EXHIBIT (17)(a)(iii)

Eaton Vance AMT-Free Limited Maturity Municipal Income Fund

Class A Shares - EXFLX Class B Shares - ELFLX Class C Shares - EZFLX Class I Shares - EILMX |

Eaton Vance National Limited Maturity Municipal Income Fund

Class A Shares - EXNAX Class B Shares - ELNAX Class C Shares - EZNAX Class I Shares - EINAX |

| Mutual funds seeking tax-exempt income and limited principal fluctuation |

Prospectus Dated

August 1, 2010

as revised February 17, 2011 |

The Securities and Exchange Commission has not approved or disapproved these securities or

determined whether this Prospectus is truthful or complete. Any representation to the contrary

is a criminal offense. |

This Prospectus contains important information about the Funds and the services

available to shareholders. Please save it for reference.

| |

| Table of Contents | |

| |

| Fund Summaries | 3 |

| AMT-Free Limited Maturity Municipal Income Fund | 3 |

| National Limited Maturity Municipal Income Fund | 7 |

| Important Information Regarding Fund Shares | 11 |

| Investment Objectives & Principal Policies and Risks | 12 |

| Management and Organization | 14 |

| Valuing Shares | 15 |

| Purchasing Shares | 15 |

| Sales Charges | 18 |

| Redeeming Shares | 20 |

| Shareholder Account Features | 21 |

| Additional Tax Information | 22 |

| Financial Highlights | 23 |

| AMT-Free Limited Maturity Municipal Income Fund | 23 |

| National Limited Maturity Municipal Income Fund | 25 |

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

Fund Summaries

AMT-Free Limited Maturity Municipal Income Fund

Investment Objective

The Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and limited principal fluctuation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a reduced sales charge if you invest, or agree to invest over a 13-month period, at least $100,000 in Eaton Vance Funds. More information about these and other discounts is available from your financial intermediary and in Sales Charges beginning on page 18 of this Prospectus and page 20 of the Fund’s Statement of Additional Information.

| | | | |

| Shareholder Fees (fees paid directly from your investment) | Class A | Class B | Class C | Class I |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | 2.25% | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value at purchase or redemption) | None | 3.00% | 1.00% | None |

| | | | | |

| Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | Class A | Class B | Class C | Class I |

|

| Management Fees | 0.43% | 0.43% | 0.43% | 0.43% |

| Distribution and Service (12b-1) Fees | 0.15% | 0.90% | 0.90% | n/a |

| Other Expenses (estimated for Class I) | 0.33% | 0.33% | 0.33% | 0.33% |

| Total Annual Fund Operating Expenses | 0.91% | 1.66% | 1.66% | 0.76% |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | Expenses with Redemption | Expenses without Redemption |

|

|

| | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

|

| Class A shares | $316 | $509 | $718 | $1,319 | $316 | $509 | $718 | $1,319 |

| Class B shares | $469 | $723 | $816 | $1,414 | $169 | $523 | $816 | $1,414 |

| Class C shares | $269 | $523 | $902 | $1,965 | $169 | $523 | $902 | $1,965 |

| Class I shares | $78 | $243 | $422 | $ 942 | $78 | $243 | $422 | $ 942 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 34% of the average value of its portfolio.

Principal Investment Strategies

Under normal market circumstances, the Fund invests at least 80% of its net assets in municipal obligations, the interest on which is exempt from regular federal income tax (the “80% Policy”). The Fund will not invest in an obligation if the interest on that obligation is subject to the federal alternative minimum tax. At least 75% of net assets will normally be invested in municipal obligations rated at least investment grade at the time of investment (which are those rated Baa or higher by Moody’s Investors Services, Inc. ("Moody’s"), or BBB or higher by either Standard & Poor’s Ratings Group ("S&P") or Fitch Ratings ("Fitch")) or, if unrated, determined by the investment adviser to be of at least investment grade quality. The balance of net assets may be invested in municipal obligations rated below investment grade and in unrated municipal obligations considered to be of comparable quality by the investment adviser ("junk bonds"). The Fund will not invest more than 10% of its net assets in obligations rated below B by Moody’s, S&P or Fitch or in unrated obligations considered to be of comparable quality by the investment adviser. The Fund may invest up to 35% of its net assets in municipal obligations issued by the governments of Puerto Rico, the U.S. Virgin Islands and Guam. The Fund may invest in securities in any rating category, including those in default. The Fund may purchase or sell

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

derivative instruments (such as residual interest bonds, futures contracts and options thereon, interest rate swaps, and forward rate contracts) for hedging purposes, for total return or as a substitute for the purchase or sale of securities.

Although the Fund invests in obligations to seek to maintain a dollar-weighted average portfolio duration of between three and nine years, the Fund may invest in individual municipal obligations of any maturity. Duration represents the dollar-weighted average maturity of expected cash flows (i.e., interest and principal payments) on one or more municipal obligations, discounted to their present values. The Fund may use various techniques to shorten or lengthen its dollar-weighted average duration, including the acquisition of municipal obligations at a premium or discount, and transactions in futures contracts and options on futures. The Fund may concentrate 25% or more of its total assets in certain types of municipal obligations (such as general obligations, municipal leases, revenue bonds and industrial development bonds) and in one or more sectors (such as housing, hospitals, healthcare facilities or utilities).

The investment adviser’s process for selecting obligations for purchase and sale is research intensive and emphasizes the creditworthiness of the issuer or other person obligated to repay the obligation and the relative value of the obligation in the market. Although the investment adviser considers ratings when making investment decisions, it performs credit and investment analysis primarily with respect to lower rated securities and generally does not rely on the ratings assigned by the rating services. The portfolio manager also may trade securities to minimize taxable capital gains to shareholders.

Principal Risks

Municipal Bond Market Risk. The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds and the investment performance of the Fund may be more dependent on the analytical abilities of the investment adviser than would be the case for a stock fund or corporate bond fund. The secondary market for municipal bonds also tends to be less well-developed and less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at attractive prices. In addition, municipal obligations can experience downturns in trading activity and the supply of municipal obligations may exceed the demand in the market. During such periods, the spread can widen between the price at which an obligation can be purchased and the price at which it can be sold. Less liquid obligations can become more difficult to value and be subject to erratic price movements. Economic and other events (whether real or perceived) can reduce the demand for certain investments or for investments generally, which may reduce market prices and cause the value of Fund shares to fall. The frequency and magnitude of such changes cannot be predicted. The increased presence of non-traditional participants in the municipal markets may lead to greater volatility in the markets.

