| As filed with the Securities and Exchange Commission on July 20, 2010 |

| 1933 Act File No. ___________ |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ___ ¨

Post-Effective Amendment No. ___ ¨

EATON VANCE MUNICIPALS TRUST

(Exact name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

(617) 482-8260

(Registrant's Telephone Number)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Service) |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of the registration statement.

It is proposed that this filing will go effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Shares of Beneficial Interest of Eaton Vance National Municipals Fund

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended. Pursuant to Rule 429, this Registration Statement relates to shares previously registered on Form N-1A (File No. 33-572).

CONTENTS OF REGISTRATION STATEMENT ON FORM N-14

This Registration Statement consists of the following papers and documents.

| |

| Cover Sheet | |

| Part A - | Proxy Statement/Prospectus |

| Part B - | Statement of Additional Information |

| Part C - | Other Information |

| Signature Page | |

| Exhibit Index | |

| Exhibits | |

EATON VANCE COLORADO MUNICIPAL INCOME FUND

EATON VANCE INSURED MUNICIPAL INCOME FUND

EATON VANCE KANSAS MUNICIPAL INCOME FUND

EATON VANCE LOUISIANA MUNICIPAL INCOME FUND

Two International Place

Boston, Massachusetts 02110 |

Dear Shareholder:

We cordially invite you to attend a joint Special Meeting of Shareholders of Eaton Vance Colorado Municipal Income Fund (the “CO Fund”), Eaton Vance Kansas Municipal Income Fund (the “KS Fund”) and Eaton Vance Louisiana Municipal Income Fund (the “LA Fund”) (collectively, the “State Funds”) and Eaton Vance Insured Municipal Income Fund (“the Insured Fund”) (together, the “Acquired Funds”) on October 15, 2010 to consider a proposal to approve an Agreement and Plan of Reorganization to convert shares of the Acquired Funds into corresponding shares of Eaton Vance National Municipal Income Fund (the “National Fund”) (the “Reorganization). The Insured Fund and KS Fund are each a series of Eaton Vance Municipals Trust II, and the CO Fund, the LA Fund and the National Fund are each a series of Eaton Vance Municipals Trust (collectively, the “Trusts”).

The investment objective of each Fund is to provide current income exempt from regular federal income tax and, in the case of the State Funds, from particular state and local income or other taxes. Each Fund has similar investment policies and restrictions. The enclosed combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) describes the Reorganization in detail. We ask you to read the enclosed information carefully and to submit your vote promptly.

After consideration and recommendation by Eaton Vance Management, the Boards of Trustees have determined that it is in the best interests of the Acquired Funds if the Acquired Funds are merged into the National Fund. We believe that you would benefit from the Reorganization because you would become shareholders of a larger, more diversified fund with a higher yield and distribution rate and a lower expense ratio.

We realize that most shareholders will not be able to attend the meeting and vote their shares in person. However, each Acquired Fund does need your vote. You can vote by mail or by telephone, as explained in the enclosed material. If you later decide to attend the meeting, you may revoke your proxy and vote your shares in person. By voting promptly, you can help the Acquired Funds avoid the expense of additional mailings.

If you would like additional information concerning this proposal, please call one of our service representatives at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. Your participation in this vote is extremely important.

| |

| Sincerely, | Sincerely, |

| |

| /s/ Thomas M. Metzold | /s/ Cynthia J. Clemson |

| |

| Thomas M. Metzold | Cynthia J. Clemson |

| President | President |

| Eaton Vance Municipals Trust | Eaton Vance Municipals Trust II |

| Your vote is important – please return your proxy card promptly. |

Shareholders are urged to sign and mail the enclosed proxy in the enclosed postage prepaid envelope or vote by telephone by following the enclosed instructions. Your vote is important whether you own a few shares or many shares.

EATON VANCE COLORADO MUNICIPAL INCOME FUND

EATON VANCE INSURED MUNICIPAL INCOME FUND

EATON VANCE KANSAS MUNICIPAL INCOME FUND

EATON VANCE LOUISIANA MUNICIPAL INCOME FUND

Two International Place

Boston, Massachusetts 02110

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To Be Held October 15, 2010 |

A joint Special Meeting of Shareholders of Eaton Vance Colorado Municipal Income Fund, Eaton Vance Kansas Municipal Income Fund and Eaton Vance Louisiana Municipal Income Fund (collectively, the “State Funds”) and Eaton Vance Insured Municipal Income Fund (the “Insured Fund”) (together, the “Acquired Funds”) will be held at the principal office of the Acquired Funds, Two International Place, Boston, Massachusetts 02110, on Friday, October 15, 2010 at 2:00 p.m. (Eastern time), for the following purposes:

| 1. | To consider and act upon a proposal to approve an Agreement and Plan of Reorganization (the “Plan”) to convert shares of each Acquired Fund into corresponding shares of Eaton Vance National Municipal Income Fund (the “National Fund”). The Plan provides for the transfer of all of the assets and liabilities of each Acquired Fund to the National Fund in exchange for corresponding shares of the National Fund; and |

| |

| 2. | To consider and act upon any other matters which may properly come before the meeting and any adjourned or postponed session thereof. |

The meeting is called pursuant to the By-Laws of Eaton Vance Municipals Trust and Eaton Vance Municipals Trust II (collectively, the “Trusts”). The Boards of Trustees of the Trusts have fixed the close of business on August 19, 2010 as the record date for the determination of the shareholders of each State Fund and the Insured Fund entitled to notice of, and to vote at, the joint meeting and any adjournments or postponements thereof.

| | By Order of the Boards of Trustees,

/s/ Maureen A. Gemma

Maureen A. Gemma

Secretary

Eaton Vance Municipals Trust

Eaton Vance Municipals Trust II |

August 31, 2010

Boston, Massachusetts |

Shareholders can help the Boards of Trustees of the Acquired Funds avoid the necessity and additional expense of further solicitations, which may be necessary to obtain a quorum, by promptly returning the enclosed proxy or voting by telephone. The enclosed addressed envelope requires no postage if mailed in the United States and is included for your convenience.

PROXY STATEMENT/PROSPECTUS

Acquisition of the Assets of

EATON VANCE COLORADO MUNICIPAL INCOME FUND

EATON VANCE INSURED MUNICIPAL INCOME FUND

EATON VANCE KANSAS MUNICIPAL INCOME FUND

EATON VANCE LOUISIANA MUNICIPAL INCOME FUND

By And In Exchange For Shares of

EATON VANCE NATIONAL MUNICIPAL INCOME FUND |

Two International Place

Boston, Massachusetts 02110 |

We are sending you this combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) in connection with the joint Special Meeting of Shareholders (the “Special Meeting”) of Eaton Vance Colorado Municipal Income Fund (the “CO Fund”), Eaton Vance Kansas Municipal Income Fund (the “KS Fund”) and Eaton Vance Louisiana Municipal Income Fund (the “LA Fund”) (collectively, the “State Funds”) and Eaton Vance Insured Municipal Income Fund (the “Insured Fund”) (together, the “Acquired Funds”) on October 15, 2010 at 2:00 p.m., Eastern time, at Two International Place, Boston, Massachusetts 02110. This document is both the Proxy Statement of the Acquired Funds and a Prospectus of Eaton Vance National Municipal Income Fund (the “National Fund”). The Acquired Funds and the National Fund hereinafter are sometimes referred to as a “Fund” or collectively as the “Funds.� 48; The KS Fund and the Insured Fund are each a series of Eaton Vance Municipals Trust II, and the CO Fund, LA Fund and National Fund are each a series of Eaton Vance Municipals Trust (collectively, the “Trusts”). The Trusts are each Massachusetts business trusts registered as open-end management investment companies. Proxy cards are enclosed with the foregoing Notice of a joint Special Meeting of Shareholders for the benefit of shareholders who wish to vote, but do not expect to be present at the joint Special Meeting. Shareholders also may vote by telephone. The proxy is solicited on behalf of the Boards of Trustees of the Trusts (the “Boards” or “Trustees”).

This Proxy Statement/Prospectus relates to the proposed reorganization of each class of shares of each Acquired Fund into a corresponding class of shares of the National Fund (the “Reorganization”). The Form of Agreement and Plan of Reorganization for each Fund (the “Plan”) is attached as Appendix A and provides for the transfer of all of the assets and liabilities of each Acquired Fund to the National Fund in exchange for shares of the National Fund. Following the transfer, National Fund shares will be distributed to shareholders of each Acquired Fund, and each Acquired Fund will be terminated. As a result, each shareholder of an Acquired Fund will receive National Fund shares equal to the value of such shareholder’s respective Acquired Fund shares, in each case calculated as of the close of regular trading on the New York Stock Exchange on the Closing date (as defined herein).

