| As filed with the Securities and Exchange Commission on July 20, 2010 |

| 1933 Act File No. __________ |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ___ ¨

Post-Effective Amendment No. ___ ¨

EATON VANCE INVESTMENT TRUST

(Exact name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

(617) 482-8260

(Registrant's Telephone Number)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Service) |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of the registration statement.

It is proposed that this filing will go effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Shares of Beneficial Interest of Eaton Vance National Limited Maturity Municipal Income Fund

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended. Pursuant to Rule 429, this Registration Statement relates to shares previously registered on Form N-1A (File No. 33-1121).

| CONTENTS OF REGISTRATION STATEMENT ON FORM N-14 |

This Registration Statement consists of the following papers and documents.

| | |

| Cover Sheet | |

| | | |

| Part A | - | Proxy Statement/Prospectus |

| | | |

| Part B | - | Statement of Additional Information |

| | | |

| Part C | - | Other Information |

| | |

| Signature Page | |

| | |

| Exhibit Index | |

| | |

| Exhibits | |

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPAL INCOME FUND

Two International Place

Boston, Massachusetts 02110 |

Dear Shareholder:

We cordially invite you to attend a Special Meeting of Shareholders of Eaton Vance California Limited Maturity Municipal Income Fund (“the CA Limited Fund”), a series of Eaton Vance Investment Trust (the “Trust”), on October 15, 2010 to consider a proposal to approve an Agreement and Plan of Reorganization to convert shares of the CA Limited Fund into corresponding shares of Eaton Vance National Limited Maturity Municipal Income Fund (the “National Limited Fund”), also a series of the Trust (the “Reorganization). The investment objective for each Fund is to provide a high level of current income exempt from regular federal income tax (and, in the case of the CA Limited Fund, from California state personal income taxes) and limited principal fluctuation. The investment policies of each Fund are substantially similar. The enclosed combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus� 48;) describes the Reorganization in detail. We ask you to read the enclosed information carefully and to submit your vote promptly.

After consideration and recommendation by Eaton Vance Management, the Board of Trustees has determined that it is in the best interests of the CA Limited Fund if the CA Limited Fund is merged into the National Limited Fund. We believe that you would benefit from the Reorganization because you would become shareholders of a larger, more diversified fund with a lower expense ratio and higher yield and distribution rate.

We realize that most shareholders will not be able to attend the meeting and vote their shares in person. However, the CA Limited Fund does need your vote. You can vote by mail or by telephone, as explained in the enclosed material. If you later decide to attend the meeting, you may revoke your proxy and vote your shares in person. By voting promptly, you can help the CA Limited Fund avoid the expense of additional mailings.

If you would like additional information concerning this proposal, please call one of our service representatives at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. Your participation in this vote is extremely important.

| | Sincerely,

/s/ Cynthia J. Clemson

Cynthia J. Clemson

President

Eaton Vance Investment Trust |

Your vote is important – please return your proxy card promptly.

Shareholders are urged to sign and mail the enclosed proxy in the enclosed postage prepaid envelope or vote by telephone by following the enclosed instructions. Your vote is important whether you own a few shares or many shares.

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPAL INCOME FUND

Two International Place

Boston, Massachusetts 02110 |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held October 15, 2010 |

A Special Meeting of Shareholders of Eaton Vance California Limited Maturity Municipal Income Fund (the “CA Limited Fund”) will be held at the principal office of the CA Limited Fund, Two International Place, Boston, Massachusetts 02110, on Friday, October 15, 2010 at 3:00 p.m. (Eastern time), for the following purposes:

| 1. | To consider and act upon a proposal to approve an Agreement and Plan of Reorganization (the “Plan”) to convert shares of the CA Limited Fund into corresponding shares of Eaton Vance National Limited Maturity Municipal Income Fund (the “National Limited Fund”). The Plan provides for the transfer of all of the assets and liabilities of the CA Limited Fund to the National Limited Fund in exchange for corresponding shares of the National Limited Fund; and |

| |

| 2. | To consider and act upon any other matters which may properly come before the meeting and any adjourned or postponed session thereof. |

The meeting is called pursuant to the By-Laws of Eaton Vance Investment Trust (the “Trust”). The Board of Trustees of the Trust has fixed the close of business on [August 19, 2010] as the record date for the determination of the shareholders of the CA Limited Fund entitled to notice of, and to vote at, the meeting and any adjournments or postponements thereof.

| | By Order of the Board of Trustees,

/s/ Maureen A. Gemma

Maureen A. Gemma

Secretary

Eaton Vance Investment Trust |

August 31, 2010

Boston, Massachusetts |

IMPORTANT

Shareholders can help the Board of Trustees of the CA Limited Fund avoid the necessity and additional expense of further solicitations, which may be necessary to obtain a quorum, by promptly returning the enclosed proxy or voting by telephone. The enclosed addressed envelope requires no postage if mailed in the United States and is included for your convenience.

PROXY STATEMENT/PROSPECTUS

Acquisition of the Assets of

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPAL INCOME FUND

By And In Exchange For Shares of

EATON VANCE NATIONAL LIMITED MATURITY MUNICIPAL INCOME FUND |

Two International Place

Boston, Massachusetts 02110 |

We are sending you this combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) in connection with the Special Meeting of Shareholders (the “Special Meeting”) of Eaton Vance California Limited Maturity Municipal Income Fund (the “CA Limited Fund”), a series of Eaton Vance Investment Trust, a Massachusetts business trust registered as an open-end management investment company (the “Trust”) to be held on October 15, 2010 at 3:00 p.m., Eastern time, at Two International Place, Boston, Massachusetts 02110. This document is both the Proxy Statement of the CA Limited Fund and a Prospectus of Eaton Vance National Limited Maturity Municipal Income Fund (the “National Limited Fund”), also a series of the Trust. The CA Limited Fund and the National Limited Fund hereinafter are sometimes referred to as a “Fund” or collectively as the “Funds”. A proxy card is enclosed with the foregoing Notice of a Special Meeting of Shareholders for the benefit of shareholders who wish to vote, but do not expect to be present at the Special Meeting. Shareholders also may vote by telephone. The proxy is solicited on behalf of the Board of Trustees of the Trust (the “Board” or “Trustees”).

This Proxy Statement/Prospectus relates to the proposed reorganization of each class of shares of the CA Limited Fund into a corresponding class of shares of the National Limited Fund (the “Reorganization”). The Form of Agreement and Plan of Reorganization (the “Plan”) is attached as Appendix A and provides for the transfer of all of the assets and liabilities of the CA Limited Fund to the National Limited Fund in exchange for shares of the National Limited Fund. Following the transfer, National Limited Fund shares will be distributed to shareholders of the CA Limited Fund and the CA Limited Fund will be terminated. As a result, each shareholder of the CA Limited Fund will receive National Limited Fund shares equal to the value of such shareholder’s CA Limited Fund shares, calculated as of the close of regular trading on the New York Stock Exchange on the Closing date (as defined herein).

Each proxy will be voted in accordance with its instructions. If no instruction is given, an executed proxy will authorize the persons named as proxies, or any of them, to vote in favor of each matter. A written proxy is revocable by the person giving it, prior to exercise by a signed writing filed with the Fund’s proxy tabulator, D.F. King, 48 Wall Street, New York, NY 10005, or by executing and delivering a later dated proxy, or by attending the Special Meeting and voting the shares in person. Proxies voted by telephone may be revoked at any time in the same manner that proxies voted by mail may be revoked. This Proxy Statement/Prospectus is initially being mailed to shareholders on or about August 31, 2010. Supplementary solicitations may be made by mail, telephone, telegraph, facsimile or electronic means.

The Trustees have fixed the close of business on August 19, 2010 as the record date (“Record Date”) for the determination of the shareholders entitled to notice of and to vote at the Special Meeting and any adjournments or postponements thereof. Shareholders at the close of business on the Record Date will be entitled to one vote for each share of the CA Limited Fund held. The number of shares of beneficial interest of each class of each Fund outstanding and the persons who held of record more than five percent of the outstanding shares of each Fund as of the Record Date, along with such information for the combined fund as if the Reorganization was consummated on the Record Date, are set forth in Appendix C.