Interest Rate Risk. As interest rates rise, the value of Fund shares is likely to decline. Conversely, when interest rates decline, the value of Fund shares is likely to rise. Obligations with longer maturities typically offer higher yields, but involve greater risk because the prices of such obligations are more sensitive to changes in interest rates than obligations with shorter maturities. In a declining interest rate environment, prepayments of obligations may increase if the issuer has the ability to pre-pay or "call" the obligation. In such circumstances, the Fund may have to reinvest the prepayment proceeds at lower yields. Because the Fund is managed toward an income objective, it may hold more longer-maturity obligations and thereby be more exposed to interest rate risk than municipal income funds that are managed with a greater emphasis on total return.

Credit Risk. Changes in economic conditions or other circumstances may reduce the capacity of issuers of fixed income securities to make principal and interest payments and may lead to defaults. Such defaults may reduce the value of Fund shares and income distributions. The value of a fixed income security also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. In addition, the credit rating of securities held by the Fund may be lowered if an issuer’s financial condition changes. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected. In the case of an insured bond, the bond’s rating will be deemed to be the higher of the rating assigned to the bond’s issuer or the insurer.

Duration Risk. Duration measures the expected life of a fixed-income security, which can determine its sensitivity to changes in the general level of interest rates. Securities with longer durations tend to be more sensitive to interest rate changes than securities with shorter durations. A mutual fund with a longer dollar-weighted average duration can be expected to be more sensitive to interest rate changes than a fund with a shorter dollar-weighted average duration. Duration differs from maturity in that it considers a security’s coupon payments in addition to the amount of time until the security matures. As the value of a security changes over time, so will its duration.

Risk of Lower Rated Investments. Investments in obligastions rated below investment grade and comparable unrated securities ("junk bonds") have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments generally are subject to greater price volatility and illiquidity than higher rated investments.

Derivatives Risk. The use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create investment leverage in the Fund, which magnifies the Fund’s exposure to the underlying investment. Derivative risks may be more significant when they are used to enhance return or as a substitute for a position or security, rather than solely to hedge the risk of a position or securitiy held by the Fund. Derivatives for hedging purposes may not reduce risk if they are not sufficiently correlated to the position being hedged. A decision as to whether, when and how to use derivatives involves the exercise of specialized skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Derivative instruments may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. The loss on derivative transactions may substantially exceed the initial investment.

Risk of Leveraged Investments. The Fund may enter into residual interest bond transactions, which expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments that the Fund receives on the residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity.

Sector Concentration Risk. Because the Fund may concentrate its investments in certain types of municipal obligations and may concentrate in certain sectors, the value of Fund shares may be affected by events that adversely affect that sector or type of obligation and may fluctuate more than that of a less concentrated fund. General obligation bonds issued by municipalities are adversely affected by economic downturns and the resulting decline in tax revenues.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or non-compliant conduct of a bond issuer. The Fund will not invest in an obligation if the interest on that obligation is subject to the federal alternative minimum tax.

Risks Associated with Active Management. The Fund is an actively managed portfolio and its success depends upon the investment skills and analytical abilities of the investment adviser to develop and effectively implement strategies that achieve the Fund’s investment objective. Subjective decisions made by the investment adviser may cause the Fund to incur losses or to miss profit opportunities on which it may otherwise have capitalized.

General Fund Investing Risks. The Fund is not a complete investment program and you may lose money by investing in the Fund. All investments carry a certain amount of risk and there is no guarantee that the Fund will be able to achieve its investment objective. In general, the Fund’s Annual Fund Operating Expenses as a percentage of Fund average daily net assets will change as Fund assets increase and decrease, and the Fund’s Annual Fund Operating Expenses may differ in the future. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its objective. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person. You may lose money by investing in the Fund.

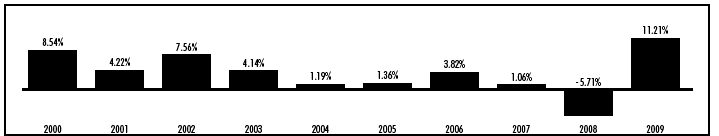

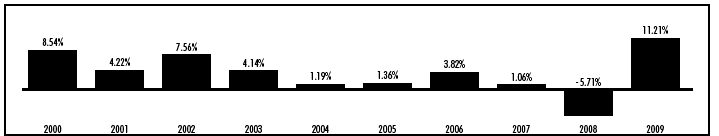

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad-based securities market index. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. No performance is shown for Class I shares because the Class had not commenced operations as of March 31, 2010. Past performance (both before and after taxes) is no guarantee of future results. Updated Fund performance information can be obtained by visiting www.eatonvance.com.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

During the ten years ended December 31, 2009, the highest quarterly total return for Class B was 7.07% for the quarter ended September 30, 2009, and the lowest quarterly return was –4.14% for the quarter ended September 30, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2009 to June 30, 2010) was 2.02%. For the 30 days ended March 31, 2010, the SEC yield and SEC tax-equivalent yield (assuming a federal income tax rate of 35.0%) for Class A shares were 2.67% and 4.11%, respectively, for Class B shares were 1.96% and 3.02%, respectively, and for Class C shares were 1.98% and 3.04%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| Average Annual Total Return as of December 31, 2009 | One Year | Five Years | Ten Years |

|

| Class A Return Before Taxes | 9.53% | 2.49% | 4.18% |

| Class B Return Before Taxes | 8.21% | 2.20% | 3.64% |

| Class B Return After Taxes on Distributions | 8.17% | 2.19% | 3.63% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 6.35% | 2.30% | 3.59% |

| Class C Return Before Taxes | 10.23% | 2.22% | 3.64% |

| Barclays Capital 7-Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 7.61% | 4.58% | 5.59% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable contingent deferred sales charge (“CDSC”) for Class B and Class C. Investors cannot invest directly in an Index. (Source for Barclays Capital 7-Year Municipal Bond Index: Lipper, Inc.)

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

Management

Investment Adviser. Boston Management and Research ("BMR").

