U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15 (d) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended: DECEMBER 31, 2007 |

| | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| | SECURITIES EXCHANGE ACT OF 1934 |

| | For transition period from _____ to _____. |

Commission File Number: 000-33053

FASTFUNDS FINANCIAL CORPORATION

(Name of Registrant in its charter)

| NEVADA | 87-0425514 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

319 CLEMATIS STREET, SUITE 703, WEST PALM BEACH, FLORIDA 33401

(Address of principal executive offices)(Zip Code)

Issuer’s telephone number: (561) 514-9042

Securities registered under Section 12 (b) of the Exchange Act:

NONE

Securities registered under Section 12 (g) of the Exchange Act:

COMMON STOCK, $.001 PAR VALUE

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: ¨Yes xNo

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ¨

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Exchange during the past 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 Days: xYes ¨No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer: Large Accelerated Filer ¨, Accelerated Filer ¨, Non-Accelerated Filer x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ¨Yes xNo

The aggregate market value of the voting stock held by non-affiliates of the Registrant was $1,739,166 based on the last sale price of the Registrant's common stock as of the last business day of the Registrants’ most recently completed second fiscal quarter, ($0.51 per share as of June 30, 2007) as reported on the Over-the-Counter Bulletin Board.

The Registrant had 8,175,432 shares of common stock outstanding as of July 31, 2008.

Documents incorporated by reference: None

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the fiscal year ended December 31, 2007, originally filed with the SEC on April 15, 2008, is being filed solely for the purpose of updating the disclosures contained in Exhibit 31.1 - Certification of Principal Executive Officer and Principal Accounting Officer Pursuant to Section 302 of Sarbanes-Oxley Act of 2002.

This Amendment No. 1 on Form 10-K/A does not reflect events occurring after the filing of the original Form 10-K or modify or update those disclosures affected by subsequent events. Except for the items described above or contained in this Amendment, this Amendment continues to speak as of the date of the original Form 10-K, and does not modify, amend or update in any way the financial statements or any other item or disclosures for events occurring after the filing of the original Form 10-K on April 15, 2008.

FASTFUNDS FINANCIAL CORPORATION

FORM 10-K

THIS REPORT MAY CONTAIN CERTAIN “FORWARD-LOOKING” STATEMENTS AS SUCH TERM IS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 OR BY THE SECURITIES AND EXCHANGE COMMISSION IN ITS RULES, REGULATIONS AND RELEASES, WHICH REPRESENT THE REGISTRANT’S EXPECTATIONS OR BELIEFS, INCLUDING BUT NOT LIMITED TO, STATEMENTS CONCERNING THE REGISTRANT’S OPERATIONS, ECONOMIC PERFORMANCE, FINANCIAL CONDITION, GROWTH AND ACQUISITION STRATEGIES, INVESTMENTS, AND FUTURE OPERATIONAL PLANS. FOR THIS PURPOSE, ANY STATEMENTS CONTAINED HEREIN THAT ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE DEEMED TO BE FORWARD-LOOKING STATEMENTS. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, WORDS SUCH AS “MAY”, “WILL”, “EXPECT”, “BELIEVE”, “ANTICIPATE”, “INTENT”, “COULD”, “ESTIMATE”, “MIGHT”, OR “CONTINUE” OR THE NEGATIVE OR OTHER VARIATIONS THEREOF OR COMPARABLE TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS BY THEIR NATURE INVOLVE SUBSTANTIAL RISKS AND UNCERTAINTIES, CERTAIN OF WHICH ARE BEYOND THE REGISTRANT’S CONTROL, AND ACTUAL RESULTS MAY DIFFER MATERIALLY DEPENDING ON A VARIETY OF IMPORTANT FACTORS, INCLUDING UNCERTAINTY RELATED TO ACQUISITIONS, GOVERNMENTAL REGULATION, MANAGING AND MAINTAINING GROWTH, THE OPERATIONS OF THE COMPANY AND ITS SUBSIDIARIES, VOLATILITY OF STOCK PRICE AND ANY OTHER FACTORS DISCUSSED IN THIS AND OTHER REGISTRANT FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION.

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

| (a) | General development of business. |

FastFunds Financial Corporation (“FastFunds”, “FFFC” or the “Company”) is a holding company, organized in Nevada in 1985, formerly operating through its wholly owned subsidiary Chex Services, Inc. (“Chex”). Chex is a Minnesota corporation formed in 1992, and prior to the Asset Sale described and defined in the paragraph below, provided financial services, primarily check cashing, automated teller machine (ATM) access and credit and debit card advances, to customers predominantly at Native American owned casinos and gaming establishments. FastFunds previously existed under the name “Seven Ventures, Inc.” On June 7, 2004, a wholly owned subsidiary of Seven Ventures, Inc. merged with and into Chex (the "Merger”). In the Merger, Hydrogen Power, Inc. (“HPI”), exchanged its 100% ownership of Chex for 7,700,000 shares of the Company’s common stock; representing approximately 93% of the Company’s outstanding common stock immediately following the Merger. On June 29, 2004, the Company changed its name to FastFunds Financial Corporation.

On December 22, 2005, FastFunds and Chex entered into an Asset Purchase Agreement with Game Financial Corporation, pursuant to which FastFunds and Chex agreed to sell substantially all the assets of Chex (the “Asset Sale”). Such assets also represent substantially all of the operating assets of FastFunds on a consolidated basis. On January 31, 2006, FastFunds and Chex completed the Asset Sale for $14 million. Additionally, FastFunds and Chex entered into a Transition Services Agreement with Game Financial pursuant to which FastFunds and Chex agreed to provide certain services to Game Financial to ensure a smooth transition of the sale of the cash access financial services business. HPI agreed to serve as a guarantor of FastFunds and Chex’s performance obligations under the Transition Service Agreement.

On February 28, 2006, HPI (then known as Equitex, Inc.), held a special meeting of shareholders at which two proposals were approved authorizing the acquisition of Hydrogen Power, Inc. (“Old HPI”), through a newly formed wholly-owned Equitex subsidiary as well as certain related common stock issuances. Per the terms of the transaction, as amended, Equitex was obligated to deliver $5 million to Old HPI as a condition to close. On March 14, 2006, FastFunds loaned Equitex the $5 million (the “$5 Million Loan”) for one year at 10% per annum interest. As security for the $5 Million Loan, Equitex pledged to FastFunds all of the common stock of Old HPI. In addition, FastFunds is to receive a profit interest from the operations of Old HPI equal to 10% of the net profit of Old HPI, as defined in the relevant loan documents.

On January 2, 2007, pursuant to the terms of a Redemption, Stock Sale and Release Agreement (the “Redemption Agreement”) by and between HPI and the Company, we (i) redeemed 8,917,344 shares of our common stock held by HPI, (ii) acquired from HPI an aggregate of 5,000,000 shares of common stock of Denaris Corporation, a Delaware corporation (“Denaris”), (iii) acquired from HPI an aggregate of 1,000 shares of common stock of Key Financial Systems, Inc., a Delaware corporation (“Key Financial”), and (iv) acquired from HPI an aggregate of 1,000 shares of common stock of Nova Financial Systems, Inc., a Delaware corporation (“Nova Financial”). Denaris is now a majority owned subsidiary, and Key Financial and Nova Financial are wholly owned subsidiaries of FFFC. Each of Denaris, Nova Financial and Key Financial are inactive entities with no operating or intellectual property assets. The shares of common stock of each entity transferred to us pursuant to the Redemption Agreement constituted all of HPI holdings in each entity. In consideration of the redemption and acquisition of the shares of Denaris, Key Financial and Nova Financial, we released HPI from all outstanding payment obligations, including obligations under the $5 Million Note dated March 14, 2006. The outstanding balance on the $5 Million Note, including principal and interest accrued, as of the date of the Redemption Agreement was $5,402,398. The Company received a fairness opinion from an unaffiliated third party with respect to this transaction.