This Proxy Statement/Prospectus sets forth concisely the information that you should know when considering the Reorganization. You should read and retain this Proxy Statement/Prospectus for future reference. This Proxy Statement/Prospectus is accompanied by the Prospectus of the National Limited Fund dated August 1, 2010 (the “National Limited Fund Prospectus”), which is incorporated by reference herein. A Statement of Additional Information dated August 31, 2010 that relates to this Proxy Statement/Prospectus and contains additional information about the National Limited Fund and the Reorganization is on file with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Proxy Statement/Prospectus.

The Prospectus (the “CA Limited Fund Prospectus”) and the Statement of Additional Information (the “CA Limited Fund SAI”) of the CA Limited Fund, each dated August 1, 2010, and the Statement of Additional Information of the National Limited Fund dated August 1, 2010 (the “National Limited Fund SAI”) are on file with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

The Annual Reports to Shareholders for CA Limited Fund and National Limited Fund, each dated March 31, 2010, have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

To ask questions about this Proxy Statement/Prospectus, please call our toll-free number at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time.

Copies of each of the documents incorporated by reference referred to above are available upon oral or written request and without charge. To obtain a copy, write to the Funds, c/o Eaton Vance Management, Two International Place, Boston, MA 02110, Attn: Proxy Coordinator – Mutual Fund Operations, or call 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. The foregoing documents may be obtained on the Internet at www.eatonvance.com. In addition, the SEC maintains a website at www.sec.gov that contains the documents described above, material incorporated by reference, and other information about the CA Limited Fund and the National Limited Fund.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

ii

| |

| Page |

| SUMMARY | 1 |

| FUND EXPENSES | 2 |

| REASONS FOR THE REORGANIZATION | 4 |

| INFORMATION ABOUT THE REORGANIZATION | 5 |

| HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES AND POLICIES |

| OF THE CA LIMITED FUND COMPARE TO THAT OF THE NATIONAL LIMITED FUND? | 9 |

| PRINCIPAL RISK FACTORS | 10 |

| COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS | 10 |

| INFORMATION ABOUT THE FUNDS | 11 |

| VOTING INFORMATION | 11 |

| DISSENTERS RIGHTS | 14 |

| NATIONAL LIMITED FUND FINANCIAL HIGHLIGHTS | 15 |

| CA LIMITED FUND FINANCIAL HIGHLIGHTS | 18 |

| EXPERTS | 21 |

| APPENDIX A: FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| APPENDIX B: MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | B-1 |

| APPENDIX C: OUTSTANDING SHARES AND 5% HOLDERS | C-1 |

iii

The following is a summary of certain information contained in or incorporated by reference in this Proxy Statement/Prospectus. This summary is not intended to be a complete statement of all material features of the proposed Reorganization and is qualified in its entirety by reference to the full text of this Proxy Statement/ Prospectus, the Plan and the other documents referred to herein.

Proposed Transaction. The Trustees of the Trust have approved the Plan, which provides for the transfer of all of the assets of the CA Limited Fund to the National Limited Fund in exchange for the issuance of National Limited Fund shares and the assumption of all of the CA Limited Fund’s liabilities by the National Limited Fund at a closing to be held as soon as practicable following approval of the Reorganization by shareholders of the CA Limited Fund at the Special Meeting, or any adjournments or postponements thereof, and the satisfaction of all the other conditions to the Reorganization (the “Closing”). The Plan is attached hereto as Appendix A. The value of each shareholder’s account with the corresponding class of the National Limited Fund immediately after the Reorganization will be the same as the value of such shareholder’s account with the CA Limited Fund immediately prior to the Reorganization. Foll owing the transfer, National Limited Fund shares will be distributed to shareholders of the CA Limited Fund and the CA Limited Fund will be terminated. As a result of the Reorganization, each shareholder of the CA Limited Fund will receive full and fractional National Limited Fund shares equal in value at the close of regular trading on the New York Stock Exchange on the Closing date to the value of such shareholder’s shares of the CA Limited Fund. At or prior to the Closing, the CA Limited Fund shall declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to its shareholders all of its investment company taxable income, its net tax-exempt interest income, and all of its net capital gains, if any, realized for the taxable year ending at the Closing. The Trustees, including the Trustees who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (“Indepe ndent Trustees”), have determined that the interests of existing shareholders of CA Limited Fund will not be diluted as a result of the transaction contemplated by the Reorganization and that the Reorganization is in the best interests of the CA Limited Fund. The Trustees (including the Independent Trustees) have also approved the Plan on behalf of the National Limited Fund.

Background for the Proposed Transaction. The Board of Trustees of the Trust considered a number of factors, including the proposed terms of the Reorganization. The Trustees considered that, among other things, combining the Funds will reduce the expense ratio for the CA Limited Fund’s shareholders, the Reorganization would be tax-free for federal income tax purposes, and that management believes CA Limited Fund’s shareholders will receive higher yields and distribution rates as shareholders of the National Limited Fund. Moreover, the Trustees considered that shareholders of CA Limited Fund would benefit from a larger fund with increased investment opportunities and flexibility by consolidating two funds with similar investment objectives and policies.

The Board of Trustees of the Trust has determined that the Reorganization is in the best interests of the CA Limited Fund and has recommended that the CA Limited Fund’s shareholders vote FOR the Reorganization.

Objectives, Restrictions and Policies. The CA Limited Fund and National Limited Fund have substantially similar investment objectives and policies, with the exception of the CA Limited Fund’s policies to avoid California state income taxes. There are no material differences between the Funds’ fundamental and non-fundamental investment restrictions other than those related to diversification. While the National Limited Fund is a diversified fund and has an investment restriction to that effect, CA Limited Fund is a non-diversified fund.

Fund Fees, Expenses and Services. National Limited Fund (total net assets of approximately $669.4 million as of April 30, 2010) is significantly larger than CA Limited Fund (total net assets of approximately $26.5 million as of April 30, 2010). As described below, National Limited Fund has a lower total expense ratio than CA Limited Fund. As the result of the Reorganization, the CA Limited Fund’s shareholders are expected to benefit from the National Limited Fund’s lower expense ratio.

1

National Limited Fund offers classes of shares that correspond with the outstanding classes of shares of the CA Limited Fund. As a result of the Reorganization, shareholders of each class of shares of CA Limited Fund would receive shares of the corresponding class of the National Limited Fund. The privileges and services associated with the corresponding share classes of each Fund are identical. See “Distribution Arrangements” for details on the distribution and service fees. Class B shares of each Fund have a conversion feature, whereby they convert to the lower cost Class A shares four years after their initial purchase. National Limited Fund also offers Class I shares, which will not be involved in the Reorganization.

Distribution Arrangements. Shares of each Fund are sold on a continuous basis by Eaton Vance Distributors, Inc. (“EVD”), the Funds’ principal underwriter. Class A shares of each Fund are sold at net asset value per share plus a sales charge; Class B and Class C shares of each Fund are sold at net asset value subject to a contingent deferred sales charge (“CDSC”). The distribution and service fees and sales charges associated with the classes of National Limited Fund are identical to their corresponding classes of CA Limited. As a result of the Reorganization, shareholders of each class of shares of CA Limited Fund would receive shares of the corresponding class of the National Limited Fund.

Redemption Procedures and Exchange Privileges. The CA Limited Fund and the National Limited Fund offer the same redemption features pursuant to which proceeds of a redemption are remitted by wire or check after receipt of proper documents including signature guarantees. The respective classes of each Fund have the same exchange privileges.

Tax Consequences. The CA Limited Fund expects to obtain an opinion of counsel that the Reorganization will be tax-free for federal income tax purposes. As such, the CA Limited Fund’s shareholders will not recognize a taxable gain or loss on the receipt of shares of the National Limited Fund in liquidation of their interests in CA Limited Fund. Their tax basis in National Limited Fund shares received in the Reorganization will be the same as their tax basis in the CA Limited Fund shares, and the tax holding period will be the same.