Portfolio Manager. The Fund is managed by Craig R. Brandon, Vice President of BMR, who has managed the Fund since 2004.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 11 of this Prospectus.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

National Limited Maturity Muncipal Income Fund

Investment Objective

The Fund’s investment objective is to provide a high level of current income exempt from regular federal income tax and limited principal fluctuation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for a reduced sales charge if you invest, or agree to invest over a 13-month period, at least $100,000 in Eaton Vance Funds. More information about these and other discounts is available from your financial intermediary and in Sales Charges beginning on page 18 of this Prospectus and page 20 of the Fund’s Statement of Additional Information.

| | | | | |

| Shareholder Fees (fees paid directly from your investment) | | Class A | Class B | Class C | Class I |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | | 2.25% | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value at purchase or redemption) | None | 3.00% | 1.00% | None |

| | | | | | |

| Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | Class A | Class B | Class C | Class I |

|

| Management Fees | | 0.44% | 0.44% | 0.44% | 0.44% |

| Distribution and Service (12b-1) Fees | | 0.15% | 0.90% | 0.90% | n/a |

| Interest Expense(1) | 0.01% | | | | |

| Expenses other than Interest Expense (estimated for Class I) | 0.12% (0.14% for Class I) | | | | |

| Other Expenses | | 0.13% | 0.13% | 0.13% | 0.15% |

| Total Annual Fund Operating Expenses | | 0.72% | 1.47% | 1.47% | 0.59% |

| (1) | Interest Expense relates to the Fund’s liability with respect to floating rate notes held by third parties in conjunction with inverse floater securities transactions by the Fund. The Fund also records offsetting interest income in an amount equal to this expense relating to the municipal obligations underlying such transactions, and as a result net asset value and performance have not been affected by this expense. If Interest Expense was not included, Total Annual Fund Operating Expenses would have been 0.71% for Class A shares, 1.46% for Class B and Class C shares and 0.58% for Class I shares. See “Investment Objectives & Principal Policies and Risks" in this Prospectus for a description of residual interest bond transactions. |

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | Expenses with Redemption | Expenses without Redemption |

|

|

| | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

|

| Class A shares | $297 | $450 | $617 | $1,099 | $297 | $450 | $617 | $1,099 |

| Class B shares | $450 | $665 | $715 | $1,195 | $150 | $465 | $715 | $1,195 |

| Class C shares | $250 | $465 | $803 | $1,757 | $150 | $465 | $803 | $1,757 |

| Class I shares | $60 | $189 | $329 | $ 738 | $60 | $189 | $329 | $ 738 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 14% of the average value of its portfolio.

Principal Investment Strategies

Under normal market circumstances, the Fund invests at least 80% of its net assets in municipal obligations, the interest on which is exempt from regular federal income tax (the “80% Policy”). The Fund may invest without limit in obligations the income from which is subject to the federal alternative minimum tax. At least 65% of net assets will normally be invested in municipal obligations rated at least investment grade at the time of investment (which are those rated Baa or higher by Moody’s Investors Services, Inc. ("Moody’s"), or BBB or higher by either Standard & Poor’s Ratings Group ("S&P") or Fitch Ratings ("Fitch")) or, if unrated, determined by the investment adviser to be of at least investment grade quality. The balance of net assets may be invested in municipal obligations rated below investment grade and in unrated municipal obligations considered to be of comparable quality

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

by the investment adviser ("junk bonds"). The Fund will not invest more than 10% of its net assets in obligations rated below B by Moody’s, S&P or Fitch or in unrated obligations considered to be of comparable quality by the investment adviser. The Fund may purchase or sell derivative instruments (such as residual interest bonds, futures contracts and options thereon, interest rate swaps and forward rate contracts) for hedging purposes, for total return or as a substitute for the purchase or sale of securities.

Although the Fund invests in obligations to seek to maintain a dollar-weighted average portfolio duration of between three and nine years, the Fund may invest in individual municipal obligations of any maturity. Duration represents the dollar-weighted average maturity of expected cash flows (i.e., interest and principal payments) on one or more municipal obligations, discounted to their present values. The Fund may use various techniques to shorten or lengthen its dollar-weighted average duration, including the acquisition of municipal obligations at a premium or discount, and transactions in futures contracts and options on futures. The Fund may concentrate 25% or more of its total assets in certain types of municipal obligations (such as general obligations, municipal leases, revenue bonds and industrial development bonds) and in one or more sectors (such as housing, hospitals, healthcare facilities or utilities).

The investment adviser’s process for selecting obligations for purchase and sale is research intensive and emphasizes the creditworthiness of the issuer or other person obligated to repay the obligation and the relative value of the obligation in the market. Although the investment adviser considers ratings when making investment decisions, it performs credit and investment analysis primarily with respect to lower rated securities and generally does not rely on the ratings assigned by the rating services. The portfolio manager also may trade securities to minimize taxable capital gains to shareholders. A portion of the Fund’s distributions generally will be subject to alternative minimum tax. The Fund may not be suitable for investors subject to the alternative minimum tax.

Principal Risks

Municipal Bond Market Risk. The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds and the investment performance of the Fund may be more dependent on the analytical abilities of the investment adviser than would be the case for a stock fund or corporate bond fund. The secondary market for municipal bonds also tends to be less well-developed and less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at attractive prices. In addition, municipal obligations can experience downturns in trading activity and the supply of municipal obligations may exceed the demand in the market. During such periods, the spread can widen between the price at which an obligation can be purchased and the price at which it can be sold. Less liquid obligations can become more difficult to value and be subject to erratic price movements. Economic and other events (whether real or perceived) can reduce the demand for certain investments or for investments generally, which may reduce market prices and cause the value of Fund shares to fall. The frequency and magnitude of such changes cannot be predicted. The increased presence of non-traditional participants in the municipal markets may lead to greater volatility in the markets.

Interest Rate Risk. As interest rates rise, the value of Fund shares is likely to decline. Conversely, when interest rates decline, the value of Fund shares is likely to rise. Obligations with longer maturities typically offer higher yields, but involve greater risk because the prices of such obligations are more sensitive to changes in interest rates than obligations with shorter maturities. In a declining interest rate environment, prepayments of obligations may increase if the issuer has the ability to pre-pay or "call" the obligation. In such circumstances, the Fund may have to reinvest the prepayment proceeds at lower yields. Because the Fund is managed toward an income objective, it may hold more longer-maturity obligations and thereby be more exposed to interest rate risk than municipal income funds that are managed with a greater emphasis on total return.

Credit Risk. Changes in economic conditions or other circumstances may reduce the capacity of issuers of fixed income securities to make principal and interest payments and may lead to defaults. Such defaults may reduce the value of Fund shares and income distributions. The value of a fixed income security also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. In addition, the credit rating of securities held by the Fund may be lowered if an issuer’s financial condition changes. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected. In the case of an insured bond, the bond’s rating will be deemed to be the higher of the rating assigned to the bond’s issuer or the insurer.

