U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT UNDER SECTION 13 OR 15 (d) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended: DECEMBER 31, 2006 |

| | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 |

| | For transition period from _____ to _____ |

Commission File Number: 333-1026-D

FASTFUNDS FINANCIAL CORPORATION

(Name of Registrant in its charter)

NEVADA | 87-0425514 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

319 CLEMATIS STREET, SUITE 703, WEST PALM BEACH, FLORIDA 33401

(Address of principal executive offices)(Zip Code)

Issuer’s telephone number: (561) 514-9042

Securities registered under Section 12 (b) of the Exchange Act:

NONE

Securities registered under Section 12 (g) of the Exchange Act:

COMMON STOCK, $.001 PAR VALUE

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: ¨Yes xNo

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ¨

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Exchange during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 Days: xYes ¨No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer: Large Accelerated Filer ¨, Accelerated Filer ¨, Non-Accelerated Filer x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): xYes ¨No

The aggregate market value of the voting stock held by non-affiliates of the Registrant was $1,983,600 based on the last sale price of the Registrant's common stock as of the last business day of the Registrants’ most recently completed second fiscal quarter, ($0.60 per share as of June 30, 2006) as reported on the Over-the-Counter Bulletin Board.

The Registrant had 7,095,301 shares of common stock outstanding as of April 27, 2007.

Documents incorporated by reference: None

FASTFUNDS FINANCIAL CORPORATION

FORM 10-K

THIS REPORT MAY CONTAIN CERTAIN “FORWARD-LOOKING” STATEMENTS AS SUCH TERM IS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 OR BY THE SECURITIES AND EXCHANGE COMMISSION IN ITS RULES, REGULATIONS AND RELEASES, WHICH REPRESENT THE REGISTRANT’S EXPECTATIONS OR BELIEFS, INCLUDING BUT NOT LIMITED TO, STATEMENTS CONCERNING THE REGISTRANT’S OPERATIONS, ECONOMIC PERFORMANCE, FINANCIAL CONDITION, GROWTH AND ACQUISITION STRATEGIES, INVESTMENTS, AND FUTURE OPERATIONAL PLANS. FOR THIS PURPOSE, ANY STATEMENTS CONTAINED HEREIN THAT ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE DEEMED TO BE FORWARD-LOOKING STATEMENTS. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, WORDS SUCH AS “MAY”, “WILL”, “EXPECT”, “BELIEVE”, “ANTICIPATE”, “INTENT”, “COULD”, “ESTIMATE”, “MIGHT”, OR “CONTINUE” OR THE NEGATIVE OR OTHER VARIATIONS THEREOF OR COMPARABLE TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS BY THEIR NATURE INVOLVE SUBSTANTIAL RISKS AND UNCERTAINTIES, CERTAIN OF WHICH ARE BEYOND THE REGISTRANT’S CONTROL, AND ACTUAL RESULTS MAY DIFFER MATERIALLY DEPENDING ON A VARIETY OF IMPORTANT FACTORS, INCLUDING UNCERTAINTY RELATED TO ACQUISITIONS, GOVERNMENTAL REGULATION, MANAGING AND MAINTAINING GROWTH, THE OPERATIONS OF THE COMPANY AND ITS SUBSIDIARIES, VOLATILITY OF STOCK PRICE AND ANY OTHER FACTORS DISCUSSED IN THIS AND OTHER REGISTRANT FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION.

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

(a) General development of business.

FastFunds Financial Corporation (“FastFunds” or the “Company”) is a holding company, organized in Nevada in 1985, formerly operating through its wholly owned subsidiary Chex Services, Inc. (“Chex”). Chex is a Minnesota corporation formed in 1992, and prior to the Asset Sale described and defined in the paragraph below, provided financial services, primarily check cashing, automated teller machine (ATM) access and credit and debit card advances, to customers predominantly at Native American owned casinos and gaming establishments. FastFunds previously existed under the name “Seven Ventures, Inc.” On June 7, 2004, a wholly owned subsidiary of Seven Ventures, Inc. merged with and into Chex (the "Merger”). In the Merger, Hydrogen Power, Inc. (“HPI”), exchanged its 100% ownership of Chex for 7,700,000 shares of the Company’s common stock; representing approximately 93% of the Company’s outstanding common stock immediately following the Merger. On June 29, 2004, the Company changed its name to FastFunds Financial Corporation.

On December 22, 2005, FastFunds and Chex entered into an Asset Purchase Agreement with Game Financial Corporation, pursuant to which FastFunds and Chex agreed to sell substantially all the assets of Chex (the “Asset Sale”). Such assets also represent substantially all of the operating assets of FastFunds on a consolidated basis. On January 31, 2006, FastFunds and Chex completed the Asset Sale for $14 million. Additionally, FastFunds and Chex entered into a Transition Services Agreement with Game Financial pursuant to which FastFunds and Chex agreed to provide certain services to Game Financial to ensure a smooth transition of the sale of the cash access financial services business. HPI agreed to serve as a guarantor of FastFunds and Chex’s performance obligations under the Transition Service Agreement.

On February 28, 2006, HPI (then known as Equitex, Inc.), held a special meeting of shareholders at which two proposals were approved authorizing the acquisition of Hydrogen Power, Inc. (“Old HPI”), through a newly formed wholly-owned Equitex subsidiary as well as certain related common stock issuances. Per the terms of the transaction, as amended, Equitex was obligated to deliver $5 million to Old HPI as a condition to close. On March 14, 2006, FastFunds loaned Equitex the $5 million (the “$5 Million Loan”) for one year at 10% per annum interest. As security for the $5 Million Loan, Equitex pledged to FastFunds all of the common stock of Old HPI. In addition, FastFunds is to receive a profit interest from the operations of Old HPI equal to 10% of the net profit of Old HPI, as defined in the relevant loan documents.

On January 2, 2007, pursuant to the terms of a Redemption, Stock Sale and Release Agreement (the “Redemption Agreement”) by and between HPI and the Company, we (i) redeemed 8,917,344 shares of our common stock held by HPI, (ii) acquired from HPI an aggregate of 5,000,000 shares of common stock of Denaris Corporation, a Delaware corporation (“Denaris”), (iii) acquired from HPI an aggregate of 1,000 shares of common stock of Key Financial Systems, Inc., a Delaware corporation (“Key Financial”), and (iv) acquired from HPI an aggregate of 1,000 shares of common stock of Nova Financial Systems, Inc., a Delaware corporation (“Nova Financial”). Denaris is now a majority owned subsidiary, and Key Financial and Nova Financial are wholly owned subsidiaries of FFFC. Each of Denaris, Nova Financial and Key Financial are inactive entities with no operating or intellectual property assets. The shares of common stock of each entity transferred to us pursuant to the Redemption Agreement constituted all of HPI holdings in each entity. In consideration of the redemption and acquisition of the shares of Denaris, Key Financial and Nova Financial, we released HPI from all outstanding payment obligations, including obligations under the $5 Million Note dated March 14, 2006. The outstanding balance on the $5 Million Note, including principal and interest accrued, as of the date of the Redemption Agreement was $5,402,398. The Company received a fairness opinion from an unaffiliated third party with respect to this transaction.

Immediately after the closing of the transactions contemplated by the Redemption Agreement, HPI holds 3,500,000 shares of FastFunds common stock, currently constituting approximately 49% of our outstanding capital stock. So long as HPI holds 10% or more of the outstanding equity or voting interest in the Company, HPI has agreed to vote their shares of our capital stock in the same manner and proportion as other stockholders of the Company vote their shares. As of March 31, 2007, we held 1,541,858 shares of HPI common stock, constituting approximately 5.5% of HPI common stock. Pursuant to the Redemption Agreement, the Company and HPI each provided the other certain registration rights relating to the common stock of such party held by the other party.

