UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2006 |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______________ to ___________________ |

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Date of event requiring this shell company report______________ |

Commission File Number 0-13966

BLACK MOUNTAIN CAPITAL CORPORATION

(Exact name of Company as specified in its charter)

Yukon Territory, Canada

(Jurisdiction of Incorporation or Organization)

Suite 900, 555 Burrard Street

Vancouver, British Columbia V7X 1M8 Canada

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act: NONE

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares, without Par Value (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

13,283,733 Common Shares without par value outstanding as at December 31, 2006

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934. [ ] Yes [X] No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

*Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check on):

Large Accelerated File [ ] Accelerated Filer [ ] Non-Accelerated Filer [X]

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. NOT APPLICABLE

Page No.

PART I

| | 3 |

| | 3 |

| | 4 |

| | 8 |

| | 12 |

| | 12 |

| | 15 |

| | 21 |

| | 22 |

| | 23 |

| | 24 |

| | 30 |

| | 30 |

| | | |

PART II |

| | 31 |

| | 31 |

| | 31 |

| | 31 |

| | 31 |

| | 31 |

| | 31 |

| | 32 |

| | 32 |

| | | |

PART III |

| | 32 |

| | 47 |

| | 47 |

INTRODUCTION

In this annual report on Form 20-F, referred to as the "Annual Report", references to the "Company", "we", or "us" refer to Black Mountain Capital Corporation and its subsidiaries unless the context clearly suggests otherwise.

Forward-Looking Statements

Statements in this Annual Report, to the extent that they are not based on historical events, constitute forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. These statements appear in a number of different places in this Annual Report and include statements regarding the intent, belief or current expectations of the Company and its directors or officers, primarily with respect to the future market size and future operating performance of the Company and its subsidiaries. Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity, achievements or financial condition. Forward-looking statements include, without limitation, statements regarding the outlook for future operations, forecasts of future costs and expenditures, evaluation of market conditions, the outcome of legal proceedings, the adequacy of reserves or other business plans (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates", "does not anticipate", "plans", "estimates", or "intends", or stating that certain actions, events or results "may", "could", "would" or "will" be taken, occur or be achieved). Investors are cautioned that any such forward-looking statements are not guarantees and may involve risks and uncertainties and that actual results may differ from those in the forward-looking statements as a result of various factors such as general economic and business conditions, including changes in interest rates, prices and other economic conditions; actions by competitors; natural phenomena; actions by government authorities, including changes in government regulation; uncertainties associated with legal proceedings; technological development; future decisions by management in response to changing conditions; the ability to execute prospective business plans; and misjudgments in the course of preparing forward-looking statements. Readers should not place undue reliance on any forward-looking statements and should recognize that the statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results due to the risks and uncertainties described herein, as well as others not now anticipated. The foregoing statements are not exclusive and further information concerning us, including factors that could materially affect our financial results, may emerge from time to time. We do not intend to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. Investors are advised that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to the Company or persons acting on its behalf.

Exchange Rates

Unless otherwise indicated in this Annual Report, all references to "USD$" or "$" are to the lawful currency of the United States and all references to "Canadian Dollars" or "C$" are to the lawful currency of Canada.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

The following table summarizes selected consolidated financial data for the Company prepared in accordance with Canadian generally accepted accounting principles, referred to as "GAAP". Additional information is presented to show the difference which would result from the application of United States GAAP to the Company's financial information. For a description of the differences between Canadian GAAP and United States GAAP, see Note 14 of the Company's consolidated financial statements, included elsewhere in this Annual Report. The information in the following table is extracted from the more detailed financial statements and related notes included herein, referred to as the "Financial Statements", and should be read in conjunction with such Financial Statements.

Canadian GAAP

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 (as restated(1)) | |

| | | (in thousands, other than per share amounts) | |

| Revenues | | $ | 31 | | | $ | 52 | | | $ | 61 | | | $ | 76 | | | $ | 184 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | (77 | ) | | | (300 | ) | | | (1,829 | ) | | | (518 | ) | | | (365 | ) |

| Net loss per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | | (0.01 | ) | | | (0.05 | ) | | | (0.31 | ) | | | (0.09 | ) | | | (0.06 | ) |

| Fully diluted | | | (0.01 | ) | | | (0.05 | ) | | | (0.31 | ) | | | (0.09 | ) | | | (0.06 | ) |

| Total assets | | | 448 | | | | 149 | | | | 798 | | | | 2,108 | | | | 2,261 | |

| Net assets | | | 38 | | | | (361 | ) | | | (49 | ) | | | 2,039 | | | | 2,119 | |

| Debt | | | 410 | | | | 510 | | | | 847 | | | | 69 | | | | 142 | |

| Shareholders' equity | | | 38 | | | | (361 | ) | | | (49 | ) | | | 2,039 | | | | 2,119 | |

| Capital stock | | $ | 2,649 | | | | | | | | | | | | | | | | | |

| Dividends | | | – | | | | – | | | | 269 | (2) | | | – | | | | – | |

| Weighted average common stock outstanding, fully diluted (in thousands of shares) | | | 7,940 | | | | 5,934 | | | | 5,934 | | | | 5,934 | | | | 5,934 | |

_________________

(1) | During fiscal 2003, the Company changed from the temporal method of accounting for foreign exchange translation to the current rate method as required by Emerging Issues Committee 130 issued by the Canadian Institute of Chartered Accountants (see Note 2 to the Company's Financial Statements). The standard requires restatement and therefore financial statements for fiscal 2002 have been restated. |

(2) | The Company announced a special dividend consisting of 0.42 common shares of North Group Finance Limited (TSX Venture Exchange: NOR) for each common share of the Company. The Company distributed approximately 2,492,076 common shares of North Group Finance Limited to shareholders of record as of August 31, 2004. |

U.S. GAAP

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 (as restated(1)) | |

| | | (in thousands, other than per share amounts) | |

| Revenues | | $ | 31 | | | $ | 52 | | | $ | 61 | | | $ | 76 | | | $ | 184 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | (77 | ) | | | (389 | ) | | | (1,848 | ) | | | (316 | ) | | | (286 | ) |

| Net loss per share | | | | | | | | | | | | | | | | | | | | |

| Basic | | | (0.06 | ) | | | (0.065 | ) | | | (0.311 | ) | | | (0.053 | ) | | | (0.05 | ) |

| Fully diluted | | | (0.06 | ) | | | (0.065 | ) | | | (0.311 | ) | | | (0.053 | ) | | | (0.05 | ) |

| Total assets | | | 448 | | | | 551 | | | | 1,101 | | | | 2,109 | | | | 1,826 | |

| Net assets | | | 38 | | | | 41 | | | | 254 | | | | 2,040 | | | | 1,684 | |

| Debt | | | 410 | | | | 510 | | | | 847 | | | | 69 | | | | 142 | |

| Shareholders' equity | | | 38 | | | | 41 | | | | 254 | | | | 2,040 | | | | 1,684 | |

| Capital stock | | $ | 2,649 | | | | | | | | | | | | | | | | | |

| Dividends | | | – | | | | – | | | | 269 | (2) | | | – | | | | – | |

| Weighted average common stock outstanding, fully diluted (in thousands of shares) | | | 7,940 | | | | 5,934 | | | | 5,934 | | | | 5,934 | | | | 5,934 | |

_________________________

(1) | During fiscal 2003, the Company changed from the temporal method of accounting for foreign exchange translation to the current rate method as required by Emerging Issues Committee 130 issued by the Canadian Institute of Chartered Accountants (see Note 2 to the Company's Financial Statements). The standard requires restatement and therefore financial statements for fiscal 2002 have been restated. |

(2) | The Company announced a special dividend consisting of 0.42 common shares of North Group Finance Limited (TSX Venture Exchange: NOR) for each common share of the Company. The Company distributed approximately 2,492,076 common shares of North Group Finance Limited to shareholders of record as of August 31, 2004. |

Exchange Rates

The following table sets forth information as to the period end, average, high and low exchange rate data for Canadian Dollars and United States Dollars for the periods indicated based on the noon buying rate in New York City for cable transfers in Canadian Dollars as certified for customs purposes by the Federal Reserve Bank of New York (C$ = USD$1).

Year Ended December 31, | Average | Period End | High | Low |

| 2002 | 1.5704 | 1.5800 | 1.6128 | 1.5108 |

| 2003 | 1.4008 | 1.2923 | 1.5750 | 1.2923 |

| 2004 | 1.3017 | 1.2034 | 1.3970 | 1.1775 |

| 2005 | 1.2116 | 1.1656 | 1.2703 | 1.1507 |

| 2006 | 1.1340 | 1.1652 | 1.1726 | 1.0989 |

The following table sets forth the high and low exchange rate for the past six months. As of June 15, 2007, the exchange rate was C$1.0678 for each USD$1.00.

Month | High | Low |

| December 2006 | 1.1652 | 1.1415 |

| January 2007 | 1.1824 | 1.1647 |

| February 2007 | 1.1852 | 1.1586 |

| March 2007 | 1.1810 | 1.1530 |

| April 2007 | 1.1583 | 1.1068 |

| May 2007 | 1.1136 | 1.0701 |

B. Capitalization and Indebtedness

Not Applicable.