HPI currently holds 3,500,000 shares of FastFunds common stock, constituting approximately 47% of our outstanding capital stock. So long as HPI holds 10% or more of the outstanding equity or voting interest in the Company, HPI has agreed to vote their shares of our capital stock in the same manner and proportion as other stockholders of the Company vote their shares. As of March 31, 2008, we held 1,541,858 shares of HPI common stock, constituting approximately 5.2% of HPI common stock. Pursuant to the Redemption Agreement, the Company and HPI each provided the other certain registration rights relating to the common stock of such party held by the other party.

On January 18, 2008, the Company filed a complaint in the Superior Court of Washington in King County (the “Superior Court”). The complaint was filed by FastFunds Financial Corporation, Daniel Bishop, Barbara M. Schaper, HF Services LLC, VP Development Corporation, and Gulfstream Financial Partners, LLC (collectively, the “Plaintiffs”) against Dilbagh Singh Gujral, Ricky Gurdish Gujral, Virendra Chaudhary, Gurinder Dilawari, Global Hydrofuels Technology, Inc. (“GHTI”) and Hydrogen Power, Inc. (collectively, the “Defendants”).

Messrs. Chaudhary and Dilawari are directors of HPI. GHTI is the majority shareholder of HPI. Ricky Gurdish Gujral is the former chief executive officer of HPI. The complaint alleges fraud, misappropriation of corporate opportunity and breach of fiduciary duty by the Defendants relating to the merger of Equitex, Inc. and Hydrogen Power, Inc., the Sublicense Agreement with GHTI, and payments to Ricky Gurdish Gujral. The complaint seeks the appointment of a receiver to take possession of the property and assets of the Company and to manage and operate the Company pending completion of the action. The complaint also seeks damages in the excess of $500,000, exemplary damages, attorney’s fees plus interest and costs and any other relief the court finds just and proper. On January 25, 2008, the Superior Court appointed a receiver of HPI with respect to HPI’s assets. On March 11, 2008, Lenders (Note 7) notified the court and the receiver that they were initiating foreclosure proceedings on HPI. The amount claimed by the Lender is approximately $561,000.

On January 29, 2008, FFFC announced that it executed a new non-binding letter of intent to acquire Industrial Systems, Inc. ("ISI"). ISI, founded in 1991 and based in Delta, Colorado, provides turn-key engineering procurement and construction services to the mining, energy and natural resources industries throughout the United States. The letter of intent calls for FFFC to acquire 100% of the outstanding securities of ISI in an all stock tax-free exchange. While specific details are being negotiated as part of a definitive agreement, terms of the letter of intent call for the existing stockholders of ISI to own approximately 65% of the Company's common stock at closing of the transaction, with the potential to earn an estimated additional 6% based on post-closing incentives. Completion of the transaction is subject to FFFC having no liabilities on its balance sheet unless mutually agreed upon, as well as further due diligence by each party, negotiation and execution of a definitive agreement, and other customary pre-closing conditions, and is anticipated to occur during the quarter ending June 30, 2008. If consummated, this transaction would likely be accounted for as public shell merger or a reverse acquisition with the Company being treated for accounting purposes as the accounting acquiree.

As a holding company, from time to time we evaluate opportunities for strategic investments or acquisitions that would complement our current services and products, enhance our technical capabilities or otherwise offer growth opportunities. As a result, acquisition discussions and, in some cases, negotiations may take place and future investments or acquisitions involving cash, debt or equity securities or a combination thereof may result. FastFunds Financial Corporation maintains its principal office at 319 Clematis Street, Suite 703, West Palm Beach, Florida. You can reach us by telephone at (514) 514-9042.

| (b) | Financial information about segments. |

Through January 31, 2006, we operated in one industry segment, cash disbursement services. We no longer have any operations.

| (c) | Narrative description of business. |

Prior to the Asset Sale, Chex operated at casinos, gaming and other retail establishments throughout the United States. At each of these locations Chex provided any one or a combination of: check cashing; credit/debit card cash advance systems; and ATM terminals. Chex either staffed the locations with its personnel or provided its products and services to the locations based upon the contract with the location.

Chex’s services were provided pursuant to the terms of financial services agreements entered into with each respective establishment. These agreements specified which cash access services were to be provided by Chex, the transaction fees to be charged by Chex to patrons for each type of cash access transaction, and the amount of compensation to be paid by Chex to the location. Pursuant to all of these agreements, Chex maintained the exclusive rights (with rare exception) to provide its services for the term of the contract.

Subsequent to the Asset Sale, the Company has not conducted operations and is the process of locating a business to acquire. The Company currently employs one full-time employee.

ITEM 1A. RISK FACTORS

The purchase of shares of the Company’s common stock is very speculative and involves a very high degree of risk. An investment in the Company is suitable only for the persons who can afford the loss of their entire investment. Accordingly, investors should carefully consider the following risk factors, as well as other information set forth herein, in making an investment decision with respect to securities of the Company.

RISKS ASSOCIATED WITH OUR COMPANY AND HISTORY:

We have no operating business and therefore no revenues. We have also posted significant losses in each of the past two fiscal years.

In January 2006, we sold substantially all of our operating business, owned by Chex, to Game Financial Corporation. The Company currently has no operating business and therefore little or no revenues. In addition, we have posted significant losses in each of our past two fiscal years including $3,912,298 for the year ended December 31, 2007 and $1,409,680 for the year ended December 31, 2006. As a result, any investment in the Company must be considered purely speculative.

The Company’s balance sheet contains certain notes payable, which are currently in default/were due February 28, 2008.

Chex previously relied on promissory notes (the “Notes”) issued to private investors to provide operating capital for its business. As of December 31, 2007, the balance of the Notes was $2,098,000. The Company renewed $283,000 of the Notes on the same terms and conditions as previously existed. In April 2007 the Company, through a financial advisor, restructured $1,825,000 of the Notes (the “Restructured Notes”). The Restructured Notes carry a stated interest rate of 15% and matured on February 28, 2008. The Company has not paid the interest on the Notes since June 30, 2007 and did not repay the Notes on their maturity date and does not currently have sufficient capital to repay the Notes. In January 2008, the Company received a complaint from the financial advisor (acting as agent to the holders of the Restructured Notes) and the holders of the Restructured Notes. The claim is seeking $1,946,250 plus per diem interest beginning January 22, 2008 at the rate of twenty percent (20%) per annum, plus $37,000 due the financial advisor for unpaid fees.

Chex is a guarantor of certain debt of HPI, and the Company’s entire investment in Chex (i.e., its ownership of all outstanding Chex stock) is subject to a security interest securing such obligation. Furthermore, all of the assets of Chex are subject to a security interest for the same debt.

In March 2004, HPI closed on $5 million of debt financing and issued convertible promissory notes in that principal amount to two financial institutions (the “Lenders”). The proceeds from the promissory notes were immediately thereafter loaned to Chex. The promissory notes are collateralized, among other things, by all of the assets of Chex, and by the 3,500,000 shares of Company common stock owned by HPI. In conjunction with the Asset Sale, the holders of the promissory notes consented to the sale of certain assets that secured their notes. In contemplation of the Redemption Agreement described above, on December 29, 2006, HPI and the Company obtained the consent of the Lenders to complete the transactions contemplated by the Redemption Agreement. Contemporaneously with receipt of the consent, HPI and the Company entered into a Note and Security Amendment Agreement dated December 29, 2006 with the Lenders, pursuant to which it was agreed to amend certain terms of the Convertible Promissory Note dated March 8, 2004 in favor of Lenders in the principal amount of $5,000,000 to increase the interest rate applicable to the Convertible Promissory Notes from 7% per annum to 10% per annum and the default interest rate from 10% to 13%. Accordingly, if HPI defaults on the obligations specified under the promissory notes, and if Chex cannot cure such defaults, the Company’s remaining assets could be lost.