Expenses shown are those for the year ended April 30, 2010 and on a pro forma basis giving effect to the Reorganization as of such date.

| | | |

| Fund Fees and Expenses | | | |

| |

| Shareholder Fees | | | |

| |

| (fees paid directly from your investment) | Class A | Class B | Class C |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | 2.25% | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of | | | |

| net asset value at time of purchase or redemption) | None | 3.00% | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Distributions | None | None | None |

2

Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment)

| | | | |

| | | Distribution and | | Total Annual |

| | Management | Service (12b-1) | Other | Fund Operating |

| | Fees | Fees | Expenses(1) | Expenses |

|

| CA Limited Fund | | | | |

| Class A | 0.45% | 0.15% | 0.43% | 1.03% |

| Class B | 0.45% | 0.90% | 0.43% | 1.78% |

| Class C | 0.45% | 0.90% | 0.43% | 1.78% |

| |

| National Limited Fund | | | | |

| Class A | 0.44% | 0.15% | 0.13% | 0.72% |

| Class B | 0.44% | 0.90% | 0.13% | 1.47% |

| Class C | 0.44% | 0.90% | 0.13% | 1.47% |

| |

| Pro Forma Combined Fund | | | | |

| Class A | 0.44% | 0.15% | 0.13% | 0.72% |

| Class B | 0.44% | 0.90% | 0.13% | 1.47% |

| Class C | 0.44% | 0.90% | 0.13% | 1.47% |

| (1) | “Other Expenses” includes interest expense of 0.01% for National Limited Fund and 0.01% for Pro Forma Combined Fund relating to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income in an amount equal to this expense relating to the municipal obligations underlying such transactions, and as a result net asset value and performance have not been affected by this expense. |

Example. This Example is intended to help you compare the cost of investing in the Pro Forma Combined Fund after the Reorganization with the cost of investing in the Funds without the Reorganization. The Example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same as stated in the Fund Fees and Expenses table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | |

| | Expenses with Redemption | | Expenses without Redemption |

|

|

| | 1 Year | 3 Years | 5 Years | 10 Years | | 1 Year | 3 Years | 5 Years | 10 Years |

|

| CA Limited Fund | | | | | | | | | |

| Class A shares | $328 | $545 | $781 | $1,456 | | $328 | $545 | $781 | $1,456 |

| Class B shares | $481 | $760 | $878 | $1,549 | | $181 | $560 | $878 | $1,549 |

| Class C shares | $281 | $560 | $964 | $2,095 | | $181 | $560 | $964 | $2,095 |

| National Limited Fund | | | | | | | | | |

| Class A shares | $297 | $450 | $617 | $1,099 | | $297 | $450 | $617 | $1,099 |

| Class B shares | $450 | $665 | $715 | $1,195 | | $150 | $465 | $715 | $1,195 |

| Class C shares | $250 | $465 | $803 | $1,757 | | $150 | $465 | $803 | $1,757 |

| Pro Forma Combined Fund | | | | | | | | | |

| Class A shares | $297 | $450 | $617 | $1,099 | | $297 | $450 | $617 | $1,099 |

| Class B shares | $450 | $665 | $715 | $1,195 | | $150 | $465 | $715 | $1,195 |

| Class C shares | $250 | $465 | $803 | $1,757 | | $150 | $465 | $803 | $1,757 |

3

| REASONS FOR THE REORGANIZATION |

The Reorganization was proposed to the Board of Trustees of the Trust by Eaton Vance Management (“EVM” or “Eaton Vance”) in response to inquiries from the Trustees with respect to the expense levels and the small size of the CA Limited Fund. In reaching the decision to recommend that the shareholders of the CA Limited Fund vote to approve the Reorganization, the Trustees considered a number of factors, including factors identified by EVM in connection with its recommendation that the Trustees approve the Reorganization. The Trustees, including the Independent Trustees, determined that the Reorganization would be in the best interests of the CA Limited Fund that the interests of existing shareholders would not be diluted as a consequence thereof. The factors considered by the Trustees including the following:

| |

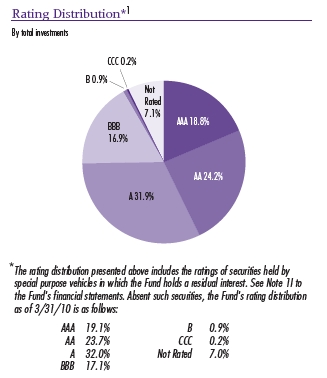

| • | Changes in Objectives, Restrictions and Policies. The CA Limited Fund and National Limited |

| Fund have substantially similar investment objectives and policies and their fundamental and non- |

| fundamental investment restrictions are substantially the same. One distinction in their investment |

| policies is that the CA Limited Fund is required to invest at least 75% of its net assets in investment |

| grade obligations, while National Limited Fund is required to invest at least 65% of its net assets in |

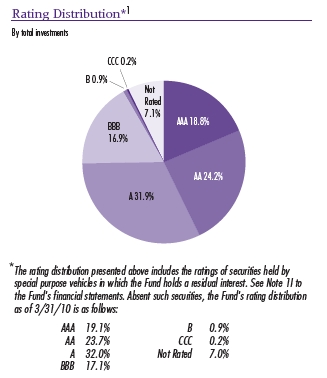

| investment grade obligations. As of March 31, 2010, however, National Limited Fund has over 90% |

| of its net assets invested in investment grade obligations. Investment grade obligations are those |

| rated BBB or higher by Standard & Poor’s Ratings Group (“S&P”) or Fitch Ratings (“Fitch”) or Baa or |

| higher by Moody’s Investors Service, Inc. (“Moody’s”). |

| |

| While the Funds have identical policies with respect to the maturity of the obligations they will acquire, |

| the National Limited Fund historically has had longer average durations and longer average |

| maturities than the CA Limited Fund. Also, because of its much larger size than CA Limited Fund, the |

| National Limited Fund has had more opportunities to invest in residual interest bond investments than |

| the CA Limited Fund. For these reasons, the National Limited Fund may have a slightly higher risk |

| profile than the CA Limited Fund. |

| |

| The National Limited Fund is a diversified fund, while the CA Limited Fund is a non-diversified fund. |

| The National Limited Fund is broadly diversified with minimal concentration risk. In contrast, CA |

| Limited Fund’s portfolio is highly concentrated in obligations issued by California issuers. The |

| Reorganization would substantially reduce the CA Limited Fund’s shareholders’ exposure to issuers |

| in California. |

| |

| • | Effect on Fund Fees, Expenses and Services. The National Limited Fund is significantly larger |

| than the CA Limited Fund. As described above, the National Limited Fund has a lower effective |

| advisory fee and a lower total expense ratio than the CA Limited Fund. As a result of the |

| Reorganization, the CA Limited Fund shareholders are expected to benefit from the National Limited |

| Fund’s lower expense ratio. |

| |

| If the Reorganization is consummated, EVM estimates the CA Limited Fund will realize a significant |

| reduction in other expenses. On a pro forma basis assuming the consummation of the |

| Reorganization on April 30, 2010, the total fund expenses payable by former CA Limited Fund |

| shareholders would decrease by approximately 31 basis points (or 0.31%) for Class A, Class B and |

| Class C shareholders after the Reorganization. |

| |

| • | Costs of the Reorganization. The CA Limited Fund will bear the costs of the Reorganization |

| including legal, printing, mailing and solicitation costs. These costs are estimated at approximately |

| $10,000. |

| |

| • | Tax Consequences. The CA Limited Fund expects to receive an opinion of counsel that the |

| Reorganization will be tax-free for federal income tax purposes. As such, the CA Limited Fund |

| shareholders will not recognize a taxable gain or loss on the receipt of shares of the National Limited |

| Fund in liquidation of their interests in the CA Limited Fund. Their tax basis in National Limited Fund |

| shares received in the Reorganization will be the same as their tax basis in the CA Limited Fund |

| shares, and the tax holding period will be the same. National Limited Fund’s tax basis for the assets |

| received in the Reorganization will be the same as the CA Limited Fund’s basis immediately before |