C. | Reasons for Offer and Use of Proceeds |

Not Applicable.

The Company's primary risks are transaction risks. In addition, the Company has been and may continue to be affected by many other factors, including but not limited to: (1) economic and market conditions, including the liquidity of capital markets; (2) the volatility of market prices, rates and indices; (3) the timing and volume of market activity; (4) inflation; (5) the cost of capital, including interest rates; (6) political events, including legislative, regulatory and other developments; (7) competitive forces, including the Company's ability to attract and retain personnel; (8) support systems; and (9) litigation. In determining whether to make an investment in the Company's capital stock, investors should consider carefully all of the information set forth in this Annual Report and, in particular, the following risk factors.

Transaction Risks

The Company manages transaction risk through allocating and monitoring its capital investments and carefully screening clients and transactions. Nevertheless, transaction risks can arise from, among other things, the Company's merchant banking and private equity activities and relate to the risks of the proposed transaction. These risks include market risks associated with the Company's role in providing advisory services.

The Company often makes investments in highly unstructured situations and in companies undergoing severe financial stress. Such investments also often involve severe time constraints. These investments may expose the Company to significant transaction risks and place the Company's funds in illiquid situations. An unsuccessful investment may result in the total loss of such investment and may have a material adverse effect on the Company's business, results of operations and financial condition.

Additionally, in order to grow its business, the Company may seek to acquire or invest in new companies. The Company's failure to make such acquisitions may limit its growth. In pursuing acquisition opportunities, the Company may be in competition with other companies having similar growth and investment strategies. Competition for these acquisitions or investment targets could result in increased acquisition or investment prices and a diminished pool of businesses, technologies, services or products available for acquisition or investment.

Competition Risks

The Company conducts its business in a highly competitive environment. Many of its competitors have far greater resources, capital and access to information than the Company. Competition includes firms traditionally engaged in financial services, such as banks, broker-dealers and investment dealers. Increased competition may lead the Company to become involved in transactions with more risk.

Market Risks

Market risk relates to fluctuations in the liquidity of securities, as well as volatility in market conditions generally. The markets for securities and other related products are affected by many factors over which the Company has little or no control. These factors include the financial performance and prospects of specific companies and industries, world markets and economic conditions, the availability of credit and capital, political events and perceptions of market participants.

The Company is exposed to the risk of a market downturn.

As a financial services company, the Company's business is materially affected by conditions in the financial markets and economic conditions generally. In the event of a market downturn, the Company's business, results of operations and financial condition could be adversely affected. In addition, there is no assurance that an active public market for the Company's securities will continue.

A market downturn could lead to a decline in the number and size of the transactions that the Company executes for its clients, including transactions in which the Company provides financial advisory and other services, and to a corresponding decline in the revenues the Company receives from fees.

A market downturn could further result in losses to the extent that the Company owns assets in such market. Conversely, to the extent that the Company has sold assets the Company does not own (i.e., if the Company has short positions) in any market, an upturn in such market could expose the Company to potentially unlimited losses as it attempts to cover its short positions by acquiring assets in a rising market.

Even in the absence of a market downturn, the Company is exposed to substantial risk of loss due to market volatility.

Our share price has been volatile in recent years.

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies in our sector have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. In particular, the per share price of the Company's common shares fluctuated from a high of $0.25 to a low of $0.10 on the TSX-V within the twelve month period preceding the date of this Annual Report. There can be no assurance that continual fluctuations in price will not occur.

Operating history and significant historical operating losses.

In fiscal 2002, 2003, 2004, 2005 and 2006, we reported losses of $365,000, $518,000, $1,829,000, $300,000 and $77,000, respectively. As at December 31, 2006, we had an accumulated deficit of $4,000,000. The ability of the Company to continue as a going-concern depends upon its ability to develop profitable operations and to continue to raise adequate equity financing. There can be no assurance that the Company will be able to continue to raise funds, in which case the Company may be unable to meet its obligations.

A rise in inflation may affect the Company's results.

The Company does not believe that inflation has had a material impact on its revenues or income over the past three fiscal years. In addition, since the Company's assets to a large extent are liquid in nature, they are not significantly affected by inflation. However, increases in inflation could result in increases in the Company's expenses. To the extent that inflation results in rising interest rates and has other adverse effects on capital markets, it could adversely affect the Company's business, results of operations and financial condition.

Market risk may increase the other risks that the Company faces.

In addition to the market risks described above, market risks could exacerbate the other risks that the Company faces. For example, if the Company incurs substantial trading losses, its need for liquidity could rise sharply while its access to liquidity could be impaired.

Legal and Regulatory Risks

The Company is exposed to legal risks in its business and the volume and amount of damages claimed in litigation against financial intermediaries is increasing. These risks include potential liability under securities or other laws for materially false or misleading statements made in connection with securities and other transactions and potential liability for advice the Company provides to participants in corporate transactions. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. See Note 10 of the Financial Statements for additional information with respect to the Company's legal and regulatory proceedings.

Enforcement Risks

The enforcement of civil liabilities by investors under applicable United States federal and state securities laws may be adversely affected because the Company is organized under the laws of the Yukon Territory, Canada and none of its officers or directors are residents of the United States. As a result, it may be difficult or impossible for United States investors to effect service of process upon the Company's officers or directors within the United States. It may also be difficult to realize against the Company or its officers or directors in the United States upon judgments of United States courts for civil liabilities under applicable United States federal and state securities laws. Courts in Canada or elsewhere may not enforce: (1) judgments of United States courts obtained in actions against the Company or its officers or directors predicated upon the civil liability provisions of applicable United States federal and state securities laws; and (2) in original actions, liabilities against the Company or officers or directors predicated upon such laws.

Additionally, the Company's principal operating assets are located outside of the United States. Under bankruptcy laws in the United States, courts typically have jurisdiction over a debtor's property, wherever it is located, including property situated in other countries. Courts outside of the United States may not recognize the United States bankruptcy court's jurisdiction. Accordingly, investors may have difficulty administering a United States bankruptcy case involving a Canadian debtor with property located outside of the United States. Any orders or judgments of a bankruptcy court in the United States may not be enforceable.

Other Risks

Certain provisions of the Company's charter documents and the applicable corporate legislation may discourage, delay or prevent a change of control or changes in its management that shareholders consider favourable. These include provisions that authorize the board of directors of the Company to issue preferred stock in series, provide for the election of the directors of the Company with staggered, three-year terms and limit the persons who may call special meetings of shareholders.

In addition, the Investment Canada Act, referred to as the "ICA", may impose limitations on the rights of non-Canadians to acquire the Company's common shares.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

The Company was originally incorporated in 1952 under the Canada Corporations Act and was continued under the Canada Business Corporations Act in 1980. The Company amalgamated with Metanetix Corporation and Canadian Capital Financial Markets Inc. on January 1, 1995. The Company changed its name on January 22, 1999 from "Hariston Corporation" to "Midland Holland Inc." On January 24, 2000, the Company was continued under the Business Corporations Act (Yukon) under the name "Mercury Partners & Company Inc." On December 28, 2001, the Company completed an amalgamation with Pacific Mercantile Company Limited, referred to as "PMCL". The Company changed its name on April 29, 2005 from "Mercury Partners & Company Inc." to "Black Mountain Capital Corporation." At the Company's 2006 annual and special meeting of shareholders, which we refer to as the "2006 Annual Meeting", to be held on July 16, 2007, shareholders of the Company will be asked to pass a special resolution approving an amendment to the Company's articles to change the name of the Company to "SRJ Investment Corporation" or to such other name as determined by the directors of the Company and that is acceptable to the Yukon Registrar of Corporations and the TSX Venture Exchange, referred to as the "TSX-V".

The Company's principal place of business is Suite 900, 555 Burrard Street, Vancouver, British Columbia, Canada V7X 1M8 and its telephone number is (604) 443-5059.

At a special meeting of shareholders of the Company held on August 25, 1998, the slate of nominee directors proposed by a dissident shareholder was elected. Following the change in directorship, the Company initiated a comprehensive restructuring plan, which included, among other things, monetizing all non-cash assets, reducing corporate overhead expenses, consolidating the Company's share capital and settling all outstanding litigation. In addition, the Company changed the focus of its business from investing in a wide variety of start-up or early stage businesses to engaging primarily in private equity and merchant banking activities.

On September 26, 2001, shareholders of PMCL and the Company approved the amalgamation between the companies, referred to as the "Amalgamation". Prior to the Amalgamation, PMCL was the largest shareholder of the Company, owning 2,250,219 common shares or approximately 49.5% of the Company. Under the terms of an amalgamation agreement between the Company, PMCL and 940296 Alberta Ltd., a wholly owned subsidiary of the Company, each common share of PMCL was exchanged for five common shares of the Company following the amalgamation of PMCL and 940296 Alberta Ltd., resulting in 3,681,310 shares of the Company being issued to the shareholders of PMCL. The 2,250,219 common shares of the Company owned by PMCL, which had a carrying value of $322,191, were canceled in June 2007.