Each proxy will be voted in accordance with its instructions. If no instruction is given, an executed proxy will authorize the persons named as proxies, or any of them, to vote in favor of each matter. A written proxy is revocable by the person giving it, prior to exercise by a signed writing filed with the Fund’s proxy tabulator, D. F. King and Co., Inc., 48 Wall Street, New York, NY 10005, or by executing and delivering a later dated proxy, or by attending the joint Special Meeting and voting the shares in person. Proxies voted by telephone may be revoked at any time in the same manner that proxies voted by mail may be revoked. This Proxy Statement/Prospectus is initially being mailed to shareholders on or about August 31, 2010. Supplementary solicitations may be made by mail, telephone, telegraph, facsimile or electronic means.

The Trustees have fixed the close of business on August 19, 2010 as the record date (“Record Date”) for the determination of the shareholders entitled to notice of and to vote at the joint Special Meeting and any adjournments or postponements thereof. Shareholders at the close of business on the Record Date will be entitled to one vote for each Acquired Fund share held. The number of shares of beneficial interest of each class of each Fund outstanding and the persons who held of record more than five

percent of the outstanding shares of each Fund as of the Record Date, along with such information for the combined fund as if the Reorganization was consummated on the Record Date, are set forth in Appendix C.

This Proxy Statement/Prospectus sets forth concisely the information that you should know when considering the Reorganization. You should read and retain this Proxy Statement/Prospectus for future reference. This Proxy Statement/Prospectus is accompanied by the Prospectus of the National Fund dated February 1, 2010 (the “National Fund Prospectus”), which is incorporated by reference herein. A Statement of Additional Information dated August 31, 2010 that relates to this Proxy Statement/Prospectus and contains additional information about the National Fund and the Reorganization is on file with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Proxy Statement/Prospectus.

The Prospectus of the CO Fund dated December 1, 2009, the Prospectus of the LA Fund dated January 1, 2010, the Prospectus of the KS Fund and the Insured Fund dated June 1, 2010 (the “Acquired Funds’ Prospectuses”), the Statement of Additional Information of the CO Fund dated December 1, 2009, the Statement of Additional Information of the LA Fund dated January 1, 2010, and the Statement of Additional Information of the KS Fund and the Insured Fund dated June 1, 2010 (the “Acquired Funds’ SAIs”) and the Statement of Additional Information of the National Fund dated February 1, 2010 (the “National Fund SAI”) are on file with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

The Annual Report to Shareholders for the CO Fund (dated July 31, 2009), LA Fund dated (August 31, 2009), KS Fund and Insured Fund (dated January 31, 2010) and National Fund (dated September 30, 2009) and the Semiannual Reports to Shareholders for the CO Fund (dated January 31, 2010), LA Fund (dated February 28, 2010) and the National Fund (dated March 31, 2010) have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

To ask questions about this Proxy Statement/Prospectus, please call our toll-free number at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time.

Copies of each of the documents incorporated by reference referred to above are available upon oral or written request and without charge. To obtain a copy, write to the Funds, c/o Eaton Vance Management, Two International Place, Boston, MA 02110, Attn: Proxy Coordinator – Mutual Fund Operations, or call 800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. The foregoing documents may be obtained on the Internet at www.eatonvance.com. In addition, the SEC maintains a website at www.sec.gov that contains the documents described above, material incorporated by reference, and other information about the Acquired Funds and the National Fund.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

ii

| |

| Page |

| SUMMARY | 1 |

| FUND EXPENSES | 2 |

| REASONS FOR THE REORGANIZATION | 5 |

| INFORMATION ABOUT THE REORGANIZATION | 7 |

| HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES | |

| AND POLICIES OF THE ACQUIRED FUNDS COMPARE TO THAT OF THE NATIONAL FUND? | 13 |

| PRINCIPAL RISK FACTORS | 17 |

| COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS | 17 |

| INFORMATION ABOUT THE FUNDS | 18 |

| VOTING INFORMATION | 18 |

| DISSENTERS RIGHTS | 21 |

| NATIONAL FUND FINANCIAL HIGHLIGHTS | 22 |

| COLORADO FUND FINANCIAL HIGHLIGHTS | 25 |

| INSURED FUND FINANCIAL HIGHLIGHTS | 28 |

| KANSAS FUND FINANCIAL HIGHLIGHTS | 30 |

| LOUISIANA FUND FINANCIAL HIGHLIGHTS | 32 |

| EXPERTS | 35 |

| APPENDIX A: FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| APPENDIX B: MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | B-1 |

| APPENDIX C: OUTSTANDING SHARES AND 5% HOLDERS | C-1 |

iii

The following is a summary of certain information contained in or incorporated by reference in this Proxy Statement/Prospectus. This summary is not intended to be a complete statement of all material features of the proposed Reorganization and is qualified in its entirety by reference to the full text of this Proxy Statement/ Prospectus, the Plan and the other documents referred to herein.

Proposed Transaction. The Trustees of the Trusts have approved the Plan for each Acquired Fund, which provides for the transfer of all of the assets of the Acquired Fund to the National Fund in exchange for the issuance of National Fund shares and the assumption of the Acquired Fund’s liabilities by the National Fund at a closing to be held as soon as practicable following approval of the Reorganization by shareholders of the Acquired Fund at the joint Special Meeting, or any adjournments or postponements thereof, and the satisfaction of all the other conditions to the Reorganization (the “Closing”). The Plan is attached hereto as Appendix A. The value of each shareholder’s account with the corresponding class of the National Fund immediately after the Reorganization will be the same as the value of such shareholder’s account with his or her Acquired Fund immediately prior to the Reorganization. Following the transfer, National Fund shares will be distributed to shareholders of the Acquired Funds and the Acquired Funds will be terminated. As a result of the Reorganization, each shareholder of the Acquired Funds will receive full and fractional National Fund shares equal in value at the close of regular trading on the New York Stock Exchange on the Closing date to the value of such shareholder’s shares of his or her Acquired Fund. At or prior to the Closing, each Acquired Fund shall declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to its shareholders all of its investment company taxable income, its net tax-exempt interest income, and all of its net capital gains, if any, realized for the taxable year ending at the Closing. The Trustees, including the Trustees who are not “interested persons” of the Trusts as defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (“Independent Trustees”), h ave determined that the interests of existing shareholders of each Acquired Fund will not be diluted as a result of the transactions contemplated by the Reorganization and that the Reorganization is in the best interests of each Acquired Fund. The Trustees of Eaton Vance Municipals Trust (including the Independent Trustees) have also approved the Plan on behalf of the National Fund.

Background for the Proposed Transaction. The Boards of Trustees of the Trusts considered a number of factors, including the proposed terms of the Reorganization. The Trustees considered that, among other things, combining the Funds will reduce the expense ratio for each Acquired Fund’s shareholders (as described herein), the Reorganization would be tax-free for federal income tax purposes, and that management believes Acquired Fund shareholders will receive higher yields and distribution rates as shareholders of the National Fund. Moreover, the Trustees considered that shareholders of each Acquired Fund would benefit from a larger fund with increased investment opportunities and flexibility by consolidating five funds with similar investment objectives and policies and that invest in similar securities.

The Boards of Trustees of the Trusts have determined that the Reorganization is in the best interests of each Acquired Fund and has recommended that each Acquired Fund’s shareholders vote FOR the Reorganization. The reorganization of each of CO Fund, KS Fund, LA Fund and Insured Fund into National Fund is a separate and independent transaction. Approval of the Reorganization by shareholders of any other Fund is not required for either of CO Fund, KS Fund, LA Fund or Insured Fund to consummate the Reorganization.

Objectives, Restrictions and Policies. The Acquired Funds and National Fund have similar investment objectives and policies, with the exception of (i) policies to avoid particular state income taxes and (ii) for the Insured Fund, the requirement to invest at least 80% of its net assets in municipal obligations that are insured by insurers with a claims-paying ability rated at least Baa or BBB. Ratings of Baa or higher by Moody’s Investor Services, Inc. (“Moody’s”) or BBB or higher by Standard & Poor’s Ratings Group (“S&P”) or Fitch Ratings (“Fitch”) are considered to be of investment grade quality. The National Fund and the State Funds are required to invest at least 65% and 75% of their net assets, respectively, in investment grade obligations. There are no material differences between the Funds’ fundamental and non-fundamental investment restrictions other than those related to diversification. While the National Fund is a diversified fund and has an investment restriction to that effect, the Acquired Funds are non-diversified funds.

1

Fund Fees, Expenses and Services. National Fund (total net assets of approximately $5.9 billion as of April 30, 2010) is significantly larger than each Acquired Fund, (CO Fund, KS Fund, LA Fund and Insured Fund have net assets of approximately $35.9 million, $35.8 million, $38.9 million and $64.1 million, respectively, as of April 30, 2010). As described below and excluding Interest Expense associated with inverse floater securities transactions, National Fund has a lower total expense ratio than each Acquired Fund, which the Acquired Funds’ shareholders are expected to benefit from as a result of the Reorganization.

