Securities Act File No. 333-[_____]

As filed with the Securities and Exchange Commission on September 3, 2020

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933 ☒

Pre-Effective Amendment No. ☐

Post-Effective Amendment No. ☐

TRANSAMERICA SERIES TRUST

(Exact Name of Registrant as Specified in Charter)

1801 California Street, Suite 5200

Denver, CO 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: 1-888-233-4339

Erin D. Nelson, Esq.,

1801 California Street, Suite 5200

Denver, CO 80202

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Initial Class and Service Class shares of beneficial interest, no par value, of Transamerica S&P 500 Index VP.

It is proposed that this filing will become effective on October 3, 2020 pursuant to Rule 488 under the Securities Act of 1933.

No filing fee is required because an indefinite number of shares has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

The information in this Proxy Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Proxy Statement/Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED [ ], 2020

COMBINED PROXY STATEMENT

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA WMC US GROWTH II VP

AND

PROSPECTUS

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA S&P 500 INDEX VP

The address and telephone number of each Portfolio is:

1801 California Street, Suite 5200

Denver, Colorado 80202

(Toll free) 1-800-851-9777

TRANSAMERICA SERIES TRUST

1801 California Street, Ste. 5200

Denver, Colorado 80202

(Toll free) l-800-851-9777

[ ], 2020

Dear Policyowner:

You are being asked to vote on the proposed reorganization of Transamerica WMC US Growth II VP (the “Target Portfolio”) into Transamerica S&P 500 Index VP (formerly, Transamerica U.S. Equity Index VP) (the “Destination Portfolio”), each a separate series of Transamerica Series Trust (the “Trust”). Detailed information about the proposal is contained in the enclosed Proxy Statement/Prospectus.

The Board of Trustees of the Trust has called a special meeting of shareholders of the Target Portfolio to be held as a virtual meeting on November 16, 2020 at 10:00 a.m. Mountain Time, to consider and vote on an Agreement and Plan of Reorganization pursuant to which the Target Portfolio would reorganize into the Destination Portfolio. Shares of the portfolios are not offered directly to the public but are sold only to separate accounts of Transamerica insurance companies to fund benefits under variable life policies or variable annuity contracts (owners of these policies and contracts invested in the portfolios through the separate accounts, the “Policyowners”). As such, the only shareholders of the portfolios are the insurance company separate accounts.

The Trust has agreed to solicit voting instructions from Policyowners invested in the Target Portfolio in connection with the proposed reorganization. You have received this Proxy Statement/Prospectus because you are a Policyowner. As a Policyowner, you have the right to give voting instructions on shares of the Target Portfolio that are attributable to your policy, if your voting instructions are properly submitted on your voting instruction form and received prior to the special meeting.

After careful consideration, the Trust’s Board unanimously approved the proposed reorganization, and recommends that shareholders of the Target Portfolio vote “FOR” the proposal. Target Portfolio shareholders are now being asked to approve the proposed reorganization. Shareholders of record of the Target Portfolio as of the close of business on October 2, 2020 are entitled to vote at the special meeting and any adjournments or postponements thereof.

Your voting instructions are very important regardless of the size of your investment in the Target Portfolio. Please read the Proxy Statement/Prospectus and provide voting instructions promptly. To provide voting instructions, follow the instructions on the enclosed proxy card to vote by telephone or on the internet or complete, sign and return the proxy card in the enclosed postage-paid envelope.

If you have any questions, please call 1-800-851-9777 between 8 a.m. and 5 p.m., Eastern Time, Monday through Friday. Thank you for your investment in the Transamerica funds.

|

| Sincerely, |

|

/s/ Marijn P. Smit |

Chairman of the Board, President and Chief Executive Officer |

TRANSAMERICA SERIES TRUST

1801 California Street, Ste. 5200

Denver, Colorado 80202

(Toll free) l-800-851-9777

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Scheduled to be Held Virtually on November 16, 2020

A special meeting of shareholders of Transamerica WMC US Growth II VP (the “Special Meeting”) will be held as a virtual meeting on November 16, 2020 at 10:00 a.m., Mountain Time, to consider and vote on the following proposals, as more fully described in the accompanying combined Proxy Statement/Prospectus:

| | |

| PROPOSAL I: | | To approve an Agreement and Plan of Reorganization, providing for (i) the acquisition of all of the assets of Transamerica WMC US Growth II VP by Transamerica S&P 500 Index VP, in exchange for shares of Transamerica S&P 500 Index VP to be distributed to the shareholders of Transamerica WMC US Growth II VP and the assumption of all of the liabilities of Transamerica WMC US Growth II VP by Transamerica S&P 500 Index VP, (ii) the approval of Transamerica S&P 500 Index VP’s fundamental investment policy regarding concentration, and (iii) the subsequent liquidation of Transamerica WMC US Growth II VP; and |

| |

| PROPOSAL II: | | Any other business that may properly come before the Special Meeting. |

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE IN FAVOR OF THE PROPOSED REORGANIZATION OF TRANSAMERICA WMC US GROWTH II VP INTO TRANSAMERICA S&P 500 INDEX VP.

Shareholders of record of your portfolio at the close of business on October 2, 2020 are entitled to vote at the Special Meeting and any adjournments or postponements thereof.

PLEASE NOTE: In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the officers of Transamerica Series Trust have determined that the Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual Special Meeting are included in this Proxy Statement/Prospectus.

|

| By Order of the Board of Trustees, |

|

/s/ Erin D. Nelson |

| Chief Legal Officer and Secretary |

Denver, Colorado

[ ], 2020

If shareholders do not return their proxies in sufficient numbers, your portfolio may be required to make additional solicitations.

COMBINED PROXY STATEMENT

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA WMC US GROWTH II VP

(the “Target Portfolio”)

AND

PROSPECTUS

OF

TRANSAMERICA SERIES TRUST

on behalf of its Series:

TRANSAMERICA S&P 500 INDEX VP

(the “Destination Portfolio”)

The address and telephone number of each Portfolio is:

1801 California Street, Suite 5200

Denver, CO 80202

(Toll free) 1-800-851-9777

Shares of the Destination Portfolio have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

An investment in the Target Portfolio or Destination Portfolio (each sometimes referred to herein as a “Portfolio”) is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in the Portfolios.

This Proxy Statement/Prospectus sets forth information about the Destination Portfolio that an investor ought to know before investing. Please read this Proxy Statement/Prospectus carefully before investing and keep it for future reference.

INTRODUCTION

This combined proxy statement and prospectus, dated [ ], 2020 (the “Proxy Statement/Prospectus”), is being furnished in connection with the solicitation proxies to be used at a special virtual meeting (the “Special Meeting”) of shareholders of Transamerica WMC US Growth II VP (the “Target Portfolio”) related to the proposed Agreement and Plan of Reorganization that provides for the reorganization of the Target Portfolio into Transamerica S&P 500 Index VP (the “Destination Portfolio”) (the “Reorganization”). The Special meeting will be held as a virtual meeting on November 16, 2020 at 10:00 a.m., Mountain Time. This Proxy Statement/Prospectus is being mailed to shareholders of the Target Portfolio on or about [October 19, 2020].

The Target Portfolio and the Destination Portfolio are each separate series of Transamerica Series Trust (“TST”), an open-end management investment company organized as a Delaware statutory trust.

The Board of Trustees of TST (the “Board” or the “Trustees”) has determined that the Reorganization is in the best interests of the Target Portfolio and the Destination Portfolio. A copy of the form of Agreement and Plan of Reorganization (the “Plan”) for the Reorganization is attached to this Proxy Statement/Prospectus as Exhibit A.