4

| |

| the Reorganization, and National Limited Fund’s tax holding period for those assets will include CA |

| Limited Fund’s holding period. Shareholders should consult their tax advisors regarding the effect, if |

| any, of the Reorganization in light of their individual circumstances. For more information, see |

| “Information About the Reorganization – Federal Income Tax Consequences.” |

| |

| • | Relative Performance. National Limited Fund outperformed CA Limited Fund on a total return basis |

| for the one-year, three-year, five-year and ten-year periods ended March 31, 2010. As of April 30, |

| 2010, the yields and distribution rate of the National Limited Fund were higher than the CA Limited |

| Fund. |

| | |

| | CA Limited Fund | National Limited Fund |

|

| 30-day yield | 2.66% | 3.17% |

| Tax-equivalent yield(1) | 4.58% | 4.88% |

| Distribution rate | 3.57% | 3.90% |

| |

| (1) Tax-equivalent yield is adjusted for both state and federal income taxes in the |

| case of the CA Limited Fund. National Limited Fund tax-equivalent yields are |

| adjusted for federal income tax only. | |

| |

| • | No Dilution. After the Reo5rganization, each former shareholder of the CA Limited Fund will own |

| shares of National Limited Fund equal to the aggregate value of his or her shares of the CA Limited |

| Fund immediately prior to the Reorganization. Because shares of National Limited Fund will be |

| issued at the per share net asset value of the Fund in exchange for the assets of the CA Limited |

| Fund, that, net of the liabilities of the CA Limited Fund assumed by National Limited Fund, will equal |

| the aggregate value of those shares, the net asset value per share of National Limited Fund will be |

| unchanged. Thus, the Reorganization will not result in any dilution to shareholders. |

| |

| • | Terms of the Plan. The Trustees considered the terms and conditions of the Plan and the costs |

| associated with the Reorganization, to be borne by the CA Limited Fund. |

| |

| • | Impact on EVM. EVM and its affiliates, including BMR and EVD, will continue to collect advisory and |

| distribution and service fees on CA Limited Fund’s assets acquired by the National Limited Fund |

| pursuant to the Reorganization. In the case of advisory fees, EVM would collect fees on the CA |

| Limited Fund’s assets at the incremental advisory fee rate (0.44% annually) applicable to the National |

| Limited Fund, assuming the Reorganization occurred on April 30, 2010. At asset levels as of that |

| date, the Reorganization would result in approximately $6,800 in decreased fee revenue annually to |

| EVM. |

The Board of Trustees of the Trust has determined that the Reorganization is in the best interests of the CA Limited Fund and recommends that the CA Limited Fund’s shareholders vote FOR the Reorganization.

| INFORMATION ABOUT THE REORGANIZATION |

At a meeting held on August 9, 2010, the Board of Trustees of the Trust approved the Plan in the form set forth as Appendix A to this Proxy Statement/Prospectus. The summary of the Plan is not intended to be a complete statement of all material features of the Plan and is qualified in its entirety by reference to the full text of the Plan attached hereto as Appendix A.

Agreement and Plan of Reorganization. The Plan provides that, at the Closing, the Trust shall transfer all of the assets of the CA Limited Fund and assign all liabilities to National Limited Fund, and National Limited Fund shall acquire such assets and shall assume such liabilities upon delivery by National Limited Fund to the CA Limited Fund on the Closing date of Class A, Class B and Class C National Limited Fund shares (including, if applicable, fractional shares). The value of Class A, Class B and Class C shares issued to the CA Limited Fund by National Limited Fund will be the same as the value of Class A, Class B and Class C shares that the CA Limited Fund has outstanding at the close of business on the Closing date. The National Limited Fund shares received by the CA Limited Fund will be distributed to the CA Limited Fund’s shareholders, and the CA Limited Fund shareholders will receive shares of the co rresponding class of the National Limited Fund equal in value to those of the CA Limited Fund held by the shareholder.

5

National Limited Fund will assume all liabilities, expenses, costs, charges and reserves of the CA Limited Fund on the Closing date. At or prior to the Closing, the CA Limited Fund shall declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the CA Limited Fund’s shareholders all of the CA Limited Fund’s investment company taxable income, net tax-exempt interest income, and net capital gain, if any, realized (after reduction for any available capital loss carry-forwards) in all taxable years ending at or prior to the Closing.

At, or as soon as practicable after the Closing, the CA Limited Fund shall liquidate and distribute pro rata to its shareholders of record as of the close of trading on the New York Stock Exchange on the Closing date the full and fractional National Limited Fund Class A, Class B and Class C shares equal in value to the CA Limited Fund’s shares exchanged. Such liquidation and distribution will be accomplished by the establishment of shareholder accounts on the share records of National Limited Fund in the name of each shareholder of the CA Limited Fund, representing the respective pro rata number of full and fractional National Limited Fund Class A, Class B and Class C shares due such shareholder. All of National Limited Fund’s future distributions attributable to the shares issued in the Reorganization will be paid to shareholders in cash or invested in additional s hares of National Limited Fund at the price in effect as described in the National Limited Fund’s current prospectus on the respective payment dates in accordance with instructions previously given by the shareholder to the Fund’s transfer agent.

The consummation of the Plan is subject to the conditions set forth therein. Notwithstanding approval by shareholders of the CA Limited Fund, the Plan may be terminated at any time prior to the consummation of the Reorganization without liability on the part of either party or its respective officers, trustees or shareholders, by either party on written notice to the other party if certain specified representations and warranties or conditions have not been performed or do not exist on or before December 31, 2010. The Plan may be amended by written agreement of its parties without approval of shareholders and a party may waive without shareholder approval any default by the other or any failure to satisfy any of the conditions to its obligations; provided, however, that following the Special Meeting, no such amendment or waiver may have the effect of changing the provision for determining the number of National Limited Fund shares to be issued to the CA Limited Fund&# 146;s shareholders to the detriment of such shareholders without their further approval.

Costs of the Reorganization. The CA Limited Fund will bear the costs of the Reorganization, including legal, printing, mailing and solicitation costs. The costs of the Reorganization are estimated at approximately $10,000.

Description of National Limited Fund Shares. Full and fractional Class A, Class B and Class C shares of National Limited Fund will be distributed to the CA Limited Fund’s shareholders in accordance with the procedures under the Plan as described above. Each National Limited Fund share will be fully paid, non-assessable when issued and transferable without restrictions and will have no preemptive or cumulative voting rights and have only such conversion or exchange rights as the Trustees may grant in their discretion.

Federal Income Tax Consequences. It is expected that the Reorganization will qualify as a tax-free transaction under Section 368(a) of the Internal Revenue Code, which is expected to be confirmed by the legal opinion of K&L Gates LLP at the Closing. Accordingly, shareholders of the CA Limited Fund will not recognize any capital gain or loss and the CA Limited Fund’s assets and capital loss carry-forwards should be transferred to National Limited Fund without recognition of gain or loss.

It is possible, however, that the Reorganization may fail to satisfy all of the requirements necessary for tax-free treatment, in which event the transaction will nevertheless proceed on a taxable basis. In this event, the Reorganization will result in the recognition of gain or loss to the CA Limited Fund’s shareholders depending upon their tax basis (generally, the original purchase price) for their CA Limited Fund shares, which includes the amounts paid for shares issued in reinvested distributions, and the net asset value of shares of National Limited Fund received in the Reorganization. Shareholders of the CA

6

Limited Fund would, in the event of a taxable transaction, receive a new tax basis in the shares they receive of National Limited Fund (equal to their initial value) for calculation of gain or loss upon their ultimate disposition and would start a new holding period for such shares.

Shareholders should consult their tax advisors regarding the effect, if any, of the proposed Reorganization in light of their individual circumstances. Because the foregoing discussion relates only to the federal income tax consequences of the Reorganization, shareholders should also consult their tax advisors as to state and local tax consequences, if any.