National Fund offers classes of shares that correspond with the outstanding classes of shares of the Acquired Funds. As a result of the Reorganization, shareholders of each class of shares of each respective Acquired Fund would receive shares of the corresponding class of the National Fund. The privileges and services associated with the corresponding share classes of each Fund are identical. See “Distribution Arrangements” for details on the distribution and service fees. Class B shares of each Fund have a conversion feature, whereby they convert to the lower cost Class A shares eight years after their initial purchase. National Fund also offers Class I shares, which will not be involved in the Reorganization.

Distribution Arrangements. Shares of each Fund are sold on a continuous basis by Eaton Vance Distributors, Inc. (“EVD”), the Funds’ principal underwriter. Class A shares of each Fund are sold at net asset value per share plus a sales charge; Class B and Class C shares of each Fund are sold at net asset value subject to a contingent deferred sales charge (“CDSC”). As a result of the Reorganization, shareholders of each class of shares of each Acquired Fund would receive shares of the corresponding class of the National Fund. The distribution and service fee payable for Class A shares of each Acquired Fund is 0.20%, while the distribution and service fee payable for Class A shares of National Fund is 0.25%. Class B shares and Class C shares of each Acquired Fund pay distribution and service fees equal to 0.95% of average daily net assets annually, while Class B and Class C shares of National Fund pay distributio n and service fees equal to 1.00%. As a result of the Reorganization, shareholders of Class A shares, Class B shares and Class C shares of each Acquired Fund would receive shares of the corresponding class of the National Fund. Although distribution and service fees payable on Class A, Class B and Class C shares of National Fund are 0.05% higher than those of each class of Acquired Fund shares, the Acquired Funds are expected to benefit from a decrease in total expenses as a result of the Reorganization, as described below.

Redemption Procedures and Exchange Privileges. The Acquired Funds and the National Fund offer the same redemption features pursuant to which proceeds of a redemption are remitted by wire or check after receipt of proper documents including signature guarantees. The respective classes of each Fund have the same exchange privileges.

Tax Consequences. The Acquired Funds expect to obtain an opinion of counsel that the Reorganization will be tax-free for federal income tax purposes. As such, the Acquired Funds’ shareholders will not recognize a taxable gain or loss on the receipt of shares of the National Fund in liquidation of their interests in the Acquired Funds. Their tax basis in National Fund shares received in the Reorganization will be the same as their tax basis in their respective Acquired Fund shares, and the tax holding period will be the same.

Expenses shown are those for the year ended April 30, 2010 and on a pro forma basis giving effect to the Reorganization as of such date. For each Acquired Fund, the pro forma expenses giving effect to only that one Acquired Fund reorganizing into National Fund would be the same as the pro forma expenses stated below giving effect to all Acquired Funds collectively reorganizing into National Fund.

2

| | | |

| Fund Fees and Expenses | | | |

| Shareholder Fees | | | |

| (fees paid directly from your investment) | Class A | Class B | Class C |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | 4.75% | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of | | | |

| net asset value at time of purchase or redemption) | None | 5.00% | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Distributions | None | None | None |

Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment)

| | | | | | |

| | Class A Shares |

|

| | | | | | | Pro Forma |

| | CO Fund | KS Fund | LA Fund | Insured | National | Combined |

| | | | | Fund | Fund | Fund(1) |

|

| Management Fees | 0.22% | 0.21% | 0.24% | 0.29% | 0.34% | 0.34% |

| Distribution and Service (12b-1 Fees)(2) | 0.20% | 0.20% | 0.20% | 0.20% | 0.25% | 0.25% |

| Other Expenses (including Interest Expense) | 0.31% | 0.41% | 0.34% | 0.39% | 0.31% | 0.31% |

| Interest Expense(3) | 0.00% | 0.02% | 0.04% | 0.03% | 0.23% | 0.23% |

| Other Expenses (excluding Interest Expense) | 0.31% | 0.39% | 0.30% | 0.36% | 0.08% | 0.08% |

| Total Annual Fund Operating | 0.73% | 0.82% | 0.78% | 0.88% | 0.90% | 0.90% |

| Expenses* | | | | | | |

|

| * Class A Total Annual Fund Operating | | | | | | |

| Expenses (excluding Interest Expense): | 0.73% | 0.80% | 0.74% | 0.85% | 0.67% | 0.67%(4) |

| |

| |

| | Class B Shares |

|

| | | | | | | Pro Forma |

| | CO Fund | KS Fund | LA Fund | Insured | National | Combined |

| | | | | Fund | Fund | Fund(1) |

|

| Management Fees | 0.22% | 0.21% | 0.24% | 0.29% | 0.34% | 0.34% |

| Distribution and Service (12b-1 Fees)(2) | 0.95% | 0.95% | 0.95% | 0.95% | 1.00% | 1.00% |

| Other Expenses (including Interest Expense) | 0.31% | 0.41% | 0.34% | 0.39% | 0.31% | 0.31% |

| Interest Expense(3) | 0.00% | 0.02% | 0.04% | 0.03% | 0.23% | 0.23% |

| Other Expenses (excluding Interest Expense) | 0.31% | 0.39% | 0.30% | 0.36% | 0.08% | 0.08% |

| Total Annual Fund Operating | 1.48% | 1.57% | 1.53% | 1.63% | 1.65% | 1.65% |

| Expenses* | | | | | | |

|

| * Class B Total Annual Fund Operating | | | | | | |

| Expenses (excluding Interest Expense): | 1.48% | 1.55% | 1.49% | 1.60% | 1.42% | 1.42%(4) |

| |

| |

| | Class C Shares |

|

| | | | | | | Pro Forma |

| | CO Fund | KS Fund | LA Fund | Insured | National | Combined |

| | | | | Fund | Fund | Fund(1) |

|

| Management Fees | 0.22% | 0.21% | 0.24% | 0.29% | 0.34% | 0.34% |

| Distribution and Service (12b-1 Fees)(2) | 0.95% | 0.95% | 0.95% | 0.95% | 1.00% | 1.00% |

| Other Expenses (including Interest Expense) | 0.31% | 0.41% | 0.34% | 0.39% | 0.31% | 0.31% |

| Interest Expense(3) | 0.00% | 0.02% | 0.04% | 0.03% | 0.23% | 0.23% |

| Other Expenses (excluding Interest Expense) | 0.31% | 0.39% | 0.30% | 0.36% | 0.08% | 0.08% |

| Total Annual Fund Operating | 1.48% | 1.57% | 1.53% | 1.63% | 1.65% | 1.65% |

| Expenses* | | | | | | |

|

| * Class C Total Annual Fund Operating | | | | | | |

| Expenses (excluding Interest Expense): | 1.48% | 1.55% | 1.49% | 1.60% | 1.42% | 1.42%(4) |

3

| (1) | The pro forma results of the merger are the same assuming any one Acquired Fund merges into the National Fund or if all four Acquired Funds merge into the National Fund. |

| (2) | The Acquired Funds are authorized under their distribution plans to pay service fees up to 0.25% annually. |

| (3) | “Interest Expense” represents the interest expense relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income in an amount equal to this expense relating to the municipal obligations underlying such transactions, and as a result net asset value and performance have not been affected by this expense. |

| (4) | On a pro forma basis, National Fund’s total expense ratio decreases slightly (less than 0.01%). |

Example. This Example is intended to help you compare the cost of investing in the Pro Forma Combined Fund after the Reorganization with the costs of investing in the Funds without the Reorganization. The Example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same as stated in the Fund Fees and Expenses tables above. This Example assumes the Total Annual Fund Operating Expenses including the Interest Expense described above, while the footnote below the table describes such costs excluding Interest Expense. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | Expenses with Redemption | Expenses without Redemption |