This Proxy Statement/Prospectus contains information you should know before providing voting instructions on the Reorganization.

1

You are entitled to vote at the Special Meeting of the Target Portfolio as of the close of business on October 2, 2020 (the “Record Date”). You are receiving these materials because you own a policy that invests in the Target Portfolio and for which you are entitled to provide voting instructions with respect to the Target Portfolio.

PLEASE NOTE: The Special Meeting will be held virtually over the internet. To attend, vote, and submit any questions at the Special Meeting, please register at attendameeting@astfinancial.com.

In order for beneficial owners of shares registered in the name of a broker, bank, or other nominee to attend, participate, and vote at the virtual Special Meeting, you must first obtain a legal proxy from the relevant broker, bank, or other nominee and then register your attendance ahead of the Special Meeting at attendameeting@astfinancial.com.

Please read this Proxy Statement/Prospectus, including Exhibit A, carefully.

The date of this Proxy Statement/Prospectus is [ ], 2020

For more complete information about each Portfolio, please read the Portfolios’ prospectus and statement of additional information, as they may be amended and/or supplemented. Each Portfolio’s prospectus and statement of additional information, and other additional information about each Portfolio, has been filed with the SEC (http://www.sec.gov) and is available upon oral or written request and without charge.

| | |

| Where to Get More Information | | |

| Each Portfolio’s current prospectus and statement of additional information, including any applicable supplements thereto. | | On file with the SEC (http://www.sec.gov) (File Nos. 033-00507; 811-04419) and available at no charge by calling the Portfolios’ toll-free number: 1-800-851-9777 or visiting the Portfolios’ website at http://www.transamericaseriestrust.com/content/prospectus.aspx. |

| | | |

| Each Portfolio’s most recent annual and semi–annual reports to holders. | | On file with the SEC (http://www.sec.gov) (File No. 811-04419) and available at no charge by calling the Portfolios’ toll-free number: 1-800-851-9777 or by visiting the Portfolios’ website at http://www.transamericaseriestrust.com/content/prospectus.aspx. |

| | | |

| A statement of additional information for this Proxy Statement/Prospectus, dated [ ], 2020 (the “SAI”). The SAI contains additional information about the Target Portfolio and the Destination Portfolio. | | On file with the SEC (http://www.sec.gov) (File No. ) and available at no charge by calling the Portfolios’ toll-free number: 1-800-851-9777. The SAI is incorporated by reference into this Proxy Statement/Prospectus. |

| | | |

| To ask questions about this Proxy Statement/Prospectus. | | Call the following toll-free telephone number: 1-800-851-9777. |

The Target Portfolio’s prospectus, dated May 1, 2020, as supplemented, and statement of additional information dated May 1, 2020, as supplemented (File Nos. 033-00507 and 811-04419), are incorporated by reference into this Proxy Statement/Prospectus.

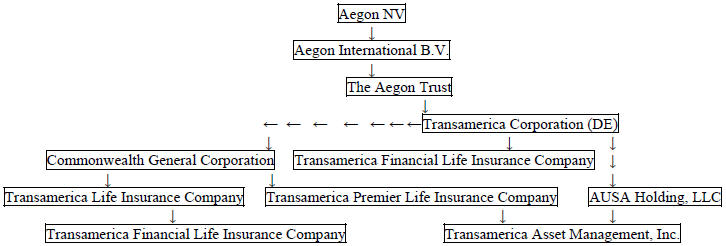

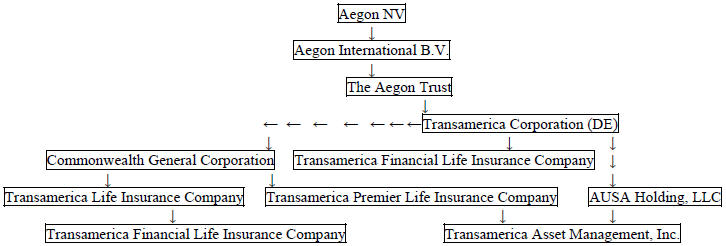

Shares of the Portfolios are not offered directly to the public but are sold only to insurance companies and their separate accounts as the underlying investment medium for owners (each a “Policyowner” and collectively, “Policyowners”) of variable annuity contracts and variable life policies (collectively, the “Policies”). As such, Transamerica Life Insurance Company (“TLIC”), Transamerica Financial Life Insurance Company (“TFLIC”) and Transamerica Premier Life Insurance Company (“TPLIC”) (collectively, the “Insurance Companies”) are the only shareholders of the investment portfolios offered by TST. The Insurance Companies each offer the opportunity to invest in the Portfolios through their respective products.

Policyowners are not shareholders of the Portfolios. For ease of reference, throughout the Proxy Statement/Prospectus, shareholders and Policyowners may collectively be referred to as “shareholders” of the Portfolios.

TST has agreed to solicit voting instructions from Policyowners invested in the Target Portfolio in connection with the proposed Reorganization. You have received this Proxy Statement/Prospectus because you own a Policy of one of these Insurance Companies and that Policy is invested in the Target Portfolio. You have the right to give voting instructions on shares of the Target Portfolio that are attributable to your Policy, if your voting instructions are properly submitted on your voting instruction form and received prior to the Special Meeting.

2

TABLE OF CONTENTS

3

QUESTIONS AND ANSWERS

For your convenience, we have provided a brief overview of the proposed Reorganization. Additional information is contained elsewhere in this Proxy Statement/Prospectus and the Agreement and Plan of Reorganization relating to the Reorganization, a form of which is attached to this Proxy Statement/Prospectus as Exhibit A. Shareholders should read this entire Proxy Statement/Prospectus, including Exhibit A and Exhibit B, and the Destination Portfolio’s prospectus carefully for more complete information.

How Will the Reorganization Work?

| | • | | The Target Portfolio will transfer all of its property and assets to the Destination Portfolio. In exchange, the Destination Portfolio will assume all of the liabilities of the Target Portfolio and issue shares, as described below. |

| | • | | The Destination Portfolio will issue a number of its Initial Class shares to the Target Portfolio on the closing date of the Reorganization (the “Closing Date”) having aggregate net asset values equal to the respective aggregate net asset value of the Target Portfolio’s Initial Class shares. The Target Portfolio currently offers only Initial Class shares (Service Class shares are registered but have never been offered). The Destination Portfolio currently offers both Initial Class and Service Class shares. |

| | • | | Initial Class shares of the Destination Portfolio will then be distributed on the Closing Date to the Target Portfolio’s shareholders in complete liquidation of the Target Portfolio in proportion to the relative net asset value of each shareholder’s Initial Class share holdings of the Target Portfolio. Therefore, on the Closing Date, upon completion of the Reorganization, each Target Portfolio shareholder will hold Initial Class shares of the Destination Portfolio with the same aggregate net asset value as its holdings of the Initial Class shares of the Target Portfolio immediately prior to the Reorganization. The net asset value attributable to the shares of the Target Portfolio will be determined using the Target Portfolio’s valuation policies and procedures and the net asset value attributable to the shares of the Destination Portfolio will be determined using the Destination Portfolio’s valuation policies and procedures. The portfolio assets of the Target Portfolio and Destination Portfolio are valued using the same valuation policies and procedures. |

| | • | | The Target Portfolio will be terminated after the Closing Date. |

| | • | | No sales load, contingent deferred sales charge, commission, redemption fee or other transactional fee will be charged as a result of the Reorganization. Following the Reorganization, shareholders of the Target Portfolio will be subject to the fees and expenses of the Destination Portfolio. Please see “Why did the Trustees Approve the Reorganization?” and “How do the Target Portfolio and the Destination Portfolio compare?” below for a further discussion of fees and expenses. |

| | • | | Following the Reorganization, (i) Transamerica Asset Management, Inc. (“TAM”) will continue to act as investment manager to the Destination Portfolio; and (ii) SSGA Funds Management, Inc. (“SSGA”) will continue to act as sub-adviser to the Destination Portfolio. |

| | • | | It is anticipated that the Reorganization will be treated as a taxable transaction. However, based on the tax profiles of the Target Portfolio’s investors, its investors generally are not expected to suffer material adverse U.S. tax consequences as a result of the Reorganization. Please see “What are the Federal Income Tax Consequences of the Reorganization?” below for a further discussion of the tax consequences. |

Why did the Trustees Approve the Reorganization?