Capitalization. The following table (which is unaudited) sets forth the capitalization of CA Limited Fund and National Limited Fund as of April 30, 2010, and on a pro forma basis as of that date giving effect to the proposed acquisition of assets of the CA Limited Fund at net asset value.

| | | |

| | Net Assets | Net Asset Value per Share | Shares Outstanding |

| CA Limited Fund | | | |

| Class A | $23,932,671 | $10.01 | 2,390,353 |

| Adjustments* | (9,013) | | |

| Class B | 272,804 | $9.98 | 27,328 |

| Adjustments* | (103) | | |

| Class C | 2,349,329 | $9.68 | 242,678 |

| Adjustments* | (884) | | |

| Total before adjustments | $26,554,804 | | |

| Adjustments* | (10,000) | | |

| Total | $26,544,804 | | 2,660,359 |

| | | | |

| National Limited Fund | | | |

| Class A | $407,906,866 | $10.07 | 40,517,933 |

| Class B | 5,929,691 | $10.07 | 588,690 |

| Class C | 145,301,857 | $9.44 | 15,386,023 |

| Class I | 110,212,944 | $10.07 | 10,947,148 |

| Total | $669,351,358 | | 67,439,794 |

| | | | |

| Pro Forma Combined After Reorganization | | |

| Class A | $431,830,524 | $10.07 | 42,893,669 |

| Class B | 6,202,392 | $10.07 | 615,771 |

| Class C | 147,650,302 | $9.44 | 15,634,799 |

| Class I | 110,212,944 | $10.07 | 10,947,148 |

| Total | $695,896,162 | | 70,091,387 |

| * | The CA Limited Fund will bear the expenses of the Reorganization including those as described in “How Will Proxies be Solicited and Tabulated?” below. |

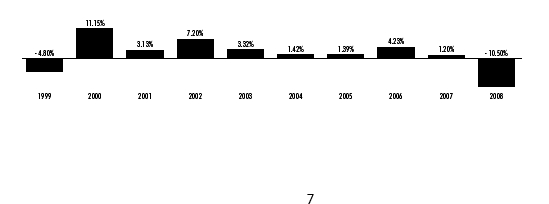

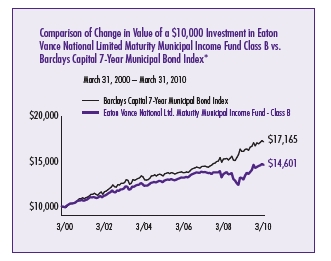

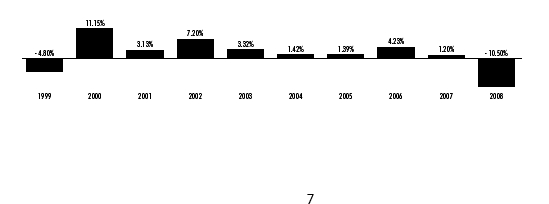

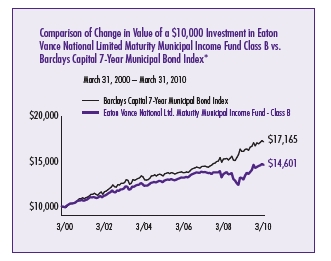

Performance Information. The following bar charts and tables provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad-based securities market index. The returns in the bar charts are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. Past performance (both before and after taxes) is no guarantee of future results.

CA Limited Fund

| | | |

| CA Limited Fund Average Annual Total Return as of December 31, 2008 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | -11.83% | 0.29% | 2.16% |

| Class B Return Before Taxes | -13.10% | -0.59% | 1.61% |

| Class B Return After Taxes on Distributions | -13.10% | -0.59% | 1.59% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | -7.46% | -0.03% | 1.85% |

| Class C Return Before Taxes* | -11.37% | 0.60% | 1.60% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for | | | |

| fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

| * | The Class C performance shown above for the period prior to March 23, 2005 (commencement of operations) is the performance of Class B shares adjusted for the sales charge that applies to Class C shares (but not adjusted for any other differences in the expenses of the two classes). |

| | | | |

| National Limited Fund Average Annual Total Return as of December 31, 2008 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | -11.28% | 0.29% | 2.49% |

| Class B Return Before Taxes | -12.68% | -0.01% | 1.93% |

| Class B Return After Taxes on Distributions | -12.68% | -0.02% | 1.92% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | -7.15% | 0.51% | 2.20% |

| Class C Return Before Taxes | -10.86% | 0.00% | 1.93% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for | | | |

| fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. Barclays Capital 7-Year Municipal Bond Index is an unmanaged market index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7-Year Municipal Bond Index is Lipper, Inc.)

After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold Fund shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

Management’s Discussion of Fund Performance. The total returns of National Limited Fund and the factors that materially affected its performance during the most recent fiscal year are contained in its Annual Report dated March 31, 2010, which is incorporated by reference into this Proxy Statement/Prospectus and relevant portions of which are attached hereto as Appendix B.

The performance of CA Limited Fund is described under the caption “Performance Information” and “Portfolio Composition” in the Annual Report of CA Limited Fund for the year ended March 31, 2010, which was previously mailed to CA Limited Fund shareholders and is incorporated by reference into this Proxy Statement/Prospectus.

8

HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES AND POLICIES

OF THE CA LIMITED FUND COMPARE TO THAT OF THE NATIONAL LIMITED FUND?

Below is a summary comparing the business, investment objectives, principal investment strategies and policies of the CA Limited Fund and the National Limited Fund. Each Fund’s current prospectus contains a detailed discussion of each Fund’s respective investment strategies and other investment policies.

| | |

| | CA Limited Fund | National Limited Fund |

|

| Business | A non-diversified series of the Trust. | A diversified series of the Trust. |

| Investment | Seeks to provide a high level of current | Seeks to provide a high level of current |

| Objective | income exempt from regular federal | income exempt from regular federal |

| | income tax and California state personal | income tax and limited principal |

| | income taxes, and limited principal | fluctuation. |

| | fluctuation. | |

|

| 80% | Under normal market circumstances, | Under normal market circumstances, |

| Investment | invests at least 80% of its net assets in | invests at least 80% of its net assets in |

| Policy | municipal obligations, the interest on which | municipal obligations, the interest on |

| | is exempt from regular federal income tax | which is exempt from regular federal |

| | and from California state personal income | income tax. |

| | taxes. | |

|

| Investment | Primarily invests in investment grade municipal obligations (those rated BBB or Baa or |

| Policies | higher), but may also invest in lower rated obligations. Will not invest more than 10% of |

| | net assets in obligations rated below B. The Fund invests in obligations to seek to |

| | maintain a dollar-weighted average portfolio duration of between three and nine years. |

|

| Investment | At least 75% of net assets normally will be | At least 65% of net assets normally will be |

| Grade | invested in municipal obligations rated at | invested in municipal obligations rated at |

| Securities | least investment grade at the time of | least investment grade at the time of |

| | investment. | investment. |

|

| Concentration | May concentrate 25% or more of its total assets in certain types of municipal obligations |

| | (such as general obligations, municipal leases, revenue bonds and industrial |

| | development bonds) and in one or more economic sectors (such as housing, hospitals, |

| | healthcare facilities or utilities). |

|

| Borrowing | Authorized to borrow in accordance with applicable regulations up to one-third of total |

| | assets (including borrowings), but currently intends to borrow only for temporary |

| | purposes (such as to satisfy redemption requests, to remain fully invested in anticipation |

| | of expected cash inflows and to settle transactions). The Fund will not purchase |

| | additional investment securities while outstanding borrowings exceed 5% of the value of |

| | its total assets. |

|

| Buy/Sell | Portfolio manager purchases and sells securities to maintain a competitive yield and to |

| Strategy | enhance return based upon the relative value of securities in the marketplace. Portfolio |

| | manager may also trade securities to minimize taxable capital gains to shareholders. |

| | Portfolio manager attempts to limit principal fluctuation by investing to limit overall |

| | portfolio duration. |

|

| Derivative | May purchase derivative instruments, which derive their value from another instrument, |

| Instruments | security or index. May purchase and sell various kinds of financial futures contracts and |

| | options thereon to hedge against changes in interest rates or as a substitute for the |

| | purchase of portfolio securities. May also enter into interest rate swaps, forward rate |

| | contracts and credit derivatives, which may include credit default swaps, total return |

| | swaps or credit options, as well as purchase an instrument that has greater or lesser |

| | credit risk than the municipal bonds underlying the instrument. |

|

9

| | |

| | CA Limited Fund | National Limited Fund |

|

| Residual | The Fund may invest in residual interests of a trust (the “trust”) that holds municipal |

| Interest Bonds | securities (“residual interest bonds”). The trust will also issue floating rate notes to third |

