period of time since 2011-12, ending the fiscal year at 2.7%. With this economic backdrop, the Federal Reserve has continued to raise the Fed Funds target rate, which rose 75 basis points over the course of fiscal year, from 1.00-1.25% to 1.75-2.00%. Thus far, the markets have had a muted response to trade tariffs imposed by the US on many countries, especially China, implying the prevailing sentiment that a full blown trade war will be averted before there is significant detrimental impact to the economy.

In response to the Federal Reserve’s tightening and expected future tightening of the Fed Funds target rate, the three month T-Bill rates rose steadily over the course of the year, with a range from 1.00% to 2.12%, ending the fiscal year at 2.09%. The yield on the two-year note also rose steadily over the course of the year, rising from a low of 1.26% in early September 2017 to close out the fiscal year at 2.63%.

Intermediate and longer dated US Treasuries rose in the first half of the fiscal year and then remained rangebound in the second half of the year, leading to the aforementioned flattening of the yield curve. The five-year note rose from 1.63% to 2.69% through the first half of the year, then generally traded between 2.60% and 2.85%, ending the fiscal year at 2.74%. The 10 year US Treasury bond yield rose during the first half of the fiscal year, rising from 2.04% in September 2017 to 2.95% in mid-February 2018. Though it did trade outside both bounds for brief periods, the remainder of the year traded from 2.8% to 3.00%.The 30-year yield followed the same pattern but with less volatility, rising from 2.67% to 3.22% over the first half of the year before settling into a range that was generally between 2.95% and 3.2%, ending the year at 3.02%.

The U.S. Government Securities Fund ended the fiscal year ended August 31, 2018 with a duration of 4.24 years and a total return of the Direct Shares for the period of -1.88%. The fund returns, as is the case for all fixed income investments, have been negatively impacted by the rising interest rates. All of the securities in the Fund are backed by the full faith and credit of the United States.

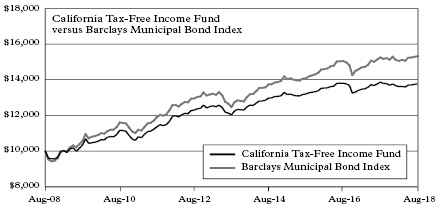

California municipal market bond yields do not necessarily move in lock step with US Treasury yields, but are subject to the level and shape of the benchmark U.S. Treasury curve, as well as the specific economic circumstances of both the State of California and each specific issuer. The relative value of municipal bonds to US Treasuries, as measured by the Bloomberg AAA Muni Yield % of Treasury, ended the year very close to where it started across the yield curve. There was some volatility during the year though, as municipal bond spreads widened significantly in November 2017 on speculation that tax reform (eventually passed as the Tax Cuts and Jobs Act) would limit or nullify the Federal tax-exempt status of most municipal bond income. This resulted in rising yields due to concern about tax-exempt status and a large supply of new issuance as issuers accelerated bringing deals to market in an attempt to issue debt before potentially negative impacts of tax reform. This spike in yields which began in early November 2017 and lasted about a month, after which the relative value of municipals to US Treasuries changed little the remainder of the year. Most California municipal bond investors continue to benefit from generally strong and improving economic conditions throughout the state. Standard & Poor’s, Moody’s and Fitch all maintained their rating on CA GO bonds at AA-, Aa3, and AA- respectively. The Bloomberg US California Muni yield curve, like the US Treasury curve, flattened over the course of the year. The difference in yield between the 2 year and 10 year bonds at fiscal year end was at 0.8% compared to 1.14% at the end of the prior fiscal year end.

The California Tax-Free Income Fund’s total return for the fiscal year ended August 31, 2018 was -0.74%, and the duration was 4.99 years at fiscal year end. The portfolio average credit rating was maintained at AA.

1

Historical Performance and Manager’s Discussion (Unaudited) (Continued) | August 31, 2018 |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

California Tax-Free Income Fund | -0.74% | 2.73% | 3.25% | 5.59% |

Barclays Municipal Bond Index | 0.49% | 4.20% | 4.36% | 6.17% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

U.S. Government Securities Fund | -1.88% | 0.75% | 1.51% | 5.24% |

Barclays GNMA Index | -0.40% | 2.33% | 3.51% | 6.32% |

Barclays Treasury Index | -1.54% | 1.72% | 2.86% | 6.06% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

U.S. Government Securities Fund | -2.37% | 0.25% | 1.00% | 1.80% |

Barclays GNMA Index | -0.40% | 2.33% | 3.51% | 3.92% |

Barclays Treasury Index | -1.54% | 1.72% | 2.86% | 3.38% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

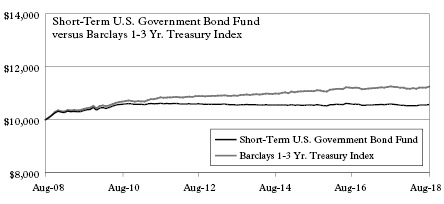

Short-Term U.S. Government Bond Fund | -0.21% | 0.04% | 0.56% | 1.96% |

Barclays 1-3 Yr. Treasury Index | -0.08% | 0.62% | 1.19% | 2.81% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

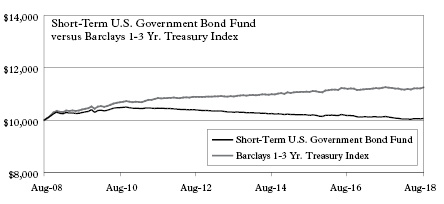

Short-Term U.S. Government Bond Fund | -0.72% | -0.47% | 0.07% | 0.83% |

Barclays 1-3 Yr. Treasury Index | -0.08% | 0.62% | 1.19% | 1.92% |

2

Historical Performance and Manager’s Discussion (Unaudited) (Continued) | August 31, 2018 |

Stock Funds

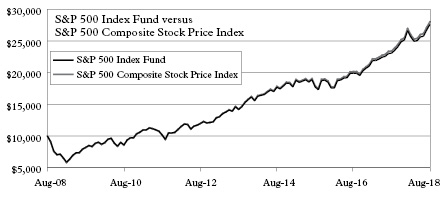

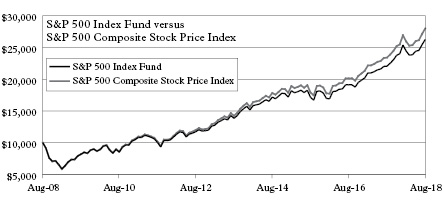

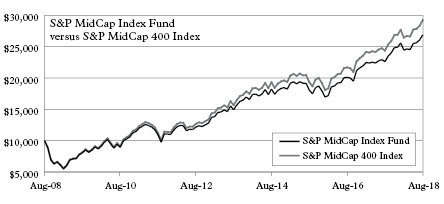

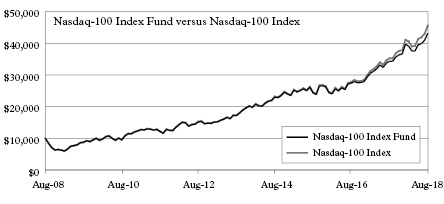

By definition, the objective for managing the index funds is to match the performance of the funds to their index benchmarks. Each of our index funds tracked their respective benchmarks tightly during this last fiscal year. We measure the index fund performance by using a correlation coefficient. This is a statistical measure that compares the daily performance of a fund against its benchmark index. A measure of 1.000 indicates that the performance is perfectly correlated and a measure of -1.000 implies they are negatively correlated. According to Bloomberg, LLC, The S&P Nasdaq-100 Index Fund had a correlation of 0.997 for the fiscal year. The S&P 500 Index Fund, SmallCap Fund and S&P MidCap Index Fund each had a correlation of 0.999.

During the fiscal year, the Direct shares of the S&P SmallCap Index Fund out-performed the Direct Shares of the S&P 500 and MidCap Index Fund by posting gains of 30.95%, compared to 19.64% and 19.48%, respectively. It’s important to note, however, that during the year the relative performance varied substantially. After the new tax bill that went into effect in the beginning of the year, the S&P SmallCap fund substantially outperformed the S&P 500 and MidCap Index funds. Though the returns of these three funds remained relatively flat for the balance of the fiscal year, the SmallCap fund had a strong rally compared to the other two funds during the last four months.

The Nasdaq-100 Index Fund (Direct Shares) finished up 25.73%, versus a benchmark performance of 29.14%. It is important to note that while this index is a popular and widely tracked investment benchmark, it is constructed in a different way than the S&P indices that we track. As of October 2018, Apple Inc. alone made up 12.94% of the index and the top ten holdings accounted for over 50% of the index. It provides investors a strong technology exposure as well as the related volatility.

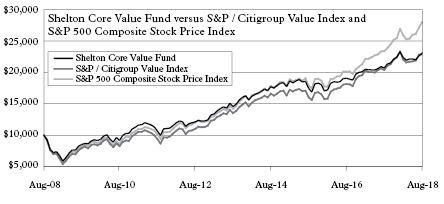

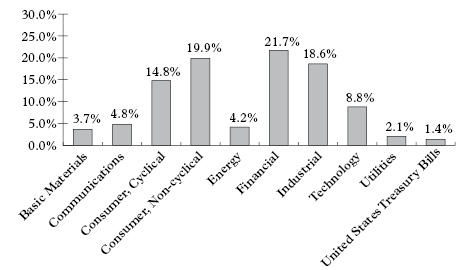

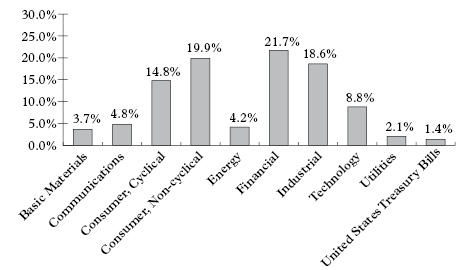

The Shelton Core Value Fund is a value fund that focuses on income as well as the potential for capital appreciation. The Direct Shares were up 11.32% for the year. The performance of the fund trailed the U.S. stock market as measured by the S&P 500 Index by 8.33% and the LargeCap value market, as measured by the S&P 500 Value Index, by 1.47%. United States equity markets performed exceptionally well through the year, delivering excellent returns in all but one sector. The single biggest factor in the US Markets was one of market and business optimism. A graph of the Small Business Optimism Index and the recent positive spike best captures the “animal spirits” that are driving investment and growth. The Tax Cuts and Jobs Act of 2017 and the subsequent economic performance reinforced views that the regulatory environment would ease and business conditions would improve. Sectors such as technology and consumer discretionary substantially outperformed as measures of unemployment improved. In managing the Core Value Fund, we spent much of the year positioned to deliver conservative returns while working to protect some of the fund from macro risks in the market.

