Securities Act File No. [ ]

As filed with the Securities and Exchange Commission on October 7, 2016

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | ☒ |

| | Pre-Effective Amendment No. | | ☐ |

| | Post-Effective Amendment No. | | ☐ |

TRANSAMERICA SERIES TRUST

(Exact Name of Registrant as Specified in Charter)

1801 California Street, Suite 5200

Denver, CO 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (319)-355-2747

Tané T. Tyler, Esq.,

1801 California Street, Suite 5200

Denver, CO 80202

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on November 7, 2016 pursuant to Rule 488 under the Securities Act of 1933.

No filing fee is required because an indefinite number of shares has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended

The information in this Information Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Information Statement/Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 7, 2016

COMBINED INFORMATION STATEMENT

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA VOYA LIMITED MATURITY BOND VP

TRANSAMERICA VOYA MID CAP OPPORTUNITIES VP

AND

PROSPECTUS

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA JPMORGAN CORE BOND VP

TRANSAMERICA JANUS MID-CAP GROWTH VP

The address and telephone number of each Target Portfolio and each Destination Portfolio is:

1801 California Street, Suite 5200

Denver, CO 80202

(Toll free) 1–888–233–4339

Transamerica Series Trust

1801 California Street, Suite 5200

Denver, CO 80202

[ ], 2016

Dear Policyowner:

The Board of your Transamerica portfolio has approved the reorganization of your portfolio into another Transamerica portfolio. The reorganization is expected to occur on or about December [16], 2016. Upon completion of the reorganization, you will become a holder of the destination Transamerica portfolio, and you will receive shares of the destination portfolio equal in value to your shares of your current Transamerica portfolio.

The reorganization does not require holder approval, and you are not being asked to vote. We do, however, ask that you review the enclosed combined Information Statement/Prospectus, which contains information about the destination portfolio, including its investment objective, strategies, risks, performance, fees and expenses.

The Board has unanimously approved your portfolio’s reorganization and believes the reorganization is in the best interests of your portfolio and its shareholders.

If you have any questions, please call 1-888-233-4339 between 8 a.m. and 5 p.m., Eastern Time, Monday through Friday. Thank you for your investment in the Transamerica funds.

|

| Sincerely, |

|

/s/ Marijn P. Smit |

| Marijn P. Smit |

| Trustee, President and Chief Executive Officer |

DATED [ ] 2016

COMBINED INFORMATION STATEMENT

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA VOYA LIMITED MATURITY BOND VP

TRANSAMERICA VOYA MID CAP OPPORTUNITIES VP

(each, a “Target Portfolio” and together, the “Target Portfolios”)

AND

PROSPECTUS

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA JPMORGAN CORE BOND VP

TRANSAMERICA JANUS MID-CAP GROWTH VP

(each, a “Destination Portfolio” and together, the “Destination Portfolios”)

The address and telephone number of the each Target Portfolio and each Destination Portfolio is:

1801 California Street, Suite 5200

Denver, CO 80202

(Toll free) 1-888-233-4339

Shares of the Destination Portfolios have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the accuracy or adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

An investment in any Target Portfolio or Destination Portfolio (each sometimes referred to herein as a “Portfolio”) is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This Information Statement/Prospectus sets forth information about the Destination Portfolios that an investor ought to know before investing. Please read this Information Statement/Prospectus carefully before investing and keep it for future reference.

INTRODUCTION

This combined information statement and prospectus, dated [ ], 2016 (the “Information Statement/Prospectus”), is being furnished in connection with the reorganizations (each, a “Reorganization,” and together the “Reorganizations”) of certain series of Transamerica Series Trust, a Delaware statutory trust (each, a “Target Portfolio,” and together the “Target Portfolios”), into certain other series of Transamerica Series Trust (each, a “Destination Portfolio,” and together the “Destination Portfolios”). The Information Statement/Prospectus is being mailed to Target Portfolio holders on or about [ ], 2016.

Each Target Portfolio and Destination Portfolio is a series of Transamerica Series Trust (“TST”), an open-end management investment company organized as a Delaware statutory trust.

The Board of Trustees of TST (the “Board” or the “Trustees”) has determined that the Reorganizations are in the best interests of each Target Portfolio and Destination Portfolio. A copy of the form of Agreement and Plan of Reorganization (the “Plan”) for each Reorganization is attached to this Information Statement/Prospectus as Exhibit A.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATIONAL PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT. WE ARE NOT ASKING YOU FOR A PROXY OR WRITTEN CONSENT, AND YOU ARE REQUESTED NOT TO SEND US A PROXY OR WRITTEN CONSENT.

The following table indicates (a) the Target Portfolio and corresponding Destination Portfolio involved in each Reorganization, (b) the corresponding Destination Portfolio shares that each Target Portfolio holder will receive, and (c) on what page of this Information Statement/Prospectus the discussion regarding each Reorganization begins. The Reorganizations are numbered for convenience. The consummation of each Reorganization is not contingent on the consummation of the other Reorganization.

| | | | | | |

Reorganization | | Target Portfolio & Shares | | Destination Portfolio & Shares | | Page |

| 1 | | Transamerica Voya Limited Maturity Bond VP | | Transamerica JPMorgan Core Bond VP | | [ ] |

| | Initial Class Service Class | | Initial Class Service Class | | |

| | | |

| 2 | | Transamerica Voya Mid Cap Opportunities VP | | Transamerica Janus Mid-Cap Growth VP | | [ ]

|

| | Initial Class Service Class | | Initial Class Service Class | | |

Please read this Information Statement/Prospectus, including Exhibit A, carefully. Although each Reorganization is similar in structure, you should read carefully the specific discussion regarding your Target Portfolio’s Reorganization.

The date of this Information Statement/Prospectus is [ ], 2016

1

For more complete information about each Portfolio, please read the Portfolio’s prospectus and statement of additional information, as they may be amended and/or supplemented. Each Portfolio’s prospectus and statement of additional information, and other additional information about each Portfolio, has been filed with the SEC (http://www.sec.gov) and is available upon oral or written request and without charge. See “Where to Get More Information” below.

Where to Get More Information

| | |

| Each Portfolio’s current prospectus and statement of additional information, including any applicable supplements thereto. | | On file with the SEC (http://www.sec.gov) and available at no charge by calling the Portfolios’ toll-free number: 1-888-233-4339 or visiting the Portfolios’ website at http://www.transamericaseriestrust.com/content/prospectus.aspx. |

| |

| Each Portfolio’s most recent annual and semi–annual reports to holders. | | On file with the SEC (http://www.sec.gov) and available at no charge by calling the Portfolios’ toll-free number: 1-888-233-4339 or by visiting the Portfolios’ website at http://www.transamericaseriestrust.com/content/prospectus.aspx. |

| |

| A statement of additional information for this Information Statement/Prospectus, dated [ ], 2016 (the “SAI”). The SAI contains additional information about the Target Portfolios and the Destination Portfolios. | | On file with the SEC (http://www.sec.gov) and available at no charge by calling the Portfolios’ toll-free number: 1-888-233-4339 or by visiting the Portfolios’ website at http://www.transamericaseriestrust.com/content/prospectus.aspx. The SAI is incorporated by reference into this Information Statement/Prospectus. |

| |

| To ask questions about this Information Statement/Prospectus. | | Call the following toll-free telephone number: 1-888-233-4339. |

The Target Portfolios’ prospectus, dated May 1, 2016, as supplemented, and statement of additional information, as amended and restated on July 1, 2016 and as further supplemented (Files No. 033-00507 and 811-04419), are incorporated by reference into this Information Statement/Prospectus.