|

|

| | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

|

| CO Fund | | | | | | | | |

| Class A shares | $546 | $697 | $ 862 | $1,338 | $546 | $697 | $862 | $1,338 |

| Class B shares | $651 | $868 | $1,008 | $1,565 | $151 | $468 | $808 | $1,565 |

| Class C shares | $251 | $468 | $ 808 | $1,768 | $151 | $468 | $808 | $1,768 |

| |

| KS Fund | | | | | | | | |

| Class A shares | $555 | $724 | $ 908 | $1,440 | $555 | $724 | $908 | $1,440 |

| Class B shares | $660 | $896 | $1,055 | $1,666 | $160 | $496 | $855 | $1,666 |

| Class C shares | $260 | $496 | $ 855 | $1,867 | $160 | $496 | $855 | $1,867 |

| |

| LA Fund | | | | | | | | |

| Class A shares | $551 | $712 | $ 888 | $1,395 | $551 | $712 | $888 | $1,395 |

| Class B shares | $656 | $883 | $1,034 | $1,621 | $156 | $483 | $834 | $1,621 |

| Class C shares | $256 | $483 | $ 834 | $1,824 | $156 | $483 | $834 | $1,824 |

| |

| Insured Fund | | | | | | | | |

| Class A shares | $561 | $742 | $ 939 | $1,508 | $561 | $742 | $939 | $1,508 |

| Class B shares | $666 | $914 | $1087 | $1,732 | $166 | $514 | $887 | $1,732 |

| Class C shares | $266 | $514 | $ 887 | $1,933 | $166 | $514 | $887 | $1,933 |

| |

| National Fund | | | | | | | | |

| Class A shares | $562 | $748 | $ 950 | $1,530 | $562 | $748 | $950 | $1,530 |

| Class B shares | $668 | $920 | $1,097 | $1,754 | $168 | $520 | $897 | $1,754 |

| Class C shares | $268 | $520 | $ 897 | $1,955 | $168 | $520 | $897 | $1,955 |

| |

| Pro Forma Combined | | | | | | | | |

| Fund | | | | | | | | |

| Class A shares | $562 | $748 | $ 950 | $1,530 | $562 | $748 | $950 | $1,530 |

| Class B shares | $668 | $920 | $1,097 | $1,754 | $168 | $520 | $897 | $1,754 |

| Class C shares | $268 | $520 | $ 897 | $1,955 | $168 | $520 | $897 | $1,955 |

4

Excluding Interest Expense associated with inverse floater securities transactions, the cost of investing would be:

- Insured Fund Class A shares: $559, $736, $929 and $1,485 for the 1 year, 3 year, 5 year and 10 year periods, respectively; Class B shares: $664, $908, $1,076 and $1,710 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and Class C shares: $263, $505, $871 and $1,900 for the 1 year, 3 year, 5 year and 10 year periods, respectively;

- KS Fund Class A shares: $553, $718, $898 and $1,418 for the 1 year, 3 year, 5 year and 10 year periods, respectively; Class B shares: $658, $890, $1,045 and $1,643 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and Class C shares: $258, $490, $845 and $1,845 for the 1 year, 3 year, 5 year and 10 year periods, respectively;

- LA Fund Class A shares: $549, $706, $877 and $1,372 for the 1 year, 3 year, 5 year and 10 year periods, respectively; Class B shares: $654, $877, $1,024 and $1,599 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and Class C shares: $253, $474, $818 and $1,791 for the 1 year, 3 year, 5 year and 10 year periods, respectively;

- National Fund Class A shares: $543, $688, $846 and $1,304 for the 1 year, 3 year, 5 year and 10 year periods, respectively; Class B shares: $648, $859, $992 and $1,531 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and Class C shares: $248, $459, $792 and $1,735 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and

- Pro Forma Combined Fund Class A shares: $543, $688, $846 and $1,304 for the 1 year, 3 year, 5 year and 10 year periods, respectively; Class B shares: $648, $859, $992 and $1,531 for the 1 year, 3 year, 5 year and 10 year periods, respectively; and Class C shares: $248, $459, $792 and $1,735 for the 1 year, 3 year, 5 year and 10 year periods, respectively.

If you did not redeem your Class B or Class C shares, your expenses would be as follows:

- Insured Fund Class B shares: $164, $508 and $876 for the 1 year, 3 year and 5 year periods, respectively, and Class C shares: $163 for the 1 year period;

- KS Fund Class B shares: $158, $490 and $845 for the 1 year, 3 year and 5 year periods, respectively, and Class C shares: $158 for the 1 year period;

- LA Fund Class B shares: $154, $477 and $824 for the 1 year, 3 year and 5 year periods, respectively, and Class C shares: $153 for the 1 year period;

- National Fund Class B shares: $148, $459 and $792 for the 1 year, 3 year and 5 year periods, respectively, and Class C shares: $148 for the 1 year period; and

- Pro Forma Combined Fund Class B shares: $148, $459 and $792 for the 1 year, 3 year and 5 year periods, respectively, and Class C shares: $148 for the 1 year period.

| REASONS FOR THE REORGANIZATION |

The Reorganization has been considered by the Boards of Trustees of the Trusts. In reaching the decision to recommend that the shareholders of the Acquired Funds vote to approve the Reorganization, the Trustees, including the Independent Trustees, determined that the Reorganization would be in the best interests of each of the Acquired Funds and that the interests of existing shareholders of each of the Acquired Funds would not be diluted as a consequence thereof. In making this determination, the Trustees considered a number of factors, including the following:

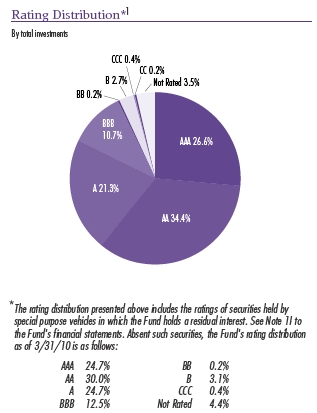

| Objectives, Restrictions and Policies. With the exception of policies to avoid particular state income taxes, the Acquired Funds and National Fund have similar investment objectives, policies and restrictions. One distinction is the Insured Fund’s requirement to invest at least 80% of its net assets in municipal obligations that are insured by insurers with a claims-paying ability rated at least Baa or BBB. Ratings of Baa or higher by Moody’s or BBB or higher by S&P or Fitch are considered to be of investment grade quality. The State Funds are required to invest at least 75% of their assets in investment grade municipal obligations, while the National Fund is required to invest at least 65% of its assets in investment grade municipal obligations. As of March 31, 2010, however, National Fund had over 90% of its net assets invested in investment grade obligations. |

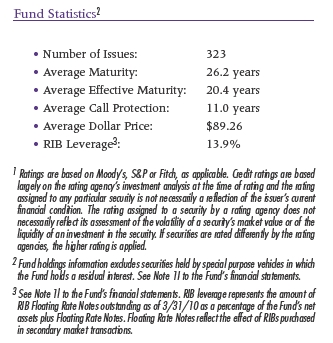

| While the Acquired Funds have identical policies with respect to the maturity of the obligations they will acquire, the National Fund historically has had longer average durations and longer average maturities than the Acquired Funds. Also, because of its much larger size than each of the Acquired Funds, the National Fund has had more opportunities to invest in residual interest bond investments than the Acquired Funds. For these reasons, the National Fund may have a slightly higher risk profilethan the Acquired Funds. |

5

| As a fundamental investment restriction, National Fund is a diversified fund, while the Acquired Funds are registered as non-diversified funds. The National Fund is broadly diversified with minimal concentration risk. In contrast, each State Fund’s portfolio is highly concentrated in obligations issued by issuers in its respective state. The Reorganization would substantially reduce each State Fund’s shareholders’ exposure to issuers in their respective state. While the Insured Fund’s portfolio is primarily invested in municipal obligations that are insured as to principal and interest payments, the National Fund is not required to invest primarily in insured obligations and, therefore, has historically invested a much smaller percentage of its net assets in such securities. The Reorganization would substantially reduce the Insured Fund’s percentage of investment in insured obligations. The payment of principal and interest on uninsured obligations is the sole r esponsibility of the issuer of the obligations and may be more dependent on such issuer’s creditworthiness. EVM has a robust credit analysis process and performs its own credit and investment analysis when making investment decisions. |

- Effect on Fund Fees, Expenses and Services. The National Fund is significantly larger than each Acquired Fund. As described above and excluding Interest Expense associated with inverse floater securities transactions, the National Fund has a lower total expense ratio than each Acquired Fund, which the Acquired Funds’ shareholders are expected to benefit from as a result of the Reorganization.

| If the Reorganization is consummated, EVM estimates the Acquired Funds will realize a significant reduction in other expenses. On a pro forma basis assuming the consummation of the Reorganization on April 30, 2010, the total fund expenses payable by former shareholders of CO Fund, KS Fund, LA Fund and Insured Fund shareholders (excluding Interest Expense as described above) would decrease by approximately 6 basis points (or 0.06%), 13 basis points (or 0.13%), 7 basis points (or 0.07%) and 18 basis points (or 0.18%), respectively, after the Reorganizations. National Fund’s total expenses following the Reorganizations would be slightly reduced by a de minimus amount. |

- Tax Consequences. The Acquired Funds expect to obtain an opinion of counsel that the Reorganization will be tax-free for federal income tax purposes. As such, the Acquired Funds’ shareholders will not recognize a taxable gain or loss on the receipt of shares of the National Fund in liquidation of their interests in the Acquired Funds. Their tax basis in National Fund shares received in the Reorganization will be the same as their tax basis in their respective Acquired Fund shares, and the tax holding period will be the same. National Fund’s tax basis for the assets received in the Reorganization will be the same as the respective Acquired Fund’s basis immediately before the Reorganization, and National Fund’s tax holding period for those assets will include each such Acquired Fund& #146;s holding period. Shareholders should consult their tax advisors regarding the effect, if any, of the Reorganization in light of their individual circumstances. For more information, see “Information About the Reorganization – Federal Income Tax Consequences.”

