UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-04438 |

| |

| Exact name of registrant as specified in charter: | | Aberdeen Australia Equity Fund, Inc. |

| |

| Address of principal executive offices: | | 800 Scudders Mill Road Plainsboro, New Jersey 08536 |

| |

| Name and address of agent for service: | | Mr. Joseph Malone Aberdeen Asset Management Inc. 1735 Market Street 37th Floor Philadelphia, PA 19103 |

| |

| Registrant’s telephone number, including area code: | | 866-839-5205 |

| |

| Date of fiscal year end: | | October 31 |

| |

| Date of reporting period: | | April 30, 2008 |

Item 1—Reports to Stockholders—

08

Invests primarily in equity securities of Australian companies listed on the Australian Stock Exchange Limited.

Aberdeen Australia Equity Fund, Inc.

Semi-Annual Report

April 30, 2008

Letter to Shareholders

June 16, 2008

Dear Shareholder,

We present this Semi-Annual Report which covers the activities of Aberdeen Australia Equity Fund, Inc. (the “Fund”) for the six months ended April 30, 2008. The Fund’s principal investment objective is long-term capital appreciation through investment primarily in equity securities of Australian companies listed on the Australian Stock Exchange Limited. The Fund’s secondary investment objective is current income.

Net Asset Value Performance

The Fund’s total return based on net asset value (“NAV”) was -10.1% for the six months ended April 30, 2008, assuming reinvestment of distributions, compared with -14.0%, in U.S. dollar terms, for the S&P/ASX 200 Accumulation Index. Although the return for the period was negative, the Fund’s relative out-performance was principally as a result of stock selection, rather than sector allocation. The Fund’s biggest overweight position was to Rio Tinto Limited, which is currently subject to a hostile bid from another of the Fund’s holdings, namely BHP Billiton Limited. Both of these stocks performed very well in the period, as did the Materials sector generally. The Fund was also underweight to Property Trusts, which performed poorly, impacted by negative sentiment to the sector.

Share Price Performance

The Fund’s share price decreased 10.7% over the six months, from $18.25 on October 31, 2007 to $16.30 on April 30, 2008. The Fund’s share price on April 30, 2008 represented a premium of 4.4% to the NAV per share of $15.62 on that date, compared with a discount of 1.5% to the NAV per share of $18.53 on October 31, 2007. At the date of this letter, the share price was $16.32, representing a premium of 7.9% to the NAV per share of $15.13.

Managed Distribution Policy

The Fund has a managed distribution policy of paying quarterly distributions at an annual rate, set once a year, that is a percentage of the rolling average of the Fund’s prior four quarter-end net asset values. In March 2008, the Board of Directors determined the rolling distribution rate to be 10% for the 12 month period commencing with the distribution payable in April 2008. This policy will be subject to regular review by the Fund’s Board of Directors. The distributions will be made from current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

On June 11, 2008, the Board of Directors authorized a quarterly distribution of 41 cents per share, payable on July 11, 2008 to all shareholders of record as of June 30, 2008.

Portfolio Holdings Disclosure

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund makes the information on Form N-Q available to shareholders on the Fund’s website or upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted proxies relating to portfolio securities during the twelve months ended June 30, 2007, is available: (i) upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205; and (ii) on the SEC’s website at http://www.sec.gov.

Aberdeen Australia Equity Fund, Inc.

1

Letter to Shareholders (concluded)

Investor Relations Information

For information about the Fund, daily updates of share price, NAV and details of recent distributions, please contact Aberdeen Asset Management Inc. by:

| • | | Calling toll free at 1-866-839-5205 in the United States, |

| • | | E-mailing InvestorRelations@aberdeen-asset.com, or |

| • | | Visiting the website at www.aberdeeniaf.com. |

For information about the Aberdeen Group, visit the Aberdeen website at www.aberdeen-asset.com.

Yours sincerely,

Vincent Esposito

President

All amounts are U.S. dollars unless otherwise stated.

Your Board’s policy is to provide investors with a stable distribution rate. Each quarterly distribution will be paid out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

The Fund is subject to U.S. corporate, tax and securities laws. Under U.S. tax accounting rules, the amount of distributable income for each fiscal period depends on the actual exchange rates during the entire year between the U.S. dollar and the currencies in which Fund assets are denominated and on the aggregate gains and losses realized by the Fund during the entire year.

Therefore, the exact amount of distributable income for each fiscal year can only be determined as of the end of the Fund’s fiscal year, October 31. However, under the U.S. Investment Company Act of 1940, the Fund may be required to indicate the sources of certain distributions to shareholders.

The Fund estimates that distributions for the fiscal year commencing November 1, 2007, including the distribution paid on April 11, 2008, are comprised of 12% net investment income and 88% realized capital gains.

This estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

In January 2009, a Form 1099-DIV will be sent to shareholders, which will state the amount and composition of distributions and provide information with respect to their appropriate tax treatment for the 2008 calendar year.

Aberdeen Australia Equity Fund, Inc.

2

Dividend Reinvestment and Cash Purchase Plan

We invite you to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan (the “Plan”), which allows you to automatically reinvest your distributions in shares of the Fund’s common stock at favorable commission rates. Distributions made under the Plan are taxable to the same extent as are cash distributions. The Plan also enables you to make additional cash investments in shares of at least $100 per transaction, with a maximum of $10,000 per month, and an aggregate annual limit of $120,000. Under this arrangement, The Bank of New York Mellon Corporation (the “Plan Agent”) will purchase shares for you on the American Stock Exchange or otherwise on the open market on or before the investment date. The investment date is the 15th day of each month, but if such date is not a business day, the preceding business day.