A few very real concerns include the threat of war on the Korean Peninsula, the normalization of Fed interest rate policy, a “never attempted before” unwinding the Federal Reserve’s balance sheet, the rapid growth of our national debt as a percentage of GDP, an ongoing threat of political crisis driven by special counsel investigations and finally, an increasingly polarized political environment and a breathless 24 hour media. Finally, US trade negotiators have taken on a new style where they have used much more aggressive styles. While this has so far proven to be very favorable for getting Mexico and Canada to move, it involves a lot of alarming headlines and subsequently, an alarmingly high risk of a trade war with China. With this, we focused on maintaining a lower risk profile in the fund by maintaining our higher level of cash and sticking to our investment style of holding stocks for the long-term, that we believe to have strong strong fundementals and solid business models and predictable future earnings. The net is that the fund underperformed the broader market by being much more conservatively invested.

Predicting market momentum and relative performance is a guessing game at best. As such, we strongly encourage shareholders to consider a balanced approach for the portion of their portfolios dedicated to stock funds. By this, we mean owning equal balances of each of the three core index funds (S&P 500, MidCap and SmallCap Funds) to achieve a more diversified equity portfolio. Over the past several years, a balanced portfolio like this has outperformed a total market index such as the Wilshire 5000.

The reason for this is that smaller companies’ market caps represent a very small piece of the massive Wilshire 5000. Therefore, their performance does not factor significantly into the total return. Keep in mind, however, that during periods where large-cap stocks out-perform their smaller counterparts, this strategy may result in underperformance. So why balance these three sectors in this way? Two reasons: First, at times we need access to our capital. By employing this method, we maintain a degree of flexibility where we can draw from. As an investor, you can reduce holdings from any of the three holdings based on relative valuations. This can prove handy for a number of reasons. Second, history is on our side in that although more volatile, small-cap stocks have returned more to investors over the long haul.

Our view at the time of writing is that while growth will continue to come slowly, corporations will be profitable, and US equities represent an attractive investment opportunity for investors who are comfortable with the associated risks and volatility. The current political dysfunction, in our opinion, is singularly responsible for the poor economic growth we are seeing in the economy. We will become much more bullish if the political dialog about economic policy improves as we believe this is the simplest, most direct route to economic growth and labor market participation. Capital markets perform best with a strong rule of law governing property rights and minimal incremental government influence.

While we cannot predict what the future holds, we can easily make the case that investors who have continued to invest through troubled markets in the past have been rewarded for their tenacity. We encourage you to maintain a diversified portfolio using both stock and bond funds, in a balance that is appropriate for your particular investment objectives.

Shelton Green Alpha Fund

The Shelton Green Alpha Fund invests primarily in stocks of companies that are believed by the Sub-Advisor, Green Alpha Advisors, LLC, to be leaders in managing environmental risks and opportunities, have above average growth potential and are reasonably valued relative to their growth potential. For the year ending August 31, 2018 the Shelton Green Alpha Fund’s return was 2.19%, underperforming the 19.65% return of the S&P 500 Index, the fund’s benchmark. While most sectors contributed positively to performance during the period, the fund’s exposure to renewable energy was a significant detractor and contributed to the underperformance versus the fund’s benchmark.

In line with the Fund’s environmental focus, the Fund’s investments throughout the year reflected the Sub-Advisor’s view of a diversified portfolio of companies who are leaders in a number of industries includes wind energy, solar PV and thin-film, water desalination, waste-to-value building materials, efficient industrial machinery and automation, electric transportation, mobile communications, internet of things, data infrastructure, energy efficiency and lighting, and natural foods, among others.

3

Historical Performance and Manager’s Discussion (Unaudited) (Continued) | August 31, 2018 |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P 500 Index Fund | 19.64% | 14.25% | 10.69% | 9.73% |

S&P 500 Composite Stock Price Index | 19.65% | 14.51% | 10.85% | 9.89% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P 500 Index Fund | 19.05% | 13.67% | 10.14% | 8.57% |

S&P 500 Composite Stock Price Index | 19.65% | 14.51% | 10.85% | 9.29% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P MidCap Index Fund | 19.48% | 13.02% | 10.95% | 11.98% |

S&P MidCap 400 Index | 19.98% | 13.27% | 11.33% | 12.30% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P MidCap Index Fund | 18.86% | 12.46% | 10.40% | 9.91% |

S&P MidCap 400 Index | 19.98% | 13.27% | 11.33% | 10.89% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P SmallCap Index Fund | 30.95% | 14.92% | 11.97% | 10.41% |

S&P SmallCap 600 Index | 32.36% | 15.38% | 12.40% | 11.09% |

4

Historical Performance and Manager’s Discussion (Unaudited) (Continued) | August 31, 2018 |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

S&P SmallCap Index Fund | 30.26% | 14.34% | 11.41% | 10.60% |

S&P SmallCap 600 Index | 32.36% | 15.38% | 12.40% | 11.60% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

Shelton Core Value Fund | 11.32% | 10.07% | 9.19% | 8.17% |

S&P / Citigroup Value Index | 13.23% | 11.31% | 8.73% | 8.15% |

S&P 500 Composite Stock Price Index | 19.65% | 14.51% | 10.85% | 9.05% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

Shelton Core Value Fund | 10.75% | 9.52% | 8.66% | 8.03% |

S&P / Citigroup Value Index | 13.23% | 11.31% | 8.73% | 8.21% |

S&P 500 Composite Stock Price Index | 19.65% | 14.51% | 10.85% | 9.29% |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

Nasdaq-100 Index Fund | 25.73% | 20.18% | 15.75% | 4.02% |

Nasdaq-100 Index | 29.14% | 21.46% | 16.38% | 4.71% |

K SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

Nasdaq-100 Index Fund | 25.03% | 19.58% | 15.18% | 11.79% |

Nasdaq-100 Index | 29.14% | 21.46% | 16.38% | 12.93% |

5

Historical Performance and Manager’s Discussion (Unaudited) (Continued) | August 31, 2018 |

DIRECT SHARES

Average Annual Total Returns*

for the periods ended 8/31/18

Fund/Benchmark | One

Year | Five Year

(Annualized) | Ten Year

(Annualized) | Since

Inception

(Annualized) |

Shelton Green Alpha Fund** | 2.19% | 8.15% | N/A | 11.00% |

S&P 500 Composite Stock Price Index | 19.65% | 14.51% | N/A | 14.96% |

* | Past performance does not predict future performance.The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

** | Shelton Green Alpha Fund commencement of operations was March 12, 2013. |

6

About Your Fund’s Expenses (Unaudited) August 31, 2018 |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution fees and other Fund expenses. Operating expenses, which are deducted from the Funds’ gross income, directly reduce the investment return of the Funds. The Funds’ expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. This example is intended to help you understand your ongoing cost (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from September 1, 2017 to February 28, 2018.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you have paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The Funds do not charge any sales charges. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional cost, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period.

| | Beginning

Account Value

March 1, 2018 | Ending

Account Value

August 31, 2018 | Expenses Paid

During Period* | Net Annual

Expense Ratio |

California Tax-Free Income Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,011 | $ 3.48 | 0.69% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,047 | $ 3.54 | 0.69% |

U.S. Government Securities Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,009 | $ 3.73 | 0.74% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,046 | $ 3.80 | 0.74% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,006 | $ 6.24 | 1.24% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,044 | $ 6.35 | 1.24% |

Short-Term U.S. Government Bond Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,005 | $ 2.97 | 0.59% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,047 | $ 3.03 | 0.59% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,002 | $ 5.47 | 1.09% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,045 | $ 5.59 | 1.09% |

The United States Treasury Trust |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,006 | $ 2.67 | 0.53% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,047 | $ 2.72 | 0.53% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,004 | $ 5.17 | 1.03% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,045 | $ 5.28 | 1.03% |

S&P 500 Index Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,077 | $ 2.50 | 0.48% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,048 | $ 2.46 | 0.48% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,074 | $ 5.10 | 0.98% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,045 | $ 5.02 | 0.98% |

S&P MidCap Index Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,103 | $ 3.37 | 0.64% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,047 | $ 3.28 | 0.64% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,099 | $ 6.00 | 1.14% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,044 | $ 5.84 | 1.14% |

7

About Your Fund’s Expenses (Unaudited) August 31, 2018 (Continued) |

| | Beginning

Account Value

March 1, 2018 | Ending

Account Value

August 31, 2018 | Expenses Paid

During Period* | Net Annual

Expense Ratio |

S&P SmallCap Index Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,195 | $ 4.40 | 0.80% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,046 | $ 4.10 | 0.80% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,192 | $ 7.14 | 1.30% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,043 | $ 6.66 | 1.30% |

Shelton Core Value Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,026 | $ 3.81 | 0.75% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,046 | $ 3.85 | 0.75% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,024 | $ 6.34 | 1.25% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,044 | $ 6.41 | 1.25% |

Nasdaq-100 Index Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,104 | $ 2.58 | 0.49% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,048 | $ 2.52 | 0.49% |

K Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,101 | $ 5.21 | 0.99% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,045 | $ 5.08 | 0.99% |

Shelton Green Alpha Fund |

Direct Shares | | | | |

Based on Actual Fund Return | $ 1,000 | $ 1,015 | $ 6.57 | 1.30% |

Based on Hypothetical 5% Return before expenses | $ 1,000 | $ 1,043 | $ 6.66 | 1.30% |