Duration Risk. Duration measures the expected life of a fixed-income security, which can determine its sensitivity to changes in the general level of interest rates. Securities with longer durations tend to be more sensitive to interest rate changes than securities with shorter durations. A mutual fund with a longer dollar-weighted average duration can be expected to be more sensitive to interest rate changes than a fund with a shorter dollar-weighted average duration. Duration differs from maturity in that it considers a security’s coupon payments in addition to the amount of time until the security matures. As the value of a security changes over time, so will its duration.

Risk of Lower Rated Investments. Investments in obligastions rated below investment grade and comparable unrated securities ("junk bonds") have speculative characteristics because of the credit risk associated with their issuers. Changes in

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments generally are subject to greater price volatility and illiquidity than higher rated investments.

Derivatives Risk. The use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create investment leverage in the Fund, which magnifies the Fund’s exposure to the underlying investment. Derivative risks may be more significant when they are used to enhance return or as a substitute for a position or security, rather than solely to hedge the risk of a position or securitiy held by the Fund. Derivatives for hedging purposes may not reduce risk if they are not sufficiently correlated to the position being hedged. A decision as to whether, when and how to use derivatives involves the exercise of specialized skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Derivative instruments may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. The loss on derivative transactions may substantially exceed the initial investment.

Risk of Leveraged Investments. The Fund may enter into residual interest bond transactions, which expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments that the Fund receives on the residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity.

Sector Concentration Risk. Because the Fund may concentrate its investments in certain types of municipal obligations and may concentrate in certain sectors, the value of Fund shares may be affected by events that adversely affect that sector or type of obligation and may fluctuate more than that of a less concentrated fund. General obligation bonds issued by municipalities are adversely affected by economic downturns and the resulting decline in tax revenues.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or non-compliant conduct of a bond issuer. A portion of the Fund’s income may be taxable to shareholders subject to the federal alternative minimum tax.

Risks Associated with Active Management. The Fund is an actively managed portfolio and its success depends upon the investment skills and analytical abilities of the investment adviser to develop and effectively implement strategies that achieve the Fund’s investment objective. Subjective decisions made by the investment adviser may cause the Fund to incur losses or to miss profit opportunities on which it may otherwise have capitalized.

General Fund Investing Risks. The Fund is not a complete investment program and you may lose money by investing in the Fund. All investments carry a certain amount of risk and there is no guarantee that the Fund will be able to achieve its investment objective. In general, the Fund’s Annual Fund Operating Expenses as a percentage of Fund average daily net assets will change as Fund assets increase and decrease, and the Fund’s Annual Fund Operating Expenses may differ in the future. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its objective. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person. You may lose money by investing in the Fund.

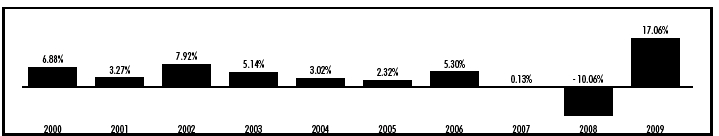

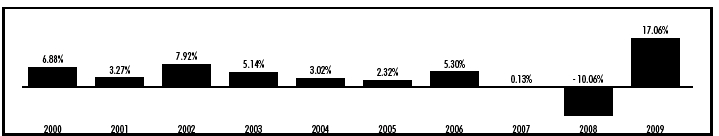

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad-based securities market index. The returns in the bar chart are for Class B shares and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. Past performance (both before and after taxes) is no guarantee of future results. Updated Fund performance information can be obtained by visiting www.eatonvance.com.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

During the ten years ended December 31, 2009, the highest quarterly total return for Class B was 7.58% for the quarter ended September 30, 2009, and the lowest quarterly return was –5.12% for the quarter ended December 31, 2008. The year-to-date total return through the end of the most recent calendar quarter (December 31, 2009 to June 30, 2010) was 1.89%. For the 30 days ended March 31, 2010, the SEC yield and SEC tax-equivalent yield (assuming a federal income tax rate of 35.0%) for Class A shares were 3.06% and 4.70%, respectively, for Class B shares were 2.37% and 3.65%, respectively, for Class C shares were 2.38% and 3.66%, respectively and for Class I shares were 3.29% and 5.06%, respectively. A lower tax rate would result in lower tax-equivalent yields. For current yield information call 1-800-262-1122.

| | | |

| Average Annual Total Return as of December 31, 2009 | One Year | Five Years | Ten Years |

|

| Class A Return Before Taxes | 15.32% | 2.90% | 4.45% |

| Class B Return Before Taxes | 14.06% | 2.58% | 3.89% |

| Class B Return After Taxes on Distributions | 14.06% | 2.57% | 3.88% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 10.43% | 2.66% | 3.86% |

| Class C Return Before Taxes | 16.09% | 2.59% | 3.90% |

| Class I Return Before Taxes | 17.77% | 3.35% | 4.68% |

| Barclays Capital 7-Year Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 7.61% | 4.58% | 5.59% |

These returns reflect the maximum sales charge for Class A (2.25%) and any applicable contingent deferred sales charge (“CDSC”) for Class B and Class C. The Class I performance shown above for the period prior to October 1, 2009 (commencement of operations) is the performance of Class A shares at net asset value without adjustment for any differences in the expenses of the Classes. If adjusted for expenses, returns would be different. Investors cannot invest directly in an Index. (Source for Barclays Capital 7-Year Municipal Bond Index: Lipper, Inc.)

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

Management

Investment Adviser. Boston Management and Research ("BMR").

Portfolio Manager. The Fund is managed by William H. Ahern, Vice President of BMR, who has managed the Fund since 1997.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 11 of this Prospectus.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

Important Information Regarding Fund Shares

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange Fund shares on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Fund shares either through your financial intermediary or directly from the Fund either by writing to Eaton Vance Funds, P.O. Box 9653, Providence, RI 02940-9653, or by calling 1-800-262-1122. The minimum initial purchase or exchange into the Fund is $1,000 for Class A, Class B and Class C and $250,000 for Class I (waived in certain circumstances). There is no minimum for subsequent investments.

Tax Information

Each Fund’s distributions are expected to be exempt from regular federal income tax. Distributions of any net realized gains are expected to be taxable.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank) (collectively, "financial intermediaries"), a Fund, its principal underwriter and its affiliates may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your financial intermediary’s web site for more information.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

Investment Objectives & Principal Policies and Risks

A statement of the investment objective and principal investment policies and risks of the Fund is set forth above in Fund Summaries Set forth below is additional information about such policies and risks.

Each Fund is permitted to engage in the following investment practices to the extent set forth in "Fund Summaries" above. References to the "Fund" below are to each Fund, as applicable.