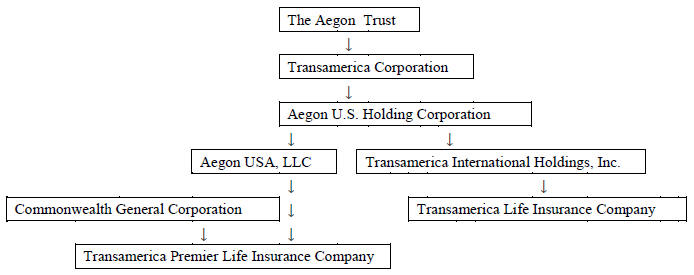

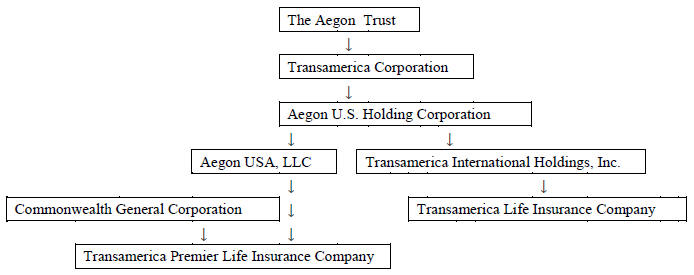

Shares of the Portfolios are not offered directly to the public but are sold only to insurance companies and their separate accounts as the underlying investment medium for owners (each a “Policyowner,” collectively, “Policyowners”) of variable annuity contracts and variable life policies (collectively, the “Policies”). As such, Transamerica Life Insurance Company (“TLIC”), Transamerica Financial Life Insurance Company (“TFLIC”), Transamerica Advisors Life Insurance Company (“TALIC”) and Transamerica Premier Life Insurance Company (“TPLIC”) (collectively, the “Insurance Companies”) and certain asset allocation portfolios are the only shareholders of the investment portfolios offered by TST. TLIC, TFLIC, TALIC and TPLIC each offer the Portfolios in their respective products.

Policyowners are not shareholders of the Portfolios. For ease of reference, throughout the Information Statement/Prospectus, shareholders and Policyowners may collectively be referred to as “shareholders” of the Portfolios.

TST has agreed to provide information to Policyowners invested in each Target Portfolio in connection with a Reorganization into the applicable Destination Portfolio. You have received this Information Statement/Prospectus because you have a Policy of one of these Insurance Companies and that Policy is invested in a Target Portfolio.

2

TABLE OF CONTENTS

SUMMARY

This Summary section is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus and the Agreement and Plan of Reorganization relating to each Reorganization, which is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus, including Exhibit A, and the Portfolios’ prospectus carefully for more complete information.

How Will the Reorganizations Work?

| | • | | Each Target Portfolio will transfer all of its property and assets to the corresponding Destination Portfolio. In exchange, the corresponding Destination Portfolio will assume all of the liabilities of the Target Portfolio and issue shares, as described below. |

| | • | | Each Destination Portfolio will issue a number of its Initial Class and Service Class shares, as applicable, to the corresponding Target Portfolio on the closing date of the applicable Reorganization (the “Closing Date”) having an aggregate net asset value equal to the aggregate net asset value of such Target Portfolio’s Initial Class and Service Class shares, respectively. |

| | • | | Shares of the corresponding class of each Destination Portfolio will then be distributed on the Closing Date to the corresponding Target Portfolio’s shareholders in complete liquidation of the Target Portfolio in proportion to the relative net asset value of their holdings of the applicable class of shares of the Target Portfolio. Therefore, on the Closing Date, upon completion of the applicable Reorganization, each Target Portfolio shareholder will hold shares of the corresponding class of the corresponding Destination Portfolio with the same aggregate net asset value as its holdings of the applicable class of shares of the Target Portfolio immediately prior to the Reorganization. The net asset value attributable to a class of shares of a Target Portfolio will be determined using the Target Portfolio’s valuation policies and procedures and the net asset value attributable to a class of shares of a Destination Portfolio will be determined using the Destination Portfolio’s valuation policies and procedures. The portfolio assets of each Target Portfolio and corresponding Destination Portfolio are valued using the same valuation policies and procedures. |

| | • | | Each Target Portfolio will be terminated after the Closing Date. |

| | • | | The consummation of each Reorganization is not contingent on the consummation of the other Reorganization. |

| | • | | No sales load, contingent deferred sales charge, commission, redemption fee or other transactional fee will be charged as a result of the Reorganizations. Following a Reorganization, shareholders of the applicable Target Portfolio will be subject to the fees and expenses of the corresponding Destination Portfolio. |

| | • | | Following the Reorganizations, (i) Transamerica Asset Management, Inc. (“TAM”) will continue to act as investment manager to each Destination Portfolio; (ii) J.P. Morgan Investment Management, Inc. will continue to act as sub-adviser to the Destination Portfolio in Reorganization 1; and (iii) Janus Capital Management LLC will continue to act as sub-adviser to the Destination Portfolio in Reorganization 2. |

| | • | | The exchange of Target Portfolio shares for Destination Portfolio shares in a Reorganization will not result in income, gain or loss being recognized for federal income tax purposes by an exchanging shareholder. Each Reorganization generally will not result in the recognition of gain or loss for federal income tax purposes by the applicable Target Portfolio or Destination Portfolio. |

Why did the Trustees Approve the Reorganizations?

In approving the Reorganization of your Target Portfolio, the Board, including all of the Trustees who are not “interested” persons (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Portfolios, TAM or Transamerica Capital, Inc. (“TCI”), the Portfolios’ distributor (the “Independent Trustees”), after careful consideration, has determined that the Reorganization is in the best interests of your Target Portfolio and will not dilute the interests of the existing shareholders of the Target Portfolio. The Board has made this determination based on various factors, which include those that are discussed in this Information Statement/Prospectus in the section entitled “Reasons for the Proposed Reorganization.”

1

The Board also serves as the Board of each corresponding Destination Portfolio. The Board, including all of the Independent Trustees, has approved the Reorganization with respect to each Destination Portfolio. The Board has determined that the Reorganization is in the best interests of such Destination Portfolio and that the interests of the Destination Portfolio’s shareholders would not be diluted as a result of the Reorganization.

Who Bears the Expenses Associated with the Reorganizations?

It is anticipated that the total cost of preparing, printing and mailing this Information Statement/Prospectus will be approximately $40,000. In light of the benefits expected to be received by each Target Portfolio as a result of the Reorganizations, this cost will be borne by the Target Portfolios. Each Target Portfolio (and ultimately the shareholders of that Target Portfolio) will bear $40,000 of the costs.

What are the Federal Income Tax Consequences of the Reorganizations?