- Relative Performance. The National Fund outperformed each Acquired Fund for the one- and ten- year periods ended April 30, 2010 on a total return basis. For the three-year period, the National Fund underperformed each Acquired Fund on a total return basis. For the five-year period, the National Fund outperformed the Insured Fund and underperformed the State Funds. The underperformance of the National Fund during the three- and five-year periods is attributable to its relatively longer duration and historic anomalies that occurred in the credit markets in late 2008. As of April 30, 2010, the yields and distribution rate of the National Fund are markedly higher than each of the Acquired Funds:

6

| | | | | |

| | CO Fund | KS Fund | LA Fund | Insured Fund | National Fund |

|

| 30-day yield | 3.89% | 3.41% | 4.34% | 3.55% | 5.23% |

| Tax-equivalent yield* | 6.28% | 5.61% | 7.10% | 5.46% | 8.05% |

| Distribution rate | 4.15% | 3.88% | 4.54% | 3.91% | 5.28% |

| |

| * Tax-equivalent yield is adjusted for both state and federal income taxes in the case of the Acquired Funds. |

| National Fund tax-equivalent yields are adjusted for federal income tax only. |

- No Dilution. After the Reorganization, each former shareholder of the Acquired Funds will own shares of National Fund equal to the aggregate value of his or her Acquired Fund shares immediately prior to the Reorganization. Because shares of National Fund will be issued at the per share net asset value of the Fund in exchange for the assets of the Acquired Funds, that, net of the liabilities of the Acquired Funds assumed by National Fund, will equal the aggregate value of those shares, the net asset value per share of National Fund will be unchanged. Thus, the Reorganization will not result in any dilution to shareholders.

- Terms of the Plan. The Trustees considered the terms and conditions of the Plan and the costs associated with the Reorganization, including the fact that the first $47,000 of such costs be borne by the Funds’ investment adviser, Boston Management and Research (“BMR”), or an affiliate thereof, and the remaining costs will be borne by the Acquired Funds.

- Impact on Eaton Vance Management (“EVM” or “Eaton Vance”). EVM and its affiliates, including BMR and EVD, will continue to collect advisory and distribution and service fees on Acquired Fund assets acquired by the National Fund pursuant to the Reorganization. In the case of advisory fees, BMR would collect fees on the Acquired Funds’ assets at the incremental advisory fee rate (0.29% annually) applicable to the National Fund assuming the Reorganization occurred on April 30, 2010.

At current asset levels, the Reorganization would result in approximately $70,400 in increased fee revenue annually to BMR. With respect to the service fees that are payable by Class A, Class B and Class C shares of each Acquired Fund, EVD will receive a 0.05% higher fee on these Acquired Fund assets after the Reorganization. However, with respect to assets that are over one year old, such fee will be paid to financial intermediaries and generally will not be retained by EVD.

The Boards of Trustees of the Trusts have determined that the Reorganization is in the best interests of each Acquired Fund and recommend that each Acquired Fund’s shareholders vote FOR the Reorganization.

| INFORMATION ABOUT THE REORGANIZATION |

At a meeting held on August 9, 2010, the Boards of Trustees of the Trusts approved the Plan in the form set forth as Appendix A to this Proxy Statement/Prospectus. The summary of the Plan is not intended to be a complete statement of all material features of the Plan and is qualified in its entirety by reference to the full text of the Plan attached hereto as Appendix A.

Agreement and Plan of Reorganization. The Plan provides that, at the Closing, the respective Trust shall transfer all of the assets of the relevant Acquired Fund and assign all liabilities to National Fund, and National Fund shall acquire such assets and shall assume such liabilities upon delivery by National Fund to the State Funds and the Insured Fund on the Closing date of Class A, Class B and Class C National Fund shares (including, if applicable, fractional shares). The value of Class A, Class B and Class C shares issued to the Acquired Funds by National Fund will be the same as the value of Class A, Class B and Class C shares that the Acquired Fund has outstanding on the Closing date. The National Fund shares received by the Acquired Funds will be distributed to the Acquired Funds’ shareholders, and each such shareholder will receive shares of the corresponding class of National Fund equal in value to those of the Acquired Fund held by the shareholder.

7

National Fund will assume all liabilities, expenses, costs, charges and reserves of the Acquired Funds on the Closing date. At or prior to the Closing, the Acquired Funds shall declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the Acquired Fund’s shareholders all of the Acquired Fund’s investment company taxable income, net tax-exempt interest income, and net capital gain, if any, realized (after reduction for any available capital loss carry-forwards) in all taxable years ending at or prior to the Closing.

At, or as soon as practicable after the Closing, each Acquired Fund shall liquidate and distribute pro rata to its shareholders of record as of the close of trading on the New York Stock Exchange on the Closing date the full and fractional National Fund Class A, Class B and Class C shares equal in value to the Acquired Fund’s shares exchanged. Such liquidation and distribution will be accomplished by the establishment of shareholder accounts on the share records of National Fund in the name of each shareholder of the Acquired Fund, representing the respective pro rata number of full and fractional National Fund Class A, Class B and Class C shares due such shareholder. All of National Fund’s future distributions attributable to the shares issued in the Reorganization will be paid to shareholders in cash or invested in additional shares of National Fund at the price i n effect as described in the National Fund’s prospectus on the respective payment dates in accordance with instructions previously given by the shareholder to the Funds’ transfer agent.

The consummation of the Plan is subject to the conditions set forth therein. Notwithstanding approval by shareholders of the Acquired Funds, the Plan may be terminated at any time prior to the consummation of the Reorganization without liability on the part of either party or its respective officers, trustees or shareholders, by either party on written notice to the other party if certain specified representations and warranties or conditions have not been performed or do not exist on or before December 31, 2010. The Plan may be amended by written agreement of its parties without approval of shareholders and a party may waive without shareholder approval any default by the other or any failure to satisfy any of the conditions to its obligations; provided, however, that following the joint Special Meeting, no such amendment or waiver may have the effect of changing the provision for determining the number of National Fund shares to be issued to the Acquired Funds’ shareholders to the detriment of such shareholders without their further approval.

Costs of the Reorganization. The Acquired Funds will collectively bear the costs of the Reorganization, including legal, printing, mailing and solicitation costs, provided that the Funds’ investment adviser, or an affiliate thereof, has agreed to bear the first $47,000 of the Acquired Funds’ collective Reorganization costs (based on each Acquired Funds’ pro rata net assets). The costs of the Reorganization are estimated at approximately $10,000 per Acquired Fund.

Description of National Fund Shares. Full and fractional Class A, Class B and Class C shares of National Fund will be distributed to the Acquired Funds’ shareholders in accordance with the procedures under the Plan as described above. Each National Fund share will be fully paid, non-assessable when issued and transferable without restrictions and will have no preemptive or cumulative voting rights and have only such conversion or exchange rights as the Trustees may grant in their discretion.

Federal Income Tax Consequences. It is expected that the Reorganization will qualify as a tax-free transaction under Section 368(a) of the Internal Revenue Code, which is expected to be confirmed by the legal opinion of K&L Gates LLP at the Closing. Accordingly, shareholders of each Acquired Fund will not recognize any capital gain or loss and each Acquired Fund’s assets and capital loss carry-forwards should be transferred to National Fund without recognition of gain or loss.

It is possible, however, that the Reorganization may fail to satisfy all of the requirements necessary for tax-free treatment, in which event the transaction will nevertheless proceed on a taxable basis. In this event, the Reorganization will result in the recognition of gain or loss to such Acquired Fund’s shareholders depending upon their tax basis (generally, the original purchase price) for their Acquired Fund shares, which includes the amounts paid for shares issued in reinvested distributions, and the net asset value of shares of National Fund received in the Reorganization. Shareholders of the Acquired Funds would, in the event of a taxable transaction, receive a new tax basis in the shares they receive of National Fund (equal to their initial value) for calculation of gain or loss upon their ultimate disposition and would start a new holding period for such shares.

8

Shareholders should consult their tax advisors regarding the effect, if any, of the proposed Reorganization in light of their individual circumstances. Because the foregoing discussion relates only to the federal income tax consequences of the Reorganization, shareholders should also consult their tax advisors as to state and local tax consequences, if any.

