UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4474

Name of Registrant: Vanguard California Tax-Free Funds

| |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| |

| Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2009 – May 31, 2010

Item 1: Reports to Shareholders

|

| Vanguard California Tax-Exempt Funds |

| Semiannual Report |

|

| May 31, 2010 |

|

|

|

|

| Vanguard California Tax-Exempt Money Market Fund |

| Vanguard California Intermediate-Term Tax-Exempt Fund |

| Vanguard California Long-Term Tax-Exempt Fund |

> In an environment of short-term interest rates just above zero, Vanguard California Tax-Exempt Money Market Fund returned 0.05% for the six months ended May 31, 2010; this result was above the average return of competitive state funds.

> The Investor Shares of Vanguard California Intermediate-Term Tax-Exempt Fund returned 3.40%, ahead of the benchmark index and the average return of peer funds.

> Vanguard California Long-Term Tax-Exempt Fund returned 4.22% for Investor Shares, outpacing the fund’s benchmark but trailing the average return of competitors.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 9 |

| California Tax-Exempt Money Market Fund. | 12 |

| California Intermediate-Term Tax-Exempt Fund. | 28 |

| California Long-Term Tax-Exempt Fund. | 57 |

| About Your Fund’s Expenses. | 79 |

| Trustees Approve Advisory Arrangement. | 81 |

| Glossary. | 82 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Veronica Coia.

| | | | | |

| Your Fund’s Total Returns | | | | | |

| |

| |

| |

| |

| Six Months Ended May 31, 2010 | | | | | |

| | | Taxable- | | | |

| | SEC Equivalent | Income | Capital | Total |

| | Yields | Yields | Returns | Returns | Returns |

| Vanguard California Tax-Exempt Money | | | | | |

| Market Fund | 0.14% | 0.24% | 0.05% | 0.00% | 0.05% |

| California Tax-Exempt Money Market Funds | | | | | |

| Average | | | | | 0.01 |

| California Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. | | | |

| Vanguard California Intermediate-Term Tax-Exempt Fund | | | | |

| Investor Shares | 3.13% | 5.38% | 1.93% | 1.47% | 3.40% |

| Admiral™ Shares | 3.21 | 5.52 | 1.97 | 1.47 | 3.44 |

| Barclays Capital 7 Year Municipal Bond Index | | | | | 2.66 |

| California Intermediate Municipal Debt Funds | | | | | |

| Average | | | | | 3.17 |

| California Intermediate Municipal Debt Funds Average: Derived from data provided by Lipper Inc. | | | |

| Vanguard California Long-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 3.75% | 6.45% | 2.22% | 2.00% | 4.22% |

| Admiral™ Shares | 3.83 | 6.59 | 2.26 | 2.00 | 4.26 |

| Barclays Capital 10 Year Municipal Bond Index | | | | | 3.46 |

| California Municipal Debt Funds Average | | | | | 4.73 |

| California Municipal Debt Funds Average: Derived from data provided by Lipper Inc. | | | |

7-day SEC yield for the California Tax-Exempt Money Market Fund; 30-day SEC yield for the California Intermediate-Term Tax-Exempt Fund and California Long-Term Tax-Exempt Fund.

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 35% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

Admiral Shares are a lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

1

Chairman’s Letter

Dear Shareholder:

Municipal bonds performed well in the six months ended May 31, even as serious budget shortfalls at the state and local levels continued to take center stage nationwide. As you know, California seems to be in the spotlight more often than most.

Confidence in your state’s ability to make it through these difficult times can be seen in investors’ continuing acceptance of California bonds, which have produced solid returns for both the California Intermediate-Term Tax-Exempt Fund and the California Long-Term Tax-Exempt Fund, whose Investor Shares returned 3.40% and 4.22%, respectively, for the half-year. Both funds solidly outperformed their benchmark indexes. The intermediate-term fund also topped the average return of competitor funds, while the long-term fund trailed its peers.

At the short-term end of the interest rate spectrum, Federal Reserve policy—aimed at stimulating the economy—anchored both taxable and tax-exempt money market rates and returns near zero. Vanguard California Tax-Exempt Money Market Fund returned only 0.05%, but the fund’s low expenses helped it stay ahead of the average return of its peer group.

Yields for the Vanguard California bond funds dipped during the six-month period (in fact, many tax-exempt yields hovered near four-decade lows) as investors’ search

2

for higher yields lifted prices for intermediate-term bonds and, for the longest-term bonds, strong demand faced a supply reduction. For Investor Shares, the Intermediate-Term Fund’s yield slid to 3.13% from 3.29%, and the Long-Term Fund’s yield fell to 3.75% from 3.95%. The Tax-Exempt Money Market Fund’s yield was little changed (0.14% versus 0.17%). As shown on page 1, the taxable-equivalent yield of each fund was higher.

Note: The funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of May 31, the Money Market Fund had some exposure to these securities, but the Intermediate-Term and Long-Term Funds did not.

Surprising developments, fast-changing sentiment

For most of the past six months, corporate and municipal bonds were the fixed income market’s best performers, although returns were generally tepid compared with last year’s exceptional rally. Municipal bonds again outpaced the broad taxable bond market. Riskier securities delivered the highest returns, while U.S. Treasury prices drifted lower. These dynamics reflected both optimism that the U.S. economic recovery was gaining traction, enhancing the credit-worthiness of borrowers, and investors’ wide-ranging search for yield in response to record-low short-term interest rates.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended May 31, 2010 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 2.08% | 8.42% | 5.33% |

| Barclays Capital Municipal Bond Index | 3.60 | 8.52 | 4.52 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.12 | 2.67 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 1.53% | 22.33% | 0.67% |

| Russell 2000 Index (Small-caps) | 14.84 | 33.62 | 2.77 |

| Dow Jones U.S. Total Stock Market Index | 2.78 | 23.49 | 1.25 |

| MSCI All Country World Index ex USA (International) | -7.74 | 11.08 | 4.49 |

| |

| CPI | | | |

| Consumer Price Index | 0.85% | 2.02% | 2.33% |

3

Toward the end of the period, however, investors—rattled by Europe’s sovereign debt crisis—retreated into U.S. Treasuries. For the full six months, the broad taxable market returned a little more than 2%; municipal securities returned more than 3%.

Amid global stock market turmoil, small-caps were a bright spot

Swift reversals were a theme in the stock market, too. Stock prices rallied at the start of the period, pulled back in January, then surged higher on rapid growth in corporate earnings and pervasive optimism about the strength of the economic recovery. In May, however, as the scope of Europe’s fiscal challenges seemed to expand, stock prices retreated sharply. For the full six months, U.S. stocks returned about 3%. Small-caps, which are less exposed to global turmoil than large-cap multinationals, performed much better than larger stocks.

International stocks posted a weak six-month return. For U.S.-based investors, a strengthening U.S. dollar reduced the value of assets denominated in other currencies.

Firm demand for longer-term munis, less interest in money markets

A variety of market forces worked to the benefit of the municipal bond market during the last six months.

Not surprisingly—given their near-zero return—tax-exempt money market funds continued to experience net cash out-

| | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| California Tax-Exempt Money Market | | | |

| Fund | 0.17% | — | 0.52% |

| California Intermediate-Term | | | |

| Tax-Exempt Fund | 0.20 | 0.12% | 0.87 |

| California Long-Term Tax-Exempt | | | |

| Fund | 0.20 | 0.12 | 1.06 |

The fund expense ratios shown are from the prospectus dated April 22, 2010, and represent estimated costs for the current fiscal year based on the funds’ net assets as of the prospectus date. For the six months ended May 31, 2010, the funds’ annualized expense ratios were: for the California Tax-Exempt Money Market Fund, 0.17%; for the California Intermediate-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; and for the California Long-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2009.

Peer groups: For the California Tax-Exempt Money Market Fund, California Tax-Exempt Money Market Funds; for the California Intermediate-Term Tax-Exempt Fund, California Intermediate Municipal Debt Funds; for the California Long-Term Tax-Exempt Fund, California Municipal Debt Funds.

4

flows. Some of that cash has been reinvested in longer-term funds, helping to support prices.

The unfolding debt crisis in Greece and other European nations also spurred demand as investors became risk-averse, turning to ultrasafe Treasury securities as well as munis. Notwithstanding the fiscal stress faced by state and local governments, munis are still perceived as relatively safe havens, given their historically low default rates and the ability of many issuers to increase taxes to close funding gaps; this, of course, is one of the steps that California has taken.