As a condition to the closing of each Reorganization, the applicable Target Portfolio and Destination Portfolio must receive an opinion of Morgan, Lewis & Bockius LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor the applicable Destination Portfolio nor, in general, your Target Portfolio will recognize gain or loss as a direct result of the Reorganization of your Target Portfolio, and that the aggregate tax basis of the Destination Portfolio shares that you receive in the Reorganization will equal the aggregate tax basis of the Target Portfolio shares that you surrender in the Reorganization. However, in order to maintain its qualification for tax treatment as a regulated investment company and avoid portfolio-level taxes, each Target Portfolio will declare and pay a distribution of its realized net capital gains, if any, its undistributed investment company taxable income (computed without regard to the dividends-paid deduction), if any, and its net tax–exempt income, if any, for the taxable year ending on the Closing Date to its shareholders shortly before the applicable Reorganization. The corresponding Destination Portfolio may make a comparable distribution to its shareholders shortly before the Reorganization. In addition, following the Reorganization, the corresponding Destination Portfolio will declare and pay to its shareholders, for the taxable year in which the Reorganization occurs, a distribution of any remaining income and gains from such taxable year. All such distributions generally will be taxable to the shareholders, but as long as the Policies funded by the Target Portfolios or by the corresponding Destination Portfolios qualify to be treated as annuity contracts or life insurance policies under the Code, such distributions will not be currently taxable to the Policyowners and the Reorganization should not otherwise result in any tax liability to the Policyowners. For more information, see “Tax Status of the Reorganizations” in this Information Statement/Prospectus.

2

REORGANIZATION 1

TRANSAMERICA VOYA LIMITED MATURITY BOND VP

(the “Target Portfolio”)

TRANSAMERICA JPMORGAN CORE BOND VP

(the “Destination Portfolio”)

Summary

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated herein. You should read carefully the entire Information Statement/Prospectus, including the exhibits, which include additional information that is not included in the summary and is a part of this Information Statement/Prospectus. Exhibit A is the form of Agreement and Plan of Reorganization. For a discussion of the terms of the Agreement and Plan of Reorganization, please see the section entitled “Terms of the Agreement and Plan of Reorganization” in the back of this Information Statement/Prospectus, after the discussion of the Reorganizations.

In the Reorganization, the Destination Portfolio will issue a number of its Initial Class and Service Class shares, as applicable, to the Target Portfolio having an aggregate net asset value equal to the aggregate net asset value of the Target Portfolio’s Initial Class and Service Class shares, respectively.

The consummation of the Reorganization is not contingent on the consummation of the other Reorganization.

Both the Target Portfolio and the Destination Portfolio are managed by Transamerica Asset Management, Inc. (“TAM”). The Target Portfolio is sub-advised by Voya Investment Management Co. LLC (“Voya”) and the Destination Portfolio is sub-advised by J.P. Morgan Investment Management, Inc. (“JPMorgan”). The Target Portfolio and Destination Portfolio have substantially similar investment objectives, and similar principal investment strategies and policies, and related risks. The tables below provide a comparison of certain features of the Portfolios. In the tables below, if a row extends across the entire table, the information disclosed applies to both the Destination Portfolio and the Target Portfolio.

Comparison of Transamerica Voya Limited Maturity Bond VP

and Transamerica JPMorgan Core Bond VP

| | | | |

| | | Transamerica Voya Limited Maturity Bond VP | | Transamerica JPMorgan Core Bond VP |

| Investment Objective | | Seeks high current income consistent with low risk to principal and liquidity. As a secondary objective, the portfolio seeks to enhance its total return through capital appreciation when market factors, such as falling interest rates and rising bond prices, indicate that capital appreciation may be available without significant risk to principal. | | Seeks total return, consisting of current income and capital appreciation. |

| | |

| Principal investment strategies | | Under normal market conditions, the portfolio’s sub-adviser, Voya Investment Management Co. LLC (the “sub-adviser”) invests at least 80% of the portfolio’s net assets (plus the amount of borrowing, if any, for investment purposes) in a portfolio of bonds that are limited maturity debt securities. These limited maturity debt securities have remaining maturities of seven years or less. The average dollar-weighted maturity of the portfolio generally will not exceed 5 years. For the portfolio’s holdings in asset-backed, mortgage-backed and similar securities, weighted average life will be used in the calculation. Under normal market conditions, the portfolio maintains significant exposure to government securities. The portfolio invests in non-government debt securities, issued by companies of all sizes, only if rated investment-grade by a nationally recognized statistical rating organization (e.g. , Baa3 or better by Moody’s Investors Service, Inc. (“Moody’s”) or BBB- or better by Standard & Poor’s Ratings Services (“S&P”) or BBB- or better by Fitch Ratings (“Fitch”)) or, if not rated by Moody’s, S&P or Fitch, if the sub-adviser determines at the time of purchase that they are of comparable quality. Money market securities must be rated in the two highest rating categories by Moody’s (P-1 or P-2), S&P (A-1+, A-1 or A-2) or Fitch (A-1+, A-1 or A-2), or determined, at the time of purchase, to be of comparable quality by the sub-adviser. | | The portfolio’s sub-adviser, J.P. Morgan Investment Management Inc. (the “sub-adviser”), seeks to achieve the portfolio’s objective by investing, under normal circumstances, at least 80% of the portfolio’s net assets (plus the amount of borrowings, if any, for investment purposes) in bonds, including (without limitation): • U.S. government securities, including Treasury obligations and government sponsored enterprises such as Fannie Mae, Ginnie Mae, Freddie Mac and securities issued by other government agencies and instrumentalities • Medium- to high-quality corporate bonds • Mortgage-backed securities, including U.S. agency and non-agency pass through and collateralized mortgage obligations (“CMOs”) • Asset-backed securities • Commercial mortgage-backed securities (“CMBS”) Generally, such bonds will have intermediate to long maturities. To a lesser extent, the portfolio may invest in: • U.S. dollar-denominated foreign bonds • Short-term securities, including agency discount notes, commercial paper and money market funds |

3

| | | | |

| | The portfolio may also invest in: preferred stocks; U.S. government securities, securities of foreign governments, and supranational organizations; mortgage bonds; municipal bonds, notes, and commercial paper; and debt securities of foreign issuers. The portfolio may engage in dollar roll transactions and swap agreements, including credit default swaps. The portfolio may use options and futures contracts involving securities, securities indices and interest rates to hedge against market risk, to enhance returns and as a substitute for conventional securities. A portion of the portfolio’s assets may be invested in mortgage-backed and asset-backed debt securities. In addition, private placements of debt securities (which are often restricted securities) are eligible for purchase along with other illiquid securities, subject to appropriate limits. The portfolio may borrow up to 10% of its net assets. This amount may be increased to 25% for temporary purposes. The sub-adviser utilizes the following decision making process to achieve the portfolio’s objectives: Active Duration Management. The average duration of the portfolio is actively managed relative to the benchmark’s average duration. In rising interest rate environments, the average duration will tend to be equal to or less than the benchmark and in falling interest rate environments, the average duration will tend to be greater than the benchmark; Yield Curve Analysis. The yield curve shape is assessed to identify the risk/reward trade-off of maturity decisions and market expectations of future interest rates; Sector Selection. Sectors are overweighted or underweighted relative to the benchmark based on sector analysis and market opportunities. Sectors are broadly defined to include U.S. Treasury securities, U.S. government agency securities, corporate securities, mortgage-backed securities, asset-backed securities, and money market securities. The sub-adviser may further evaluate groupings within sectors such as various industry groups within the corporate securities sector (e.g., finance, industrials, utilities, etc.); and Security Selection. The sub-adviser emphasizes individual securities with positive credit fundamentals, liquidity, and relative value within their respective sectors. The sub-adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. | | The portfolio may invest in bonds and other debt securities that are rated in the lowest investment grade category. The portfolio’s average weighted maturity will ordinarily range between four and 12 years. The sub-adviser analyzes four major factors in managing and constructing the portfolio’s portfolio: duration, market sector, maturity concentrations and individual securities. The sub-adviser looks for market sectors and individual securities that it believes will perform well over time. The sub-adviser is value oriented and selects individual securities after performing a risk/reward analysis that includes an evaluation of interest rate risk, credit risk, and the complex legal and technical structure of the transaction. The portfolio may use futures contracts, options, swaps and other derivatives as tools in the management of portfolio assets. The portfolio may use derivatives as a substitute for various investments, to alter the investment characteristics of the portfolio, for risk management and/or to increase income or gain to the portfolio. |