Capitalization. The following table (which is unaudited) sets forth the capitalization of each Acquired Fund and National Fund (excluding Class I shares) as of April 30, 2010, and on a pro forma basis as of that date giving effect to the proposed acquisition of assets of each Acquired Fund at net asset value.

| | | |

| | Net Assets | Net Asset Value per Share | Shares Outstanding |

| |

| CO Fund | | | |

| Class A | $33,990,421 | $8.85 | 3,841,320 |

| Class B | 1,582,895 | 9.63 | 164,332 |

| Class C | 357,600 | 9.64 | 37,074 |

| Total | $35,930,916 | | 4,042,726 |

| |

| |

| KS Fund | | | |

| Class A | $28,335,340 | $9.80 | 2,889,849 |

| Class B | 2,028,230 | 9.72 | 208,678 |

| Class C | 5,423,654 | 9.73 | 557,368 |

| Total | $35,787,224 | | 3,655,895 |

| |

| |

| LA Fund | | | |

| Class A | $35,470,602 | $9.36 | 3,788,570 |

| Class B | 1,676,607 | 9.90 | 169,375 |

| Class C | 1,825,477 | 9.91 | 184,167 |

| Total | $39,972,686 | | 4,142,112 |

| |

| |

| Insured Fund | | | |

| Class A | $45,051,634 | $10.17 | 4,427,221 |

| Class B | 6,490,964 | 10.07 | 644,409 |

| Class C | 12,588,932 | 10.08 | 1,249,341 |

| Total | $64,131,530 | | 6,320,971 |

| |

| |

| National Fund | | | |

| Class A | $4,042,761,446 | $9.75 | 414,521,913 |

| Class B | 163,382,051 | 9.75 | 16,752,316 |

| Class C | 1,269,448,323 | 9.75 | 130,162,389 |

| Class I | 452,932,739 | 9.75 | 46,434,672 |

| Total | $5,928,524,559 | | 607,871,290 |

| |

| |

| Pro Forma Combined After Reorganization | | | |

| Class A | $4,185,582,639 | $9.75 | 429,170,240 |

| Class B | 175,158,788 | 9.75 | 17,960,186 |

| Class C | 1,289,640,749 | 9.75 | 132,233,407 |

| Class I | 452,932,739 | 9.75 | 46,434,672 |

| Total | $6,103,314,915 | | 625,798,505 |

| * The Acquired Funds will bear the expenses of the Reorganization including those as described in “How Will Proxies be Solicited and Tabulated?” below. |

9

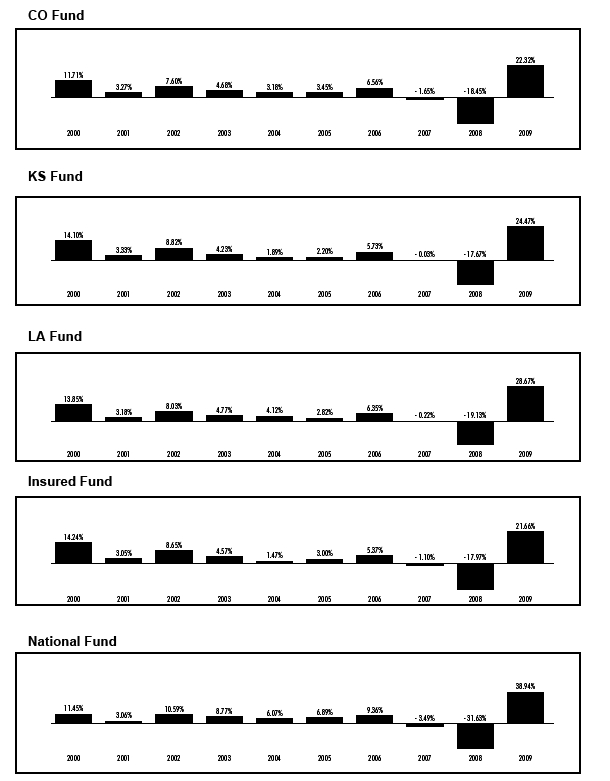

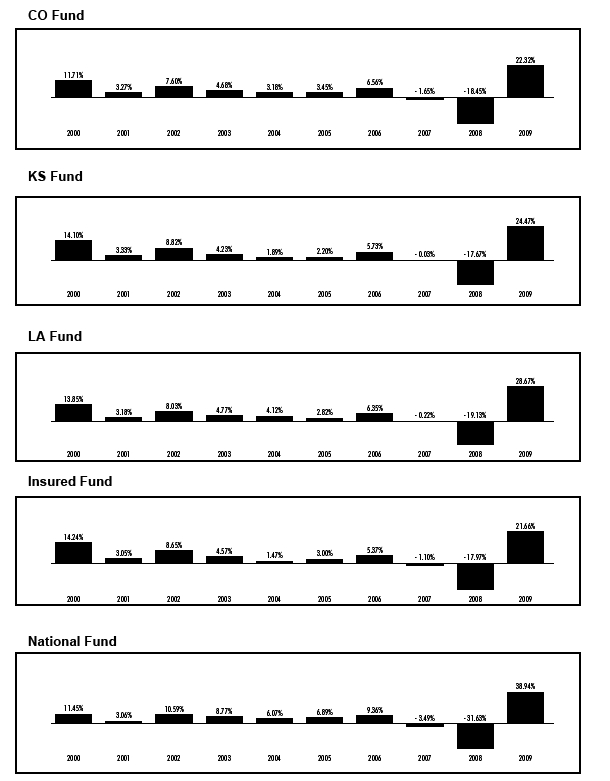

Performance Information. The following bar charts and tables provide some indication of the risks of investing in each CO Fund, KS Fund, LA Fund and the Insured Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of two broad-based securities market indices. The returns in the bar charts are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. Past performance (both before and after taxes) is no guarantee of future results.

| | | |

| CO Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 17.45% | 1.36% | 4.04% |

| Class B Return Before Taxes | 17.32% | 1.24% | 3.78% |

| Class B Return After Taxes on Distributions | 17.32% | 1.23% | 3.77% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 12.78% | 1.58% | 3.83% |

| Class C Return Before Taxes* | 21,42% | 1.60% | 3.80% |

| Barclays Capital Municipal Bond Index (reflects no deduction for fees, | | | |

| expenses or taxes) | 12.91% | 4.32% | 5.75% |

| Barclays Capital 20 Year Municipal Bond Index (reflects no deduction | | | |

| for fees, expenses or taxes) | 18.52% | 4.49% | 6.50% |

| |

| * The Class C performance prior to the inception of CO Fund Class C shares on October 1, 2007 is the |

| performance of Class B shares adjusted for the sales charge that applies to Class C shares (but not adjusted for |

| any other differences in the expenses of the two classes). |

| |

| KS Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 19.71% | 1.85% | 4.45% |

| Class B Return Before Taxes | 19.47% | 1.71% | 4.19% |

| Class B Return After Taxes on Distributions | 19.44% | 1.70% | 4.19% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 14.00% | 1.95% | 4.15% |

| Class C Return Before Taxes* | 23.60% | 2.07% | 4.20% |

| Barclays Capital Municipal Bond Index (reflects no deduction for fees, | | | |

| expenses or taxes) | 12.91% | 4.32% | 5.75% |

| Barclays Capital 20 Year Municipal Bond Index (reflects no deduction | | | |

| for fees, expenses or taxes) | 18.52% | 4.49% | 6.50% |

| |

| * The Class C performance prior to the inception of KS Fund Class C shares on December 4, 2007 is the |

| performance of Class B shares adjusted for the sales charge that applies to Class C shares (but not adjusted for |

| any other differences in the expenses of the two classes). |

| |

| LA Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 23.50% | 2.34% | 4.88% |

| Class B Return Before Taxes | 23.67% | 2.23% | 4.62% |

| Class B Return After Taxes on Distributions | 23.65% | 2.2% | 4.61% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 17.08% | 2.46% | 4.57% |

| Class C Return Before Taxes* | 27.76% | 2.60% | 4.64% |

| Barclays Capital Municipal Bond Index (reflects no deduction for fees, | | | |

| expenses or taxes) | 12.91% | 4.32% | 5.75% |

| Barclays Capital 20 Year Municipal Bond Index (reflects no deduction | | | |

| for fees, expenses or taxes) | 18.52% | 4.49% | 6.50% |

| |

| *The Class C performance prior to the inception of LA Fund Class C shares on December 4, 2007 is |

| the performance of Class B shares adjusted for the sales charge that applies to Class C shares |

| (but not adjusted for any other differences in the expenses of the two classes). |

