UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04443 |

|

Eaton Vance Investment Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | March 31, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders

| | | |

|

A n n u a l R e p o r t M a r c h 3 1 , 2 0 0 5 | |

| | | | |

| | EATON VANCE

LIMITED

MATURITY

MUNICIPALS

FUNDS | | California Florida Massachusetts New Jersey New York Ohio

Pennsylvania |

| | |

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy (“Privacy Policy”) with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer’s account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer’s account (i.e. fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser’s privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance’s Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called “householding” and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and it’s underlying Portfolio will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC’s website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC’s public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds’ and Portfolios’ Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to Portfolio securities during the 12 month period ended June 30, without charge, upon request, by calling

1-800-262-1122. This description is also available on the SEC’s website at www.sec.gov.

Eaton Vance Limited Maturity Municipals Funds as of March 31, 2005

T A B L E O F C O N T E N T S

President’s Letter to Shareholders | 2 |

| |

Market Recap | 3 |

| |

Fund Investment Updates | |

California | 4 |

Florida | 6 |

Massachusetts | 8 |

New Jersey | 10 |

New York | 12 |

Ohio | 14 |

Pennsylvania | 16 |

| |

Disclosure of Fund Expenses | 18 |

| |

Financial Statements | 42 |

| |

Management and Organization | 84 |

1

Eaton Vance Limited Maturity Municipals Funds as of March 31, 2005

L E T T E R T O S H A R E H O L D E R S

Thomas J. Fetter

President

The municipal bond market is a center of capital formation for states, municipalities and, in some cases, private economic initiatives. In this edition of our continuing educational series, we will discuss industrial development revenue (IDR) bonds. IDR bonds have long been used as a financing mechanism by local governments to provide assistance to local employers and encourage job retention and creation within their communities.

IDR bonds finance private activities that benefit the public...

IDR bonds are issued by municipal authorities to finance projects and facilities used by private corporations. Historically, IDR bonds have represented a partnership between the private and public sectors – a source of dedicated funding for companies and a source of job creation in projects beneficial to local communities. The “Private-Activities” provision of the Tax Reform Act of 1986 permits issuance of tax-exempt bonds for specific activities, including pollution control; gas and electric service; water distribution; wastewater systems; solid waste disposal; airports and selected transportation projects; and other industrial projects.

The Act also placed a cap on the dollar amount that may be raised for IDR bonds in each state, limiting the amount to $50 per person/per state/per year, with a $150 million maximum. These limitations provide protection against potential abuse and ensure that tax-exempt IDR bonds will indeed be issued for projects that will benefit the public.

IDR bonds finance utility-related projects and other key industrial initiatives...

Typically, IDR bonds provide financing for manufacturing, processing or utility facilities. Historically, about one-half of these bonds have been issued to finance pollution control facilities for manufacturers and electric utilities. As many utilities and manufacturers have been ordered to comply with stricter environmental and fuel standards, pollution control bonds have helped finance the retrofits of existing plants. Other IDR bonds have served as inducements from state and local issuers to locate plants or build new facilities, in the hope that such construction might generate further economic growth for a community.

IDR bonds are secured by corporate revenues – not those of state or local governments...

IDR bond issues are secured by the credit of the underlying corporation. The municipal issuing authority acts solely as a conduit to permit tax-exempt financing. The corporation pledges to makepayments sufficient to meet all debt service obligations. Unlike some revenue issues, IDR bonds are backed by revenues of the entire corporation, not solely by those of the project being financed.

Because IDR bonds are backed by corporate revenues and not by the taxing authority of a state or local jurisdiction, they have historically provided coupon premiums above those of general obligations and other more traditional revenue bonds. Bonds may be either collateralized or unsecured. Collateralized bonds have a lien against the company’s assets, which may provide bond holders enhanced bargaining power in the event of a bankruptcy. Unsecured bonds have no such lien.

While providing new opportunities, IDR bonds require rigorous analysis...

While IDR bonds may provide unusual investment opportunities, they also may entail increased risk and, therefore, demand especially intensive analysis. At Eaton Vance, we have credit analysts and resources dedicated to IDR bond research.

We feel that IDR bonds represent a key segment of the municipal bond market and should remain an important source of capital formation. In our view, the experience and resources needed to evaluate these issues further demonstrates the value of professional management. We will continue to look for opportunities in this sector of the municipal market.

| Sincerely, |

| |

| /s/ Thomas J. Fetter | |

| Thomas J. Fetter |

| President |

| May 11, 2005 |

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of

2

Eaton Vance Limited Maturity Municipals Funds as of March 31, 2005

M A R K E T R E C A P

The U.S. economy continued to generate moderate growth during the year ended March 31, 2005. While higher gasoline and energy prices pinched consumers, the weak U.S. dollar raised inflationary concerns and helped push interest rates higher.