| Investment manager | | TAM |

| | |

| Sub–adviser | | Voya | | JPMorgan |

| | |

| Portfolio managers | | Christine Hurtsellers, CFA – Portfolio Manager since 2013 Matthew Toms, CFA – Portfolio Manager since 2013 | | Barbara Miller – Portfolio Manager since 2015 Peter Simons, CFA – Portfolio Manager since 2015 Richard Figuly, CFA – Portfolio Manager since 2016 |

| |

| | The Portfolios’ statement of additional information provides additional information about the portfolio manager(s)’ compensation, other accounts managed by the portfolio manager(s), and the portfolio manager(s)’ ownership of securities in the Portfolios. |

| | |

| Net assets (as of August 31, 2016) | | $86,083,046 | | $761,879,945 |

4

Classes of Shares, Fees and Expenses

| | | | |

| | | Transamerica Voya Limited Maturity Bond VP | | Transamerica JPMorgan Core Bond VP |

| Initial Class sales charges and fees | | Initial Class shares are offered without an initial sales charge and are not subject to a contingent deferred sales charge. Initial Class shares can have up to a maximum Rule 12b-1 fee equal to an annual rate of 0.15% (expressed as a percentage of average daily net assets of the Portfolio), but TST does not intend to pay any distribution fees for Initial Class shares through May 1, 2017. TST reserves the right to pay such fees after that date. |

| |

| Service Class sales charges and fees | | Service Class shares are offered without an initial sales charge and are not subject to a contingent deferred sales charge. Service Class shares have a maximum Rule 12b–1 fee equal to an annual rate of 0.25% (expressed as a percentage of average daily net assets of the Portfolio), which is used to pay distribution and service fees for the sale and distribution of the Portfolio’s shares and to pay for non–distribution activities and services provided to shareholders. These services include compensation to financial intermediaries that sell Portfolio shares and/or service shareholder accounts. |

| | |

| Management fees | | TAM receives compensation, calculated daily and paid monthly, from the Target Portfolio at an annual rate (expressed as a specified percentage of the Portfolio’s average daily net assets) of 0.53% of the first $250 million; 0.505% over $250 million up to $1 billion; and 0.49% in excess of $1 billion. | | TAM receives compensation, calculated daily and paid monthly, from the Destination Portfolio at an annual rate (expressed as a specified percentage of the Portfolio’s average daily net assets) of 0.48% of the first $750 million; 0.43% over $750 million up to $1 billion; and 0.405% in excess of $1 billion. |

| | |

| Fee waiver and expense limitations | | TAM has contractually undertaken through May 1, 2017 to pay expenses on behalf of the portfolio to the extent normal operating expenses (including investment advisory fees but excluding, as applicable, 12b–1 fees, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business) exceed, as a percentage of the portfolio’s average daily net assets, 0.88%. TAM is entitled to reimbursement by the portfolio of fees waived or expenses reduced during any of the previous 36 months if on any day or month the estimated annualized portfolio operating expenses are less than the cap. | | TAM has contractually undertaken through May 1, 2017 to pay expenses on behalf of the portfolio to the extent normal operating expenses (including investment advisory fees but excluding, as applicable, 12b–1 fees, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business) exceed, as a percentage of the portfolio’s average daily net assets, 0.70%. TAM is entitled to reimbursement by the portfolio of fees waived or expenses reduced during any of the previous 36 months if on any day or month the estimated annualized portfolio operating expenses are less than the cap. |

| |

| | For a comparison of the gross and net expenses of the Portfolios, please see the class fee tables in “The Portfolios’ Fees and Expenses” below. |

Comparison of Principal Risks of Investing in the Portfolios

Because the Portfolios have substantially similar investment objectives and similar principal investment strategies and policies, they are subject to similar principal risks. Risk is inherent in all investing. The value of your investment in a Portfolio, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in a Portfolio or your investment may not perform as well as other similar investments.

Your primary risk in investing in the Portfolios is you could lose money. You should carefully assess the risks associated with an investment in the Portfolios.

Each Portfolio is subject to the following principal risks (in alphabetical order) of investing in the Portfolio:

| | • | | Counterparty – The portfolio will be subject to credit risk (meaning the risk of adverse changes in an issuer’s real or perceived financial strength) with respect to counterparties to derivatives, repurchase agreements and other financial contracts entered into by the portfolio or held by special purpose or structured vehicles. Adverse changes to counterparties may cause the value of financial contracts to go down. If a counterparty becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties, the value of your investment in the portfolio may decline. |

| | • | | Credit – If an issuer or other obligor (such as a party providing insurance or other credit enhancement) of a security held by the portfolio or a counterparty to a financial contract with the portfolio defaults or is downgraded, or is perceived to be less creditworthy, or if the value of any underlying assets declines, the value of your investment will typically decline. Below investment grade, high-yield debt securities (commonly known as “junk bonds”) have a higher risk of default and are considered speculative. Subordinated securities are more likely to suffer a credit loss than non-subordinated securities of the same issuer and will be disproportionately affected by a default, downgrade or perceived decline in creditworthiness. |

| | • | | Currency – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could reduce or eliminate investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls, and speculation. |

5

| | • | | Derivatives – Using derivatives exposes the portfolio to additional risks and can increase portfolio losses and reduce opportunities for gains when market prices, interest rates, currencies, or the derivatives themselves, behave in a way not anticipated by the portfolio. Using derivatives also can have a leveraging effect and increase portfolio volatility. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Derivatives may be difficult to sell, unwind or value, and the counterparty may default on its obligations to the portfolio. Use of derivatives may have different tax consequences for the portfolio than an investment in the underlying security, and those differences may affect the amount, timing and character of income distributed to shareholders. The U.S. government and foreign governments are in the process of adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin and reporting requirements. The ultimate impact of the regulations remains unclear. Additional regulation of derivatives may make derivatives more costly, limit their availability or utility, otherwise adversely affect their performance or disrupt markets. For additional information regarding derivatives, see “More on Risks of Investing in the Portfolio — More on Principal Risks: Derivatives” in the prospectus. In addition, the SEC has proposed a new rule that would change the regulation of the use of derivatives by registered investment companies, such as the portfolio. If the proposed rule takes effect, it could limit the ability of the portfolio to invest in derivatives. |

| | • | | Extension – When interest rates rise, repayments of fixed income securities, particularly asset- and mortgage-backed securities, may occur more slowly than anticipated, extending the effective duration of these fixed income securities at below market interest rates and causing their market prices to decline more than they would have declined due to the rise in interest rates alone. This may cause the portfolio’s share price to be more volatile. |

| | • | | Fixed-Income Securities – The market prices of fixed-income securities may go up or down, sometimes rapidly and unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. In addition, the market value of a fixed income security may decline if the issuer or other obligor of the security fails to pay principal and/or interest, otherwise defaults or has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines. When market prices fall, the value of your investment will go down. The value of your investment will generally go down when interest rates rise. Interest rates have been at historically low levels, so the portfolio faces a heightened risk that interest rates may rise. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. |