| | parties that may be senior to the Fund’s residual interest bonds. The Fund receives |

| | interest payments on residual interest bonds that bear an inverse relationship to the |

| | interest rate paid on the floating rate notes. As required by applicable accounting |

| | standards, interest paid by the trust to the floating rate note holders may be reflected as |

| | income in a Fund’s financial statements with an offsetting expense for the interest paid |

| | by the trust to the floating rate note holders. |

|

| Illiquid | May not invest more than 15% of its net assets in illiquid securities. |

| Securities | | |

|

| Investment | Boston Management and Research (“BMR”), a subsidiary of Eaton Vance, with offices |

| Adviser | at Two International Place, Boston, MA 02110 |

|

| Administrator | Eaton Vance |

|

| Portfolio | Cynthia J. Clemson | William H. Ahern, Jr. |

| Manager | * Vice President, Eaton Vance and BMR | * Vice President, Eaton Vance and BMR |

| | * Portfolio manager since 1992 | * Portfolio manager since 1997 |

|

| Distributor | Eaton Vance Distributors, Inc. |

|

Generally. As discussed above, the Funds have substantially similar investment objectives and policies and, as such, are subject to substantially similar types of risks. See “Investment Objectives & Principal Policies and Risks” in the National Limited Fund Prospectus for a description of the principal risks of investing in the Funds.

Principal Differences between the CA Limited Fund and the National Limited Fund. Although the CA Limited Fund and the National Limited Fund have identical policies with respect to the maturity of the obligations they will acquire, the National Limited Fund historically has had a longer average duration and longer average maturity than the CA Limited Fund. Also, because of its much larger size than CA Limited Fund, the National Limited Fund has had more opportunities to invest in residual interest bonds than CA Limited Fund. For these reasons, the National Limited Fund may have a higher risk profile than the CA Limited Fund.

The duration of a municipal obligation measures the sensitivity of its price to interest rate movements, and obligations with longer maturities are more sensitive to changes in interest rates than short-term obligations. A fund with a longer average duration and maturity may carry more risk and have higher price volatility than a fund with lower average duration and maturity. Residual interest bonds expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments received on residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity.

| COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS |

General. CA Limited Fund and National Limited Fund are each a separate series of the Trust, a Massachusetts business trust governed by an Amended and Restated Declaration of Trust dated January 11, 1993, as amended from time to time, and by applicable Massachusetts law.

Shareholder Liability. Under Massachusetts law, shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable for the obligations of the Trust, including its other series. However, the Declaration of Trust disclaims shareholder liability for acts or obligations of the Trust and other series of the Trust and requires that notice of such disclaimer be given in each agreement, obligation, or instrument entered into or executed by the Trust or the Trustees. Indemnification out of the

10

Trust property for all losses and expenses of any shareholder held personally liable by virtue of his or her status as such for the obligations of the Trust is provided for in the Declaration of Trust and By-Laws. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability is considered to be remote because it is limited to circumstances in which the respective disclaimers are inoperative and the series would be unable to meet their respective obligations.

Copies of the Declaration of Trust may be obtained from the Trust upon written request at its principal office or from the Secretary of the Commonwealth of Massachusetts.

| INFORMATION ABOUT THE FUNDS |

Information about National Limited Fund is included in the current National Limited Fund Prospectus, a copy of which is included herewith and incorporated by reference herein. Additional information about National Limited Fund is included in the National Limited Fund SAI, which has been filed with the SEC and is incorporated by reference herein. Information concerning the operation and management of the CA Limited Fund is incorporated herein by reference from the CA Limited Fund Prospectus and CA Limited Fund SAI. Copies may be obtained without charge on Eaton Vance’s website at www.eatonvance.com, by writing Eaton Vance Distributors, Inc., Two International Place, Boston, MA 02110 or by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time.

You will find and may copy information about each Fund (including the statement of additional information and shareholder reports): at the SEC’s public reference room in Washington, DC (call 1-202-942-8090 for information on the operation of the public reference room); on the EDGAR Database on the SEC’s Internet site (http://www.sec.gov); or, upon payment of copying fees, by writing to the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, or by electronic mail at publicinfo@sec.gov.

The Trust, on behalf of each Fund, is currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith files proxy material, reports and other information with the SEC. These reports can be inspected and copied at the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, as well as at the following regional offices: New York Regional Office, 3 World Financial Center, Suite 400, New York, NY 10281-1022; and Chicago Regional Office, 175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604. Copies of such material can also be obtained from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549 at prescribed rates.

Householding: One Proxy Statement/Prospectus may be delivered to multiple shareholders at the same address unless you request otherwise. You may request that we do not household proxy statements and/or obtain additional copies of the Proxy Statement/Prospectus by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time or writing to Eaton Vance Management, ATTN: Proxy Coordinator – Mutual Fund Operations, Two International Place, Boston, MA 02110.

What is the Vote Required to Approve the Proposal?

The affirmative vote of the holders of a majority of CA Limited Fund’s outstanding shares, as defined in the 1940 Act, is required to approve the Plan. Such “majority” vote is the vote of the holders of the lesser of (a) 67% or more of the shares of CA Limited Fund present or represented by proxy at the Special Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (b) 50% of the outstanding shares of CA Limited Fund. Class A, Class B and Class C shareholders of CA Limited Fund will vote together as a single group. Approval of the Plan by CA Limited Fund shareholders is a condition of the consummation of the Reorganization.

11

How Do I Vote in Person?

If you do attend the Special Meeting and wish to vote in person, we will provide you with a ballot prior to the vote. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a letter from the nominee indicating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote. Please call the Fund at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time if you plan to attend the Special Meeting. If you plan to attend the Special Meeting in person, please be prepared to present photo identification.

How Do I Vote By Proxy?

Whether you plan to attend the Special Meeting or not, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Special Meeting and vote.

If you properly fill in and sign your proxy card and send it to us in time to vote at the Special Meeting, your “proxy” (the individual named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares “FOR” the proposal and in accordance with management’s recommendation on other matters.

If you authorize a proxy, you may revoke it at any time before it is exercised by sending in another proxy card with a later date or by notifying the Secretary of the CA Limited Fund before the Special Meeting that you have revoked your proxy; such notice must be in writing and sent to the Secretary of the CA Limited Fund at the address set forth on the cover page of this Proxy Statement/Prospectus. In addition, although merely attending the Special Meeting will not revoke your proxy, if you are present at the Special Meeting you may withdraw your proxy and vote in person. Shareholders may also transact any other business not currently contemplated that may properly come before the Special Meeting in the discretion of the proxies or their substitutes.

How Will Proxies be Solicited and Tabulated?

The expense of preparing, printing and mailing this Proxy Statement/Prospectus and enclosures and the costs of soliciting proxies on behalf of the CA Limited Fund’s Board of Trustees will be borne by the CA Limited Fund. Proxies will be solicited by mail and may be solicited in person or by telephone, facsimile or other electronic means by officers of the CA Limited Fund, by personnel of Eaton Vance, by the CA Limited Fund’s transfer agent, BNY Mellon Asset Servicing, by broker-dealer firms or by a professional solicitation organization. The CA Limited Fund has retained D.F. King, to assist in the solicitation of proxies, for which the CA Limited Fund will pay an estimated fee of approximately $8,000, including out-of-pocket expenses. Estimated costs assume a moderate level of solicitation activity. If a greater solicitation effort is required, the solicitation costs would be higher. The expenses connected with the solicitation of this proxy and with any fur ther proxies which may be solicited by the CA Limited Fund’s officers, by Eaton Vance personnel, by the transfer agent, by broker-dealer firms or by D.F. King, in person, or by telephone, by telegraph, by facsimile or other electronic means, will be borne by the CA Limited Fund. A written proxy may be delivered to the CA Limited Fund or its transfer agent prior to the meeting by facsimile machine, graphic communication equipment or other electronic transmission. The CA Limited Fund will reimburse banks, broker-dealer firms, and other persons holding shares registered in their names or in the names of their nominees, for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares. Total estimated costs of the Reorganization are approximately $10,000.