As a Participant in the Plan, you will benefit from:

| • | | Automatic reinvestment – the Plan Agent will automatically reinvest your distributions, allowing you to gradually grow your holdings in the Fund; |

| • | | Lower cost – shares are purchased on your behalf under the Plan at low brokerage rates. Brokerage on share purchases is currently 2 cents per share; |

| • | | Convenience – the Plan Agent will hold your shares in non-certificated form and will provide a detailed plan account statement of your holdings at the end of each month. |

To request a brochure containing information on the Plan, together with an enrollment form, please contact the Plan Agent:

The Bank of New York Mellon Corporation

Shareholder Relations Department

480 Washington Blvd.

Jersey City, NJ 07310

or call toll free at 1-866-221-1606.

Aberdeen Australia Equity Fund, Inc.

3

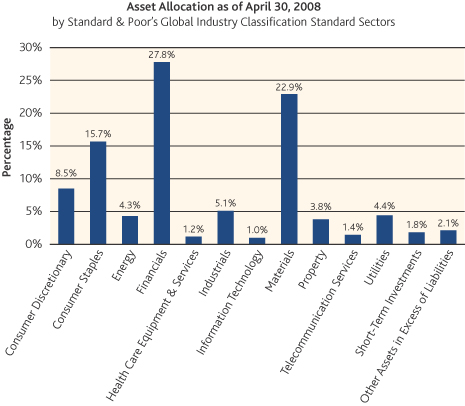

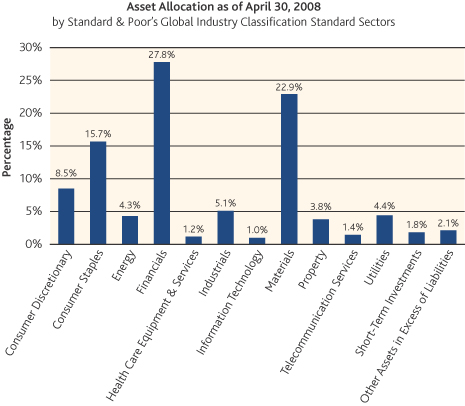

Portfolio Composition

The following chart summarizes the composition of the Fund’s portfolio, in industry classification standard sectors, expressed as a percentage of net assets. An industry classification standard sector can include more than one industry group. The Fund may invest between 25% and 35% of its total assets in the securities of any one industry group if, at the time of investment, that industry group represents 20% or more of the S&P/ASX 200 Accumulation Index. As of April 30, 2008, the Fund did not have more than 25% of its assets invested in any industry group. The financial industry sector is comprised of several groups.

As of April 30, 2008, the Fund held 96.1% of its net assets in equities, 1.8% in a short-term investment and 2.1% in other assets in excess of liabilities.

Aberdeen Australia Equity Fund, Inc.

4

Top Ten Equity Holdings

The following were the Fund’s top ten holdings as of April 30, 2008:

| | | |

| Name of Security | | Percentage of Net Assets | |

| BHP Billiton Limited | | 11.7 | % |

| Rio Tinto Limited | | 8.2 | % |

| QBE Insurance Group Limited | | 7.3 | % |

| Westpac Banking Corporation Limited | | 5.8 | % |

| Australia & New Zealand Banking Group Limited | | 5.5 | % |

| Wesfarmers Limited | | 4.6 | % |

| Commonwealth Bank of Australia | | 4.4 | % |

| Woolworths Limited | | 4.4 | % |

| Woodside Petroleum Limited | | 4.3 | % |

| Westfield Group Limited | | 3.8 | % |

Aberdeen Asset Management Asia Limited

June 2008

Aberdeen Australia Equity Fund, Inc.

5

Aberdeen Australia Equity Fund, Inc.

Financial Statements

As of April 30, 2008

Portfolio of Investments (unaudited)

As of April 30, 2008

| | | | | |

| Shares | | Description | | (US$) |

| LONG-TERM INVESTMENTS—96.1% |

| Common Stocks—96.1% |

| Consumer Discretionary—8.5% |

| 477,500 | | Billabong International Limited | | $ | 5,406,272 |

| 1,641,000 | | Fairfax Media Limited | | | 5,419,010 |

| 838,200 | | TABCORP Holdings Limited | | | 9,031,441 |

| 2,220,000 | | Tattersall’s Limited | | | 5,718,195 |

| | | | | | 25,574,918 |

| Consumer Staples—15.7% |

| 2,848,773 | | Goodman Fielder Limited | | | 4,811,208 |

| 1,047,500 | | Lion Nathan Limited | | | 8,252,467 |

| 1,830,500 | | Metcash Limited | | | 7,288,287 |

| 388,687 | | Wesfarmers Limited | | | 13,715,603 |

| 482,500 | | Woolworths Limited | | | 13,065,394 |

| | | | | | 47,132,959 |

| Energy—4.3% |

| 243,500 | | Woodside Petroleum Limited | | | 12,842,633 |

| Financials—27.8% |

| 799,000 | | Australia & New Zealand Banking Group Limited | | | 16,509,510 |

| 218,500 | | Australian Stock Exchange Limited | | | 7,398,918 |

| 564,500 | | AXA Asia Pacific Holdings Limited | | | 3,163,688 |

| 358,016 | | Bendigo Bank Limited | | | 4,131,162 |

| 310,000 | | Commonwealth Bank of Australia | | | 13,117,994 |

| 912,800 | | QBE Insurance Group Limited | | | 21,780,496 |

| 750,500 | | Westpac Banking Corporation Limited | | | 17,341,345 |

| | | | | | 83,443,113 |

| Health Care Equipment & Services—1.2% |

| 313,000 | | Ramsay Health Care Limited | | | 3,514,266 |

| Industrials—5.1% |

| 397,000 | | Bradken Limited | | | 3,090,208 |

| 158,750 | | Leighton Holdings Limited | | | 7,053,192 |

| 667,500 | | Toll Holdings Limited | | | 4,994,221 |

| | | | | | 15,137,621 |

| Information Technology—1.0% |

| 367,000 | | Computershare Limited | | | 3,099,077 |

| Materials—22.9% |

| 878,000 | | BHP Billiton Limited | | | 35,016,285 |

| 30,800 | | Incitec Pivot Limited | | | 4,701,600 |

| 163,000 | | Orica Limited | | | 4,475,318 |

| 190,500 | | Rio Tinto Limited | | | 24,458,656 |

| | | | | | 68,651,859 |

| Property—3.8% |

| 668,500 | | Westfield Group Limited | | | 11,504,548 |

See Notes to Financial Statement.