The Board of the Target Portfolio, including all of the Trustees who are not “interested” persons (as defined in the Investment Company Act of 1940, as amended, (the “1940 Act”)) of the Portfolios, TAM or Transamerica Capital, Inc. (“TCI”), the Portfolios’ distributor, (the “Independent Trustees”), after careful consideration, has determined that the Reorganization is in the best interests of the Target Portfolio and will not dilute the interests of the existing shareholders of the Target Portfolio. The Board also serves as the Board of the Destination Portfolio. The Board, including all of the Independent Trustees, approved the Reorganization with respect to the Destination Portfolio. The Board determined that the Reorganization is in the best interests of the Destination Portfolio and that the interests of the Destination Portfolio’s shareholders will not be diluted as a result of the Reorganization.

4

While the Target Portfolio is actively managed and the Destination Portfolio is passively managed, TAM views the Portfolios as having compatible investment strategies, given that both are U.S large cap equity funds. In approving the Reorganization, the Board considered, among other things, (i) that both the Target Portfolio and the Destination Portfolio typically invest in the common stocks of large capitalization U.S. companies, but that the Target Portfolio and the Destination Portfolio have differing investment objectives and strategies, (ii) that the Target Portfolio is sub-scale, (iii) the larger combined asset base resulting from the Reorganization will offer the potential for greater operating efficiencies and economies of scale and would streamline the Transamerica product line, (iv) the management fee of the combined Destination Portfolio following the Reorganization is expected to be significantly lower than the Target Portfolio’s current management fee, and (v) the fact that the net expense ratio of the Initial Class shares of the combined Destination Portfolio following the Reorganization is expected to be lower than the current net expense ratio of the Initial Class shares of the Target Portfolio prior to the Reorganization. Please see “Reasons for the Proposed Reorganization” for additional information regarding the Board’s considerations.

How do the Target Portfolio and the Destination Portfolio compare?

There are similarities between the Portfolios, as well as certain differences, including:

| | • | | Investment Manager, Sub-Advisers and Portfolio Managers. Each Portfolio is managed by TAM. Wellington Management Company LLP (“WMC”) serves as the sub-adviser to the Target Portfolio. Mammen Chally, CFA, Douglas McLane, CFA, and David Siegle, CFA, are portfolio managers responsible for the day-to-day management of the Target Portfolio. SSGA serves as the sub-adviser to the Destination Portfolio. Michael Feehily, CFA, Keith Richardson and Karl Schneider are portfolio managers responsible for the day-to-day management of the Destination Portfolio. The analytical tools, techniques and investment selection process used by SSGA in sub-advising the Destination Portfolio differ from those used by WMC in sub-advising the Target Portfolio. |

| | • | | Investment Objective. The Target Portfolio’s investment objective seeks long-term capital growth and the Destination Portfolio’s investment objective seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”). |

| | • | | Investment Strategy. Both Portfolios generally invest in common stocks of large capitalization U.S. companies. The Target Portfolio is actively managed and invests primarily in common stocks of growth-oriented companies. The Target Portfolio’s sub-adviser emphasizes stock specific risk, while minimizing other sources of broad market risk. The goal is a portfolio whose relative performance is not dependent on the market environment. The Target Portfolio utilizes a “bottom-up” stock selection approach that evaluates individual companies in the context of broader market factors. Investments may consist of 1) securities held in the Russell 1000® Growth and S&P 500® Growth Indices; 2) Equity securities within the market-cap range of the index with historical or projected growth rates greater than the Russell 1000® Index median; and 3) stocks that meet other growth criteria as determined by the sub-adviser. |

The Destination Portfolio’s sub-adviser utilizes a “passive” or “indexing” investment approach that corresponds to the total return performance of the Index by employing a sampling and/or replication strategy. The goal is to replicate the returns of the Index by investing in the securities of the Index in approximately their Index weight, which may not be possible or practicable under certain circumstances. In those cases, the Destination Portfolio may purchase a sample of stocks in the Index in proportions expected to replicate generally the performance of the Index as a whole. The sub-adviser may at times purchase or sell futures contracts in lieu of investment directly in the stocks making up the Index. The Destination Portfolio’s sub-adviser might do so, for example, in order to increase the portfolio’s investment exposure pending investment of cash in the stocks comprising the Index. Alternatively, the Destination Portfolio’s sub-adviser might use futures to reduce its investment exposure to the Index in situations where it intends to sell a portion of the stocks in the portfolio but the sale has not yet been completed.

The Target Portfolio may invest up to 20% of its assets in the securities of foreign issuers, and may invest to a lesser extent in derivatives, including futures, forwards, options and swaps. The Destination Portfolio may at times invest in derivatives securities.

| | • | | Fundamental Investment Policies. The Target Portfolio and the Destination Portfolio have identical fundamental investment policies, except that the Destination Portfolio has an additional fundamental investment policy allowing the Destination Portfolio to concentrate in any industry in which the index that the Destination Portfolio tracks becomes concentrated to approximately the same degree during the same period. |

5

| | • | | Principal Risks. The Target Portfolio and the Destination Portfolio are subject to a number of common principal risks, including counterparty, credit, derivatives, equity securities, investments by affiliated portfolios, large capitalization companies, leveraging, liquidity, management and market. An investment in the Target Portfolio is also subject to active trading, currency, depositary receipts, foreign investments, growth stocks, small and medium capitalization companies and valuation risk. An investment in the Destination Portfolio is also subject to index fund, industry concentration and passive strategy/index risk. |

| | • | | Performance. The Target Portfolio has outperformed the Destination Portfolio over year-to-date 1-, 2- and 3- year periods as of May 31, 2020. The Target Portfolio has exhibited higher total risk (as measured by standard deviation) over those same periods. |

| | • | | Management Fee. There will be no changes to the management fee schedule for the Destination Portfolio in connection with the Reorganization. The management fee of the combined Destination Portfolio is expected to be significantly lower than the current management fee of the Target Portfolio. Please see “The Portfolios’ Fees and Expenses” for the Destination Portfolio’s current management fee schedule. |

| | • | | Total Operating Expenses. The total expense ratio of Initial Class shares of the combined Destination Portfolio is expected to be significantly lower than the current total expense ratio of Initial Class shares of the Target Portfolio. Following the Reorganization, the total expense ratio for the Destination Portfolio is also expected to be lower for Initial Class shares. |

Contractual arrangements have been made with TAM, through May 1, 2021 to waive fees and/or reimburse fund expenses to the extent that total annual fund operating expenses exceed 0.30% for Initial Class shares of the Target Portfolio and 0.14% for Initial Class shares of the Destination Portfolio, subject to certain exclusions.

Following the Reorganization, contractual arrangements have been made with TAM, through May 1, 2022 to waive fees and/or reimburse fund expenses to the extent that total annual fund operating expenses exceed 0.14% for Initial Class shares of the combined Destination Portfolio, subject to certain exclusions.