* | Expenses are equal to the Fund’s expense ratio annualized. |

8

Top Holdings and Sector Breakdowns (Unaudited) | August 31, 2018 |

California Tax-Free Income Fund

Security | Description | Market

Value | Percentage

of Total

Investment |

| 1 | East Side Union High School District | General Obligation Refunding Bonds (2012 Crossover); 2006 | $ 3,421,220 | 5.1% |

| 2 | California State Public Works Board | Lease Revenue Bonds; 2009 Series I-1 | 3,161,130 | 4.7% |

| 3 | Los Rios Community College District | Tax-Exempt Various Purpose General Obligation Bonds | 2,799,050 | 4.1% |

| 4 | San Francisco Bay Area Rapid Transit District | General Obligation Bonds; 2008 Election, Series B | 2,706,249 | 4.0% |

| 5 | Mount San Antonio Community College District | San Francisco BART District GO Bonds 2017 Refunding Series E (Green Bonds) | 2,644,034 | 3.9% |

| 6 | California Educational Facilities Authority | General Obligation Bonds; Election of 2008, Series 2013A | 2,507,050 | 3.7% |

| 7 | William S Hart Union High School District | Revenue Bonds (University of Southern California); Series 2009A | 2,506,254 | 3.7% |

| 8 | East Bay Municipal Utility District Water System Revenue | General Obligation Bonds; 2001 Election, Series B | 2,431,608 | 3.6% |

| 9 | City of Los Angeles CA | Water System Revenue Bonds; 2015 Series B | 2,197,680 | 3.3% |

| 10 | Los Angeles Department of Water | General Obligation refunding Bonds; Series 2012-A | 2,189,157 | 3.2% |

U.S. Government Securities Fund

Security | Maturity | Market

Value | Percentage of Total Investment |

1 | United States Treasury Note/Bond | 08/15/2023 | $ 2,472,607 | 12.9% |

2 | United States Treasury Note/Bond | 02/15/2022 | 2,343,938 | 12.2% |

3 | United States Treasury Note/Bond | 05/15/2025 | 2,109,336 | 11.0% |

4 | United States Treasury Note/Bond | 08/15/2020 | 2,100,000 | 10.9% |

5 | United States Treasury Note/Bond | 02/15/2021 | 2,044,844 | 10.6% |

6 | United States Treasury Note/Bond | 02/15/2019 | 1,703,652 | 8.9% |

7 | United States Treasury Note/Bond | 02/29/2024 | 1,257,953 | 6.5% |

8 | United States Treasury Note/Bond | 02/15/2026 | 972,109 | 5.1% |

9 | United States Treasury Note/Bond | 08/15/2027 | 857,549 | 4.5% |

10 | United States Treasury Note/Bond | 05/15/2037 | 650,313 | 3.4% |

Short-Term U.S. Government Bond Fund

Security | Maturity | Market

Value | Percentage of Total Investment |

1 | United States Treasury Note/Bond | 01/31/2020 | $ 1,082,318 | 17.1% |

2 | United States Treasury Note/Bond | 07/31/2020 | 988,574 | 15.6% |

3 | United States Treasury Note/Bond | 01/31/2021 | 987,500 | 15.6% |

4 | United States Treasury Note/Bond | 01/31/2019 | 896,414 | 14.2% |

5 | United States Treasury Note/Bond | 07/31/2021 | 790,234 | 12.5% |

6 | United States Treasury Note/Bond | 06/30/2019 | 692,125 | 10.9% |

7 | United States Treasury Bill | 10/18/2018 | 299,275 | 4.7% |

8 | United States Treasury Note/Bond | 06/30/2019 | 298,061 | 4.7% |

9 | United States Treasury Note/Bond | 06/30/2022 | 195,680 | 3.1% |

10 | Ginnie Mae II Pool | 11/20/2034 | 67,494 | 1.1% |

9

Top Holdings and Sector Breakdowns (Unaudited) (Continued) | August 31, 2018 |

The United States Treasury Trust

Security | Maturity | Market

Value | Percentage of Total Investment |

1 | United States Treasury Bill | 11/08/2018 | $ 9,264,852 | 17.0% |

2 | United States Treasury Bill | 10/18/2018 | 8,079,320 | 14.8% |

3 | United States Treasury Bill | 09/20/2018 | 7,792,156 | 14.3% |

4 | United States Treasury Bill | 09/06/2018 | 6,998,156 | 12.9% |

5 | United States Treasury Bill | 10/04/2018 | 6,987,769 | 12.8% |

6 | United States Treasury Bill | 11/29/2018 | 6,965,240 | 12.8% |

7 | United States Treasury Bill | 12/06/2018 | 3,779,020 | 6.9% |

8 | United States Treasury Bill | 01/03/2019 | 2,581,169 | 4.7% |

9 | United States Treasury Bill | 11/15/2018 | 1,991,564 | 3.7% |

S&P 500 Index Fund

Security | Market

Value | Percentage of Total Investment |

1 | Apple Inc | $ 8,731,659 | 4.6% |

2 | Microsoft Corp | 6,745,304 | 3.5% |

3 | Amazon.com Inc | 6,329,973 | 3.3% |

4 | Facebook Inc | 3,295,640 | 1.7% |

5 | Berkshire Hathaway Inc | 3,148,124 | 1.6% |

6 | JPMorgan Chase & Co | 3,090,910 | 1.6% |

7 | Alphabet Inc - Class C | 2,930,965 | 1.5% |

8 | Johnson & Johnson | 2,822,833 | 1.5% |

9 | Alphabet Inc - Class A | 2,815,895 | 1.5% |

10 | Exxon Mobil Corp | 2,614,344 | 1.4% |

S&P MidCap Index Fund

Security | Market

Value | Percentage of Total Investment |

1 | WellCare Health Plans Inc | $ 952,188 | 0.7% |

2 | Domino's Pizza Inc | 922,849 | 0.7% |

3 | Jack Henry & Associates Inc | 865,082 | 0.7% |

4 | Fortinet Inc | 852,342 | 0.7% |

5 | Keysight Technologies Inc | 829,164 | 0.6% |

6 | IDEX Corp | 827,487 | 0.6% |

7 | PTC Inc | 816,810 | 0.6% |

8 | Teleflex Inc | 787,817 | 0.6% |

9 | Steel Dynamics Inc | 766,069 | 0.6% |

10 | Trimble Inc | 749,338 | 0.6% |

10

Top Holdings and Sector Breakdowns (Unaudited) (Continued) | August 31, 2018 |

S&P SmallCap Index Fund

Security | Market

Value | Percentage of Total Investment |

1 | United States Treasury Bill | $ 1,198,065 | 1.4% |

2 | Ligand Pharmaceuticals Inc | 555,477 | 0.6% |

3 | Trex Co Inc | 500,238 | 0.6% |

4 | HealthEquity Inc | 496,487 | 0.6% |

5 | Neogen Corp | 483,645 | 0.5% |

6 | CACI International Inc | 483,210 | 0.5% |

7 | Inogen Inc | 462,533 | 0.5% |

8 | ASGN Inc | 456,746 | 0.5% |

9 | Insperity Inc | 449,557 | 0.5% |

10 | Ingevity Corp | 426,565 | 0.5% |

Shelton Core Value Fund

Security | Market

Value | Percentage of Total Investment |

1 | JPMorgan Chase & Co | $ 8,137,472 | 4.5% |

2 | United States Treasury Bill | 7,288,230 | 4.1% |

3 | Sprouts Farmers Market Inc | 6,882,200 | 3.8% |

4 | Wells Fargo & Co | 5,139,749 | 2.9% |

5 | Ford Motor Co | 4,955,196 | 2.8% |

6 | Bank of America Corp | 4,330,200 | 2.4% |

7 | Microsoft Corp | 4,227,315 | 2.4% |

8 | The Goldman Sachs Group Inc | 3,769,289 | 2.1% |

9 | BP PLC | 3,492,019 | 1.9% |

10 | Chevron Corp | 3,473,721 | 1.9% |

Nasdaq-100 Index Fund

Security | Market

Value | Percentage of Total Investment |

1 | Apple Inc | $ 68,618,608 | 10.4% |

2 | Amazon.com Inc | 47,693,176 | 7.3% |

3 | Microsoft Corp | 47,392,476 | 7.2% |

4 | Alphabet Inc - Class C | 25,739,137 | 3.9% |

5 | Alphabet Inc - Class A | 24,962,427 | 3.8% |

6 | Facebook Inc | 23,813,172 | 3.6% |

7 | Cisco Systems Inc | 20,464,047 | 3.1% |

8 | Intel Corp | 20,102,857 | 3.1% |

9 | Comcast Corp | 15,245,872 | 2.3% |

10 | NVIDIA Corp | 14,764,891 | 2.2% |

11

Top Holdings and Sector Breakdowns (Unaudited) (Continued) | August 31, 2018 |

Shelton Green Alpha Fund

Security | Market

Value | Percentage of Total Investment |

1 | Pattern Energy Group Inc | $ 2,751,300 | 5.7% |

2 | Vestas Wind Systems A/S | 2,658,225 | 5.5% |

3 | Applied Materials Inc | 2,086,470 | 4.3% |

4 | First Solar Inc | 2,057,160 | 4.3% |

5 | Tesla Inc | 2,051,288 | 4.3% |

6 | Sunrun Inc | 1,836,800 | 3.8% |

7 | Alphabet Inc - Class C | 1,705,466 | 3.5% |

8 | Canadian Solar Inc | 1,704,532 | 3.5% |

9 | International Business Machines Corp | 1,538,040 | 3.2% |

10 | Hannon Armstrong Sustainable Infrastructure Capital Inc | 1,379,840 | 2.9% |

12

California Tax-Free Income Fund | Portfolio of Investments | 8/31/18 |

Security Description | | Par Value | | | Rate | | | Maturity | | | Value

(Note 1) | |

Municipal Bonds (95.01%) |

| |

BUTTE-GLENN COMMUNITY COLLEGE |

2012 General Obligation Refunding Bonds | | $ | 1,000,000 | | | | 4.000% | | | | 08/01/2026 | | | $ | 1,079,070 | |

CALIFORNIA DEPARTMENT OF PUBLIC WORKS BOARD |

Lease Revenue Bonds; 2009 Series I-1 | | | 3,000,000 | | | | 6.125% | | | | 11/01/2029 | | | | 3,161,130 | |

CALIFORNIA DEPARTMENT OF WATER RESOURCES |

Power Supply Revenue Bonds; Series 2010L | | | 1,000,000 | | | | 5.000% | | | | 05/01/2019 | | | | 1,023,520 | |

CALIFORNIA EDUCATIONAL FACILITIES AUTHORITY |

Revenue Bonds (University of Southern California); Series 2009A | | | 2,500,000 | | | | 5.250% | | | | 10/01/2038 | | | | 2,507,050 | |

CALIFORNIA HEALTH FACILITIES FINANCING AUTHORITY |

Kaiser Permanente Revenue Bonds; Subseries 2017A-1 (Green Bonds) | | | 1,700,000 | | | | 5.000% | | | | 11/01/2027 | | | | 2,076,941 | |