In August 2004, the Company announced a special dividend consisting of 0.42 common shares of North Group Finance Limited (TSX-V: NOR) for each common share of the Company. The Company distributed approximately 2,492,076 common shares of North Group Finance Limited to shareholders as of the record date of August 31, 2004. For registered shareholders with addresses in the United States, the shares of North Group Finance Limited which they would otherwise be entitled to were sold on their behalf and the proceeds of the sale were distributed.

During the year ended December 31, 2005, the Company settled with the Alberta Securities Commission, referred to as the "ASC", in respect of an alleged breach of takeover bid rules and control persons’ reporting obligations. Pursuant to the terms of the settlement, the Company paid $40,693 to the ASC to, among other things, mitigate the continuing expense of protracted litigation. This amount and related legal costs of $55,396 were recorded as a loss on settlement of lawsuits for the year ended December 31, 2005.

The Company is a publicly traded financial services company engaging primarily in private equity and merchant banking activities in Canada and the United States. The Company's shares are quoted on the NASD Over-the-Counter Bulletin Board, referred to as the "OTCBB", in the United States under the symbol "BMMUF" and on the TSX-V, in United States dollars under the symbol "BMM.U". The Company's investment objective is to acquire influential ownership in companies and, through direct involvement, bring about the changes required to realize their potential value. The Company concentrates on return on investment and cash flow to build long-term shareholder value. Accordingly, the Company continually evaluates its existing investments and operations and investigates the possible acquisition of new businesses.

The Company assists companies in developing their businesses through active involvement in capital financings, acquisitions and business strategy development. The Company develops innovative solutions for projects that are practical, responsible and pragmatic in their implementation. However, the Company takes a cautious approach to new initiatives, selectively allocating capital and concentrating on areas where its financial and management expertise can be best applied.

The Company's principal sources of funds are its available cash resources, bank financing, public financing and revenues generated from the Company's merchant banking activities and realized investment gains from the Company's private equity operations. The Company has no recurring cash requirements other than repayment of interest and principal on its debt, tax payments and corporate overhead.

Private Equity

The Company's private equity operations include reviewing investment opportunities in undervalued companies or assets, management or leveraged buy-outs and turn around or workout situations. In furtherance of this strategy, the Company often advises and invests in the restructuring of businesses that are having financial distress or have defaulted on their debt obligations. The Company earns advisory fees by providing strategic and financial advice for clients. The following is a brief description of the Company's private equity operations.

Undervalued companies or assets.

The Company seeks influential ownership in companies or assets whose intrinsic values are not fully reflected in their price. Specifically, the Company invests in businesses that demonstrate consistently high earnings and free cash flow and companies priced at a significant discount in terms of net asset value, earnings multiples or other valuation criteria. The Company works to bring about the changes required to realize the strategic value of those companies.

Management and leveraged buy-outs.

The Company invests and assists in arranging financing for a management or succession-leveraged buy-out of a business. The Company invests in equity and mezzanine securities arising from leveraged acquisitions and recapitalizations and other similar types of transactions, which involve significant financial leverage. The Company structures transactions that allow owners to sell part of their equity in advance of their departure while maintaining management continuity.

Turn-arounds or workouts.

The Company invests in the securities of distressed or troubled companies or assets where the business value is evident but the company suffers from financial or non-financial difficulties. The Company also invests in companies with underperforming management, where the underlying business value is still evident. The Company works to bring about the change required to realize the strategic value of these businesses.

Merchant Banking

The Company's merchant banking operations include financial and management services for corporate finance transactions, including mergers and acquisitions and corporate restructurings. Through merchant banking partnerships, the Company provides companies and their management with investment capital and financial direction. The Company receives fees for services provided including options and other conversion privileges to participate as an equity investor in businesses to which merchant banking services have been provided. The following is a brief description of the Company's merchant banking operations.

Mergers & acquisitions.

The Company is active in public company mergers and acquisitions transactions, including unsolicited take-over bids. The Company assists companies in identifying and financing acquisitions and provides recommendations regarding financial restructuring.

Corporate restructuring.

The Company provides creative and responsible solutions to restructure businesses and their balance sheets so as to improve profitability. In certain circumstances, a company's financial flexibility is enhanced by the Company acquiring loans owing to the Company's traditional lenders, which are then restructured on financial terms consistent with the Company's immediate requirements.

Investment Review

Through its representatives on the board of directors and board committees, the Company plays an active role in setting a company's long-term strategic plans and assessing performance against approved business plans in companies in which it invests. The Company monitors the performance of its investments by requiring the chief executive officers of each company to present to their respective boards business plans and financial forecasts and targets against which actual performance can be measured.

Competition

The Company currently competes against brokerage firms, investment bankers, merchant banks and other investment managers for appropriate investments. Such businesses are highly competitive and are subject to fluctuations based upon many factors over which the Company has no control, such as the condition of public markets, interest rates and the state of capital markets. Many of the Company's competitors are national or international companies with far greater resources, capital and access to information than the Company. As a result, the Company may become involved in transactions with more risk than if it had greater resources.

C. Organizational Structure

The following is a list of the Company's significant operating subsidiaries as of December 31, 2006:

Subsidiary | Jurisdiction of Incorporation | Proportion of Ownership Interest |

| Lucky Minerals Inc. | Canada | 100% |

D. Property, Plants and Equipment

The Company's principal executive office is located in Vancouver, British Columbia, Canada, and is leased. In March 2007, the Company entered into an option agreement with Diagnos Inc. to acquire a 100% interest in two prospective nickel properties in the Abitibi region of Quebec, Canada. The 75 claims cover approximately 3,200 acres of terrain in a region with two significant nickel deposits and one past-producing mine. The Company paid Diagnos Inc. a sum of $45,000 for each property within 45 days of the execution of the option agreement. Under the terms of the option agreement, for each property upon which an economic discovery of nickel is made, a bonus of $70,000 will be paid to Diagnos Inc. in shares of the Company. There is a two percent net smelter return, referred to as the "NSR", issued to Diagnos Inc., of which the Company has an option to acquire one percent of the NSR for $1,000,000.

Not applicable.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The following discussion and analysis of the financial condition and results of operations of the Company for the three years ended December 31, 2006, 2005 and 2004 should be read in conjunction with the Financial Statements included in this Annual Report. The Company's Financial Statements included herein were prepared in accordance with Canadian GAAP and are expressed in United States dollars. Additional information is presented to show the difference which would result from the application of U.S. GAAP to the Company's financial information. For a reconciliation of the Company's Financial Statements included herein to U.S. GAAP, see Note 14 to the Financial Statements. Certain reclassifications may have been made to the prior periods' financial statements to conform to the current period's presentation.

A. Operating Results

The Company operates in both the United States and Canada and, as such, the Company's consolidated financial results are subject to foreign currency exchange rate fluctuations. The Company reports its results of operations in United States dollars and translates assets and liabilities into United States dollars at the rate of exchange on the balance sheet date. Unrealized gains and losses from these translations are recorded on the consolidated balance sheet as a "cumulative translation adjustment".