On January 31, 2007, FastFunds announced that it executed a letter of intent to acquire Industrial Systems, Inc. (“ISI”). ISI, founded in 1991 and based in Delta, Colorado, provides turn-key engineering procurement and construction services to the mining, energy and natural resources industries throughout the United States. The letter of intent calls for FastFunds to acquire 100% of the outstanding securities of ISI in an all stock tax-free transaction. While specific details are being negotiated as part of a definitive agreement, terms of the letter of intent call for the stockholders of ISI to own approximately 65% of the Company’s common stock at closing of the transaction; with the potential to earn an estimated additional 6% based on post-closing incentives. Completion of the transaction is subject to further due diligence by each party, negotiation and execution of a definitive agreement, and other customary pre-closing conditions; and is anticipated to occur prior to June 30, 2007.

As a holding company, from time to time we evaluate opportunities for strategic investments or acquisitions that would complement our current services and products, enhance our technical capabilities or otherwise offer growth opportunities. As a result, acquisition discussions and, in some cases, negotiations may take place and future investments or acquisitions involving cash, debt or equity securities or a combination thereof may result. FastFunds Financial Corporation maintains its principal office at 319 Clematis Street, Suite 703, West Palm Beach, Florida. You can reach us by telephone at (514) 514-9042.

(b) Financial information about segments.

Through January 31, 2006, we operated in one industry segment, cash disbursement services. We no longer have any operations.

(c) Narrative description of business.

Prior to the Asset Sale, Chex operated at casinos, gaming and other retail establishments throughout the United States. At each of these locations Chex provided any one or a combination of: check cashing; credit/debit card cash advance systems; and ATM terminals. Chex either staffed the locations with its personnel or provided its products and services to the locations based upon the contract with the location.

Chex’s services were provided pursuant to the terms of financial services agreements entered into with each respective establishment. These agreements specified which cash access services were to be provided by Chex, the transaction fees to be charged by Chex to patrons for each type of cash access transaction, and the amount of compensation to be paid by Chex to the location. Pursuant to all of these agreements, Chex maintained the exclusive rights (with rare exception) to provide its services for the term of the contract.

Subsequent to the Asset Sale, the Company has not conducted operations and is the process of locating a business to acquire. The Company currently employs one full-time employee.

ITEM 1A. RISK FACTORS

The purchase of shares of the Company’s common stock is very speculative and involves a very high degree of risk. An investment in the Company is suitable only for the persons who can afford the loss of their entire investment. Accordingly, investors should carefully consider the following risk factors, as well as other information set forth herein, in making an investment decision with respect to securities of the Company.

RISKS ASSOCIATED WITH OUR COMPANY AND HISTORY:

We have no operating business.

In January 2006, we sold substantially all of our operating business, owned by Chex, to Game Financial Corporation. The Company currently has no operating business. As a result, any investment in the Company must be considered purely speculative.

The Company’s balance sheet contains certain notes payable, which were due February 28, 2007.

Chex previously relied on promissory notes (the “Notes”) issued to private investors to provide operating capital for its business. As of December 31, 2006, the balance of the Notes was $2,108,000. The Company renewed $283,000 of the Notes on the same terms and conditions as previously existed. In April 2007 the Company, through a financial advisor, restructured $1,825,000 of the Notes (the “Restructured Notes”). The Restructured Notes carry a stated interest rate of 15% and mature on February 28, 2008. Of the Restructured Notes, $150,000 and $175,000, respectively, have 90 day and 120 day provisions, whereby the noteholder can request repayment. However, the Company does not currently have enough capital to repay the Restructured Notes when they mature. Accordingly, the noteholders may take action against the Company, including forcing the Company into bankruptcy.

Chex is a guarantor of certain debt of HPI, and the Company’s entire investment in Chex (i.e., its ownership of all outstanding Chex stock) is subject to a security interest securing such obligation. Furthermore, all of the assets of Chex are subject to a security interest for the same debt.

In March 2004, HPI closed on $5 million of debt financing and issued convertible promissory notes in that principal amount to two financial institutions (the “Lenders”). The proceeds from the promissory notes were immediately thereafter loaned to Chex. The promissory notes are collateralized, among other things, by all of the assets of Chex, and by the Company common stock owned by HPI. In conjunction with the Asset Sale, the holders of the promissory notes consented to the sale of assets that secured their notes. In contemplation of the Redemption Agreement described above, on December 29, 2006, HPI and the Company obtained the consent of the two financial institutions to complete the transactions contemplated by the Redemption Agreement. Contemporaneously with receipt of the consent, HPI and the Company entered into an Note and Security Amendment Agreement dated December 29, 2006 with the Lenders, pursuant to which it was agreed to amend certain terms of the Convertible Promissory Note dated March 8, 2004 in favor of Lenders in the principal amount of $5,000,000 to increase the interest rate applicable to the Convertible Promissory Notes from 7% per annum to 10% per annum and the default interest rate from 10% to 13%. Accordingly, if HPI defaults on the obligations specified under the promissory notes, and if Chex cannot cure such defaults, the Company’s remaining assets could be lost.

There are currently outstanding securities convertible into or exchangeable for an aggregate of 4,329,280 shares of our common stock which, if converted or exchanged, will substantially dilute our existing stockholders.

The Company currently has outstanding notes and securities convertible into or exchangeable for an aggregate of 4,807,064 shares of common stock under certain conditions. In addition, the effective conversion and exercise prices of such securities significantly lower than the current market value of our common stock. If these securities are converted into or exchanged for common stock, their issuance would have a substantial dilutive effect on the percentage ownership of our current stockholders. These securities consist of: (i) outstanding warrants to purchase an aggregate of 189,000 shares of our common stock at a purchase price of $0.10 per share, which were originally issued to HPI in connection with the Merger; (ii) options to purchase 455,000 shares of our common stock at an average purchase price of $1.05 per share; and (iii) warrants to purchase an aggregate of 3,685,280 shares of our common stock at a weighted average purchase price of $0.98 per share.

HPI is a controlling stockholder of the Company and is able to effectively control our management and operations.

At December 31, 2006, HPI owned 12,417,344 shares of our outstanding common stock, representing approximately 80% of the voting power of our outstanding securities. Currently, HPI owns 3,500,000 shares of outstanding common stock, or approximately 49%. As a result, HPI, both alone or together with our directors and executive officers, has the ability to control our management and affairs through the election and removal of our entire board of directors and will control the outcome of all matters requiring stockholder approval, including the future merger, consolidation or sale of all or substantially all of our assets. This concentrated control could discourage others from initiating any potential merger, takeover or other change of control transaction that may otherwise be beneficial to our stockholders. As a result, the return on your investment in our common stock through the market price of our common stock or ultimate sale of our business could be adversely affected.

Our common stock trades only in an illiquid trading market, which generally results in lower prices for our common stock.

Trading of our common stock is conducted on the Over-The-Counter Bulletin Board. This has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and the lack of security analysts’ and the media’s coverage of our Company and its common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

We have not paid dividends to date, and have no intention of paying dividends to our stockholders.

To date, we have not paid any cash dividends and do not anticipate the payment of cash dividends in the foreseeable future. Accordingly, the only return on an investment in our common stock, if any, may occur upon a subsequent sale of the shares of common stock.

ITEM 2. PROPERTIES.

FastFunds leases approximately 1,300 square feet for its executive office in West Palm Beach, Florida, which is adequate for its current needs. The current minimum lease payment is approximately $2,900 per month through January 31, 2010, when it expires. Pursuant to the terms of the lease, FastFunds is also responsible for its pro-rata share of taxes, operating expenses and improvement costs.

ITEM 3. LEGAL PROCEEDINGS.

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse impact either individually or in the aggregate on our consolidated results of operations, financial position or cash flows.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

(a) Market Information.