We will require additional financing to complete our proposed merger with ISI, but we are uncertain whether such financing will be available to us.

We will require additional capital to continue or to expand our business plans. We have identified a potential candidate business with which to merge, however, we cannot be certain that business will have revenues from operations that will generate cash flow sufficient to finance our operations and growth thereafter. In addition, we will require additional financing to complete the potential merger, to eliminate our current debt, or for working capital purposes to operate our business both now, and in the future, including any operations following a successful acquisition, if any.

Additional financing could be sought from a number of sources, including but not limited to additional sales of equity or debt securities, or loans from banks, other financial institutions or affiliates of the Company. If additional funds are raised by the issuance of our equity, then the ownership interest of our existing stockholders will be diluted. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (i.e., negative operating covenants), and such securities may have rights senior to those of the holders of our existing common stock. It is also possible that financing will not be available to us on terms acceptable to us, if at all. If adequate funds are not available on acceptable terms, we may be unable to fund our business including the potential acquisition of an operating company.

There are currently outstanding securities convertible into or exchangeable for an aggregate of 4,204,280 shares of our common stock which, if converted or exchanged, will substantially dilute our existing stockholders.

The Company currently has outstanding notes and securities convertible into or exchangeable for an aggregate of 4,204,280 shares of common stock under certain conditions. In addition, the effective conversion and exercise prices of such securities significantly lower than the current market value of our common stock. If these securities are converted into or exchanged for common stock, their issuance would have a substantial dilutive effect on the percentage ownership of our current stockholders. These securities consist of: (i) outstanding warrants to purchase an aggregate of 189,000 shares of our common stock at a purchase price of $0.10 per share, which were originally issued to HPI in connection with the Merger; (ii) options to purchase 455,000 shares of our common stock at an average purchase price of $1.05 per share; and (iii) warrants to purchase an aggregate of 3,560,280 shares of our common stock at a weighted average purchase price of $0.95 per share.

Our common stock trades only in an illiquid trading market, which generally results in lower prices for our common stock.

Trading of our common stock is conducted on the Over-The-Counter Bulletin Board. This has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and the lack of security analysts’ and the media’s coverage of our Company and its common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

We have not paid dividends to date, and have no intention of paying dividends to our stockholders.

To date, we have not paid any cash dividends and do not anticipate the payment of cash dividends in the foreseeable future. Accordingly, the only return on an investment in our common stock, if any, may occur upon a subsequent sale of the shares of common stock.

FastFunds leases approximately 1,300 square feet for its executive office in West Palm Beach, Florida, which is adequate for its current needs. The current minimum lease payment is approximately $2,900 per month through January 31, 2010, when it expires. Pursuant to the terms of the lease, FastFunds is also responsible for its pro-rata share of taxes, operating expenses and improvement costs.

ITEM 3. LEGAL PROCEEDINGS.

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters may have a material adverse impact either individually or in the aggregate on our consolidated results of operations, financial position or cash flows.

In January 2008 we and three guarantors received a complaint filed by Grace Capital, LLC (as agent) and individual noteholders in the Fourth Judicial District in the County of Hennepin, in the State of Minnesota. The complaint seeks payment of principal and interest of $1,946,250 as of January 22, 2008, plus default per diem interest at the rate of twenty percent (20%) per annum and $37,000 for unpaid fees to Grace Capital, LLC.

Pursuant to the terms of Asset Sale, we owed Game Financial Corporation ("Game") approximately $300,000. The parties agreed to settle the balance due for $275,000. We didn't make any payments as sitpulated in the settlement, and subsequently Game filed a complaint against us. We have agreed to a judgement of $275,000 plus interest and attorney fees for a total of $329,146.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

Our common stock is not listed on any exchange; however, market quotes for the Company’s common stock (under the symbol FFFC) may be obtained from the Over-the-Counter Bulletin Board Service. The bulletin board service is a regulated quotation service that displays real-time quotes, last-sale prices and volume information in over-the-counter securities. The table below states the quarterly high and low bid prices for the common stock as reported by the bulletin board service. However, such Over-the-Counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission and may not represent actual transactions.

| | | | |

| Quarter Ended | High | | Low |

2007 | | | |

| March 31, 2007 | $0.97 | | $0.46 |

| June 30, 2007 | $0.80 | | $0.40 |

| September 30, 2007 | $0.57 | | $0.26 |

| December 31, 2007 | $0.57 | | $0.13 |

| | | | |

| Quarter Ended | High | | Low |

2006 | | | |

| March 31, 2006 | $1.04 | | $0.83 |

| June 30, 2006 | $1.10 | | $0.60 |

| September 30, 2006 | $0.60 | | $0.30 |

| December 31, 2006 | $0.70 | | $0.22 |

The number of record holders of our common stock as of March 31, 2008 was 140 according to our transfer agent. This figure excludes an indeterminate number of shareholders whose shares are held in “street” or “nominee” name.

FastFunds has not declared nor paid cash dividends on our common stock during the previous two fiscal years, nor do we anticipate paying any cash dividends in the foreseeable future. We currently intend to retain any future earnings to fund our limited operations.

| (d) | Securities Authorized for Issuance Under Equity Compensation Plans. |

We have the following securities authorized for issuance under our equity compensation plans as of December 31, 2007, including options outstanding or available for future issuance under our 2004 Stock Option Plan.

| Equity Compensation Plan Information |

| | | | | | | |

| Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plan |

| | | (a) | | (b) | | (c) |

| | | | | | | |

| Equity compensation plans not approved by security holders | | 455,000 | | $ 1.05 | | 1,345,000 |

| | | | | | | |

| Total | | 455,000 | | $ 1.05 | | 1,345,000 |

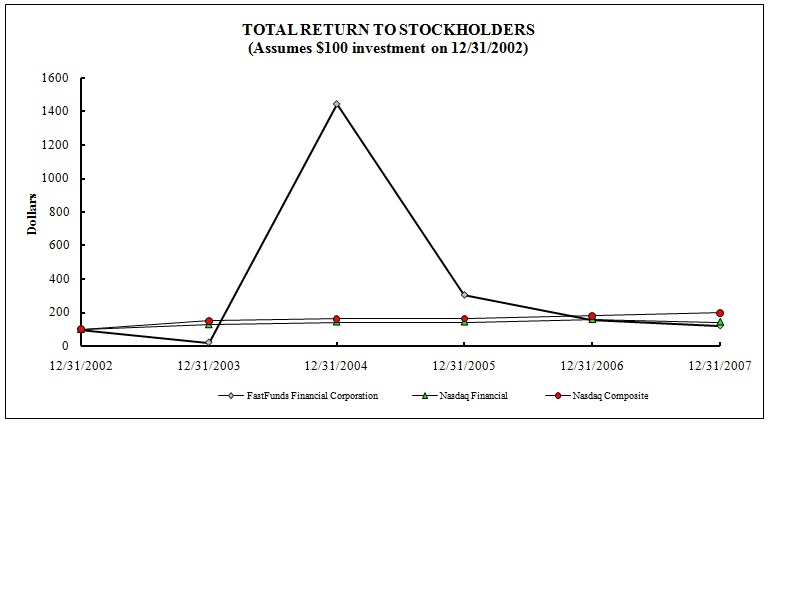

| Total Return Analysis | | | | | | | |

| | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 | 12/31/2007 |

| FastFunds Financial Corporation | $100.00 | $20.00 | $1,442.86 | $302.86 | $157.14 | $120.00 |

| Nasdaq Financial | | $100.00 | $128.10 | $144.20 | $144.01 | $159.30 | $143.79 |

| Nasdaq Composite | | $100.00 | $150.01 | $162.89 | $165.13 | $180.85 | $198.60 |

| Source: CTA Integrated Communications www.ctaintegrated.com (303) 665-4200. Data from ReutersBRIDGE Data Networks | | |

Recent Sales of Unregistered Securities

For each of the following transactions, we relied upon the exemptions from registration provided by Sections 4(6) or 4(2) of the Securities Act of 1933 and Rule 506 promulgated thereunder based upon (i) representations from each investor that it was an accredited or sophisticated investor with experience in investing in securities such that it could evaluate the merits and risks related to our securities; (ii) the fact that no general solicitation of the securities was made by us; (iii) representations from each investor that it was acquiring the securities for its own account and not with a view towards further distribution; (iv) the fact that the securities issued were “restricted securities” as that term is defined under Rule 144 promulgated under the Securities Act; (v) the fact that we placed appropriate restrictive legends on the certificates representing the securities; and (vi) the fact that prior to completion of the transaction, each investor was informed in writing of the restricted nature of the securities, provided with all information regarding FastFunds and were given the opportunity to ask questions of and receive additional information from us regarding our financial condition and operations. During the quarter ended December 31, 2007 there were no shares of our common stock issued.