Who Bears the Expenses Associated with the Reorganization?

It is anticipated that the total cost of preparing, printing and mailing this Proxy Statement/Prospectus and the solicitation costs (including the fees and expenses of AST Fund Solutions, the proxy solicitor), will be approximately $45,000 to $60,000. The associated costs will be borne by TAM.

What are the Federal Income Tax Consequences of the Reorganization?

The Target Portfolio and the Destination Portfolio intend to take the position that the Reorganization will not qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), that the Reorganization will be a taxable transaction, and that the Target Portfolio will recognize gain or loss in connection with the transfer of its assets to the Destination Portfolio, which may require the Target Portfolio to make taxable distributions to its shareholders. In addition, the insurance company separate accounts that hold shares of the Target Portfolio are expected to take the position that they will recognize gain or loss on the exchange of their shares of the Target Portfolio for shares of the Destination Portfolio. Based on the tax profiles of the Target Portfolio’s investors, however, the Target Portfolio’s investors generally are not expected to suffer material adverse U.S. tax consequences as a result of the Reorganization. In particular, it is not anticipated that the Policyowners of the Policies funded by insurance company separate accounts invested in the Target Portfolio will recognize any income or gain as a result of the Reorganization. For more information, see “Tax Status of the Reorganization” in this Proxy Statement/Prospectus.

What happens if the Reorganization is not approved?

If the required holder approval of the Target Portfolio is not obtained, the Special Meeting may be adjourned as more fully described in this Proxy Statement/Prospectus. If the Target Portfolio’s Reorganization is not approved, you will remain a holder of the Target Portfolio, and the Board of the Target Portfolio will consider what further action may be appropriate, which may include re-soliciting shareholders to approve the proposal.

Who is eligible to vote?

Shareholders of record of the Target Portfolio at the close of business on the Record Date are entitled to attend and vote at the Special Meeting of the Target Portfolio or any adjournment or postponement thereof. Shareholders of the Target Portfolio, regardless of the class of shares held, will vote together as a single class. Each whole share (or fractional share) of the Target Portfolio shall entitle the holder thereof to a number of votes equal to the net asset value of the share (or fractional share) in United States dollars determined as

6

of the close of business on the Record Date. Shares represented by properly executed proxies, unless revoked before or at the Special Meeting, will be voted according to holders’ instructions. If you sign a proxy but do not fill in a vote, your shares will not be voted to approve the Plan. If any other business comes before the Special Meeting, your shares will be voted at the discretion of the persons named as proxies.

How do I provide voting instructions?

You can provide voting instructions by telephone by calling the toll-free number on the enclosed proxy card or by computer by going to the internet address provided on the proxy card and following the instructions, using your proxy card as a guide. Alternatively, you can vote your shares by signing and dating the enclosed proxy card, and mailing it in the enclosed postage-paid envelope.

You can also virtually attend the Special Meeting as described below. However, even if you intend to do so, we encourage you to provide voting instructions by one of the methods described above.

When and where will the Special Meeting be held?

The Special Meeting will be held as a virtual meeting on November 16, 2020, at 10 a.m. (Mountain Time). In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the officers of the Trust have determined that the Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual Special Meeting are included in this Proxy Statement/Prospectus.

Who do I call if I have questions?

If you need more information or have any questions about the proposals, please call the Trust toll-free at 1-888-233-4339. If you have any questions about voting, please call the Portfolio’s proxy solicitor, AST Fund Solutions at 1-800-967-5071.

It is important that you vote promptly.

7

PROPOSAL I — APPROVAL OF AGREEMENT AND PLAN OF REORGANIZATION

TRANSAMERICA WMC US GROWTH II VP

(the “Target Portfolio”)

TRANSAMERICA S&P 500 INDEX VP

(the “Destination Portfolio”)

Summary

The following is a summary of more complete information appearing later in this Proxy Statement/Prospectus or incorporated herein. You should read carefully the entire Proxy Statement/Prospectus, including the exhibits, which include additional information that is not included in the summary and is a part of this Proxy Statement/Prospectus. Exhibit A is the form of Agreement and Plan of Reorganization. For a discussion of the terms of the Agreement and Plan of Reorganization, please see the section entitled “Terms of the Agreement and Plan of Reorganization” in the back of this Proxy Statement/Prospectus, after the discussion of the Reorganization.

The proposed Reorganization is subject to approval by shareholders of the Target Portfolio.

In the Reorganization (assuming shareholder approval), the Destination Portfolio will issue a number of its Initial Class shares to the Target Portfolio having aggregate net asset values equal to the respective aggregate net asset values of the Target Portfolio’s Initial Class shares.

Both the Target Portfolio and the Destination Portfolio are managed by TAM. The Target Portfolio is sub-advised by WMC and the Destination Portfolio is sub-advised by SSGA. The Target Portfolio and the Destination Portfolio have similar principal investment strategies and policies, and related risks. The tables below provide a comparison of certain features of the Portfolios. In the tables below, if a row extends across the entire table, the information disclosed applies to both the Destination Portfolio and the Target Portfolio.

Comparison of Transamerica WMC US Growth II VP

and Transamerica S&P 500 Index VP

| | | | |

| | | Target Portfolio Transamerica WMC US Growth II VP | | Destination Portfolio Transamerica S&P 500 Index VP |

| Investment objective | | Seeks long-term capital growth. | | Seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. |

| | |

| Principal investment strategies | | The portfolio invests, under normal circumstances, at least 80% of its net assets (plus the amount of borrowings, if any, for investment purposes) in domestic common stocks. The portfolio invests primarily in common stocks of growth-oriented companies. Portfolio construction emphasizes stock specific risk while minimizing other sources of broad market risk. The goal is a portfolio whose relative performance is not dependent on the market environment. The portfolio’s sub-adviser, WMC, employs a “bottom up” approach, using fundamental analysis to identify specific securities within industries or sectors for purchase or sale. A “bottom-up” approach evaluates individual companies in the context of broader market factors. The sub-adviser’s stock selection process is derived from its observation that the quality and persistence of a company’s business is often not reflected in its current stock price. Central to the investment process | | Under normal circumstances, the portfolio invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities listed in the S&P 500® Index (the “Index”)1. Under normal circumstances, however, the portfolio intends to invest substantially all of its assets in securities of companies included in the Index and close substitutes, including index futures contracts. The Index is a well-known stock market index that includes common stocks of approximately 500 companies from all major industries representing a significant portion of the market value of all common stocks publicly traded in the United States. Stocks in the Index are weighted according to their float adjusted capitalizations. The Index, which is constructed and maintained by S&P Dow Jones Indices LLC, is normally rebalanced each March, June, September and December, and is reconstituted on an as needed basis and on pre-determined dates as constituents change in size. The portfolio will concentrate (invest 25% or more of the value of its assets) in the securities of issuers having their principal business activities in the same industry if the Index is also concentrated in such industry. |