Our common stock is not listed on any exchange; however, market quotes for the Company’s common stock (under the symbol FFFC) may be obtained from the Over-the-Counter Bulletin Board Service. The bulletin board service is a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter securities. The table below states the quarterly high and low bid prices for the common stock as reported by the bulletin board service. However, such Over-the-Counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission and may not represent actual transactions.

| | | | |

| Quarter Ended | High | | Low |

2005 | | | |

| March 31, 2005 | $5.50 | | $5.00 |

| June 30, 2005 | $5.50 | | $2.00 |

| September 30, 2005 | $2.50 | | $1.02 |

| December 31, 2005 | $1.20 | | $0.97 |

| | | | |

| Quarter Ended | High | | Low |

2006 | | | |

| March 31, 2006 | $1.04 | | $0.83 |

| June 30, 2006 | $1.10 | | $0.60 |

| September 30, 2006 | $0.60 | | $0.30 |

| December 31, 2006 | $0.70 | | $0.22 |

For each of the following transactions, we relied upon the exemptions from registration provided by Sections 4(6) or 4(2) of the Securities Act of 1933 and Rule 506 promulgated thereunder based upon (i) representations from each investor that it was an accredited or sophisticated investor with experience in investing in securities such that it could evaluate the merits and risks related to our securities; (ii) the fact that no general solicitation of the securities was made by us; (iii) representations from each investor that it was acquiring the securities for its own account and not with a view towards further distribution; (iv) the fact that the securities issued were “restricted securities” as that term is defined under Rule 144 promulgated under the Securities Act; (v) the fact that we placed appropriate restrictive legends on the certificates representing the securities; and (vi) the fact that prior to completion of the transaction, each investor was informed in writing of the restricted nature of the securities, provided with all information regarding FastFunds and were given the opportunity to ask questions of and receive additional information from us regarding our financial condition and operations. During the quarter ended December 31, 2006 we issued 86,486 shares of our $0.001 par value common stock. The shares were issued upon the cashless exercise of warrants to purchase 108,000 shares of our common stock. The warrants were exercised by one of our board of directors and he utilized 21,514 shares of common stock to “pay” for the exercise.

In March 2007 the Company issued 181,686 shares of our common stock upon the cashless exercise of warrants to purchase 226,000 shares of our common stock. Additionally, in March 2007 the Company issued, to an accredited investor, 250,000 shares of our common stock in exchange for accrued and unpaid legal fees of $125,000.

(b) Holders.

The number of record holders of our common stock as of March 31, 2007 was 137 according to our transfer agent. This figure excludes an indeterminate number of shareholders whose shares are held in “street” or “nominee” name.

(c) Dividends.

FastFunds has not declared nor paid cash dividends on our common stock during the previous two fiscal years, nor do we anticipate paying any cash dividends in the foreseeable future. We currently intend to retain any future earnings to fund our limited operations.

(d) Securities Authorized for Issuance Under Equity Compensation Plans.

We have the following securities authorized for issuance under our equity compensation plans as of December 31, 2006, including options outstanding or available for future issuance under our 2004 Stock Option Plan.

| Equity Compensation Plan Information |

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | (a) | | (b) | | (c) |

| Equity compensation plans approved by security holders | | | | | |

| Equity compensation plans not approved by security holders | 385,000 | | $ 1.10 | | 1,415,000 |

| Total | 385,000 | | $ 1.10 | | 1,415,000 |

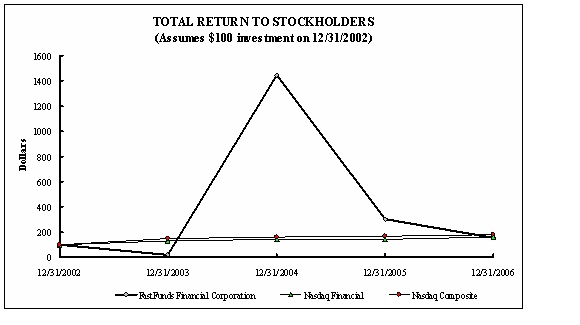

(e) Performance graph

| Total Return Analysis | | | | | | |

| | | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 |

| FastFunds Financial Corporation | | $100.00 | $20.00 | $1,442.86 | $302.86 | $157.14 |

| Nasdaq Financial | | $100.00 | $128.10 | $144.20 | $144.01 | $159.30 |

| Nasdaq Composite | | $100.00 | $150.01 | $162.89 | $165.13 | $180.85 |

ITEM 6. SELECTED FINANCIAL DATA.

The following table contains selected financial data of FastFunds for the previous five years. The selected financial data presented for periods prior to the June 7, 2004 Merger are those of Chex. The historical basic and diluted income (loss) per share presented is adjusted to reflect the new capital structure as a result of the merger.

In light of the foregoing, and as a result of our sale of substantially all of our assets to Game Financial Corporation in January 2006, the historical data presented below is not indicative of future results. You should read this information in conjunction with the audited consolidated financial statements of the Company, including the notes to those statements (Item 8), and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations (Item 7) that follows.

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | | | | | | | | | | | |

| Revenues | | $ | 2,192,382 | | $ | 18,531,141 | | $ | 15,233,735 | | $ | 18,100,788 | | $ | 19,580,399 | |

| Location gross margin | | | 992,197 | | | 4,755,134 | | | 3,942,225 | | | 5,390,552 | | | 5,887,321 | |

| Corporate operating | | | | | | | | | | | | | | | | |

| expenses | | | 3,680,045 | | | 6,496,681 | | | 6,752,919 | | | 4,605,327 | | | 3,634,467 | |

| Gain on sale of net | | | | | | | | | | | | | | | | |

| operating assets of | | | | | | | | | | | | | | | | |

| subsidiary | | | 4,145,835 | | | | | | | | | | | | | |

| Other expenses | | | 2,010,754 | | | 3,143,294 | | | 1,455,411 | | | 1,103,215 | | | (1,411,389 | ) |

| | | | | | | | | | | | | | | | | |

| Net (loss) income | | | (1,409,680 | ) | | (5,906,347 | ) | | (4,787,994 | ) | | (504,990 | ) | | 786,465 | |

| Basic and diluted net | | | | | | | | | | | | | | | | |

| (loss) income per share | | | (0.09 | ) | | (0.56 | ) | | (0.54 | ) | | (0.07 | ) | | 0.10 | |

| | | | | | | | | | | | | | | | | |

| Total assets | | | 220,164 | | | 19,939,846 | | | 22,714,759 | | | 22,853,342 | | | 24,891,057 | |

| Total long-term | | | | | | | | | | | | | | | | |

| Liabilities | | | - | | | 4,506,331 | | | 3,044,016 | | | 37,243 | | | 240,629 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and notes thereto for the years ended December 31, 2006, 2005 and 2004. The financial statements presented for the year ended December 31, 2006, 2005 and 2004 include Chex, Collection Solutions, FastFunds from June 7, 2004, and FastFunds International Limited from July 15, 2004.

In light of the foregoing, and the Company’s sale of substantially all of its assets in January 2006, the historical data presented below is not indicative of, and therefore, not useful for purposes of predicting future results. You should read this information in conjunction with the audited consolidated financial statements of the Company, including the notes to those statements (Item 8), and the following “Management’s Discussion and Analysis of Financial Conditions and Results of Operations”.

The Company’s financial statements for the year ended December 31, 2006 have been prepared on a going concern basis, which contemplates the realization of its remaining assets and the settlement of liabilities and commitments in the normal course of business. The Company has incurred significant losses since its inception and has a working capital deficit of $5,564,701, and an accumulated deficit of $12,153,214 as of December 31, 2006. Moreover, it presently has no ongoing business operations or sources of revenue, and little available resources with which to obtain or develop new operations.