After a promising recovery in 2004, slower growth in early 2005...

The nation’s Gross Domestic Product grew by 3.1% in the first quarter of 2005, according to preliminary Commerce Department figures, following a 3.8% rise in the fourth quarter of 2004. Manufacturing activity, which had expanded strongly in the second half of 2004, slackened somewhat in the first quarter of 2005, amid slower industrial production and weakening demand for durable goods.

Consumer spending, which helped fuel the economic recovery over the past year, weakened considerably, as higher fuel costs and rising interest rates on loans and mortgages prompted consumers to tighten their belts. Capital spending also slowed, as businesses curtailed new investments in plants and factories, while reducing the pace of investment in productivity-enhancing equipment and software. Residential construction remained relatively strong, although slightly off the torrid pace set in 2004.

After recovering dramatically in 2004, job creation weakened somewhat in early 2005...

The nation’s labor markets strengthened during the year, although the pace of job creation weakened at the close of the period. Hiring picked up during the year in areas that had suffered large technology sector layoffs. Also, manufacturing, financial services, business services, trucking, shipping, construction, energy, health care, and media also generated new jobs. In the first quarter of 2005, however, employers showed some reticence in hiring practices, as they were forced to cope with unpredictable fuel cost hikes.

Intermediate-term municipal bonds yield 80% of Treasury yields

5-Year AAA-rated | Taxable equivalent yield |

General Obligation (GO) Bonds* | in 35.0% tax bracket |

5-Year Treasury Bond

Principal and interest payments of Treasury securities are guaranteed by the U.S. government.

*GO yields are a compilation of a representative variety of general obligations and are not necessarily representative of a Fund’s yield. Statistics are as of March 31, 2005.

Past performance is no guarantee of future results.

Source: Bloomberg, L.P.

The Federal Reserve continued to raise short-term interest rates in 2005...

The Federal Reserve pushed short-term rates higher, suggesting it will continue to raise rates to keep the economy from growing too quickly and, thereby, reviving inflation. Beginning in June 2004, the Fed increased its Federal Funds rate – a key short-term interest rate barometer – on eight occasions, raising that benchmark from 1.00% to 3.00%, including its most recent rate hike in May 2005.

The municipal bond market posted a modest gain for the year, slightly outperforming the Treasury market. For the year ended March 31, 2005, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million –had a total return of 2.67.%.*

*It is not possible to invest directly in an Index. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

3

Eaton Vance California Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 0.99% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.29 per share on March 31, 2005 from $10.56 on March 31, 2004, and the reinvestment of $0.372 in dividends.(2)

• The Fund’s Class B shares had a total return of 0.31% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.26 per share on March 31, 2005 from $10.52 on March 31, 2004, and the reinvestment of $0.293 in dividends.(2)

• The Fund’s Class C shares had a total return of -0.01% for the period from inception on March 23, 2005 through March 31, 2005.(1) This return was the result of a decrease in NAV to $9.95 per share on March 31, 2005 from $10.00 on March 23, 2005.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the Fund’s most recent dividends annualized and NAVs on March 31, 2005 of $10.29 per share for Class A and $10.26 for Class B, the Fund’s distribution rates were 3.62% and 2.85%, respectively.(4) The distribution rates are equivalent to taxable rates of 6.14% and 4.83%, respectively.(5)

• The SEC 30-day yields for Class A and Class B shares at March 31, 2005 were 3.24% and 2.57%, respectively.(6) The SEC 30-day yields are equivalent to taxable yields of 5.50% and 4.36%, respectively.(5)

Cynthia J. Clemson

Portfolio Manager

Management Discussion

• California’s economy generated good job growth in late 2004 and early 2005. The business services sector added the largest number of jobs, with construction and financial services also making significant contributions. The government sector, subject to budgetary restraints, remained a sore spot in the state economy. The state’s March 2005 jobless rate was 5.8%, down from 6.4% a year ago.

• Insured** general obligations (GOs) constituted the Fund’s largest sector weighting at March 31, 2005. These bonds have continued to perform well as the California economy continued its economic recovery.

• Insured** and uninsured special tax revenue bonds were among the Fund’s prominent holdings. The Fund’s investments included issues that financed transportation projects, watershed improvements and local community development programs.

• Insured** water and sewer bonds are frequent issuers in the California municipal market, as stricter environmental rules have forced communities to upgrade their water and wastewater systems. Management focused on issuers with healthy finances, sound long-term planning and a growing service area.