Another key driver of tax-exempt bond performance has been the remarkable success of taxable Build America Bonds. Created as part of the massive federal stimulus package in early 2009, these bonds provide a federal subsidy to help reduce state and local governments’ borrowing costs. California has been the largest issuer of Build America Bonds, selling $22 billion of them during the 12 months ended April 30, double the amount sold by the second-largest issuer, New York State.

The issuance of more than $100 billion taxable Build America Bonds nationwide in just over a year has crowded out new tax-exempt issues, causing investors—especially those seeking longer-maturity bonds—to bid up tax-exempt prices (thereby lowering yields). The supply shrinkage has been notable: In the first five months of calendar-year 2010, only about two-thirds of muni issuance was tax-exempt, compared with an average of well above 90% for the January–May period in the last five years.

The Vanguard California bond funds’ results reflected these countrywide dynamics as well as individual security selection. The funds’ returns were about three-quarters of a percentage point above the returns of their respective benchmarks. Both funds’ returns were near the average returns of their peer groups: The Intermediate-Term Fund outpaced its peers while the Long-Term Fund lagged. Your funds’ orientation toward higher credit quality served as a headwind during the period, as lower-quality bonds generally outperformed.

Municipal defaults remain rare, despite financial struggles

The health of state and municipal finances often lags that of the national economy, and this appears to be the case in the current economic cycle—the fiscal conditions of state and local governments are likely to remain fragile for at least another year or longer.

In common with most states, California confronts some of the toughest challenges since the Great Depression as it strives to balance its budget during a slow-paced economic recovery that has driven the state unemployment rate above 12%.

Despite such dilemmas in California and other states, municipal default rates across the United States have remained considerably lower than those of corporate debt.

5

For more information on the funds’ positioning and performance during the past six months, please see the Advisor’s Report following this letter.

Tune out the noise, and focus on the long term

It’s hard to pick up a newspaper or go online without reading about state and local furloughs, teacher layoffs, and stopgap funding measures—not to mention concerns that weak European economies may stunt global economic growth. Even though many of these developments hit close to home, and may tempt you to respond, don’t let them distract you. Instead, focus on maintaining a portfolio that is appropriately balanced among asset classes and is consistent with your investment goals.

Also, within asset classes, don’t lose sight of the need to diversify your bond holdings, not just your stocks. Recent Vanguard research underscores the benefits of a broadly diversified bond portfolio—regardless of the possible direction of interest rates.

|

| Investment insight |

| |

| A word about credit ratings |

| You may have noticed recently that some municipal securities appear to have been |

| upgraded, even while state and local authorities struggle to balance their budgets and |

| meet their obligations. |

| |

| This apparent improvement resulted from a nationwide “recalibration” of municipal |

| bond ratings by two major credit-rating agencies, which have stressed that the |

| changes are not upgrades. Both agencies now rate municipal debt by the same |

| standards they use to rate corporate debt, a change intended to make ratings more |

| comparable across categories of taxable and tax-exempt bonds. For many municipal |

| issuers—including California—the result has been a new rating unrelated to any |

| change in the issuer’s financial conditions. The new ratings are reflected in the Fund |

| Profile statistics in this semiannual report. |

| |

| Another consequence of the agencies’ new approach is that their ratings of municipal |

| borrowers are now clustered in a narrower range, making it more difficult for individual |

| investors to discriminate among them. This puts a premium on the type of thorough |

| and independent analysis that Vanguard’s highly experienced team of credit analysts |

| conducts as a matter of course. As they continually monitor all the securities in our |

| funds, and evaluate prospective purchases, our analysts even meet face-to-face with |

| issuers’ representatives to get a solid understanding of creditworthiness. The analysts’ |

| independent judgment provides an exceptionally solid grounding for the high credit |

| quality of our funds. |

6

For higher-tax-bracket investors in the state, Vanguard California Tax-Exempt Bond Funds can help provide diversification with the added advantages of exemption from state income taxes, as well as low costs and the seasoned judgment of Vanguard’s team of portfolio managers and credit analysts.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

June 11, 2010

7

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2009 , Through May 31, 2010 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard California Tax-Exempt Money Market | | | | |

| Fund | $1.00 | $1.00 | $0.001 | $0.000 |

| Vanguard California Intermediate-Term | | | | |

| Tax-Exempt Fund | | | | |

| Investor Shares | $10.86 | $11.02 | $0.206 | $0.000 |

| Admiral Shares | 10.86 | 11.02 | 0.210 | 0.000 |

| Vanguard California Long-Term Tax-Exempt | | | | |

| Fund | | | | |

| Investor Shares | $10.98 | $11.20 | $0.239 | $0.000 |

| Admiral Shares | 10.98 | 11.20 | 0.243 | 0.000 |

8

Advisor’s Report

For the six months ended May 31, 2010, Vanguard California Tax-Exempt Money Market Fund returned 0.05%. This near-zero return was nonetheless greater than the average return of peer-group state funds. The California Intermediate-Term Tax-Exempt Fund returned 3.40% for Investor Shares and 3.44% for Admiral Shares, outpacing both the fund’s national benchmark index and the average return of its peers. The California Long-Term Tax-Exempt Fund, with returns of 4.22% for Investor Shares and 4.26% for Admiral Shares, exceeded its national benchmark but trailed the average return of competing funds.

The investment environment

As shown in the table, at the end of May municipal bond yields were about where they started the new fiscal year for short- and intermediate-term bonds, but lower for longer-term bonds. Overall, yields were close to a four-decade low.

In addition, the spread in yields between lowest-risk and higher-risk municipal bonds continued to narrow from the extremely wide spans that characterized the muni bond market during the worst of the financial crisis in late 2008 and early 2009. The narrowing was only slightly interrupted by investors’ reaction late in the period to the debt crisis in Europe, which started with uncertainty about whether Greece would be able to meet its obligations.

One response to the ratcheted-up uncertainty about the global economic recovery has been a flight to quality. That fueled demand for U.S. Treasury securities, a traditional safe haven. This

| | |

| Yields of Tax-Exempt Municipal Bonds | | |

| (AAA-Rated General-Obligation Issues) | | |

| | November 30, | May 31, |

| Maturity | 2009 | 2010 |

| 2 years | 0.61% | 0.58% |

| 5 years | 1.50 | 1.59 |

| 10 years | 2.78 | 2.80 |

| 30 years | 4.28 | 4.00 |

| Source: Vanguard. | | |

9

dynamic made tax-exempt municipal bonds more attractive, despite the financial stresses imposed on most states and municipalities by the severe recession. Higher demand raises bond prices but reduces yields, because prices and yields move inversely to each other. As the European debt crisis began to dominate financial headlines in April and May, Treasury and tax-exempt bond yields fell.

Other factors leading to lower yields were set in motion from opposite ends of the maturity spectrum. With short-term interest rates held close to zero by the Federal Reserve, money market mutual funds such as the California Tax-Exempt Money Market Fund could offer investors virtually no yield. Many investors moved on to municipal bonds and bond funds in the 1- to 10-year maturity range, such as the California Intermediate-Term Tax-Exempt Bond Fund.

At the longer end of the spectrum, demand for tax-exempt bonds was steady; however, the supply of new tax-exempt issues declined, a result of the growing issuance by state and local governments of taxable Build America Bonds. These “BABs” were created by the American Recovery and Reinvestment Act of 2009, the federal government’s huge economic stimulus package. Through an attractive subsidy, BABs allow states and municipalities to lower their financing costs for a variety of projects, including improvements to highways, schools, and water and sewer systems. Because long-term bonds pay the most interest, the subsidy encourages the issuance of long-term BABs, which in turn reduces the pool of securities available to funds like the California Long-Term Tax-Exempt Fund.

For perspective, before the introduction of BABs, just about all state and municipal bond issuance nationwide consisted of tax-exempt issues. In recent years, total municipal new-issue volume has been running at about $400 billion annually, and BABs have been capturing an increasing share of that supply: More than $100 billion of BABs were issued from April 2009 through May 2010. During the six months ended May 31, California issuers raised about $8 billion through BABs and $20 billion through traditional munis, compared with combined issuance of $32 billion in the first half of fiscal-year 2009. The Vanguard California Tax-Exempt Funds generally do not invest in securities, such as BABs, that generate taxable income.

The end result of these market forces is a yield curve that is anchored at zero at the shortest end, extraordinarily steep in the 1- to 10-year range, and flat at the longest end. In fact, during the past six months the yields of traditional AAA-rated 30-year munis dipped below 4% for a time, a rare event.

Management of the funds

The investment world is now waiting for the Federal Reserve’s next move on interest rates. We believe that the Fed will begin to raise rates when there is consistent month-to-month growth in employment, which is necessary to sustain a recovery from the worst recession since the Great Depression.