These factors raise substantial doubt about the Company’s ability to continue as a going concern. There can be no assurance that the Company will have adequate resources to fund future operations or that funds will be available to the Company when needed, or if available, will be available on favorable terms or in amounts required by the Company. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

On January 31, 2007, FFFC announced that it executed a letter of intent to acquire Industrial Systems, Inc. ("ISI"). ISI, founded in 1991 and based in Delta, Colorado, provides turn-key engineering procurement and construction services to the mining, energy and natural resources industries throughout the United States. The letter of intent calls for FFFC to acquire 100% of the outstanding securities of ISI in an all stock tax-free exchange. While specific details are being negotiated as part of a definitive agreement, terms of the letter of intent call for the existing stockholders of ISI to own approximately 65% of the Company's common stock at closing of the transaction, with the potential to earn an estimated additional 6% based on post-closing incentives. Completion of the transaction is subject to further due diligence by each party, negotiation and execution of a definitive agreement, and other customary pre-closing conditions, and if consummated, is anticipated to occur during the quarter ending June 30, 2007. If consummated, this transaction would likely be accounted for as a public shell merger or a reverse acquisition with the Company being treated for financial reporting purposes as the accounting acquiree.

(a) Liquidity and Capital Resources

For the year ended December 31, 2006, net cash used in operating activities was $4,145,264 compared to net cash provided by operating activities of $94,882 for the year ended December 31, 2005. Due to the Asset Sale in January 2006, location gross margin decreased approximately $3,763,000 for the year ended December 31, 2006 compared to the prior year. Net loss for the year ended December 31, 2006 was $1,409,680 compared to a net loss of $5,906,347 for the year ended December 31, 2005. The significant decrease in the net loss for the year ended December 31, 2006 is the result of the gain on the Asset Sale of $4,145,835, offset by deferred income taxes of $851,000, other expenses of $2,010,754 and other operating losses of $2,693,761. Non-cash adjustments to the net loss for the year ended December 31, 2006 were approximately $3,437,000 and consisted primarily of $1,237,000 of non-cash expenses related to debt extinguishment costs, non-cash interest expense of $765,000, depreciation and amortization of $602,000, provision for losses including bad debt expense of $478,000 and stock-based compensation of $355,000. Non-cash expenses for the year ended December 31, 2005 were approximately $4,578,000 and consisted primarily of non-cash interest expense related to warrants and beneficial conversion features in convertible notes payable of $1,715,000, depreciation and amortization of $1,748,000 and deferred income tax expense of $993,000.

Cash provided by investing activities for the year ended December 31, 2006 was $12,803,245 compared to cash used in investing activities of $2,087 for the year ended December 31, 2005. Net cash provided by investing activities for the year ended December 31, 2006, was attributable to the net proceeds on the Asset Sale of $12,642,784 and $160,461 received in payments on notes receivable. Net cash used in investing activities for the year ended December 31, 2005 was the result of purchases of property and equipment of $729,077, advances made on notes receivable of $86,073, reduced by payments received on notes receivables of $813,063.

Cash used in financing activities for the year ended December 31, 2006 was $16,878,044 compared to $257,883 for the year ended December 31, 2005. The 2006 activity includes the Company receiving $450,000 upon the issuance of notes payable, as well as receiving $400 from repayments on parent company notes receivable. The Company utilized such proceeds and the proceeds from the Asset Sale to repay notes payable and long-term debt of $9,593,497, convertible promissory notes of $1,012,500, advances of $5,424,769 to HPI and purchased 41,858 shares of HPI common stock for $192,299. The 2005 activity includes an increase in a bank overdraft of $1,105,379, as well as borrowings on notes and loans payable of $2,036,000 and proceeds from the sale of HPI stock of $220,329. The Company repaid a total of $3,453,552 on various debt instruments.

For the year ended December 31, 2006, net cash decreased $8,220,063 compared to $165,088 for the year ended December 31, 2005. Ending cash at December 31, 2006, was $53,190 compared to $8,273,253 at December 31, 2005.

Other sources available to us that we may utilize include the sale of equity securities as well as the exercise of stock options and/or warrants, all of which may cause dilution to our stockholders. We may also be able to borrow funds from related and/or third parties.

Contractual obligations for future payments under existing debt and lease commitments at December 31, 2006, were as follows:

Contractual Obligation | | Total | | Less than one year | | 1-3 years | | 3-5 years | | More than 5 years |

| | | | | | | | | | | |

Notes payable (1) | | $2,108,000 | | | | | | | | |

| Convertible promissory | | | | | | | | | | |

| Notes | | | | | | | | | | |

Long-term debt (2) | | 50,000 | | | | | | | | |

| Operating lease obligations | | | | | | | | | | |

| | | | | | | | | | | |

| Total | | $2,158,000 | | | | | | | | |

(1) Notes are unsecured, matured February 28, 2007. The Company renewed $283,000 of the Notes on the same terms and conditions as previously existed. In April 2007 the Company, through a financial advisor, restructured $1,825,000 of the Notes (the “Restructured Notes”). The Restructured Notes carry a stated interest rate of 15% and mature on February 28, 2008. Of the Restructured Notes, $150,000 and $175,000, respectively, have 90 day and 120 day provisions, whereby the noteholder can request repayment.

(2) Long-term debt excludes discounts on certain notes payable of $20,419.

(b) Results of operations.

Critical Accounting Policies and Estimates

Preparation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheets and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Moreover, except as described below, we do not employ any critical accounting policies that are selected from among available alternatives or require the exercise of significant management judgment to apply.

We believe that the following are some of the more critical accounting policies that currently affect our financial condition and results of operations:

| | 1) | stock based compensation; and, |

| | 2) | income taxes, deferred taxes |

Stock Based Compensation

Share-based compensation expense is based on the estimated fair value at the grant date of the portion of share-based payment awards that are ultimately expected to vest during the period. The grant date fair value of stock-based awards to employees and directors is calculated using the Black-Scholes option pricing model. The assumptions used in the Black-Scholes option pricing model, particularly the Company’s estimates of expected term and volatility, are based in some respects on management’s judgments and historical trends. Compensation expense for the share-based payment awards granted subsequent to December 31, 2005, are based on the grant date fair value estimated in accordance with the provisions of SFAS No. 123(R).

Income Taxes, Deferred Taxes

The operations of the Company for periods subsequent to the acquisition of the Company by HPI (then known as Equitex) and through August 2004, at which time HPI’s ownership interest fell below 80% are included in consolidated federal income tax returns filed by HPI. Subsequent to August 2004 and through January 29, 2006, the Company will file a separate return. As of January 30, 2006, HPI’s ownership interest again exceeded 80% and the operations of the Company will be included in a consolidated federal income tax return from that date forward. However, for financial reporting purposes, the Company’s provision for income taxes has been computed as if the Company were to file a separate income tax return.

In prior years the Company recorded a valuation allowance to reduce its deferred tax assets to the amount, if any, then deemed more likely than not to be realized. The Company considers future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for the valuation allowance. During 2006, the Company removed its deferred tax valuation allowance and utilized the remainder of its deferred tax assets related to net operating losses to offset the taxable gain resulting from the Asset Sale. In addition, during 2006 the Company utilized a portion of HPI’s net operating losses to offset the remainder of 2006 taxable income resulting in a payable due to HPI. See RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS below for a discussion of the likely future effect of adopting Financial Accounting Standards Board (“FASB”) Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes: an interpretation on FASB Statement No. 109.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In July 2006, the FASB issued Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes: an interpretation of FASB Statement No. 109. This interpretation clarifies the accounting for uncertainty in income taxes recognized in an entity’s financial statements in accordance with SFAS No. 109, “Accounting for Income Taxes”. FIN 48 prescribes a recognition threshold and measurement principles for financial statement disclosure of tax positions taken or expected to be taken on a tax return. This interpretation will be effective for the first quarter of 2007. The Company is currently assessing the impact the adoption of FIN 48 will have on its consolidated financial statements and expects that it may be material.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements. This statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. This statement applies under other accounting pronouncements that require or permit fair value measurements. SFAS in February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities, including an amendment to FASB No. 115. SFAS No. 159 will permit companies the option to choose to measure many financial instruments and other items at fair value. SFAS Nos. 157 and 159 will be effective for the Company’s fiscal year 2008. The Company is currently assessing the impact, if any, that adoption of SFAS Nos. 157 and 159 will have on its consolidated financial statements.