8

| | | | |

| | | Target Portfolio Transamerica WMC US Growth II VP | | Destination Portfolio Transamerica S&P 500 Index VP |

| | is fundamental research focused on uncovering companies with improving quality metrics, business momentum, and attractive relative valuations. The investment process is aided by a proprietary screening process that narrows the investment universe to companies that are consistent with the investment philosophy. The initial investment universe is comprised of: • Securities held in the Russell 1000® Growth and S&P 500® Growth Indexes1 • Equity securities within the market-cap range of the index with historical or projected growth rates greater than the Russell 1000® Index median • Stocks that meet other growth criteria as determined by the Team Consistent with the portfolio’s objective and other policies, the portfolio may invest to a lesser extent in derivatives, including futures, forwards, options and swaps. The portfolio may invest up to 20% of its total assets in foreign securities (not including American Depositary Receipts, American Depositary Shares or U.S. dollar denominated securities of foreign issuers). 1 “Russell®” and other service marks and trademarks related to the Russell indexes are trademarks of the London Stock Exchange Group companies. | | The portfolio’s sub-adviser, SSGA, does not sub-advise the portfolio according to traditional methods of “active” investment management, which involve the buying and selling of securities based upon economic, financial and market analysis and investment judgment. Instead, the sub-adviser utilizes a “passive” or “indexing” investment approach, seeking to provide investment results that, before expenses, correspond generally to the total return performance of the Index by employing a sampling strategy. The sub-adviser seeks to replicate the returns of the Index by investing in the securities of the Index in approximately their Index weight. However, under various circumstances, it may not be possible or practicable to purchase all of those securities in those weightings. In those circumstances, the portfolio may purchase a sample of stocks in the Index in proportions expected to replicate generally the performance of the Index as a whole. In addition, from time to time, stocks are added to or removed from the Index. The portfolio may sell stocks that are represented in the Index, or purchase stocks that are not yet represented in the Index, in anticipation of their removal from or addition to the Index. The sub-adviser may at times purchase or sell futures contracts in lieu of investment directly in the stocks making up the Index. The sub-adviser might do so, for example, in order to increase the portfolio’s investment exposure pending investment of cash in the stocks comprising the Index. Alternatively, the sub-adviser might use futures to reduce its investment exposure to the Index in situations where it intends to sell a portion of the stocks in the portfolio but the sale has not yet been completed. 1 Standard & Poor’s does not sponsor the portfolio, nor is it affiliated in any way with the portfolio or the portfolio’s advisers. “Standard & Poor’s®,” “S&P®,” “S&P 500®,” and “Standard & Poor’s 500®” are trademarks of McGraw-Hill, Inc. The portfolio is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representation or warranty, express or implied, regarding the advisability of investing in the portfolio. |

| |

| Investment manager | | TAM |

| | |

| Sub-adviser | | Wellington Management Company LLP | | SSGA Funds Management, Inc. |

| | |

| Portfolio Managers | | Mammen Chally, CFA, Lead Portfolio Manager since 2014 Douglas McLane, CFA, Portfolio Manager since 2017 David Siegle, CFA, Portfolio Manager since 2017 | | Michael Feehily, CFA, Portfolio Manager since 2017 Keith Richardson, Portfolio Manager since 2019 Karl Schneider, Portfolio Manager since 2017 |

| |

| | The Portfolios’ Statement of Additional Information provides additional information about the portfolio managers’ compensation, other accounts managed by the portfolio managers, and the portfolio managers’ ownership of securities in the Portfolios. |

| Net assets (as of May 31, 2020) | | $12.4 million | | $262.9 million |

9

Classes of Shares, Fees and Expenses

| | | | |

| | | Target Portfolio Transamerica WMC US Growth II VP | | Destination Portfolio Transamerica S&P 500 Index VP |

| Initial Class sales charges and fees | | Initial Class shares are offered without an initial sales charge and are not subject to a contingent deferred sales charge. Initial Class shares can have up to a maximum Rule 12b-1 fee equal to an annual rate of 0.15% (expressed as a percentage of average daily net assets of the Portfolio), but TST does not intend to pay any distribution fees for Initial Class shares through May 1, 2021. TST reserves the right to pay such fees after that date. |

| | |

| Management fees | | TAM receives compensation, calculated daily and paid monthly, from the Target Portfolio at an annual rate (expressed as a specified percentage of the Portfolio’s average daily net assets) of 0.33%. For the fiscal year ended December 31, 2019, the Target Portfolio paid management fees of 0.05% of the Portfolio’s average daily net assets. | | TAM currently receives compensation, calculated daily and paid monthly, from the Destination Portfolio at an annual rate (expressed as a specified percentage of the Portfolio’s average daily net assets) of 0.08%. For the fiscal year ended December 31, 2019, the Destination Portfolio paid management fees of 0.03% of the Portfolio’s average daily net assets. |

| | |

| Fee waiver and expense limitations | | Contractual arrangements have been made with the portfolio’s investment manager, TAM, through May 1, 2021 to waive fees and/or reimburse portfolio expenses to the extent that total annual fund operating expenses exceed 0.30% for Initial Class shares, excluding, as applicable, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business. These arrangements cannot be terminated prior to May 1, 2021 without the Board of Trustees’ consent. TAM is permitted to recapture amounts waived and/or reimbursed to a class during any of the 36 months from the date on which TAM waived fees and/or reimbursed expenses for the class. A class may reimburse TAM only if such reimbursement does not cause, on any particular business day of the portfolio, the class’s total annual operating expenses (after the reimbursement is taken into account) to exceed the applicable limits described above or the expense cap in place at the time such amounts were waived. | | Contractual arrangements have been made with the portfolio’s investment manager, TAM, through May 1, 2021 to waive fees and/or reimburse portfolio expenses to the extent that total annual fund operating expenses exceed 0.14% for Initial Class shares, excluding, as applicable, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business. These arrangements cannot be terminated prior to May 1, 2021 without the Board of Trustees’ consent. TAM is permitted to recapture amounts waived and/or reimbursed to a class during any of the 36 months from the date on which TAM waived fees and/or reimbursed expenses for the class. A class may reimburse TAM only if such reimbursement does not cause, on any particular business day of the portfolio, the class’s total annual operating expenses (after the reimbursement is taken into account) to exceed the applicable limits described above or the expense cap in place at the time such amounts were waived. |

| |

| | For a comparison of the gross and net expenses of the Portfolios, please see the class fee tables in “The Portfolios’ Fees and Expenses” below. |

10

Comparison of Principal Risks of Investing in the Portfolios

The Portfolios are subject to certain similar principal risks. Risk is inherent in all investing. The value of your investment in a Portfolio, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in a Portfolio or your investment may not perform as well as other similar investments.

Your primary risk in investing in the Portfolios is you could lose money. You should carefully assess the risks associated with an investment in the Portfolios.

The following is a description of certain key principal risks of investing in each Portfolio. Additional principal risks of the Portfolios are discussed later in this section.

| | • | | Market—The market prices of the portfolio’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as overall economic trends or events, government actions or interventions, market disruptions caused by trade disputes or other factors, political factors or adverse investor sentiment. The market prices of securities also may go down due to events or conditions that affect particular sectors, industries or issuers. Adverse market conditions may be prolonged and may not have the same impact on all types of securities. If the market prices of the securities owned by the portfolio fall, the value of your investment will go down. The portfolio may experience a substantial or complete loss on any individual security. |

Economies and financial markets throughout the world are increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, terrorism, technology and data interruptions, natural disasters, and other circumstances in one or more countries or regions could be highly disruptive to, and have profound impacts on, global economies or markets. The COVID-19 pandemic has caused substantial market disruption and dislocation around the world including the U.S. During periods of market disruption, which may trigger trading halts, the portfolio’s exposure to the risks described elsewhere in the Portfolio’s prospectus will likely increase. As a result, whether or not the portfolio invests in securities of issuers located in or with significant exposure to the countries directly affected, the value and liquidity of the portfolio’s investments may be negatively affected.