Aberdeen Australia Equity Fund, Inc.

7

Portfolio of Investments (unaudited) (continued)

As of April 30, 2008

| | | | | |

| Shares | | Description | | (US$) |

| LONG-TERM INVESTMENTS (continued) |

| Telecommunication Services—1.4% |

| 1,380,388 | | Telecom Corporation of New Zealand Limited | | $ | 4,089,537 |

| Utilities—4.4% |

| 676,500 | | AGL Energy Limited | | | 7,978,498 |

| 4,401,500 | | SP Ausnet | | | 5,274,092 |

| | | | | | 13,252,590 |

| | | Total Long Term Investments—96.1% (cost $167,737,117) | | | 288,243,121 |

Par

Amount | | | | |

| SHORT-TERM INVESTMENT—1.8% |

| $5,550,000 | | Repurchase Agreement, State Street Bank and Trust Company, 1.63% dated 4/30/08, due 5/01/08 in the amount of $5,550,251 (collateralized by $4,025,000 U.S. Treasury Bond, 8.00% due 11/15/21; value $5,665,188) | | | 5,550,000 |

| | | Total Short-Term Investments—1.8% (cost $5,550,000) | | | 5,550,000 |

| | | Total Investments—97.9% (cost $173,287,117) | | | 293,793,121 |

| | |

| | | Other assets in excess of liabilities—2.1% | | | 6,245,481 |

| | | Net Assets—100.0% | | $ | 300,038,602 |

Tax Cost of Investments

The United States federal income tax basis of the Fund’s investments and net unrealized appreciation as of April 30, 2008 were as follows:

| | | | | | | | | |

| Tax Cost Basis | | Appreciation | | Depreciation | | Net Unrealized Appreciation |

| $173,287,117 | | $ | 126,713,688 | | $ | 6,207,684 | | $ | 120,506,004 |

See Notes to Financial Statements.

Aberdeen Australia Equity Fund, Inc.

8

Statement of Assets and Liabilities (unaudited)

As of April 30, 2008

| | | | |

| Assets | | | |

Investments, at value (cost $173,287,117) | | $ | 293,793,121 | |

Foreign currency, at value (cost $5,663,367) | | | 5,808,625 | |

Cash | | | 9,139 | |

Receivable for investments sold | | | 1,921,292 | |

Dividends and interest receivable | | | 179,476 | |

| Other assets | | | 13,163 | |

Total assets | | | 301,724,816 | |

| |

| Liabilities | | | | |

Payable for investments purchased | | | 1,181,665 | |

Investment management fee payable | | | 211,315 | |

Administration fee payable | | | 22,375 | |

| Accrued expenses and other liabilities | | | 270,859 | |

Total liabilities | | | 1,686,214 | |

| | | | | |

Net Assets | | $ | 300,038,602 | |

| |

| Composition of Net Assets | | | | |

Common Stock (par value $.01 per share) | | $ | 192,060 | |

Paid-in capital in excess of par | | | 166,720,465 | |

Distributions in excess of net investment income | | | (7,447,584 | ) |

Accumulated net realized gains on investment transactions | | | 7,533,531 | |

Net unrealized appreciation on investments | | | 80,808,964 | |

Accumulated net realized foreign exchange gains | | | 12,367,657 | |

| Net unrealized foreign exchange gains | | | 39,863,509 | |

Net Assets | | $ | 300,038,602 | |

| Net asset value per common share based on 19,206,003 shares issued and outstanding | | $ | 15.62 | |

See Notes to Financial Statements.

Aberdeen Australia Equity Fund, Inc.

9

Statement of Operations (unaudited)

For the Six Months Ended April 30, 2008

| | | | |

| Net Investment Income | | | |

| |

| Income | | | | |

Dividends (net of foreign withholding taxes of $65,447) | | $ | 6,421,283 | |

| Interest | | | 403,863 | |

| | | | 6,825,146 | |

| |

| Expenses | | | | |

Investment management fee | | | 1,226,198 | |

Administration fee | | | 130,780 | |

Legal fees and expenses | | | 115,073 | |

Directors’ fees and expenses | | | 108,535 | |

Insurance expense | | | 64,304 | |

Reports to shareholders and proxy solicitation | | | 60,402 | |

Custodian’s fees and expenses | | | 53,882 | |

Investor relations fees and expenses | | | 39,917 | |

Independent auditors’ fees and expenses | | | 37,771 | |

Transfer agent’s fees and expenses | | | 16,946 | |

| Miscellaneous | | | 21,910 | |

| Total expenses | | | 1,875,718 | |

| | | | | |

| Net investment income | | | 4,949,428 | |

| |

| Realized and Unrealized Gains/(Losses) on Investments and Foreign Currencies | | | | |

| |

Net realized gain on: | | | | |

Investment transactions | | | 7,556,694 | |

| Foreign currency transactions | | | 6,575,680 | |

| | | | 14,132,374 | |

| |

Net change in unrealized appreciation on: | | | | |

Investments | | | (52,224,251 | ) |

| Foreign currency translation | | | (2,832,044 | ) |

| | | | (55,056,295 | ) |

| Net loss on investments and foreign currencies | | | (40,923,921 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (35,974,493 | ) |

See Notes to Financial Statements.

Aberdeen Australia Equity Fund, Inc.