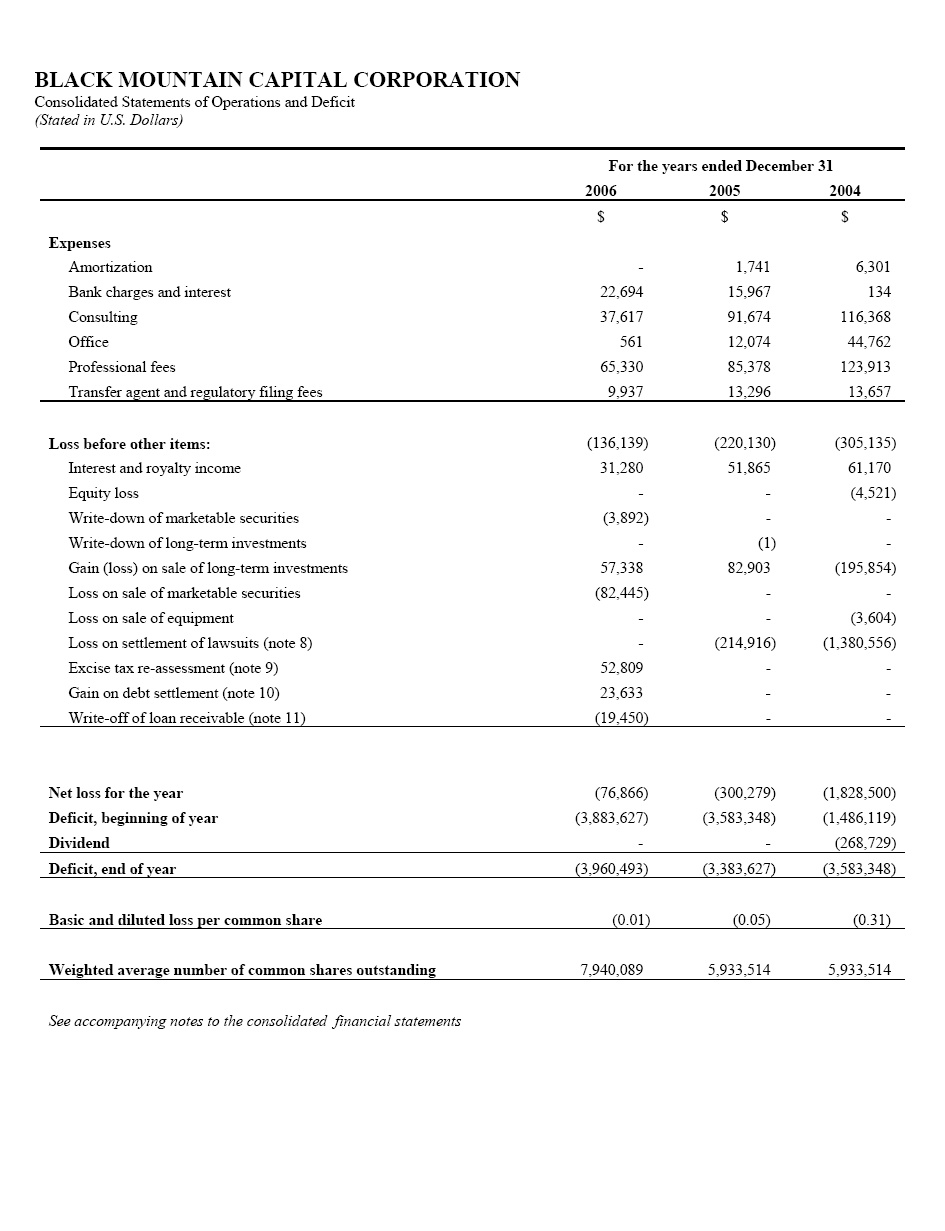

The Company's financial results for the past three years are summarized below.

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | |

| Revenue | | $ | 31,280 | | | $ | 51,865 | | | $ | 61,170 | |

| Operating Expenses | | | 136,139 | | | | 220,130 | | | | 305,135 | |

| Net loss | | | (76,866 | ) | | | (300,279 | ) | | | (1,828,500 | ) |

| Net loss per share | | | (0.01 | ) | | | (0.05 | ) | | | (0.31 | ) |

Revenues during fiscal 2006, 2005 and 2004 were generated from the Company's merchant banking operations, investment income from the Company's private equity investments and oil and gas royalties. In fiscal 2006, the Company's revenues decreased to $31,280 compared to revenues of $51,865 and $61,170, respectively for the periods ending December 31, 2005 and 2004.

Expenses decreased to $136,139 in fiscal 2006 compared to $220,130 in fiscal 2005 and $305,135 in fiscal 2004. For the year ended December 31, 2006, expenses consisted mainly of professional fees of $65,330, consulting fees of $37,617, bank charges and interest of $22,694 and regulatory, transfer agent and shareholder communication fees of $9,937.

Other income before other items includes interest and royalty income of $31,280 for fiscal 2006 compared to revenues of $51,865 and $61,170, respectively for the periods ending December 31, 2005 and 2004. Other gains before other items includes a gain of $57,338 from the sale of long-term investments, a gain of $52,809 from excise tax re-assessment and a gain on debt settlement of $23,633.

Losses before other items include a loss on the sale of marketable securities of $82,445, the write-off of loan receivables of $19,450 and the write down of marketable securities of $3,892.

The Company reported a net loss of $76,866 in fiscal 2006 compared to a net loss of $300,279 in fiscal 2005 and a net loss of $1,828,500 in fiscal 2004. Basic and diluted loss per common share was $0.01 in 2006 compared to losses of $0.05 and $0.31 in fiscal 2005 and 2004, respectively.

The Company and certain of its subsidiaries have tax loss carry-forwards and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties.

Impact of Inflation

The Company does not believe that inflation has had a material impact on revenues or income over the past three fiscal years.

Foreign Currency

The Company's operations are conducted in international markets and its consolidated financial results are subject to foreign currency exchange rate fluctuations. During fiscal 2003, the Company changed from the temporal method of accounting for foreign exchange translation to the current rate method as required by Emerging Issues Committee 130 issued by the Canadian Institute of Chartered Accountants (see Note 2 of the Financial Statements).

Application of Critical Accounting Policies

The preparation of financial statements in conformity with GAAP requires the Company's management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

Management routinely makes judgments and estimates about the effects of matters that are inherently uncertain. As the number of variables and assumptions affecting the probable future resolution of the uncertainties increase, these judgments become even more subjective and complex. The Company has identified certain accounting policies, described below, that are most important to the portrayal of its current financial condition and results of operations. The significant accounting policies are disclosed in Note 2 to the Financial Statements included in this Annual Report.

Marketable securities

Marketable securities are recorded at the lower of cost or quoted market value on a specific identification basis.

Long-term investments

Investments in companies over which the Company has significant influence are accounted for by the equity method, whereby the original cost of the shares is adjusted for the Company's share of earnings or losses less dividends since significant influence was acquired. Investments in which the Company has no significant influence and that it intends to hold longer than one-year are accounted for on the cost basis and reported as long-term investments. Cost of investments includes acquisition costs of shares as well as legal and consulting costs related to maintaining the Company's interest. Investments are written-down to their estimated net realizable value when there is evidence of a decline in value below their carrying amount that is other than temporary.

A decline in market value may be only temporary in nature or may reflect conditions that are more persistent. Declines may be attributable to general market conditions, either globally or regionally, that reflect prospects of the economy as a whole or prospects of a particular industry or a particular company. Such declines may or may not indicate the likelihood of ultimate recovery of the carrying amount of a security. Management regularly reviews the Company's portfolio position to determine whether an other-than-temporary decline exists.

In determining whether the decline in value is other than temporary, quoted market price is not the only deciding factor, particularly for thinly-traded securities, large block holdings and restricted shares.

B. Liquidity and Capital Resources

The Company's principal assets consist of cash. The Company's principal sources of funds are its available cash resources and its bank and public financing. The Company has no recurring cash requirements other than repayment of interest and principal on its debt, tax payments and corporate overhead. In the opinion of the Company, current working capital is sufficient for its current requirements.

In May 2006, the Company completed a non-brokered private placement for 2,500,000 units. Each unit consisted of one common share of the Company and one share purchase warrant. Each share purchase warrant entitled the holder to purchase one common share of the Company at a price of $0.10 for a term of one year from the date of issue of such share purchase warrant. The company raised an aggregate of $175,000 from the sale of the units priced at $0.07 per unit. The resulting proceeds were used for general corporate purposes. All of the warrants issued pursuant to this private placement were exercised in full in May 2007.

In October 2006, the Company completed a non-brokered private placement for 2,600,000 units for a price of $0.12 per unit. Each unit consisted of one common share of the Company and one share purchase warrant. Each share purchase warrant entitles the holder to purchase one common share of the Company at a price of $0.165 for a term of one year from the date of issue of such share purchase warrant. The Company raised an aggregate of $312,000 from the sale of the units. The Company is using the proceeds of the private placement for working capital.

