EXHIBIT (17)(a)(i)

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPAL INCOME FUND

Supplement to Prospectus dated August 1, 2009 |

The Board of Trustees of the fund named above (the "Fund") recently approved a proposal to reorganize the Fund into Eaton Vance National Limited Maturity Municipal Income Fund, a series of Eaton Vance Investment Trust with substantially the same investment objective as the Fund. Proxy materials describing the proposed reorganization are expected to be mailed in September 2010 to the Fund’s record date shareholders. If shareholders of the Fund approve the reorganization, it is expected to be completed in the fourth quarter of 2010. For additional information regarding the investment strategies and principal risks of National Limited Maturity Municipal Income Fund, please see that fund’s prospectus, which can be located at http://funddocuments.eatonvance.com.

After the close of business on June 18, 2010, the Fund will be closed to new investors.

| | |

| June 14, 2010 | 4646-6/10 | LTDP8/1PS |

EATON VANCE ALABAMA MUNICIPALS FUND

EATON VANCE ARKANSAS MUNICIPALS FUND

EATON VANCE GEORGIA MUNICIPALS FUND

EATON VANCE KENTUCKY MUNICIPALS FUND

EATON VANCE LOUISIANA MUNICIPALS FUND

EATON VANCE MARYLAND MUNICIPALS FUND

EATON VANCE MISSOURI MUNICIPALS FUND

EATON VANCE NORTH CAROLINA MUNICIPALS FUND

EATON VANCE OREGON MUNICIPALS FUND

EATON VANCE SOUTH CAROLINA MUNICIPALS FUND

EATON VANCE TENNESSEE MUNICIPALS FUND

EATON VANCE VIRGINIA MUNICIPALS FUND

Supplement to Prospectus dated January 1, 2009

EATON VANCE CALIFORNIA MUNICIPALS FUND

EATON VANCE MASSACHUSETTS MUNICIPALS FUND

EATON VANCE NATIONAL MUNICIPALS FUND

EATON VANCE NEW YORK MUNICIPALS FUND

EATON VANCE OHIO MUNICIPALS FUND

EATON VANCE RHODE ISLAND MUNICIPALS FUND

Supplement to Prospectuses dated February 1, 2009

EATON VANCE AMT-FREE MUNICIPAL BOND FUND

Supplement to Prospectus dated May 1, 2009

EATON VANCE HIGH YIELD MUNICIPALS FUND

EATON VANCE INSURED MUNICIPALS FUND

EATON VANCE KANSAS MUNICIPALS FUND

Supplement to Prospectuses dated June 1, 2009

EATON VANCE AMT-FREE LIMITED MATURITY MUNICIPALS FUND

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPALS FUND

EATON VANCE MASSACHUSETTS LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NATIONAL LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW JERSEY LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW YORK LIMITED MATURITY MUNICIPALS FUND

EATON VANCE PENNSYLVANIA LIMITED MATURITY MUNICIPALS FUND

Supplement to Prospectuses dated August 1, 2009 |

Effective December 1, 2009, each Fund will change its name as follows:

| | Eaton Vance Alabama Municipal Income Fund

Eaton Vance AMT-Free Limited Maturity Municipal Income Fund

Eaton Vance AMT-Free Municipal Income Fund

Eaton Vance Arkansas Municipal Income Fund

Eaton Vance California Limited Maturity Municipal Income Fund

Eaton Vance California Municipal Income Fund

Eaton Vance Georgia Municipal Income Fund

Eaton Vance High Yield Municipal Income Fund

Eaton Vance Insured Municipal Income Fund

Eaton Vance Kansas Municipal Income Fund

Eaton Vance Kentucky Municipal Income Fund

Eaton Vance Louisiana Municipal Income Fund

Eaton Vance Maryland Municipal Income Fund

Eaton Vance Massachusetts Limited Maturity Municipal Income Fund |

| | Eaton Vance Massachusetts Municipal Income Fund

Eaton Vance Missouri Municipal Income Fund

Eaton Vance National Limited Maturity Municipal Income Fund

Eaton Vance National Municipal Income Fund

Eaton Vance New Jersey Limited Maturity Municipal Income Fund

Eaton Vance New York Limited Maturity Municipal Income Fund

Eaton Vance New York Municipal Income Fund

Eaton Vance North Carolina Municipal Income Fund

Eaton Vance Ohio Municipal Income Fund

Eaton Vance Oregon Municipal Income Fund

Eaton Vance Pennsylvania Limited Maturity Municipal Income Fund

Eaton Vance Rhode Island Municipal Income Fund

Eaton Vance South Carolina Municipal Income Fund

Eaton Vance Tennessee Municipal Income Fund

Eaton Vance Virginia Municipal Income Fund |

In addition, the following changes to Eaton Vance Insured Municipals Fund are effective immediately:

1. The following replaces the fourth sentence in the paragraph under “Investment Objectives and Principal Strategies” under “Fund Summaries”:

The Insured Fund primarily invests in municipal obligations that are insured as to principal and interest payments by insurers having a claims-paying ability rated at least investment grade.

2. The following replaces the third paragraph under “Investment Objectives & Principal Policies and Risks” in its entirety:

At least 80% of the Insured Fund’s net assets will normally be invested in obligations that are insured as to principal and interest payments by insurers having a claims-paying ability rated at least investment grade (i.e., rated Baa or higher by Moody’s or BBB or higher by S&P or Fitch). The Insured Fund may invest up to 20% of its net assets in unrated obligations deemed by the investment adviser to be of investment grade quality and obligations that are uninsured. Insurance does not protect the market value of insured obligations or the net asset value of the Insured Fund. The value of an obligation will be affected by the credit standing of its insurer.

| | |

| November 2, 2009 | 4187-11/09 | COMBPROPS |

2

EATON VANCE FLOATING-RATE ADVANTAGE FUND

EATON VANCE FLOATING-RATE FUND

EATON VANCE FLOATING-RATE & HIGH INCOME FUND

Supplement to Prospectus dated March 1, 2009

EATON VANCE AMT-FREE LIMITED MATURITY MUNICIPALS FUND

EATON VANCE CALIFORNIA LIMITED MATURITY MUNICIPALS FUND

EATON VANCE MASSACHUSETTS LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NATIONAL LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW JERSEY LIMITED MATURITY MUNICIPALS FUND

EATON VANCE NEW YORK LIMITED MATURITY MUNICIPALS FUND

EATON VANCE PENNSYLVANIA LIMITED MATURITY MUNICIPALS FUND

Supplement to Prospectuses dated August 1, 2009 |

The following changes to each Fund’s prospectus are effective October 12, 2009:

1. The following replaces the table in "Class A Front-End Sales Charge." under "Sales Charges":

| | | |

| | Sales Charge* | Sales Charge* | Dealer Commission |

| | as Percentage of | as Percentage of Net | as Percentage of |

| Amount of Purchase | Offering Price | Amount Invested | Offering Price |

|

| Less than $100,000 | 2.25% | 2.30% | 2.00% |

| $100,000 but less than $250,000 | 1.75% | 1.78% | 1.50% |

| $250,000 but less than $500,000 | 1.50% | 1.52% | 1.25% |

| $500,000 but less than $1,000,000 | 1.00% | 1.01% | 0.85% |

| $1,000,000 or more | 0.00** | 0.00** | 0.75% |

| * | Because the offering price per share is rounded to two decimal places, the actual sales charge you pay on a purchase of Class A shares may be more or less than your total purchase amount multiplied by the applicable sales charge percentage. |

| ** | No sales charge is payable at the time of purchase on investments of $1 million or more. A CDSC of 1.00% will be imposed on such investments (as described below) in the event of redemptions within 18 months of purchase. |

| EATON VANCE MISSISSIPPI MUNICIPALS FUND

EATON VANCE WEST VIRGINIA MUNICIPALS FUND

Supplement to Prospectus dated February 1, 2009

EATON VANCE HAWAII MUNICIPALS FUND

Supplement to Prospectus dated June 1, 2009

EATON VANCE OHIO LIMITED MATURITY

MUNICIPALS FUND

Supplement to Prospectus dated August 1, 2009 |

Effective after the close of business on September 18, 2009,

shares of each Fund will no longer be available for purchase

or exchange. |

| |

| September 18, 2009 | COMBSTATEPS |

Eaton Vance California Limited Maturity Municipals Fund

Eaton Vance Massachusetts Limited Maturity Municipals Fund

Eaton Vance New Jersey Limited Maturity Municipals Fund

Eaton Vance New York Limited Maturity Municipals Fund

Eaton Vance Ohio Limited Maturity Municipals Fund

Eaton Vance Pennsylvania Limited Maturity Municipals Fund

| Mutual funds seeking tax-exempt income and limited principal fluctuation |

Prospectus Dated

August 1, 2009 |

The Securities and Exchange Commission has not approved or disapproved these securities or

determined whether this prospectus is truthful or complete. Any representation to the contrary

is a criminal offense. |

This prospectus contains important information about the Funds and the services

available to shareholder. Please save it for reference.

| |

| Table of Contents | |

| |

| Fund Summaries | 3 |

| California Fund | 4 |

| Massachusetts Fund | 5 |

| New Jersey Fund | 6 |

| New York Fund | 7 |

| Ohio Fund | 8 |

| Pennsylvania Fund | 9 |

| Fund Fees and Expenses | 10 |

| Investment Objectives & Principal Policies and Risks | 12 |

| Management and Organization | 14 |

| Valuing Shares | 15 |

| Purchasing Shares | 15 |

| Sales Charges | 18 |

| Redeeming Shares | 20 |

| Shareholder Account Features | 20 |

| Tax Information | 22 |

| Financial Highlights | 25 |

| California Fund | 25 |

| Massachusetts Fund | 27 |

| New Jersey Fund | 29 |

| New York Fund | 31 |

| Ohio Fund | 33 |

| Pennsylvania Fund | 35 |

2

Fund Summaries

This section summarizes the investment objectives, and principal strategies and risks of investing in an Eaton Vance Limited Maturity Municipals Fund. You will find more specific information about each Fund in the pages that follow.

Investment Objectives and Principal Strategies

The investment objective of each Fund is to provide a high level of current income exempt from regular federal income tax and from particular state or local income or other taxes, as applicable, and limited principal fluctuation. Under normal market conditions, each Fund will invest at least 80% of its net assets in municipal obligations that are exempt from regular federal income tax and from state taxes which, in accordance with the Fund’s investment objective, the Fund seeks to avoid. Each Fund primarily invests in investment grade municipal obligations (those rated BBB or Baa or higher), but may also invest in lower rated obligations. Each Fund invests in obligations to seek to maintain a dollar-weighted average portfolio duration of between three and nine years.

Each Fund may concentrate in certain types of municipal obligations (such as industrial development bonds, housing bonds, hospital bonds or utility bonds), so Fund shares could be affected by events that adversely affect a particular sector. Each Fund may purchase derivative instruments (such as futures contracts and options thereon, and interest rate swaps), bonds that do not make regular payments of interest, bonds issued on a “when issued” basis and municipal leases. A portion of each Fund’s distributions generally will be subject to alternative minimum tax.

Each portfolio manager purchases and sells securities to maintain a competitive yield and to enhance return based upon the relative value of the securities in the marketplace. The portfolio managers may also trade securities to minimize taxable capital gains to shareholders. The managers attempt to limit principal fluctuation by investing to limit overall portfolio duration.

Principal Risk Factors

The value of Fund shares may change when interest rates change. When interest rates rise, the value of Fund shares typically will decline. Fund yields will also fluctuate over time. Each Fund invests a significant portion of assets in obligations of issuers located in a single state and is sensitive to factors affecting that state, such as changes in the economy, decreases in tax collection or the tax base, legislation which limits taxes and changes in issuer credit ratings. Because obligations rated BBB or Baa and obligations rated below BBB or Baa (so-called “junk bonds”) are more sensitive to the financial soundness of their issuers than higher quality obligations, Fund shares may fluctuate more in value than shares of a fund investing solely in higher quality obligations. Obligations rated BBB or Baa have speculative characteristics, while lower rated obligations are predominantly speculative.

A Fund’s use of derivatives may expose the Fund to increased risk of principal loss due to imperfect correlation, failure of the counterparty and unexpected price or interest rate movements. Bonds that do not make regular interest payments may experience greater volatility in response to interest rate changes. When-issued securities are subject to the risk that when delivered to the Fund they will be worth less than the price the Fund agreed to pay for them. Municipal leases often require a legislative appropriation of funds for payment. If the necessary appropriation is not made, the issuer of the lease may not be able to meet its obligations.

As a non-diversified fund, each Fund may invest a larger portion of its assets in the obligations of a limited number of issuers than may a diversified fund. This makes each Fund more susceptible to adverse economic, business or other developments affecting such issuers. Each Fund may invest, with respect to 50% of its total assets, more than 5% (but not more than 25%) of its total assets in securities of any one issuer, such limitations do not apply to U.S. Government securities.