10

Our best estimate suggests that the Fed will begin tightening in 2011, although the European debt crisis may now have become a factor influencing the timing of that decision. We have set the durations, or interest rate sensitivity, of our funds accordingly. In other words, our funds are positioned for continued economic recovery, and we are poised to react appropriately when the Fed is ready to take its next steps.

Outlook

As the broad economy continues to bounce back, the condition of stressed-out state and municipal finances is also likely to improve, though slowly and unevenly. We’re sure that you’ll be hearing and reading about the many difficult decisions that California and other states and localities will be making about spending and allocation of resources, especially given the rough-and-tumble political process. Moreover, it may be that federal help will diminish as the U.S. government focuses on its own critical fiscal challenges.

The current state of municipal finances has naturally raised concern among investors about default risk. As a practical matter, there’s a major incentive for a muni-bond issuer not to default: It would mean being shut out of the capital markets for years to come. In fact, municipal defaults have been rare: According to data submitted to Congress about the default experience of bonds rated by Moody’s Investors Service, the ten-year cumulative default rate for muni bonds from 1970 to 2009 was a fraction of 1%, compared with corporate default rates of about 11%. In recent years, muni defaults have often involved nonrated, high-risk projects, such as real estate developments, which we don’t consider suitable for our funds.

Most important, at the heart of the management of our funds is an intimate knowledge of the fiscal conditions of the state and local governments that issue bonds. Such understanding is crucial in evaluating potential purchases and in monitoring bonds already in the portfolio. Our knowledge base—difficult for individual investors to develop on their own, given the complexities of the muni bond market—is constantly refreshed by a team of credit analysts, including sector specialists, who collectively have many decades of experience and work together with portfolio managers and traders to keep on top of municipal conditions. In sum, our credit analyst team is one of the strongest in the business.

We are confident that our analytical insight, our long-term focus, and the portfolios’ low costs will help us deliver competitive returns through both challenging and more normal markets.

Kathryn T. Allen, Principal,

Portfolio Manager

John M. Carbone, Principal,

Portfolio Manager

Christopher W. Alwine, CFA, Principal,

Head of Municipal Money Market and Bond Groups

Vanguard Fixed Income Group

June 15, 2010

11

California Tax-Exempt Money Market Fund

Fund Profile

As of May 31, 2010

| |

| Financial Attributes | |

| Ticker Symbol | VCTXX |

| Expense Ratio1 | 0.17% |

| 7-Day SEC Yield | 0.14% |

| Average Quality | MIG-1 |

| Average Weighted | |

| Maturity | 18 days |

Average quality: Moody’s Investors Service.

| |

| Distribution by Credit Quality (% of portfolio) |

| MIG-1/SP-1+ | 82.9% |

| A-1/P-1 | 17.1 |

Ratings: Moody’s Investors Service, Standard & Poor’s.

1 The expense ratio shown is from the prospectus dated April 22, 2010, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the six months ended May 31, 2010, the annualized expense ratio was 0.17%.

12

California Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

| | |

| Fiscal-Year Total Returns (%): November 30, 1999, Through May 31, 2010 | |

| | | CA Tax-Exempt |

| | | Money Mkt |

| | | Funds Avg |

| Fiscal Year | Total Returns | Total Returns |

| 2000 | 3.44% | 3.06% |

| 2001 | 2.57 | 2.17 |

| 2002 | 1.33 | 0.92 |

| 2003 | 0.91 | 0.54 |

| 2004 | 1.05 | 0.60 |

| 2005 | 2.17 | 1.70 |

| 2006 | 3.24 | 2.78 |

| 2007 | 3.55 | 3.06 |

| 2008 | 2.21 | 1.81 |

| 2009 | 0.37 | 0.17 |

| 2010 | 0.05 | 0.01 |

7-day SEC yield (5/31/2010): 0.14%

California Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc.

Note: For 2010, performance data reflect the six months ended May 31, 2010.

Average Annual Total Returns: Periods Ended March 31, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| California Tax-Exempt Money | | | | |

| Market Fund | 6/1/1987 | 0.21% | 2.19% | 1.98% |

See Financial Highlights for dividend information.

13

California Tax-Exempt Money Market Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information). In addition, the fund publishes its holdings on a monthly basis at www.vanguard.com.

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.1%) | | | | |

| California (100.1%) | | | | |

| ABAG Finance Auth. for Non-Profit Corp. California | | | | |

| Rev. (Computer History Museum) VRDO | 0.270% | 6/7/10 LOC | 7,000 | 7,000 |

| ABAG Finance Auth. for Non-Profit Corp. California | | | | |

| Rev. (Institute for Defense Analyses) VRDO | 0.250% | 6/7/10 LOC | 11,945 | 11,945 |

| Bay Area Toll Auth. CA Toll Bridge Rev. | | | | |

| (San Francisco Bay Area) VRDO | 0.150% | 6/7/10 | 15,000 | 15,000 |

| Bay Area Toll Auth. CA Toll Bridge Rev. | | | | |

| (San Francisco Bay Area) VRDO | 0.200% | 6/7/10 | 12,500 | 12,500 |

| Bay Area Toll Auth. CA Toll Bridge Rev. | | | | |

| (San Francisco Bay Area) VRDO | 0.250% | 6/7/10 | 99,000 | 99,000 |

| 1 Bay Area Toll Auth. CA Toll Bridge Rev. TOB PUT | 0.450% | 11/4/10 | 9,865 | 9,865 |

| 1 Bay Area Toll Auth. CA Toll Bridge Rev. TOB VRDO | 0.290% | 6/7/10 | 41,910 | 41,910 |

| 1 Bay Area Toll Auth. CA Toll Bridge Rev. TOB VRDO | 0.310% | 6/7/10 | 7,500 | 7,500 |

| Bay Area Toll Auth. CA Toll Bridge Rev. VRDO | 0.250% | 6/7/10 | 18,250 | 18,250 |

| Berkeley CA Rev. (Berkeley-Albany YMCA) VRDO | 0.220% | 6/7/10 LOC | 13,065 | 13,065 |

| California Communities NT Program NT | | | | |

| Participation TRAN | 2.000% | 6/30/10 | 17,500 | 17,522 |

| 1 California Dept. of Veteran Affairs Rev. TOB VRDO | 0.290% | 6/7/10 | 11,140 | 11,140 |

| California Educ. Fac. Auth. Rev. | | | | |

| (California Institute of Technology) VRDO | 0.230% | 6/7/10 | 67,300 | 67,300 |

| 1 California Educ. Fac. Auth. Rev. | | | | |

| (Loyola Marymount Univ.) TOB VRDO | 0.290% | 6/7/10 LOC | 3,998 | 3,998 |

| California Educ. Fac. Auth. Rev. (Stanford Univ.) CP | 0.400% | 7/7/10 | 40,000 | 40,000 |

| California Educ. Fac. Auth. Rev. (Stanford Univ.) CP | 0.400% | 7/14/10 | 33,000 | 33,000 |

| California Educ. Fac. Auth. Rev. (Stanford Univ.) CP | 0.400% | 7/21/10 | 40,000 | 40,000 |

| 1 California Educ. Fac. Auth. Rev. (Stanford Univ.) | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 4,470 | 4,470 |

| California Educ. Fac. Auth. Rev. | | | | |

| (Stanford Univ.) VRDO | 0.140% | 6/7/10 | 5,468 | 5,468 |

| 1 California Educ. Fac. Auth. Rev. | | | | |

| (Stanford Univ.) VRDO | 0.140% | 6/7/10 | 4,580 | 4,580 |

| 1 California Educ. Fac. Auth. Rev. | | | | |

| (Stanford Univ.) VRDO | 0.140% | 6/7/10 | 7,565 | 7,565 |

| 1 California Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Southern California) TOB VRDO | 0.290% | 6/7/10 | 4,860 | 4,860 |

| 1 California Educ. Fac. Auth. Rev. | | | | |

| (Univ. of Southern California) TOB VRDO | 0.290% | 6/7/10 | 5,345 | 5,345 |

| 1 California Educ. Fac. Auth. Rev. TOB VRDO | 0.290% | 6/7/10 | 6,450 | 6,450 |