Municipal Obligations. Municipal obligations include bonds, notes and commercial paper issued by a municipality, a group of municipalities or participants in qualified issues of municipal debt for a wide variety of both public and private purposes. Municipal obligations also include municipal leases and participations in municipal leases. An issuer’s obligation under such leases is often subject to the appropriation by a legislative body, on an annual or other basis, of funds for the payment of the obligations.

Certain municipal obligations may be purchased on a “when-issued” basis, which means that payment and delivery occur on a future settlement date. The price and yield of such securities are generally fixed on the date of commitment to purchase. The values of zero coupon bonds and principal only strips are subject to greater fluctuation in response to changes in market interest rates than bonds which pay interest currently. The Fund accrues income on these investments and is required to distribute that income each year. The Fund may be required to sell securities to obtain cash needed for income distributions.

The interest on municipal obligations is (in the opinion of the issuer’s counsel) exempt from regular federal income taxes. AMT-Free Fund will not invest in an obligation if the interest on that obligation is subject to the federal alternative minimum tax ("AMT"). Interest income from certain types of municipal obligations held by National Fund generally will be subject to the AMT for individuals. Distributions to corporate investors also may be subject to the AMT. The National Fund may not be suitable for investors subject to the AMT.

Credit Quality. Rating agencies are private services that provide ratings of the credit quality of certain fixed income securities. Although the investment adviser considers ratings when making decisions, it performs credit and investment analysis primarily with respect to lower rated securities and generally does not rely on the ratings assigned by the rating services. Credit ratings issued by rating agencies are based on a number of factors including, but not limited to, the issuer's financial condition and the rating agency's investment analysis, if applicable, at the time of rating. The ratings assigned are not absolute standards of credit quality and do not evaluate market risks or necessarily reflect the issuer's current financial condition. An issuer's current financial condition may be better or worse than the current rating indicates. A credit rating may have a modifier (such as plus, minus or a numerical modifier) to denote its relative status within the rating. The presence of a modifier does not change the security’s credit rating (meaning that BBB- and Baa3 are within the investment grade rating) for purposes of the Fund’s investment limitations.

Duration. Duration measures the time-weighted expected cash flows of a fixed-income security, which can determine its sensitivity to changes in the general level of interest rates. Securities with longer durations tend to be more sensitive to interest rate changes than securities with shorter durations. A mutual fund with a longer dollar-weighted average duration can be expected to be more sensitive to interest rate changes than a fund with a shorter dollar-weighted average duration. Duration differs from maturity in that it considers a security’s coupon payments in addition to the amount of time until the security matures. Various techniques may be used to shorten or lengthen Fund duration. As the value of a security changes over time, so will its duration.

Derivatives. The Fund may enter into derivatives transactions with respect to any security or other instrument in which it is permitted to invest or any related security, instrument, index or economic indicator ("reference instruments"). Derivatives are financial instruments the value of which is derived from the underlying reference instrument. Derivatives allow the Fund to increase or decrease the level of risk to which the Fund is exposed more quickly and efficiently than transactions in other types of instruments. The Fund incurs costs in connection with opening and closing derivatives positions. The Fund may engage in the derivative transactions set forth below, as well as in other derivative transactions with substantially similar characteristics and risks.

| Residual Interest Bonds. Residual interest bonds are issued by a trust (the “trust”) that holds municipal securities and the value of the residual interest bonds is derived from the value of such securities. The trust also issues floating rate notes to third parties that may be senior to the residual interest bonds. Residual interest bonds make interest payments to holders that bear an inverse relationship to the interest rate paid on the floating rate notes. As required by applicable accounting standards, interest paid by the trust to the floating rate note holders may be reflected as income in the Fund’s financial statements with an offsetting expense for the interest paid by the trust to the floating rate note holders. While residual interest bonds create leverage risk, they do not constitute borrowings for purposes of the Fund’s restrictions on borrowings. |

| Futures Contracts. The Fund may engage in transactions in futures contracts and options on futures contracts. Futures are standardized, exchange-traded contracts that obligate a purchaser to take delivery, and a seller to make delivery, of a specific amount of an asset at a specified future date at a specified price. Futures contracts involve substantial leverage risk. The Fund also is authorized to purchase or sell call and put options on futures contracts. The primary risks associated with the use of futures contracts and options are imperfect correlation, liquidity, unanticipated market movement and counterparty risk. |

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

| Interest Rate Swaps. Interest rate swaps involve the exchange by the Fund with another party of their respective commitments to pay or receive interest, e.g., an exchange of fixed rate payments for floating rate payments. Interest rate swaps involve counterparty risk and the risk of imperfect correlation. |

| Credit Default Swaps. Credit default swap agreements ("CDS") enable the Fund to buy or sell credit protection on an individual issuer or basket of issuers (i.e., the reference instrument). The Fund may enter into CDS to gain or short exposure to a reference instrument. Long CDS positions are utilized to gain exposure to a reference instrument (similar to buying the instrument) and are akin to selling insurance on the instrument. Short CDS positions are utilized to short exposure to a reference instrument (similar to shorting the instrument) and are akin to buying insurance on the instrument. In response to market events, federal and certain state regulators have proposed regulation of the CDS market. These regulations may limit the Fund’s ability to use CDS and/or the benefits of CDS. CDS involve risks, including the risk that the counterparty may be unable to fulfill the transaction or that the Fund may be required to purchase securities or other instruments to meet delivery obligations. The Fund may have difficulty, be unable or may incur additional costs to acquire such securities or instruments. |

| Total Return Swaps. In a total return swap, the buyer receives a periodic return equal to the total return of a specified security, securities or index, for a specified period of time. In return, the buyer pays the counterparty a variable stream of payments, typically based upon short term interest rates, possibly plus or minus an agreed upon spread. These transactions involve risks, including counterparty risk. |

| Credit Linked Notes, Credit Options and Similar Investments. Credit linked notes are obligations between two or more parties where the payment of principal and/or interest is based on the performance of some obligation, basket of obligations, index or economic indicator (a "reference instrument"). In addition to the credit risk associated with the reference instrument and interest rate risk, the buyer and seller of a credit linked note or similar structured investment are subject to counterparty risk. Credit options are options whereby the purchaser has the right, but not the obligation, to enter into a transaction involving either an asset with inherent credit risk or a credit derivative, at terms specified at the initiation of the option. These transactions involve risks, including counterparty risk. |

| Forward Rate Agreements. Under forward rate agreements, the buyer locks in an interest rate at a future settlement date. If the interest rate on the settlement date exceeds the lock rate, the buyer pays the seller the difference between the two rates. If the lock rate exceeds the interest rate on the settlement date, the seller pays the buyer the difference between the two rates. These transactions involve risks, including counterparty risk. |

Maturity. Many obligations permit the issuer at its option to “call,” or redeem, its securities. As such, the effective maturity of an obligation may be reduced as the result of call provisions. The effective maturity of an obligation is its likely redemption date after consideration of any call or redemption features.