Results of operations

Results of continuing operations for the year ended December 31, 2006 vs. December 31, 2005

REVENUES

Total revenues for 2006 were $2,192,382 compared to $18,531,141 for 2005. Effective January 31, 2006, the Company sold substantially all of its assets and accordingly, the current year results reflect one-month of fees from providing financial services of $1,714,882, as well as $477,500 of fees received under the TSA from the buyer of the assets. Revenues of $18,531,141 for 2005 were the result of fees derived from providing financial services.

OPERATING EXPENSES

LOCATION EXPENSES

Chex location expenses for 2006 were $1,200,185 compared to $13,766,007 for the year ended December 31, 2005 were $13,776,007. The decrease is a result of the sale of substantially all of the assets that were generating revenues and their associated costs at January 31, 2006.

CORPORATE OPERATING (INCOME) EXPENSES

Corporate operating expenses for 2006 were $3,680,045 and $6,496,681 for 2005. The expenses were comprised of the following:

| | | 2006 | | 2005 | |

| | | | | | |

| Salaries and benefits | | $ | 465,125 | | $ | 1,897,250 | |

| Stock-based compensation | | | | | | 9,500 | |

| Accounting, legal and consulting | | | 1,457,345 | | | 1,264,850 | |

| Travel and entertainment | | | 66,967 | | | 336,479 | |

| Advertising | | | 3,446 | | | 155,114 | |

| Depreciation and amortization | | | 351,710 | | | 1,283,408 | |

| Provision for valuation allowances and bad debt expense | | | 478,184 | | | 111,199 | |

| Other | | | 857,268 | | | 1,438,881 | |

| | | | | | | | |

| | | $ | 3,680,045 | | $ | 6,496,681 | |

Corporate operating expenses include Chex’s Minneapolis administrative office which through January 31, 2006, supported the operating locations and was closed on May 31, 2006, and also includes for 2005 those expenses associated with FFI’s London and Chicago offices. As of June 2005, the London and Chicago offices have been closed.

Salaries and related costs decreased significantly for 2006 compared to the year ended December 31, 2005 period primarily as a result of the elimination of the corporate staffing of FFI’s London office, as well as the reduction of the Minneapolis administrative staff during the second quarter of 2006. As of May 31, 2006, the Company vacated that office and will not be incurring any future staffing costs related to the Chex operations.

Accounting, legal and consulting expenses increased for the year ended December 31, 2006 compared to 2005. The increase for the year ended December 31, 2006 was primarily as a result of an increase in consulting fees of approximately $648,000, for costs associated with the refinancing of investor notes. The 2006 costs were comprised of $134,972 of cash, $224,215 of HPI common stock and the issuance of 436,206 FastFunds warrants to purchase common stock at $1.00 per share, valued at $355,000 under the Black-Scholes option pricing method. In addition, FFFC has entered into consulting agreements with a financial advisor and individuals who provide various consulting services to the Company. These continuing agreements require the Company to pay approximately $15,000 per month. This increase partially was offset by decreases of

approximately $282,000, $100,000 and $52,000, respectively for professional fees, other advisory fees and director fees.

Travel and entertainment expense decreased for the year ended December 31, 2006 compared to December 31, 2005 primarily as a result of the elimination of travel associated with the closure of the Company’s London and Chicago offices during the second quarter of 2005 and the Minneapolis office in the second quarter of 2006.

In June 2006, the Company decreased the valuation allowance on a customer receivable that previously had been fully provided for as the Company negotiated a settlement with the customer and received $135,000 in July 2006. Additionally, $140,000 was paid in January 2007 and the Company also reduced the valuation allowance by $140,000. The valuation allowance on a related party receivable (including interest of $63,392) and a note receivable was increased by $268,392 and $50,000, respectively during the second quarter. Additionally, approximately $300,000 of bad debt expense related to the settlement of receiving $1.2 million shares of HPI common stock for amounts owed, and the write-off of a stock subscription receivable of $135,000 as part of a settlement. The valuation allowance on the note receivable from the estate of a deceased officer was decreased by $90,000 for the nine months ended September 30, 2005. Shares of HPI common stock collateralized the note and the allowance was adjusted accordingly based on the value of the underlying collateral. This note was repaid during 2005.

Other costs included in corporate operating expenses decreased for the year ended December 31, 2006 compared to the year ended December 31, 2005. The decrease for the year ended December 31, 2006 was a result of approximately $625,000 of expenses incurred in the fourth quarter 2005 that did not occur in 2006. These 2005 expenses included restructuring costs associated with closing our London office and the operations of FFI, as well as costs associated with terminating certain contracts. During the year ended December 31, 2005, these decreases were partially offset by increases in 2006, including the write-down of $146,553 of property and equipment, and costs of approximately $130,000 related to the closure of the Minneapolis office.

OTHER INCOME (EXPENSE)

Other expense, net for the year ended December 31, 2006 was $2,010,754 compared to expenses of $3,143,294 for the year ended December 31, 2005. Interest expense for the year ended December, 2006 and 2005 is summarized as:

| | | 2006 | | 2005 | |

| | | | | | |

| Beneficial conversion features | | $ | 586,521 | | $ | 1,487,767 | |

| HPI $5 million note payable | | | 17,533 | | | 261,928 | |

| Notes payable to individual investors | | | 491,169 | | | 1,237,703 | |

| Amortization of note discounts | | | 242,377 | | | 523,146 | |

| Other | | | 501 | | | 20,154 | |

| | | | | | | | |

| | | $ | 1,338,101 | | $ | 3,530,698 | |

Interest income increased to $564,296 for the year ended December 31, 2006 from $387,404 for the year ended December 31, 2005. The increase for the year ended December 31, 2006 was due primarily to the interest income of approximately $400,000 recorded on the $5.0 million HPI Note issued in March 2006. Also included in other expenses for the year ended December 31, 2006, was $670,000 of costs related to the extinguishment of convertible notes payable due from third parties in exchange for the issuance of 180,000 shares of parent company common stock. In addition, the Company recorded $493,067 of expense related to the settlement of $200,000 of convertible debt. The settlement terms stipulate a registration rights penalty clause and a price protection clause whereby HPI must reimburse the former debt holders if the market price of the HPI common stock issued to them in the settlement is below $4.00 per share at the time they sell the stock. As a result, the Company has recorded a liability of $493,067, of which $450,000 at December 31, 2006 represented the difference between the market value of the shares issued as of December 31, 2006 and the $4.00 stated in the settlement agreement, and costs incurred due to late registration of the 180,000 shares of common stock.

INCOME TAX EXPENSE

Income tax expense for the year ended December 31, 2006 was $856,913 compared to $1,021,506 for the year ended December 31, 2005. The 2006 amount is primarily related to $851,000 the Company recorded as deferred income tax expense as a result of the Asset Sale in January 2006. This expense represents the use of HPI’s net operating losses, as the Company does not have sufficient loss carryforwards available to offset the total taxable gain on the Asset Sale.

Results of continuing operations for the year ended December 31, 2005 vs. December 31, 2004

REVENUES

Consolidated revenues for the year ended December 31, 2005 were $18,531,141 compared to revenues of $15,233,735 for the year ended December 31, 2004.