No Fund is a complete investment program and you may lose money by investing in a Fund. There is no guarantee that a Fund will be able to achieve its investment objective. An investment in a Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

3

Eaton Vance California Limited Maturity Municipals Fund

The California Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and California state personal income taxes, and limited principal fluctuation.

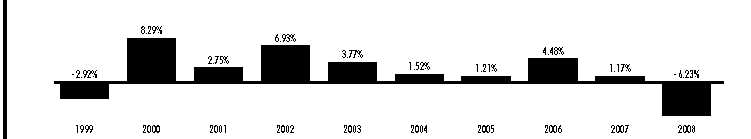

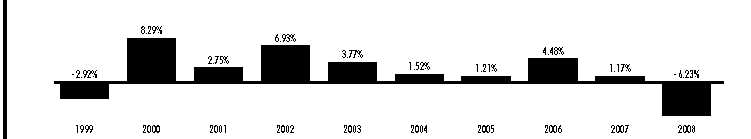

Performance Information. The following bar chart and table provide information about the California Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 5.13% for the quarter ended September 30, 2002, and the lowest quarterly return was –6.43% for the quarter ended December 31, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 8.86%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 41.05%) for Class A shares were 3.69% and 6.26%, respectively, for Class B shares were 3.02% and 5.12%, respectively, and for Class C shares were 3.01% and 5.11%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –11.83% | –0.29% | 2.16% |

| Class B Return Before Taxes | –13.10% | –0.59% | 1.61% |

| Class B Return After Taxes on Distributions | –13.10% | –0.59% | 1.59% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –7.46% | –0.03% | 1.85% |

| Class C Return Before Taxes | –11.37% | –0.60% | 1.60% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable contingent deferred sales charge ("CDSC") for Class B and Class C. The Class C performance shown above for the period prior to March 23, 2005 is the performance of Class B shares, adjusted for the sales charge that applies to Class C shares (but not adjusted for any other differences in the expenses of the classes). Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

4

Eaton Vance Massachusetts Limited Maturity Municipals Fund

The Massachusetts Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and Massachusetts state personal income taxes, and limited principal fluctuation.

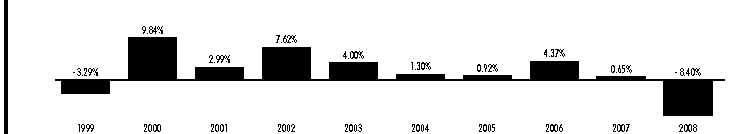

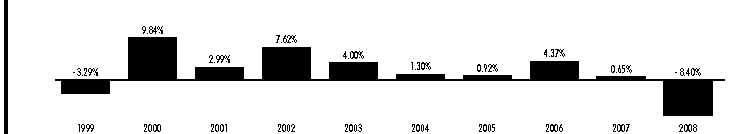

Performance Information. The following bar chart and table provide information about the Massachusetts Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 4.13% for the quarter ended September 30, 2002, and the lowest quarterly return was –2.75% for the quarter ended September 30, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 6.99%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 38.45%) for Class A shares were 2.92% and 4.74%, respectively, for Class B shares were 2.24% and 3.64%, respectively, and for Class C shares were 2.29% and 3.72%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –6.73% | 0.70% | 2.63% |

| Class B Return Before Taxes | –8.09% | 0.41% | 2.06% |

| Class B Return After Taxes on Distributions | –8.09% | 0.41% | 2.06% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –4.26% | 0.78% | 2.23% |

| Class C Return Before Taxes | –6.19% | 0.40% | 2.09% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

5

Eaton Vance New Jersey Limited Maturity Municipals Fund |

The New Jersey Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and New Jersey state personal income taxes, and limited principal fluctuation.

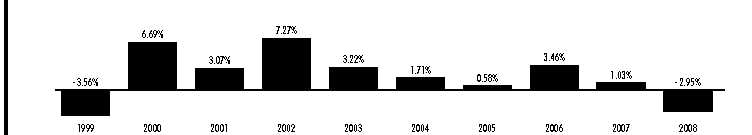

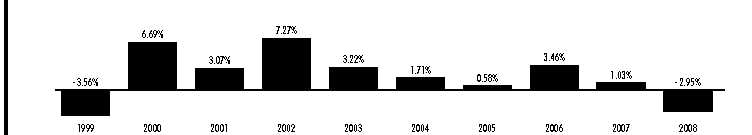

Performance Information. The following bar chart and table provide information about the New Jersey Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 3.32% for the quarter ended December 31, 2000 and the lowest quarterly return was –2.95% for the quarter ended September 30, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 7.76%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 40.83%) for Class A shares were 2.99% and 5.05%, respectively, for Class B shares were 2.30% and 3.89%, respectively, and for Class C shares were 2.30% and 3.89%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –7.72% | 0.63% | 2.55% |

| Class B Return Before Taxes | –8.96% | 0.37% | 2.01% |

| Class B Return After Taxes on Distributions | –8.96% | 0.36% | 2.00% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –4.78% | 0.76% | 2.19% |

| Class C Return After Taxes on Distributions | –7.33% | 0.32% | 1.99% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. The Class C performance shown above for the period prior to August 1, 2006 is the performance of Class B shares, adjusted for the sales charge that applies to Class C shares (but not adjusted for any other differences in the expenses of the classes). Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source of Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

6

Eaton Vance New York Limited Maturity Municipals Fund

The New York Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and New York state and New York City personal income taxes, and limited principal fluctuation.

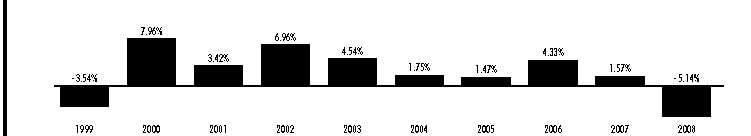

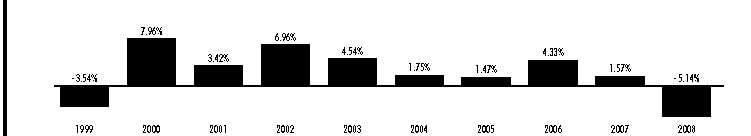

Performance Information. The following bar chart and table provide information about the New York Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 4.04% for the quarter ended December 31, 2000, and the lowest quarterly return was –4.23% for the quarter ended December 31, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 8.14%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 39.45%) for Class A shares were 3.66% and 6.04%, respectively, for Class B shares were 2.99% and 4.94%, respectively, and for Class C shares were 2.99% and 4.94%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –9.86% | –0.04% | 2.43% |

| Class B Return Before Taxes | –11.06% | –0.33% | 1.88% |

| Class B Return After Taxes on Distributions | –11.06% | –0.33% | 1.87% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –6.10% | 0.20% | 2.10% |

| Class C Return Before Taxes | –9.35% | –0.35% | 1.90% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