14

California Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California GO | 5.250% | 9/1/10 (Prere.) | 5,945 | 6,017 |

| California GO | 5.250% | 10/1/10 (Prere.) | 7,650 | 7,777 |

| 1 California GO TOB VRDO | 0.290% | 6/7/10 | 23,098 | 23,098 |

| California GO VRDO | 0.230% | 6/7/10 LOC | 20,000 | 20,000 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Adventist Health System) VRDO | 0.230% | 6/1/10 LOC | 8,260 | 8,260 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Children’s Hosp.) VRDO | 0.170% | 6/7/10 LOC | 42,900 | 42,900 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Children’s Hosp.) VRDO | 0.170% | 6/7/10 LOC | 7,100 | 7,100 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Children’s Hosp.) VRDO | 0.170% | 6/7/10 LOC | 3,950 | 3,950 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Lucile Salter Packard Hosp.) VRDO | 0.180% | 6/7/10 | 5,850 | 5,850 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Lucile Salter Packard Hosp.) VRDO | 0.180% | 6/7/10 | 10,250 | 10,250 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Lucile Salter Packard Hosp.) VRDO | 0.240% | 6/7/10 | 18,450 | 18,450 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Memorial Health Services) VRDO | 0.180% | 6/7/10 | 69,475 | 69,475 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Scripps Health) VRDO | 0.230% | 6/7/10 LOC | 14,265 | 14,265 |

| California Health Fac. Finance Auth. Rev. | | | | |

| (Stanford Hosp.) PUT | 0.550% | 6/16/10 | 17,000 | 17,000 |

| 1 California Health Fac. Finance Auth. Rev. | | | | |

| (Sutter Health) TOB VRDO | 0.290% | 6/7/10 | 6,700 | 6,700 |

| 1 California Health Fac. Finance Auth. Rev. | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 14,995 | 14,995 |

| 1 California Health Fac. Finance Auth. Rev. | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 10,000 | 10,000 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.270% | 6/7/10 LOC | 20,000 | 20,000 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.280% | 6/7/10 LOC | 20,000 | 20,000 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.290% | 6/7/10 LOC | 9,285 | 9,285 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.290% | 6/7/10 LOC | 33,545 | 33,545 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.290% | 6/7/10 LOC | 55,300 | 55,300 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.310% | 6/7/10 LOC | 14,600 | 14,600 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.310% | 6/7/10 LOC | 15,800 | 15,800 |

| California Housing Finance Agency | | | | |

| Home Mortgage Rev. VRDO | 0.310% | 6/7/10 LOC | 25,000 | 25,000 |

| California Housing Finance Agency | | | | |

| Single Family Mortgage Rev. VRDO | 0.310% | 6/7/10 LOC | 12,975 | 12,975 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (Academy Motion Picture) VRDO | 0.260% | 6/7/10 LOC | 22,400 | 22,400 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (American National Red Cross) VRDO | 0.230% | 6/7/10 LOC | 14,575 | 14,575 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (Buck Institute) VRDO | 0.170% | 6/7/10 LOC | 34,430 | 34,430 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (California Academy of Sciences) VRDO | 0.250% | 6/1/10 LOC | 5,000 | 5,000 |

15

California Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (California Academy of Sciences) VRDO | 0.250% | 6/1/10 LOC | 14,125 | 14,125 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (California IDB SRI Intl.) VRDO | 0.260% | 6/7/10 LOC | 4,585 | 4,585 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (J. Paul Getty Trust) VRDO | 0.200% | 6/1/10 | 5,700 | 5,700 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (J. Paul Getty Trust) VRDO | 0.200% | 6/1/10 | 18,500 | 18,500 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (J. Paul Getty Trust) VRDO | 0.200% | 6/1/10 | 11,225 | 11,225 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (JSerra Catholic High School Project) VRDO | 0.220% | 6/7/10 LOC | 3,100 | 3,100 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (Pacific Gas & Electric) VRDO | 0.230% | 6/1/10 LOC | 3,100 | 3,100 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (Pacific Gas & Electric) VRDO | 0.240% | 6/1/10 LOC | 10,790 | 10,790 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (Prinsco Inc. Project) VRDO | 0.350% | 6/7/10 LOC | 8,100 | 8,100 |

| California Infrastructure & Econ. Dev. Bank Rev. | | | | |

| (SRI International) VRDO | 0.260% | 6/7/10 LOC | 5,000 | 5,000 |

| California Muni. Financing Auth. Rev. | | | | |

| (Notre Dame High School) VRDO | 0.340% | 6/7/10 LOC | 6,090 | 6,090 |

| California PCR Financing Auth. | | | | |

| (Atlantic Richfield) CP | 0.330% | 6/11/10 | 24,000 | 24,000 |

| 1 California Public Works Board Lease | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 11,110 | 11,110 |

| California School Cash Reserve | | | | |

| Program Auth. Pool TRAN | 2.500% | 7/1/10 LOC | 12,000 | 12,019 |

| California State Dept. of Water Resources | | | | |

| Power Supply Rev. VRDO | 0.230% | 6/7/10 LOC | 6,800 | 6,800 |

| California State Dept. of Water Resources | | | | |

| Power Supply Rev. VRDO | 0.250% | 6/7/10 LOC | 5,640 | 5,640 |

| California State Dept. of Water Resources | | | | |

| Power Supply Rev. VRDO | 0.260% | 6/7/10 LOC | 39,400 | 39,400 |

| California State Dept. of Water Resources | | | | |

| Power Supply Rev. VRDO | 0.270% | 6/7/10 (4) | 9,950 | 9,950 |

| California State Dept. of Water Resources | | | | |

| Power Supply Rev. VRDO | 0.350% | 6/7/10 (4) | 32,200 | 32,200 |

| California State Econ. Recovery Bonds | 5.000% | 3/1/11 (Prere.) | 37,220 | 38,547 |

| California State Econ. Recovery Bonds PUT | 5.000% | 7/1/10 (Prere.) | 55,000 | 55,208 |

| 1 California State Univ. Rev. TOB VRDO | 0.310% | 6/7/10 (4) | 20,475 | 20,475 |

| California Statewide Communities Dev. Auth. | | | | |

| Multifamily Housing Rev. | | | | |

| (Ridgeway Apartments) VRDO | 0.240% | 6/7/10 LOC | 7,200 | 7,200 |

| California Statewide Communities Dev. Auth. | | | | |

| Multifamily Rev. (Canyon Springs) VRDO | 0.300% | 6/7/10 LOC | 10,105 | 10,105 |

| California Statewide Communities Dev. Auth. | | | | |

| Multifamily Rev. (Knoll Apartments) VRDO | 0.280% | 6/7/10 LOC | 12,715 | 12,715 |

| California Statewide Communities Dev. Auth. | | | | |

| Multifamily Rev. (Valley Palms Apartments) VRDO | 0.260% | 6/7/10 LOC | 13,500 | 13,500 |

| California Statewide Communities Dev. Auth. | | | | |

| Multifamily Rev. (Village Green Apartments) VRDO | 0.290% | 6/7/10 | 5,800 | 5,800 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Cottage Health Systems) VRDO | 0.170% | 6/7/10 LOC | 37,420 | 37,420 |

| California Statewide Communities Dev. Auth. Rev. | | | | |

| (Cottage Health Systems) VRDO | 0.170% | 6/7/10 LOC | 19,300 | 19,300 |

16

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Fiorella Investments LLC) VRDO | 1.000% | 6/7/10 LOC | 8,825 | 8,825 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Kaiser Permanente) CP | 0.340% | 7/19/10 | 15,000 | 15,000 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Kaiser Permanente) VRDO | 0.260% | 6/7/10 | 41,800 | 41,800 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Kaiser Permanente) VRDO | 0.270% | 6/7/10 | 21,300 | 21,300 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Los Angeles County Museum) VRDO | 0.240% | 6/7/10 LOC | 20,000 | 20,000 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Motion Picture and Television Fund) VRDO | 0.270% | 6/7/10 LOC | 9,500 | 9,500 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Redlands Community Hosp.) VRDO | 0.290% | 6/7/10 LOC | 14,000 | 14,000 |

| 1 California Statewide Communities Dev. Auth. | | | | |

| Rev. (Sutter Health) TOB VRDO | 0.290% | 6/7/10 | 46,065 | 46,065 |

| California Statewide Communities Dev. Auth. | | | | |

| Rev. (Univ. of San Diego) VRDO | 0.280% | 6/7/10 LOC | 18,415 | 18,415 |

| Castaic Lake CA Water Agency Rev. COP VRDO | 0.230% | 6/7/10 LOC | 20,160 | 20,160 |

| 1 Central Basin Muni. Water Dist. CA COP | | | | |

| TOB VRDO | 0.310% | 6/7/10 (4) | 7,500 | 7,500 |

| 1 Cerritos CA Community College Dist. GO | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 7,845 | 7,845 |