• Insured** lease revenue/certificates of participation remained large investments for the Fund. These issues provided combined financing for a variety of California jurisdictions, representing a flexible and cost-effective funding source for borrowers at the state and local level.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal and state income taxes and/or alternative minimum tax. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 41.05% federal and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

4

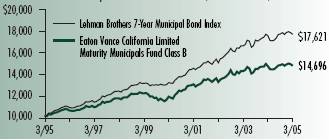

Eaton Vance California Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

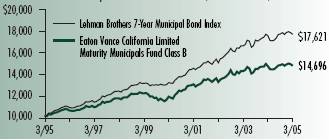

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-Year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers 7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 0.99 | % | 0.31 | % | N.A. | |

Five Years | | 5.27 | | 4.46 | | N.A. | |

Ten Years | | N.A. | | 3.93 | | N.A. | |

Life of Fund† | | 4.68 | | 4.07 | | -0.50 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | -1.26 | % | -2.61 | % | N.A. | |

Five Years | | 4.80 | | 4.46 | | N.A. | |

Ten Years | | N.A. | | 3.93 | | N.A. | |

Life of Fund† | | 4.40 | | 4.07 | | -1.49 | |

†Inception Dates – Class A: 6/27/96; Class B: 5/29/92; Class C: 3/23/05

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

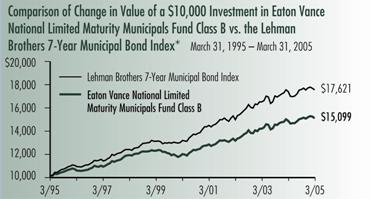

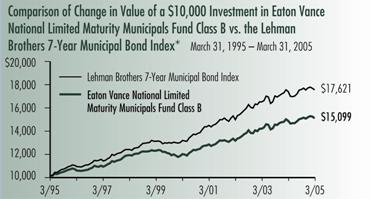

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

California Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

*Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 5/29/92.

A $10,000 hypothetical investment at net asset value in Class A and Class C on 6/27/96 and 3/23/05, respectively, would have been valued at $14,923 and $9,950, respectively, on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,586. The investment in Class C shares would have been valued at $9,851 after deduction of the applicable CDSC. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

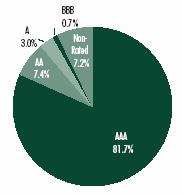

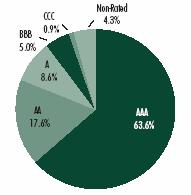

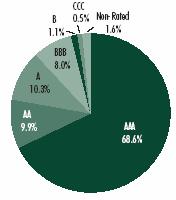

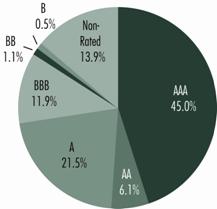

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

5

Eaton Vance Florida Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 1.06% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.23 per share on March 31, 2005 from $10.50 on March 31, 2004, and the reinvestment of $0.379 in dividends.(2)

• The Fund’s Class B shares had a total return of 0.28% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.23 per share on March 31, 2005 from $10.50 on March 31, 2004, and the reinvestment of $0.299 in dividends.(2)

• The Fund’s Class C shares had a total return of 0.19% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $9.65 per share on March 31, 2005 from $9.91 on March 31, 2004, and the reinvestment of $0.279 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the Fund’s most recent dividends annualized and NAVs on March 31, 2005 of $10.23 per share for Class A and Class B and $9.65 for Class C, the Fund’s distribution rates were 3.71%, 2.93% and 2.95%, respectively.(4) The distribution rates are equivalent to taxable rates of 5.71%, 4.51% and 4.54%, respectively.(5)

• The SEC 30-day yields for Class A, Class B and Class C shares at March 31, 2005 were 2.93%, 2.25% and 2.25%, respectively.(6) The SEC 30-day yields are equivalent to taxable yields of 4.51%, 3.46% and 3.46%, respectively.(5)

Craig Brandon

Portfolio Manager

Management Discussion

• Florida’s economy continued to expand during the period. Residential construction and service sectors remained very strong, a result of a population growth rate twice that of the U.S. rate. Boosted by the weak U.S. dollar, even tourism grew in 2004, despite a severe hurricane season. The state’s jobless rate was 4.5% in March 2005, down from 4.8% a year ago.

• Insured** water and sewer bonds were the Fund’s largest sector weighting at March 31, 2005. Population growth, aging infrastructure and new environmental rules have prompted many communities to initiate upgrades to their water systems. Backed by water and sewer bill payments, water and sewer utilities have historically represented a relatively stable revenue source.

• Insured** transportation bonds were significant investments for the Fund. As the demands on Florida’s transportation infrastructure have surged in recent years, these bonds have helped finance improvements and upgrades for local seaports, airport authorities and expressways.

• Insured** general obligations were a significant commitment for the Fund. While some states struggled with a slow recovery and weak revenues, a strong economic rebound bolstered tax receipts for Florida state, county and local issuers.