Chex recognizes revenue at the time certain financial services are performed. For the periods presented, revenues were derived from check cashing fees, credit and debit card advance fees, and automated teller machine (“ATM”) surcharge and transaction fees. Chex revenues were comprised of:

| | | 2005 | | 2004 | |

| | | | | | | | | | | | | | |

| | | Number of Transactions | | Dollars Handled | | Earned Revenues | | Number of Transactions | | Dollars Handled | | Earned Revenues | |

| | | | | | | | | | | | | \ | |

| Personal checks | | | 661,579 | | $ | 128,036,112 | | $ | 6,227,598 | | | 674,195 | | $ | 125,011,732 | | $ | 6,361,227 | |

| “Other” checks | | | 289,272 | | | 98,009,404 | | | 943,102 | | | 261,662 | | | 88,555,373 | | | 822,140 | |

| Credit cards | | | 253,368 | | | 91,944,873 | | | 5,610,570 | | | 219,354 | | | 76,272,507 | | | 3,544,278 | |

| Debit cards | | | 47,176 | | | 14,759,419 | | | 399,916 | | | 36,442 | | | 11,201,804 | | | 174,592 | |

| ATM transactions | | | 2,628,895 | | | 241,569,619 | | | 4,887,250 | | | 2,008,275 | | | 176,176,451 | | | 3,807,382 | |

| NSF Collection fees | | | - | | | - | | | 368,247 | | | - | | | - | | | 413,142 | |

| Other | | | - | | | - | | | 94,458 | | | - | | | - | | | 110,974 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | 3,880,290 | | $ | 574,319,427 | | $ | 18,531,141 | | | 3,199,928 | | $ | 477,217,867 | | $ | 15,233,735 | |

Prior to the Asset Sale, Chex cashed personal checks at its cash access locations for fees based upon a percentage of the face amount of the check cashed per each casino contract. Chex also cashed "other" checks, comprised of tax and insurance refunds, casino employee payroll checks and casino jackpot winnings.

Chex credit/debit card cash advance services allowed patrons to use their VISA, MasterCard, Discover and American Express cards to obtain cash. In July 2004, Chex began using its own proprietary credit and debit cash advance platform to process cash advance transactions. Accordingly, for the year ended December 31, 2005, Chex recorded additional revenues of approximately $1,473,000 compared to the year ended December 31, 2004 due to the new software and approximately $818,000 due to increased transactions and volume. During the year ended December 31, 2004, third party vendors, at their expense, supplied, installed and maintained the equipment to operate the cash advance system. Under vendor agreements, the vendor charges each customer a services fee based upon the cash advance amount and paid a portion of such service fee to Chex.

ATM surcharge and transaction fees reflected in the table above are comprised of upfront patron transaction fees or surcharges assessed at the time the transaction is initiated and a percentage of interchange fees paid by the patron’s issuing bank. These issuing banks share the interchange revenue with the Company. Upfront patron transaction fees are recognized when a transaction is initiated, and interchange revenue is recognized on a monthly basis based on the total transactions occurring during the month.

Chex utilized its own in-house collections department to pursue collection of returned checks, and generally charges an insufficient funds fee when it ultimately collects the check.

LOCATION EXPENSES

Chex location expenses were $13,776,007 for the year ended December 31, 2005 compared to $11,291,510 for the year ended December 31, 2004. Chex location expenses were comprised as follows:

| | 2005 | | 2004 |

| | | | | | |

| Fees to casinos | $ | 6,458,907 | | $ | 5,312,522 |

| Salaries and related costs | | 3,120,414 | | | 3,098,663 |

| Processing fees | | 2,154,421 | | | 838,292 |

| Returned checks, net of collections | | 525,064 | | | 623,871 |

| Selling, general and administrative | | 1,517,201 | | | 1,418,162 |

| | | | | | |

| | $ | 13,776,007 | | $ | 11,291,510 |

Fees to casinos were comprised of compensation paid to the casino pursuant to the terms of each financial services agreement that the company has entered into with the respective establishment. At locations where Chex provided check-cashing services, Chex paid the location operator a commission based upon the monthly amount of checks cashed or a fixed percentage of the net income from operations at that location. Chex passed on an agreed upon percentage of the surcharge commissions to the locations where ATM’s are utilized. At the locations at which Chex used third party vendors to provide credit/debit card advance services, it paid the operator a commission for each completed transaction. For the locations where Chex’s proprietary product was used, Chex paid a fee to the casino based on the fees it received from processing the transaction. For these transactions, Chex also incurred a cost of processing the transaction. Chex began installing its proprietary product in July 2004, and therefore, processing fees were significantly higher in the 2005 period compared to the 2004 period.

For the periods reflected above, Chex generally recorded a returned check expense for potential losses in the period such checks were returned.

Selling, general and administrative expenses for locations included bank charges, depreciation, communications, insurance, licensing, collections and travel and entertainment.

CORPORATE OPERATING EXPENSES

Corporate operating expenses for the year ended December 31, 2005, were $6,496,681 compared to $6,752,919 for the year ended December 31, 2004. The expenses were comprised of the following:

| | 2005 | | 2004 |

| | | | | | |

| Salaries and related costs | $ | 1,897,250 | | $ | 2,168,770 |

| Accounting, legal and consulting | | 1,264,850 | | | 934,571 |

| Travel and entertainment | | 336,479 | | | 422,595 |

| Advertising | | 155,114 | | | 220,059 |

| Allocated expenses from Equitex | | | | | 91,000 |

| Depreciation and amortization | | 1,283,408 | | | 1,233,968 |

| Provision for valuation losses and bad debt expense | | 111,199 | | | 462,500 |

| Other | | 1,438,881 | | | 967,456 |

| Stock-based compensation | | 9,500 | | | 252,000 |

| | | | | | |

| | $ | 6,496,681 | | $ | 6,752,919 |

Corporate operating expenses include Chex’s Minneapolis administrative office, which supported the operating locations and also includes for part of the year ended December 31, 2005, those expenses associated with FFI’s London and Chicago offices. As of June 2005, the London and Chicago offices have been closed and the Company will incur no further expenses related to these locations.

Salaries and related costs decreased for year ended December 31, 2005 compared to the year ended December 31, 2004 period primarily as a result of the elimination of the corporate staffing of FFI’s London office.

Accounting, legal and consulting expenses increased for the year ended December 31, 2005 compared to the year ended December 31, 2004. The increase for the year ended December 31, 2005 was primarily the result of an increase in consulting fees of approximately $107,000. In 2004 FFI hired marketing and sales consultants to assist the Company in entering the stored-value card international market in the gaming and retail industries. As a result of no revenues being generated to offset these operating costs in June 2005, the Company terminated certain sales and marketing consulting and advisory agreements that previously required the Company to pay approximately $36,000 per month. In addition, FastFunds has entered into various consulting agreements with a financial advisor and individuals who provide various consulting services to the Company. These continuing agreements require the Company to pay approximately $15,000 per month.

The stock based compensation expense of $9,500 for the year ended December 31, 2005 was a result of the Company’s issuing 20,000 options to purchase FastFunds common stock at $1.10 per share to an officer of the Company for services. The stock-based compensation expense of $252,000 for the year ended December 31, 2004 was a result of HPI, then known as Equitex, distributing to Chex employees 280,000 of the 800,000 warrants to purchase FastFunds common stock at $0.10 per share it received in the Merger. The warrants were determined to have a fair value of $1.00 on the distribution date.

Travel and entertainment expense decreased for the year ended December 31, 2005 compared to December 31, 2004 primarily as a result of the elimination of travel associated with consultants and the closure of the Company’s London and Chicago offices.

Prior to July 1, 2004, HPI, then known as Equitex, was incurring certain general and administrative expenses on behalf of Chex that were allocated by HPI to Chex. Beginning July 1, 2004, Chex and FastFunds began incurring these expenses on their own behalf, and accordingly, there is no longer an allocation from HPI.

Depreciation and amortization increased for the year ended December 31, 2005 compared year ended December 31, 2004 primarily as a result of increased depreciation as a result of additional fixed assets, as well as the amortization of deferred loan costs.

The provision for losses decreased to $111,119 for the year ended December 31, 2005 from $462,500 for the year ended December 31, 2004. The 2005 provision for losses was comprised of allowances of $100,000 and $65,532 on notes and accounts receivable, write-off of bad debts of $44,567, offset by a $90,000 reduction on the note receivable allowance of a deceased officer. The 2004 provision for losses was comprised of a $236,500 allowance on a note receivable, as well as $226,000 on a note receivable from a deceased officer.