CALIFORNIA INFRASTRUCTURE & ECONOMIC DEVELOPMENT BANK |

California Infrastructure & Economic Development Bank | | | 1,200,000 | | | | 5.000% | | | | 10/01/2033 | | | | 1,403,064 | |

Clean Water State Revolving fund Revenue Bonds Series 2016 (Green Bonds) | | | 200,000 | | | | 2.000% | | | | 10/01/2019 | | | | 201,422 | |

CITY OF LOS ANGELES |

General Obligation Refunding Bonds; Series 2012-A | | | 2,000,000 | | | | 5.000% | | | | 09/01/2021 | | | | 2,197,680 | |

EAST BAY MUNICIPAL UTILITY DISTRICT |

Water System Revenue Bonds; 2015 Series B | | | 2,050,000 | | | | 5.000% | | | | 06/01/2026 | | | | 2,431,608 | |

EAST SIDE UNION HIGH SCHOOL DISTRICT |

General Obligation Refunding Bonds (2012 Crossover); 2006 | | | 2,975,000 | | | | 5.250% | | | | 09/01/2023 | | | | 3,421,220 | |

FOOTHILL-DE ANZA COMMUNITY COLLEGE DISTRICT |

Election of 1999 General Obligation Bonds; Series C | | | 2,000,000 | | | | 0.000% | | | | 08/01/2027 | | | | 1,577,860 | |

HARBOR DEPARTMENT OF THE CITY OF LOS ANGELES |

Revenue Bonds; 2014 Series C | | | 290,000 | | | | 4.000% | | | | 08/01/2023 | | | | 320,398 | |

LA MIRADA REDEVELOPMENT AGENCY, SUCCESSOR AGENCY TO THE |

Subordinate Tax Allocation Refunding Bonds; 2014 Series A | | | 1,000,000 | | | | 5.000% | | | | 08/01/2023 | | | | 1,143,600 | |

LOS ANGELES CA WASTEWATER SYSTEM REVENUE |

Los Angeles CA Wstwter System Revenue Bond | | | 500,000 | | | | 5.000% | | | | 06/01/2044 | | | | 567,435 | |

LOS ANGELES COMMUNITY COLLEGE DISTRICT |

General Obligation Bonds; 2008 Election, Series G | | | 865,000 | | | | 5.000% | | | | 08/01/2028 | | | | 1,004,663 | |

LOS ANGELES COUNTY METROPOLITAN TRANSPORTATION AUTHORITY |

Proposition A First Tier Los Angeles County Met Transport | | | 500,000 | | | | 4.000% | | | | 07/01/2028 | | | | 552,040 | |

Proposition A First Tier Senior Sales Tax Revenue Refunding Bonds; Series 2012-A | | | 1,000,000 | | | | 5.000% | | | | 07/01/2021 | | | | 1,098,090 | |

Proposition C Sales Tax Revenue Refunding Bonds; Senior Bonds; Series 2013-A | | | 1,500,000 | | | | 5.000% | | | | 07/01/2023 | | | | 1,726,710 | |

LOS ANGELES DEPARTMENT OF WATER AND POWER |

Water System Revenue Bonds; 2012 Series A | | | 1,985,000 | | | | 5.000% | | | | 07/01/2037 | | | | 2,189,157 | |

LOS RIOS COMMUNITY COLLEGE DISTRICT |

General Obligation Bonds; 2008 Election, Series B | | | 2,500,000 | | | | 5.000% | | | | 08/01/2032 | | | | 2,799,050 | |

METROPOLITAN WATER DISTRICT OF SOUTHERN CALIFORNIA |

Water Revenue Bonds; 2008 Authorization, Series C | | | 1,000,000 | | | | 5.000% | | | | 07/01/2035 | | | | 1,027,640 | |

MIDPENINSULA REGIONAL OPEN SPACE DISTRICT |

Midpeninsula Regional Open Space District | | | 200,000 | | | | 4.000% | | | | 09/01/2021 | | | | 213,954 | |

MT. DIABLO UNIFIED SCHOOL DISTRICT |

General Obligation Refunding Bonds; Election Of 2002, Series B | | | 500,000 | | | | 5.000% | | | | 07/01/2020 | | | | 532,450 | |

MT. SAN ANTONIO COMMUNITY COLLEGE DISTRICT |

General Obligation Bonds; Election of 2008, Series 2013A | | | 2,345,000 | | | | 5.000% | | | | 08/01/2034 | | | | 2,644,034 | |

PASADENA ELECTRIC REVENUE |

Electric Revenue Refunding Bonds; Series 2010A | | | 1,205,000 | | | | 4.000% | | | | 06/01/2020 | | | | 1,257,767 | |

RANCHO SANTIAGO COMMUNITY COLLEGE DISTRICT |

General Obligation Refunding Bonds; 2012 | | | 1,380,000 | | | | 4.000% | | | | 09/01/2020 | | | | 1,450,973 | |

REGENTS OF THE UNIVERSITY OF CALIFORNIA |

General Revenue Bonds; 2014 Series AM | | | 925,000 | | | | 5.000% | | | | 05/01/2029 | | | | 1,065,017 | |

ROSEVILLE FINANCE AUTHORITY ELECTRIC SYSTEM REVENUE |

Electric System Revenue Refunding Bonds; Series 2013 | | | 750,000 | | | | 5.000% | | | | 02/01/2025 | | | | 852,368 | |

ROSEVILLE NATURAL GAS FINANCING AUTHORITY |

Gas Revenue Bonds; Series 2007 | | | 1,000,000 | | | | 5.000% | | | | 02/01/2024 | | | | 1,114,110 | |

SACRAMENTO MUNICIPAL UTILITY DISTRICT |

Electric Revenue Bonds; 1997 Series K | | | 1,000,000 | | | | 5.250% | | | | 07/01/2024 | | | | 1,140,770 | |

SAN DIEGO COMMUNITY COLLEGE DISTRICT |

General Obligation Bonds; Election of 2002, Series 2013 | | | 1,175,000 | | | | 5.000% | | | | 08/01/2027 | | | | 1,337,138 | |

SAN FRANCISCO BAY AREA RAPID TRANSIT DISTRICT |

San Francisco BART District GO Bonds 2017 Refunding Series E (Green Bonds) | | | 2,300,000 | | | | 5.000% | | | | 08/01/2036 | | | | 2,706,249 | |

San Francisco BART District GO Bonds 2017 Series A-1 (Green Bonds) | | | 645,000 | | | | 4.000% | | | | 08/01/2034 | | | | 693,498 | |

See accompanying notes to financial statements.

13

California Tax-Free Income Fund | Portfolio of Investments (Continued) | 8/31/18 |

Security Description | | Par Value | | | Rate | | | Maturity | | | Value

(Note 1) | |

SAN FRANCISCO, CITY AND COUNTY |

General Obligation Bonds (Clean and Safe Neighborhood Parks Bonds, 2012); Series 2013A | | $ | 1,000,000 | | | | 4.000% | | | | 06/01/2033 | | | $ | 1,048,220 | |

SAN FRANCISCO, CITY AND COUNTY AIRPORT |

General Obligation Bonds (Clean and Safe Neighborhood Parks Bonds, 2012); Series 2013A | | | 500,000 | | | | 5.000% | | | | 05/01/2020 | | | | 528,670 | |

SAN FRANCISCO CITY AND COUNTY PUBLIC UTILITIES COMMISSION

WASTEWATER REVENUE |

San Francisco City & County Public Utilities Commission Wastewater Revenue | | | 700,000 | | | | 4.000% | | | | 10/01/2021 | | | | 751,254 | |

SAN FRANCISCO, PUBLIC UTILITIES COMMISSION WATER REVENUE |

2017 Sub-Series D Refunding Bonds (Green Bonds) | | | 1,000,000 | | | | 5.000% | | | | 11/01/2034 | | | | 1,180,100 | |

City of San Francisco CA Public Utilities Commission Water Revenue | | | 1,170,000 | | | | 5.000% | | | | 11/01/2036 | | | | 1,319,210 | |

San Francisco City and Green Bond Series A | | | 680,000 | | | | 5.000% | | | | 11/01/2030 | | | | 779,572 | |

SANTA CLARA VALLEY TRANSPORTATION AUTHORITY |

2000 Measure A Sales Tax Revenue Refunding Bonds; 2015 Series A | | | 1,000,000 | | | | 5.000% | | | | 04/01/2034 | | | | 1,140,230 | |

SANTA MARIA JOINT UNION HIGH SCHOOL DISTRICT |

General Obligation Bonds; Election of 2004, Series 2005 | | | 2,500,000 | | | | 0.000% | | | | 08/01/2029 | | | | 1,729,000 | |

SOUTHERN CALIFORNIA PUBLIC POWER AUTHORITY |

Southern California Public Power Authority Windy Pt/Windy Flats Project 1 | | | 1,400,000 | | | | 5.000% | | | | 07/01/2026 | | | | 1,487,458 | |

Windy Point/Windy Flats Project Revenue Bonds; 2010-1 | | | 1,000,000 | | | | 5.000% | | | | 07/01/2023 | | | | 1,063,590 | |

STATE OF CALIFORNIA |

Tax-Exempt Various Purpose General Obligation Bonds | | | 555,000 | | | | 3.000% | | | | 10/01/2028 | | | | 564,885 | |

TRUSTEES OF THE CALIFORNIA STATE UNIVERSITY |

Systemwide Revenue Bonds; Series 2012A | | | 1,100,000 | | | | 4.000% | | | | 11/01/2030 | | | | 1,185,921 | |

TUOLUMNE WIND PROJECT AUTHORITY |

Tuolumne Wind Project Authority | | | 1,000,000 | | | | 5.000% | | | | 01/01/2020 | | | | 1,046,980 | |