• Management continued to adjust the Fund’s coupondistribution to reflect a changing interest rate outlook. In addition, management continued to upgrade call structure to protect the Fund against untimely calls.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal income and/or alternative minimum tax and state intangibles taxes. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 35.00% combined federal and state intangibles tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

6

Eaton Vance Florida Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

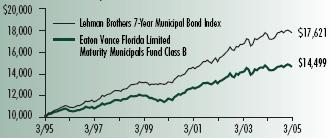

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-Year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers

7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 1.06 | % | 0.28 | % | 0.19 | % |

Five Years | | 5.34 | | 4.57 | | 4.52 | |

Ten Years | | N.A. | | 3.78 | | 3.74 | |

Life of Fund† | | 4.55 | | 4.06 | | 3.35 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | -1.20 | % | -2.64 | % | -0.78 | % |

Five Years | | 4.86 | | 4.57 | | 4.52 | |

Ten Years | | N.A. | | 3.78 | | 3.74 | |

Life of Fund† | | 4.28 | | 4.06 | | 3.35 | |

†Inception Dates – Class A: 6/27/96; Class B: 5/29/92; Class C: 12/8/93

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

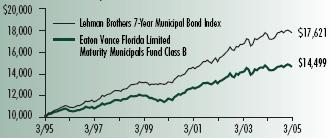

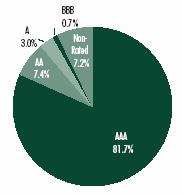

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

Florida Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

* Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 5/29/92.

A $10,000 hypothetical investment at net asset value in Class A and Class C on 6/27/96 and 3/31/95, respectively, would have been valued at $14,766 and $14,434, respectively, on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,436. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

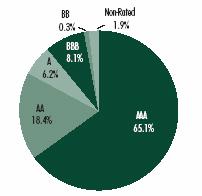

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

7

Eaton Vance Massachusetts Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 0.79% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.18 per share on March 31, 2005 from $10.46 on March 31, 2004, and the reinvestment of $0.362 in dividends.(2)

• The Fund’s Class B shares had a total return of 0.02% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.17 per share on March 31, 2005 from $10.45 on March 31, 2004, and the reinvestment of $0.282 in dividends.(2)

• The Fund’s Class C shares had a total return of -0.14% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $9.74 per share on March 31, 2005 from $10.02 on March 31, 2004, and the reinvestment of $0.267 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the Fund’s most recent dividends annualizedand NAVs on March 31, 2005 of $10.18 per share for Class A, $10.17 for Class B and $9.74 for Class C, the Fund’s distribution rates were 3.56%, 2.78% and 2.80%, respectively.(4) The distributionrates are equivalent to taxable rates of 5.78%, 4.52% and 4.55%, respectively.(5)

• The SEC 30-day yields for Class A, Class B and Class C shares at March 31, 2005 were 3.17%, 2.49% and 2.49%, respectively.(6) The SEC 30-day yields are equivalent to taxable yields of 5.15%, 4.05% and 4.05%, respectively.(5)

William H. Ahern

Co-Portfolio Manager

Management Discussion

• The Massachusetts economy made progress in 2004 and 2005, although not yet achieving pre-recession employment levels. Business services, health care, education and residential building remained areas of strong job creation. The manufacturing sector continued to struggle. The state’s March 2005 jobless rate was 4.9%, down from 5.4% a year ago and below the national rate.

• Insured** general obligations (GOs) were the Fund’s largest sector weighting at March 31, 2005. Insured* school district, public improvement and local GOs have been valued by investors in a relatively slow recovery that has continued to pressure some industrial and economically sensitive issuers.

• Education bonds constituted significant holdings for the Fund. Investments included some of the Commonwealth’s leading universities and secondary schools. Historically, these institutions have enjoyed strong applicant demand and the ability to generate annual hikes in tuition and fee income.

• The Fund maintained a significant investment in insured** transportation bonds. The Fund’s investments included issues for mass transit, highways and port authority bonds. Many of these issues are backed, in part, by toll revenues and are considered less vulnerable to economic fluctuations than cyclical issues.

• Selected Puerto Rico bonds have provided the Fund opportunities for additional diversification. The Fund’s Puerto Rico investments included insured** electric utilities, general obligations, transportation and lease revenue bonds.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal income and/or alternative minimum tax and state and local income taxes (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 38.45% combined federal and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

8

Eaton Vance Massachusetts Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers

7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 0.79 | % | 0.02 | % | -0.14 | % |

Five Years | | 5.19 | | 4.36 | | 4.38 | |

Ten Years | | N.A. | | 3.77 | | 3.77 | |

Life of Fund† | | 4.56 | | 3.98 | | 3.42 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | -1.47 | % | -2.90 | % | -1.11 | % |

Five Years | | 4.72 | | 4.36 | | 4.38 | |

Ten Years | | N.A. | | 3.77 | | 3.77 | |

Life of Fund† | | 4.29 | | 3.98 | | 3.42 | |

†Inception Dates – Class A: 6/27/96; Class B: 6/1/92; Class C: 12/8/93

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

Massachusetts Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

* Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 6/1/92.