7

| Eaton Vance Ohio Limited Maturity Municipals Fund |

The Ohio Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and Ohio state personal income taxes, and limited principal fluctuation. The Board of Trustees of the Ohio Fund has voted to recommend that shareholders approve the merger of the Ohio Fund into Eaton Vance National Limited Maturity Municipals Fund (the "National Fund"), a diversified national limited maturity municipal bond fund with substantially similar investment objectives and policies to the Ohio Fund (with the exception of policies to avoid particular state income taxes). Shareholders of the Fund will be asked to approve the merger at a special meeting scheduled to be held on September 25, 2009. If approved, the Ohio Fund will transfer its assets to the National Fund in exchange for shares of the National Fund, and the National Fund will assume the liabilities of the Ohio Fund. Immediately following this exchange, which will be effected on the basis of the relative net asset value of the Ohio Fund, the Ohio Fund will distribute shares of National Fund to its shareholders pro rata in liquidiation of the Ohio Fund.

Performance Information. The following bar chart and table provide information about the Ohio Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 3.57% for the quarter ended September 30, 2002, and the lowest quarterly return was –2.21% for the quarter ended June 30, 2004. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 4.64%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 38.85%) for Class A shares were 2.27% and 3.71%, respecti vely, for Class B shares were 1.57% and 2.57%, respectively, and for Class C shares were 1.57% and 2.57%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –4.50% | 1.05% | 2.53% |

| Class B Return Before Taxes | –5.78% | 0.74% | 1.99% |

| Class B Return After Taxes on Distributions | –5.78% | 0.74% | 1.99% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –2.73% | 1.07% | 2.17% |

| Class C Return Before Taxes | –4.11% | 0.68% | 1.96% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. The Class C performance shown above for the period prior to August 1, 2006 is the performance of Class B shares, adjusted for the sales charge that applies to Class C shares (but not adjusted for any other differences in the expenses of the classes). Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

8

Eaton Vance Pennsylvania Limited Maturity Municipals Fund

The Pennsylvania Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and Pennsylvania state and local taxes in the form of an investment exempt from Pennsylvania personal property taxes, and limited principal fluctuation.

Performance Information. The following bar chart and table provide information about the Pennsylvania Fund’s performance for each calendar year through December 31, 2008. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. The table contains returns for each Class of shares and a comparison to the performance of a national index of intermediate-maturity municipal obligations. Returns in the table for Class B shares are shown before and after the reduction of taxes. Although past performance (both before and after taxes) is no guarantee of future results, this performance information demonstrates the risk that the value of your investment will change.

During the ten years ended December 31, 2008, the highest quarterly total return for Class B was 3.64% for the quarter ended September 30, 2002, and the lowest quarterly return was –2.26% for the quarter ended September 30, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2008 to June 30, 2009) was 6.15%. For the 30 days ended March 31, 2009, the SEC yield and SEC tax-equivalent yield (assuming a combined state and federal income tax rate of 37.00%) for Class A shares were 3.04% and 4.83%, respectively, for Class B shares were 2.35% and 3.73%, respectively, and for Class C shares were 2.37% and 3.76%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| | One | Five | Ten |

| Average Annual Total Return as of December 31, 2008 | Year | Years | Years |

|

| Class A Return Before Taxes | –6.60% | 1.05% | 2.81% |

| Class B Return Before Taxes | –7.90% | 0.74% | 2.25% |

| Class B Return After Taxes on Distributions | –7.90% | 0.74% | 2.25% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | –4.04% | 1.11% | 2.43% |

| Class C Return Before Taxes | –5.99% | 0.74% | 2.27% |

| Barclays Capital 7 Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 4.59% | 3.69% | 4.80% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable CDSC for Class B and Class C. Barclays Capital 7 Year Municipal Bond Index is an unmanaged index of intermediate-maturity municipal obligations. Investors cannot invest directly in an Index. (Source for Barclays Capital 7 Year Municipal Bond Index: Lipper, Inc.)

Total returns are historical and are calculated by determining the percentage change in net asset value or public offering price with all distributions reinvested. The Fund's past performance (both before and after taxes) is no guarantee of future results. Investment return and principal value of Fund shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For the Fund’s performance as of the most recent month-end, please refer to www.eatonvance.com.

After-tax returns are calculated using certain assumptions. After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

9

Fund Fees and Expenses. These tables describe the fees and expenses that you may pay if you buy and hold shares. Annual Fund Operating Expenses are stated as a percentage of a Fund’s average daily net assets for its most recently completed fiscal year. In general, Annual Fund Operating Expenses as a percentage of Fund average daily net assets will change as Fund assets increase and decrease, and Annual Fund Operating Expenses may differ in the future. The net assets of each Fund as of its last five fiscal year ends are included in the Financial Highlights in this prospectus.

| Shareholder Fees (fees paid directly from your investment) | | | |

| | Class A | Class B | Class C |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | 2.25% | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value at time of purchase or time of redemption) | None | 3.00% | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Distributions | None | None | None |

| | | | |

| | | | | |

| Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | |

| | | | | | |

| | | Management | Distribution and | Other | Total Annual Fund |

| | | Fees | Service (12b-1) Fees | Expenses | Operating Expenses |

|

| California Fund | Class A shares | 0.44% | 0.15% | 0.35% | 0.94% |

| | Class B shares | 0.44% | 0.90% | 0.36% | 1.70% |

| | Class C shares | 0.44% | 0.90% | 0.36% | 1.70% |

|

| Massachusetts Fund | Class A shares | 0.45% | 0.15% | 0.25% | 0.85% |

| | Class B shares | 0.45% | 0.90% | 0.25% | 1.60% |

| | Class C shares | 0.45% | 0.90% | 0.25% | 1.60% |

|

| New Jersey Fund | Class A shares | 0.44% | 0.15% | 0.30% | 0.89% |

| | Class B shares | 0.44% | 0.90% | 0.30% | 1.64% |

| | Class C shares | 0.44% | 0.90% | 0.30% | 1.64% |

|

| New York Fund | Class A shares | 0.44% | 0.15% | 0.21% | 0.80% |

| | Class B shares | 0.44% | 0.90% | 0.21% | 1.55% |

| | Class C shares | 0.44% | 0.90% | 0.21% | 1.55% |

|

| Ohio Fund | Class A shares | 0.44% | 0.15% | 0.50% | 1.09% |

| | Class B shares | 0.44% | 0.90% | 0.50% | 1.84% |

| | Class C shares | 0.44% | 0.90% | 0.49% | 1.83% |

|

| Pennsylvania Fund | Class A shares | 0.45% | 0.15% | 0.27% | 0.87% |

| | Class B shares | 0.45% | 0.90% | 0.27% | 1.62% |

| | Class C shares | 0.45% | 0.90% | 0.27% | 1.62% |

| | | | | | |

Examples. These Examples are intended to help you compare the cost of investing in a Fund with the cost of investing in other mutual funds. Each Example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. Each Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same as stated in the Fund Fees and Expenses table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | |

| | | 1 Year | 3 Years | 5 Years | 10 Years |

|

| California Fund | Class A shares | $319 | $518 | $733 | $1,354 |

| | Class B shares* | $473 | $736 | $835 | $1,452 |

| | Class C shares | $273 | $536 | $923 | $2,009 |

|

| Massachusetts Fund | Class A shares | $310 | $490 | $686 | $1,250 |

| | Class B shares* | $463 | $705 | $784 | $1,345 |

| | Class C shares | $263 | $505 | $871 | $1,900 |

|

| New Jersey Fund | Class A shares | $314 | $502 | $707 | $1,296 |

| | Class B shares* | $467 | $717 | $805 | $1,391 |

| | Class C shares | $267 | $517 | $892 | $1,944 |

|

| New York Fund | Class A shares | $305 | $475 | $659 | $1,193 |

| | Class B shares* | $458 | $690 | $758 | $1,288 |

| | Class C shares | $258 | $490 | $845 | $1,845 |

|

| Ohio Fund | Class A shares | $334 | $564 | $812 | $1,524 |

| | Class B shares* | $487 | $779 | $910 | $1,617 |

| | Class C shares | $286 | $576 | $990 | $2,148 |

|

| Pennsylvania Fund | Class A shares | $312 | $496 | $696 | $1,273 |

| | Class B shares* | $465 | $711 | $795 | $1,368 |

| | Class C shares | $265 | $511 | $881 | $1,922 |

| |

| You would pay the following expenses if you did not redeem your shares: | | | |

| | | | | | |

| | | 1 Year | 3 Years | 5 Years | 10 Years |

|

| California Fund | Class A shares | $319 | $518 | $733 | $1,354 |

| | Class B shares* | $173 | $536 | $835 | $1,452 |

| | Class C shares | $173 | $536 | $923 | $2,009 |

|

| Massachusetts Fund | Class A shares | $310 | $490 | $686 | $1,250 |

| | Class B shares* | $163 | $505 | $784 | $1,345 |

| | Class C shares | $163 | $505 | $871 | $1,900 |

|

| New Jersey Fund | Class A shares | $314 | $502 | $707 | $1,296 |

| | Class B shares* | $167 | $517 | $805 | $1,391 |

| | Class C shares | $167 | $517 | $892 | $1,944 |

|

| New York Fund | Class A shares | $305 | $475 | $659 | $1,193 |

| | Class B shares* | $158 | $490 | $758 | $1,288 |

| | Class C shares | $158 | $490 | $845 | $1,845 |

|

| Ohio Fund | Class A shares | $334 | $564 | $812 | $1,524 |

| | Class B shares* | $187 | $579 | $910 | $1,617 |

| | Class C shares | $186 | $576 | $990 | $2,148 |

|

| Pennsylvania Fund | Class A shares | $312 | $496 | $696 | $1,273 |

| | Class B shares* | $165 | $511 | $795 | $1,368 |

| | Class C shares | $165 | $511 | $881 | $1,922 |

* Reflects the expenses of Class A shares after four years because Class B shares automatically convert to Class A shares after four years.

11

Investment Objectives & Principal Policies and Risks

The investment objective of each Fund is to provide a high level of current income exempt from regular federal income tax and particular state or local income or other taxes, as applicable, and limited principal fluctuation. Each Fund seeks to achieve its objective by investing primarily (i.e., at least 80% of its net assets during periods of normal market conditions) in municipal obligations, the interest on which is exempt from regular federal income tax and from the state taxes which, in accordance with the Fund’s investment objective, the Fund seeks to avoid. This is a fundamental policy of each Fund which only may be changed with shareholder approval. For purposes of this policy, "net assets" include any assets purchased with borrowings for investment purposes. Each Fund’s investment objective and certain other policies may be changed by the Trustees without shareholder approval. There is no present intention to make any such change and shareholders will receive at least 60 days’ notice of any material change in a Fund’s investment objective.

At least 75% of net assets will normally be invested in municipal obligations rated at least investment grade at the time of investment (which are those rated Baa or higher by Moody’s Investors Services, Inc. ("Moody’s"), or BBB or higher by either Standard & Poor’s Ratings Group ("S&P") or Fitch Ratings ("Fitch")) or, if unrated, determined by the investment adviser to be of at least investment grade quality. The balance of net assets may be invested in municipal obligations rated below investment grade and in unrated municipal obligations considered to be of comparable quality by the investment adviser. Municipal obligations rated Baa or BBB have speculative characteristics, while lower quality obligations are predominant ly speculative. Also, changes in economic conditions or other circumstances are more likely to reduce the capacity of issuers of lower-rated obligations to make principal and interest payments. Lower rated obligations also may be subject to greater price volatility than higher rated obligations. No Fund will invest more than 10% of its net assets in obligations rated below B by Moody’s, S&P and Fitch, or in unrated obligations considered to be of comparable quality by the investment adviser. A credit rating may have a modifier (such as plus, minus or a numerical modifier) to denote its relative status within the rating. The presence of a modifier does not change the security’s credit rating (meaning that BBB- and Baa3 are within the investment grade rating).

Municipal obligations include bonds, notes and commercial paper issued by a municipality, a group of municipalities or participants in qualified issues of tax-exempt debt for a wide variety of both public and private purposes. Municipal obligations also include municipal leases and participations in municipal leases. An issuer’s obligation under such leases is often subject to the appropriation by the appropriate legislative body, on an annual or other basis, of funds for the payment of the obligations. Certain municipal obligations may be purchased on a “when-issued” basis, which means that payment and delivery occur on a future settlement date. The price and yield of such securities are generally fixed on the date of commitment to purchase.