| | • | | Equity Securities—Equity securities represent an ownership interest in an issuer, rank junior in a company’s capital structure and consequently may entail greater risk of loss than debt securities. Equity securities include common and preferred stocks. Stock markets are volatile and the value of equity securities may go up or down sometimes rapidly and unpredictably. Equity securities may have greater price volatility than other asset classes, such as fixed income securities. The value of equity securities fluctuates based on changes in a company’s financial condition, factors affecting a particular industry or industries, and overall market and economic conditions. If the market prices of the equity securities owned by the portfolio fall, the value of your investment in the portfolio will decline. If the portfolio holds equity securities in a company that becomes insolvent, the portfolio’s interests in the company will rank junior in priority to the interests of debtholders and general creditors of the company, and the portfolio may lose its entire investment in the company. |

| | • | | Large Capitalization Companies—The portfolio’s investments in large capitalization companies may underperform other segments of the market because they may be less responsive to competitive challenges and opportunities and unable to attain high growth rates during periods of economic expansion. As a result, the portfolio’s value may not rise as much as, or may fall more than, the value of portfolios that focus on companies with smaller market capitalizations. |

| | • | | Management—The value of your investment may go down if the investment manager’s judgments and decisions are incorrect or otherwise do not produce the desired results. You may also suffer losses if there are imperfections, errors or limitations in the quantitative, analytic or other tools, resources, information and data used, investment techniques applied, or the analyses employed or relied on, by the investment manager, if such tools, resources, information or data are used incorrectly or otherwise do not work as intended, or if the investment manager’s investment style is out of favor or otherwise fails to produce the desired results. The portfolio’s investment strategies may not work as intended or otherwise fail to produce the desired results. Any of these things could cause the portfolio to lose value or its results to lag relevant benchmarks or other funds with similar objectives. |

The Target Portfolio is subject to the following additional key principal risks:

| | • | | Growth Stocks – Returns on growth stocks may not move in tandem with returns on other categories of stocks or the market as a whole. Growth stocks typically are particularly sensitive to market movements and may involve larger price swings because their market prices tend to reflect future expectations. When it appears those expectations may not be met, the prices of growth securities typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market for a long period of time, for example, while the market favors “value” stocks. |

11

| | • | | Small and Medium Capitalization Companies – The portfolio will be exposed to additional risks as a result of its investments in the securities of small or medium capitalization companies. Small or medium capitalization companies may be more at risk than large capitalization companies because, among other things, they may have limited product lines, operating history, market or financial resources, or because they may depend on a limited management group. The prices of securities of small and medium capitalization companies generally are more volatile than those of large capitalization companies and are more likely to be adversely affected than large capitalization companies by changes in earnings results and investor expectations or poor economic or market conditions. Securities of small and medium capitalization companies may underperform large capitalization companies, may be harder to sell at times and at prices the portfolio managers believe appropriate and may offer greater potential for losses. |

| | • | | Foreign Investments – Investing in securities of foreign issuers or issuers with significant exposure to foreign markets involves additional risks. Foreign markets can be less liquid, less regulated, less transparent and more volatile than U.S. markets. The value of the portfolio’s foreign investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support, tariffs and trade disruptions, political or financial instability, social unrest or other adverse economic or political developments. Lack of information and weaker legal systems and accounting standards also may affect the value of these securities. Foreign investments may have lower liquidity and be more difficult to value than investments in U.S. issuers. |

| | • | | Liquidity – The portfolio may make investments that are illiquid or that become illiquid after purchase. Illiquid investments can be difficult to value, may trade at a discount from comparable, more liquid investments, and may be subject to wide fluctuations in value. As a general matter, a reduction in the willingness or ability of dealers and other institutional investors to make markets in fixed income securities may result in even less liquidity in certain markets. If the portfolio is forced to sell an illiquid investment to meet redemption requests or other cash needs, the portfolio may be forced to sell at a loss. The portfolio may not receive its proceeds from the sale of less liquid or illiquid securities for an extended period (for example, several weeks or even longer), and such sale may involve additional costs. Liquidity of particular investments, or even an entire market segment, can deteriorate rapidly, particularly during times of market turmoil, and those investments may be difficult or impossible for the portfolio to sell. This may prevent the portfolio from limiting losses. |

| | • | | Valuation – The sales price the portfolio could receive for any particular portfolio investment may differ from the portfolio’s valuation of the investment, particularly for securities that trade in thin or volatile markets, that are priced based upon valuations provided by third-party pricing services that use matrix or evaluated pricing systems, or that are valued using a fair value methodology. Investors who purchase or redeem portfolio shares on days when the portfolio is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the portfolio had not fair-valued securities or had used a different valuation methodology. The portfolio’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers. |

The Destination Portfolio is subject to the following additional key principal risks:

| | • | | Passive Strategy/Index – The portfolio is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities, regardless of the current or projected performance of the Index or of the actual securities comprising the Index. This differs from an actively-managed fund, which typically seeks to outperform a benchmark index. As a result, the portfolio’s performance may be less favorable than that of a portfolio managed using an active investment strategy. The structure and composition of the Index will affect the performance, volatility, and risk of the Index and, consequently, the performance, volatility, and risk of the portfolio. |

| | • | | Index Fund – While the portfolio seeks to track the performance of the MSCI EAFE Index (i.e., achieve a high degree of correlation with the index), the portfolio’s return may not match the return of the expenses not applicable to the index, and incurs costs in buying and selling securities. In addition, the portfolio may not be fully invested at times, generally as a result of cash flows into or out of the portfolio or reserves of cash held by the portfolio to meet redemptions. The portfolio may attempt to replicate the index return by investing in fewer than all of the securities in the index, or in some securities not included in the index, potentially increasing the risk of divergence between the portfolio’s return and that of the index. |

| | • | | Industry Concentration – The portfolio will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration in a particular industry subjects the portfolio to the risks associated with that industry. As a result, the portfolio may be subject to greater price volatility and risk of loss as a result of adverse economic, business or other developments affecting that industry than portfolios investing in a broader range of industries. |

12

| | • | | Derivatives – Derivatives involve special risks and costs and may result in losses to the portfolio. Using derivatives exposes the portfolio to additional or heightened risks, including leverage risk, liquidity risk, valuation risk, market risk, counterparty risk and credit risk. Their usage can increase portfolio losses and reduce opportunities for gains when market prices or volatility, interest rates, currencies, or the derivatives themselves, behave in a way not anticipated. Using derivatives may have a leveraging effect, increase portfolio volatility and not produce the result intended. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Even a small investment in derivatives can have a disproportionate impact on the portfolio. Derivatives may be difficult to sell, unwind or value, and the counterparty (including, if applicable, the portfolio’s clearing broker, the derivatives exchange or the clearinghouse) may default on its obligations to the portfolio. In certain cases, the portfolio may incur costs and may be hindered or delayed in enforcing its rights against or closing out derivatives instruments with a counterparty, which may result in additional losses. Derivatives are subject to additional risks such as operational risk, including settlement issues, and legal risk, including that underlying documentation is incomplete or ambiguous. Derivatives are also generally subject to the risks applicable to the assets, rates, indices or other indicators underlying the derivative, including market risk, credit risk, liquidity risk, management and valuation risk. Also, suitable derivative transactions may not be available in all circumstances. The value of a derivative may fluctuate more or less than, or otherwise not correlate well with, the underlying assets, rates, indices or other indicators to which it relates. The portfolio may be required to segregate or earmark liquid assets or otherwise cover its obligations under derivatives transactions and may have to liquidate positions before it is desirable in order to meet these segregation and coverage requirements. Use of derivatives may have different tax consequences for the portfolio than an investment in the underlying assets or indices, and those differences may affect the amount, timing and character of income distributed to shareholders. |