| | • | | Foreign Investments – Investing in securities of foreign issuers or issuers with significant exposure to foreign markets involves additional risk. Foreign countries in which the portfolio may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the portfolio’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, reduction of government or central bank support, political or financial instability or other adverse economic or political developments. Lack of information and weaker accounting standards also may affect the value of these securities. |

| | • | | Interest Rate – Interest rates in the U.S. have been at historically low levels, so the portfolio faces a heightened risk that interest rates may rise. The value of fixed income securities generally goes down when interest rates rise, and therefore the value of your investment in the portfolio may also go down. Debt securities have varying levels of sensitivity to changes in interest rates. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which could adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions from the portfolio. |

| | • | | Legal and Regulatory – Legal and regulatory changes could occur that may adversely affect the portfolio, its investments, and its ability to pursue its investment strategies and/or increase the costs of implementing such strategies. Certain changes have already been proposed and additional changes are expected. New or revised laws or regulations may be imposed by the U.S. Securities and Exchange Commission, the U.S. Commodity Futures Trading Commission, the Internal Revenue Service, the U.S. Federal Reserve or other governmental regulatory authorities or self-regulatory organizations that could adversely affect the portfolio. The portfolio also may be adversely affected by changes in the enforcement or interpretation of existing statutes and rules by governmental regulatory authorities or self-regulatory organizations. |

| | • | | Leveraging – The value of your investment may be more volatile to the extent that the portfolio borrows or uses derivatives or other investments that have a leveraging effect on the portfolio. Other risks also will be compounded. This is because leverage generally magnifies the effect of a change in the value of an asset and creates a risk of loss of value on a larger pool of assets than the portfolio would otherwise have had. The use of leverage is considered to be a speculative investment practice and may result in the loss of a substantial amount, and possibly all, of the portfolio’s assets. The portfolio also may have to sell assets at inopportune times to satisfy its obligations. |

| | • | | Liquidity – The portfolio may make investments that are illiquid or that become illiquid after purchase. Investments may become illiquid due to the lack of an active market, a reduced number of traditional market participants, or reduced capacity of traditional market participants to make a market in securities. The liquidity and value of investments can deteriorate rapidly and those investments may be difficult or impossible for the portfolio to sell, particularly during times of market turmoil. These |

6

| | illiquid investments can be difficult to value. If the portfolio is forced to sell an illiquid investment to meet redemption requests or other cash needs, the portfolio may be forced to sell at a loss. The portfolio may not receive its proceeds from the sale of certain securities for an extended period (for example, several weeks or even longer). |

| | • | | Management – The portfolio is subject to the risk that the Investment Manager’s or sub-adviser’s judgments and decisions may be incorrect or otherwise may not produce the desired results. The value of your investment may decrease if the sub-adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or issuer, industry, sector, region or market segment, or about the economy or interest rates, is incorrect. The portfolio may also suffer losses if there are imperfections, errors or limitations in the tools, resources, information and data used, or the analyses employed or relied on, by the sub-adviser, or if the sub-adviser’s investment style is out of favor or otherwise fails to produce the desired results. The portfolio’s investment strategies designed by the investment manager may not work as intended. In addition, the portfolio’s investment strategies or policies may change from time to time. Those changes may not lead to the results intended by the investment manager and could have an adverse effect on the value or performance of the portfolio. Any of these things could cause the portfolio to lose value or its results to lag relevant benchmarks or other funds with similar objectives. |

| | • | | Market – The market prices of the portfolio’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates or currency rates, lack of liquidity in the markets or adverse investor sentiment. Adverse market conditions may be prolonged and may not have the same impact on all types of securities. Market prices of securities also may go down due to events or conditions that affect particular sectors, industries or issuers. When market prices fall, the value of your investment will go down. The portfolio may experience a substantial or complete loss on any individual security. |

In the past several years, financial markets, such as those in the United States, Europe, Asia and elsewhere, have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. Governmental and non-governmental issuers defaulted on, or were forced to restructure, their debts. These market conditions may continue, worsen or spread.

The U.S. government and the Federal Reserve, as well as certain foreign governments and their central banks have taken steps to support financial markets, including keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The Federal Reserve recently has reduced its market support activities. Further reduction or withdrawal of Federal Reserve or other U.S. or non-U.S. governmental or central bank support, including interest rate increases, could negatively affect financial markets, generally increase market volatility and reduce the value and liquidity of securities in which the portfolio invests.

Policy and legislative changes in the United States and in other countries are affecting many aspects of financial regulation, and may in some instances contribute to decreased liquidity and increased volatility in the financial markets. The impact of these changes on the markets, and the practical implications for market participants, may not be fully known for some time.

Economies and financial markets throughout the world are becoming increasingly interconnected. As a result, whether or not the portfolio invests in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the portfolio’s investments may be negatively affected.

| | • | | Mortgage-Related and Asset-Backed Securities – The value of mortgage-related and asset-backed securities will be influenced by factors affecting the housing market and the assets underlying such securities. As a result, during periods of declining asset values, difficult or frozen credit markets, swings in interest rates, or deteriorating economic conditions, mortgage-related and asset-backed securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. Mortgage-backed securities may be issued by private issuers, by government-sponsored entities such as Fannie Mae or Freddie Mac or by agencies of the U.S. government, such as Ginnie Mae. Mortgage-backed securities represent direct or indirect participations in, or are collateralized by and payable from, mortgage loans secured by real property. Unlike mortgage-related securities issued or guaranteed by agencies of the U.S. government or government-sponsored entities, mortgage-related securities issued by private issuers do not have a government or government-sponsored entity guarantee (but may have other credit enhancement), and may, and frequently do, have less favorable collateral, credit risk or other underwriting characteristics. Asset-backed securities represent participations in, or are secured by and payable from, assets such as installment sales or loan contracts, leases, credit card receivables and other categories of receivables. The value of mortgage-backed and asset-backed securities may be affected by changes in credit quality or value of the mortgage loans or other assets that support the securities. Mortgage-backed and asset-backed securities are subject to prepayment or call and extension risks. Some of these securities may receive little or no collateral protection from the underlying assets. The risk of default is generally higher in the case of mortgage backed investments that include so-called “sub-prime” mortgages. The structure of some of these securities may be complex and there may be less information available than for other types of debt securities. Upon the occurrence of certain triggering events or defaults, the portfolio may become the holder of underlying assets at a time when those assets may be difficult to sell or may be sold only at a loss. |

7

| | • | | Prepayment or Call – Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right. If this happens, the portfolio will not benefit from the rise in market price that normally accompanies a decline in interest rates, and will be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security. The portfolio also may lose any premium it paid on the security. |

| | • | | U.S. Government Agency Obligations – Government agency obligations have different levels of credit support and, therefore, different degrees of credit risk. Securities issued by agencies and instrumentalities of the U.S. government that are supported by the full faith and credit of the U.S. generally present a lesser degree of credit risk than securities issued by agencies and instrumentalities sponsored by the U.S. government that are supported only by the issuer’s right to borrow from the U.S. Treasury and securities issued by agencies and instrumentalities sponsored by the U.S. government that are supported only by the credit of the issuing agencies. |

| | • | | Valuation – The sales price the portfolio could receive for any particular portfolio investment may differ from the portfolio’s valuation of the investment, particularly for securities that trade in thin or volatile markets, that are priced based upon valuations provided by third-party pricing services that use matrix or evaluated pricing systems, or that are valued using a fair value methodology. The portfolio’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers. |