Shareholders also may choose to give their proxy votes by telephone rather than return their proxy cards. Please see the proxy card for details. The CA Limited Fund may arrange for Eaton Vance, its affiliates or agents to contact shareholders who have not returned their proxy cards and offer to have votes recorded by telephone. If the CA Limited Fund records votes by telephone, it will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. If the enclosed proxy card is executed and returned, or a telephonic vote is delivered, that vote may

12

nevertheless be revoked at any time prior to its use by written notification received by the CA Limited Fund, by the execution of a later-dated proxy card, by the CA Limited Fund’s receipt of a subsequent valid telephonic vote, or by attending the meeting and voting in person.

All proxy cards solicited by the Board of Trustees that are properly executed and telephone votes that are properly delivered and received by the Secretary prior to the meeting, and which are not revoked, will be voted at the meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on the proxy card, it will be voted FOR the matters specified on the proxy card. Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the broker or nominee does not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted. Accordingly, abstentions and broker non-votes will assist the CA Limited Fund in obtaining a quorum, but m ay have the effect of a “No” vote on the proposal.

How is a Quorum Determined and What Happens if There is an Adjournment?

What constitutes a quorum for purposes of conducting a valid shareholder meeting, such as the Special Meeting, is set forth in the Trust’s By-Laws. Under the By-Laws of the Trust, the presence, in person or by proxy, of a majority of the outstanding shares is necessary to establish a quorum.

If a quorum is not present at the Special Meeting, the persons named as proxies in the enclosed proxy card may propose to adjourn the meeting to permit further solicitation of proxies in favor of the proposal. A meeting, including the Special Meeting, may be adjourned one or more times. Each such adjournment requires the affirmative vote of the holders of a majority of CA Limited Fund’s shares that are present at the meeting, in person or by proxy. The persons named as proxies will vote in favor of or against, or will abstain with respect to, adjournment in the same proportions they are authorized to vote for or against, or to abstain with respect to, the proposal.

THE TRUSTEES OF THE TRUST, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMEND

APPROVAL OF THE PLAN OF REORGANIZATION.

13

Neither the Declaration of Trust nor Massachusetts law grants the shareholders of the CA Limited Fund any rights in the nature of dissenters rights of appraisal with respect to any action upon which such shareholders may be entitled to vote; however, the normal right of mutual fund shareholders to redeem their shares (subject to any applicable contingent deferred sales charges) is not affected by the proposed Reorganization.

14

| NATIONAL LIMITED FUND FINANCIAL HIGHLIGHTS |

The financial highlights are intended to help you understand the National Limited Fund’s financial performance for the period(s) indicated. Certain information in the table reflects the financial results for a single Fund share. The total returns in the table represent the rate an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all distributions at net asset value). This information has been audited by Deloitte & Touche LLP, an independent registered public accounting firm. The report of Deloitte & Touche LLP and the National Limited Fund’s financial statements are incorporated herein by reference and included in the National Limited Fund’s annual report, which is available upon request.

| | | | | | |

| | Year Ended March 31, |

| |

|

| | 2010 | 2009 |

| |

|

| | Class A | Class B | Class C | Class A | Class B | Class C |

|

| Net asset value – Beginning of year | $9.200 | $9.200 | $8.630 | $9.930 | $9.940 | $9.310 |

|

| |

| |

| Income (Loss) From Operations | | | | | | |

|

| Net investment income(1) | $0.398 | $0.324 | $0.303 | $0.394 | $0.322 | $0.302 |

| Net realized and unrealized gain (loss) | 0.804 | 0.815 | 0.756 | (0.733) | (0.745) | (0.685) |

|

| Total income (loss) from operations | $1.202 | $1.139 | $1.059 | $(0.339) | $(0.423) | $(0.383) |

|

| Less Distributions | | | | | | |

|

| From net investment income | $(0.392) | $(0.319) | $(0.299) | $(0.391) | $(0.317) | $(0.297) |

|

| Total distributions | $(0.392) | $(0.319) | $(0.299) | $(0.391) | $(0.317) | $(0.297) |

|

| Net asset value – End of year | $10.010 | $10.020 | $9.390 | $9.200 | $9.200 | $8.630 |

|

| Total Return(2) | 13.22% | 12.50% | 12.39% | (3.50)% | (4.34)% | (4.20)% |

| |

| Ratios/Supplemental Data | | | | | | |

|

| Net assets, end of year (000’s omitted) | $410,009 | $6,157 | $143,883 | $500,869 | $6,130 | $104,893 |

| Ratios (As a percentage of average daily | | | | | | |

| net assets): | | | | | | |

| Expenses excluding interest and fees | 0.71% | 1.46% | 1.46% | 0.72% | 1.47% | 1.47% |

| Interest and fee expense(3) | 0.01% | 0.01% | 0.01% | 0.02% | 0.02% | 0.02% |

| Total expenses before custodian fee | 0.72% | 1.47% | 1.47% | 0.74% | 1.49% | 1.49% |

| reduction | | | | | | |

| Expenses after custodian fee reduction | | | | | | |

| excluding interest and fees | 0.71% | 1.46% | 1.46% | 0.71% | 1.46% | 1.46% |

| Net investment income | 4.05% | 3.29% | 3.28% | 4.12% | 3.37% | 3.38% |

| Portfolio Turnover | 14% | 14% | 14% | 33% | 33% | 33% |

|

15

| | | | | | |

| NATIONAL LIMITED FUND FINANCIAL HIGHLIGHTS (continued) | | | |

| |

| | Year Ended March 31, |

| |

|

| | 2008 | 2007 |

| |

|

| | Class A | Class B | Class C | Class A | Class B | Class C |

|

| Net asset value – Beginning of year | $10.420 | $10.420 | $9.770 | $10.290 | $10.290 | $9.640 |

|

| Income (Loss) From Operations | | | | | | |

|

| Net investment income(1) | $0.392 | $0.318 | $0.297 | $0.410 | $0.340 | $0.316 |

| Net realized and unrealized gain (loss) | (0.488) | (0.482) | (0.461) | 0.134 | 0.127 | 0.129 |

|

| Total income (loss) from operations | $(0.096) | $(0.164) | $(0.164) | $0.544 | $0.467 | $0.445 |

|

| Less Distributions | | | | | | |

|

| From net investment income | $(0.394) | $(0.316) | $(0.296) | $(0.414) | $(0.337) | $(0.315) |

|

| Total distributions | $(0.394) | $(0.316) | $(0.296) | $(0.414) | $(0.337) | $(0.315) |

|

| Net asset value – End of year | $9.930 | $9.940 | $9.310 | $10.420 | $10.420 | $9.770 |

|

| Total Return(2) | (0.94)% | (1.59)% | (1.70)% | 5.38% | 4.60% | 4.68% |

| |

| Ratios/Supplemental Data | | | | | | |

|

| Net assets, end of year (000’s omitted) | $541,176 | $6,512 | $100,866 | $367,010 | $11,435 | $81,411 |

| Ratios (As a percentage of average daily | | | | | | |

| net assets): | | | | | | |

| Expenses excluding interest and fees | 0.71% | 1.46% | 1.46% | 0.78% | 1.53% | 1.53% |

| Interest and fee expense(3) | 0.05% | 0.05% | 0.05% | 0.10% | 0.10% | 0.10% |

| Total expenses before custodian fee | 0.76% | 1.51% | 1.51% | 0.88% | 1.63% | 1.63% |