A $10,000 hypothetical investment at net asset value in Class A and Class C on 6/27/96 and 3/31/95, respectively, would have been valued at $14,780 and $14,475, respectively, on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,447. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

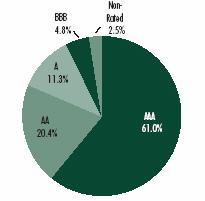

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

9

Eaton Vance New Jersey Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 0.98% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.10 per share on March 31, 2005 from $10.36 on March 31, 2004, and the reinvestment of $0.360 in dividends.(2)

• The Fund’s Class B shares had a total return of 0.30% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.10 per share on March 31, 2005 from $10.35 on March 31, 2004, and the reinvestment of $0.280 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the most recent dividends annualized and NAVs on March 31, 2005 of $10.10 per share for Class A and Class B, the Fund’s distribution rates were 3.56% and 2.77%, respectively.(4) The distribution rates of Class A and Class B are equivalent to taxable rates of 6.02% and 4.68%, respectively.(5)

• The SEC 30-day yields for Class A and B shares at March 31, 2005 were 3.08% and 2.39%, respectively.(6) The SEC 30-day yields of Class A and Class B are equivalent to taxable yields of 5.21% and 4.04%, respectively.(5)

Craig Brandon

Portfolio Manager

Management Discussion

• In late 2004 and early 2005, New Jersey enjoyed good job growth, the state’s strongest since 2000. Leisure, business services, trade, transportation, and utilities generated the fastest job growth. Not surprisingly, manufacturing remained among the state’s weakest sectors. The state’s March 2005 jobless rate was 4.4%, down from 5.2% a year ago.

• Insured** general obligations were the Fund’s largest sector weighting at March 31, 2005, representing a high-quality investment in a rebounding economy. The Fund’s investments were focused on regional and township school district bonds and local board of education issues.

• In the insured** transportation sector, the Fund’s investments constituted primarily a mix of regional transportation authorities and port authorities. The Fund also had investments in the state’s transportation trust fund authority, which – backed by motor fuel tax receipts – finances repairs to bridges, highways and park-ride facilities.

• Insured** water and sewer bonds represented a major investment. Many New Jersey cities and towns needed to upgrade their water infrastructure. Increased issuance of bonds to finance watershed and wastewater projects has provided the Fund with high quality income opportunities.

• Management continues to adjust coupon structure in response to changing market conditions. The Fund maintained a broad diversification according to issuer, sector, coupon and insurer. Retaining good call protection remained another key strategic consideration.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal and state income taxes and/or alternative minimum tax. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 40.83% combined federal income and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

10

Eaton Vance New Jersey Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-Year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers 7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | |

| | | | | |

Average Annual Total Returns (at net asset value) | | | | | |

One Year | | 0.98 | % | 0.30 | % |

Five Years | | 4.86 | | 4.06 | |

Ten Years | | N.A. | | 3.71 | |

Life of Fund† | | 4.50 | | 3.95 | |

| | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

One Year | | -1.30 | % | -2.63 | % |

Five Years | | 4.38 | | 4.06 | |

Ten Years | | N.A. | | 3.71 | |

Life of Fund† | | 4.23 | | 3.95 | |

†Inception date: Class A: 6/27/96; Class B: 6/1/92

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

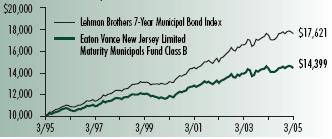

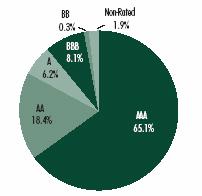

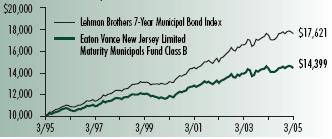

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

New Jersey Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

* Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 6/1/92.

A $10,000 hypothetical investment at net asset value in Class A on 6/27/96 would have been valued at $14,711 on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,379. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

11

Eaton Vance New York Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 0.73% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.54 per share on March 31, 2005 from $10.85 on March 31, 2004, and the reinvestment of $0.388 in dividends.(2)

• The Fund’s Class B shares had a total return of -0.03% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.53 per share on March 31, 2005 from $10.84 on March 31, 2004, and the reinvestment of $0.306 in dividends.(2)

• The Fund’s Class C shares had a total return of -0.07% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.02 per share on March 31, 2005 from $10.31 on March 31, 2004, and the reinvestment of $0.284 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the Fund’s most recent dividends annualized and NAVs on March 31, 2005 of $10.54 per share for Class A, $10.53 for Class B and $10.02 for Class C, the Fund’s distribution rates were 3.69%, 2.92% and 2.89%, respectively.(4) The distribution rates are equivalent to taxable rates of 6.15%, 4.87% and 4.82%, respectively.(5)