11

| | | |

| Insured Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 16.51% | 1.15% | 4.06% |

| Class B Return Before Taxes | 16.66% | 1.05% | 3.81% |

| Class B Return After Taxes on Distributions | 16.56% | 1.03% | 3.80% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 12.23% | 1.41% | 3.85% |

| Class C Return Before Taxes | 20.64% | 1.41% | 3.82% |

| Barclays Capital Municipal Bond Index (reflects no deduction for fees, | | | |

| expenses or taxes) | 12.91% | 4.32% | 5.75% |

| Barclays Capital Long (22+) Municipal Bond Index (reflects no deduction | | | |

| for fees, expenses or taxes) | 23.43% | 3.88% | 6.28% |

| |

| |

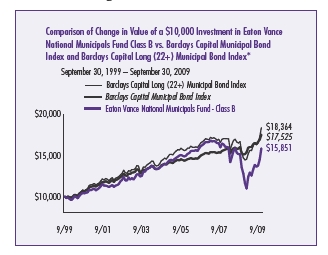

| National Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 37.15% | 1.16% | 4.69% |

| Class B Return Before Taxes | 33.94% | 1.06% | 4.61% |

| Class B Return After Taxes on Distributions | 33.93% | 1.06% | 4.61% |

| Cass B Return After Taxes on Distributions and the Sale of Class B Shares | 24.34% | 1.55% | 4.71% |

| Class C Return Before Taxes | 34.94% | 1.39% | 4.42% |

| Barclays Capital Municipal Bond Index (reflects no deduction for fees, | | | |

| expenses or taxes) | 12.91% | 4.32% | 5.75% |

| Barclays Capital Long (22+) Municipal Bond Index (reflects no deduction | | | |

| for fees, expenses or taxes) | 23.43% | 3.88% | 6.28% |

These returns reflect the maximum sales charge for Class A (4.75%) and any applicable CDSC for Class B and Class C. Barclays Capital Municipal Bond Index is an unmanaged index of municipal bonds. Barclays Capital 20 Year Municipal Bond Index consists of bonds in the Barclays Capital Municipal Bond Index with maturities of between 17 and 20 years. Barclays Capital Long (22+) Municipal Bond Index is the long bond component of the Barclays Capital Municipal Bond Index. Investors cannot invest directly in an Index. (Source for Barclays Capital Municipal Bond Index, Barclays Capital 20 Year Municipal Bond Index and Barclays Capital Long (22+) Municipal Bond Index is Lipper, Inc.)

After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

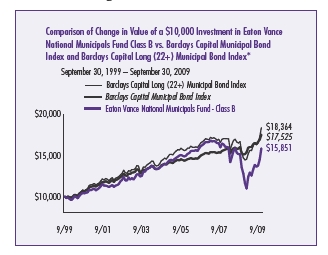

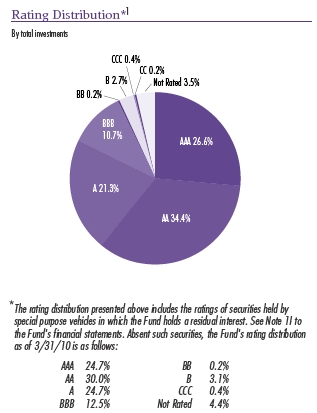

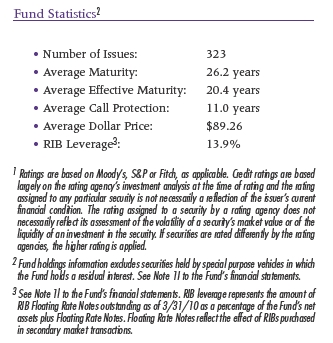

Management’s Discussion of Fund Performance. The total returns of National Fund and the factors that materially affected its performance during the most recent fiscal year and semiannual period are contained in its Annual Report dated September 30, 2009 and Semiannual Report dated March 31, 2010, both of which are incorporated by reference into this Proxy Statement/Prospectus and relevant portions of which are attached hereto as Appendix B.

The performance of CO Fund is described under the caption “Performance Information and Portfolio Composition” in the Annual Report of CO Fund for the year ended July 31, 2009 and Semiannual Report dated January 31, 2010, both of which were previously mailed to CO Fund shareholders and are incorporated by reference into this Proxy Statement/Prospectus. The performance of KS Fund and Insured Fund are described under the same caption as the CO Fund in the Annual Report of KS Fund and Insured Fund for the year ended January 31, 2010, which was previously mailed to KS Fund and Insured Fund shareholders and is incorporated by reference into this Proxy Statement/Prospectus. The performance of LA Fund is described under the same caption as the CO Fund in the Annual Report of LA Fund for the year ended August 31, 2009 and Semiannual Report dated February 28, 2010, both of which were previously mailed to LA Fund shareholders and are incorporated by reference into this Proxy Statement/Prospectus.

12

HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES AND POLICIES

OF THE ACQUIRED FUNDS COMPARE TO THAT OF THE NATIONAL FUND? |

Below is a summary comparing the business, investment objectives, principal investment strategies and policies of the Acquired Funds and the National Fund. Each Fund’s current prospectus contains a detailed discussion of each Fund’s respective investment strategies and other investment policies.

The National Fund is a diversified fund and has an investment restriction to that effect. The Acquired Funds are registered as non-diversified funds.

| | | | | |

|

| | CO Fund | KS Fund | LA Fund | Insured Fund | National Fund |

|

| |

| Business | A non-diversified series | A non-diversified series | Same as CO Fund. | Same as KS Fund. | A diversified series of |

| | of Eaton Vance | of Eaton Vance | | | Eaton Vance |

| | Municipals Trust. | Municipals Trust II. | | | Municipals Trust. |

|

|

|

|

| Investment | Seeks to provide current | Seeks to provide | Seeks to provide | Seeks to provide | Seeks to provide |

| Objective | income exempt from | current income exempt | current income | current income exempt | current income exempt |

| | regular federal income | from regular federal | exempt from regular | from regular federal | from regular federal |

| | tax and Colorado state | income tax and Kansas | federal income tax | income tax. | income tax. |

| | personal income taxes. | state individual income | and Louisiana state | | |

| | | taxes. | individual and | | |

| | | | corporate income | | |

| | | | taxes. | | |

|

|

|

| 80% Investment | Under normal market | Under normal market | Under normal market | Under normal market | Under normal market |

| Policy | conditions, invests at | conditions, invests at | conditions, invests at | conditions, invests at | conditions, invests at |

| | least 80% of its net | least 80% of its net | least 80% of its net | least 80% of its net | least 80% of its net |

| | assets in municipal | assets in municipal | assets in municipal | assets in insured | assets in municipal |

| | obligations, the interest | obligations, the interest | obligations, the | municipal obligations, | obligations, the |

| | on which is exempt from | on which is exempt | interest on which is | the interest on which is | interest on which is |

| | regular federal income | from regular federal | exempt from regular | exempt from regular | exempt from regular |

| | tax and from Colorado | income tax and from | federal income tax | federal income tax. | federal income tax. |

| | state personal income | Kansas state individual | and from Louisiana | | |

| | tax. | income taxes. | state individual and | | |

| | | | corporate income | | |

| | | | taxes. | | |

|

|

|

| Investment | In pursuing objective, normally invests in municipal obligations with maturities of ten years or more. | |

| Strategy | | | | | |

|

13

| | | | | |

|

| | CO Fund | KS Fund | LA Fund | Insured Fund | National Fund |

|

| |

| Investment Grade | At least 75% of net | Same as CO Fund. | Same as CO Fund. | At least 80% of net | At least 65% of net |

| Securities | assets will normally be | | | assets will normally be | assets will normally be |

| | invested in municipal | | | invested in municipal | invested in municipal |

| | obligations rated at least | | | obligations that are | obligations rated at |

| | investment grade at the | | | insured as to principal | least investment grade |

| | time of investment. | | | and interest payments | at the time of |

| | Investment grade | | | by insurers having a | investment. |

| | obligations are those | | | claims-paying ability | |

| | rated at least BBB by | | | rated at least Baa or | The balance of net |

| | S&P or Fitch or Baa by | | | BBB. | assets may be |

| | Moody’s. | | | | invested in municipal |

| | | | May invest up to 20% | obligations rated |

| | The balance of net | | | of net assets in | below investment |

| | assets may be invested | | | unrated obligations | grade ("junk bonds") |

| | in municipal obligations | | | deemed to be of | and in unrated |

| | rated below investment | | | investment grade | municipal obligations |

| | grade (“junk bonds”) and | | | quality and obligations | considered to be of |

| | in unrated municipal | | | that are uninsured. | comparable quality by |

| | obligations considered to | | | | the investment |

| | be of comparable quality | | | | adviser. |

| | by the investment | | | | |

| | adviser. | | | | |

|

| Other Investment | Under normal market | Same as CO Fund. | Same as CO Fund. | N/A | N/A |

| Policies | conditions, invests at | | | | |

| | least 65% of its total | | | | |

| | assets in obligations | | | | |

| | issued by the state or its | | | | |

| | political subdivisions, | | | | |

| | agencies, authorities and | | | | |

| | instrumentalities. If | | | | |

| | consistent with relevant | | | | |

| | state tax requirements, | | | | |

| | may invest up to 35% of | | | | |

| | its net assets in municipal | | | | |

| | obligations issued by the | | | | |

| | governments of Puerto | | | | |

| | Rico, the U.S. Virgin | | | | |

| | Islands and Guam. | | | | |

|

14

| | | | | |

|

| | CO Fund | KS Fund | LA Fund | Insured Fund | National Fund |

|

| Concentration | May invest 25% or more of its total assets in municipal obligations in the same sector (such as leases, housing finance, public |