WILLIAM S. HART UNION HIGH SCHOOL DISTRICT |

General Obligation Bonds; 2001 Election, Series B | | | 3,595,000 | | | | 0.000% | | | | 09/01/2029 | | | | 2,506,254 | |

| | | | | | | | | | | | | | | | | |

Total Municipal Bonds (Cost $62,757,156) | | | 64,849,020 | |

| |

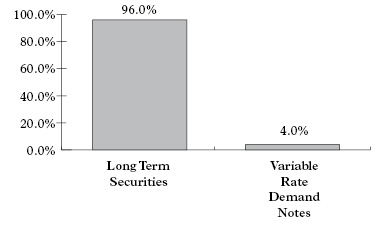

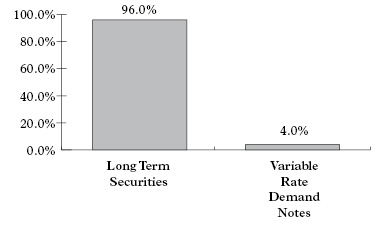

Variable Rate Demand Notes* (4.01%) |

California Health Facilities Financing Authority*** | | | 1,000,000 | | | | 5.000%** | | | | 07/01/2043 | | | | 1,034,350 | |

Metropolitan Water District of Southern California*** | | | 700,000 | | | | 1.260%** | | | | 07/01/2035 | | | | 700,000 | |

Tax-Exempt Various Purpose General Obligation Bonds | | | 1,000,000 | | | | 1.260%** | | | | 05/01/2034 | | | | 1,000,000 | |

| | | | | | | | | | | | | | | | | |

Total Variable Rate Demand Notes (Cost $2,873,179) | | | 2,734,350 | |

| | | | | |

Total Investments (Cost $65,630,335) (a) (99.02%) | | $ | 67,583,370 | |

Other Net Assets (0.98%) | | | 669,589 | |

Net Assets (100.00%) | | $ | 68,252,959 | |

| (a) | Aggregate cost for federal income tax purposes is $65,629,108. |

At August 31, 2018, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | | | | | | | | | | | | | $ | 2,340,680 | |

Unrealized depreciation | | | | | | | | | | | | | | | (386,418 | ) |

Net unrealized appreciation | | | | | | | | | | | | | | $ | 1,954,262 | |

| * | Stated maturity reflects next reset date. |

| ** | Rate Effective as of August 31, 2018. |

| *** | In accordance with the offering documents, daily interest rates are determined by the Remarketing Agents. |

See accompanying notes to financial statements.

14

U.S. Government Securities Fund | Portfolio of Investments | 8/31/18 |

Security Description | | Par Value | | | Rate | | | Maturity | | | Value

(Note 1) | |

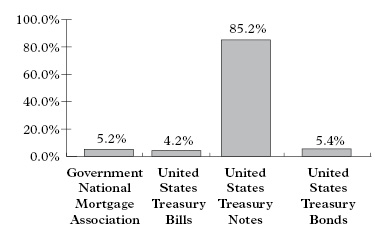

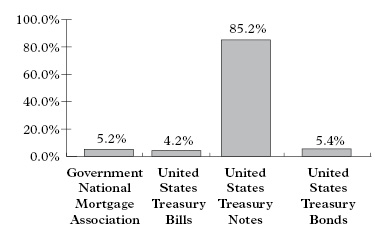

Government National Mortgage Association (5.20%) |

| | | $ | 80 | | | | 10.000 | | | | 09/15/2018 | | | $ | 80 | |

| | | | 19,438 | | | | 5.000 | | | | 07/15/2020 | | | | 20,129 | |

| | | | 38,395 | | | | 5.500 | | | | 01/15/2025 | | | | 41,303 | |

| | | | 78,230 | | | | 6.000 | | | | 06/15/2038 | | | | 84,836 | |

| | | | 104,498 | | | | 6.000 | | | | 01/15/2026 | | | | 113,907 | |

| | | | 140,848 | | | | 5.500 | | | | 04/15/2036 | | | | 152,507 | |

| | | | 162,992 | | | | 5.000 | | | | 03/15/2038 | | | | 174,341 | |

| | | | 416,674 | | | | 3.500 | | | | 11/20/2044 | | | | 419,524 | |

Total Government National Mortgage Association (Cost $977,992) | | | 1,006,627 | |

| |

United States Treasury Bills (4.11%) |

| | | | 200,000 | | | | 0.000 | | | | 10/11/2018 | | | | 199,565 | |

| | | | 200,000 | | | | 0.000 | | | | 10/25/2018 | | | | 199,437 | |

| | | | 400,000 | | | | 0.000 | | | | 01/03/2019 | | | | 397,150 | |

Total United States Treasury Bills (Cost $796,053) | | | 796,152 | |

| |

United States Treasury Bonds (5.34%) |

| | | | 400,000 | | | | 2.750 | | | | 08/15/2042 | | | | 382,992 | |

| | | | 500,000 | | | | 5.000 | | | | 05/15/2037 | | | | 650,313 | |

Total United States Treasury Bonds (Cost $1,089,232) | | | 1,033,305 | |

| |

United States Treasury Notes (84.58%) |

| | | | 400,000 | | | | 6.375 | | | | 08/15/2027 | | | | 511,469 | |

| | | | 800,000 | | | | 6.000 | | | | 02/15/2026 | | | | 972,109 | |

| | | | 900,000 | | | | 2.250 | | | | 08/15/2027 | | | | 857,549 | |

| | | | 1,300,000 | | | | 2.125 | | | | 02/29/2024 | | | | 1,257,953 | |

| | | | 1,700,000 | | | | 2.750 | | | | 02/15/2019 | | | | 1,703,652 | |

| | | | 2,000,000 | | | | 3.625 | | | | 02/15/2021 | | | | 2,044,844 | |

| | | | 2,100,000 | | | | 2.625 | | | | 08/15/2020 | | | | 2,100,000 | |

| | | | 2,200,000 | | | | 2.125 | | | | 05/15/2025 | | | | 2,109,336 | |

| | | | 2,400,000 | | | | 2.000 | | | | 02/15/2022 | | | | 2,343,938 | |

| | | | 2,500,000 | | | | 2.500 | | | | 08/15/2023 | | | | 2,472,606 | |

Total United States Treasury Notes (Cost $16,787,478) | | | 16,373,456 | |

| | | | | |

Total Investments (Cost $19,650,755) (a) (99.23%) | | $ | 19,209,540 | |

Other Net Assets (0.77%) | | | 149,769 | |

Net Assets (100.00%) | | $ | 19,359,309 | |

| (a) | Aggregate cost for federal income tax purposes is $19,650,755. |

At August 31, 2018, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | | | | | | | | | | | | | $ | 48,205 | |

Unrealized depreciation | | | | | | | | | | | | | | | (489,419 | ) |

Net unrealized depreciation | | | | | | | | | | | | | | $ | (441,215 | ) |

See accompanying notes to financial statements.

15

Short-Term U.S. Government Bond Fund | Portfolio of Investments | 8/31/18 |

Security Description | | Par Value | | | Rate | | | Maturity | | | Value

(Note 1) | |

Government National Mortgage Association (1.57%) |

| | | $ | 31,985 | | | | 4.125 | | | | 06/20/2034 | | | $ | 32,738 | |

| | | | 65,050 | | | | 3.125 | | | | 11/20/2034 | | | | 67,494 | |

Total Government National Mortgage Association (Cost $97,493) | | | 100,232 | |

| |

United States Treasury Notes (92.64%) |

| | | | 200,000 | | | | 2.125 | | | | 06/30/2022 | | | | 195,680 | |

| | | | 300,000 | | | | 1.625 | | | | 06/30/2019 | | | | 298,061 | |

| | | | 700,000 | | | | 1.000 | | | | 06/30/2019 | | | | 692,125 | |

| | | | 800,000 | | | | 2.250 | | | | 07/31/2021 | | | | 790,234 | |

| | | | 900,000 | | | | 1.250 | | | | 01/31/2019 | | | | 896,414 | |

| | | | 1,000,000 | | | | 2.125 | | | | 01/31/2021 | | | | 987,500 | |

| | | | 1,000,000 | | | | 2.000 | | | | 07/31/2020 | | | | 988,574 | |

| | | | 1,100,000 | | | | 1.375 | | | | 01/31/2020 | | | | 1,082,318 | |

Total United States Treasury Notes (Cost $5,981,119) | | | 5,930,906 | |

| |

United States Treasury Bills (4.67%) |

| | | | 300,000 | | | | 0.000 | | | | 10/18/2018 | | | | 299,275 | |

Total United States Treasury Bills (Cost $299,238) | | | 299,275 | |

| | | | | |

Total Investments (Cost $6,377,850) (a) (98.88%) | | $ | 6,330,413 | |

Other Net Assets (1.12%) | | | 72,018 | |

Net Assets (100.00%) | | $ | 6,402,431 | |

| (a) | Aggregate cost for federal income tax purposes is $6,377,850. |

At August 31, 2018, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows:

Unrealized appreciation | | | | | | | | | | | | | | $ | 2,967 | |

Unrealized depreciation | | | | | | | | | | | | | | | (50,404 | ) |

Net unrealized depreciation | | | | | | | | | | | | | | $ | (47,437 | ) |

The United States Treasury Trust | Portfolio of Investments | 8/31/18 |

| Security Description | | Par Value | | | Maturity | | | Value

(Note 1) | |

| United States Treasury Bills, DN (b) (99.10%) |

| | | $ | 2,000,000 | | | 11/15/2018 | | | $ | 1,991,564 | |

| | | | 2,600,000 | | | 01/03/2019 | | | | 2,581,169 | |

| | | | 3,800,000 | | | 12/06/2018 | | | | 3,779,020 | |

| | | | 7,000,000 | | | 09/06/2018 | | | | 6,998,156 | |

| | | | 7,000,000 | | | 10/04/2018 | | | | 6,987,769 | |

| | | | 7,000,000 | | | 11/29/2018 | | | | 6,965,240 | |

| | | | 7,800,000 | | | 09/20/2018 | | | | 7,792,156 | |

| | | | 8,100,000 | | | 10/18/2018 | | | | 8,079,320 | |

| | | | 9,300,000 | | | 11/08/2018 | | | | 9,264,853 | |

| Total United States Treasury Bills, DN (Cost $54,439,247) | | | | | | | | | | 54,439,247 | |

| | | | | | | | | | | | |

| Total Investments (Cost $54,439,247) (a) (99.10%) | | | | | | | | | $ | 54,439,247 | |

| Other Net Assets (0.90%) | | | | | | | | | | 496,583 | |

| Net Assets (100.00%) | | | | | | | | | $ | 54,935,830 | |

| (a) | Aggregate cost for federal income tax purposes is $54,439,247. |

| (b) | Discount Note. Yield to maturity is between 0.81% - 1.11%. |

See accompanying notes to financial statements.