The investment adviser’s process for selecting securities for purchase and sale is research intensive and emphasizes the creditworthiness of the issuer or other person obligated to repay the obligation. Although the investment adviser considers ratings when making investment decisions, it performs its own credit and investment analysis and does not rely primarily on the ratings assigned by the rating services. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of the security’s market value or of the liquidity of an investment in the security.

The interest on municipal obligations is (in the opinion of the issuer’s counsel) exempt from regular federal income tax. Interest income from certain types of municipal obligations generally will be subject to the federal alternative minimum tax (the “AMT”) for individuals. Distributions to corporate investors may also be subject to the AMT. The Funds may not be suitable for investors subject to the AMT.

Although a Fund invests in obligations to maintain a dollar weighted average portfolio duration of between three and nine years, a Fund may invest in individual municipal obligations of any maturity. Duration represents the dollar weighted average maturity of expected cash flows (i.e., interest and principal payments) on one or more municipal obligations, discounted to their present values. Each Fund may use various techniques to shorten or lengthen its dollar weighted average duration, including the acquisition of municipal obligations at a premium or discount, and transactions in futures contracts and options on futures. Many obligations permit the issuer at its option to “call”, or redeem, its securities. If an issuer calls securities during a time of declining interest rates, it may not be possible to reinvest the proceeds in securities providing the same investment return as the securities redeemed.

Under normal conditions, each Fund invests at least 65% of its total assets in obligations issued by its respective state or its political subdivisions, agencies, authorities and instrumentalities. Municipal obligations of issuers in a single state may be adversely affected by economic developments (including insolvency of an issuer) and by legislation and other governmental activities in that state. Each Fund may also invest up to 35% of its net assets in municipal obligations issued by the governments of Puerto Rico, the U.S. Virgin Islands and Guam.

12

Each Fund may invest 25% or more of its total assets in municipal obligations in the same sector (such as leases, housing finance, public housing, municipal utilities, hospital and health facilities or industrial development). This may make a Fund more susceptible to adverse economic, political or regulatory occurrences or adverse court decisions affecting a particular sector.

The net asset value of a Fund’s shares will change in response to changes in prevailing interest rates and changes in the value of securities held by the Fund. The value of securities held will be affected by the credit quality of the issuer of the obligation, and general economic and business conditions that affect the specific economic sector of the issuer as well as any actual or anticipated change to the tax treatment of securities held by a Fund. Changes by rating agencies in the rating assigned to an obligation may also affect the value of that obligation. To the extent that securities held by a Fund are insured as to principal and interest payments by insurers whose claims-paying ability or other rating is downgraded by a ratings agency, the value of such securities may be affected. When the supply of municipal obligations exceeds demand, the value of Fund shares may decl ine. The increased presence of non-traditional participants in the municipal markets may lead to greater volatility in the markets.

Each Fund may purchase derivative instruments, which derive their value from another instrument, security or index. For example, each Fund may purchase and sell various kinds of financial futures contracts and options thereon to hedge against changes in interest rates or as a substitute for the purchase of portfolio securities. Each Fund may also enter into interest rate swaps, forward rate contracts and credit derivatives, which may include credit default swaps, total return swaps or credit options, as well as purchase an instrument that has greater or lesser credit risk than the municipal bonds underlying the instrument. The use of derivative instruments for both hedging and investment purposes involves a risk of loss or depreciation due to a variety of factors including counterparty risk, unexpected market, interest rate or securities price movements, and tax and regulatory constraints. The use of derivatives is highly specialized and engaging in derivative transactions for purp oses other than hedging is speculative. Derivative hedging transactions may not be effective because of imperfect correlations, i.e. offsetting markets which do not experience price changes in perfect correlation with each other, and other factors.

Each Fund may invest in residual interests of a trust (the ”trust”) that holds municipal securities (“inverse floaters”). The trust will also issue floating rate notes to third parties that may be senior to the inverse floaters held by the Fund. The Fund receives interest payments on inverse floaters that bear an inverse relationship to the interest rate paid on the floating rate notes. As a result of Financial Accounting Standards Statement No. 140 (“FAS 140”), interest paid by the trust to the floating rate note holders may be reflected as income in the Fund’s financial statements with an offsetting expense for the interest paid by the trust to the floating rate note holders. Inverse floaters involve leverage risk and will involve greater risk than an investment in a fixed rate bond. Because changes in the interest rate paid to the floating rate note holders inversely affects the interest paid on the inver se floater, the value and income of an inverse floater are generally more volatile than that of a fixed rate bond. Inverse floaters have varying degrees of liquidity, and the market for these securities is relatively volatile. These securities tend to underperform the market for fixed rate bonds in a rising long-term interest rate environment, but tend to outperform the market for fixed rate bonds when long-term interest rates decline. While inverse floaters expose a Fund to leverage risk, they do not constitute borrowings for purposes of a Fund’s restrictions on borrowings.

Each Fund may invest in zero coupon bonds, which do not require the issuer to make periodic interest payments. The values of these bonds are subject to greater fluctuation in response to changes in market interest rates than bonds which pay interest currently. Each Fund accrues income on these investments and is required to distribute that income each year. Each Fund may be required to sell securities to obtain cash needed for income distributions.

The limited liquidity of certain securities in which each Fund may invest (including those eligible for resale under Rule 144A of the Securities Act of 1933) could affect their market prices, thereby adversely affecting net asset value and the ability to pay income. The amount of publicly available information about certain municipal obligations may be limited and the investment performance of a Fund may be more dependent on the portfolio manager’s analysis than if this were not the case.

Each Fund may borrow amounts up to one-third of the value of its total assets (including assets acquired using borrowings), but it will not borrow more than 5% of the value of its total assets except to satisfy redemption requests or for other temporary purposes. Such borrowings would result in increased expense to a Fund and, while they are outstanding, would magnify increases or decreases in the value of Fund shares. No Fund will purchase additional investment securities while outstanding borrowings exceed 5% of the value of its total assets.

During unusual market conditions, each Fund may temporarily invest up to 50% of its total assets in cash or cash equivalents, including short-term municipal securities, which is not consistent with a Fund’s investment objective. While temporarily invested, a Fund may not achieve its objective, and interest income from temporary investments may be taxable. Each Fund might not use all of the strategies and techniques or invest in all of the types of securities described in this Prospectus or the Statement of Additional Information. While at times a Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so.