10

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Six Months Ended

April 30, 2008

(unaudited) | | | For the Year Ended

October 31, 2007 | |

| | |

| Increase/(Decrease) in Net Assets | | | | | | | | |

| | |

| Operations | | | | | | | | |

Net investment income | | $ | 4,949,428 | | | $ | 7,255,920 | |

Net realized gain on investments transactions | | | 7,556,694 | | | | 21,618,820 | |

Net realized gain on foreign currency transactions | | | 6,575,680 | | | | 7,420,923 | |

Net change in unrealized appreciation on investments | | | (52,224,251 | ) | | | 64,153,593 | |

Net change in unrealized appreciation/(depreciation) on foreign currency translation | | | (2,832,044 | ) | | | 28,258,224 | |

Net increase/(decrease) in net assets resulting from operations | | | (35,974,493 | ) | | | 128,707,480 | |

| | |

| Distributions to shareholders from: | | | | | | | | |

Net investment income | | | (9,050,562 | ) | | | (9,948,183 | ) |

Realized capital gains | | | (10,691,713 | ) | | | (18,208,002 | ) |

Total decrease in net assets from distributions to shareholders | | | (19,742,275 | ) | | | (28,156,185 | ) |

| | |

| Common Stock Transactions | | | | | | | | |

Reinvestment of dividends resulting in the issuance of 50,245 and 61,637 shares of common stock, respectively | | | 785,161 | | | | 966,485 | |

Proceeds from the offering of common stock | | | – | | | | 31,150,000 | |

Expenses in connection with offering of common stock | | | – | | | | (1,285,591 | ) |

Total increase in net assets from common stock transactions | | | 785,161 | | | | 30,830,894 | |

Total increase/(decrease) in net assets resulting from operations | | | (54,931,607 | ) | | | 131,382,189 | |

| | |

| Net Assets | | | | | | | | |

Beginning of period | | | 354,970,209 | | | | 223,588,020 | |

End of period (including distributions in excess of net investment income of ($7,447,584) and ($3,346,450), respectively) | | $ | 300,038,602 | | | $ | 354,970,209 | |

See Notes to Financial Statements.

Aberdeen Australia Equity Fund, Inc.

11

Financial Highlights

| | | |

| | | For the

Six Months Ended

April 30, 2008

(unaudited) | |

| PER SHARE OPERATING PERFORMANCE(1): | | | |

| Net asset value, beginning of period | | $18.53 | |

| |

| Net investment income | | 0.26 | |

| Net realized and unrealized gains/(losses) on investments and foreign currencies | | (2.14 | ) |

| Total from investment operations | | (1.88 | ) |

| |

| Distributions from: | | | |

| Net investment income | | (0.47 | ) |

| Realized capital gains | | (0.56 | ) |

| Tax return of capital | | – | |

| Total distributions | | (1.03 | ) |

| Payment by shareholder of short-swing profit | | – | |

| Offering costs on common stock | | – | |

| Increase resulting from Fund share repurchase | | – | |

| Net asset value, end of period | | $15.62 | |

| Market value, end of period | | $16.30 | |

| |

| Total Investment Return Based on(2): | | | |

| Market value | | (4.71% | ) |

| Net asset value | | (10.06% | ) |

| |

| Ratio to Average Net Assets/Supplementary Data: | | | |

| Net assets, end of period (000 omitted) | | $300,039 | |

| Average net assets (000 omitted) | | 309,410 | |

| Net expenses | | 1.22% | (4) |

| Expenses without reimbursement | | 1.22% | (4) |

| Net investment income | | 3.22% | (4) |

| Portfolio turnover | | 16% | |

| (1) | | Based on average shares outstanding. |

| (2) | | Total Investment return is calculated assuming a purchase of common stock on the first day and a sale on the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment return does not reflect brokerage commissions. |

| (3) | | Less than $0.005 per share. |

See Notes to Financial Statements.

Aberdeen Australia Equity Fund, Inc.

12

| | | | | | | | | | | | | | | |

| | | For the Year Ended October 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | |

| | | $13.25 | | | $11.75 | | | $10.64 | | | $9.38 | | | $6.84 | |

| | | | | |

| | 0.39 | | | 0.41 | | | 0.37 | | | 0.28 | | | 0.12 | |

| | | 6.47 | | | 2.47 | | | 1.79 | | | 1.76 | | | 2.58 | |

| | | 6.86 | | | 2.88 | | | 2.16 | | | 2.04 | | | 2.70 | |

| | | | | |

| | | | | | | | | | | | | | | |

| | (0.53 | ) | | (0.48 | ) | | (0.51 | ) | | (0.30 | ) | | (0.10 | ) |

| | (0.98 | ) | | (0.90 | ) | | (0.54 | ) | | (0.36 | ) | | (0.07 | ) |

| | | – | | | – | | | – | | | (0.12 | ) | | – | |

| | | (1.51 | ) | | (1.38 | ) | | (1.05 | ) | | (0.78 | ) | | (0.17 | ) |

| | – | | | – | (3) | | – | | | – | | | – | |

| | (0.07 | ) | | – | | | – | | | – | | | – | |

| | | – | | | – | | | – | | | – | | | 0.01 | |

| | | $18.53 | | | $13.25 | | | $11.75 | | | $10.64 | | | $9.38 | |

| | | $18.25 | | | $14.00 | | | $12.99 | | | $10.25 | | | $8.40 | |

| | | | | |

| | | | | | | | | | | | | | | |

| | 43.46% | | | 20.09% | | | 38.98% | | | 32.53% | | | 50.40% | |

| | 53.91% | | | 25.66% | | | 21.11% | | | 23.19% | | | 40.69% | |

| | | | | |

| | | | | | | | | | | | | | | |

| | $354,970 | | | $223,588 | | | $197,421 | | | $178,551 | | | $157,419 | |

| | $283,749 | | | $209,507 | | | $194,946 | | | $166,284 | | | $128,662 | |

| | 1.44% | | | 1.45% | | | 1.48% | | | 1.75% | | | 2.55% | |

| | 1.51% | | | 1.55% | | | 1.48% | | | 1.75% | | | 2.55% | |

| | 2.56% | | | 3.31% | | | 3.21% | | | 2.85% | | | 1.66% | |

| | | 30% | | | 16% | | | 28% | | | 23% | | | 32% | |

Aberdeen Australia Equity Fund, Inc.