| 1 Chino Basin CA Regional Financing Auth. Rev. | | | | |

| (Inland Empire Util. Agency Sewer) TOB VRDO | 0.310% | 6/7/10 | 10,815 | 10,815 |

| Chula Vista CA Multi-Family Housing Rev. VRDO | 0.290% | 6/7/10 LOC | 18,970 | 18,970 |

| 1 Contra Costa CA Community College Dist. | | | | |

| TOB VRDO | 0.290% | 6/7/10 (4) | 5,110 | 5,110 |

| Contra Costa CA Housing Finance Agency | | | | |

| Home Mortgage Rev. (Park Regency) VRDO | 0.290% | 6/7/10 LOC | 42,200 | 42,200 |

| 1 Contra Costa CA Water Dist. Rev. TOB VRDO | 0.320% | 6/7/10 | 5,200 | 5,200 |

| Contra Costa County CA MFH Pleasant Hill VRDO | 0.290% | 6/7/10 LOC | 58,800 | 58,800 |

| 1 Desert CA Community College Dist. TOB VRDO | 0.290% | 6/7/10 (4) | 12,375 | 12,375 |

| East Bay CA Muni. Util. Dist. | | | | |

| Water System Rev. PUT | 0.290% | 12/1/10 | 24,750 | 24,750 |

| 1 Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer COP TOB VRDO | 0.290% | 6/7/10 | 1,590 | 1,590 |

| 1 Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer Rev. TOB VRDO | 0.310% | 6/7/10 | 3,940 | 3,940 |

| Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer Rev. VRDO | 0.230% | 6/7/10 | 33,000 | 33,000 |

| Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer Rev. VRDO | 0.240% | 6/7/10 | 27,400 | 27,400 |

| Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer Rev. VRDO | 0.260% | 6/7/10 | 7,520 | 7,520 |

| 1 Eastern California Muni. Water. Dist. | | | | |

| Water & Sewer Rev. VRDO | 0.260% | 6/7/10 | 20,000 | 20,000 |

| Escondido CA Community Dev. COP | | | | |

| (Escondido Community Dev.) VRDO | 0.350% | 6/7/10 LOC | 9,400 | 9,400 |

| Fresno County CA TRAN | 2.000% | 6/30/10 | 50,000 | 50,062 |

| Garden Grove CA Housing Auth. | | | | |

| Multifamily Rev. VRDO | 0.300% | 6/7/10 LOC | 9,100 | 9,100 |

| Golden State Tobacco Securitization Corp. California | 5.600% | 6/1/10 (Prere.) | 2,260 | 2,260 |

| Hayward CA Housing Auth. Rev. | | | | |

| (Barrington Hills) VRDO | 0.260% | 6/7/10 LOC | 6,150 | 6,150 |

17

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Irvine CA Assessment Dist. | | | | |

| Improvement Bonds VRDO | 0.250% | 6/1/10 LOC | 31,970 | 31,970 |

| 1 Irvine California USD Special Tax TOB VRDO | 0.390% | 6/7/10 LOC | 22,695 | 22,695 |

| Kern County CA TRAN | 2.500% | 6/30/10 | 35,000 | 35,052 |

| Livermore CA Redev. Agency | | | | |

| Multi-Family Housing Rev. VRDO | 0.240% | 6/7/10 LOC | 6,640 | 6,640 |

| 1 Long Beach CA Harbor Rev. TOB VRDO | 0.460% | 6/7/10 | 16,005 | 16,005 |

| Long Beach CA Water Rev. CP | 0.340% | 8/4/10 | 11,000 | 11,000 |

| Los Angeles CA Community Redev. Agency | | | | |

| Multifamily Housing Rev. | | | | |

| (Hollywood & Vine Apartments) VRDO | 0.260% | 6/7/10 LOC | 25,000 | 25,000 |

| 1 Los Angeles CA Dept. of Airports | | | | |

| International Airport Rev. TOB VRDO | 0.260% | 6/7/10 | 14,000 | 14,000 |

| 1 Los Angeles CA Dept. of Airports | | | | |

| International Airport Rev. TOB VRDO | 0.310% | 6/7/10 | 5,530 | 5,530 |

| 1 Los Angeles CA Dept. of Airports | | | | |

| International Airport Rev. TOB VRDO | 0.370% | 6/7/10 | 18,880 | 18,880 |

| 1 Los Angeles CA Dept. of Airports | | | | |

| International Airport Rev. TOB VRDO | 0.370% | 6/7/10 | 7,975 | 7,975 |

| 1 Los Angeles CA Dept. of Water & Power | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 7,495 | 7,495 |

| 1 Los Angeles CA Dept. of Water & Power | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 LOC | 8,090 | 8,090 |

| 1 Los Angeles CA Dept. of Water & Power | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 4,440 | 4,440 |

| 1 Los Angeles CA Dept. of Water & Power | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 (4) | 14,245 | 14,245 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.240% | 6/1/10 | 12,800 | 12,800 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.200% | 6/7/10 | 14,400 | 14,400 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.240% | 6/7/10 | 51,300 | 51,300 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.240% | 6/7/10 | 86,500 | 86,500 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.250% | 6/7/10 | 32,400 | 32,400 |

| Los Angeles CA Dept. of Water & Power | | | | |

| Rev. VRDO | 0.260% | 6/7/10 | 55,015 | 55,015 |

| Los Angeles CA Multifamily Housing Rev. | | | | |

| (Beverly Park) VRDO | 0.270% | 6/7/10 LOC | 15,500 | 15,500 |

| Los Angeles CA Multifamily Housing Rev. | | | | |

| (Fountain Park) VRDO | 0.290% | 6/7/10 LOC | 25,500 | 25,500 |

| Los Angeles CA Multifamily Housing Rev. | | | | |

| (Queen Portfolio) VRDO | 0.310% | 6/7/10 LOC | 7,300 | 7,300 |

| Los Angeles CA Multifamily Housing Rev. | | | | |

| (San Regis) VRDO | 0.310% | 6/7/10 LOC | 23,600 | 23,600 |

| Los Angeles CA Regional Airports | | | | |

| Improvement Corp. Rev. VRDO | 0.250% | 6/1/10 LOC | 45,900 | 45,900 |

| 1 Los Angeles CA TOB VRDO | 0.290% | 6/7/10 | 4,020 | 4,020 |

| Los Angeles CA USD GO | 1.500% | 7/1/10 | 18,970 | 18,989 |

| Los Angeles CA USD GO | 2.000% | 7/1/10 | 14,835 | 14,852 |

| 1 Los Angeles CA USD GO TOB VRDO | 0.290% | 6/7/10 | 6,660 | 6,660 |

| 1 Los Angeles CA USD GO TOB VRDO | 0.290% | 6/7/10 | 9,995 | 9,995 |

| 1 Los Angeles CA USD GO TOB VRDO | 0.290% | 6/7/10 (4) | 22,500 | 22,500 |

| 1 Los Angeles CA USD TOB VRDO | 0.330% | 6/7/10 | 8,965 | 8,965 |

18

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Los Angeles CA USD TRAN | 2.000% | 8/12/10 | 25,000 | 25,068 |

| 1 Los Angeles CA Wastewater System | | | | |

| Rev. TOB VRDO | 0.270% | 6/7/10 | 24,475 | 24,475 |

| 1 Los Angeles CA Wastewater System | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 7,500 | 7,500 |

| 1 Los Angeles CA Wastewater System | | | | |

| Rev. TOB VRDO | 0.300% | 6/7/10 | 25,000 | 25,000 |

| Los Angeles CA Wastewater System | | | | |

| Rev. VRDO | 0.230% | 6/7/10 LOC | 8,600 | 8,600 |

| Los Angeles CA Wastewater System | | | | |

| Rev. VRDO | 0.240% | 6/7/10 LOC | 14,440 | 14,440 |

| Los Angeles CA Wastewater System | | | | |

| Rev. VRDO | 0.250% | 6/7/10 LOC | 11,730 | 11,730 |

| Los Angeles CA Wastewater System | | | | |

| Rev. VRDO | 0.260% | 6/7/10 LOC | 8,640 | 8,640 |

| Los Angeles County CA Capital Asset | | | | |

| Leasing Corp. Rev. | 0.300% | 7/13/10 LOC | 16,000 | 16,000 |

| Los Angeles County CA Housing Auth. | | | | |

| Multifamily Housing Rev. VRDO | 0.370% | 6/7/10 LOC | 6,120 | 6,120 |

| Los Angeles County CA Metro. Transp. | | | | |

| Auth. Sales Tax Rev. | 2.500% | 7/1/10 | 16,015 | 16,043 |

| Los Angeles County CA Metro. Transp. | | | | |

| Auth. Sales Tax Rev. VRDO | 0.280% | 6/1/10 | 60,775 | 60,775 |

| Manteca CA Redev. Agency Tax | | | | |

| Allocation Rev. VRDO | 0.300% | 6/1/10 LOC | 22,025 | 22,025 |

| 1 Metro. Water Dist. of Southern California | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 8,995 | 8,995 |