• The SEC 30-day yields for Class A, Class B and Class C shares at March 31, 2005 were 3.11%, 2.43% and 2.43%, respectively.(6) The SEC 30-day yields are equivalent to taxable yields of 5.18%, 4.05% and 4.05%, respectively.(5)

William H. Ahern

Portfolio Manager

Management Discussion

• During 2004 and into early 2005, New York State posted positive job growth for the first time since 2000. Job creation in business services, education, health care and tourism have been the main drivers of growth. Gains in finance have been modest, while the state continued to lose manufacturing jobs at a faster rate than the nation as a whole. The state’s March 2005 jobless rate was 5.1%, down from 6.1% a year ago.

• Escrowed and insured** escrowed bonds were the Fund’s largest sector weighting at March 31, 2005. Escrowed issues have been pre-refunded and backed by Treasury bonds, most often as the result of a refinancing of existing higher-coupon debt. They are valued by investors for their very high quality and relatively stable performance characteristics.

• Insured** general obligations constituted large commitments for the Fund. The Fund’s investments were focused on city and town school district bonds and county public improvement bonds. A stronger state and local economy would likely improve the revenue outlook for these local issuers.

• Insured** transportation bonds were prominent investments in the Fund. Transportation has historically been a key factor in the New York economy, and the demands have become even more acute in recent years. The Fund’s investments included issues for public transit, bridges and tunnels, airports, port authorities and highways.

• The Fund took advantage of its flexibility to own Puerto Rico bonds, adding further diversification. The Fund’s Puerto Rico bonds included transportation bonds, generation obligations and industrial development revenue bonds.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal and state income taxes and/or alternative minimum tax. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable equivalent figures assume a maximum 40.01% combined federal income and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

12

Eaton Vance New York Limited Maturity Municipals Fund as of March 31, 2005

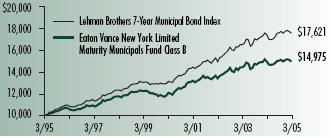

F U N D P E R F O R M A N C E

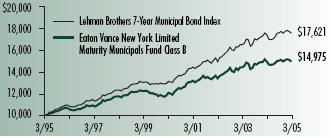

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers 7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 0.73 | % | -0.03 | % | -0.07 | % |

Five Years | | 5.21 | | 4.40 | | 4.42 | |

Ten Years | | N.A. | | 4.12 | | 4.12 | |

Life of Fund† | | 4.94 | | 4.28 | | 3.66 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | -1.54 | % | -2.95 | % | -1.04 | % |

Five Years | | 4.74 | | 4.40 | | 4.42 | |

Ten Years | | N.A. | | 4.12 | | 4.12 | |

Life of Fund† | | 4.67 | | 4.28 | | 3.66 | |

†Inception Dates – Class A: 6/27/96; Class B: 5/29/92; Class C: 12/8/93

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

New York Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995– March 31, 2005

* Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 5/29/92.

A $10,000 hypothetical investment at net asset value in Class A and Class C on 6/27/96 and 3/31/95, respectively, would have been valued at $15,255 and $14,976, respectively, on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,912. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

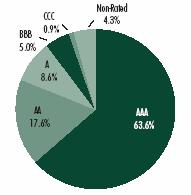

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

13

Eaton Vance Ohio Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 0.70% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $9.74 per share on March 31, 2005 from $10.02 on March 31, 2004, and the reinvestment of $0.349 in dividends.(2)

• The Fund’s Class B shares had a total return of -0.05% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $9.73 per share on March 31, 2005 from $10.01 on March 31, 2004, and the reinvestment of $0.274 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the most recent dividends annualized and NAVs on March 31, 2005 of $9.74 per share for Class A and $9.73 per share for Class B, the Fund’s distribution rates were 3.59% and 2.83%, respectively.(4) The distribution rates of Class A and Class B are equivalent to taxable rates of 5.97% and 4.71%, respectively.(5)

• The SEC 30-day yields for Class A and B shares at March 31, 2005 were 2.65% and 1.99%, respectively.(6) The SEC 30-day yields of Class A and Class B are equivalent to taxable yields of 4.41% and 3.31%, respectively.(5)

William H. Ahern

Portfolio Manager

Management Discussion

• Ohio’s economy generated job growth in 2004 and early 2005, benefiting from the strength in the service sector. Business services, education and health care were areas of job growth. However, while losses in the key manufacturing sector slowed, a continuing focus on productivity and restructurings limited the extent of the recovery. The state’s March 2005 jobless rate was 6.4%, up slightly from 6.1% a year ago.