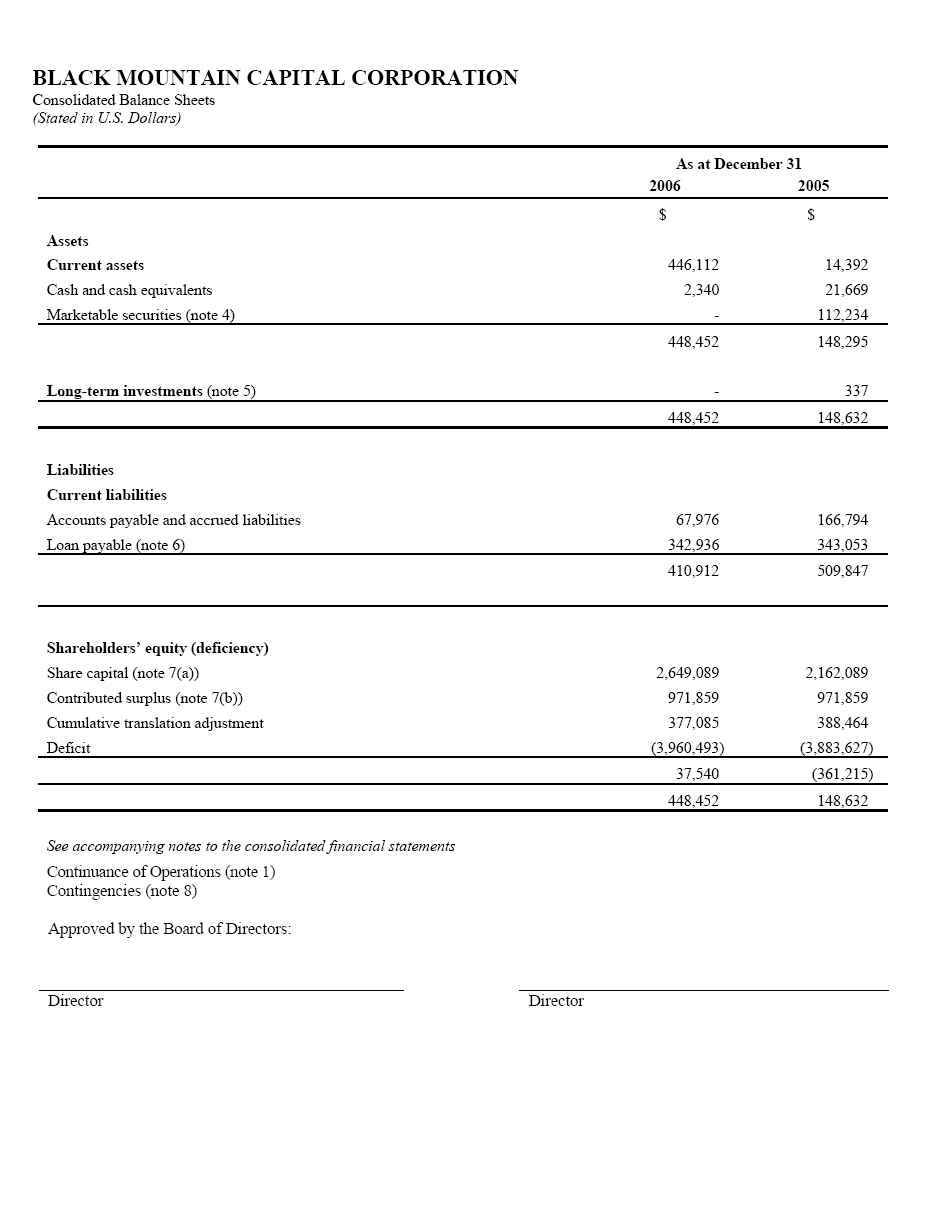

At December 31, 2006, the Company's readily available cash increased to $466,112 compared to $14,392 at December 31, 2005. Total current assets at December 31, 2006 increased to $448,452 from $148,295 for the corresponding comparative period.

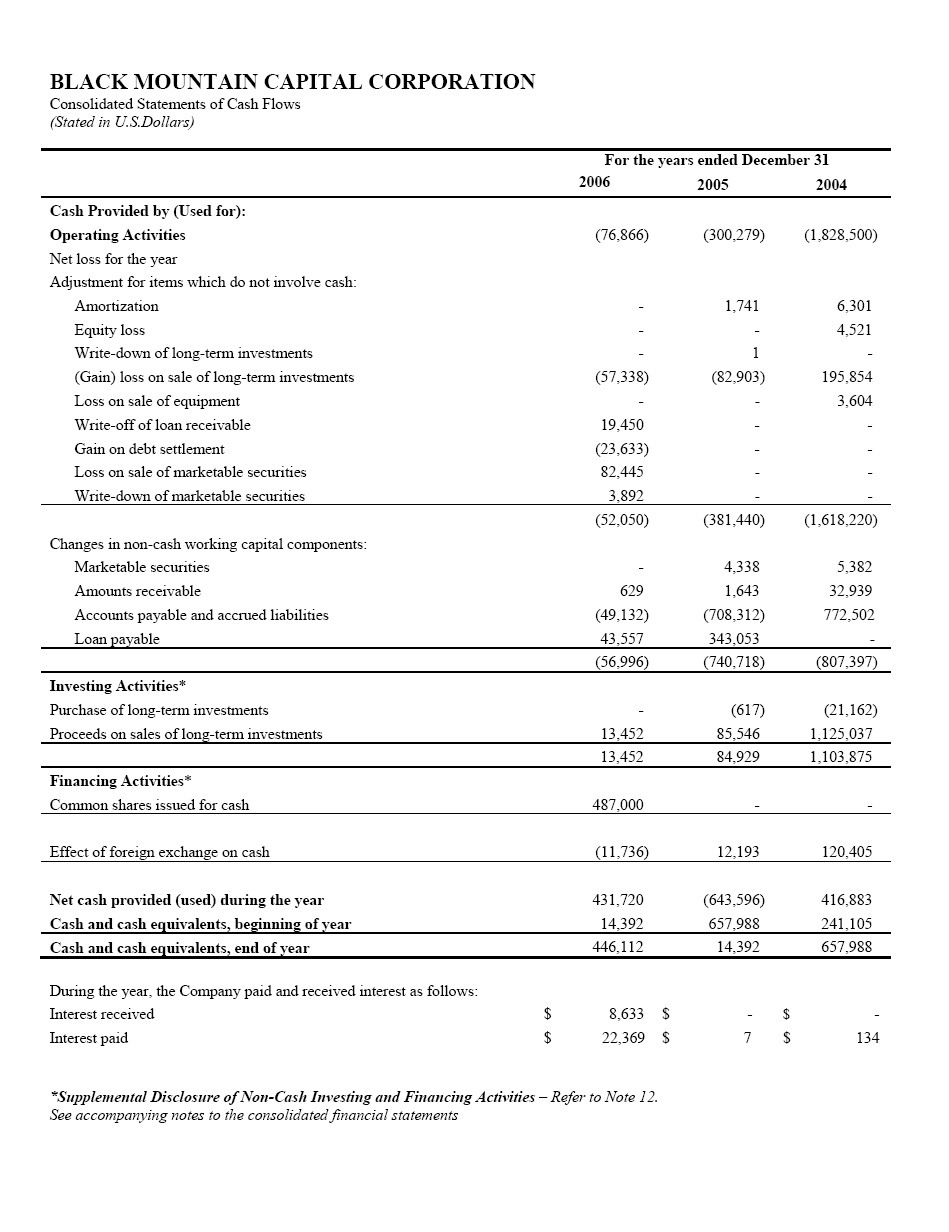

Operating activities used cash of $56,996 in fiscal 2006 compared to $740,718 and $807,397 during fiscal 2005 and 2004, respectively, predominately from the net loss incurred during the year. Investing activities generated cash of $13,452 from proceeds from the sale of long-term investments during fiscal 2006 compared to investing activities generating cash of $84,929 in fiscal 2005 and investing activities generating cash of $1,103,875 in fiscal 2004. Financing activities generated cash of $487,000 from the issuance of common shares in fiscal 2006. Financing activities provided no cash in fiscal 2005 and 2004.

Total assets of the Company at December 31, 2006 increased to $448,452 compared to $148,632 at December 31, 2005.

The Company's liabilities decreased to $410,912 as of December 31, 2006 compared to $509,847 as of December 31, 2005.

Shareholders' Equity

Shareholders' equity as at December 31, 2006 was $37,540 compared to a deficiency of $361,215 as at December 31, 2005. The Company had 11,033,514 shares issued and outstanding as at December 31, 2006 and an additional 2,250,219 which were held in treasury for cancellation. The 2,259,219 shares held in treasury for cancellation were cancelled in June 2007. The weighted average number of common shares outstanding as at December 31, 2006 was 7,940,089.

C. Research and Development, Patents and Licenses

Not applicable.

D. Trend Information

For the current financial year, the Company is not aware of any trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the Company's net sales or revenues, income from continuing operations, profitability, liquidity or capital resources, or that would cause reported financial information not necessarily to be indicative of future operating results or financial condition.

E. Off-balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

F. Tabular Disclosure of Contractual Obligations

Not applicable.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. Directors and Senior Management

The Company's Articles provide for three classes of directors with staggered terms. Each director holds office until the expiry of his term or until his successor is elected or appointed, unless his office is earlier vacated in accordance with the Bylaws of the Company or the provisions of the Business Corporations Act (Yukon). At each annual meeting of the Company, a class of directors is elected to hold office for a three year term. Successors to the class of directors whose term expires are identified as being of the same class as the directors they succeed and are elected to hold office for a term expiring at the third succeeding annual meeting of shareholders of the Company. A director appointed or elected to fill a vacancy on the board of directors holds office for the unexpired term of his predecessor. Officers of the Company serve at the discretion of the board of directors of the Company.

The following table sets out certain information concerning the directors and executive officers of the Company as at the date hereof:

Name and Present Position with the Company | Principal Occupation | Director Since | Expiration of Current Term of Office |

Navchand Jagpal(1) Chief Executive Officer, Chief Financial Officer, President, Secretary and Director | Chief Executive Officer, Chief Financial Officer, President and Secretary of the Corporation from July 2006 to present; Managing Director of JC Business Alliance Group from November 1996 to January 2003; Chief Financial Officer and Secretary of American United Gold Corp. from August 2004 to November 2005; Corporate Secretary of Anderson Gold Corp. from December 2003 to November 2006. | July 31, 2006 | 2009(2) |

J. Lewis Dillman(1) Director | President and Chief Executive Officer of Western Eagle Resources Corp, from 1995 to present; Funding Director of Mountainview Energy Ltd. from January 2001 to June 2002 and Abington Ventures Inc. from June 1999 to present; director of Zappa Resources Ltd. from July 2002 to Present; director of Abenteuer Resources Corp. from June 2006 to Present. | July 31, 2006 | 2008(2) |

Greg MacRae(1) Director | President of CSI Capital Solutions Inc.; Director of North Group Finance Limited, Black Mountain Capital Corporation; Director and Secretary of Pacific Northwest Partners Limited; Director of LML Payment Systems Inc.; Director of Starfire Minerals Inc. | August 7, 2003 | 2007(2) |

Mahmoud S. Aziz(3) Proposed nominee for Director | Chairman, President and Secretary of Sino Pharmaceutical Corporation from 2001 to present; Chairman and Chief Executive Officer of the Fazio Group of Companies from 1983 to present. | N/A | N/A(2) |

(1) Member of the audit committee of the Company.