In February 2008 the Company issued 842,835 shares of our common stock upon the conversion of $137,500 of convertible debentures and unpaid interest of $14,842. The shares were issued at a conversion price of approximately $0.18 per share pursuant to the debenture agreement.

ITEM 6. SELECTED FINANCIAL DATA.

The following table contains selected financial data of FastFunds for the previous five years. The selected financial data presented for periods prior to the June 7, 2004 Merger are those of Chex. The historical basic and diluted income (loss) per share presented is adjusted to reflect the new capital structure as a result of the merger.

In light of the foregoing, and as a result of our sale of substantially all of our assets to Game Financial Corporation in January 2006, the historical data presented below is not indicative of future results. You should read this information in conjunction with the audited consolidated financial statements of the Company, including the notes to those statements (Item 8), and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations (Item 7) that follows.

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Revenues | | $ | 91,587 | | | $ | 2,192,382 | | | $ | 18,531,141 | | | $ | 15,233,735 | | | $ | 18,100,788 | |

| Location gross margin | | | 32,814 | | | | 992,197 | | | | 4,755,134 | | | | 3,942,225 | | | | 5,390,552 | |

| Corporate operating | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 2,055,420 | | | | 3,680,045 | | | | 6,496,681 | | | | 6,752,919 | | | | 4,605,327 | |

| Gain on sale of net | | | | | | | | | | | | | | | | | | | | |

| operating assets of | | | | | | | | | | | | | | | | | | | | |

| Subsidiary | | | | | | | 4,145,835 | | | | | | | | | | | | | |

| Other expenses | | | 1,889,692 | | | | 2,010,754 | | | | 3,143,294 | | | | 1,455,411 | | | | 1,103,215 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | (3,912,298 | ) | | | (1,409,680 | ) | | | (5,906,347 | ) | | | (4,787,994 | ) | | | (504,990 | ) |

| Basic and diluted net | | | | | | | | | | | | | | | | | | | | |

| loss per share | | | (0.54 | ) | | | (0.09 | ) | | | (0.56 | ) | | | (0.54 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 617,087 | | | | 220,164 | | | | 19,939,846 | | | | 22,714,759 | | | | 22,853,342 | |

| Total long-term | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | - | | | | - | | | | 4,506,331 | | | | 3,044,016 | | | | 37,243 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and notes thereto for the years ended December 31, 2007, 2006 and 2005. The financial statements presented for the year ended December 31, 2007, 2006 and 2005 include FastFunds, Chex, Collection Solutions and FastFunds International Limited. Key, Nova and Denaris are included beginning January 2, 2007.

In light of the foregoing, and the Company’s sale of substantially all of its assets in January 2006, the historical data presented below is not indicative of, and therefore, not useful for purposes of predicting future results. You should read this information in conjunction with the audited consolidated financial statements of the Company, including the notes to those statements (Item 8), and the following “Management’s Discussion and Analysis of Financial Conditions and Results of Operations”.

The Company’s financial statements for the year ended December 31, 2007 have been prepared on a going concern basis, which contemplates the realization of its remaining assets and the settlement of liabilities and commitments in the normal course of business. The Company has incurred significant losses since its inception and has a working capital deficit of $4,596,454, and an accumulated deficit of $16,065,512 as of December 31, 2007. Moreover, it presently has no ongoing business operations or sources of revenue, and little available resources with which to obtain or develop new operations.

These factors raise substantial doubt about the Company’s ability to continue as a going concern. There can be no assurance that the Company will have adequate resources to fund future operations or that funds will be available to the Company when needed, or if available, will be available on favorable terms or in amounts required by the Company. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

On January 29, 2008, FFFC announced that it executed a new non-binding letter of intent to acquire Industrial Systems, Inc. ("ISI"). ISI, founded in 1991 and based in Delta, Colorado, provides turn-key engineering procurement and construction services to the mining, energy and natural resources industries throughout the United States. The letter of intent calls for FFFC to acquire 100% of the outstanding securities of ISI in an all stock tax-free exchange. While specific details are being negotiated as part of a definitive agreement, terms of the letter of intent call for the existing stockholders of ISI to own approximately 65% of the Company's common stock at closing of the transaction, with the potential to earn an estimated additional 6% based on post-closing incentives. Completion of the transaction is subject to FFFC having no liabilities on its balance sheet unless mutually agreed upon, as well as further due diligence by each party, negotiation and execution of a definitive agreement, and other customary pre-closing conditions, and is anticipated to occur during the quarter ending June 30, 2008. If consummated, this transaction would likely be accounted for as public shell merger or a reverse acquisition with the Company being treated for accounting purposes as the accounting acquiree.

| (a) | Liquidity and Capital Resources |

For the year ended December 31, 2007, net cash used in operating activities was $521,988 compared to $4,145,264 for the year ended December 31, 2006. Due to the Asset Sale in January 2006, location gross margin decreased approximately $959,383 for the year ended December 31, 2007 compared to the prior year. Net loss for the year ended December 31, 2007 was $3,912,298 compared to a net loss of $1,409,680 for the year ended December 31, 2006. The significant activity in the net loss in 2007 includes the permanent impairment of the HPI common stock of $1,206,000, stock based compensation expense of $912,551, interest expense of $495,486 and $245,571 and $240,630 of debt restructuring charges and depreciation and amortization, respectively. The significant activity in the net loss for the year ended December 31, 2006 is the result of the gain on the Asset Sale of $4,145,835, offset by deferred income taxes of $851,000, other expenses of $2,010,754 and other operating losses of $2,693,761. Non-cash adjustments to the net loss for the year ended December 31, 2007 was $2,299,761 and included $1,206,000 for the permanent impairment of the HPI common stock, $912,551 for stock based compensation expense, $240,630 of depreciation and amortization, deferred income taxes of $75,000 and $64,711 of other non-cash expenses. Non-cash adjustments to the net loss for the year ended December 31, 2006 were approximately $3,437,000 and consisted primarily of $1,237,000 of non-cash expenses related to debt extinguishment costs, non-cash interest expense of $765,000, depreciation and amortization of $602,000, provision for losses including bad debt expense of $478,000 and stock-based compensation of $355,000.

Cash provided by investing activities for the year ended December 31, 2007 was $207,363 compared to $12,803,245 for the year ended December 31, 2006. Net cash provided in 2007 was the result of $255,000 received in payments on notes and interest receivable, offset by $50,000 in notes issued. Net cash provided by investing activities for the year ended December 31, 2006, was attributable to the net proceeds on the Asset Sale of $12,642,784 and $160,461 received in payments on notes receivable. Net cash used in investing activities for the year ended December 31, 2005 was the result of purchases of property and equipment of $729,077, advances made on notes receivable of $86,073, reduced by payments received on notes receivables of $813,063.