13

Each Fund’s investment policies include a fundamental investment provision allowing the Fund to invest substantially all of its investable assets in one or more open-end management investment companies having substantially the same investment policies and restrictions as the Fund. Any such company or companies would be advised by the Fund’s investment adviser (or an affiliate) and the Fund would not pay directly any advisory fee with respect to the assets so invested. The Fund will indirectly bear its proportionate share of any management fees paid by investment companies in which it invests in addition to the advisory fee paid by the Fund. The Fund may initiate investments in one or more investment companies at any time without shareholder approval.

Management and Organization

Management. Each Fund’s investment adviser is Boston Management and Research (“BMR”), a subsidiary of Eaton Vance Management (“Eaton Vance”), with offices at Two International Place, Boston, MA 02110. Eaton Vance has been managing assets since 1924 and managing mutual funds since 1931. Eaton Vance and its affiliates currently manage over $135 billion on behalf of mutual funds, institutional clients and individuals.

The investment adviser manages the investments of each Fund. Under its investment advisory agreement with each Fund, BMR receives a monthly advisory fee equal to the aggregate of a daily asset based fee and a daily income based fee. The fees are applied on the basis of the following categories.

| | | |

| | | Annual | Daily |

| Category | Daily Net Assets | Asset Rate | Income Rate |

|

| 1 | up to $500 million | 0.300% | 3.00% |

| 2 | $500 million but less than $1 billion | 0.275% | 2.75% |

| 3 | $1 billion but less than $1.5 billion | 0.250% | 2.50% |

| 4 | $1.5 billion but less than $2 billion | 0.225% | 2.25% |

| 5 | $2 billion but less than $3 billion | 0.200% | 2.00% |

| 6 | $3 billion and over | 0.175% | 1.75% |

For the fiscal year ended March 31, 2009, the effective annual rate of investment advisory fees paid to BMR based on average daily net assets are stated below.

| | |

| | Net Assets on | Investment |

| Fund | March 31, 2009 | Advisory Fee |

|

| California | $22,697,542 | 0.44% |

| Massachusetts | $60,321,830 | 0.45% |

| New Jersey | $42,912,918 | 0.44% |

| New York | $87,914,751 | 0.44% |

| Ohio | $19,165,981 | 0.44% |

| Pennsylvania | $50,894,819 | 0.45% |

Each Fund’s most recent shareholder report provides information regarding the basis for the Trustees’ approval of each Fund’s investment advisory agreement.

William H. Ahern, Jr. is the portfolio manager of the Ohio Fund (since October 1994), the Massachusetts Fund (since May 1997), and the New York Fund (since November 1997). Cynthia J. Clemson is the portfolio manager of the California Fund (since May 1997). Craig R. Brandon is the portfolio manager of the New Jersey Fund (since September 2004). Adam A. Weigold is the portfolio manager of the Pennsylvania Fund (since October 2007). Each portfolio manager is a Vice President of Eaton Vance and BMR and also manages other Eaton Vance portfolios, and Mr. Ahern and Ms. Clemson have managed Eaton Vance portfolios for more than five years. Mr. Brandon was appointed portfolio manager of the New Jersey Fund in 2004, and has been a municipal credit analyst at Eaton Vance for more than five years. Mr. Weigold was appointed portfolio manager of the Pennsylvania Fund in 2007, and has been a municipal credit analyst at Eaton Vance for more than five years.

The Statement of Additional Information provides additional information about each portfolio manager’s compensation, other accounts managed by each portfolio manager, and each portfolio manager’s ownership of Fund shares with respect to which that portfolio manager has management responsibility.

Eaton Vance serves as the administrator of each Fund, providing each Fund with administrative services and related office facilities. Eaton Vance does not currently receive a fee for serving as administrator.

14

Eaton Vance also serves as the sub-transfer agent for each Fund. For the sub-transfer agency services it provides, Eaton Vance receives an aggregate fee based upon the actual expenses it incurs in the performance of sub-transfer agency services. This fee is paid to Eaton Vance by a Fund’s transfer agent from the fees the transfer agent receives from the Eaton Vance funds.

Organization. Each Fund is a series of Eaton Vance Investment Trust (the "Trust"), a Massachusetts business trust. Each Fund offers multiple classes of shares. Each Class represents a pro rata interest in a Fund but is subject to different expenses and rights. The Funds do not hold annual shareholder meetings but may hold special meetings for matters that require shareholder approval (such as electing or removing trustees, approving management or advisory contracts or changing investment policies that may only be changed with shareholder approval).

Because the Funds use this combined prospectus, a Fund could be held liable for a misstatement or omission made about another Fund. The Trust’s Trustees considered this risk in approving the use of a combined prospectus.

Valuing Shares

Each Fund values its shares once each day only when the New York Stock Exchange (the "Exchange") is open for trading (typically Monday through Friday), as of the close of regular trading on the Exchange (normally 4:00 p.m. eastern time). The purchase price of Fund shares is their net asset value (plus a sales charge for Class A shares), which is derived from the value of Fund holdings. When purchasing or redeeming Fund shares through an investment dealer, your investment dealer must communicate your order to the principal underwriter by a specific time each day in order for the purchase price or the redemption price to be based on that day’s net asset value per share. It is the investment dealer’s responsibility to transmit orders promptly. Each Fund may accept purchase and redemption orders as of the time of their receipt by certain investment dealers (or their designated intermediaries).

The Trustees have adopted procedures for valuing investments and have delegated to the investment adviser the daily valuation of such investments. Municipal obligations owned by the Funds are normally valued on the basis of valuations furnished by a pricing service. The pricing service considers various factors relating to bonds and market transactions to determine value. In certain situations, the investment adviser may use the fair value of a security if market prices are unavailable or deemed unreliable. A security that is fair valued may be valued at a price higher or lower than actual market quotations or the value determined by other funds using their own fair valuation procedures. The investment adviser expects to use fair value pricing for municipal obligations under limited circumstances, such as when an obligation is not priced by the pricing service or is in default. Eaton Vance has established a Valuation Committee that oversees the valuation of investments.

Purchasing Shares

You may purchase shares through your investment dealer or by mailing an account application form to the transfer agent (see back cover for address). Purchases will be executed at the net asset value (plus any applicable sales charge) next determined after their receipt in good order by a Fund’s transfer agent. A Fund’s transfer agent or your investment dealer must receive your purchase in good order no later than the close of regular trading on the Exchange (normally 4:00 p.m. eastern time) for your purchase to be effected at that day’s net asset value. If you purchase shares through an investment dealer, that dealer may charge you a fee for executing the purchase for you. Each Fund may suspend the sale of its shares at any time and any purchase order may be refused for any reason. The Funds do not issue share certificates.