Borrowing. The Fund is authorized to borrow in accordance with applicable regulations, but currently intends to borrow only for temporary purposes (such as to satisfy redemption requests, to remain fully invested in anticipation of expected cash inflows and to settle transactions). The Fund will not purchase additional investment securities while outstanding borrowings exceed 5% of the value of its total assets.

Illiquid Securities. The Fund may not invest more than 15% of its net assets in illiquid securities, which may be difficult to value properly and may involve greater risks than liquid securities. Illiquid securities include those legally restricted as to resale (such as those issued in private placements), and may include securities eligible for resale pursuant to Rule 144A thereunder. Certain Rule 144A securities may be treated as liquid securities if the investment adviser determines that such treatment is warranted. Even if determined to be liquid, holdings of these securities may increase the level of Fund illiquidity if eligible buyers become uninterested in purchasing them.

Cash and Cash Equivalents. The Fund may invest in cash or cash equivalents, including short-term municipal securities, for cash management purposes. During unusual market conditions, the Fund may invest up to 50% of its assets in cash or cash equivalents temporarily, which may be inconsistent with its investment objective. Interest income from temporary investments may be taxable.

General. Unless otherwise stated, the Fund’s investment objective and certain other policies may be changed without shareholder approval. Shareholders will receive 60 days’ written notice of any material change in the investment objective The Fund might not use all of the strategies and techniques or invest in all of the types of securities described in this Prospectus or the Statement of Additional Information. While at times the Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so.

The Fund’s 80% Policy only may be changed with shareholder approval and, for the purpose of such policy, net assets include any assets purchased with borrowings for investment purposes.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

The Fund’s investment policies include a provision allowing the Fund to invest (i) all of its investable assets in an open-end management investment company with substantially the same investment objective, policies and restrictions as the Fund; or (ii) in more than one open-end management investment company sponsored by Eaton Vance or its affiliates, provided any such companies have investment objectives, policies and restrictions that are consistent with those of the Fund. Any such company or companies would be advised by the Fund’s investment adviser (or an affiliate) and the Fund would not pay directly any advisory fee with respect to the assets so invested. Each Fund may initiate investments in one or more such investment companies at any time without shareholder approval.

Management and Organization

Management. Each Fund’s investment adviser is Boston Management and Research (“BMR”), a subsidiary of Eaton Vance Management (“Eaton Vance”), with offices at Two International Place, Boston, MA 02110. Eaton Vance has been managing assets since 1924 and managing mutual funds since 1931. Eaton Vance and its affiliates currently manage over $185 billion on behalf of mutual funds, institutional clients and individuals.

The investment adviser manages the investments of each Fund. Under its investment advisory agreement with each Fund, BMR receives a monthly advisory fee equal to the aggregate of a daily asset based fee and a daily income based fee. The fees are applied on the basis of the following categories.

| | | |

| | | Annual | Daily |

| Category | Daily Net Assets | Asset Rate | Income Rate |

|

| 1 | up to $500 million | 0.300% | 3.00% |

| 2 | $500 million but less than $1 billion | 0.275% | 2.75% |

| 3 | $1 billion but less than $1.5 billion | 0.250% | 2.50% |

| 4 | $1.5 billion but less than $2 billion | 0.225% | 2.25% |

| 5 | $2 billion but less than $3 billion | 0.200% | 2.00% |

| 6 | $3 billion and over | 0.175% | 1.75% |

On March 31, 2010, AMT-Free Fund had net assets of $71,909,262 and National Fund had net assets of $658,299,997. For the fiscal year ended March 31, 2010, the effective annual rate of investment advisory fees paid to BMR, based on average daily net assets of each Fund was 0.43% for AMT-Free Fund and 0.44% for National Fund.

Each Fund’s most recent shareholder report provides information regarding the basis for the Trustees’ approval of the Fund’s investment advisory agreement.

William H. Ahern, Jr. is the portfolio manager of National Fund (since May, 1997). Craig R. Brandon is the portfolio manager of AMT-Free Fund (since September, 2004). Each portfolio manager is a Vice President of Eaton Vance and BMR and also manages other Eaton Vance portfolios. Mr. Ahern and Mr. Brandon have managed Eaton Vance portfolios for more than 5 years.

The Statement of Additional Information provides additional information about each portfolio manager’s compensation, other accounts managed by each portfolio manager, and each portfolio manager’s ownership of Fund shares with respect to which that portfolio manager has management responsibility.

Eaton Vance serves as the administrator of each Fund, providing each Fund with administrative services and related office facilities. Eaton Vance does not currently receive a fee for serving as administrator.

Eaton Vance also serves as the sub-transfer agent for each Fund. For the sub-transfer agency services it provides, Eaton Vance receives an aggregate fee based upon the actual expenses it incurs in the performance of sub-transfer agency services. This fee is paid to Eaton Vance by a Fund’s transfer agent from the fees the transfer agent receives from the Eaton Vance funds.

Organization. Each Fund is a series of Eaton Vance Investment Trust, a Massachusetts business trust. Each Fund offers multiple classes of shares. Each Class represents a pro rata interest in a Fund but is subject to different expenses and rights. The Funds do not hold annual shareholder meetings but may hold special meetings for matters that require shareholder approval (such as electing or removing trustees, approving management or advisory contracts or changing investment policies that may only be changed with shareholder approval).

Because the Funds use this combined Prospectus, a Fund could be held liable for a misstatement or omission made about another Fund.

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

Valuing Shares

Each Fund values its shares once each day only when the New York Stock Exchange (the "Exchange") is open for trading (typically Monday through Friday), as of the close of regular trading on the Exchange (normally 4:00 p.m. eastern time). The purchase price of Fund shares is their net asset value (plus a sales charge for Class A shares), which is derived from the value of Fund holdings. When purchasing or redeeming Fund shares through a financial intermediary, your financial intermediary must receive your order not later than 4:00 p.m. in order for the purchase price or the redemption price to be based on that day’s net asset value per share. It is the financial intermediary’s responsibility to transmit orders promptly. Each Fund may accept purchase and redemption orders as of the time of their receipt by certain financial intermediaries (or their designated intermediaries).