Cash provided by financing activities for the year ended December 31, 2007 was $261,914 compared to cash used of $16,878,044 for the year ended December 31, 2006. The 2007 activity includes the Company receiving $323,172 upon the issuance of notes payable. The Company also repaid $19,000 of convertible notes and notes payable and incurred deferred loan costs of $45,250. The 2006 activity includes the Company receiving $450,000 upon the issuance of notes payable, as well as receiving $400 from repayments on parent company notes receivable. The Company utilized such proceeds and the proceeds from the Asset Sale to repay notes payable and long-term debt of $9,593,497, convertible promissory notes of $1,012,500, advances of $5,424,769 to HPI and purchased 41,858 shares of HPI common stock for $192,299.

For the year ended December 31, 2007, net cash decreased $52,711 compared to $8,220,063 for the year ended December 31, 2006. Ending cash at December 31, 2007, was $479 compared to $53,190 at December 31, 2006.

Other sources available to us that we may utilize include the sale of equity securities as well as the exercise of stock options and/or warrants, all of which may cause dilution to our stockholders. We may also be able to borrow funds from related and/or third parties.

Contractual obligations for future payments under existing debt and lease commitments at December 31, 2007, were as follows:

Contractual Obligation | | Total | | Less than one year | | 1-3 years | | 3-5 years | | More than 5 years |

| | | | | | | | | | | |

Notes payable (1) | | $2,324,672 | | $2,324,672 | | $ - | | | | |

| Convertible debentures (2) | | 137,500 | | 137,500 | | | | | | |

| Operating lease obligations | | 75,200 | | 35,000 | | 40,200 | | | | |

| | | | | | | | | | | |

| Total | | $2,537,342 | | $2,497,172 | | $ 40,200 | | | | |

| (1) | In April 2007 the Company, through a financial advisor, restructured $1,825,000 of the Notes (the “Restructured Notes”). The Restructured Notes carry a stated interest rate of 15% and mature on February 28, 2008. The Company is currently in default and the agent for the Restructured Notes and the Restructured noteholders has filed a claim against the Company seeking payment. |

| (2) | Convertible debentures exclude discounts of $5,223. |

| (b) | Results of operations. |

Critical Accounting Policies and Estimates

Preparation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheets and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Moreover, except as described below, we do not employ any critical accounting policies that are selected from among available alternatives or require the exercise of significant management judgment to apply.

We believe that the following are some of the more critical accounting policies that currently affect our financial condition and results of operations:

| 1) | stock based compensation; and, |

| 2) | income taxes, deferred taxes |

Stock Based Compensation

Share-based compensation expense is based on the estimated fair value at the grant date of the portion of share-based payment awards that are ultimately expected to vest during the period. The grant date fair value of stock-based awards to employees and directors is calculated using the Black-Scholes option pricing model. The assumptions used in the Black-Scholes option pricing model, particularly the Company’s estimates of expected term and volatility, are based in some respects on management’s judgments and historical trends. Compensation expense for the share-based payment awards granted subsequent to December 31, 2005, are based on the grant date fair value estimated in accordance with the provisions of SFAS No. 123(R).

Income Taxes, Deferred Taxes

The operations of the Company for periods subsequent to the acquisition of the Company by HPI (then known as Equitex) and through August 2004, at which time HPI’s ownership interest fell below 80% are included in consolidated federal income tax returns filed by HPI. Subsequent to August 2004 and through January 29, 2006, the Company will file a separate return. As of January 30, 2006, HPI’s ownership interest again exceeded 80% and the operations of the Company will be included in a consolidated federal income tax return from that date through October 29, 2006 when the ownership fell below 80%. As of October 30, 2006, the Company will be filing separate income tax returns. For financial reporting purposes, the Company’s provision for income taxes has been computed, and current and deferred taxes have been allocated on a basis as if the Company has filed a separate income tax return for each year presented. Management assesses the realization of its deferred tax assets to determine if it is more likely than not that the Company's deferred tax assets will be realizable. The Company adjusts the valuation allowance based on this assessment.

In prior years the Company recorded a valuation allowance to reduce its deferred tax assets to the amount, if any, then deemed more likely than not to be realized. The Company considers future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for the valuation allowance. During 2006, the Company removed its deferred tax valuation allowance and utilized the remainder of its deferred tax assets related to net operating losses to offset the taxable gain resulting from the Asset Sale. In addition, during 2006 the Company utilized a portion of HPI’s net operating losses to offset the remainder of 2006 taxable income resulting in a payable due to HPI. See RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS below for a discussion of the likely future effect of adopting Financial Accounting Standards Board (“FASB”) Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes: an interpretation on FASB Statement No. 109.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value under generally accepted accounting principles, and expands disclosures about fair value measurements. This statement, as it relates to financial assets and liabilities, is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. On February 12, 2008, the FASB issued FSP No. FAS 157-2, “Effective Date of FASB Statement No. 157,” which delayed the effective date of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on at least an annual basis, until January 1, 2009 for calendar year-end entities. Upon adoption, the provisions of SFAS No. 157 are to be applied prospectively with limited exceptions. The adoption of SFAS No. 157 is not expected to have a material impact on our Consolidated Financial Statements.

The Company adopted the provisions of Financial Standards Accounting Board Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes” - an Interpretation of FASB Statement No. 109 (“FIN 48”) on January 1, 2007. There were no unrecognized tax benefits and there was no effect

on the Company’s financial condition or results of operations as a result of implementing FIN 48. The Company files income tax returns in the U.S. federal jurisdiction and various state and jurisdictions. The Company is no longer subject to U.S. federal tax examinations for years before 1995, and state tax examinations for years before 1995. Management does not believe there will be any material changes in our unrecognized tax positions over the next 12 months. The Company’s policy is to recognize interest and penalties accrued on any unrecognized tax benefits as a component of income tax expense. As of the date of adoption of FIN 48, there was no accrued interest or penalties associated with any unrecognized tax benefits, nor were any interest expense recognized during the quarter.

As of January 1, 2007, the Company also adopted SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments” which amends SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” and SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.” The adoption of SFAS No. 155 did not have a material impact on our Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, “Fair Value Option for Financial Assets and Financial Liabilities”, which permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value and establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company did not adopt SFAS No. 159 on any individual instrument as of January 1, 2008.

In May 2007, the FASB issued FSP FIN No. 46R-7, "Application of FASB Interpretation No. 46(R) to Investment Companies." FSP FIN No. 46R-7 amends the scope of the exception to FIN No. 46R to state that investments accounted for at fair value in accordance with the specialized accounting guidance in the American Institute of Certified Public Accountants Audit and Accounting Guide, Investment Companies, are not subject to consolidation under FIN No. 46R. This interpretation is effective for fiscal years beginning on or after December 15, 2007. The Company does not expect the adoption of FSP FIN No. 46R-7 to have a material impact on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS No. 141R”). SFAS No. 141R is a revision to SFAS No. 141 and includes substantial changes to the acquisition method used to account for business combinations (formerly the “purchase accounting” method), including broadening the definition of a business, as well as revisions to accounting methods for contingent consideration and other contingencies related to the acquired business, accounting for transaction costs, and accounting for adjustments to provisional amounts recorded in connection with acquisitions. SFAS No.141R retains the fundamental requirement of SFAS No. 141 that the acquisition method of accounting be used for all business combinations and for an acquirer to be identified for each business combination. SFAS No. 141R is effective for periods beginning on or after December 15, 2008, and will apply to all business combinations occurring after the effective date. The Company is currently evaluating the requirements of SFAS No. 141R.