13

Notes to Financial Statements (unaudited)

Aberdeen Australia Equity Fund, Inc. (the “Fund”) is a closed-end, non-diversified management investment company incorporated in Maryland on September 30, 1985. The Fund’s principal investment objective is long-term capital appreciation through investment primarily in equity securities of Australian companies listed on the Australian Stock Exchange Limited. The Fund’s secondary investment objective is current income. In order to comply with a rule adopted by the Securities and Exchange Commission under the Investment Company Act of 1940 regarding fund names, the Board of Directors has adopted an investment policy that, for as long as the name of the Fund remains Aberdeen Australia Equity Fund, Inc., it shall be the policy of the Fund normally to invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities, consisting of common stock, preferred stock and convertible stock, of Australian companies listed on the Australian Stock Exchange Limited. For these purposes, “Australian companies” means companies that are tied economically to Australia. This 80% investment policy is a non-fundamental policy of the Fund and may be changed by the Board of Directors upon 60 days prior written notice to shareholders.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Basis of Presentation:

The financial statements of the Fund are prepared in accordance with accounting principles generally accepted in the United States of America using the United States dollar as both the functional and reporting currency. However, the Australian dollar is the functional currency for Federal tax purposes (see Taxes on page 16).

Securities Valuation:

The Fund’s Board of Directors has adopted Pricing and Valuation Procedures (the “Procedures”) to be used in determining the value of the assets held by the Fund. In accordance with the Procedures, investments are stated at value. Investments for which market quotations are readily available are valued at the last trade price on the date of determination as obtained from a pricing source. If no such trade price is available, such investments are valued at the quoted bid price or the mean between the quoted bid and asked price on the date of determination as obtained from a pricing source.

Short-term securities which mature in more than 60 days are valued at current market quotations. Short-term securities which mature in 60 days or less are valued at amortized cost, which approximates market value.

Securities for which market quotations are not readily available (including investments which are subject to limitations as to their sale) are to be valued at fair value. As a general rule, whether or not the Fund is required to “fair value price” an asset is dependent on the ready availability of current market quotes or, even if readily available, the reliability of such quotes. Any assets for which market quotations are not readily available or for which available prices are not reliable, shall be determined in a manner that most fairly reflects the asset’s (or group of assets) “fair value” (i.e., the amount that the Fund might reasonably expect to receive for the asset upon its current sale) on the valuation date, based on a consideration of all available information.

The Procedures provide that in certain instances, including without limitation, if there is a “stale price” for a portfolio security, in an emergency situation, or if a significant event occurs after the close of trading of a portfolio security, but before the calculation of the Fund’s net asset value, the security may be valued at its fair value.

Repurchase Agreements:

In connection with transactions in repurchase agreements with U.S. financial institutions, it is the Fund’s policy that its custodian/counterparty segregate the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest.

Aberdeen Australia Equity Fund, Inc.

14

Notes to Financial Statements (unaudited) (continued)

To the extent that any repurchase transaction exceeds one business day, the collateral is valued on a daily basis to determine its adequacy. If the seller defaults and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Foreign Currency Translation:

Australian dollar (“A$”) amounts are translated into United States dollars (“US$”) on the following basis:

| | (i) | market value of investment securities, other assets and liabilities – at the exchange rates at the end of the reporting period; and |

| | (ii) | purchases and sales of investment securities, income and expenses – at the rate of exchange prevailing on the respective dates of such transactions. |

The Fund isolates that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at the end of the reporting period. Similarly, the Fund isolates the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the reporting period.

Net realized exchange gains/(losses) include realized foreign exchange gains/(losses) from sales and maturities of portfolio securities, sales of foreign currencies, currency gains/(losses) realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the US$ equivalent amounts actually received or paid. Net unrealized foreign exchange appreciation/(depreciation) include changes in the value of portfolio securities and other assets and liabilities arising as a result of changes in the

exchange rate. Accumulated net realized and unrealized foreign exchange gains/(losses) shown in the composition of net assets represent foreign exchange gains/(losses) for book purposes that may not have been recognized for tax purposes.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin, including unanticipated movements in the value of the foreign currency relative to the US$.

Securities Transactions and Net Investment Income:

Securities transactions are recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Expenses are recorded on an accrual basis.

Forward Foreign Currency Exchange Contracts:

A forward foreign currency exchange contract (“FX”) involves an obligation to purchase and sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. The FX is marked-to-market daily and the change in market value is recorded by the Fund as unrealized appreciation or depreciation. When the FX is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. These instruments may involve market risk and credit risk. These risks arise from unanticipated movements in the value of the foreign currencies involved in the transaction and from the potential inability of counterparties to meet the terms of their contracts. There were no FXs outstanding as of April 30, 2008.

Aberdeen Australia Equity Fund, Inc.

15

Notes to Financial Statements (unaudited) (continued)

Distributions:

The Fund has a managed distribution policy of paying quarterly distributions at an annual rate, set once a year, that is a percentage of the rolling average of the Fund’s prior four quarter-end net asset values. In March 2008, the Board of Directors determined the rolling distribution rate to be 10%, for the 12 month period commencing with the distribution payable in April 2008. This policy is subject to regular review by the Fund’s Board of Directors. Under the policy, distributions will be made from current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

On an annual basis, the Fund intends to distribute its net realized capital gains, if any, by way of a final distribution to be declared during the calendar quarter ending December 31. Dividends and distributions to shareholders are recorded on the ex-dividend date.