The Trustees have adopted procedures for valuing investments and have delegated to the investment adviser the daily valuation of such investments. Municipal obligations owned by the Funds are normally valued on the basis of valuations furnished by a pricing service. The pricing service considers various factors relating to bonds and market transactions to determine value. In certain situations, the investment adviser may use the fair value of a security if market prices are unavailable or deemed unreliable. A security that is fair valued may be valued at a price higher or lower than actual market quotations or the value determined by other funds using their own fair valuation procedures. The investment adviser expects to use fair value pricing for municipal obligations under limited circumstances, such as when an obligation is not priced by the pricing service or is in default. Eaton Vance has established a Valuation Committee that oversees the valuation of investments.

Purchasing Shares

You may purchase shares through your financial intermediary or by mailing an account application form to the transfer agent (see back cover for address). Purchase orders will be executed at the net asset value (plus any applicable sales charge) next determined after their receipt in proper form (meaning that they are complete and contain all necessary information) by a Fund’s transfer agent. A Fund’s transfer agent or your financial intermediary must receive your purchase in proper form no later than the close of regular trading on the Exchange (normally 4:00 p.m. eastern time) for your purchase to be effected at that day’s net asset value. If you purchase shares through a financial intermediary, that intermediary may charge you a fee for executing the purchase for you. Each Fund may suspend the sale of its shares at any time and any purchase order may be refused for any reason. The Funds do not issue share certificates.

Class A, Class B and Class C Shares

Your initial investment must be at least $1,000. After your initial investment, additional investments may be made in any amount at any time by sending a check payable to the order of the Fund or the transfer agent directly to the transfer agent (see back cover for address). Please include your name and account number and the name of the Fund and Class of shares with each investment. You also may make additional investments by accessing your account via the Eaton Vance website at www.eatonvance.com. Purchases made through the Internet from a pre-designated bank account will have a trade date that is the first business day after the purchase is requested. For more information about purchasing shares through the Internet, please call 1-800-262-1122.

You may make automatic investments of $50 or more each month or each quarter from your bank account. You can establish bank automated investing on the account application or by providing written instructions. Please call 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. (eastern time) for further information. The minimum initial investment amount and Fund policy of redeeming accounts with low account balances are waived for bank automated investing accounts (other than for Class I), certain group purchase plans (including proprietary fee-based programs sponsored by financial intermediaries) and for persons affiliated with Eaton Vance, its affiliates and certain Fund service providers (as described in the Statement of Additional Information).

Class I Shares

Class I shares are offered to clients of financial intermediaries who (i) charge such clients an ongoing fee for advisory, investment, consulting or similar services, or (ii) have entered into an agreement with the principal underwriter to offer Class I shares through a no-load network or platform. Such clients may include individuals, corporations, endowments, foundations and qualified plans (including tax-deferred retirement plans and profit sharing plans). Class I shares also are offered to investment and institutional clients of Eaton Vance and its affiliates and certain persons affiliated with Eaton Vance and certain Fund service providers. Your initial investment must be at least $250,000. Subsequent investments of any amount may be made at any time, including through automatic investment each month or quarter from your bank account. You may make automatic investments of $50 or more each month or each quarter from your bank account. You can establish bank automated investing on the account application or by providing written instructions. Please call 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. (eastern time) for further information.

The minimum initial investment is waived for persons affiliated with Eaton Vance, its affiliates and certain Fund service providers (as described in the Statement of Additional Information). The initial minimum investment also is waived for individual accounts of a financial intermediary that charges an ongoing fee for its services or offers Class I shares through a no-load network or platform

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

(in each case, as described above), provided the aggregate value of such accounts invested in Class I shares is at least $250,000 (or is anticipated by the principal underwriter to reach $250,000) and for corporations, endowments, foundations and qualified plans with assets of at least $100 million.

Class I shares may be purchased through a financial intermediary or by requesting your bank to transmit immediately available funds (Federal Funds) by wire. To make an initial investment by wire, you must complete an account application and telephone the Shareholder Services Department at 1-800-262-1122 to be assigned an account number. You may request a current account application by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. (eastern time). The Shareholder Services Department must be advised by telephone of each additional investment by wire.

Restrictions on Excessive Trading and Market Timing. The Funds are not intended for excessive trading or market timing. Market timers seek to profit by rapidly switching money into a fund when they expect the share price of the fund to rise and taking money out of the fund when they expect those prices to fall. By realizing profits through short-term trading, shareholders that engage in rapid purchases and sales or exchanges of a fund’s shares may dilute the value of shares held by long-term shareholders. Volatility resulting from excessive purchases and sales or exchanges of fund shares, especially involving large dollar amounts, may disrupt efficient portfolio management. In particular, excessive purchases and sales or exchanges of a fund’s shares may cause a fund to have difficulty implementing its investment strategies, may force the fund to sell portfolio securities at inopportune times to raise cash or may cause increased expenses (such as increased brokerage costs, realization of taxable capital gains without attaining any investment advantage or increased administrative costs).

A fund that invests in securities that are, among other things, thinly traded, traded infrequently or relatively illiquid (including certain municipal obligations) is susceptible to the risk that the current market price for such securities may not accurately reflect current market values. A shareholder may seek to engage in short-term trading to take advantage of these pricing differences (commonly referred to as “price arbitrage”). The investment adviser is authorized to use the fair value of a security if prices are unavailable or are deemed unreliable (see “Valuing Shares”). The use of fair value pricing and the restrictions on excessive trading and market timing described below are intended to reduce a shareholder’s ability to engage in price arbitrage to the detriment of the Funds.

The Boards of Trustees of the Eaton Vance funds have adopted policies to discourage short-term trading and market timing and to seek to minimize their potentially detrimental effects. Pursuant to these policies, if an investor (through one or more accounts) makes more than one round-trip exchange (exchanging from one fund to another fund and back again) within 90 days, it will be deemed to constitute market timing or excessive trading. Under the policies, each Fund or its principal underwriter will reject or cancel a purchase order, suspend or terminate the exchange privilege or terminate the ability of an investor to invest in the Eaton Vance funds if the Fund or the principal underwriter determines that a proposed transaction involves market timing or excessive trading that it believes is likely to be detrimental to the Fund. Each Fund and its principal underwriter use reasonable efforts to detect market timing and excessive trading activity, but they cannot ensure that they will be able to identify all cases of market timing and excessive trading. Each Fund or its principal underwriter may also reject or cancel any purchase order (including an exchange) from an investor or group of investors for any other reason. Decisions to reject or cancel purchase orders (including exchanges) in a Fund are inherently subjective and will be made in a manner believed to be in the best interest of a Fund’s shareholders. No Eaton Vance fund has any arrangement to permit market timing.