Other costs included in corporate operating expenses increased for the year ended December 31, 2005 compared to the year ended December 31, 2004. The increase for the year ended December 31, 2005 was caused by the loss on disposal of approximately $296,000 of hardware and software assets. Additional expenses were incurred related to a contract buyout of approximately $220,000, director’s compensation of $150,000, costs of $108,000 incurred in connection with the closure of the Company’s London and Chicago offices and directors and officers insurance of approximately $106,000.

OTHER INCOME (EXPENSE)

Other expense, net for the year ended December 31, 2005 was $3,143,294 compared to $1,455,411 for the year ended December 31, 2004. Interest expense for the year ended December 31, 2005 was $3,530,698 compared to $1,910,974 for the year ended December 31, 2004. The primary reason for the increase was an increase in interest expense of approximately $1,314,000 related to the beneficial conversion features on convertible promissory notes. Interest income decreased to $387,404 for the year ended December 31, 2005, from $455,563 for the year ended December 31, 2004. The decrease was due primarily to the interest income of $96,111 recorded in the 2004 period on the $2.0 million iGames Note.

INCOME TAX EXPENSES

Income tax expense for the year ended December 31, 2005 was $1,021,506 compared to $521,889 for the year ended December 31, 2004. The 2005 amount is primarily related to $993,000 the Company recorded as deferred income tax expense as a result of the Asset Sale in January 2006. In 2004, during the quarter ended June 30, 2004, management reassessed the realization of its recorded deferred tax assets. Based on this assessment, management concluded, that it was more likely than not that existing deferred tax assets would not be realizable, and determined a valuation allowance was required for recorded deferred tax assets. Accordingly, the Company’s valuation allowance was increased by $473,000 during the second quarter of 2004, which resulted in an increase to the provision for income taxes of the same amount.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates and a decline in the stock market. The Company does not enter into derivatives or other financial instruments for trading or speculative purposes. The Company has limited exposure to market risks related to changes in interest rates. The Company does not currently invest in equity instruments of public or private companies for business or strategic purposes.

The principal risks of loss arising from adverse changes in market rates and prices to which the Company and its subsidiaries are exposed relate to interest rates on debt. The Company has only fixed rate debt. Chex has $2,158,000 (before certain discounts on notes) of debt outstanding as of December 31, 2006, of which $2,108,000 has been borrowed at fixed rates ranging from 9% to 12%. This fixed rate debt is subject to renewal quarterly or annually and was due February 28, 2007. The fixed rate debt was restructured and the new fixed rate range effective March 1, 2007 is from 10% to 15%. This change in the fixed rate of interest is expected to increase interest expense by approximately $100,000 for the year ending December 31, 2007.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The financial statements are listed under Item 15.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

Not applicable.

ITEM 9A. CONTROLS AND PROCEDURES.

Under the supervision and with the participation of management, including our acting chief executive officer, we conducted an evaluation of the effectiveness of the design and operation of disclosure controls and procedures as of December 31, 2006 (the “Evaluation Date”). Based on this evaluation, the Company’s acting chief executive officer concluded that as of the Evaluation Date, our disclosure controls and procedures were effective at ensuring that the material information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported as required in applicable SEC rules and forms, except as noted below.

In connection with the 2006 audit, our independent registered public accounting firm has advised us and our Board of Directors that there are material weaknesses in our internal controls and procedures. The identified material weaknesses primarily relate to the limited number of Company employees engaged in the authorization, recording, processing and reporting of transactions, as well as the overall financial reporting process. These material weaknesses have caused significant delays in our financial reporting process. In addition, during the 2006 audit, we were not able to timely produce adequate documentation supporting all transactions underlying the financial statements. We are currently considering taking certain steps to correct the material weaknesses by enhancing our reporting process in future. Enhancing our internal controls to correct the material weaknesses will result in increased costs to us.

Additionally, there were no significant changes in our internal controls during the quarter ended December 31, 2006, or in other factors that could significantly affect these controls subsequent to the Evaluation Date.

ITEM 9B. OTHER INFORMATION

Not applicable.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

(a)(b)(c) Identification of directors, executive officers and certain significant persons

| Name | | Age | | Offices Held | | Length of service |

| | | | | | | |

| Henry Fong | | 70 | | Chairman | | Since June 2004 |

| | | | | | | |

| Thomas B. Olson | | 40 | | Secretary | | Since June 2004 |

| | | | | | | |

| James Welbourn | | 56 | | Director and President | | Since June 2004, Resigned January 2, 2007 |

| | | | | | | |

| Aaron A. Grunfeld | | 60 | | Director | | Since June 2004 |

Our directors hold office until the next annual meeting of the stockholders and until their respective successors have been elected and qualified. Officers are appointed by our Board of Directors and hold office until their successors are duly elected and qualified.

No arrangement exists between any of the above officers and directors pursuant to which any one of those persons was elected or appointed to such office or position.

(d) Family relationships.

Not applicable.

(e) Business experience.

HENRY FONG

Mr. Fong became the Company’s chairman and chief executive officer upon the effectiveness of the Merger. In July 2004, Mr. Graham Newall was hired as the chief executive officer. Mr. Fong has served in a variety of roles for other public corporations. Mr. Fong has been the president, treasurer and a director of Equitex from its inception in January 1983 to January 2007. Mr. Fong has been president and a director of Equitex 2000, Inc. since its inception in 2001. Mr. Fong has been President and a Director of Torpedo Sports USA, Inc. since March 2002. Torpedo Sports USA, Inc. is a publicly traded manufacturer and distributor of recreational equipment. Mr. Fong has been president and a director of Inhibiton Therapeutics, Inc. since its inception in May 2004. Inhibiton Therapeutics, Inc. is a publicly traded company performing research and development on new cancer therapies. From December 2000 to January 2002, Mr. Fong was a director of Popmail.com, Inc., a publicly traded Internet marketing company. From 1959 to 1982 Mr. Fong served in various accounting, finance and budgeting positions with the Department of the Air Force. During the period from 1972 to 1981 he was assigned to senior supervisory positions at the Department of the Air Force headquarters in the Pentagon. In 1978, he was selected to participate in the Federal Executive Development Program and in 1981, he was appointed to the Senior Executive Service. In 1970 and 1971, he attended the Woodrow Wilson School, Princeton University and was a Princeton Fellow in Public Affairs. Mr. Fong received the Air Force Meritorious Civilian Service Award in 1982. Mr. Fong has passed the uniform certified public accountant exam. In March 1994, Mr. Fong was one of twelve CEOs selected as Silver Award winners in FINANCIAL WORLD magazine’s corporate American “Dream Team.”

THOMAS B. OLSON

Mr. Olson became the Company’s secretary upon the effectiveness of the Merger. Mr. Olson also served as secretary of Equitex from January 1988 to April 2007, and has been a director of Chex since May 2002. Since March 2002, Mr. Olson has been the secretary of Torpedo Sports USA, Inc., a publicly traded manufacturer and distributor of recreational equipment. Mr. Olson has been Secretary of Equitex 2000, Inc. since its inception in 2001. Mr. Olson has been secretary of Inhibiton Therapeutics, Inc. since its inception in May 2004. Inhibiton Therapeutics, Inc. is a publicly traded company performing research and development on new cancer therapies. From August 2002 to July 2004, Mr. Olson was the secretary of El Capitan Precious Metals, Inc., a publicly

traded company with ownership interest in a mining property. Mr. Olson has attended Arizona State University and the University of Colorado at Denver.

AARON A. GRUNFELD

Mr. Grunfeld became a director of the Company’s upon the effectiveness of the Merger. Mr. Grunfeld was a director of Equitex from November 1991 to December 2006. Mr. Grunfeld has been a director of Equitex 2000, Inc. since its inception in 2001. Mr. Grunfeld has been engaged in the practice of law since 1971 and has been of counsel to the firm of Resch Polster Alpert & Berger, LLP, Los Angeles, California from November 1995 to August 2006. Since August 2006 he has practiced law as a principal of Law Offices of Aaron A. Grunfeld and Associates. Mr. Grunfeld received an A.B. in Political Science from UCLA in 1968 and a J.D. from Columbia University in 1971. He is a member of the California Bar Association.