(2) At the 2006 Annual Meeting, shareholders of the Company will be called upon to elect one Class II director. Mr. Mahmoud S. Aziz is expected to be elected as a Class II director to serve for a term of three years until the annual meeting of shareholders for the year 2009, to be held in the year 2010.

(3) Mr. Aziz is expected to be appointed as a member of the audit committee of the Company effective the date of the 2006 Annual Meeting to replace Mr. MacRae.

There are no arrangements or understandings with major shareholders, customers or others pursuant to which any person referred to above was selected as a director or executive officer.

B. Compensation

During the fiscal year ended December 31, 2006, the Company did not pay any compensation to its independent directors. The Company has not issued or granted any incentive stock options to either the Company's directors or officers or any other non-cash compensation, as more particularly described below. No other funds were set aside or accrued by the Company during the fiscal year ended December 31, 2006 to provide pension, retirement or similar benefits for directors or officers of the Company pursuant to any existing plan provided or contributed to by the Company.

The Company is required, under applicable securities legislation in Canada, to disclose to its shareholders details of compensation paid to certain of its directors and executive officers. The following fairly reflects material information regarding compensation paid thereto.

Executive Compensation

Pursuant to applicable securities legislation, the Corporation is required to provide a summary of all annual and long term compensation for services in all capacities to the Corporation and its subsidiaries for the three most recently completed financial years in respect of each individual who served as the Chief Executive Officer or Chief Financial Officer of the Corporation or acted in a similar capacity during the most recently completed financial year and the other three most highly compensated executive officers of the Corporation whose individual total compensation for the most recently completed financial year exceeded $150,000 and any individual who would have satisfied these criteria but for the fact that the individual was not serving as such an officer at the end of the most recently completed financial year, referred to as the "Named Executive Officers".

The following table states the name of each Named Executive Officer, his annual compensation, consisting of salary, bonus and other annual compensation, and long term compensation, including stock options paid, for each of the three most recently completed financial years of the Corporation.

SUMMARY COMPENSATION TABLE

Name and Principal Position | Fiscal Year | Annual Compensation | Long Term Compensation | All Other Compensation ($) |

Salary ($) | Bonus(1) ($) | Other Annual Compensation ($) | Awards | Payouts |

Securities Under Options/ SARs Granted (#) | Shares or Units Subject to Resale Restrictions ($) | LTIP Payouts ($) |

Navchand Jagpal(2) Chief Executive Officer, Chief Financial Officer and President | 2006 | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Tom S. Kusumoto(2) President & Secretary | 2006 2005 2004 | Nil Nil Nil | Nil Nil Nil | 44,782(3) 72,636(3) 65,338(3) | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

____________________________

1) Includes commission.

2) On July 31, 2006, Mr. Jagpal assumed the position of Chief Executive Officer, Chief Financial Officer, President and Secretary of the Corporation upon the resignation of Tom S. Kusumoto.

3) Fees paid or accured to Harrop County Fair Limited, a company wholly owned by Tom S. Kusumoto.

Options to Purchase Securities

During the year ended December 31, 2004, the Company’s shareholders approved and the Board adopted a stock option plan, referred to as the "SOP", whereby the Company is authorized to grant options to officers and directors, employees and consultants, enabling them to acquire up to 10% of the issued and outstanding common shares of the Company. The SOP is subject to the rules of the TSX-V. Under the SOP, the exercise price of each option cannot be less than the price permitted by the TSX-V. The options can be granted for a maximum term of five years or as allowed by the TSX-V. Requisite yearly approval of the SOP from shareholders of the Company, as required by the rules of the TSX-V, will be sought at the Company's 2006 Annual Meeting.

During the years ended December 31, 2006, 2005 and 2004, no stock options were granted or exercised.

Option Grants During the Most Recently Completed Fiscal Year

The Company did not grant any options to any of the Named Executive Officers during the fiscal year ended December 31, 2006.

Aggregated Option Exercises During the Most Recently Completed Fiscal Year and Fiscal Year End Option Values

The Named Executive Officers do not hold any options or freestanding stock appreciation rights, referred to as "SARs", to acquire securities of the Company and did not acquire any securities of the Company on the exercise of options or freestanding SARs during the financial year ended December 31, 2006.

C. Board Practices

Employment Agreements and Termination of Employment on Change of Control

There are no employment contracts between the Company and its directors or executive officers, nor are there any arrangements with the Company's directors or executive officers for compensation in the event of resignation, retirement or any other termination with the Company or change in the directors' or executive officers' responsibilities following a change of control.

Mr. Kusumoto resigned as the chief executive officer, chief financial officer, president and secretary of the Corporation on July 31, 2006.

Remuneration Committee

The Company does not have a remuneration committee of the Board. The Company's Board is primarily responsible for determining the compensation to be paid to the Company's executive officers and evaluating their performance. The compensation of executives is based upon, among other things, the responsibility, skills and experience required to carry out the functions of each position held by each executive officer and varies with the amount of time spent by each executive officer in carrying out his functions on behalf of the Company. The President's compensation is additionally based upon the responsibility, skills and experience required to conduct his functions and upon the time spent by him in relation to the affairs of the Company. In setting compensation rates for executive officers and the President, the Board compares the amounts paid to them with the amounts paid to executives in comparable positions at other comparable corporations.

Audit Committee

Mandate

The primary function of the audit committee, referred to as the "Audit Committee", is to assist the Board in fulfilling its financial oversight responsibilities by reviewing the financial reports and other financial information provided by the Company to regulatory authorities and shareholders, the Company's systems of internal controls regarding finance and accounting and the Company's auditing, accounting and financial reporting processes. Consistent with this function, the Audit Committee will encourage continuous improvement of, and should foster adherence to, the Company's policies, procedures and practices at all levels. The Audit Committee's primary duties and responsibilities are to: (i) serve as an independent and objective party to monitor the Company's financial reporting and internal control system and review the Company's financial statements; (ii) review and appraise the performance of the Company's external auditors; and (iii) provide an open avenue of communication among the Company's auditors, financial and senior management and the Board.

Composition

The members of the Audit Committee are currently Navchand Jagpal, Greg MacRae, and J. Lewis Dillman, the majority of whom are free from any relationship that, in the opinion of the Board would interfere with the exercise of his independent judgment as a member of the Audit Committee. Effective the date of the 2006 Annual Meeting, Mahmoud S. Aziz is expected to be appointed as a member of the Audit Committee to replace Greg MacRae. Mahmoud S. Aziz will be an independent member of the Audit Committee upon his expected appointment as a member of the Audit Committee.

Currently, the Audit Committee has at least one member with accounting or related financial management expertise. All members of the Audit Committee are financially literate. Mr. Aziz will be financilal literate upon his expected appointment as a member of the Audit Committee effective the date of the 2006 Annual Meeting. For the purposes of the Company's Charter, the definition of "financially literate" is the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can presumably be expected to be raised by the Company's financial statements.

Meetings

The Audit Committee meets annually or more frequently as circumstances dictate. As part of its mandate to foster open communication, the Audit Committee meets with the external auditors.

Responsibilities and Duties

To fulfill its responsibilities and duties, the Committee:

Documents/Reports Review

(a) Reviews and updates its Charter annually.

(b) | Reviews the Company's financial statements, MD&A, any annual and interim earnings and press releases before the Company's publicly discloses this information and any reports or other financial information (including quarterly financial statements), which are submitted to any governmental body, or to the public, including any certification, report, opinion or review rendered by the external auditors. |

External Auditors

(a) | Reviews annually the performance of the external auditors who shall be ultimately accountable to the board of directors and the Committee as representatives of the shareholders of the Company. |

(b) | Obtains annually a formal written statement of external auditors setting forth all relationships between the external auditors and the Company, consistent with Independence Standards Board Standard 1. |

(c) | Reviews and discusses with the external auditors any disclosed relationships or services that may impact the objectivity and independence of the external auditors. |

(d) | Takes or recommends that the full board of directors take appropriate action to oversee the independence of the external auditors. |

(e) | Advises the board of directors on selection and, where applicable, the replacement of the external auditors nominated annually for shareholder approval. |

(f) | At each meeting, consults with the external auditors, without the presence of management, about the quality of the Company's accounting principles, internal controls and the completeness and accuracy of the Company's financial statements. |

(g) | Reviews and approves the Company's hiring policies regarding partners, employees and former partners and employees of the present and former external auditors of the Company. |

(h) | Reviews with management and the external auditors the audit plan for the year-end financial statements and intended template for such statements. |

(i) | Reviews and pre-approves all audit and audit-related services and the fees and other compensation related thereto, and any non-audit services, provided by the Company's external auditors. The pre-approval requirement is waived with respect to the provision of non-audit services if: |

(1) | The aggregate amount of all such non-audit services provided to the Company constitutes not more than five (5%) percent of the total amount of revenues paid by the Company to its external auditors during the fiscal year in which the non-audit services are provided; |

(2) | Such services were not recognized by the Company at the time of the engagement to be non-audit services; and |

(3) | Such services are promptly brought to the attention of the Committee by the Company and approved prior to the completion of the audit by the Committee or by one or more members of the Committee who are members of the board of directors to whom authority to grant such approvals has been delegated by the Committee. |

Provided the pre-approval of the non-audit services is presented to the Committee's first scheduled meeting following such approval such authority may be delegated by the Committee to one or more independent members of the Committee.