The following fund share transactions generally are exempt from the market timing and excessive trading policy described above because each Fund and the principal underwriter believe they generally do not raise market timing or excessive trading concerns:

- transactions made pursuant to a systematic purchase plan or as the result of automatic reinvestment of dividends or distributions, or initiated by a Fund (e.g., for failure to meet applicable account minimums);

- transactions made by participants in employer sponsored retirement plans involving participant payroll or employer contributions or loan repayments, redemptions as part of plan terminations or at the direction of the plan, mandatory retirement distributions, or rollovers;

- transactions made by asset allocation and wrap programs where the adviser to the program directs transactions in the accounts participating in the program in concert with changes in a model portfolio; or

- transactions in shares of Eaton Vance U.S. Government Money Market Fund and Eaton Vance Tax Free Reserves.

It may be difficult for a Fund or the principal underwriter to identify market timing or excessive trading in omnibus accounts traded through financial intermediaries. The Funds and the principal underwriter have provided guidance to financial intermediaries (such as banks, broker-dealers, insurance companies and retirement administrators) concerning the application of the Eaton Vance funds’ market timing and excessive trading policies to Fund shares held in omnibus accounts maintained and administered by such intermediaries, including guidance concerning situations where market timing or excessive trading is considered to be detrimental to a Fund. Each Fund or its principal underwriter may rely on a financial intermediary’s policy to restrict market timing and excessive

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

trading if it believes that policy is likely to prevent market timing that is likely to be detrimental to the Fund. Such policy may be more or less restrictive than a Fund’s policy. Although each Fund or the principal underwriter reviews trading activity at the omnibus account level for activity that indicates potential market timing or excessive trading activity, the Funds and the principal underwriter typically will not request or receive individual account data unless suspicious trading activity is identified. Each Fund and the principal underwriter generally rely on financial intermediaries to monitor trading activity in omnibus accounts in good faith in accordance with their own or Fund policies. Each Fund and the principal underwriter cannot ensure that these financial intermediaries will in all cases apply the policies of the Fund or their own policies, as the case may be, to accounts under their control.

Choosing a Share Class. Each Fund offers different classes of shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different sales charges and expenses and will likely have different share prices due to differences in class expenses. In choosing the class of shares that suits your investment needs, you should consider:

- how long you expect to own your shares;

- how much you intend to invest;

- the sales charge and total operating expenses associated with owning each class; and

- whether you qualify for a reduction or waiver of any applicable sales charges (see “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below).

Each investor’s considerations are different. You should speak with your financial intermediary to help you decide which class of shares is best for you. Set forth below is a brief description of each class of shares offered by the Funds.

| Class A shares are offered at net asset value plus a front-end sales charge of up to 2.25%. This charge is deducted from the amount you invest. The Class A sales charge is reduced for purchases of $100,000 or more. The sales charge applicable to your purchase may be reduced under the right of accumulation or a statement of intention, which are described in “Reducing or Eliminating Class A Sales Charges” under “Sales Charges” below. Some investors may be eligible to purchase Class A shares at net asset value under certain circumstances, which are also described below. Class A shares pay distribution and service fees equal to 0.15% annually of average daily net assets. |

| Class B shares are offered at net asset value with no front-end sales charge. If you sell your Class B shares within four years of purchase, you generally will be subject to a contingent deferred sales charge or “CDSC”. The amount of the CDSC applicable to a redemption of Class B shares decreases over four years, as described in the CDSC schedule in “Contingent Deferred Sales Charge” under “Sales Charges” below. The CDSC is deducted from your redemption proceeds. Under certain circumstances, the Class B CDSC may be waived (such as in the case of the death of the shareholder). See “CDSC Waivers” under “Sales Charges” below. Class B shares pay distribution and service fees equal to 0.90% annually of average daily net assets. Class B shares will automatically convert to Class A shares after the longer of four years or the time when the CDSC applicable to the Class B shares expires. Orders for Class B shares of one or more Eaton Vance funds will be refused when the total value of the purchase (including the aggregate value of all Eaton Vance fund shares held within the purchasing shareholder’s account) is $100,000 or more. Investors considering cumulative purchases of $100,000 or more, or who, after a purchase of shares, would own shares of Eaton Vance funds with a current market value of $100,000 or more, should consider whether Class A shares would be more advantageous and consult their financial intermediary. |

| Class C shares are offered at net asset value with no front-end sales charge. If you sell your Class C shares within one year of purchase, you generally will be subject to a CDSC. The CDSC is deducted from your redemption proceeds. Under certain circumstances, the Class C CDSC may be waived (such as certain redemptions from tax-deferred retirement plan accounts). See “CDSC Waivers” under “Sales Charges” below. Class C shares pay distribution and service fees equal to 0.90% annually of average daily net assets. Orders for Class C shares of one or more Eaton Vance funds will be refused when the total value of the purchase (including the aggregate value of all Eaton Vance fund shares held within the purchasing shareholder’s account) is $1,000,000 or more. Investors considering cumulative purchases of $1,000,000 or more, or who, after a purchase of shares, would own shares of Eaton Vance funds with a current market value of $1,000,000 or more, should consider whether Class A shares would be more advantageous and consult their financial intermediary. |

| Class I shares are offered to clients of financial intermediaries who (i) charge such clients an ongoing fee for advisory, investment, consulting or similar services, or (ii) have entered into an agreement with the principal underwriter to offer Class I shares through a no-load network or platform. Such clients may include individuals, corporations, endowments, foundations and qualified plans (as described above). Class I shares are also offered to investment and institutional clients of Eaton Vance and its affiliates and certain persons affiliated with Eaton Vance and certain Fund service providers. Class I shares do not pay distribution or service fees. |

| Eaton Vance National Limited Maturity Municipal Income Funds |

| Prospectus dated August 1, 2010 as revised February 17, 2011 |

Payments to Financial Intermediaries. In addition to payments disclosed under "Sales Charges" below, the principal underwriter, out of its own resources, may make cash payments to certain financial intermediaries who provide marketing support, transaction processing and/or administrative services and, in some cases, include some or all Eaton Vance funds in preferred or specialized selling programs. Payments made by the principal underwriter to a financial intermediary may be significant and are typically in the form of fees based on Fund sales, assets, transactions processed and/or accounts attributable to that financial intermediary. Financial intermediaries also may receive amounts from the principal underwriter in connection with educational or due diligence meetings that include information concerning Eaton Vance funds. The principal underwriter may pay or allow other promotional incentives or payments to financial intermediaries to the extent permitted by applicable laws and regulations.