• Insured** and uninsured general obligations (GOs) were among the Fund’s largest sector weightings at March 31, 2005. The Fund’s investments focused on school district GOs of communities with a good local economy and a solid property tax base. Stable revenues are especially important in a state where the industrial economy has been slow to recover.

• The Fund was very selective with respect to its investments in the hospital sector. With the competitive hospital industry under pressure to reduce costs, management emphasized institutions with sound financial structures, good management and the ability to offer attractive health care specialties.

• The Fund maintained significant investments in insured** water and sewer bonds. The need to modernize aging water infrastructure has resulted in increased issuance of water bonds, producing further opportunities in state and local issuers.

• The Fund made structural changes to adjust to shifting market conditions. Management maintained a well-diversified coupon allocation, balancing higher-income housing and utility issues with interest-rate-sensitive, low- and zero-coupon issues for appreciation potential.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal and state income taxes and/or alternative minimum tax. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 39.88% combined federal income and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

14

Eaton Vance Ohio Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-Year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers

7-year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | |

| | | | | |

Average Annual Total Returns (at net asset value) | | | | | |

One Year | | 0.70 | % | -0.05 | % |

Five Years | | 4.76 | | 3.99 | |

Ten Years | | N.A. | | 3.67 | |

Life of Fund† | | 4.20 | | 3.54 | |

| | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | |

One Year | | -1.56 | % | -2.97 | % |

Five Years | | 4.28 | | 3.99 | |

Ten Years | | N.A. | | 3.67 | |

Life of Fund† | | 3.91 | | 3.54 | |

†Inception date: Class A: 10/22/96; Class B: 4/16/93

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

Ohio Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

*Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 4/16/93.

A $10,000 hypothetical investment at net asset value in Class A on 10/22/96 would have been valued at $14,148 on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $13,825. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

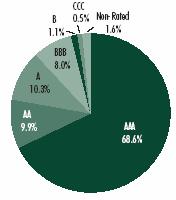

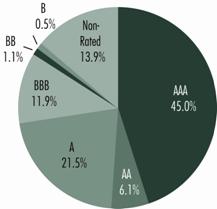

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

15

Eaton Vance Pennsylvania Limited Maturity Municipals Fund as of March 31, 2005

I N V E S T M E N T U P D A T E

The Fund

Performance for the Past Year*

• The Fund’s Class A shares had a total return of 1.25% for the year ended March 31, 2005.(1) This return was the result of a decrease in net asset value (NAV) to $10.28 per share on March 31, 2005 from $10.55 on March 31, 2004, and the reinvestment of $0.400 in dividends.(2)

• The Fund’s Class B shares had a total return of 0.48% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $10.28 per share on March 31, 2005 from $10.55 on March 31, 2004, and the reinvestment of $0.320 in dividends.(2)

• The Fund’s Class C shares had a total return of 0.44% for the year ended March 31, 2005.(1) This return was the result of a decrease in NAV to $9.75 per share on March 31, 2005 from $10.00 on March 31, 2004, and the reinvestment of $0.294 in dividends.(2)

• For comparison, the Lehman Brothers 7-Year Municipal Bond Index – an unmanaged index of investment-grade, municipal debt securities with an average maturity of 7 years – had a total return of 0.80% for the year ended March 31, 2005.(3)

• Based on the Fund’s most recent dividends annualized and NAVs on March 31, 2005 of $10.28 per share for Class A and Class B and $9.75 for Class C, the Fund’s distribution rates were 3.89%, 3.11% and 3.08%, respectively.(4) The distribution rates are equivalent to taxable rates of 6.17%, 4.94% and 4.89%, respectively.(5)

• The SEC 30-day yields for Class A, Class B and Class C shares at March 31, 2005 were 3.22%, 2.54% and 2.54%, respectively.(6) The SEC 30-day yields are equivalent to taxable yields of 5.11%, 4.03% and 4.03%, respectively.(5)

Craig Brandon

Portfolio Manager

Management Discussion

• Pennsylvania saw positive job growth in 2004 for the first time since 2000, although growth was uneven around the state. Business, education, tourism, construction and health care were major contributors. Manufacturing, especially in western Pennsylvania, continued to shed jobs. Pennsylvania’s March 2005 jobless rate was 5.2%, down from 5.5% a year ago.

• Insured** general obligations were the Fund’s largest sector weighting at March 31, 2005. Management focused on issuer of cities, townships, counties and school districts it believes have relatively strong local economies, a sound tax base and reasonable future borrowing needs.

• Insured** transportation bonds were prominent in the Fund. Transportation bonds finance improvements and expansions for the Commonwealth’s highway and port facilities, which are key to moving commercial traffic. The Fund’s investments included issues for highways, turnpikes, transportation and airport authorities.

• Insured** escrowed/prerefunded bonds remained a significant focus of the Fund. Escrowed bonds are those that have been pre-refunded as the result of a refinancing and are backed by Treasuries. The bonds are deemed very high quality by investors and often provide above-average coupons.