Income distributions and capital and currency gains distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments for foreign currencies.

Recent Accounting Pronouncements:

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), was issued and is effective for fiscal years beginning after November 15, 2007. FAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The Fund will adopt FAS 157 during the fiscal 2009 year and the impact on the Fund’s financial statements is currently being assessed.

In addition, in March 2008, Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”) was issued and is effective for fiscal years beginning after November 15, 2008. FAS 161 is intended to improve financial reporting for derivative instruments by requiring enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position. Management is currently evaluating the implications of FAS 161. The impact on the Fund’s financial statement disclosures, if any, is currently being assessed.

Taxes:

For Federal income and excise tax purposes, substantially all of the Fund’s transactions are accounted for using the Australian dollar as the functional currency. Accordingly, only realized currency gains/(losses) resulting from the repatriation of Australian dollars into U.S. dollars are recognized for U.S. tax purposes.

No provision has been made for United States of America Federal income taxes because it is the Fund’s policy to meet the requirements of the United States Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to shareholders.

Effective April 30, 2008, the Fund implemented Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity, including investment companies, before being measured and recognized in the financial statements. Management has evaluated the application of FIN 48 to the Fund, and has determined that the adoption of FIN 48 does not have a material impact on the Fund’s financial statements. The Fund files U.S. federal and various state and local tax returns. No income tax

Aberdeen Australia Equity Fund, Inc.

16

Notes to Financial Statements (unaudited) (continued)

returns are currently under examination. The statute of limitations on the Fund’s U.S. federal tax returns remains open for the years ended October 31, 2004 through October 31, 2006. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction.

Use of Estimates:

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

2. Agreements

Aberdeen Asset Management Asia Limited (the “Investment Manager”) serves as investment manager to the Fund and Aberdeen Asset Management Limited (the “Investment Adviser”) serves as investment adviser to the Fund, pursuant to a management agreement and an advisory agreement, respectively. The Investment Adviser is an indirect, wholly-owned subsidiary of the Investment Manager, which is a direct, wholly-owned subsidiary of Aberdeen Asset Management PLC.

The Investment Manager makes investment decisions on behalf of the Fund on the basis of recommendations and information furnished to it by the Investment Adviser, including the selection of, and responsibility for the placement of orders with, brokers and dealers to execute portfolio transactions on behalf of the Fund.

The management agreement provides the Investment Manager with a fee, payable monthly, at the following annual rates: 1.10% of the Fund’s average weekly Managed Assets up to $50 million, 0.90% of Managed Assets between $50 million and $100 million and 0.70% of Managed Assets in excess of $100 million. Managed Assets are defined in the management agreement as net assets plus the amount of any borrowings for investment purposes.

The Investment Manager pays fees to the Investment Adviser for its services rendered. The Investment Manager informed the Fund that it paid $293,939 to the Investment Adviser during the six months ended April 30, 2008.

Aberdeen Asset Management Inc. (“AAMI”), an affiliate of the Investment Manager and the Investment Adviser, is the Fund’s Administrator, pursuant to an agreement under which AAMI receives a fee, payable monthly, at an annual rate of 0.085% of the Fund’s average weekly Managed Assets up to $600 million and 0.06% of the Fund’s average weekly Managed Assets in excess of $600 million. Managed Assets are defined as net assets plus the amount of any borrowings for investment purposes.

Under terms of an Investor Relations Services Agreement, AAMI serves as the Fund’s investor relations services provider. This agreement provides AAMI with a monthly retainer fee of $5,000 plus out-of-pocket expenses. During the six months ended April 30, 2008, the Fund incurred fees of approximately $30,000 for the services of AAMI. Investor relations fees and expenses in the Statement of Operations include certain out-of-pocket expenses.

Purchases and sales of investment securities, other than short-term investments, for the six months ended April 30, 2008 aggregated $48,005,893 and $60,983,106, respectively.

There are 30 million shares of $0.01 par value common stock authorized. At April 30, 2008, there were 19,206,003 shares issued and outstanding.

On March 1, 2001, the Board of Directors approved a stock repurchase program. The stock repurchase program allows the Fund to

Aberdeen Australia Equity Fund, Inc.

17

Notes to Financial Statements (unaudited) (concluded)

repurchase up to 10% of its outstanding common stock in the open market during any 12 month period if and when the discount to NAV is at least 8%. For the six months ended April 30, 2008 and the fiscal year ended October 31, 2007, the Fund did not repurchase any shares through this program.

Based upon filings with the Securities and Exchange Commission, on May 21, 2008, of Landesbank Berlin AG (“LB”), a wholly-owned subsidiary of Landesbank Berlin Holdings AG, was the beneficial owner of 2,051,309 shares of common stock (constituting approximately 10.7% of the Fund’s shares then outstanding).

Subsequent to April 30, 2008, the Fund declared a quarterly distribution of 41 cents per share, payable on July 11, 2008 to shareholders of record on June 30, 2008.

Aberdeen Australia Equity Fund, Inc.

18

Supplemental Information (unaudited)

Results of Annual Meeting of Shareholders

The Annual Meeting of Shareholders was held on Tuesday, March 25, 2008 at 1735 Market Street, Philadelphia, Pennsylvania. The description of the proposals and number of shares voted at the meeting are as follows:

To elect three directors to serve as Class II directors for a three-year term expiring in 2011:

| | | | |

| | | Votes For | | Votes Withheld |

| P. Gerald Malone | | 17,473,588 | | 243,880 |

| Peter D. Sacks | | 17,496,471 | | 220,997 |

| Hugh Young | | 17,503,544 | | 213,924 |

To elect one director to serve as Class III directors for a one-year term expiring in 2009:

| | | | |

| | | Votes For | | Votes Withheld |

| Brain M. Sherman | | 17,498,182 | | 219,286 |

Directors whose term of office continued beyond this meeting are as follows: Neville J. Miles, William J. Potter, Moritz Sell, and John T. Sheehy.