| 1 Metro. Water Dist. of Southern California | | | | |

| Rev. TOB VRDO | 0.290% | 6/7/10 | 5,000 | 5,000 |

| Metro. Water Dist. of Southern California | | | | |

| Rev. VRDO | 0.250% | 6/1/10 | 7,000 | 7,000 |

| Metro. Water Dist. of Southern California | | | | |

| Rev. VRDO | 0.230% | 6/7/10 | 16,600 | 16,600 |

| Metro. Water Dist. of Southern California | | | | |

| Rev. VRDO | 0.230% | 6/7/10 | 26,900 | 26,900 |

| Metro. Water Dist. of Southern California | | | | |

| Rev. VRDO | 0.240% | 6/7/10 | 36,000 | 36,000 |

| Mission Viejo CA Community Dev. Financing | | | | |

| Auth. (Mission Viejo Mall Improvement) VRDO | 0.250% | 6/7/10 LOC | 25,800 | 25,800 |

| 1 New Haven CA USD TOB VRDO | 0.290% | 6/7/10 LOC | 11,302 | 11,302 |

| Newport Beach CA Rev. | | | | |

| (Hoag Memorial Hosp.) VRDO | 0.230% | 6/7/10 | 28,795 | 28,795 |

| 1 Nuveen California Municipal Market | | | | |

| Opportunity Fund VRDP VRDO | 0.410% | 6/7/10 LOC | 20,000 | 20,000 |

| 1 Oakland CA Redev. Agency Tax Allocation | | | | |

| (Central Dist.) TOB VRDO | 0.290% | 6/7/10 LOC | 13,710 | 13,710 |

| Oakland-Alameda County CA Coliseum Auth. | | | | |

| Lease Rev. (Oakland Coliseum Project) VRDO | 0.250% | 6/7/10 LOC | 70,300 | 70,300 |

| Orange County CA Apartment Dev. Rev. VRDO | 0.260% | 6/7/10 LOC | 8,150 | 8,150 |

| 1 Orange County CA Sanitation Dist. COP | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 10,925 | 10,925 |

| Orange County CA TRAN | 2.000% | 6/30/10 | 80,000 | 80,102 |

| Orange County CA Water Dist. COP VRDO | 0.240% | 6/7/10 | 37,550 | 37,550 |

| Otay CA Water Dist. (Capital Project) COP VRDO | 0.300% | 6/7/10 LOC | 8,800 | 8,800 |

19

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Palomar Pomerado Health System California GO | | | | |

| TOB VRDO | 0.270% | 6/7/10 (12) | 18,500 | 18,500 |

| 1 Piedmont CA USD TOB VRDO | 0.290% | 6/7/10 | 6,445 | 6,445 |

| Pittsburg CA Redev. Agency Tax Allocation | | | | |

| (Los Medanos Community Dev.) VRDO | 0.300% | 6/1/10 LOC | 112,655 | 112,655 |

| 1 Port of Oakland CA Rev. TOB VRDO | 0.340% | 6/7/10 (13) | 13,665 | 13,665 |

| 1 Rancho Santiago CA Community College | | | | |

| Dist. TOB VRDO | 0.270% | 6/7/10 (4) | 4,765 | 4,765 |

| Riverside CA Electric Rev. VRDO | 0.280% | 6/7/10 LOC | 54,200 | 54,200 |

| Riverside County CA Public Fac. Project VRDO | 0.280% | 6/7/10 LOC | 10,400 | 10,400 |

| Riverside County CA Transp. Commission | | | | |

| Sales Tax Rev. VRDO | 0.270% | 6/7/10 | 4,885 | 4,885 |

| Riverside County CA Transp. Commission | | | | |

| Sales Tax Rev. VRDO | 0.270% | 6/7/10 | 29,975 | 29,975 |

| Sacramento CA Muni. Util. Dist. Rev. CP | 0.300% | 6/10/10 LOC | 7,000 | 7,000 |

| 1 Sacramento CA Muni. Util. Dist. Rev. TOB VRDO | 0.310% | 6/7/10 (4) | 13,510 | 13,510 |

| Sacramento CA Transp. Auth. Sales Tax Rev. VRDO | 0.260% | 6/7/10 | 47,300 | 47,300 |

| Sacramento County CA Sanitation Dist. | | | | |

| Financing Auth. VRDO | 0.260% | 6/7/10 LOC | 5,000 | 5,000 |

| 1 San Bernardino CA Community College | | | | |

| Dist. TOB VRDO | 0.290% | 6/7/10 (4) | 7,500 | 7,500 |

| 1 San Bernardino CA Community College | | | | |

| Dist. TOB VRDO | 0.320% | 6/7/10 | 38,720 | 38,720 |

| San Bernardino County CA TRAN | 2.000% | 6/30/10 | 50,000 | 50,063 |

| 1 San Diego CA Community College | | | | |

| Dist. GO TOB VRDO | 0.290% | 6/7/10 | 3,995 | 3,995 |

| 1 San Diego CA Community College | | | | |

| Dist. GO TOB VRDO | 0.290% | 6/7/10 | 5,000 | 5,000 |

| 1 San Diego CA Community College | | | | |

| Dist. GO TOB VRDO | 0.290% | 6/7/10 | 5,000 | 5,000 |

| San Diego CA County & School Dist. TRAN | 2.000% | 6/30/10 | 80,000 | 80,103 |

| San Diego CA Housing Auth. Multifamily Housing | | | | |

| Rev. (Bay Vista Apartments Projects) VRDO | 0.270% | 6/7/10 LOC | 9,690 | 9,690 |

| San Diego CA Housing Auth. Multifamily | | | | |

| Housing Rev. (Canyon Rim Apartments) VRDO | 0.260% | 6/7/10 LOC | 32,440 | 32,440 |

| San Diego CA Public Fac. Financing | | | | |

| Auth. Water Rev. | 2.500% | 8/1/10 | 5,245 | 5,262 |

| 1 San Diego CA Public Fac. Financing | | | | |

| Auth. Water Rev. TOB VRDO | 0.290% | 6/7/10 | 7,495 | 7,495 |

| San Diego CA USD TRAN | 2.000% | 7/8/10 | 45,000 | 45,067 |

| 1 San Diego CA Water Auth. Rev. COP TOB VRDO | 0.290% | 6/7/10 (4) | 6,840 | 6,840 |

| 1 San Diego CA Water Auth. Rev. COP TOB VRDO | 0.290% | 6/7/10 (4) | 9,500 | 9,500 |

| 1 San Diego CA Water Auth. Rev. COP TOB VRDO | 0.310% | 6/7/10 | 10,100 | 10,100 |

| San Diego County CA COP VRDO | 0.280% | 6/7/10 LOC | 9,760 | 9,760 |

| 1 San Diego County CA Water Auth. Rev. | | | | |

| COP TOB VRDO | 0.270% | 6/7/10 (4) | 16,900 | 16,900 |

| 1 San Diego County CA Water Auth. Rev. | | | | |

| TOB VRDO | 0.290% | 6/7/10 (4) | 9,800 | 9,800 |

| 1 San Diego County CA Water Auth. Rev. | | | | |

| TOB VRDO | 0.290% | 6/7/10 (4) | 6,100 | 6,100 |

| 1 San Francisco CA Bay Area Rapid Transit | | | | |

| Dist. Rev. TOB VRDO | 0.290% | 6/7/10 | 10,000 | 10,000 |

| 1 San Francisco CA Bay Area Rapid Transit | | | | |

| Dist. Sales Tax Rev. TOB VRDO | 0.290% | 6/7/10 | 13,595 | 13,595 |

20

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| San Francisco CA Bay Area Rapid Transit Rev. | 6.750% | 7/1/10 | 6,370 | 6,402 |

| San Francisco CA City & County Finance Corp. | | | | |

| Lease Rev. (Moscone Center Expansion) VRDO | 0.230% | 6/7/10 LOC | 7,600 | 7,600 |