Your initial investment must be at least $1,000. After your initial investment, additional investments may be made in any amount at any time by sending a check payable to the order of the Fund or the transfer agent directly to the transfer agent (see back cover for address). Please include your name and account number and the name of the Fund and Class of shares with each investment.

You may make automatic investments of $50 or more each month or each quarter from your bank account. You can establish bank automated investing on the account application or by providing written instructions. Please call 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. (eastern time) for further information. The minimum initial investment amount and Fund policy of redeeming accounts with low account balances are waived for bank automated investing accounts (other than for Class I), certain group purchase plans (including proprietary fee-based programs sponsored by broker-dealers) and for persons affiliated with Eaton Vance, its affiliates and certain Fund service providers (as described in the Statement of Additional Information).

Restrictions on Excessive Trading and Market Timing. The Funds are not intended for excessive trading or market timing. Market timers seek to profit by rapidly switching money into a fund when they expect the share price of the fund to rise and taking money out of the fund when they expect those prices to fall. By realizing profits through short-term trading, shareholders that engage in rapid purchases and sales or exchanges of a fund’s shares may dilute the value of shares held by long-term shareholders. Volatility resulting from excessive purchases and sales or exchanges of fund shares, especially involving large dollar amounts, may disrupt efficient portfolio management. In particular, excessive purchases and sales or exchanges of a fund’s shares may cause a fund to have difficulty implementing its investment strategies, may force the fund to sell portfolio securities at inopportune times to raise

15

cash or may cause increased expenses (such as increased brokerage costs, realization of taxable capital gains without attaining any investment advantage or increased administrative costs).

A fund that invests in securities that are, among other things, thinly traded, traded infrequently or relatively illiquid (including certain municipal obligations) is susceptible to the risk that the current market price for such securities may not accurately reflect current market values. A shareholder may seek to engage in short-term trading to take advantage of these pricing differences (commonly referred to as “price arbitrage”). The investment adviser is authorized to use the fair value of a security if prices are unavailable or are deemed unreliable (see “Valuing Shares”). The use of fair value pricing and the restrictions on excessive trading and market timing described below are intended to reduce a shareholder’s ability to engage in price arbitrage to the detriment of the Funds.

The Boards of Trustees of the Eaton Vance funds have adopted policies to discourage short-term trading and market timing and to seek to minimize their potentially detrimental effects. Pursuant to these policies, if an investor (through one or more accounts) makes more than one round-trip exchange (exchanging from one fund to another fund and back again) within 90 days, it will be deemed to constitute market timing or excessive trading. Under the policies, each Fund or its principal underwriter will reject or cancel a purchase order, suspend or terminate the exchange privilege or terminate the ability of an investor to invest in the Eaton Vance funds if the Fund or the principal underwriter determines that a proposed transaction involves market timing or excessive trading that it believes is likely to be detrimental to the Fund. Each Fund and its principal underwriter use reasonable efforts to detect market timing and excessive trading activity, but they cannot ensure that they will be able to identify all cases of market timing and excessive trading. Each Fund or its principal underwriter may also reject or cancel any purchase order (including an exchange) from an investor or group of investors for any other reason. Decisions to reject or cancel purchase orders (including exchanges) in a Fund are inherently subjective and will be made in a manner believed to be in the best interest of a Fund’s shareholders. No Eaton Vance fund has any arrangement to permit market timing.

The following fund share transactions generally are exempt from the market timing and excessive trading policy described above because each Fund and the principal underwriter believe they generally do not raise market timing or excessive trading concerns:

- transactions made pursuant to a systematic purchase plan or as the result of automatic reinvestment of dividends or distributions, or initiated by a Fund (e.g., for failure to meet applicable account minimums);

- transactions made by participants in employer sponsored retirement plans involving participant payroll or employer contributions or loan repayments, redemptions as part of plan terminations or at the direction of the plan, mandatory retirement distributions, or rollovers;

- transactions made by asset allocation and wrap programs where the adviser to the program directs transactions in the accounts participating in the program in concert with changes in a model portfolio; or

- transactions in shares of Eaton Vance Cash Management Fund, Eaton Vance Money Market Fund, Eaton Vance Tax Free Reserves and Eaton Vance Institutional Short Term Income Fund.

It may be difficult for a Fund or the principal underwriter to identify market timing or excessive trading in omnibus accounts traded through financial intermediaries. The Funds and the principal underwriter have provided guidance to financial intermediaries (such as banks, broker-dealers, insurance companies and retirement administrators) concerning the application of the Eaton Vance funds’ market timing and excessive trading policies to Fund shares held in omnibus accounts maintained and administered by such intermediaries, including guidance concerning situations where market timing or excessive trading is considered to be detrimental to a Fund. Each Fund or its principal underwriter may rely on a financial intermediary’s policy to restrict market timing and excessive trading if it believes that policy is likely to prevent market timing that is likely to be detrimental to the Fund. Such policy may be more or less restrictive than a Fund’s policy. Although each Fund or the principal underwriter reviews trading activity at the omnibus account level for activity that indicates potential market timing or excessive trading activity, the Funds and the principal underwriter typically will not request or receive individual account data unless suspicious trading activity is identified. Each Fund and the principal underwriter generally rely on financial intermediaries to monitor trading activity in omnibus accounts in good faith in accordance with their own or Fund policies. Each Fund and the principal underwriter cannot ensure that these financial intermediaries will in all cases apply the policies of the Fund or their own policies, as the case may be, to accounts under their control.

Choosing a Share Class. Each Fund offers different classes of shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different sales charges and expenses and will likely have different share prices due to differences in class expenses. In choosing the class of shares that suits your investment needs, you should consider:

- how long you expect to own your shares;

- how much you intend to invest;

- the sales charge and total operating expenses associated with owning each class; and

16

- whether you qualify for a reduction or waiver of any applicable sales charges (see “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below).

Each investor’s considerations are different. You should speak with your investment dealer to help you decide which class of shares is best for you. Set forth below is a brief description of each class of shares offered by the Funds.

| Class A shares are offered at net asset value plus a front-end sales charge of up to 2.25%. This charge is deducted from the amount you invest. The Class A sales charge is reduced for purchases of $100,000 or more. The sales charge applicable to your purchase may be reduced under the right of accumulation or a statement of intention, which are described in “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below. Some investors may be eligible to purchase Class A shares at net asset value under certain circumstances, which are also described below. Class A shares pay distribution and service fees equal to 0.15% annually of average daily net assets. Returns on Class A shares are generally higher than returns on Class B and Class C shares because Class A has lower annual expenses than those classes. |