16

S&P 500 Index Fund | Portfolio of Investments | 8/31/18 |

Security Description | | Shares | | | Value

(Note 1) | |

Common Stock (99.40%) |

| |

Basic Materials (1.92%) |

Air Products & Chemicals Inc | | | 1,615 | | | $ | 268,558 | |

Albemarle Corp | | | 868 | | | | 82,911 | |

CF Industries Holdings Inc | | | 1,795 | | | | 93,250 | |

DowDuPont Inc | | | 17,485 | | | | 1,226,223 | |

Eastman Chemical Co | | | 1,048 | | | | 101,687 | |

FMC Corp | | | 1,102 | | | | 94,166 | |

Freeport-McMoRan Inc | | | 6,887 | | | | 96,762 | |

IFF | | | 683 | | | | 88,988 | |

International Paper Co | | | 3,175 | | | | 162,370 | |

LyondellBasell Industries NV - Class A | | | 2,532 | | | | 285,559 | |

The Mosaic Co | | | 2,068 | | | | 64,666 | |

Newmont Mining Corp | | | 3,766 | | | | 116,859 | |

Nucor Corp | | | 2,404 | | | | 150,250 | |

PPG Industries Inc | | | 2,102 | | | | 232,355 | |

Praxair Inc | | | 2,168 | | | | 342,957 | |

The Sherwin-Williams Co | | | 628 | | | | 286,105 | |

Total Basic Materials | | | 3,693,666 | |

| |

Communications (14.65%) |

Alphabet Inc - Class A* | | | 2,286 | | | | 2,815,895 | |

Alphabet Inc - Class C* | | | 2,406 | | | | 2,930,965 | |

Amazon.com Inc* (c) | | | 3,145 | | | | 6,329,973 | |

AT&T Inc | | | 56,729 | | | | 1,811,924 | |

Booking Holdings Inc* | | | 361 | | | | 704,510 | |

CBS Corp - Class B | | | 2,752 | | | | 145,911 | |

CenturyLink Inc | | | 4,581 | | | | 97,850 | |

Charter Communications Inc* | | | 1,463 | | | | 454,115 | |

Cisco Systems Inc | | | 37,866 | | | | 1,808,859 | |

Comcast Corp - Class A | | | 36,651 | | | | 1,355,720 | |

Discovery Inc - Class A* | | | 1,878 | | | | 52,265 | |

Discovery Inc - Class C* | | | 1,878 | | | | 48,152 | |

DISH Network Corp* | | | 1,784 | | | | 63,064 | |

eBay Inc* | | | 8,321 | | | | 287,990 | |

Expedia Group Inc | | | 689 | | | | 89,915 | |

F5 Networks Inc* | | | 602 | | | | 113,850 | |

Facebook Inc* (c) | | | 18,754 | | | | 3,295,640 | |

The Interpublic Group of Cos Inc | | | 3,241 | | | | 75,677 | |

Juniper Networks Inc | | | 2,718 | | | | 77,273 | |

Motorola Solutions Inc | | | 1,430 | | | | 183,555 | |

Netflix Inc* | | | 3,319 | | | | 1,220,330 | |

News Corp - Class A | | | 3,745 | | | | 48,947 | |

News Corp - Class B | | | 910 | | | | 12,376 | |

Omnicom Group Inc | | | 1,982 | | | | 137,392 | |

Symantec Corp | | | 5,172 | | | | 104,268 | |

TripAdvisor Inc* | | | 850 | | | | 46,164 | |

Twenty-First Century Fox Inc | | | 3,726 | | | | 167,297 | |

Twenty-First Century Fox Inc - Class A | | | 8,143 | | | | 369,692 | |

Twitter Inc* | | | 5,110 | | | | 179,770 | |

VeriSign Inc* | | | 689 | | | | 109,282 | |

Verizon Communications Inc | | | 31,159 | | | | 1,694,115 | |

Viacom Inc - Class B | | | 2,740 | | | | 80,227 | |

The Walt Disney Co | | | 11,275 | | | | 1,263,026 | |

Total Communications | | | 28,175,989 | |

| |

Consumer, Cyclical (8.49%) |

Advance Auto Parts Inc | | | 548 | | | | 89,888 | |

Alaska Air Group Inc | | | 963 | | | | 64,993 | |

American Airlines Group Inc | | | 4,021 | | | | 162,770 | |

Aptiv PLC | | | 2,173 | | | | 191,246 | |

AutoZone Inc* | | | 275 | | | | 210,892 | |

Best Buy Co Inc | | | 1,956 | | | | 155,619 | |

BorgWarner Inc | | | 1,664 | | | | 72,833 | |

CarMax Inc* | | | 1,689 | | | | 131,826 | |

Carnival Corp | | | 3,334 | | | | 205,008 | |

Chipotle Mexican Grill Inc* | | | 234 | | | | 111,192 | |

Costco Wholesale Corp | | | 3,160 | | | | 736,691 | |

Darden Restaurants Inc | | | 933 | | | | 108,265 | |

Delta Air Lines Inc | | | 5,026 | | | | 293,920 | |

Dollar General Corp | | | 1,932 | | | | 208,134 | |

Dollar Tree Inc* | | | 1,907 | | | | 153,533 | |

DR Horton Inc | | | 2,495 | | | | 111,052 | |

Fastenal Co | | | 2,014 | | | | 117,537 | |

Foot Locker Inc | | | 1,044 | | | | 51,469 | |

Ford Motor Co | | | 27,615 | | | | 261,790 | |

The Gap Inc | | | 2,194 | | | | 66,588 | |

General Motors Co | | | 10,151 | | | | 365,944 | �� |

Genuine Parts Co | | | 1,170 | | | | 116,825 | |

The Goodyear Tire & Rubber Co | | | 1,847 | | | | 41,908 | |

Hanesbrands Inc | | | 3,007 | | | | 52,743 | |

Harley-Davidson Inc | | | 1,765 | | | | 75,224 | |

Hasbro Inc | | | 950 | | | | 94,345 | |

Hilton Worldwide Holdings Inc | | | 1,615 | | | | 125,356 | |

The Home Depot Inc | | | 9,397 | | | | 1,886,636 | |

Kohl’s Corp | | | 1,587 | | | | 125,548 | |

L Brands Inc | | | 1,787 | | | | 47,230 | |

Leggett & Platt Inc | | | 1,017 | | | | 46,212 | |

Lennar Corp | | | 2,200 | | | | 113,674 | |

LKQ Corp* | | | 2,347 | | | | 81,018 | |

Lowe’s Cos Inc | | | 6,732 | | | | 732,105 | |

Macy’s Inc | | | 2,961 | | | | 108,225 | |

Marriott International Inc | | | 2,467 | | | | 312,001 | |

Mattel Inc | | | 2,508 | | | | 38,698 | |

McDonald’s Corp | | | 6,382 | | | | 1,035,352 | |

MGM Resorts International | | | 3,988 | | | | 115,612 | |

Michael Kors Holdings Ltd* | | | 1,328 | | | | 96,439 | |

Mohawk Industries Inc* | | | 459 | | | | 87,940 | |

Newell Brands Inc | | | 3,701 | | | | 80,386 | |

NIKE Inc - Class B | | | 10,668 | | | | 876,910 | |

Nordstrom Inc | | | 1,123 | | | | 70,581 | |

Norwegian Cruise Line Holdings* | | | 1,599 | | | | 85,722 | |

O’Reilly Automotive Inc* | | | 665 | | | | 223,054 | |

PACCAR Inc | | | 2,601 | | | | 177,960 | |

PulteGroup Inc | | | 2,804 | | | | 78,372 | |

PVH Corp | | | 574 | | | | 82,174 | |

Ralph Lauren Corp | | | 449 | | | | 59,632 | |

Ross Stores Inc | | | 3,322 | | | | 318,181 | |

Royal Caribbean Cruises Ltd | | | 1,236 | | | | 151,509 | |

Southwest Airlines Co | | | 4,671 | | | | 286,332 | |

Starbucks Corp | | | 10,948 | | | | 585,171 | |

Tapestry Inc | | | 2,156 | | | | 109,288 | |

Target Corp | | | 4,818 | | | | 421,575 | |

Tiffany & Co | | | 950 | | | | 116,518 | |

The TJX Cos Inc | | | 5,416 | | | | 595,598 | |

Tractor Supply Co | | | 1,050 | | | | 92,694 | |

Ulta Beauty Inc* | | | 468 | | | | 121,680 | |

Under Armour Inc - Class A* | | | 1,210 | | | | 24,745 | |

Under Armour Inc - Class C* | | | 1,218 | | | | 23,105 | |

United Continental Holdings Inc* | | | 2,214 | | | | 193,548 | |

VF Corp | | | 2,588 | | | | 238,432 | |

Walgreens Boots Alliance Inc | | | 6,346 | | | | 435,082 | |

Walmart Inc | | | 11,851 | | | | 1,136,037 | |

Whirlpool Corp | | | 570 | | | | 71,239 | |

WW Grainger Inc | | | 441 | | | | 156,145 | |

Wynn Resorts Ltd | | | 526 | | | | 78,027 | |

Yum! Brands Inc | | | 2,700 | | | | 234,603 | |

Total Consumer, Cyclical | | | 16,328,581 | |

| |

Consumer, Non-Cyclical (21.70%) |

Abbott Laboratories | | | 13,435 | | | | 897,995 | |

AbbVie Inc | | | 12,821 | | | | 1,230,560 | |

Aetna Inc | | | 2,584 | | | | 517,498 | |

Alexion Pharmaceuticals Inc* | | | 1,383 | | | | 169,058 | |

Align Technology Inc* | | | 600 | | | | 231,894 | |

Allergan PLC | | | 2,617 | | | | 501,705 | |

Altria Group Inc | | | 14,863 | | | | 869,783 | |

AmerisourceBergen Corp | | | 1,565 | | | | 140,803 | |

Amgen Inc | | | 5,284 | | | | 1,055,796 | |

Anthem Inc | | | 2,002 | | | | 529,989 | |

Archer-Daniels-Midland Co | | | 4,902 | | | | 247,061 | |

Automatic Data Processing Inc | | | 3,564 | | | | 523,017 | |

Avery Dennison Corp | | | 891 | | | | 93,715 | |

Baxter International Inc | | | 3,880 | | | | 288,556 | |

Becton Dickinson and Co | | | 1,897 | | | | 496,767 | |

Biogen Inc* | | | 1,739 | | | | 614,719 | |

Boston Scientific Corp* | | | 11,526 | | | | 409,865 | |

Bristol-Myers Squibb Co | | | 12,265 | | | | 742,646 | |

Brown-Forman Corp - Class B | | | 1,728 | | | | 90,236 | |

Campbell Soup Co | | | 1,449 | | | | 57,163 | |

Cardinal Health Inc | | | 2,511 | | | | 131,049 | |

Celgene Corp* | | | 6,007 | | | | 567,361 | |

Centene Corp* | | | 1,292 | | | | 189,252 | |

Church & Dwight Co Inc | | | 1,996 | | | | 112,934 | |

Cigna Corp | | | 2,081 | | | | 391,936 | |

Cintas Corp | | | 801 | | | | 170,909 | |

The Clorox Co | | | 943 | | | | 136,716 | |

The Coca-Cola Co | | | 30,037 | | | | 1,338,749 | |

Colgate-Palmolive Co | | | 6,558 | | | | 435,517 | |

Conagra Brands Inc | | | 2,987 | | | | 109,772 | |

Constellation Brands Inc | | | 1,083 | | | | 225,481 | |

The Cooper Cos Inc | | | 374 | | | | 95,662 | |

Coty Inc - Class A | | | 3,684 | | | | 45,534 | |

CVS Health Corp | | | 7,932 | | | | 596,804 | |

Danaher Corp | | | 4,166 | | | | 431,348 | |

DaVita Inc* | | | 1,224 | | | | 84,811 | |

DENTSPLY SIRONA Inc | | | 1,160 | | | | 46,307 | |

Ecolab Inc | | | 1,937 | | | | 291,480 | |

Edwards Lifesciences Corp* | | | 1,716 | | | | 247,516 | |

Eli Lilly & Co | | | 7,419 | | | | 783,817 | |

Envision Healthcare Corp* | | | 910 | | | | 41,278 | |

Equifax Inc | | | 870 | | | | 116,554 | |

The Estee Lauder Cos Inc | | | 1,800 | | | | 252,216 | |

Express Scripts Holding Co* | | | 4,798 | | | | 422,320 | |

FleetCor Technologies Inc* | | | 699 | | | | 149,404 | |

Gartner Inc* | | | 714 | | | | 106,929 | |

General Mills Inc | | | 4,683 | | | | 215,465 | |

Gilead Sciences Inc | | | 10,033 | | | | 759,799 | |

Global Payments Inc | | | 1,172 | | | | 146,008 | |

H&R Block Inc | | | 1,994 | | | | 53,958 | |

HCA Healthcare Inc | | | 2,209 | | | | 296,249 | |

Henry Schein Inc* | | | 1,256 | | | | 97,566 | |

The Hershey Co | | | 1,114 | | | | 111,979 | |

Hologic Inc* | | | 2,135 | | | | 84,888 | |

Hormel Foods Corp | | | 2,128 | | | | 83,311 | |

Humana Inc | | | 1,191 | | | | 396,913 | |

IDEXX Laboratories Inc* | | | 691 | | | | 175,542 | |

IHS Markit Ltd* | | | 2,494 | | | | 137,170 | |

Illumina Inc* | | | 1,143 | | | | 405,571 | |

Incyte Corp* | | | 1,363 | | | | 100,739 | |

Intuitive Surgical Inc* | | | 855 | | | | 478,800 | |

IQVIA Holdings Inc* | | | 1,146 | | | | 145,645 | |

See accompanying notes to financial statements.