| San Francisco CA City & County | | | | |

| International Airport Rev. VRDO | 0.270% | 6/7/10 LOC | 16,000 | 16,000 |

| San Francisco CA City & County Redev. Agency | | | | |

| Multifamily Rev. VRDO | 0.290% | 6/7/10 LOC | 65,200 | 65,200 |

| San Jose CA Financing Auth. Lease Rev. CP | 0.370% | 8/3/10 LOC | 34,302 | 34,302 |

| 1 San Jose CA Financing Auth. Lease Rev. | | | | |

| TOB VRDO | 0.300% | 6/7/10 (13) | 25,960 | 25,960 |

| San Jose CA Financing Auth. Lease Rev. VRDO | 0.260% | 6/7/10 LOC | 28,980 | 28,980 |

| San Jose CA Multifamily Housing Rev. | | | | |

| (Cinnabar Commons) VRDO | 0.260% | 6/7/10 LOC | 16,700 | 16,700 |

| 1 San Jose CA USD Santa Clara County TOB VRDO | 0.290% | 6/7/10 LOC | 5,000 | 5,000 |

| 1 San Jose CA USD Santa Clara County TOB VRDO | 0.290% | 6/7/10 | 5,000 | 5,000 |

| 1 San Marcos CA Public Fac. Auth. Tax Allocation | | | | |

| TOB VRDO | 0.310% | 6/7/10 (13) | 8,690 | 8,690 |

| 1 San Mateo County CA Community College Dist. | | | | |

| TOB VRDO | 0.290% | 6/7/10 | 11,660 | 11,660 |

| Santa Barbara County CA TRAN | 2.500% | 6/30/10 | 25,000 | 25,043 |

| Santa Clara County CA El Camino Hosp. Dist. Fac. | | | | |

| Auth. Rev. (Valley Medical Center Project) VRDO | 0.280% | 6/7/10 LOC | 16,150 | 16,150 |

| Santa Clara County CA El Camino Hosp. Dist. Fac. | | | | |

| Auth. Rev. (Valley Medical Center Project) VRDO | 0.280% | 6/7/10 LOC | 17,000 | 17,000 |

| Santa Clara County CA Financing Auth. Lease Rev. | | | | |

| (VMC Fac. Replacement Project) VRDO | 0.190% | 6/7/10 | 27,430 | 27,430 |

| 1 Semitropic CA Water Storage Dist. Rev. TOB VRDO | 0.290% | 6/7/10 | 9,590 | 9,590 |

| 1 Sequoia CA USD TOB VRDO | 0.290% | 6/7/10 (4) | 5,860 | 5,860 |

| 1 Sonoma County CA (Jr. College Dist.) TOB VRDO | 0.290% | 6/7/10 (4) | 31,030 | 31,030 |

| 1 Sonoma County CA (Jr. College Dist.) TOB VRDO | 0.290% | 6/7/10 (4) | 3,440 | 3,440 |

| Sonoma County CA TRAN | 1.500% | 10/28/10 | 30,000 | 30,136 |

| South Placer CA Wastewater Auth. Rev. VRDO | 0.200% | 6/7/10 LOC | 35,725 | 35,725 |

| Southern California Home Financing Auth. | | | | |

| Single Family Mortgage Rev. VRDO | 0.290% | 6/7/10 LOC | 15,980 | 15,980 |

| Southern California Home Financing Auth. | | | | |

| Single Family Mortgage Rev. VRDO | 0.290% | 6/7/10 LOC | 33,560 | 33,560 |

| Southern California Public Power Auth. | | | | |

| (Linden Windenergy Project) RAN | 2.000% | 10/1/10 | 42,680 | 42,904 |

| Southern California Public Power Auth. | | | | |

| (Tieten Hydropower) RAN | 2.000% | 8/16/10 | 11,180 | 11,217 |

| 1 Sweetwater CA USD GO TOB VRDO | 0.290% | 6/7/10 (13) | 16,445 | 16,445 |

| 1 Univ. of California Barclays TOB VRDO | 0.260% | 6/7/10 | 6,665 | 6,665 |

| Univ. of California Regents VRDO | 0.240% | 6/1/10 | 29,115 | 29,115 |

| Univ. of California Rev. (Multiple Purpose Project) | 5.000% | 9/1/10 (Prere.) | 3,500 | 3,576 |

| Univ. of California Rev. (Multiple Purpose Project) | 5.000% | 9/1/10 (Prere.) | 5,000 | 5,108 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 29,195 | 29,195 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 (13) | 15,280 | 15,280 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 3,495 | 3,495 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 6,000 | 6,000 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 5,995 | 5,995 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 3,470 | 3,470 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 10,000 | 10,000 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 | 1,890 | 1,890 |

| 1 Univ. of California Rev. TOB VRDO | 0.290% | 6/7/10 (4) | 16,820 | 16,820 |

| Ventura County CA TRAN | 2.500% | 7/1/10 | 32,000 | 32,056 |

21

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Vista CA USD GO TOB VRDO | 0.320% | 6/7/10 (4) | 9,475 | 9,475 |

| Western Municipal Water Dist. Fac. Auth. | | | | |

| California Water Rev. VRDO | 0.220% | 6/7/10 LOC | 8,700 | 8,700 |

| Whittier CA Insured Health Fac. Rev. | | | | |

| (Presbyterian Hosp.) VRDO | 0.240% | 6/7/10 LOC | 15,600 | 15,600 |

| Total Tax-Exempt Municipal Bonds (Cost $4,901,718) | | | | 4,901,718 |

| Other Assets and Liabilities (-0.1%) | | | | |

| Other Assets | | | | 46,039 |

| Liabilities | | | | (51,983) |

| | | | | (5,944) |

| Net Assets (100%) | | | | |

| Applicable to 4,895,248,866 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | | 4,895,774 |

| Net Asset Value Per Share | | | | $1.00 |

| |

| |

| At May 31, 2010, net assets consisted of: | | | | |

| | | | | Amount |

| | | | | ($000) |

| Paid-in Capital | | | | 4,895,763 |

| Undistributed Net Investment Income | | | | — |

| Accumulated Net Realized Gains | | | | 11 |

| Net Assets | | | | 4,895,774 |

• See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2010, the aggregate value of these securities was $1,051,293,000, representing 21.5% of net assets.

See accompanying Notes, which are an integral part of the Financial Statements.

A key to abbreviations and other references follows the Statement of Net Assets.

22

California Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

IDA—Industrial Development Authority Bond.

IDR—Industrial Development Revenue Bond.

PCR—Pollution Control Revenue Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

UFSD—Union Free School District.

USD—United School District.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corp.

(13) Berkshire Hathaway Assurance Corp.

(14) National Public Finance Guarantee Corp.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

23

| |

| California Tax-Exempt Money Market Fund | |

| |

| |

| Statement of Operations | |

| |

| | Six Months Ended |

| | May 31, 2010 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 7,094 |

| Total Income | 7,094 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 560 |

| Management and Administrative | 2,971 |

| Marketing and Distribution | 803 |

| Custodian Fees | 19 |

| Shareholders’ Reports | 9 |

| Trustees’ Fees and Expenses | 4 |

| Total Expenses | 4,366 |

| Net Investment Income | 2,728 |

| Realized Net Gain (Loss) on Investment Securities Sold | 11 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,739 |

See accompanying Notes, which are an integral part of the Financial Statements.

24

| | |

| California Tax-Exempt Money Market Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Six Months Ended | Year Ended |

| | May 31, | November 30, |

| | 2010 | 2009 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 2,728 | 23,796 |

| Realized Net Gain (Loss) | 11 | 506 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 2,739 | 24,302 |

| Distributions | | |

| Net Investment Income | (2,728) | (23,796) |

| Realized Capital Gain | — | — |

| Total Distributions | (2,728) | (23,796) |

| Capital Share Transactions (at $1.00) | | |

| Issued | 1,649,109 | 3,668,931 |

| Issued in Lieu of Cash Distributions | 2,633 | 22,754 |

| Redeemed | (2,111,437) | (5,842,322) |

| Net Increase (Decrease) from Capital Share Transactions | (459,695) | (2,150,637) |

| Total Increase (Decrease) | (459,684) | (2,150,131) |

| Net Assets | | |

| Beginning of Period | 5,355,458 | 7,505,589 |

| End of Period | 4,895,774 | 5,355,458 |

See accompanying Notes, which are an integral part of the Financial Statements.