| | housing, municipal utilities, hospital and health facilities or industrial development). This may make a Fund more susceptible |

| | to adverse economic, political or regulatory occurrences or adverse court decisions affecting a particular sector. |

|

| Borrowing | May borrow up to one- | May borrow in | Same as CO Fund. | Same as KS Fund. | Same as CO Fund. |

| | third of its total assets | accordance with | | | |

| | (including borrowings), | applicable regulations, | | | |

| | but it will not borrow | but currently intends to | | | |

| | more than 5% of the | borrow only for | | | |

| | value of its total assets | temporary purposes. | | | |

| | except to satisfy | | | | |

| | redemption requests or | | | | |

| | for other temporary | | | | |

| | purposes. | | | | |

|

| Buy/Sell Strategy | The investment adviser’s process for selecting obligations for purchase and sale is research intensive and emphasizes the |

| | creditworthiness of the issuer or other person obligated to repay the obligation and the relative value of the obligation in the |

| | market. Although the investment adviser considers ratings when making investment decisions, it performs its own credit and |

| | investment analysis and does not rely primarily on the ratings assigned by the rating services. The portfolio manager also may |

| | trade securities to seek to minimize taxable capital gains to shareholders. |

|

| Derivative | May purchase derivative instruments, which derive their value from another instrument, security or index, including the inverse |

| Instruments | floaters described below. May also purchase and sell various kinds of financial futures contracts and options thereon to hedge |

| | against changes in interest rates or as a substitute for the purchase of portfolio securities. May also enter into interest rate |

| | swaps, forward rate contracts and credit derivatives, which may include credit default swaps, total return swaps or credit |

| | options, as well as purchase an instrument that has greater or lesser credit risk than the municipal bonds underlying the |

| | instrument. |

|

| Residual Interest | Each Fund may invest in residual interest bonds issued by a trust (the “trust”) that holds municipal securities. The trust also |

| Bonds | issues floating rate notes to third parties that may be senior to the Fund’s residual interest bonds. The Fund receives interest |

| | payments on residual interest bonds that bear an inverse relationship to the interest rate paid on the floating rate notes. As |

| | required by applicable accounting standards, interest paid by the trust to the floating rate note holders may be reflected as |

| | income in the Fund’s financial statements with an offsetting expense for the interest paid by the trust to the floating rate note |

| | holders. |

|

| Illiquid Securities | May not own illiquid securities if more than 15% of its net assets would be invested in securities that are not readily |

| | marketable. |

|

| |

| Federal Alternative | A portion of the Fund’s | N/A | Same as CO Fund. | Same as CO Fund. | Same as CO Fund. |

| Minimum Tax | distributions generally | | | | |

| | will be subject to the | | | | |

| federal alternative | | | | |

| minimum tax. | | | | |

|

15

| | | | | |

|

| | CO Fund | KS Fund | LA Fund | Insured Fund | National Fund |

|

| Investment Adviser | Boston Management and Research (“BMR”), a subsidiary of Eaton Vance, with offices at Two International Place, Boston, MA |

| | 02110 |

|

| |

| Administrator | Eaton Vance |

|

| Portfolio Managers | William H. Ahern | Adam A. Weigold | Thomas M. Metzold | Craig R. Brandon | Thomas M. Metzold |

| | • Vice President, Eaton | • Vice President, | • Vice President, | • Vice President, | • Vice President, |

| | Vance and BMR | Eaton Vance and | Eaton Vance and | Eaton Vance and | Eaton Vance and |

| | • Portfolio manager since | BMR | BMR | BMR | BMR |

| | 1997 | • Portfolio manager | • Portfolio manager | • Portfolio manager | • Portfolio manager |

| | | since 2007 | since 2010 | since 2004 | since 1993 |

|

| Distributor | Eaton Vance Distributors, Inc. |

|

16

Generally. As discussed above, the Funds have similar investment objectives and policies and, as such, are subject to similar types of risks. See “Investment Objective & Principal Policies and Risks” in the National Fund Prospectus for a description of the principal risks of investing in the Funds.

Principal Differences between the Acquired Funds and the National Fund. Although each Acquired Fund and the National Fund have identical policies with respect to the maturity of the obligations they will acquire, the National Fund historically has had a longer average duration and longer average maturity than the Acquired Funds. Also, because of its much larger size than each of the Acquired Funds, the National Fund has had more opportunities to invest in residual interest bonds than the Acquired Funds. For these reasons, the National Fund may have a higher risk profile than the Acquired Funds.

The duration of a municipal obligation measures the sensitivity of its price to interest rate movements, and obligations with longer maturities are more sensitive to changes in interest rates than short-term obligations. A fund with a longer average duration and maturity may carry more risk and have higher price volatility than a fund with lower average duration and maturity. Residual interest bonds involve leverage risk and will involve greater risk than an investment in a fixed rate bond. Because changes in the interest rate paid to the floating rate note holders inversely affects the interest paid on the inverse floater, the value and income of an inverse floater are generally more volatile than that of a fixed rate bond. Inverse floaters have varying degrees of liquidity, and the market for these securities is relatively volatile. These securities tend to underperform the market for fixed rate bonds in a rising long-term interest rate environment, but tend to outp erform the market for fixed rate bonds when long-term interest rates decline.

Unlike the Insured Fund, the National Fund is not subject to the requirement to invest in municipal obligations insured as to principal and interest payments and, therefore, has historically invested a much smaller percentage of its net assets in insured obligations. The payment of principal and interest on uninsured municipal obligations is the sole responsibility of the issuer of the obligations and may be more dependent on such issuer’s creditworthiness. EVM has a robust credit analysis process and performs its own credit and investment analysis when making investment decisions.

COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS

General. Insured Fund and KS Fund are each a separate series of Eaton Vance Municipals Trust II, a Massachusetts business trust governed by a Declaration of Trust dated October 24, 1993, as amended from time to time, and by applicable Massachusetts law. CO Fund, LA Fund and National Fund are each a separate series of Eaton Vance Municipals Trust, a Massachusetts business trust governed by an Amended and Restated Declaration of Trust dated January 11, 1993, as amended from time to time, and by applicable Massachusetts law.

Shareholder Liability. Under Massachusetts law, shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable for the obligations of the trust, including its other series. However, the Declaration of Trust disclaims shareholder liability for acts or obligations of the trust and other series of the trust and requires that notice of such disclaimer be given in each agreement, obligation, or instrument entered into or executed by the trust or the trustees. Indemnification out of the trust property for all losses and expenses of any shareholder held personally liable by virtue of his or her status as such for the obligations of the trust is provided for in the Declaration of Trust and By-Laws. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability is considered to be remote because it is limited to circumstances in which the respective disclaimers are ino perative and the series would be unable to meet their respective obligations.

Copies of each Declaration of Trust may be obtained from the respective Trust upon written request at its principal office or from the Secretary of the Commonwealth of Massachusetts.

17

| INFORMATION ABOUT THE FUNDS |

Information about National Fund is included in the current National Fund Prospectus, a copy of which is included herewith and incorporated by reference herein. Additional information about National Fund is included in the National Fund SAI, which has been filed with the SEC and is incorporated by reference herein. Information concerning the operation and management of the Acquired Funds is incorporated herein by reference from the Acquired Funds’ Prospectuses and the Acquired Funds’ SAIs. Copies may be obtained without charge on Eaton Vance’s website at www.eatonvance.com, by writing Eaton Vance Distributors, Inc., Two International Place, Boston, MA 02110 or by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time.

You will find and may copy information about each Fund (including the statement of additional information and shareholder reports): at the SEC’s public reference room in Washington, DC (call 1-202-942-8090 for information on the operation of the public reference room); on the EDGAR Database on the SEC’s Internet site (http://www.sec.gov); or, upon payment of copying fees, by writing to the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, or by electronic mail at publicinfo@sec.gov.

The Trusts, on behalf of their respective Funds, are currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith file proxy material, reports and other information with the SEC. These reports can be inspected and copied at the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, as well as at the following regional offices: New York Regional Office, 3 World Financial Center, Suite 400, New York, NY 10281-1022; and Chicago Regional Office, 175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604. Copies of such material can also be obtained from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549 at prescribed rates.

Householding: One Proxy Statement/Prospectus may be delivered to multiple shareholders at the same address unless you request otherwise. You may request that we do not household proxy statements and/or obtain additional copies of the Proxy Statement/Prospectus by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time or writing to Eaton Vance Management, Attn: Proxy Coordinator – Mutual Fund Operations, Two International Place, Boston, MA 02110.

What is the Vote Required to Approve the Proposal?