17

S&P 500 Index Fund | Portfolio of Investments (Continued) | 8/31/18 |

Security Description | | Shares | | | Value

(Note 1) | |

The JM Smucker Co | | | 823 | | | $ | 85,082 | |

Johnson & Johnson (c) | | | 20,958 | | | | 2,822,832 | |

Kellogg Co | | | 1,816 | | | | 130,371 | |

Kimberly-Clark Corp | | | 2,926 | | | | 338,070 | |

The Kraft Heinz Co | | | 4,282 | | | | 249,512 | |

The Kroger Co | | | 8,014 | | | | 252,441 | |

Laboratory Corp of America Holdings* | | | 705 | | | | 121,873 | |

McCormick & Co Inc | | | 975 | | | | 121,758 | |

McKesson Corp | | | 1,736 | | | | 223,510 | |

Medtronic PLC | | | 10,936 | | | | 1,054,340 | |

Merck & Co Inc | | | 21,298 | | | | 1,460,829 | |

Molson Coors Brewing Co | | | 1,200 | | | | 80,088 | |

Mondelez International Inc | | | 11,909 | | | | 508,752 | |

Monster Beverage Corp* | | | 3,387 | | | | 206,234 | |

Moody’s Corp | | | 1,498 | | | | 266,674 | |

Mylan NV* | | | 3,101 | | | | 121,342 | |

Nektar Therapeutics* | | | 1,277 | | | | 84,908 | |

Nielsen Holdings PLC | | | 1,879 | | | | 48,854 | |

PayPal Holdings Inc* | | | 8,321 | | | | 768,278 | |

PepsiCo Inc | | | 11,085 | | | | 1,241,630 | |

Perrigo Co PLC | | | 677 | | | | 51,797 | |

Pfizer Inc | | | 45,992 | | | | 1,909,587 | |

Philip Morris International Inc | | | 11,608 | | | | 904,147 | |

The Procter & Gamble Co | | | 20,266 | | | | 1,681,064 | |

Quanta Services Inc* | | | 1,601 | | | | 55,379 | |

Quest Diagnostics Inc | | | 1,168 | | | | 128,457 | |

Regeneron Pharmaceuticals Inc* | | | 562 | | | | 228,594 | |

ResMed Inc | | | 1,127 | | | | 125,559 | |

Robert Half International Inc | | | 1,032 | | | | 80,682 | |

S&P Global Inc | | | 2,019 | | | | 418,034 | |

Stryker Corp | | | 2,155 | | | | 365,122 | |

Sysco Corp | | | 3,758 | | | | 281,174 | |

Thermo Fisher Scientific Inc | | | 3,062 | | | | 732,124 | |

Total System Services Inc | | | 1,190 | | | | 115,597 | |

Tyson Foods Inc - Class A | | | 2,328 | | | | 146,222 | |

United Rentals Inc* | | | 724 | | | | 112,850 | |

UnitedHealth Group Inc | | | 7,607 | | | | 2,042,174 | |

Universal Health Services Inc | | | 683 | | | | 88,899 | |

Varian Medical Systems Inc* | | | 875 | | | | 98,018 | |

Verisk Analytics Inc* | | | 1,197 | | | | 142,551 | |

Vertex Pharmaceuticals Inc* | | | 1,731 | | | | 319,196 | |

The Western Union Co | | | 4,688 | | | | 88,697 | |

Zimmer Biomet Holdings Inc | | | 1,338 | | | | 165,417 | |

Zoetis Inc | | | 3,718 | | | | 336,851 | |

Total Consumer, Non-Cyclical | | | 41,725,655 | |

| |

Energy (5.55%) |

Anadarko Petroleum Corp | | | 3,750 | | | | 241,500 | |

Andeavor | | | 1,028 | | | | 157,068 | |

Apache Corp | | | 2,792 | | | | 122,373 | |

Baker Hughes a GE Co | | | 3,384 | | | | 111,570 | |

Cabot Oil & Gas Corp | | | 3,164 | | | | 75,398 | |

Chevron Corp (c) | | | 14,364 | | | | 1,701,560 | |

Cimarex Energy Co | | | 657 | | | | 55,503 | |

Concho Resources Inc* | | | 1,114 | | | | 152,785 | |

ConocoPhillips | | | 8,936 | | | | 656,170 | |

Devon Energy Corp | | | 2,767 | | | | 118,787 | |

EOG Resources Inc | | | 3,850 | | | | 455,186 | |

EQT Corp | | | 1,085 | | | | 55,357 | |

Exxon Mobil Corp (c) | | | 32,610 | | | | 2,614,345 | |

Halliburton Co | | | 6,883 | | | | 274,563 | |

Helmerich & Payne Inc | | | 805 | | | | 52,784 | |

Hess Corp | | | 1,823 | | | | 122,761 | |

Kinder Morgan Inc | | | 15,052 | | | | 266,420 | |

Marathon Oil Corp | | | 5,187 | | | | 111,572 | |

Marathon Petroleum Corp | | | 4,098 | | | | 337,224 | |

National Oilwell Varco Inc | | | 3,192 | | | | 150,247 | |

Newfield Exploration Co* | | | 988 | | | | 26,953 | |

Noble Energy Inc | | | 2,616 | | | | 77,748 | |

Occidental Petroleum Corp | | | 5,892 | | | | 470,594 | |

ONEOK Inc | | | 3,307 | | | | 217,964 | |

Phillips 66 | | | 3,493 | | | | 413,955 | |

Pioneer Natural Resources Co | | | 1,287 | | | | 224,839 | |

Schlumberger Ltd | | | 11,025 | | | | 696,340 | |

TechnipFMC PLC | | | 3,637 | | | | 111,401 | |

Valero Energy Corp | | | 3,459 | | | | 407,747 | |

The Williams Cos Inc | | | 6,307 | | | | 186,624 | |

Total Energy | | | 10,667,338 | |

| |

Financial (17.89%) |

Affiliated Managers Group Inc | | | 409 | | | | 59,751 | |

Aflac Inc | | | 6,890 | | | | 318,594 | |

Alexandria Real Estate Equities Inc | | | 700 | | | | 89,845 | |

Alliance Data Systems Corp | | | 400 | | | | 95,432 | |

The Allstate Corp | | | 3,124 | | | | 314,181 | |

American Express Co | | | 5,917 | | | | 627,084 | |

American International Group Inc | | | 6,822 | | | | 362,726 | |

American Tower Corp | | | 2,860 | | | | 426,483 | |

Ameriprise Financial Inc | | | 1,369 | | | | 194,343 | |

Aon PLC | | | 2,040 | | | | 296,942 | |

Apartment Investment & Management | | | 1,070 | | | | 46,866 | |

Arthur J Gallagher & Co | | | 1,374 | | | | 99,120 | |

Assurant Inc | | | 596 | | | | 61,281 | |

AvalonBay Communities Inc | | | 1,044 | | | | 191,355 | |

Bank of America Corp | | | 74,761 | | | | 2,312,358 | |

The Bank of New York Mellon Corp | | | 8,692 | | | | 453,288 | |

BB&T Corp | | | 5,247 | | | | 271,060 | |

Berkshire Hathaway Inc* | | | 15,083 | | | | 3,148,124 | |

BlackRock Inc | | | 941 | | | | 450,795 | |

Boston Properties Inc | | | 1,078 | | | | 140,625 | |

Brighthouse Financial Inc* | | | 700 | | | | 29,057 | |

Brookfield Property Partners LP | | | 1,549 | | | | 30,944 | |

Capital One Financial Corp | | | 4,021 | | | | 398,441 | |

Cboe Global Markets Inc | | | 706 | | | | 71,165 | |

CBRE Group Inc* | | | 2,058 | | | | 100,451 | |

The Charles Schwab Corp | | | 9,317 | | | | 473,210 | |

Chubb Ltd | | | 3,685 | | | | 498,359 | |

Cincinnati Financial Corp | | | 1,179 | | | | 90,394 | |

Citigroup Inc | | | 20,197 | | | | 1,438,834 | |

Citizens Financial Group Inc | | | 3,885 | | | | 159,907 | |

CME Group Inc | | | 2,250 | | | | 393,143 | |

Comerica Inc | | | 1,331 | | | | 129,746 | |

Crown Castle International Corp | | | 2,760 | | | | 314,723 | |

Digital Realty Trust Inc | | | 1,218 | | | | 151,373 | |

Discover Financial Services | | | 3,035 | | | | 237,094 | |

Duke Realty Corp | | | 2,792 | | | | 79,544 | |

E*TRADE Financial Corp* | | | 1,181 | | | | 69,514 | |

Equinix Inc | | | 434 | | | | 189,280 | |

Equity Residential | | | 2,164 | | | | 146,611 | |