The FASB also issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements – an amendment of Accounting Research Bulletin No. 51, Consolidated Financial Statements” in December 2007. This Statement amends ARB No. 51 to establish new standards that will govern the (1) accounting for and reporting of non-controlling interests in partially owned consolidated subsidiaries and (2) the loss of control of subsidiaries. Non-controlling interest will be reported as part of equity in the consolidated financial statements. Losses will be allocated to the non-controlling interest, and, if control is maintained, changes in ownership interests will be treated as equity transactions. Upon a loss of control, any gain or loss on the interest sold will be recognized in earnings. SFAS No. 160 is effective for periods beginning after December 15, 2008. The Company is currently evaluating the requirements of SFAS No. 160.

The FASB also issued SFAS No. 161 “Disclosures about Derivatives Instruments and Hedging Activities” in March 2008. This statement requires enhanced disclosure about an entities derivative and hedging activities and thereby improves the transparency of financial reporting. This statement is effective for financial statements for fiscal years and interim periods beginning after November 15, 2008, with earlier application encouraged. The Company is currently evaluating the requirements of SFAS No. 161.

Results of operations

Results of continuing operations for the year ended December 31, 2007 vs. December 31, 2006

REVENUES

Total revenues for 2007 were $91,587 compared to $2,192,382 for 2006. Revenues for the year ended December 31, 2007 consist of credit card income on Nova’s remaining credit card portfolio. Effective January 31, 2006, the Company sold substantially all of its assets and accordingly, the prior year’s results reflect one-month of fees from providing financial services of $1,714,882, as well as $477,500 of fees received under the TSA from the buyer of the assets.

OPERATING EXPENSES

Operating expenses were $58,173 for the year ended December 31, 2007 compared to $1,200,185 for 2006. The operating expenses for the year ended December 31, 2007 primarily consisted of expenses related to third party servicing fees of Nova’s remaining credit card portfolio. Chex location expenses were $1,200,185 for 2006. The expense is for one-month of activity as a result of the sale of substantially all of the assets that were generating revenues and their associated costs at January 31, 2006.

CORPORATE OPERATING (INCOME) EXPENSES

Corporate operating expenses for 2007 were $2,055,420 and $3,680,045 for 2006. The expenses were comprised of the following:

| | | 2007 | | | 2006 | |

| | | | | | | |

| Salaries and benefits | | $ | 52,069 | | | $ | 465,125 | |

| Stock-based compensation | | | 912,551 | | | | 355,000 | |

| Accounting, legal and consulting | | | 552,154 | | | | 1,102,345 | |

| Travel and entertainment | | | 11,773 | | | | 66,967 | |

| Advertising | | | - | | | | 3,446 | |

| Depreciation and amortization | | | 11,304 | | | | 351,710 | |

| Provision for valuation allowances and bad debt expense | | | - | | | | 478,184 | |

| Derivative liability expense (income) | | | 368,499 | | | | (9,099 | ) |

| Other | | | 147,070 | | | | 866,367 | |

| | | | | | | | | |

| | | $ | 2,055,420 | | | $ | 3,680,045 | |

Corporate operating expenses for 2006 include Chex’s Minneapolis administrative office which through January 31, 2006, supported the operating locations and was closed on May 31, 2006.

Salaries and related costs decreased significantly for 2007 compared to the year ended December 31, 2006 period primarily as a result of the elimination of the Minneapolis administrative staff during the second quarter of 2006. The Company had one fulltime employee for 2007. As of May 31, 2006, the Company vacated that office and will not be incurring any future staffing costs related to the Chex operations.

Accounting, legal and consulting expenses decreased for the year ended December 31, 2007. The decrease for the year ended December 31, 2007 was primarily as a result of decreases in consulting fees of approximately $743,000, of which approximately $725,000 were for costs associated with the refinancing of investor notes. The 2006 consulting costs related to the refinancing were primarily comprised of $134,972 of cash, $224,215 of HPI common stock and the issuance of 436,206 FastFunds warrants to purchase common stock at $1.00 per share, valued at $355,000 under the Black-Scholes option pricing method. In addition, FFFC has entered into consulting agreements with a financial advisor and individuals who provide various consulting services to the Company. These continuing agreements require the Company to pay approximately $15,000 per month. There were also decreases of approximately $145,000 and $47,000, respectively for professional fees and director fees for the year ended December 31, 2007 compared to the year ended December 31, 2006.

In 2006, the Company decreased the valuation allowance on a customer receivable that previously had been fully provided for as the Company negotiated a settlement with the customer for $275,000. The Company received $135,000 in July 2006 and $140,000 was paid in January 2007. The valuation allowance on a related party receivable (including interest of $63,392) and a note receivable was increased by $268,392 and $50,000, respectively during the second quarter of 2006. Additionally, approximately $300,000 of bad debt expense related to the settlement of receiving $1.2 million shares of HPI common stock for amounts owed, and the write-off of a stock subscription receivable of $135,000 as part of a settlement.

Other costs included in corporate operating expenses decreased for the year ended December 31, 2007 compared to the year ended December 31, 2006.

Stock based compensation expense of $912,551 for the year ended December 31, 2007 consisted of the amortization of warrants issued related to guaranty fees and other costs related to the Restructured Notes and $39,151 related to options issued to directors and officers. The expense for the year ended December 31, 2006 of $355,000 resulted from the issuance of 436,206 warrants to purchase shares of the Company’s common stock at $1.00 per share, valued at $355,000 under the Black-Scholes option pricing model.

OTHER INCOME (EXPENSE)

Other expense, net for the year ended December 31, 2007 was $1,889,692 compared to expenses of $2,010,754 for the year ended December 31, 2006. Included in this for the year ended December 31, 2007 was loss on debt extinguishment costs of $245,571 compared to $1,236,949 for the year ended December 31, 2006. Included in other expenses for the year ended December 31, 2006, was $670,000 of costs related to the extinguishment of convertible notes payable due from third parties in exchange for the issuance of 180,000 shares of parent company common stock. In addition, the Company recorded $493,067 of expense related to the settlement of $200,000 of convertible debt. The settlement terms stipulate a registration rights penalty clause and a price protection clause whereby HPI must reimburse the former debt holders if the market price of the HPI common stock issued to them in the settlement is below $4.00 per share at the time they sell the stock. As a result, the Company has recorded a liability of $493,067, of which $450,000 at December 31, 2006 represented the difference between the market value of the shares issued as of December 31, 2006 and the $4.00 stated in the settlement agreement, and costs incurred due to late registration of the 180,000 shares of common stock. Due to the permanent impairment of the HPI common stock, the Company also expensed $1,206,000 for the year ended December 31, 2007. Interest expense for the year ended December, 2007 and 2006 is summarized as:

| | | 2007 | | | 2006 | |

| | | | | | | |

| Beneficial conversion features | | $ | 168,236 | | | $ | 586,521 | |

| HPI $5 million note payable | | | - | | | | 17,533 | |

| Notes payable to individual investors | | | 327,250 | | | | 491,169 | |

| Amortization of note discounts | | | - | | | | 242,377 | |

| Other | | | - | | | | 501 | |

| | | | | | | | | |

| | | $ | 495,486 | | | $ | 1,338,101 | |

Interest income decreased to $57,365 for the year ended December 31, 2007 compared to $564,296 for the year ended December 31, 2006. The decrease for the year ended December 31, 2007 was due primarily to the interest income in 2006 of approximately $400,000 recorded on the $5.0 million HPI Note issued in March 2006 and interest income of $164,463 on cash balances during 2006.

INCOME TAX EXPENSE

There was no income tax expense recorded for the year ended December 31, 2007. Income tax expense for the year ended December 31, 2006 was $856,913. The 2006 amount is primarily related to $851,000 the Company recorded as deferred income tax expense as a result of the Asset Sale in January 2006. This expense represents the use of HPI’s net operating losses, as the Company does not have sufficient loss carryforwards available to offset the total taxable gain on the Asset Sale.