| reduction | | | | | | |

| Expenses after custodian fee reduction | | | | | | |

| excluding interest and fees | 0.70% | 1.45% | 1.45% | 0.76% | 1.51% | 1.51% |

| Net investment income | 3.84% | 3.11% | 3.10% | 3.95% | 3.27% | 3.24% |

| Portfolio Turnover | 39% | 39% | 39% | 38% | 38% | 38% |

|

16

| | | |

| NATIONAL LIMITED FUND FINANCIAL HIGHLIGHTS (continued) | | |

| |

| | Year Ended March 31, |

| |

|

| | 2006 |

| |

|

| | Class A | Class B | Class C |

|

| Net asset value – Beginning of year | $10.210 | $10.220 | $9.580 |

|

| Income (Loss) From Operations | | | |

|

| Net investment income(1) | $0.411 | $0.335 | $0.313 |

| Net realized and unrealized gain (loss) | 0.078 | 0.068 | 0.059 |

|

| Total income (loss) from operations | $0.489 | $0.403 | $0.372 |

|

| Less Distributions | | | |

|

| From net investment income | $(0.409) | $(0.333) | $(0.312) |

|

| Total distributions | $(0.409) | $(0.333) | $(0.312) |

|

| Net asset value – End of year | $10.290 | $10.290 | $9.640 |

|

| Total Return(2) | 4.88% | 3.99% | 3.93% |

| |

| Ratios/Supplemental Data | | | |

|

| Net assets, end of year (000’s omitted) | $180,401 | $20,610 | $77,379 |

| Ratios (As a percentage of average daily net assets): | | | |

| Expenses excluding interest and fees | 0.79% | 1.54% | 1.54% |

| Interest and fee expense(3) | — | — | — |

| Total expenses before custodian fee reduction | 0.79% | 1.54% | 1.54% |

| Expenses after custodian fee reduction excluding interest and | 0.78% | 1.53% | 1.53% |

| fees | | | |

| Net investment income | 3.99% | 3.25% | 3.25% |

| Portfolio Turnover | 48% | 48% | 48% |

|

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Interest and fee expense relates to the liability for floating rate notes issued in conjunction with inverse floater securities transactions. |

17

CALIFORNIA LIMITED FUND FINANCIAL HIGHLIGHTS

The financial highlights are intended to help you understand the California Limited Fund’s financial performance for the period(s) indicated. Certain information in the table reflects the financial results for a single Fund share. The total returns in the table represent the rate an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all distributions at net asset value. This information has been audited by Deloitte & Touche LLP, an independent registered public accounting firm. The report of Deloitte & Touche LLP and CA Limited Fund’s financial statements are incorporated herein by reference and included in CA Limited Fund’s annual report, which is available on request.

| | | | | | |

| | Year Ended March 31, |

| |

|

| | 2010 | 2009 |

| |

|

| | Class A | Class B | Class C | Class A | Class B | Class C |

|

| Net asset value – Beginning of year | $9.290 | $9.260 | $8.980 | $10.030 | $10.000 | $9.690 |

|

| Income (Loss) From Operations | | | | | | |

|

| Net investment income(1) | $0.359 | $0.294 | $0.276 | $0.376 | $0.299 | $0.290 |

| Net realized and unrealized gain (loss) | 0.655 | 0.647 | 0.636 | (0.734) | (0.733) | (0.703) |

|

| Total income (loss) from operations | $1.014 | $0.941 | $0.912 | $(0.358) | $(0.434) | $(0.413) |

|

| Less Distributions | | | | | | |

|

| From net investment income | $(0.374) | $(0.301) | $(0.292) | $(0.382) | $(0.306) | $(0.297) |

|

| Total distributions | $(0.374) | $(0.301) | $(0.292) | $(0.382) | $(0.306) | $(0.297) |

|

| Net asset value – End of year | $9.930 | $9.900 | $9.600 | $9.290 | $9.260 | $8.980 |

|

| Total Return(2) | 11.04% | 10.26% | 10.25% | (3.67)% | (4.42)% | (4.35)% |

| |

| Ratios/Supplemental Data | | | | | | |

|

| Net assets, end of year (000’s omitted) | $23,432 | $ 270 | $2,328 | $20,017 | $ 860 | $1,820 |

| Ratios (As a percentage of average daily | | | | | | |

| net assets): | | | | | | |

| Expenses before custodian fee reduction | 1.03% | 1.78% | 1.78% | 0.94% | 1.70% | 1.70% |

| Expenses after custodian fee reduction | 1.03% | 1.78% | 1.78% | 0.93% | 1.68% | 1.68% |

| Net investment income | 3.66% | 3.04% | 2.91% | 3.87% | 3.14% | 3.12% |

| Portfolio Turnover | 22% | 22% | 22% | 7% | 7% | 7% |

|

18

| | | | | | |

| CALIFORNIA LIMITED FUND FINANCIAL HIGHLIGHTS (continued) |

| |

| | Year Ended March 31, |

| |

|

| | 2008 | 2007 |

| |

|

| | Class A | Class B | Class C | Class A | Class B | Class C |

|

| Net asset value – Beginning of year | $10.410 | $10.370 | $10.050 | $10.330 | $10.300 | $9.980 |

|

| Income (Loss) From Operations | | | | | | |

|

| Net investment income(1) | $0.381 | $0.304 | $0.294 | $0.378 | $0.303 | $0.280 |

| Net realized and unrealized gain (loss) | (0.380) | (0.372) | (0.361) | 0.082 | 0.068 | 0.082 |

|

| Total income (loss) from operations | $0.001 | $(0.068) | $(0.067) | $0.460 | $0.371 | $0.362 |

|

| Less Distributions | | | | | | |

|

| From net investment income | $(0.381) | $(0.302) | $(0.293) | $(0.380) | $(0.301) | $(0.292) |

|

| Total distributions | $(0.381) | $(0.302) | $(0.293) | $(0.380) | $(0.301) | $(0.292) |

|

| Net asset value – End of year | $10.030 | $10.000 | $9.690 | $10.410 | $10.370 | $10.050 |

|

| Total Return(2) | 0.00%(3) | (0.68)% | (0.69)% | 4.52% | 3.64% | 3.67% |

| |

| Ratios/Supplemental Data | | | | | | |

|

| Net assets, end of year (000’s omitted) | $36,615 | $ 607 | $1,449 | $35,937 | $ 770 | $ 562 |

| Ratios (As a percentage of average daily | | | | | | |

| net assets): | | | | | | |

| Expenses before custodian fee reduction | 0.85% | 1.60% | 1.60% | 0.93% | 1.68% | 1.68% |

| Expenses after custodian fee reduction | 0.82% | 1.57% | 1.57% | 0.90% | 1.65% | 1.65% |

| Net investment income | 3.70% | 2.96% | 2.96% | 3.65% | 2.94% | 2.78% |

| Portfolio Turnover | 55% | 55% | 55% | 32% | 32% | 32% |

|

19

CALIFORNIA LIMITED FUND FINANCIAL HIGHLIGHTS (continued)

| | | |

| | Year Ended March 31, |

| |

|

| | 2006 |

| |

|

| | Class A | Class B | Class C |

|

| Net asset value – Beginning of period | $10.290 | $10.260 | $ 9.950 |

|

| Income (Loss) From Operations | | | |

|

| Net investment income(1) | $0.377 | $0.298 | $0.282 |

| Net realized and unrealized gain (loss) | 0.036 | 0.035 | 0.034 |

|

| Total income (loss) from operations | $0.413 | $0.333 | $0.316 |

|

| Less Distributions | | | |

|

| From net investment income | $(0.373) | $(0.293) | $(0.286) |

|

| Total distributions | $(0.373) | $(0.293) | $(0.286) |

|

| Net asset value – End of period | $10.330 | $10.300 | $9.980 |

|

| Total Return(2) | 4.06% | 3.28% | 3.15% |

| |

| Ratios/Supplemental Data | | | |

|

| Net assets, end of year (000’s omitted) | $33,830 | $ 2,687 | $22 |

| Ratios (As a percentage of average daily net | | | |

| assets): | | | |

| Expenses before custodian fee reduction | 0.86% | 1.61% | 1.61% |

| Expenses after custodian fee reduction | 0.84% | 1.59% | 1.59% |

| Net investment income | 3.64% | 2.89% | 2.83% |

| Portfolio Turnover | 28% | 28% | 28% |

|

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sale charges. |

| (3) | Amount is less than 0.01%. |

20

The financial statements incorporated in this Proxy Statement/Prospectus by reference from each Fund’s Annual Report for the year ended March 31, 2010 on Form N-CSR have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference, and have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

21

FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (“Agreement”) is made as of this ____ day of ________, 2010, by and among Eaton Vance Investment Trust, a Massachusetts business trust (“Investment Trust”) on behalf of its series Eaton Vance California Limited Maturity Municipal Income Fund (“California Limited Fund”) and Investment Trust, on behalf of its series Eaton Vance National Limited Maturity Municipal Income Fund (“National Limited Fund”).