The Target Portfolio is subject to the following related principal risks:

| | • | | Active Trading – The portfolio is actively managed and may purchase and sell securities without regard to the length of time held. Active trading may have a negative impact on performance by increasing transaction costs and may generate greater amounts of net short-term capital gains, which, for shareholders holding shares in taxable accounts, would generally be subject to tax at ordinary income tax rates upon distribution. |

| | • | | Dollar Rolls – The use of dollar rolls is a speculative technique involving leverage, and can have an economic effect similar to borrowing money for investment purposes. Dollar roll transactions involve the risk that the market value of the securities the portfolio is required to purchase may decline below the agreed upon repurchase price of those securities. If the broker/dealer to whom the portfolio sells securities becomes insolvent, the portfolio’s right to purchase or repurchase securities may be restricted. |

| | • | | Emerging Markets – Investments in the securities of issuers located in or principally doing business in emerging markets are subject to foreign investments risks. These risks are greater for investments in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. Emerging market securities are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility. |

| | • | | Equity Securities – Equity securities represent an ownership interest in an issuer, rank junior in a company’s capital structure and consequently may entail greater risk of loss than debt securities. Equity securities include common and preferred stocks. Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the equity securities owned by the portfolio fall, the value of your investment in the portfolio will decline. |

| | • | | High-Yield Debt Securities – High-yield debt securities, commonly referred to as “junk” bonds, are securities that are rated below “investment grade” or, if unrated, determined to be below investment grade by the sub-adviser. Changes in interest rates, the market’s perception of the issuers and the creditworthiness of the issuers may significantly affect the value of these bonds. Junk bonds are considered speculative, have a higher risk of default, tend to be less liquid and may be more difficult to value than higher grade securities. Junk bonds tend to be volatile and more susceptible to adverse events and negative sentiments. |

| | • | | Investment Companies – To the extent that the portfolio invests in other investment companies, such as closed-end or exchange-traded funds, it is subject to the risks of these investment companies and bears its pro rata share of the investment companies’ expenses. |

| | • | | Municipal Securities – Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. The value of municipal securities can also be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory and political developments, tax law changes or other legislative actions, and by uncertainties and public perceptions concerning these and other factors. To the extent the portfolio invests significantly in a single state or in securities the payments on which are dependent upon a single project or source of revenues, or that relate to a sector or industry, the portfolio will be more susceptible to associated risks and developments. In recent periods an increasing number of municipal issuers have defaulted on obligations, commenced insolvency proceedings, or suffered credit downgrading. Financial difficulties of municipal issuers may continue or worsen. |

8

| | • | | Preferred Stock – Preferred stock’s right to dividends and liquidation proceeds is junior to the rights of a company’s debt securities. The value of preferred stock may be subject to factors that affect fixed income and equity securities, including changes in interest rates and in a company’s creditworthiness. The value of preferred stock tends to vary more with fluctuations in the underlying common stock and less with fluctuations in interest rates and tends to exhibit greater volatility. Shareholders of preferred stock may suffer a loss of value if dividends are not paid and have limited voting rights. |

| | • | | Rule 144A and Privately Placed Securities – The portfolio’s investments may include privately placed securities such as Rule 144A securities, which are subject to resale restrictions. Rule 144A permits certain qualified institutional buyers, such as the portfolio, to trade in privately placed securities that have not been registered for sale to the public. Rule 144A and other privately placed securities may be deemed illiquid, and the portfolio might be unable to dispose of such securities promptly or at reasonable prices. |

| | • | | Small and Medium Capitalization Companies – The portfolio will be exposed to additional risks as a result of its investments in the securities of small or medium capitalization companies. Small or medium capitalization companies may be more at risk than large capitalization companies because, among other things, they may have limited product lines, operating history, market or financial resources, or because they may depend on a limited management group. The prices of securities of small and medium capitalization companies generally are more volatile than those of large capitalization companies and are more likely to be adversely affected than large capitalization companies by changes in earnings results and investor expectations or poor economic or market conditions. Securities of small and medium capitalization companies may underperform large capitalization companies, may be harder to sell at times and at prices the portfolio managers believe appropriate and may offer greater potential for losses. |

| | • | | Sovereign Debt – Sovereign debt instruments are subject to the risk that the governmental entity may delay or fail to pay interest or repay principal on its sovereign debt. If a governmental entity defaults, it may ask for more time in which to pay or for further loans. There may be no established legal process for collecting sovereign debt that a government does not pay, nor are there bankruptcy proceedings through which all or part of the sovereign debt that a governmental entity has not repaid may be collected. |

The Portfolios’ Past Performance

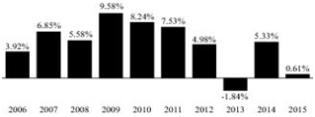

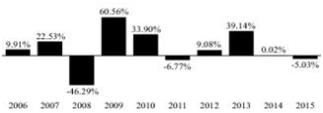

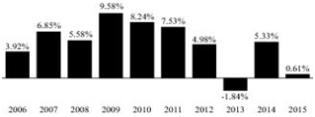

The bar charts and the tables below provide some indication of the risks of investing in the Portfolios by showing you how the performance of each Portfolio’s Initial Class shares has varied from year to year since inception, and how the average annual total returns of each Portfolio’s Initial Class shares for different periods compare to the returns of a broad measure of market performance. Absent any applicable limitation of or cap on a Portfolio’s expenses, performance would have been lower. Each Portfolio’s Service Class shares will have different performance because they have different expenses than the Portfolio’s Initial Class shares. In the “Since Inception” column of the table, share class returns are for since inception of the applicable share class. Index returns are since the inception of the oldest share class. The performance calculations do not reflect charges or deductions that are, or may be, imposed under your variable life insurance policy or variable annuity contract; if they did, the performance would have been lower. A Portfolio’s past performance (before and after taxes) is not necessarily an indication of how the Portfolio will perform in the future. Following the Reorganization, the Destination Portfolio will be the surviving fund for accounting and performance purposes.

Updated performance information is available on our website at www.transamericaseriestrust.com/content/Performance.aspx or by calling 1-888-233-4339.