Financial Reporting Processes

(a) | In consultation with the external auditors, reviews with management the integrity of the Company's financial reporting process, both internal and external. |

(b) | Considers the external auditor's judgments about the quality and appropriateness of the Company's accounting principles as applied in its financial reporting. |

| (c) | Considers and approves, if appropriate, changes to the Company's auditing and accounting principles and practices as suggested by the external auditors and management. |

| (d) | Reviews significant judgments made by management in the preparation of the financial statements and the view of the external auditors as to appropriateness of such judgments. |

(e) | Following completion of the annual audit, reviews separately with management and the external auditors any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information. |

(f) | Reviews any significant disagreement among management and the external auditors in connection with the preparation of the financial statements. |

(g) | Reviews with the external auditors and management the extent to which changes and improvements in financial or accounting practices have been implemented. |

(h) | Reviews any complaints or concerns about any questionable accounting, internal accounting controls or auditing matters. |

(i) Reviews the certification process.

(j) | Establishes a procedure for the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

Other

Reviews any related party transactions.

Audit Committee Oversight

At no time since the commencement of the Company's most recently completed financial year was a recommendation of the Audit Committee to nominate or compensate an external auditor not adopted by the Board.

D. Employees

As at December 31, 2006, the Company did not have any employees.

E. Share Ownership

As at June 29, 2007, the Named Executive Officers did not own, directly or indirectly any shares of the Company.

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. Major Shareholders

To the knowledge of the Company's directors and officers, there are no persons that own, directly or indirectly, more than five percent of the Company's common shares as at •, 2007. All of the Company's common shares carry the same voting rights. None of the Company's officers and directors own or control, directly or indirectly, any of the Company's outstanding common shares.

To the extent known to the Company, the Company is not, directly or indirectly, owned or controlled by another corporation, by any foreign government or by any other natural or legal person(s) severally or jointly.

The Company is unaware of any arrangements which may at a subsequent date result in a change in control of the Company.

Shareholder Distribution

As at June 15, 2007, there were approximately 86 holders of record of the Company’s common shares. Approximately 1,985,875 or 12.58% of the Company’s common shares are held of record by 36 United States holders.

B. Related Party Transactions

As part of the Company's merchant banking activities, the Company often appoints a representative to the client company's board of directors. Accordingly, such transactions are considered to be related party transactions in nature.

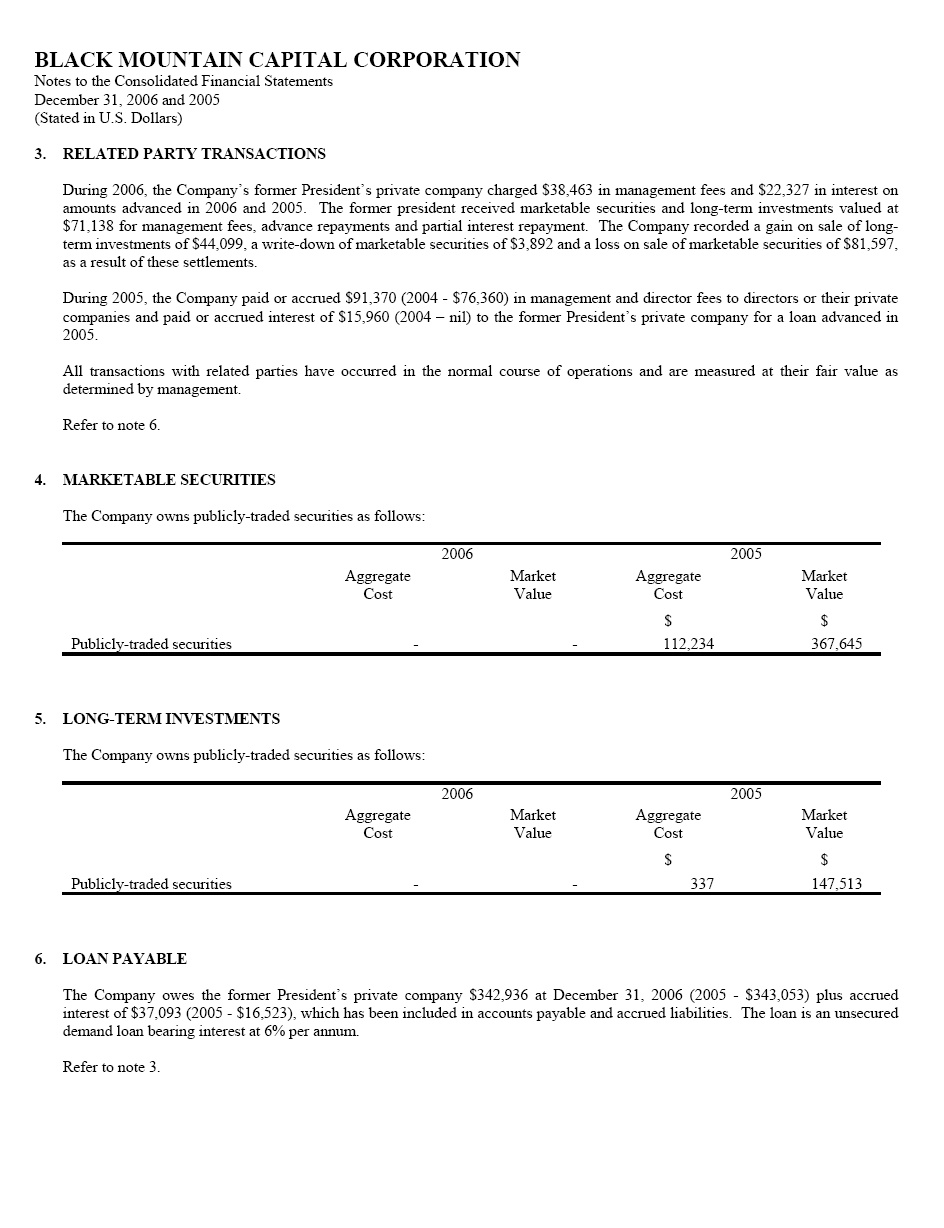

During 2006, the Company's former President's private company charged $38,463 in management fees and $22,327 in interest on amounts advanced in 2006 and 2005. The former President received marketable securities and long-term investments valued at $71,138 for management fees, advance repayments and partial interest repayment. The Company recorded a gain on sale of long-term investments of $44,099, a write-down of marketable securities of $3,892 and a loss on sale of marketable securities of $81,597, as a result of these settlements.

During 2005, the Company paid or accrued $91,370 (2004 - $76,360) in management and director fees to directors or their private companies and paid or accrued interest of $15,960 (2004 - nil) to the former President's private company for a loan advanced in 2005.

All transactions with related parties have occurred in the normal course of operations and are measured at their fair value as determined by management.

C. Interests of Experts and Counsel

Not Applicable.

A. Consolidated Statements and Other Financial Information

See "Item 17. Financial Statements" for financial statements filed as part of this Annual Report.

Legal Proceedings

The Company is subject to routine litigation incidental to the Company's business and is named from time to time as a defendant in various legal actions arising in connection with the Company's activities. The Company is also involved, from time to time, in investigations and proceedings by governmental and self-regulatory agencies. Some of these legal actions, investigations and proceedings may result in adverse judgments, penalties or fines. Please see Note 8 of the Financial Statements for further information.

In view of the inherent difficulty of predicting the outcome of such matters, particularly in cases in which substantial damages are sought, the Company cannot state what the eventual outcome of pending matters will be. The Company is contesting the allegations made in each pending matter and believes, based on current knowledge and after consultation with counsel, that the outcome of such matters will not have a material adverse effect on the Company's consolidated financial condition, but may be material to the Company's operating results for any particular period, depending on the level of the Company's income for such period.

The following is a description of material legal proceedings involving the Company.

Oil and Gas Properties

A statement of claim has been filed against the Company to recover certain oil and gas properties, which the claimant alleges were sold to it by the former management of the Company. The Company believes these oil and gas properties were not included as part of the properties sold to the claimant. The Company has offered to transfer certain of the interests in exchange for a waiver of court costs.