Aberdeen Australia Equity Fund, Inc.

19

Corporate Information

Directors

Neville J. Miles, Chairman

P. Gerald Malone

William J. Potter

Peter D. Sacks

Moritz Sell

John T. Sheehy

Brian M. Sherman

Hugh Young

Officers

Vincent Esposito, President

Bill Bovingdon, Vice President

Mark Daniels, Vice President

Martin Gilbert, Vice President

Jennifer Nichols, Vice President

Timothy Sullivan, Vice President

Vincent McDevitt, Vice President – Compliance

Joseph Malone, Treasurer and Principal Accounting Officer

Megan Kennedy, Assistant Treasurer

Lucia Sitar, Secretary

Investment Manager

Aberdeen Asset Management Asia Limited

21 Church Street

#01-01 Capital Square Two

Singapore 049480

Investment Adviser

Aberdeen Asset Management Limited

Level 6, 201 Kent Street

Sydney, NSW 2000, Australia

Administrator

Aberdeen Asset Management Inc.

1735 Market Street, 37th Floor

Philadelphia, PA 19103

Custodian

State Street Bank and Trust Company

One Heritage Drive

North Quincy, MA 02171

Transfer Agent

The Bank of New York Mellon Corporation

Shareholder Relations Department

480 Washington Blvd.

Jersey City, NJ 07310

1-866-221-1606

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

300 Madison Avenue

New York, NY 10017

Legal Counsel

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006

Investor Relations

Aberdeen Asset Management Inc.

1735 Market Street, 37th Floor

Philadelphia, PA 19103

1-866-839-5205

InvestorRelations@aberdeen-asset.com

Aberdeen Asset Management Asia Limited

The accompanying Financial Statements as of April 30, 2008 were not audited and accordingly, no opinion is expressed thereon.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase, from time to time, shares of its common stock in the open market.

Shares of Aberdeen Australia Equity Fund, Inc. are traded on the American Stock Exchange under the symbol “IAF”. Information about the Fund’s net asset value and market price is available at www.aberdeeniaf.com

This report, including the financial information herein, is transmitted to the shareholders of Aberdeen Australia Equity Fund, Inc. for their general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. Past performance is no guarantee of future returns.

Item 2—Code of Ethics.

Not required to be included in this filing.

Item 3—Audit Committee Financial Expert.

Not required to be included in this filing.

Item 4—Principal Accountant Fees and Services.

Not required to be included in this filing.

Item 5—Audit Committee of Listed Registrants.

Not required to be included in this filing.

Item 6—Investments.

(a) Included as part of the Report to Stockholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7—Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not required to be included in this filing.

Item 8—Portfolio Managers of Closed-End Management Investment Companies.

(a)

(1) Pursuant to Item 8(b), the information in the table below is as of the date of this filing.

| | | | |

Individual & Position | | Services Rendered | | Past Business Experience |

William Bovingdon (Commenced June 2007) Head of Australian Fixed Income [Sydney] | | Head of Australian Fixed Income | | Currently is the Head of Australian Fixed Income. Joined in June 2007 when Aberdeen acquired Deutsche Australia where he served as Deputy CIO in addition to his role as Head of Australian Fixed Income. Prior to joining Deutsche, spent ten years at Treasury Corporation of Victoria as a fixed income specialist. |

(2) The information in the table below is as of April 30, 2008.

| | | | | | | | | | | | | | | |

| | | Registered Investment

Companies Managed by

Portfolio Manager | | Pooled Investment

Vehicle Managed by

Portfolio Manager | | Other Accounts

Managed by

Portfolio Manager |

Name of Portfolio Manager | | Number of

Accounts | | FUM

USD($M) | | Number of

Accounts | | FUM

USD($M) | | Number of

Accounts | | FUM

USD($M) |

William Bovingdon | | 2 | | $ | 2,556,941 | | 2 | | $ | 561,508 | | 3 | | $ | 1,832,122 |

Total Assets are as of April 30, 2008 and have been translated into U.S. dollars at a rate of £1.00 = $1.9806.

There are no accounts with respect to which part of the advisory fee is based on the performance of the account.

The portfolio managers’ management of other accounts may give rise to potential conflicts of interest in connection with their management of the Fund’s investments, on the other hand, and the management of the other accounts (including the portfolio manager’s personal account, if the portfolio manager has an account), on the other. The other accounts may have the same investment objective as the Fund. Therefore, a potential conflict of interest may arise as a result of the identical investment objectives, whereby the portfolio manager could favor one account over another. However, the Adviser believes that these risks are mitigated by the fact that: (i) accounts with like investment strategies managed by a particular portfolio manager are generally managed in a similar fashion, subject to exceptions to account for particular investment restrictions or policies applicable only to certain accounts, differences in cash flows and account sizes, and similar factors; and (ii) portfolio manager personal trading is monitored to avoid potential conflicts.

(3) The Aberdeen Group recognizes the need to provide a competitive compensation package in order to attract and retain high calibre staff. In addition to an attractive base salary and performance-related bonus, investment professionals also receive a competitive benefits package and participation in a company-wide stock ownership plan. Key executives participate in a substantial stock option plan, as well as cash-backed and equity-backed long-term incentive plans. A description of the various compensation plans is provided below:

Executive Share Option Plan. The Aberdeen Group has an executive share option plan. Options are granted based on an assessment of the individual’s expected contribution to future Aberdeen Group performance. Options are granted for no consideration. Options granted may only be exercised if the Aberdeen Group’s Remuneration Committee is satisfied that the prescribed performance criteria are met. The criteria have been chosen as being reflective of success in the industry sector within which the Aberdeen Group

operates. The criteria have also been deemed to be appropriate in order to achieve the goal of delivering good returns to clients and shareholders alike.