JAMES P. WELBOURN

Mr. Welbourn became a director and president of the Company upon effectiveness of the Merger and resigned as a director in January 2007. Mr. Welbourn is a founder of Chex and was the President and Chief Executive Officer of Chex since it’s inception in 1992 through January 31, 2005. He also served as Chairman of the Chex’ Board of Directors. Mr. Welbourn also serves on the board of directors of Denaris, Inc., a subsidiary of Equitex, whose primary business is developing private network and specialty use programs for “Stored Value Cards” and on the board of directors of Paymaster Jamaica, a Kingston, Jamaica company that provides bill pay and other products and service throughout the island. Mr. Welbourn graduated from Marquette University with a degree in Education and earned his MBA degree from George Williams College. Mr. Welbourn has been selected as an honored professional of the National Directory of Who’s Who in Executive and Professionals from 1996 through 2002 and was appointed to the Business Advisory Council in 2001 and the Presidents Business Commission in 2002.

(f) Involvement in certain legal proceedings.

Not applicable.

(g) Promoters and control persons.

Not applicable.

(h) Audit committee financial expert.

See (i) below.

(i) Identification of the audit committee

The Company does not currently have an audit committee of the board of directors, as none is required, and the board believes it can effectively serve in that function and, therefore, currently does. Management believes that certain individuals on the board of directors may have the necessary attributes to serve as a financial expert on an audit committee, if required.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater-than-10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. We believe that during 2006, based solely on a review of the copies of such forms furnished to us during 2006 and written representations from the executive officers, directors and greater-than-10% beneficial owners of our common stock, have complied with all Section 16 filing requirements.

CODE OF ETHICS

We have adopted a Code of Ethics for our senior financial management, which includes our chief executive officer and chief financial officer as principal executive and accounting officers, that has been filed as an exhibit to this report.

ITEM 11. EXECUTIVE COMPENSATION.

Compensation Discussion and Analysis

Equity Compensation

Mr. Michael Casazza became our chief executive officer on May 26, 2005. In July 2005, the Company’s Board of Directors authorized a proposal for a stock based compensation plan (the “Plan”) for the Company’s CEO. In August 2005, the Board of Directors retained an independent consultant to review the Plan for reasonableness. As a result of that review, in September 2005, the board of directors approved the Plan, which consists of the following: i) a warrant to purchase up to 125,000 shares of the Company’s $.001 par value common stock for a period of three years at an exercise price of $1.81 per share (the 10 day average market price of the stock from the date of the proposal); ii) a number of shares of common stock of the Company based on 5% of the increase in the market value of the Company’s common stock on an annual basis; and, iii) a grant of 125,000 options under FastFunds 2004 Stock Option Plan. Each option has an exercise price of $1.10 (the market value of the common stock on the date of grant) with an expiration of September 2015. Mr. Casazza resigned December 15, 2006.

Mr. Ijaz Anwar became the chief financial officer of FastFunds in June 2005 and became the chief operating officer of FastFunds in July 2004. From September 2002 until February 2006, Mr. Anwar served as the chief financial officer and treasurer of Chex and from March 2002 through August 2002 Mr. Anwar served as the controller of Chex. Mr. Anwar resigned from his positions with Chex and FastFunds effective as of February 22, 2006.

Mr. Anwar entered into an employment agreement with Chex on March 1, 2003. Under that agreement, Mr. Anwar received a base compensation of $50,092, $141,115 and $119,011 for the years ended December 31, 2006, 2005 and 2004, respectively. The employment agreement terminated upon Mr. Anwar’s resignation from the Company on February 22, 2006.

Cash Incentive Bonuses

We had no cash incentive bonus program in effect for 2006.

Severance and Change-in-Control Benefits

We had no provisions for mandatory severance benefits in the event of a termination of change of control of the Company.

We have no plan or arrangement with respect to any officer’s of the Company that will result from a change in control of the Company or a change in the individual’s responsibilities following a change in control. For descriptions of applicable employment agreements and arrangements, please refer to the above paragraph (a) of this Item.

Other Benefits

Through the Asset Sale on January 31, 2006, our executives were eligible to participate in all of our employee benefit plans, such as medical, dental, vision, group life and disability insurance on the same basis as our other employees.

We currently have no benefit plan.

Summary Compensation Table

The following table sets forth information regarding compensation paid to our officers during the years ended December 31, 2006, 2005 and 2004:

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqual-ified Deferred Compen-sation Earnings ($) | All Other Compen-sation ($) | Total ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

Michael Casazza (1) Chief Executive Officer | 2006 2005 | $- | | | | | | $275,000 | $275,000 |

Ijaz Anwar (2) Chief Financial Officer | 2006 2005 2004 | 50,092 141,115 119,011 | | | | | | 111,846 11,312 13,160 | 161,932 152,427 132,171 |

James Welbourn (3) | 2006 2005 2004 | 3,738 48,500 166,418 | | | | | | 5,055 46,620 49,592 | 8,793 95,120 216,010 |

| (1) | Mr. Casazza became the chief executive officer May 26, 2005. Mr. Casazza received no base salary during his tenure as chief executive officer. Mr. Casazza received other compensation related to the Asset Sale, guaranty fees and other. Mr. Casazza resigned December 15, 2006. |

| (2) | Mr. Anwar’s all other compensation is comprised of auto allowances of $1,615 (2006), $8,400 (2005) and 2004 and of $231 (2006), $2,912 (2005) and $4,760 (2004) of employer 401(k) match. Additionally, Mr. Anwar received $110,000 for his role in the Asset Sale. Mr. Anwar resigned February 22, 2006. |

| (3) | Mr. Welbourn’s all other compensation is comprised of earned commissions of $4,432 (2006), $40,390 (2005) and $33,205 (2004), an auto allowance of $623 (2006), $6,230 (2005) and $8,400 (2004), and $7,987 (2005) and $7,908 (2004) as a result of employer 401(k) match. Mr. Welbourn resigned January 2, 2007. |

Grant of Plan-Based Awards

There were no equity awards granted to the Company’s executive officers during the year ended December 31, 2006.

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth information regarding each unexercised option held by each of our named executive officers as of December 31, 2006.

| | Option Awards | Stock Awards |

Name | Number of Securities Under-lying Unexer-cised Options (#) Exer-cisable | Number of Securities Under-lying Unexer-cised Options (#) Unexer-cisable | Equity Incentive Plan Awards: Number of Securities Under-lying Unexer-cised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Securities That Have Not Vested (#) | Market Value of Securities That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Securities or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Securities or Other Rights That Have Not Vested ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| Henry Fong | 60,000 | 0 | 0 | $1.10 | 9/15/2015 | 0 | $0 | 0 | $0 |

Option Exercises and Stock Vested Table

The following table shows the number of shares acquired upon exercise of options by each named executive officer during the year ended December 31, 2006 and the number of shares of restricted stock held by each named executive officer that vested during the year ended December 31, 2006.

| | Option Awards | Stock Awards |

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) |

(a) | (b) | (c) | (d) | (e) |

Ijaz Anwar (1) | 63,457 | 0 | 0 | 0 |

(1) Mr. Anwar exercised 70,000 options to purchase common stock in a cashless exercise transaction, utilizing 6,543 options and acquired 63,457 shares of common stock of the Company.

Non-Qualified Deferred Compensation Plans

We have no non-qualified deferred compensation plans currently in effect.

Director Compensation

The following table shows the compensation earned by each of our non-officer directors for the year ended December 31, 2006.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-Qualified Deferred Compensation Earnings | All Other Compensation | Total ($) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

Henry Fong | $25,000 | 0 | 0 | 0 | 0 | 0 | $25,000 |

James Welbourn (1) | $25,000 | 0 | 0 | 0 | 0 | 0 | $25,000 |

| Aaron Grunfeld | $25,000 | 0 | 0 | 0 | 0 | 0 | $25,000 |