Cybersurf Litigation

During the year ended December 31, 2003, Cybersurf Corp., referred to as "Cybersurf", filed a statement of claim claiming that the Company engaged in improper actions during the Company’s attempt to replace the board of directors of Cybersurf at its annual general meeting held on November 28, 2002. As a result of the statement of claim, Cybersurf postponed its annual general meeting for almost two years. The Company was Cybersurf’s largest shareholder until it sold its investment during the year ended December 31, 2005 for proceeds of $1,125,037. During the year ended December 31, 2004, the Company paid a court judgment of $79,003 for costs related to the Company’s legal challenge to the election of directors of Cybersurf at its November 28, 2002 annual general meeting

On March 23, 2005, the Company announced it had entered into an agreement to settle and dismiss its litigation with Cybersurf. The Company did not admit to any liability or wrongdoing. Pursuant to the settlement, the Company contributed $601,760 in exchange for a full release of claims and a withdrawal of the complaints of Cybersurf. This amount and related legal costs of $699,793 (2005 - $118,827) were recorded as a loss on settlement of lawsuit for the year ended December 31, 2004.

Alberta Securities Commission Settlement

During the year ended December 31, 2005, the Company settled with the ASC in respect of an alleged breach of takeover bid rules and control persons’ reporting obligations. Pursuant to the terms of the settlement, the Company paid $40,693 to the ASC to, among other things, mitigate the continuing expense of protracted litigation. This amount and related legal costs of $55,396 were recorded as a loss on settlement of lawsuits for the year ended December 31, 2005.

Dividend Information

In the year ended December 31, 2004, the Company paid a dividend-in-kind, valued at $268,729, to shareholders in the form of shares of North Group Finance Limited.

Any decision to pay dividends on the common shares in the future will be made by the board of directors on the basis of earnings, financial requirements and other conditions existing at the time. Currently, the board does not intend to pay any dividends.

B. Significant Changes

No significant changes have occurred since the date of the Financial Statements provided in Item 17 below, other than as disclosed elsewhere in this Annual Report.

A. Markets and Price History

The Company's common shares are quoted on the OTCBB under the symbol "BMMUF" and on the TSX-V in United States dollars under the symbol "BMM.U". The following table sets forth the high and low sales price of the Company's common shares on the OTCBB and TSX-V for the periods indicated:

| | | OTCBB | | | TSX-V | |

| | | High | | | Low | | | High | | | Low | |

Annual Highs and Lows | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 2002 | | | 0.76 | | | | 0.15 | | | | 0.65 | | | | 0.13 | |

| 2003 | | | 0.75 | | | | 0.23 | | | | 0.60 | | | | 0.15 | |

| 2004 | | | 0.25 | | | | 0.05 | | | | 0.22 | | | | 0.09 | |

| 2005 | | | 0.12 | | | | 0.10 | | | | 0.14 | | | | 0.10 | |

| 2006 | | | 0.25 | | | | 0.06 | | | | 0.23 | | | | 0.05 | |

| | | | | | | | | | | | | | | | | |

Quarterly Highs and Lows | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

2005 | | | | | | | | | | | | | | | | |

| First Quarter | | | 0.23 | | | | 0.23 | | | | 0.19 | | | | 0.17 | |

| Second Quarter | | | 0.12 | | | | 0.10 | | | | 0.14 | | | | 0.12 | |

| Third Quarter | | | 0.11 | | | | 0.10 | | | | 0.12 | | | | 0.11 | |

| Fourth Quarter | | | 0.11 | | | | 0.11 | | | | 0.14 | | | | 0.10 | |

| | | OTCBB | | | TSX-V | |

| | | High | | | Low | | | High | | | Low | |

2006 | | | | | | | | | | | | | | | | |

| First Quarter | | | 0.11 | | | | 0.06 | | | | 0.09 | | | | 0.05 | |

| Second Quarter | | | 0.08 | | | | 0.06 | | | | 0.145 | | | | 0.10 | |

| Third Quarter | | | 0.25 | | | | 0.12 | | | | 0.185 | | | | 0.165 | |

| Fourth Quarter | | | 0.205 | | | | 0.10 | | | | 0.20 | | | | 0.13 | |

| | | | | | | | | | | | | | | | | |

Most Recent Six Months: Highs and Lows | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

2007 | | | | | | | | | | | | | | | | |

| January | | | 0.125 | | | | 0.10 | | | | 0.13 | | | | 0.125 | |

| February | | | 0.24 | | | | 0.10 | | | | 0.22 | | | | 0.13 | |

| March | | | 0.15 | | | | 0.10 | | | | 0.225 | | | | 0.22 | |

| April | | | 0.15 | | | | 0.13 | | | | 0.23 | | | | 0.18 | |

| May | | | 0.13 | | | | 0.13 | | | | 0.175 | | | | 0.175 | |

June(1) | | | 0.125 | | | | 0.125 | | | | 0.16 | | | | 0.125 | |

_____________________

A. Articles and Bylaws

The Company is organized under the laws of the Yukon Territory, Canada and has been assigned corporate access number 31180.

The Company's Articles and Bylaws do not contain a description of the Company's objects and purposes, except insofar as Section 5 of the Company's Articles restrict the Company from carrying on the business of a railway, steamship, air transport, canal, telegraph, telephone or irrigation company. The Company may perform any and all corporate activities permissible under the laws of the Yukon Territory.

The Company's Articles and Bylaws do not restrict a director's power to vote on a proposal, arrangement or contract in which the director is materially interested, vote compensation to themselves or any other members of their body in the absence of an independent quorum or exercise borrowing powers. There is no mandatory retirement age for the Company's directors and the Company's directors are not required to own securities of the Company in order to serve as directors.

The Company's authorized capital consists of an unlimited number of common shares without par value and an unlimited number of class A preferred shares. The Company's class A preferred shares may be issued in one or more series and the Company's directors may fix the number of shares which is to comprise each series and the designation, rights, privileges, restrictions and conditions attaching to each series. Currently, the Company has not issued any class A preferred shares.

Holders of the Company's common shares are entitled to receive notice of, attend at and vote at all meetings of shareholders, except meetings at which only holders of a specified class of shares are entitled to vote, receive any dividend declared by the Company and, subject to the rights, privileges, restrictions and conditions attaching to any other class of shares of the Company, receive the remaining property of the Company upon dissolution, liquidation or winding-up.

The Company's class A preferred shares of each series rank on parity with the Company's class A preferred shares of any other series and are entitled to a preference over the Company's common shares with respect to the payment of dividends and the distribution of assets or return of capital in the event of the liquidation, dissolution or winding-up of the Company.

The provisions in the Company's Articles attaching to the Company's common shares and class A preferred shares may be altered, amended, repealed, suspended or changed by the affirmative vote of the holders of not less than two-thirds of the common shares and two-thirds of the class A preferred shares, respectively.

The Company's Articles provide for three classes of directors with staggered terms. Each director holds office until the expiry of his term or until his successor is elected or appointed, unless his office is earlier vacated in accordance with the Company's Bylaws or with the provisions of the Business Corporations Act (Yukon). At each annual meeting of the Company, a class of directors is elected to hold office for a three year term. Successors to the class of directors whose term expires are identified as being of the same class as the directors they succeed and are elected to hold office for a term expiring at the third succeeding annual meeting of shareholders. A director appointed or elected to fill a vacancy on the board of directors holds office for the unexpired term of his predecessor.

An annual meeting of shareholders must be held at such time in each year not later than 15 months after the last preceding annual meeting and at such place as the Company's board of directors, or failing it, the Company's Chairman, Managing Director or President, may from time to time determine. The holders of not less than five percent of the Company's issued shares that carry the right to vote at a meeting may requisition the Company's directors to call a meeting of shareholders for the purposes stated in the requisition. The quorum for the transaction of business at any meeting of shareholders is two persons present in person or by proxy who together hold or represent by proxy in aggregate not less than one-third of the Company's outstanding shares entitled to vote at the meeting. Only persons entitled to vote, the Company's directors and auditors and others who, although not entitled to vote, are otherwise entitled or required to be present, are entitled to be present at a meeting of shareholders.

Except as provided in the ICA, there are no limitations specific to the rights of non-Canadians to hold or vote the Company's common shares under the laws of Canada or the Yukon Territory, or in the Company's Articles or Bylaws. See "Exchange Controls" below for a discussion of the principal features of the ICA for non-Canadian residents proposing to acquire the Company's common shares.

As set forth above, the Company's Articles and Bylaws contain certain provisions that would have an effect of delaying, deferring or preventing a change in control of the Company, including authorizing the issuance by the Company's board of directors of preferred stock in series, providing for a classified board of directors with staggered, three-year terms and limiting the persons who may call special meetings of shareholders. The Company's Articles and Bylaws do not contain any provisions that would operate only with respect to a merger, acquisition or corporate restructuring of the Company.

The Company's Bylaws do not contain any provisions governing the ownership threshold above which shareholder ownership must be disclosed.

B. Material Contracts