Share Incentive Plan. The Share Incentive Plan is intended to encourage ownership of shares of Aberdeen PLC by employees of the Aberdeen Group, and is available to all executive directors and employees of the Aberdeen Group, thus aligning their interests with those of the shareholders. All executive directors and employees who have been employed for a minimum period of 12 months may participate in the Share Incentive Plan.

Pension. The Aberdeen Group offers a contributory money purchase pension plan to which the employer’s contribution is 15% of basic salary and the employee contributes 5%. Once an employee becomes a member of the Aberdeen Group’s pension plan, the Aberdeen Group will provide life insurance coverage that provides death-in-service benefits.

Deferred Bonus. During 2003, the Aberdeen Group implemented a deferred bonus plan designed to encourage the retention of certain key employees identified as critical to the Aberdeen Group’s achievement of its long-term goals. An employee benefit trust was established and funded for the purpose of paying potential awards under this plan. Deferred payments made in the form of cash bonuses were paid to qualifying employees over a three year period from 2004 to 2006.

Long Term Incentive Plan (“LTIP”). The LTIP is administered by an independent professional trustee. Under the LTIP, an award made by the trustee to an eligible participant may take one of the following two forms:

1. The right to acquire a specified number of shares. The number of shares which may be acquired will be determined by the performance of the Aberdeen Group over the relevant measurement period; or

2. The acquisition of shares by a participant at the time the award is made. The participant’s ownership of any shares is contingent upon the satisfaction of the Aberdeen Group’s performance targets.

In each case, the rules of the LTIP will ensure that the participant does not acquire ownership of the relevant shares until the end of the measurement period and then only to the extent that the performance targets have been satisfied.

Performance is reviewed on a formal basis once a year and this review influences individual staff members’ subsequent remuneration. The review process looks at all of the ways in which an individual has contributed to the organization, and specifically, in the case of investment managers, to the investment team. Discretionary bonuses are based on a combination of the team and the individual’s performance, as well as industry comparatives and the Aberdeen Group’s performance as a whole. The weighting of these factors varies and overall participation in team meetings, generation of original research ideas and contribution to presenting the team externally are also contributory factors. Discretionary bonuses generally range from 10% to

50% of a portfolio manager’s annual salary; equity incentives could provide a substantially greater part of compensation over the longer term (3 years or more).

(4) The information in the table below provides information on the newly identified portfolio manager’s ownership of shares of the registrant as of June 27, 2008.

| | |

Individual | | Dollar Range of Equity Securities

in the Registrant Beneficially

owner by the Portfolio Manager |

William Bovingdon | | NONE |

(b) As of the date of this filing, the information provided in response to Item 8(a)(1), (a)(2), and (a)(3) details the addition of William Bovingdon as portfolio manager.

Item 9—Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

REGISTRANT PURCHASES OF EQUITY SECURITIES

| | | | | | | | |

Period | | (a)

Total

Number of

Shares

Purchased | | (b)

Average

Price Paid

per Share | | (c)

Total

Number of

Shares

Purchased

as Part of

Publicly

Announced

Plans or

Programs1 | | (d)

Maximum

Number of

Shares

That May

Yet Be

Purchased

Under the

Plans or

Programs1 |

November 1 through November 30, 2007 | | 0 | | 0 | | 0 | | 1,915,576 |

December 1 through December 31, 2007 | | 0 | | 0 | | 0 | | 1,915,576 |

January 1 through January 31, 2008 | | 0 | | 0 | | 0 | | 1,918,467 |

February 1 through February 29, 2008 | | 0 | | 0 | | 0 | | 1,918,467 |

March 1 through March 31, 2008 | | 0 | | 0 | | 0 | | 1,918,469 |

April 1 through April 30, 2008 | | 0 | | 0 | | 0 | | 1,920,600 |

Total | | 0 | | 0 | | 0 | | — |

1 | The Registrant’s stock repurchase program was announced on March 19, 2001 and further amended by the Fund’s Board of Directors on December 12, 2007. Under the terms of the current program, the Registrant is permitted to repurchase up to 10% of its outstanding shares of common stock, par value $.01 per share, on the open market during any 12 month period if and when the discount to net asset value is at least 8%. |

Item 10—Submission of Matters to a Vote of Security Holders.

During the period ended April 30, 2008, there were no material changes to the policies by which stockholders may recommend nominees to the Fund’s Board.

Item 11—Controls and Procedures.

| | (a) | It is the conclusion of the Registrant’s principal executive officer and principal financial officer that the effectiveness of the Registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the Registrant has been recorded, processed, summarized and reported within the time period specified in the Commission’s rules and forms and that the information required to be disclosed by the Registrant has been accumulated and communicated to the Registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure. |

| | (b) | There have been no changes in the Registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 12—Exhibits.

| | (a)(2) | Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940, as amended. |

| | (b) | Certifications pursuant to Rule 30a-2(b) under the Investment Company Act of 1940, as amended. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| ABERDEEN AUSTRALIA EQUITY FUND, INC. |

| |

| By: | | /S/ VINCENT ESPOSITO |

| | Vincent Esposito, President of Aberdeen Australia Equity Fund, Inc. |

Date: June 27, 2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| | |

| By: | | /S/ VINCENT ESPOSITO |

| | Vincent Esposito, President of Aberdeen Australia Equity Fund, Inc. |

Date: June 27, 2008

| | |

| By: | | /S/ JOSEPH MALONE |

| | Joseph Malone Treasurer of Aberdeen Australia Equity Fund, Inc. |

Date: June 27, 2008

Exhibit List

12(a)(2)—Rule 30a-2(a) Certifications

12(b)—Rule 30a-2(b) Certifications