9

Transamerica Voya Limited Maturity Bond VP

Annual Total Returns (calendar years ended December 31) – Initial Class

| | | | | | |

| | | Quarter Ended | | Return | |

Best Quarter: | | 3/31/2015 | | | 0.60 | % |

Worst Quarter: | | 12/31/2015 | | | -0.30 | % |

Year-to-date return | | 9/30/2016 | | | 1.64 | % |

Average Annual Total Returns (periods ended December 31, 2015)

| | | | | | | | | | | | |

| | | 1 Year | | | Since Inception | | | Inception Date | |

Initial Class | | | 0.41 | % | | | 0.40 | % | | | 5/01/2013 | |

Service Class | | | 0.29 | % | | | 0.17 | % | | | 5/01/2013 | |

Barclays 1-3 Year U.S. Government/Credit Index (reflects no deduction for fees, expenses or taxes) | | | 0.65 | % | | | 0.64 | % | | | | |

Transamerica JPMorgan Core Bond VP

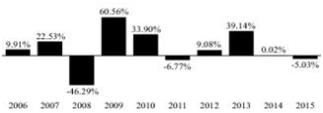

Annual Total Returns (calendar years ended December 31) – Initial Class

| | | | | | |

| | | Quarter Ended | | Return | |

Best Quarter: | | 12/31/2008 | | | 4.64 | % |

Worst Quarter: | | 6/30/2013 | | | -2.03 | % |

Year-to-date return | | 9/30/2016 | | | 5.50 | % |

Average Annual Total Returns (periods ended December 31, 2015)

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Inception

Date | |

Initial Class | | | 0.61 | % | | | 3.26 | % | | | 5.03 | % | | | 10/02/1986 | |

Service Class | | | 0.33 | % | | | 3.00 | % | | | 4.76 | % | | | 5/01/2003 | |

Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | | 0.55 | % | | | 3.25 | % | | | 4.51 | % | | | | |

10

The Portfolios’ Fees and Expenses

Shareholders of the Portfolios pay various fees and expenses, either directly or indirectly. The table below shows the fees and expenses that you would pay if you were to buy and hold shares of each Portfolio, but it does not reflect any charges that are, or may be, imposed under the policies or the annuity contracts. If such charges were reflected, fees would be higher. The fees and expenses for the Target Portfolio and Destination Portfolio in the tables appearing below are based on the fees and expenses for the fiscal year ended December 31, 2015. The table also shows the pro forma expenses of the combined Destination Portfolio after giving effect to the Reorganization based on pro forma net assets as of June 30, 2016. Pro forma numbers are estimated in good faith and are hypothetical. Actual expenses may vary significantly.

| | | | | | | | | | | | |

| | | Transamerica Voya

Limited Maturity Bond VP | | | Transamerica JPMorgan

Core Bond VP | | | Combined Portfolios

(Pro Forma) | |

| | | Initial

Class | | | Initial

Class | | | Initial

Class | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum sales charge (load) imposed on purchases (as a % of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a % of offering price) | | | None | | | | None | | | | None | |

Redemption fee (as a % of amount redeemed) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | | | | | | | | | | |

Management Fees | | | 0.53 | % | | | 0.48 | % | | | 0.48 | % |

Distribution and Service (12b–1) Fees(1) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Other Expenses | | | 0.11 | % | | | 0.07 | % | | | 0.06 | % |

Total Annual Fund Operating Expenses | | | 0.64 | % | | | 0.55 | % | | | 0.54 | % |

| | | |

| | | Transamerica Voya

Limited Maturity Bond VP | | | Transamerica JPMorgan

Core Bond VP | | | Combined Portfolios

(Pro Forma) | |

| | | Service

Class | | | Service

Class | | | Service

Class | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum sales charge (load) imposed on purchases (as a % of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a % of offering price) | | | None | | | | None | | | | None | |

Redemption fee (as a % of amount redeemed) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | | | | | | | | | | |

Management Fees | | | 0.53 | % | | | 0.48 | % | | | 0.48 | % |

Distribution and Service (12b–1) Fees | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Other Expenses | | | 0.11 | % | | | 0.07 | % | | | 0.06 | % |

Total Annual Fund Operating Expenses | | | 0.89 | % | | | 0.80 | % | | | 0.79 | % |

| (1) | The portfolio does not intend to pay any 12b-1 fees on Initial Class shares through May 1, 2017. The maximum 12b-1 fee on Initial Class shares is 0.15%. The portfolio reserves the right to pay such fees after that date. |

Example

The hypothetical example below helps you compare the cost of investing in each Portfolio. The example assumes that:

| | • | | you invest $10,000 in each Portfolio; |

| | • | | you reinvest all dividends and distributions without a sales charge; |

| | • | | you hold your shares for the time periods shown and then redeem all of your shares at the end of those periods; |

| | • | | your investment has a 5% annual return (this assumption is required by the SEC and is not a prediction of the Portfolio’s future performance); and |

| | • | | each Portfolio’s operating expenses remain the same. |

11

The example also assumes no fees for variable life insurance policies or variable annuity contracts, if applicable. Costs are the same whether you redeem at the end of any period or not. Pro forma expenses are included assuming the Reorganization of the Portfolio. The example is for comparison purposes only and is not a representation of any Portfolio’s actual expenses or returns, either past or future. Because actual return and expenses will be different, the example is for comparison only.

| | | | | | | | | | | | |

Number of Years You Own your Shares | | Transamerica Voya

Limited Maturity Bond VP | | | Transamerica JPMorgan Core Bond VP | | | Combined Portfolios

(Pro Forma) | |

Initial Class | | | | | | | | | | | | |

Year 1 | | $ | 65 | | | $ | 56 | | | $ | 55 | |

Year 3 | | $ | 237 | | | $ | 209 | | | $ | 173 | |

Year 5 | | $ | 424 | | | $ | 375 | | | $ | 302 | |

Year 10 | | $ | 964 | | | $ | 856 | | | $ | 677 | |

Service Class | | | | | | | | | | | | |

Year 1 | | $ | 91 | | | $ | 82 | | | $ | 81 | |

Year 3 | | $ | 284 | | | $ | 255 | | | $ | 252 | |

Year 5 | | $ | 493 | | | $ | 444 | | | $ | 439 | |

Year 10 | | $ | 1,096 | | | $ | 990 | | | $ | 978 | |

Portfolio Turnover

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example above, affect a Portfolio’s performance. During the Target Portfolio’s most recent fiscal year ended December 31, 2015 the portfolio turnover rate was 264% of the average value of the Target Portfolio’s portfolio. During the Destination Portfolio’s most recent fiscal year ended December 31, 2015, the portfolio turnover rate was 19% of the average value of the Destination Portfolio’s portfolio.

Reasons for the Proposed Reorganization

The Board of the Target Portfolio, including its Independent Trustees, has unanimously determined that the proposed Reorganization would be in the best interests of the Target Portfolio and would not dilute the interests of the existing shareholders of the Target Portfolio. The same Board oversees the Destination Portfolio, and both the full Board and the Independent Trustees also have unanimously determined that the Reorganization would be in the best interests of the Destination Portfolio and would not dilute the interests of the existing shareholders of the Destination Portfolio. The Board believes that the proposed Reorganization will be advantageous to the shareholders of each Portfolio. In determining whether to approve the Reorganization, the Trustees considered the potential impact of the proposed Reorganization on the Portfolios’ shareholders and a variety of related factors and considerations that they believed, in light of the legal advice furnished to them by fund counsel and independent legal counsel and their own business judgment, to be relevant, including those set forth below. The Board based its determinations on such considerations, although the Board did not identify any consideration or particular information that was controlling of its determinations and each Trustee may have attributed different weights to the various factors considered.