Each Portfolio is subject to the following additional principal risks (in alphabetical order):

| | • | | Counterparty – The portfolio will be subject to the risk that the counterparties to derivatives, repurchase agreements and other financial contracts entered into by the portfolio or held by special purpose or structured vehicles in which the portfolio invests will not fulfill their contractual obligations. Adverse changes to counterparties (including derivatives exchanges and clearinghouses) may cause the value of financial contracts to go down. If a counterparty becomes bankrupt or otherwise fails to perform its obligations, the value of your investment in the portfolio may decline. In addition, the portfolio may incur costs and may be hindered or delayed in enforcing its rights against a counterparty. |

| | • | | Credit – If an issuer or other obligor (such as a party providing insurance or other credit enhancement) of a security held by the portfolio or a counterparty to a financial contract with the portfolio is unable or unwilling to meet its financial obligations or is downgraded, or is perceived to be less creditworthy, or if the value of any underlying assets declines, the value of your investment will typically decline. A decline may be significant, particularly in certain market environments. In addition, the portfolio may incur costs and may be hindered or delayed in enforcing its rights against an issuer, obligor or counterparty. The degree of credit risk of a security or financial contract depends upon, among other things, the financial condition of the issuer and the terms of the security or contract. |

| | • | | Investments by Affiliated Portfolios – A significant portion of the portfolio’s shares may be owned by other portfolios sponsored by Transamerica. Transactions by these portfolios may be disruptive to the management of the portfolio. For example, the portfolio may experience large redemptions and could be required to sell securities at a time when it may not otherwise desire to do so. Such transactions may increase the portfolio’s brokerage and/or other transaction costs. In addition, sizeable redemptions could cause the portfolio’s total expenses to increase. |

| | • | | Leveraging—The value of your investment may be more volatile to the extent that the portfolio borrows or uses derivatives or other investments, such as ETFs, that have embedded leverage. Other risks also will be compounded because leverage generally magnifies the effect of a change in the value of an asset and creates a risk of loss of value on a larger pool of assets than the portfolio would otherwise have. The use of leverage is considered to be a speculative investment practice and may result in the loss of a substantial amount, and possibly all, of the portfolio’s assets. The portfolio also may have to sell assets at inopportune times to satisfy its obligations or meet segregation or coverage requirements. |

The Target Portfolio is subject to the following additional principal risks (in alphabetical order):

| | • | | Active Trading – The portfolio may purchase and sell securities without regard to the length of time held. Active trading may have a negative impact on performance by increasing transaction costs. During periods of market volatility, active trading may be more pronounced. |

| | • | | Currency – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. U.S. dollar-denominated securities of foreign issuers may also be affected by currency risk, as the revenue earned by issuers of these securities may also be impacted by changes in the issuer’s local currency. |

13

Currency conversion costs and currency fluctuations could reduce or eliminate investment gains or add to investment losses. Currency exchange rates can be volatile and may fluctuate significantly over short periods of time, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls, and speculation. A portfolio may be unable or may choose not to hedge its foreign currency exposure.

| | • | | Depositary Receipts—Depositary receipts are generally subject to the same risks that the foreign securities that they evidence or into which they may be converted are, and they may be less liquid than the underlying shares in their primary trading market. Any distributions paid to the holders of depositary receipts are usually subject to a fee charged by the depositary. Holders of depositary receipts may have limited voting rights, and investment restrictions in certain countries may adversely impact the value of depositary receipts because such restrictions may limit the ability to convert equity shares into depositary receipts and vice versa. Such restrictions may cause equity shares of the underlying issuer to trade at a discount or premium to the market price of the depositary receipts. |

| | • | | Derivatives – Derivatives involve special risks and costs and may result in losses to the portfolio. Using derivatives exposes the portfolio to additional or heightened risks, including leverage risk, liquidity risk, valuation risk, market risk, counterparty risk and credit risk. Their usage can increase portfolio losses and reduce opportunities for gains when market prices or volatility, interest rates, currencies, or the derivatives themselves, behave in a way not anticipated. Using derivatives may have a leveraging effect, increase portfolio volatility and not produce the result intended. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Even a small investment in derivatives can have a disproportionate impact on the portfolio. Derivatives may be difficult to sell, unwind or value, and the counterparty (including, if applicable, the portfolio’s clearing broker, the derivatives exchange or the clearinghouse) may default on its obligations to the portfolio. In certain cases, the portfolio may incur costs and may be hindered or delayed in enforcing its rights against or closing out derivatives instruments with a counterparty, which may result in additional losses. Derivatives are subject to additional risks such as operational risk, including settlement issues, and legal risk, including that underlying documentation is incomplete or ambiguous. Derivatives are also generally subject to the risks applicable to the assets, rates, indices or other indicators underlying the derivative, including market risk, credit risk, liquidity risk, management and valuation risk. Also, suitable derivative transactions may not be available in all circumstances. The value of a derivative may fluctuate more or less than, or otherwise not correlate well with, the underlying assets, rates, indices or other indicators to which it relates. The portfolio may be required to segregate or earmark liquid assets or otherwise cover its obligations under derivatives transactions and may have to liquidate positions before it is desirable in order to meet these segregation and coverage requirements. Use of derivatives may have different tax consequences for the portfolio than an investment in the underlying assets or indices, and those differences may affect the amount, timing and character of income distributed to shareholders. |

The Destination Portfolio is subject to the following additional principal risk:

| | • | | Liquidity – The portfolio may make investments that are illiquid or that become illiquid after purchase. Illiquid investments can be difficult to value, may trade at a discount from comparable, more liquid investments, and may be subject to wide fluctuations in value. As a general matter, a reduction in the willingness or ability of dealers and other institutional investors to make markets in fixed income securities may result in even less liquidity in certain markets. If the portfolio is forced to sell an illiquid investment to meet redemption requests or other cash needs, the portfolio may be forced to sell at a loss. The portfolio may not receive its proceeds from the sale of less liquid or illiquid securities for an extended period (for example, several weeks or even longer), and such sale may involve additional costs. Liquidity of particular investments, or even an entire market segment, can deteriorate rapidly, particularly during times of market turmoil, and those investments may be difficult or impossible for the portfolio to sell. This may prevent the portfolio from limiting losses. |

The Portfolios’ Fees and Expenses

Shareholders of the Portfolios pay various fees and expenses, either directly or indirectly. The table below shows the fees and expenses that you would pay if you were to buy and hold shares of each Portfolio, but it does not reflect any charges that are, or may be, imposed under the policies or the annuity contracts. If such charges were reflected, fees would be higher. Unless otherwise noted, the fees and expenses for the Target Portfolio and Destination Portfolio in the tables appearing below are based on the fees and expenses for the fiscal year ended December 31, 2019. The table also shows the pro forma expenses of the combined Destination Portfolio after giving effect to the Reorganization based on pro forma net assets as of May 31, 2020. Pro forma numbers are estimated in good faith and are hypothetical. Actual expenses may vary significantly.