Results of operations

Results of continuing operations for the year ended December 31, 2006 vs. December 31, 2005

REVENUES

Total revenues for 2006 were $2,192,382 compared to $18,531,141 for 2005. Effective January 31, 2006, the Company sold substantially all of its assets and accordingly, the current year results reflect one-month of fees from providing financial services of $1,714,882, as well as $477,500 of fees received under the TSA from the buyer of the assets. Revenues of $18,531,141 for 2005 were the result of fees derived from providing financial services.

OPERATING EXPENSES

LOCATION EXPENSES

Chex location expenses for 2006 were $1,200,185 compared to $13,766,007 for the year ended December 31, 2005 were $13,776,007. The decrease is a result of the sale of substantially all of the assets that were generating revenues and their associated costs at January 31, 2006.

CORPORATE OPERATING (INCOME) EXPENSES

Corporate operating expenses for 2006 were $3,680,045 and $6,496,681 for 2005. The expenses were comprised of the following:

| | | 2006 | | | 2005 | |

| | | | | | | |

| Salaries and benefits | | $ | 465,125 | | | $ | 1,897,250 | |

| Stock-based compensation | | | -- | | | | 9,500 | |

| Accounting, legal and consulting | | | 1,457,345 | | | | 1,264,850 | |

| Travel and entertainment | | | 66,967 | | | | 336,479 | |

| Advertising | | | 3,446 | | | | 155,114 | |

| Depreciation and amortization | | | 351,710 | | | | 1,283,408 | |

| Provision for valuation allowances and bad debt expense | | | 478,184 | | | | 111,199 | |

| Other | | | 857,268 | | | | 1,438,881 | |

| | | | | | | | | |

| | | $ | 3,680,045 | | | $ | 6,496,681 | |

Corporate operating expenses include Chex’s Minneapolis administrative office which through January 31, 2006, supported the operating locations and was closed on May 31, 2006, and also includes for 2005 those expenses associated with FFI’s London and Chicago offices. As of June 2005, the London and Chicago offices have been closed.

Salaries and related costs decreased significantly for 2006 compared to the year ended December 31, 2005 period primarily as a result of the elimination of the corporate staffing of FFI’s London office, as well as the reduction of the Minneapolis administrative staff during the second quarter of 2006. As of May 31, 2006, the Company vacated that office and will not be incurring any future staffing costs related to the Chex operations.

Accounting, legal and consulting expenses increased for the year ended December 31, 2006 compared to 2005. The increase for the year ended December 31, 2006 was primarily as a result of an increase in consulting fees of approximately $648,000, for costs associated with the refinancing of investor notes. The 2006 costs were comprised of $134,972 of cash, $224,215 of HPI common stock and the issuance of 436,206 FastFunds warrants to purchase common stock at $1.00 per share, valued at $355,000 under the Black-Scholes option pricing method. In addition, FFFC has entered into consulting agreements with a financial advisor and individuals who provide various consulting services to the Company. These continuing agreements require the Company to pay approximately $15,000 per month. This increase partially was offset by decreases of approximately $282,000, $100,000 and $52,000, respectively for professional fees, other advisory fees and director fees.

Travel and entertainment expense decreased for the year ended December 31, 2006 compared to December 31, 2005 primarily as a result of the elimination of travel associated with the closure of the Company’s London and Chicago offices during the second quarter of 2005 and the Minneapolis office in the second quarter of 2006.

In June 2006, the Company decreased the valuation allowance on a customer receivable that previously had been fully provided for as the Company negotiated a settlement with the customer and received $135,000 in July 2006. Additionally, $140,000 was paid in January 2007 and the Company also reduced the valuation allowance by $140,000. The valuation allowance on a related party receivable (including interest of $63,392) and a note receivable was increased by $268,392 and $50,000, respectively during the second quarter. Additionally, approximately $300,000 of bad debt expense related to the settlement of receiving $1.2 million shares of HPI common stock for amounts owed, and the write-off of a stock subscription receivable of $135,000 as part of a settlement. The valuation allowance on the note receivable from the estate of a deceased officer was decreased by $90,000 for the nine months ended September 30, 2005. Shares of HPI common stock collateralized the note and the allowance was adjusted accordingly based on the value of the underlying collateral. This note was repaid during 2005.

Other costs included in corporate operating expenses decreased for the year ended December 31, 2006 compared to the year ended December 31, 2005. The decrease for the year ended December 31, 2006 was a result of approximately $625,000 of expenses incurred in the fourth quarter 2005 that did not occur in 2006. These 2005 expenses included restructuring costs associated with closing our London office and the operations of FFI, as well as costs associated with terminating certain contracts. During the year ended December 31, 2005, these decreases were partially offset by increases in 2006, including the write-down of $146,553 of property and equipment, and costs of approximately $130,000 related to the closure of the Minneapolis office.

OTHER INCOME (EXPENSE)

Other expense, net for the year ended December 31, 2006 was $2,010,754 compared to expenses of $3,143,294 for the year ended December 31, 2005. Interest expense for the year ended December, 2006 and 2005 is summarized as:

| | | 2006 | | | 2005 | |

| | | | | | | |

| Beneficial conversion features | | $ | 586,521 | | | $ | 1,487,767 | |

| HPI $5 million note payable | | | 17,533 | | | | 261,928 | |

| Notes payable to individual investors | | | 491,169 | | | | 1,237,703 | |

| Amortization of note discounts | | | 242,377 | | | | 523,146 | |

| Other | | | 501 | | | | 20,154 | |

| | | | | | | | | |

| | | $ | 1,338,101 | | | $ | 3,530,698 | |

Interest income increased to $564,296 for the year ended December 31, 2006 from $387,404 for the year ended December 31, 2005. The increase for the year ended December 31, 2006 was due primarily to the interest income of approximately $400,000 recorded on the $5.0 million HPI Note issued in March 2006. Also included in other expenses for the year ended December 31, 2006, was $670,000 of costs related to the extinguishment of convertible notes payable due from third parties in exchange for the issuance of 180,000 shares of parent company common stock. In addition, the Company recorded $493,067 of expense related to the settlement of $200,000 of convertible debt. The settlement terms stipulate a registration rights penalty clause and a price protection clause whereby HPI must reimburse the former debt holders if the market price of the HPI common stock issued to them in the settlement is below $4.00 per

share at the time they sell the stock. As a result, the Company has recorded a liability of $493,067, of which $450,000 at December 31, 2006 represented the difference between the market value of the shares issued as of December 31, 2006 and the $4.00 stated in the settlement agreement, and costs incurred due to late registration of the 180,000 shares of common stock.

INCOME TAX EXPENSE

Income tax expense for the year ended December 31, 2006 was $856,913 compared to $1,021,506 for the year ended December 31, 2005. The 2006 amount is primarily related to $851,000 the Company recorded as deferred income tax expense as a result of the Asset Sale in January 2006. This expense represents the use of HPI’s net operating losses, as the Company does not have sufficient loss carryforwards available to offset the total taxable gain on the Asset Sale.

OFF BALANCE SHEET ARRANGEMENTS

None

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates and a decline in the stock market. The Company does not enter into derivatives or other financial instruments for trading or speculative purposes. The Company has limited exposure to market risks related to changes in interest rates. The Company does not currently invest in equity instruments of public or private companies for business or strategic purposes.

The principal risks of loss arising from adverse changes in market rates and prices to which the Company and its subsidiaries are exposed relate to interest rates on debt. The Company has only fixed rate debt. The Company has $2,462,172 (before certain discounts on notes) of debt outstanding as of December 31, 2007, of which $2,093,000 has been borrowed at fixed rates ranging from 10% to 15%. This fixed rate debt is subject to renewal quarterly or annually and was due February 28, 2008.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The financial statements are listed under Item 15.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

Not applicable.

ITEM 9A(T). CONTROLS AND PROCEDURES.