25

| | | | | | |

| California Tax-Exempt Money Market Fund | | | | | |

| |

| |

| Financial Highlights | | | | | | |

| |

| |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | May 31, | | | Year Ended November 30, |

| Throughout Each Period | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | | |

| Net Investment Income | .0005 | .004 | .022 | .035 | .032 | .021 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | — | — | — | — | — | — |

| Total from Investment Operations | .0005 | .004 | .022 | .035 | .032 | .021 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.0005) | (.004) | (.022) | (.035) | (.032) | (.021) |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Total Distributions | (.0005) | (.004) | (.022) | (.035) | (.032) | (.021) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.05% | 0.37% | 2.21% | 3.55% | 3.24% | 2.17% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $4,896 | $5,355 | $7,506 | $8,623 | $7,220 | $6,162 |

| Ratio of Total Expenses to | | | | | | |

| Average Net Assets | 0.17%2 | 0.17%3 | 0.11%3 | 0.10% | 0.13% | 0.13% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 0.11%2 | 0.39% | 2.19% | 3.49% | 3.20% | 2.17% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Annualized.

3 Includes fees to participate in the Treasury Temporary Guarantee Program for Money Market Funds of 0.04% for 2009 and 0.01% for 2008.

See accompanying Notes, which are an integral part of the Financial Statements.

26

California Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard California Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2006–2009), and for the period ended May 31, 2010, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At May 31, 2010, the fund had contributed capital of $916,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.37% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At May 31, 2010, 100% of the fund’s investments were valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

D. In preparing the financial statements as of May 31, 2010, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

27

California Intermediate-Term Tax-Exempt Fund

| | | |

| Fund Profile | | |

| As of May 31, 2010 | | | |

| |

| Share-Class Characteristics | | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VCAIX | VCADX |

| Expense Ratio1 | 0.20% | 0.12% |

| 30-Day SEC Yield | 3.13% | 3.21% |

| |

| Financial Attributes | | | |

| | | Barclays 7 | |

| | | Year | Barclays |

| | | Municipal | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 706 | 4,597 | 46,449 |

| Average Quality | AA- | AA/AA- | AA/AA- |

| Yield to Maturity | | | |

| (before expenses) | 3.3% | 2.7% | 3.4% |

| Average Coupon | 4.4% | 5.0% | 5.0% |

| Average Duration | 5.6 years | 5.1 years | 8.2 years |

| Average Effective | | | |

| Maturity | 6.0 years | 6.9 years | 13.5 years |

| Short-Term | | | |

| Reserves | 6.4% | — | — |

| | |

| Volatility Measures | | |

| | Barclays 7 | Barclays |

| | Year Municipal | Municipal |

| | Bond Index | Bond Index |

| R-Squared | 0.78 | 0.96 |

| Beta | 0.94 | 0.91 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

Distribution by Maturity (% of portfolio)

| |

| Under 1 Year | 10.5% |

| 1 - 3 Years | 12.8 |

| 3 - 5 Years | 19.1 |

| 5 - 10 Years | 45.6 |

| 10 - 20 Years | 11.0 |

| 20 - 30 Years | 1.0 |

Distribution by Credit Quality (% of portfolio)

| |

| AAA | 18.6% |

| AA | 38.3 |

| A | 37.5 |

| BBB | 4.2 |

| BB | 0.1 |

| Not Rated | 1.3 |

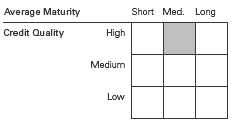

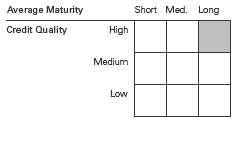

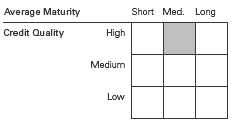

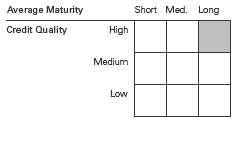

Investment Focus

1 The expense ratios shown are from the prospectus dated April 22, 2010, and represent estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the six months ended May 31, 2010, the annualized expense ratios were 0.20% for Investor Shares and 0.12% for Admiral Shares.

28

California Intermediate-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

| | | | |

| Fiscal-Year Total Returns (%): November 30, 1999, Through May 31, 2010 | |

| | | | | Barclays 7 |

| | | | | Year Municipal |

| | | | Investor Shares | Bond Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2000 | 4.94% | 3.05% | 7.99% | 6.55% |

| 2001 | 4.67 | 2.77 | 7.44 | 8.13 |

| 2002 | 4.35 | 1.53 | 5.88 | 7.02 |

| 2003 | 4.12 | 1.66 | 5.78 | 6.97 |

| 2004 | 3.93 | -1.52 | 2.41 | 2.89 |

| 2005 | 3.90 | -1.79 | 2.11 | 2.16 |

| 2006 | 4.12 | 1.28 | 5.40 | 5.09 |

| 2007 | 3.99 | -1.53 | 2.46 | 4.19 |

| 2008 | 3.79 | -6.50 | -2.71 | 2.91 |

| 2009 | 4.19 | 6.37 | 10.56 | 10.43 |

| 2010 | 1.93 | 1.47 | 3.40 | 2.66 |

| Note: For 2010, performance data reflect the six months ended May 31, 2010. | | |

Average Annual Total Returns: Periods Ended March 31, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Investor Shares | 3/4/1994 | 8.27% | 3.73% | 4.16% | 0.43% | 4.59% |

| Admiral Shares | 11/12/2001 | 8.36 | 3.81 | 4.101 | -0.361 | 3.741 |

| 1 Return since inception. | | | | | | |

See Financial Highlights for dividend and capital gains information.

29

California Intermediate-Term Tax-Exempt Fu nd

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (99.8%) | | | | |

| California (97.7%) | | | | |

| ABAG Finance Auth. for Non-Profit Corp. California | | | | |

| (899 Charleston Project) VRDO | 0.280% | 6/1/10 LOC | 21,775 | 21,775 |

| ABAG Finance Auth. for Non-Profit Corp. California | | | | |

| (Acacia Creek at Union City Project) VRDO | 0.280% | 6/1/10 | 30,075 | 30,075 |

| ABAG Finance Auth. for Non-Profit Corp. California | | | | |

| (Valley Christian Schools) VRDO | 0.300% | 6/7/10 LOC | 6,000 | 6,000 |

| Alameda CA Corridor Transp. Auth. Rev. | 5.125% | 10/1/14 (14) | 10,150 | 10,273 |

| Alameda CA Corridor Transp. Auth. Rev. | 0.000% | 10/1/20 (2) | 12,250 | 6,810 |

| Alameda CA Corridor Transp. Auth. Rev. | 0.000% | 10/1/29 (2) | 30,000 | 8,576 |

| Alameda CA Corridor Transp. Auth. Rev. | 0.000% | 10/1/30 (2) | 8,000 | 2,106 |

| Alameda County CA (Medical Center) COP | 5.250% | 6/1/12 (14)(ETM) | 1,595 | 1,669 |

| Alameda County CA (Medical Center) COP | 5.250% | 6/1/13 (14)(ETM) | 1,785 | 1,868 |

| Alameda County CA (Medical Center) COP | 5.375% | 6/1/14 (14)(ETM) | 1,880 | 1,982 |

| Alameda County CA (Medical Center) COP | 5.375% | 6/1/15 (14)(ETM) | 3,960 | 4,175 |

| Alameda County CA COP | 5.375% | 12/1/10 (14) | 2,000 | 2,036 |

| Alameda County CA COP | 5.375% | 12/1/12 (14) | 11,000 | 11,741 |

| Alameda County CA COP | 5.375% | 12/1/13 (14) | 13,930 | 14,746 |

| Alameda County CA COP | 5.375% | 12/1/14 (14) | 4,790 | 5,047 |

| Alameda County CA COP | 5.375% | 12/1/15 (14) | 1,500 | 1,570 |

| Alvord CA USD GO | 5.900% | 2/1/24 (4) | 3,865 | 4,354 |

| Anaheim CA Public Finance Auth. | | | | |

| Electric System Rev. | 5.000% | 10/1/20 (14) | 4,210 | 4,610 |

| Anaheim CA Public Finance Auth. | | | | |

| Electric System Rev. | 5.000% | 10/1/21 (14) | 4,425 | 4,807 |

| Anaheim CA Public Finance Auth. | | | | |

| Electric System Rev. | 5.000% | 10/1/22 (14) | 4,660 | 5,024 |

| Anaheim CA Public Finance Auth. | | | | |

| Electric System Rev. | 5.000% | 10/1/24 (14) | 5,175 | 5,509 |

| Anaheim CA Public Finance Auth. | | | | |

| Electric System Rev. | 5.000% | 10/1/25 (14) | 5,450 | 5,766 |

| Anaheim CA Union High School Dist. GO | 5.375% | 8/1/12 (4)(Prere.) | 1,250 | 1,374 |

| Antioch CA Public Finance Auth. | | | | |