14

| | | | | | | | | | | | |

| | | Target Portfolio

Initial Class | | | Destination Portfolio

Initial Class | | | Combined Portfolio

(Pro Forma)

Initial Class | |

Shareholder Fees (fees paid directly from your investment) | | | | | | | | | | | | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | | None | | | | None | | | | None | |

Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is lower) | | | None | | | | None | | | | None | |

Annual Fund Operating Expenses (expenses that you pay each year as a % of the value of your investment) | | | | | | | | | | | | |

Management Fees | | | 0.33 | % | | | 0.08 | % | | | 0.08 | % |

Distribution and Service (12b–1) Fees(1) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Other Expenses | | | 0.25 | % | | | 0.11 | % | | | 0.05 | % |

| | | | | | | | | | | | |

Total annual fund operating expenses | | | 0.58 | % | | | 0.19 | % | | | 0.13 | % |

| | | | | | | | | | | | |

Fee waiver and/or expense reimbursement | | | 0.28 | %(2) | | | 0.05 | %(3) | | | 0.00 | % |

Total Annual Fund Operating Expenses after Fee Waiver and/or Expense Reimbursement | | | 0.30 | % | | | 0.14 | % | | | 0.13 | % |

| (1) | The portfolio will not be charged and does not intend to pay any 12b-1 fees on Initial Class shares through May 1, 2021. The maximum 12b-1 fee on Initial Class shares is 0.15%. The portfolio reserves the right to pay such fees after that date. |

| (2) | Contractual arrangements have been made with the portfolio’s investment manager, TAM, through May 1, 2021 to waive fees and/or reimburse portfolio expenses to the extent that the total annual fund operating expenses exceed 0.30% for Initial Class shares, excluding, as applicable, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business. These arrangements cannot be terminated prior to May 1, 2021 without the Board of Trustees’ consent. TAM is permitted to recapture amounts waived and/or reimbursed to a class during any of the 36 months from the date on which TAM waived fees and/or reimbursed expenses for the class. A class may reimburse TAM only if such reimbursement does not cause, on any particular business day of the portfolio, the class’s total annual operating expenses (after the reimbursement is taken into account) to exceed the applicable limits described above or any other lower limit then in effect. |

| (3) | Contractual arrangements have been made with the portfolio’s investment manager, TAM, through May 1, 2021 to waive fees and/or reimburse portfolio expenses to the extent that the total annual fund operating expenses exceed 0.14% for Initial Class shares, excluding, as applicable, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the portfolio’s business. These arrangements cannot be terminated prior to May 1, 2021 without the Board of Trustees’ consent. TAM is permitted to recapture amounts waived and/or reimbursed to a class during any of the 36 months from the date on which TAM waived fees and/or reimbursed expenses for the class. A class may reimburse TAM only if such reimbursement does not cause, on any particular business day of the portfolio, the class’s total annual operating expenses (after the reimbursement is taken into account) to exceed the applicable limits described above or any other lower limit then in effect. |

Example

The hypothetical example below helps you compare the cost of investing in each Portfolio. The example assumes that:

| | • | | you invest $10,000 in each Portfolio; |

| | • | | you reinvest all dividends and distributions without a sales charge; |

| | • | | you hold your shares for the time periods shown and then redeem all of your shares at the end of those periods; |

| | • | | your investment has a 5% annual return (this assumption is required by the SEC and is not a prediction of a Portfolio’s future performance); and |

| | • | | each Portfolio’s operating expenses remain the same except for year one (which considers the effect of the expense limitation). |

The example also assumes no fees for variable life insurance policies or variable annuity contracts, if applicable. Only the 1 year dollar amounts shown below reflects TAM’s agreement to waive fees and/or reimburse portfolio expenses. Costs are the same whether you redeem at the end of any period or not. Pro forma expenses are included assuming the consummation of the Reorganization of the Portfolio. The example is for comparison purposes only and is not a representation of any Portfolio’s actual expenses or returns, either past or future. Because actual return and expenses will be different, the example is for comparison only.

| | | | | | | | | | | | |

Number of Years You Own your Shares | | Target Portfolio | | | Destination Portfolio | | | Combined Portfolio

(Pro Forma) | |

Initial Class | | | | | | | | | | | | |

Year 1 | | $ | 31 | | | $ | 14 | | | $ | 13 | |

Year 3 | | $ | 158 | | | $ | 56 | | | $ | 42 | |

Year 5 | | $ | 296 | | | $ | 102 | | | $ | 73 | |

Year 10 | | $ | 699 | | | $ | 238 | | | $ | 166 | |

The Portfolios’ Past Performance

The bar charts and the tables below provide some indication of the risks of investing in the Portfolios by showing you how the performance of each Portfolio’s share classes has varied from year to year since inception, and how the average annual total returns of each Portfolio’s share classes for different periods compare to the returns of a broad measure of market performance. Absent any applicable limitation of or cap on a Portfolio’s expenses, performance would have been lower. The performance calculations do not reflect charges or deductions that are, or may be, imposed under your variable life insurance policy or variable annuity contract; if they did, the performance would have been lower. A Portfolio’s past performance (before and after taxes) is not necessarily an indication of how the Portfolio will perform in the future. Following the Reorganization, the Destination Portfolio will be the surviving portfolio for accounting and performance purposes.

15

Updated performance information is available at no charge by calling the Portfolios’ toll-free number at 1-800-851-9777 or by visiting the Portfolios’ website at www.transamericaseriestrust.com/content/Performance.aspx.

Prior to April 9, 2010, the Target Portfolio was named Transamerica Equity II VP, had a different sub-adviser and used different investment strategies. The performance set forth prior to that date is attributable to that previous sub-adviser.

Prior to July 1, 2014, the Target Portfolio was named Transamerica WMC Diversified Growth II VP and used different investment strategies. The performance set forth for the period between April 9, 2010 and June 30, 2014 is attributable to those previous investment strategies.

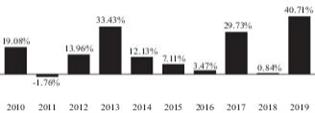

Transamerica WMC US Growth II VP

Annual Total Returns (calendar years ended December 31) – Initial Class

| | | | | | | | |

| | | Quarter Ended | | | Return | |

Best Quarter: | | | 03/31/2012 | | | | 17.71 | % |

Worst Quarter: | | | 09/30/2011 | | | | -16.78 | % |

Year-to-date return | | | 6/30/2020 | | | | 8.84 | % |

Average Annual Total Returns (periods ended December 31, 2019)

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Inception

Date | |

Initial Class | | | 40.71 | % | | | 15.32 | % | | | 15.06 | % | | | 12/30/2003 | |

Russell 1000® Growth Index1 (reflects no deduction for fees, expenses or taxes) | | | 36.39 | % | | | 14.63 | % | | | 15.22 | % | | | | |

| 1 | “Russell®” and other service marks and trademarks related to the Russell indexes are trademarks of the London Stock Exchange Group companies. |

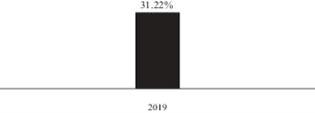

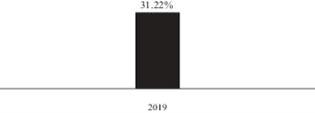

Transamerica S&P 500 Index VP

Annual Total Returns (calendar years ended December 31) – Initial Class

16

| | | | | | | | |

| | | Quarter Ended | | | Return | |

Best Quarter: | | | 03/31/2019 | | | | 13.59 | % |

Worst Quarter: | | | 09/30/2019 | | | | 1.62 | % |

Year-to-date return | | | 6/30/2020 | | | | -3.14 | % |

Average Annual Total Returns (periods ended December 31, 2019)

| | | | | | | | | | | | |

| | | 1 Year | | | Since

Inception | | | Inception

Date | |

Initial Class | | | 31.22 | % | | | 9.63 | % | | | 01/12/2018 | |

S&P 500® (reflects no deduction for fees, expenses or taxes) | | | 31.49 | % | | | 14.31 | % | | | | |

Portfolio Turnover

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example above, affect a Portfolio’s performance. During the Target Portfolio’s most recent fiscal year ended December 31, 2019, the portfolio turnover rate was 23% of the average value of the Target Portfolio’s portfolio. During the Destination Portfolio’s most recent fiscal year ended December 31, 2019, the portfolio turnover rate was 1% of the average value of the Destination Portfolio’s portfolio.

Reasons for the Proposed Reorganization