Management of the Company is responsible for establishing and maintaining an adequate system of internal control over financial reporting (as such term is defined in Rules 13a-15(f)). Under the supervision and with the participation of Barry Hollander, our Acting Chief Executive Officer, we conducted an evaluation and effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13(a)-15(e) and 15(d)-15(e) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) as of the end of the period covered by this report (the “Evaluation Date”). Based on this evaluation, our acting chief executive officer concluded that, as of the Evaluation Date, our disclosure controls and procedures are effective such that the information relating to us required to be disclosed with our with the Securities and Exchange Commission (“SEC”) reports is (i) recorded, processed, summarized and reported within the time period specified in SEC rules and forms, and (ii) is accumulated and communicated to our management, including our acting chief executive officer, as appropriate to allow timely decisions requiring timely disclosure.

Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes of accounting principles generally accepted in the United States. Because of its inherit limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance of achieving their control objectives. In evaluating the effectiveness of our internal control over financial reporting, our management used the criteria set forth in "Internal Control - Integrated Framework", issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). Based on this evaluation, our management concluded, as of December 31, 2007, our internal control over financial reporting was not effective based on those criteria. The following material weaknesses were identified from our evaluation:

Due to the small size and limited financial resources, the Company’s administrative assistant and the acting chief executive officer are the only individuals involved in the accounting and financial reporting. As a result, there is no segregation of duties in the accounting function, leaving all aspects of financial reporting and physical control of cash in the hands of the same individual, our acting chief executive officer. This lack of segregation of duties represents a material weakness. We will continue periodically review our disclosure controls and procedures and internal control over financial reporting and make modifications from time to time considered necessary or desirable.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management’s report in this annual report.

(B). CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There were no other changes in our internal control over financial reporting that occurred during the last fiscal quarter of the period covered by this report that have materially affected or are reasonably likely to materially affect our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

Not applicable.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

| (a)(b)(c) | Identification of directors, executive officers and certain significant persons |

| Name | | Age | | Offices Held | | Length of service |

| | | | | | | |

| Henry Fong | | 71 | | Chairman | | Since June 2004 |

| | | | | | | |

| Thomas B. Olson | | 42 | | Secretary | | Since June 2004 |

| | | | | | | |

| Aaron A. Grunfeld | | 61 | | Director | | Since June 2004 |

| | | | | | | |

| Barry Hollander | | 50 | | Acting Chief Executive Officer | | Since January 2007 |

Our directors hold office until the next annual meeting of the stockholders and until their respective successors have been elected and qualified. Officers are appointed by our Board of Directors and hold office until their successors are duly elected and qualified.

No arrangement exists between any of the above officers and directors pursuant to which any one of those persons was elected or appointed to such office or position.

Not applicable.

HENRY FONG

Mr. Fong became the Company’s chairman and chief executive officer upon the effectiveness of the Merger. In July 2004, Mr. Graham Newall was hired as the chief executive officer. Mr. Fong has served in a variety of roles for other public corporations. Mr. Fong has been the president, treasurer and a director of Equitex from its inception in January 1983 to January 2007. Mr. Fong has been president and a director of Equitex 2000, Inc. since its inception in 2001. Mr. Fong has been President and a Director of China Nuvo Solar Energy, Inc. since March 2002. China Nuvo Solar Energy, Inc. is an alternative energy company., that is publicly traded. Mr. Fong has been president and a director of Inhibiton Therapeutics, Inc. since its inception in May 2004. Inhibiton Therapeutics, Inc. is a publicly traded company performing research and development on new cancer therapies. From December 2000 to January 2002, Mr. Fong was a director of Popmail.com, Inc., a publicly traded Internet marketing company. From 1959 to 1982 Mr. Fong served in various accounting, finance and budgeting positions with the Department of the Air Force. During the period from 1972 to 1981 he was assigned to senior supervisory positions at the Department of the Air Force headquarters in the Pentagon. In 1978, he was selected to participate in the Federal Executive Development Program and in 1981, he was appointed to the Senior Executive Service. In 1970 and 1971, he attended the Woodrow Wilson School, Princeton University and was a Princeton Fellow in Public Affairs. Mr. Fong received the Air Force Meritorious Civilian Service Award in 1982. Mr. Fong has passed the uniform certified public accountant exam. In March 1994, Mr. Fong was one of twelve CEOs selected as Silver Award winners in FINANCIAL WORLD magazine’s corporate American “Dream Team.”

THOMAS B. OLSON

Mr. Olson became the Company’s secretary upon the effectiveness of the Merger. Mr. Olson also served as secretary of Equitex from January 1988 to April 2007, and has been a director of Chex since May 2002. Since March 2002, Mr. Olson has been the secretary of China Nuvo Solar Energy, Inc., a publicly traded alternative energy company. Mr. Olson has been Secretary of Equitex 2000, Inc. since its inception in 2001. Mr. Olson has been secretary of Inhibiton Therapeutics, Inc. since its inception in May 2004. Inhibiton Therapeutics, Inc. is a publicly traded company performing research and development on new cancer therapies. From August 2002 to July 2004, Mr. Olson was the secretary of El Capitan Precious Metals, Inc., a publicly traded company with ownership interest in a mining property. Mr. Olson has attended Arizona State University and the University of Colorado at Denver.

AARON A. GRUNFELD

Mr. Grunfeld became a director of the Company’s upon the effectiveness of the Merger. Mr. Grunfeld was a director of Equitex from November 1991 to December 2006. Mr. Grunfeld has been a director of Equitex 2000, Inc. since its inception in 2001. Mr. Grunfeld has been engaged in the practice of law since 1971 and has been of counsel to the firm of Resch Polster Alpert & Berger, LLP, Los Angeles, California from November 1995 to August 2006. Since August 2006 he has practiced law as a principal of Law Offices of Aaron A. Grunfeld and Associates. Mr. Grunfeld received an A.B. in Political Science from UCLA in 1968 and a J.D. from Columbia University in 1971. He is a member of the California Bar Association.

BARRY HOLLANDER

Mr. Hollander has been our Acting Chief Executive Officer since January 2007. Mr. Hollander has been the chief financial officer of China Nuvo Solar Energy, Inc. since May 2002. Mr. Hollander has been the chief financial officer of VP Sports since March 1999. From 1994 to 1999, Mr. Hollander was the chief financial officer of California Pro Sports, Inc., an in-line skate importer, marketer and distributor. In 1999 California Pro merged with Imaginon, Inc. Mr. Hollander has been in the sporting goods industry since 1980 in various accounting, senior management and executive positions. Mr. Hollander has a BS degree from Fairleigh Dickinson University and passed the uniform certified public accountant exam.

| (f) | Involvement in certain legal proceedings. |

Not applicable.

| (g) | Promoters and control persons. |

Not applicable.

| (h) | Audit committee financial expert. |

See (i) below.

| (i) | Identification of the audit committee |

The Company does not currently have an audit committee of the board of directors, as none is required, and the board believes it can effectively serve in that function and, therefore, currently does. Management believes that certain individuals on the board of directors may have the necessary attributes to serve as a financial expert on an audit committee, if required.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Executive officers, directors and greater-than-10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. We believe that during 2007, based solely on a review of the copies of such forms furnished to us during 2007 and written representations from the executive officers, directors and greater-than-10% beneficial owners of our common stock, have complied with all Section 16 filing requirements.

CODE OF ETHICS

We have adopted a Code of Ethics for our senior financial management, which includes our chief executive officer and chief financial officer as principal executive and accounting officers, that has been filed as an exhibit to this report.

ITEM 11. EXECUTIVE COMPENSATION.

Compensation Discussion and Analysis

Mr. Barry Hollander became Acting Chief Executive Officer in January 2007, filling a vacancy. Prior to that appointment, Mr. Hollander was providing functions related to accounting, finance and general operations of the Company as a consultant. Pursuant to the Board of Directors resolution, Mr. Hollander receives a management fee of $12,000 per month.

We had no cash incentive bonus program in effect for 2007.

Severance and Change-in-Control Benefits