• Management continued its efforts, where possible, to upgrade the Fund’s call protection. The Fund sold bonds with approaching call dates in favor of high quality, non-callable bonds and bonds with more attractive call characteristics.

* Reinvestment amounts per share are based on 366 days from 4/1/04-12/31/04 and 365 days from 1/1/05-3/31/05.

** Private insurance does not decrease the risk of loss of principal associated with this investment.

Formerly, the Fund invested its assets in a corresponding investment company (referred to as the Portfolio) that had the same investment objective and policies as the Fund. Effective October 8, 2004, the Fund began to invest its assets directly in securities. The Fund’s investment objective and other investment policies remain unchanged. In addition, Boston Management and Research, the investment adviser to the Portfolio, acts as investment adviser to the Fund. The investment advisery fee paid remains unchanged.

(1) These returns do not include the 4.75% maximum sales charge for the Fund’s Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If the sales charge were deducted, returns would be lower. (2) A portion of the Fund’s income may be subject to federal and state income taxes and/or alternative minimum tax. (3) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. (4) The Fund’s distribution rate represents actual distributions paid to shareholders and is calculated by dividing the last distribution per share (annualized) by the net asset value. (5) Taxable-equivalent figures assume a maximum 37.00% combined federal income and state income tax rate. A lower rate would result in lower tax-equivalent figures. (6) The Fund’s SEC yield is calculated by dividing the net investment income per share for the 30-day period by the offering price at the end of the period and annualizing the result.

16

Eaton Vance Pennsylvania Limited Maturity Municipals Fund as of March 31, 2005

F U N D P E R F O R M A N C E

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class B of the Fund with that of the Lehman Brothers 7-Year Municipal Bond Index, a broad-based, unmanaged market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class B and in the Lehman Brothers

7-Year Municipal Bond Index. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Performance(1) | | Class A | | Class B | | Class C | |

| | | | | | | |

Average Annual Total Returns (at net asset value) | | | | | | | |

One Year | | 1.25 | % | 0.48 | % | 0.44 | % |

Five Years | | 5.17 | | 4.36 | | 4.38 | |

Ten Years | | N.A. | | 3.91 | | 3.89 | |

Life of Fund† | | 4.72 | | 4.18 | | 3.52 | |

| | | | | | | |

SEC Average Annual Total Returns (including sales charge or applicable CDSC) | | | | | | | |

One Year | | -1.01 | % | -2.44 | % | -0.53 | % |

Five Years | | 4.69 | | 4.36 | | 4.38 | |

Ten Years | | N.A. | | 3.91 | | 3.89 | |

Life of Fund† | | 4.45 | | 4.18 | | 3.52 | |

†Inception Dates – Class A: 6/27/96; Class B: 6/1/92; Class C: 12/8/93

(1) Average annual total returns do not include the 4.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charges (CDSC) for Class B and Class C shares. If sales charges were deducted, returns would be lower. SEC average annual total returns for Class A reflect the maximum 4.75% sales charge. SEC returns for Class B reflect applicable CDSC based on the following schedule: 5% - 1st and 2nd years; 4% - 3rd year; 3% - 4th year; 2% - 5th year; 1% - 6th year. SEC 1-year return for Class C reflects a 1% CDSC.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. This performance is not typical and may not be repeated. For performance as of the most recent month end, please refer to www.eatonvance.com.

Comparison of Change in Value of a $10,000 Investment in Eaton Vance

Pennsylvania Limited Maturity Municipals Fund Class B vs. the Lehman

Brothers 7-Year Municipal Bond Index* March 31, 1995 – March 31, 2005

*Sources: Thomson Financial; Lipper, Inc.

Class B of the Fund commenced operations on 6/1/92.

A $10,000 hypothetical investment at net asset value in Class A and Class C on 6/27/96 and 3/31/95, respectively, would have been valued at $14,980 and $14,644, respectively, on March 31, 2005. A $10,000 hypothetical investment in Class A at maximum offering price would have been valued at $14,645. It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

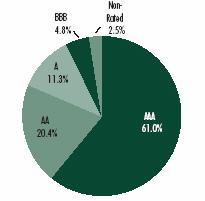

Diversification by Credit Quality(2)

(2)As a percentage of total investments, as of March 31, 2005. Holdings subject to change due to active management.

17

Eaton Vance Limited Maturity Municipals Funds as of March 31, 2005

F U N D E X P E N S E S

Example: As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2004 – March 31, 2005).

Actual Expenses: The first section of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of each table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance California Limited Maturity Municipals Fund

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period* | |

| | (10/1/04) | | (3/31/05) | | (10/1/04-3/31/05) | |

| | | | | | | |

Actual | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 999.30 | | $ | 4.34 | |