Essex Property Trust Inc | | | 463 | | | | 114,028 | |

Everest Re Group Ltd | | | 326 | | | | 72,705 | |

Extra Space Storage Inc | | | 949 | | | | 87,507 | |

Federal Realty Investment Trust | | | 548 | | | | 71,574 | |

Fifth Third Bancorp | | | 5,427 | | | | 159,717 | |

Franklin Resources Inc | | | 3,105 | | | | 98,553 | |

The Goldman Sachs Group Inc | | | 2,819 | | | | 670,386 | |

Hartford Financial Services Group | | | 2,922 | | | | 147,181 | |

HCP Inc | | | 3,020 | | | | 81,631 | |

Host Hotels & Resorts Inc | | | 5,173 | | | | 111,375 | |

Huntington Bancshares Inc | | | 5,456 | | | | 88,442 | |

Intercontinental Exchange Inc | | | 4,245 | | | | 323,596 | |

Invesco Ltd | | | 3,410 | | | | 82,181 | |

Iron Mountain Inc | | | 1,369 | | | | 49,421 | |

Jefferies Financial Group Inc | | | 1,447 | | | | 33,599 | |

JPMorgan Chase & Co | | | 26,976 | | | | 3,090,910 | |

KeyCorp | | | 6,704 | | | | 141,253 | |

Kimco Realty Corp | | | 2,994 | | | | 51,227 | |

Lincoln National Corp | | | 2,305 | | | | 151,162 | |

Loews Corp | | | 2,394 | | | | 120,442 | |

M&T Bank Corp | | | 1,180 | | | | 209,037 | |

The Macerich Co | | | 1,011 | | | | 59,386 | |

Marsh & McLennan Cos Inc | | | 4,025 | | | | 340,636 | |

Mastercard Inc | | | 7,325 | | | | 1,578,977 | |

MetLife Inc | | | 7,704 | | | | 353,537 | |

Mid-America Apartment Community | | | 858 | | | | 88,854 | |

Morgan Stanley | | | 10,374 | | | | 506,562 | |

Nasdaq Inc | | | 1,127 | | | | 107,561 | |

Northern Trust Corp | | | 1,610 | | | | 173,011 | |

People’s United Financial Inc | | | 2,887 | | | | 53,438 | |

PNC Financial Services Group Inc | | | 3,945 | | | | 566,265 | |

Principal Financial Group Inc | | | 2,041 | | | | 112,643 | |

The Progressive Corp | | | 4,123 | | | | 278,426 | |

Prologis Inc | | | 3,315 | | | | 222,702 | |

Prudential Financial Inc | | | 3,541 | | | | 347,903 | |

Public Storage | | | 1,035 | | | | 220,020 | |

Raymond James Financial Inc | | | 1,004 | | | | 93,412 | |

Realty Income Corp | | | 1,688 | | | | 98,866 | |

Regency Centers Corp | | | 1,109 | | | | 73,227 | |

Regions Financial Corp | | | 9,066 | | | | 176,424 | |

SBA Communications Corp* | | | 918 | | | | 142,501 | |

Simon Property Group Inc | | | 2,175 | | | | 398,090 | |

SL Green Realty Corp | | | 740 | | | | 77,256 | |

State Street Corp | | | 3,093 | | | | 268,813 | |

SunTrust Banks Inc | | | 3,809 | | | | 280,190 | |

SVB Financial Group* | | | 411 | | | | 132,650 | |

Synchrony Financial | | | 6,040 | | | | 191,287 | |

T Rowe Price Group Inc | | | 1,965 | | | | 227,724 | |

Torchmark Corp | | | 1,176 | | | | 103,394 | |

The Travelers Cos Inc | | | 2,411 | | | | 317,288 | |

UDR Inc | | | 2,033 | | | | 81,259 | |

Unum Group | | | 2,266 | | | | 83,570 | |

US Bancorp | | | 12,265 | | | | 663,659 | |

Ventas Inc | | | 2,081 | | | | 124,589 | |

Visa Inc - Class A | | | 14,101 | | | | 2,071,296 | |

Vornado Realty Trust | | | 1,244 | | | | 95,788 | |

Wells Fargo & Co (c) | | | 35,184 | | | | 2,057,561 | |

Welltower Inc | | | 2,792 | | | | 186,254 | |

Weyerhaeuser Co | | | 5,770 | | | | 200,277 | |

Willis Towers Watson PLC | | | 996 | | | | 146,681 | |

XL Group Ltd | | | 2,249 | | | | 129,070 | |

Zions Bancorporation | | | 1,054 | | | | 56,168 | |

Total Financial | | | 34,405,185 | |

| |

Industrial (9.58%) |

3M Co | | | 4,679 | | | | 986,895 | |

Agilent Technologies Inc | | | 2,633 | | | | 177,833 | |

Allegion PLC | | | 703 | | | | 61,316 | |

AMETEK Inc | | | 1,816 | | | | 139,759 | |

Amphenol Corp - Class A | | | 2,372 | | | | 224,344 | |

AO Smith Corp | | | 1,152 | | | | 66,908 | |

Arconic Inc | | | 2,478 | | | | 55,458 | |

See accompanying notes to financial statements.

18

S&P 500 Index Fund | Portfolio of Investments (Continued) | 8/31/18 |

Security Description | | Shares | | | Value

(Note 1) | |

Ball Corp | | | 2,268 | | | $ | 94,984 | |

The Boeing Co | | | 4,367 | | | | 1,496,963 | |

Caterpillar Inc | | | 4,752 | | | | 659,815 | |

CH Robinson Worldwide Inc | | | 1,280 | | | | 122,982 | |

Corning Inc | | | 7,332 | | | | 245,695 | |

CSX Corp | | | 7,645 | | | | 566,953 | |

Cummins Inc | | | 1,302 | | | | 184,624 | |

Deere & Co | | | 2,547 | | | | 366,259 | |

Dover Corp | | | 1,334 | | | | 114,551 | |

Eaton Corp PLC | | | 3,484 | | | | 289,660 | |

Emerson Electric Co | | | 5,336 | | | | 409,431 | |

Expeditors International of Washington Inc | | | 1,549 | | | | 113,511 | |

FedEx Corp | | | 1,881 | | | | 458,870 | |

FLIR Systems Inc | | | 1,158 | | | | 72,653 | |

Flowserve Corp | | | 1,128 | | | | 58,791 | |

Fluor Corp | | | 1,298 | | | | 74,518 | |

Fortive Corp | | | 2,083 | | | | 174,930 | |

Fortune Brands Home & Security | | | 1,197 | | | | 63,417 | |

Garmin Ltd | | | 806 | | | | 54,921 | |

General Dynamics Corp | | | 2,204 | | | | 426,254 | |

General Electric Co | | | 68,083 | | | | 880,993 | |

Harris Corp | | | 833 | | | | 135,371 | |

Honeywell International Inc | | | 5,633 | | | | 895,984 | |

Huntington Ingalls Industries | | | 358 | | | | 87,520 | |

Illinois Tool Works Inc | | | 2,619 | | | | 363,727 | |

Ingersoll-Rand PLC | | | 2,109 | | | | 213,621 | |

Jacobs Engineering Group Inc | | | 962 | | | | 69,928 | |

JB Hunt Transport Services Inc | | | 690 | | | | 83,318 | |

Johnson Controls International | | | 7,221 | | | | 272,737 | |

Kansas City Southern | | | 811 | | | | 94,044 | |

L3 Technologies Inc | | | 719 | | | | 153,665 | |

Lockheed Martin Corp | | | 1,981 | | | | 634,732 | |

Martin Marietta Materials Inc | | | 463 | | | | 92,007 | |

Masco Corp | | | 2,627 | | | | 99,747 | |

Mettler-Toledo International Inc* | | | 202 | | | | 118,061 | |

Norfolk Southern Corp | | | 2,398 | | | | 416,868 | |

Northrop Grumman Corp | | | 1,488 | | | | 444,153 | |

Packaging Corp of America | | | 752 | | | | 82,660 | |

Parker-Hannifin Corp | | | 1,096 | | | | 192,458 | |

Pentair PLC | | | 1,542 | | | | 67,046 | |

PerkinElmer Inc | | | 1,021 | | | | 94,371 | |

Raytheon Co | | | 2,443 | | | | 487,232 | |

Republic Services Inc | | | 2,203 | | | | 161,612 | |

Rockwell Automation Inc | | | 1,085 | | | | 196,342 | |

Rockwell Collins Inc | | | 1,079 | | | | 146,690 | |

Roper Technologies Inc | | | 694 | | | | 207,069 | |

Sealed Air Corp | | | 1,582 | | | | 63,454 | |