General Considerations

| | • | | The Trustees considered that the Target Portfolio would not be viable after the expected re-allocation of assets away from the Target Portfolio by certain asset allocation funds and would have to be liquidated or otherwise addressed, and pending that resolution could not effectively seek its investment objective. |

| | • | | The Trustees noted that TAM believes that the larger combined asset base resulting from the Reorganization will provide greater potential for operating efficiencies and economies of scale, including the potential for lower management fees and total expenses for shareholders of the Target Portfolio and, for the Destination Portfolio, there would be the opportunity to better diversify its holdings, effect larger portfolio transactions and spread fixed costs over a larger asset base. |

| | • | | The Trustees considered that the investment objective of the Target Portfolio and Destination Portfolio are substantially similar and the constituent portfolios’ strategies are similar (although there are differences). |

| | • | | The Trustees noted TAM’s desire to offer a more consolidated investment lineup of TST portfolios within the Transamerica variable annuity products, and to eliminate redundancies in the TST product line strengthening TAM’s ability to pursue investment and marketing opportunities that may benefit the Destination Portfolio. |

12

Fees and Expenses

| | • | | The Trustees assessed the information that was provided in advance of the meeting of the Board regarding fees and expenses for the Portfolios involved in the Reorganization, as well as projected expense ratios of the Destination Portfolio following the Reorganization. |

| | • | | The Trustees considered that, based on the anticipated asset levels following the Reorganization, the management fee paid by the combined Destination Portfolio is expected to be lower than that paid by the Target Portfolio. |

| | • | | The Trustees also considered that the net expense ratio of each class of shares of the combined Destination Portfolio is expected to be lower than the net expense ratio of the corresponding class of shares of the Target Portfolio. |

| | • | | The Trustees considered that, in light of the benefits expected to be received by the Target Portfolio as a result of the Reorganization, the expenses associated with the preparation, printing and mailing of any shareholder communications, including the Information Statement/Prospectus, and any regulatory filings in connection with the Reorganization would be borne by the Target Portfolio. |

Investment Performance

| | • | | The Trustees considered the relative investment performance of the Portfolios and whether performance and investment flexibility have the potential to be enhanced if the assets of each Portfolio are combined. |

| | • | | The Trustees considered that the Destination Portfolio has performed better than the Target Portfolio since the inception of the Target Portfolio. The Destination Portfolio’s trailing 1-year, 3-year and since inception returns are superior to that of the Target Portfolio. Risk-adjusted returns are superior for the Destination Portfolio in the 1-year period, but are otherwise slightly below that of the Target Portfolio, primarily due to slightly higher volatility of the Destination Portfolio, the primary source of which is the longer duration profile of the portfolio. |

Tax

| | • | | The Trustees considered the expected tax-free nature of the Reorganization for federal income tax purposes. |

Investment Program

| | • | | The Trustees considered the investment objective, strategies and policies of the Destination Portfolio and their compatibility with those of the Target Portfolio. In this regard, the Trustees noted that the assets of the Portfolios are managed in accordance with similar investment objectives and investment strategies. |

| | • | | The Trustees considered that TAM is the manager to the Target Portfolio and the Destination Portfolio and that Voya is the sub-adviser to the Target Portfolio and JPMorgan is the sub-adviser to the Destination Portfolio. |

Other Considerations

| | • | | The Trustees considered the terms and conditions of the Agreement and Plan of Reorganization. |

| | • | | The Trustees took into consideration the fact that the Target Portfolio and Destination Portfolio have the same valuation policies and procedures and use the same pricing vendors. |

13

CAPITALIZATION

The following table sets forth the capitalization of the Target Portfolio and the Destination Portfolio as of September 15, 2016 and the pro forma combined capitalization of the combined Destination Portfolio as if the Reorganization had occurred on that date. If the Reorganization is consummated, the actual exchange ratios on the Closing Date may vary from the exchange ratios used in the computation below. This is due to changes in the market value of the portfolio securities of both Portfolios between September 15, 2016 and the Closing Date, changes in the amount of undistributed net investment income and net realized capital gains of the Portfolios during that period resulting from income and distributions, and changes in the accrued liabilities of the Portfolios during the same period.

| | | | | | | | | | | | | | | | |

| | | Transamerica Voya

Limited Maturity Bond

VP | | | Transamerica JPMorgan

Core Bond VP | | | Pro Forma

Adjustments(A) | | | Combined | |

Net Assets by Class | | | | | | | | | | | | | | | | |

Initial Class | | $ | 85,377,416 | | | $ | 499,868,590 | | | $ | (26,303 | ) | | $ | 585,219,703 | |

Service Class | | $ | 754,948 | | | $ | 260,291,908 | | | $ | (13,697 | ) | | $ | 261,033,159 | |

Total | | $ | 86,132,364 | | | $ | 760,160,498 | | | $ | (40,000 | ) | | $ | 846,252,862 | |

| | | | |

Shares Outstanding | | | | | | | | | | | | | | | | |

Initial Class | | | 8,499,136 | | | | 37,926,745 | | | | (2,021,335 | ) | | | 44,404,546 | |

Service Class | | | 75,389 | | | | 18,527,840 | | | | (21,656 | ) | | | 18,581,573 | |

| | | | |

Net asset value per share | | | | | | | | | | | | | | | | |

Initial Class | | $ | 10.05 | | | $ | 13.18 | | | $ | (10.05 | ) | | $ | 13.18 | |

Service Class | | $ | 10.01 | | | $ | 14.05 | | | $ | (10.01 | ) | | $ | 14.05 | |

| (A) | Pro Forma Adjustments are due to the cost of the Reorganization. |

It is impossible to predict with any certainty how many shares of the Destination Portfolio will actually be received and distributed by the Target Portfolio on the Closing Date. The foregoing table should not be relied upon to determine the amount of Destination Portfolio shares that will actually be received and distributed.

ADDITIONAL INFORMATION

For information relating to each Portfolio and the Reorganization, including tax capital loss carryforwards, the tax status of the Reorganization, a comparison of the fundamental investment policies of the Portfolios, how to buy, sell or exchange Portfolio shares, how each Portfolio values its securities, financial highlights information for each Portfolio and ownership of shares of the Portfolios, please see the sections immediately following the discussion of Reorganization 2.

14

REORGANIZATION 2

TRANSAMERICA VOYA MID CAP OPPORTUNITIES VP

(the “Target Portfolio”)

TRANSAMERICA JANUS MID-CAP GROWTH VP

(the “Destination Portfolio”)

Summary

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated herein. You should read carefully the entire Information Statement/Prospectus, including the exhibits, which include additional information that is not included in the summary and is a part of this Information Statement/Prospectus. Exhibit A is the form of Agreement and Plan of Reorganization. For a discussion of the terms of the Agreement and Plan of Reorganization, please see the section entitled “Terms of the Agreement and Plan of Reorganization” in the back of this Information Statement/Prospectus, after the discussion of the Reorganizations.

In the Reorganization, the Destination Portfolio will issue a number of its Initial Class and Service Class shares, as applicable, to the Target Portfolio having an aggregate net asset value equal to the aggregate net asset value of the Target Portfolio’s Initial Class and Service Class shares, respectively.

The consummation of the Reorganization is not contingent on the consummation of the other Reorganization.

Both the Target Portfolio and the Destination Portfolio are managed by Transamerica Asset Management, Inc. (“TAM”). The Target Portfolio is sub-advised by Voya Investment Management Co. LLC (“Voya”) and the Destination Portfolio is sub-advised by Janus Capital Management LLC (“Janus”). The Target Portfolio and the Destination Portfolio have the same investment objective and similar principal investment strategies and policies, and related risks. The tables below provide a comparison of certain features of the Portfolios. In the tables below, if a row extends across the entire table, the information disclosed applies to both the Destination Portfolio and the Target Portfolio.

Comparison of Transamerica Voya Mid Cap Opportunities VP

and Transamerica Janus Mid-Cap Growth VP

| | | | |

| | | Transamerica Voya Mid Cap Opportunities VP | | Transamerica Janus Mid-Cap Growth VP |

| Investment Objective | | Seeks long-term capital appreciation. |

| | |